SMO Exclusive: Strength Report Technology Sector 2024-02-29

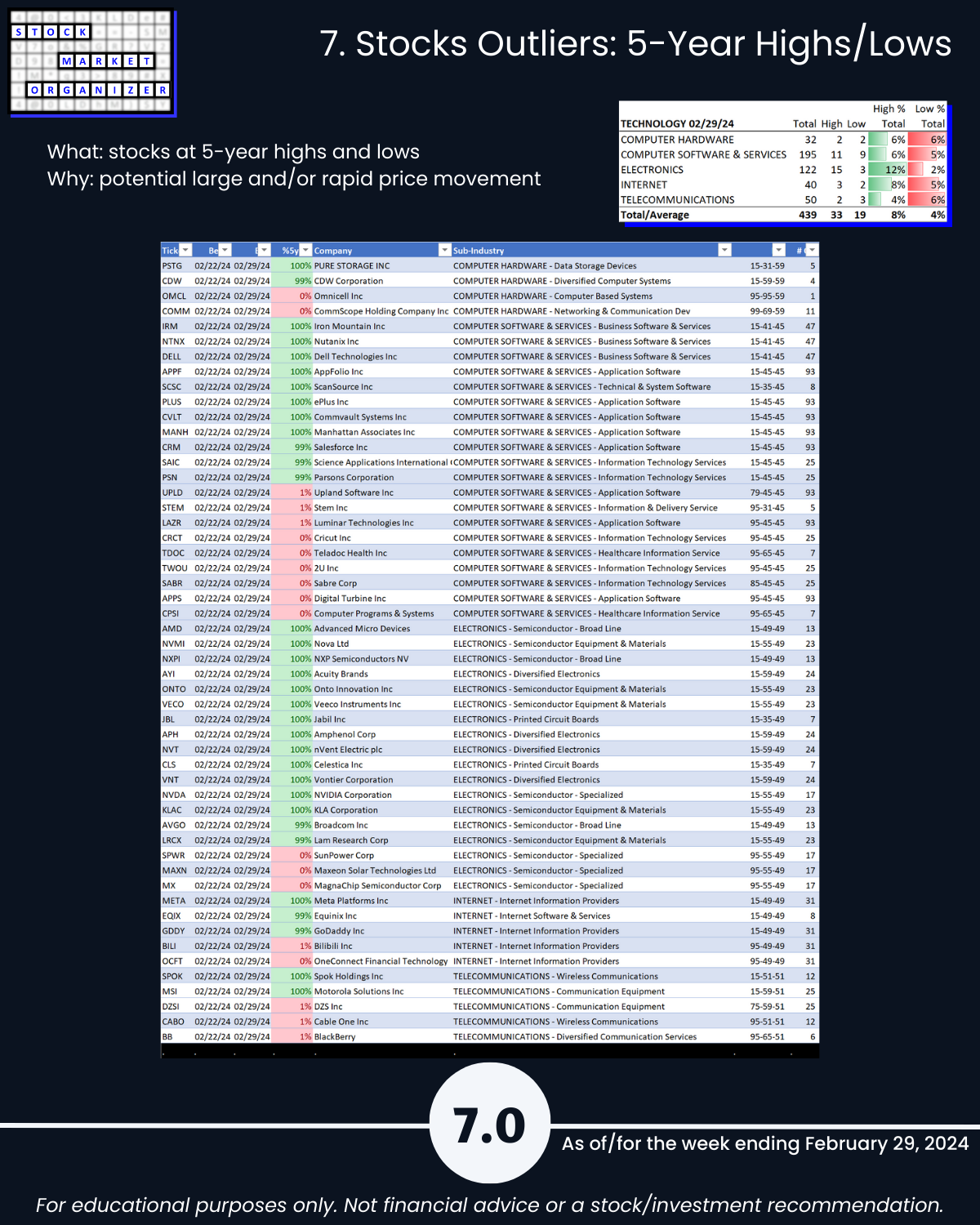

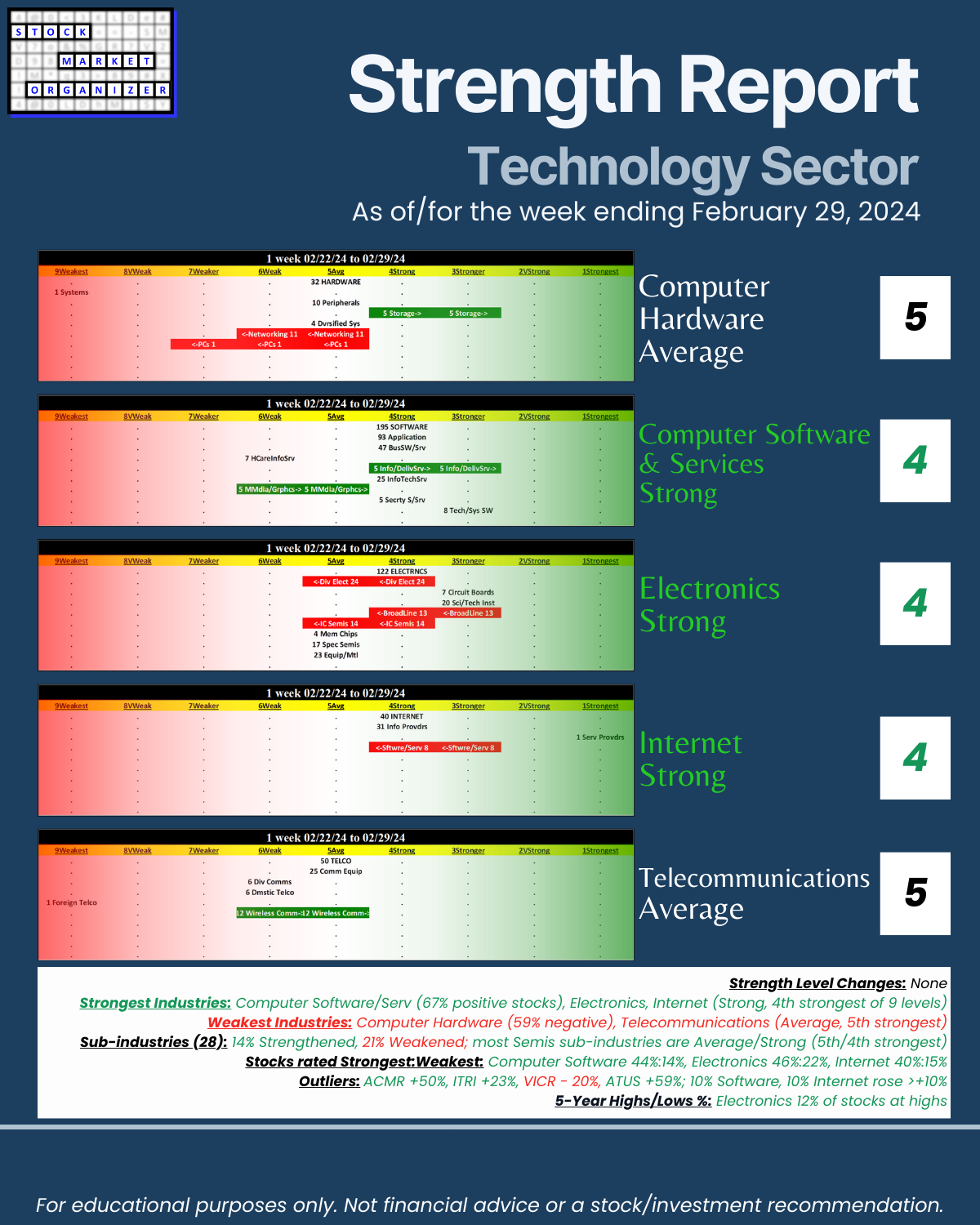

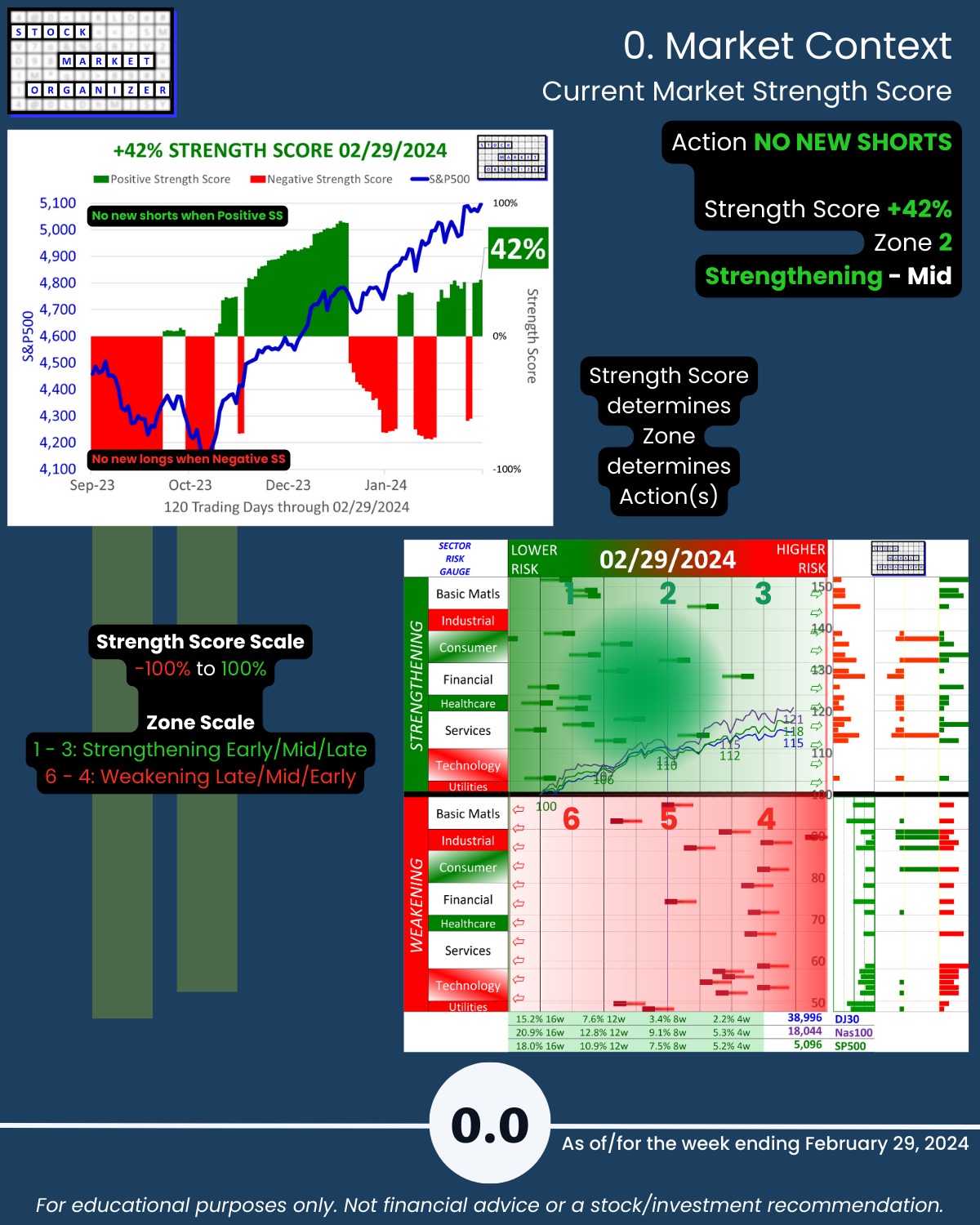

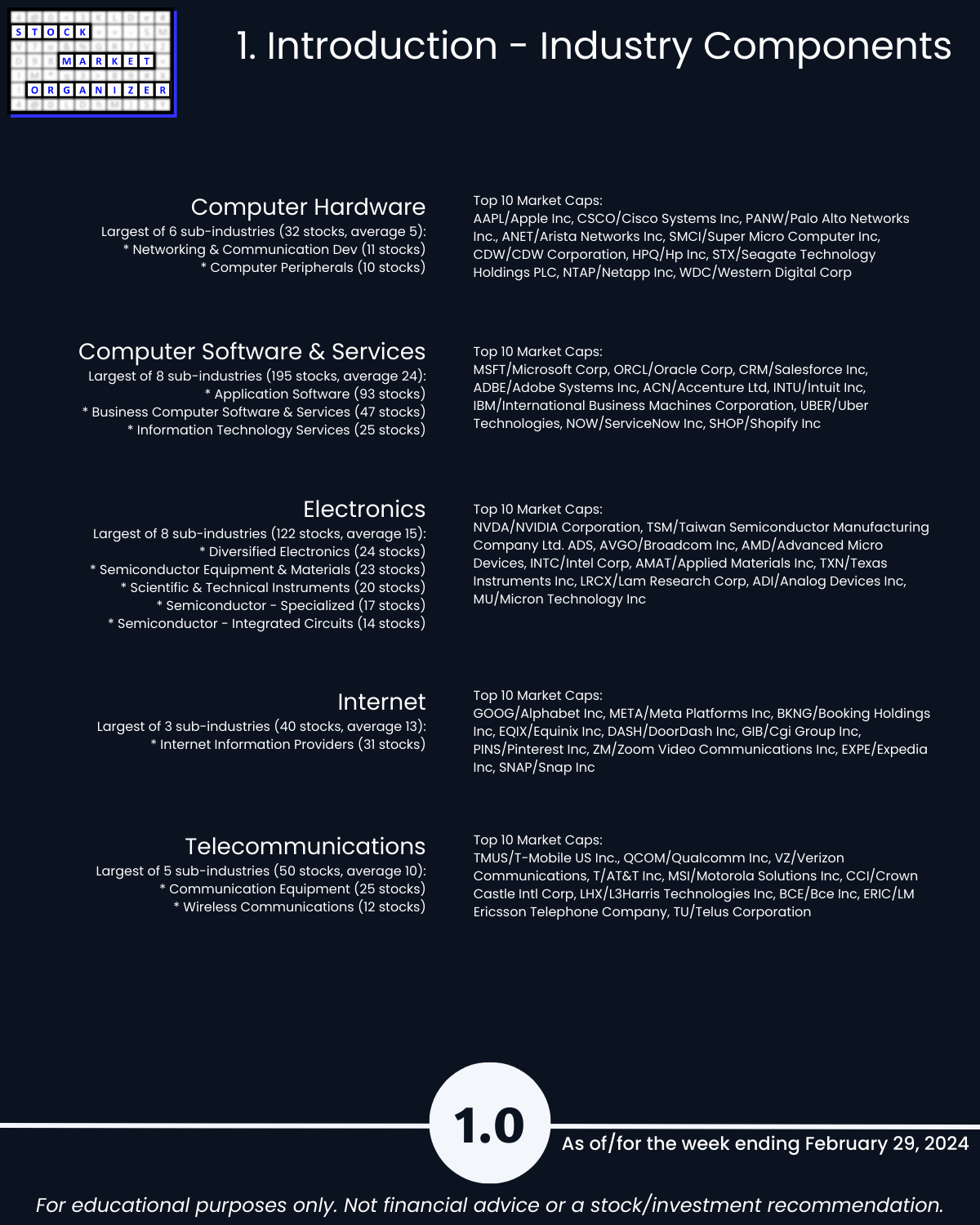

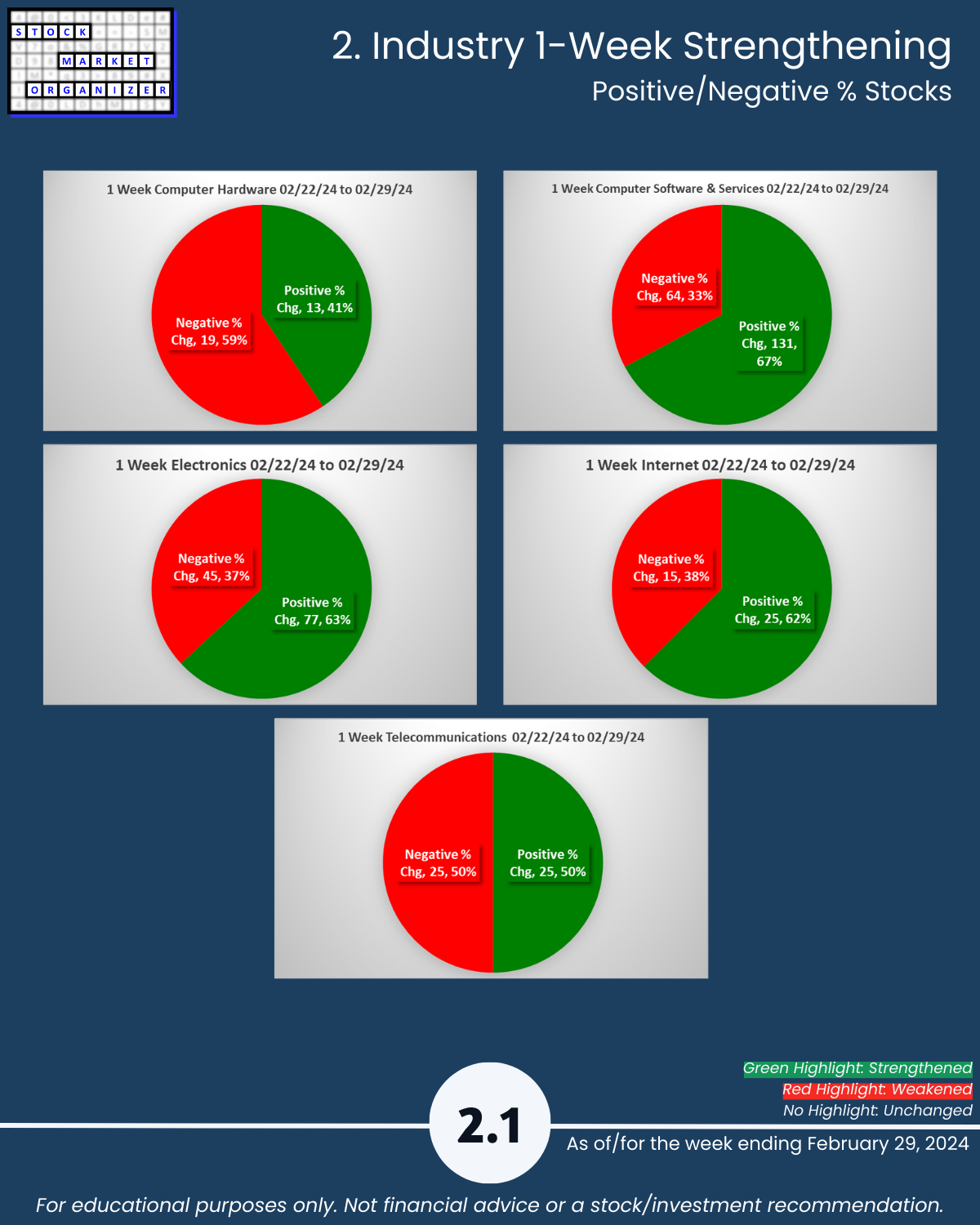

2/29/24 Tech Thursday – a Computer Software/Services bounceback this week (67% positive stocks, 10% of 195 stocks rising >10%). ACMR +50%, ATUS +59%, NVDA and SMCI who? 12% of Electronics stocks are at 5+ year highs (including NVDA). The industries: Computer Hardware, Software/Services, Electronics, Internet, Telecommunications. The focus: track strengthening at the individual stock level, because the stronger your stocks the greener your P&L. It really doesn’t have to be so complicated.

