SMO Exclusive: U.S. Stock Market Strength Report 2024-07-12 (no new Shorts)

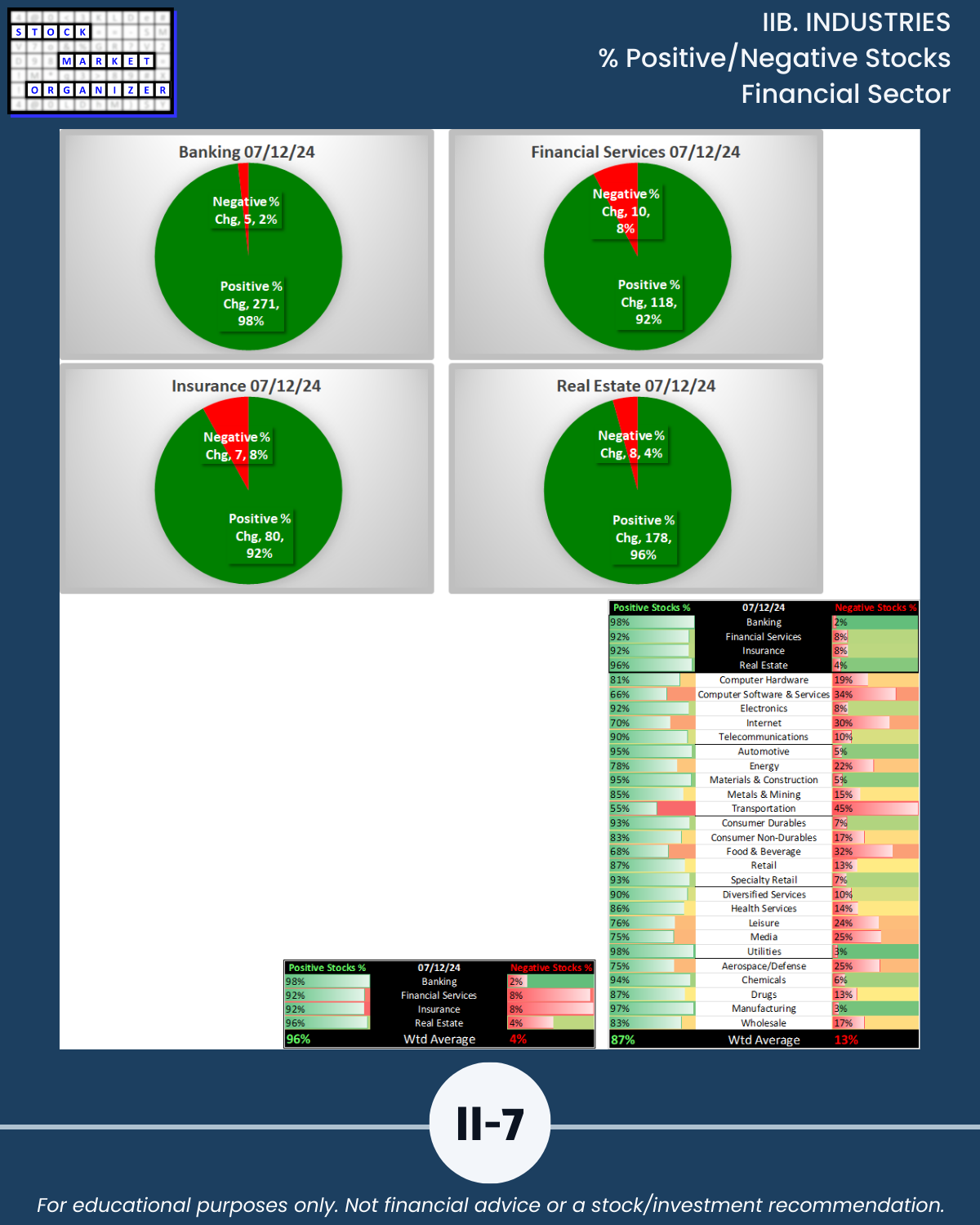

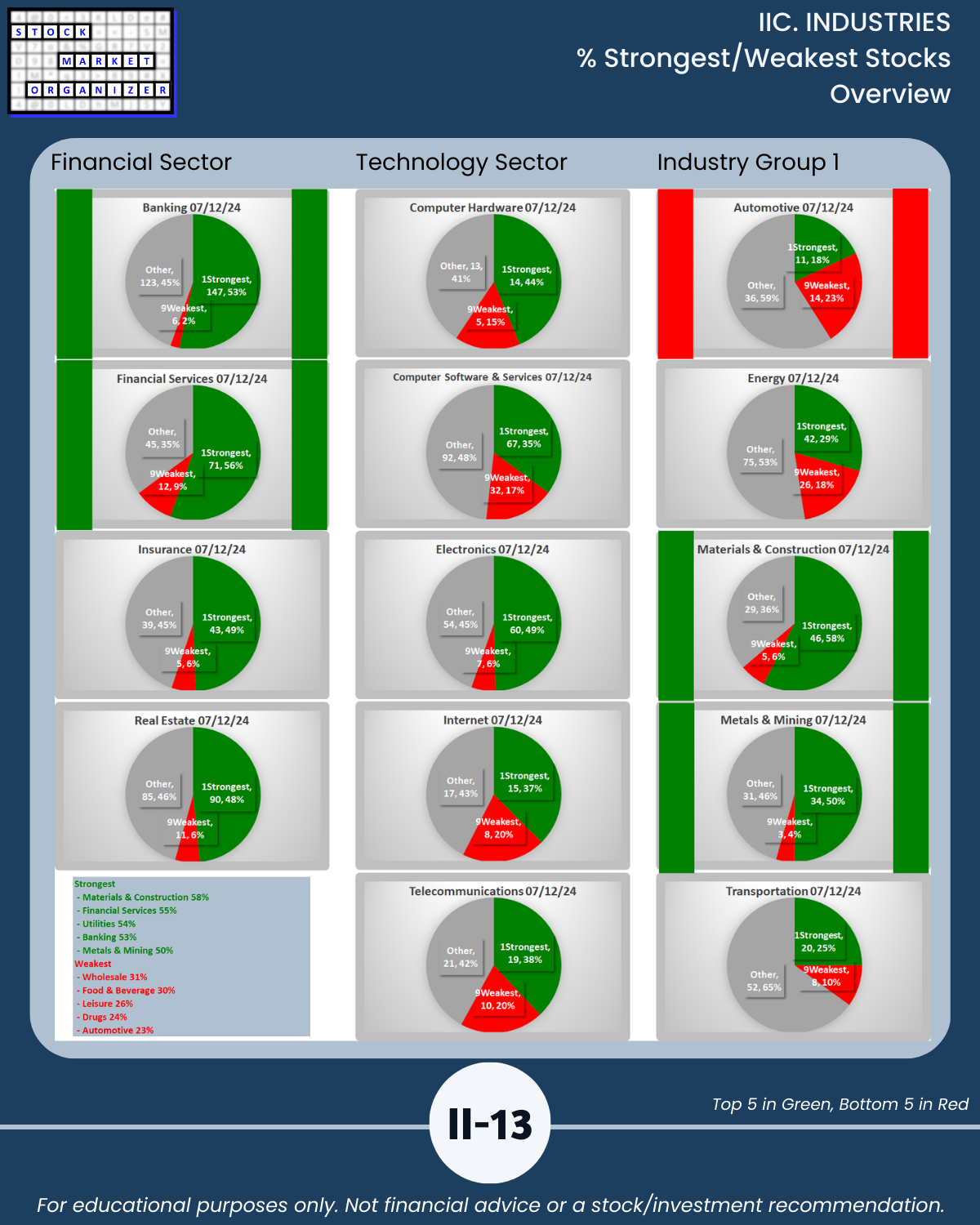

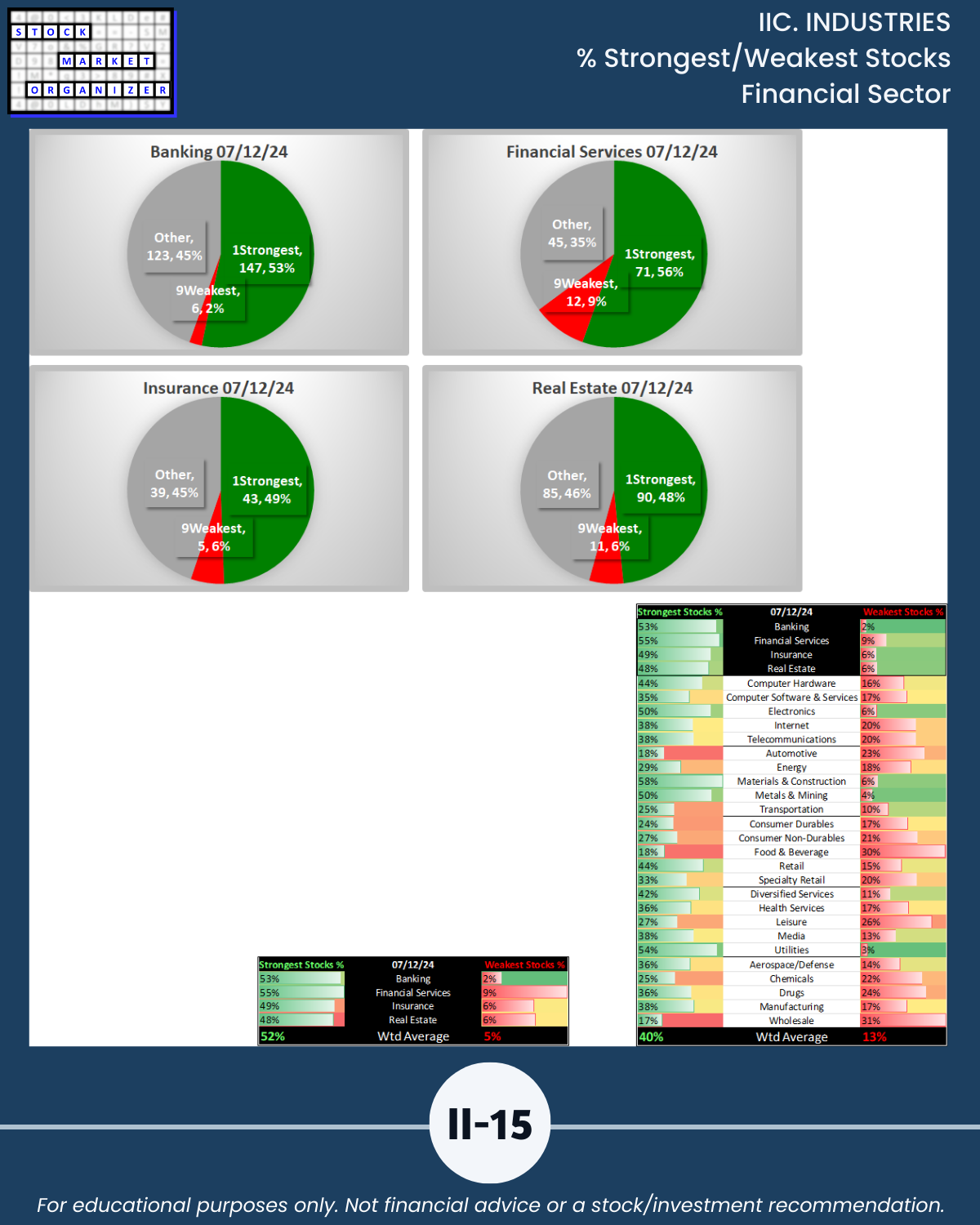

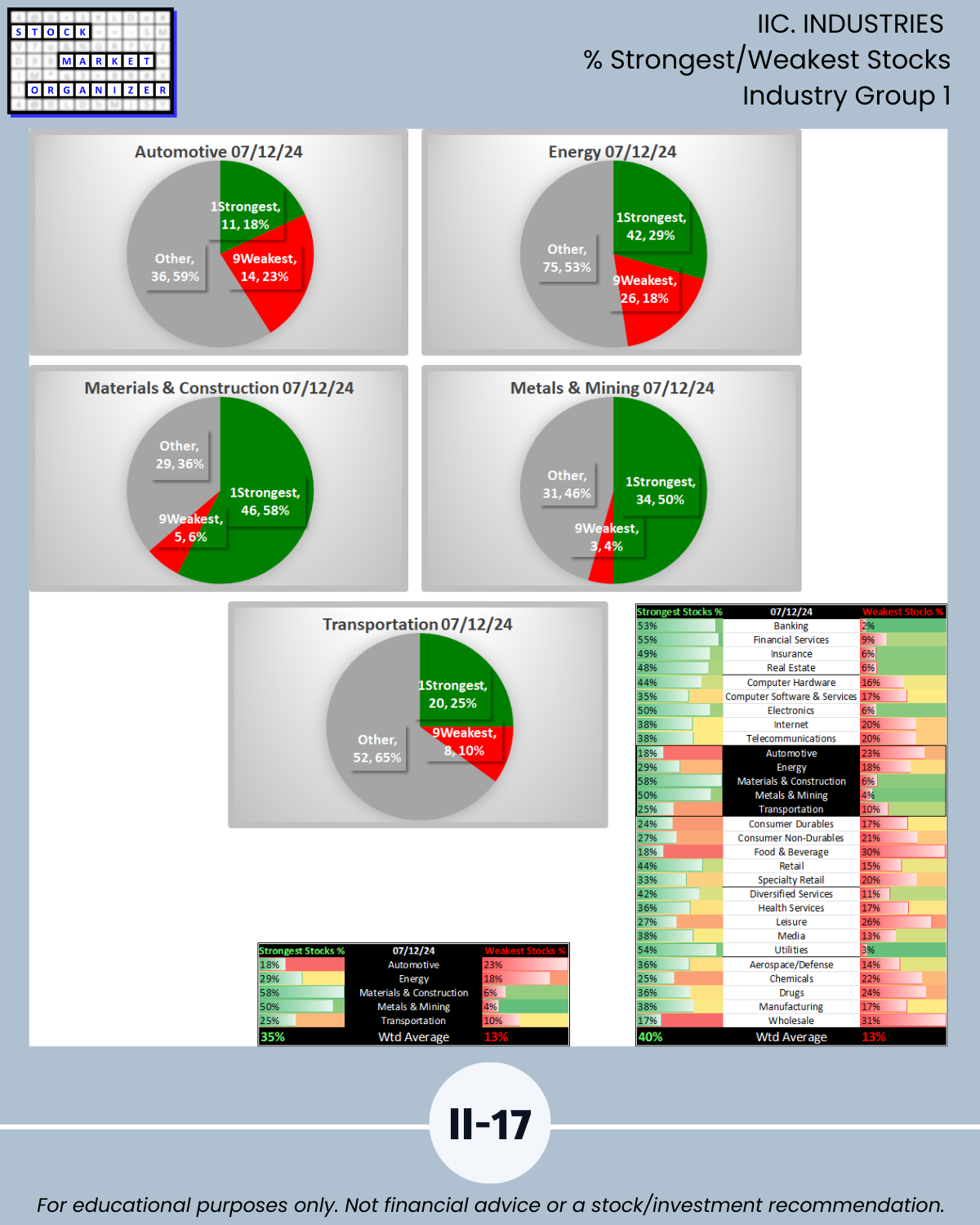

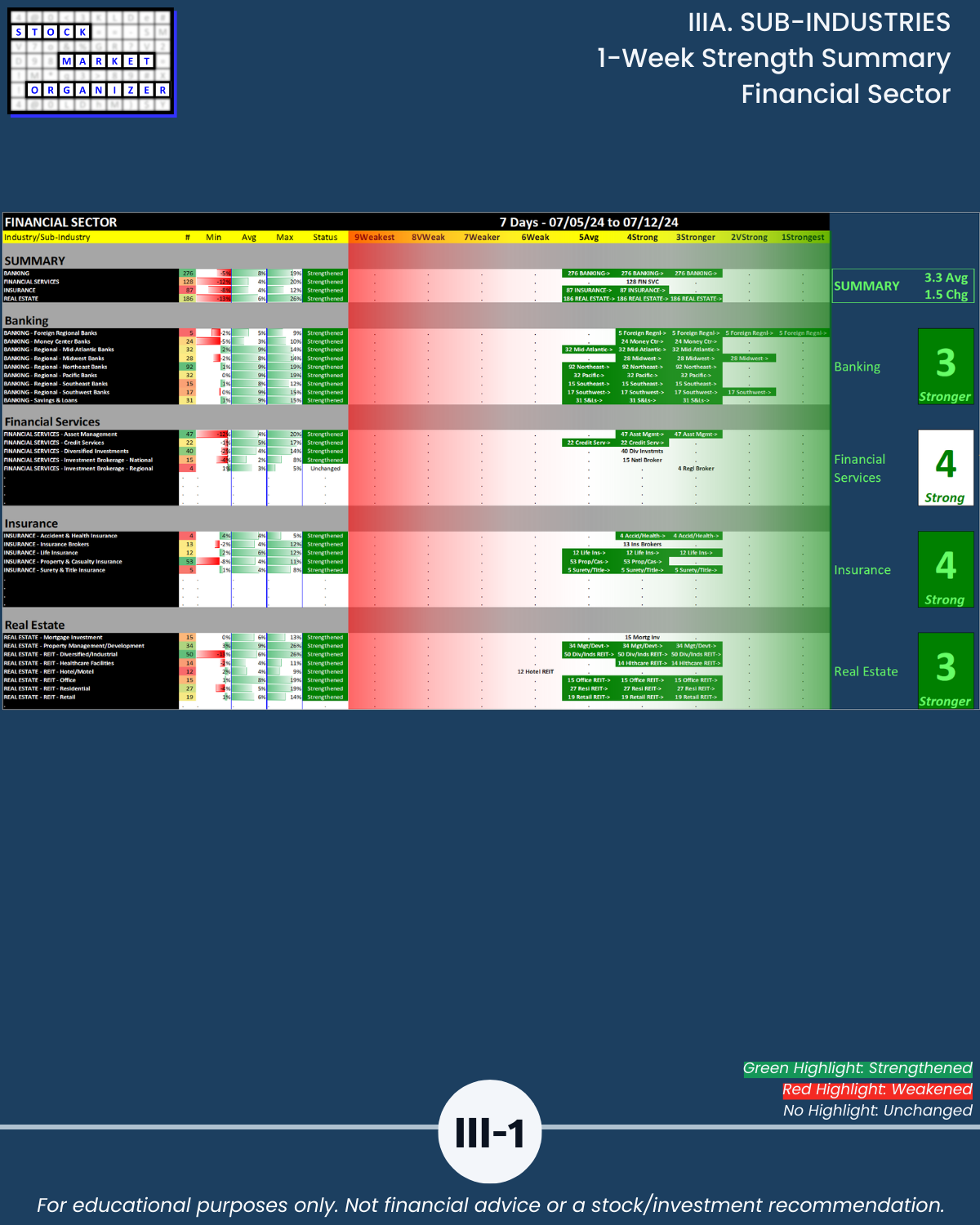

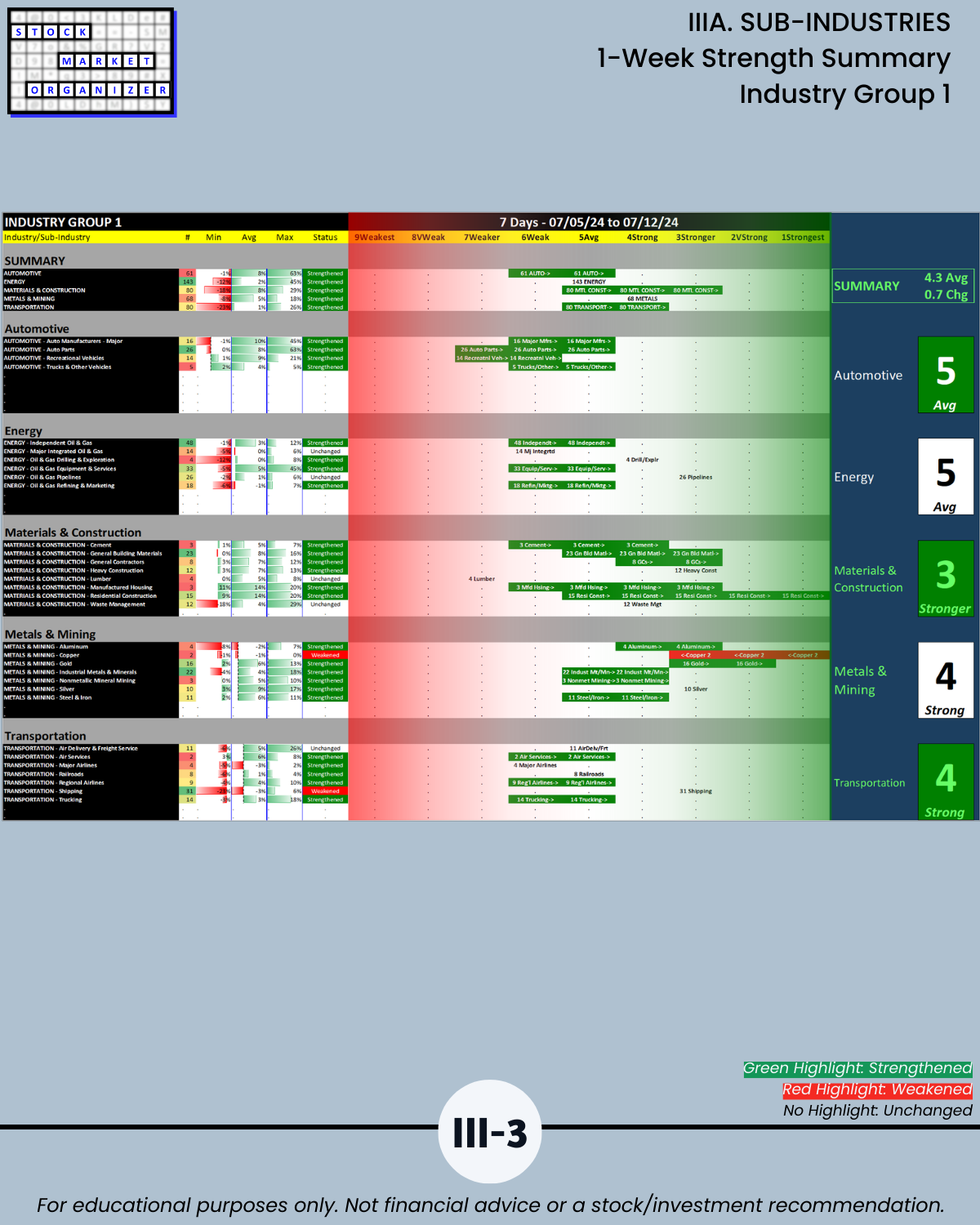

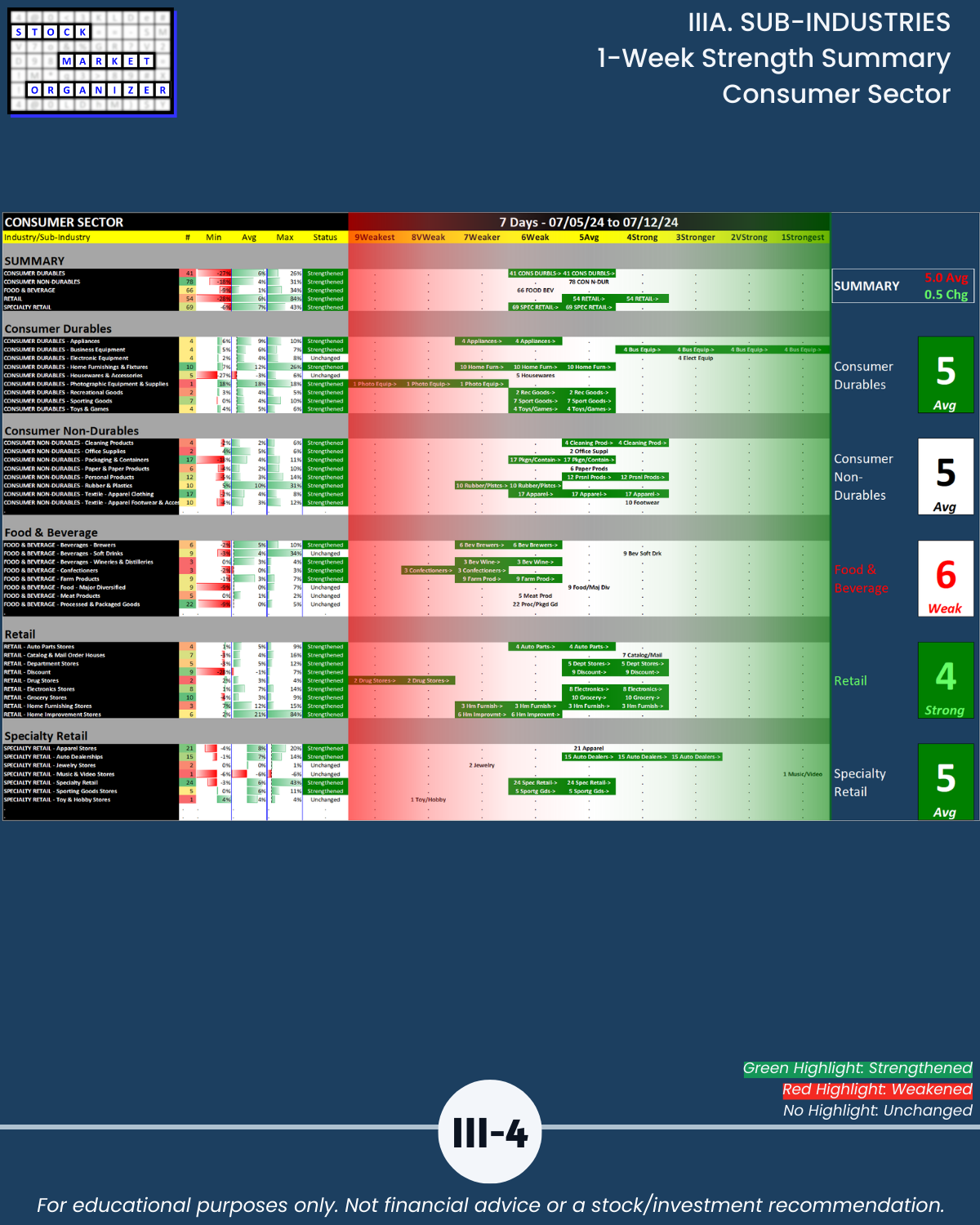

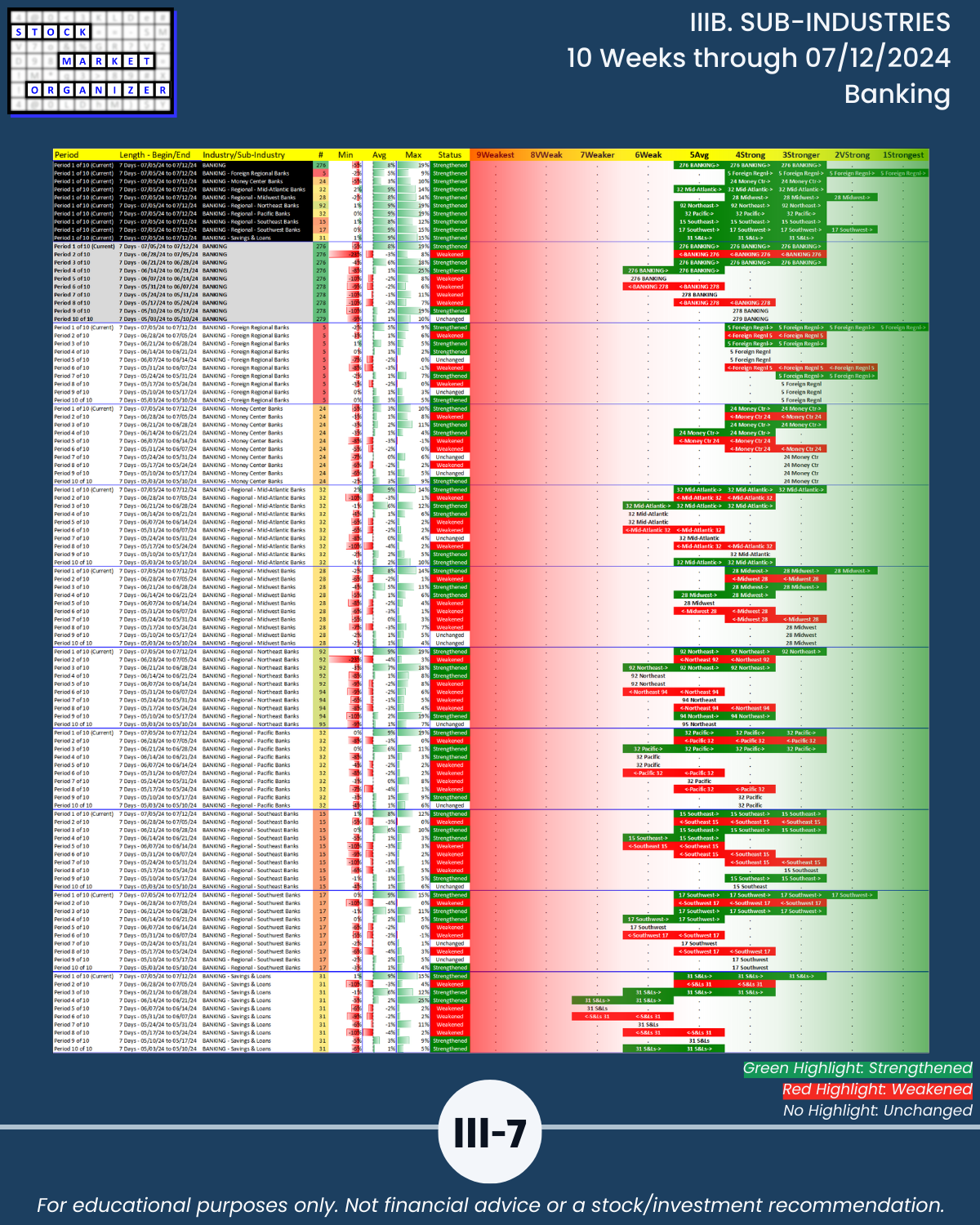

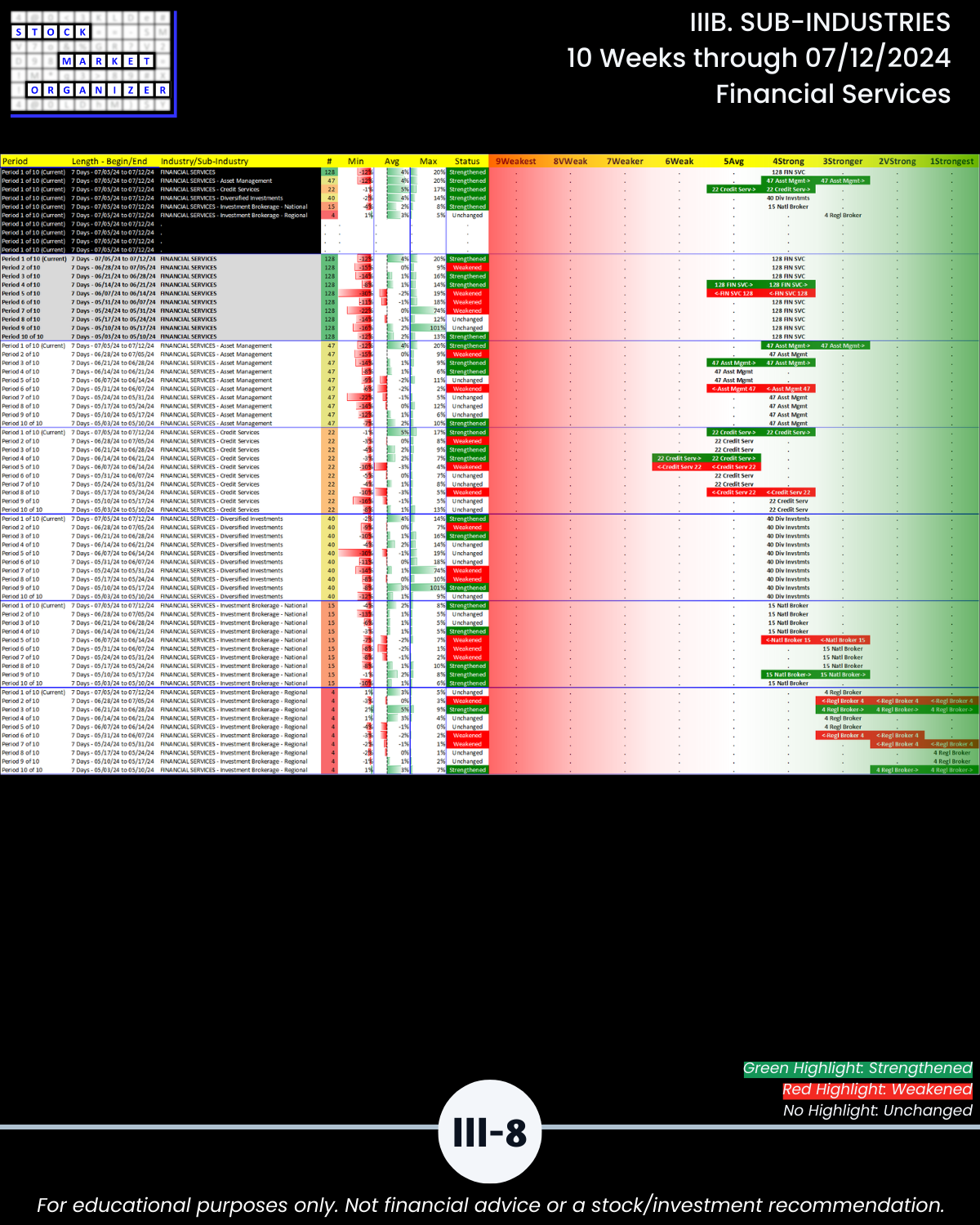

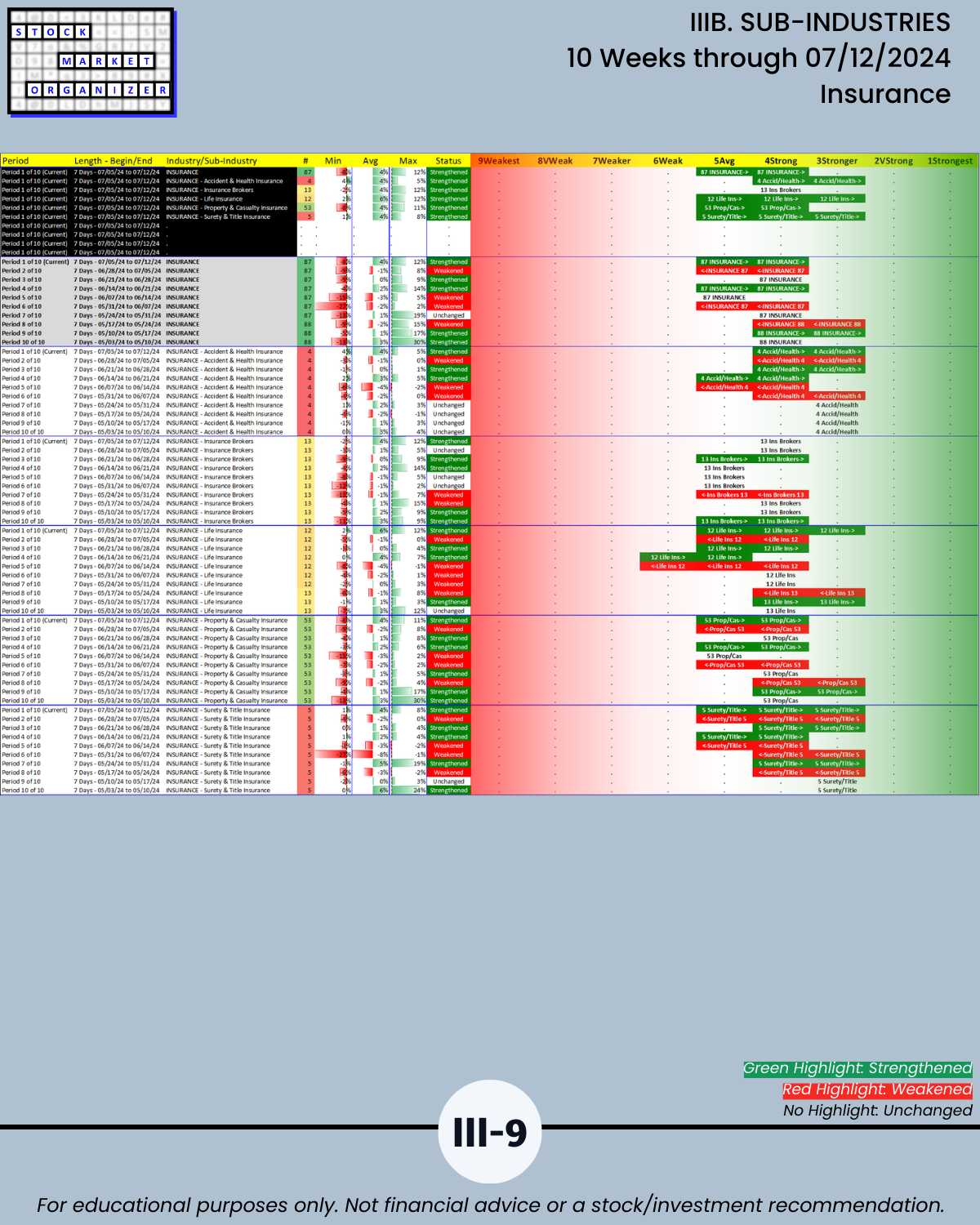

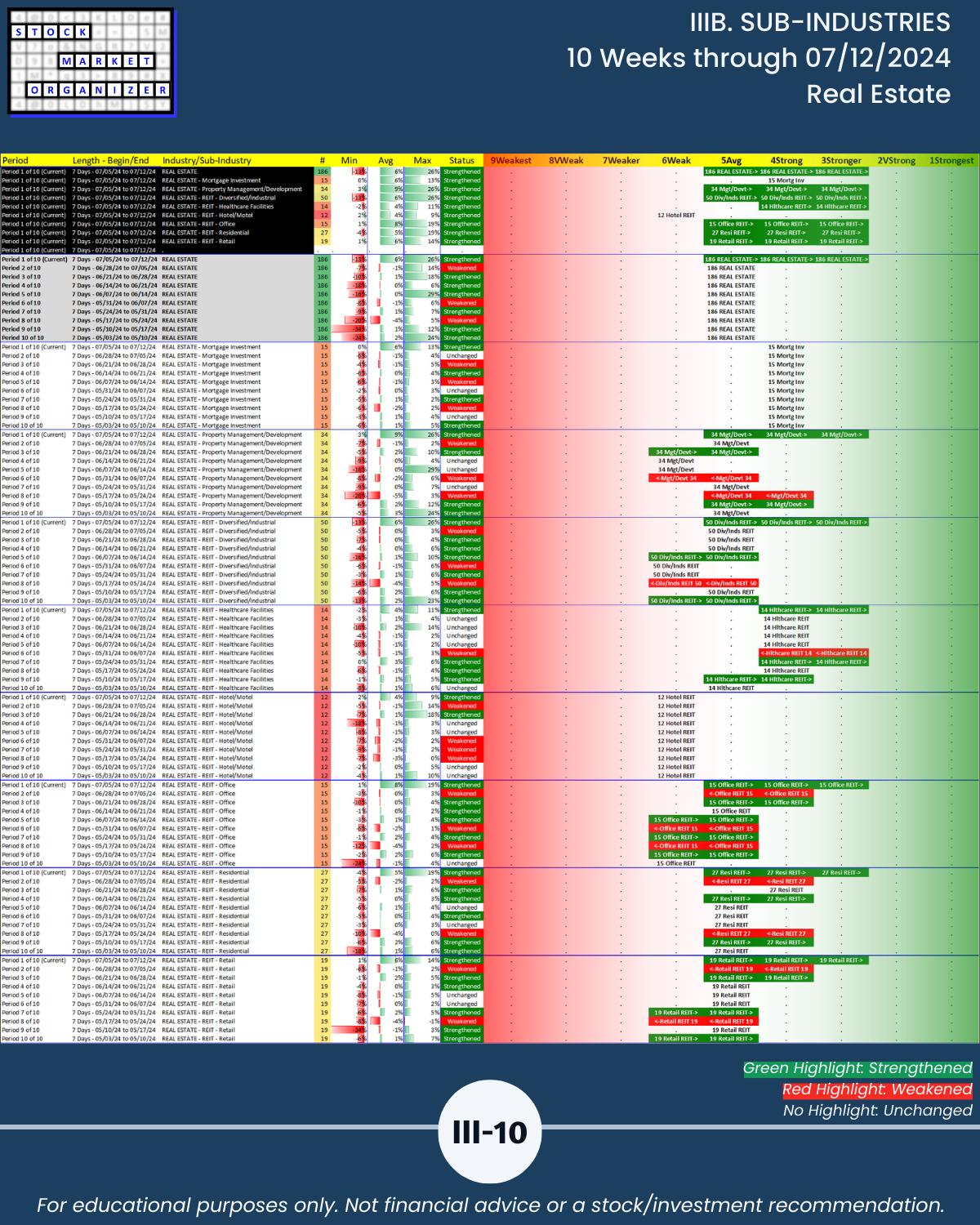

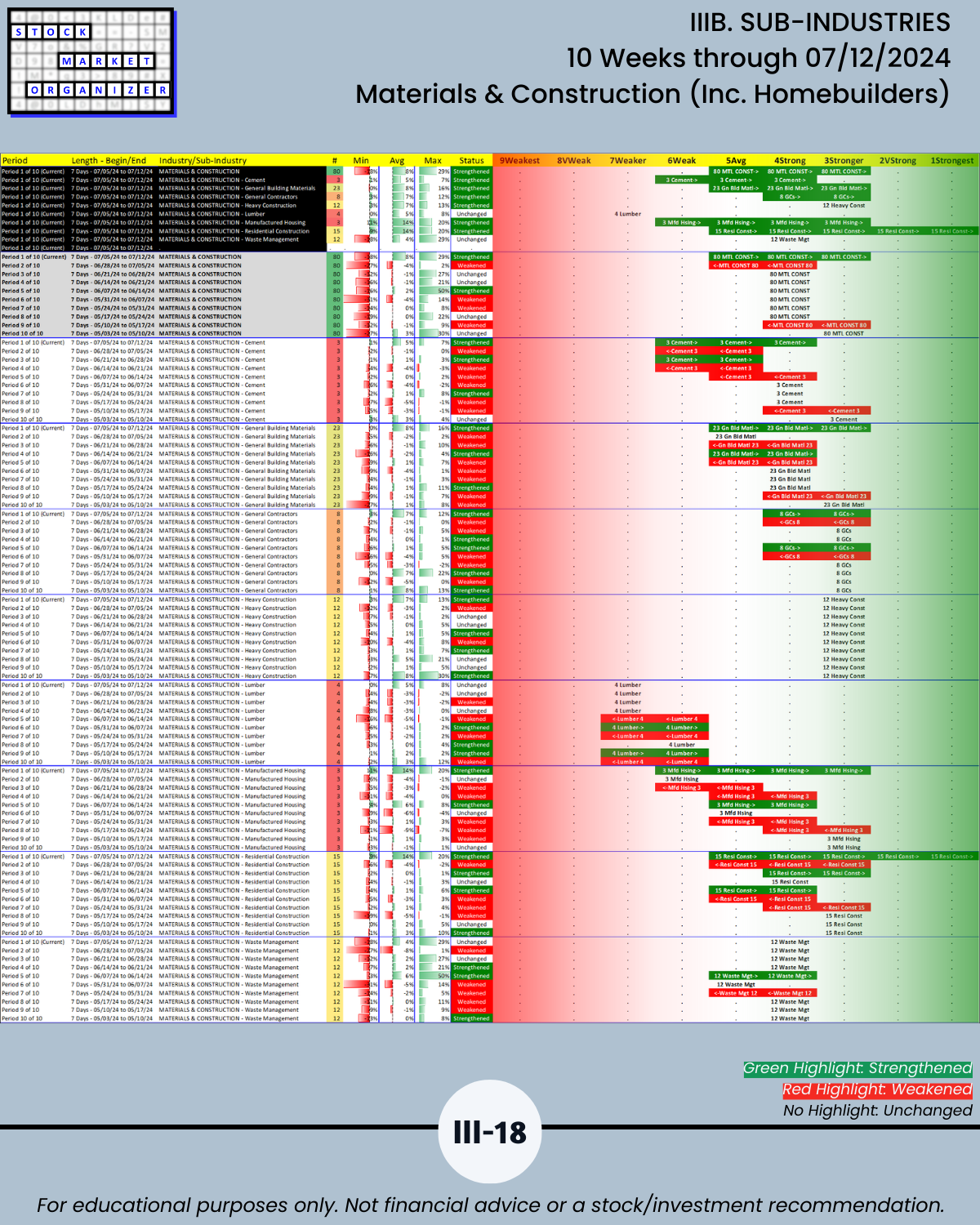

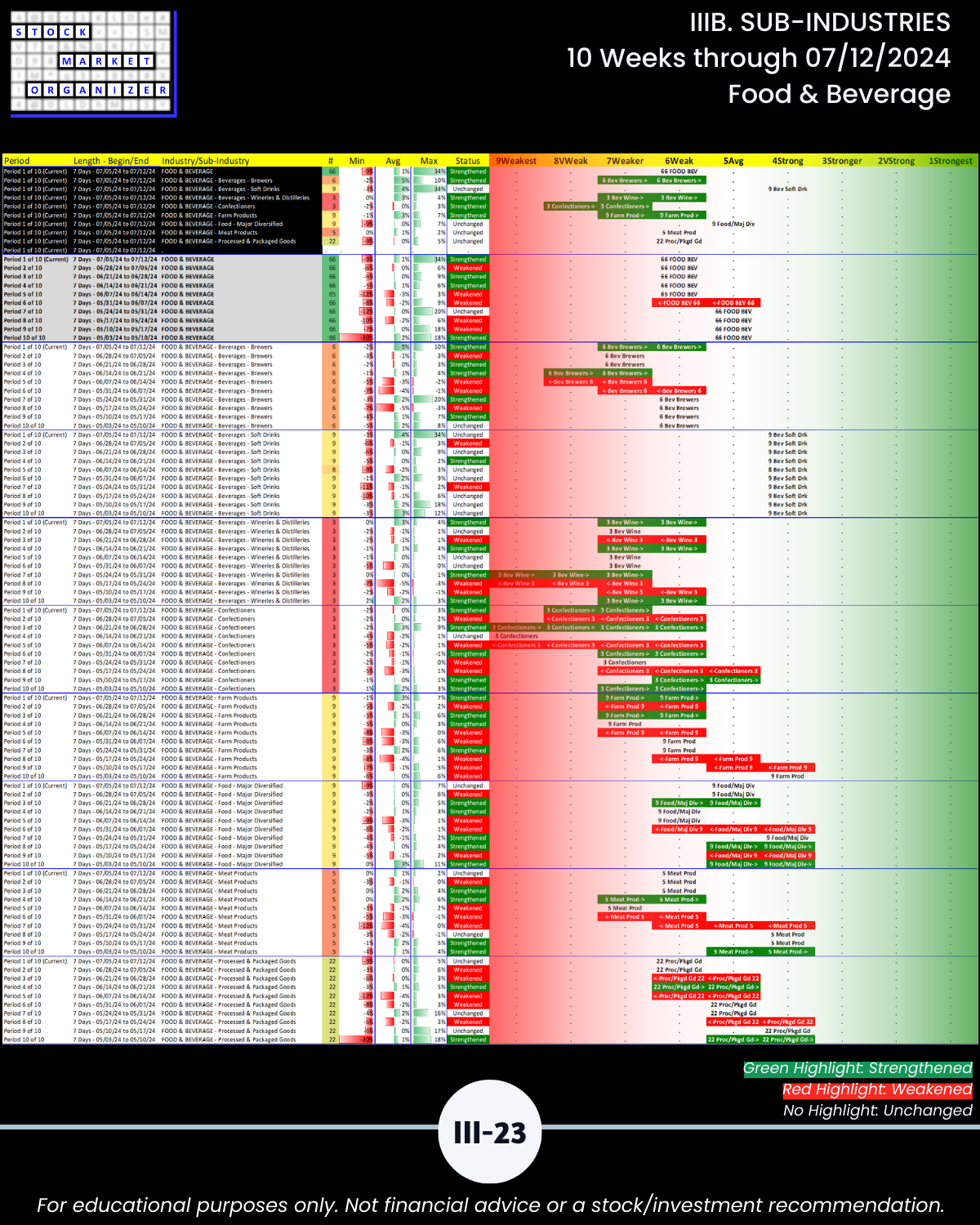

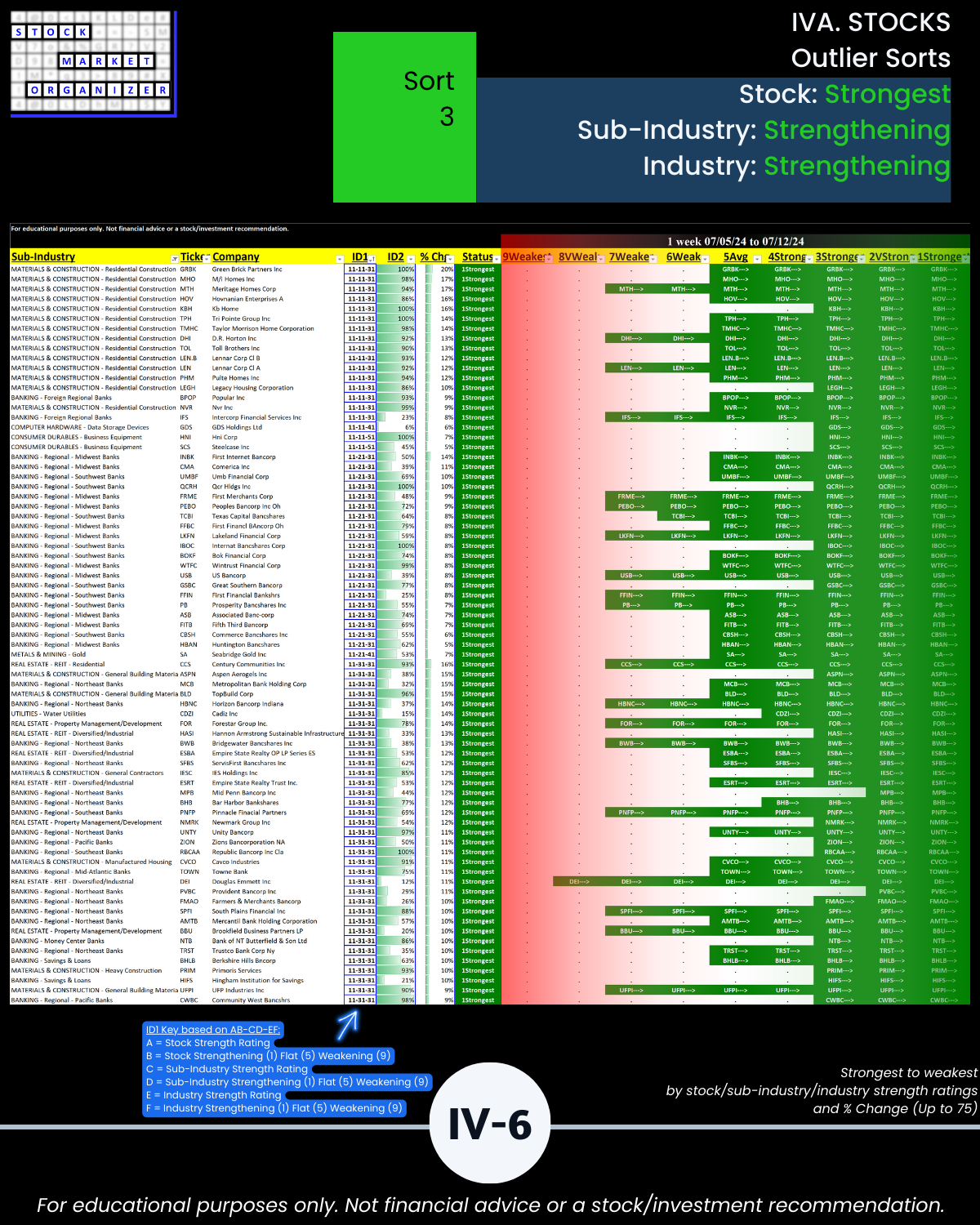

U.S. stock market as of/for the week ending 7/12/24 – missing breadth? Nope. Powerful broad advance. No new shorts, by my count still room to run. Guaranteed? Never. 🔹 Financial Sector crushed it, +1.5 to 3.3 rating (scale 9 worst to 1 best), 🔹 strongest industries at 3Stronger = Banking, Real Estate, Materials & Construction (Homebuilders), and Utilities, 🔹 weakest industry at 6Weak is Food/Beverage. More:

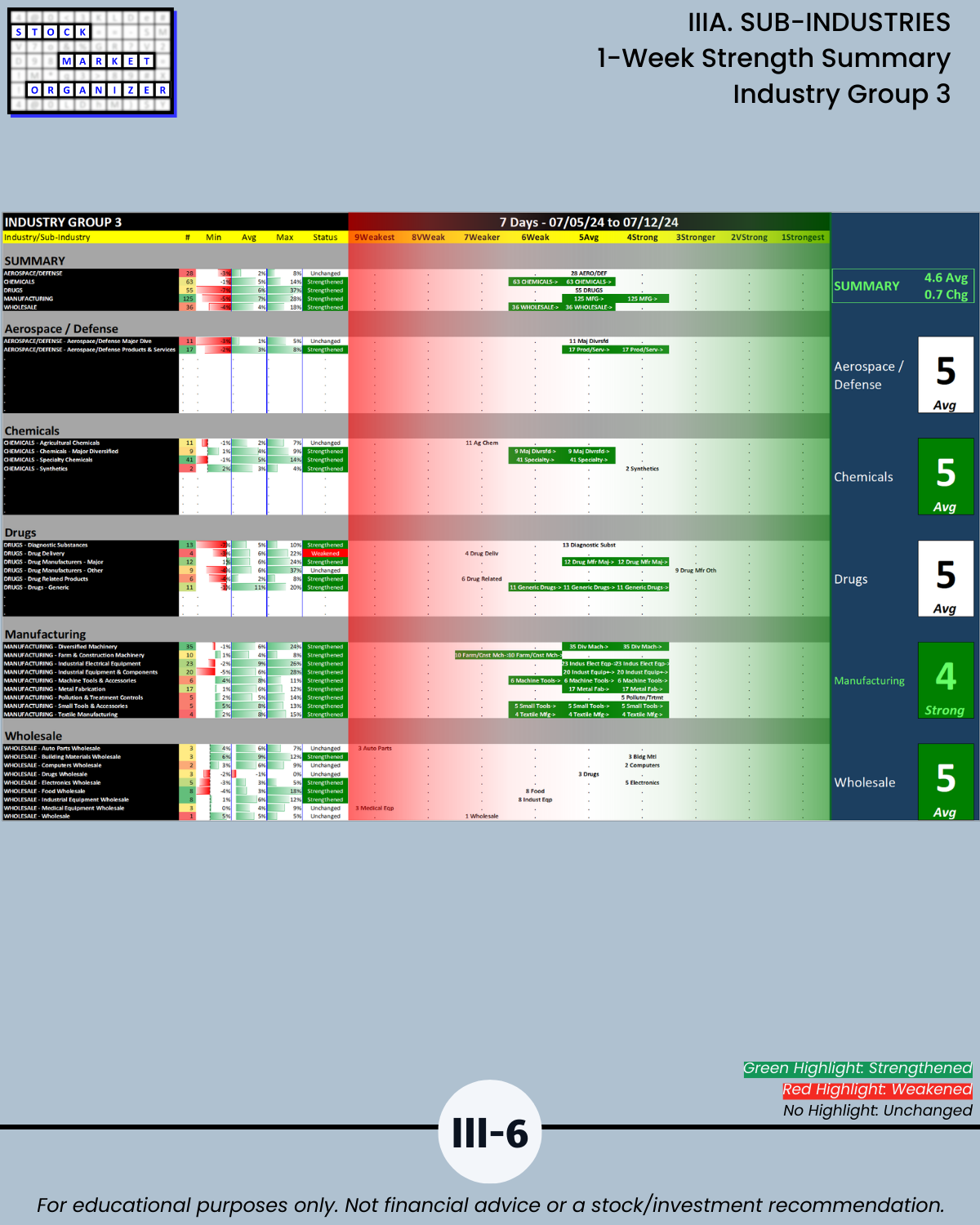

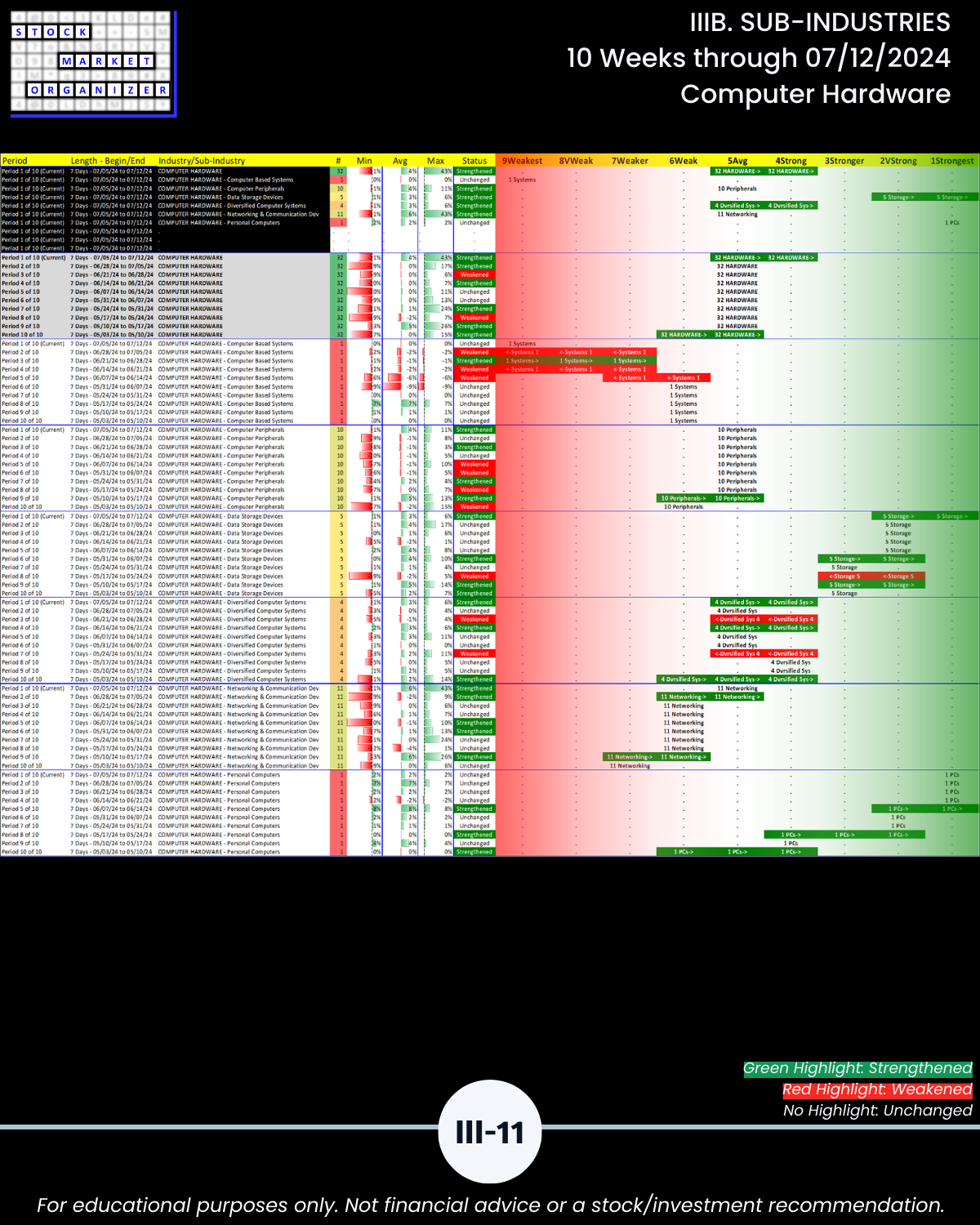

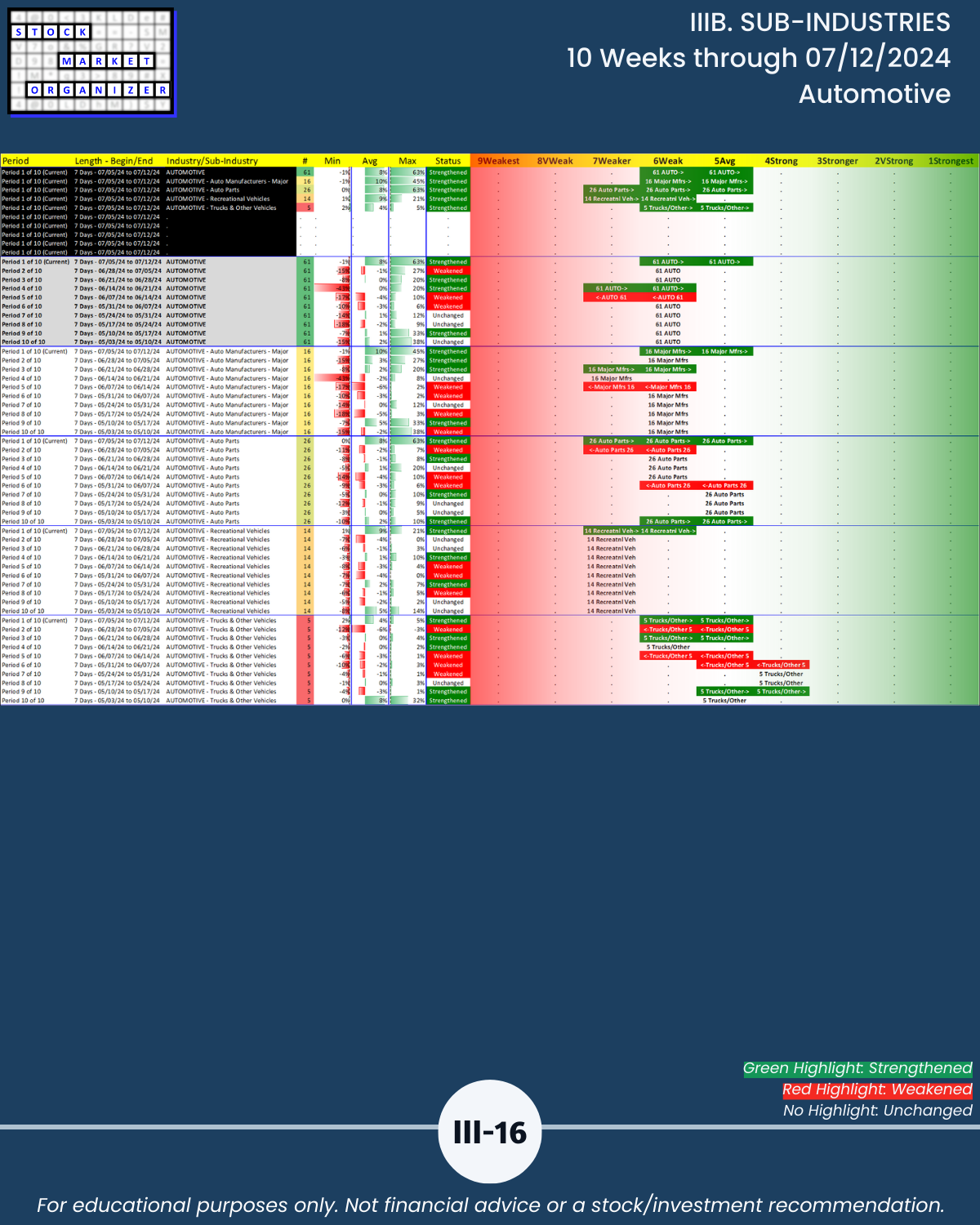

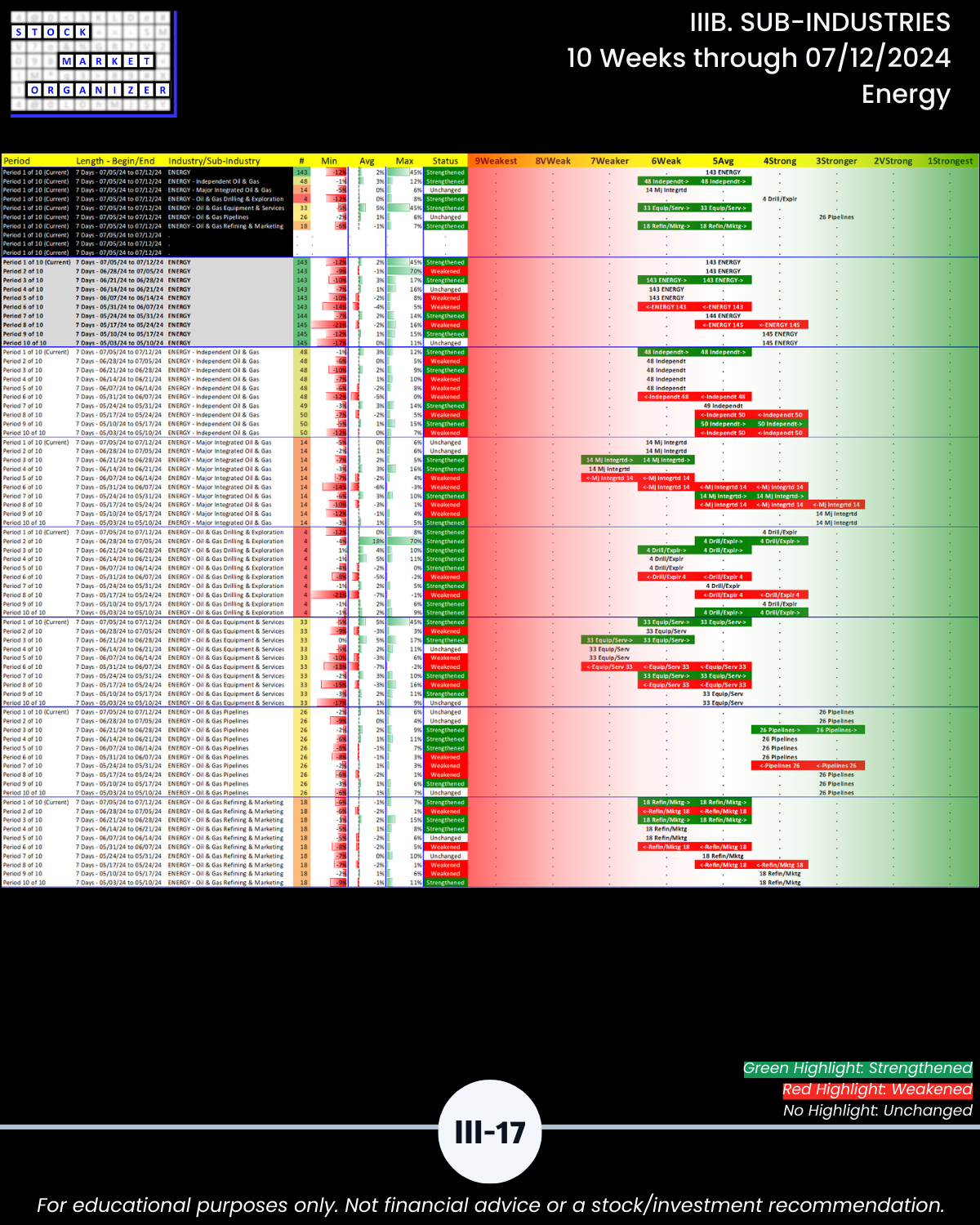

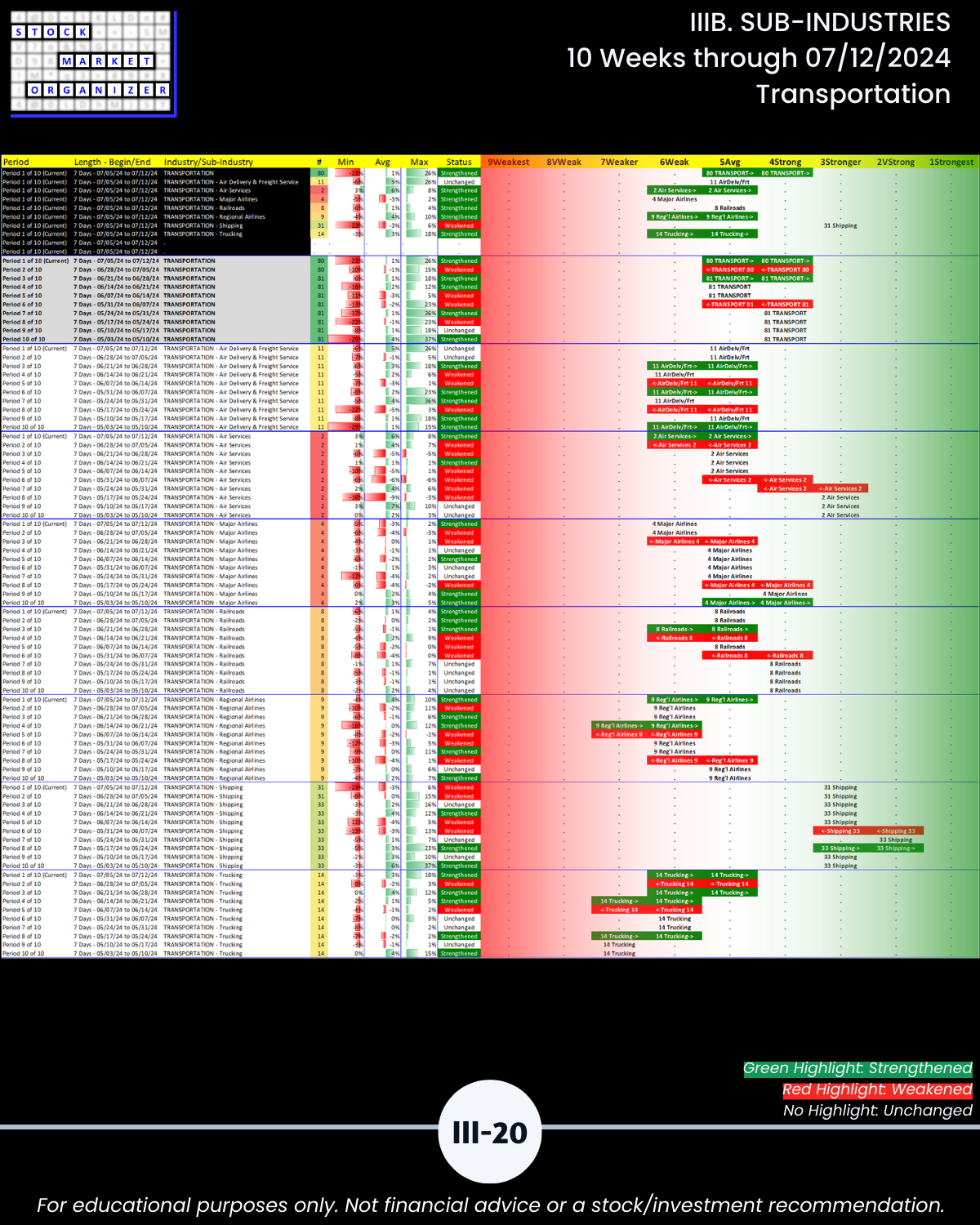

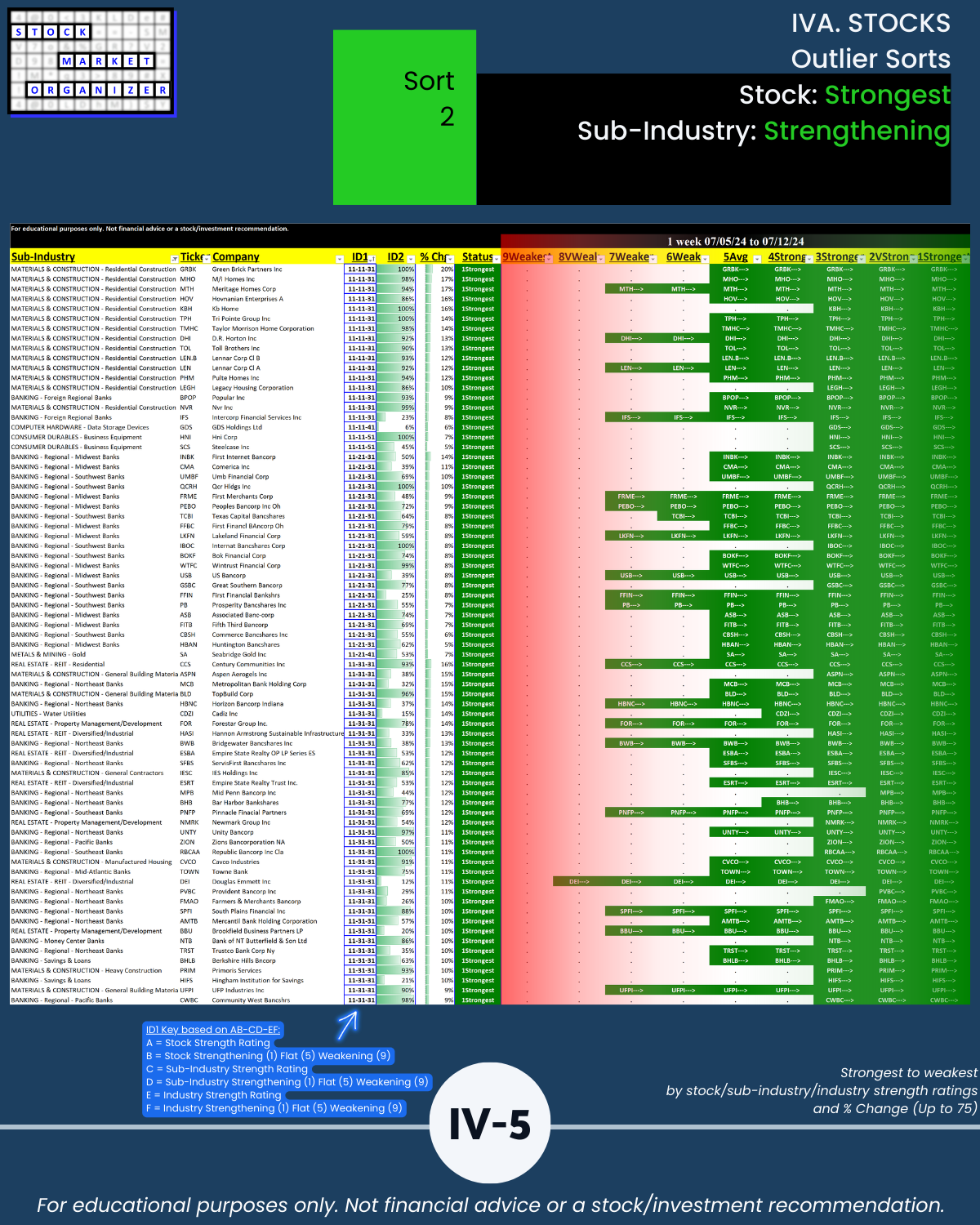

🔹 79% of 198 sub-industries strengthened, 3% weakened

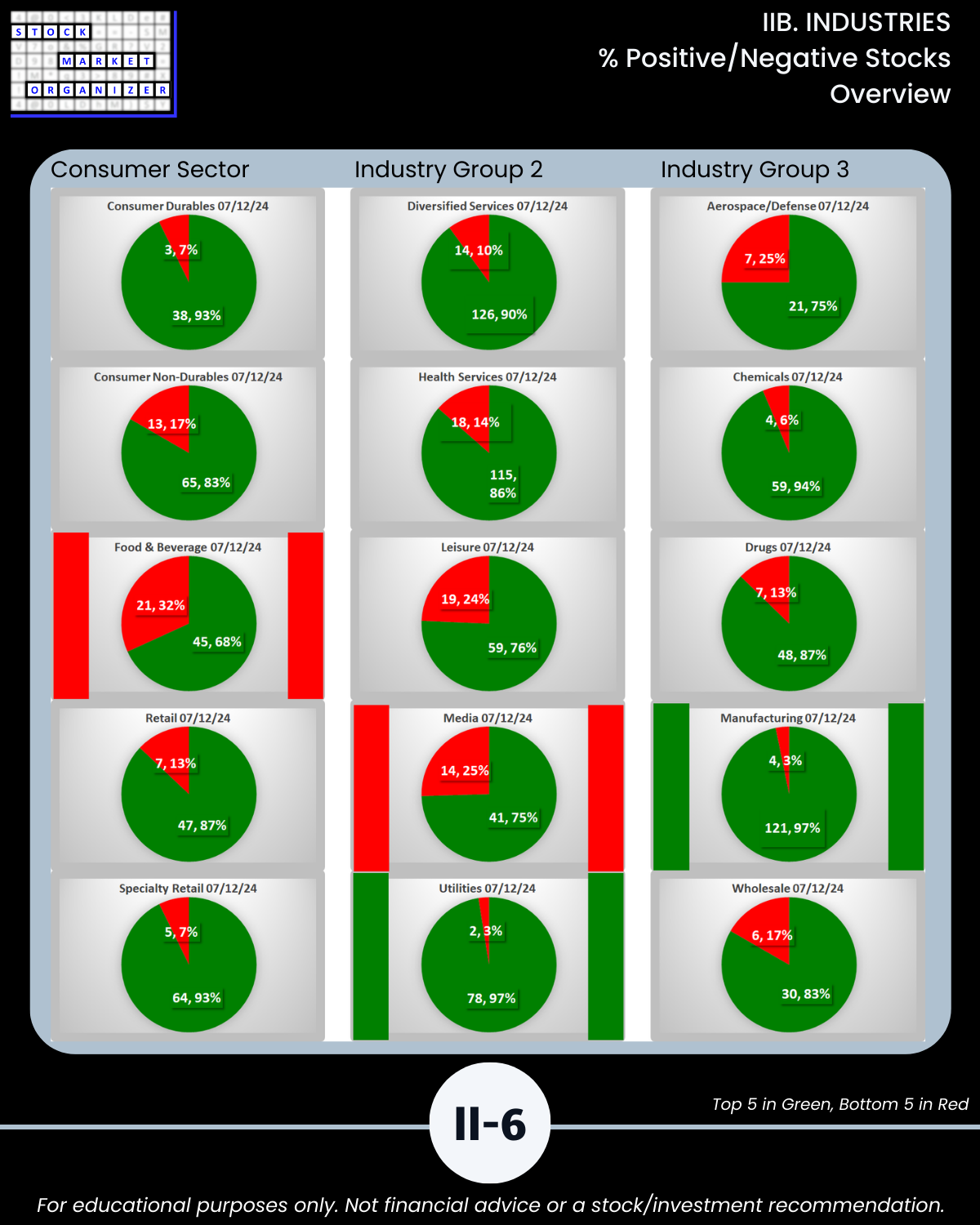

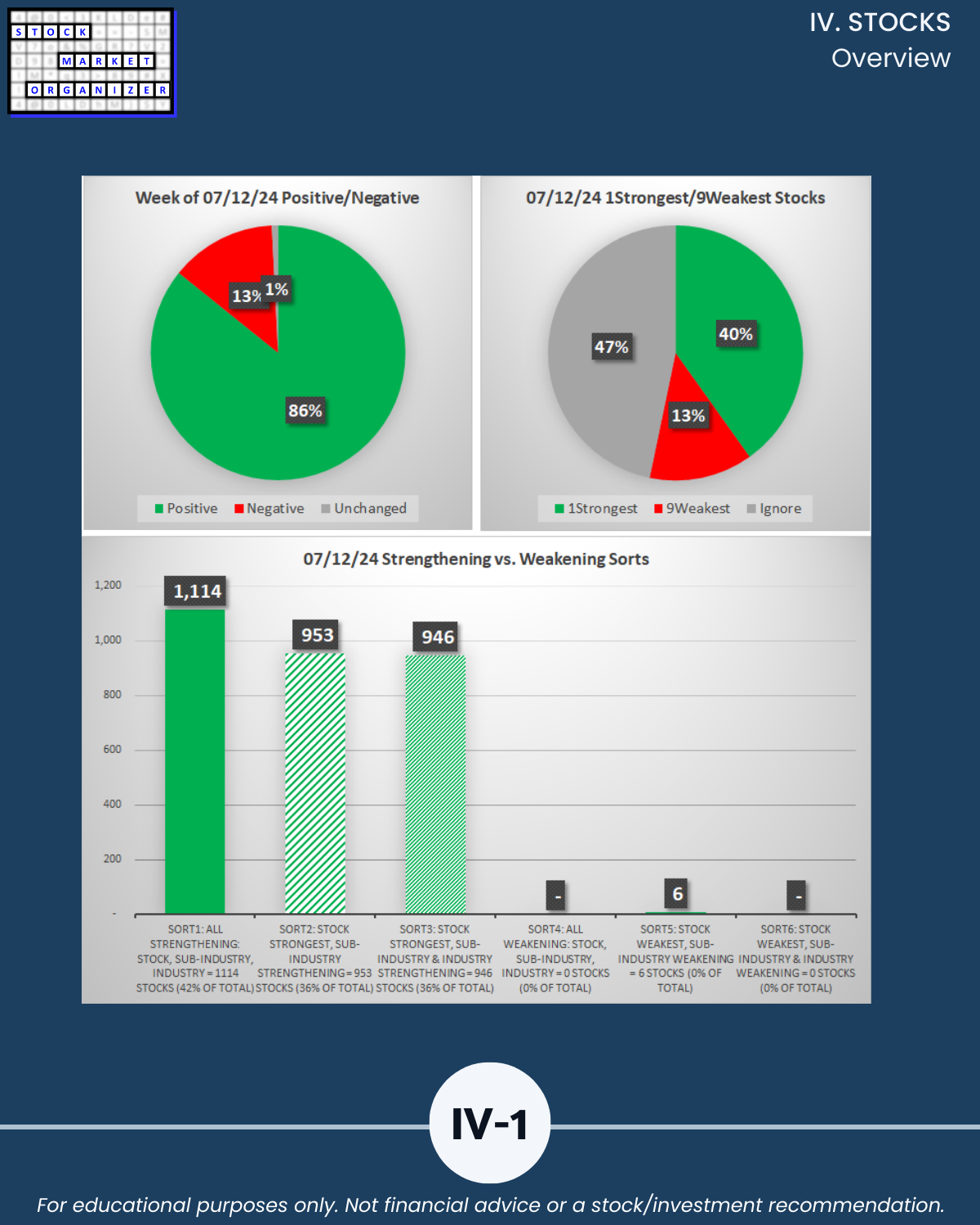

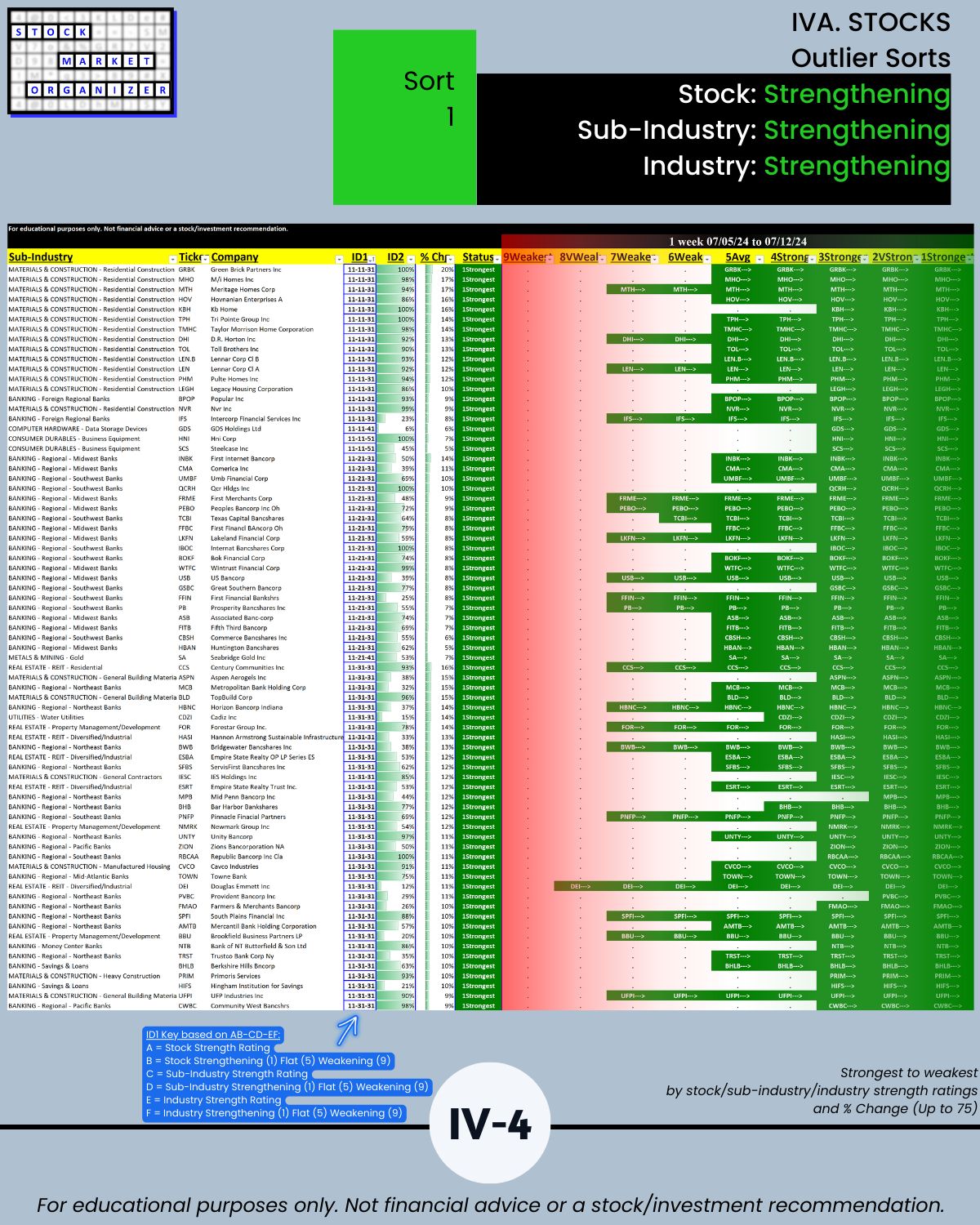

🔹 86% positive stocks this week (Banking and Utilities 98%, Manufacturing 97%, Real Estate 96%, Automotive 95%)

