SMO Exclusive: U.S. Stock Market Strength Report 2024-08-09 (no new Longs)

Down/up week summarized in the attached Stock Market Organizer U.S. market strength report as of/for the week ending 8/9/24. This report:

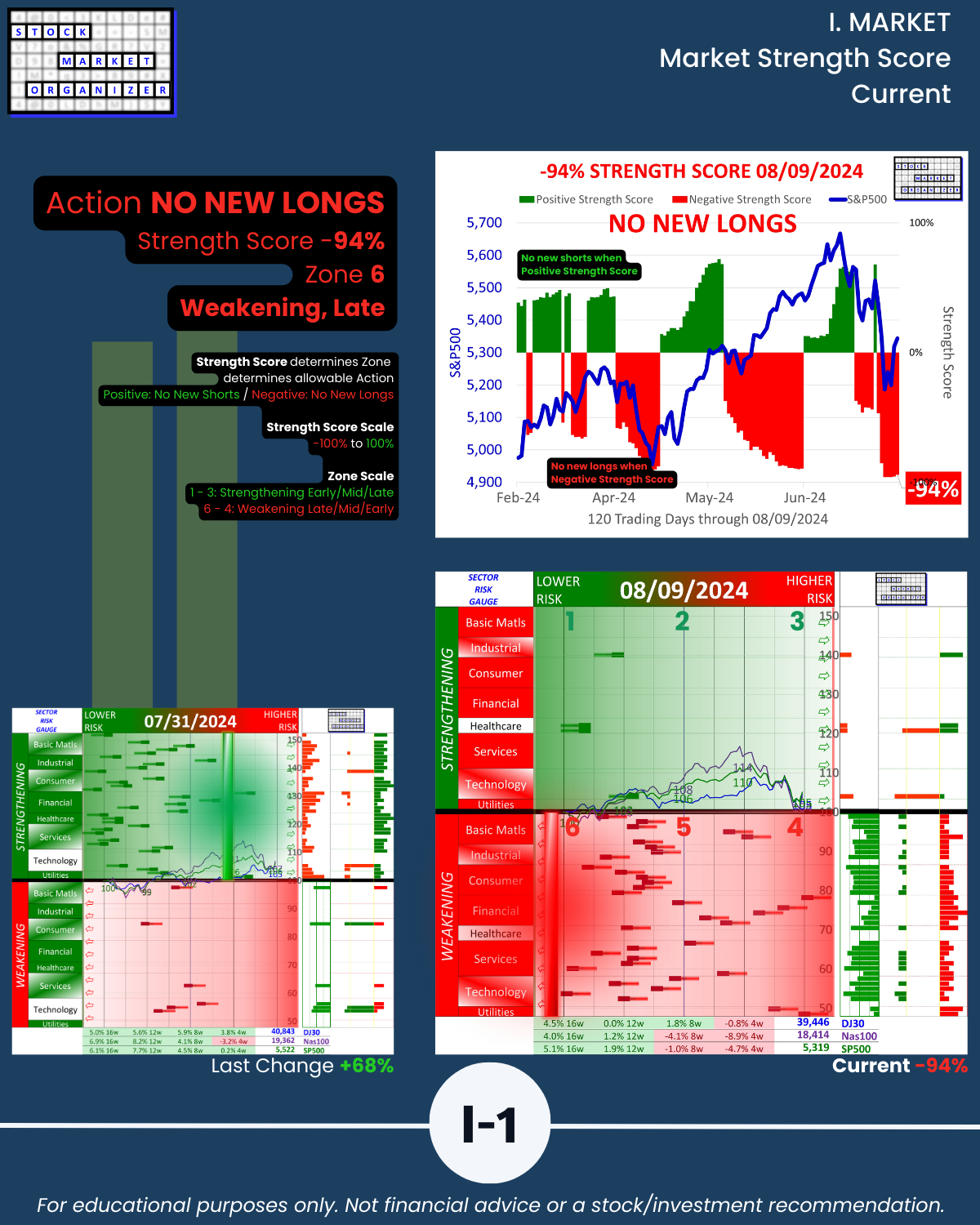

🔹 tells you what is, not what will be (-94% Market Strength Score = No New Longs)

🔹 graphically depicts strengthening and weakening at the market, sector/industry group, industry, sub-industry, and stock levels

🔹 reveals whether the rubber band is overly stretched in either direction (weighted average Market Strength Rating is 4.6 on a scale of 1/Strongest to 9/Weakest, no change from last Friday 8/2/24)

Special highlight:

- See page I-1 for a unique top-down perspective

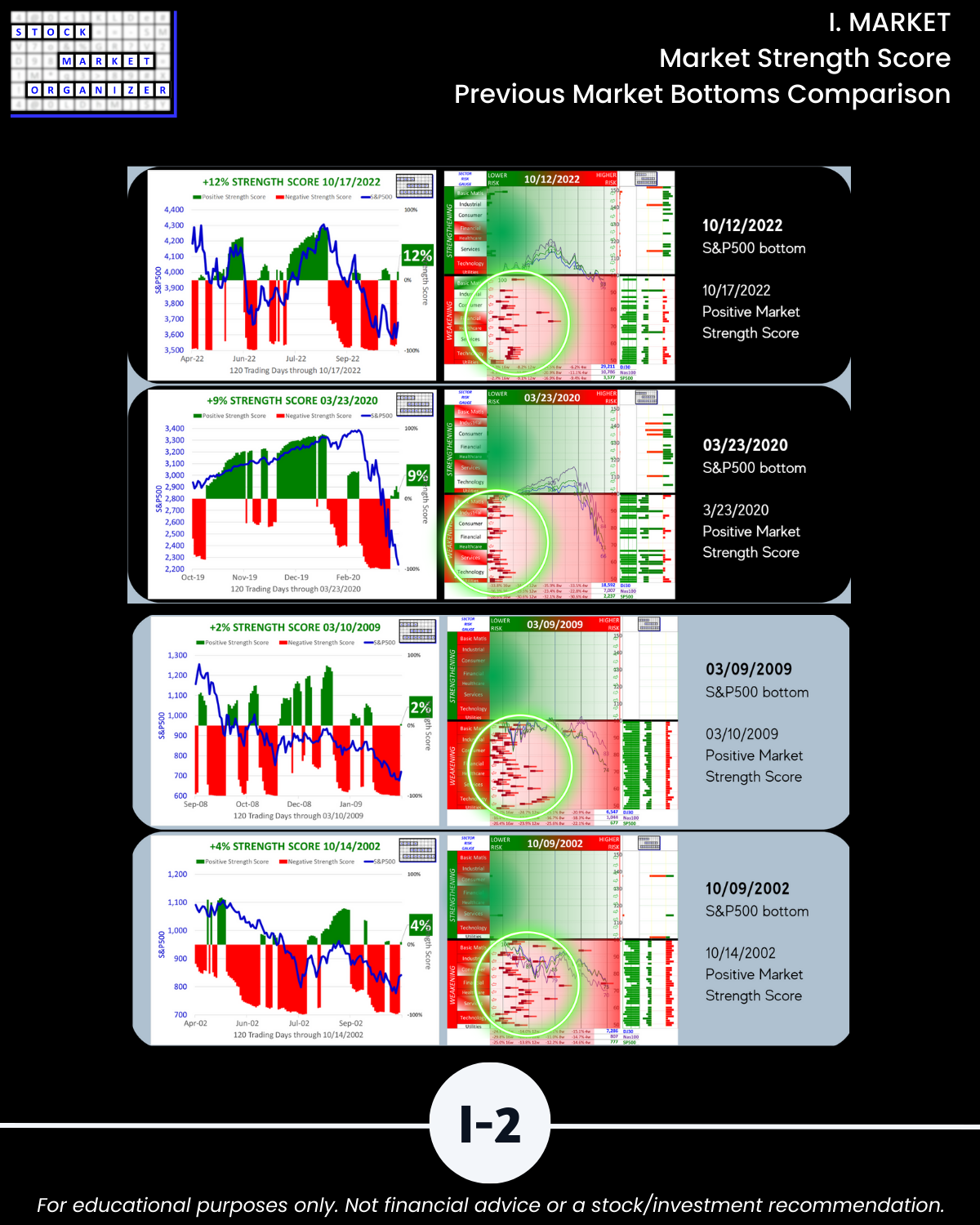

- See page I-2 for a look at previous bottoms through this top-down perspective

- Though not fool-proof this “Sector Risk Gauge” perspective gives unique and objective insight into how far downward the market is stretched.

