SMO Exclusive: Strength Report Technology Sector 2024-04-11

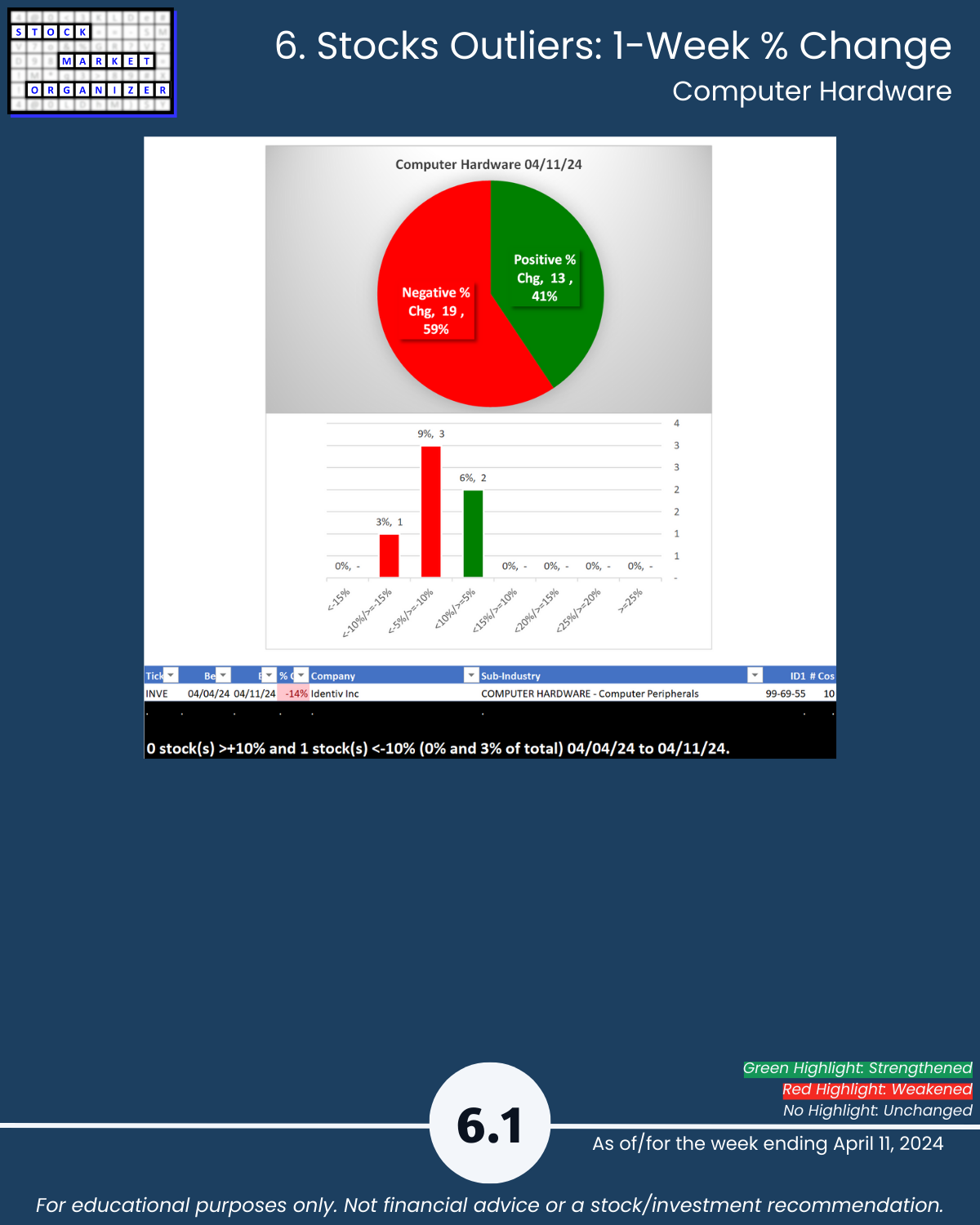

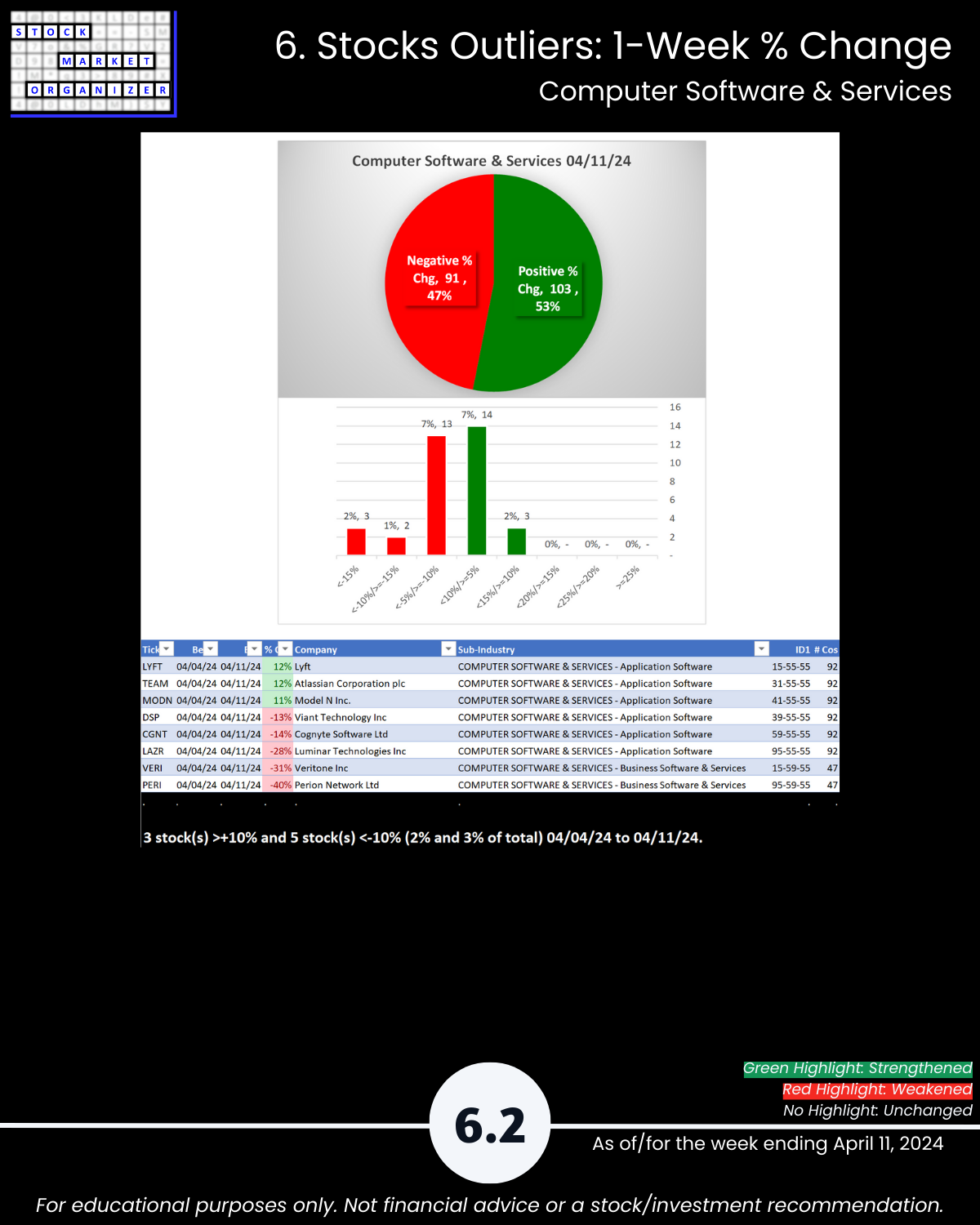

Tech 4/11/24 did last week’s bad week carry into this week? Fortunately, while not a reversal to strengthening it stabilized to treading water. No real standout information to report. Full market report coming after tomorrow’s action, today is coverage of Computer Hardware, Computer Software & Services, Electronics (aka Chips/Semis), Internet, and Telecommunications.

WHAT’S HERE? A CLOSER LOOK AT PROCESS AND DISCIPLINE

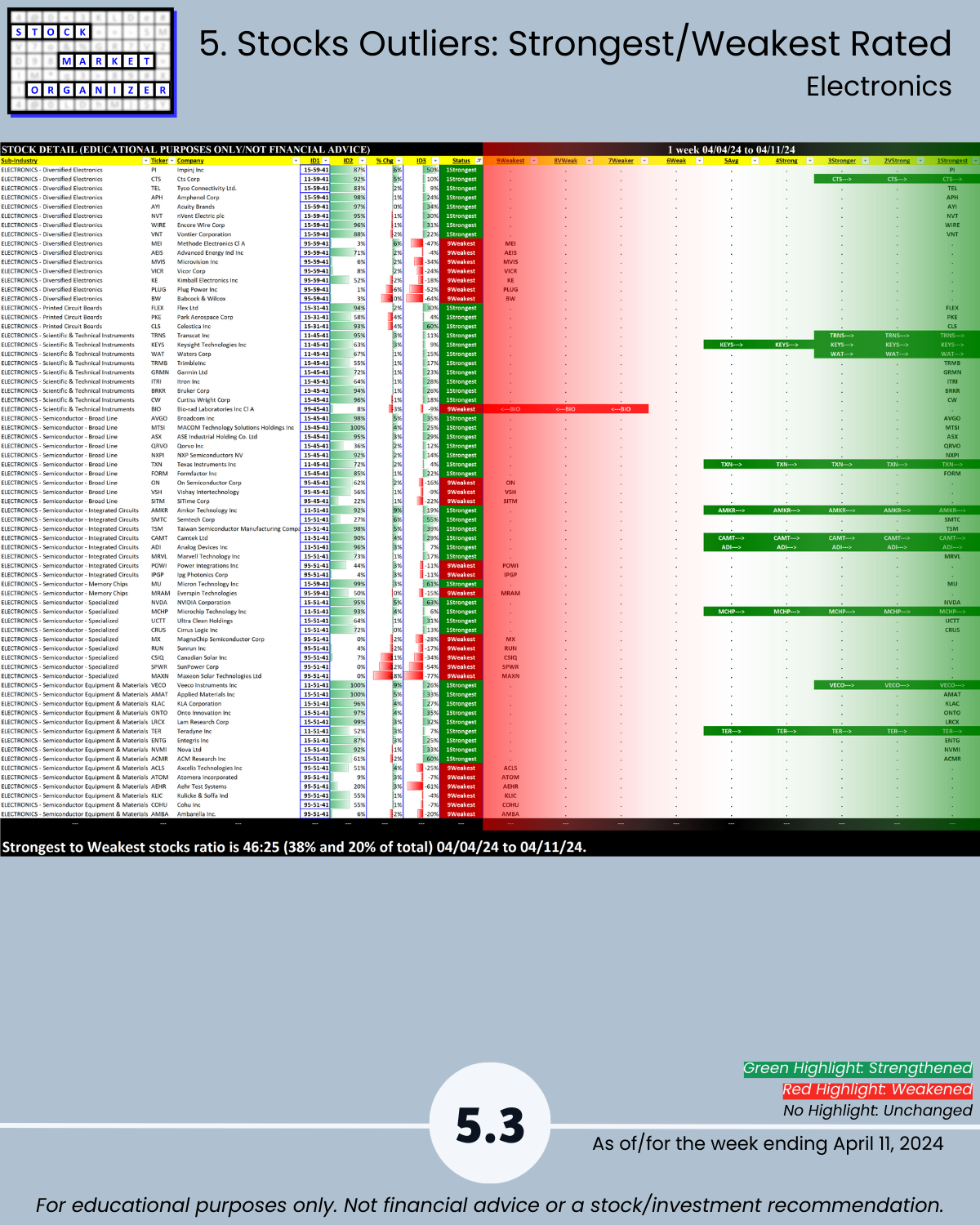

Page 5.3 – detail regarding Semiconductor Equipment & Materials, stocks rated 1Strongest and 9Weakest (highest/lowest of 9 strength ratings).

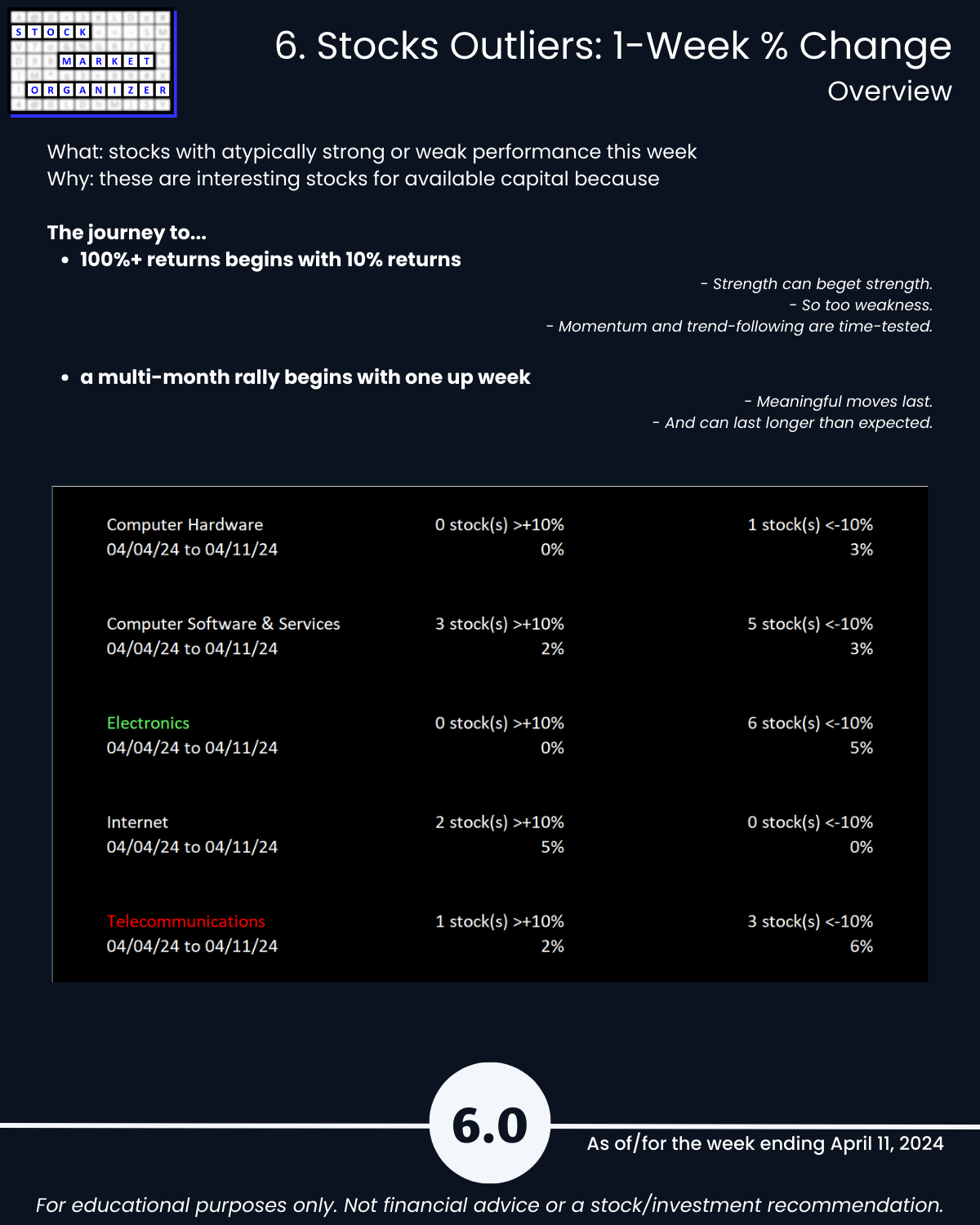

Why: these are interesting stocks for available capital because

- the Strongest have the least amount of overhead supply to dampen breakouts while

- the Weakest may be prone to volatility, subject to big pops from bottom-fishing and short-covering BUT ALSO to bigger and faster falls.

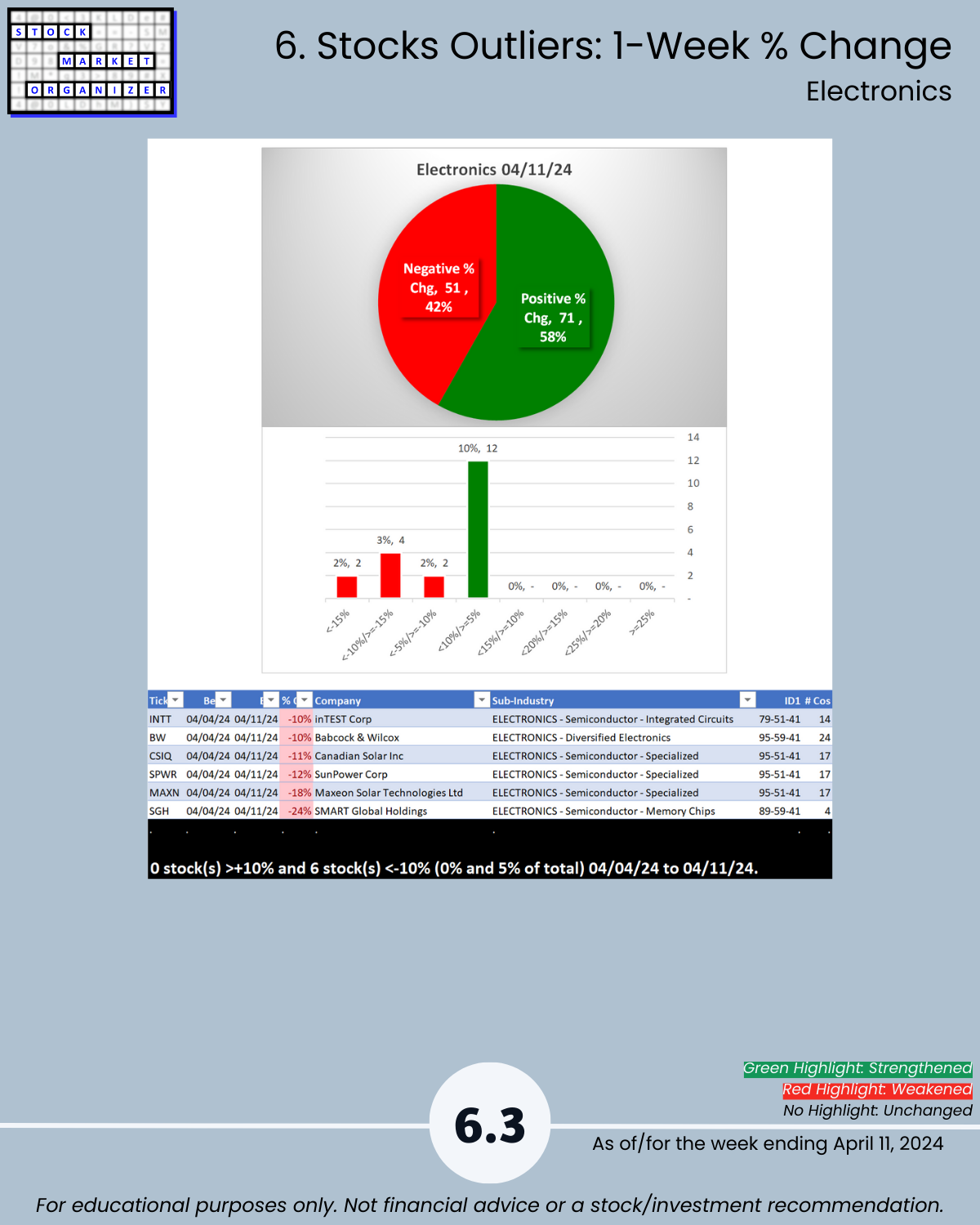

Note Semiconductor Equipment & Materials is a strengthening sub-industry (rated Average) in a strengthening industry (Electronics rated Strong).

The stocks rated 1Strongest – leading the charge – are VECO, AMAT, KLAC, ONTO, LRCX, TER, ENTG, NVMI, and ACMR.

Does this mean “buy”?

Of course not. It also doesn’t mean NOT buy, and one could take positions while applying appropriate risk management steps with the knowledge these are

🔹 stocks rated 1Strongest in a

🔹 strengthening sub-industry and

🔹 strengthening industry.

BUT – per the Stock Market Organizer system,

🔹 the prevailing environment is NO NEW LONGS due to the current negative market strength score (-70% 4/11/24).

SO

🔹 No new longs yet, despite the positives at the above-described stock, sub-industry, and industry levels.

The 9Weakest stocks are ACLS, ATOM, AEHR, KLIC, COHU, and AMBA. With a market not far from all-time highs (let’s ignore the Russell 2000 for the moment), is it better to go long stocks that haven’t participated in the rally, or short these weaklings at the appropriate time?

