SMO Exclusive: Strength Report Technology Sector 2024-04-18

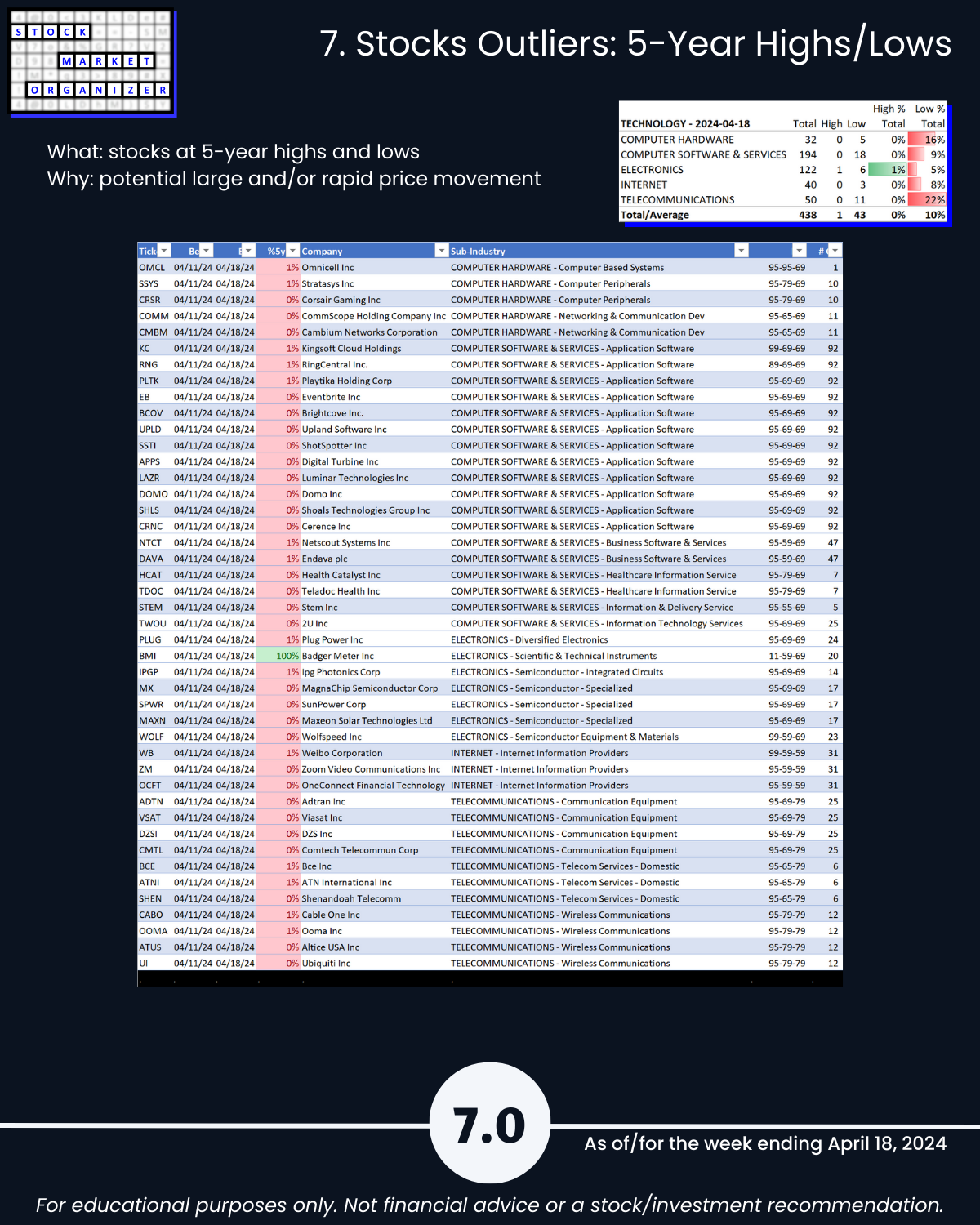

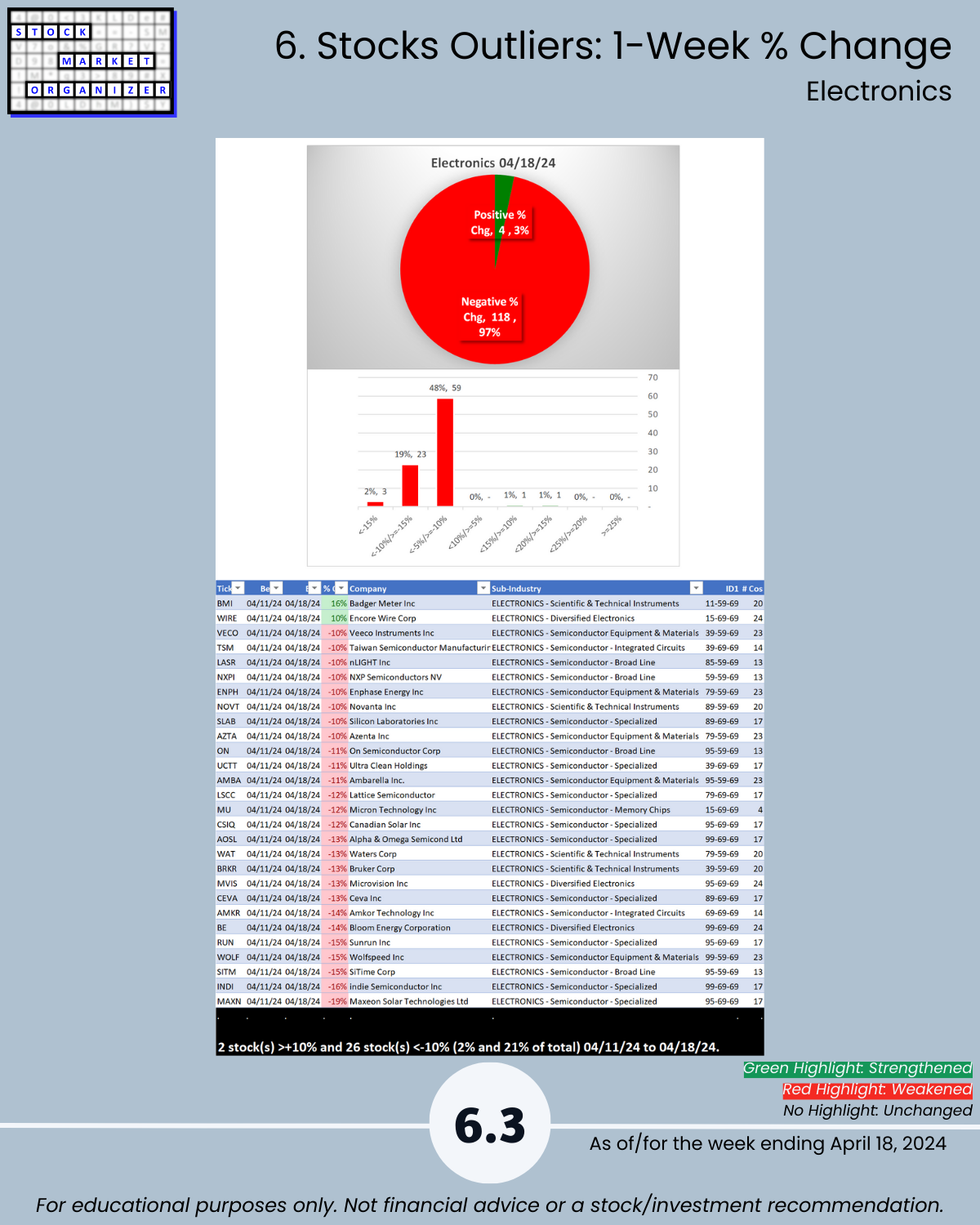

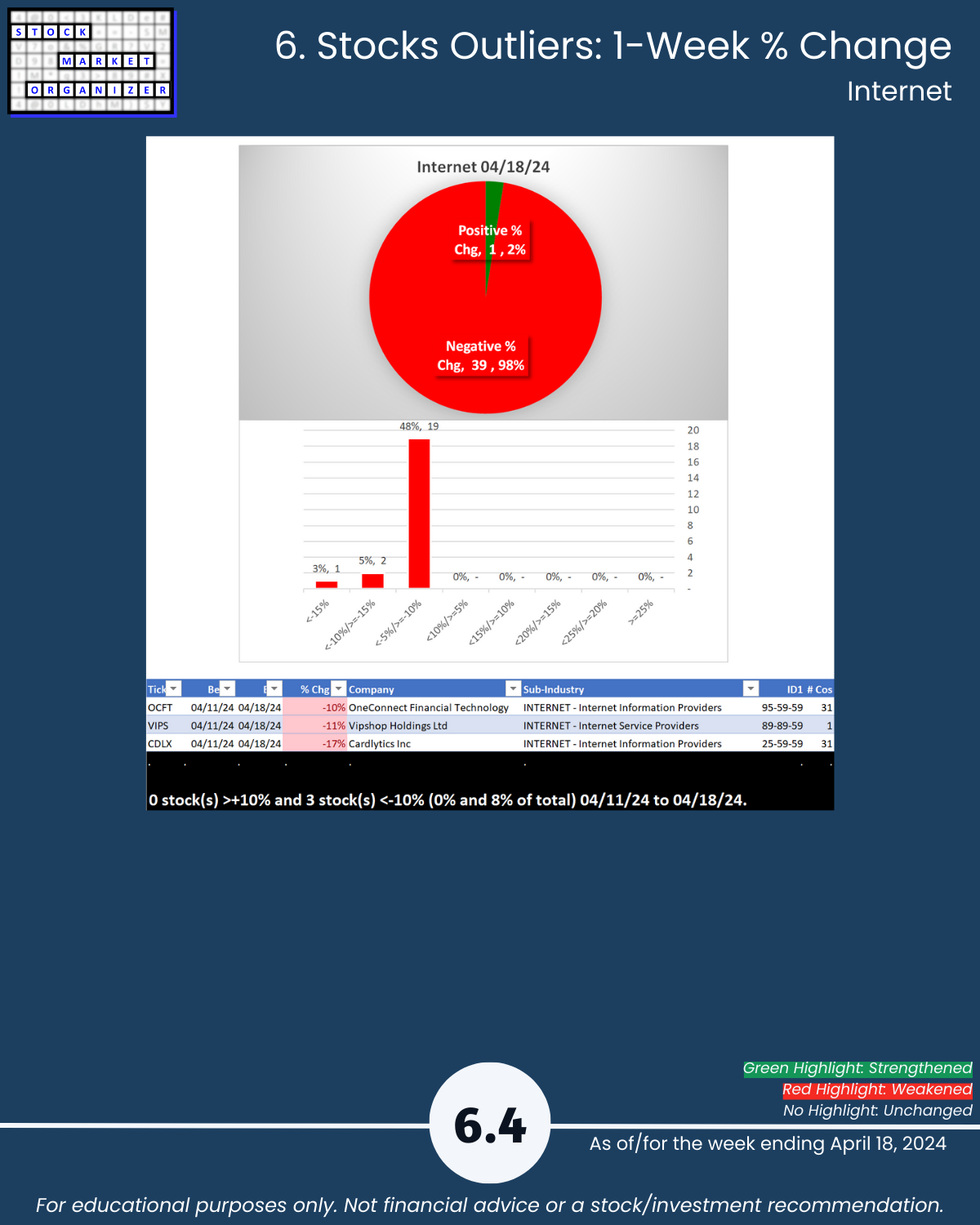

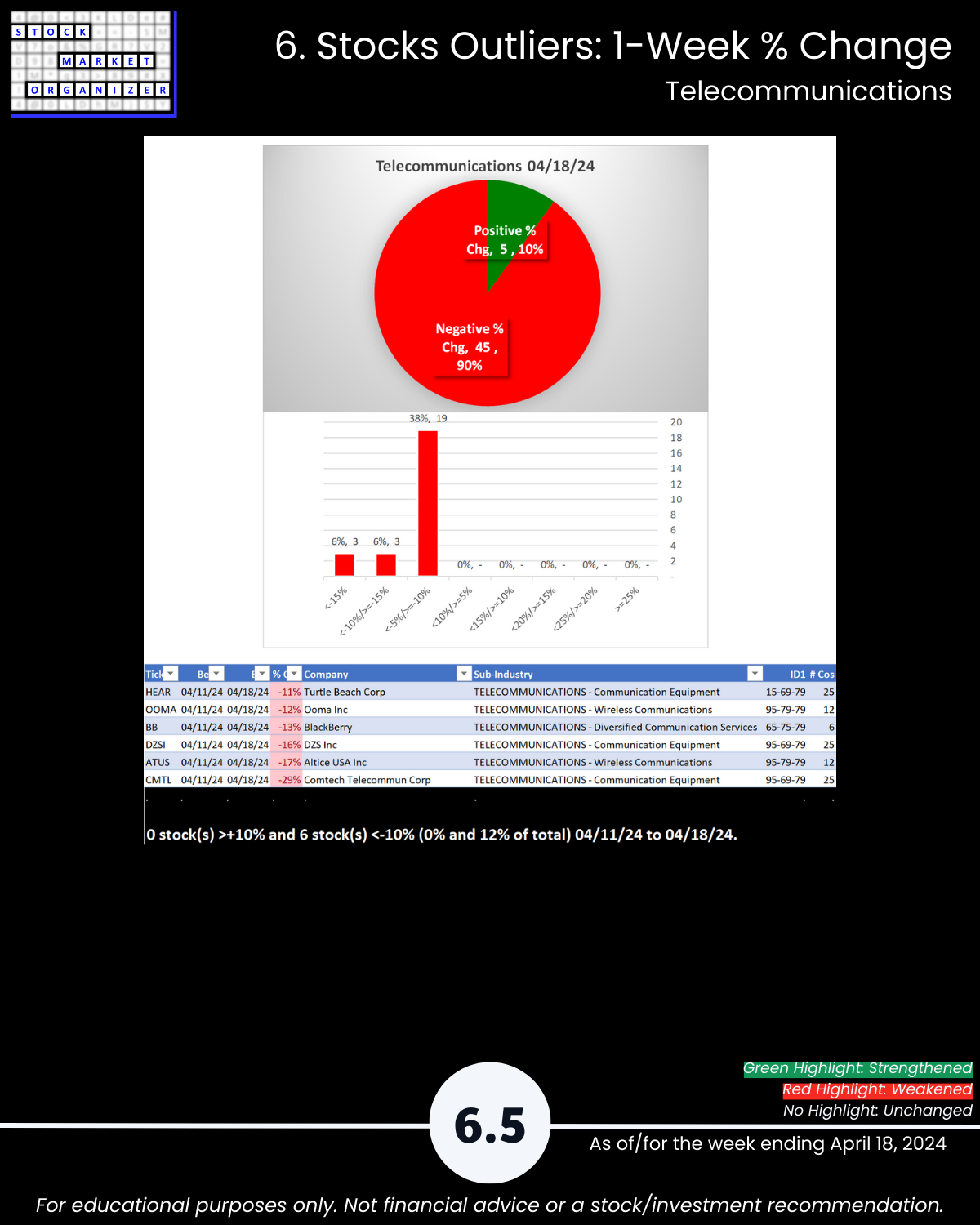

Raging red Tech 4/18/24 says “hold my beer” to this week’s earlier weak links Utilities, Automotive, and Real Estate. Message: the weakness is widespread. Will this continue? I don’t know. What I objectively DO know that you may not: 🔹 the sector composite ranking fell by a large -1.2 points to 6Weak, 🔹 94% negative stocks, 4 of 5 industries weakened ranking including Electronics by 2 levels, 3 of 5 sub-industries weakened ranking, and 77% of sub-industries weakened generally, 🔹 Computer Hardware 16% and Telco 22% of stocks are at 5 Year+ Lows, 🔹 Hardware 16%, Software 15%, Electronics 21%, and Telco 12% of stocks fell more than <-10%.

The above is generated purely from measuring the market and reporting my findings with 0% bias, emotions, feelings, interpretations, judgments, or opinions.

Therefore, I have no conviction about any of this. This information is what it is.

Instead, I have conviction about Process and Discipline.

WHAT’S HERE? A CLOSER LOOK AT PROCESS AND DISCIPLINE

I highlighted last week https://www.linkedin.com/posts/briandegracia_smo-strength-report-technology-sector-2024-activity-7184379891100925952-ZflX?utm_source=share&utm_medium=member_desktop the stocks rated 1Strongest and 9Weakest (highest/lowest of 9 strength ratings) in the Semiconductor Equipment & Materials sub-industry.

At the time this was a strengthening sub-industry (rated Average) in a strengthening industry (Electronics rated Strong)

Thus buying the 1Strongest stocks would have meant having 3 supportive strength levels.

BUT I highlighted the following:

“… per the Stock Market Organizer system,

🔹 the prevailing environment is NO NEW LONGS due to the current negative market strength score (-70% 4/11/24).

SO

🔹 No new longs yet, despite the positives at the above-described stock, sub-industry, and industry levels.”

For one week at least, this was a good stance borne of Process and Discipline.

A UNIQUE STRENGTH-BASED LOOK

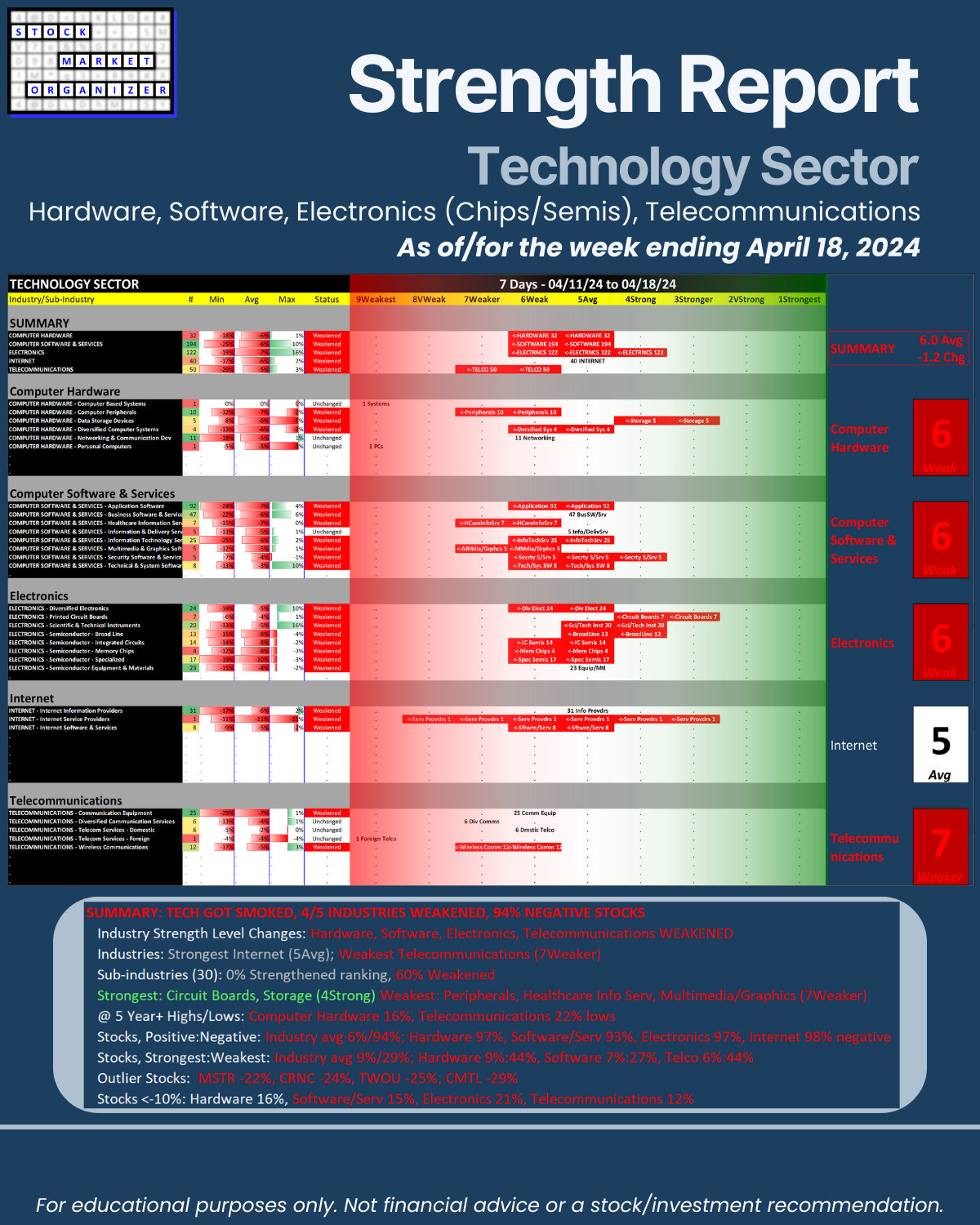

SUMMARY: TECH GOT SMOKED, 4/5 INDUSTRIES WEAKENED, 94% NEGATIVE STOCKS

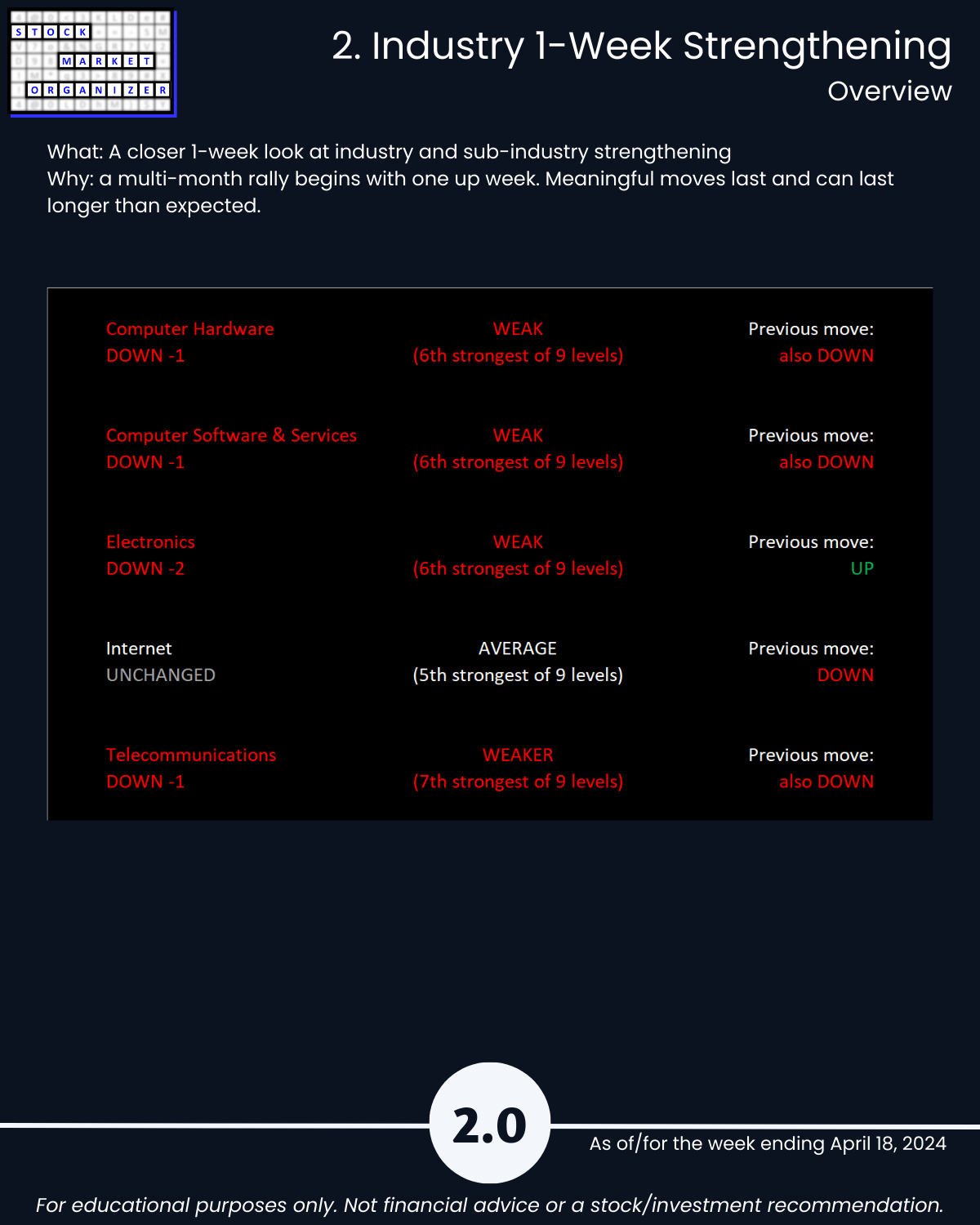

🔹 Industry Strength Level Changes: Hardware, Software, Electronics, Telecommunications WEAKENED

🔹 Industries

- Strongest Internet (5Avg)

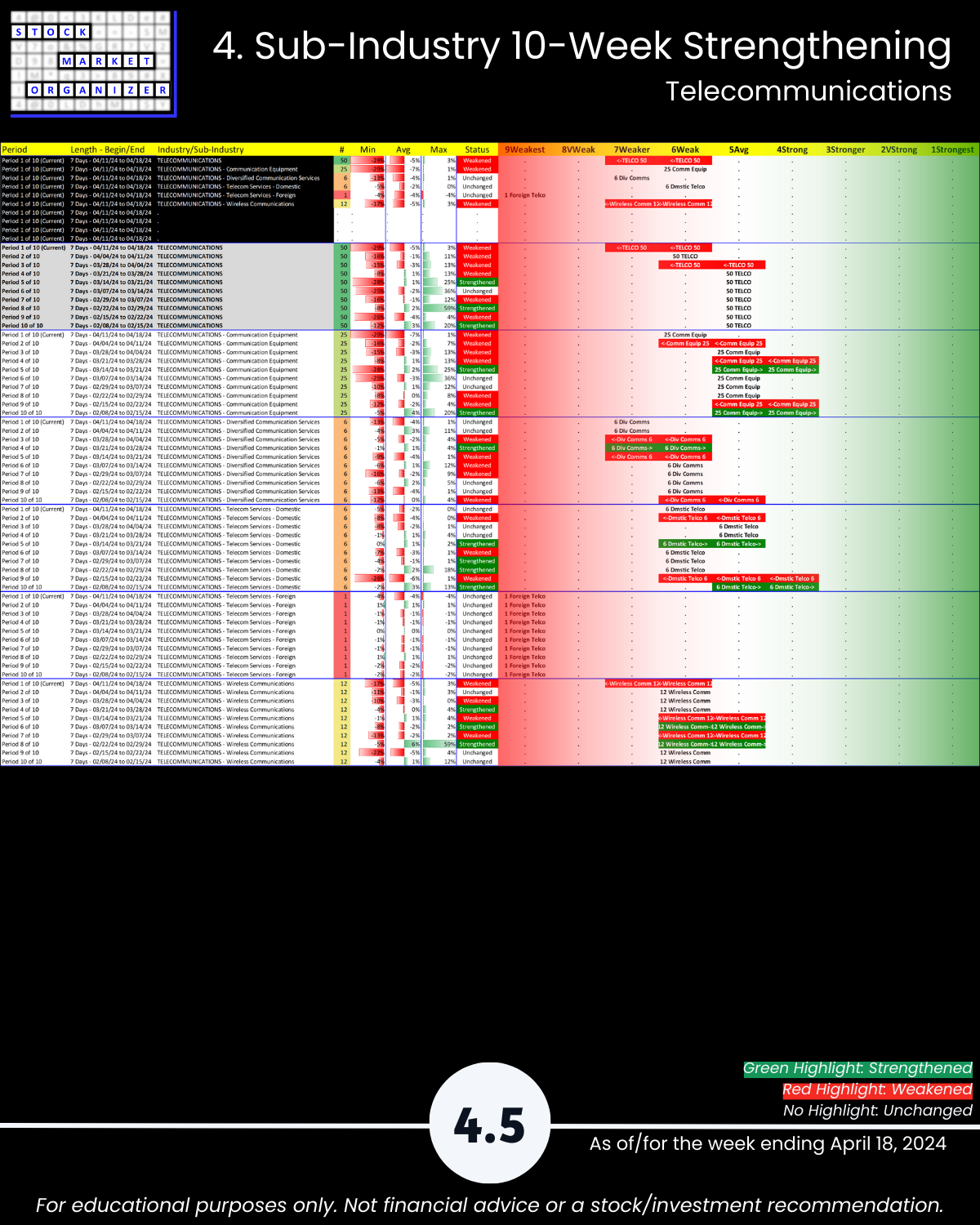

- Weakest Telecommunications (7Weaker)

🔹 Sub-industries (30)

- 0% Strengthened ranking, 60% Weakened

- Strongest: Circuit Boards, Storage (4Strong)

- Weakest: Peripherals, Healthcare Info Serv, Multimedia/Graphics (7Weaker)

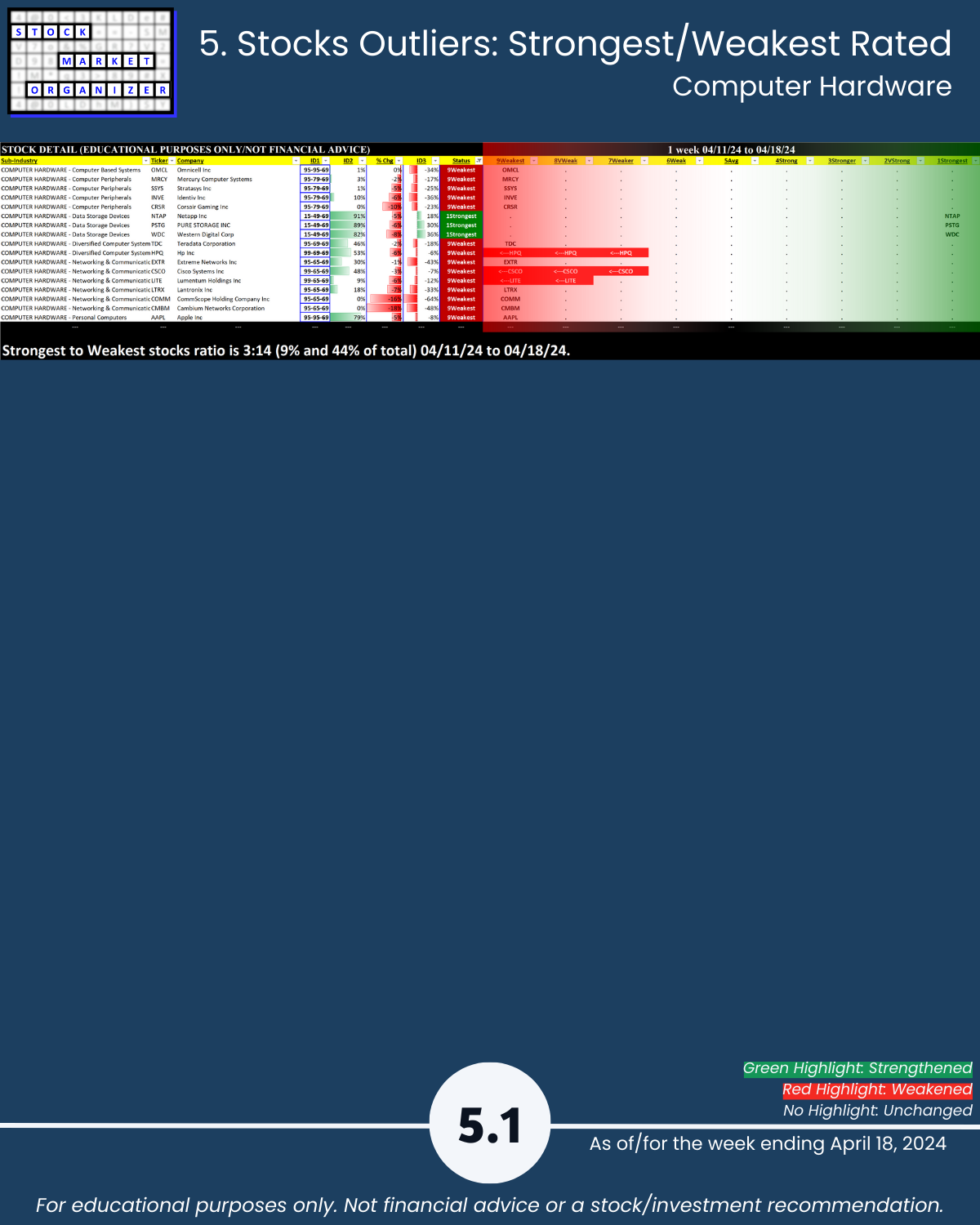

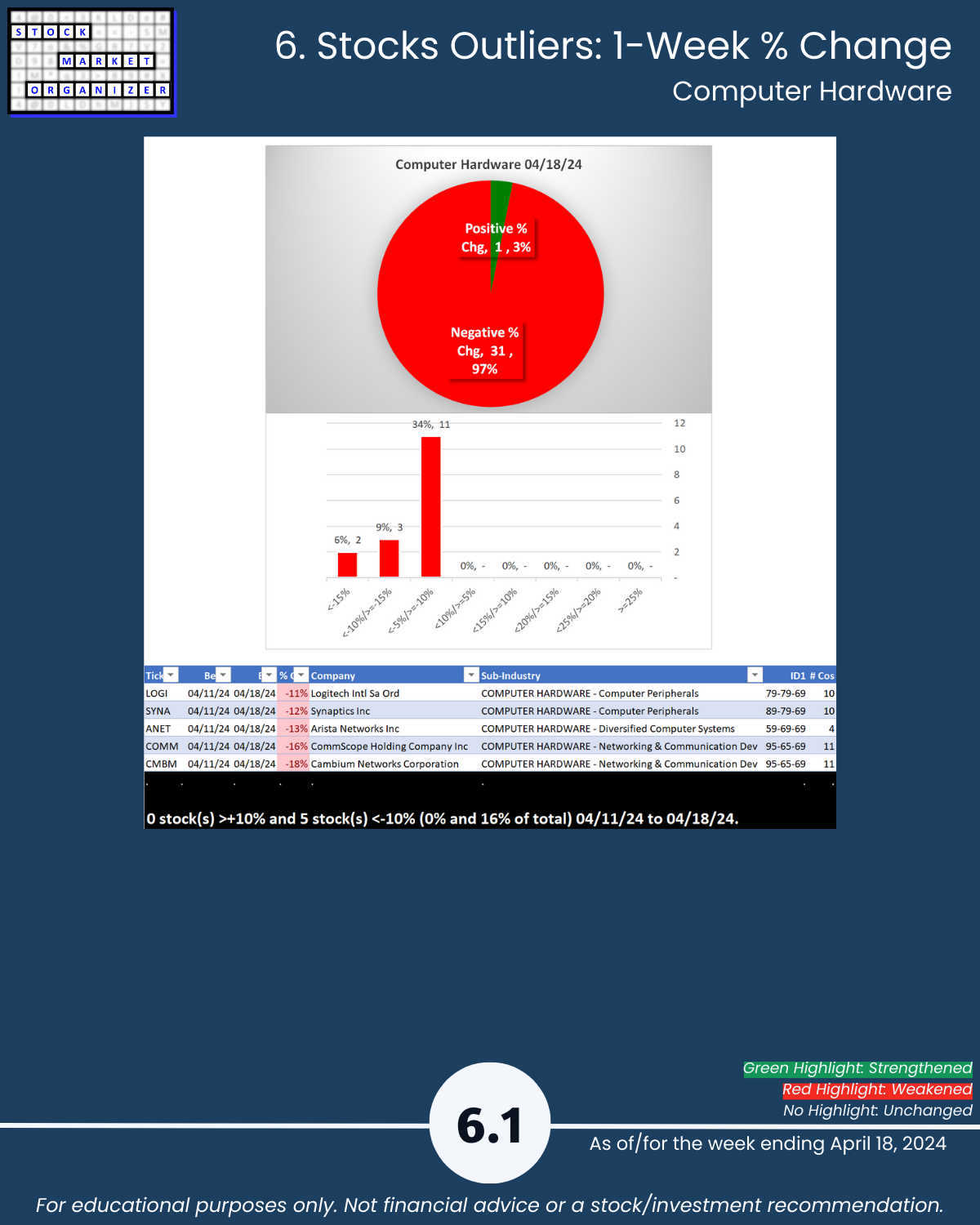

- @ 5 Year+ Highs/Lows: Computer Hardware 16%, Telecommunications 22% lows

🔹 Stocks

- Positive:Negative: Industry avg 6%/94%; Hardware 97%, Software/Serv 93%, Electronics 97%, Internet 98% negative

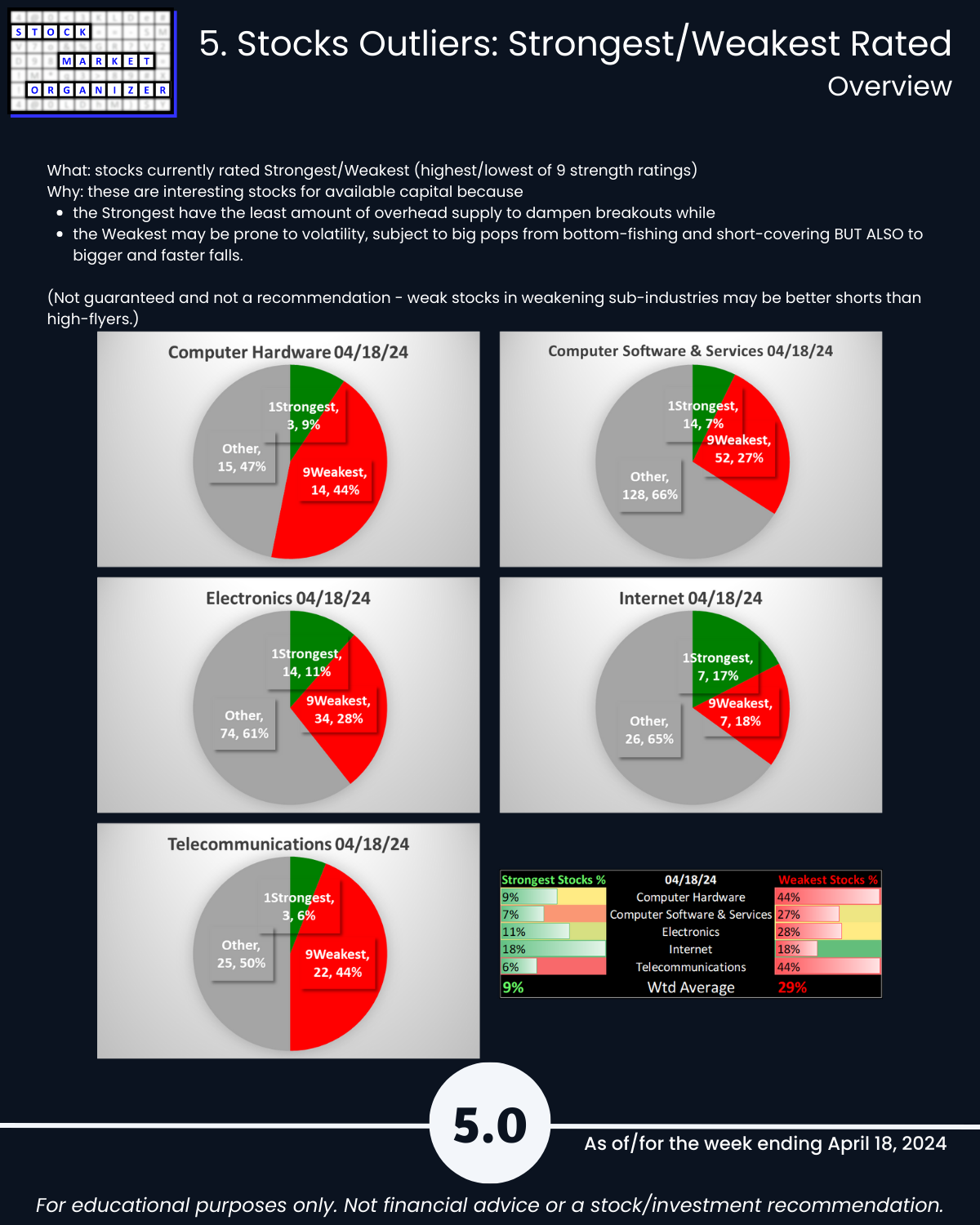

- Strongest:Weakest: Industry avg 9%/29%; Hardware 9%:44%, Software 7%:27%, Telco 6%:44%

- Outlier Stocks: MSTR -22%, CRNC -24%, TWOU -25%; CMTL -29%

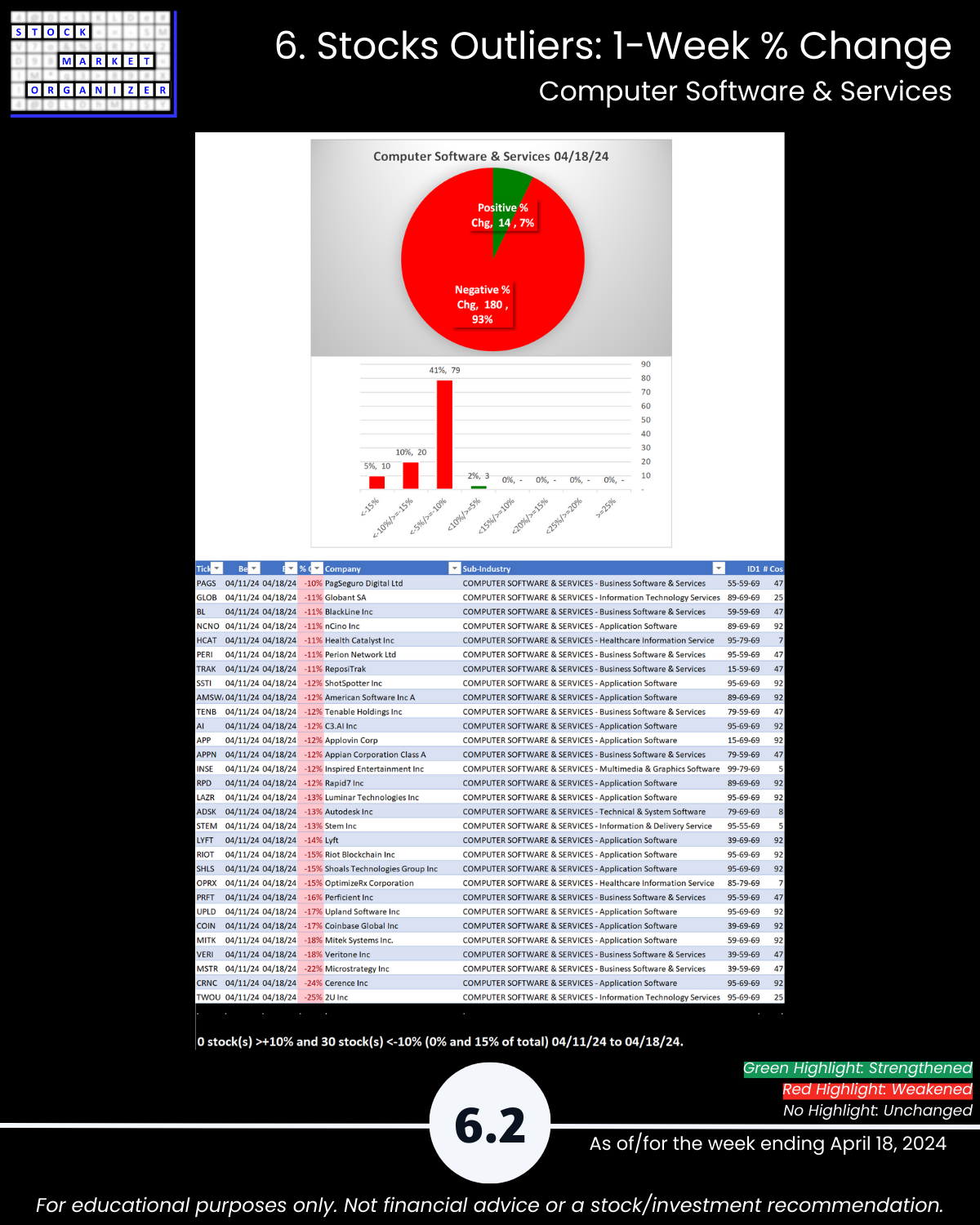

- Stocks <-10%: Hardware 16%, Software/Serv 15%, Electronics 21%, Telecommunications 12%

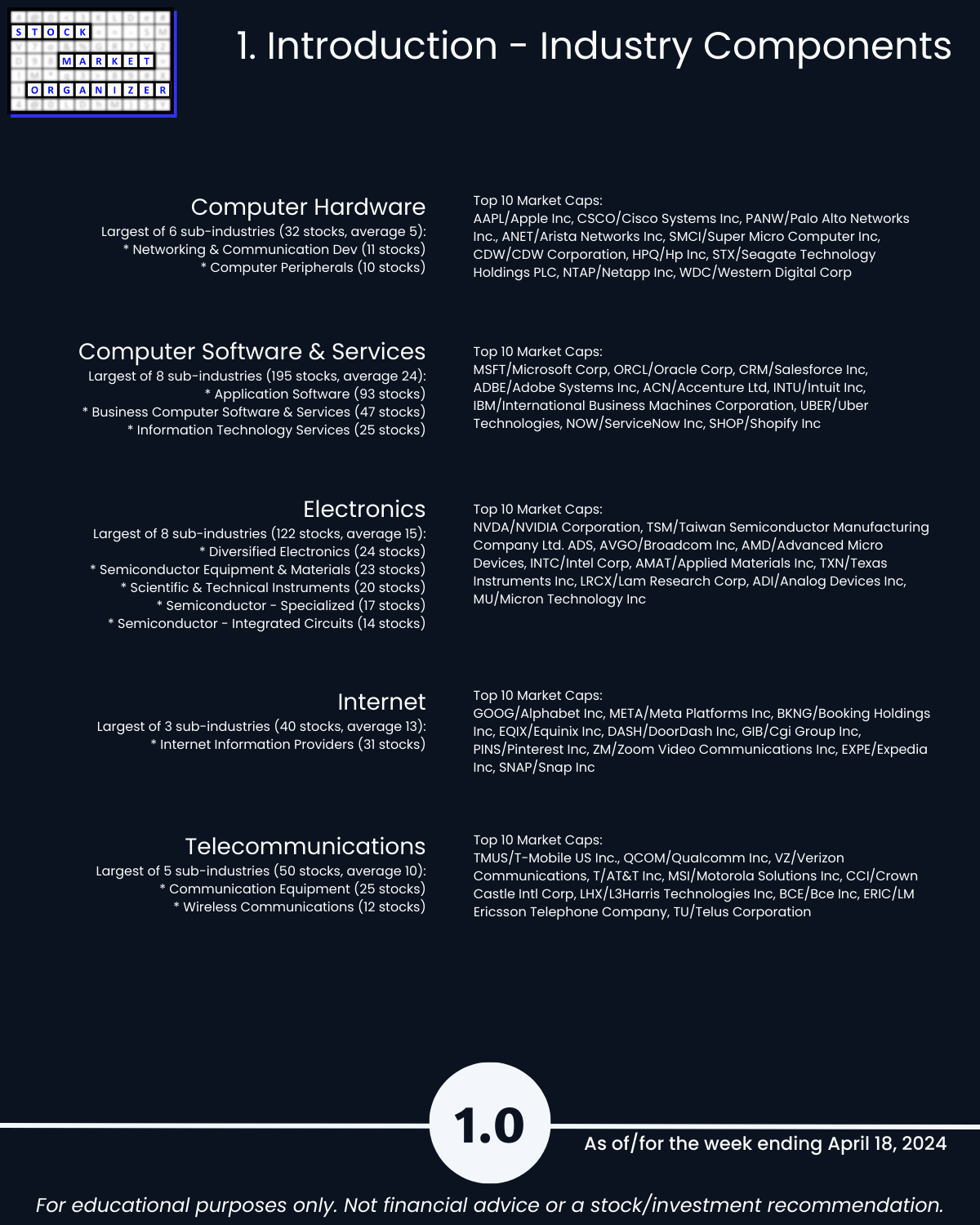

1. Introduction

2. Industry 1-Week Strengthening

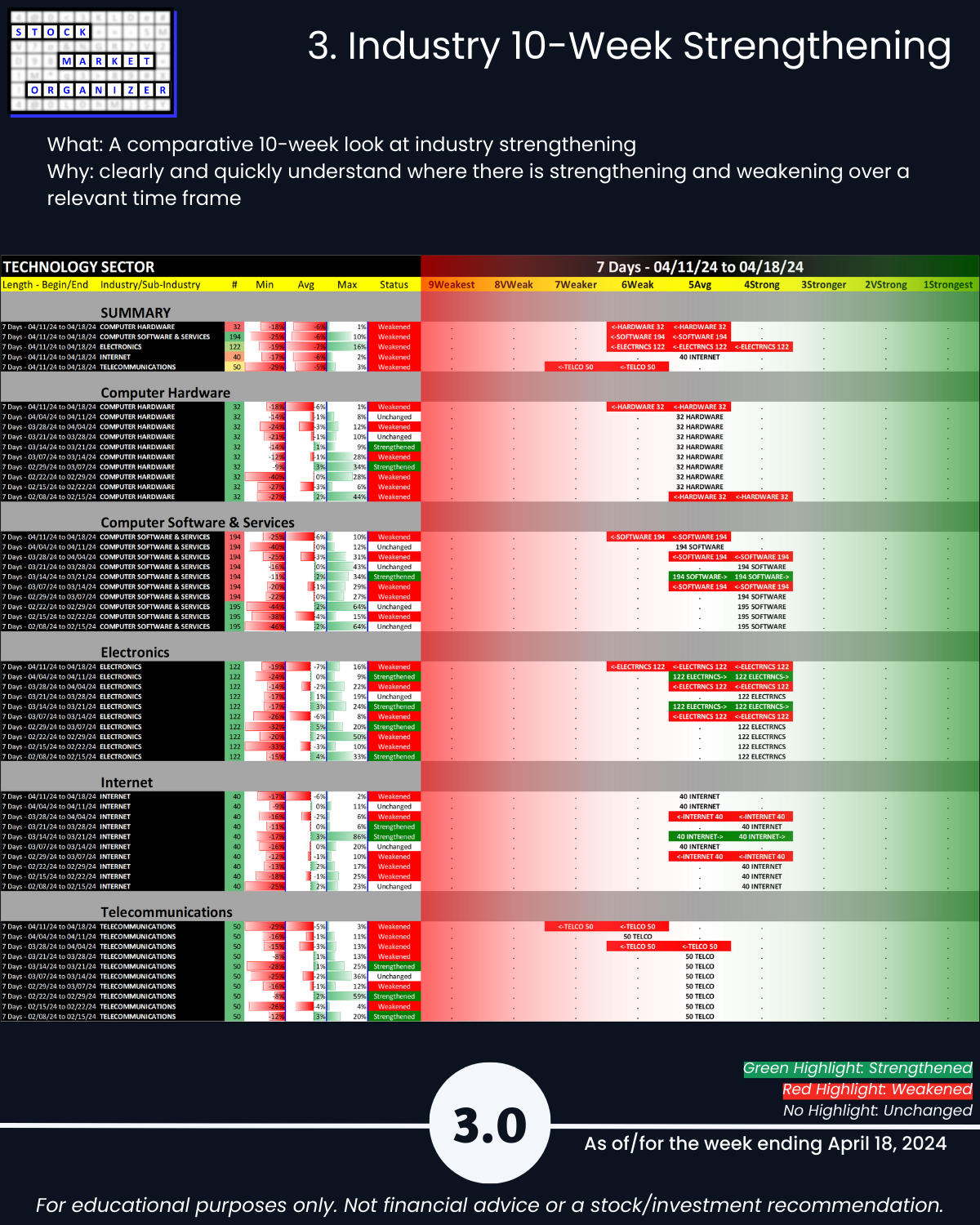

3. Industry 10-Week Strengthening