Takeaways:

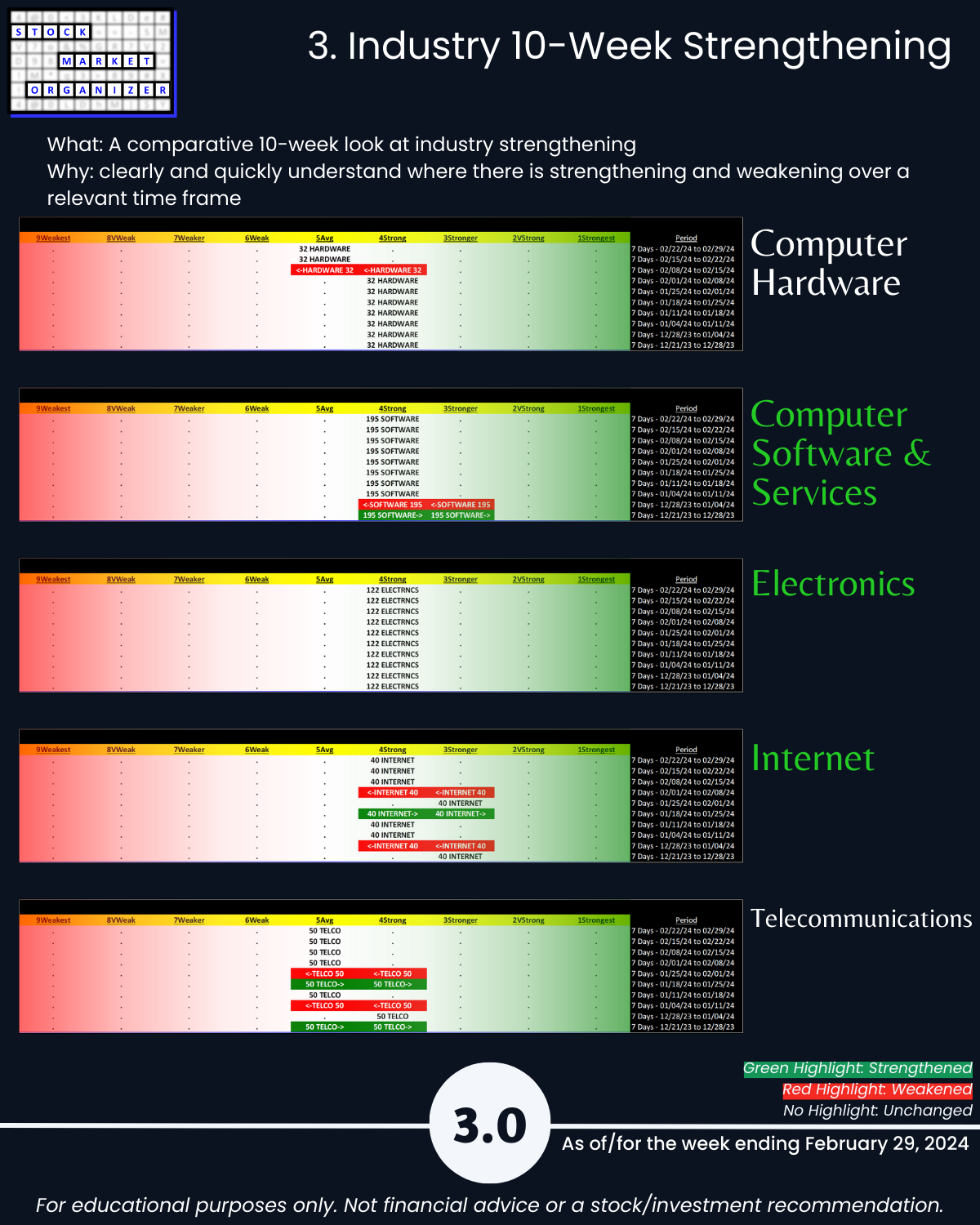

🔹 Strength Level Changes: None

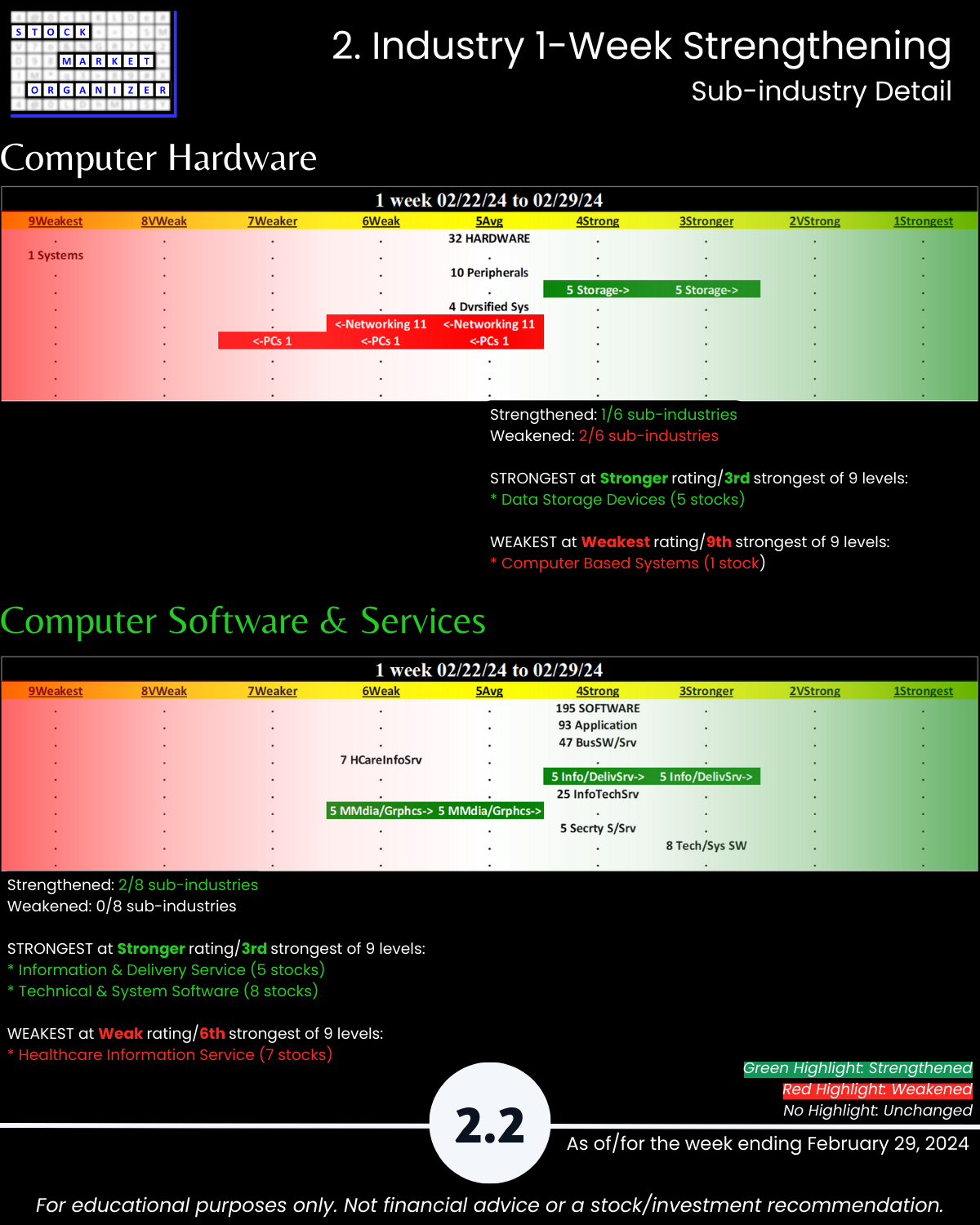

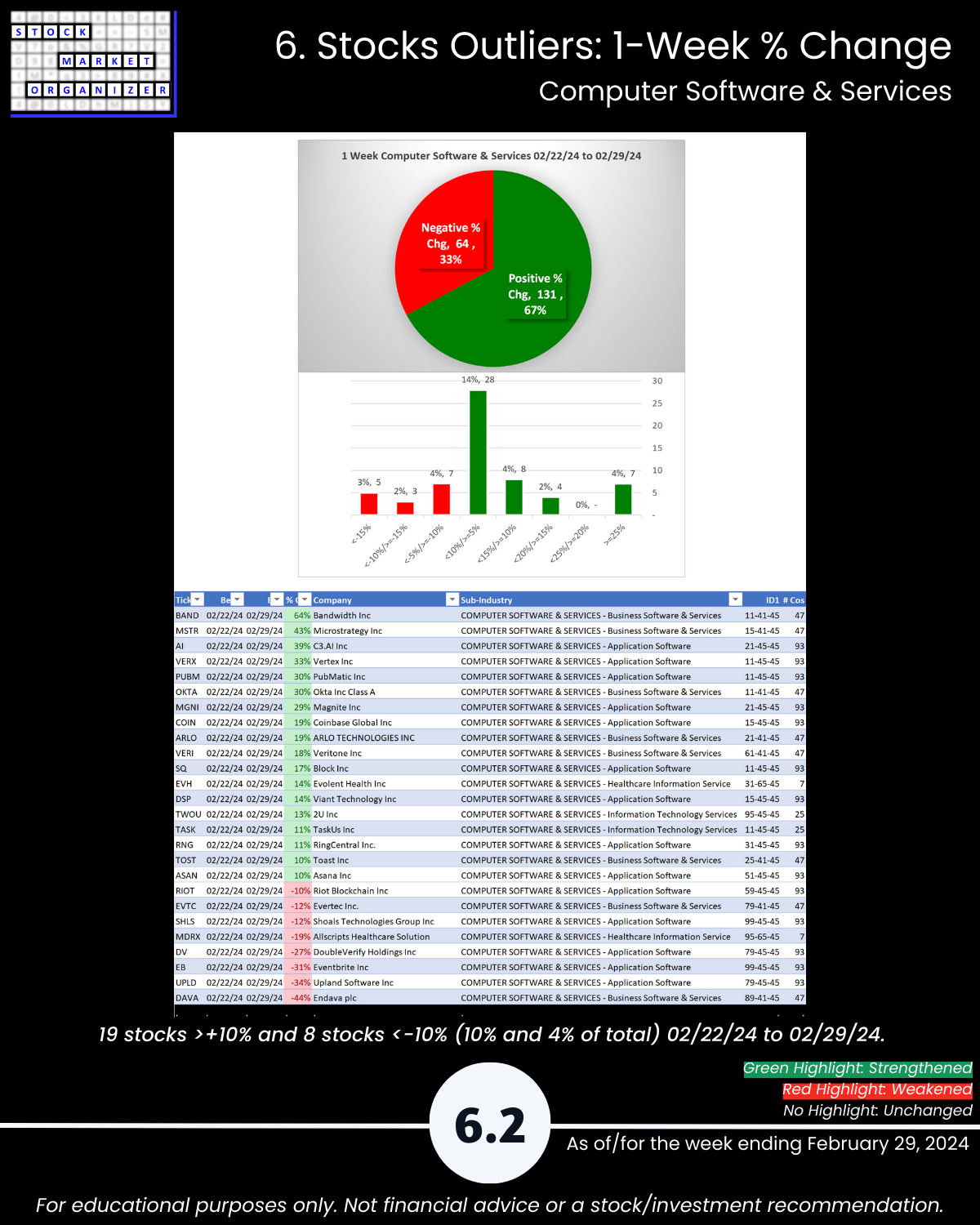

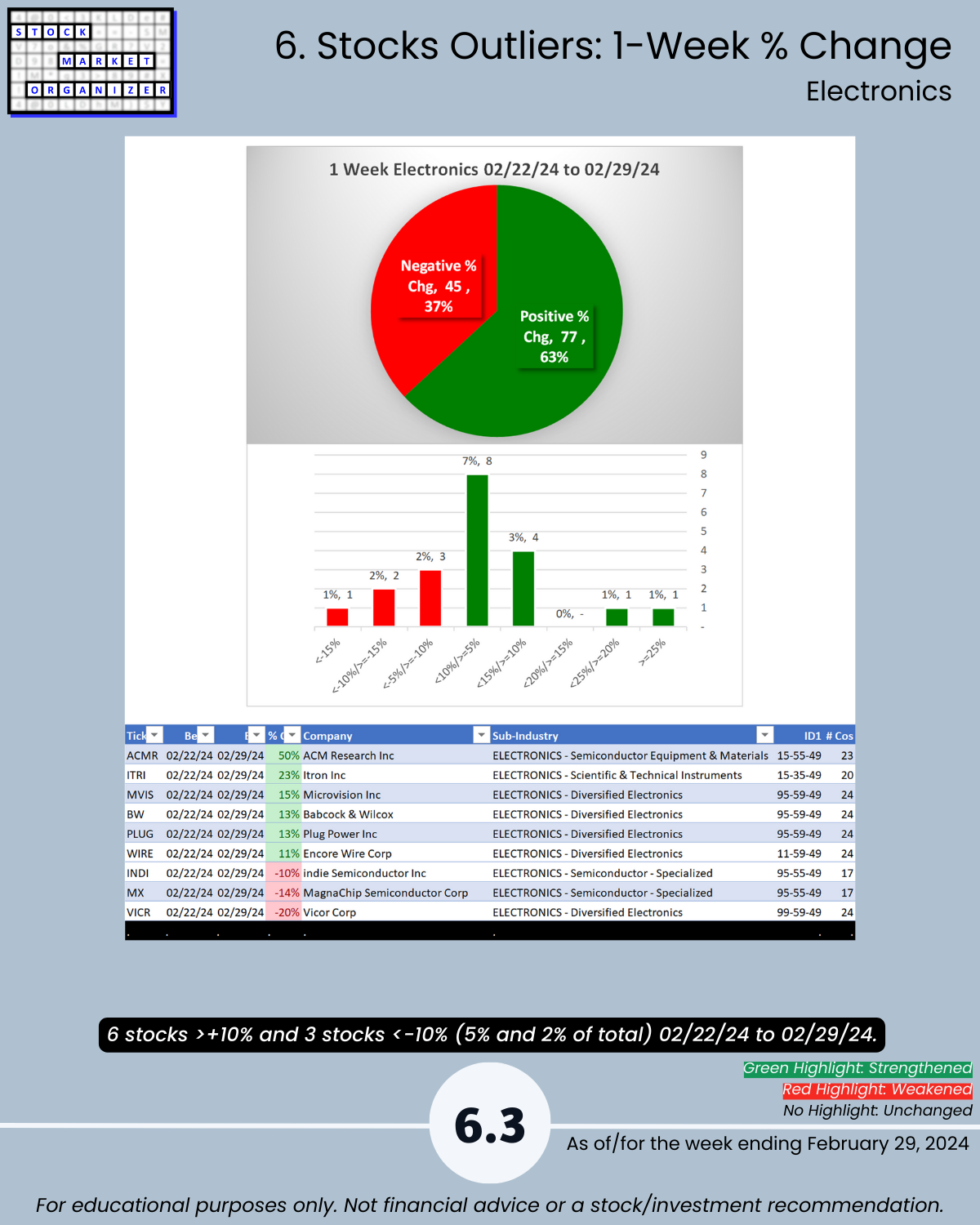

