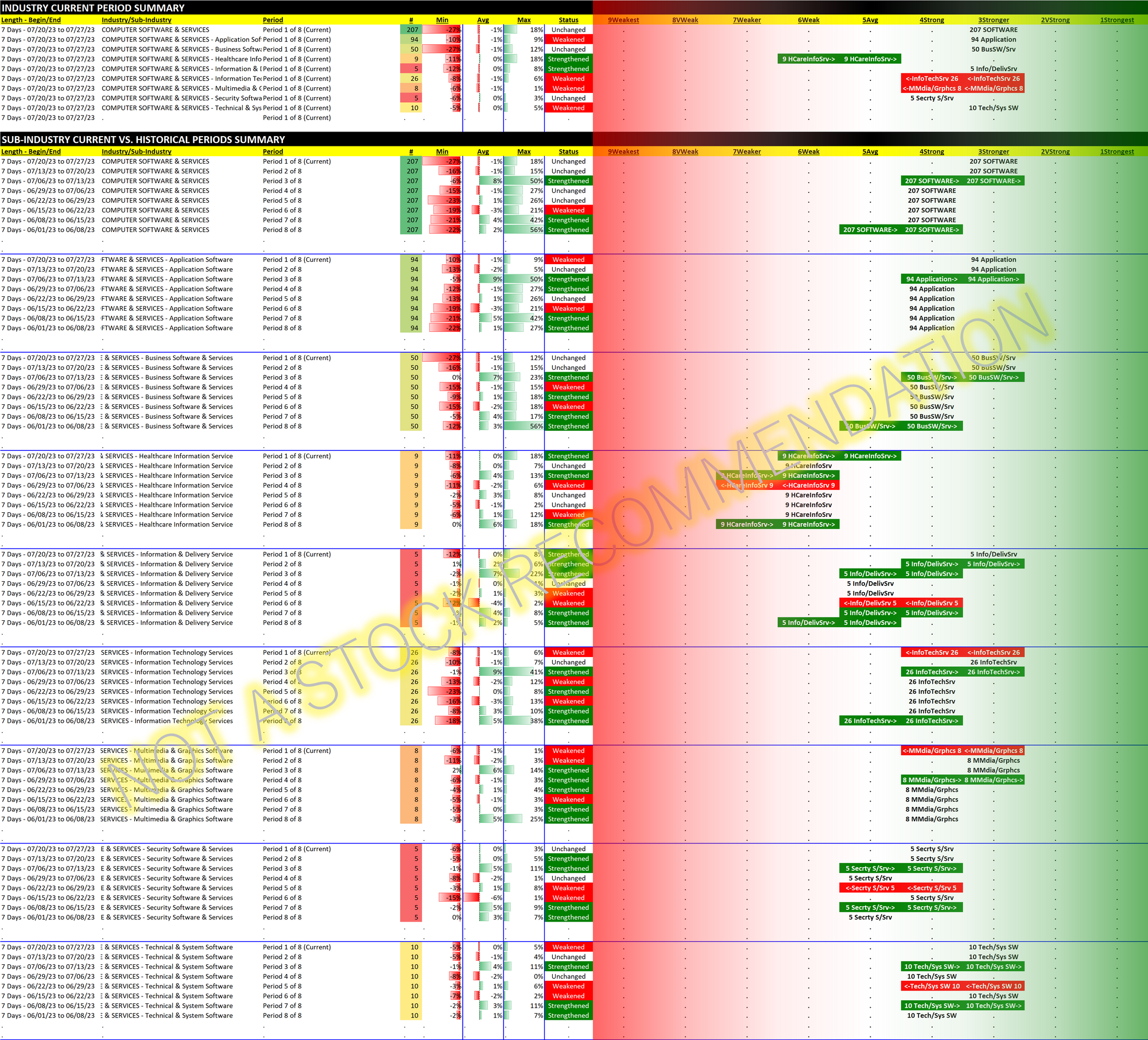

Software 2023-07-27: Unchanged at "Stronger" strength rating (3rd strongest of 9 levels), previous move was up

Here is my last look at Software.

