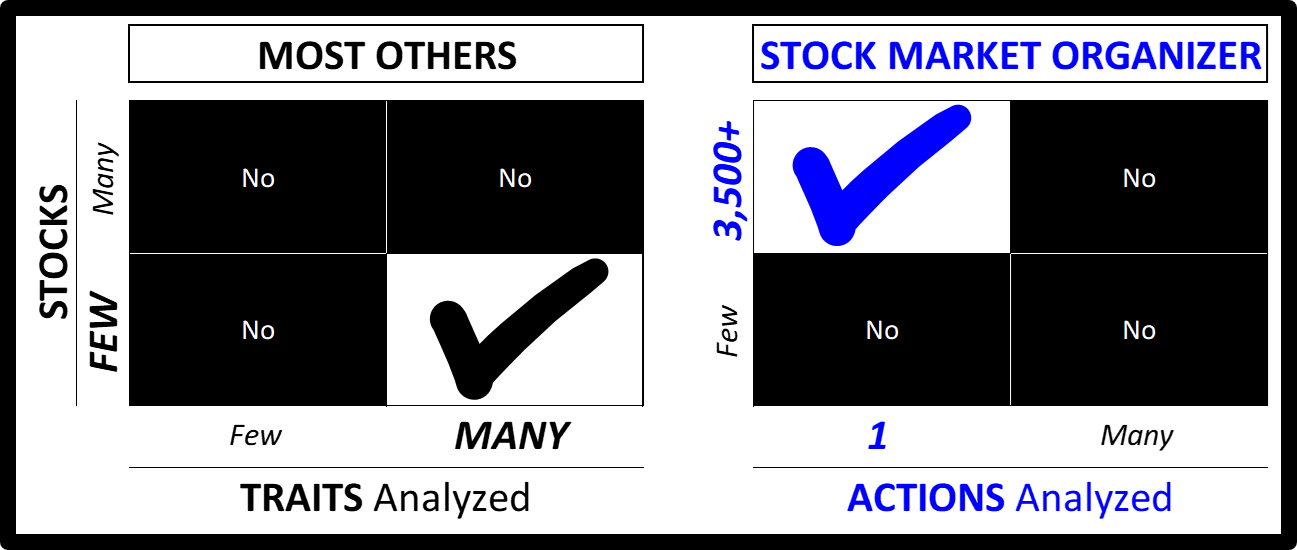

UNLIKE OTHERS: Focus on One Action, not Many Traits

If you are looking for the "same ol', same ol" there are countless websites offering fundamental analysis and price charts and economic data and any other data you could want.

You'll find none of that on this site.

The scarcity today isn't data. More data won't make you more successful. It may simply confuse and frustrate you.

The scarcity today is usable insight. I solve that problem.

Why do you care? Strength leads to higher prices, weakness to lower prices.

Does anything else really matter?

My underlying philosophy?

It does not have to be so complicated.

Get out when a position is no longer strong/strengthening.

Re-deploy available capital into then-strong/strengthening stocks in sub-industries that are strong/strengthening. (Break ties by going with the one in the industry that is strong/strengthening.)

Why?

Do you really want to own a piece of every one of the S&P500 stocks? Remember that half of them are below average. If you want to dilute your returns, feel free to own today's buggy whip manufacturer equivalents.

Deciding what to buy is only the first step

Manage your risk by position sizing based on the stock's volatility and your total portfolio size, then trail your stop based on its price action during your holding period. If/when your stop is triggered, exit. Enter a new position as noted above.

Repeating: