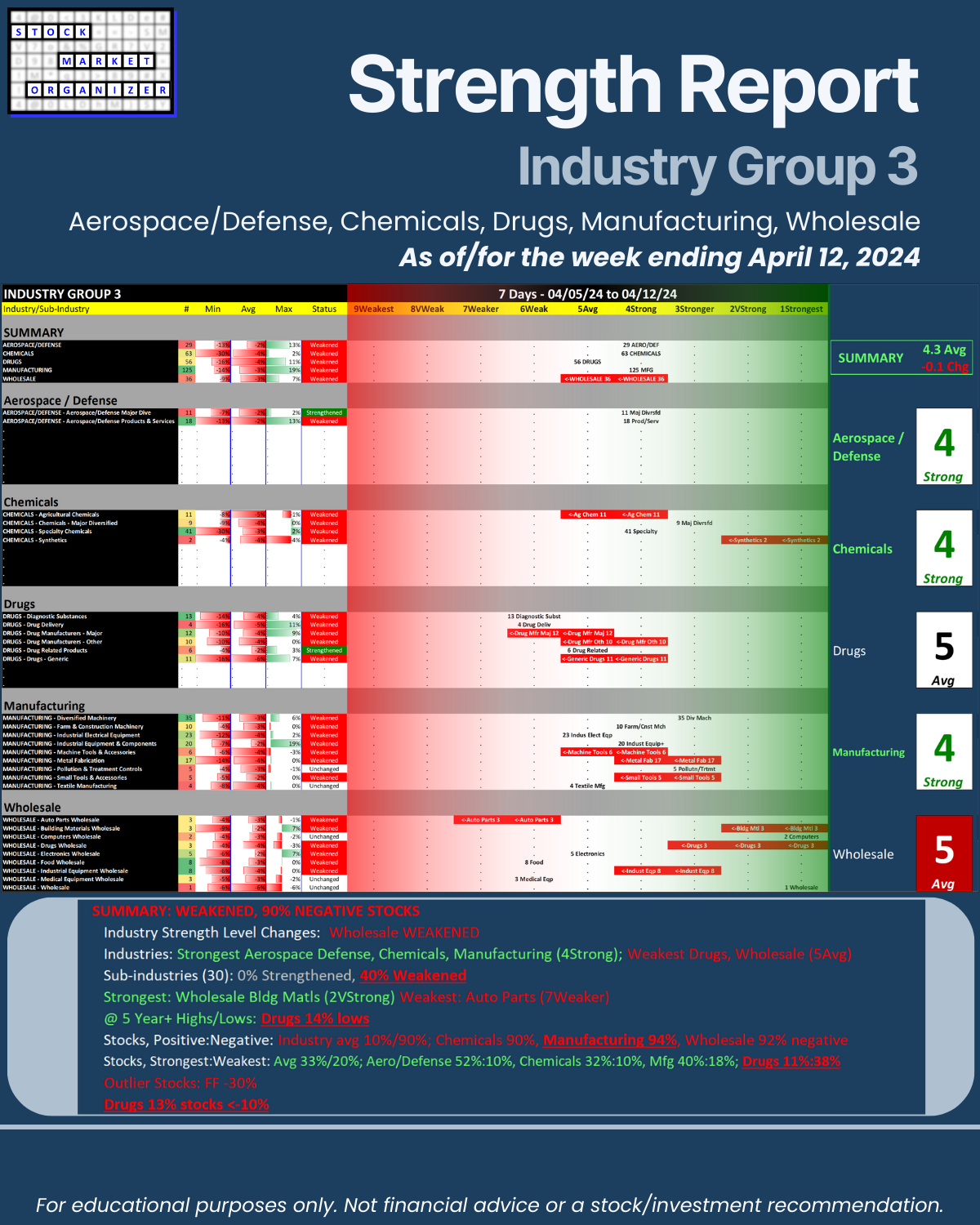

SMO Exclusive: Strength Report Group 3 2024-04-12

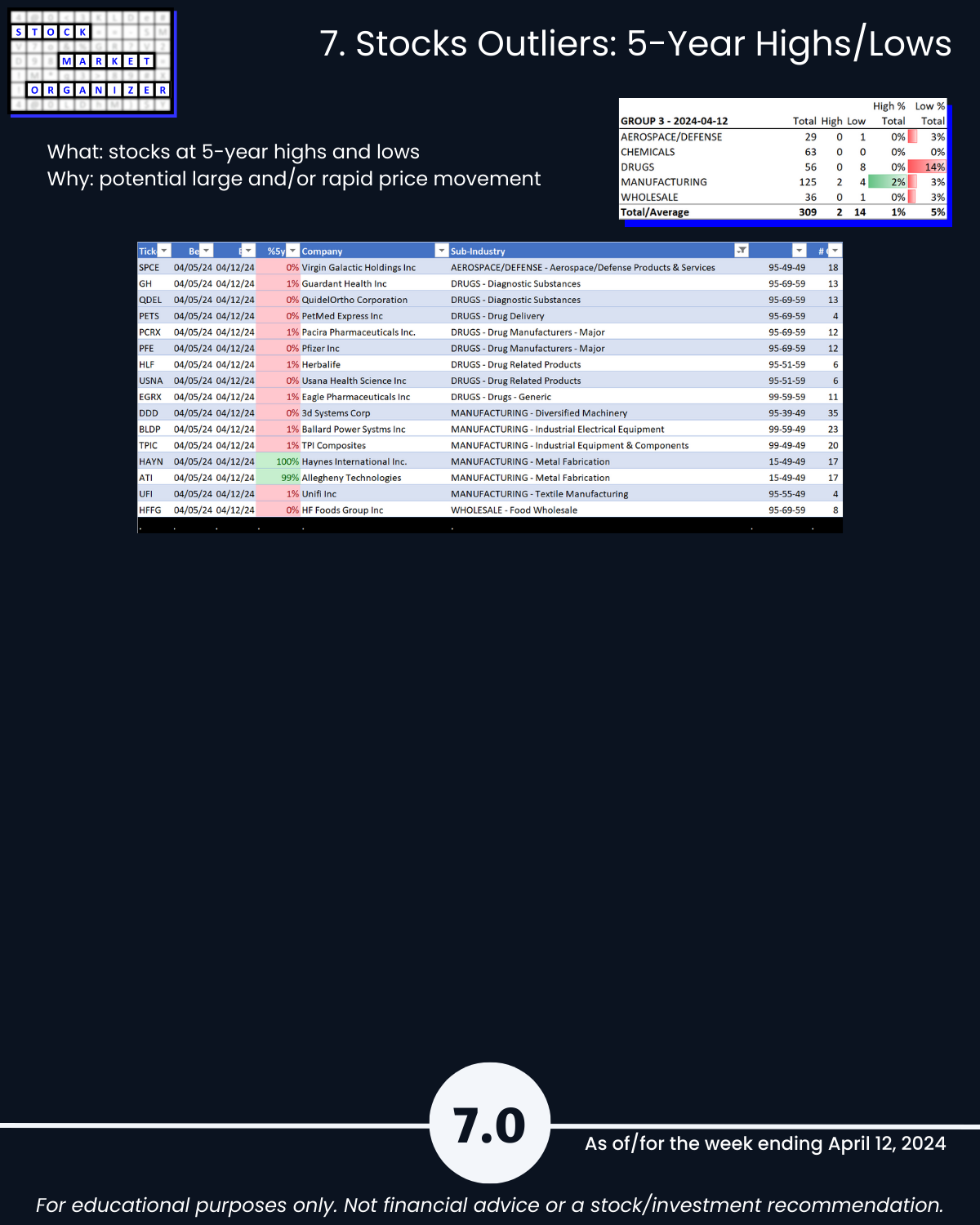

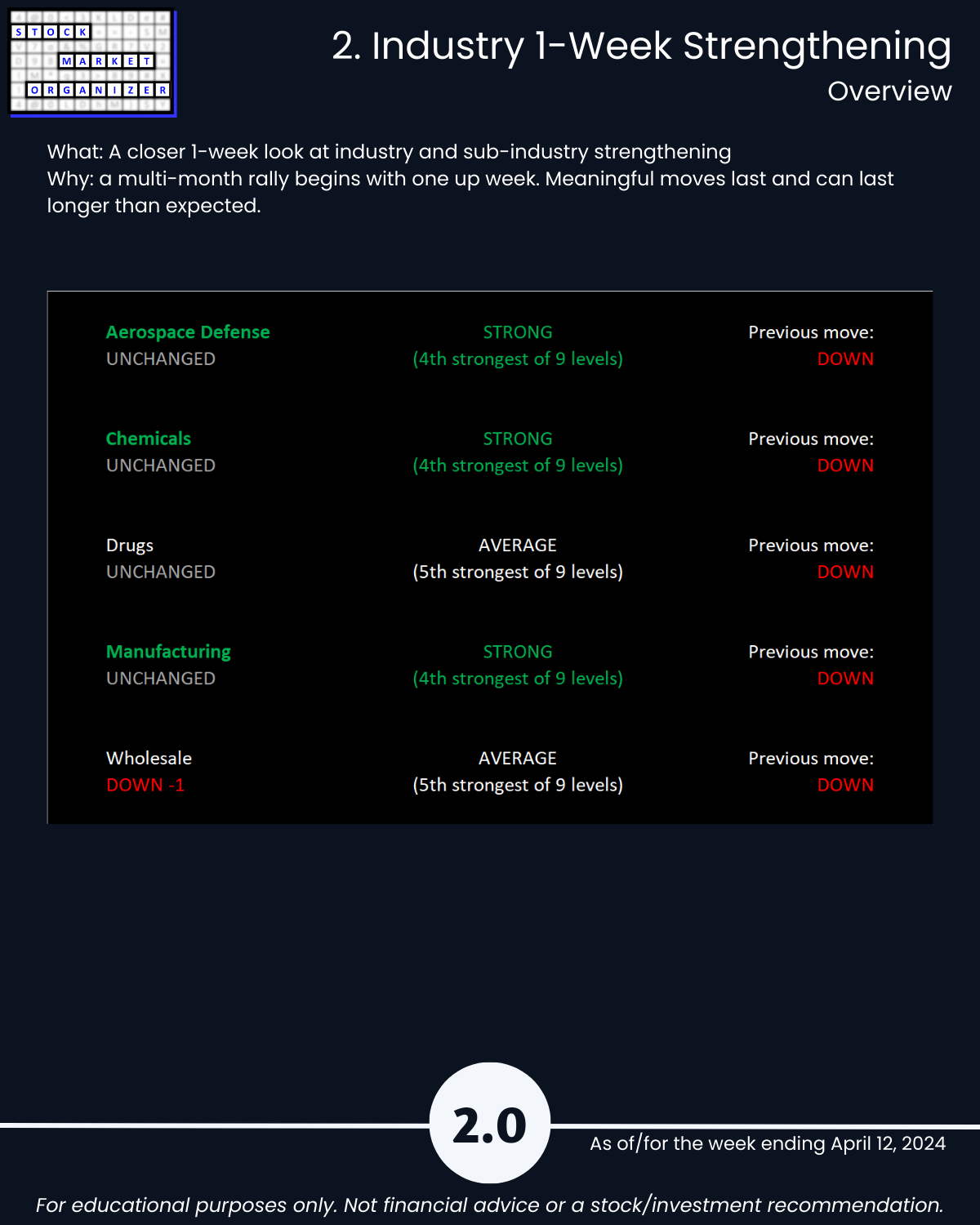

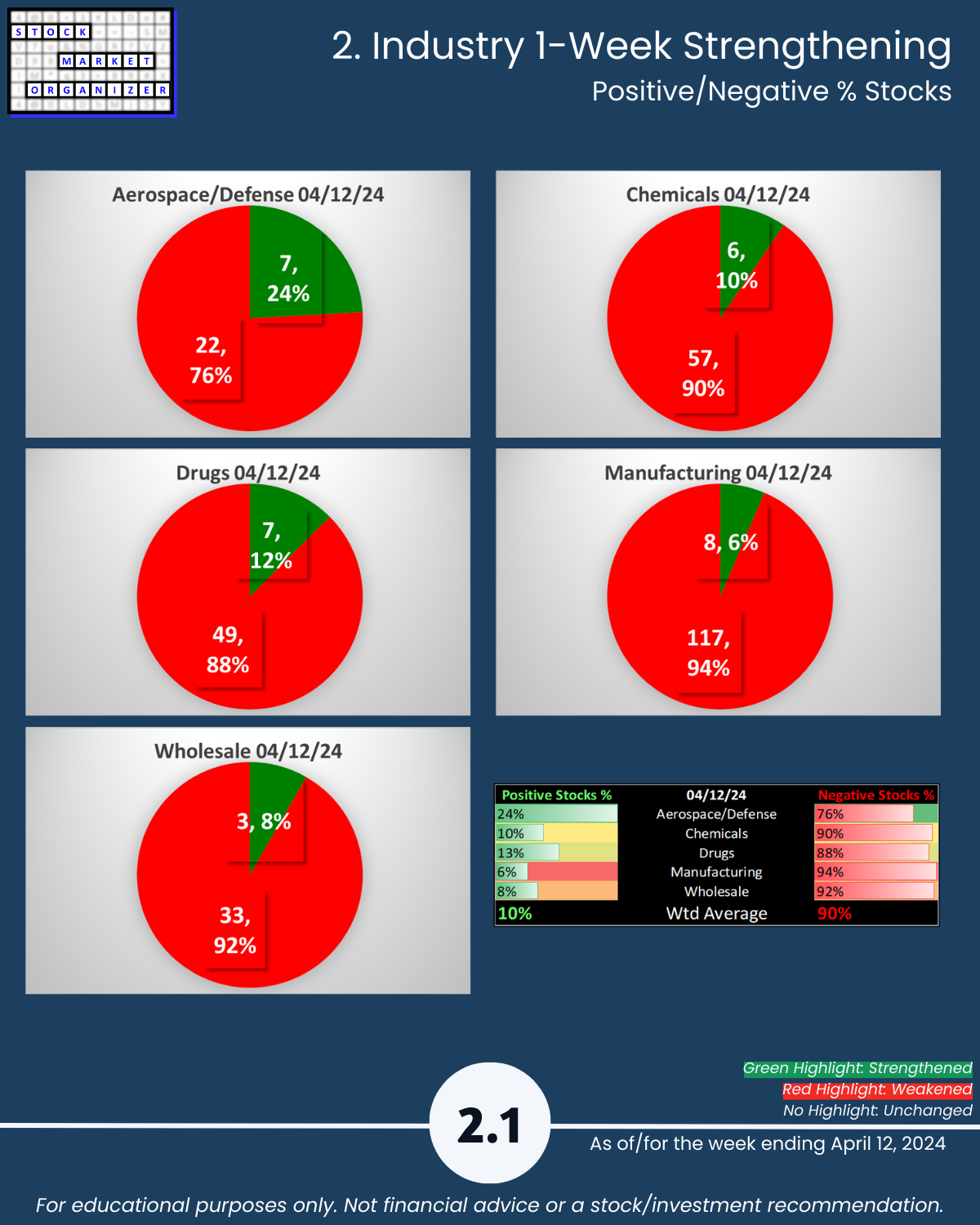

Last report before full market report 4/12/24 – Industry Group 3, Aerospace Defense, Chemicals, Drugs, Manufacturing, and Wholesale. Unique U.S. Stock Market strength-based insights: 🔹 Drugs has 14% of its stocks at 5+ year lows, a poor 11%:38% ratio of 1Strongest:9Weakest stocks, and 12% of its stocks dropping more than -10% 🔹 90% average negative stocks with Manufacturing 94%, Wholesale 92%, and Chemicals 90% 🔹 40% weakening sub-industries with none strengthening.

