SMO Exclusive: Strength Report Technology Sector 2024-03-21

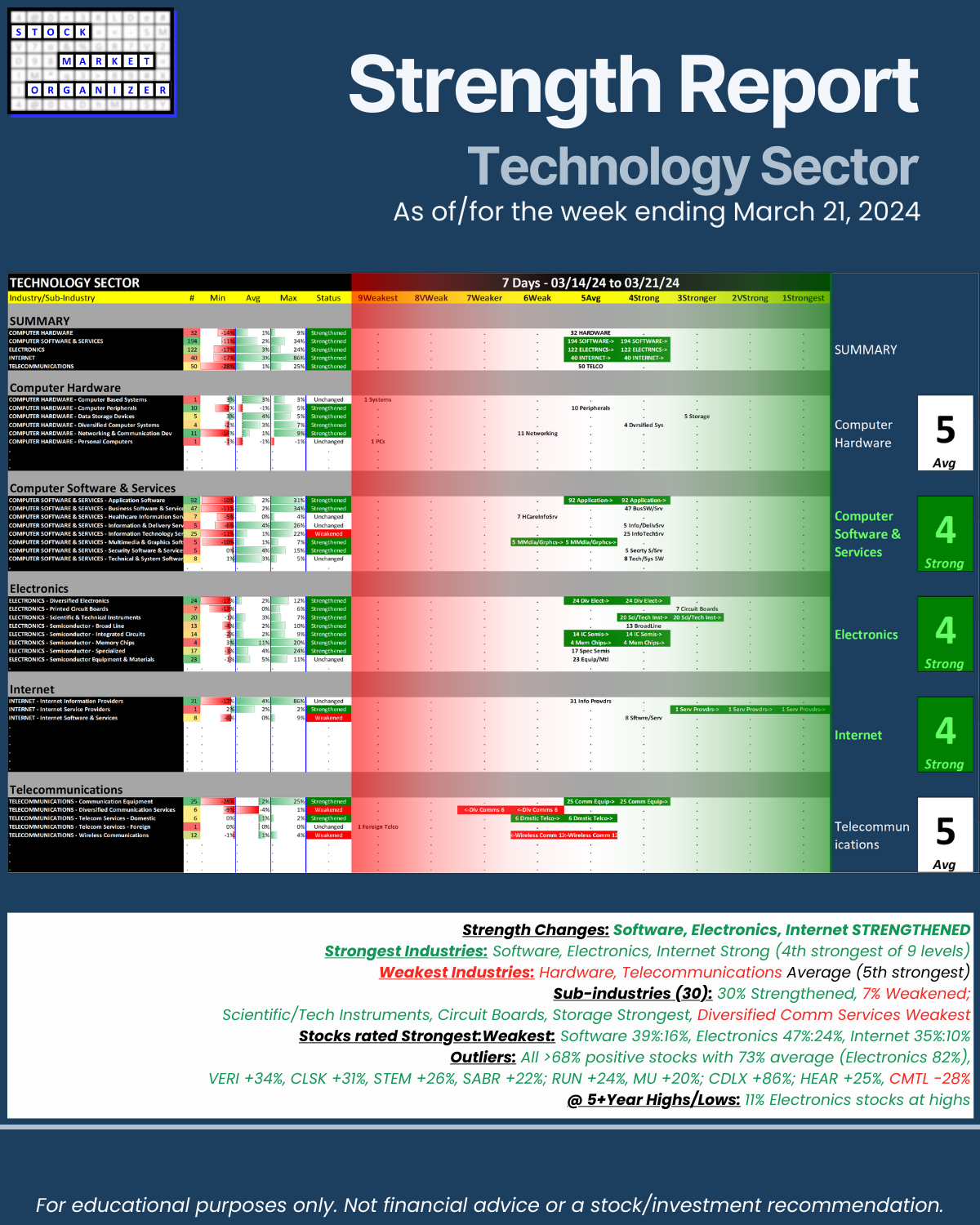

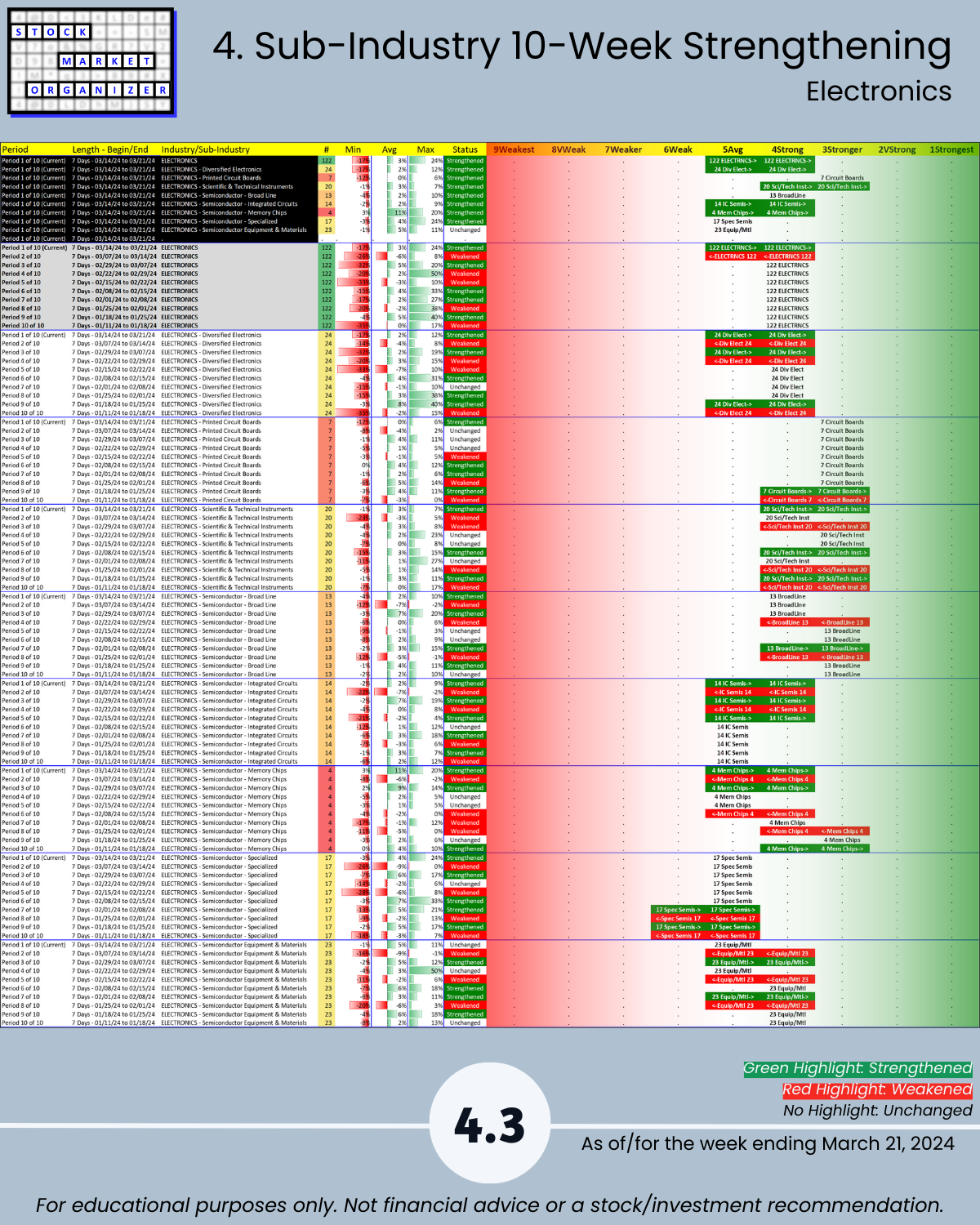

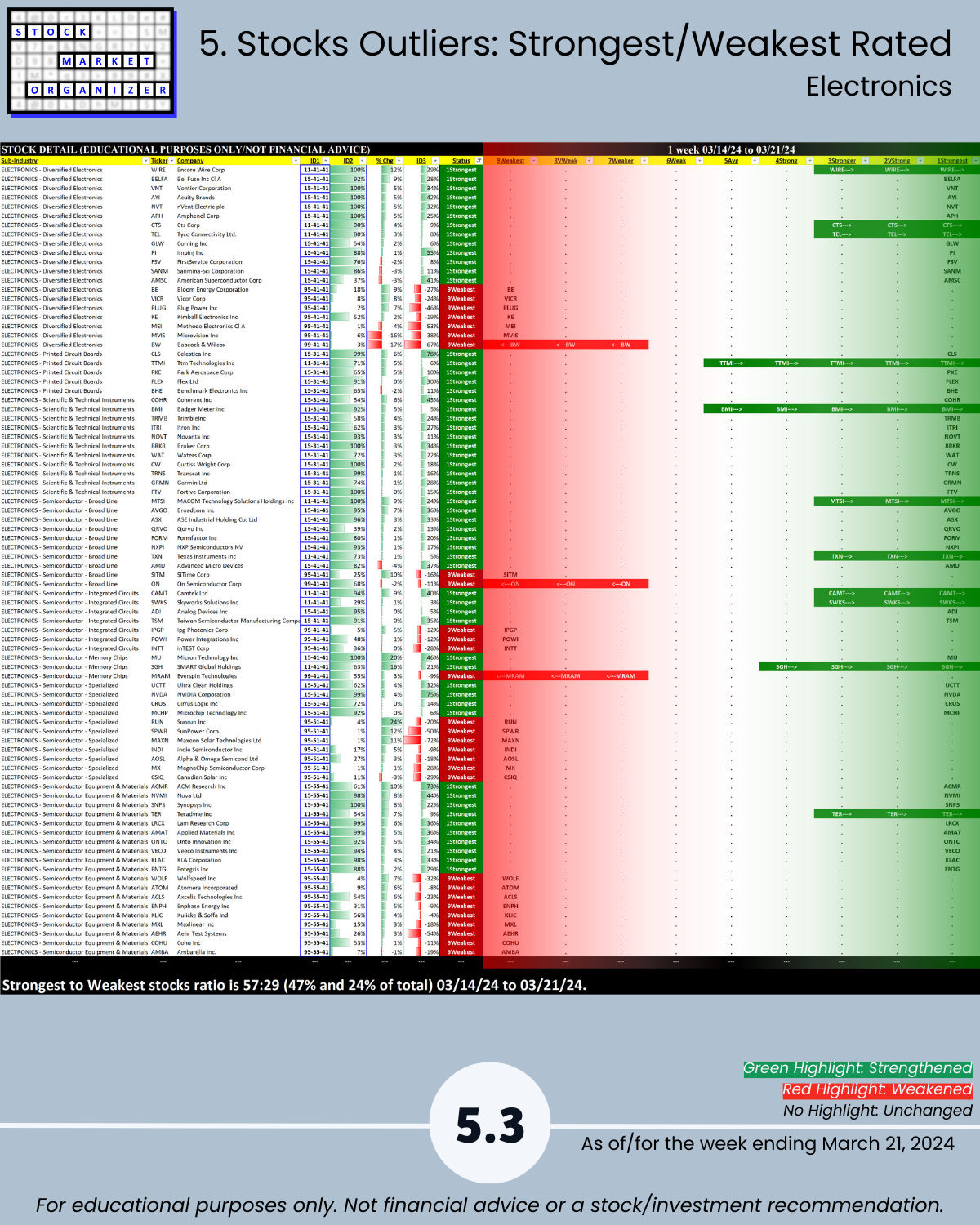

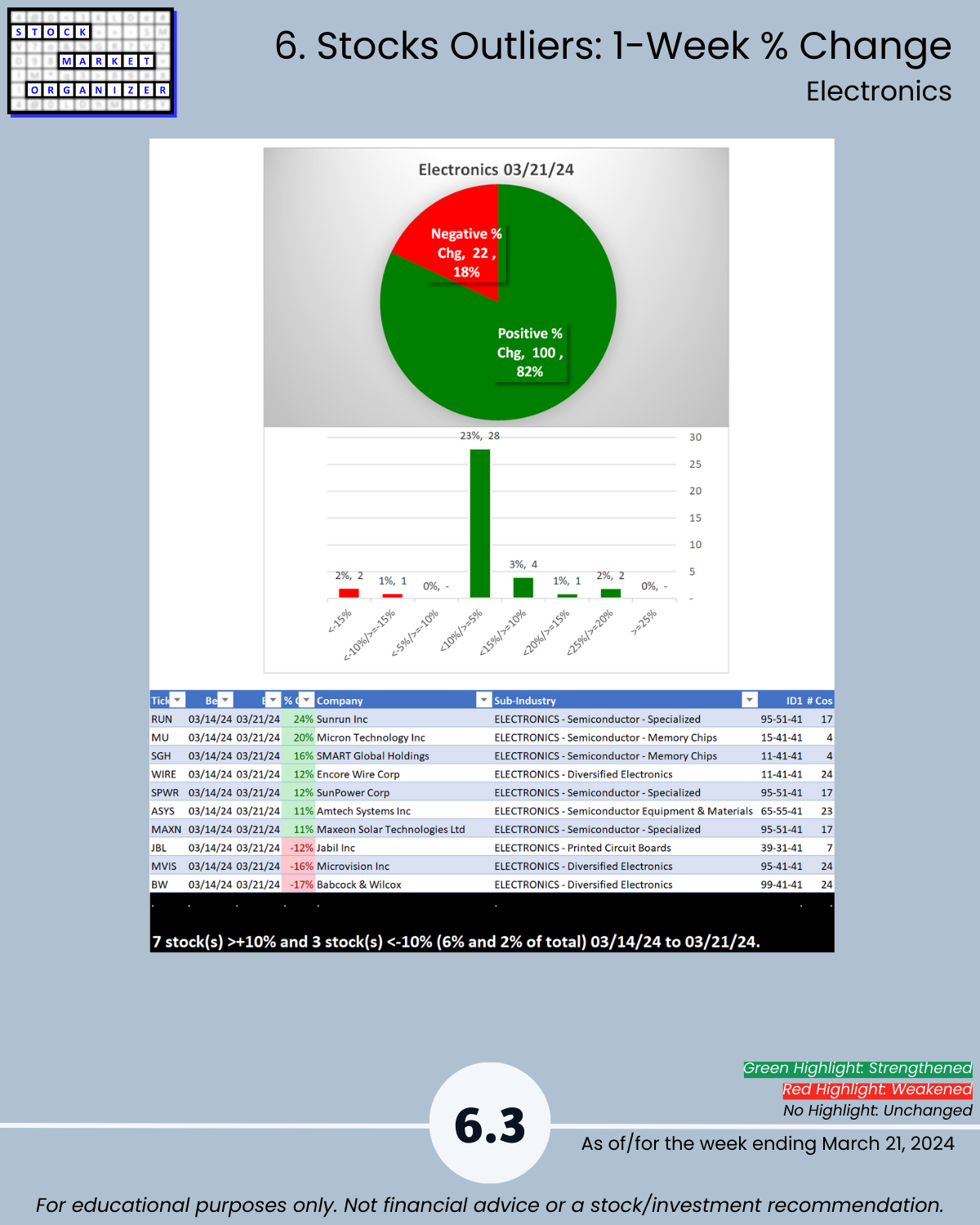

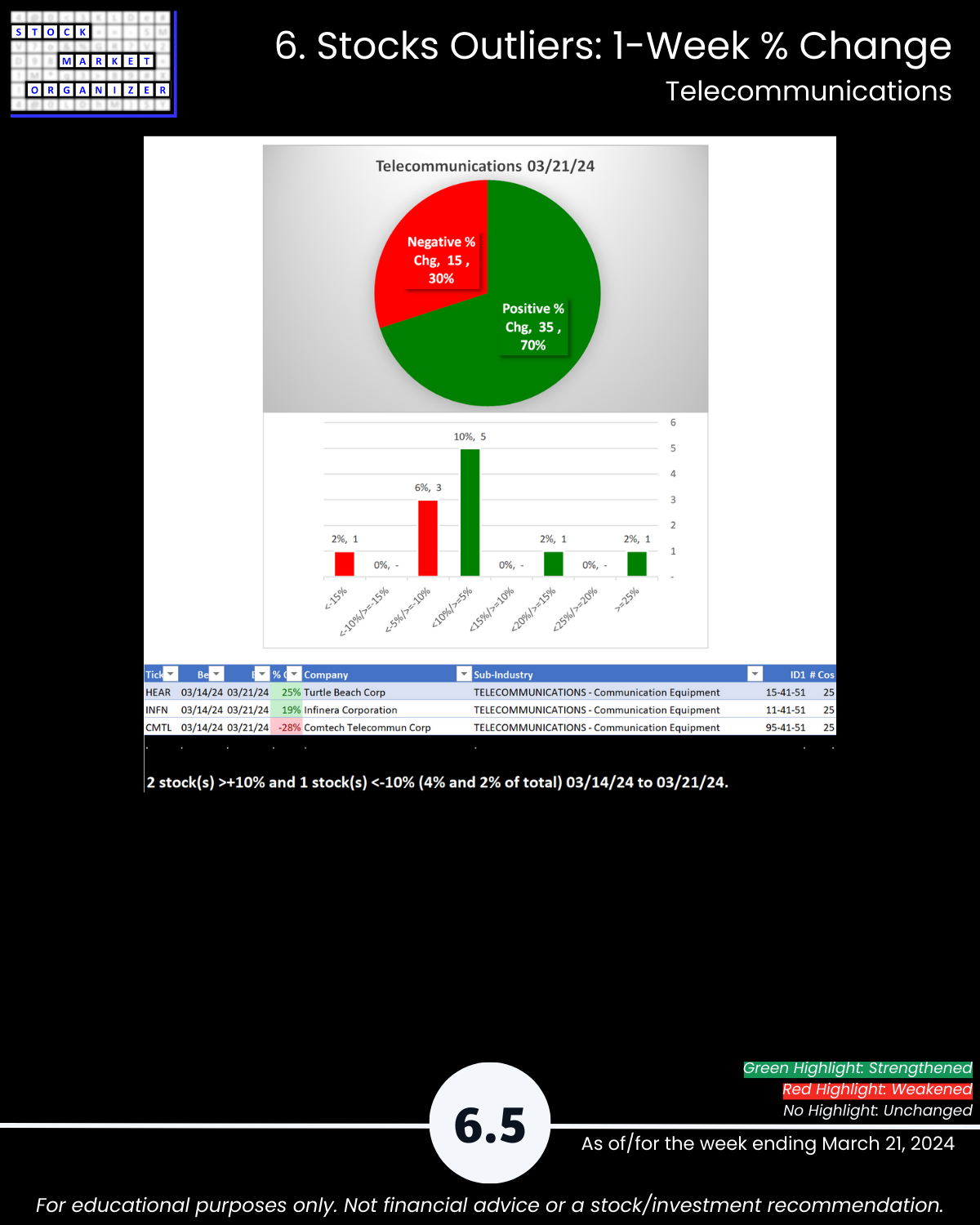

Last week I started out the Tech review asking “3/14/24 will this Electronics (chips/semis) weak week be the first of several?” 3/21/24 answer: NO. The Jekyll and Hyde Tech sector flips back as Software, Electronics, and Internet all strengthened. More: 🔹 HEAR +25% AFTER gapping up +26% on 3/14/24 alone 🔹 11% of 122 Electronics (aka Chips/Semis) industry stocks are at 5+ year highs 🔹 Electronics 82% positive stocks, the sector averaged 73%.

For context, this was a reversal from last week when Software and Electronics both weakened, Electronics had 91% negative stocks and 19% of its stocks fell more than -10%, and the sector averaged 72% negative stocks.

Will this coming week see mean reversion again, or will it be a continuation week?

I have no idea.

What I do know is every multi-week/month rally begins with one up week.

And 100%+ return stocks all started out climbing 10%.

WHAT’S HAPPENING HERE?

The focus: stacking strength at the stock, sub-industry, industry, and market levels.

How? Easy! Just start by tracking strengthening at the individual stock level. From this, build up strength at the higher levels and use this information to provide important context for individual stock strength.

Why? Because the stronger your stocks the greener your P&L.

The market does not have to be so complicated.

TAKEAWAYS

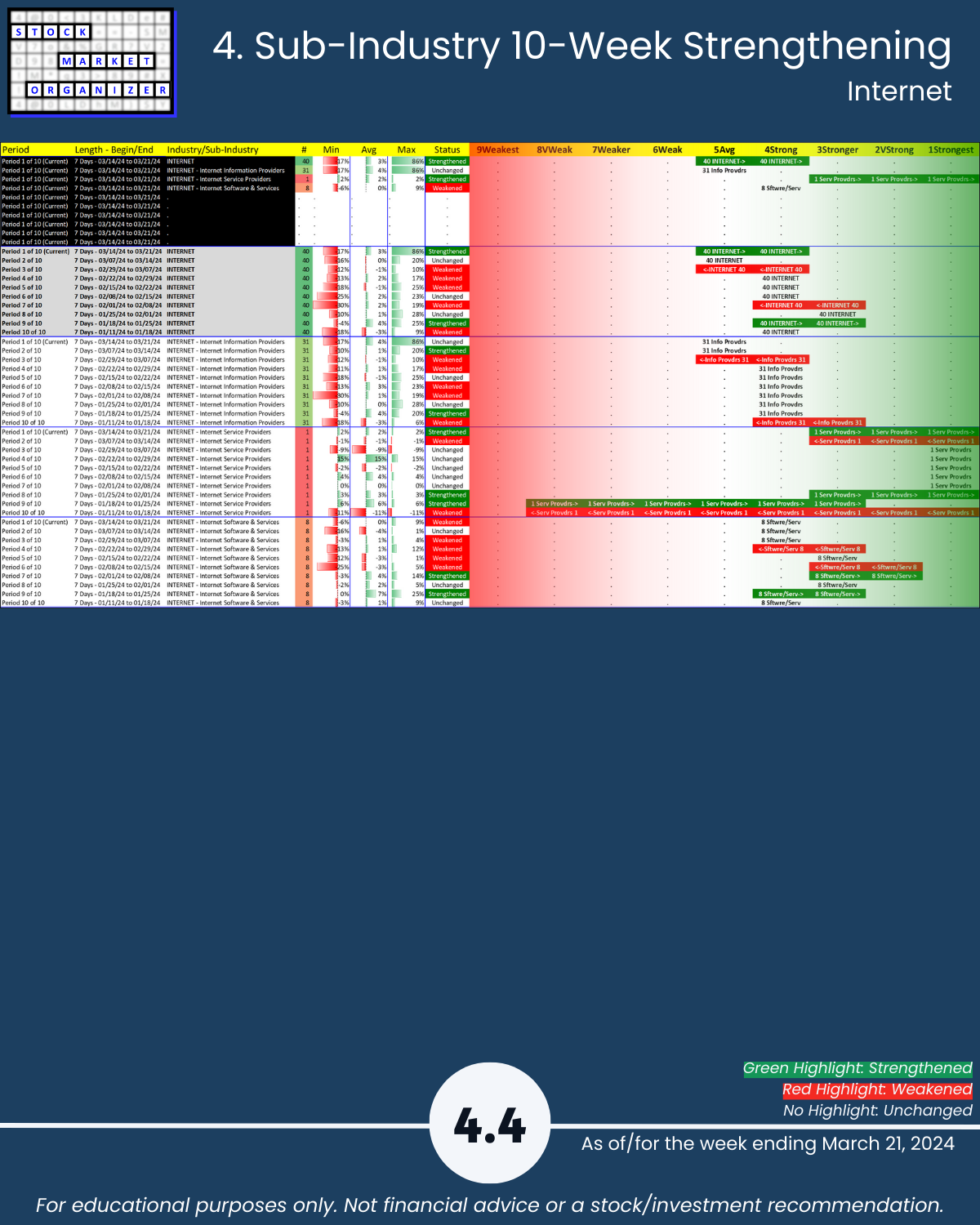

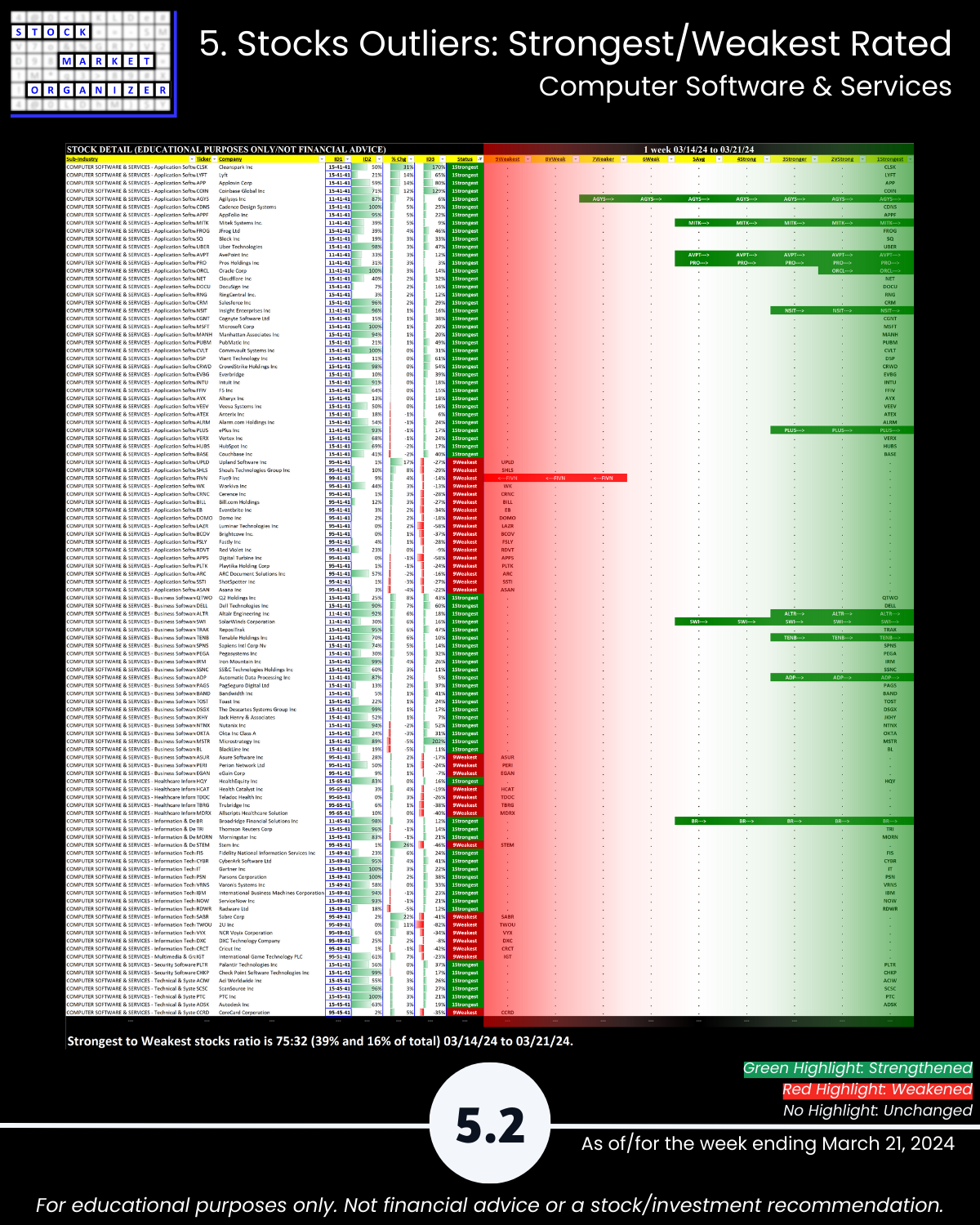

🔹 Software, Electronics, Internet STRENGTHENED

🔹 Strongest Industries: Software, Electronics, Internet Strong (4th strongest of 9 levels)

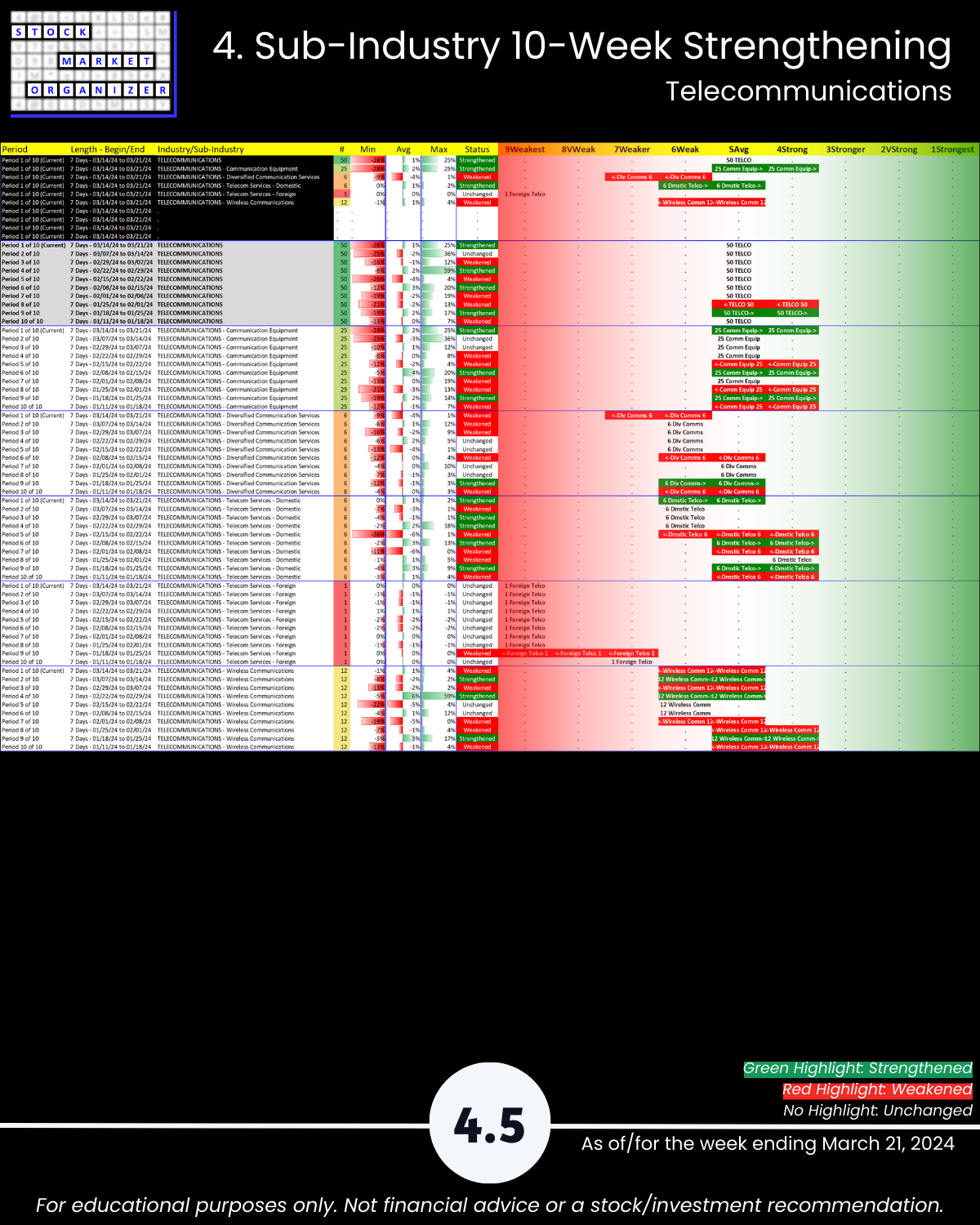

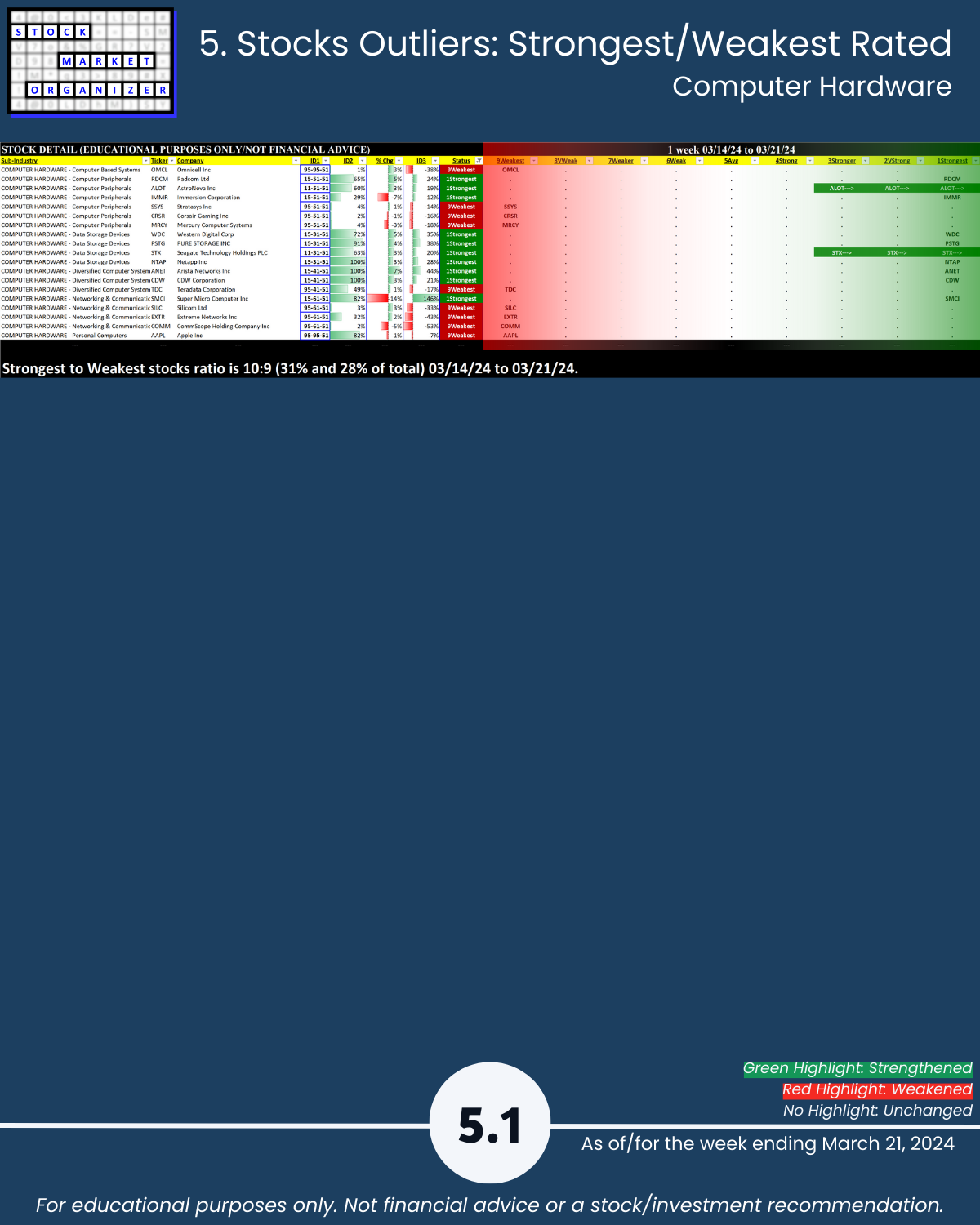

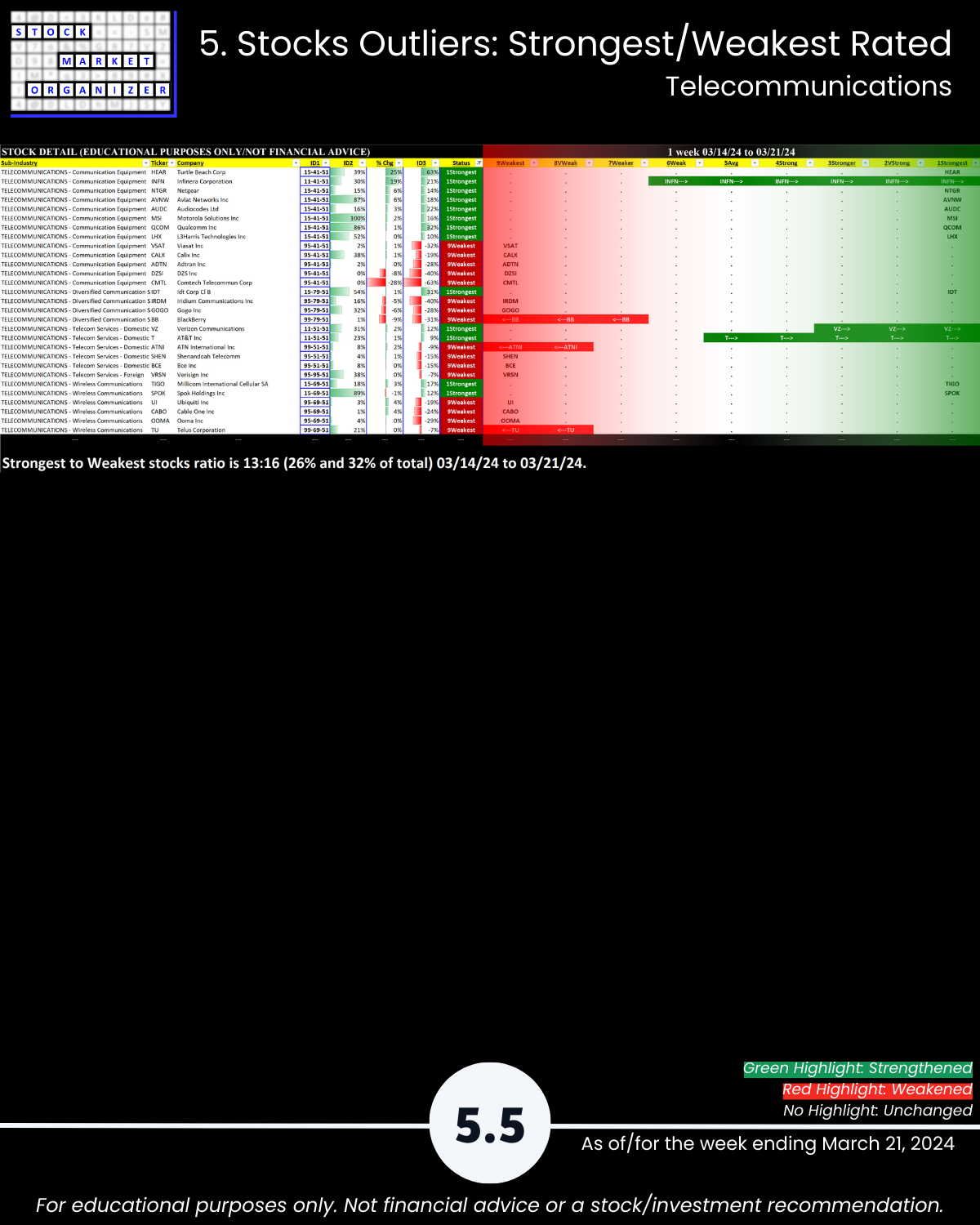

🔹 Weakest Industries: Hardware, Telecommunications Average (5th strongest)