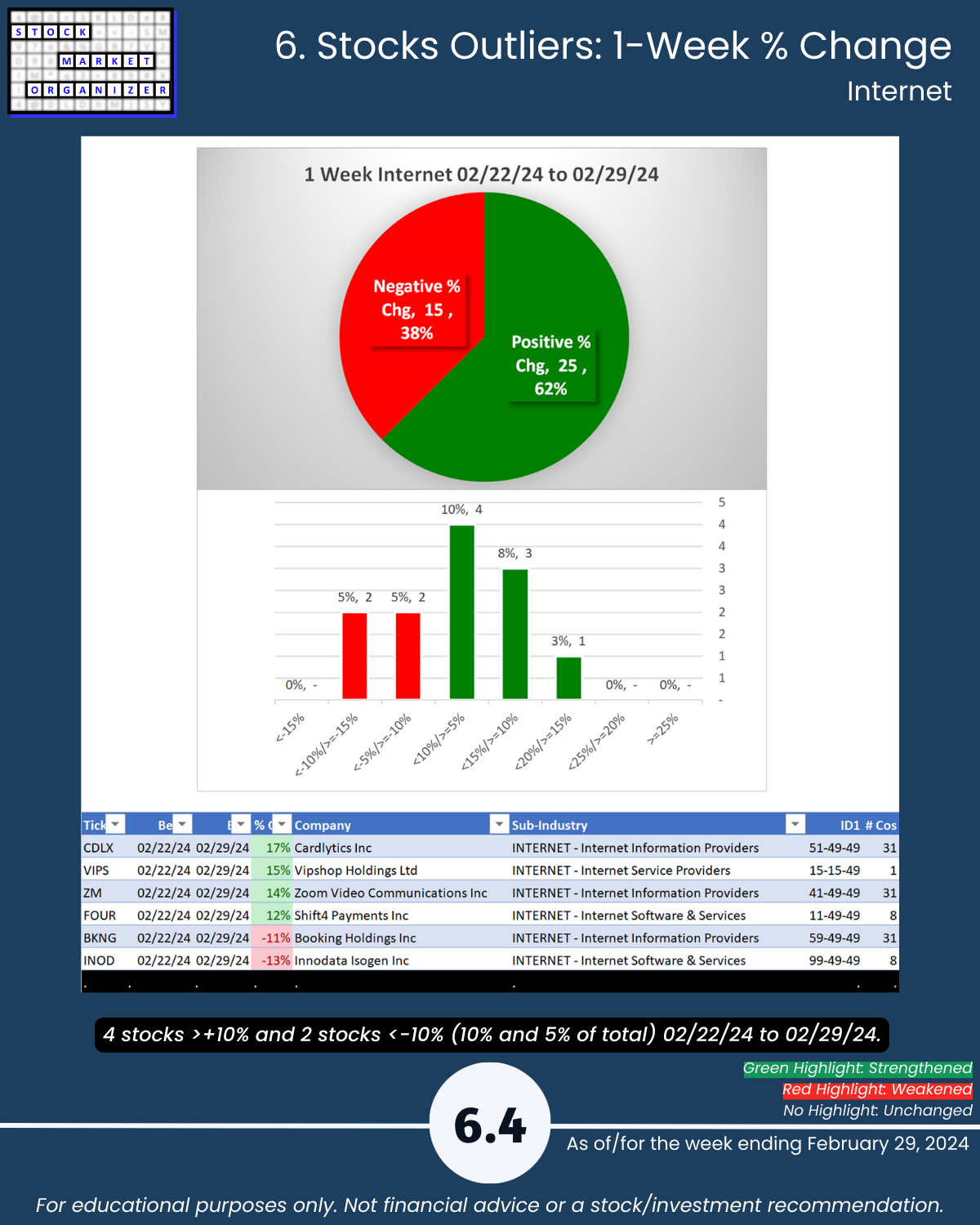

🔹 Strongest Industries: Computer Software/Serv (67% positive stocks), Electronics, Internet (Strong, 4th strongest of 9 levels)