Current Stats

- Market Strength Score: -94%, no new Longs

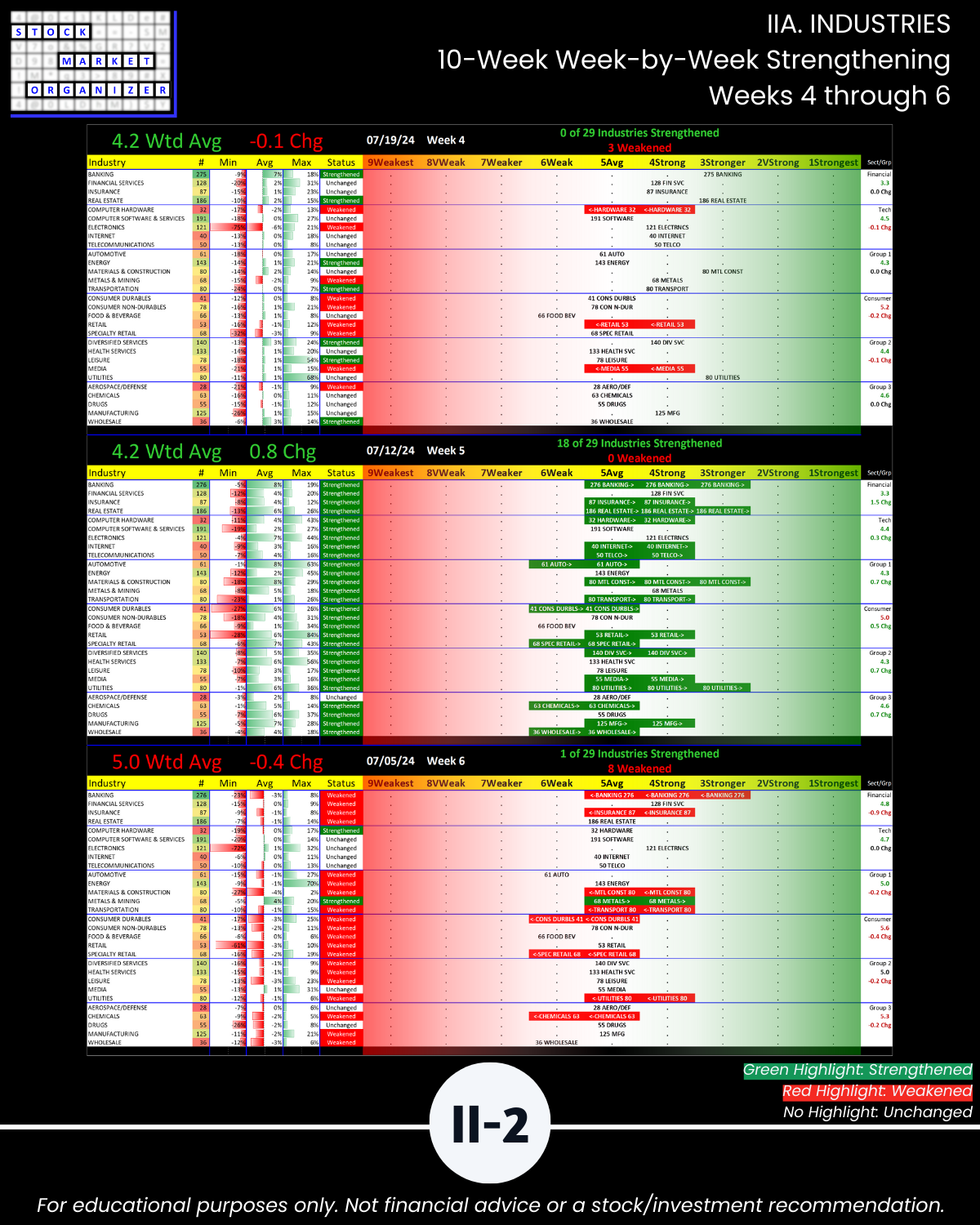

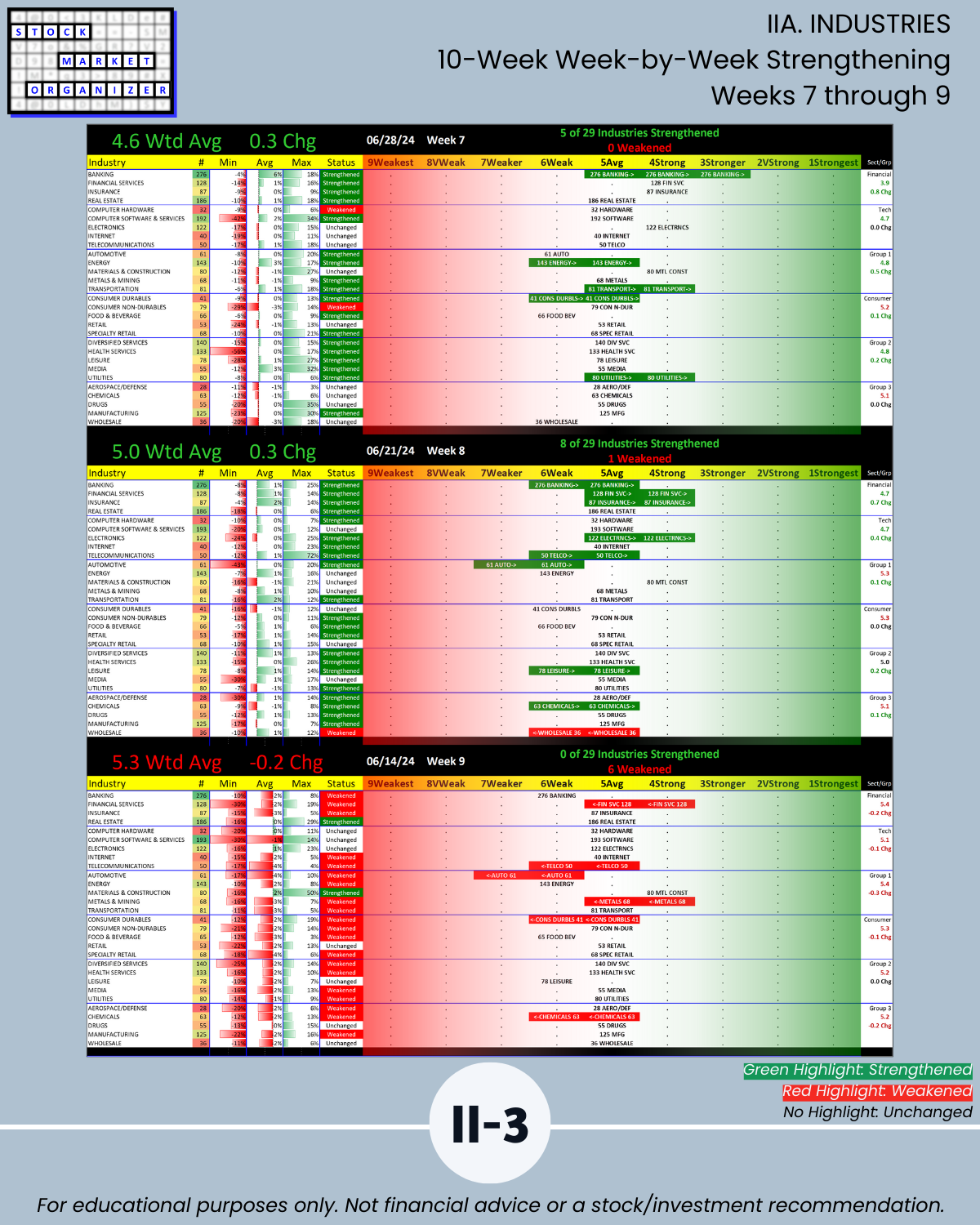

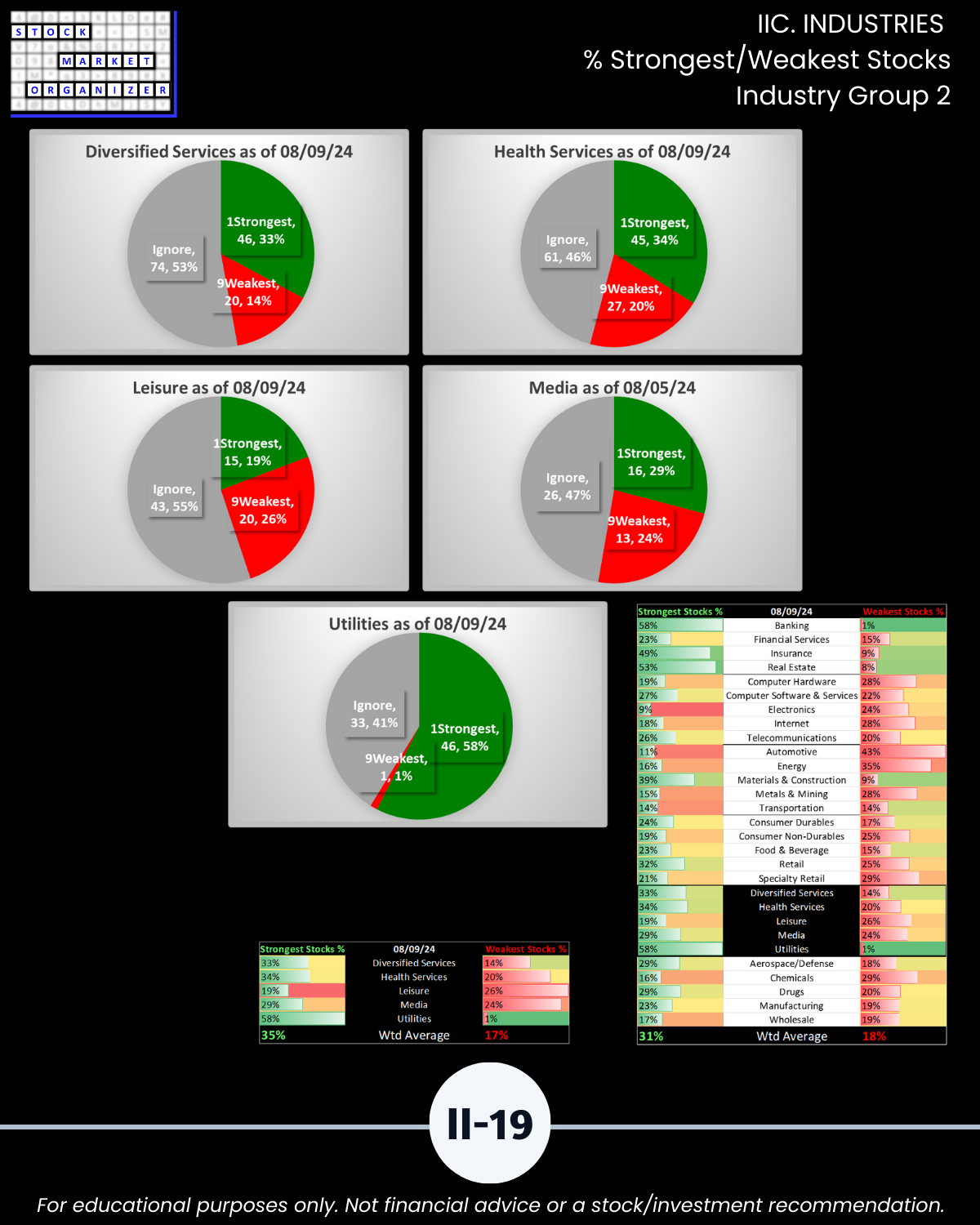

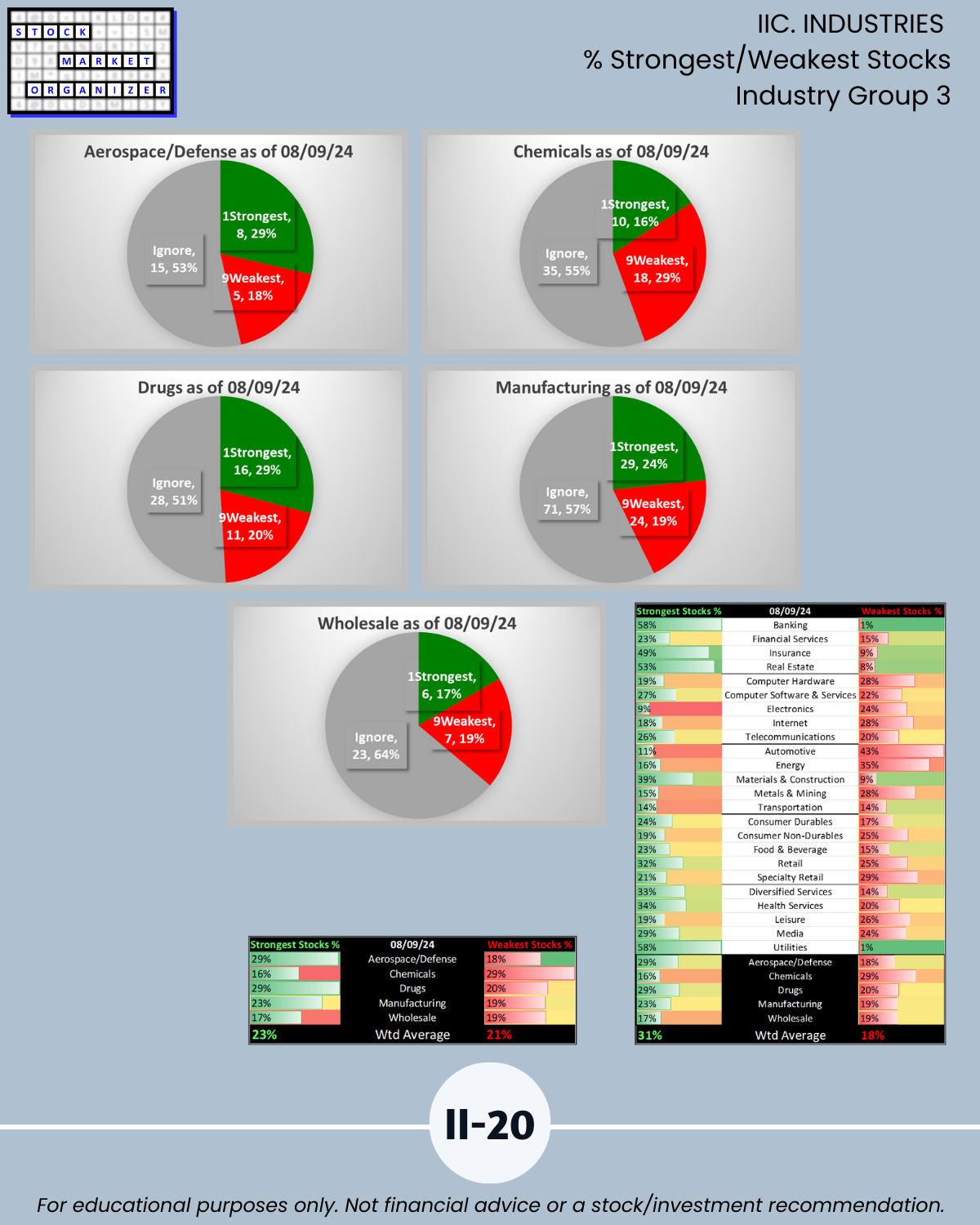

- 2 of 29 industry rankings strengthened, 2 weakened/Section II

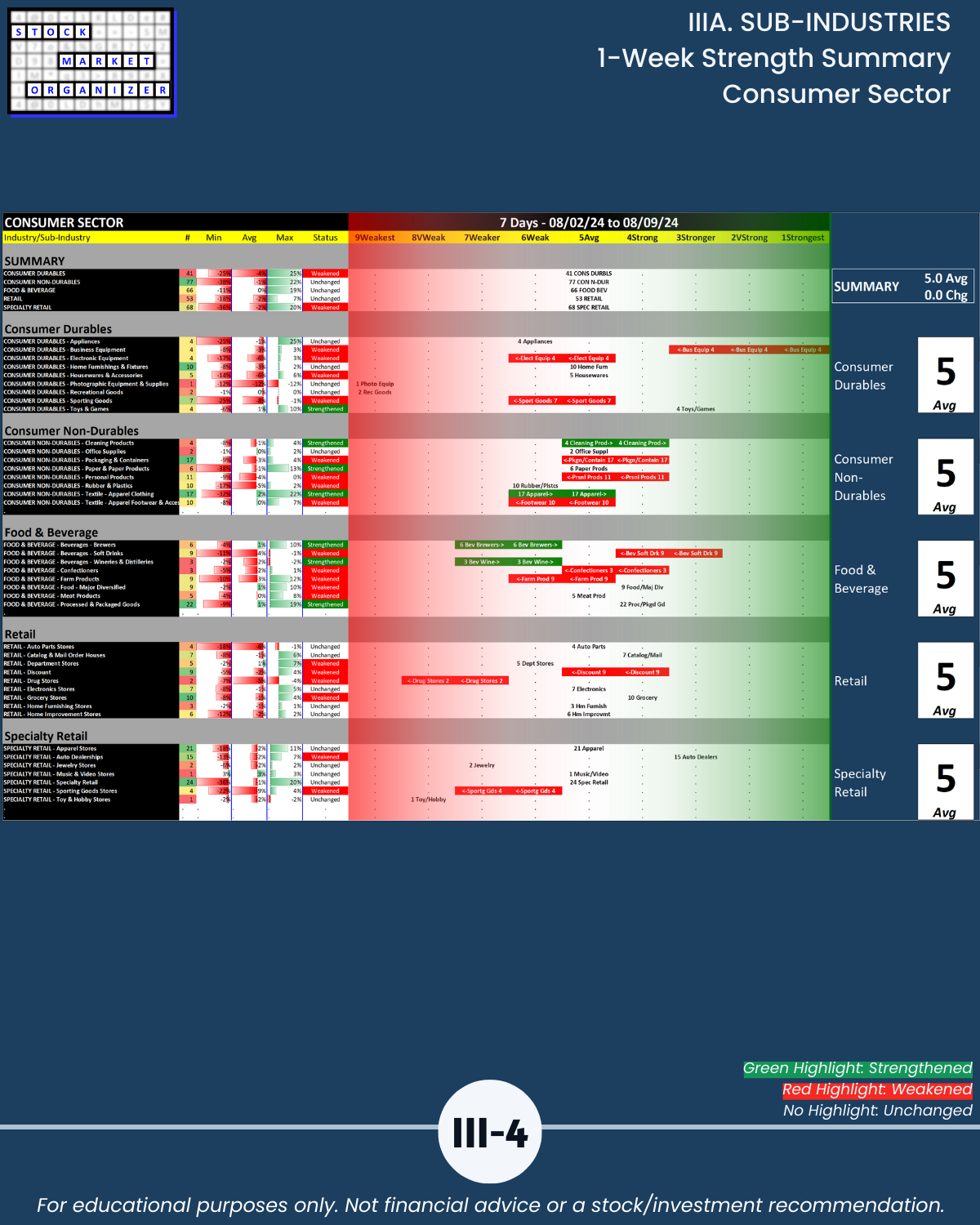

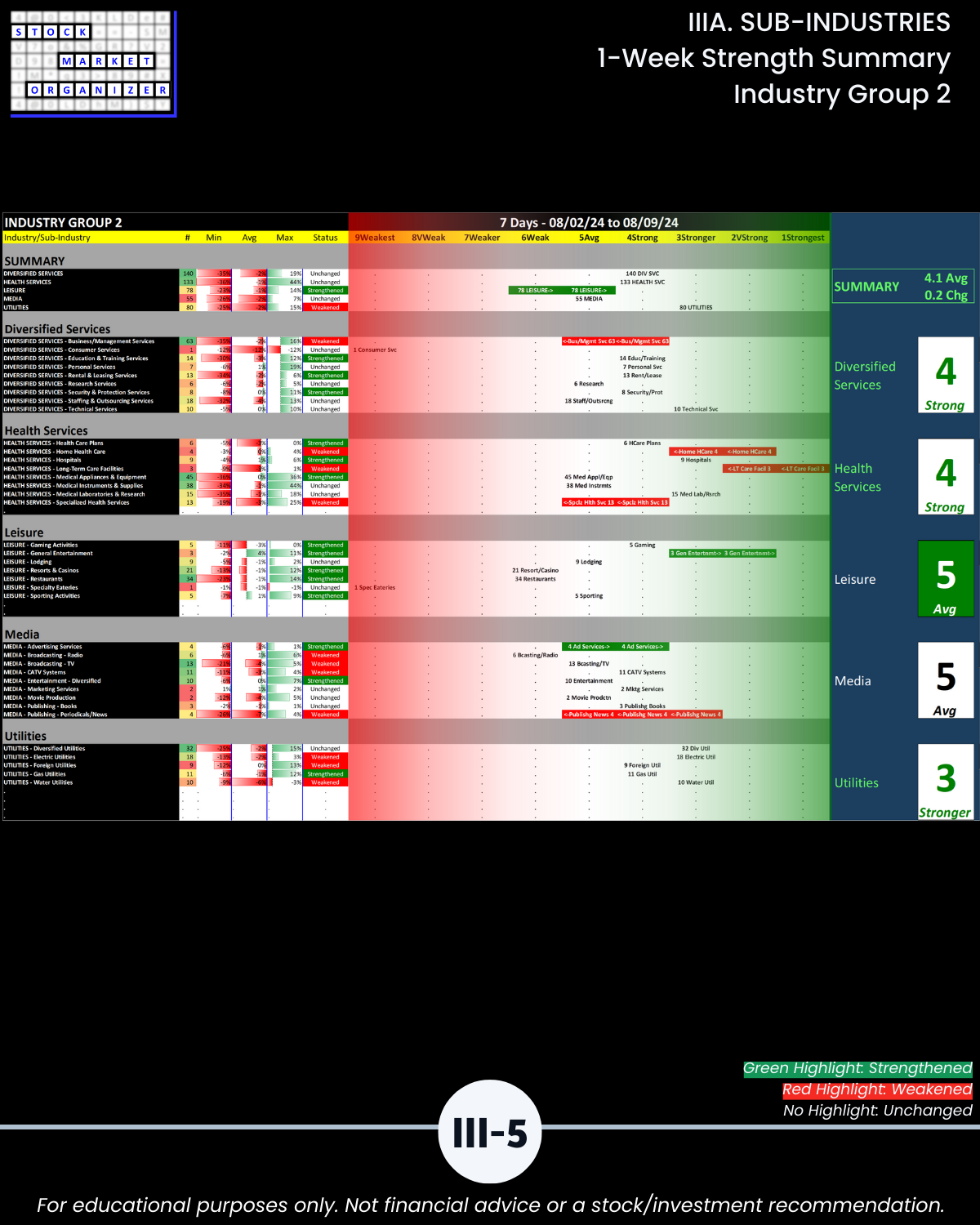

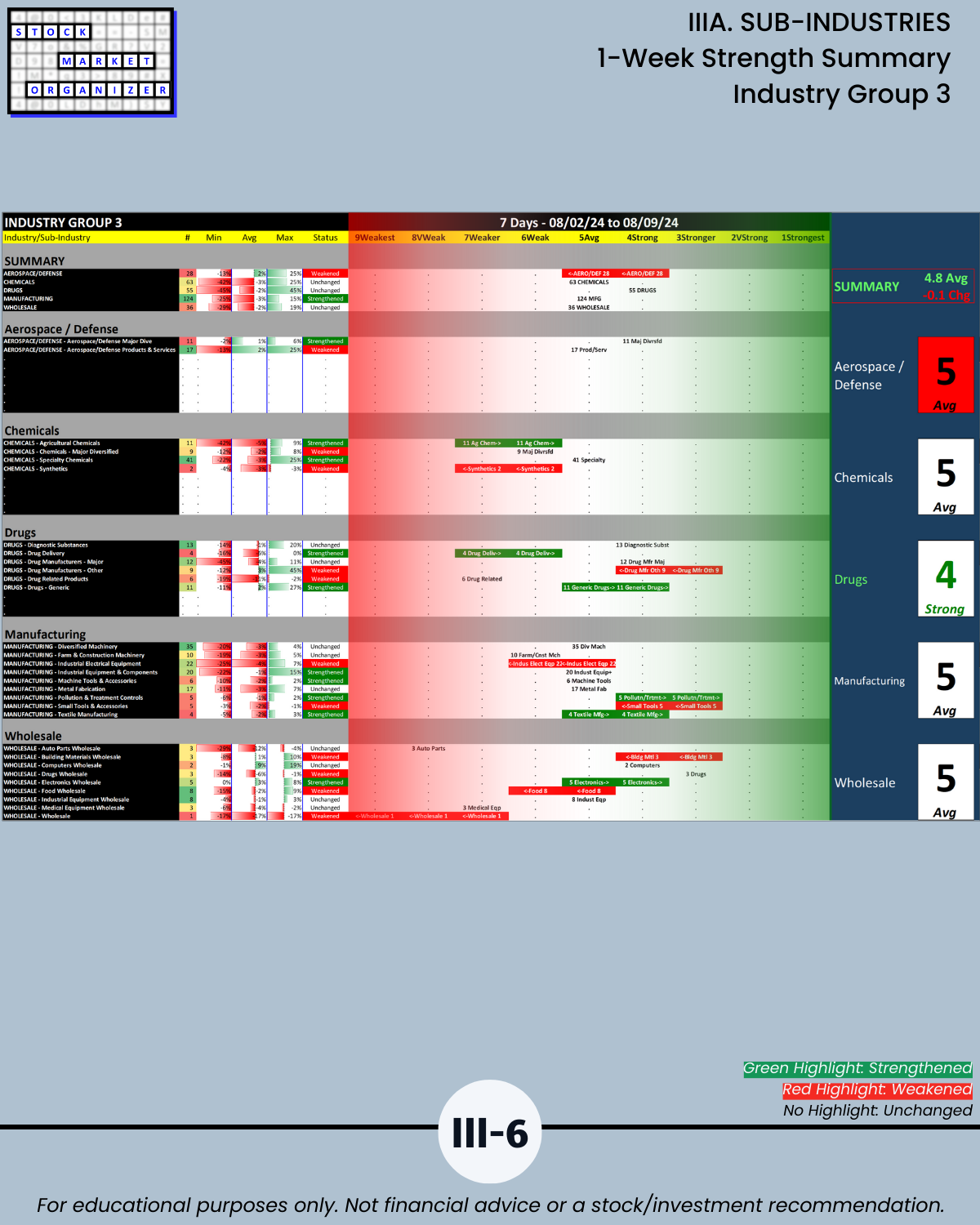

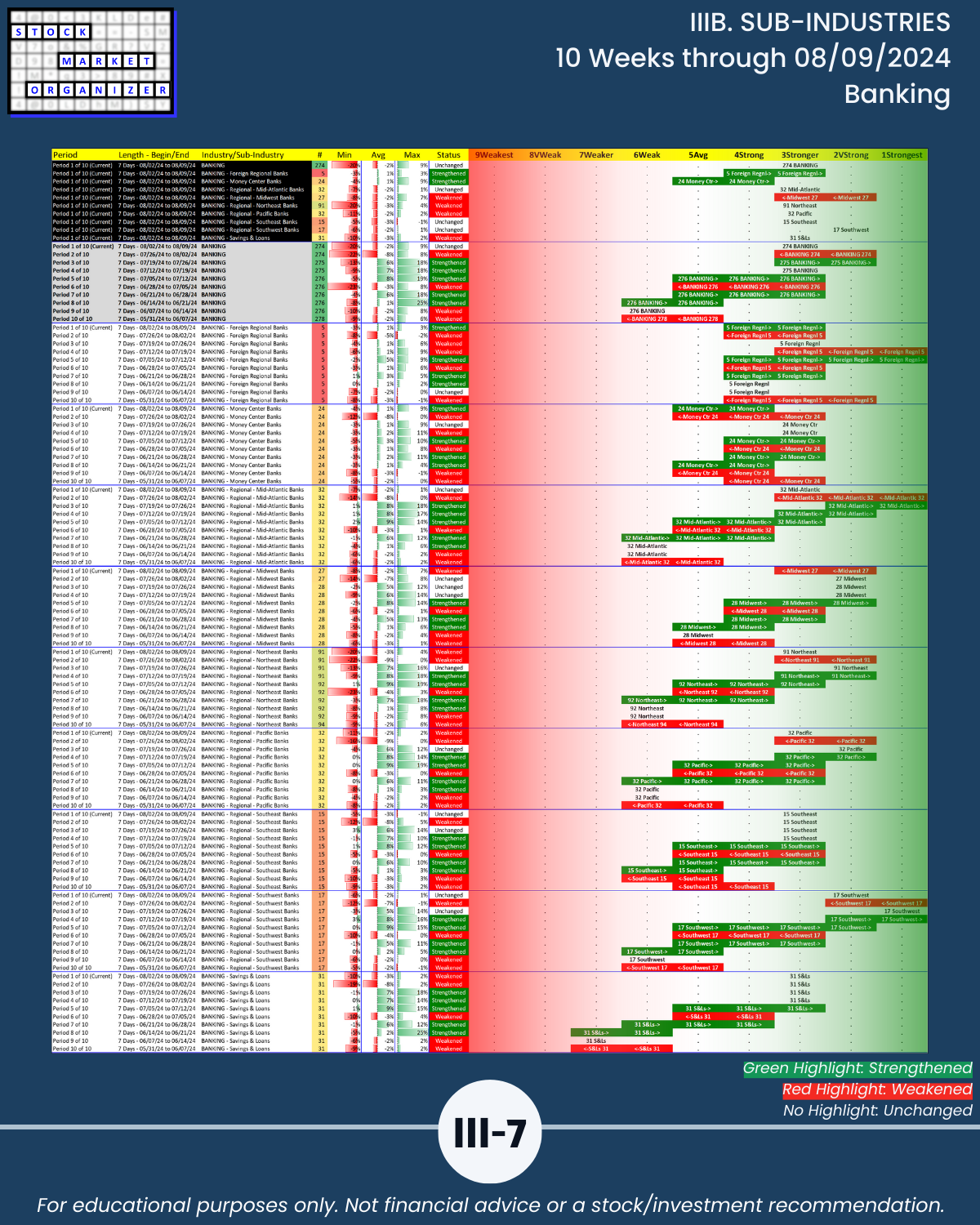

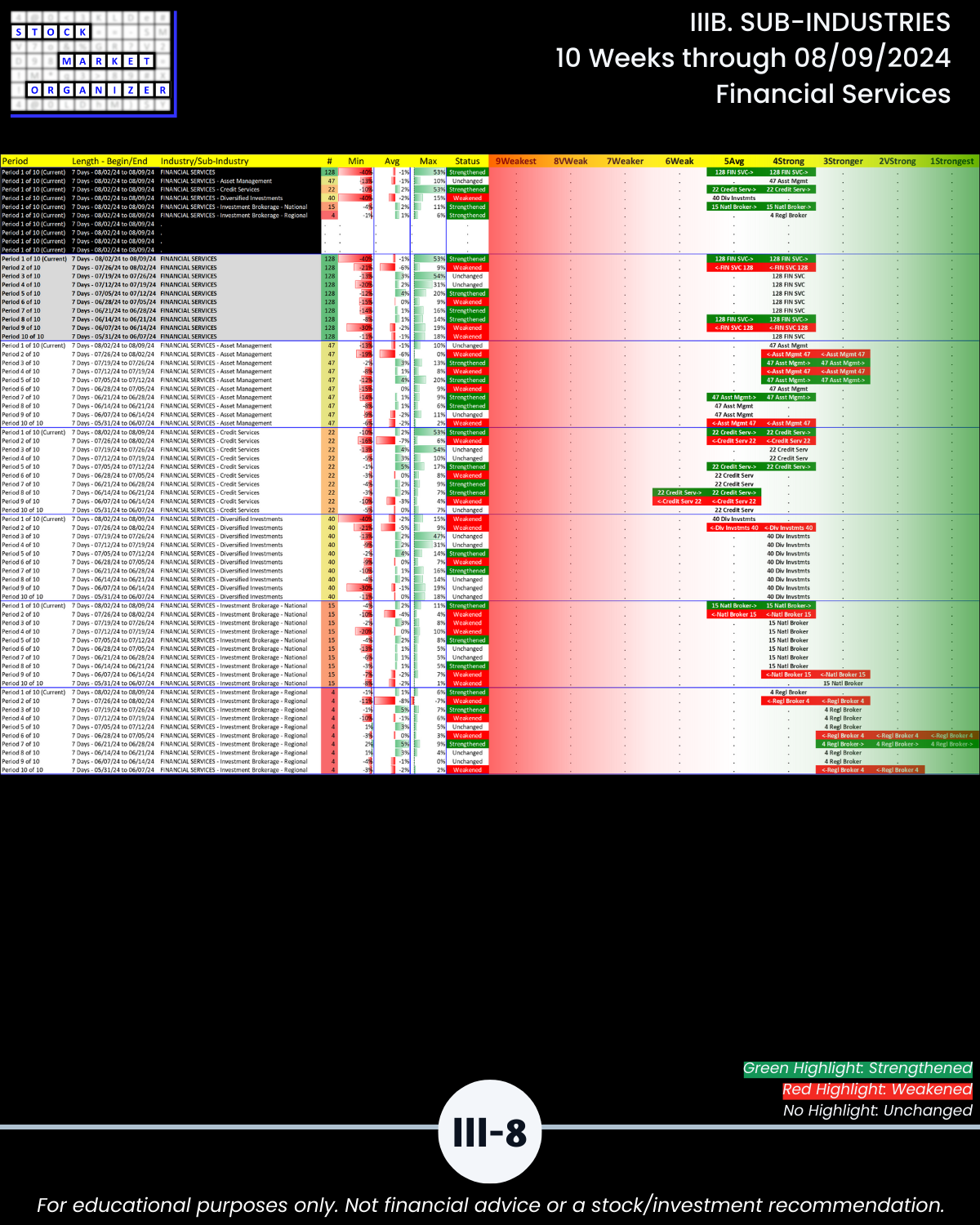

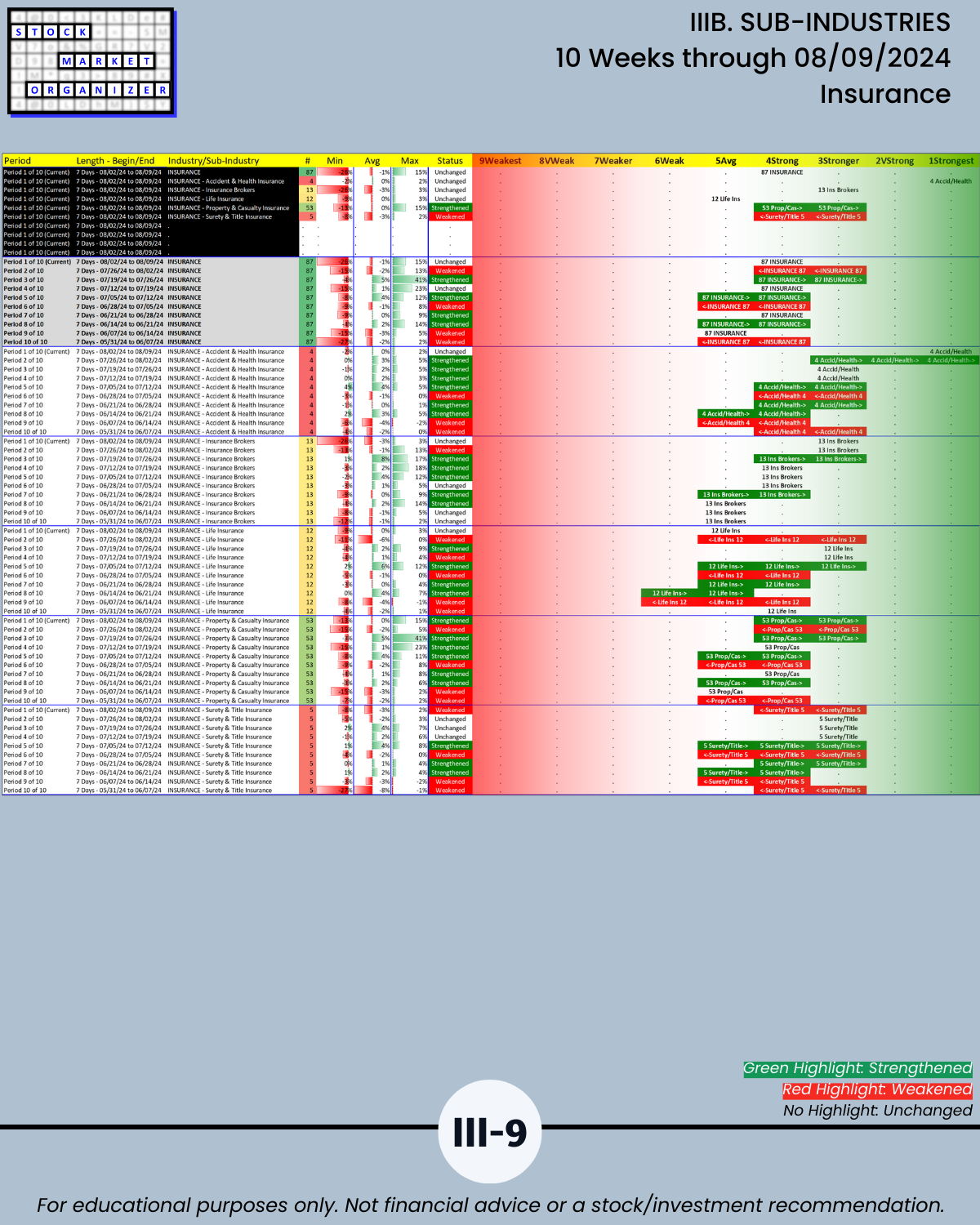

