SMO Exclusive: U.S. Stock Market Strength Report 2024-03-22 (no new Shorts)

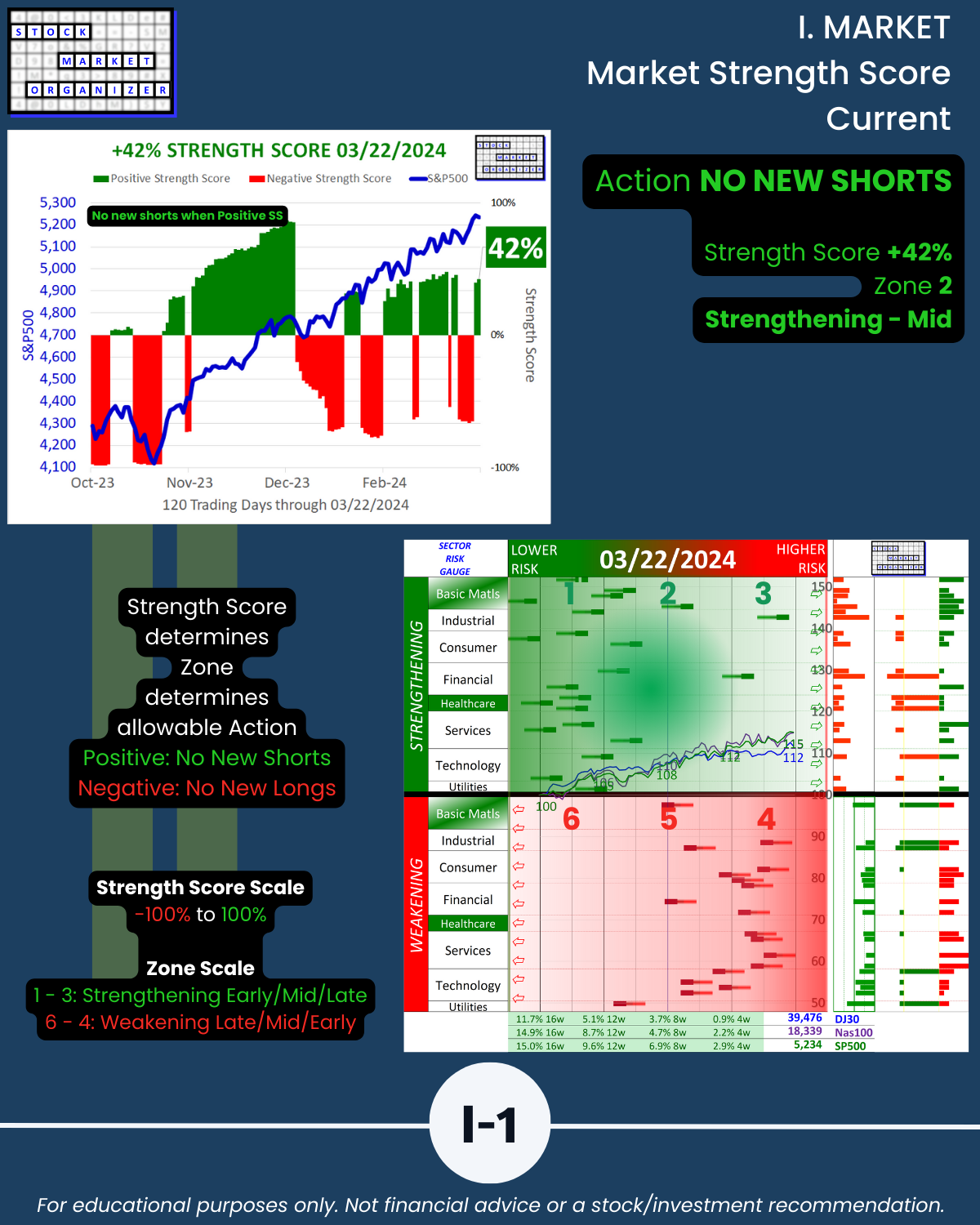

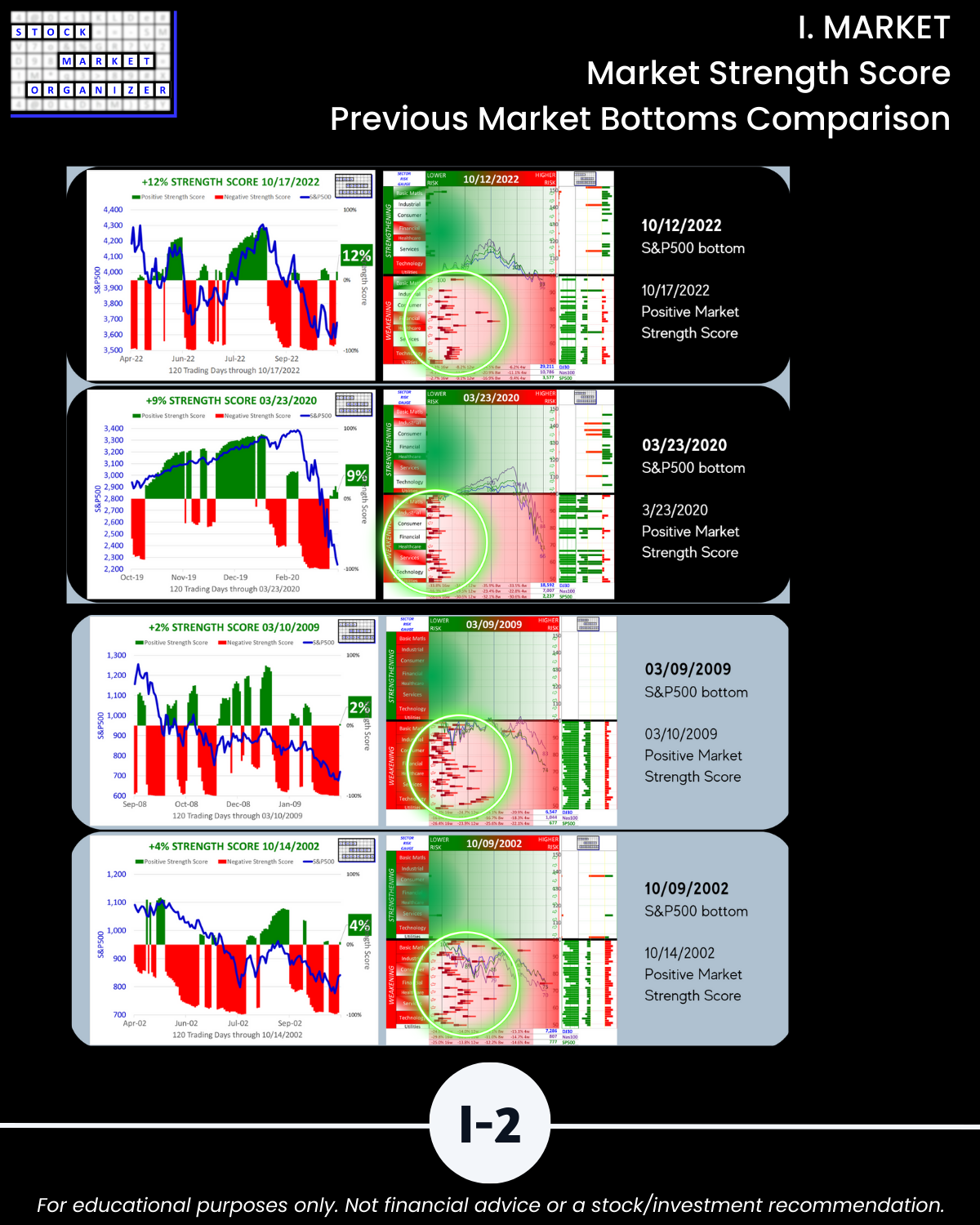

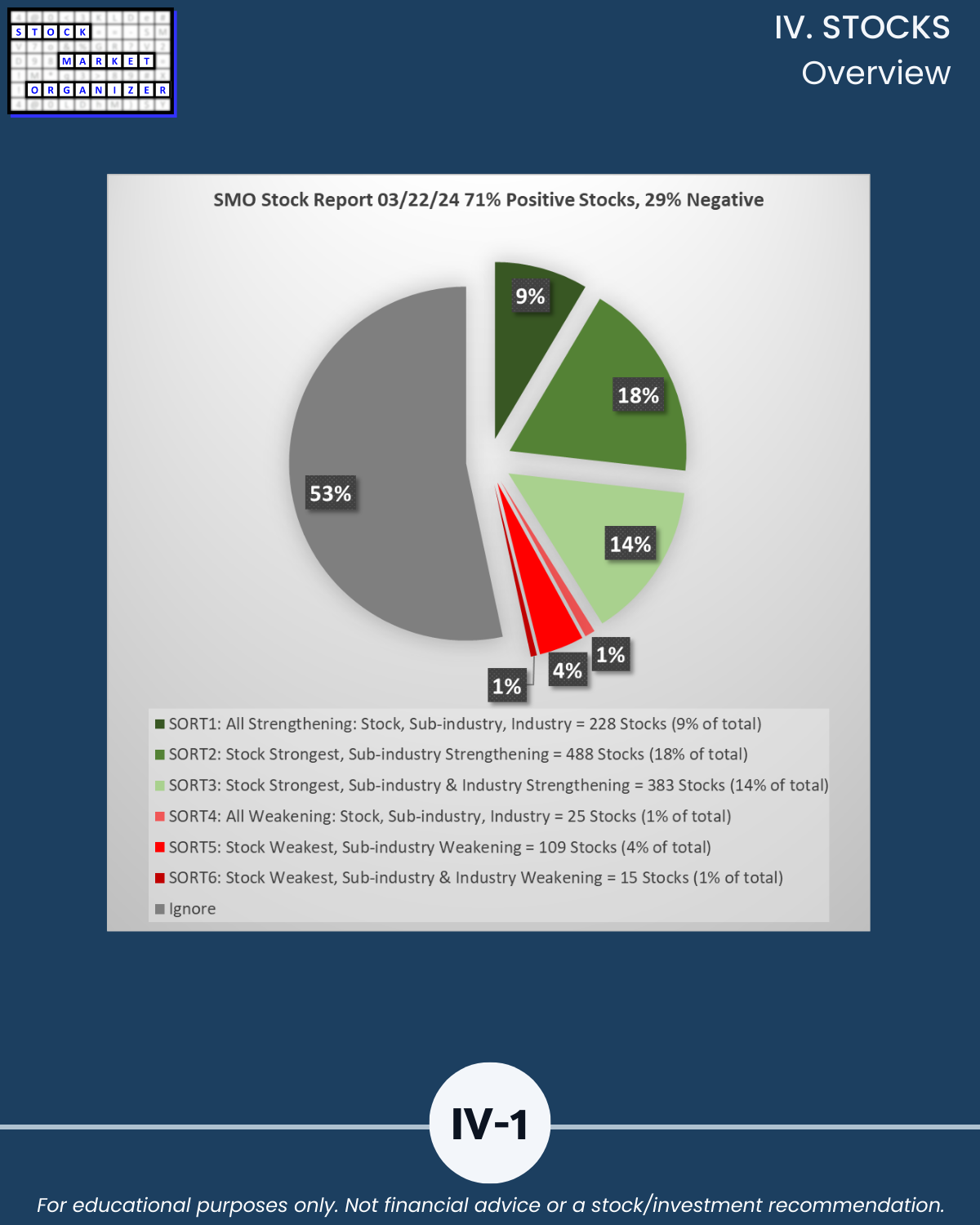

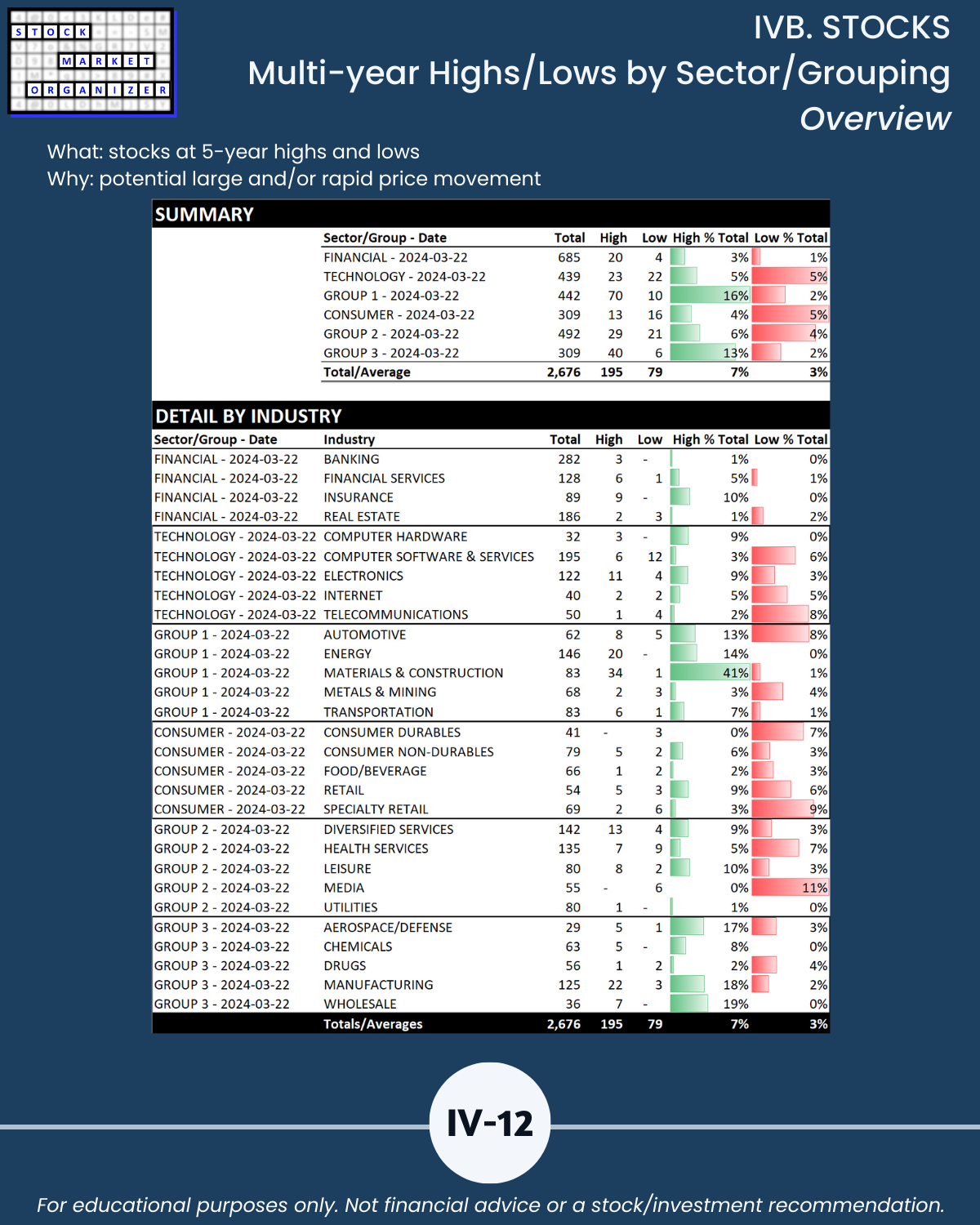

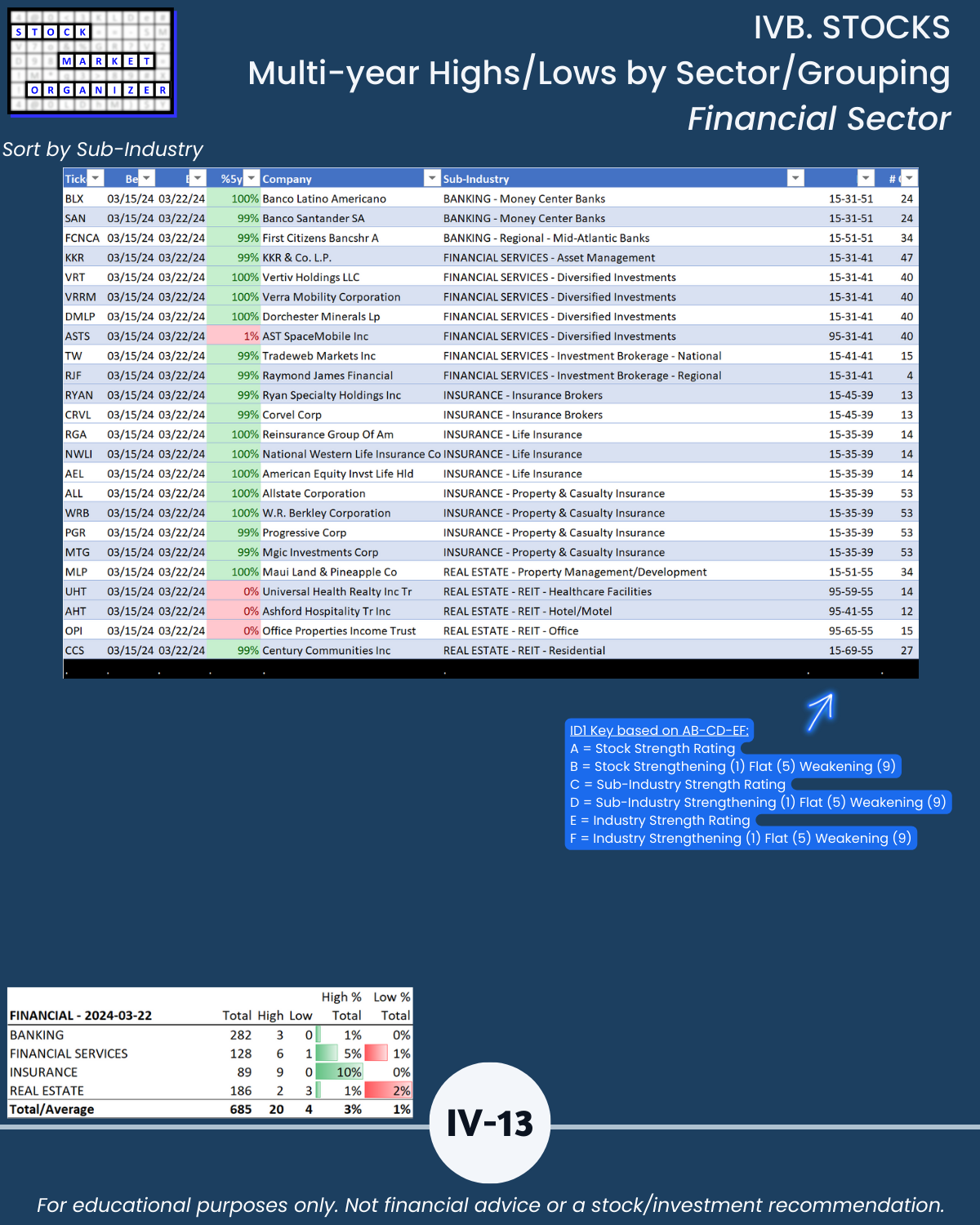

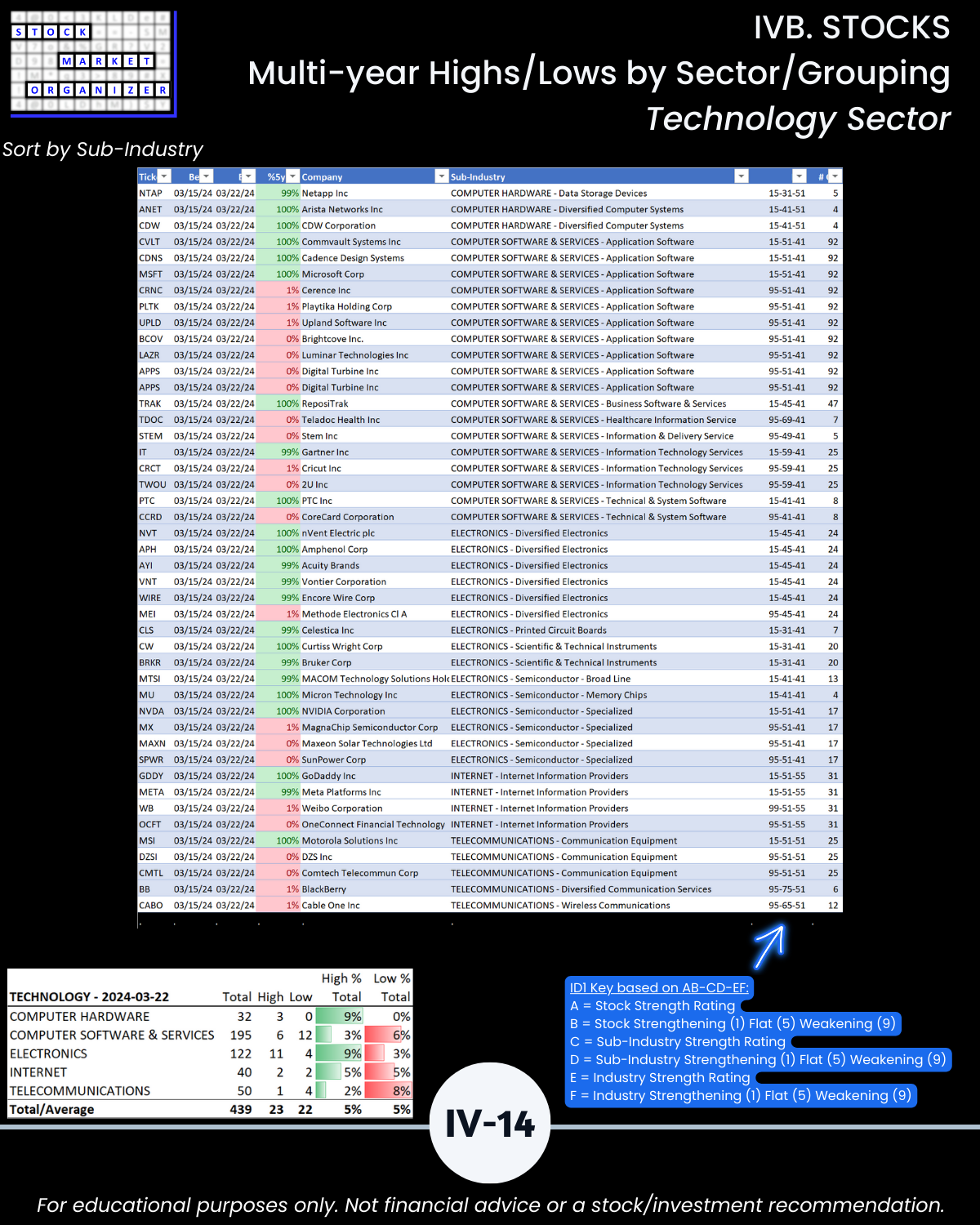

Presenting your comprehensive, actionable, improved handle on the 3/22/24 U.S. Stock Market. Bonus: with the market at ATHs see Section IV unique stock listings so you can 🔹 stack strength in your stocks and 🔹 find weak stocks in weakening sub-industries and weakening industries. If these weak stocks haven’t yet participated in the market rally, what will happen to them in a market decline? (Not stock recommendations.)

The market does not have to be so complicated. This analysis provides a unique compilation of insights available when focusing on strength in the market – at every level from individual stocks up to the overall market.

This material:

🔹 is unavailable elsewhere in this form and because of this

🔹 will complement your perspective no matter what.

WHY SHOULD YOU CARE?

See unique Section IV stock sorts.

🔹 You won’t find: marked-up price charts. You’ll do this yourself or find these elsewhere.

🔹 You will find: outliers that matter, with criteria unavailable elsewhere.

OUTLIERS THAT MATTER

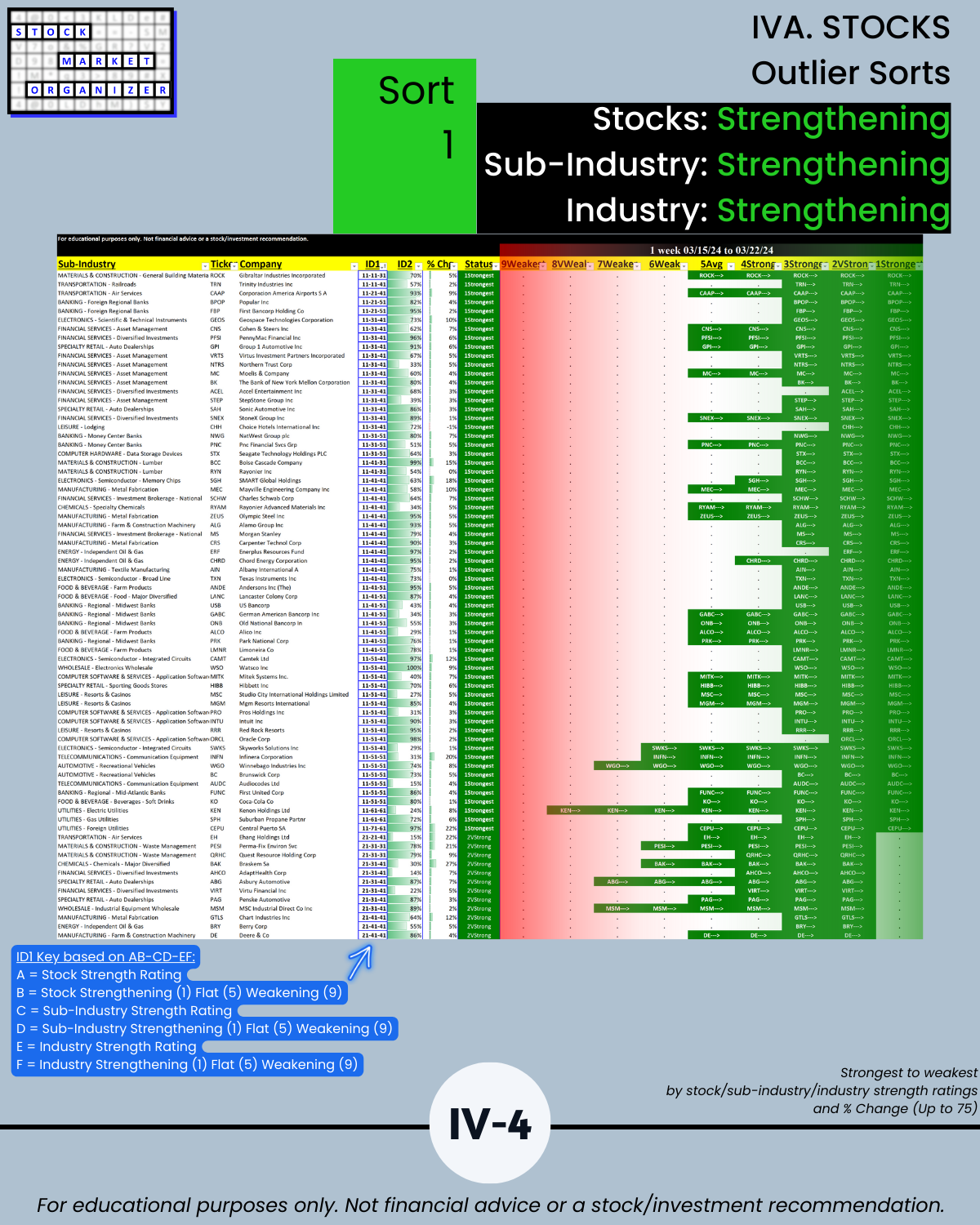

Page IV-4 Sort 1:

Stack strength in your stocks with

🔹 Strengthening stocks in

🔹 strengthening sub-industries in

🔹 strengthening industries.

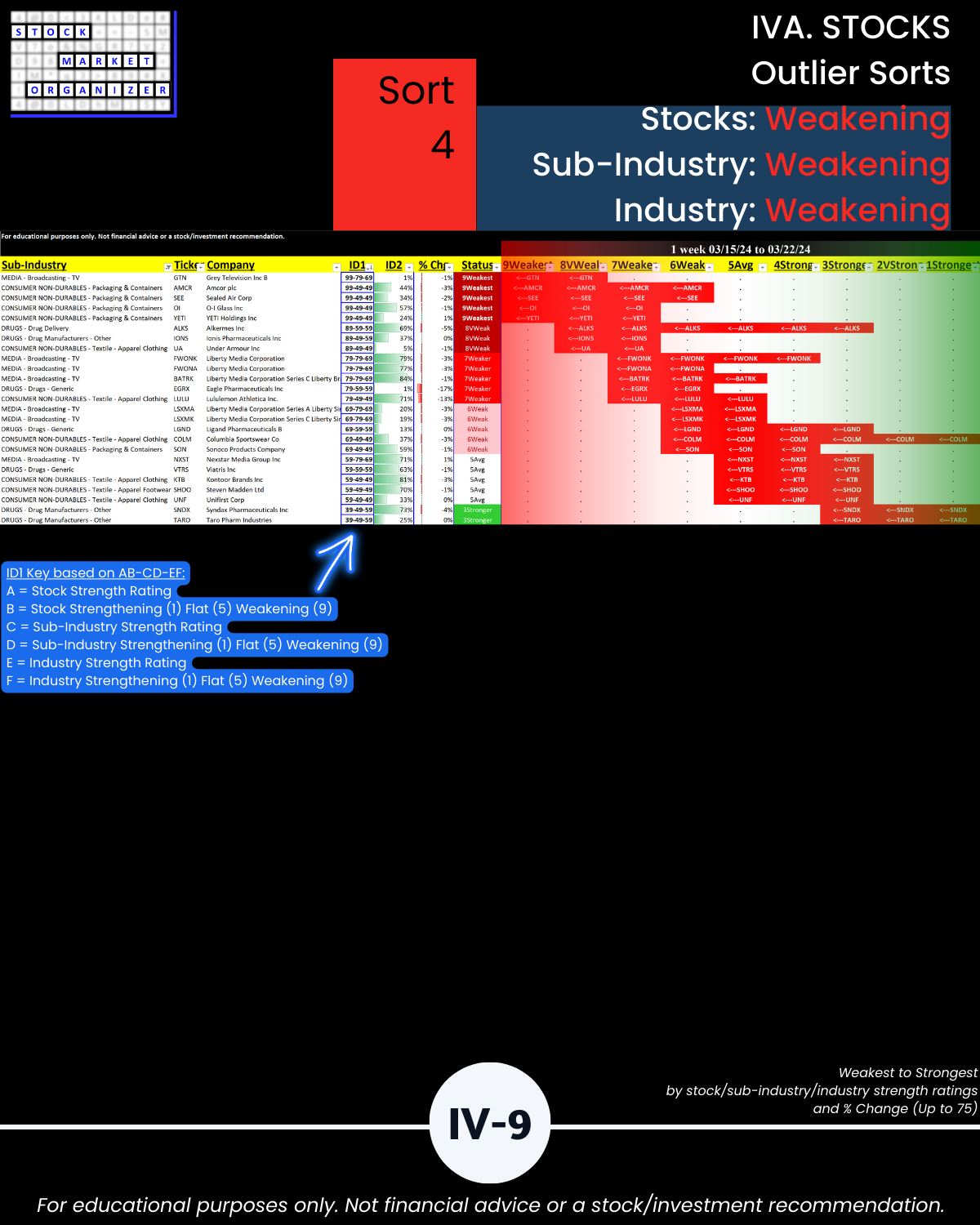

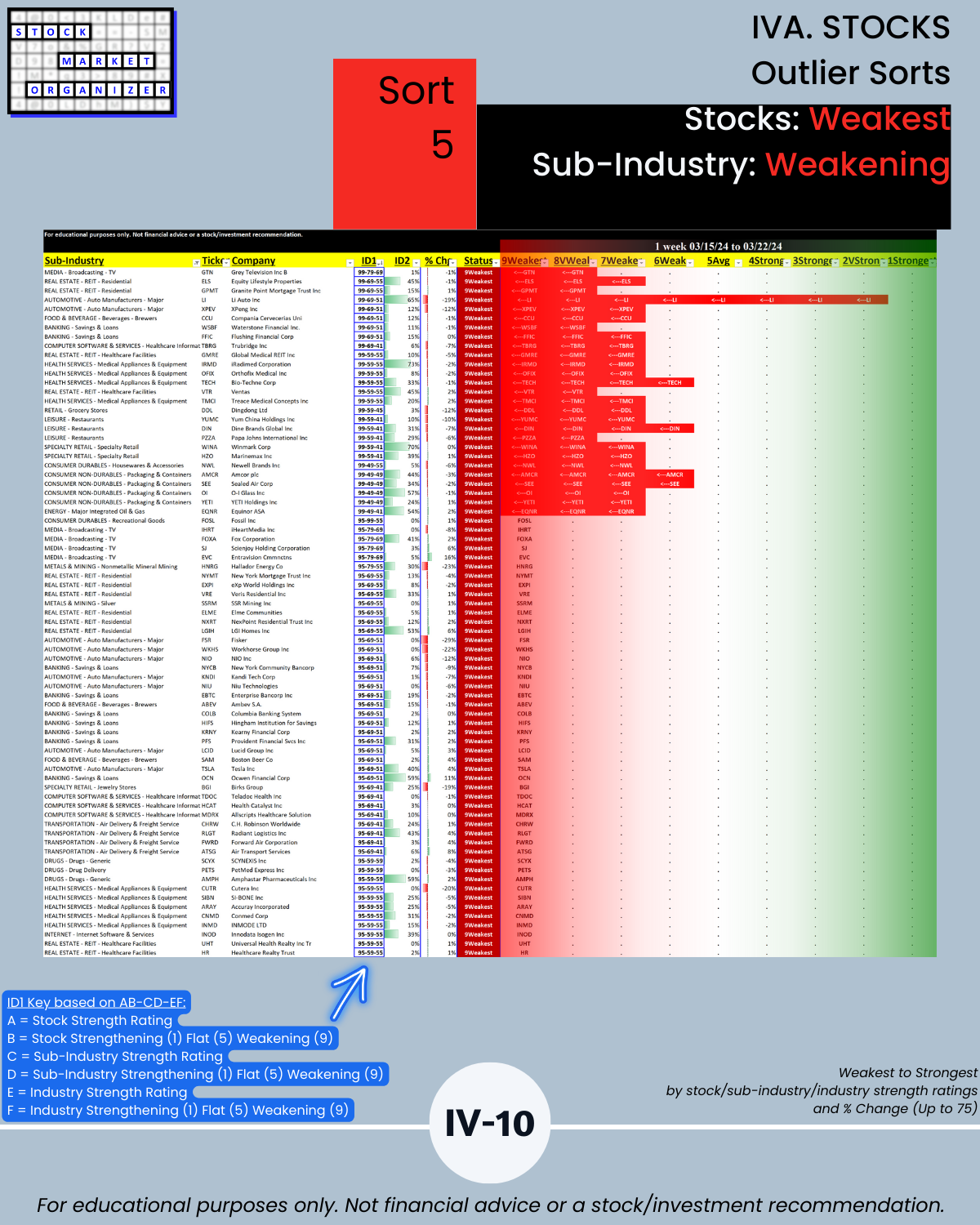

Page IV-11 Sort 6:

Find weak links with no sub-industry or industry support:

🔹 Stocks rated Weakest (lowest of 9 strength levels) in

🔹 weakening sub-industries in

🔹 weakening industries.

UNIQUE INSIGHTS

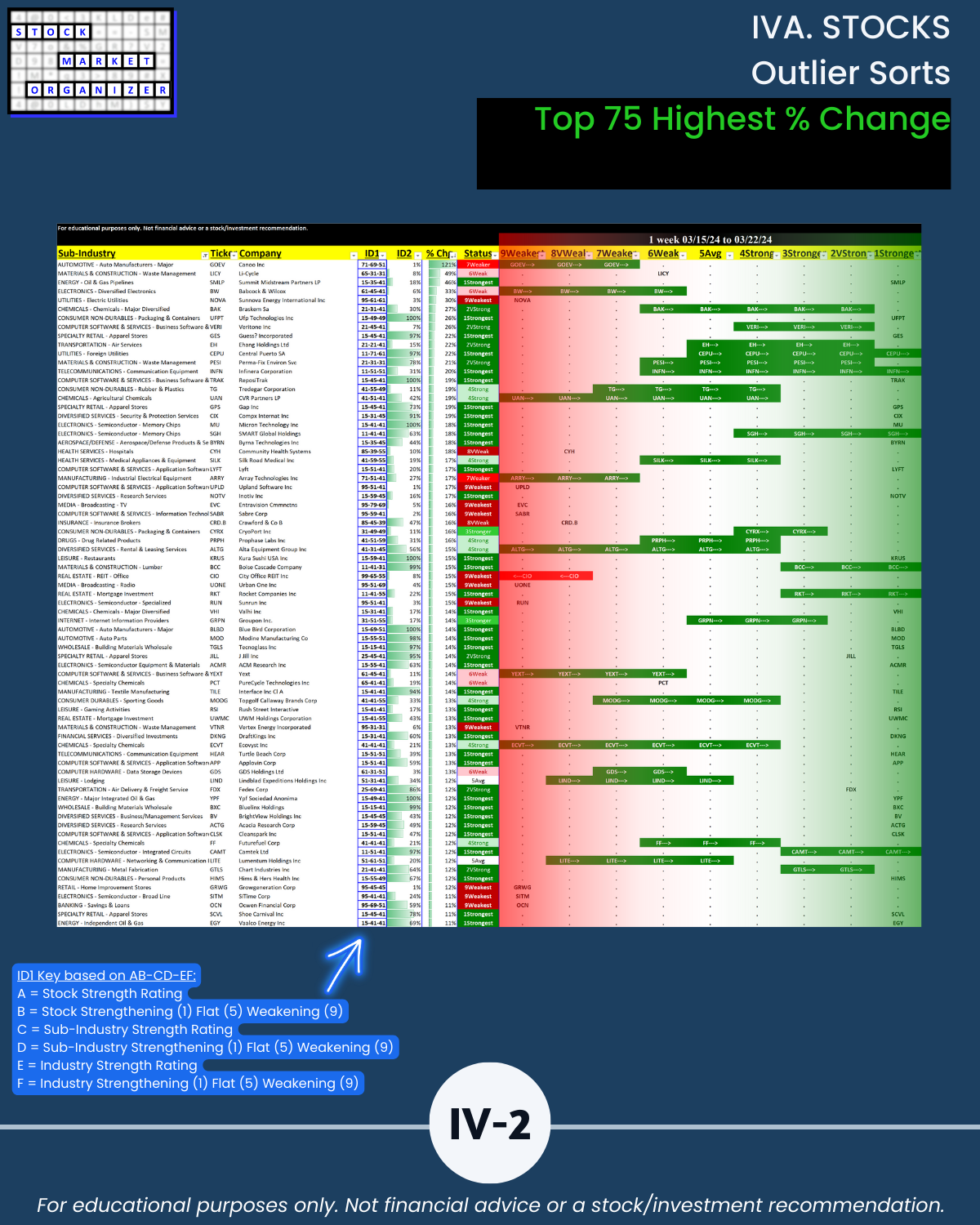

🔹 Available elsewhere: Top Weekly % Change Performers

🔹 Not available elsewhere: Stock Market Organizer ID = immediate relative standing

Page IV-2 Highest % Change report

Top performer GOEV +121% ID: 71-69-51

Status:

🔹 Stock is 7th strongest of 9 levels (Weaker) and is STRENGTHENING

🔹 Sub-industry is 6th strongest (Weak) and is WEAKENING

🔹 Industry is 5th strongest (Average) and is STRENGTHENING

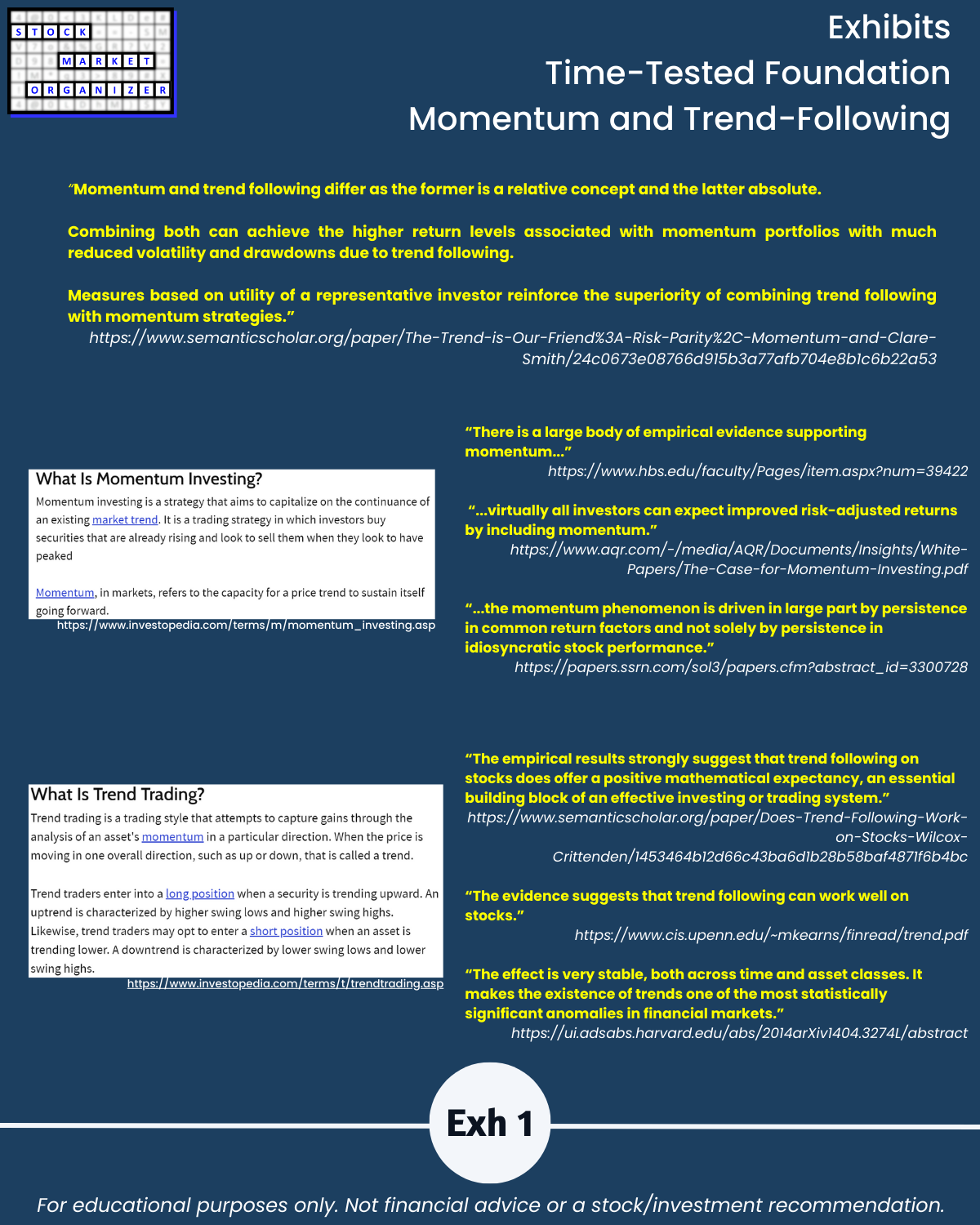

KEY CONCEPTS

🔹 Process and Discipline, not Outcome or Prediction

🔹 Market conditions matter

🔹 The stronger your stocks the greener your P&L

🔹 Prices uncoupled from fundamentals = opportunity

🔹 Multi-month+ rallies begin with one up week

🔹 100%+ returns start as 10% returns

🔹 You won’t find what you aren’t looking for

🔹 The market does not have to be so complicated

MODEL

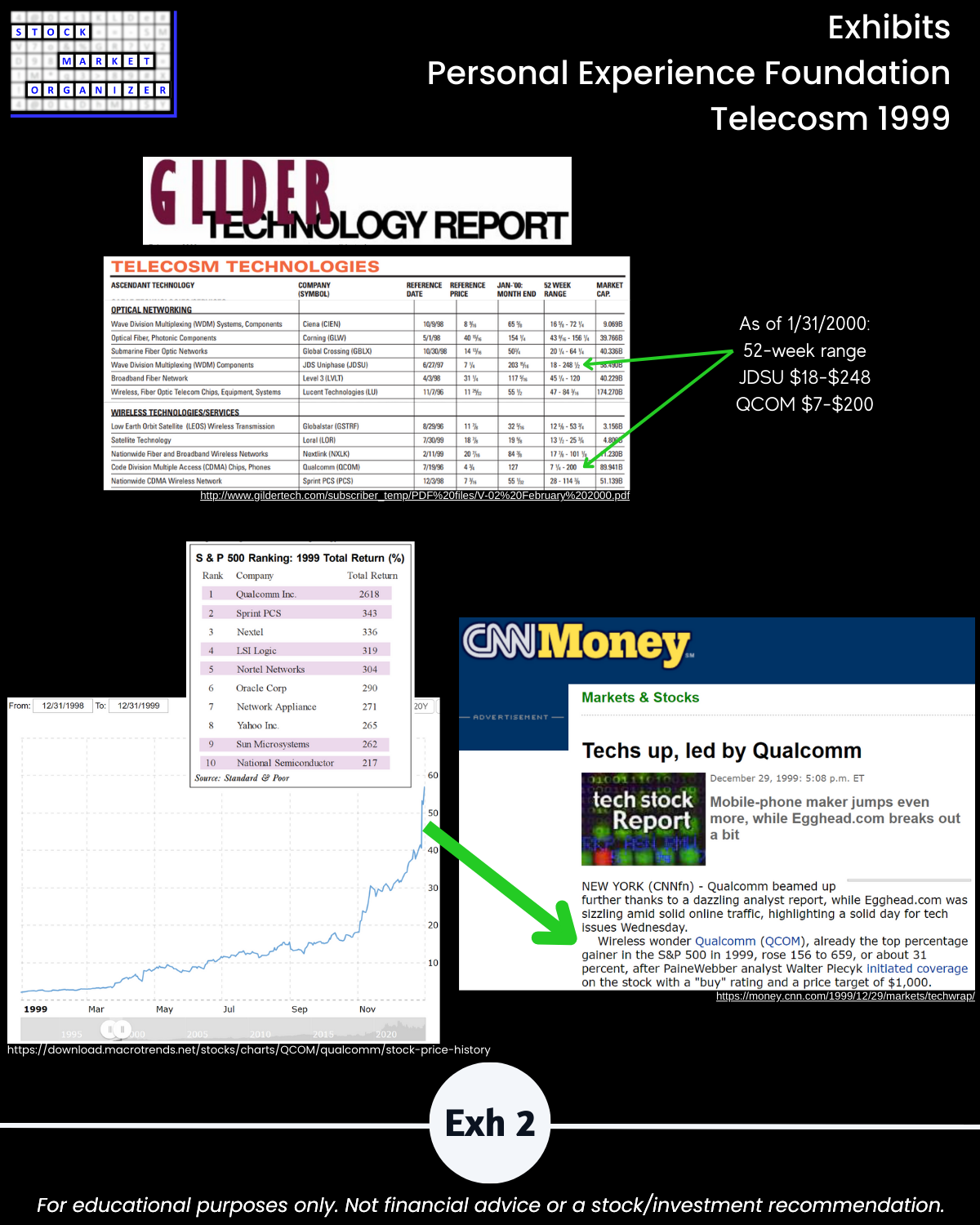

🔹 NVDA now: a rising outlier stock in a rising industry grouping (AI) in a rising market.

🔹 CSCO 1999: a rising outlier stock in a rising industry grouping (internet buildout) in a rising market.

(See Exhibit 2)

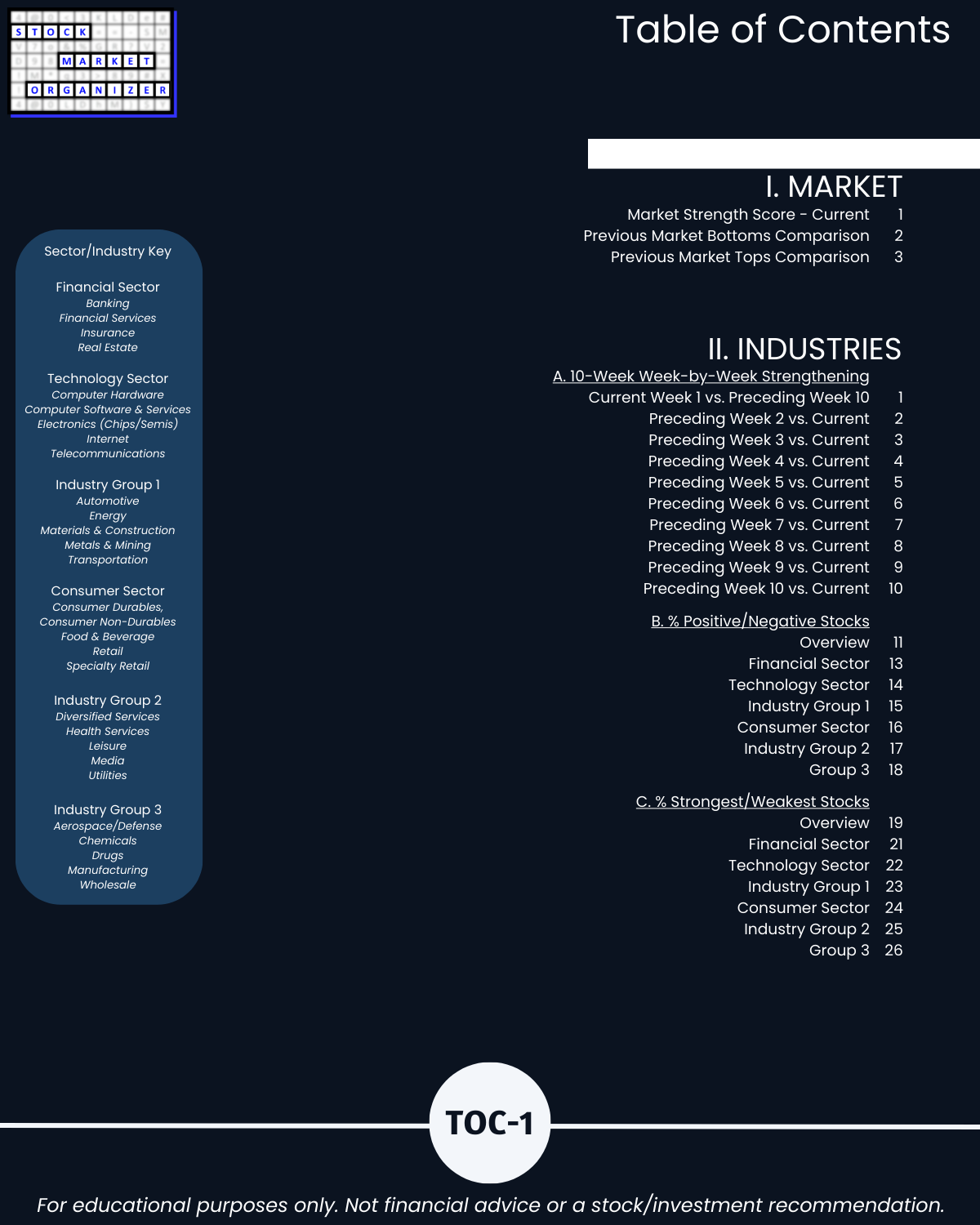

GOAL: To stack strength in the direction of outlier stocks, done via market analysis through the lens of

- 6 sectors/logical industry groupings covering

- 29 industries comprised of

- 198 sub-industries and

- 2,674 stocks.

Following are galleries with page-by-page views of this report.

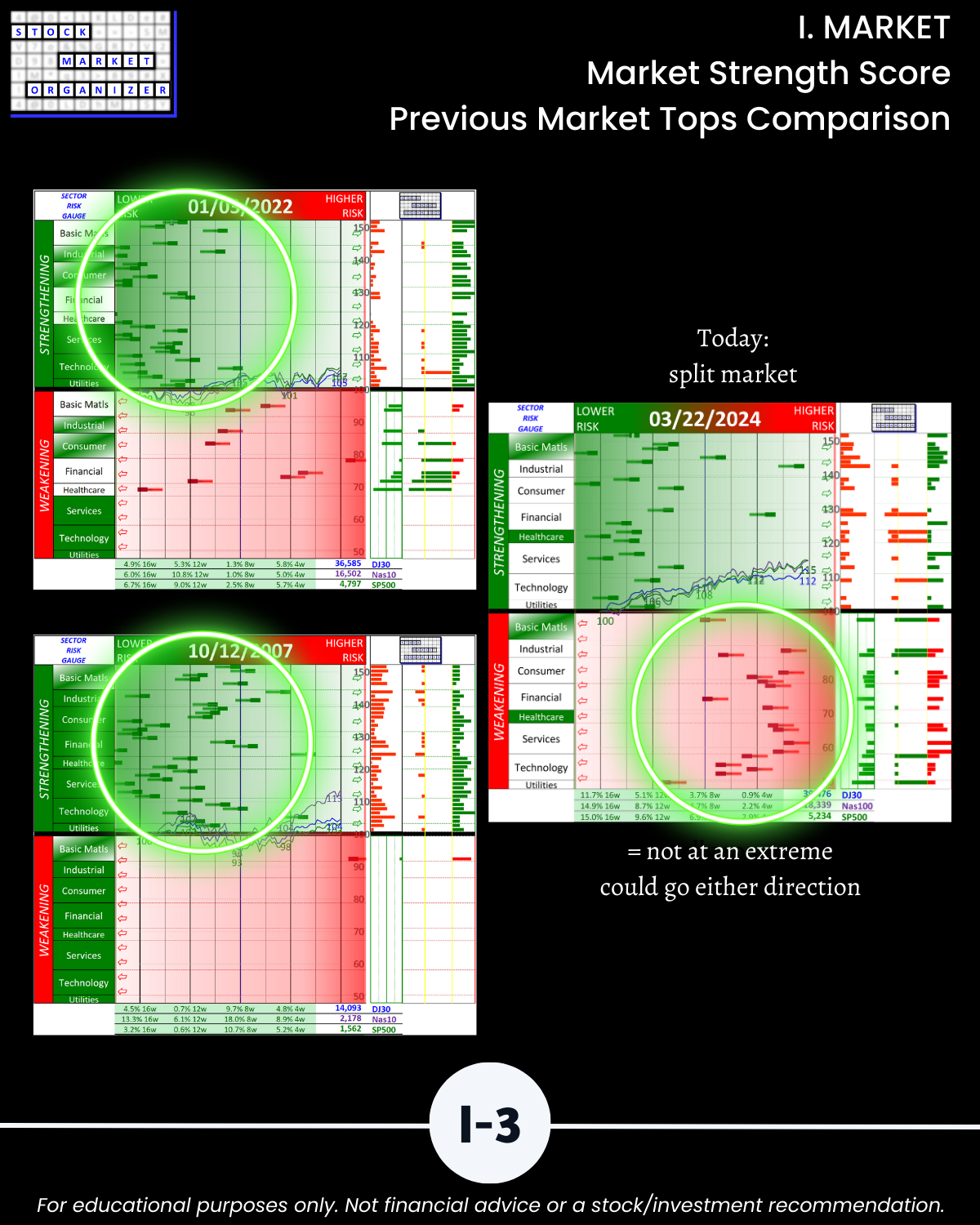

I. MARKET Prologue Critical Concepts/Market Strength Score

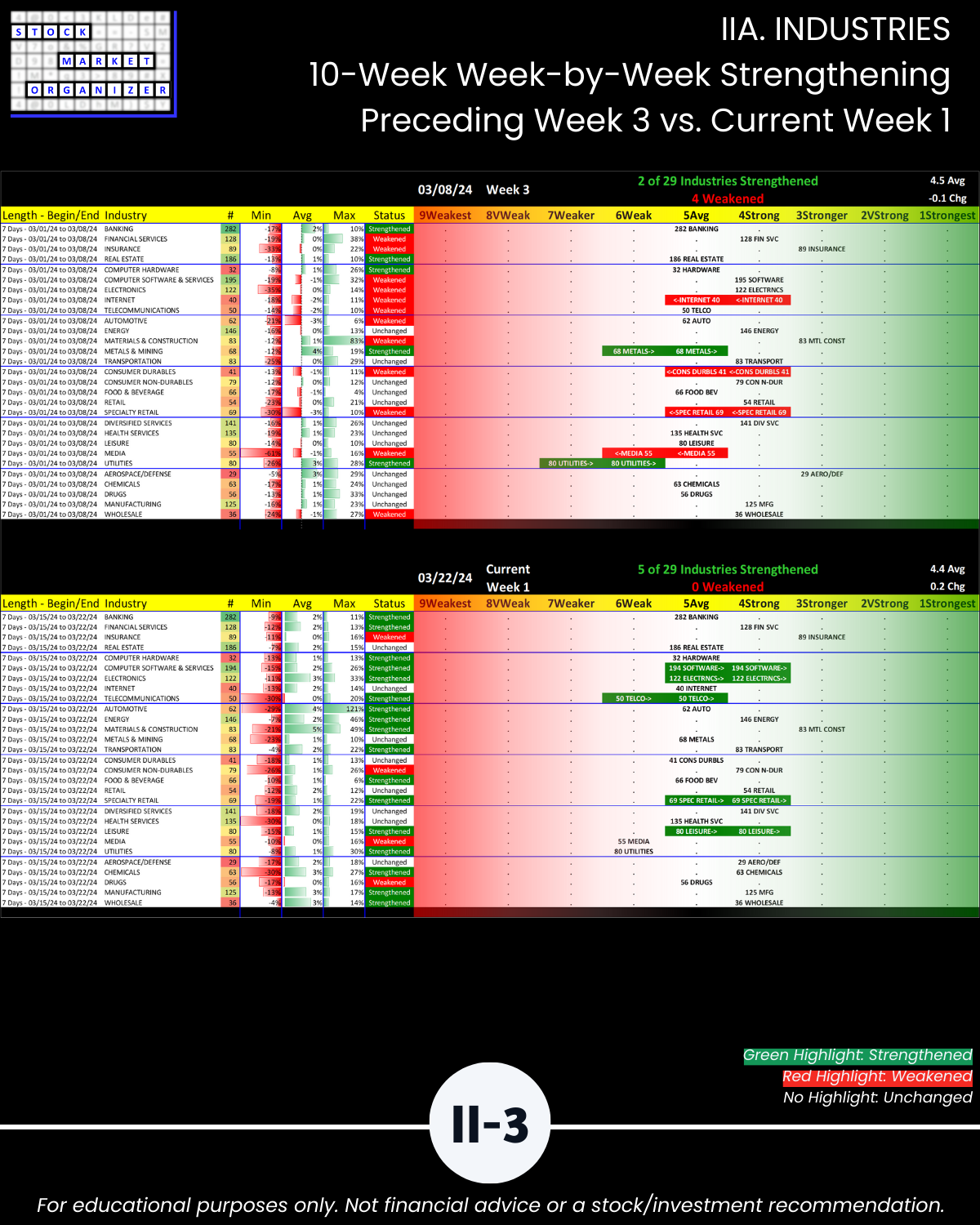

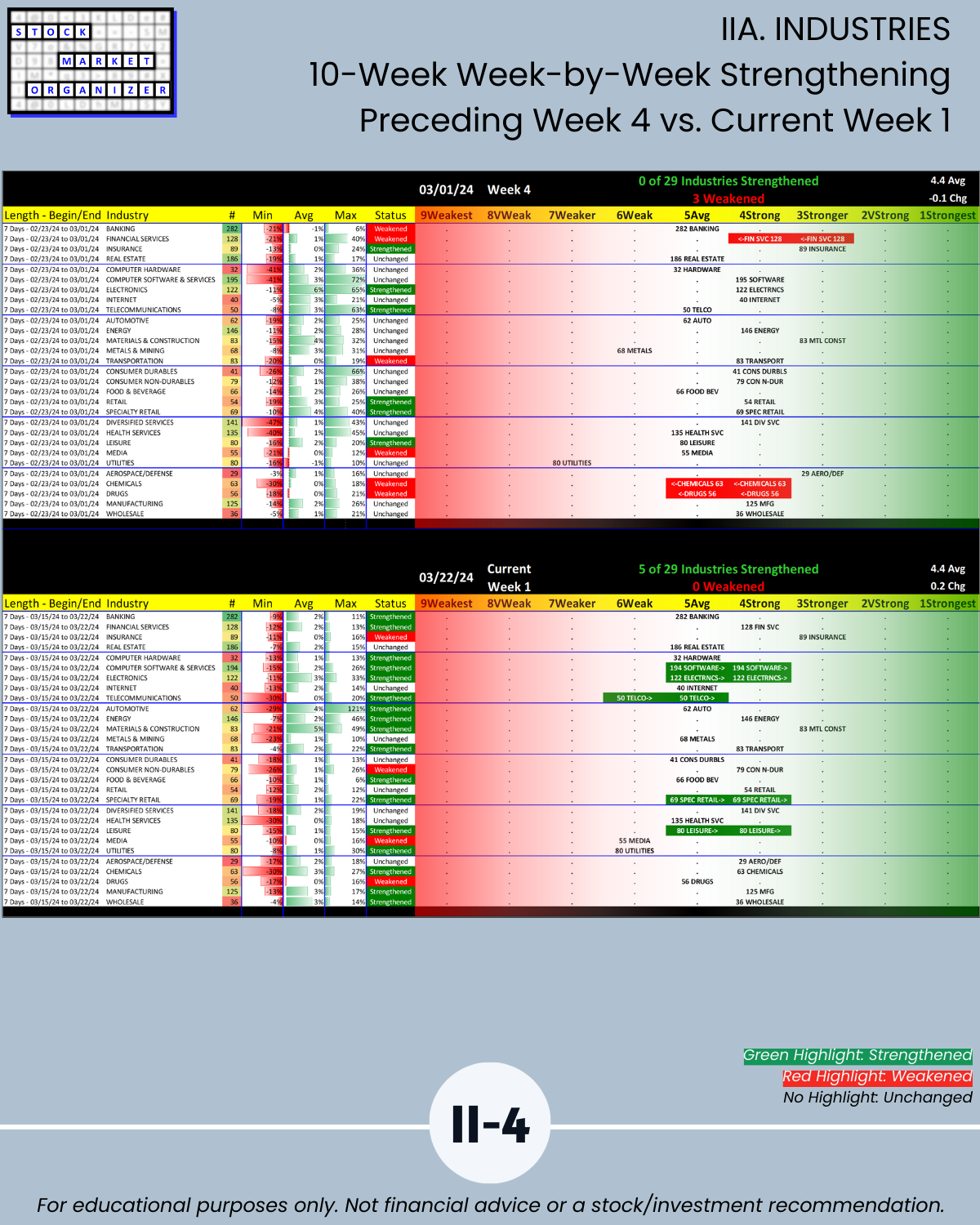

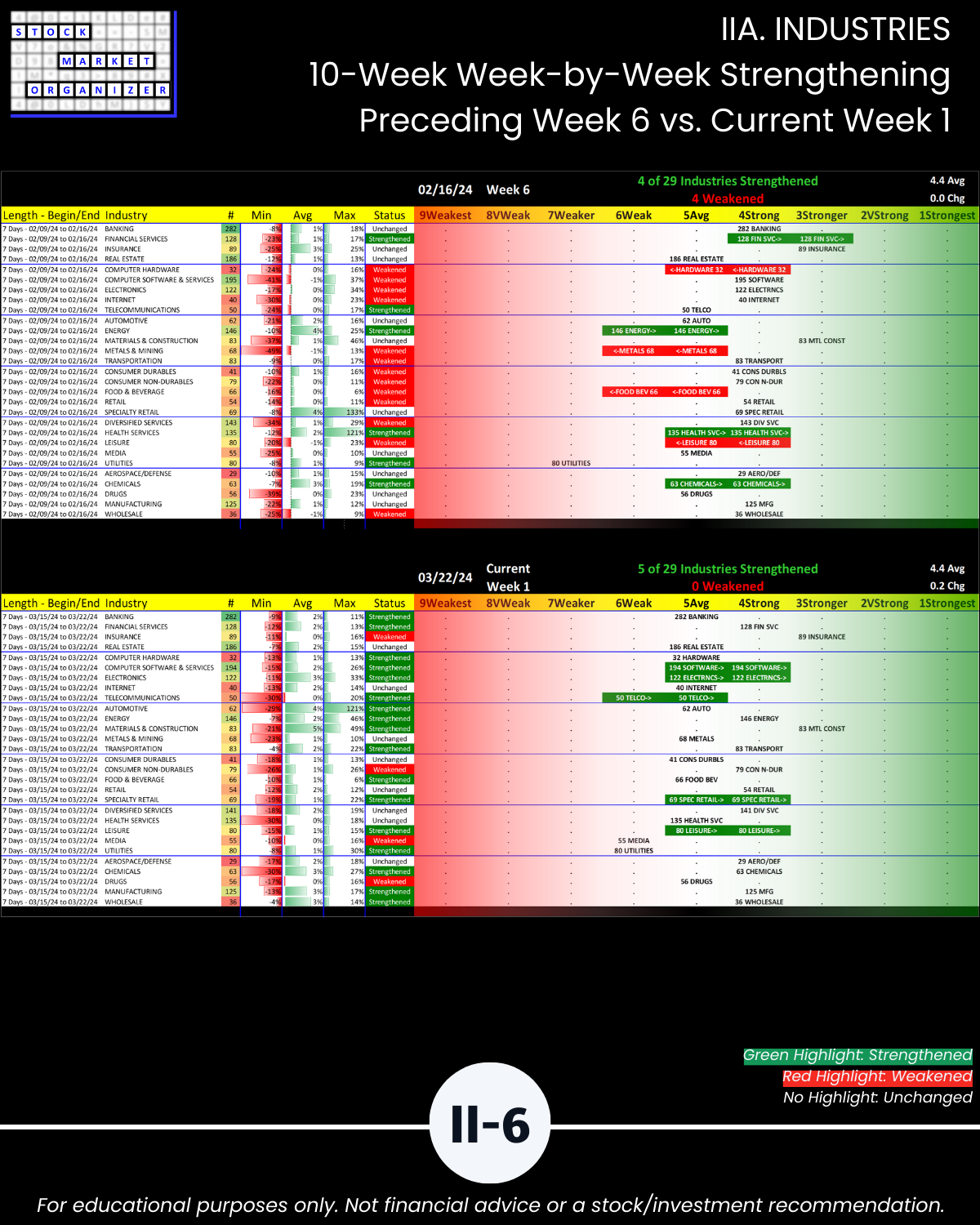

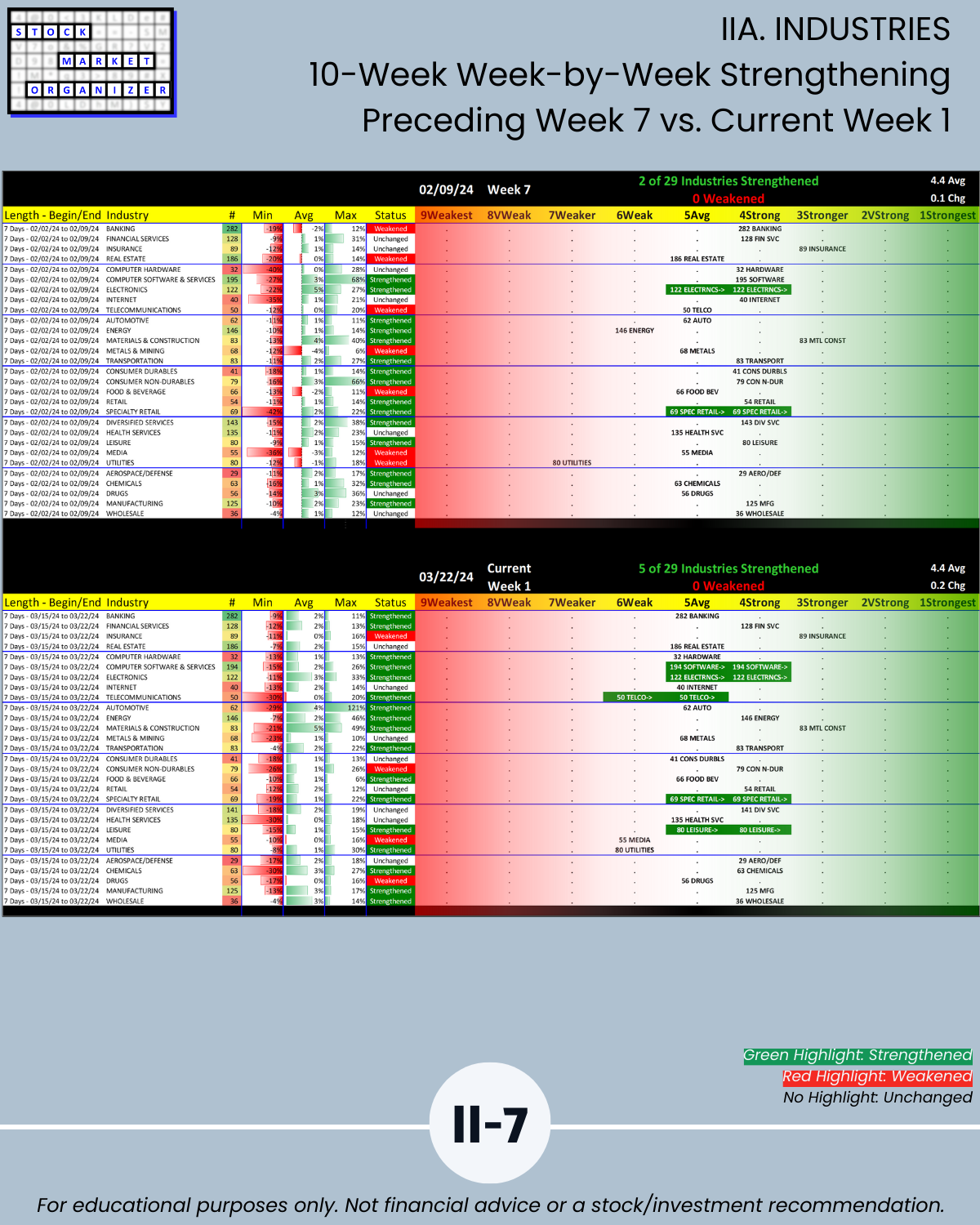

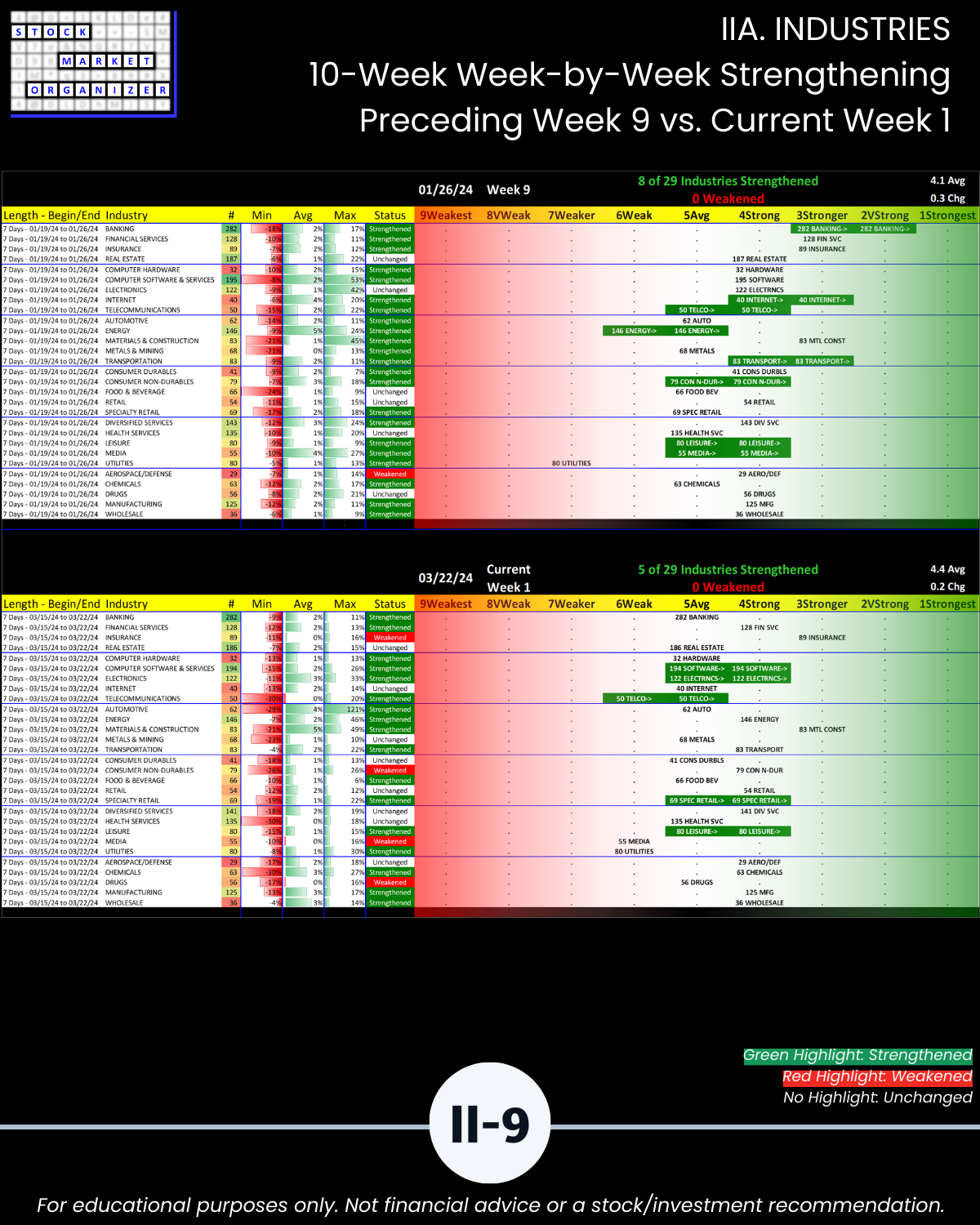

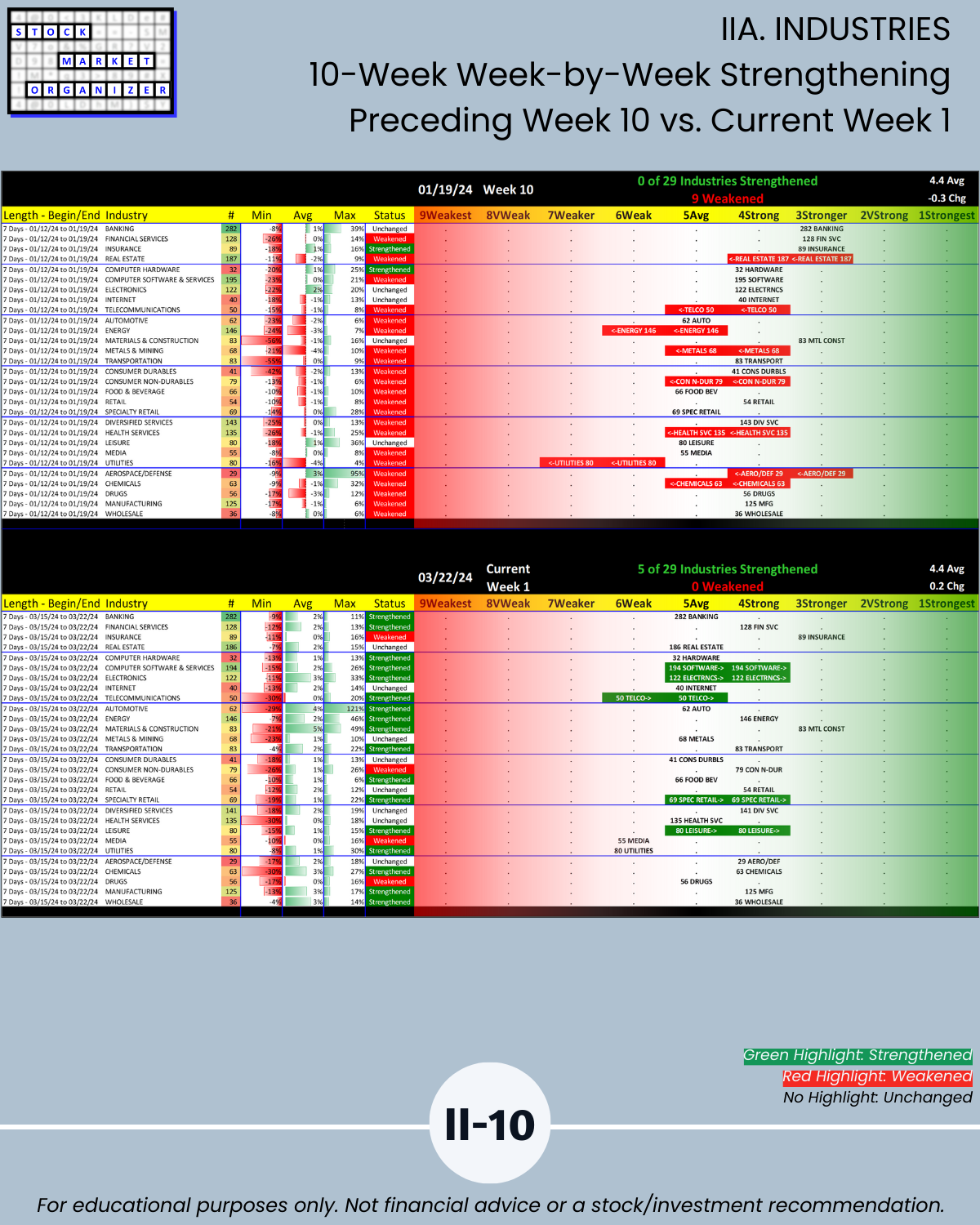

IIA. INDUSTRIES 10-Week Week-by-Week Strengthening

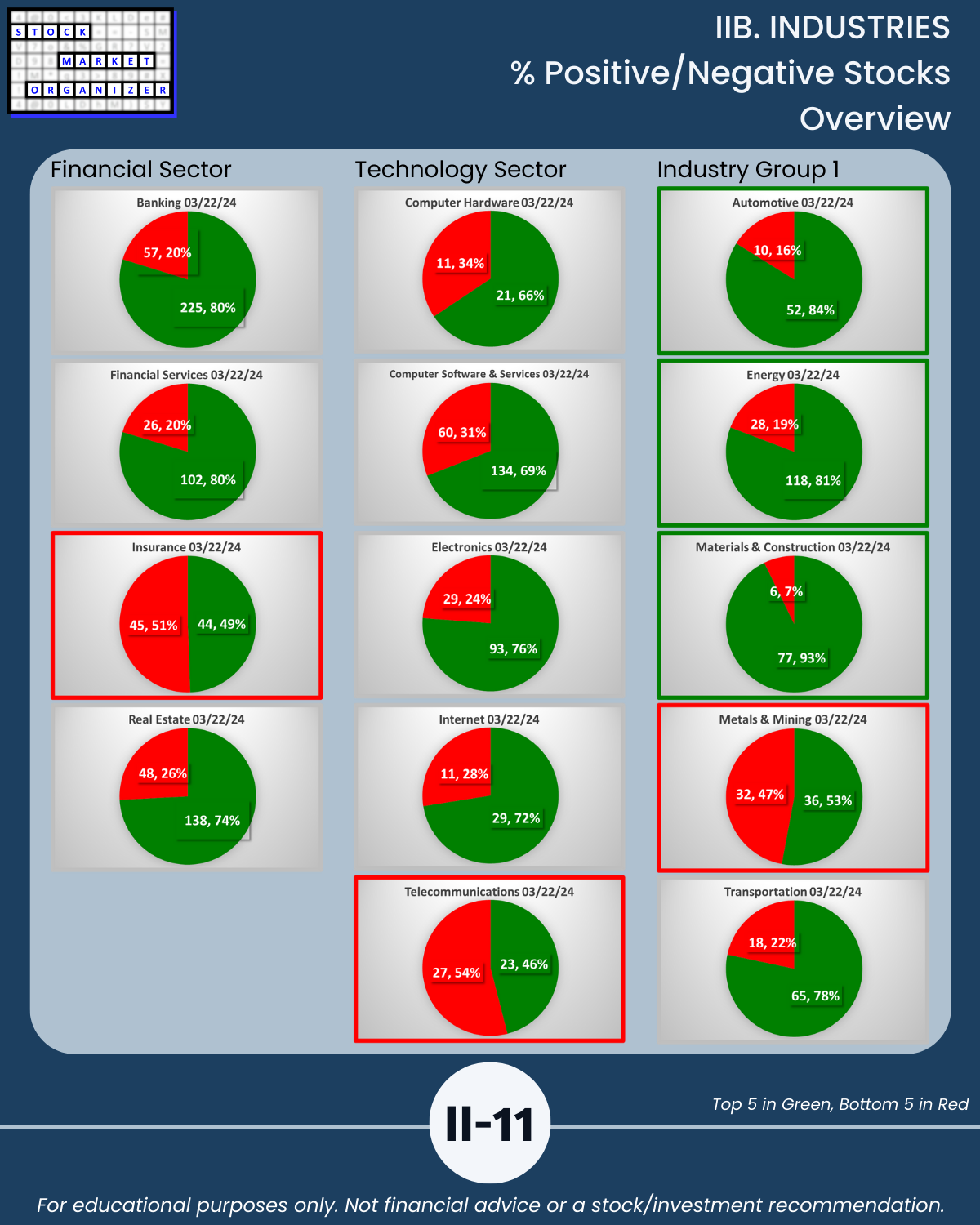

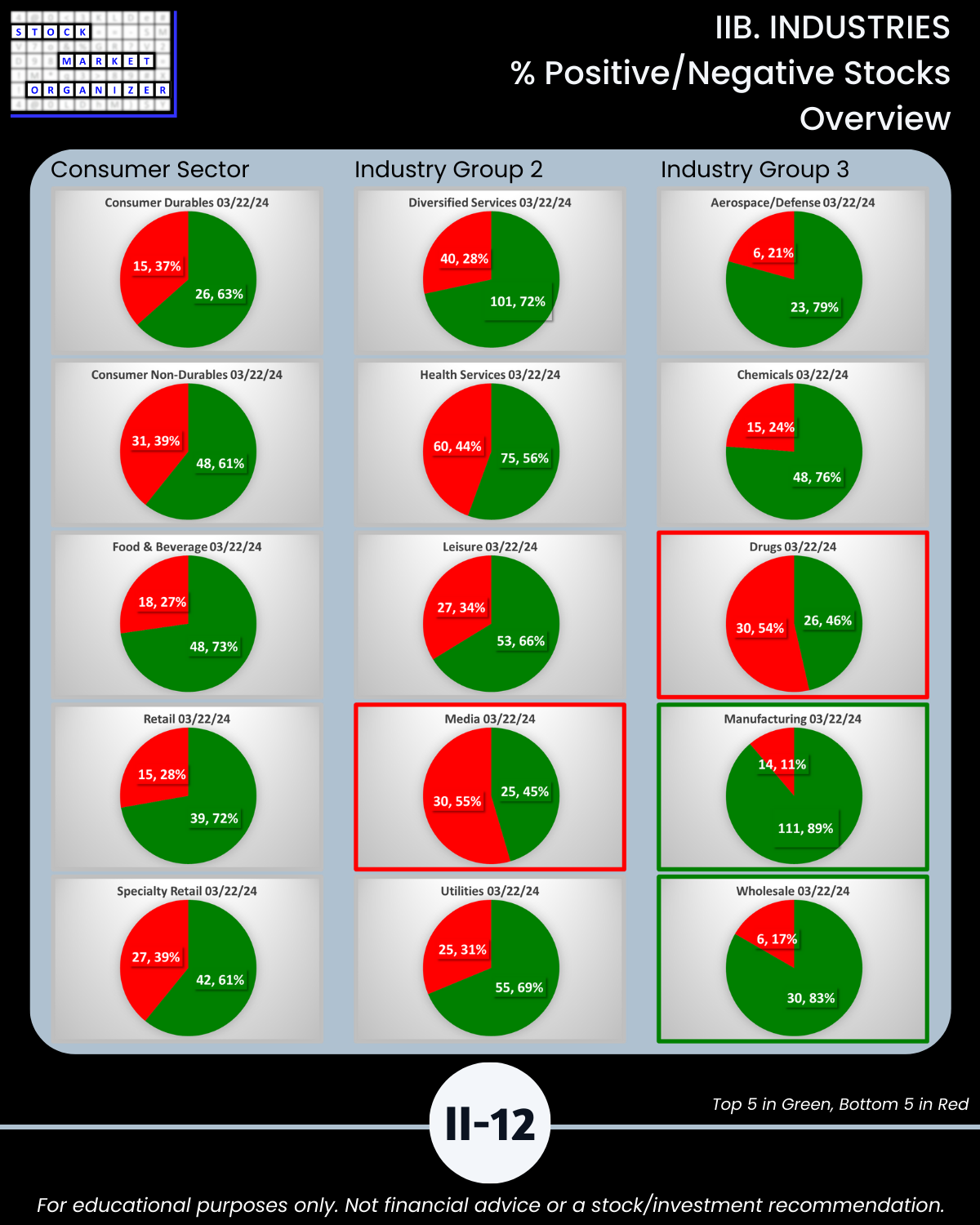

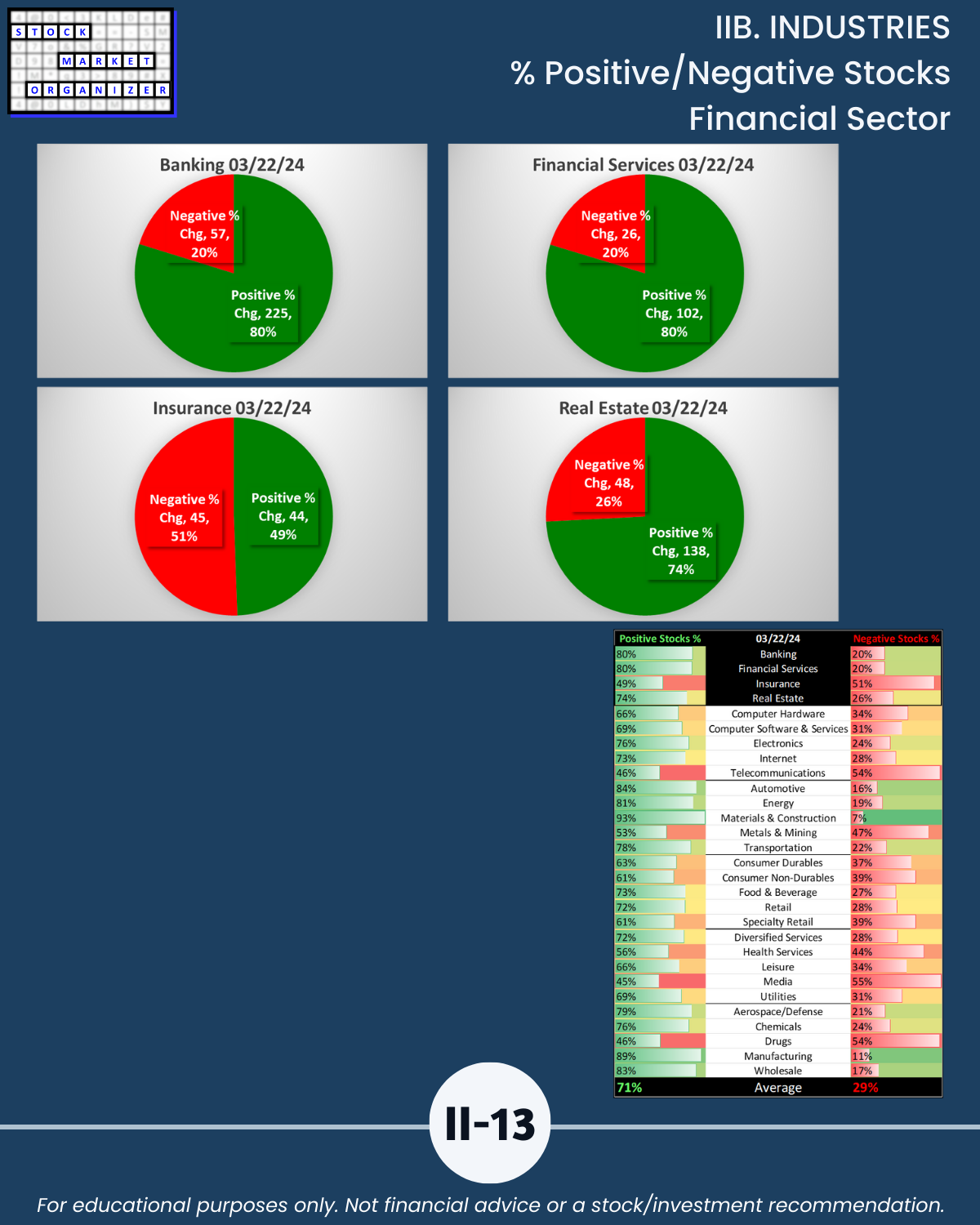

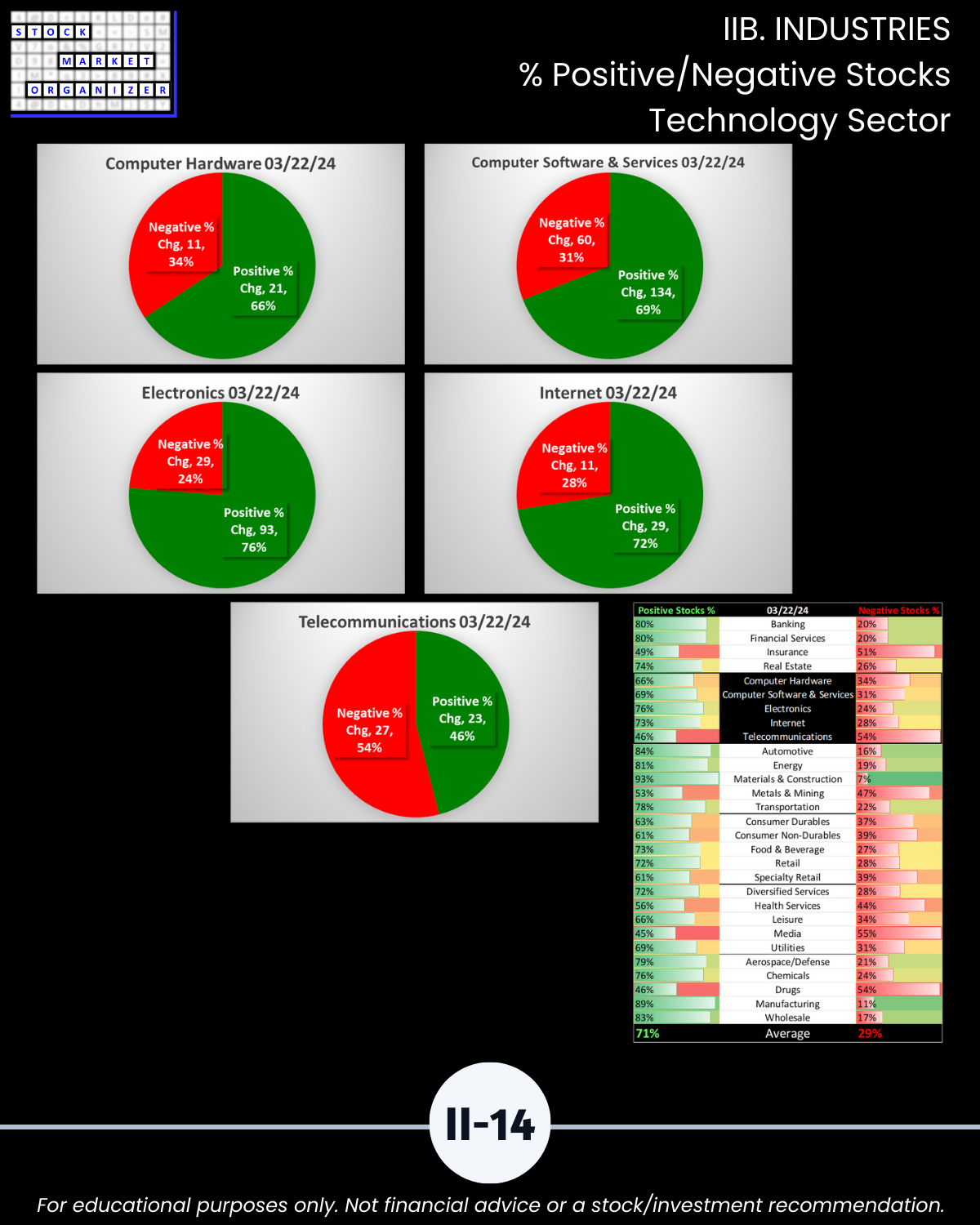

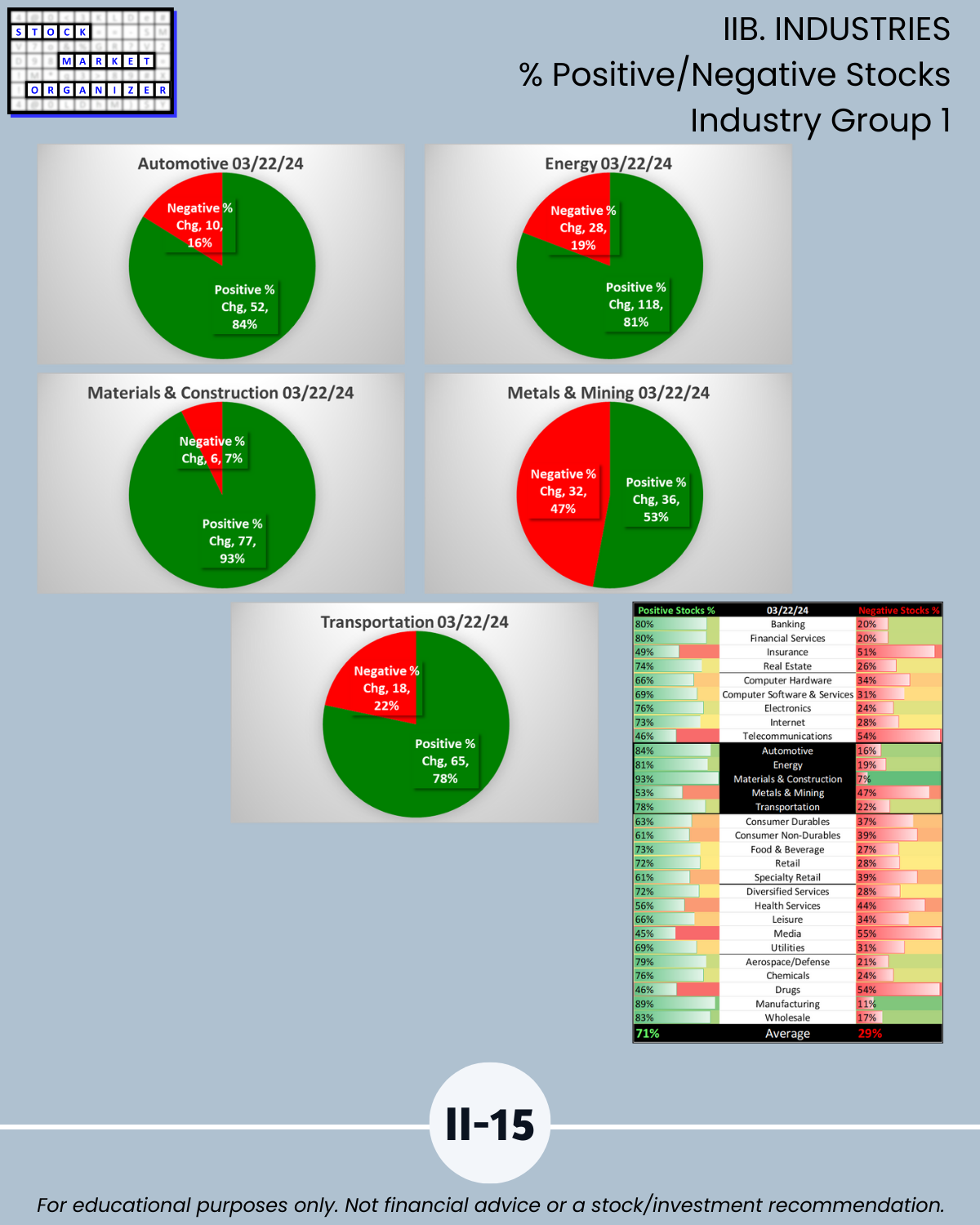

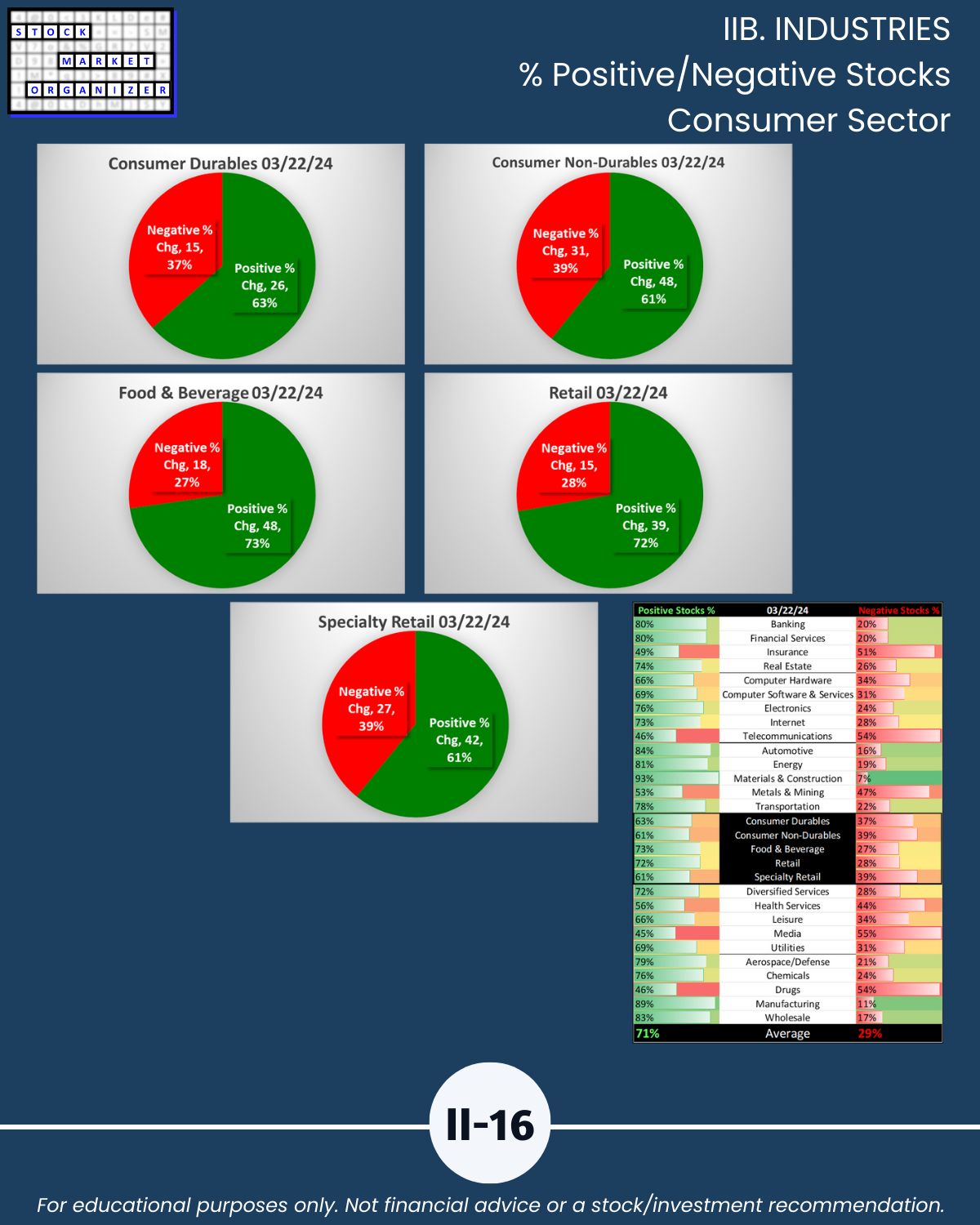

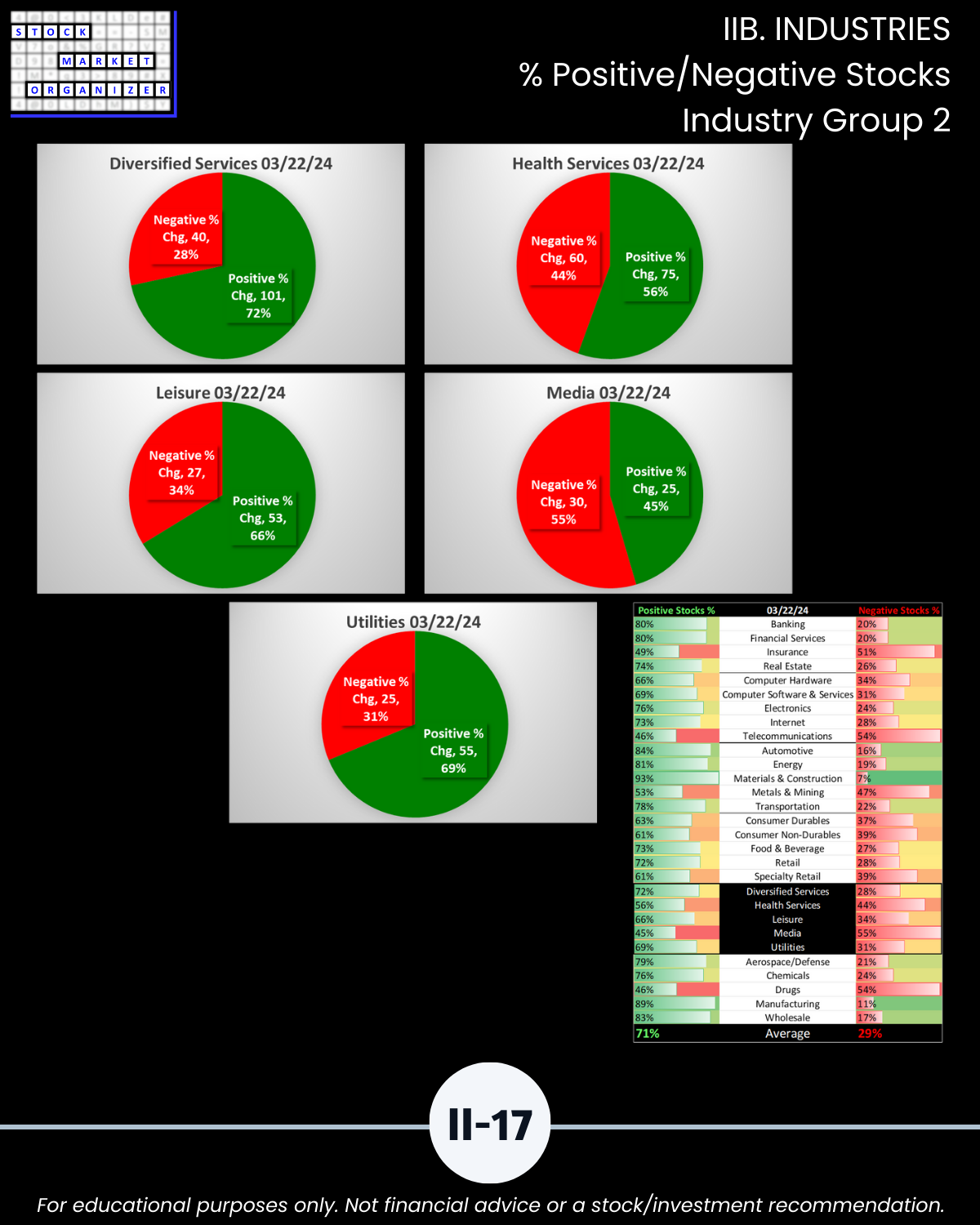

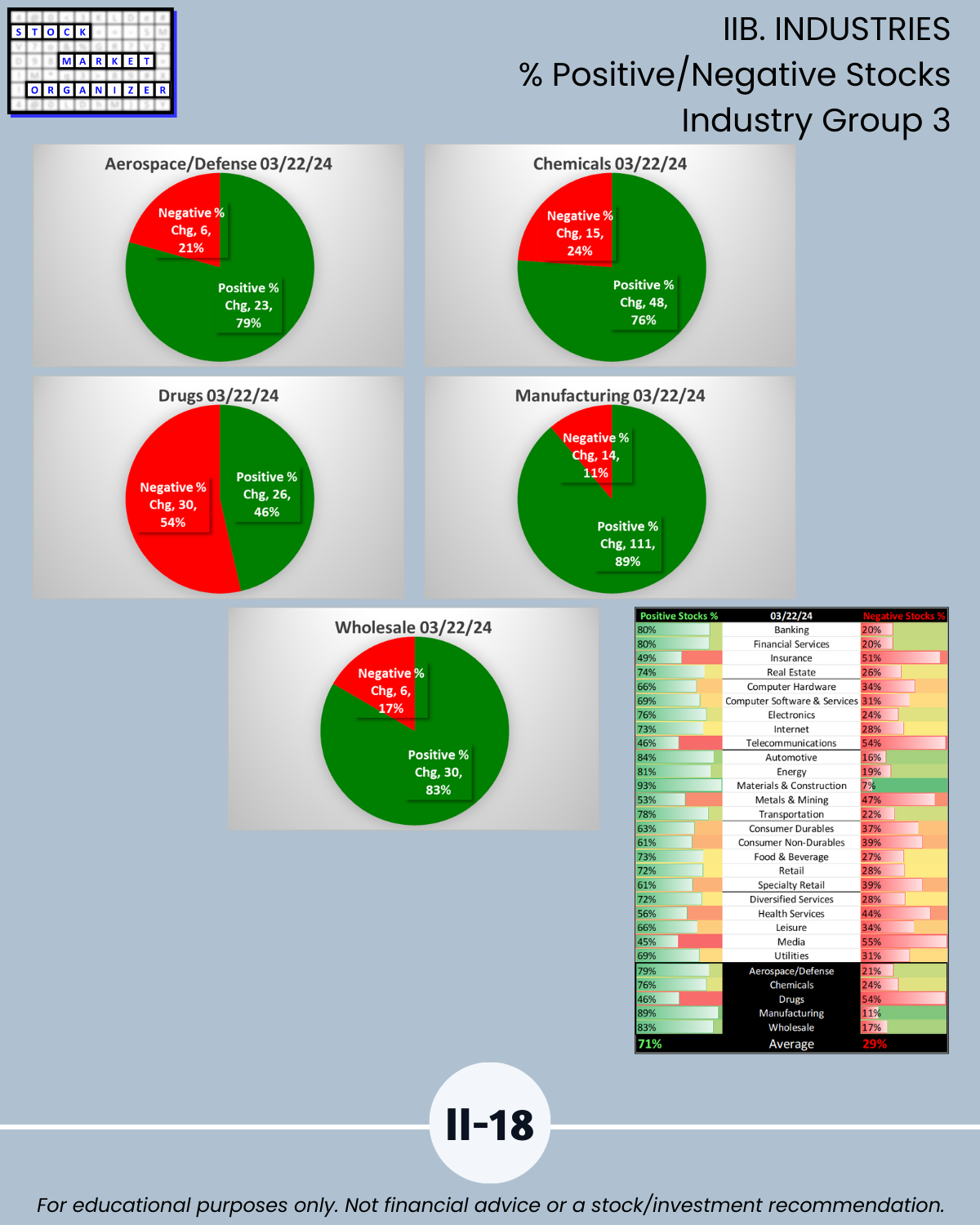

IIB. INDUSTRIES % Positive/Negative Stocks

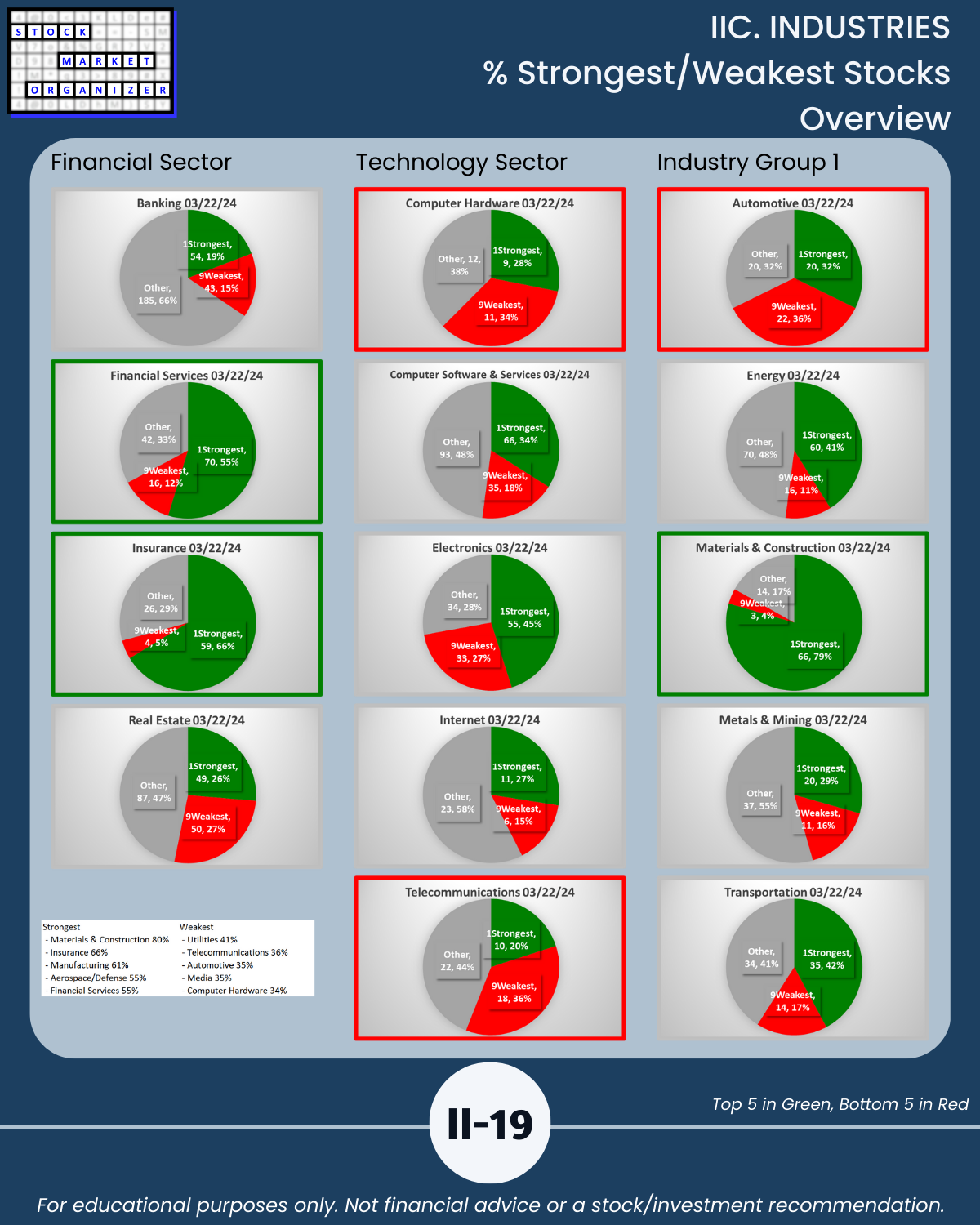

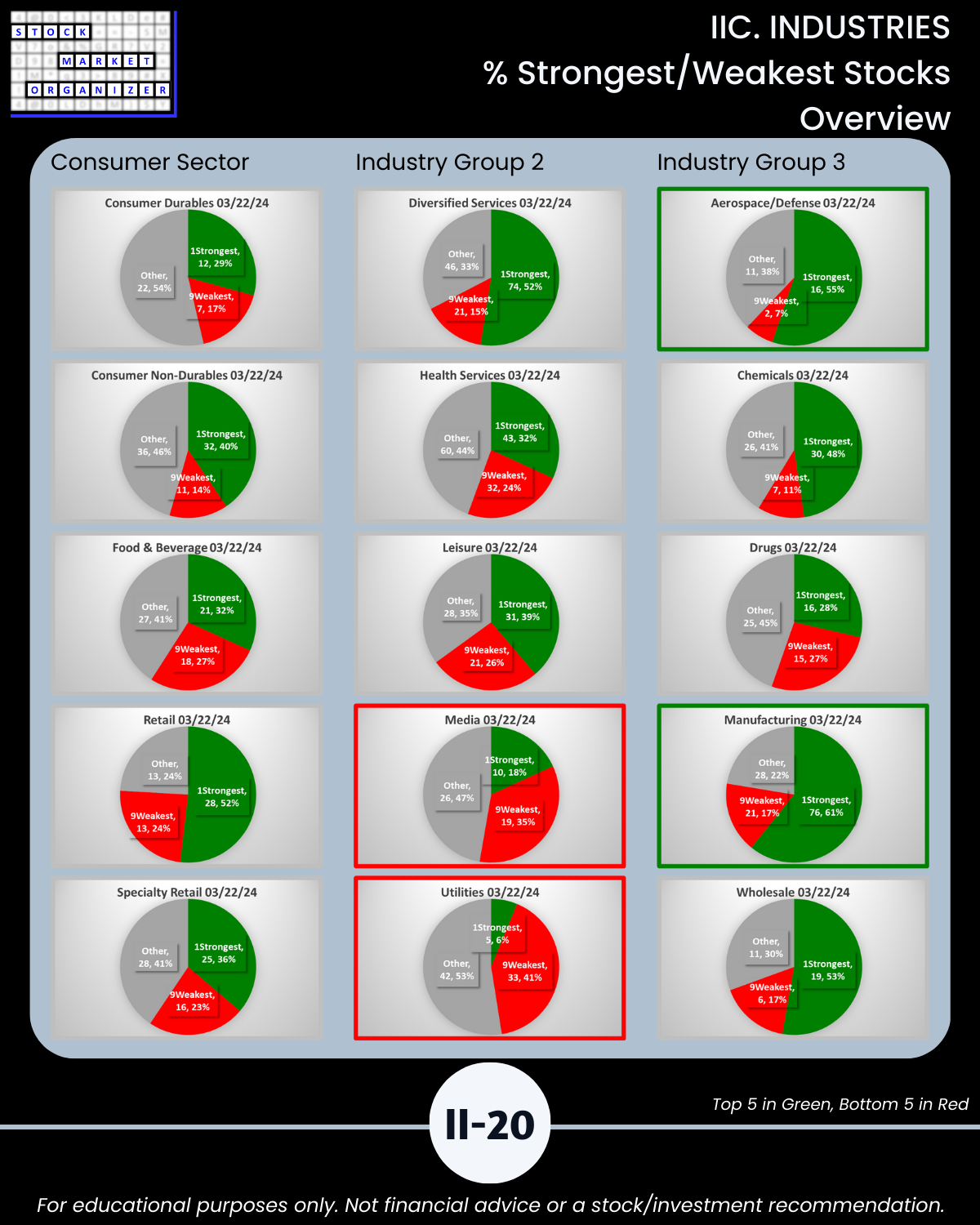

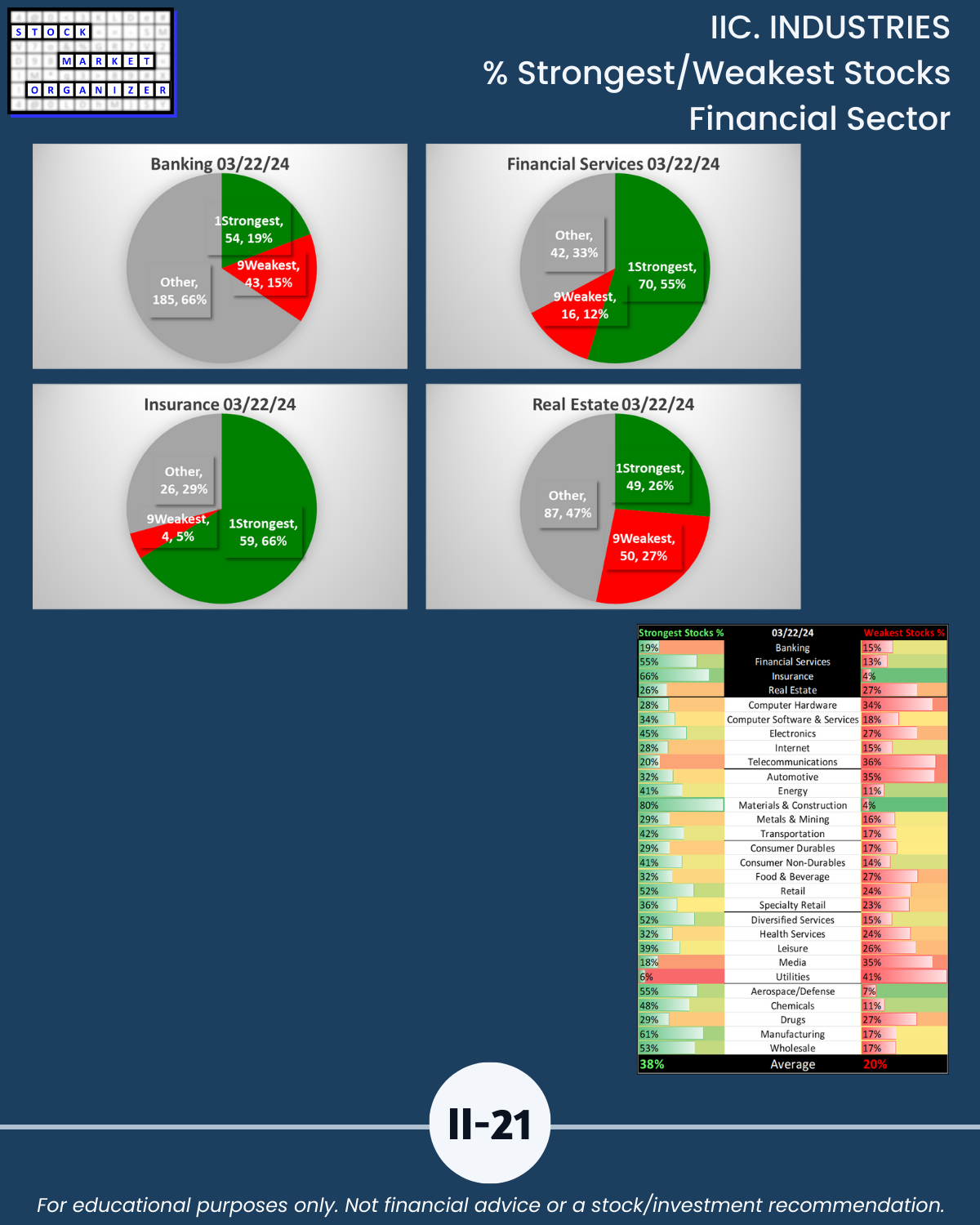

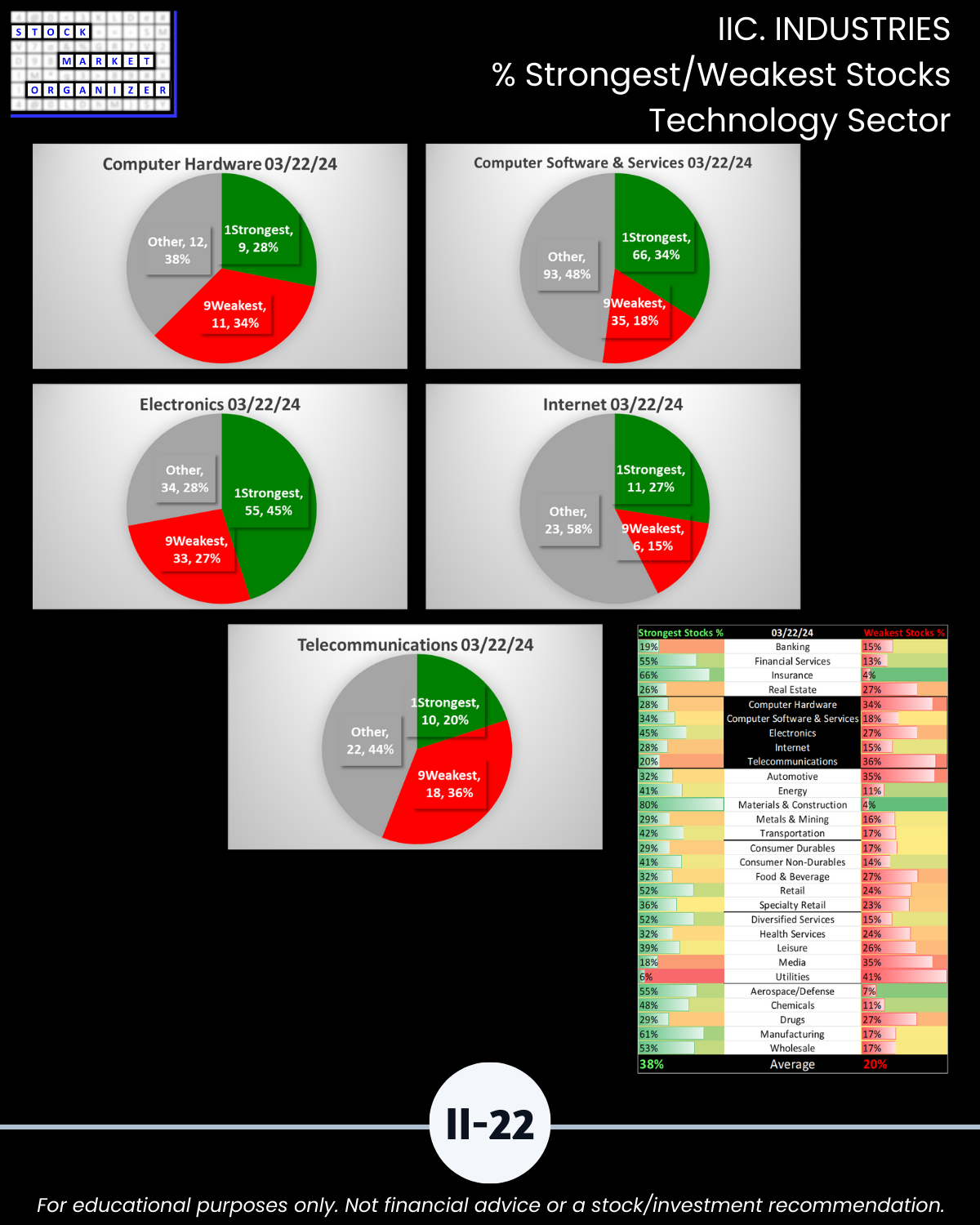

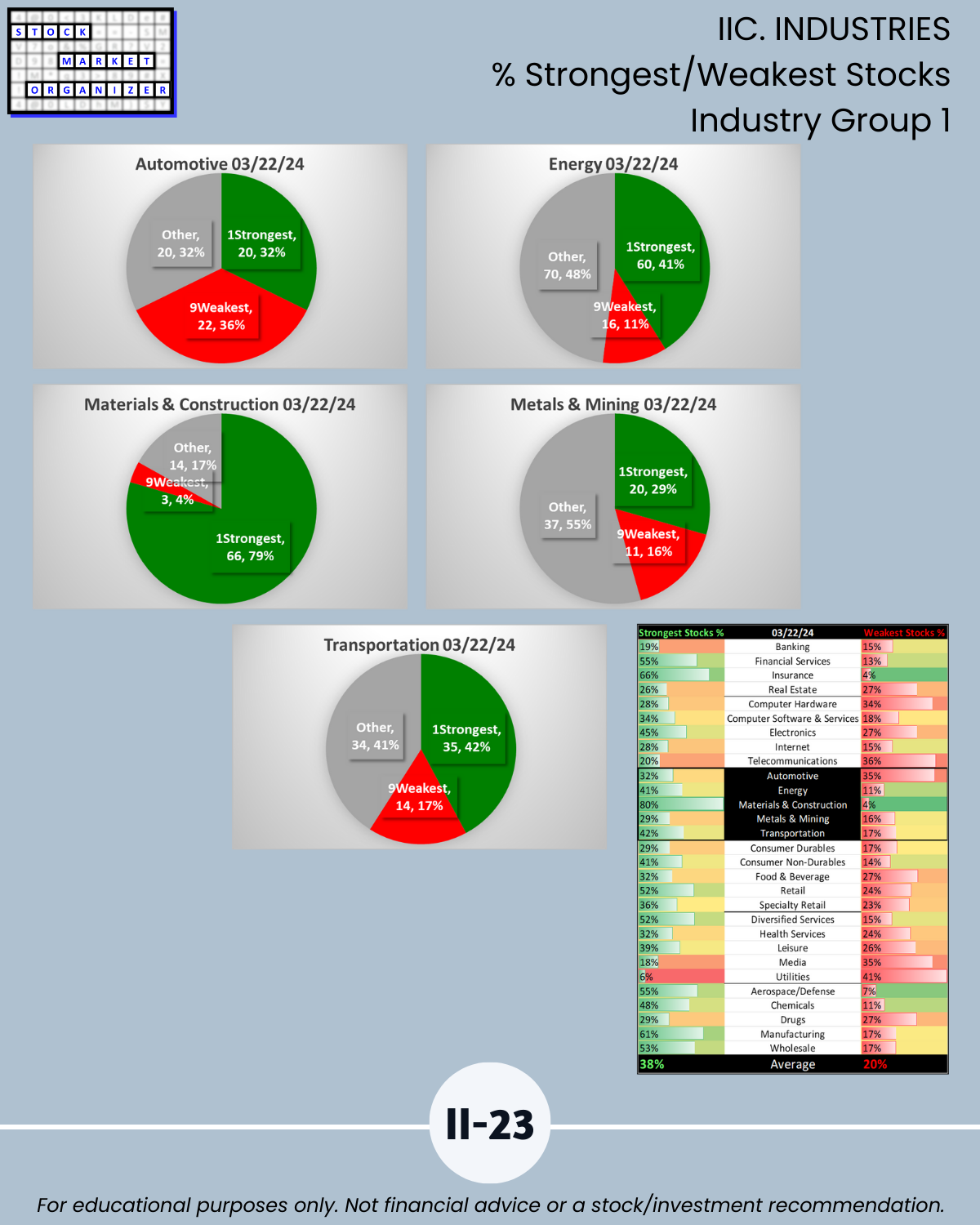

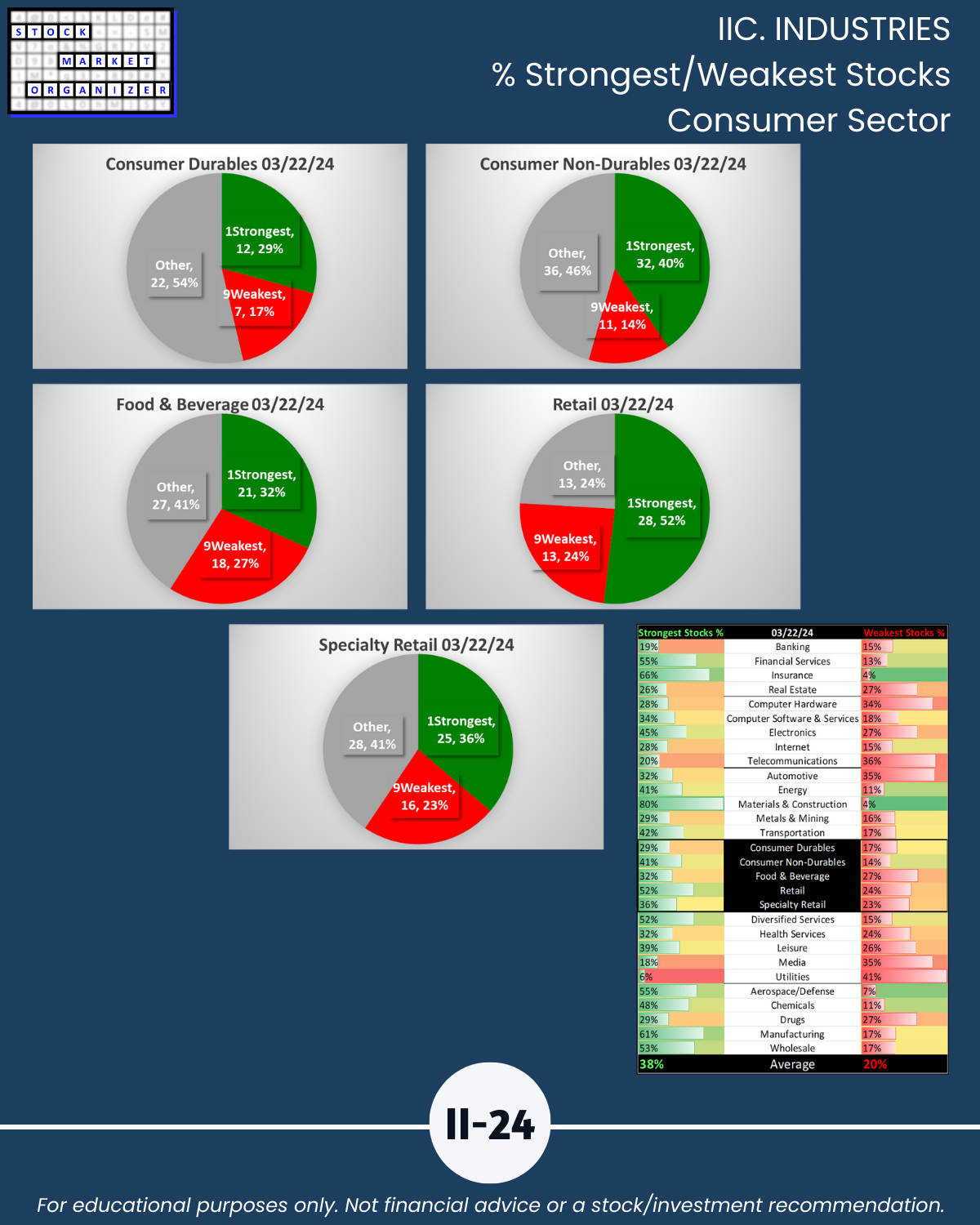

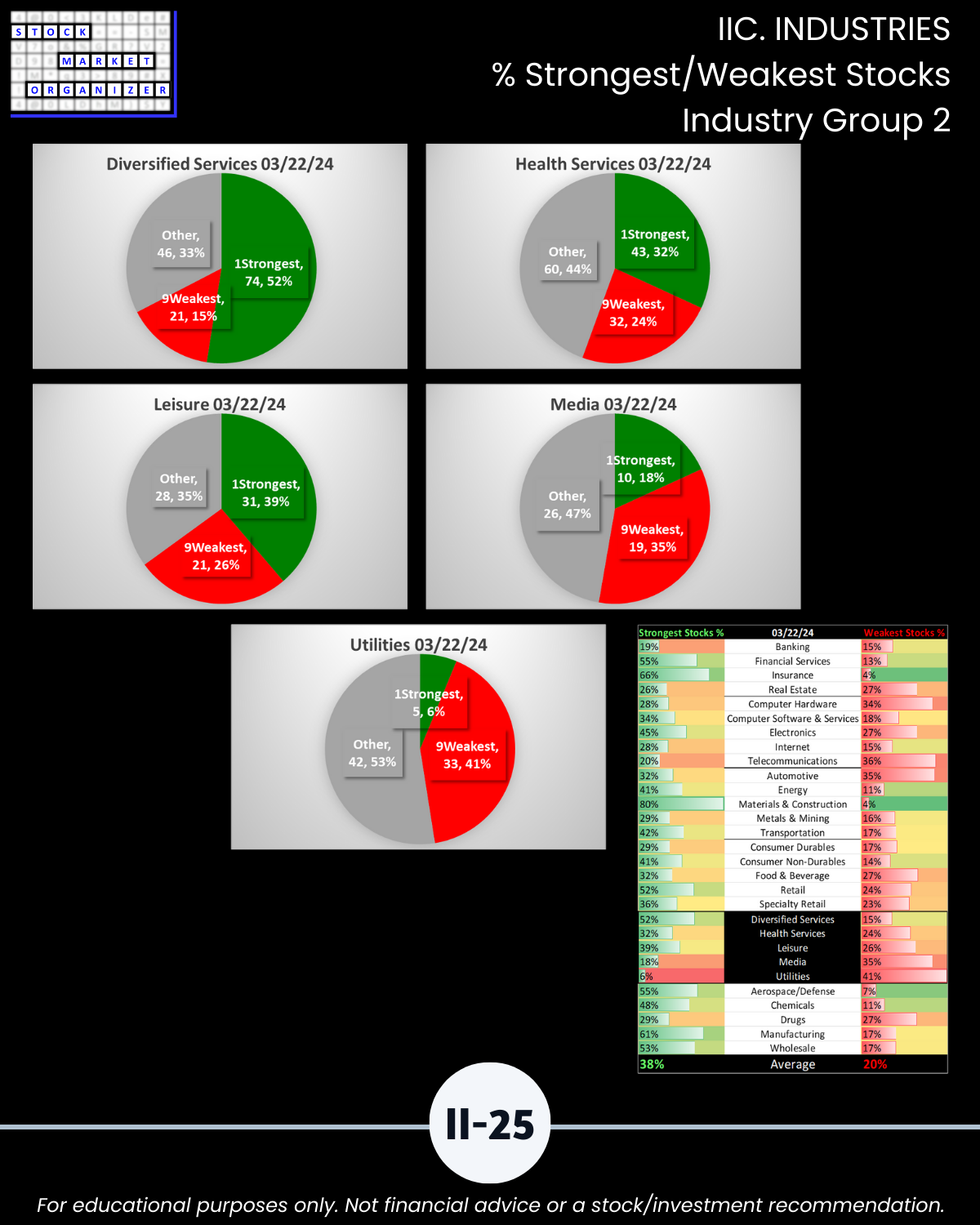

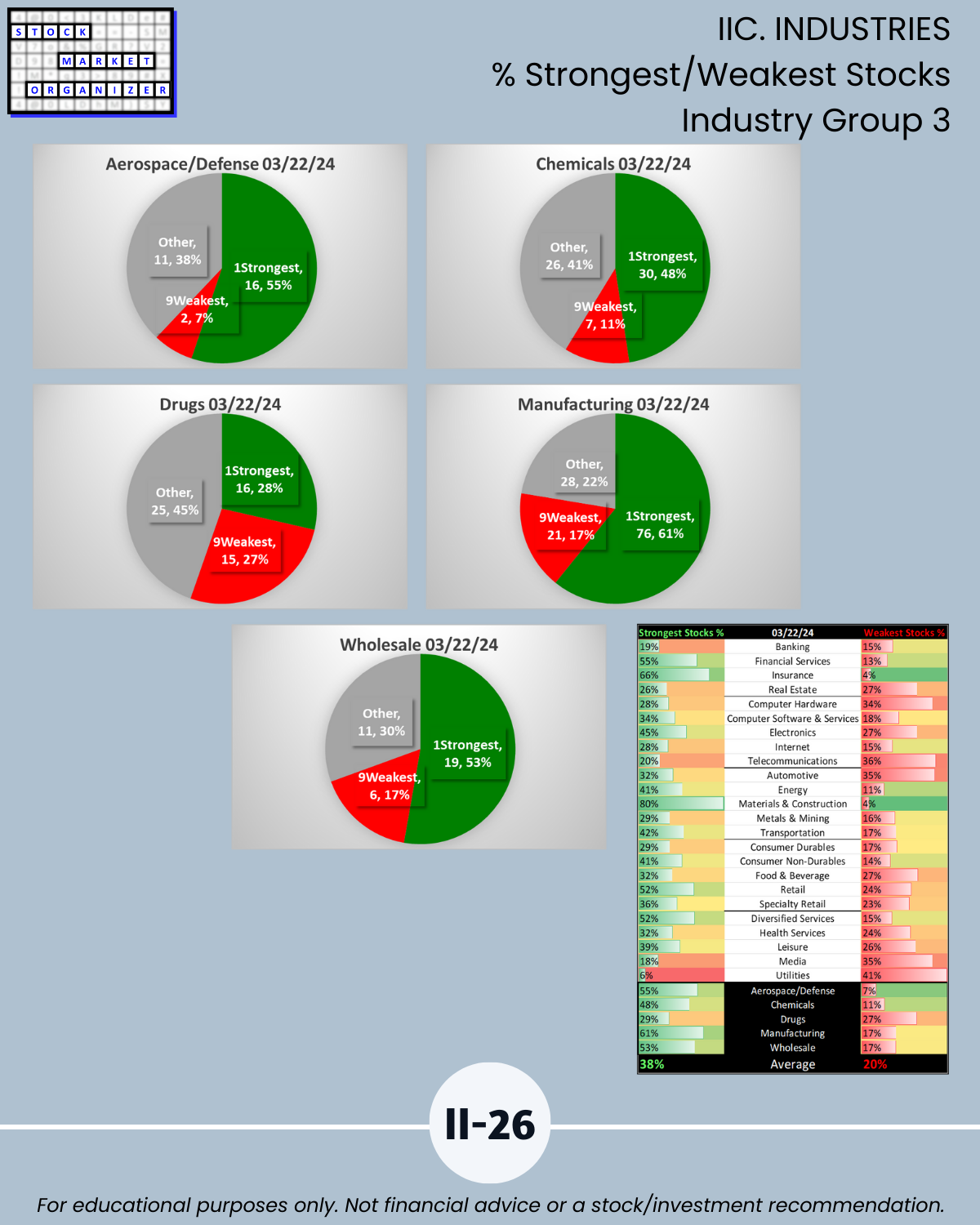

IIC. INDUSTRIES % Strongest/Weakest Stocks

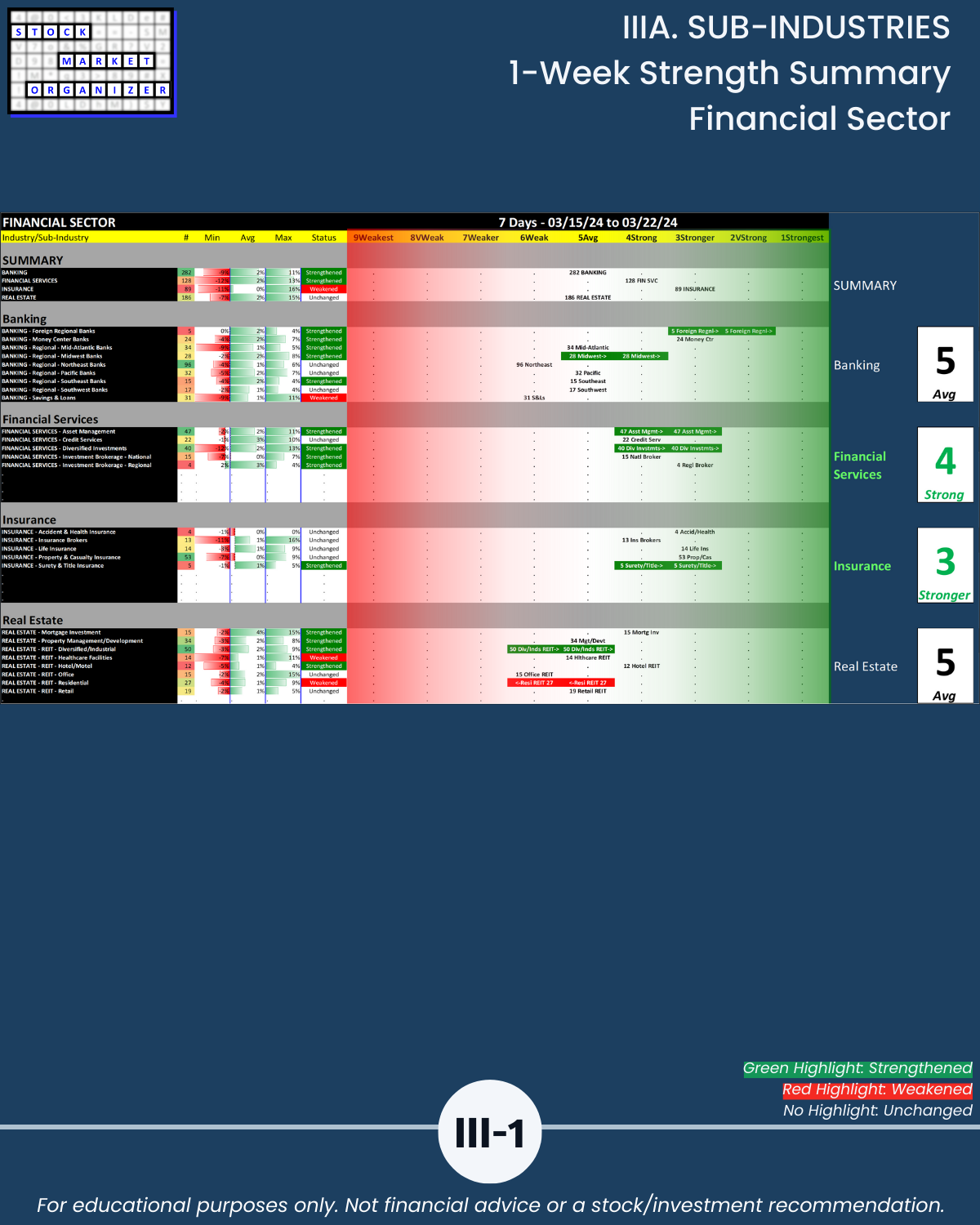

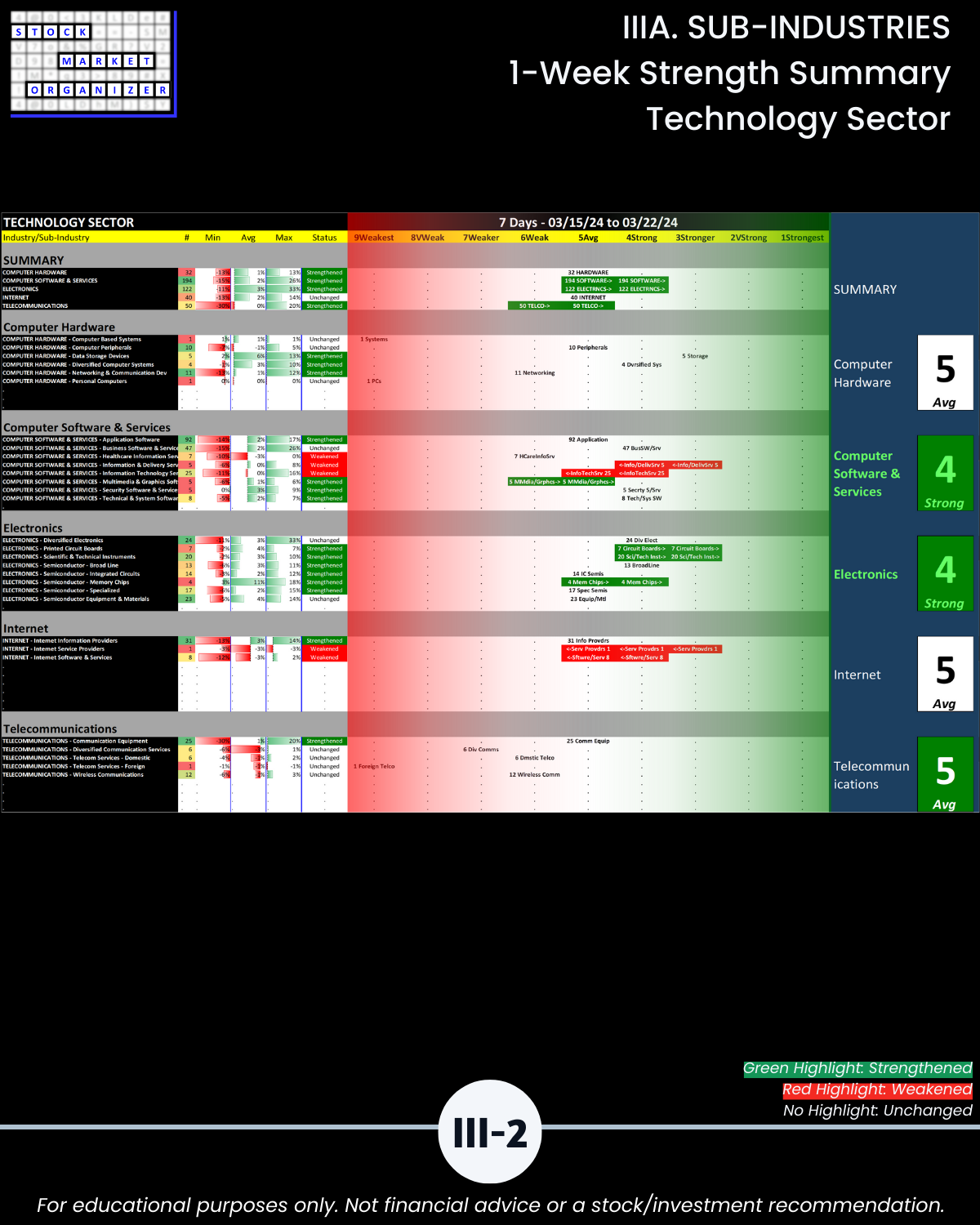

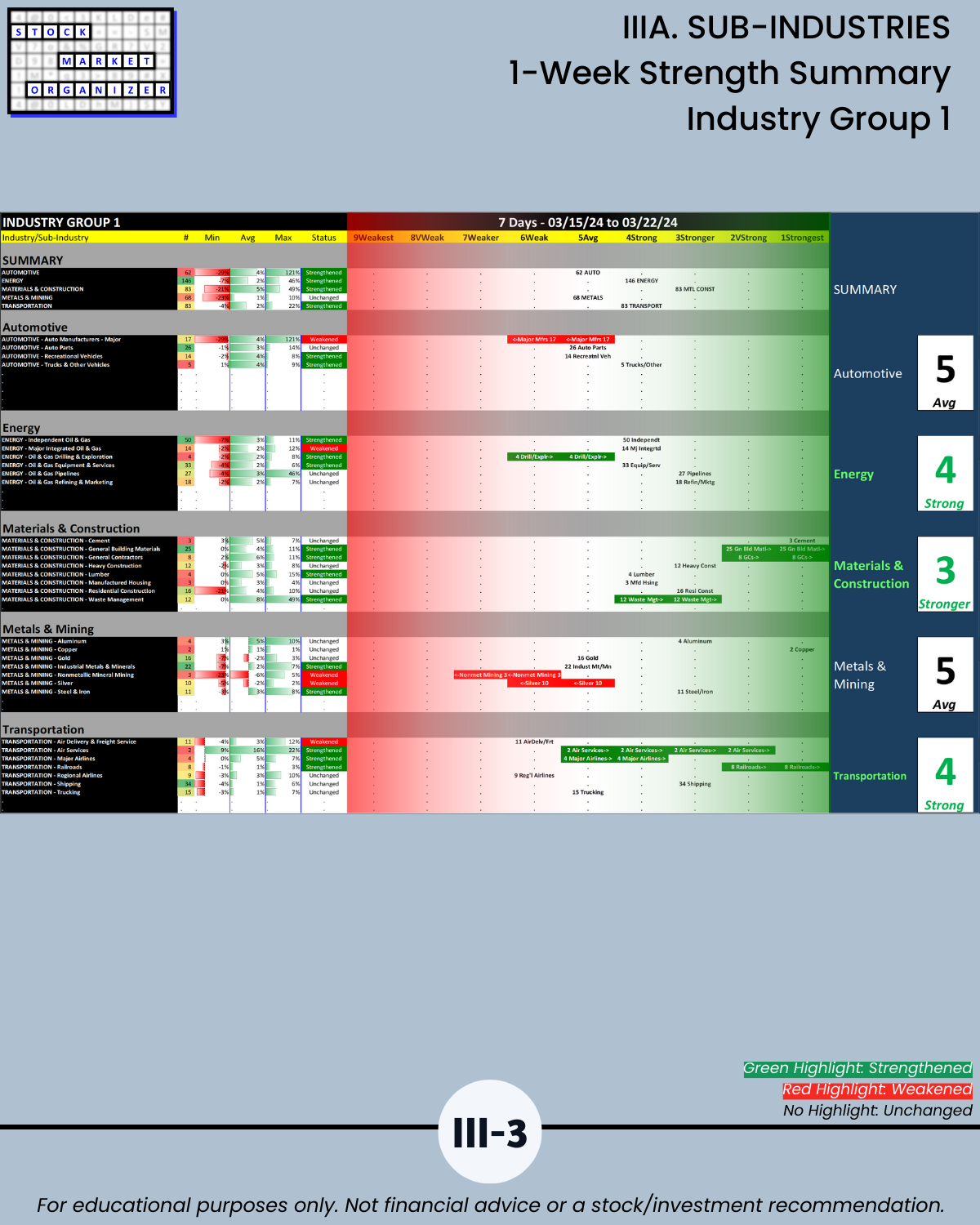

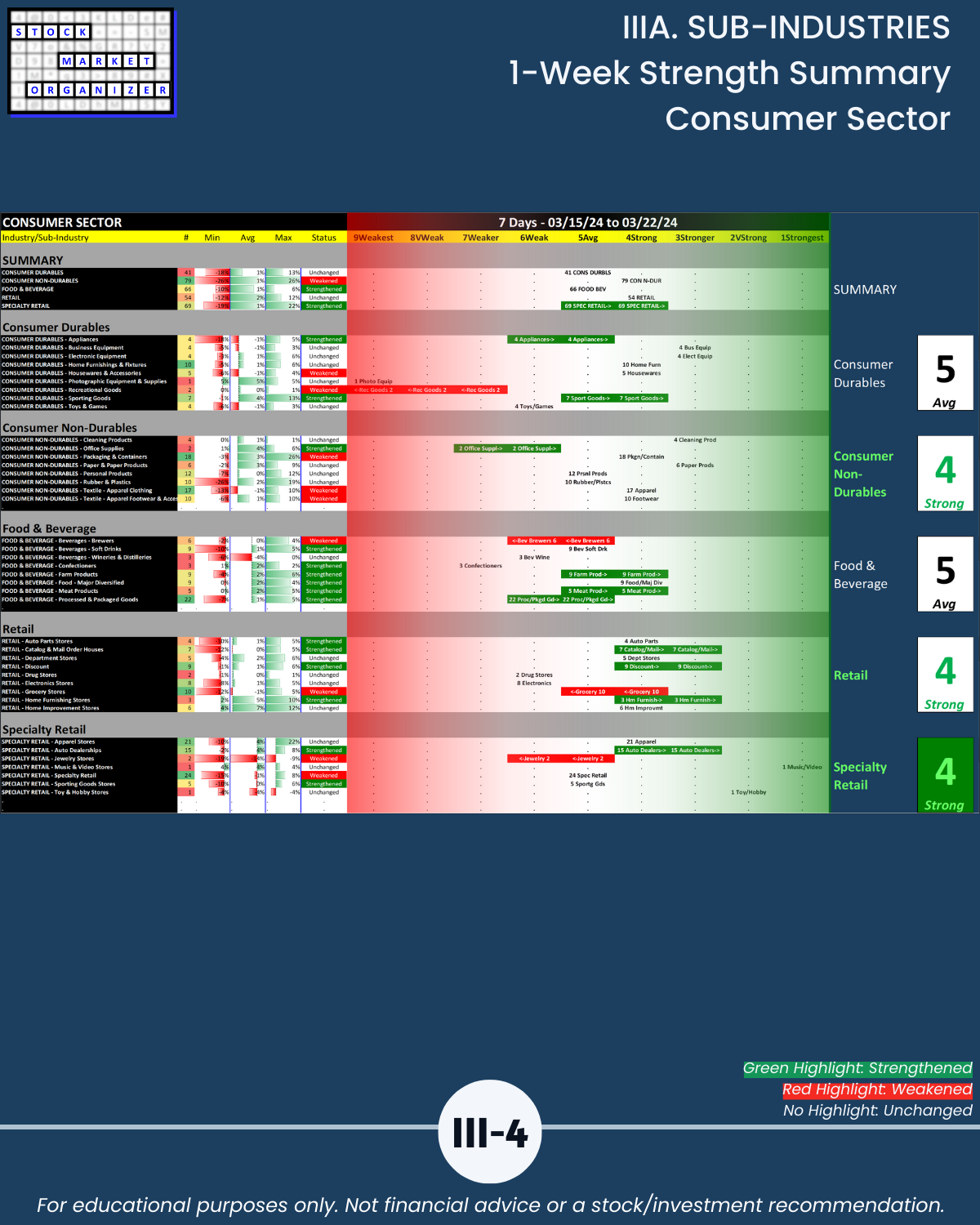

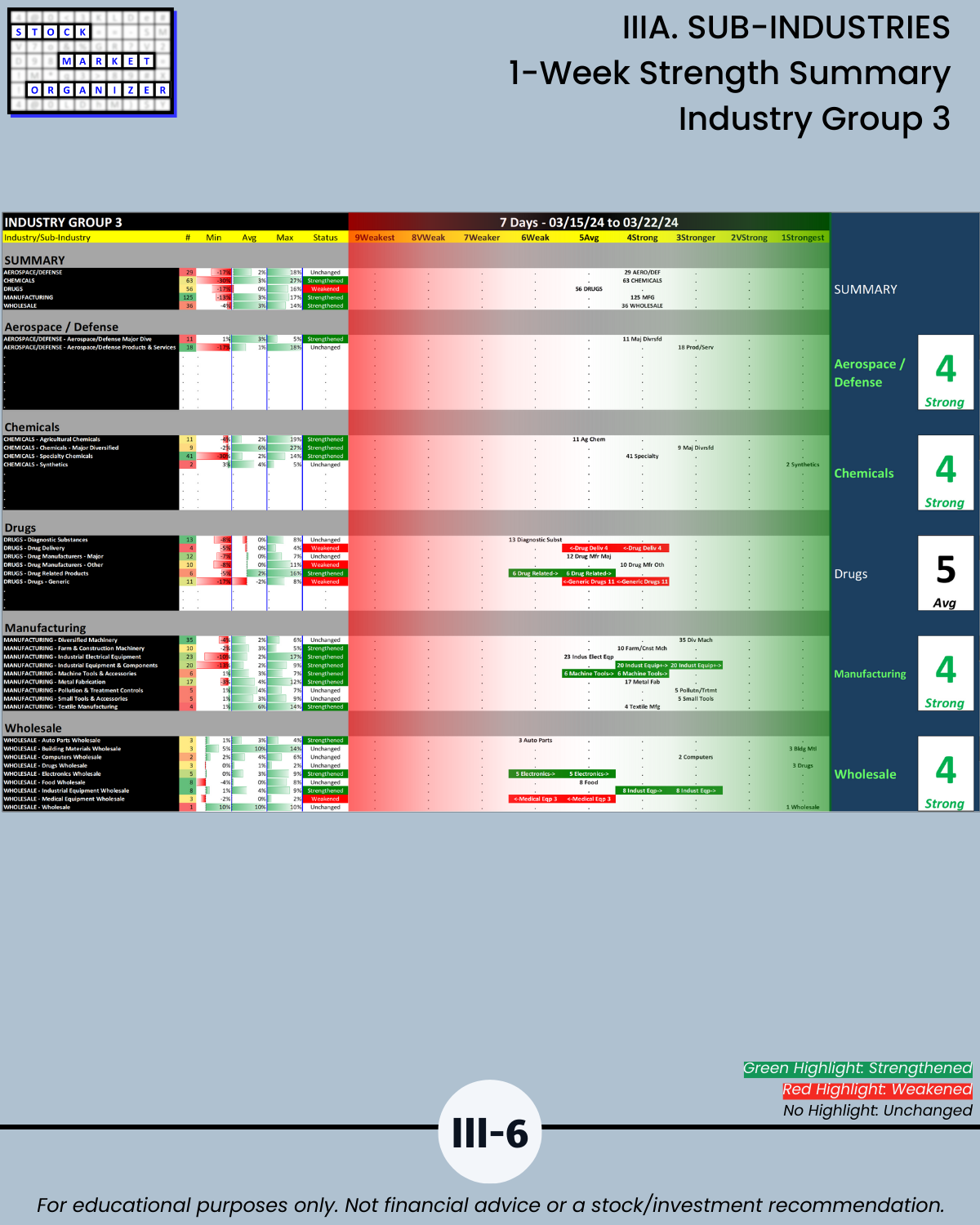

IIIA. SUB-INDUSTRIES 1-Week Strength Summary

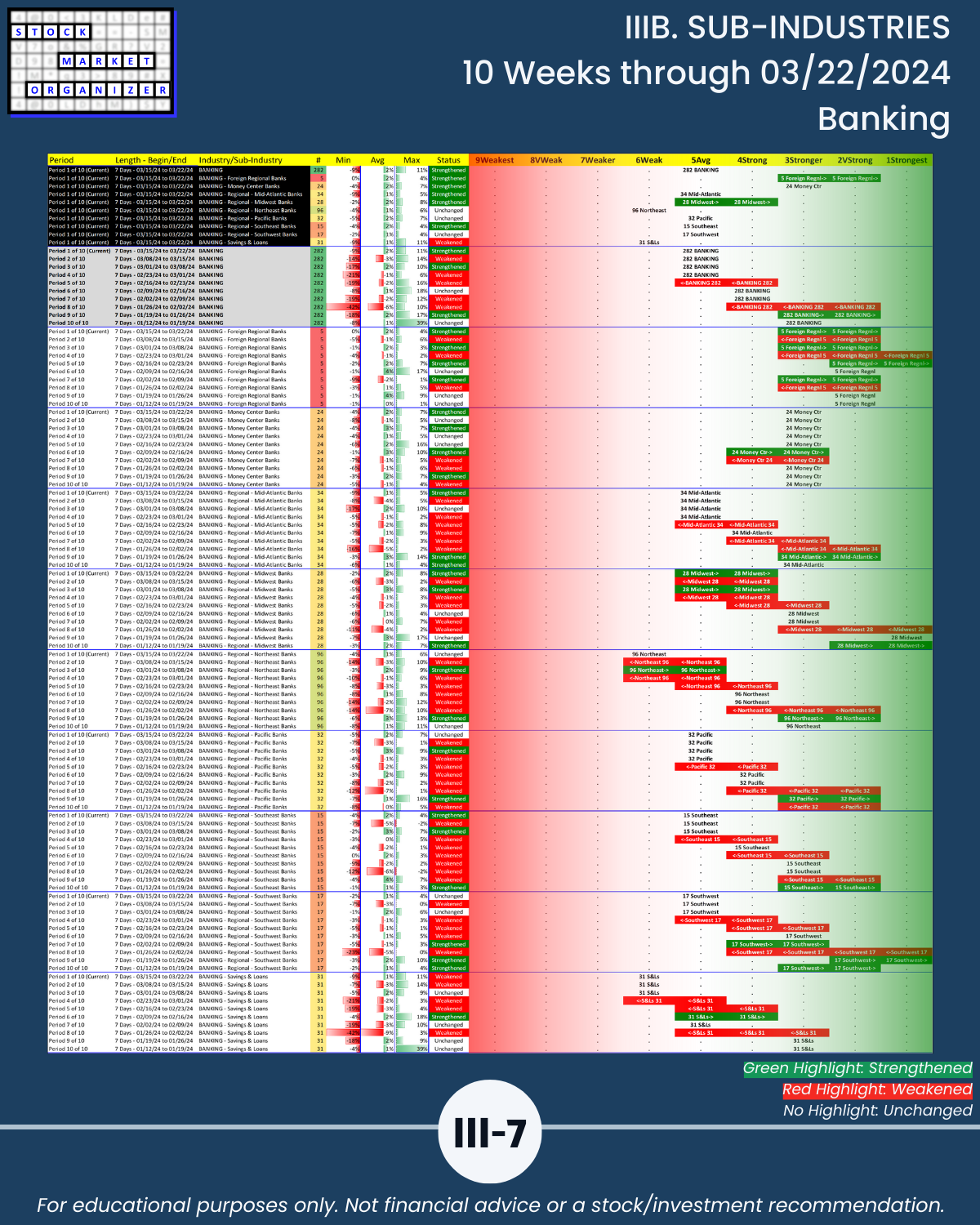

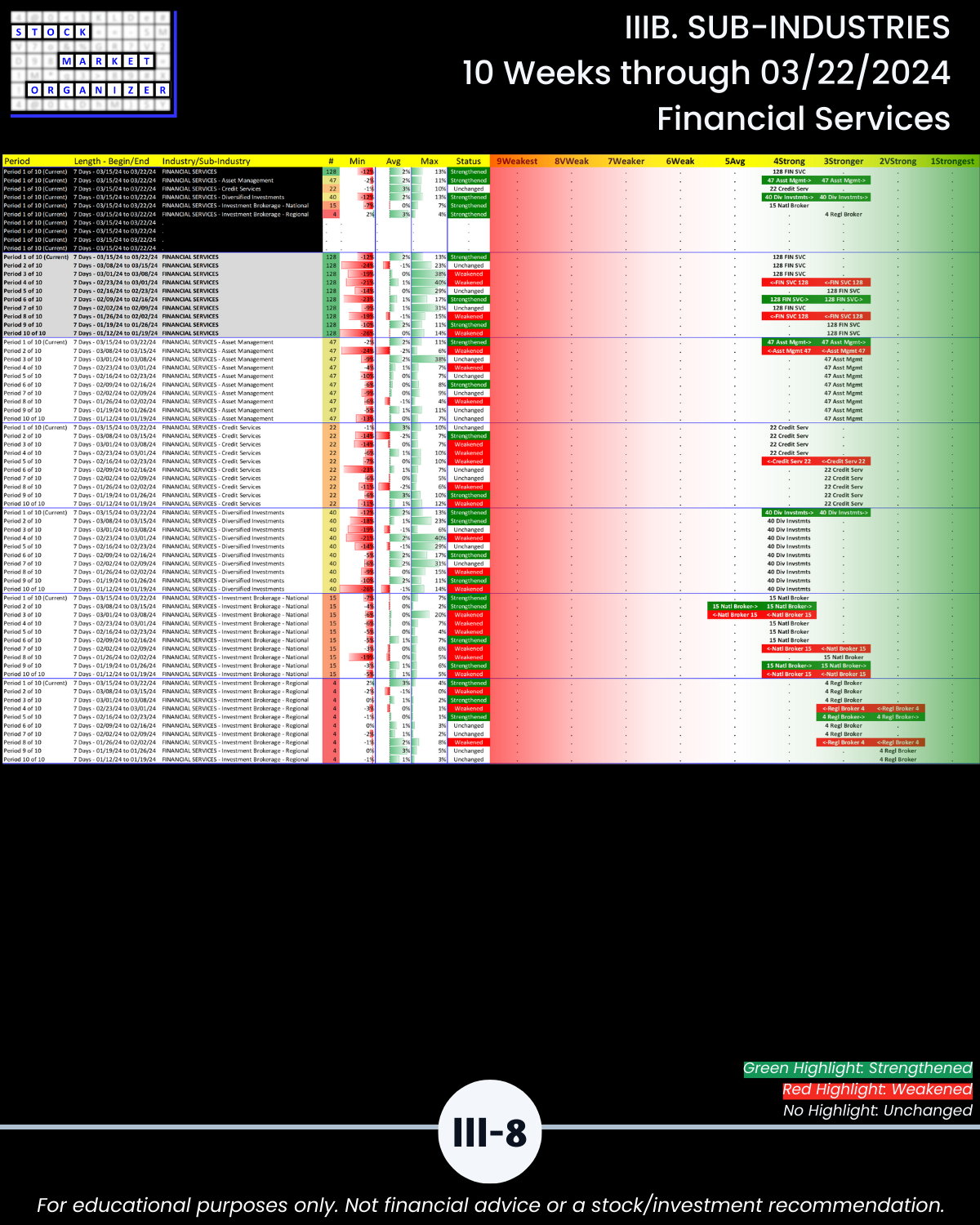

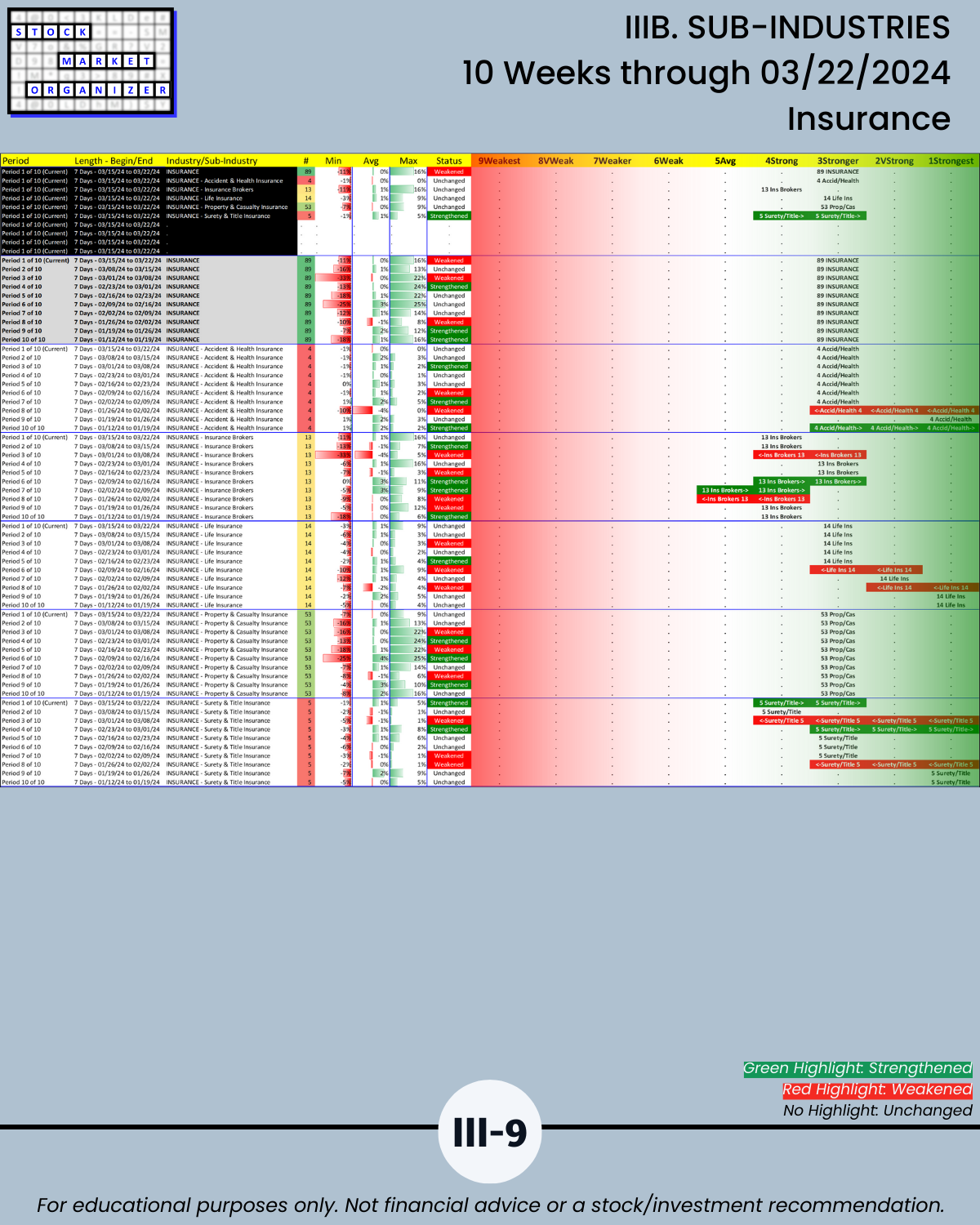

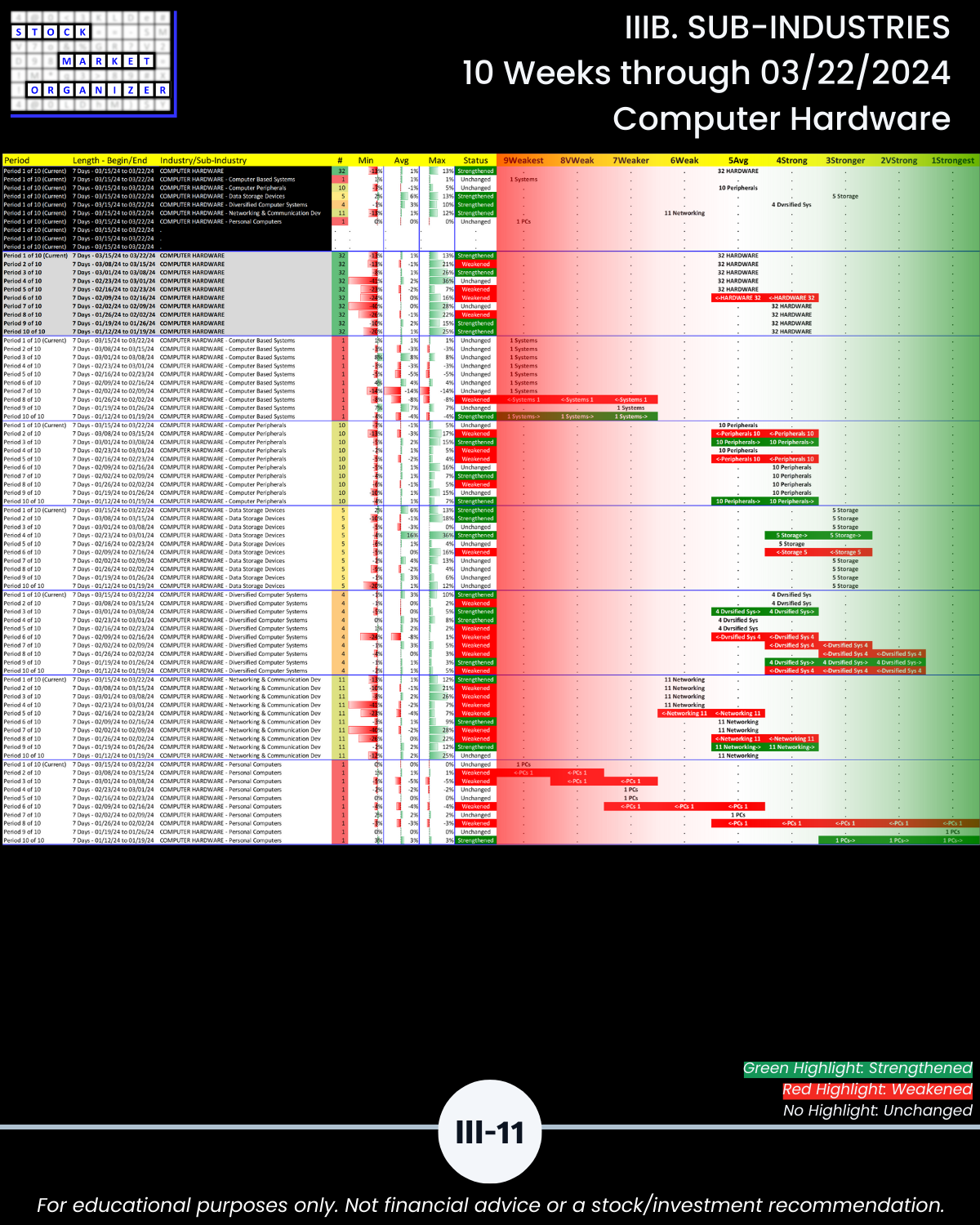

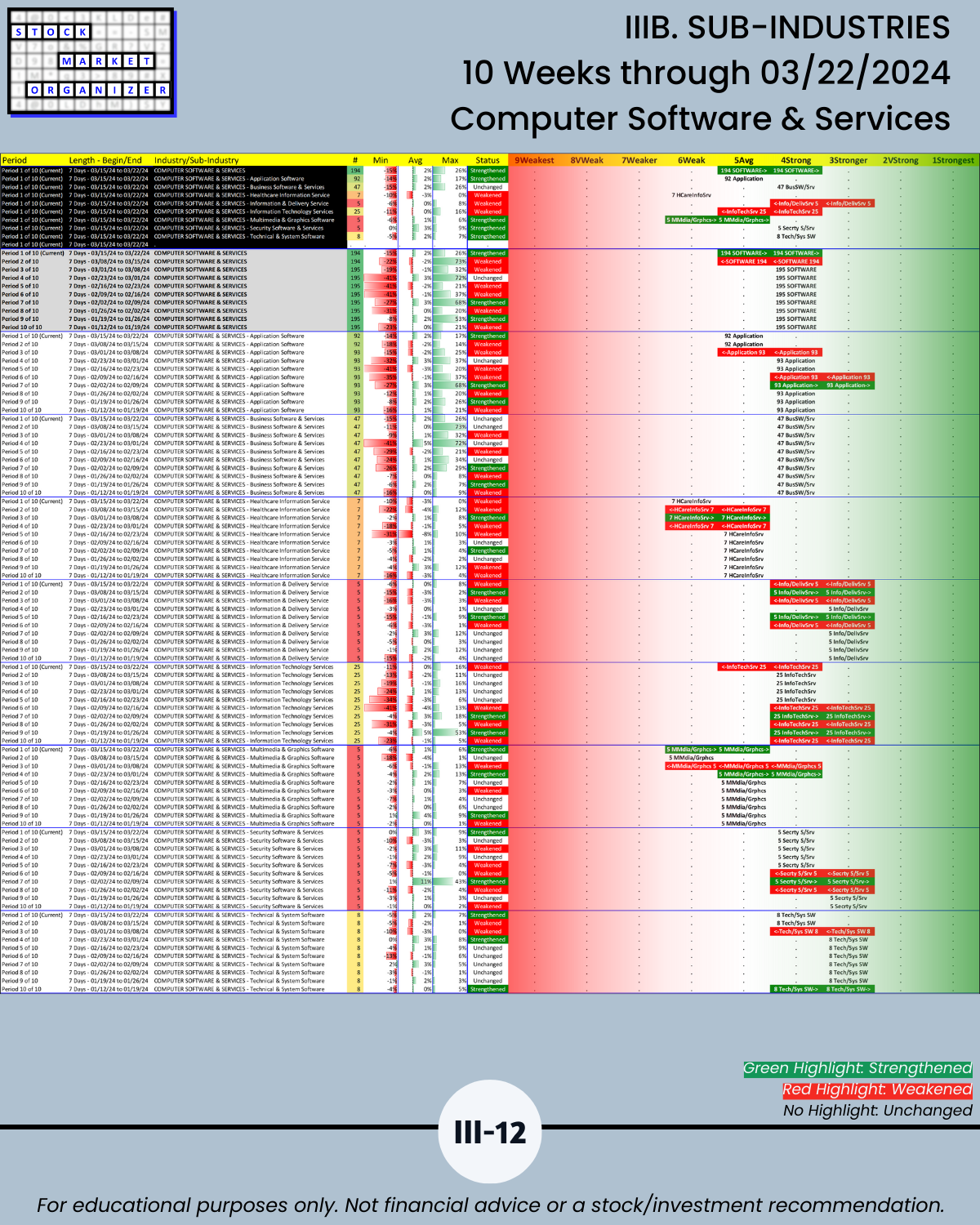

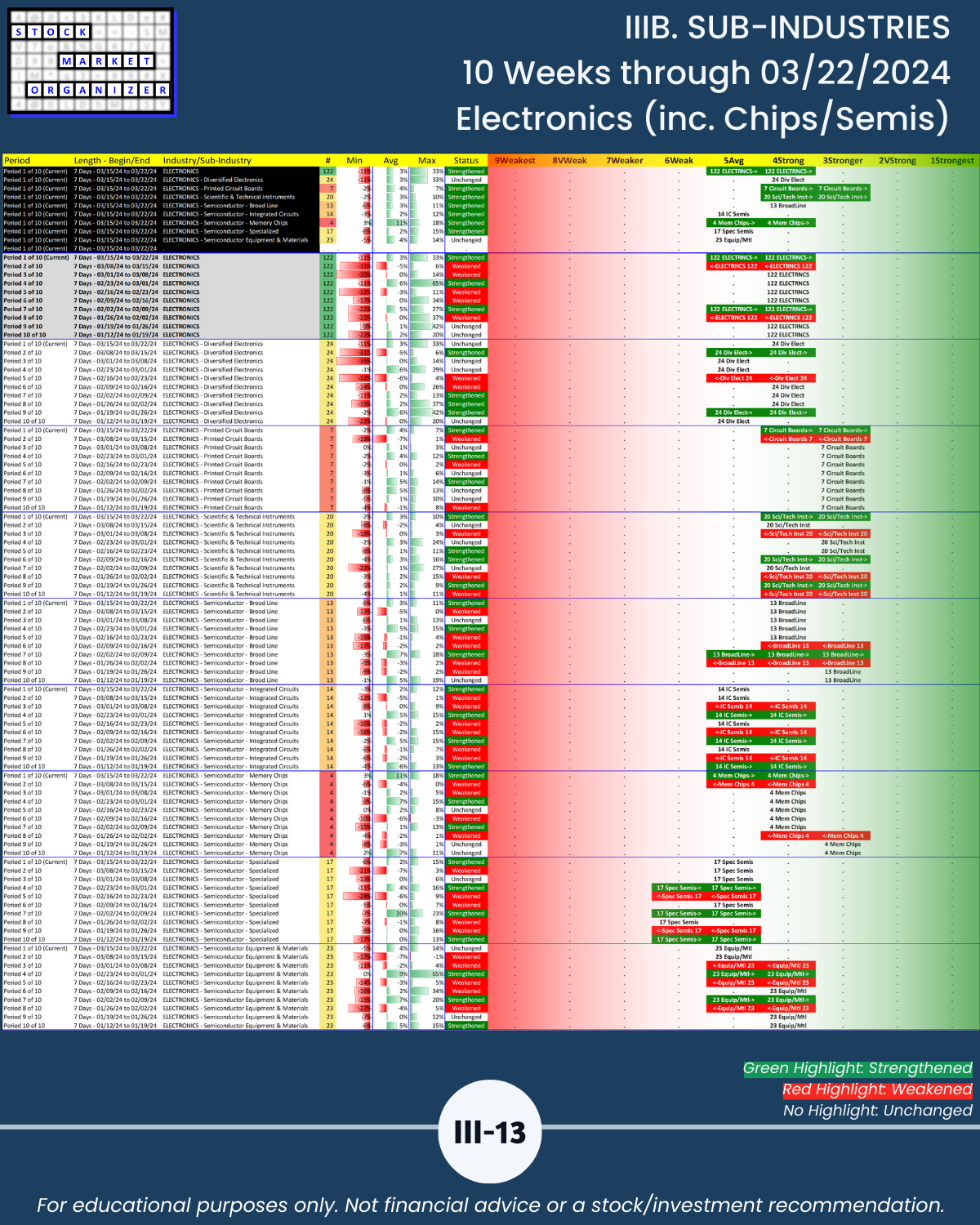

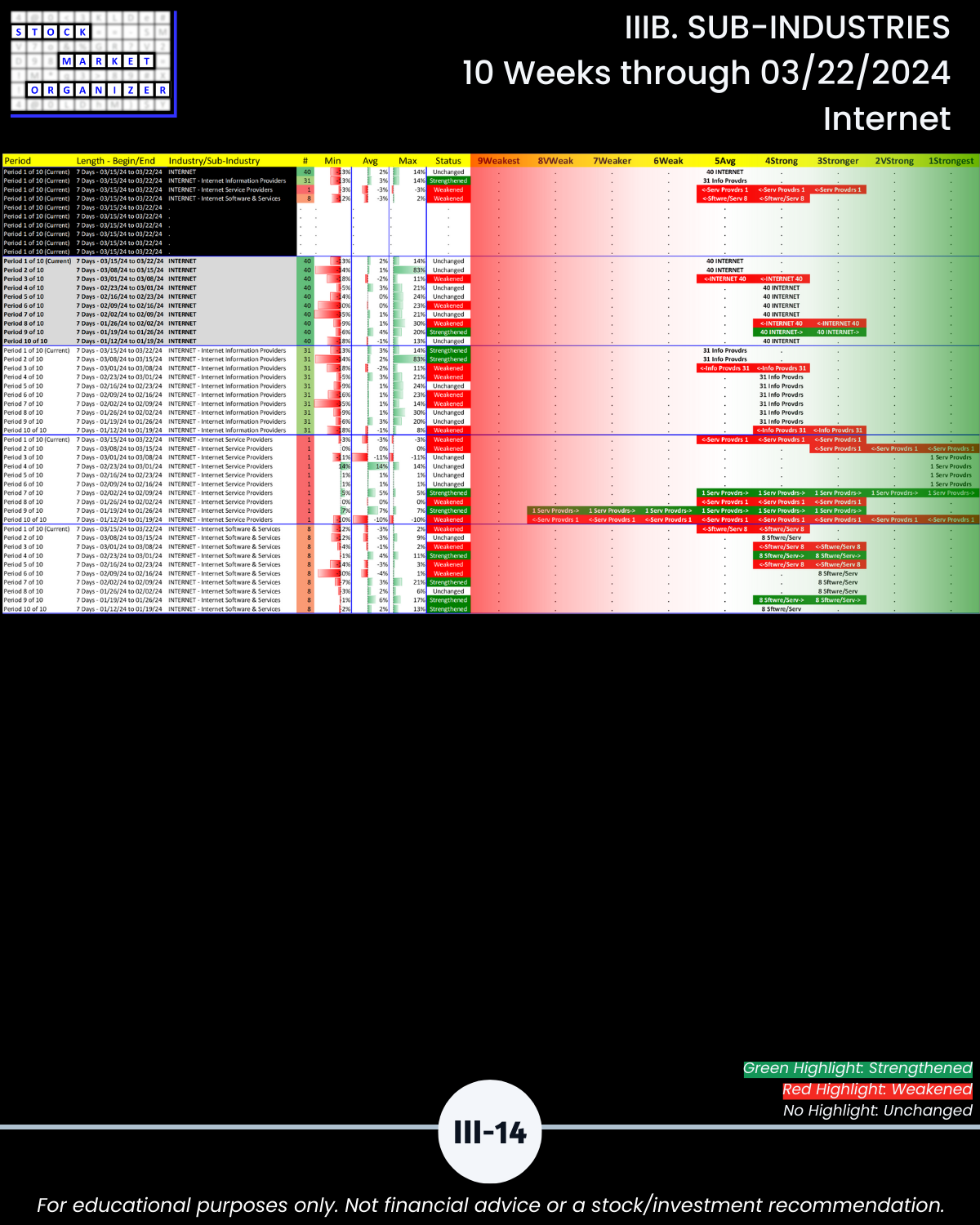

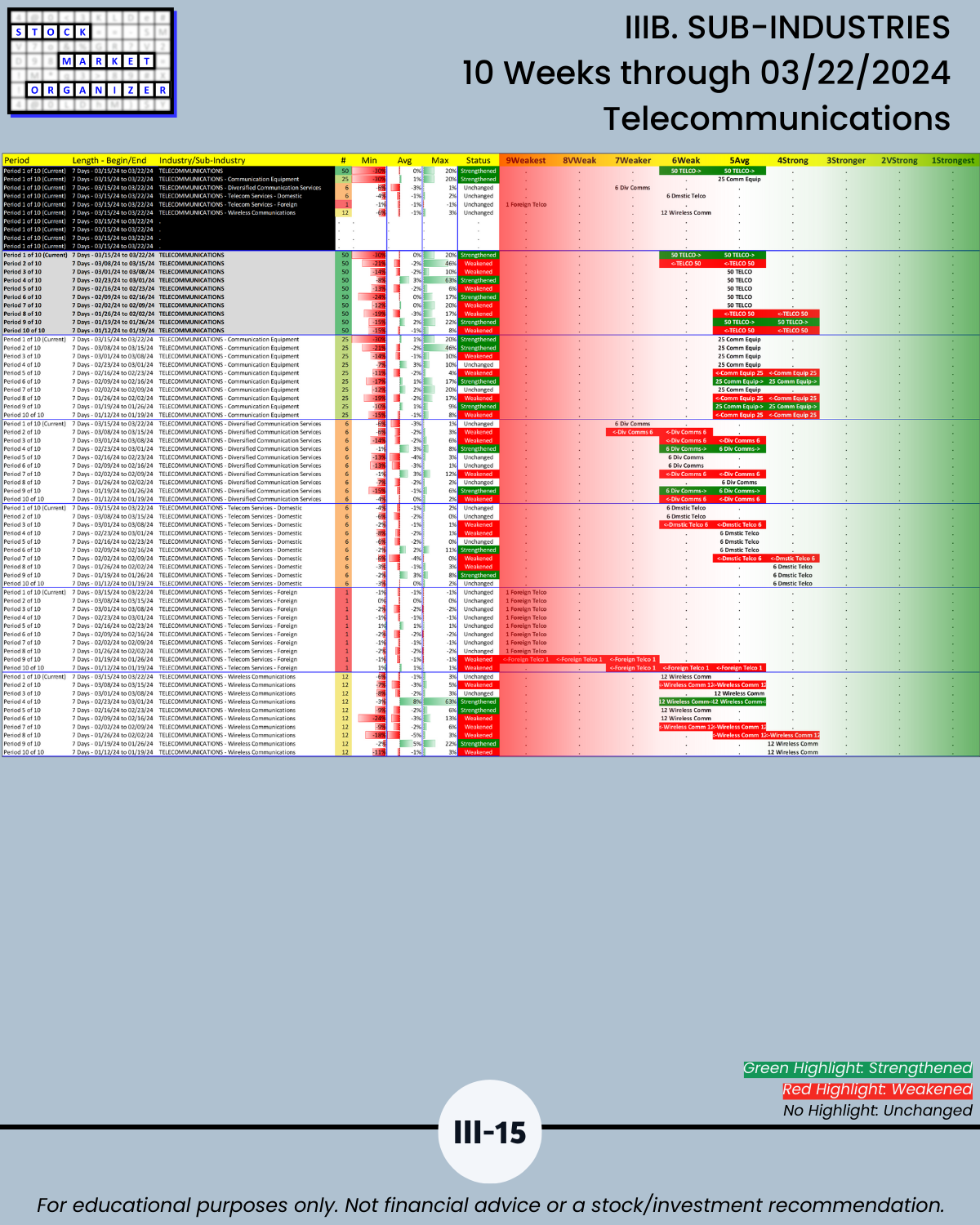

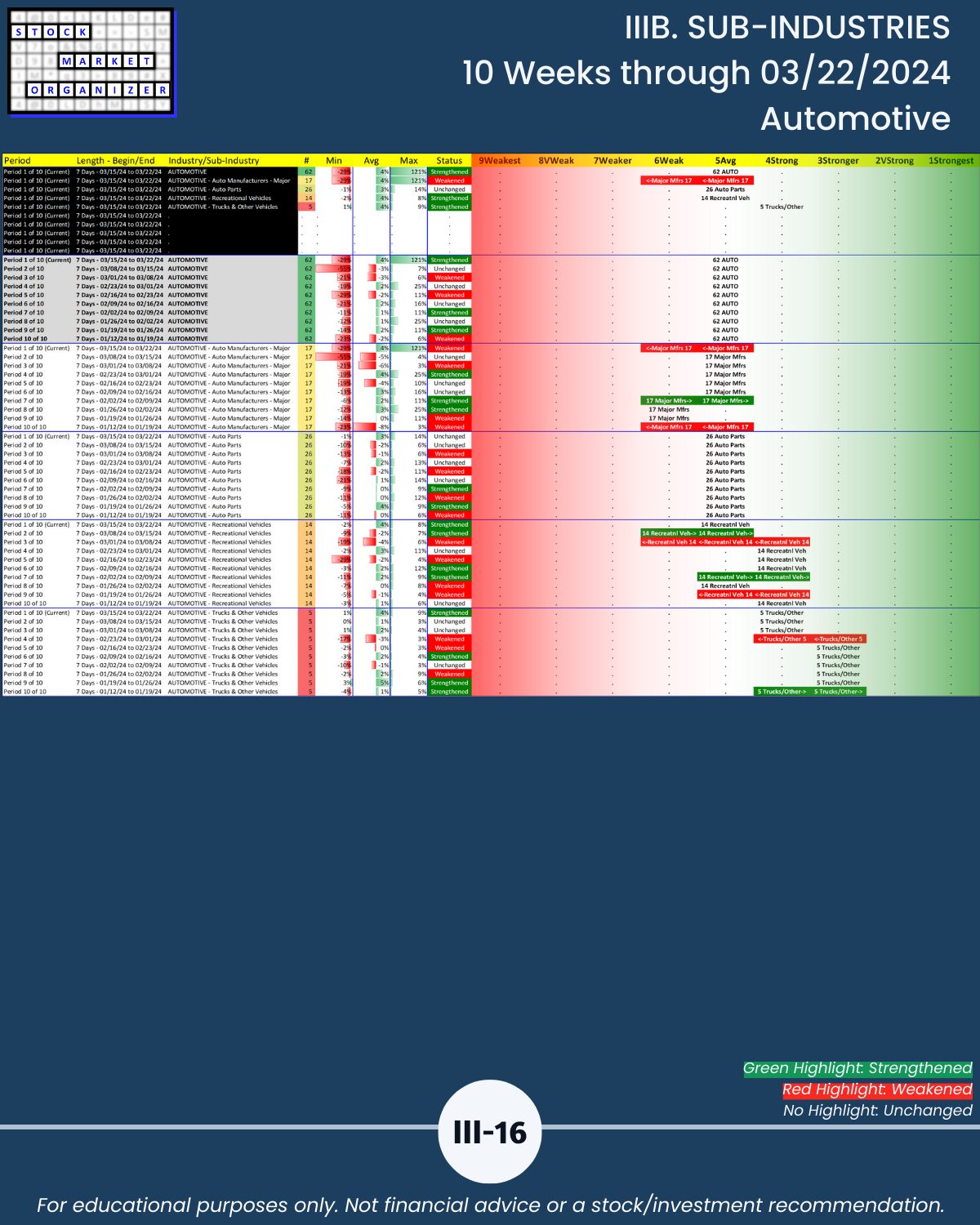

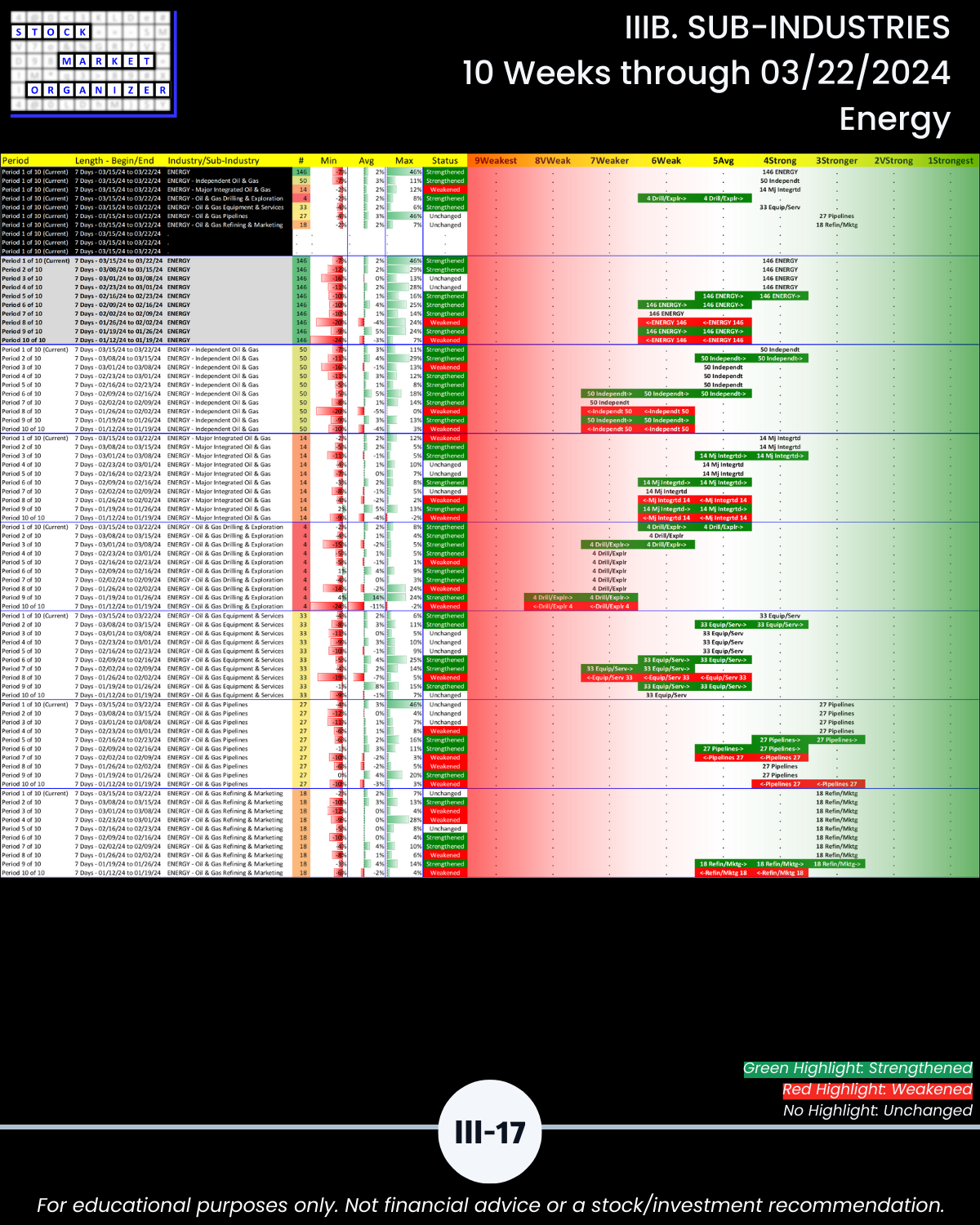

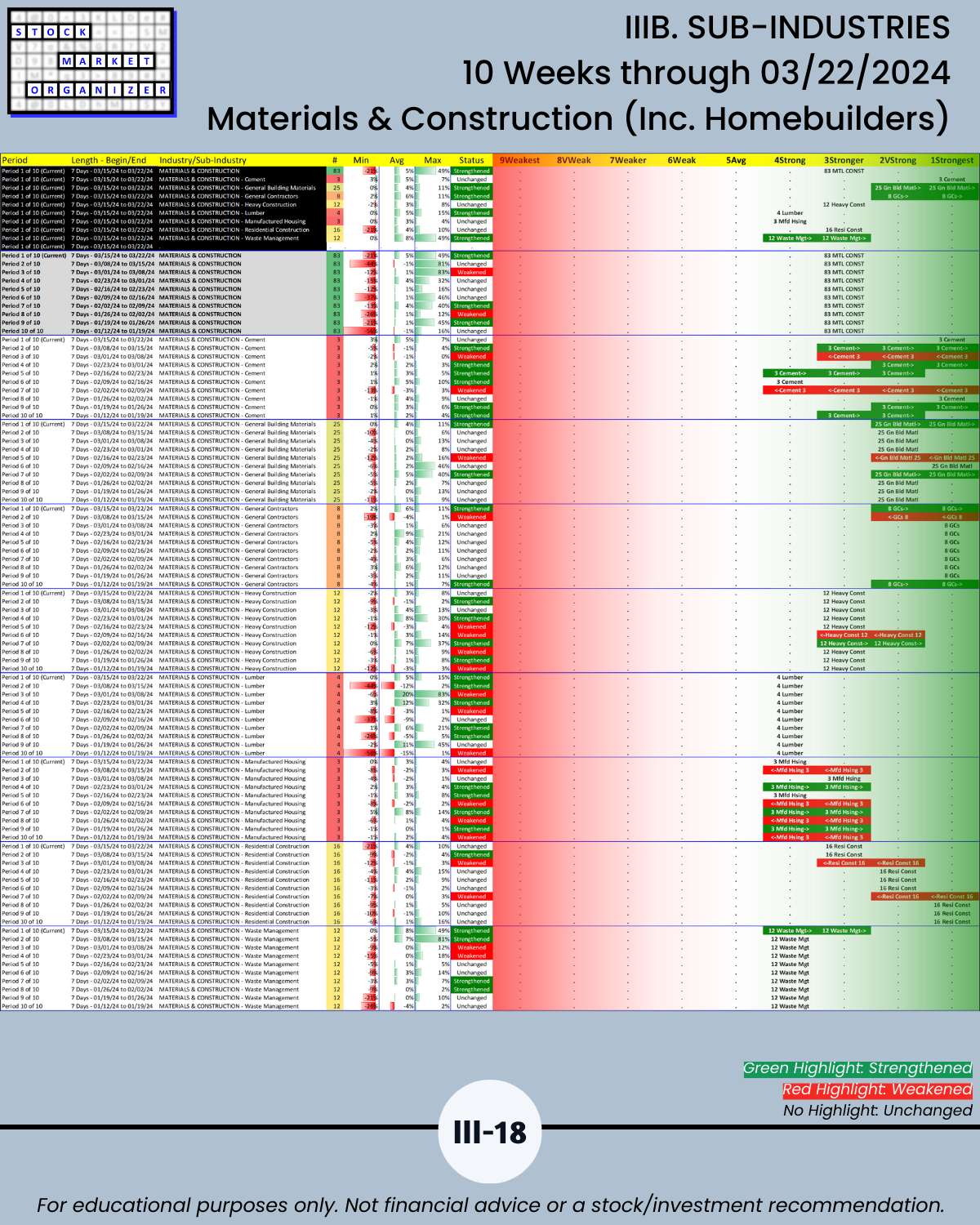

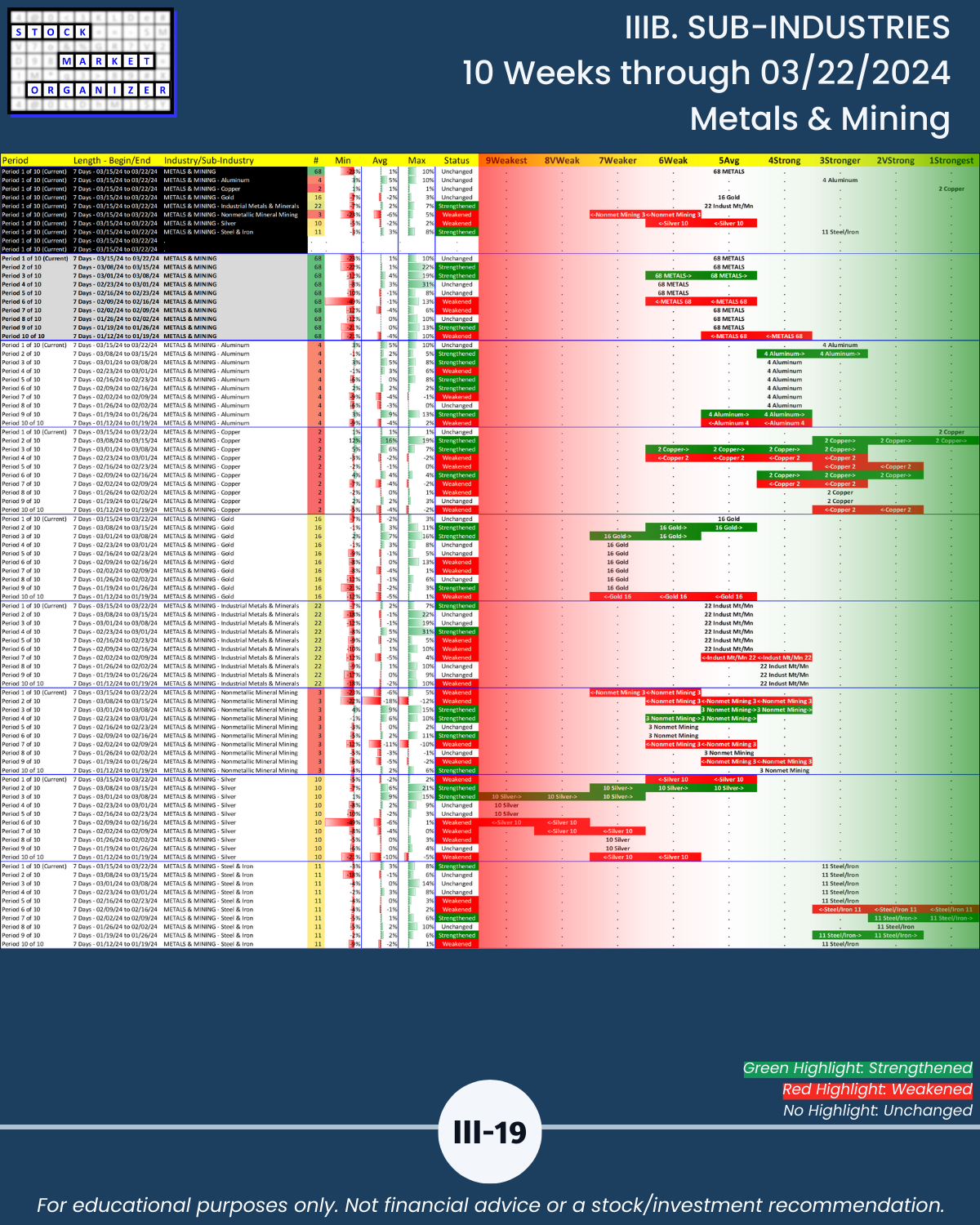

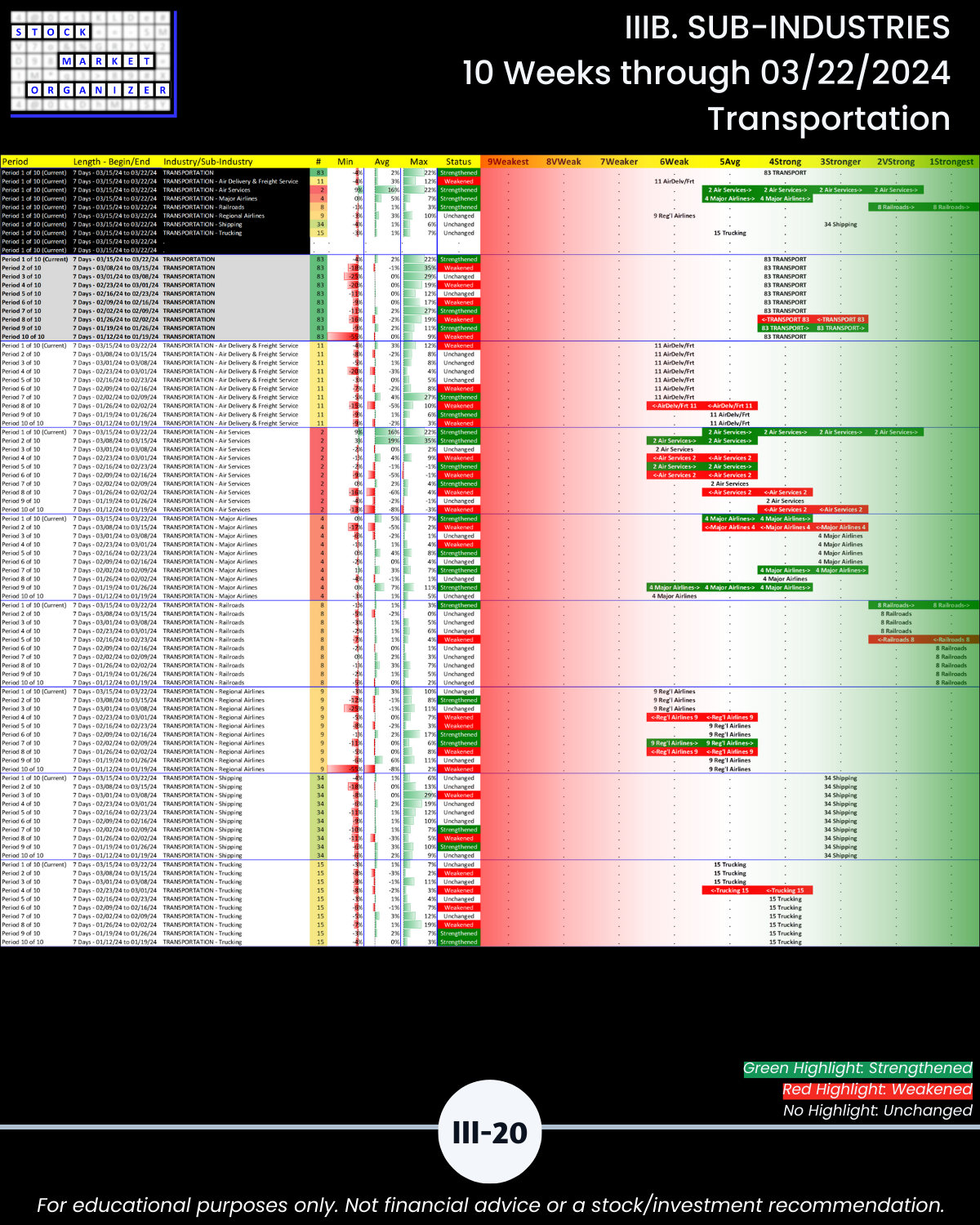

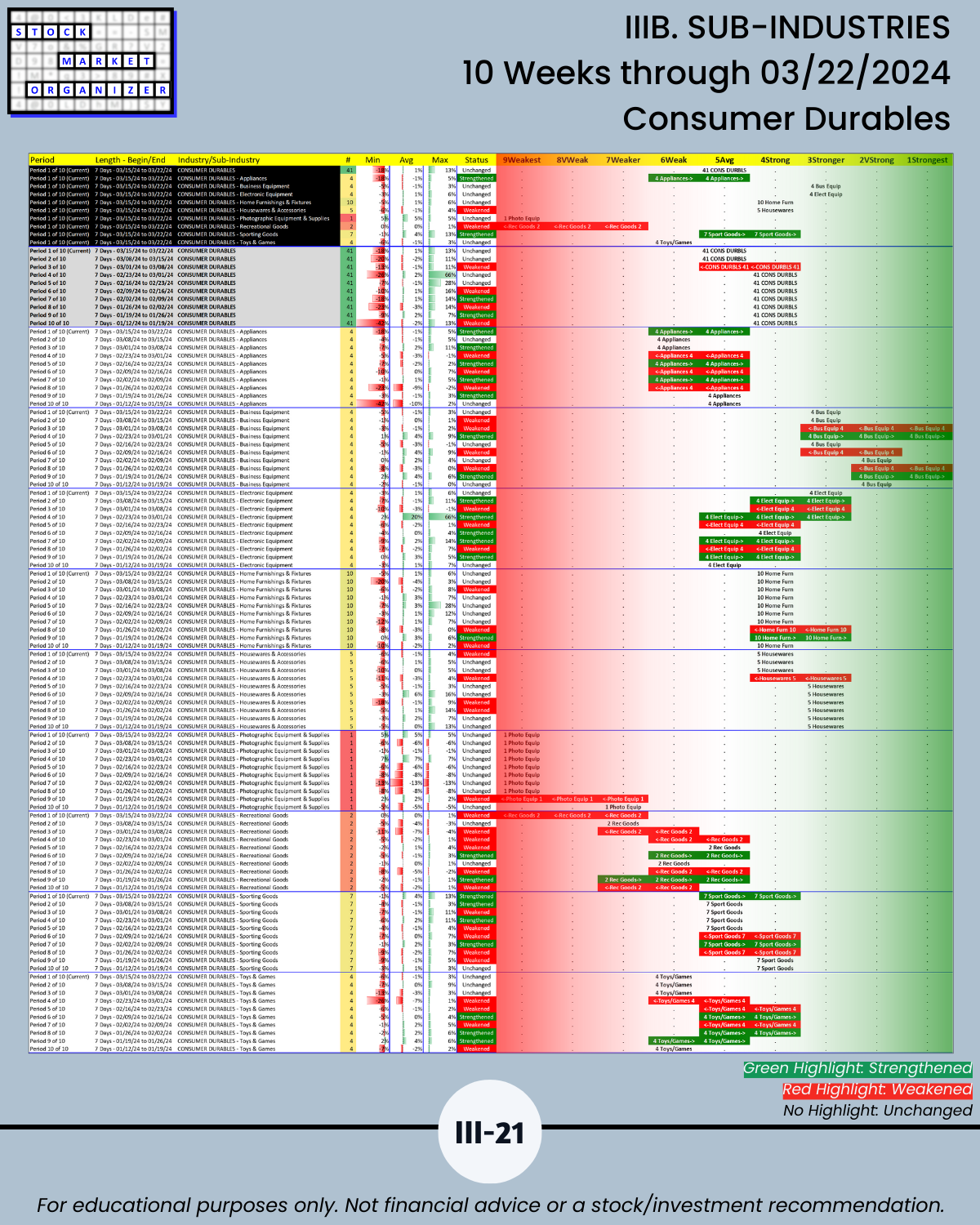

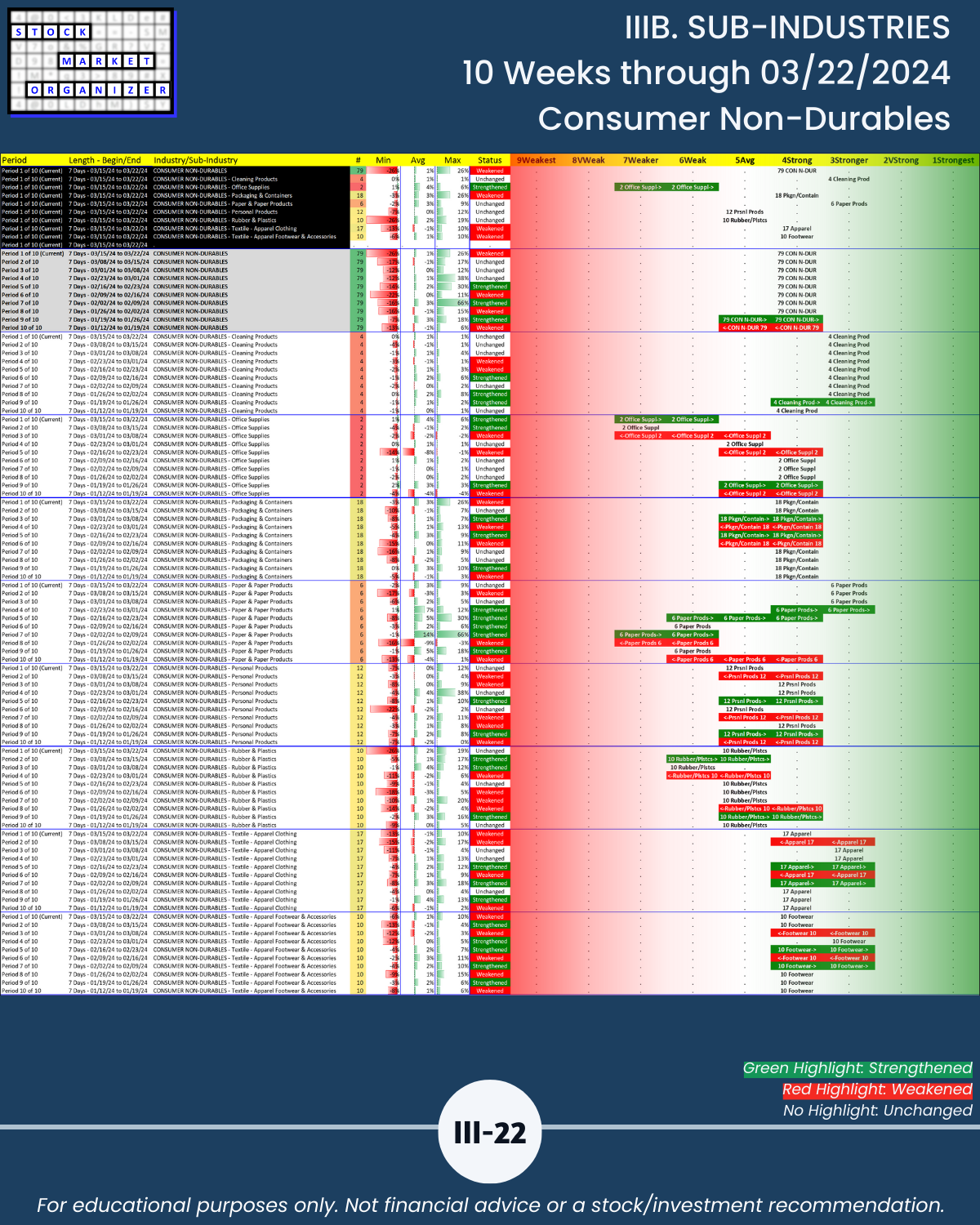

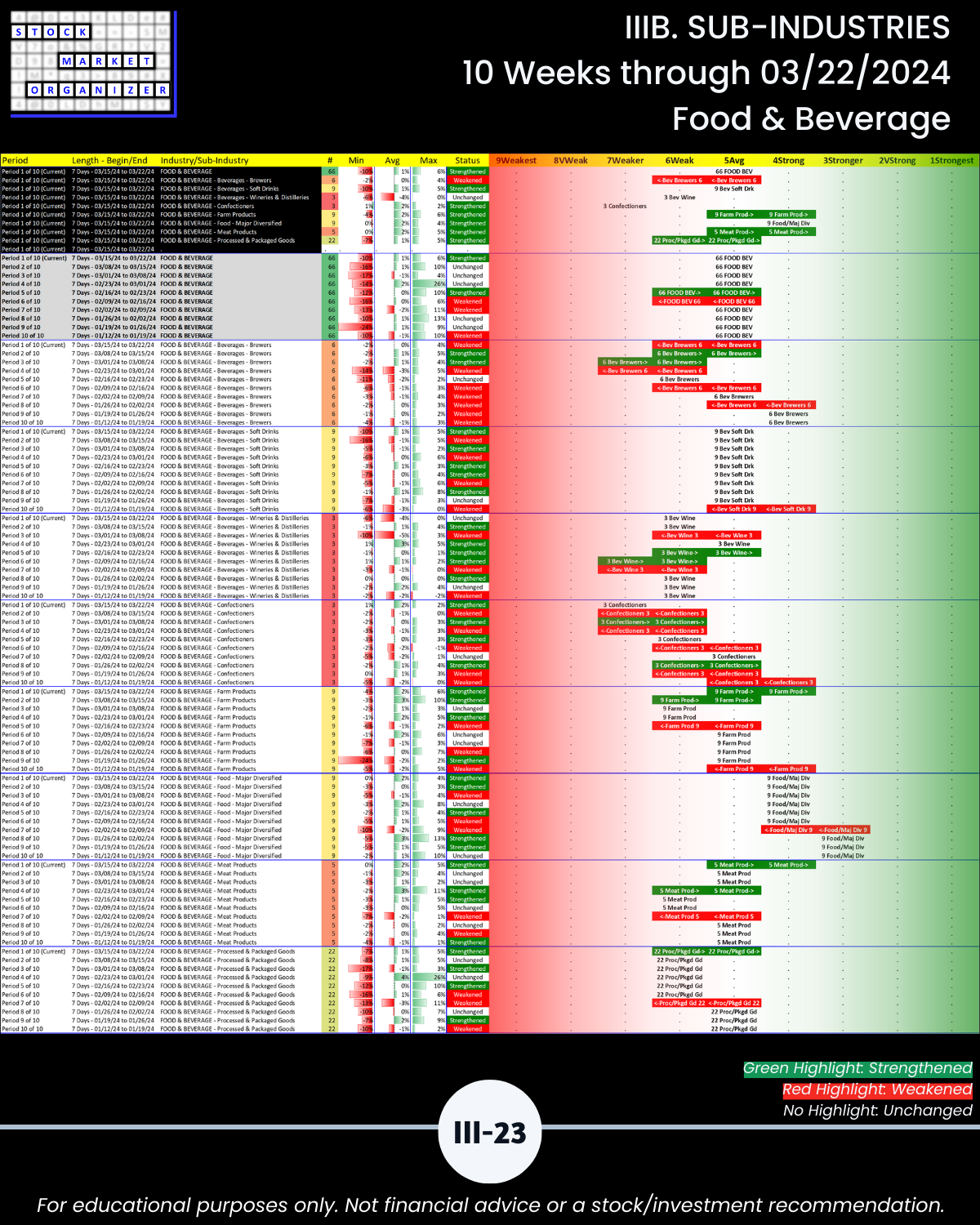

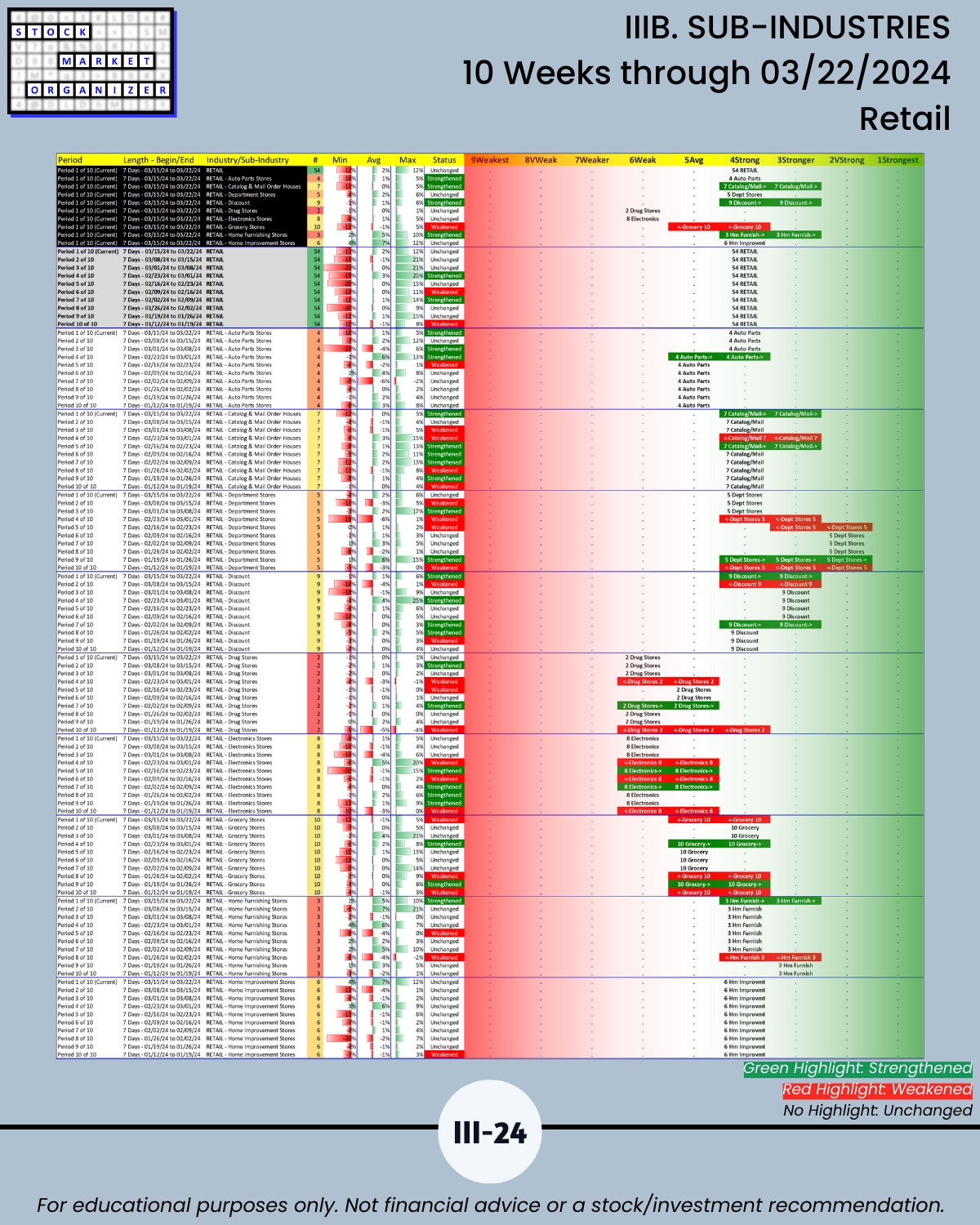

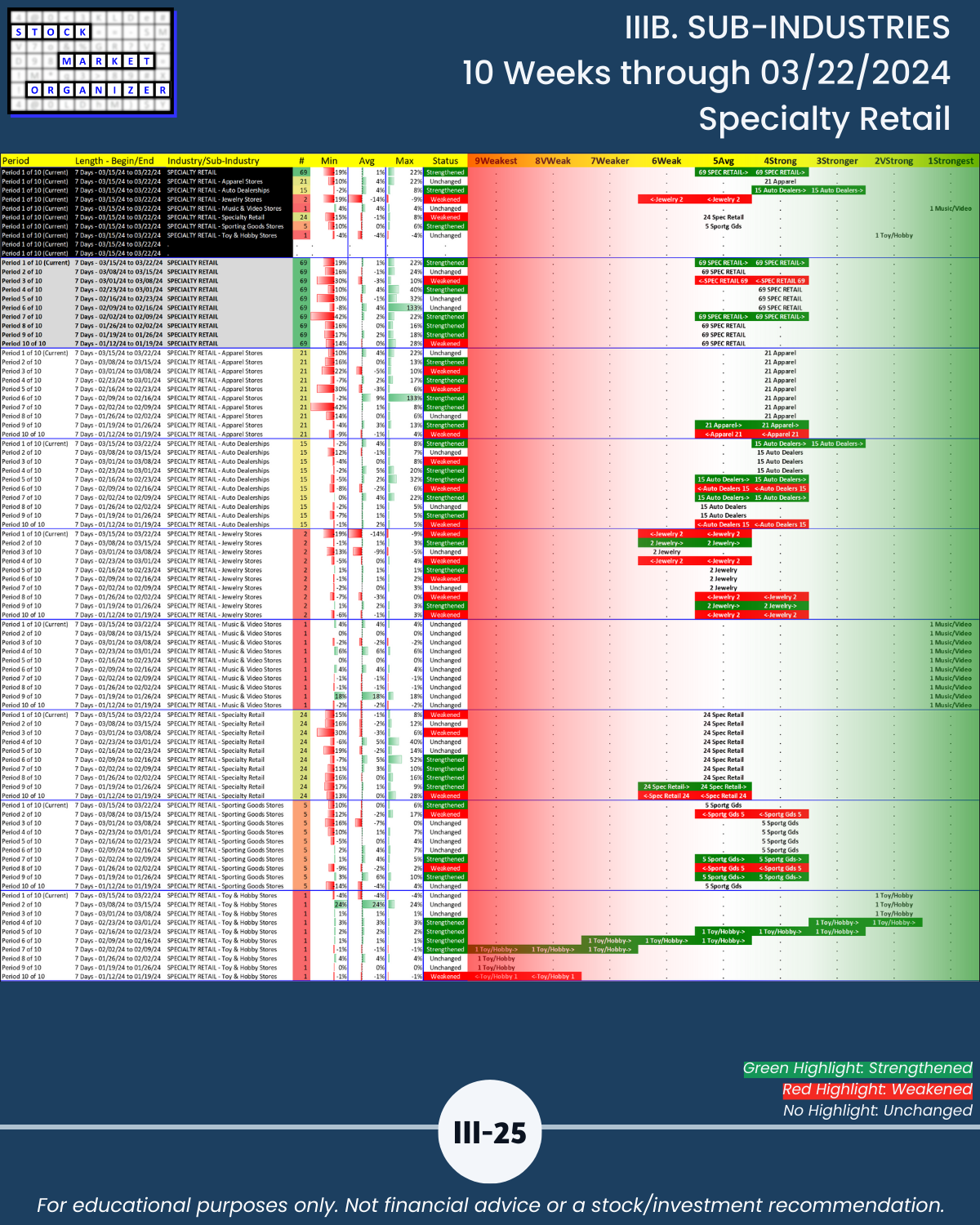

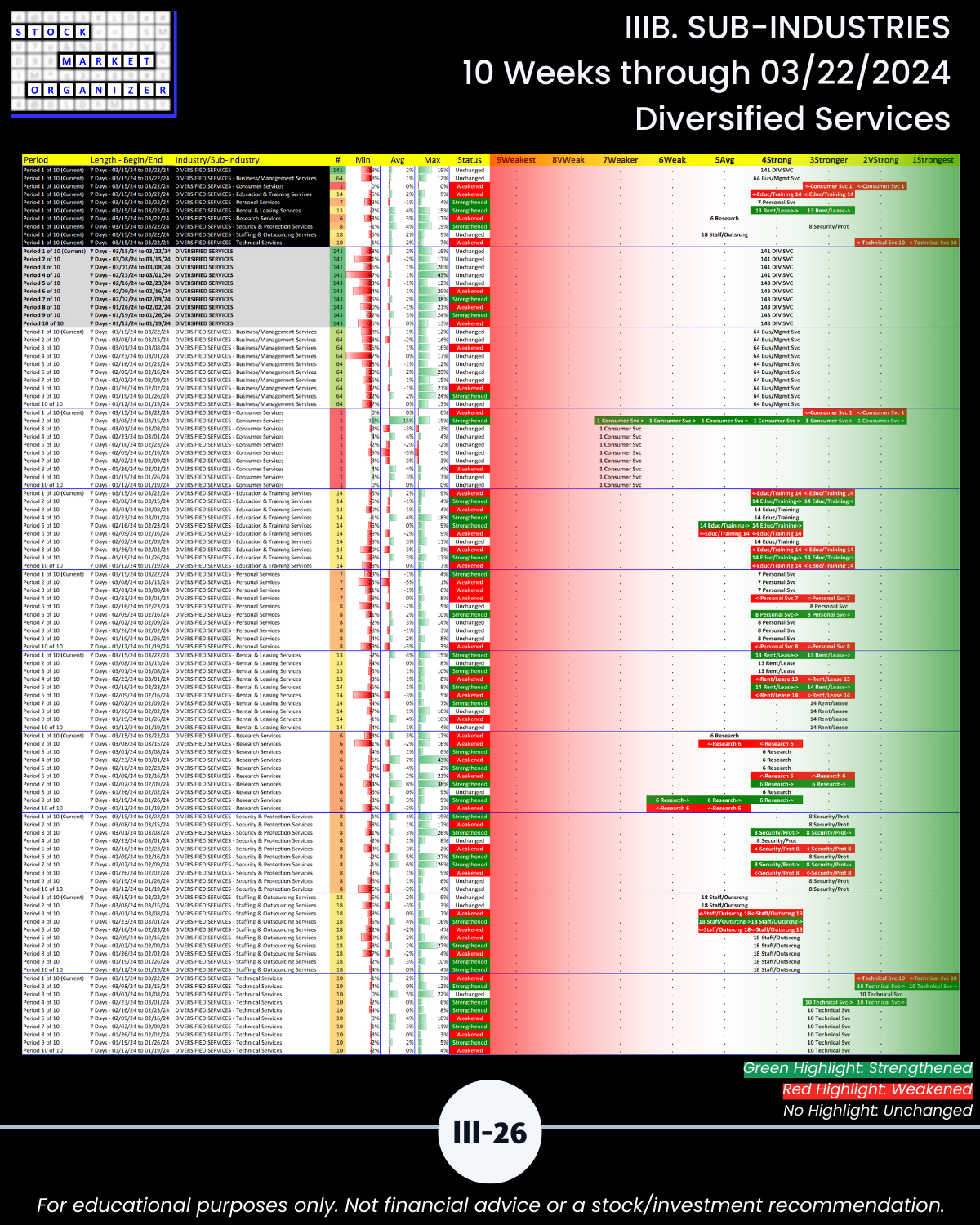

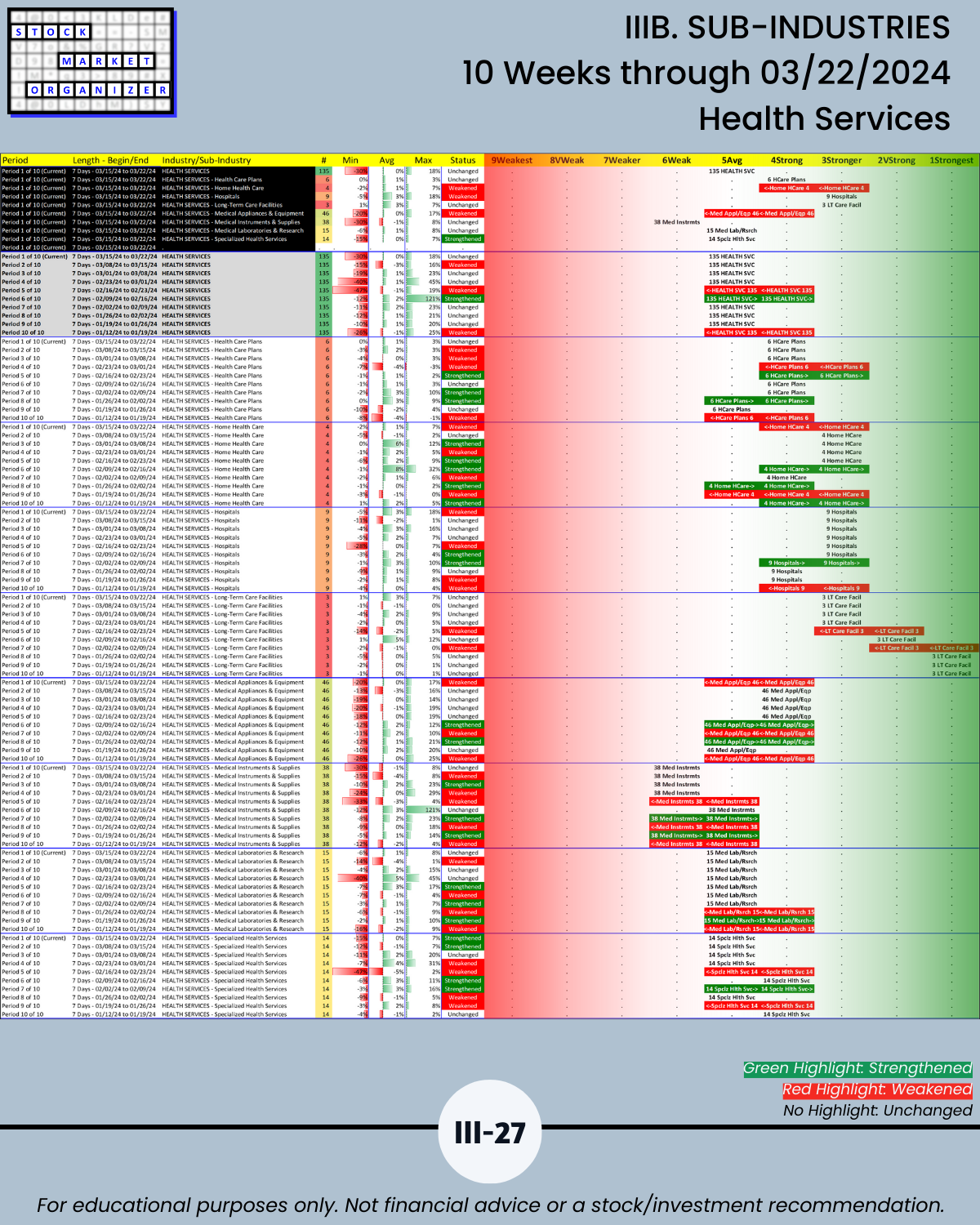

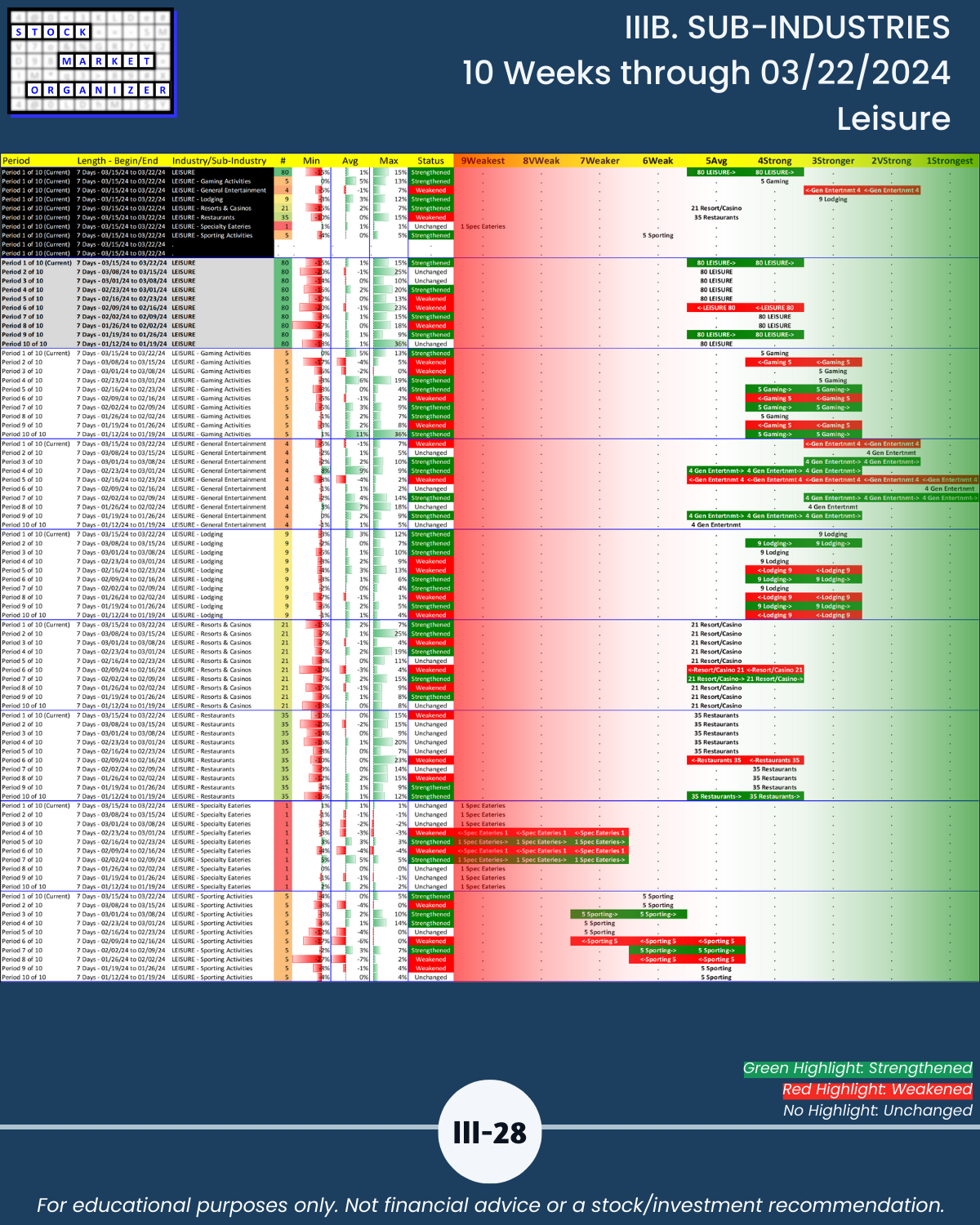

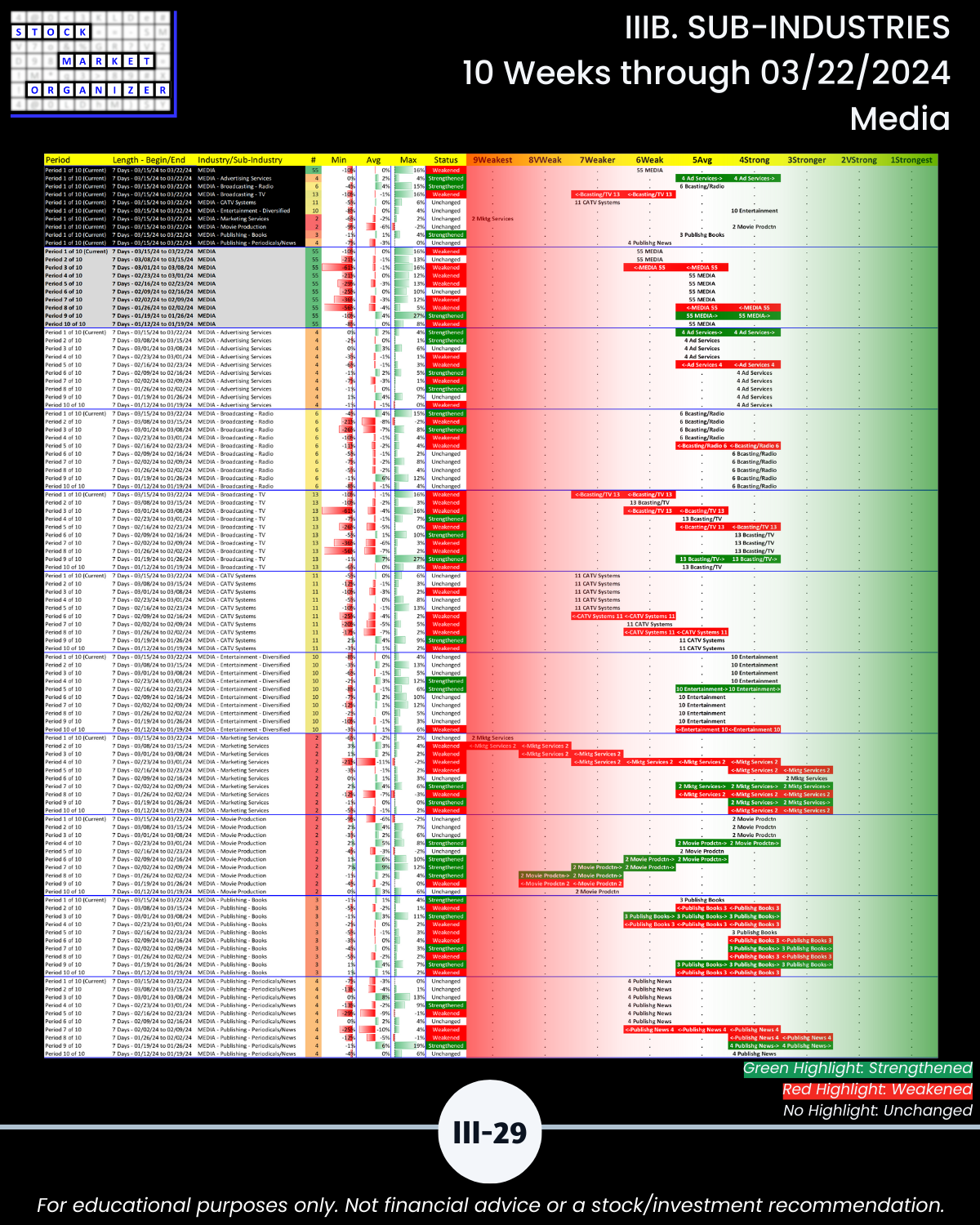

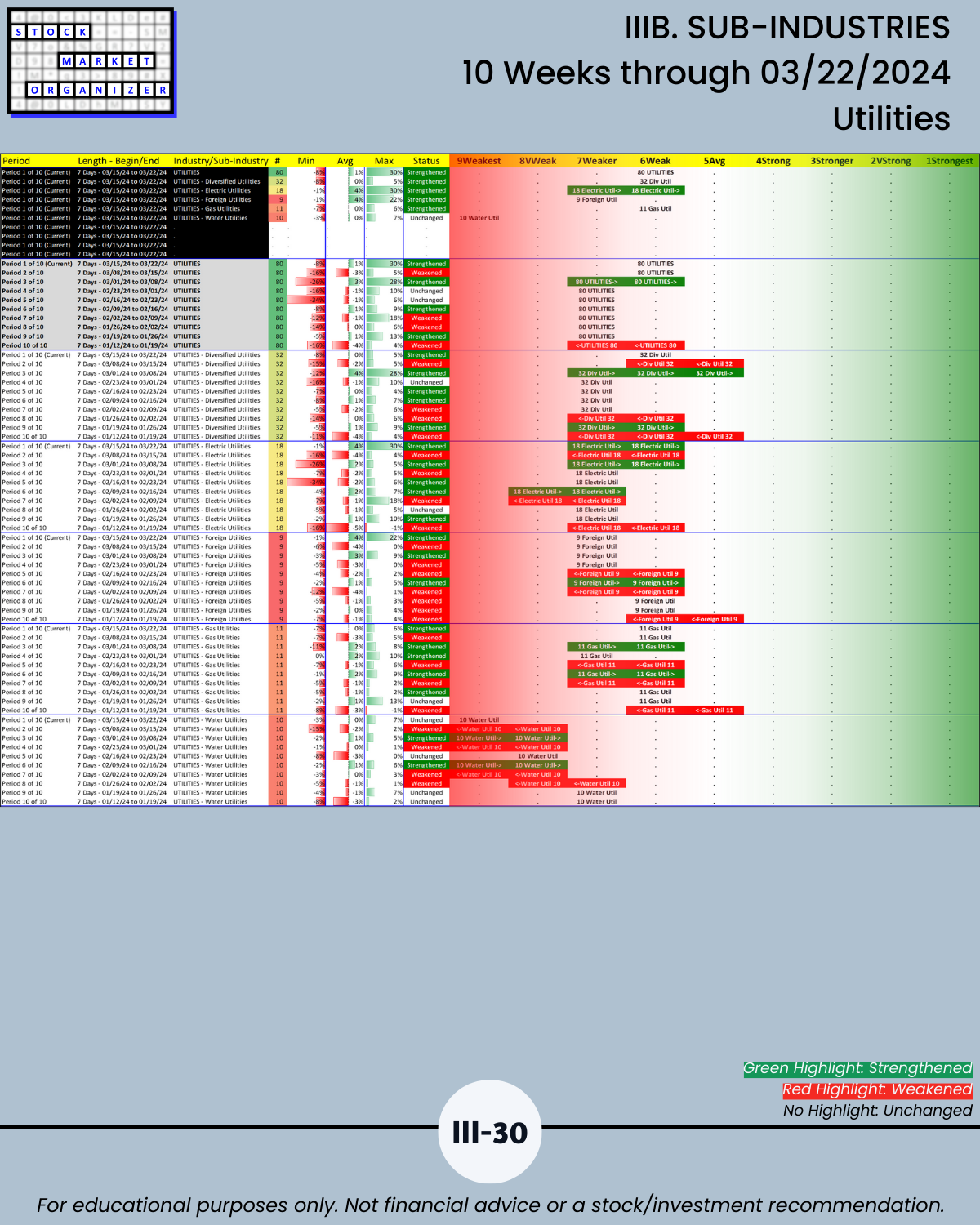

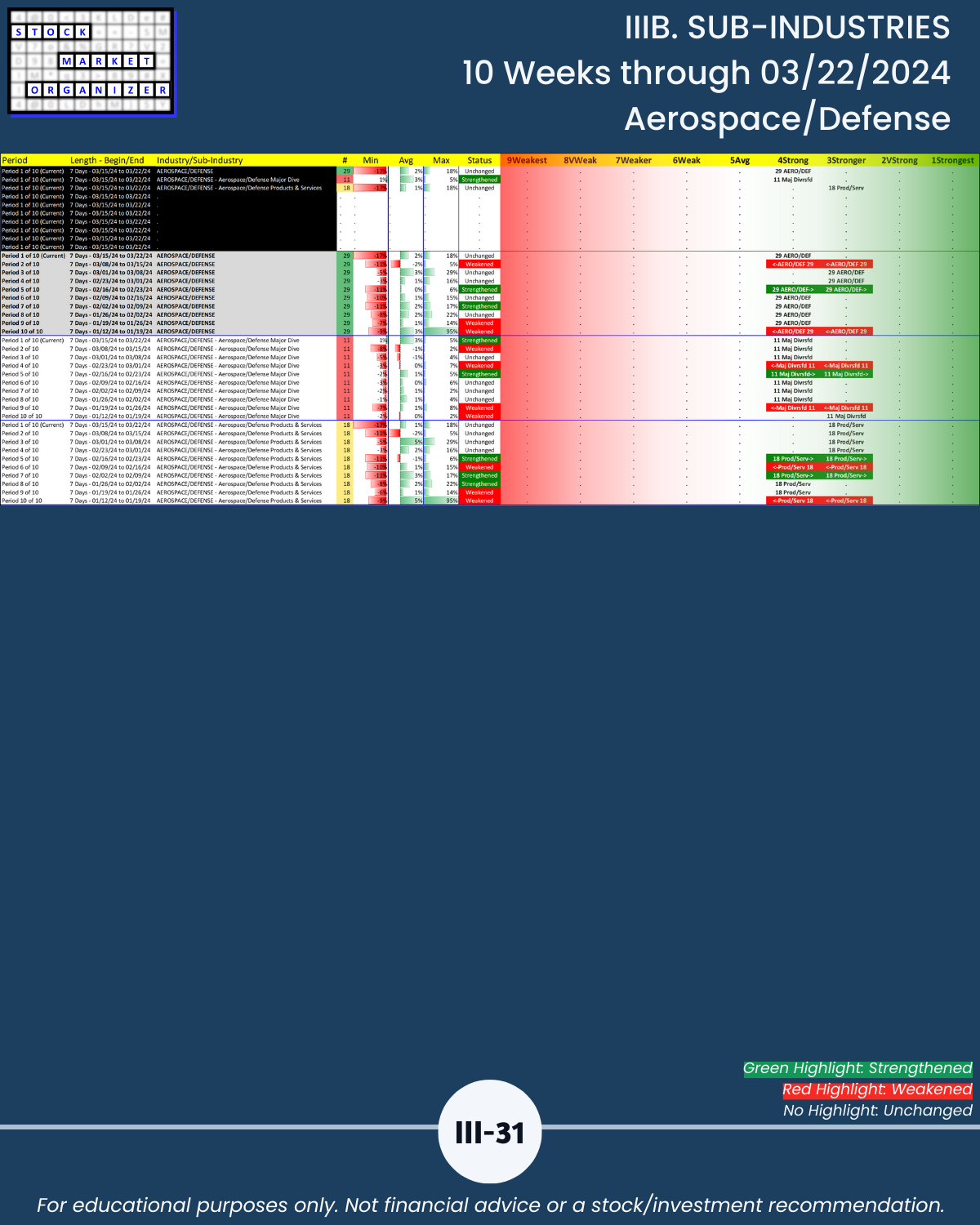

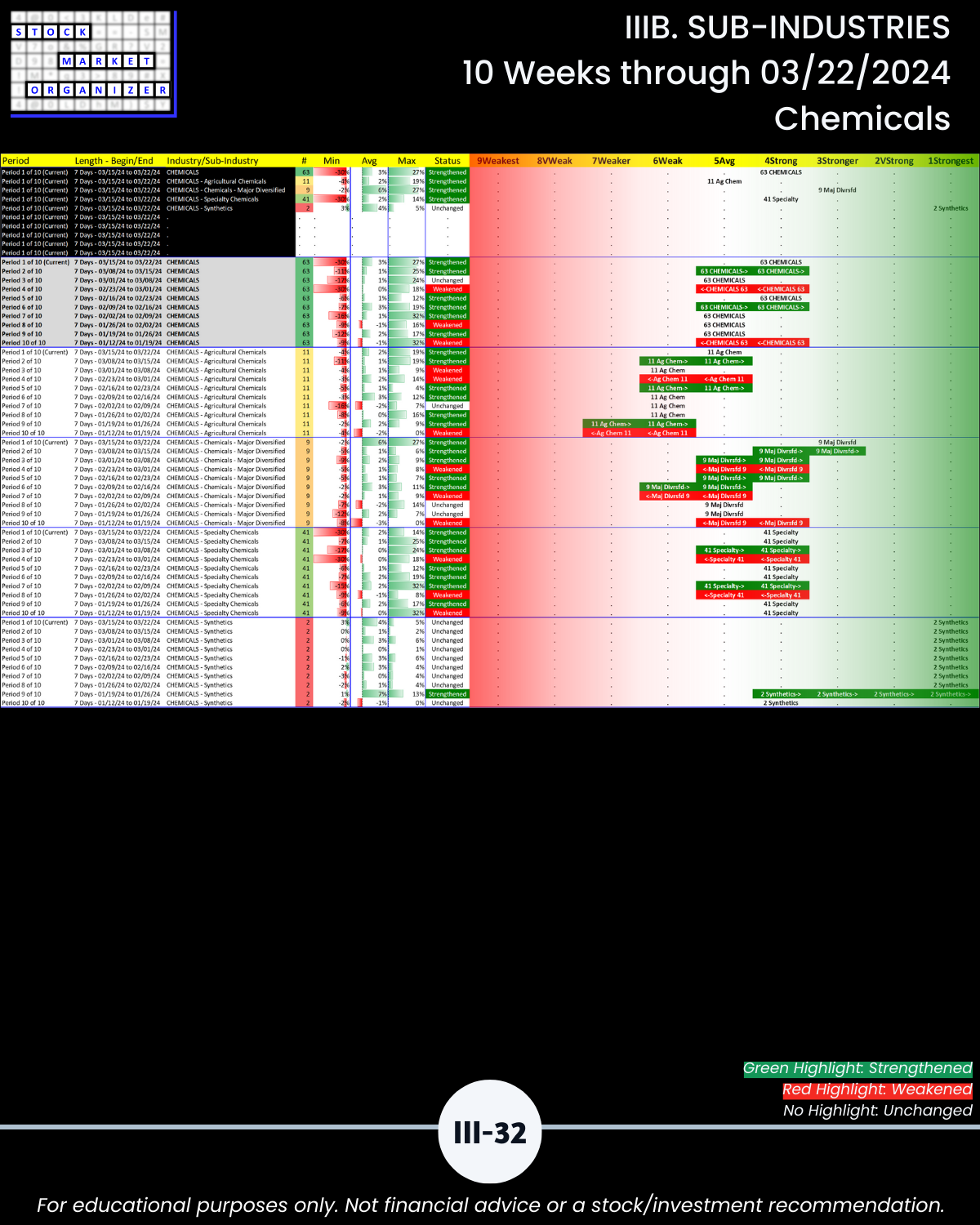

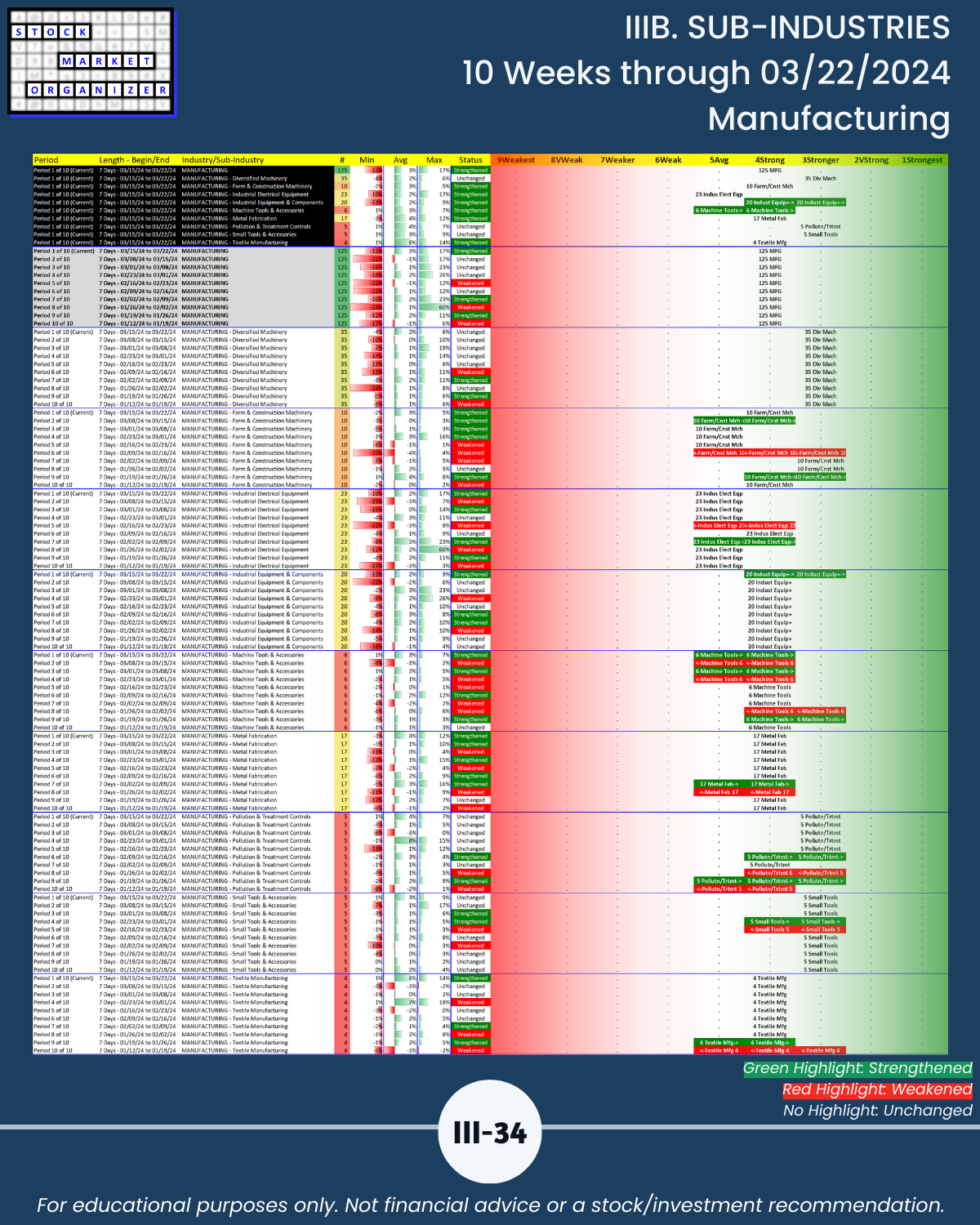

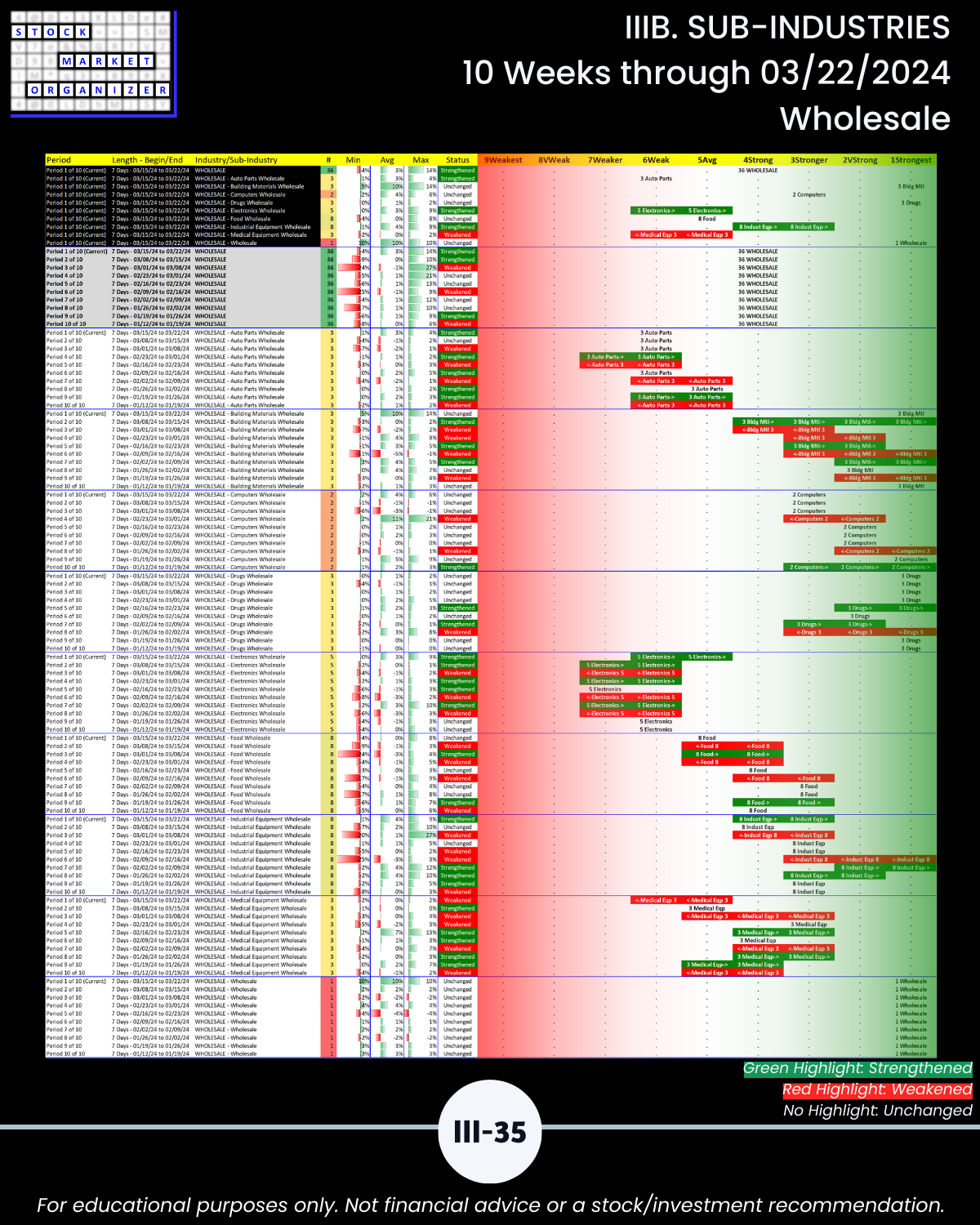

IIIB. SUB-INDUSTRIES 10-Week Strengthening/Weakening

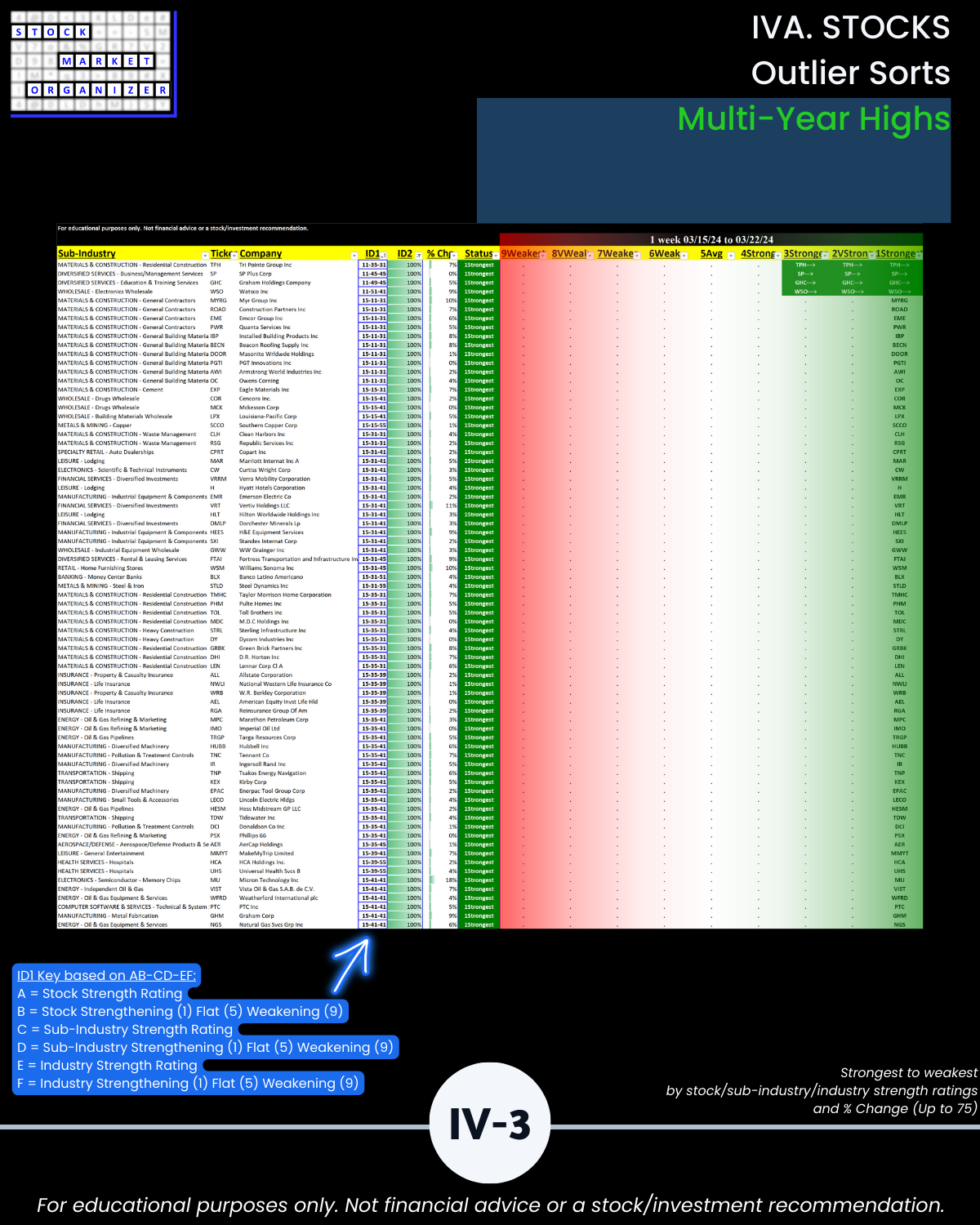

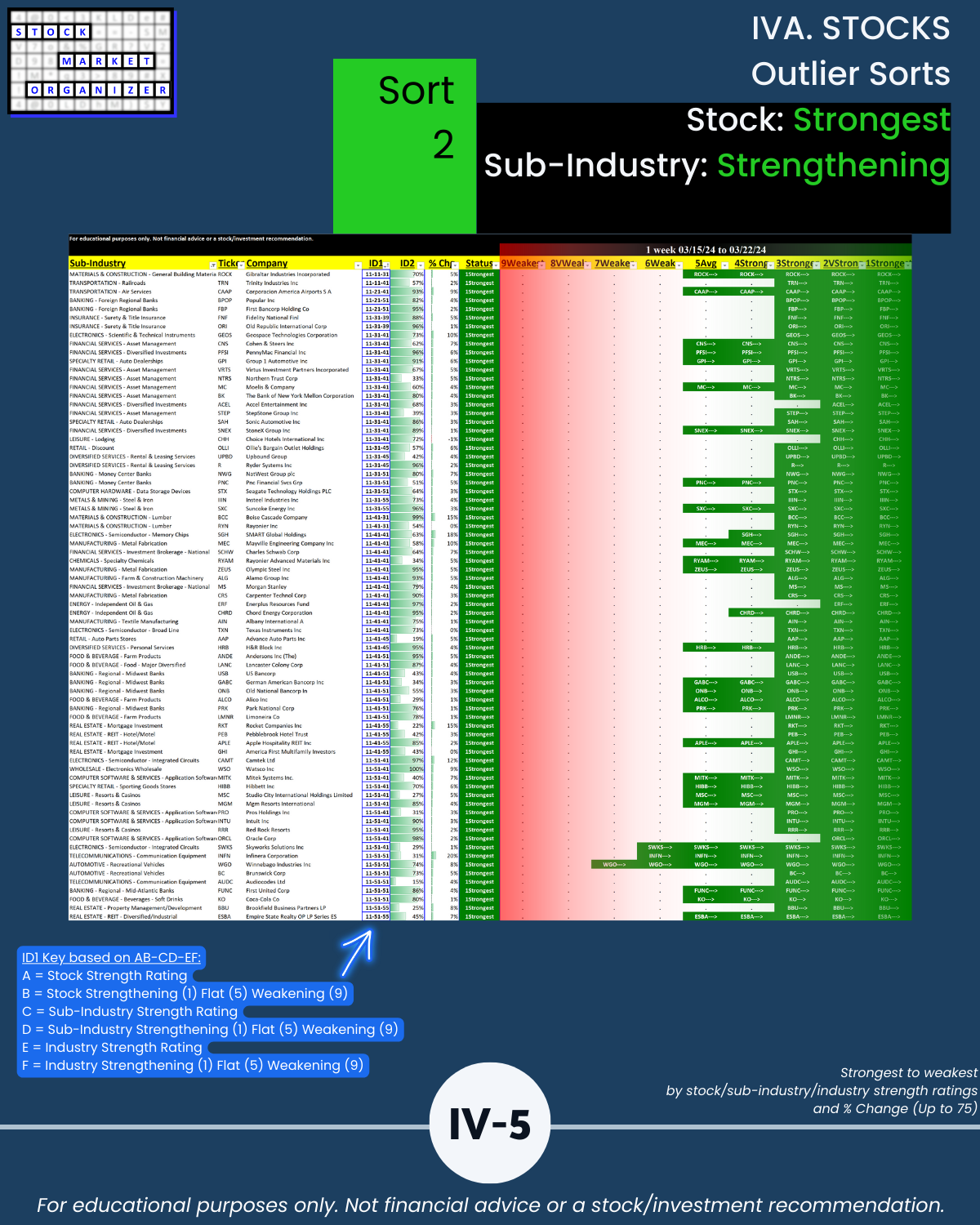

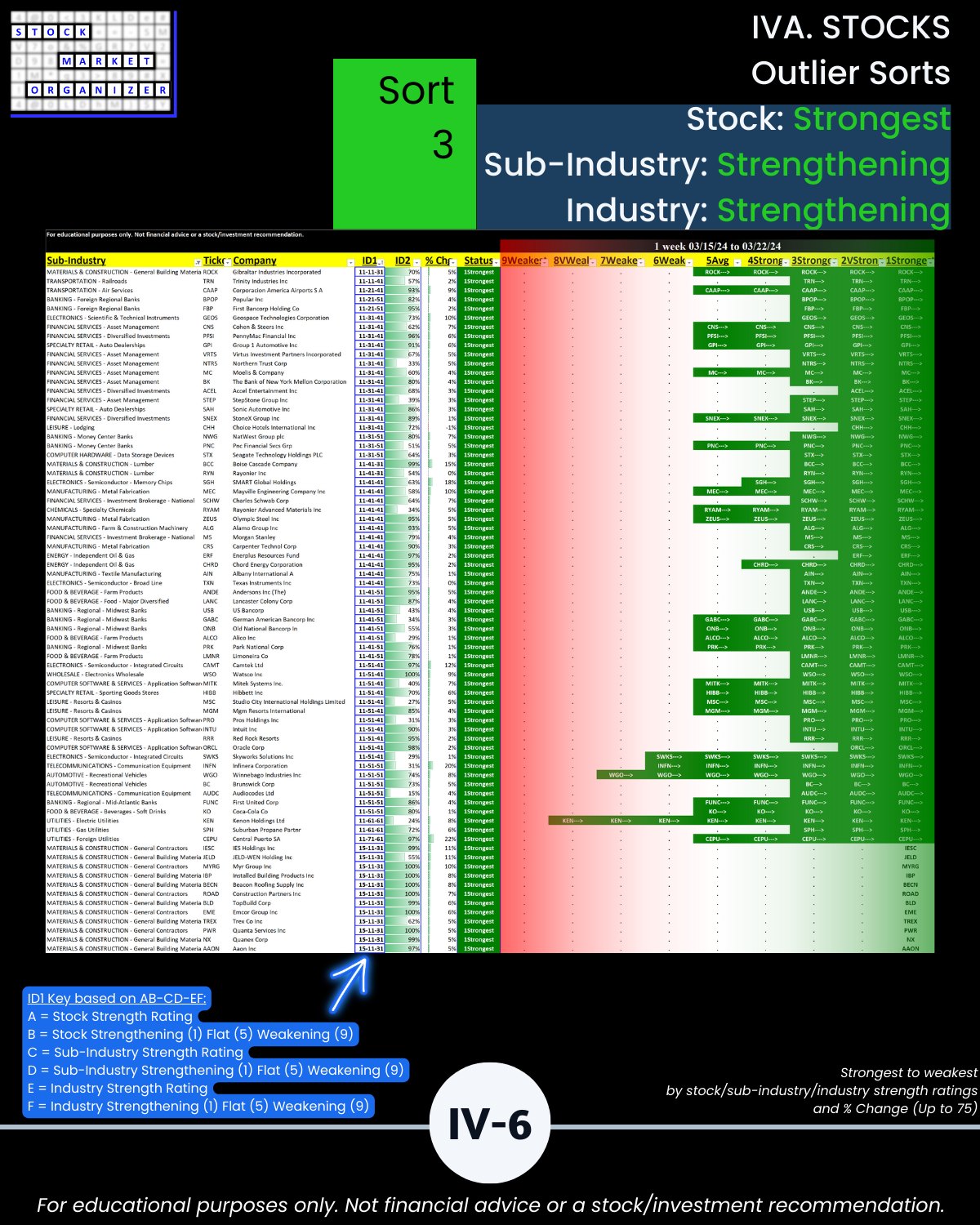

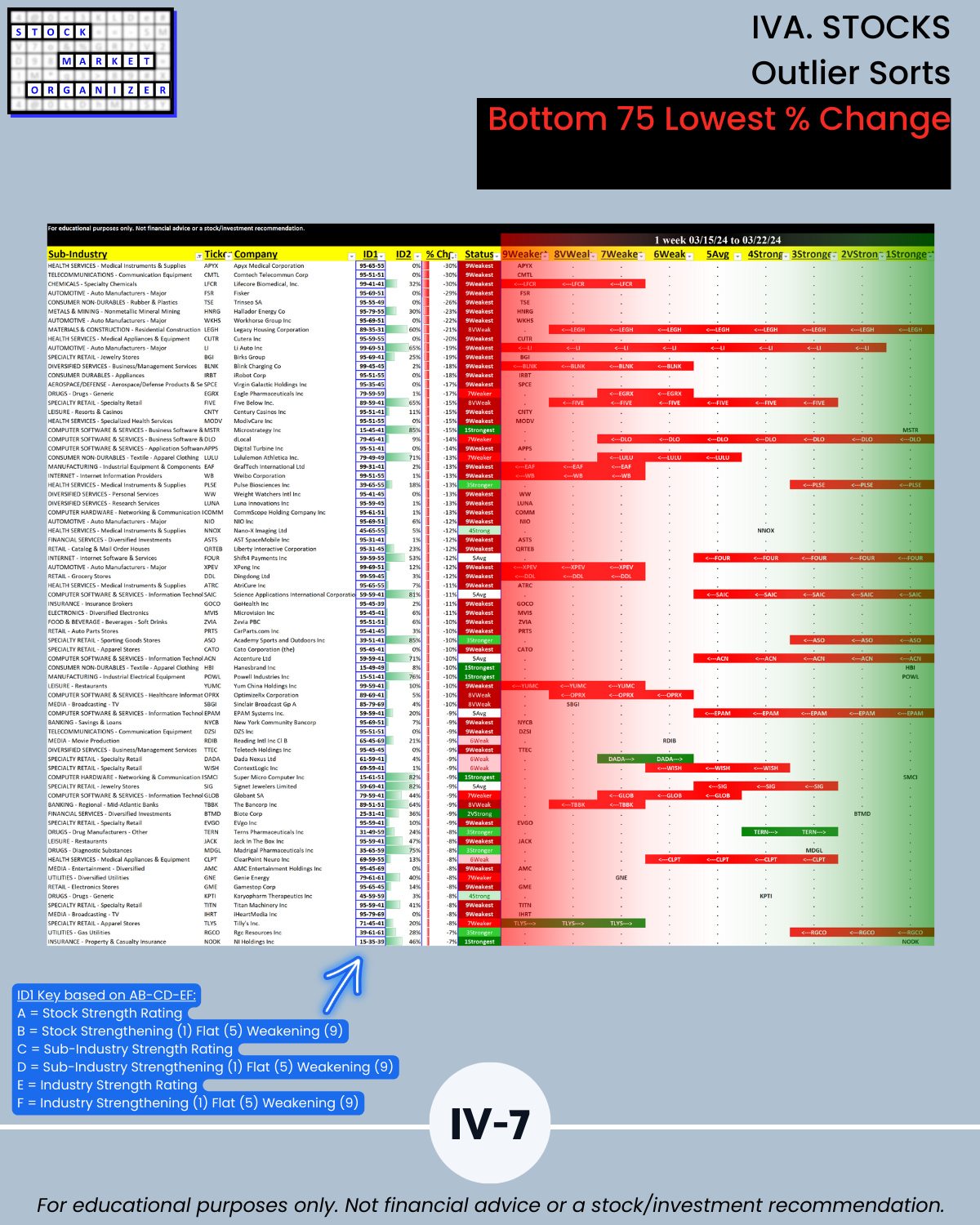

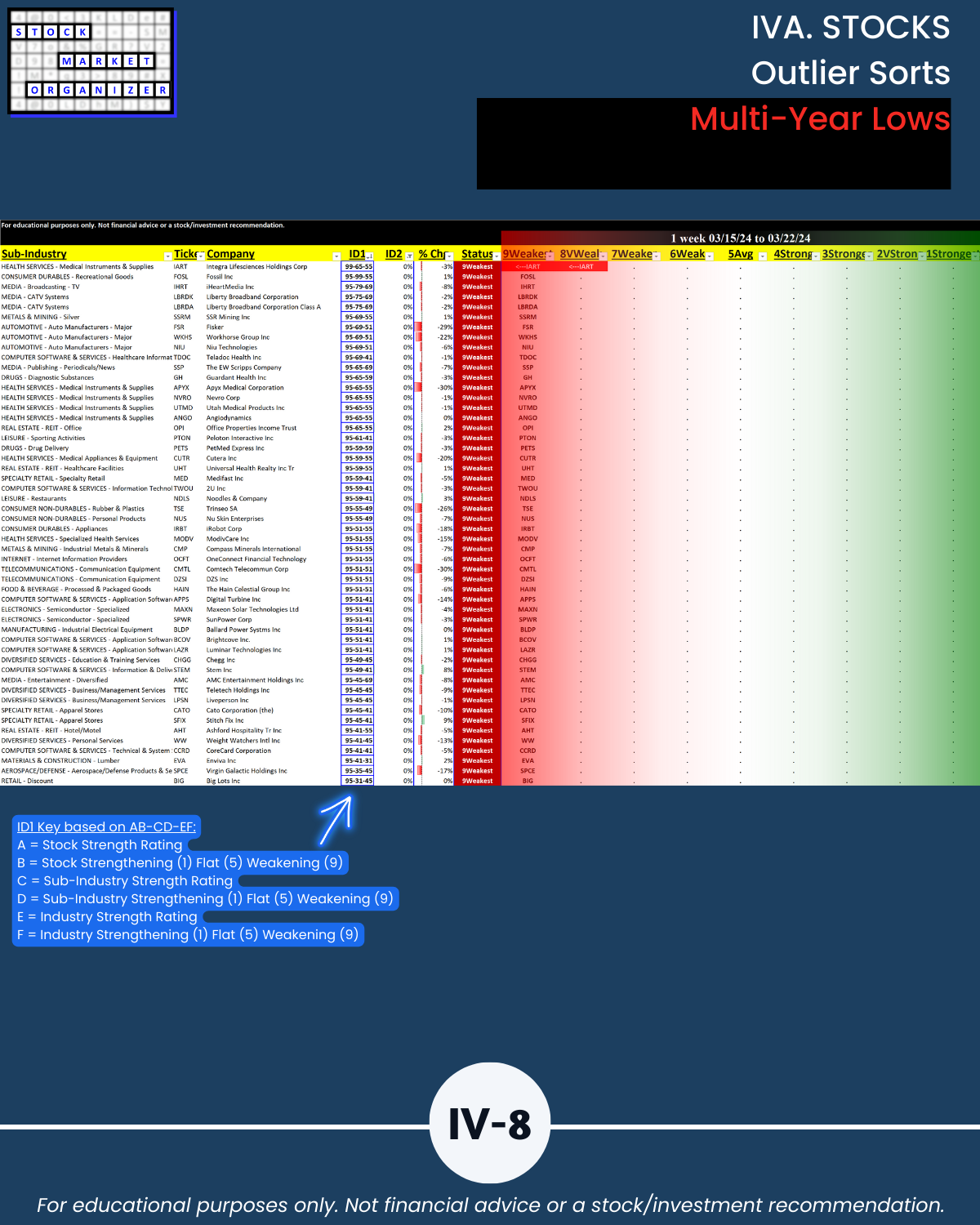

IVA. STOCKS Outlier Sorts

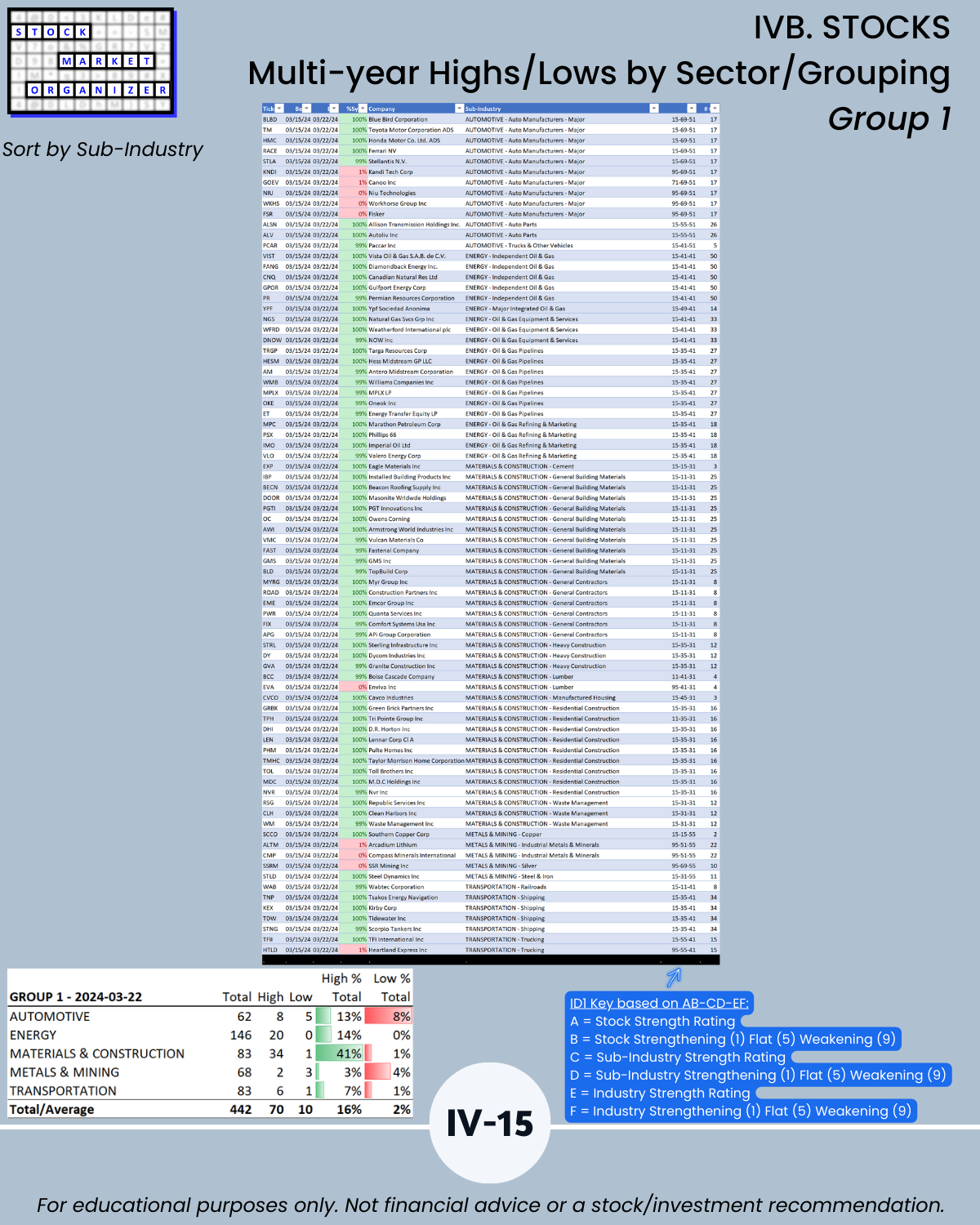

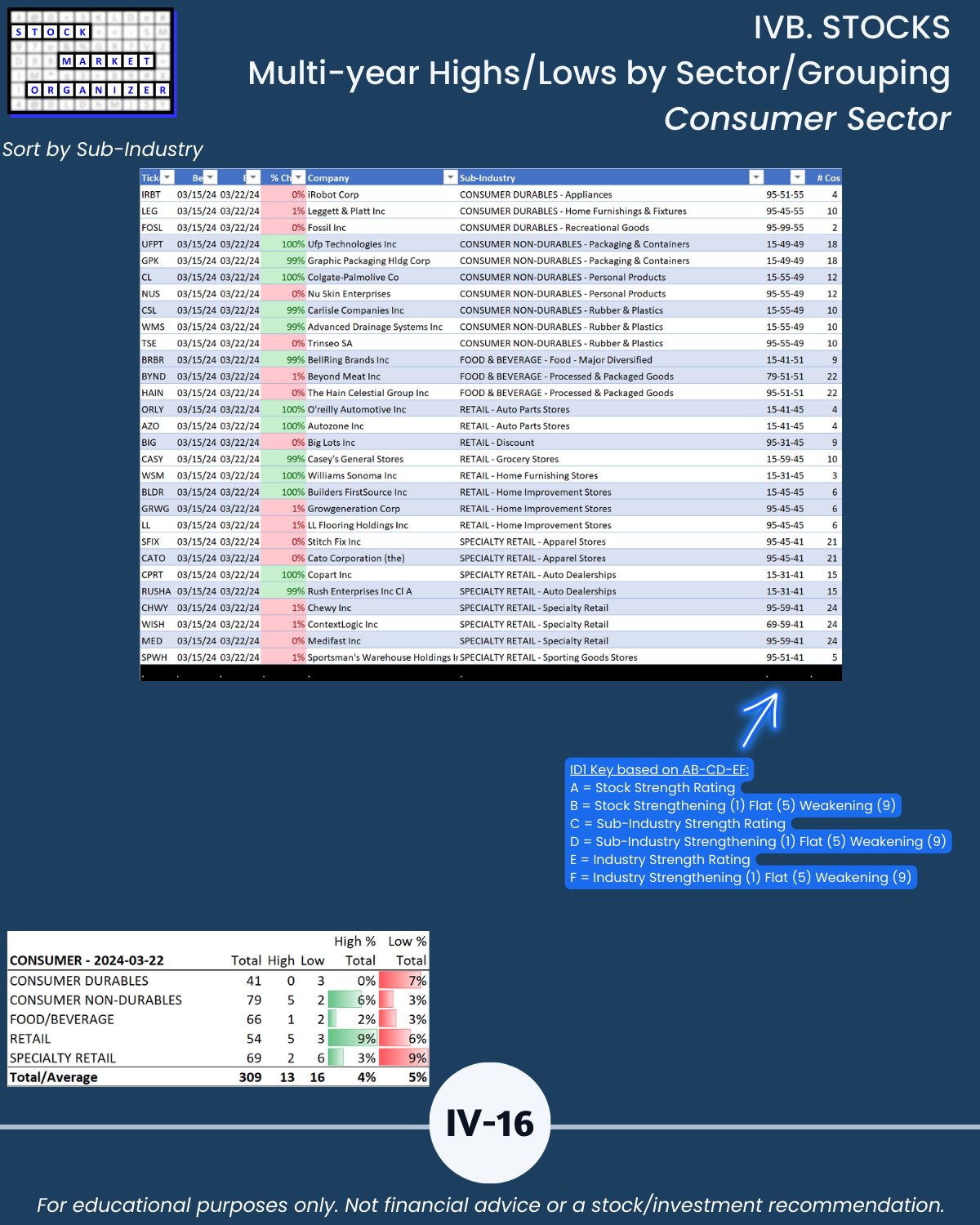

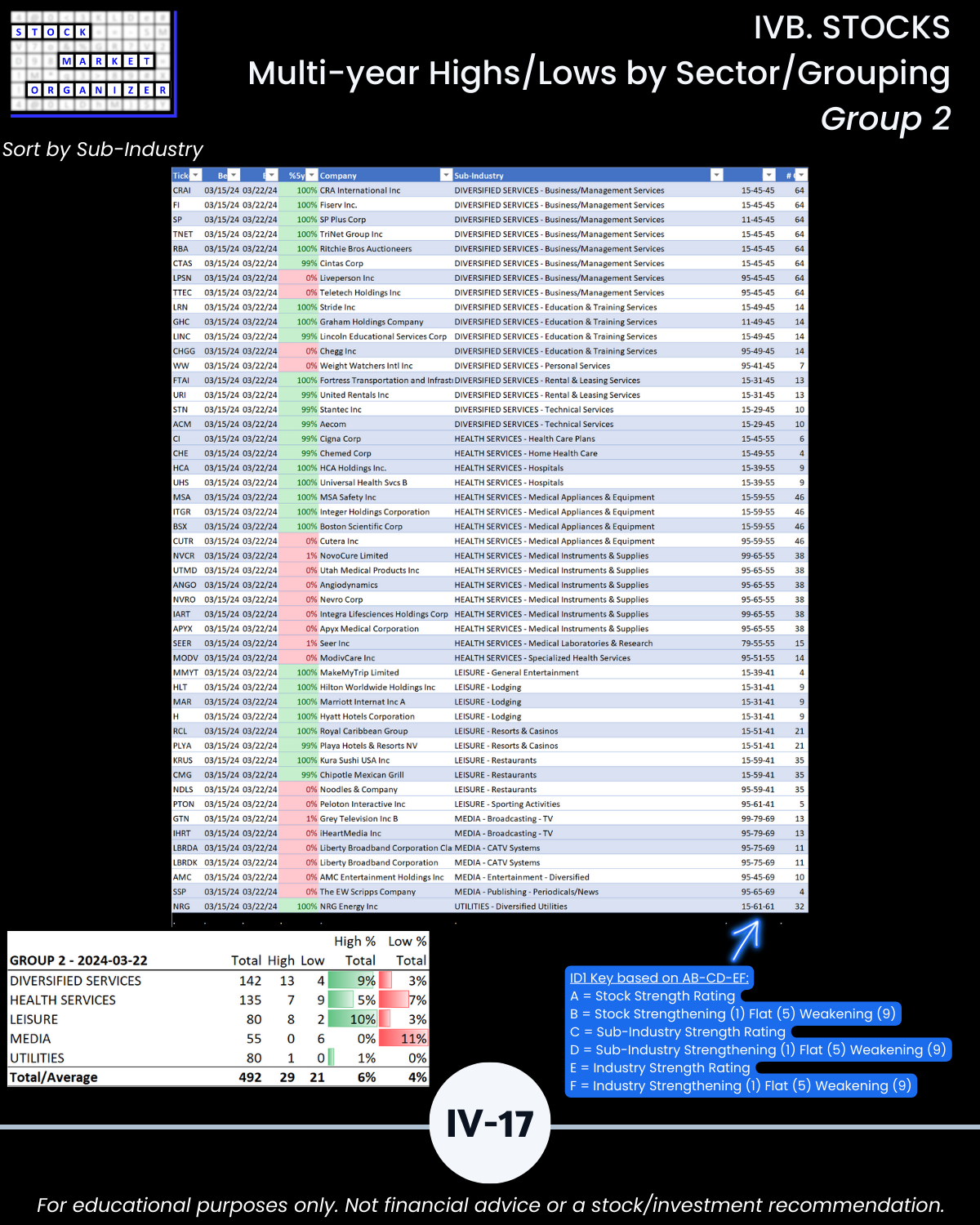

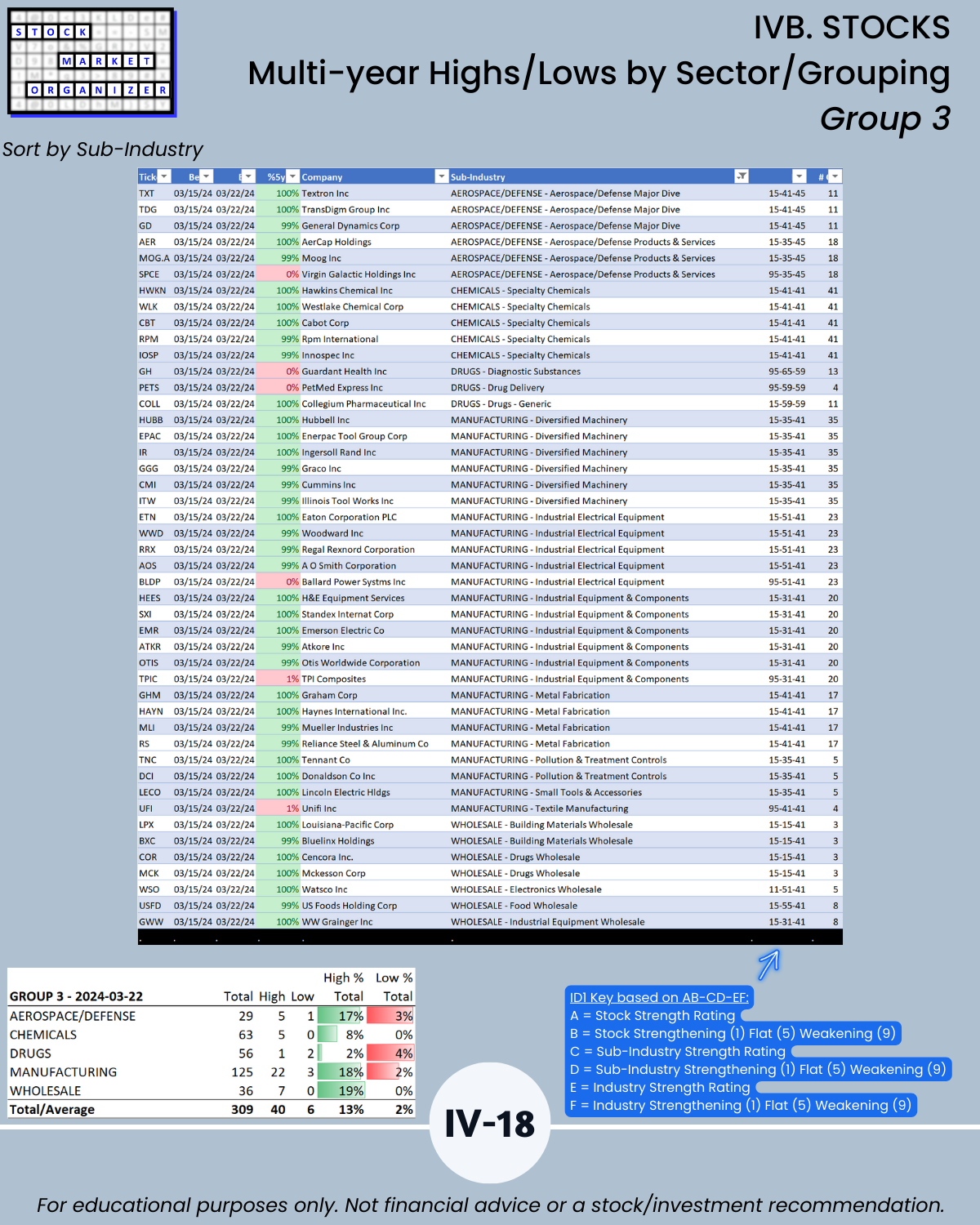

IVB. STOCKS Multi-Year Highs/Lows by Sector/Grouping

IV. EXHIBITS System Foundations