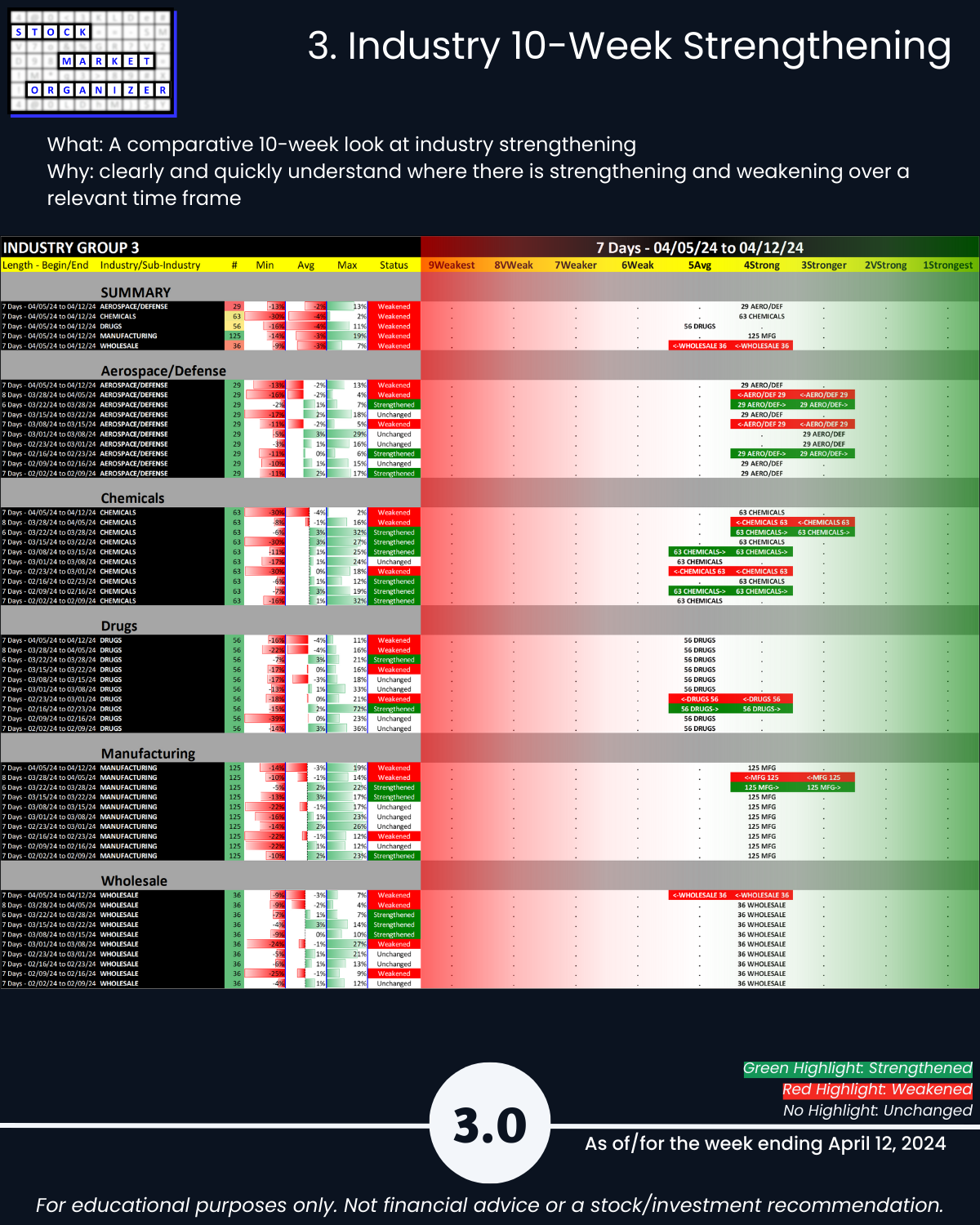

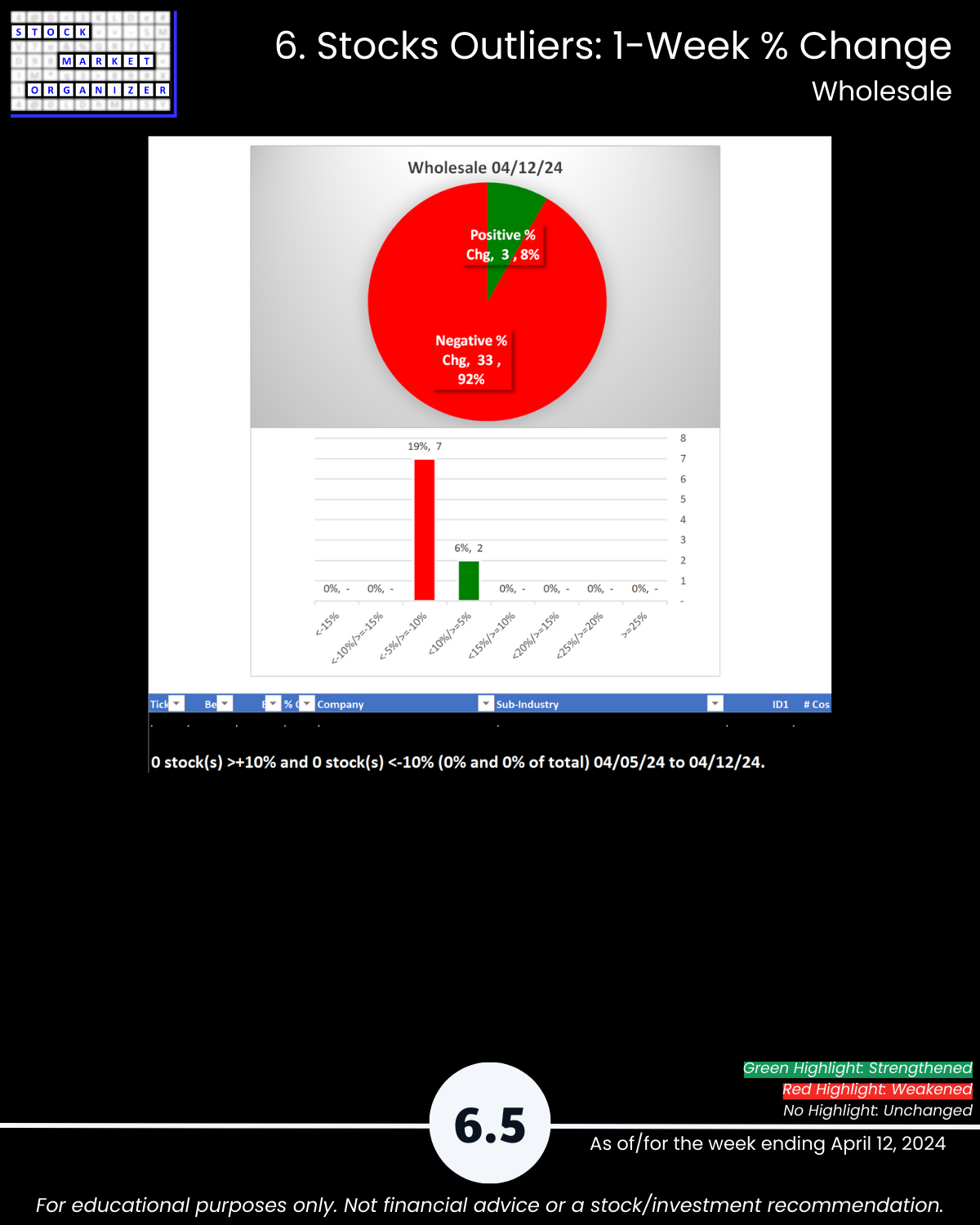

SUMMARY: WEAKENED, 90% NEGATIVE STOCKS

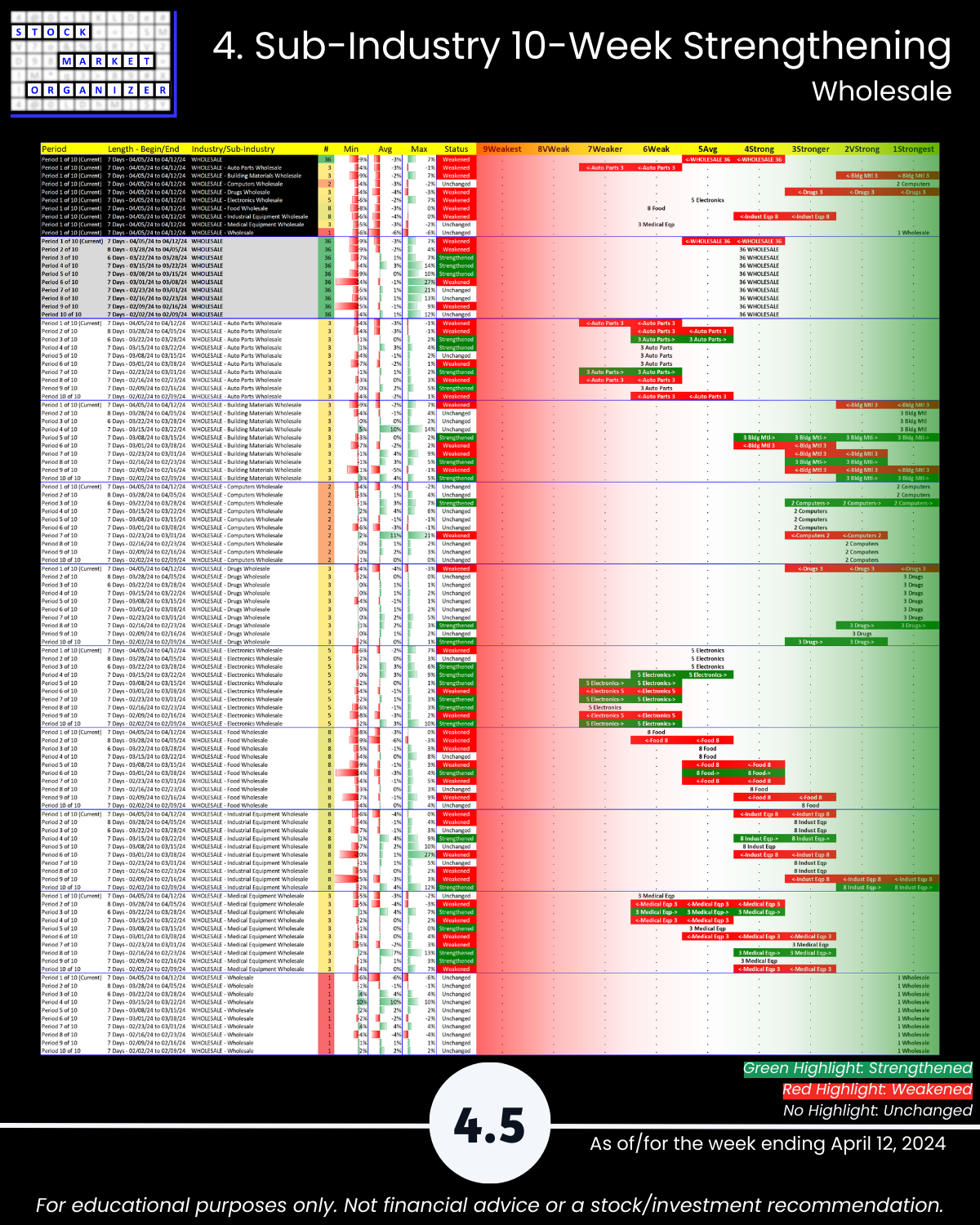

