Utilities Industry Wed 2025-04-16: 4Strong strength rating (Strengthened/0)

This post is organized as follows:

I. Introduction

II. Market Environment - TAILWIND

III. Industry Background

IV. Industry/Sub-industry Recent Performance - Tailwind

V. Stock Details

I. Introduction

This post provides detail on the Utilities industry - specifically:

🔹 An objective measurement of industry strengthening and weakening so you can objectively compare strength and weakness across/within industries and sub-industries.

🔹 A listing of stocks rated 1Strongest and 9Weakest (highest/lowest rating of 9 levels) by sub-industry, saving you significant time finding stocks that may be prone to making bigger moves faster. Stronger stocks have less overhead resistance, weaker stocks are prone to “pops” from bargain hunting and short-covering yet due to preceding weakness are also prone to falling far and fast.

Previous Utilities reports:

- April 9, 2025, 4Strong strength rating (Weakened/0)

- April 2, 2025, 4Strong strength rating (Strengthened/0)

- March 26, 2025, 4Strong strength rating (Weakened/0)

- March 19, 2025, 4Strong strength rating (Unch)

II. Market Environment

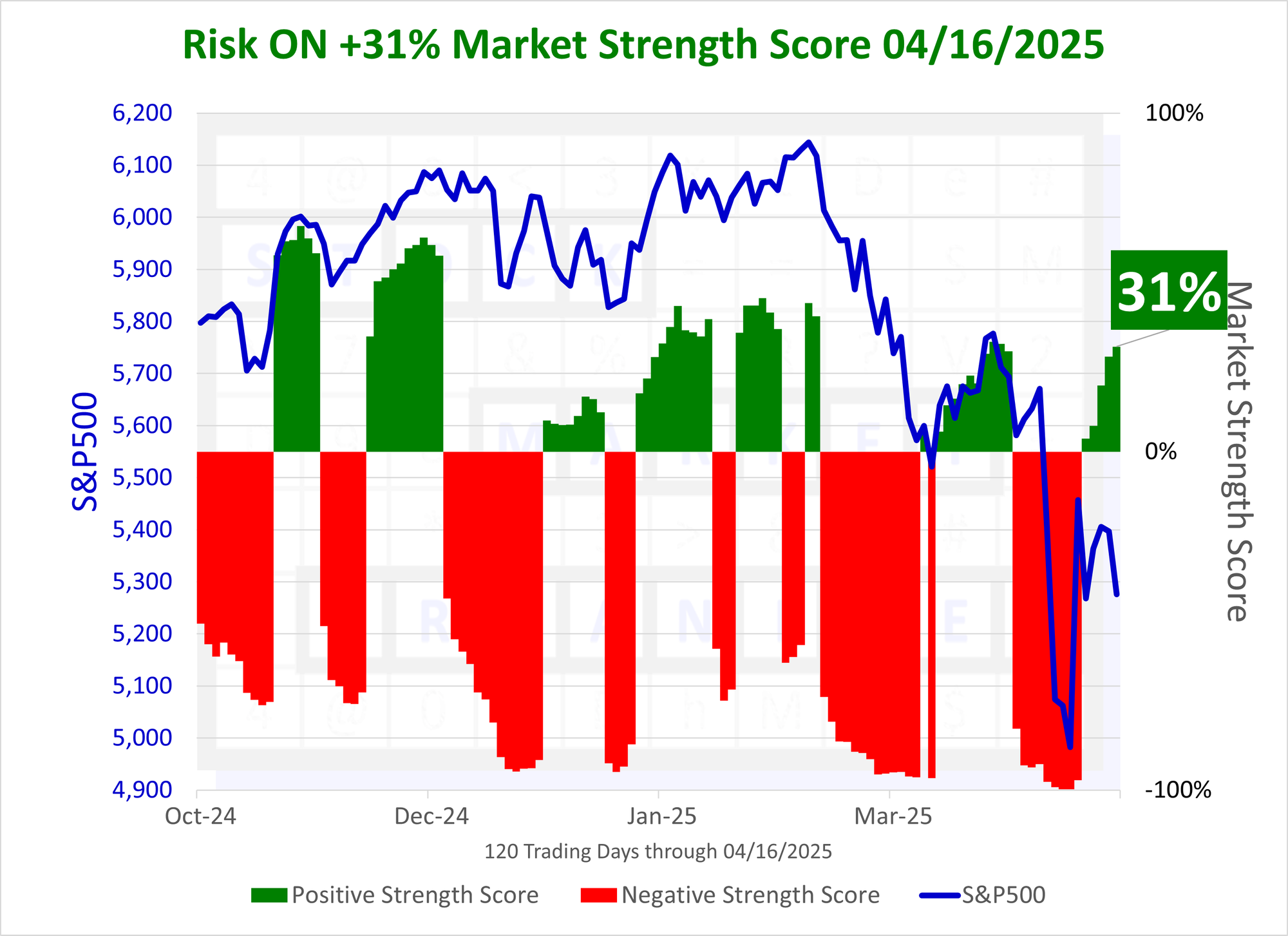

This system seeks to understand the current market environment before considering sector, industry, sub-industry, and stock-level strength. There is no guarantee this objective measurement will remain either favorable to longs (tailwinds present) or unfavorable (headwinds present). The critical factor is this acknowledges the clear influence market factors have on the levels below it and lays the groundwork for subsequent principle-based decision-making.

The Market Strength Score changed to positive ("Risk ON") at +4% as of Thursday, April 10, 2025.

The current Market Strength Score is +31% as shown below. The upper bound for this score is +100%, which means there is plenty of room for the a potential rally to run, though this is certainly not a prediction.

Here is the corresponding Sector Risk Gauge.

III. Industry Background

Largest of 5 sub-industries (76 stocks, average 15):

- Diversified Utilities (31 stocks)

- Electric Utilities (18 stocks)

- Gas Utilities (10 stocks)

Top market cap stocks: NEE/NextEra Energy, SO/Southern Company The, DUK/Duke Energy Corp, SRE/Sempra Energy, AEP/American Electric Power, D/Dominion Energy Inc, PCG/Pacific Gas & Electric Co, PEG/Public Service Enterprise Group Inc, EXC/Exelon Corporation, XEL/Xcel Energy Inc