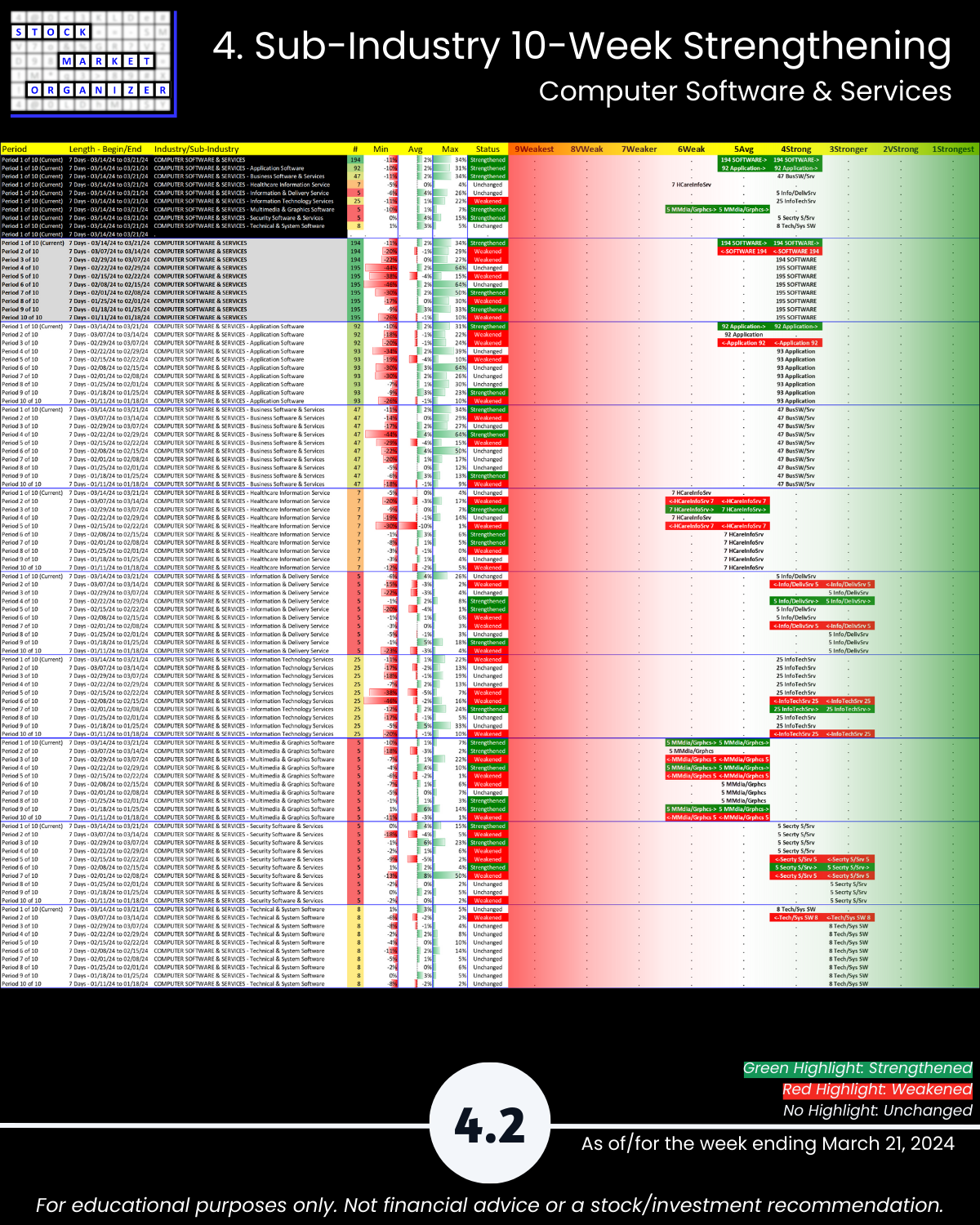

🔹 Sub-industries (30): 30% Strengthened, 7% Weakened; Scientific/Tech Instruments, Circuit Boards, Storage Strongest, Diversified Comm Services Weakest

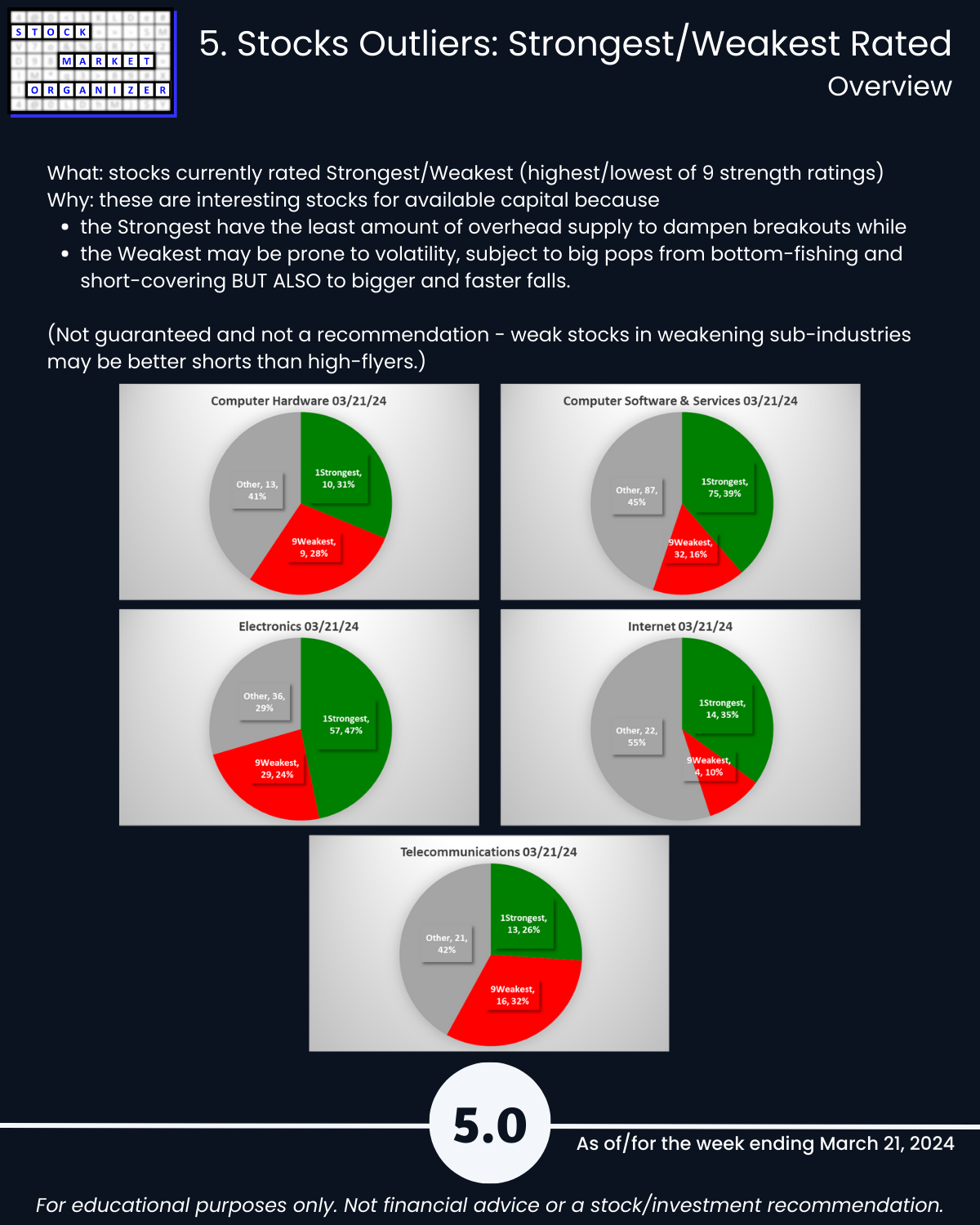

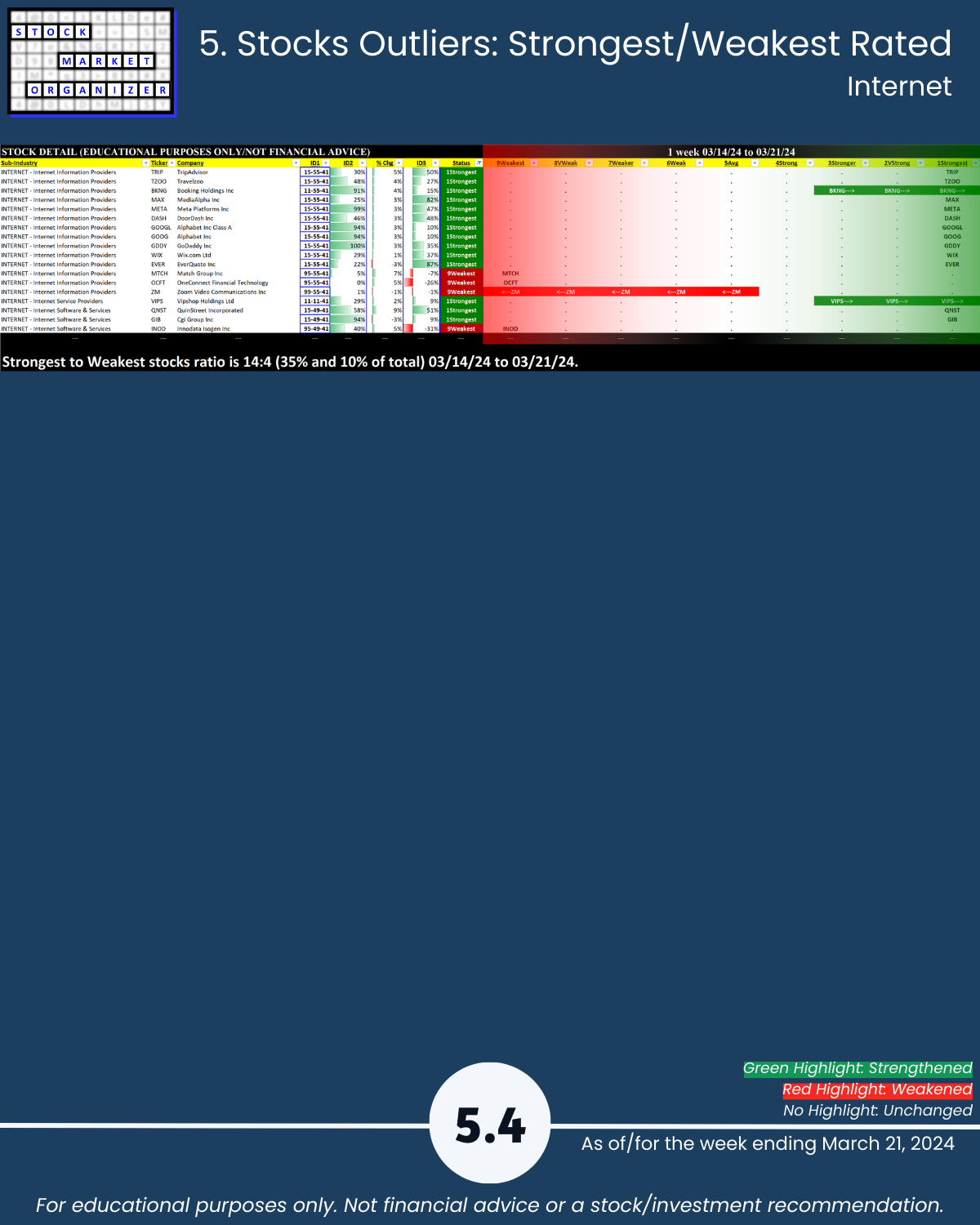

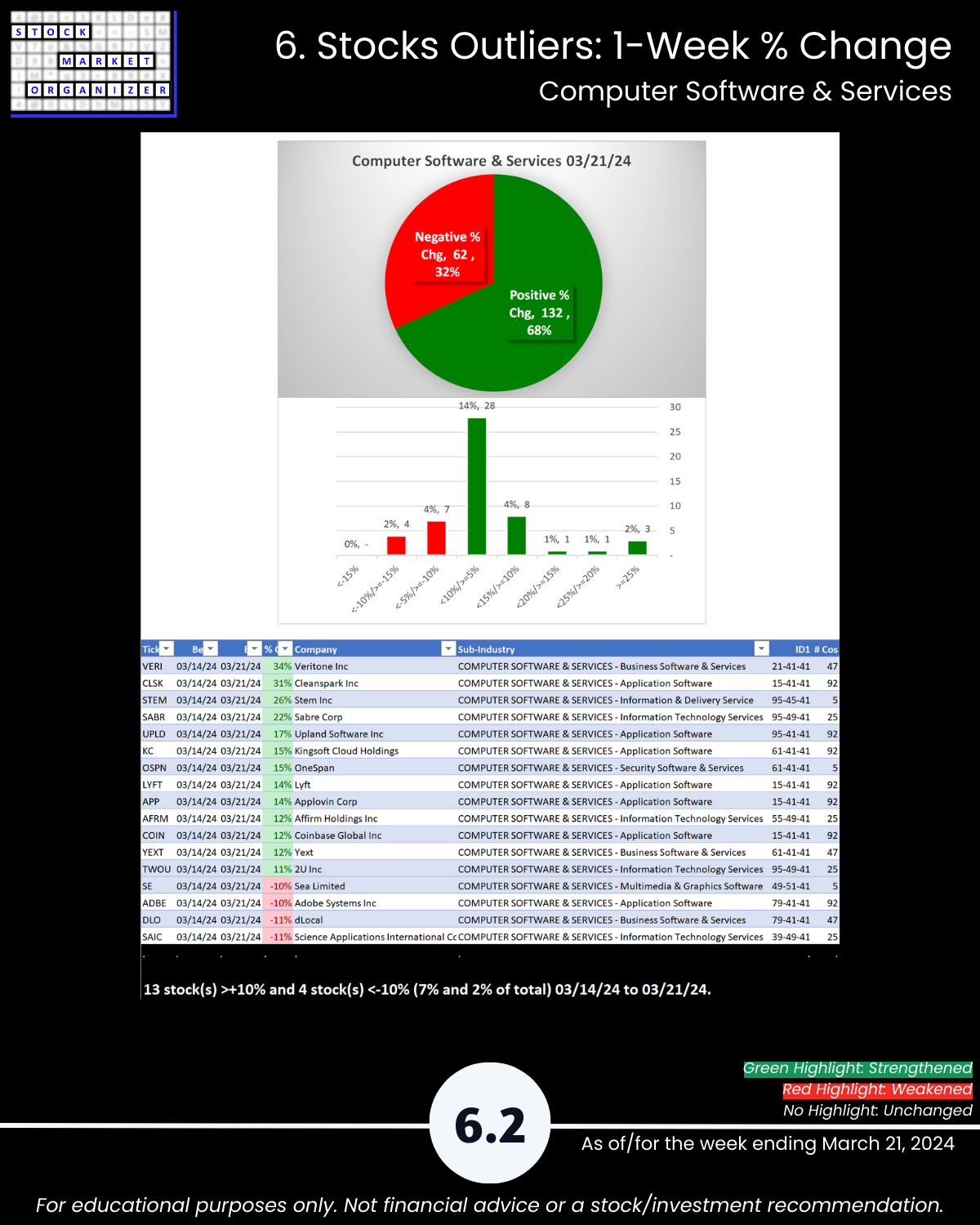

🔹 Stocks rated Strongest:Weakest: Software 39%:16%, Electronics 47%:24%, Internet 35%:10%