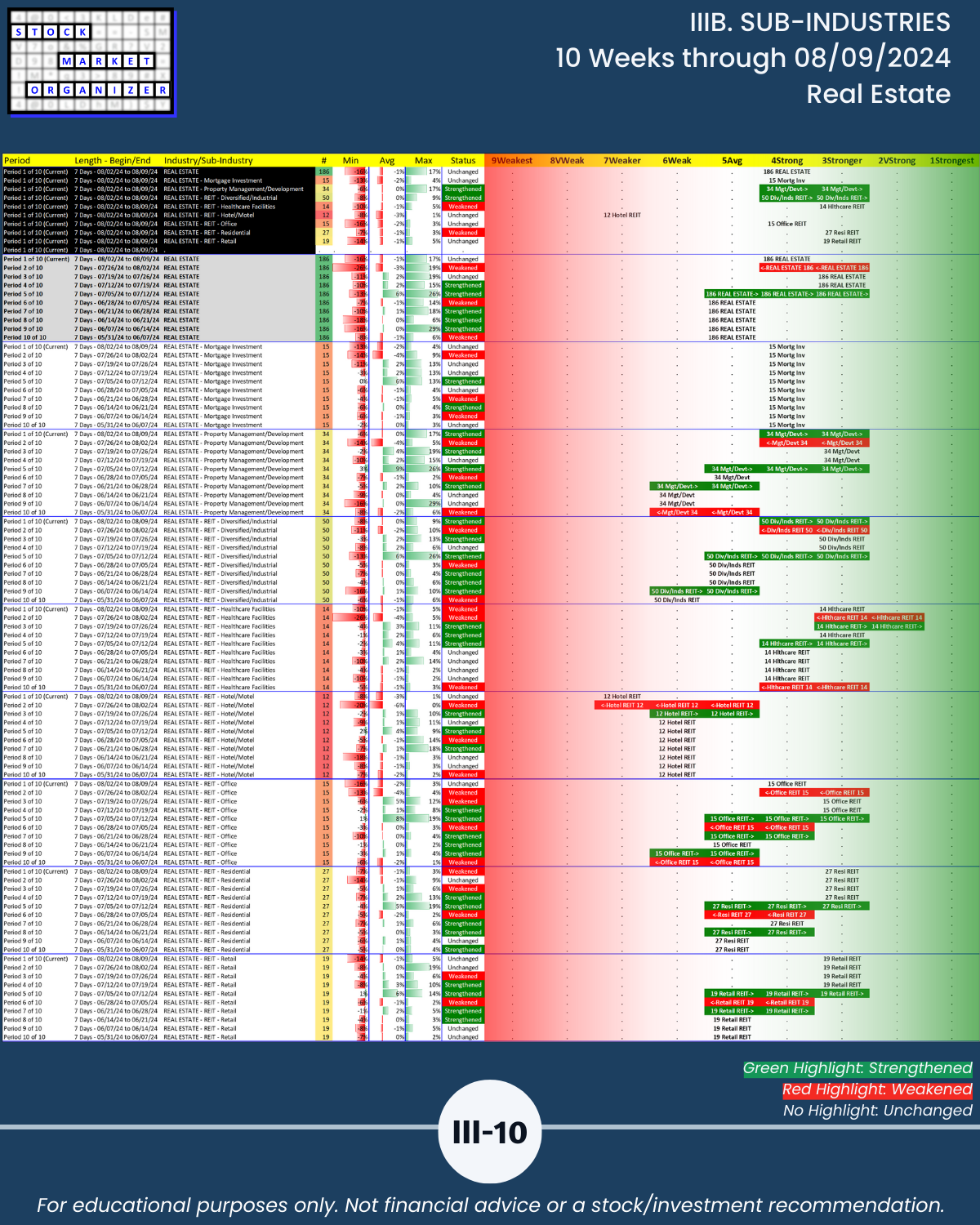

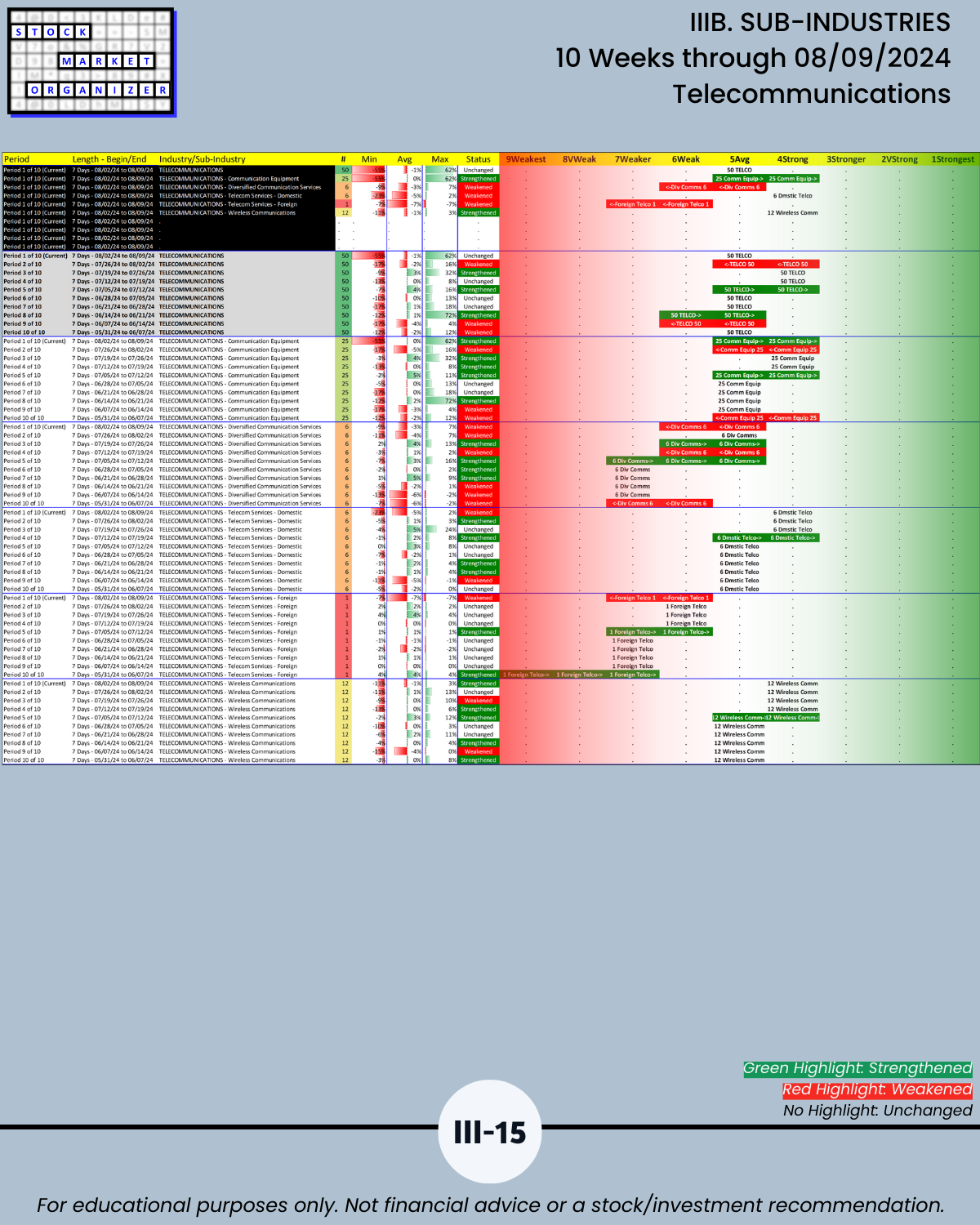

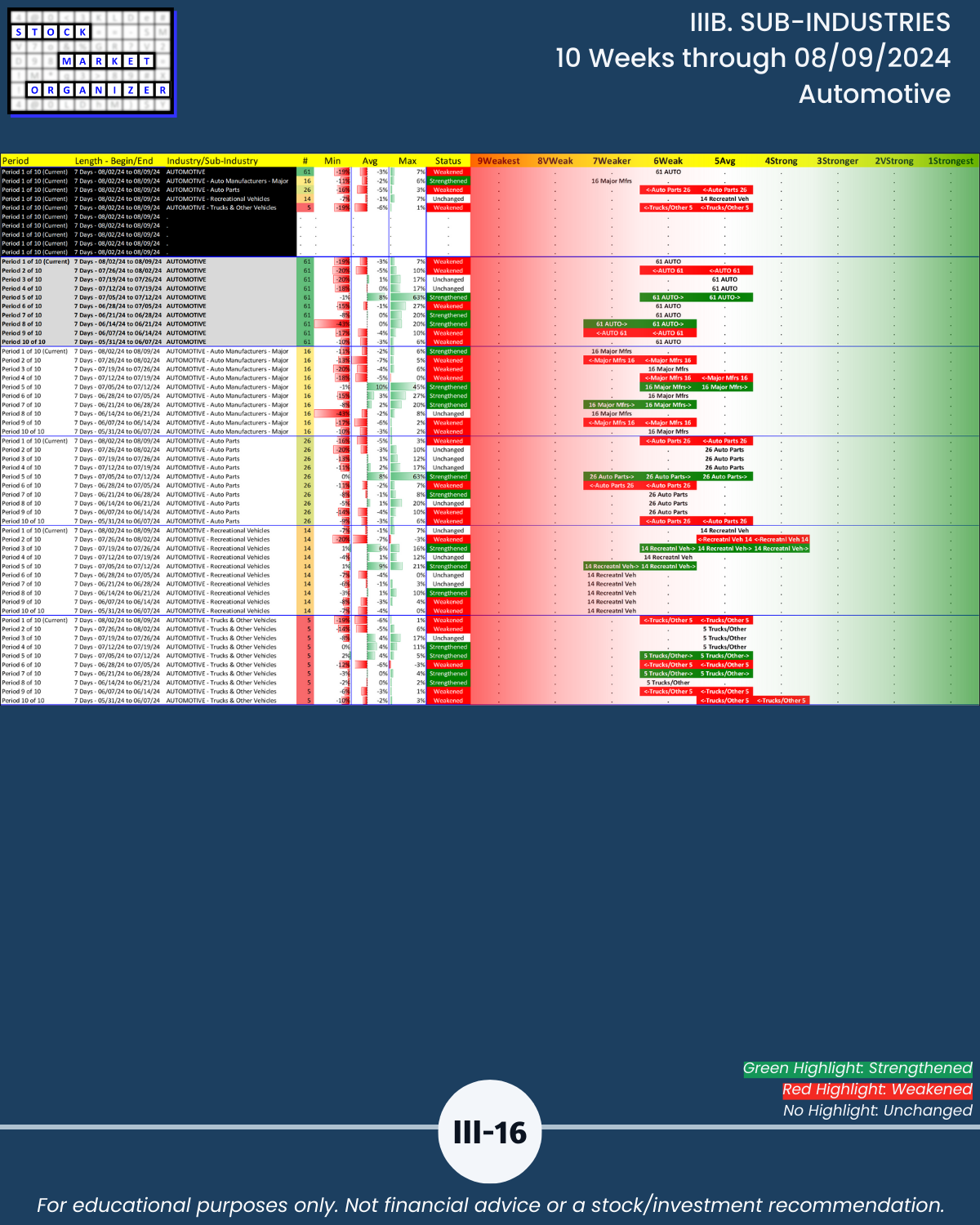

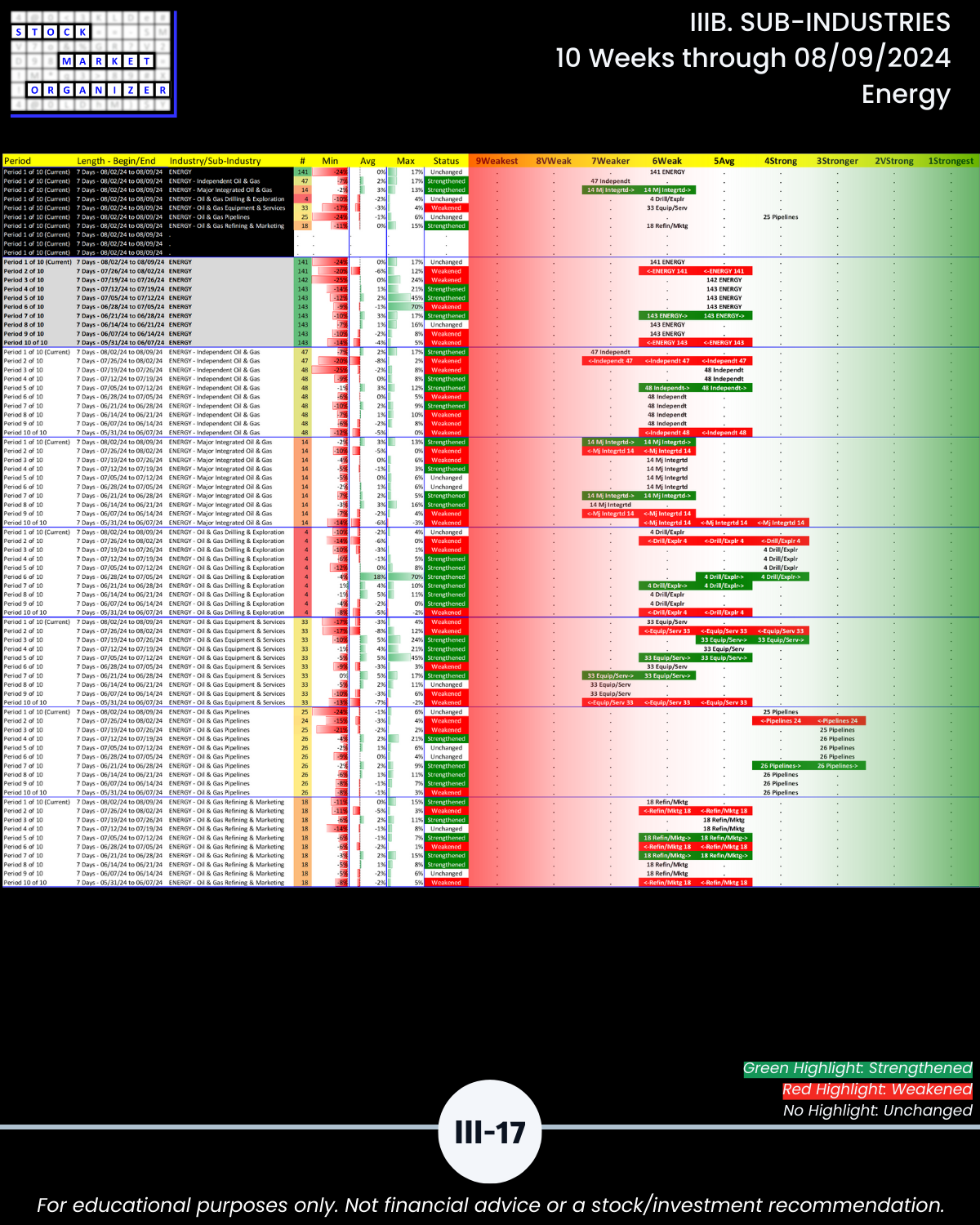

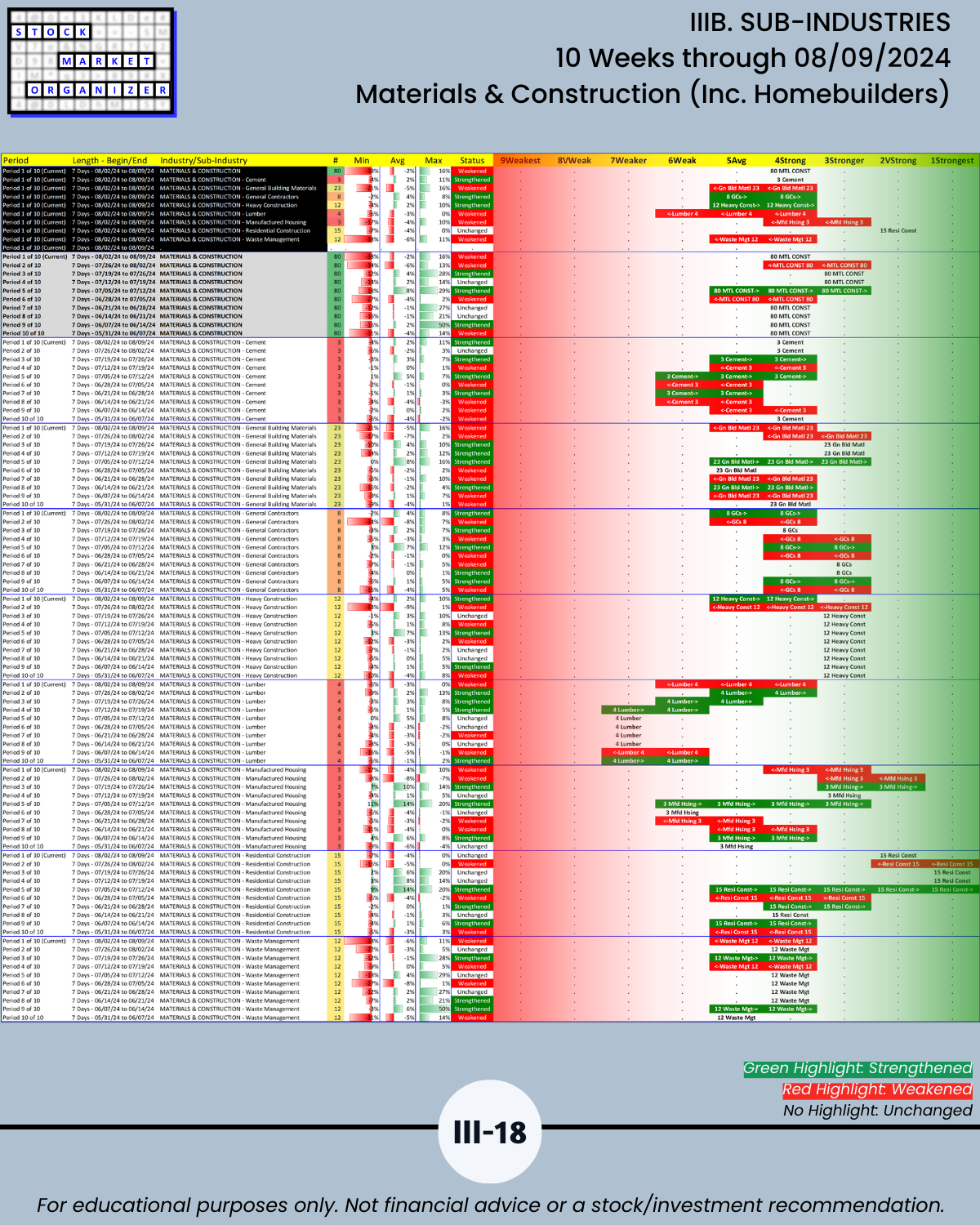

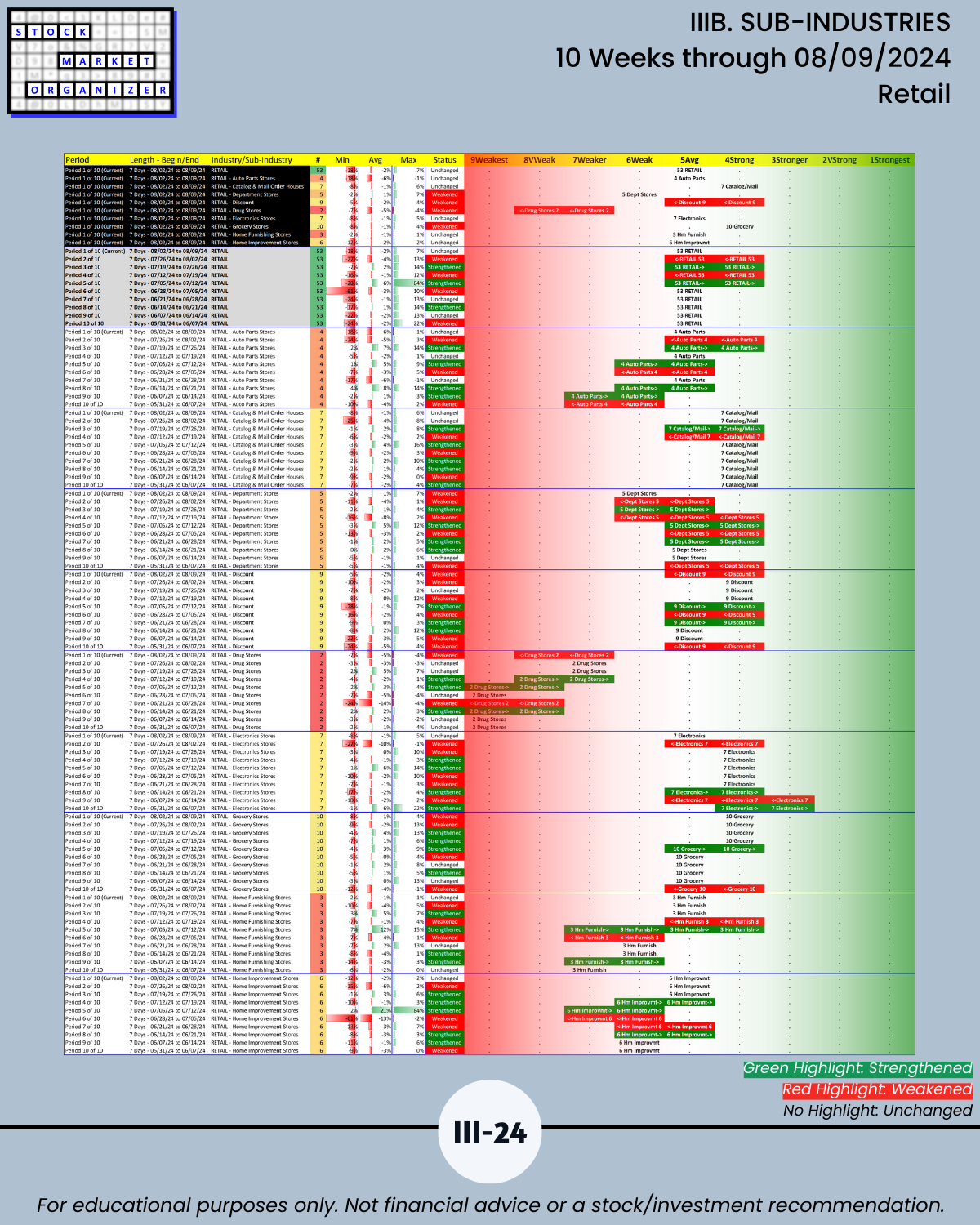

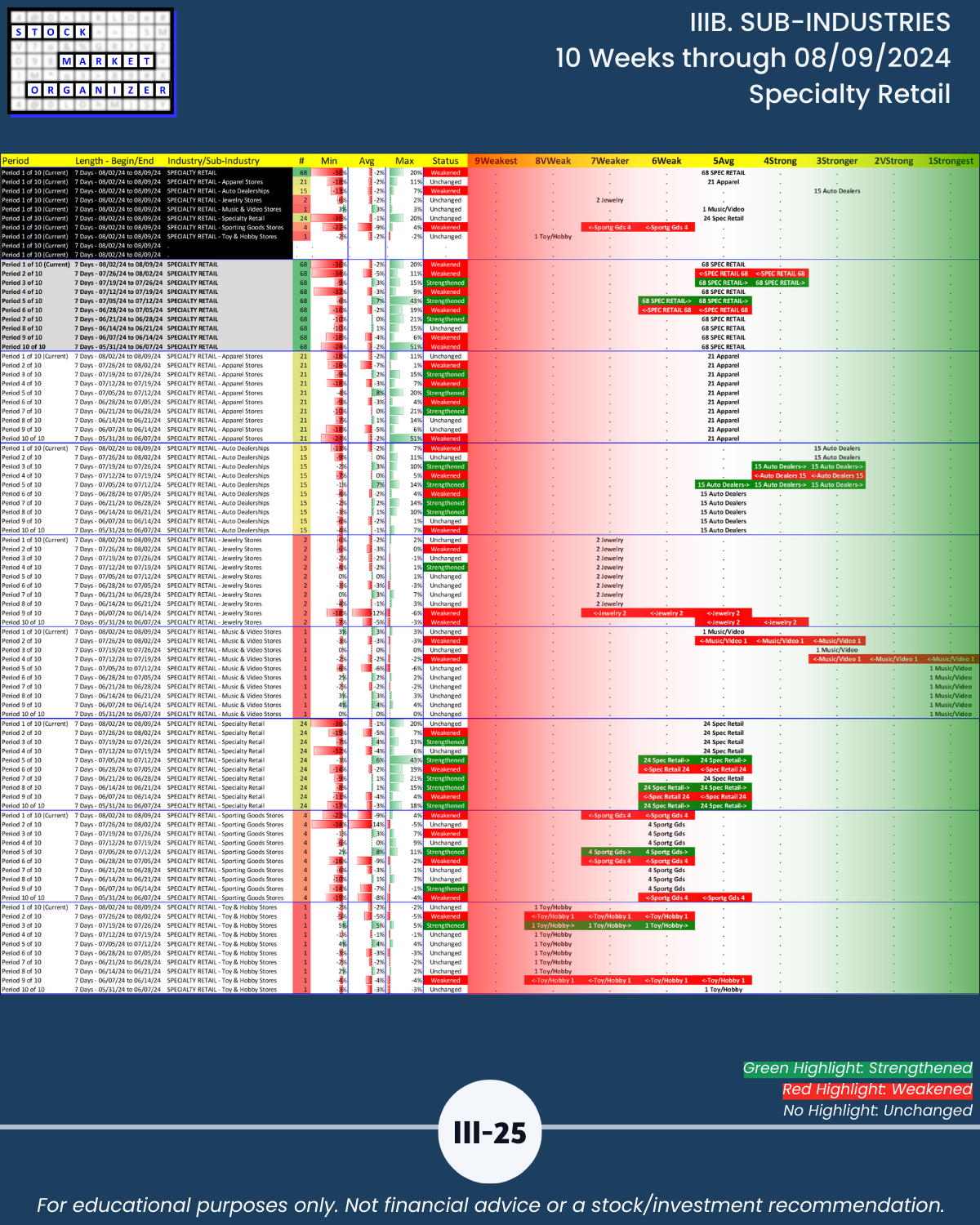

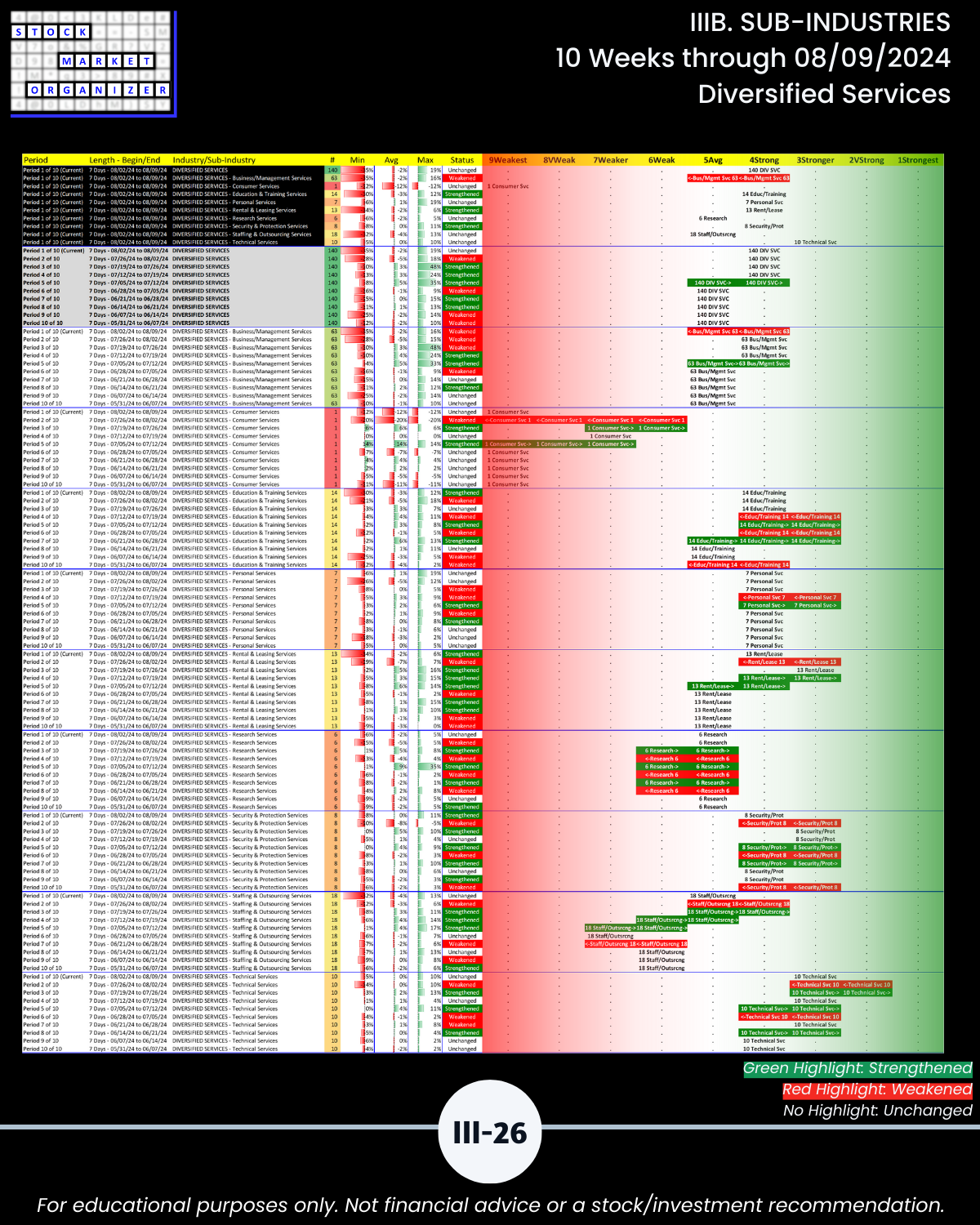

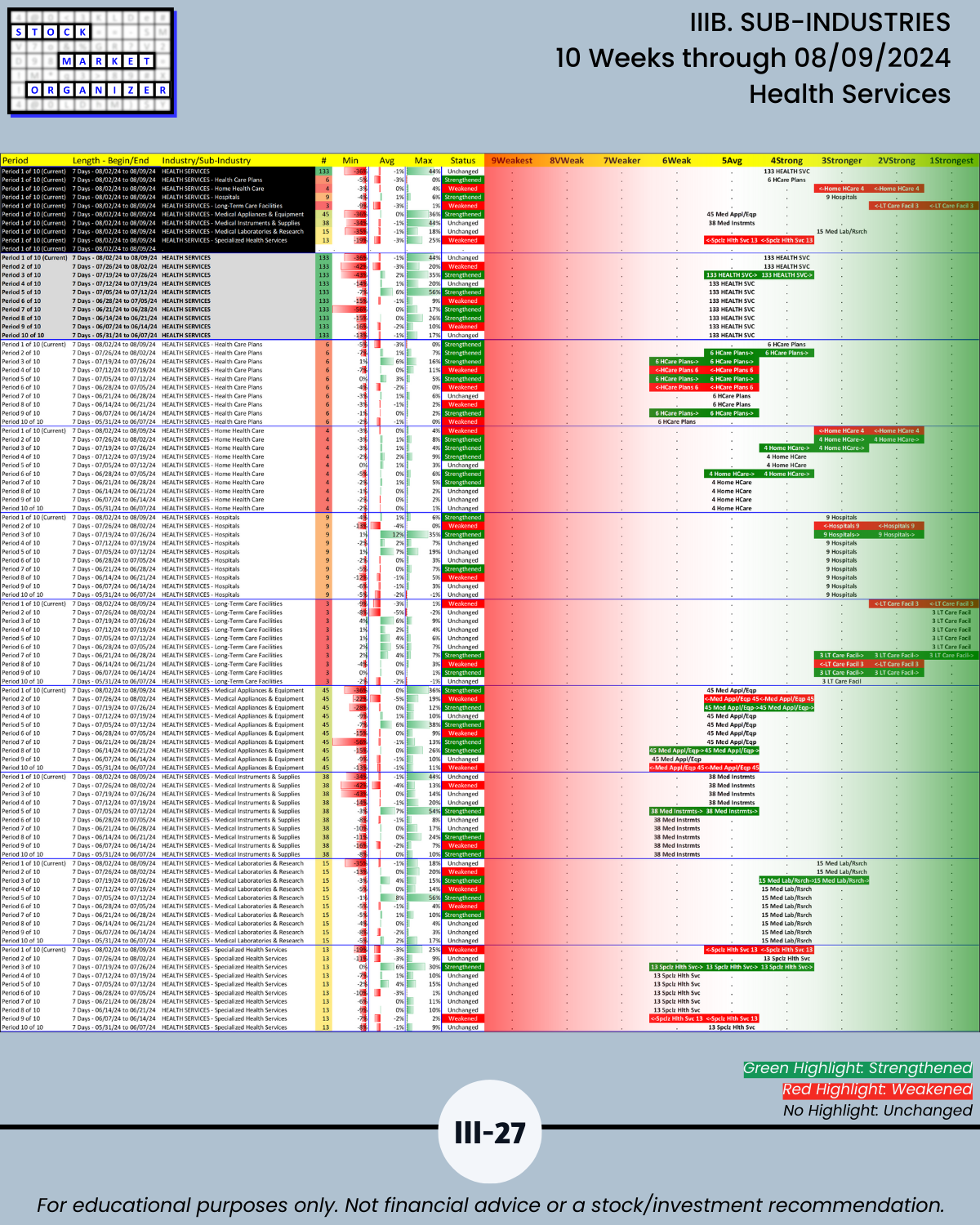

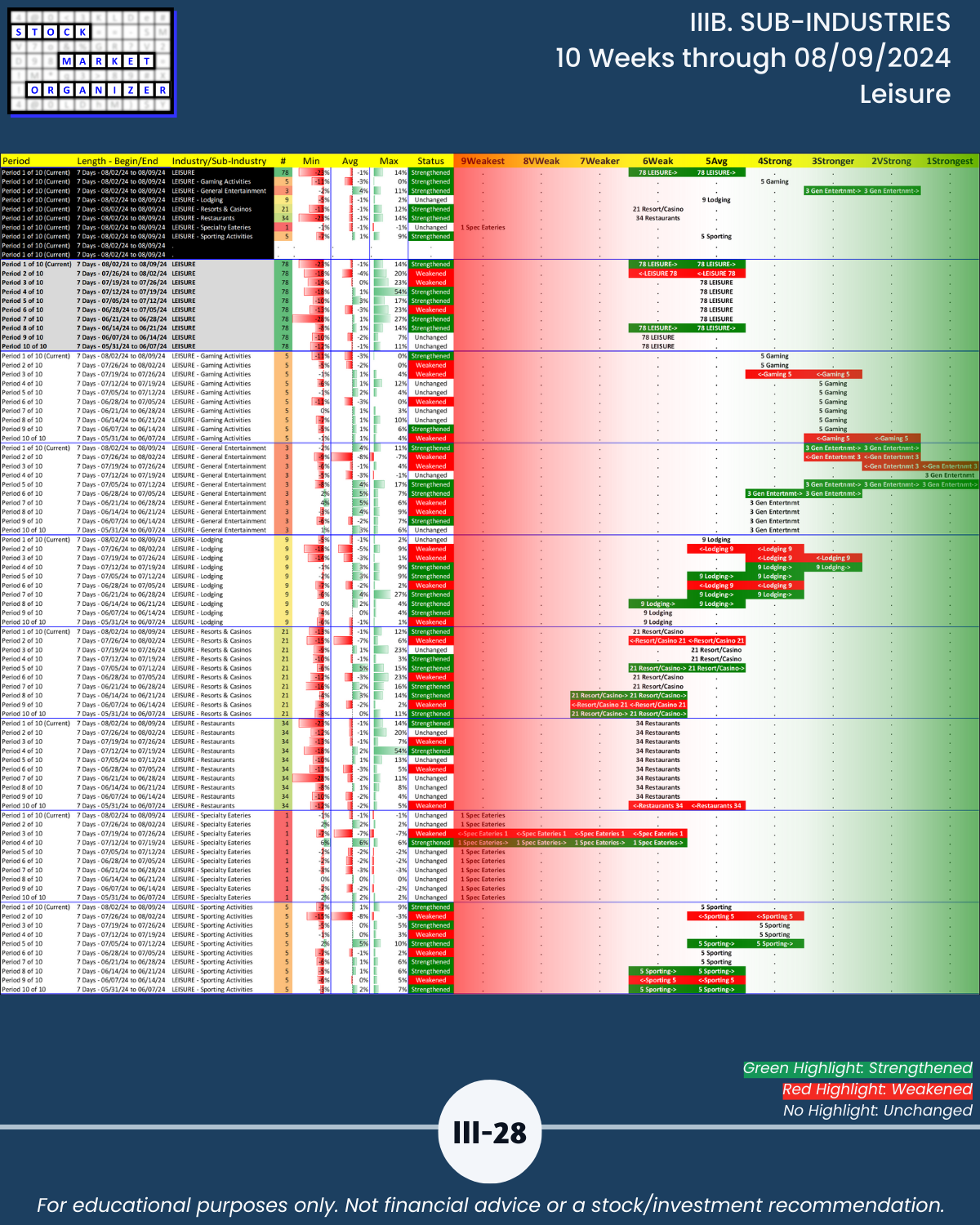

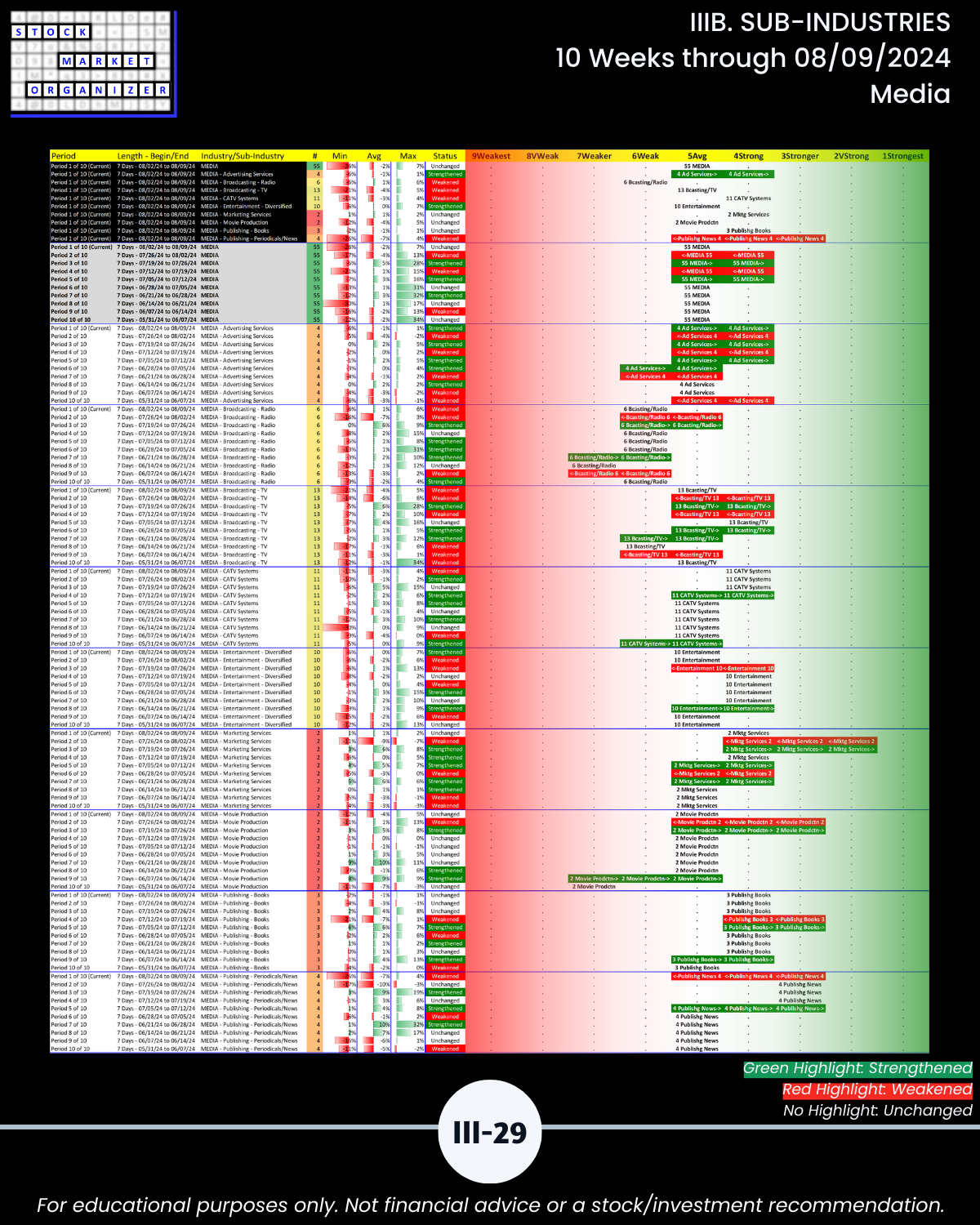

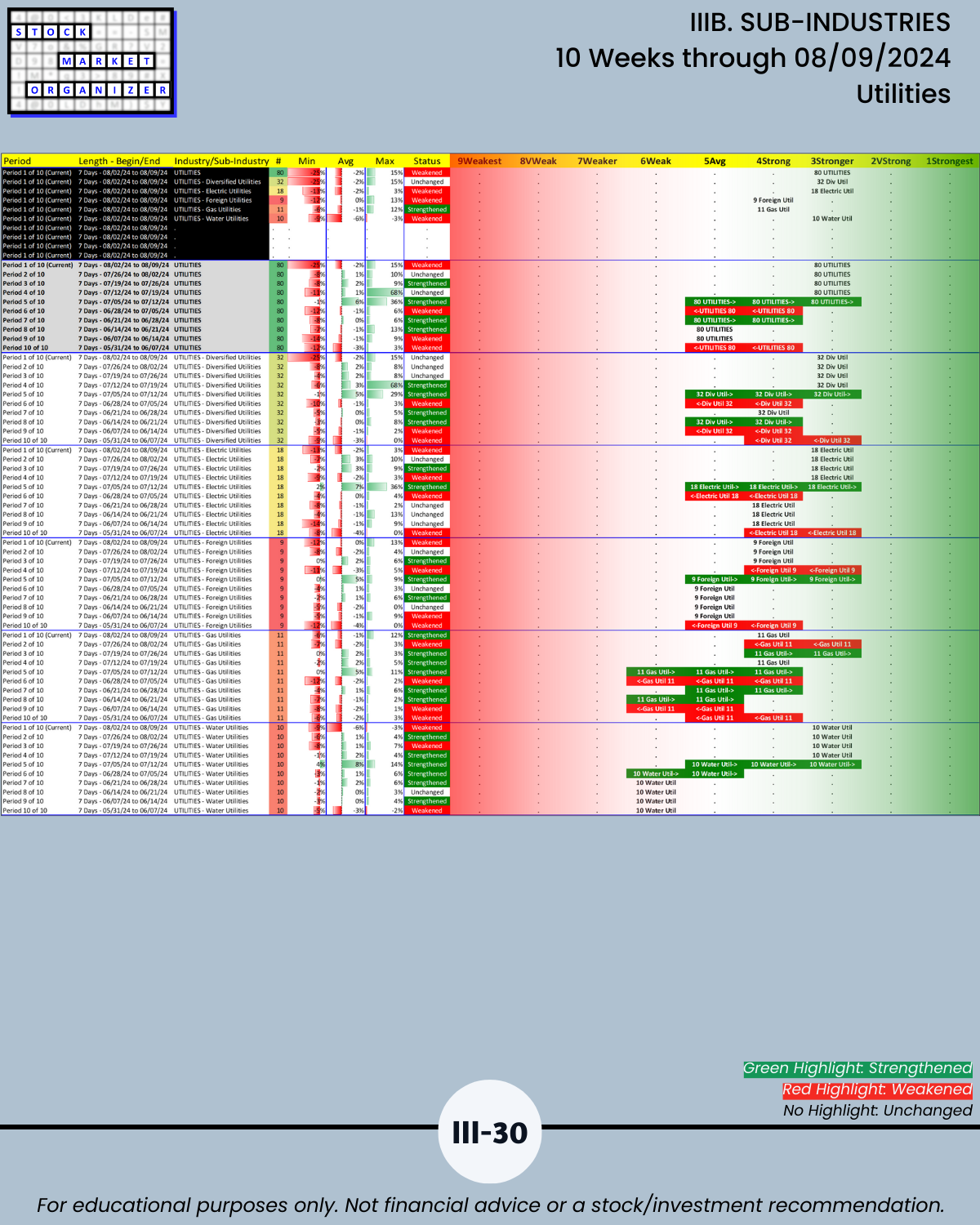

