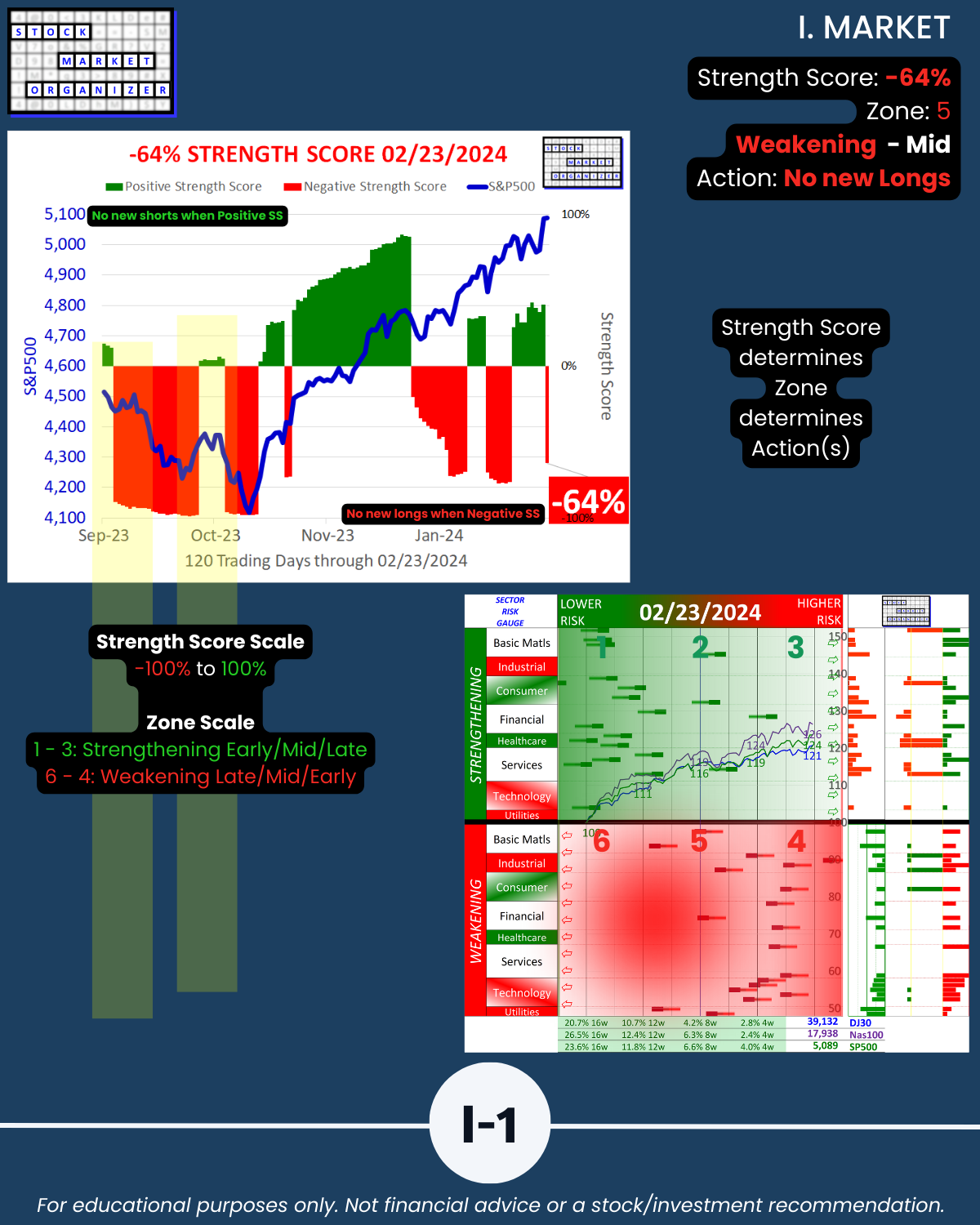

SMO Exclusive: U.S. Stock Market Strength Report 2024-02-23 (-64%, no new Longs)

Want to QUICKLY understand the current market status 2/23/24? See attached. Short but meaningful (NVDA earnings) week led to a change in environment – NO NEW LONGS because as of today 2/23/24 the Market Strength Score has changed to negative at -64%.

There’s a lot here if you look closely.

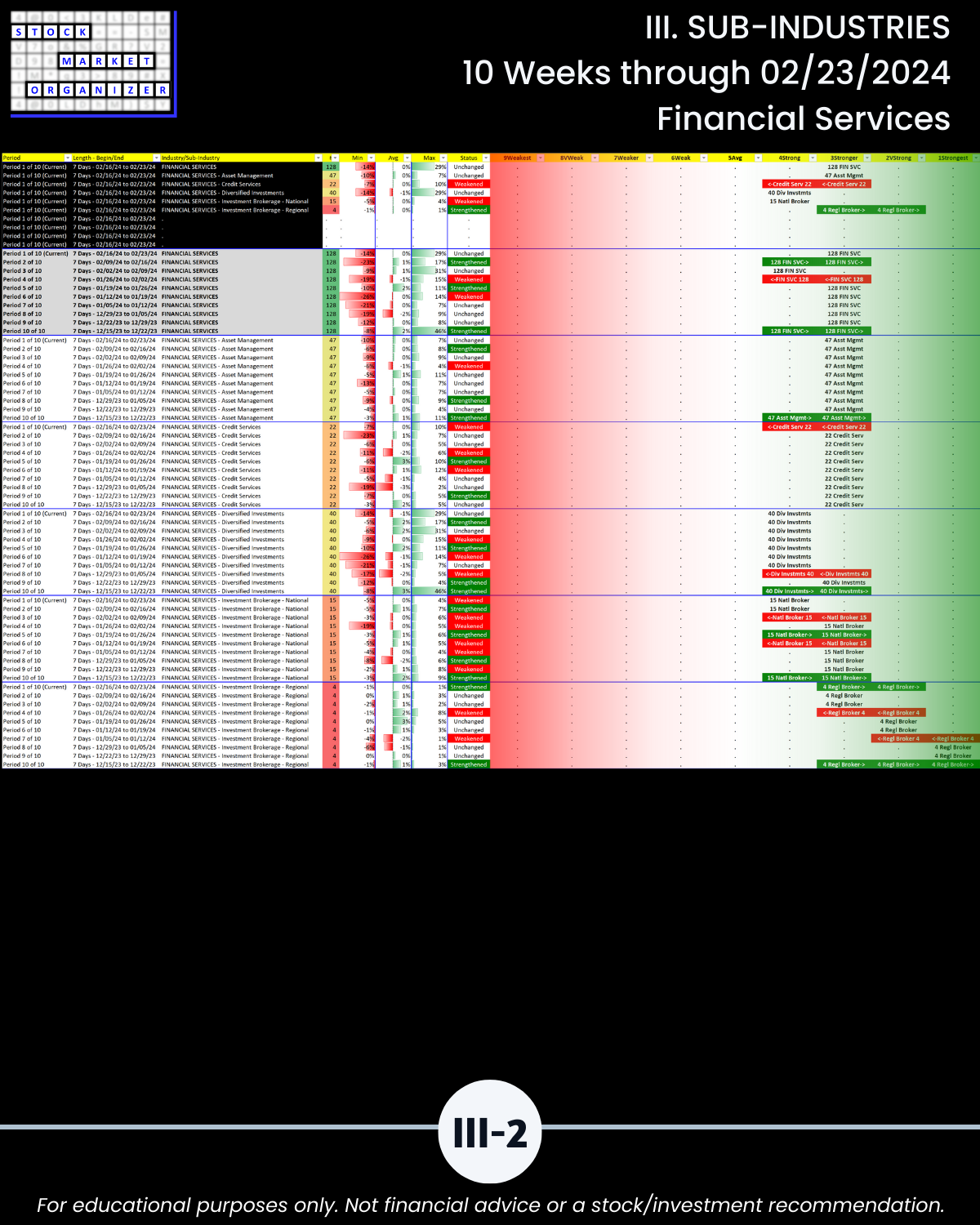

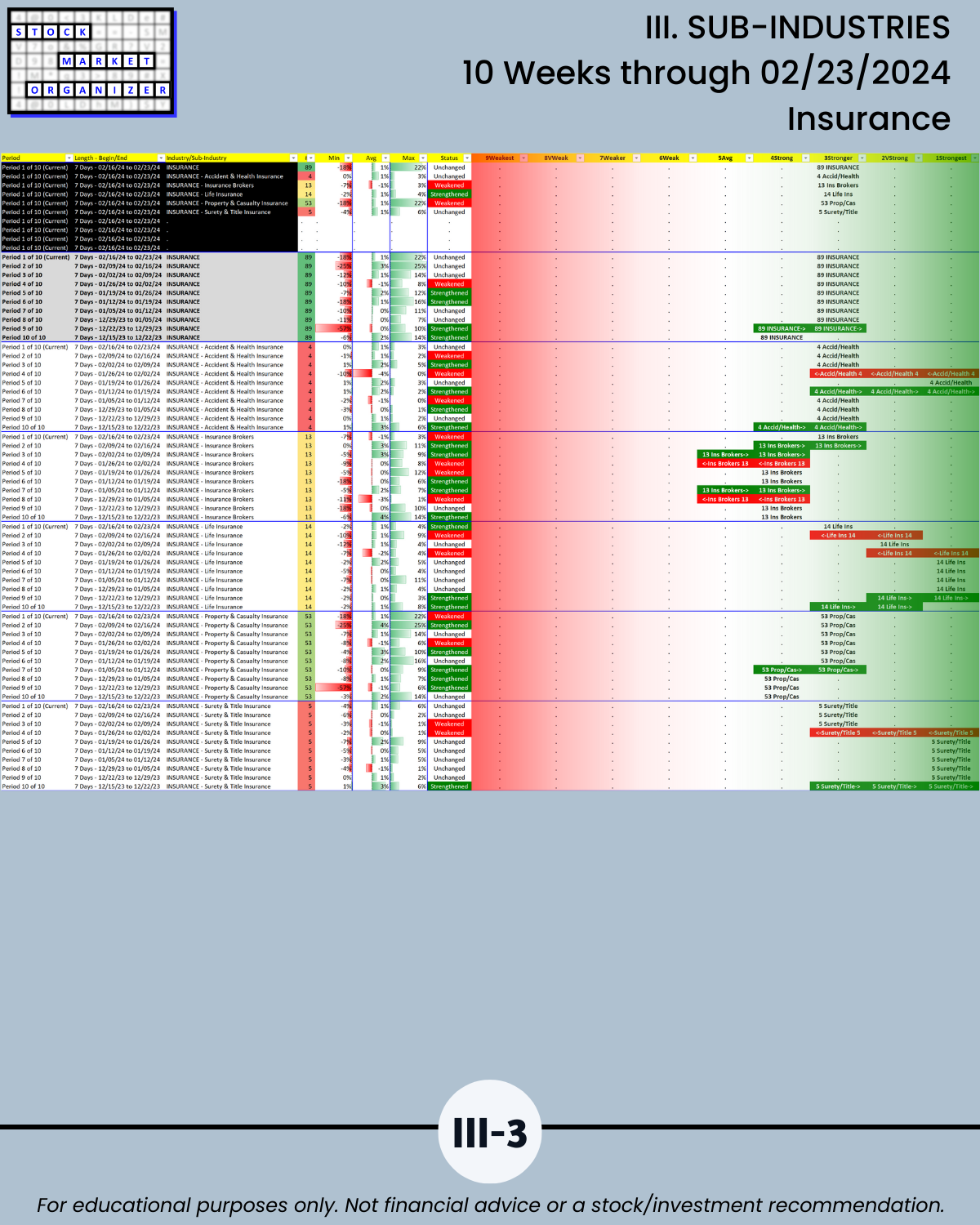

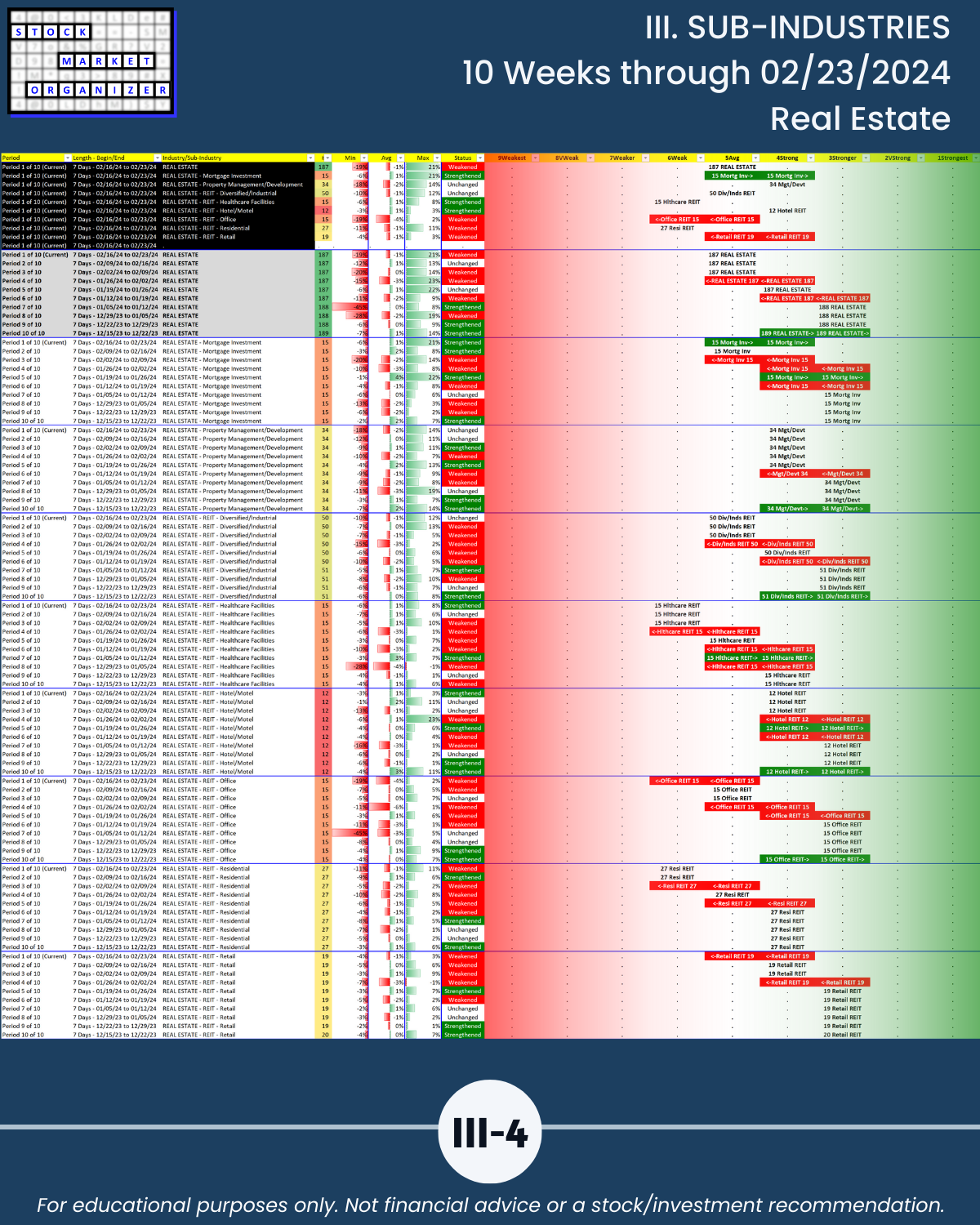

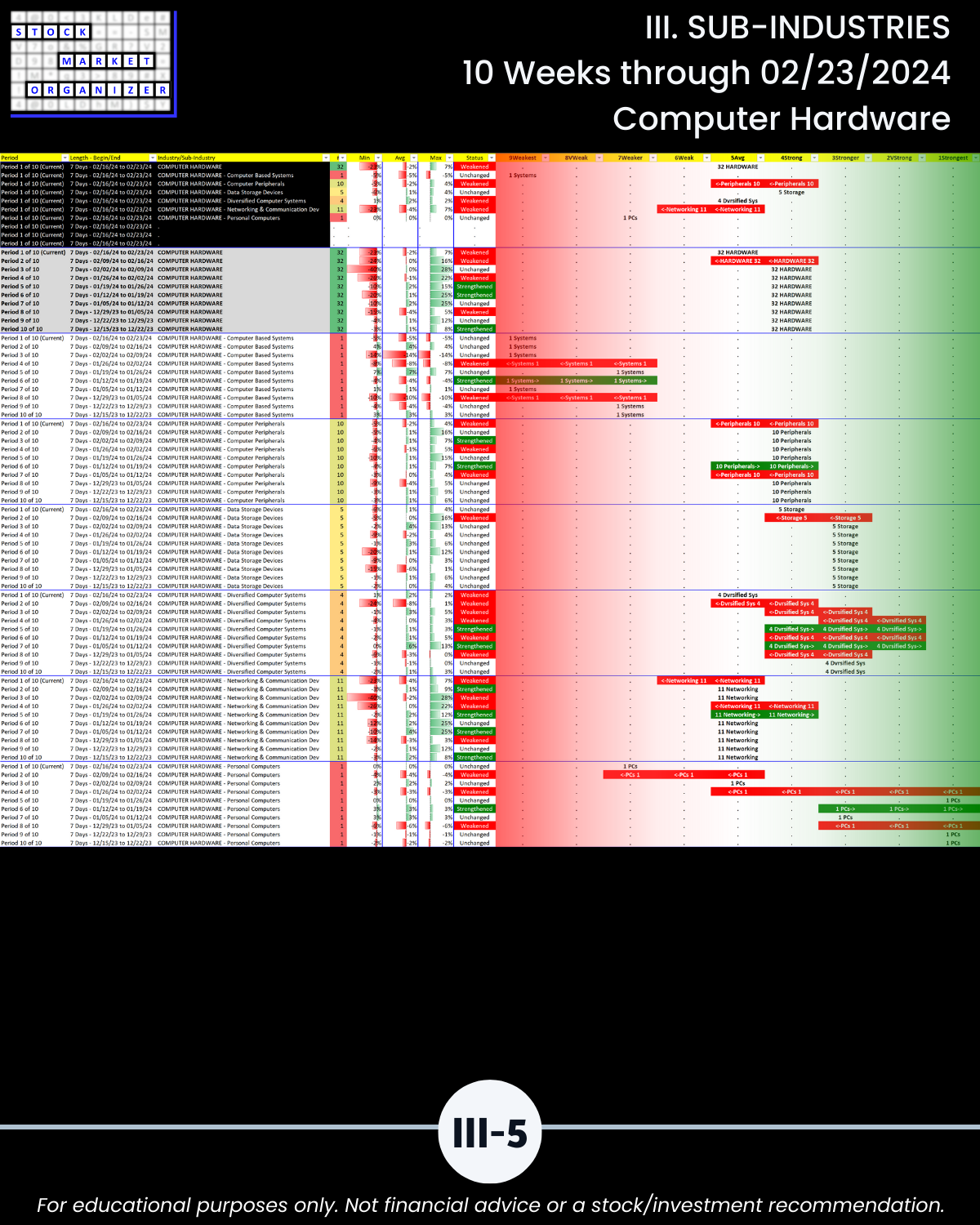

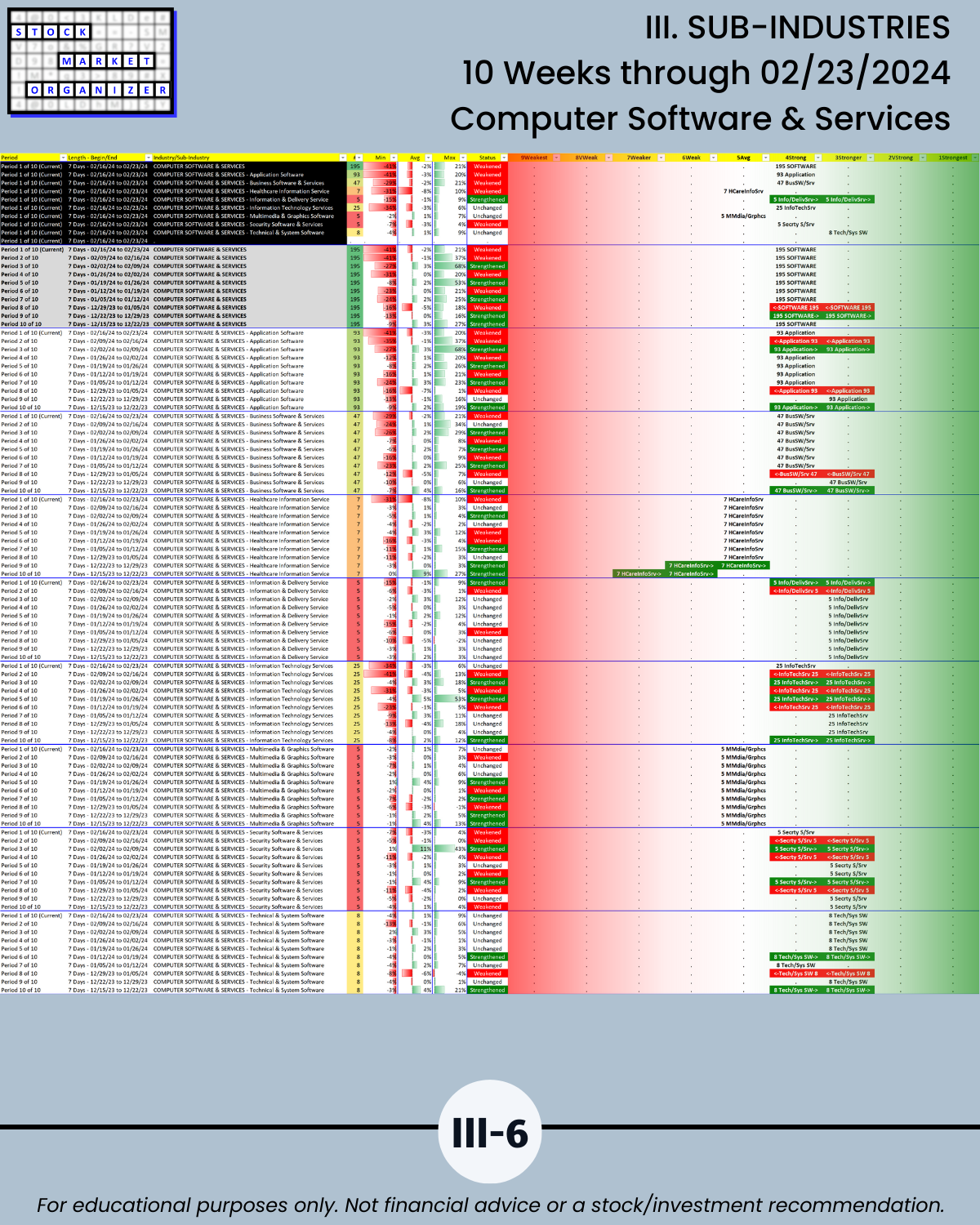

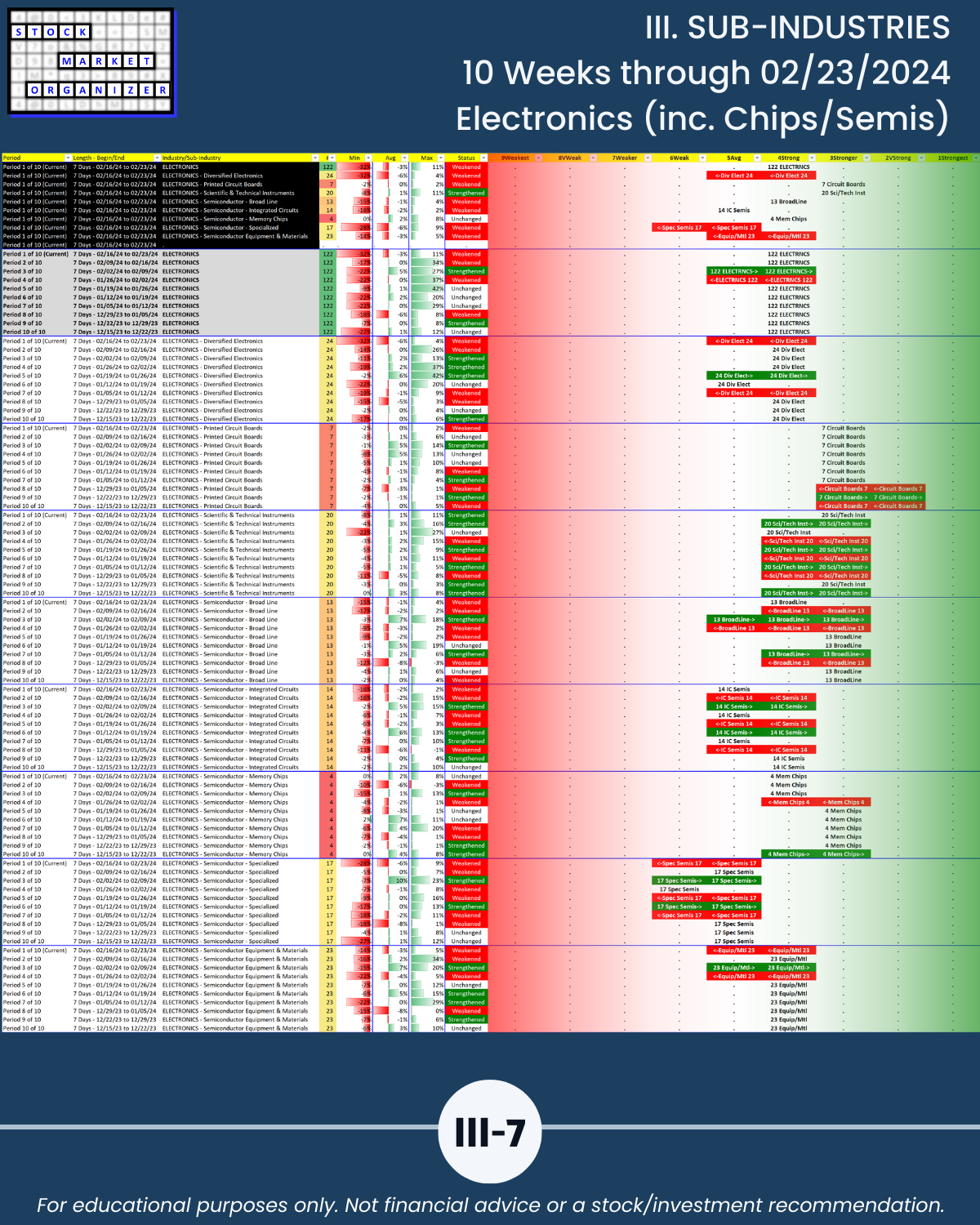

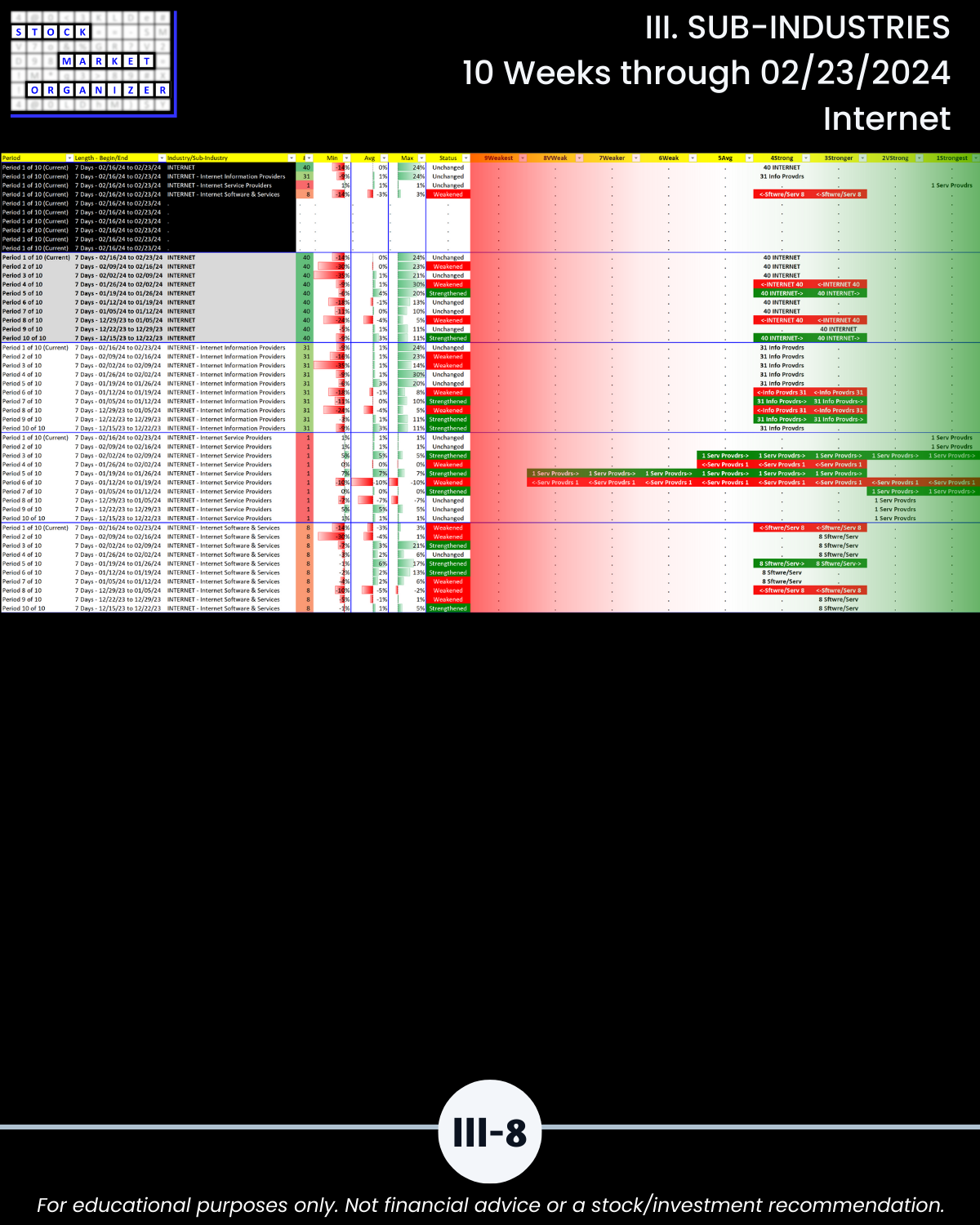

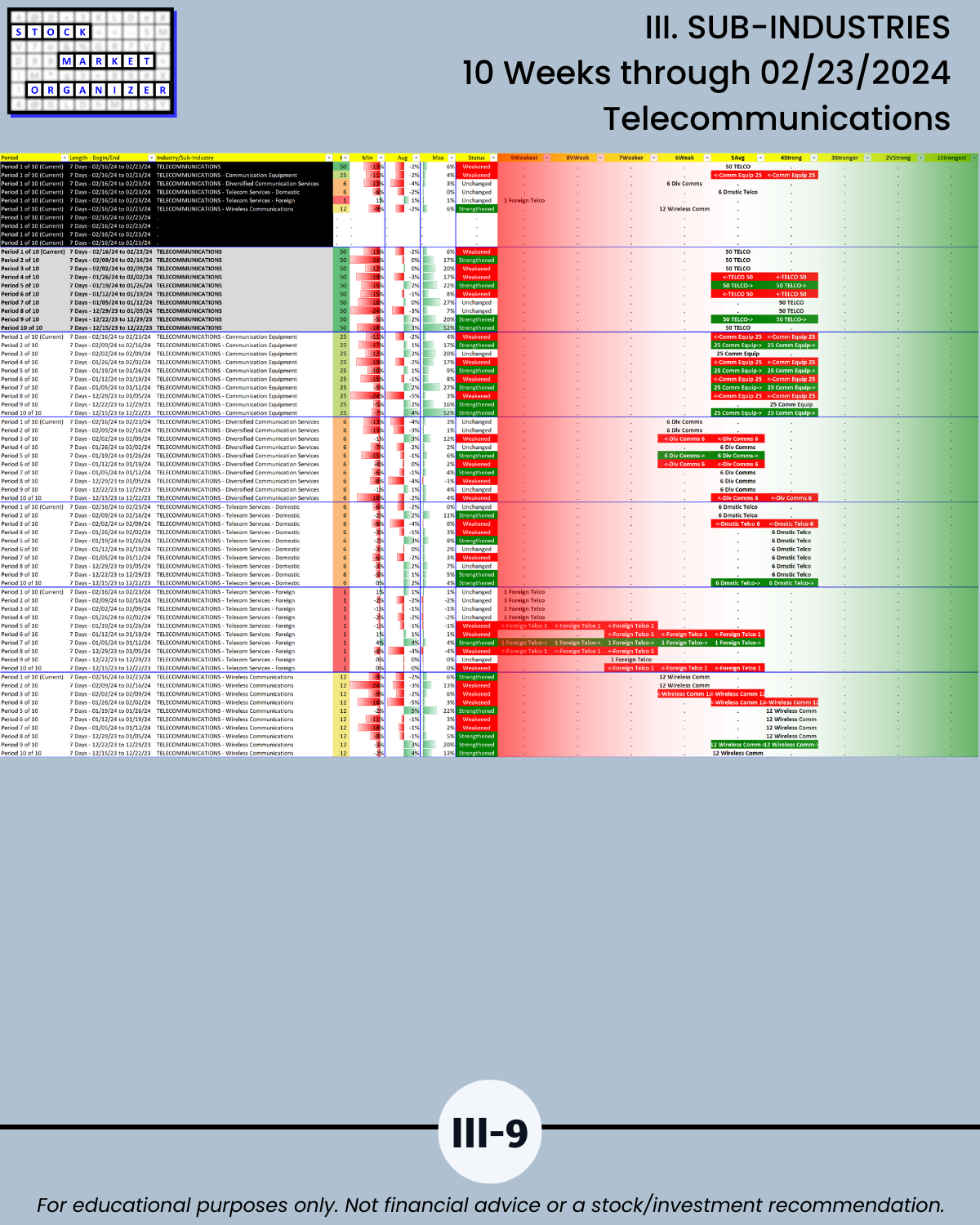

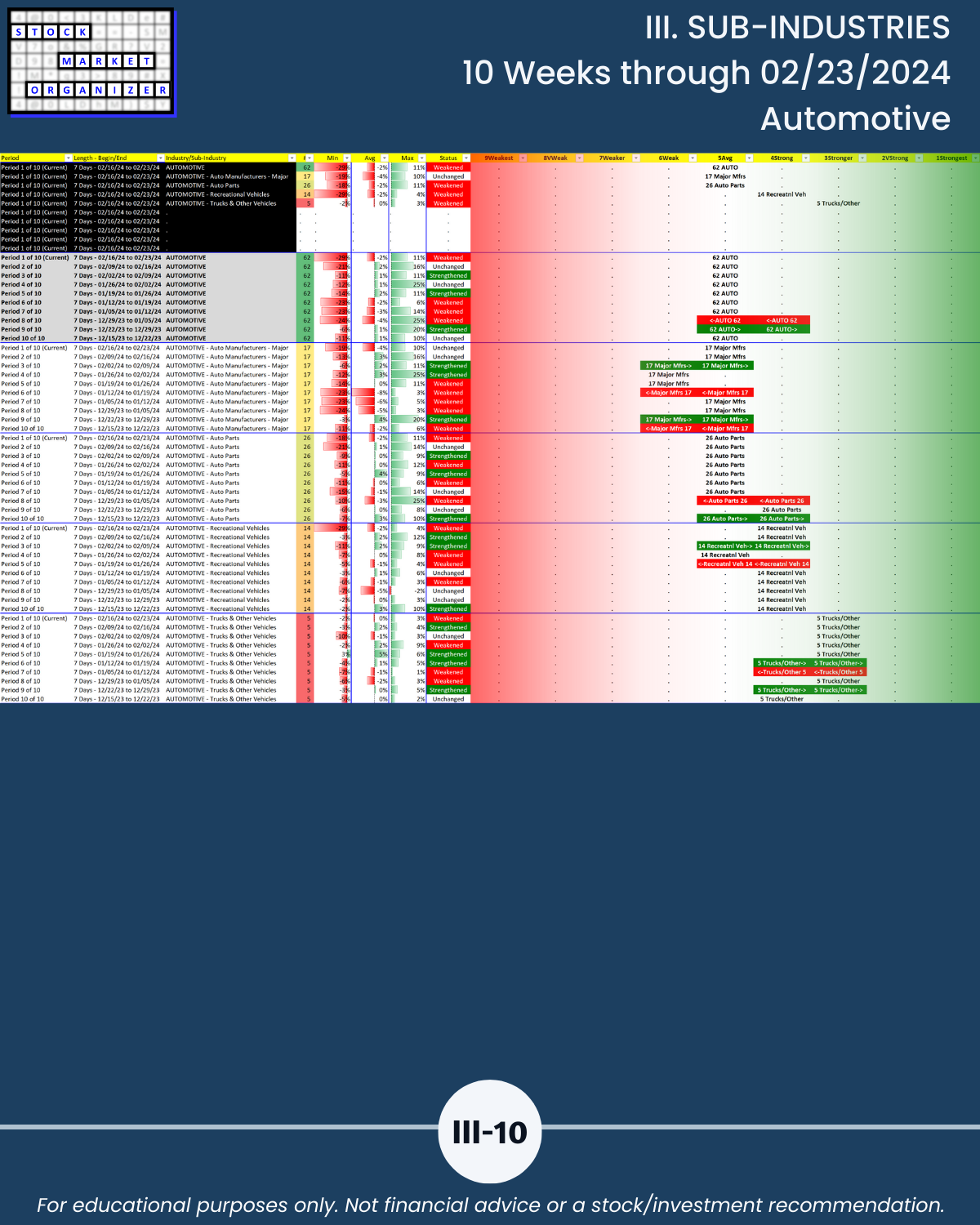

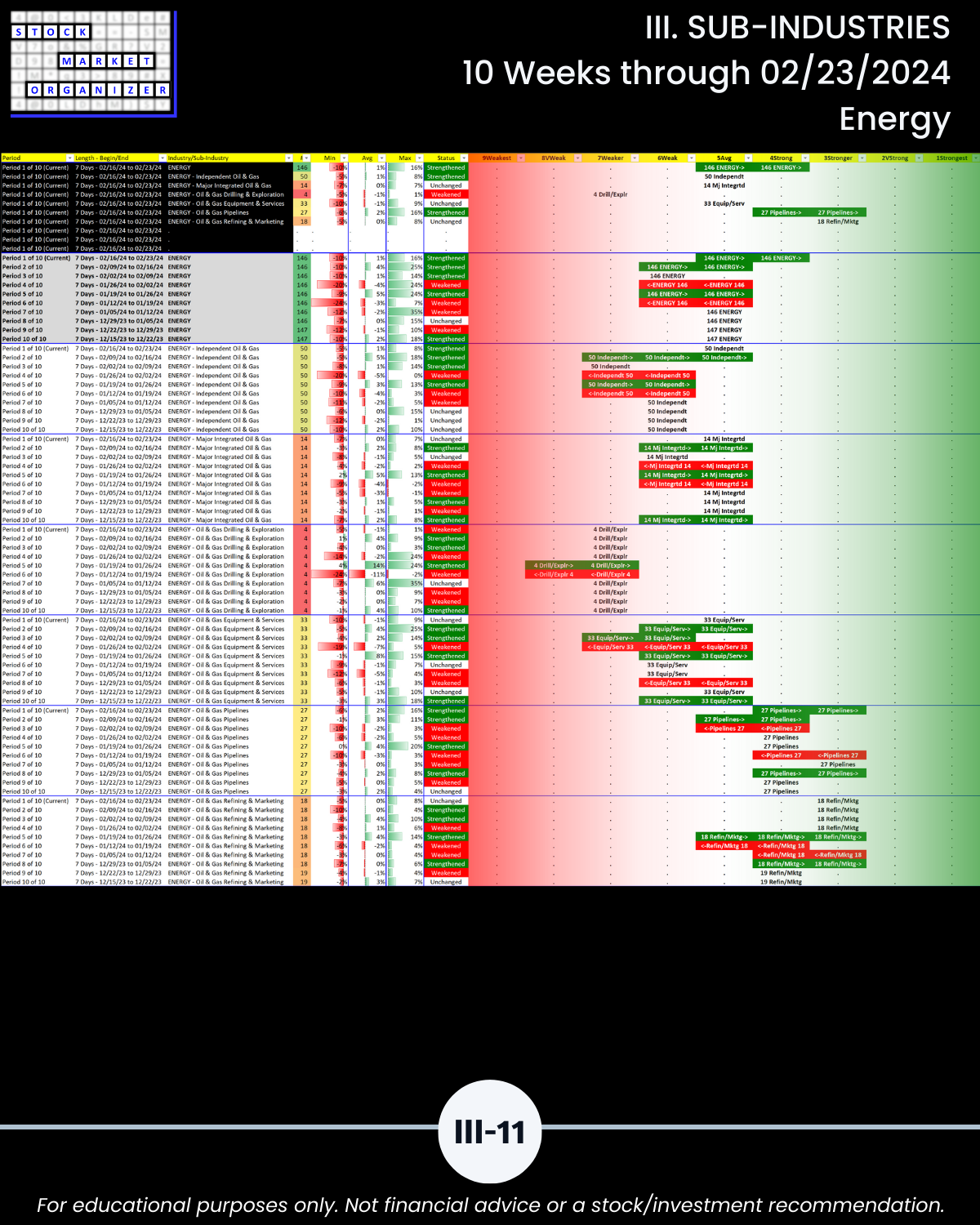

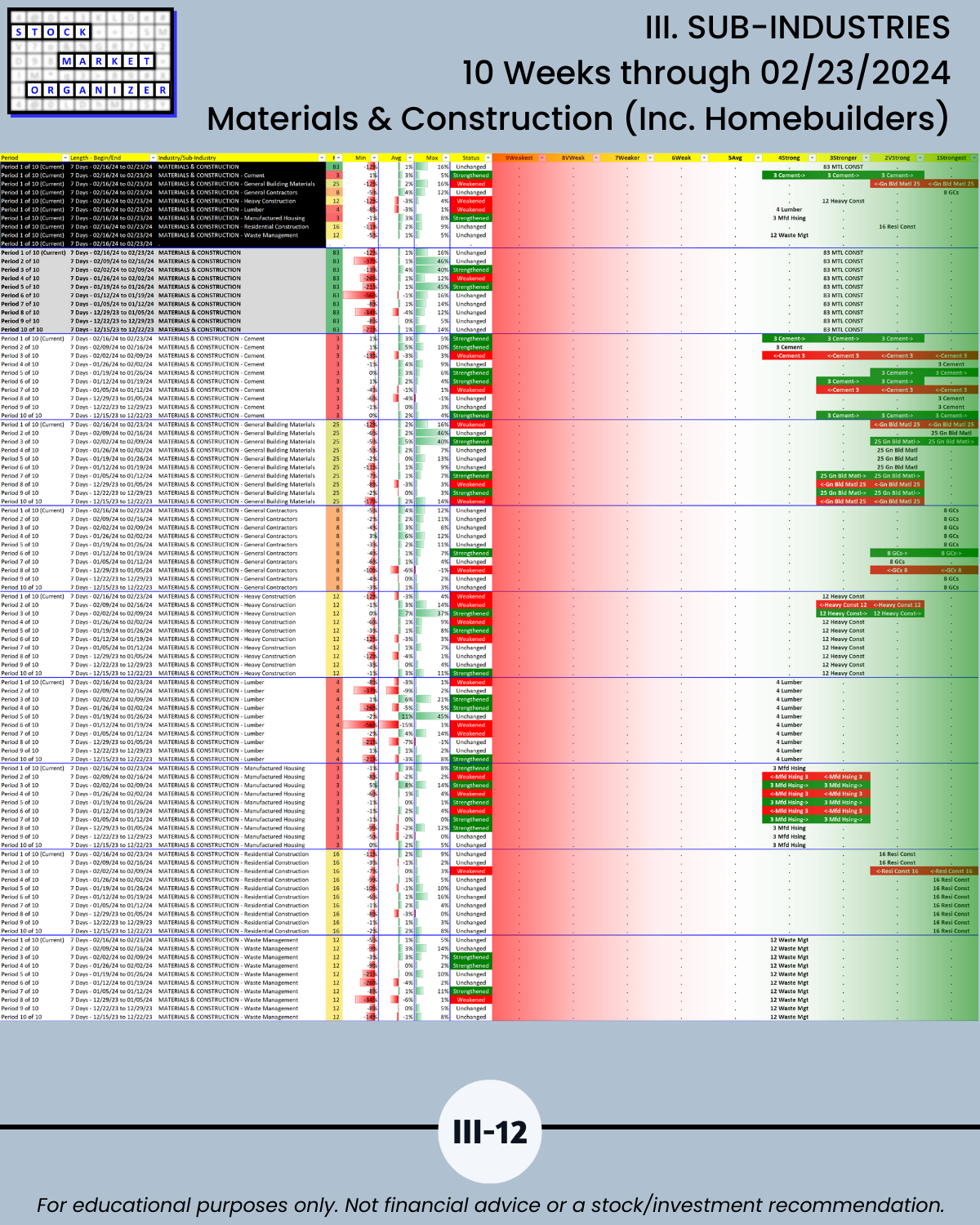

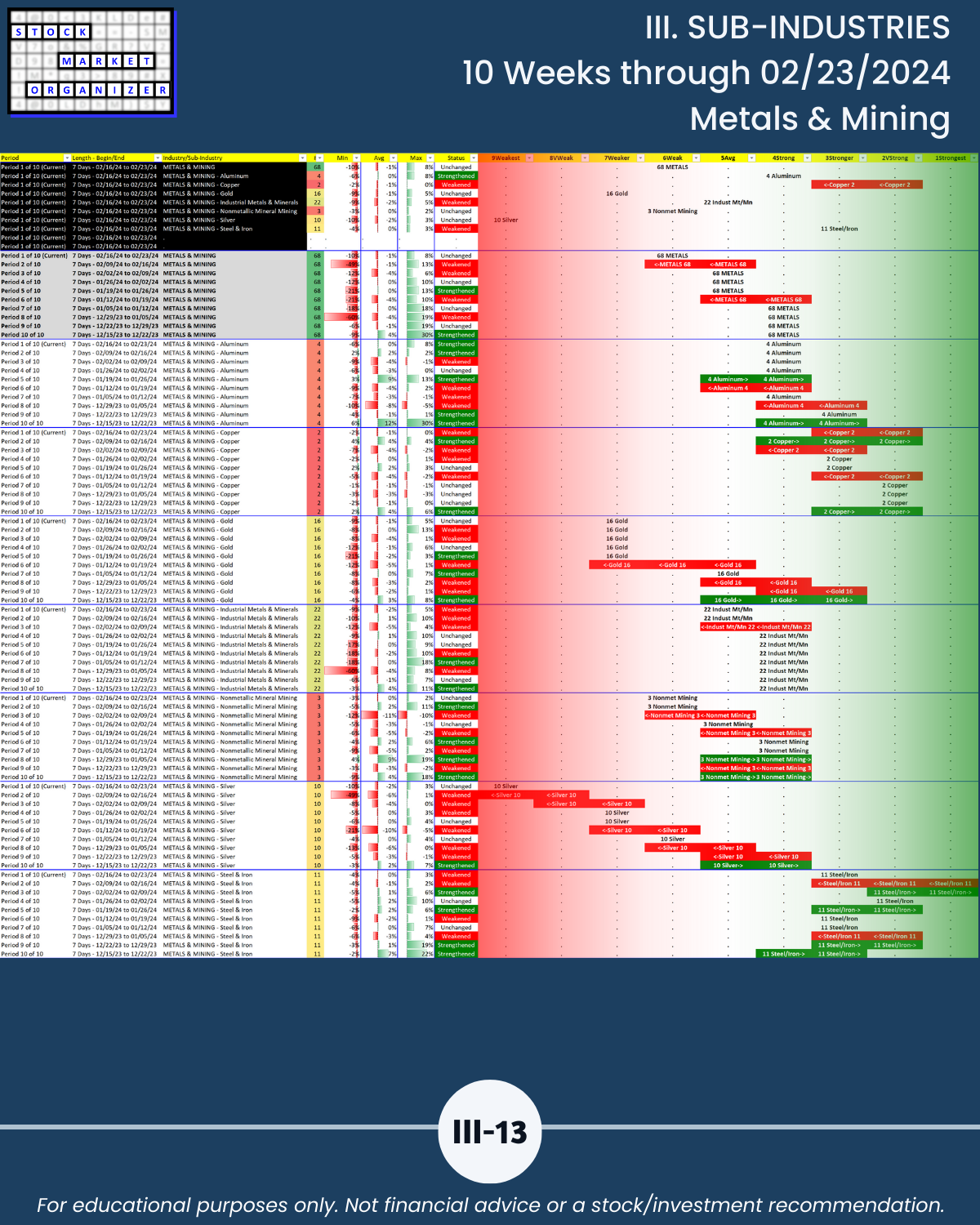

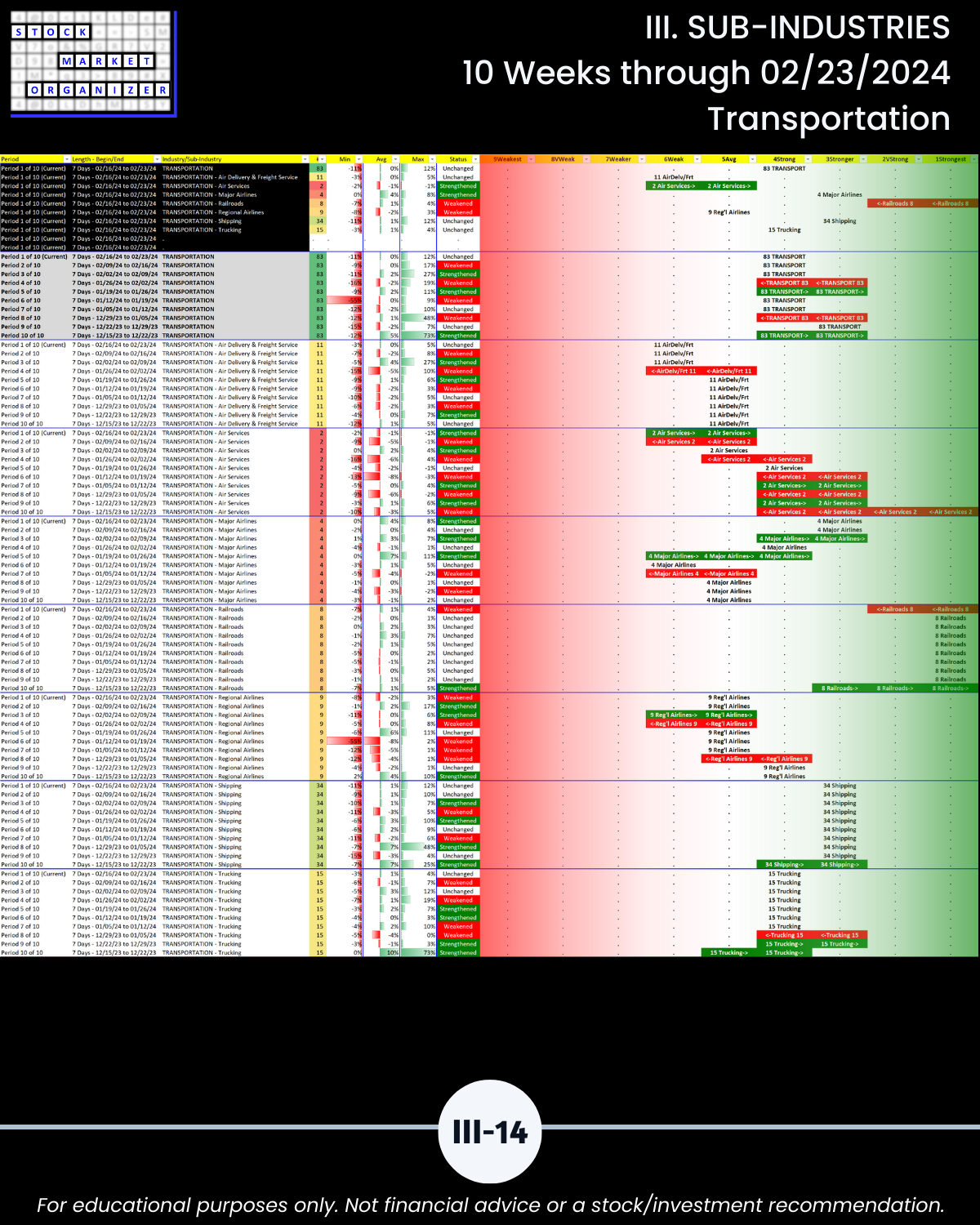

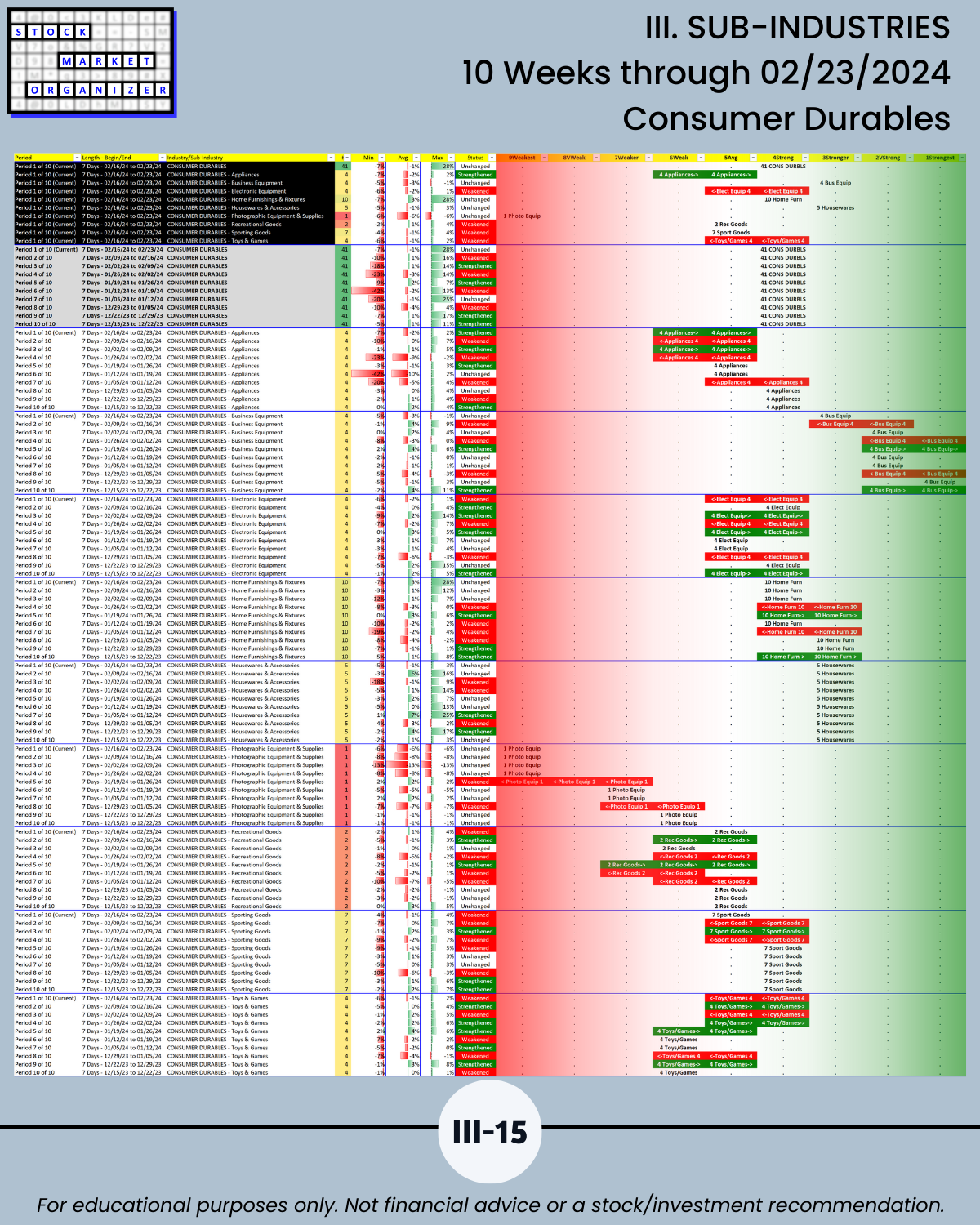

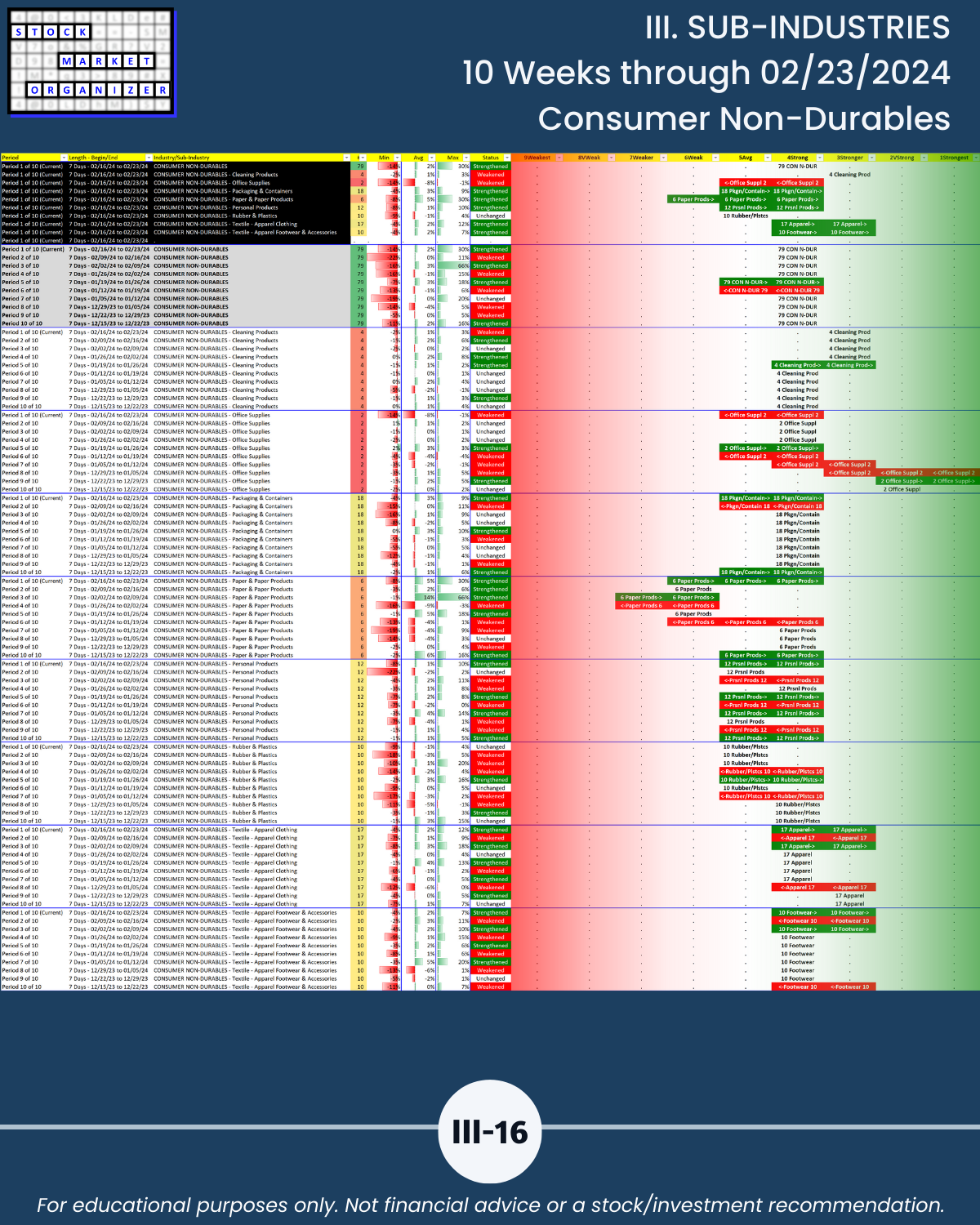

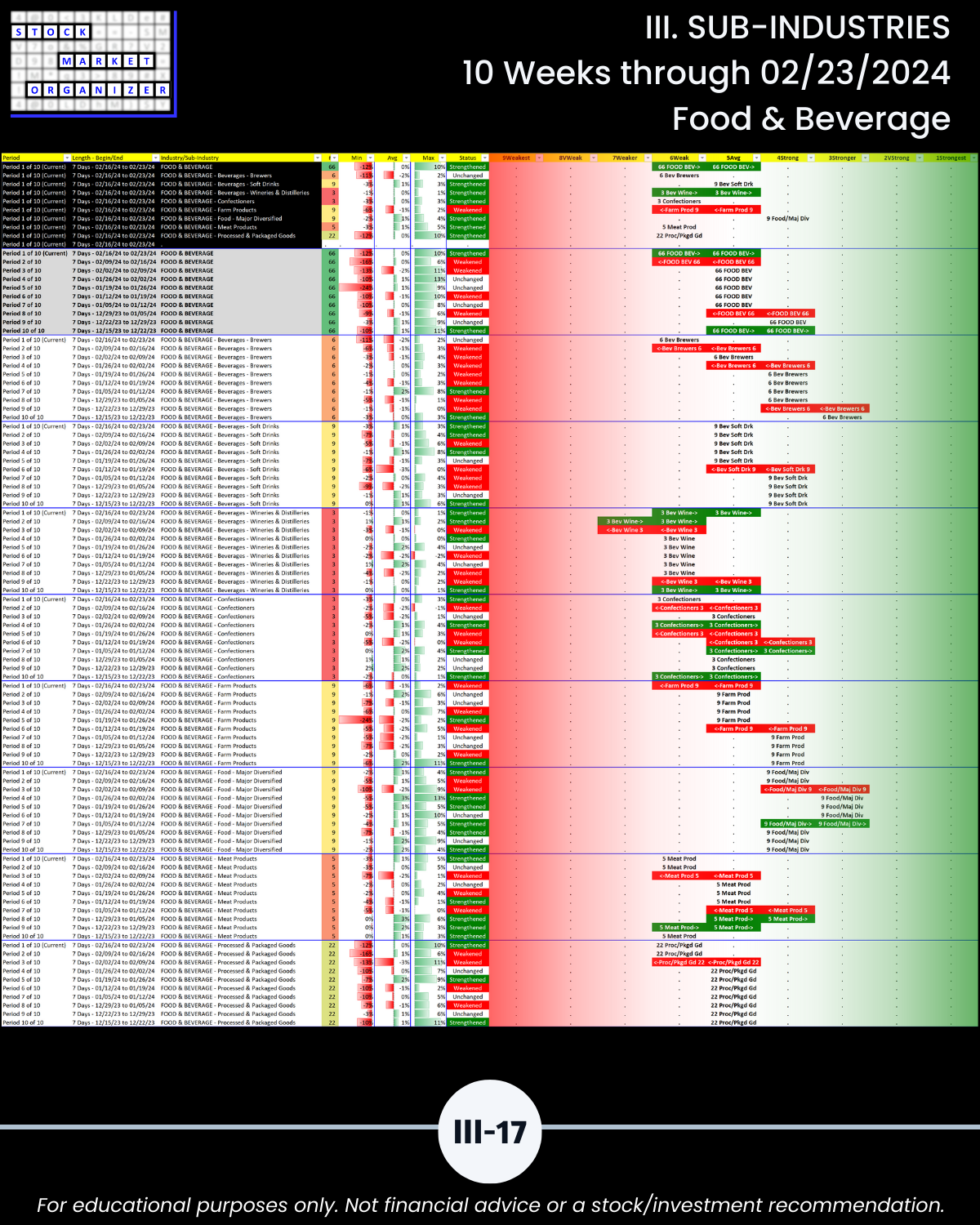

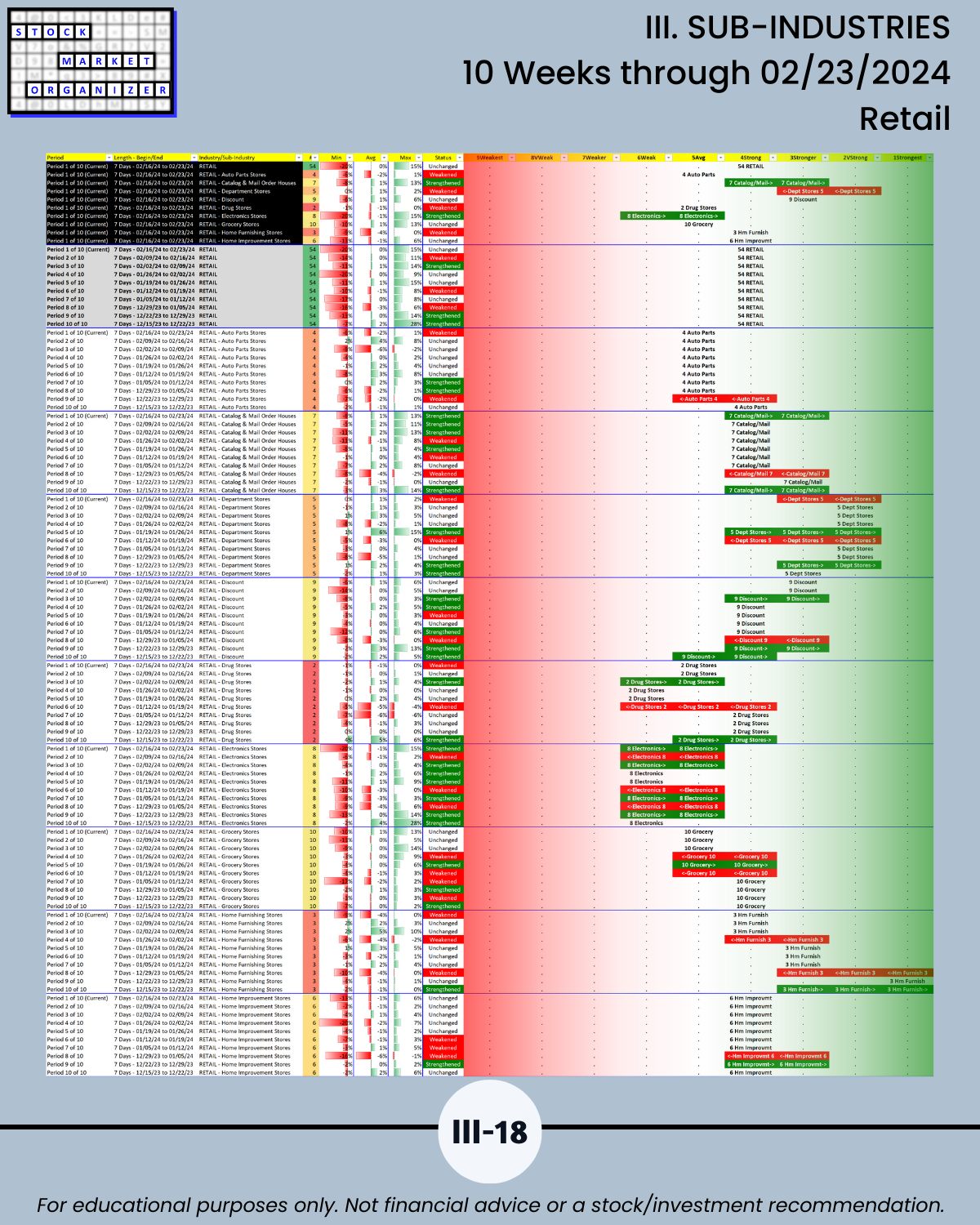

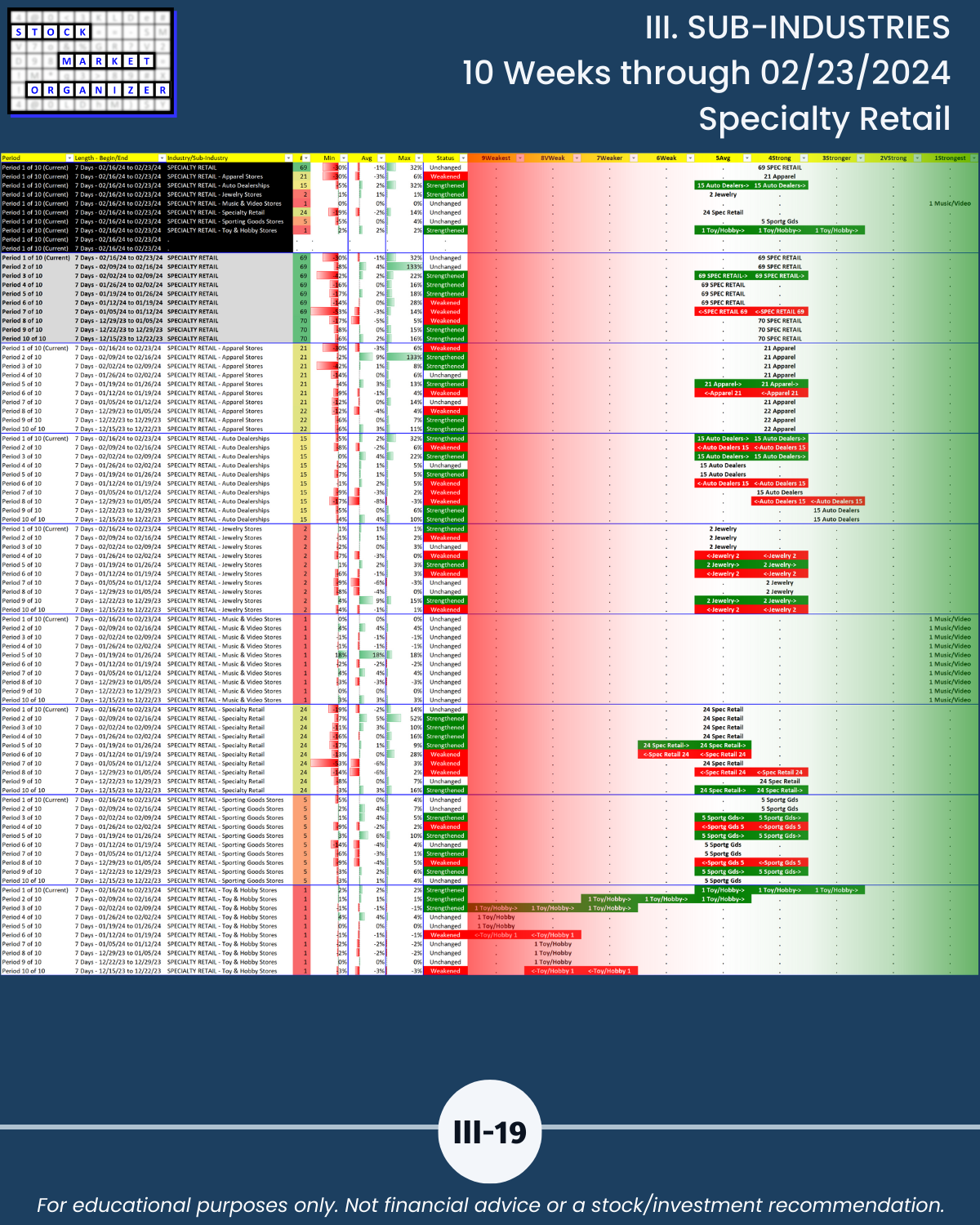

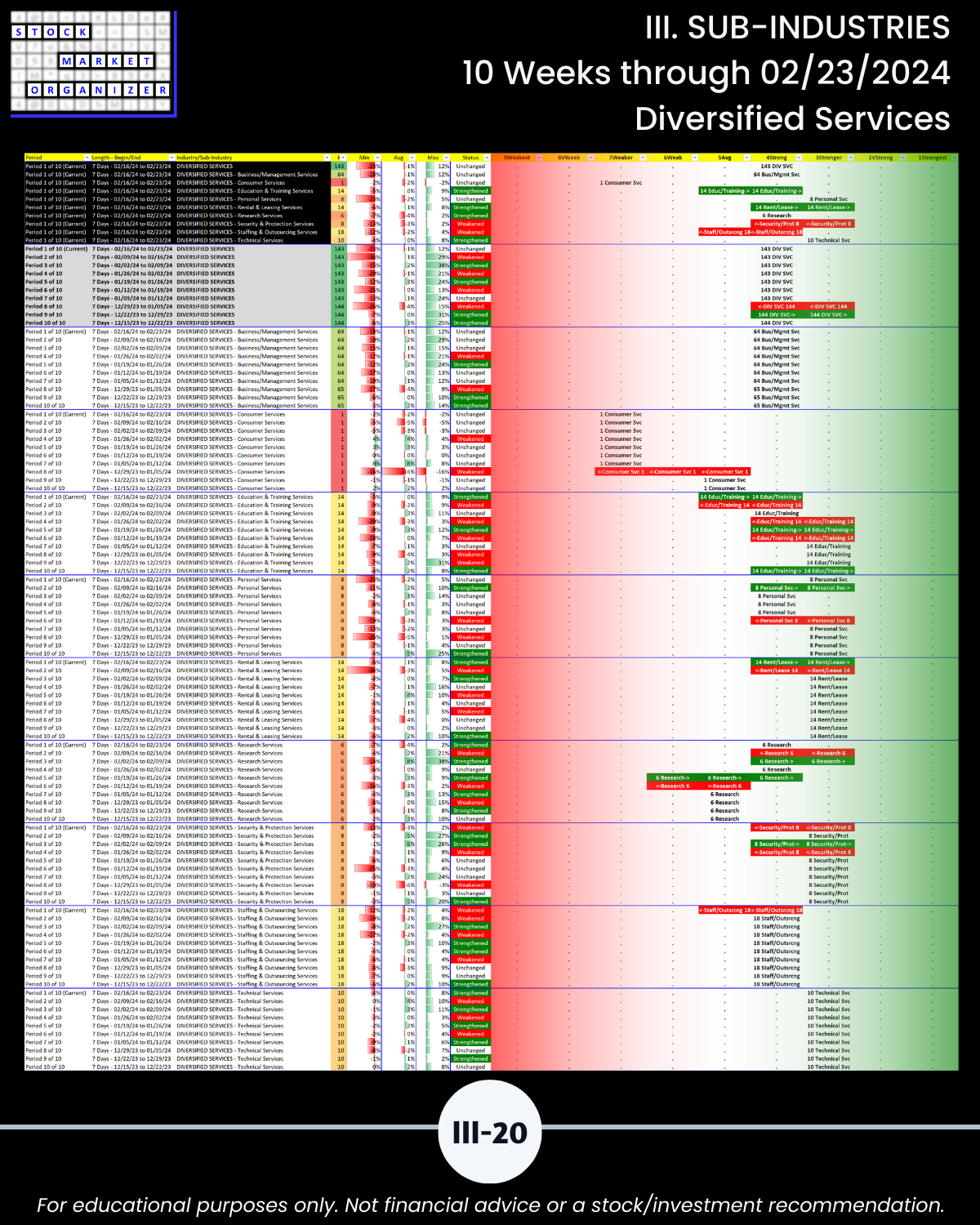

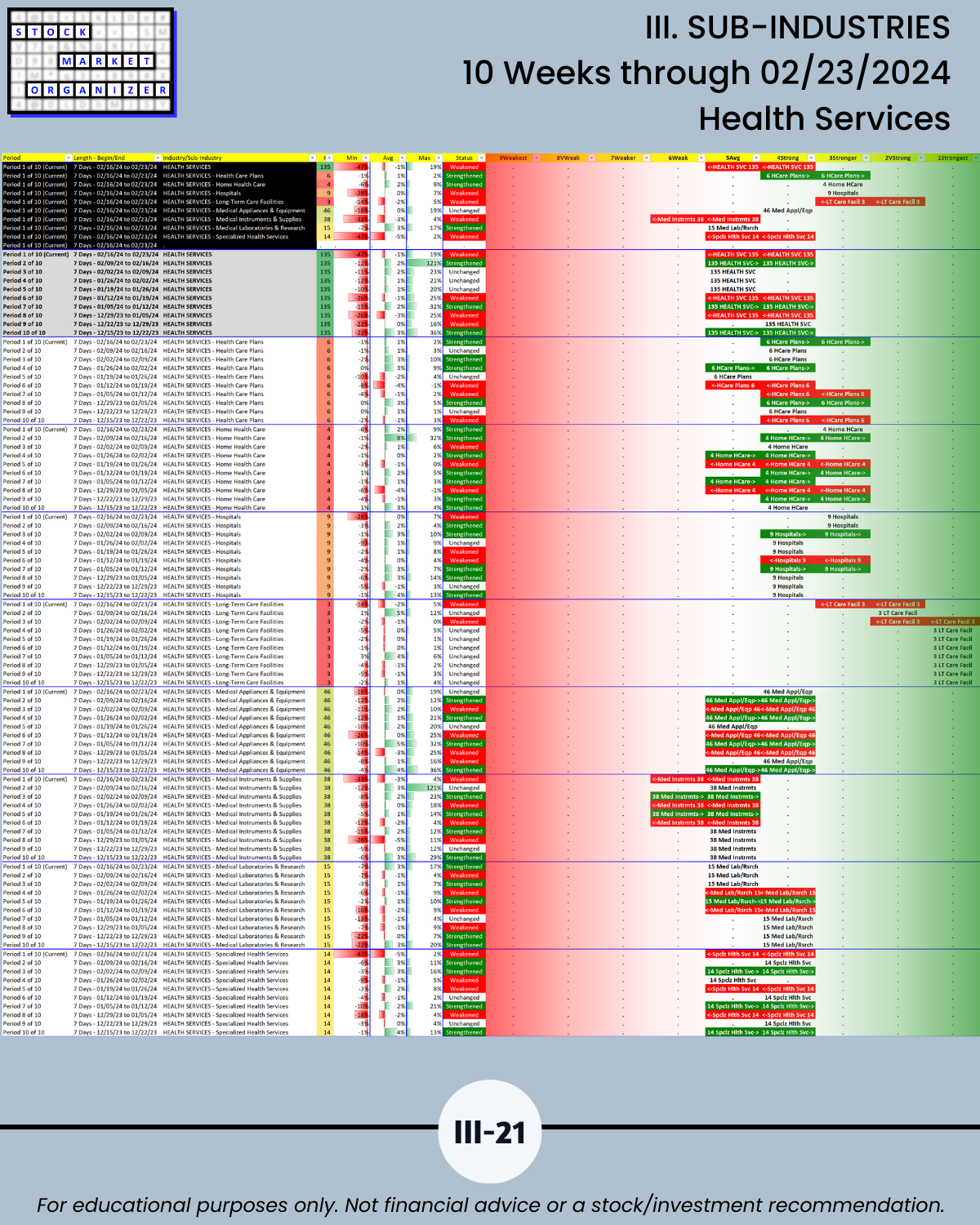

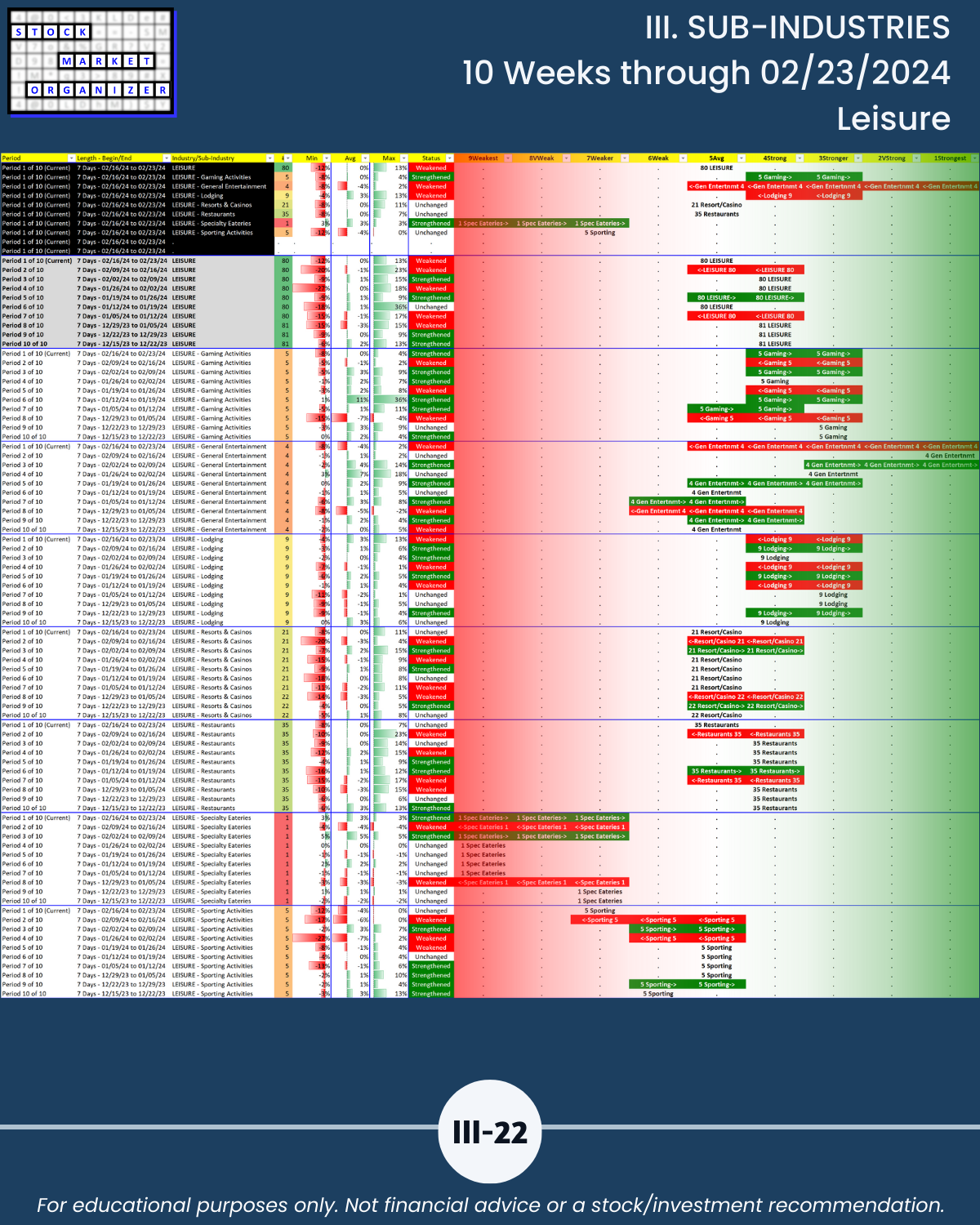

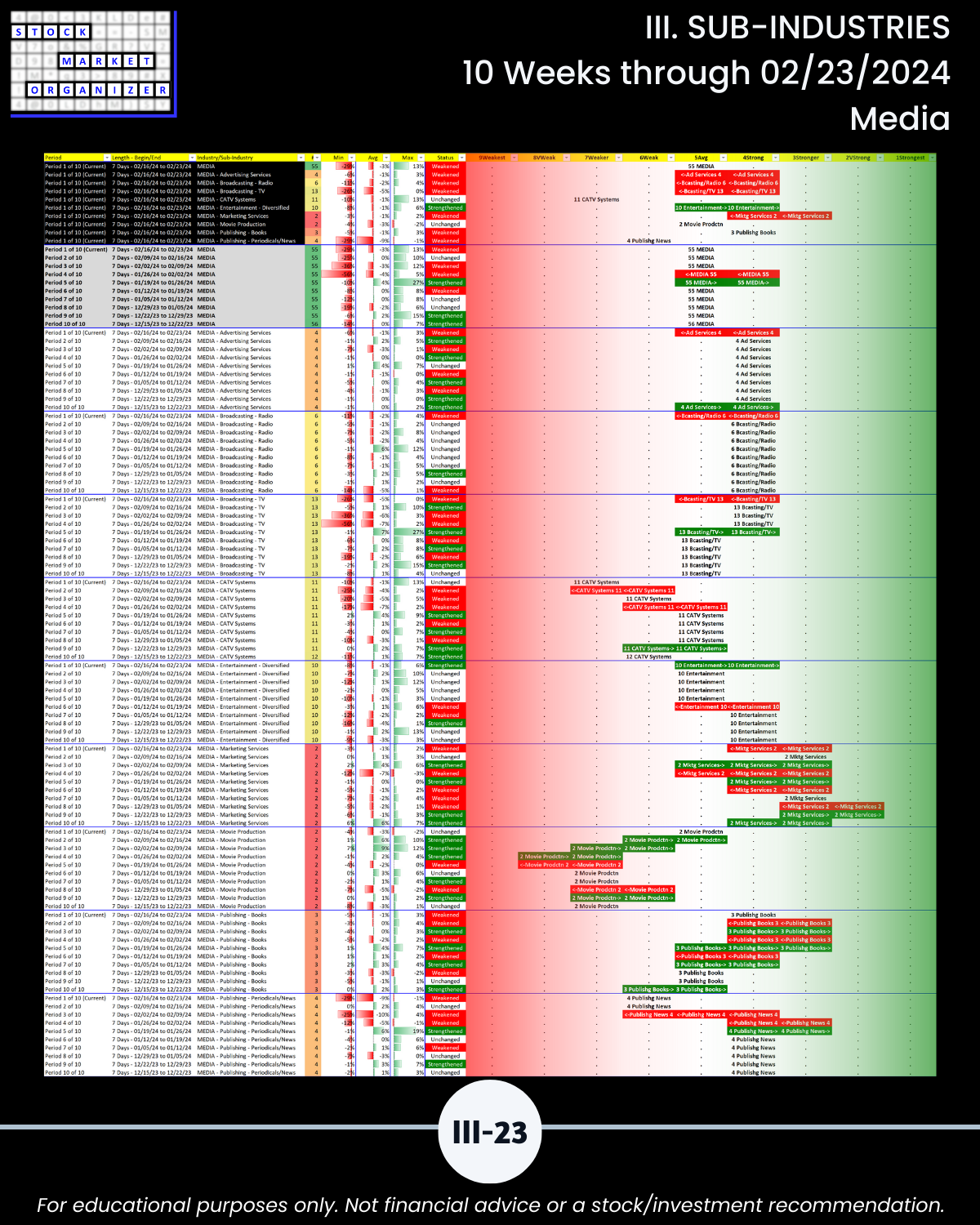

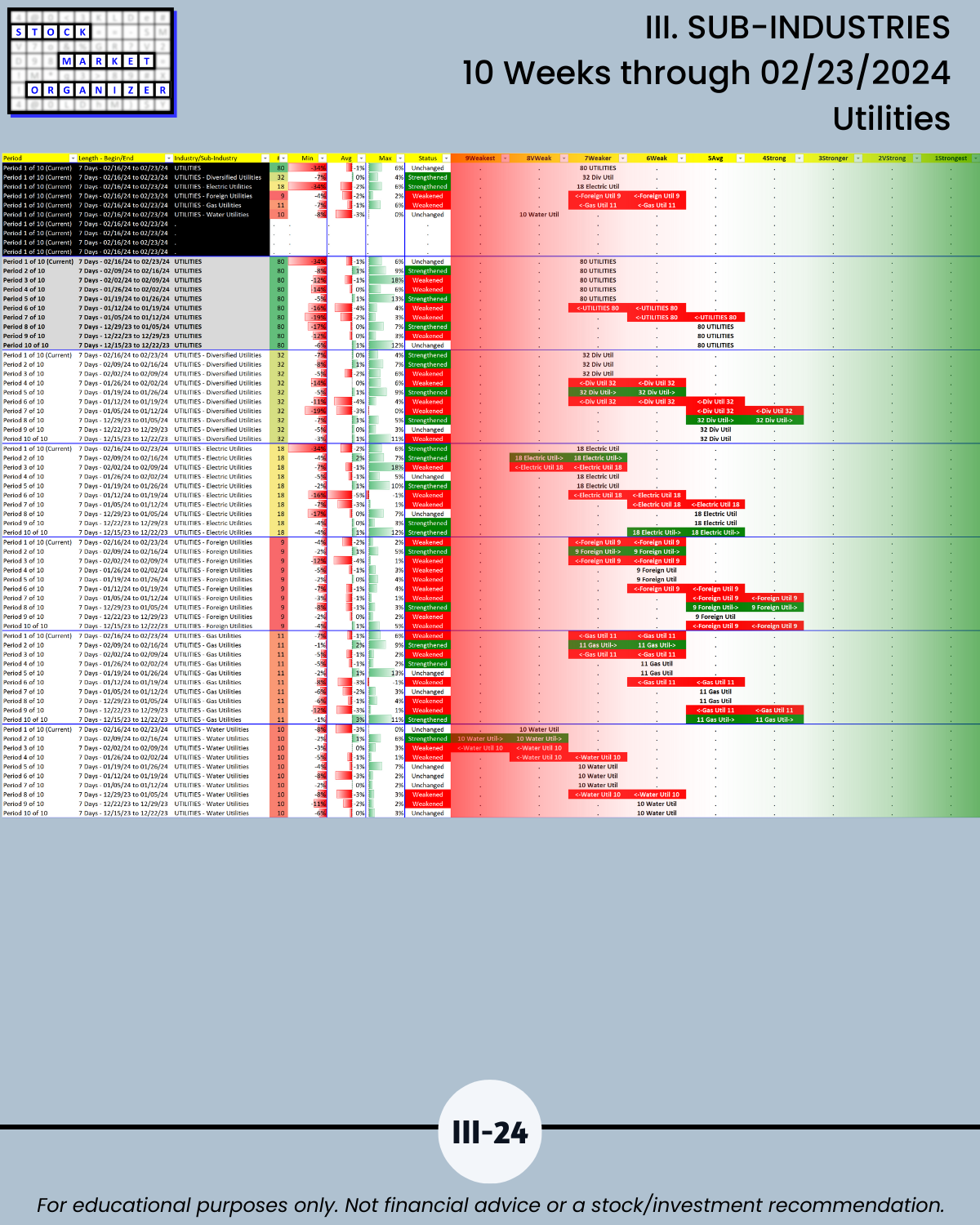

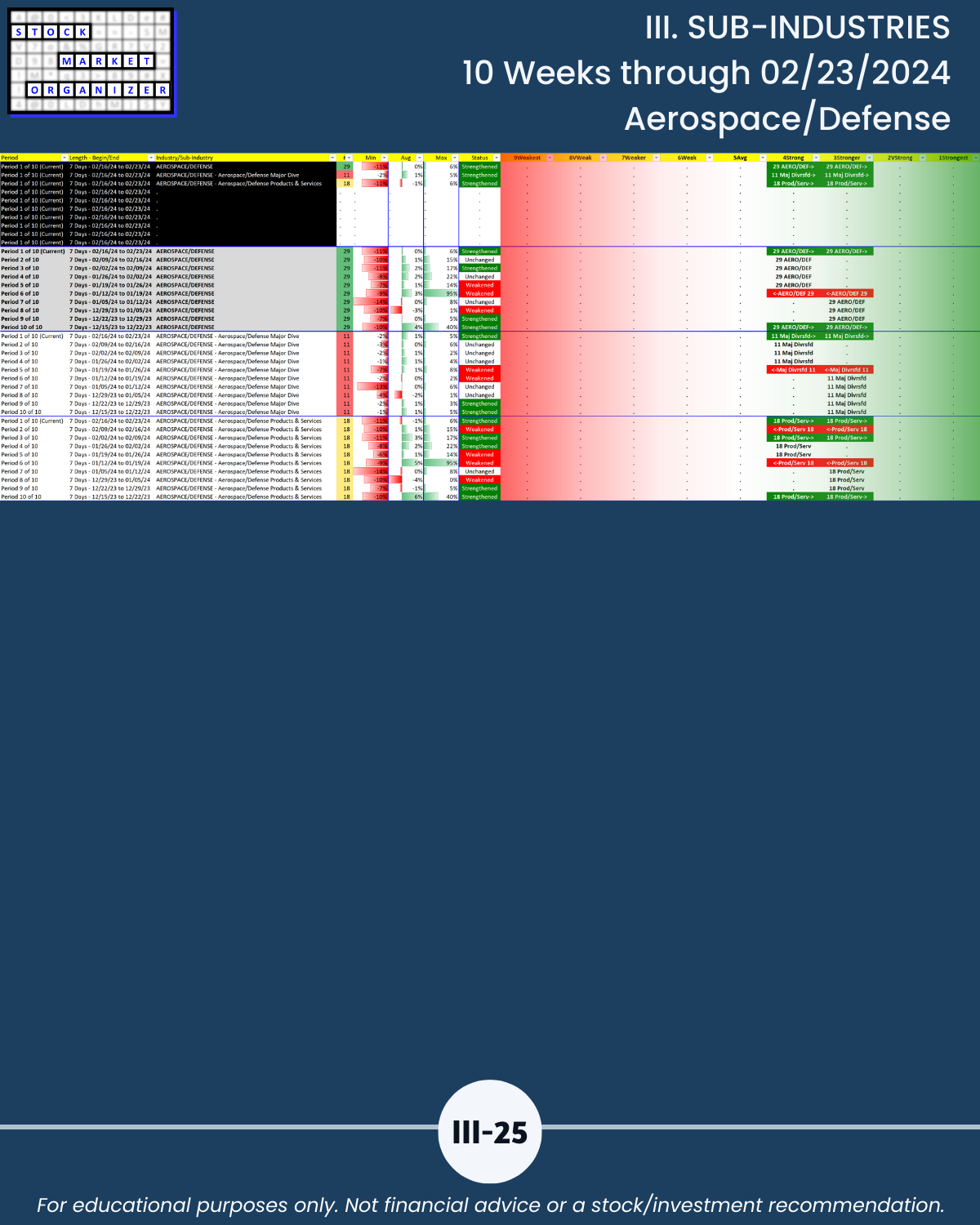

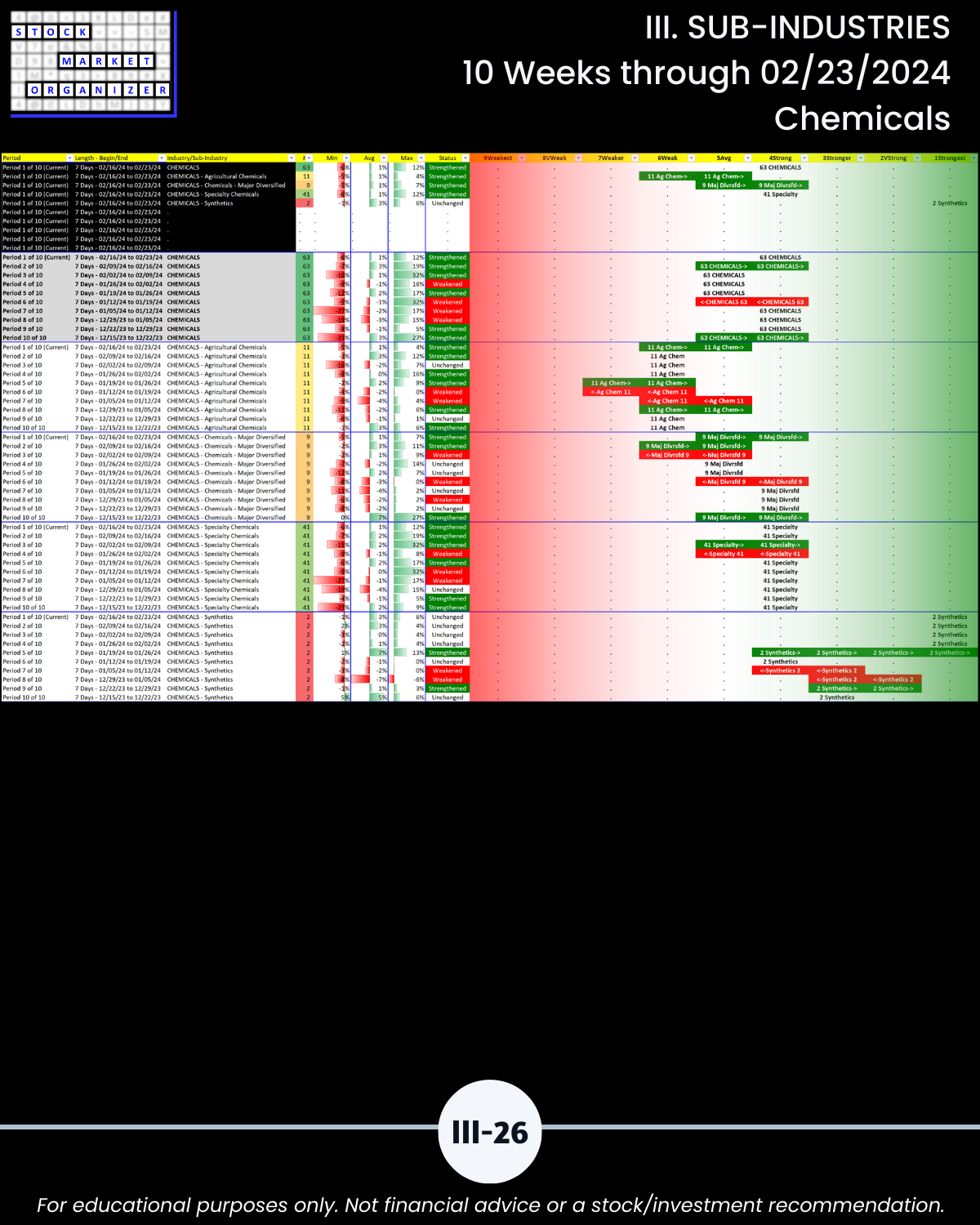

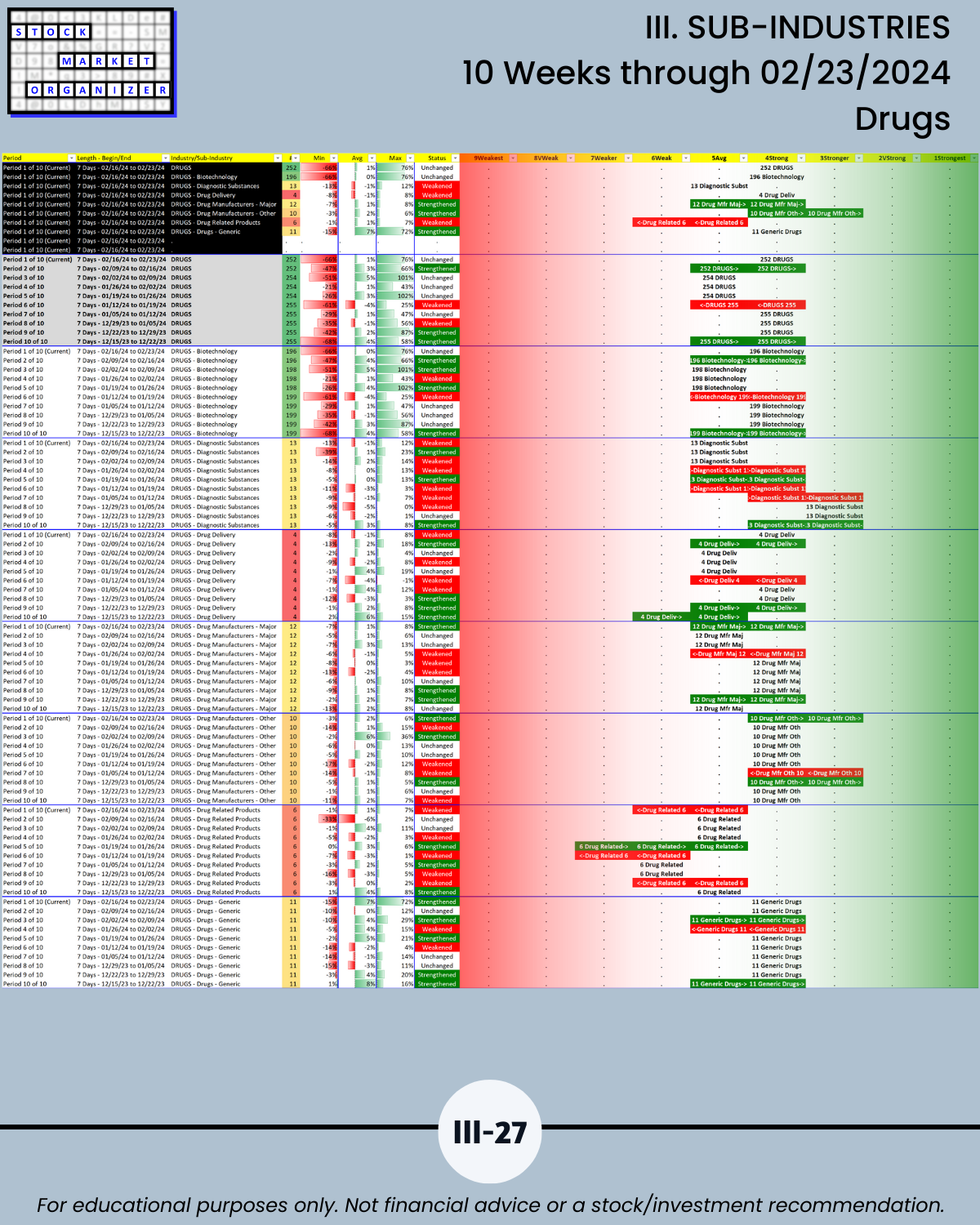

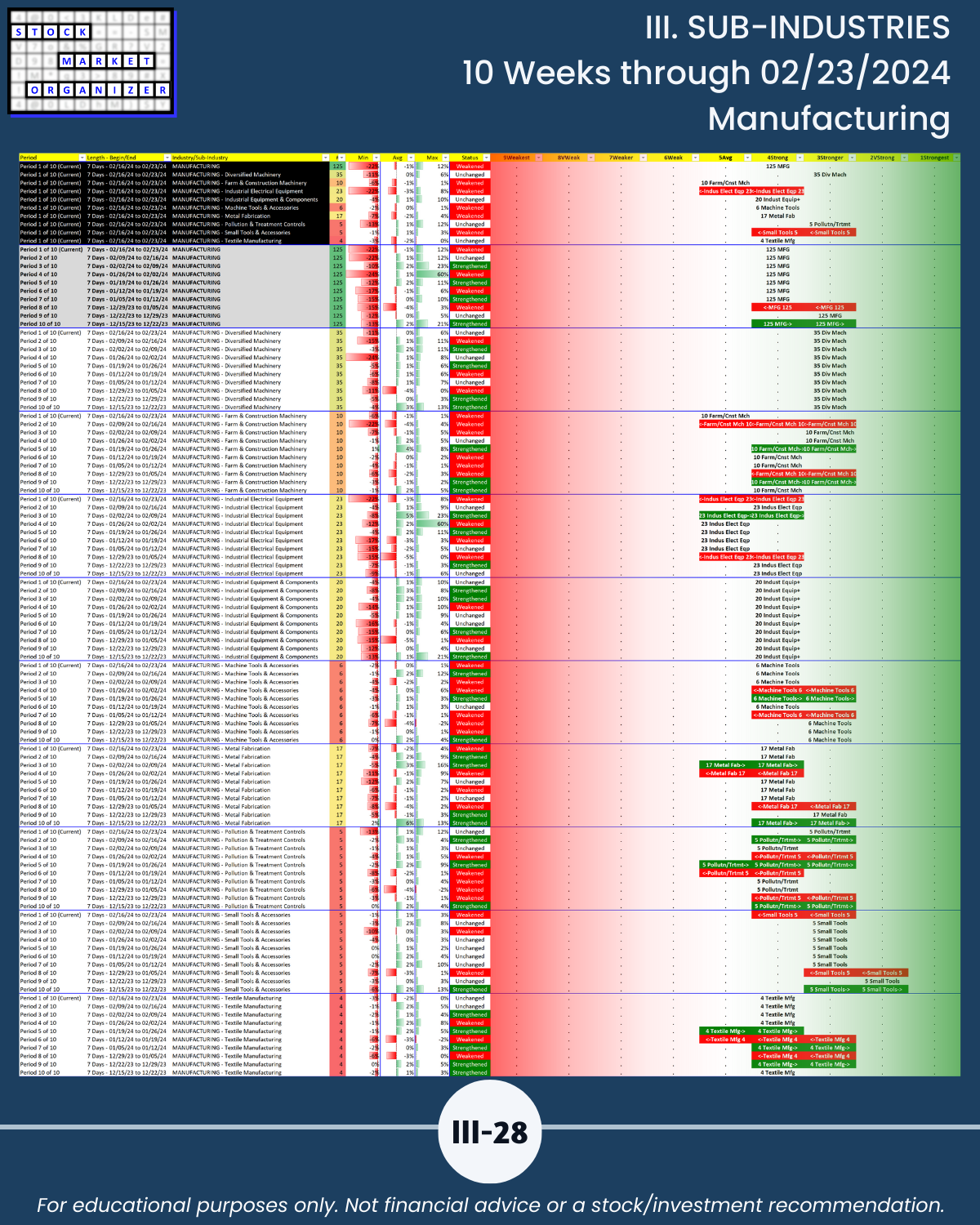

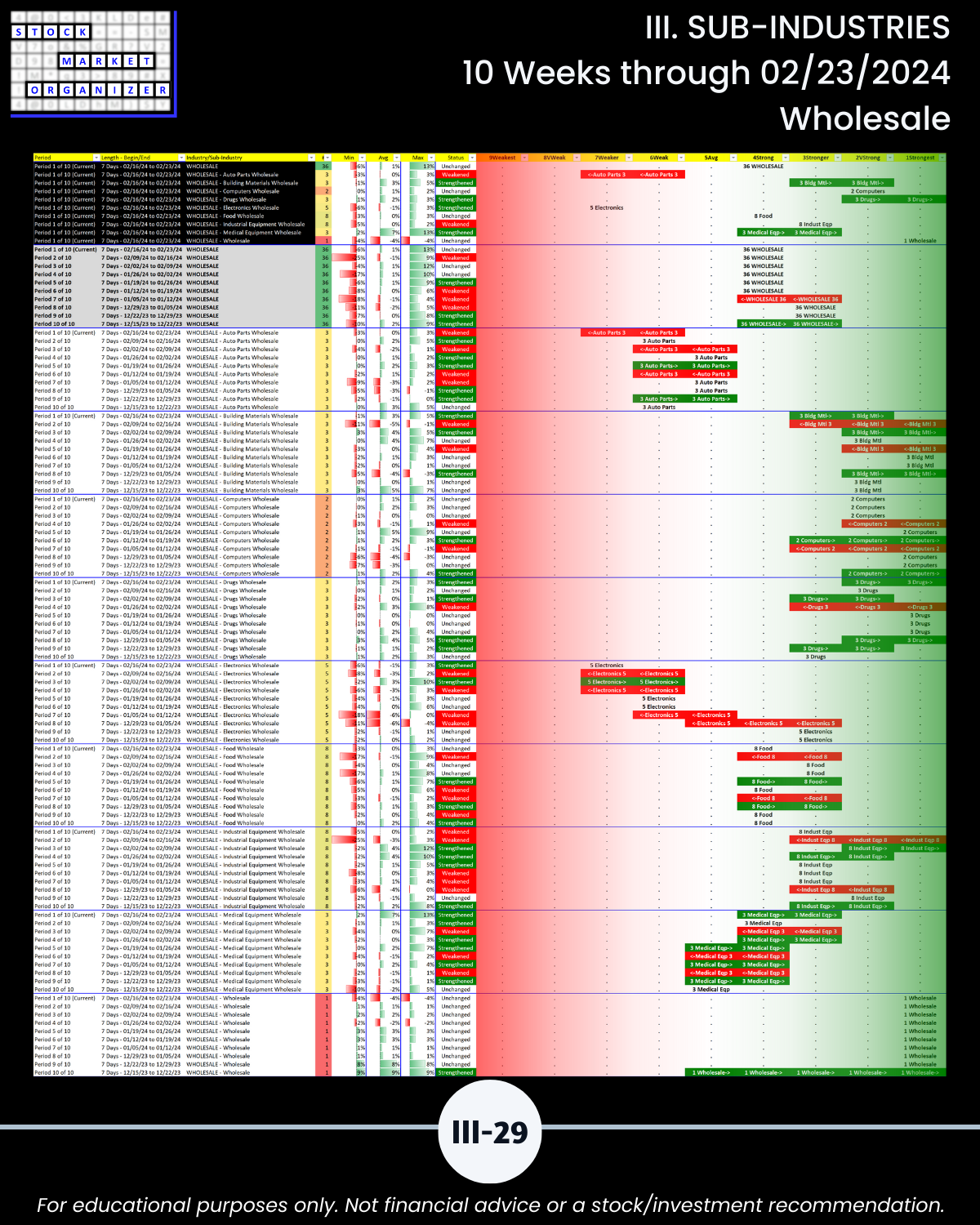

🔹 The analysis goes from Market -> Industries (divided into logical sector and other groupings) -> Sub-industries -> Stocks.

🔹 It is all based on strengthening at the individual stock level. Once you aggregate this into the larger groupings (Sub-industries -> Market), you can get valuable information. QUICKLY.

🔹 It’s all original.

🔹 It’s all worth heeding, with nothing you’ll find elsewhere.

🔹 Conversely, there’s nothing you’ll find elsewhere presented here. That is, look elsewhere if you want annotated price charts, price targets, and opinions.

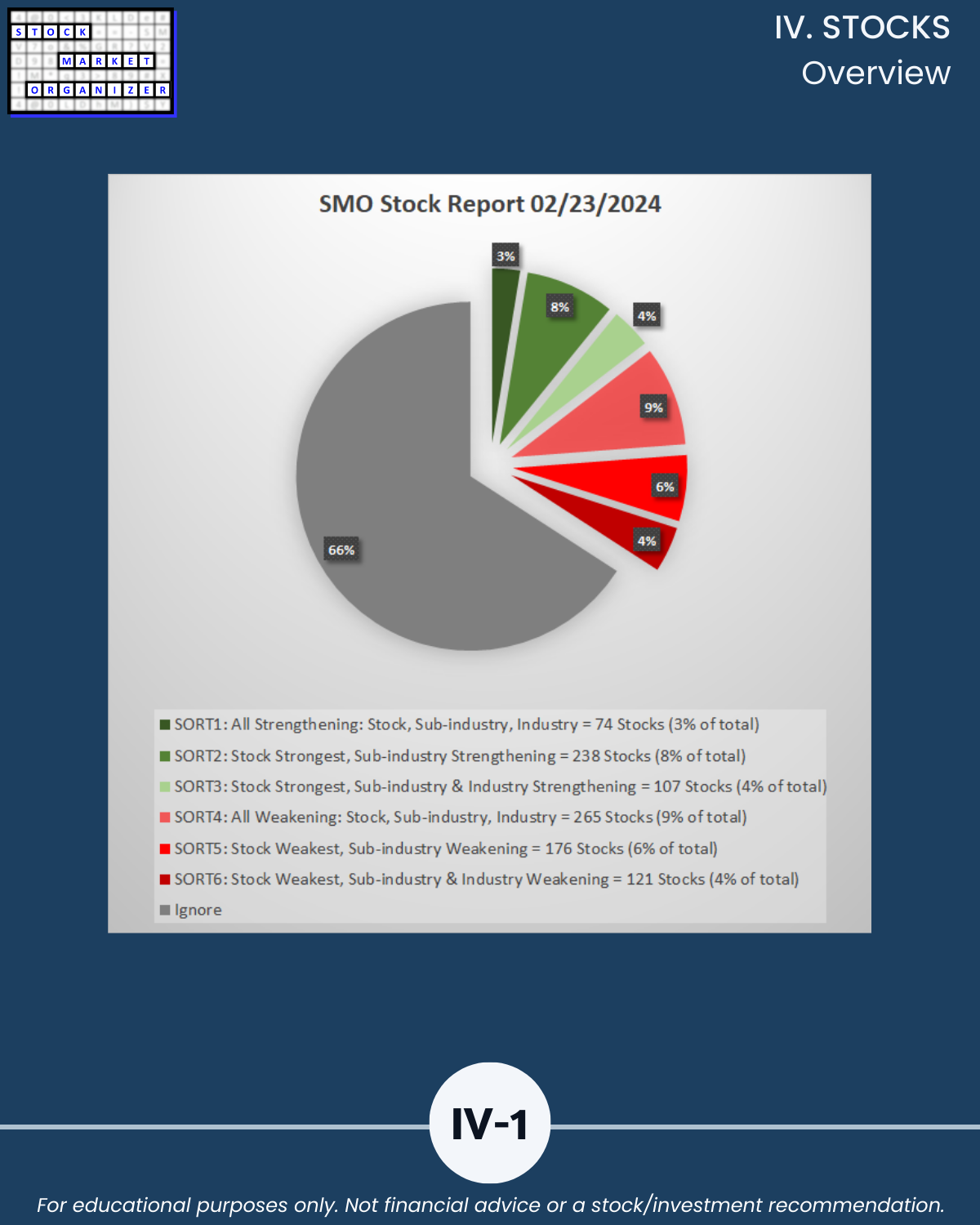

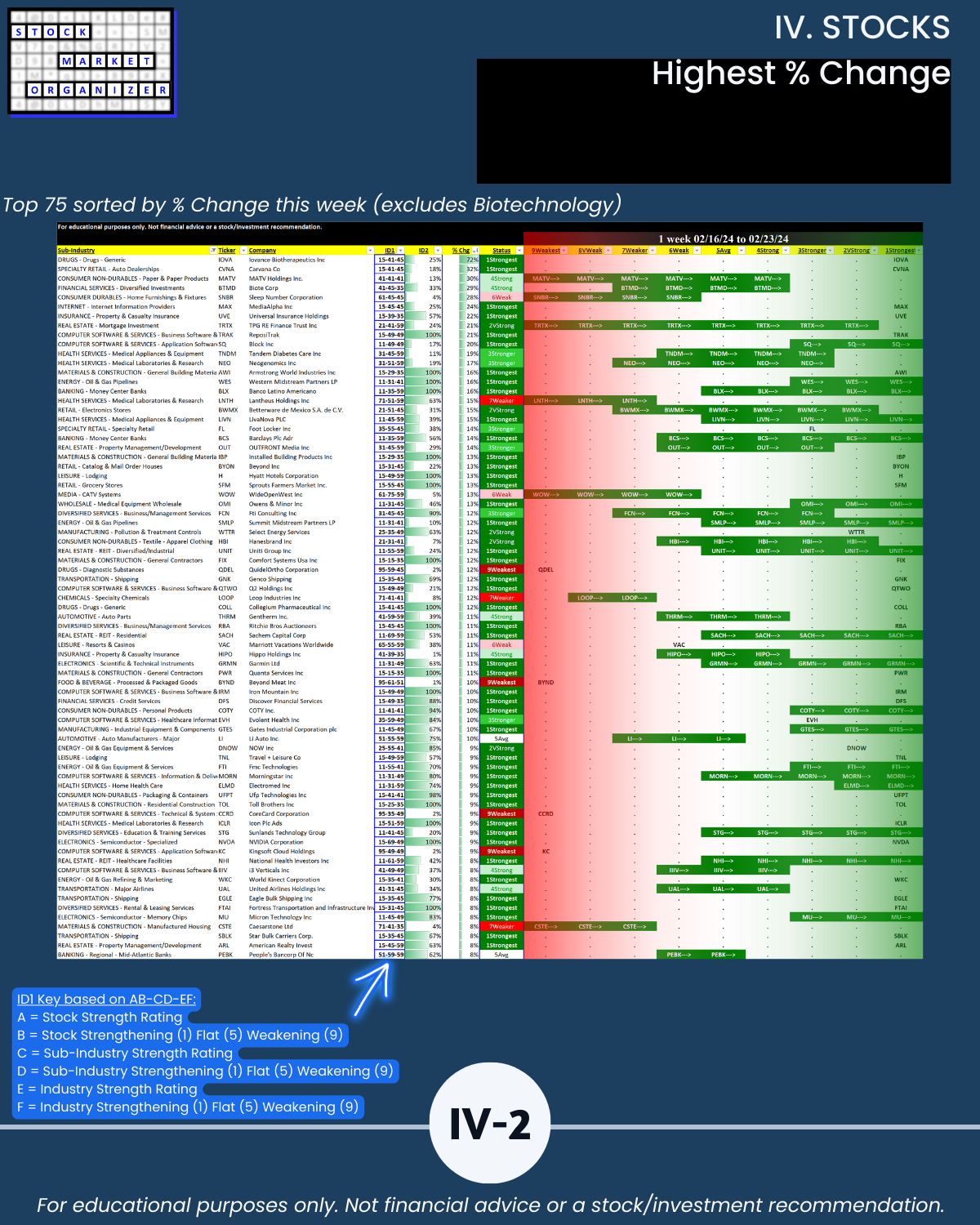

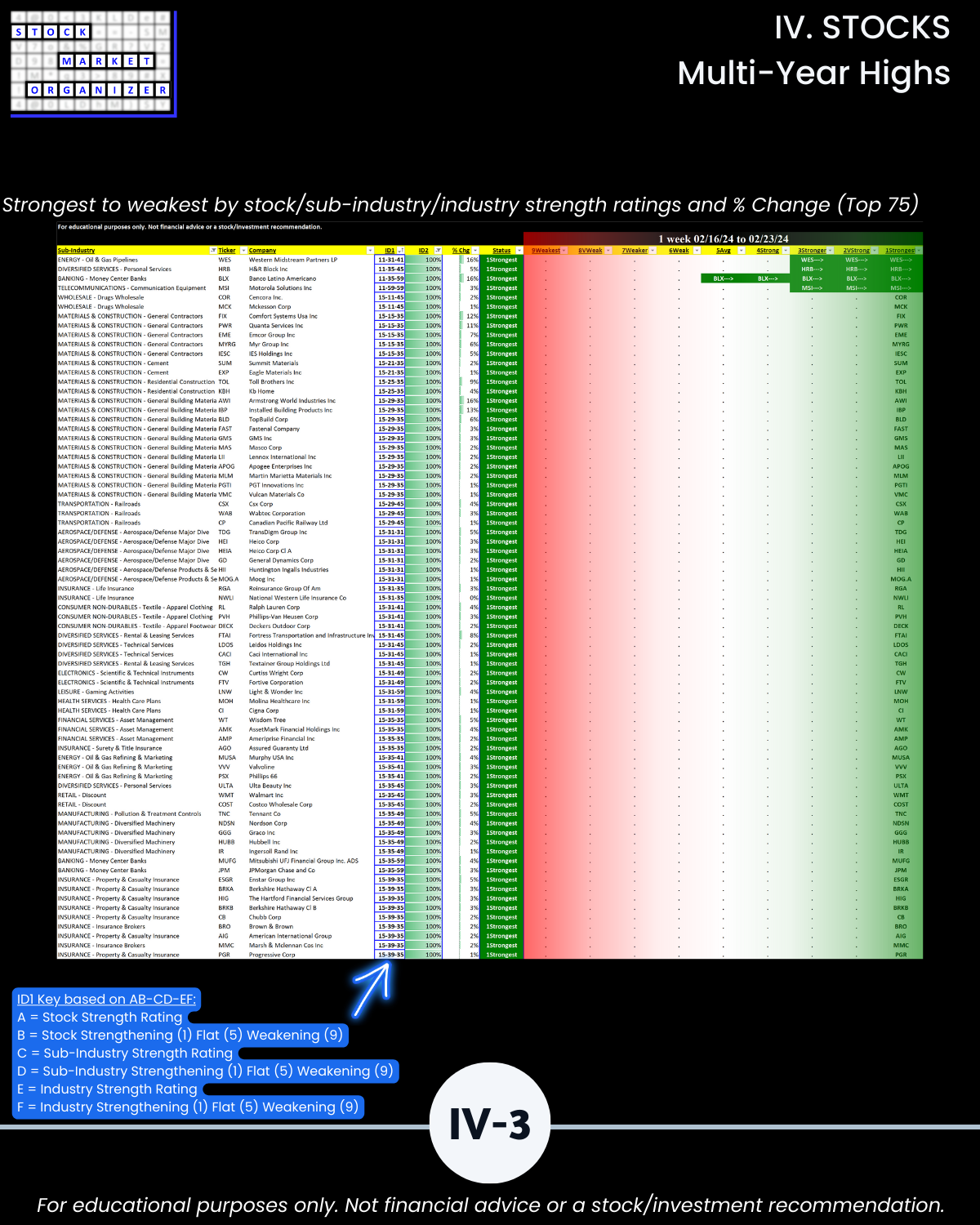

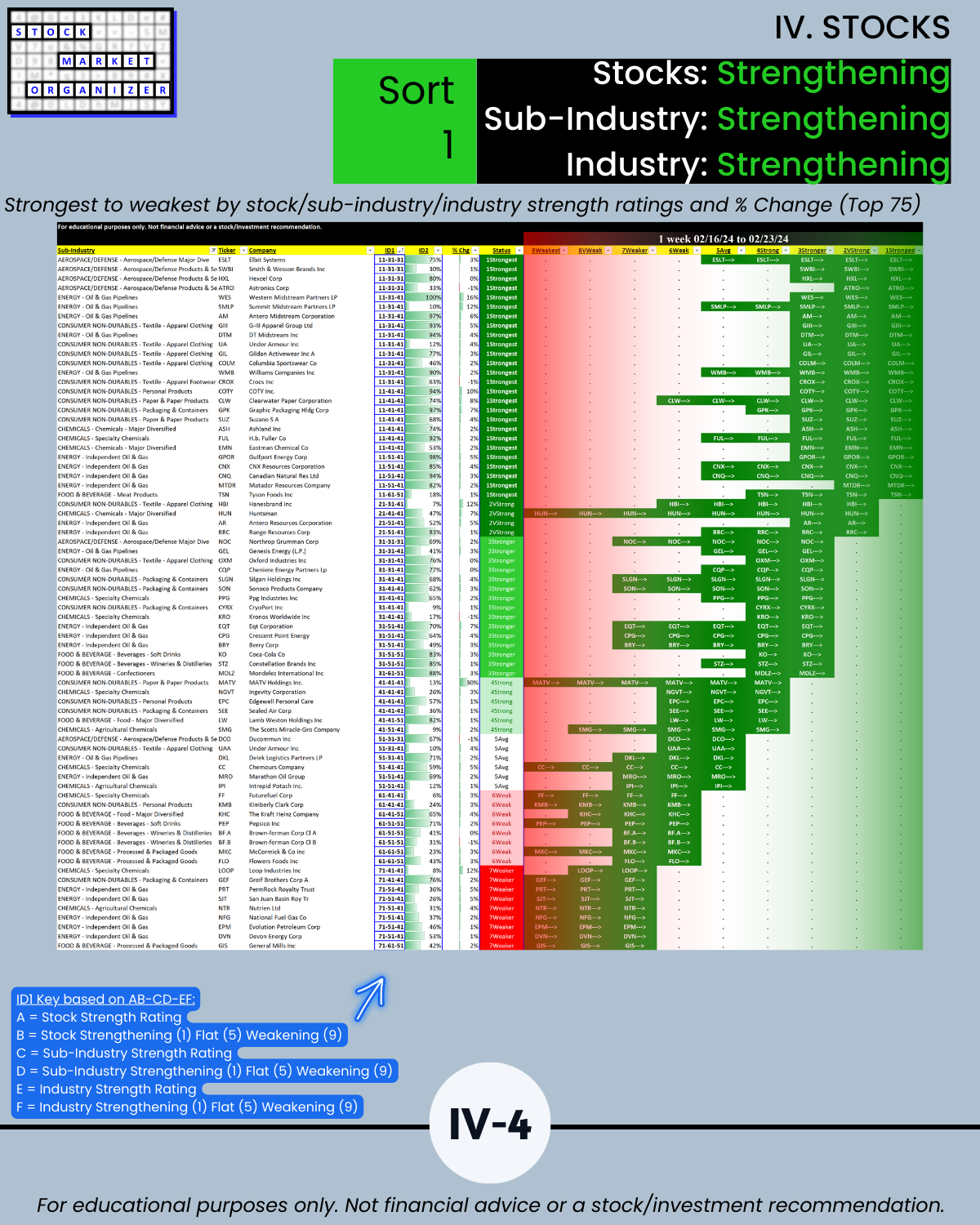

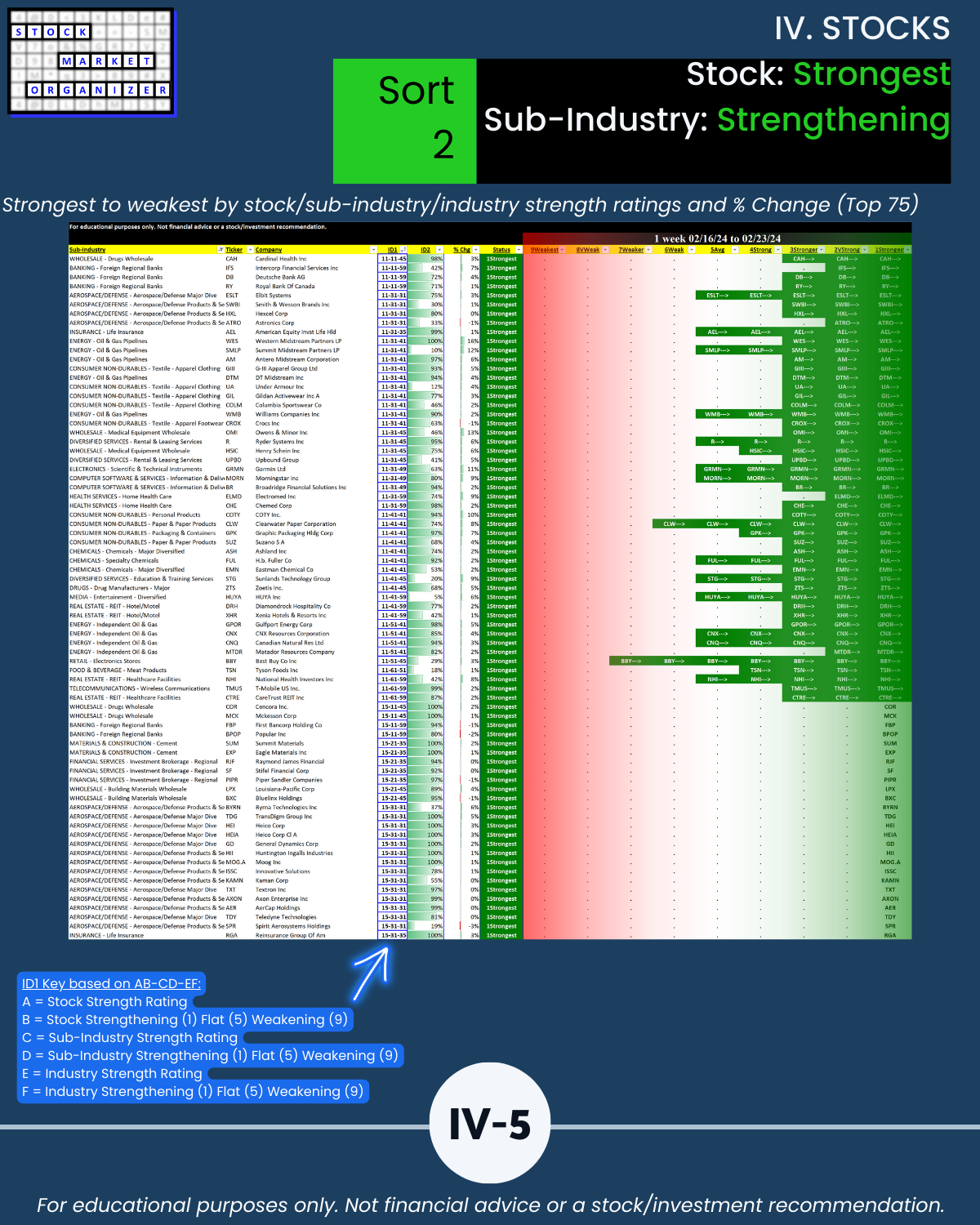

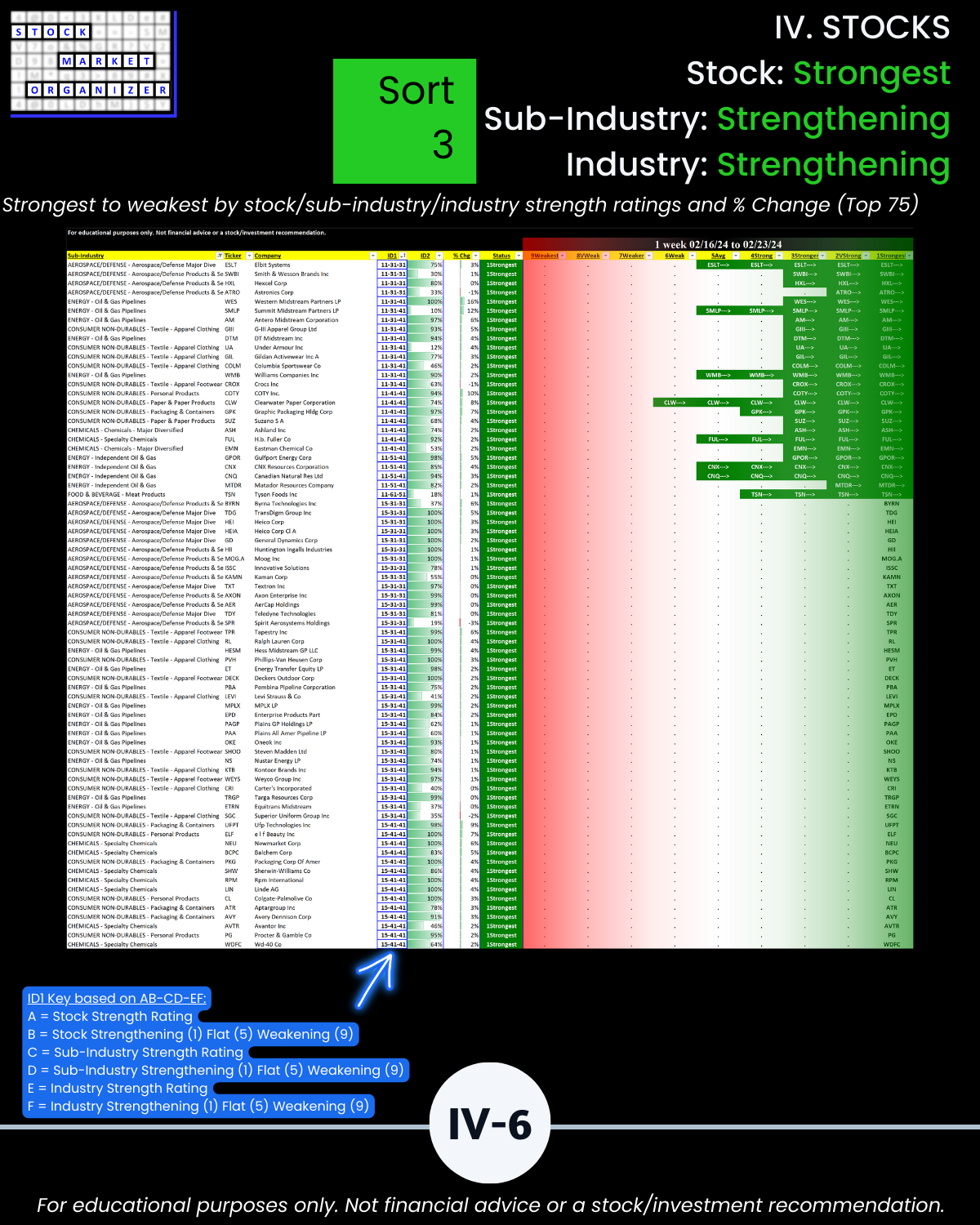

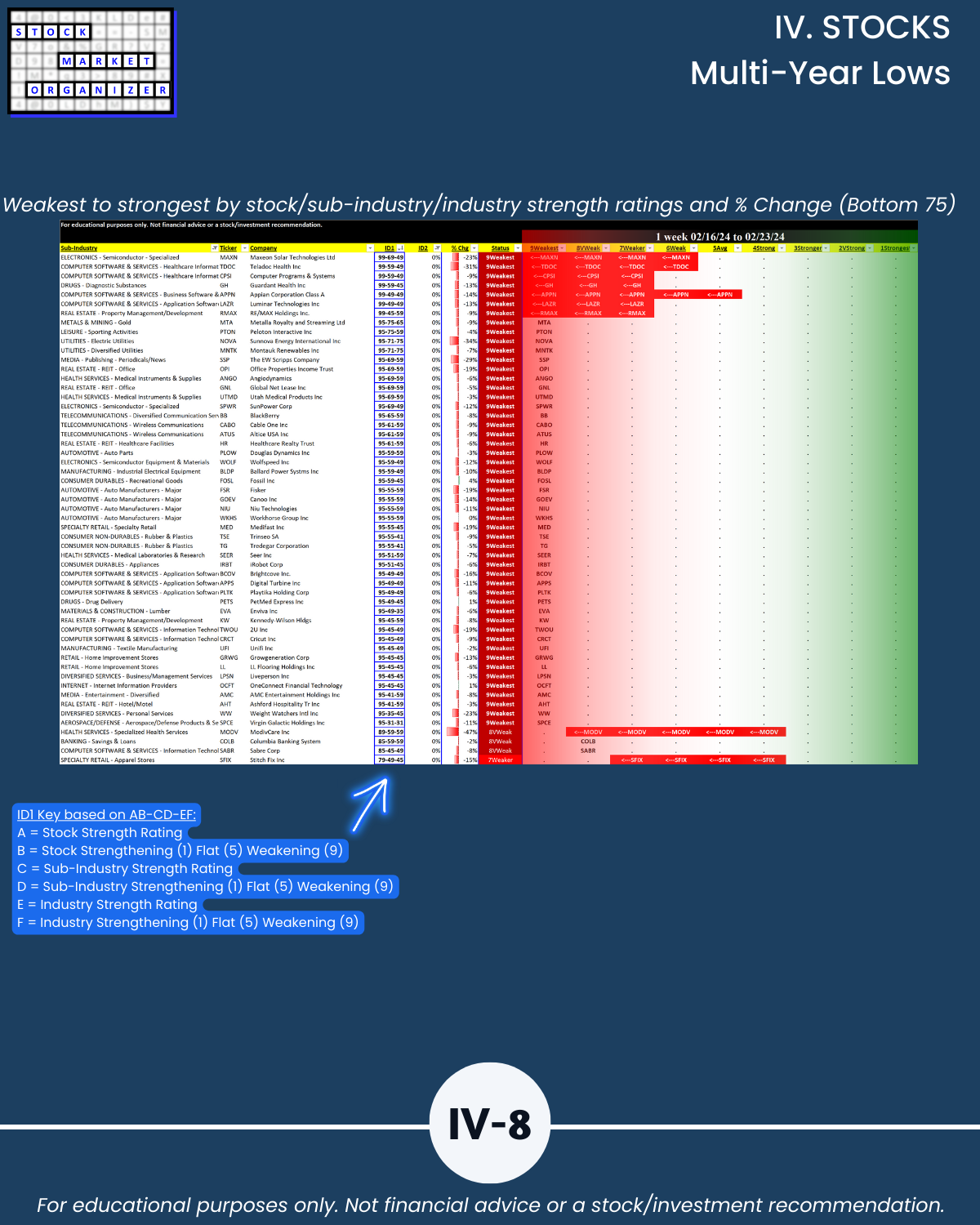

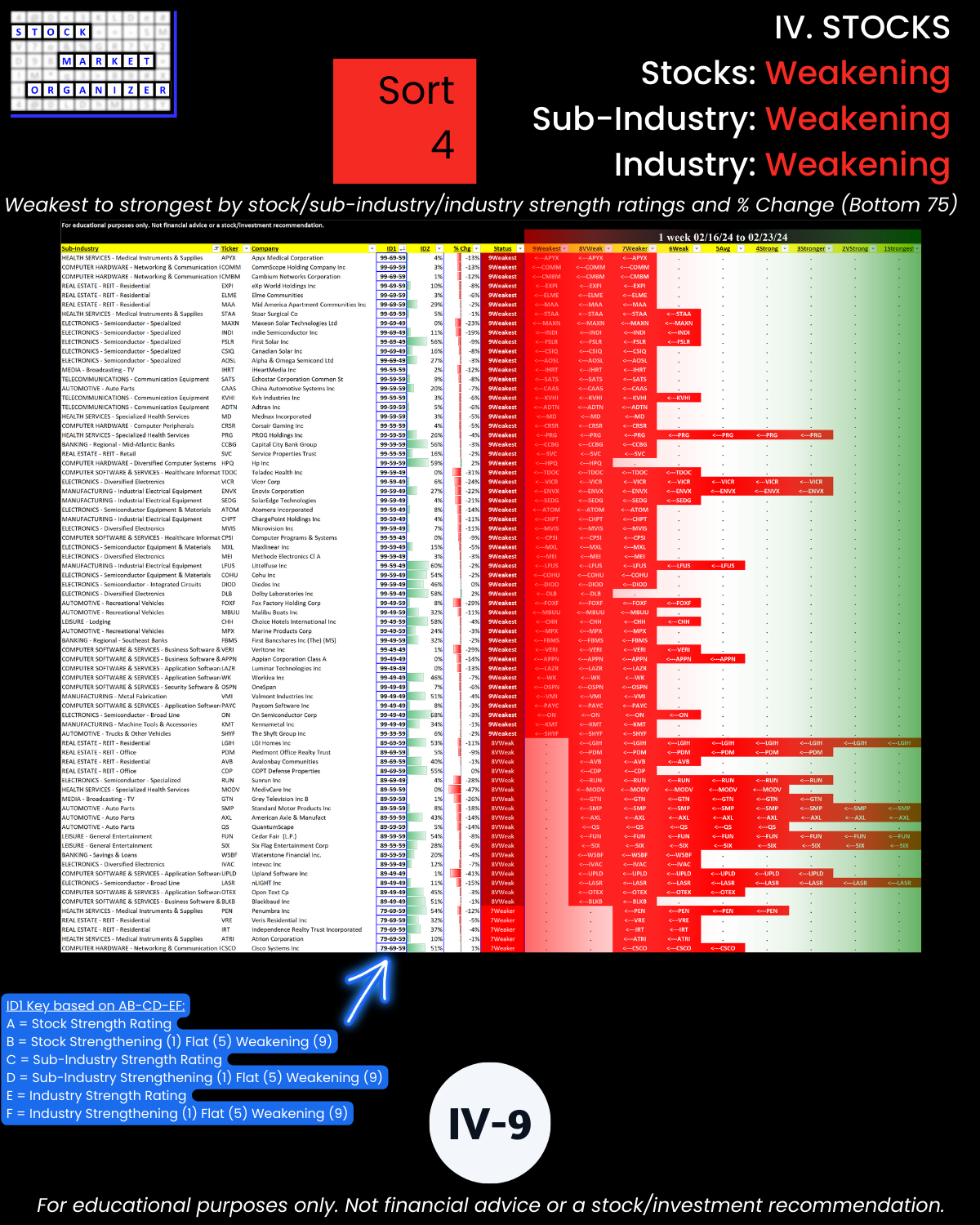

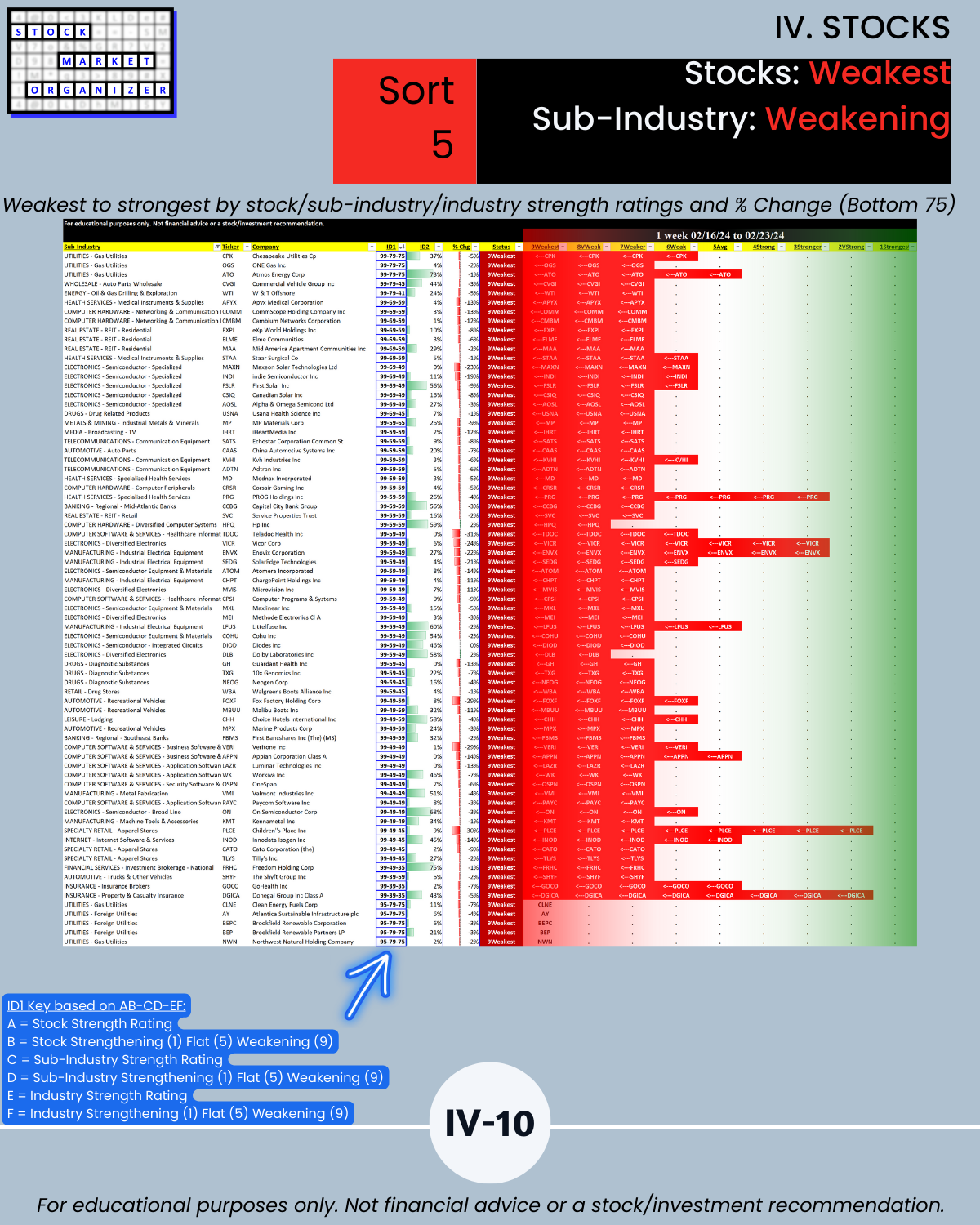

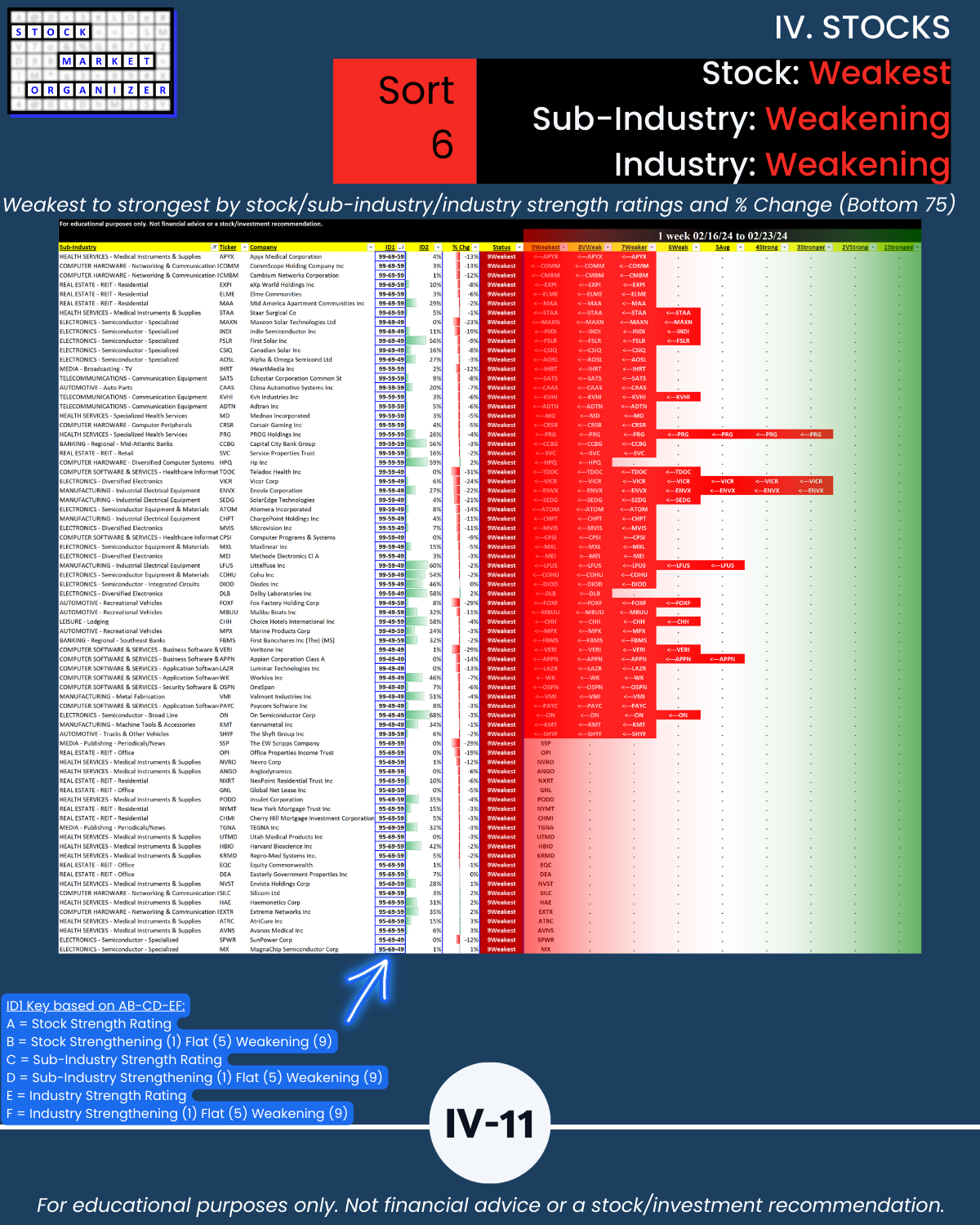

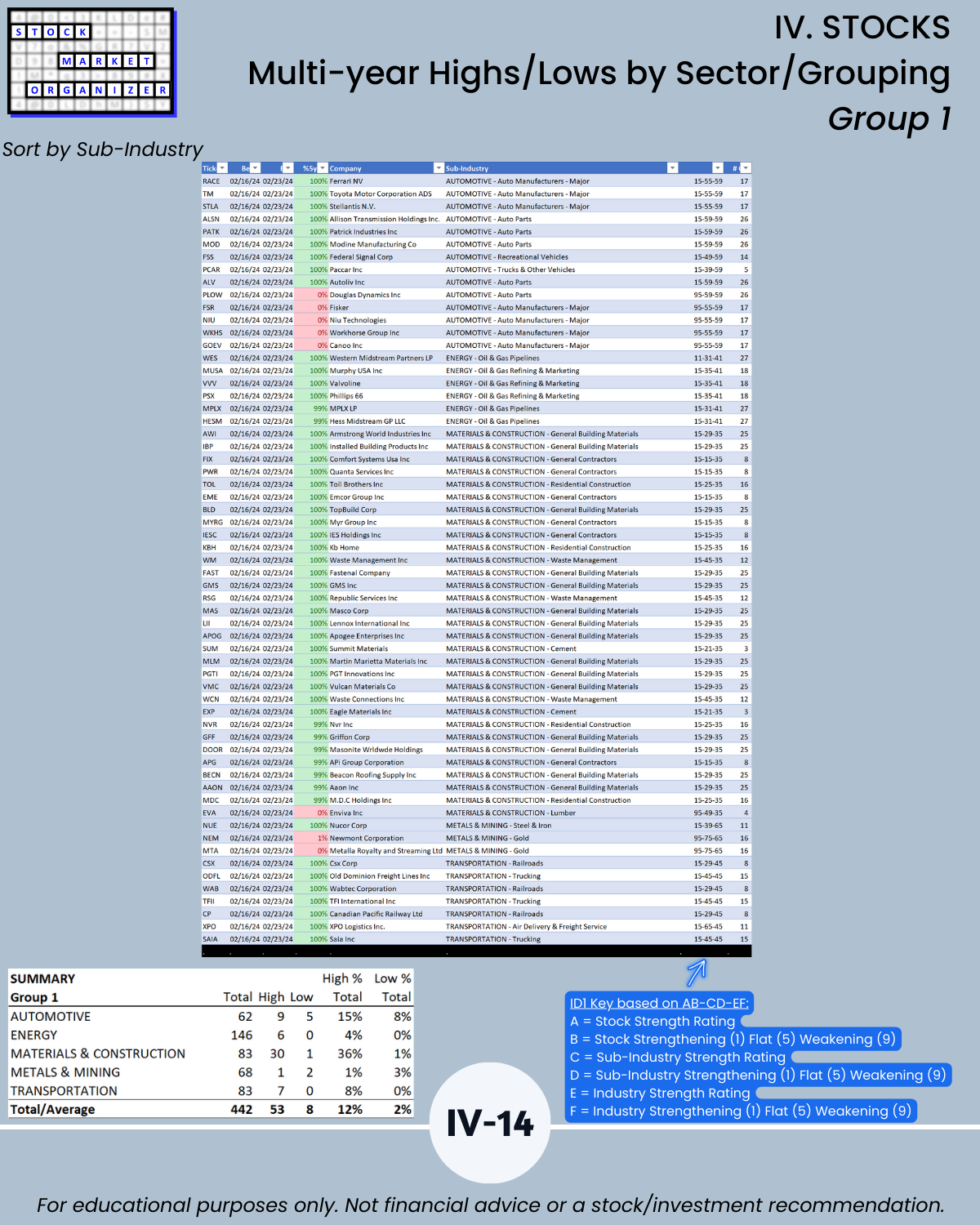

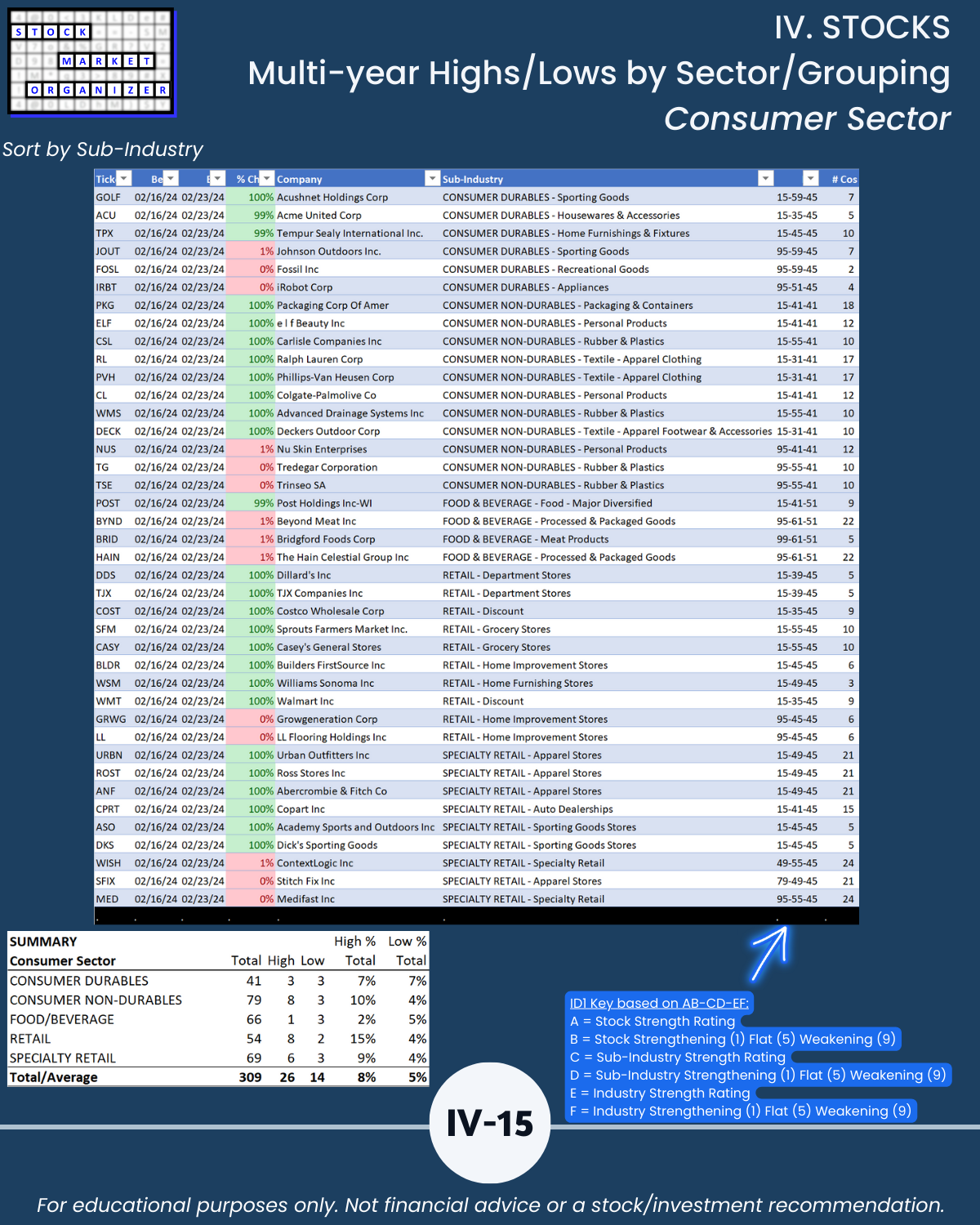

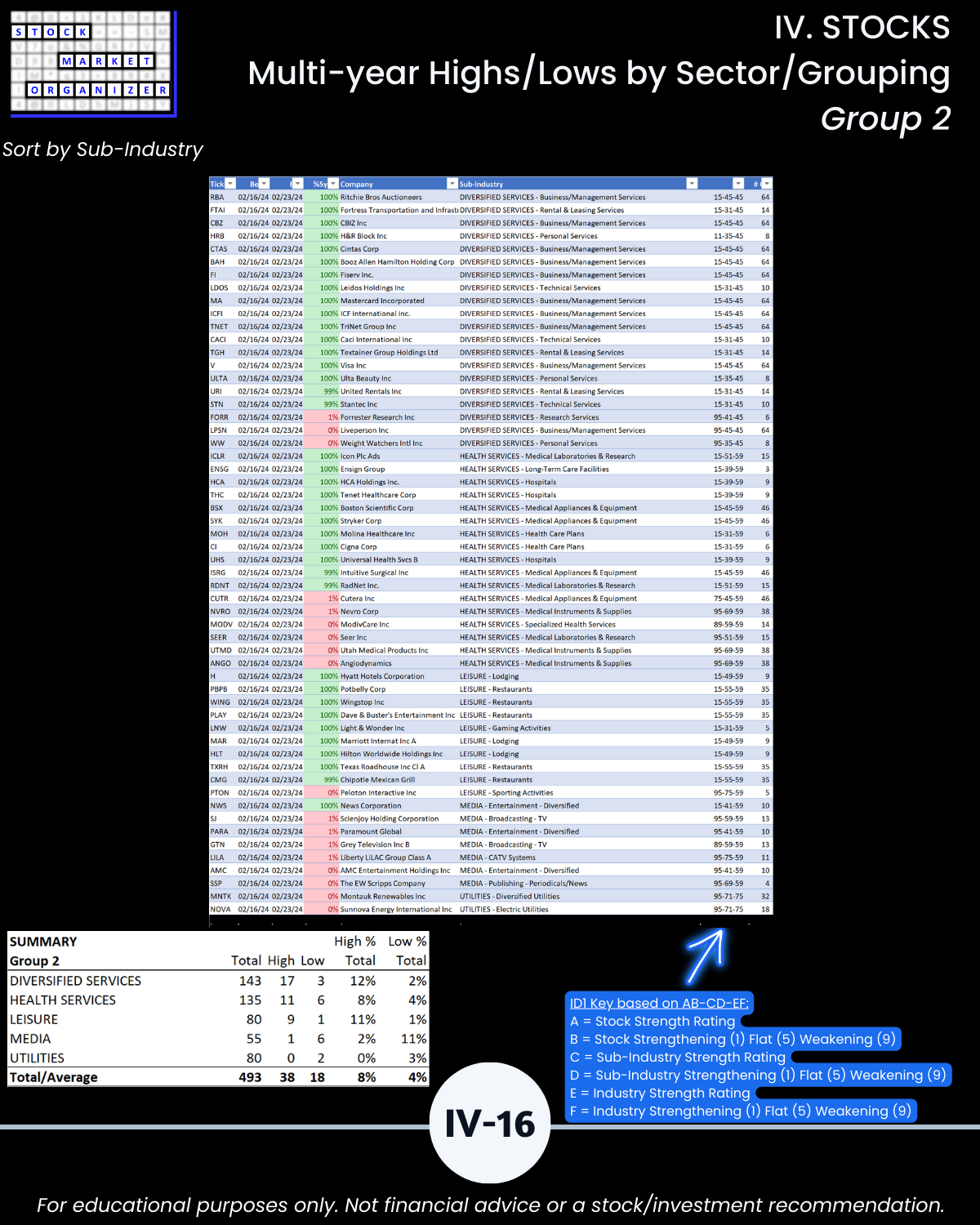

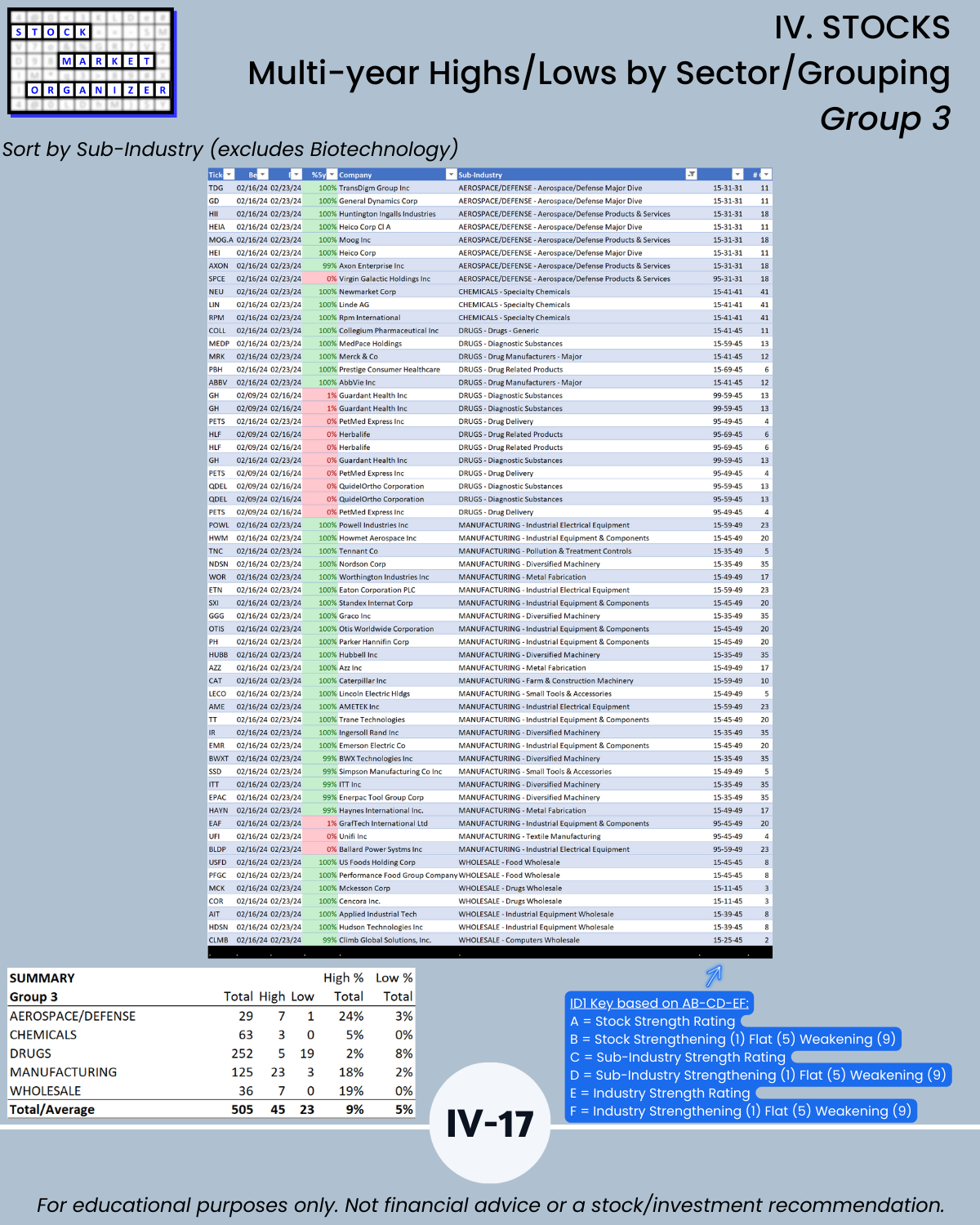

🔹 See Section IV for individual stock ideas (though these are not recommendations). Here you’ll find outliers with their sub-industry and industry strength ratings to discern attractive combinations.

DID YOU KNOW?

🔹 The -64% market strength score = mid-“No New Longs” territory

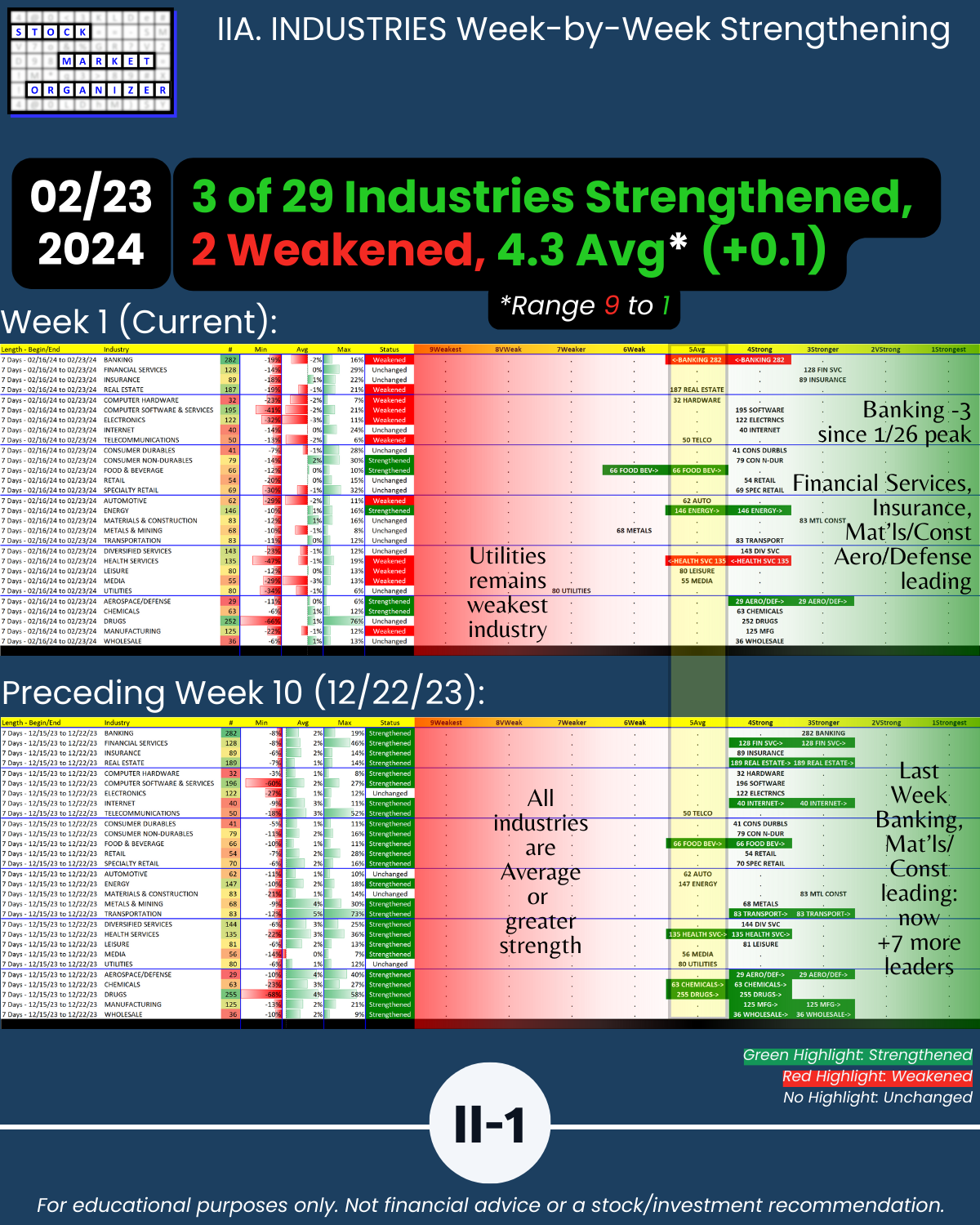

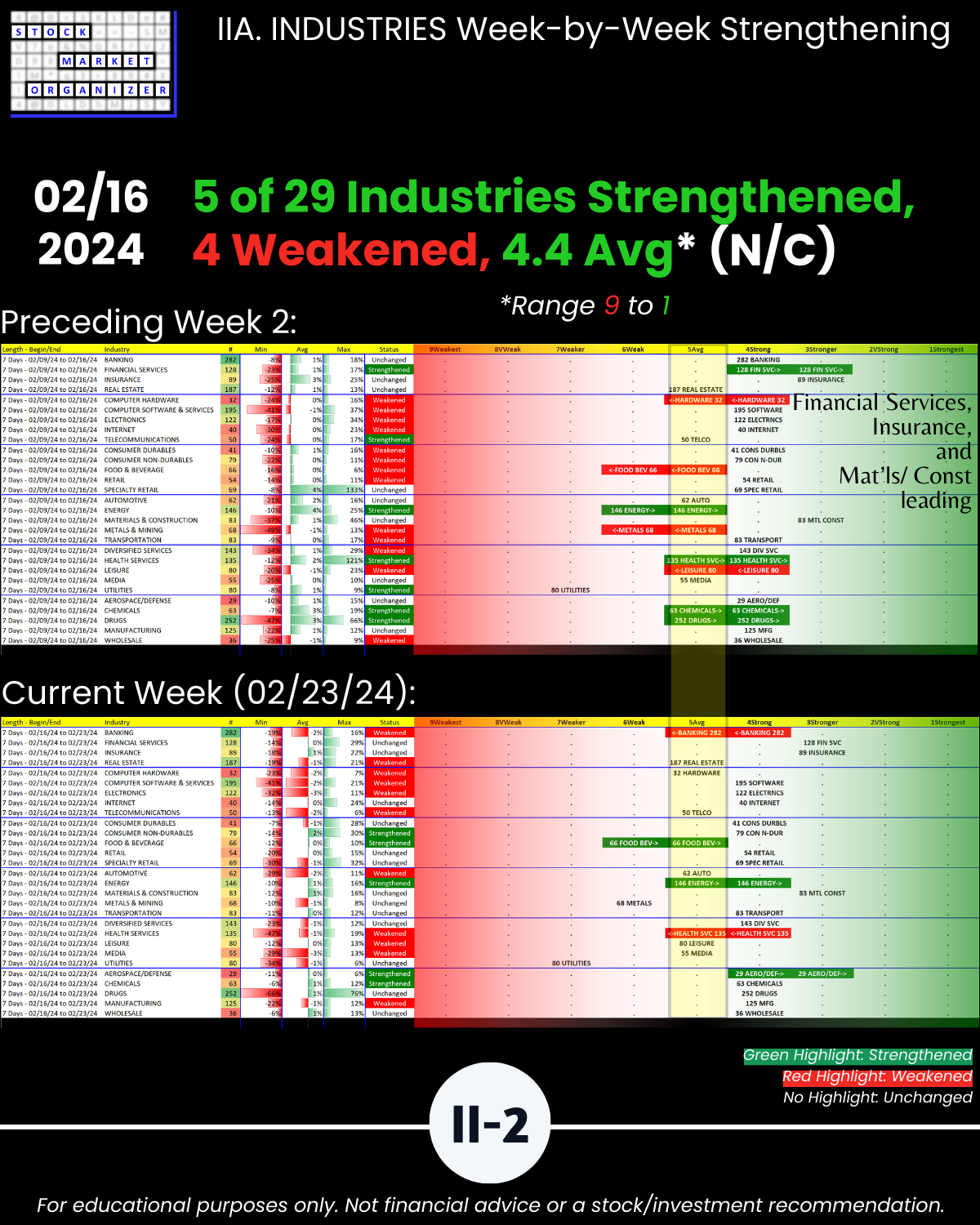

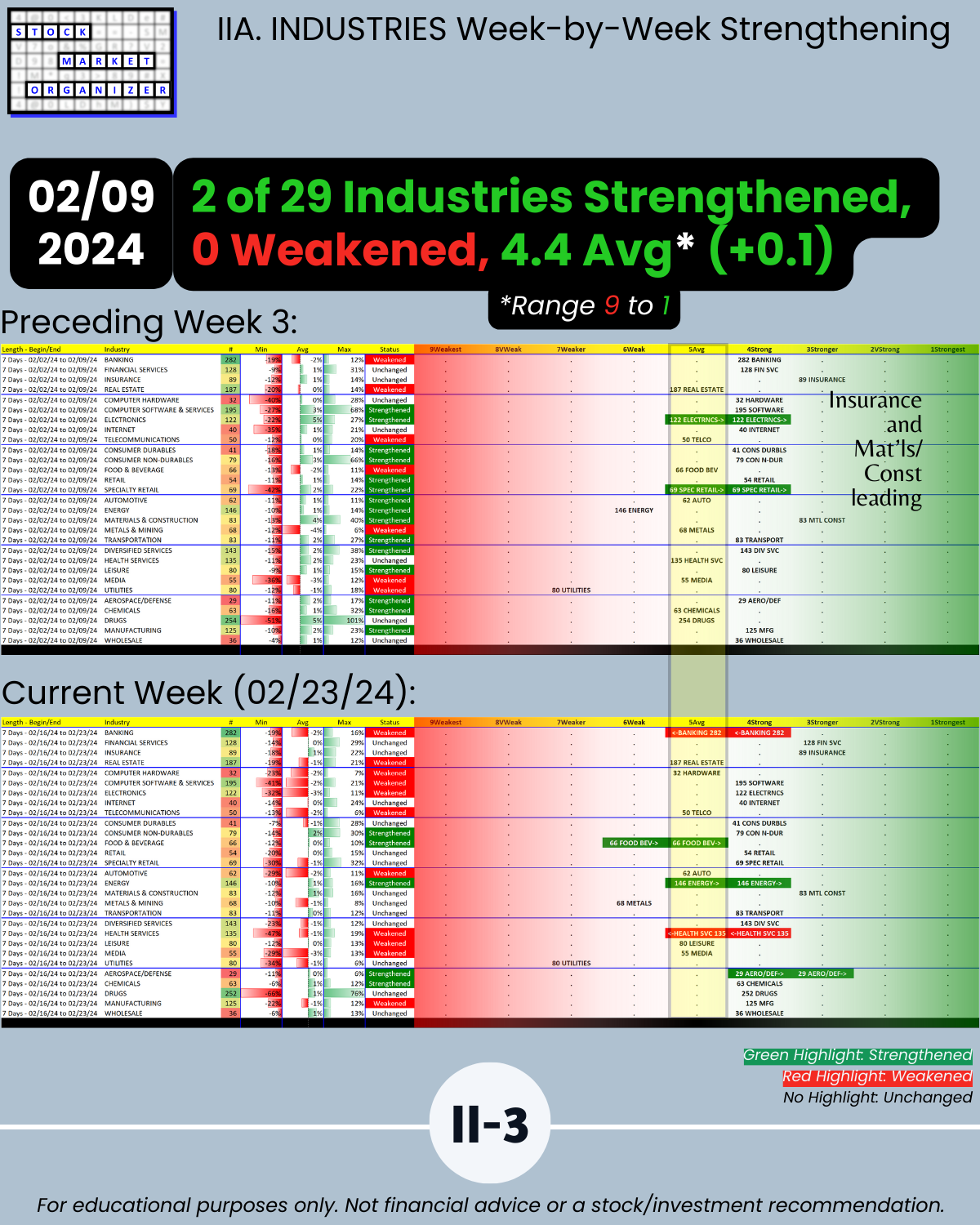

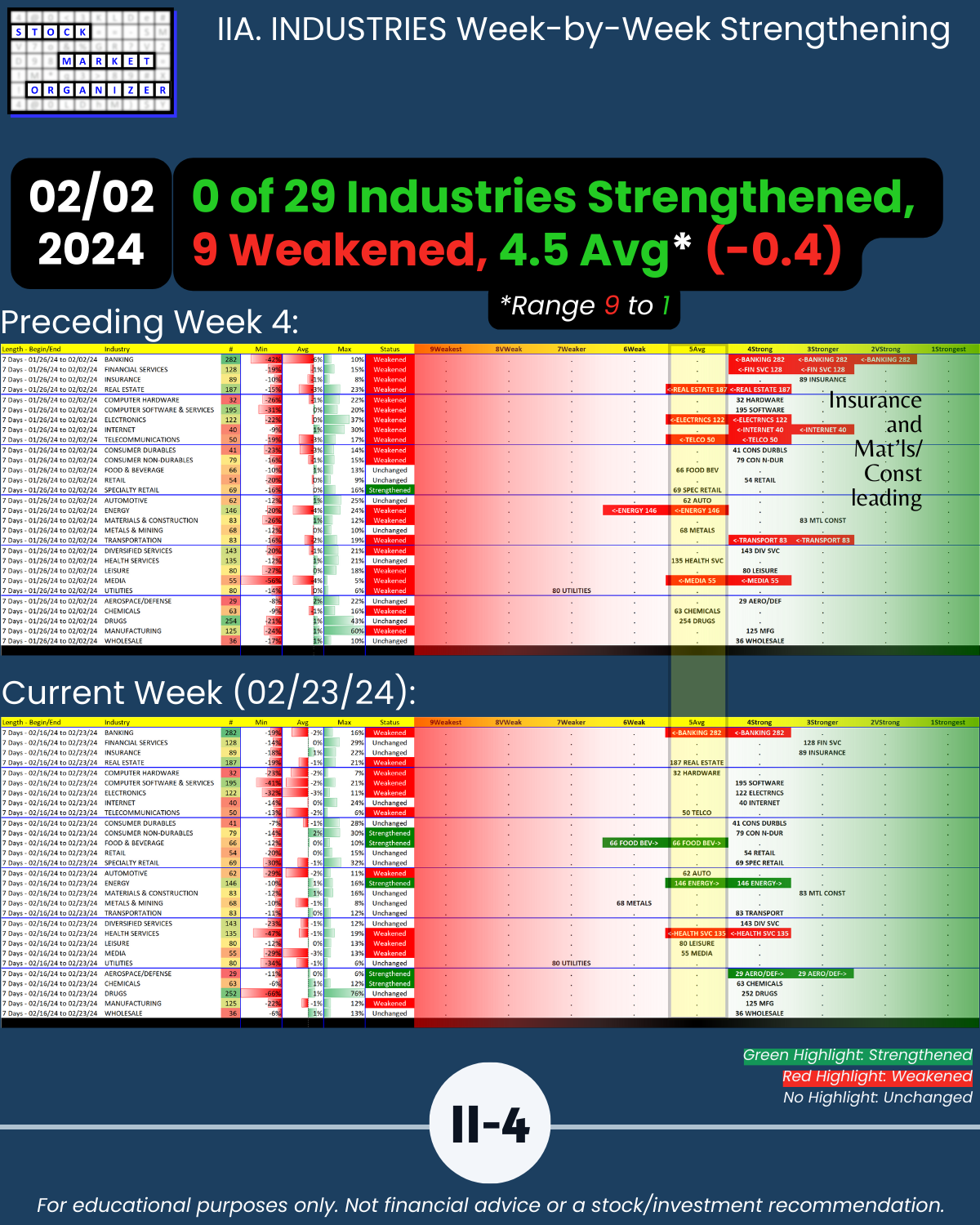

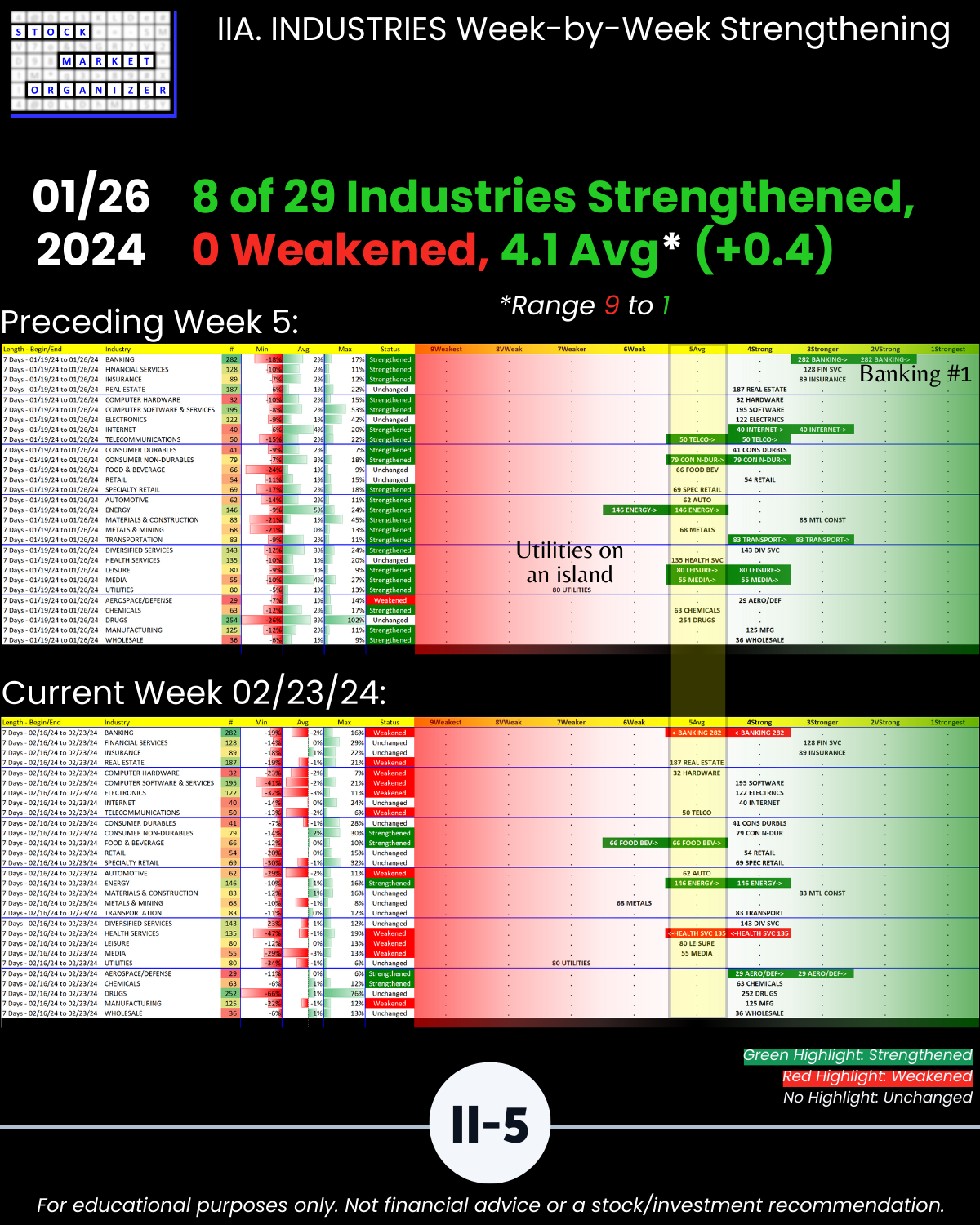

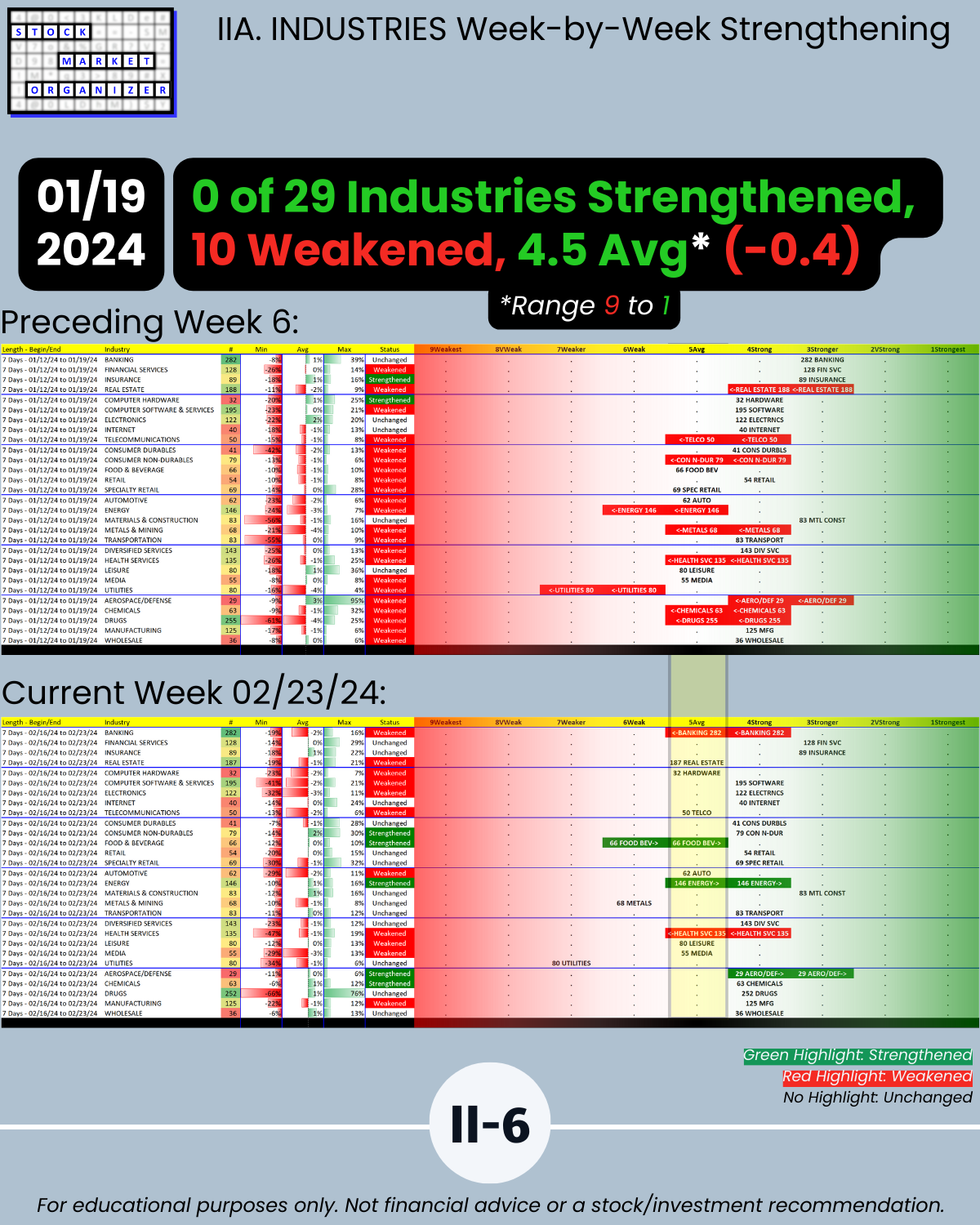

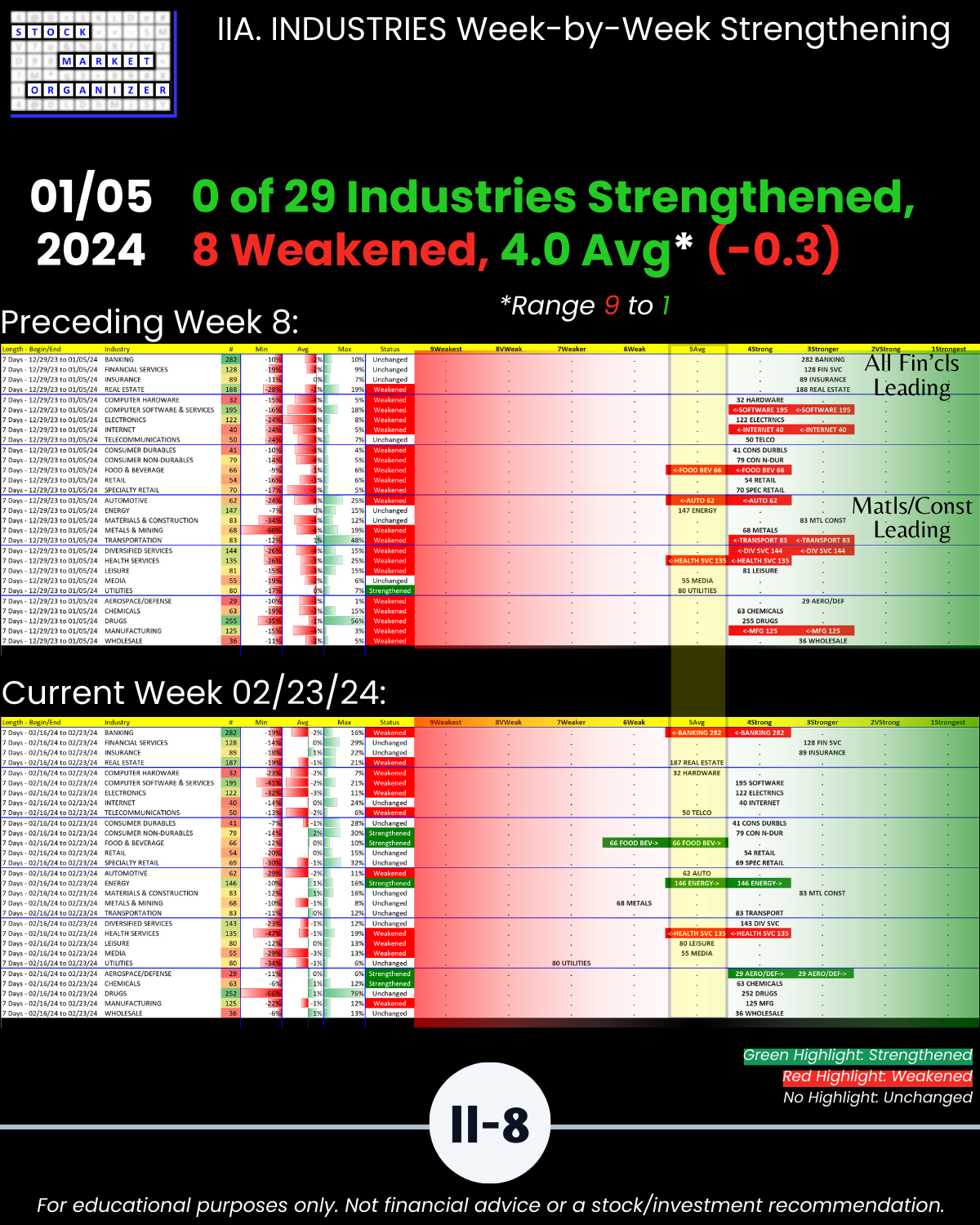

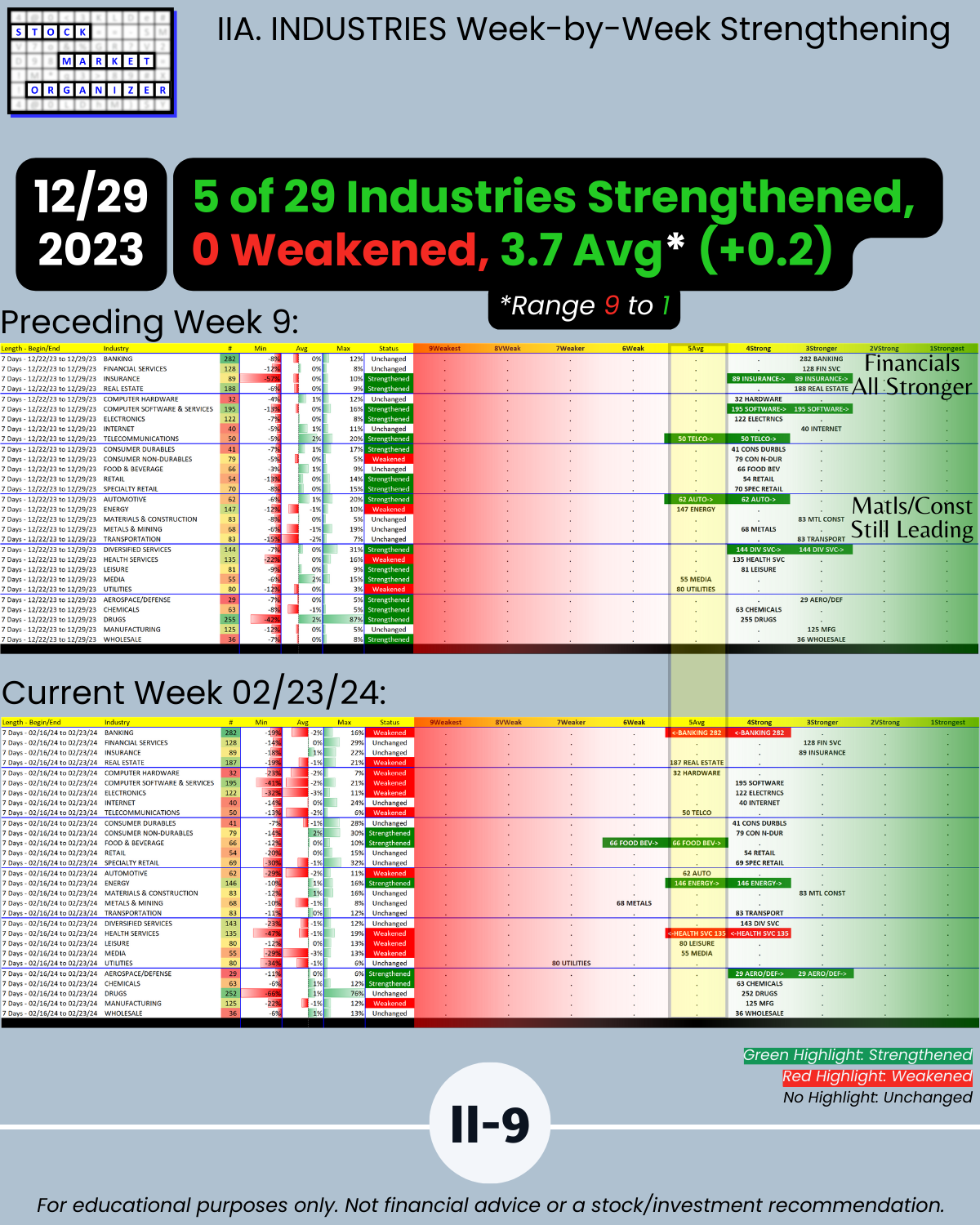

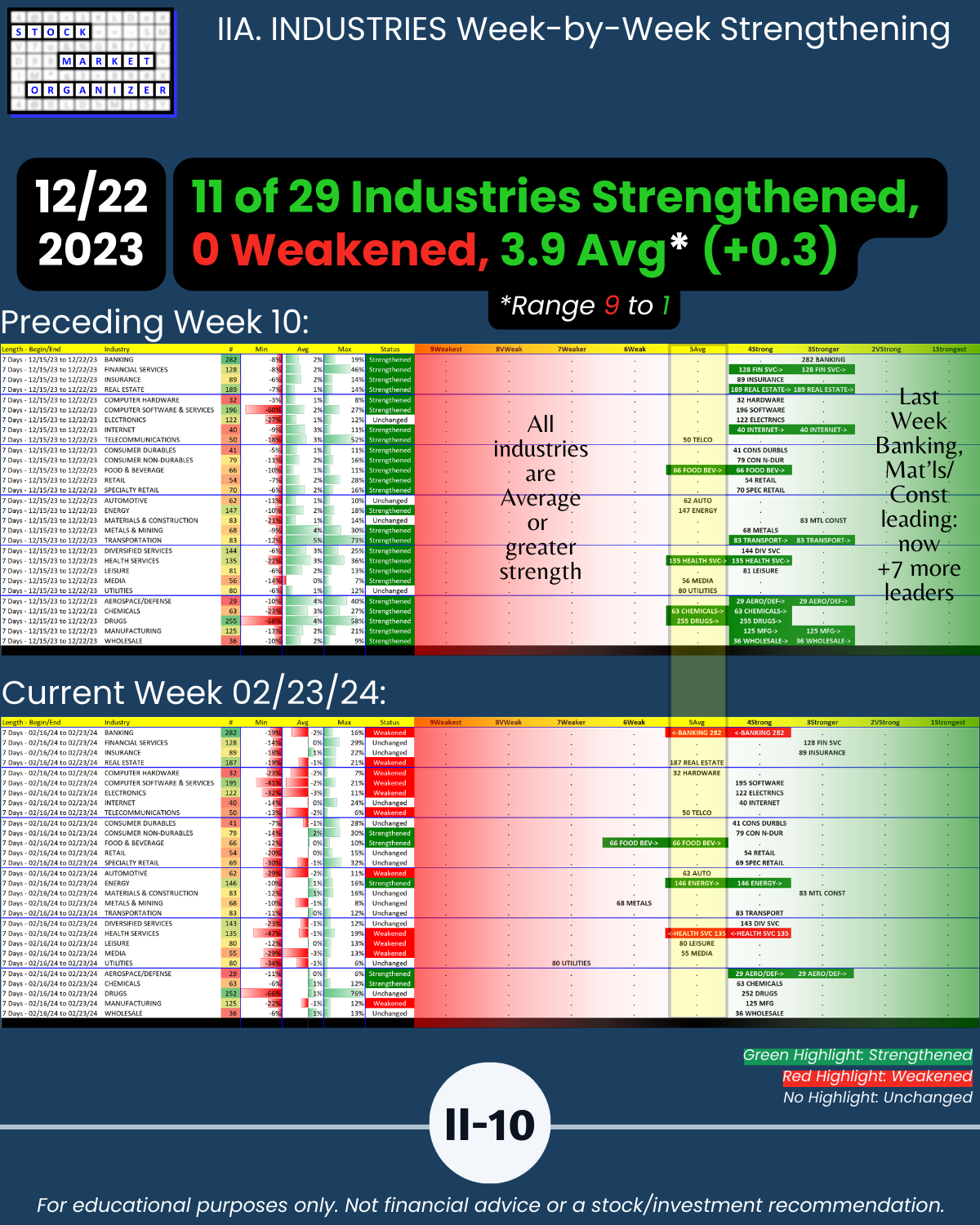

🔹 Average Industry Strength Score = 4.3 (1 = strongest 9 = weakest, +0.1 = strengthened vs. previous week)

🔹 3 of 29 industries strengthened, 2 weakened (5/4 previous week)

🔹 29% vs. 40% sub-industries Strengthening vs. Weakening (vs. 32%/36% previous week, 199 Sub-industries)

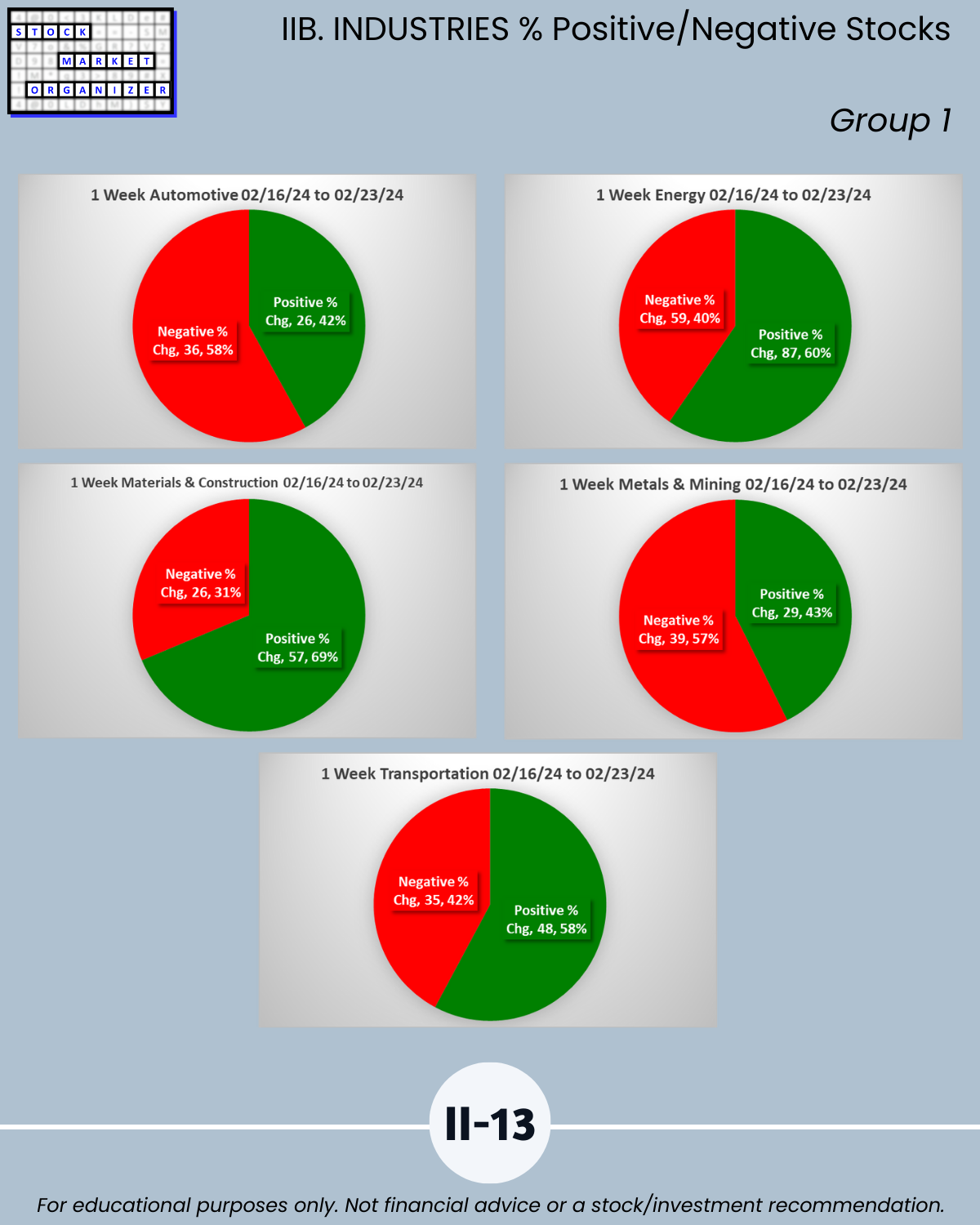

🔹 Financial Services, Insurance, Materials & Construction, and Aerospace Defense = strongest industries at Stronger (3rd strongest of 9 levels)

🔹 Utilities = weakest industry at Weaker (7th strongest)

Attached: an objective answer to “How is the overall market doing right now?”

AKA a detailed look at what you can find out about the market, sectors, industries, sub-industries, and individual stocks when you analyze a factor common to all of these: their strengthening and weakening.

Other interesting questions answered:

🔹 Are current market strengthening/weakening conditions more conducive to new longs or to new shorts?

🔹 Is market strengthening or weakening early or late in a meaningful cycle?

🔹 What are the strongest-rated stocks in strengthening sub-industries and industries?

🔹 What are the weakest-rated stocks in weakening sub-industries and industries?

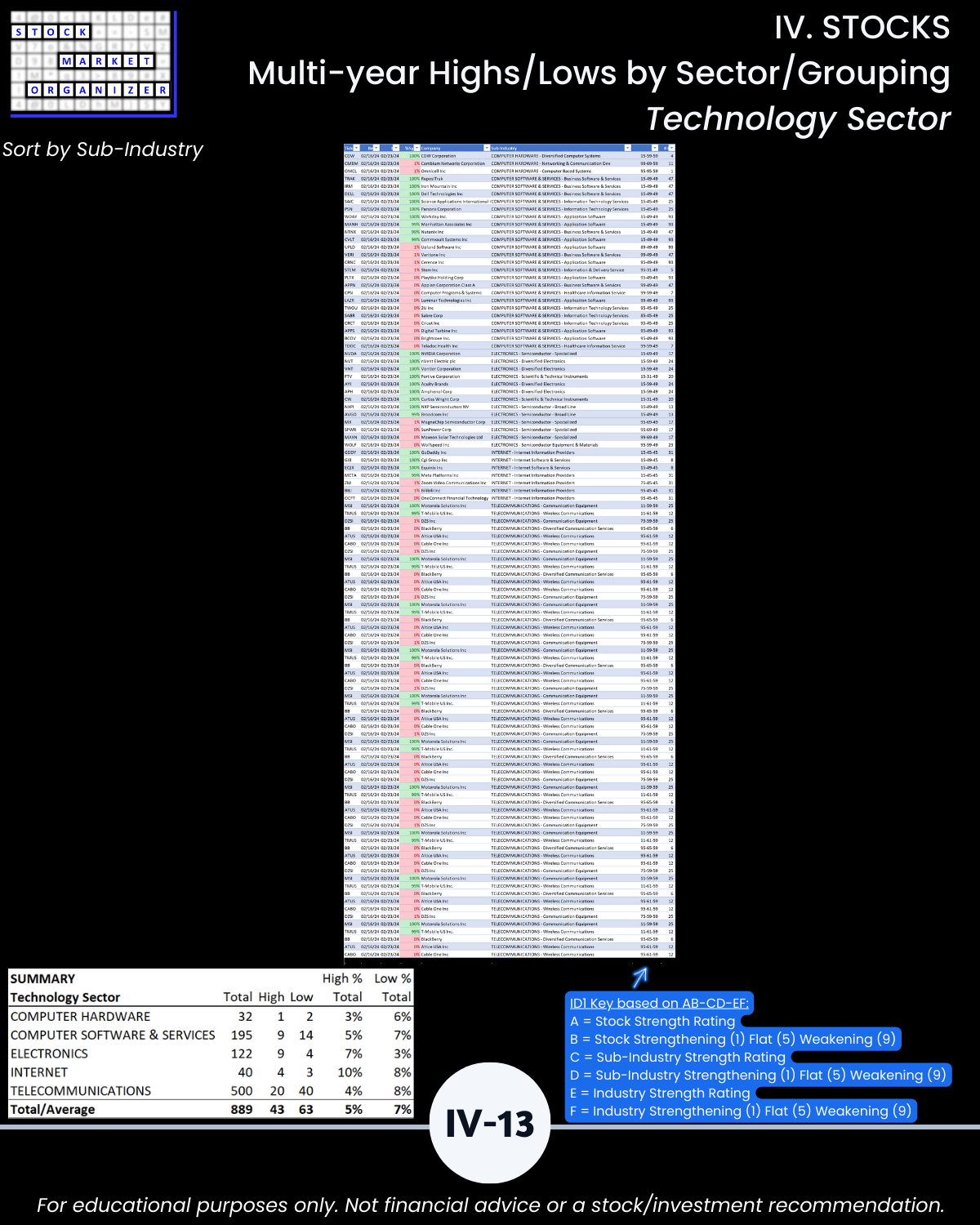

🔹 What stocks are at multi-year highs/lows, and how strong/weak are their sub-industries and industries?

WHO CARES?

Anyone who wants a U.S. stock market advantage. Really helpful if you agree with the following:

- The stronger your stocks, the greener your P&L.

- The journey to 100%+ returns begins with 10% returns.

- The journey to a multi-month rally begins with one up week.

- Most stocks do what the market does. (While the market can only do what its underlying stocks, sub-industries, and industries do.)

- 80/20: not all information is created equal. (Press buttons, not balloons.)

Following are galleries with page-by-page views of this report.

I. MARKET/Introduction/Market Strength Score

IIA. INDUSTRIES/10-Week Week-by-Week Industry Strength

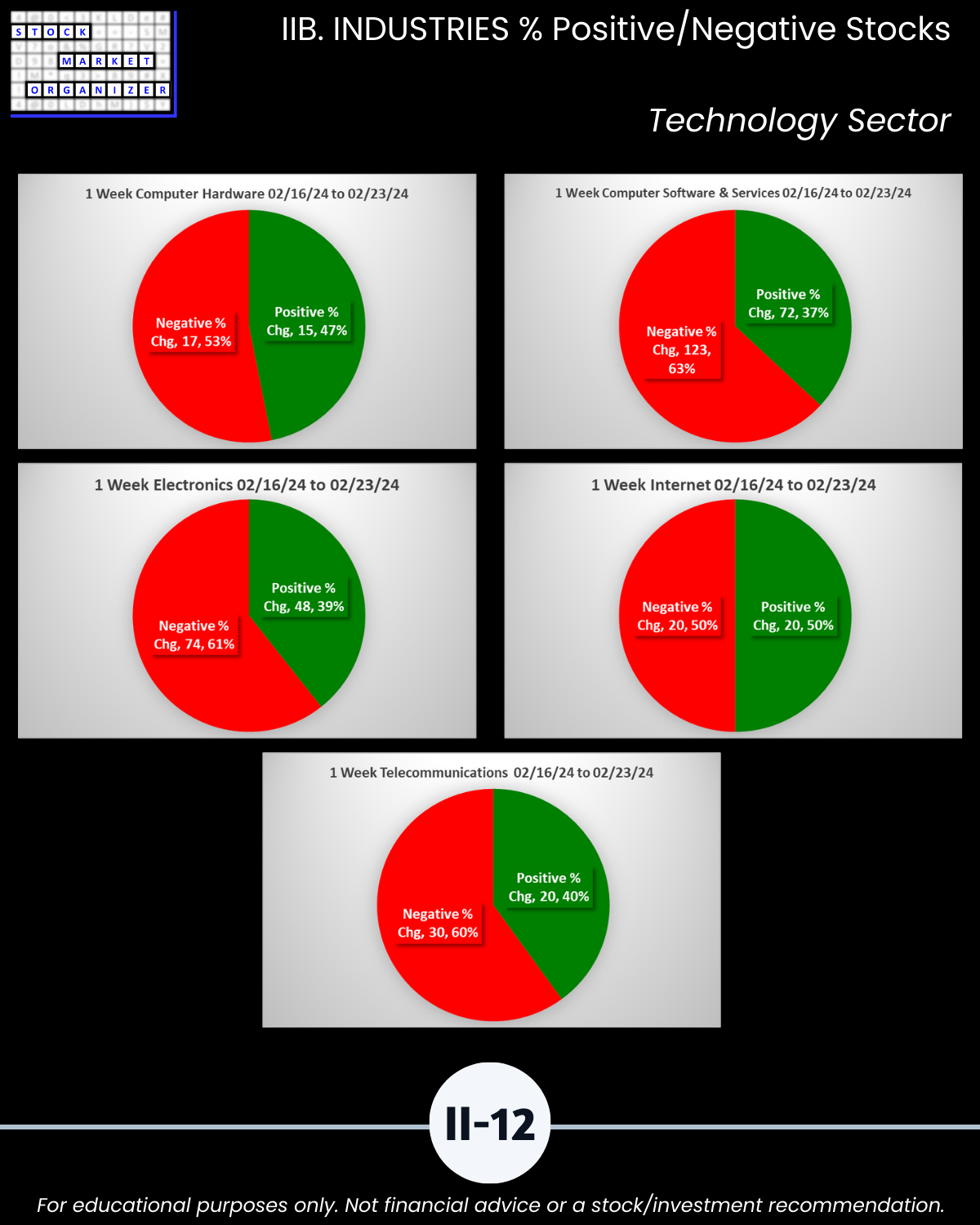

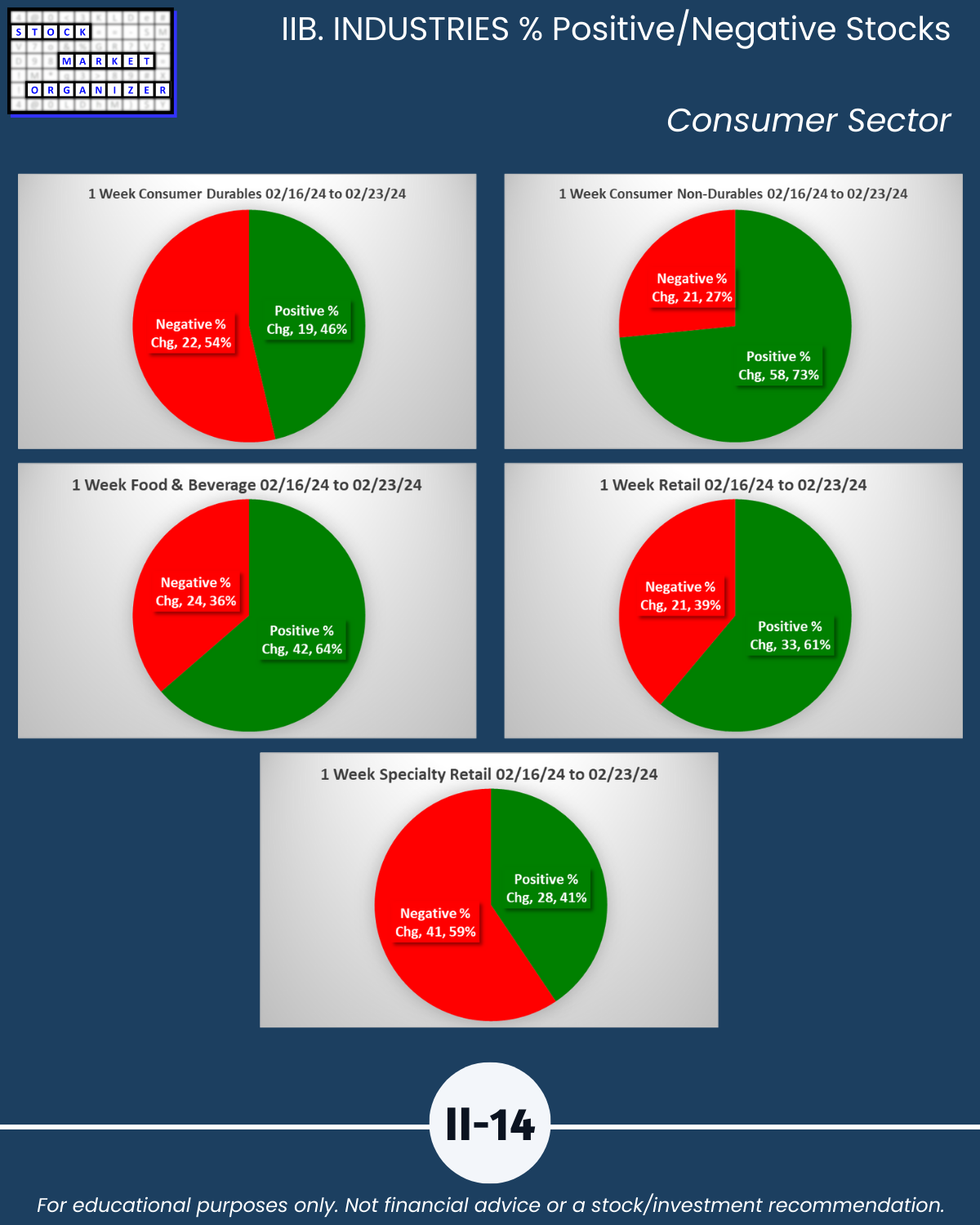

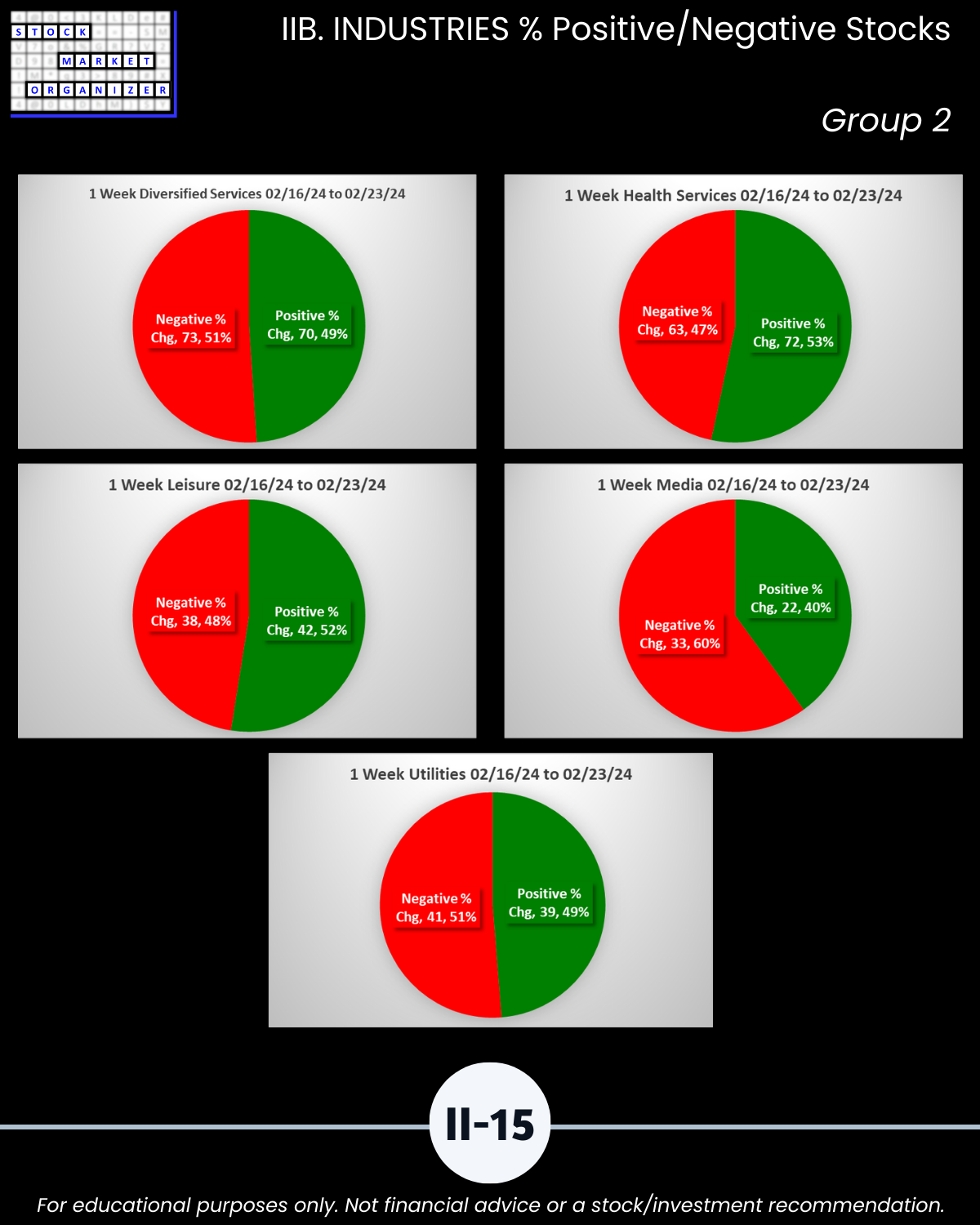

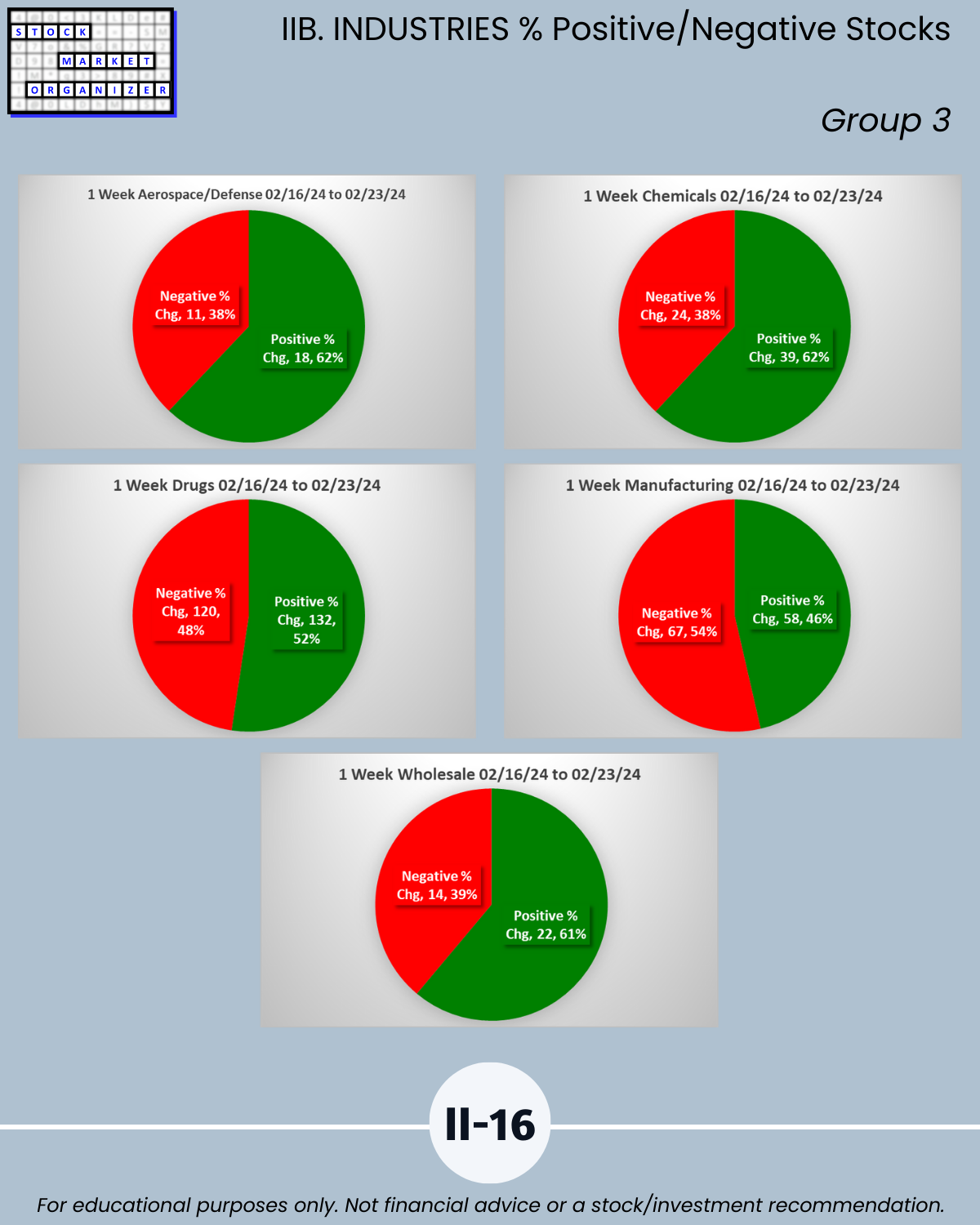

IIB. INDUSTRIES/% Positive/Negative Stocks

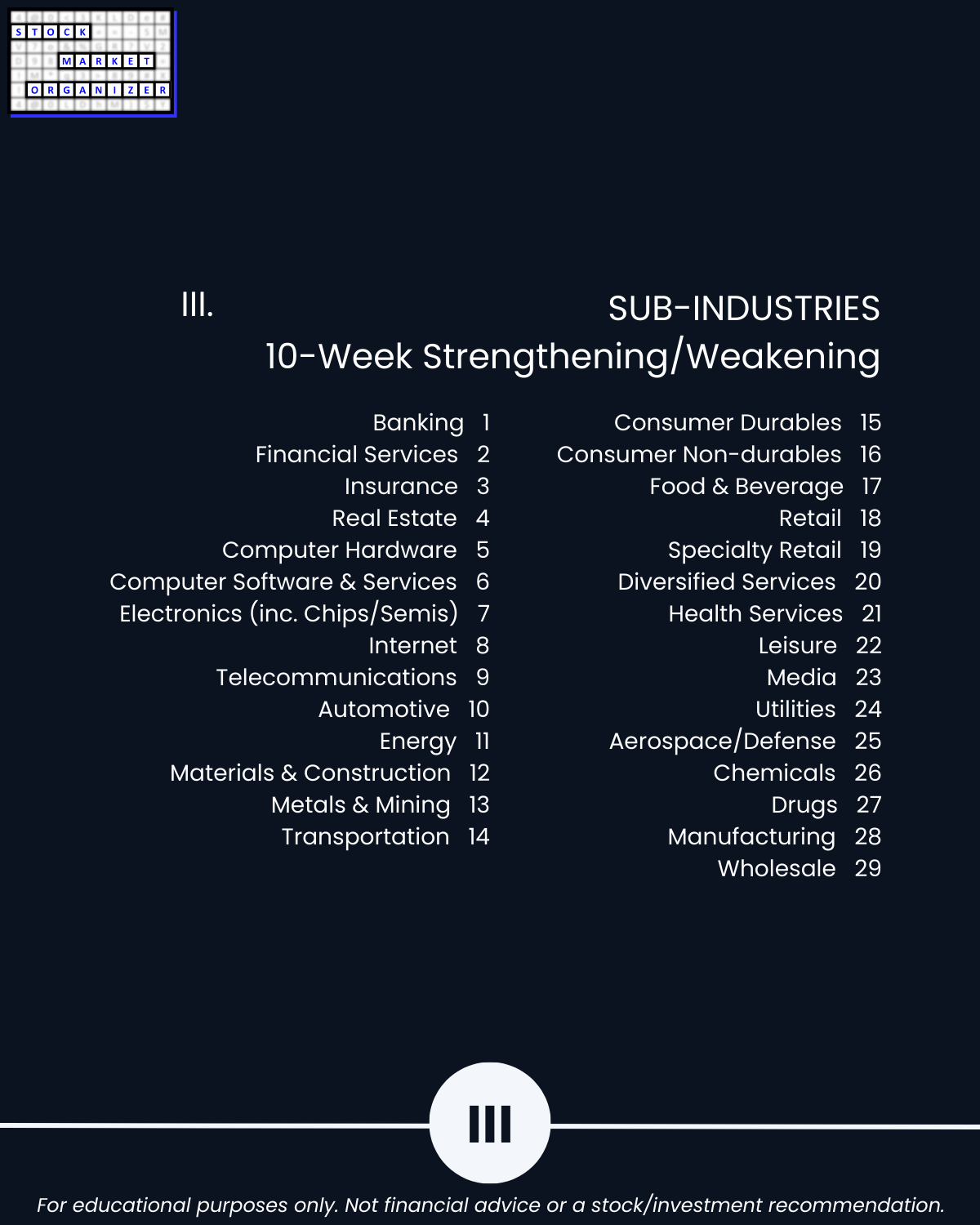

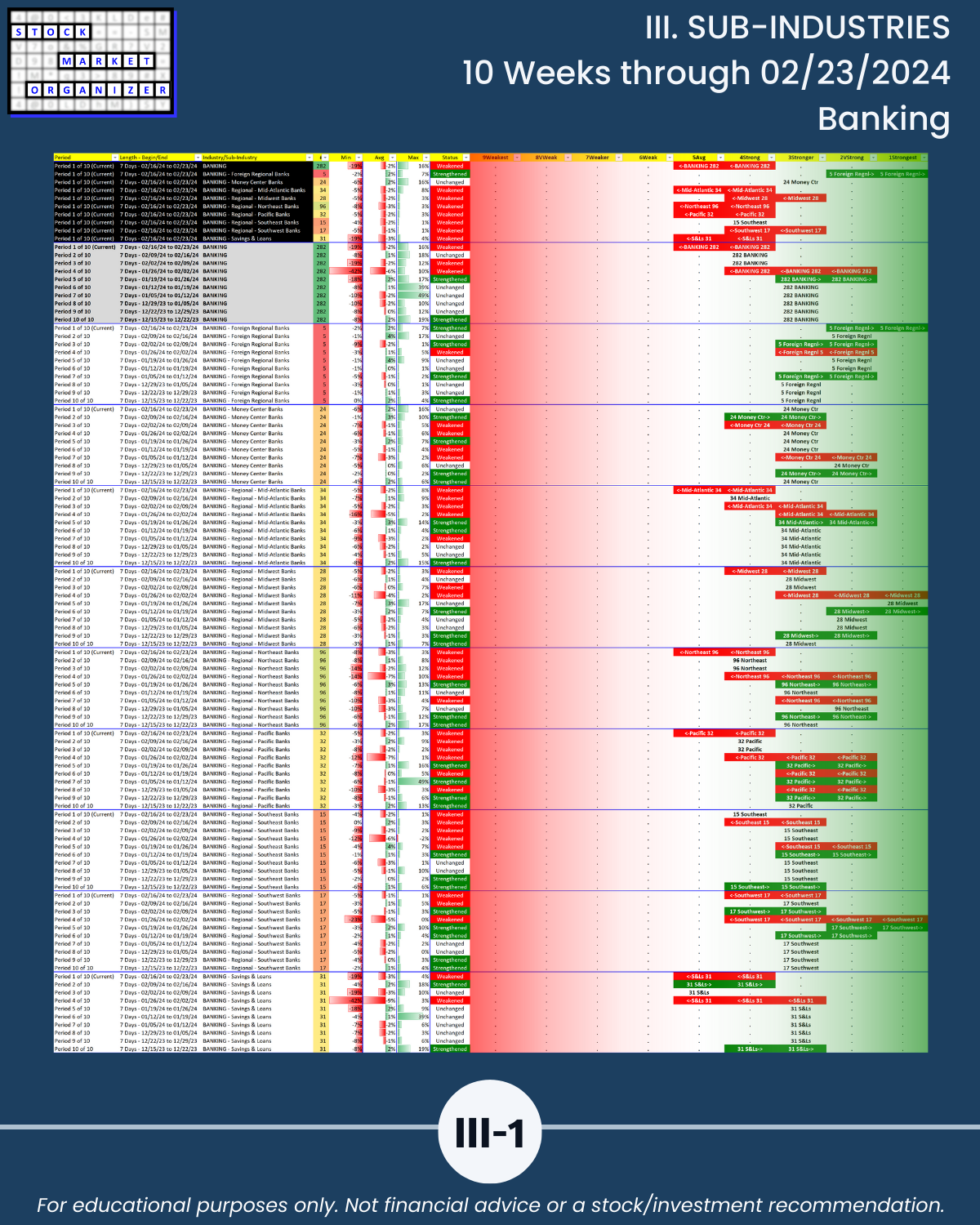

III. SUB-INDUSTRIES/10-Week Individual Sub-Industry Strength Reports

IV. STOCKS/Stock Sorts