SMO Exclusive: Strength Report Technology Sector 2024-04-25

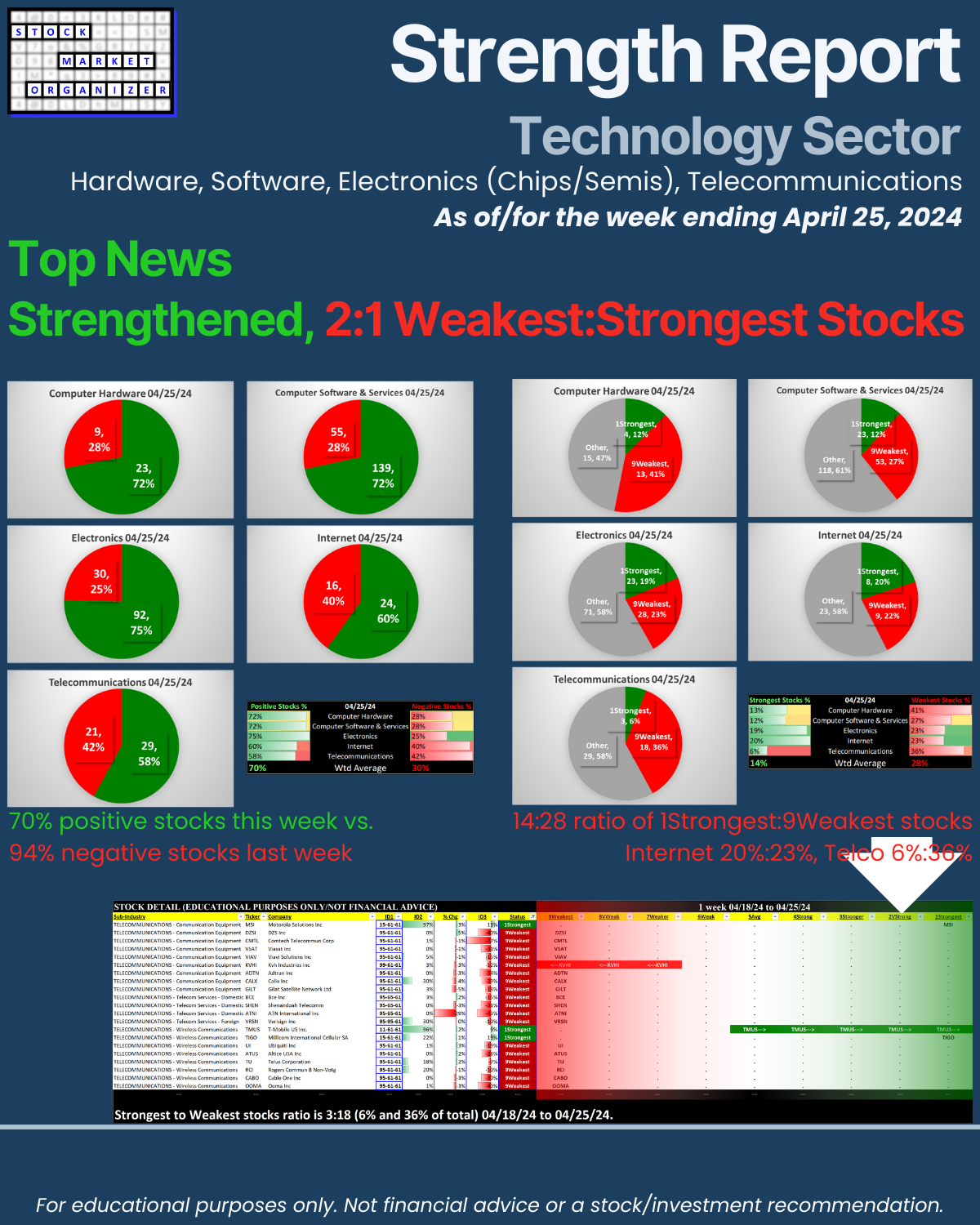

Overlaying a unique strength filter onto your U.S. stock market views - Tech Sector 4/25/24 stemmed its red tide of last week to strengthen this week, though there are still 2x stocks rated 9Weakest compared to those rated 1Strongest. More strength-based calculations: 🔹 the sector composite ranking rose +0.8 to 5.2 as it reversed much of last week’s large -1.2 point decline, 🔹 70% positive stocks as 3 of 5 industries strengthened rankings (Computer Software & Services, Electronics, Telecommunications), 🔹 Computer Hardware 16% and Telco 20% of stocks are at 5 Year+ Lows.

META earnings yesterday after the market dampened today’s results but then Alphabet and Microsoft earnings after hours today may give bulls cause to cheer. Will their after-hours strength translate into a positive day tomorrow? (INTC not so hot after hours but perhaps its smaller market cap will lessen its impact.)

Never any predictions here. Just pre-planned, disciplined actions based on what IS.

A UNIQUE STRENGTH-BASED LOOK

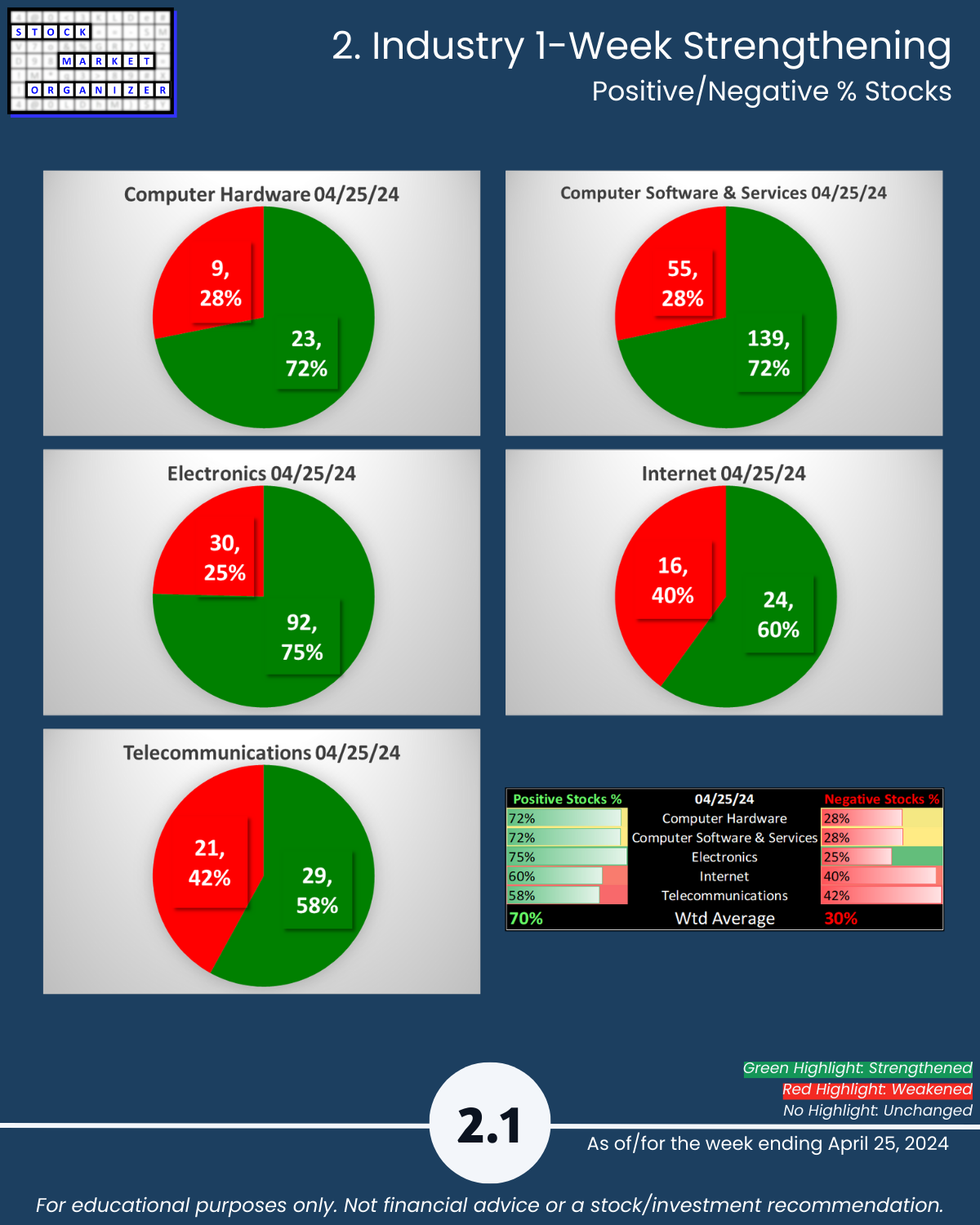

SUMMARY: STRENGTHENED, 3/5 INDUSTRIES RANKING STRENGTHENED, 70% POSITIVE STOCKS

🔹 Industry Strength Level Changes: Software, Electronics, Telecommunications STRENGTHENED