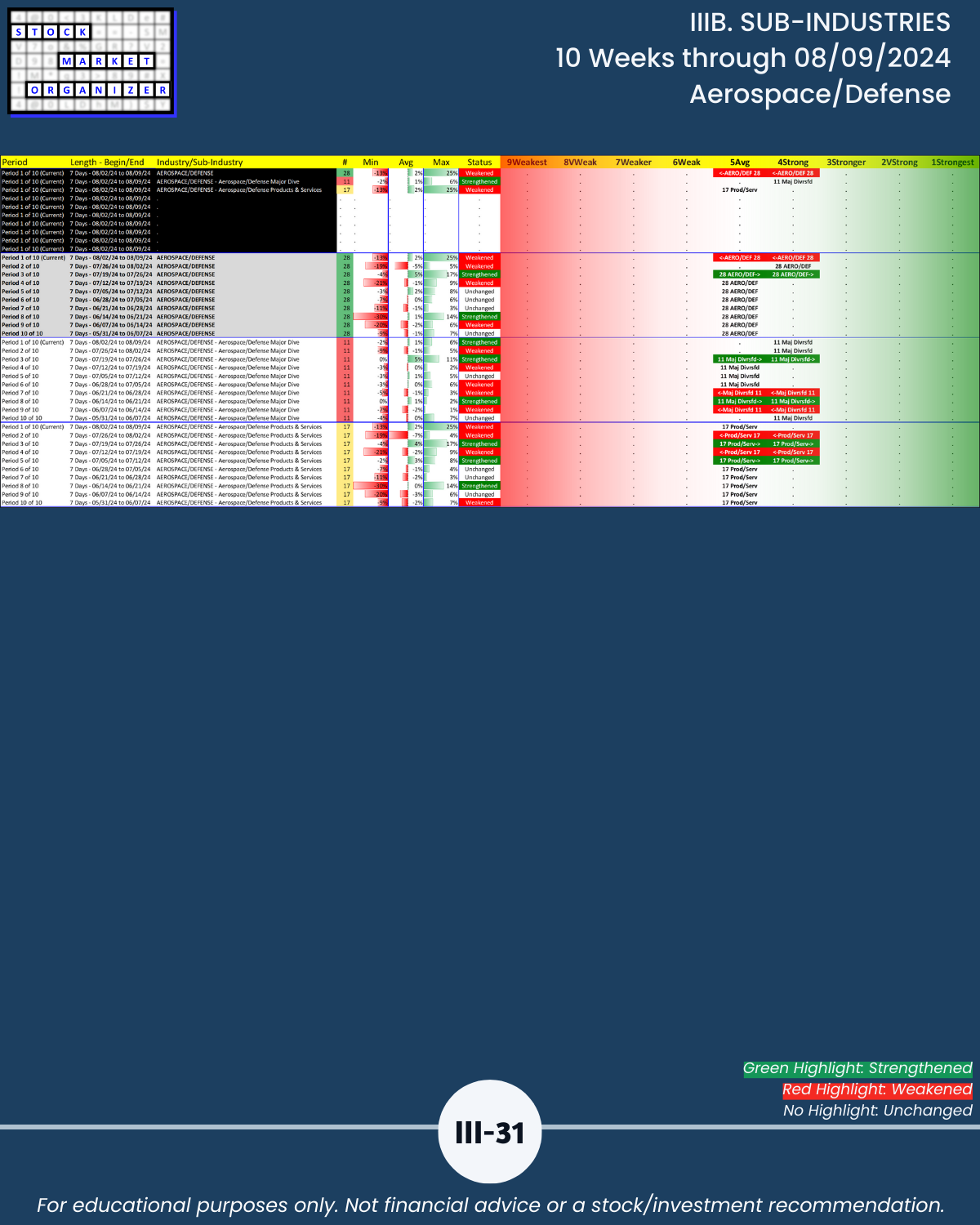

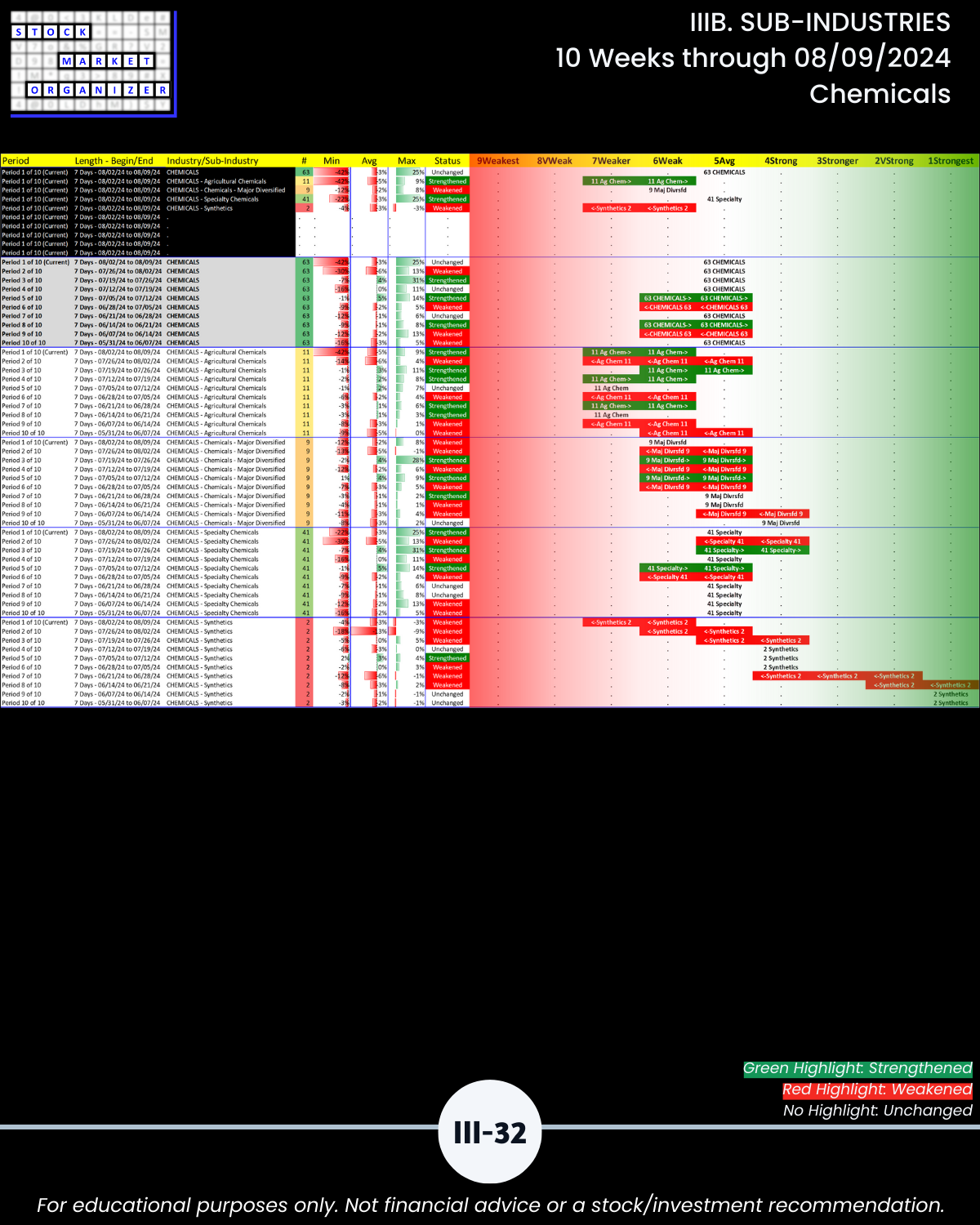

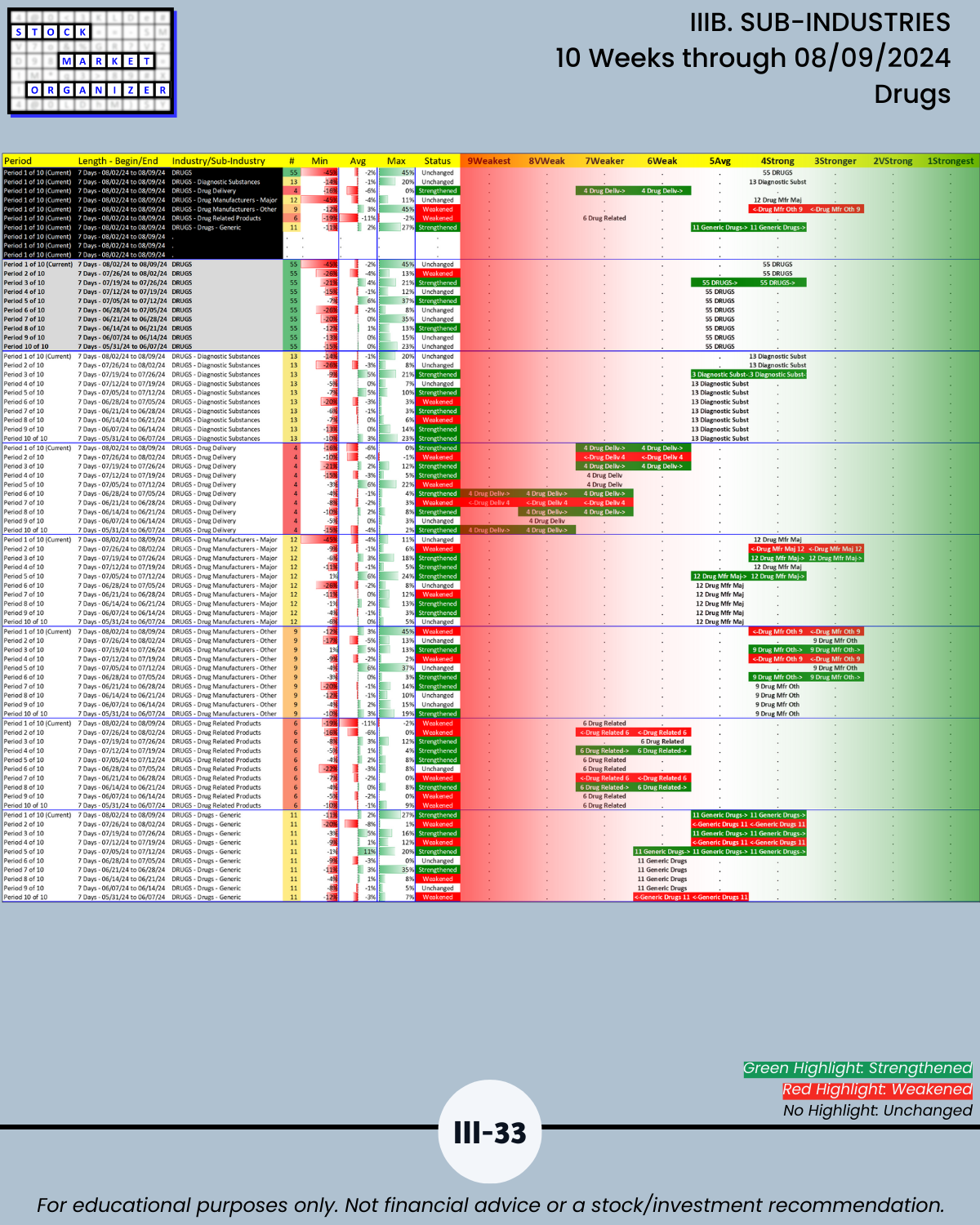

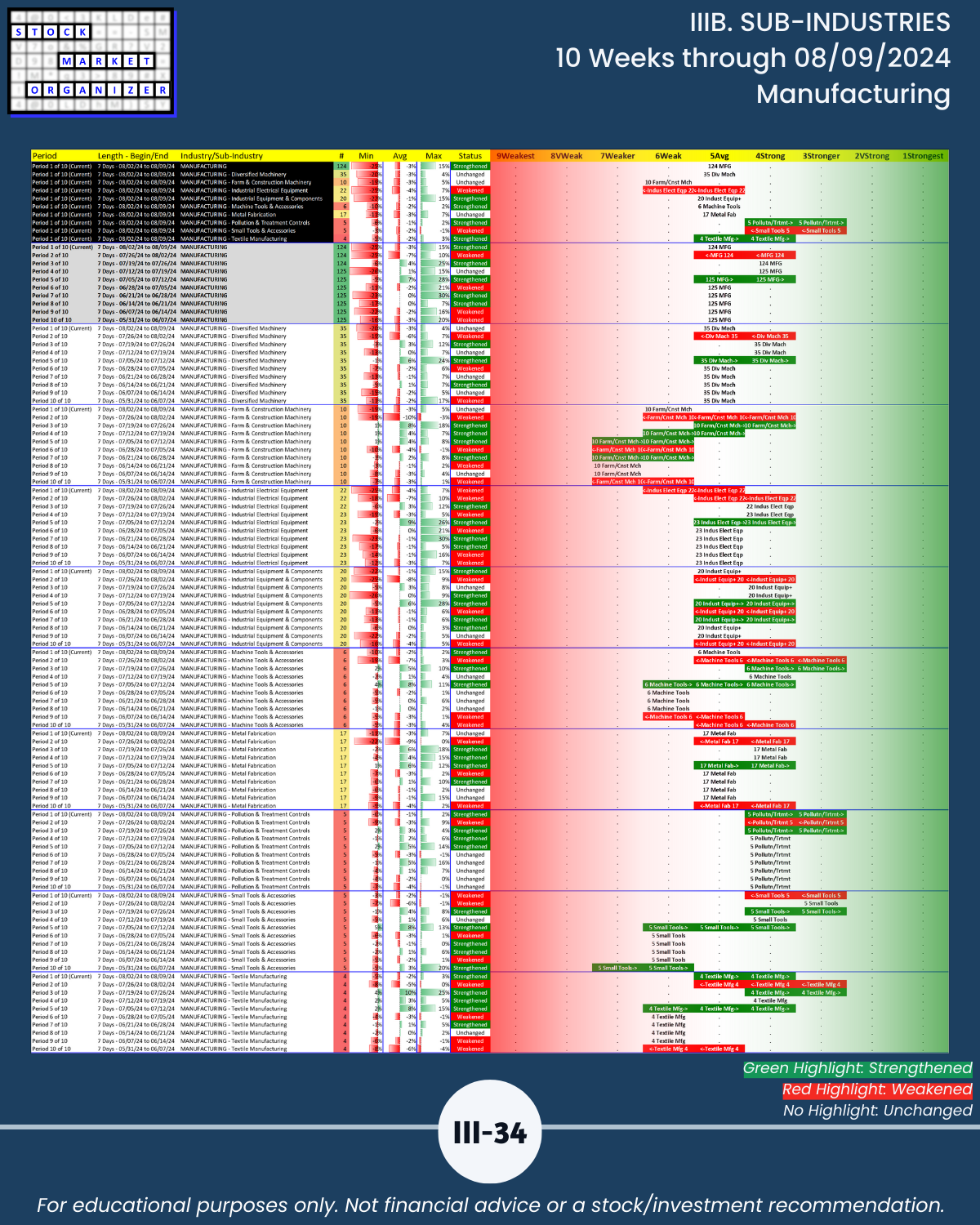

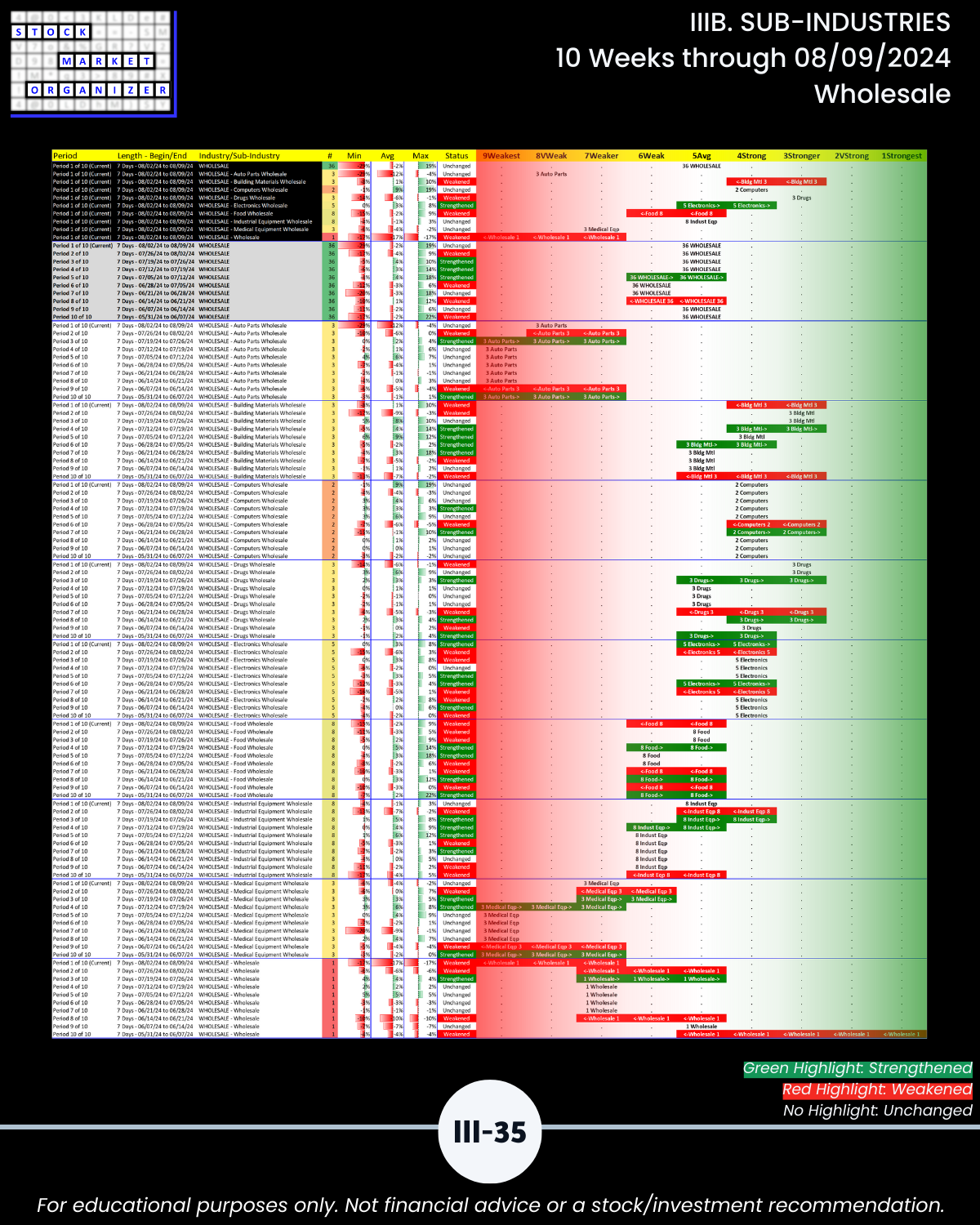

- 33% of 198 sub-industries strengthened, 31% weakened/Section III

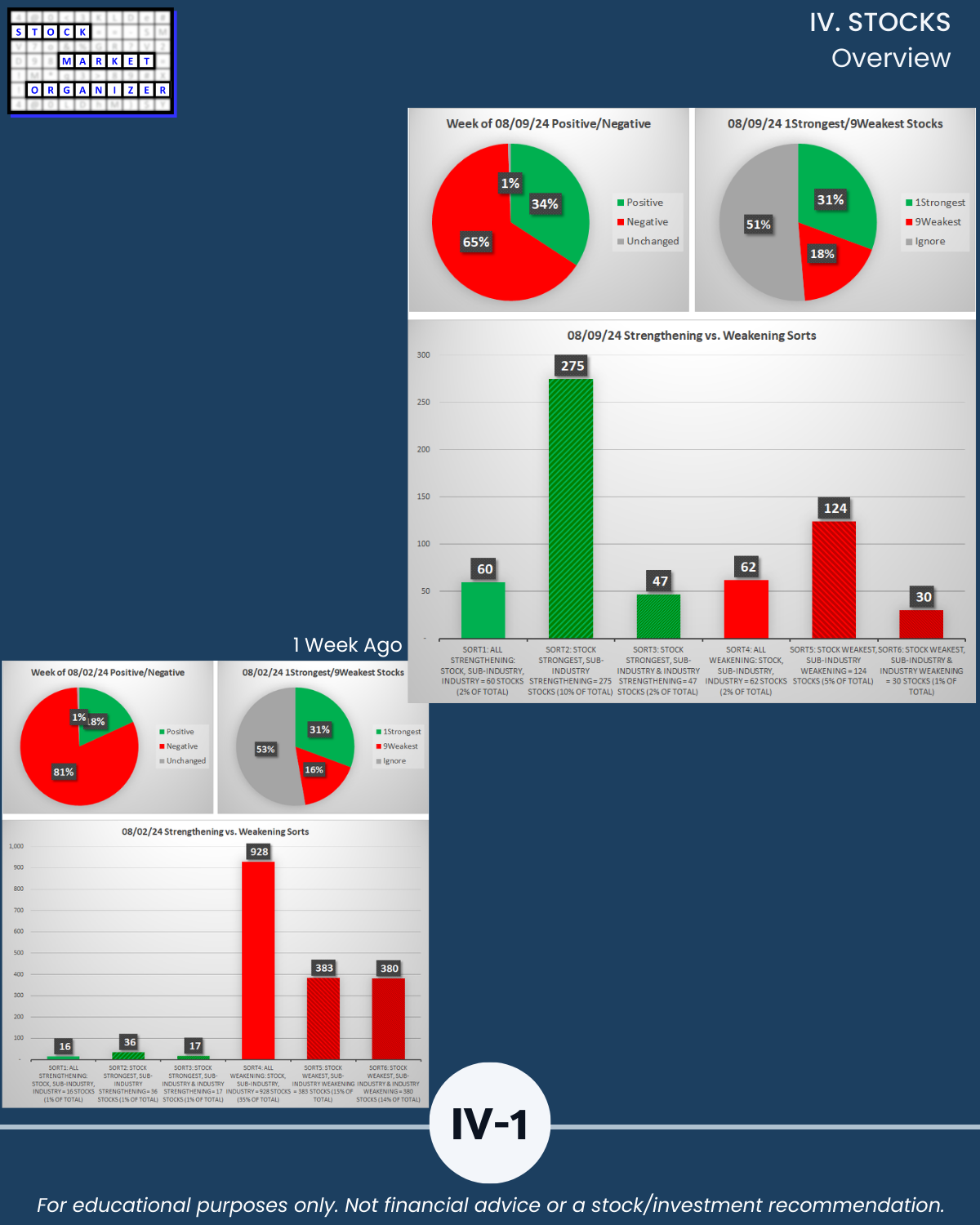

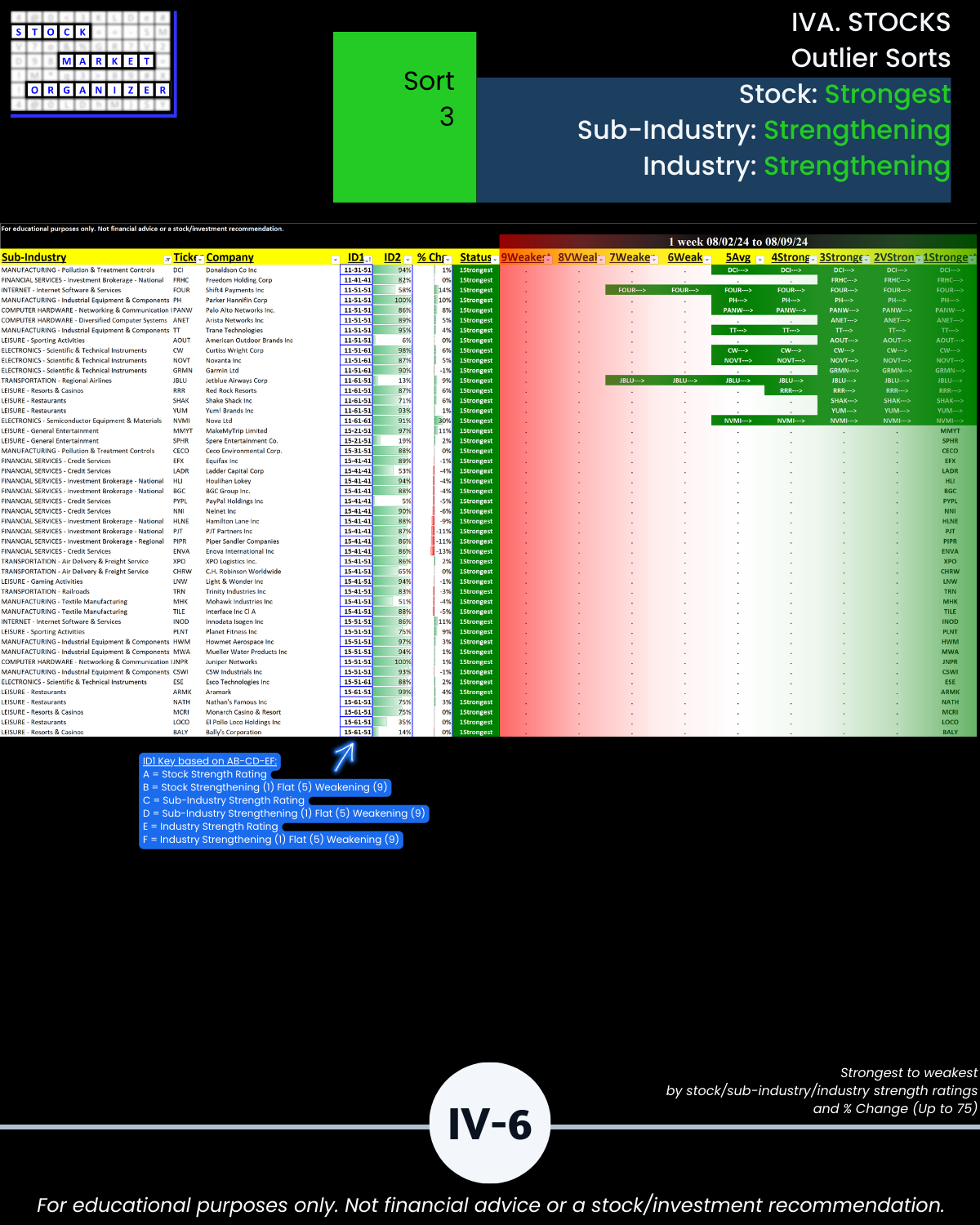

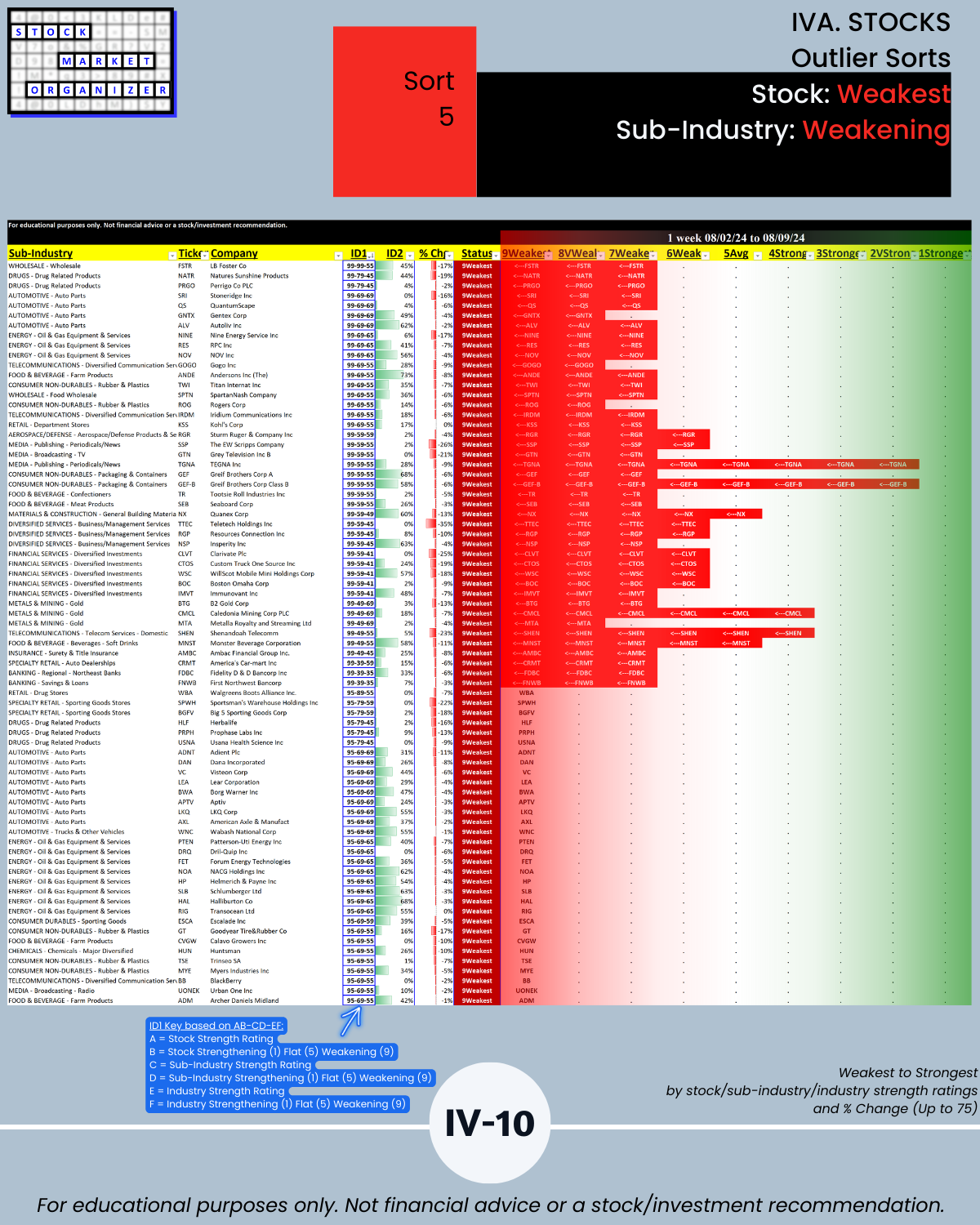

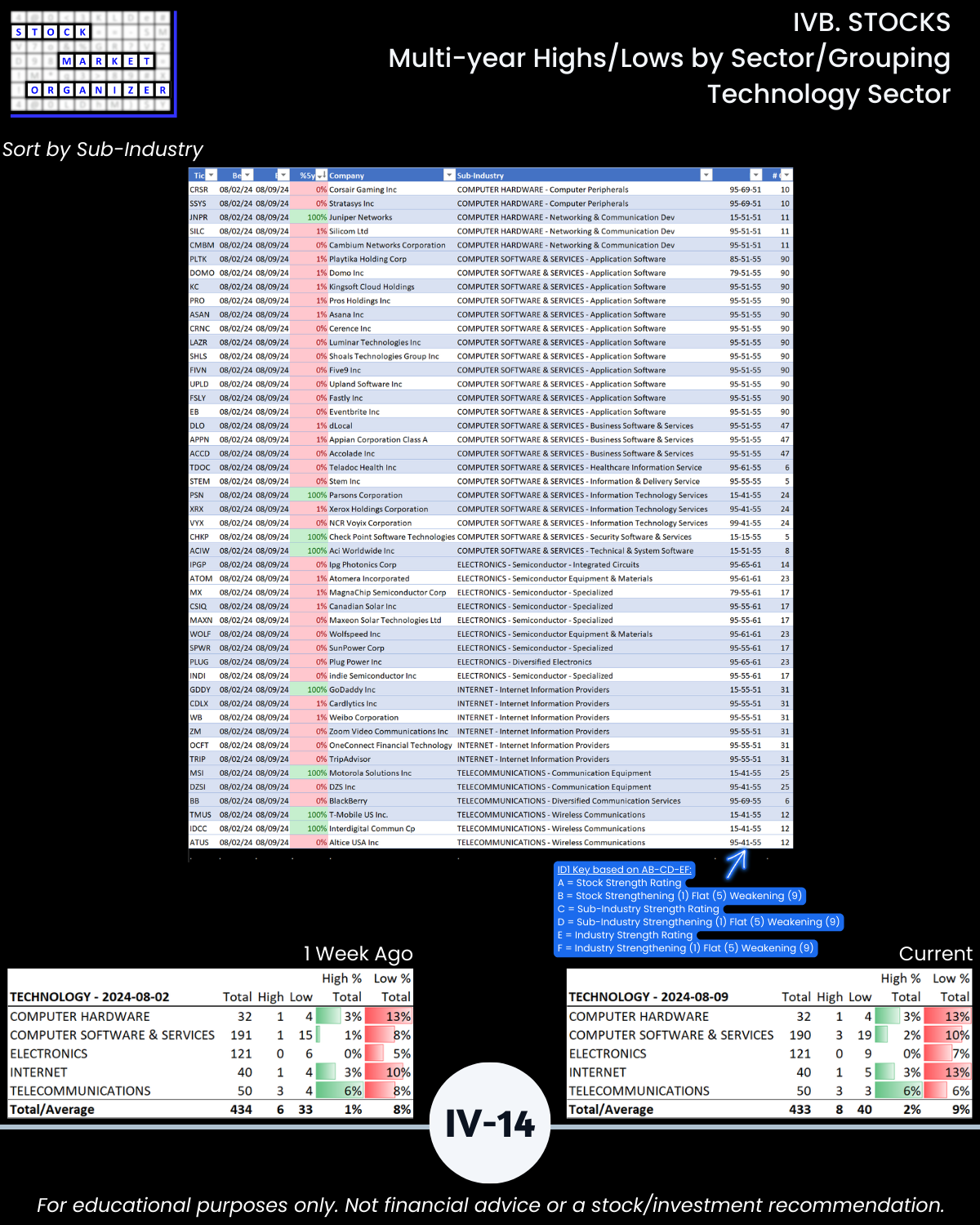

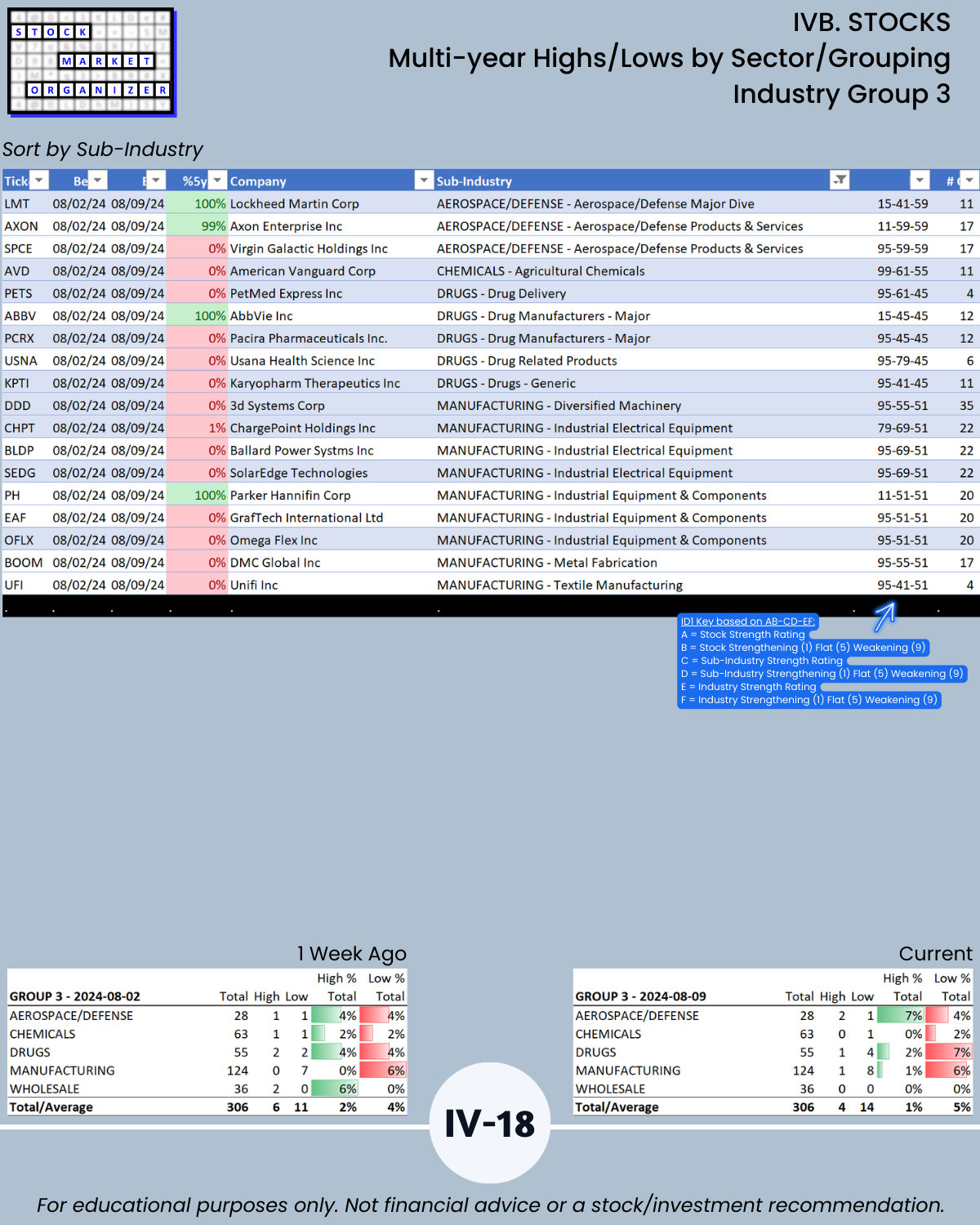

- 34% of 2,636 stocks positive, 65% negative, 31% stocks rated Strongest, 18% Weakest/Section IV