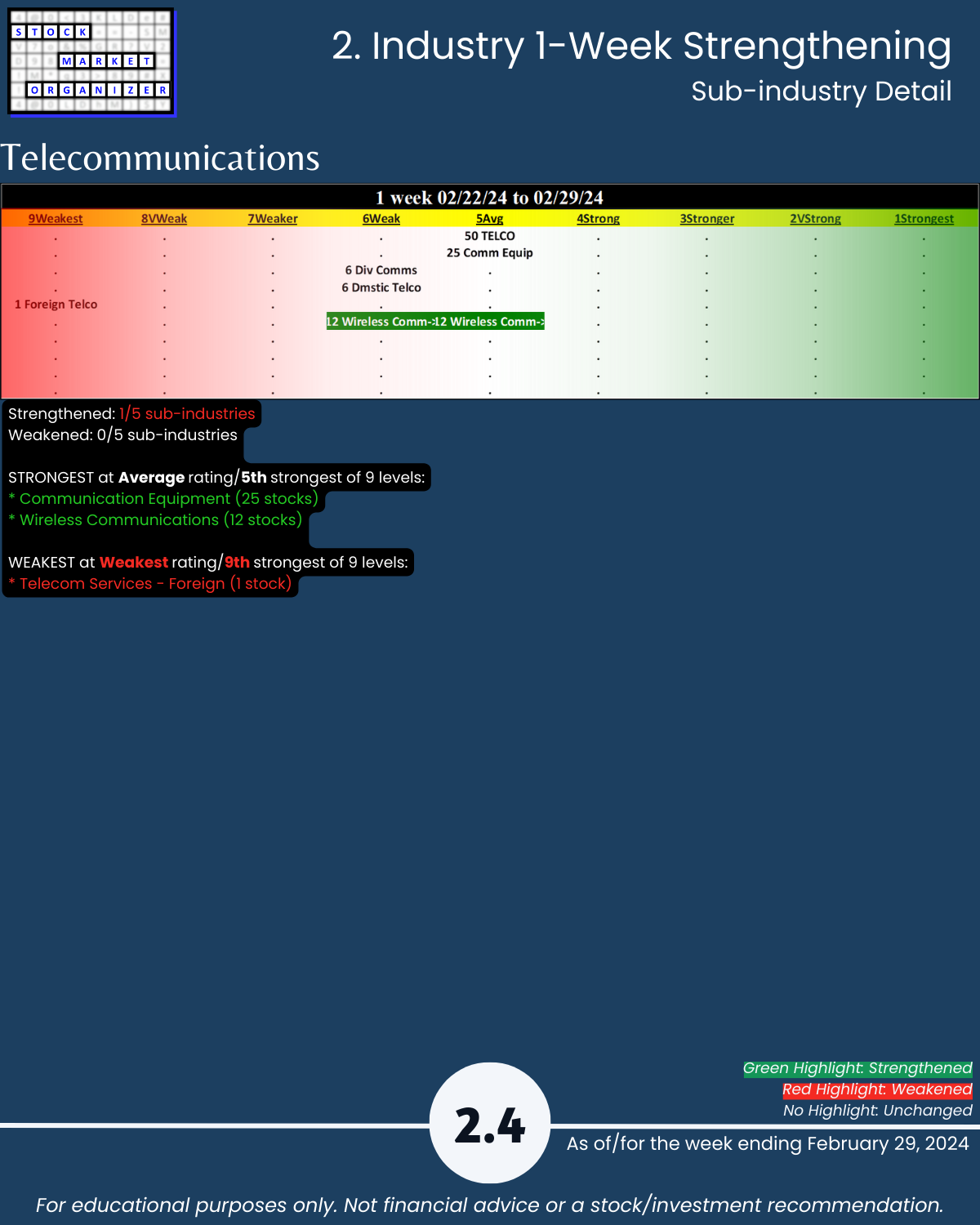

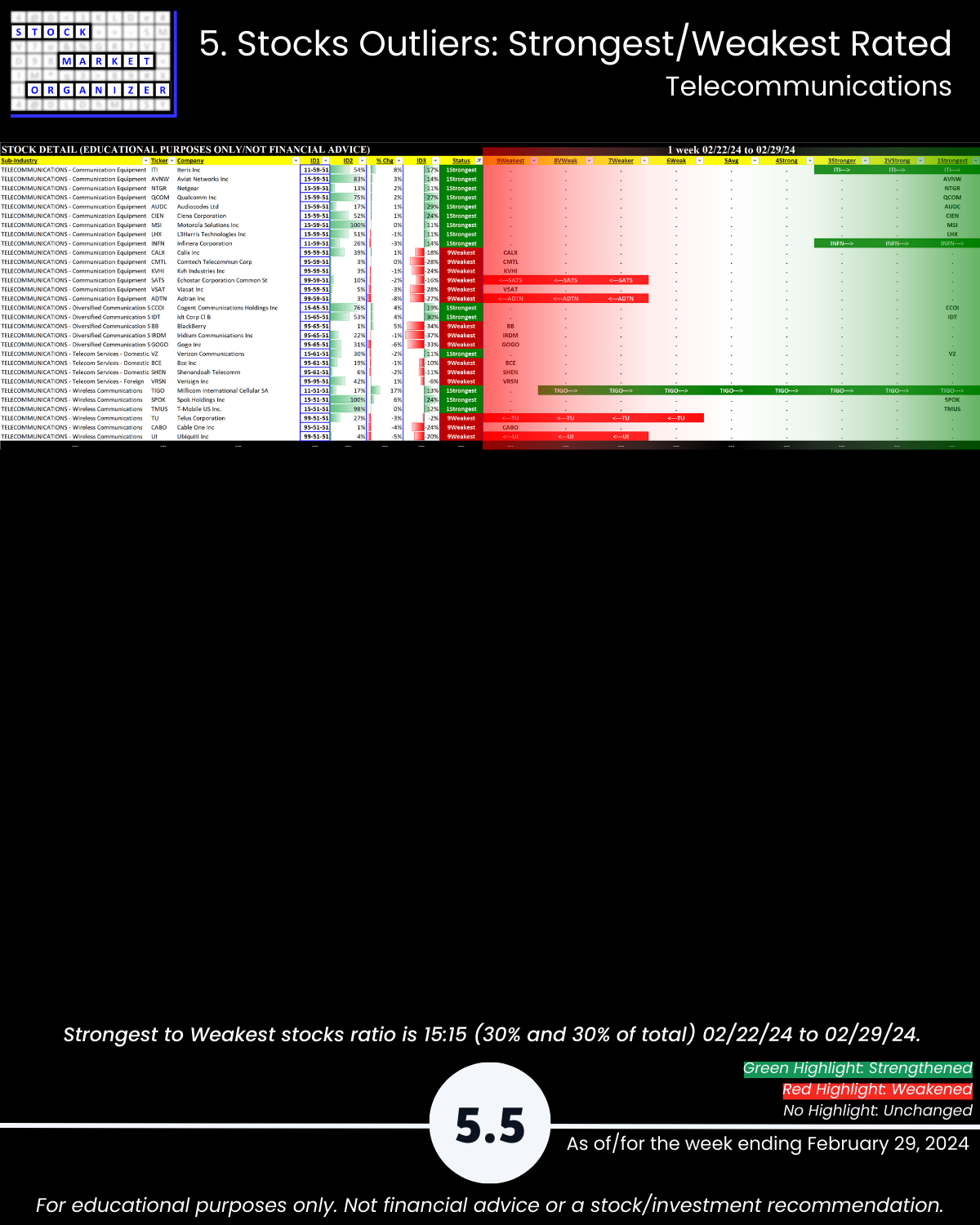

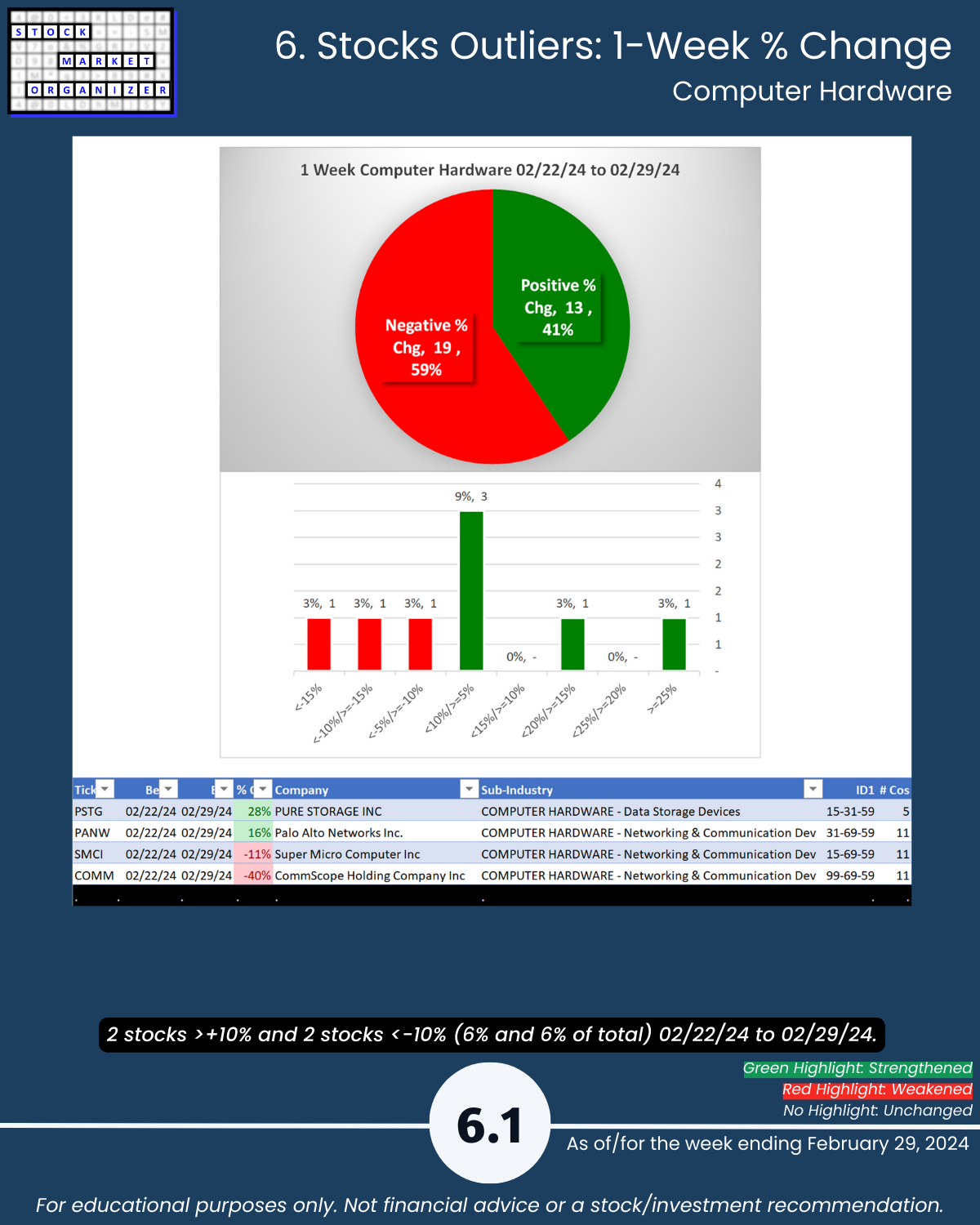

🔹 Weakest Industries: Computer Hardware (59% negative), Telecommunications (Average, 5th strongest)