You make the call.

A UNIQUE STRENGTH-BASED LOOK

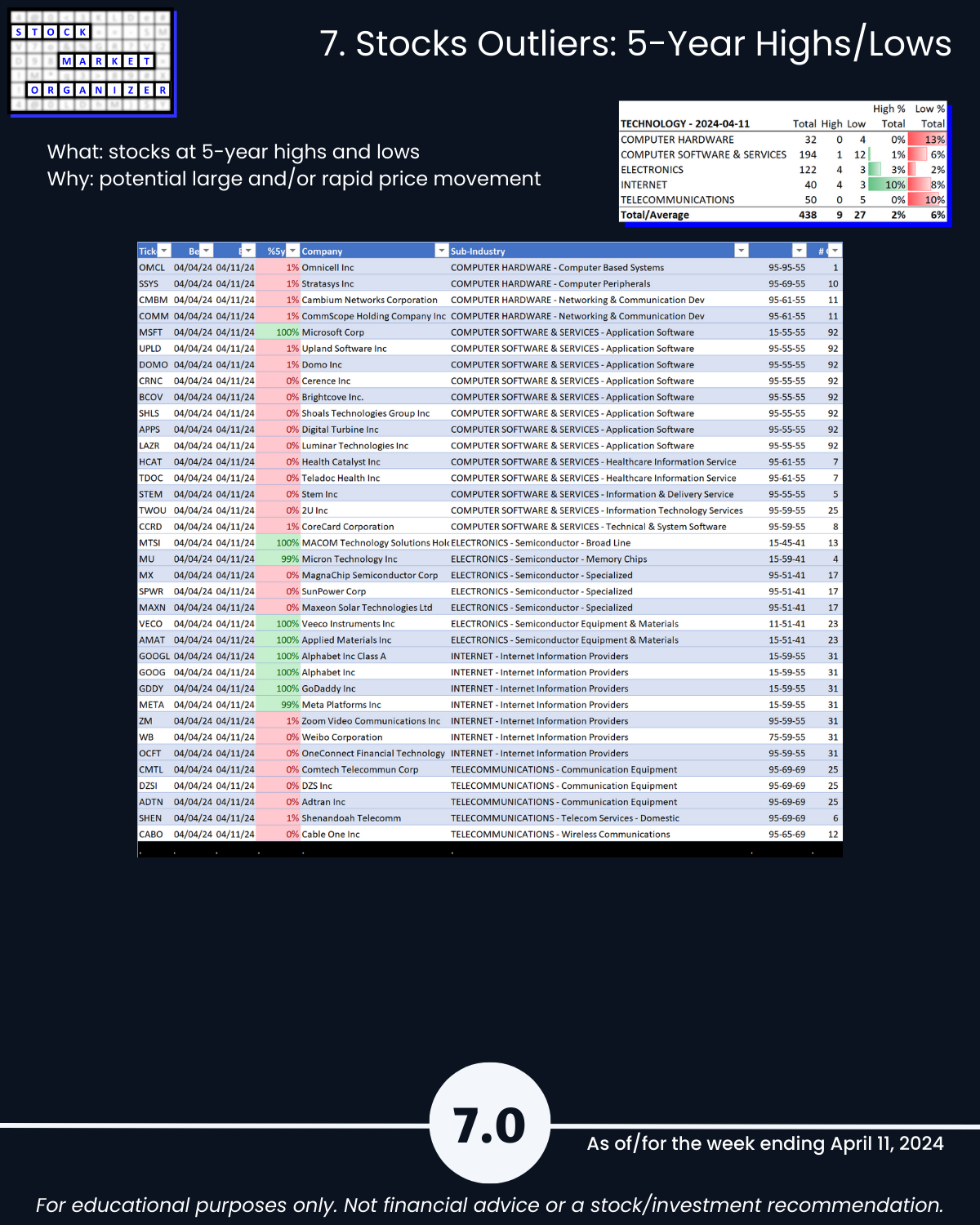

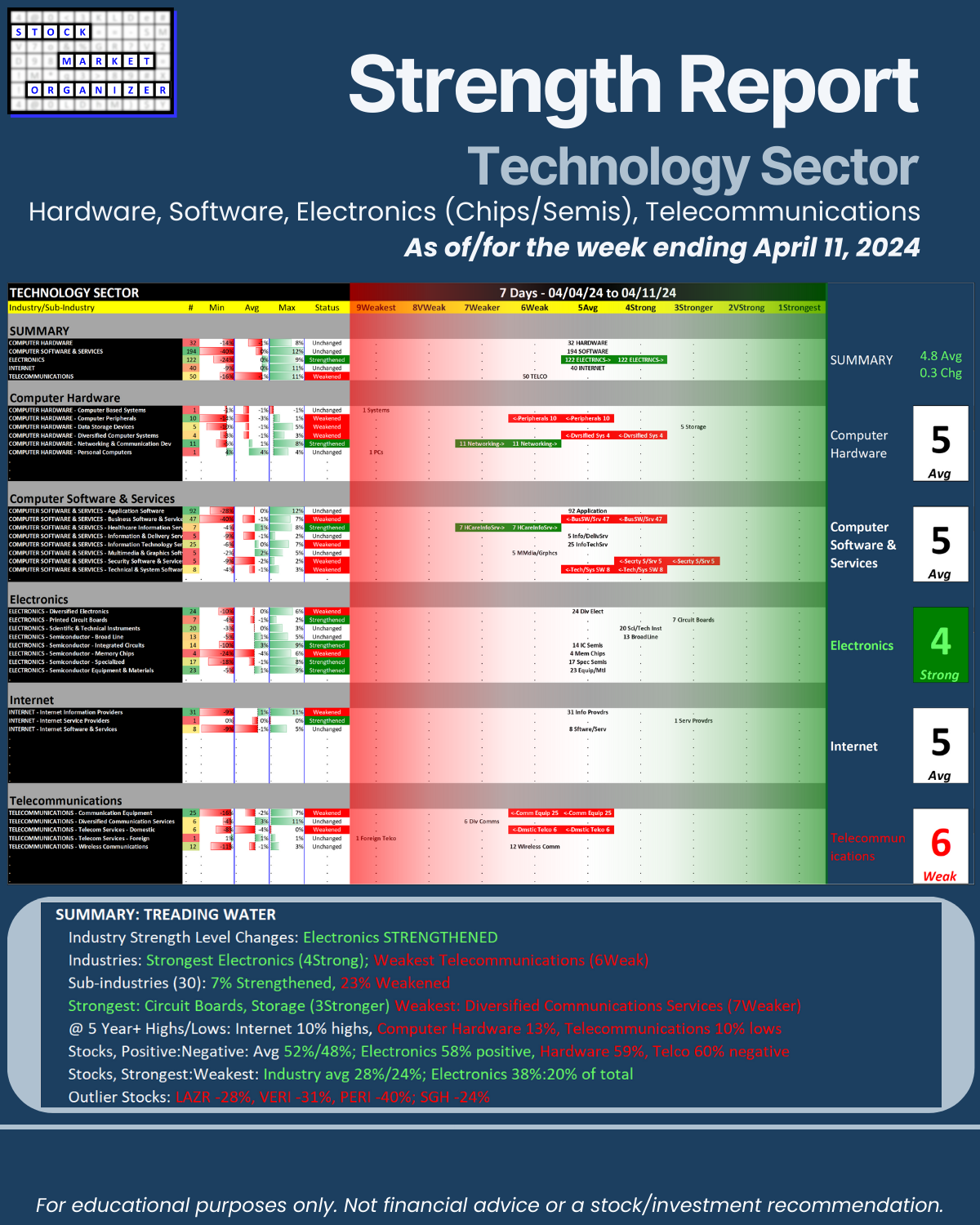

SUMMARY: TREADING WATER

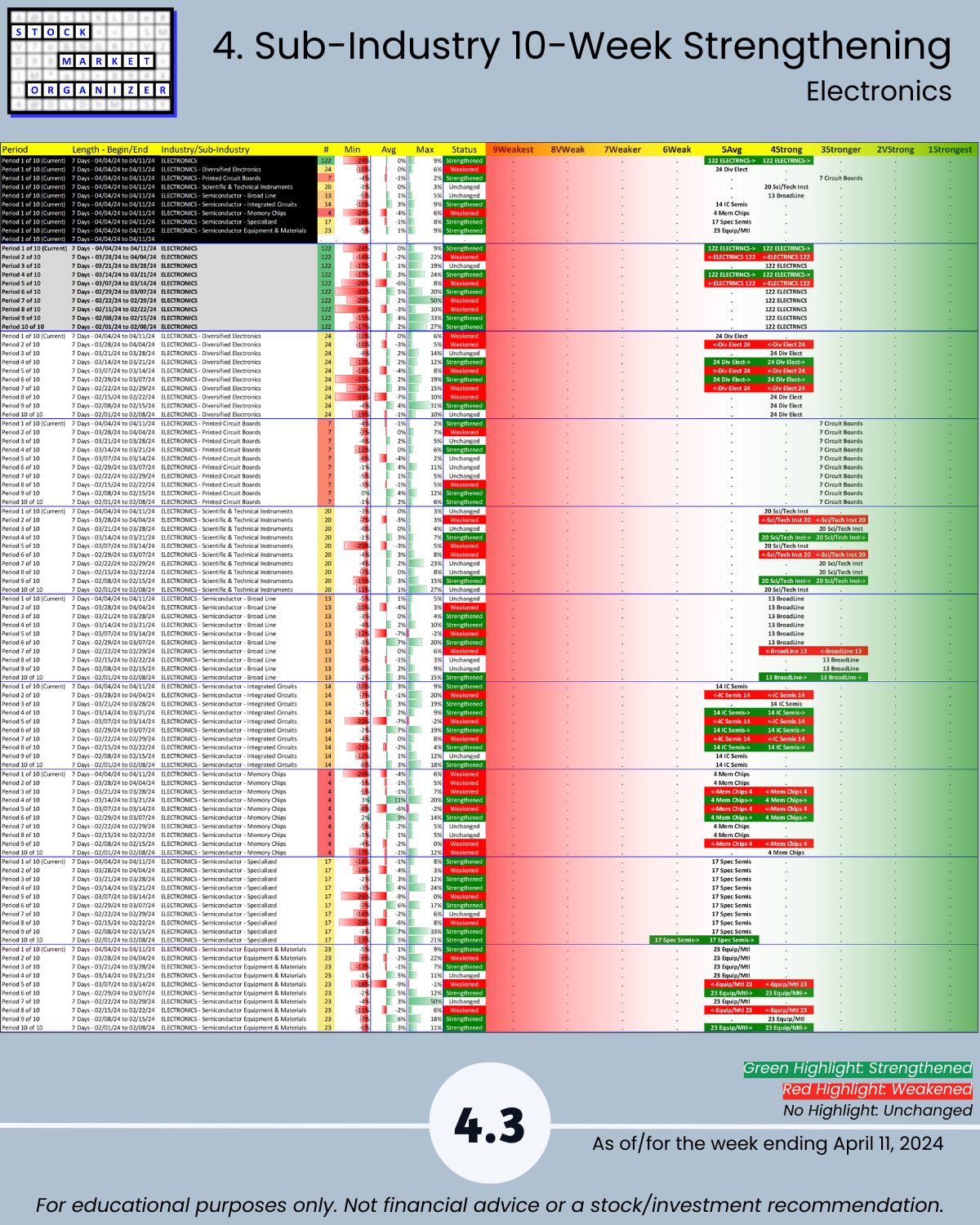

🔹 Industry Strength Level Changes: Electronics STRENGTHENED

🔹 Industries

- Strongest Electronics (4Strong)

