SMO Exclusive: Strength Report Group 2 2024-03-25

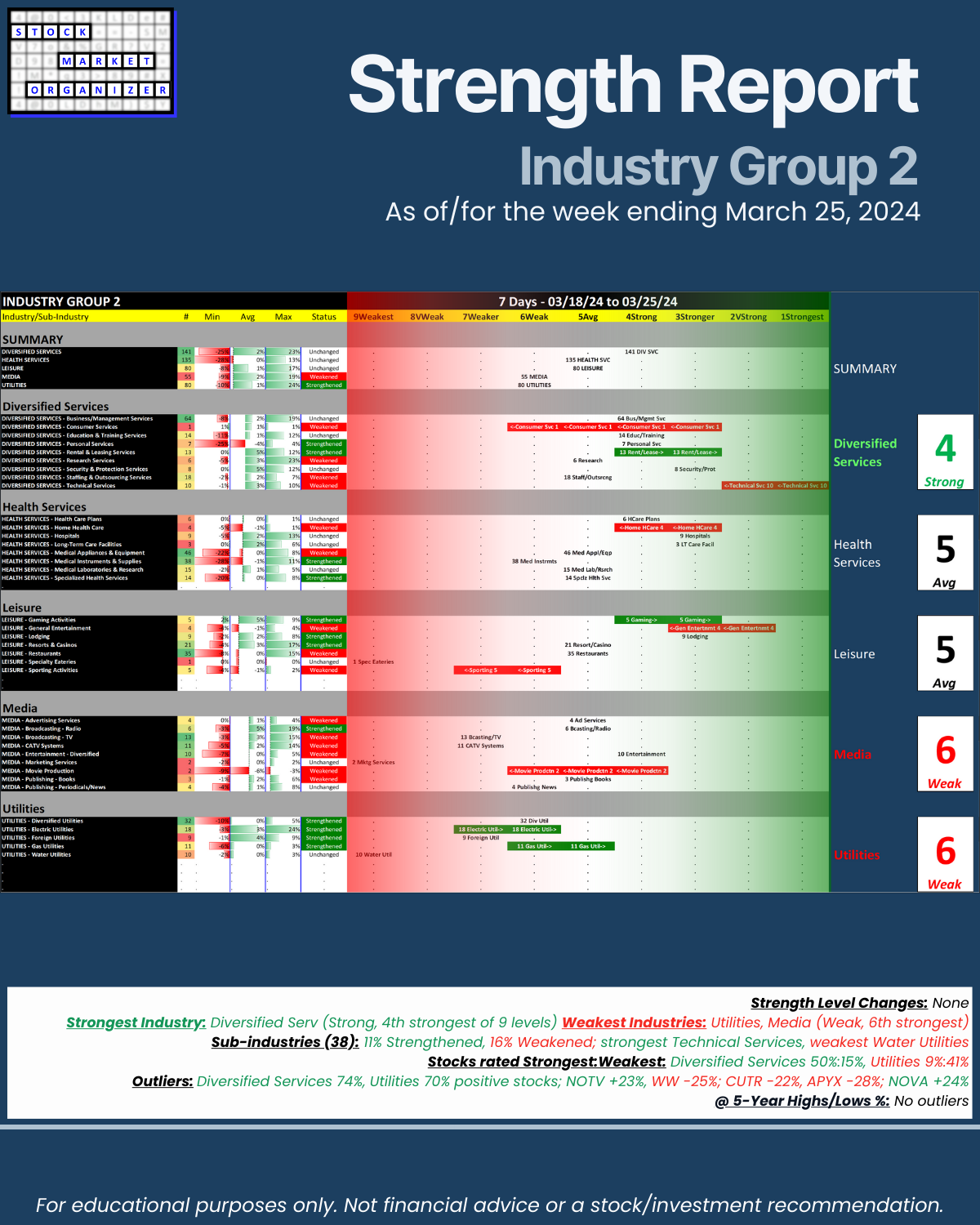

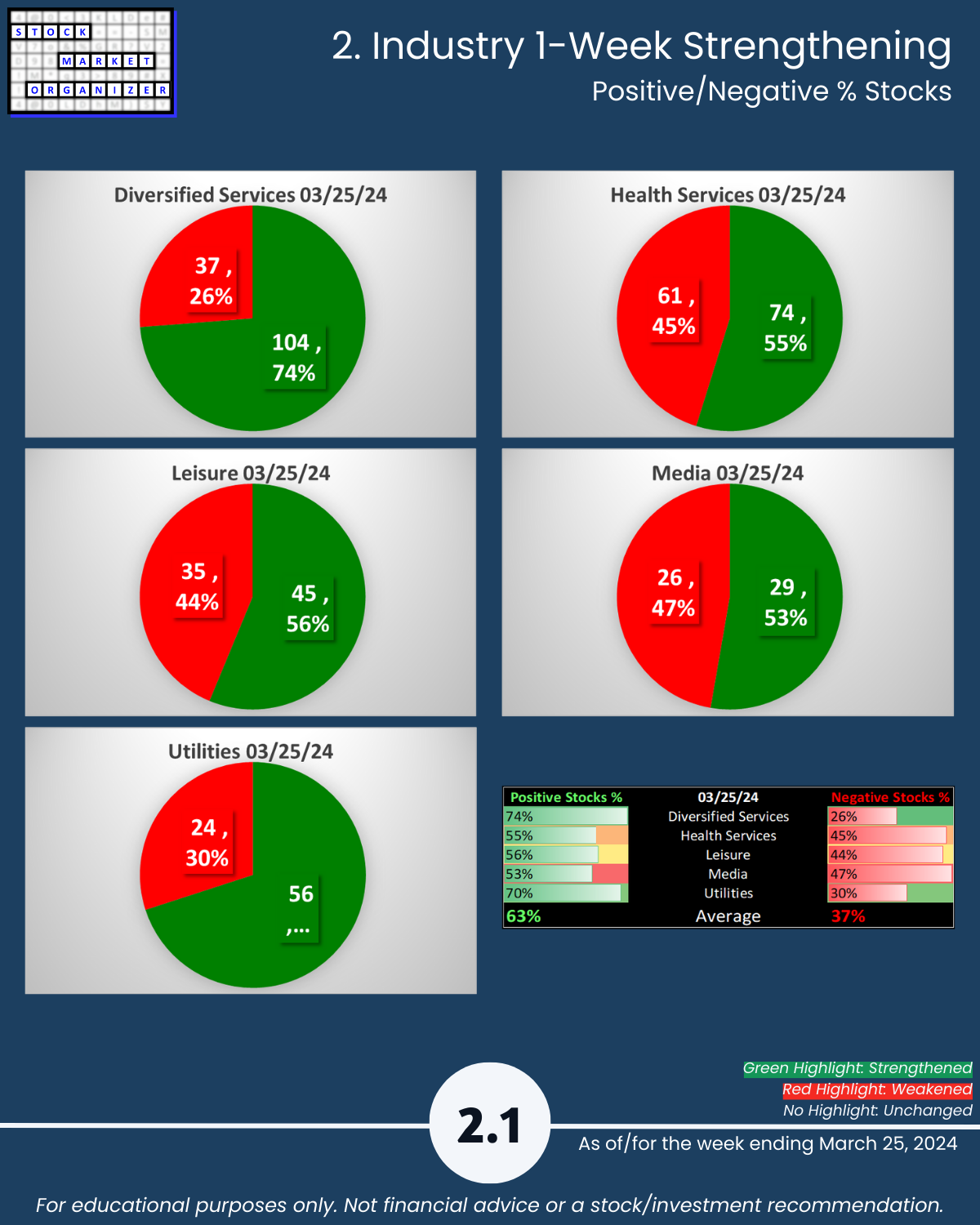

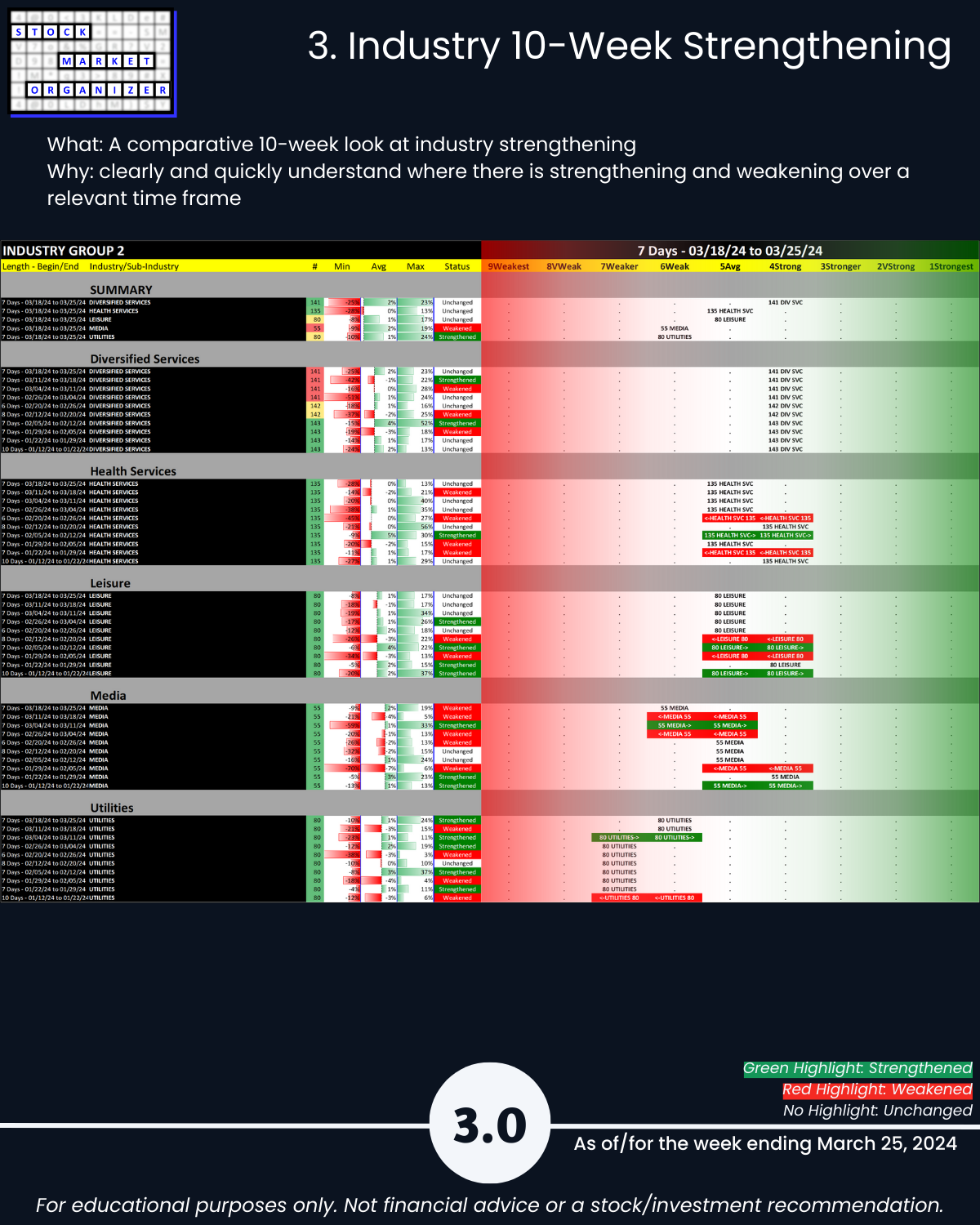

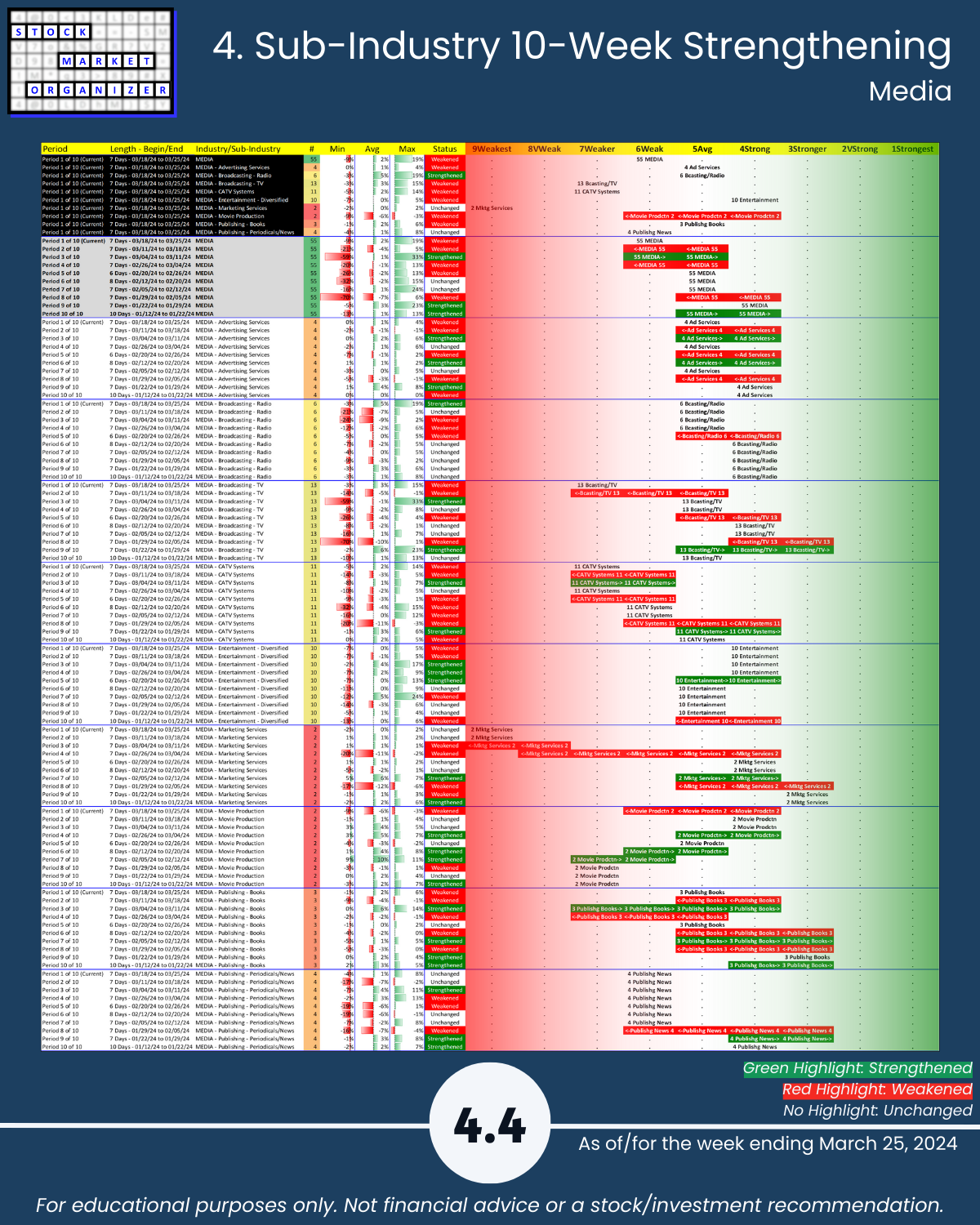

Update U.S. stock market 3/25/24 Group 2 (loosely, Services Sector) stocks: all’s quiet. Utilities and Media were rough last week but calmed down this week. Leading sub-industry Technical Services (Diversified Services industry) WEAKENED to Very Strong (2nd strongest of 9 levels) and Water Utilities remained Weakest (9th strongest). Positive:Negative stocks were 63:37 this week vs. 32:68 last week.

Reminders:

🔹 The multi-month rally (decline) begins with one up (down) week.

🔹 The journey to 100%+ returns begins with +10% returns.

🔹 The market does not have to be so complicated.

If you’re not watching everywhere for strengthening opportunities, how do you know what you are missing?

WHY THIS MATTERS

A 1-year returns comparison, Water Utilities (ranked Weakest of 9 strength levels) and Diversified Services - Technical Services (ranked Very Strong), each with 10 stocks:

🔹 Average 1-year return WUtil -21%, TServ +45%

🔹 Range WUtil -38% to +8%, TServ +17% to +107%

🔹 % Positive stocks WUtil 10%, TServ 100%

I’m not saying I’d have known 1 year ago to go long TServ stocks and short WUtil stocks. But anyone paying attention to strengthening/weakening would have automatically noticed what was happening in each sub-industry and acted accordingly. They certainly wouldn’t have held onto a Water Utilities stock that fell 38% in a year.

