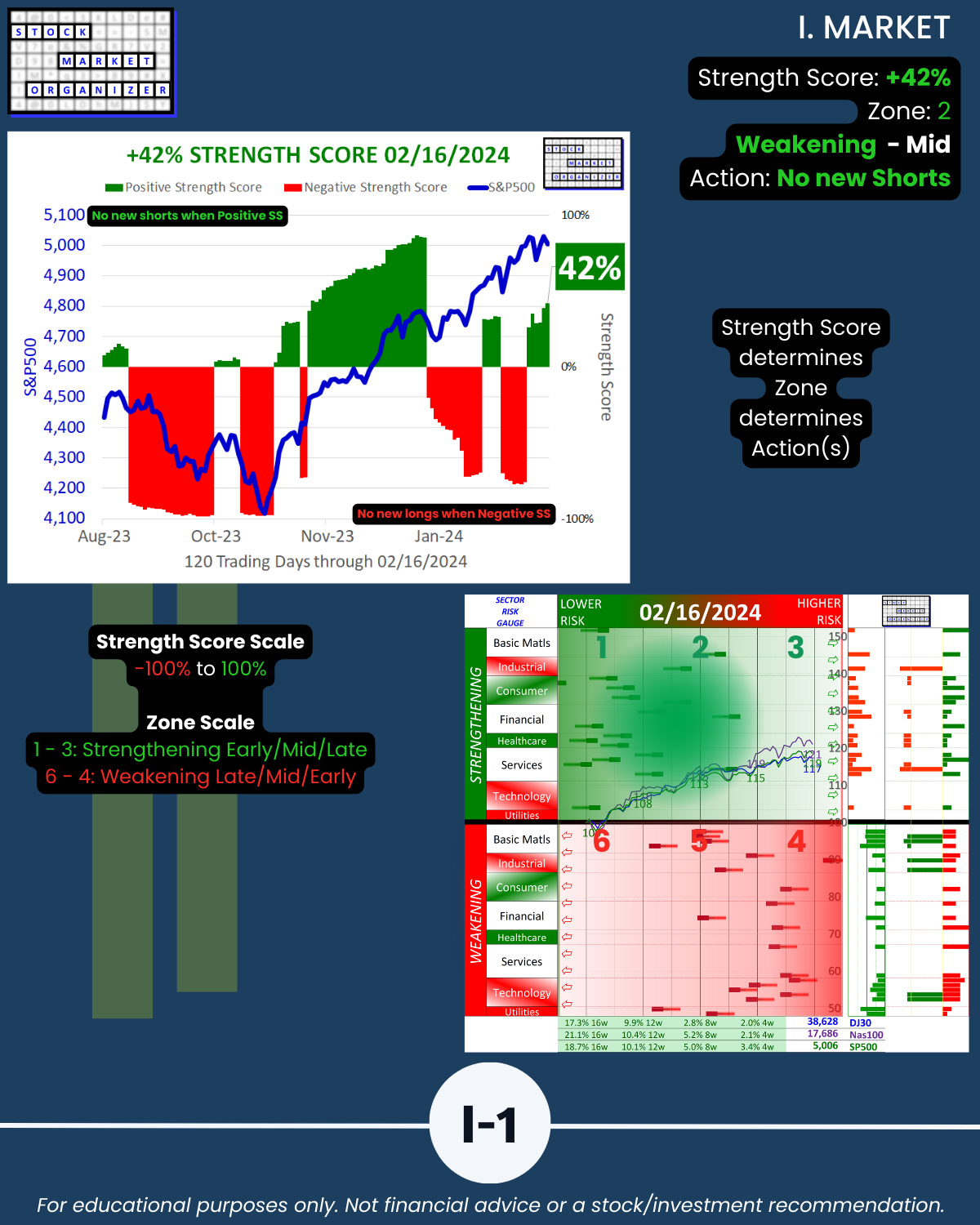

SMO Exclusive: U.S. Stock Market Strength Report 2024-02-16 (+42%, no new Shorts)

How is the market doing right now? Week ending 2/16/24 volatility rearing its head exemplified by SMCI, the new GME. LYFT after hours Tue PR typo +67%, SMCI says “hold my beer” Friday - SMCI’s $1,077.87 buyer is saying “why me” looking at the $803.32 close. Play with fire you get burned. LYFT had the decency to finish its week +37%, let’s see what SMCI has in store next. NVDA who?

(SMCI gets all the headlines but what about ANF, +454% since 5/4/23 vs. NVDA +163%. NVDA who? ANF AI t-shirts flying off the shelves.)

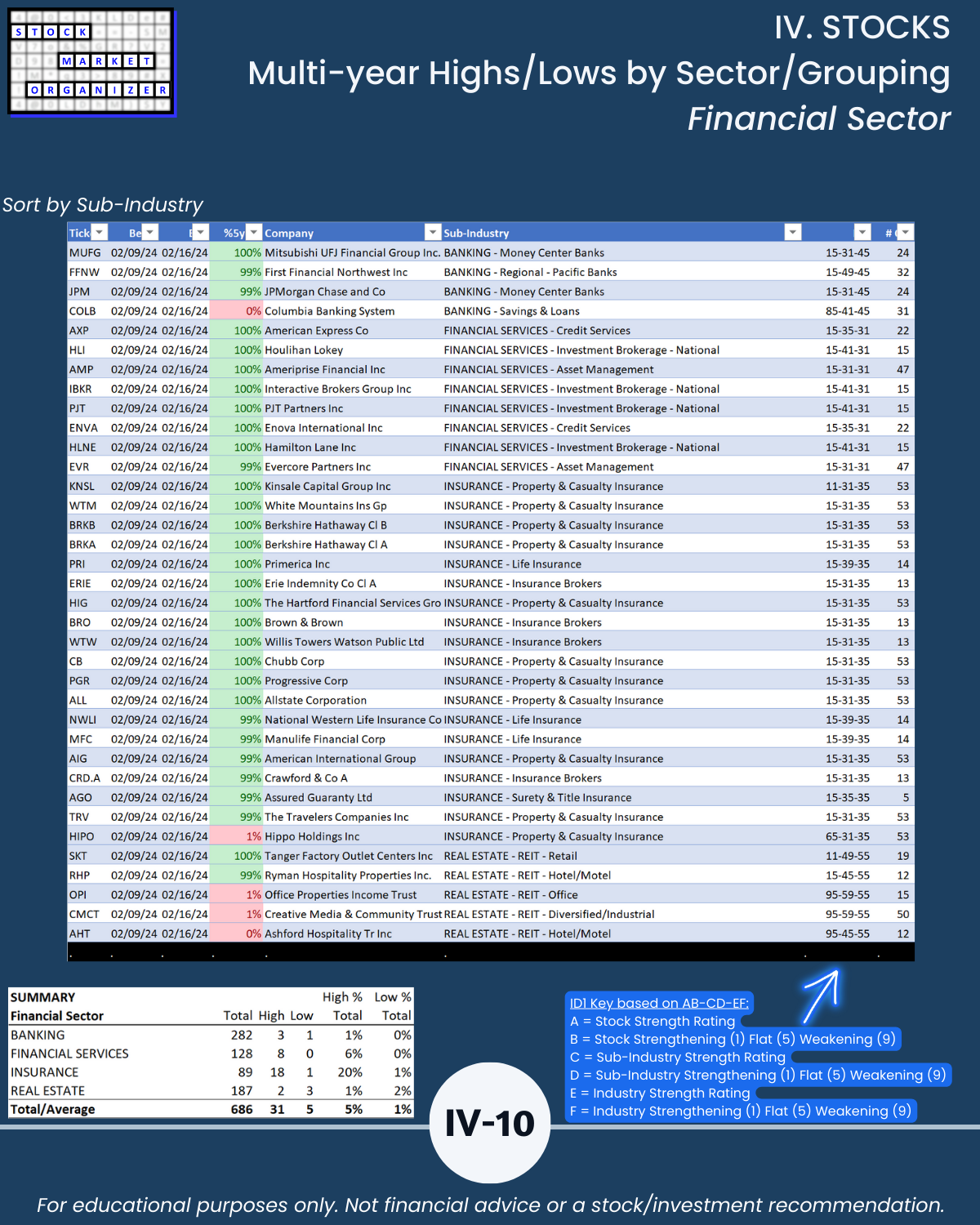

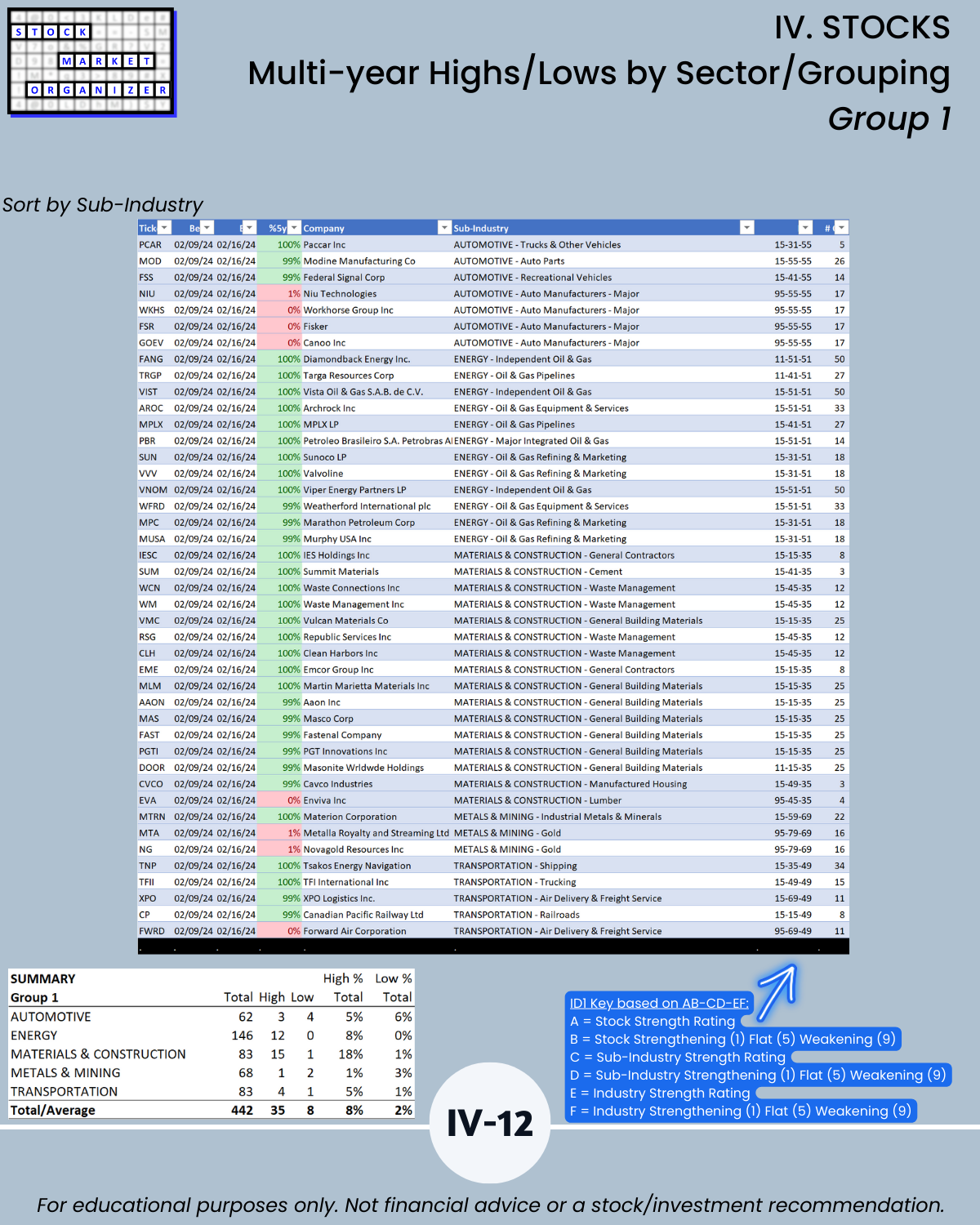

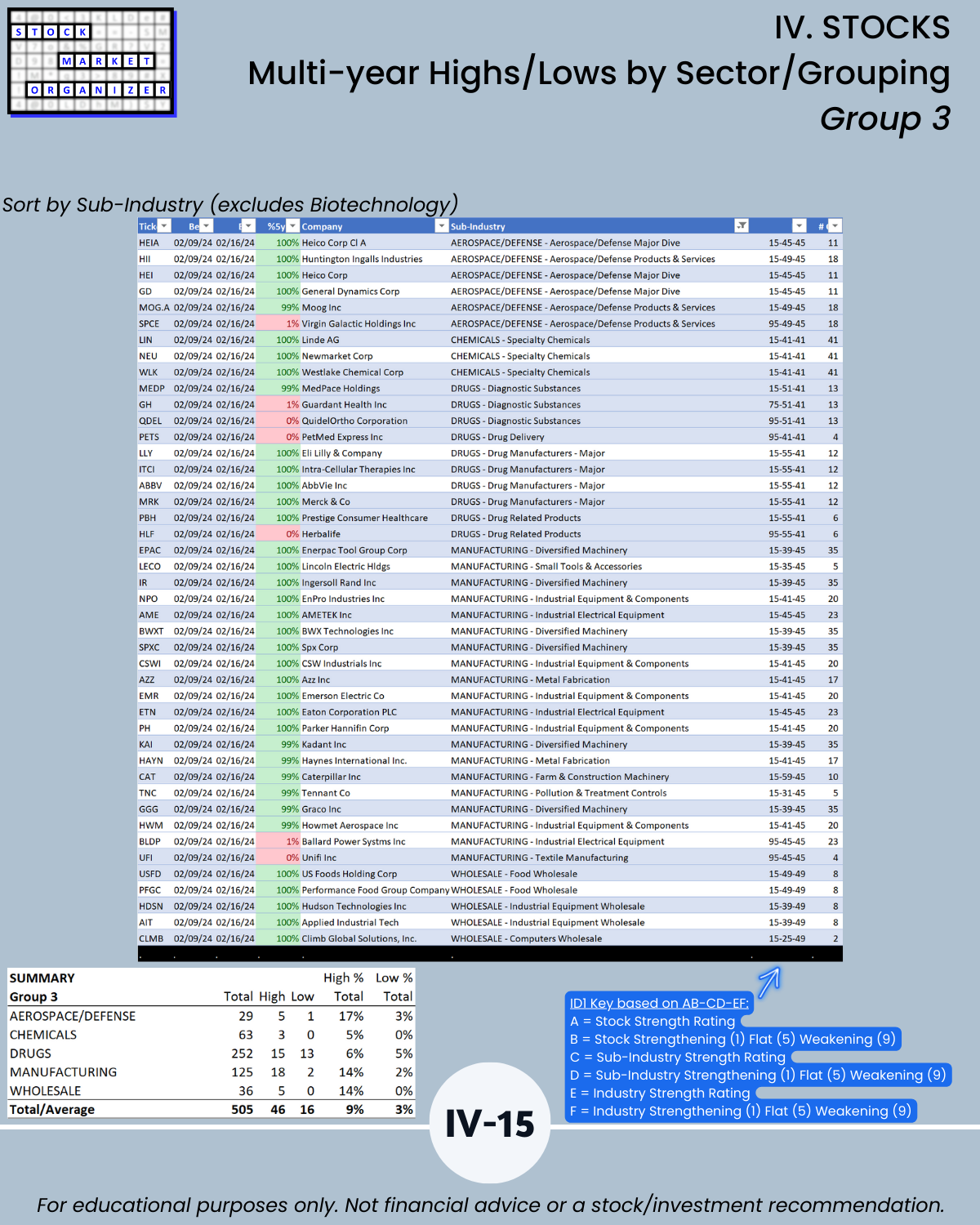

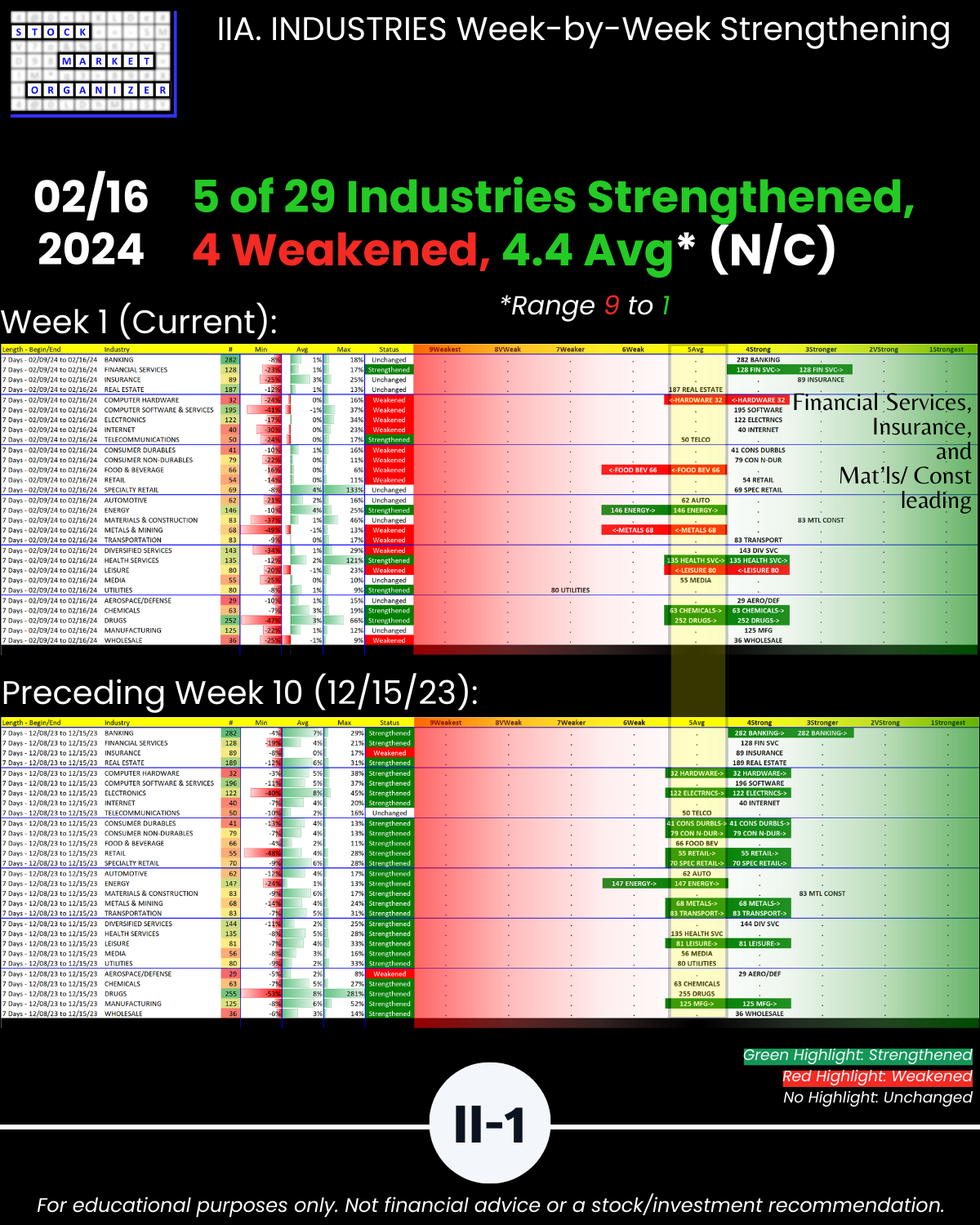

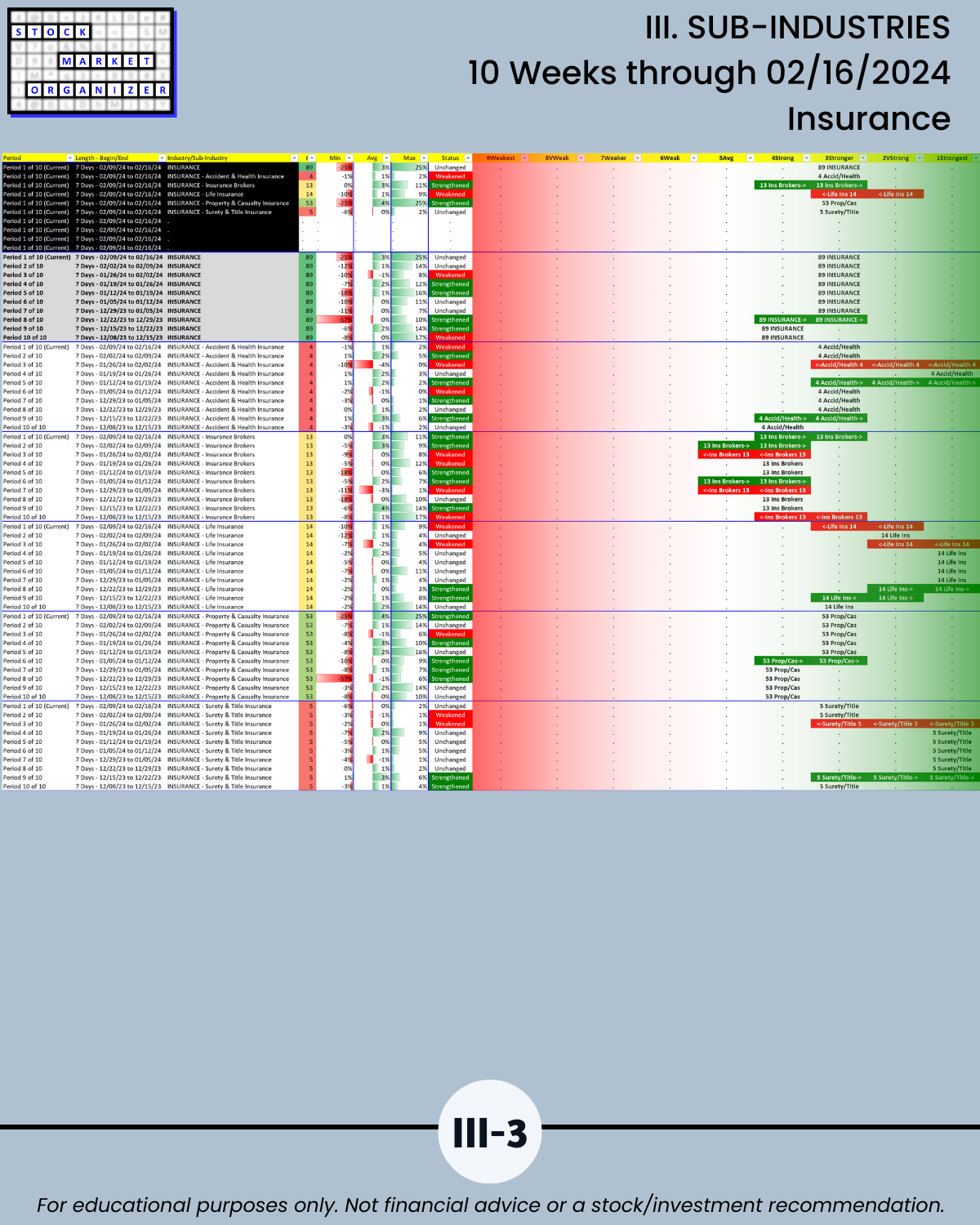

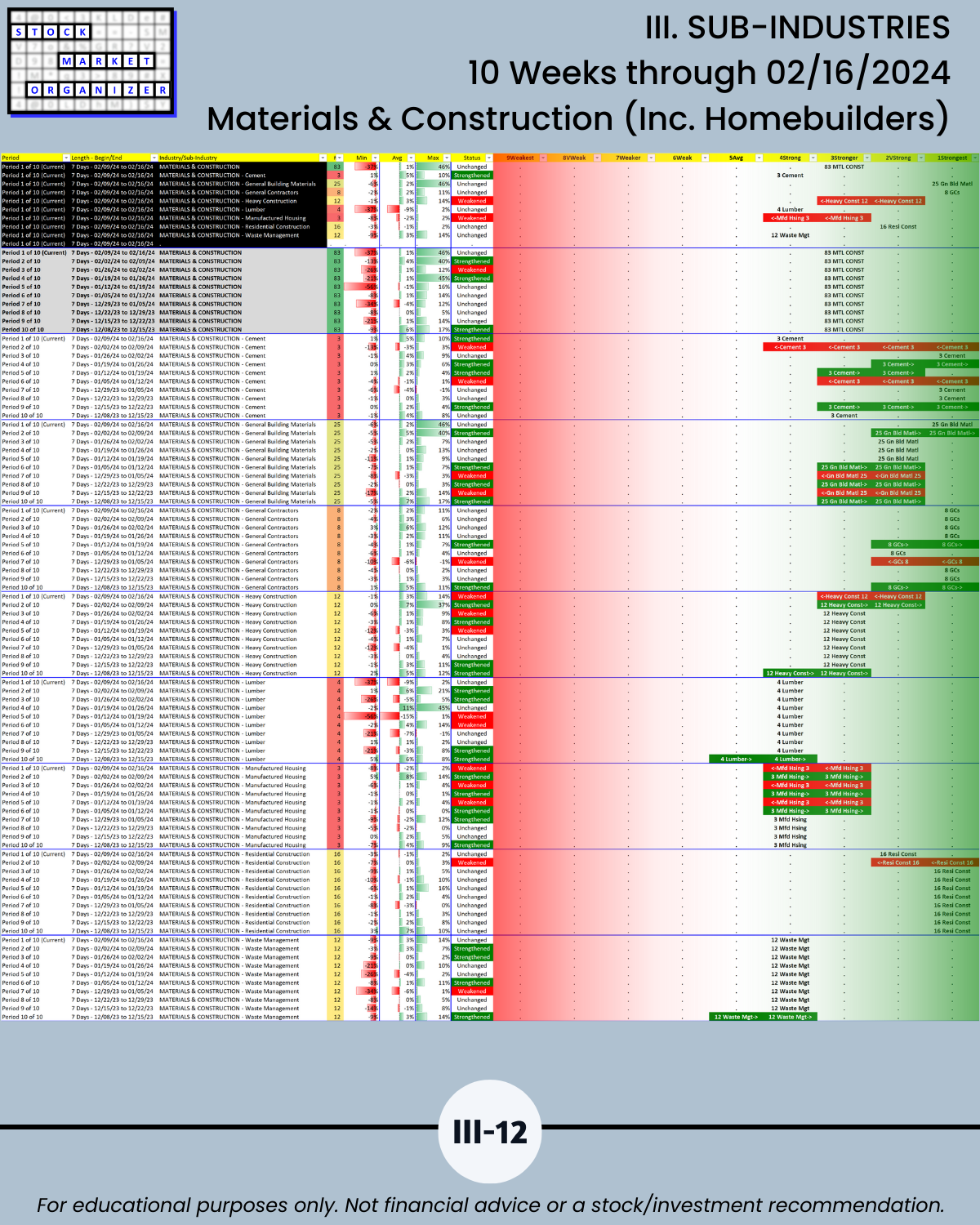

Insurance industry – 20% of its stocks are at multi-year highs. Materials & Construction at 18%, Manufacturing at 14%.

DID YOU KNOW?

The overall market is STRENGTHENING week of/ending 2/16/24.

🔹 The +42% market strength score = mid-“No New Shorts” territory

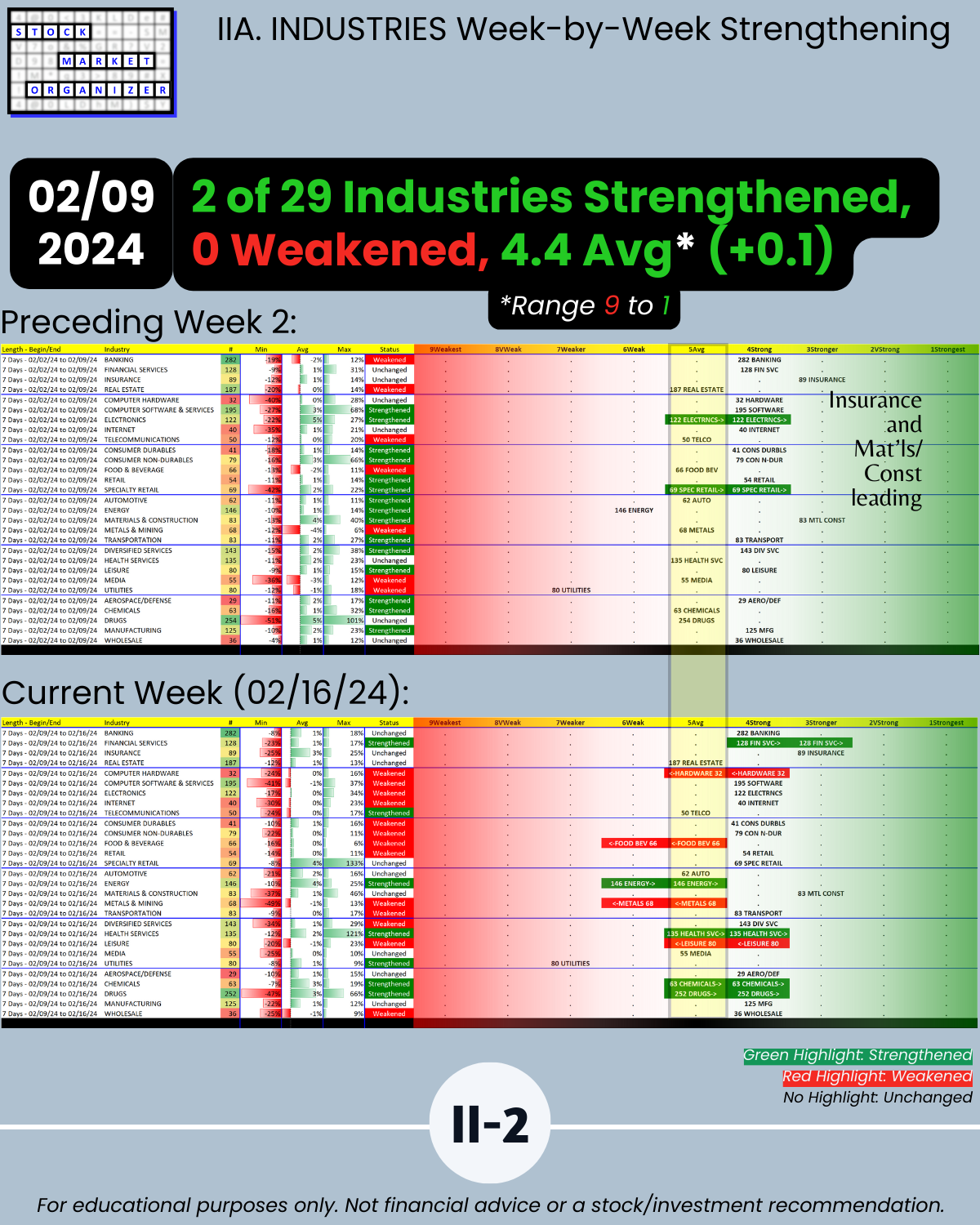

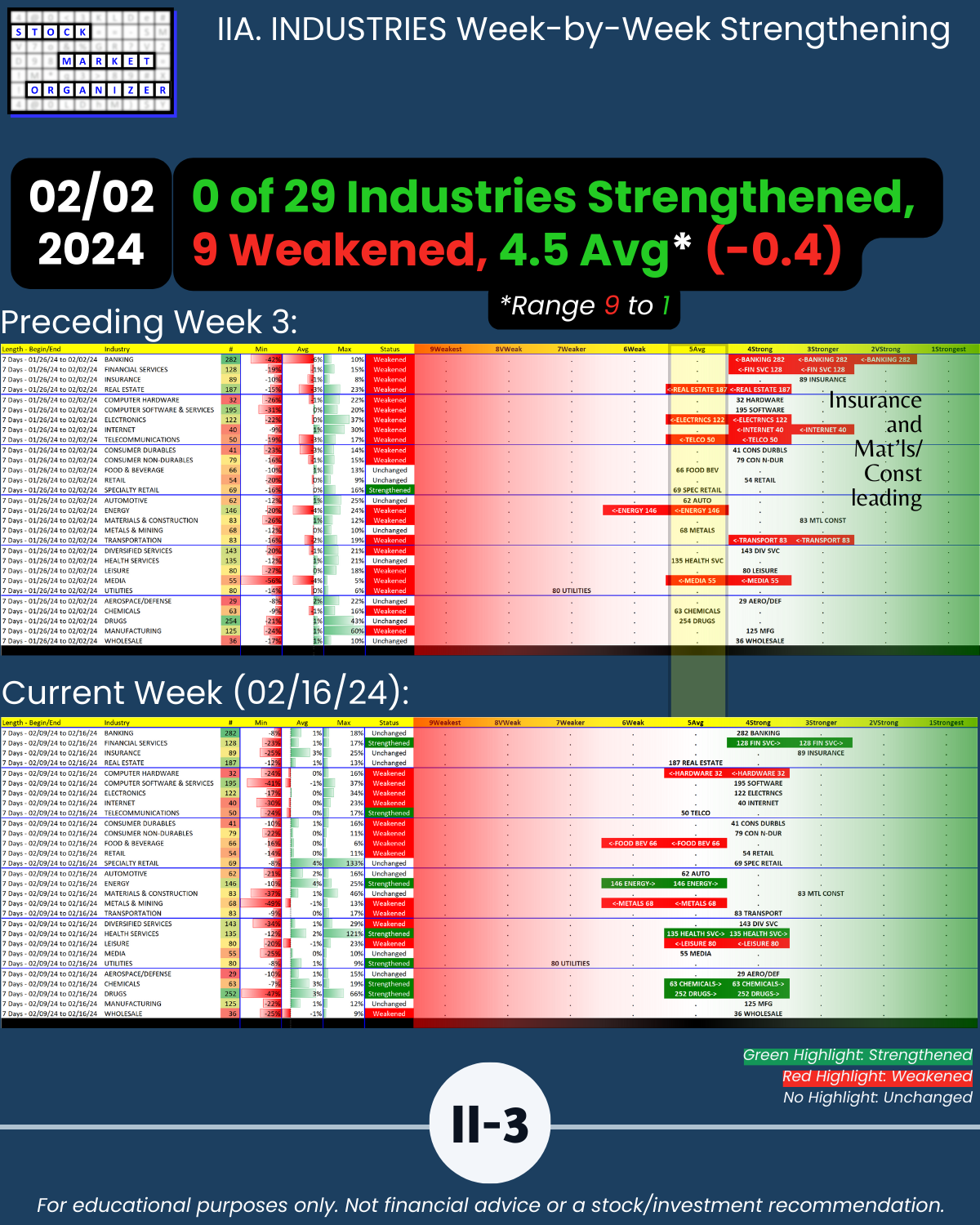

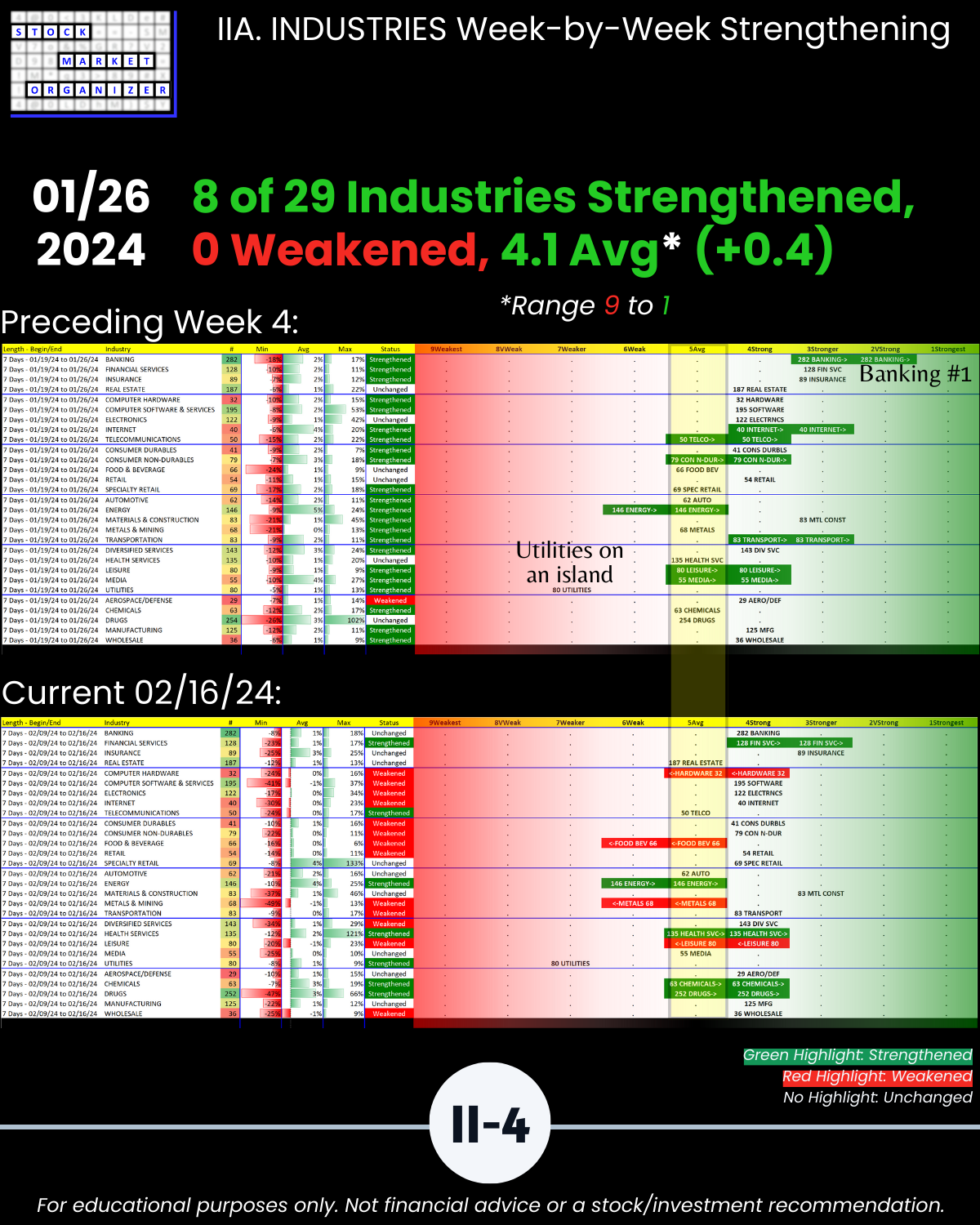

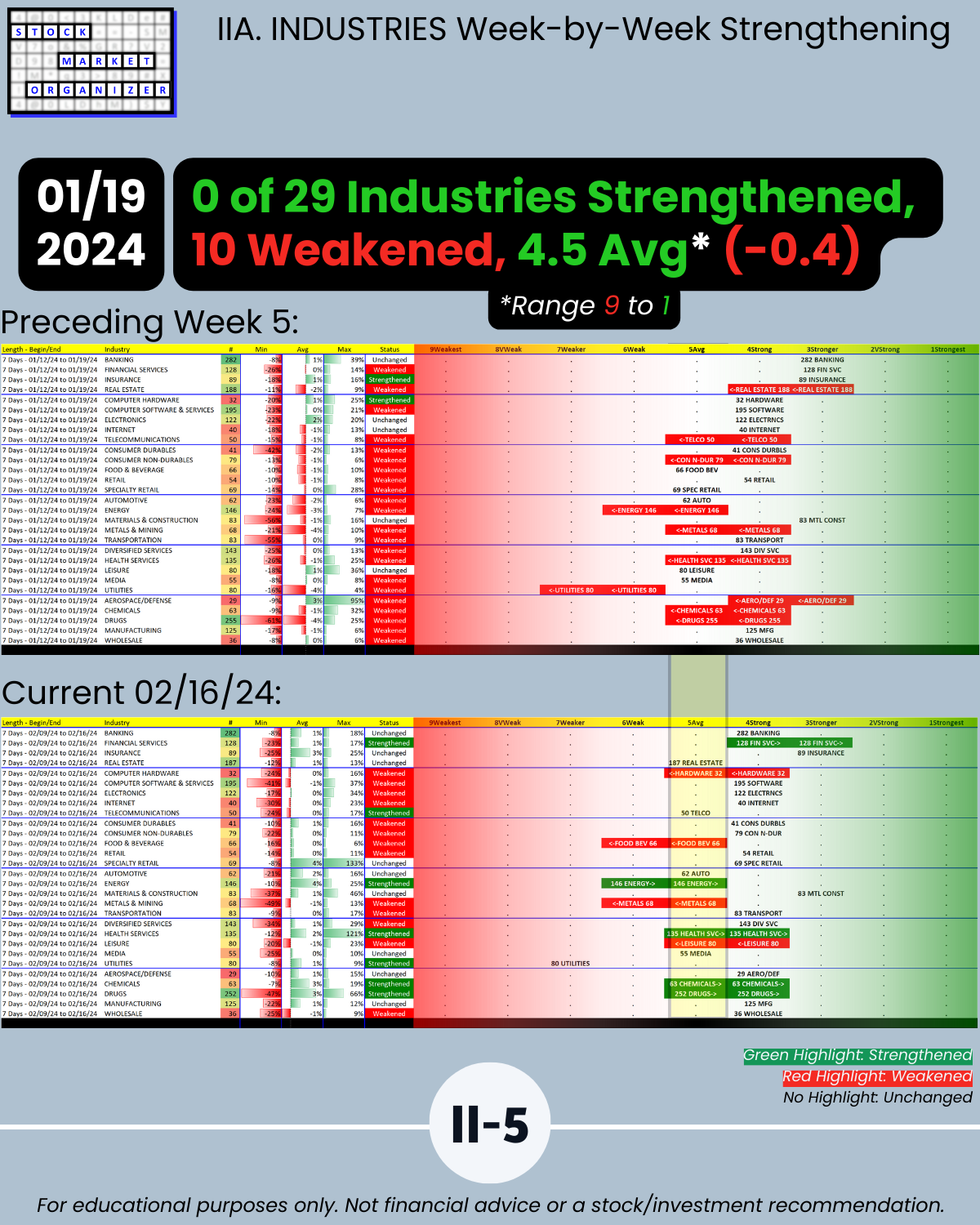

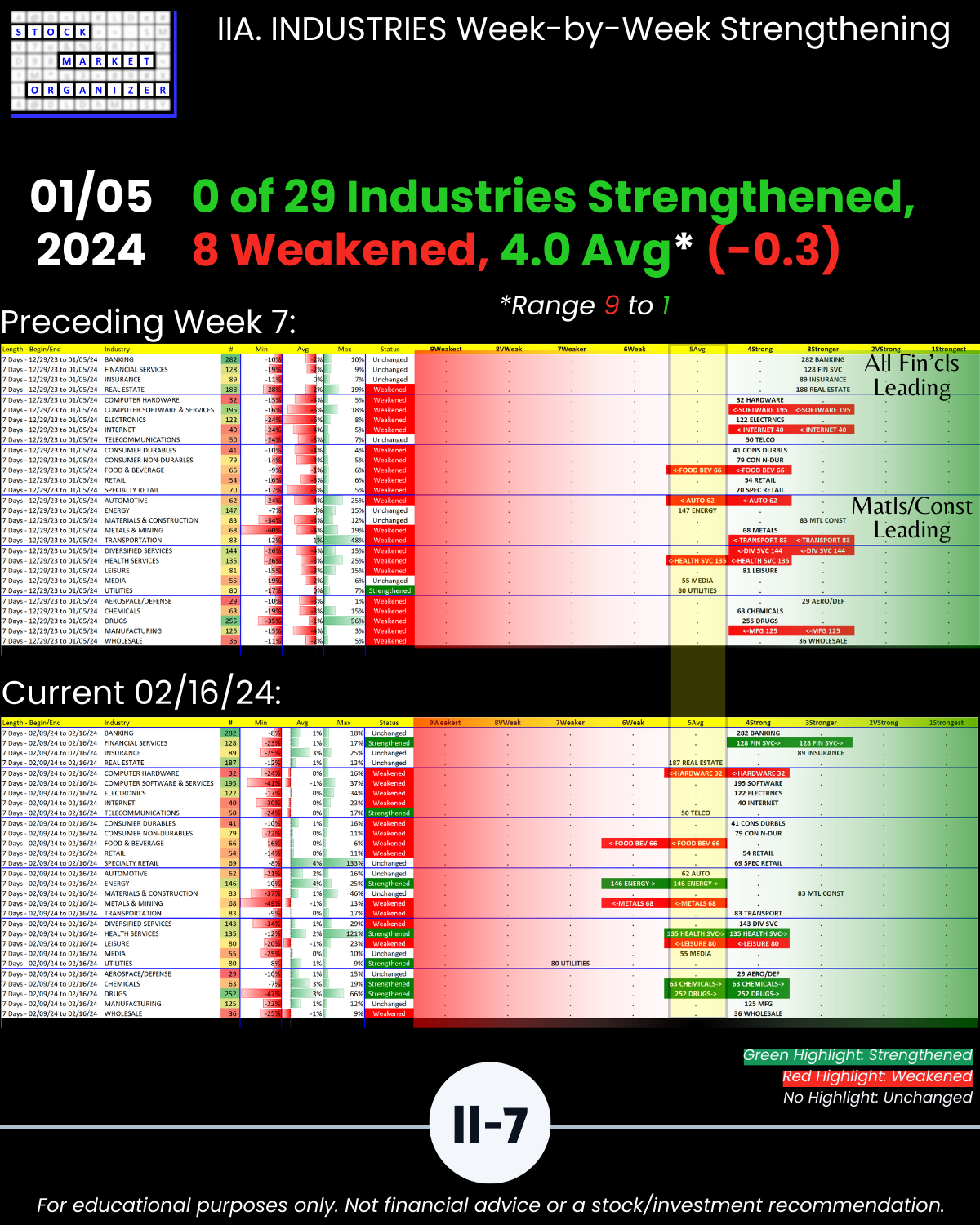

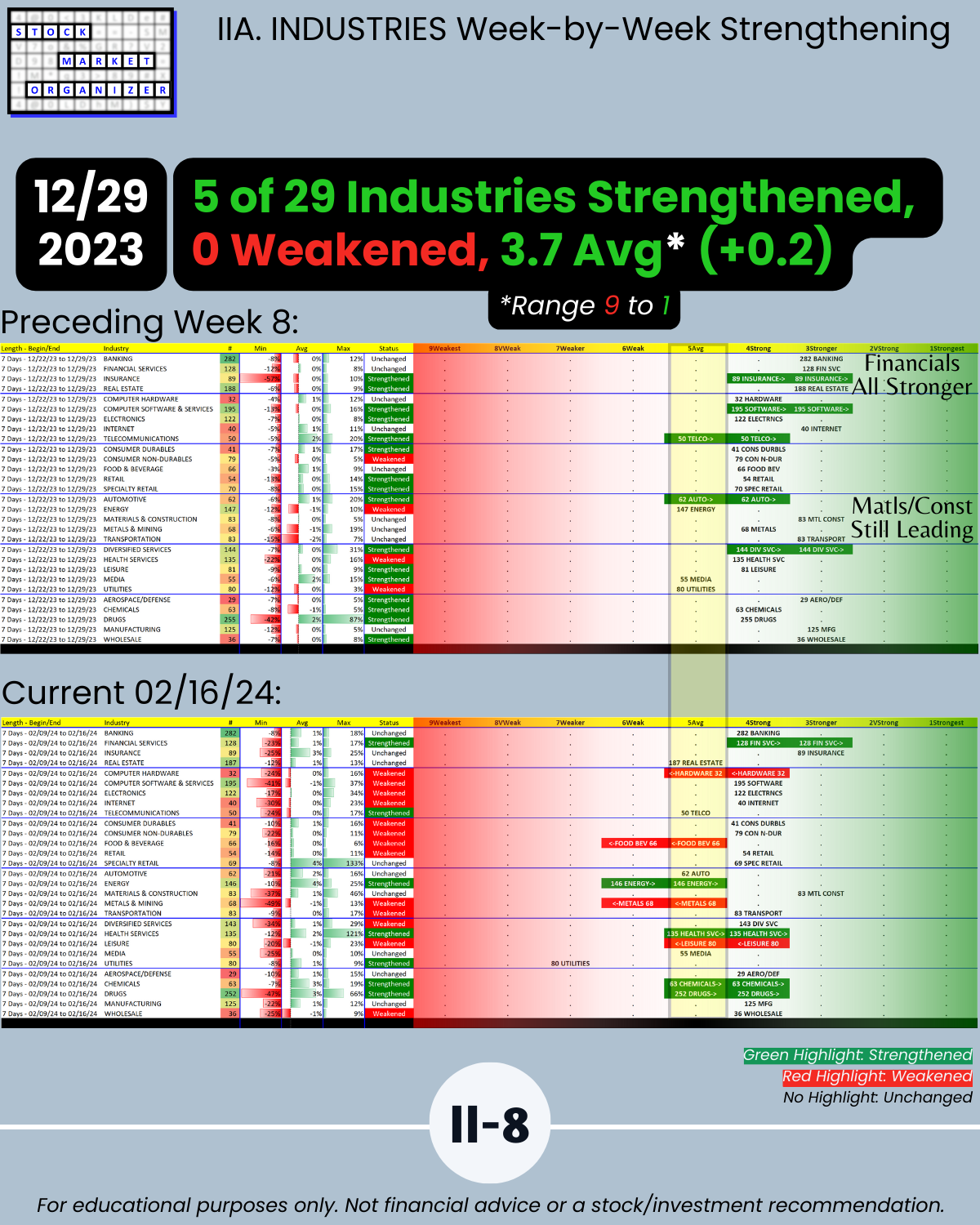

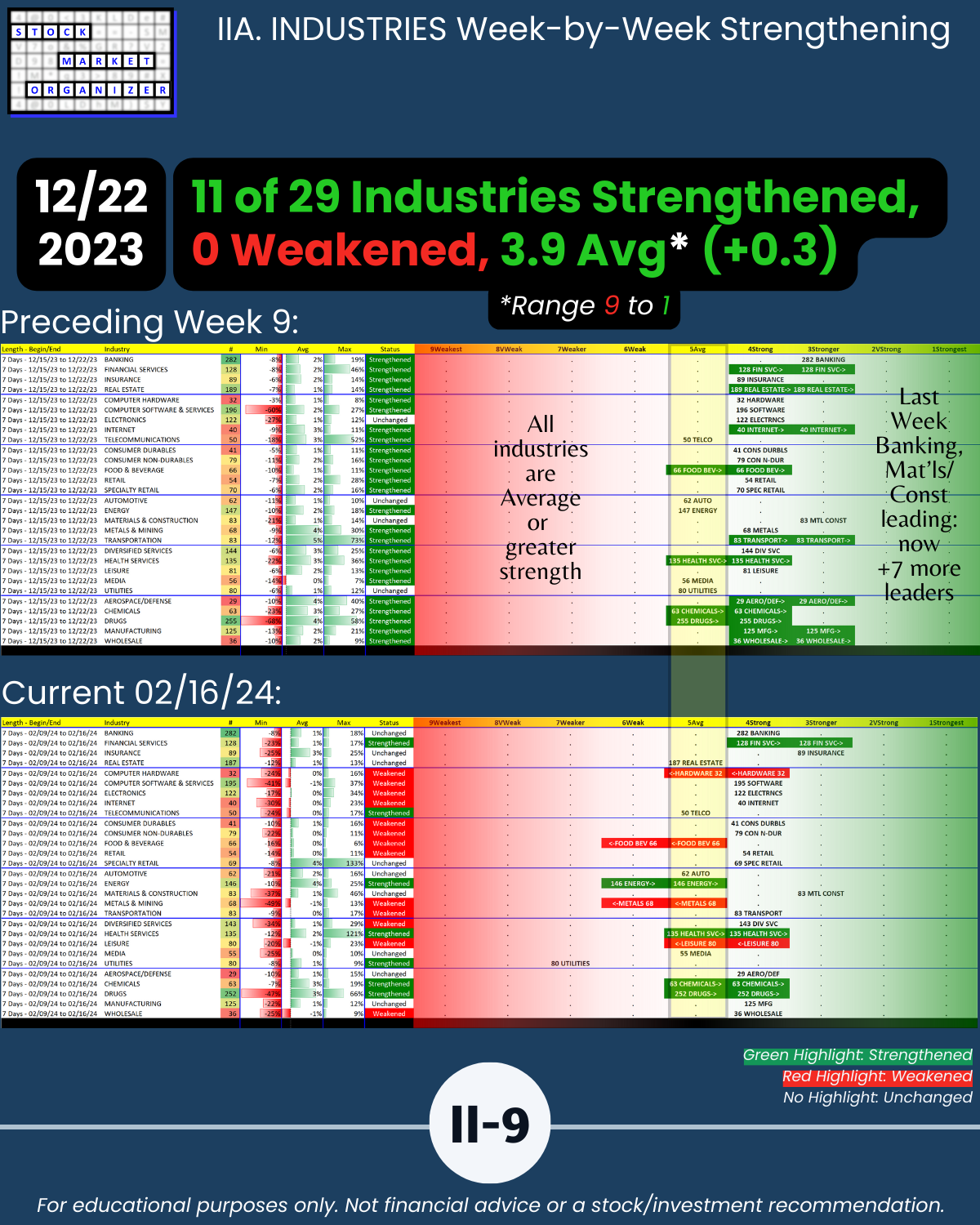

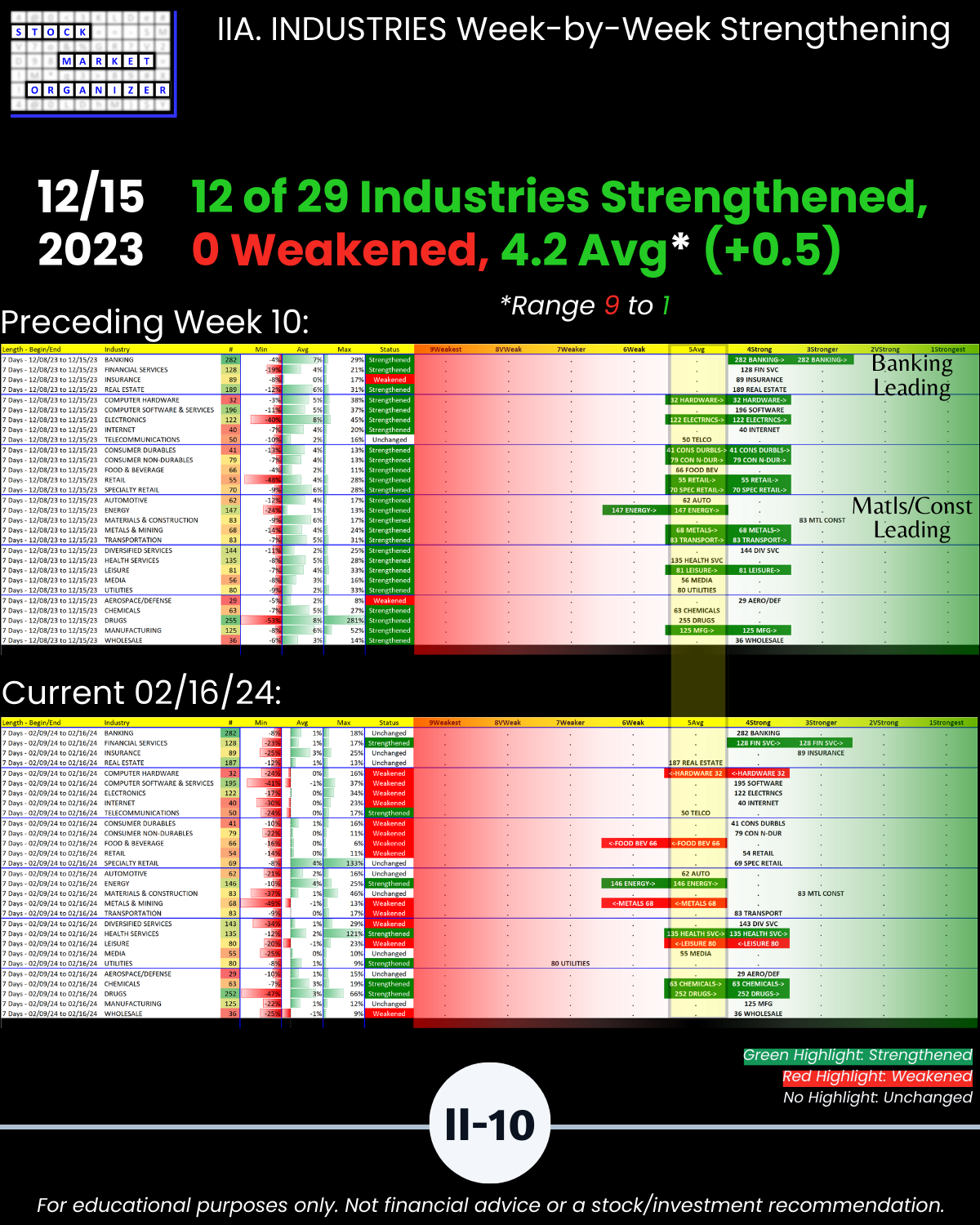

🔹 Average Industry Strength Score = 4.4 (1 = strongest 9 = weakest, no change vs. previous week)

🔹 5 of 29 industries strengthened, 4 weakened (2/0 previous week)

🔹 32% vs. 36% sub-industries Strengthening vs. Weakening (vs. 43%/29% previous week, 199 Sub-industries)

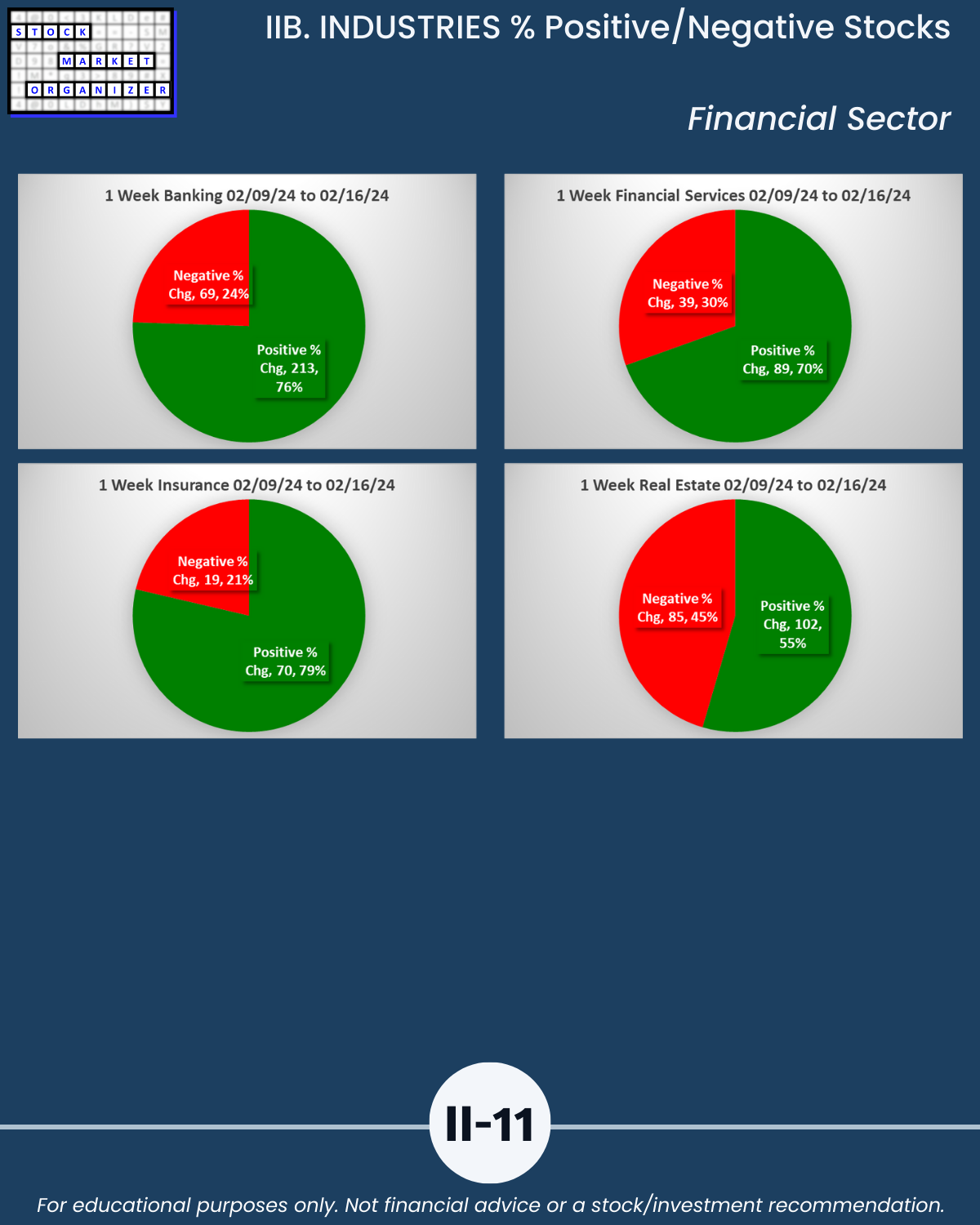

🔹 Financial Services, Insurance, and Materials & Construction = strongest industries at Stronger (3rd strongest of 9 levels)

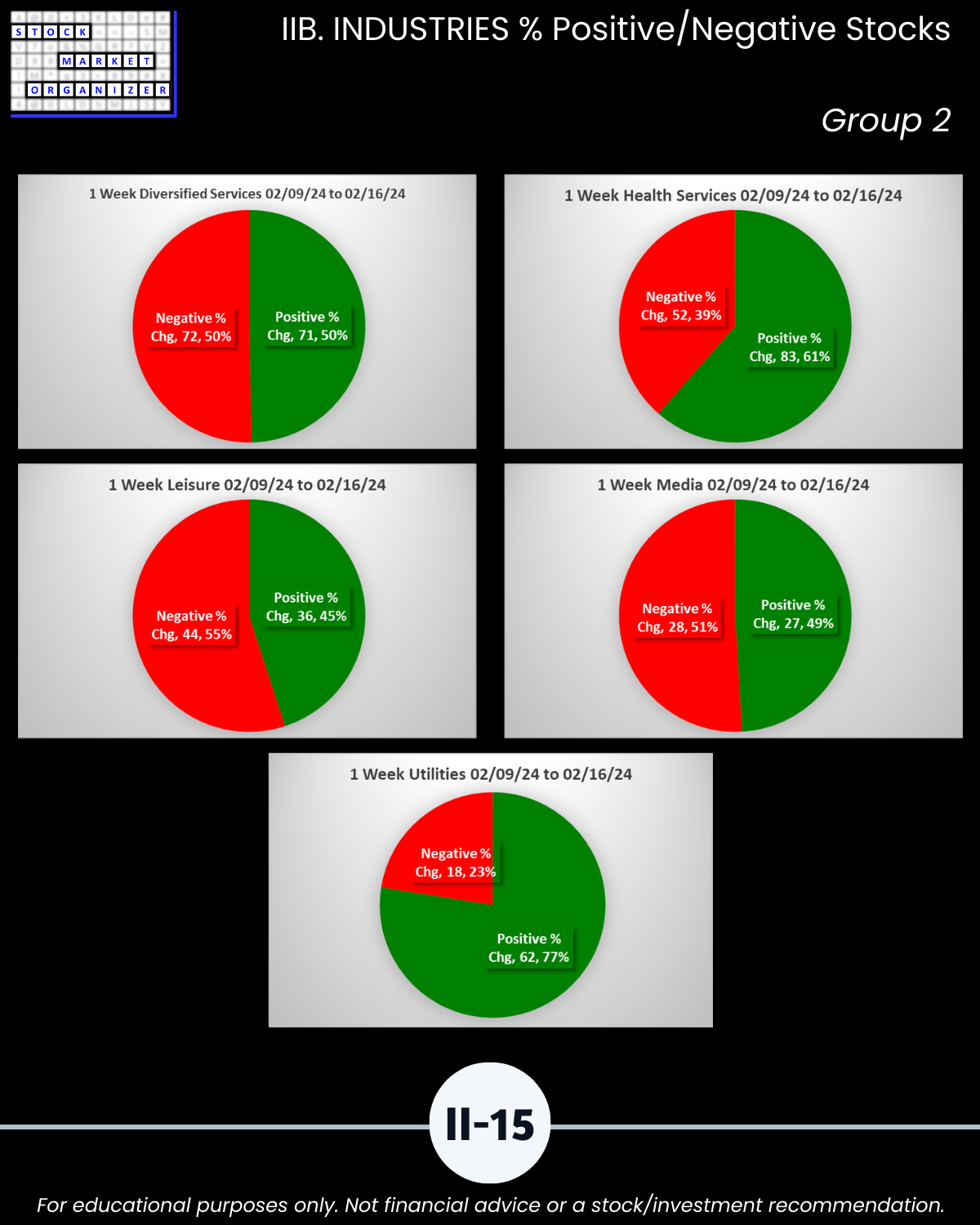

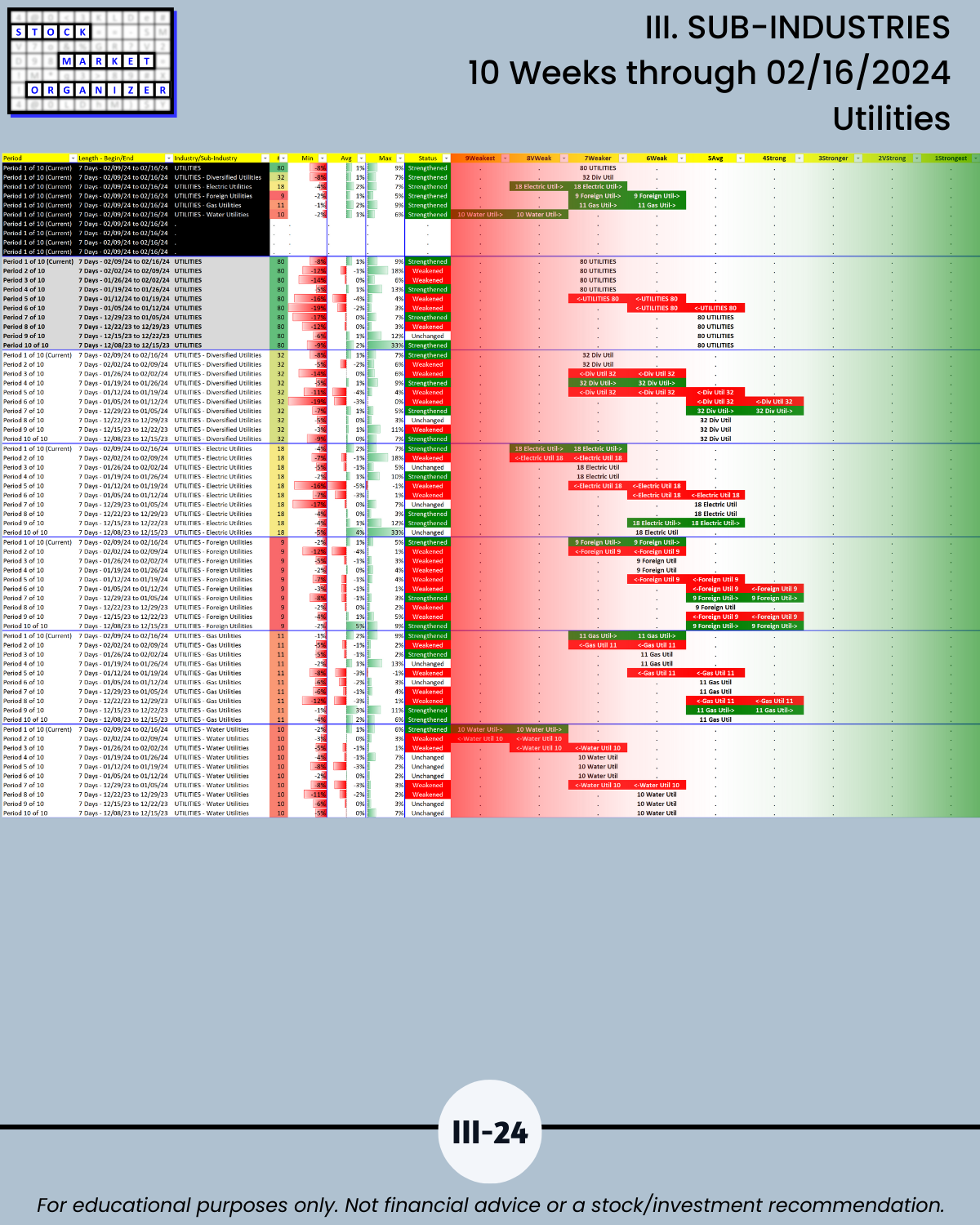

🔹 Utilities = weakest industry at Weaker (7th strongest)

Attached: an objective answer to “How is the overall market doing right now?”

AKA a detailed look at what you can find out about the market, sectors, industries, sub-industries, and individual stocks when you analyze a factor common to all of these: their strengthening and weakening.

Other interesting questions answered:

🔹 Are current market strengthening/weakening conditions more conducive to new longs or to new shorts?

🔹 Is market strengthening or weakening early or late in a meaningful cycle?

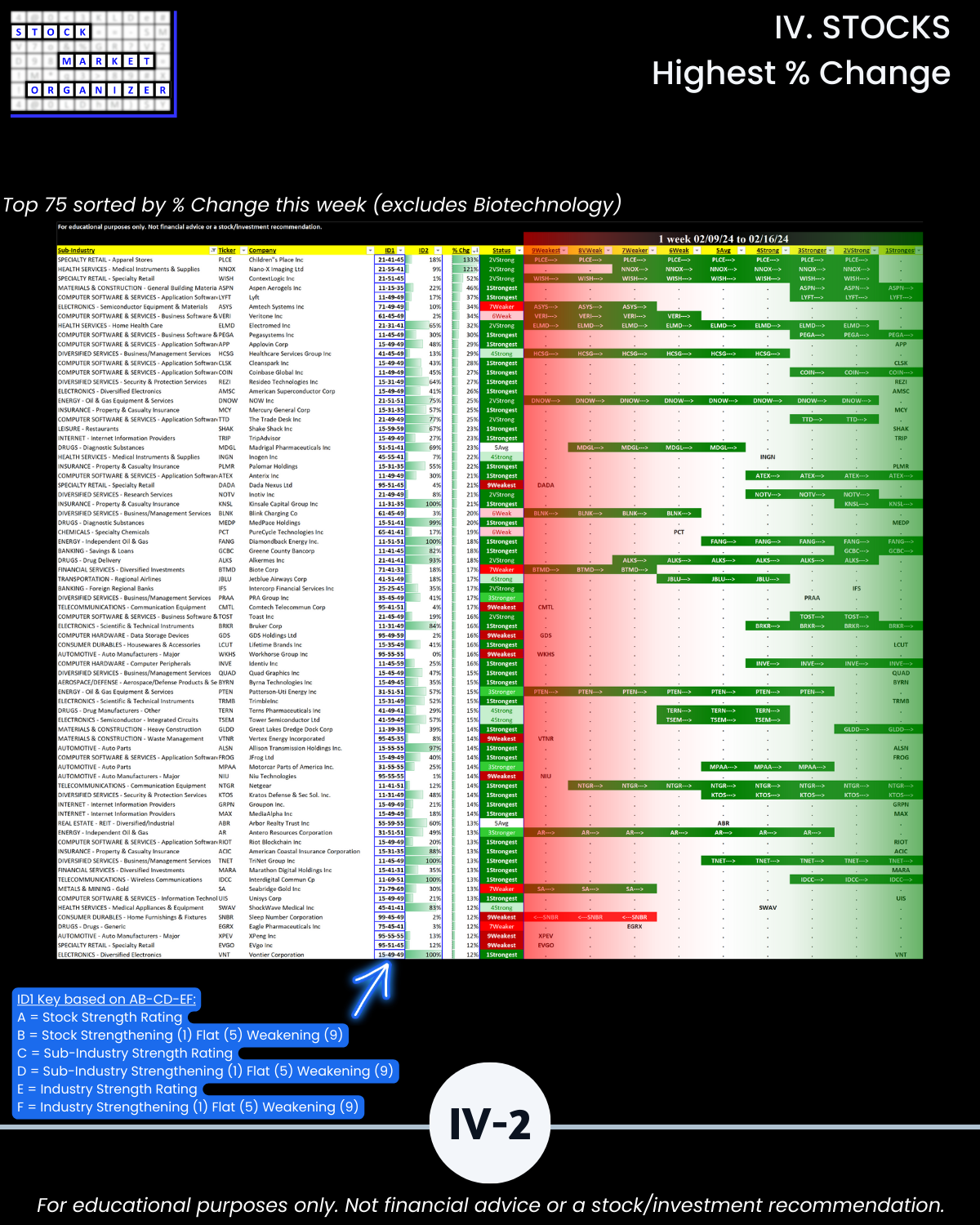

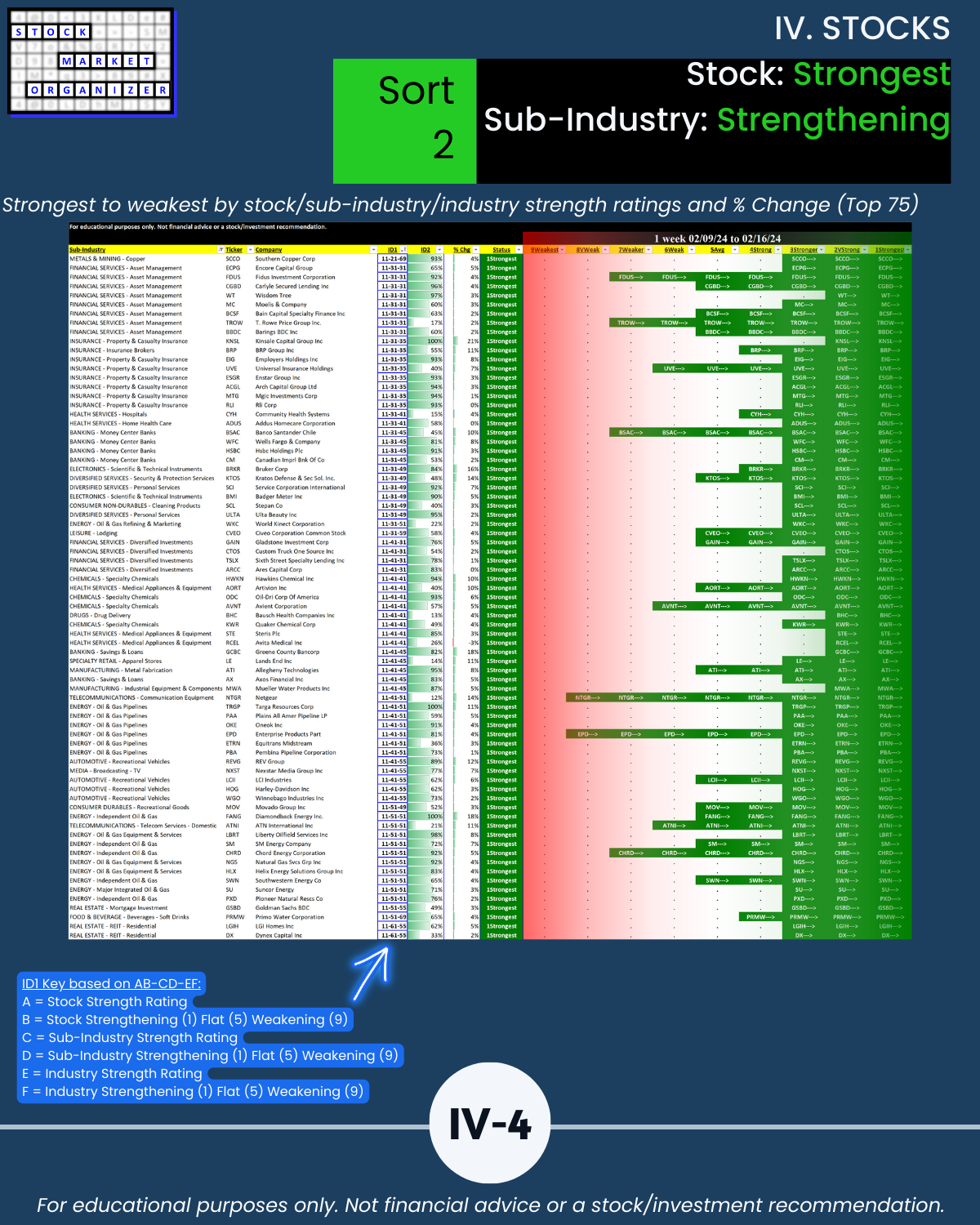

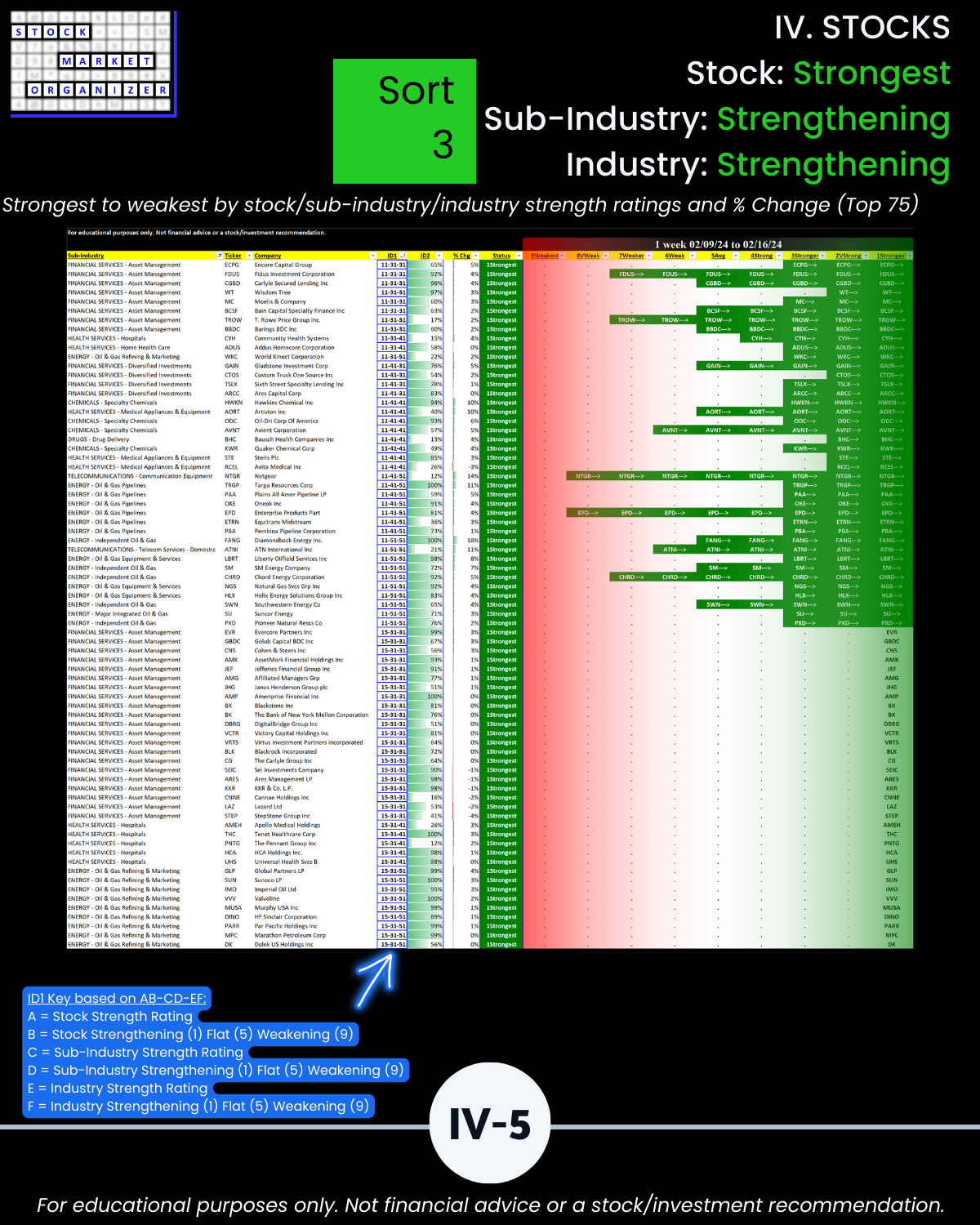

🔹 What are the strongest-rated stocks in strengthening sub-industries and industries?

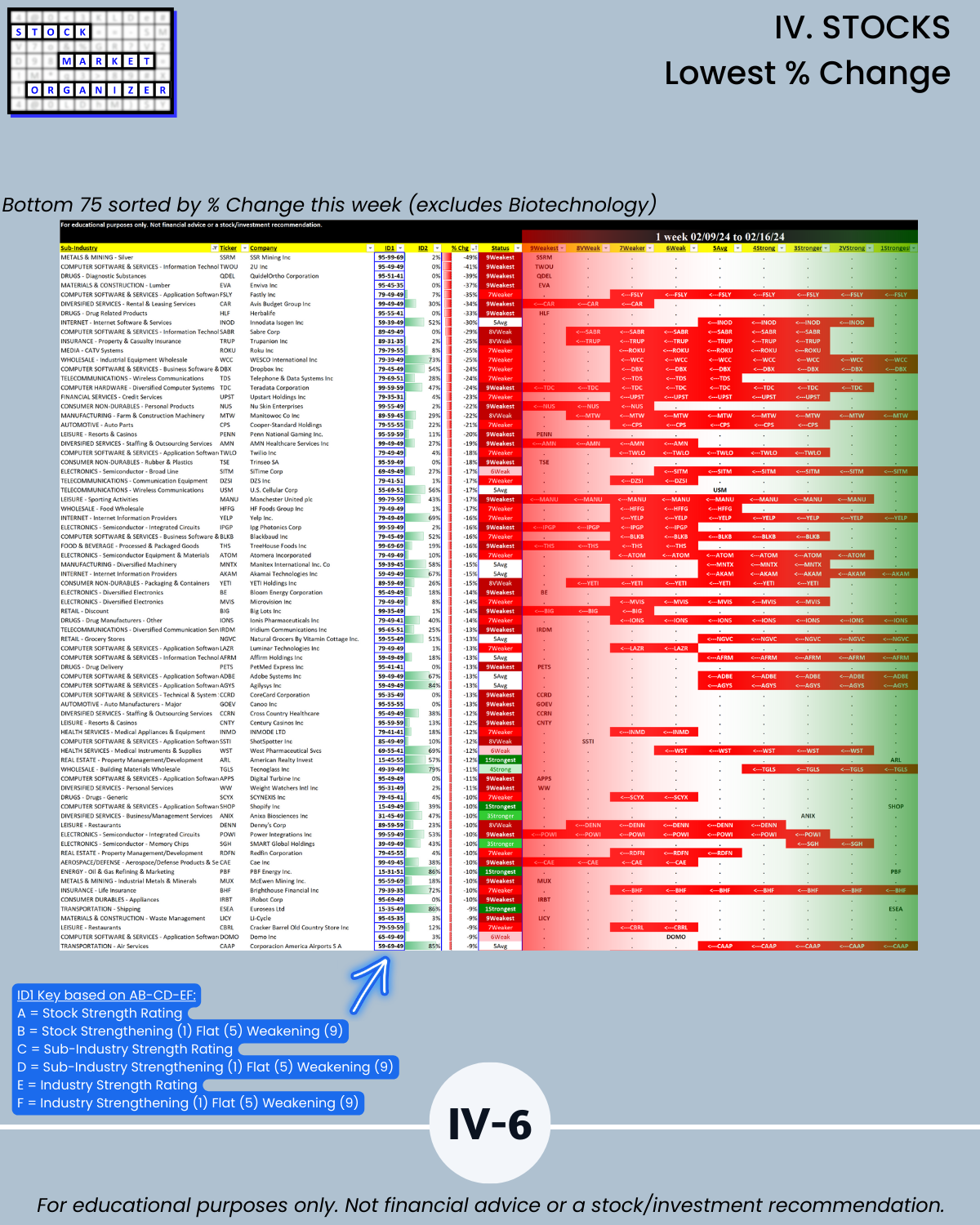

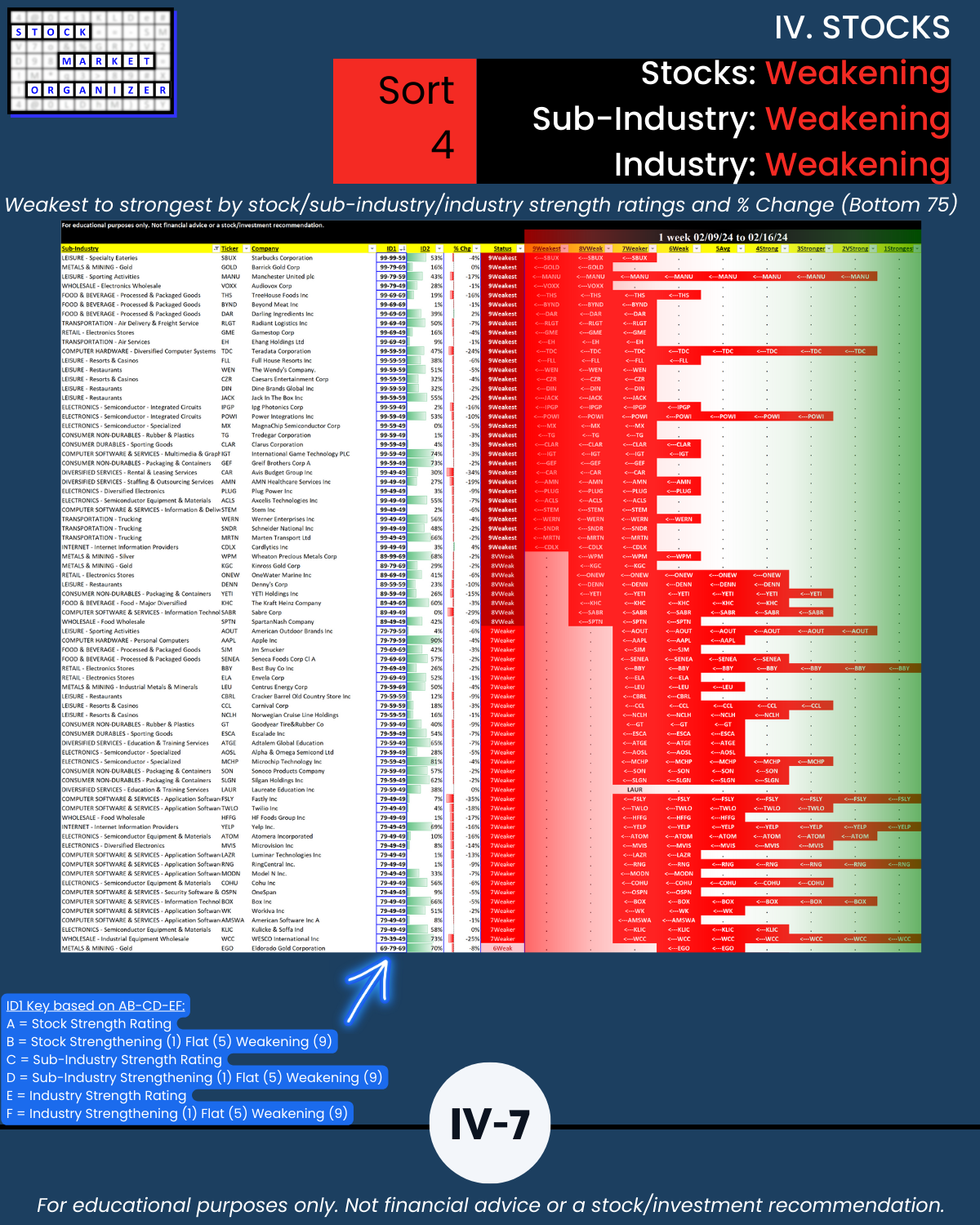

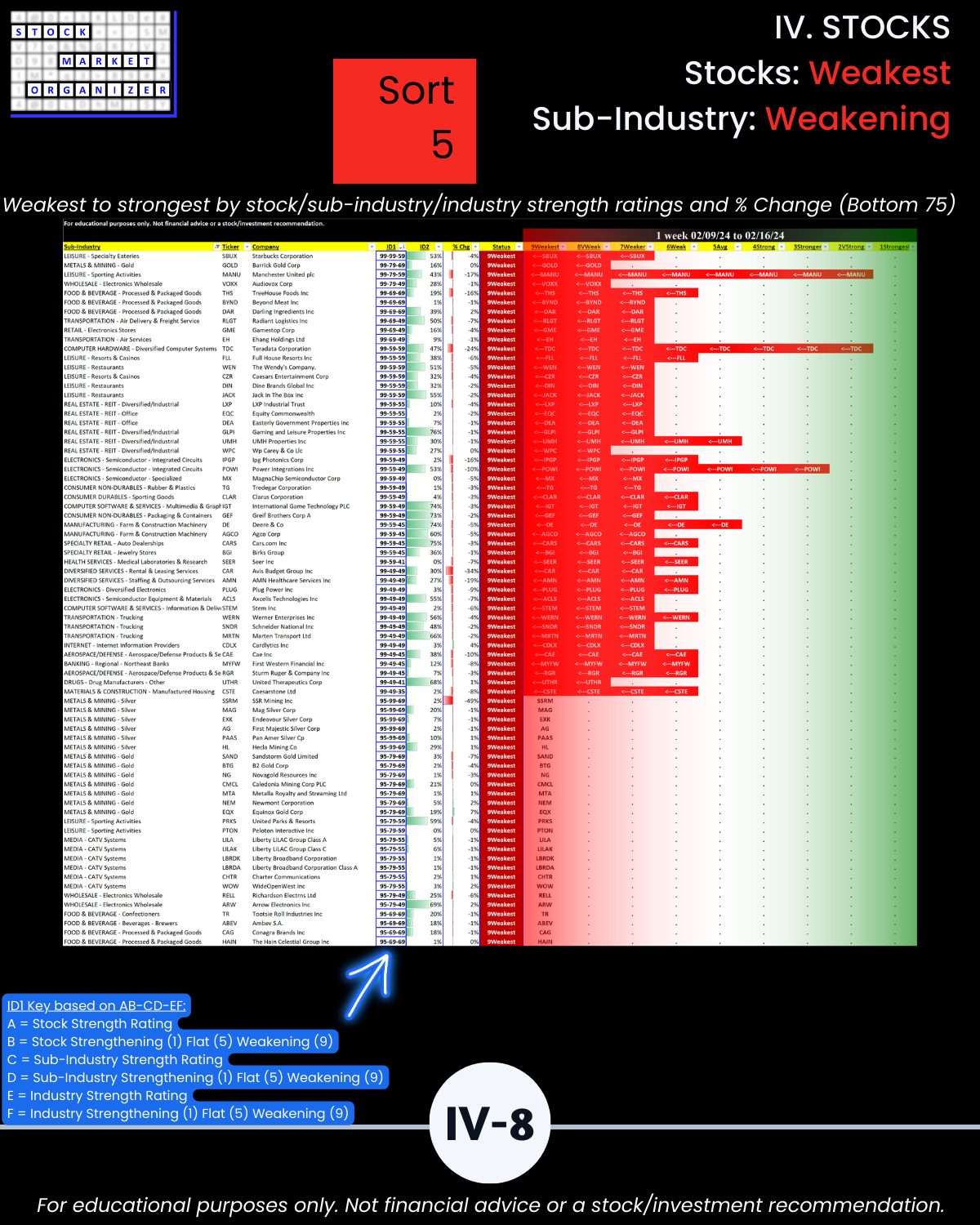

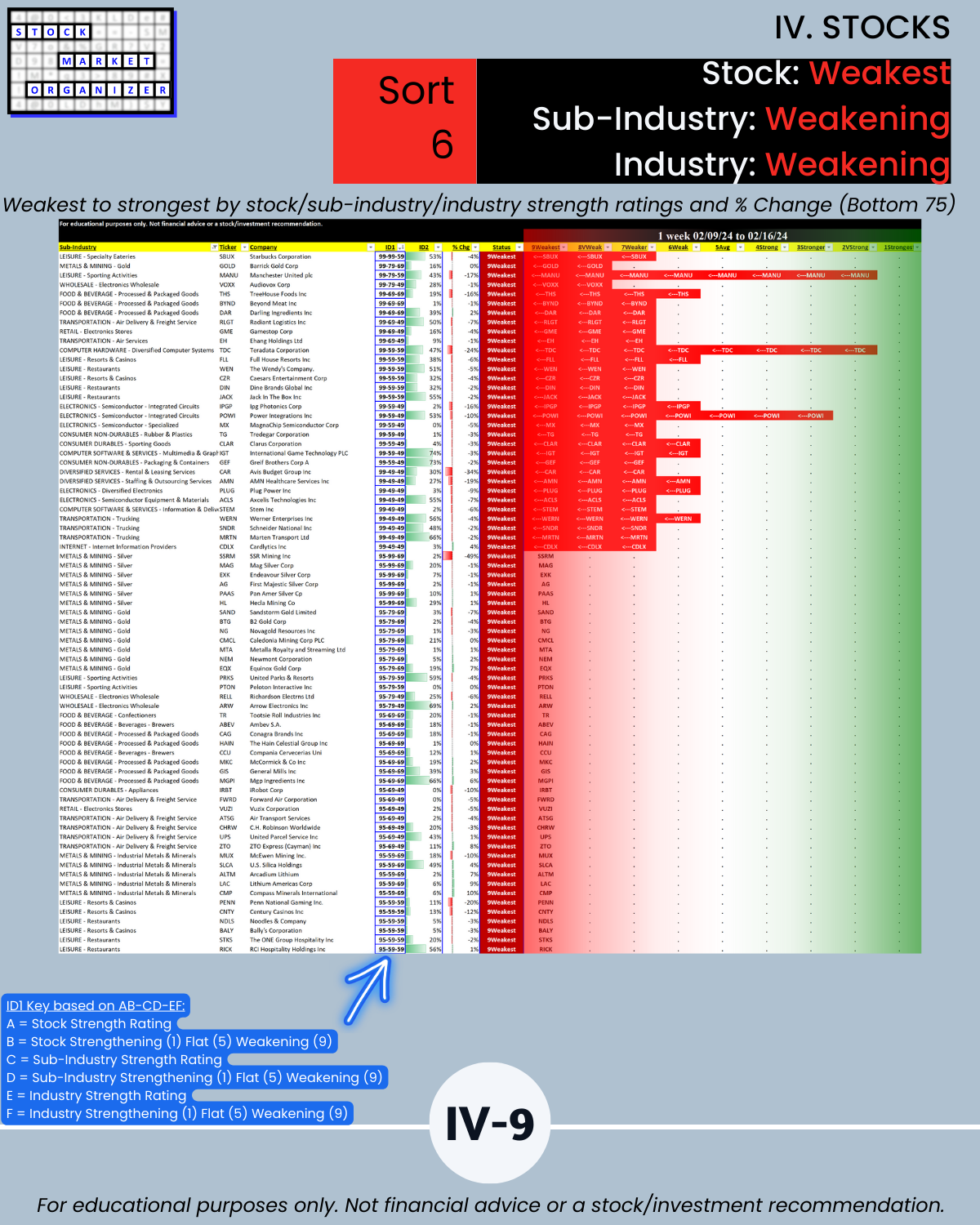

🔹 What are the weakest-rated stocks in weakening sub-industries and industries?

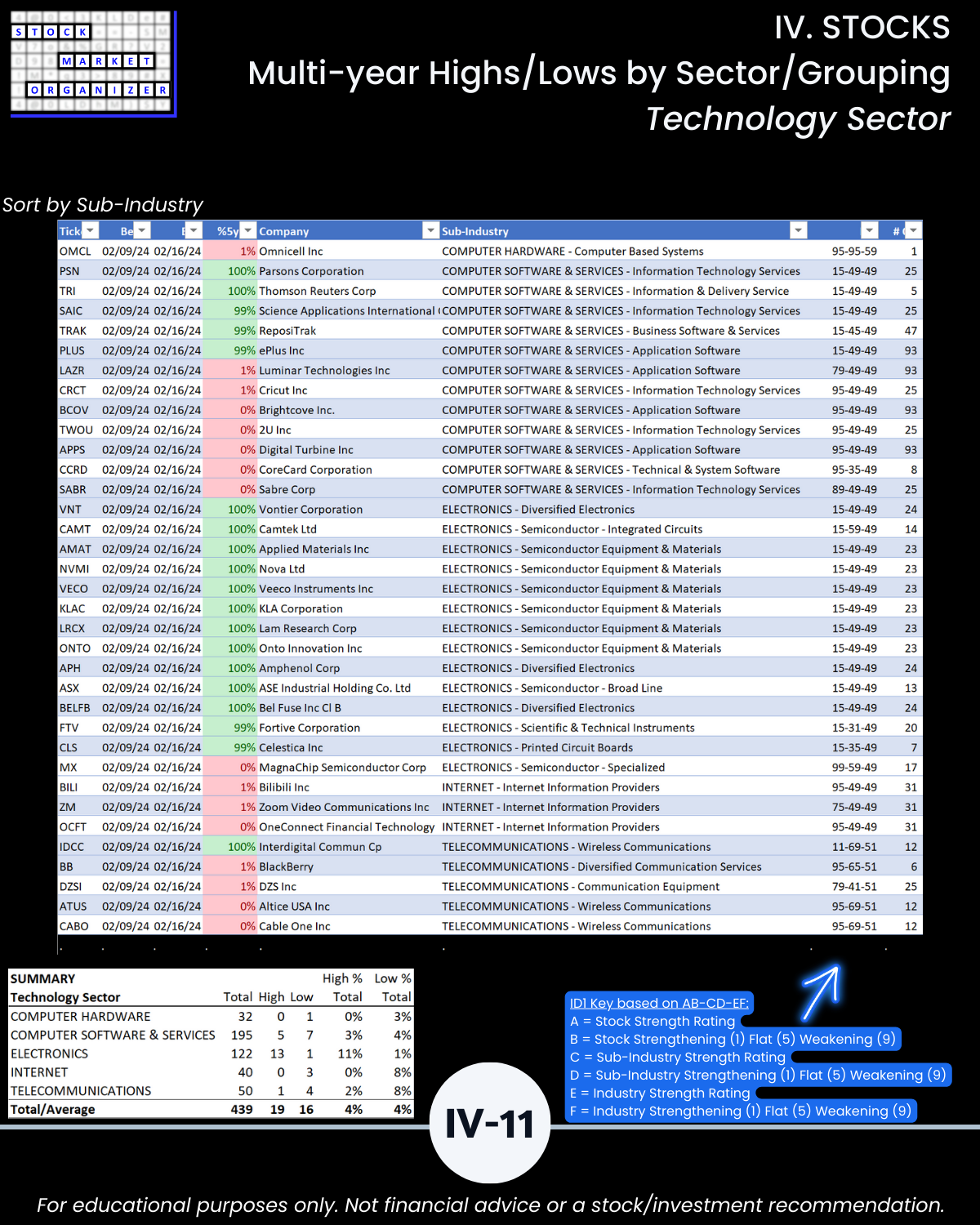

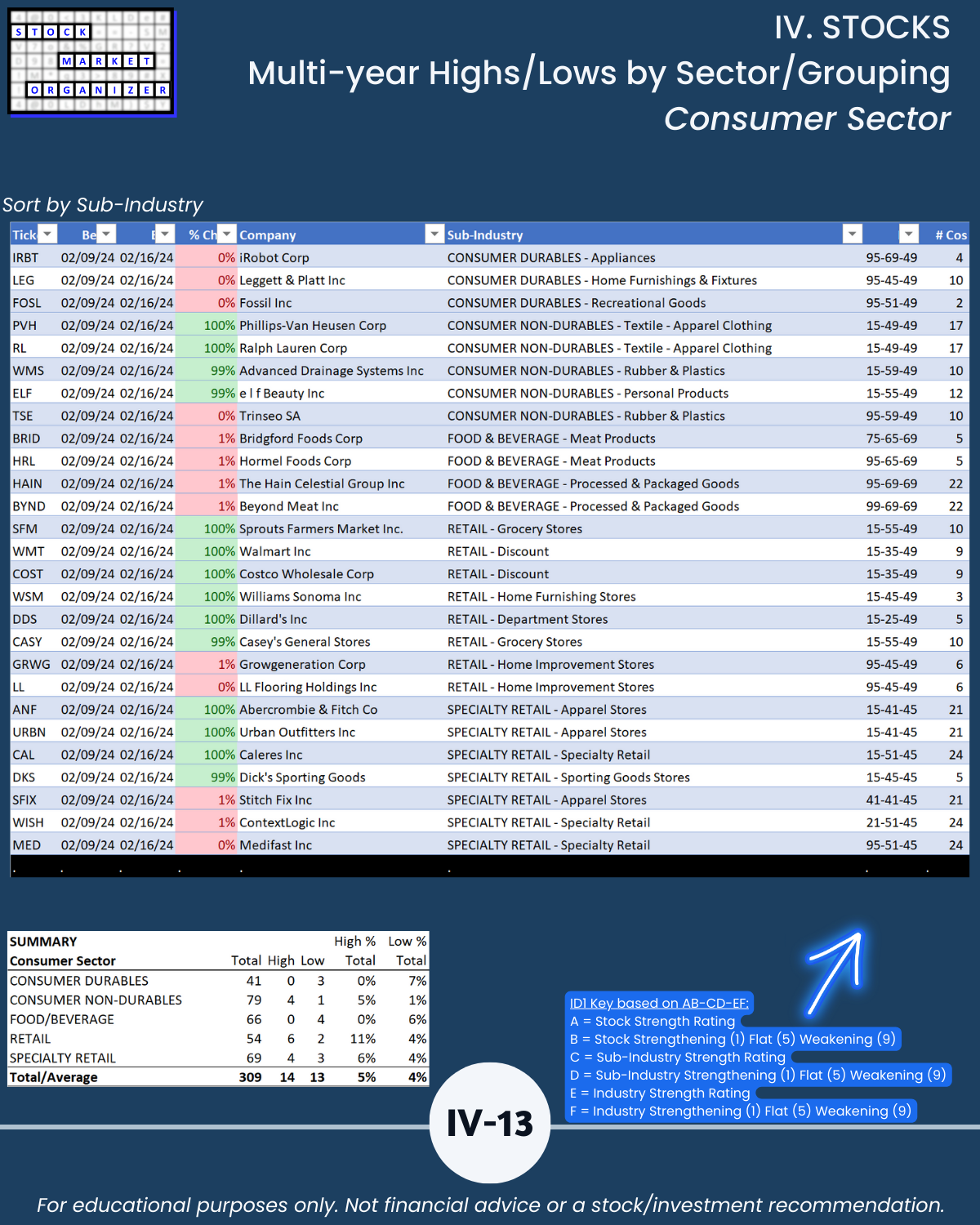

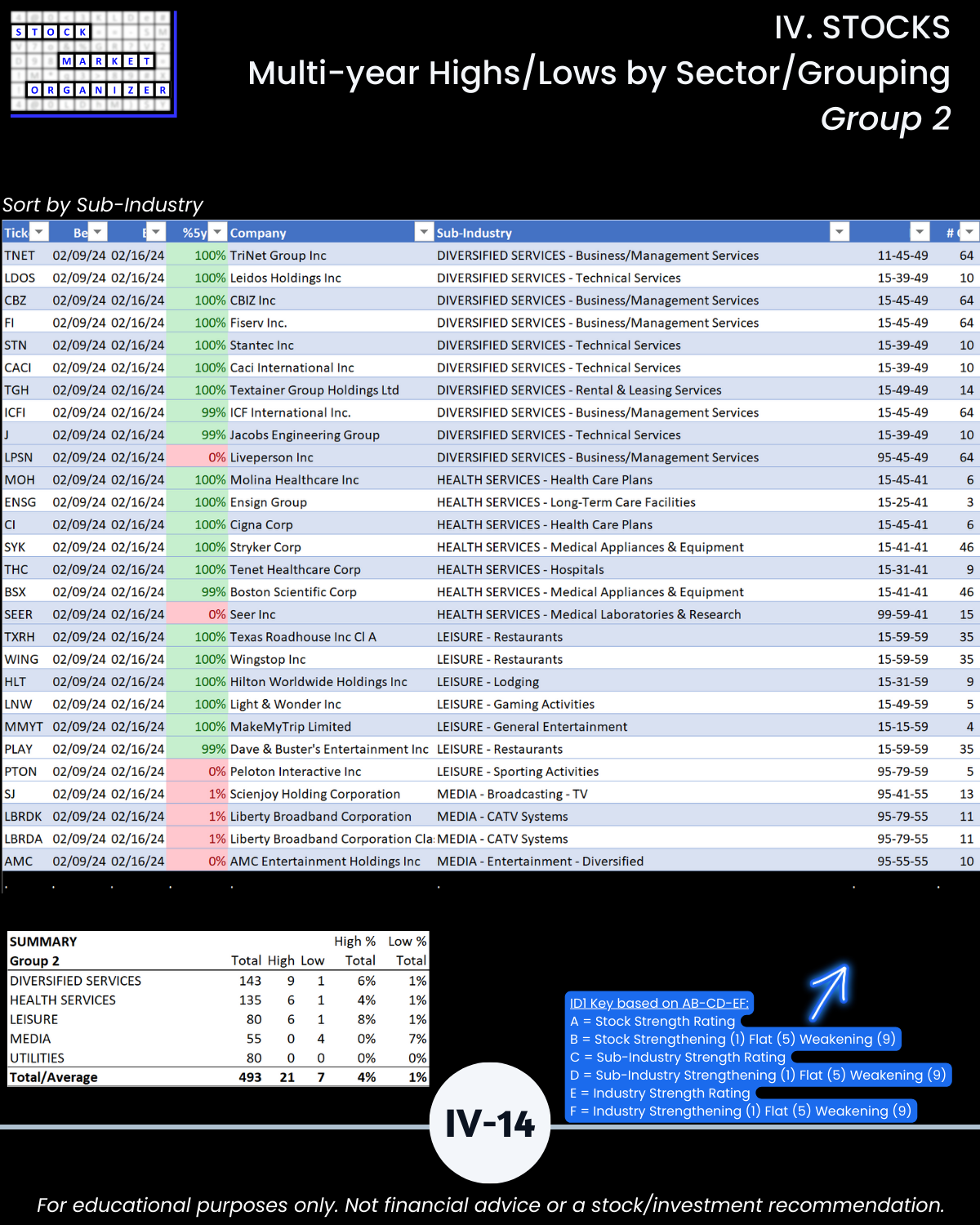

🔹 What stocks are at multi-year highs/lows, and how strong/weak are their sub-industries and industries?

WHO CARES?

Anyone who wants a U.S. stock market advantage. Really helpful if you agree with the following:

- The stronger your stocks, the greener your P&L.

- The journey to 100%+ returns begins with 10% returns.

- The journey to a multi-month rally begins with one up week.

- Most stocks do what the market does. (While the market can only do what its underlying stocks, sub-industries, and industries do.)

- 80/20: not all information is created equal. (Press buttons, not balloons.)

Following are galleries with page-by-page views of this report.

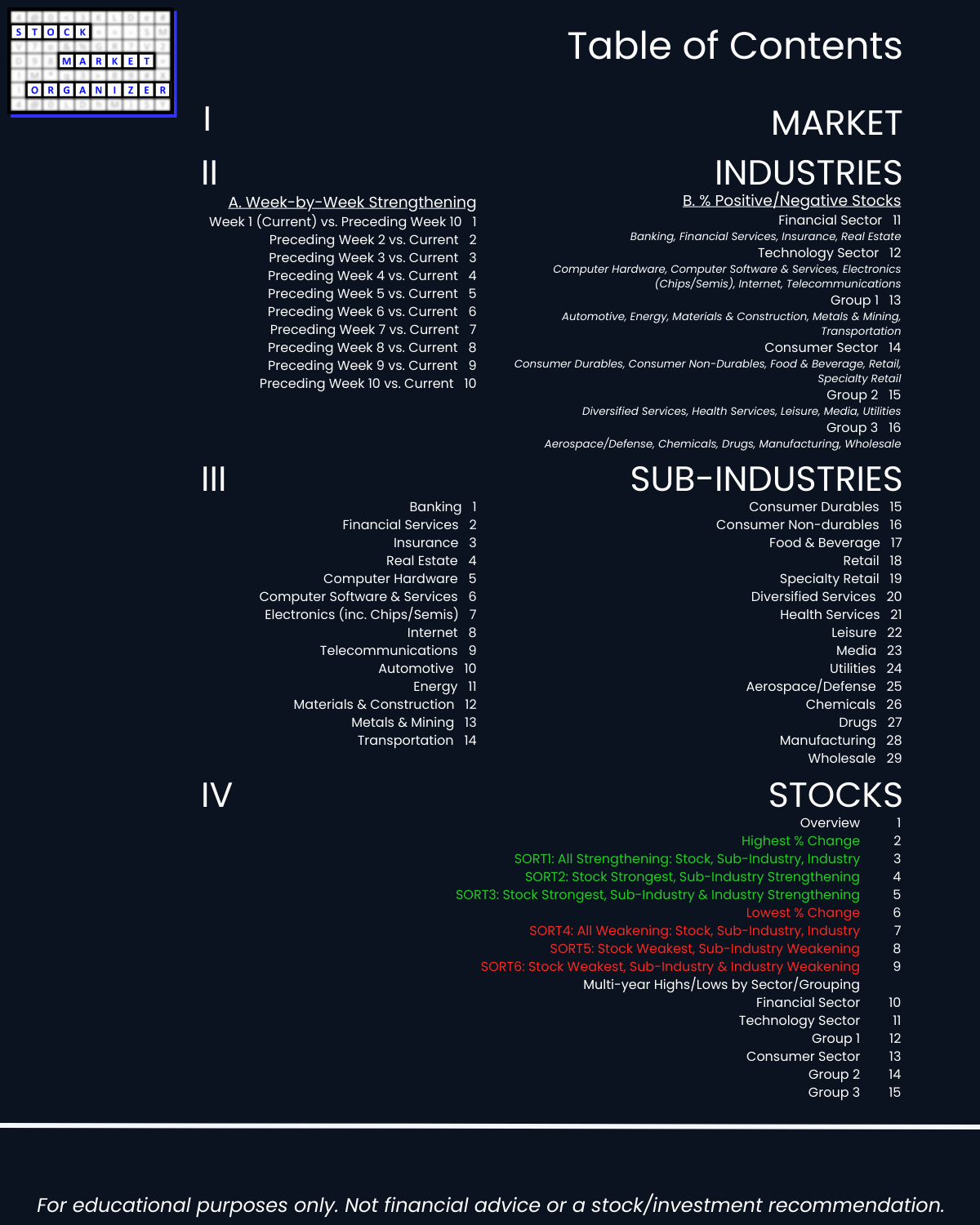

I. MARKET/Introduction/Market Strength Score

IIA. INDUSTRIES/10-Week Week-by-Week Industry Strength

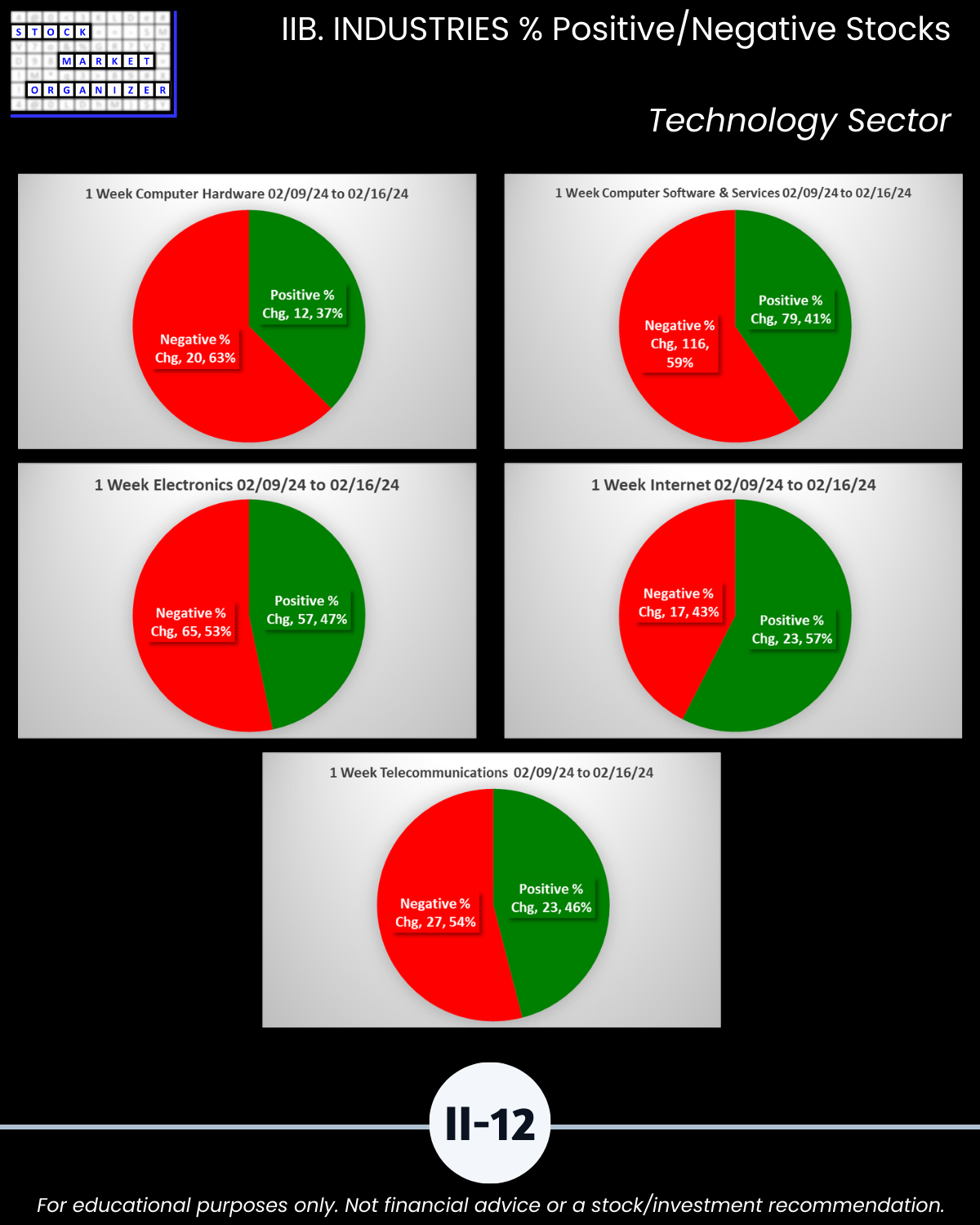

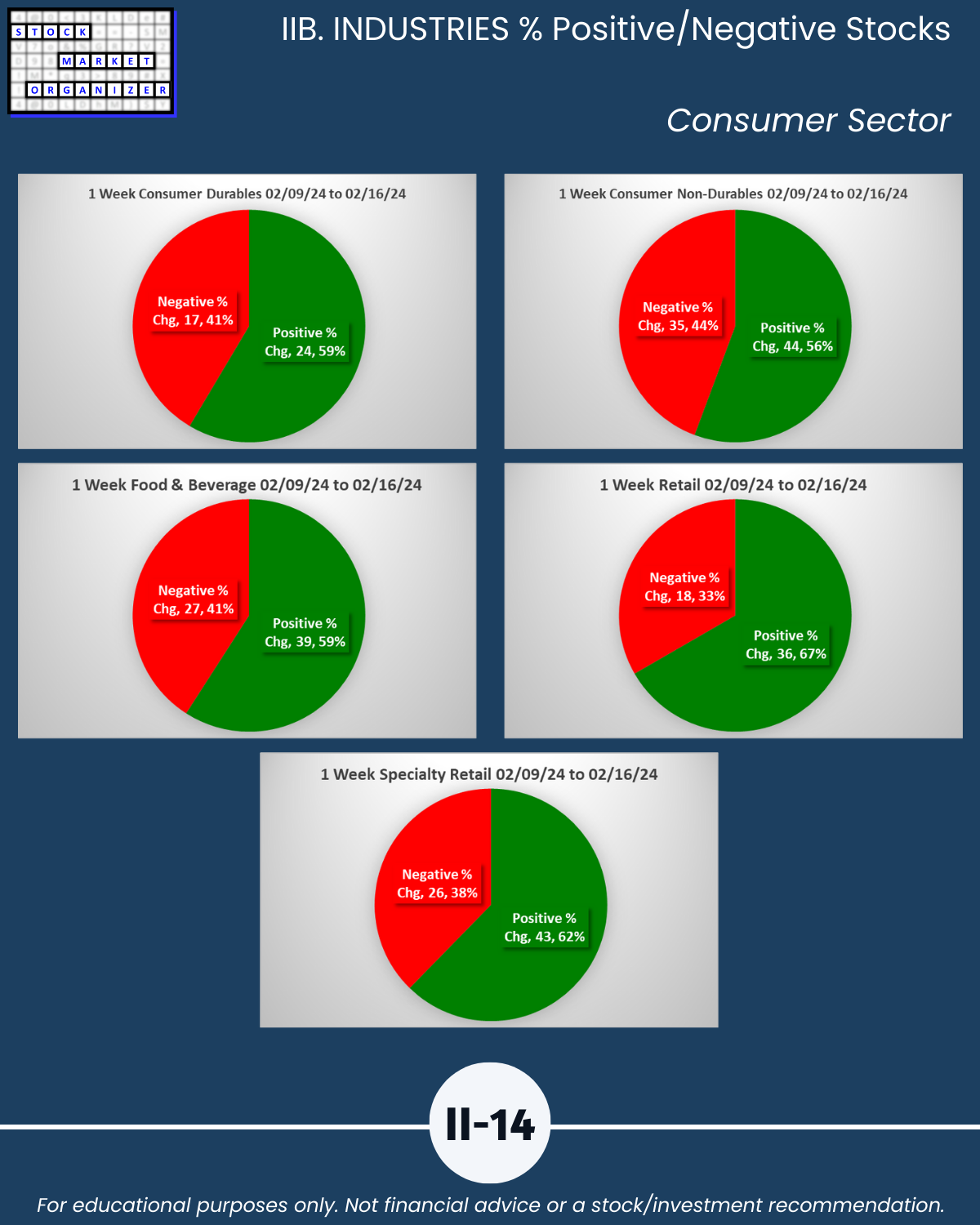

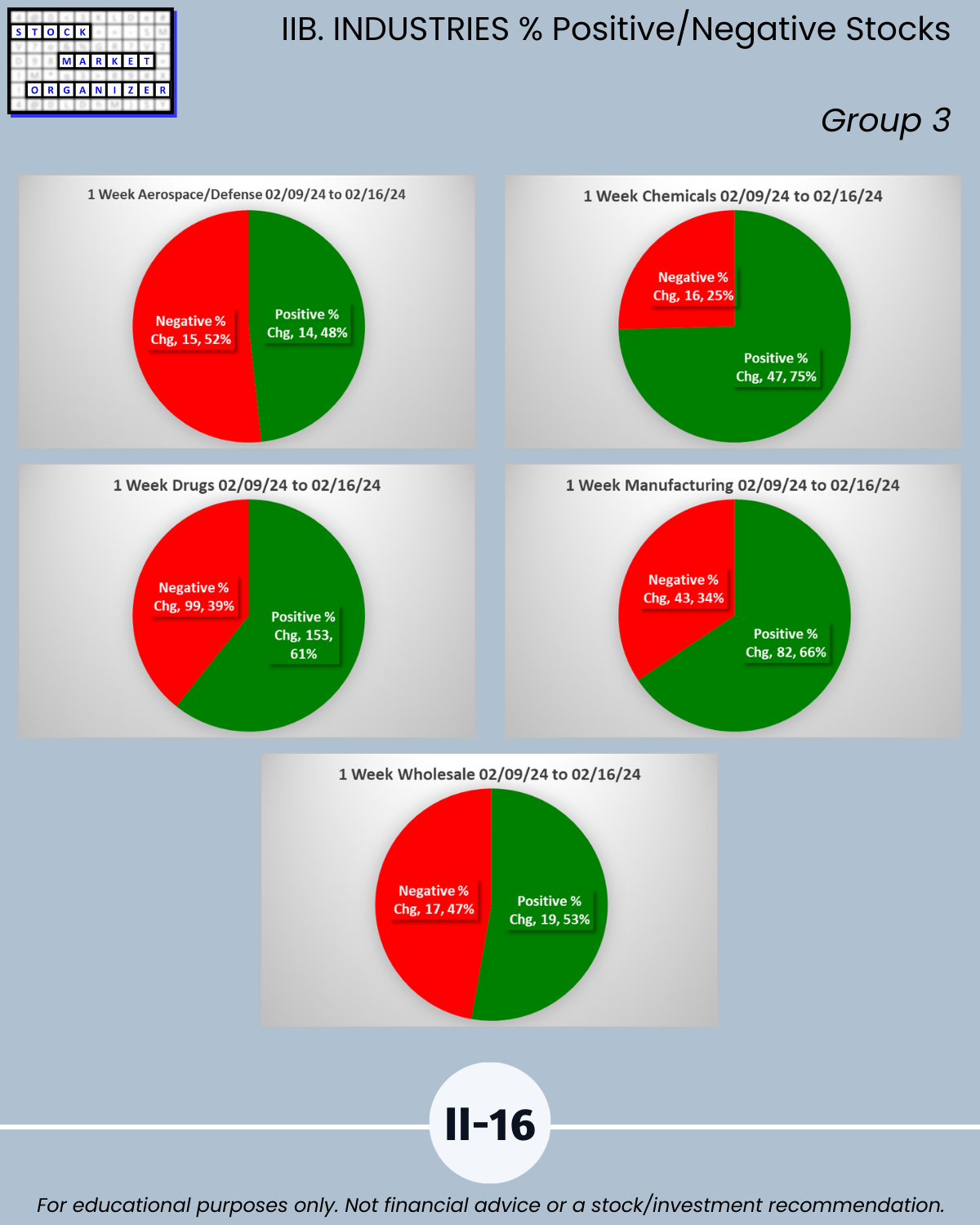

IIB. INDUSTRIES/% Positive/Negative Stocks

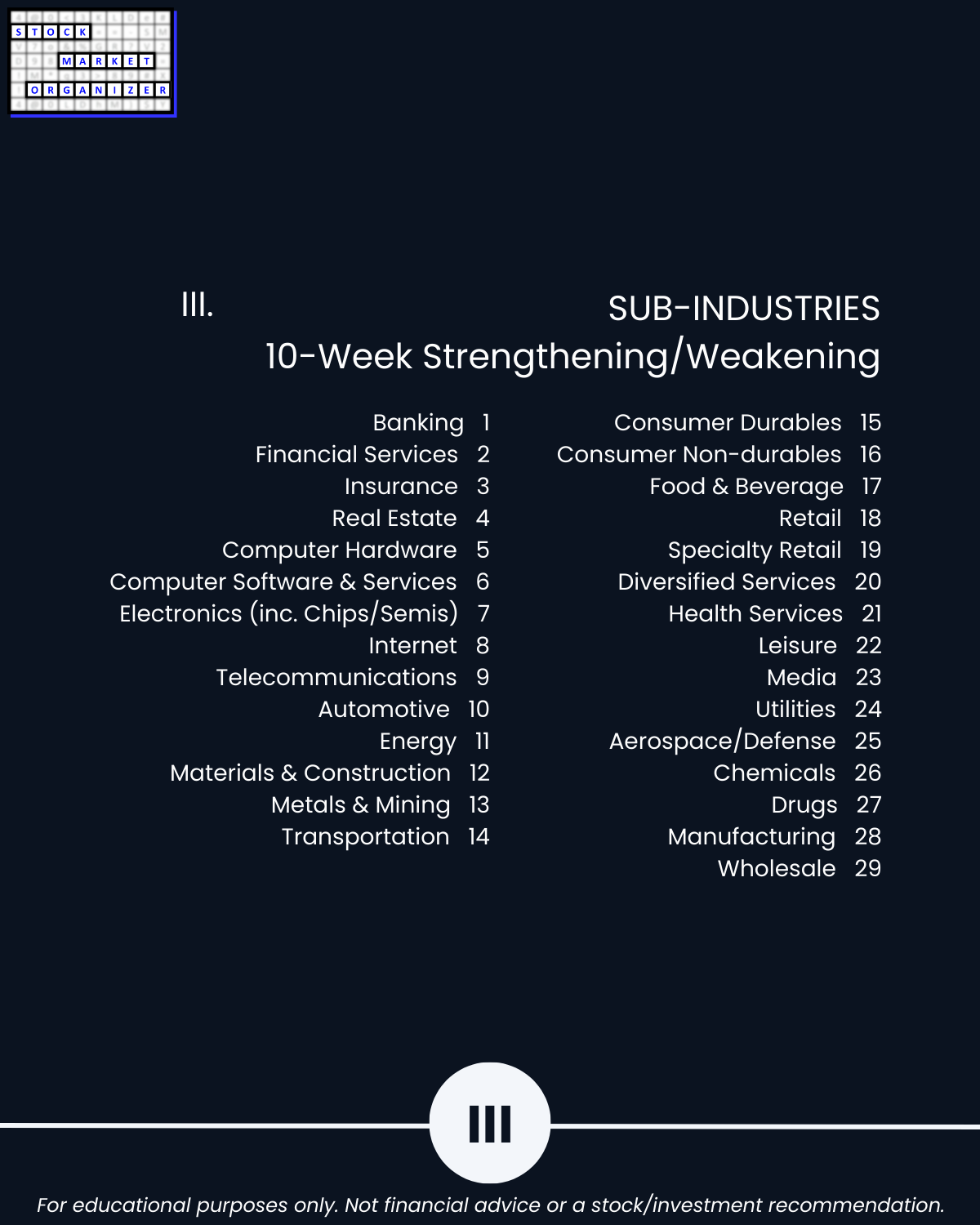

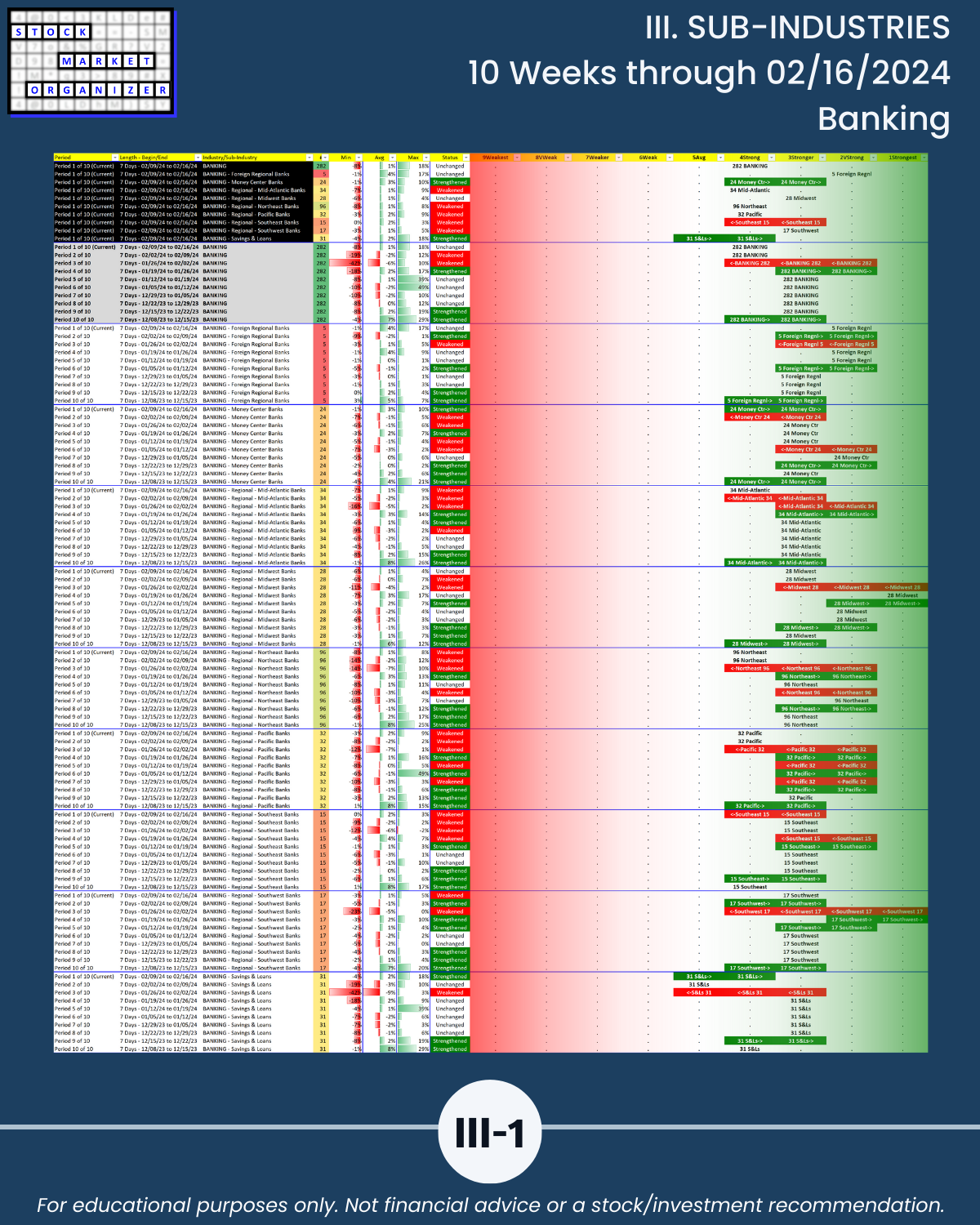