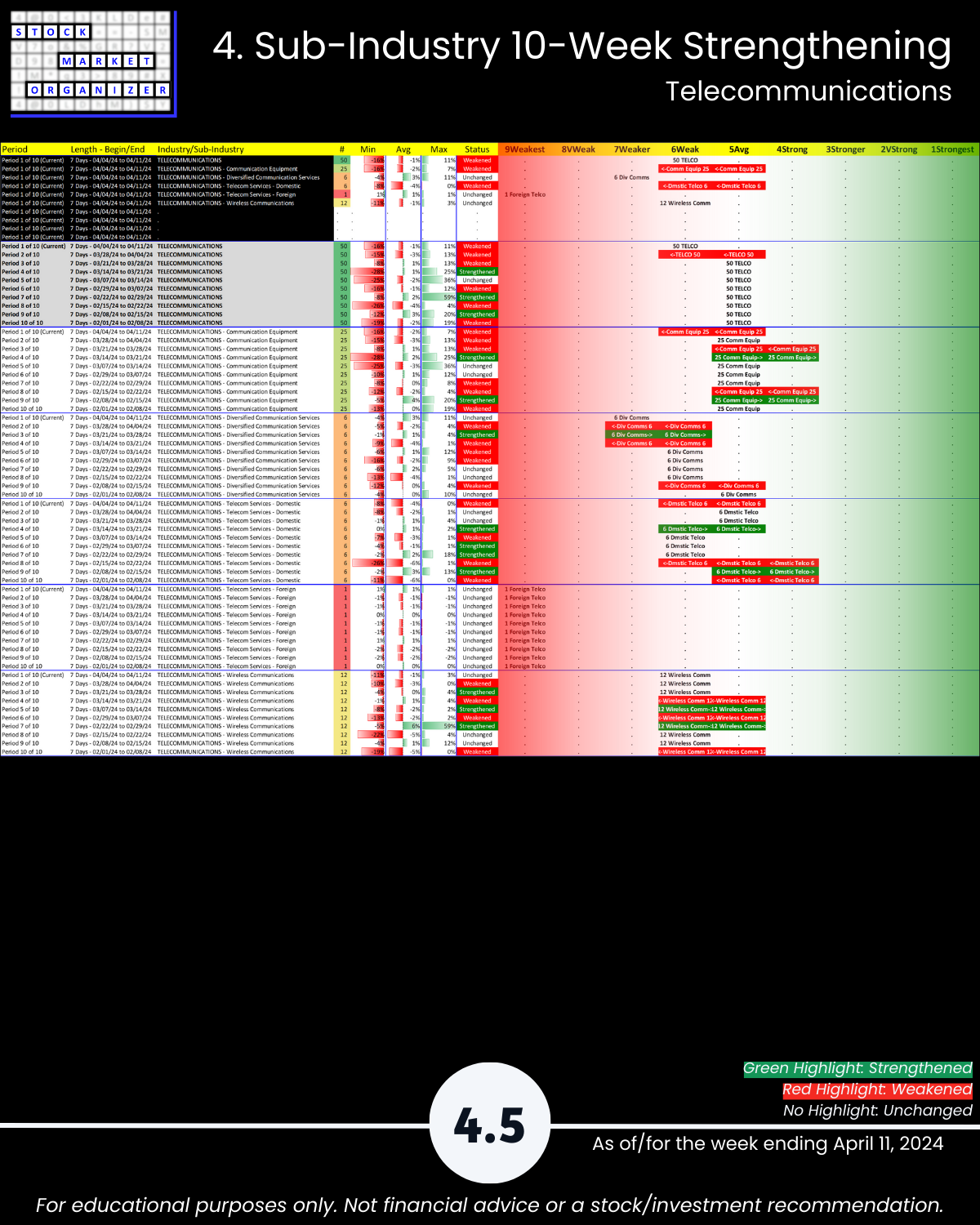

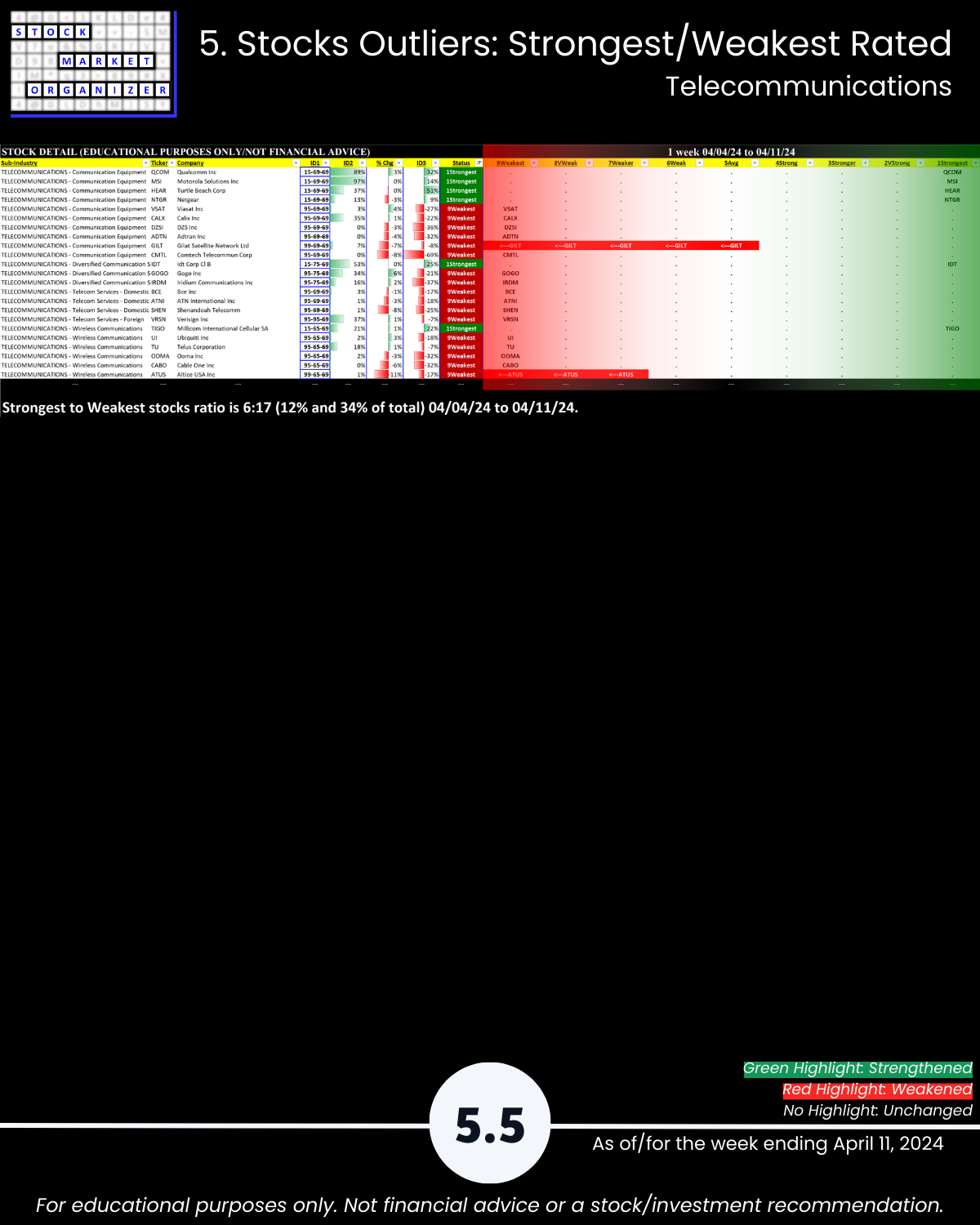

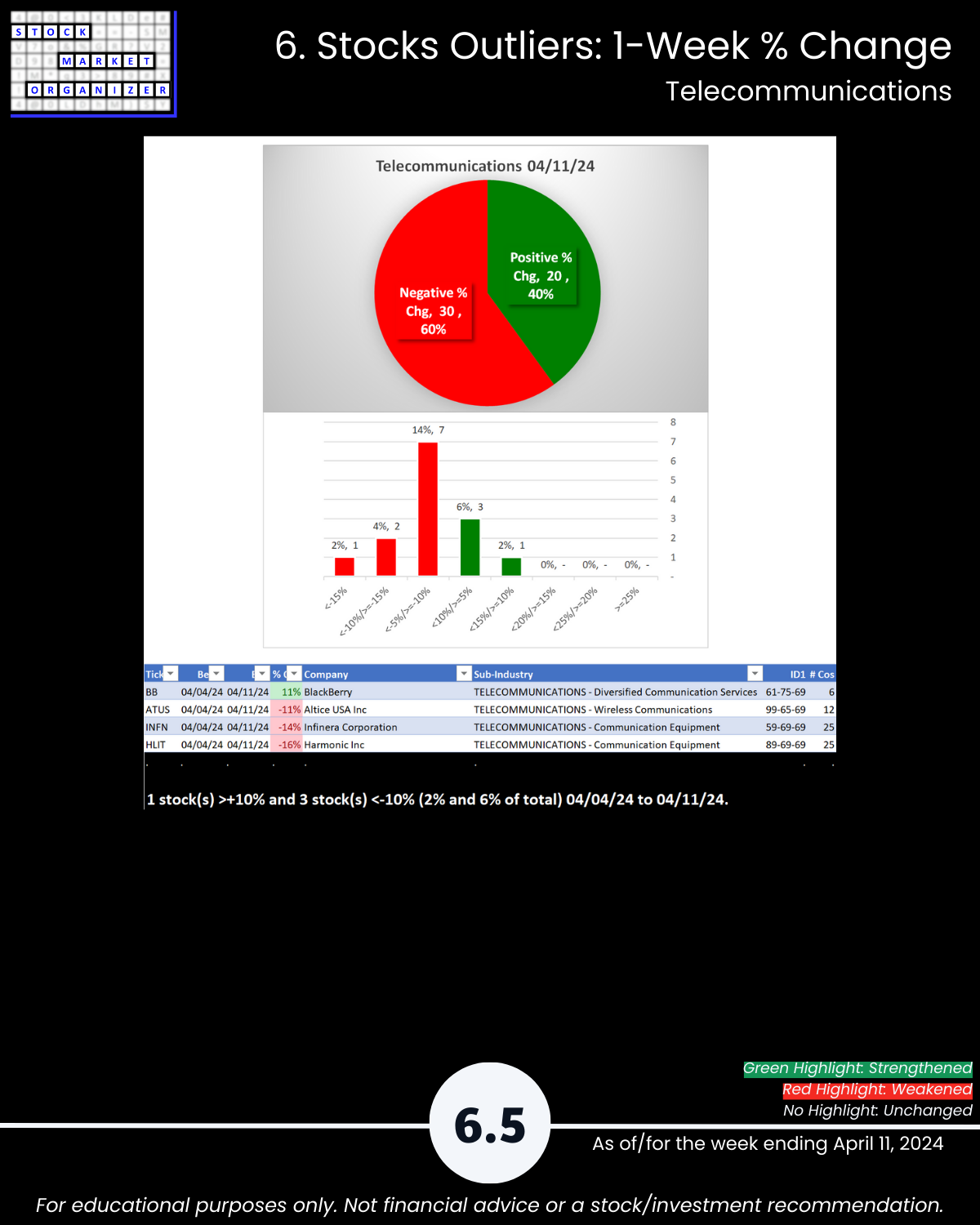

- Weakest Telecommunications (6Weak)

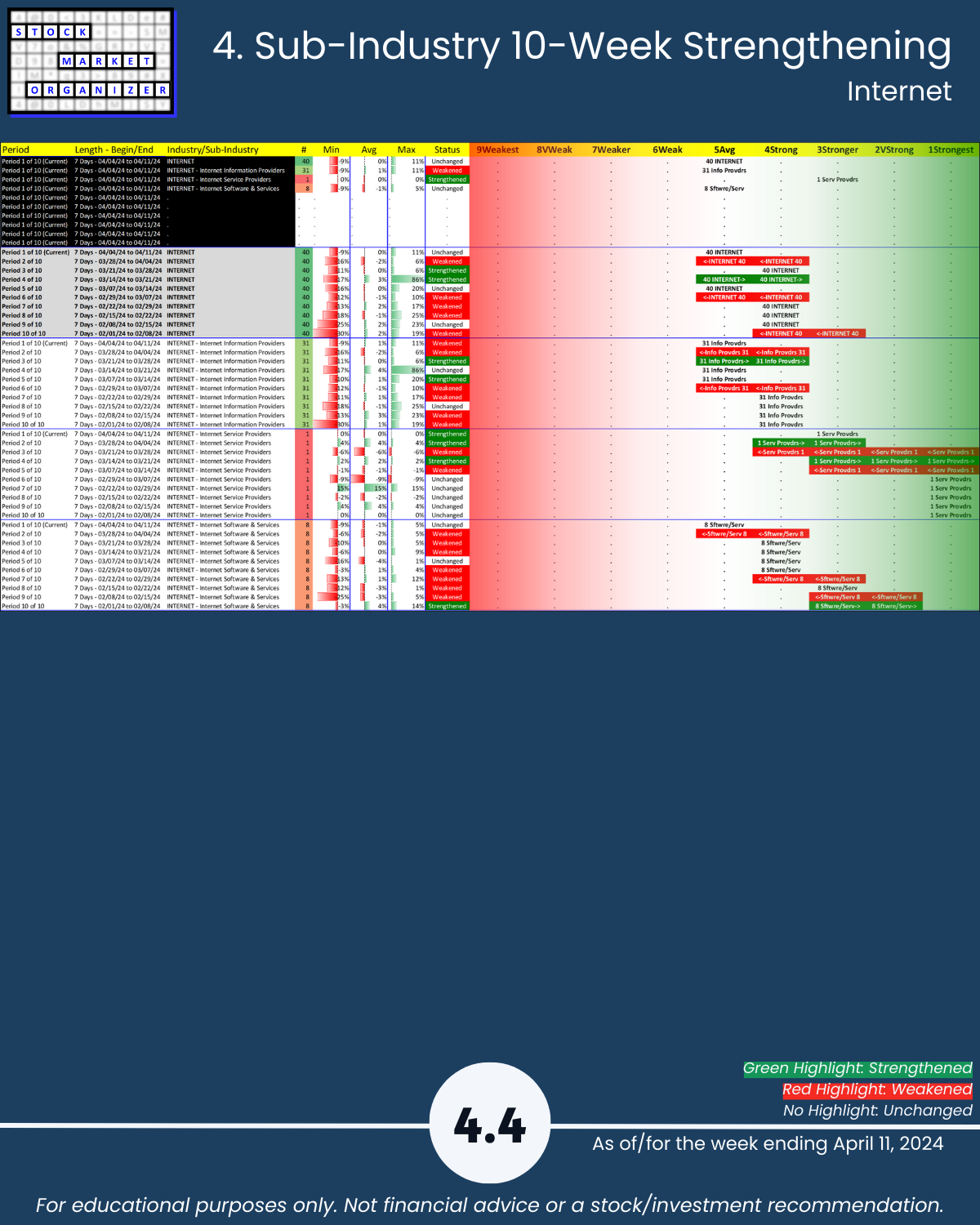

🔹 Sub-industries (30)

- 7% Strengthened, 23% Weakened

- Strongest: Circuit Boards, Storage (3Stronger)

- Weakest: Diversified Communications Services (7Weaker)

