The "crush your emotions or they will crush your portfolio" Market Rule: fear and greed decouple prices from fundamentals

The Berkshire Hathaway 2022 annual letter says:

It’s crucial to understand that stocks often trade at truly foolish prices, both high and low. “Efficient” markets exist only in textbooks.

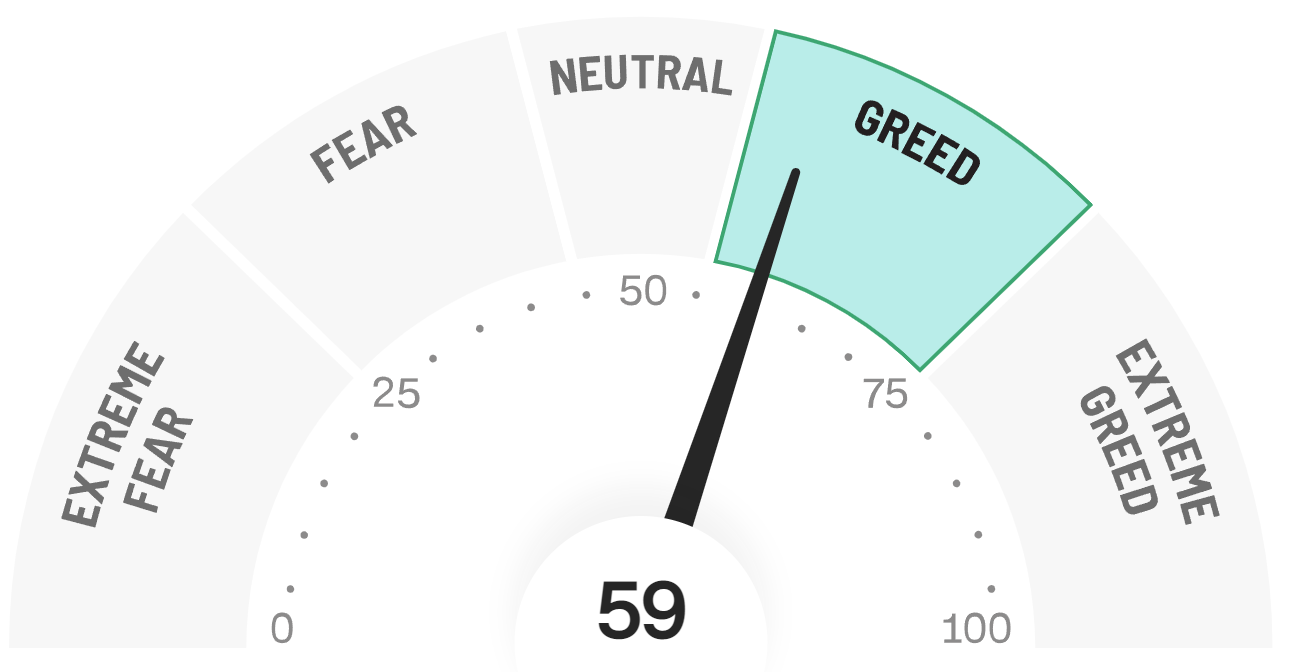

Fear and greed are your best friends - when they cause others to go wacko en la cabeza.

You - armed with 100% objective, non-predictive Stock Market Organizer analyses and your pre-determined rules for position entry, sizing, and management (see this post) - will not fall prey to fear and greed.

