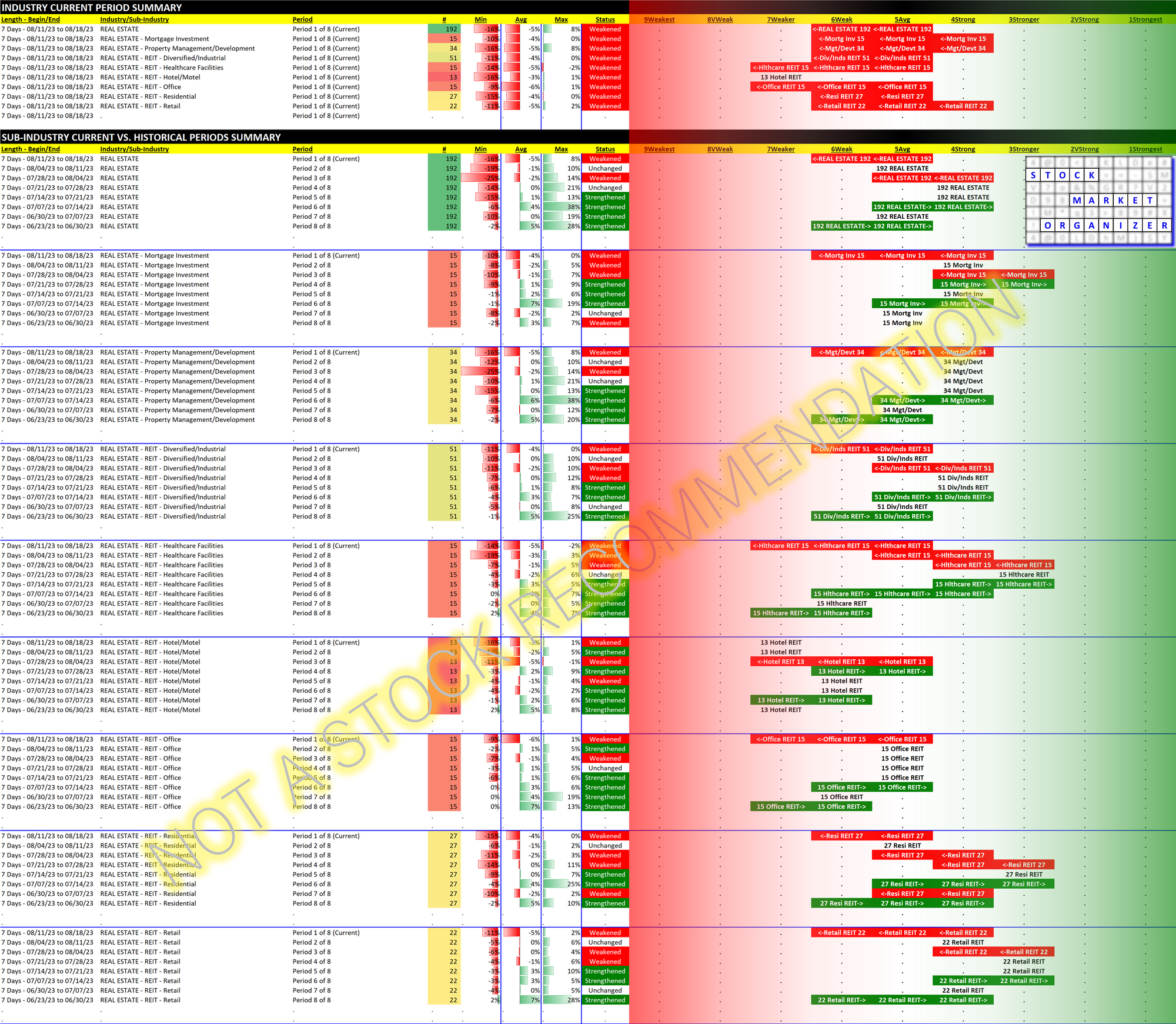

Real Estate 2023-08-18: -1 to "WEAK" strength rating (6th strongest of 9 levels), previous move was also DOWN

My previous review of Real Estate was August 4, 2023 and is available here.

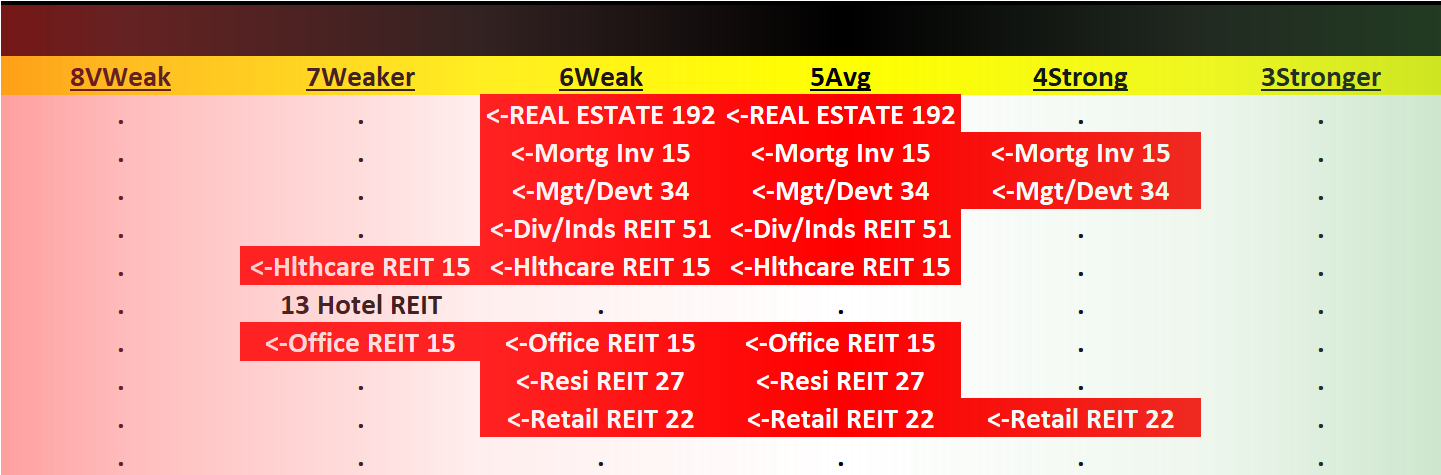

Along with Banking, Real Estate took it on the chin this week. The industry and all its sub-industries are back to their strength levels of 8 weeks ago, with the exception of Mortgage Investment which is now one strength level lower than it was 8 weeks ago.

