SMO Exclusive: U.S. Stock Market Strength Report 2024-04-19 (no new Longs)

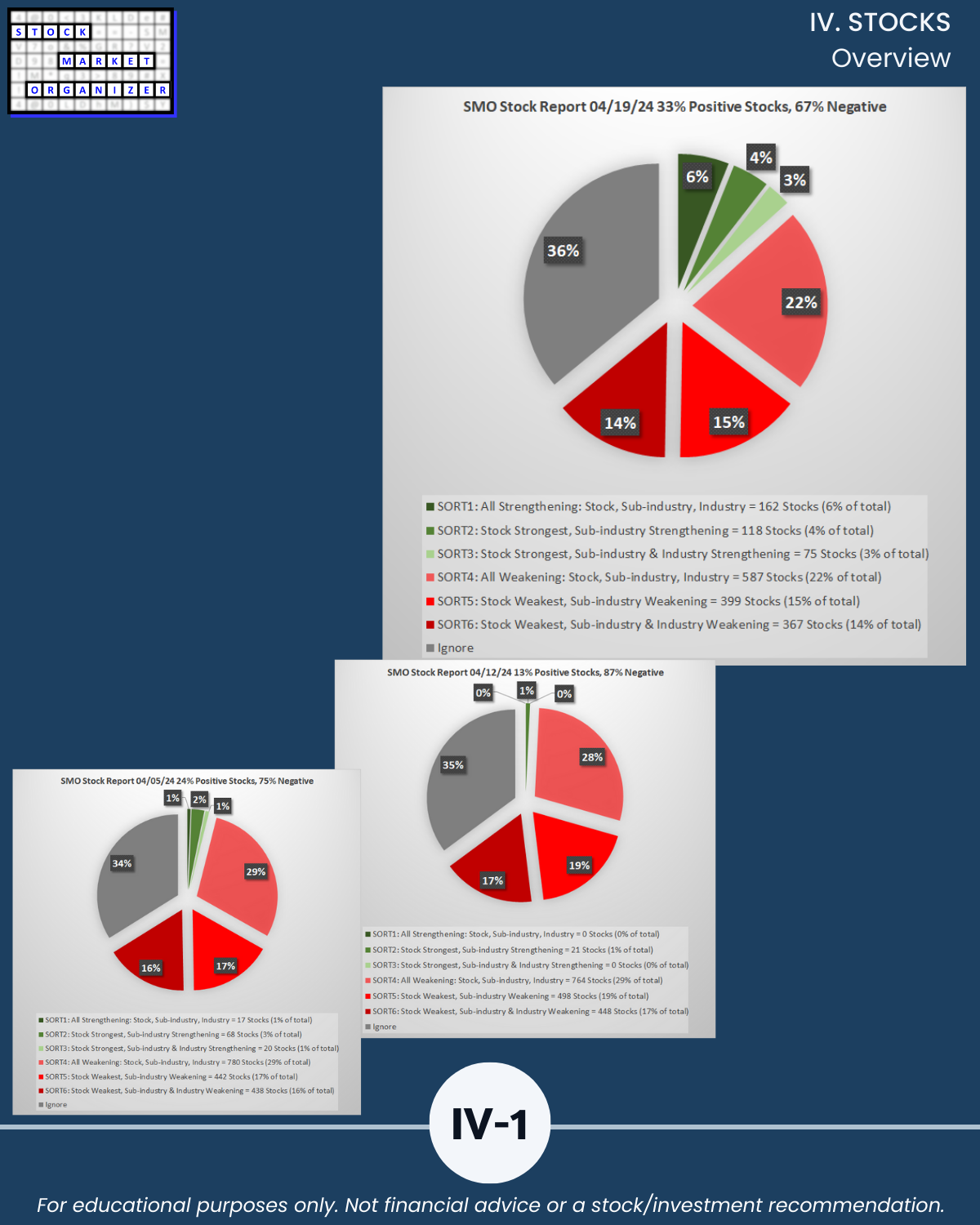

U.S. stock market 4/19/24 - to convert confusing chaos into crystal clear, calming context, see the attached unique strength-focused review. It looks at the market from the top-down, inside-out, and bottom up. It is original with insights unavailable elsewhere that will complement all other market views. Including yours. BOTTOM LINE – LESS WEAKENING STILL MEANS WEAKENING. (Especially if you own NVDA and/or SMCI.) By the numbers: 🔹 29 industries: 3 strengthened rankings (Banking, Food & Beverage, and Utilities) as 10 weakened (vs. 0/10 last week), 🔹 198 sub-industries: 20% strengthened and 58% weakened (vs. 5%/74% last week), 🔹 2,667 stocks: 67% negative (vs. 87% last week).

For more in the attached:

Market: Section I

Industries: Section II

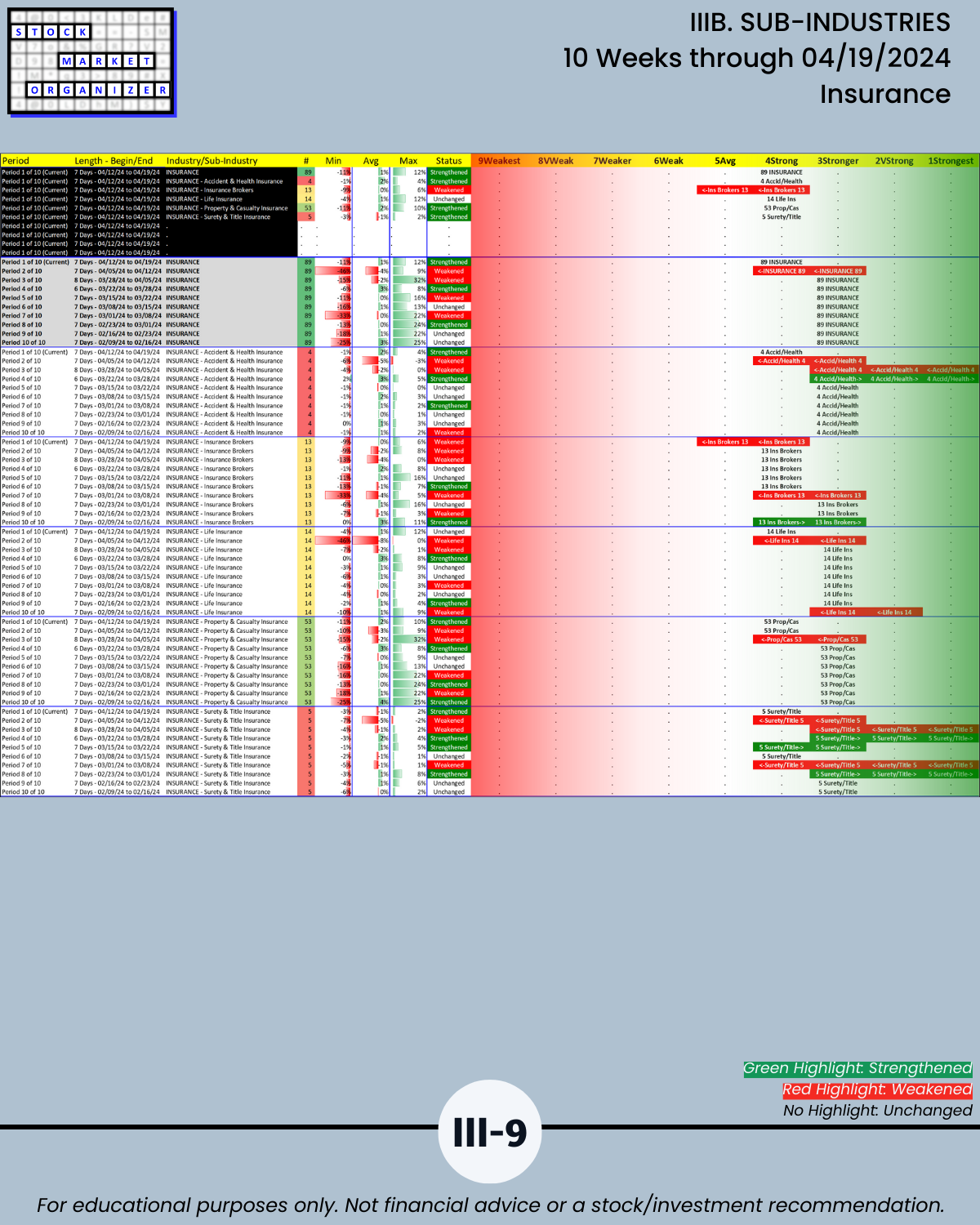

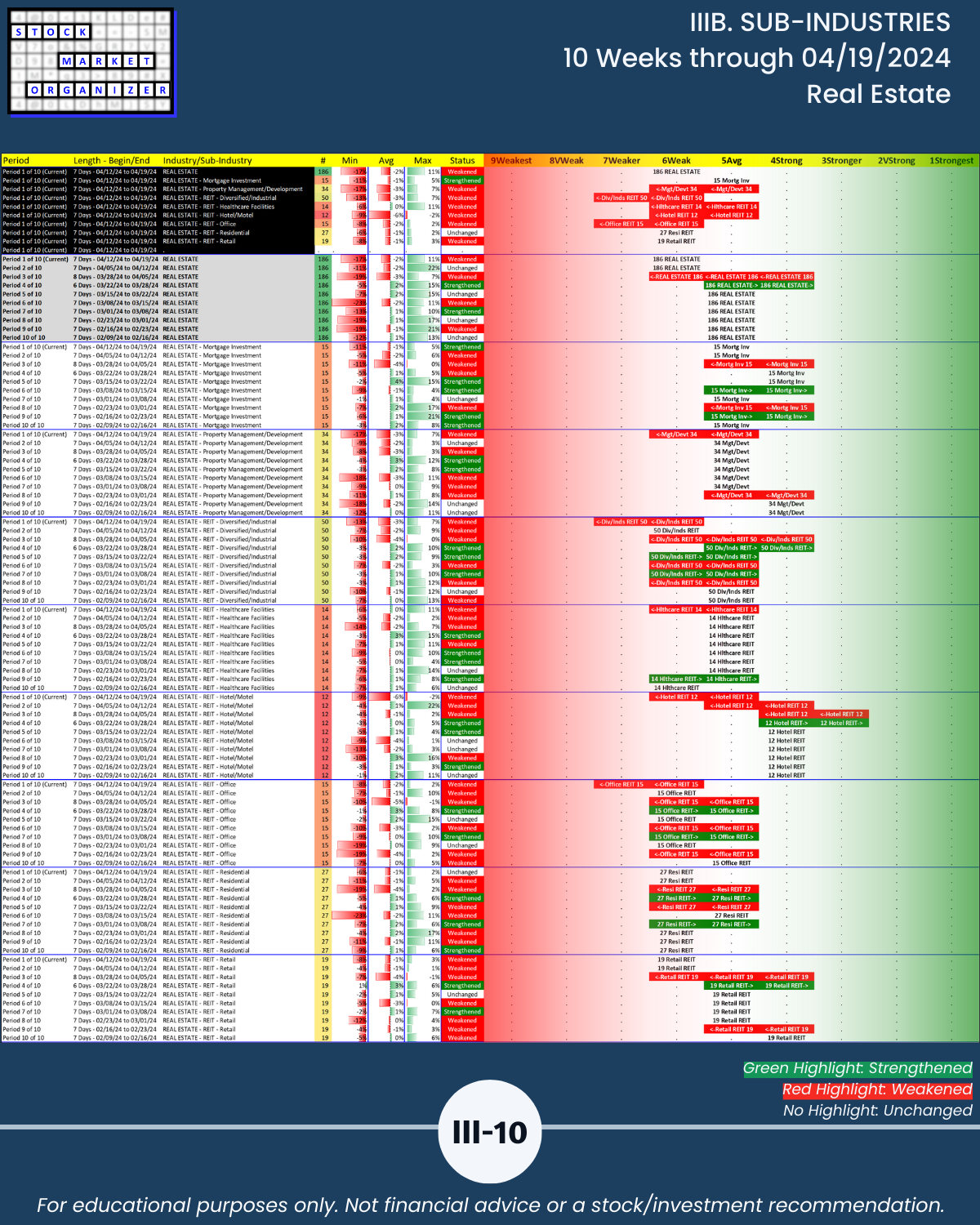

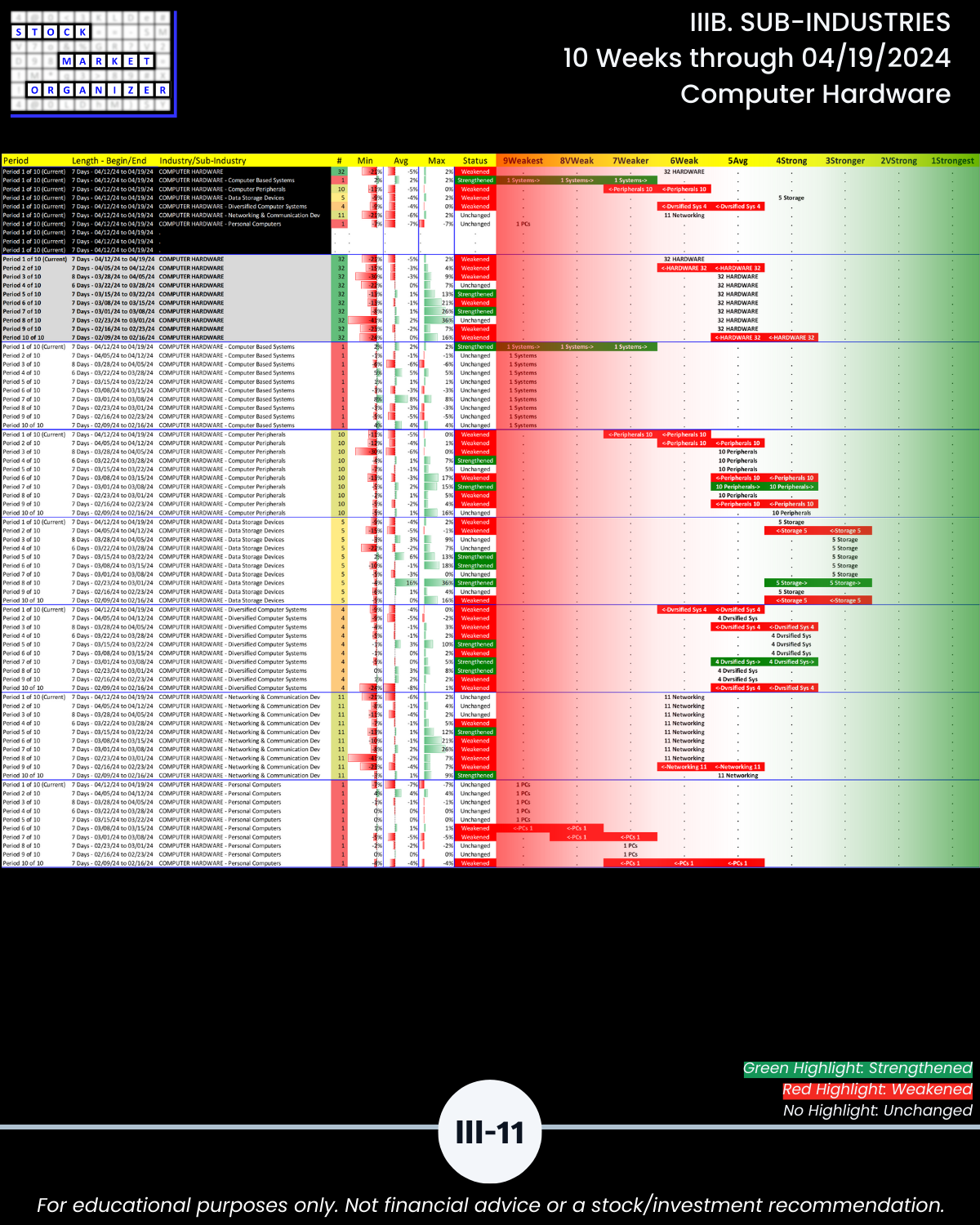

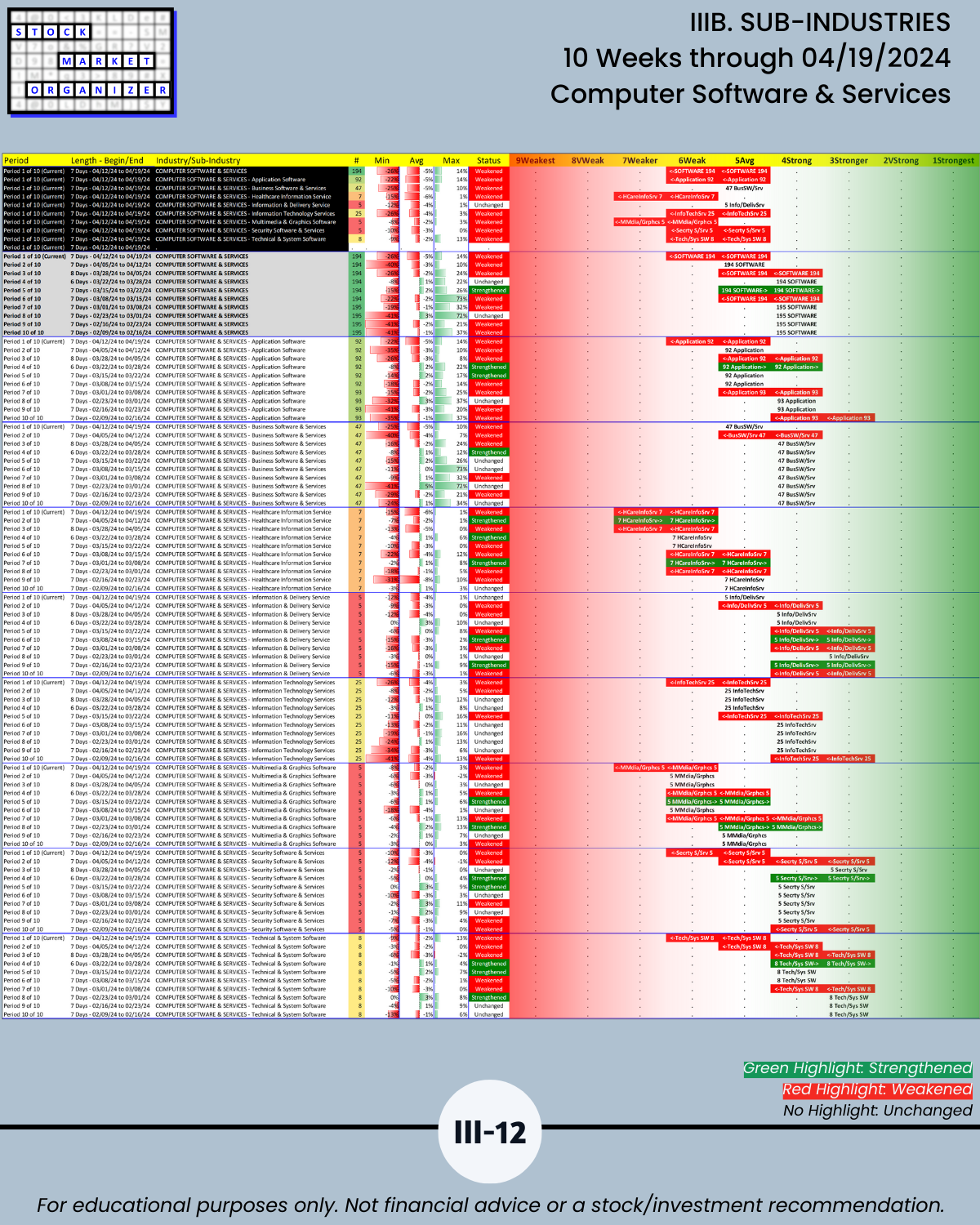

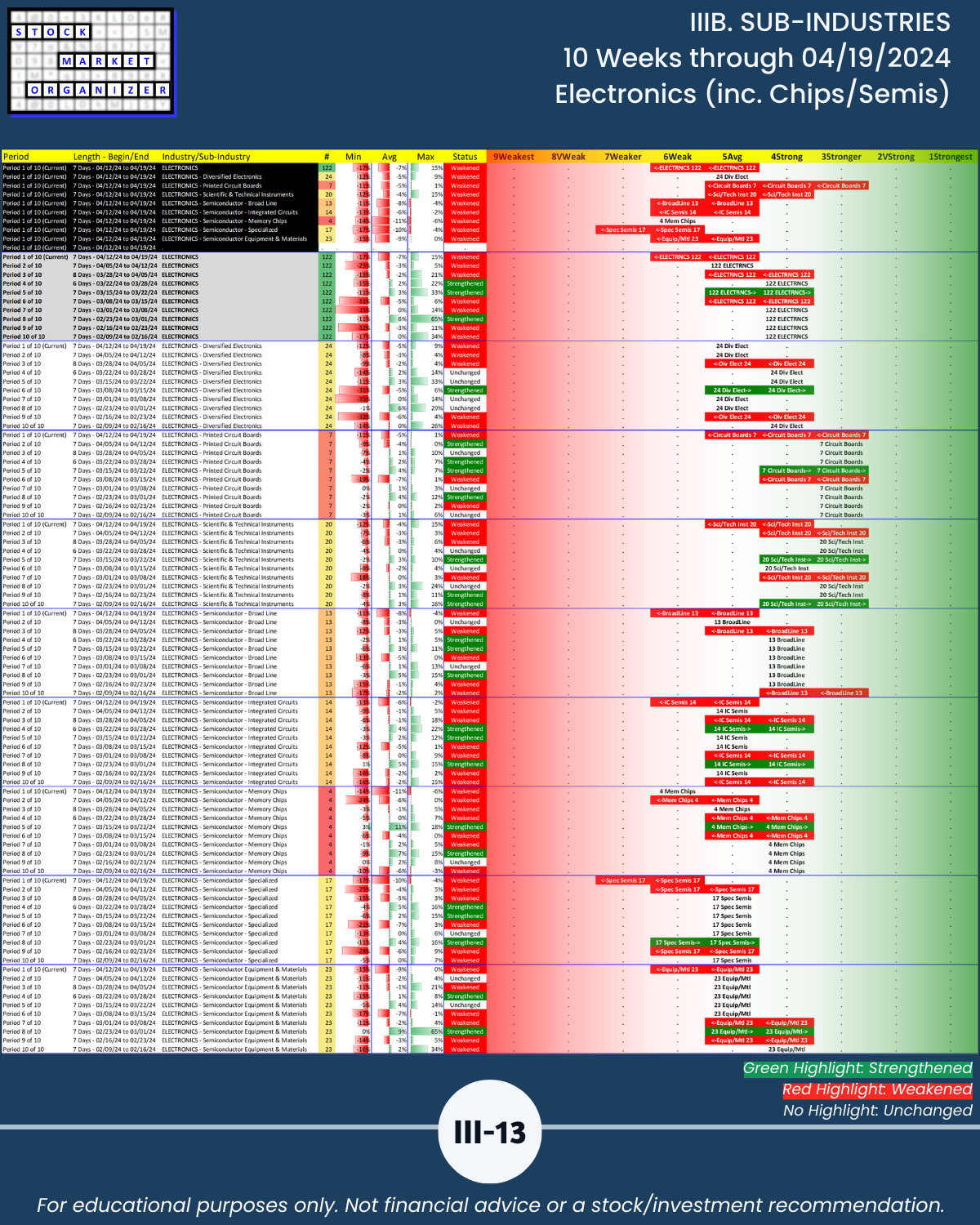

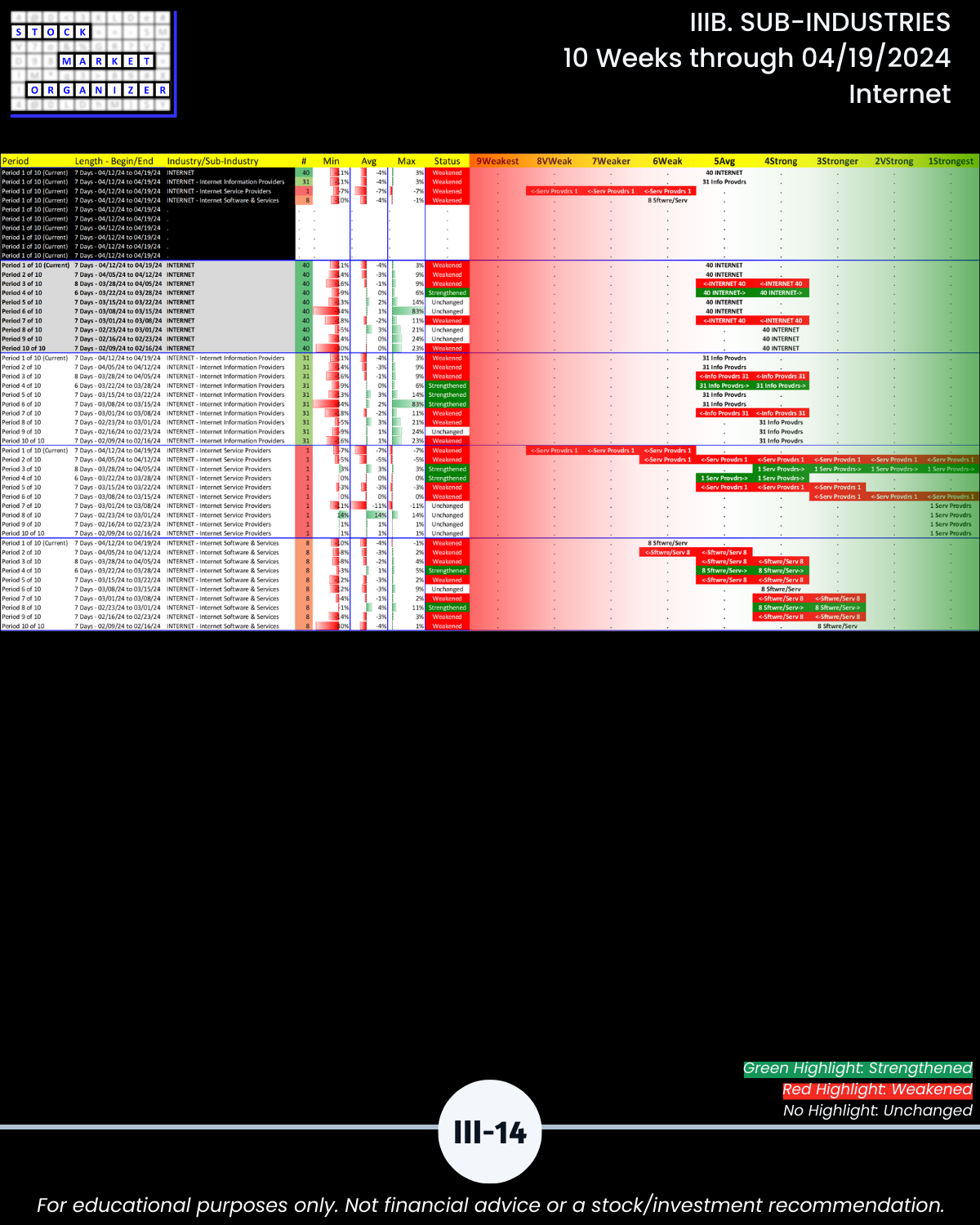

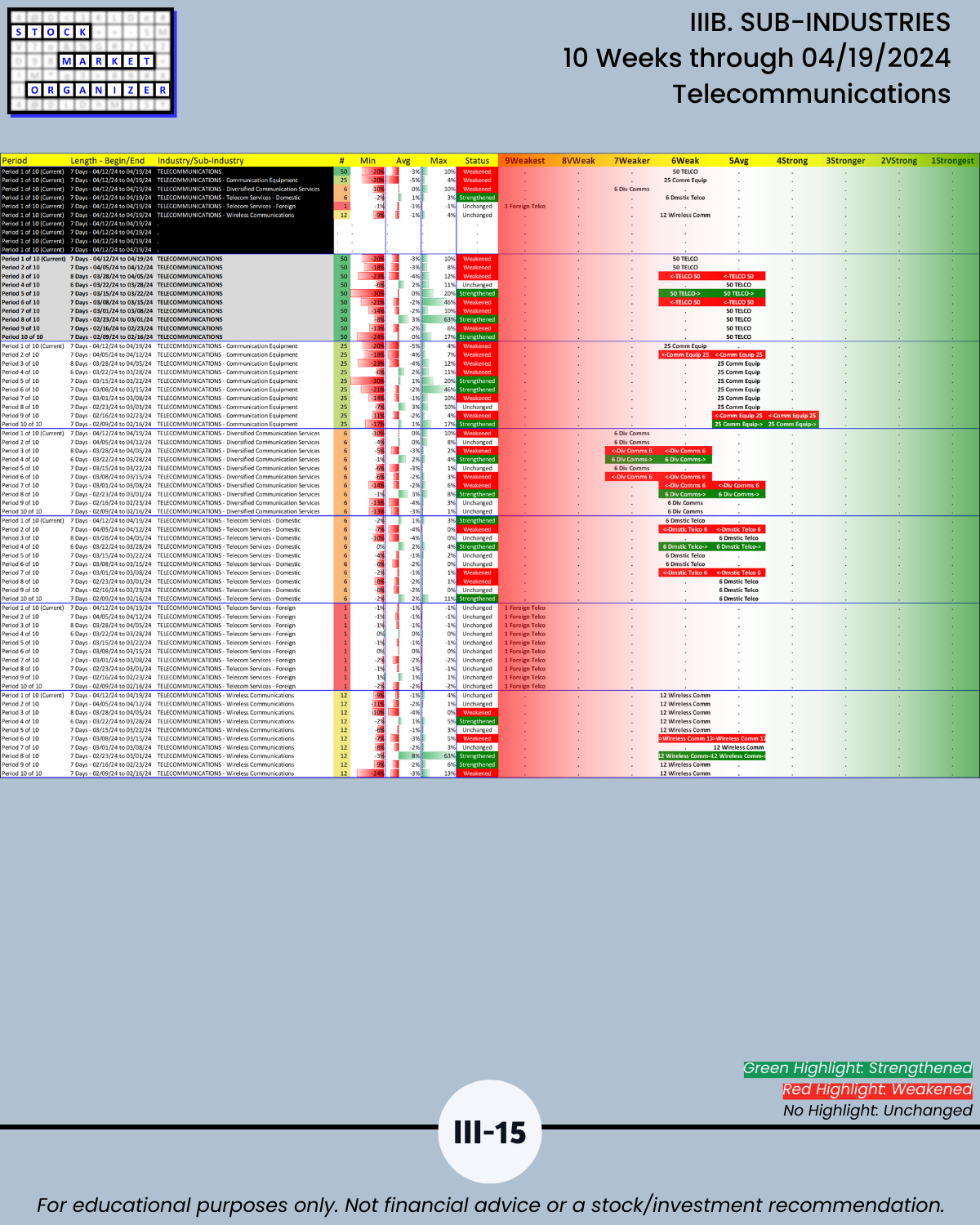

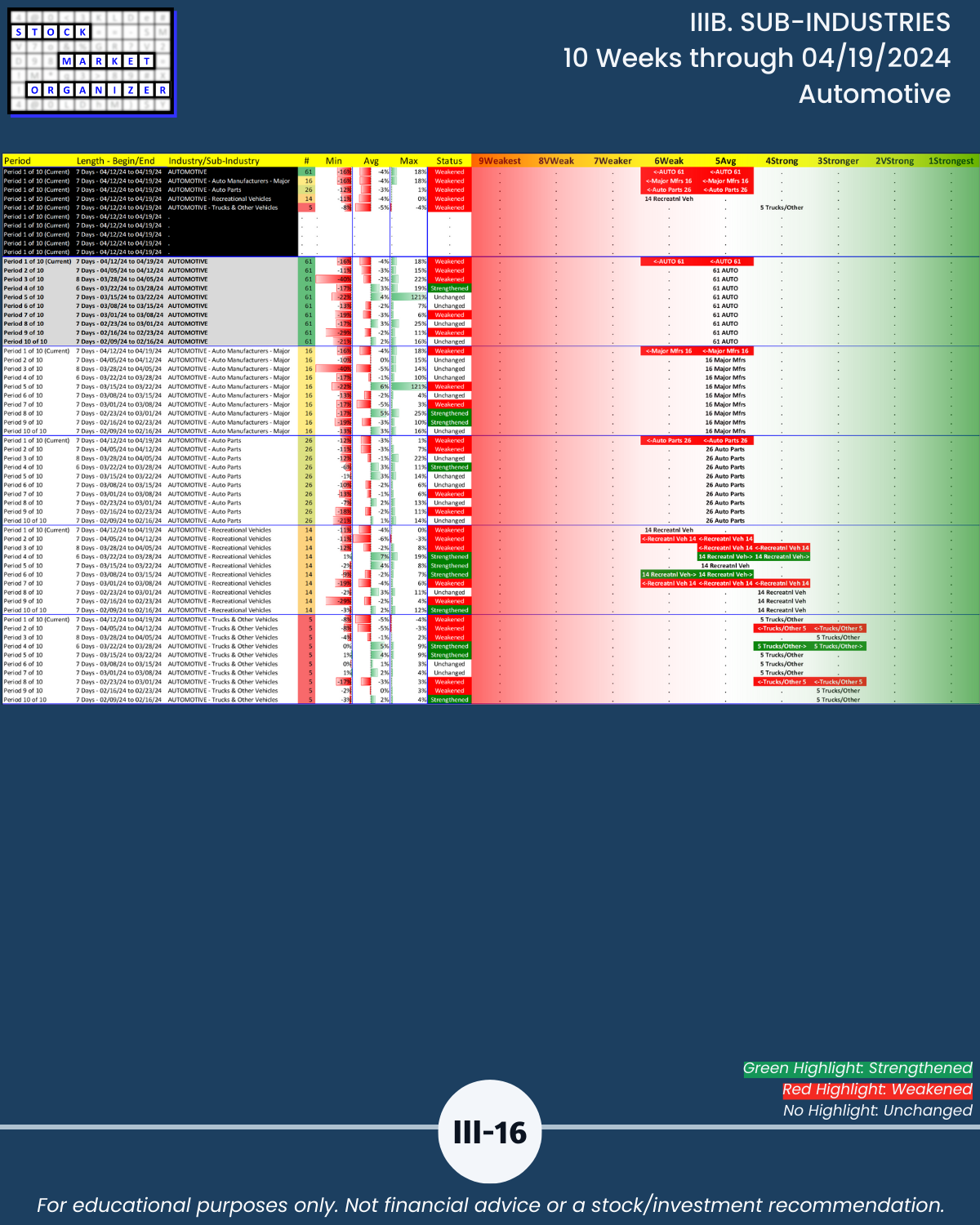

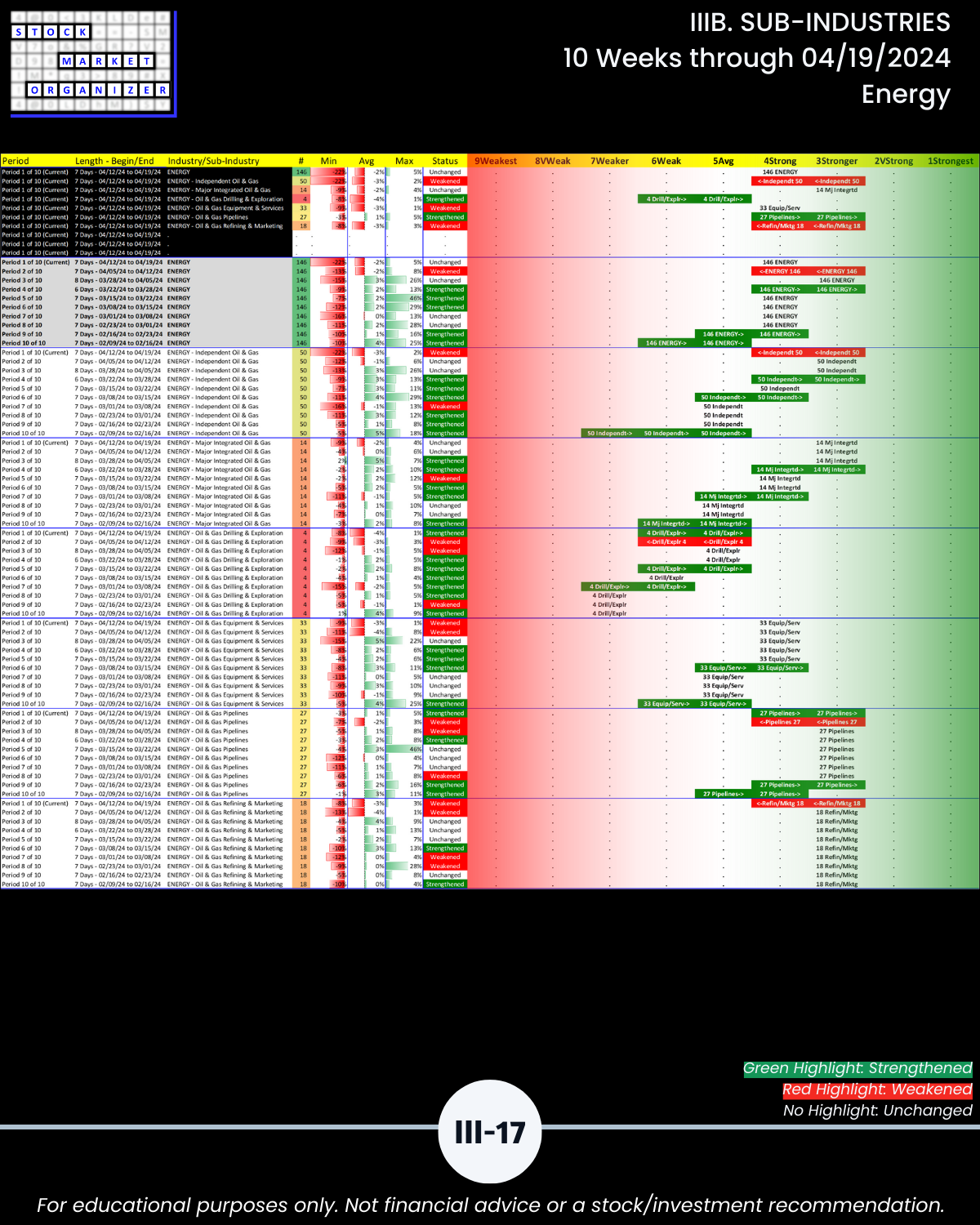

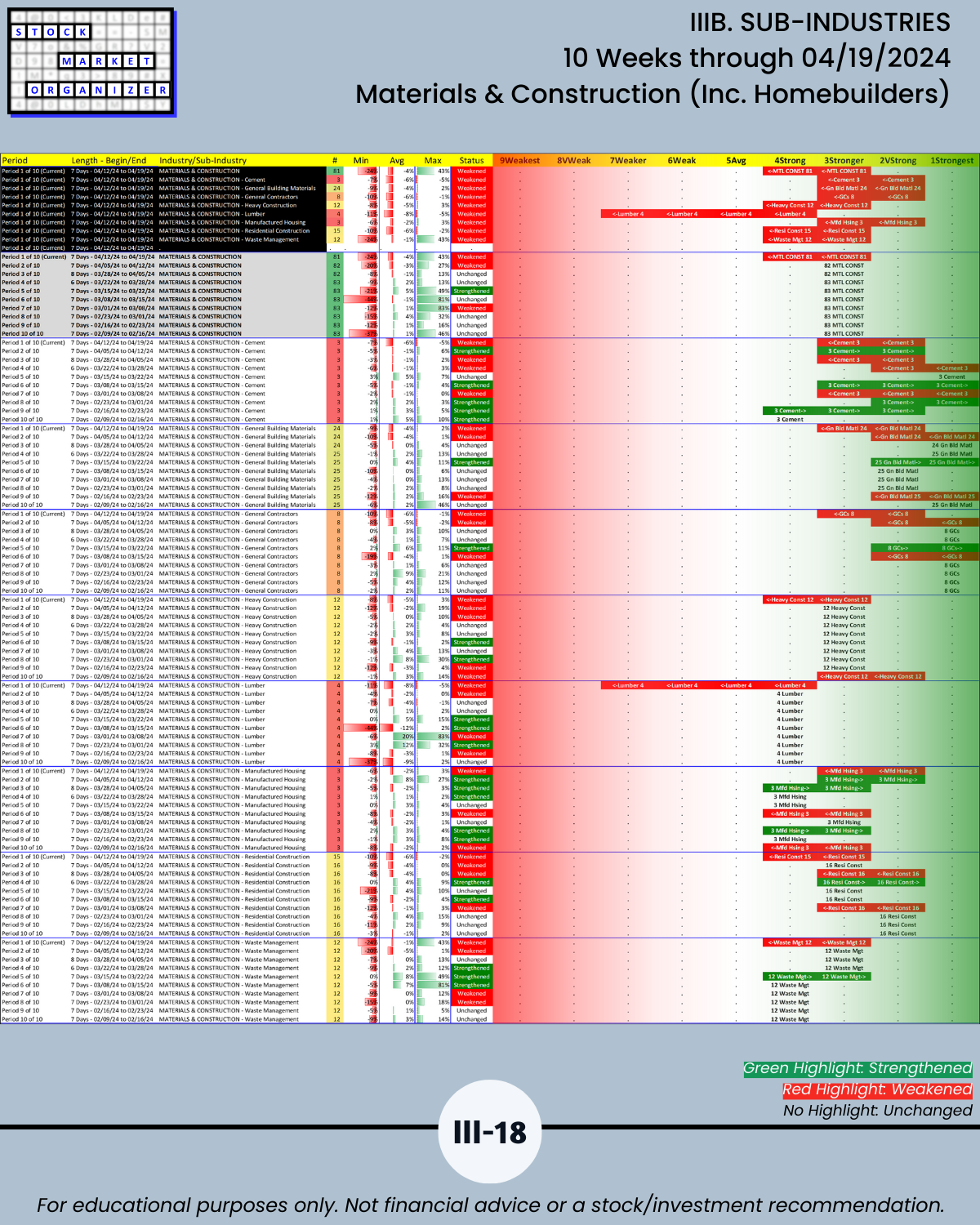

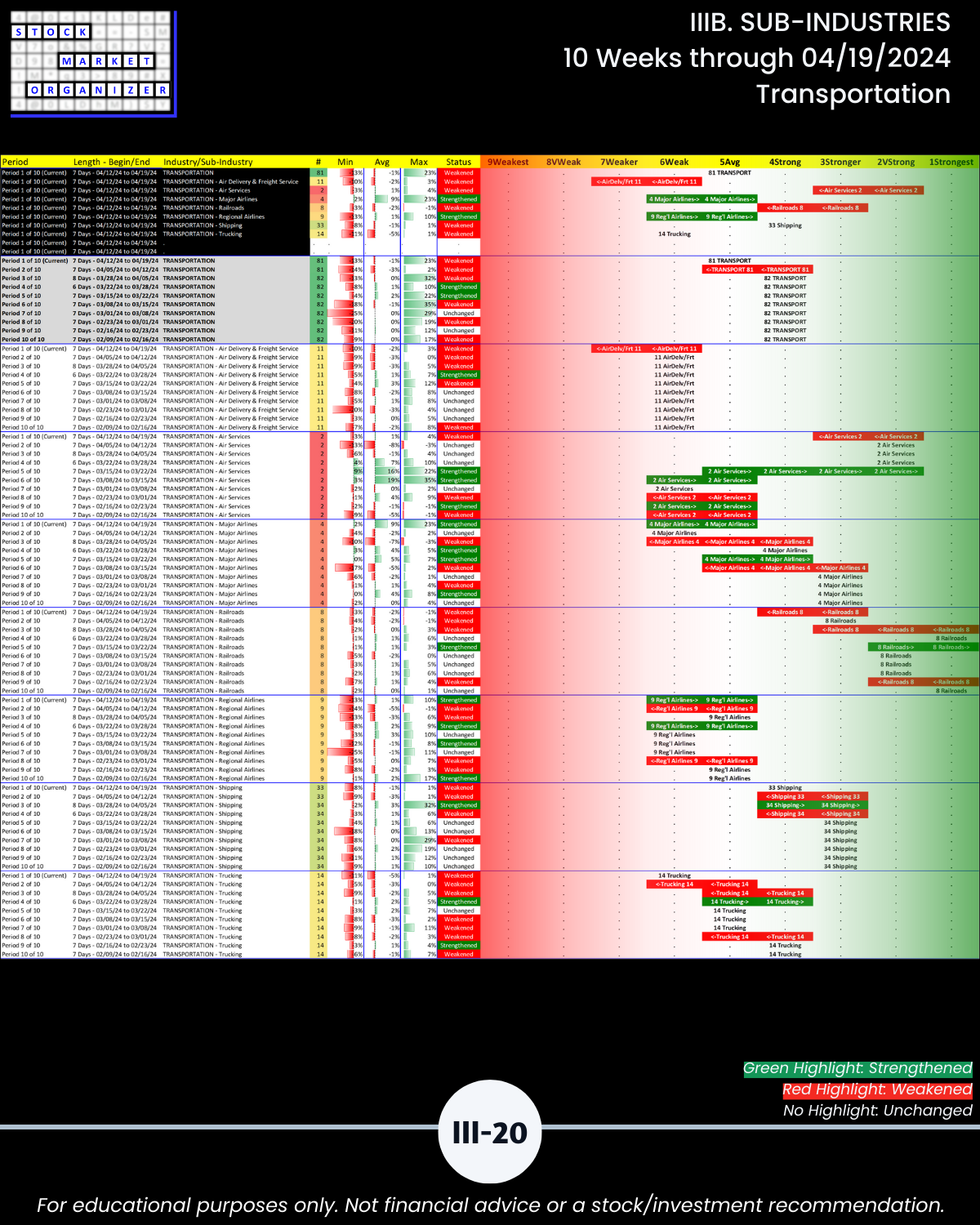

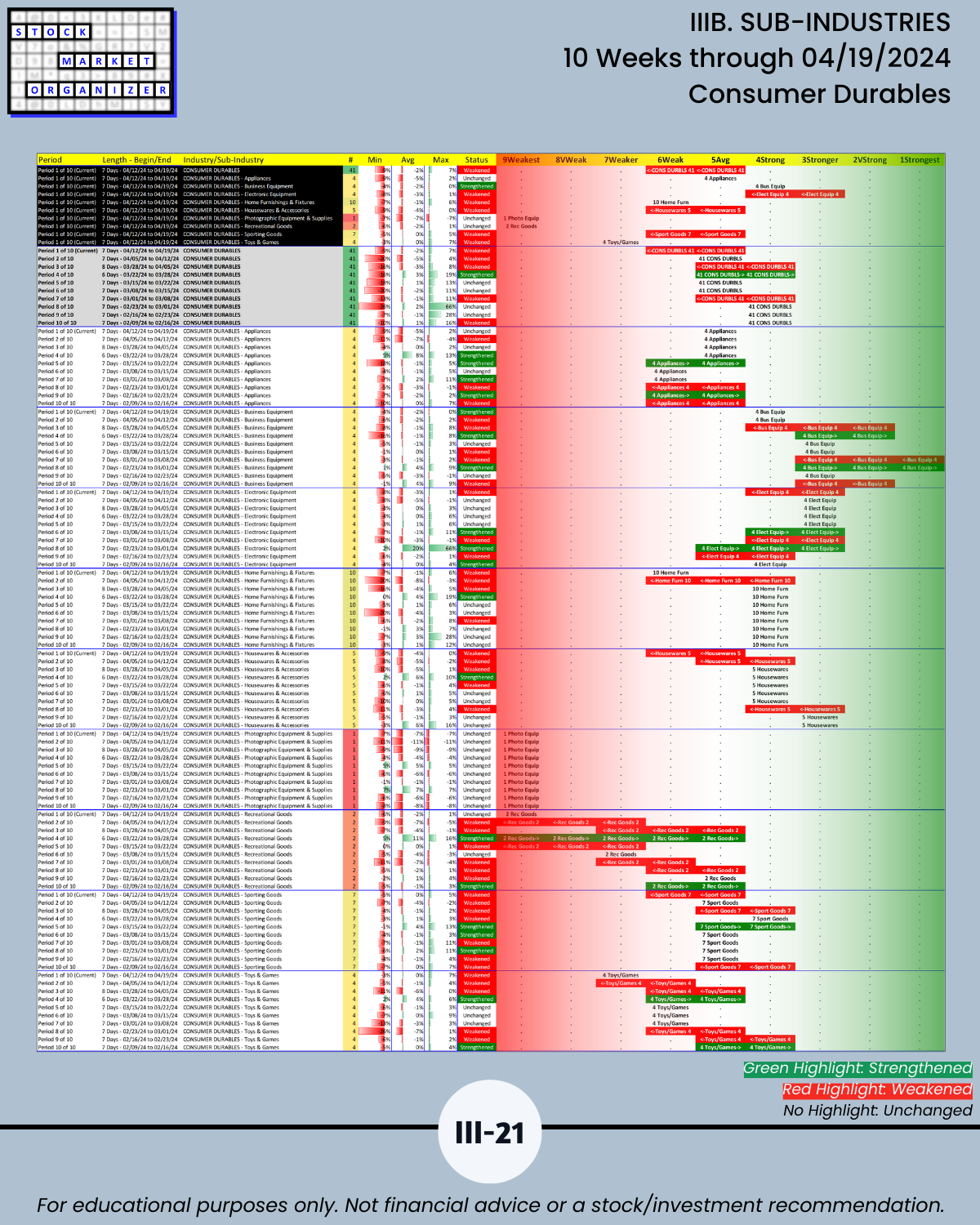

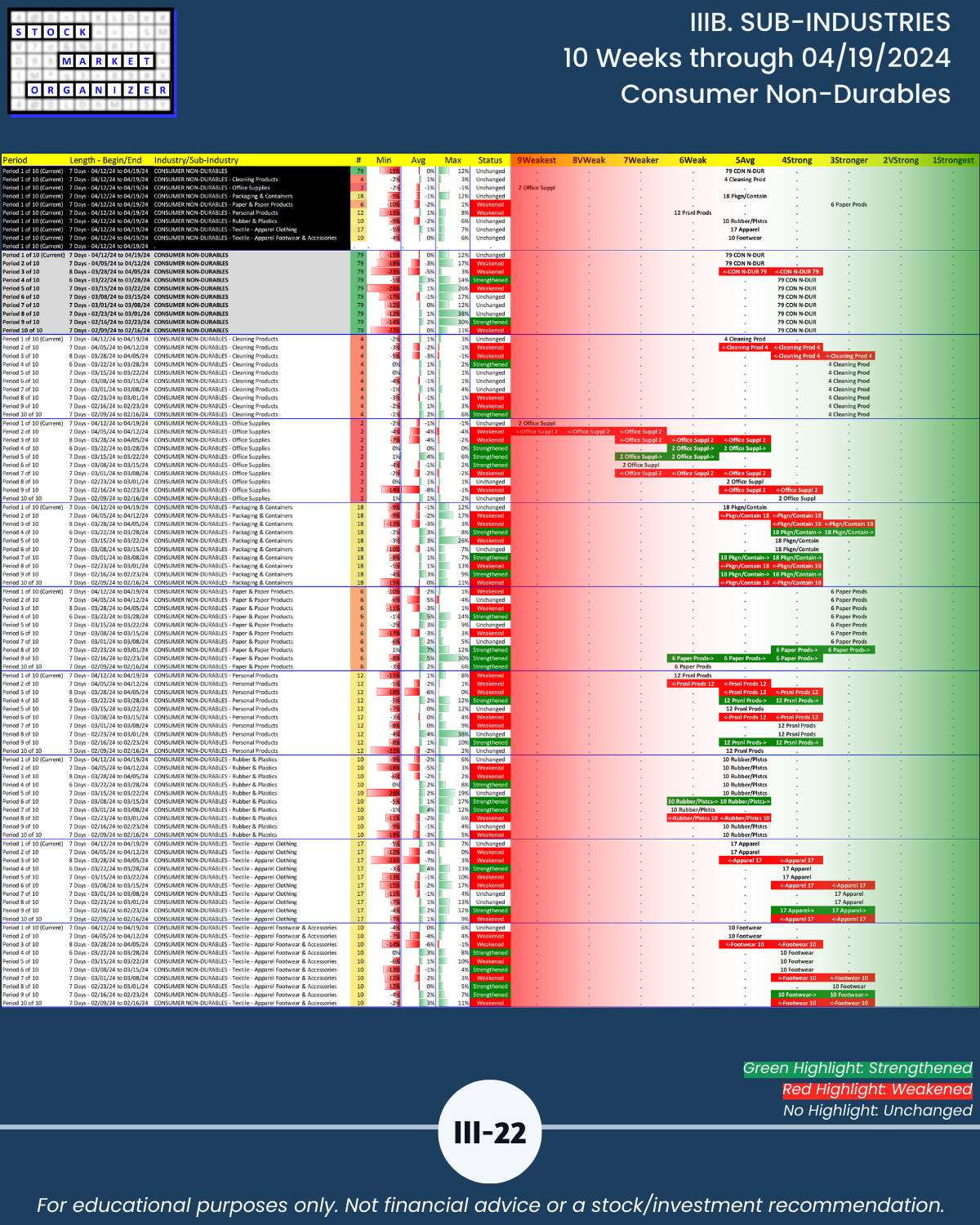