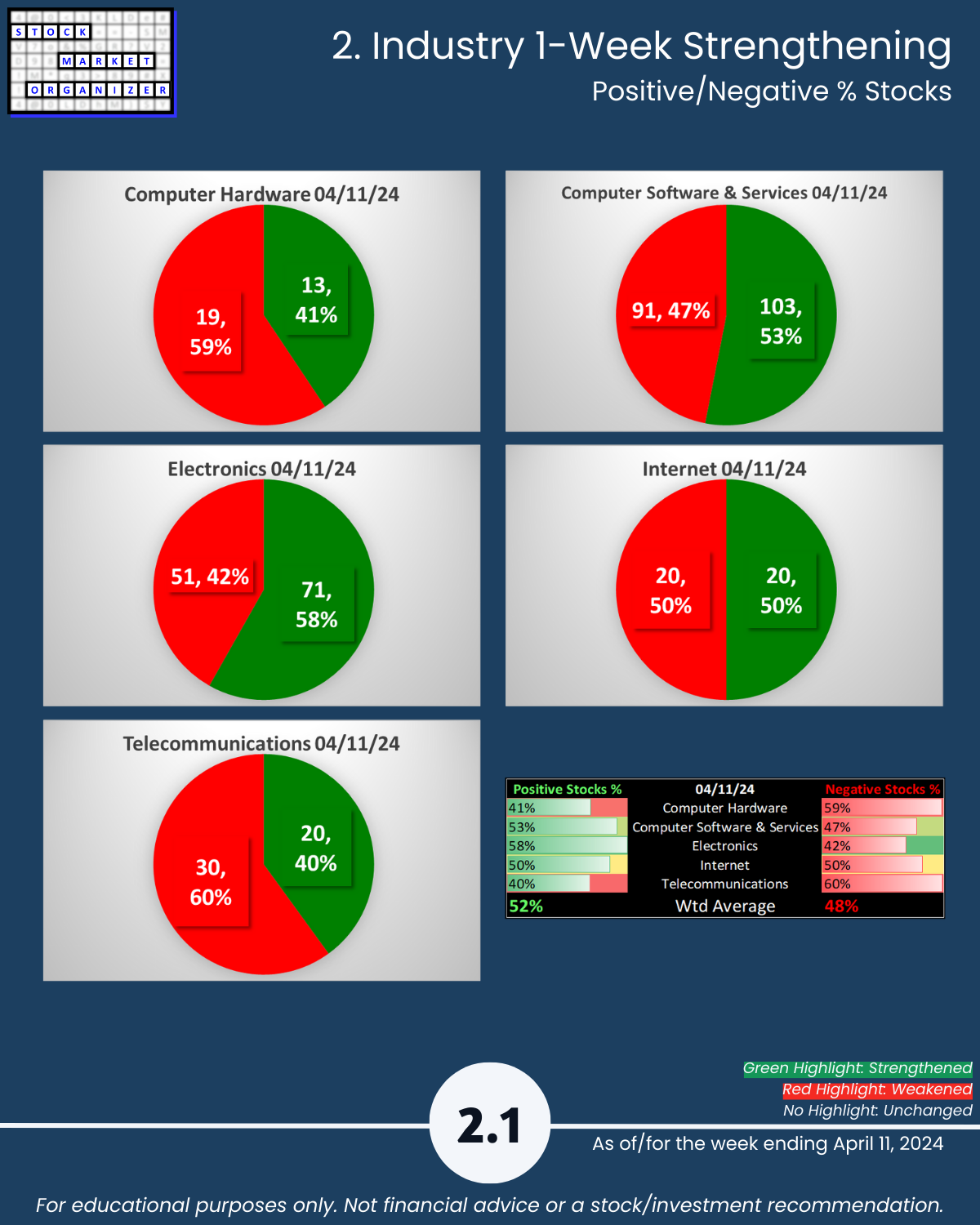

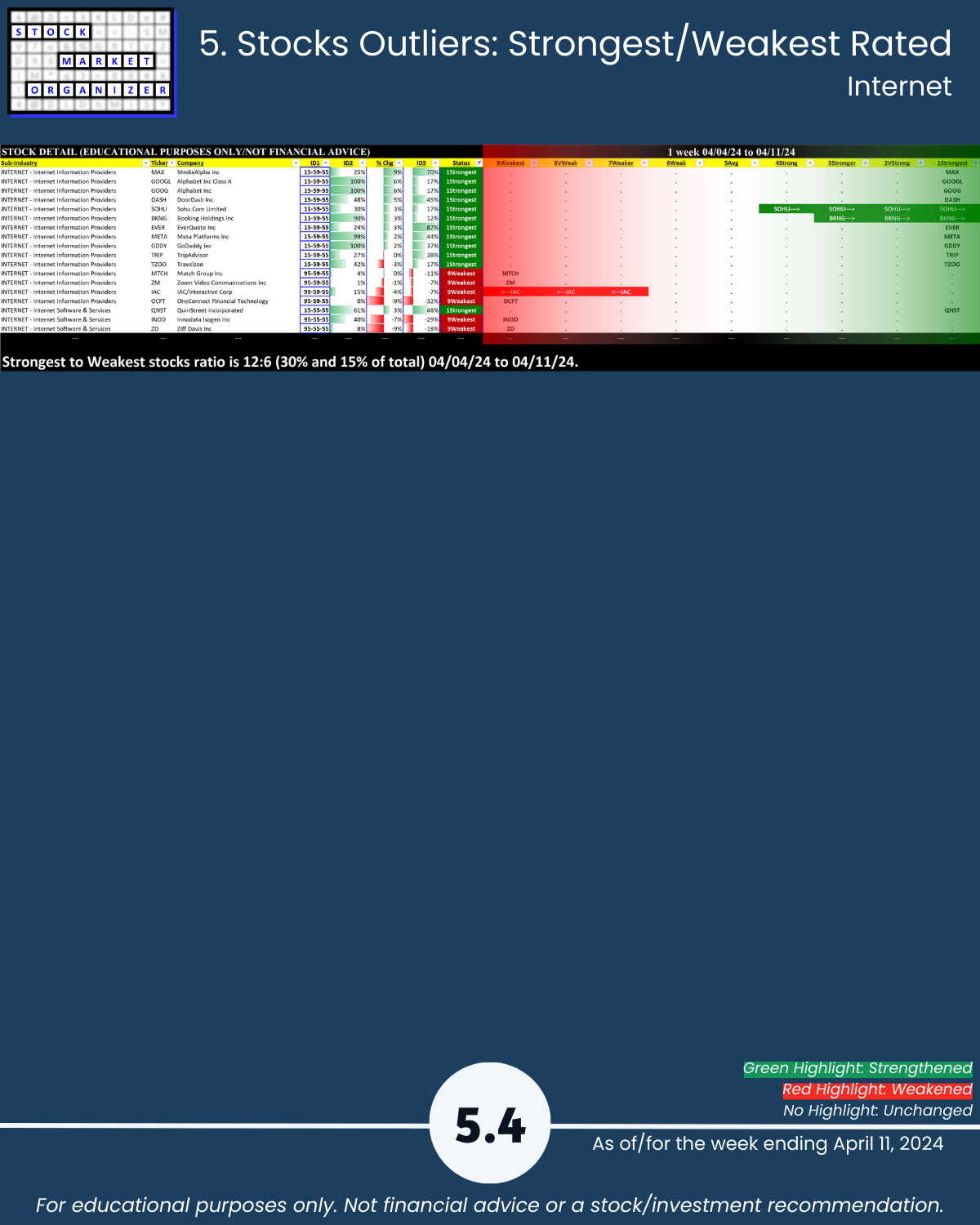

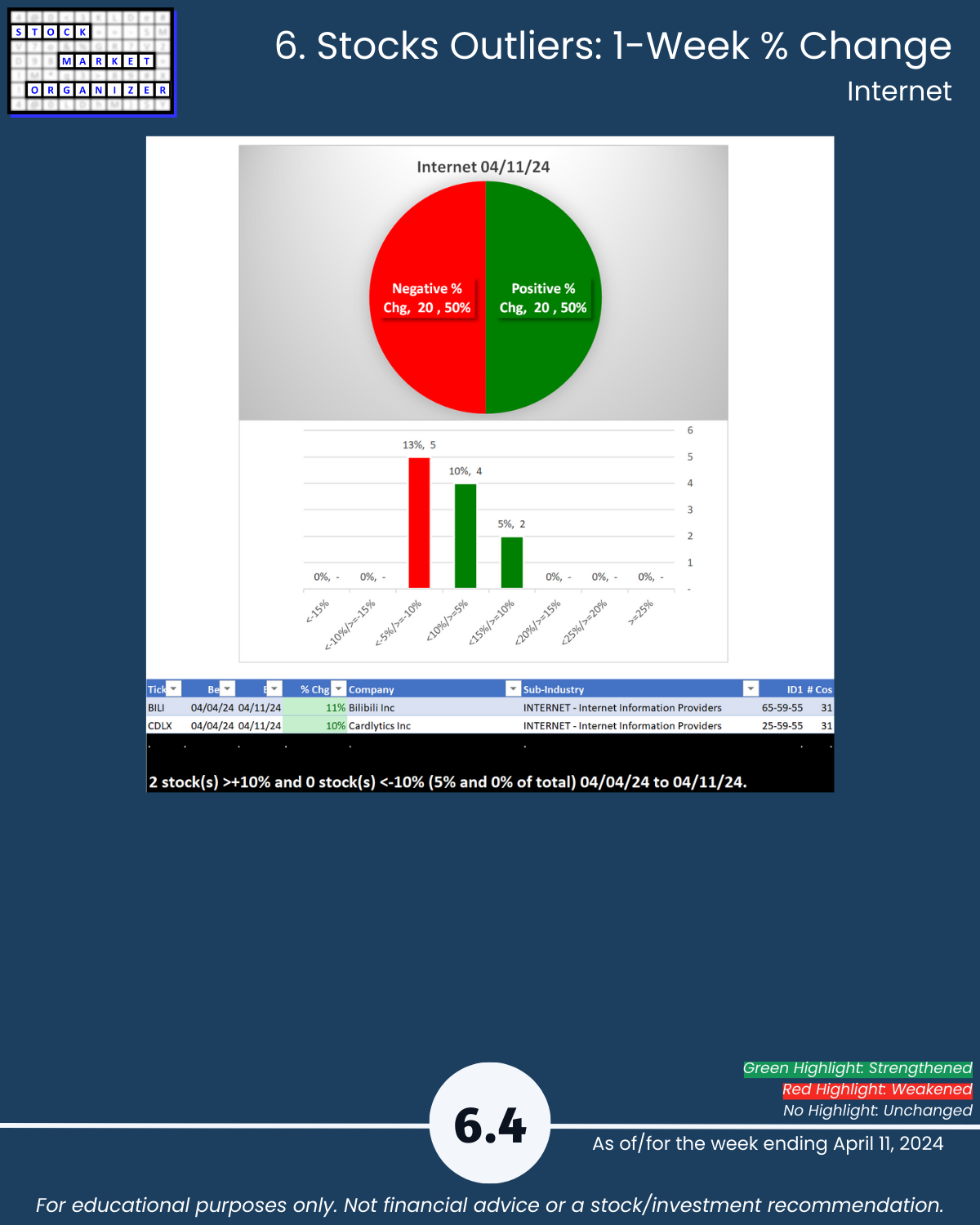

- @ 5 Year+ Highs/Lows: Internet 10% highs, Computer Hardware 13%, Telecommunications 10% lows

