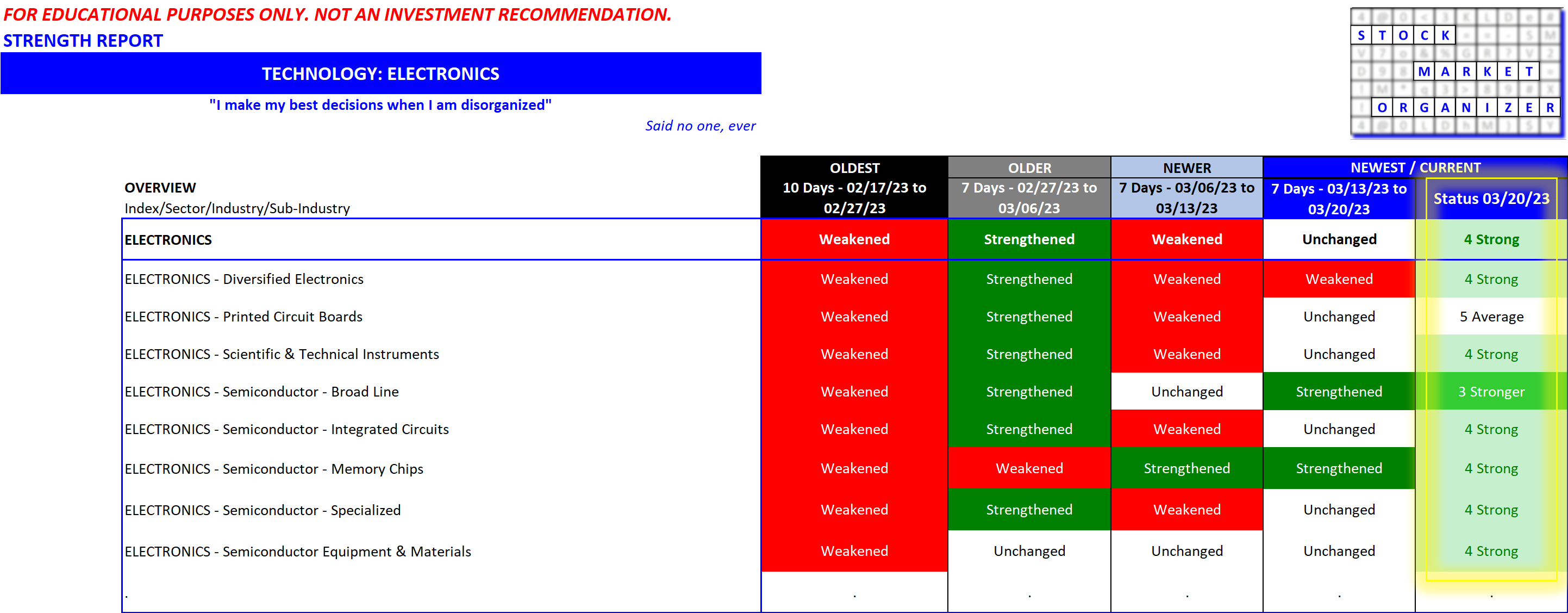

Strength in Electronics 2023-03-20 (includes Semis)

Amidst the dreariness associated with the you-know-what industry that has been hogging all the headlines, the Electronics industry has been holding up well.

What is going on in the Semiconductors - Broad Line sub-industry? Can you explain why that has held up? Even if you did, would you be right again tomorrow, next week, next month, next week? Can you guarantee that?

We don't know how long it will remain this way. We simply know this is the current status. This is enough to logically assess where are areas within the market on which to best focus, and - importantly enough - where are the areas to ignore. Additionally, we can use this to directly compare its status with other industries and their sub-industries.

If you are not using an organizing method to accurately and meaningfully assess where to focus in the market when you are in the hunt for new positions, you are handicapping your ability to compete with the people from whom you are buying your stocks.

For long term success, you need to make sure you are always better prepared than those taking the opposite side of your transactions.

