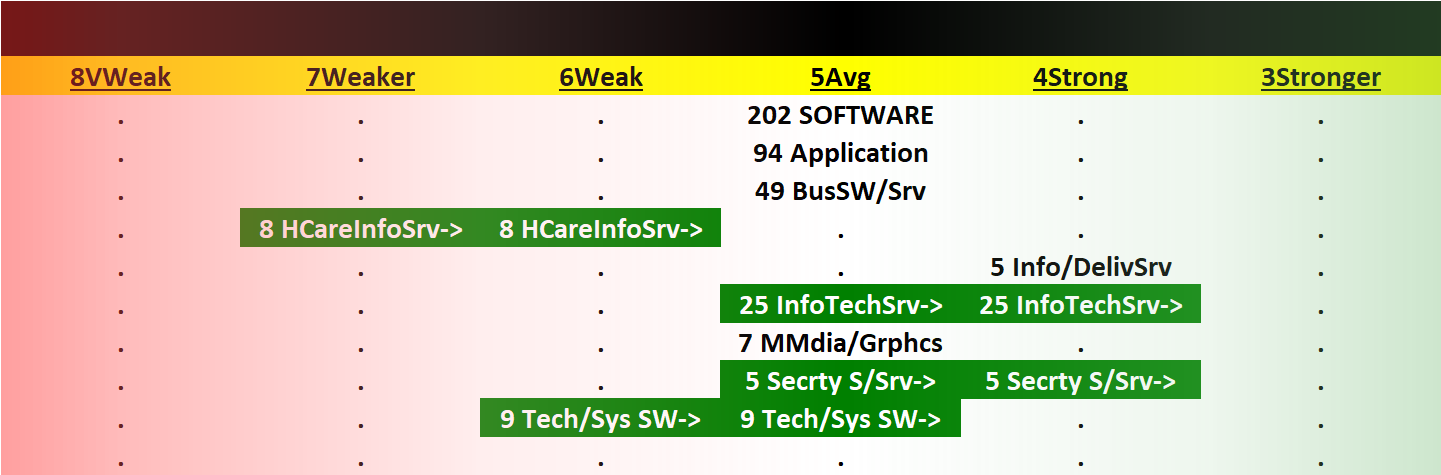

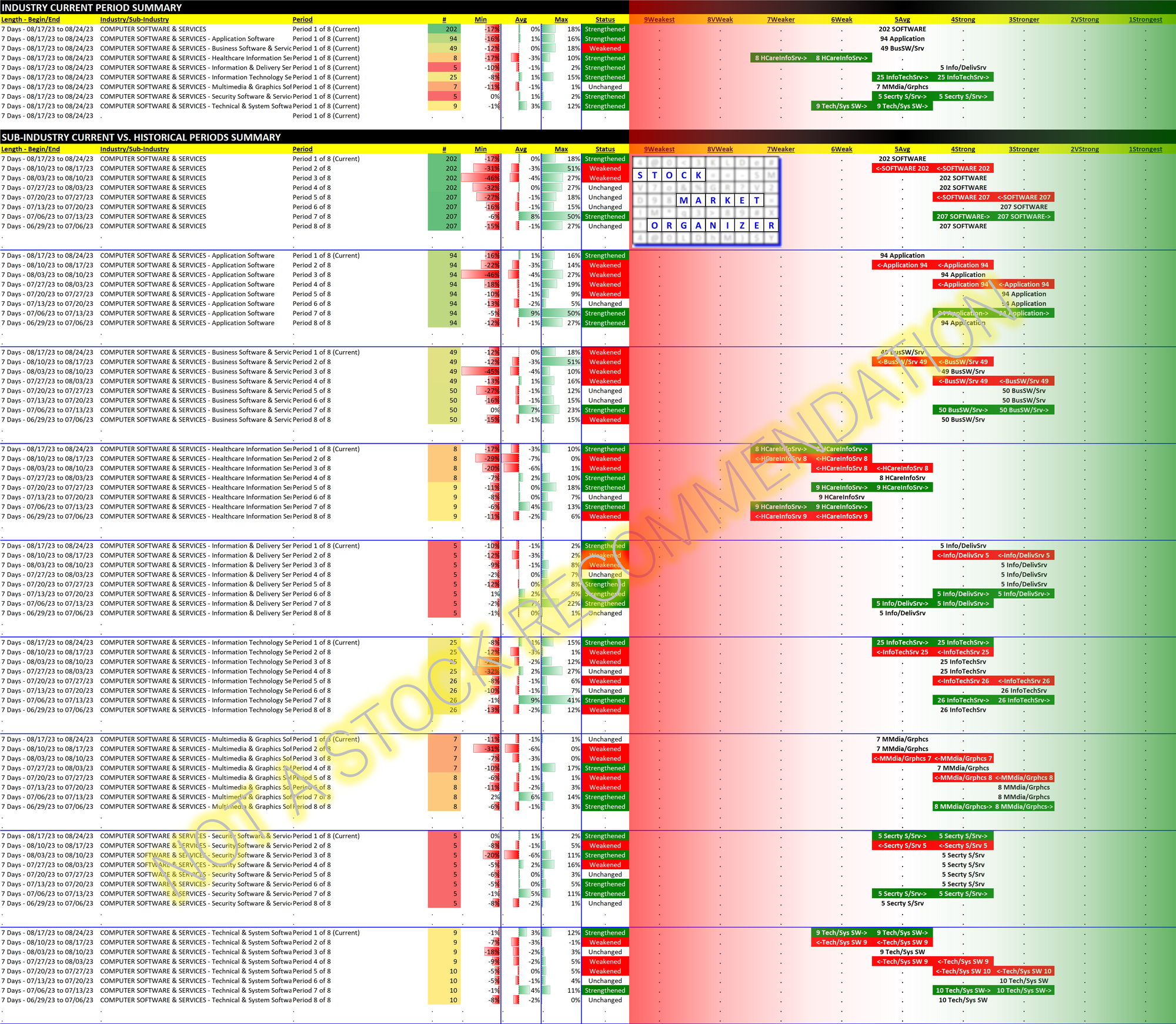

Software 2023-08-24: Unchanged at "AVERAGE" strength rating (5th strongest of 9 levels), previous move was DOWN

Previous review of Software on August 17, 2023 is available here.

