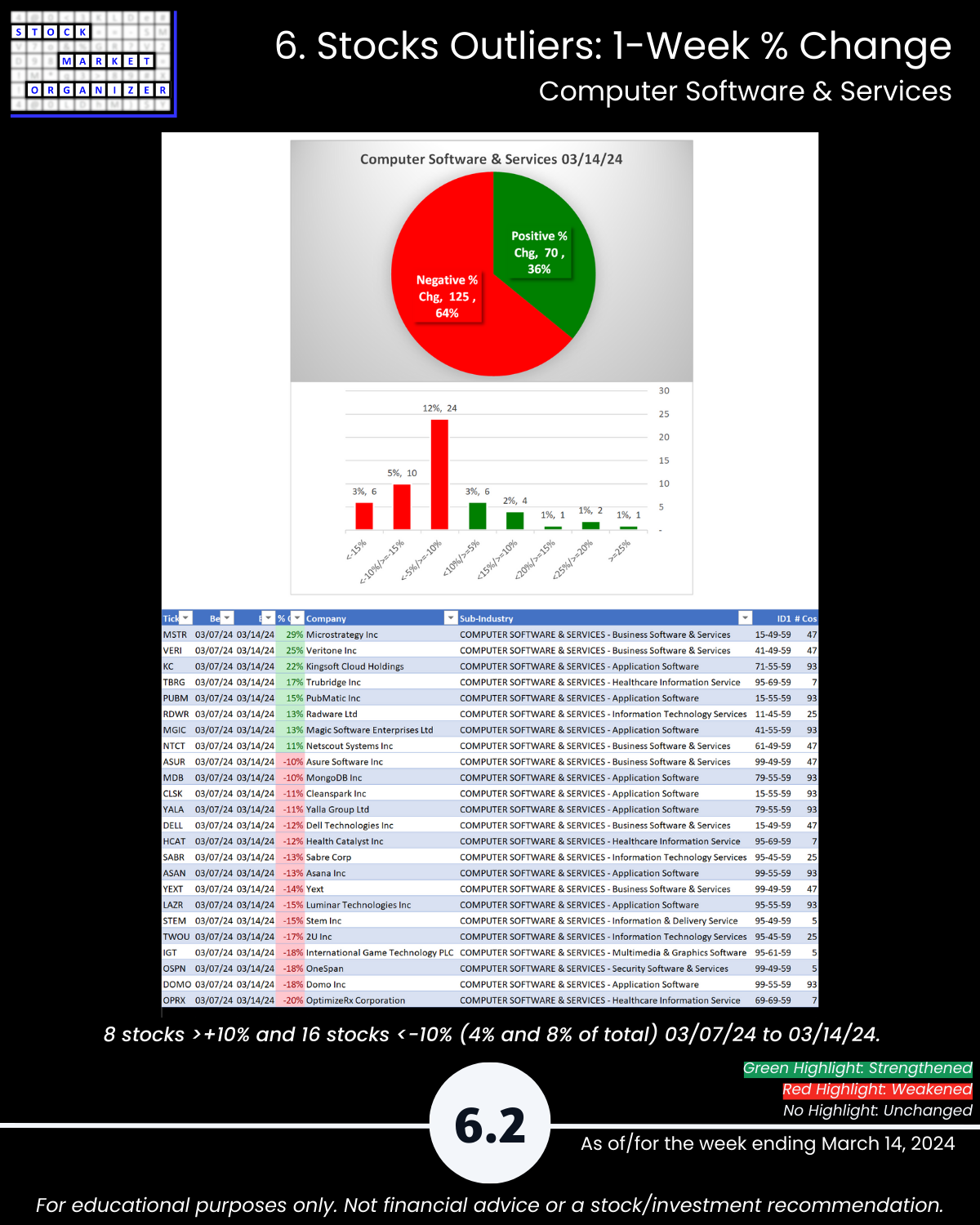

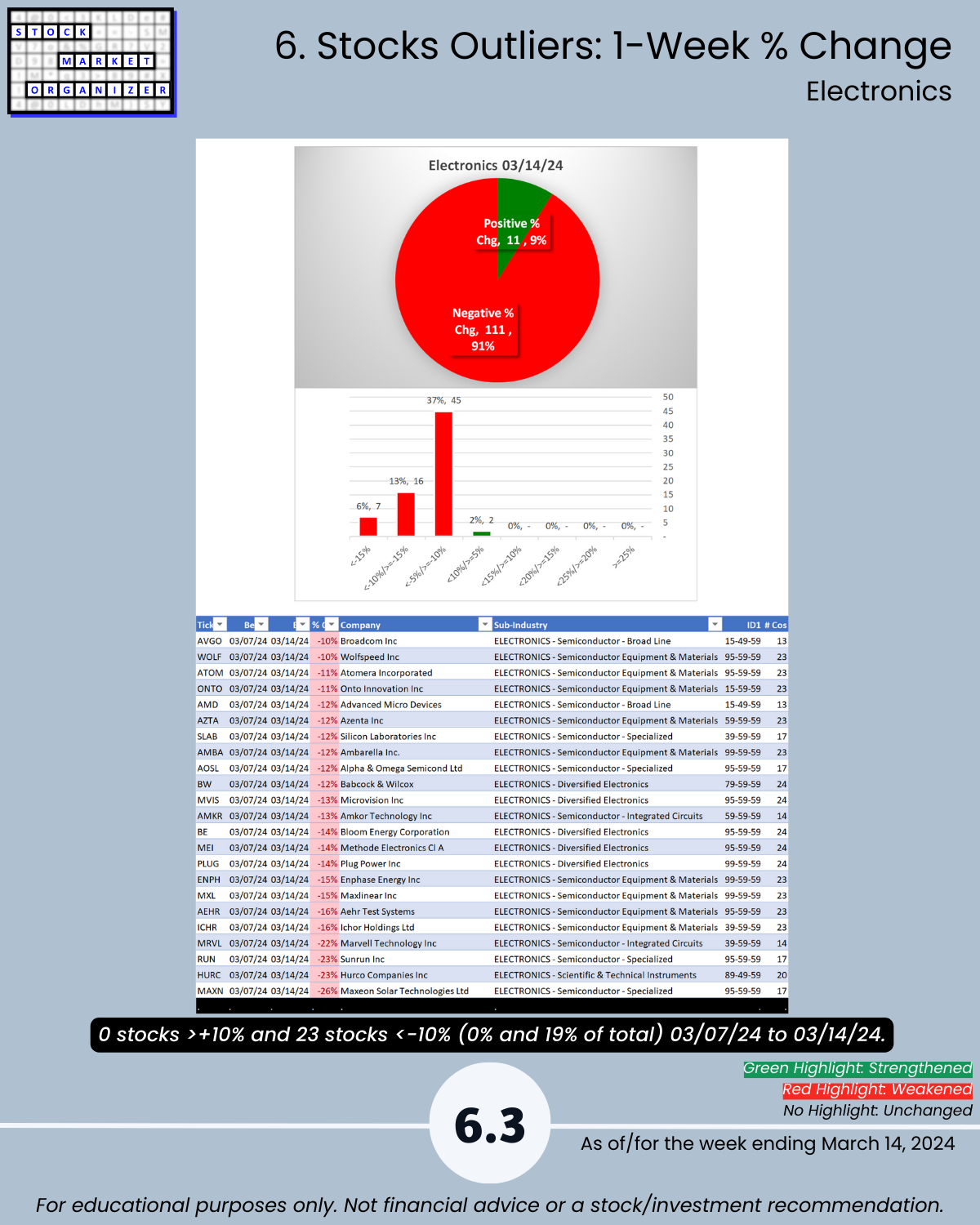

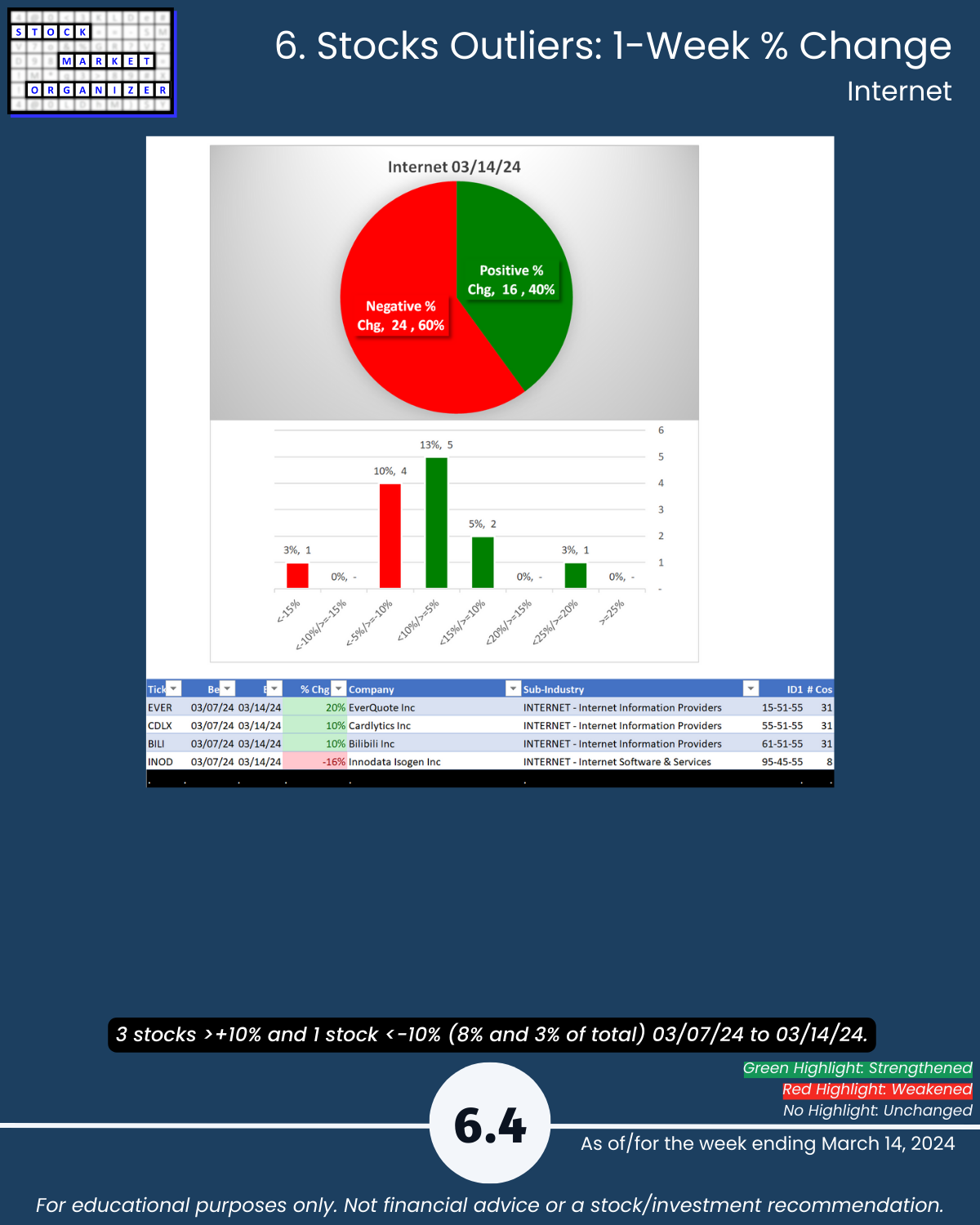

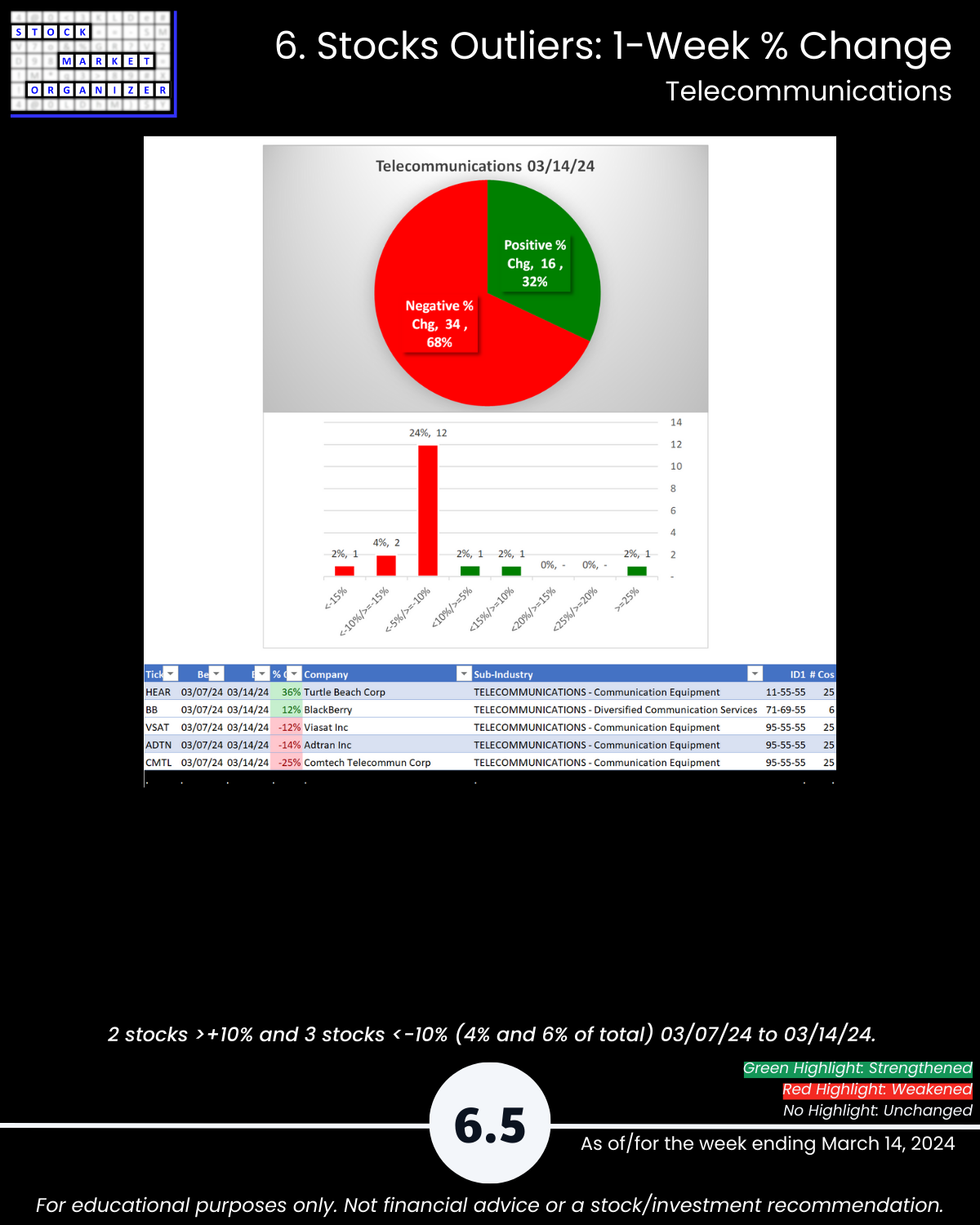

SMO Exclusive: Strength Report Technology Sector 2024-03-14

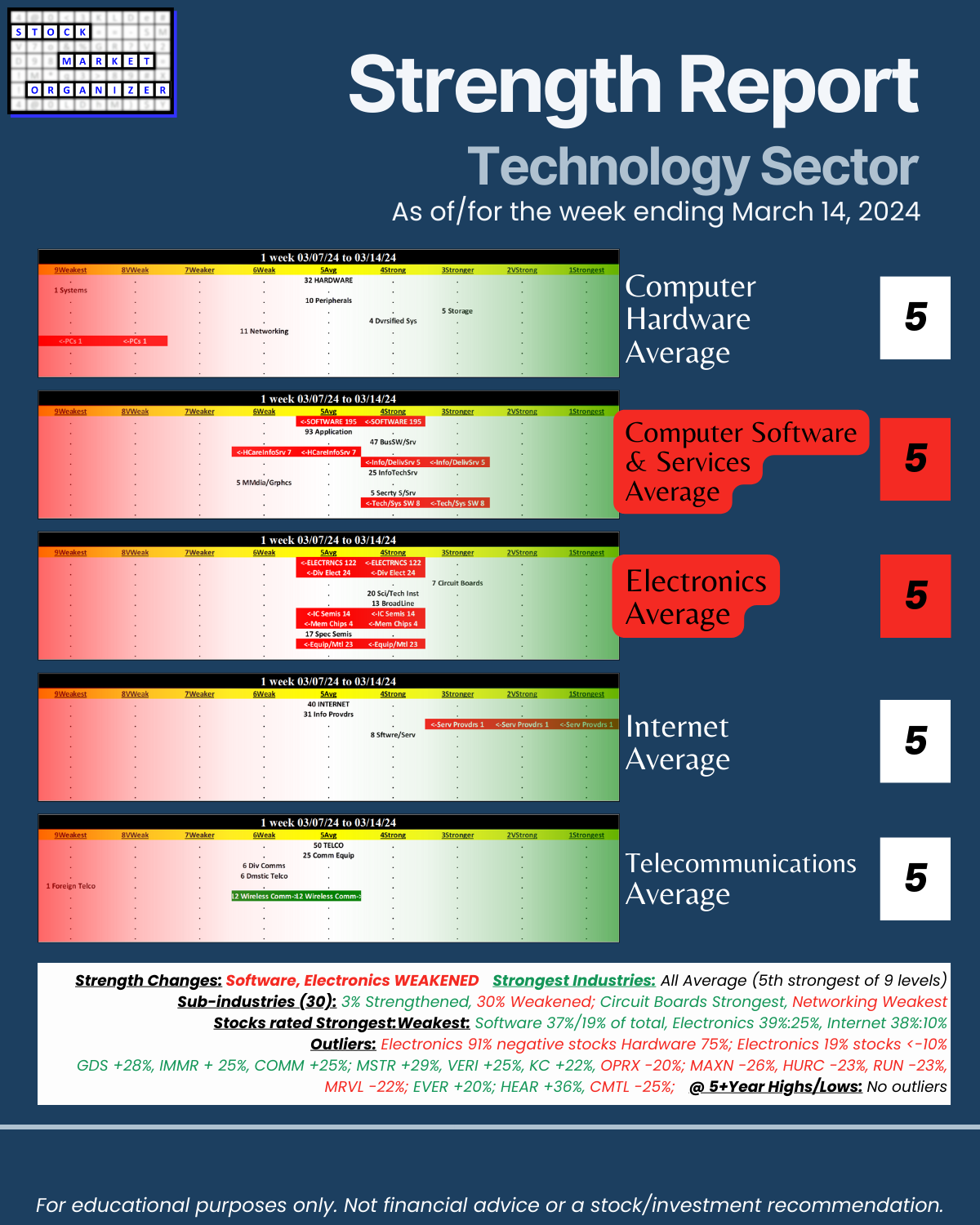

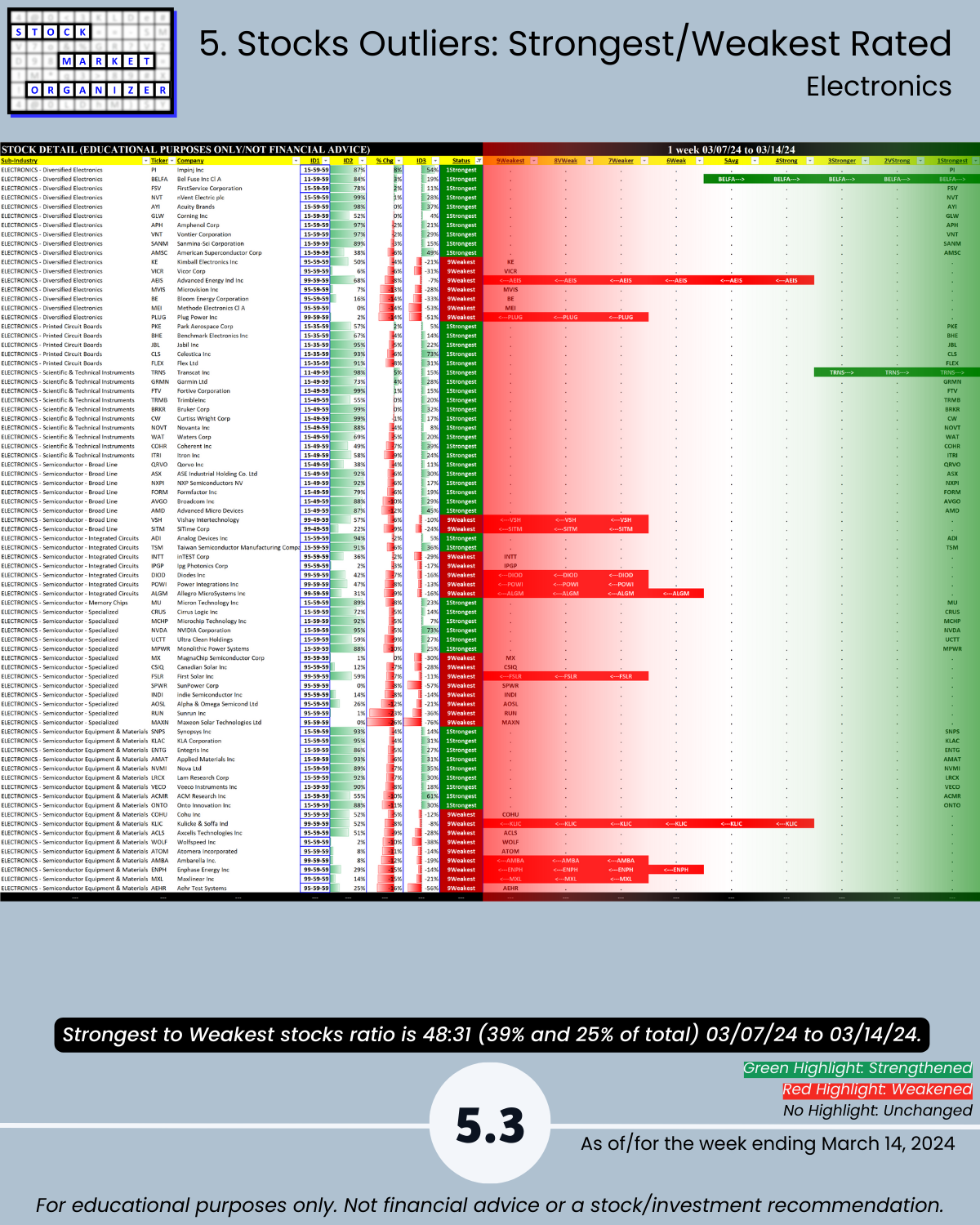

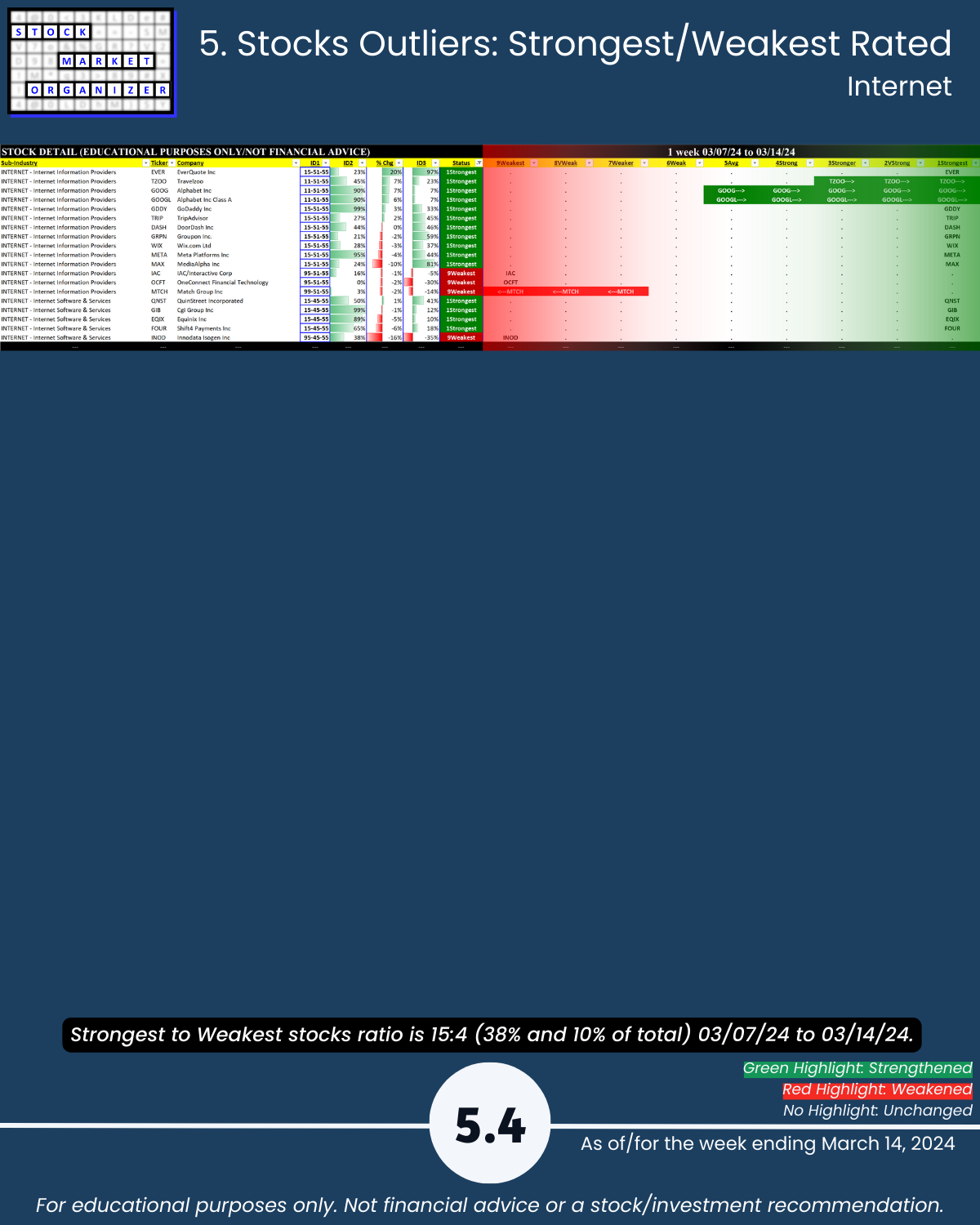

3/14/24 will this Electronics (chips/semis) weak week be the first of several? Helpful Tech sector insights from an objective strength analysis: 🔹 2/5 industries WEAKENED (Software, Electronics) 🔹 Electronics 4/8 sub-industries WEAKENED, 91% NEGATIVE stocks, and almost 1 in 5 stocks <-10% for the week = the opposite of last week with 84% positive stocks and 16% stocks > 10% 🔹 the 5 industries averaged 72% negative stocks (“best” was Internet 60% negative).

NVDA’s “bearish engulfing candle” and 36x P/S ratio Friday 3/8/24 did not lead to AI-mageddon, but the high sector negative stocks percentage may give Tech fans cause for pause.

What are you tracking? Anything that objectively tells you to load up, back off, or stand aside?

OUTLIERS = OPPORTUNITIES: SUB-INDUSTRY, INDUSTRY, AND MARKET STRENGTH WILL MATERIALLY INFLUENCE WHICH LEAD TO ACTUAL GAINS

The journey to 100%+ returns begins with 10% returns. (And the journey to multi-month rallies begins with one up week.)

You won’t find what you aren’t looking for.

CNVA -53% in 4 trading days 12/1/22-12/7/22 then +1902% in 15 months since then… is CVNA 2.0 somewhere in this week’s outlier bunch listed below? Or will a big down week lead to more downside – since a 50% decline can lead to another 50% or more decline?

(This doesn’t work for institutional investors, but for retail investors why not look for outliers that can lead to outsized outcomes?)