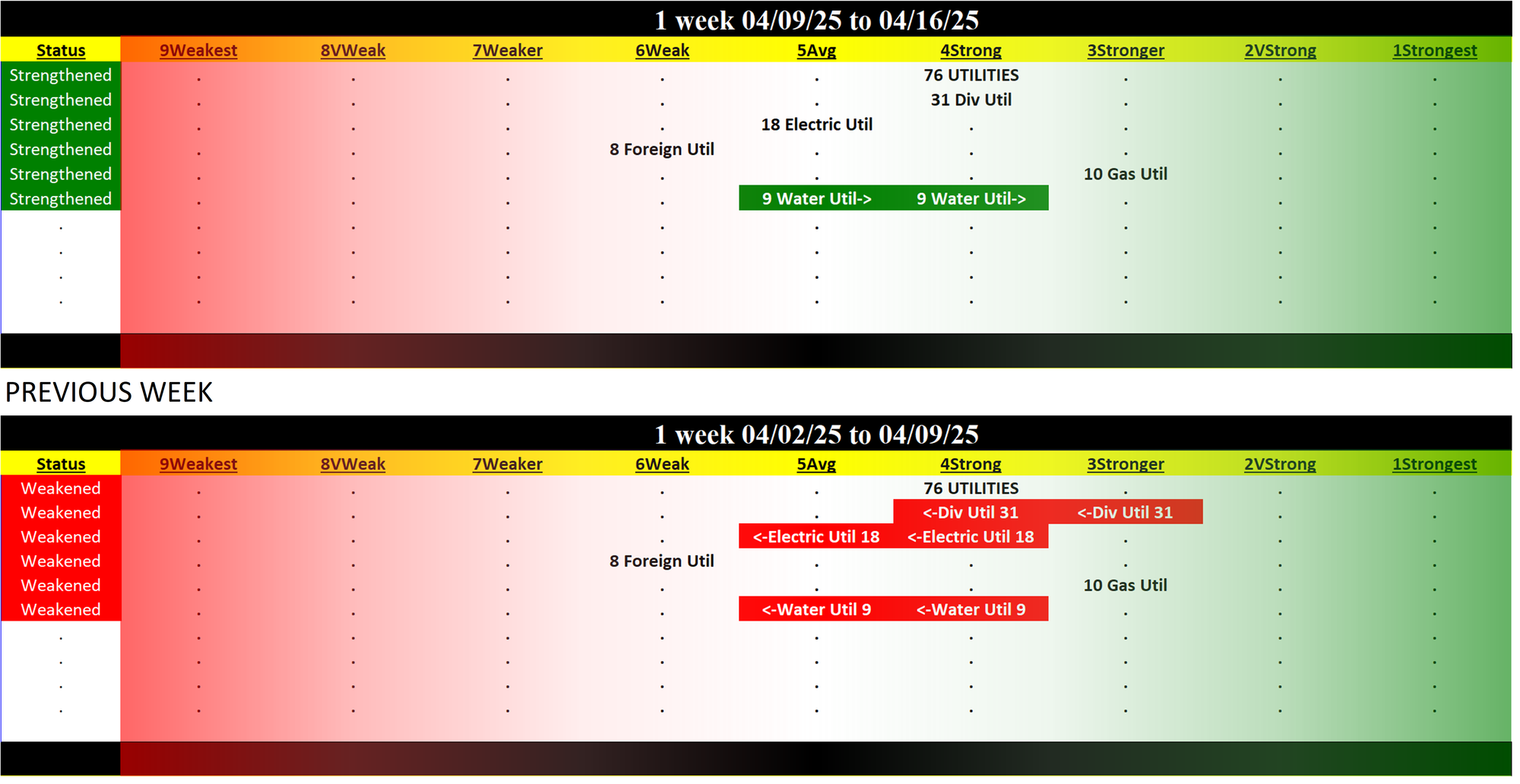

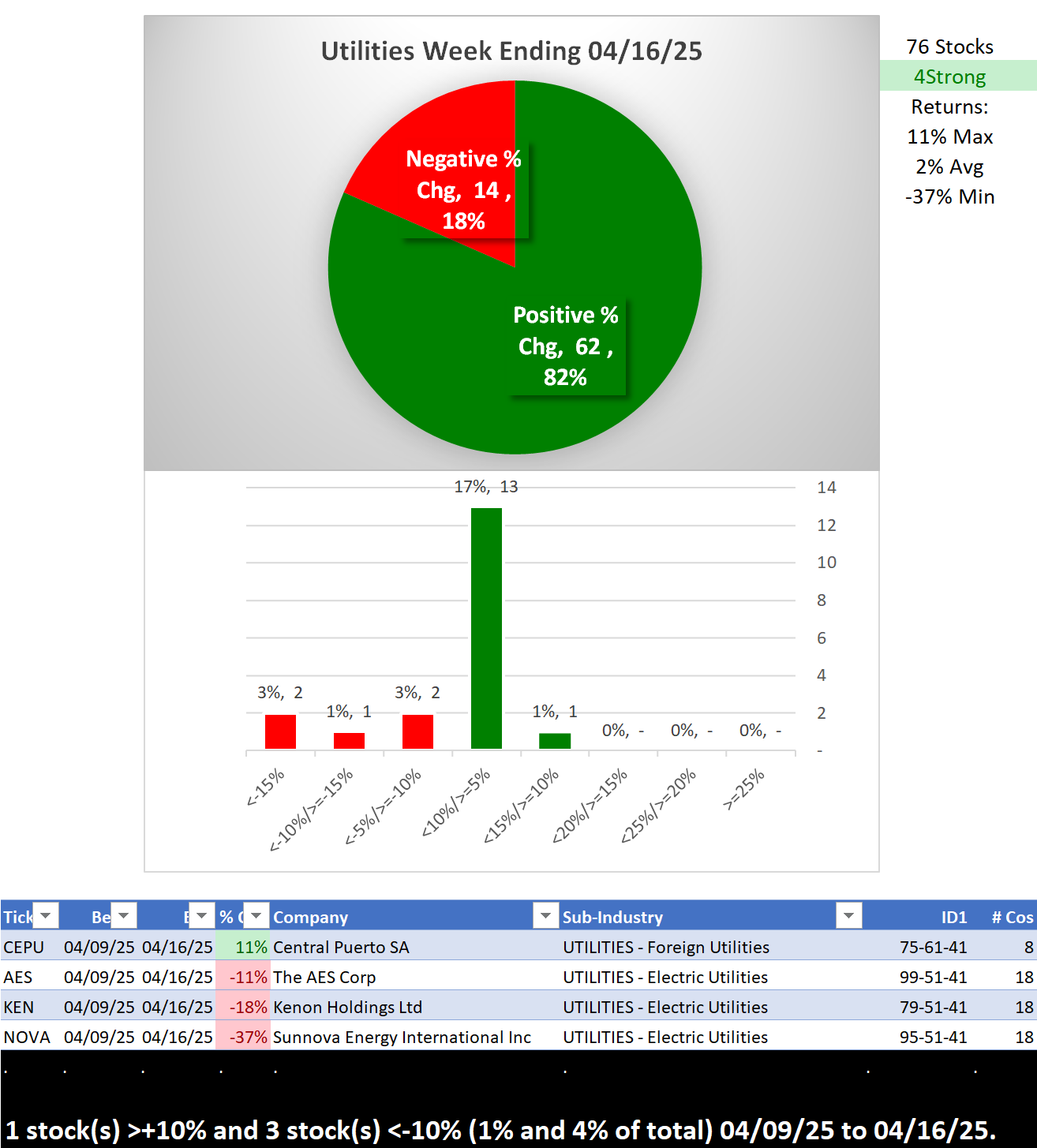

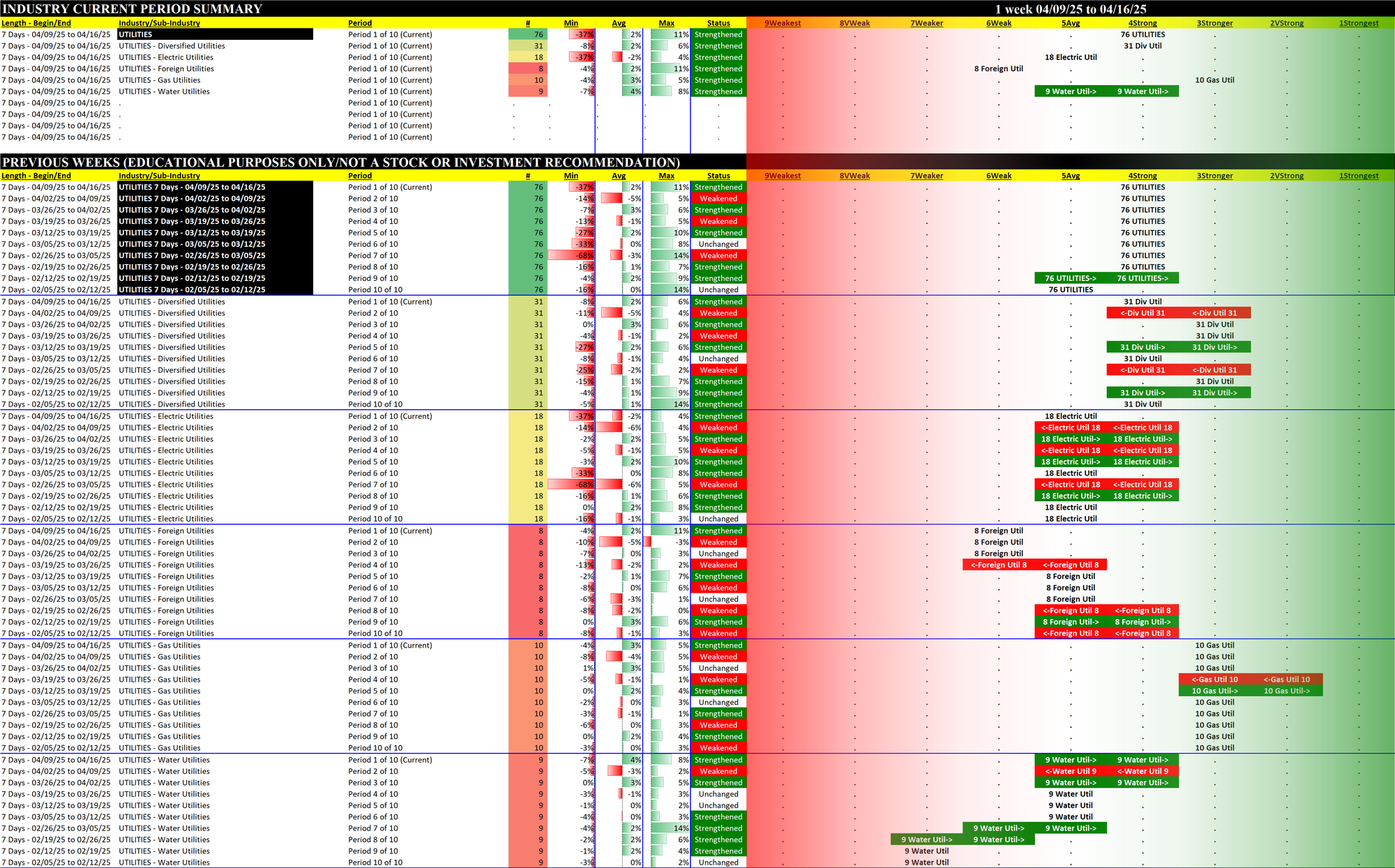

IV. Industry Recent Performance - 4Strong Weakened/0 = Neutral/Tailwind