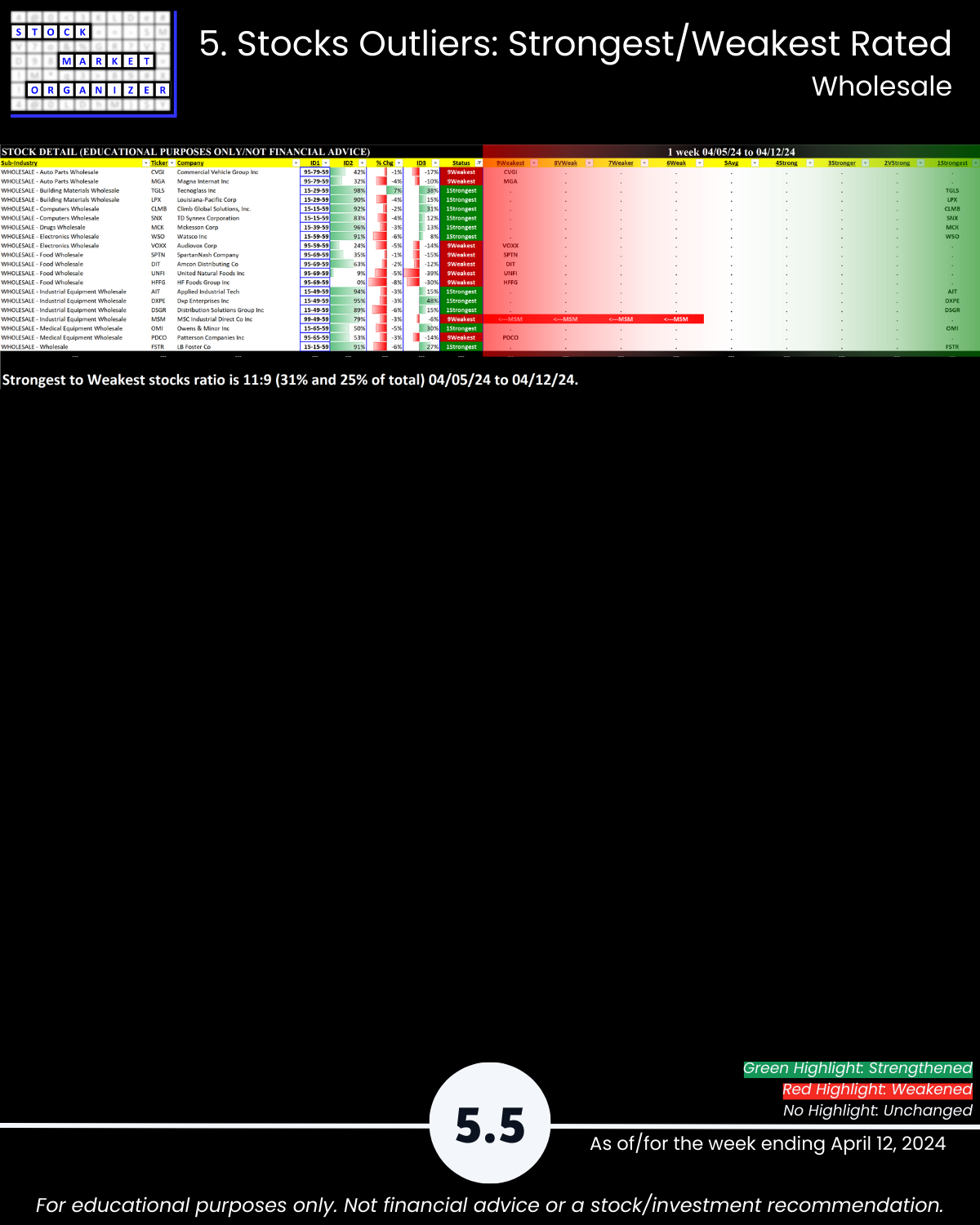

🔹 Industry Strength Level Changes: Wholesale WEAKENED

🔹 Industries

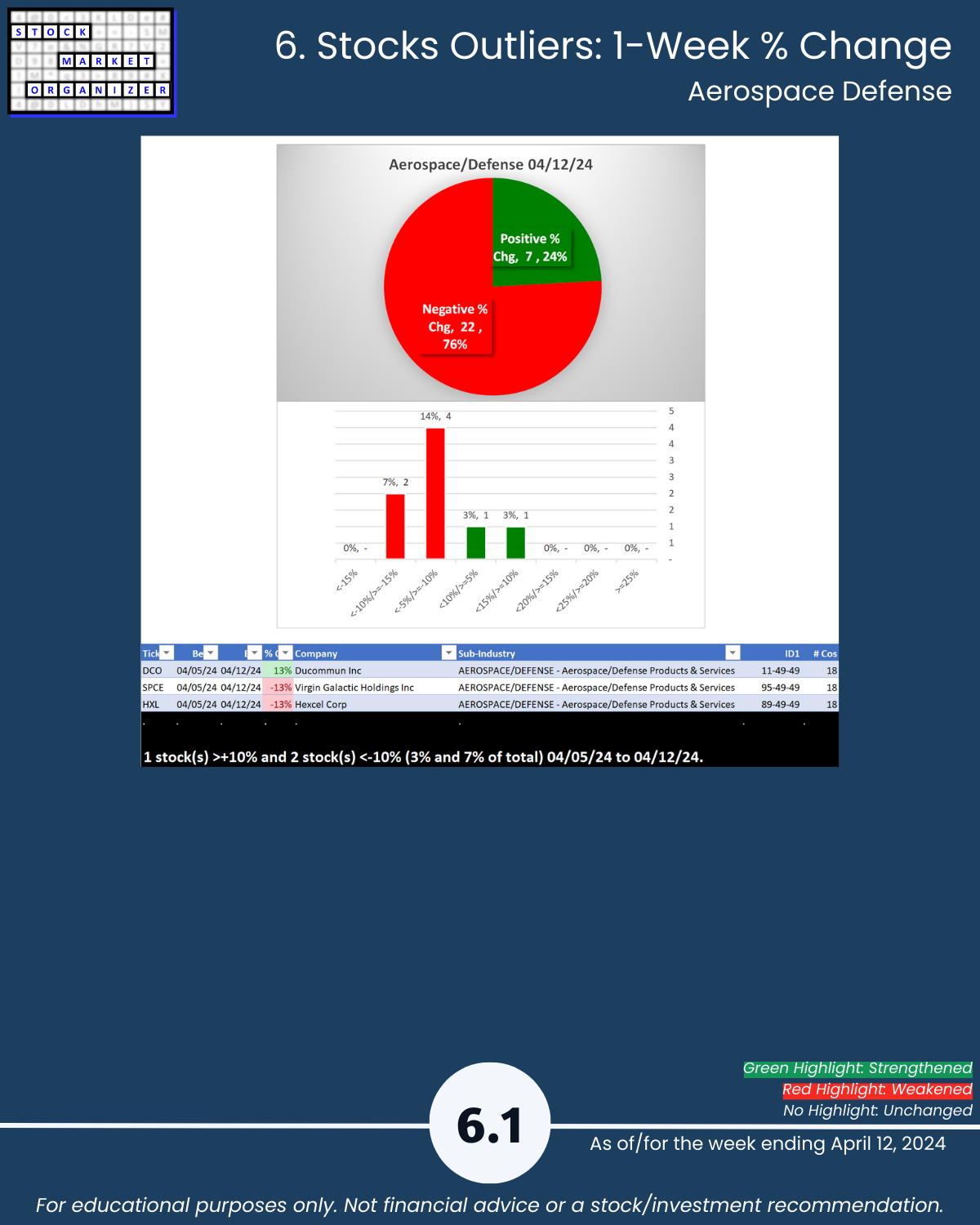