Downloadable Electronics industry stock-by-stock detailed report available below:

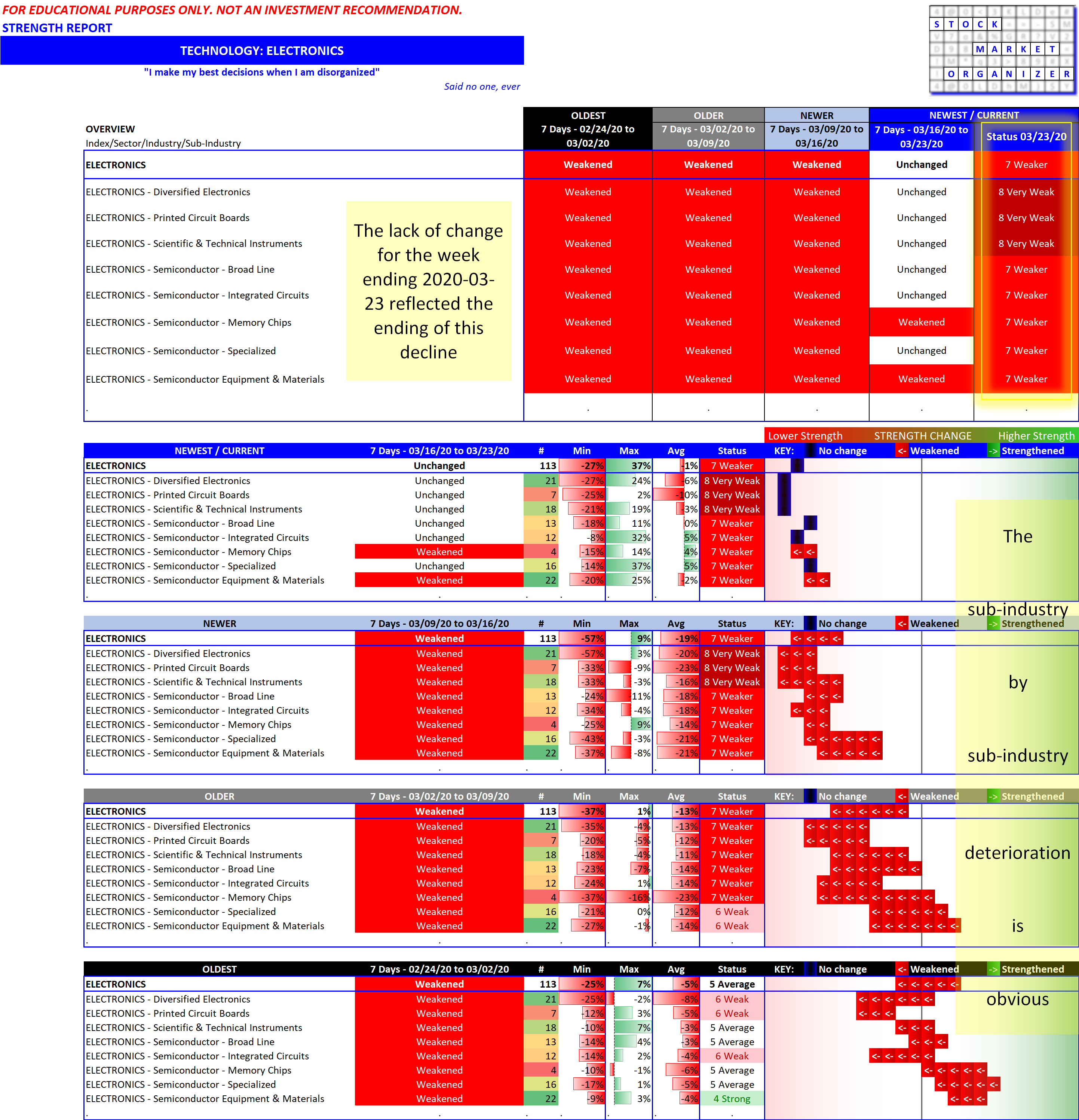

Context: revisiting the March 2020 decline/bottom

One can clearly see the decline by sub-industry for the four weeks leading up to March 23, 2020 - compare this sea of red with the graphic above showing the current industry status:

This graphic reflects the clear decline that takes place in an industry, sub-industry by sub-industry, with that information backed by stock-by-stock declines. This stock-by-stock build-up is what sets apart this method from other analytical tools.

Here is the link to the downloadable report underlying the above graphic: