SMO Exclusive: Strength Score 2023-09-27 (objectively answering the question "How low is low?")

Introduction

The SMO Strength Score, like the Sector Risk Gauge, is a tool I created to answer the question "how low is low?"

It is part of my methodology to systematically prevent unforced errors and eliminate emotions.

The moment one iota of emotion is introduced into a decision-making process, one starts heading down the path of sub-optimal outcomes. Unacceptable.

Each of the following is absent from my system: bias, emotions, feelings, interpretations, and opinions. And any of their cousins. How do I do this? Through use of original, exclusive tools like the Strength Score.

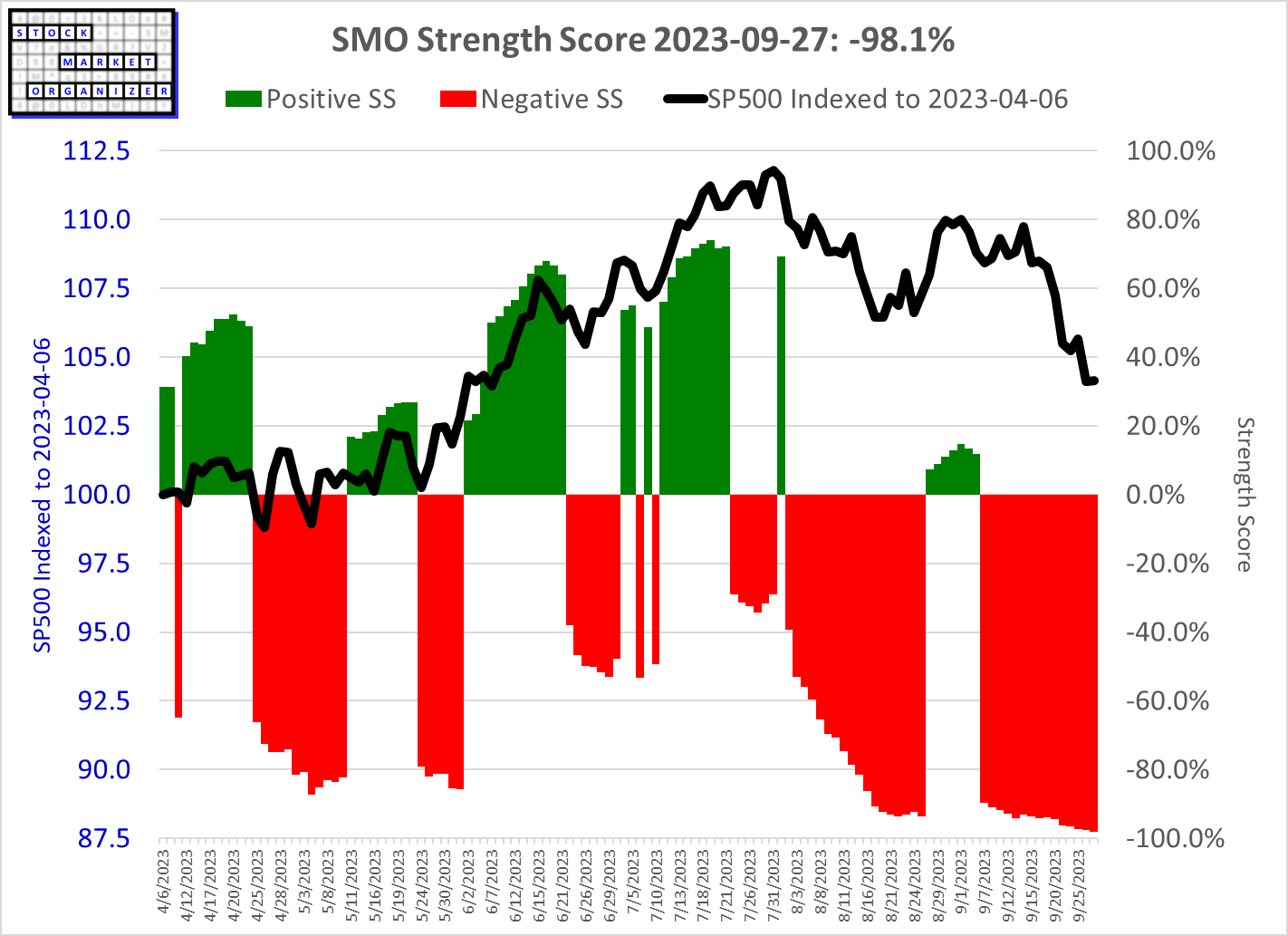

Current Strength Score Reading: -98.1%

The numbers are what they are and this is all that will determine what if anything I do. But note that the market hasn't really declined much percentage-wise. It is possible that the market capitalization-weighted construction of the S&P 500 is masking the selling that has taken place underneath the market's surface. The Magnificent 7 have certainly garnered much press for their year-to-date performance (which has dropped off lately). Nonetheless, such speculation is 100% useless and I act based on objective calculated numbers (like those from the Strength Score) rather than any feelings and opinions I or others may have.

What this reading means

-98.1% means today's market strength ranks below more than 99% of all previous readings dating back 24 years. The possible scale is from a low of -100% to +100%. The readings include those from the massive 2000-2002, GFC, and Covid shutdown-era declines.

BUT:

1. This doesn't mean it can't get worse.

2. As I noted in this recent post about Banking (which has had a hard time lately):

In a weakening market, caution may still be warranted when long-term risk is paradoxically and objectively "low" (because a lot of selling has taken place) but short-term risk remains high at a visceral level due to the prevailing skittishness of investors afraid of more downside and therefore quick to pull the sell trigger, which in itself could cause another selling cascade. And so goes the vicious cycle.

Bottom line, a low reading isn't carte blanche in my book for buying everything in sight. I do not catch falling knives.

Of course there are no guarantees. That stated, I trust my analysis enough to get me in when conditions are supportive, without guessing.

Digression: about investor psychology (a "why" for the Strength Score)

When others panic, you get hurt

Investor psychology is the X Factor in market bottoms. If we could simply measure when the market was "low," whatever that may mean, we could simply buy then and be done with it. Then we could wait until the market was "high" and then sell, repeating the process when prices were again low.

At potential market bottoms, though, "low" can be a trigger for "panic." Unstable investor psychology gets triggered when people who aren't used to hard-earned invested cash disappearing in a puff of smoke see red on their monthly statements. At some point during a decline, it is possible for an orderly decline that provides an excellent long-term buying opportunity to instead turn into a chaotic selling cascade that induces panic and widespread portfolio destruction in a vicious cycle of selling begetting more selling. This stops when there is no one left to sell... which could mean after many stocks have taken 40%, 50%, 75%, 90%, even 100% losses.

We've had 3 such cascades since 2000. They can not be considered rare. And now that we have apparently come to the end of a 4-decade falling interest rate environment that has served as a rising tide (see this post) , we have an insanely large amount of U.S. national debt ($33 trillion - incredible), and the prospects for a coming recession are high (am not a soft landing believer), I believe the chances of another selling cascade reasonably soon are uncomfortably high. No, this is not a prediction - and I have a system that accounts for all scenarios, not matter how sunny or hostile they may be. But an objective look at the facts withstands any spin about how great things are today. And this can't lead to good market events.

Remember that a 50% loss requires a 100% return just to get back to break even. This time lost that is then required to make up that loss (if it ever happens) dramatically and negatively impacts your ability to attain the "average" market return of 10% that every advisor tells you you'll get when exhorting you to dollar cost average, be a Long Term Buy and Holder, and heed the insanity of "it's time in the market, not market timing." (A post for another time - there's a material difference between compound interest and average annual stock market returns. For now, I'll just say that absent anything weird happening interest on a bond is fact while attractive average annual returns on a stock are fiction.)

Back to the main X Factor issue. Your portfolio takes a hit when others panic. And you never really know when this is going to happen. It's like the avalanche that is triggered by that one last, tiny little snowflake that lands and sends destruction hurtling down the mountain. When does that last bit of market information land that triggers a selling cascade?

How not to get hurt (too badly) in a selling cascade

If and when this happens, it will be critical that you know how to minimize portfolio damage and then take advantage of the exceptional long-term opportunity that you'll have.

To do this, you'll have to:

1. Always have a step-by-step plan for what you'll do, when, how, and why regardless of market environment.

2. Unemotionally execute your plan.

Be unemotional.

How do you do that? Start with objective tools like the Strength Score.

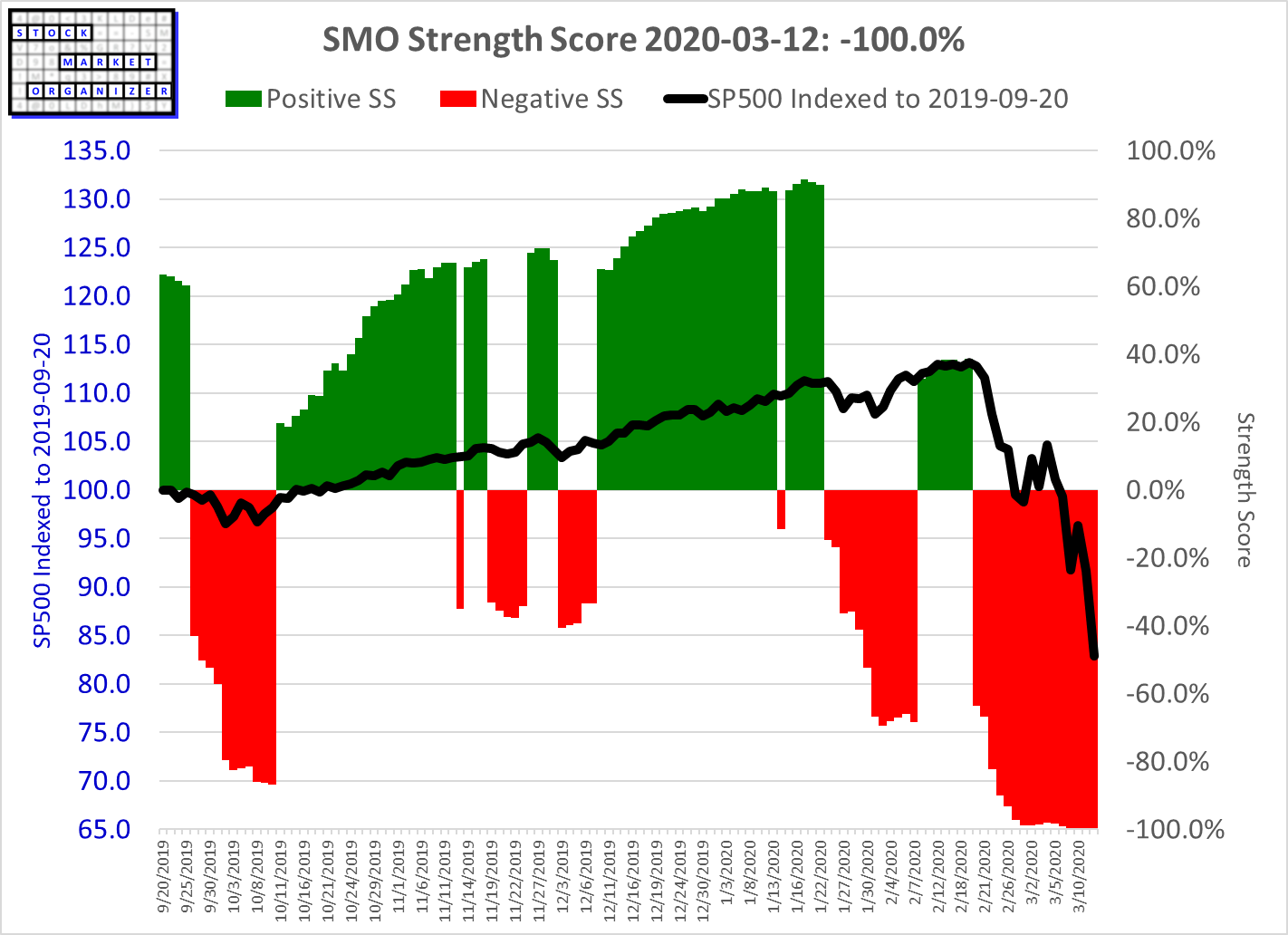

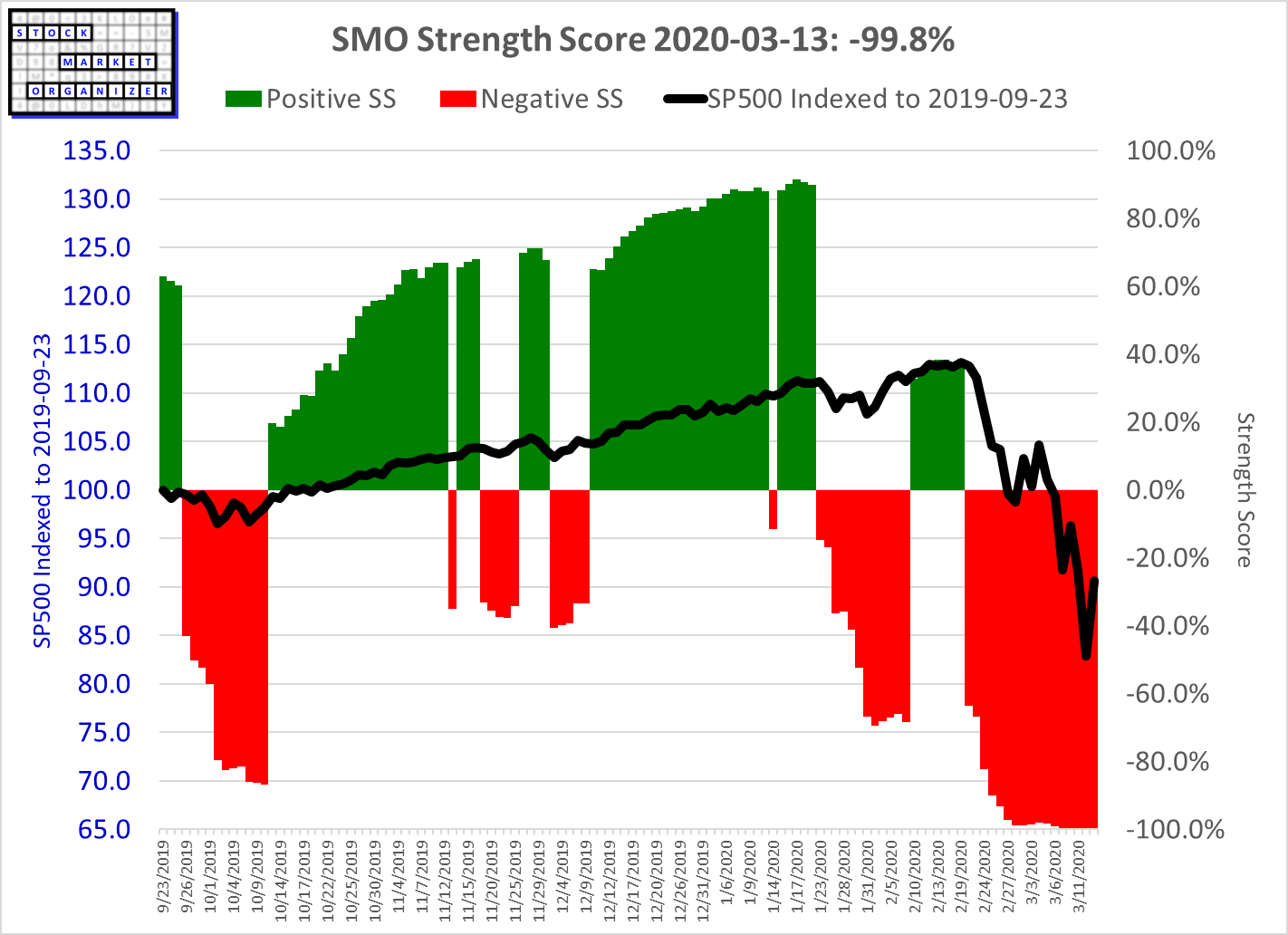

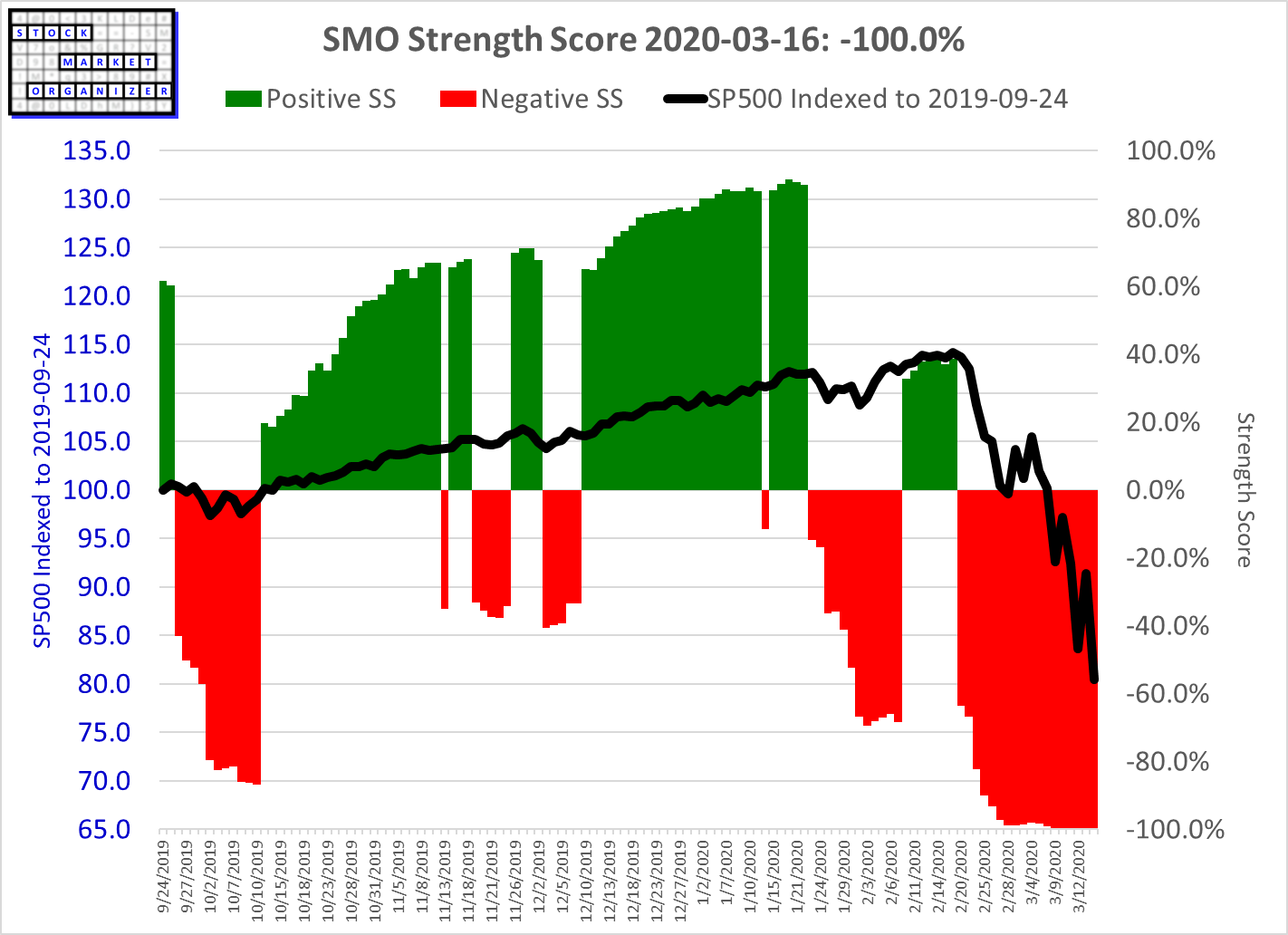

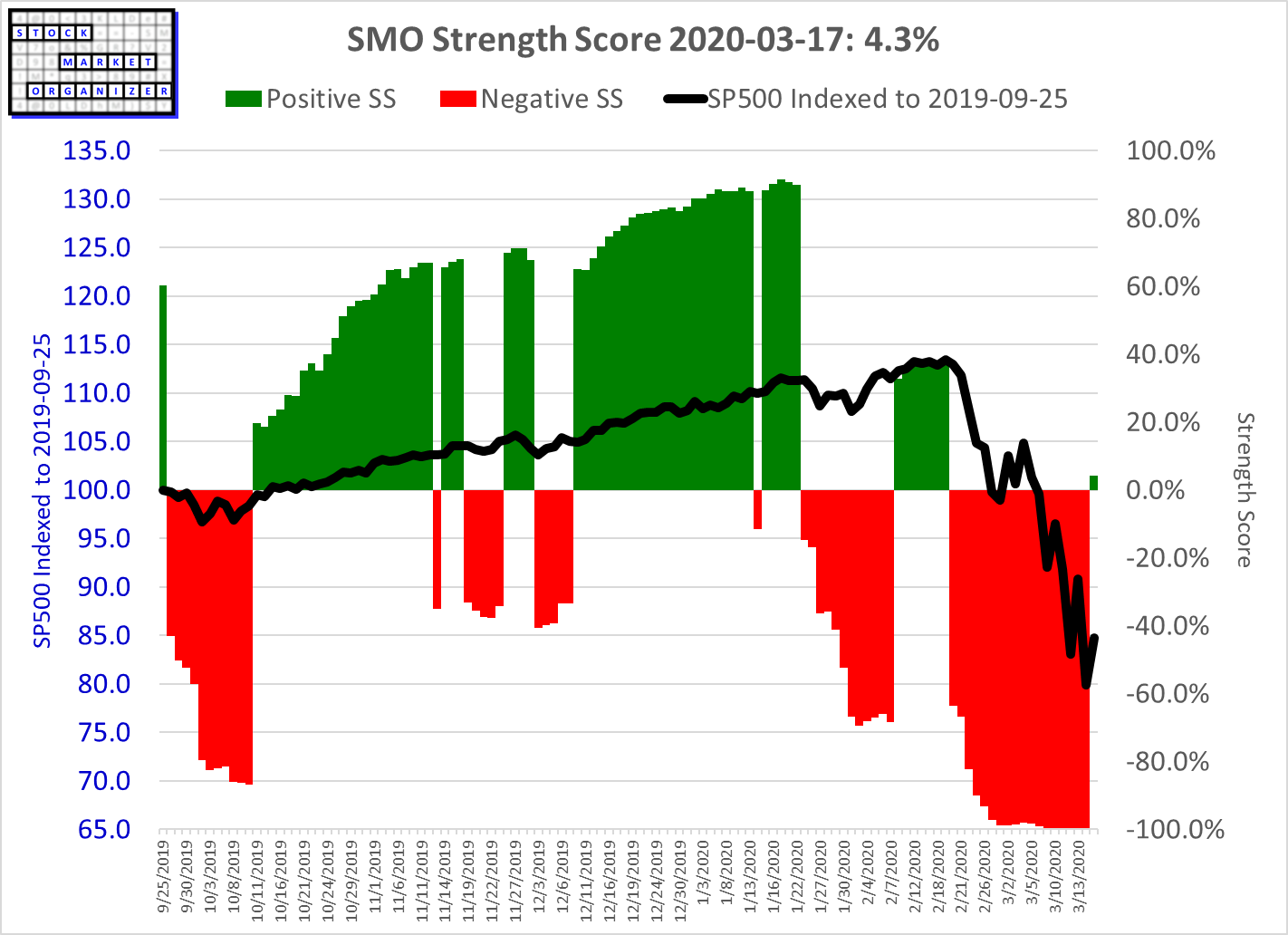

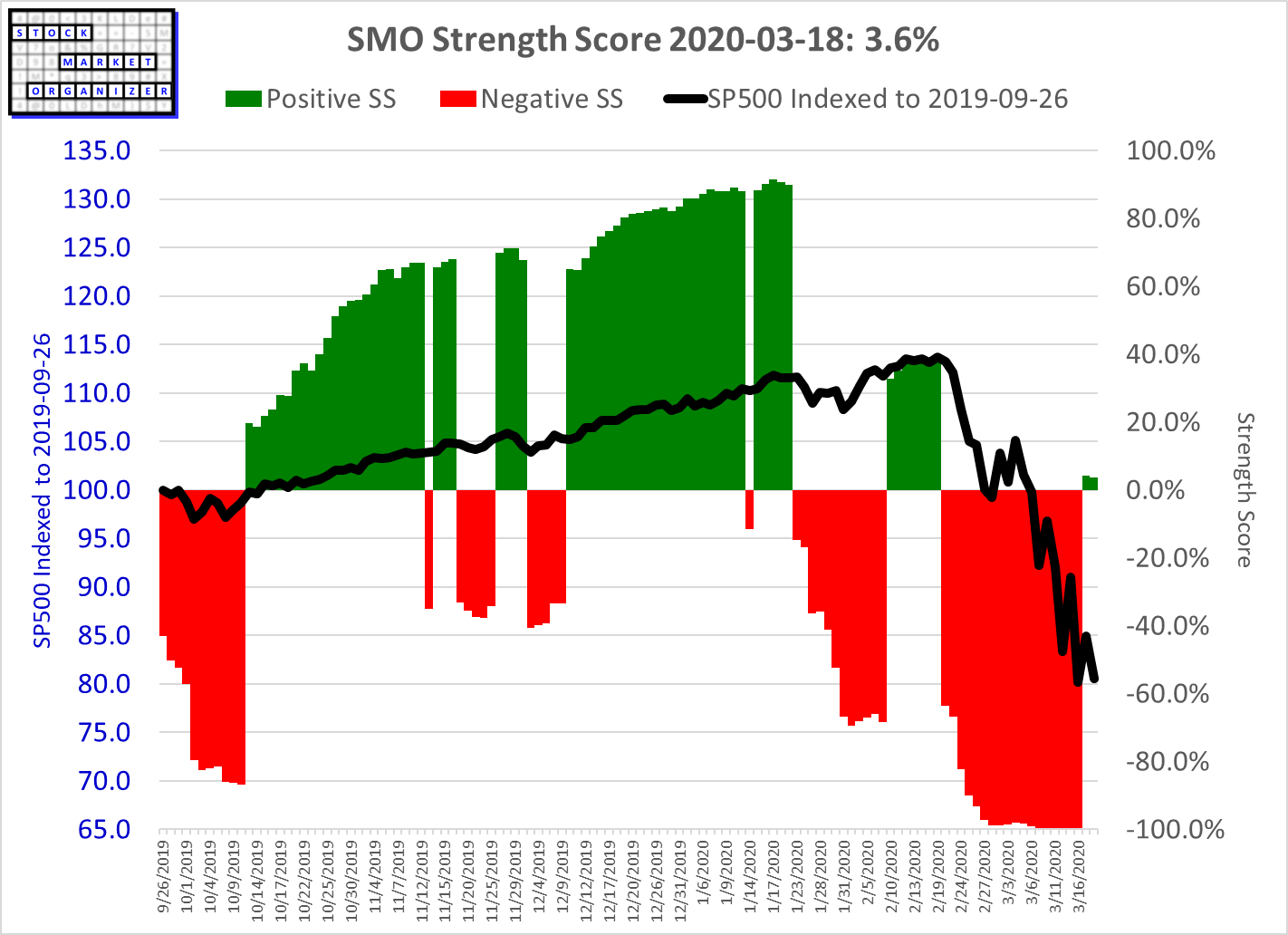

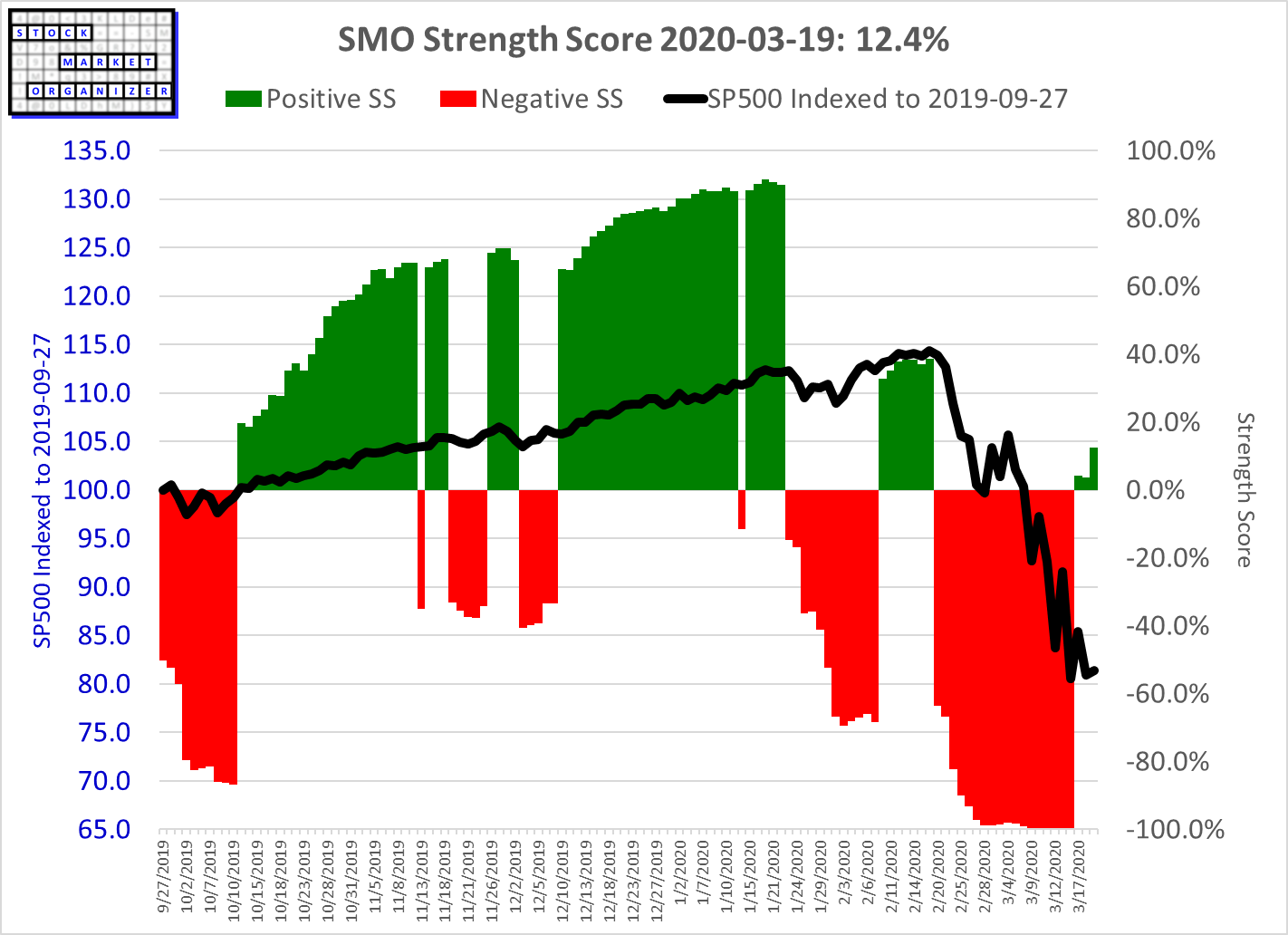

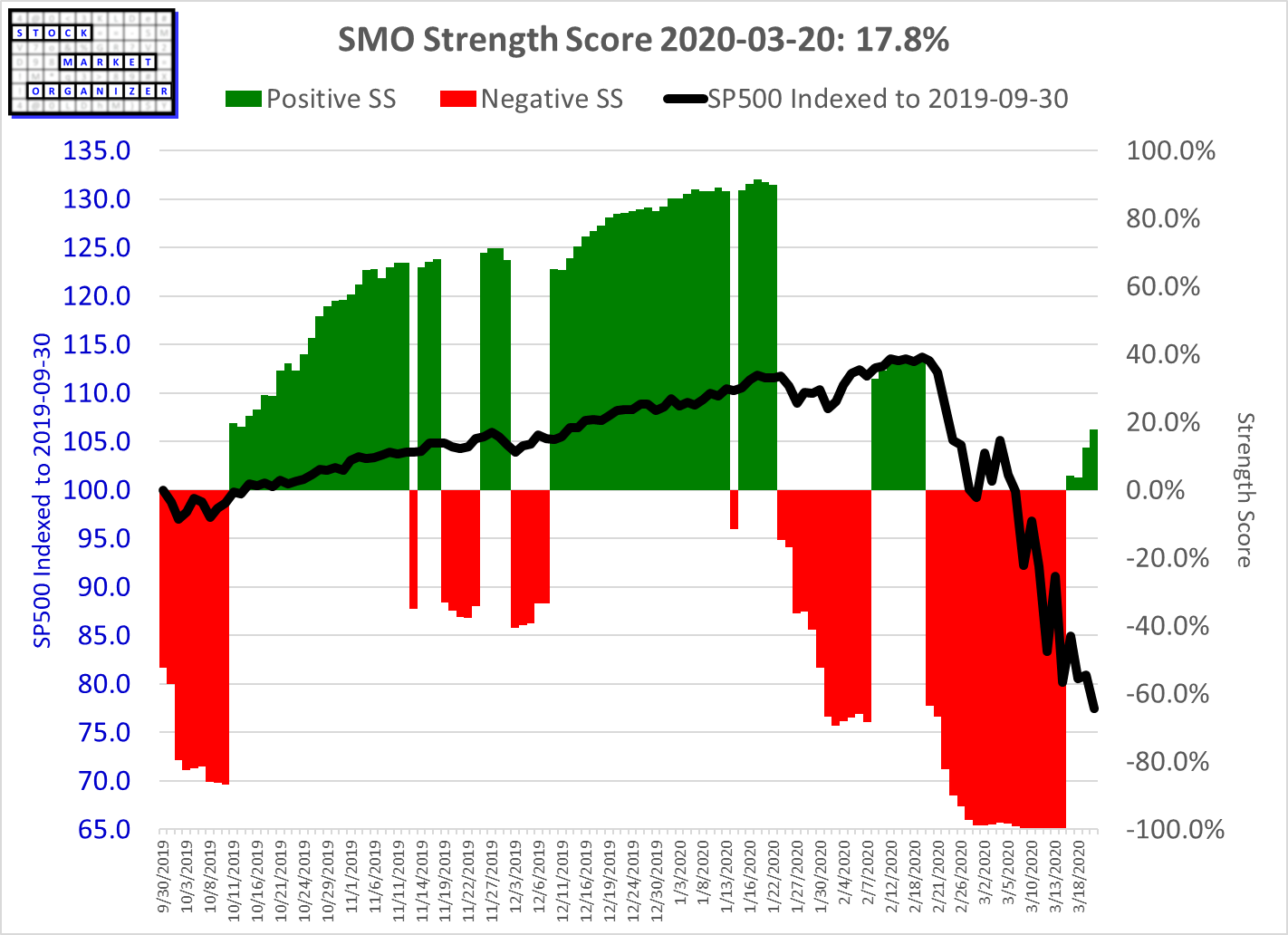

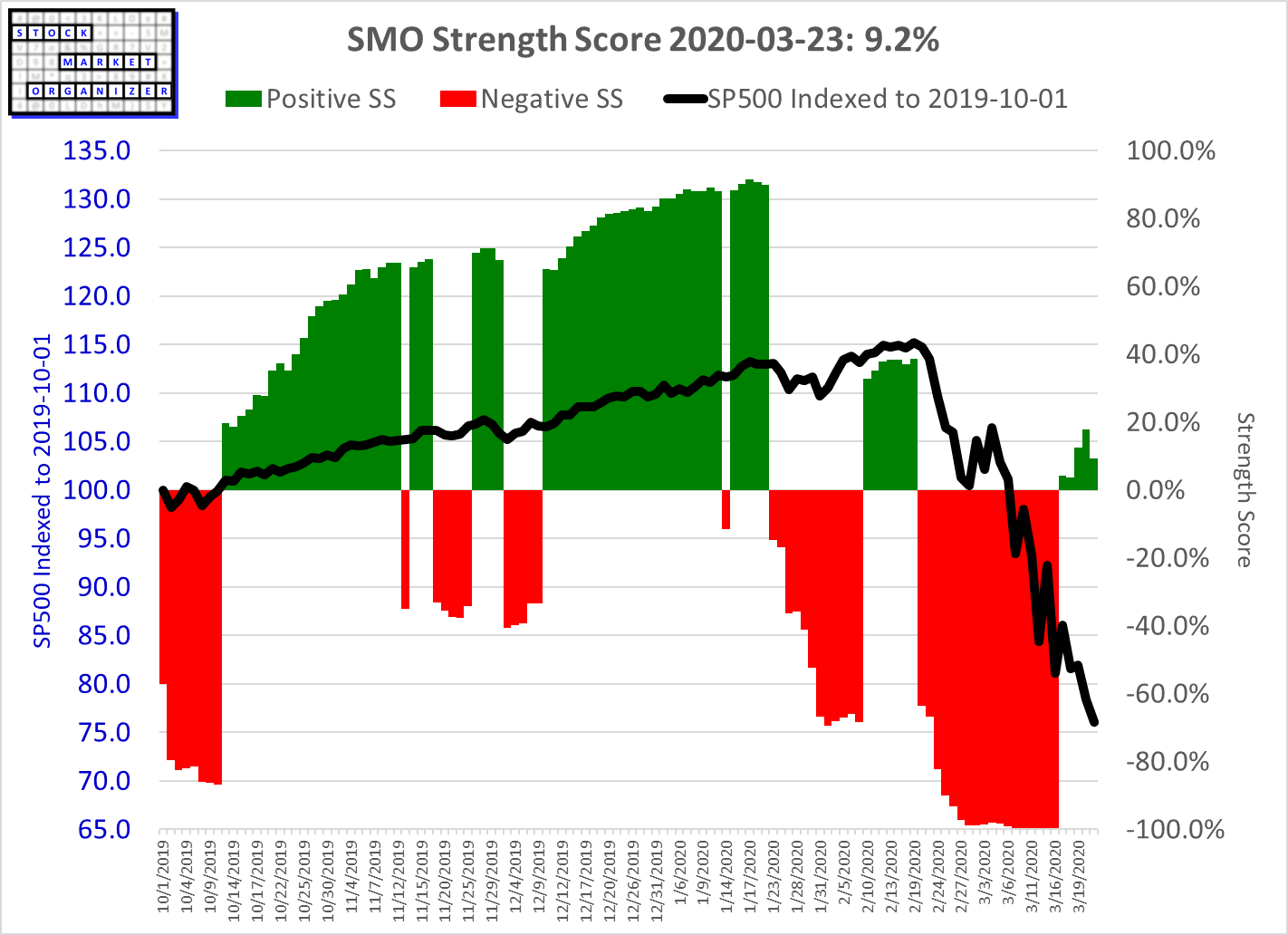

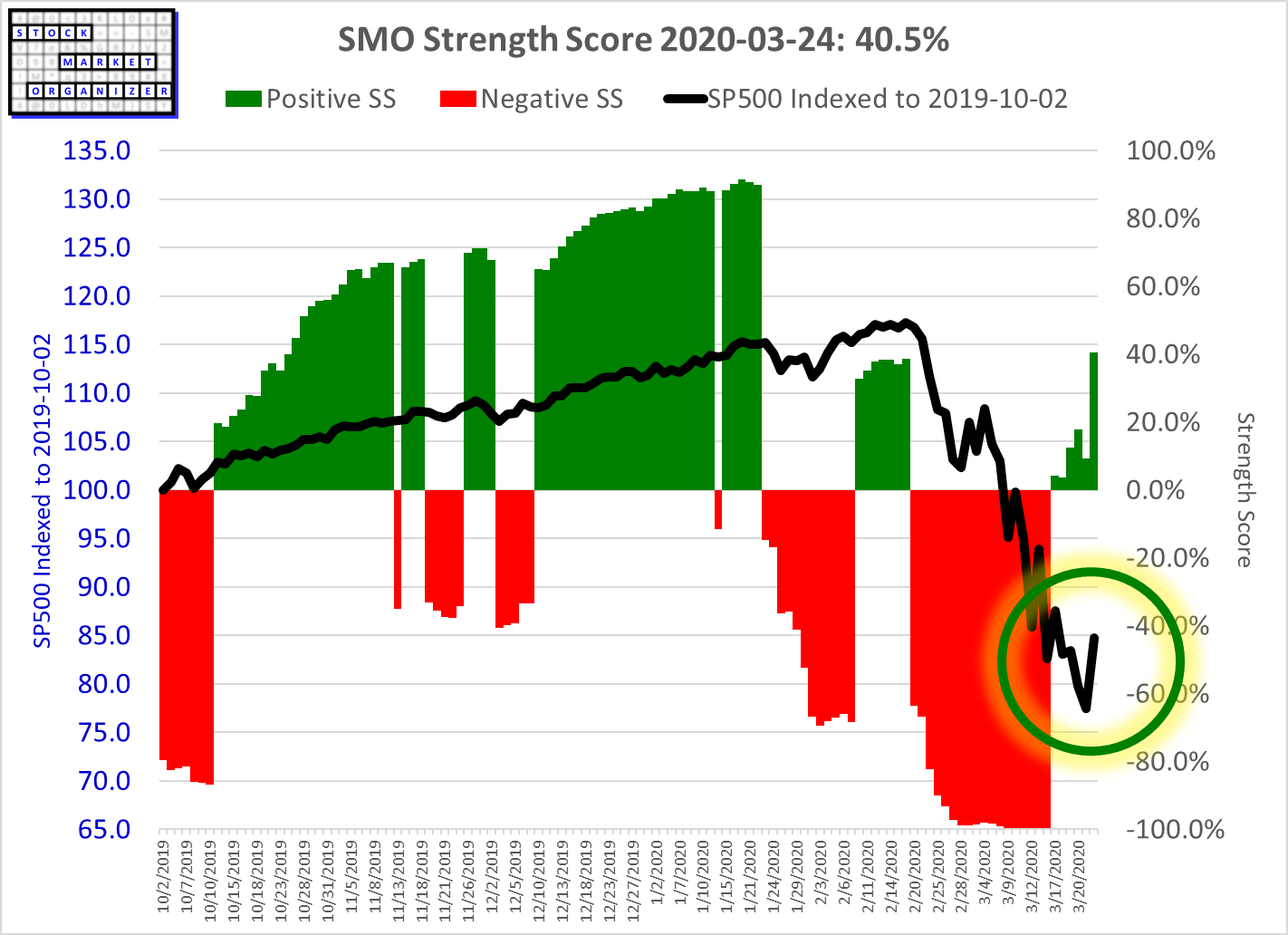

Context: March 2020 Covid shutdown-era decline

Objectively answering the question "How low is low?"

Below are selected readings from March 2020 to put into context today's reading.

Punch line: today's reading is only slightly lower than these (which reached -100%).

While this may represent an excellent long-term opportunity, it's worth repeating and keeping in mind this cautionary note from above:

In a weakening market, caution may still be warranted when long-term risk is paradoxically and objectively "low" (because a lot of selling has taken place) but short-term risk remains high at a visceral level due to the prevailing skittishness of investors afraid of more downside and therefore quick to pull the sell trigger, which in itself could cause another selling cascade. And so goes the vicious cycle.

9 daily readings from 2020-03-12 to 2020-03-24