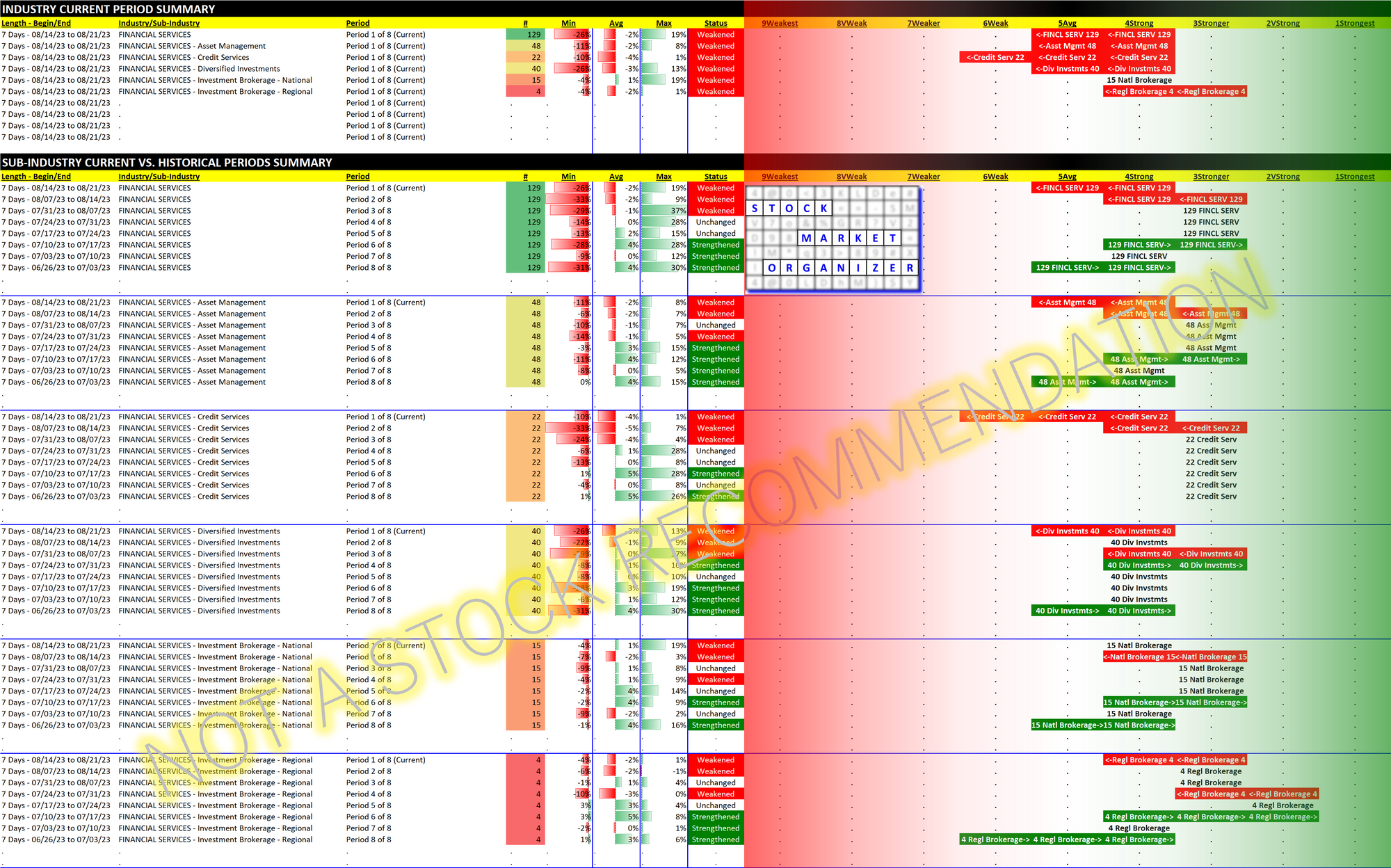

Financial Services 2023-08-21: -1 to "AVERAGE" strength rating (5th strongest of 9 levels), previous move was also DOWN

Previous review of Financial Services was one week ago 2023-08-14.

