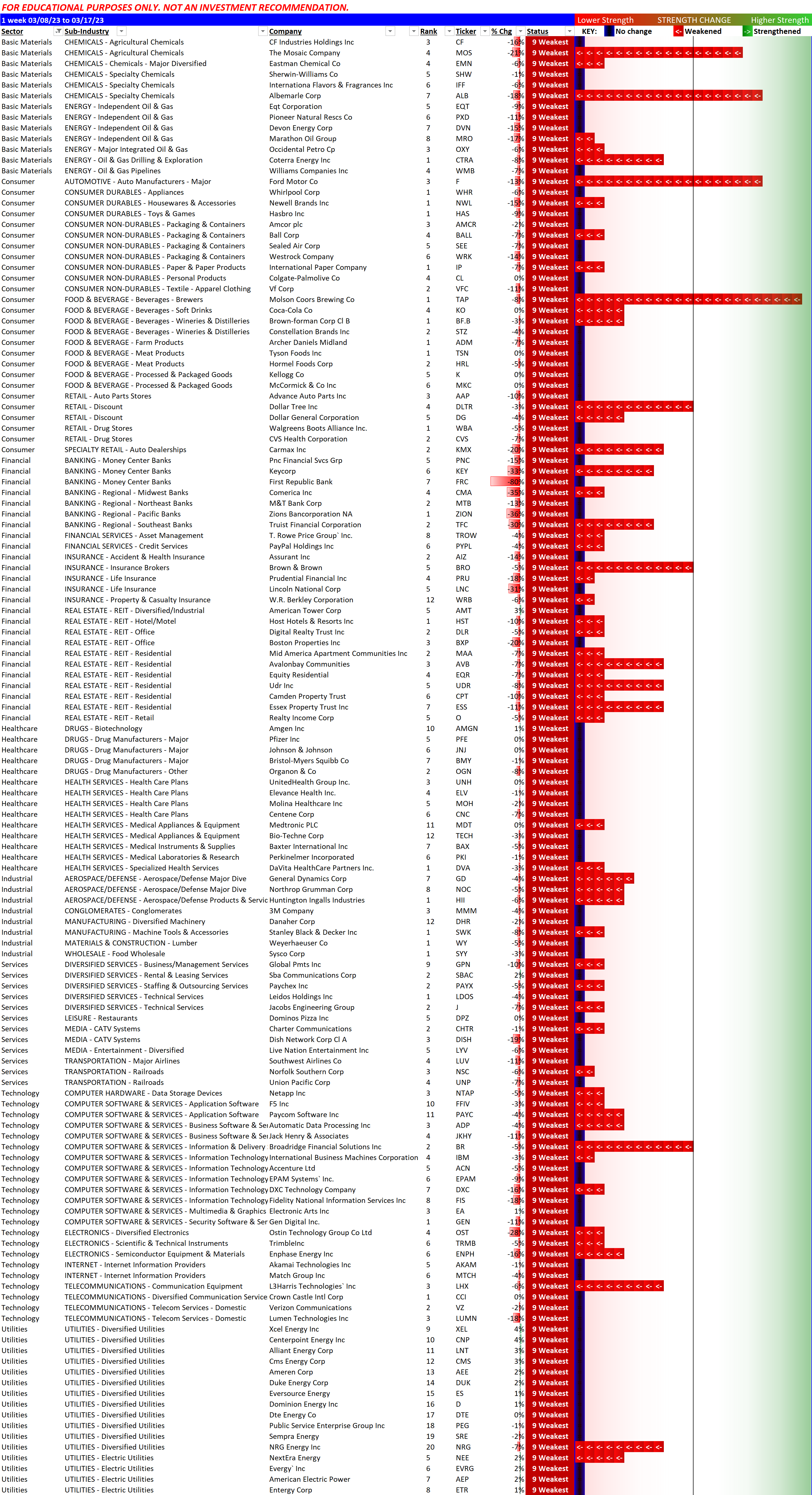

Summary comparison 2023-03-17 Banking and Real Estate (terrible shape) vs. Major Indexes

The downloadable report linked below reflects the following:

- Growth is slightly but not materially better than Value (for the S&P 500)

