SMO Exclusive: Technology Sector 2024-11-07 XLC and XLK ETF Stocks Detail

Summary

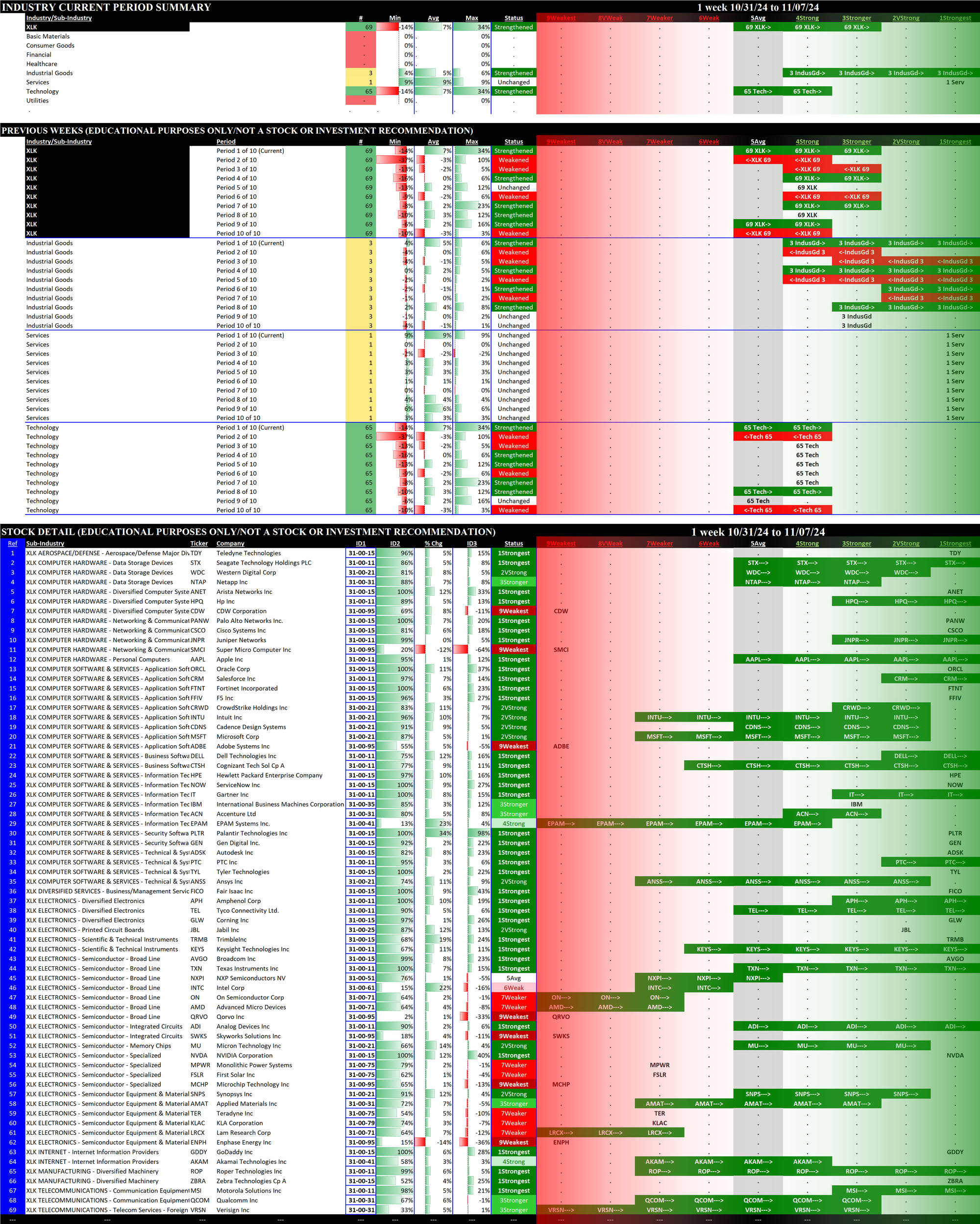

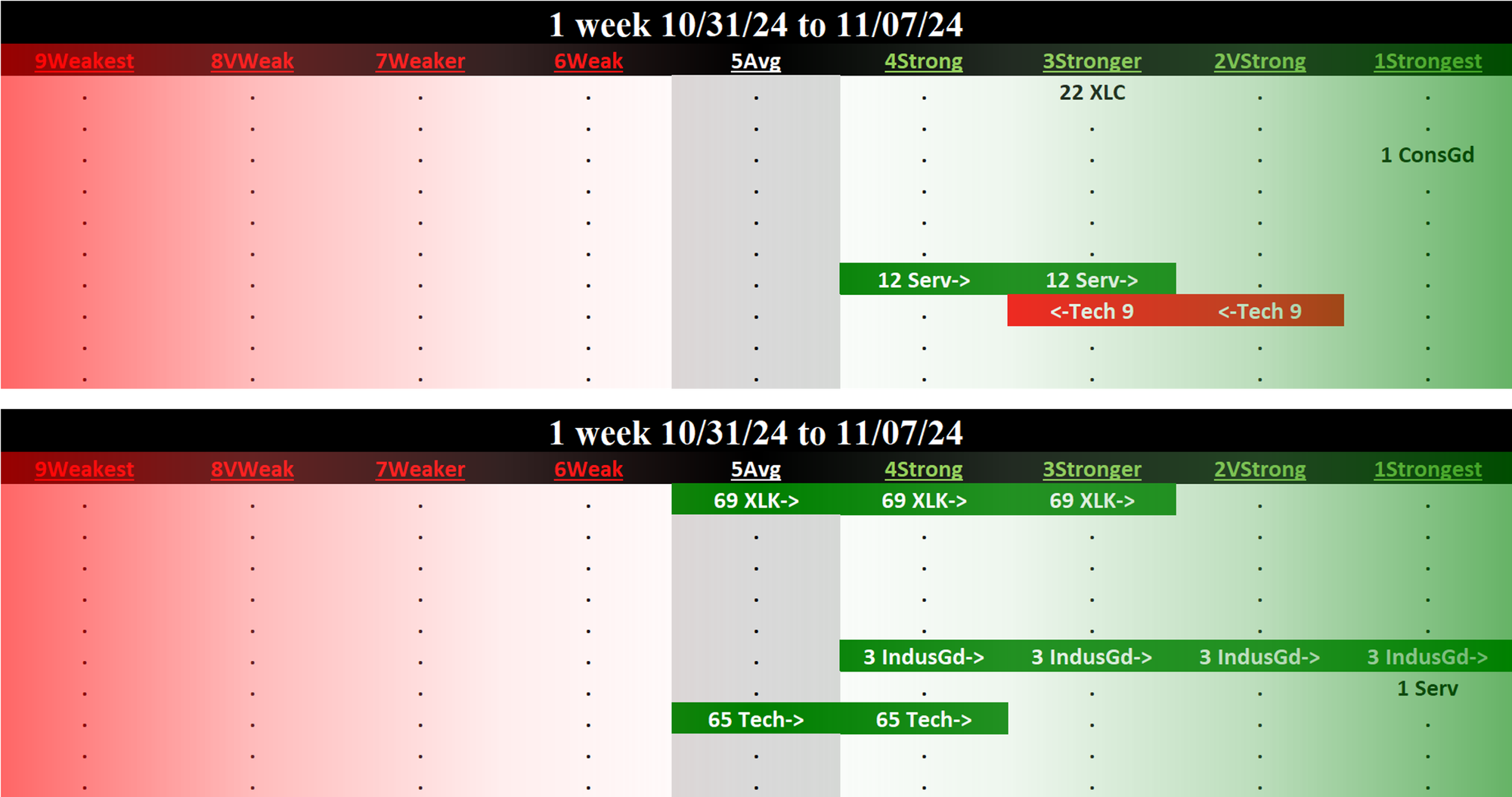

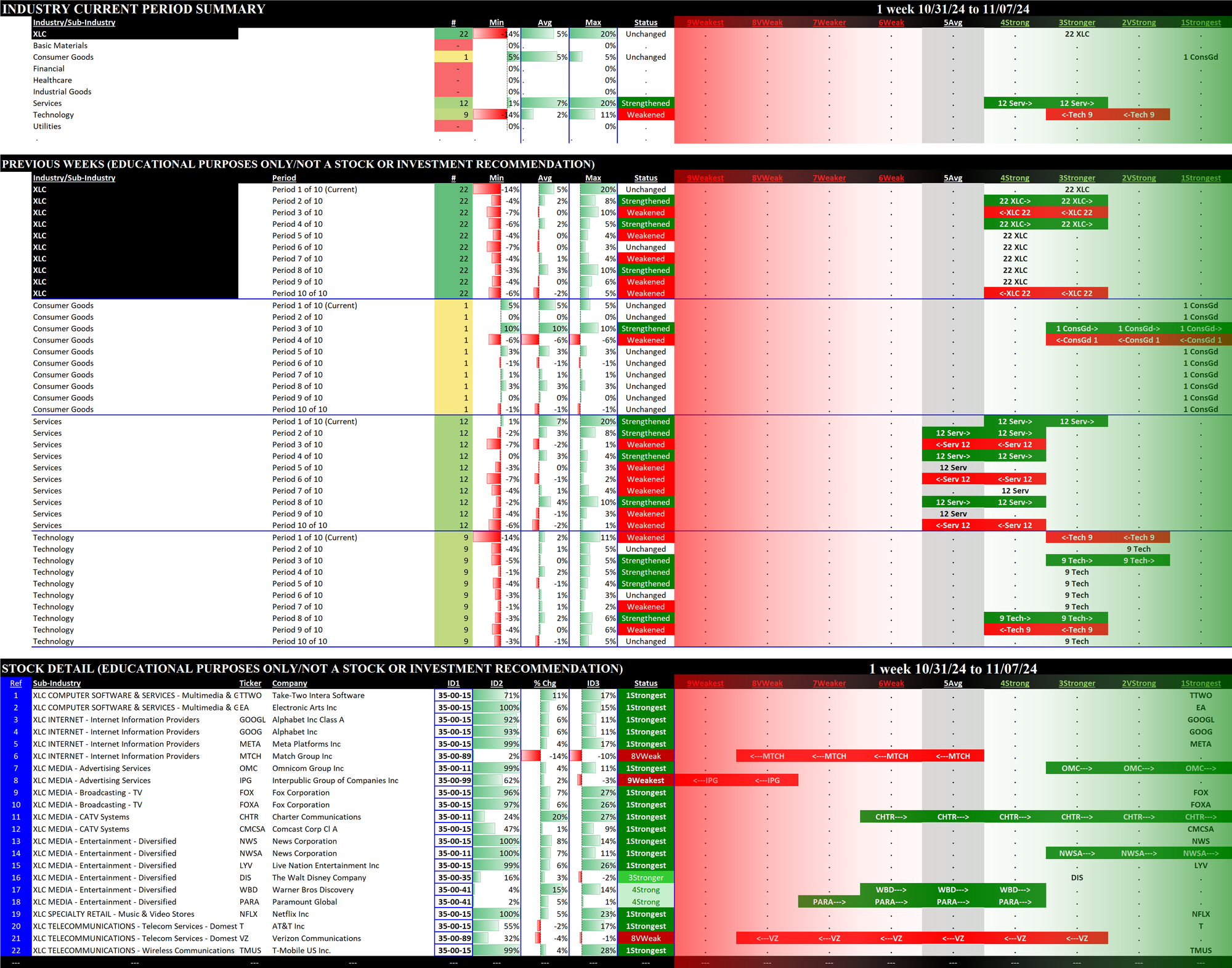

Following up the just-published Technology sector report which showed that the five Tech sector industries (in the Stock Market Organizer world) are all now rated 4Strong, this post provides stock-by-stock detail for the related SPDR ETFs XLC/Communications and XLK/Technology.

Both are now at 3Stronger, reflecting the results of the huge post-election day rally. The earlier result linked above shows that each of the five industries that comprise the Technology sector have a 4Strong rating.

The difference between the 3Stronger ETF ratings (larger market cap companies) and the 4Strong ratings from the Technology sector analysis (which includes many more companies) is due to the better relative strength in the larger cap stocks. That said, these ratings do reflect strong readings in general.

Individual Stocks Detail

See below for the current ratings of each of the 22 stocks comprising the XLC ETF and the 69 stocks comprising the XLK ETF.

The lowest section shows stock-by-stock strength ratings, with stocks segregated by sub-industry. The green bars indicate stocks that strengthened rating during the week while the red bars indicate stocks that weakened rating during the week. Tickers not highlighted were unchanged for the week.

XLC/Communications

The top portion shows that this ETF was unchanged at 3Stronger for the week.

XLK/Technology

The top portion shows that this ETF strengthened two strength levels during the week.