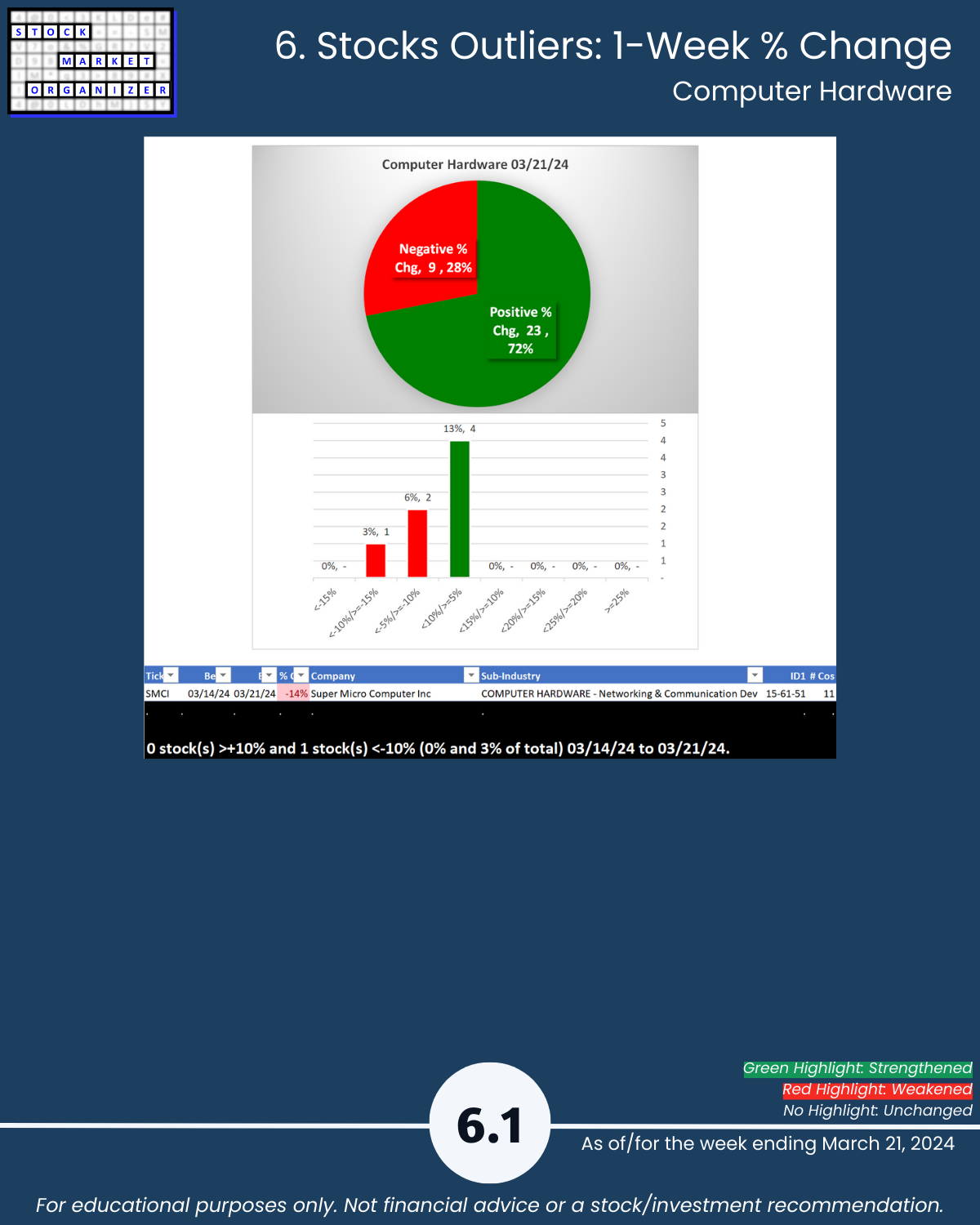

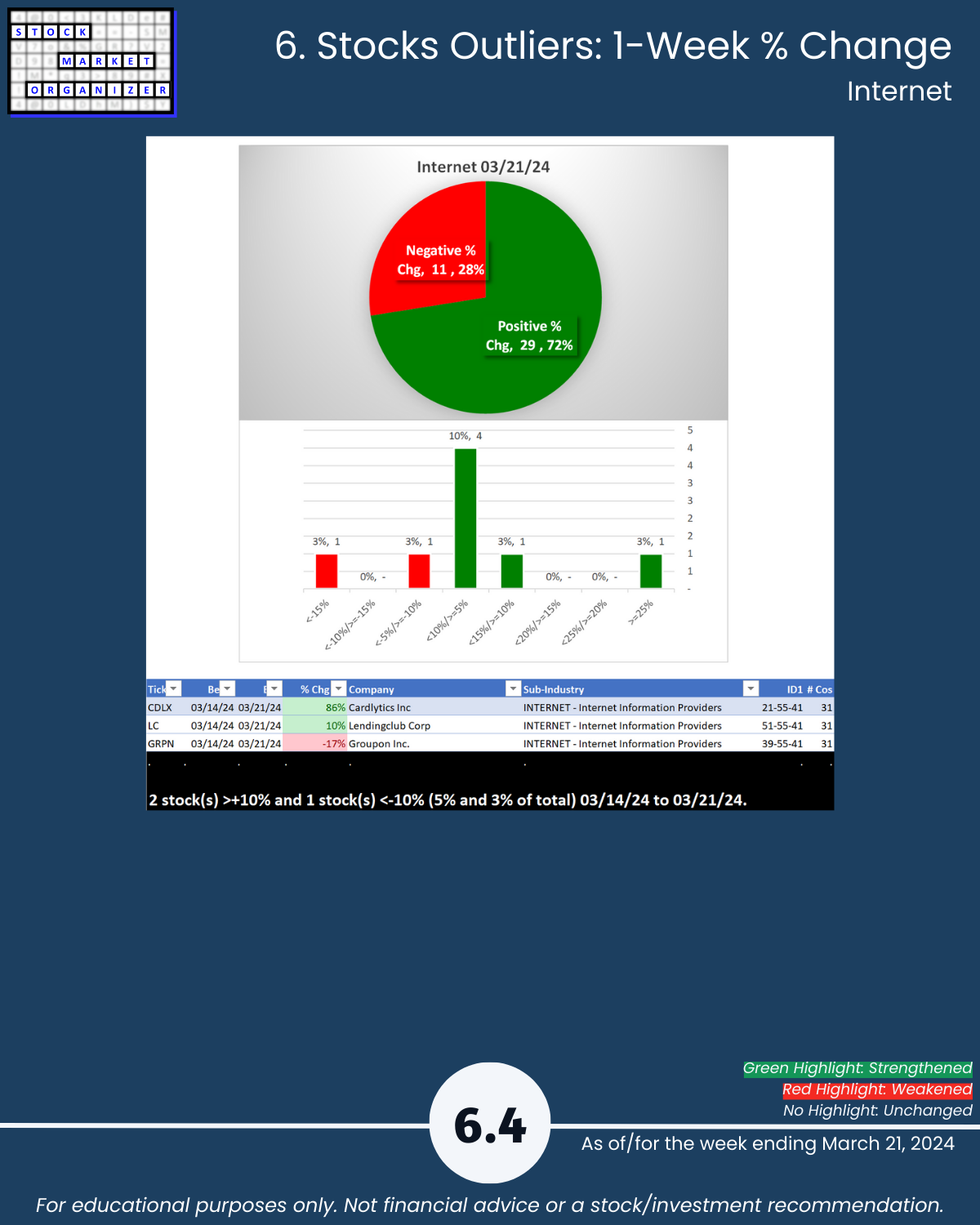

🔹 Outliers: All >68% positive stocks with 73% average (Electronics 82%), VERI +34%, CLSK +31%, STEM +26%, SABR +22%; RUN +24%, MU +20%; CDLX +86%; HEAR +25%, CMTL -28%

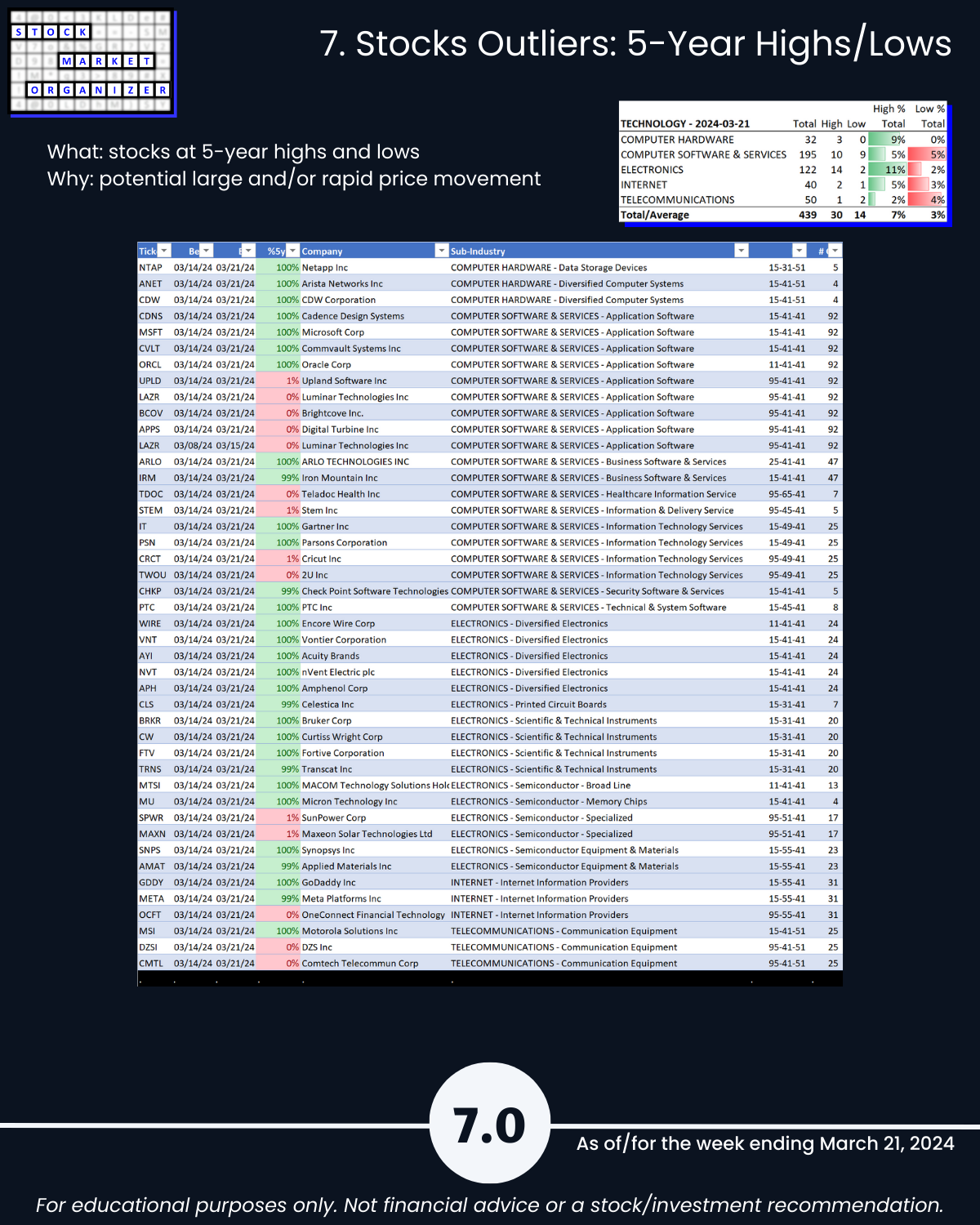

🔹 @ 5+Year Highs/Lows: 11% Electronics stocks at highs

This report may particularly be of interest if the following 5 concepts resonate with you:

- The stronger your stocks, the greener your P&L.

- The journey to 100%+ returns begins with 10% returns.

- The journey to a multi-month rally begins with one up week.

- Most stocks do what the market does. (While the market can only do what its underlying stocks, sub-industries, and industries do.)

- 80/20: not all information is created equal. (Press buttons, not balloons.)

Following are galleries with page-by-page views of this report.

1. Introduction

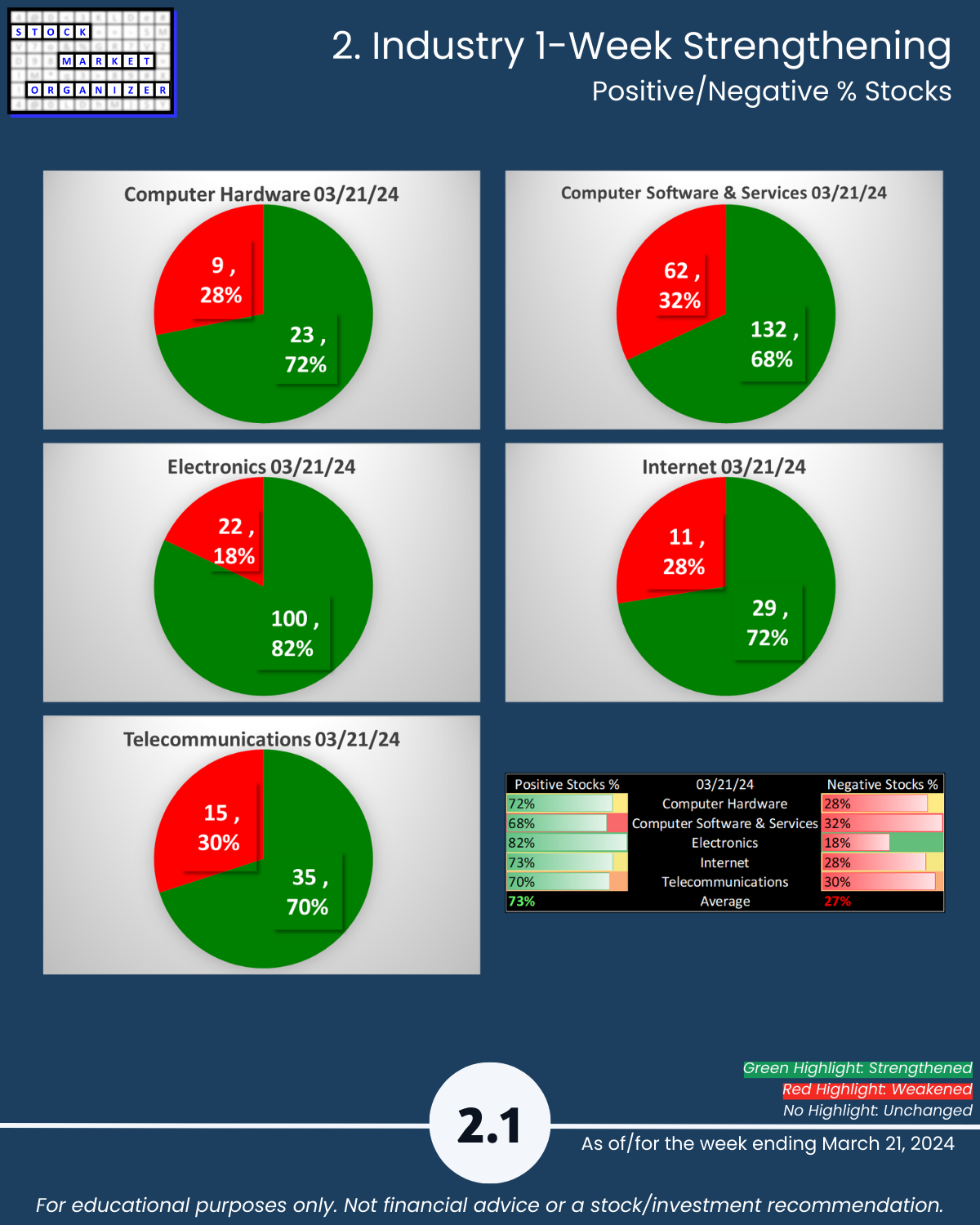

2. Industry 1-Week Strengthening

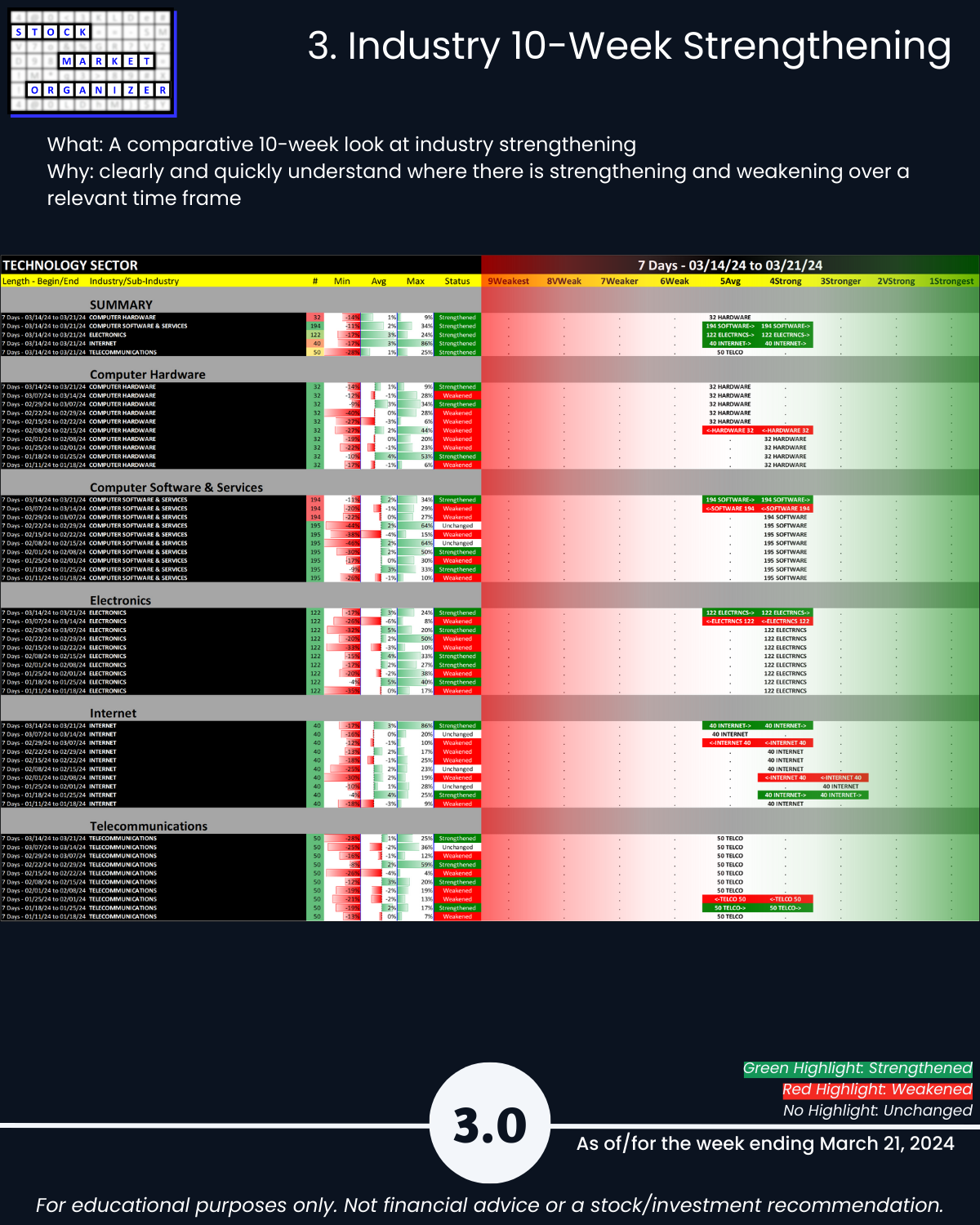

3. Industry 10-Week Strengthening

4. Sub-Industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

6. Stocks Outliers: 1-Week % Change

7. Stocks Outliers: 5-Year Highs/Lows