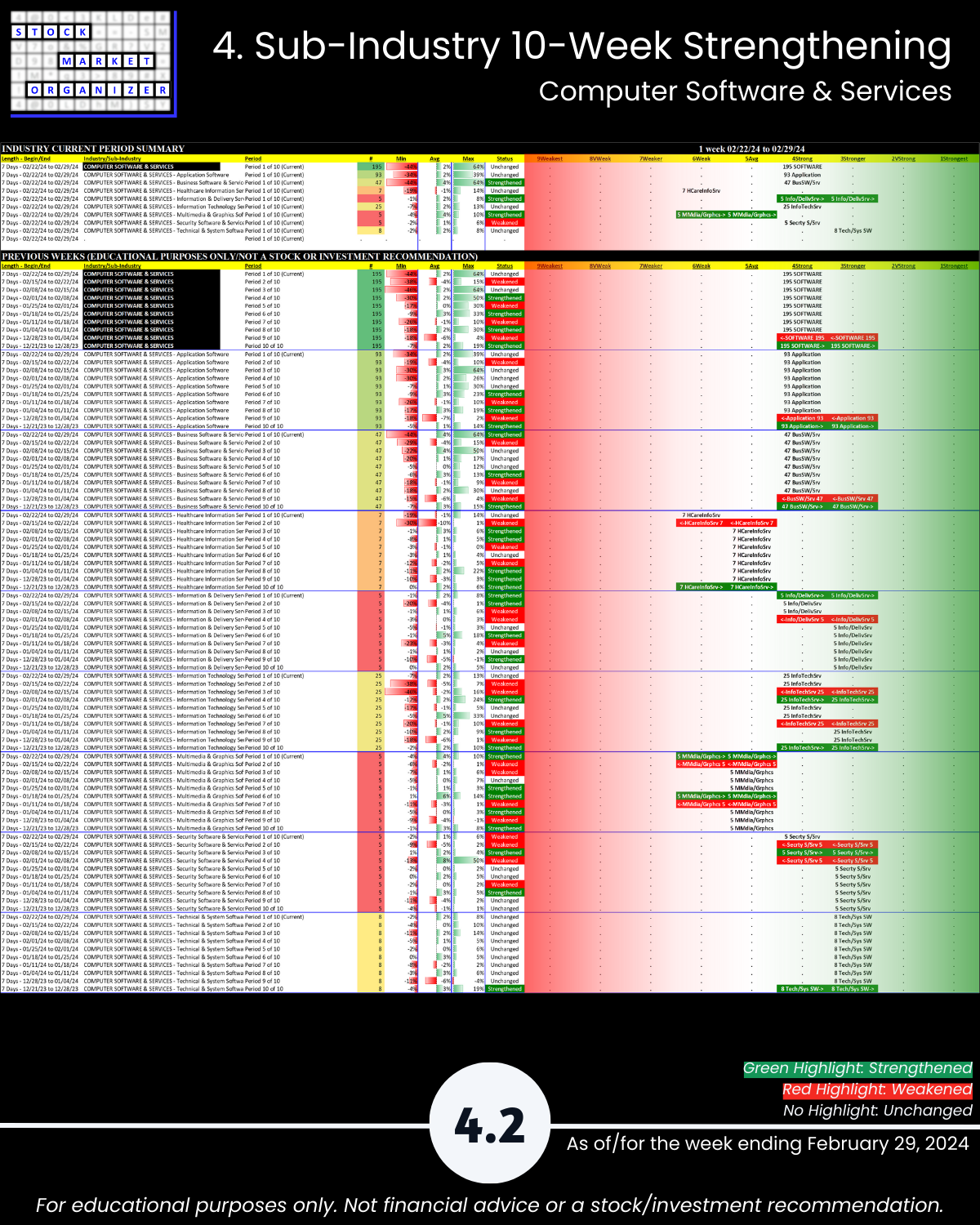

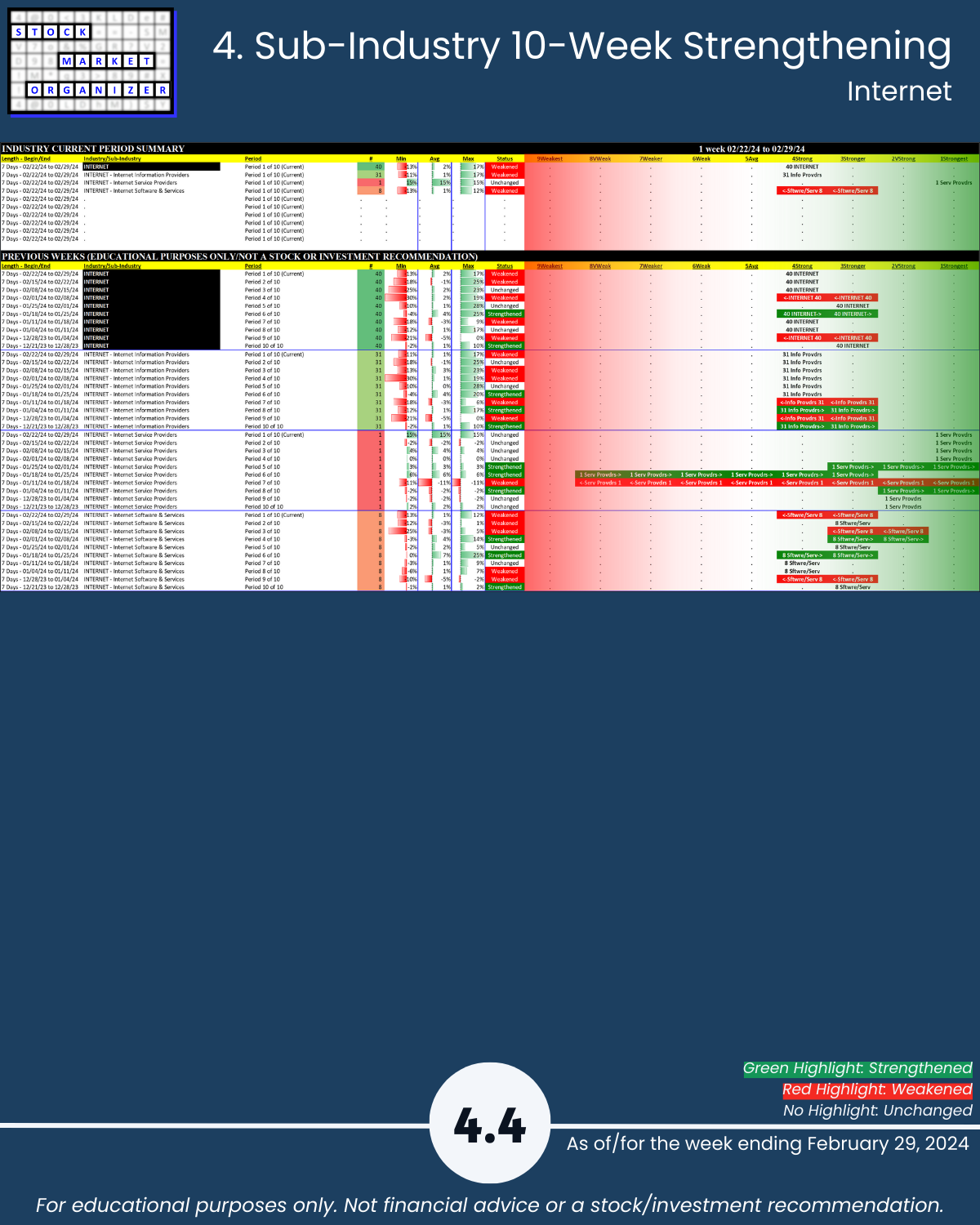

🔹 Sub-industries (28): 14% Strengthened, 21% Weakened; most Semis sub-industries are Average/Strong (5th/4th strongest)

