SMO Exclusive: Strength Report Industry Group 2 2024-02-26

Not debatable: 🔹 The stronger your stocks, the greener your P&L. 🔹 Market conditions matter. 🔹 You won’t find what you aren’t looking for. This is all put into practice in the attached 2/26/24 analysis of Group 2 industries (loosely, the Services sector) – Diversified Services, Health Services, Leisure, Media, and Utilities.

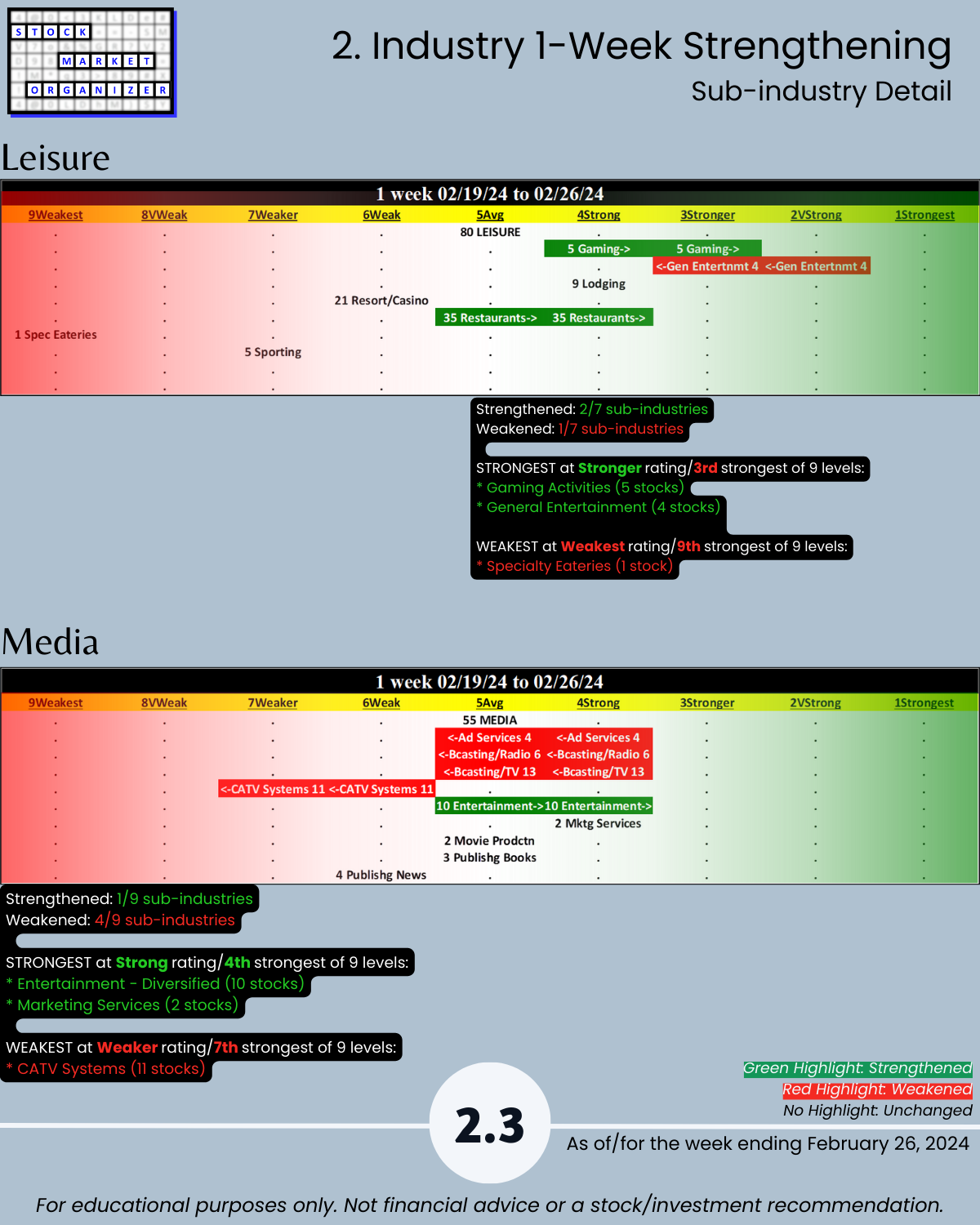

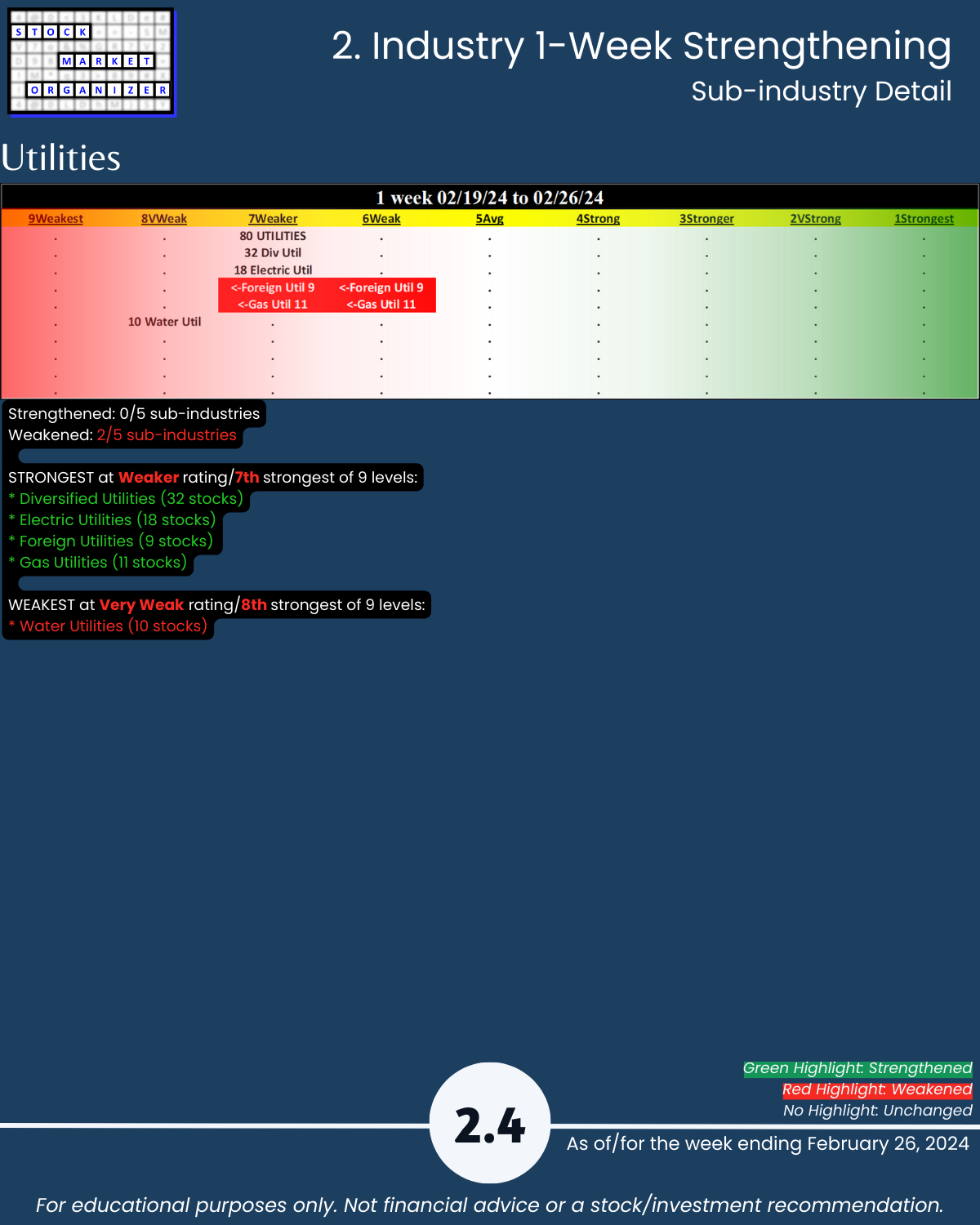

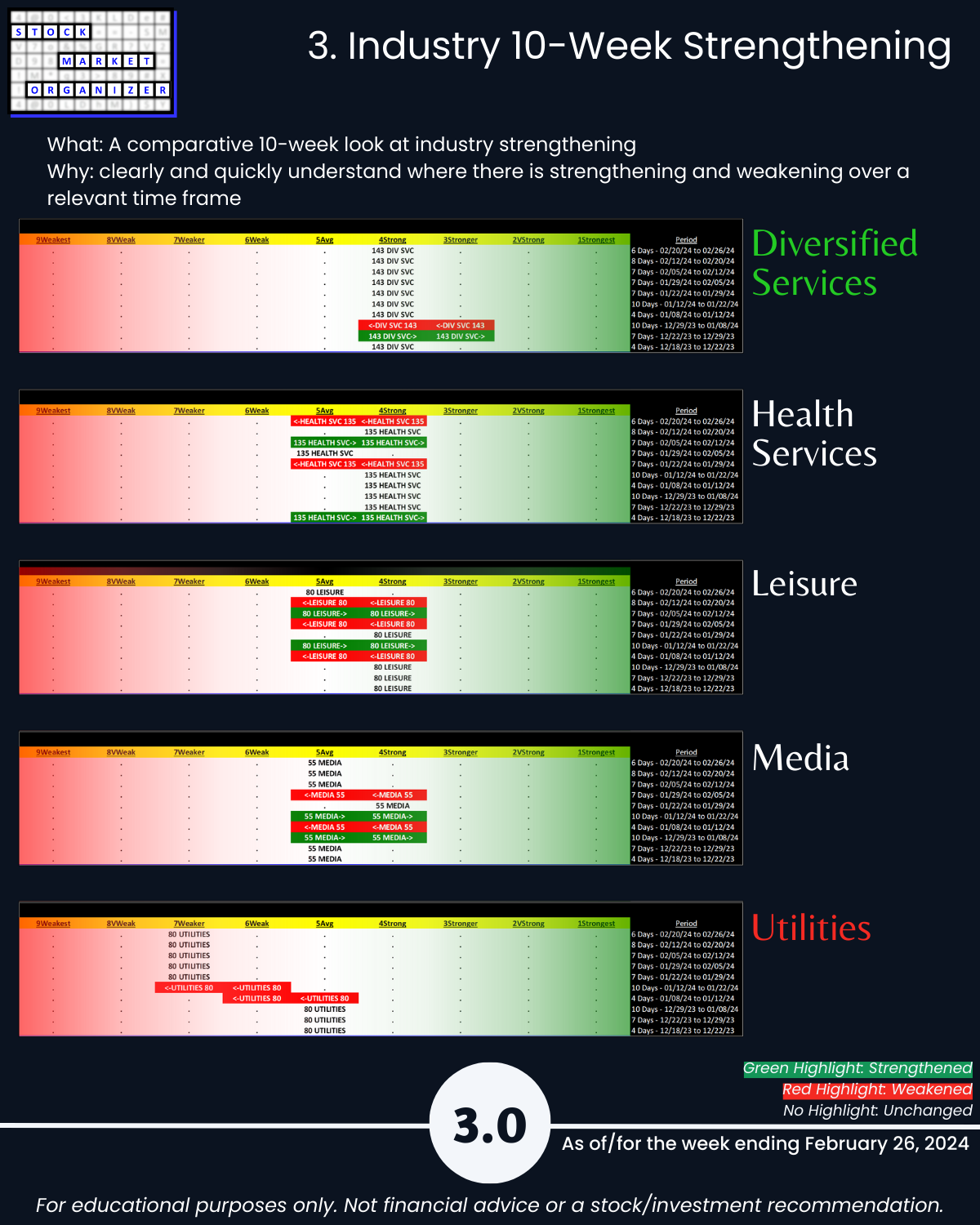

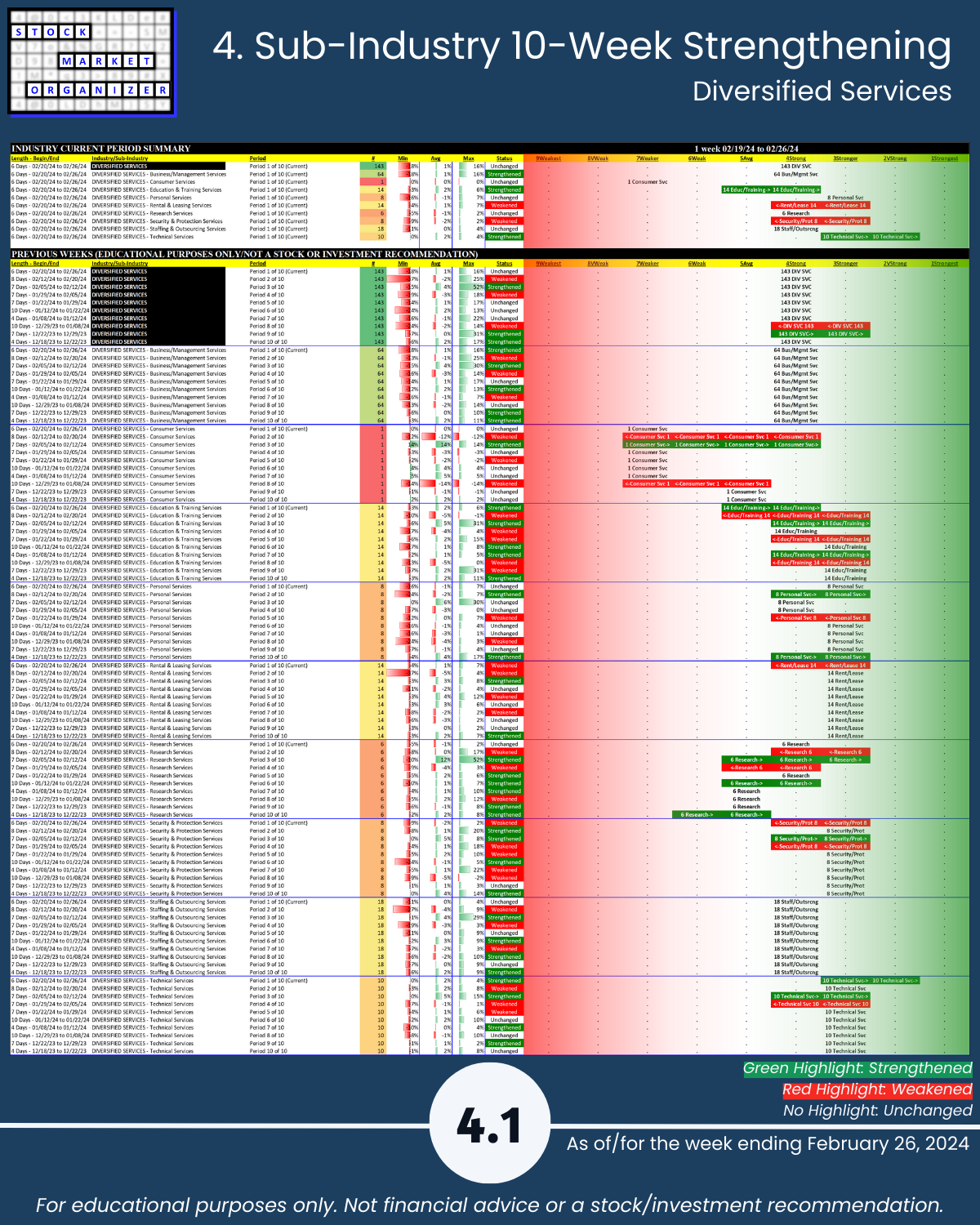

SO WHAT?

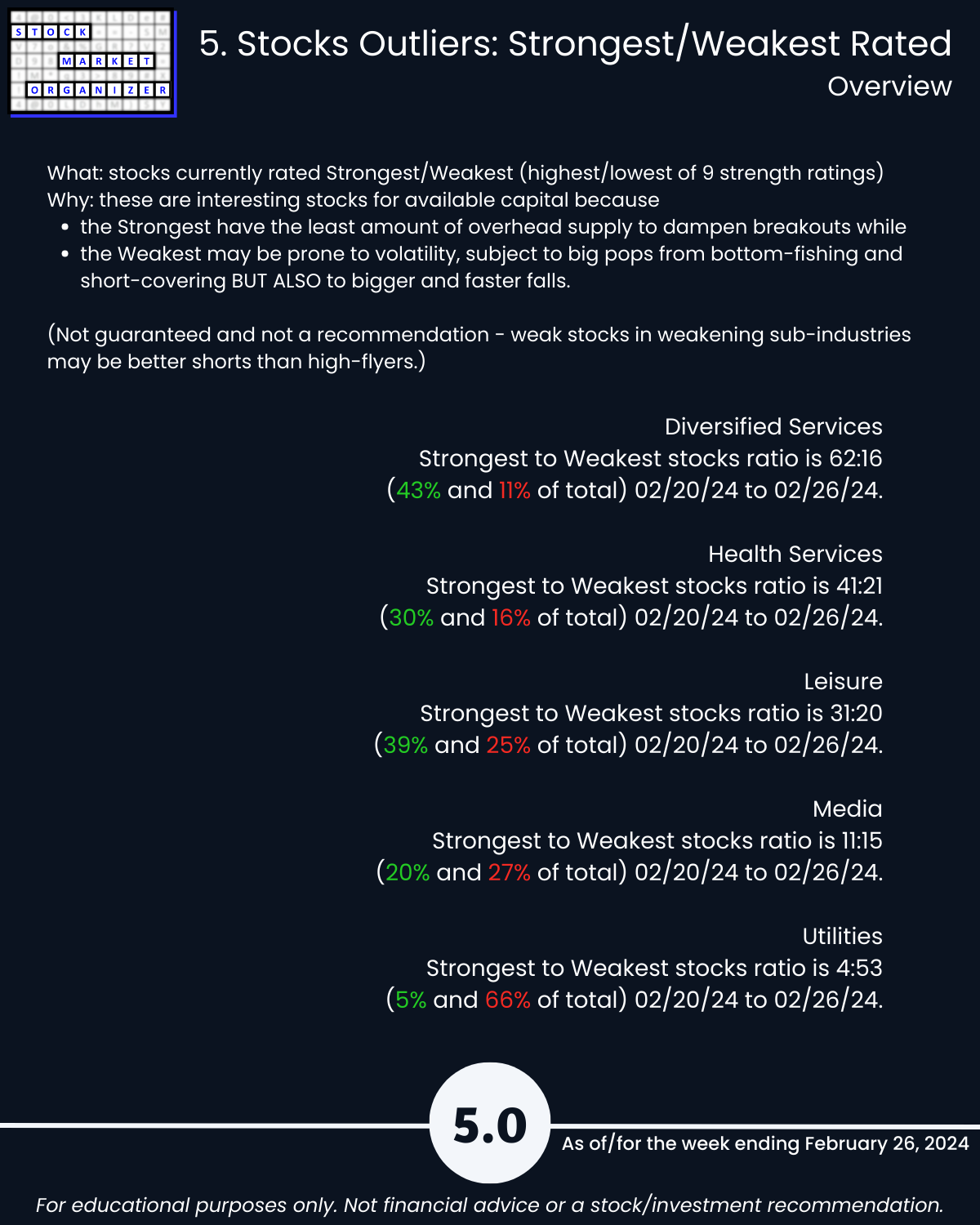

You’ll find here Strongest- and Weakest-rated Stock Market Organizer stocks and objective strengthening and weakening measurements in these industries.

This will quickly help you find strong stocks in strengthening sub-industries and strengthening industries.

WHY?

Sometimes value reigns, sometimes growth. In recent times, small caps have lagged. The common theme among top performers: strength.

The Banking industry weakened Feb-May 2023. It then strengthened until it was the strongest-rated industry as recently as the week ending 1/26/24.

From 5/15/23 through 1/26/24:

🔹 99% of banking stocks were positive

🔹 90% rose >10%

🔹 ~7 in 10 stocks rose >25%

🔹 ~1 in 4 stocks rose >50%

It was hard NOT to profit in this strengthening Banking industry.

It has been the opposite since then.

From 1/26/24 through 2/26/24 (Banking has weakened 3 of 9 strength levels):

🔹 7% of banking stocks were positive

🔹 ~3 in 4 fell more than -5%

🔹 ~4 in 10 fell more than -10%

🔹 ~1 in 10 fell more than -15%

THE BOTTOM LINE

Bottom-ticking isn’t part of the program.

Measuring strength week-by-week is.

Because

🔹 the rally of multiple months+ begins with one up week, and

🔹 the journey to 100%+ returns begins with 10% returns.

It really doesn’t have to be so complicated.

