Transportation 2023-09-27: UP +1 to AVERAGE strength rating (5th strongest of 9 levels), previous move was DOWN

TABLE OF CONTENTS

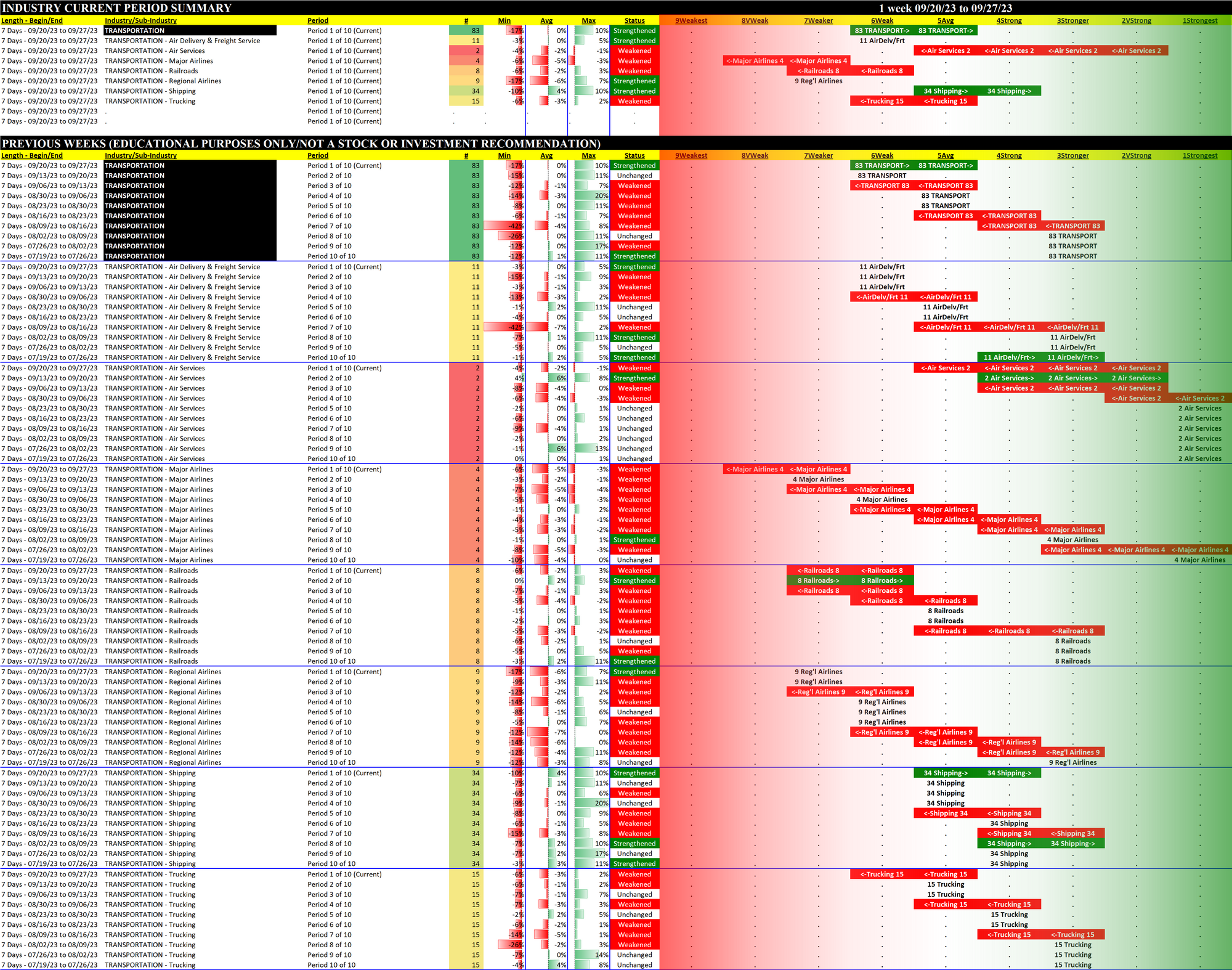

- INDUSTRY OVERVIEW

1A. Performance

1B. Background - SUB-INDUSTRIES AND STOCKS DETAIL