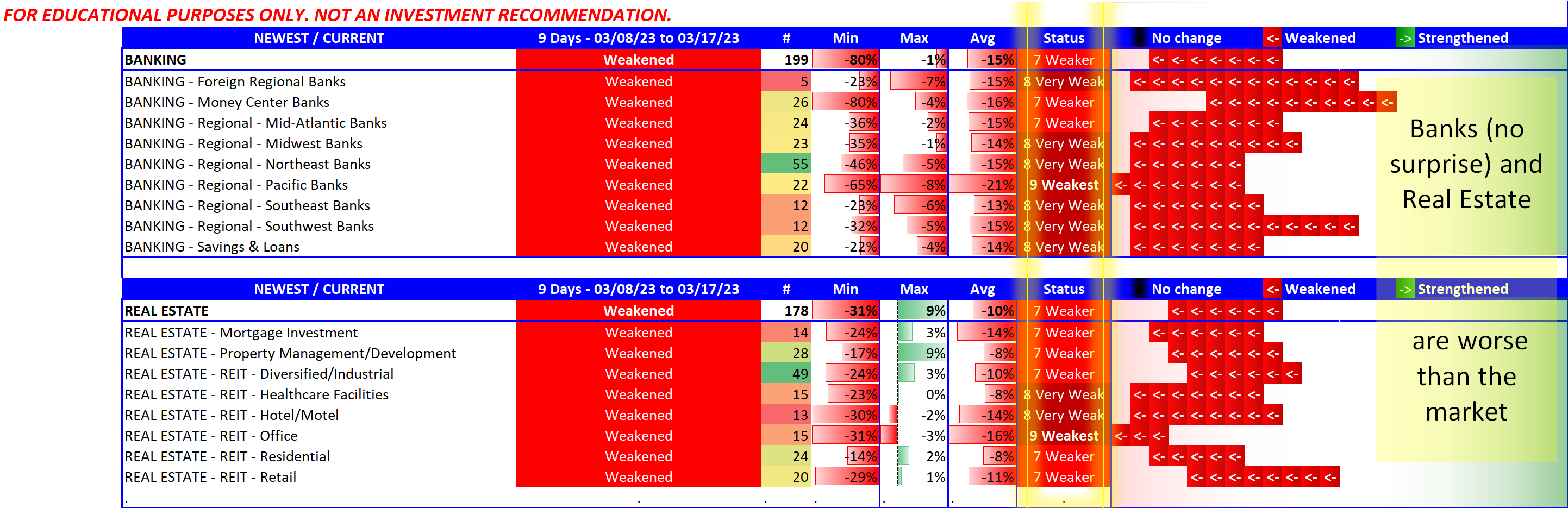

- Banks and Real Estate are worse than the overall market (per the graphic above)

- Page 2 reflects relevant proof that Value vs. Growth vs. Mid-Cap vs. Small-Cap are distinctions without merit. This is not an academic study but as I've mentioned elsewhere - and the core theme of this website is that - strengthening and weakening are more informative concepts on which to focus in the market.

- The NDX has held up better than the other main indexes - others have observed and I agree this is due to a migration to the FAANG stocks. (Note Apple's market cap is back above $2.4T and Microsoft's is above $2.0T.)

- Not many stocks impacted, but the Dow Transports had a bad 7 trading days and the Dow Utilities remain weak. Are these tea leaves that can be read to discern what is happening in the market overall, and what is in our future? I don't know, and I don't read anything into these one way or another. I prefer to measure strengthening and weakening of individual stocks and their sub-industries and industries to discern what is happening right now, so that I can take appropriate action based on an organized, objectively-determined what IS.

Reiterating a key component of my philosophy:

No predictions

Note the headline describing Banks and Real Estate as "terrible." I don't know if this will continue and I am certainly not making any predictions. I'll simply track these industries and report if and when they start strengthening again.

Downloadable S&P500 stock-by-stock detail report

S&P 500 stock-by-stock detail. Scroll down to the financials (page 3 of 7) and see the distress and deterioration that took place sector-wide for these large-cap stocks in Banking, Financial Services, Insurance, and Real Estate. The only two in the sector that have held up are Marketaxess Holdings/MKTX and CBOE Global Markets/CBOE. Why? I have no idea, and I'm sure no one else genuinely knows and could consistently make those calls.

