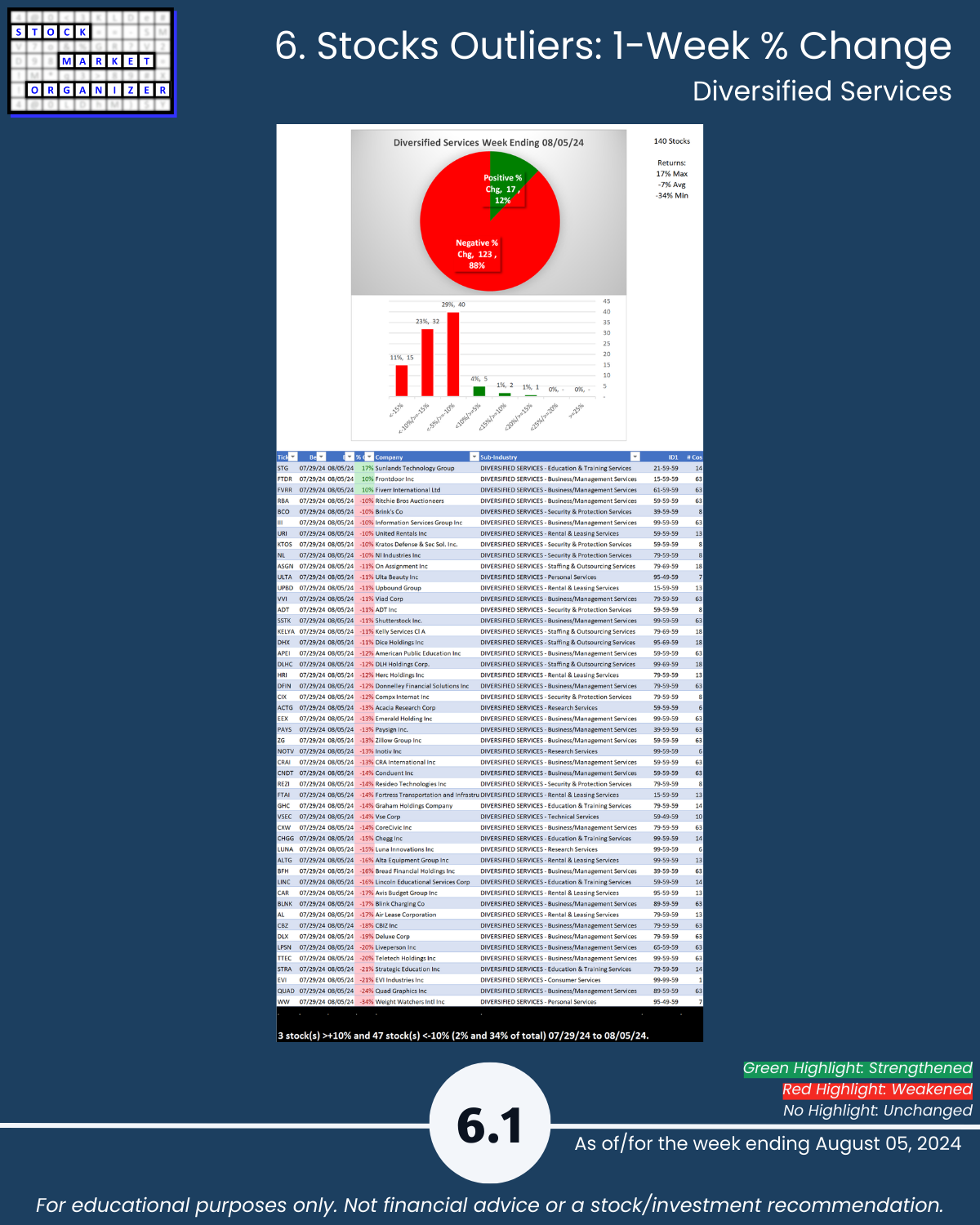

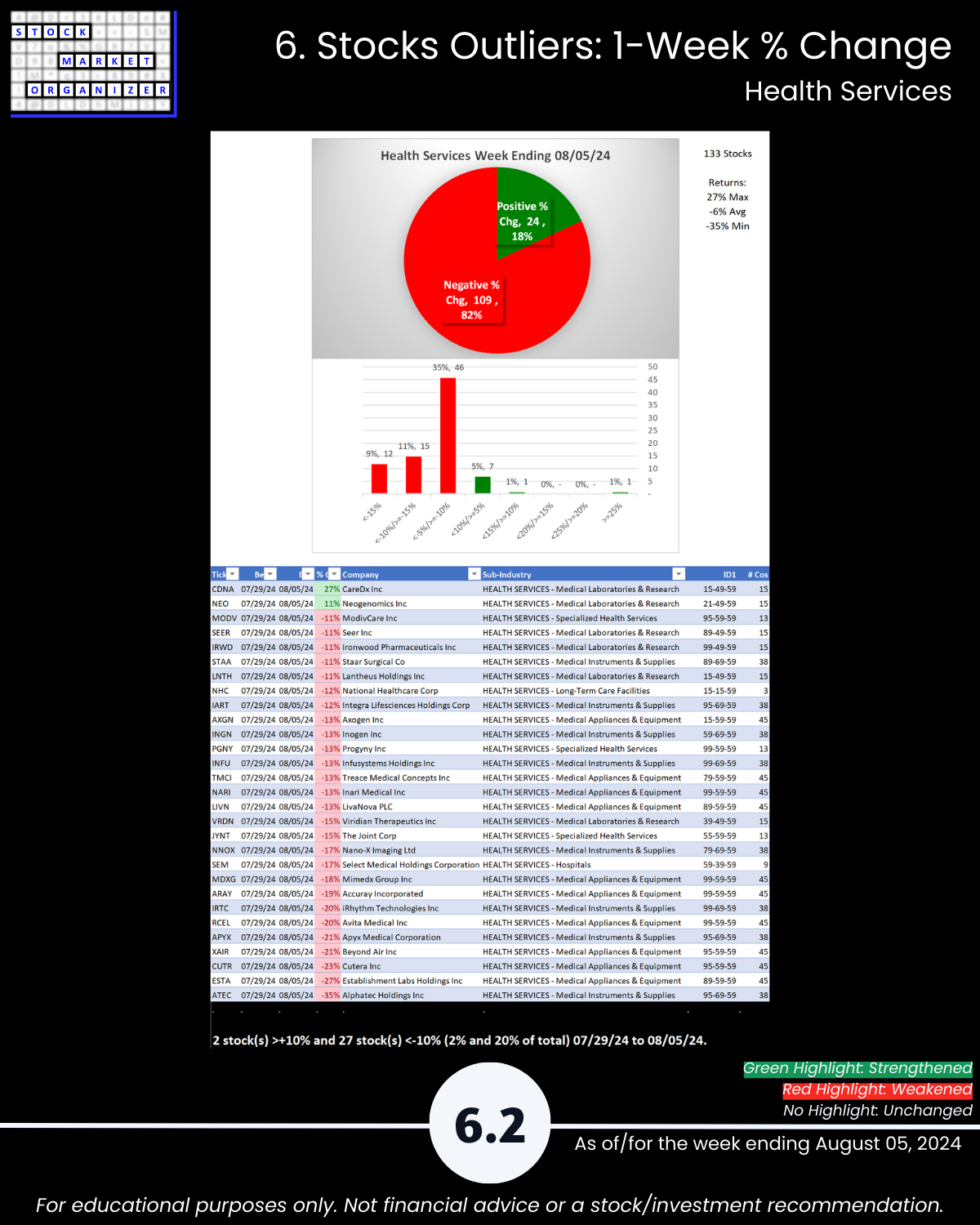

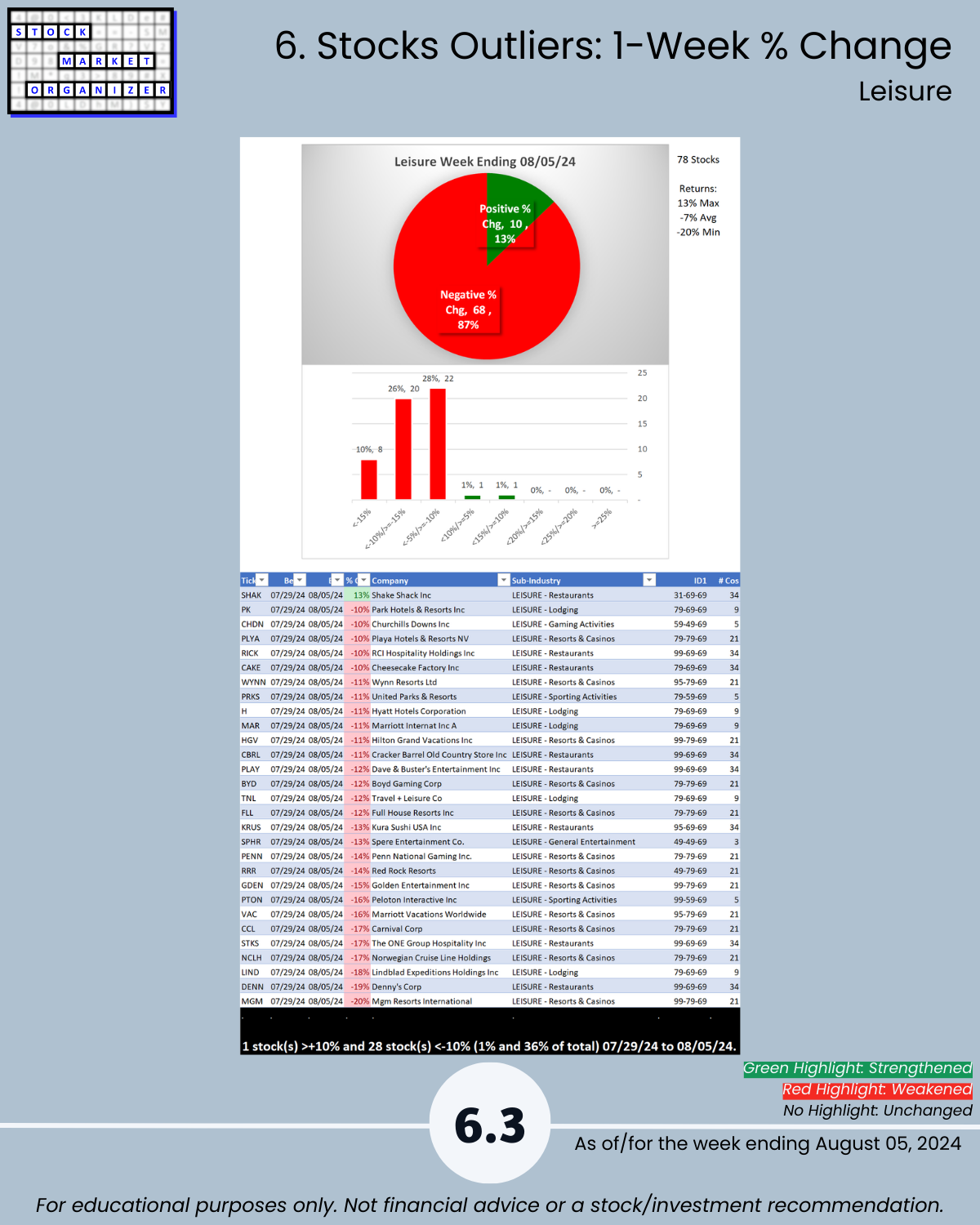

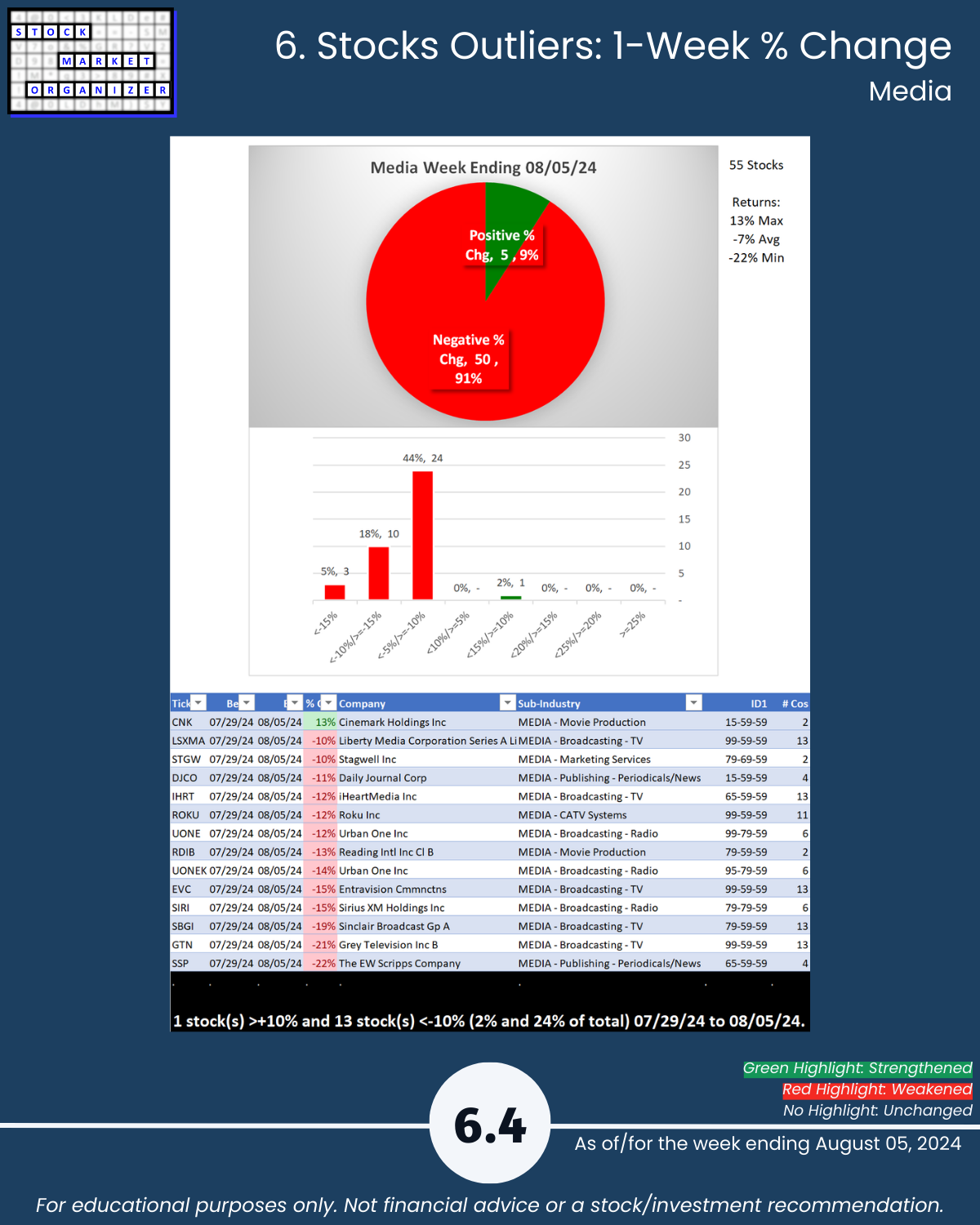

SMO Exclusive: Strength Report Group 2 2024-08-05

8/5/24 Stock Market Organizer Industry Group 2 report attached (covers the Diversified Services, Health Services, Leisure, Media, and Utilities industries). Nikkei +10% after its worst day since 1987 and its biggest 2 day drop ever. What was the flaw in the thinking that one shouldn’t attempt to time the market because missing out on the XX best days leads to drastically reduced results? Oh yeah, I remember… IT IS IMPOSSIBLE TO MISS THE XX BEST DAYS BUT NOT THE XX WORST DAYS. Good and bad days cluster. Volatility clusters. But, please, do emphasize how it is “time in the market, not market timing.”

There are certainly reasons to LTB&H, but fearing sub-par returns due to missing the best days is not one of them. Misinformation helps no one.