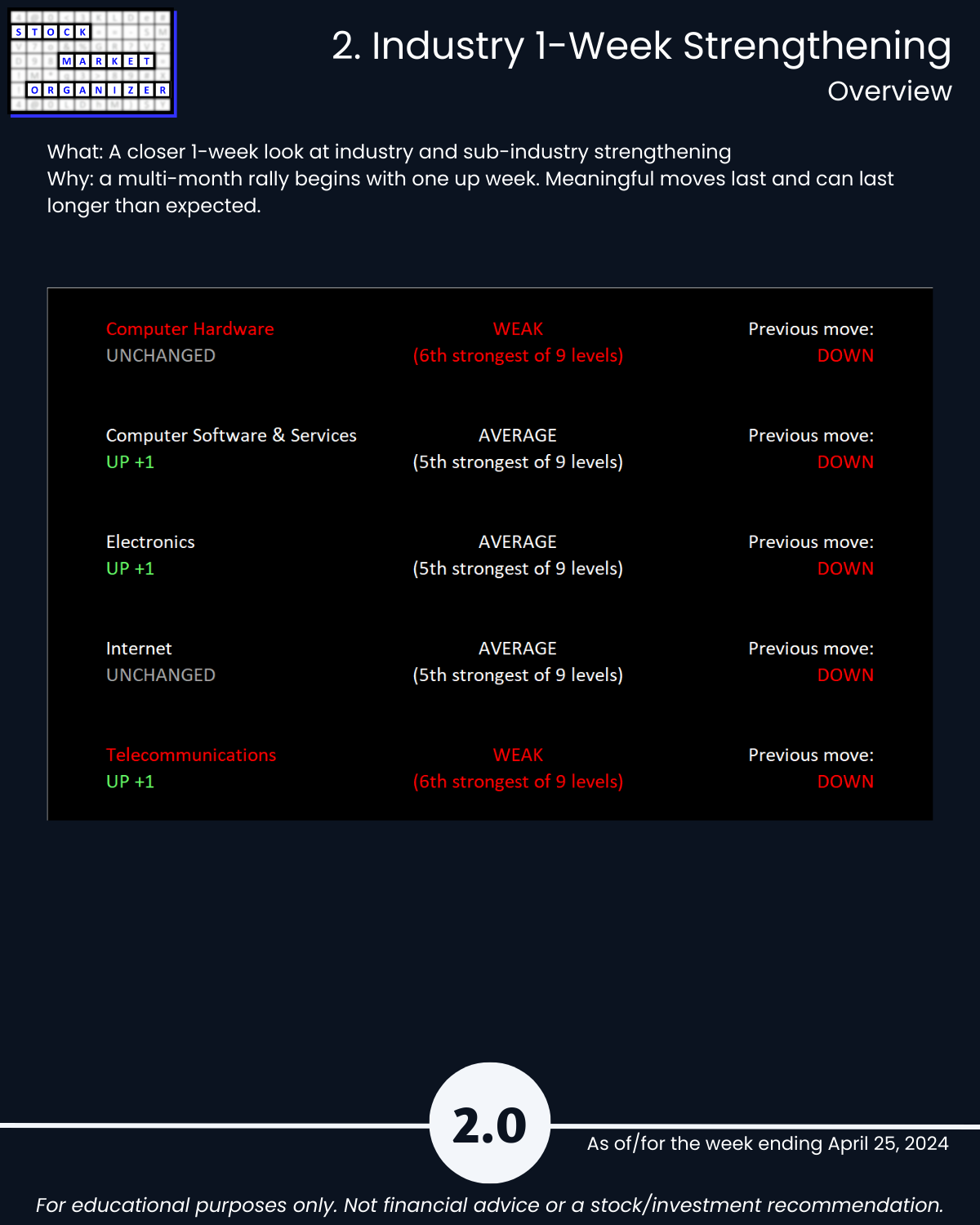

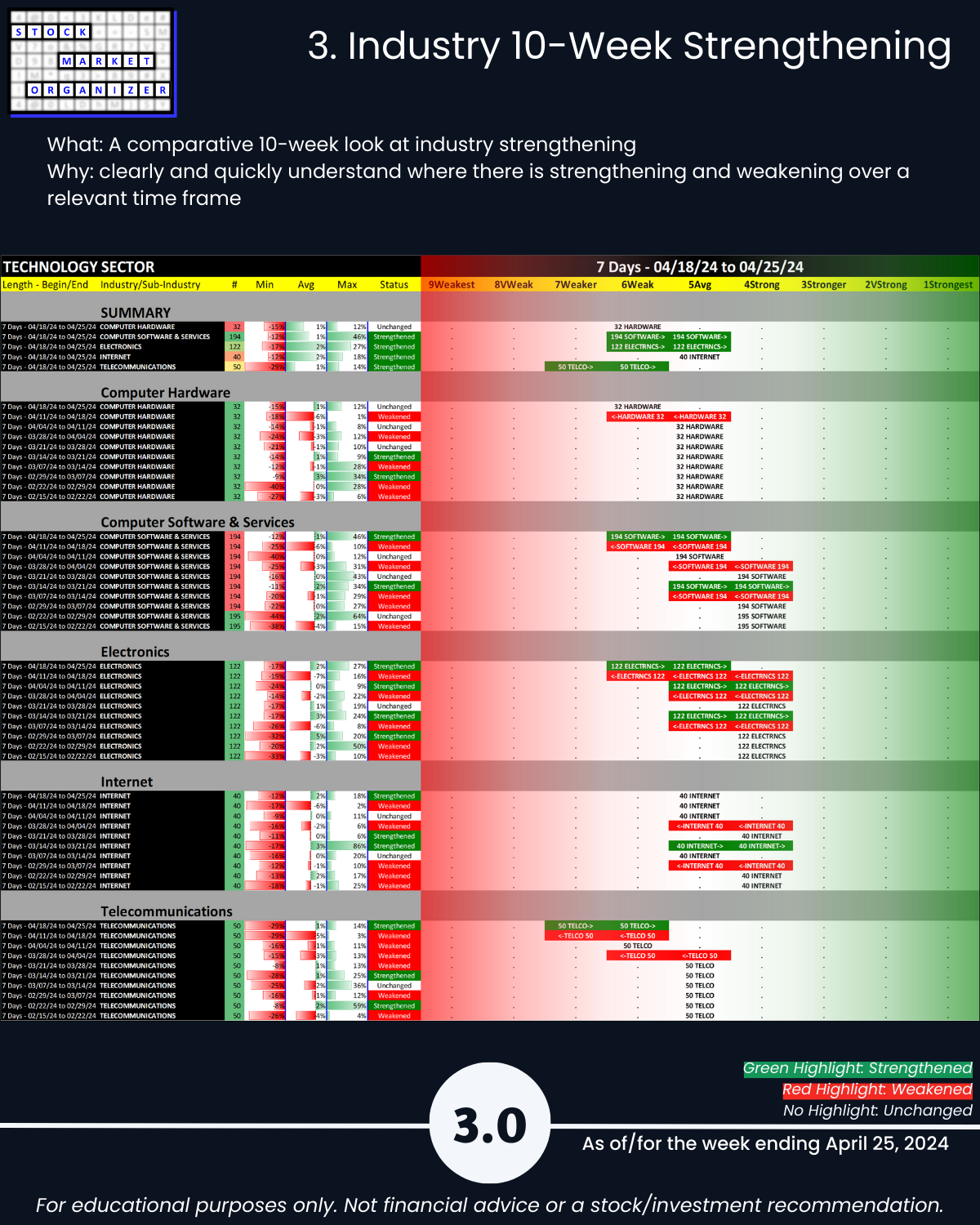

🔹 Industries

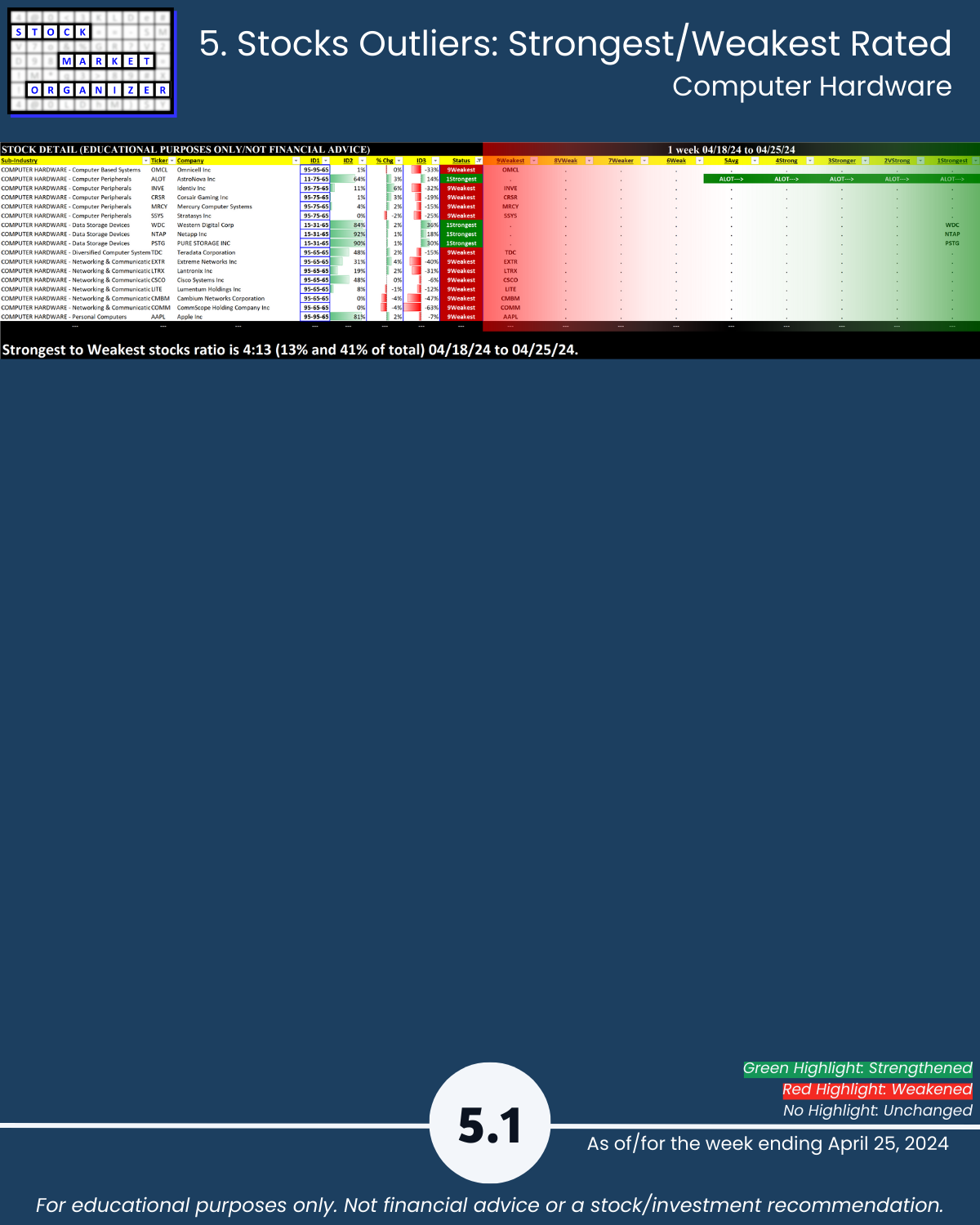