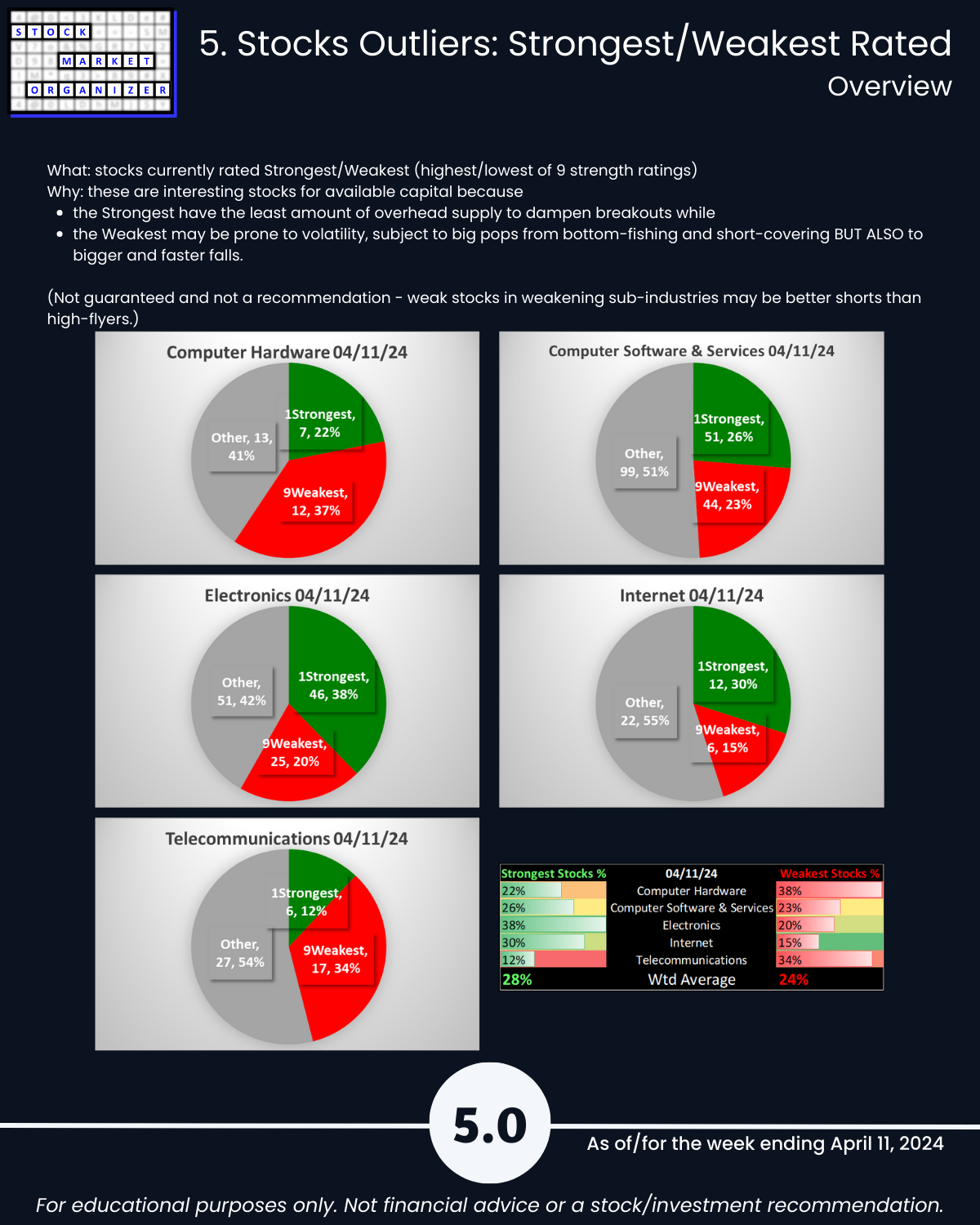

🔹 Stocks

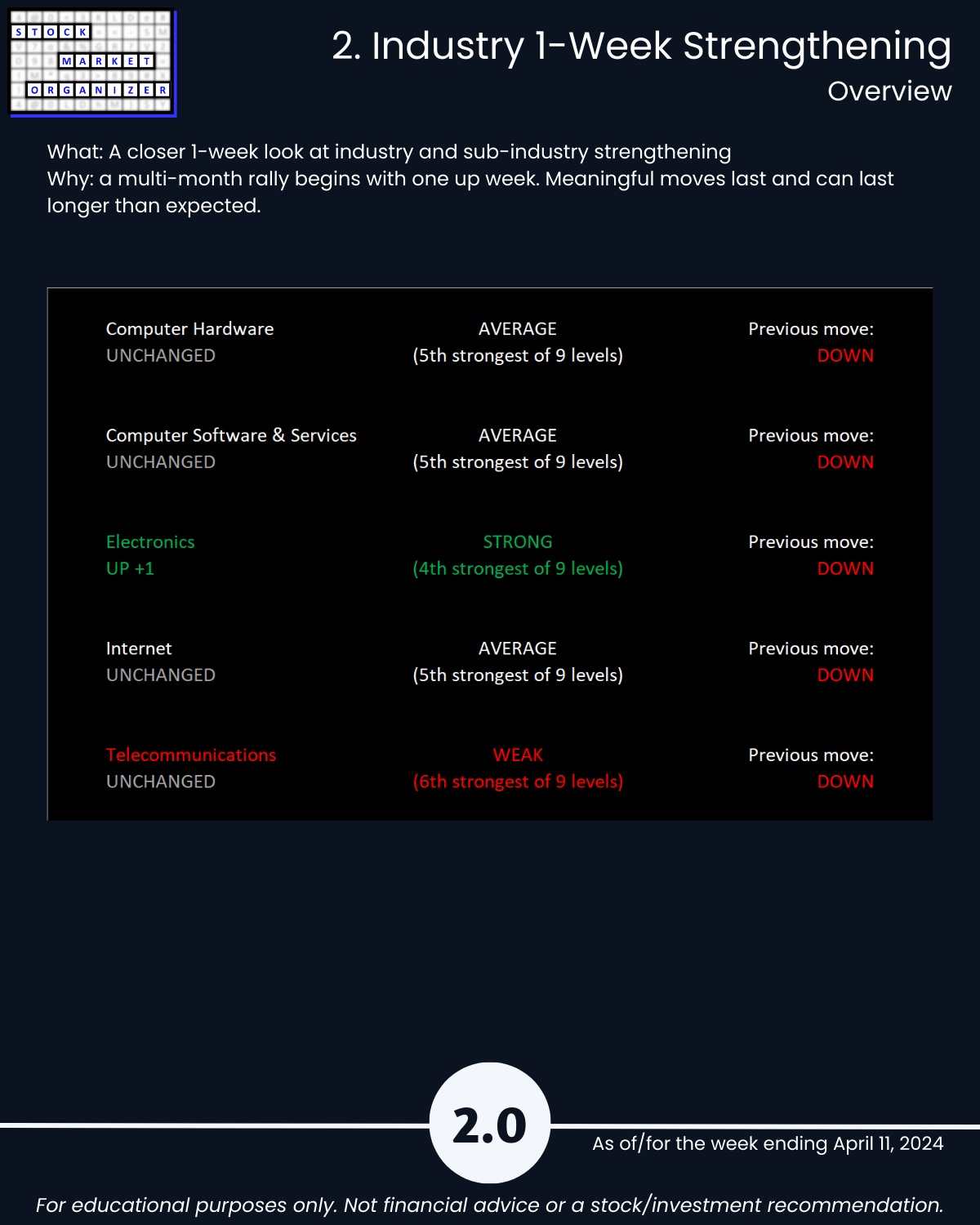

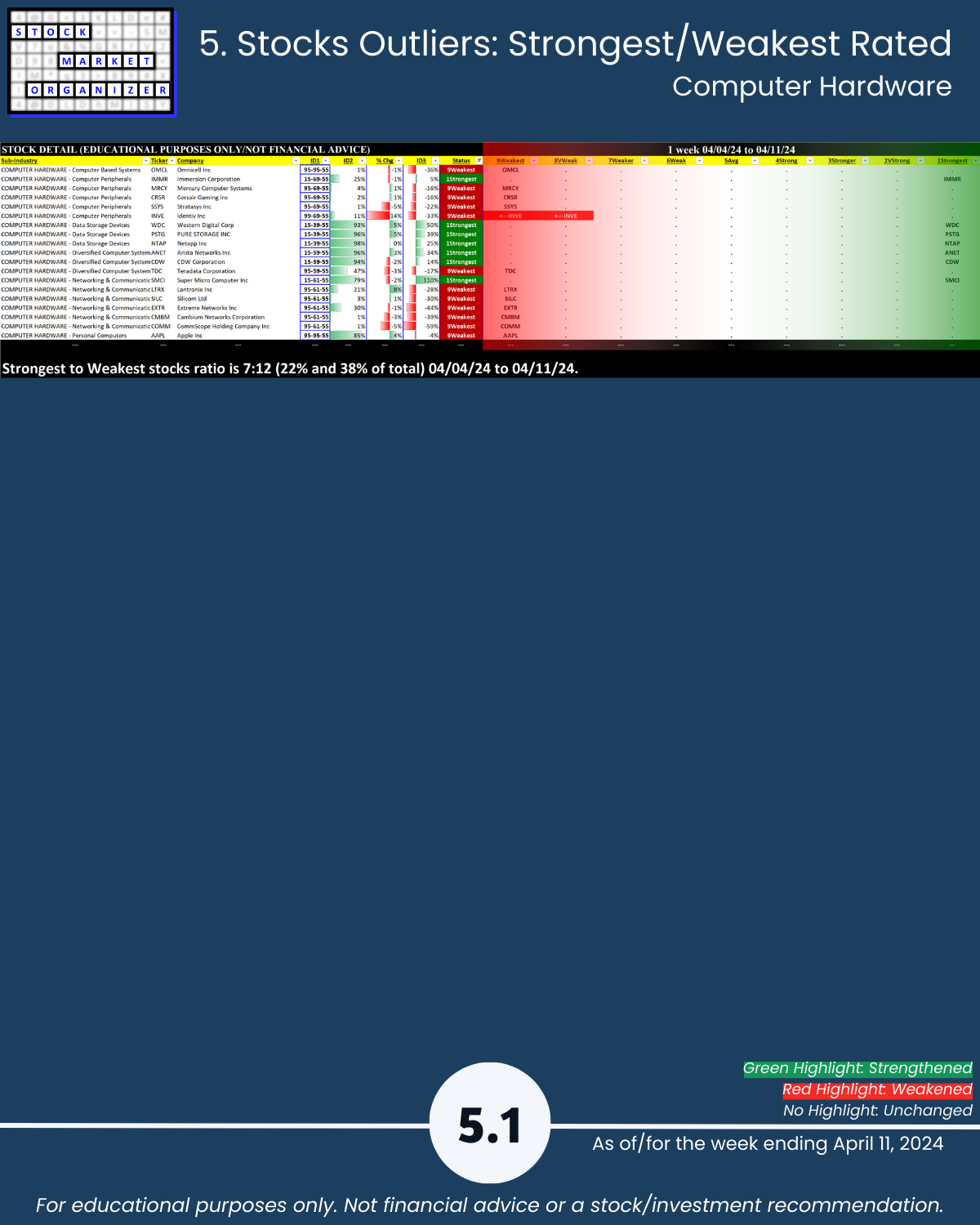

- Positive:Negative: Avg 52%/48%; Electronics 58% positive, Hardware 59%, Telco 60% negative

- Strongest:Weakest: Industry avg 28%/24%; Electronics 38%:20% of total

- Outlier Stocks: LAZR -28%, VERI -31%, PERI -40%; SGH -24%

This report may particularly be of interest if the following 5 concepts resonate with you:

- The stronger your stocks, the greener your P&L.

- The journey to 100%+ returns begins with 10% returns.

- The journey to a multi-month rally begins with one up week.

- Most stocks do what the market does. (While the market can only do what its underlying stocks, sub-industries, and industries do.)

- 80/20: not all information is created equal. (Press buttons, not balloons.)

Following are galleries with page-by-page views of this report.

