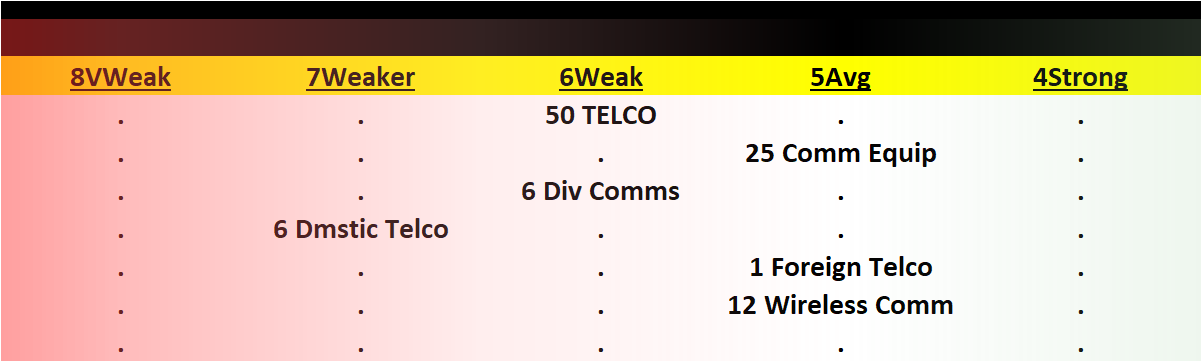

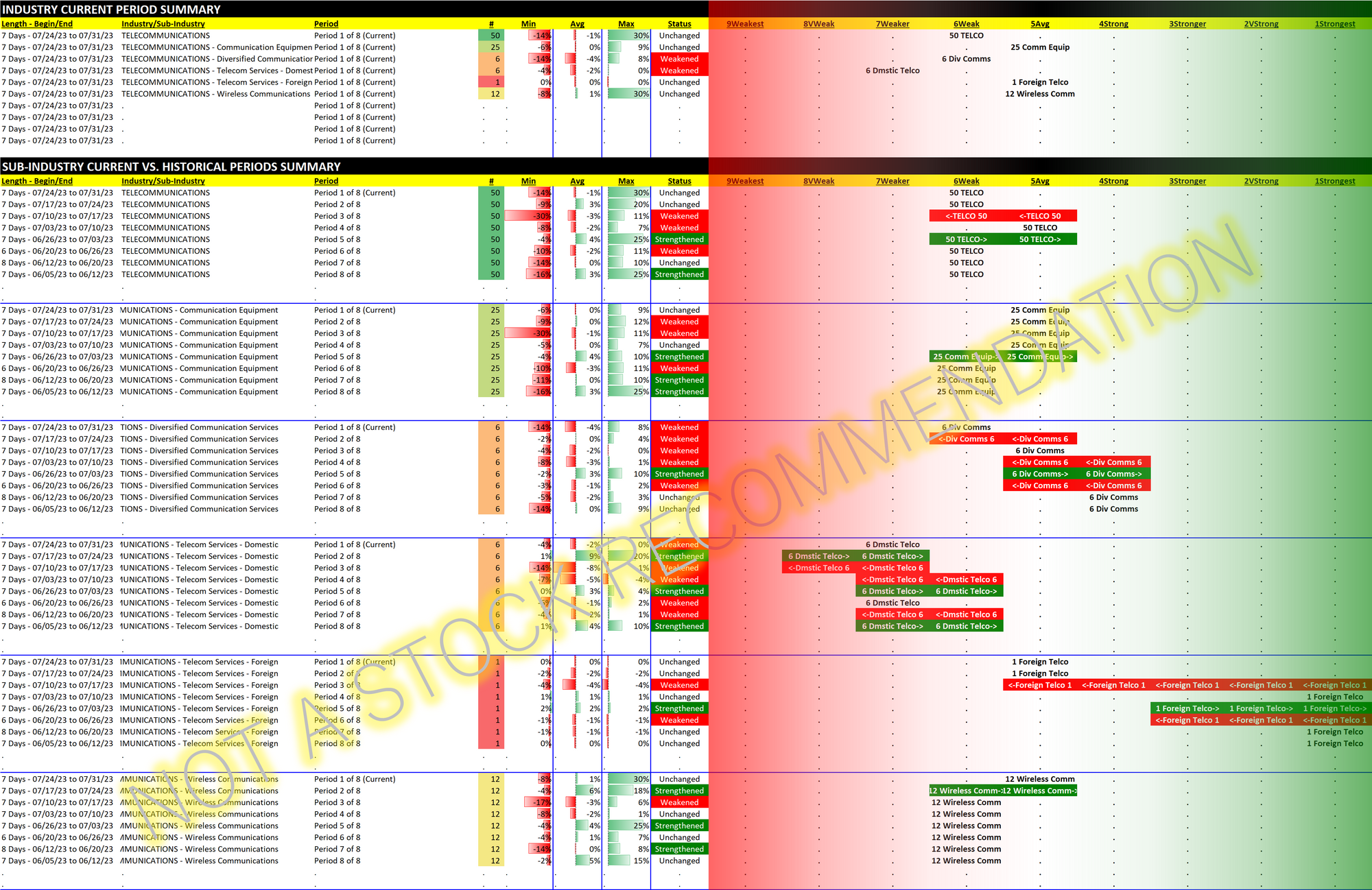

Telecommunications 2023-07-31: Unchanged at "Weak" strength rating (6th strongest of 9 levels), previous move was down

Here's my previous look at Telecommunications.

In that note, I highlighted the tough recent and longer-term sledding for VZ/Verizon and T/AT&T. Since that report both stocks have recovered 9% from their July 17, 2023 lows. It is certainly possible they'll continue to recover. It is also possible there are many potential sellers looking to get out should a rally help them reduce unrealized losses.

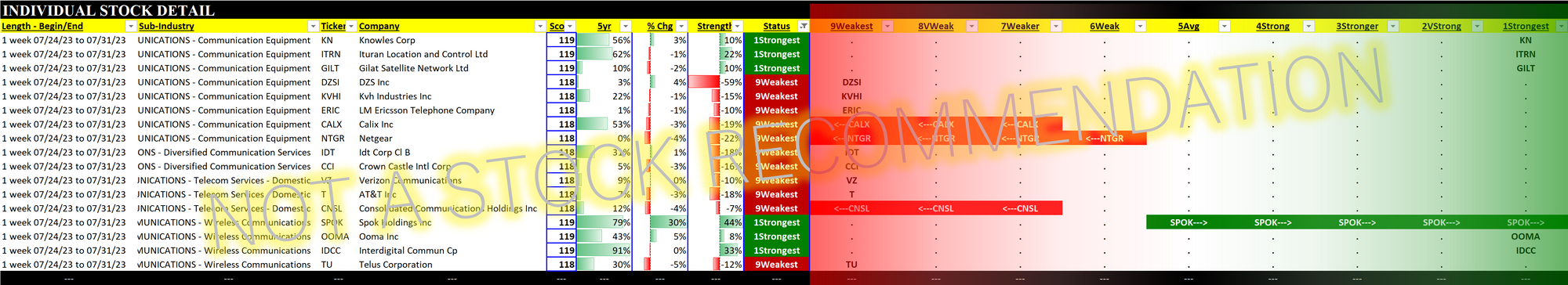

Of greater excitement, SPOK/Spok Holdings in the Wireless Communications sub-industry enjoyed a 30% pop this past week. Year-to-date it is +79%. Anyone who purchased and still holds the stock over the past 24 months is now profitable. Its owners are in a different light than owners of other stocks in Telecommunications (such as VZ and T). If and when SPOK's price falls, there is theoretically a waiting pool of buyers happy to increase their positions at lower prices.

So we have with SPOK the following:

1. a stock rated Strongest, theoretically with support in declines

2. in a sub-industry rated Average strength whose previous move was strengthening

3. in an industry rated Weak whose previous move was weakening

While 1. and 2. above are attractive, 3. is concerning especially given strengthening in other industries. I'd look elsewhere for now. This is consistent with "just because you can does not mean you should." Unless everything lines up as desired with the stock, sub-industry, and industry, any given stock is an "ignore."

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.