2A. Sub-Industries Overview

2B. Sub-Industries 10-Week Strengthening Analysis

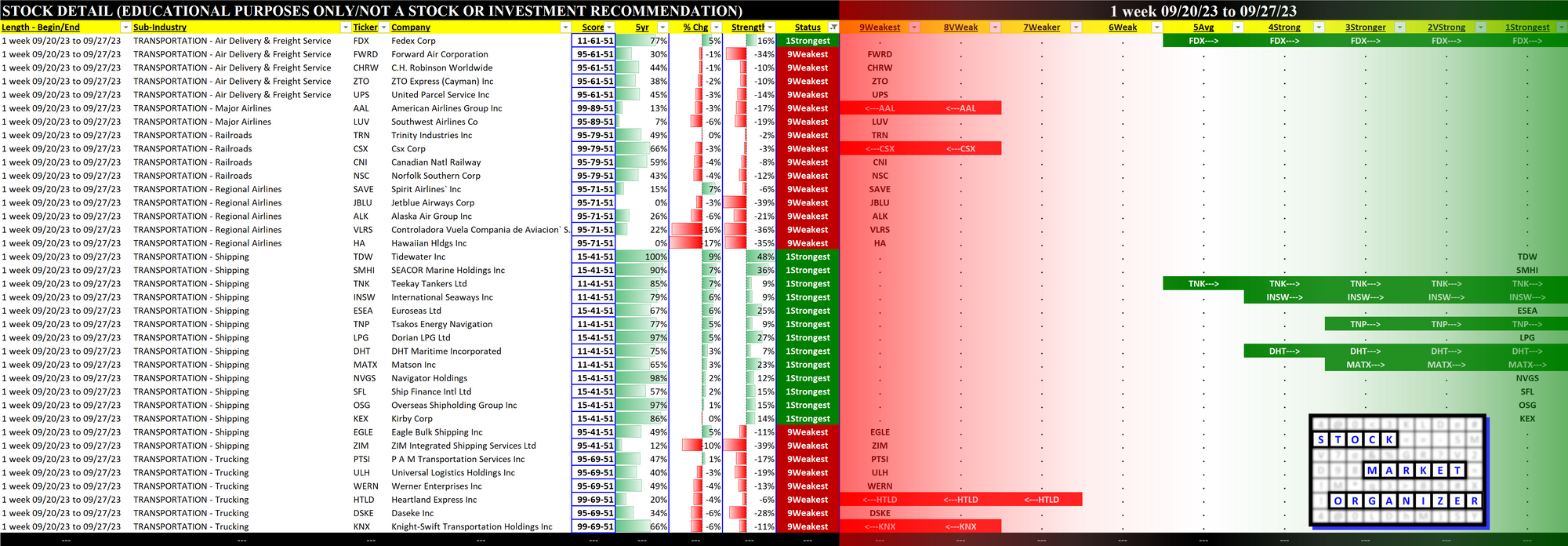

2C. Stocks 1 Week Strongest and Weakest - STRENGTH BY LOOKBACK PERIOD (with Best/Worst stocks)

