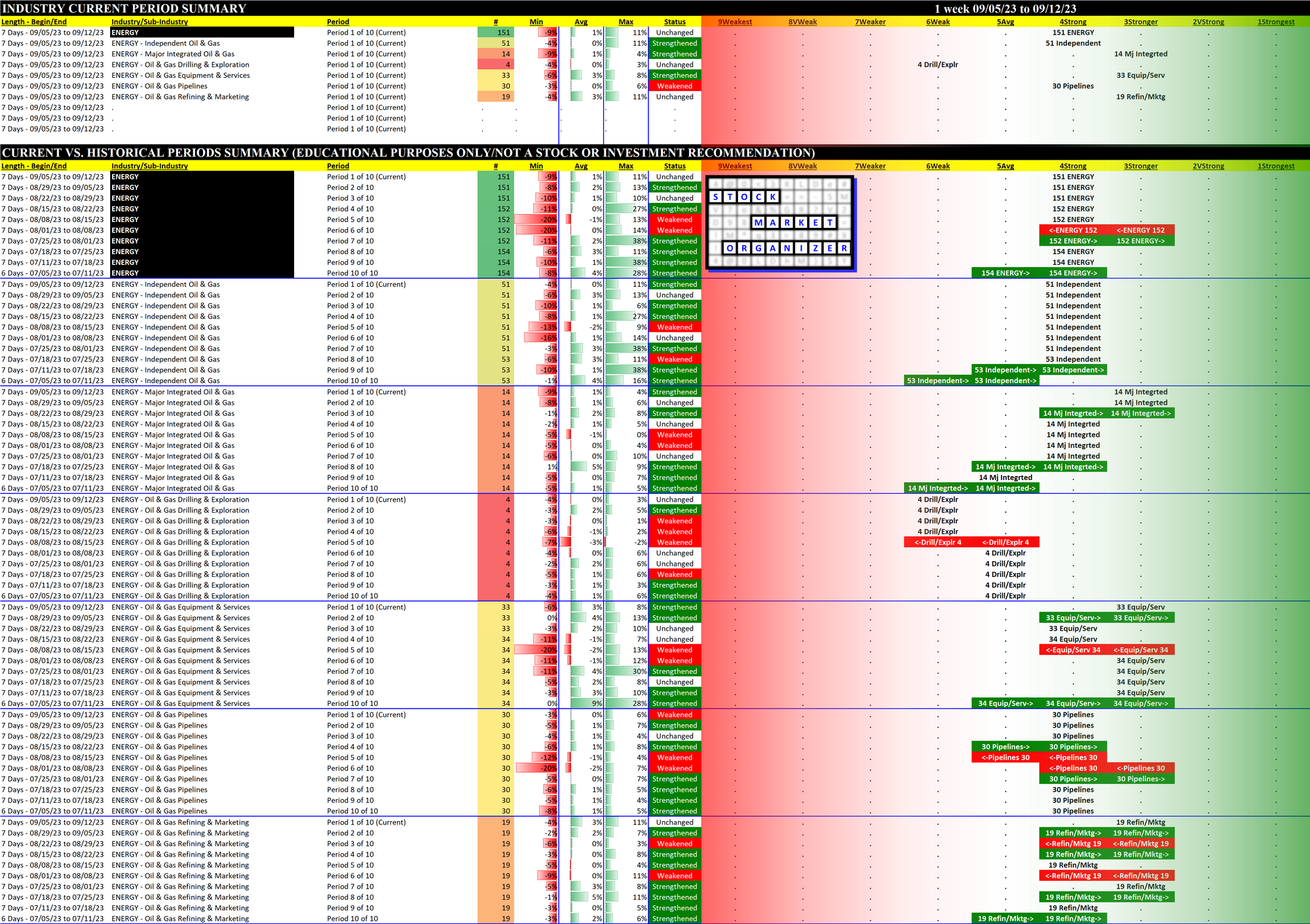

Energy 2023-09-12: Unchanged at "STRONG" strength rating (4th strongest of 9 levels), previous move was DOWN

Bottom line: Energy has generally been flat for the past 10 weeks, even with recent oil price increases.

Key stocks: XOM, CVX, TTE, COP, BP, PBR, SLB, EQNR, EOG, CNQ (top 10 by market cap).