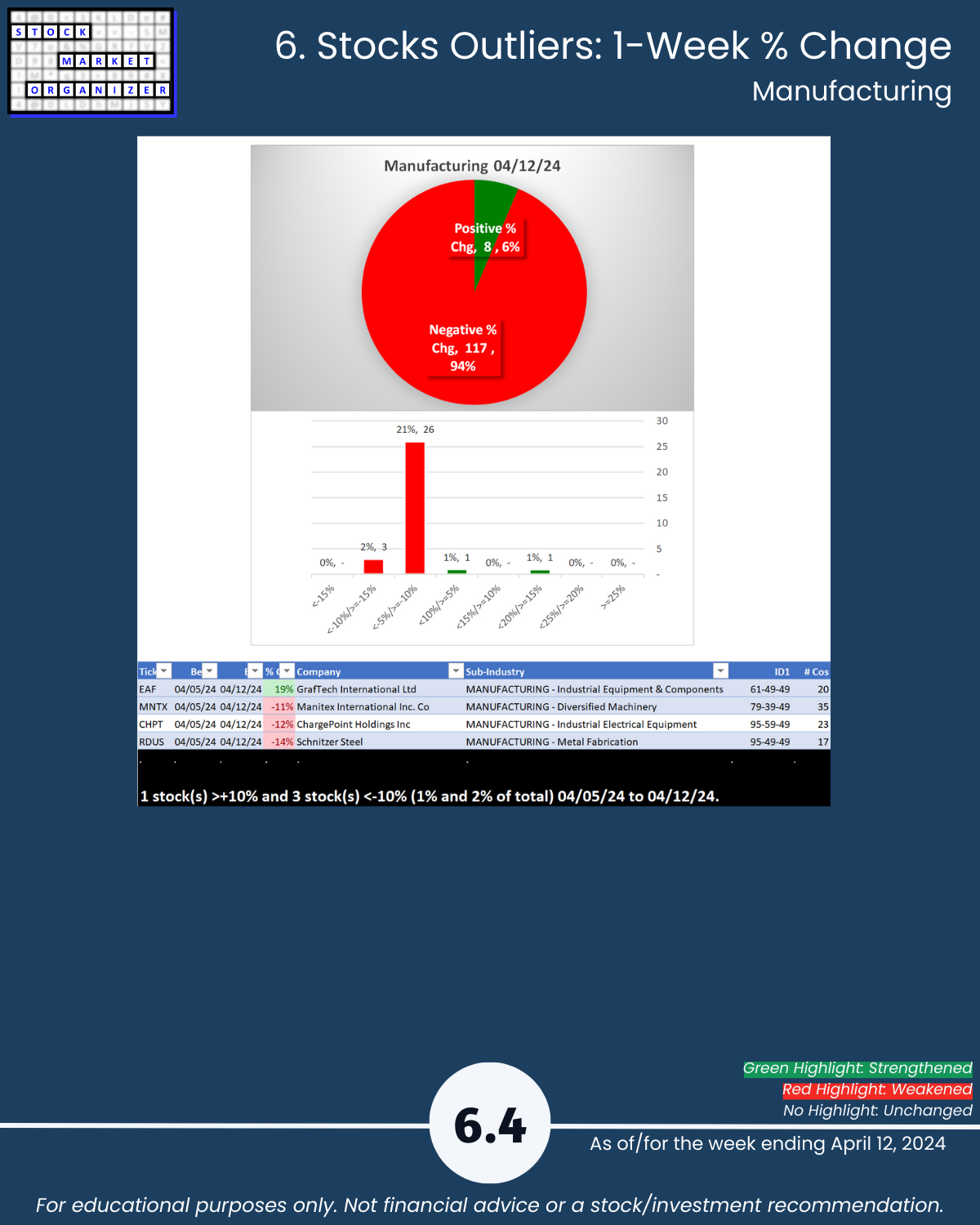

- Strongest Aerospace Defense, Chemicals, Manufacturing (4Strong)

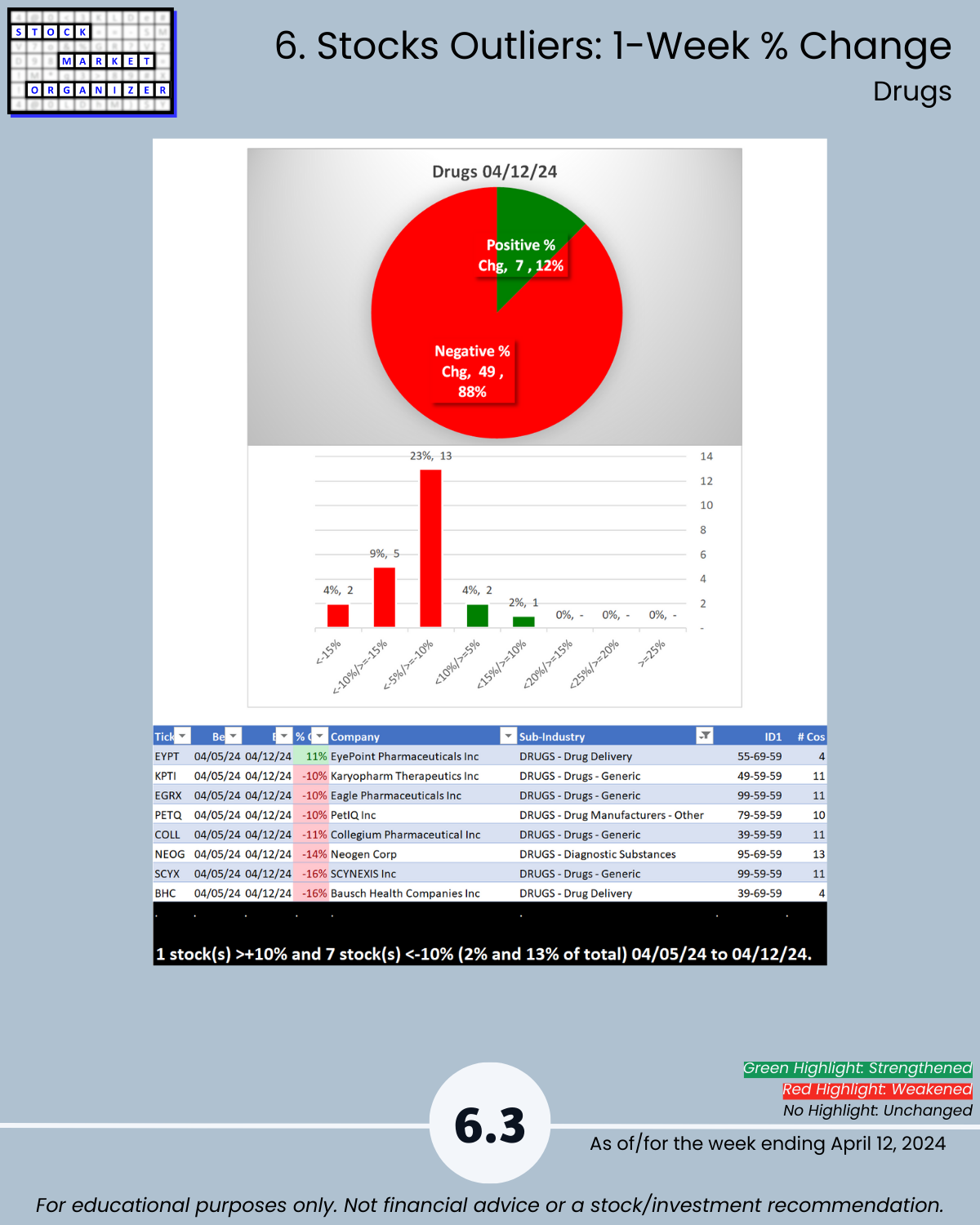

- Weakest Drugs, Wholesale (5Avg)

