SMO Exclusive: Strength Report Group 2 2024-04-01

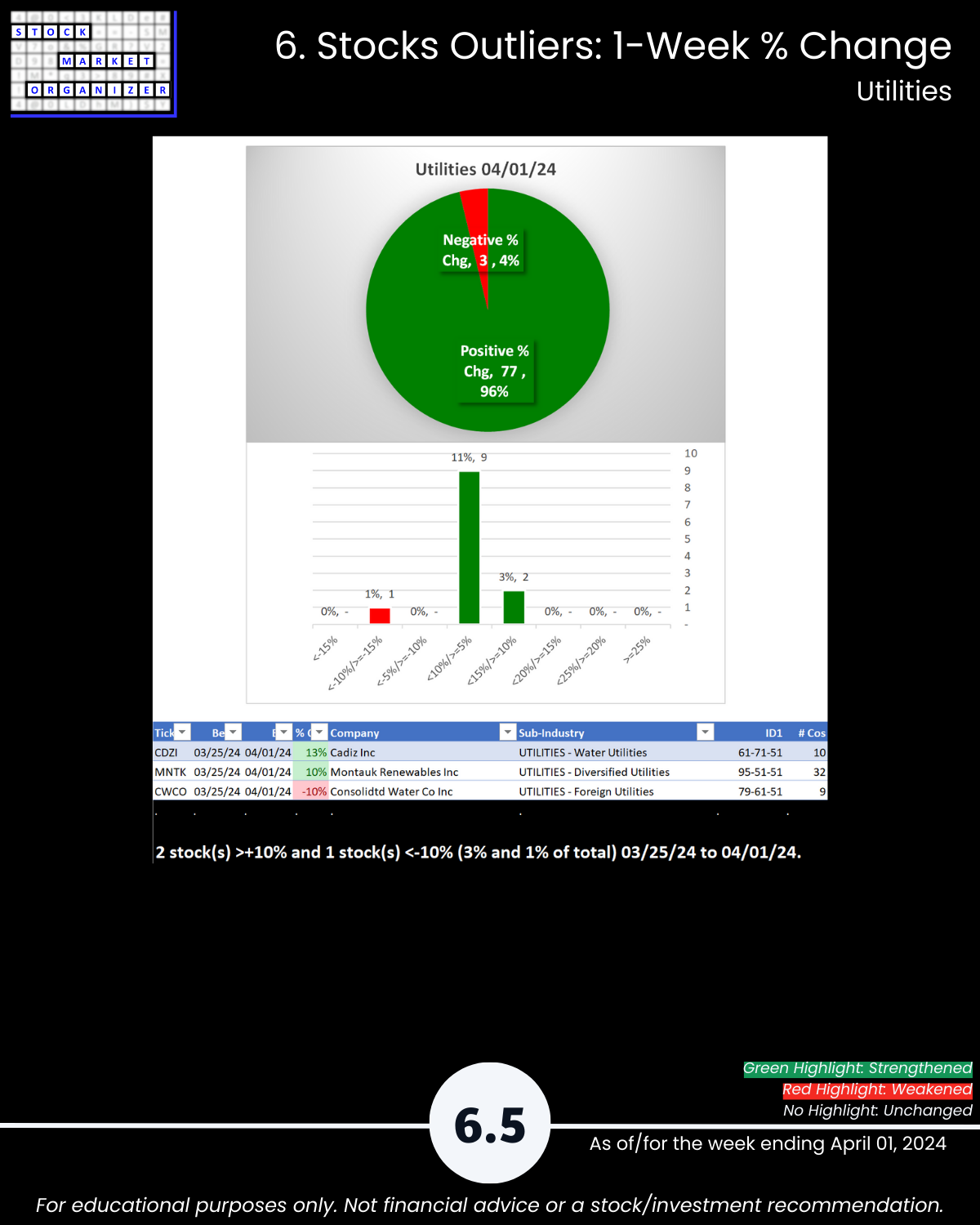

4/1/24 U.S. Market report no April Fool’s Day joke Utilities 96% positive stocks this week, continuing its improvement. What does this tell us, if anything, about rotation into other areas besides tech? I don’t know. I just know what to do about it. I also know where there is strengthening elsewhere in the market.

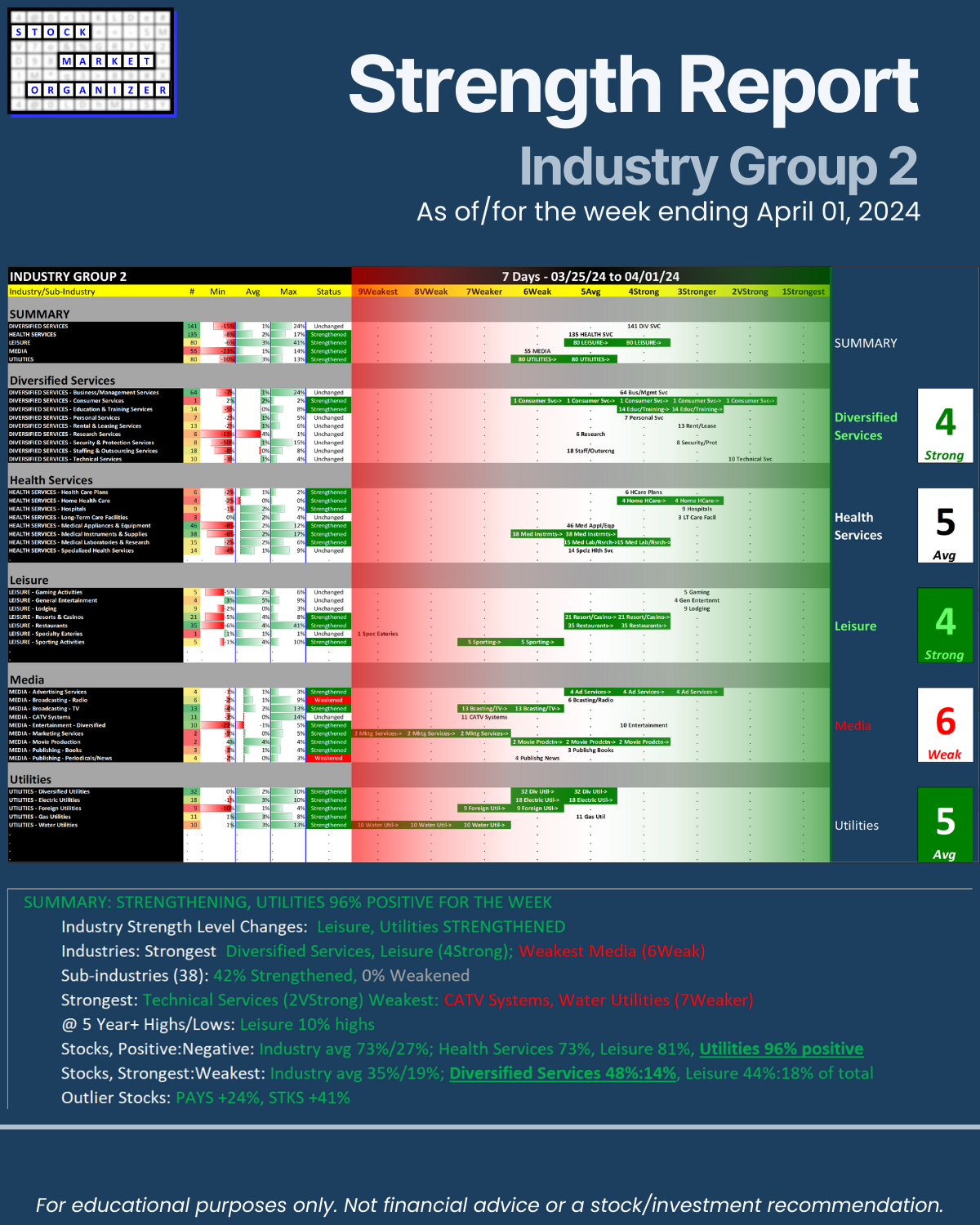

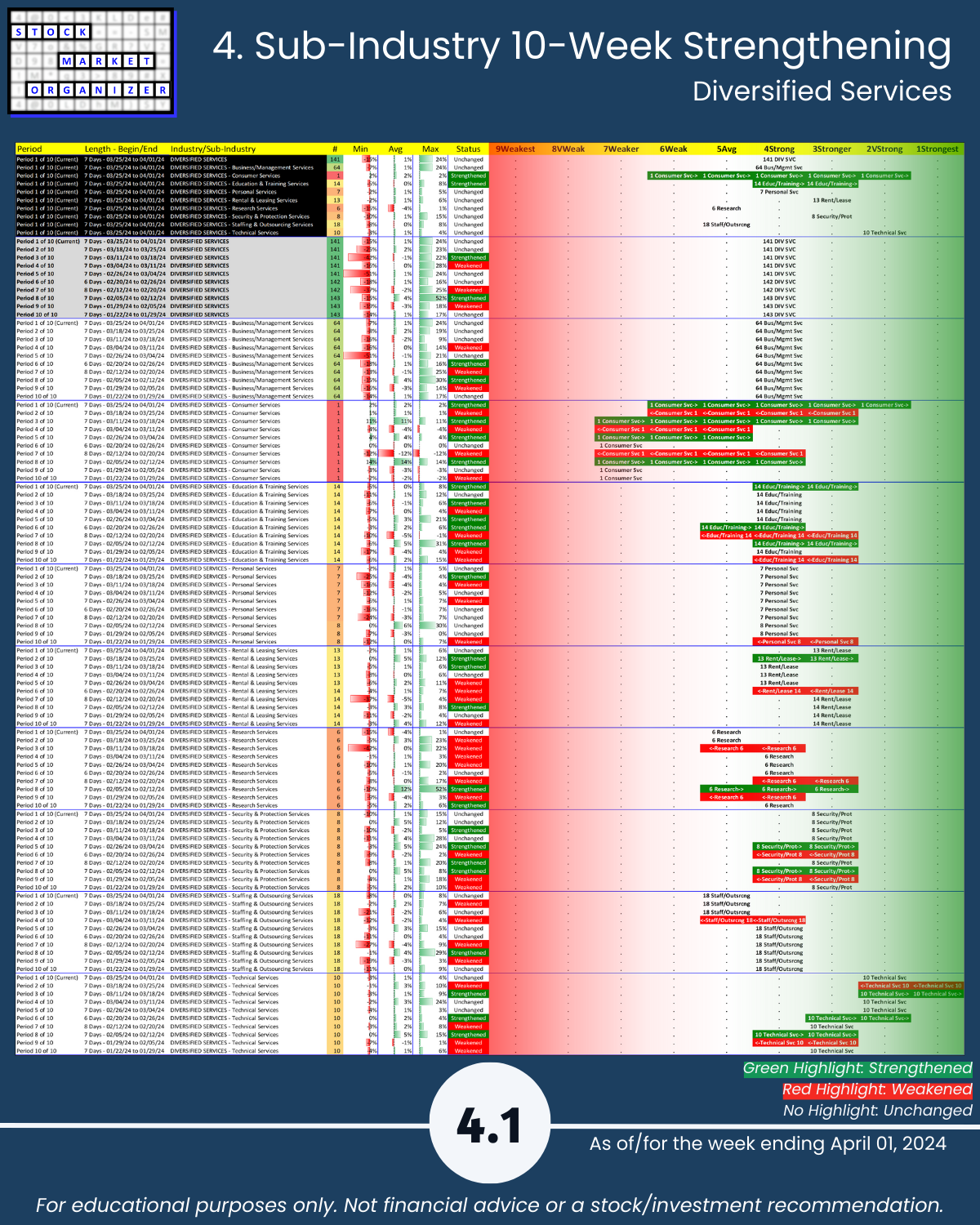

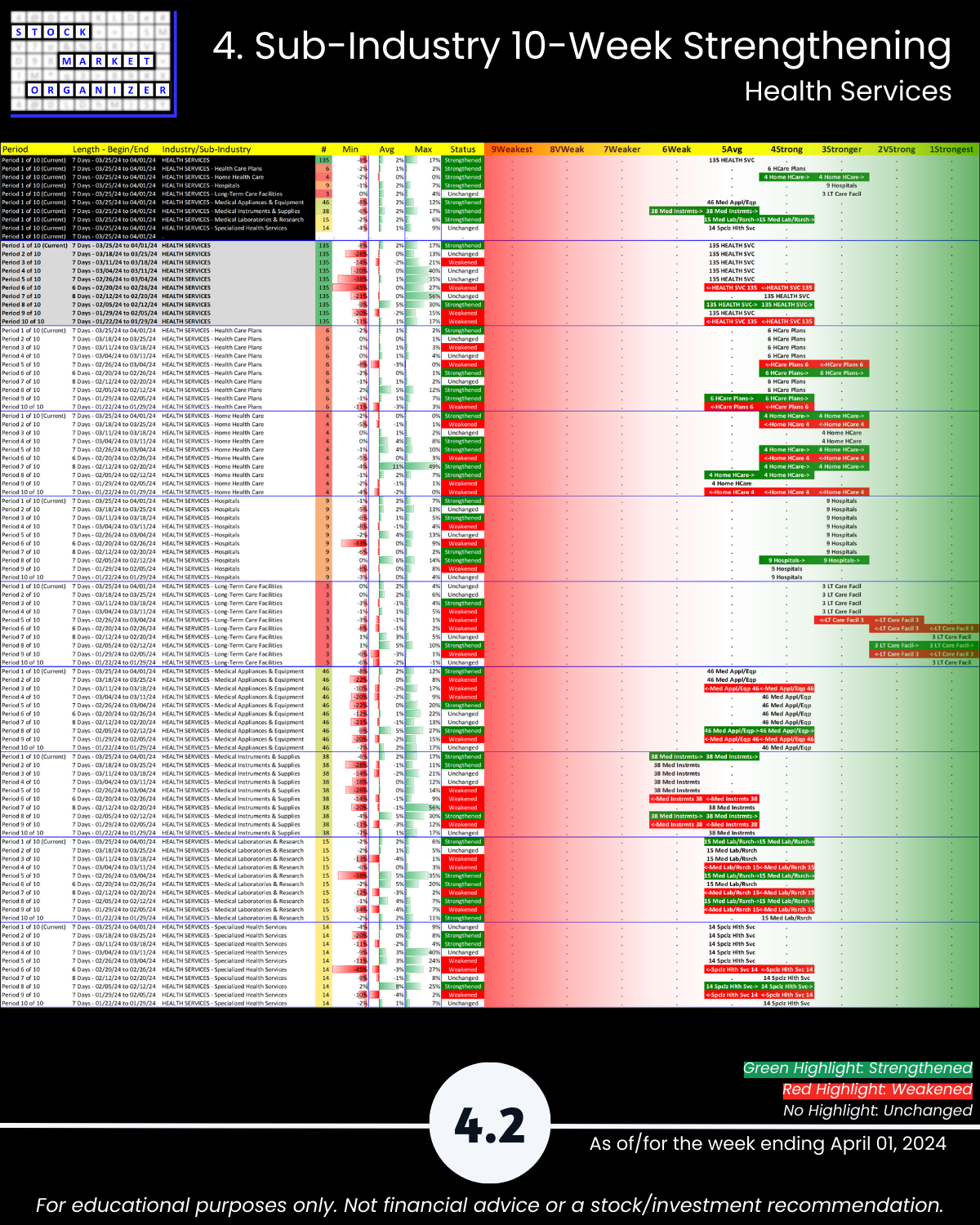

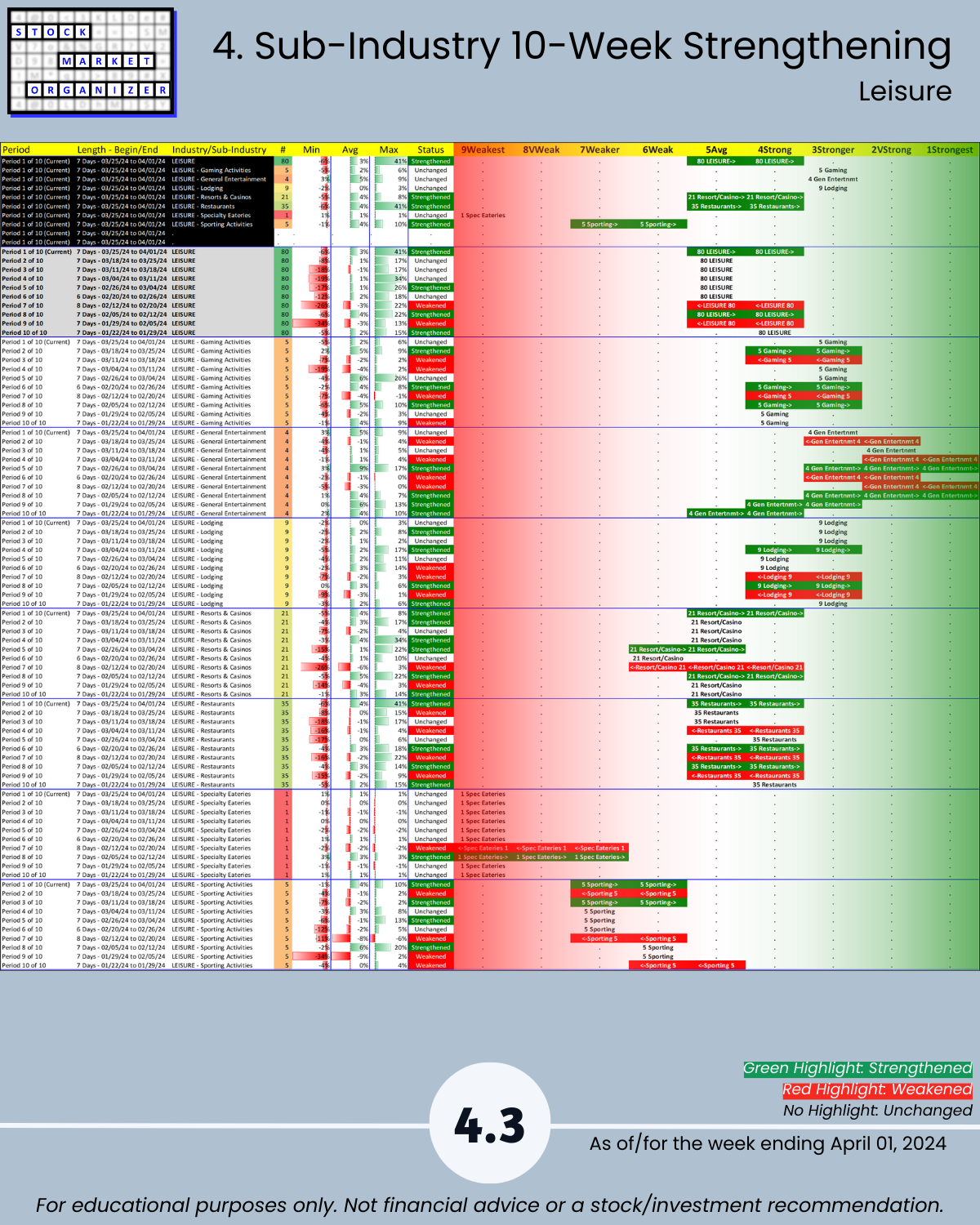

Today – a close look at Diversified Services, Health Services, Leisure, Media, and Utilities.

What’s happening here: I’m

Finding U.S. Stock Market strength from the

top down,

inside out,

and bottom up, because

the stronger your stocks, the greener your P&L.

The market does not need to be so complicated.

WHAT CAN I TELL YOU THAT YOU MAY NOT KNOW?

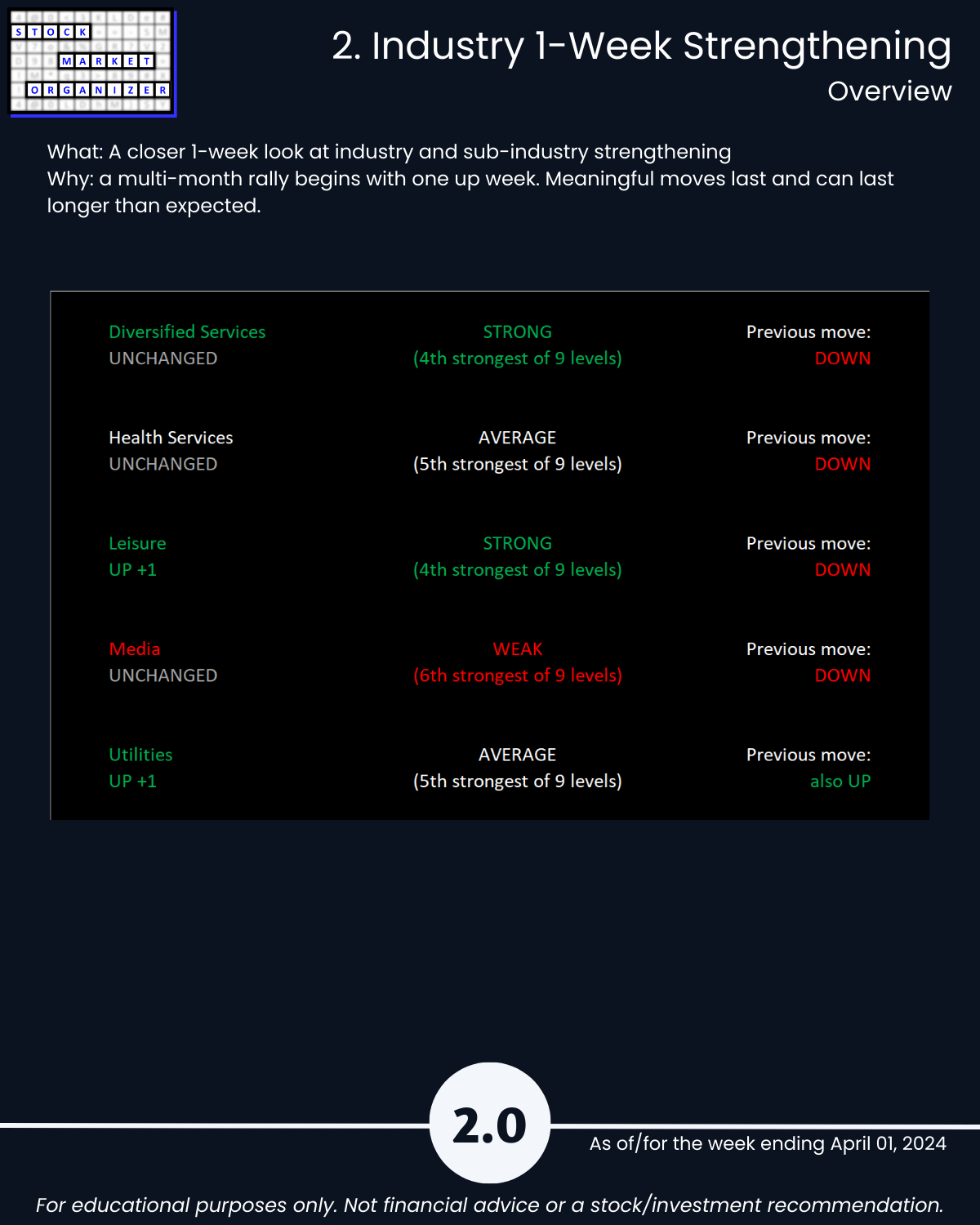

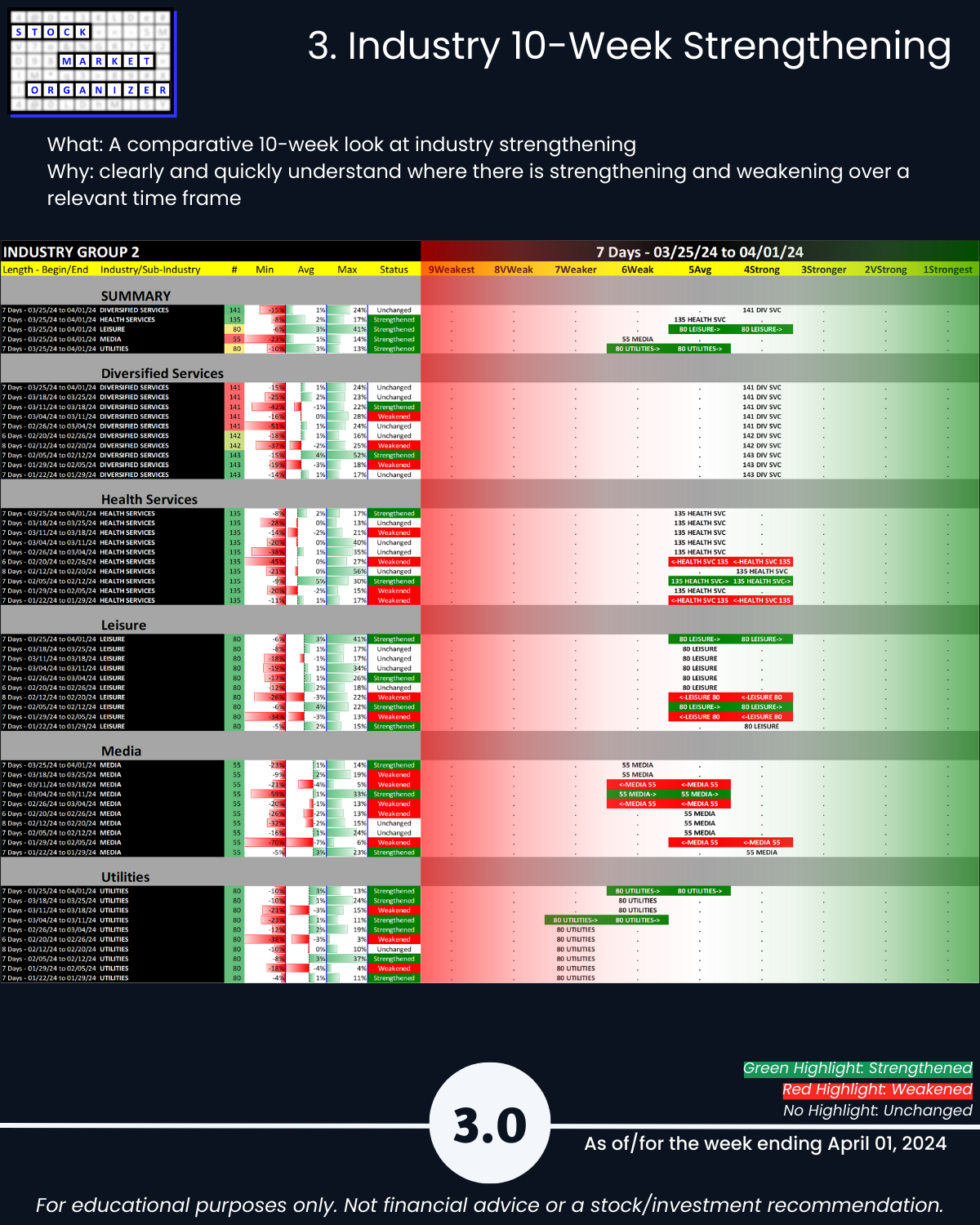

🔹 Industry Strength Level Changes: Leisure, Utilities STRENGTHENED

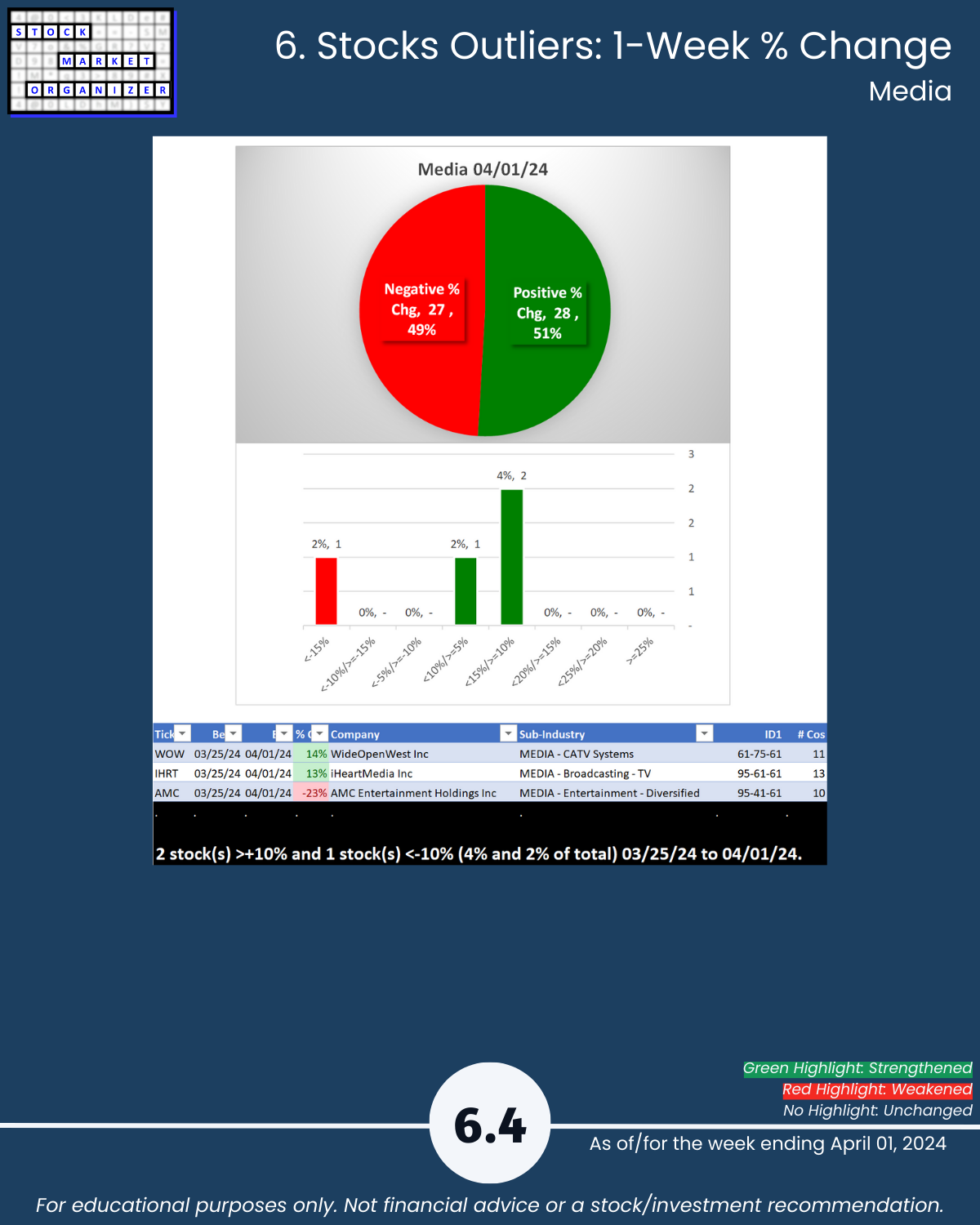

🔹 Industries: Strongest Diversified Services, Leisure (4Strong); Weakest Media (6Weak)

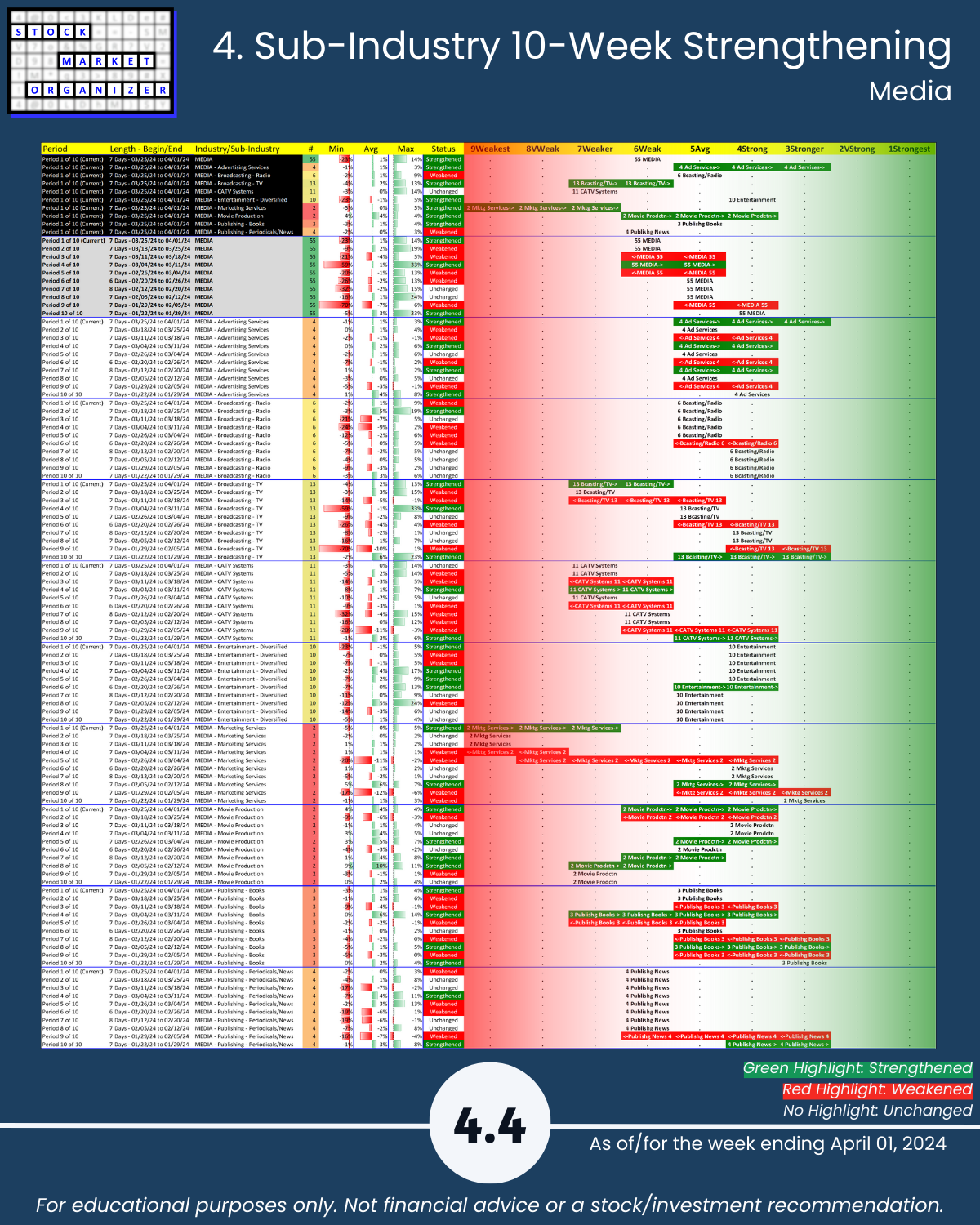

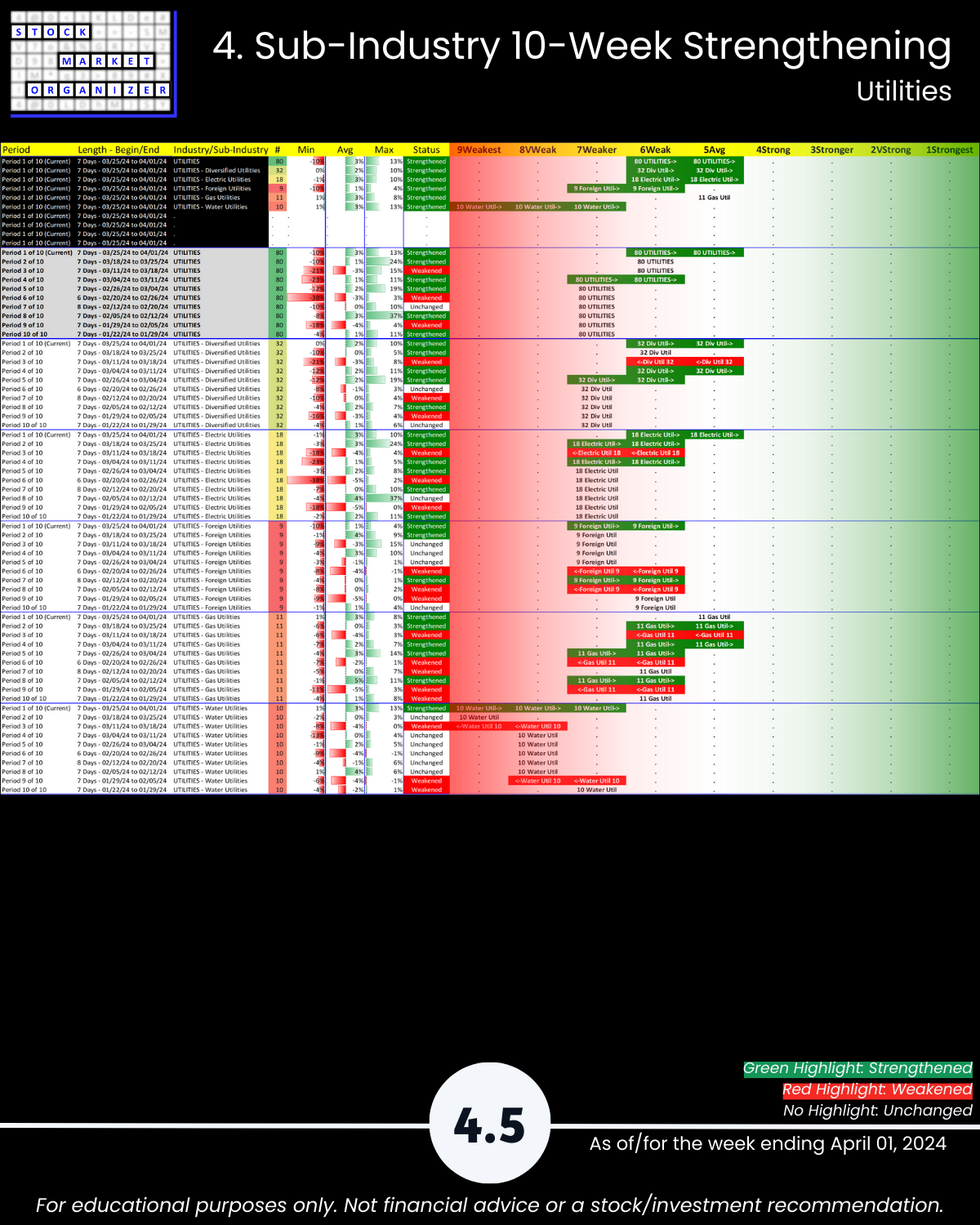

🔹 Sub-industries (38): 42% Strengthened, 0% Weakened

🔹 Strongest: Technical Services (2VStrong) Weakest: CATV Systems, Water Utilities (7Weaker)

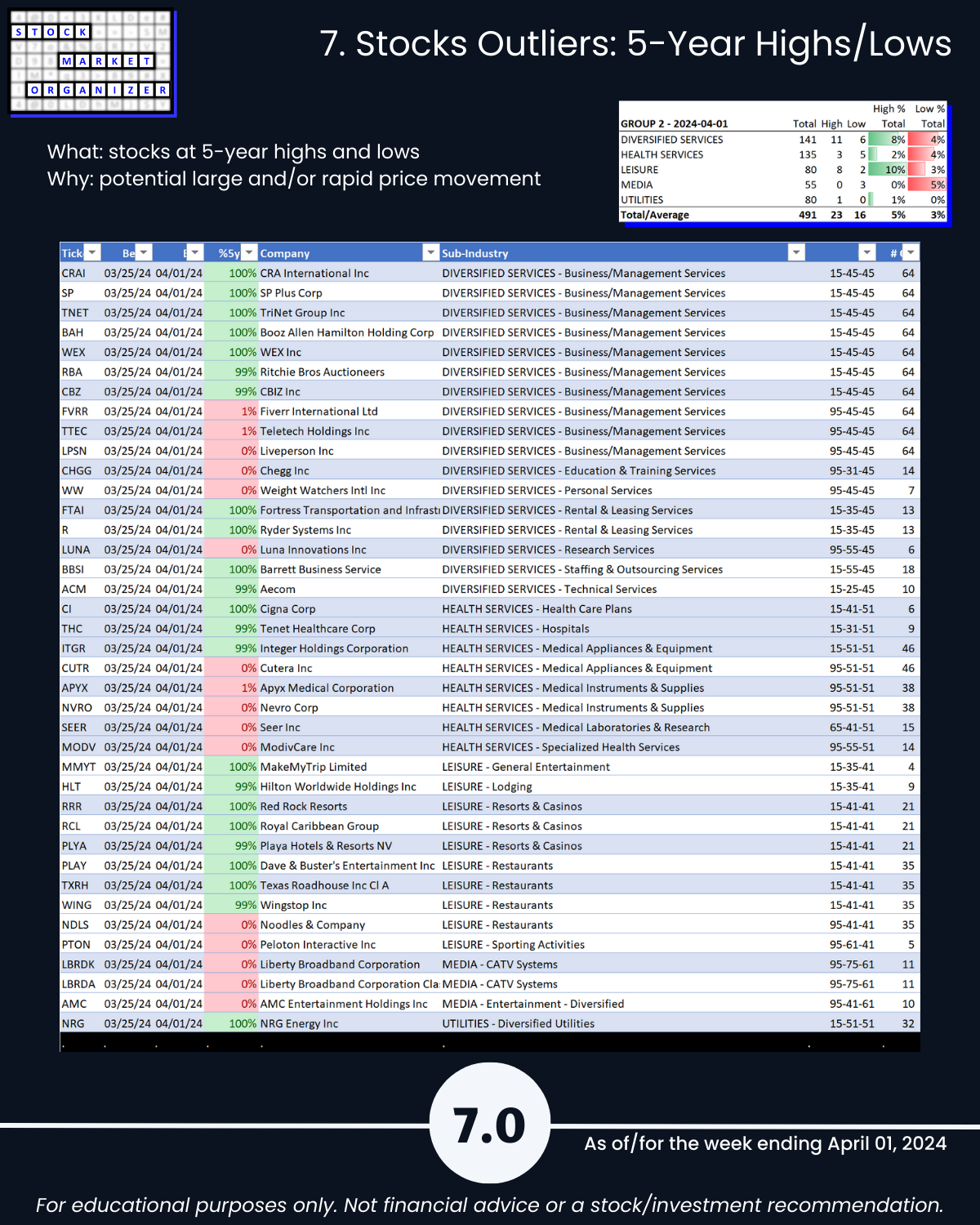

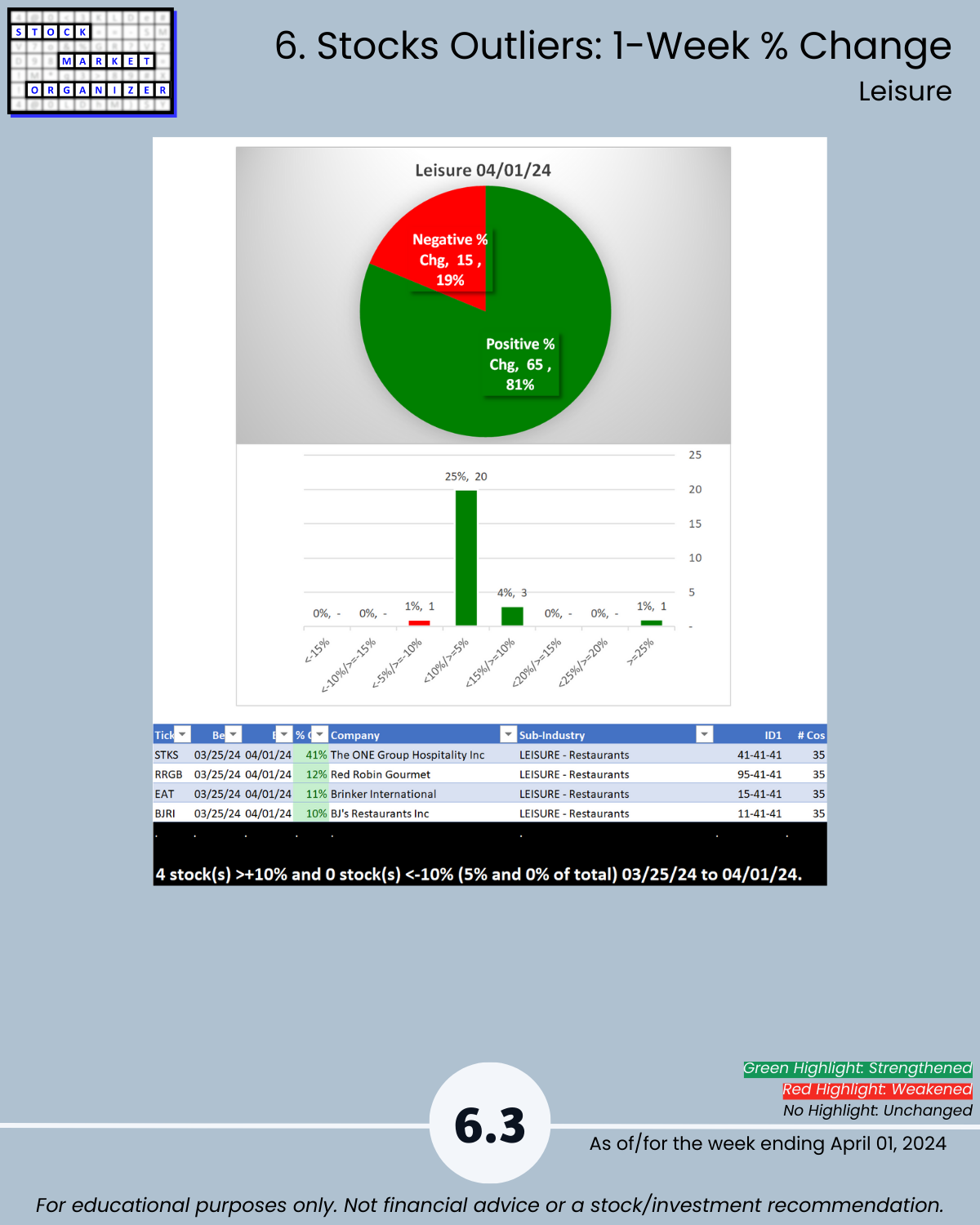

🔹 @ 5 Year+ Highs/Lows: Leisure 10% highs

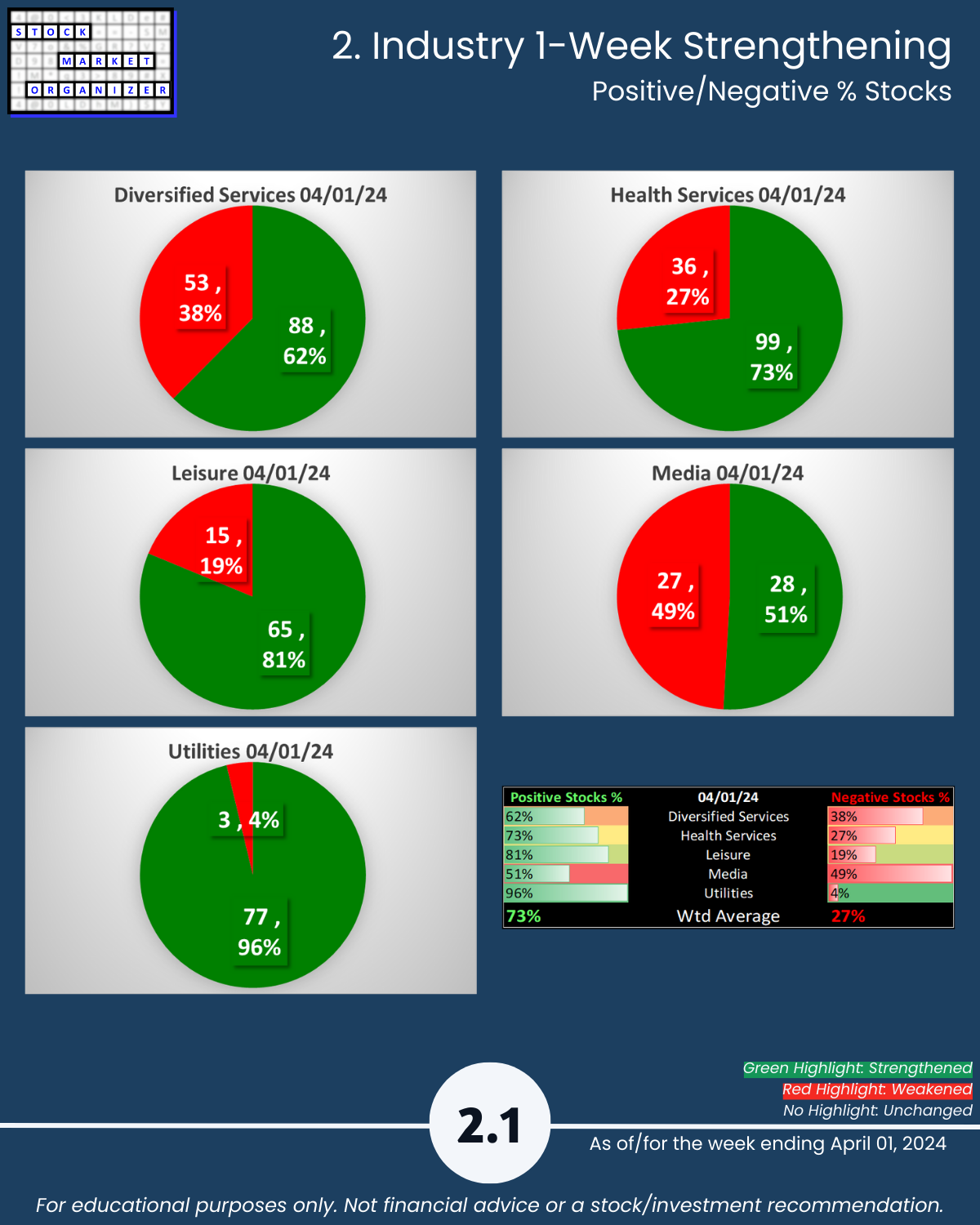

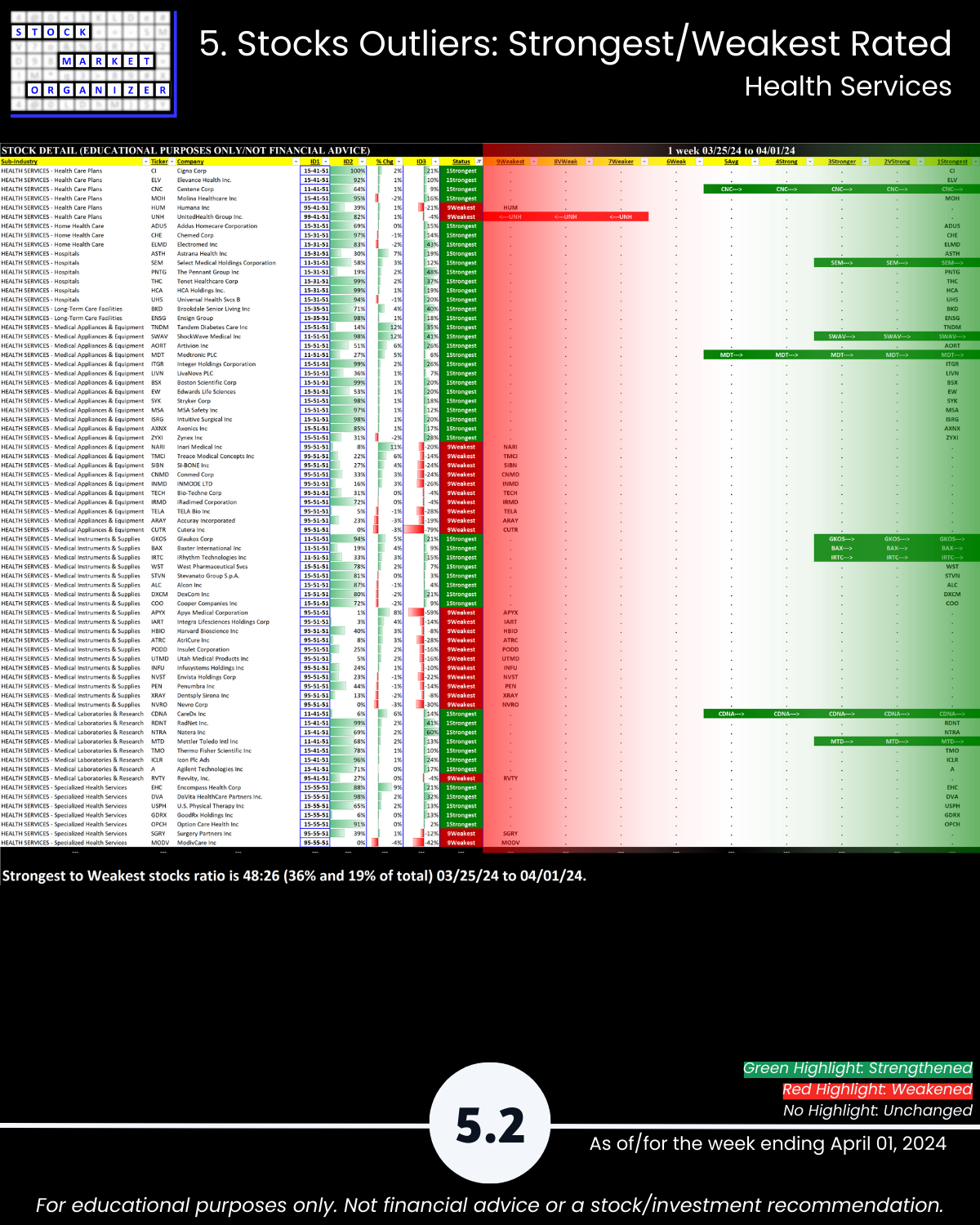

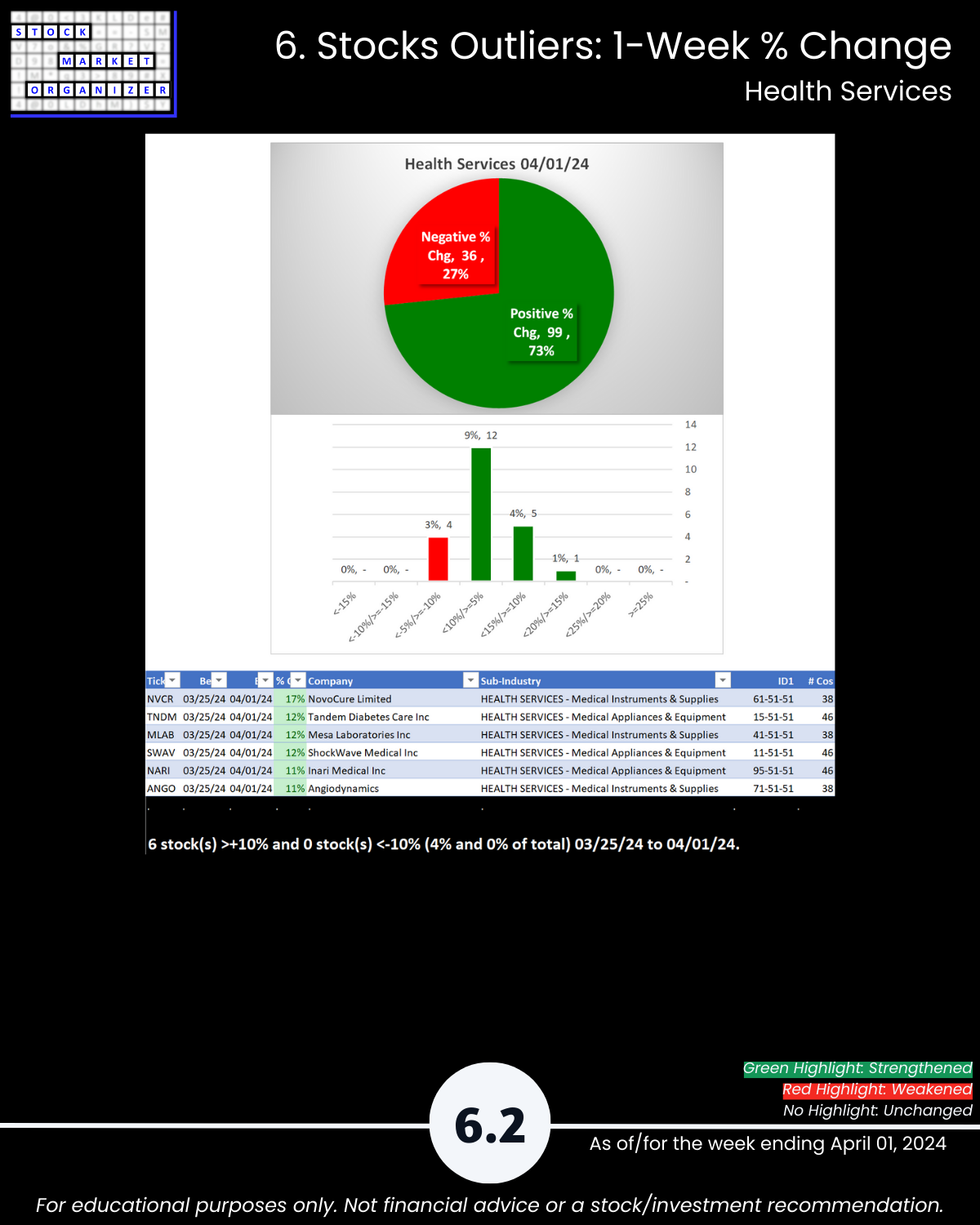

🔹 Stocks, Positive:Negative: Industry avg 73%/27%; Health Services 73%, Leisure 81%, Utilities 96% positive

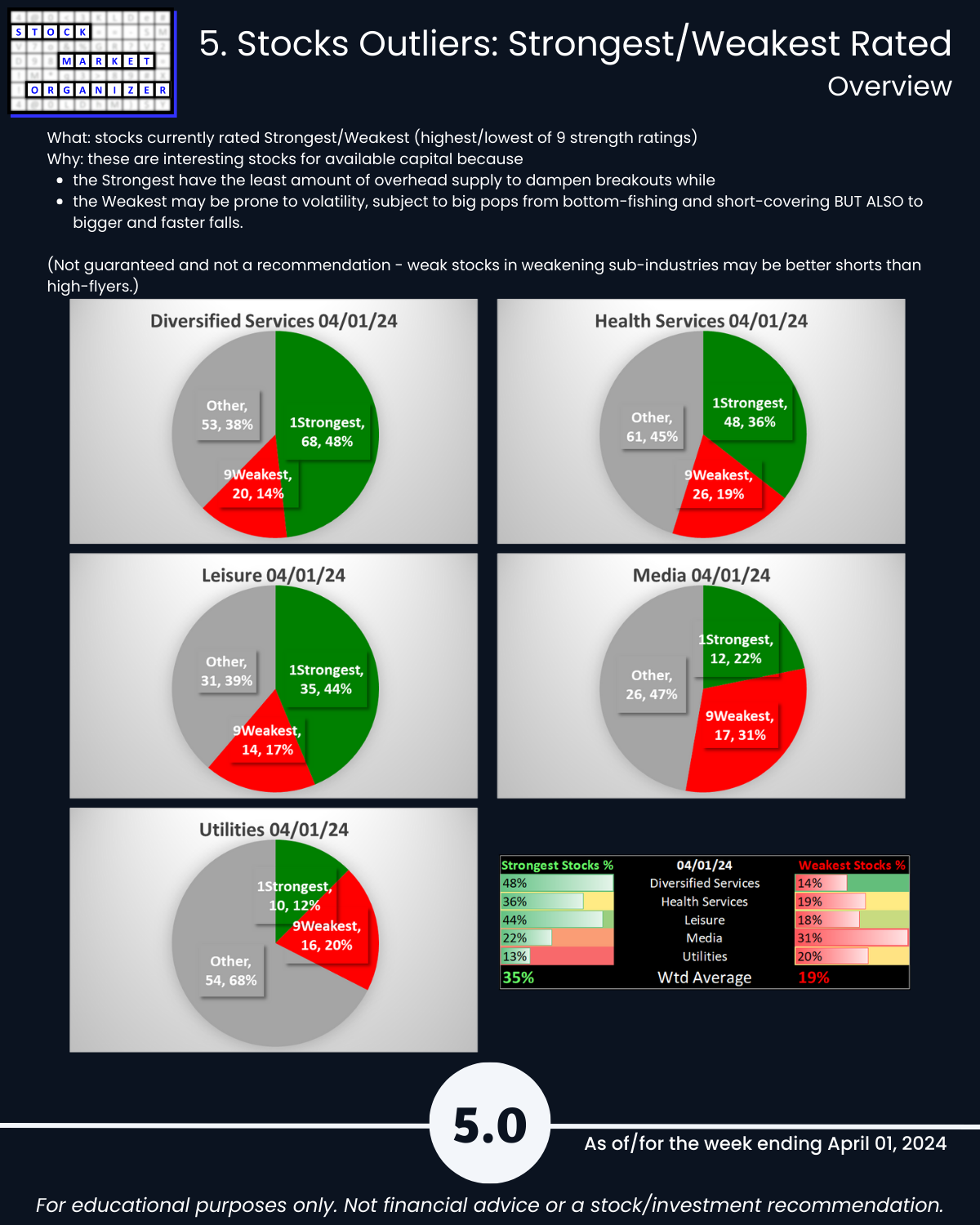

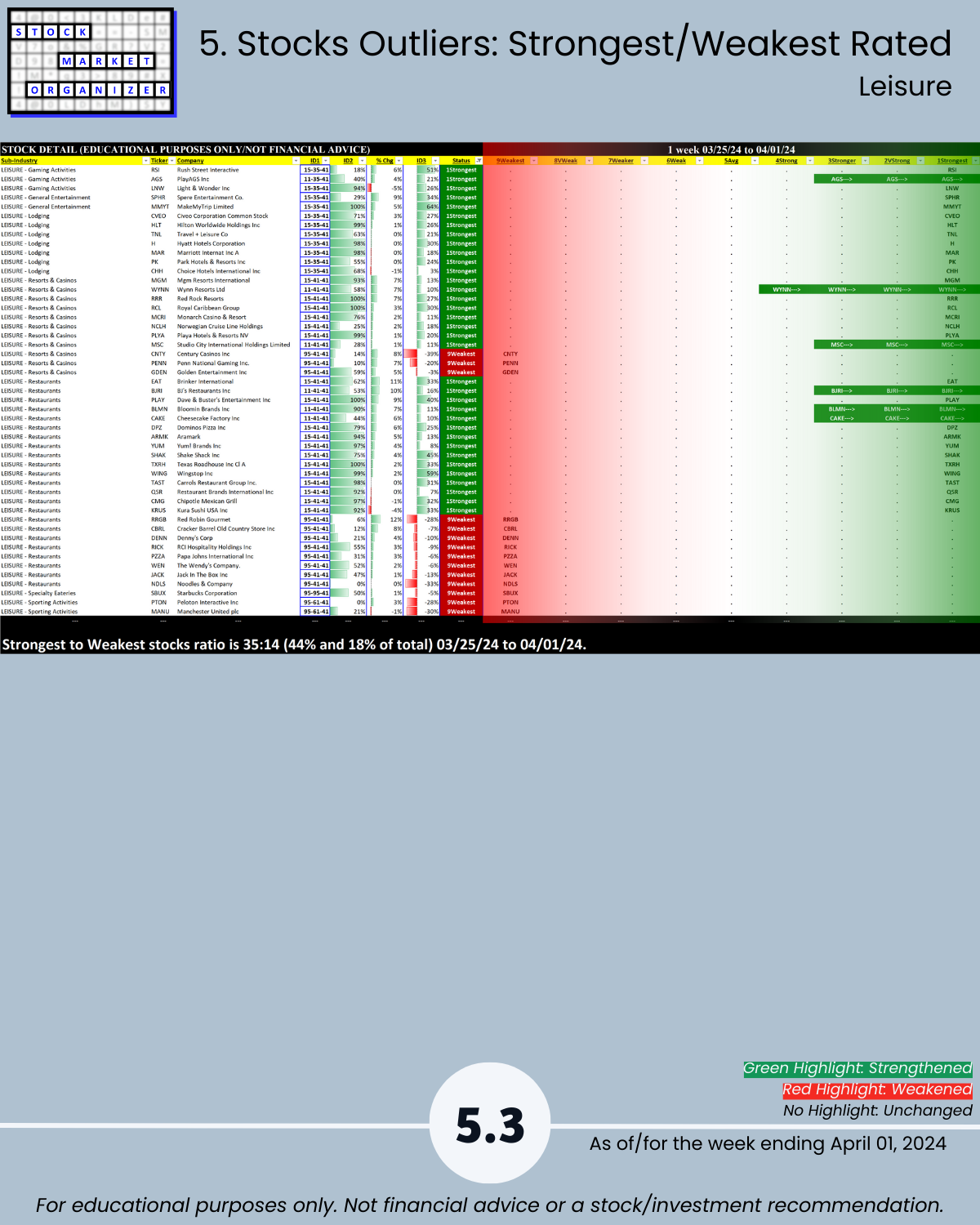

🔹 Stocks, Strongest:Weakest: Industry avg 35%/19%; Diversified Services 48%:14%, Leisure 44%:18% of total

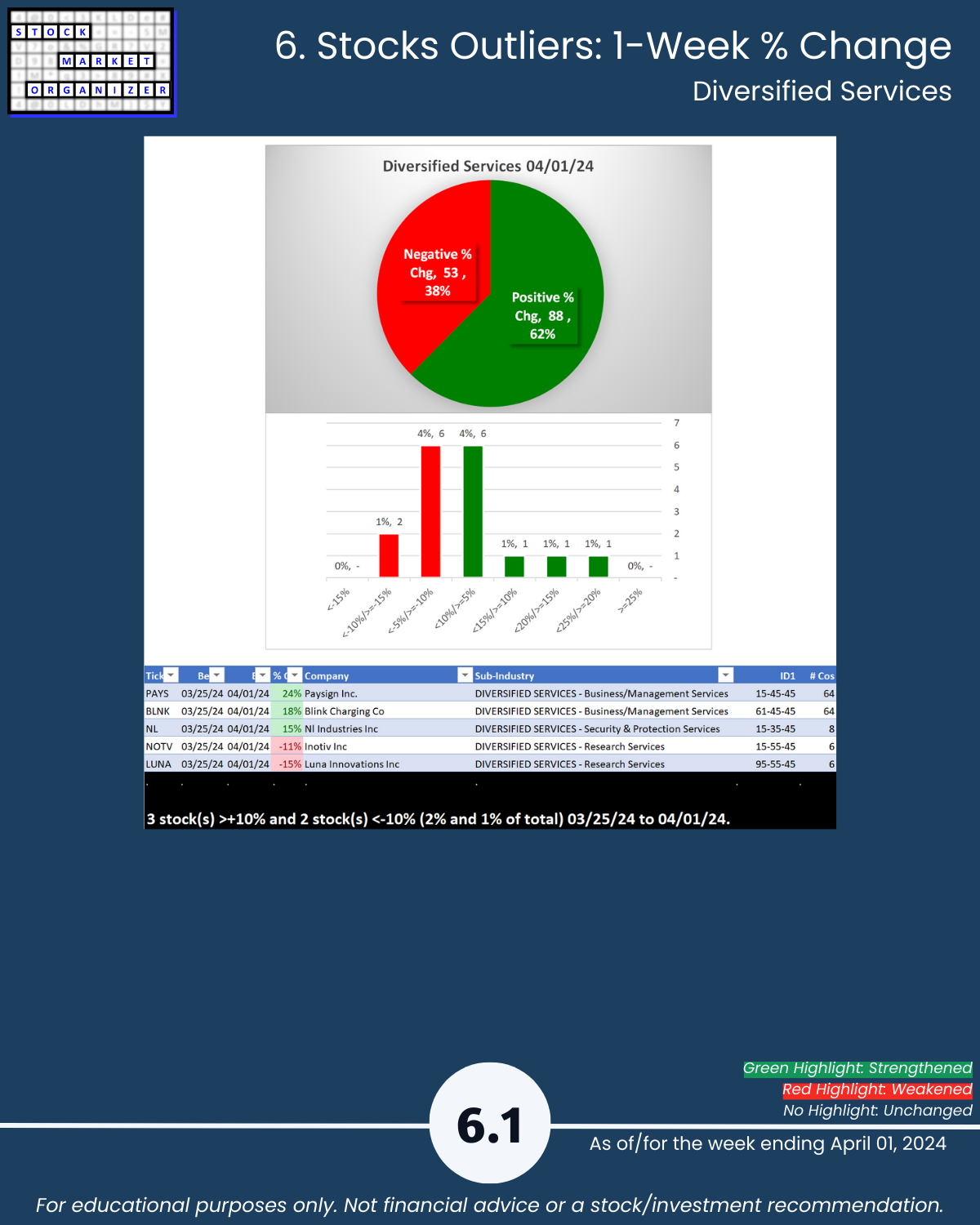

🔹 Outlier Stocks: PAYS +24%, STKS +41%

This report may particularly be of interest if the following 5 concepts resonate with you:

- The stronger your stocks, the greener your P&L.

- The journey to 100%+ returns begins with 10% returns.

- The journey to a multi-month rally begins with one up week.

- Most stocks do what the market does. (While the market can only do what its underlying stocks, sub-industries, and industries do.)

- 80/20: not all information is created equal. (Press buttons, not balloons.)

Following are galleries with page-by-page views of this report.

1. Introduction

2. Industry 1-Week Strengthening

3. Industry 10-Week Strengthening

4. Sub-Industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

6. Stocks Outliers: 1-Week % Change

7. Stocks Outliers: 5-Year Highs/Lows