How bad was it?

- All sub-industries weakened, as 5 of 8 sub-industries weakened two levels (Mortgage Investment, Property Management/Development, Healthcare Facilities REITs, Office REITs, and Retail REITs). This level of weakening is unusual.

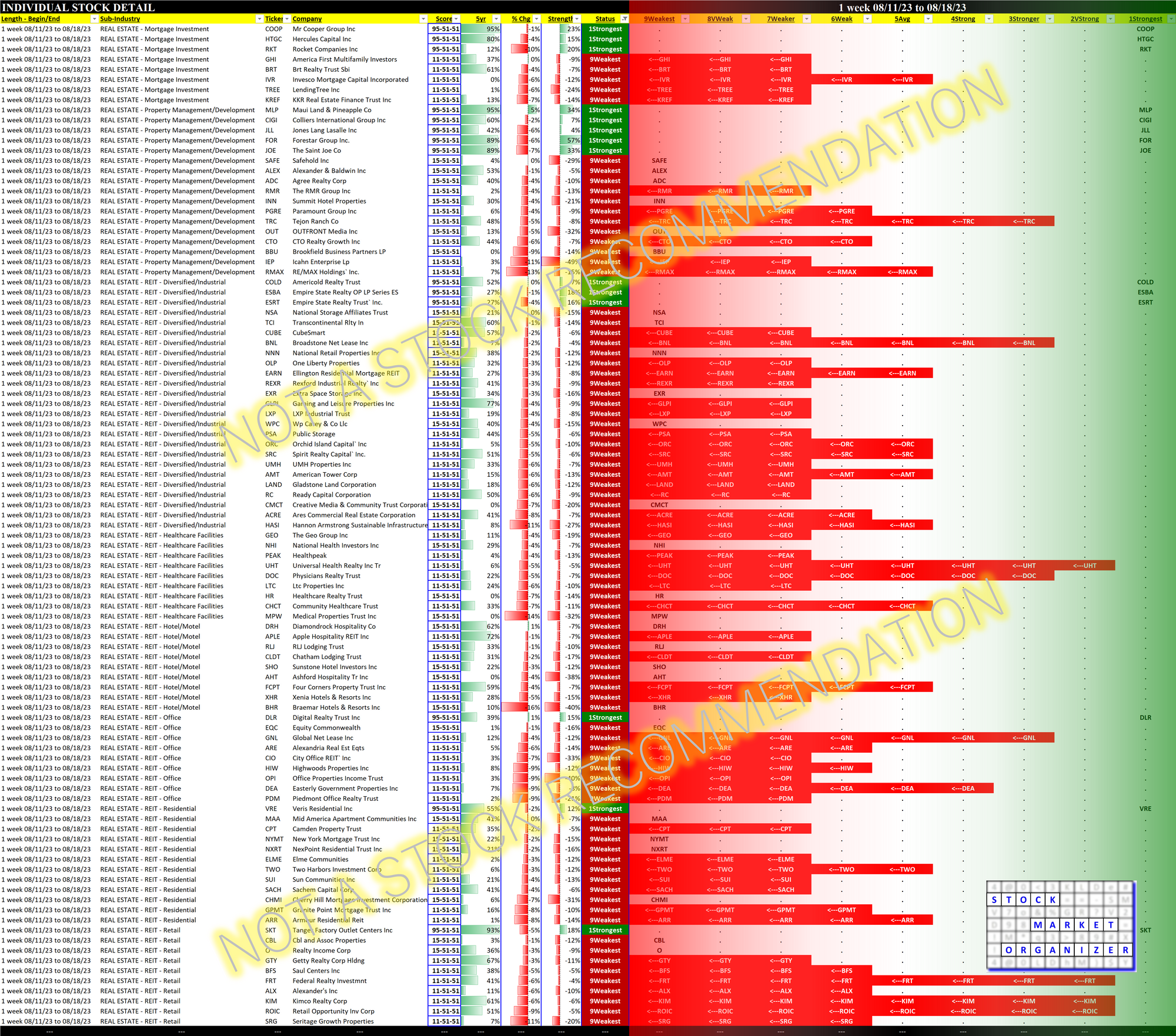

- 19 of 20 Real Estate stocks fell for the week (182 of 192).

- >4 of 10 fell more than 5%, including 12 that had double-digit percentage losses (worst: BHR/Braemar Hotels & Resorts, -16%).

- 85 Real Estate stocks are rated Weakest (lowest strength rating), up from 27 and 15 (just 2 and 4 weeks ago, respectively), 58 of these new this week.

- Best performer: ARL/American Realty Investors (from the Property Management/Development sub-industry) +8%

Will this continue? As I wrote in my current Banking review - I have no idea. The breadth and depth of the weakening is unusual. As noted above, 5 of the 8 sub-industries weakened by 2 strength levels, when most previous experience has been a 1-level decline. And, while these stocks may be setting up for an attractive entry, I would not yet open any new positions in a weakening sub-industry.

Like Banking, Real Estate is currently a no-fly zone for new positions.

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.