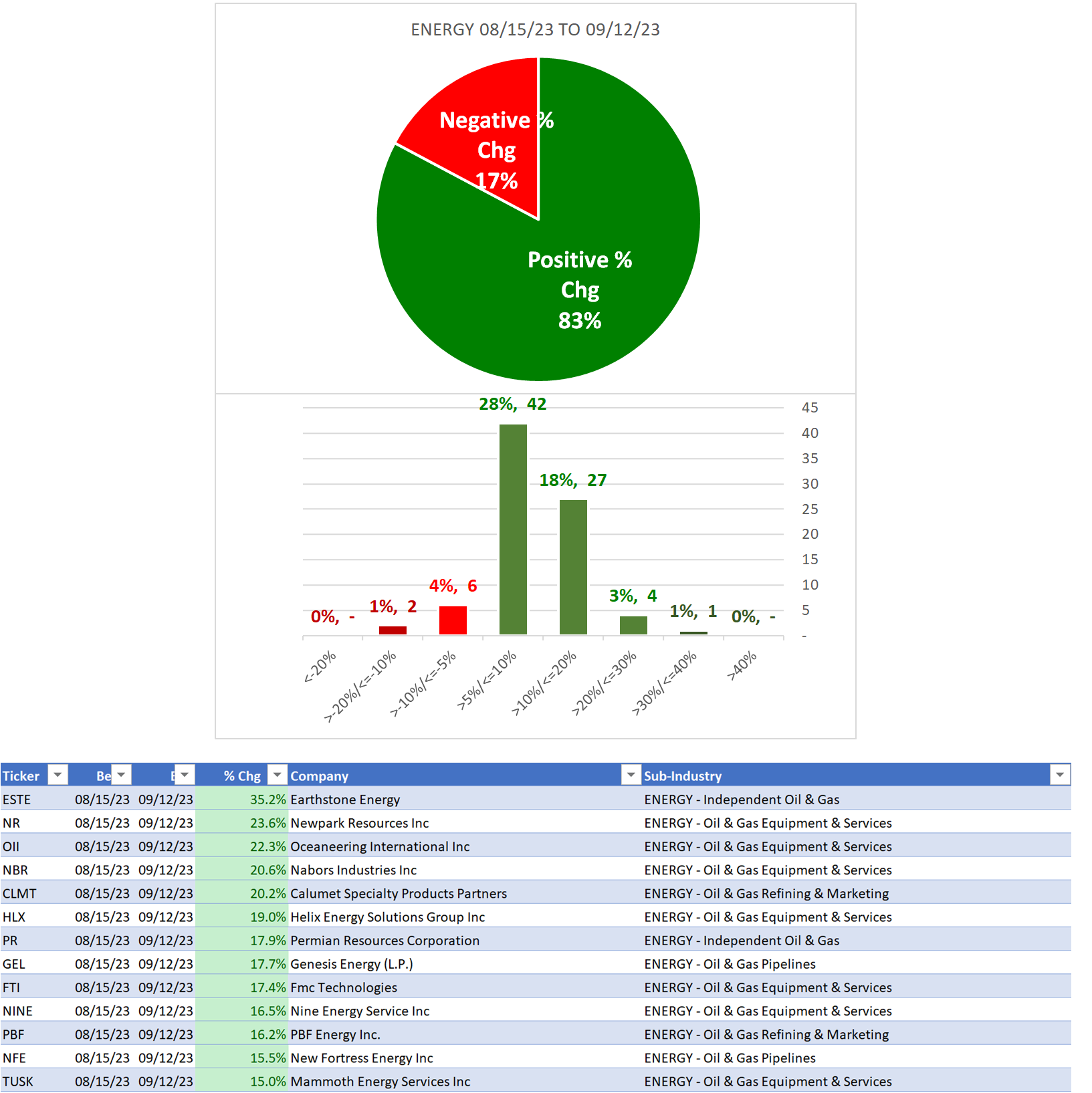

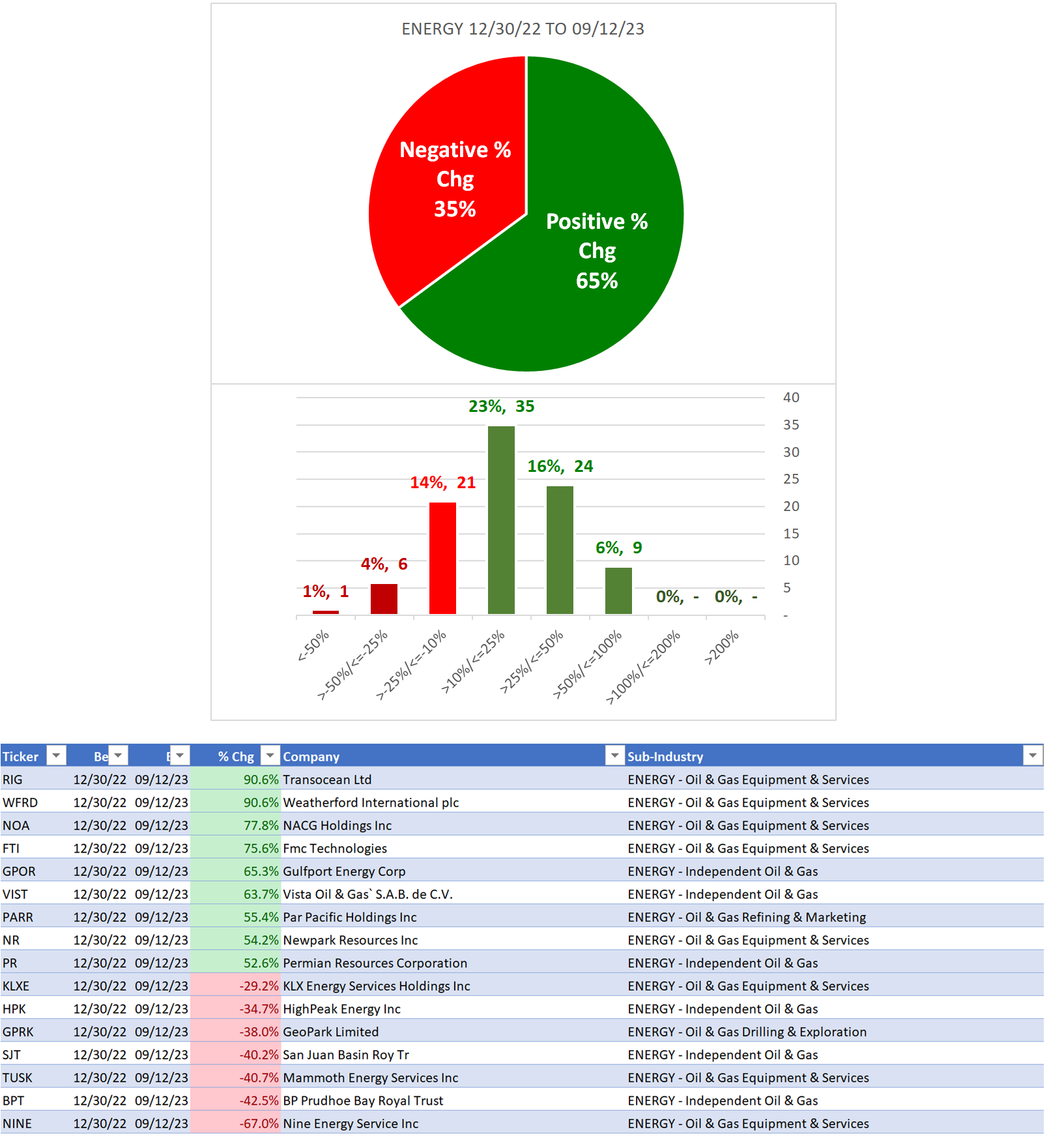

Context: The industry has seen 65% positive stocks YTD, improving from that high number to 83% positive stocks over the past month.

One week, YTD, and one month reviews below, along with links to past reviews.