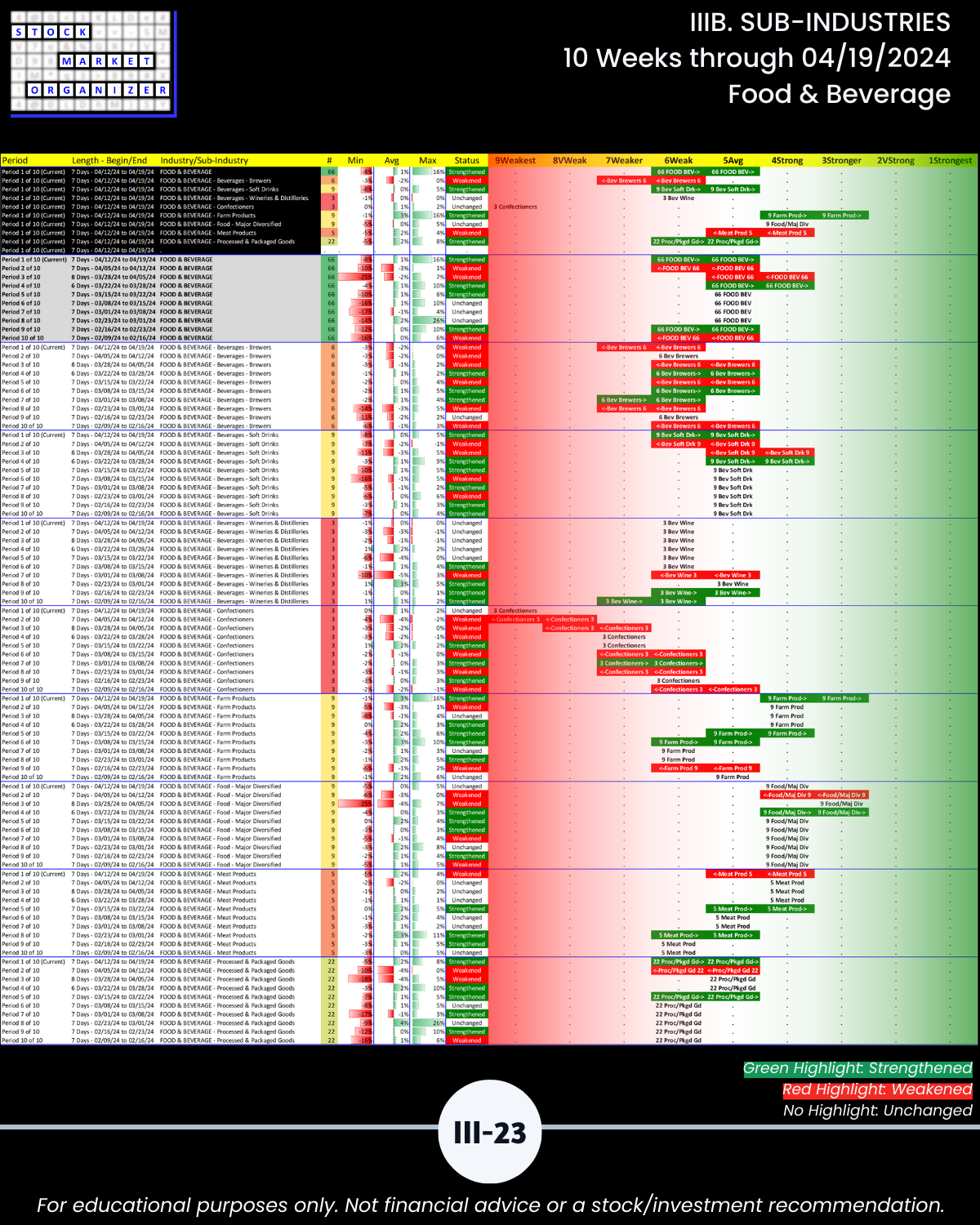

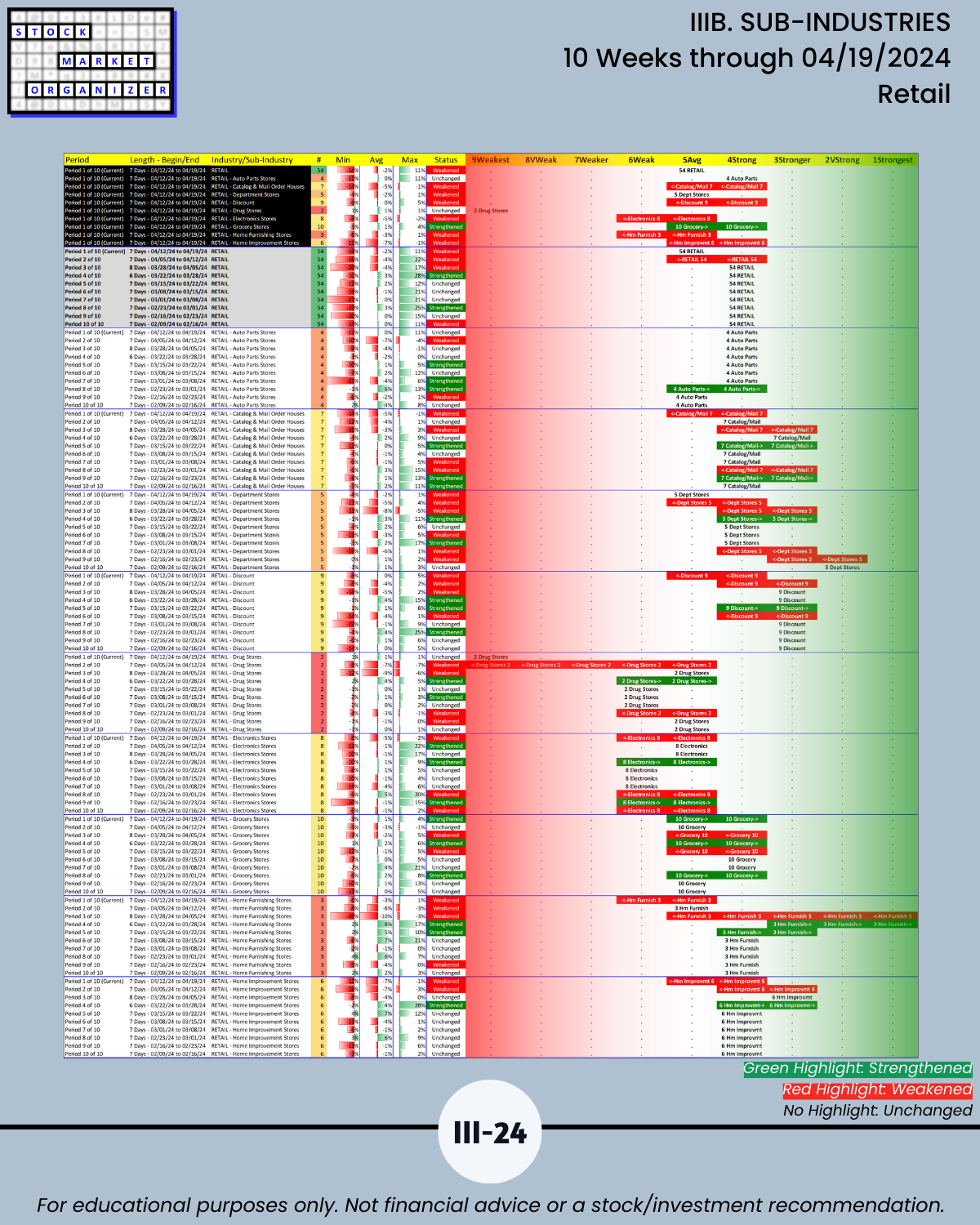

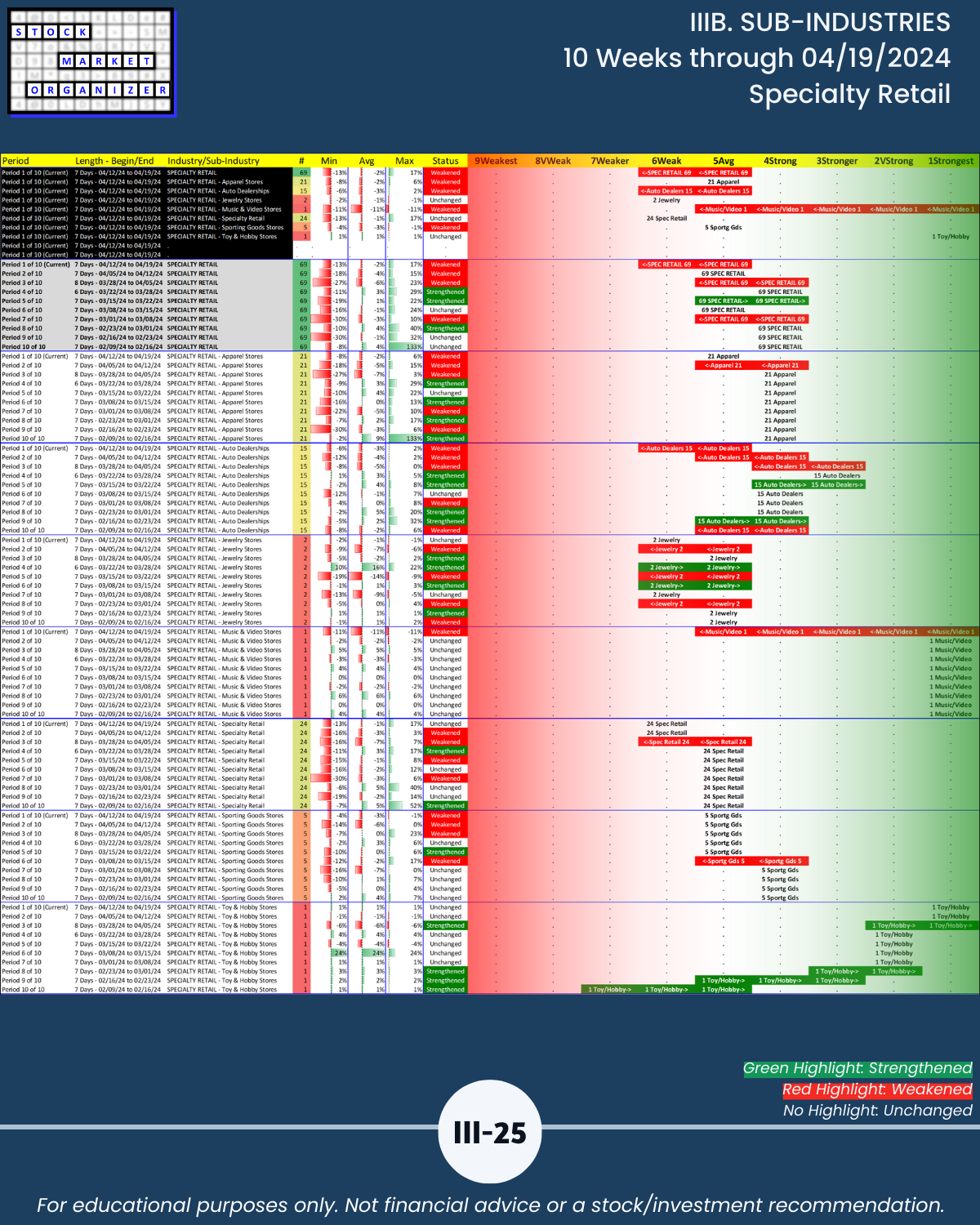

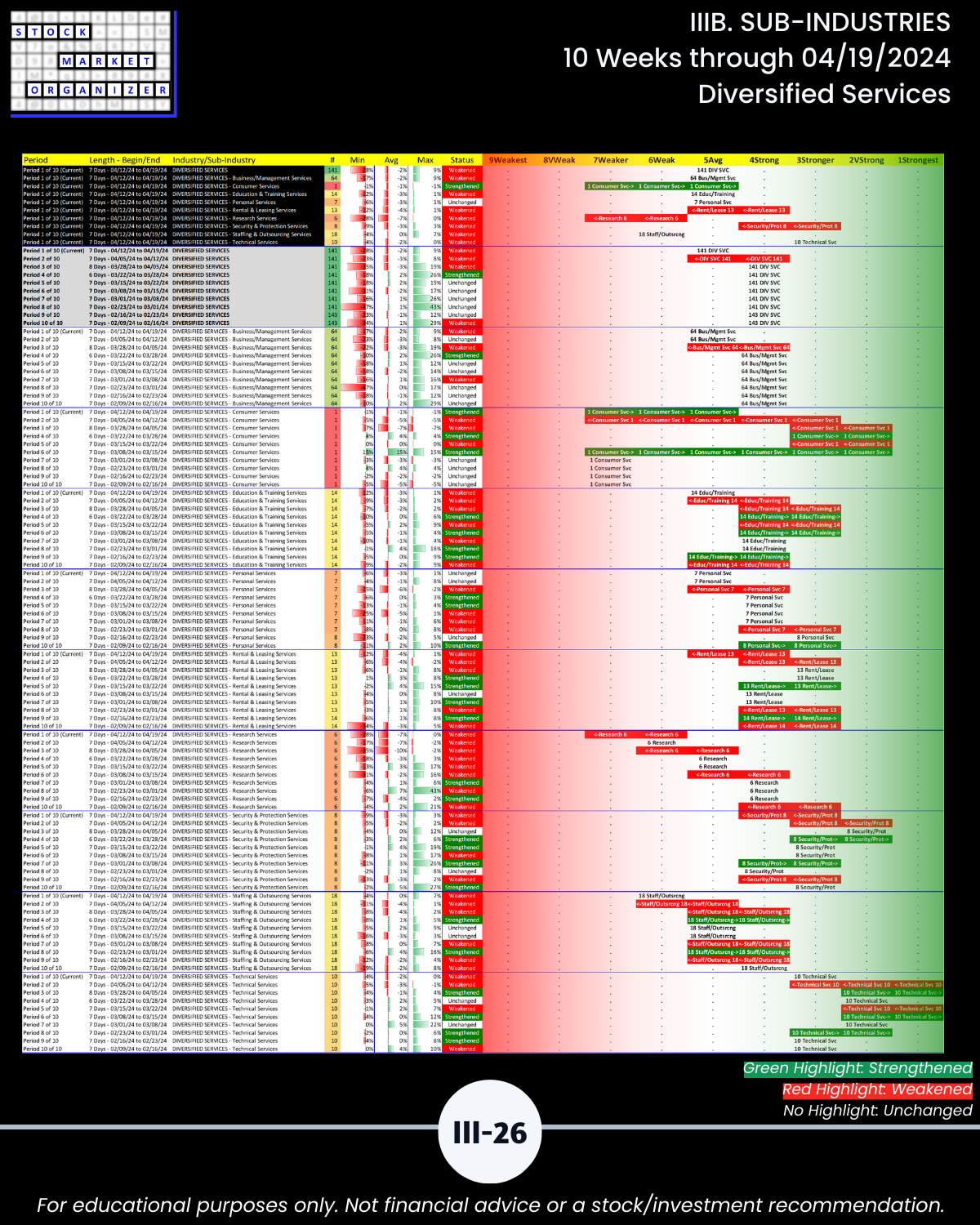

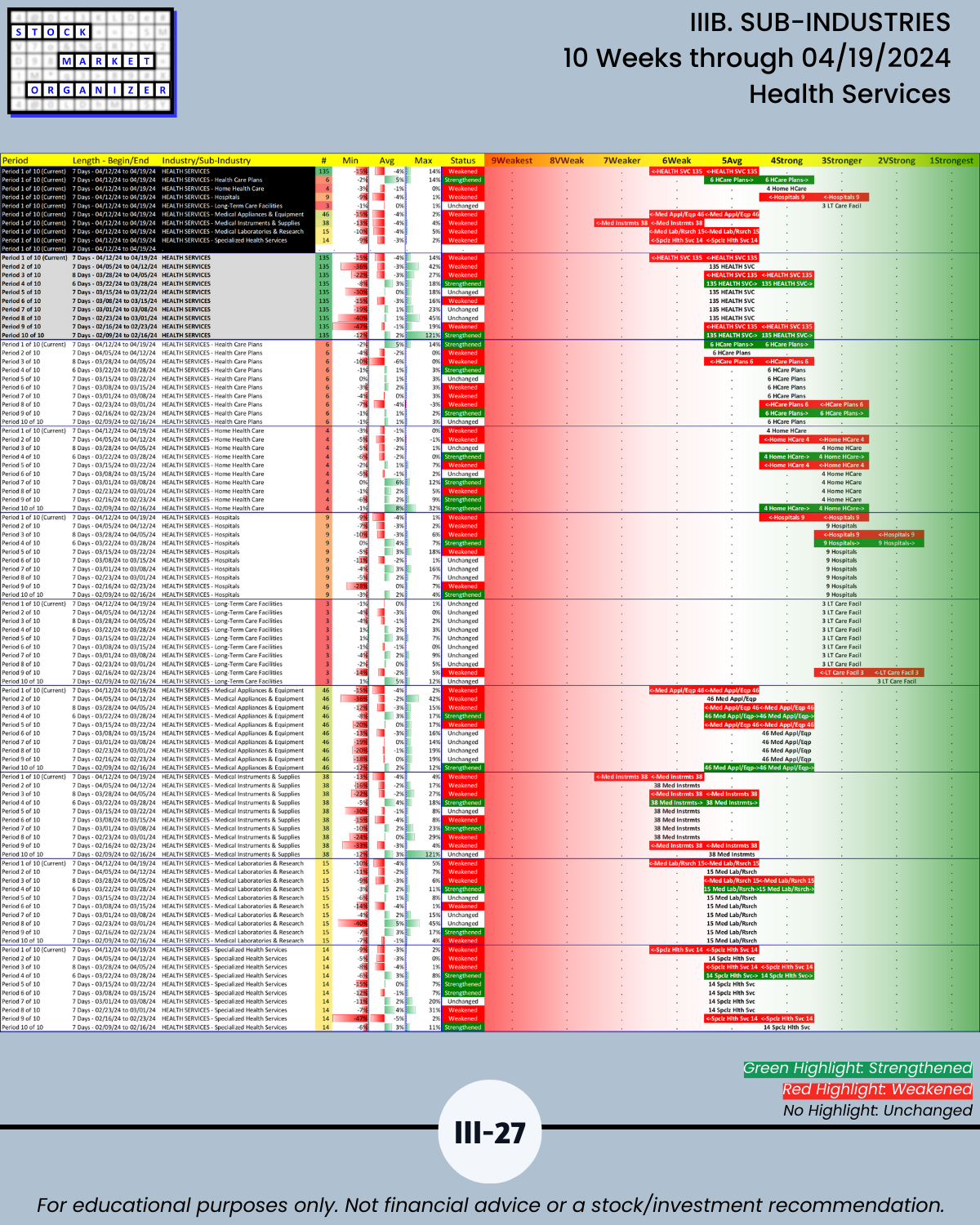

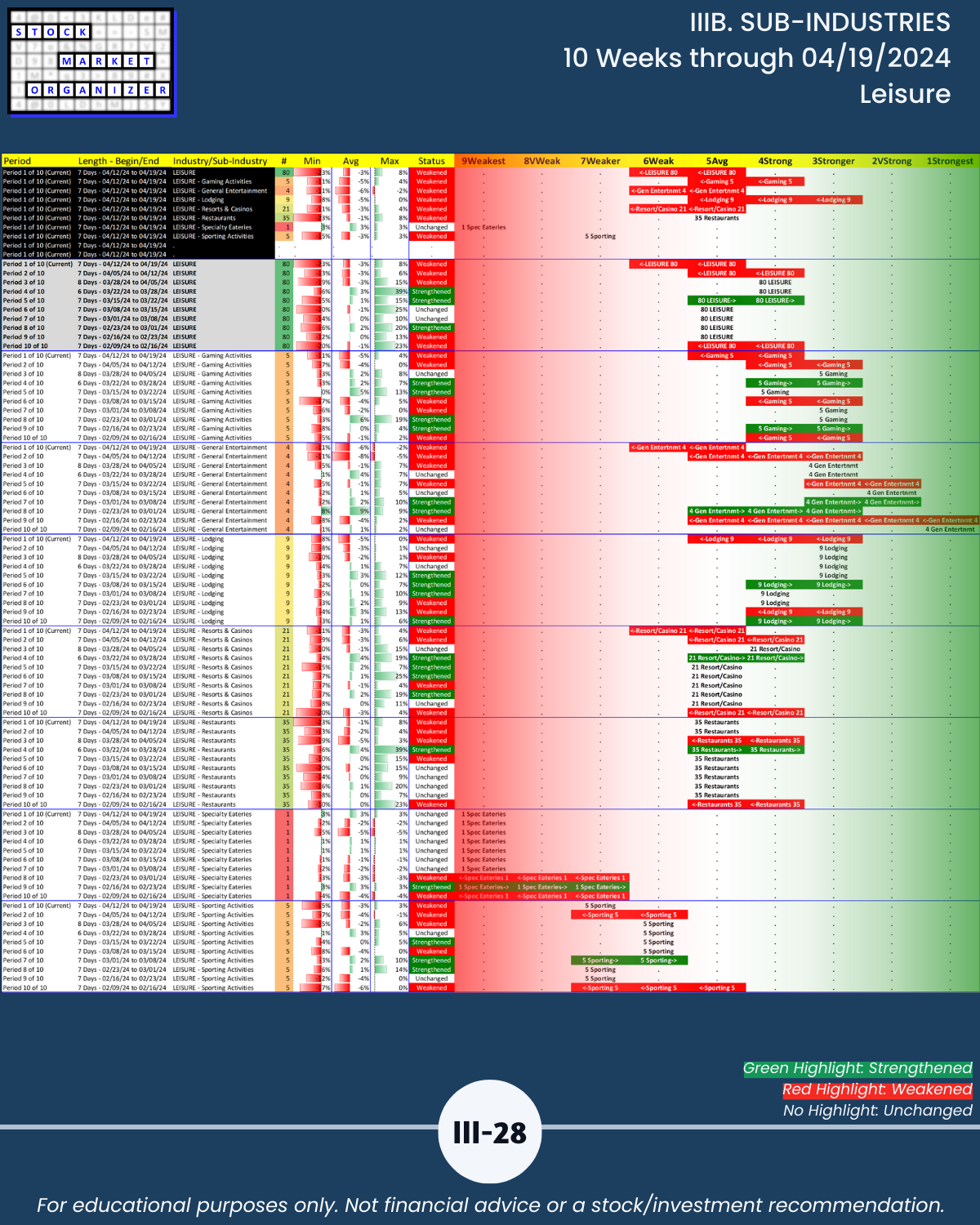

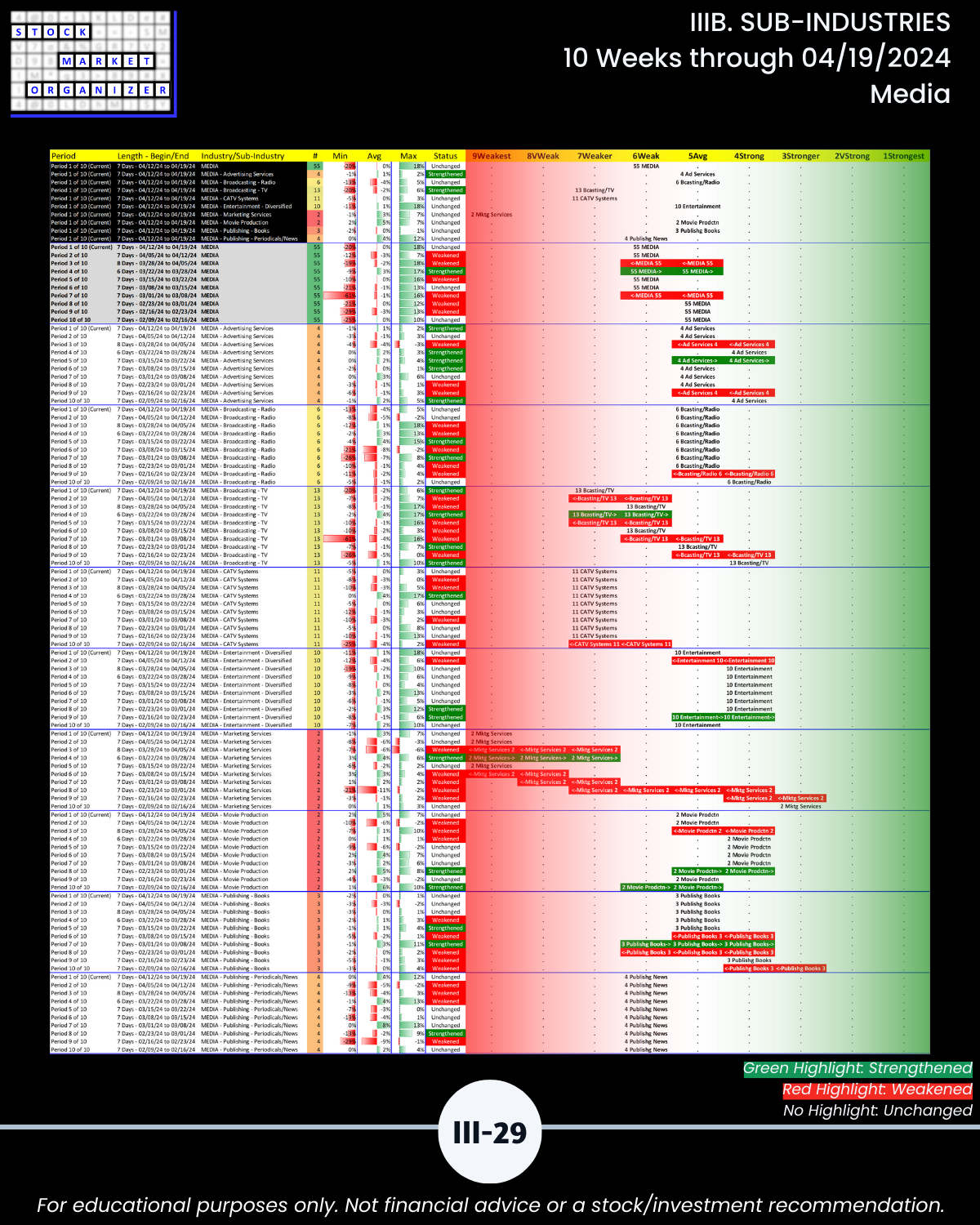

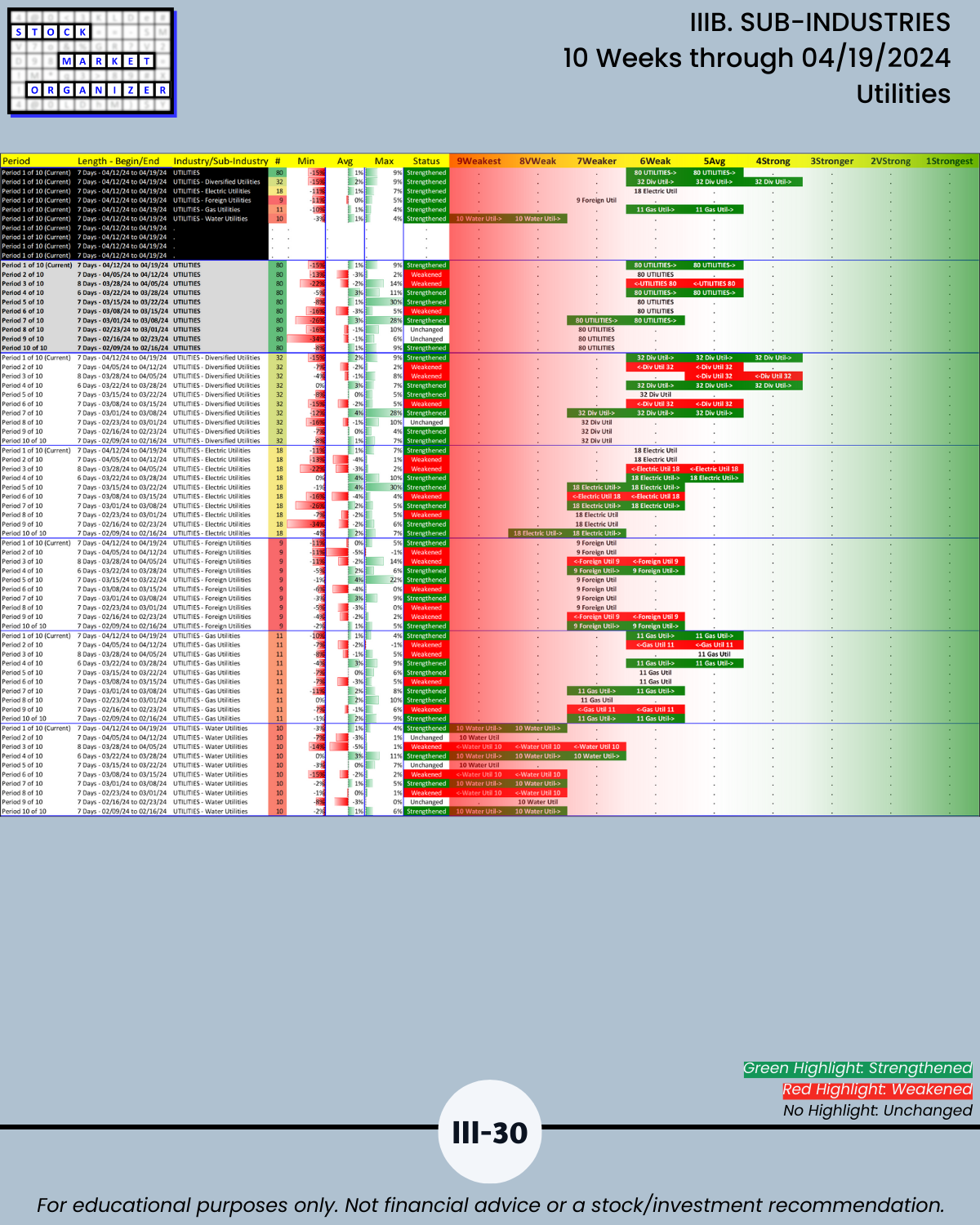

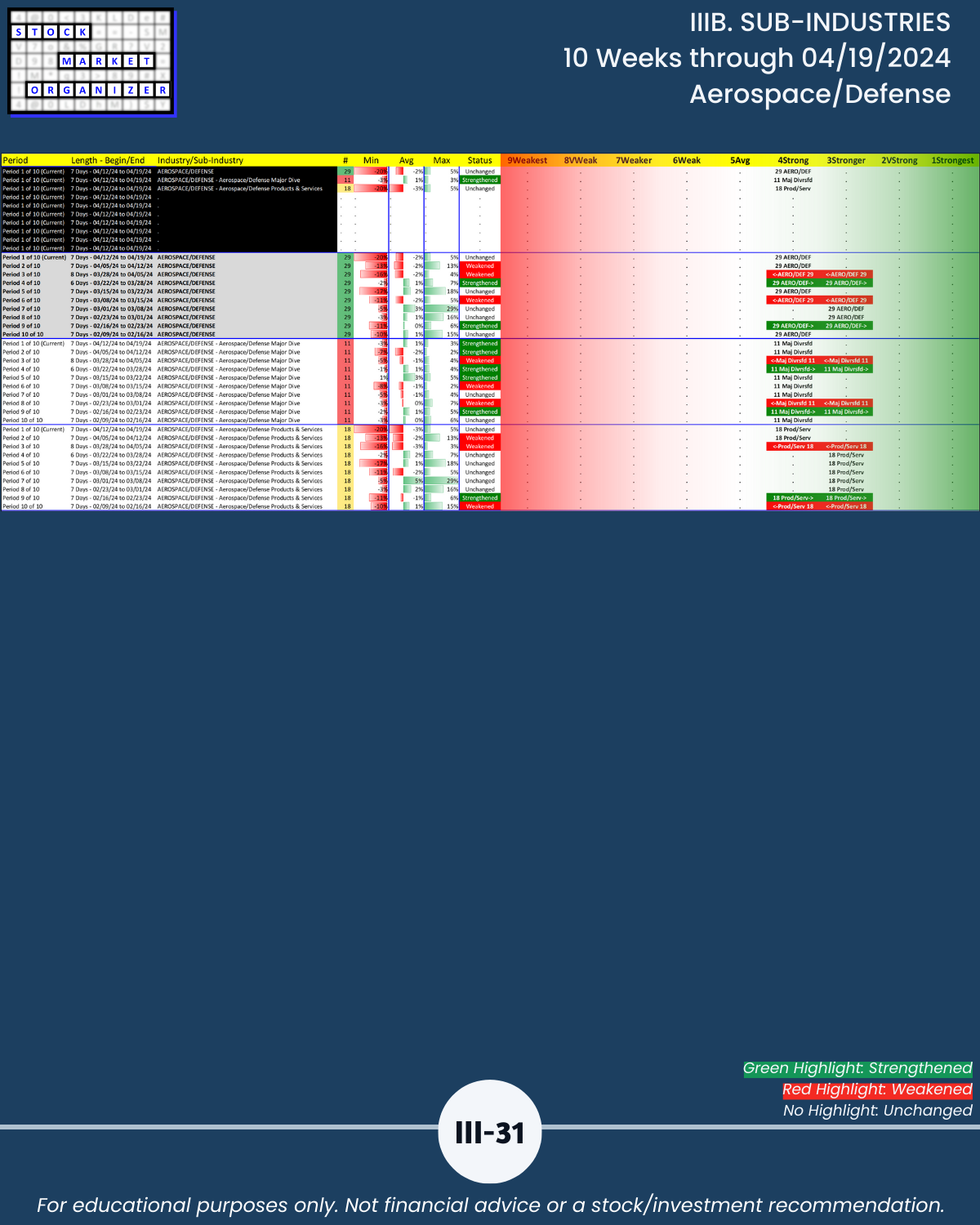

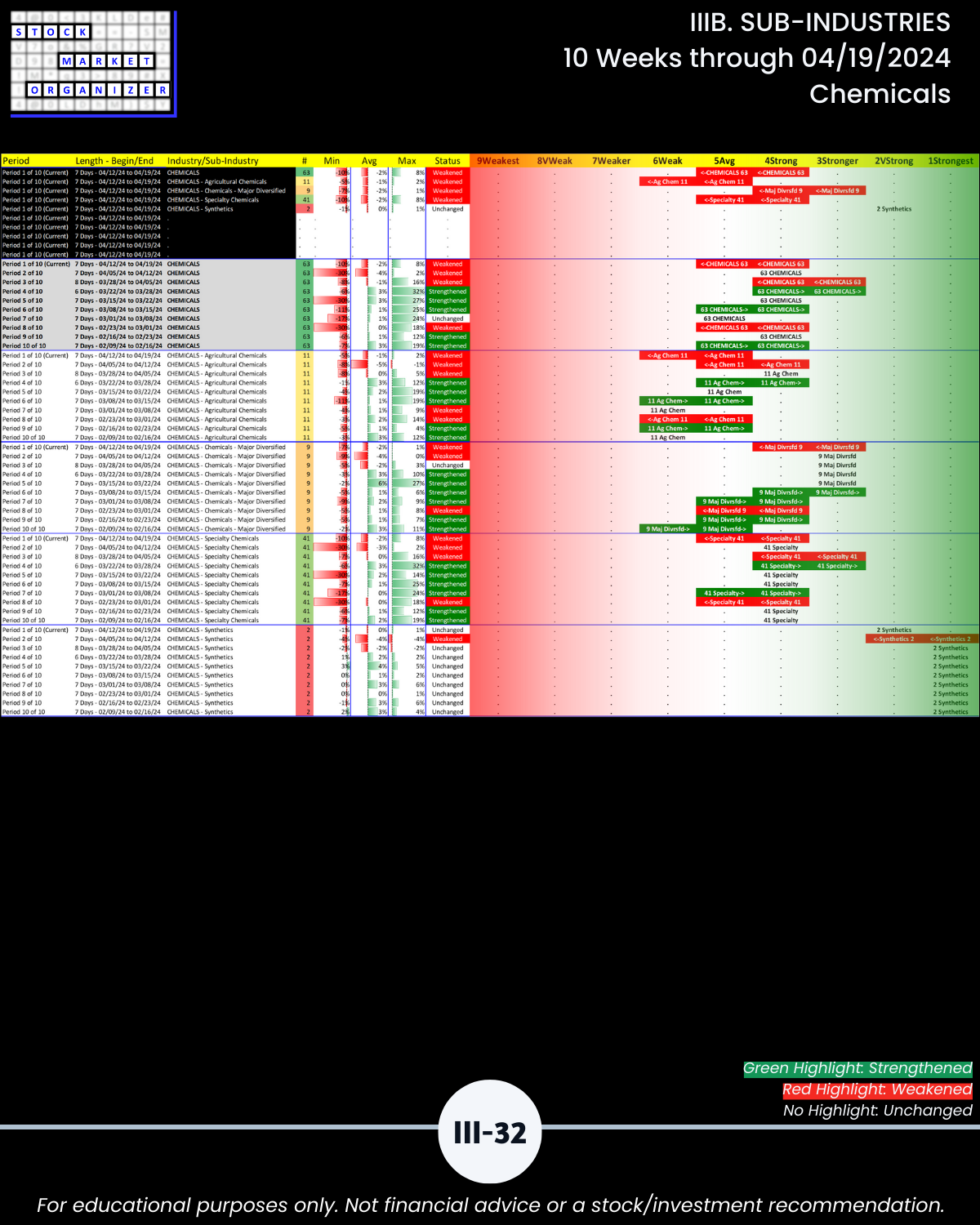

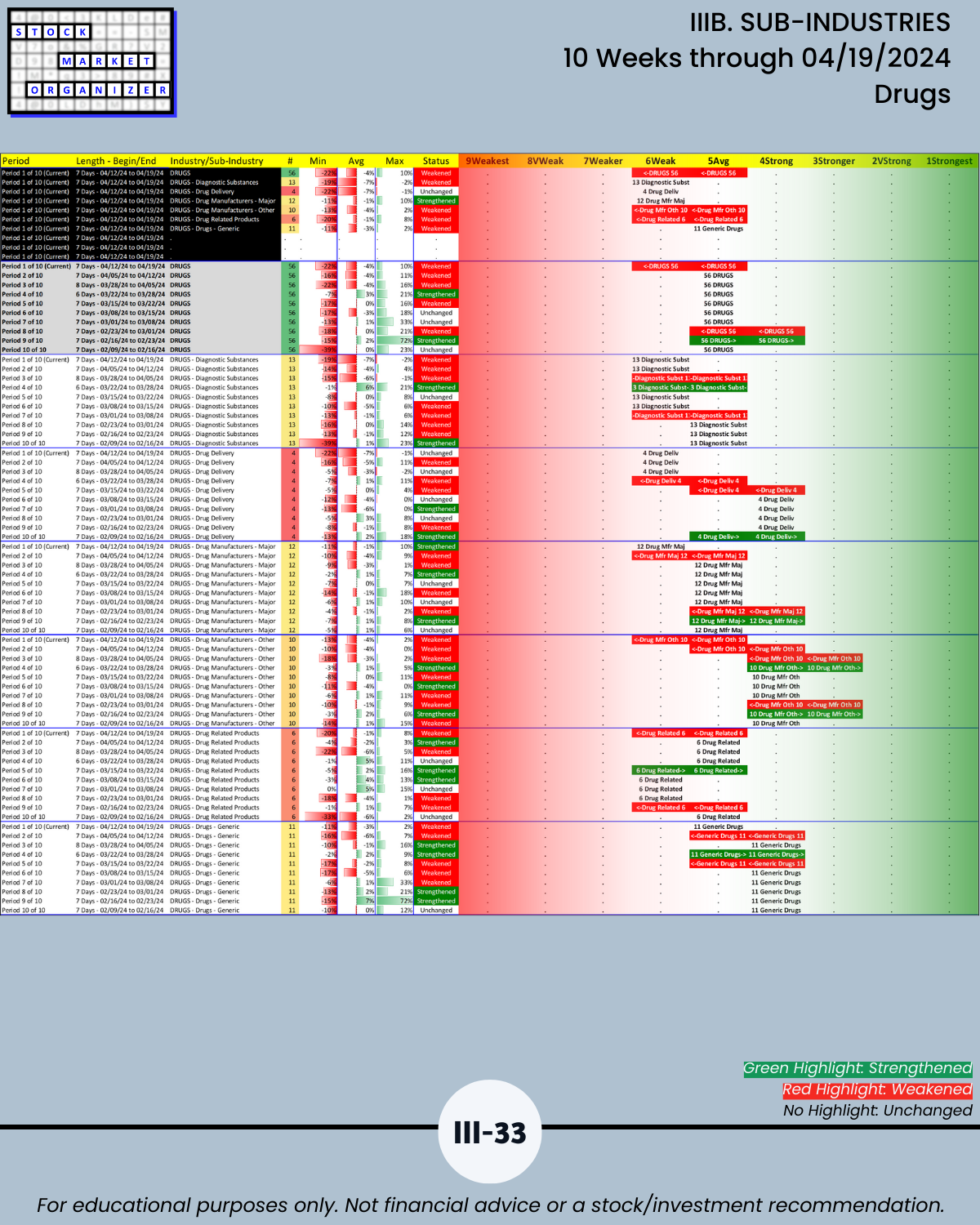

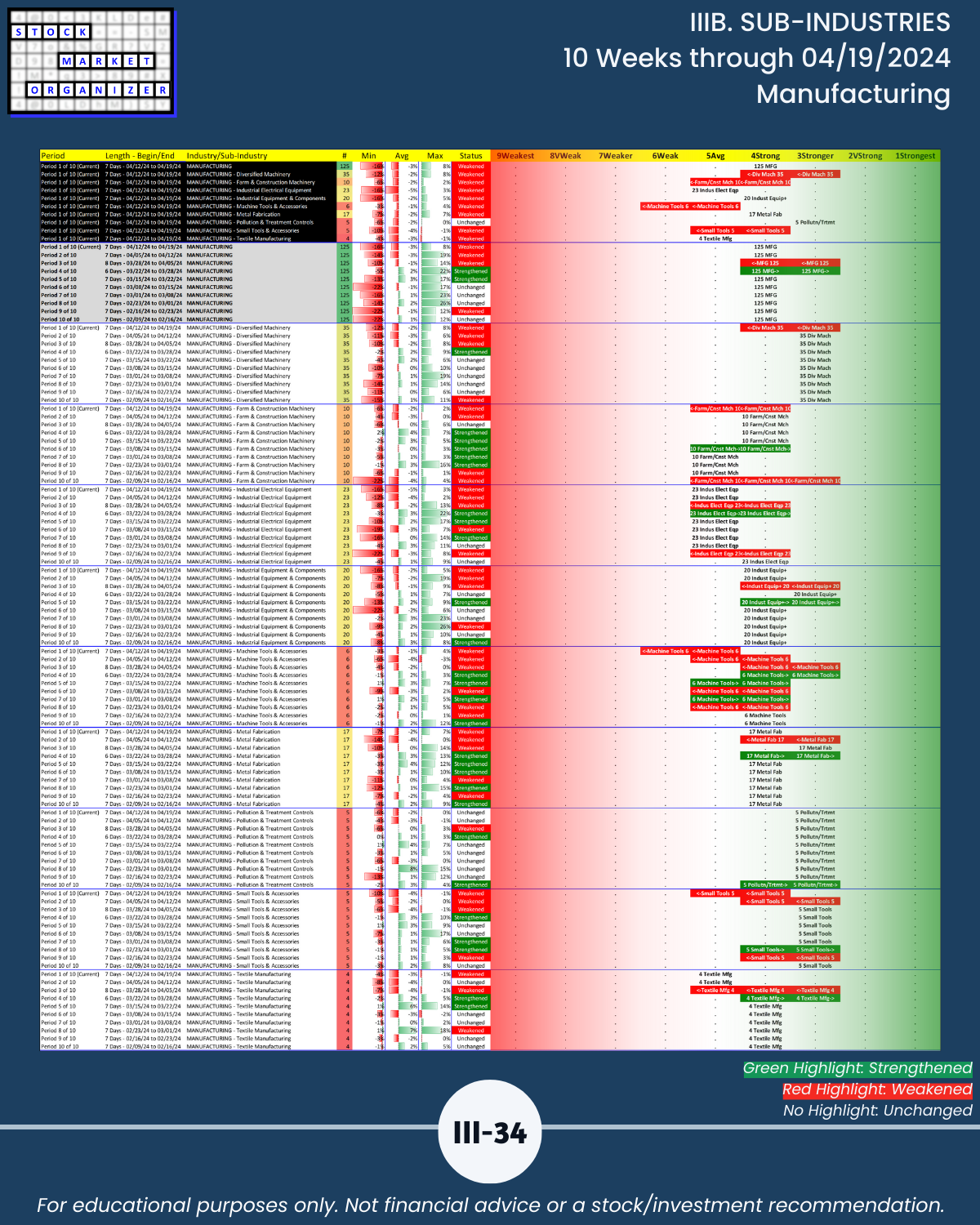

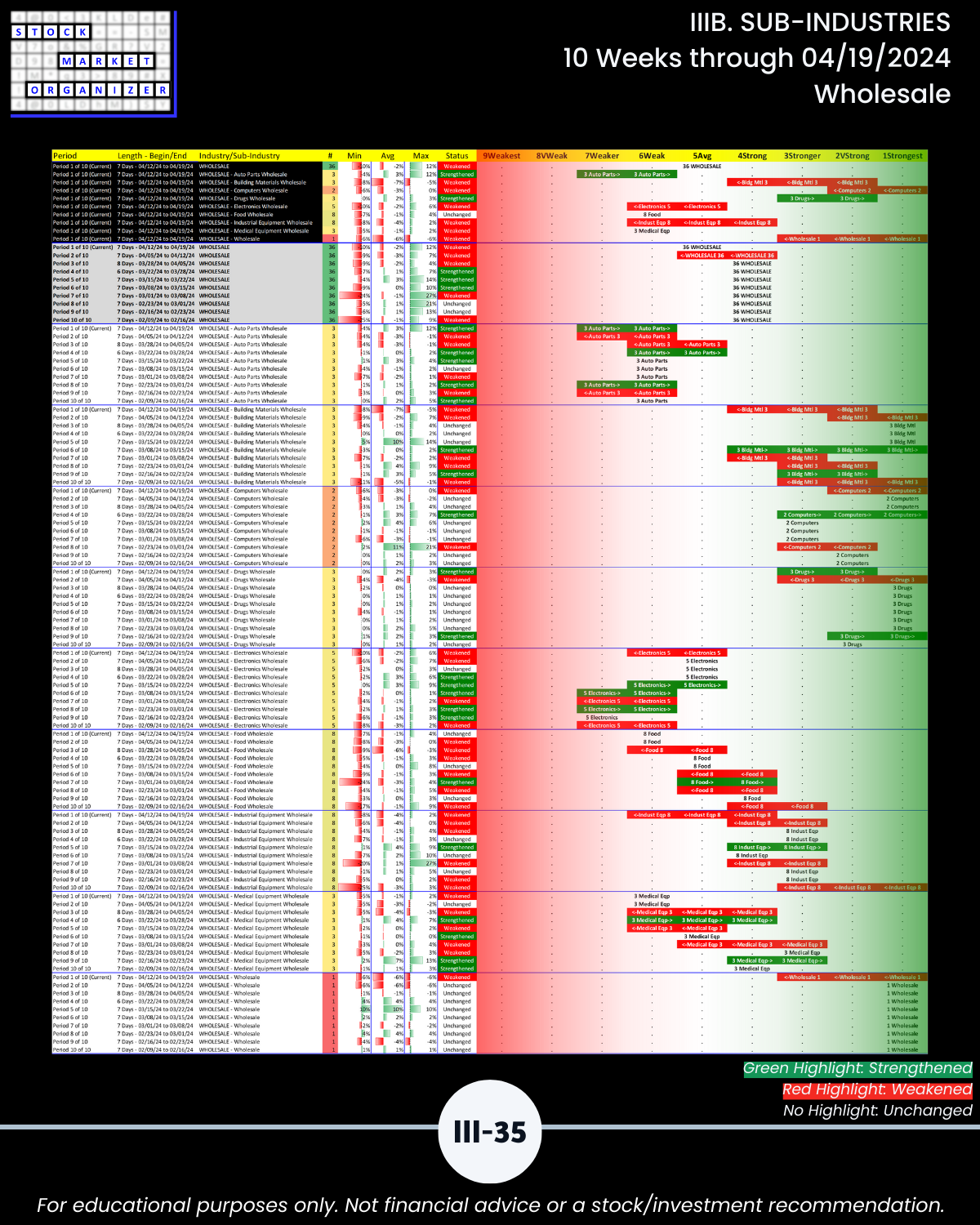

Sub-industries: Section III

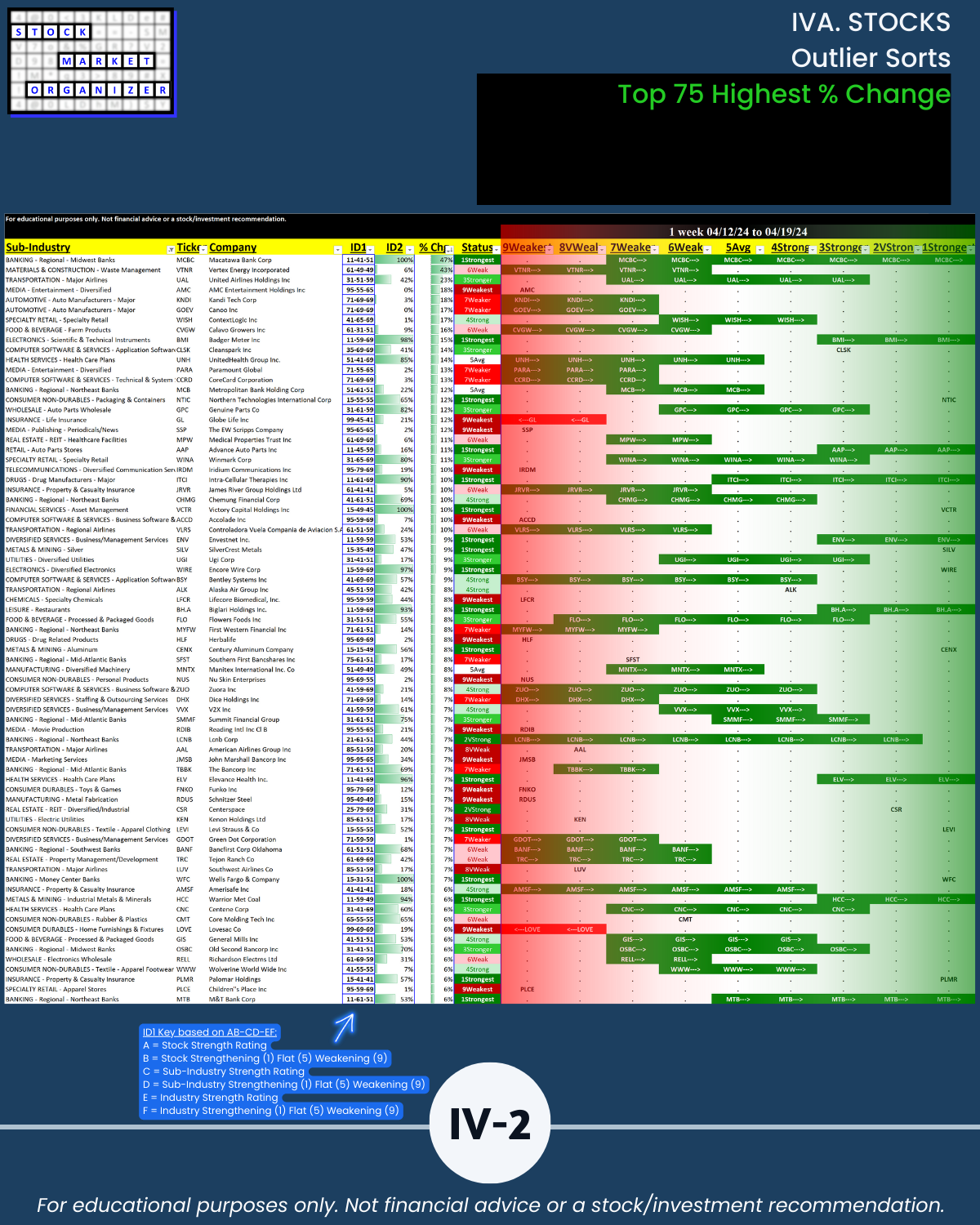

