What have you and I been told matters... that doesn't really matter?

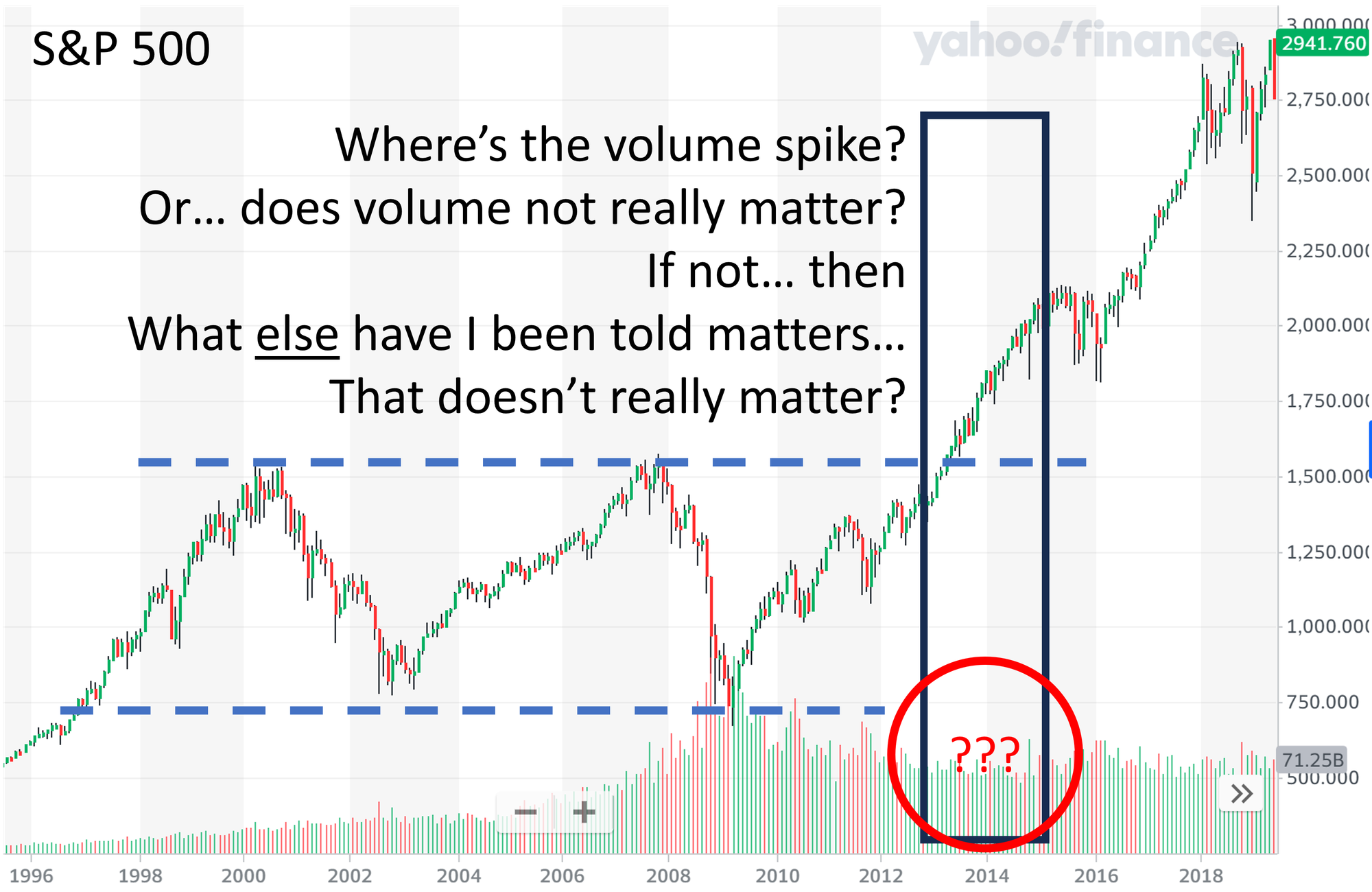

Following up this "what am I missing?" post, something in the chart I used in that post caught my eye.

Or didn't catch my eye, as the case may be.

Chartists - who draw all over price charts to discern actionable insights (nothing wrong there, there are probably many successful and profitable chartists and I say more power to them) - will tell you to look at price and volume.

I am not a chartist. I probably incorrectly drew the trend channel in the accompanying chart.

However, I'm probably close enough for government work to ask... where's the volume?

I know volume was monstrous during the 2008-9 Great Financial Crisis. So any volume level would probably pale in comparison.

But shouldn't there be more volume in the rectangular box - IF there is any real importance to volume?

Which brings me to my main point/question: Is volume just another data point thrown into the mix to prove to others how in-depth and comprehensive is the analyst, and how complicated it really all is?

Perhaps. I can only speculate.

But my perspective is this:

So many times you'll see a marketing pitch which says something like "we include xx fundamental factors and yy technical factors in our proprietary analysis which allows us to hone in on the best opportunities all the time."