🔹 40% of stocks are rated 1Strongest

🔹 >4 in 10 stocks strengthened while in strengthening sub-industries and industries

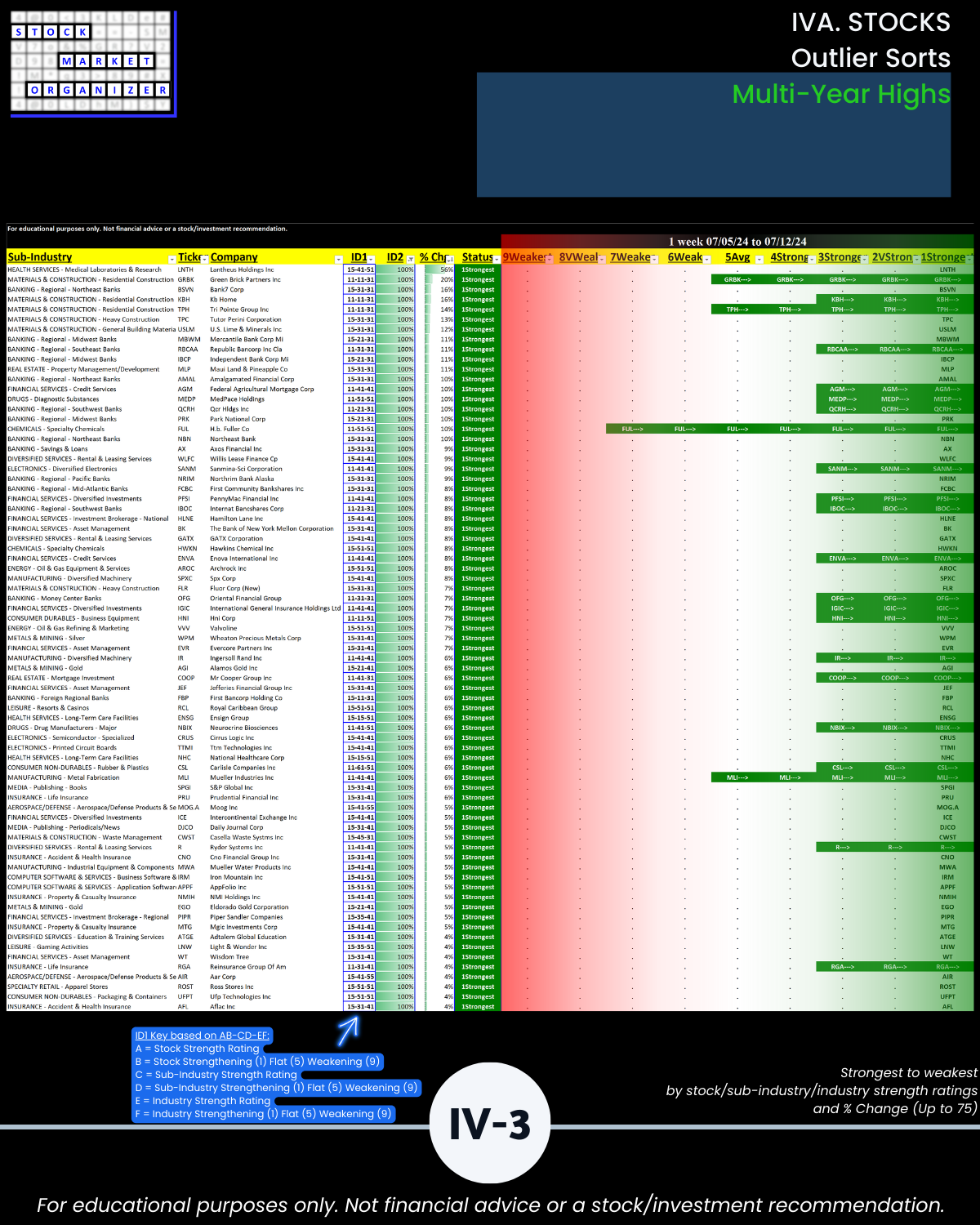

🔹 153 (6%) of stocks at 5-year highs currently, 69 (3%) two weeks ago; Financial 52/3 (8%/0%) now vs. 17/5 (3%/1%) two weeks ago

Additional insights are in the attached report – unique and not available elsewhere because I created this analysis from scratch. It uses conventional tools in unconventional ways to diversify your market, sector, industry, sub-industry, and individual stock perspectives.

Why do you care?

This report may resonate with you if you subscribe to the following:

- The stock market does not have to be so complicated.

- “What” matters, not “why.”

- Market conditions matter.

- The 100%+ rally begins with a 10% rally.

- The multi-month rally begins with one up week. (Also applies to declines.)

- The stronger your stocks, the greener your P&L.

Current stats

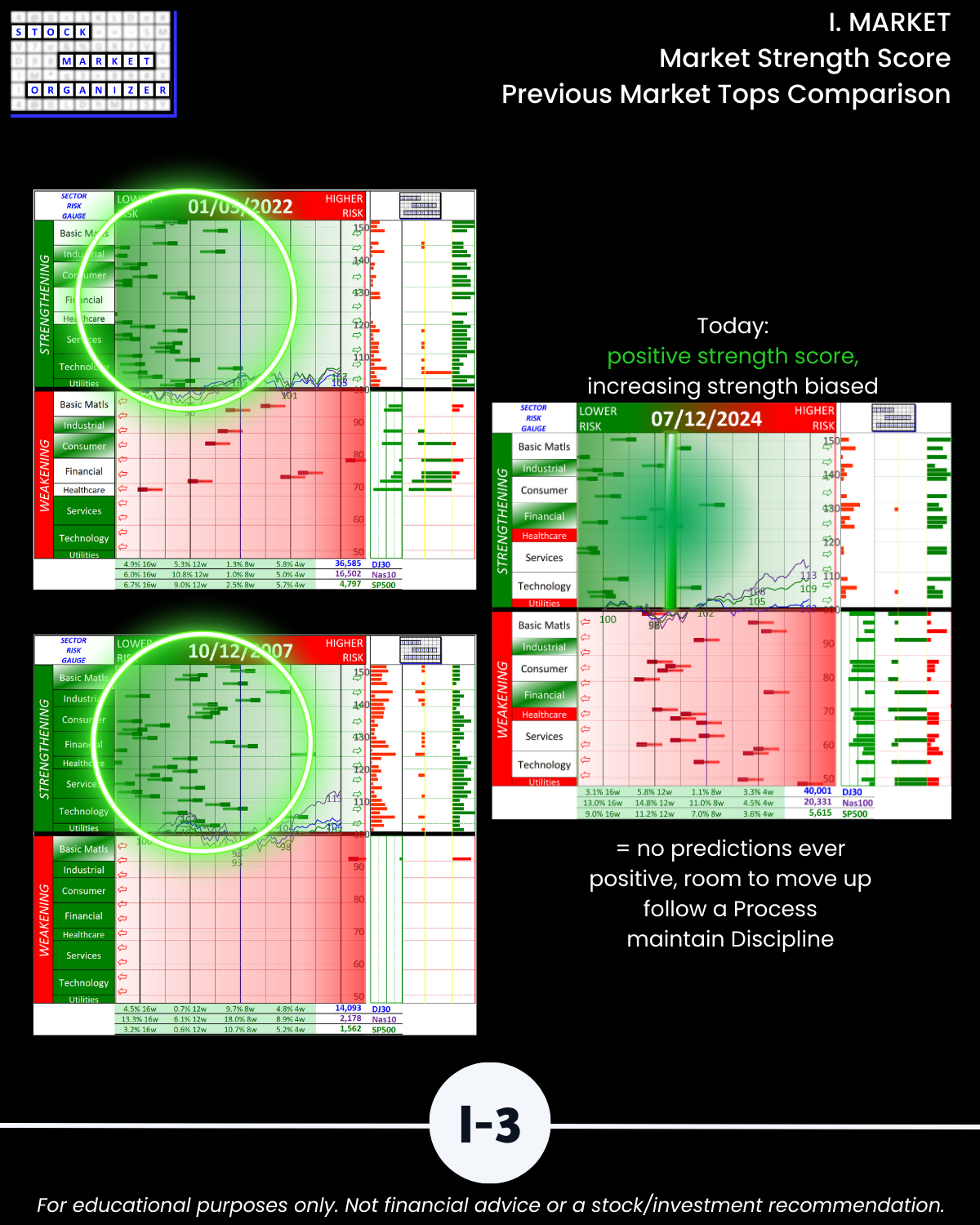

- Market Strength Score: +37%, no new Shorts

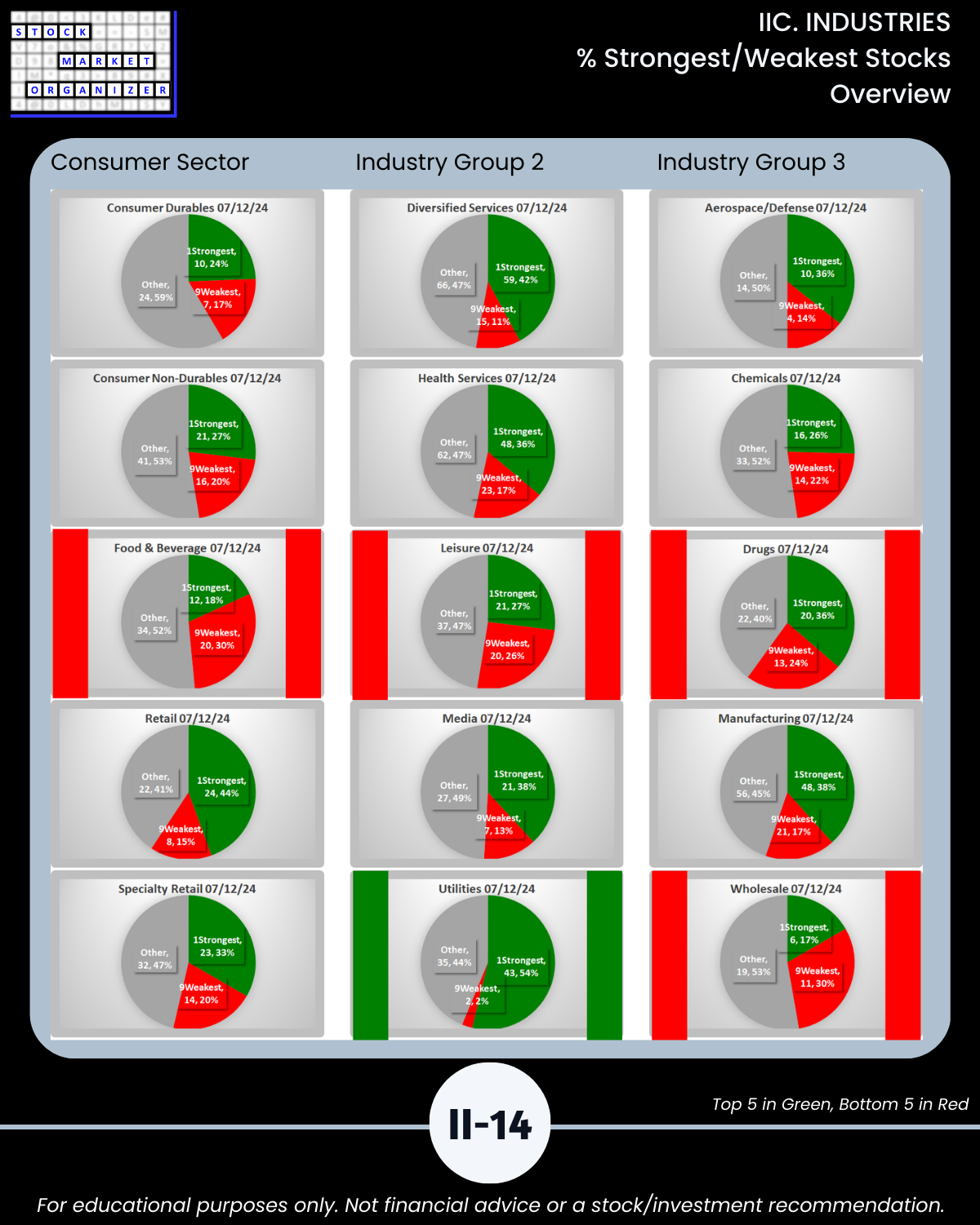

- 18 of 29 industry rankings strengthened, 0 weakened/Section II

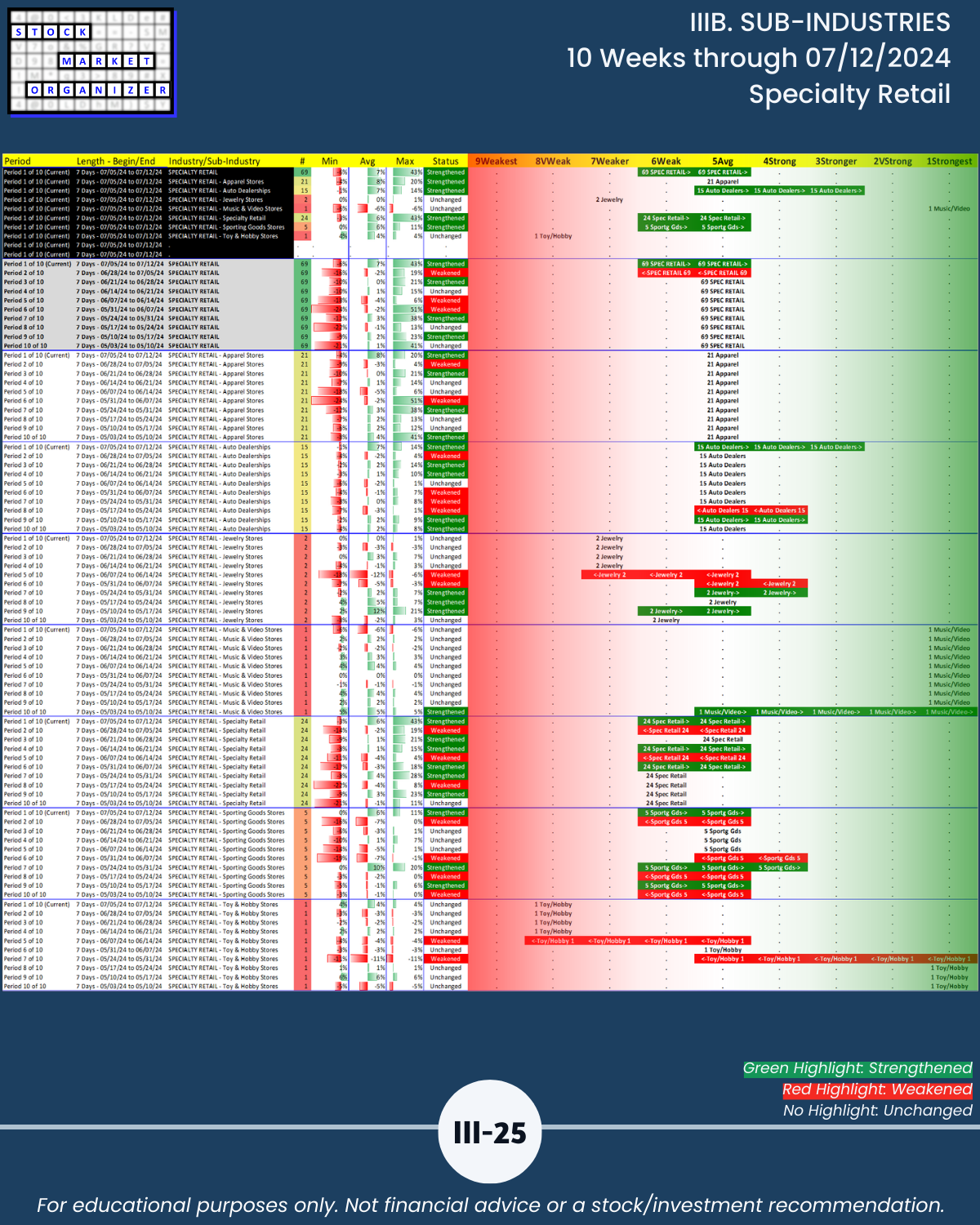

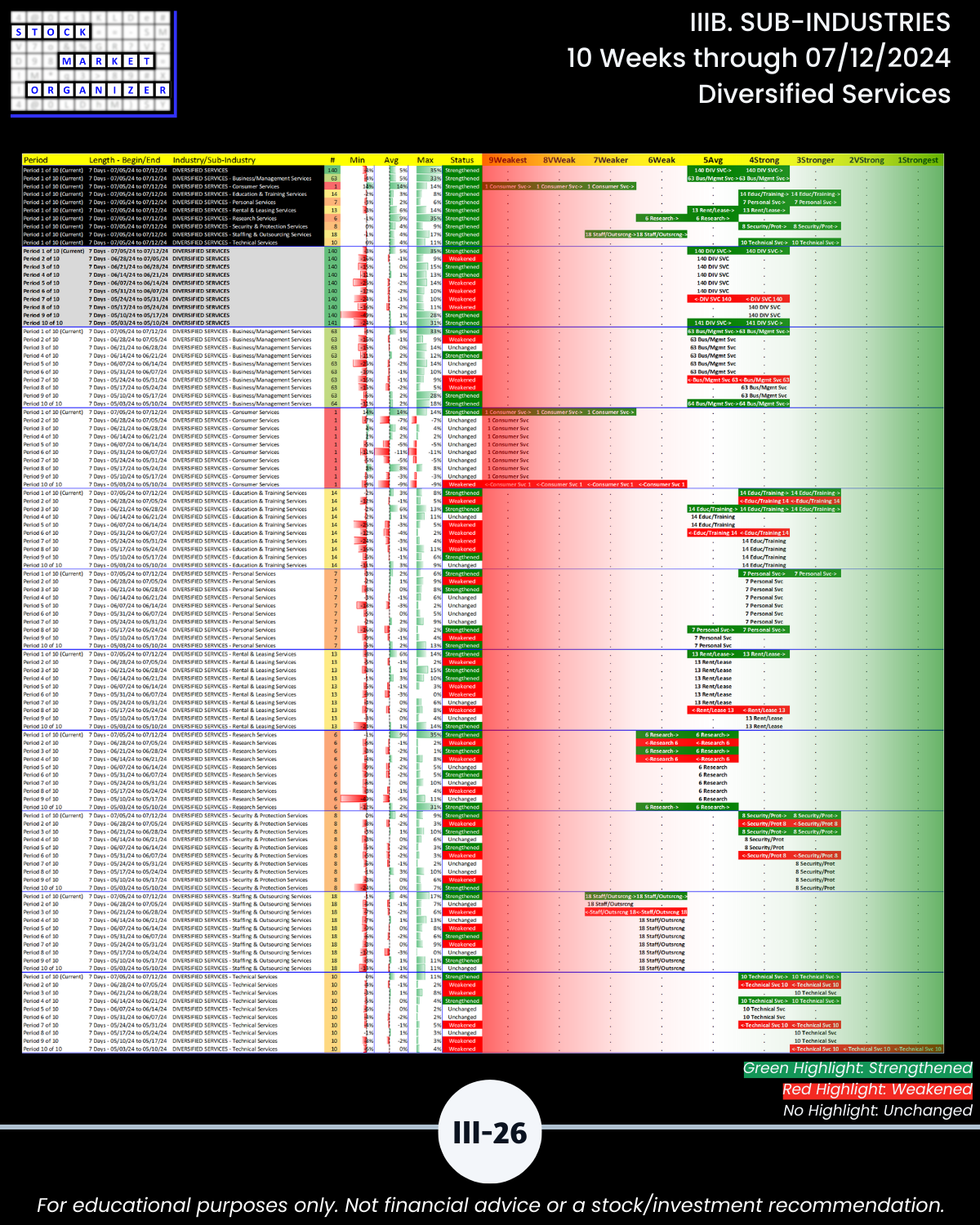

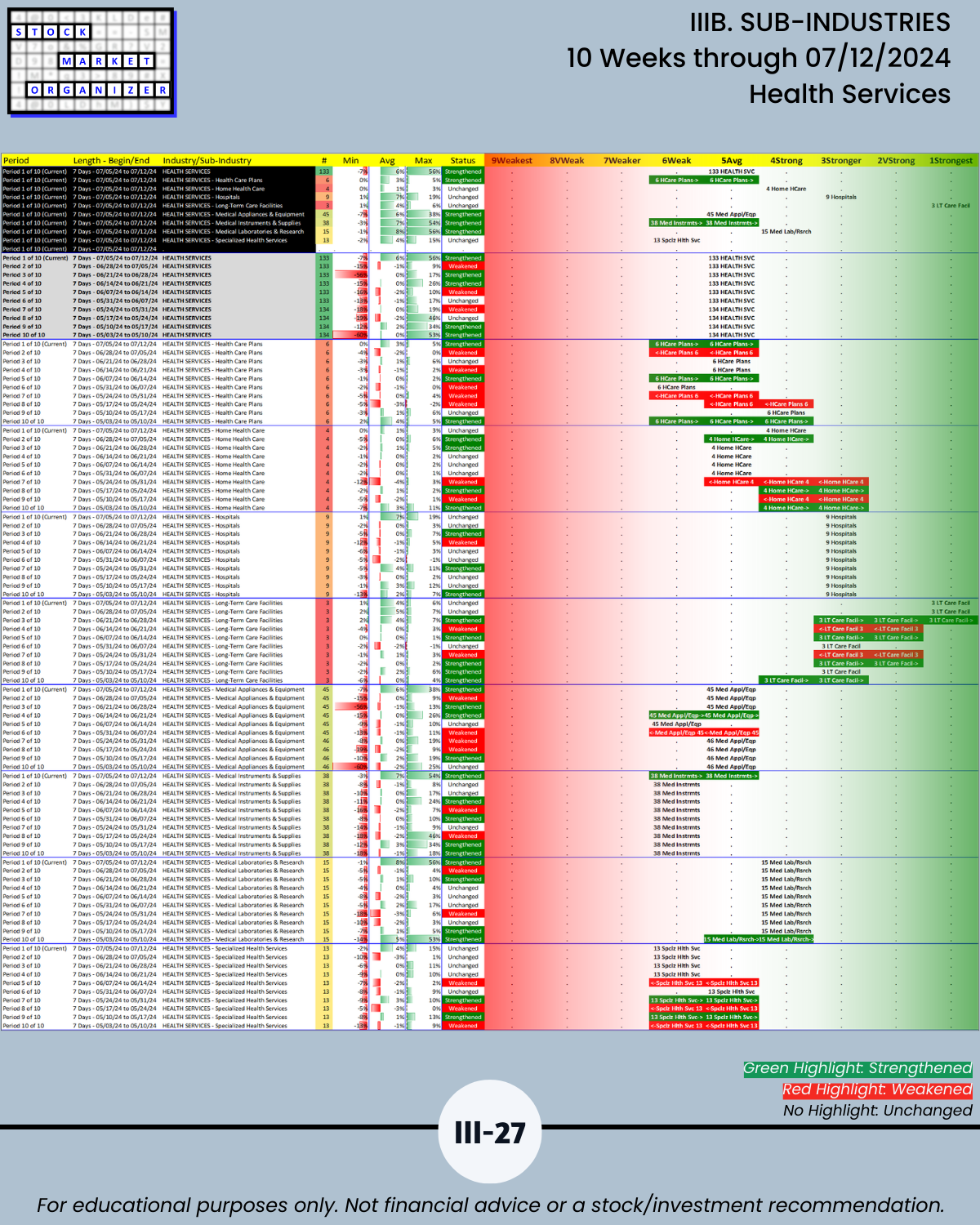

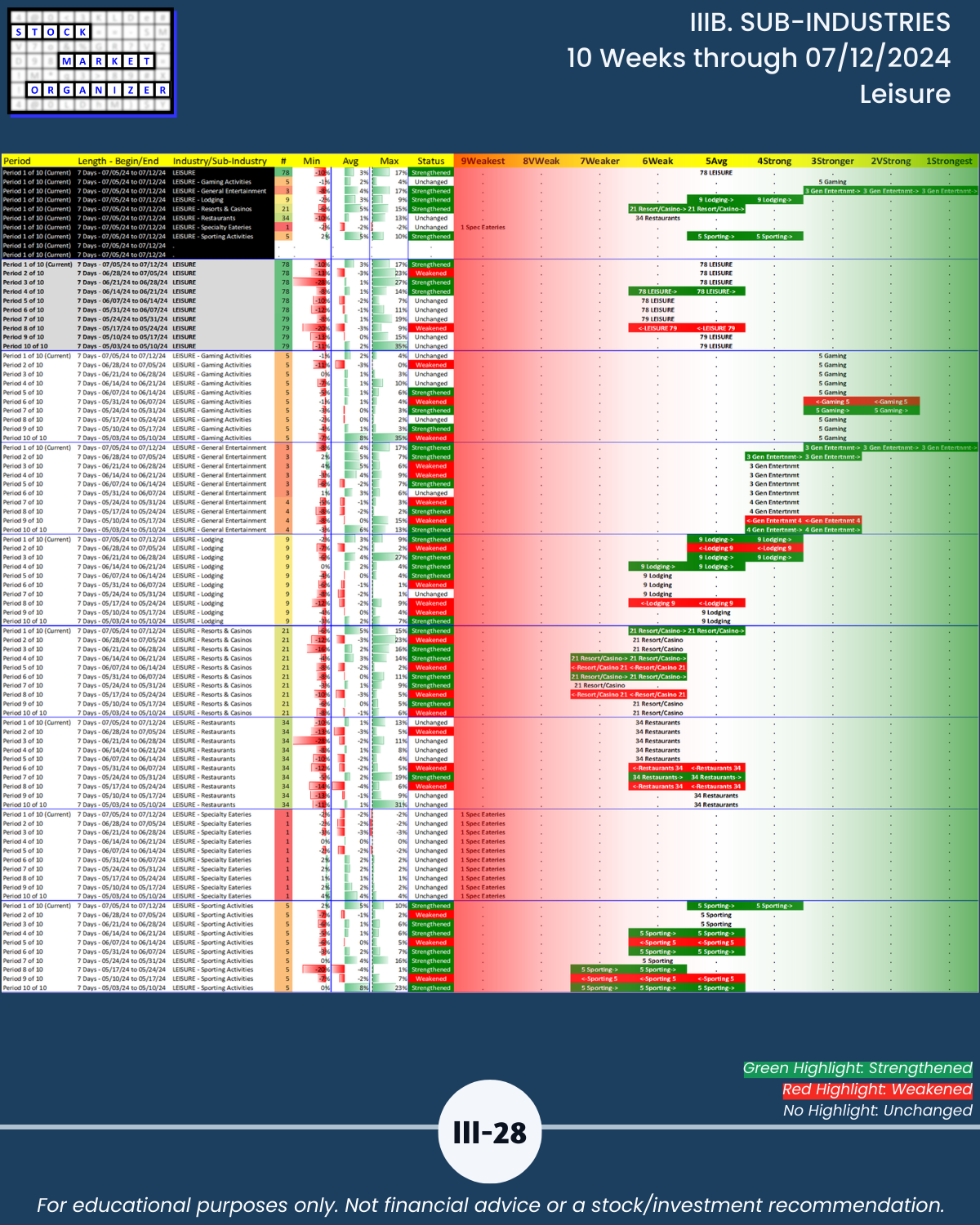

- 79% of 198 sub-industries strengthened, 3% weakened/Section III

- 86% of 2,644 stocks positive, 13% negative, 40% stocks rated Strongest, 13% Weakest/Section IV