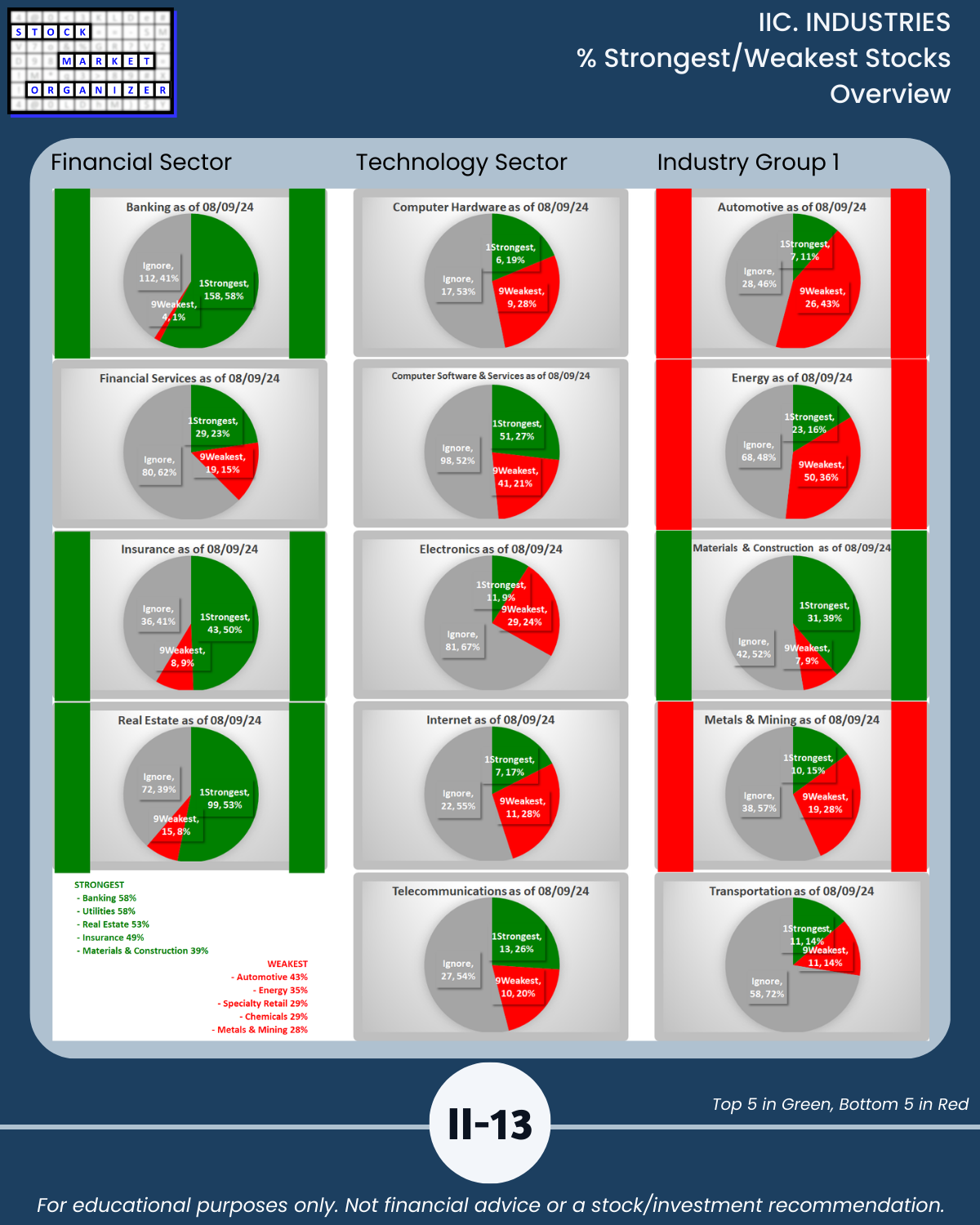

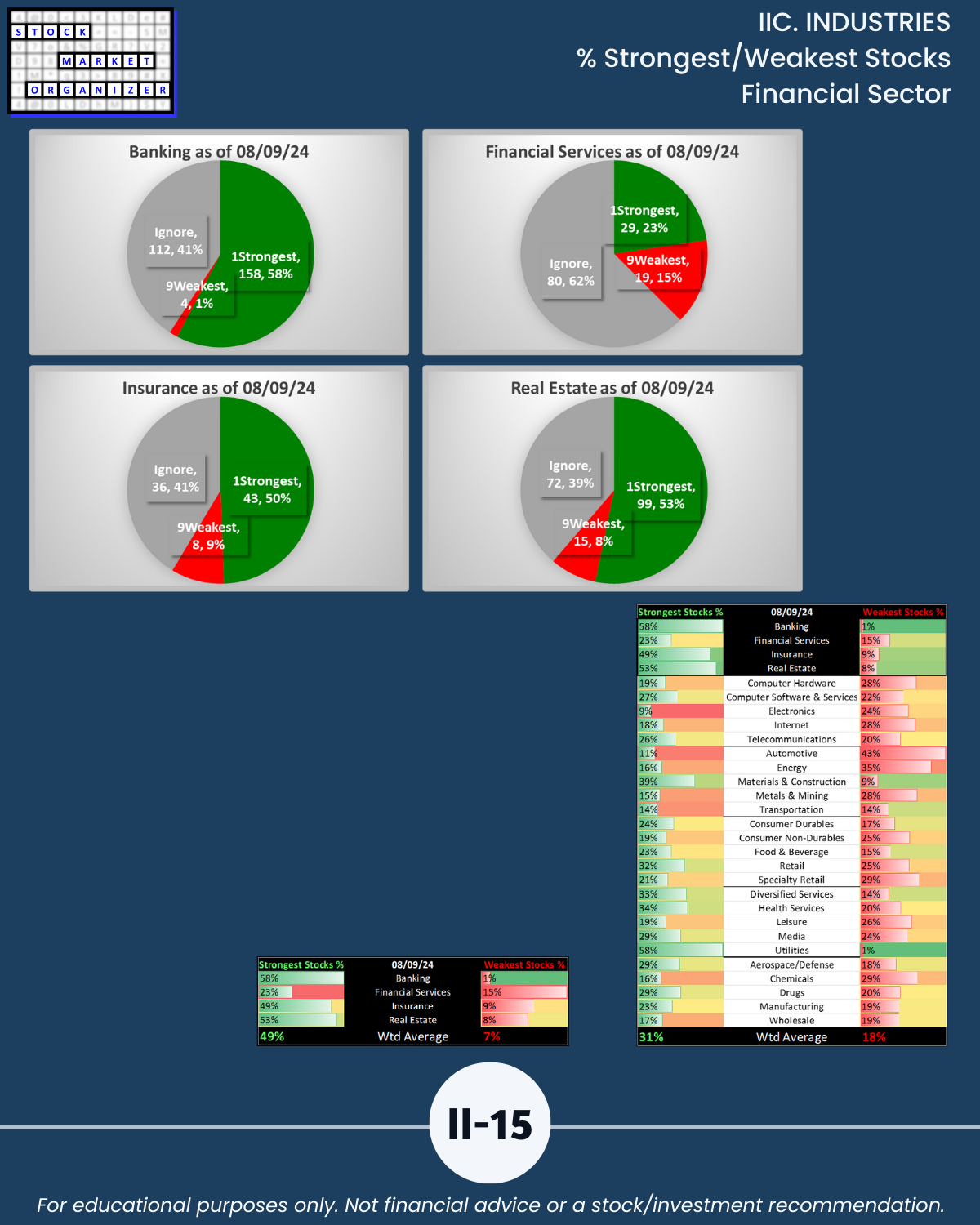

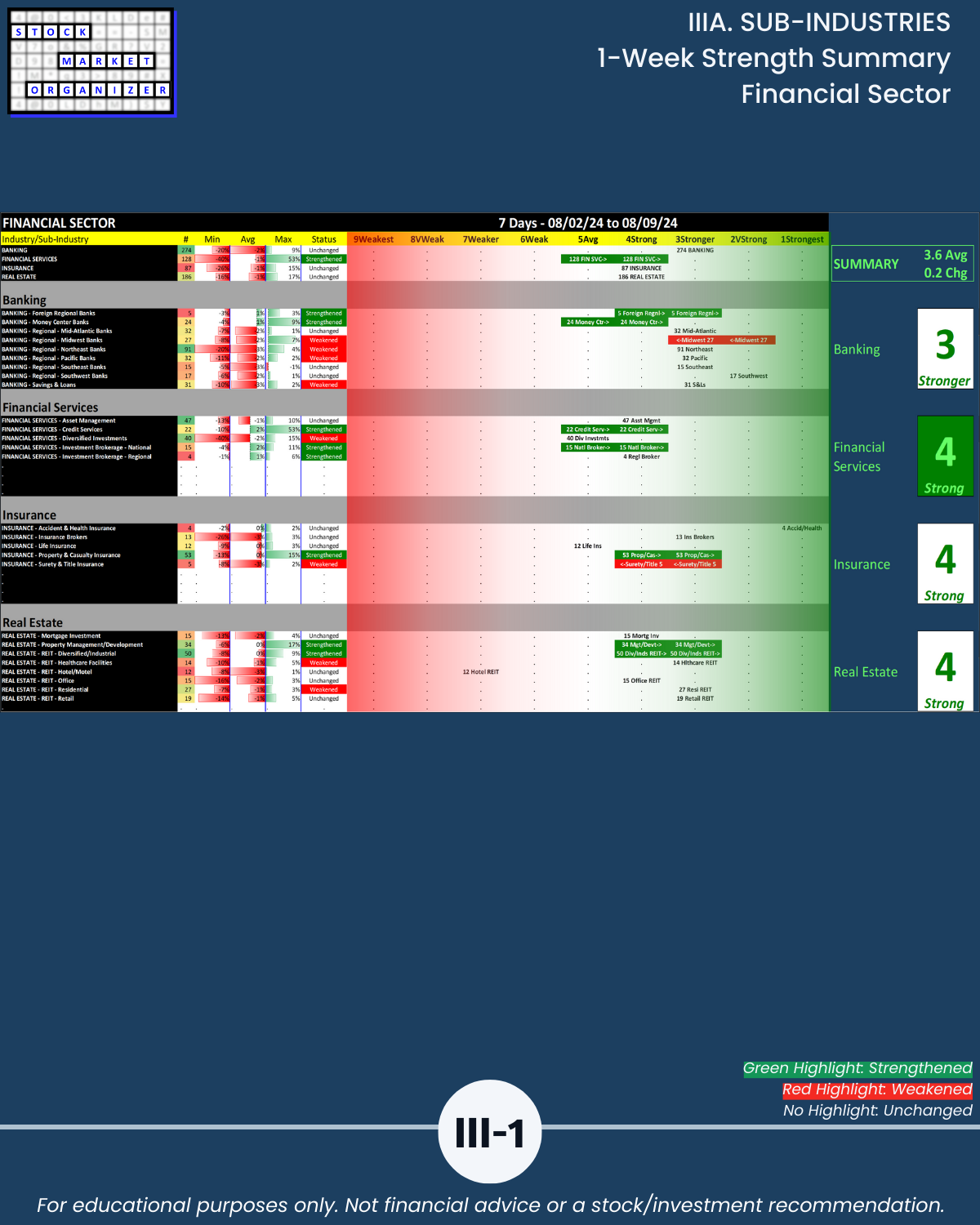

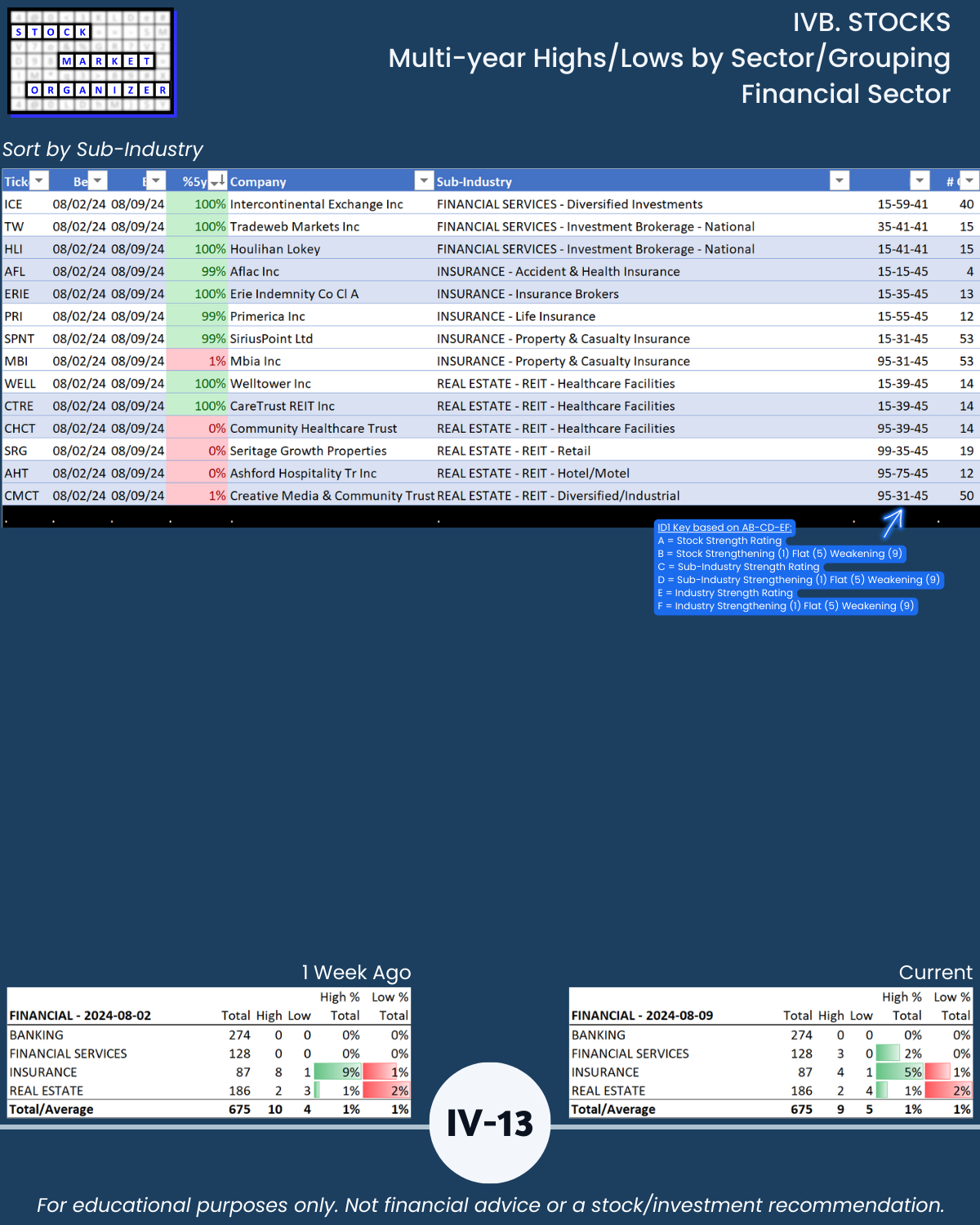

Leading Sector with a 3.6 weighted average ranking:

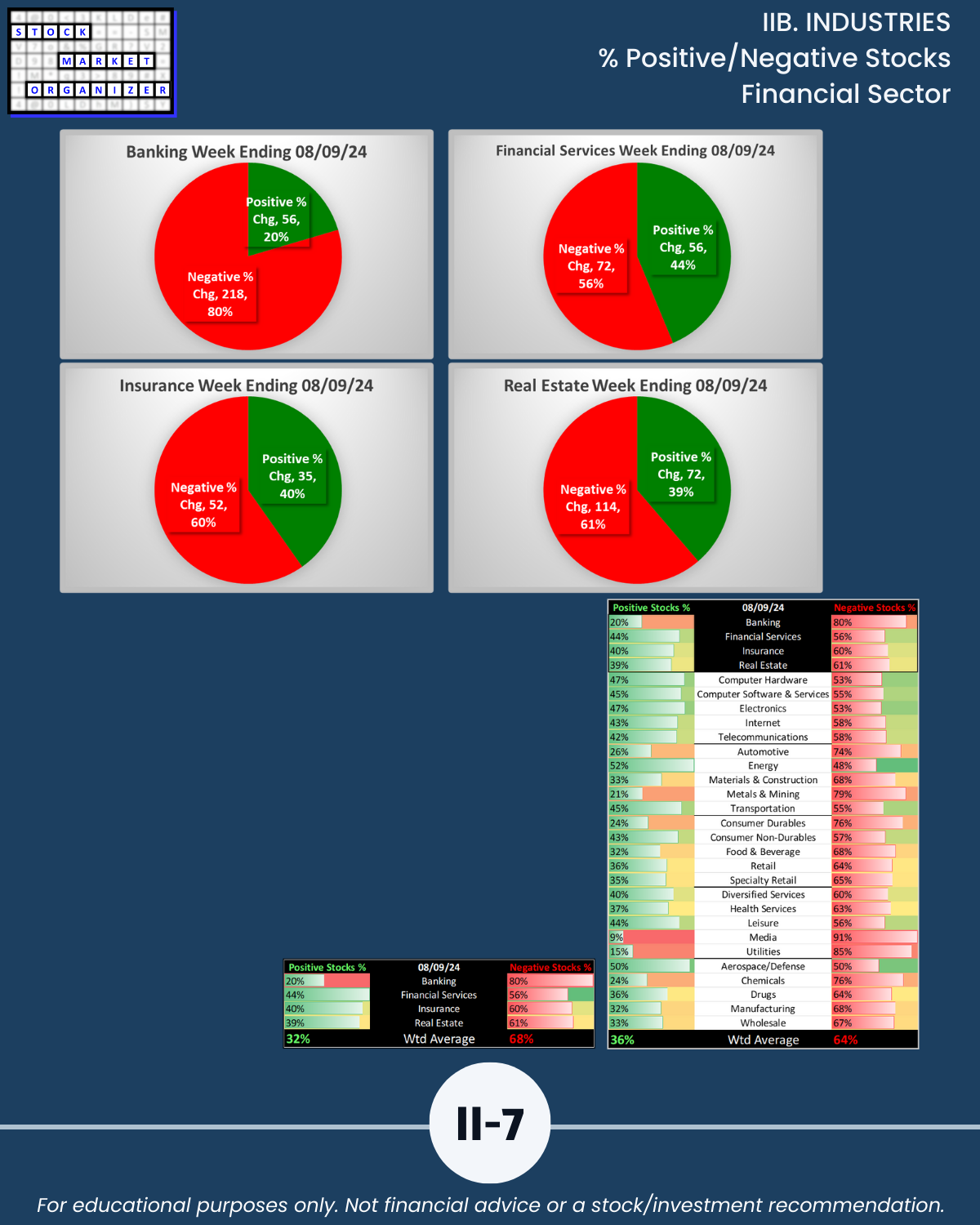

- Financial Sector (Banking, Financial Services, Insurance, Real Estate)

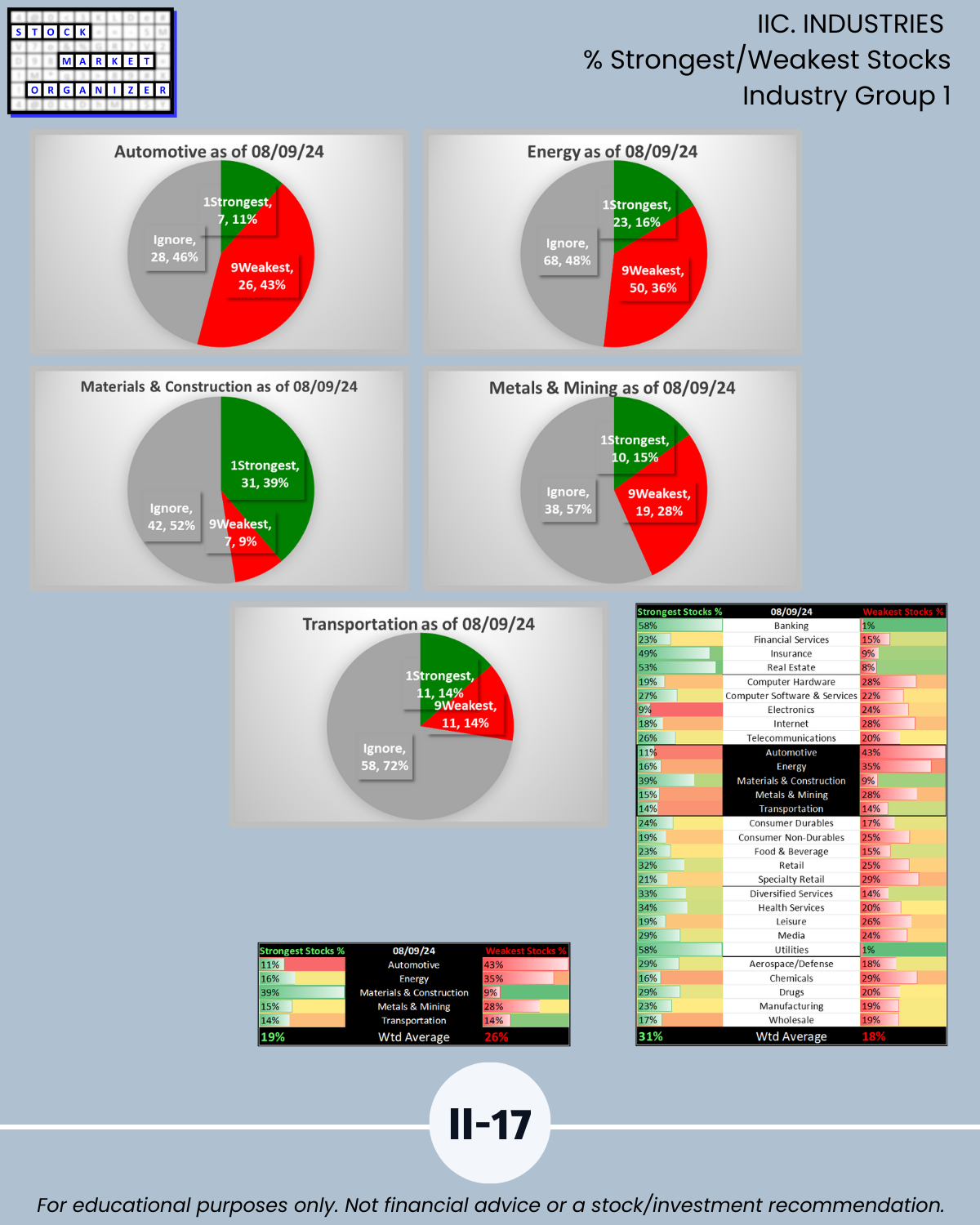

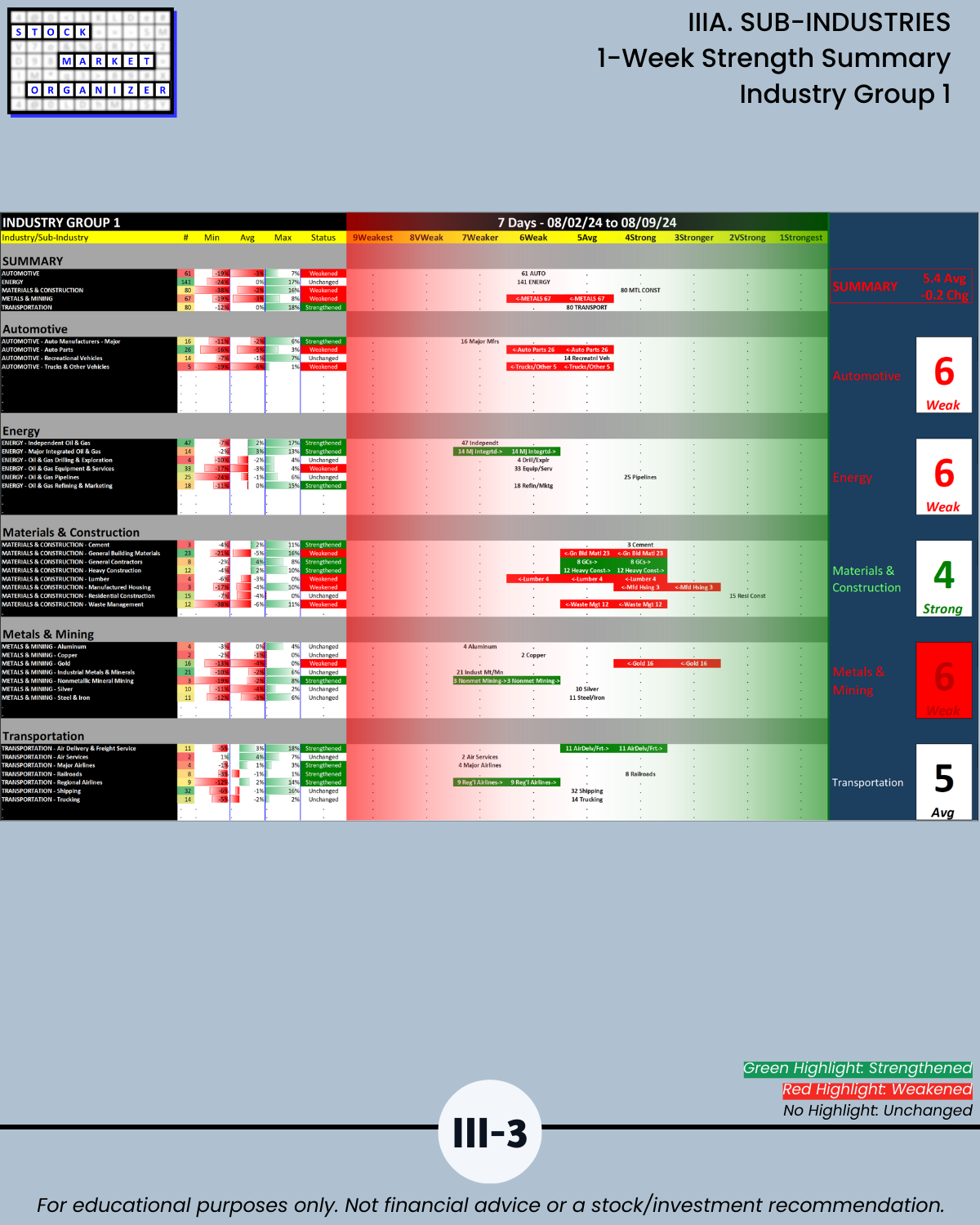

Lagging industry grouping with a 5.4 weighted average ranking:

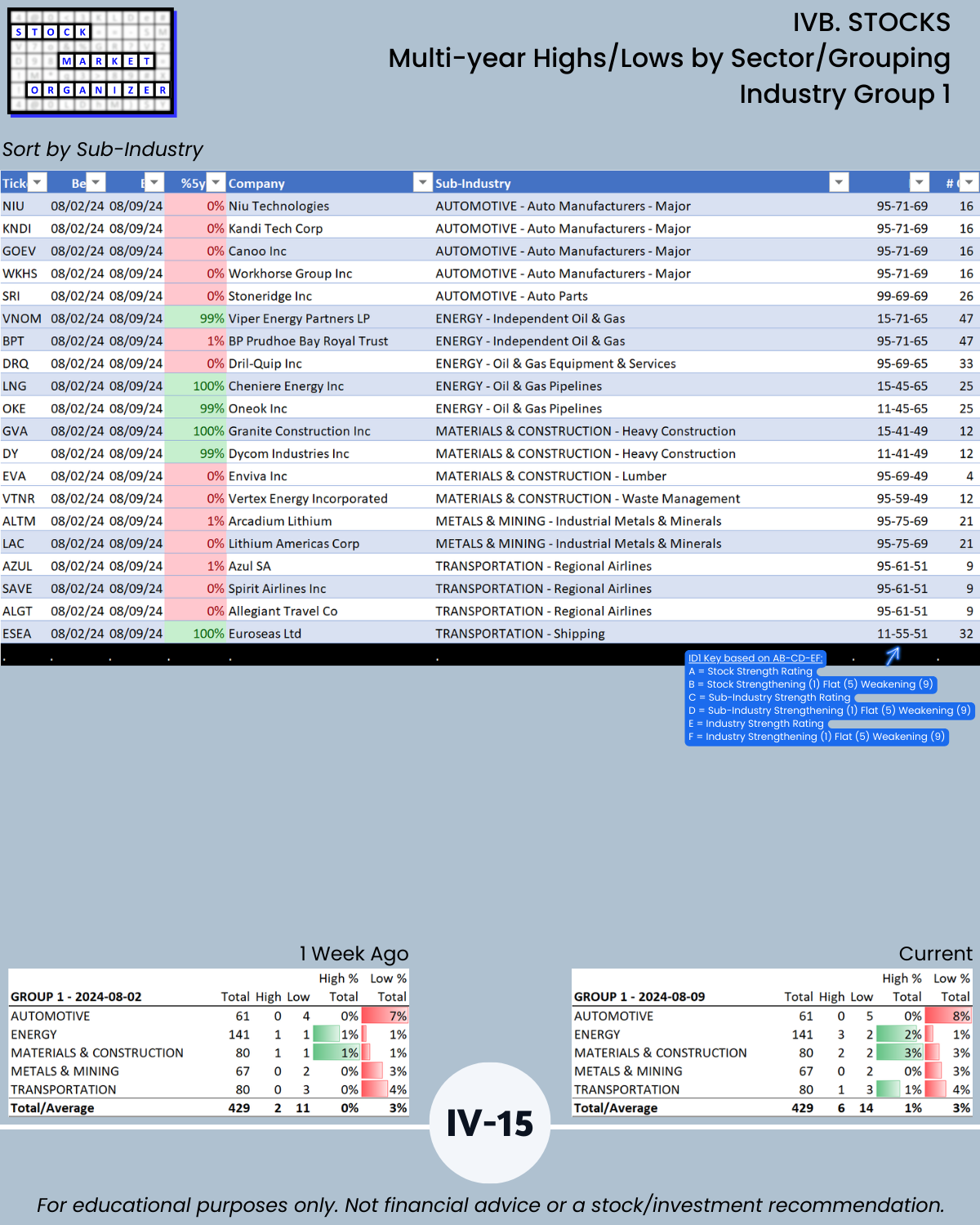

- Industry Group 1 (Automotive, Energy, Materials & Construction, Metals & Mining, Transportation)

Leading Sub-industries (minimum 3 stocks) with a 1Strongest ranking:

- INSURANCE – Accident & Health Insurance

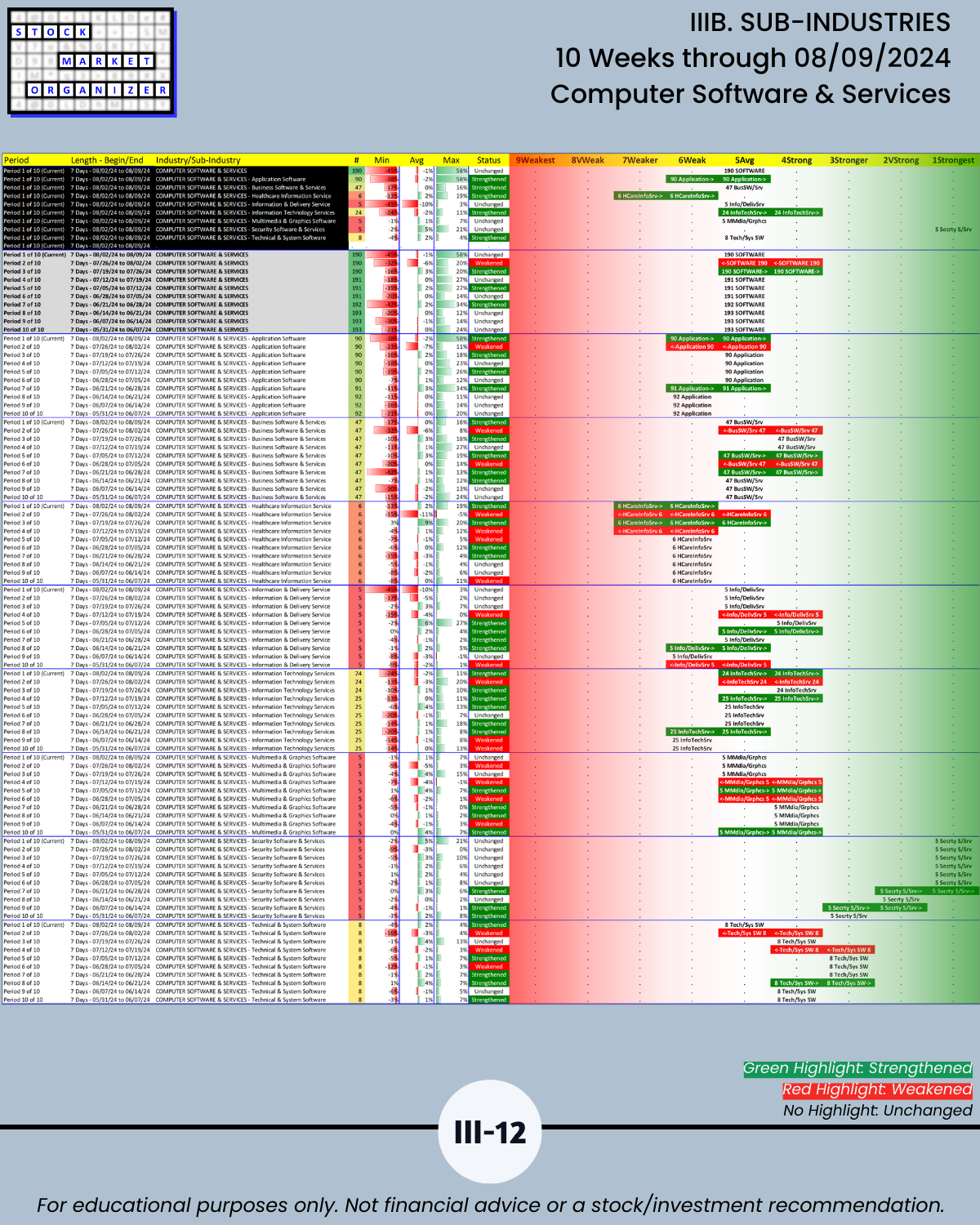

- COMPUTER SOFTWARE & SERVICES - Security Software & Services

Lagging Sub-industry (minimum 3 stocks) with an 8VeryWeak ranking:

- WHOLESALE - Auto Parts

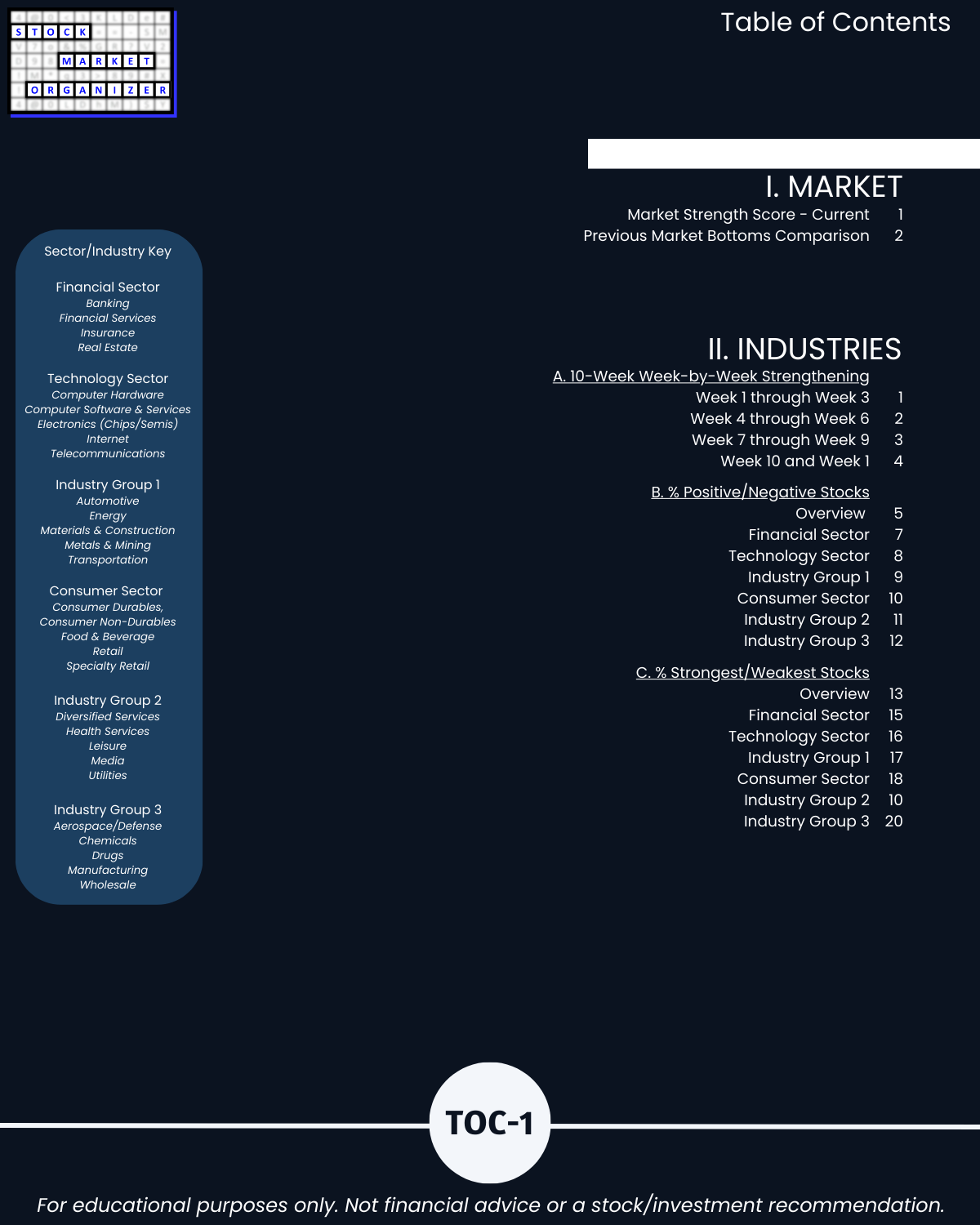

I. MARKET Prologue Critical Concepts/Market Strength Score

IIA. INDUSTRIES 10-Week Week-by-Week Strengthening

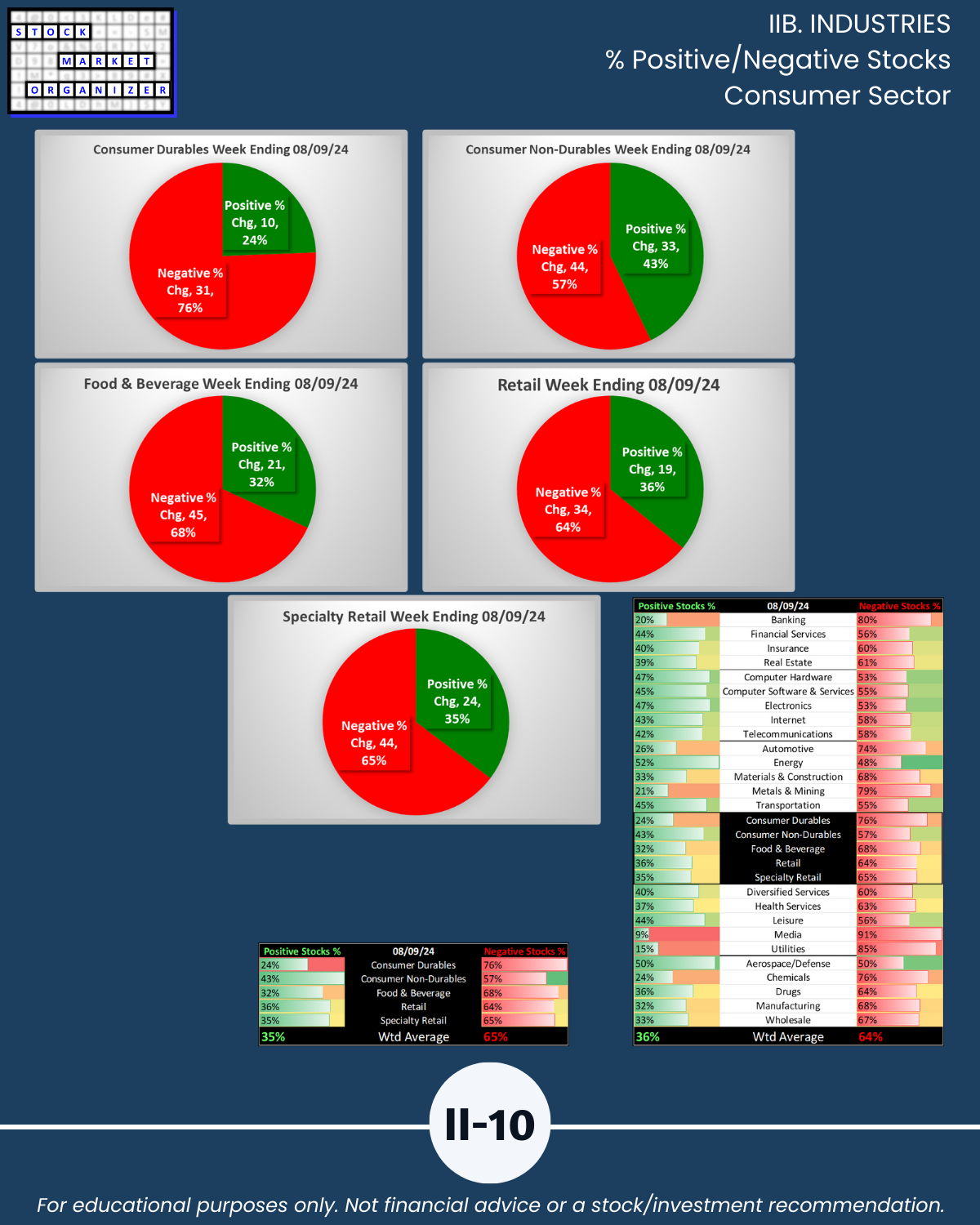

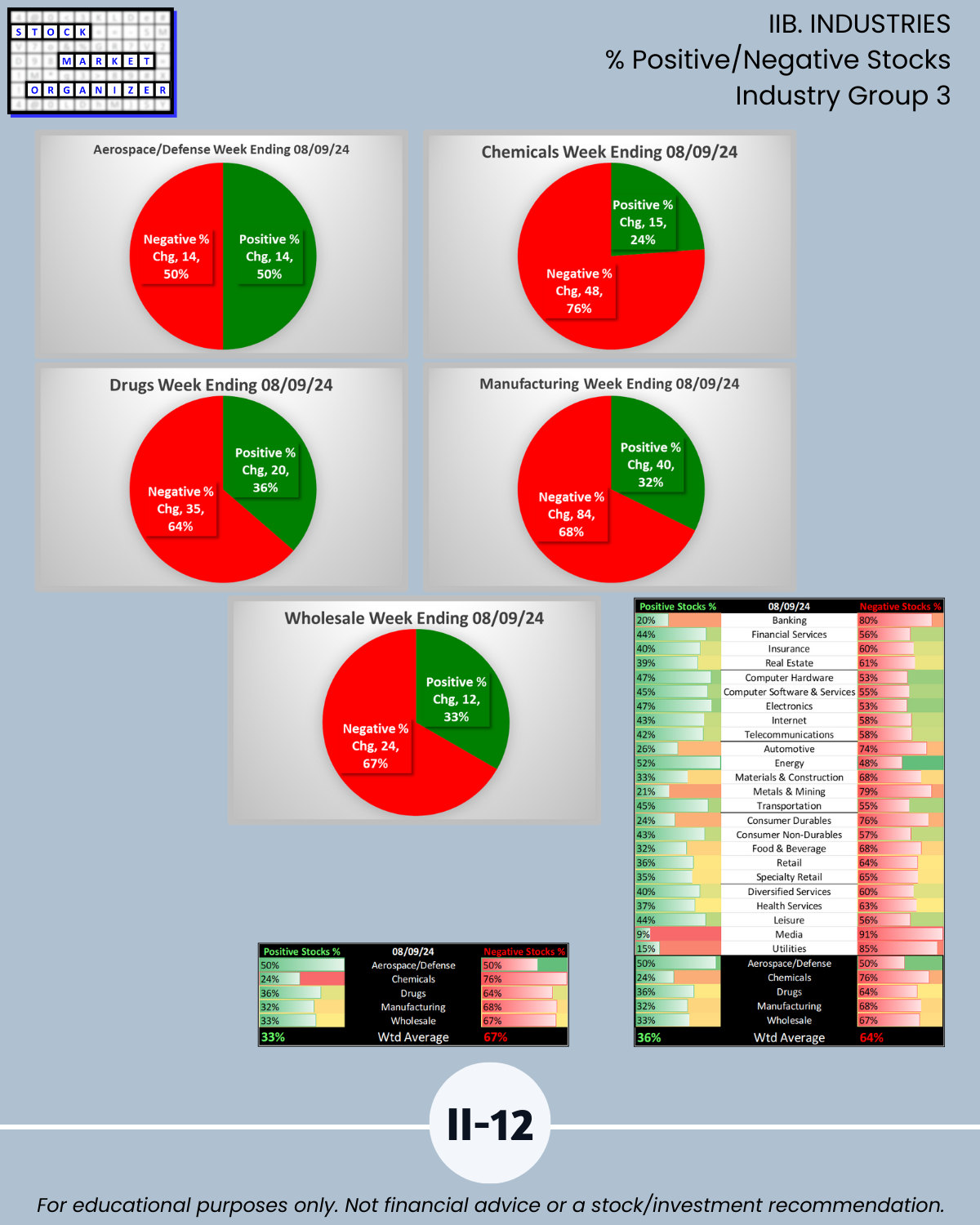

IIB. INDUSTRIES % Positive/Negative Stocks

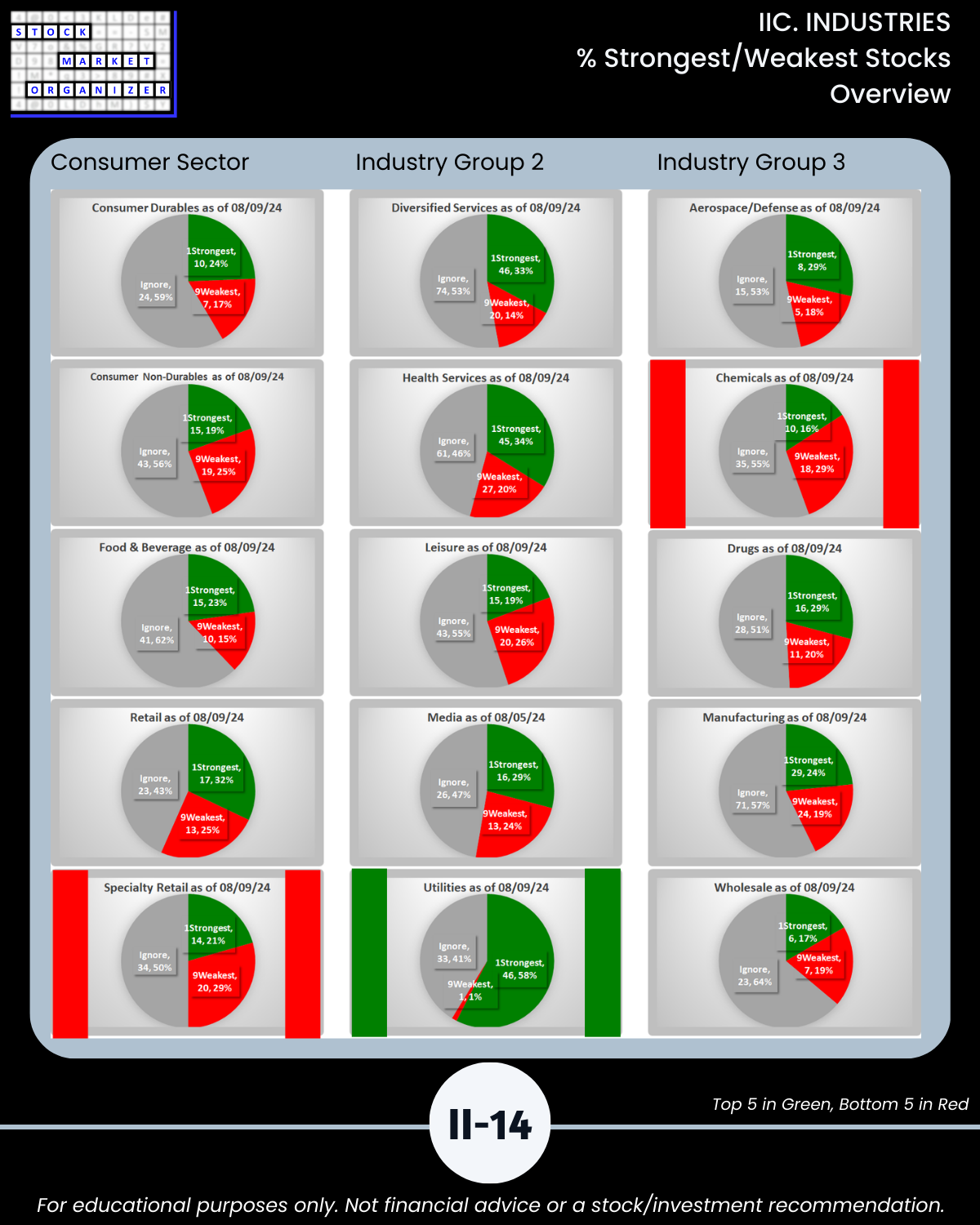

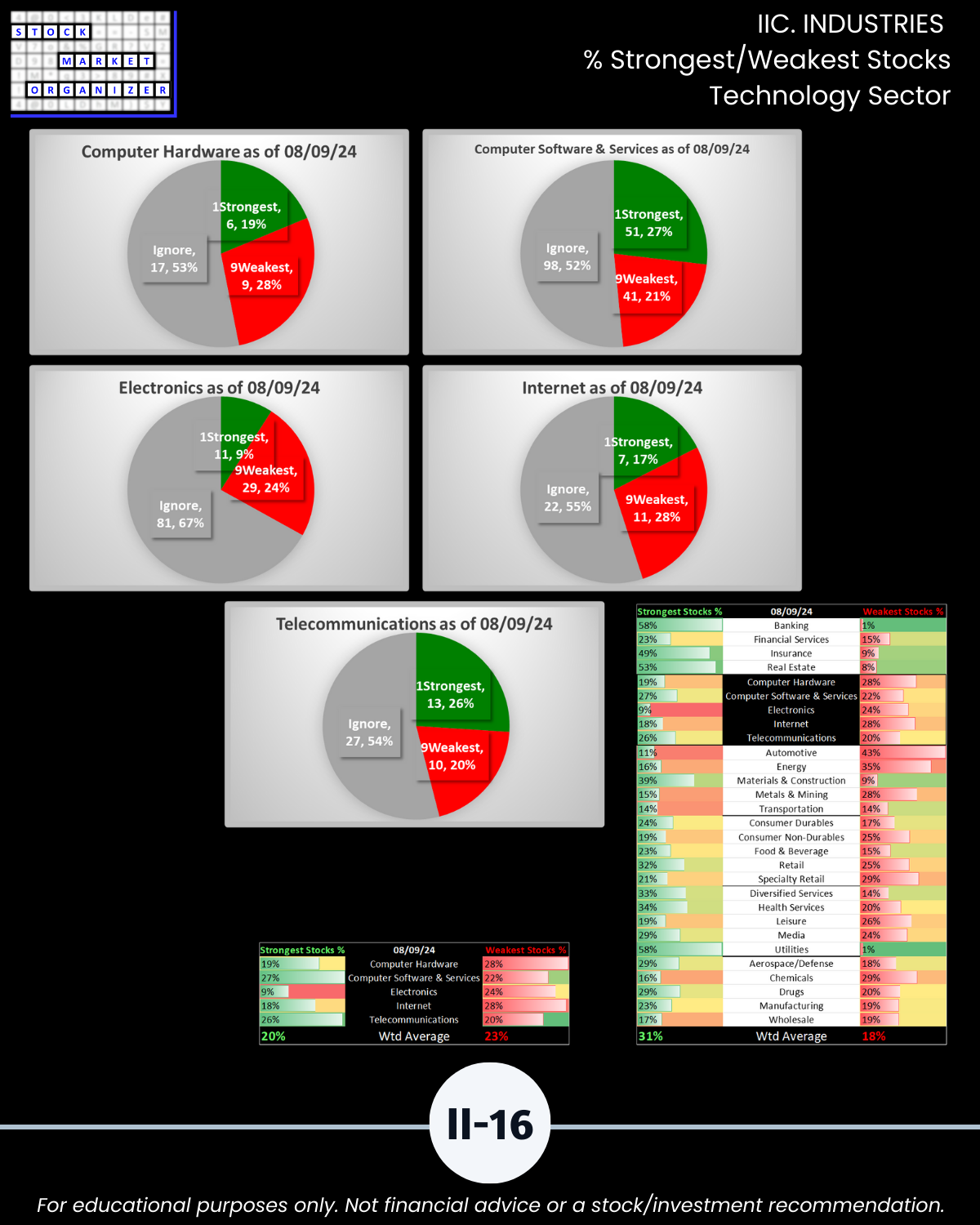

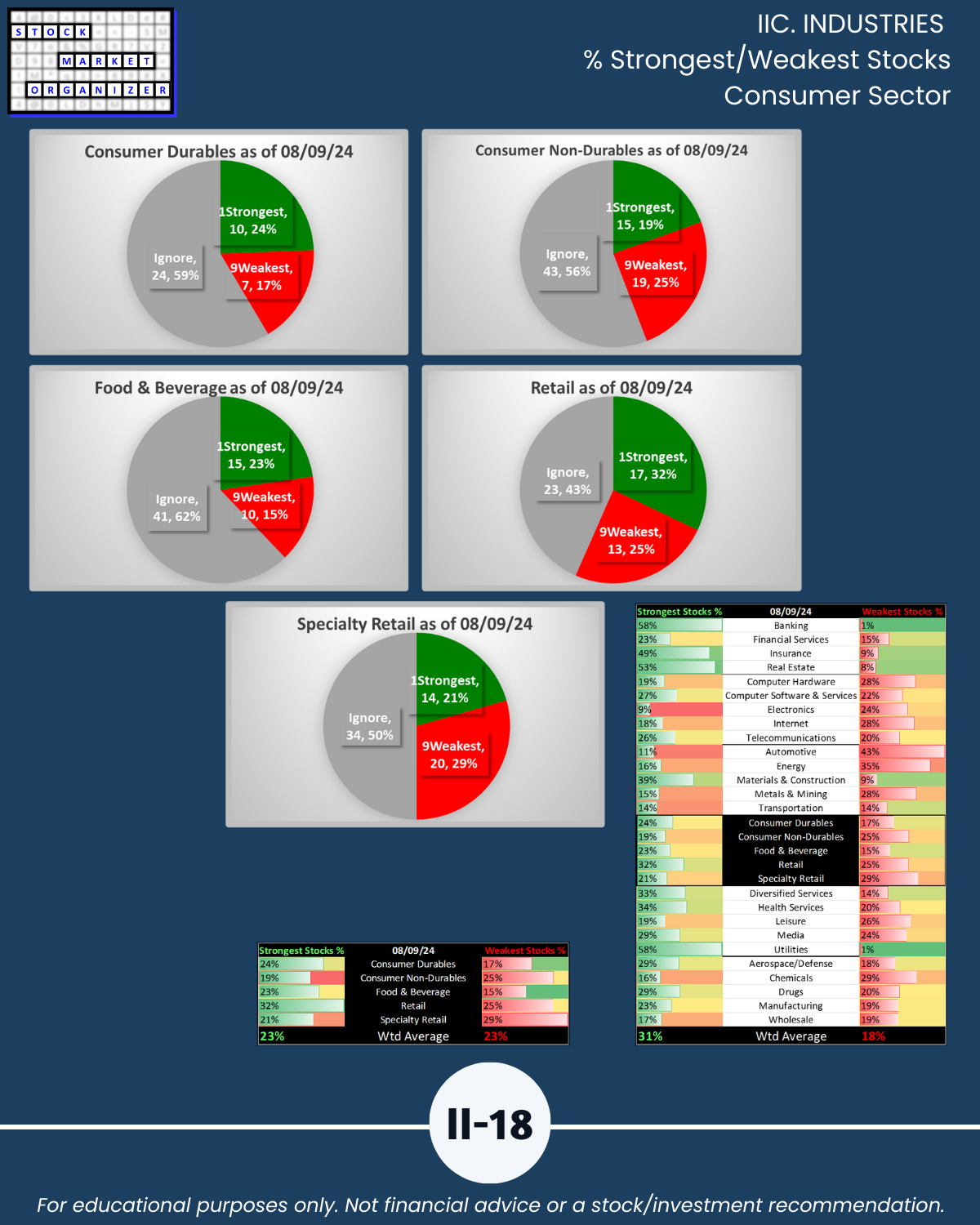

IIC. INDUSTRIES % Strongest/Weakest Stocks

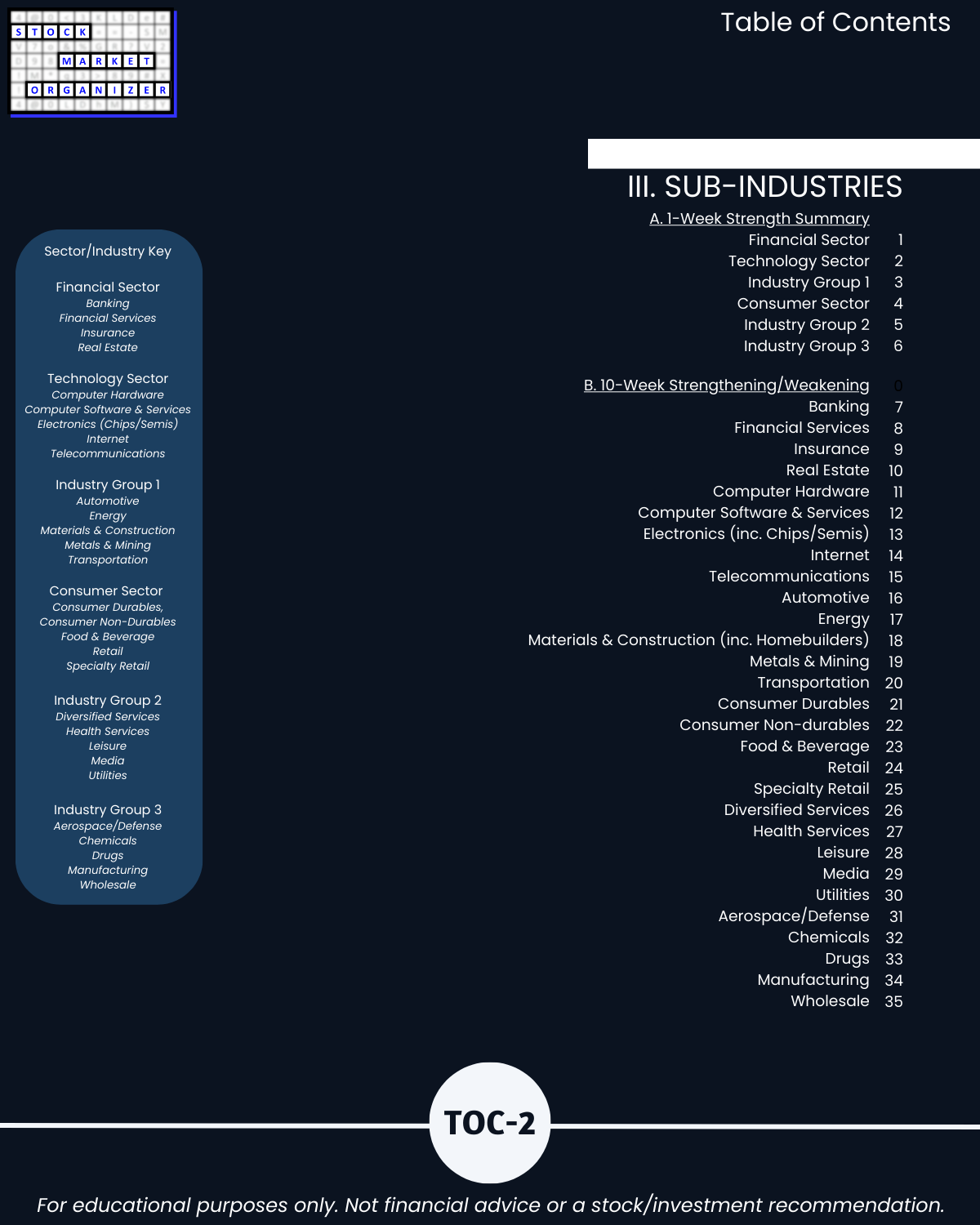

IIIA. SUB-INDUSTRIES 1-Week Strength Summary

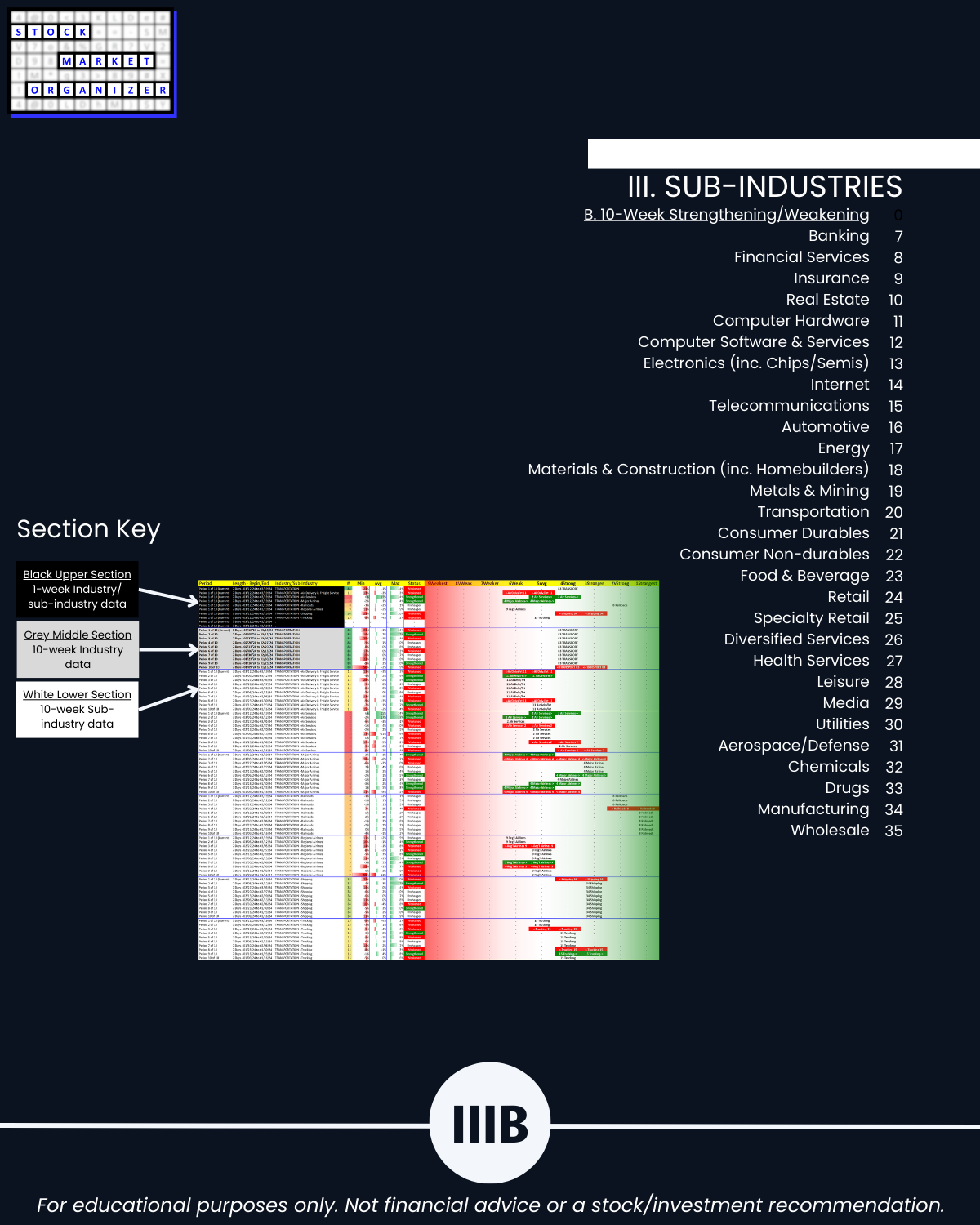

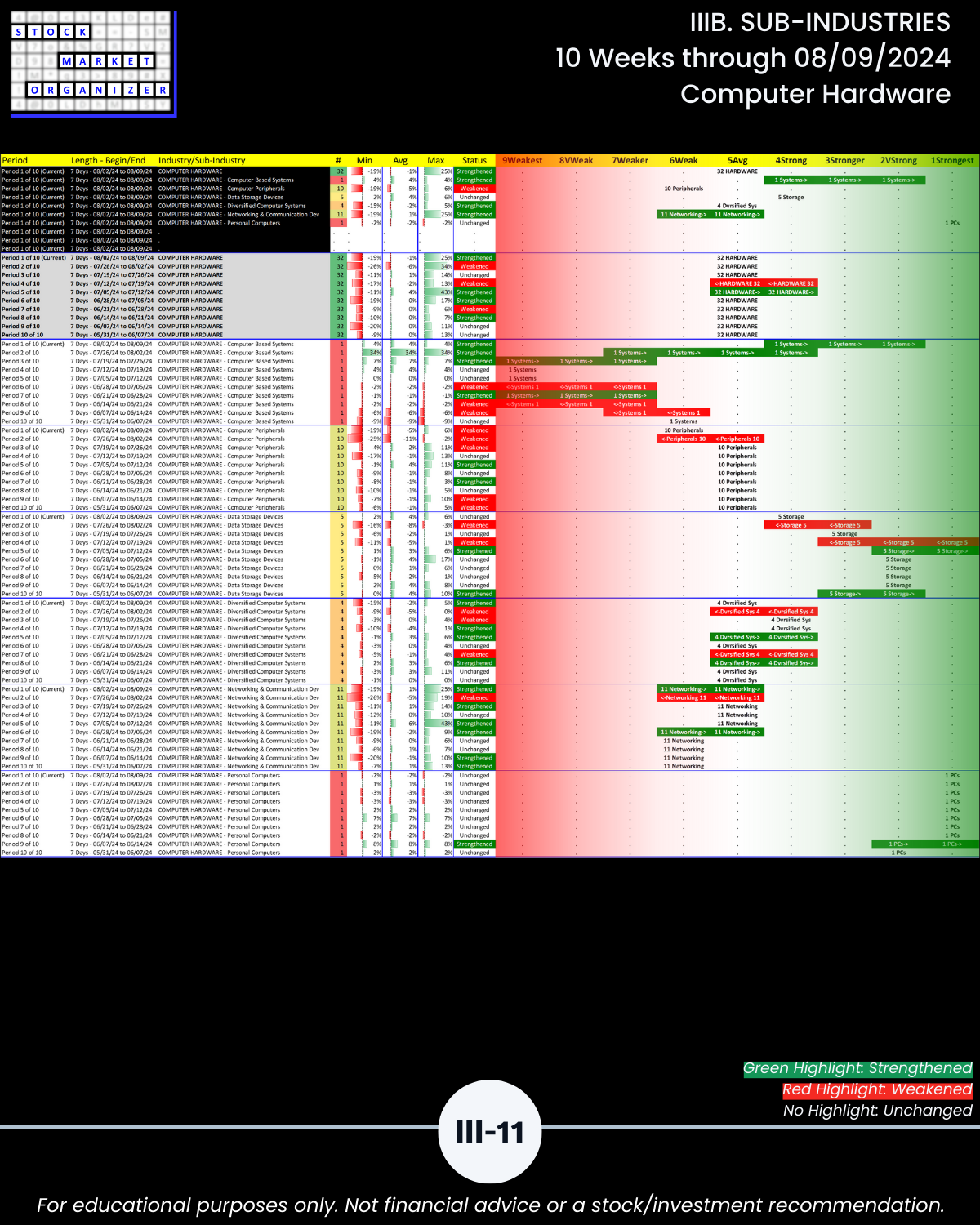