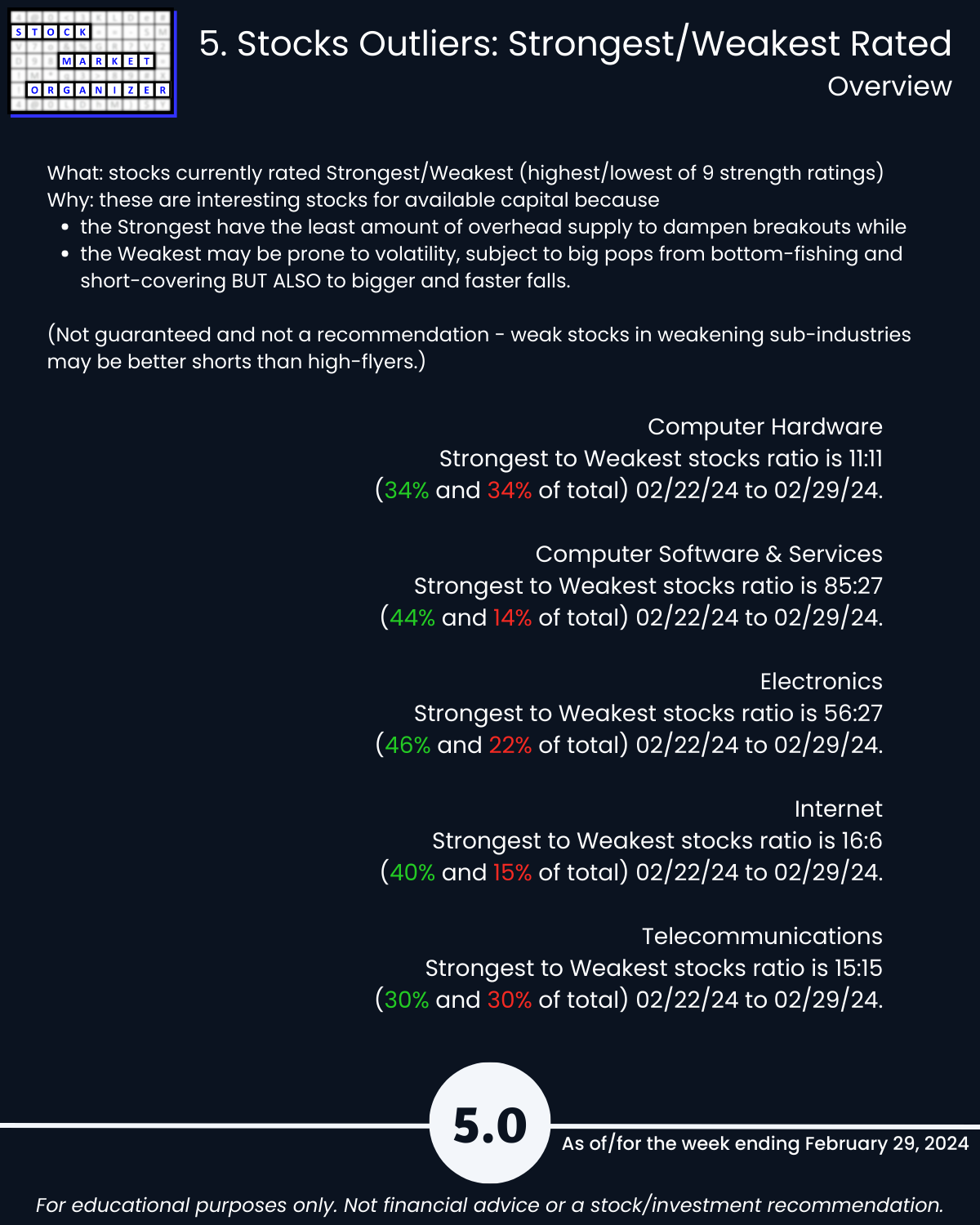

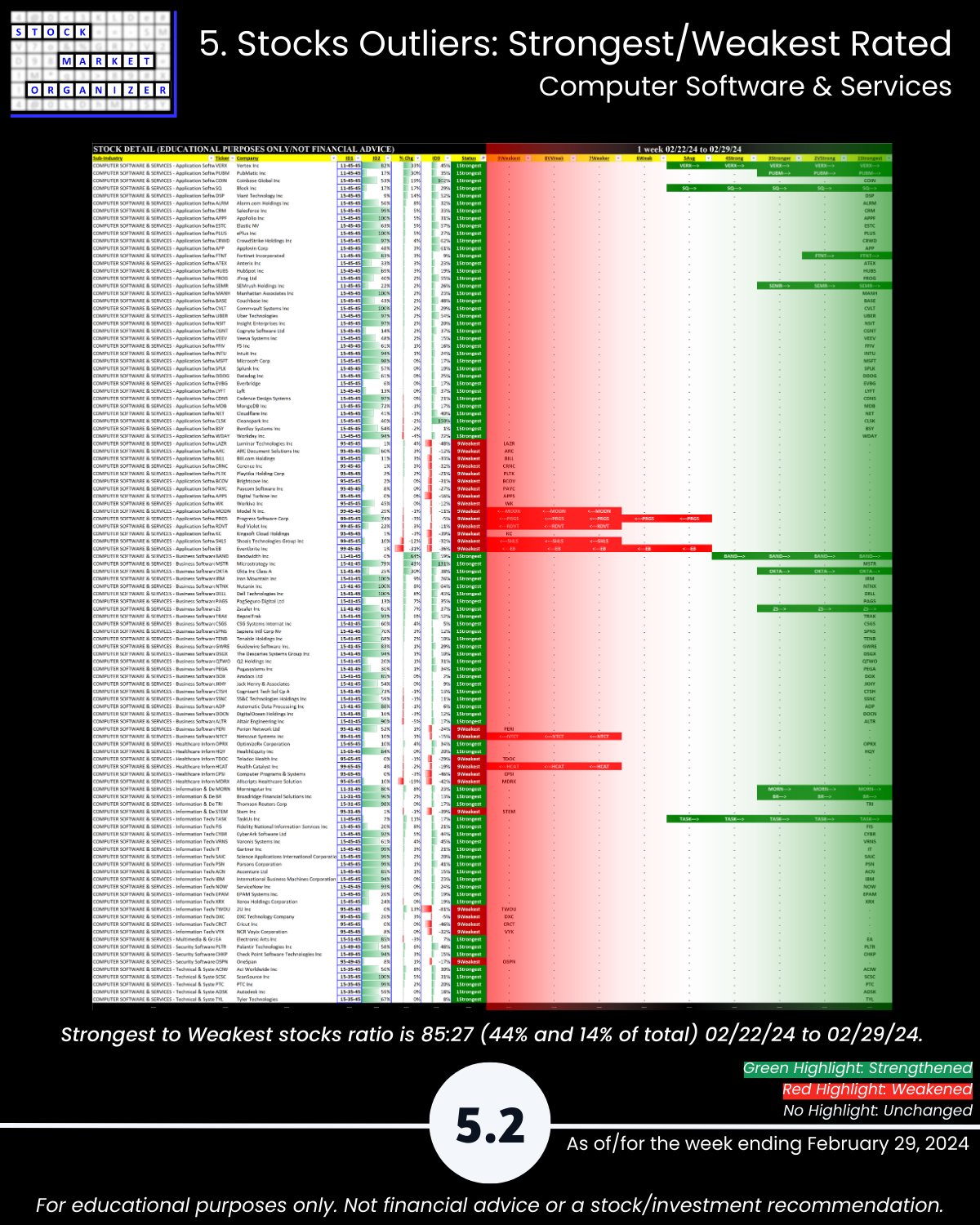

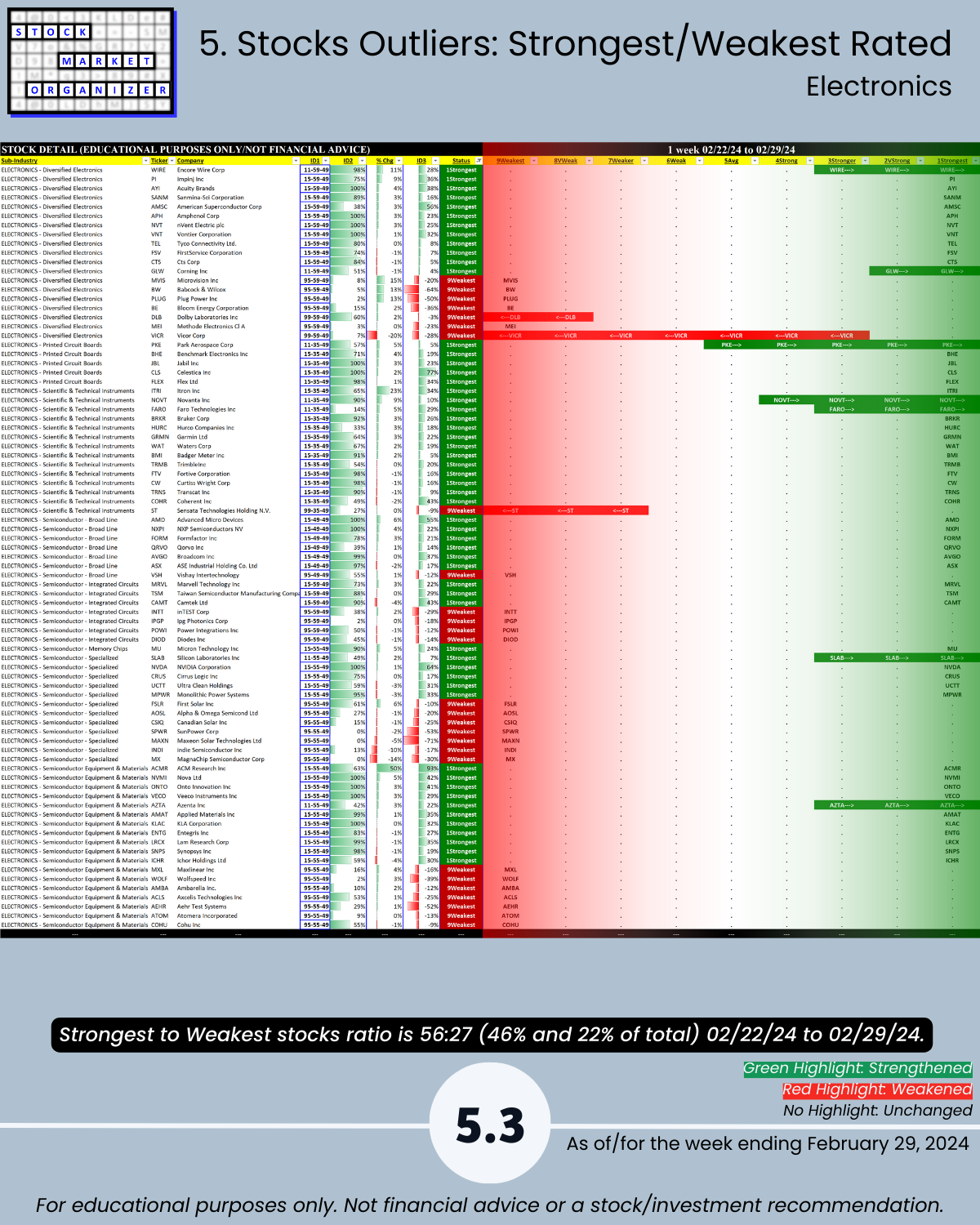

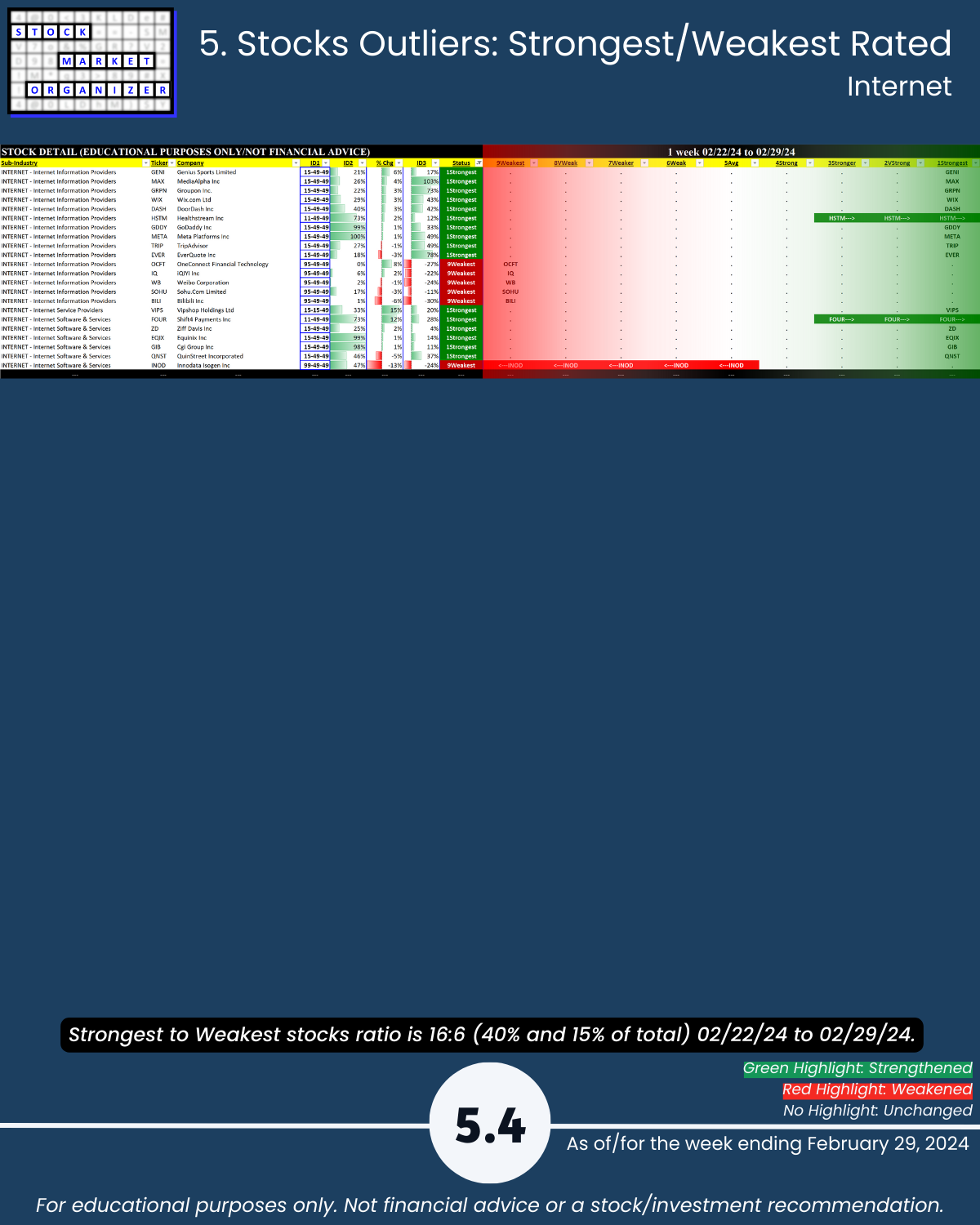

🔹 Stocks rated Strongest:Weakest: Computer Software 44%:14%, Electronics 46%:22%, Internet 40%:15%

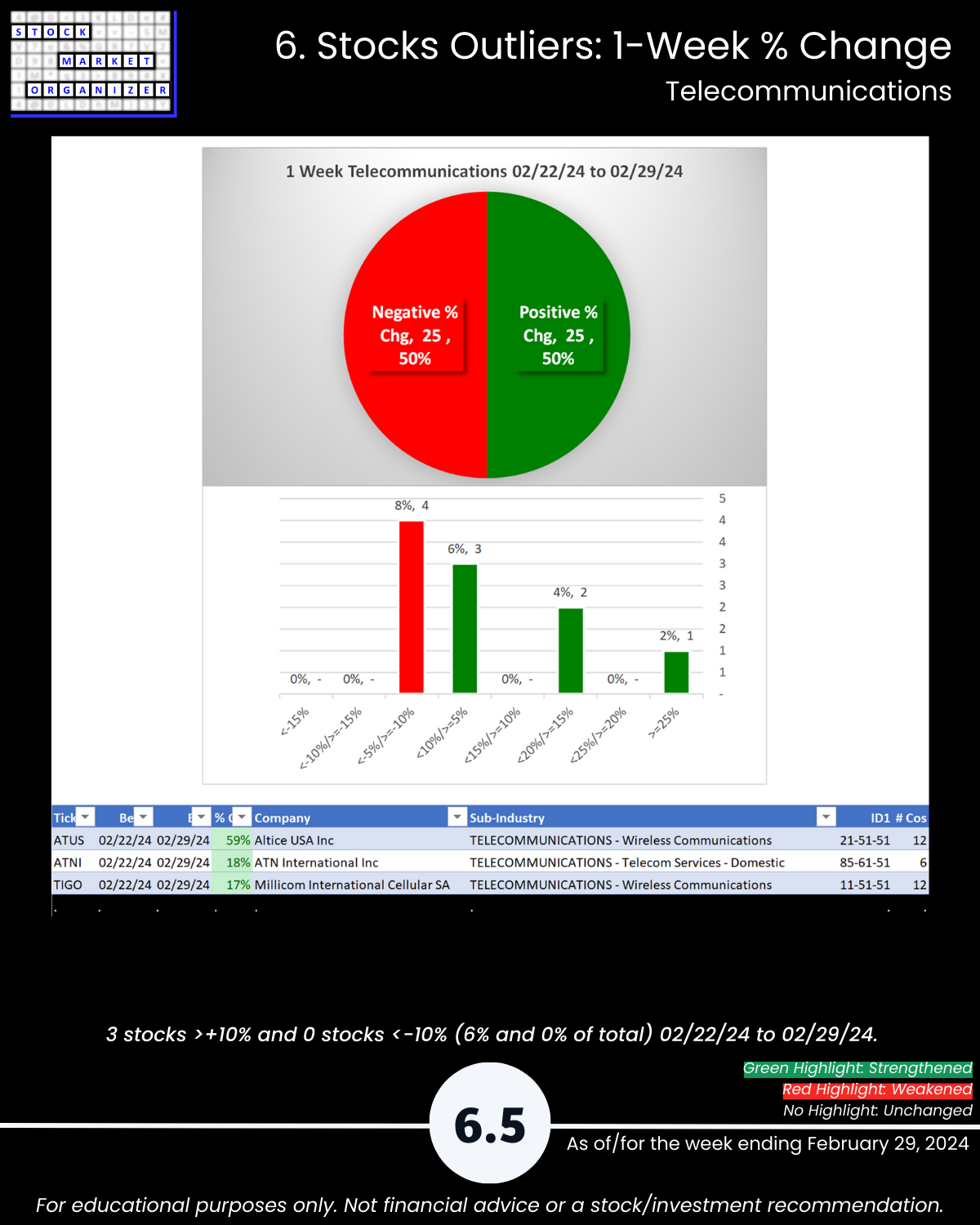

🔹 Outliers: ACMR +50%, ITRI +23%, VICR - 20%, ATUS +59%; 10% Software, 10% Internet rose >+10%

🔹 5-Year Highs/Lows %: Electronics 12% of stocks at highs

SO WHAT?

You’ll find here Strongest- and Weakest-rated Stock Market Organizer stocks and objective strengthening and weakening measurements in these industries.

This will quickly help you find strong stocks in strengthening sub-industries and strengthening industries.

WHY?

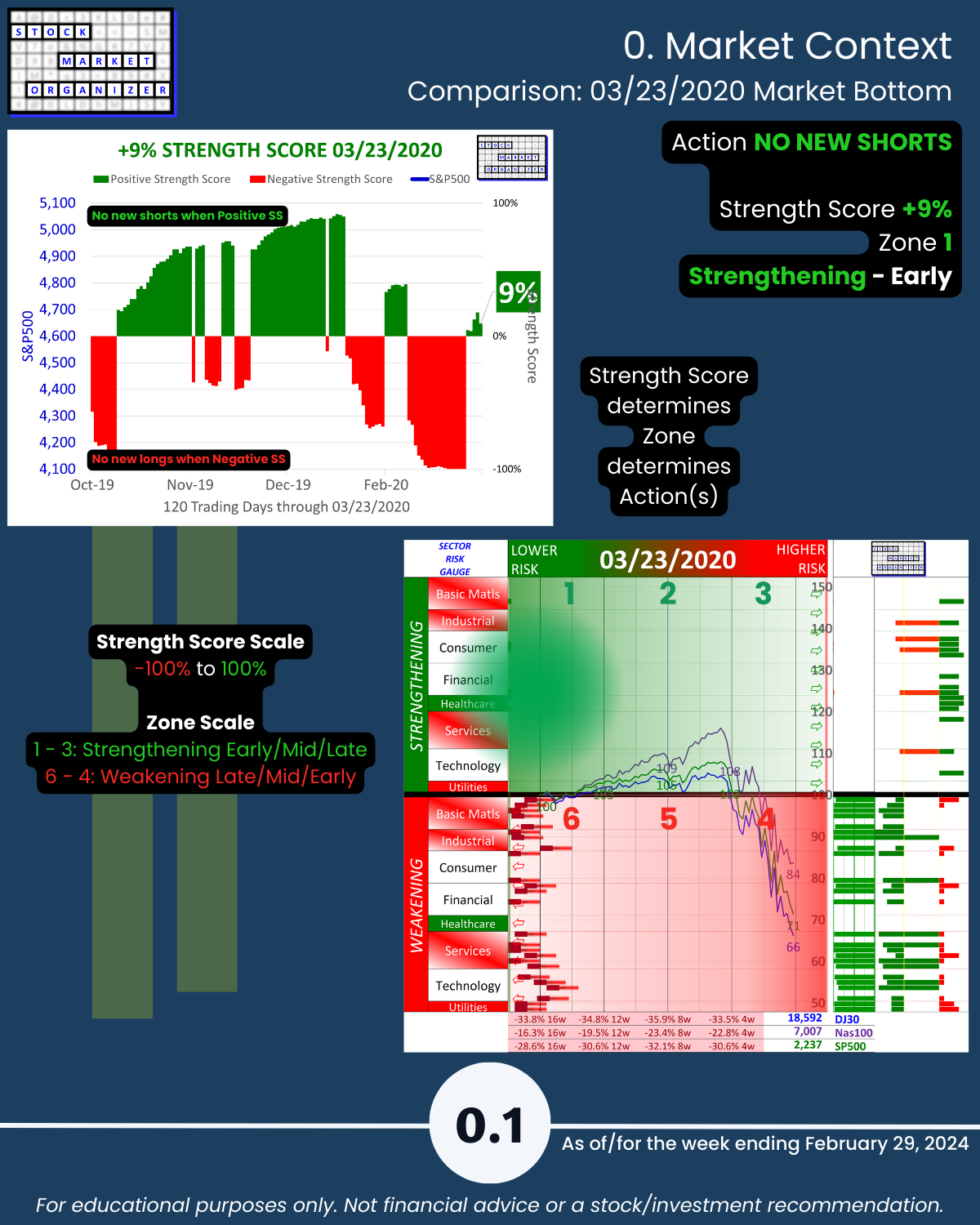

Sometimes value reigns, sometimes growth. In recent times, small caps have lagged. The common theme among top performers: strength.

The Banking industry weakened Feb-May 2023. It then strengthened until it was the strongest-rated industry as recently as the week ending 1/26/24.

From 5/15/23 through 1/26/24:

🔹 99% of banking stocks were positive

🔹 90% rose >10%

🔹 ~7 in 10 stocks rose >25%

🔹 ~1 in 4 stocks rose >50%

It was hard NOT to profit in this strengthening Banking industry. Since then, things have changed.

From 1/26/24 through 2/29/24 Banking weakened 3 of 9 strength levels and:

🔹 ~9% of banking stocks were positive

🔹 ~7 in 10 fell more than -5%

🔹 ~4 in 10 fell more than -10%

🔹 ~1 in 10 fell more than -15%

THE BOTTOM LINE

Bottom-ticking isn’t part of the program.

Measuring strength week-by-week is.

Because

🔹 the rally of multiple months+ begins with one up week, and

🔹 the journey to 100%+ returns begins with 10% returns.

This report may particularly be of interest if the following 5 concepts resonate with you:

- The stronger your stocks, the greener your P&L.

- The journey to 100%+ returns begins with 10% returns.

- The journey to a multi-month rally begins with one up week.

- Most stocks do what the market does. (While the market can only do what its underlying stocks, sub-industries, and industries do.)

- 80/20: not all information is created equal. (Press buttons, not balloons.)

Following are galleries with page-by-page views of this report.

0. Market Context

1. Introduction

2. Industry 1-Week Strengthening

3. Industry 10-Week Strengthening

4. Sub-Industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

6. Stocks Outliers: 1-Week % Change

7. Stocks Outliers: 5-Year Highs/Lows