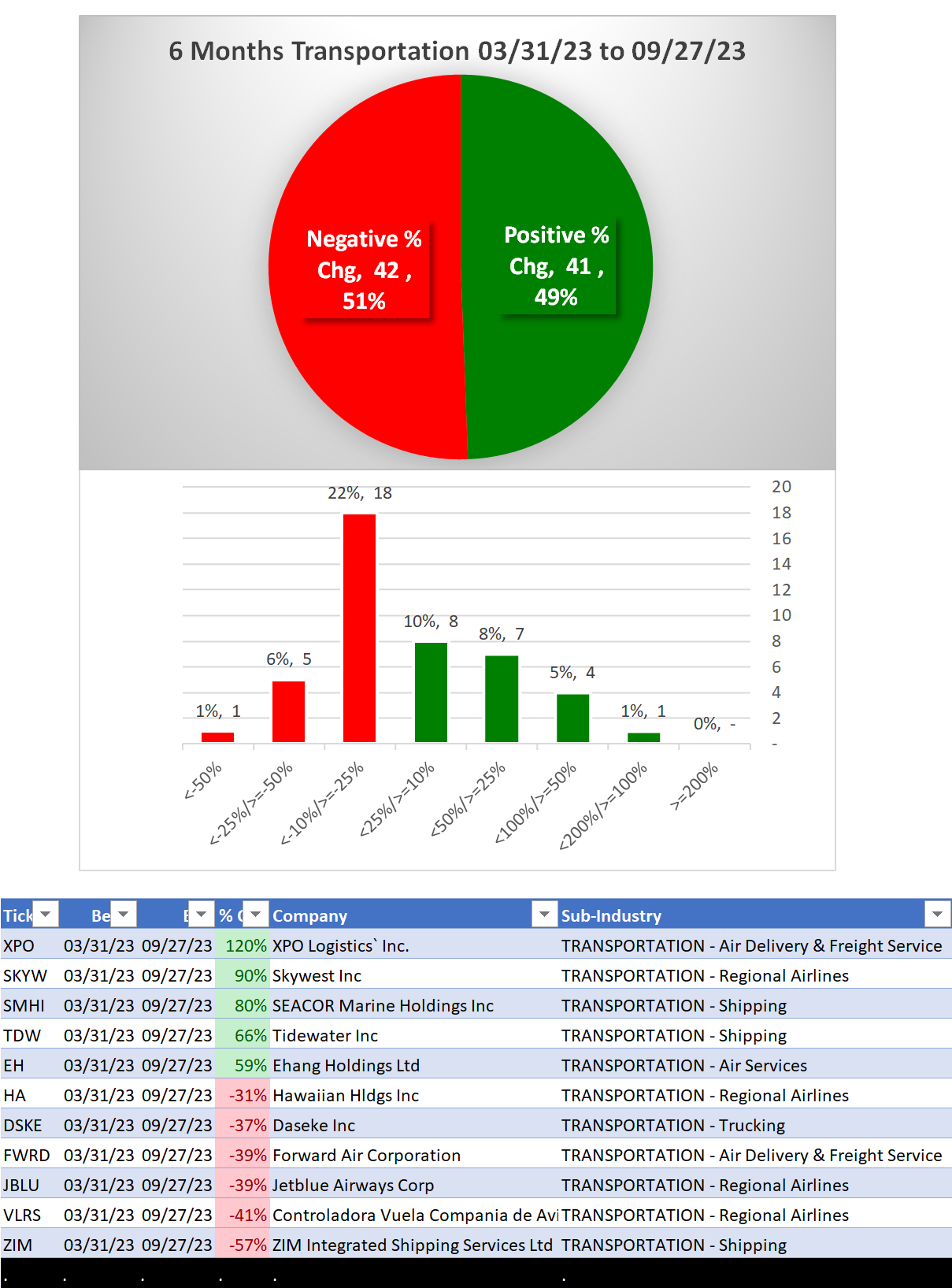

3A. Lookback 6 Months

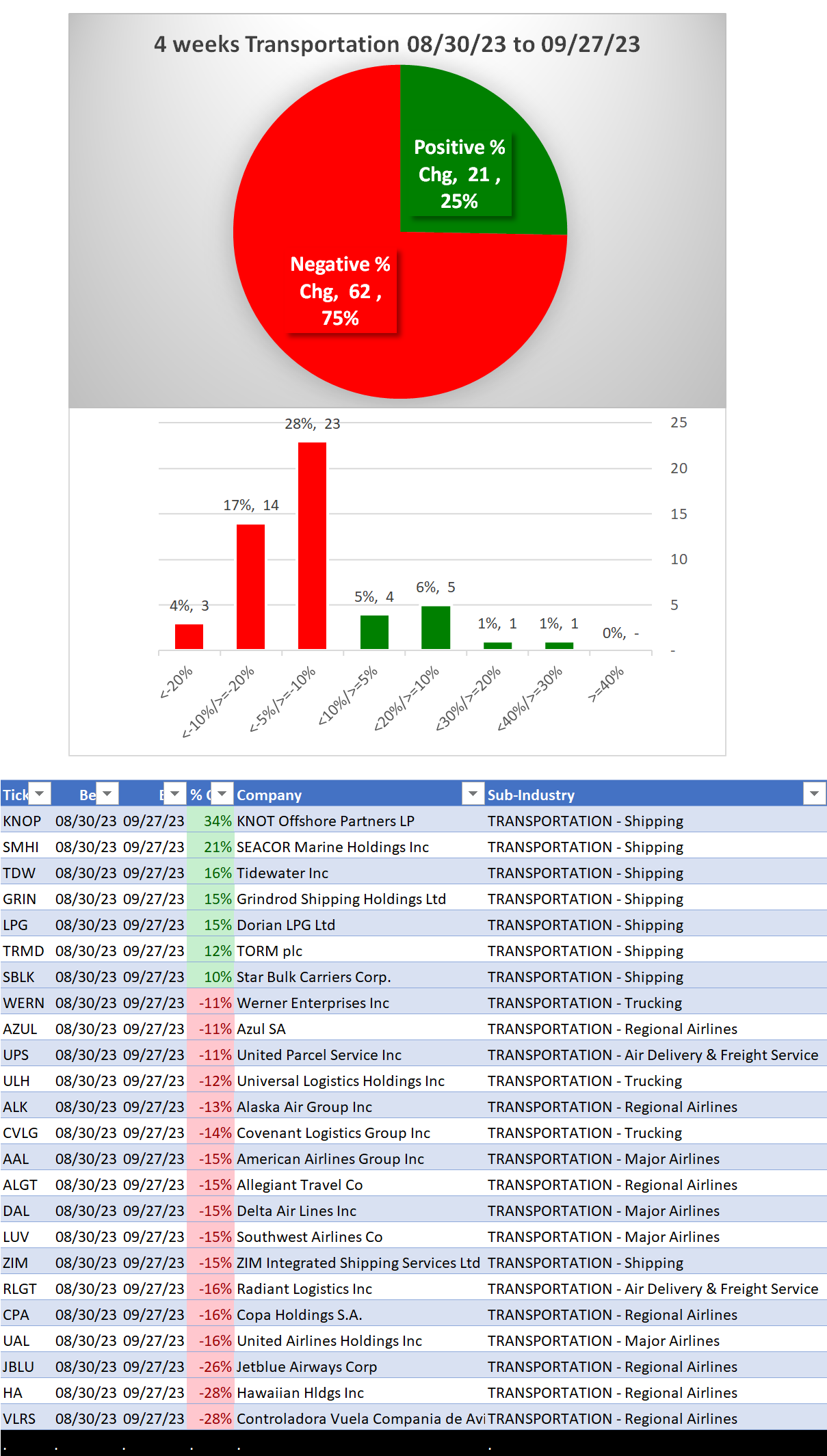

3B. Lookback 4 weeks

3C. Lookback 1 Week

1. INDUSTRY OVERVIEW

1A. Performance

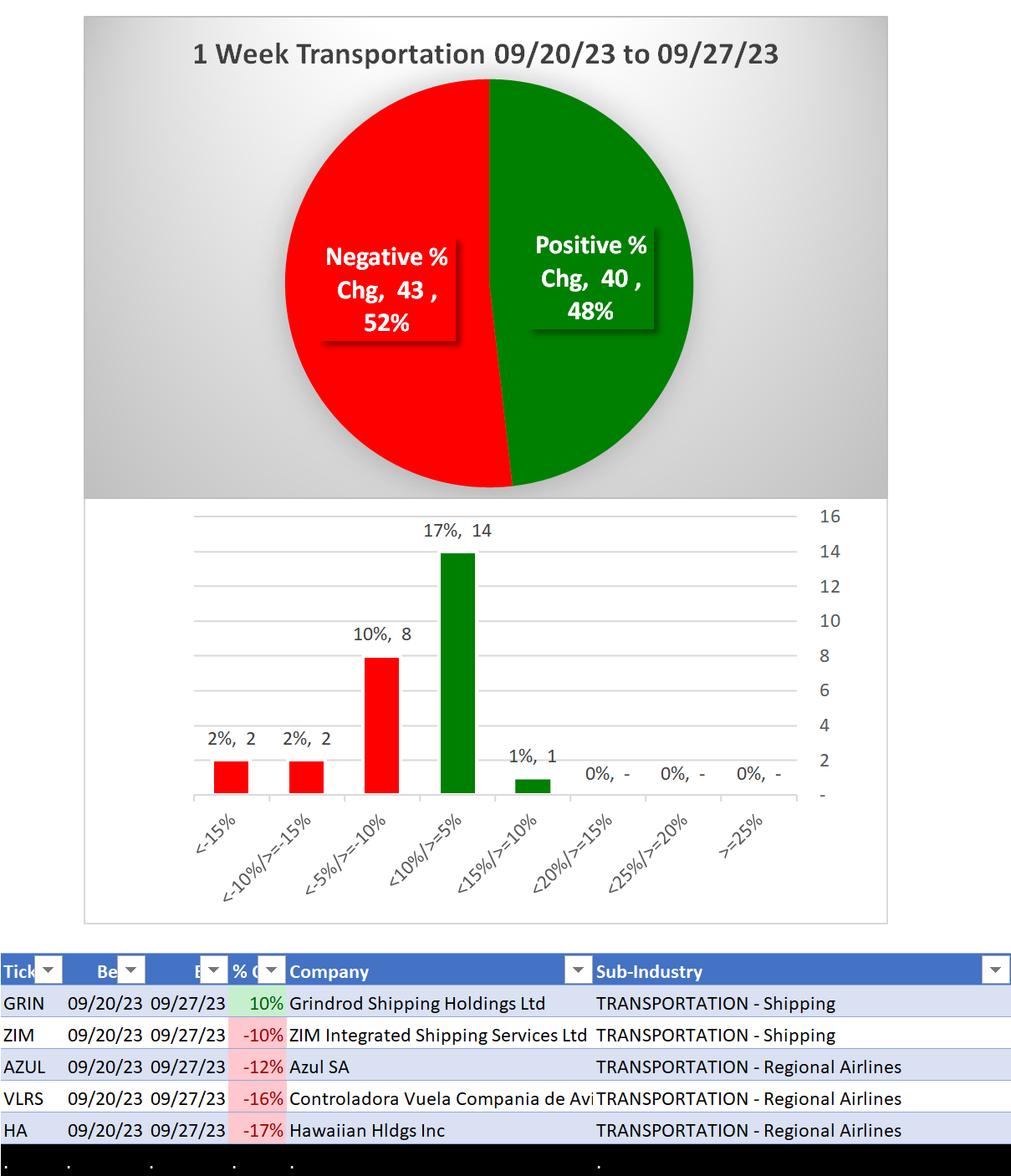

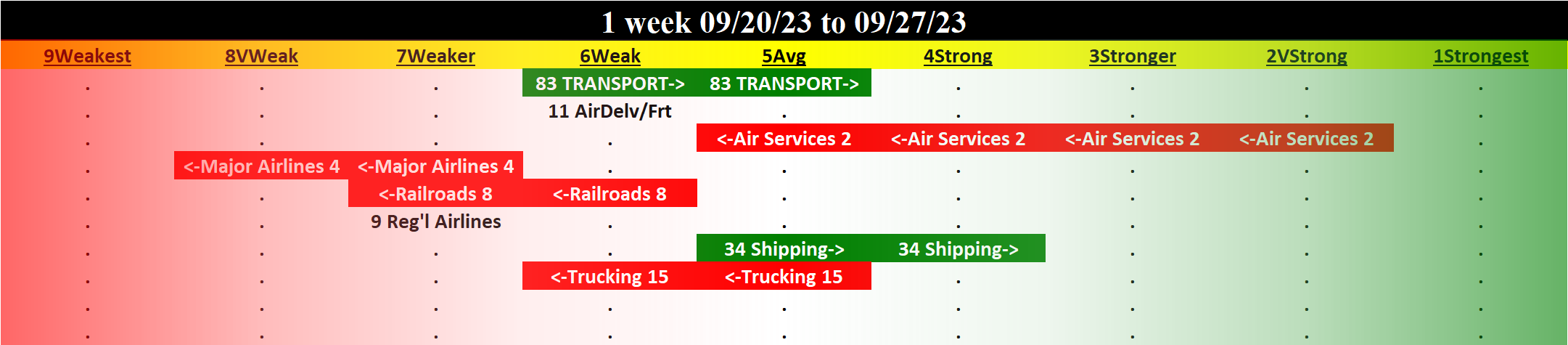

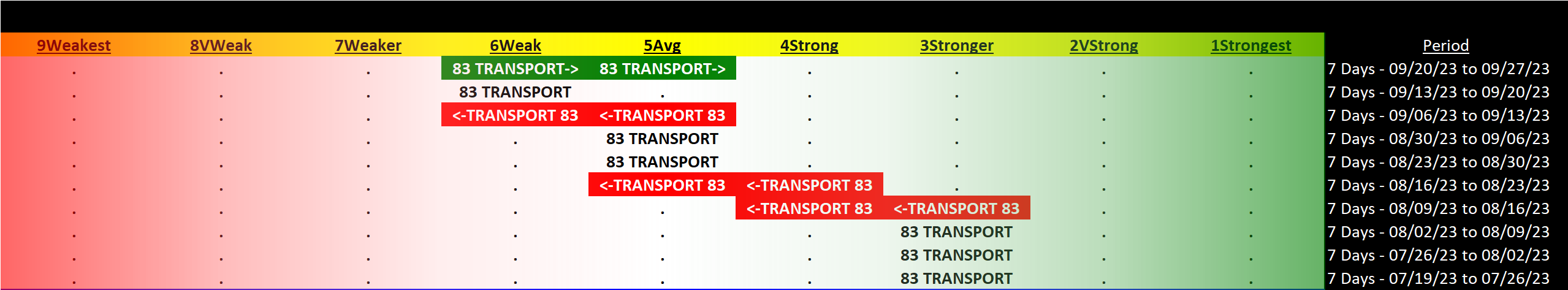

Past 10 Weeks Strengthening/Weakening week-by-week, per the following chart:

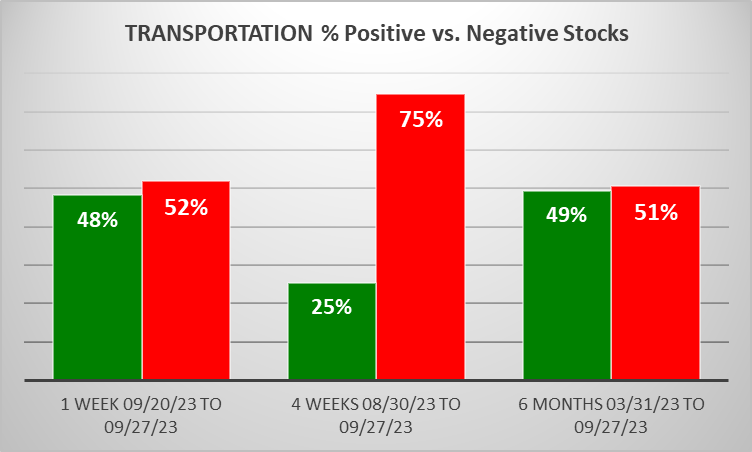

Mixed/STRENGTHENING 1 Week vs. Mid- and Longer-Term // 1 week positive/negative stocks ratio is HIGHER than 4 weeks but LOWER than 6 Months, per the following chart:

Comment:

- Major Airlines imploding over past 9 weeks (has fallen 8 of 9 strength levels). Higher oil price impact?

1B. Background

Largest of 7 sub-industries (83 stocks, average 12):

- Shipping (34 stocks)

- Trucking (15 stocks)

- Air Delivery & Freight Service (11 stocks)

- Regional Airlines (9 stocks)

Top 10 by Market Capitalization:

UPS/United Parcel Service Inc, UNP/Union Pacific Corp, CNI/Canadian Natl Railway, CP/Canadian Pacific Railway Ltd, FDX/Fedex Corp, CSX/Csx Corp, ODFL/Old Dominion Freight Lines Inc, NSC/Norfolk Southern Corp, DAL/Delta Air Lines Inc, WAB/Wabtec Corporation

2. SUB-INDUSTRIES AND STOCKS DETAIL

2A. Sub-Industries Overview

Strengthened: 1/7 sub-industries

Weakened: 4/7 sub-industries

STRONGEST at Strong rating/4th strongest of 9 levels:

- Shipping (34 stocks)

WEAKEST at Very Weak rating/8th strongest of 9 levels:

- Major Airlines (4 stocks)

2B. Sub-Industries 10-Week Strengthening Analysis

What: recent week-by-week strength changes for the industry and each underlying sub-industry

Why: objective measurement of strengthening and weakening enabling comparison within and across industries and sub-industries

2C. Stocks 1 Week Strongest and Weakest

What: stocks currently rated Strongest/Weakest (highest/lowest of 9 strength ratings)

Why: most interesting stocks for available capital because

- the Strongest have the least amount of overhead supply to dampen breakouts while

- the Weakest may be prone to volatility, subject to big pops from bottom-fishing and short-covering BUT ALSO to bigger and faster falls.

(Not guaranteed and not a recommendation - weak stocks in weakening sub-industries may be better shorts than high-flyers.)

3. STRENGTH BY LOOKBACK PERIOD (with Best/Worst stocks)

3A. Lookback 6 Months

3B. Lookback 4 weeks

3C. Lookback 1 Week