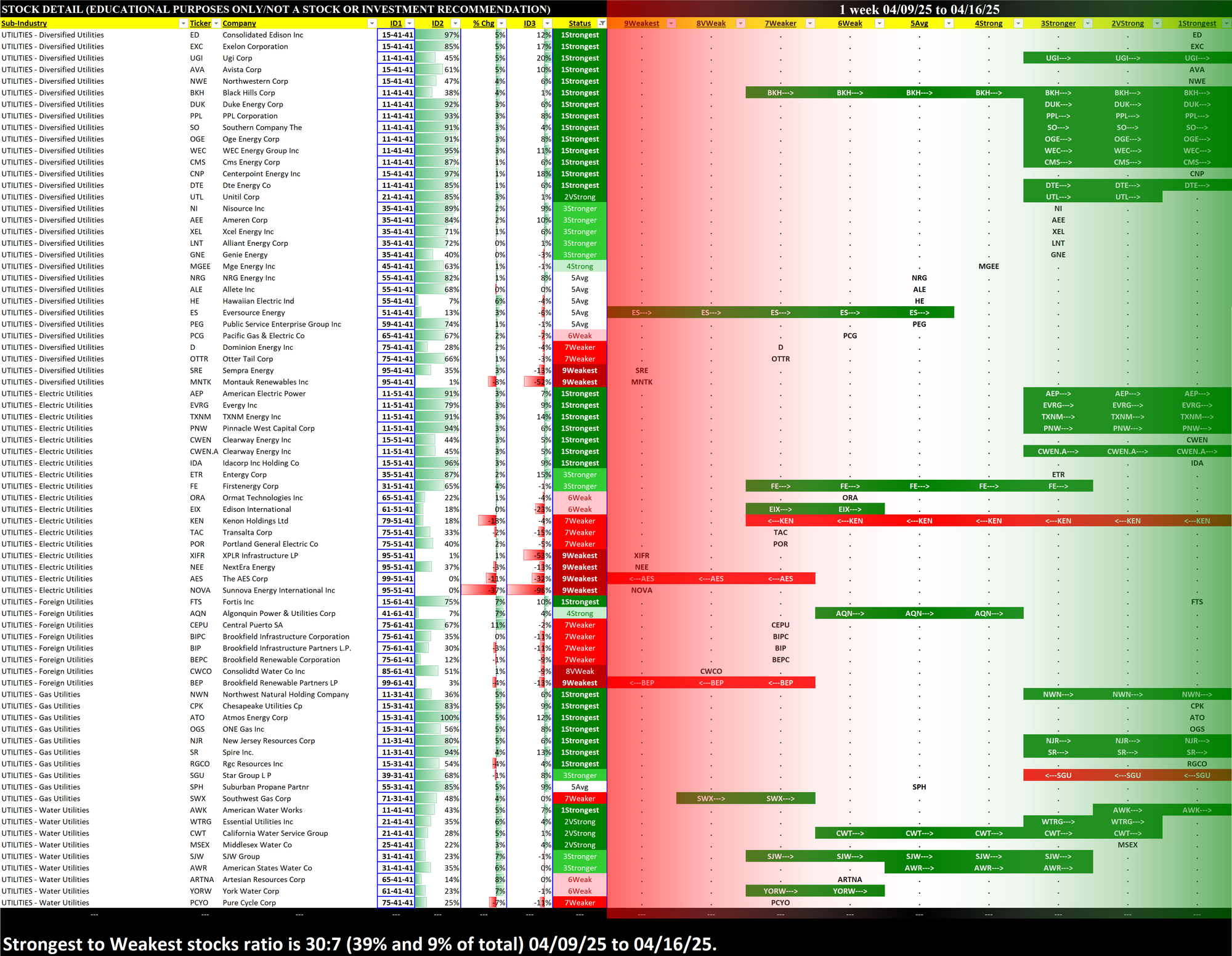

The following summarizes this week's positive/negative performance and major outliers (greater than +10% and lesser than -10%) and the past 10 weeks ratings and changes for the Utilities sub-industries.

V. Stock Details

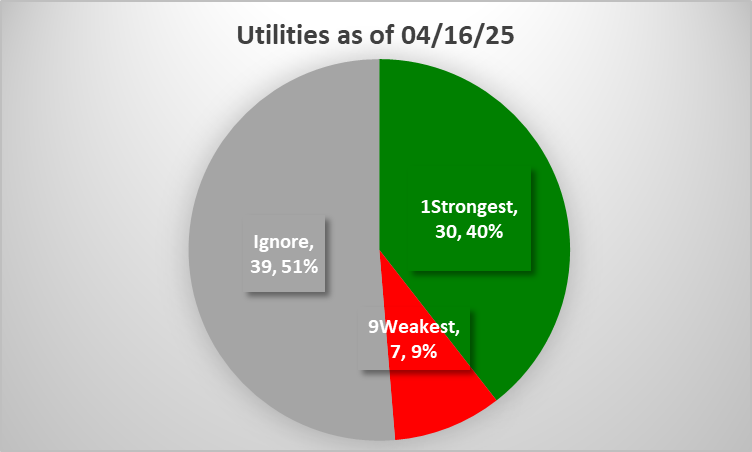

The following provides a listing of all Utilities industry stocks in order of 1) sub-industry, 2) strongest-to-weakest strength rating, then 3) highest to lowest return this week. This is preceded by a summary of the proportion of 1Strongest to 9Weakest stocks.