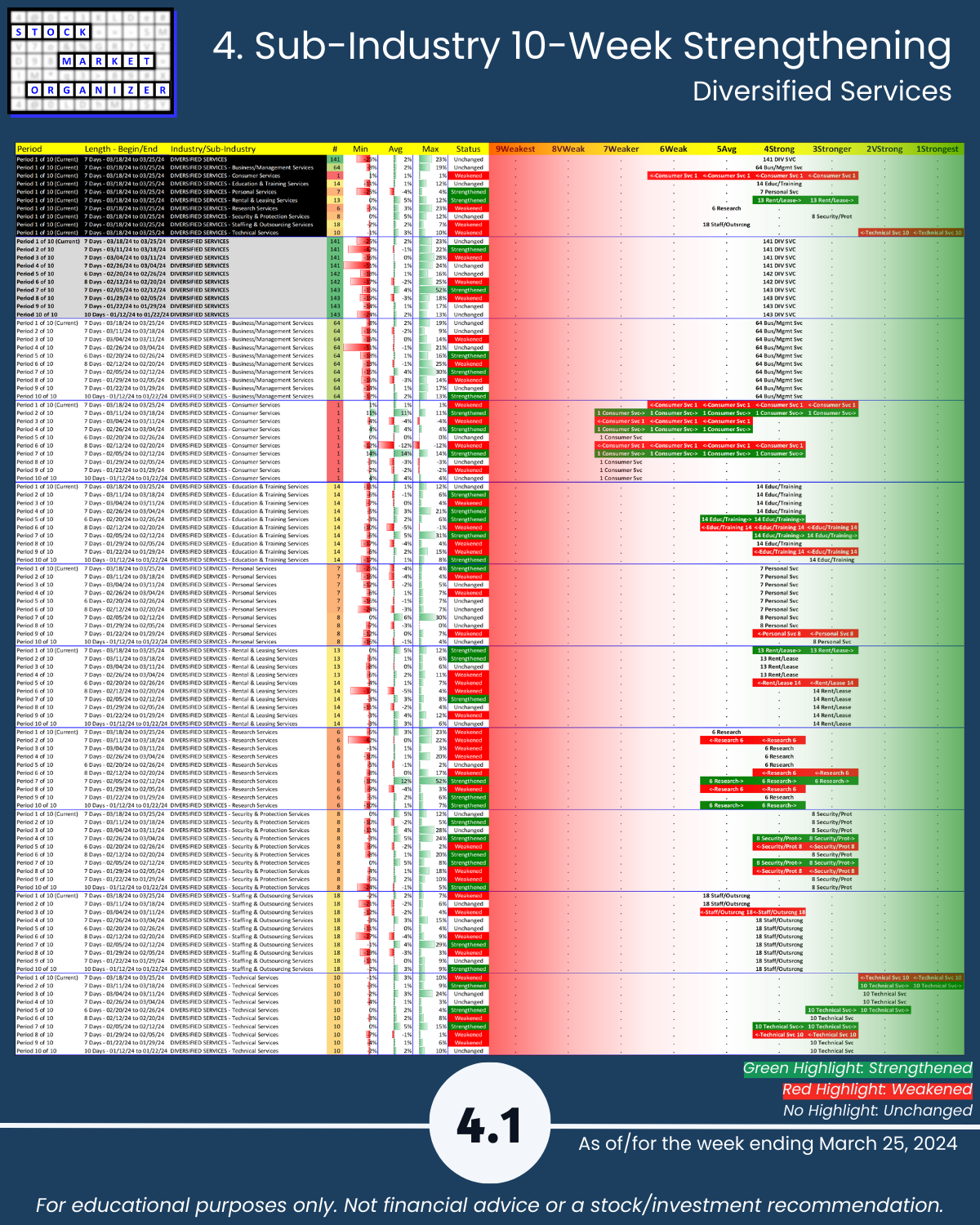

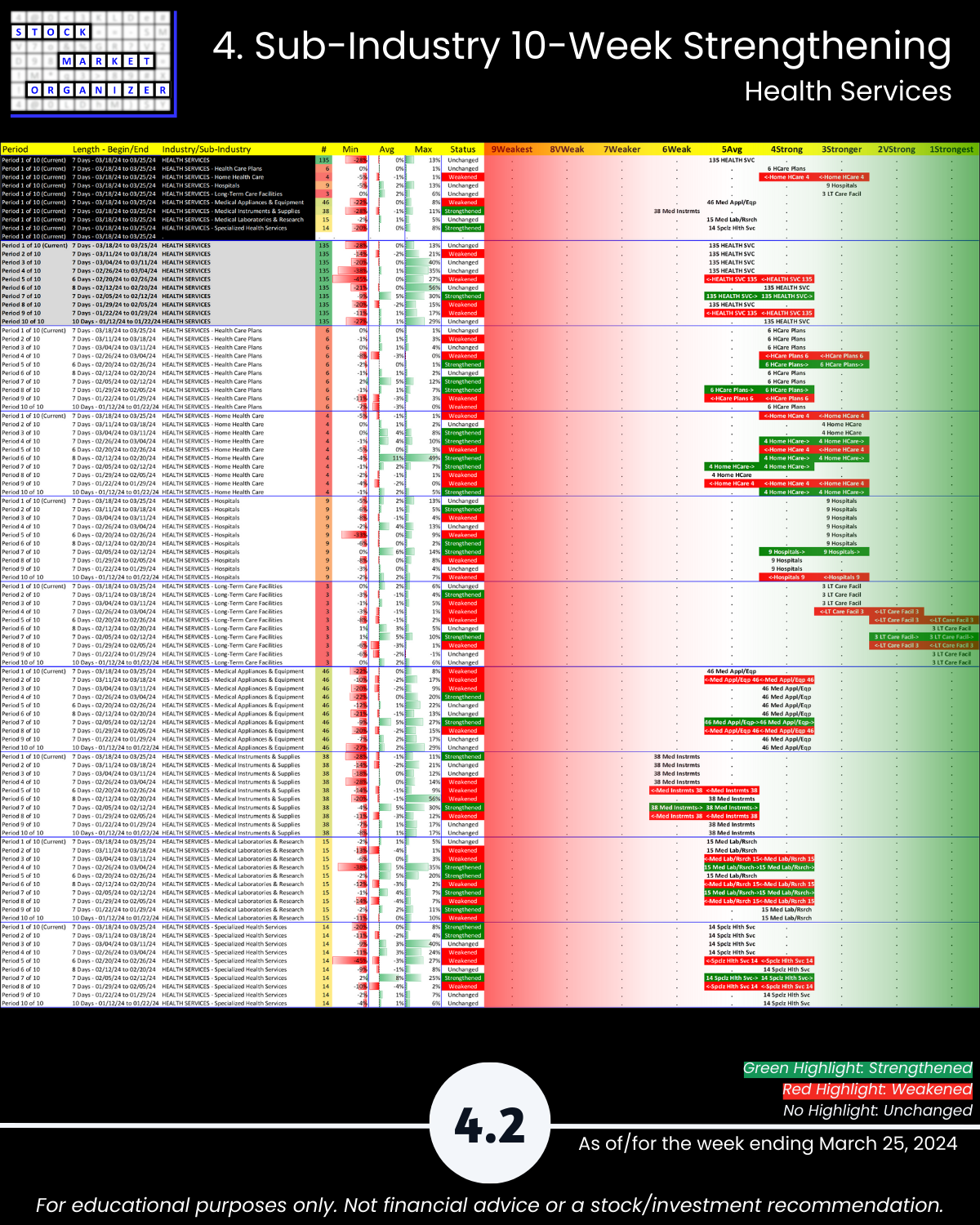

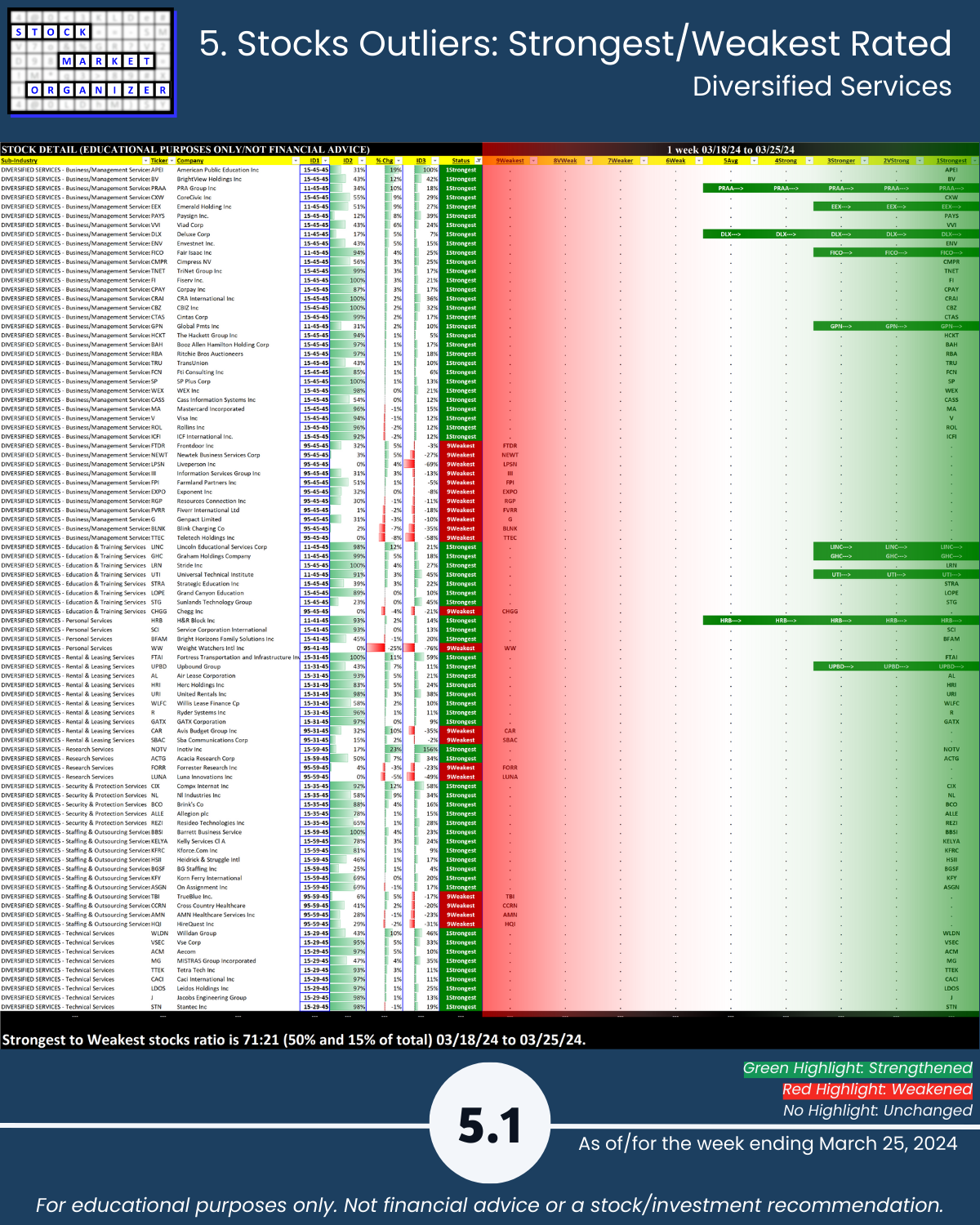

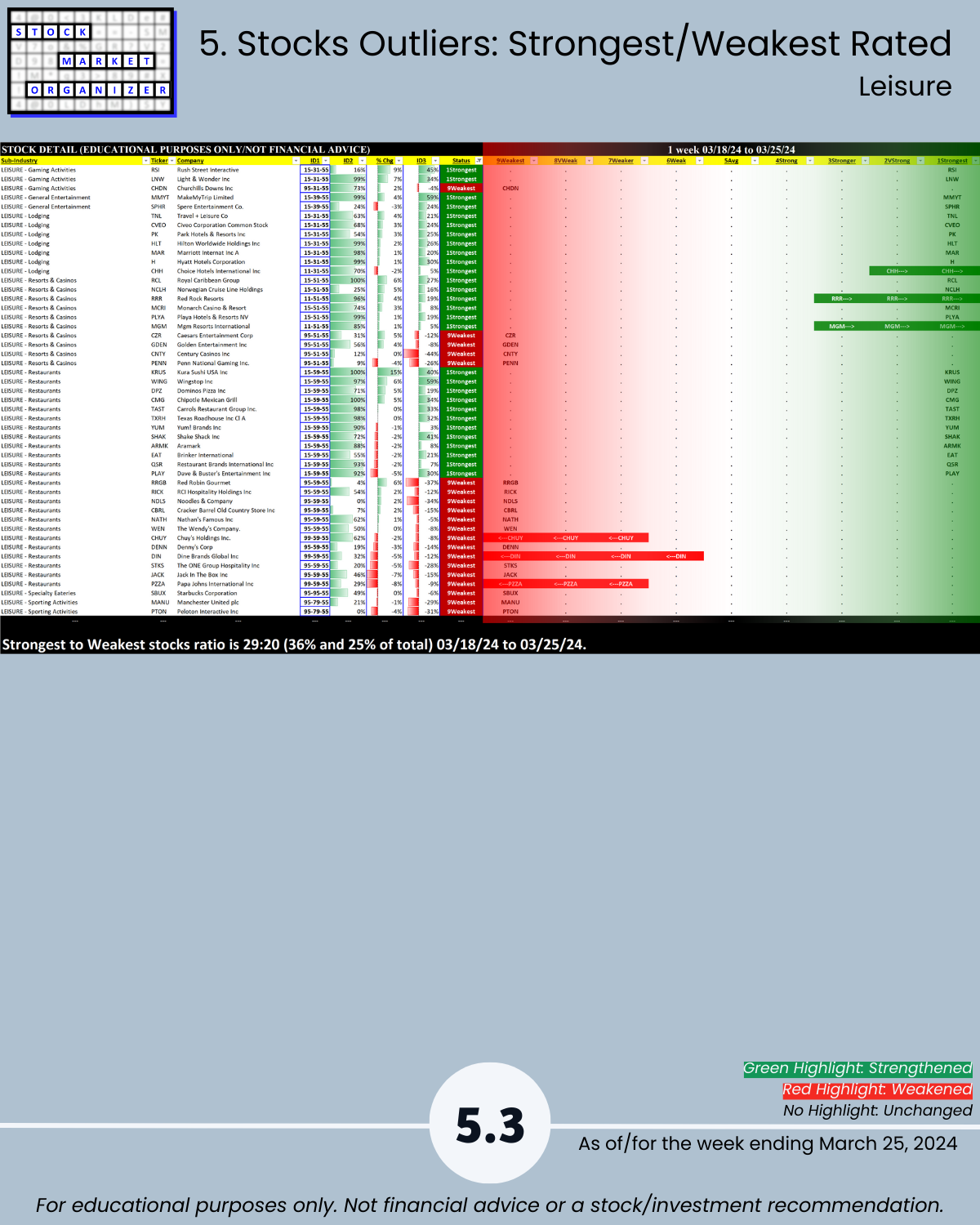

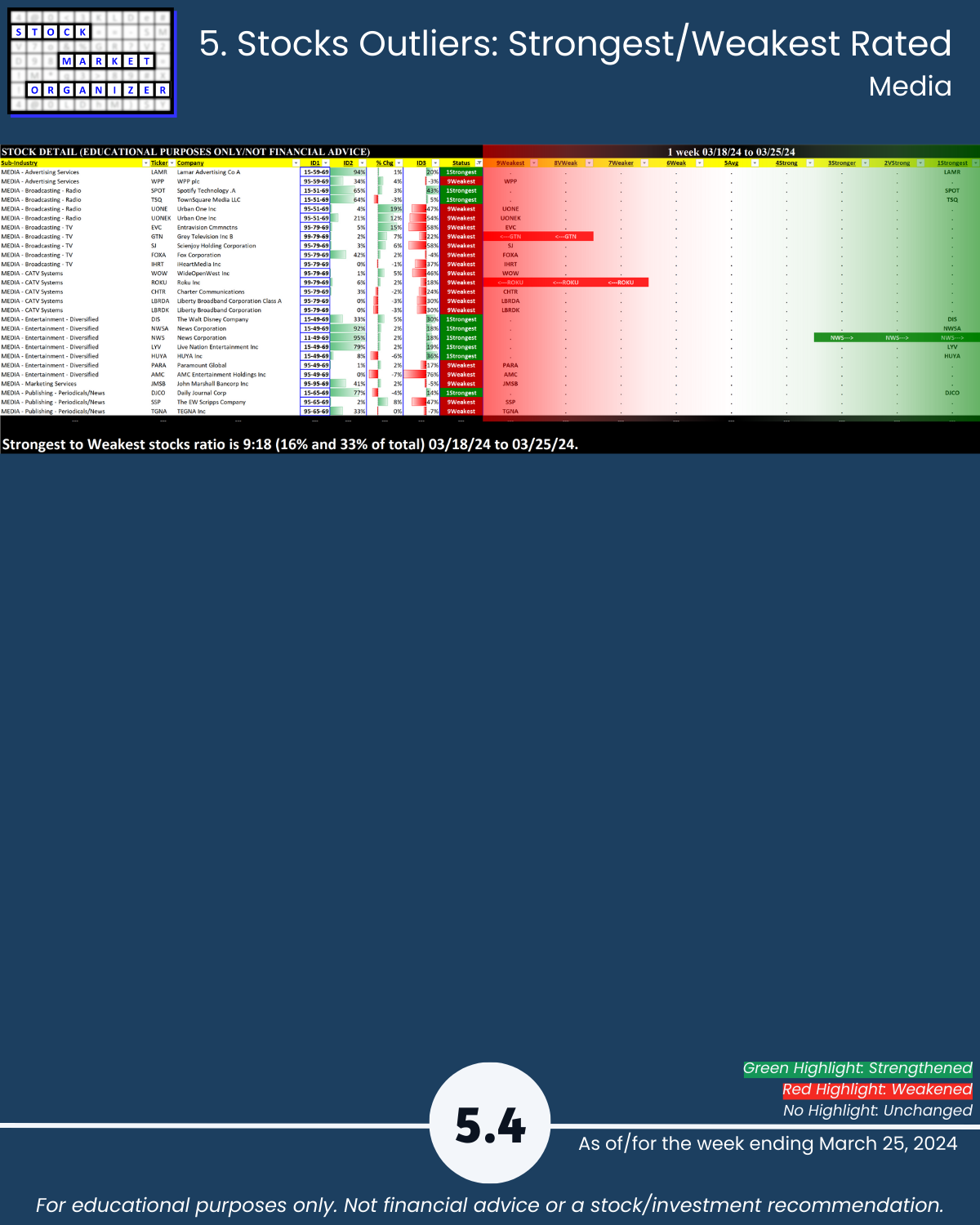