1. Introduction

2. Industry 1-Week Strengthening

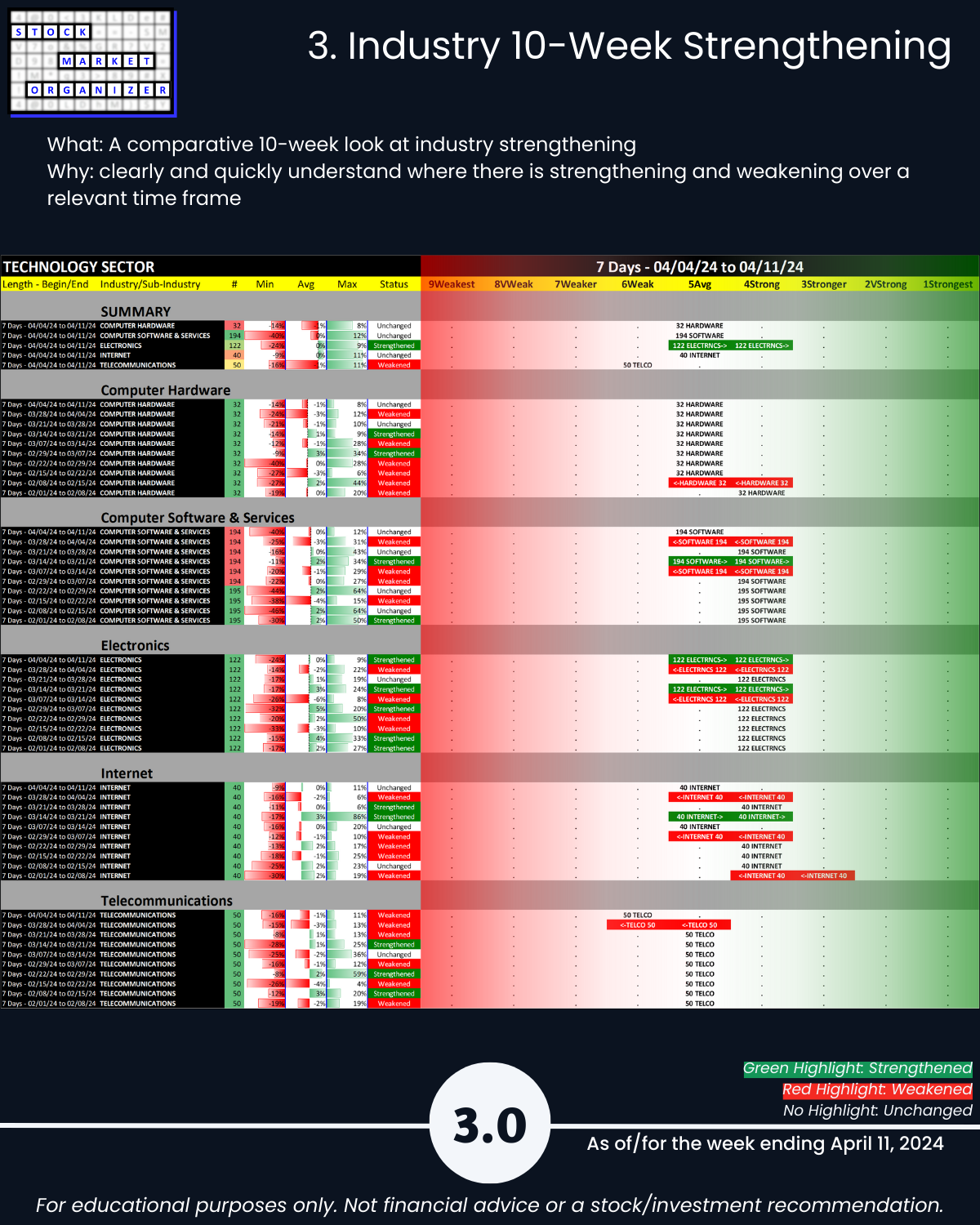

3. Industry 10-Week Strengthening

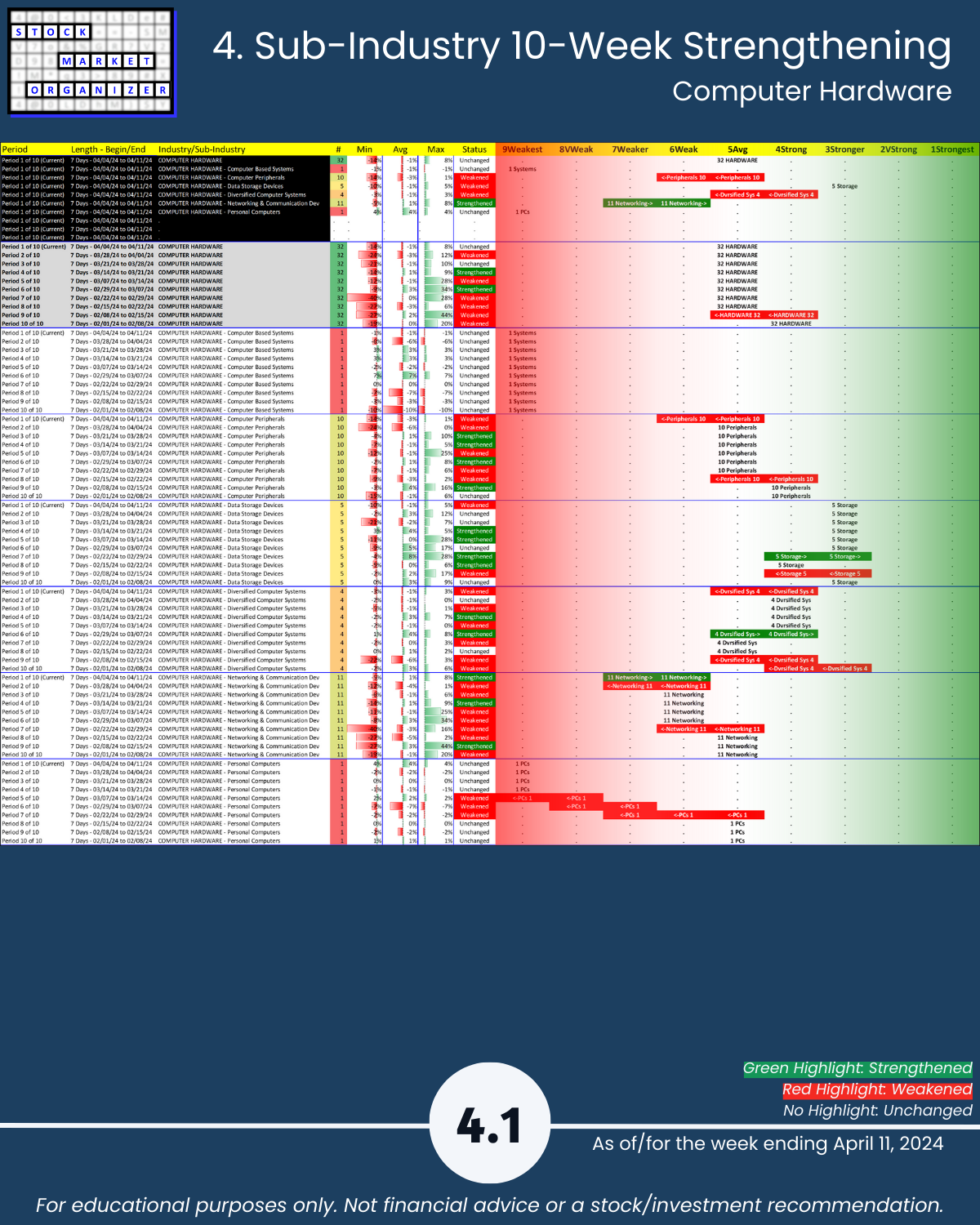

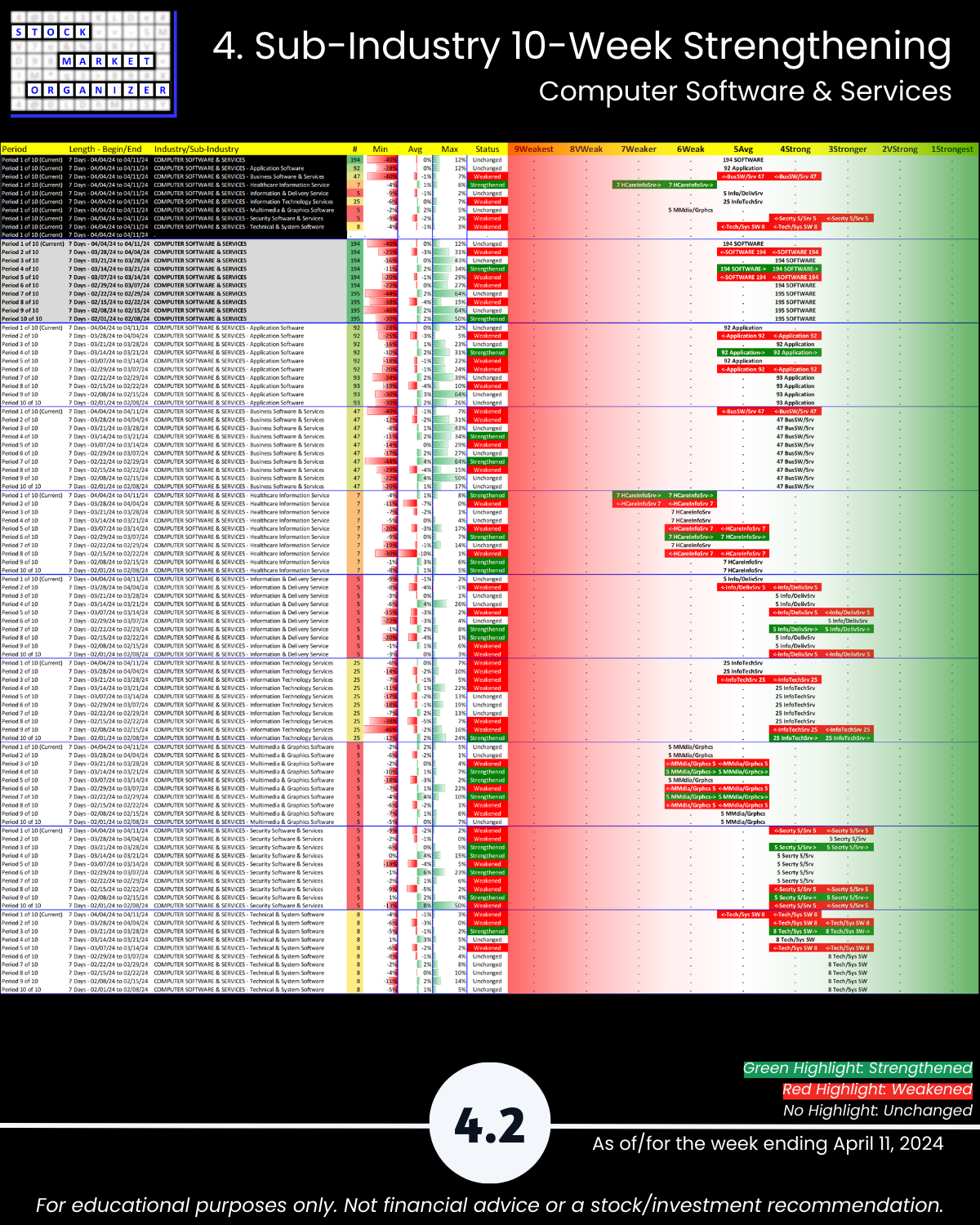

4. Sub-Industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

6. Stocks Outliers: 1-Week % Change

7. Stocks Outliers: 5-Year Highs/Lows