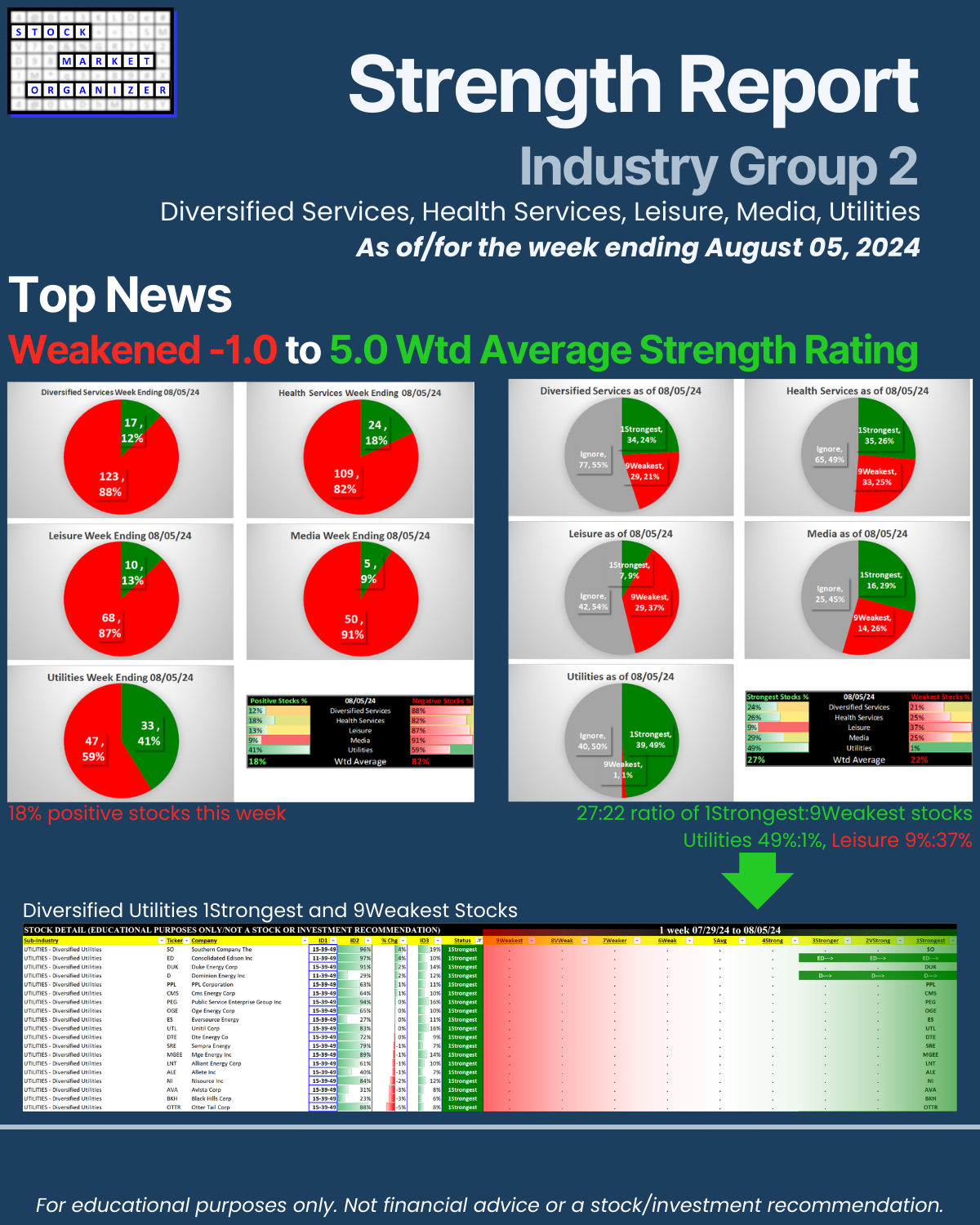

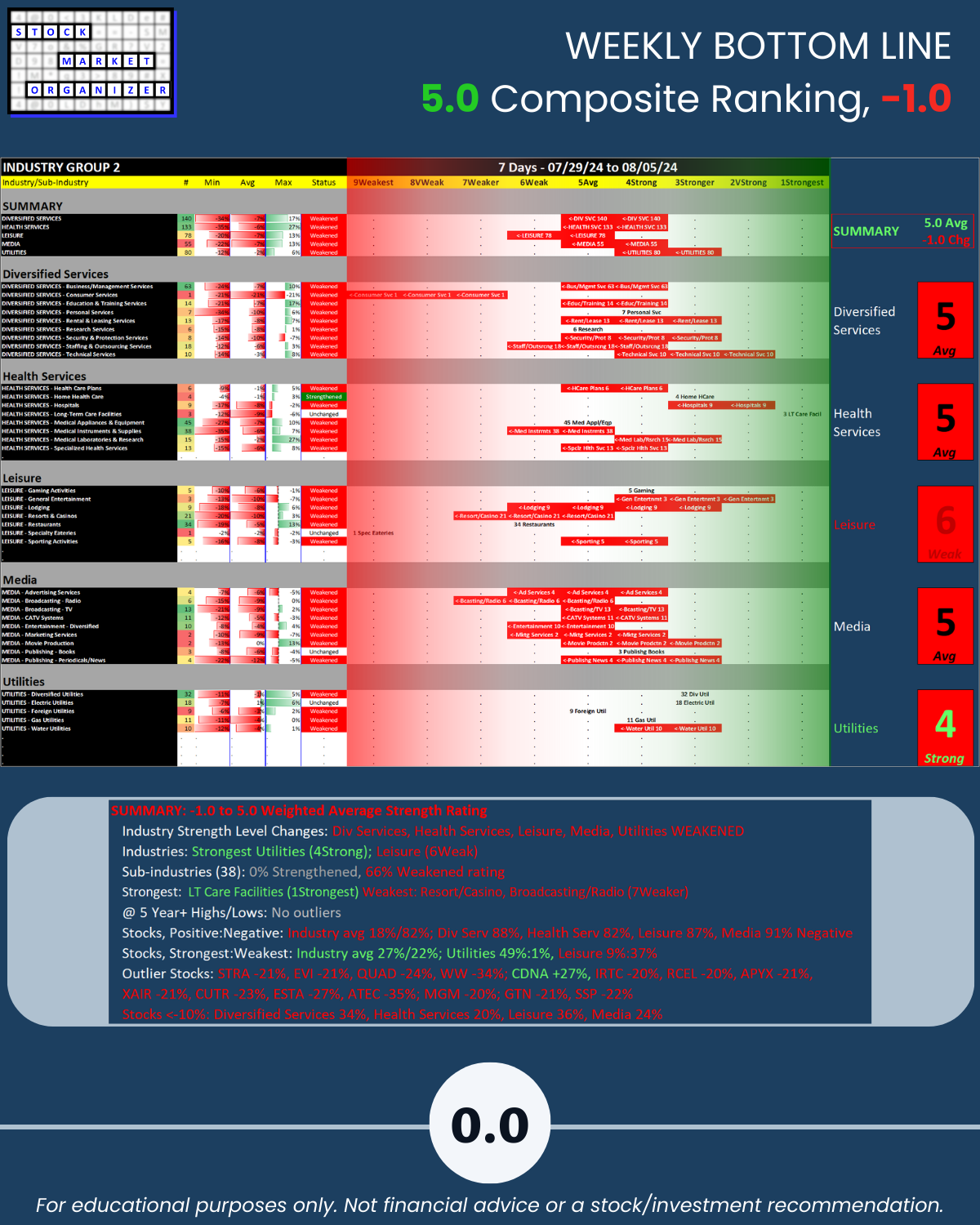

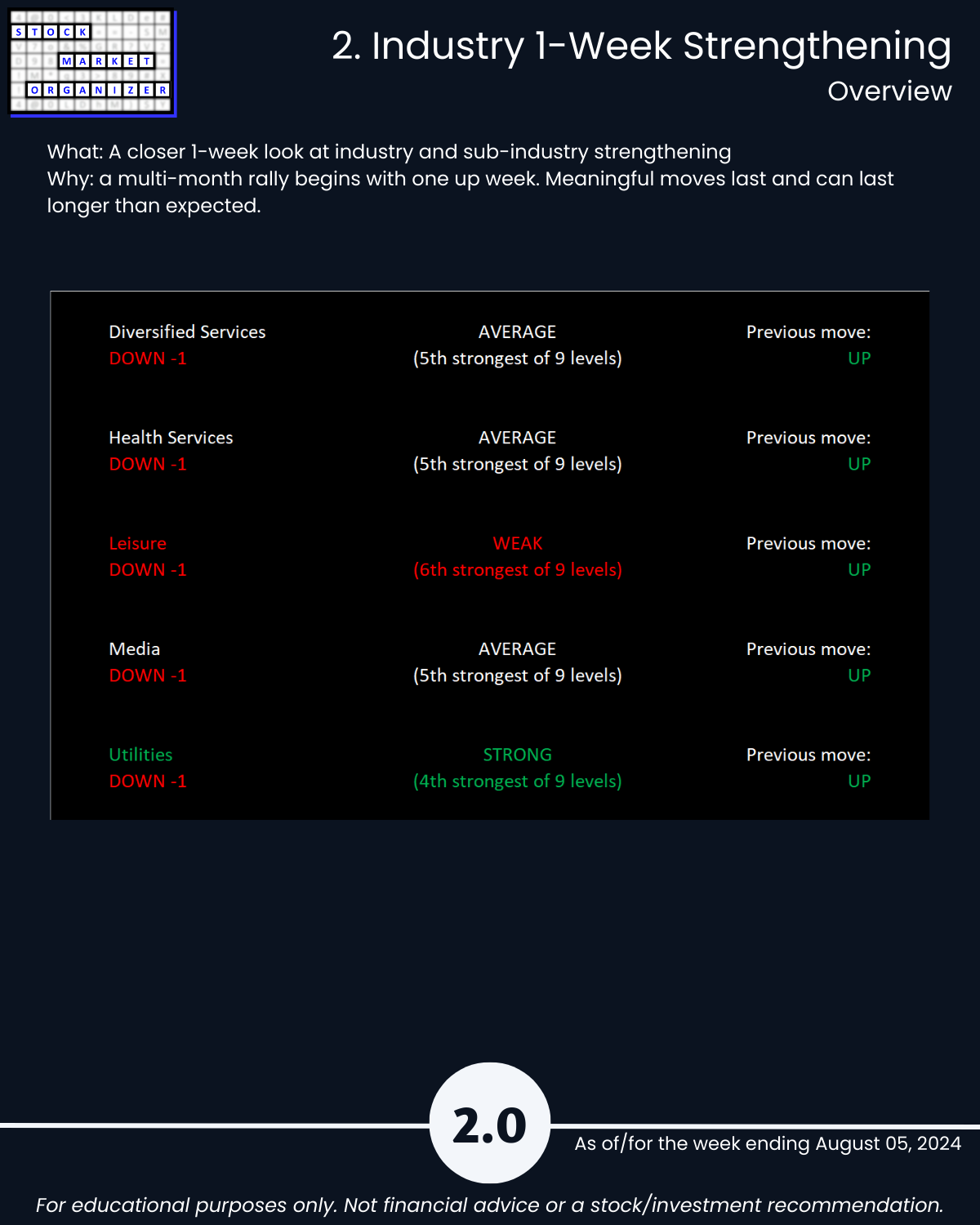

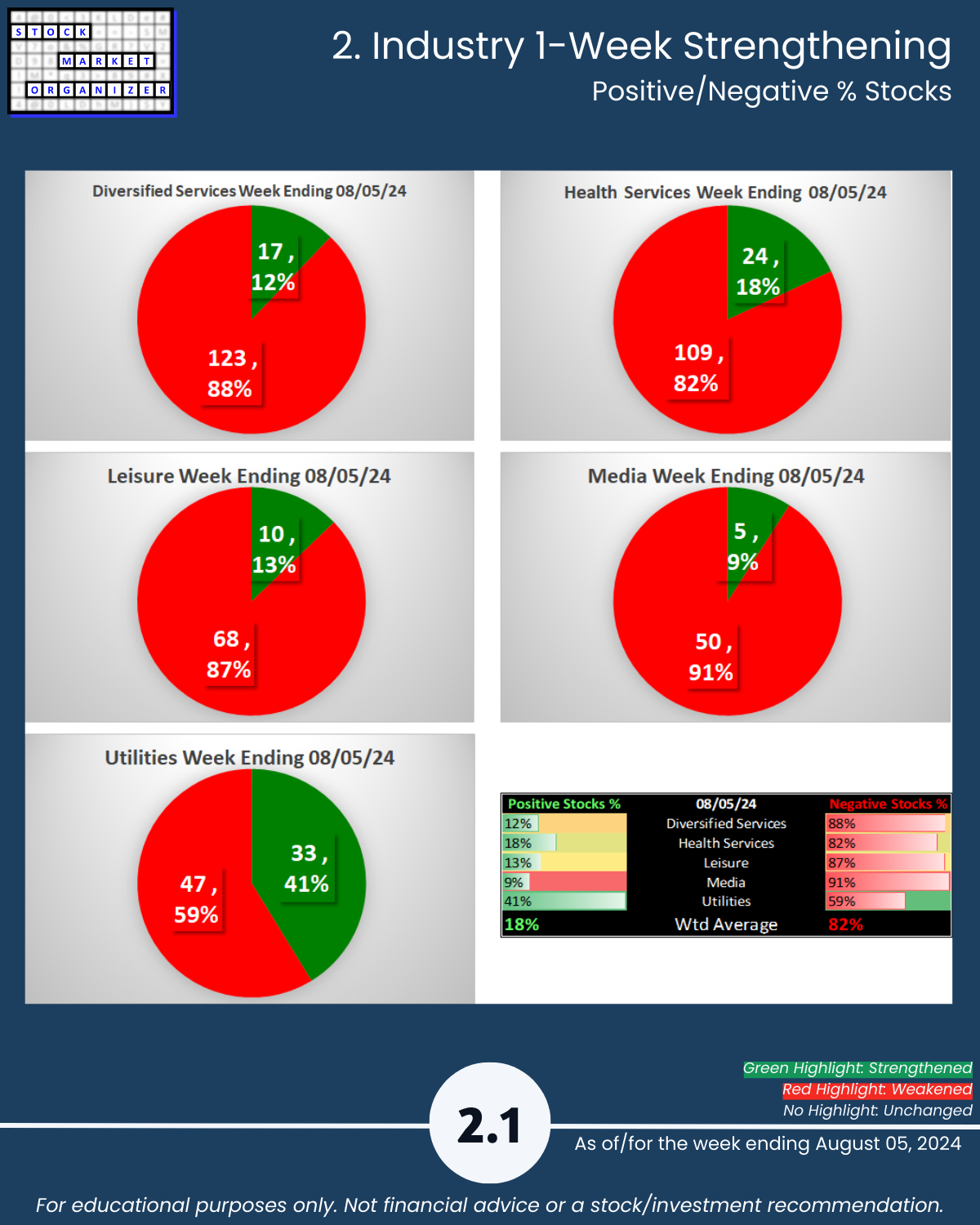