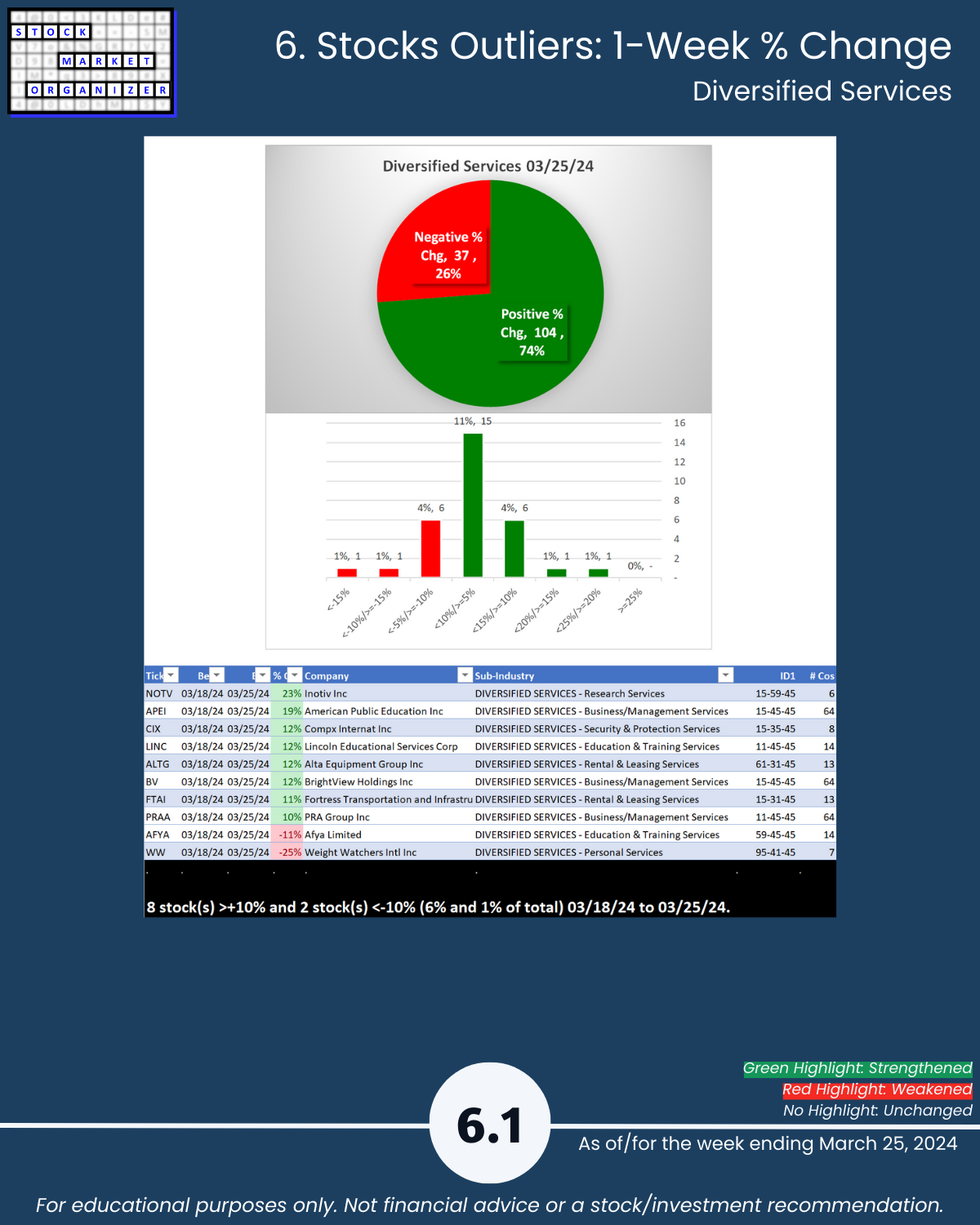

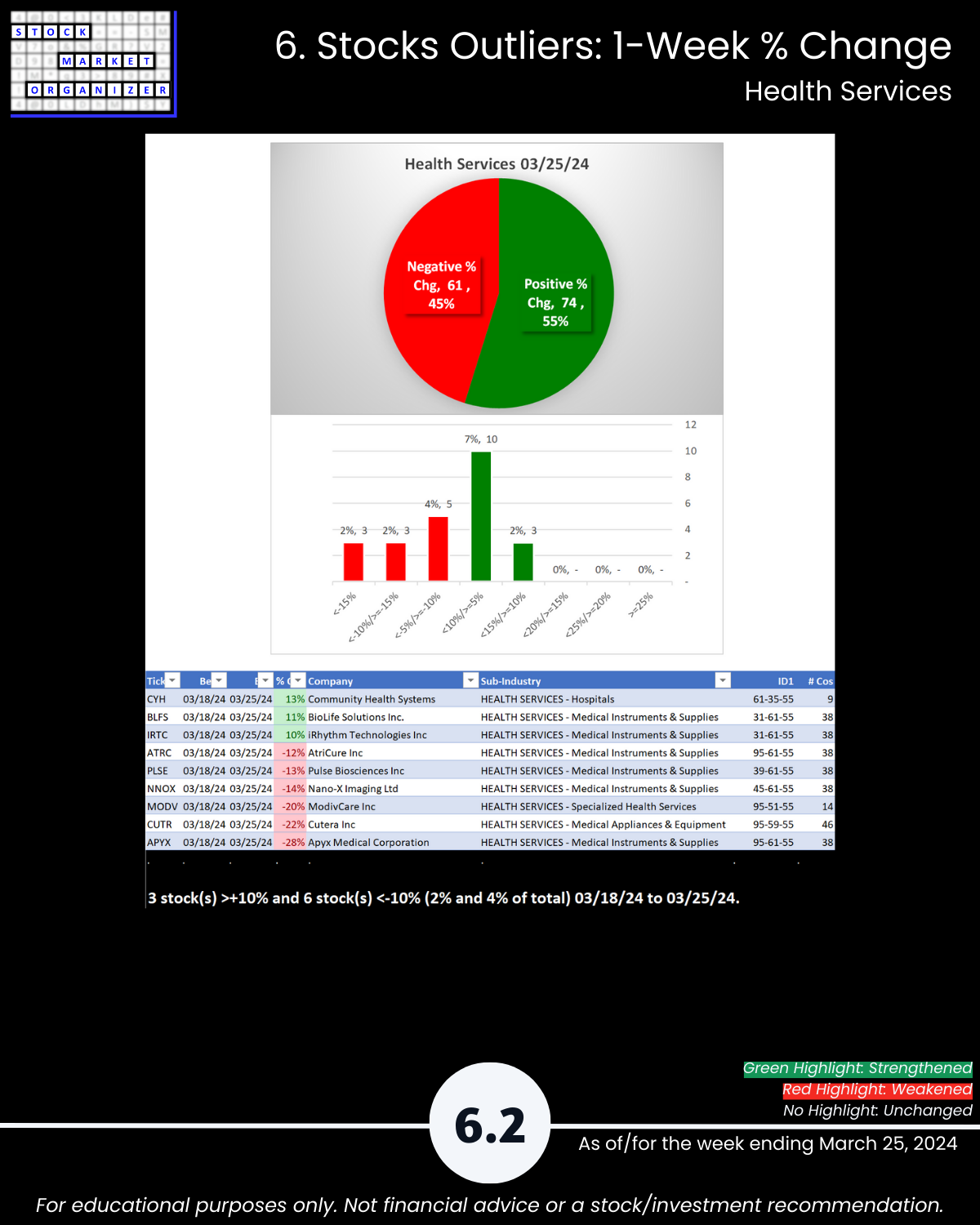

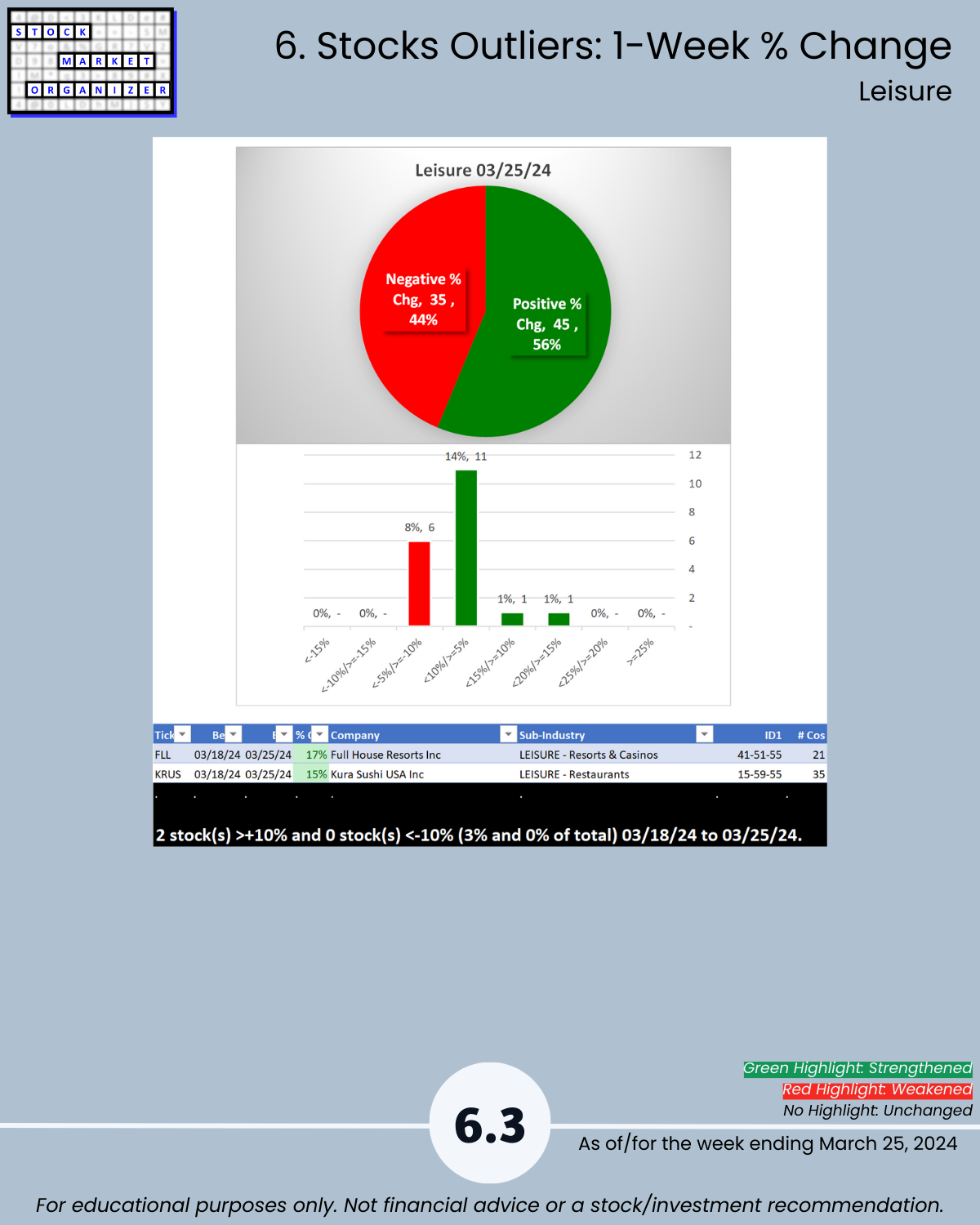

Attached: Strongest- and Weakest-rated Stock Market Organizer stocks and objective strengthening/weakening measurements in the Diversified Services, Health Services, Leisure, Media, and Utilities industries.