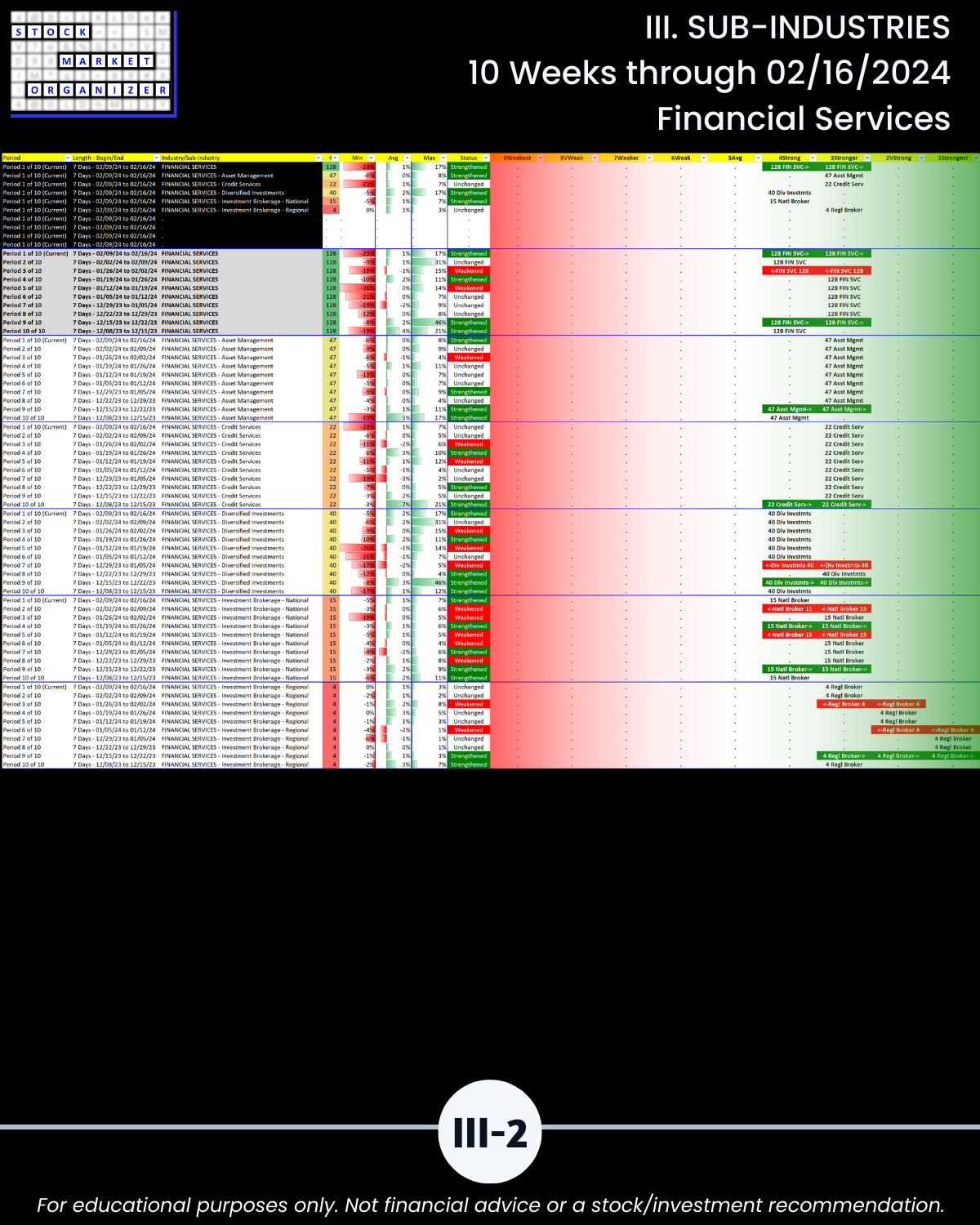

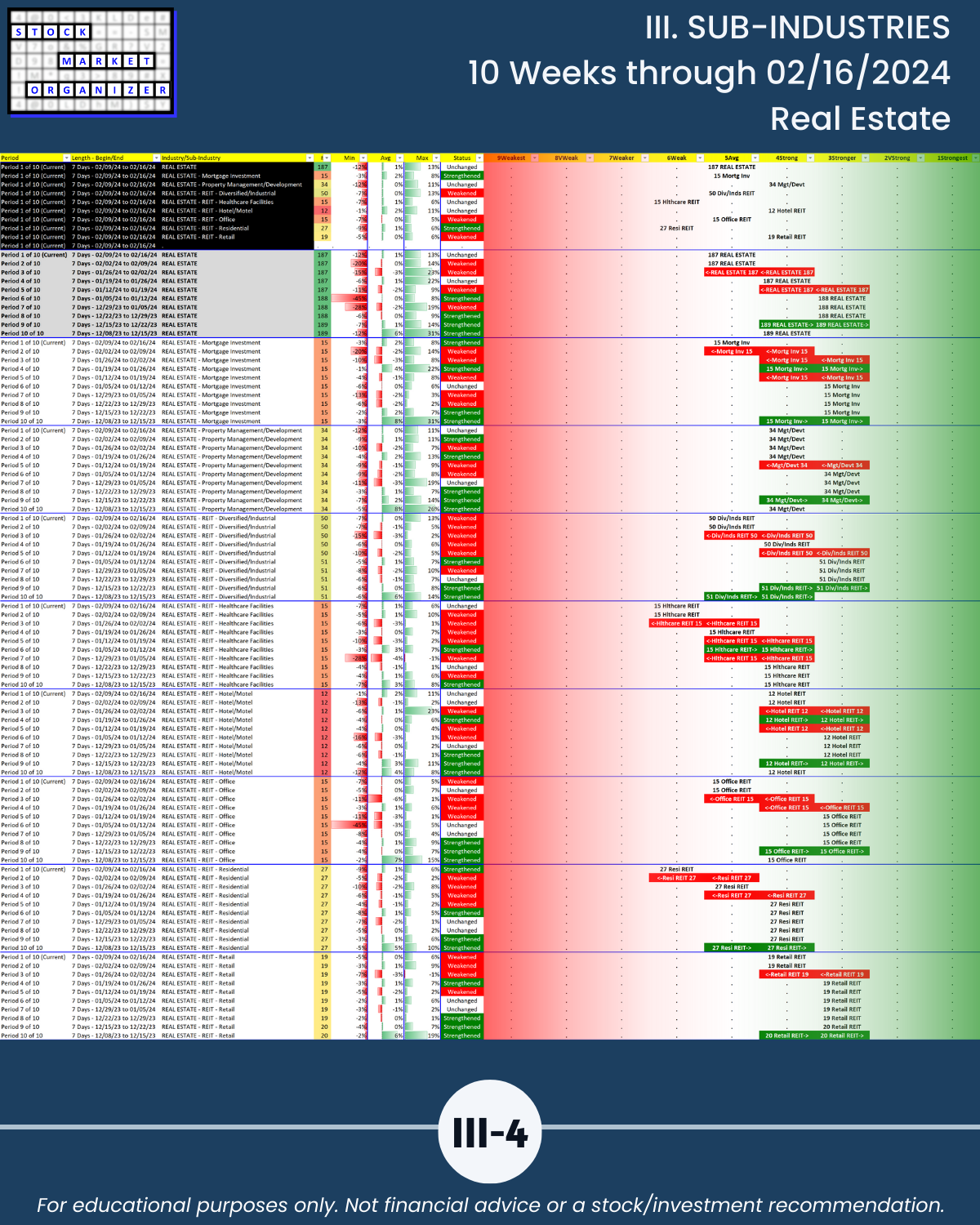

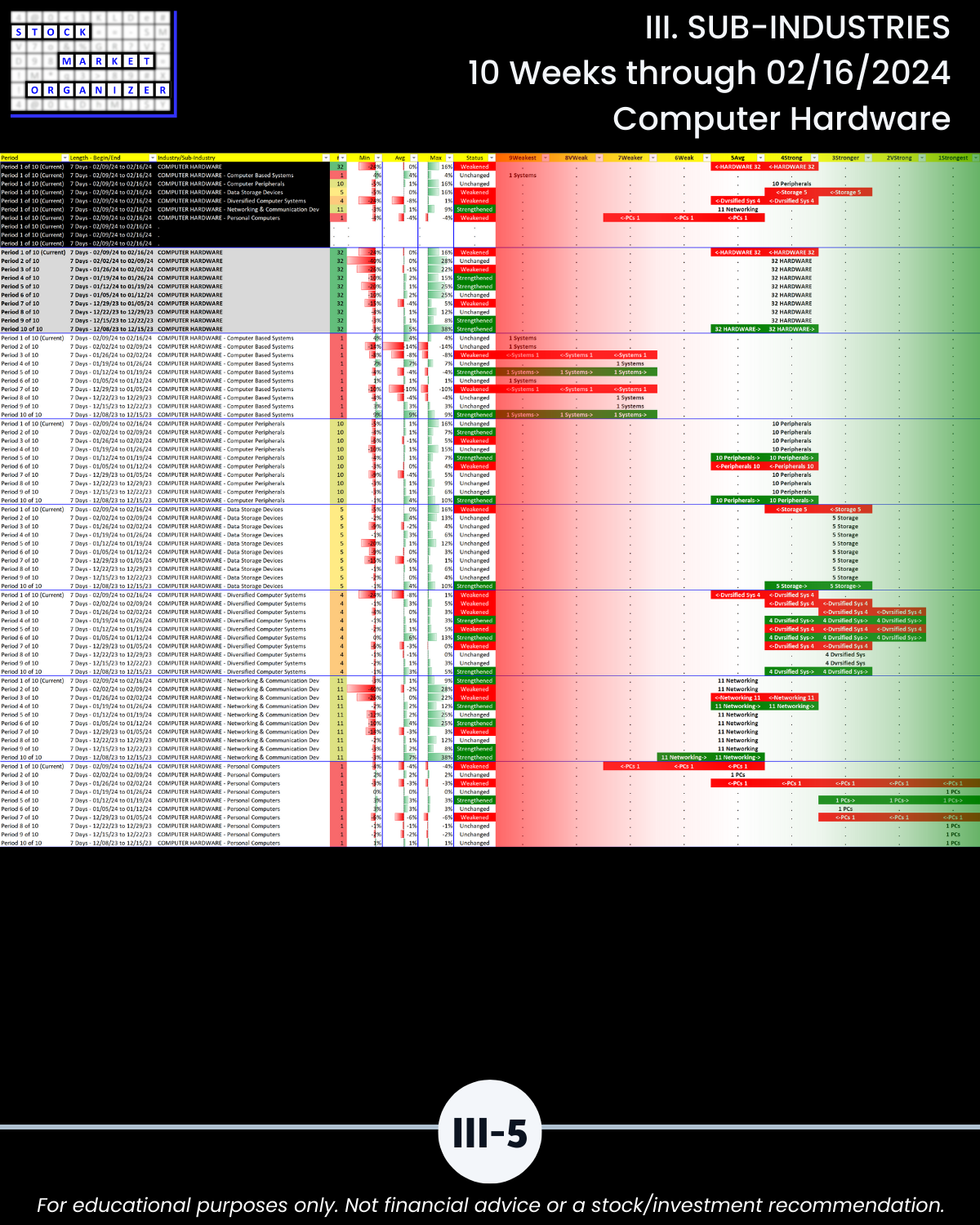

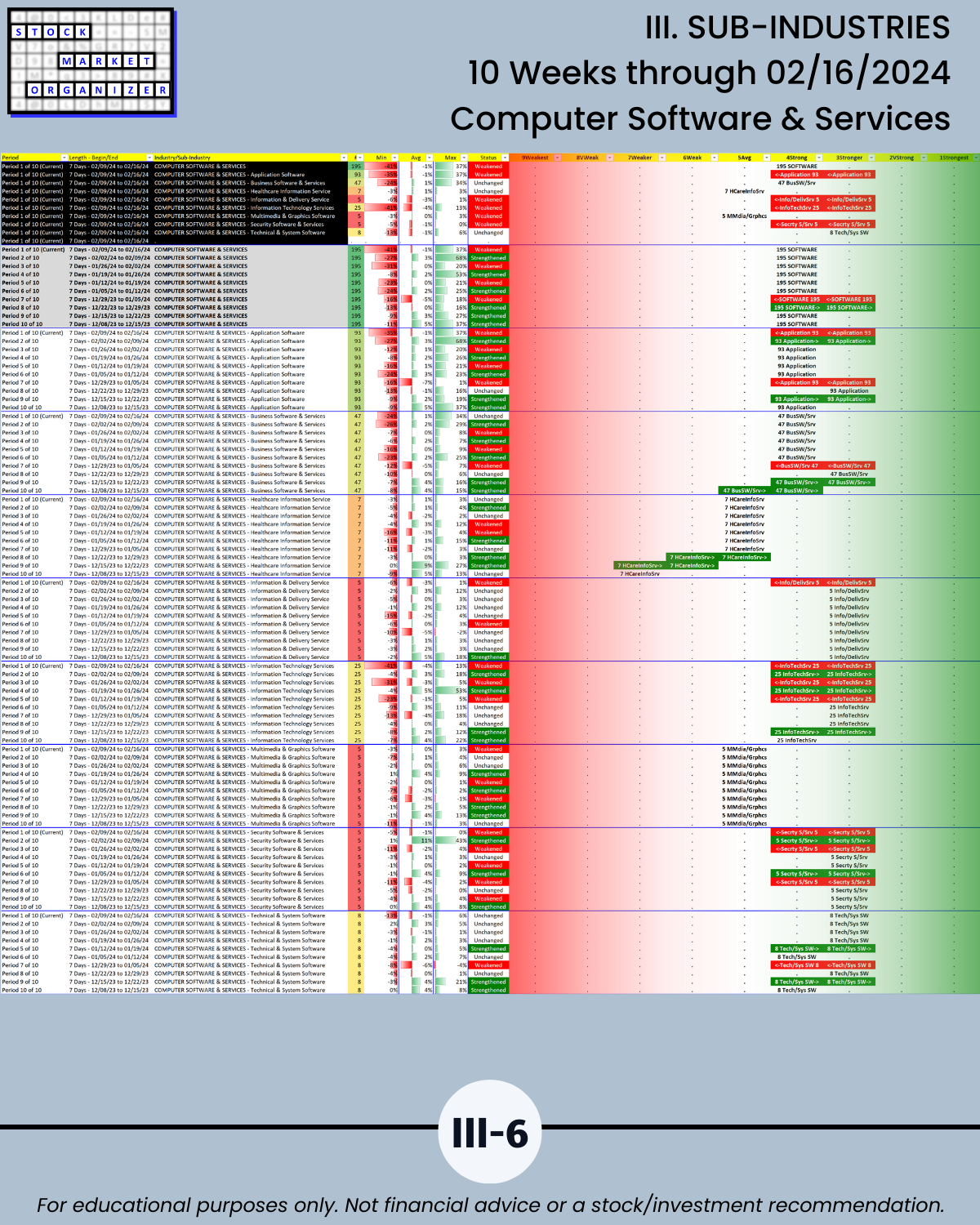

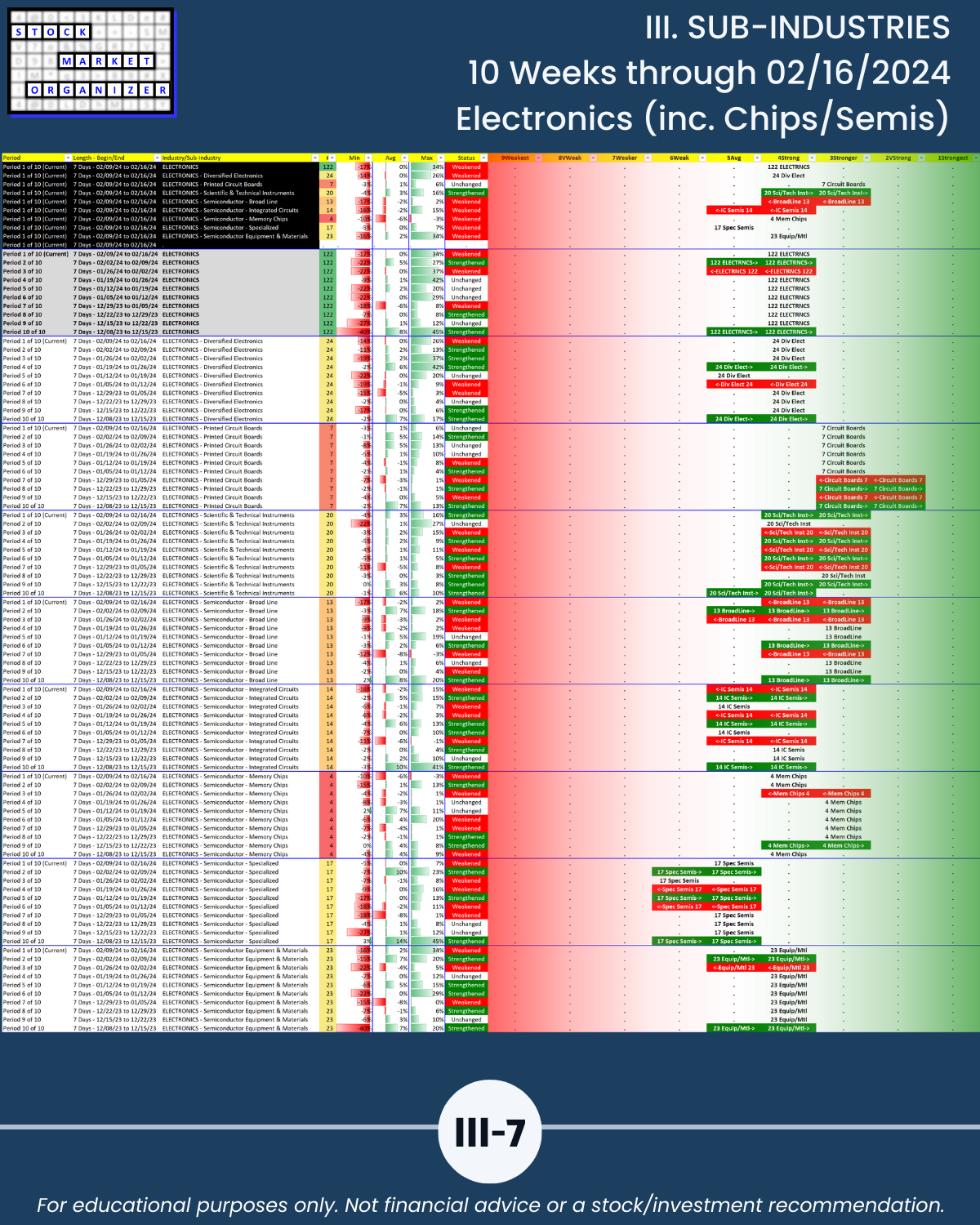

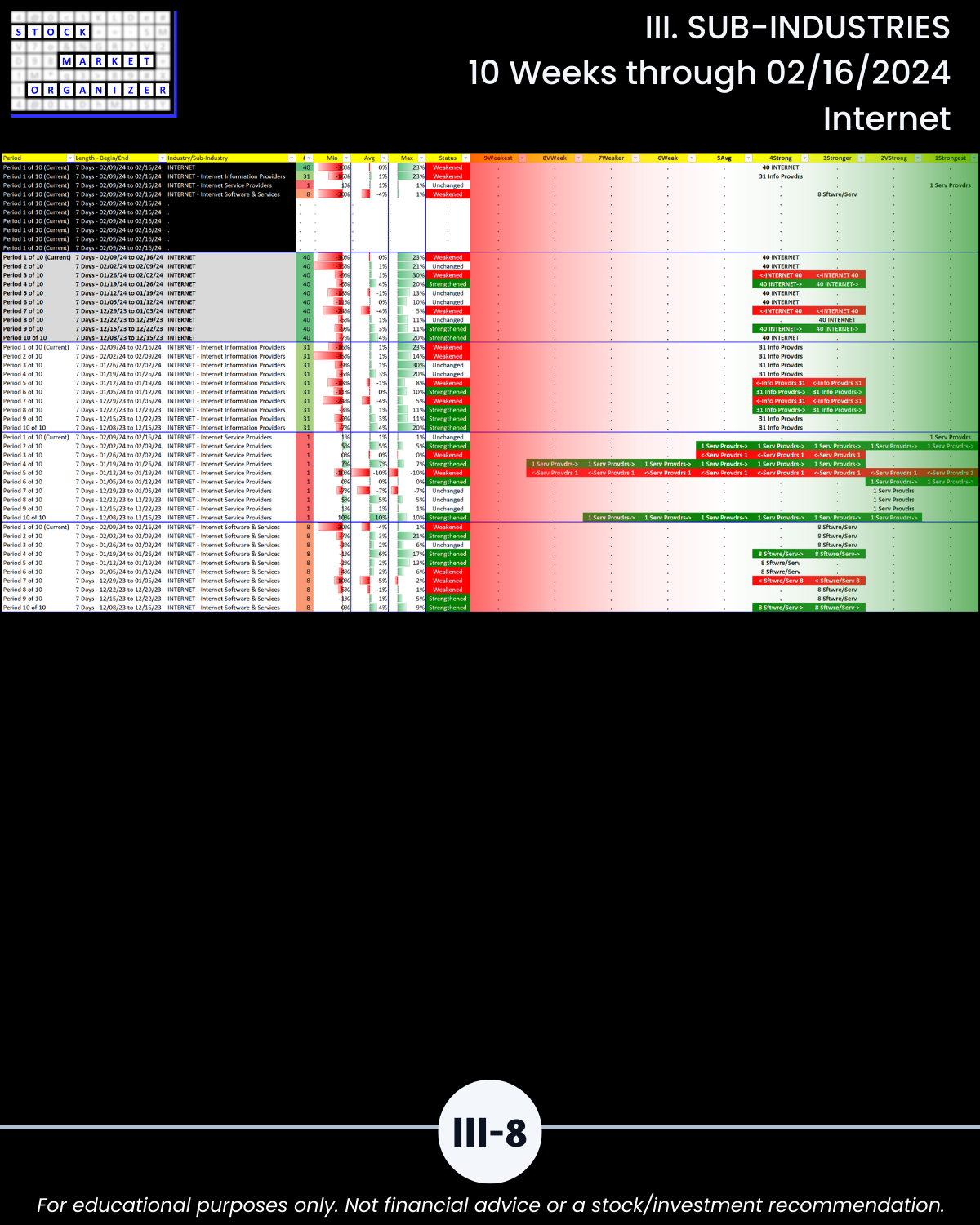

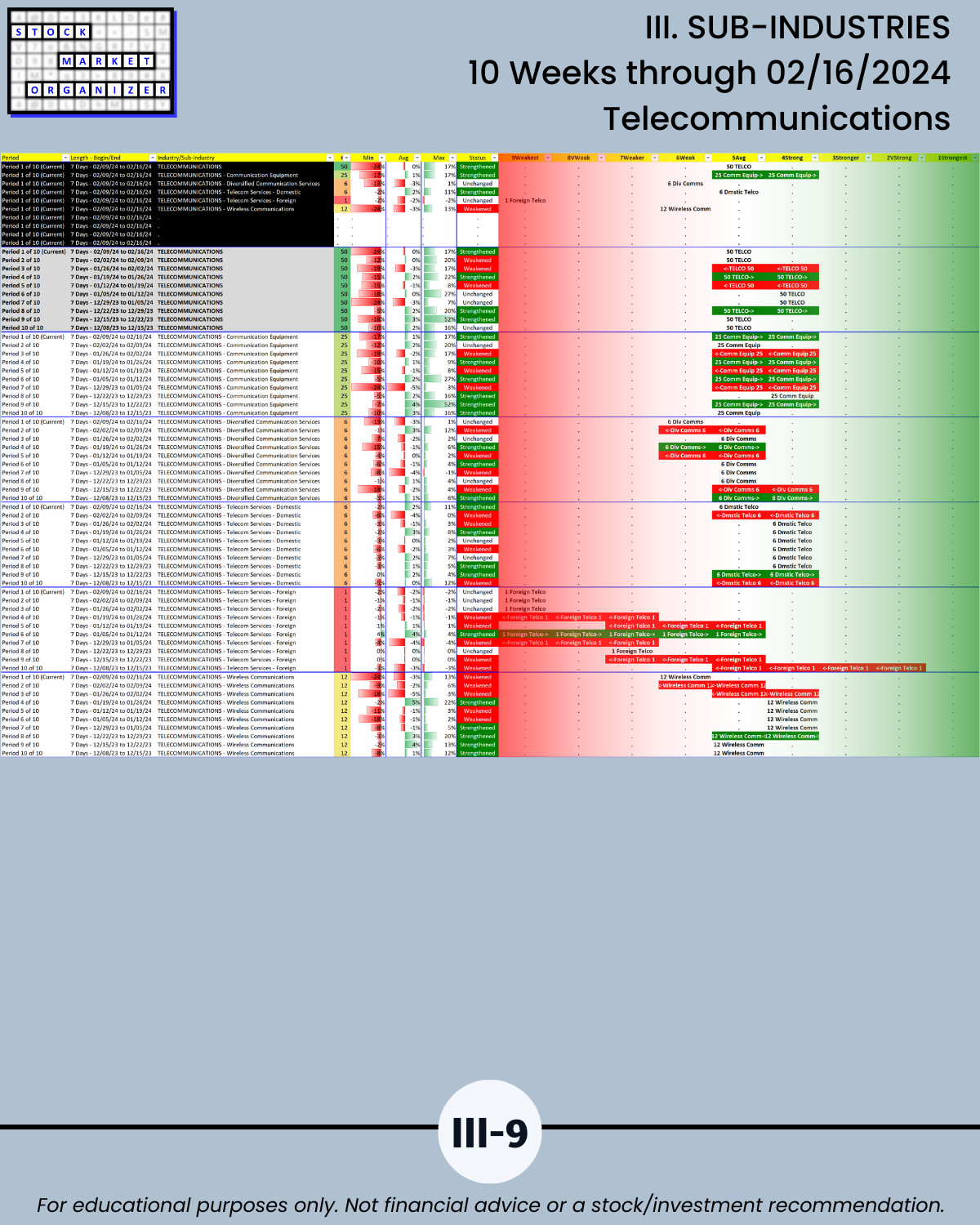

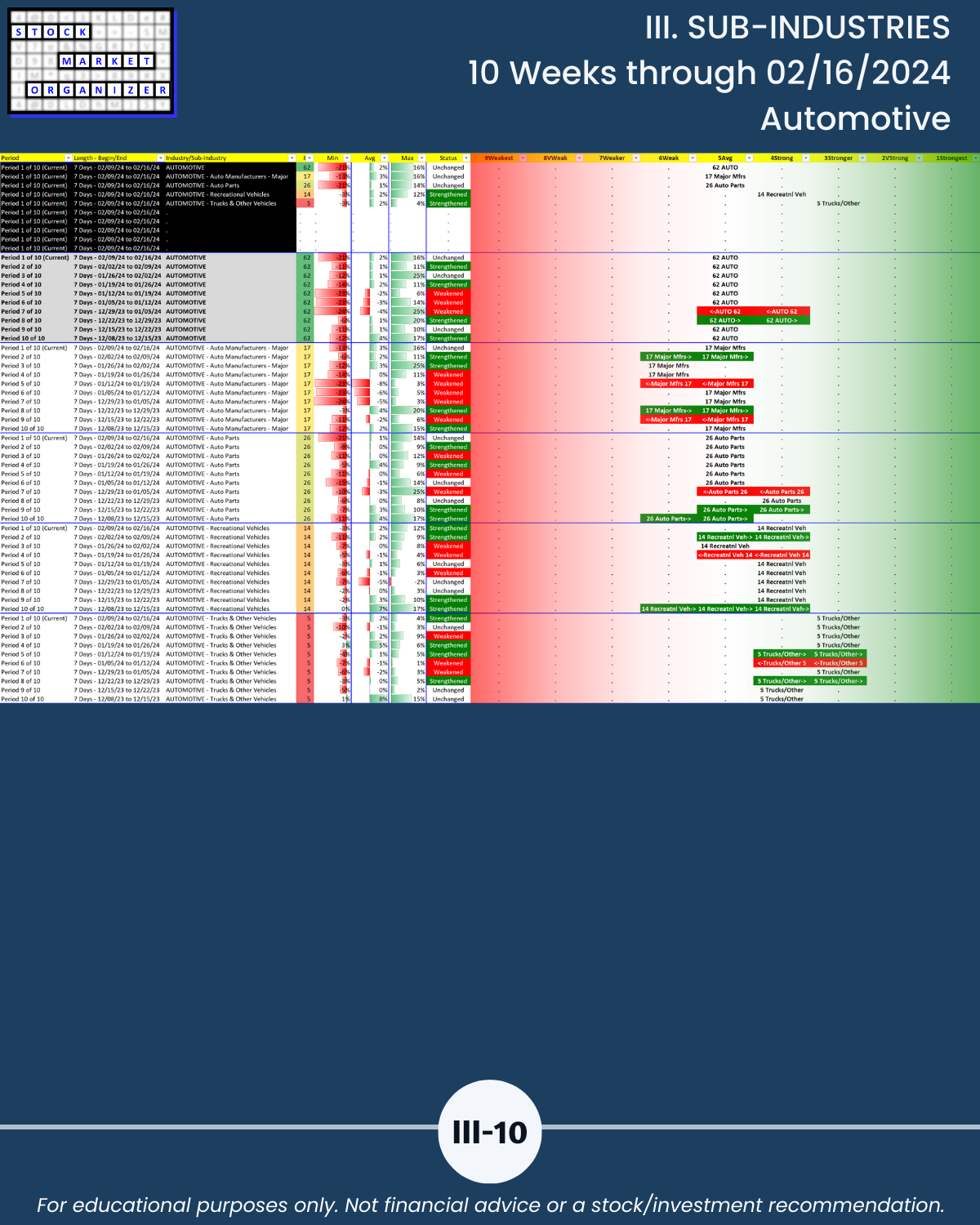

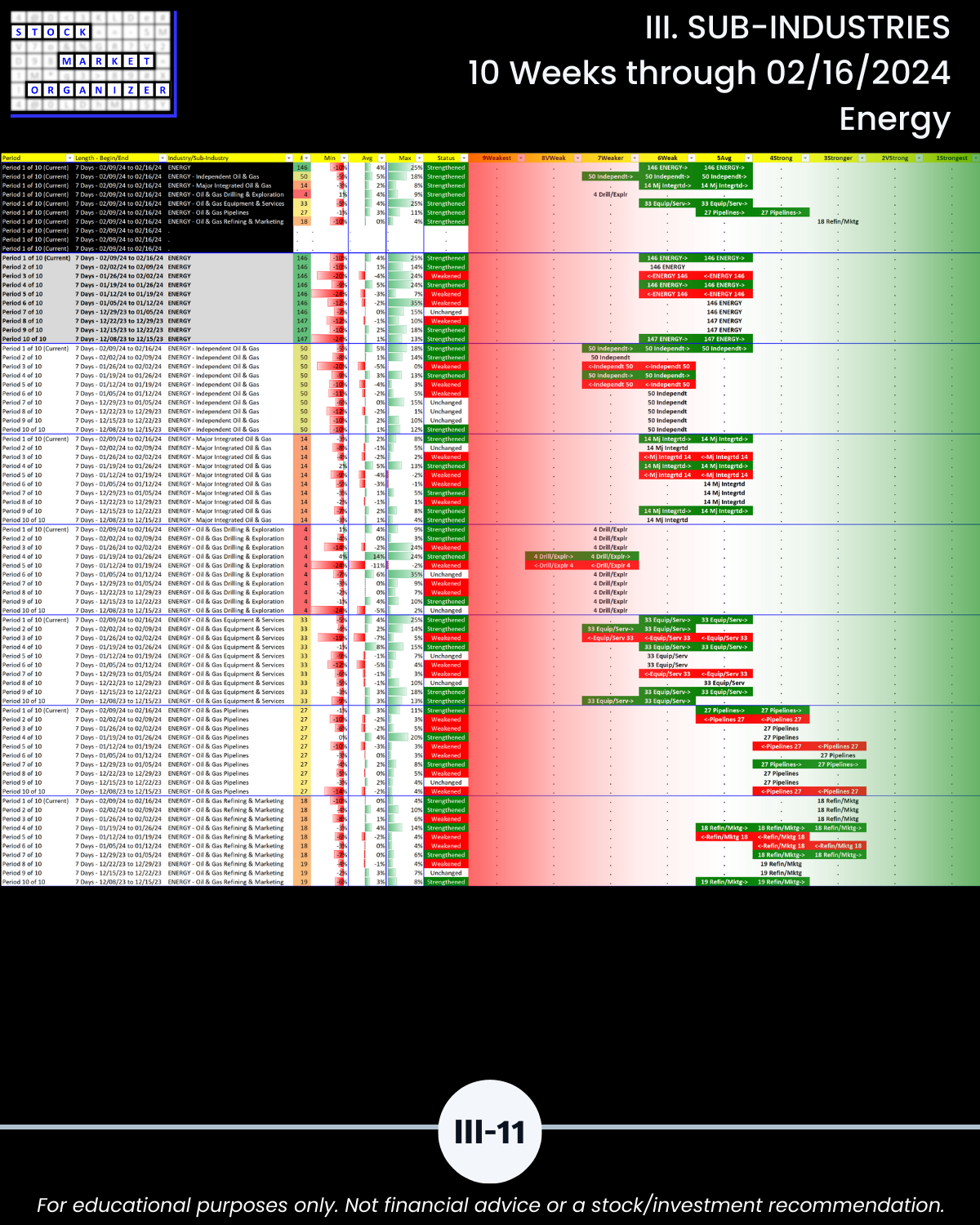