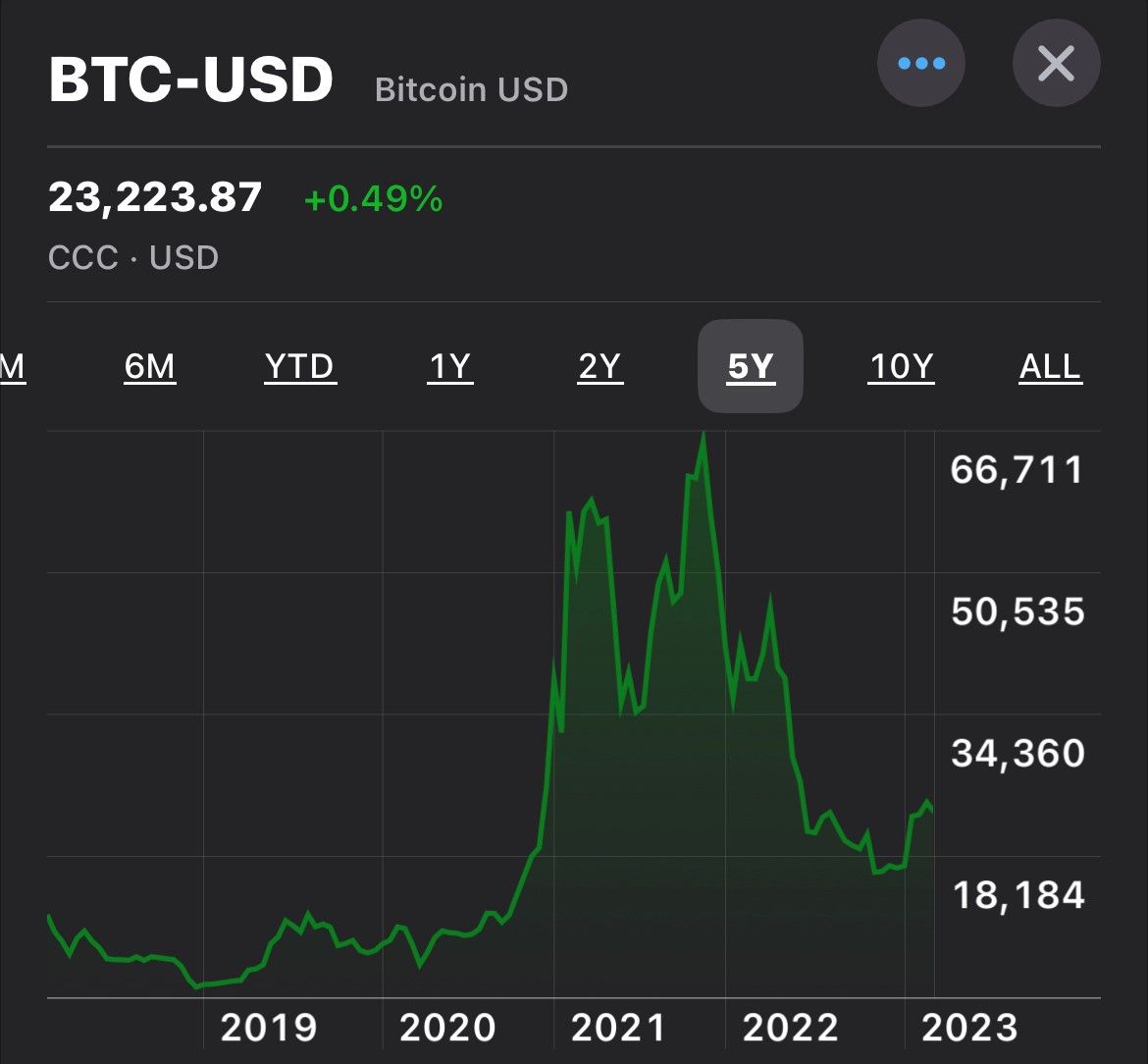

Where's the efficiency? (Some interesting charts)

Can one argue with a straight face the charts below reflect efficient pricing? Or do they show "truly foolish prices" somewhere along the way?

If you aren't actively looking for strengthening stocks - because you don't believe in the concept, and/or you don't know how - you are missing out on clear opportunities which arise all the time in the market. They may not be so obvious as in the charts below, which are influenced by the oddity that was the COVID-19 market. But stock prices take off upward all the time and go well past what their fundamentals would suggest - same on the downside. Denying this is another type of foolish. Hang on for dear life at your own peril.

Why? Greed and fear. Change my mind!