Stocks: Section IV

Retail participants – hoping you have plans to address this market. It’s dicey out there without a guide.

Advisors – hoping you can use a competitive edge that comes from offering your clients unique, concise market insights that reveal your comprehensive grasp on current conditions.

MORE TOP-DOWN, INSIDE-OUT, AND BOTTOM-UP DETAIL

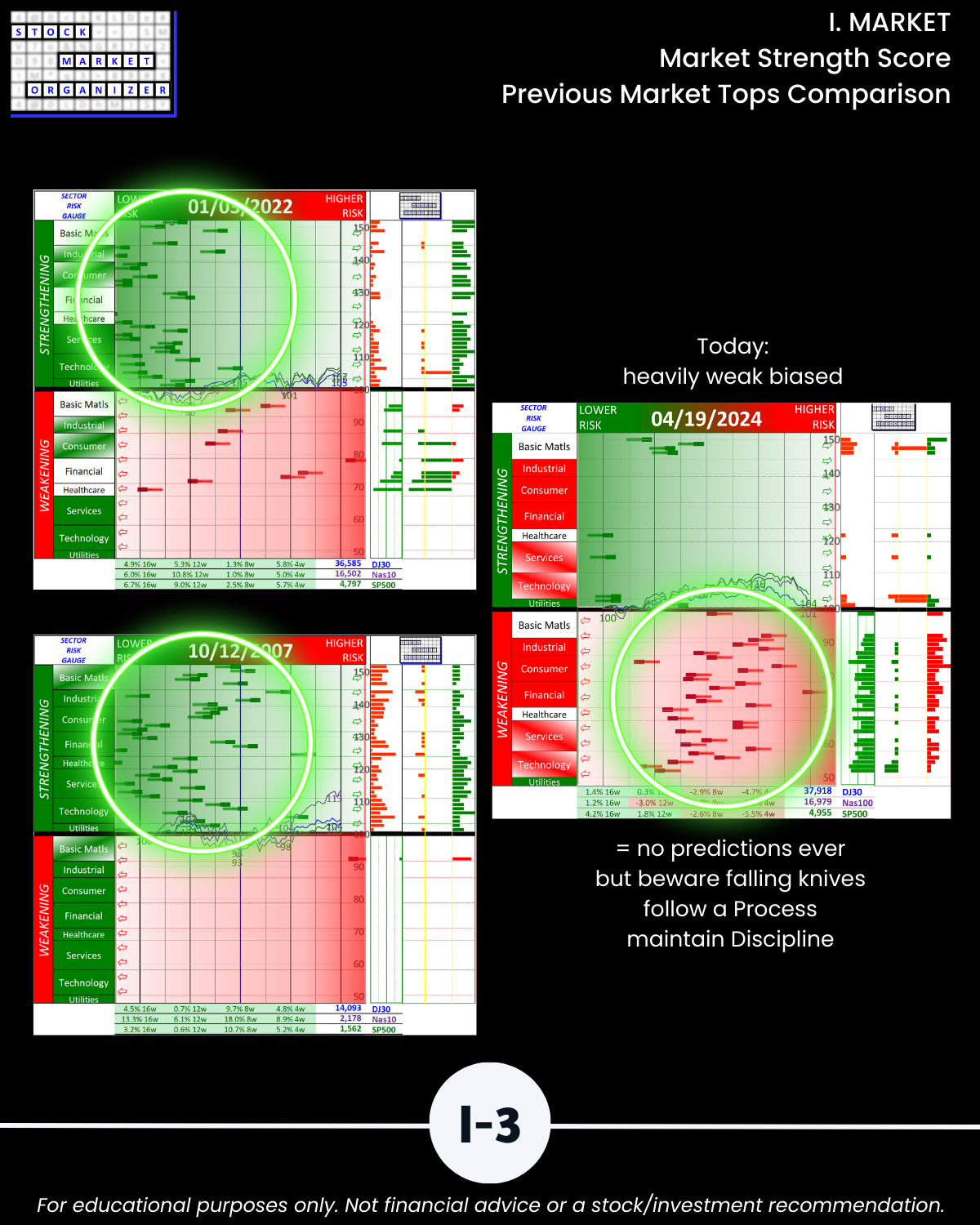

MARKET

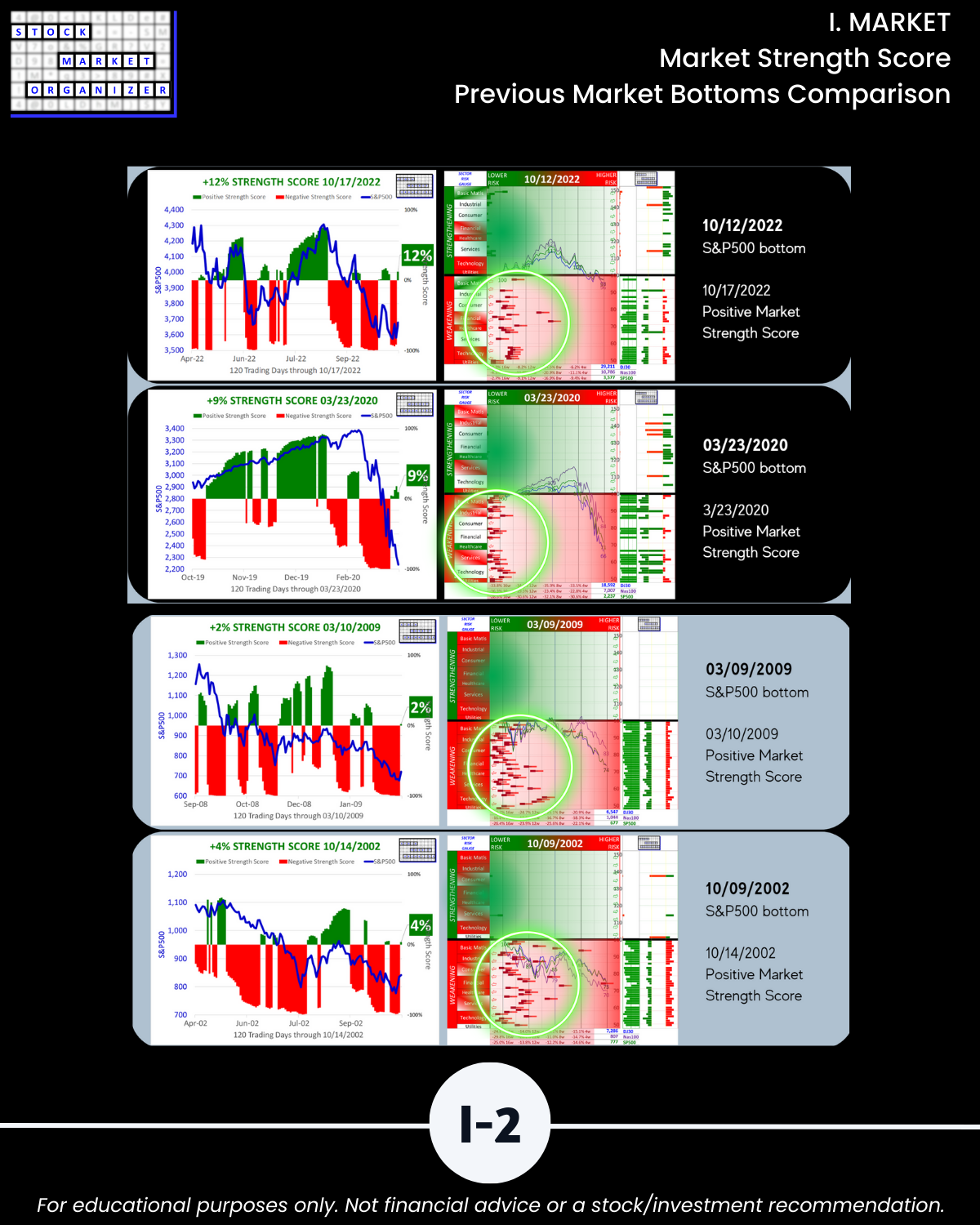

🔹 Has a negative Market Strength Score so NO NEW LONGS

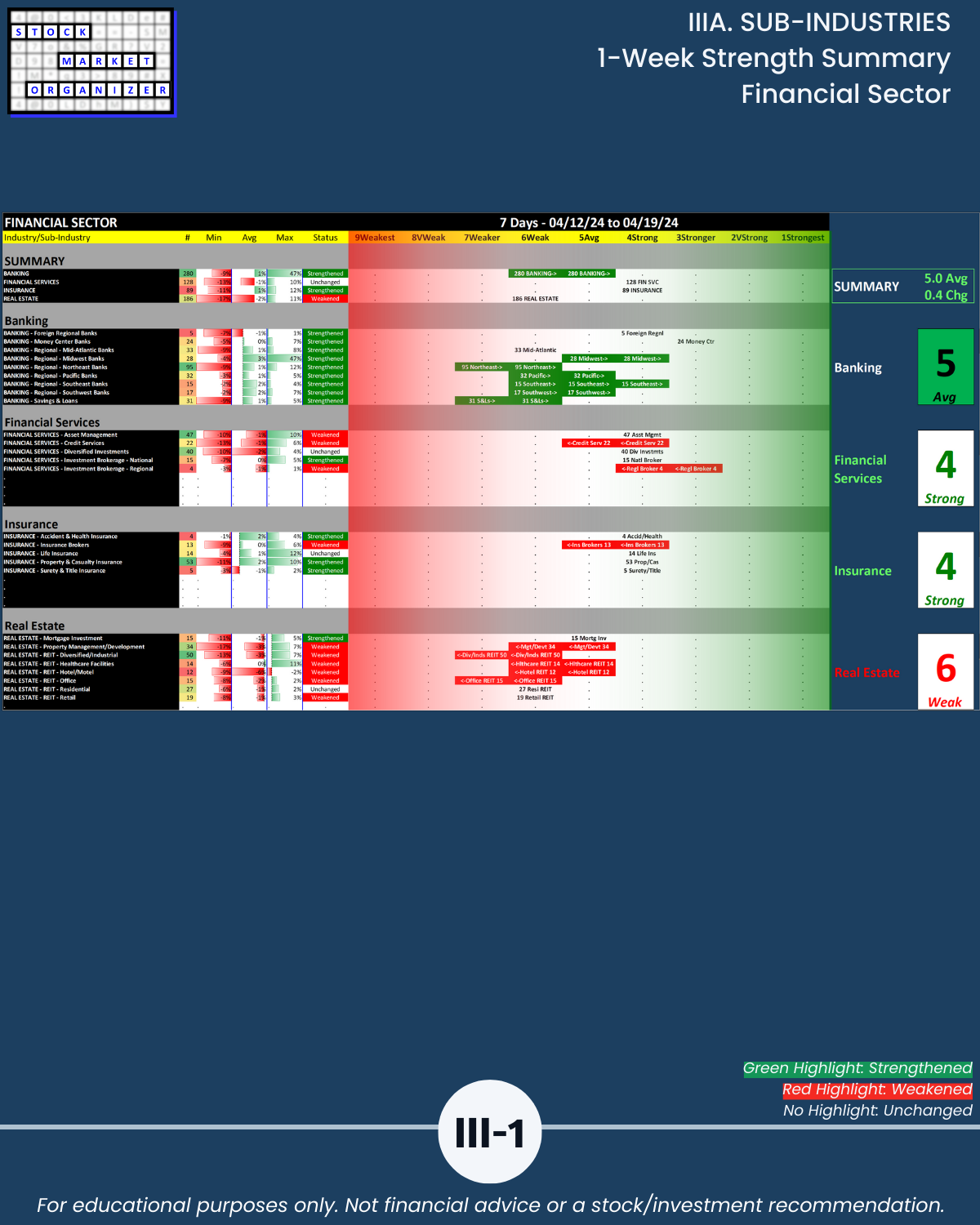

SECTORS/INDUSTRY GROUPINGS (6)