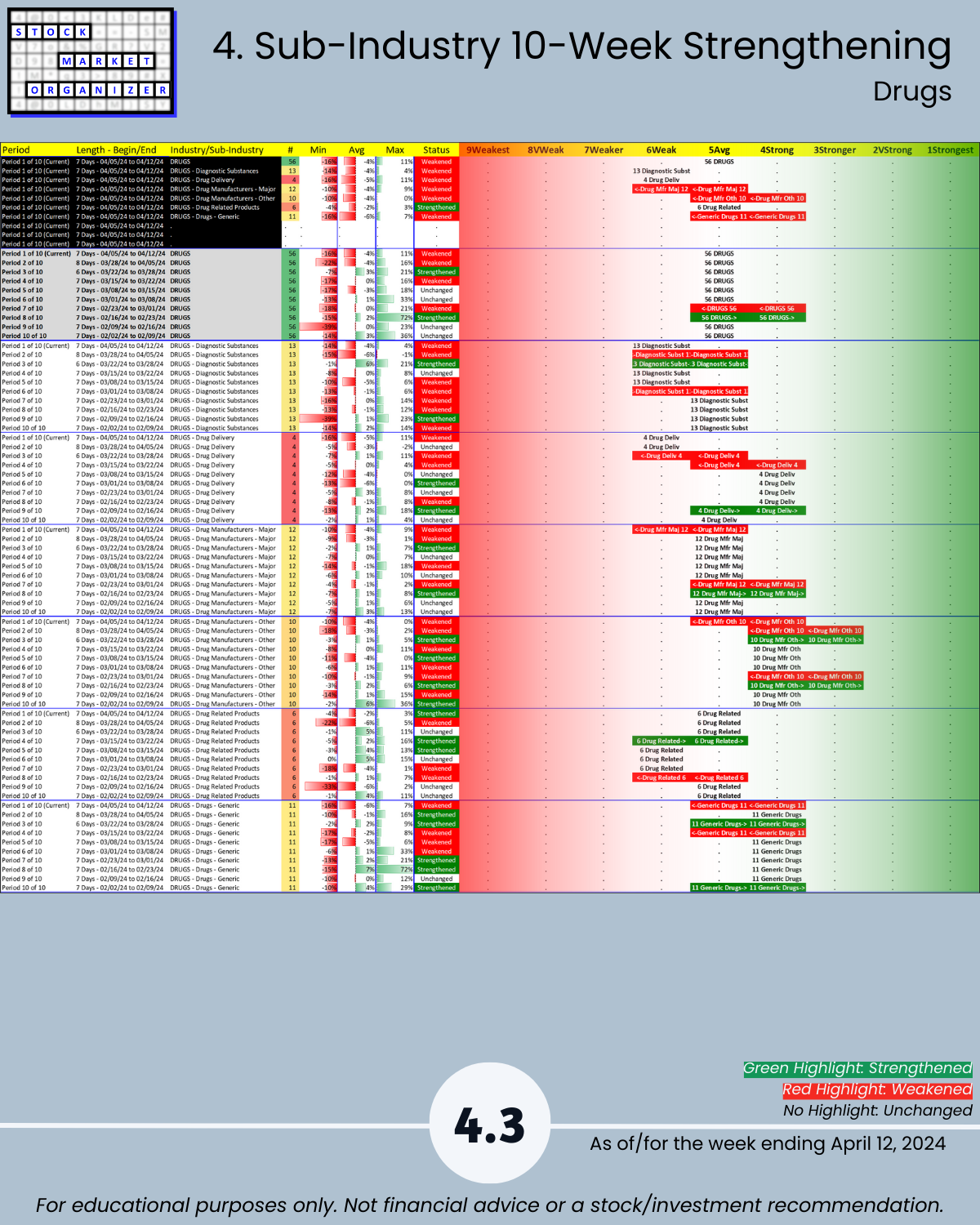

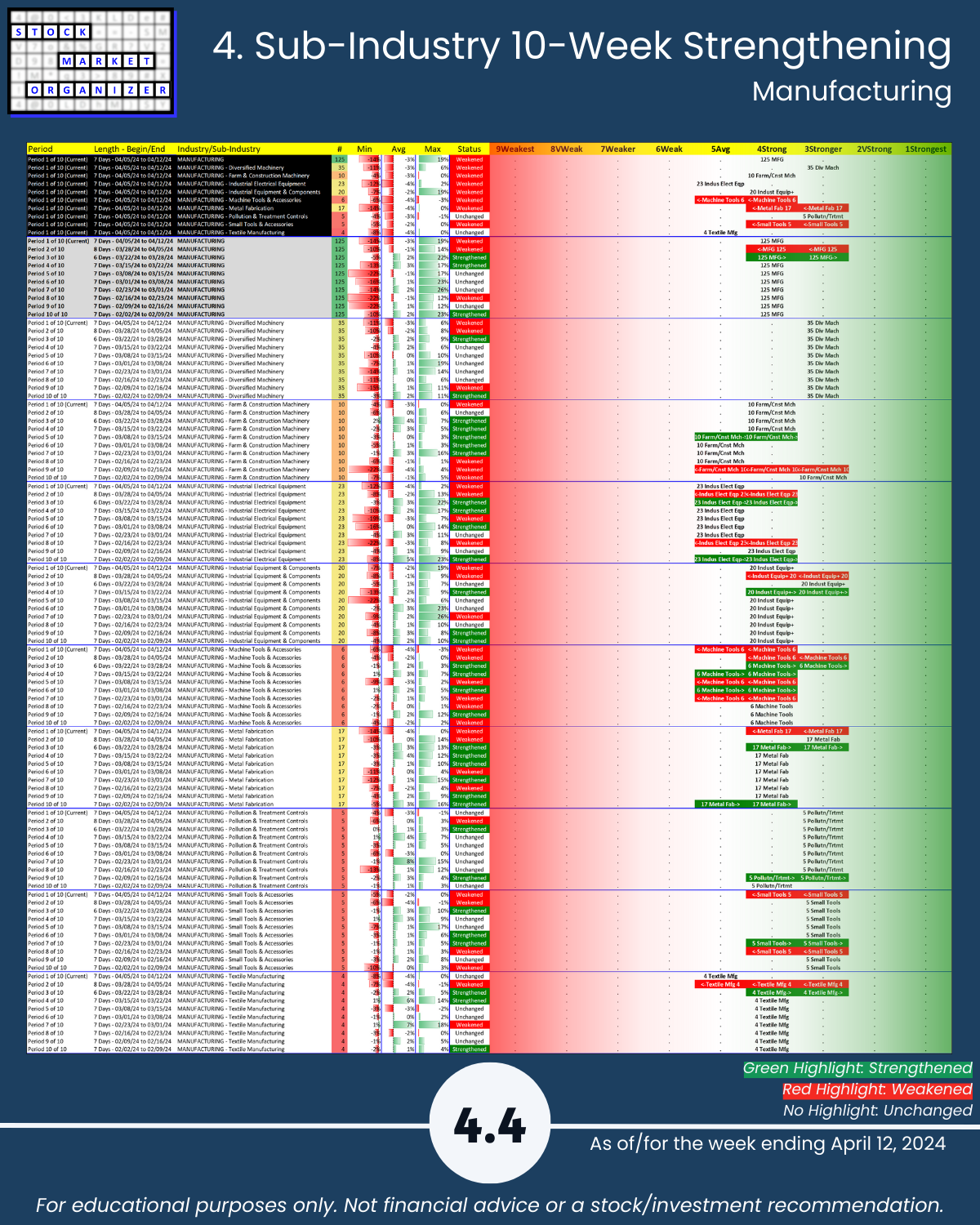

🔹 Sub-industries (30)

- 0% Strengthened, 40% Weakened

- Strongest: Wholesale Bldg Matls (2VStrong) Weakest: Auto Parts (7Weaker)

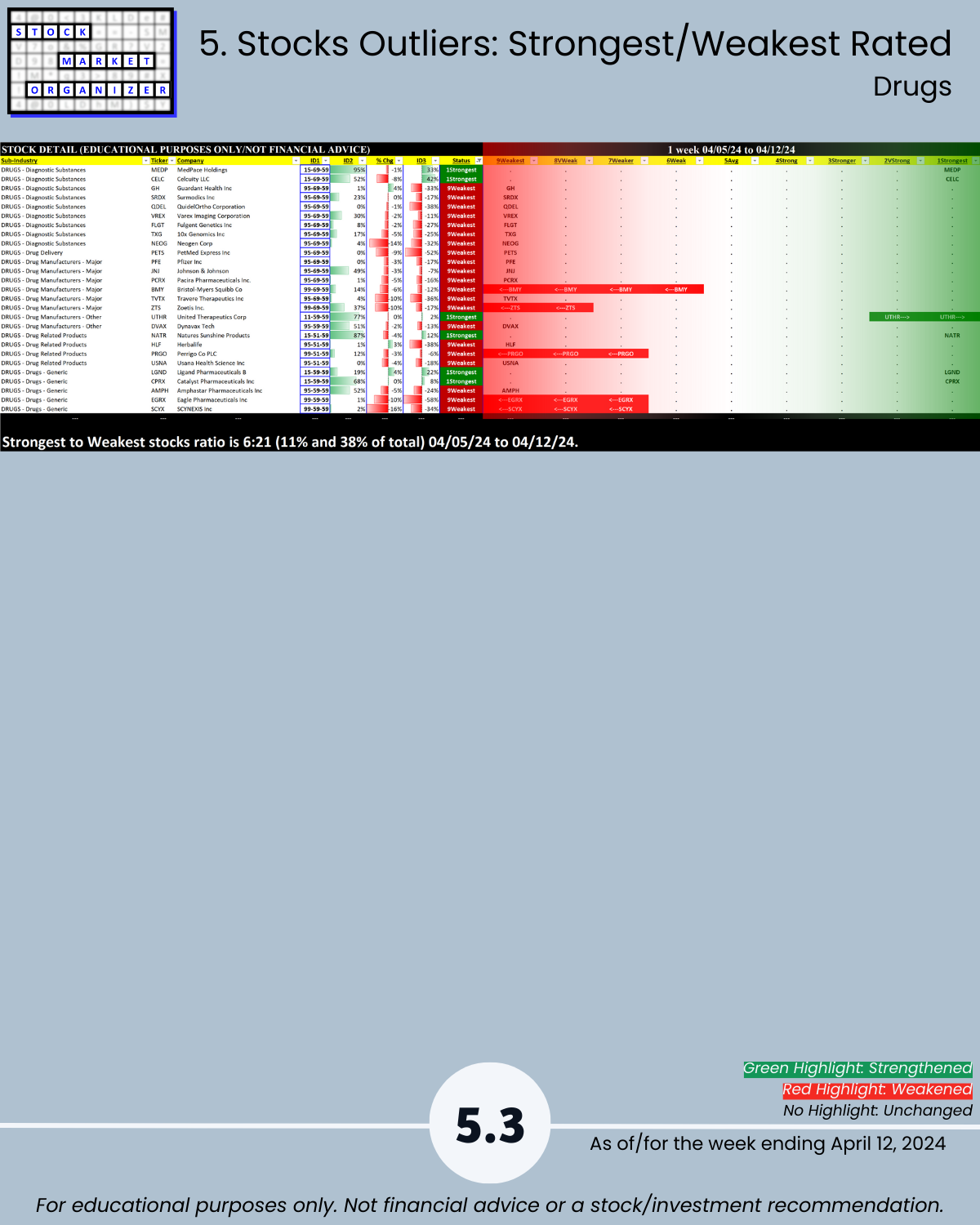

- @ 5 Year+ Highs/Lows: Drugs 14% lows

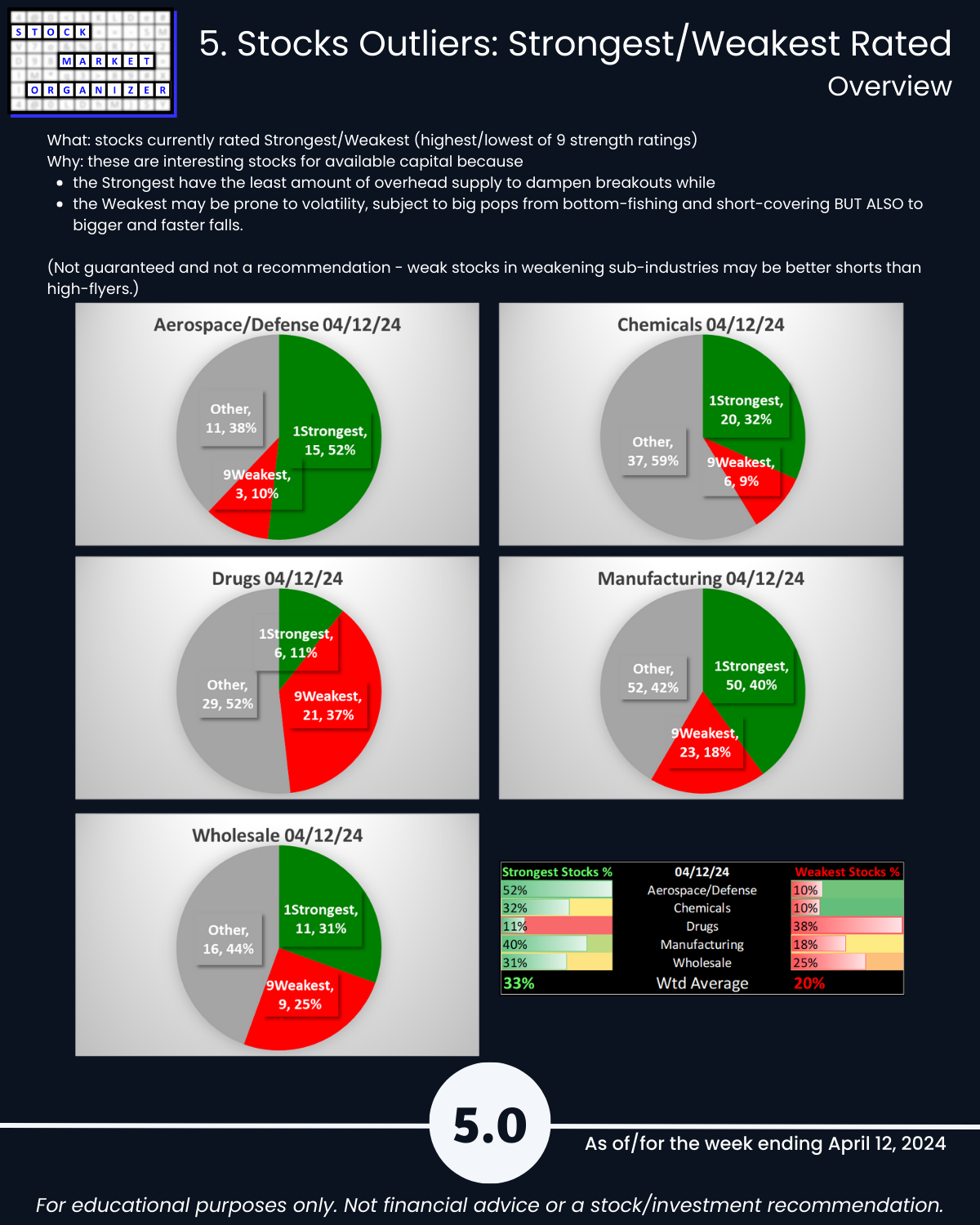

🔹 Stocks

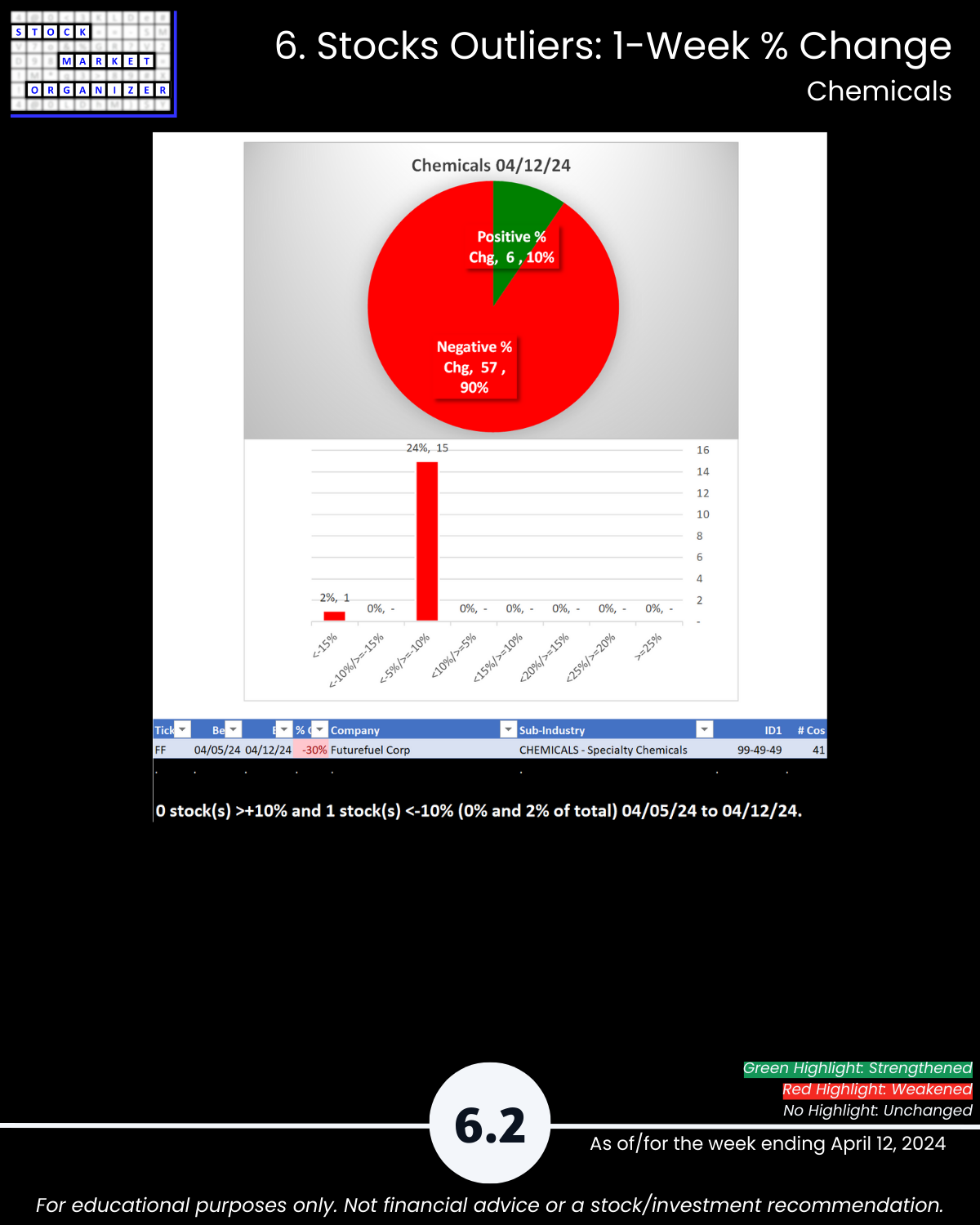

- Positive:Negative: Industry avg 10%/90%; Chemicals 90%, Manufacturing 94%, Wholesale 92% negative