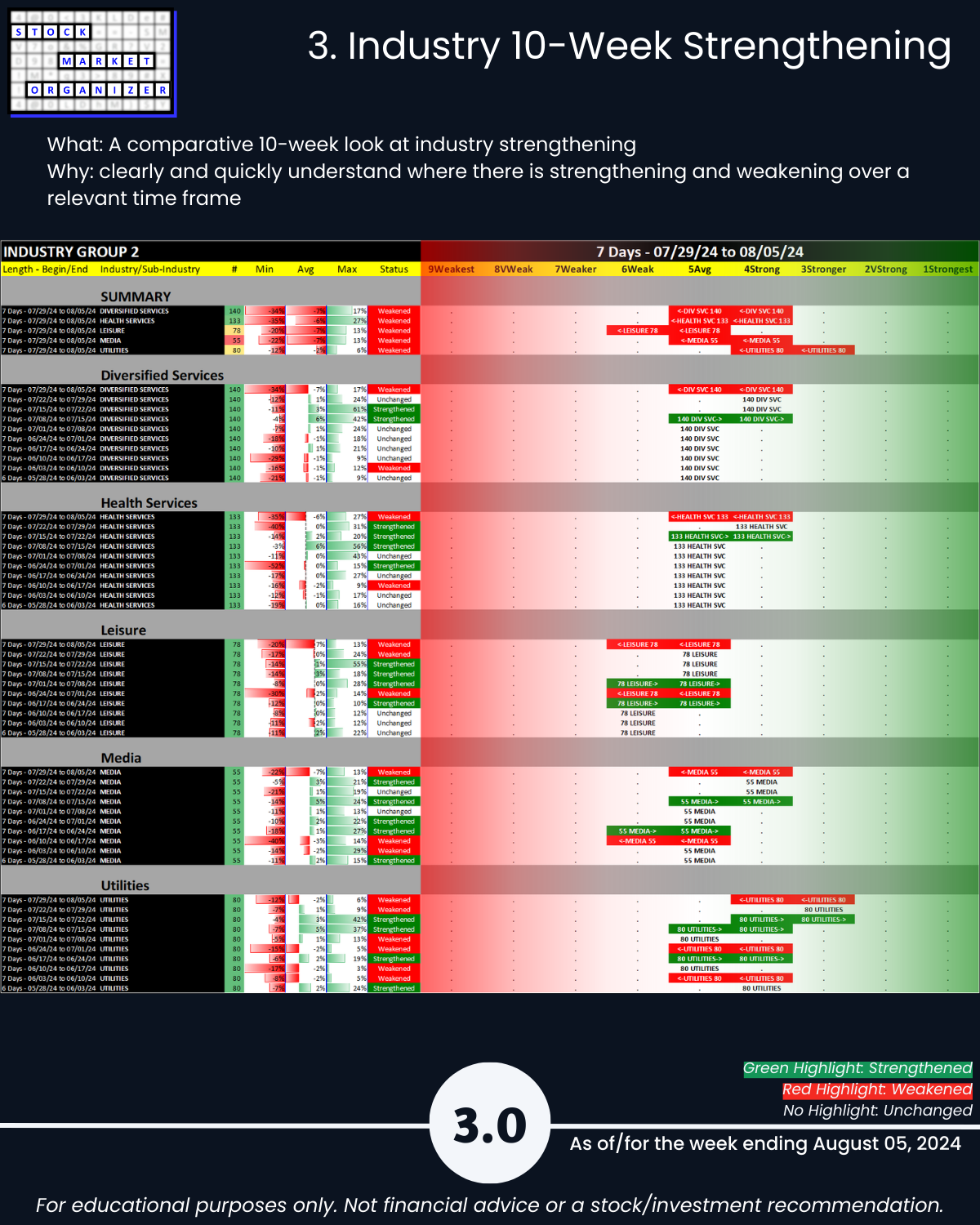

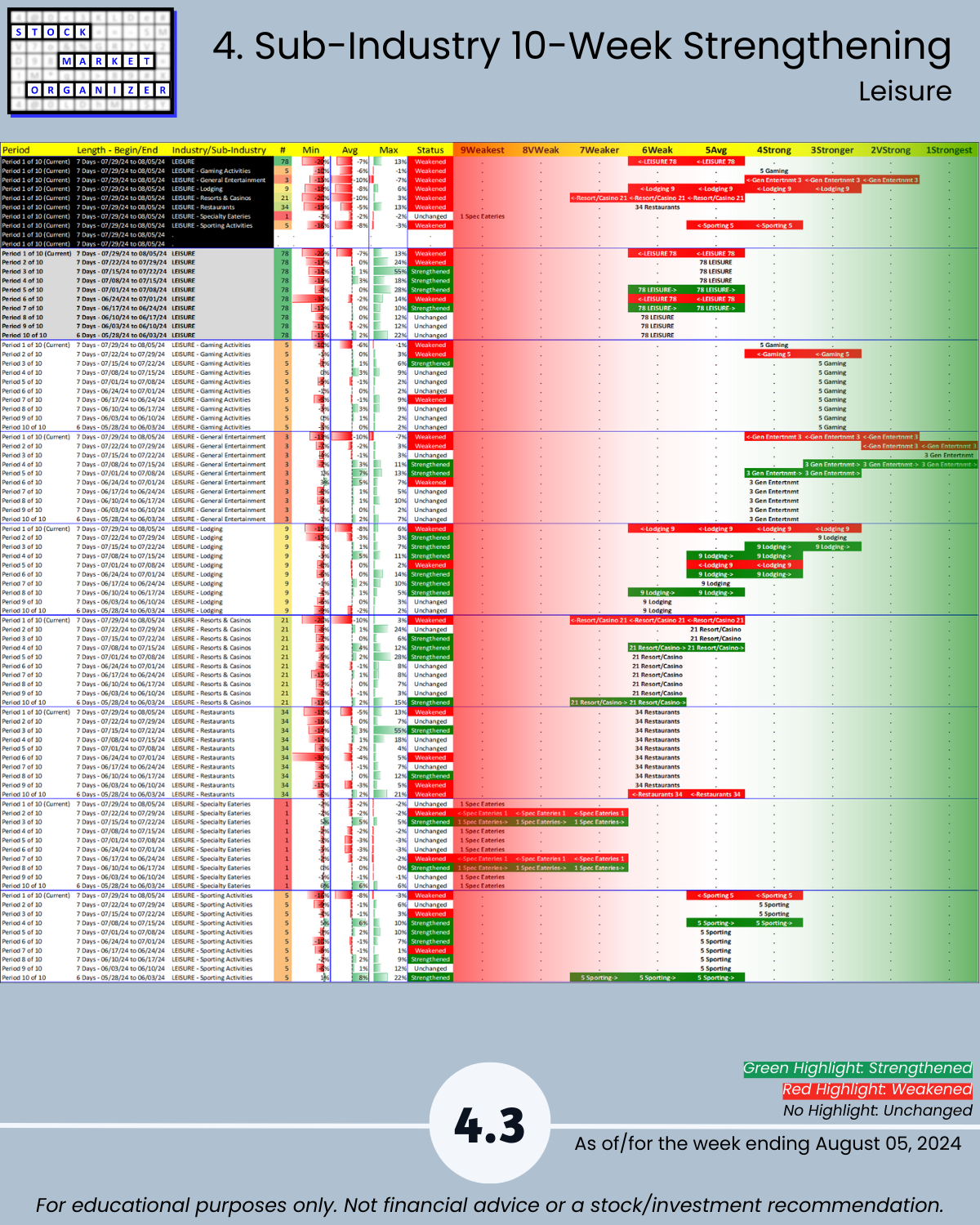

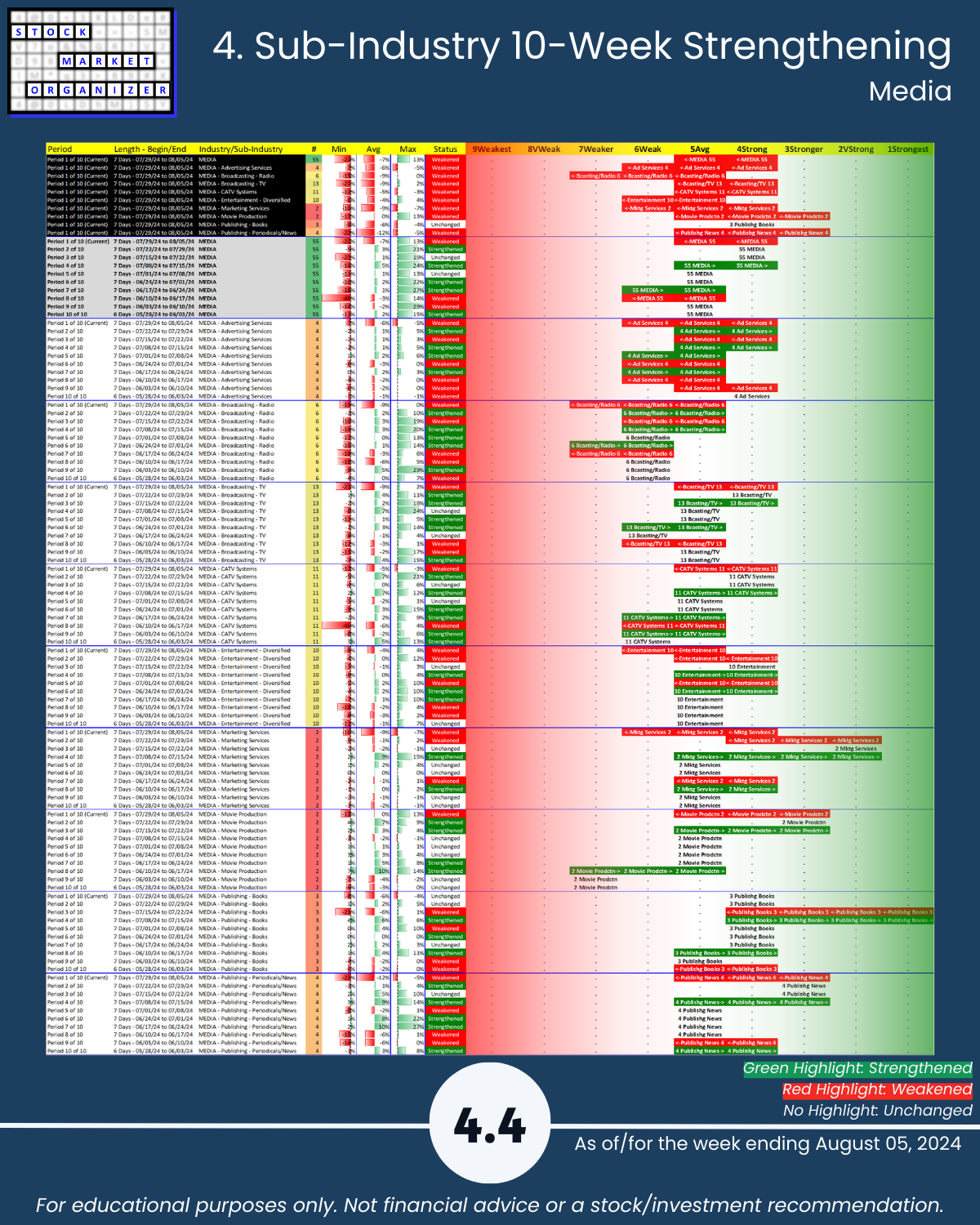

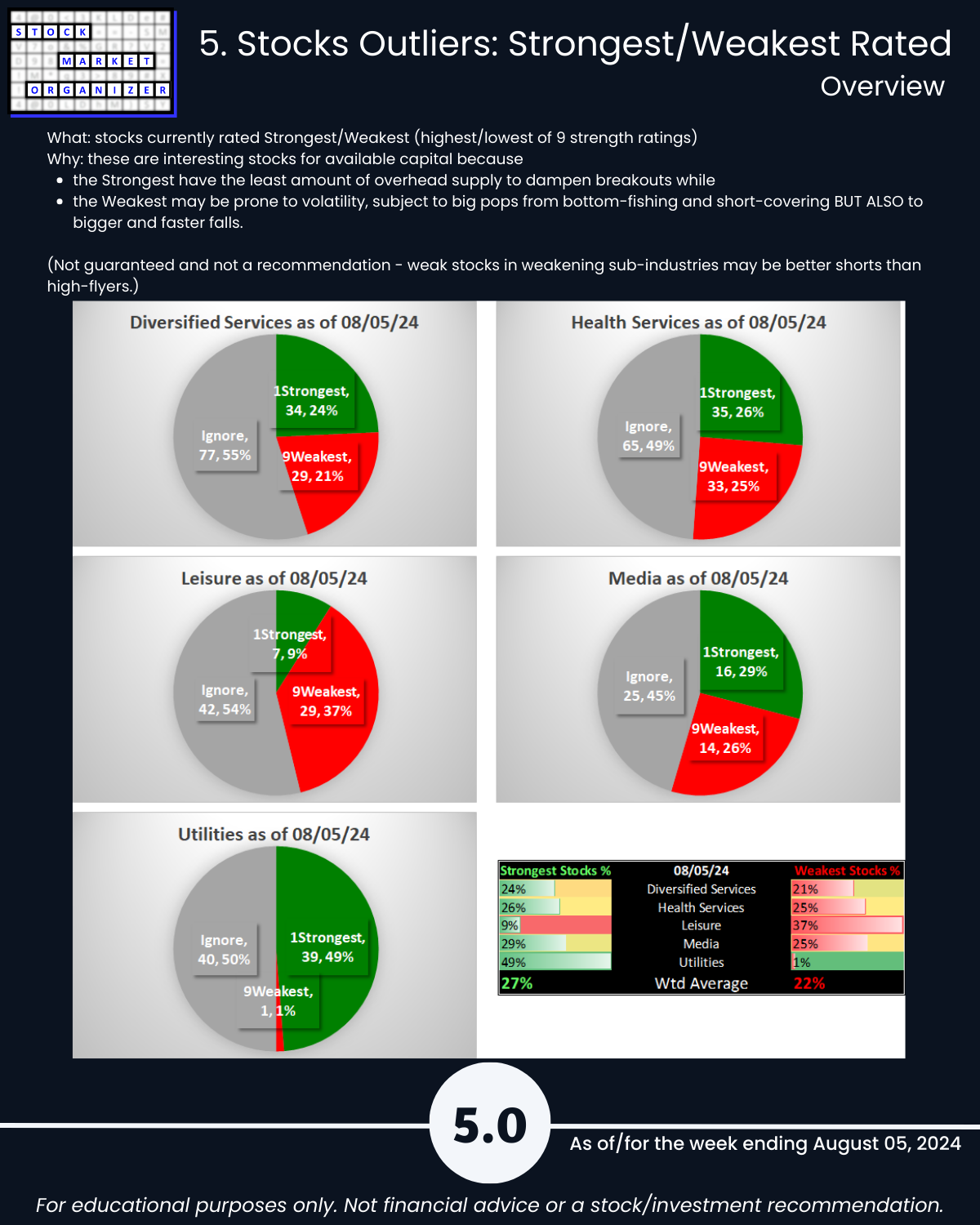

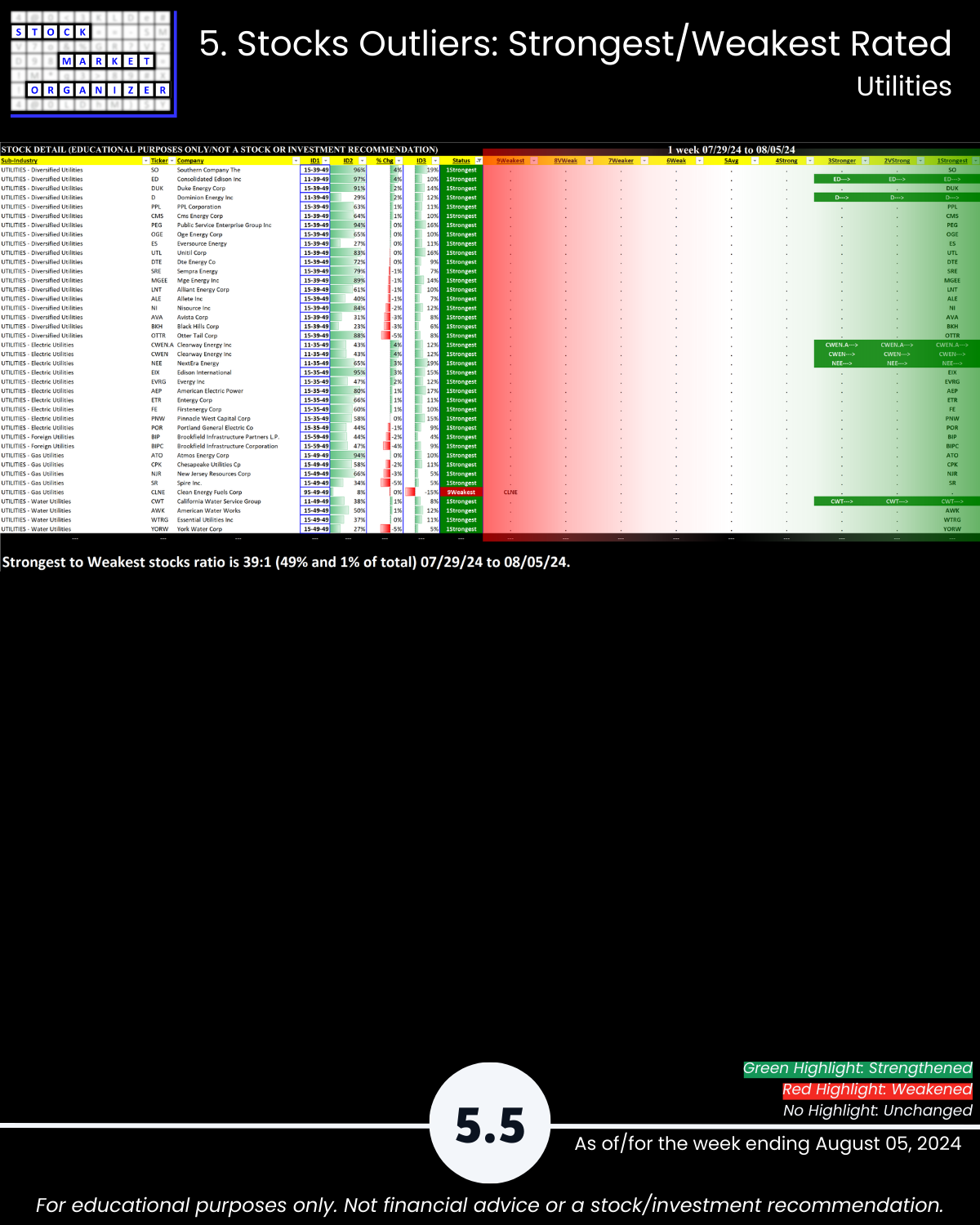

Back to this strength report – this industry grouping weakened significantly over the past week by -1.0 to a 5.0 weighted average strength rating. Much more detail in the attached including a segmenting by sub-industry of the Strongest and Weakest (in Stock Market Organizer parlance) stocks.