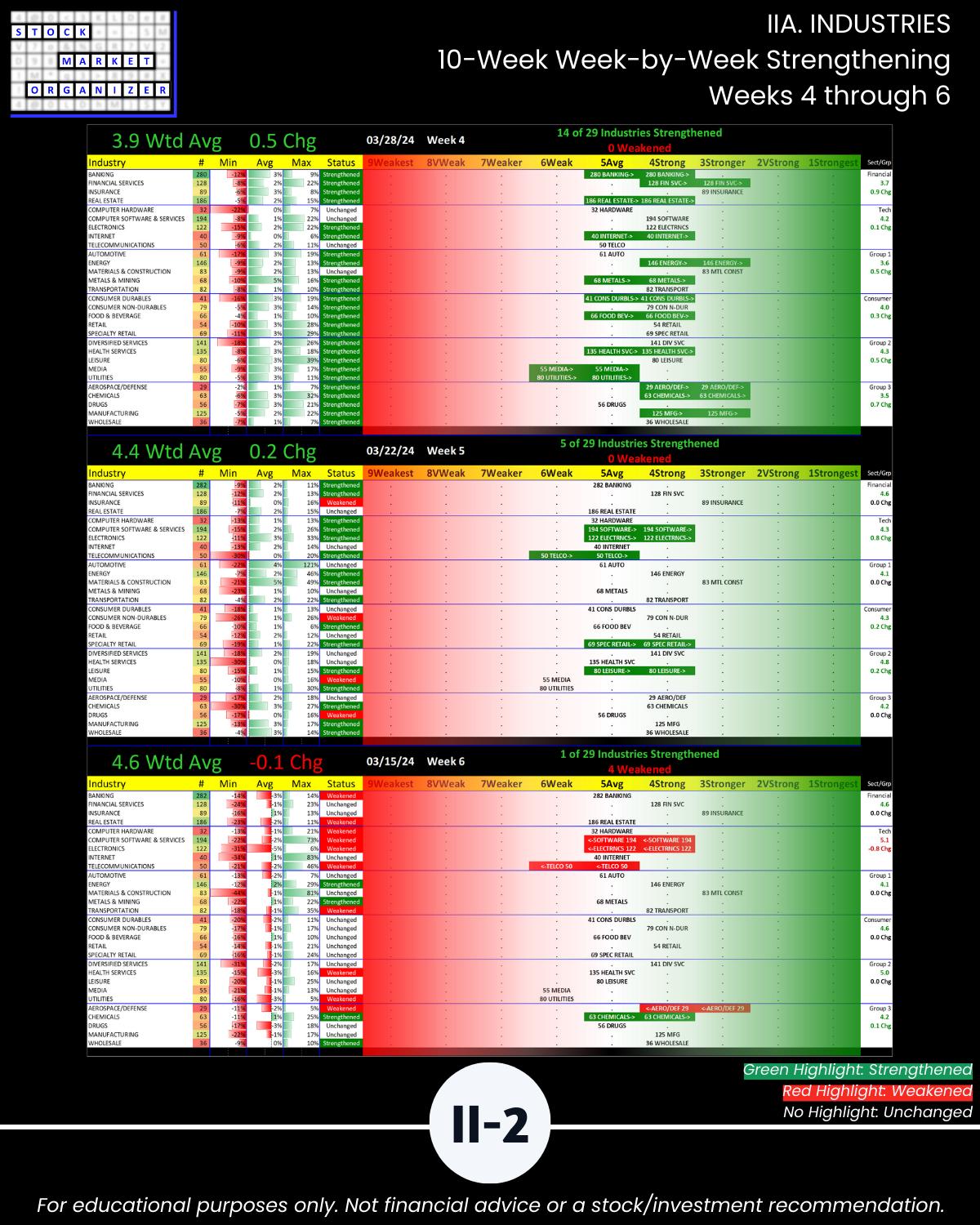

🔹 Overall weighted average strength ranking is 5.2, -0.2 this week

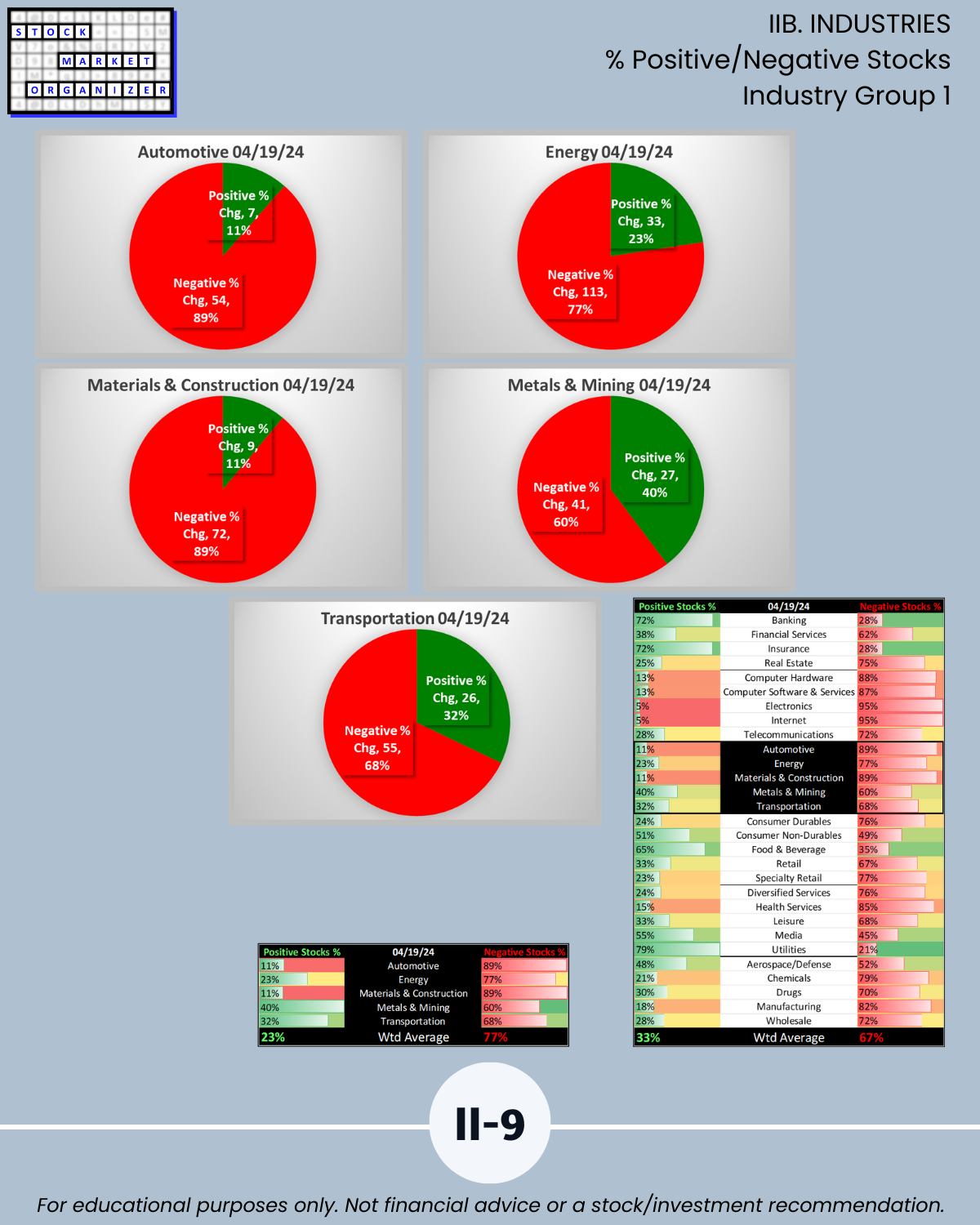

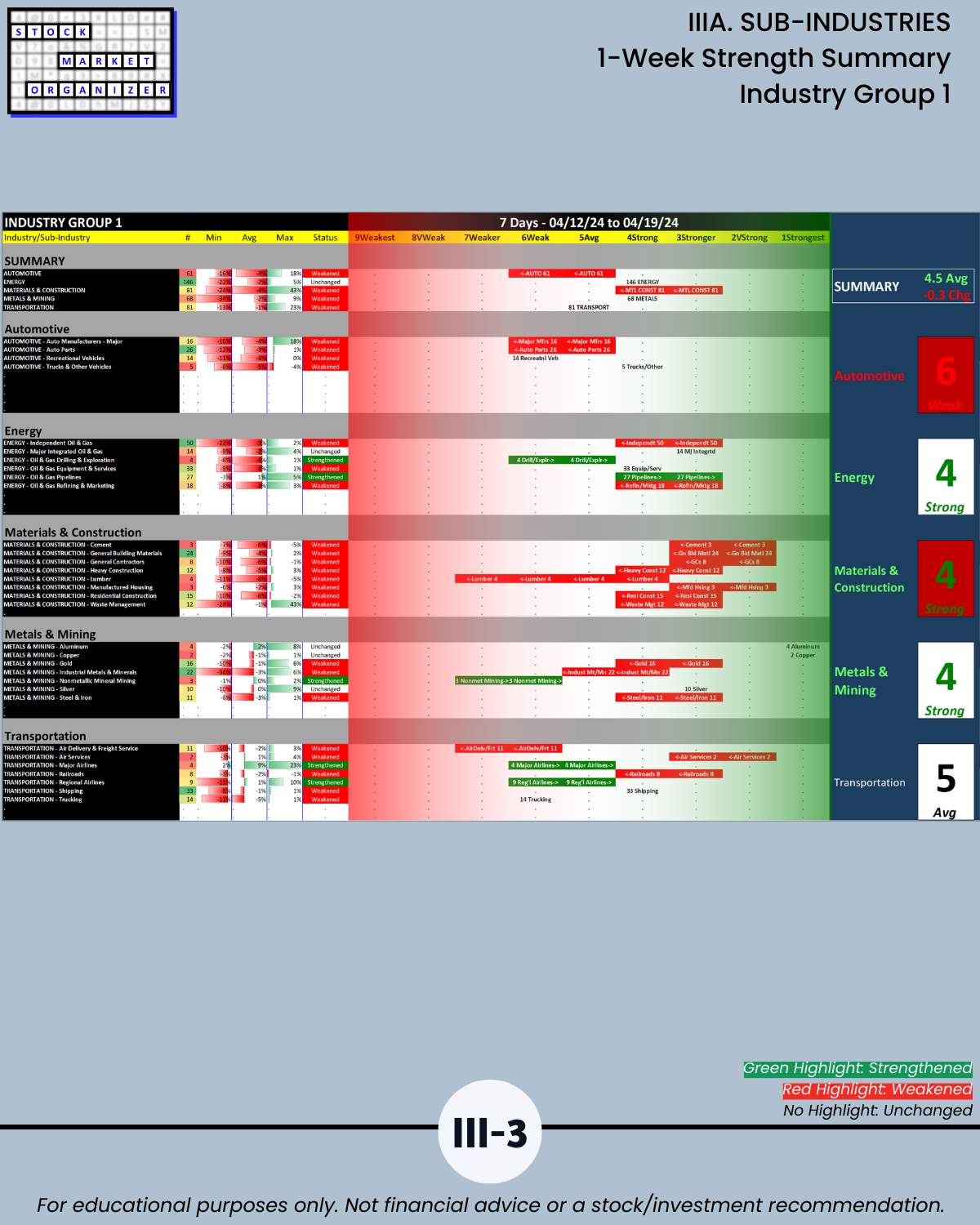

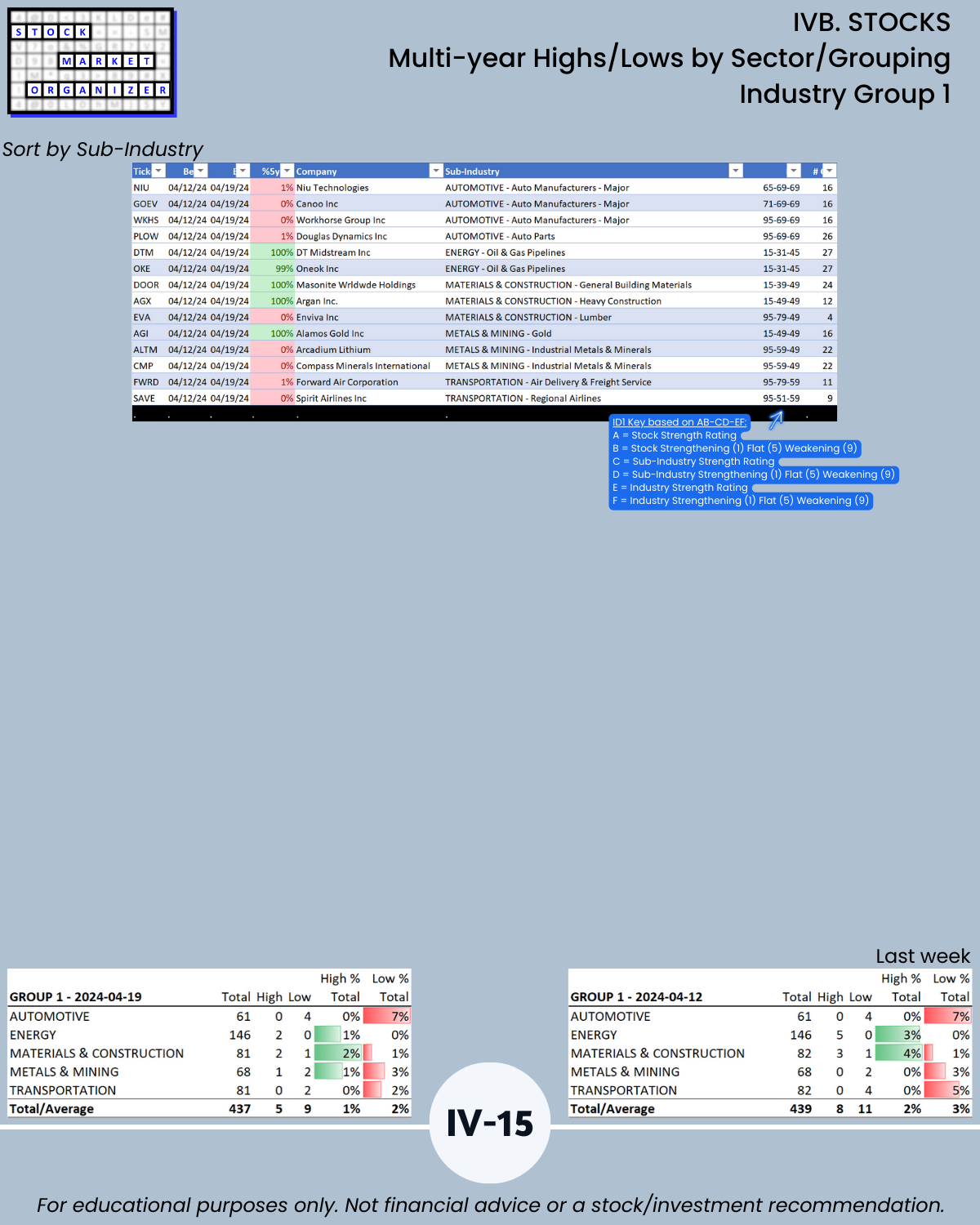

🔹 Best: Industry Group 1, 4.5 = -0.3 this week (Automotive, Energy, Materials/Construction, Metals/Mining, Transportation)

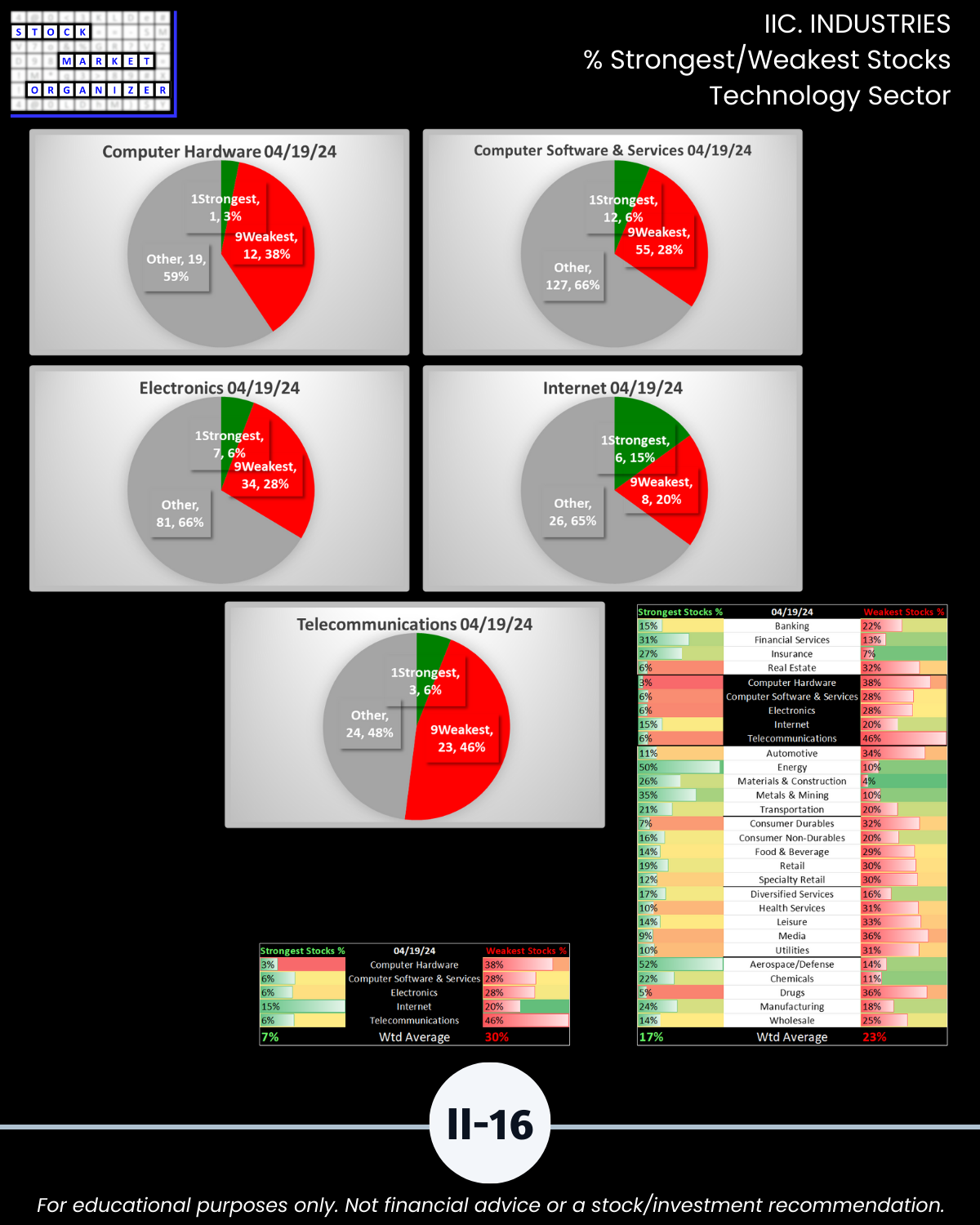

🔹 Worst: Tech Sector, 5.9 = -0.7 this week (Computer Hardware, Computer Software & Services, Electronics, Internet, and Telecommunications)