REPORT TAKEWAYS

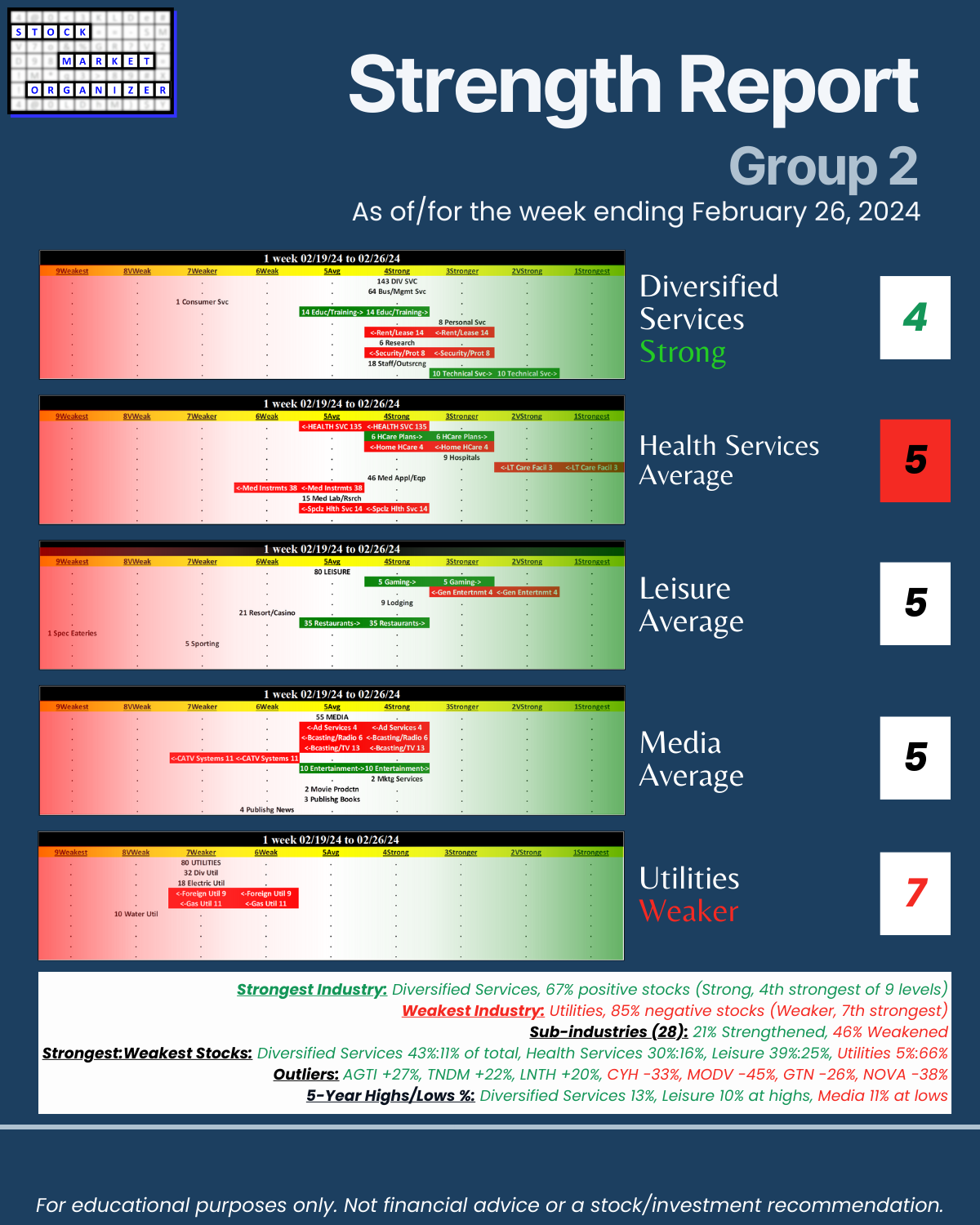

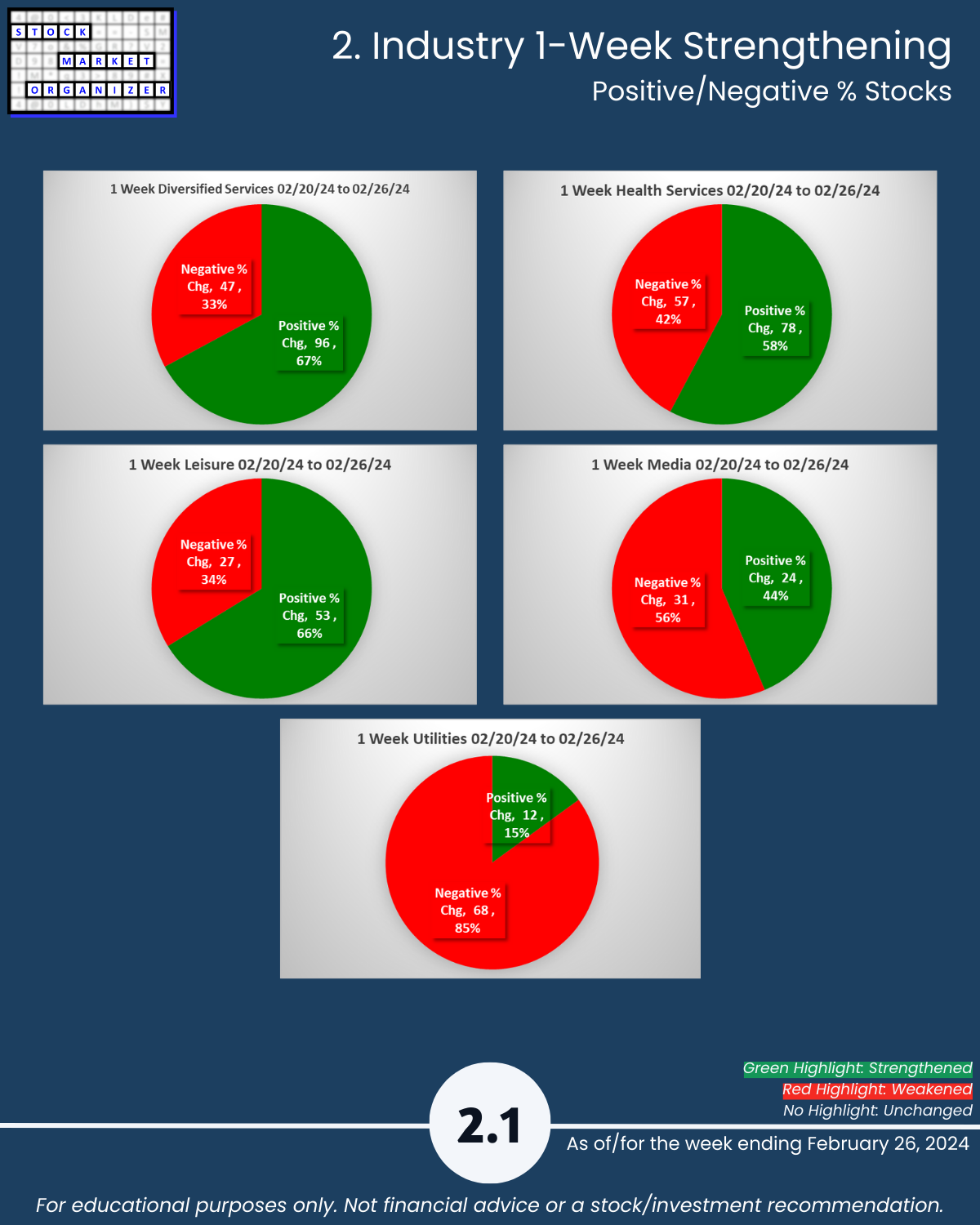

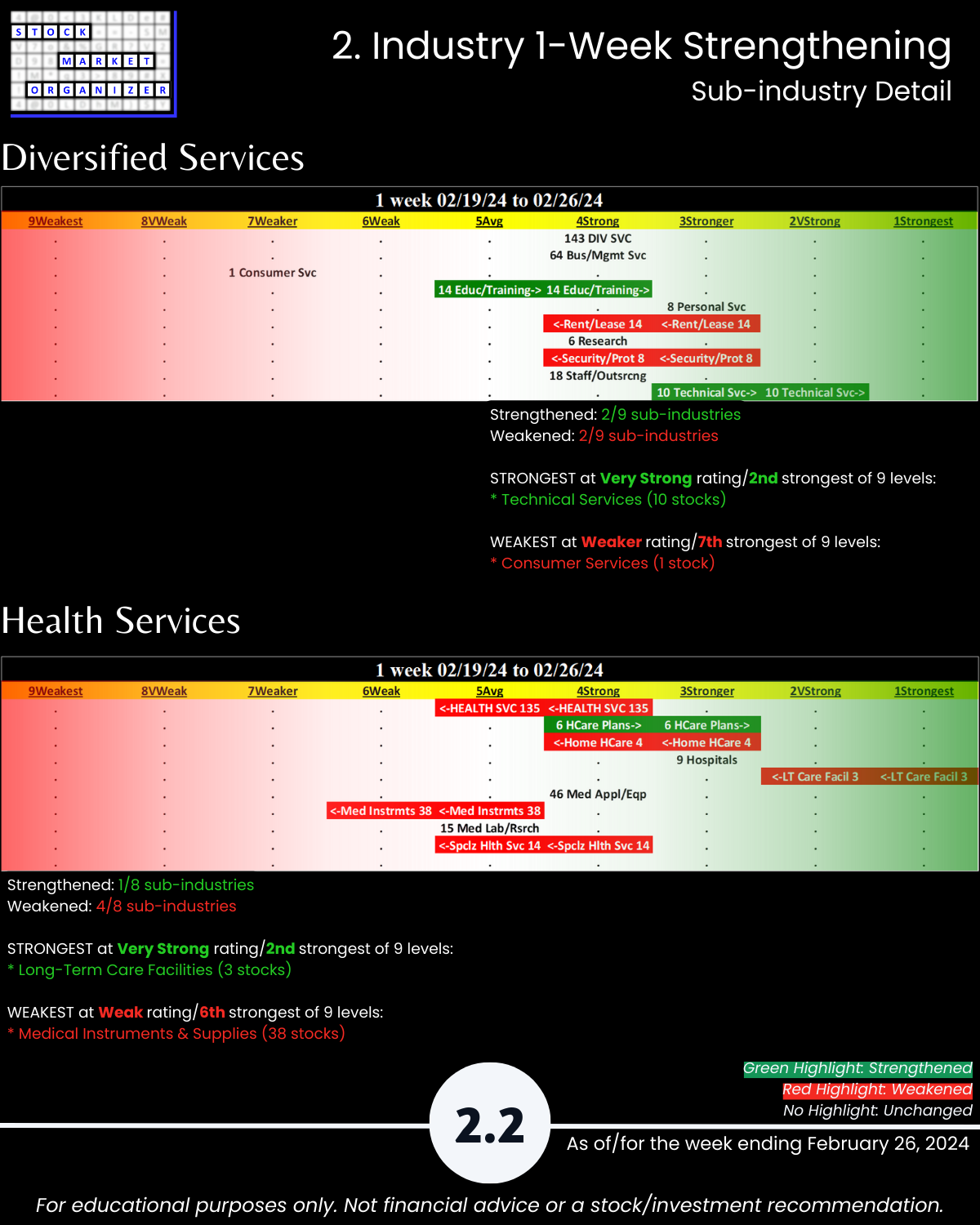

🔹 Strongest Industry: Diversified Services, 67% positive stocks (Strong, 4th strongest of 9 levels)