I prefer quality over quantity.

Not all information is created equal.

(Sounds like a blood sport. And it is. Every time you buy or sell a stock, there is someone on the other side of your transaction who believes you are wrong and they are right. If you don't have a genuine edge that you can apply in every transaction, in the short term you can get lucky but in the long term you'll lose out to those who do have a genuine edge.)

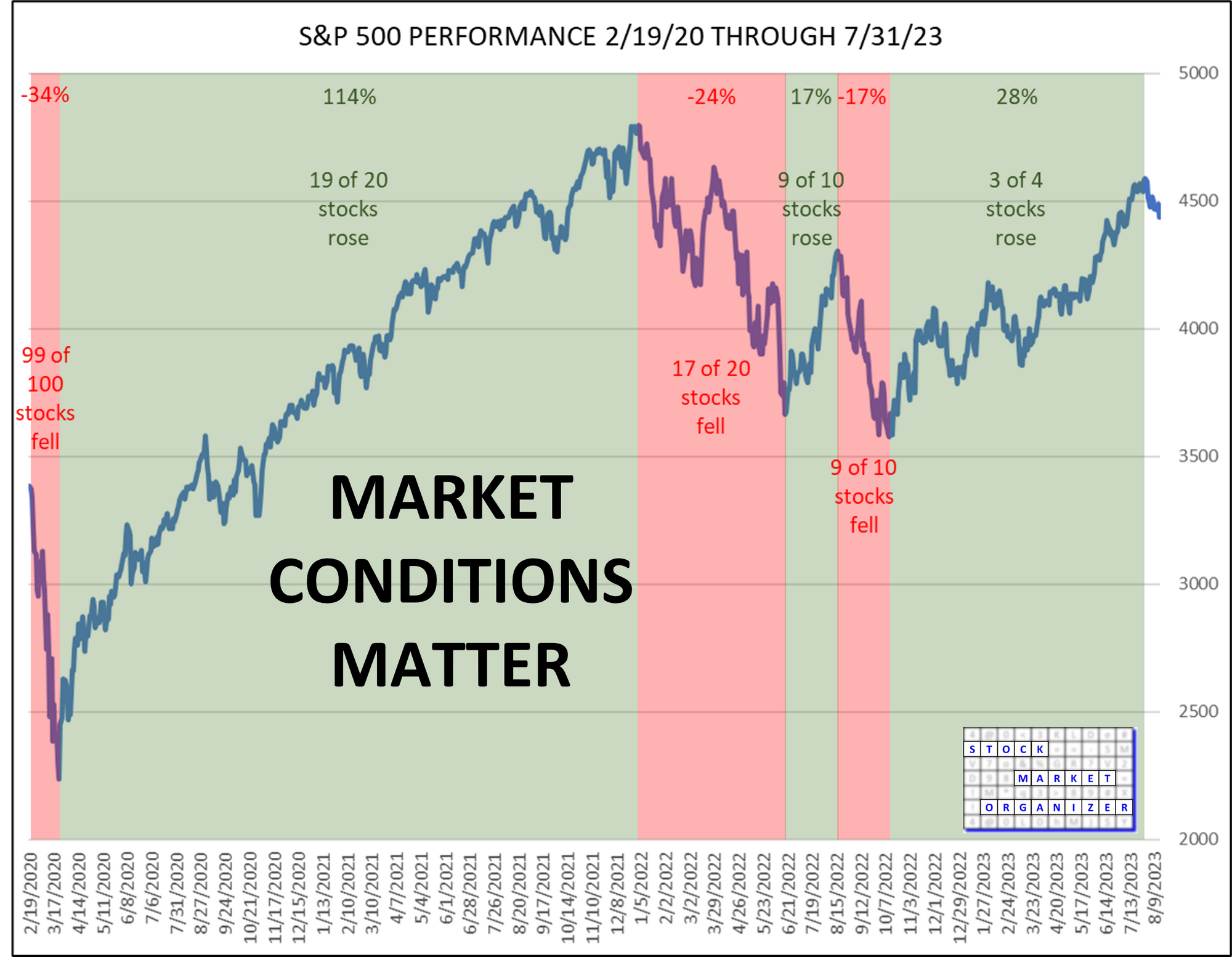

What is the most important information? Market conditions.

Consider this... the greatest football players of all time will have terrible statistics if they play a game outdoors in the midst of a torrential downpour.

Similarly, you could have completed a stock fundamental analysis that would make Benjamin Graham and Warren Buffett weep with joy. But if you owned that stock from February 19, 2020 through March 23, 2020, you had a 99% chance that your stock fell.

From this post - see the far left portion of the chart to see what happened during the above period:

If you fail to account for market conditions, market conditions will fail you. (Clever, no?)

Wrapping up this stream of consciousness, I'll repeat and answer the question in the headline: What have you and I been told matters... that doesn't really matter?

Volume. At least, not in an exploitable manner that gives me a genuine edge in the stock market.

I have more answers to this question, but they'll have to wait for another time.