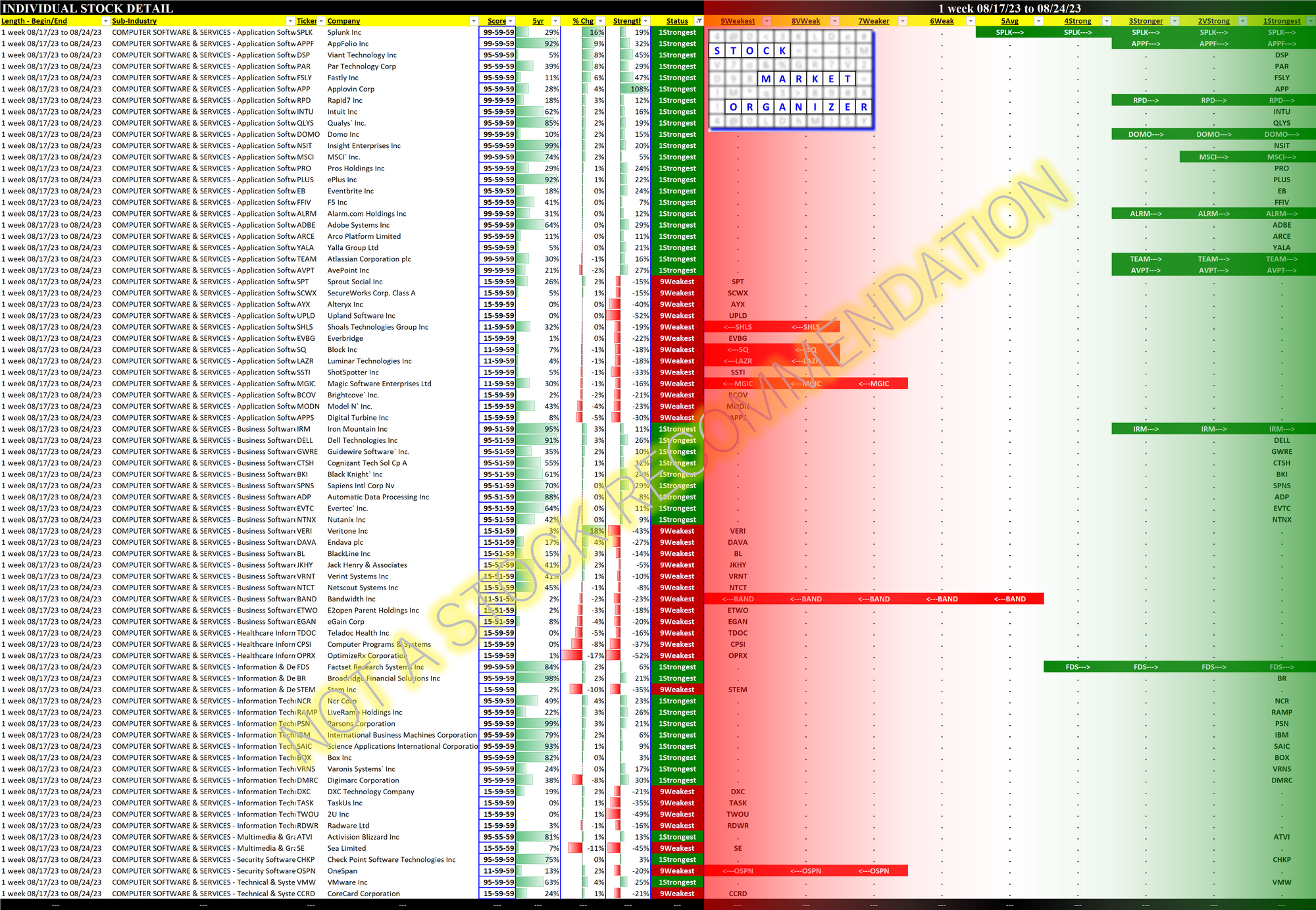

Perhaps surprisingly given the overall market in recent weeks, its own recent weakening, and today's broad weakness in the face of NVDA/Nvidia's stellar earnings report, Computer Software & Services turned in a decent week with 4 strengthening sub-industries.

For the week, a little more than half of the industry's stocks finished in the green. The leader was VERI/Veritone Inc., a small stock which was +18%, followed by SPLK/Splunk Inc. which was +16% including today's +13% (despite the down market).

SPLK beat and guided upward and had a strong day. NVDA crushed it and had a middling day - better than the market but that's not saying much. MRVL/Marvell Technology did well and got smacked.

Motley Fool on SPLK: "Splunk delivered a strong beat-and-raise performance for its fiscal second quarter"

Bloomberg on NVDA: "Nvidia Posts Blowout Quarter, But Market Rout Quashes Rally"

Barron's on MRVL: "Marvell Technology Reports Solid Earnings. Investors Seem Disappointed"

Does anyone still think that what is reported really matters, or is it more about what the market thinks about what is reported?

If the latter, then why not focus on what the market thinks, rather than what is reported?

(Spoiler alert: that is exactly what I do.)

On the downside, RIOT/Riot Platforms continued its slide, -12% for the week and -7% just today. RIOT is -49% from its July 13 peak. 7/13/23 close: $20.29. 8/24/23 close: $10.36.

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.