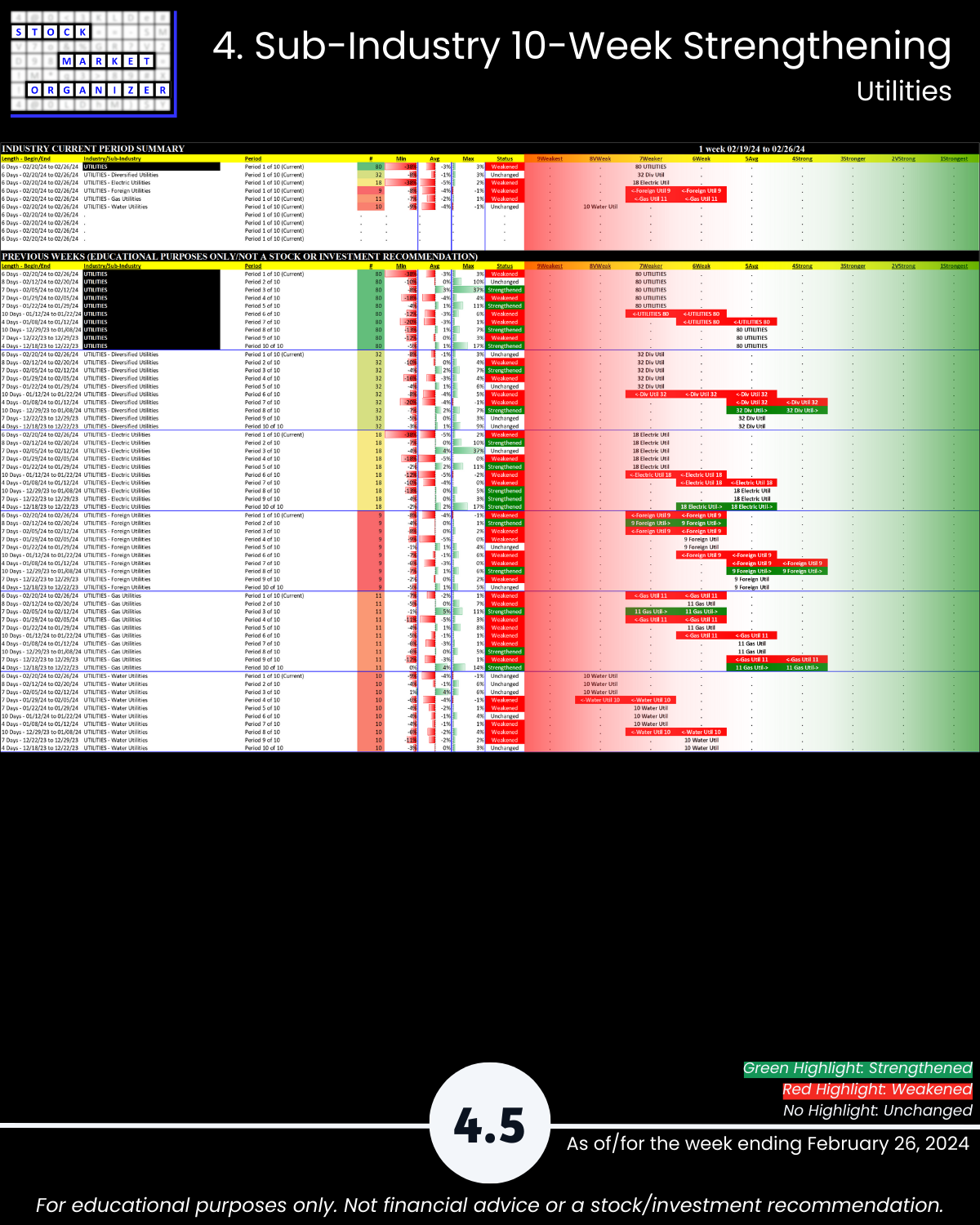

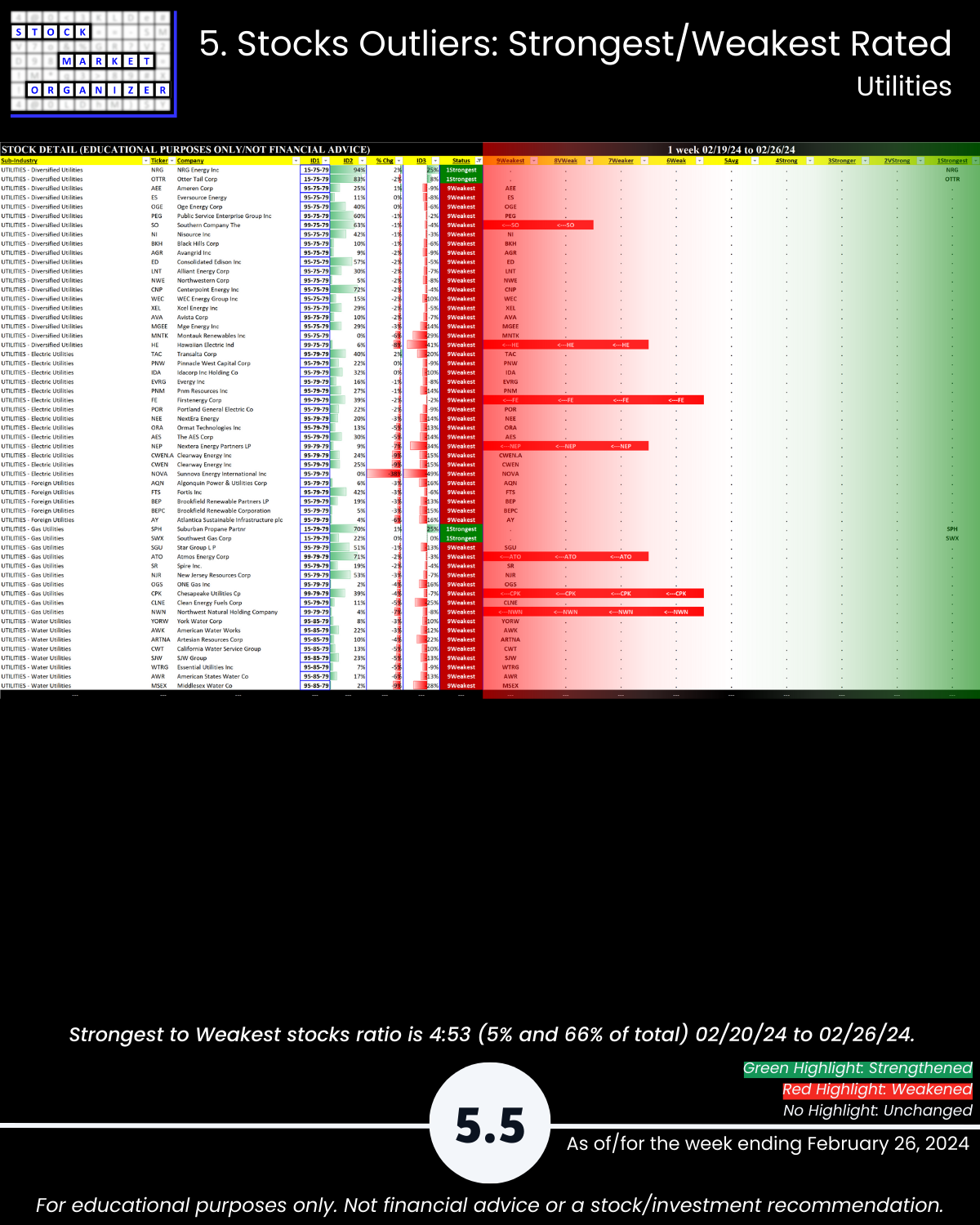

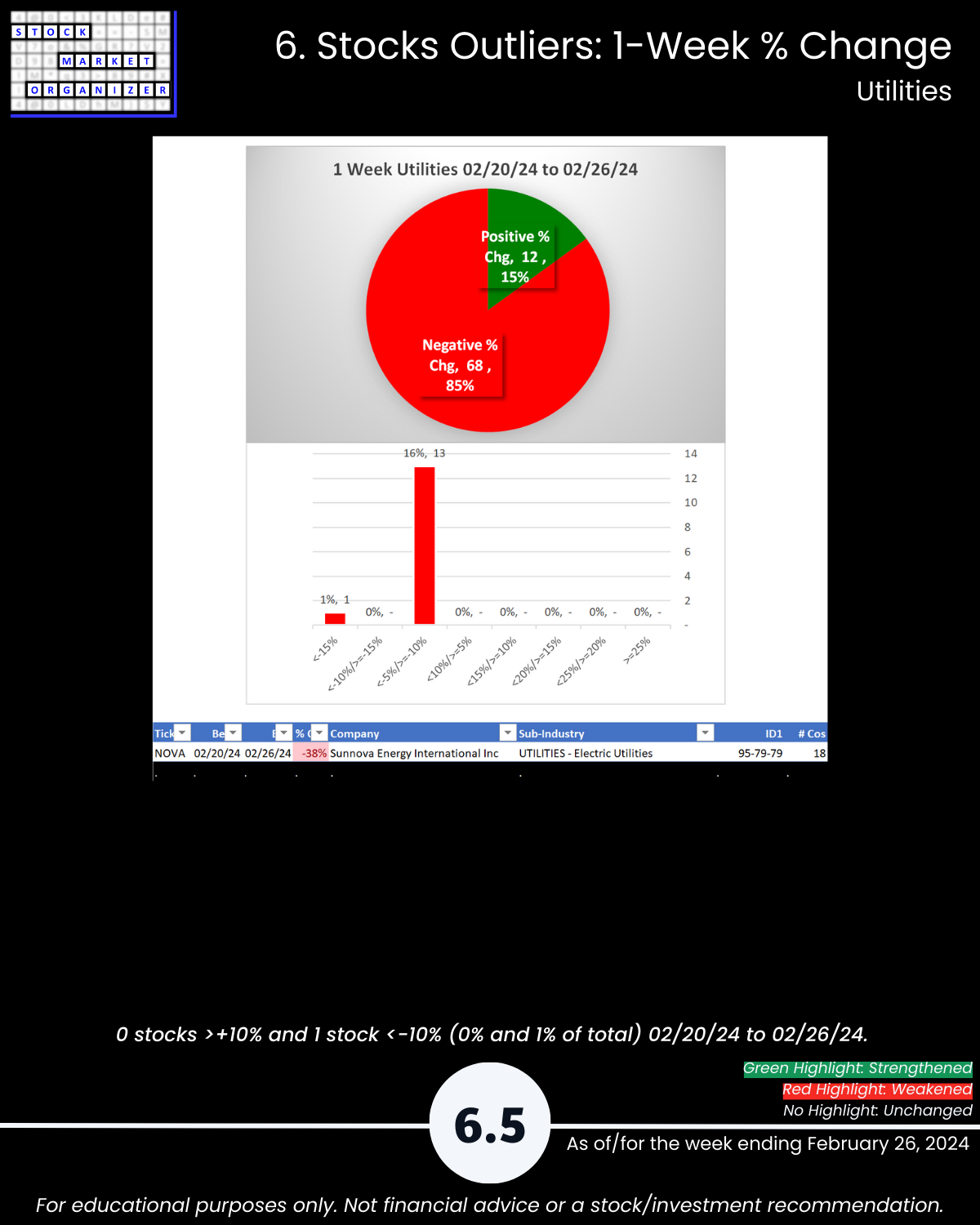

🔹 Weakest Industry: Utilities, 85% negative stocks (Weaker, 7th strongest)

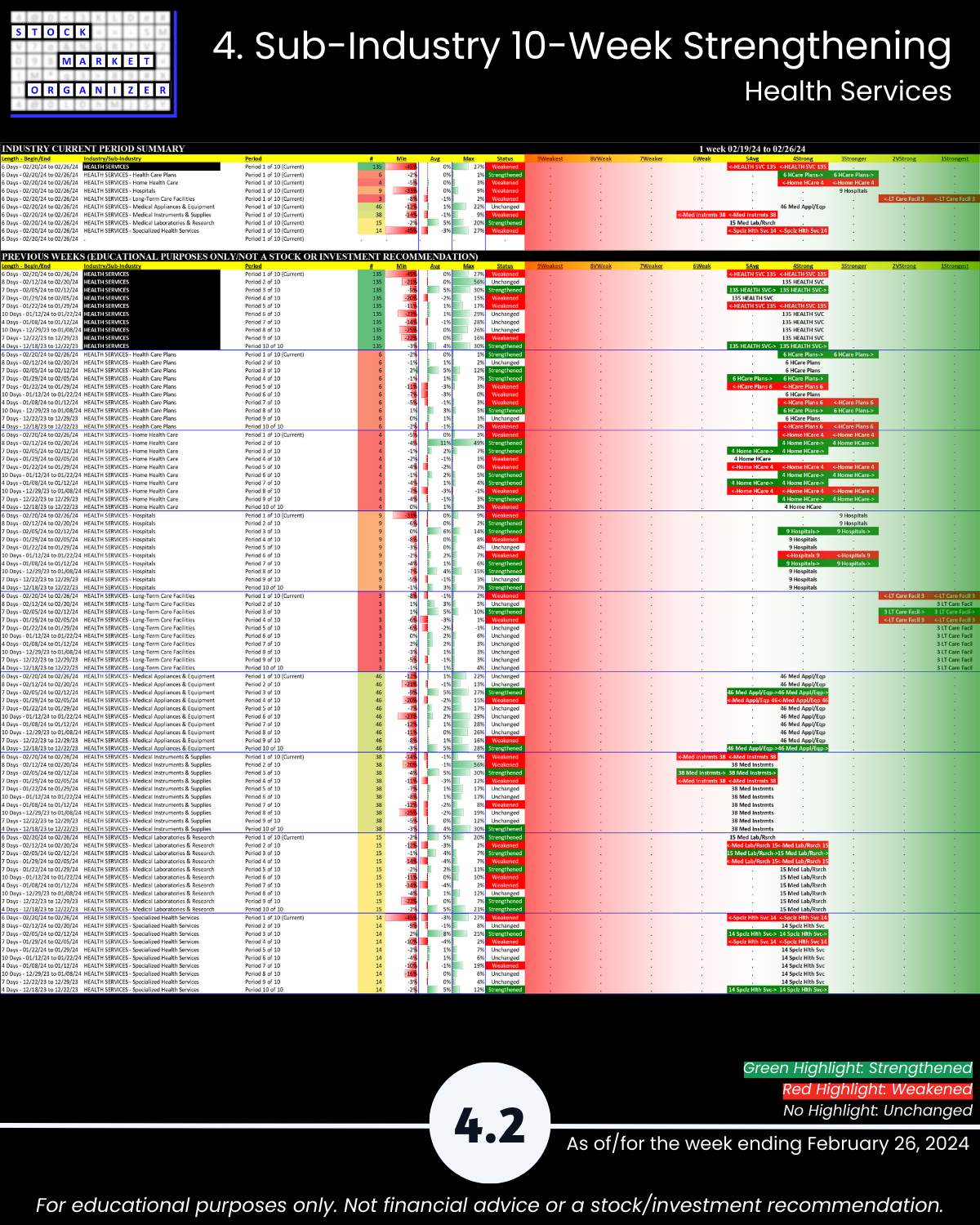

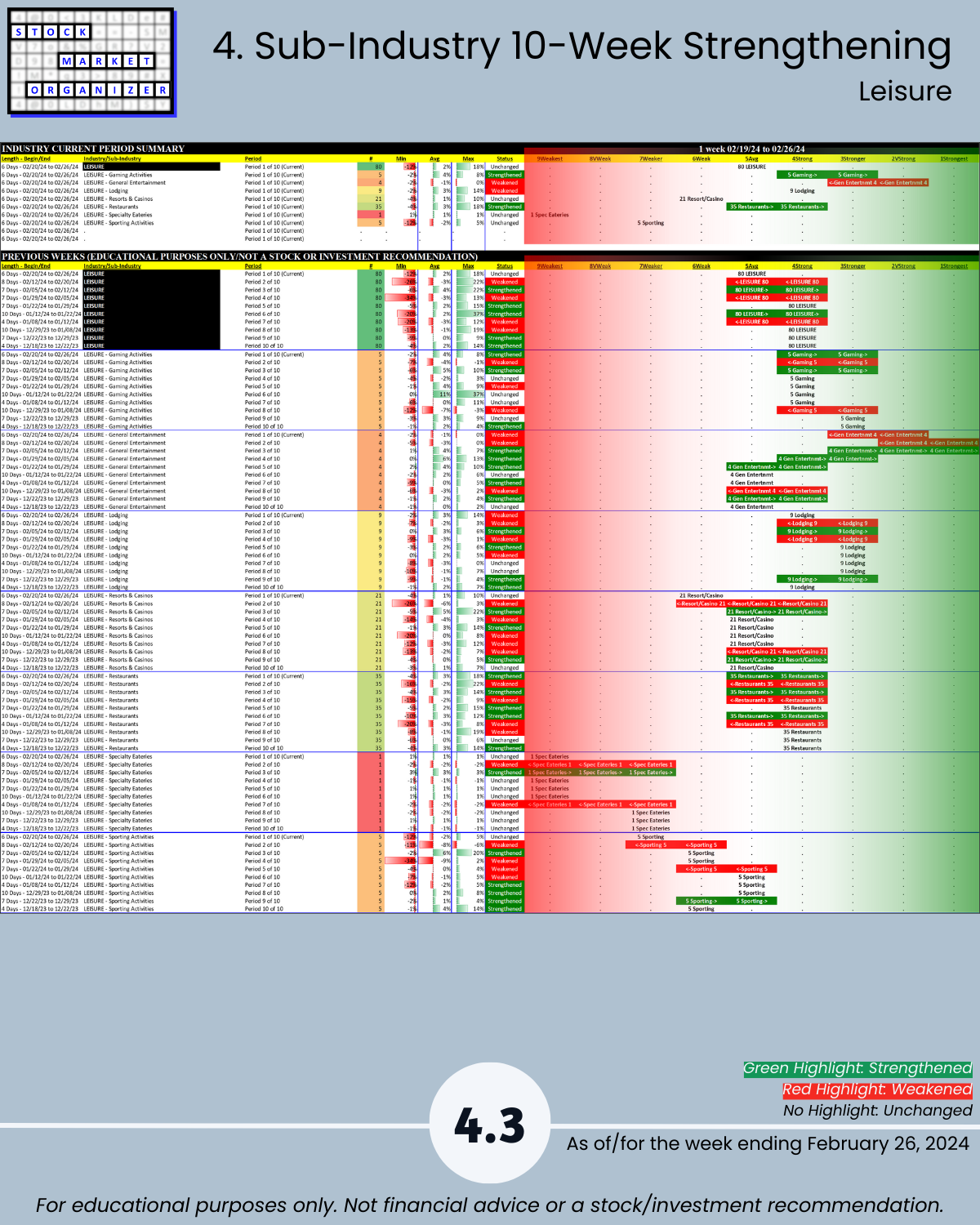

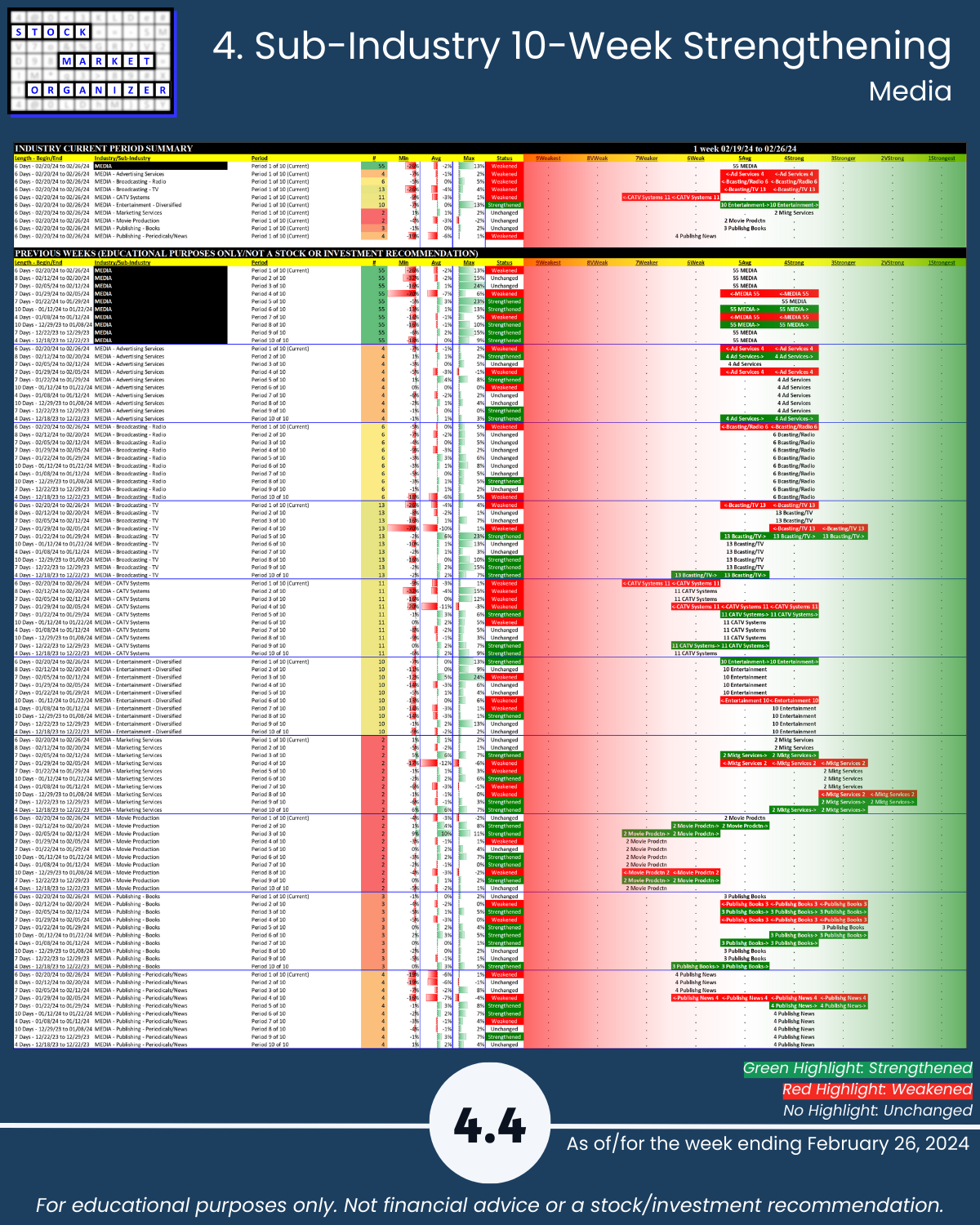

🔹 Sub-industries (28): 21% Strengthened, 46% Weakened

🔹 Strongest:Weakest Stocks: Diversified Services 43%:11% of total, Health Services 30%:16%, Leisure 39%:25%, Utilities 5%:66%

