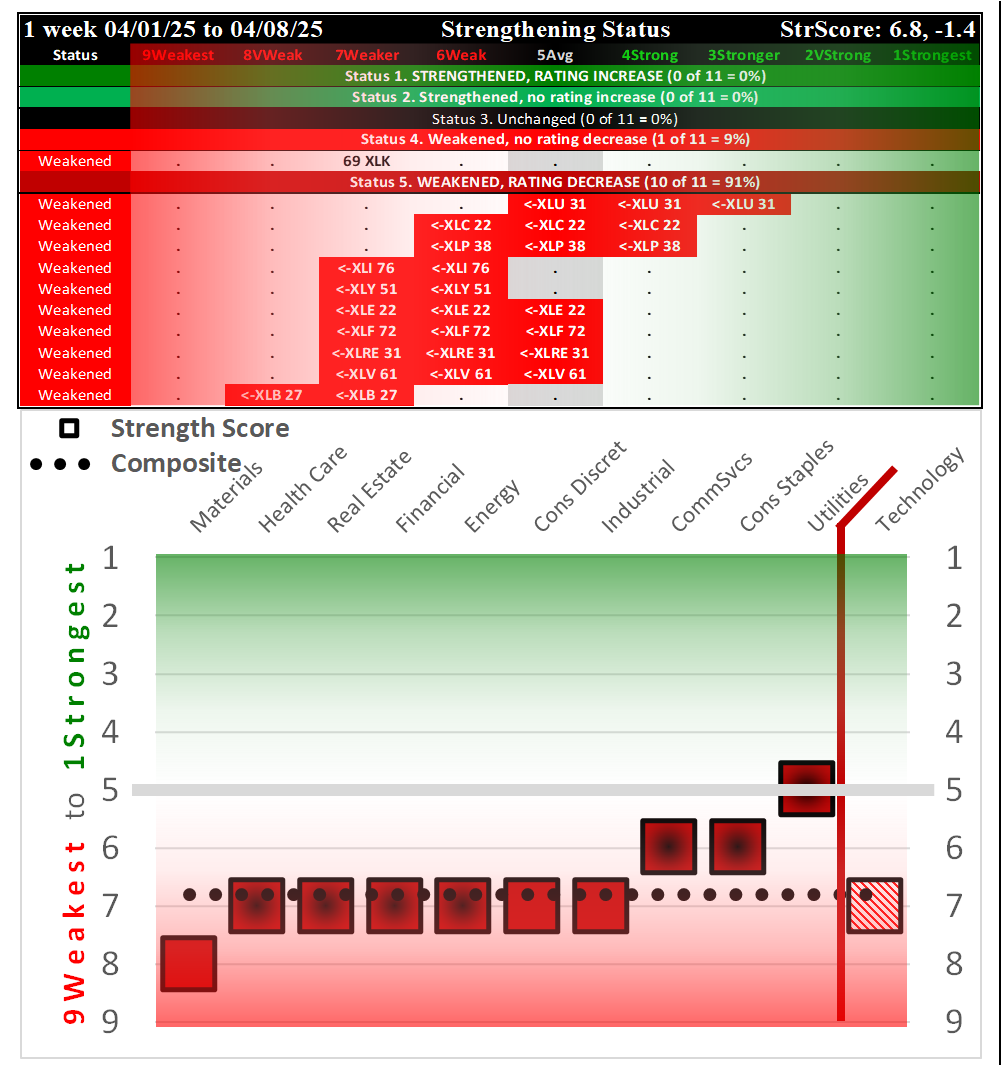

SPDR Sector ETFs Tue 2025-04-08: 6.8 Strength Score (Weakened -1.4)

This post objectively summarizing current market conditions consists of the following five sections:

I. Introduction

II. Weekly Returns

III. Spectrum Graph Analysis

IV. Today's Market Context

V. Detailed Sector ETF Analysis

Last Tuesday's report is available here (SPDR Sector ETFs Tue 2025-04-01: 5.4 Strength Score Weakened -0.3).

I. Introduction

Background

This analysis consists of the Stock Market Organizer stock-by-stock strength analysis applied to the 500 stocks that comprise the 11 SPDR Select ETFs.

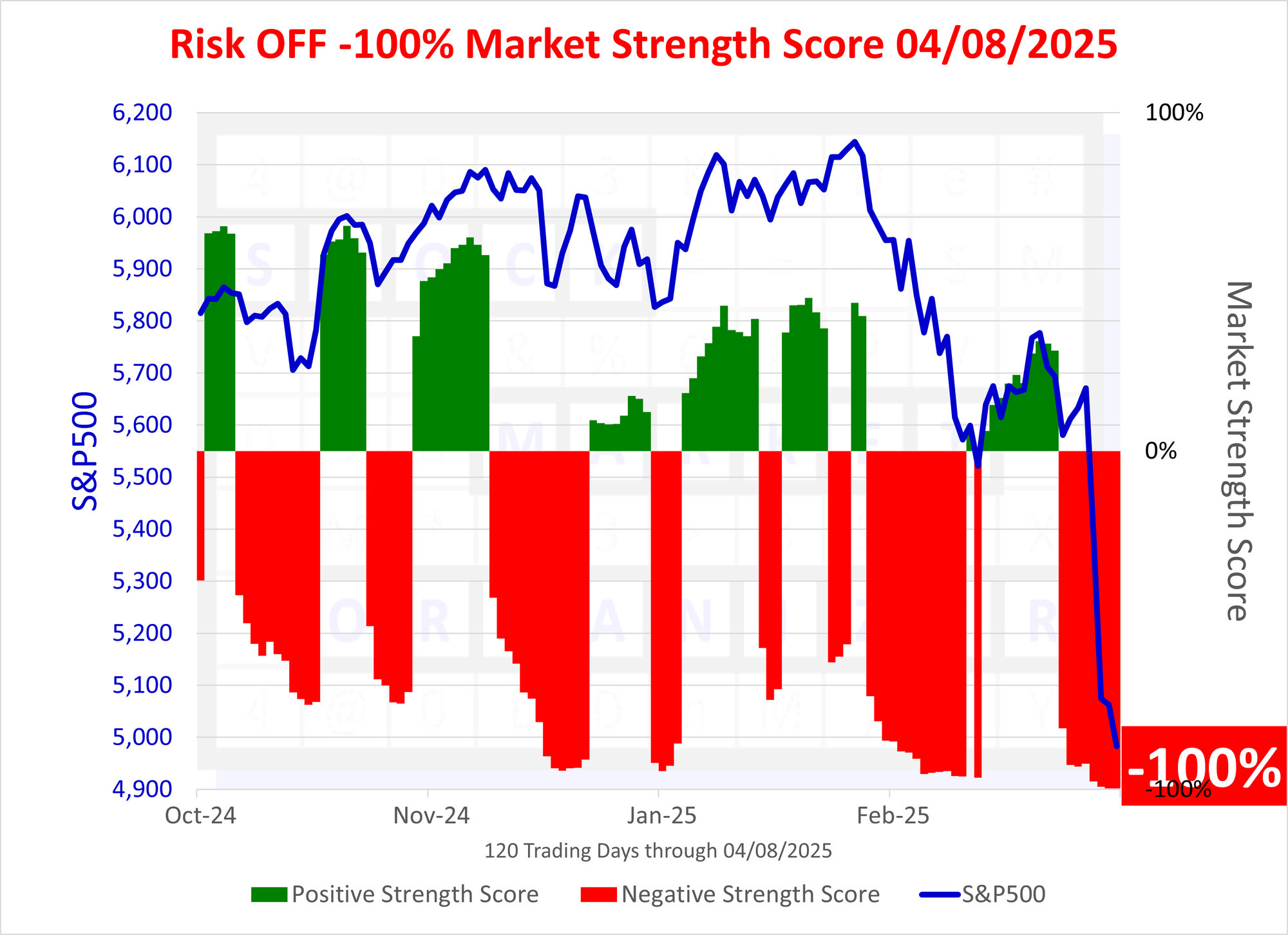

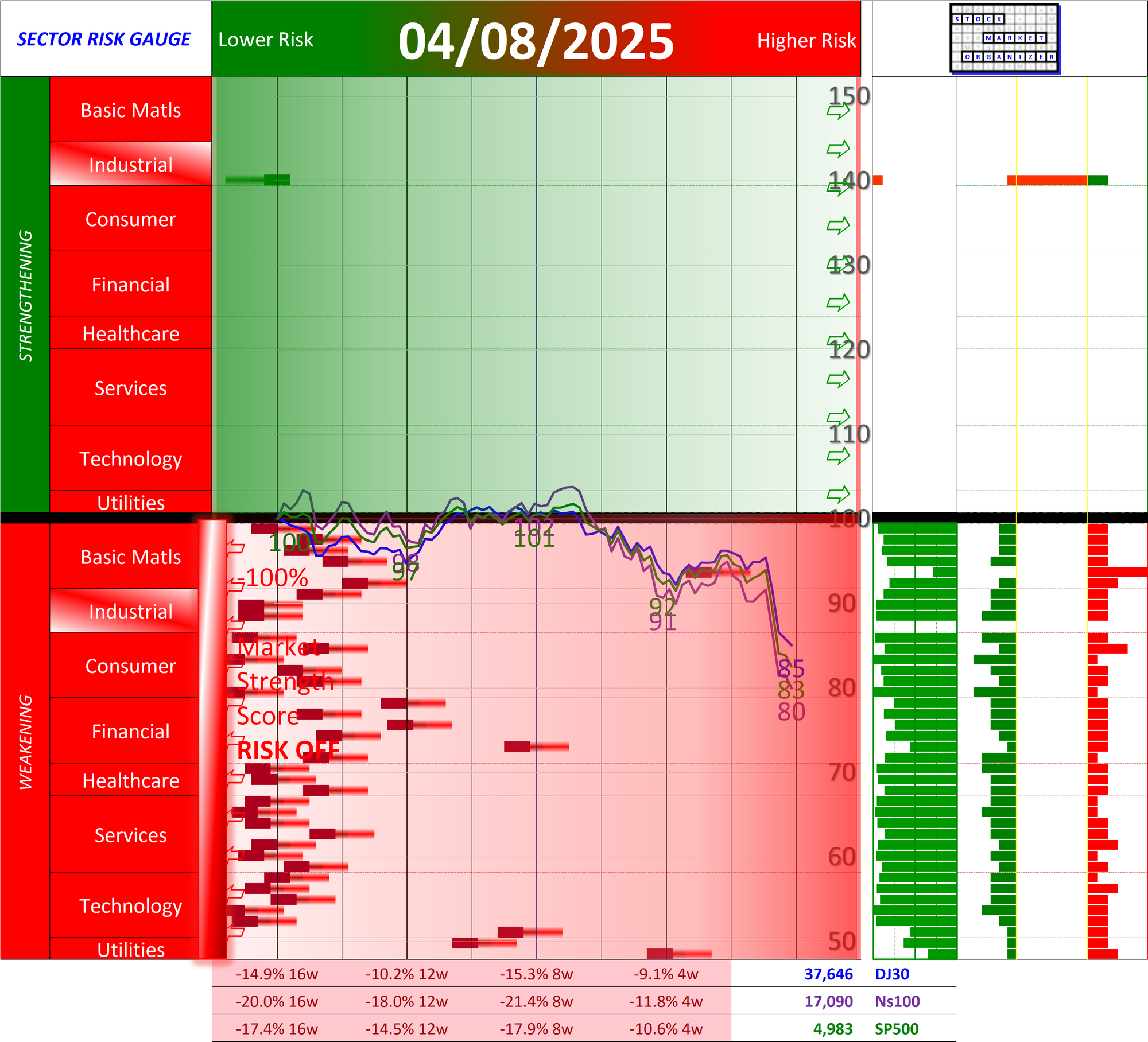

These results are combined with overall market environment readings - the Market Strength Score and the Sector Risk Gauge, which reflect "Risk OFF" as of Friday, March 28, 2025 - to discern appropriate portfolio exposure and risk/position management given prevailing market and sector conditions.

Here is the corresponding Market Strength Score:

Why do you care?

This dynamic market analysis provides a continuously updated, apples-to-apples comparison of the strengthening and weakening trends in the US market. By tracking the 500 large-cap stocks across 11 key sectors (via SPDR ETFs), this analysis offers valuable insights for investors seeking to harness momentum in their portfolios.

Each week, the analysis clearly identifies which sectors and stocks have gained, remained flat, or lost ground. With this data, investors can objectively assess sector and stock strength, refining their timing and positioning for new investments. Ultimately, this approach aims to enhance long-term portfolio performance by leveraging momentum – a proven market factor – to inform data-driven investment decisions.

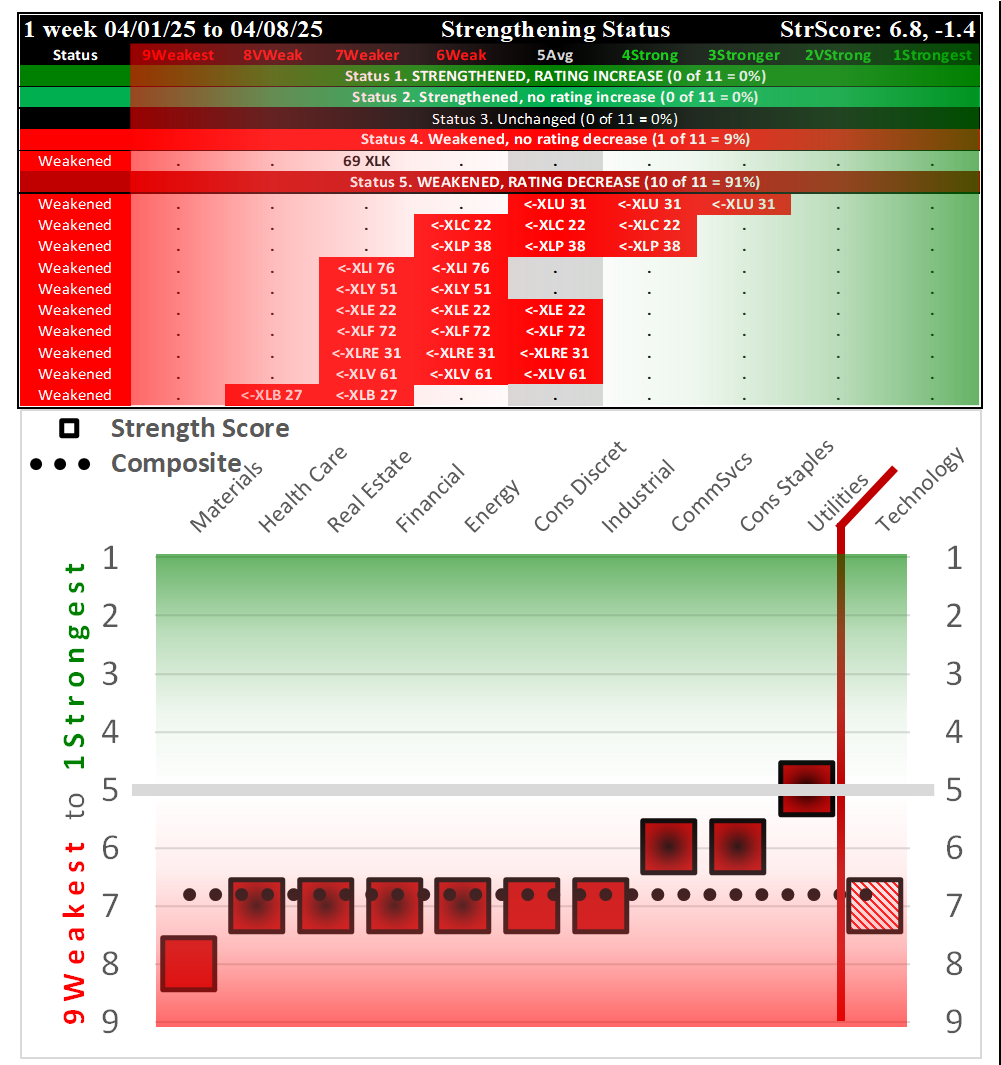

Most Important Ranking: Strengthening Status

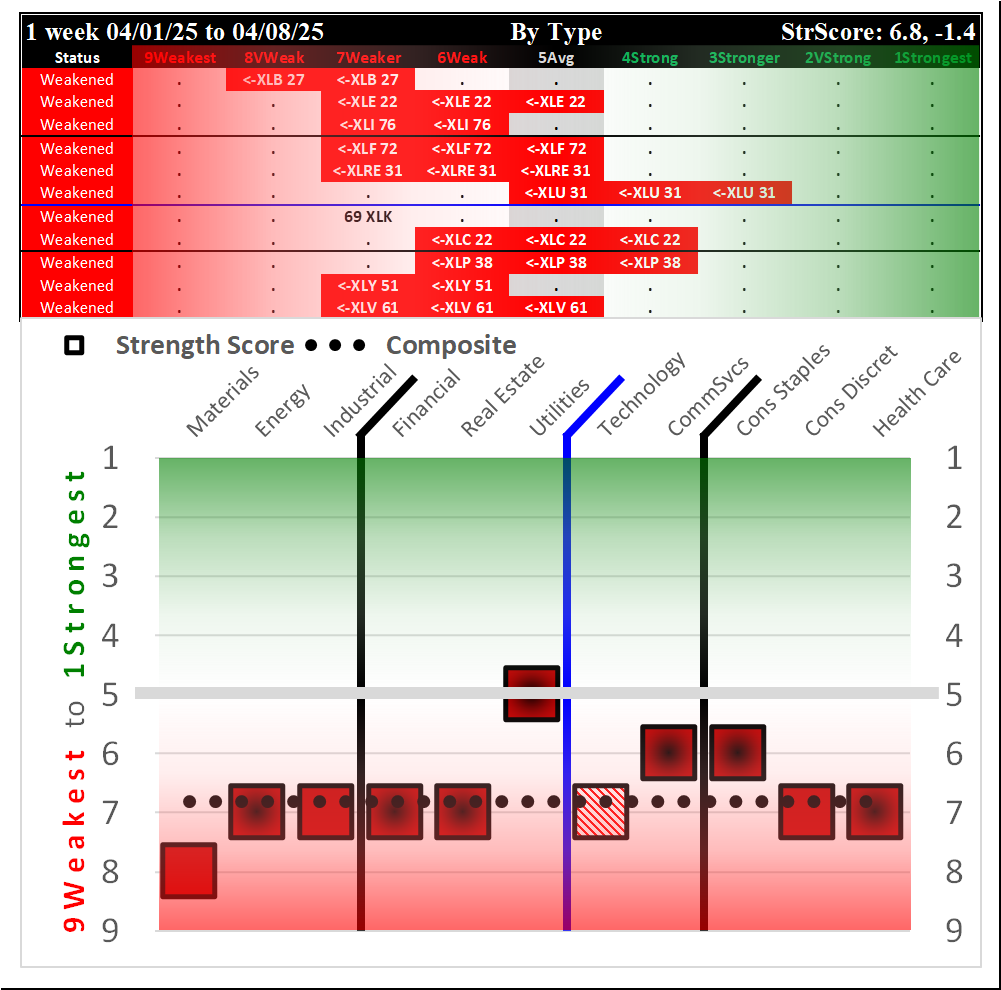

The following Strengthening Status spectrum graph shows the ETFs based on their current strengthening status, as compared to last week.

These are ordered based on important distinctions - did an ETF strengthen or weaken, enough (or not) to change rating, and where in the ratings scale (aka the spectrum of possibilities) does the ETF currently lie?

This graphic clearly provides this key information at a glance.

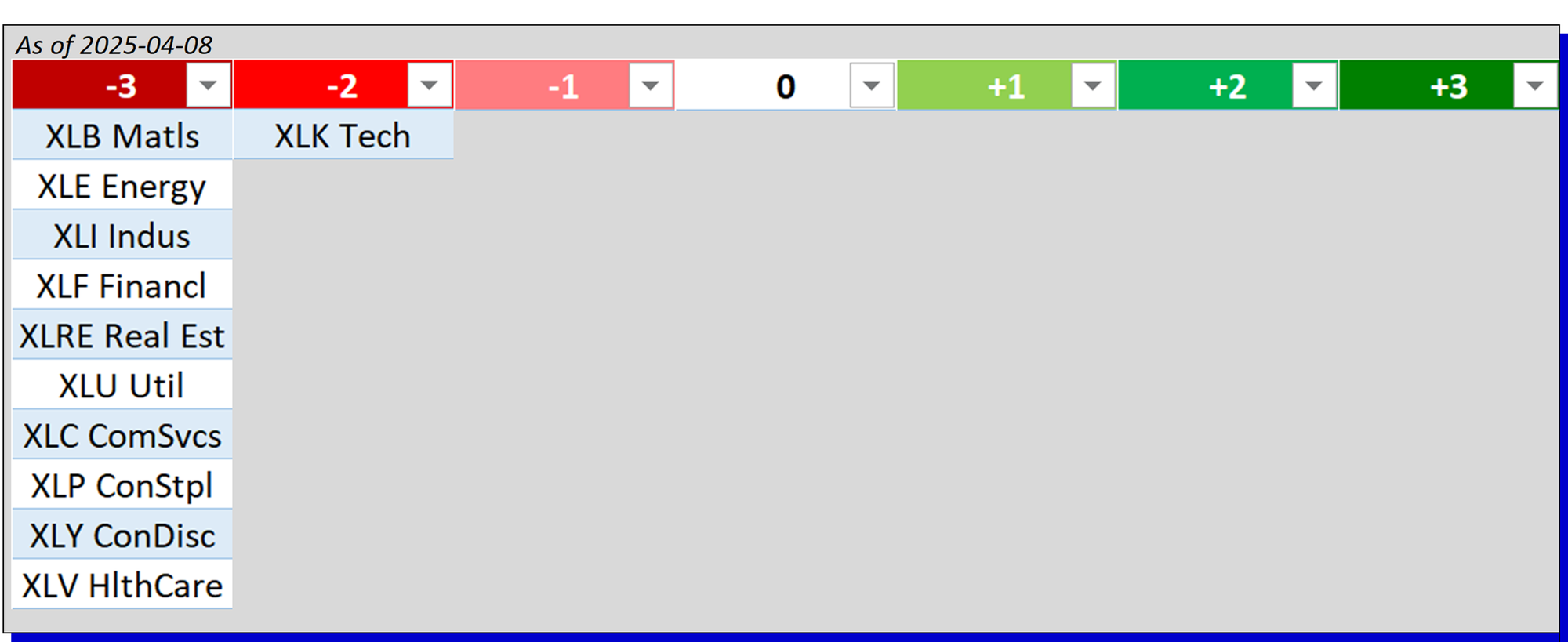

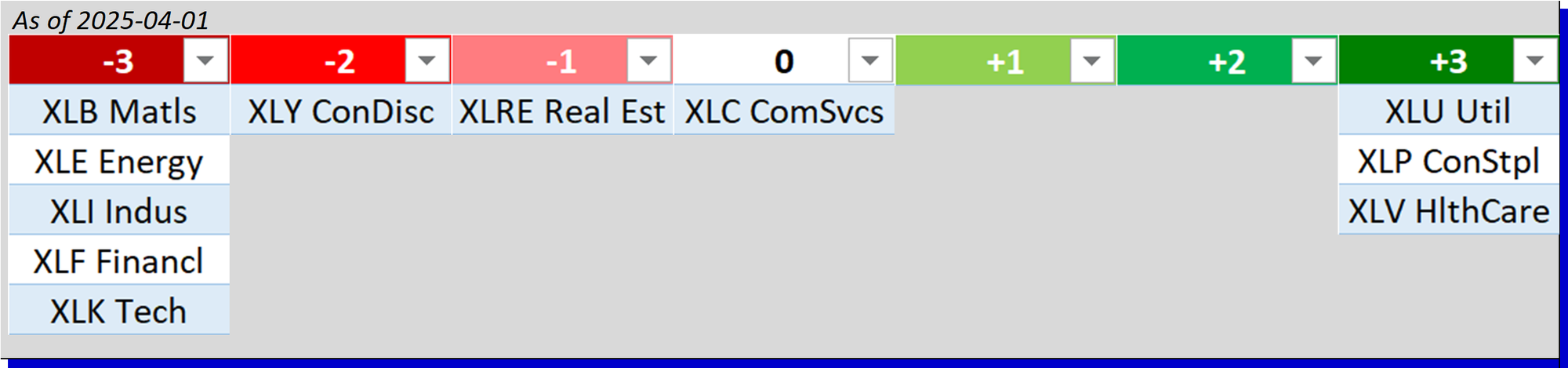

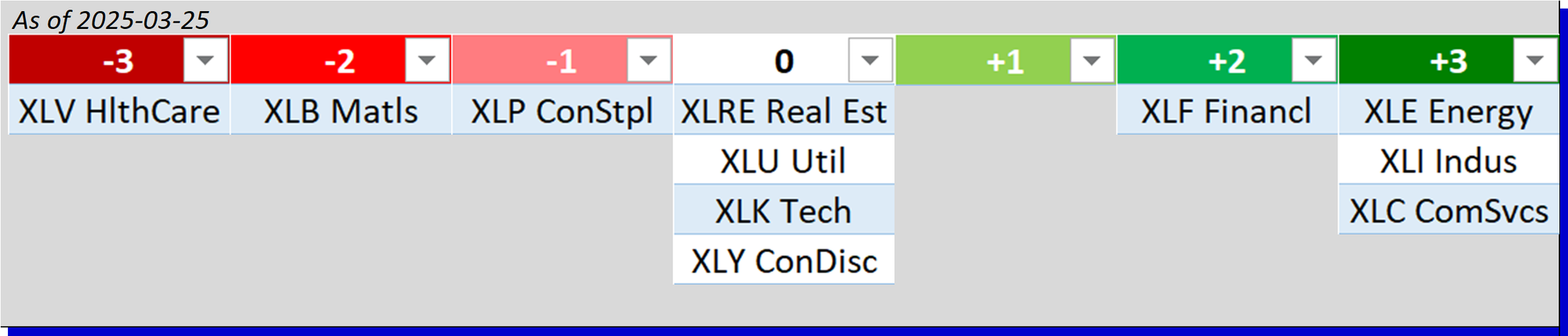

Comparison of this week vs. the past two weeks. The upper portions show strengthening from the top row down, while the lower portions show strengthening from right to left. These graphics are set up to clearly convey which ETFs/sectors strengthened or weakened, and from/to where this happened. Though it is impossible to determine how long these signals will last (what will be), the critical point is that these are the objective strength levels of these ETFs right now (what is).

Bottom Line Translation

Each ETF/Sector is given a Bottom Line rating below on a scale of -3 (Worst) to +3 (Best) based on A) the ending strength rating of each ETF and B) the strengthening/weakening action of the ETFs during the week, with the five possibilities being 1) strengthened enough to increase rating, 2) strengthened but not enough to increase rating, 3) unchanged, 4) weakened but not enough to decrease rating, and 5) weakened enough to decrease rating.

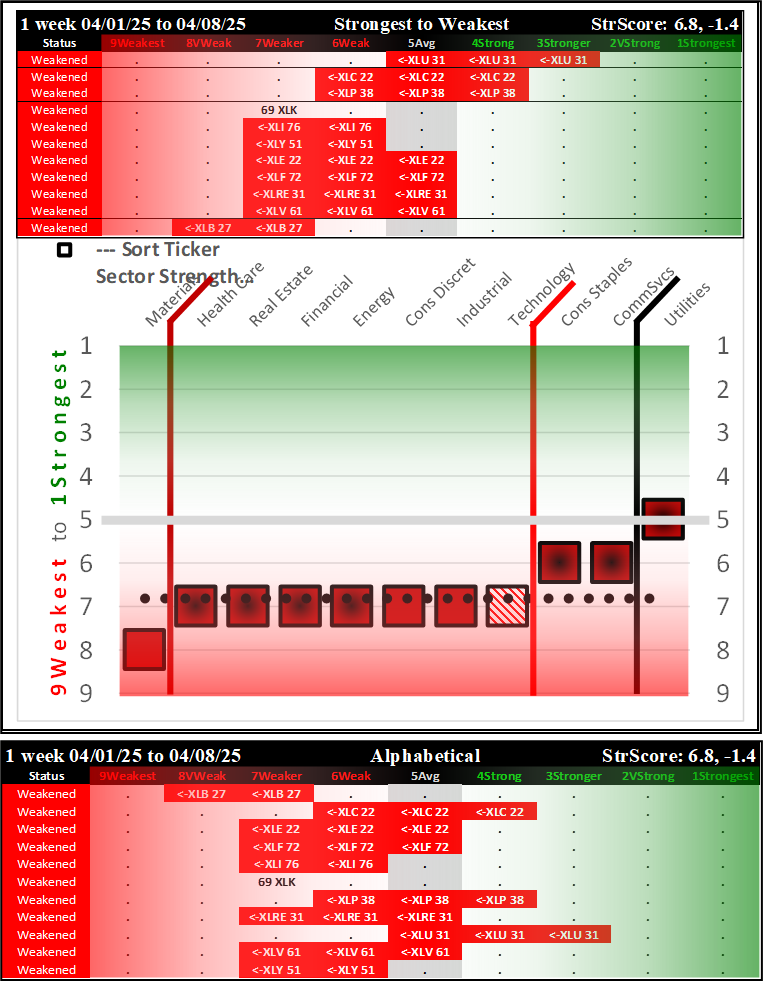

II. Weekly Returns

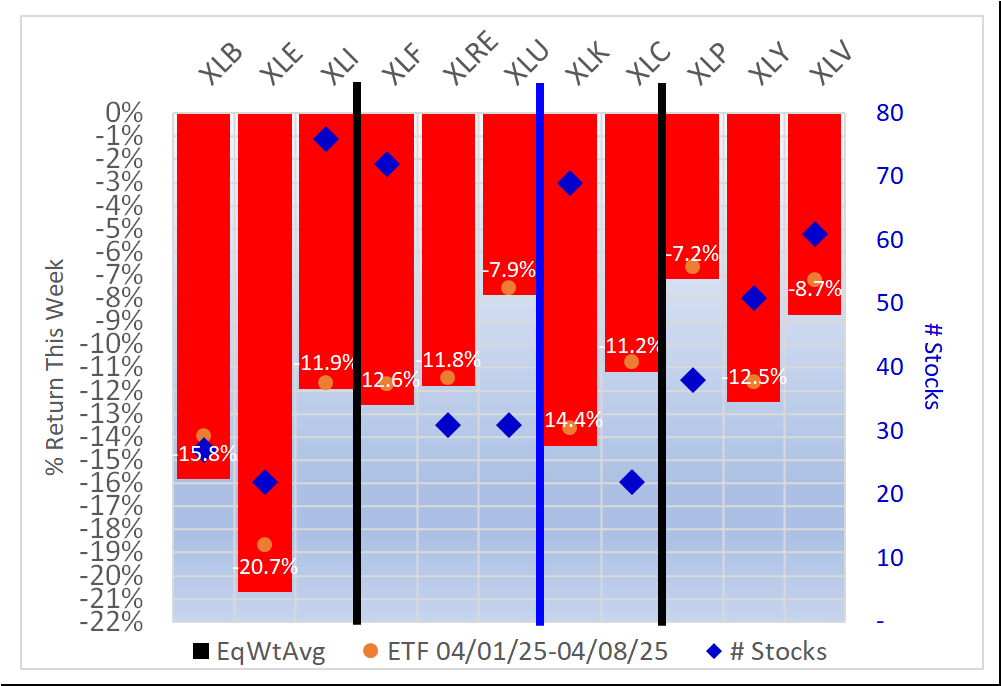

Average Returns

The average returns for the underlying stocks in each ETF are shown below - note this is NOT the return for the ETF for this week, which is shown below in Section IV. Today's Market Context.

The best and worst are highlighted below:

Best:

- XLP/Consumer Staples, -7.2% average for 38 stocks

- XLU/Utilities, -7.9% average for 31 stocks

- XLV/Health Care, -8.7% average for 61 stocks

Worst:

- XLE/Energy, -20.7% average for 22 stocks

- XLB/Materials, -15.8% average for 27 stocks

- XLK/Technology, -14.4% average for 69 stocks

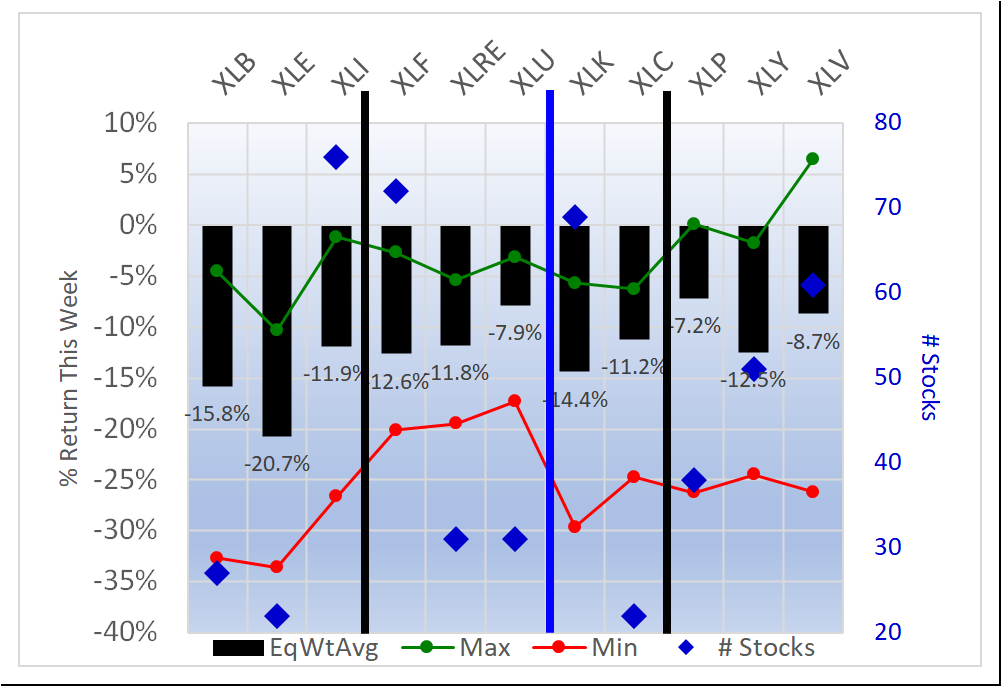

High and Low Returns

The following graphic overlays the lowest and highest returns in each sector.

III. Spectrum Graph Analysis

This methodology uses spectrum graphs to obtain key insights unavailable elsewhere.

There are currently four types of spectrum graphs in this ETF analysis:

- By Strengthening - this is the most important graph, and it clearly shows in order the ETFs/sectors based on their strengthening/weakening performance during the week:

- Strengthened rating (rating change is most important signal)

- Strengthened but not enough to change rating

- Unchanged

- Weakened but not enough to change rating, and

- Weakened rating (rating change is most important signal). - By Type - logically groups the ETFs (for example, interest rate-sensitive, technology-related, consumer-related) for direct comparison with similar ETFs.

- By Strongest to Weakest

- Alphabetically

The remainder of this section uses types 2, 3, and 4 above to show current performance.

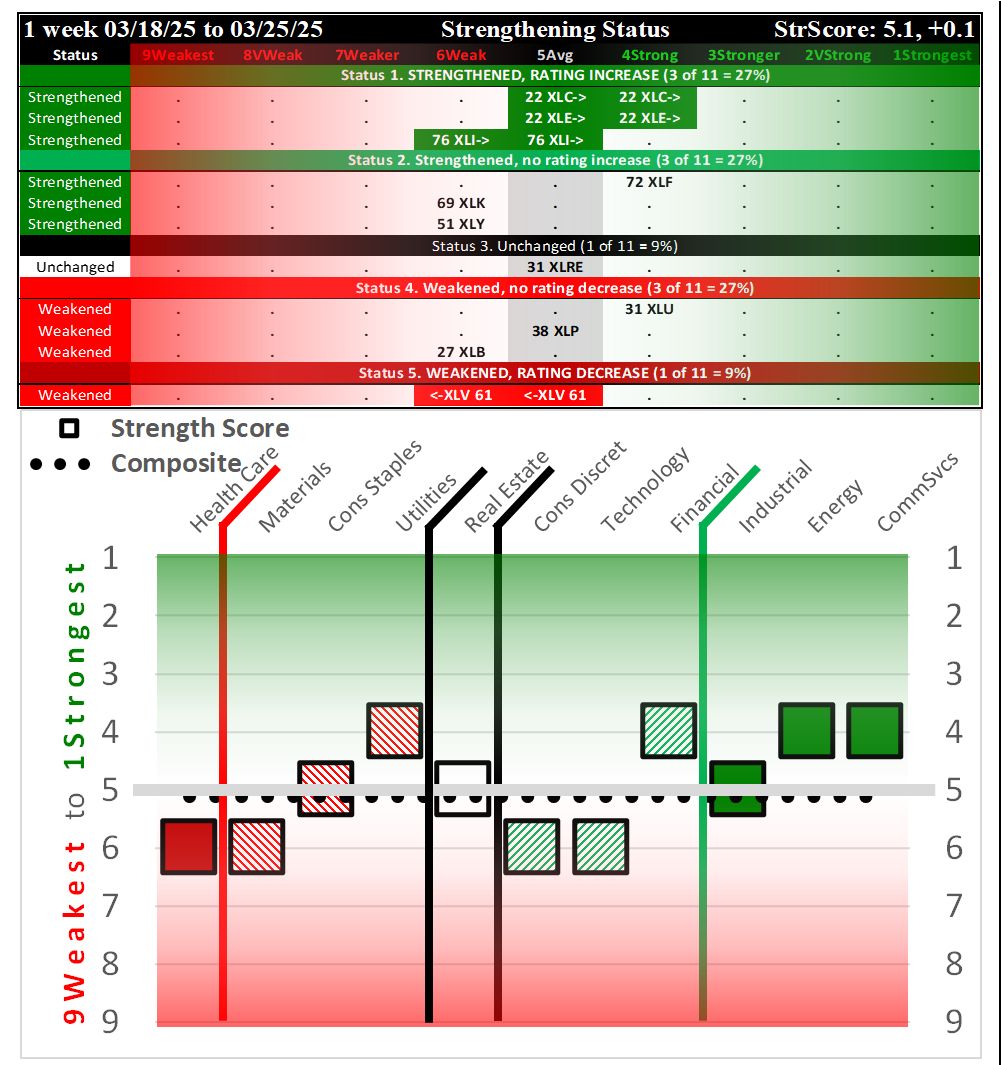

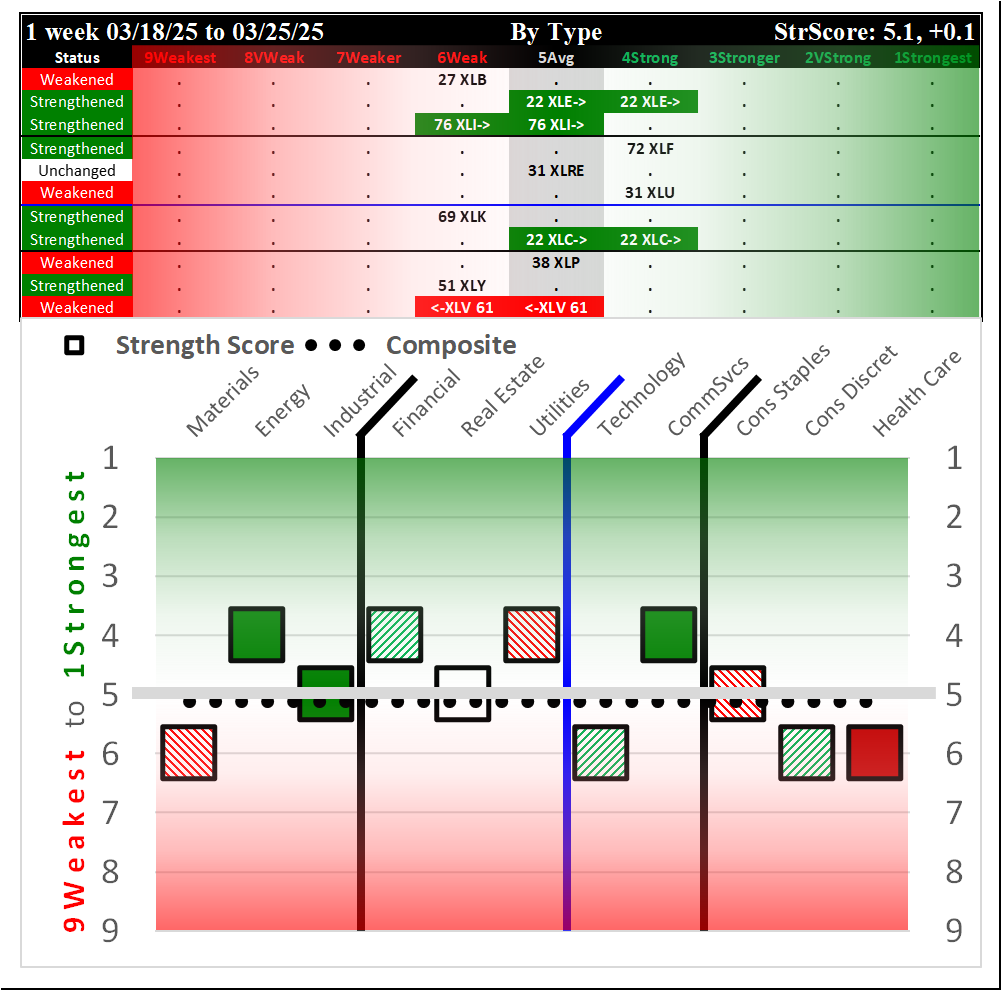

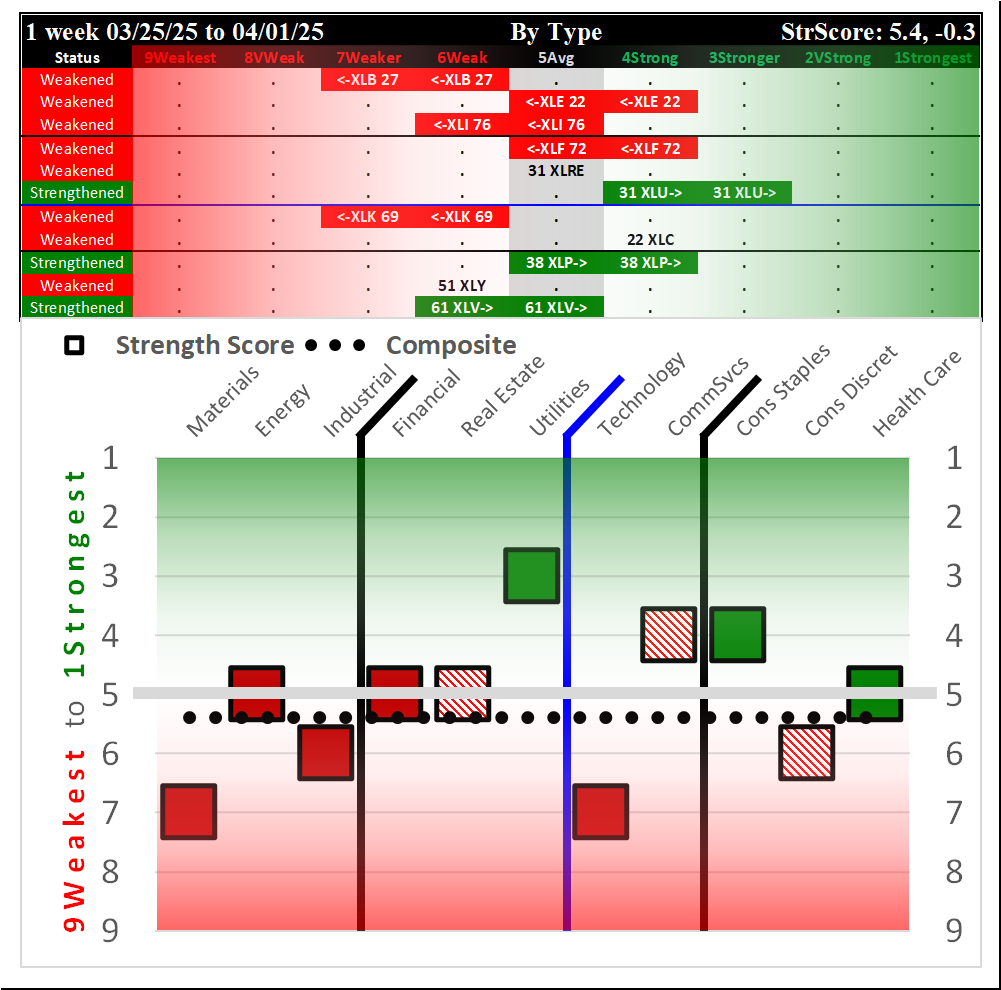

Context: Comparison to Recent Weeks

The following spectrum graphs by ETF Type show recent Tuesday week-to-week changes compared to the current week.

03/25/2025 = Strengthened, 04/01/2025 = Weakened, 04/08/2025 = Weakened.

Current Status: 6.8 Composite Score, Weakened -1.4 this week

The following spectrum graph "Strongest to Weakest" shows the composition of the ETF ratings that comprise the current composite score, in order of Strength Rating. Below that is a "play" chart (somewhat like a football play diagram) which groups the sectors on a graphic for easy review of what sectors are at what strength ratings and what was their path to arriving at these ratings. This is followed by an Alphabetical spectrum graph.

The ETFs are listed below based on their strength rating.

1Strongest

None

2VeryStrong

None

3Stronger

None

4Strong

None

5Average

- XLU/Utilities (WEAKENED 2 RATINGS)

6Weak

- XLC/Communication (WEAKENED 2 RATINGS)

- XLP/Consumer Staples (WEAKENED 2 RATINGS)

6.8 - Composite Score

7Weaker

- XLK/Technology (Weakened)

- XLI/Industrial (WEAKENED RATING)

- XLY/Consumer Discretionary (WEAKENED RATING)

- XLE/Energy (WEAKENED 2 RATINGS)

- XLF/Financial (WEAKENED 2 RATINGS)

- XLRE/Real Estate (WEAKENED 2 RATINGS)

- XLV/Health Care (WEAKENED 2 RATINGS)

8VeryWeak

- XLB/Materials (WEAKENED RATING)

9Weakest

None

IV. Today's Market Context

Indexes and ETFs Weekly Performance

Key Headlines

Marketwatch:

- S&P 500 rebound collapses in biggest U-turn since at least 1978. Investors can’t shake tariff jitters.

- Why Trump’s China tariffs are a ‘Category 5 price storm’ for U.S. consumers

- Where is bitcoin’s bottom? 3 ways Trump’s tariff face-off could shake up the crypto’s price.

- S&P 500 Drops 1.6%, Closes Near Bear Market Territory

The Nasdaq had its worst downturn in over 40 years as the morning rally fizzled. - White House Says Trump Isn't Considering Extensions or Delays; Signals He's Open to Deals

CNBC:

- Trump trade fight: Customs starts collecting new tariffs on imports from 86 countries at midnight

- Dow tumbles more than 300 points Tuesday as tariff-induced sell-off resumes

- Elon Musk ratchets up attacks on Navarro as Tesla shares slump for fourth day

- China says it will ‘fight to the end’ after Trump threatens 50% additional tariffs

- Apple drops 5% as tech, semiconductor stocks fall after market rally fades

Yahoo!:

- Trump's China tariffs send stocks tumbling as 'FOMO' rally fades

- Trump Signs Order to Expand Coal Power, Seeking to Fuel AI Boom

- Bond market swings: Uncertainty amid tariffs & rising yields

- Bill Ackman's public campaign to sway Trump

- US to hike tariffs on China to 104% starting Wednesday

Key Current Readings

SP500: 4,982.77 (5,633.07)

Nasdaq: 15,267.91 (17,449.89)

Nasdaq 100: 17,090.4 (19,436.42)

Russell 2000: 1,760.71 (2,012.24)

10Y Treasury: 4.297% (4.174%)

2YT: 3.732% (3.883%)

Oil (WTI Crude): $58.12 ($70.94)

Bitcoin: $77,102 ($84,436)

Dollar Index: 103 (104.27)

Gold: $2,996.7 ($3,148.1)

VIX: 52.33 (22.29)

(CNBC)

V. Detailed Sector ETF Analysis

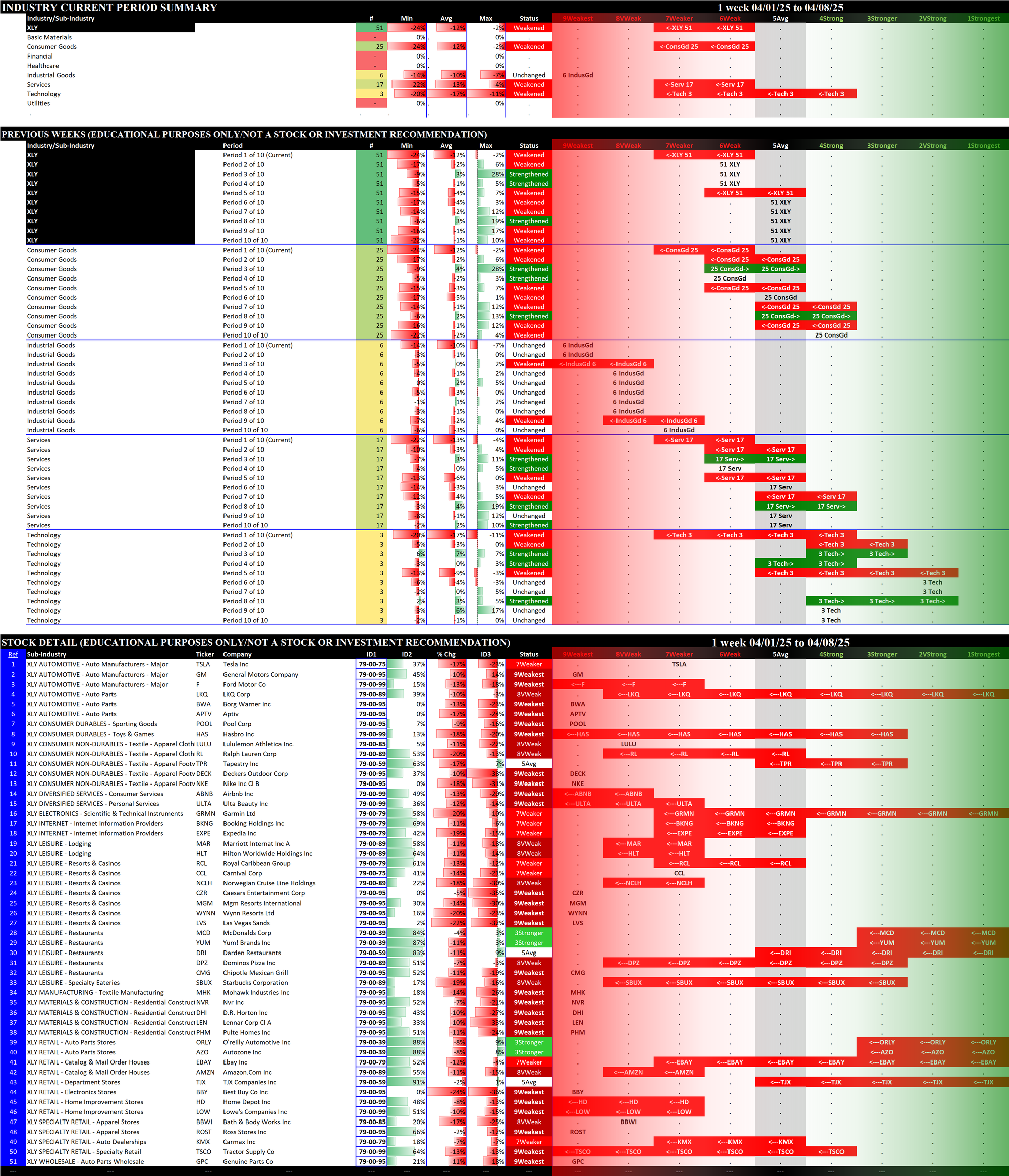

The following Stock Market Organizer strengthening/weakening analysis looks at the 11 SPDR ETFs and their underlying component stocks for the week just ended, as follows:

- ETFs Summaries

1.1 Current: Component Stocks Strength Ratings (1Strongest vs. 9Weakest vs. Ignore Status)

1.2 Current: Component Stocks Positive vs. Negative Weekly Returns

1.3 Historical: 10 Week Ratings by ETF

1.4 Historical: 10 Week Ratings by Week - ETFs Detail

2.1 XLB Materials

2.2 XLC Communications

2.3 XLE Energy

2.4 XLF Financial

2.5 XLI Industrial

2.6 XLK Technology

2.7 XLP Consumer Staples

2.8 XLRE Real Estate

2.9 XLU Utilities

2.10 XLV Health Care

2.11 XLY Consumer Discretionary - Stock Detail (downloads)

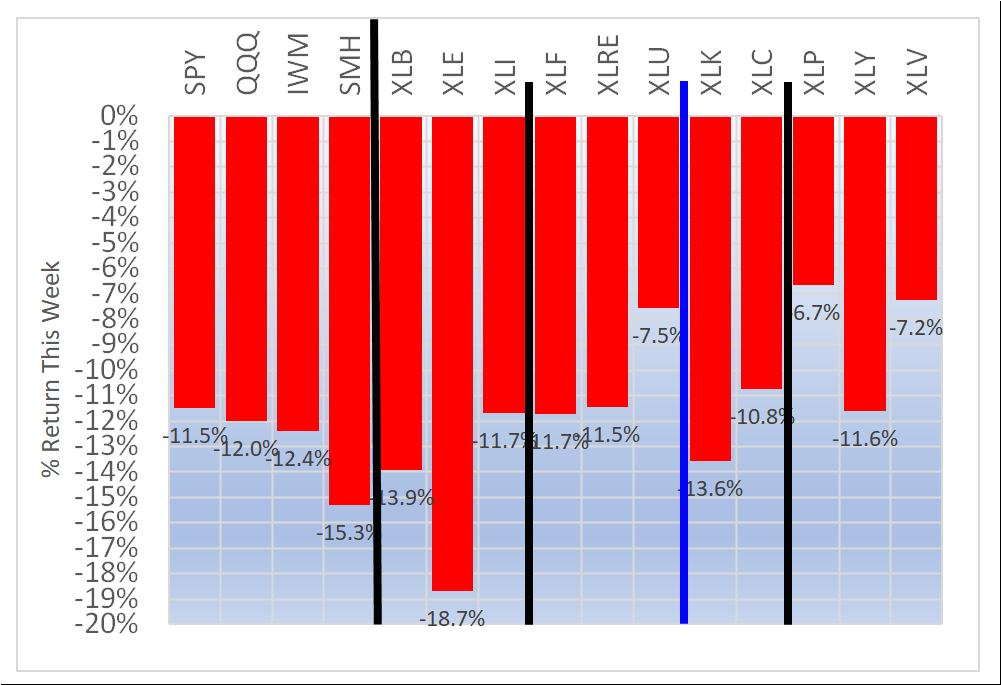

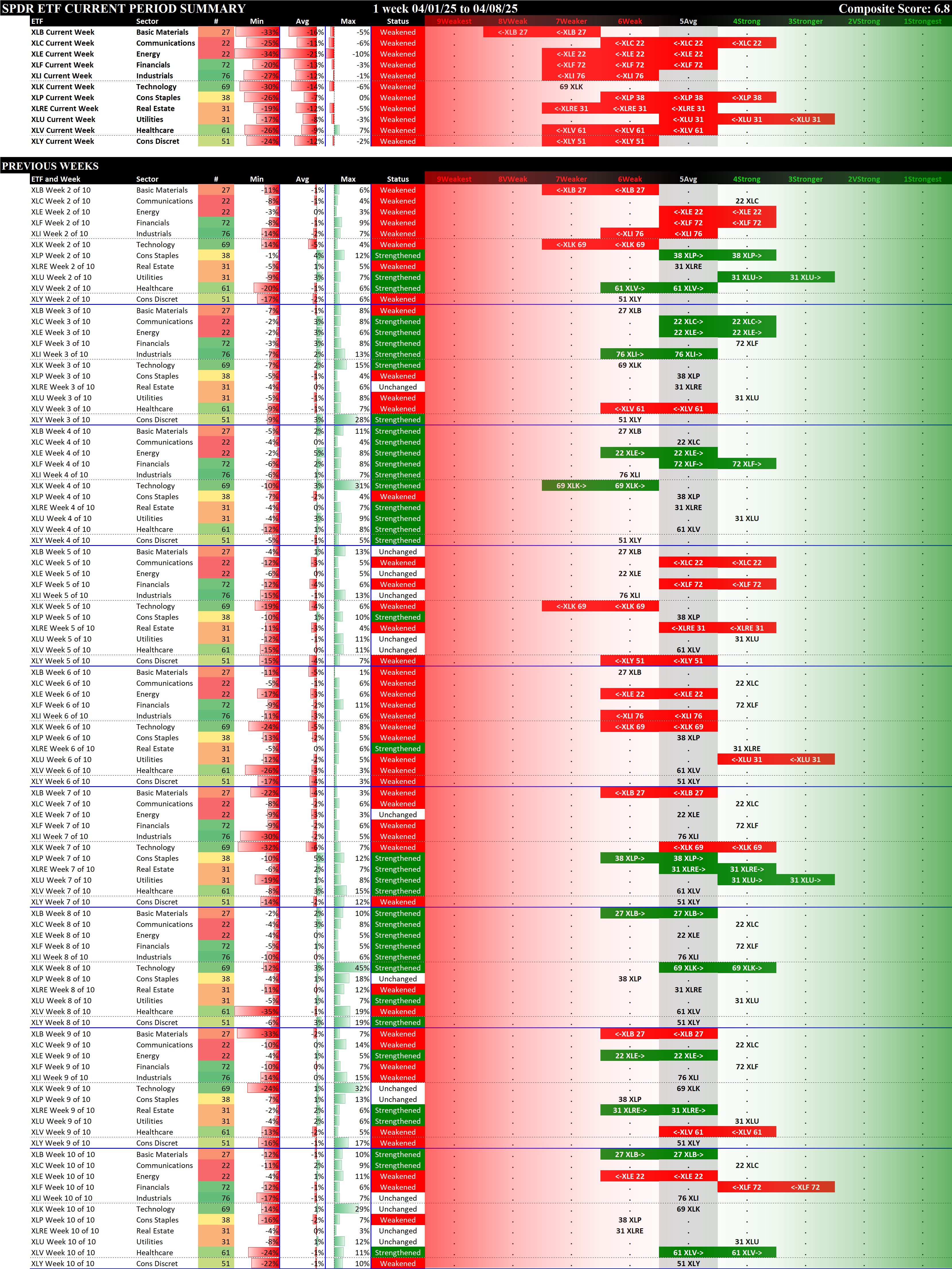

1. ETFs Summaries

1.1 Current: Component Stocks Strength Ratings (1Strongest vs. 9Weakest vs. Ignore Status)

The following graphs reflect the composition of each of the ETFs based on their underlying component stock strength ratings which range from 1Strongest to 9Weakest. I only care about the strongest and weakest in each sector and thus categorize as "Ignore" stocks rated from 2VeryStrong through 8VeryWeak.

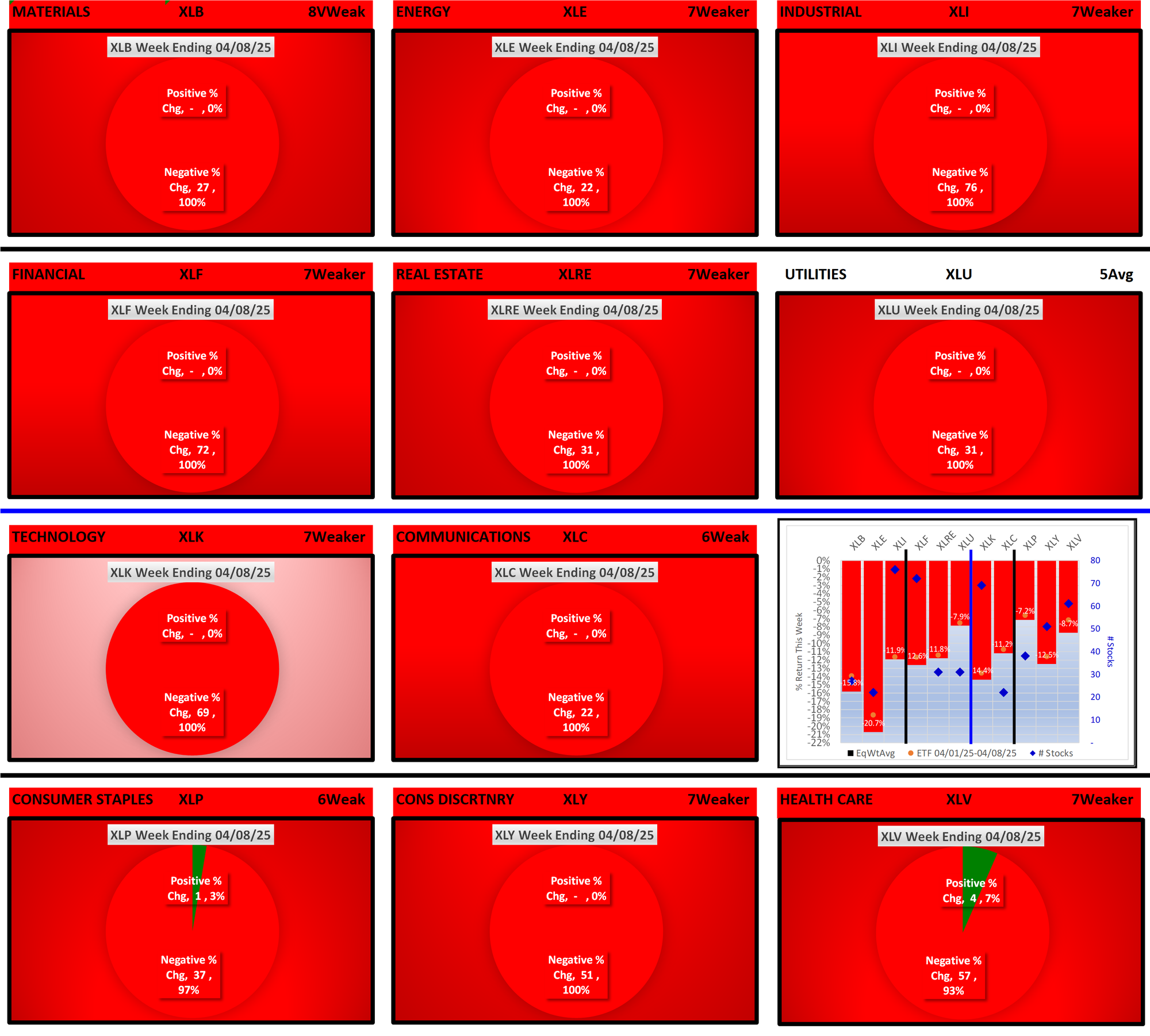

- Top row: XLB/Basic Materials, XLE/Energy, and XLI/Industrial

- Second row: interest rate-sensitive ETFs XLF/Financial, XLRE/Real Estate, and XLU/Utilities

- Third row: XLK/Technology and XLC/Communications

- Bottom row: XLP/Consumer Staples, XLY/Consumer Discretionary, and XLV/Health Care

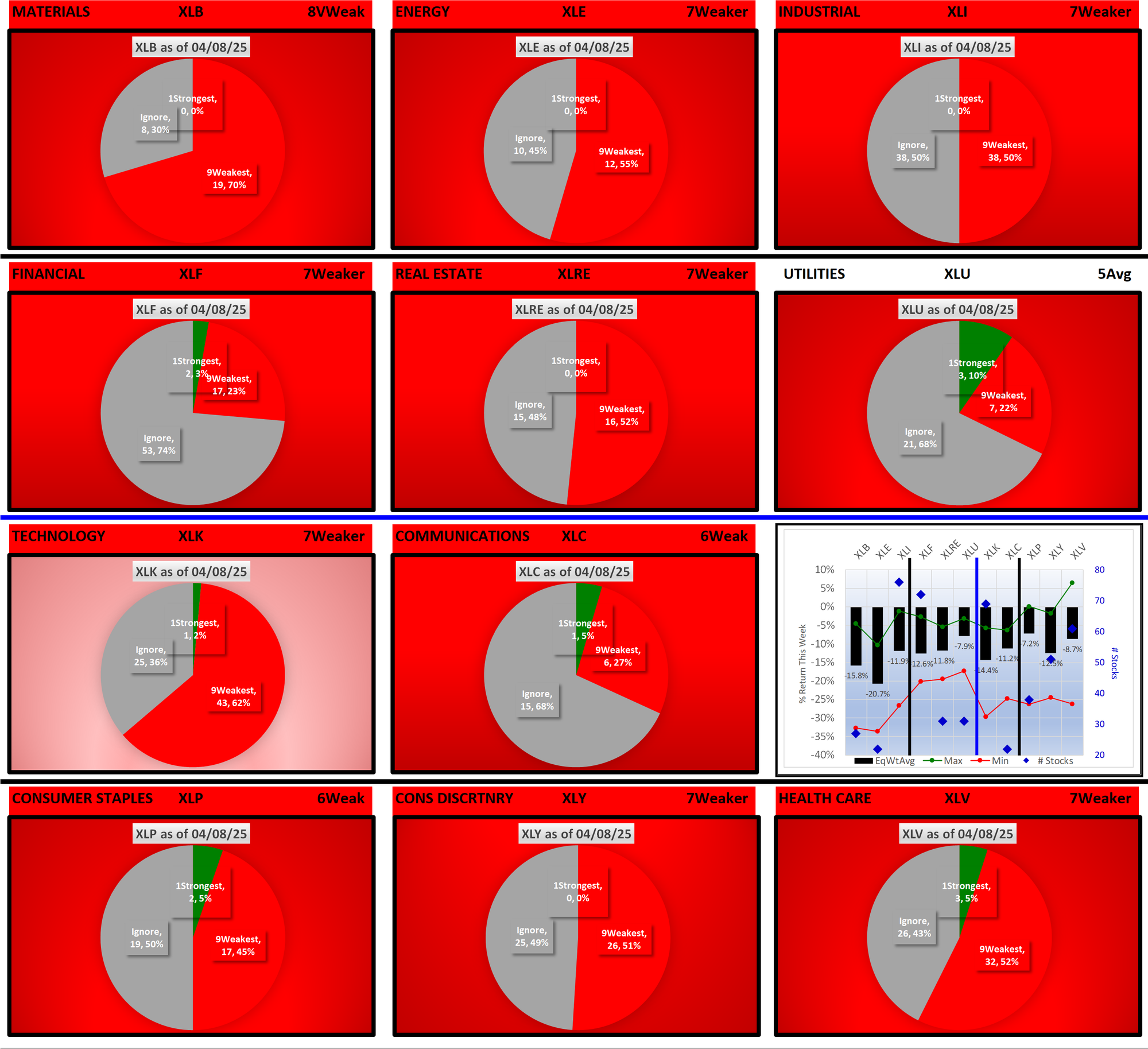

1.2 Current: Component Stocks Positive vs. Negative Weekly Returns

The following pie charts show the breadth of positive and negative returns for the week for the component stocks of each ETF.

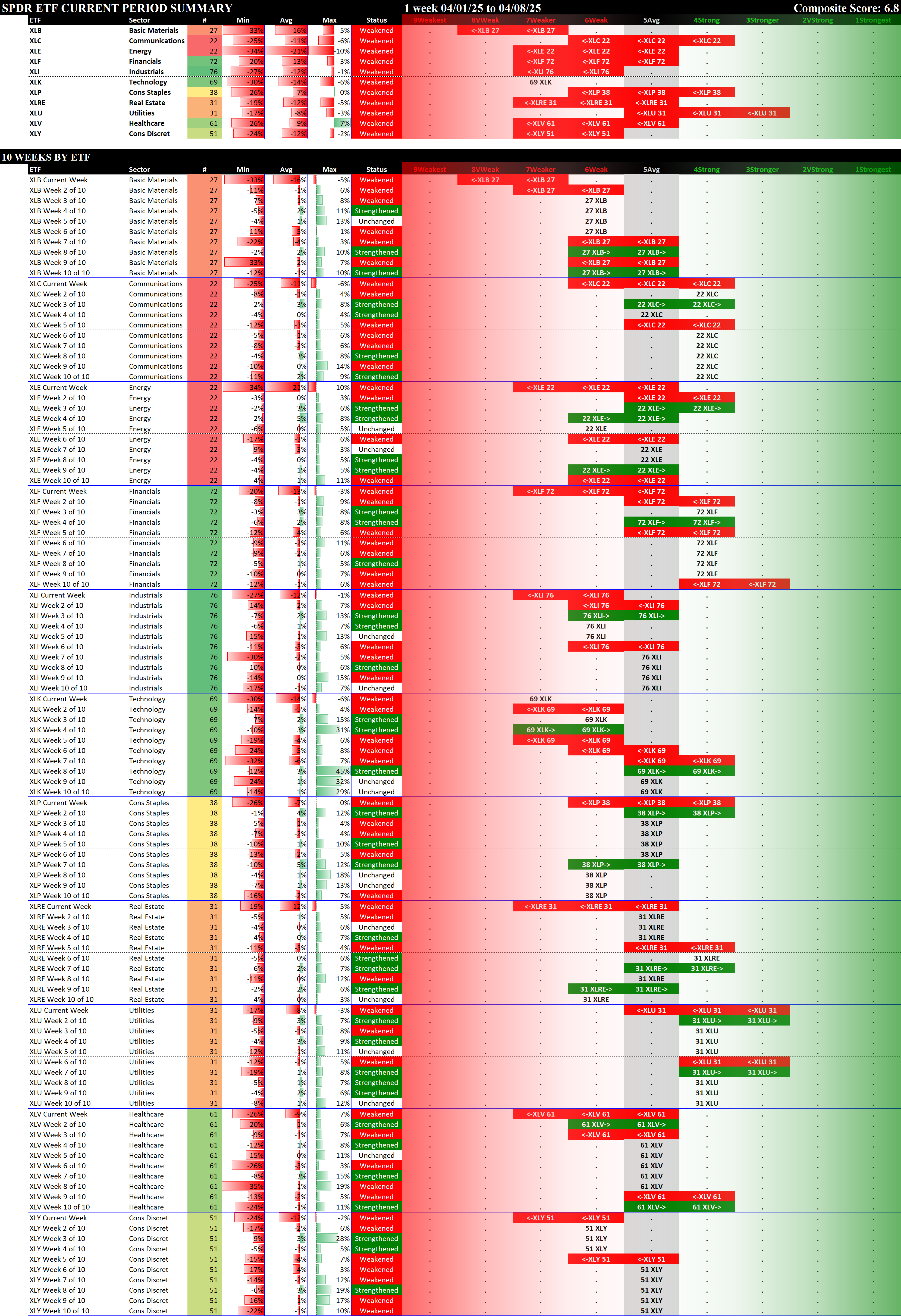

1.3 Historical: 10 Week Ratings by ETF

Below are 10-week historical strength rating summaries of the ETFs, sorted by ETF - each grouping shows the 10-week ratings change for individual ETFs. This shows the path each ETF has taken over the past 10 weeks to arrive at the current strength rating.

1.4 Historical: 10-Week Ratings by Week

Below are 10-week historical strength rating summaries of the ETFs, sorted by week - each grouping shows one week for all 11 ETFs in newest-to-oldest format. This reveals the weekly strengthening/weakening path of all the ETFs.

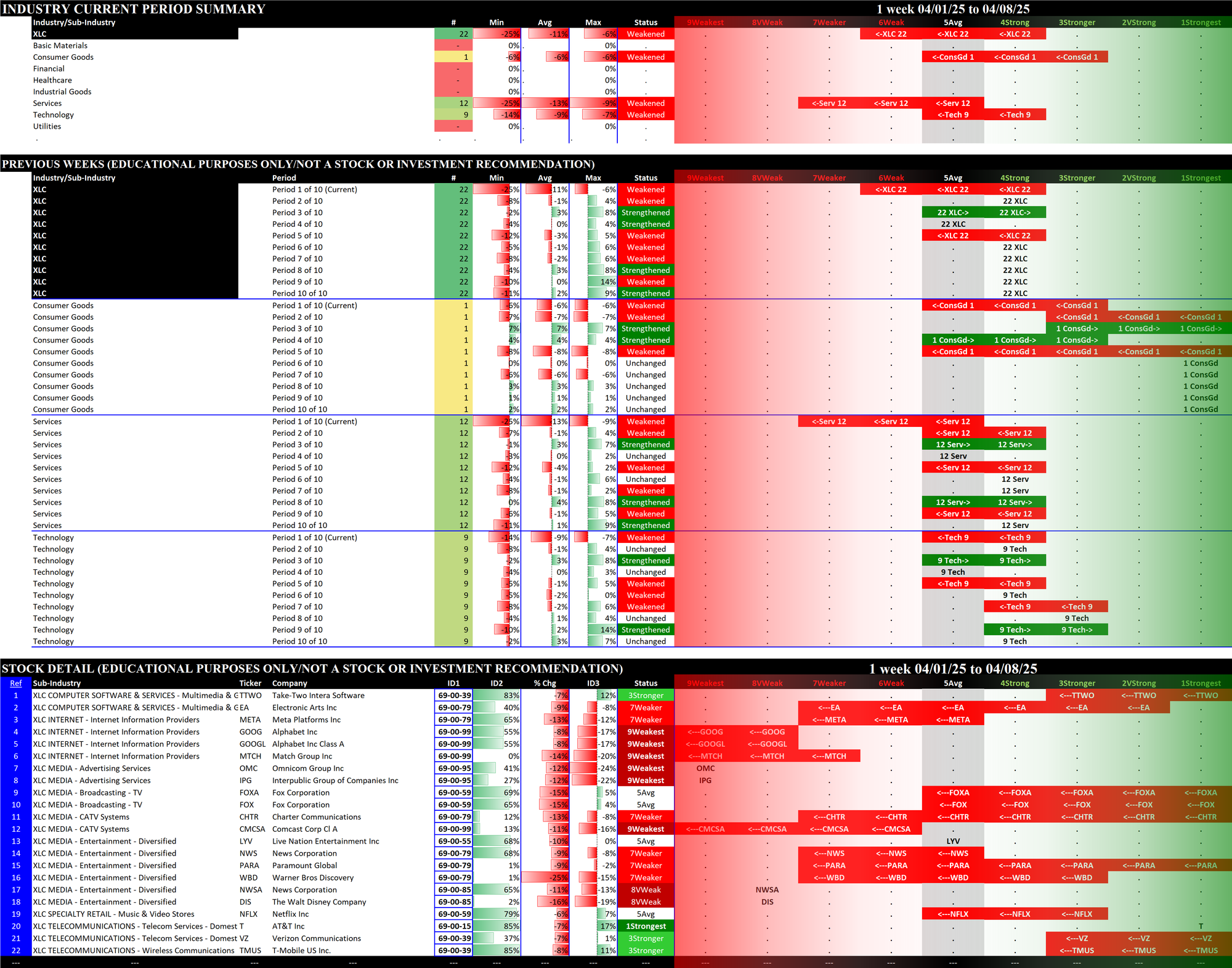

2. ETFs Detail

Details for each of the 11 ETFs are provided below. Comments:

- The top section shows the strength rating of the sectors comprising each ETF, based on the eight original Stock Market Organizer classifications and NOT the 11 ETF classifications. For example, the XLB Basic Materials ETF consists of 19 Basic Materials stocks, 6 Consumer Goods stocks, and 2 Industrial Goods stocks.

- The middle section shows the previous 10 weeks' strengthening and weakening of the relevant sectors. For example, since the XLB has Basic Materials, Consumer Goods, and Industrial Goods stocks, these three sectors are shown in the middle section of the XLB detail. The XLF (Financial) has Financial, Services, and Tech stocks.

- The bottom section shows strengthening/weakening for the underlying ETF component stocks, and includes the listing of their Stock Market Organizer industries and sub-industries. These stocks are listed in order based on Sub-industry then strongest to weakest comparative stock strength rating. The Basic Materials XLB ETF includes both Newmont Corporation/NEM in the Gold sub-industry within the Metals & Mining industry and Dow Inc./DOW in the Specialty Chemicals sub-industry within the Chemicals industry.

In these bottom sections, one can visually see the strength/strengthening and weakness/weakening of the component stocks in each ETF.

2.1 XLB Materials (27 stocks, small), WEAKENED RATING TO 8VWeak = WORST

2.2 XLC Communication Services (22 stocks, small), WEAKENED 2 RATINGS TO 6Weak

2.3 XLE Energy (22 stocks, small), WEAKENED 2 RATINGS TO 7Weaker

2.4 XLF Financial (72 stocks, large), WEAKENED 2 RATINGS TO 7Weaker

2.5 XLI Industrial (76 stocks, large), WEAKENED RATING TO 7Weaker

2.6 XLK Technology (69 stocks, large), Weakened at 7Weaker

2.7 XLP Consumer Staples (38 stocks, mid-sized), WEAKENED 2 RATINGS TO 6Weak

2.8 XLRE Real Estate (31 stocks, small/mid-sized), WEAKENED 2 RATINGS TO 7Weaker

2.9 XLU Utilities (31 stocks, small/mid-sized), WEAKENED 2 RATINGS TO 5Avg = BEST

2.10 XLV Health Care (61 stocks, large), WEAKENED 2 RATINGS TO 7Weaker

2.11 XLY Consumer Discretionary (51 stocks, mid-sized/large), WEAKENED RATING TO 7Weaker

3. Stock Detail

The downloadable PDF below lists all component stocks in order of first Strongest to Weakest ETF and second Strongest to Weakest Stock. The difference between this report and the 11 ETF stock listings above is this report consolidates all component stocks whereas the above listings are segregated by ETF.

Download the following Excel file if you are interested in sorting results yourself.