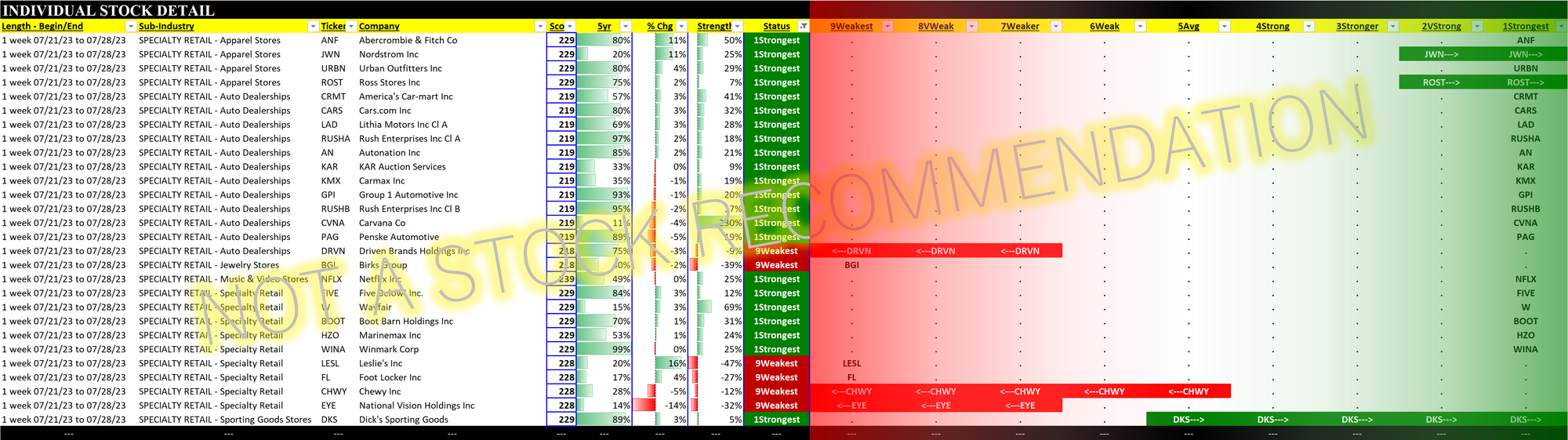

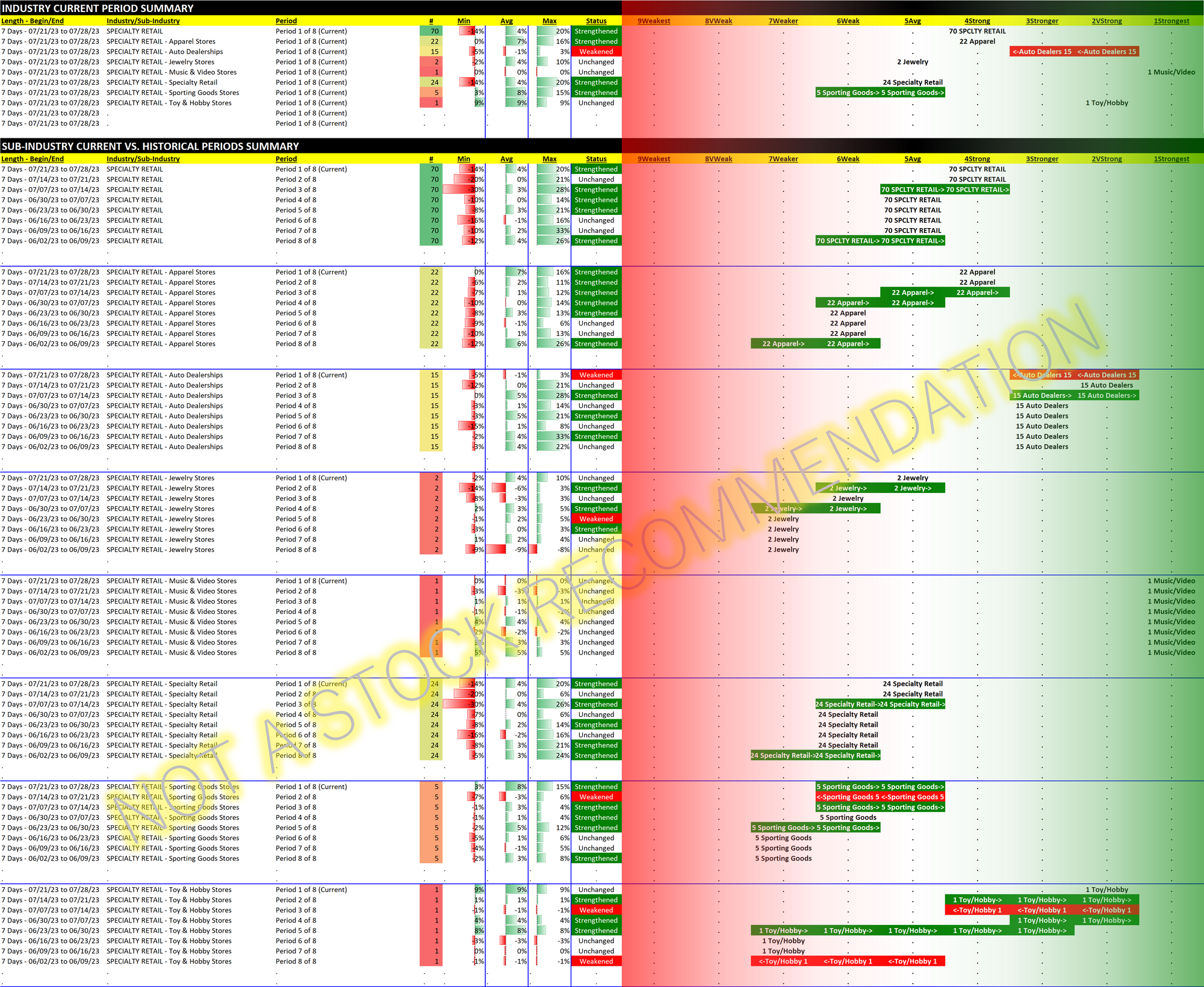

Specialty Retail 2023-07-28: Unchanged at "Strong" strength rating (4th strongest of 9 levels), previous move was up

Here's my previous update for Specialty Retail.

In my previous update I looked closely at CVNA/Carvana, which at that point had risen 884% between December 7, 2022 and July 14, 2024. Incredibly enough, over the next 3 trading days the stock rose another 48%, with a 40% increase on July 19, 2023 alone.

Certainly this is an odd situation. But add this to the pile of examples showing that shorting a rocket ship is a terrible idea. I'm certain others can point out situations where doing so has worked. It is not a concept that works for me. I have no better knowledge than anyone else as to what to do in this situation, so I would ignore it.

It is far better to short a stock that has already proven weak. Once emotional buyers have taken control of a stock (remember Redditors with GME and AMC a couple of years ago), anything can happen. Taking new long or short positions in such a stock is playing with fire.

On the other hand, if you have a very weak stock whose sub-industry (at the very least) and industry (ideally in addition to a weakening sub-industry) are weakening, that is a much better short candidate. In this case, you have helpful additional material information showing you are not going against the tide.

Also important to remember - simply because a stock has fallen a long way does not mean it cannot continue to fall by a material amount. How many stocks have fallen 75% - and then fell an additional 50% from there? There are many examples. Take CVNA itself. It was >$360 August 2021. It fell 94% to $20 July 2022. After a nice rally that took it to nearly $55 in August 2022, it declined to <$4 in December 2022 - down more than 90% from its August high, and down more than 80% from its July low.

Since its 3-day 48% advance, CVNA has fallen 21%. Where to from here I have not the slightest idea. And of course neither does anyone else. To me, it is a case of a stock that for now should be ignored in favor of many other better potential opportunities available now.

Key new information - the Auto Dealerships sub-industry has now weakened over the past week. Why? As always, I don't know why. I just know the what - and that is enough to give me pause. A one-week weakening could stop now, or it could be the beginning of a sustained downturn. I won't spend any time looking for the "why" because I will never know with reliable or meaningful certainty, at any time that I could gain an advantage from having that knowledge if it were even available. To me it is a waste of time trying to find out "why." That would be a real-life example of closing the barn door after the horse has escaped.

Conversely, there are other sub-industries that have strengthened, not just in Specialty Retail (see Sporting Goods, although there are only 5 companies there) but in other industries. I'd rather look at candidates in strengthening sub-industries, knowing that such strengthening means there are others capable of moving the price who are interested in stocks in that sub-industry.

About CVNA and its Auto Dealership sub-industry that has just weakened over the trading week just completed July 28, 2023: I would not see CVNA as a short because it is still a stock rated Strongest. If I were to short a stock in this sub-industry, it would be a stock rated Weakest.

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.