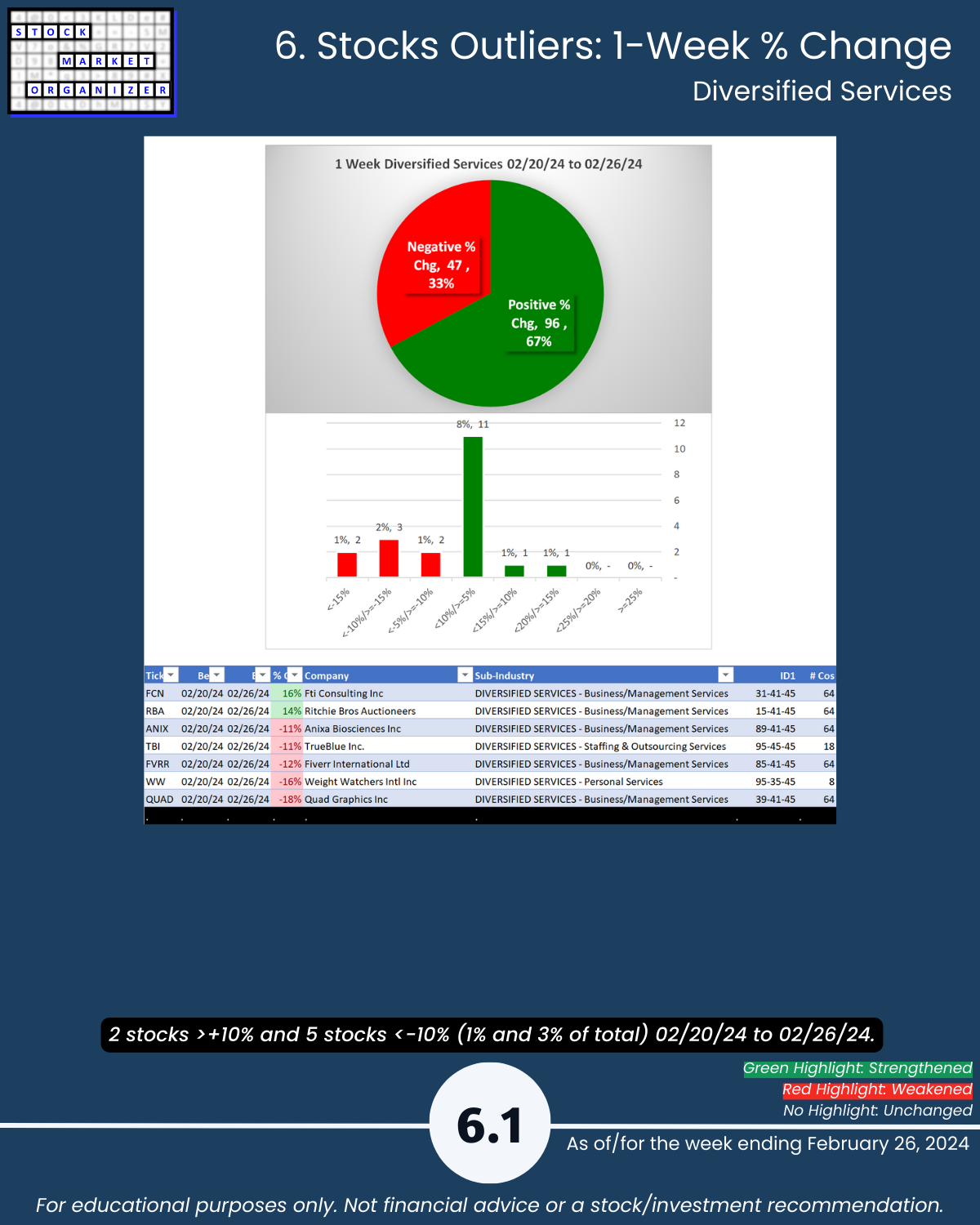

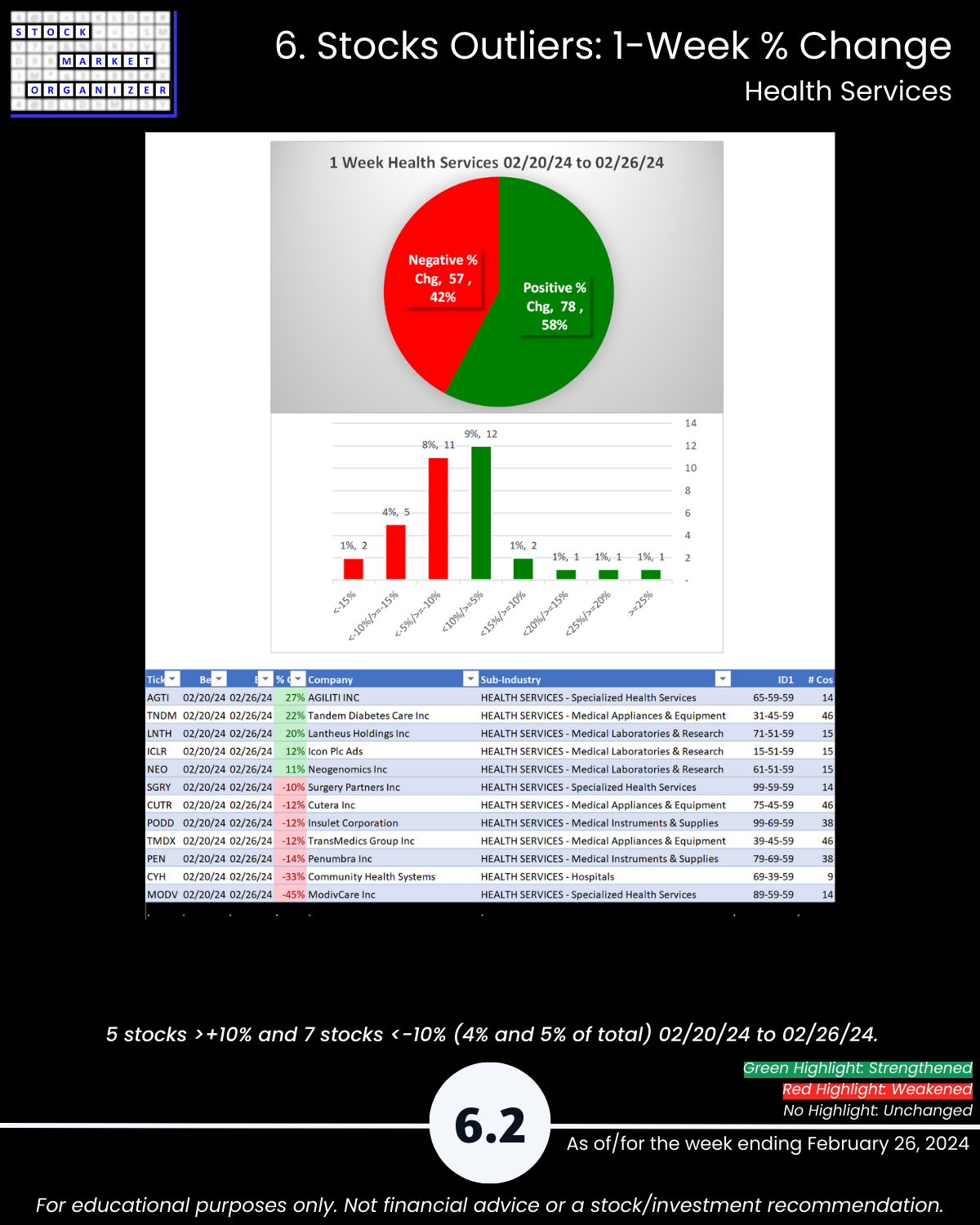

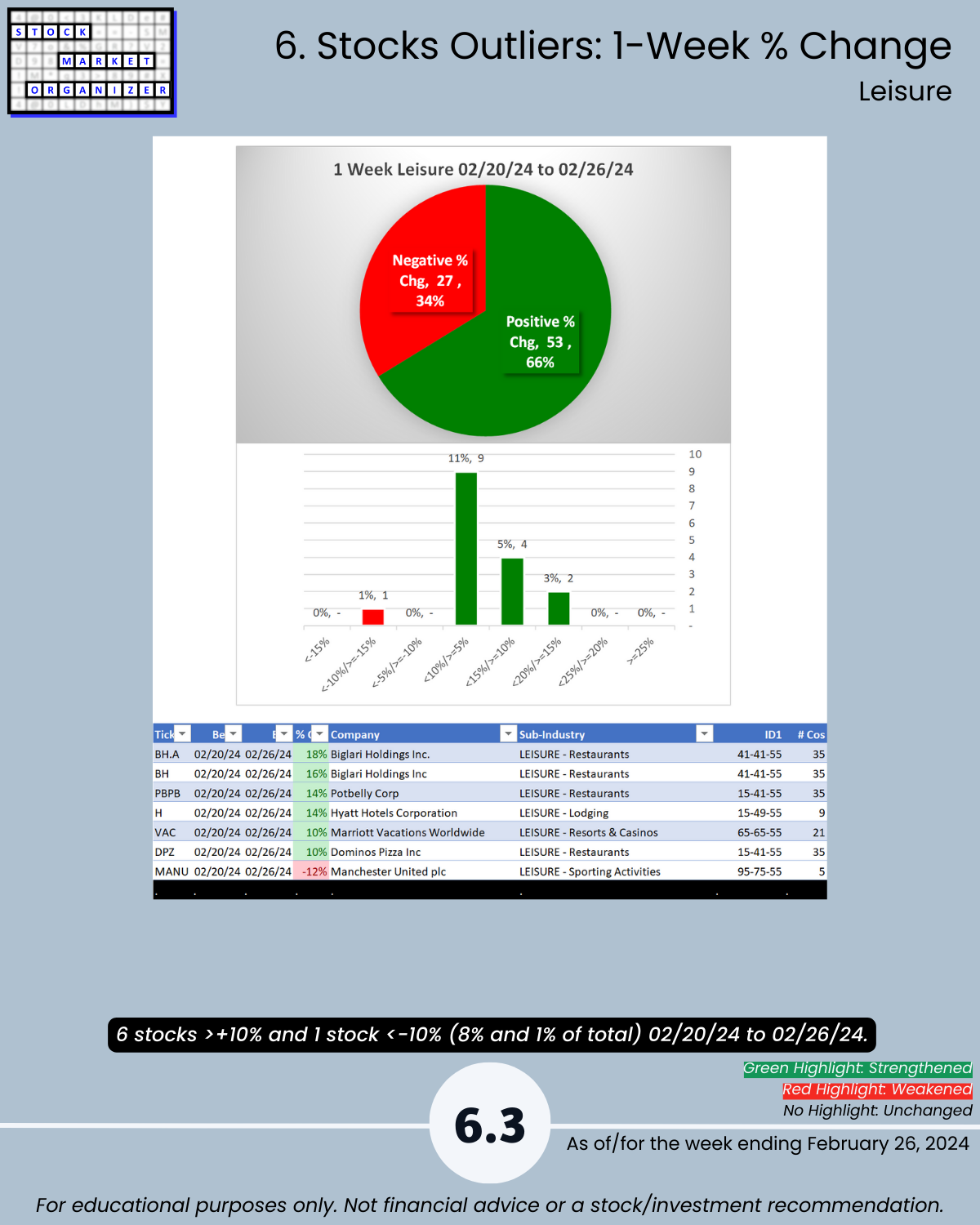

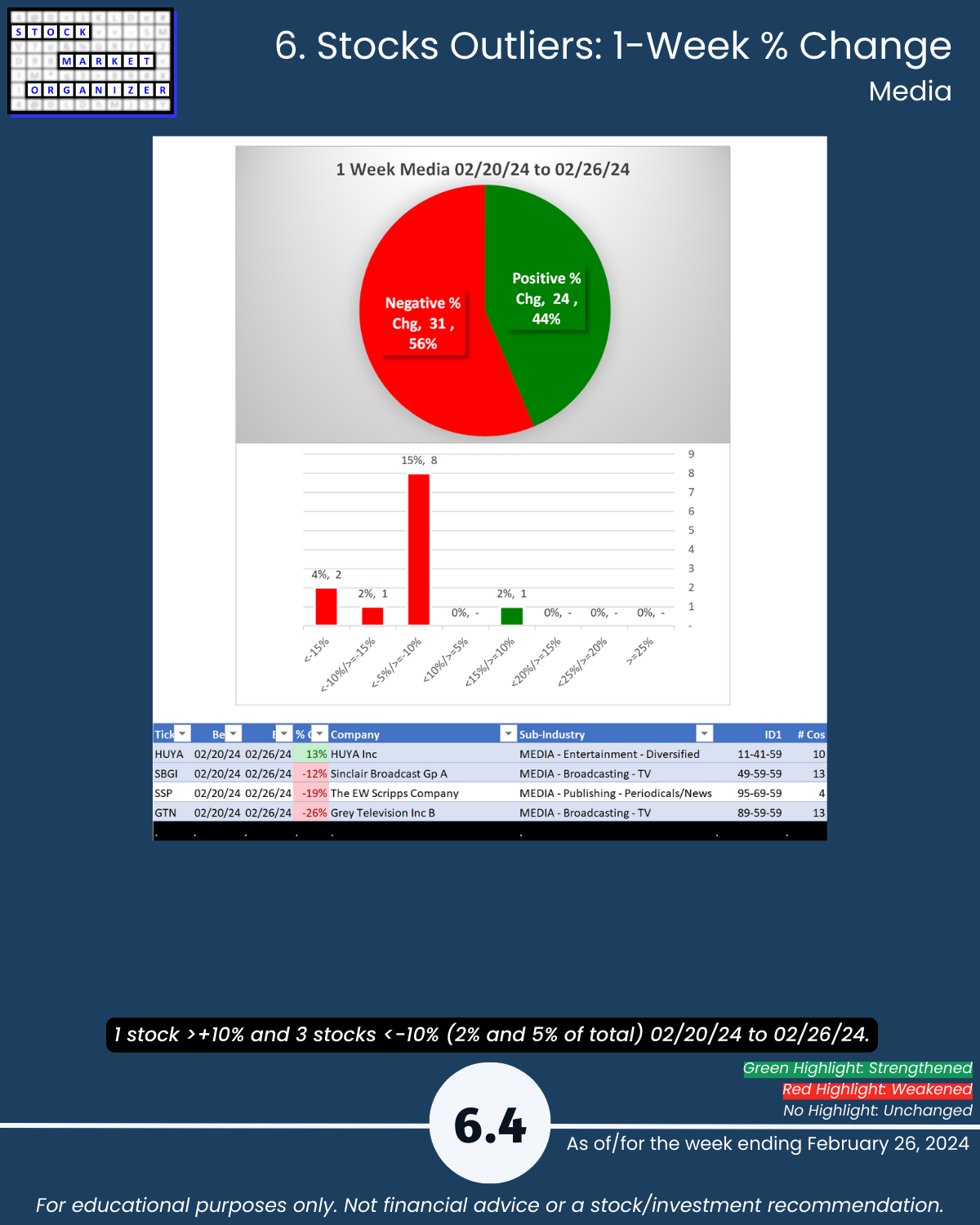

🔹 Outliers: AGTI +27%, TNDM +22%, LNTH +20%, CYH -33%, MODV -45%, GTN -26%, NOVA -38%

🔹 5-Year Highs/Lows %: Diversified Services 13%, Leisure 10% at highs, Media 11% at lows

This report may particularly be of interest if the following 5 concepts resonate with you:

- The stronger your stocks, the greener your P&L.

- The journey to 100%+ returns begins with 10% returns.

- The journey to a multi-month rally begins with one up week.

- Most stocks do what the market does. (While the market can only do what its underlying stocks, sub-industries, and industries do.)

- 80/20: not all information is created equal. (Press buttons, not balloons.)

Following are galleries with page-by-page views of this report.

1. Introduction

2. Industry 1-Week Strengthening

3. Industry 10-Week Strengthening

4. Sub-industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

6. Stocks Outliers: 1-Week % Change

7. Stocks Outliers: 5-Year Highs/Lows