Specialty Retail 2023-09-22: Unchanged at WEAK strength rating (6th strongest of 9 levels), previous move was DOWN

TABLE OF CONTENTS

- INDUSTRY OVERVIEW

1A. Performance

1B. Background - SUB-INDUSTRIES AND STOCKS DETAIL

2A. Sub-Industries Overview

2B. Sub-Industries 10-Week Strengthening Analysis

2C. Stocks 1 Week Strongest and Weakest - STRENGTH BY LOOKBACK PERIOD (with Best/Worst stocks)

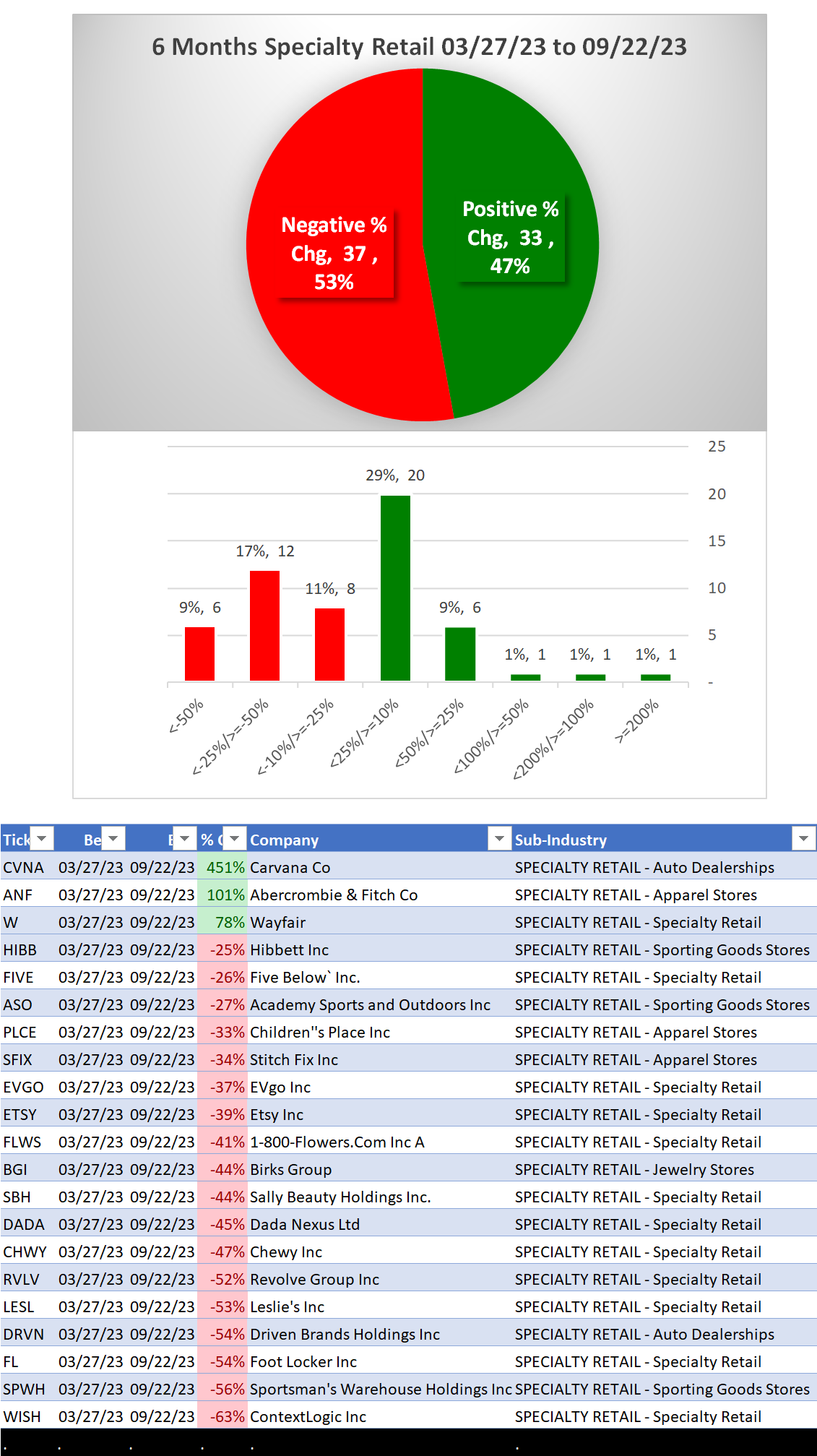

3A. Lookback 6 Months

3B. Lookback 4 weeks

3C. Lookback 1 Week

1. INDUSTRY OVERVIEW

1A. Performance

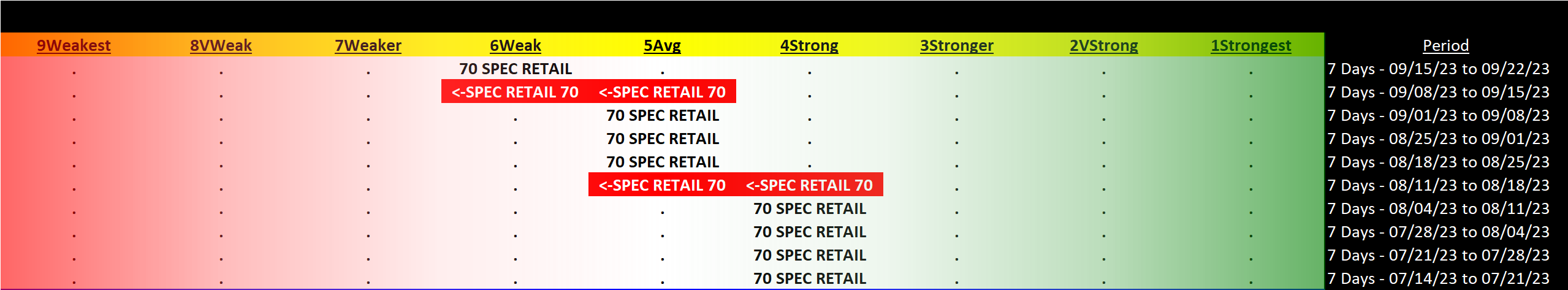

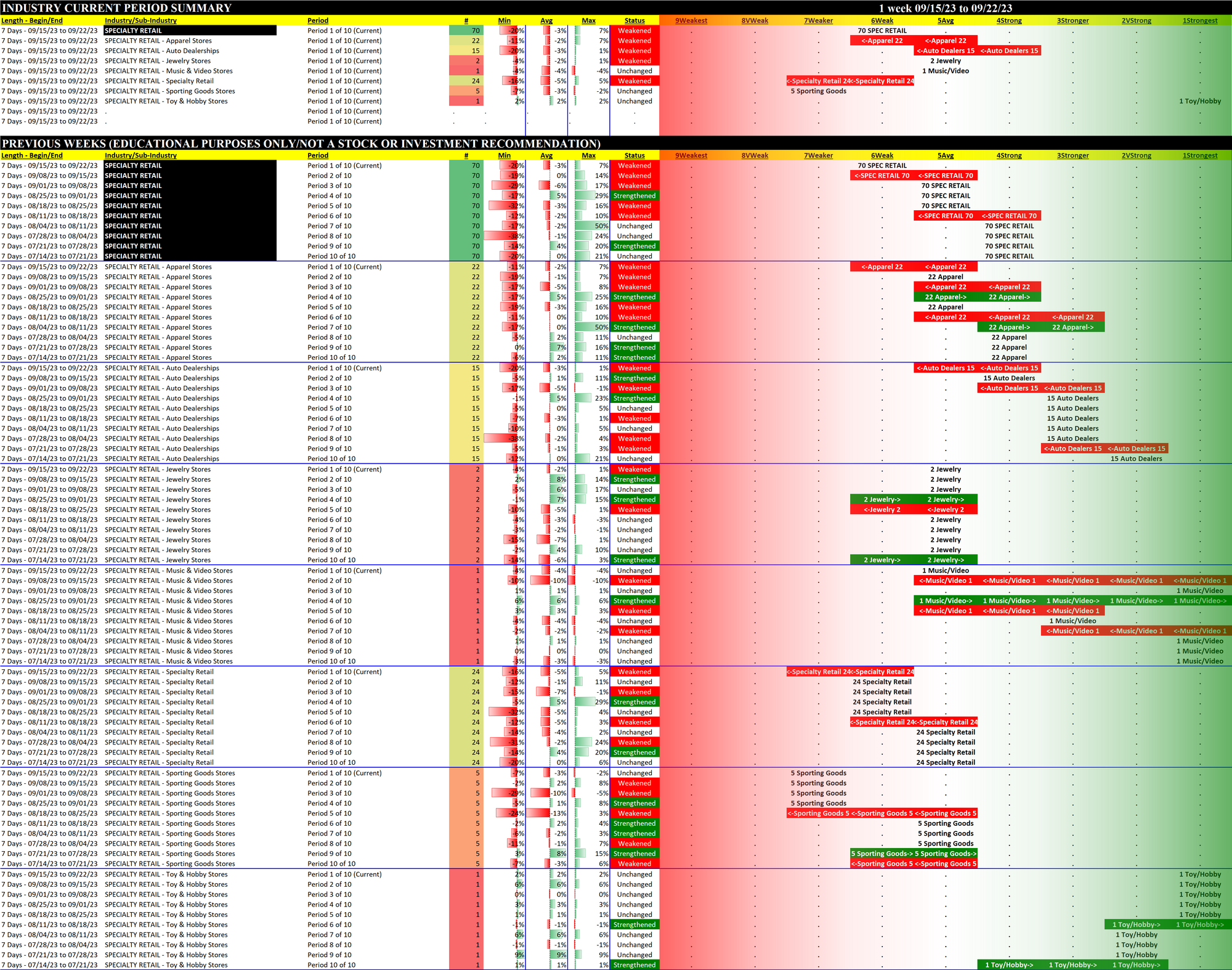

Past 10 Weeks Strengthening/Weakening week-by-week, per the following chart:

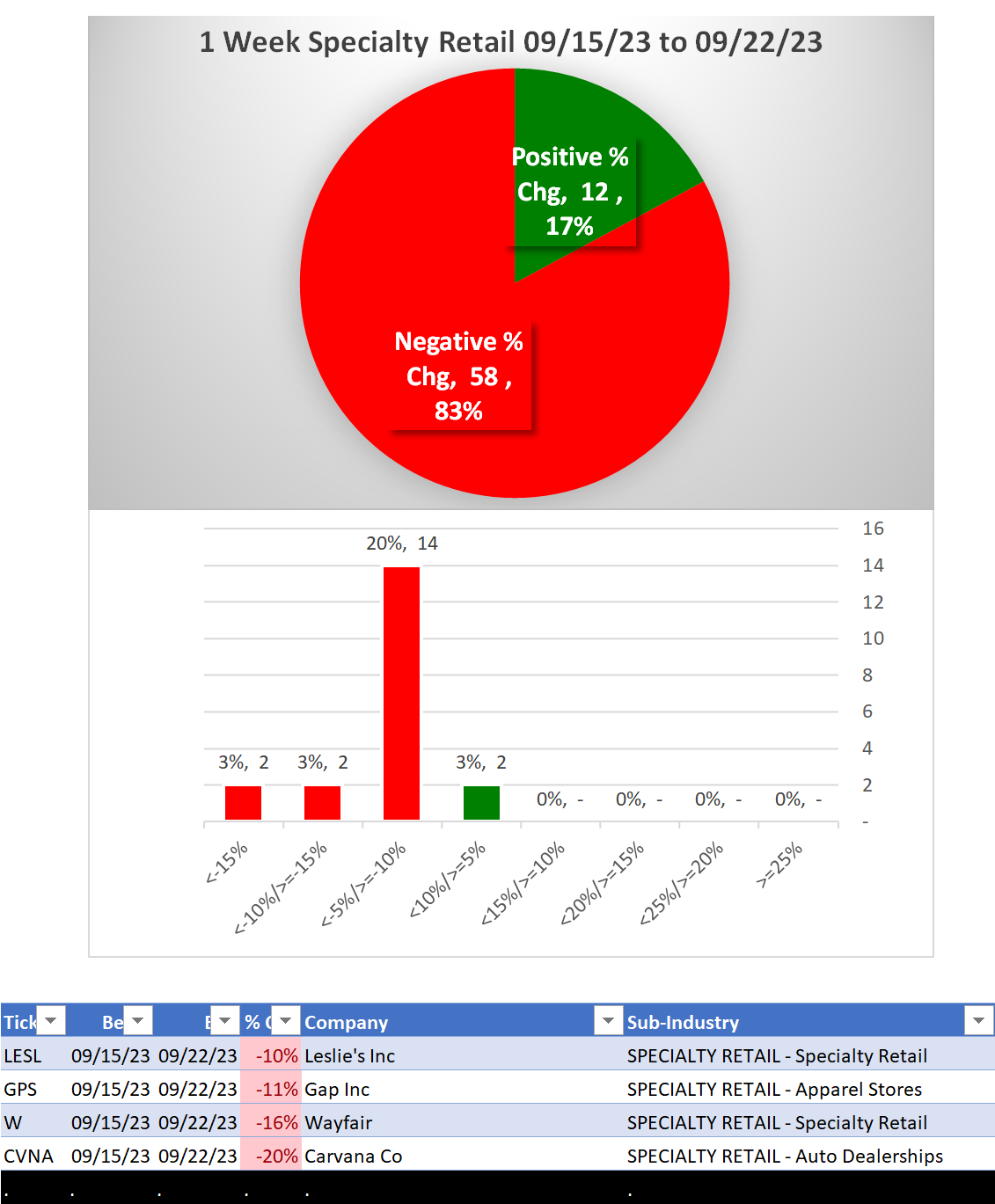

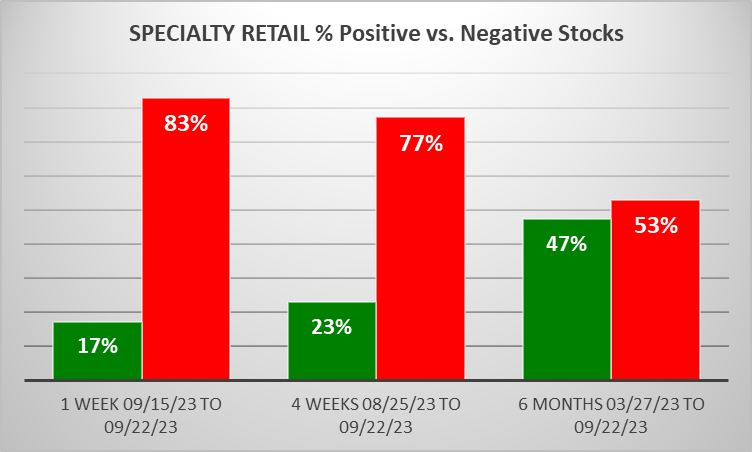

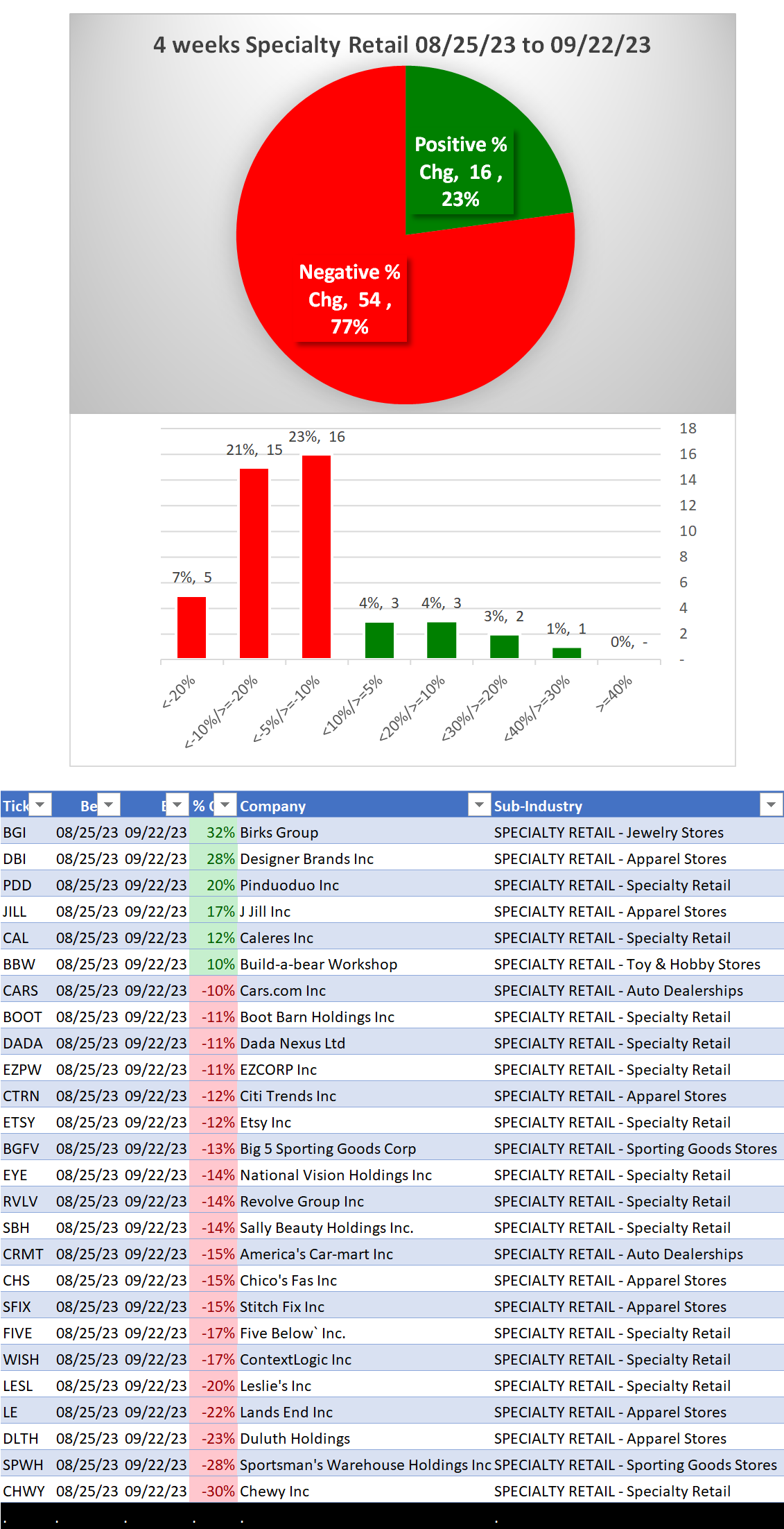

WEAKENING 1 Week vs. Mid- and Longer-Term // 1 week positive/negative stocks ratio is LOWER than both 4 weeks and 6 Months, per the following chart:

Comment:

- CVNA/Carvana 6 month return +451%.

- 6 months, 26% of total stocks are <-10%.

- 4 weeks, 29% of total stocks are <-10%.

- Weakest stocks are currently 39% of total.

1B. Background

Largest of 7 sub-industries (70 stocks, average 10):

- Specialty Retail (24 stocks)

- Apparel Stores (22 stocks)

- Auto Dealerships (15 stocks)

Top 10 by Market Capitalization:

NFLX/Netflix Inc, PDD/Pinduoduo Inc, CPRT/Copart Inc, ROST/Ross Stores Inc, TSCO/Tractor Supply Co, KMX/Carmax Inc, PAG/Penske Automotive, DKS/Dick's Sporting Goods, CVNA/Carvana Co, CHWY/Chewy Inc

2. SUB-INDUSTRIES AND STOCKS DETAIL

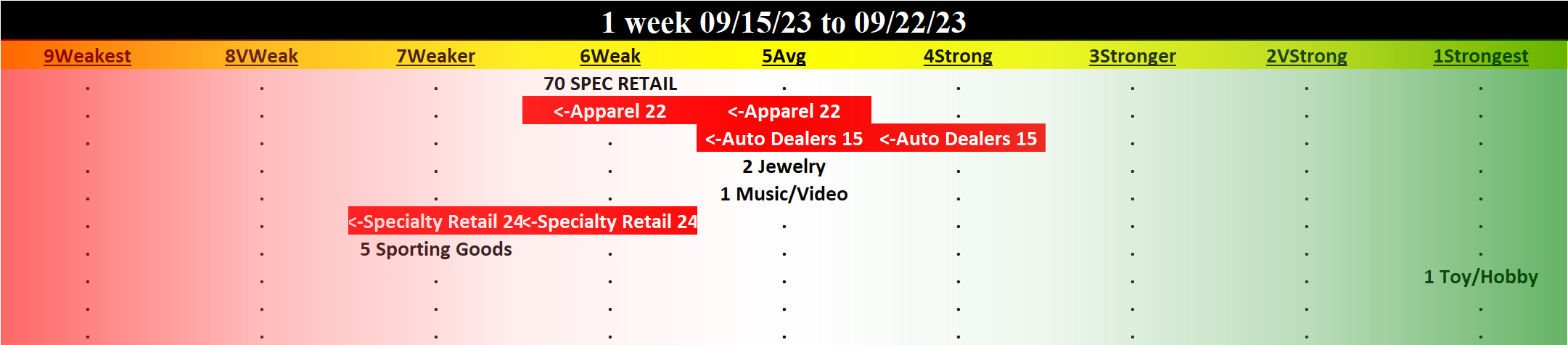

2A. Sub-Industries Overview

Strengthened: 0/7 sub-industries

Weakened: 3/7 sub-industries

STRONGEST at Strongest rating/1st strongest of 9 levels:

- Toy & Hobby Stores

- Auto Dealerships (15 stocks) (ranked 5th of 9 levels)

- Jewelry Stores (2 stocks) (ranked 5th of 9 levels)

- Music & Video Stores (1 stocks) (ranked 5th of 9 levels)

WEAKEST at Weaker rating/7th strongest of 9 levels:

- Specialty Retail (24 stocks)

- Sporting Goods Stores (5 stocks)

2B. Sub-Industries 10-Week Strengthening Analysis

What: recent week-by-week strength changes for the industry and each underlying sub-industry

Why: objective measurement of strengthening and weakening enabling comparison within and across industries and sub-industries

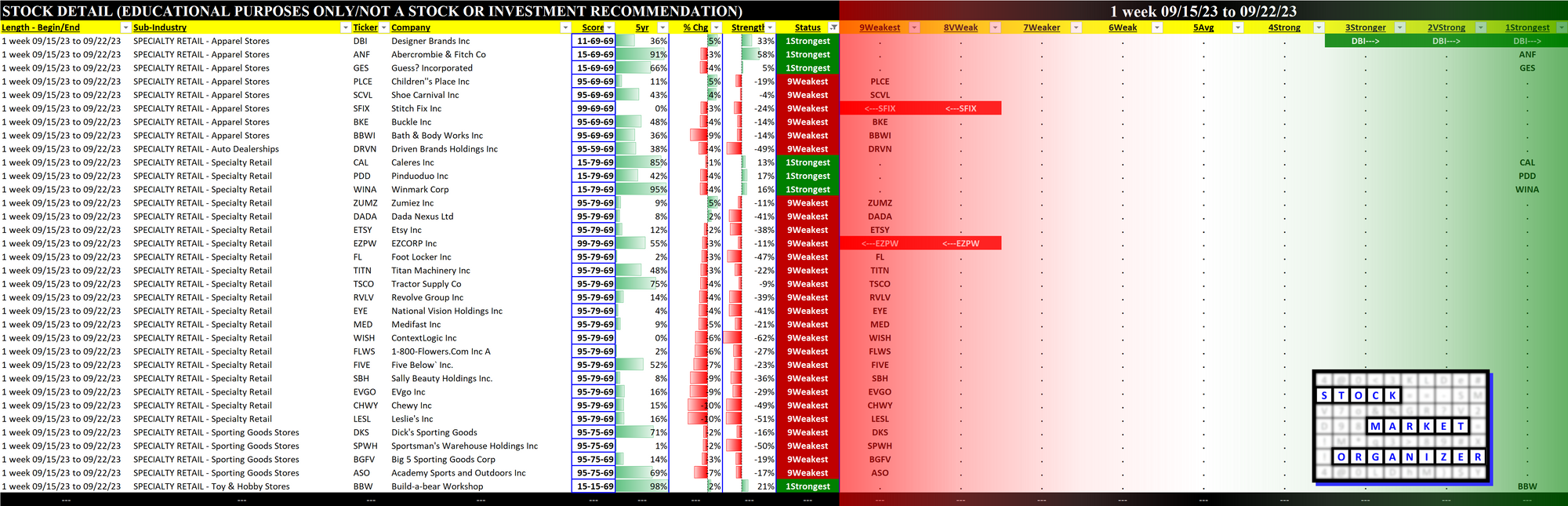

2C. Stocks 1 Week Strongest and Weakest

What: stocks currently rated Strongest/Weakest (highest/lowest of 9 strength ratings)

Why: most interesting stocks for available capital because

- the Strongest have the least amount of overhead supply to dampen breakouts while

- the Weakest may be prone to volatility, subject to big pops from bottom-fishing and short-covering BUT ALSO to bigger and faster falls.

(Not guaranteed and not a recommendation - weak stocks in weakening sub-industries may be better shorts than high-flyers.)

3. STRENGTH BY LOOKBACK PERIOD (with Best/Worst stocks)

3A. Lookback 6 Months

3B. Lookback 4 weeks

3C. Lookback 1 Week