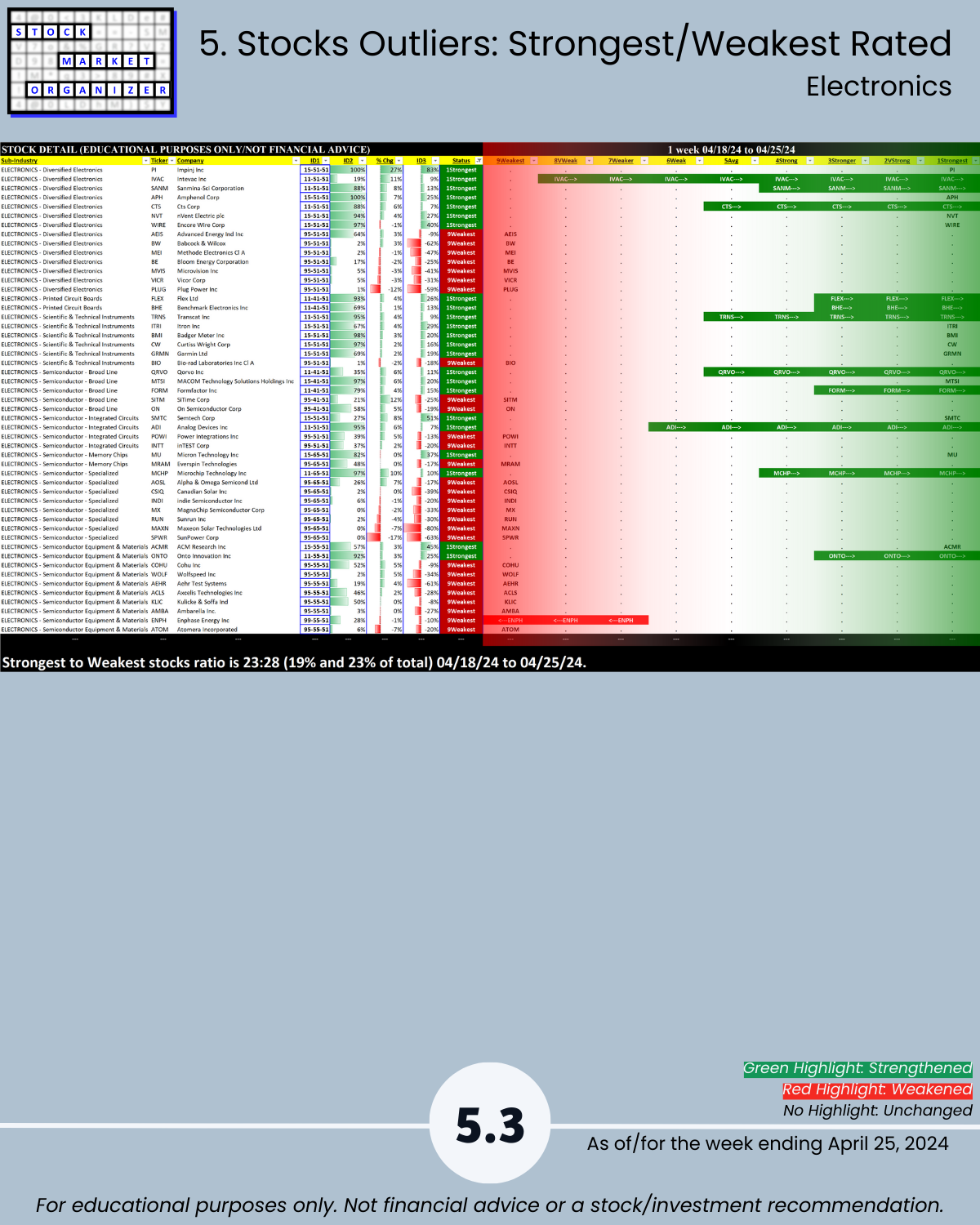

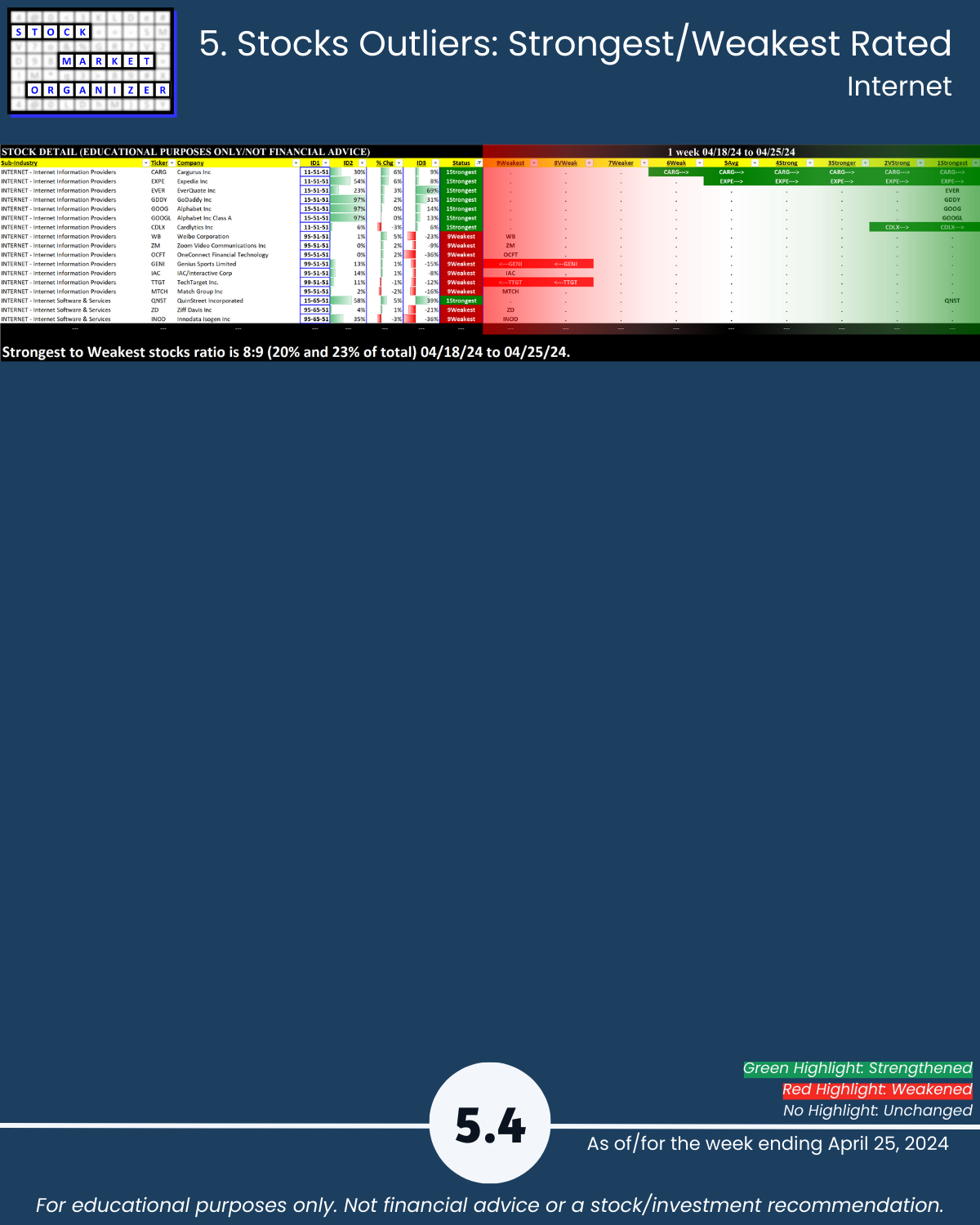

- Strongest Software, Electronics, Internet (5Avg)

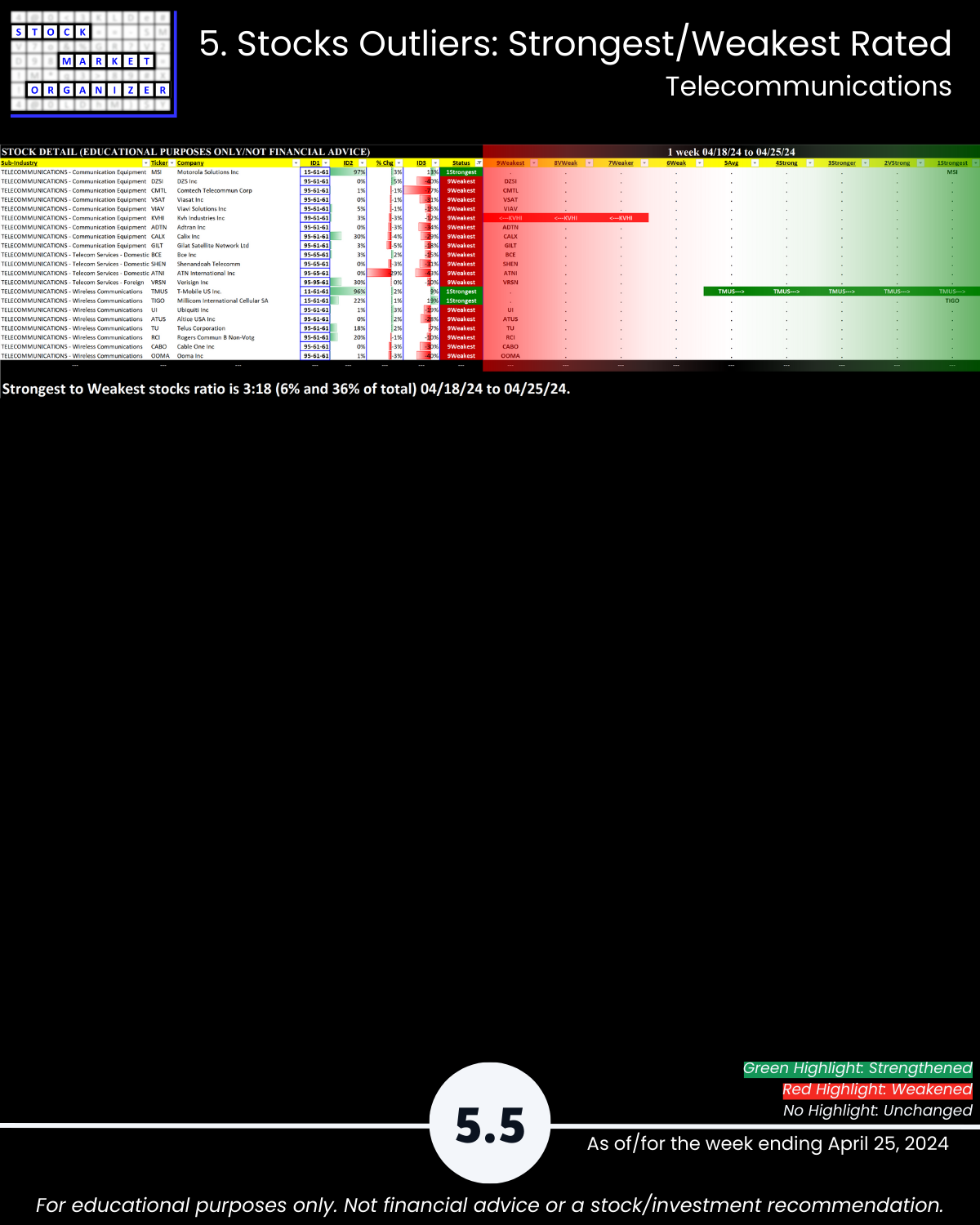

- Weakest Hardware, Telecommunications (6Weak)

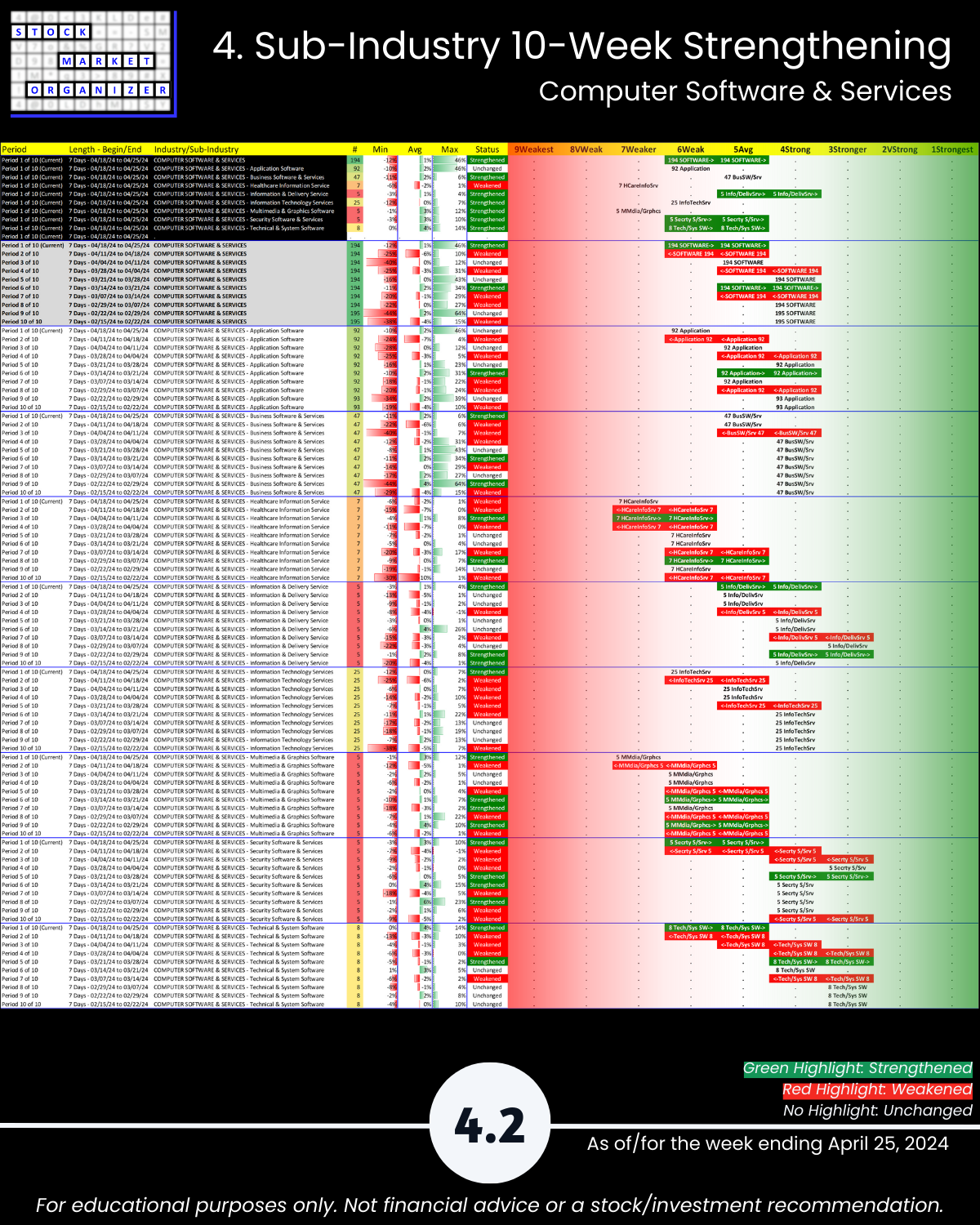

🔹 Sub-industries (30)

- 27% Strengthened ranking, 0% Weakened

- Strongest: Storage (3Stronger)

- Weakest: Peripherals, Healthcare Info Services, Diversified Communications, Multimedia/Graphics (7Weaker)