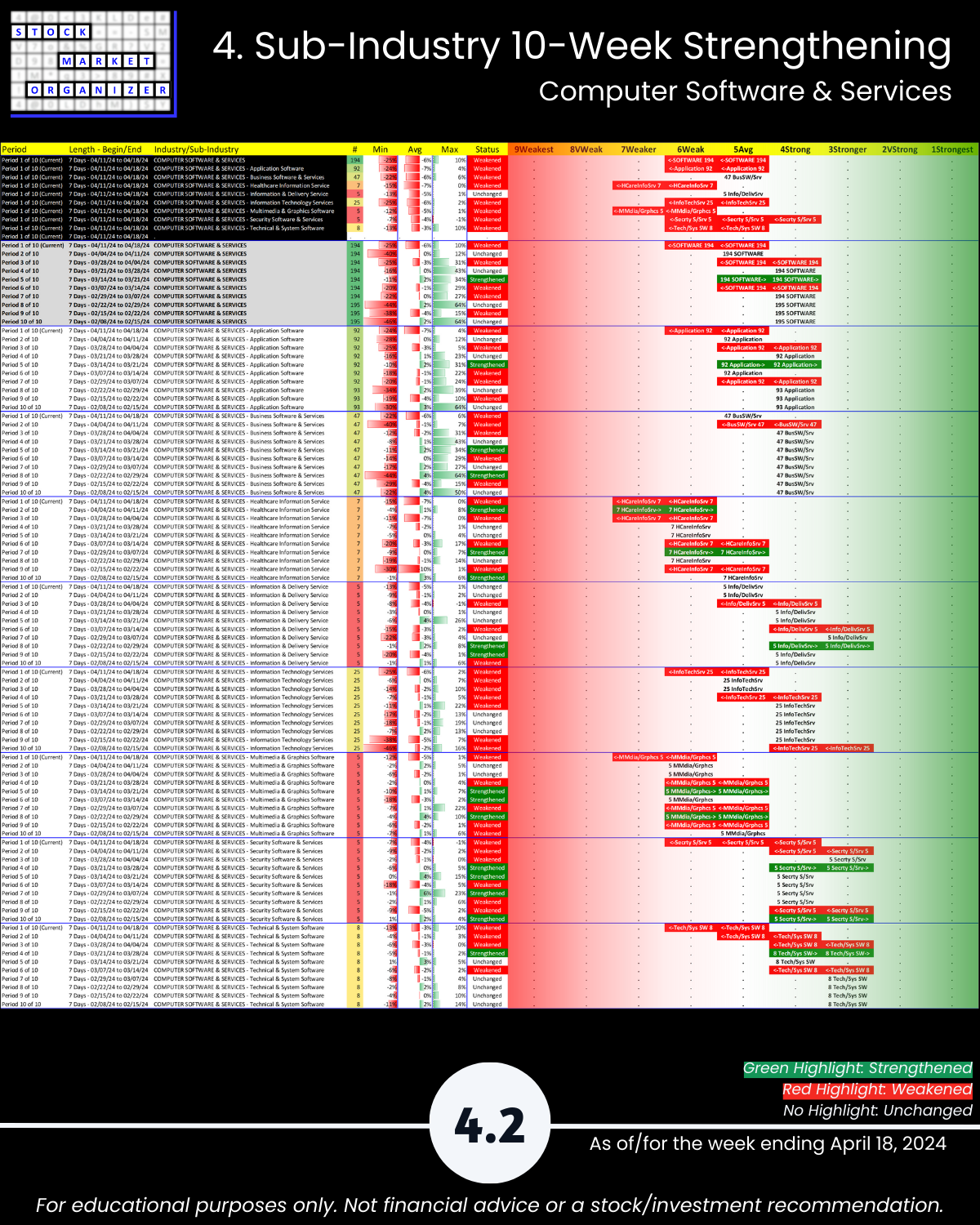

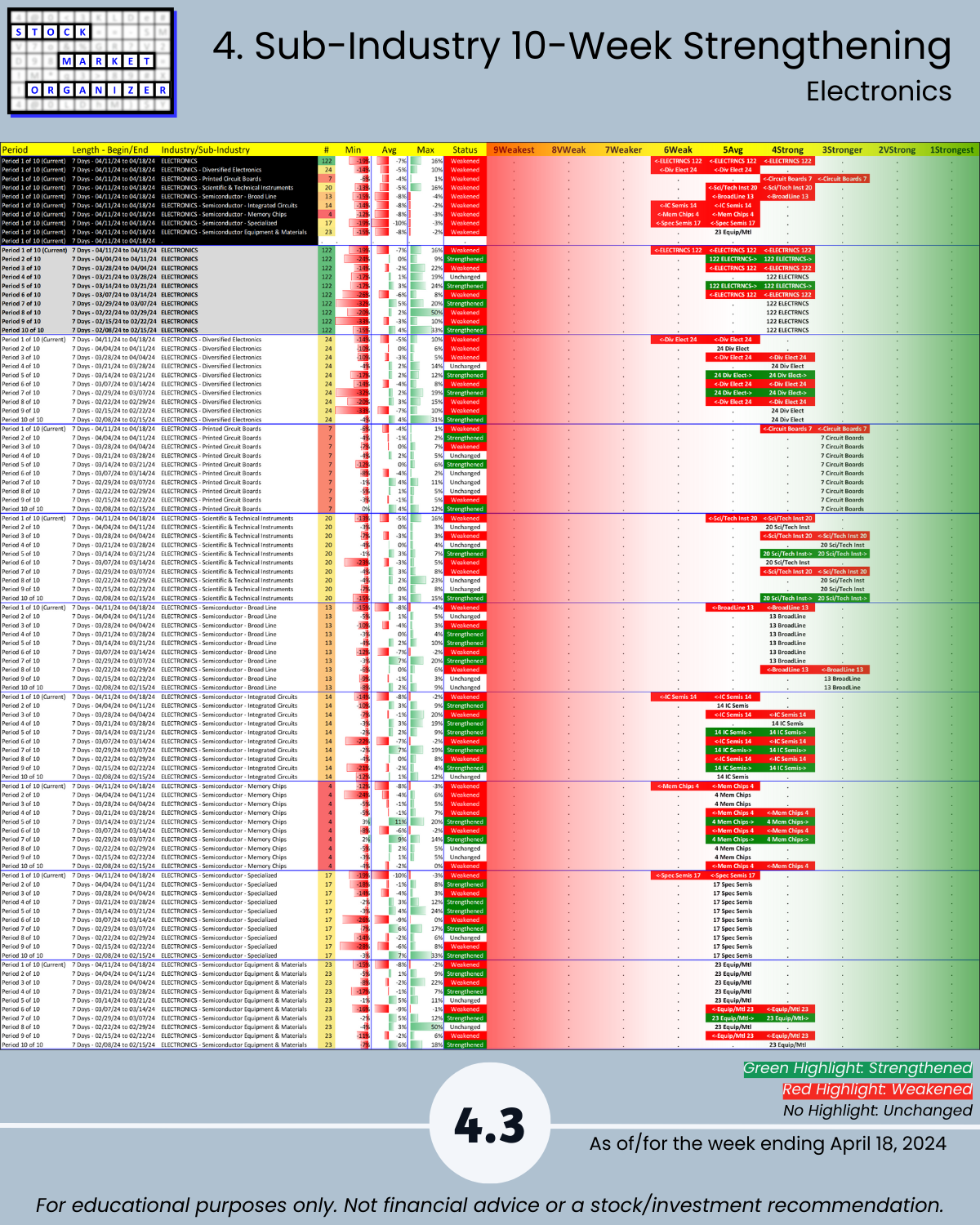

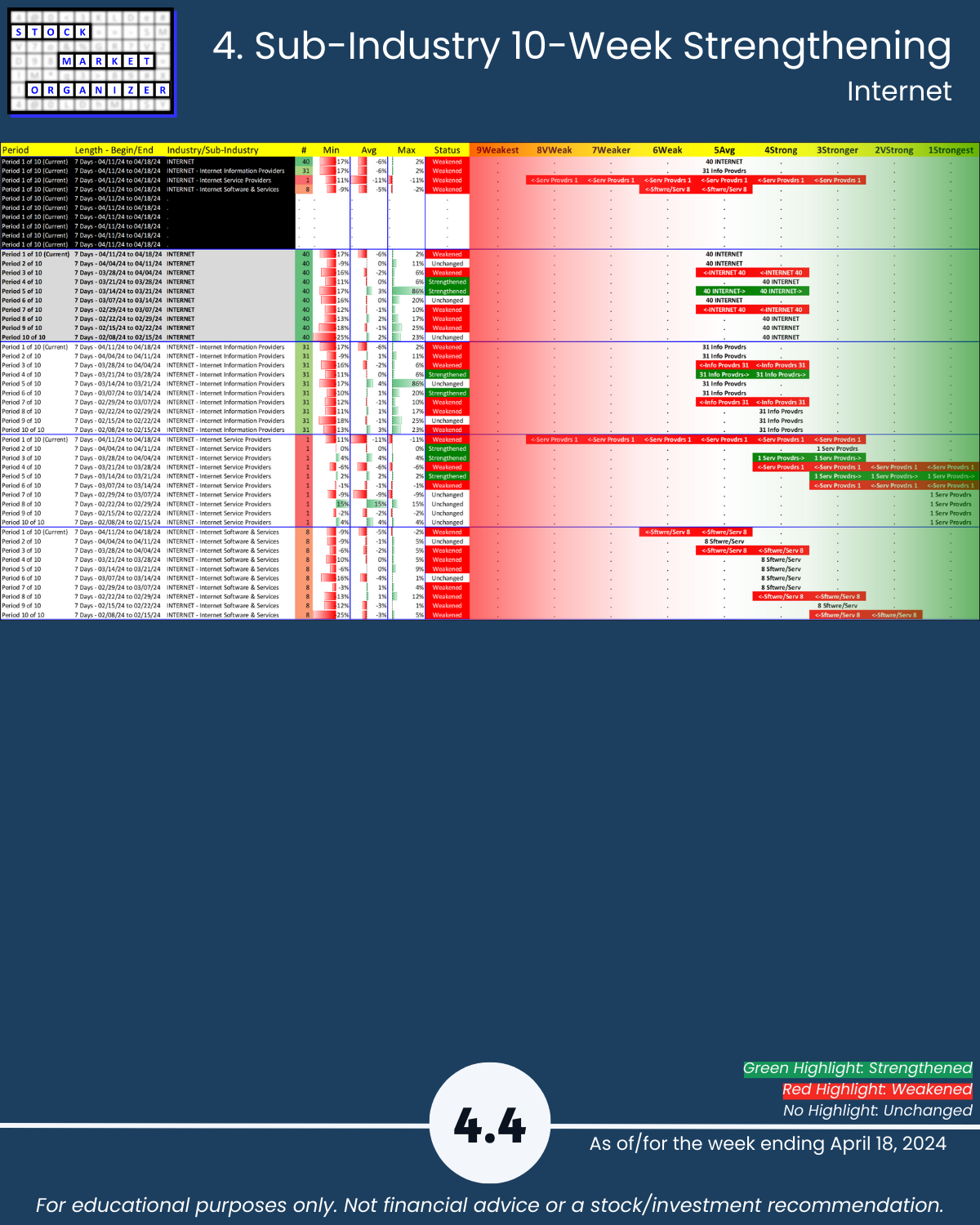

4. Sub-Industry 10-Week Strengthening

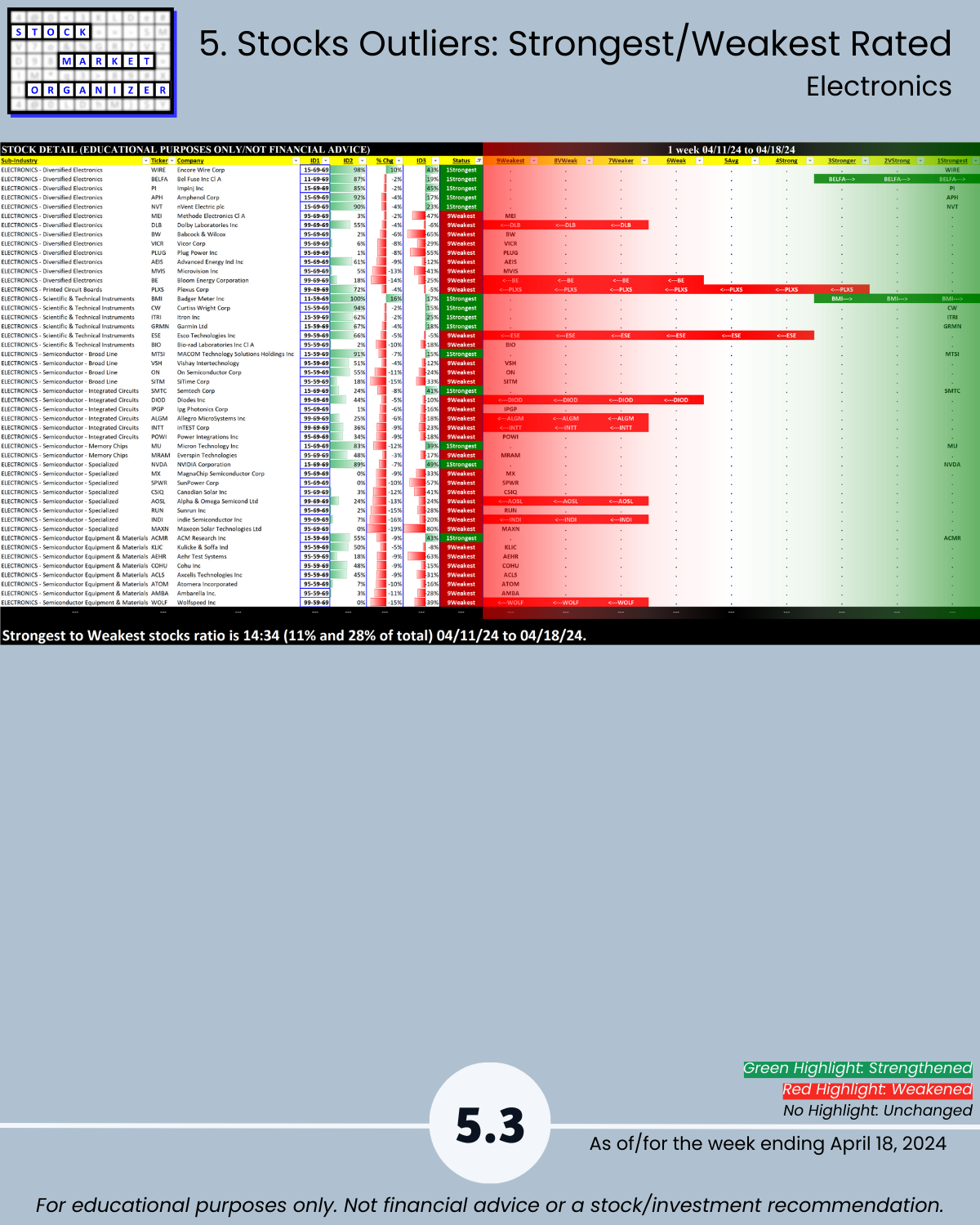