Is there a point in reviewing an industry on a weekly basis? I say yes.

There is always the risk of being too close to the action to see clearly what is happening. But the way this method is built automatically provides an on-going big picture view unlike any other I've seen. It actually ensures I see the big picture. At the same time, I can clearly see turning points at the stock, sub-industry, and industry levels, sooner than others. The horse will not get out of the barn on my watch.

This is my edge. And it is to your advantage.

A digression - I created this method so I could make sense of the flood of information that came daily. It is all too easy to get caught up in the never-ending headlines and commentaries with no way of actionably making sense of it all.

By focusing on what the market is saying through the action of its individual stocks, I can objectively understand and see the various and continually evolving cross- and under-currents. And I can do so regardless of market environment, without any influence from the headlines or experts of the day.

As I write this, many are obsessing over the imminent NVDA/Nvidia earnings report and the Fed's Jackson Hole meeting. They are playing endless "what if?" scenarios in their heads. The airwaves are filled with endless ruminating about the Magnificent 7 (I just heard of the Great 8 which I think added NFLX/Netflix, not 100% sure), dot plots, pauses, and pivots...

I understand why people do it, but it's like watching sports commentators guessing the result of the Super Bowl. Not one word of commentary means anything. The only thing that matters is playing the game itself.

If you want the real scoop as to what's currently happening, why ask anybody other than the actual market itself? #everybodyknowsmorethananybody

The reason why many don't is because they aren't sure how to discern exactly what the market is saying. (Let's differentiate between what the market is saying and what it will actually do - I have no idea about the latter.) I believe there is at least one good way to do so. And that is what you are reading on these cyber pages.

Back to Financial Services...

Last week I wrote the following:

This trading week ending 8/14/23 shows a weakening for the first time in seven weeks.

I don't know if it will continue but a consistent theme here is that a multi-week or longer decline begins with one down week.

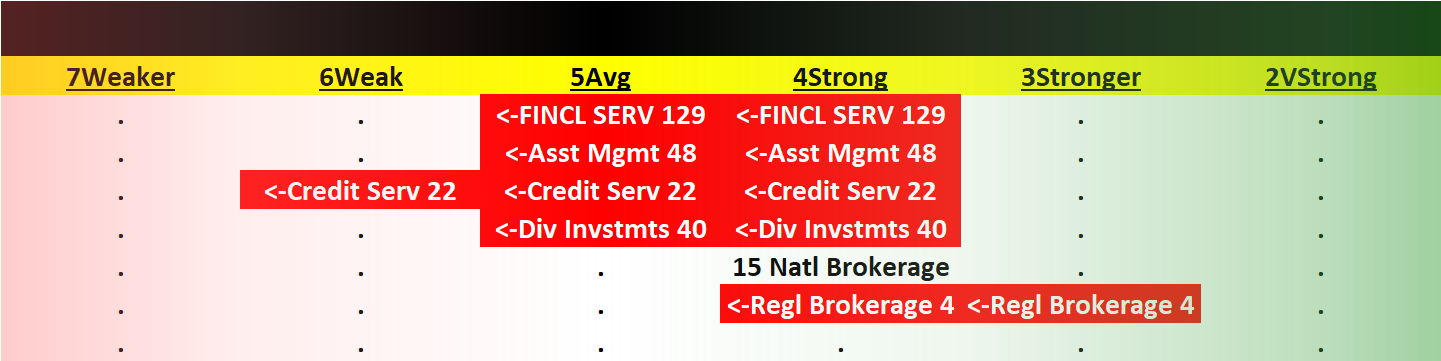

The weakening has extended to this week also. The industry has weakened for two straight weeks now. The most recent rise in any individual sub-industry was 4 weeks ago (Diversified Investments).

What does this mean? For me, it means I wouldn't open any new long positions in Financial Services.

It's as simple as that. Not only do you need to know when to fold 'em and know when to hold 'em, you also need to know when to ignore 'em.

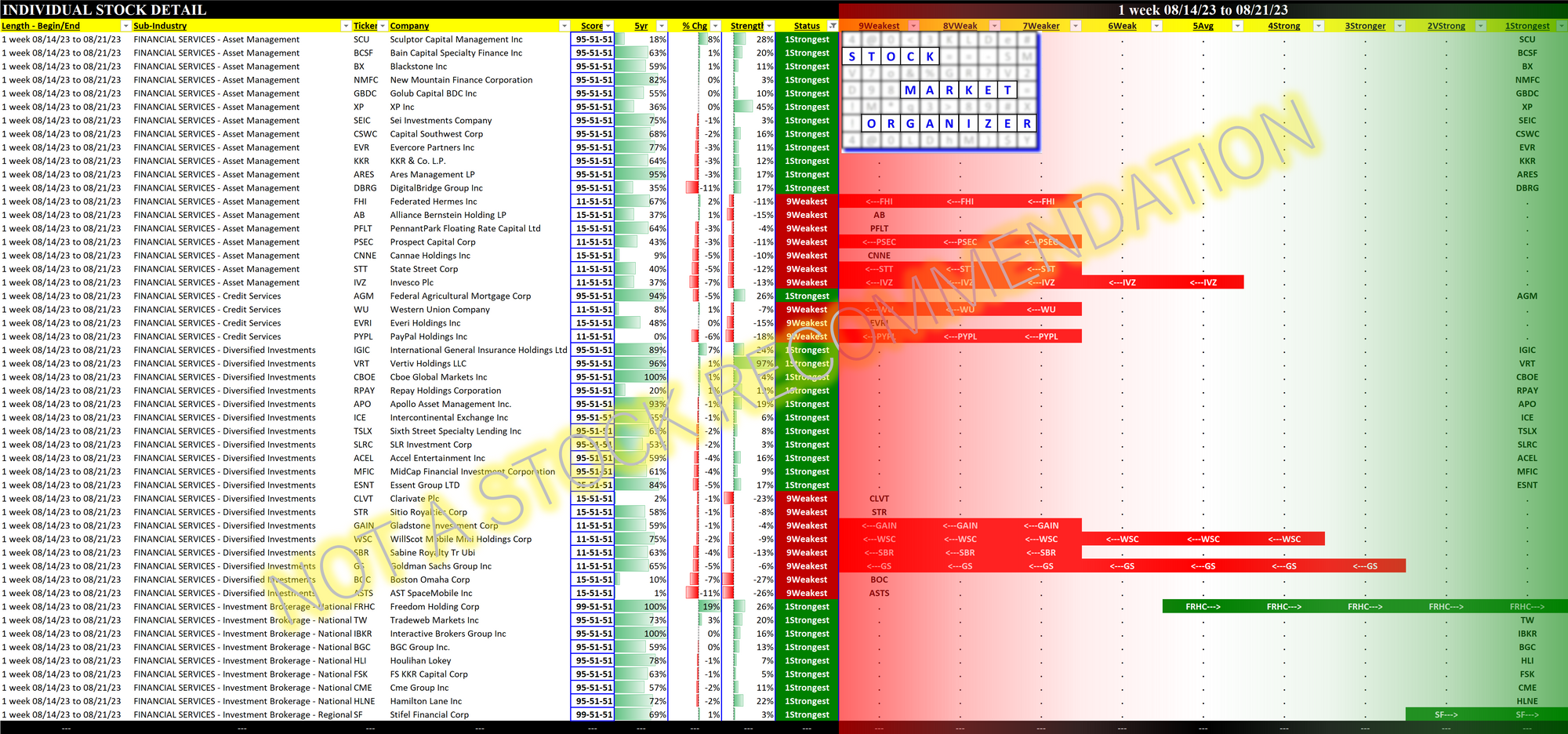

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.