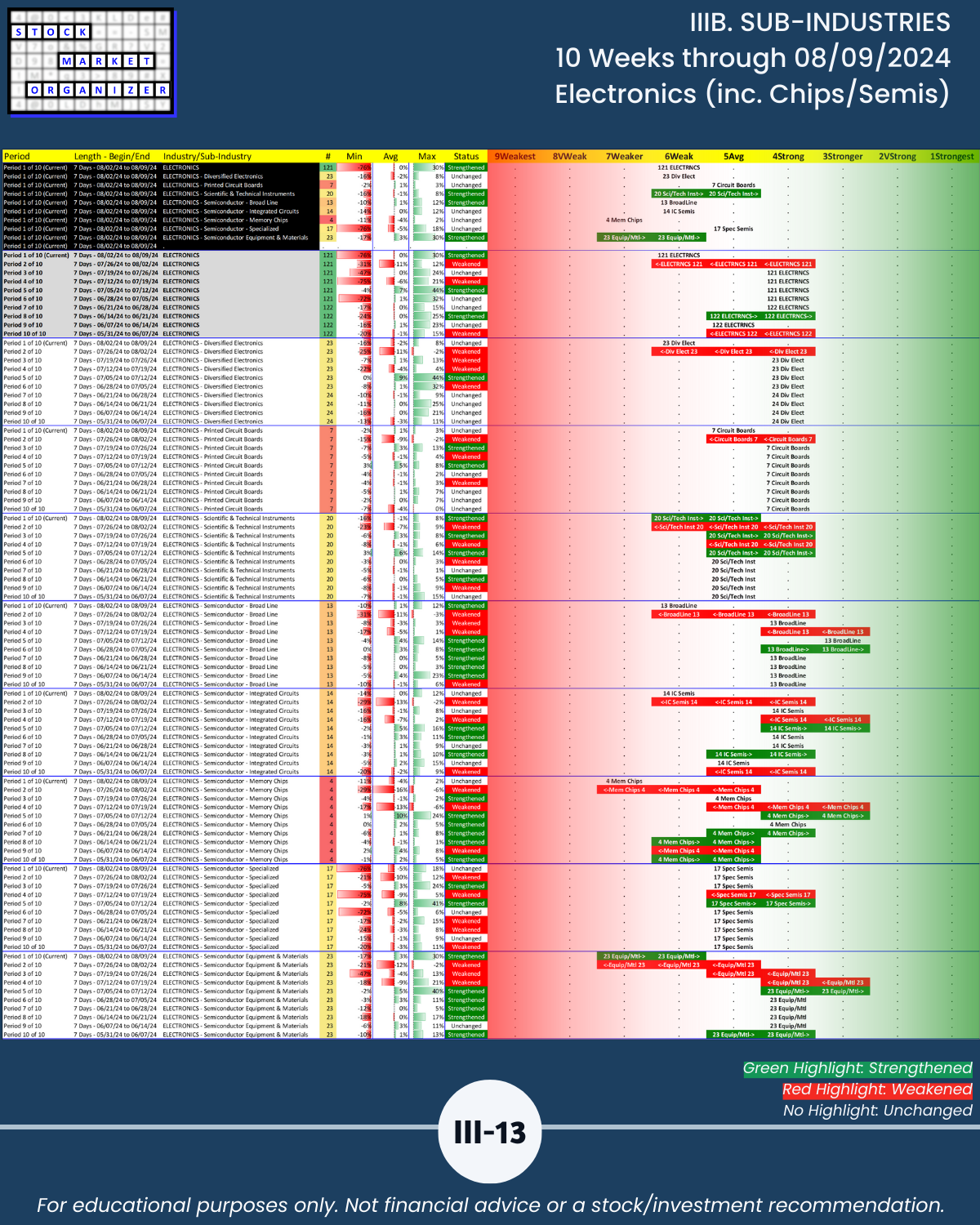

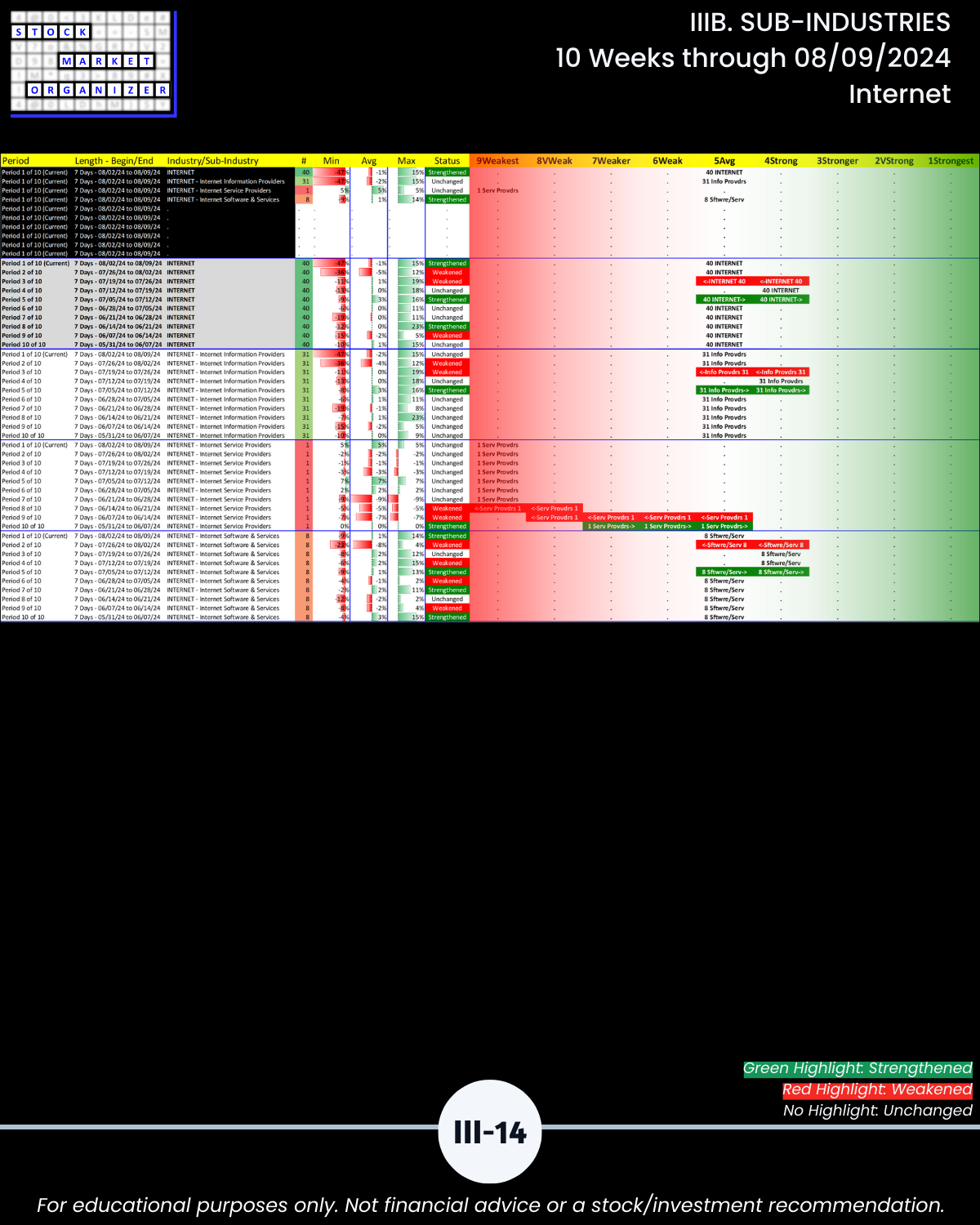

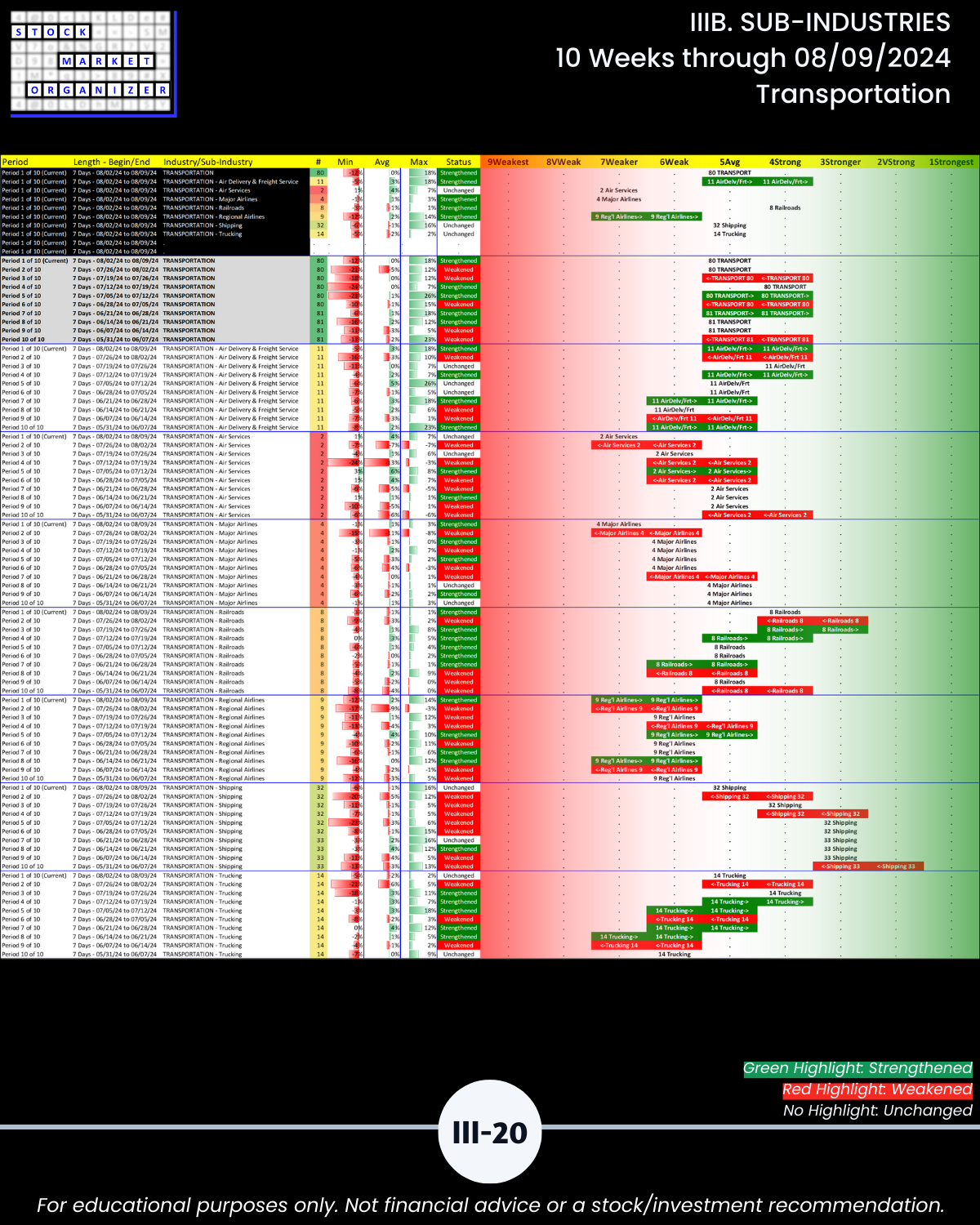

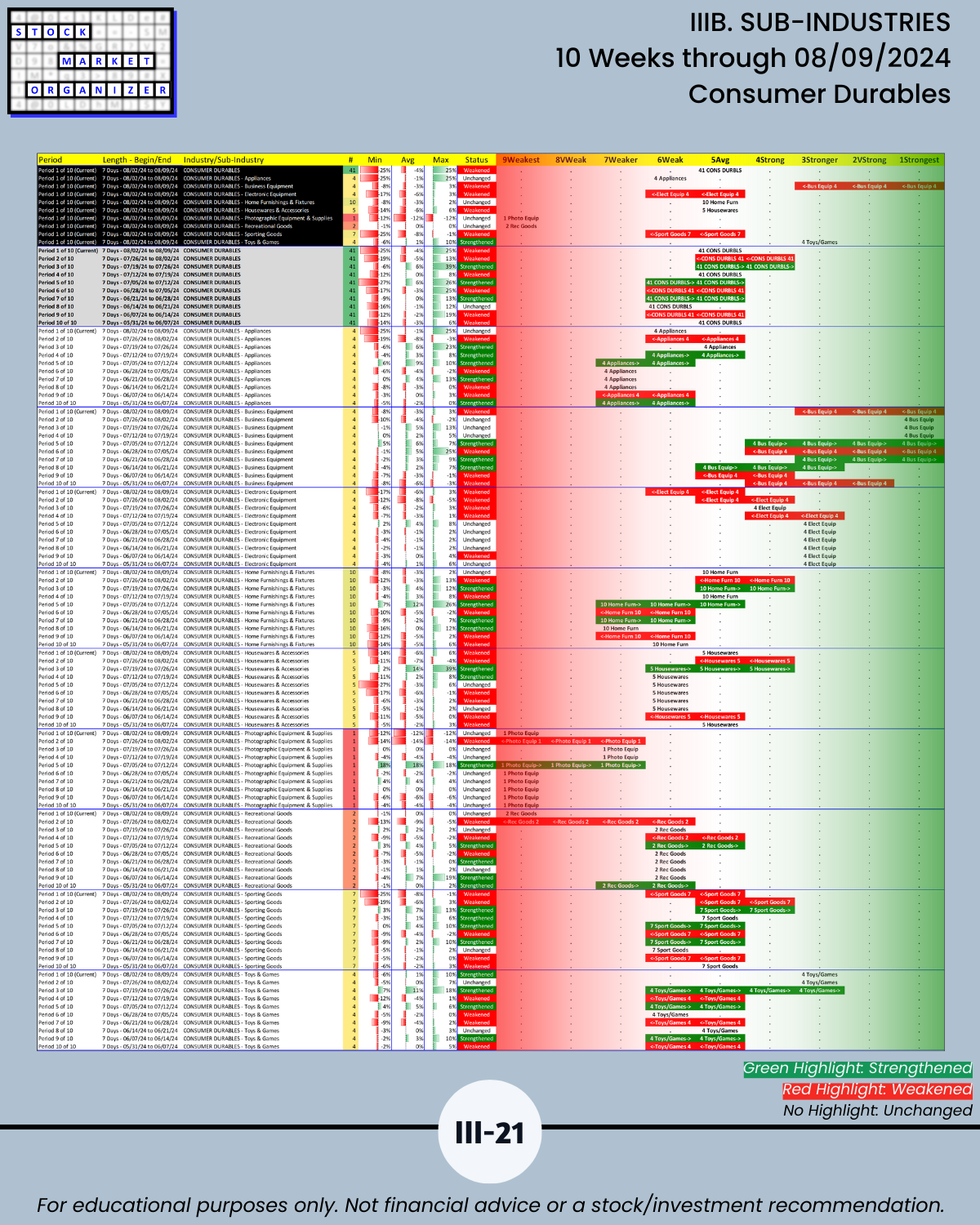

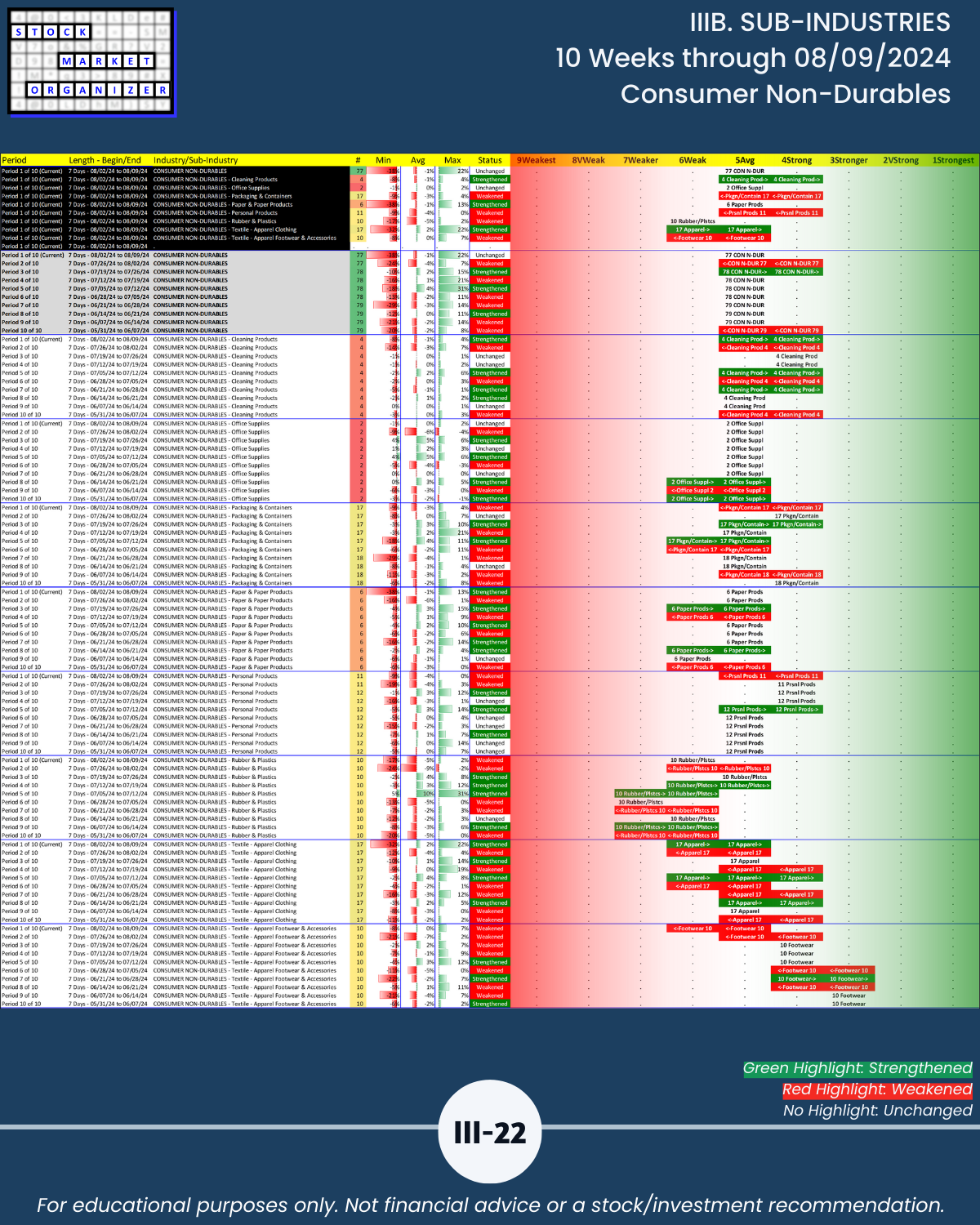

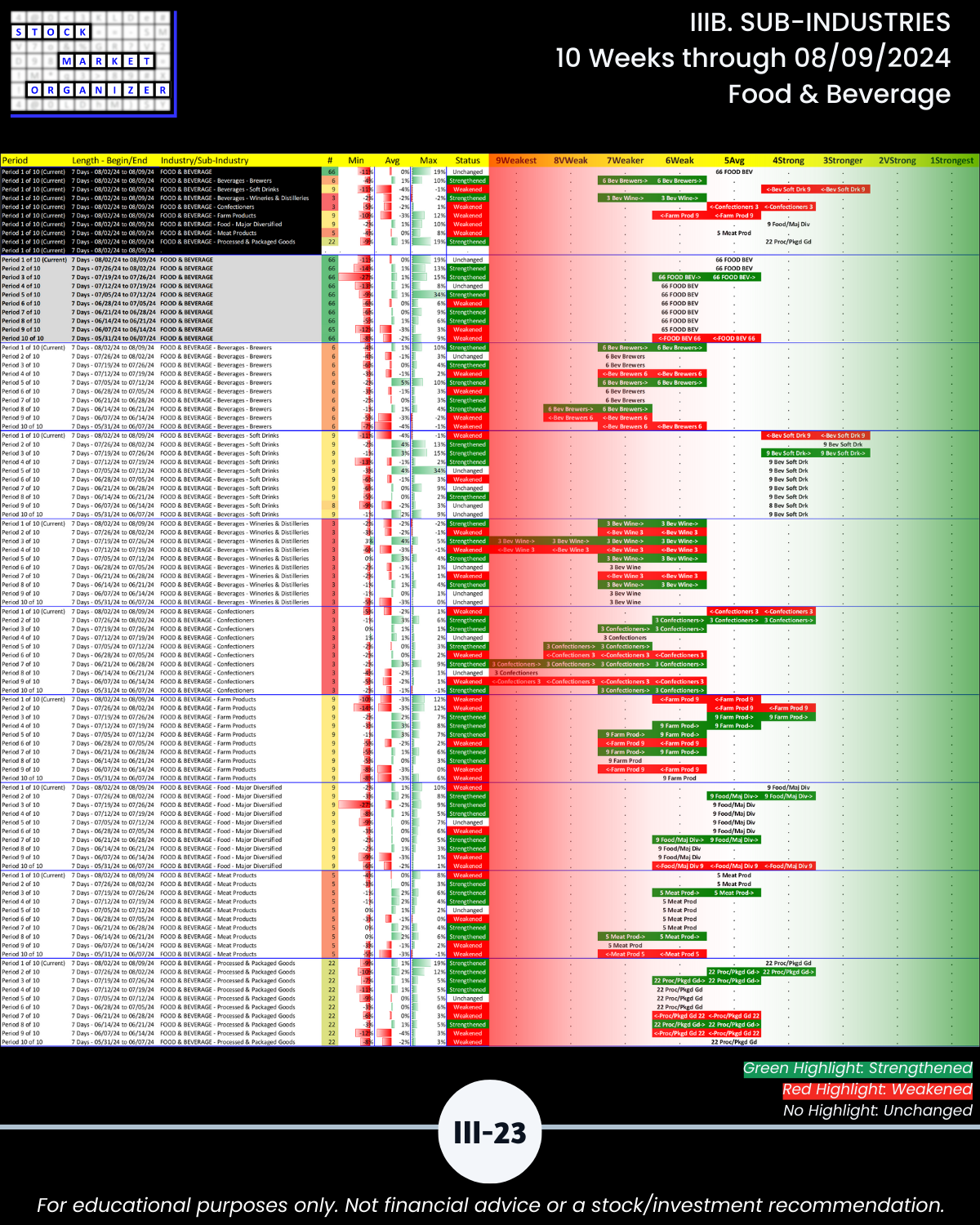

IIIB. SUB-INDUSTRIES 10-Week Strengthening/Weakening

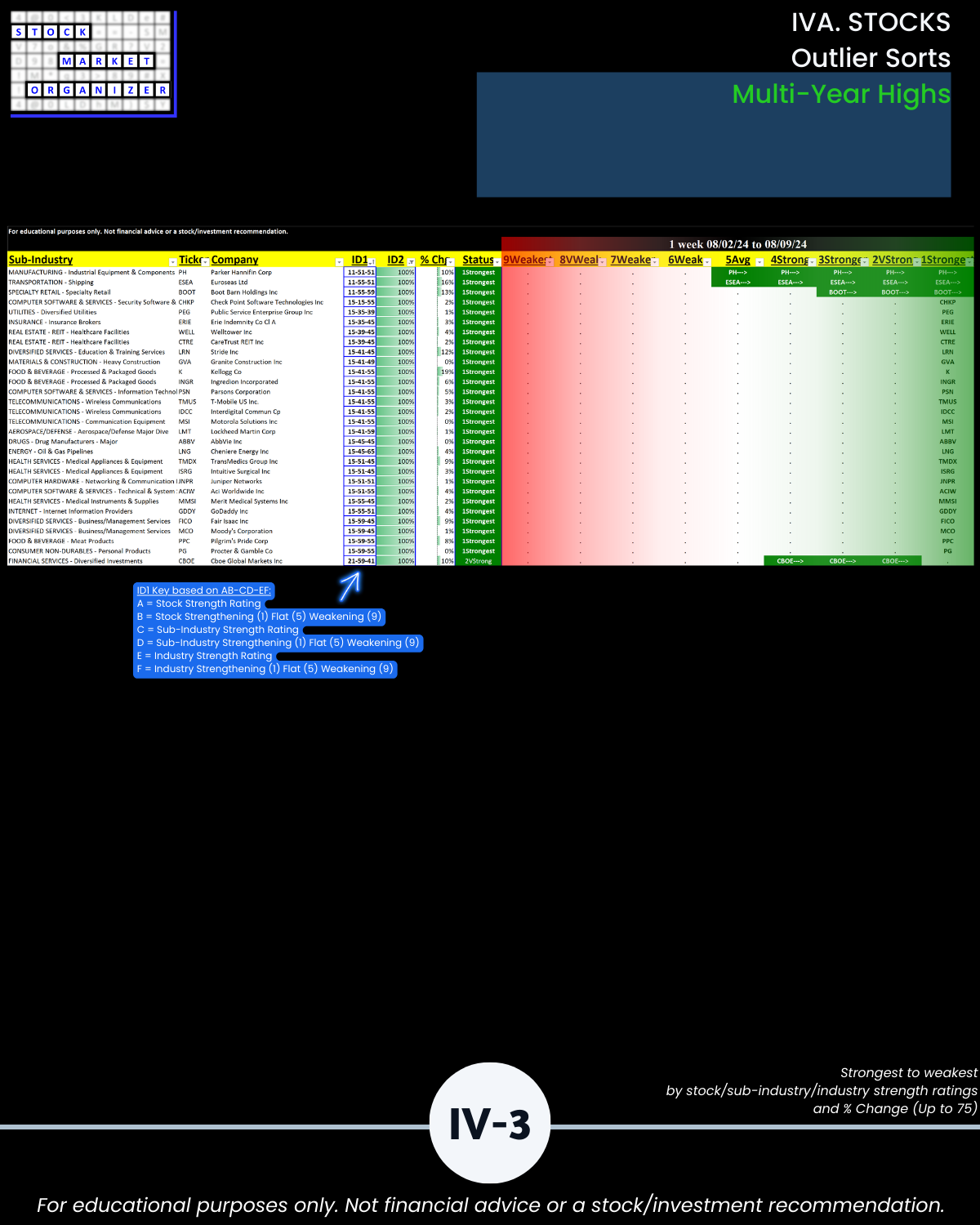

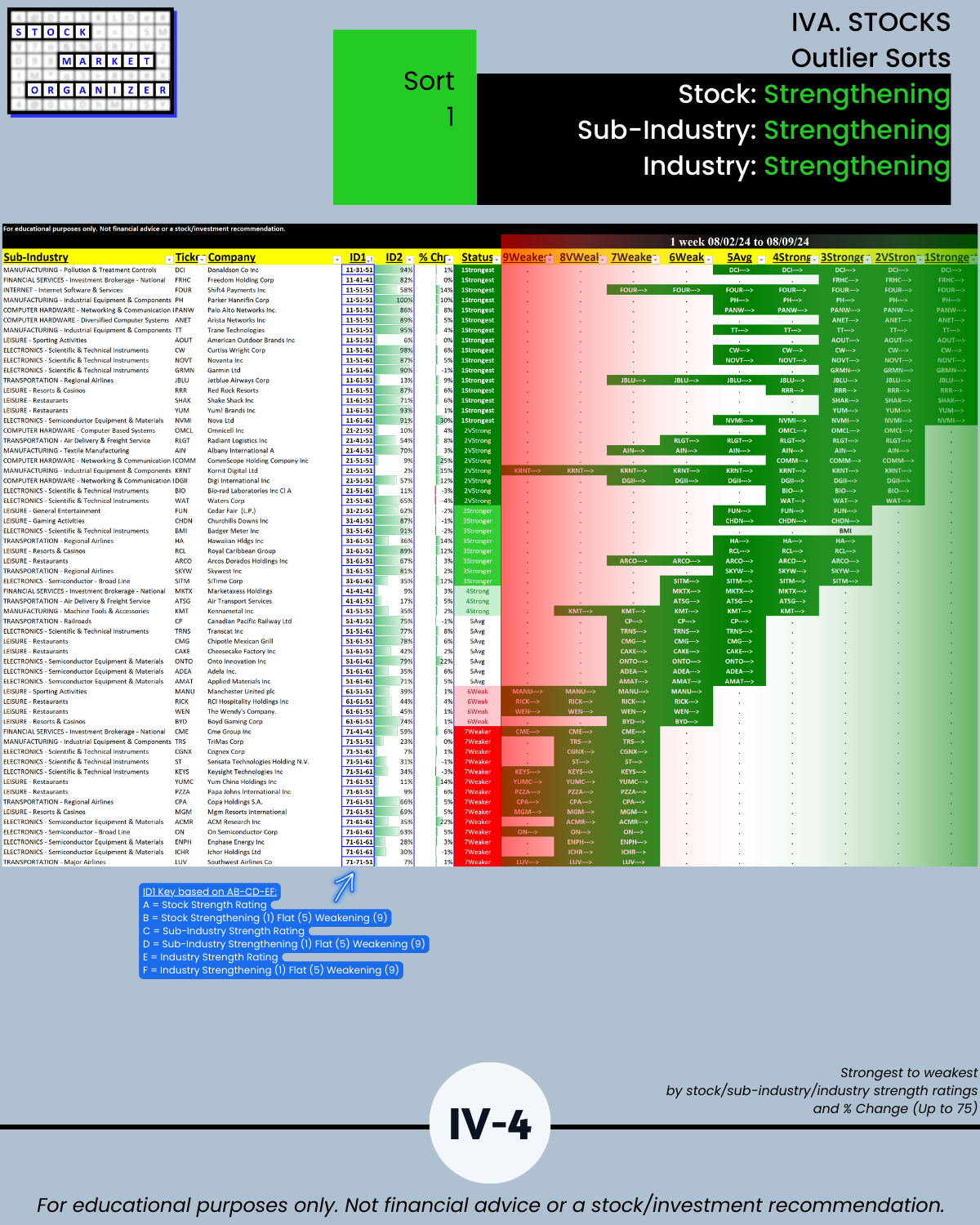

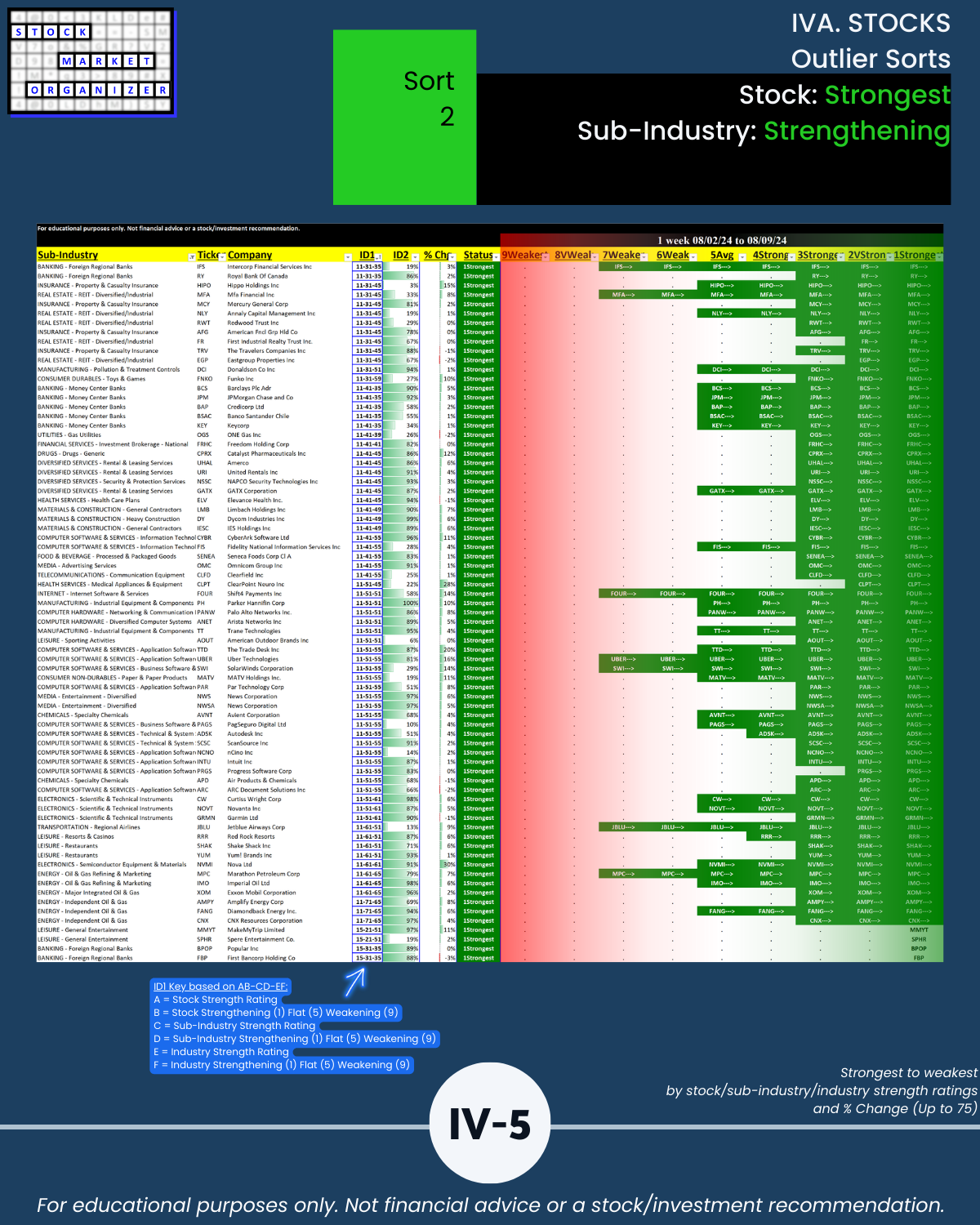

IVA. STOCKS Outlier Sorts

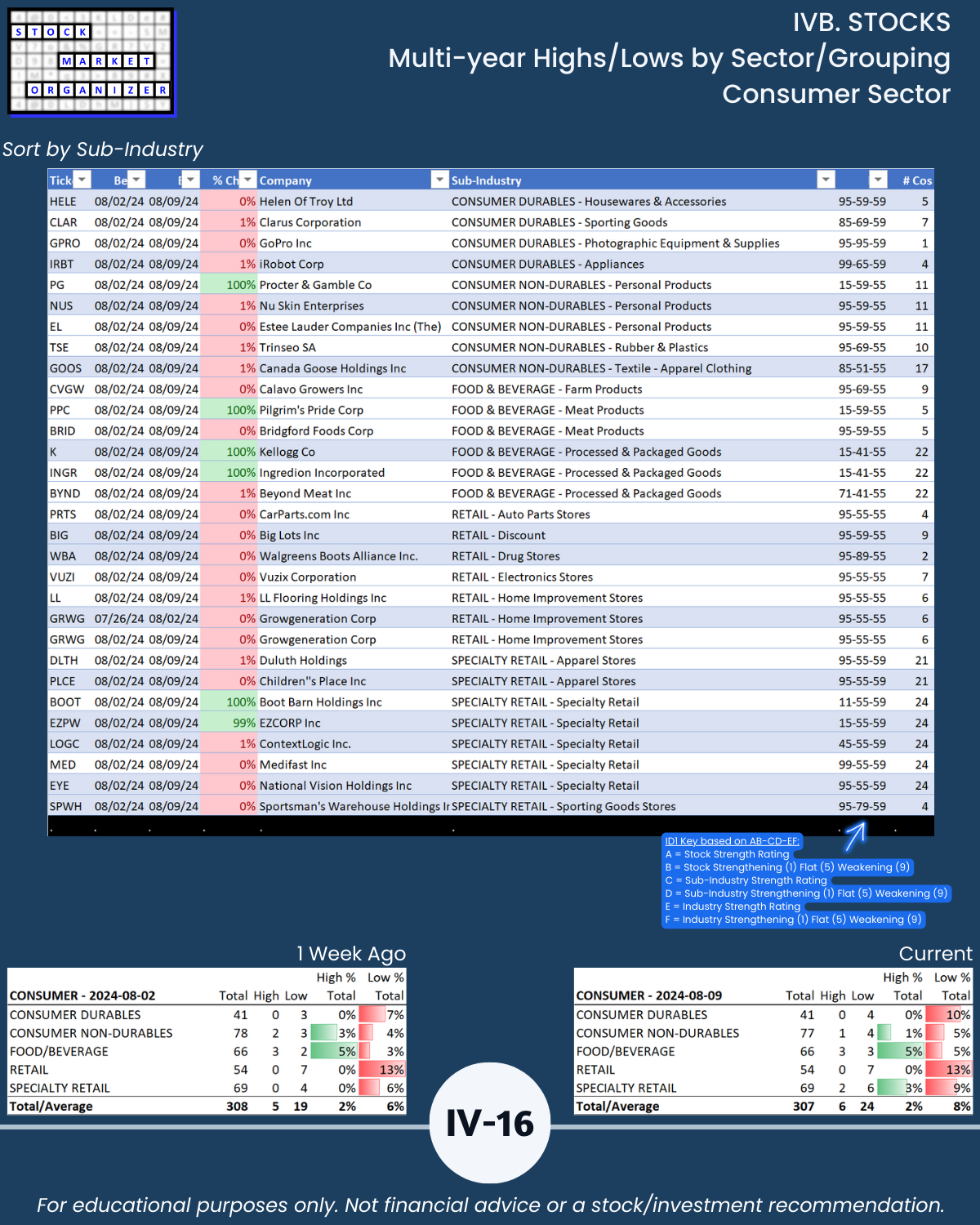

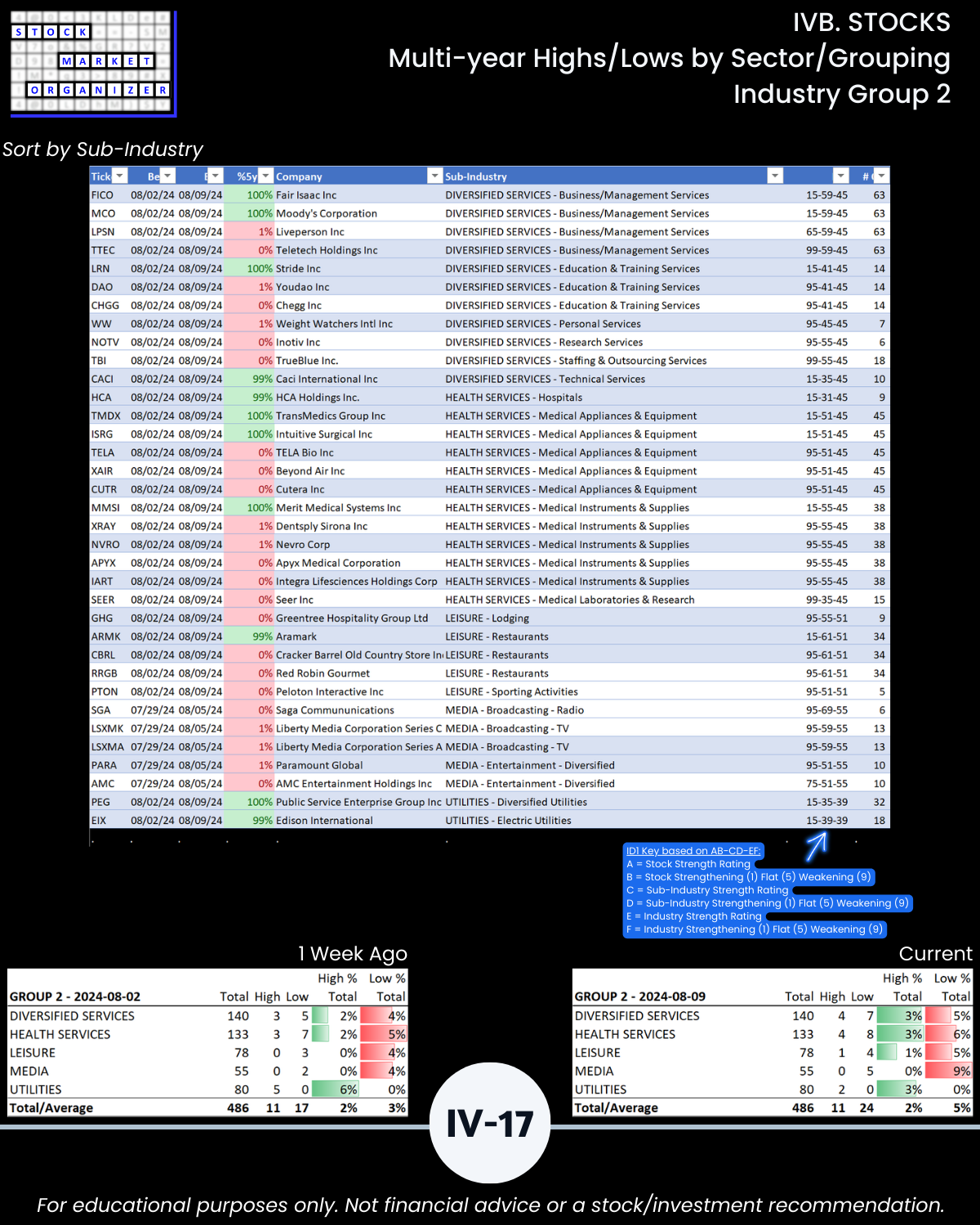

IVB. STOCKS Multi-Year Highs/Lows by Sector/Grouping

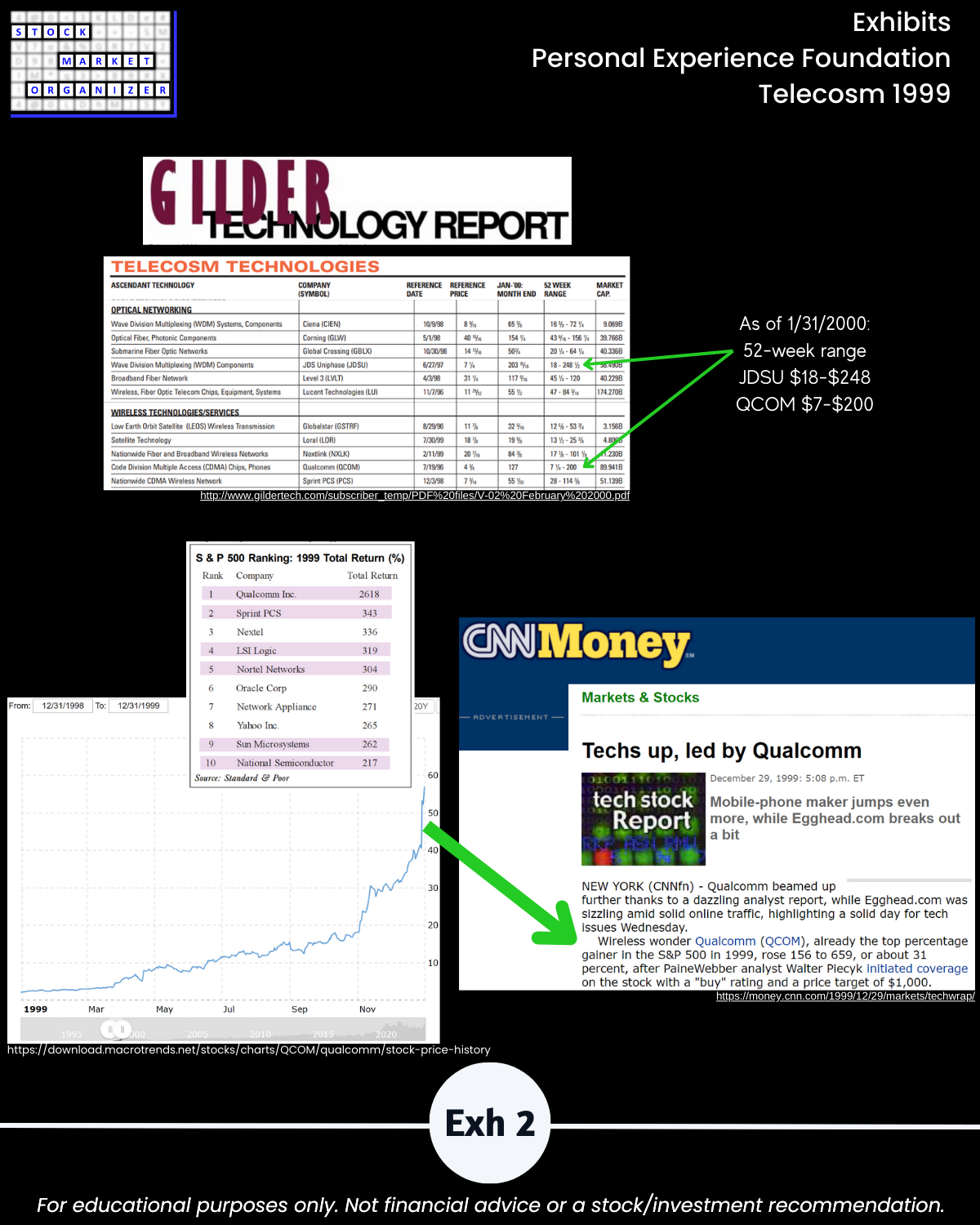

IV. EXHIBITS System Foundations