SMO Exclusive: Strength Report Technology Sector 2024-07-18

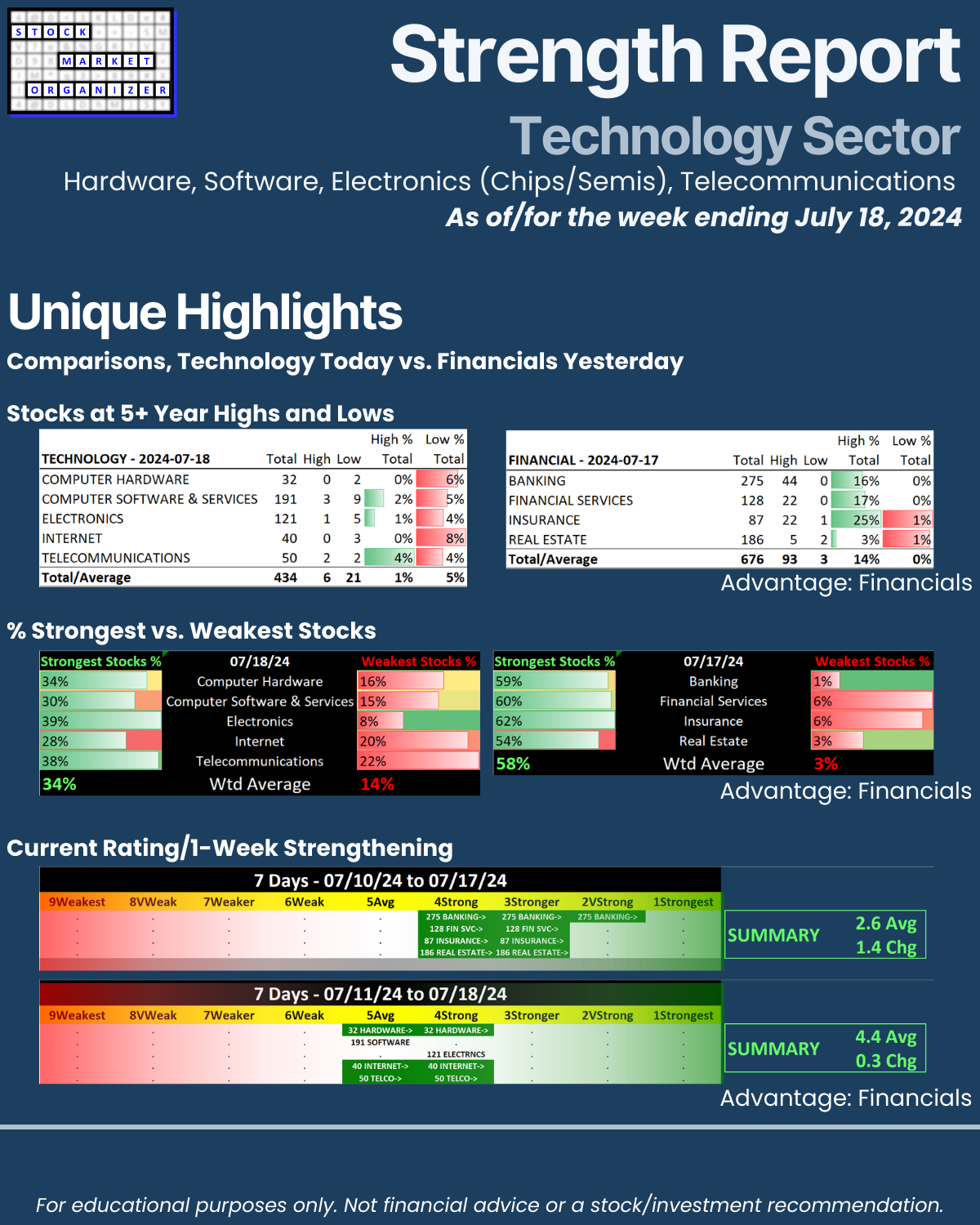

Technology Sector as of/for the week ending 7/18/24 (Hardware, Software/Services, Electronics aka Chips/Semis, Internet, Telco). Doing well but not as strong as Financials (covered yesterday). Details below, genuinely unique and unavailable elsewhere because I created this method from scratch to answer on an on-going basis the following question: “Where is there strengthening and weakening in the market at the stock, sub-industry, and industry levels?”

For more on this analytical method, here’s last Friday’s comprehensive market overview 2024-07-12.

Take a look below, you might find this helpful. Some highlights:

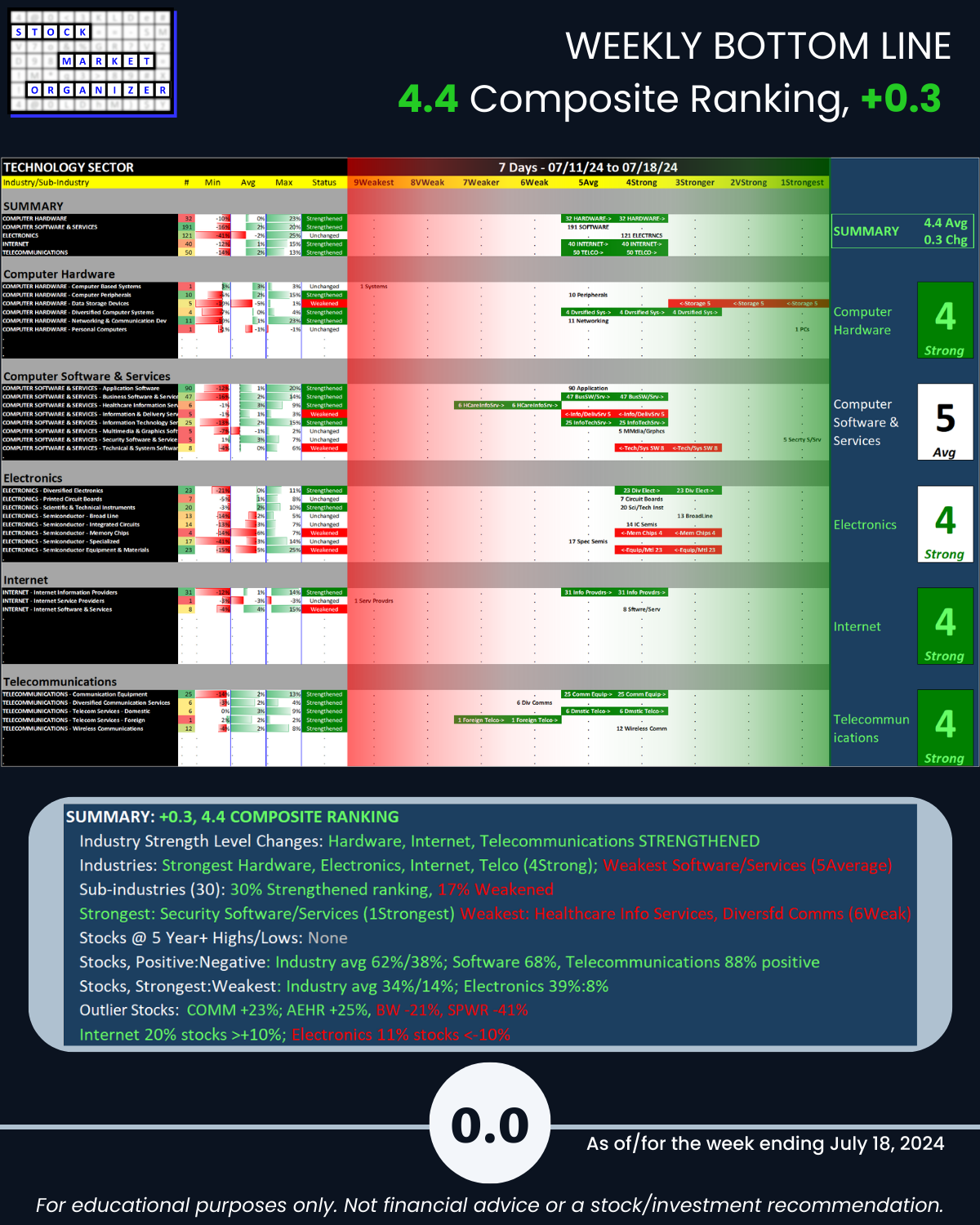

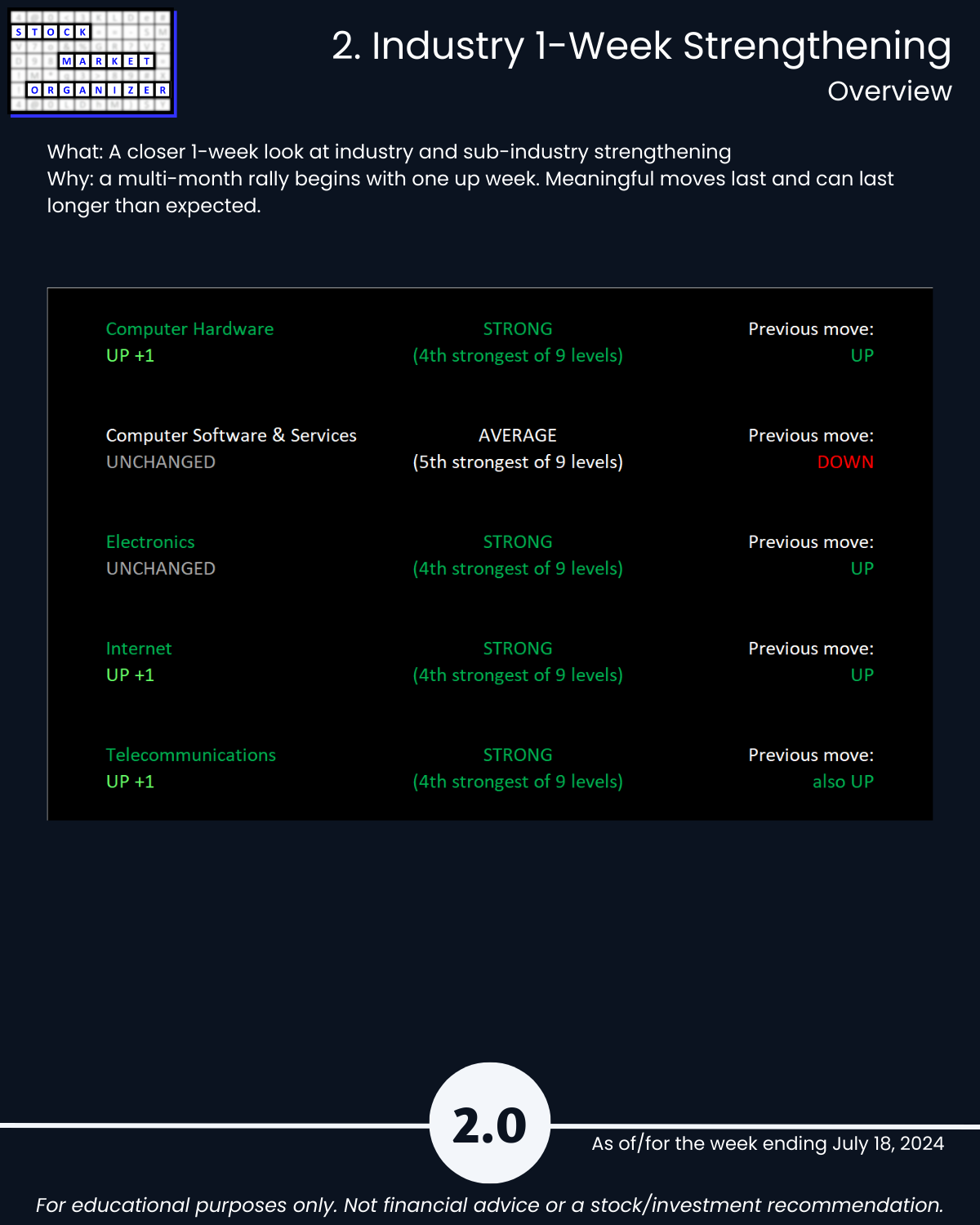

🔹 Industry Strength Level Changes: Hardware, Internet, Telecommunications STRENGTHENED

🔹 Industries: Strongest Hardware, Electronics, Internet, Telco (4Strong); Weakest Software/Services (5Average)

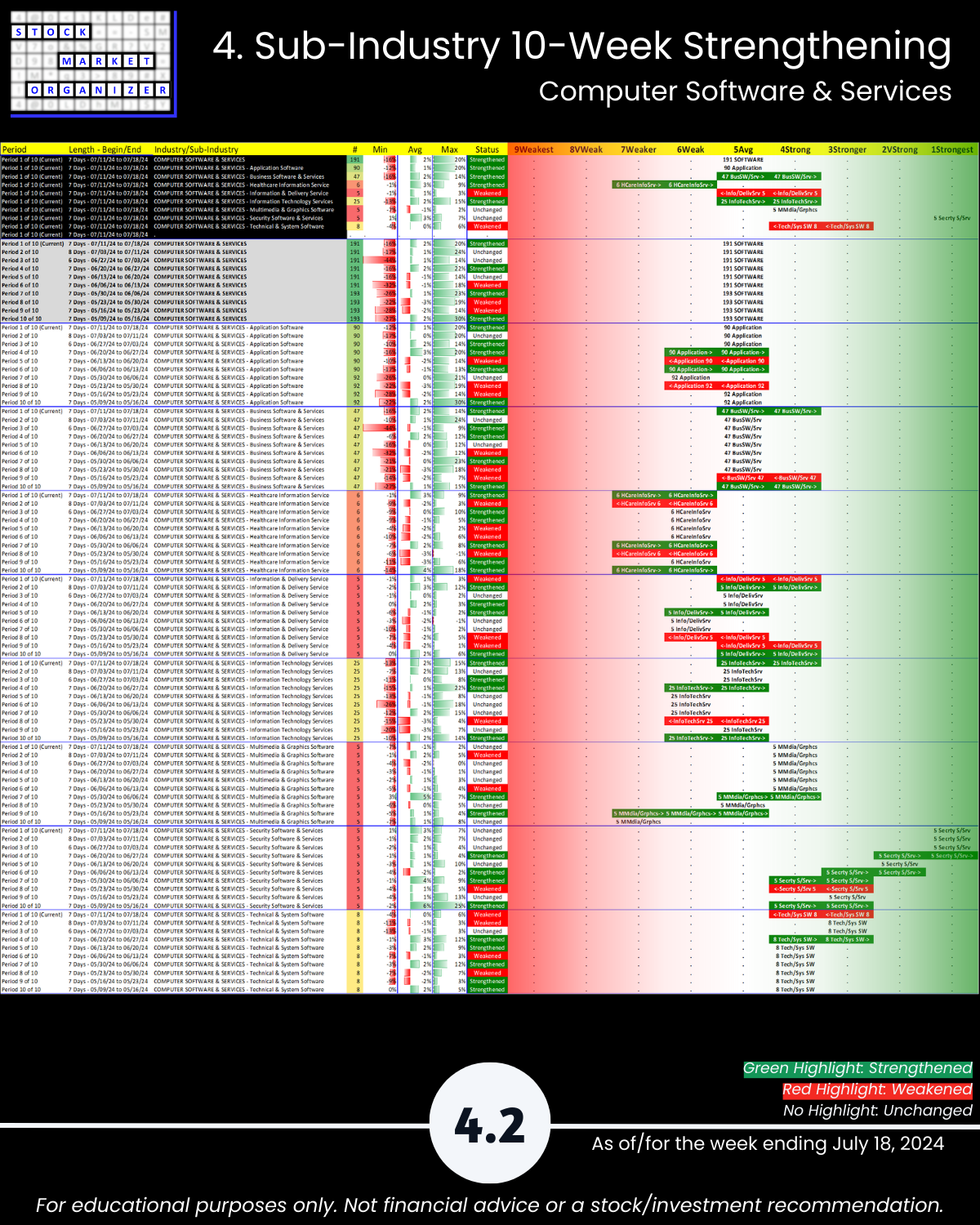

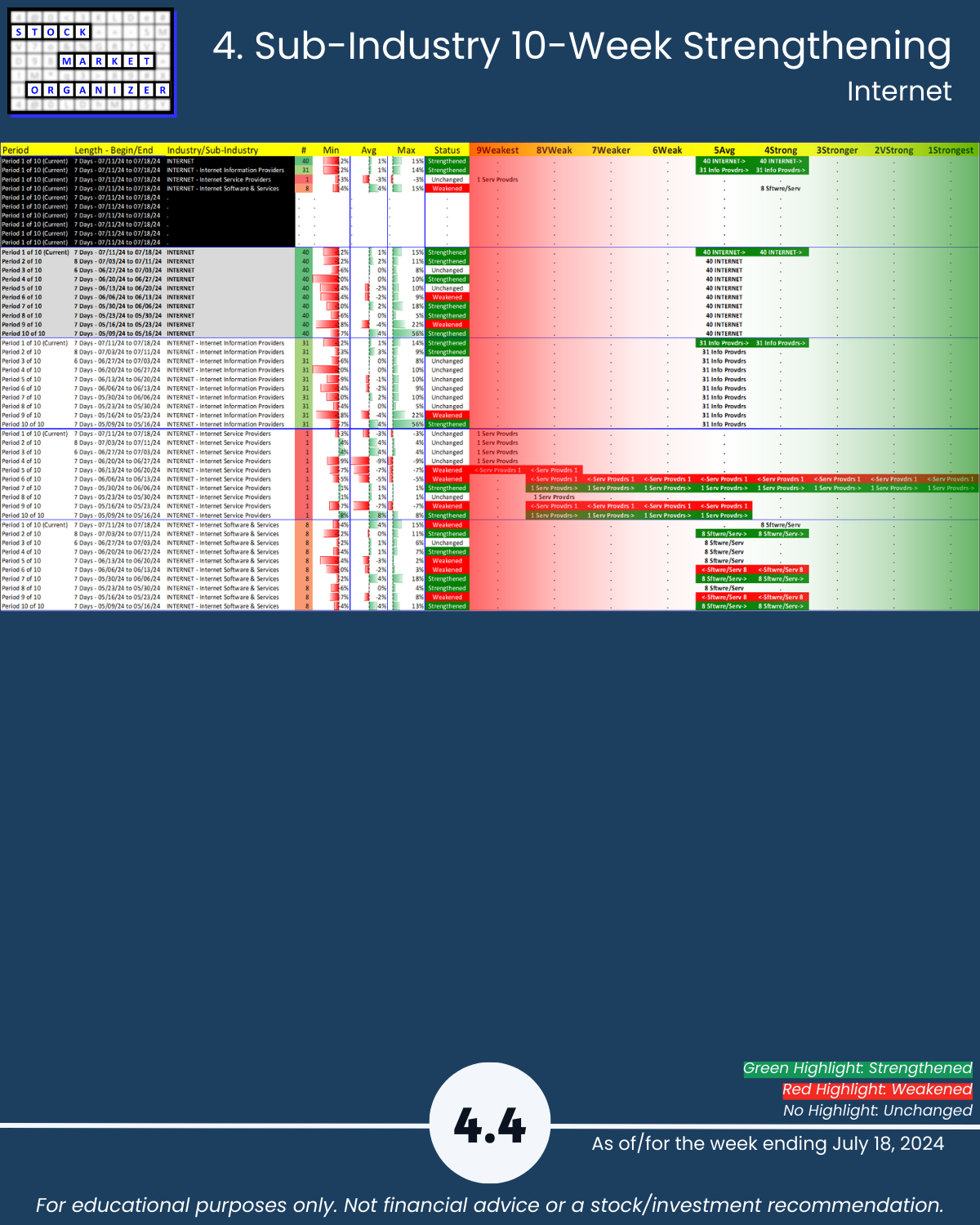

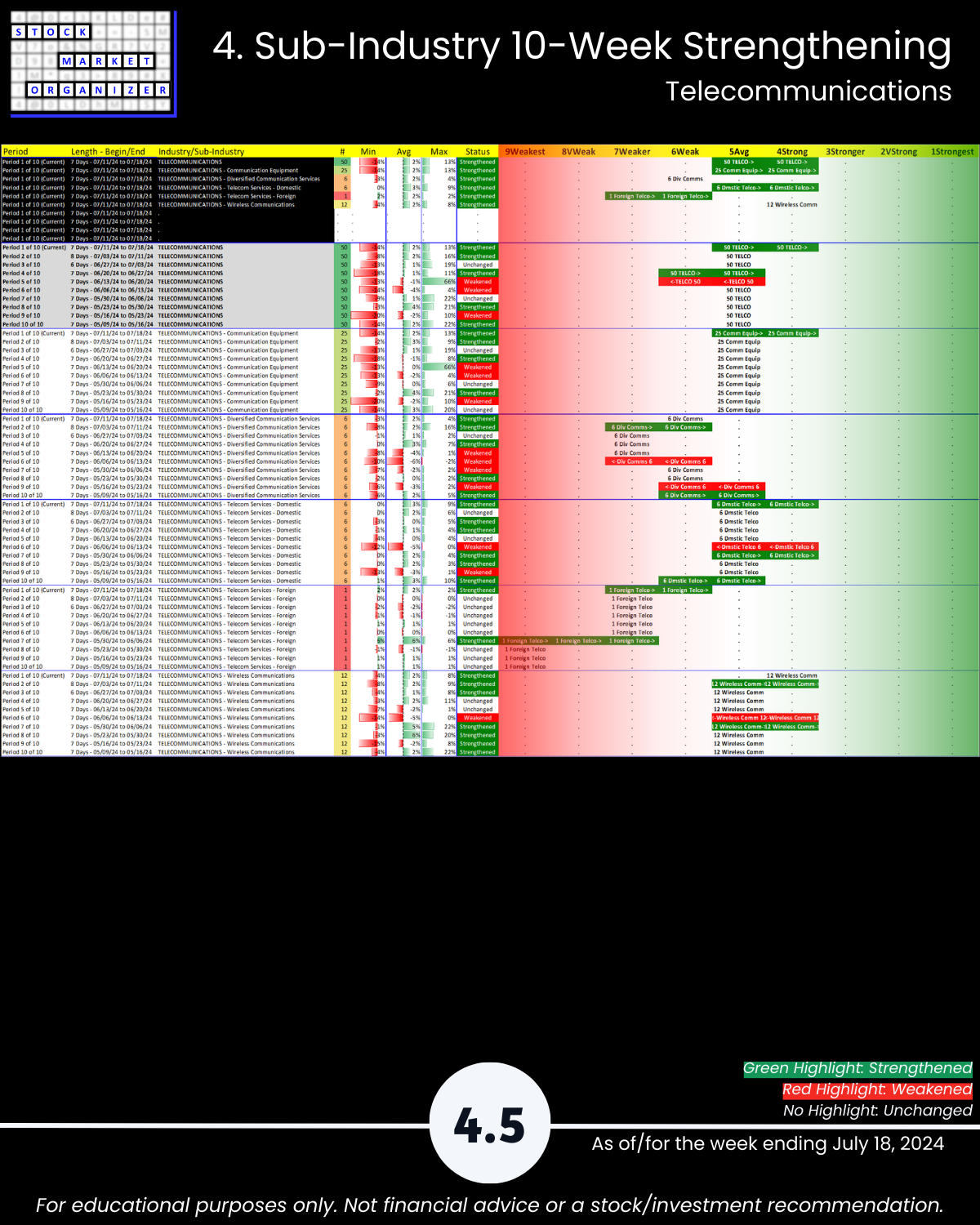

🔹 Sub-industries (30): 30% Strengthened ranking, 17% Weakened

🔹 Strongest: Security Software/Services (1Strongest) Weakest: Healthcare Info Services, Diversified Communications (6Weak)

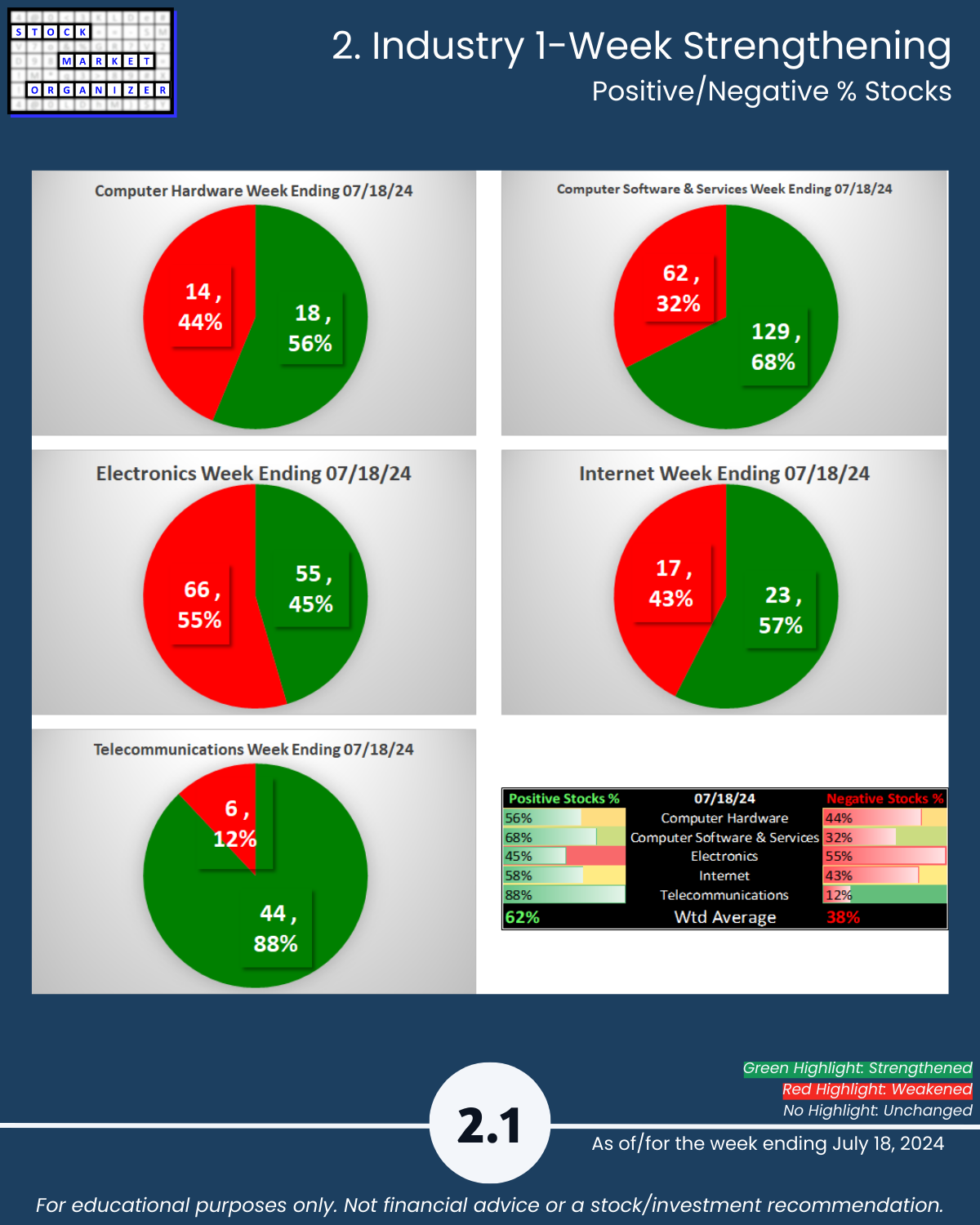

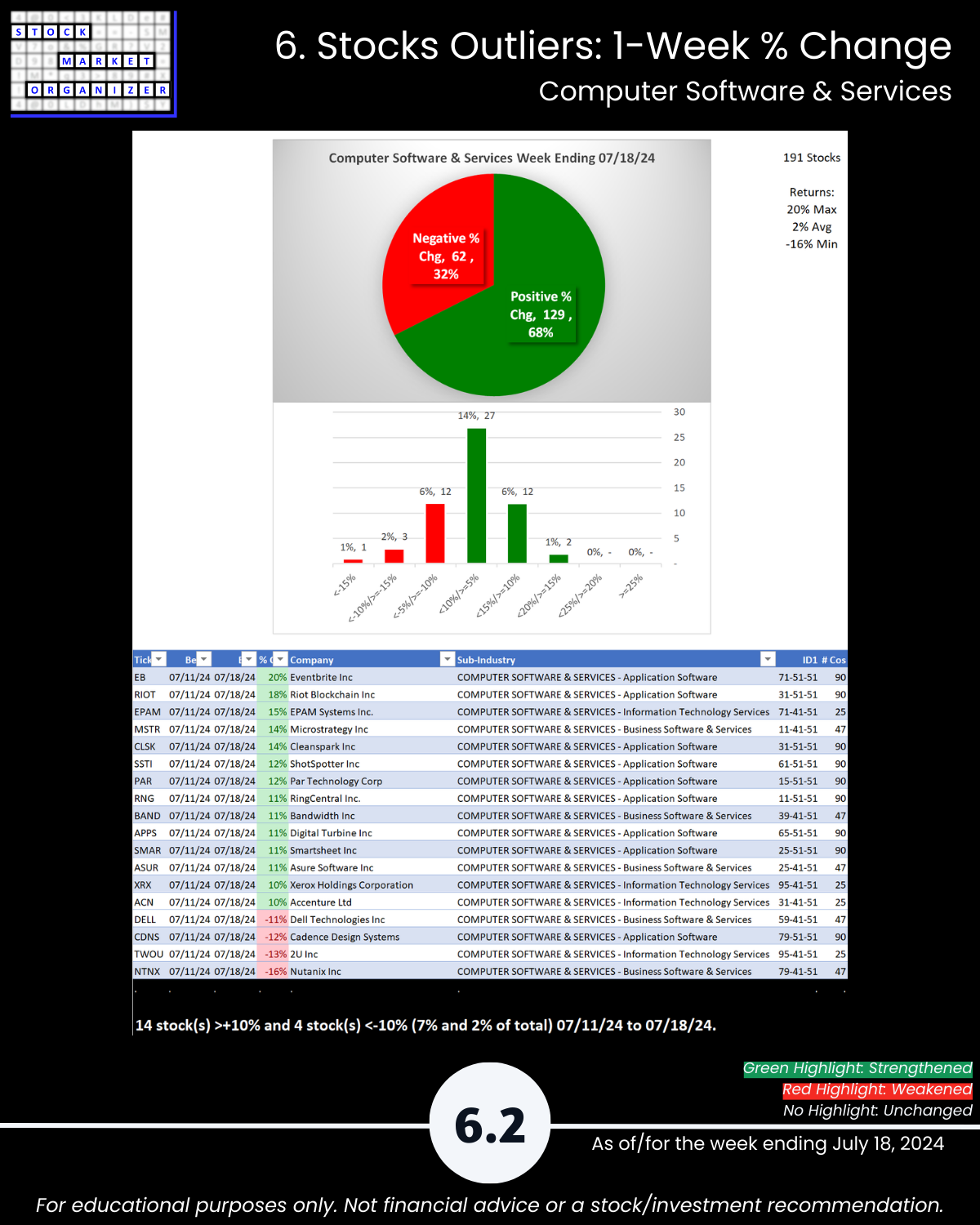

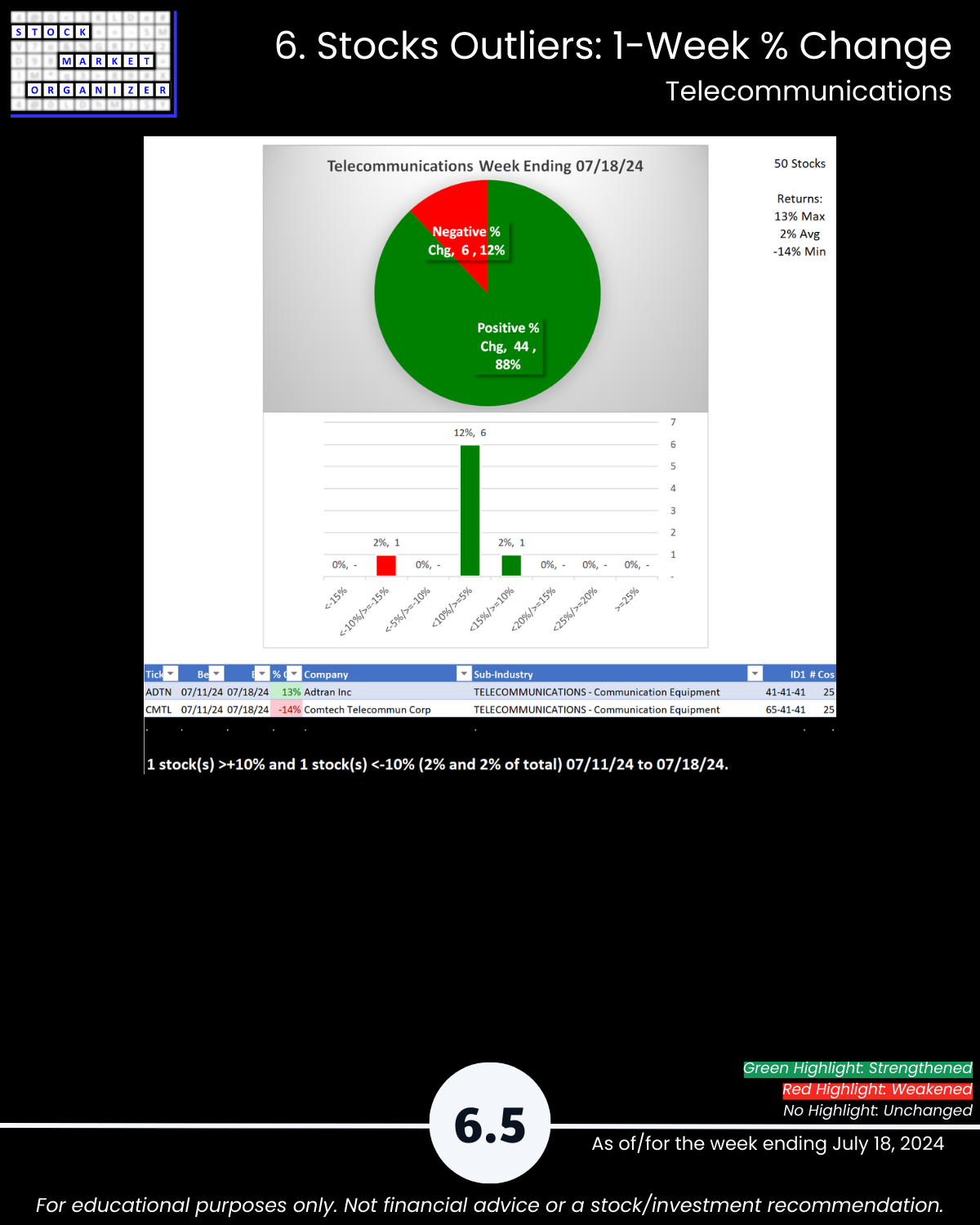

🔹 Stocks, Positive:Negative: Industry avg 62%/38%; Software 68%, Telecommunications 88% positive

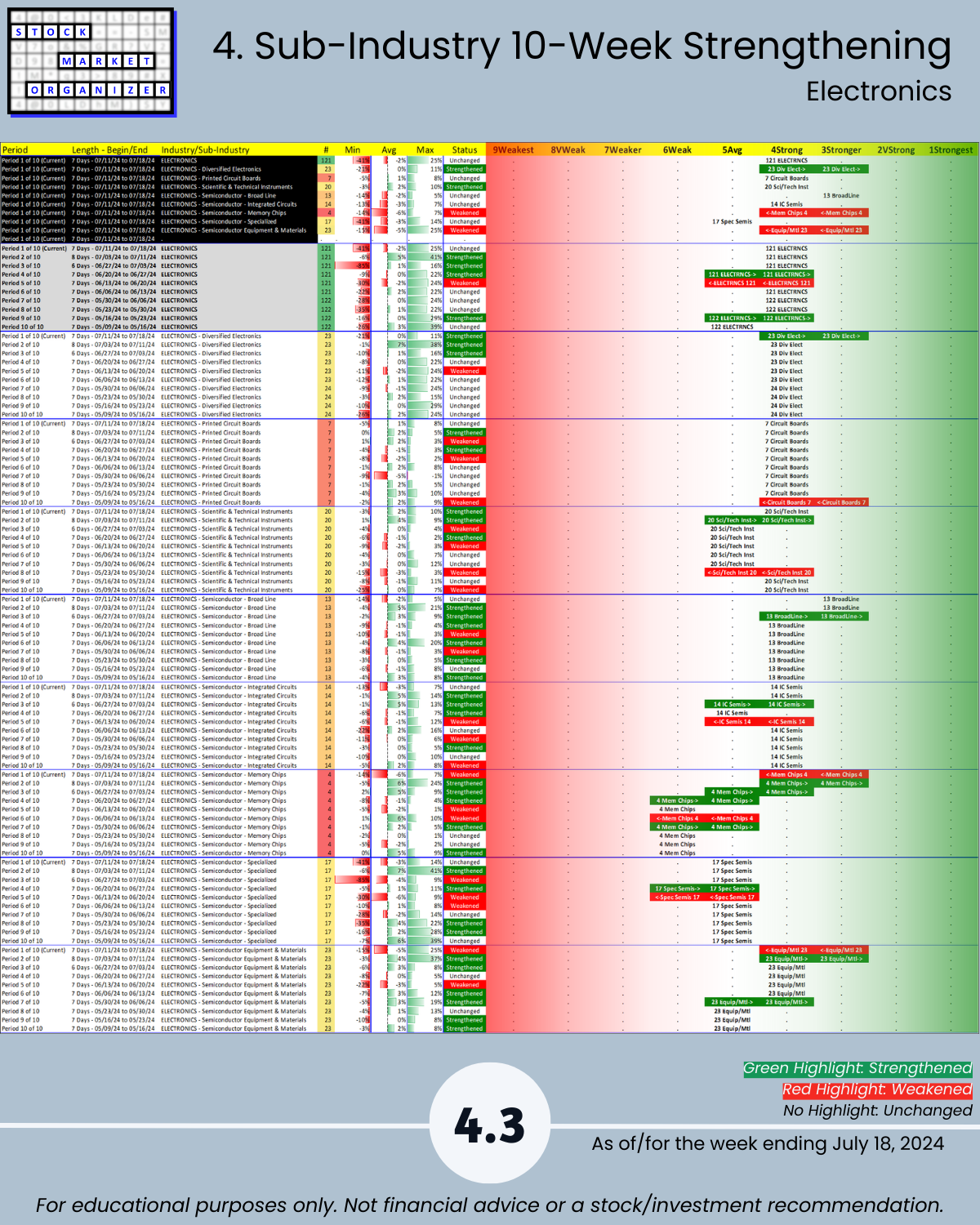

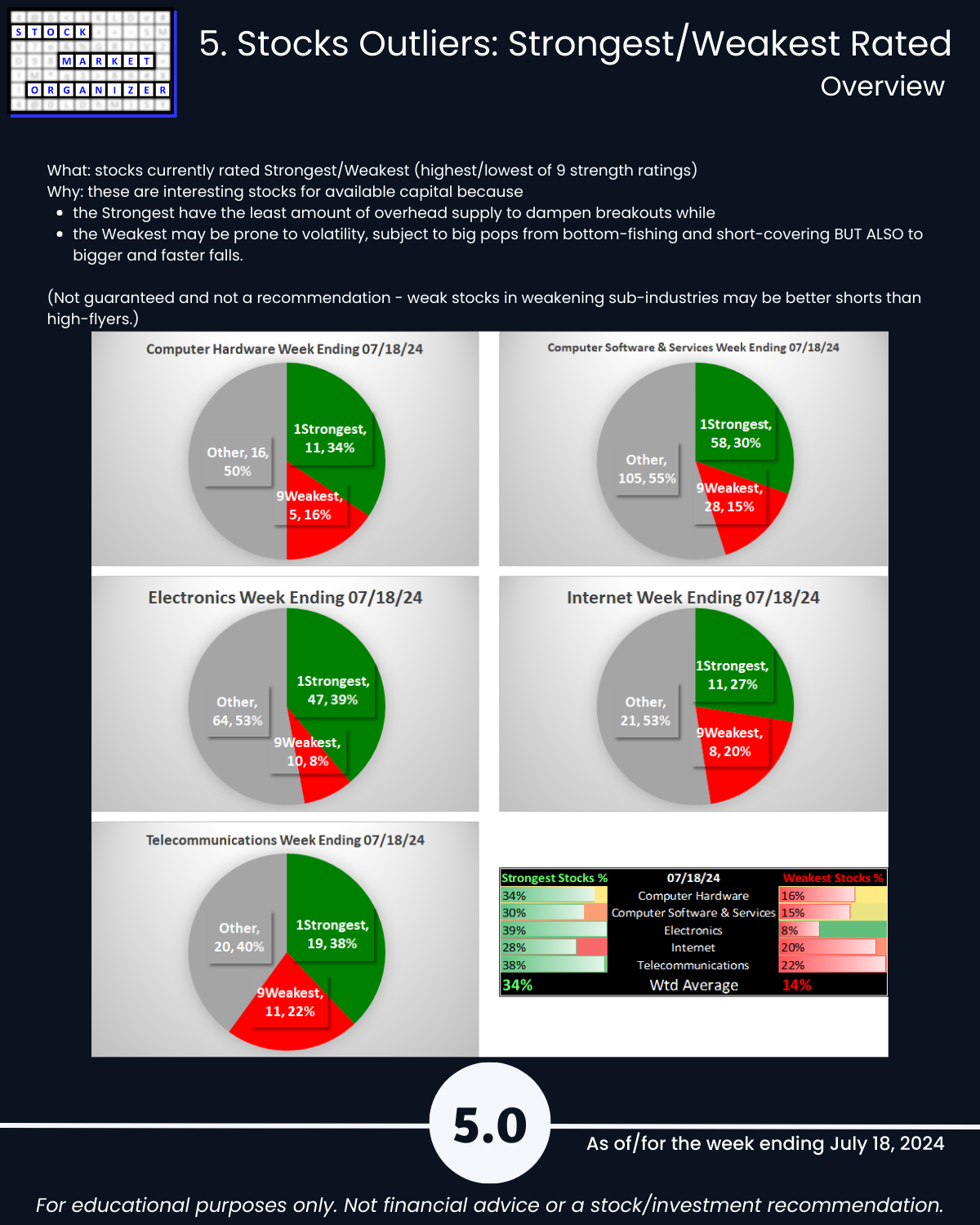

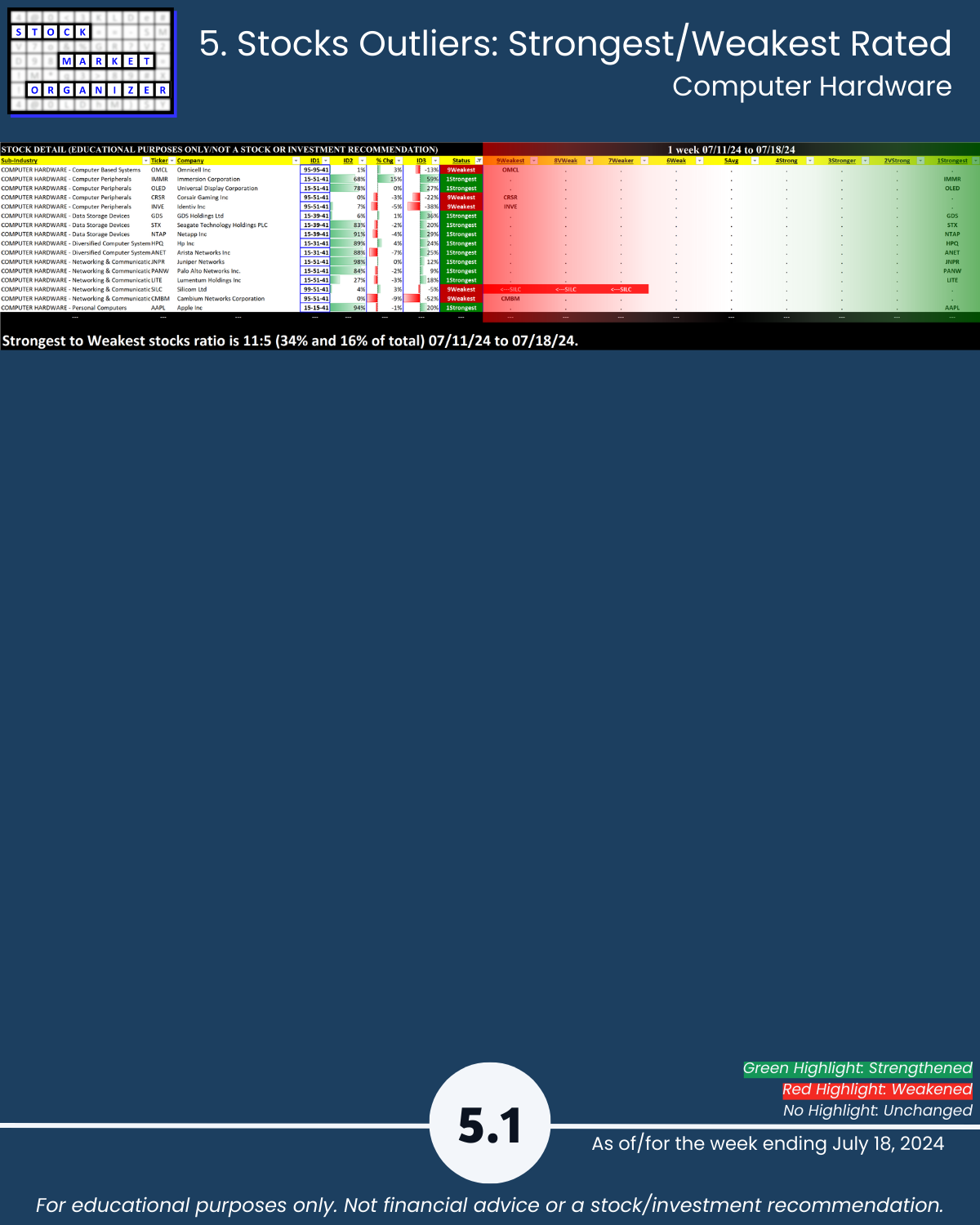

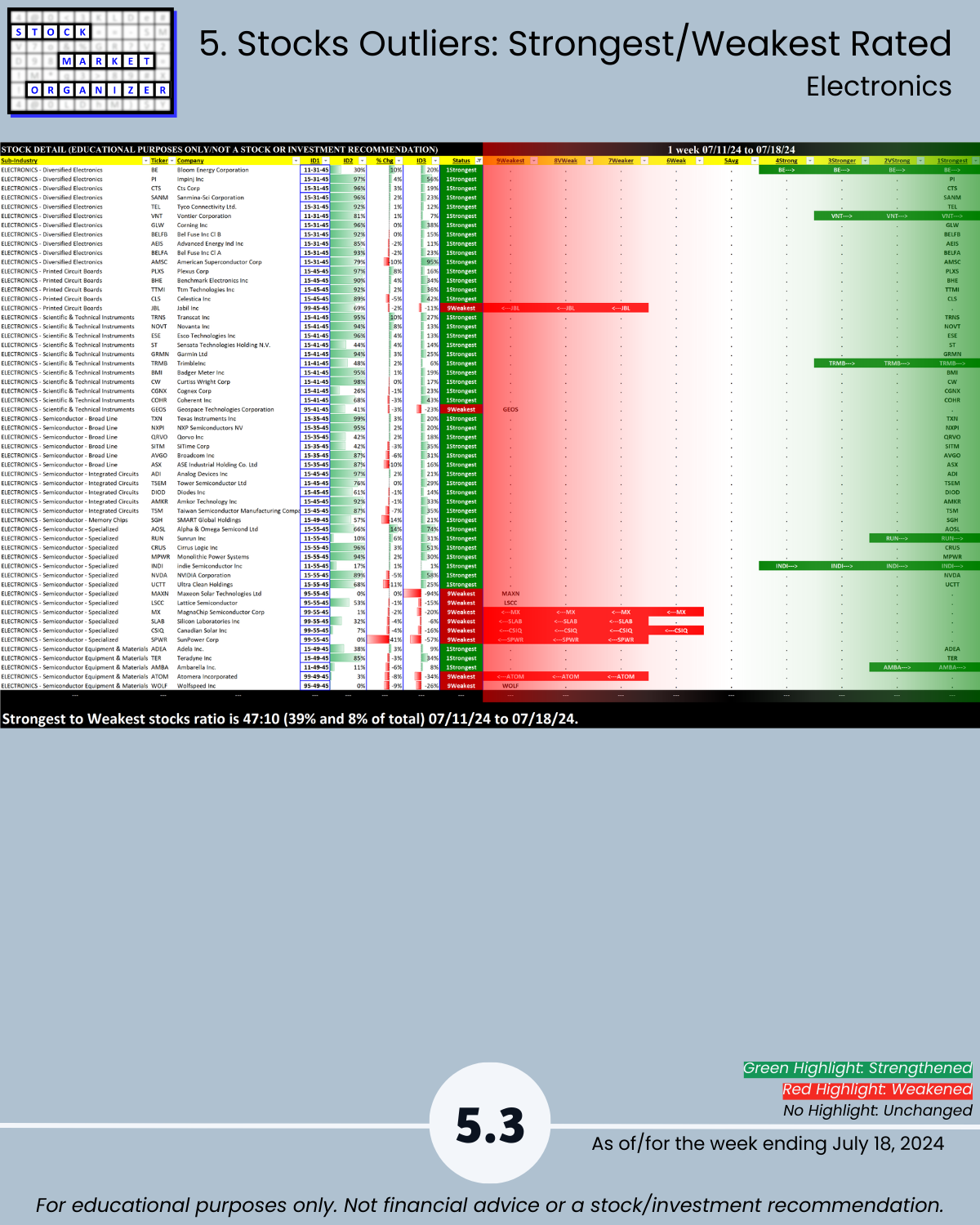

🔹 Stocks, Strongest:Weakest: Industry avg 34%/14%; Electronics 39%:8%

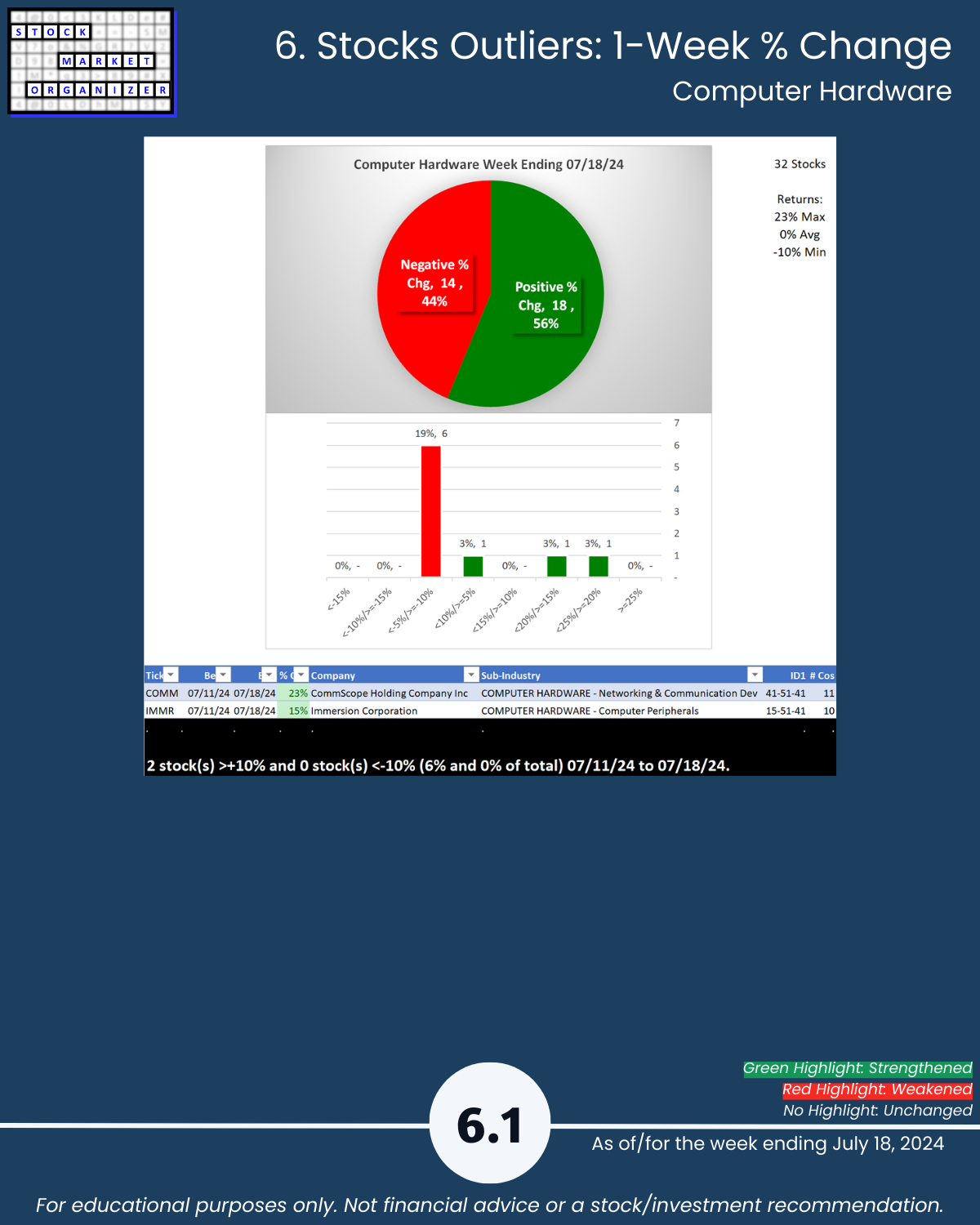

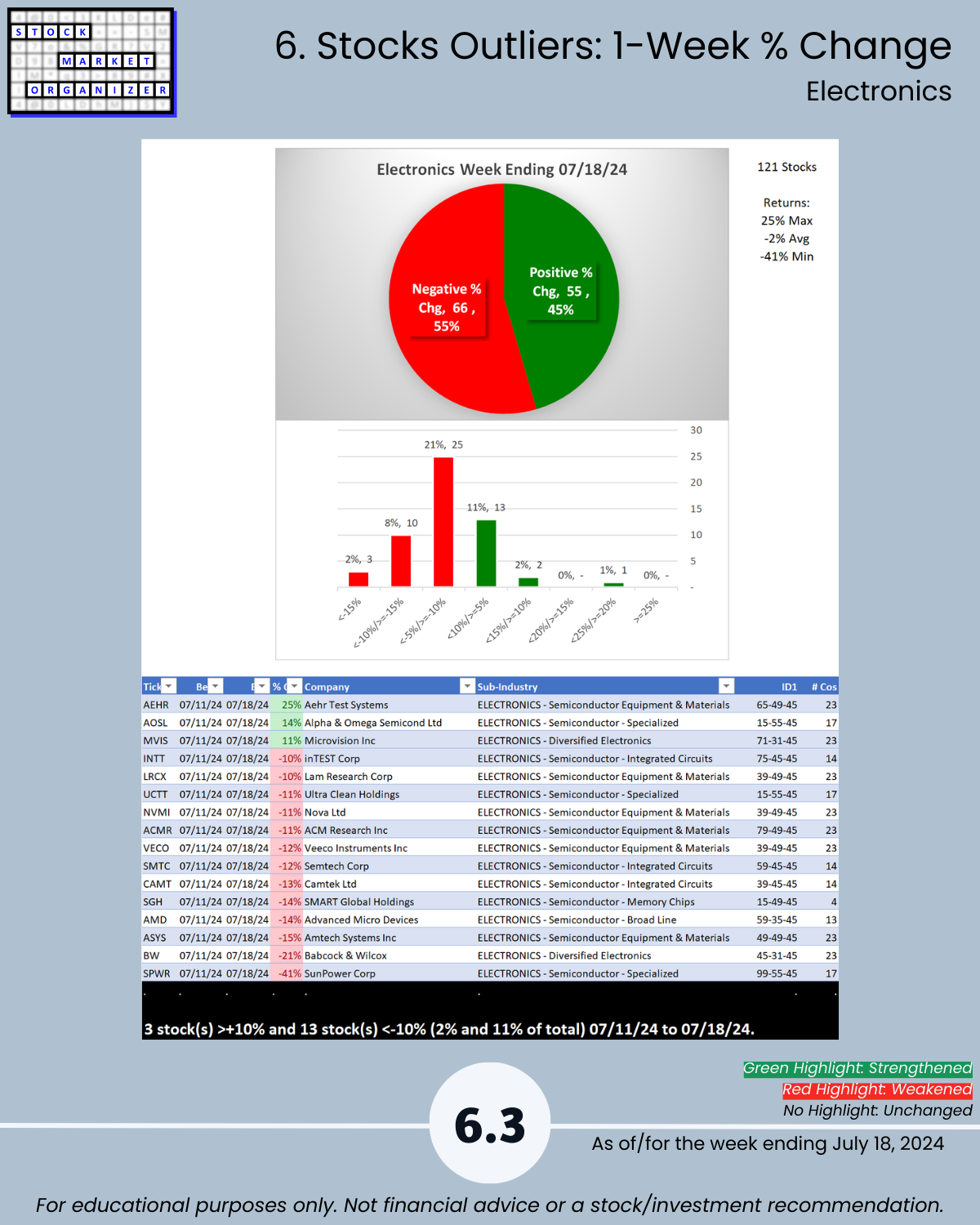

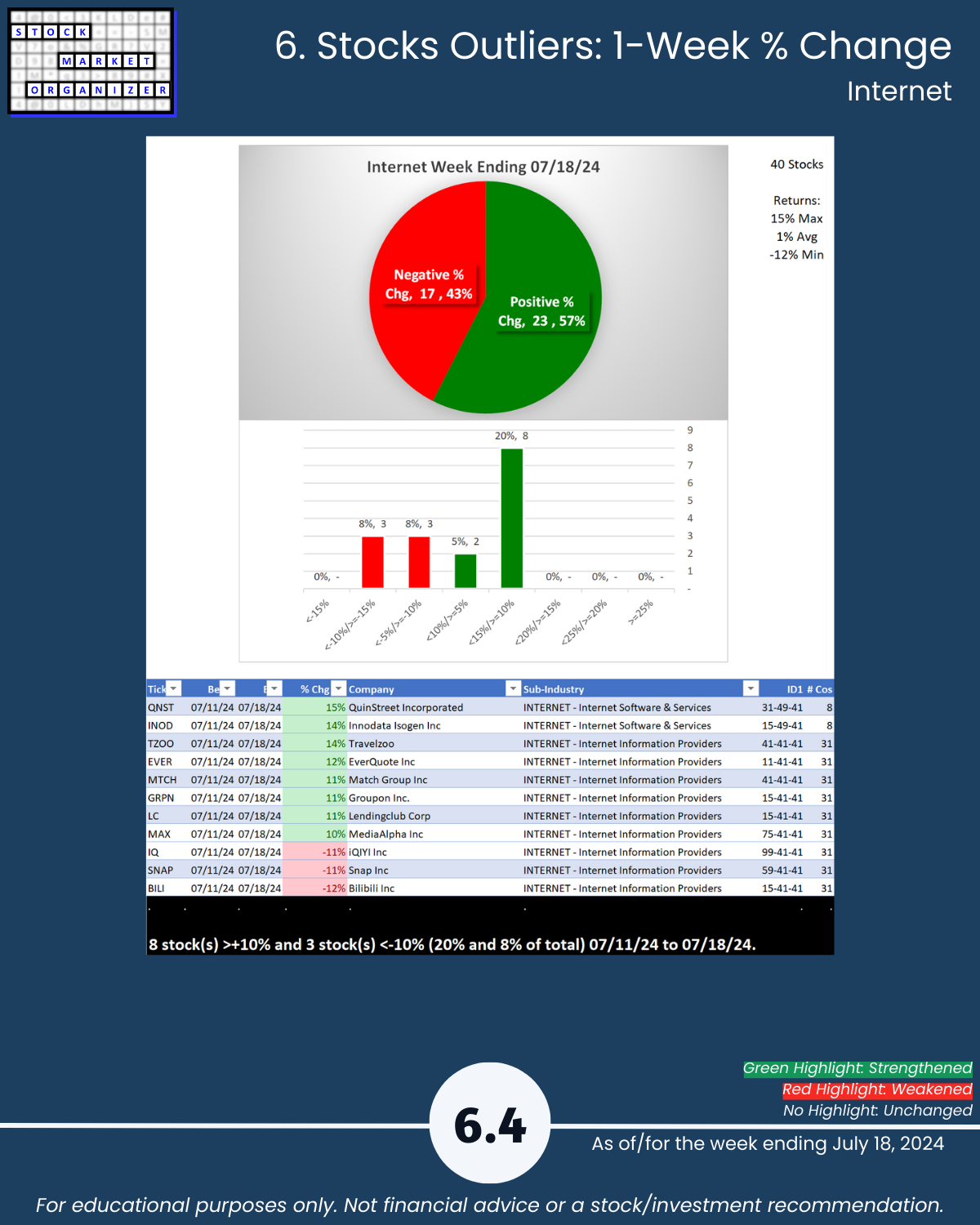

🔹 Outlier Stocks: COMM +23%; AEHR +25%, BW -21%, SPWR -41%

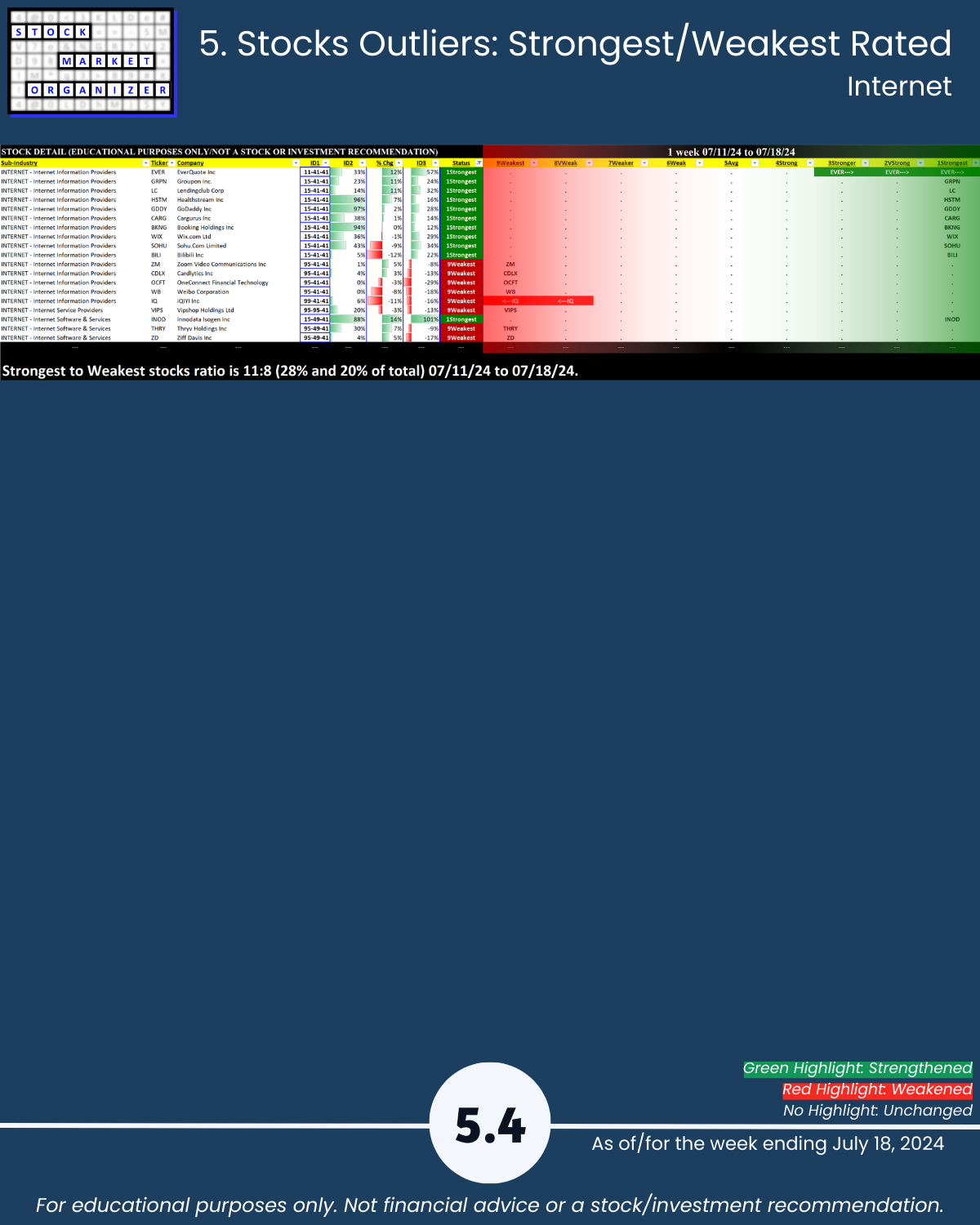

🔹 Internet 20% stocks >+10%; Electronics 11% stocks <-10%

Key concept for me - the journey to 100% returns begins with 10% returns. Act appropriately.

1. Introduction

2. Industry 1-Week Strengthening

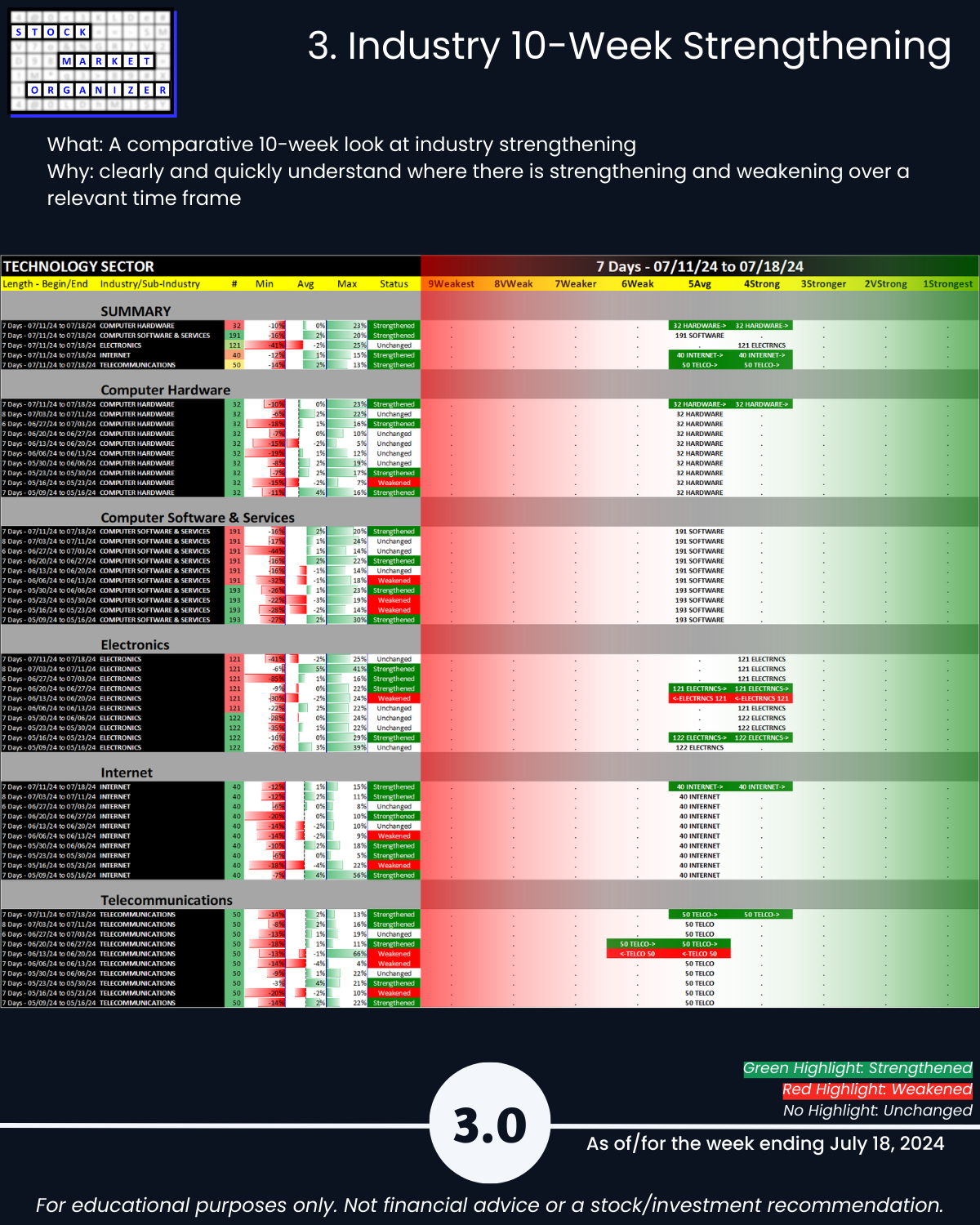

3. Industry 10-Week Strengthening

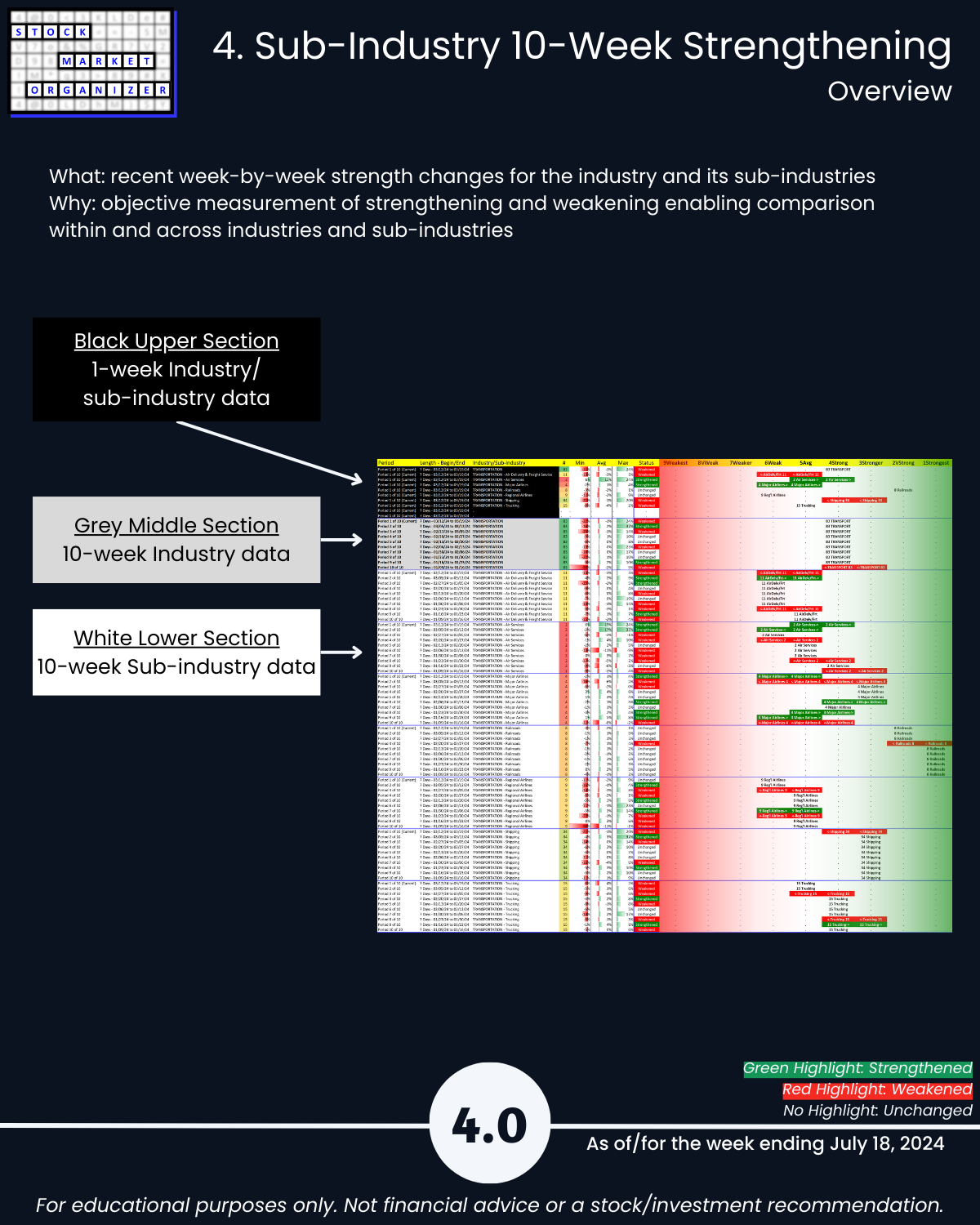

4. Sub-Industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

6. Stocks Outliers: 1-Week % Change

7. Stocks Outliers: 5-Year Highs/Lows