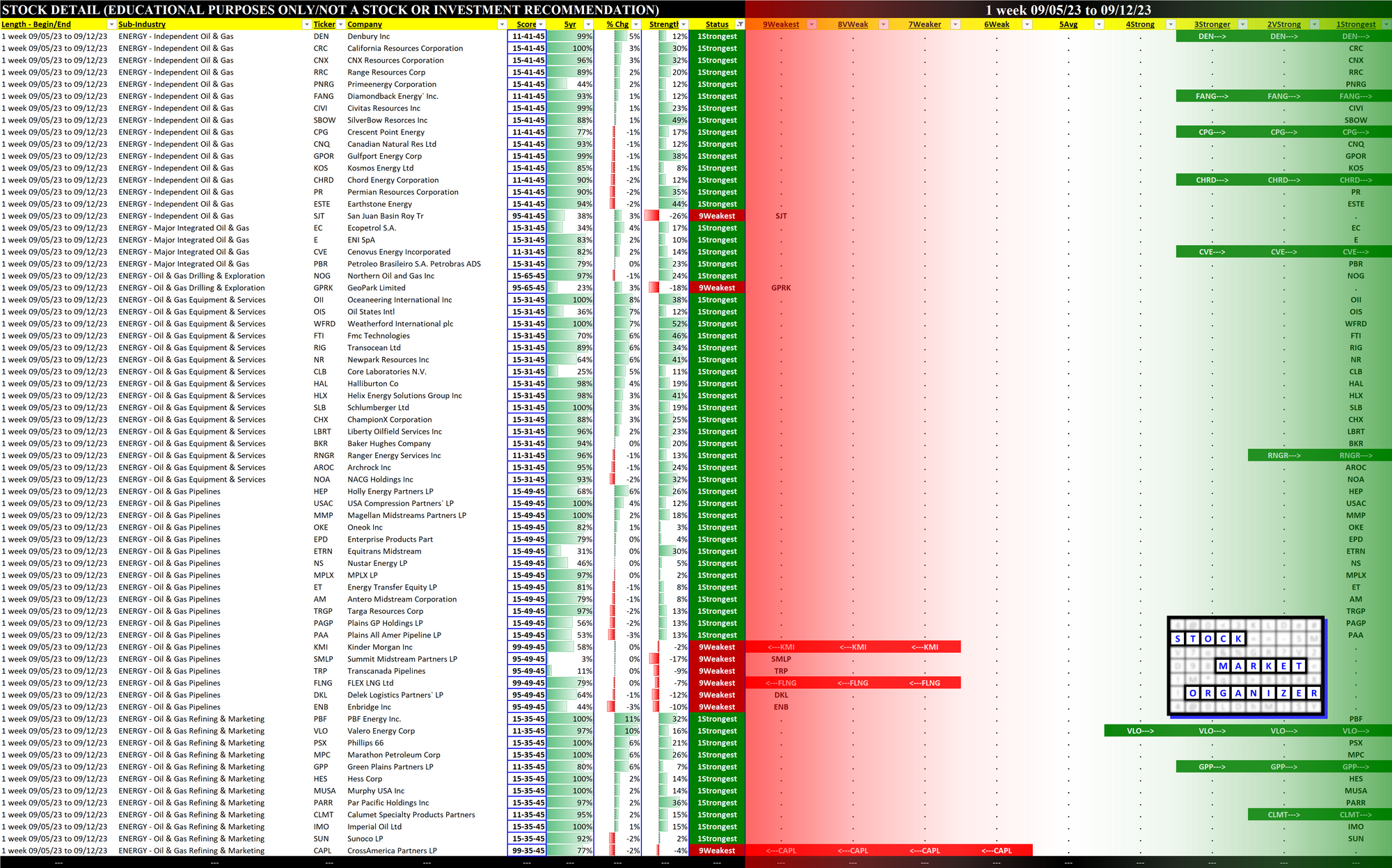

1 Week Detail

Overview

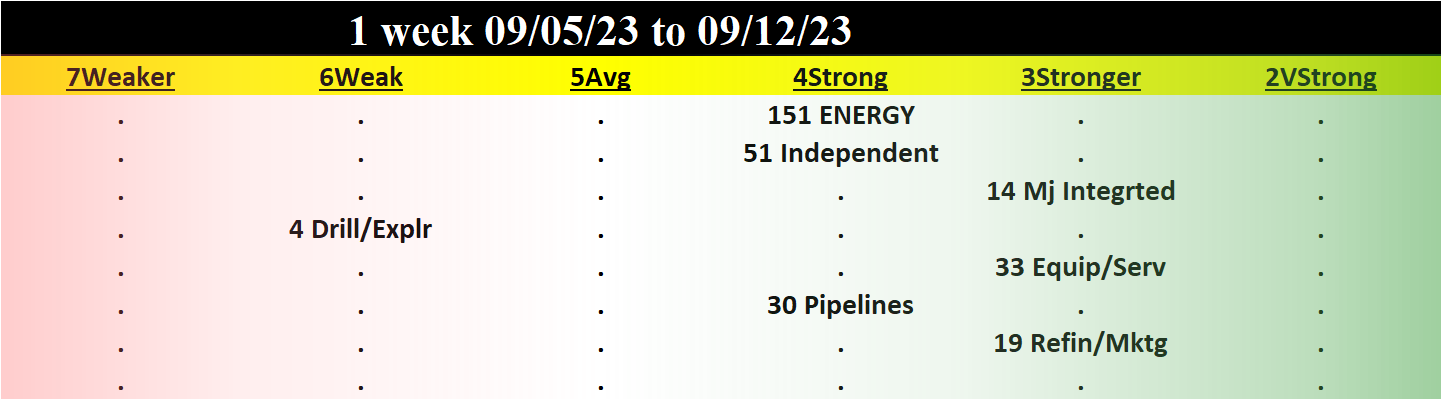

No sub-industry strengthening or weakening (6 total sub-industries).

Strongest at Stronger rating (3rd strongest of 9 levels):

1. Tie, Major Integrated O&G, O&G Equipment & Services, O&G Refining & Marketing

Weakest at Weak rating (6th strongest):

1. O&G Drilling & Exploration

10-Week Industry/Sub-industry Week-by-Week Comparison

Individual Stock Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.

Historical Context - YTD and 4 week Lookbacks

Standout winners and losers for different lookback periods are shown below including their sub-industries.

YTD Lookback

4 Week Lookback