This report may particularly be of interest if the following 5 concepts resonate with you:

- The stronger your stocks, the greener your P&L.

- The journey to 100%+ returns begins with 10% returns.

- The journey to a multi-month rally begins with one up week.

- Most stocks do what the market does. (While the market can only do what its underlying stocks, sub-industries, and industries do.)

- 80/20: not all information is created equal. (Press buttons, not balloons.)

Following are galleries with page-by-page views of this report.

1. Introduction

2. Industry 1-Week Strengthening

3. Industry 10-Week Strengthening

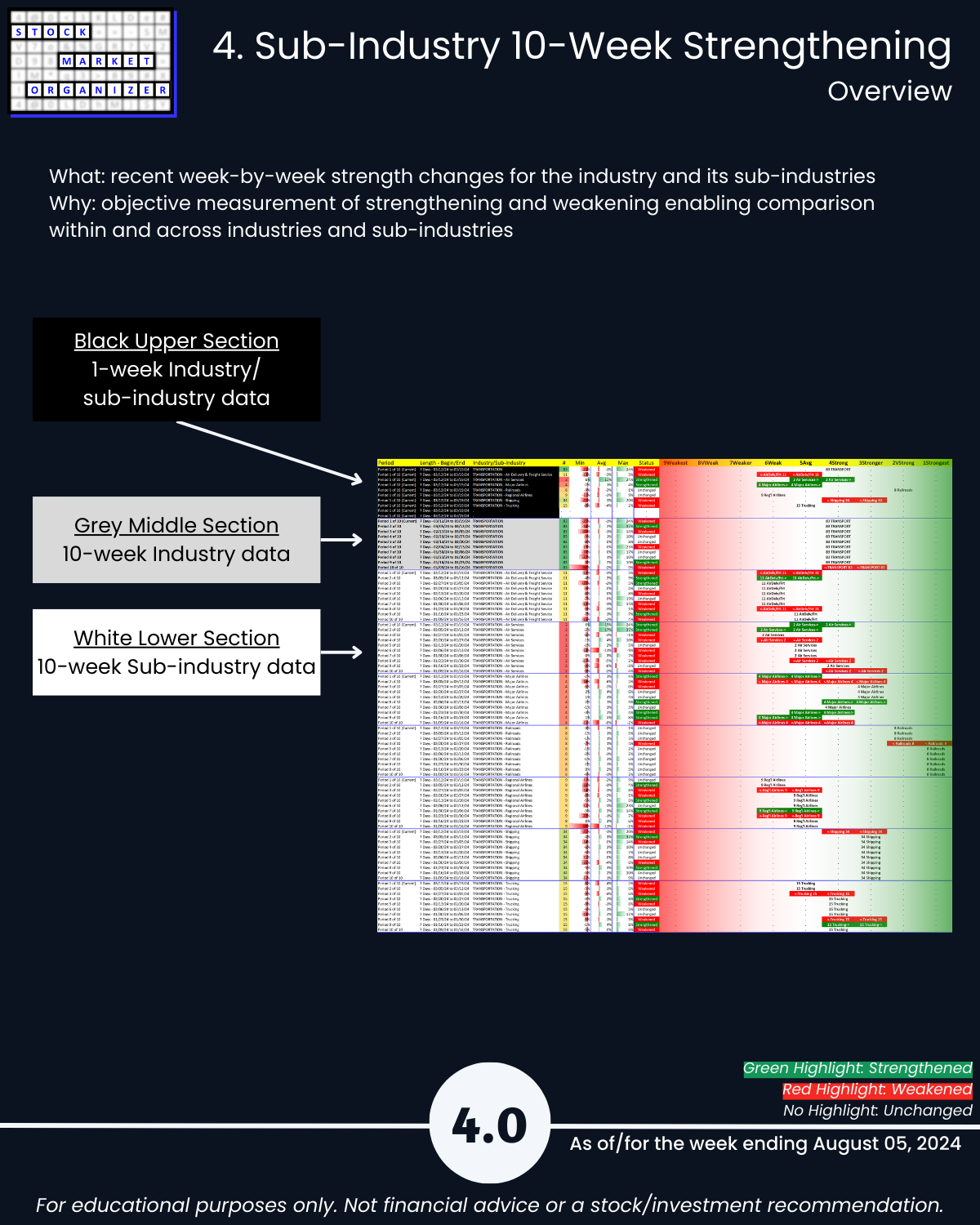

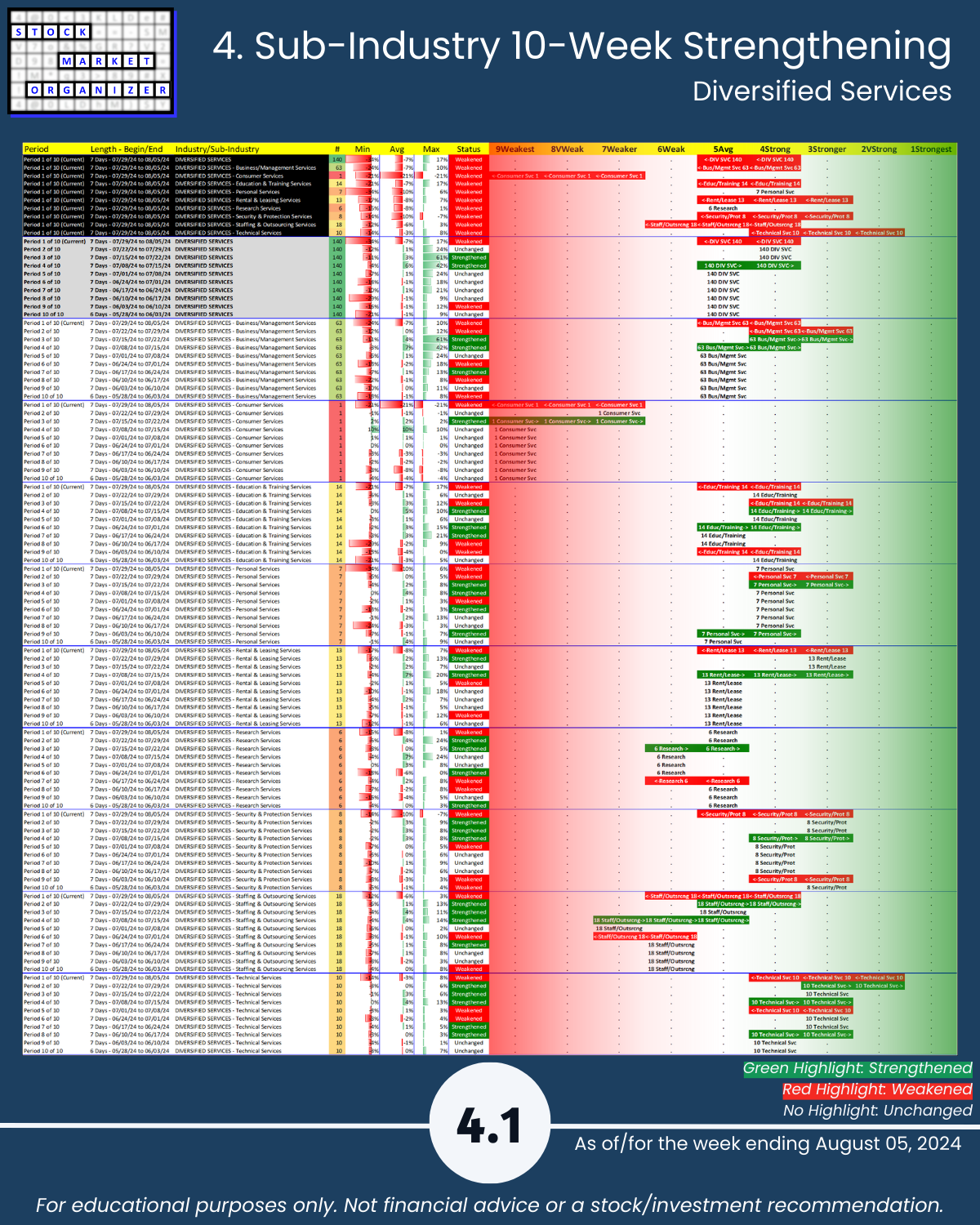

4. Sub-Industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

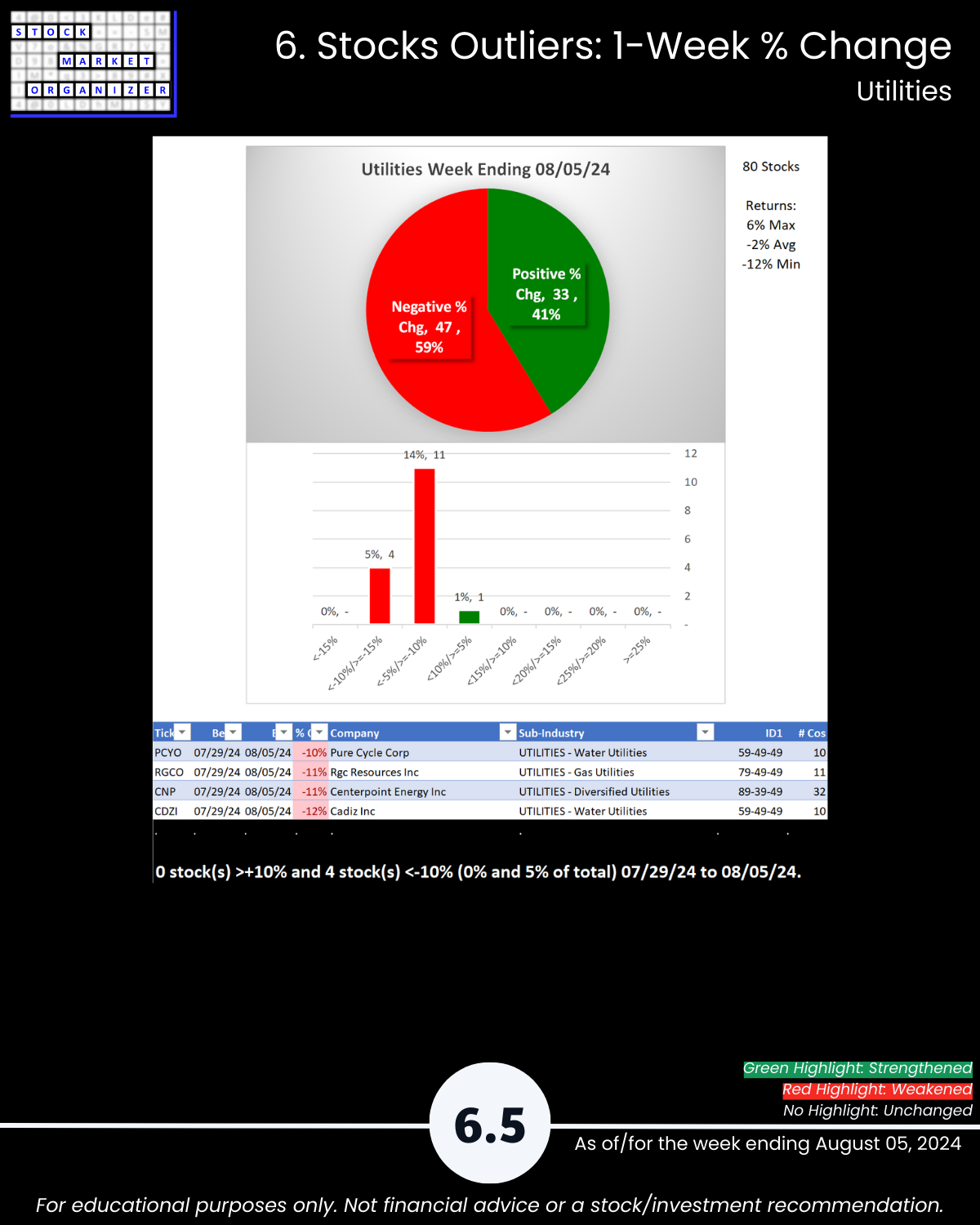

6. Stocks Outliers: 1-Week % Change

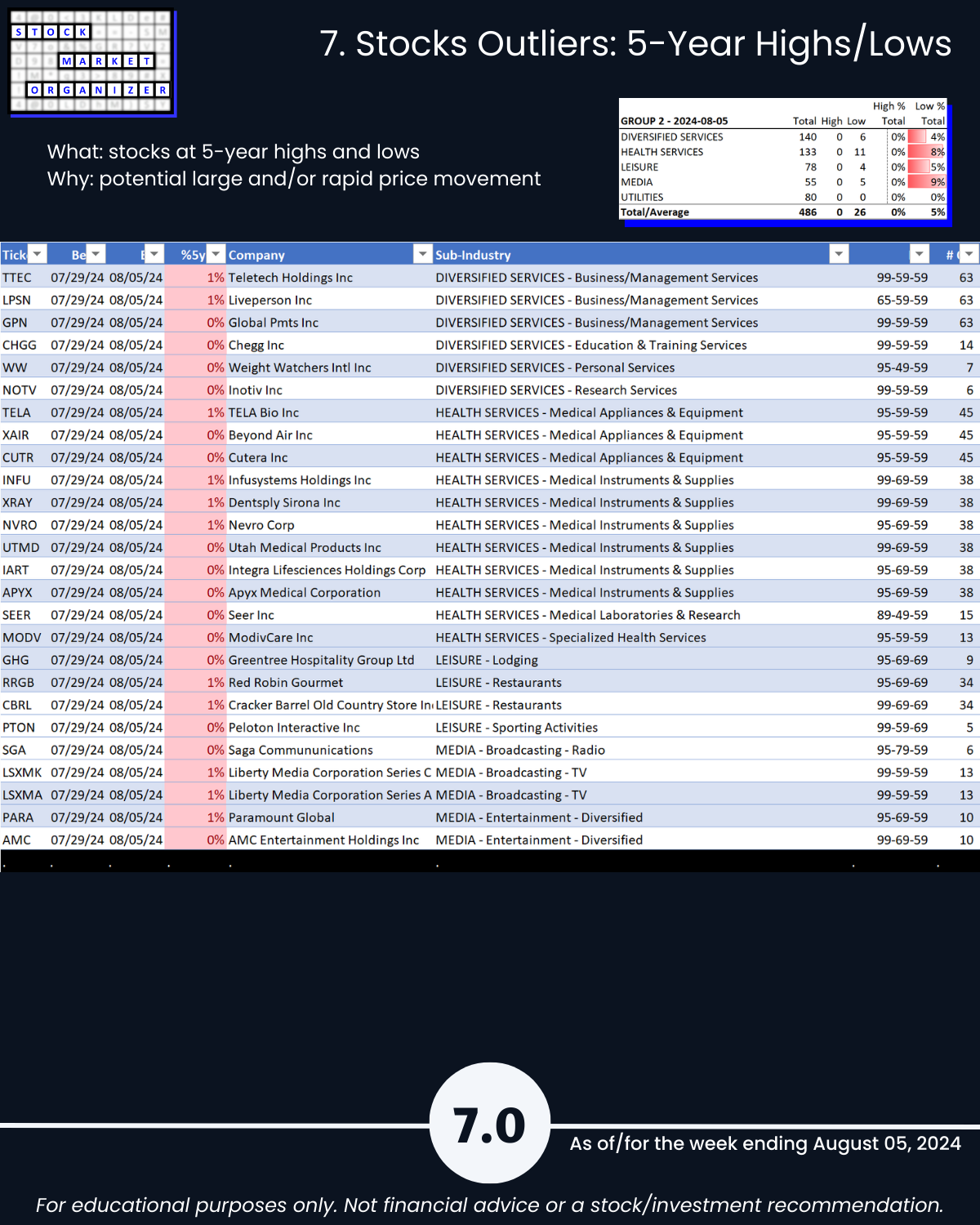

7. Stocks Outliers: 5-Year Highs/Lows