Leading Sector 3.3 wtd avg ranking:

- Financial (Banking, Financial Services, Insurance, Real Estate)

Lagging Sector 5.0 wtd avg ranking:

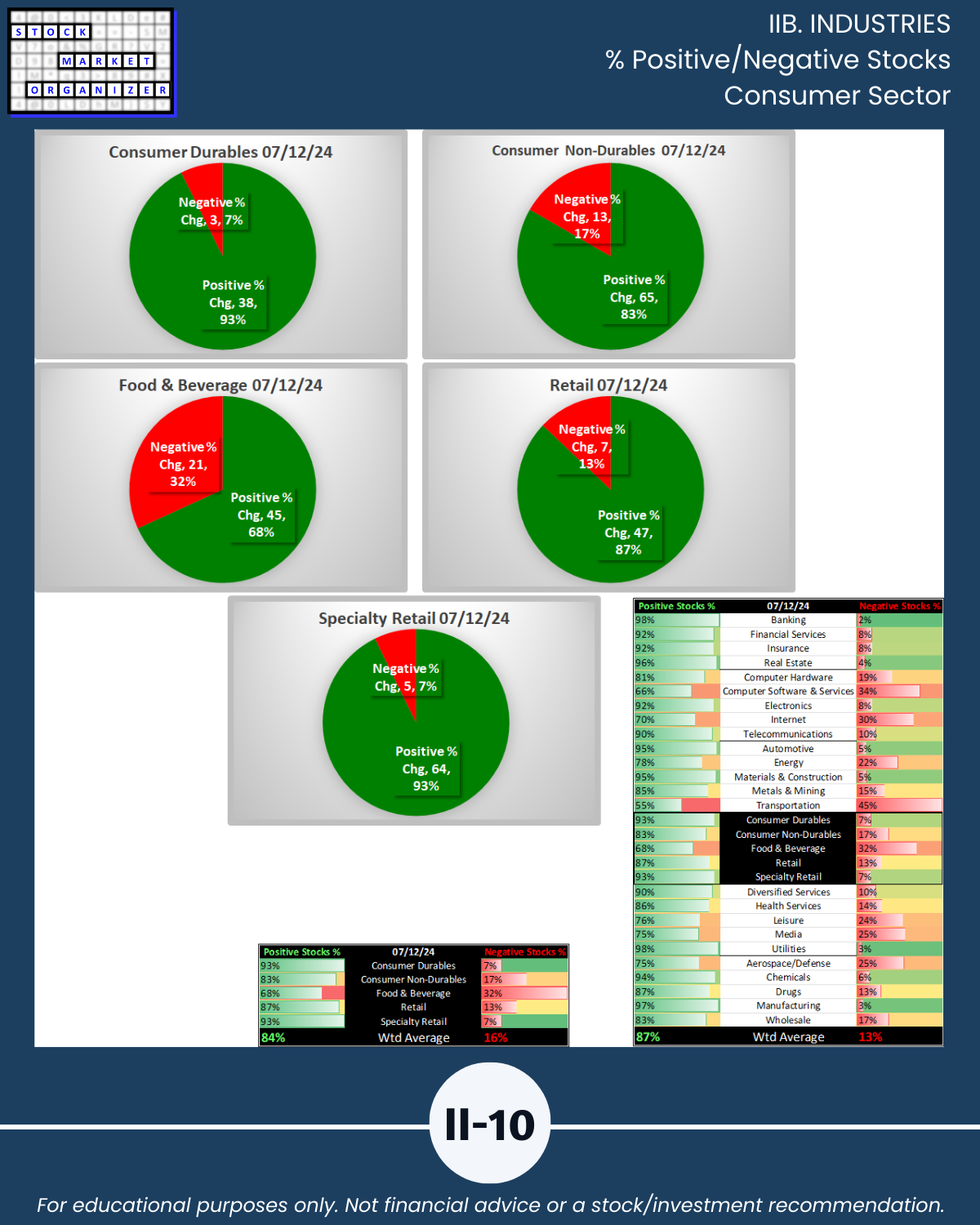

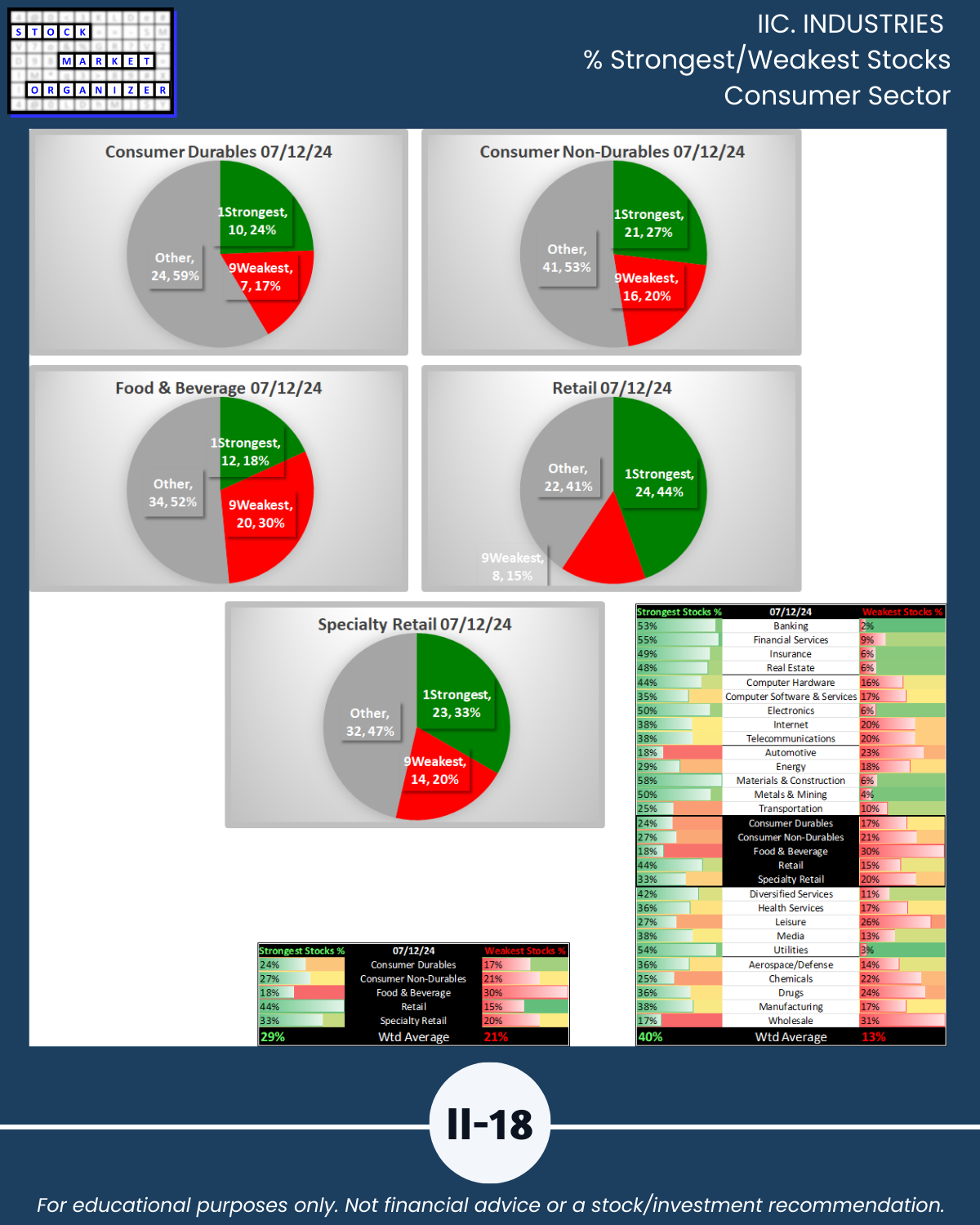

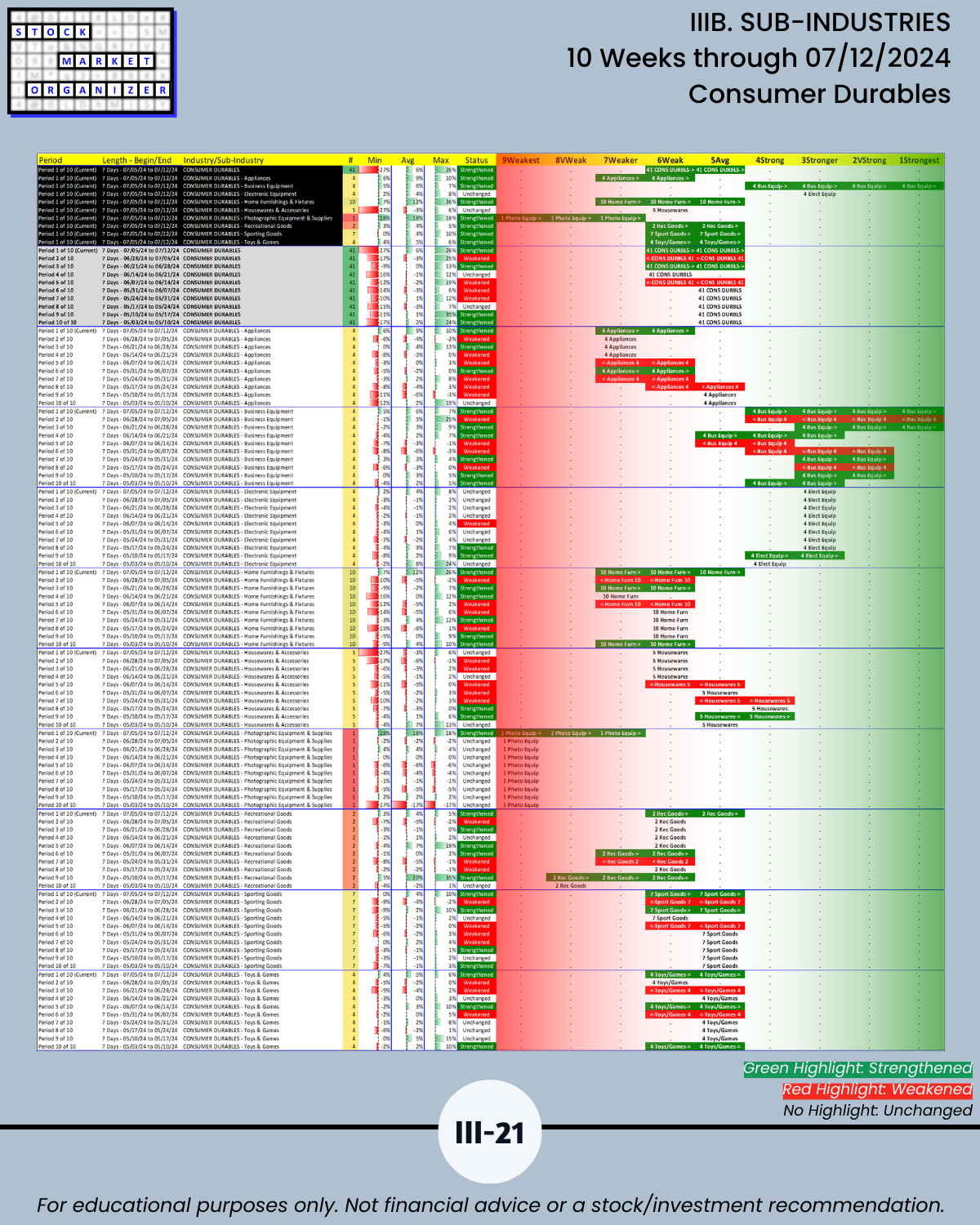

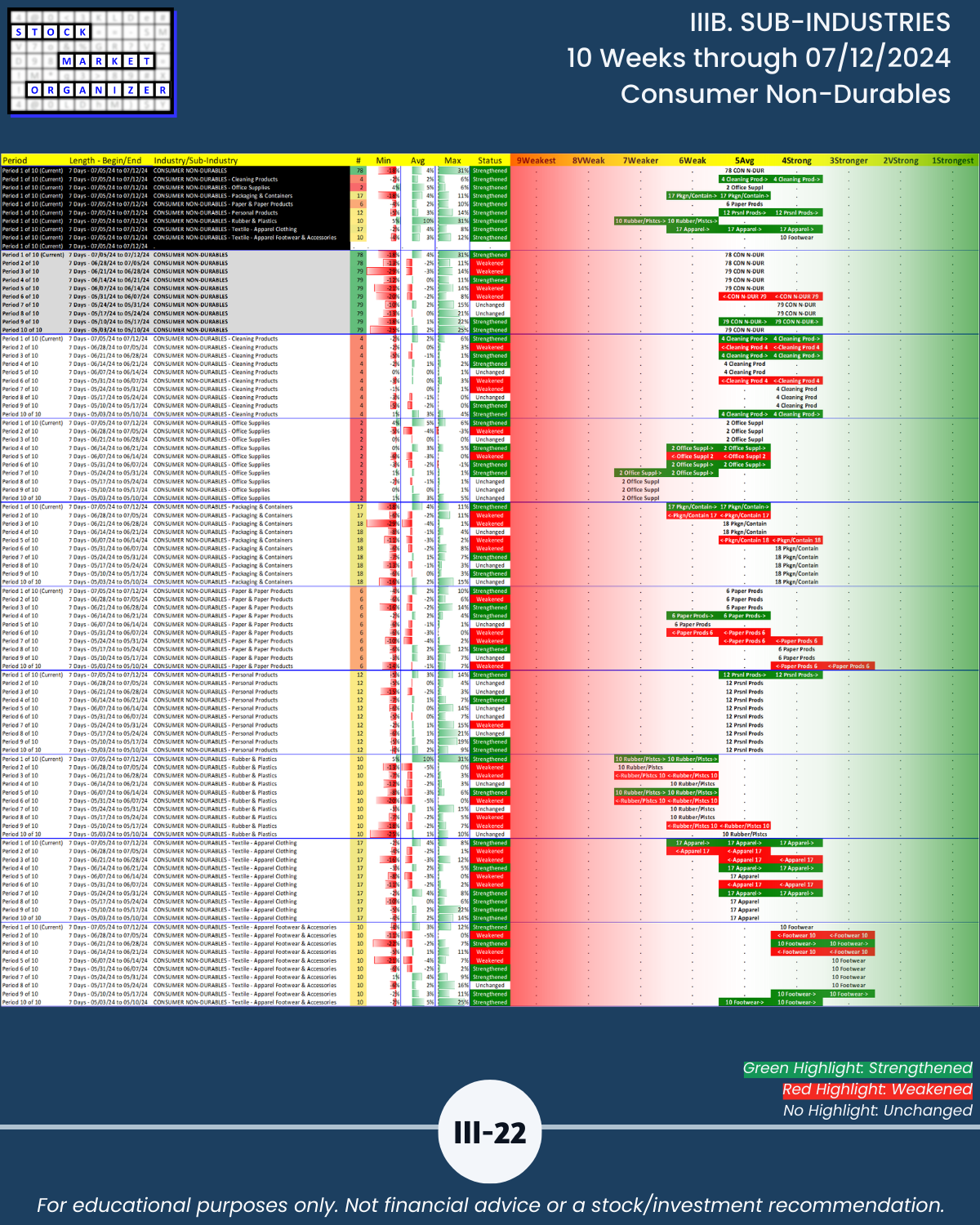

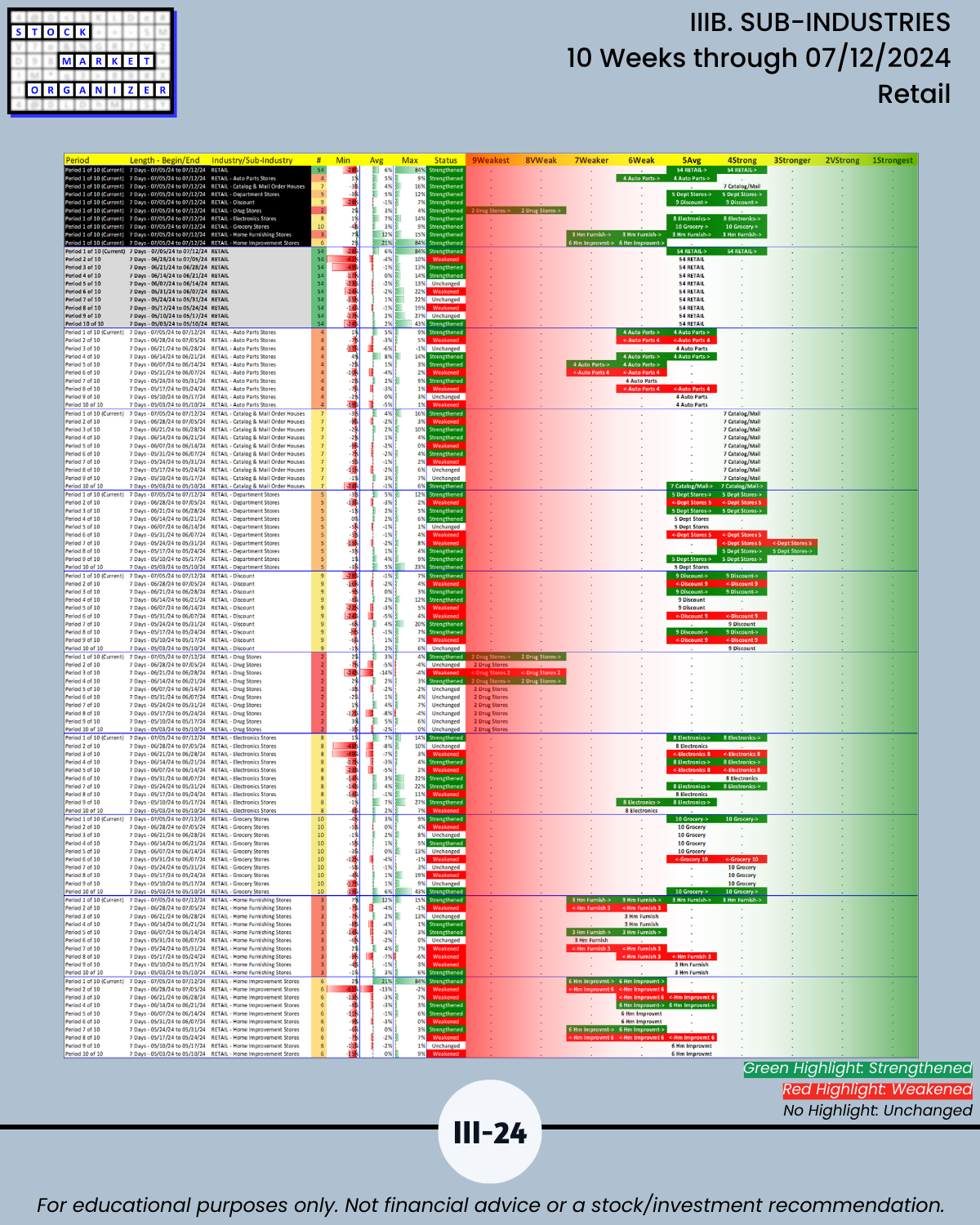

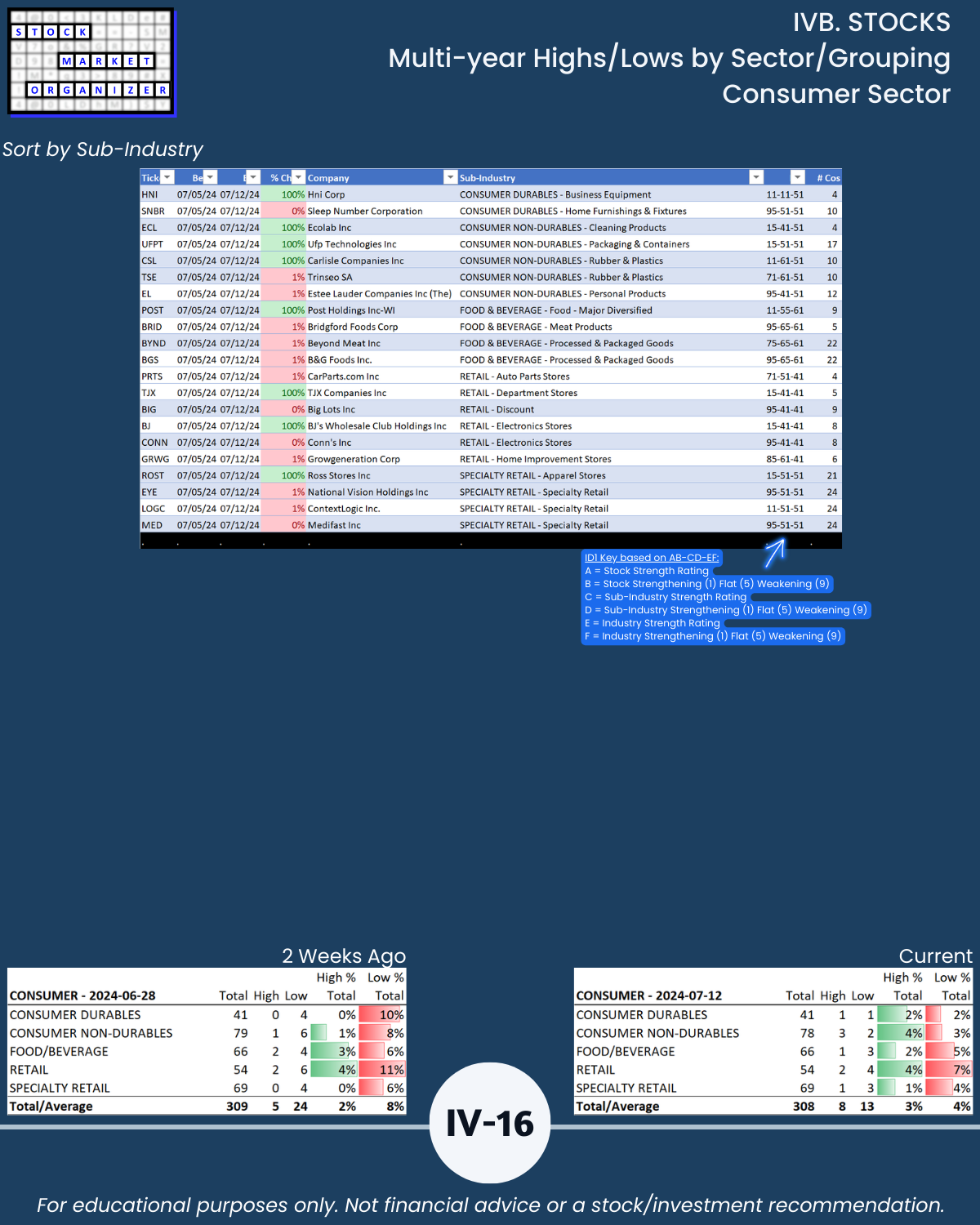

- Consumer (Consumer Durables, Consumer Non-Durables, Food & Beverage, Retail, Specialty Retail)

Leading Sub-industries (minimum 3 stocks) with a 1Strongest ranking:

- Banking – Foreign Regional Banks

- Computer Hardware – Data Storage Devices

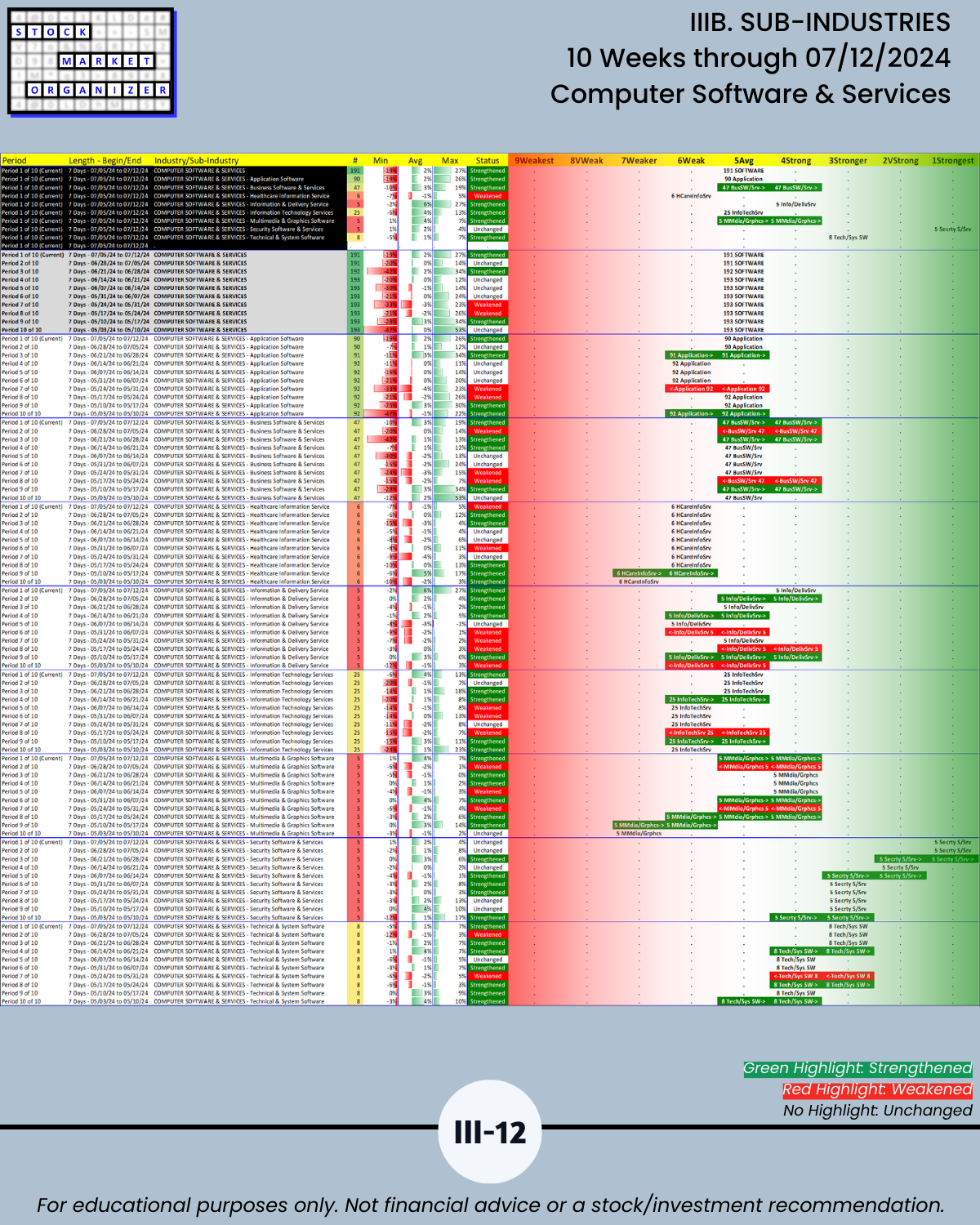

- Computer Software & Services – Security Software & Services

- Materials & Construction – Residential Construction

- Consumer Durables – Business Equipment

- Health Services – Long-Term Care Facilities

- Leisure – General Entertainment

Lagging Sub-industries (minimum 3 stocks) with a 9Weakest ranking:

- Wholesale - Auto Parts

- Wholesale - Medical Equipment

More in the market, sector, industry, sub-industry, and stock analysis below.