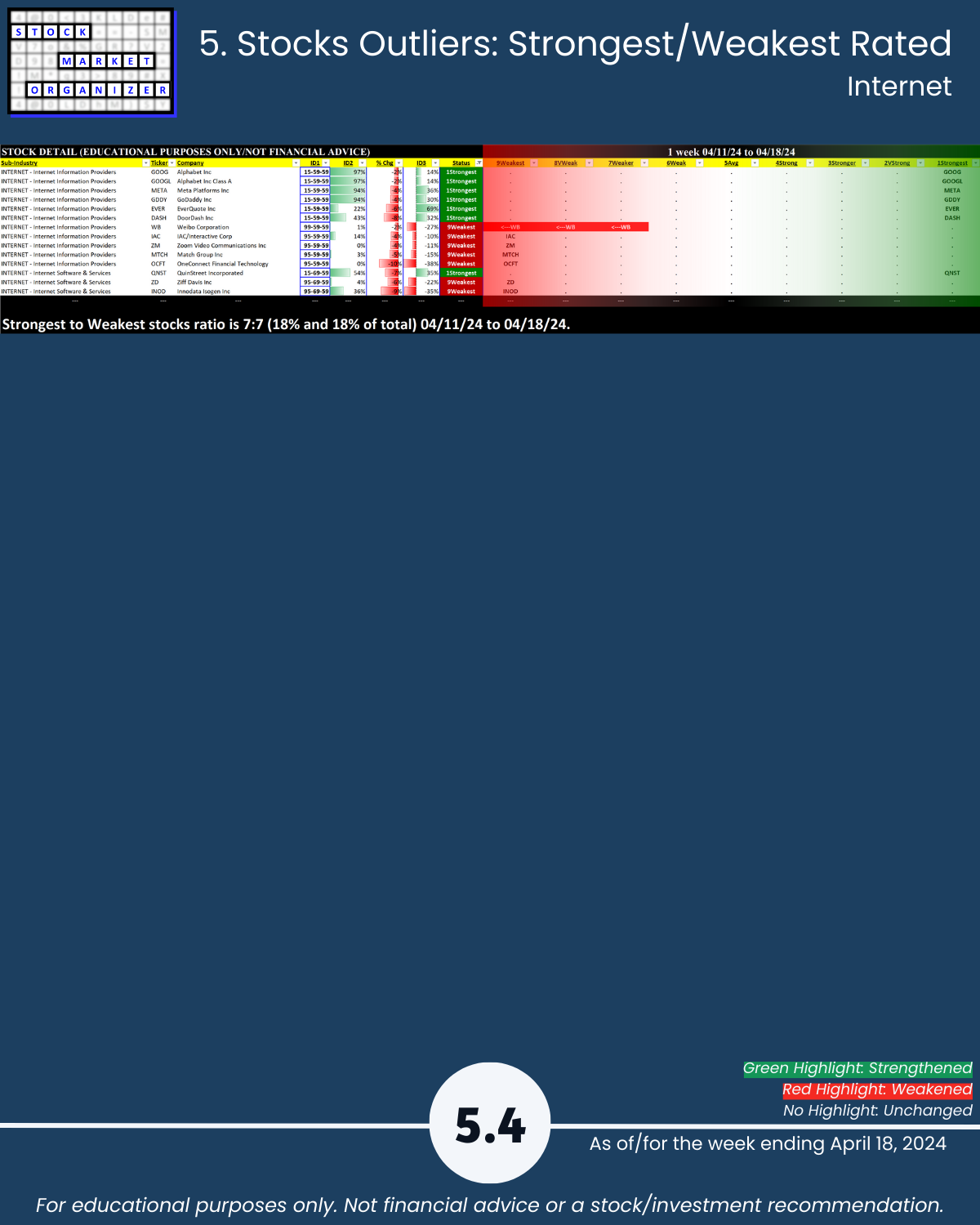

5. Stocks Outliers: Strongest/Weakest Rated

6. Stocks Outliers: 1-Week % Change

7. Stocks Outliers: 5-Year Highs/Lows