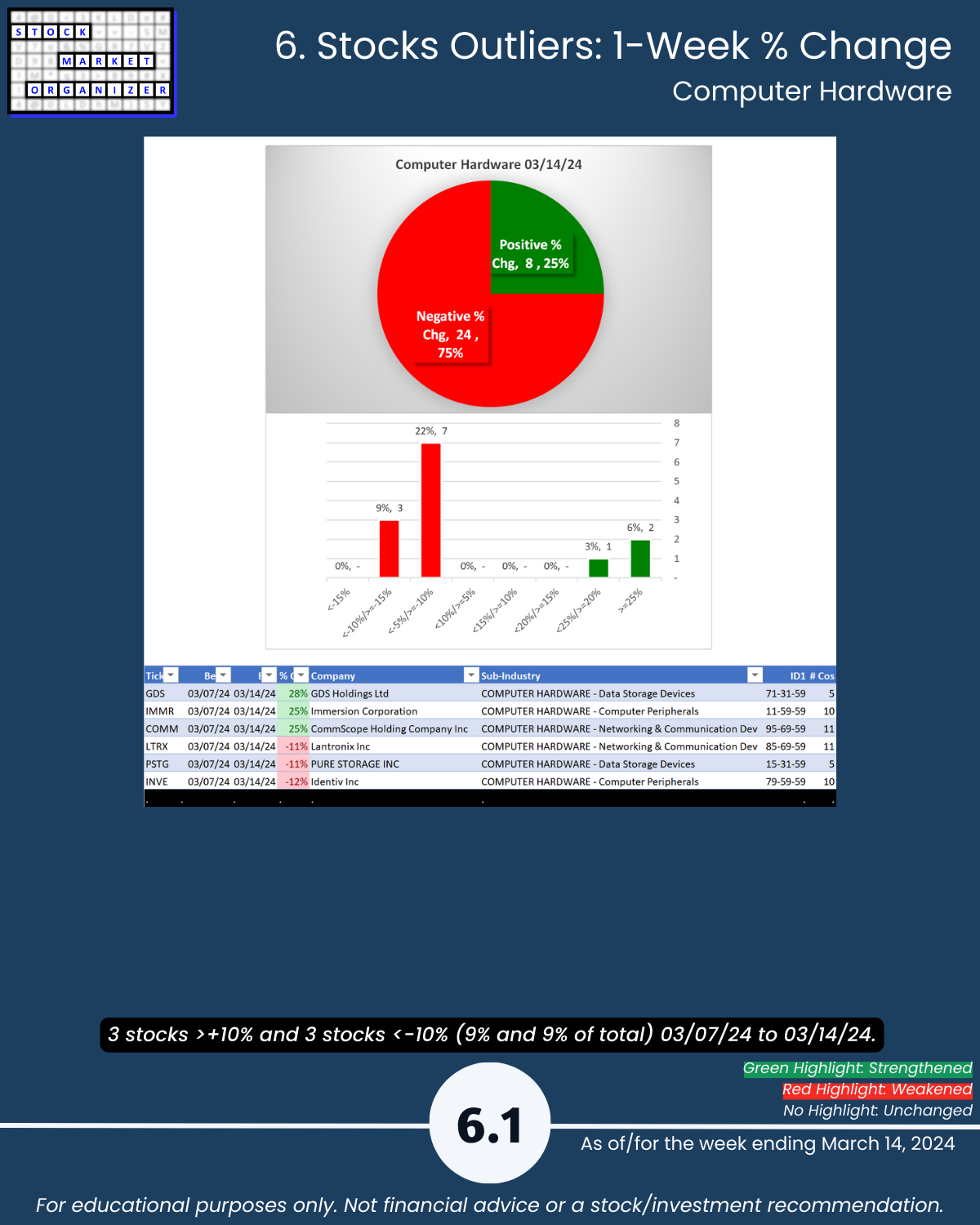

OUTLIERS UP: HEAR +36%, MSTR +29%, GDS +28%, IMMR + 25%, COMM +25%; VERI +25%, KC +22%, EVER +20%.

OUTLIERS DOWN: MAXN -26%, CMTL -25%, HURC -23%, RUN -23%, MRVL -22%, OPRX -20%.

What would help rising outliers keep rising?

Strengthening sub-industries and industries. And a rising market.

Strength in the U.S. stock market: you won’t find what you aren’t looking for.

The market does not have to be so complicated.

TAKEAWAYS for today’s industries Computer Hardware, Software/Services, Electronics, Internet, Telecommunications:

🔹 Strength Changes: Software, Electronics WEAKENED

🔹 Strongest Industries: All Average (5th strongest of 9 levels)

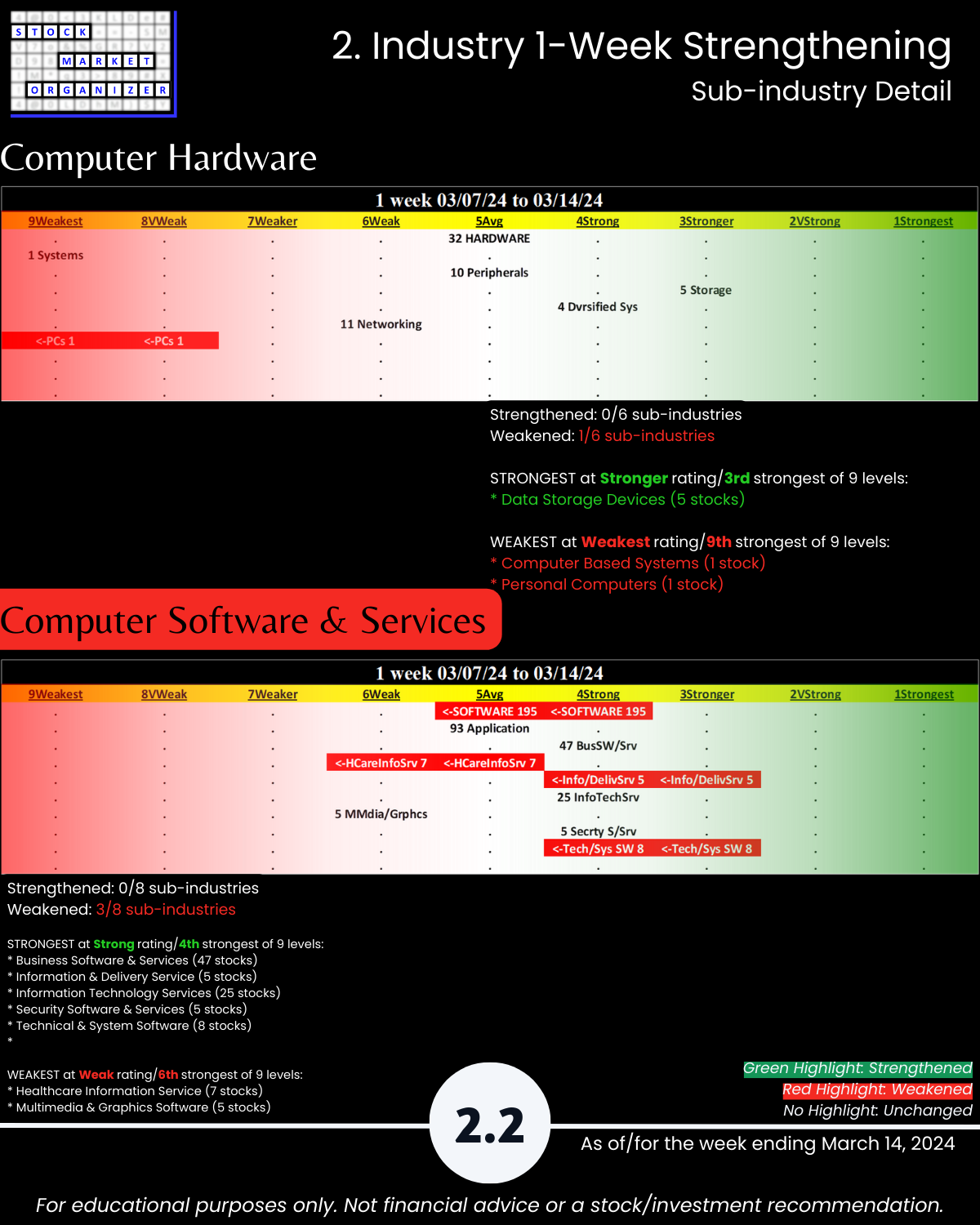

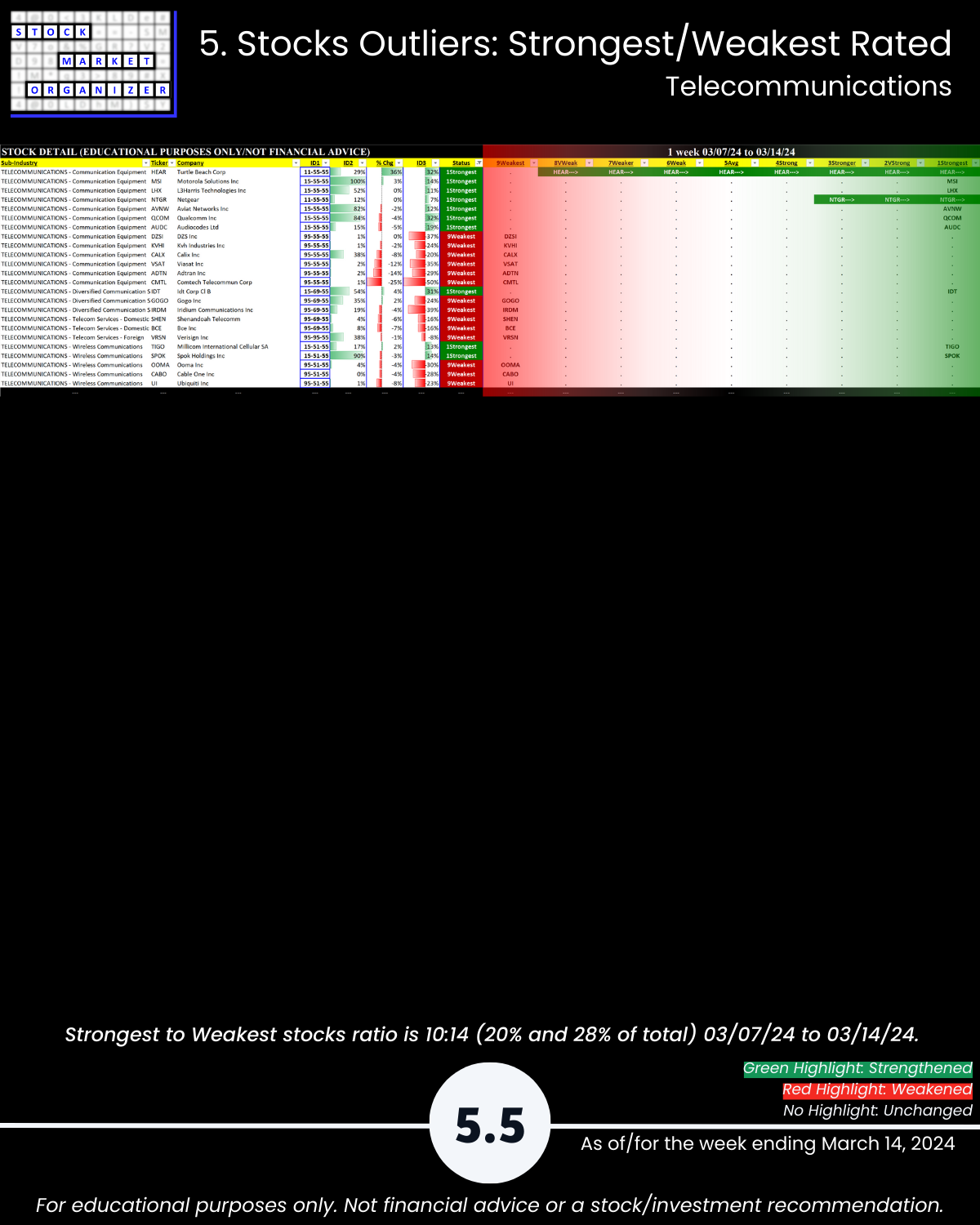

🔹 Sub-industries (30): 3% Strengthened, 27% Weakened; Circuit Boards Strongest, Networking Weakest

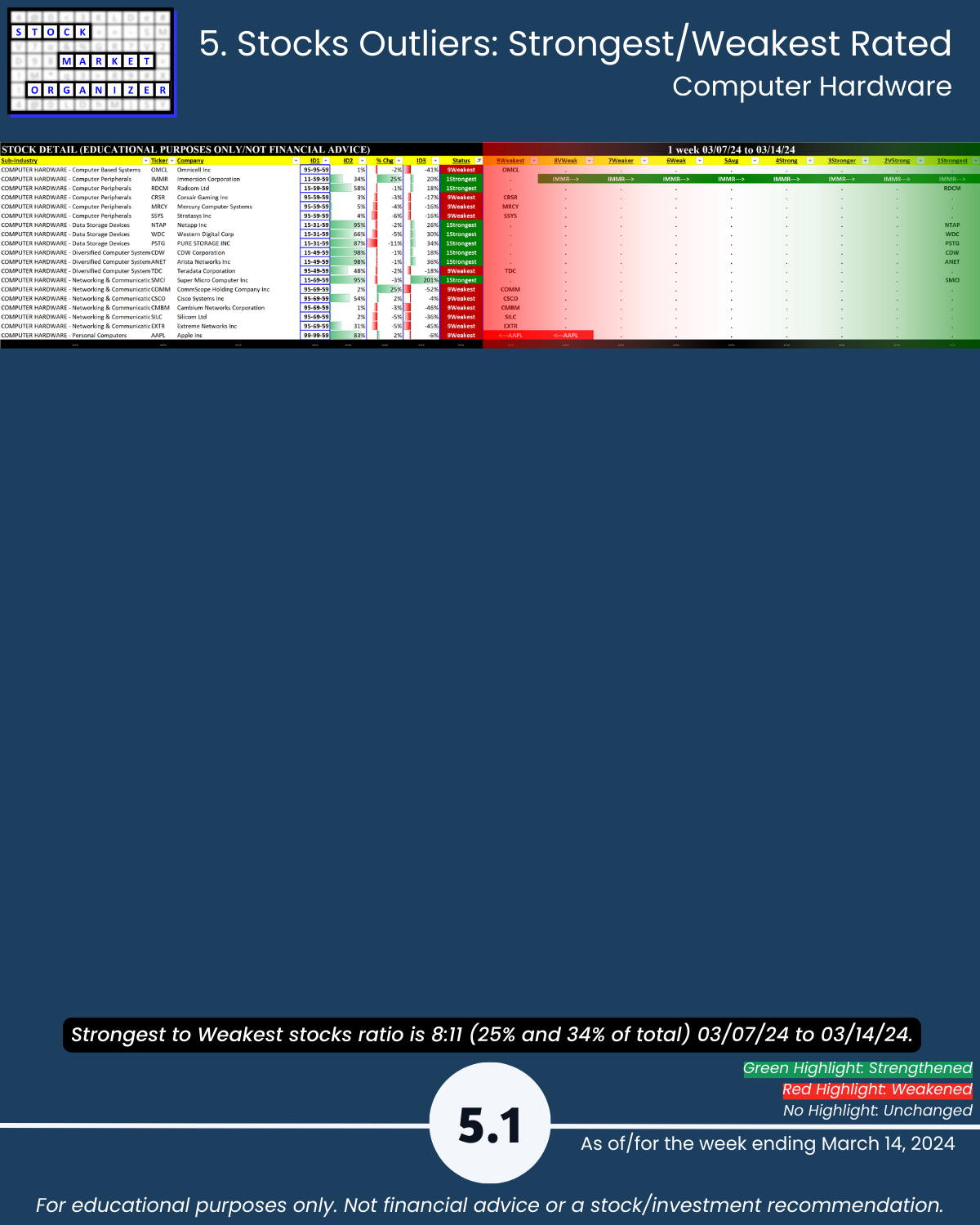

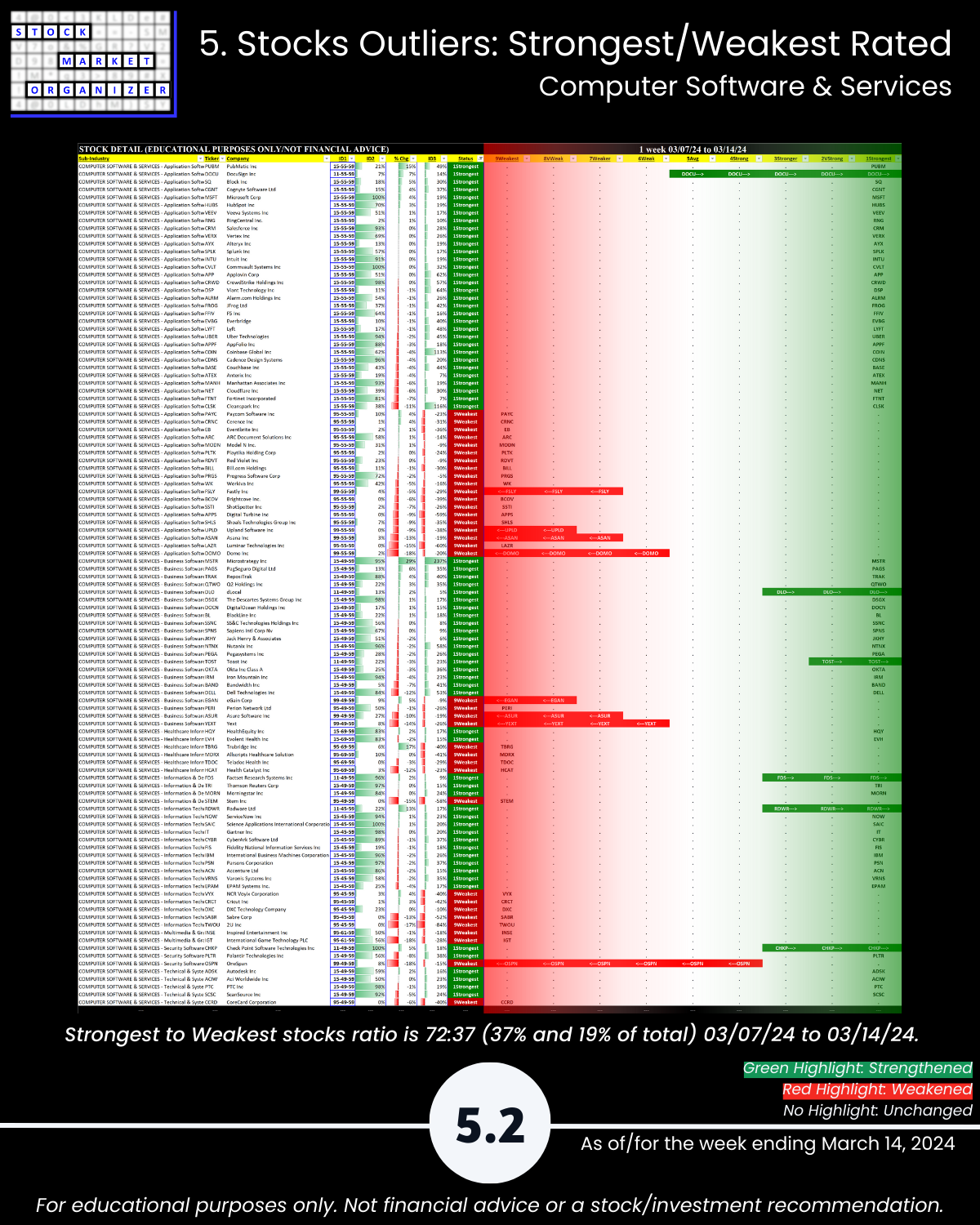

🔹 Stocks rated Strongest:Weakest: Software 37%/19% of total, Electronics 39%:25%, Internet 38%:10%

🔹 Outliers: Electronics 91% negative stocks Hardware 75%; Electronics 19% stocks <-10%; see above for individual stocks

This report may particularly be of interest if the following 5 concepts resonate with you:

- The stronger your stocks, the greener your P&L.

- The journey to 100%+ returns begins with 10% returns.

- The journey to a multi-month rally begins with one up week.

- Most stocks do what the market does. (While the market can only do what its underlying stocks, sub-industries, and industries do.)

- 80/20: not all information is created equal. (Press buttons, not balloons.)

Following are galleries with page-by-page views of this report.

1. Introduction

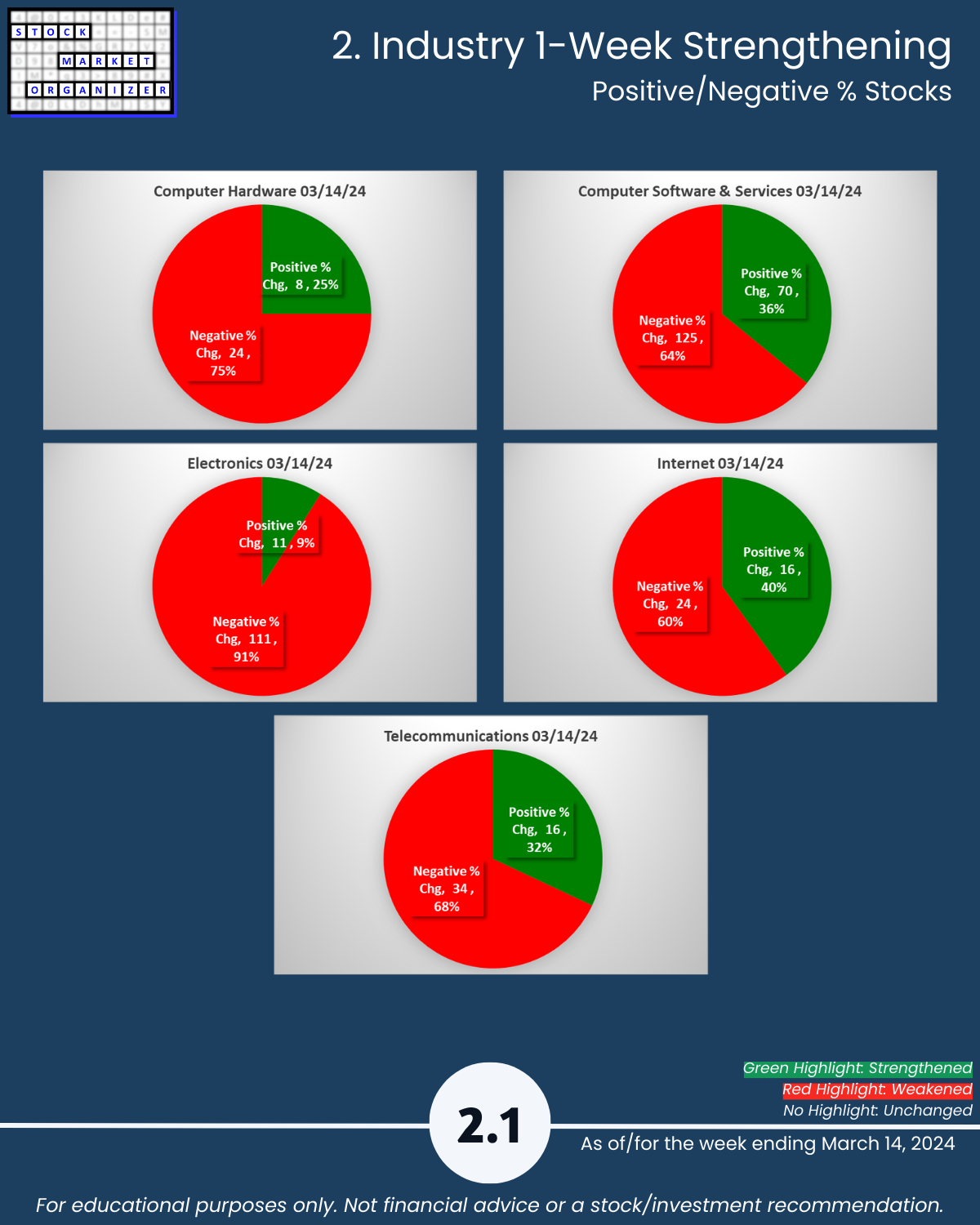

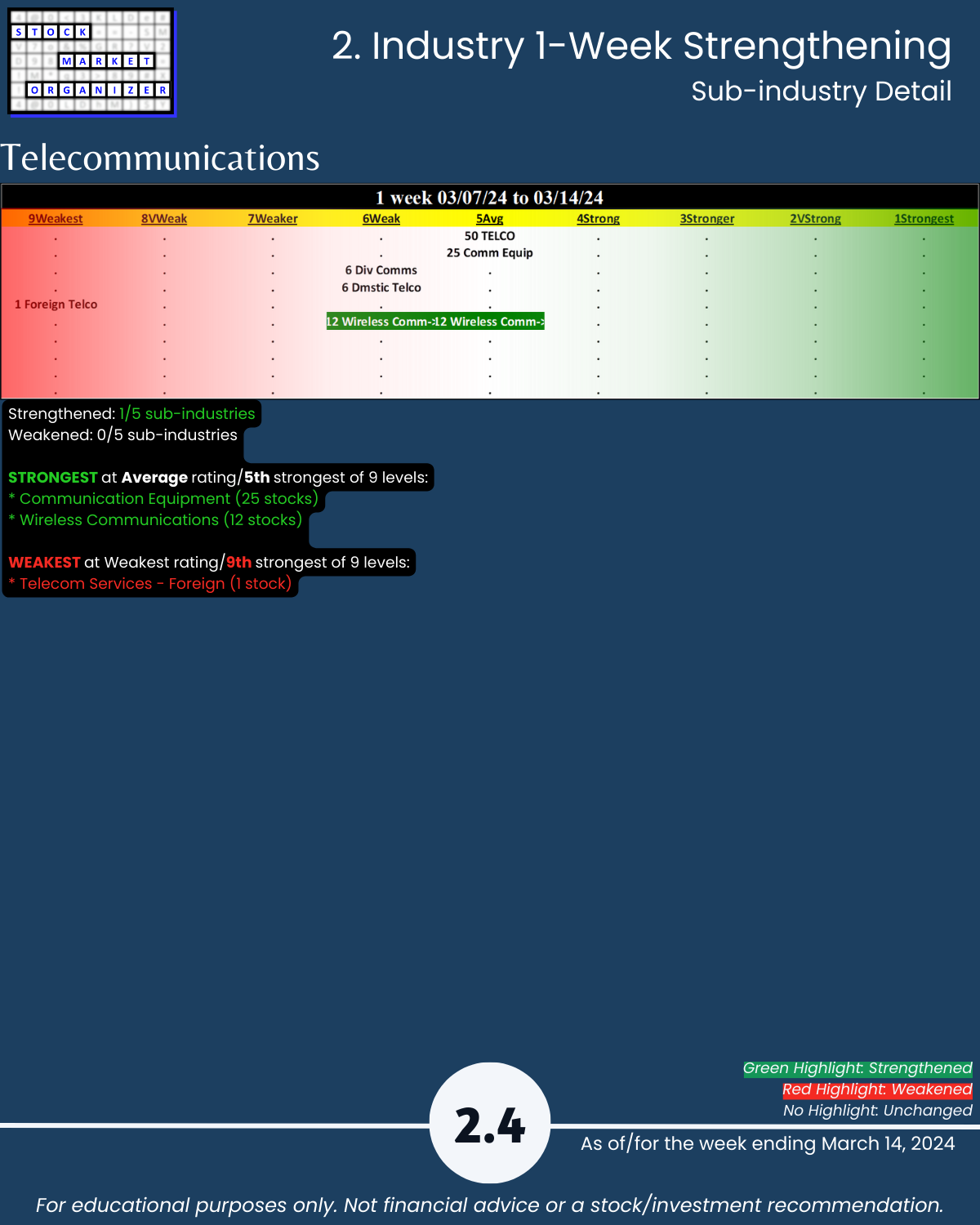

2. Industry 1-Week Strengthening

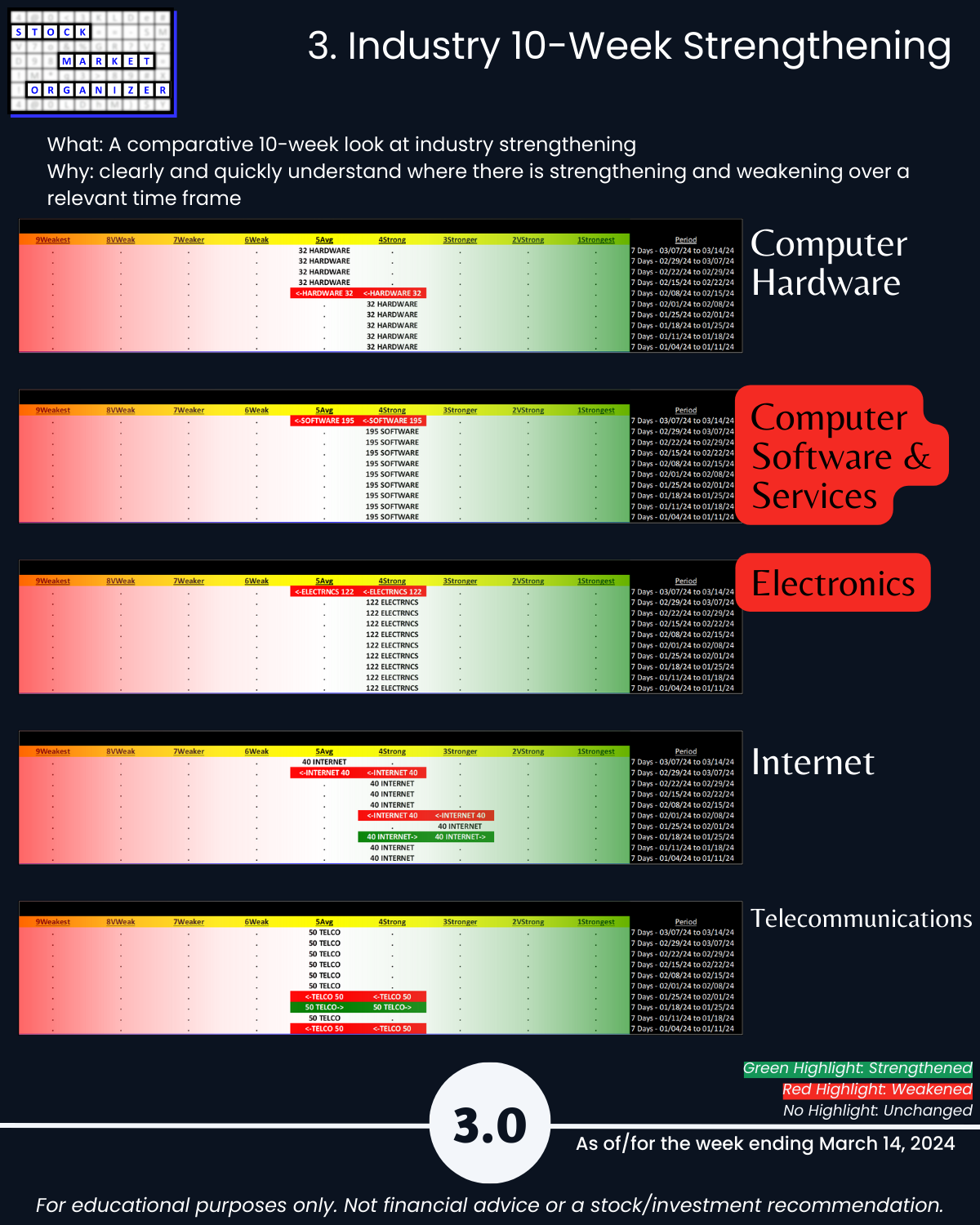

3. Industry 10-Week Strengthening

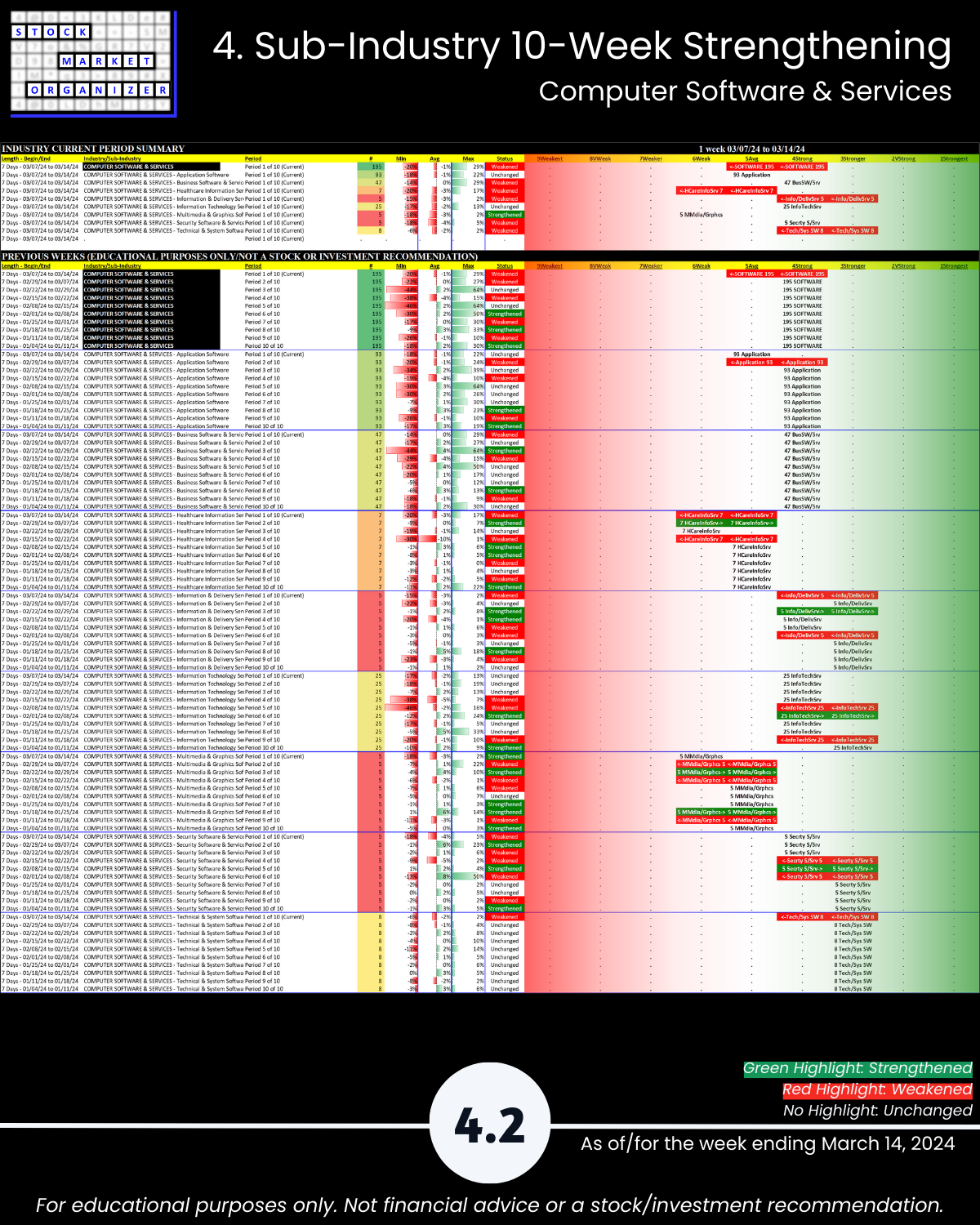

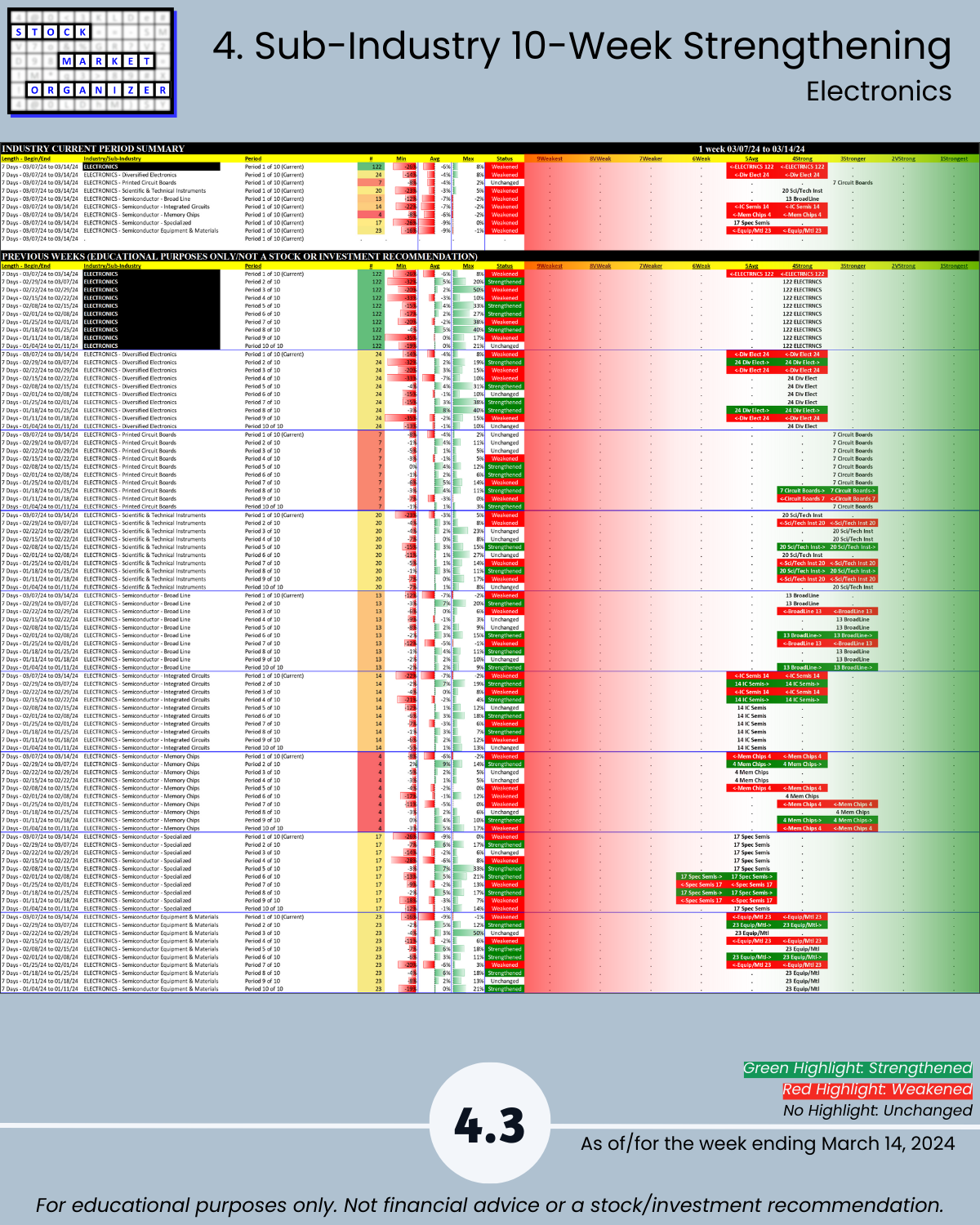

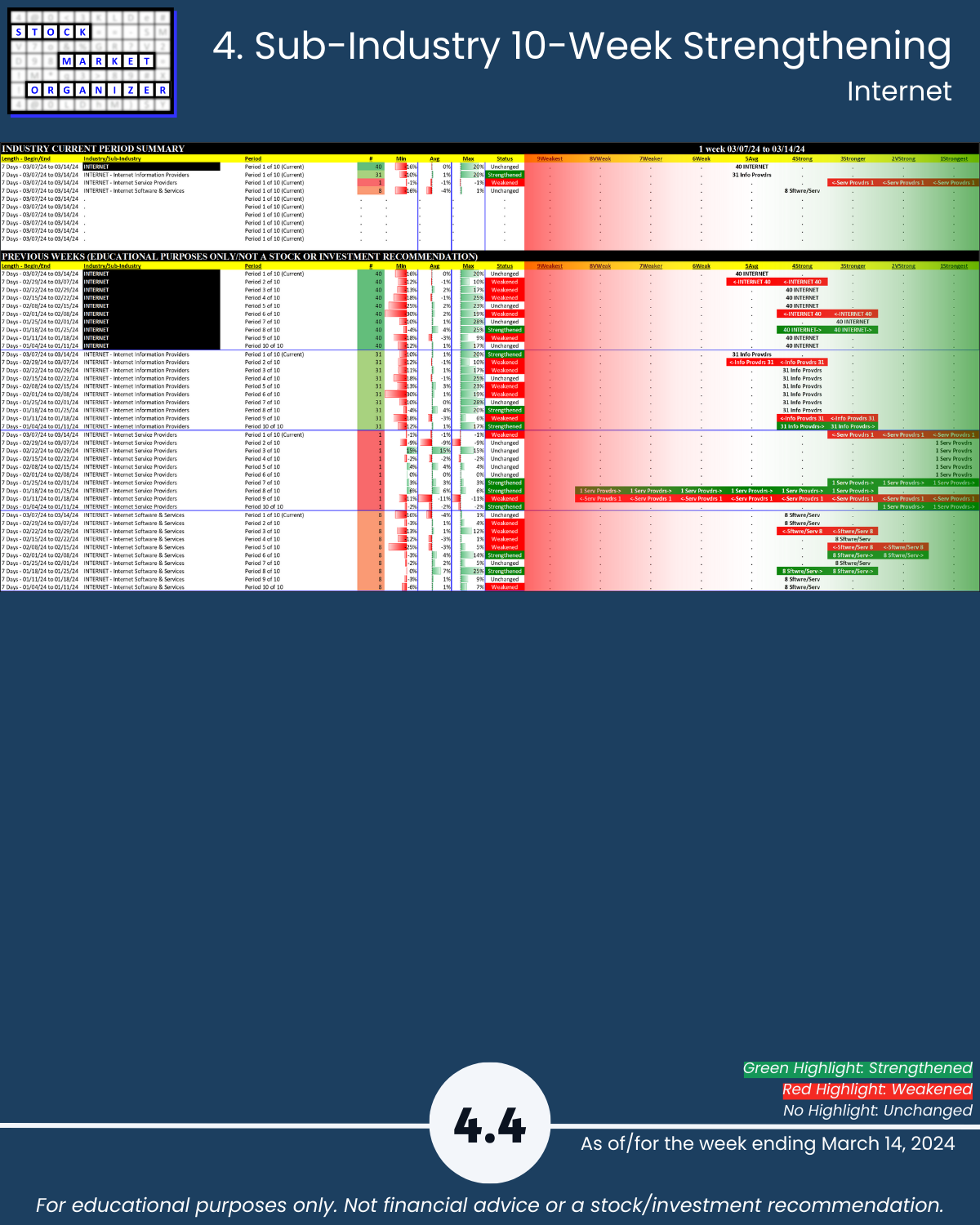

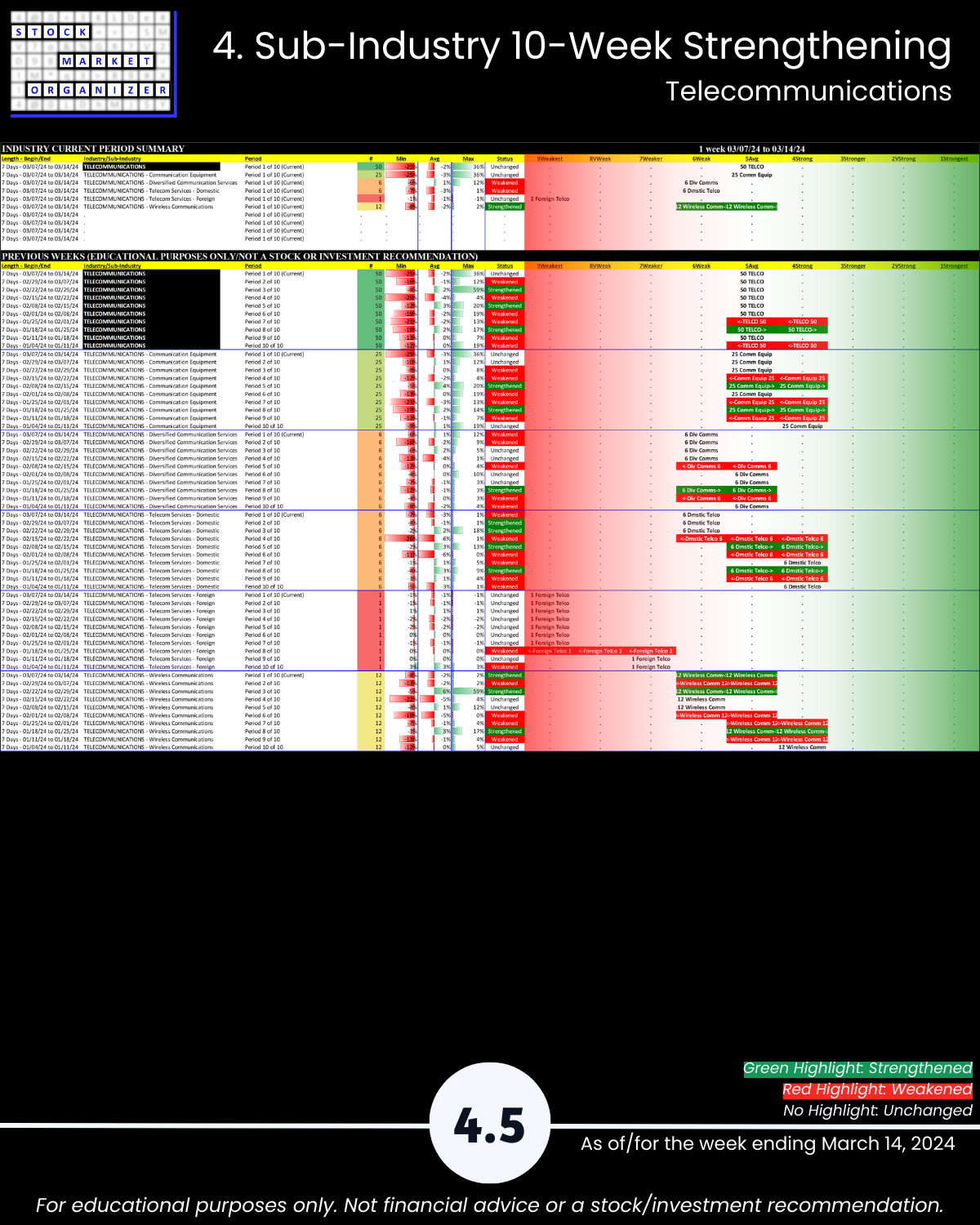

4. Sub-Industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

6. Stocks Outliers: 1-Week % Change

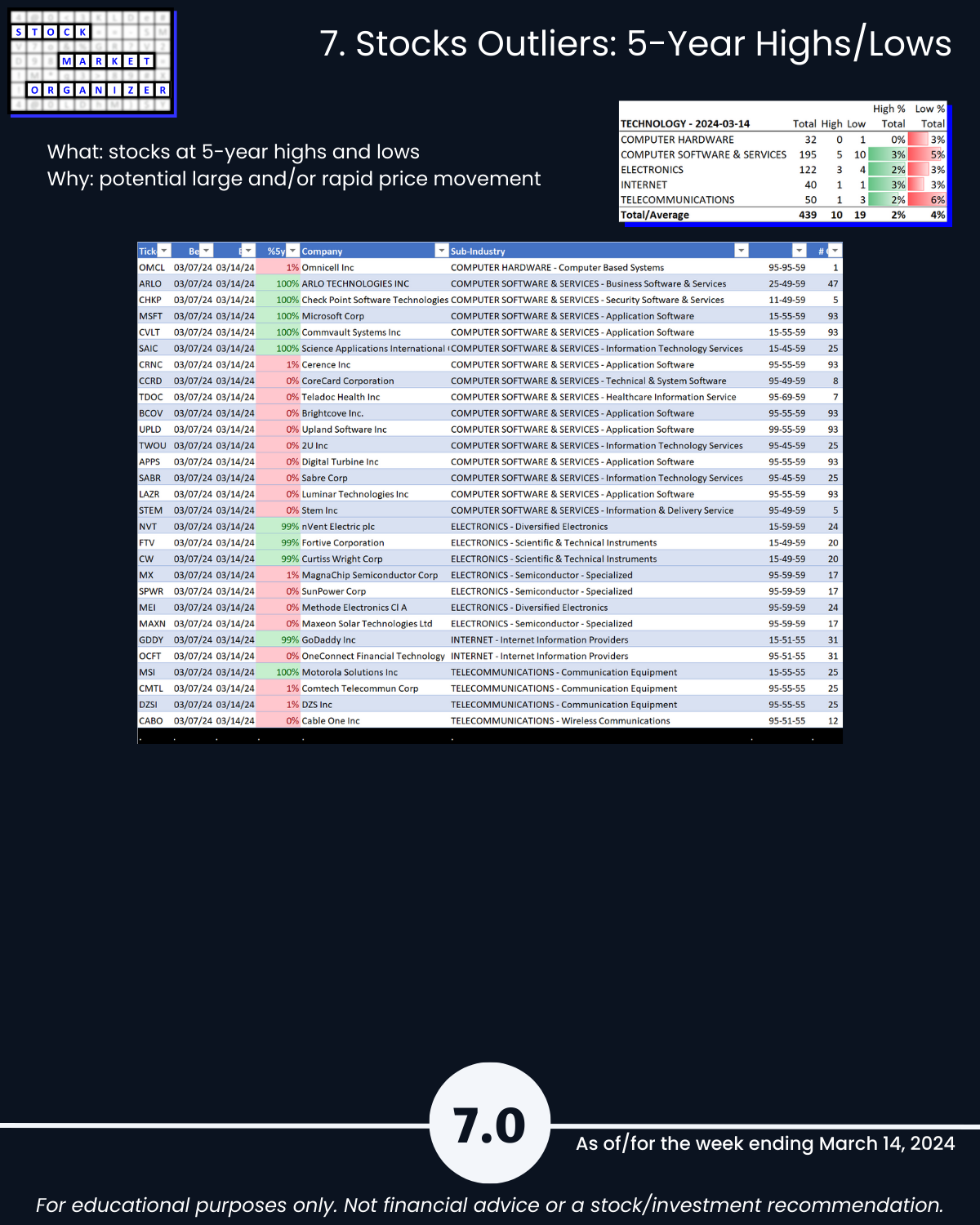

7. Stocks Outliers: 5-Year Highs/Lows