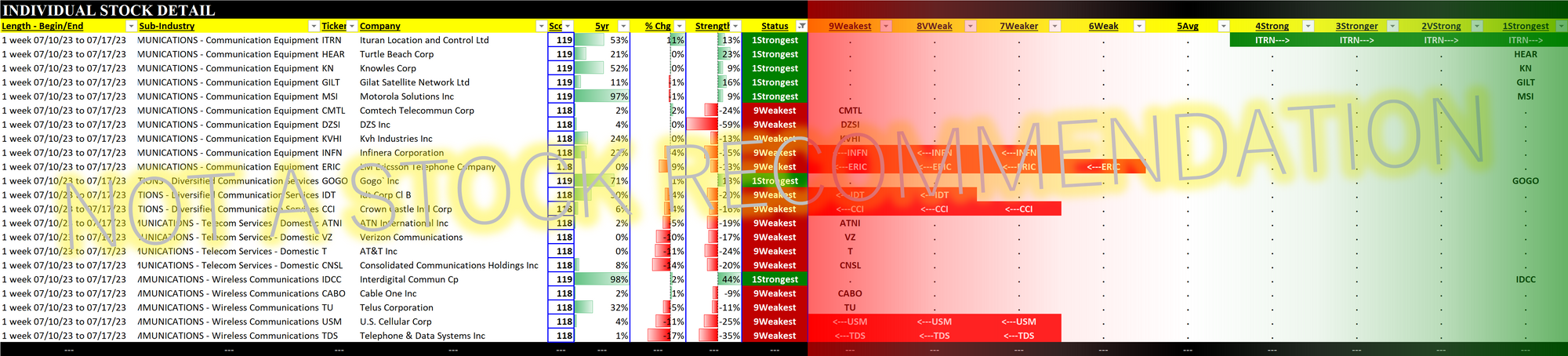

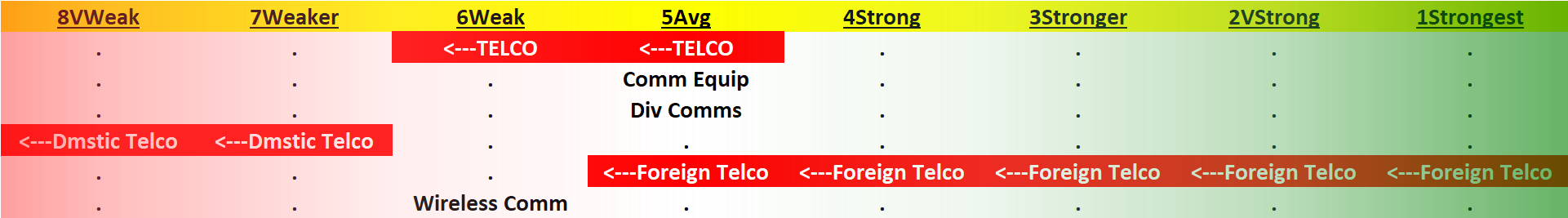

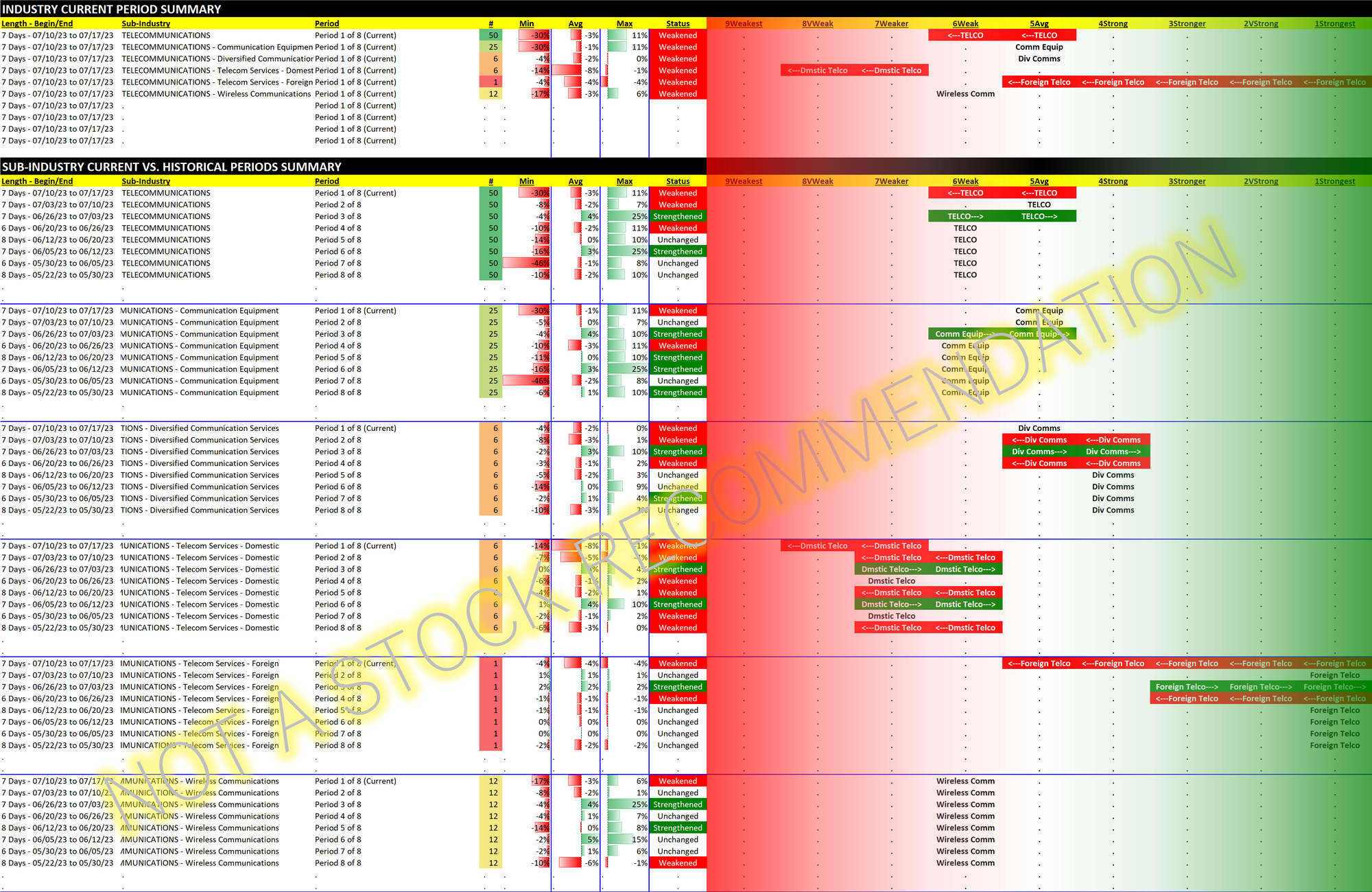

Telecommunications 2023-07-17: -1 to "Weak" strength rating (6th strongest of 9 levels), previous move was up

Telecommunications breaks the trend of strengthening industries reviewed. It is certainly not a wild mover, although two of its biggest components (VZ/Verizon and T/AT&T) have had big moves down - see "a closer look" below. The yields for both are juicier than they were Friday.

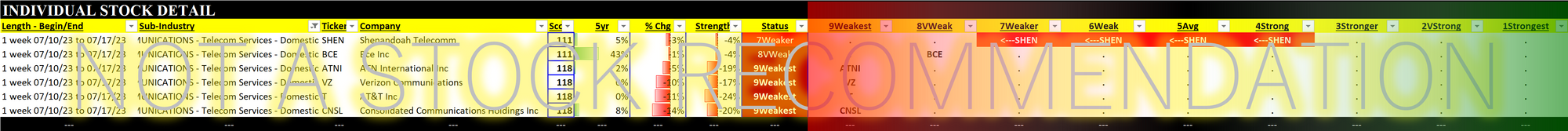

Domestic Telecom Services - a closer look

This is the home of VZ/Verizon and T/AT&T. These are two stocks impacted by recent WSJ reports of lead-sheathed cables installed in phone networks, causing liability concerns and leading to analyst downgrades (JPMorgan did so Friday 2023-07-14).

Note that both were weak at the beginning of this week, and in fact have been weak for a while: Verizon is at decade lows as AT&T says "hold my beer" because it is at three decade lows.

Verizon was at $61 in December 2020 and has rather steadily declined to today's closing of $31.46 - so it is now BOGO.

It's worse for AT&T, which was almost at $33 in July 2016. Since then, other than a rally which took it to nearly $30 in late 2019, this stock has steadily declined to today's $13.53 close. This is a seven year 59% decline.

In light of their long-term weakness, I ask with mostly sincerity and at least a smidgen of snark: how about that long term buy and hold strategy? Sure they have been paying dividends, but there's no way this does not leave a mark. Especially considering the opportunity cost of missing out on other stocks.

Is a Carvana-like pop in store for either/both these? (Though I don't make predictions, my WAG is... not a chance.)

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.