Software has been strengthening over the past 8 weeks, though it has been flat for the past two. Last time I focused on RIOT/Riot Platforms which had "...popped 50% in one week AFTER a nearly 300% YTD gain."

This RIOT gain is reminiscent of several recent events involving CVNA/Carvana (up 884% before a one day 40% pop, noted here), NVDA/Nvidia (as noted here, "Through May 24, 2023 it increased 109% for the year. It then jumped 24% in one day, and has soldiered on to another 20% gain in the subsequent two months"), and as of 7/28/23, BZH/Beazer Homes which has more than doubled YTD and which popped 27% today. Yes that is a homebuilder exhibiting crazy behavior.

Illustrating that - it cannot be emphasized enough - this is far from foolproof, RIOT has declined by 13% from that (so far) short term top. Perhaps this could be forgiven given a 50% one-week gain. My point is that meaningful uptrends and downtrends take time, and just because a stock has enjoyed a strong run does not automatically mean it is fated to be a delicious, meaty short.

Such a stock could simply go sideways for a while, representing dead money as other stocks rise. It could also - as noted above for CVNA, NVDA, and BZH - continue to rise, and taunt those not on board by tossing out mystifying pops to confuse everyone involved.

I am under no illusion there are fundamental reasons for this price movement. BZH did not change overnight before its 27% pop. While it would not necessarily be wise to jump on board a train after such a move, to ignore this facet of market activity would certainly be a mistake. If only to prevent one from seeking to short such a stock.

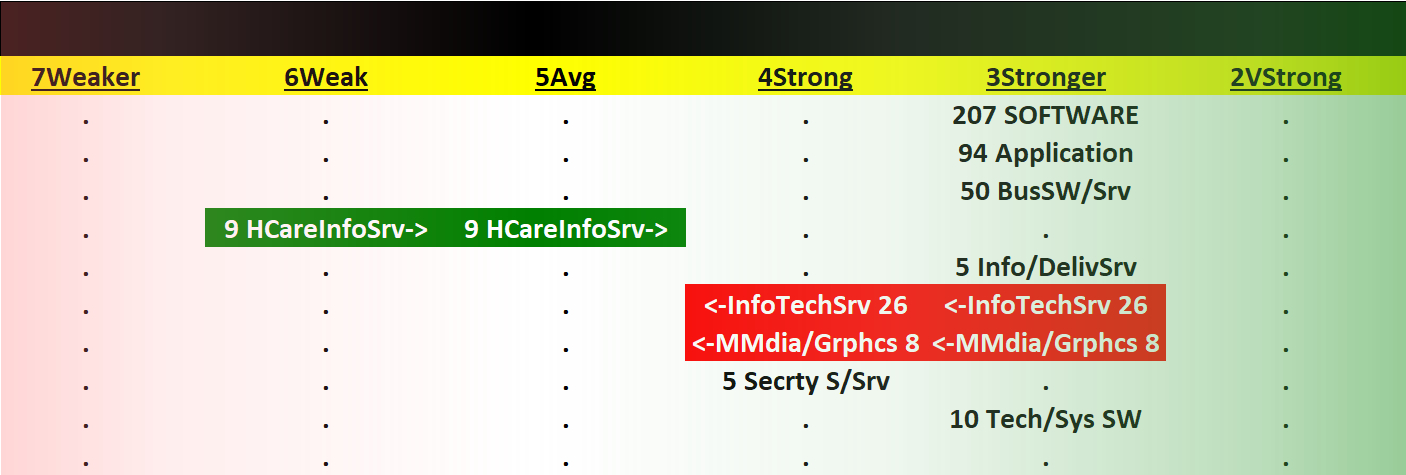

Back to Computer Software and Services, below is a detailed look at the past 8 weeks for the industry and its sub-industries:

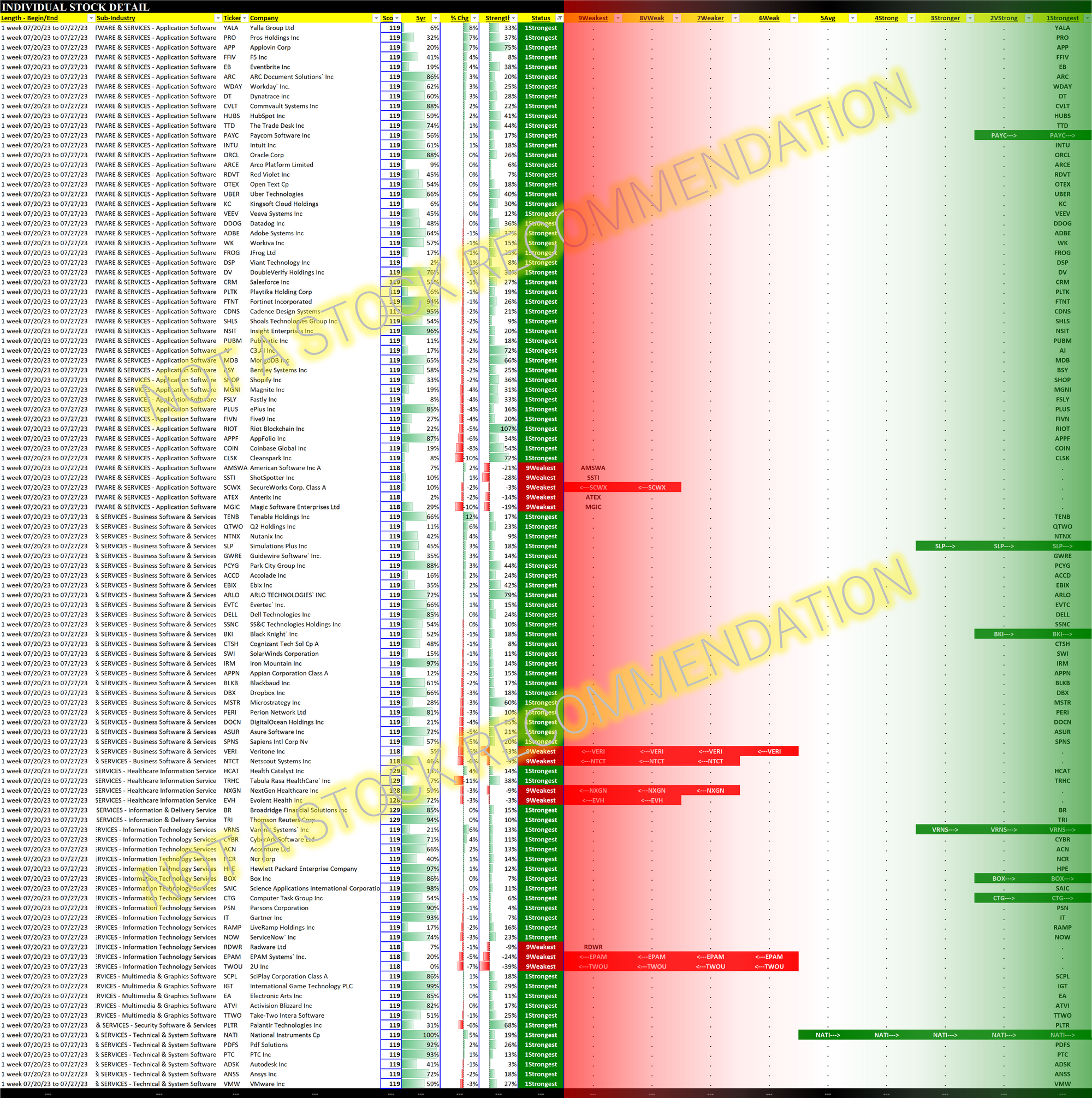

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.