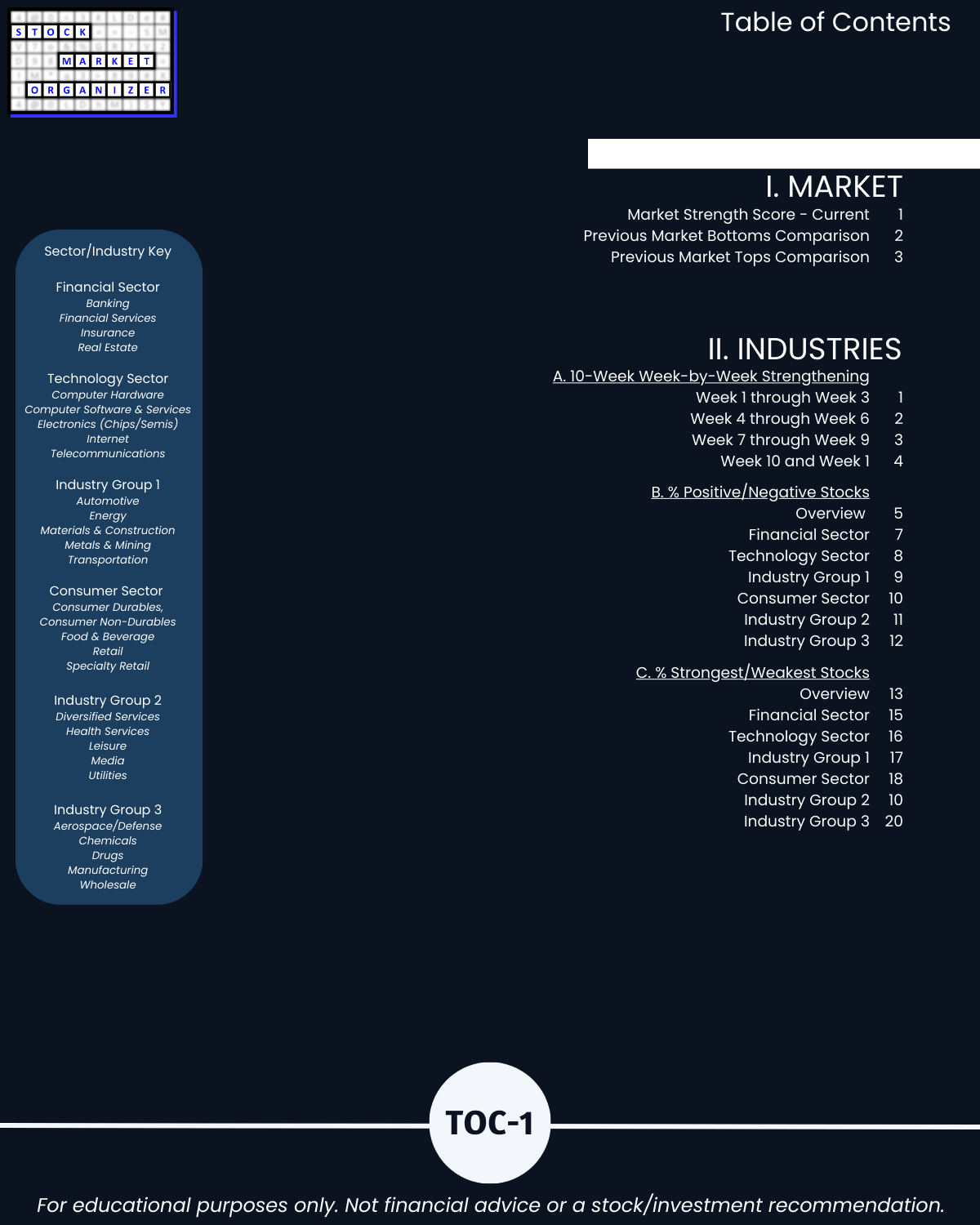

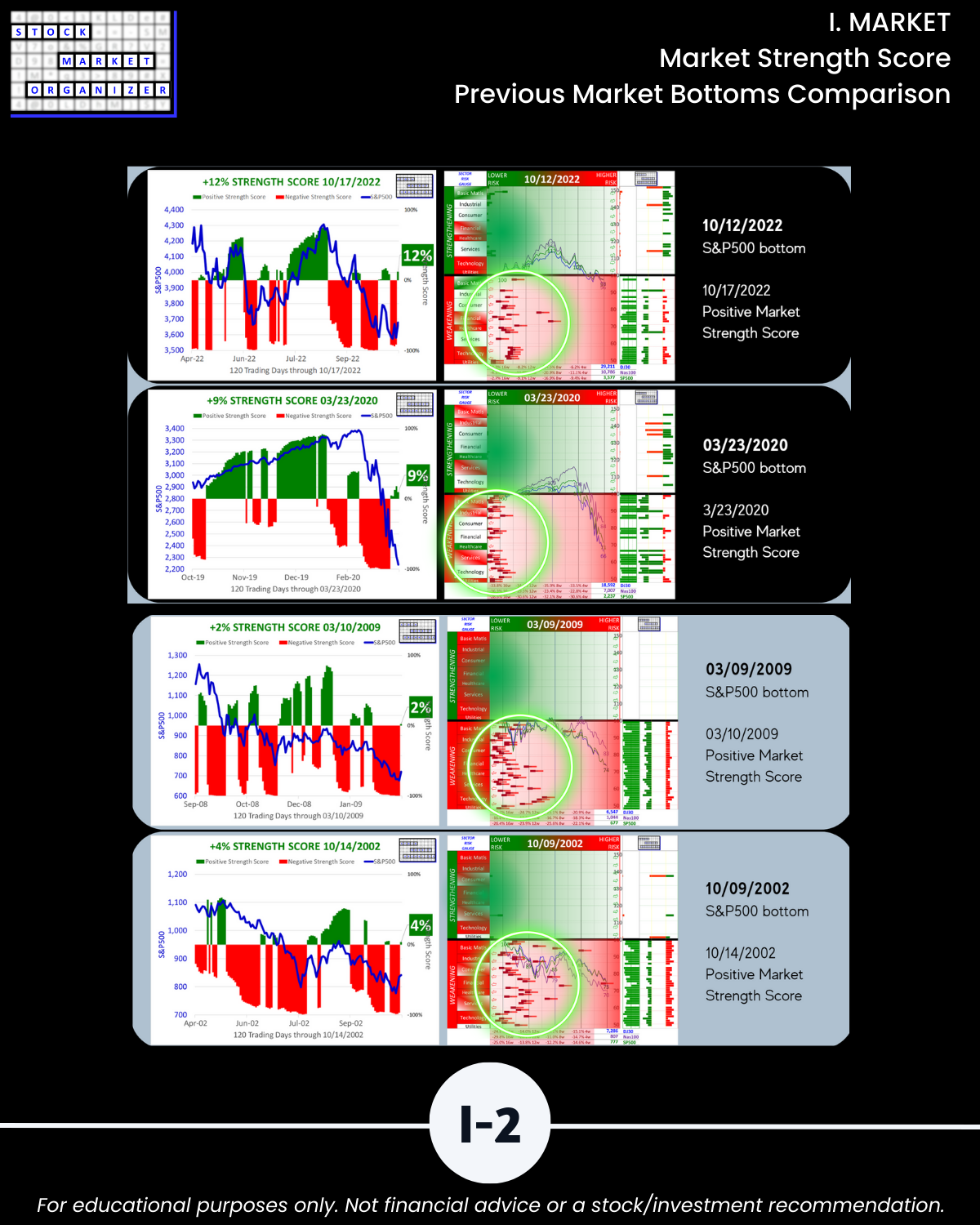

I. MARKET Prologue Critical Concepts/Market Strength Score

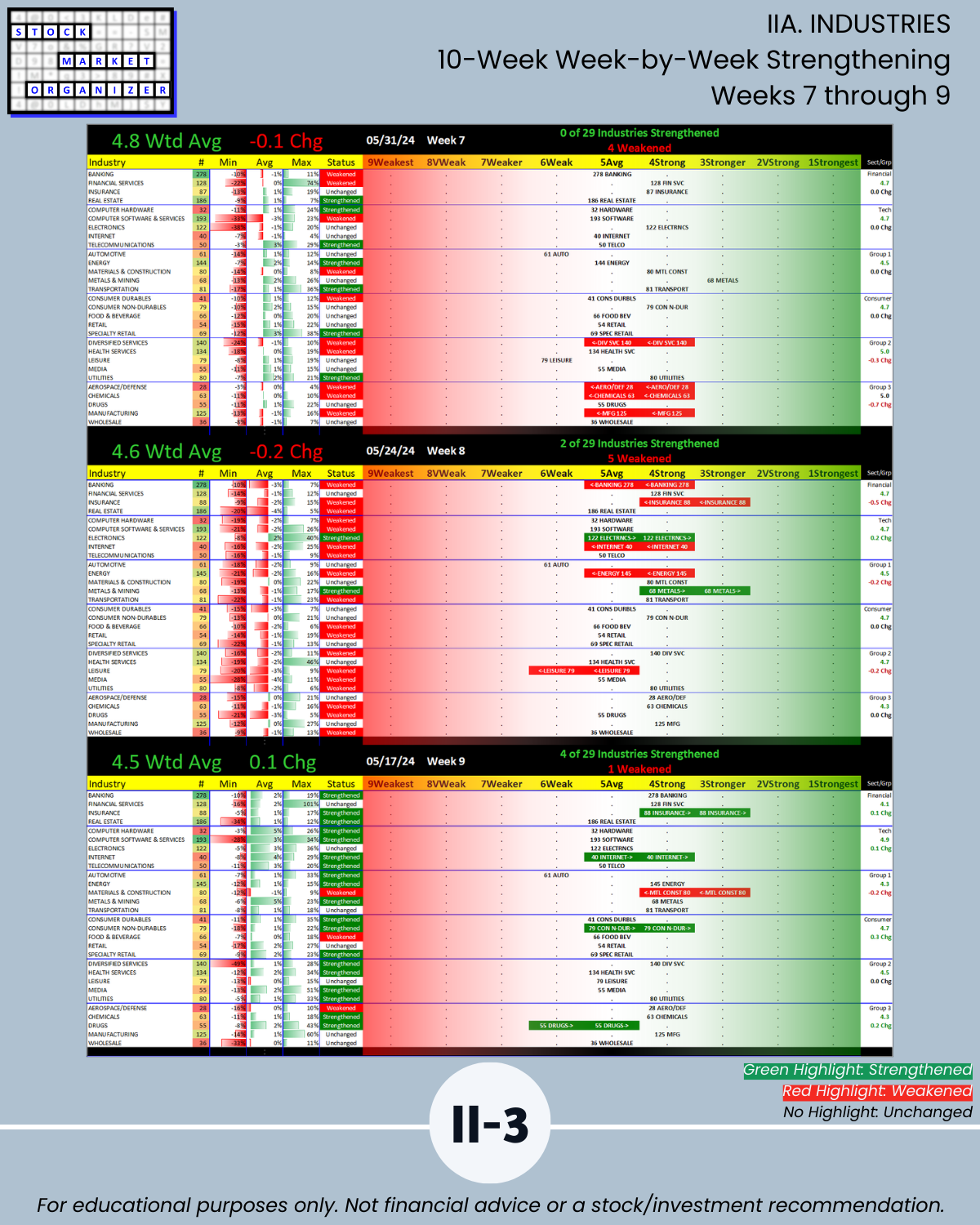

IIA. INDUSTRIES 10-Week Week-by-Week Strengthening

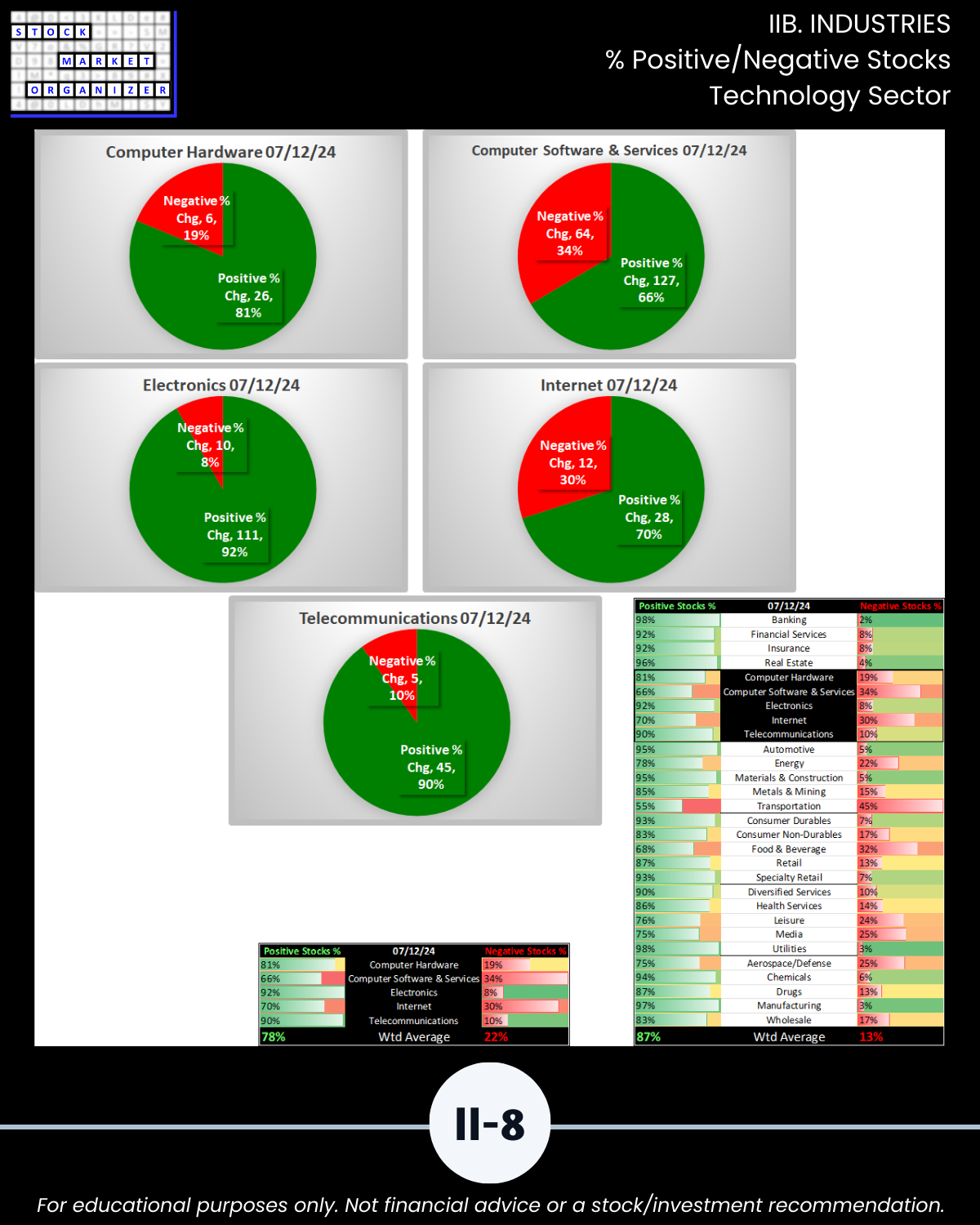

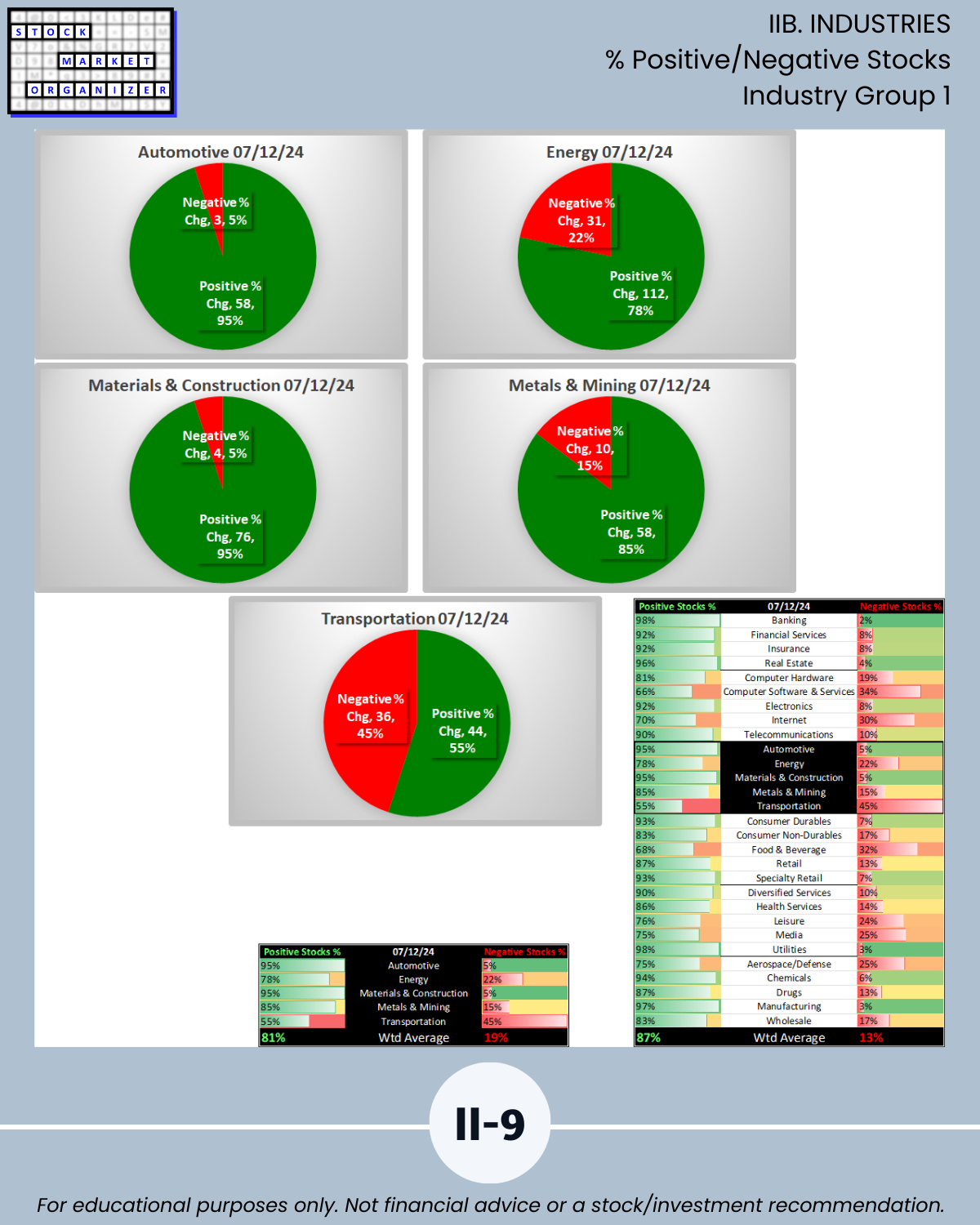

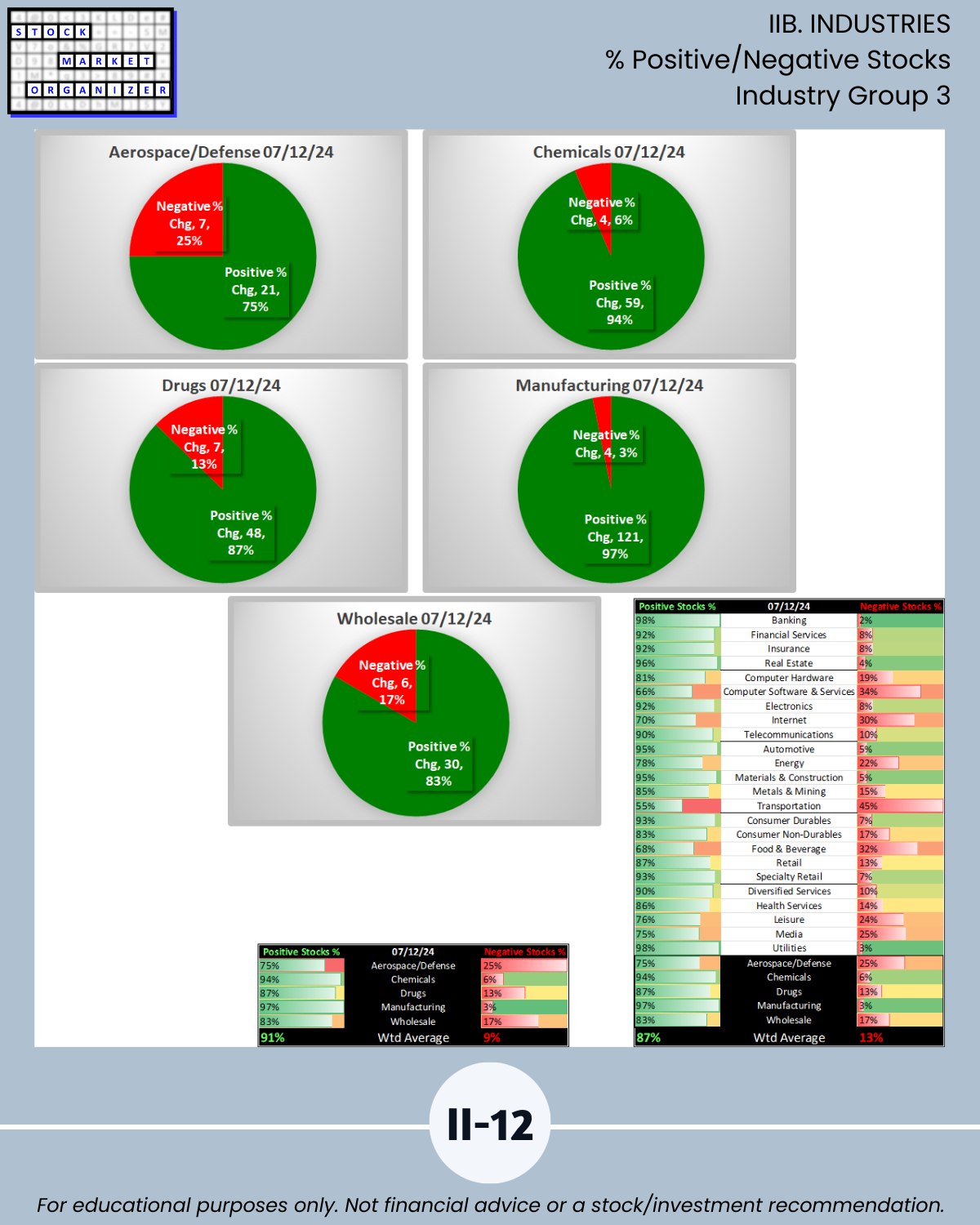

IIB. INDUSTRIES % Positive/Negative Stocks

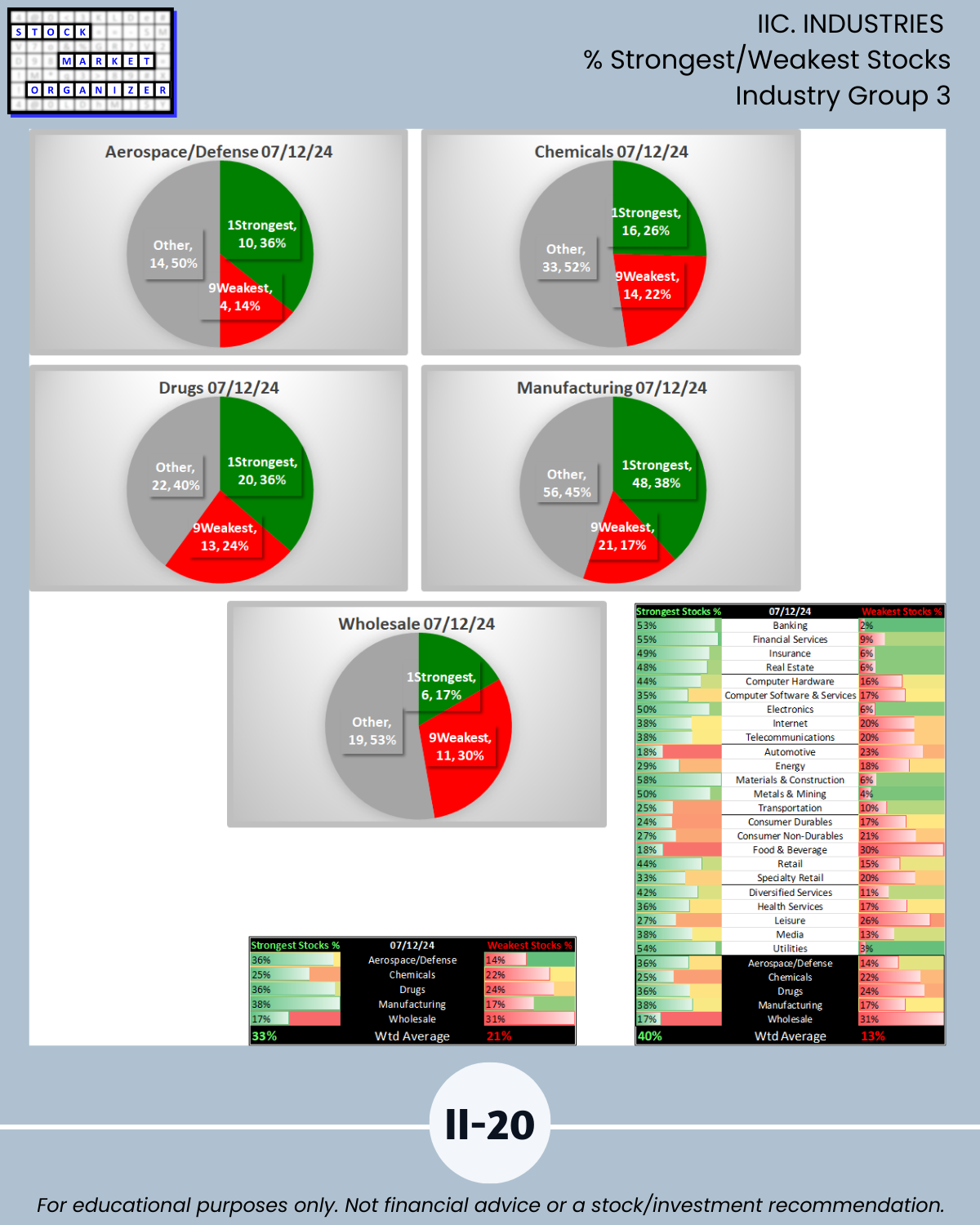