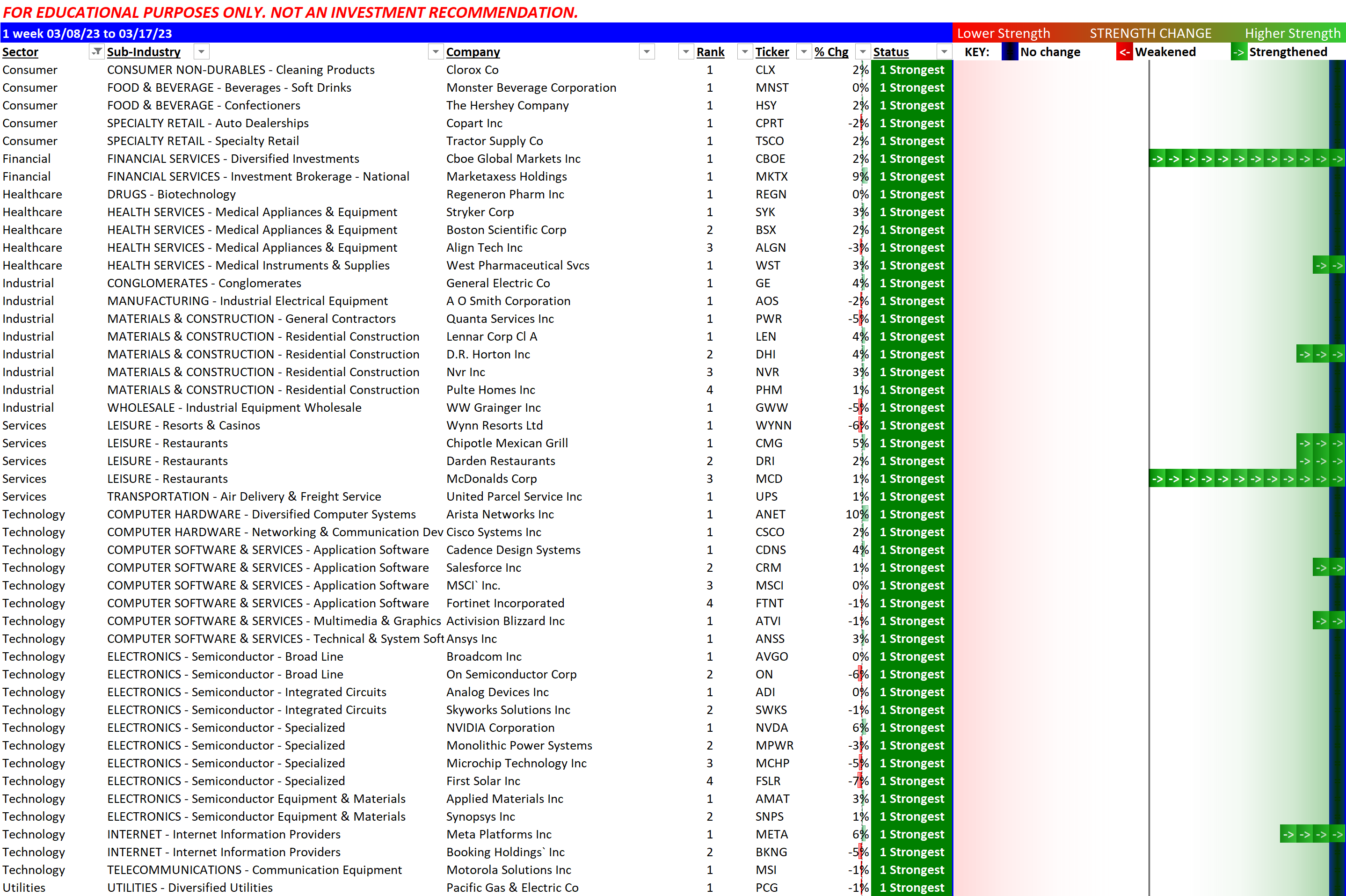

The Strongest S&P500 stocks - why have these held up?

Here's a look specifically only at the strongest S&P500 stocks - these have held up since the banking chaos started. There is a good number of tech stocks here. Note in a generally weak Utilities industry that Pacific Gas & Electric/PCG is holding up.

The Weakest S&P500 stocks - may be some "pops" coming but best wishes sustaining them (see FRC last week)

On the other hand, below are the 136 weakest in the Index. Some of these may make headlines with eye-popping gains on any upcoming given day. Will these (potential) gains last enough to bring these out of their stupor, or is this weakness destined to win out for a while?