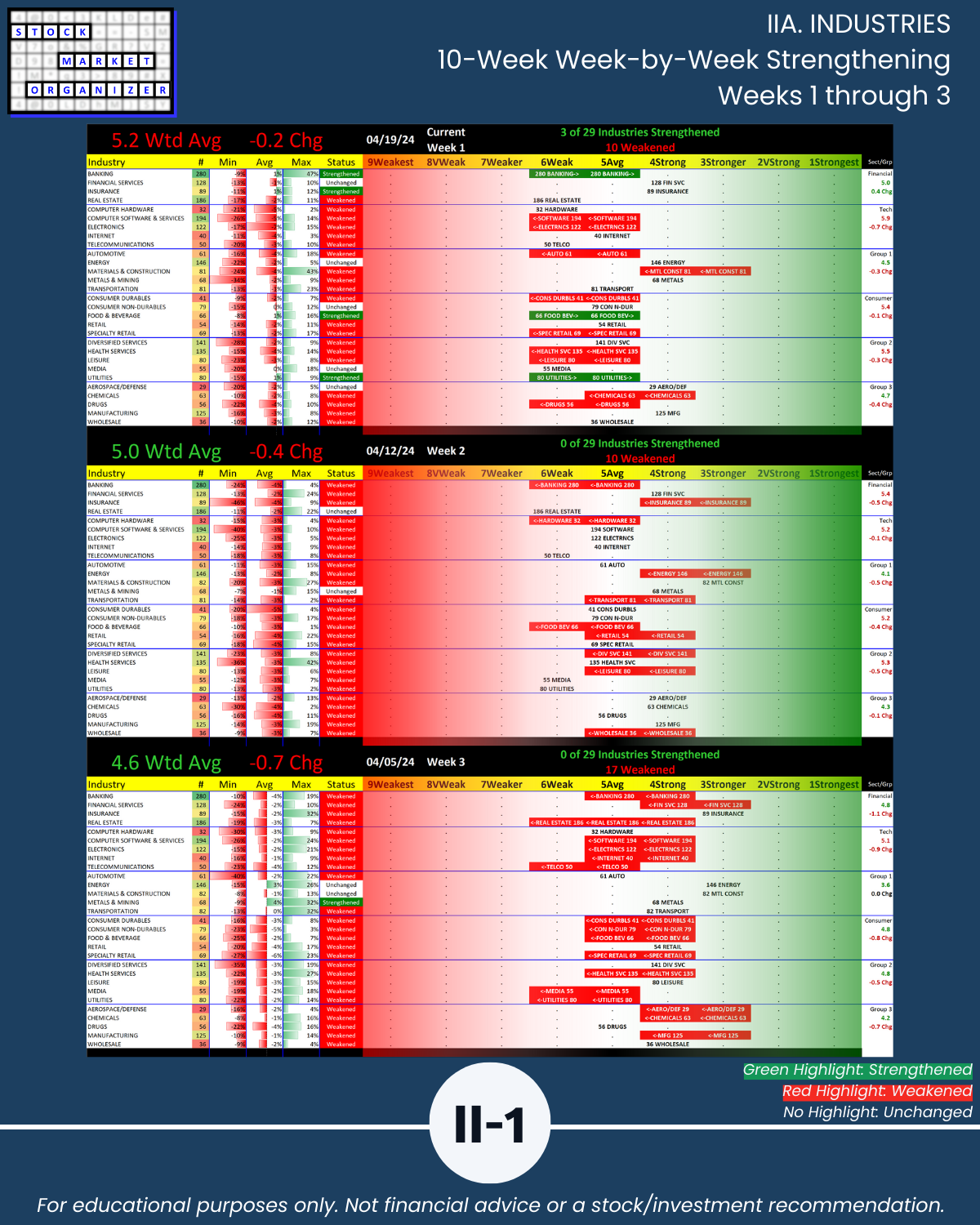

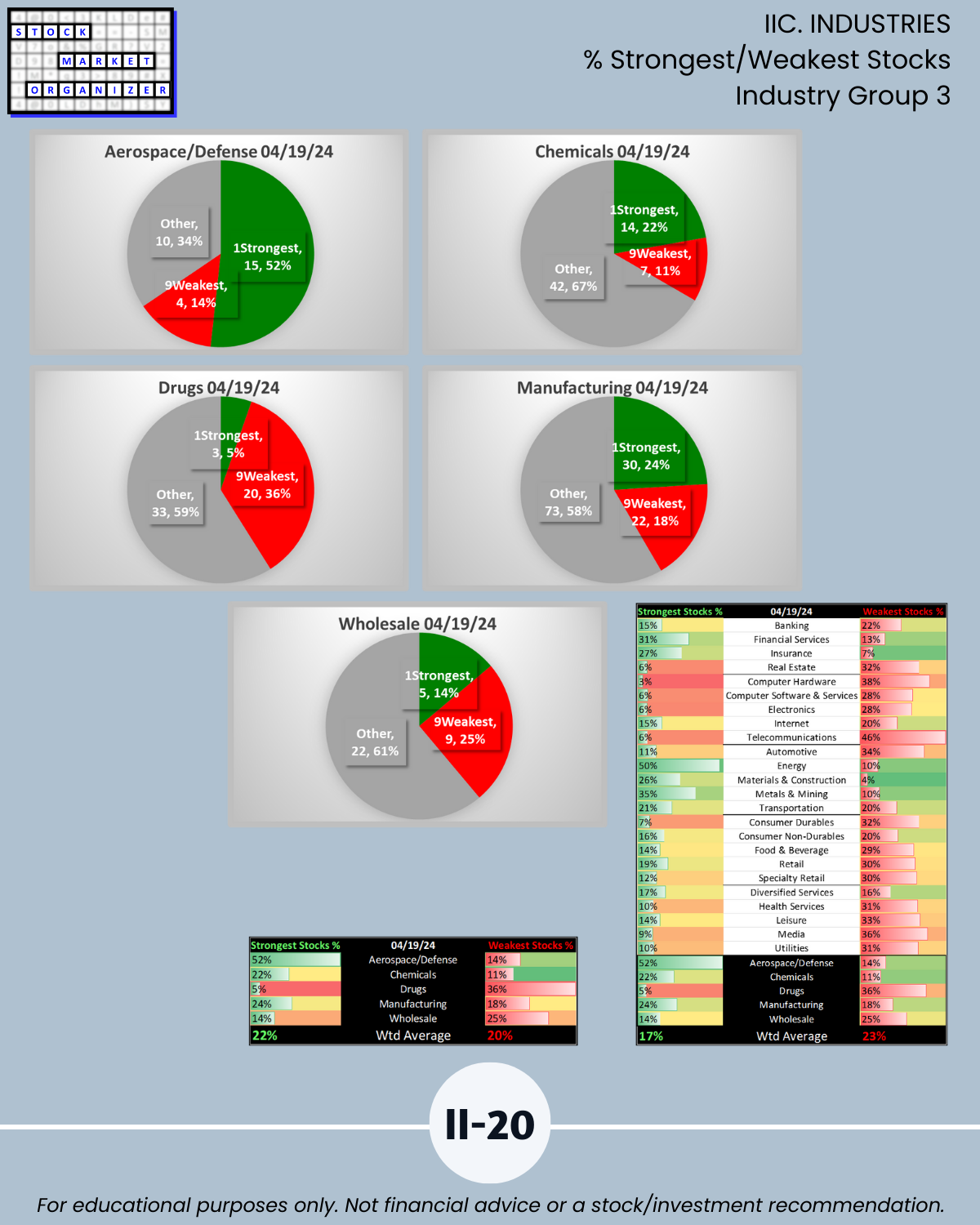

INDUSTRIES

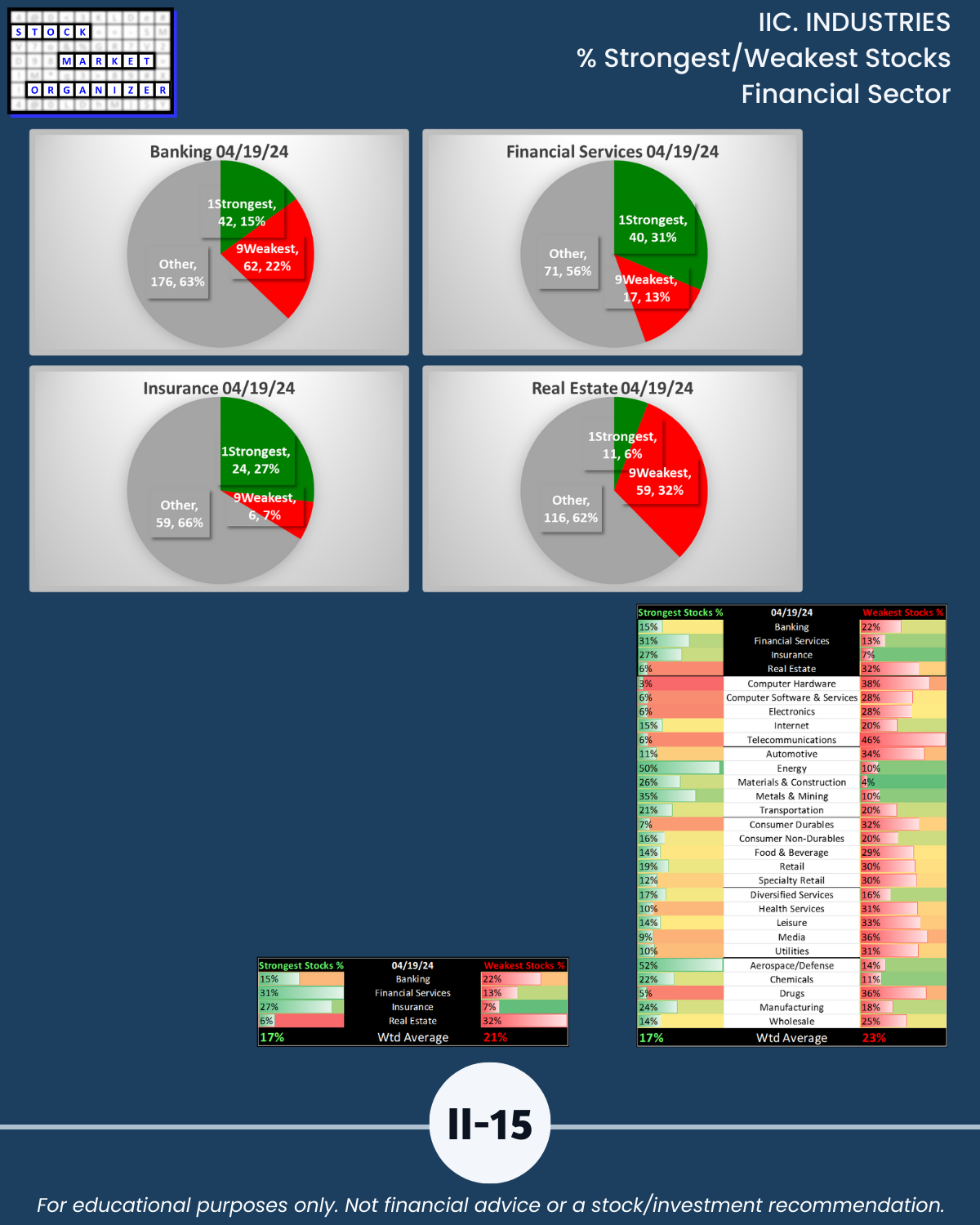

🔹 Strongest: 7-way tie at 4Strong

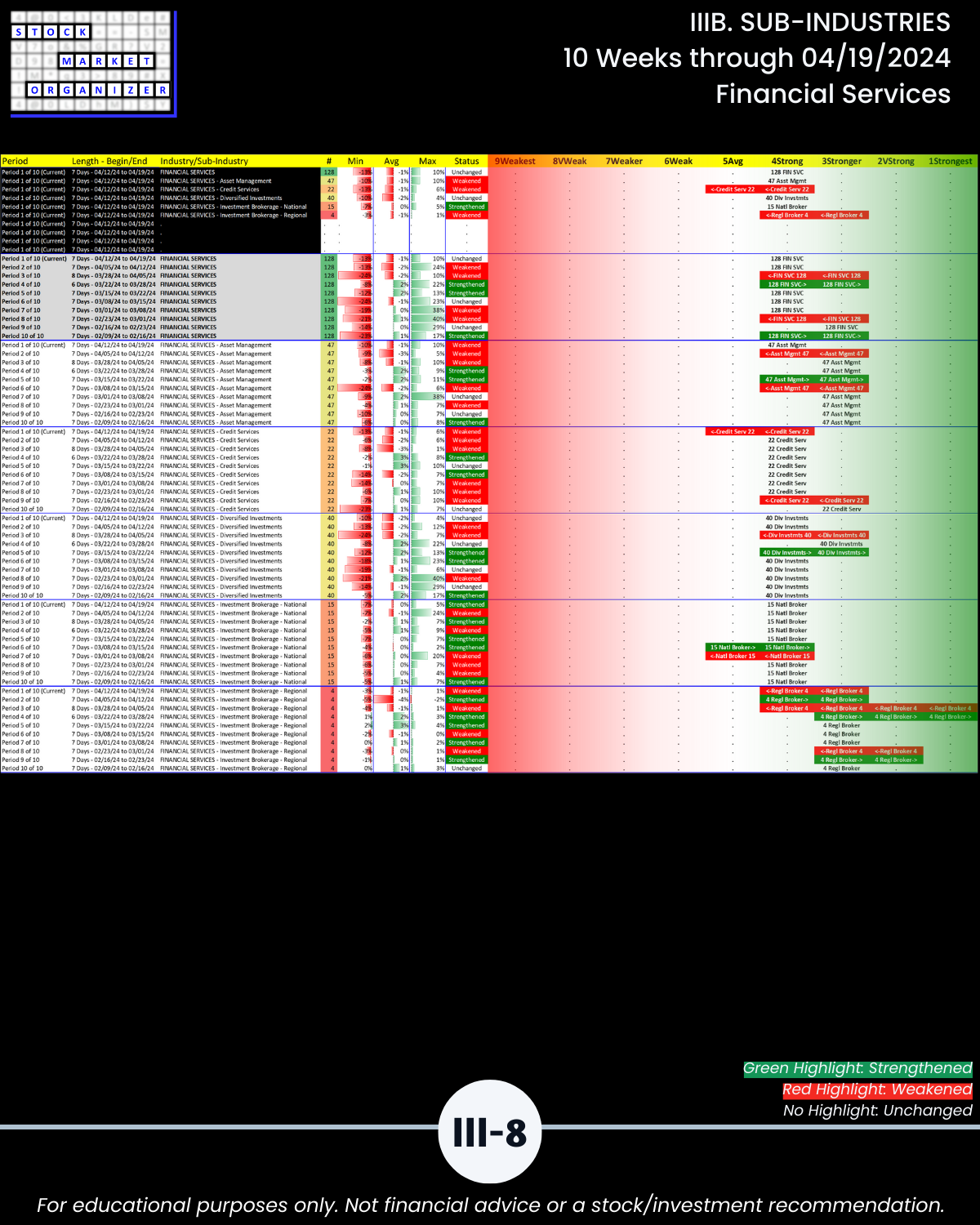

- Financial Services

- Insurance

- Energy

- Materials & Construction

- Metals & Mining

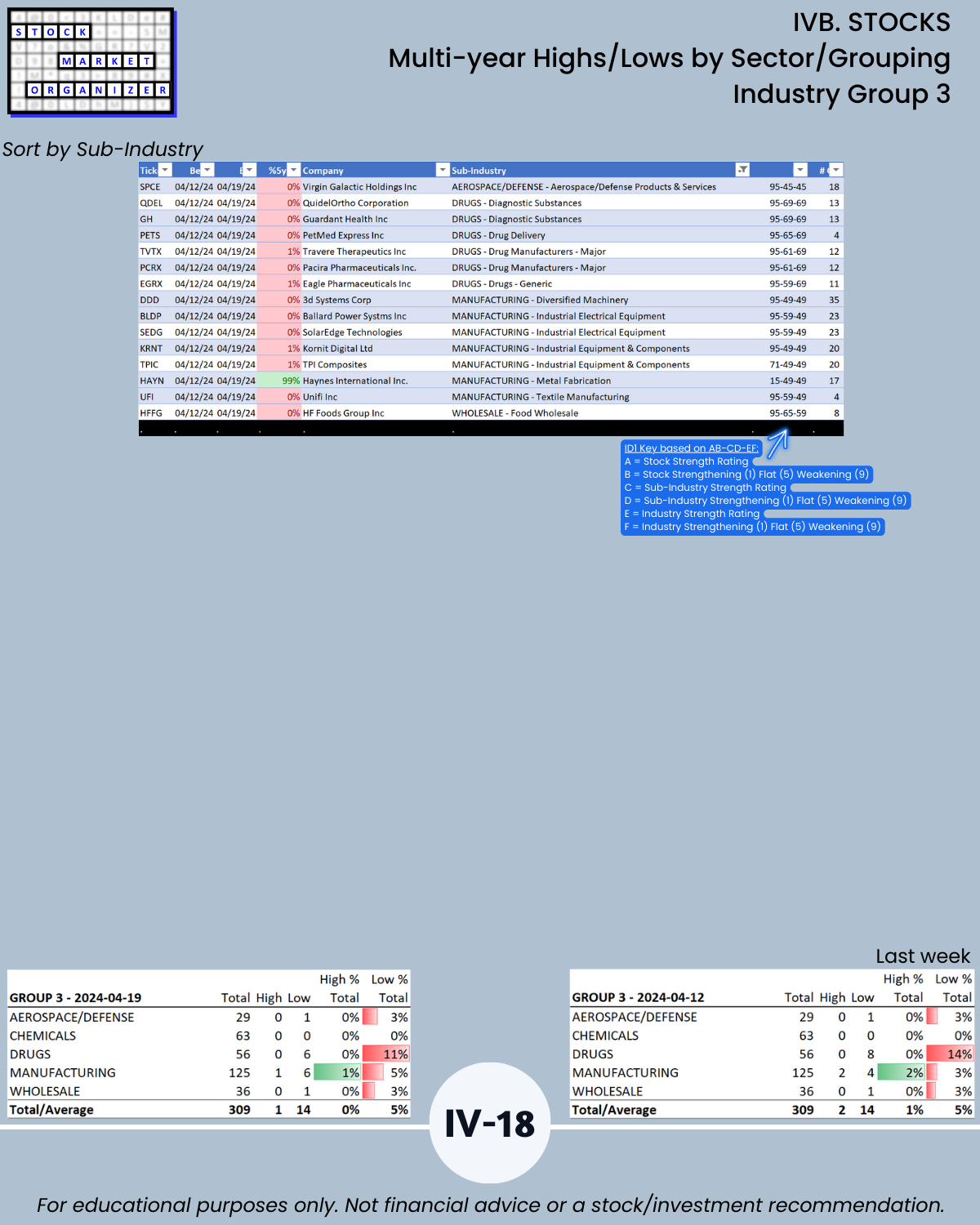

- Aerospace/Defense

- Manufacturing

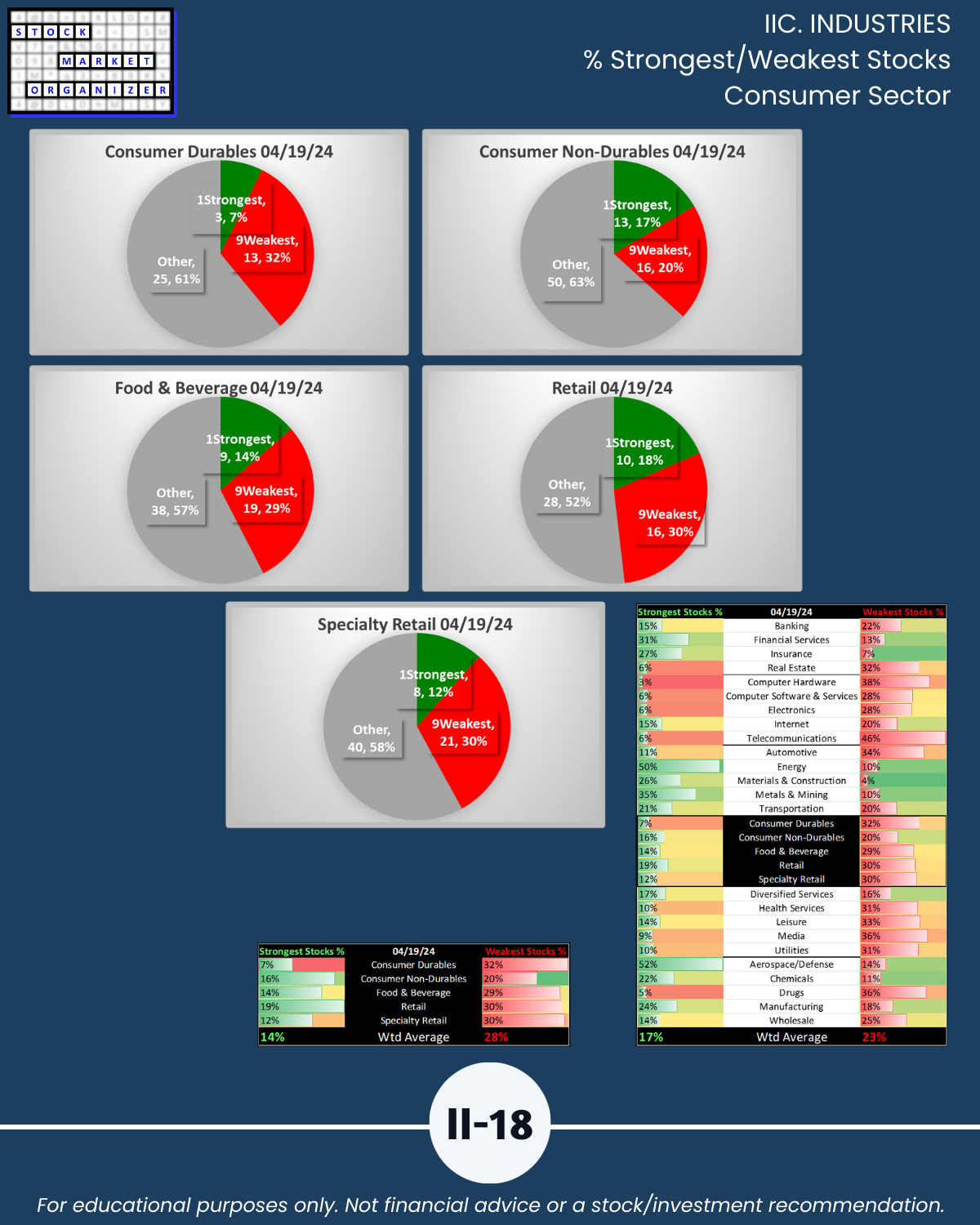

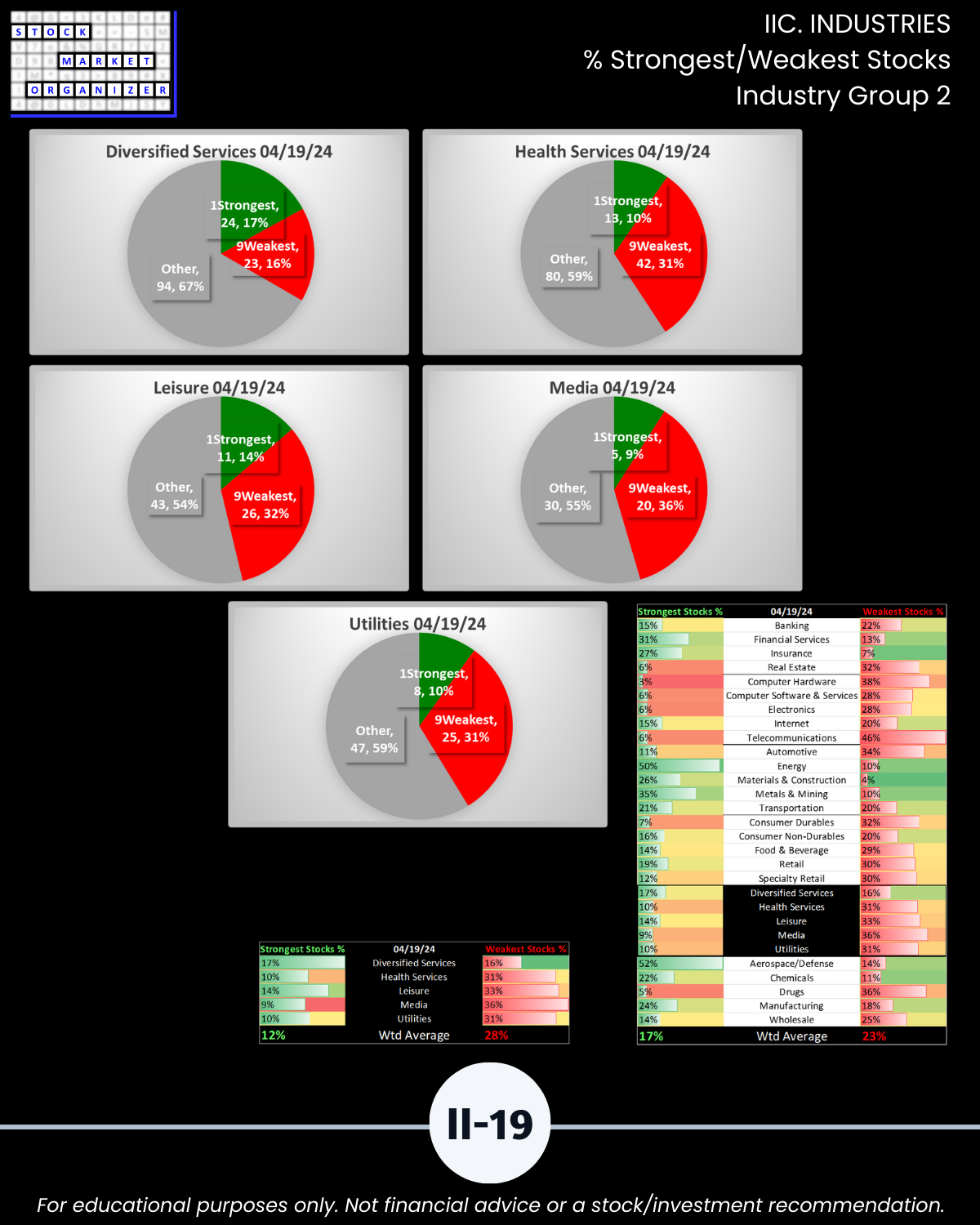

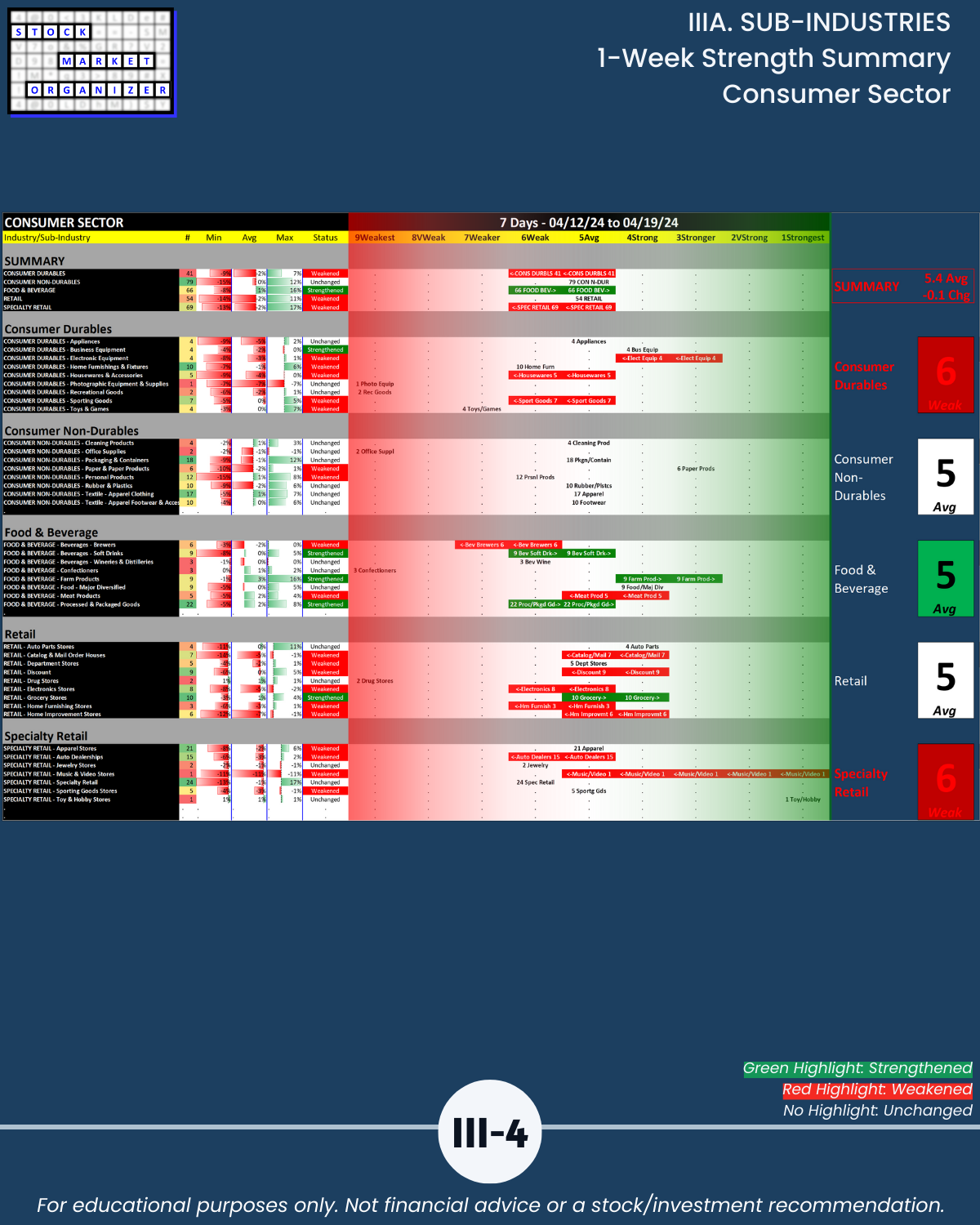

🔹 Weakest: 12-way tie at 6Weak:

- Real Estate

- Computer Hardware

- Computer Software/Services

- Electronics

- Telco

- Automotive

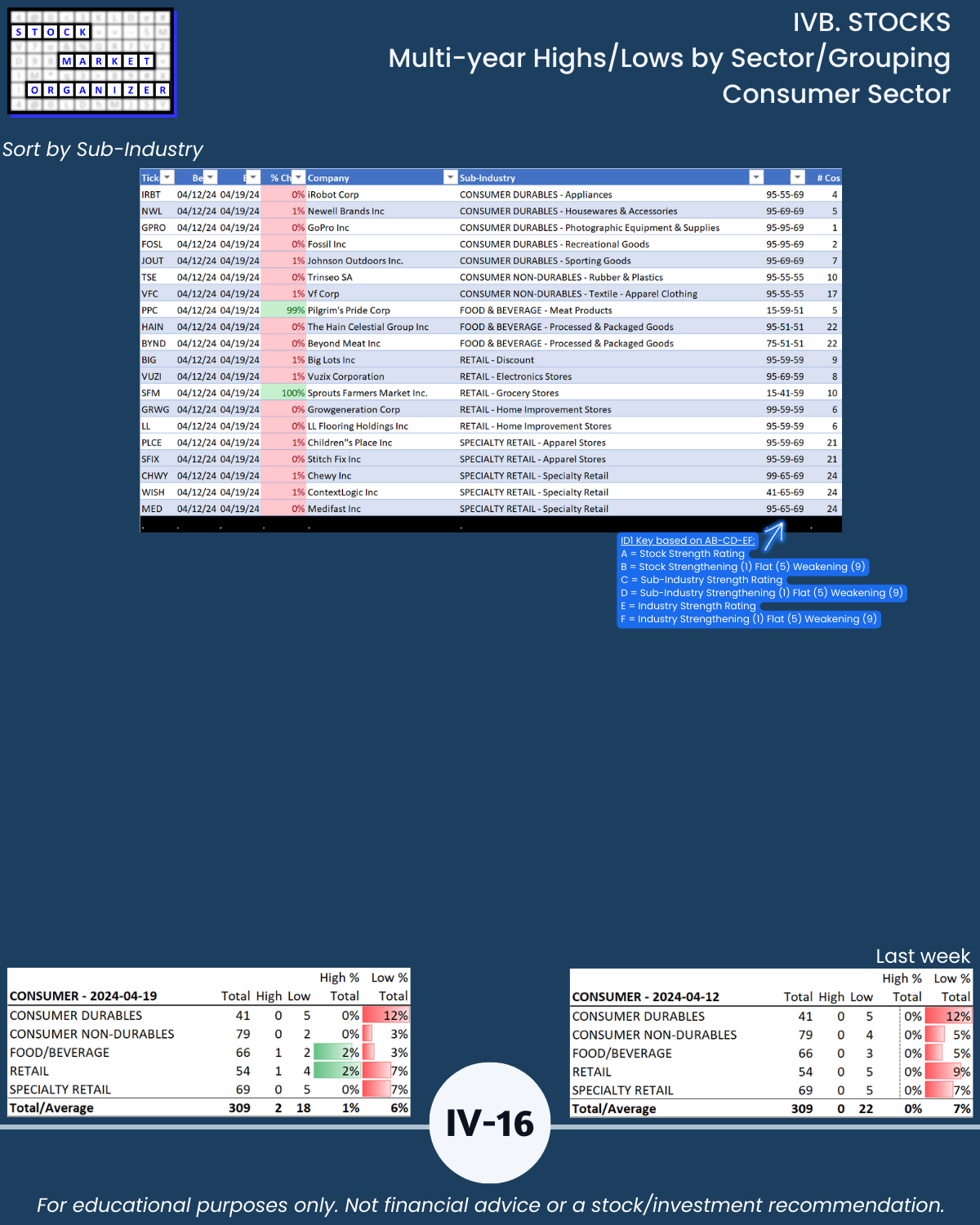

- Consumer Durables

- Specialty Retail

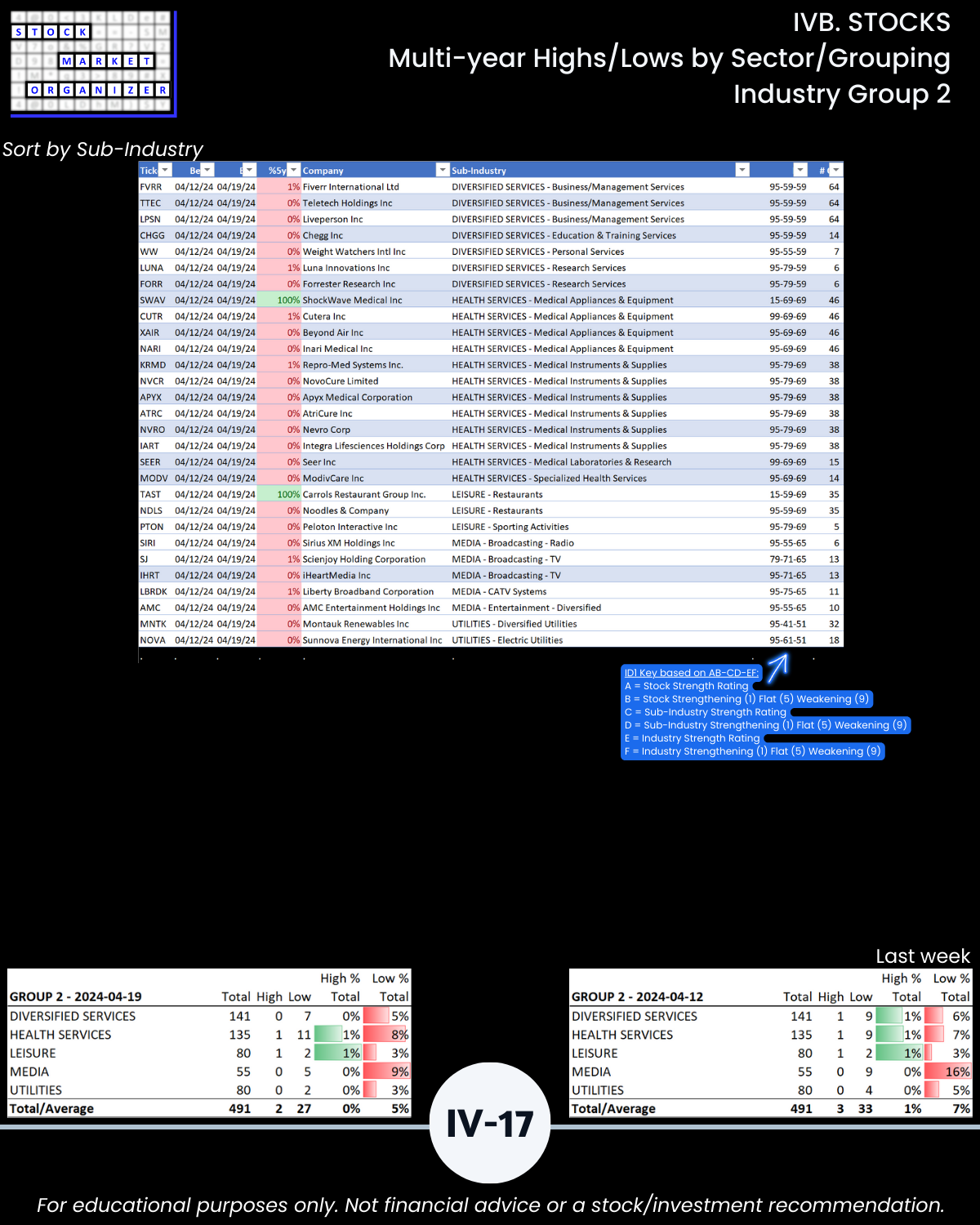

- Health Services

- Leisure

- Media

- Drugs

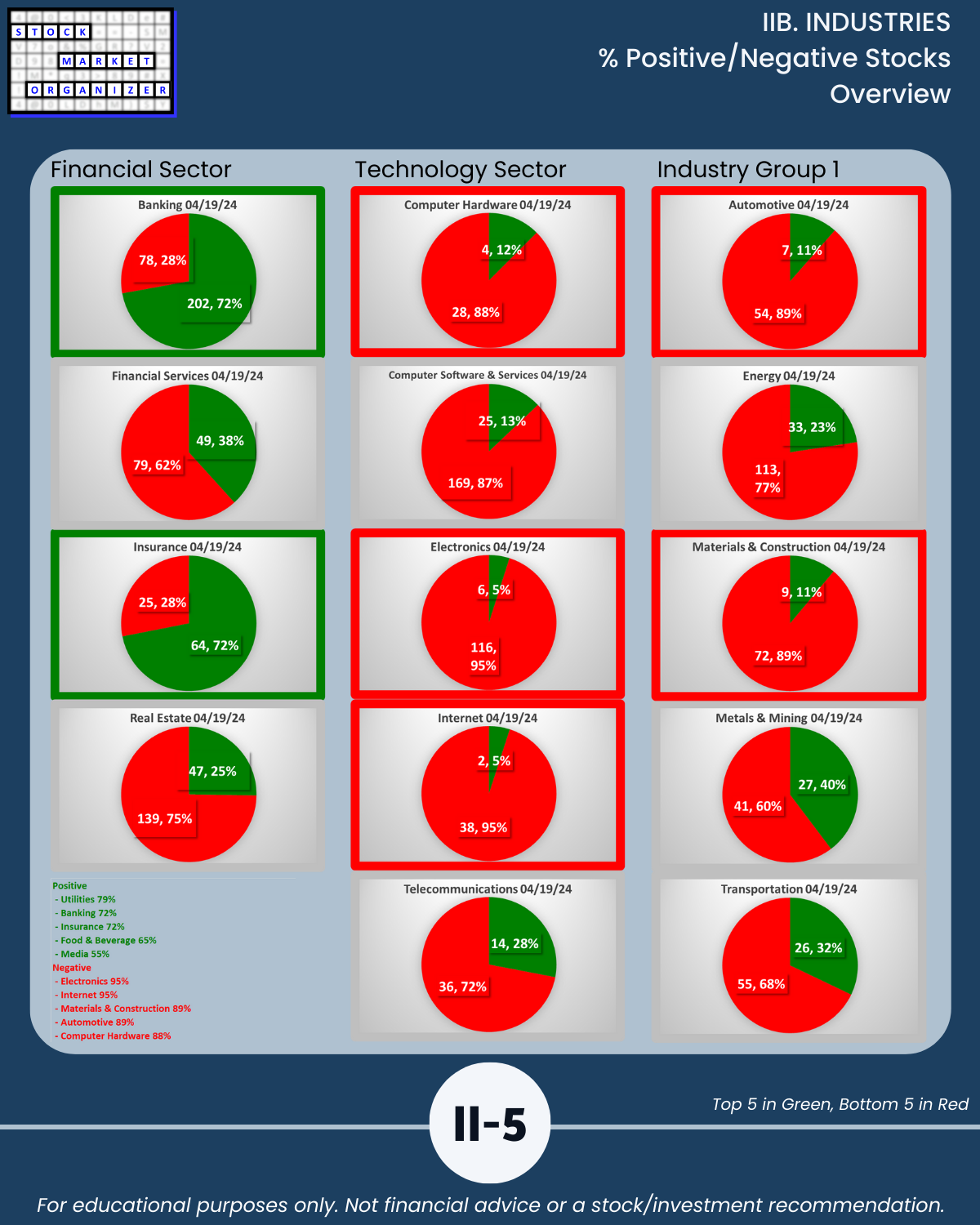

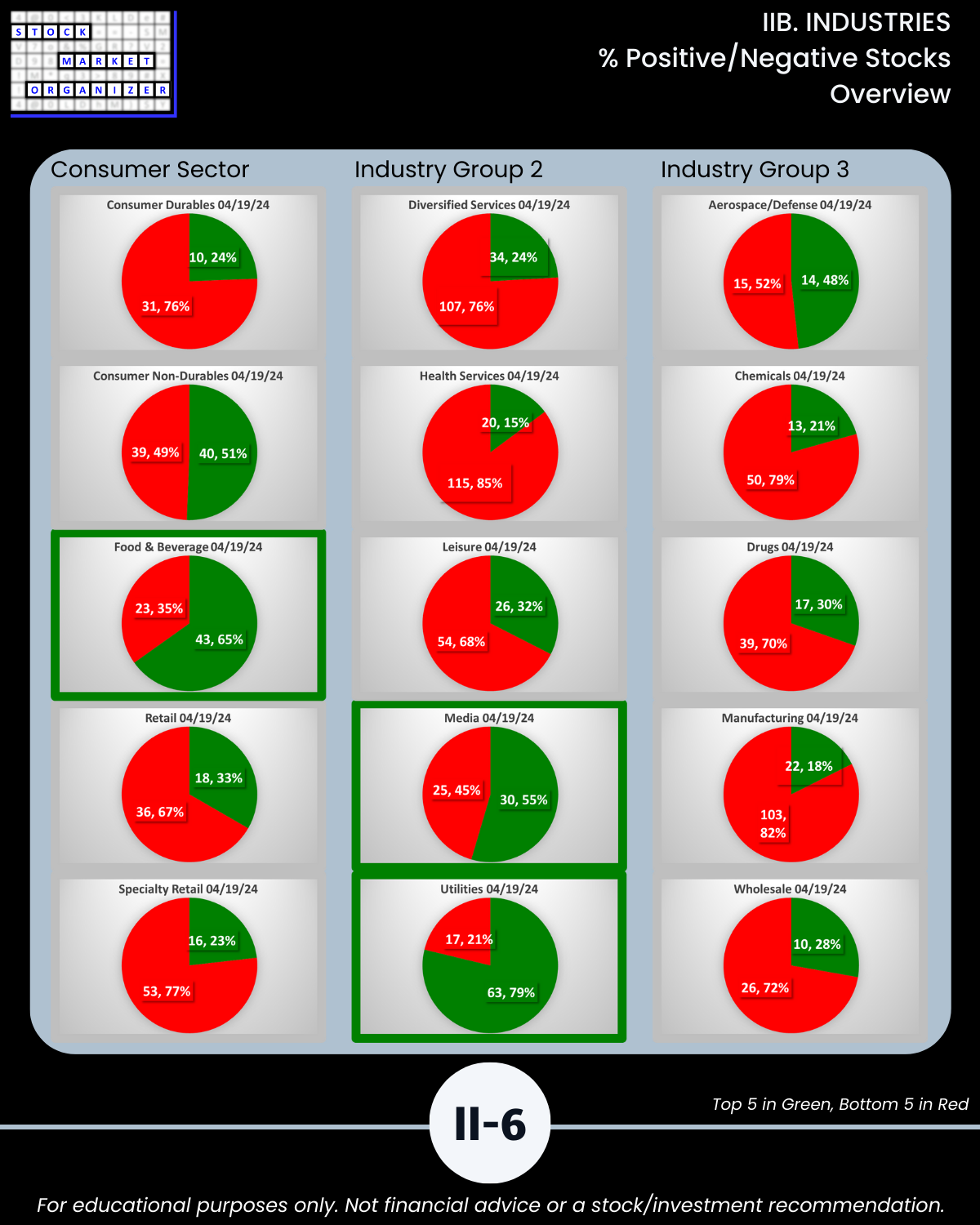

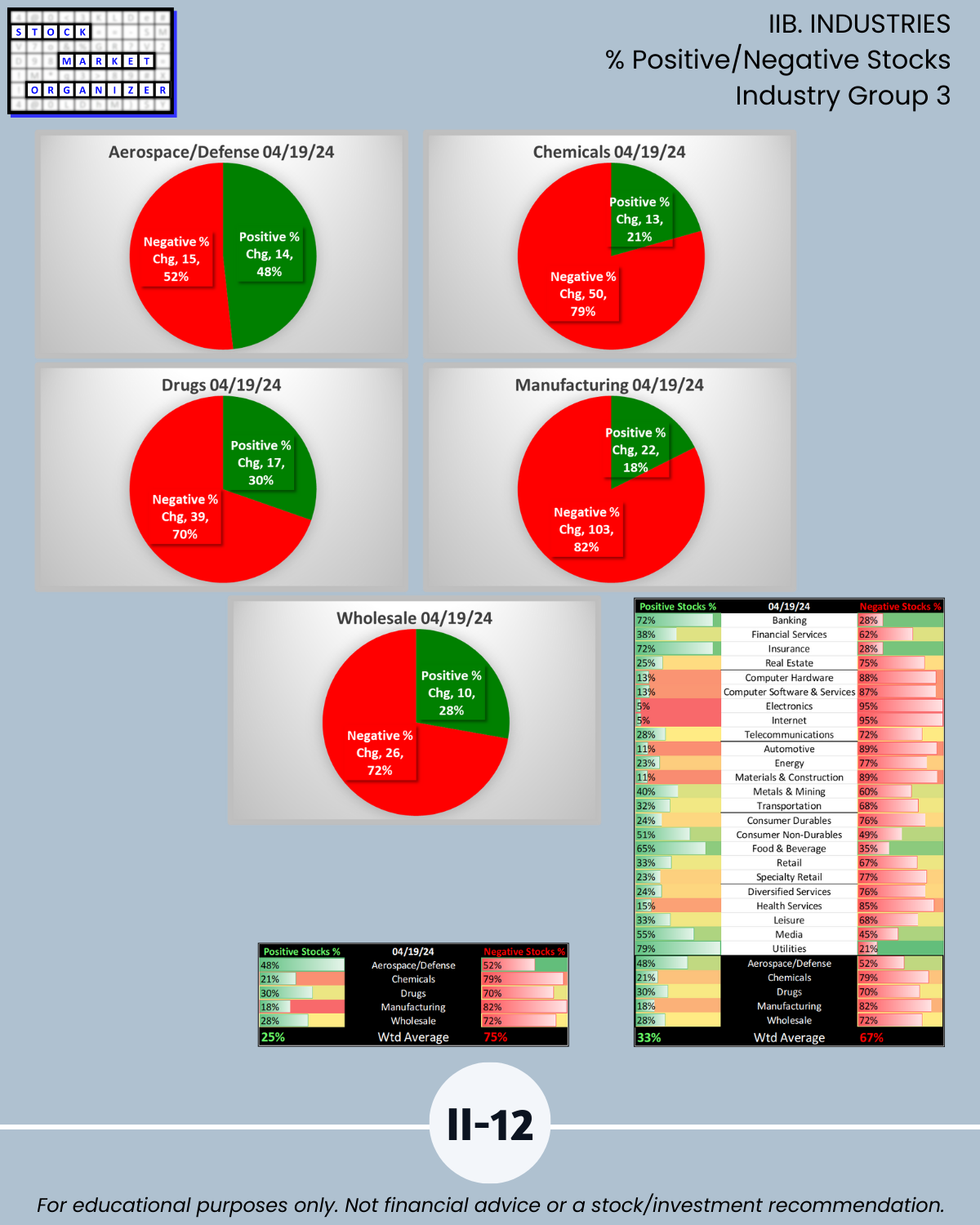

🔹 Highest Positive Stocks 55% to 79% (ABOVE last week 22% to 35%)