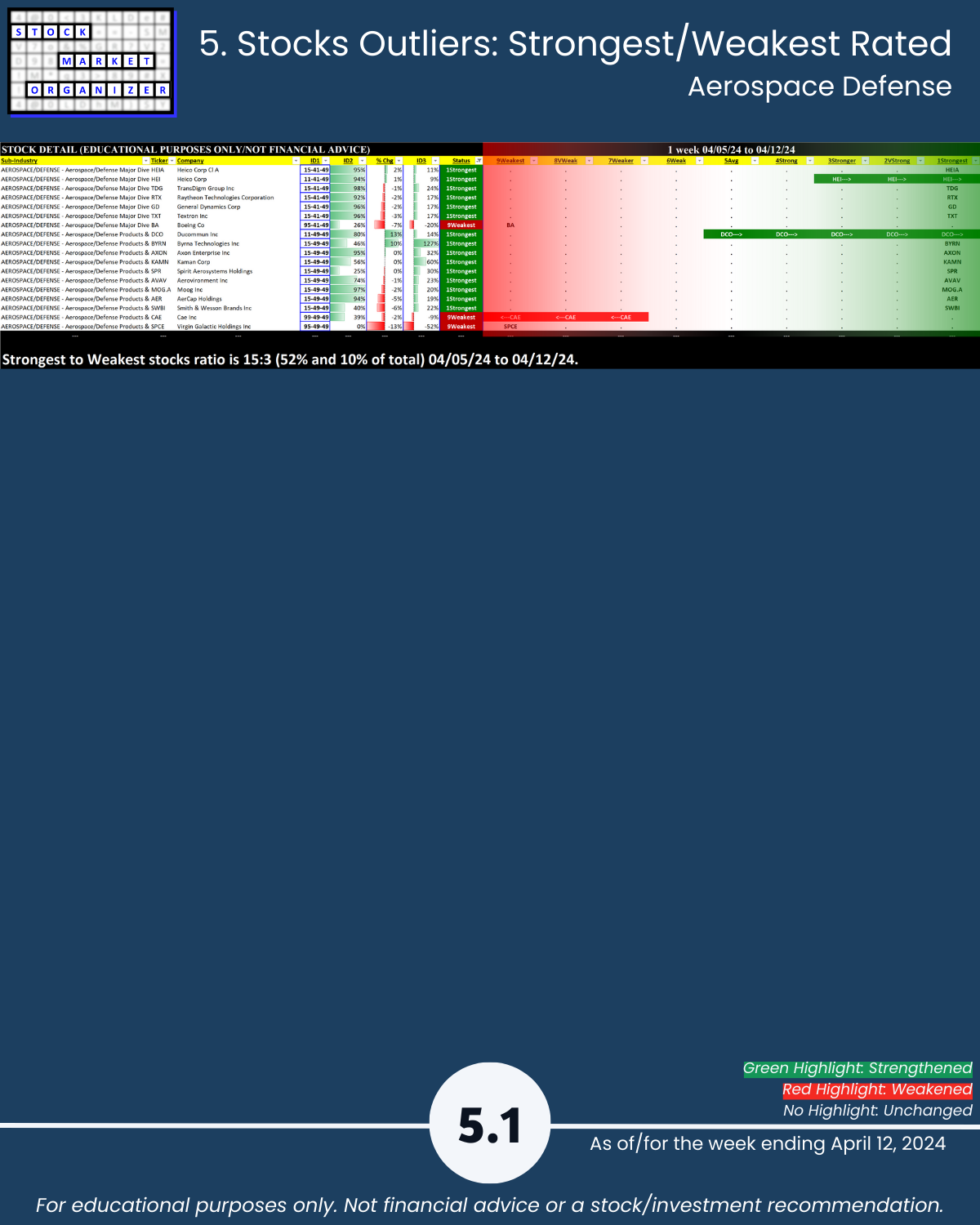

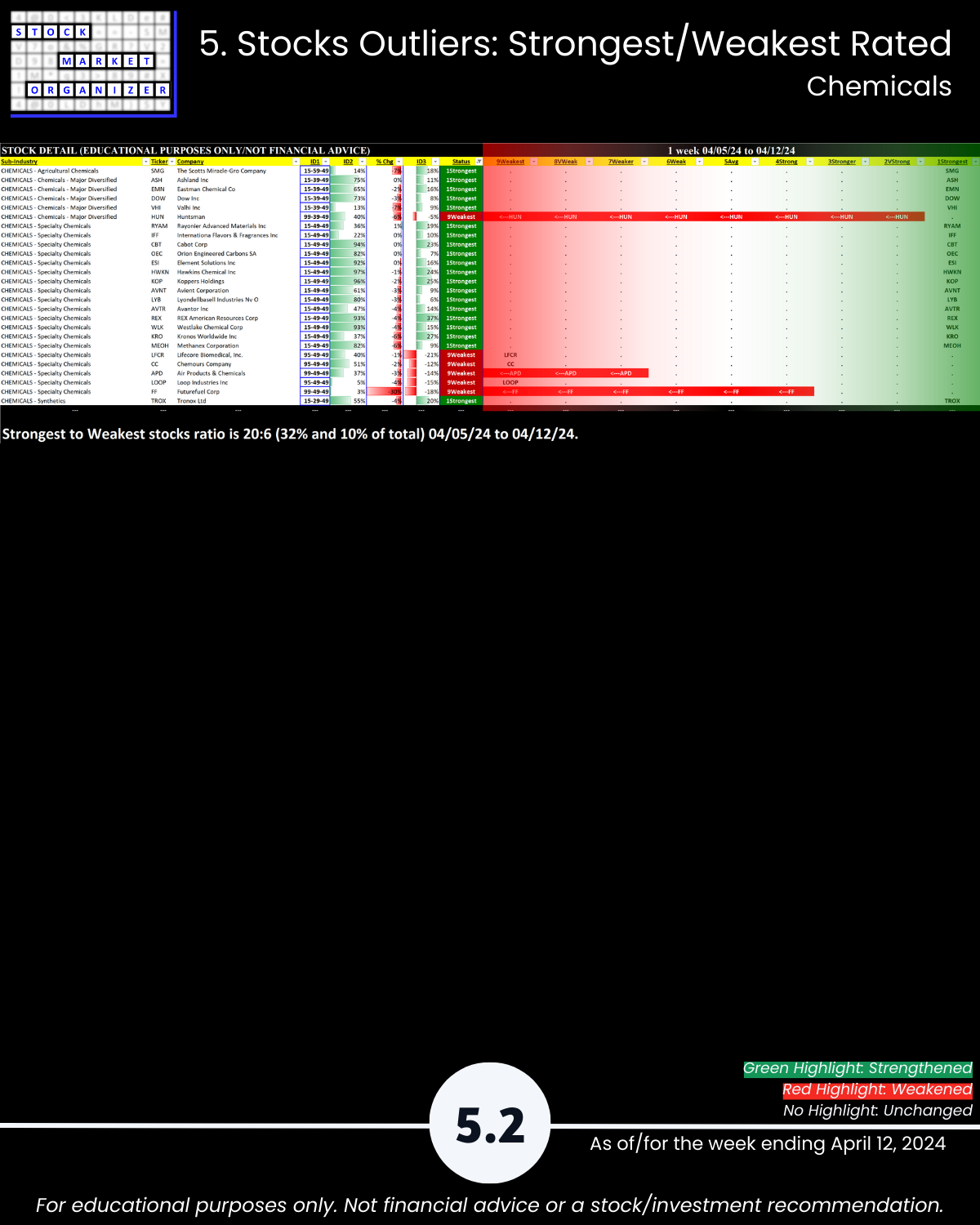

- Strongest:Weakest: Avg 33%/20%; Aero/Defense 52%:10%, Chemicals 32%:10%, Mfg 40%:18%; Drugs 11%:38%

- Outlier Stocks: FF -30%

- Drugs 13% stocks <-10%

WHAT’S HAPPENING HERE?

I am…

Finding U.S. Stock Market strength from the

top down,

inside out,

and bottom up, because

the stronger your stocks, the greener your P&L.

THE “WHY” BEHIND THIS METHOD (SEEKING STRENGTH MARKETWIDE)

The stronger your stocks the greener your P&L.

The journey to 100%+ returns begins with 10% returns.

The journey to multi-month rallies begins with one up week.

You won’t find what you aren’t looking for.

Look at any number of triple-digit gainers over the past year or less - obviously NVDA, certainly CVNA, SKYW, POWL, ANF, SMCI.

Each started with 10% gains.

Maybe 10% gainers keep going, and maybe they don’t.

But if you aren’t looking for them, and what might keep them rising (strengthening sub-industry, industry, and market), then you won’t find them.

The market does not have to be so complicated.

This report may particularly be of interest if the following 5 concepts resonate with you:

- The stronger your stocks, the greener your P&L.

- The journey to 100%+ returns begins with 10% returns.

- The journey to a multi-month rally begins with one up week.

- Most stocks do what the market does. (While the market can only do what its underlying stocks, sub-industries, and industries do.)

- 80/20: not all information is created equal. (Press buttons, not balloons.)

Following are galleries with page-by-page views of this report.