IIC. INDUSTRIES % Strongest/Weakest Stocks

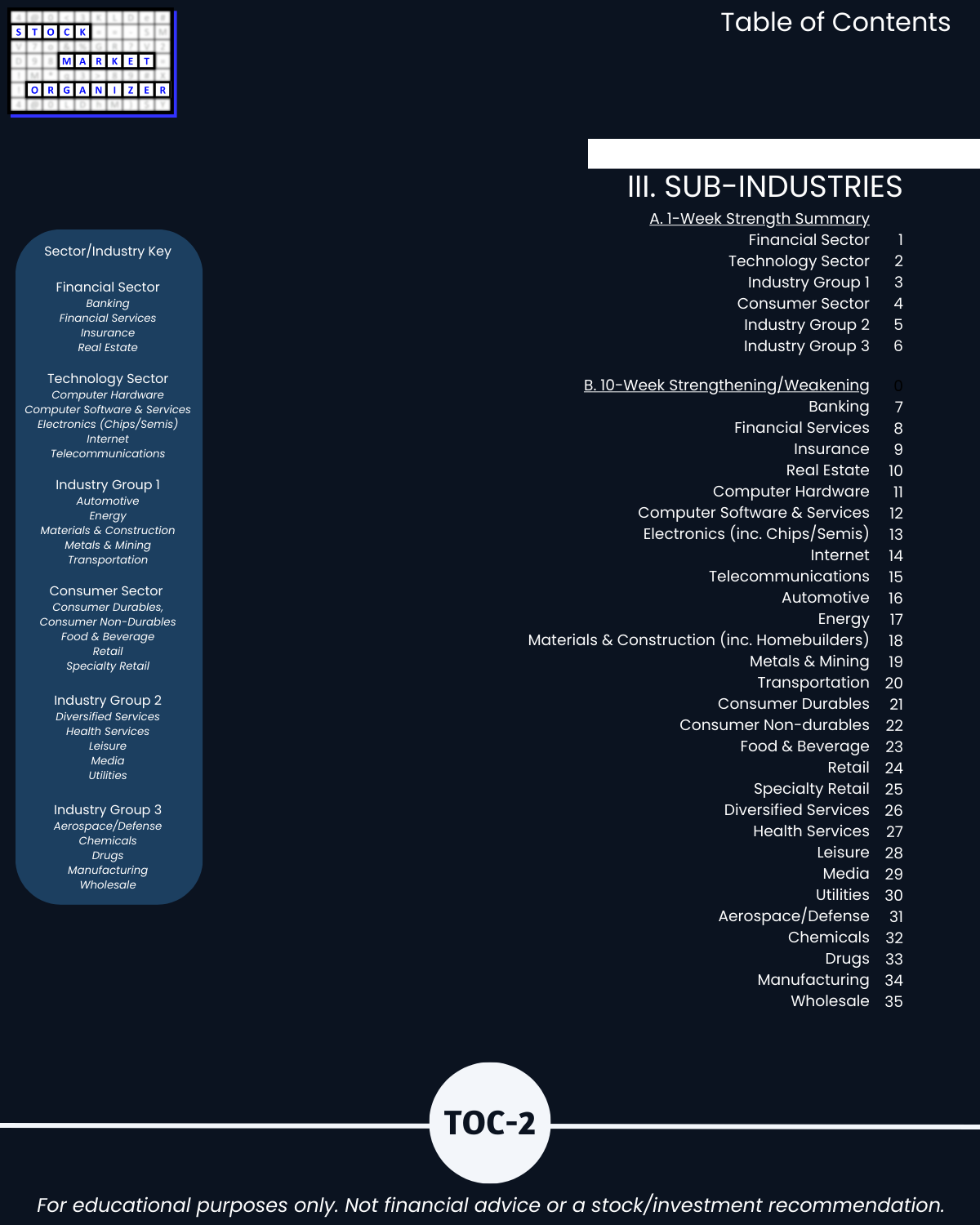

IIIA. SUB-INDUSTRIES 1-Week Strength Summary

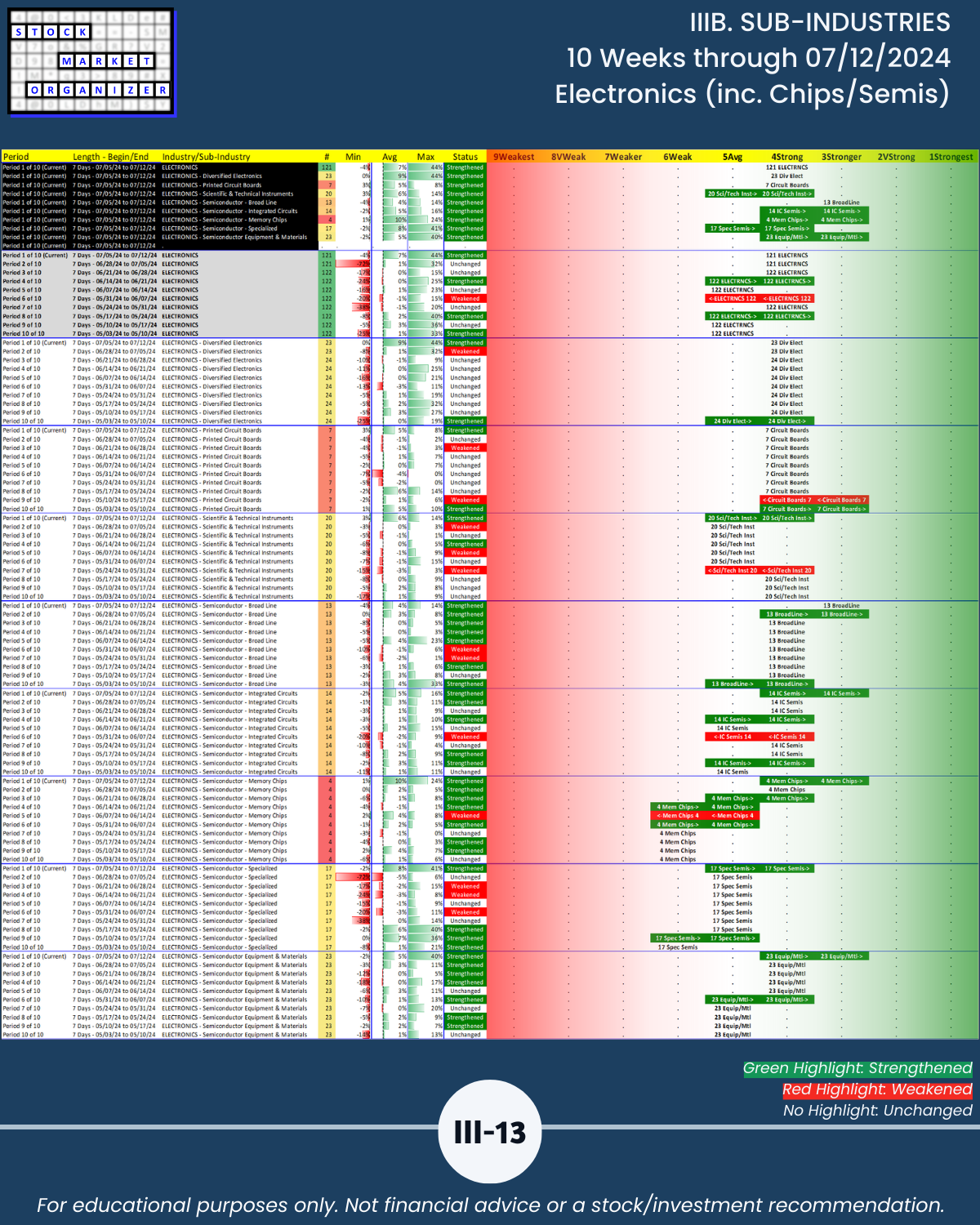

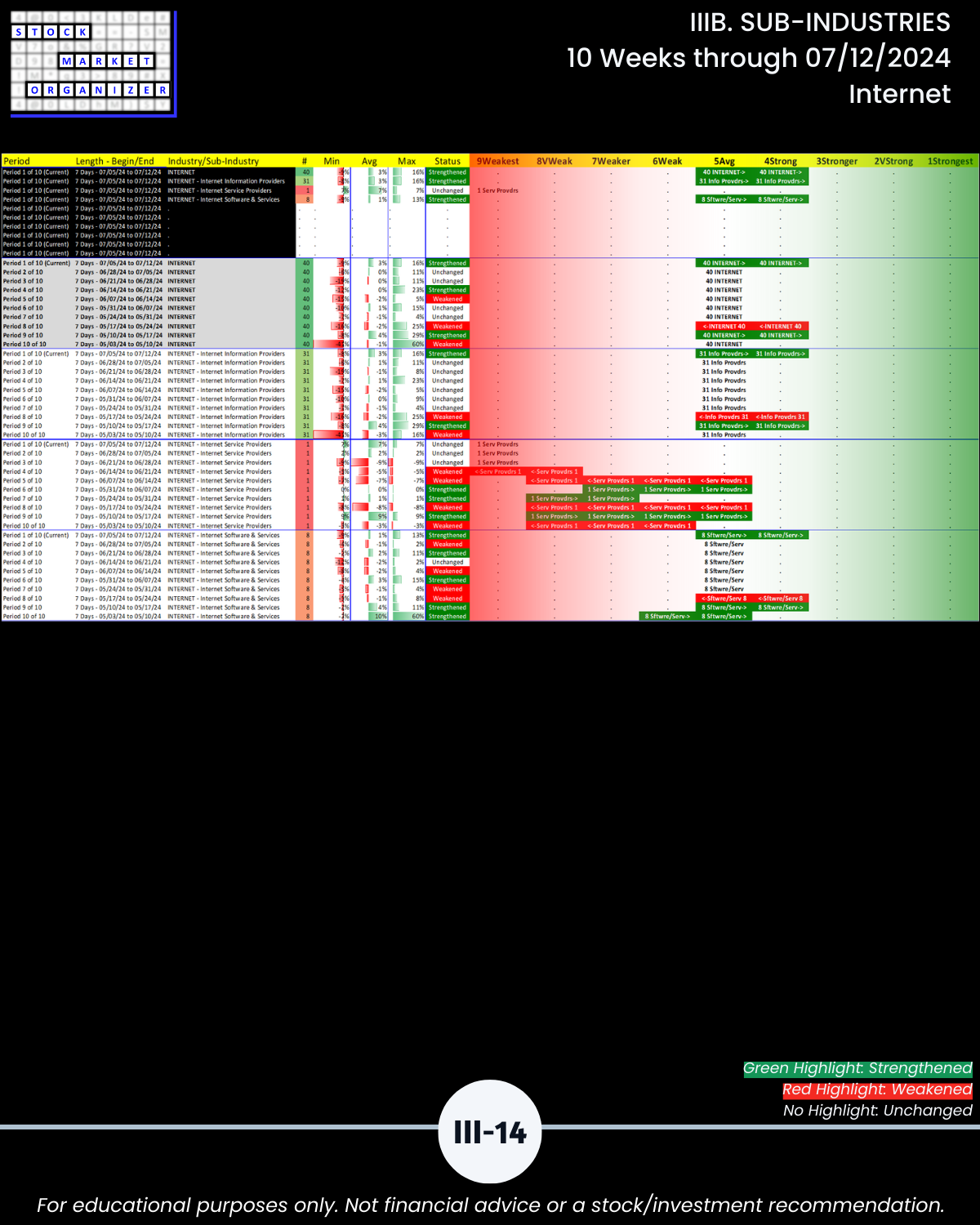

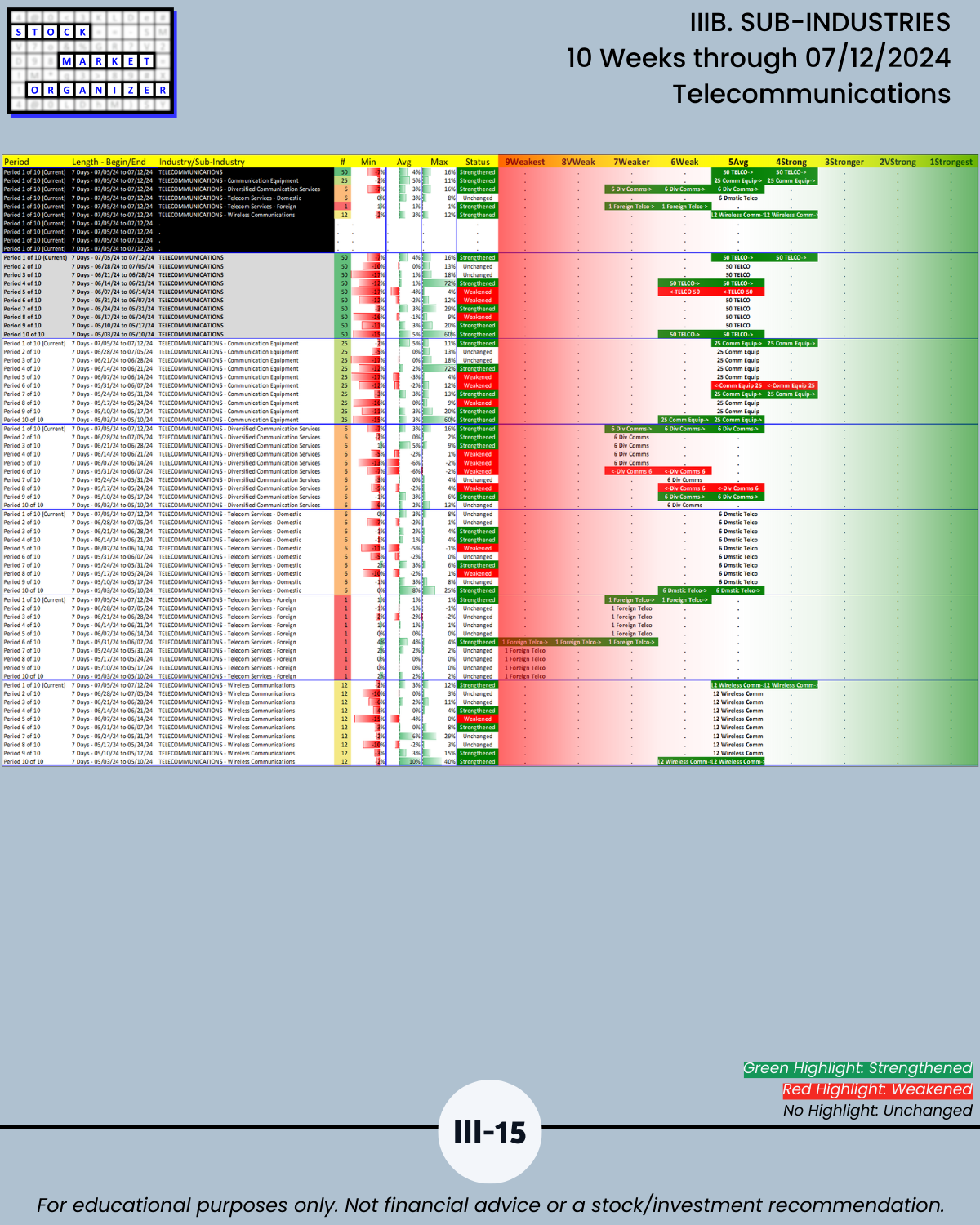

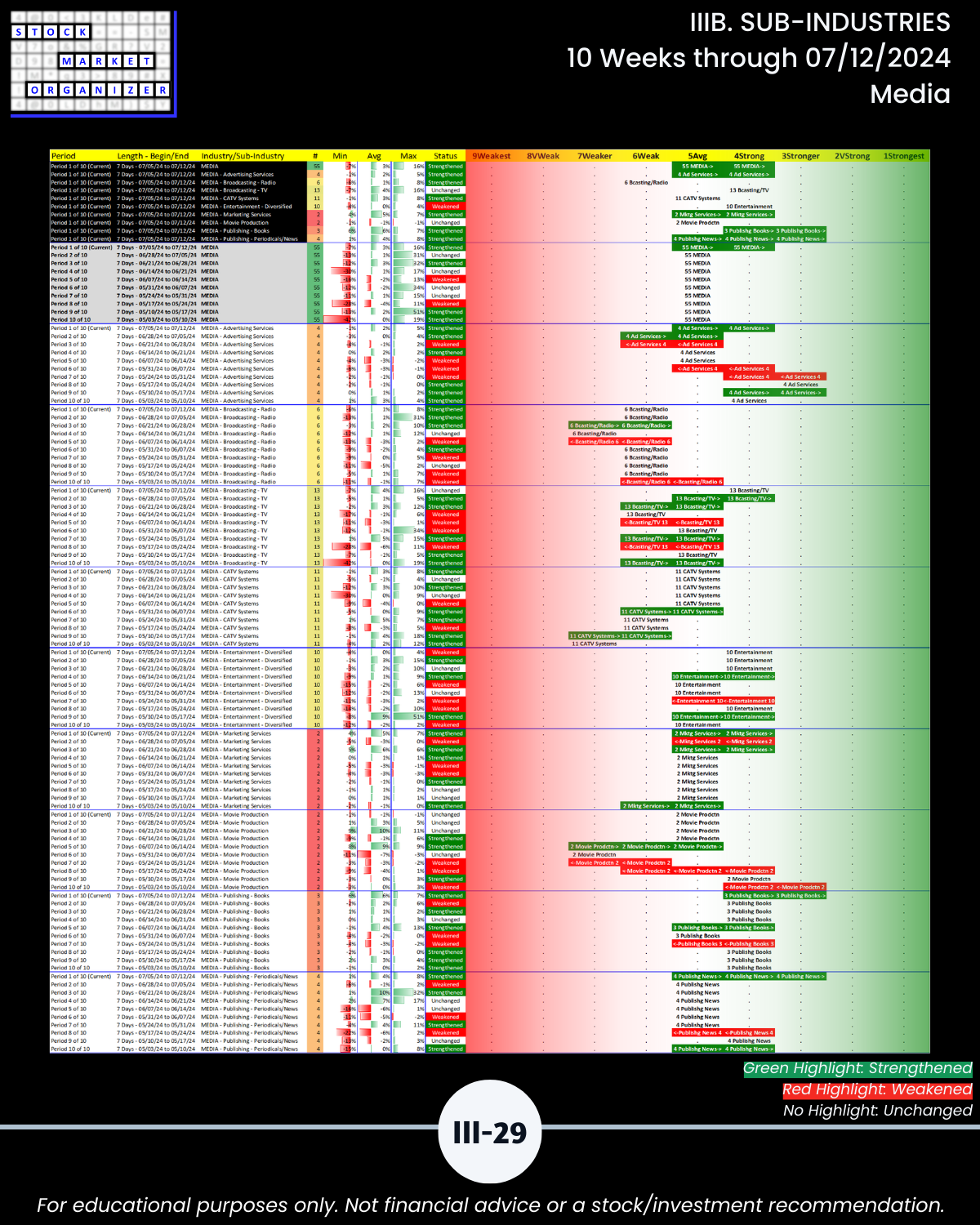

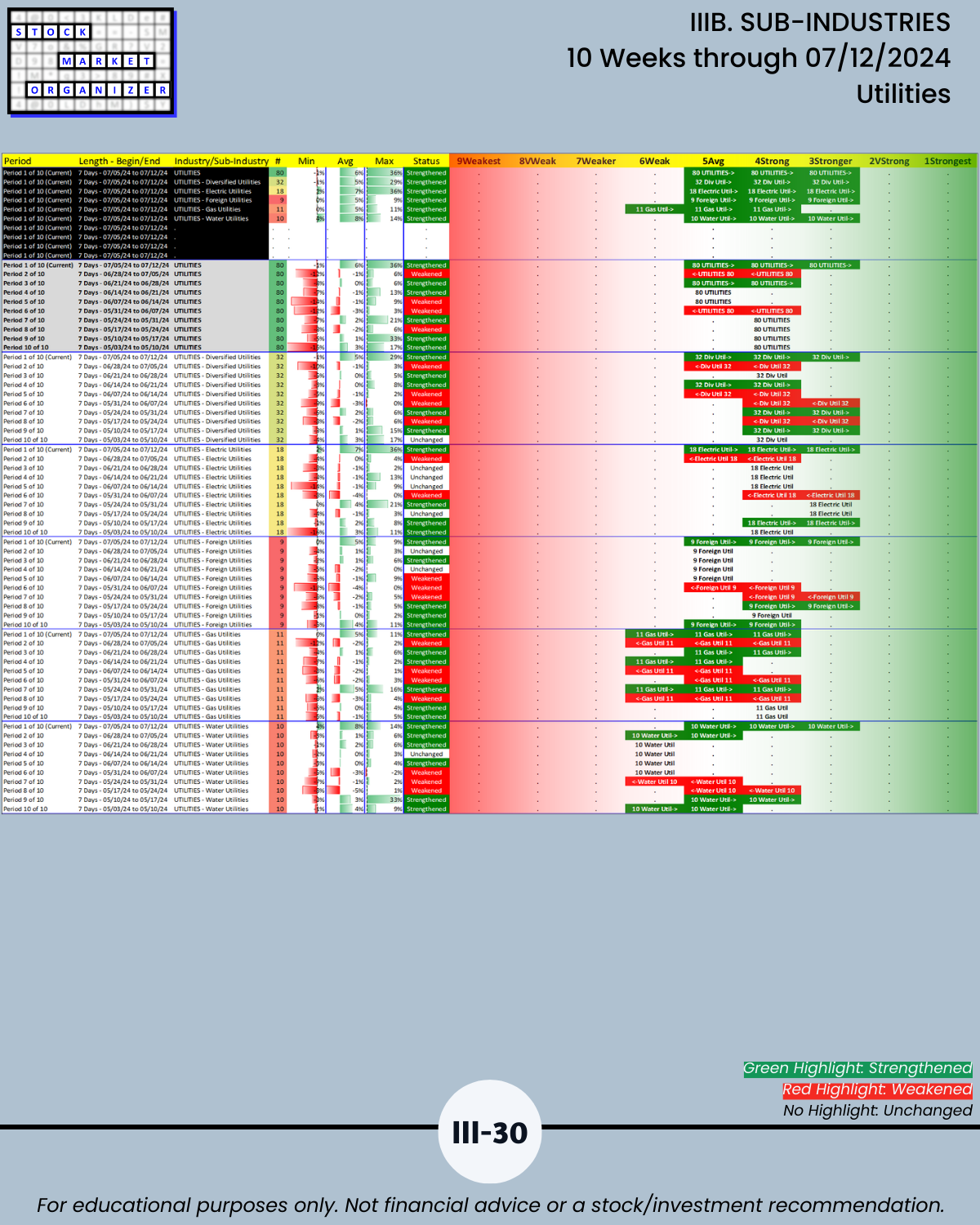

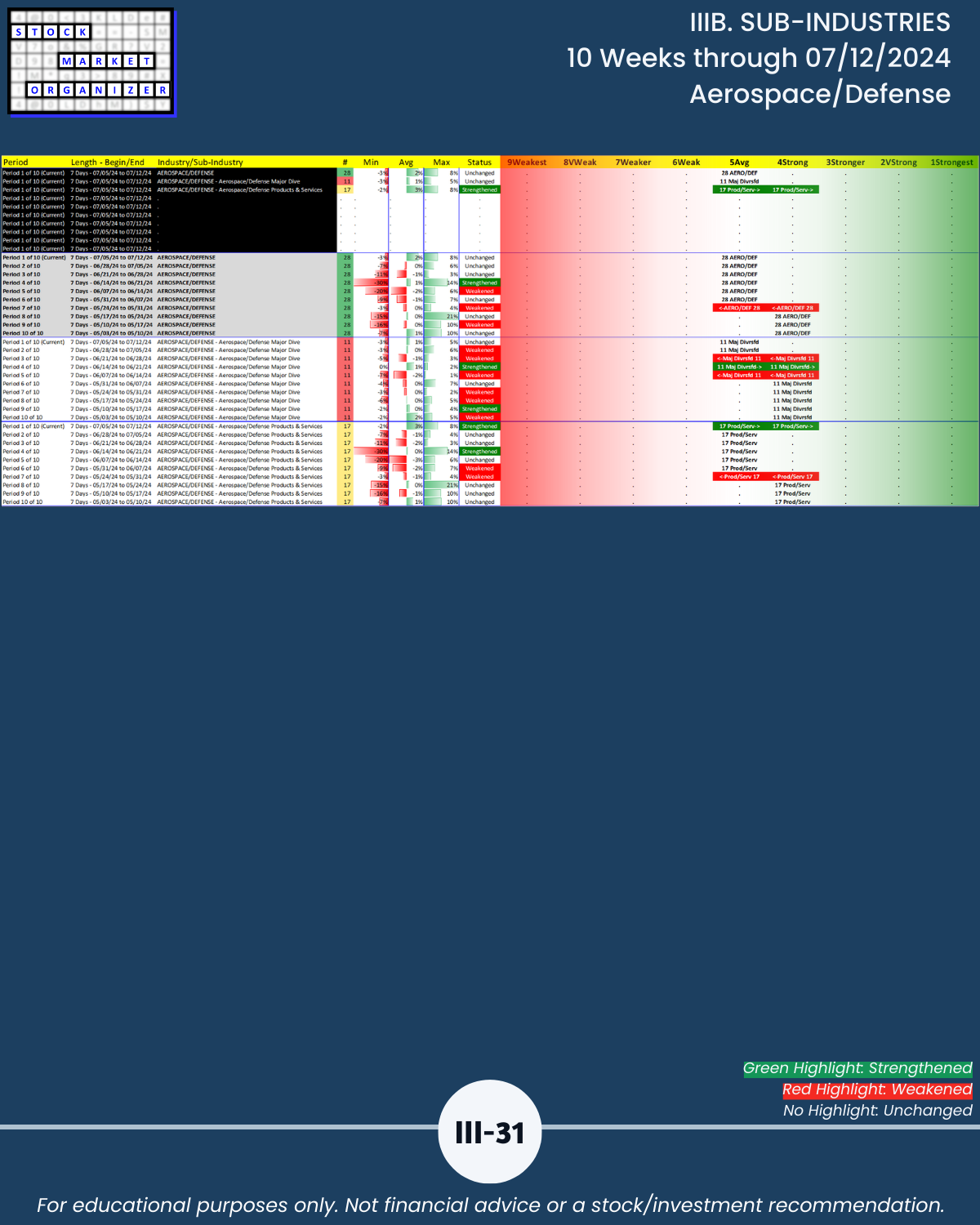

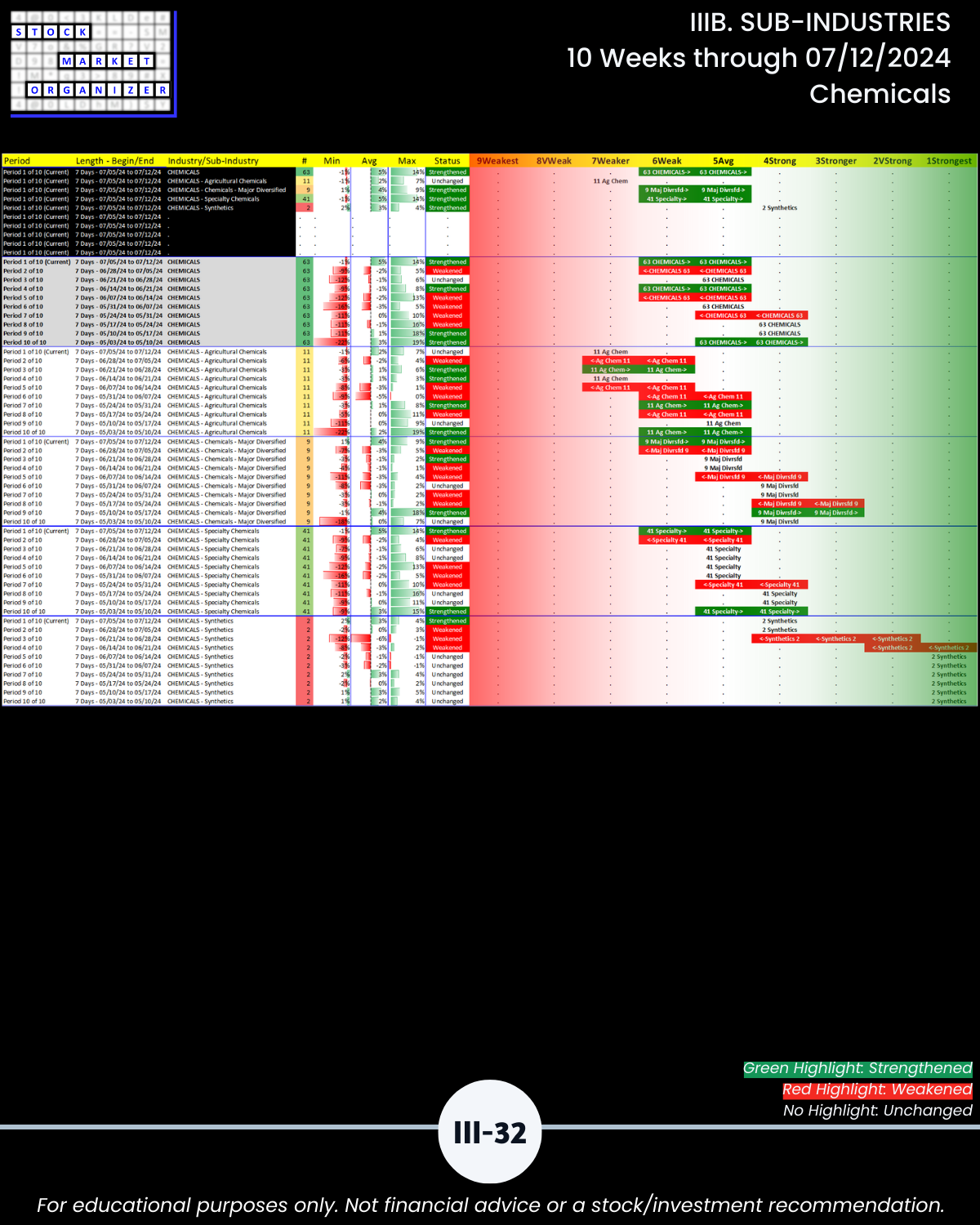

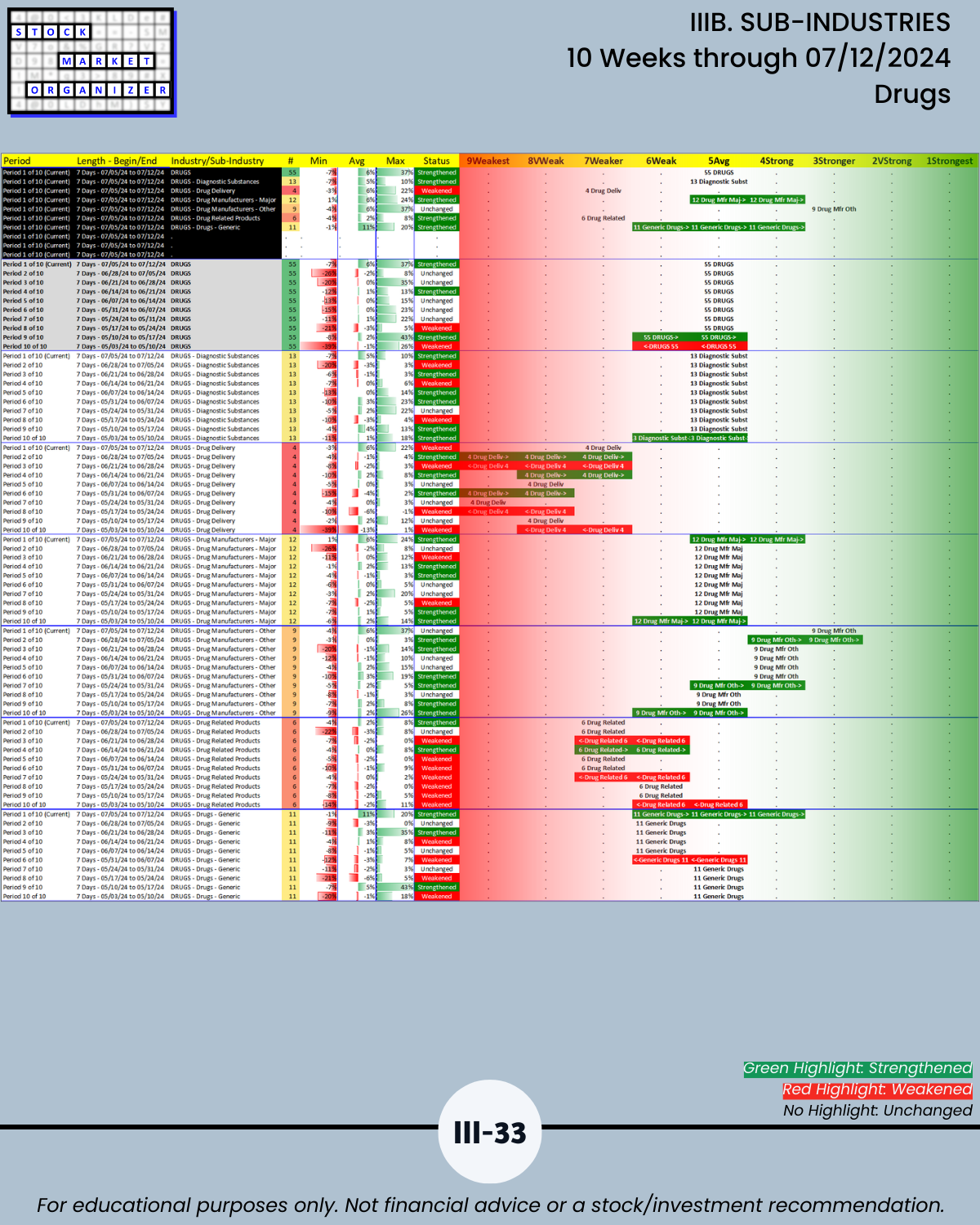

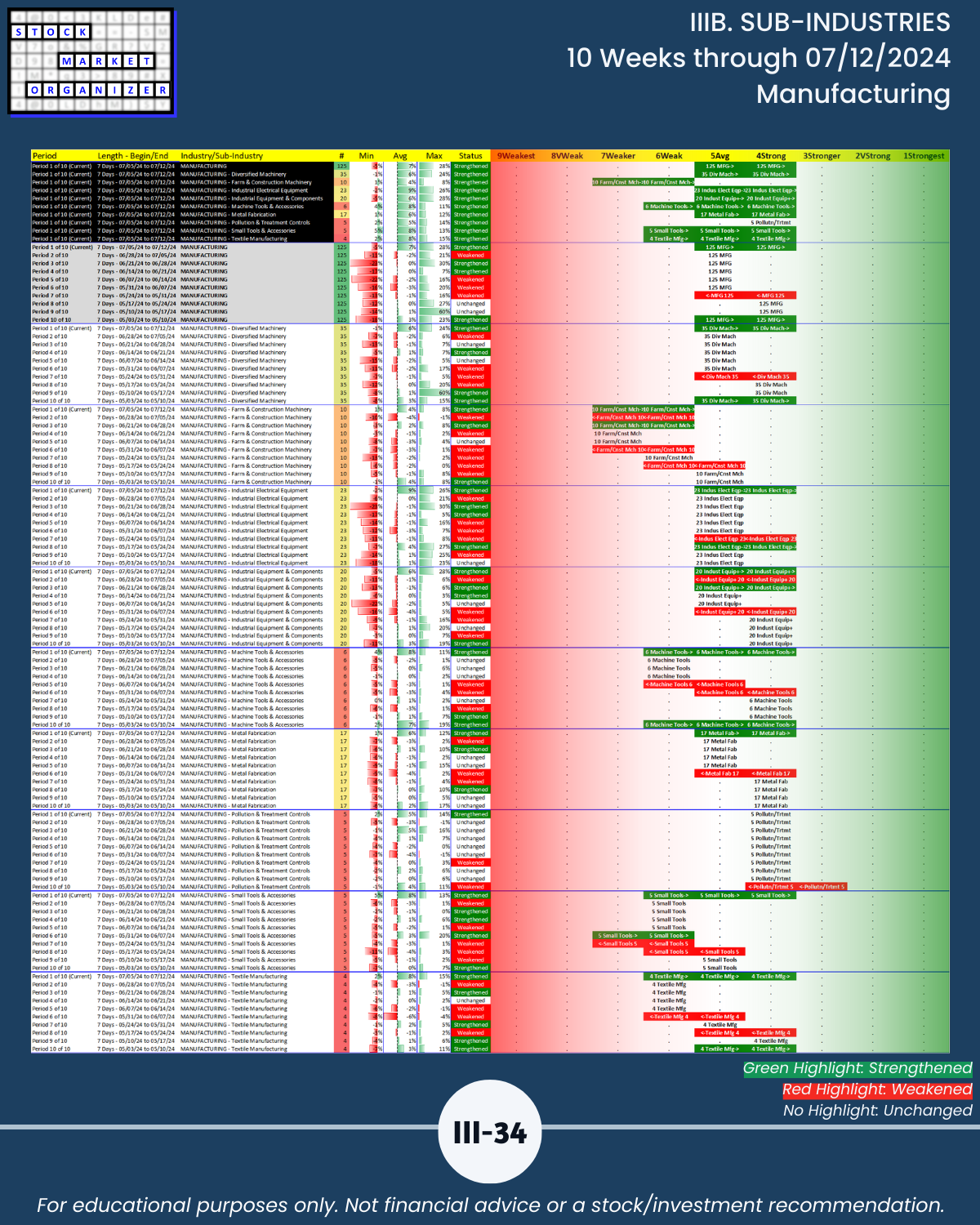

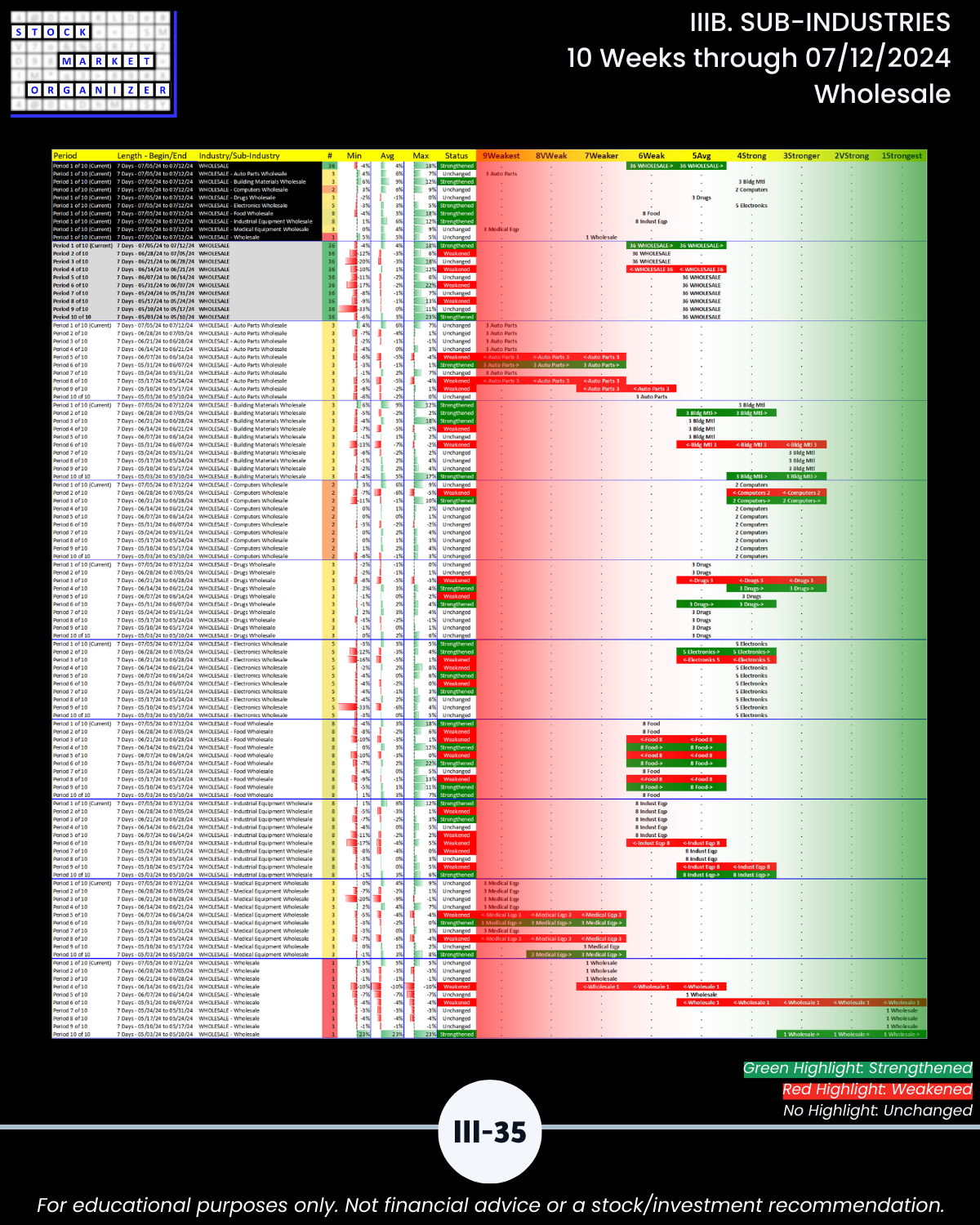

IIIB. SUB-INDUSTRIES 10-Week Strengthening/Weakening

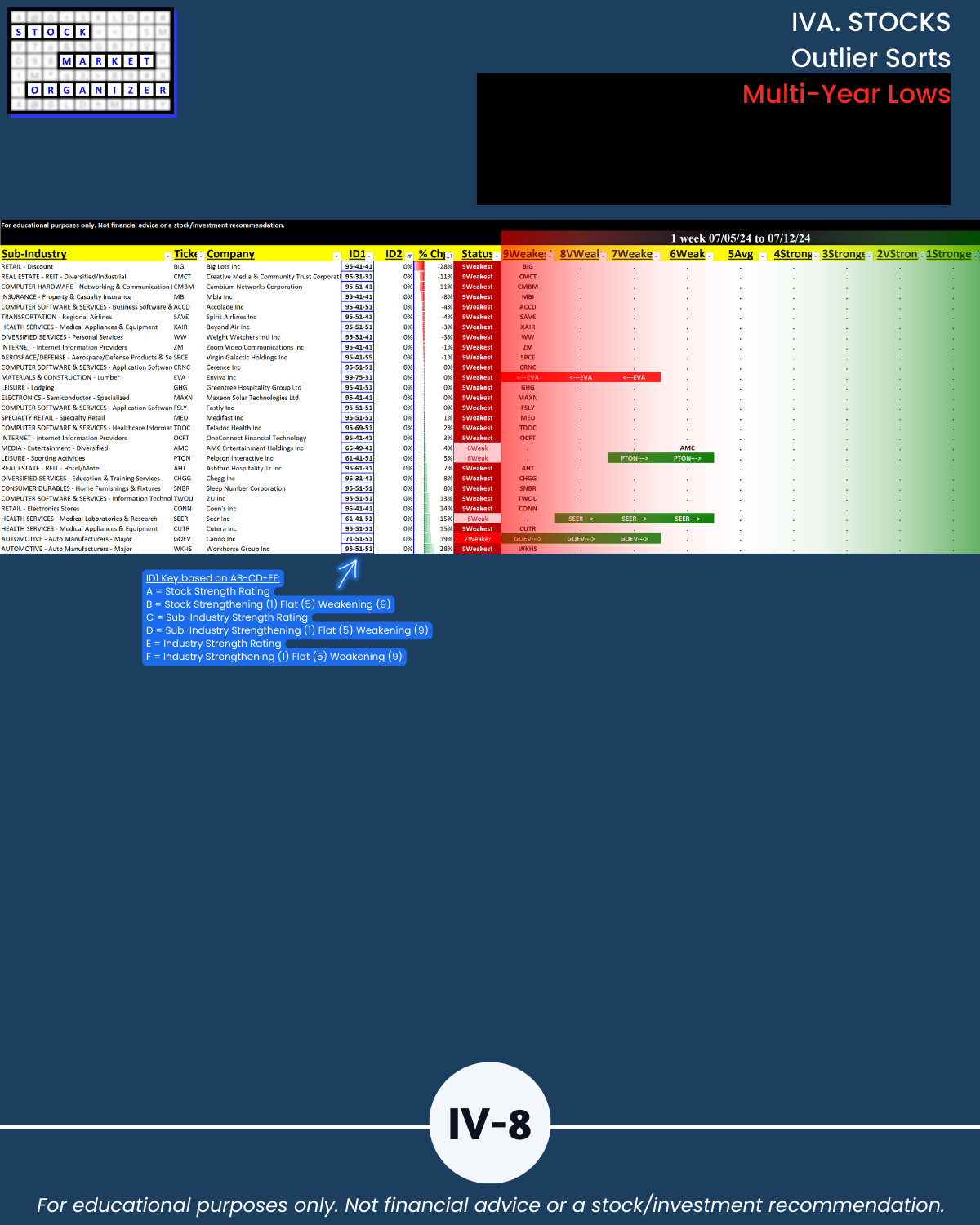

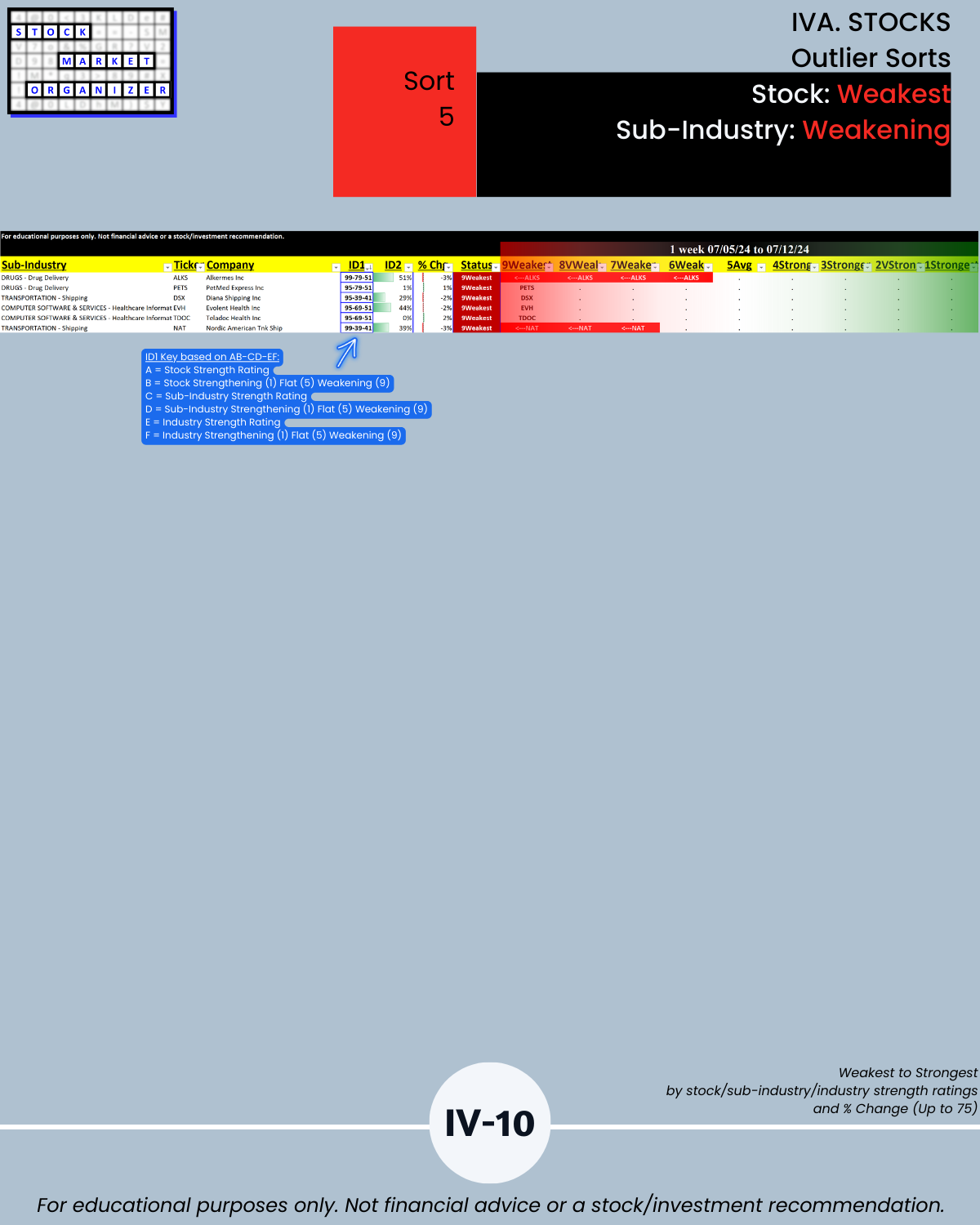

IVA. STOCKS Outlier Sorts

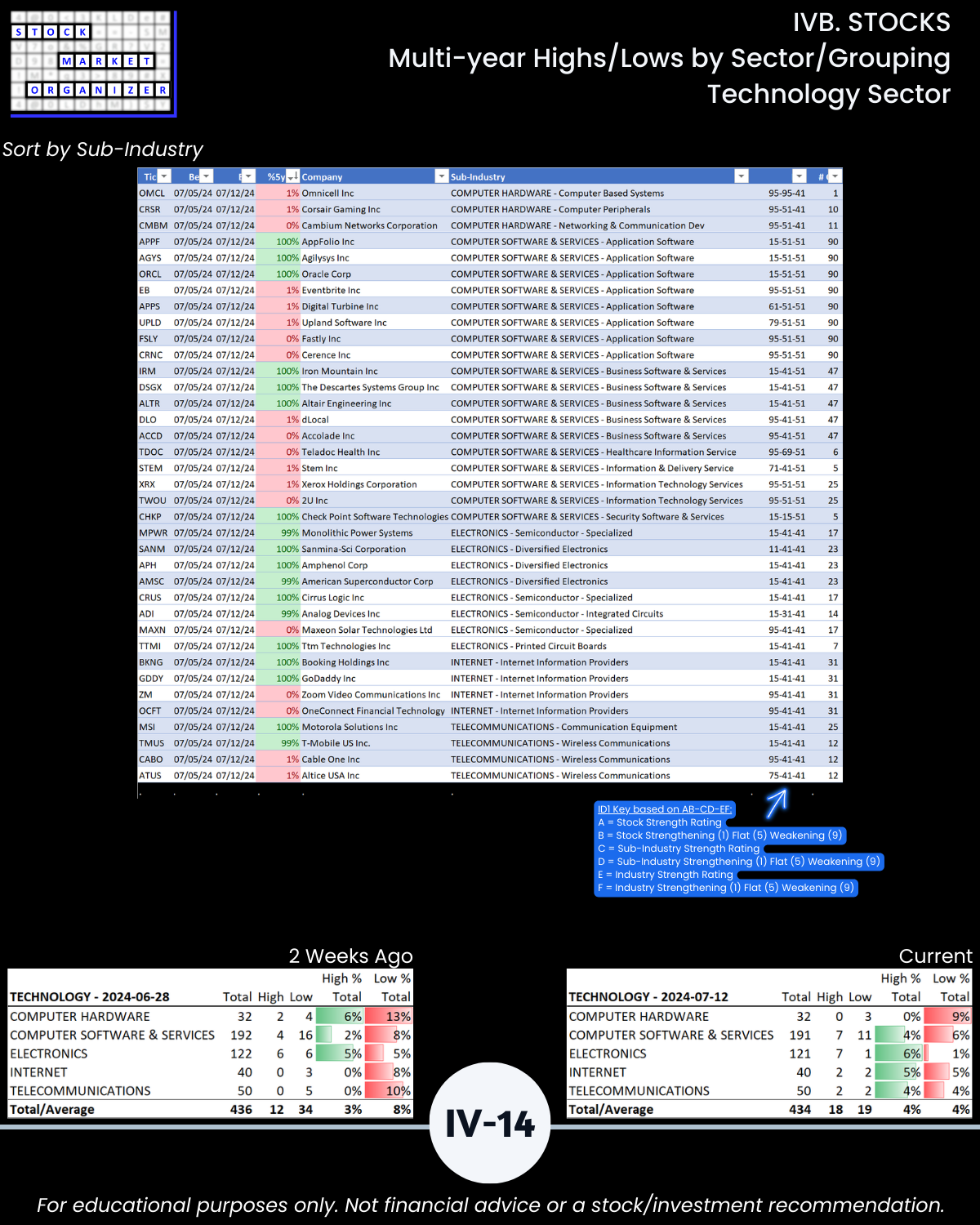

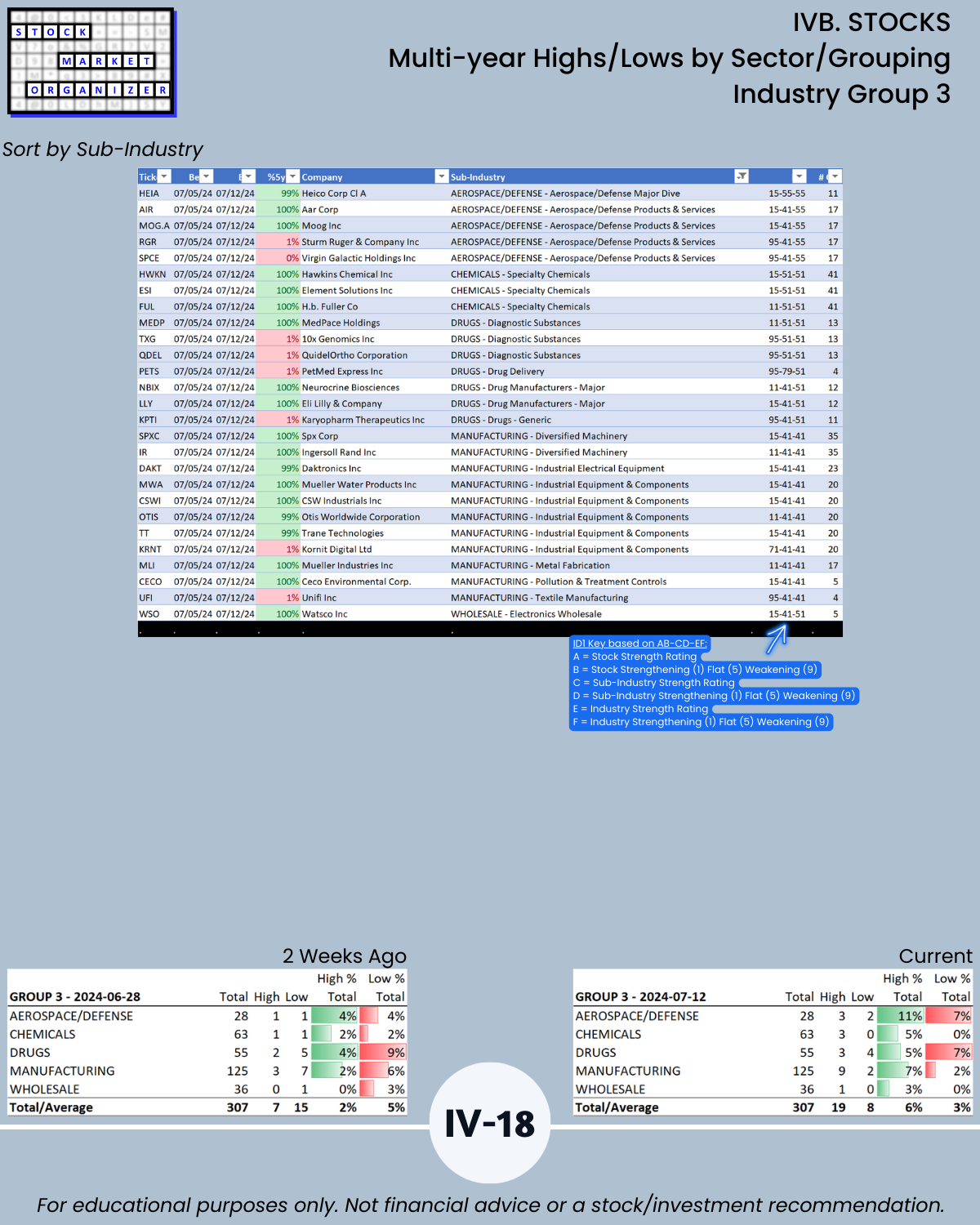

IVB. STOCKS Multi-Year Highs/Lows by Sector/Grouping

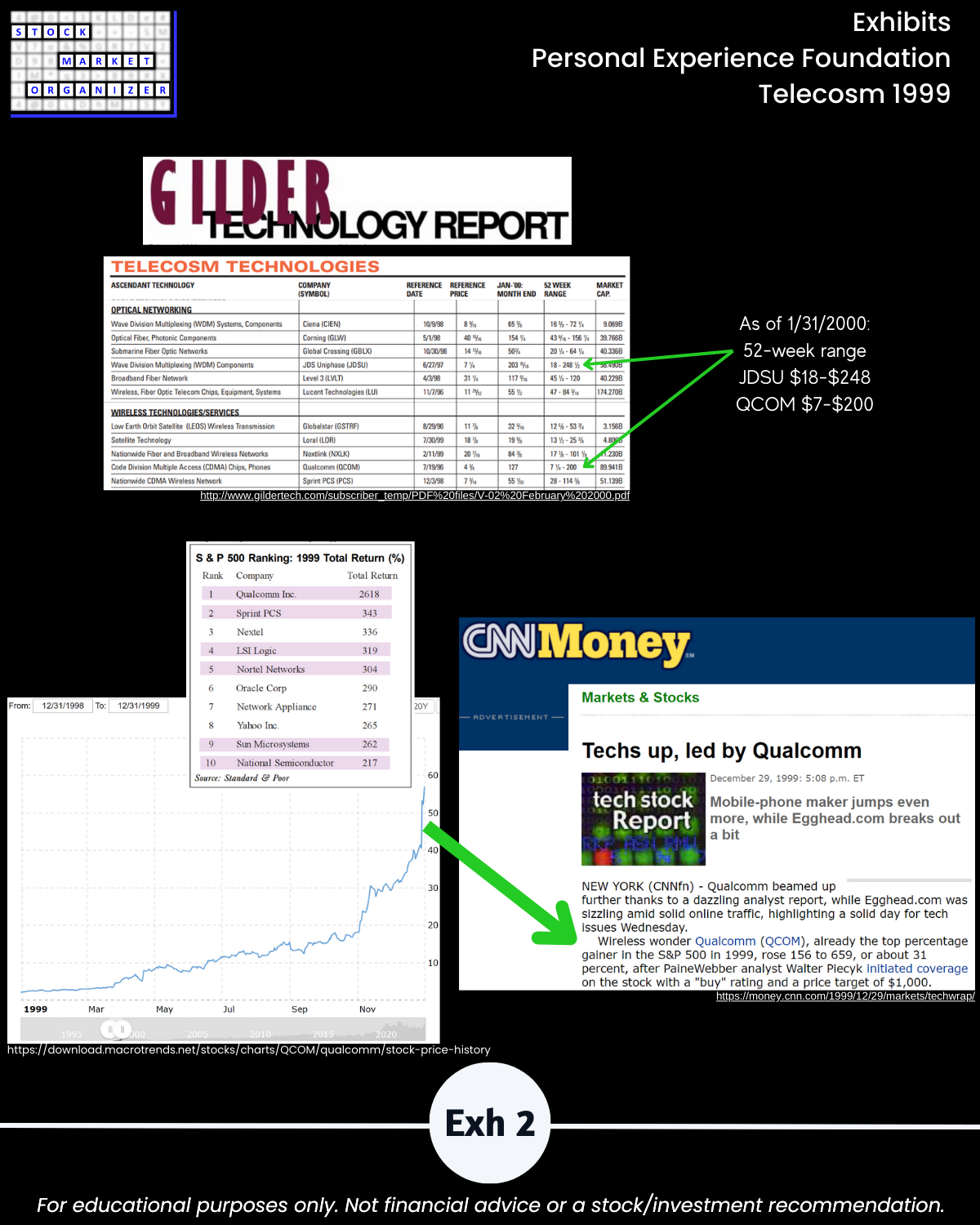

IV. EXHIBITS System Foundations