- Utilities 79%

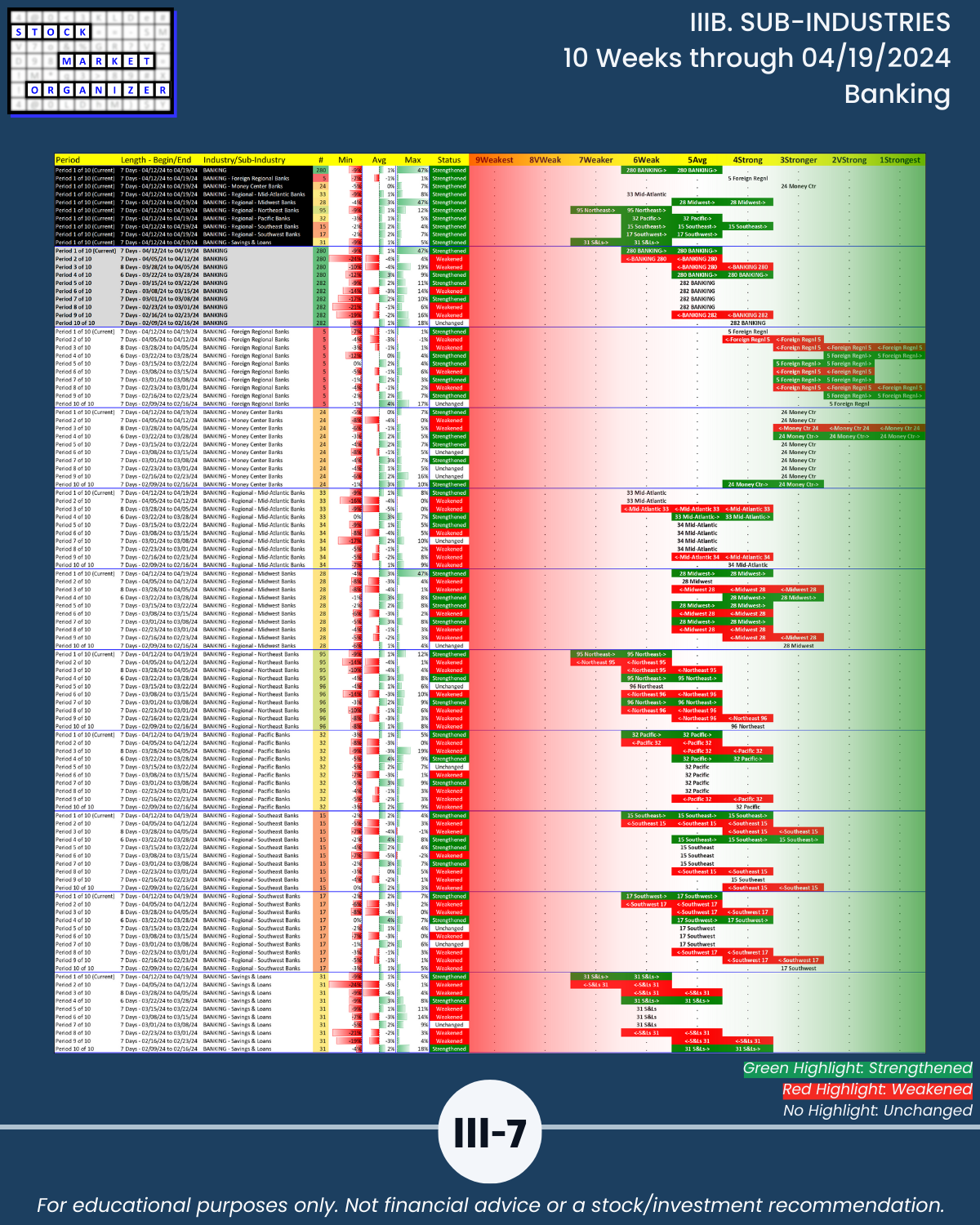

- Banking 72%

- Insurance 72%

- Food & Beverage 65%

- Media 55%

🔹 Highest Negative Stocks 88% to 95% (BELOW last week 94% to 96%)

- Electronics 95%

- Internet 95%

- Materials & Construction 89%

- Automotive 89%

- Computer Hardware 88%

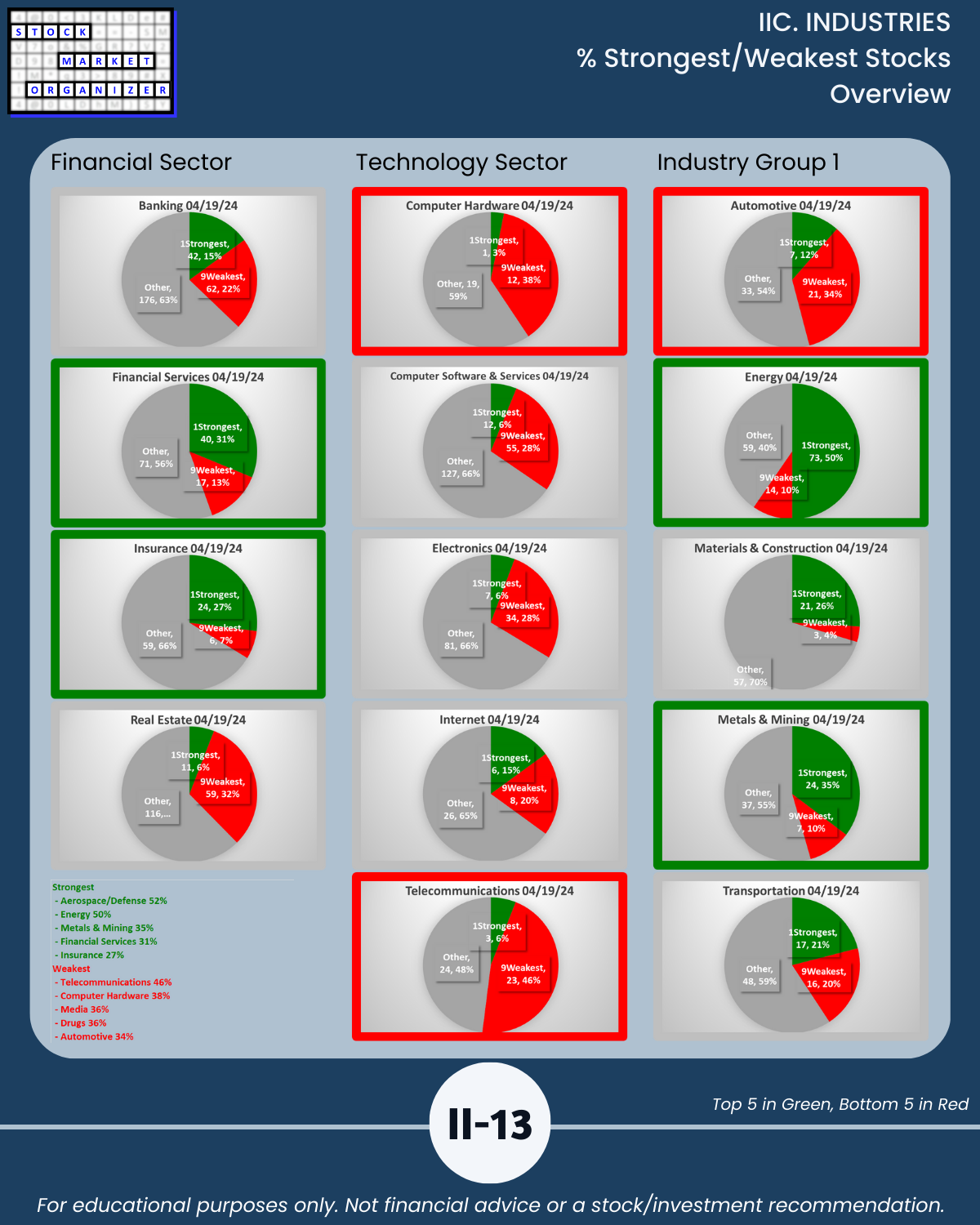

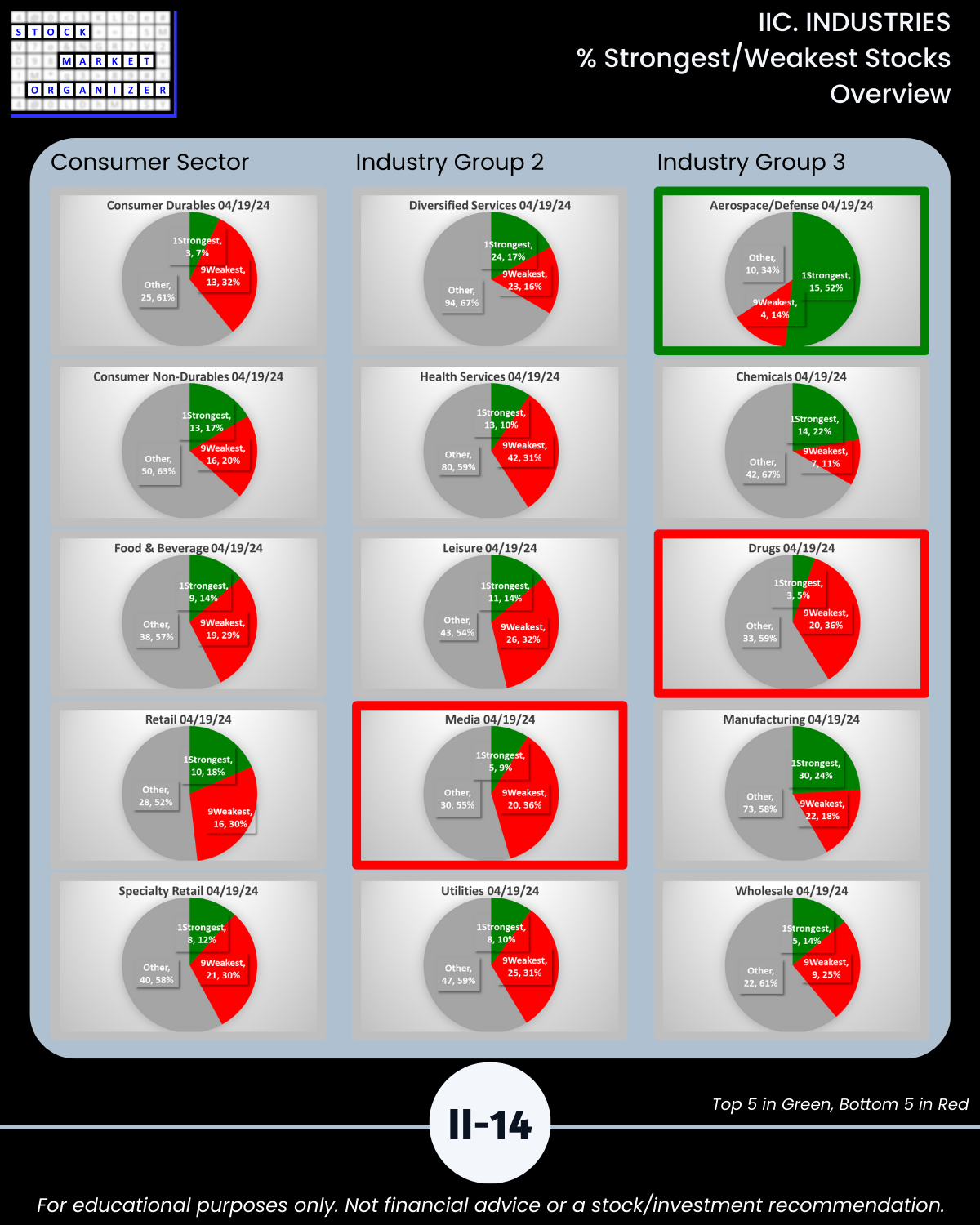

🔹 Stocks rated Strongest 27% to 52% (BELOW last week 40% to 62%)

- Aerospace/Defense 52%

- Energy 50%

- Metals & Mining 35%

- Financial Services 31%

- Insurance 27%

🔹 Stocks rated Weakest 34% to 46% (SAME AS last week 36% to 45%)

- Telecommunications 46%

- Computer Hardware 38%

- Media 36%

- Drugs 36%

- Automotive 34%

I. MARKET Prologue Critical Concepts/Market Strength Score

IIA. INDUSTRIES 10-Week Week-by-Week Strengthening

IIB. INDUSTRIES % Positive/Negative Stocks

IIC. INDUSTRIES % Strongest/Weakest Stocks

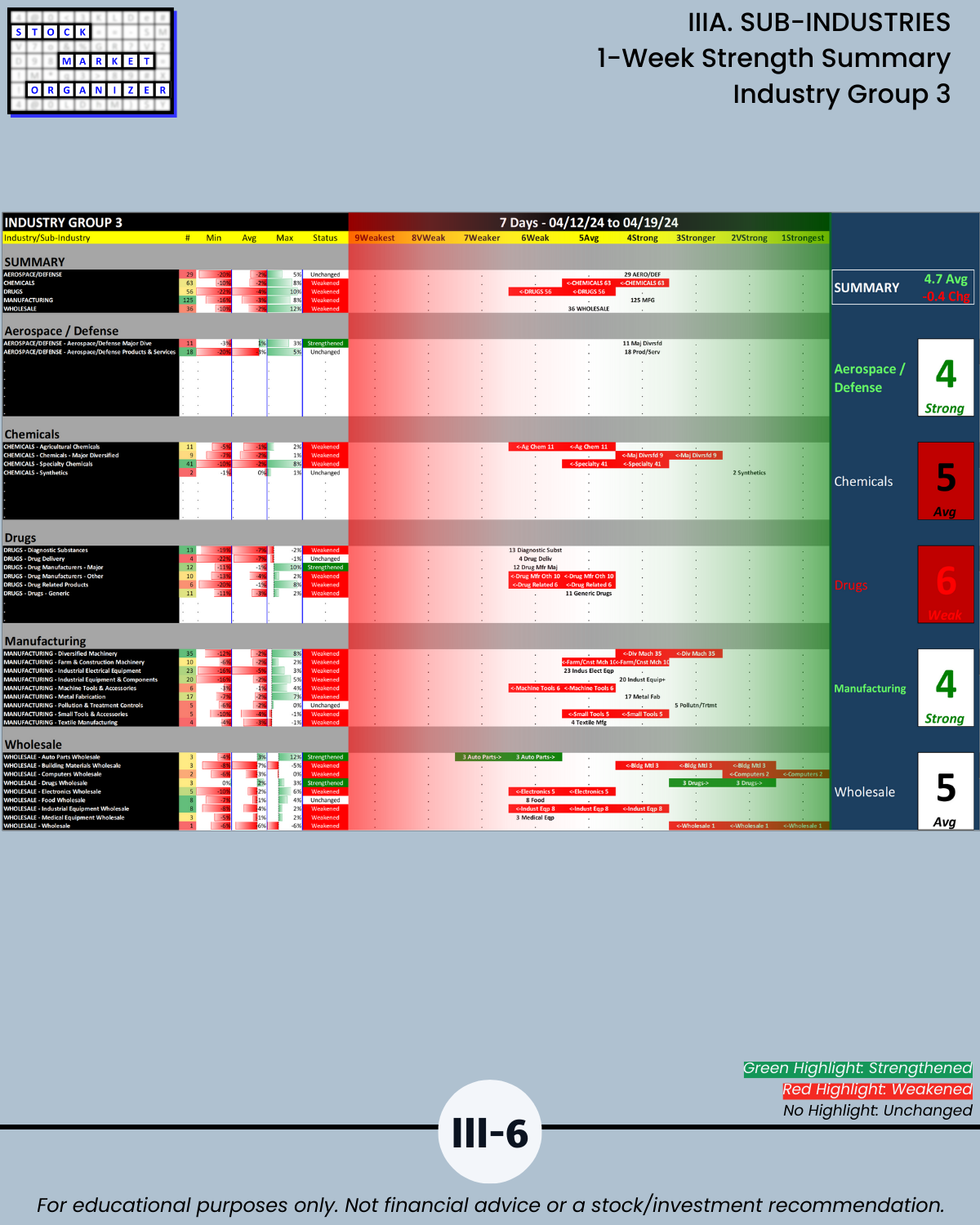

IIIA. SUB-INDUSTRIES 1-Week Strength Summary

IIIB. SUB-INDUSTRIES 10-Week Strengthening/Weakening

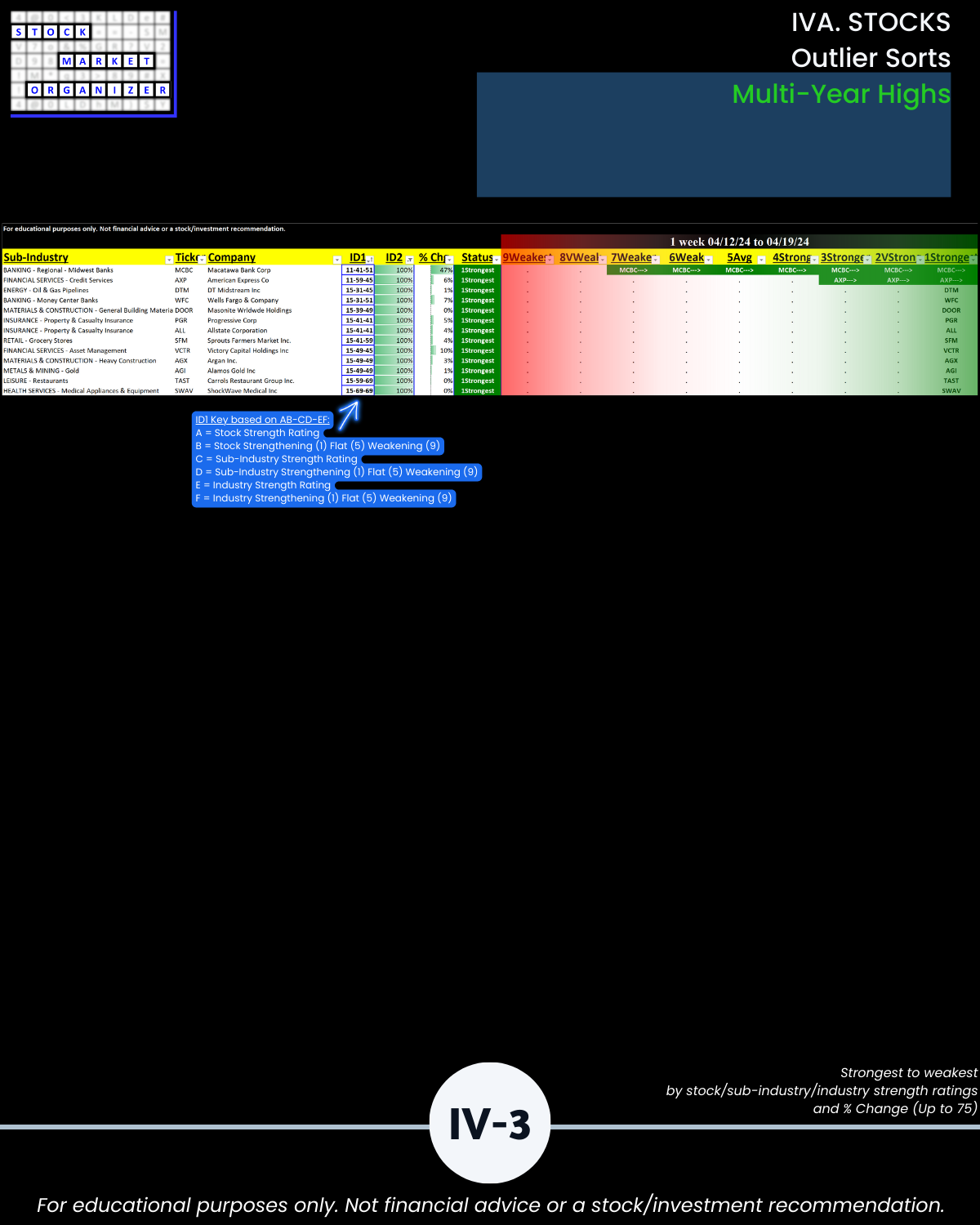

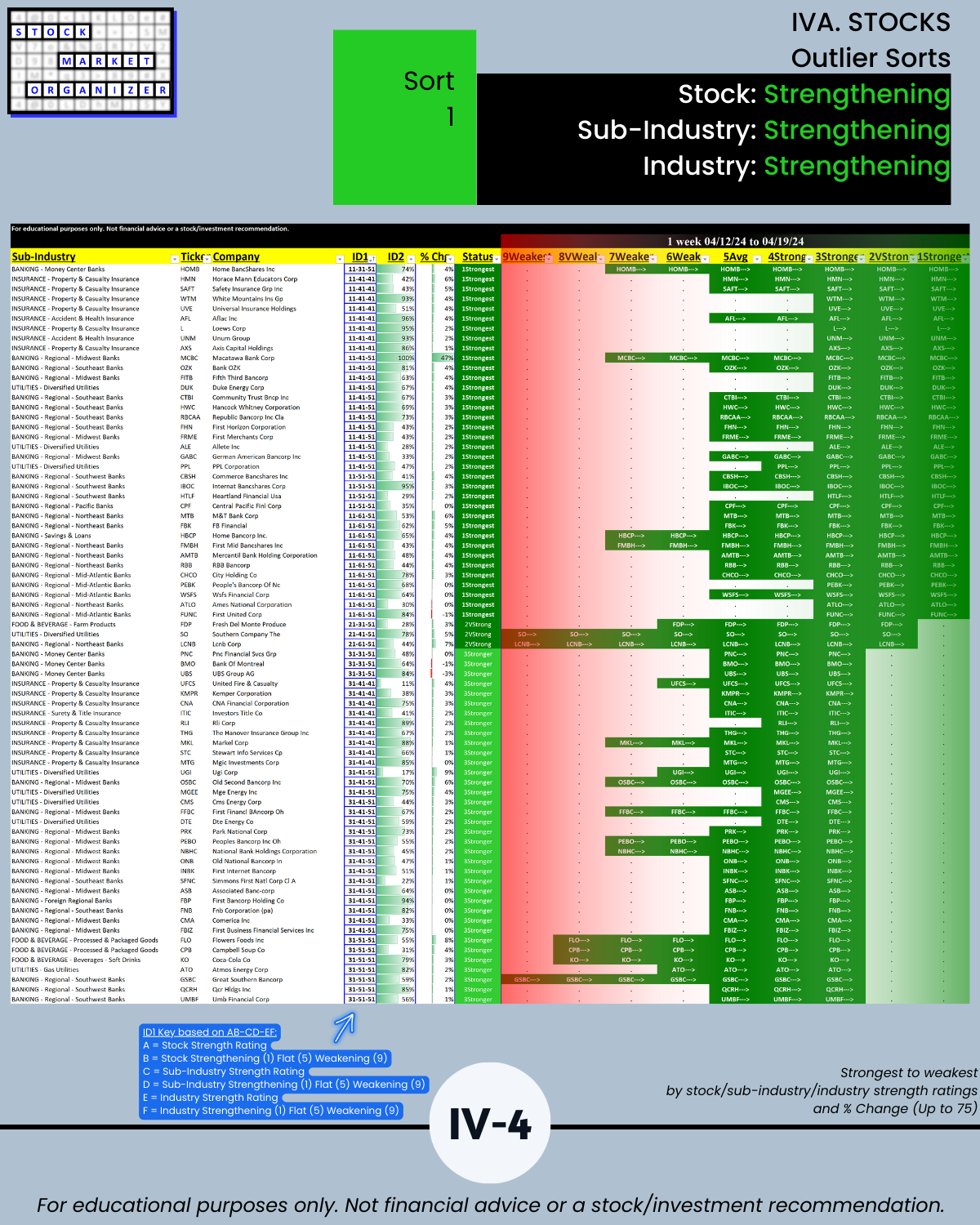

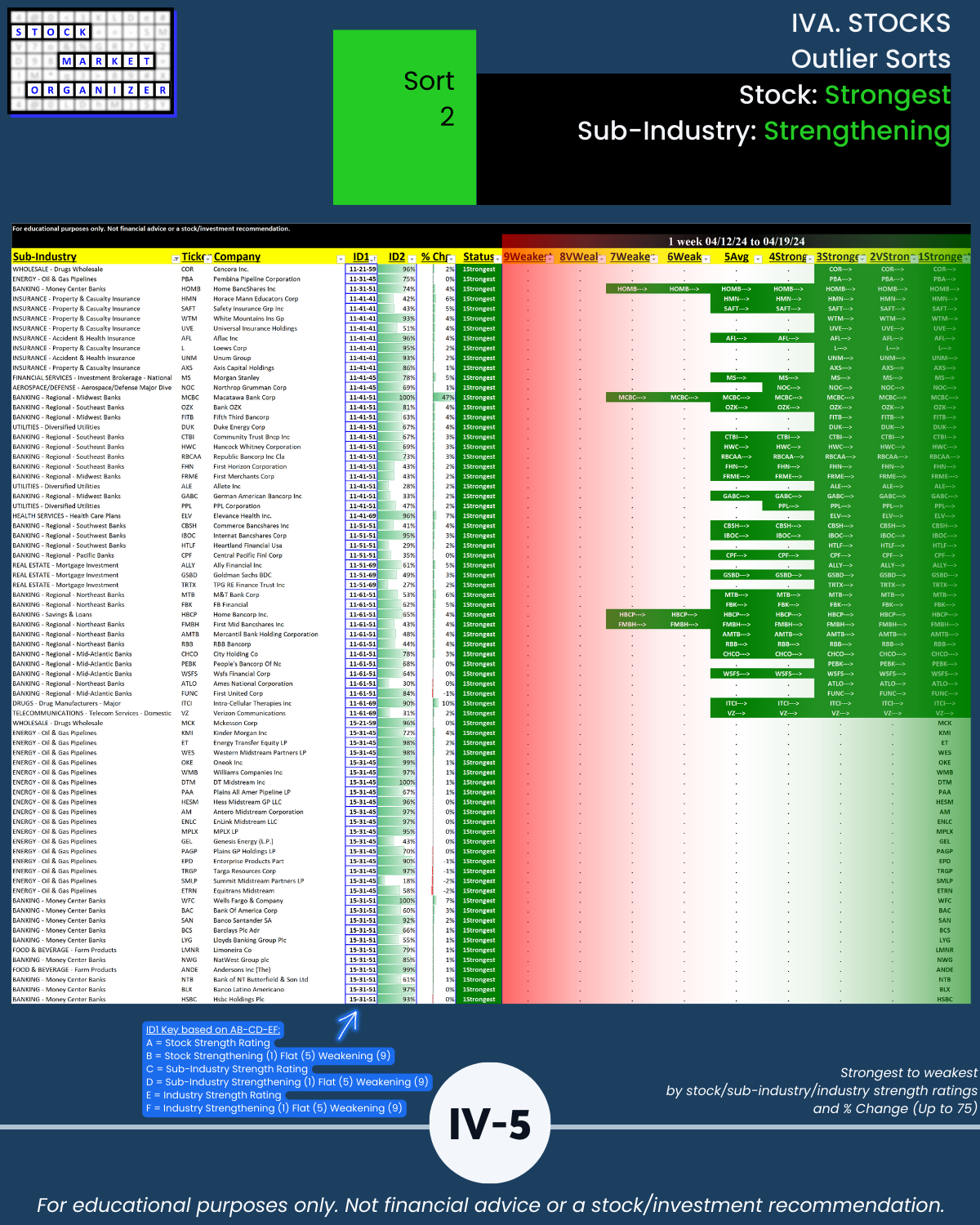

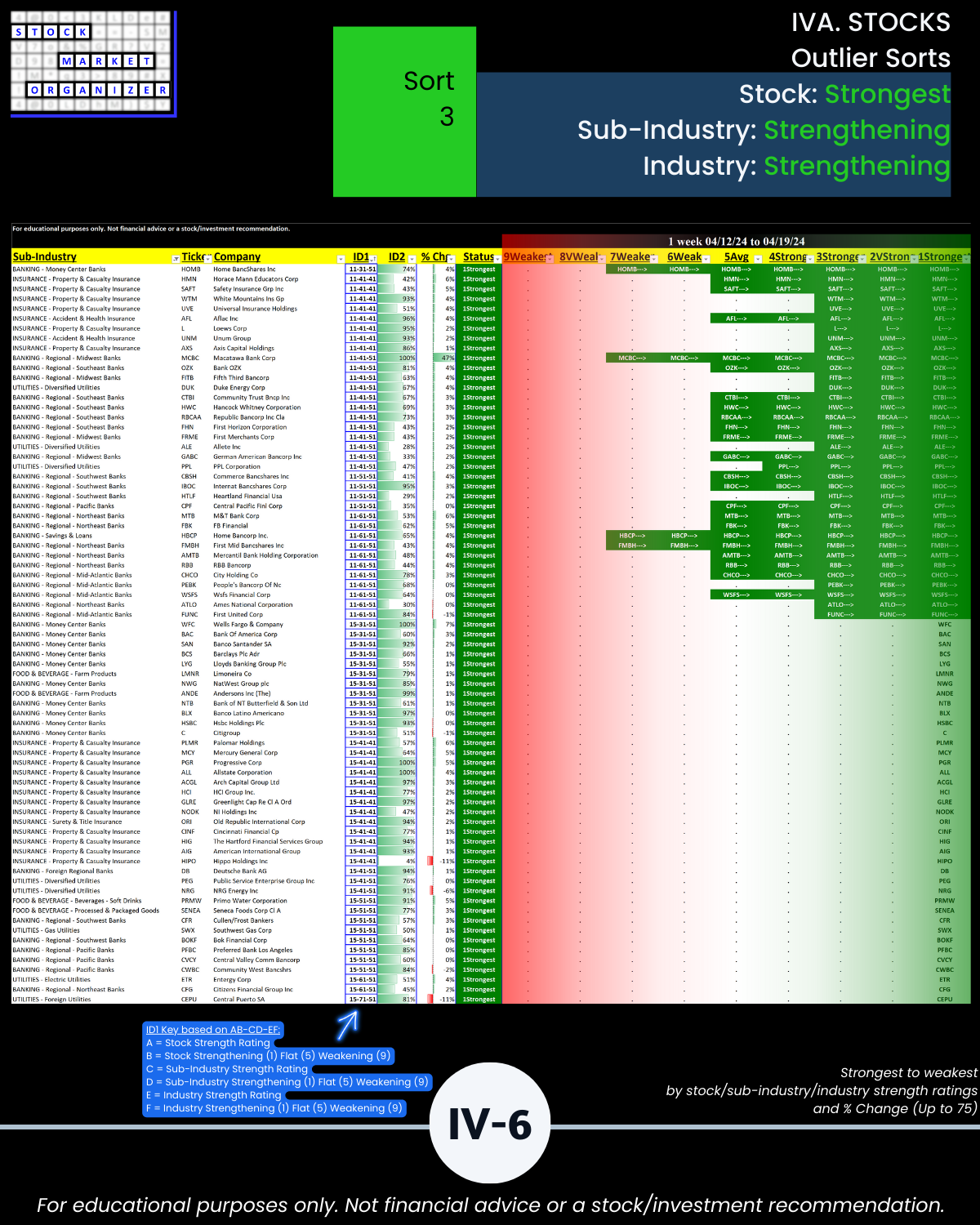

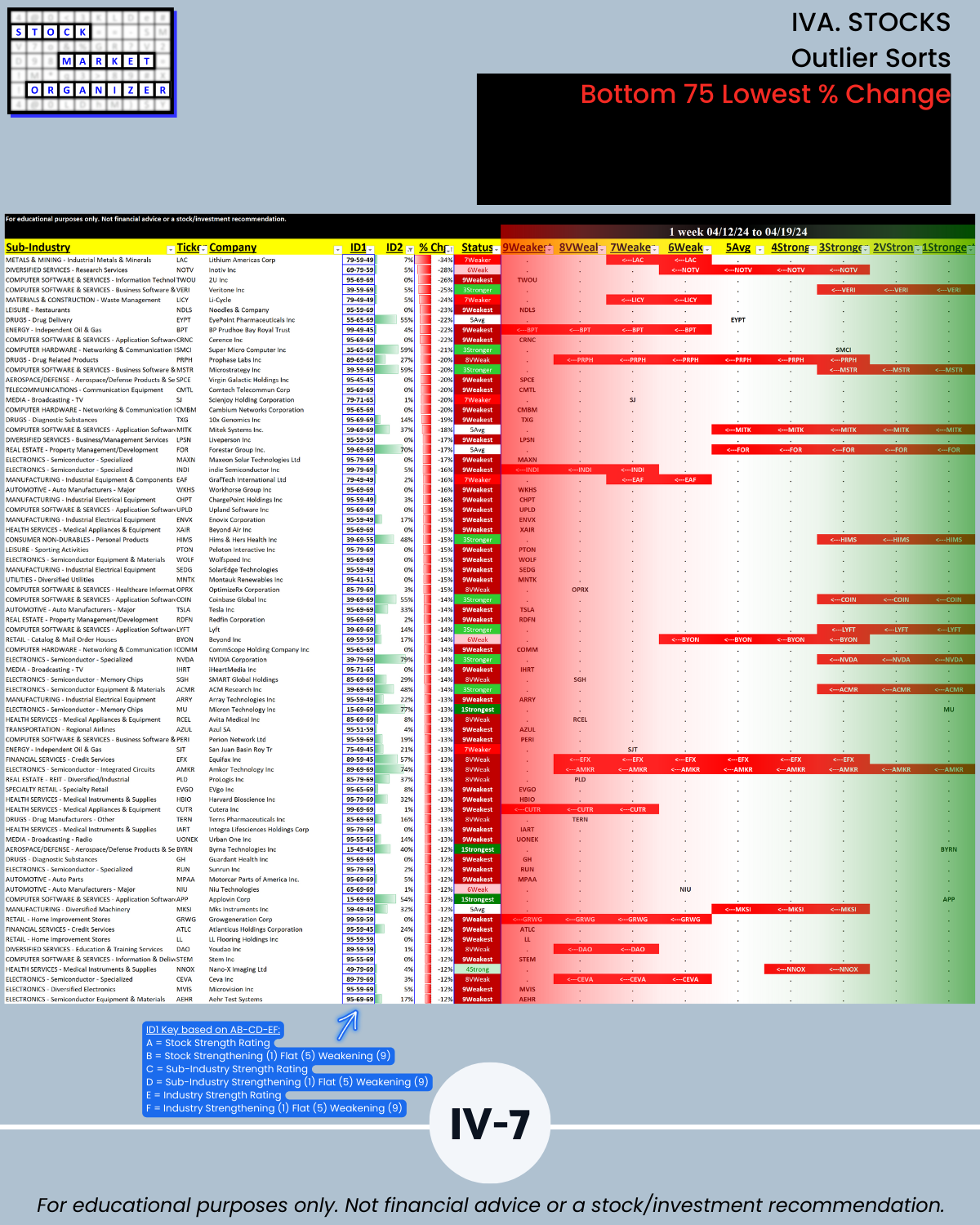

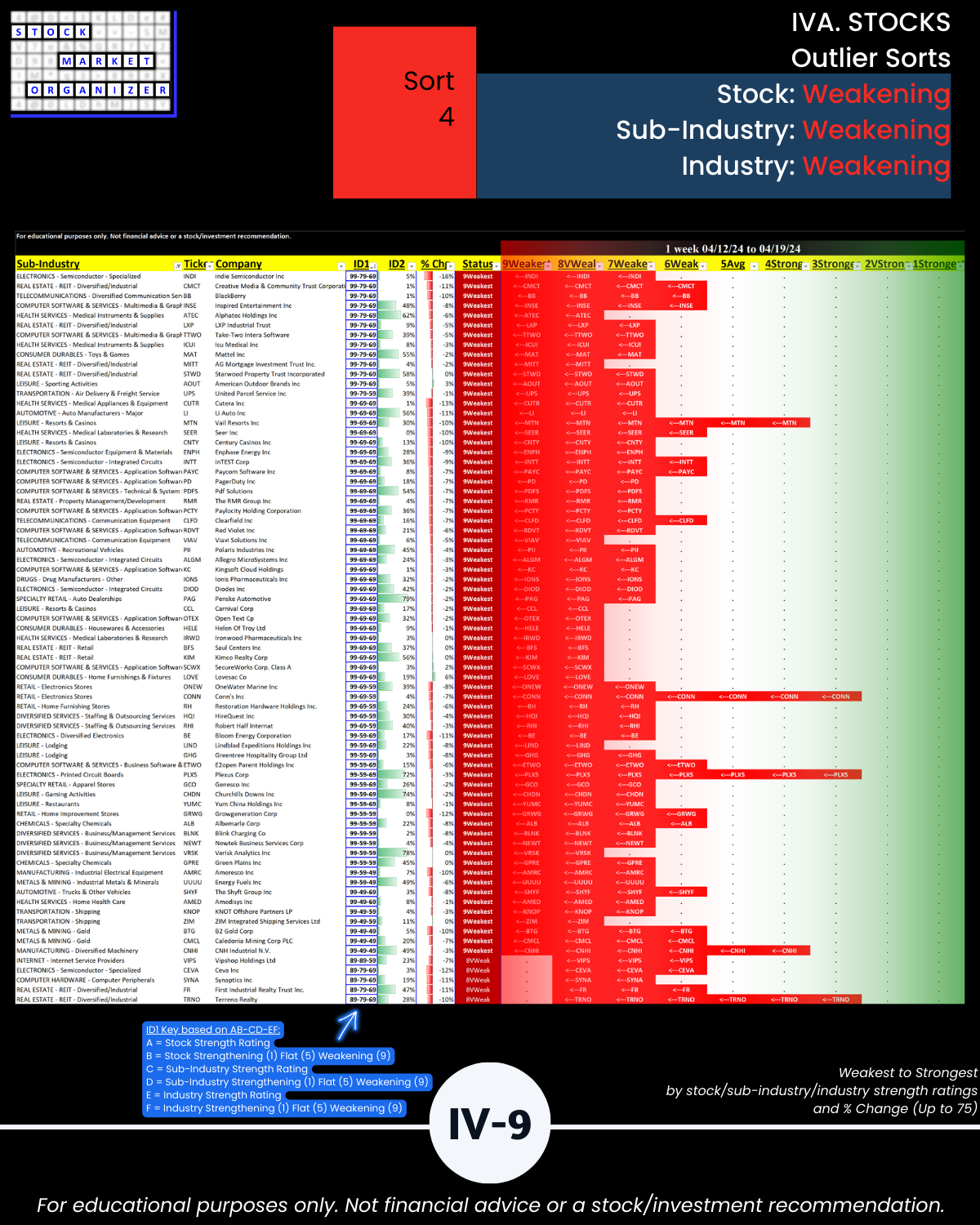

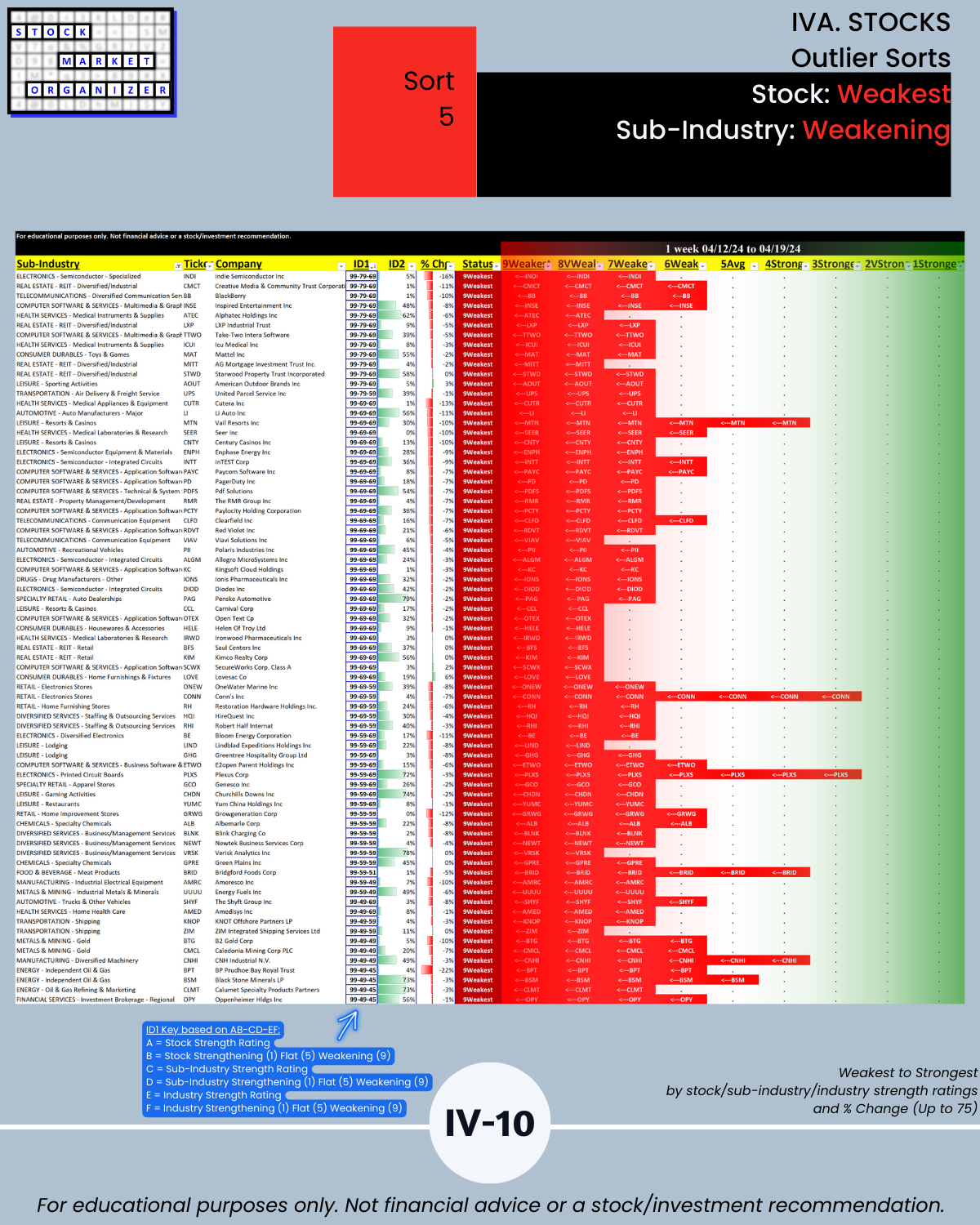

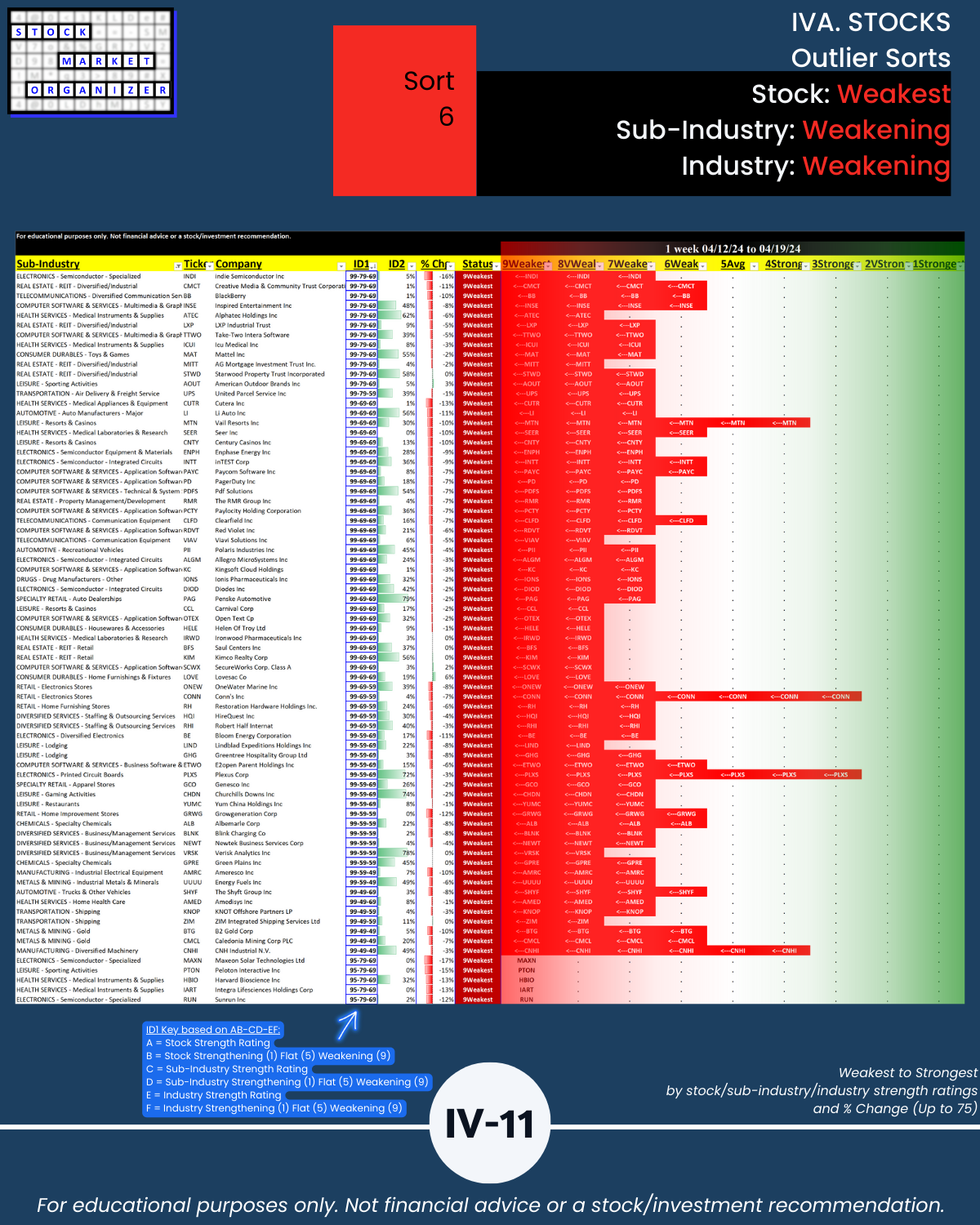

IVA. STOCKS Outlier Sorts

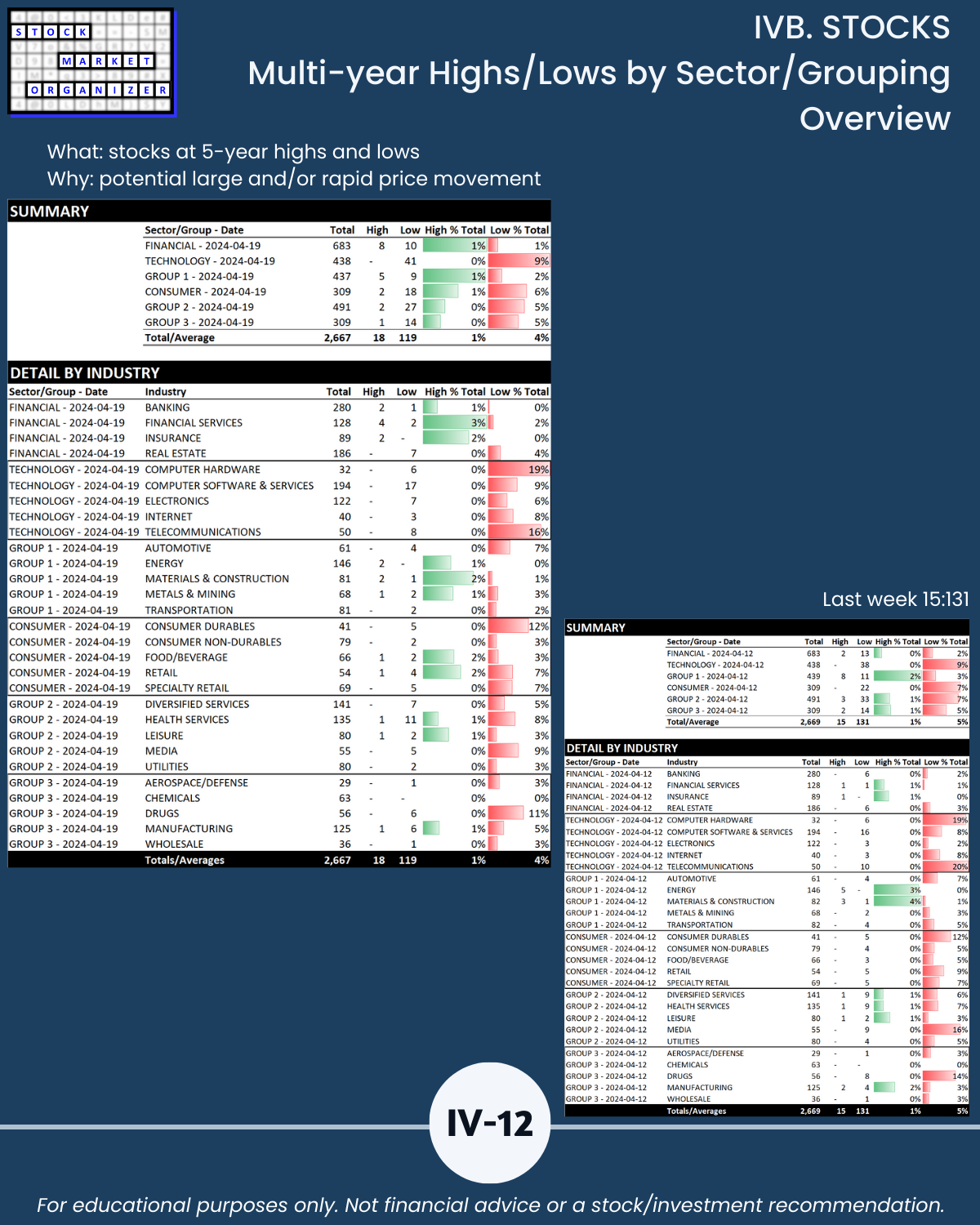

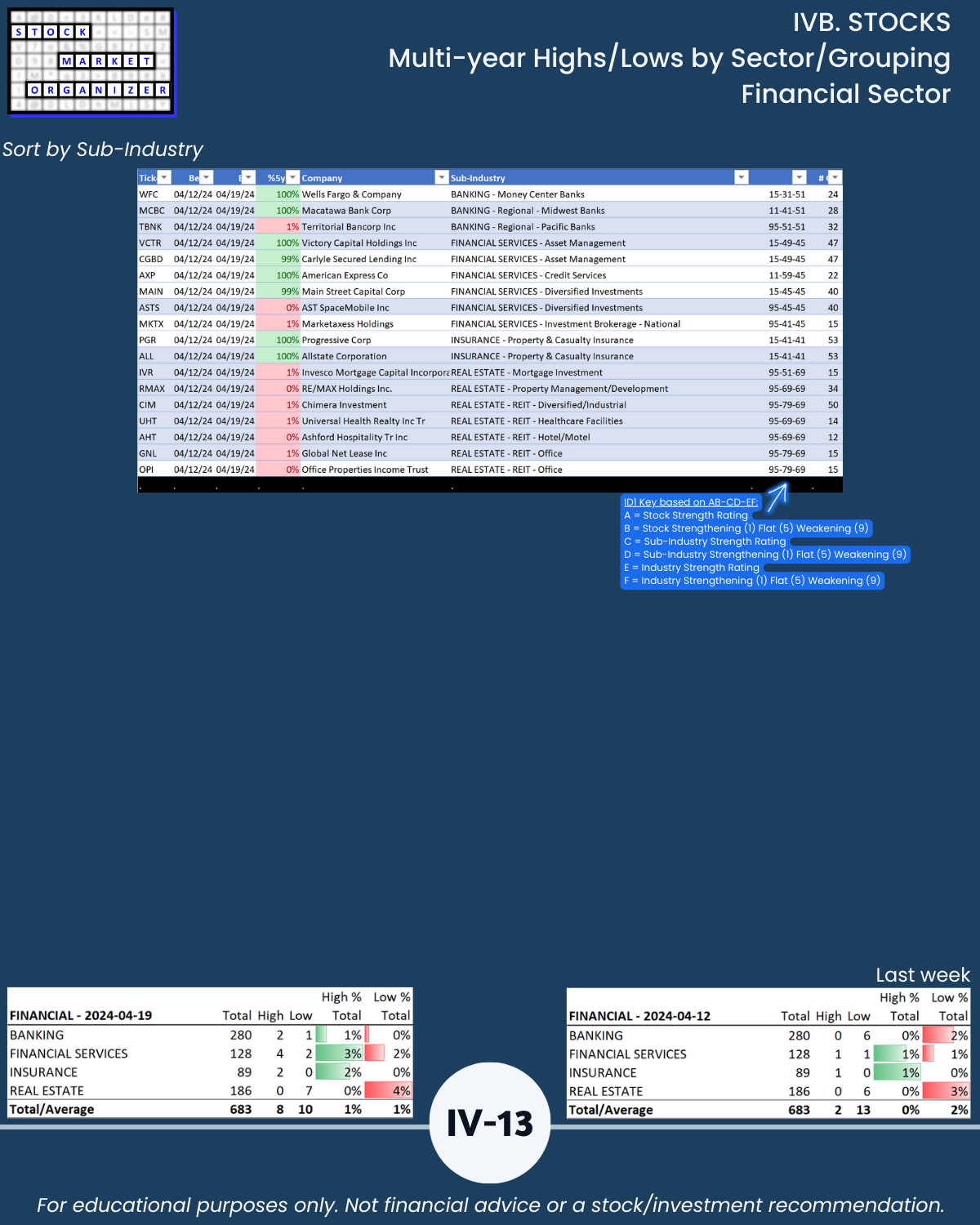

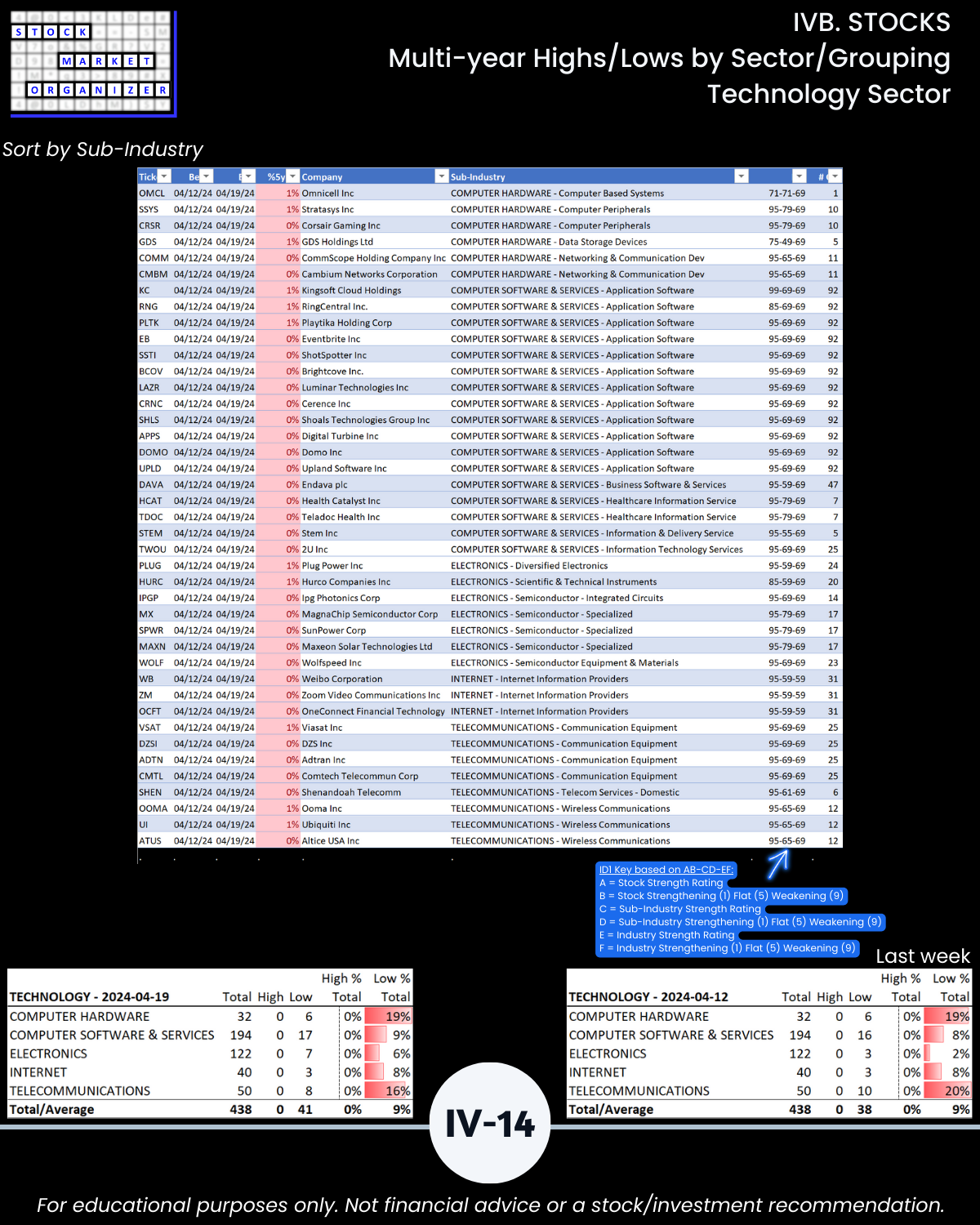

IVB. STOCKS Multi-Year Highs/Lows by Sector/Grouping

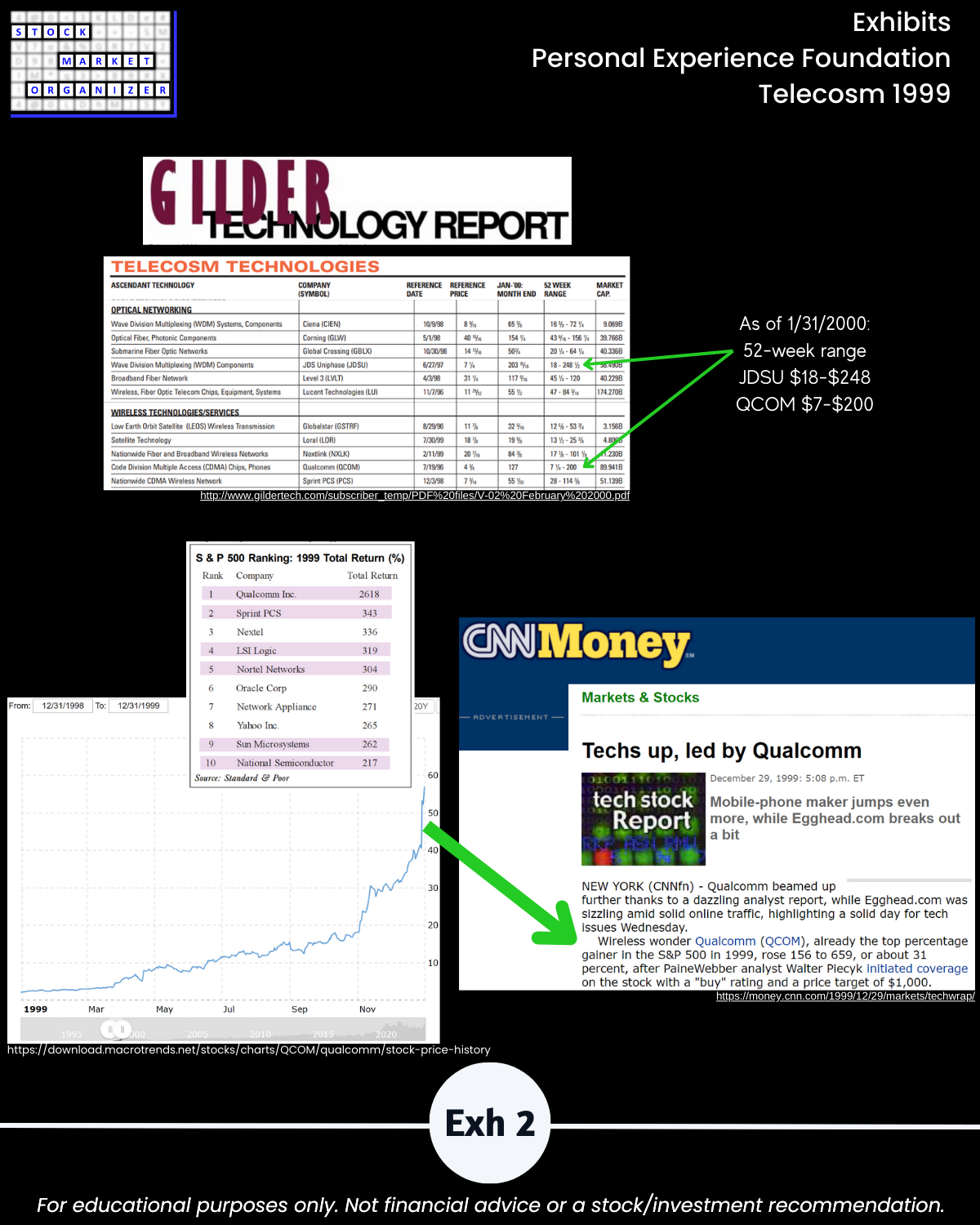

IV. EXHIBITS System Foundations