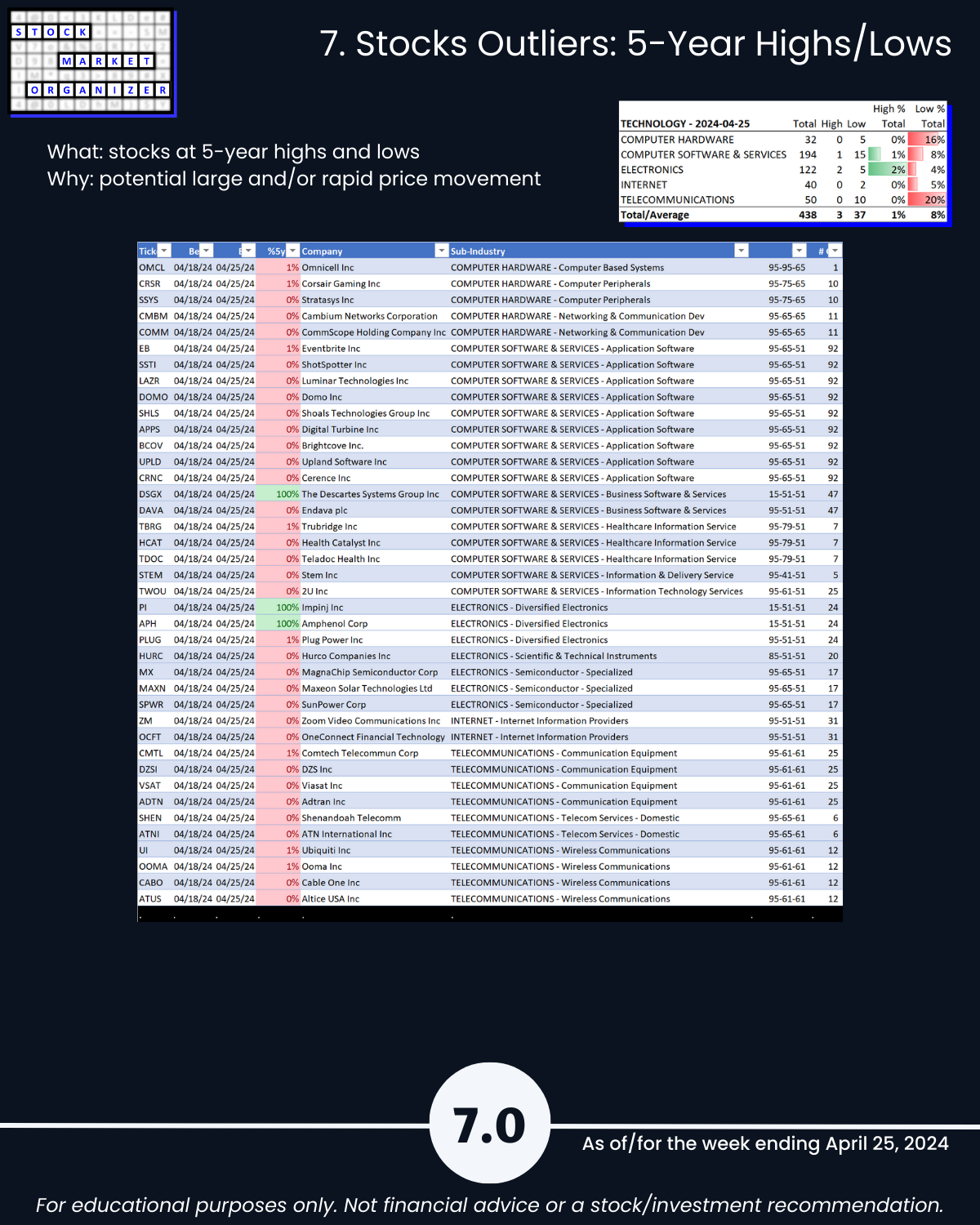

- @ 5 Year+ Highs/Lows: Computer Hardware 16%, Telecommunications 20% lows

🔹 Stocks

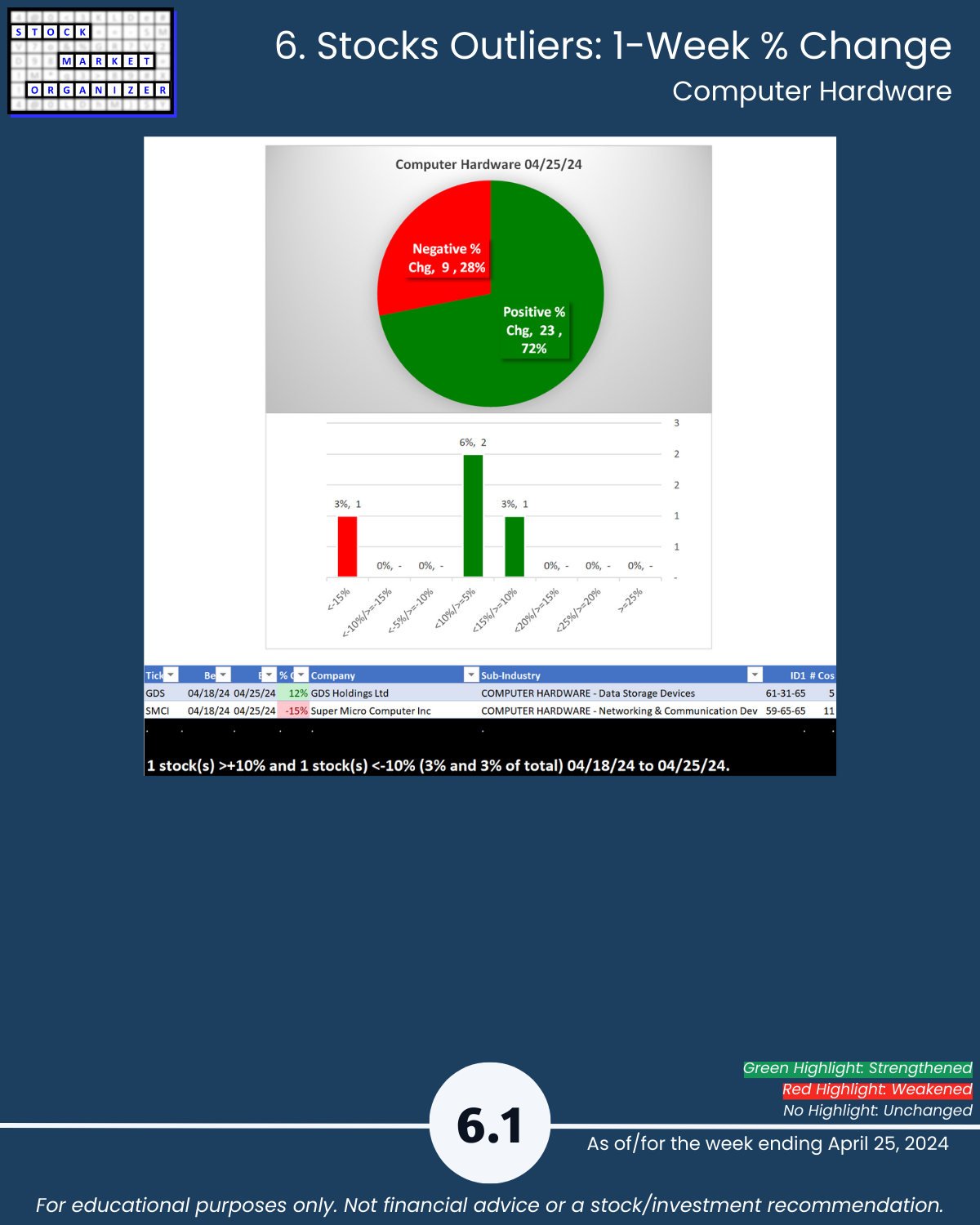

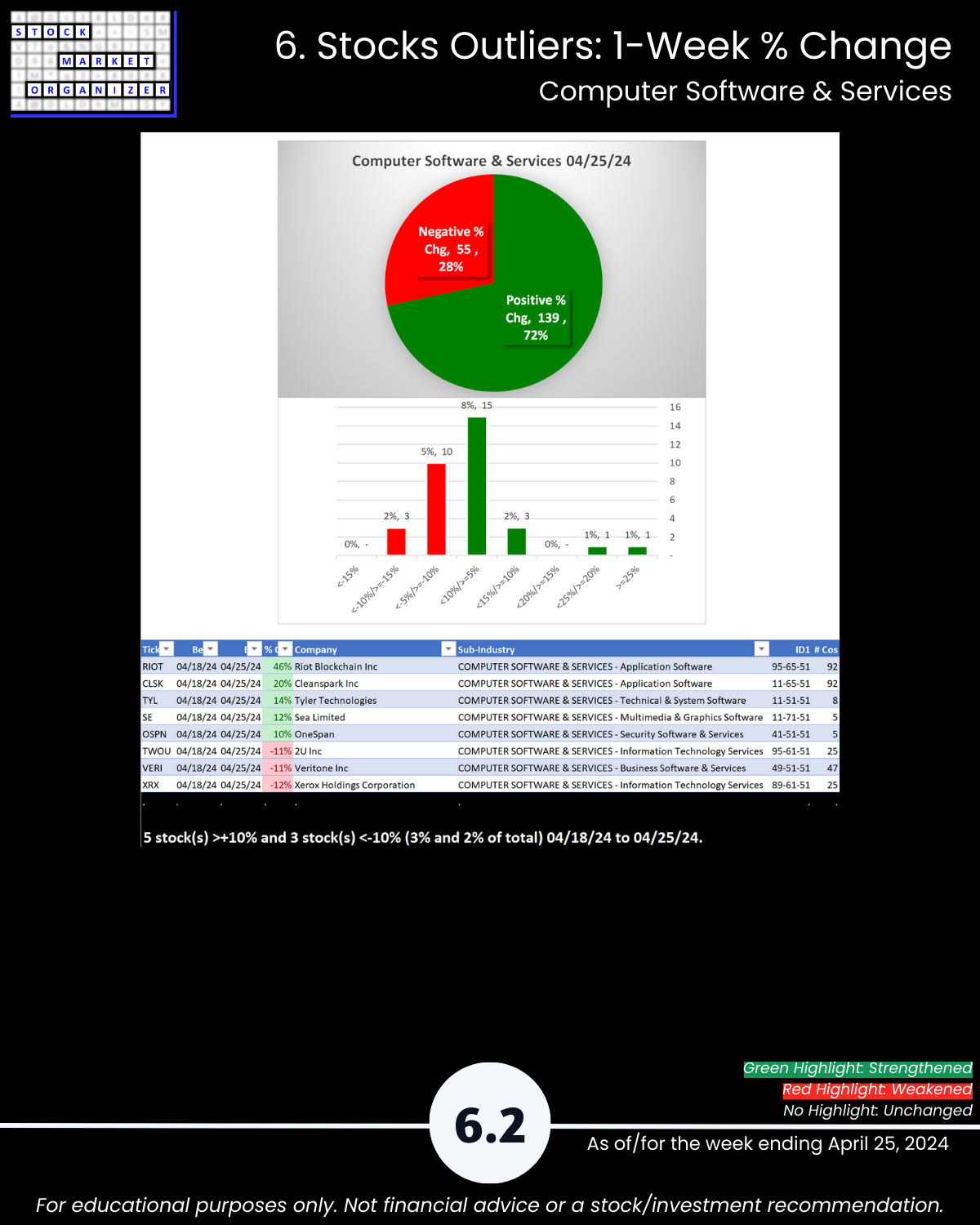

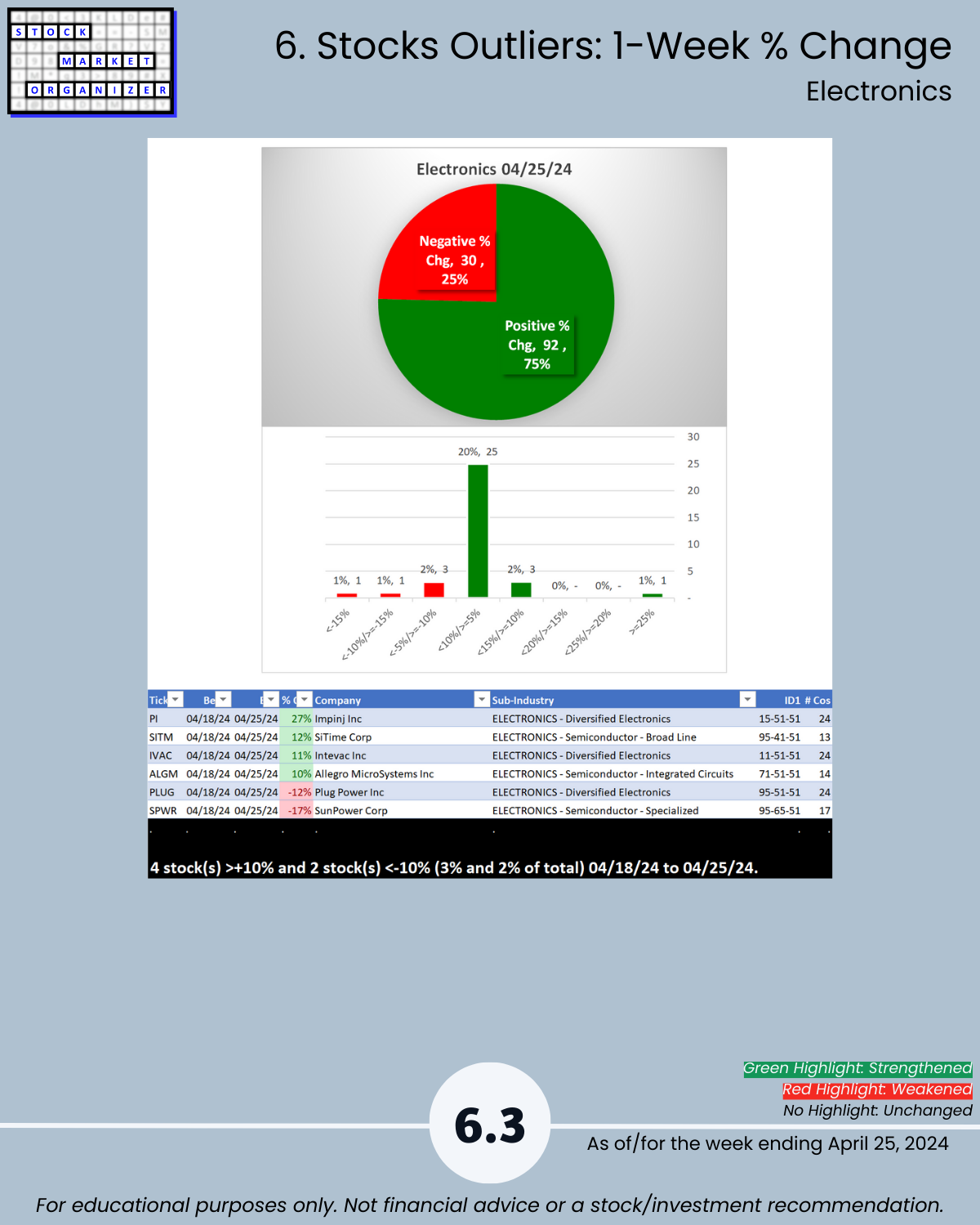

- Positive:Negative: Industry avg 70%/30%; Hardware 72%, Software/Serv 72%, Electronics 75% positive