1. Introduction

2. Industry 1-Week Strengthening

3. Industry 10-Week Strengthening

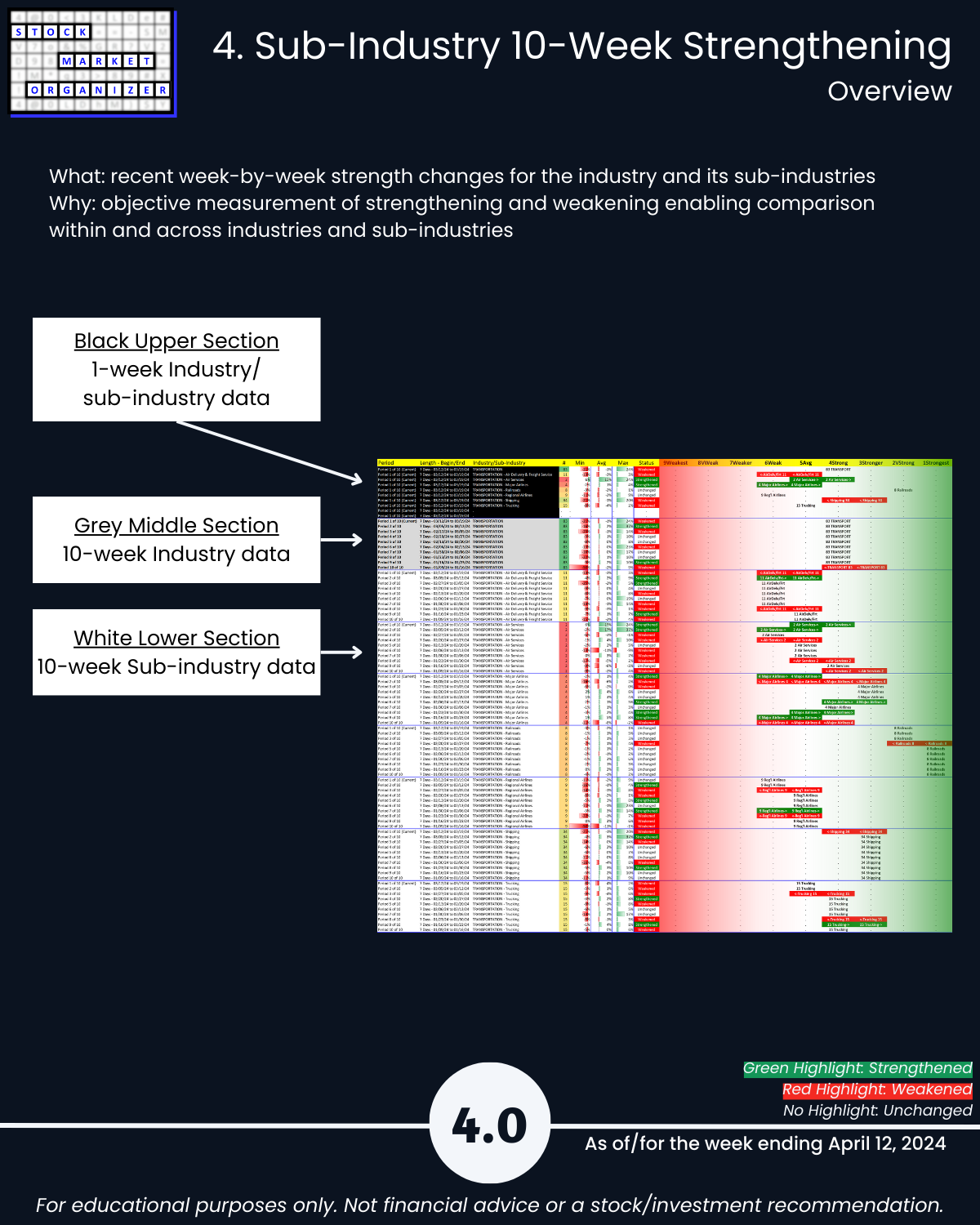

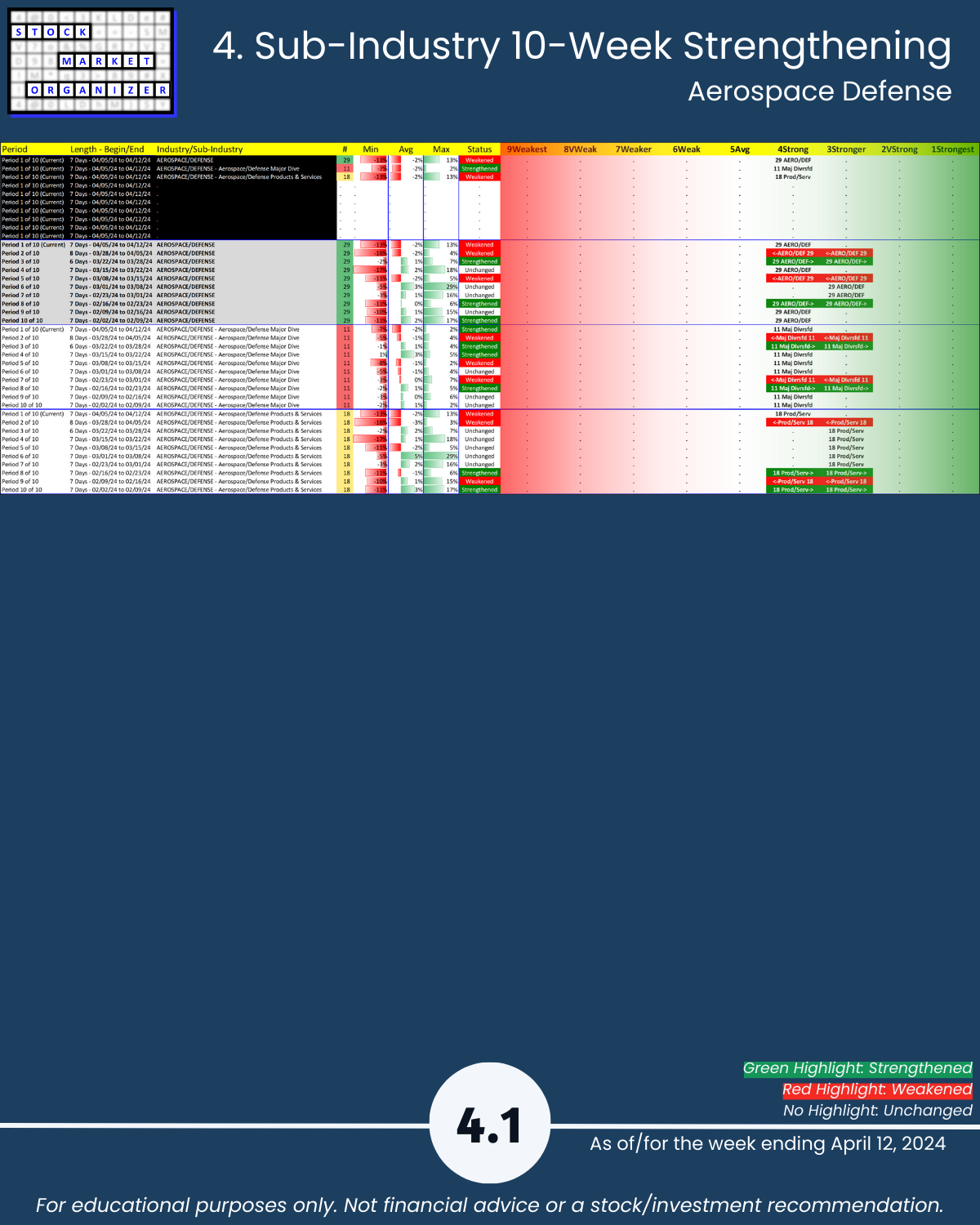

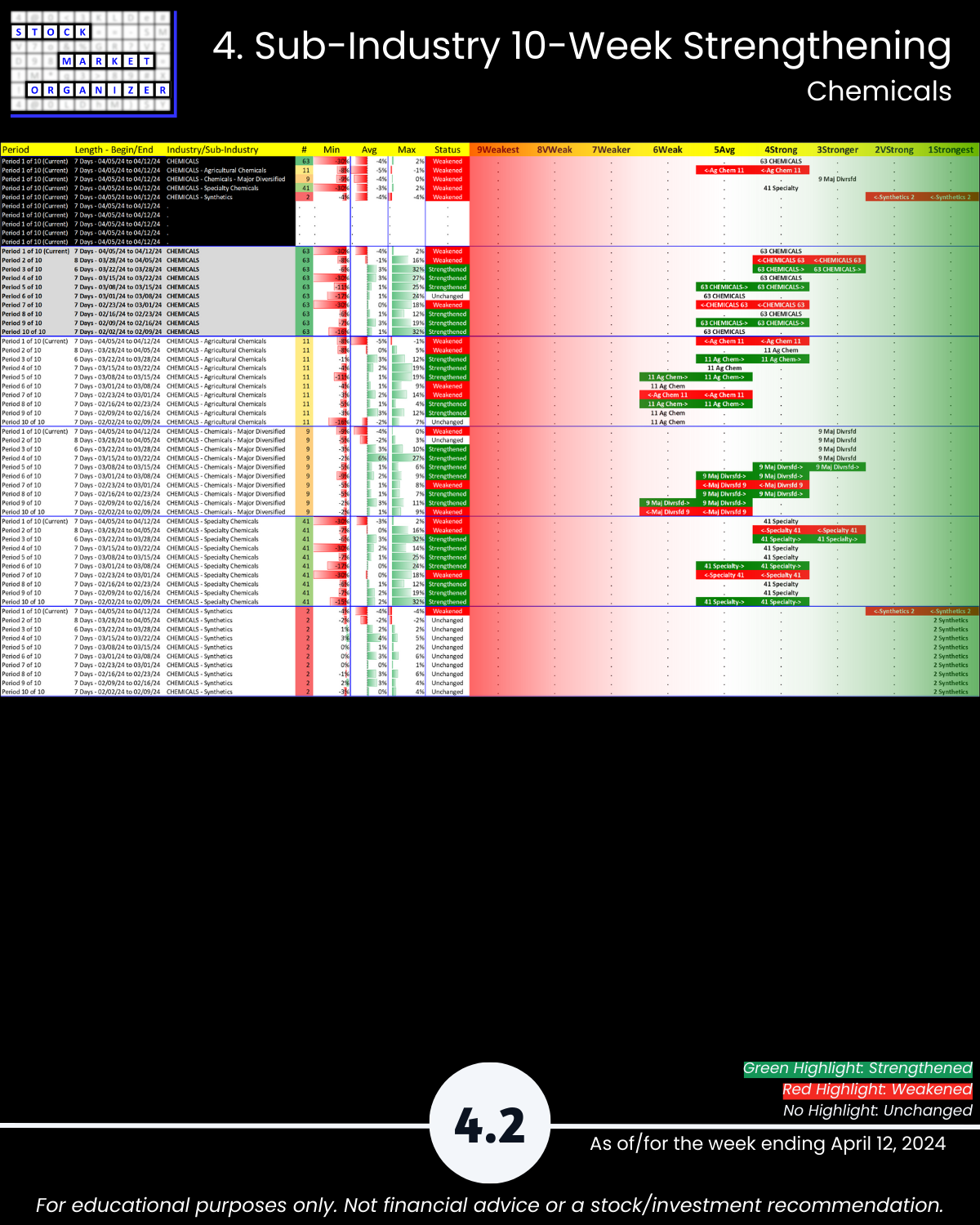

4. Sub-Industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

6. Stocks Outliers: 1-Week % Change

7. Stocks Outliers: 5-Year Highs/Lows