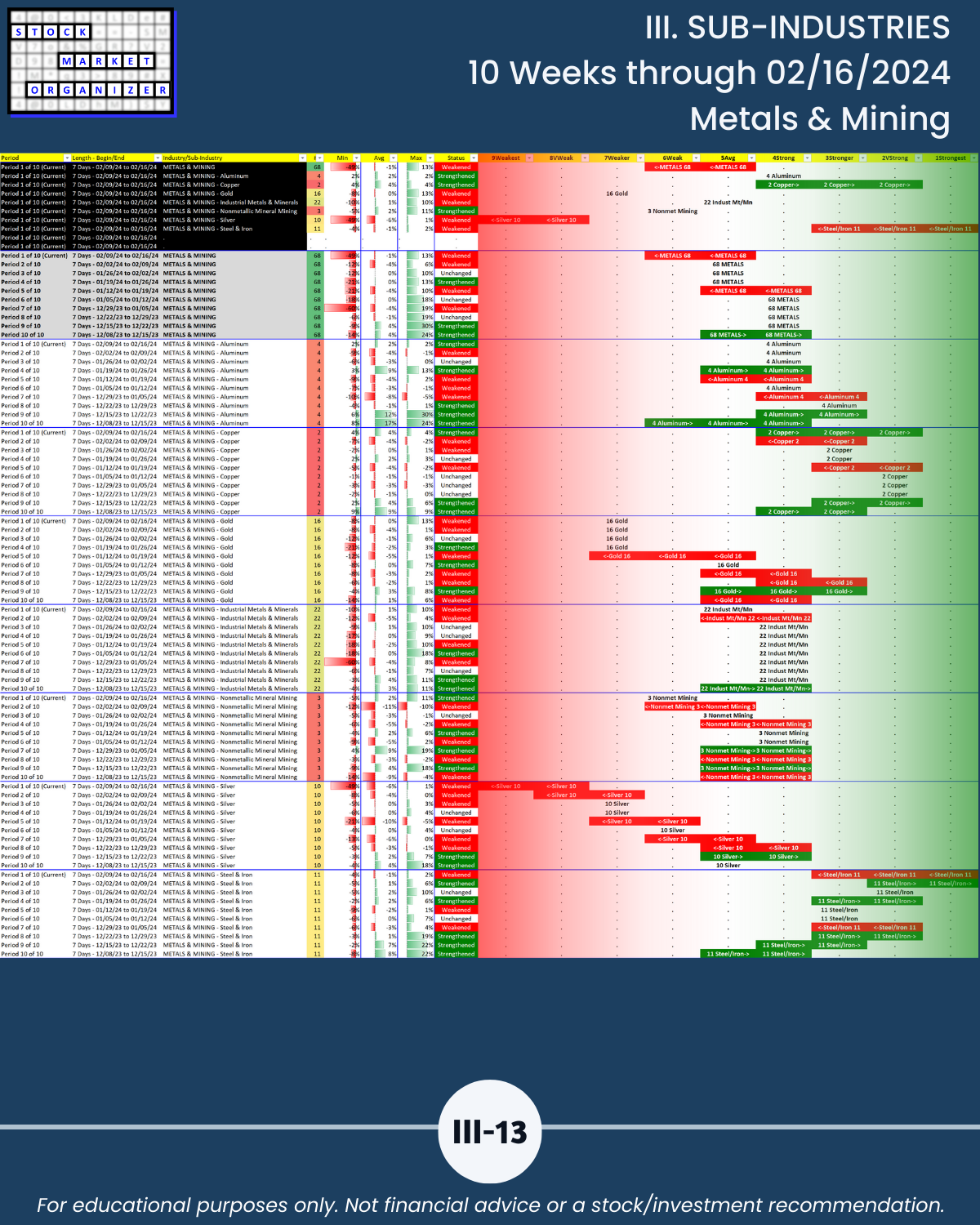

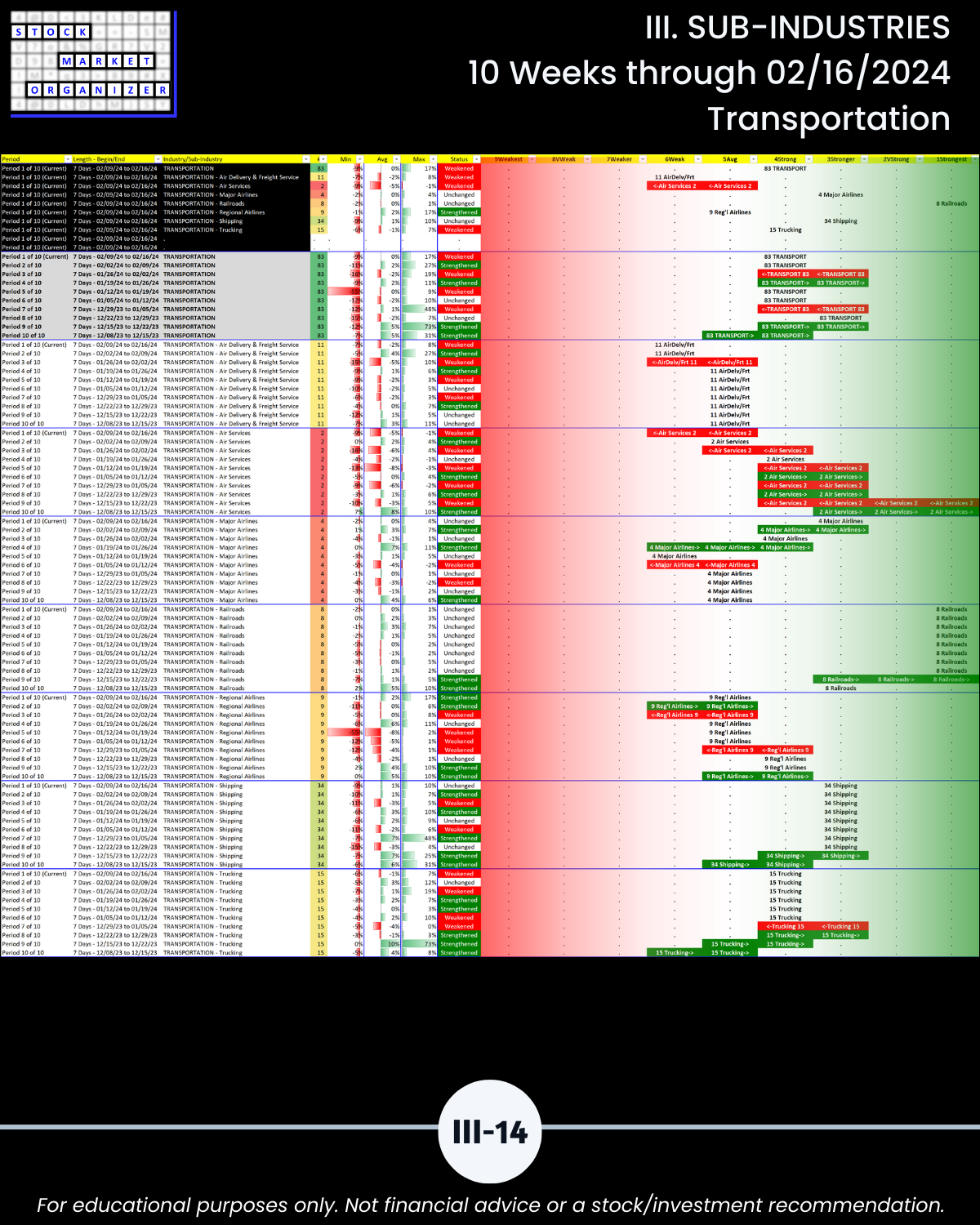

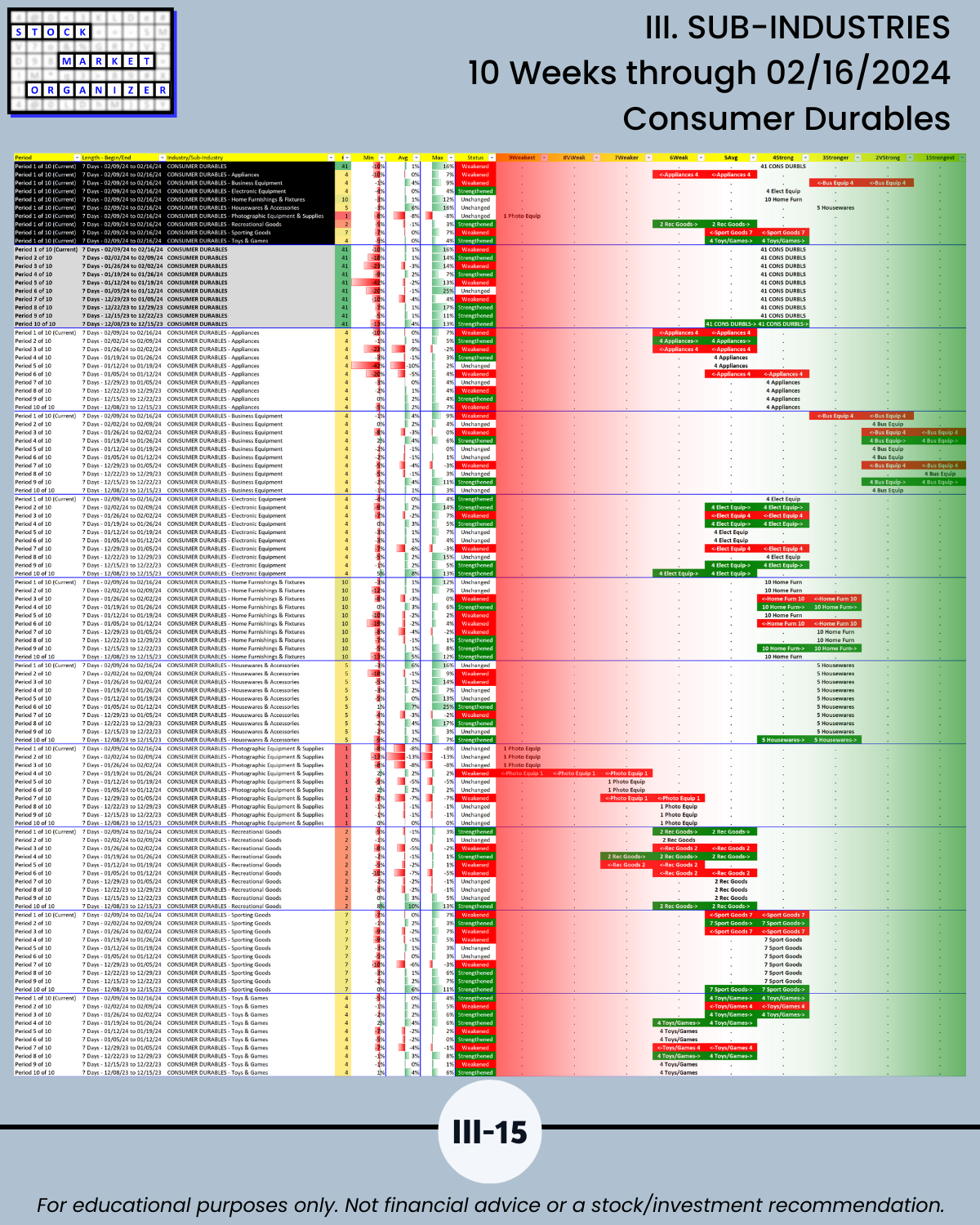

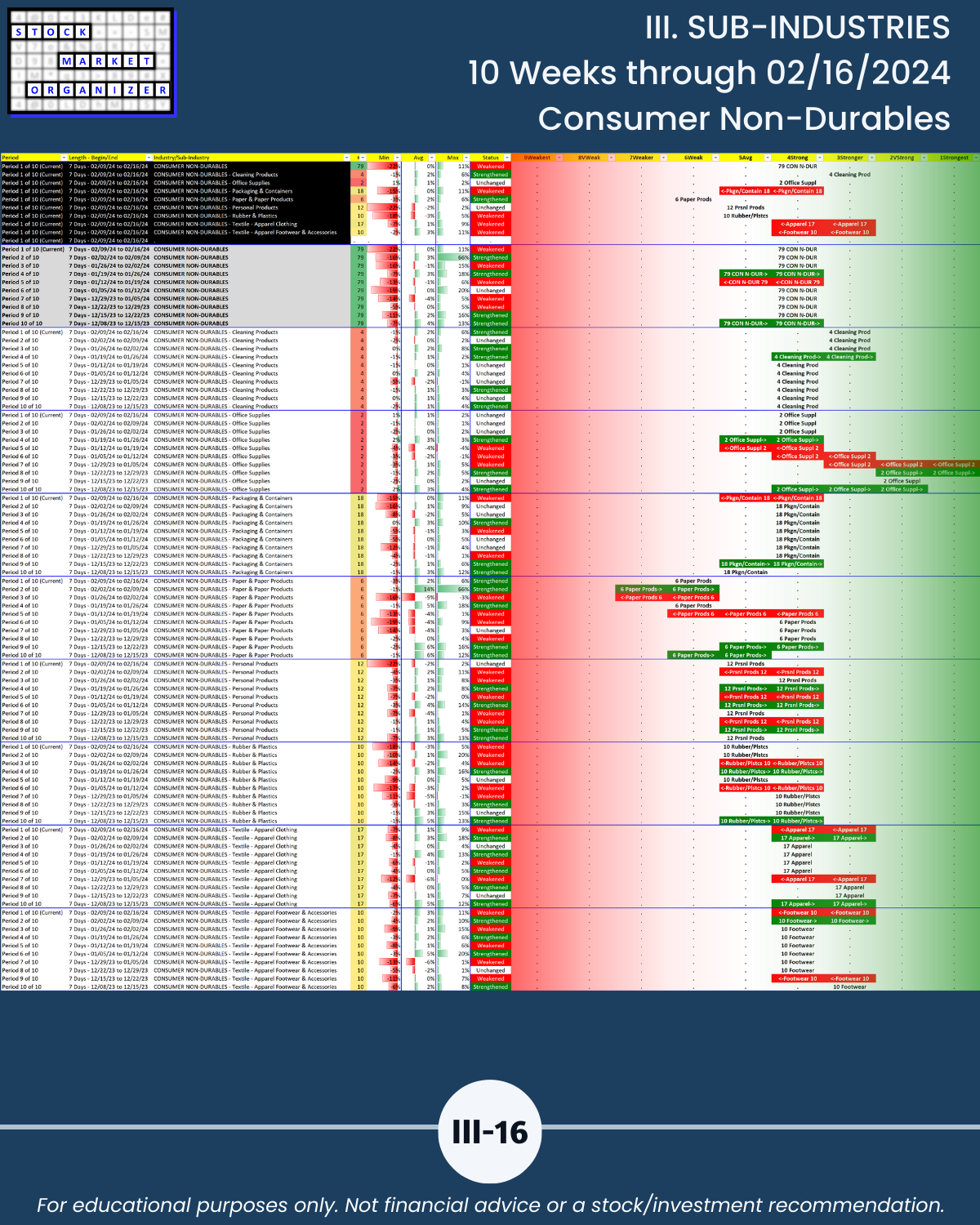

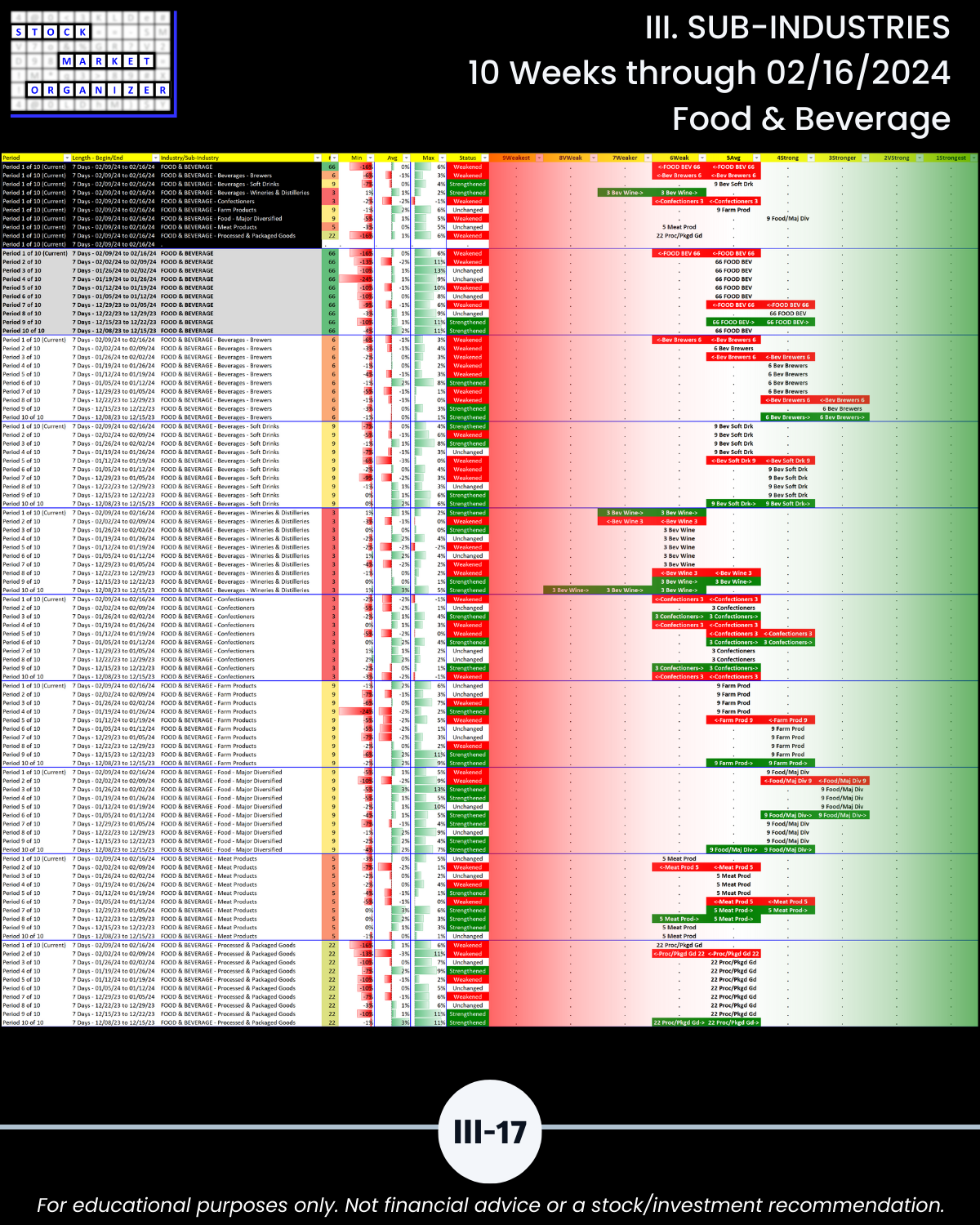

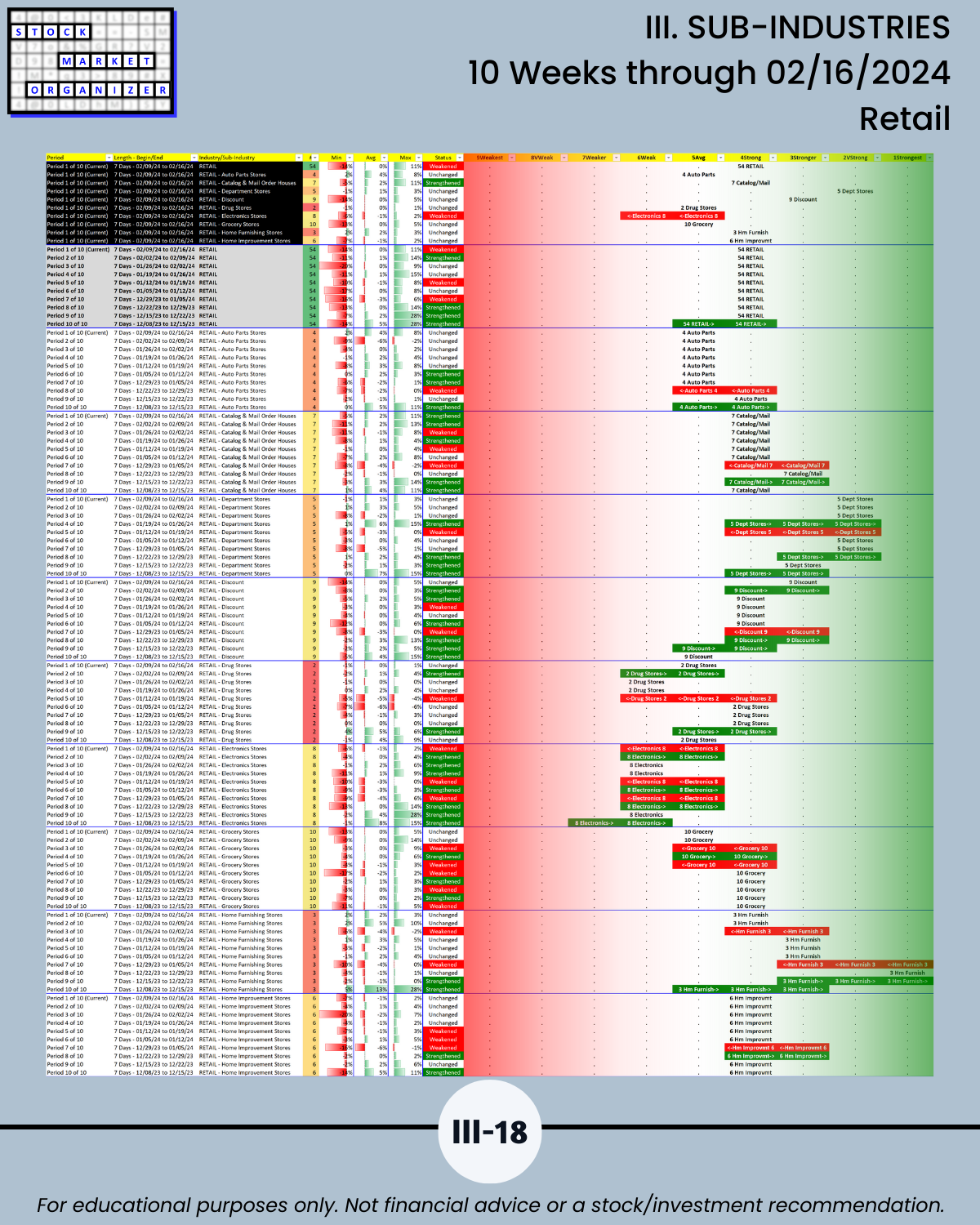

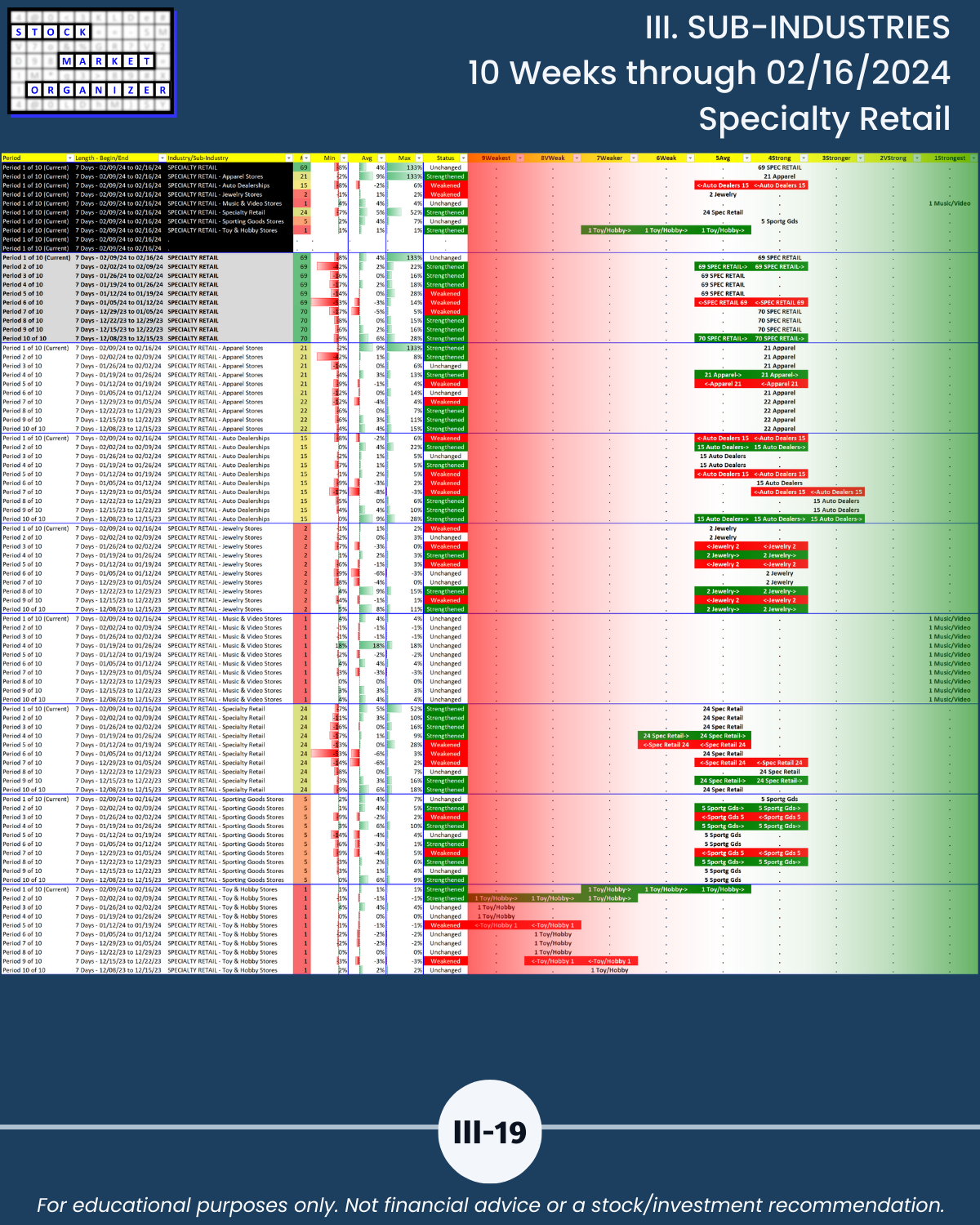

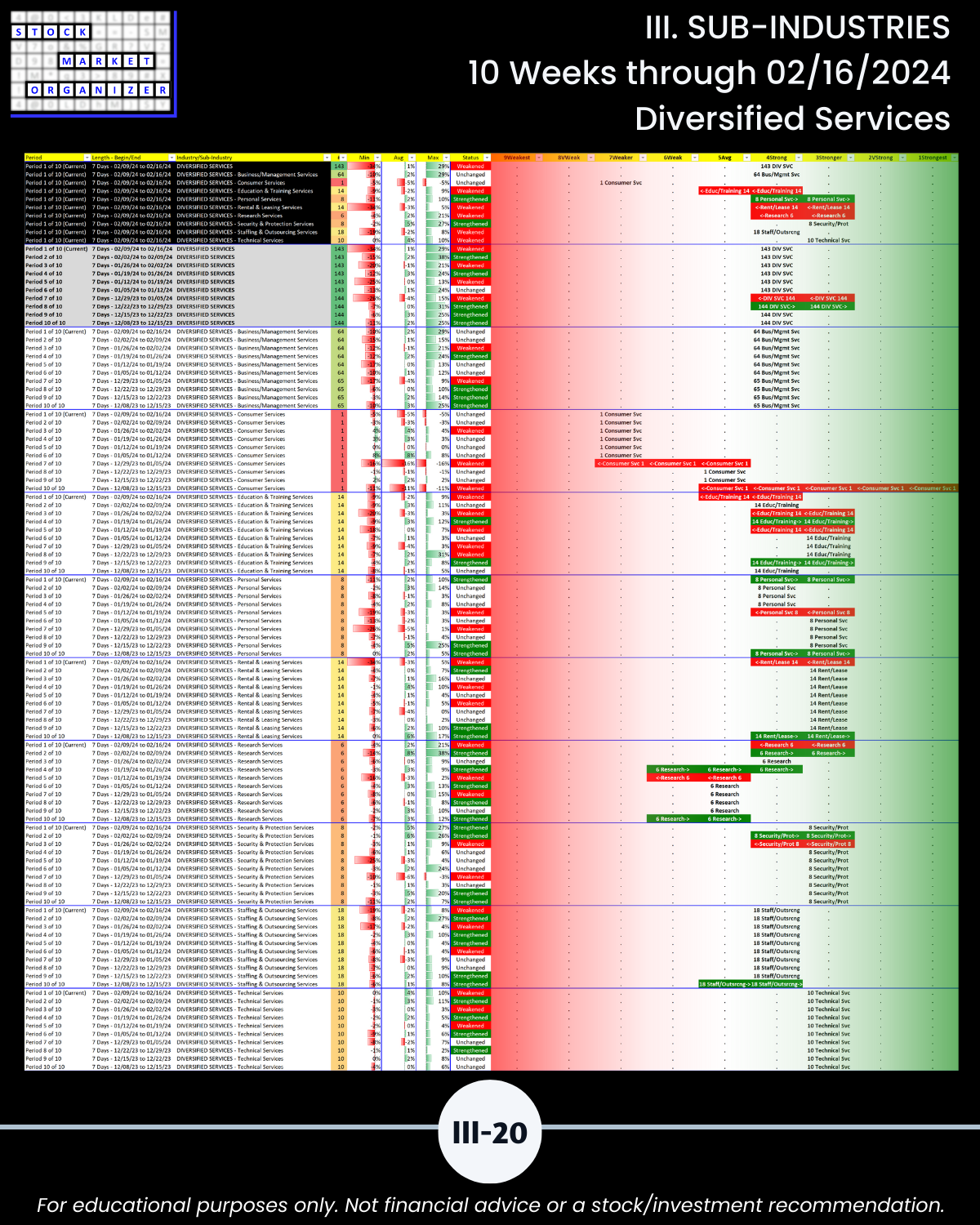

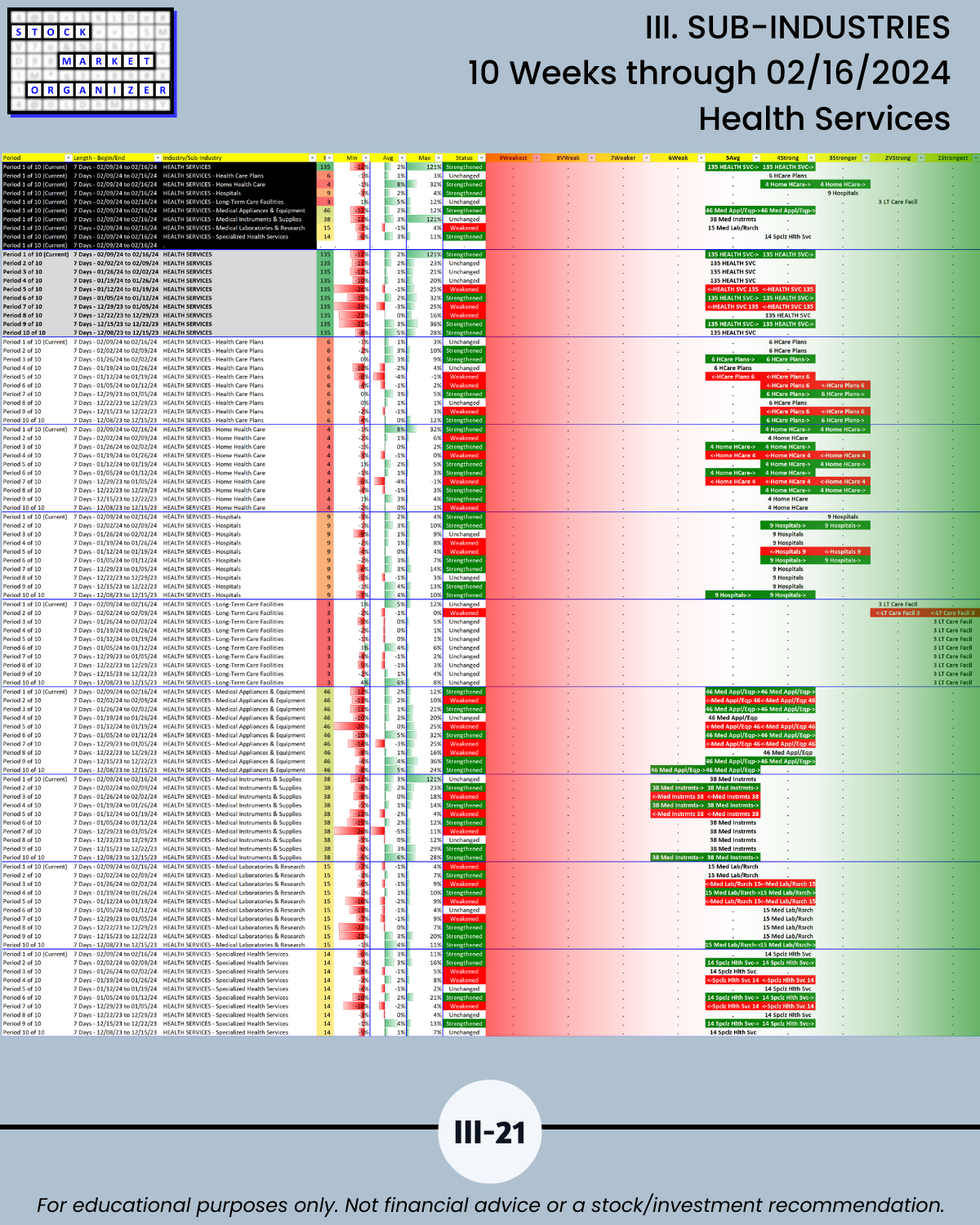

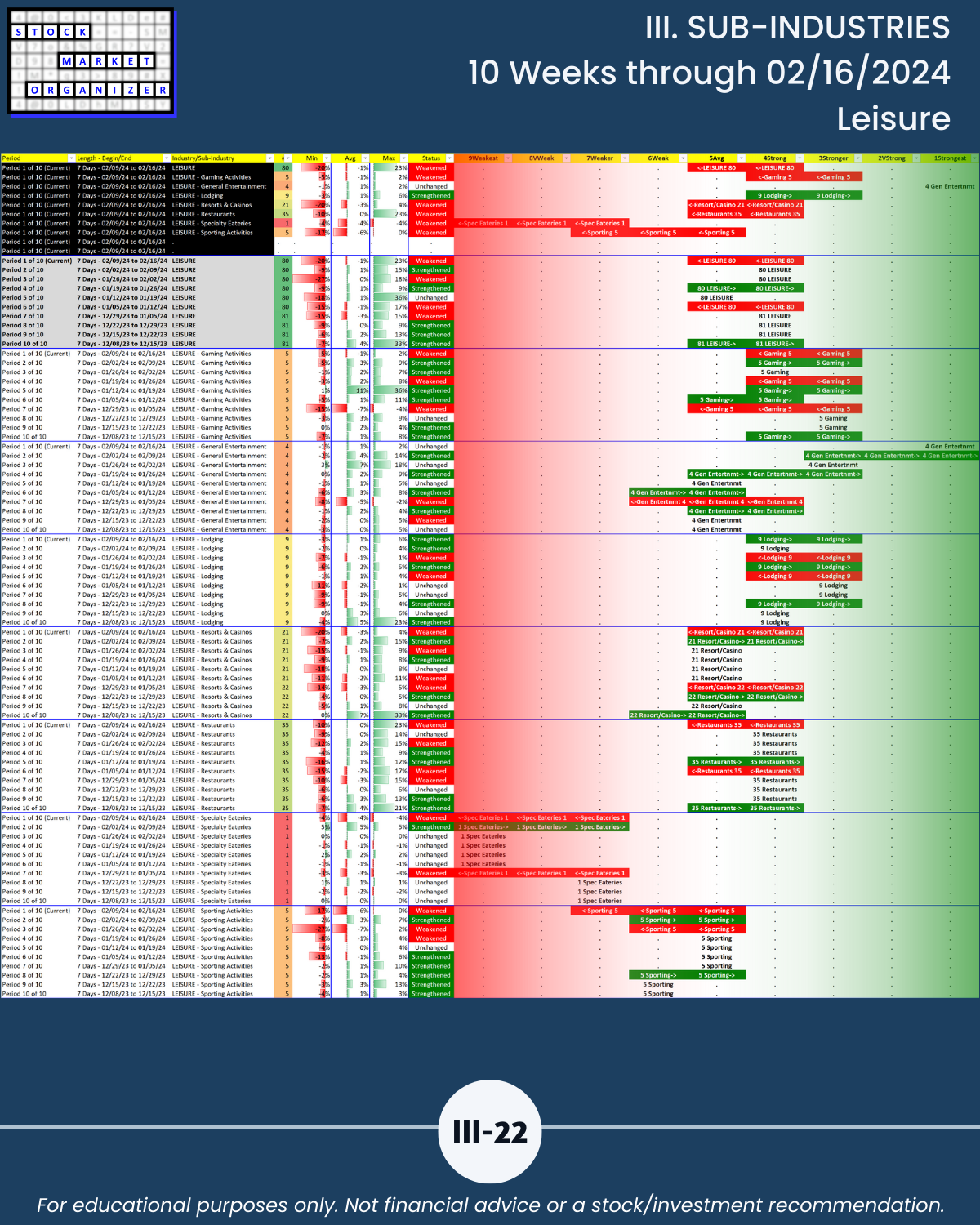

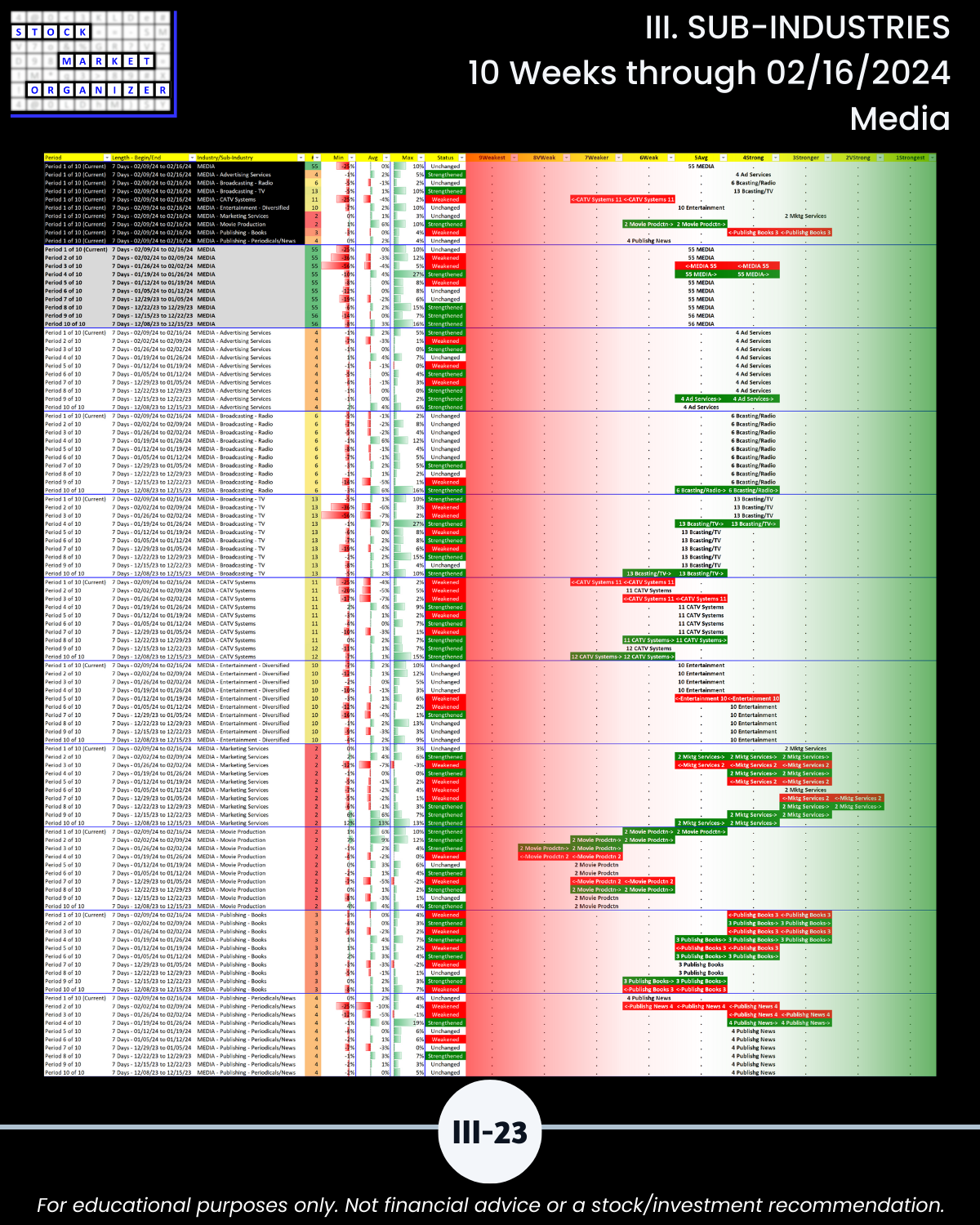

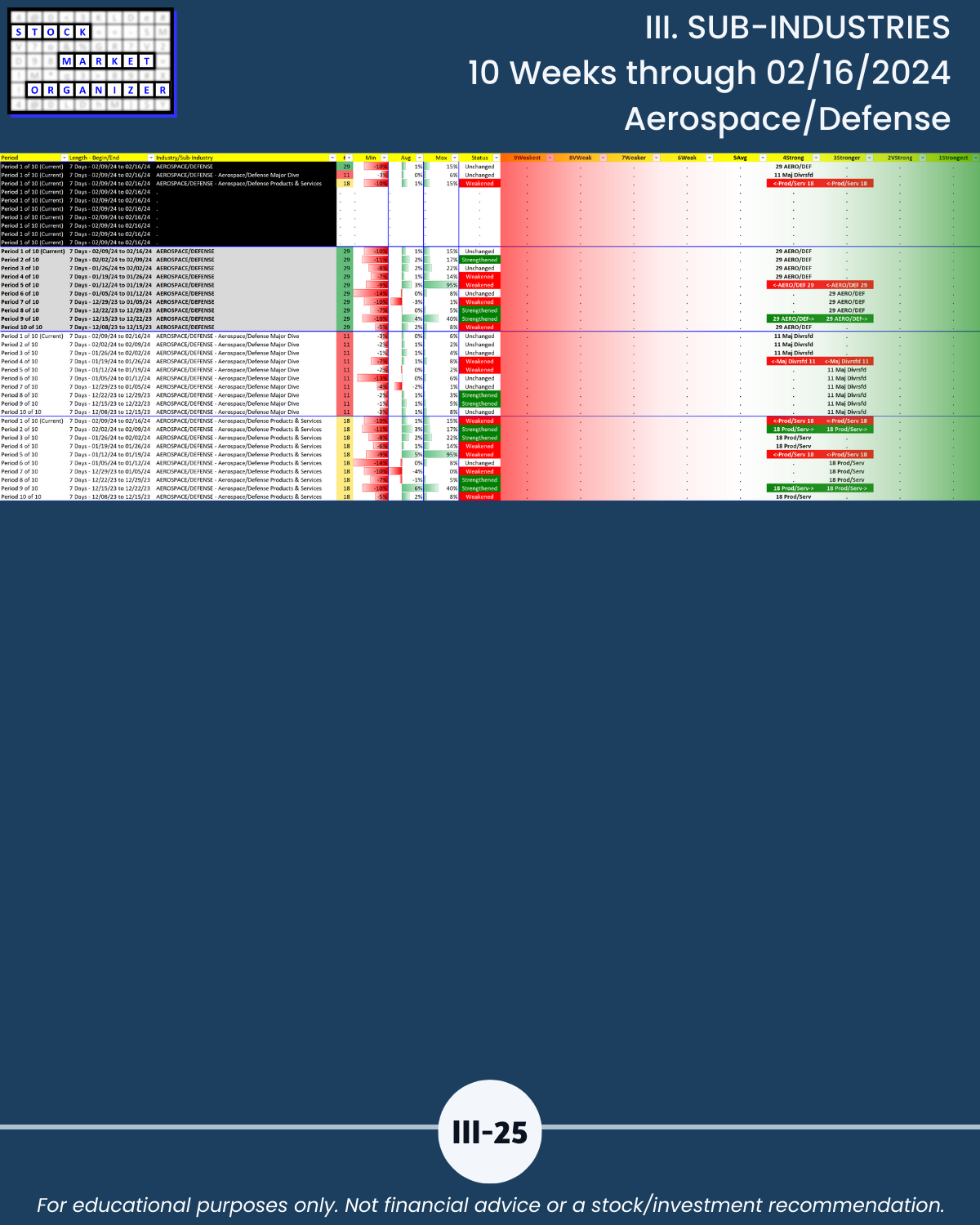

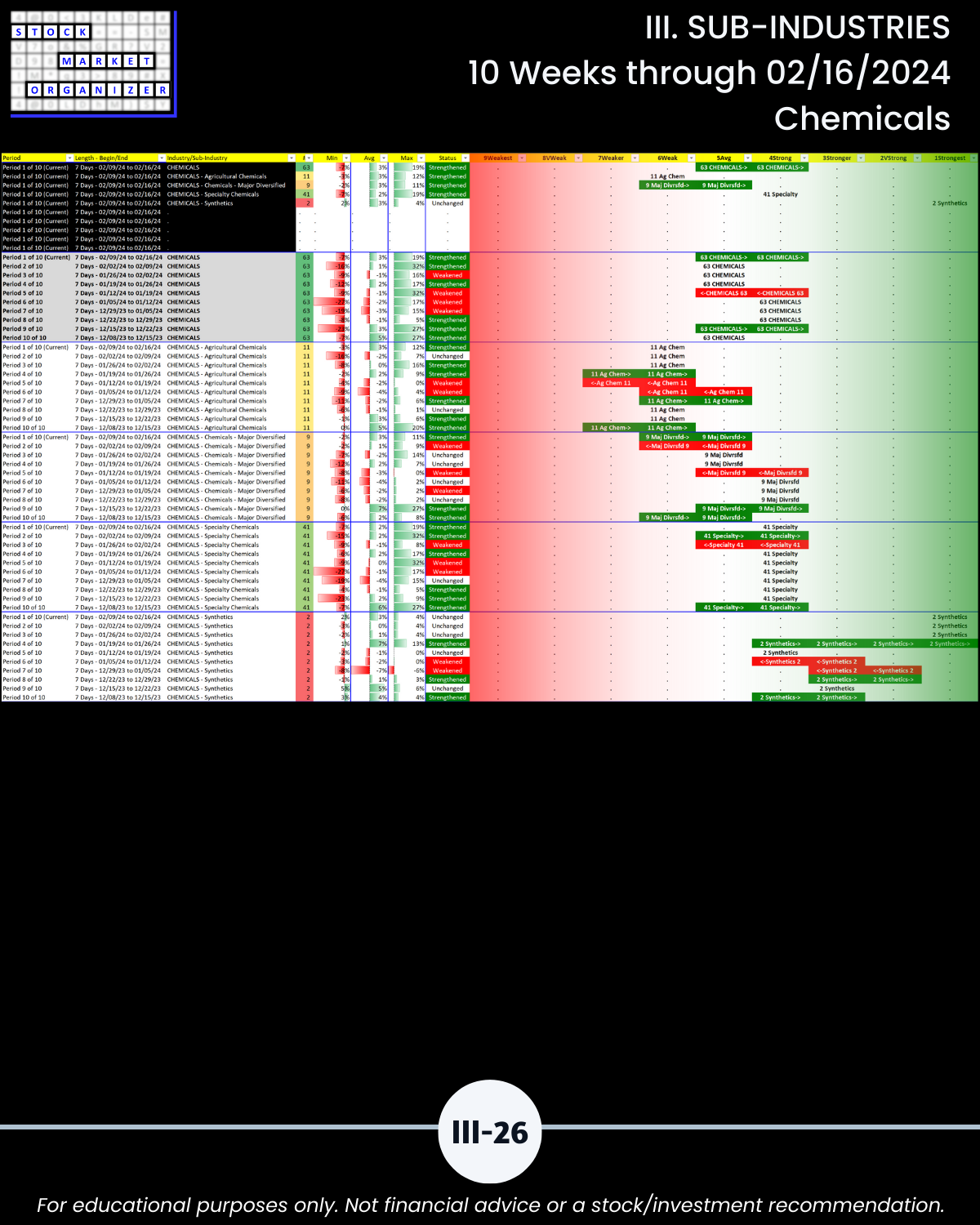

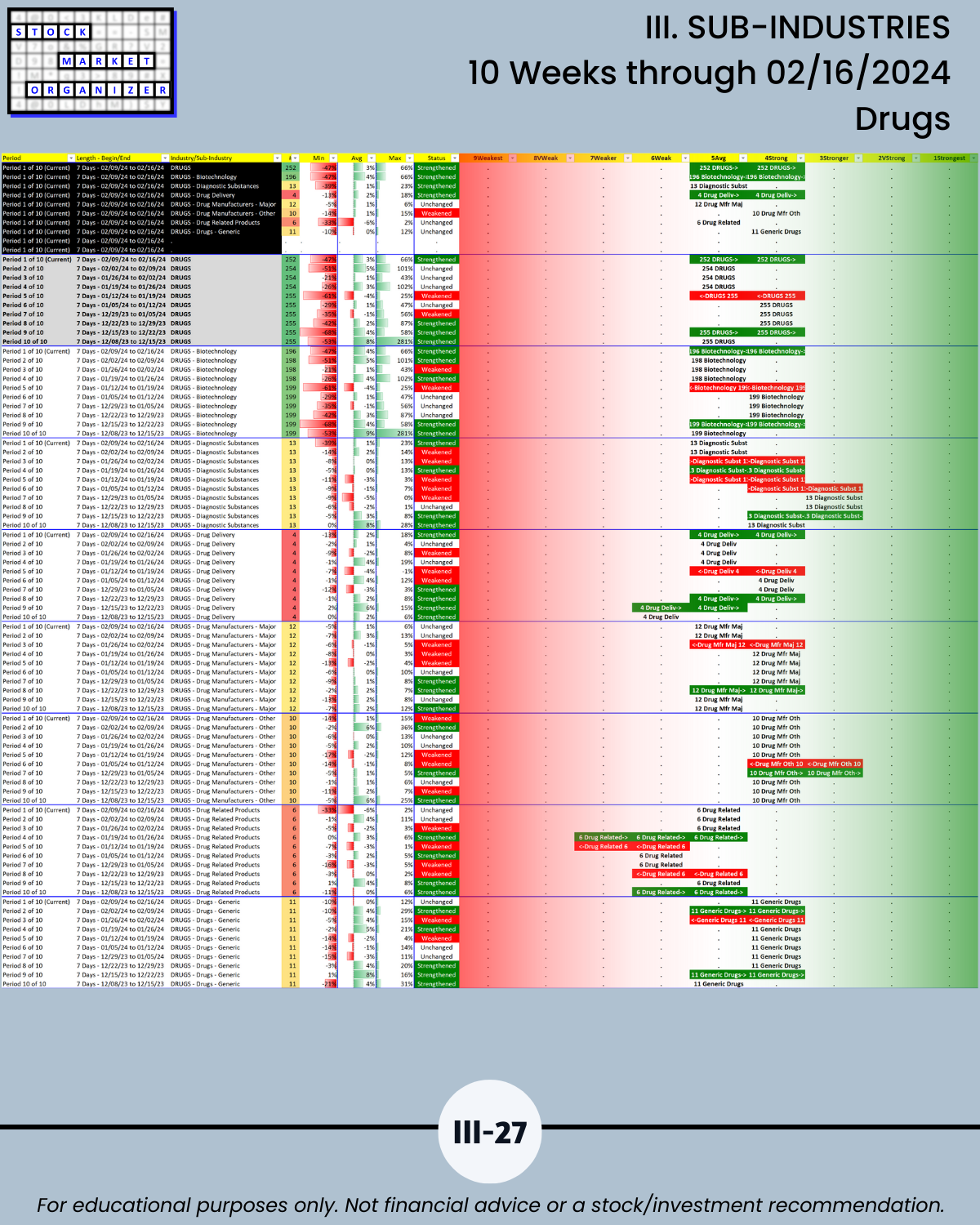

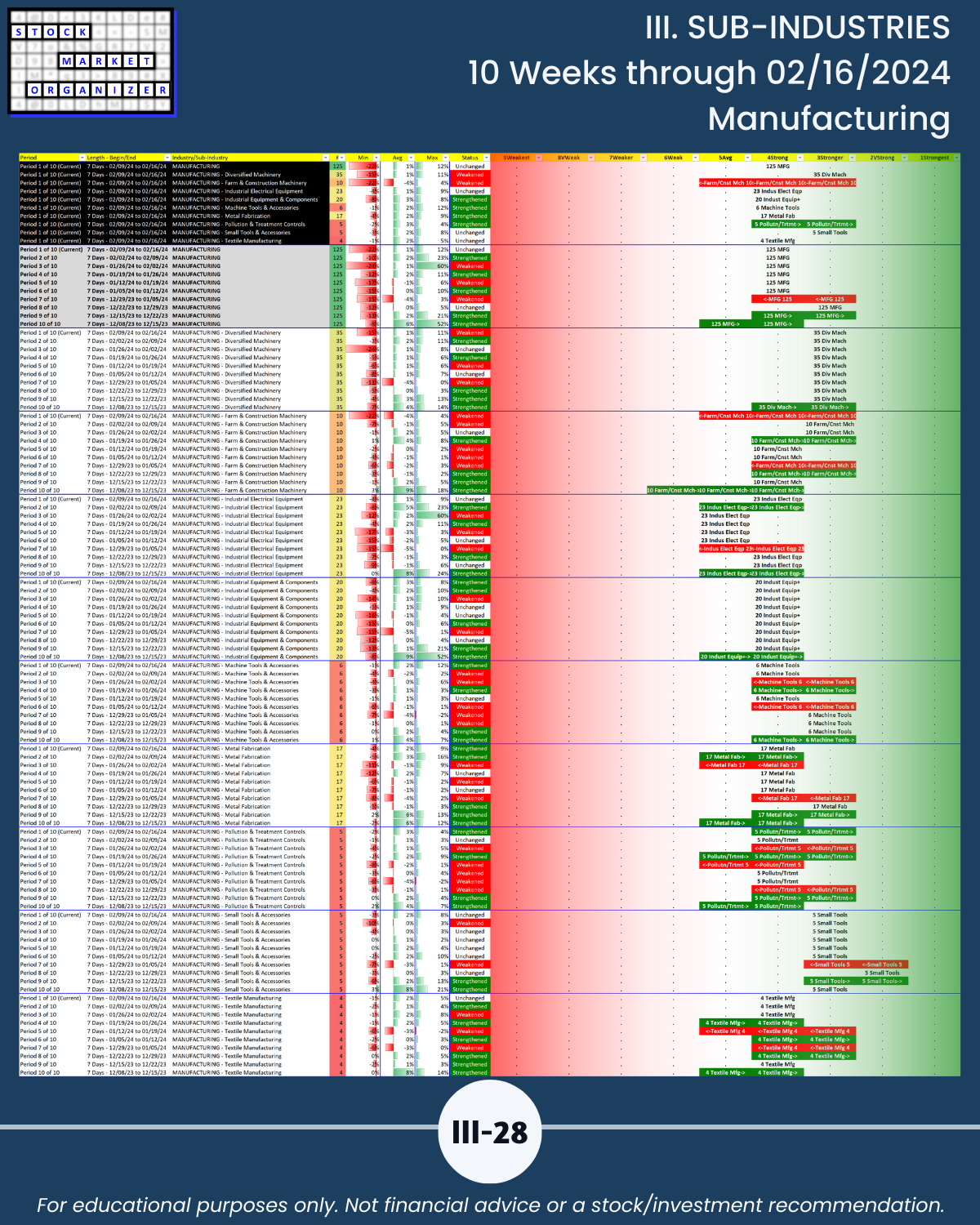

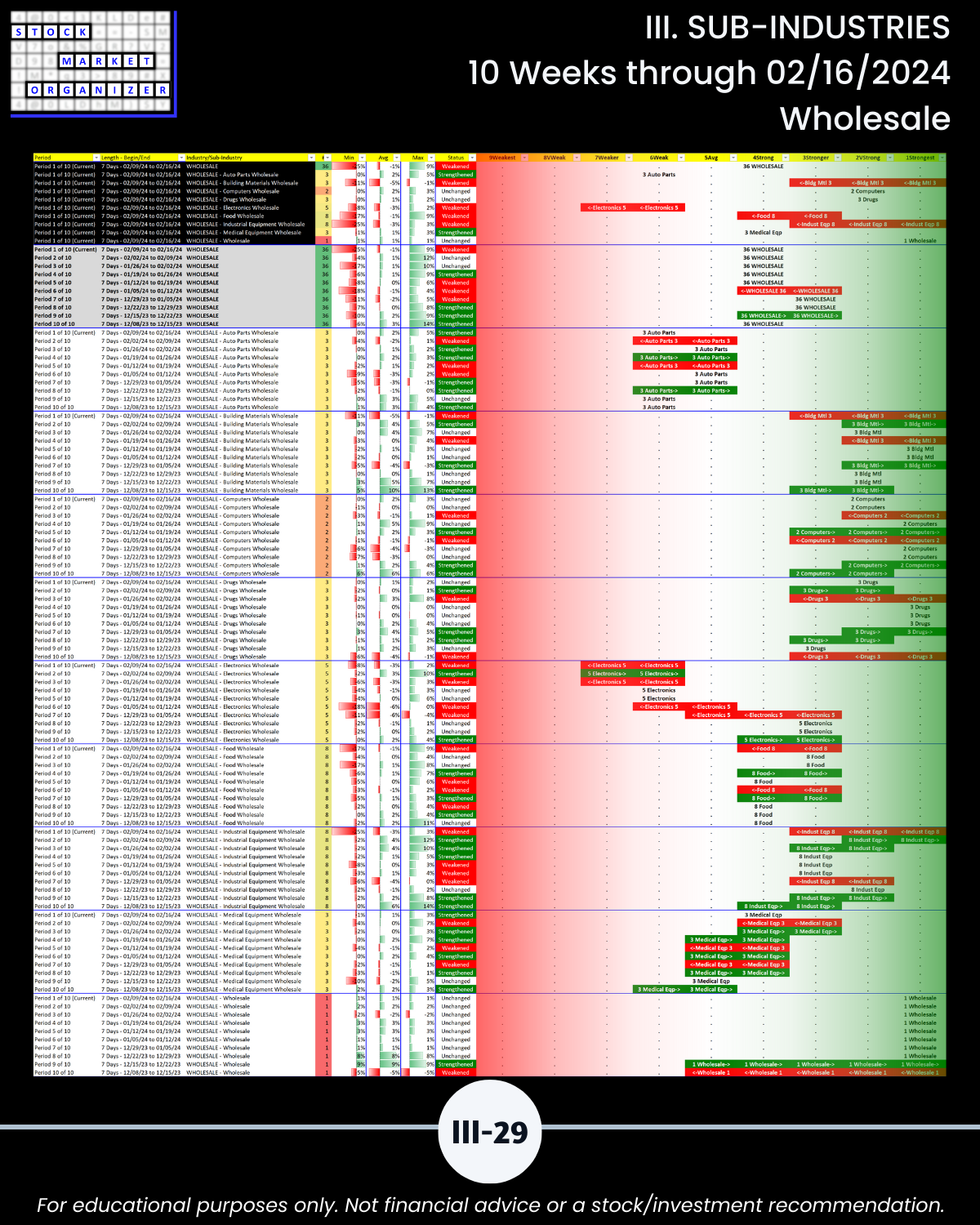

III. SUB-INDUSTRIES/10-Week Individual Sub-Industry Strength Reports

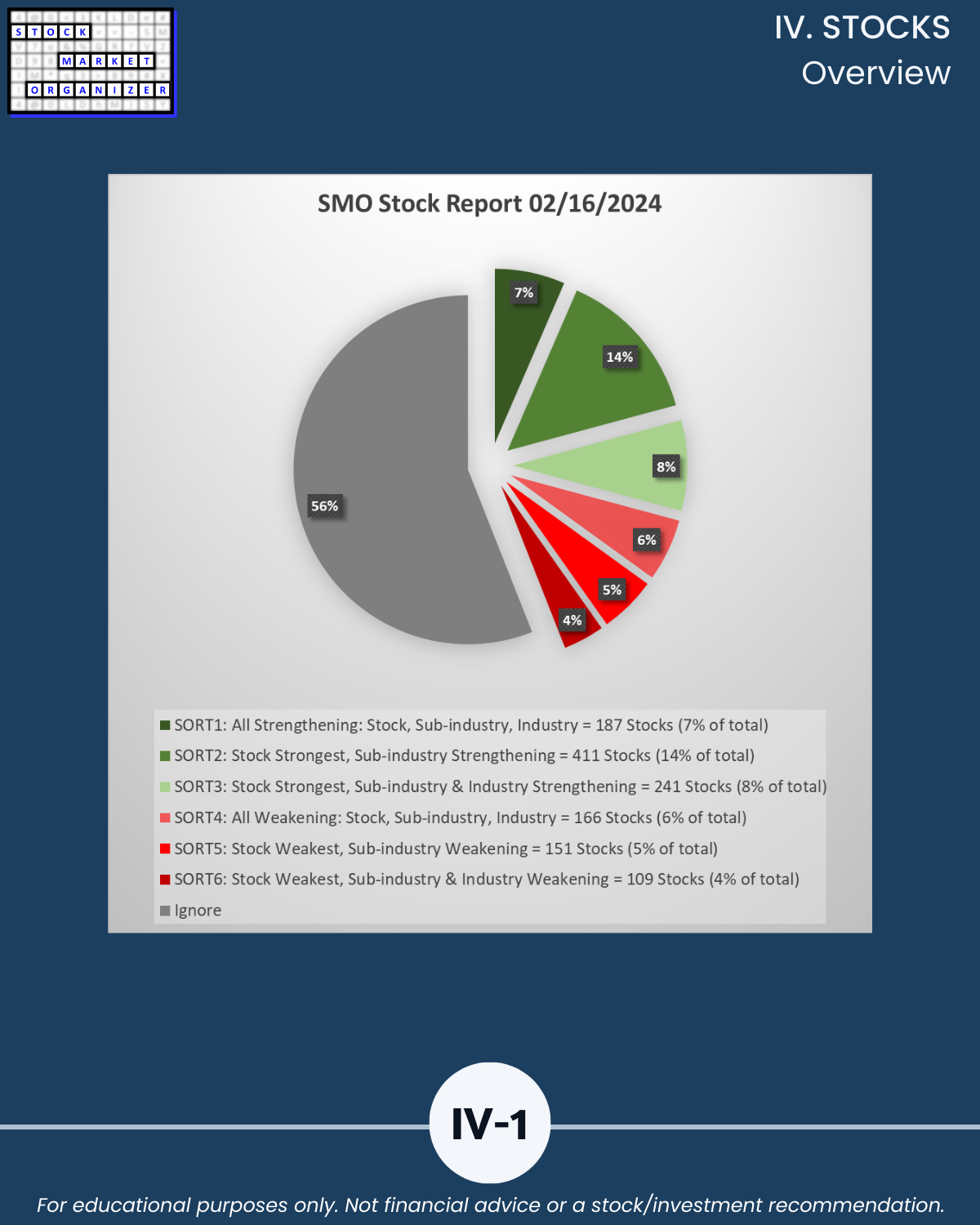

IV. STOCKS/Stock Sorts