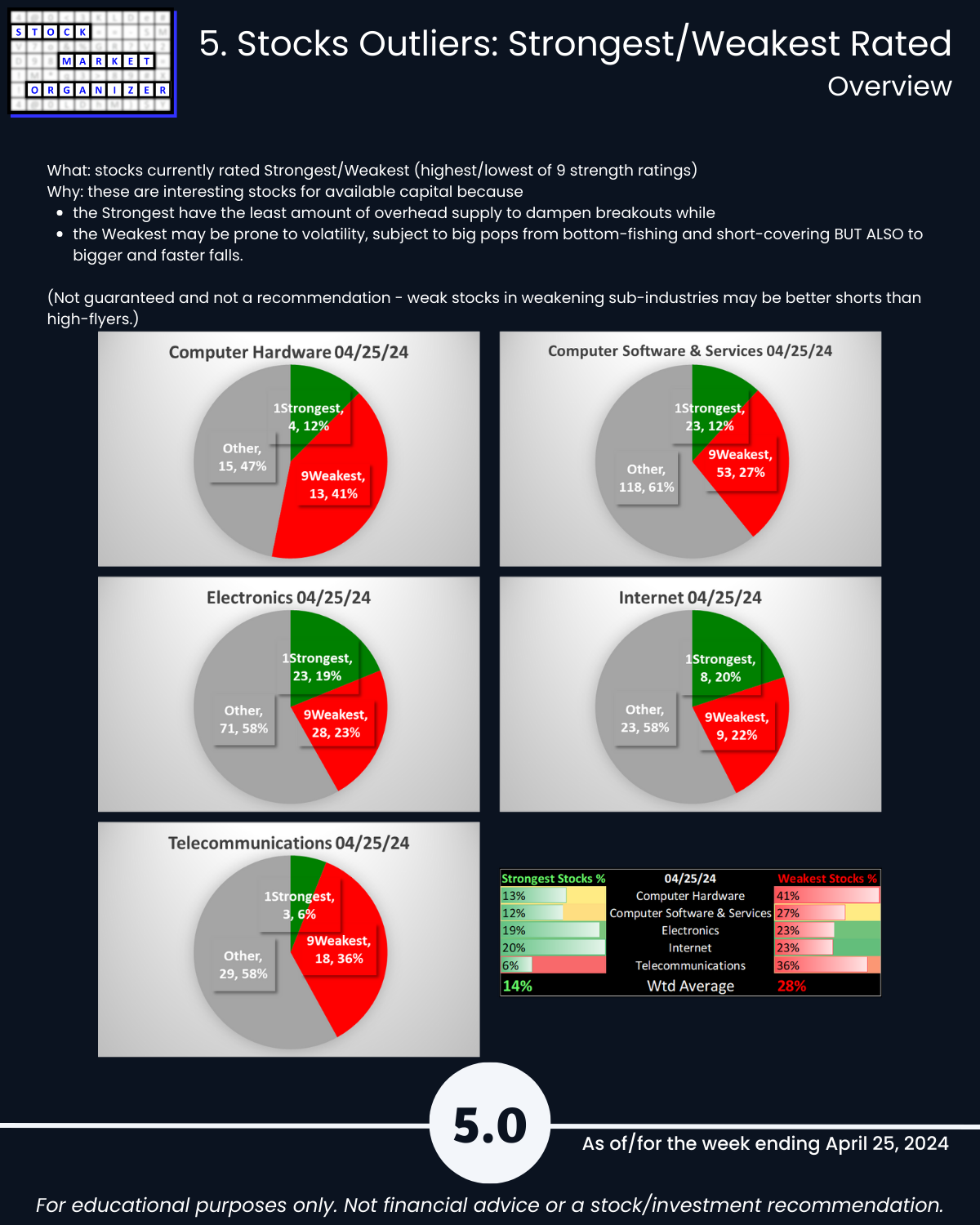

- Strongest:Weakest: Industry avg 14%/28%; Hardware 13%:41%, Telco 6%:36%

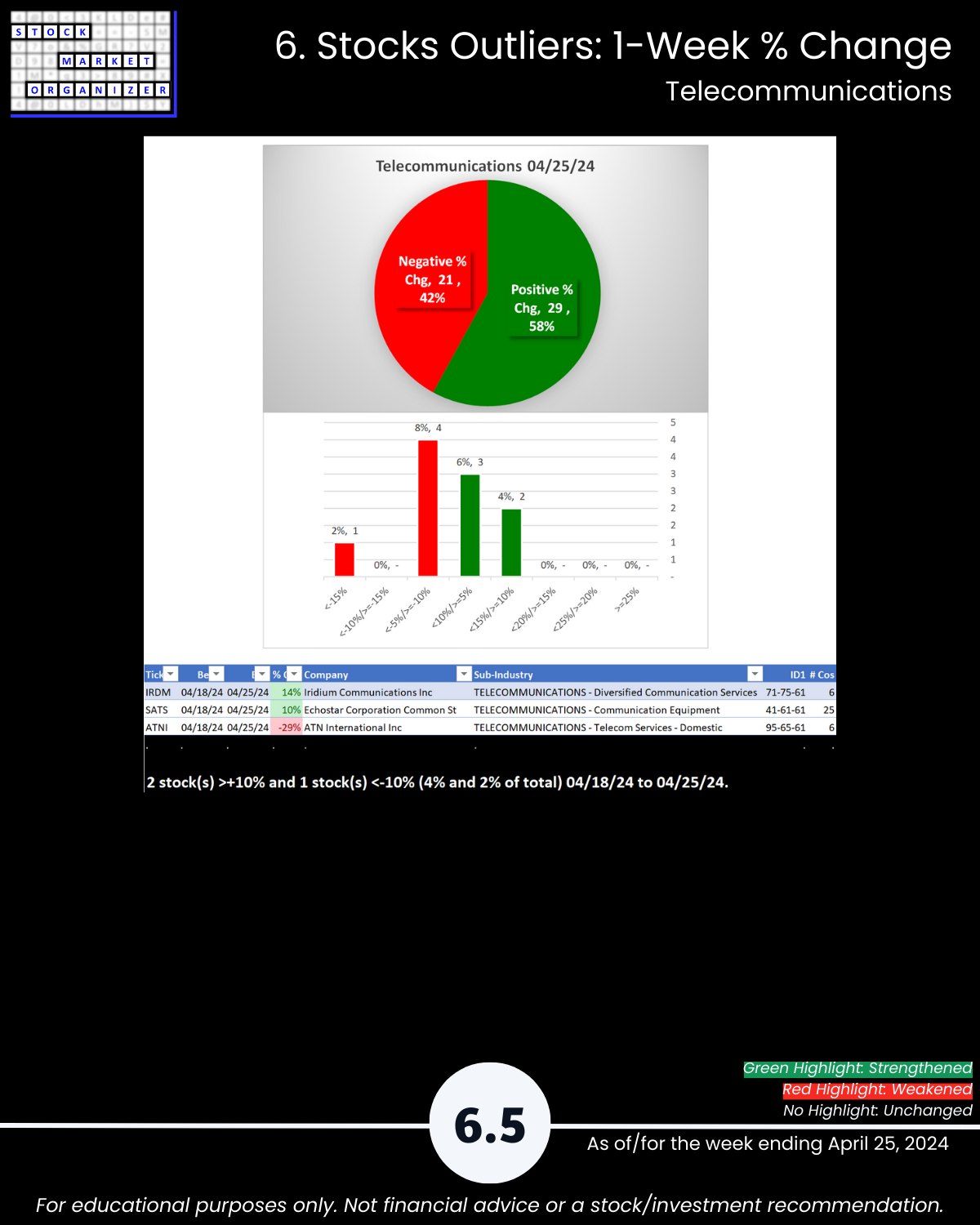

- Outlier Stocks: RIOT +46%; CLSK +20%; PI +27%, ATNI -29%

1. Introduction

2. Industry 1-Week Strengthening

3. Industry 10-Week Strengthening

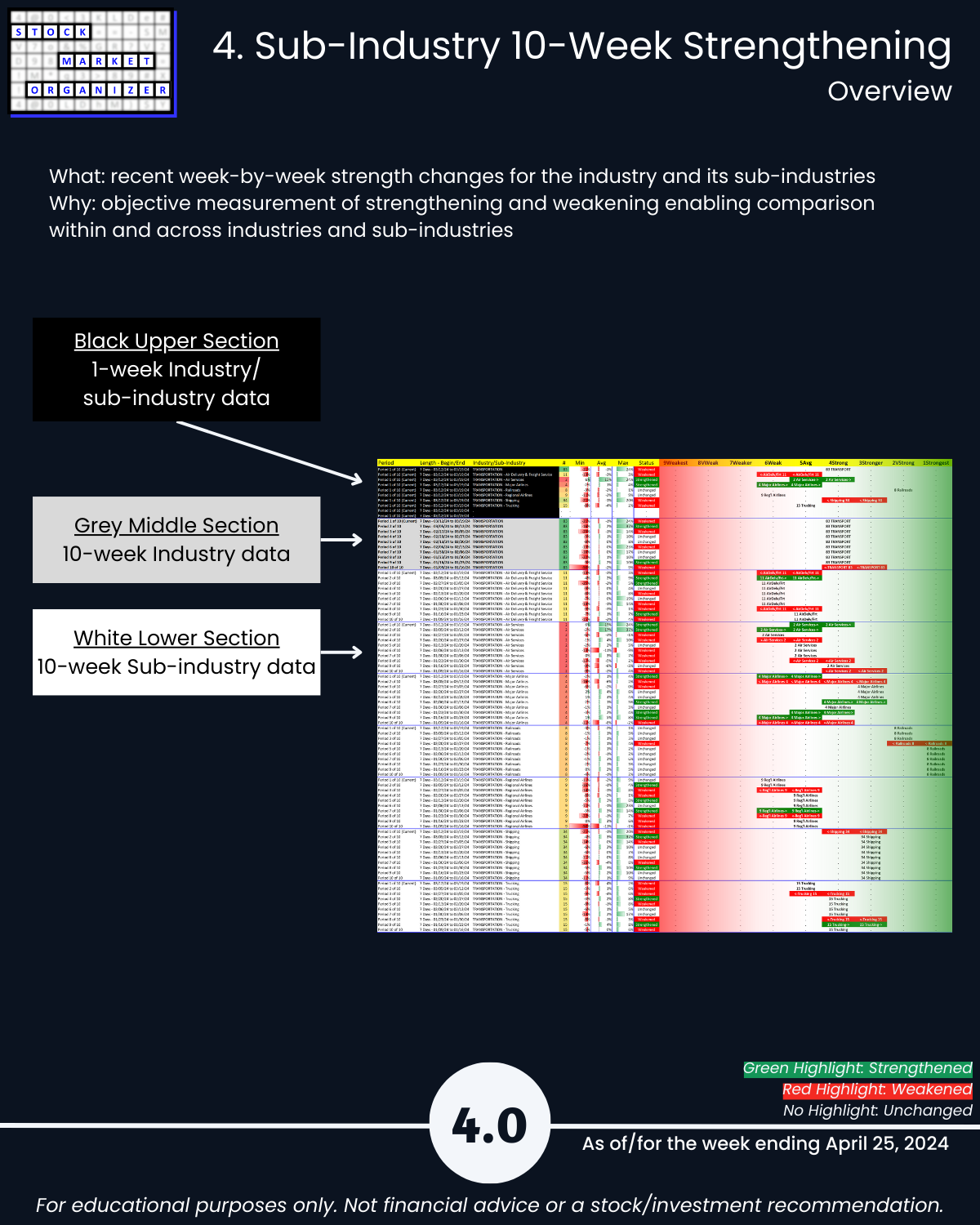

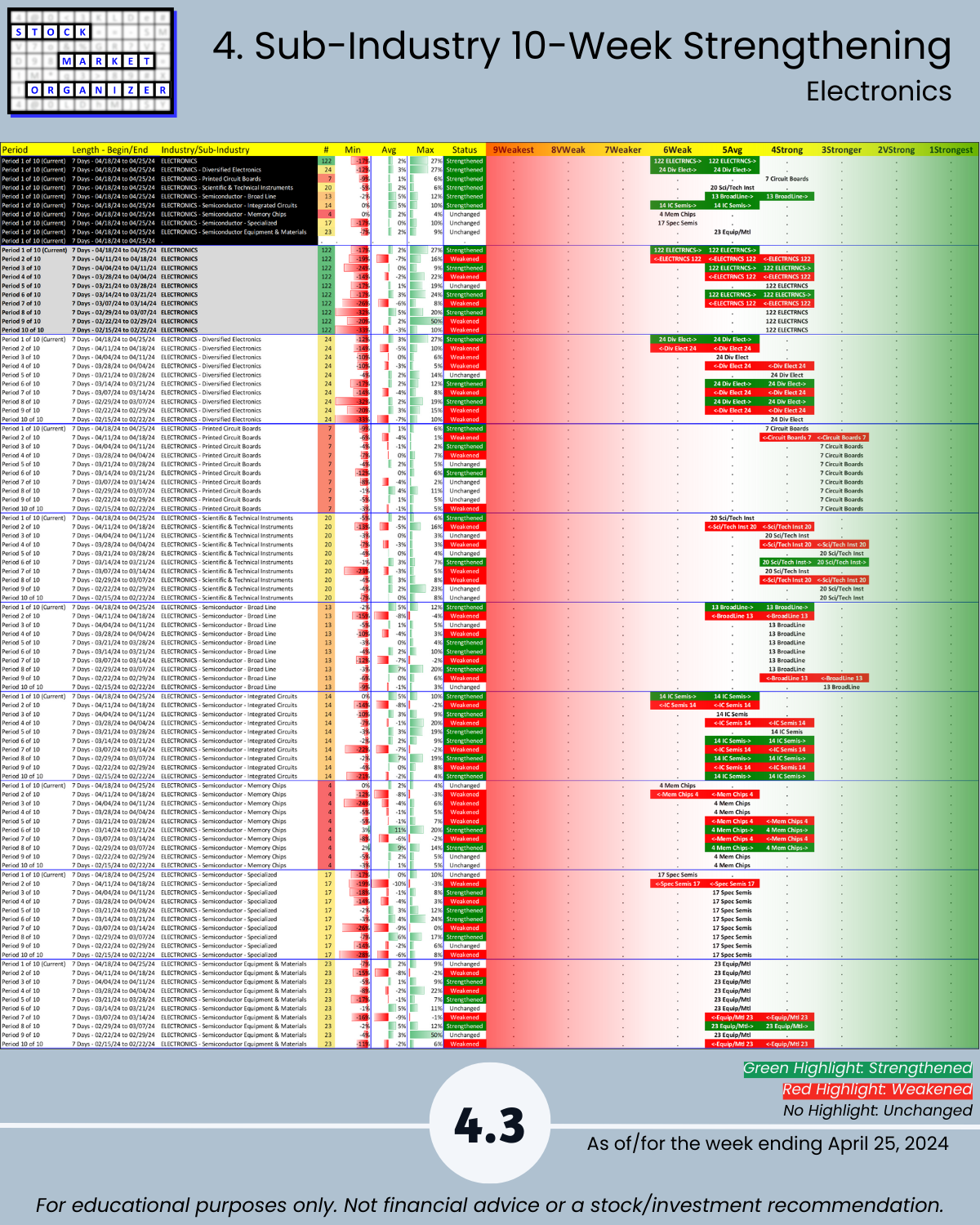

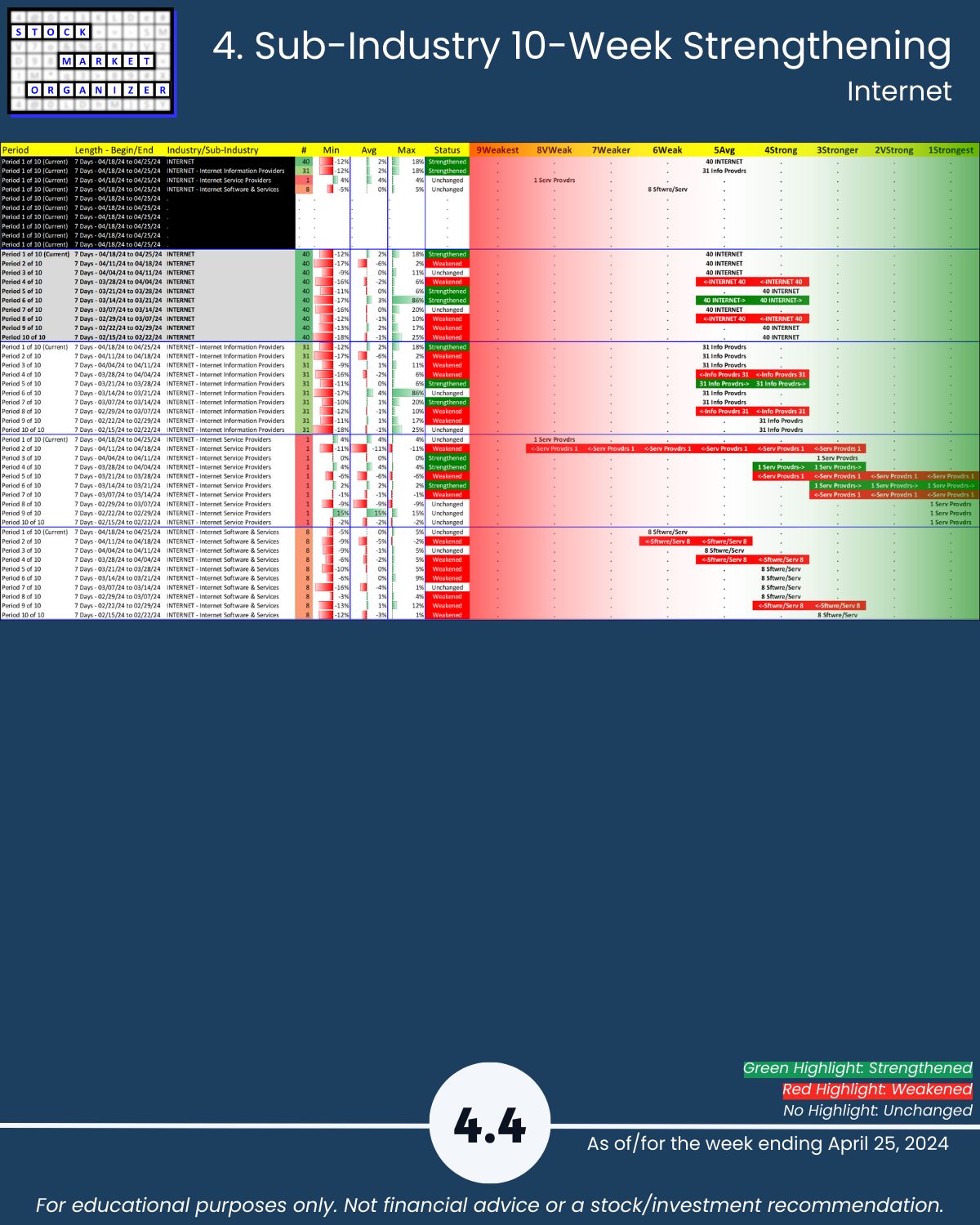

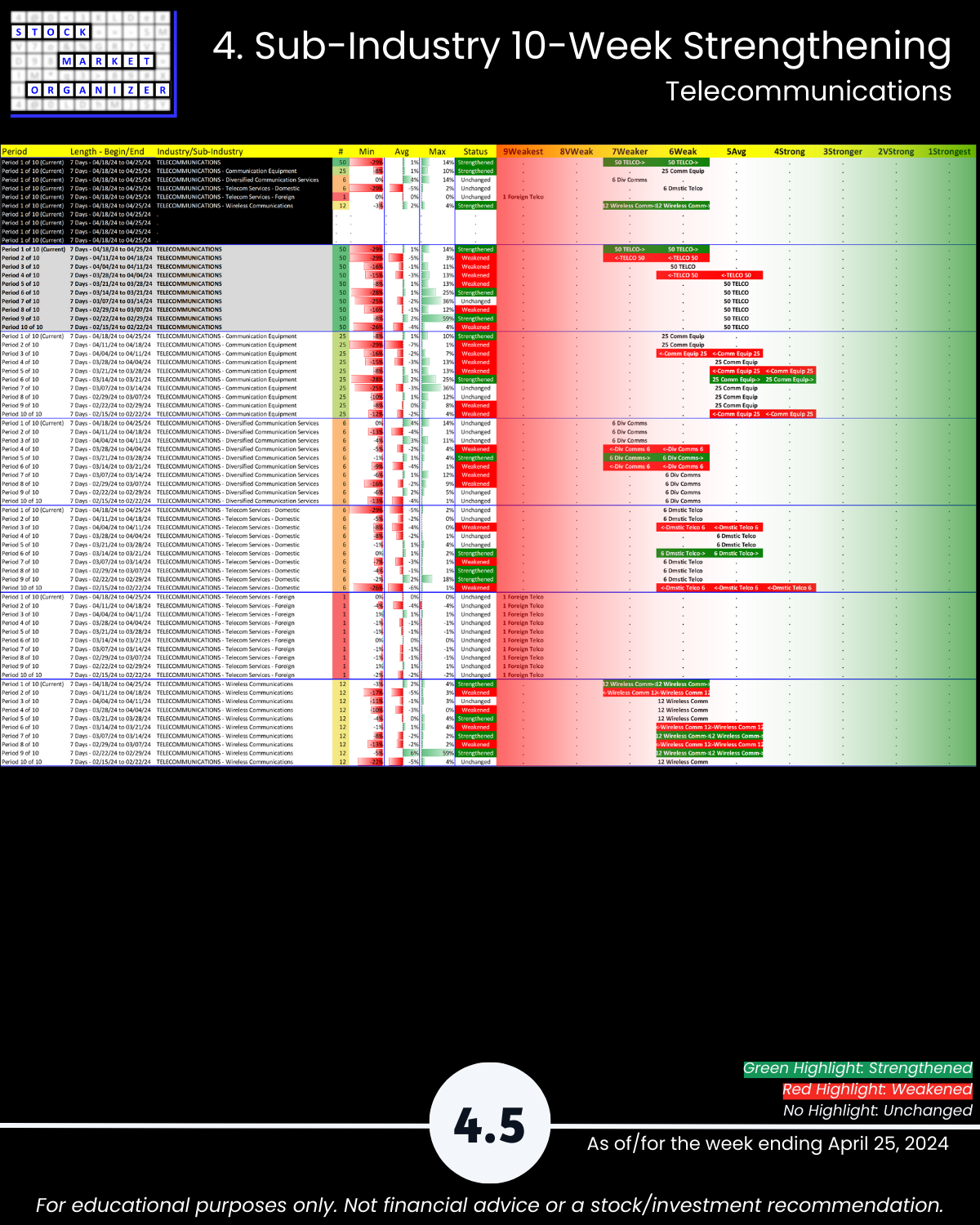

4. Sub-Industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

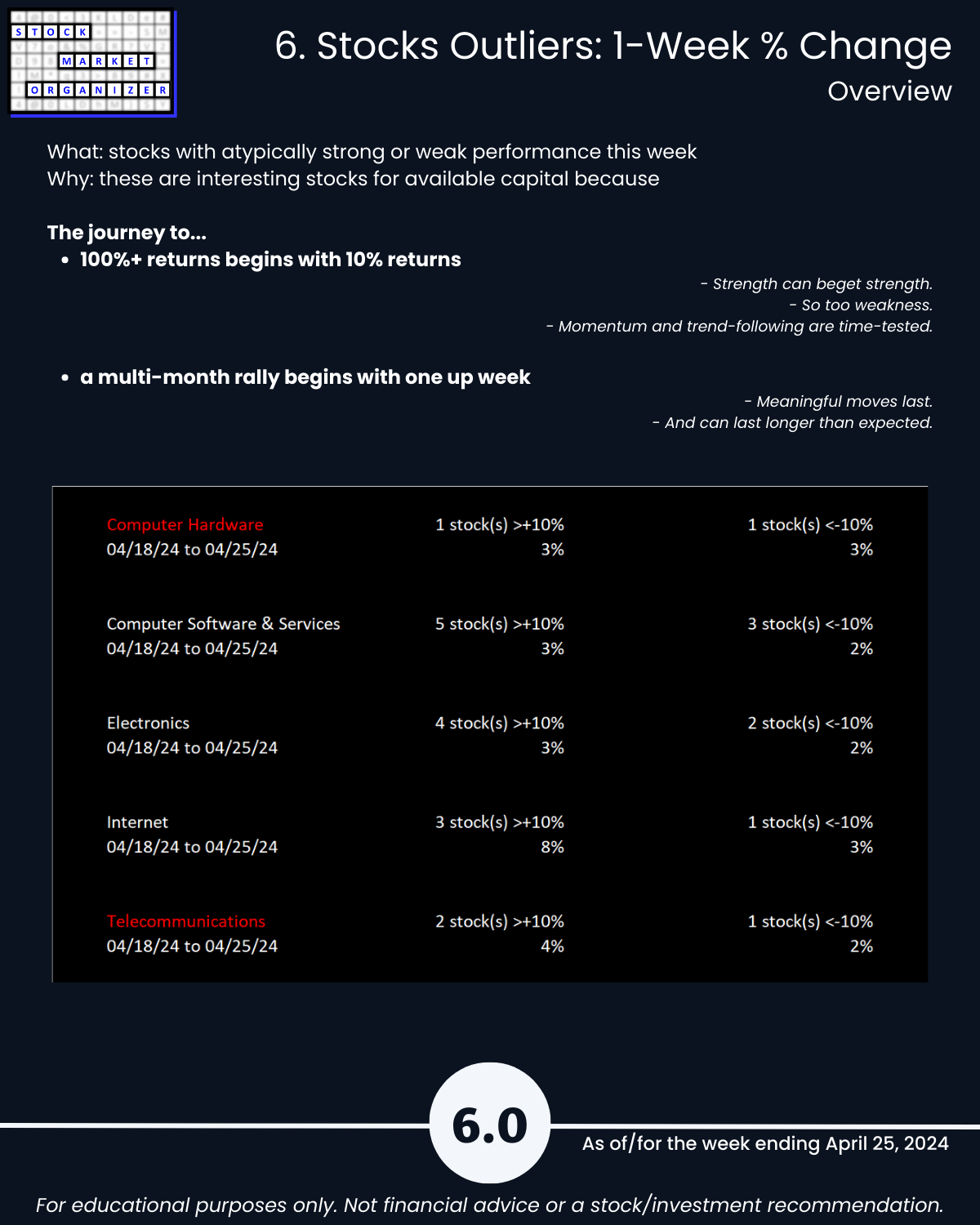

6. Stocks Outliers: 1-Week % Change

7. Stocks Outliers: 5-Year Highs/Lows