Takeaways:

🔹 Strength Level Changes: No changes

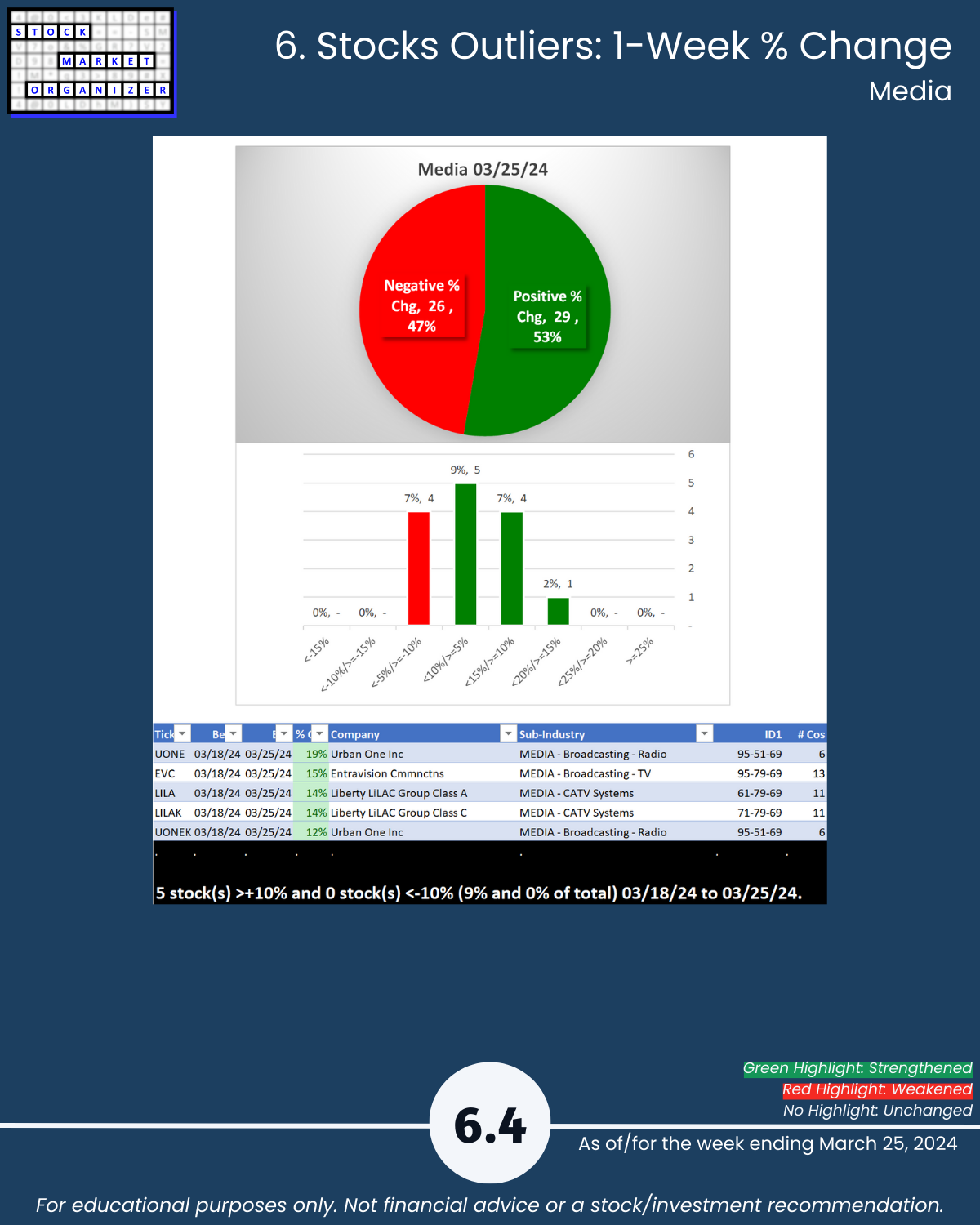

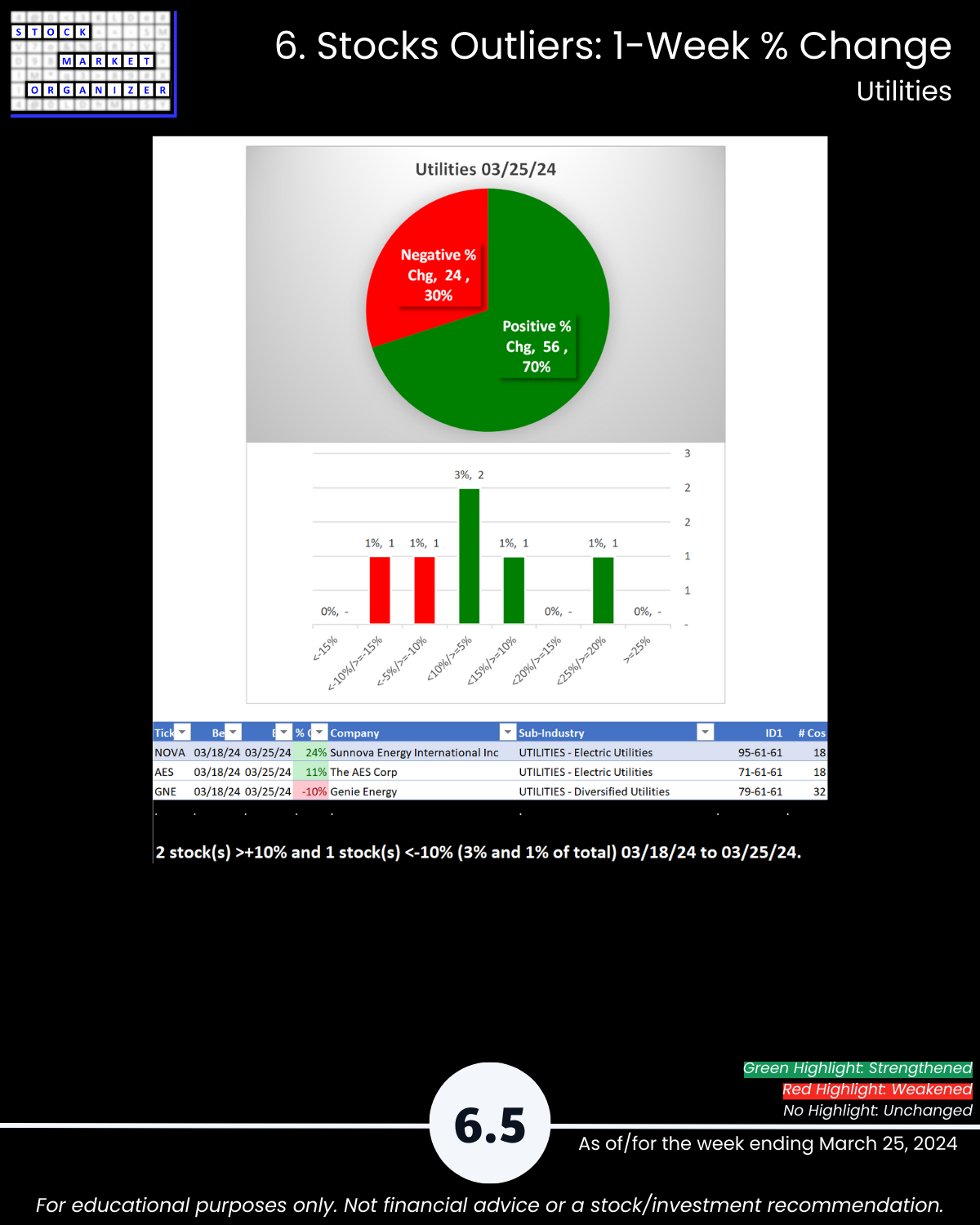

🔹 Strongest Industry: Diversified Serv (Strong, 4th strongest of 9 levels) Weakest Industries: Utilities, Media (Weak, 6th strongest)

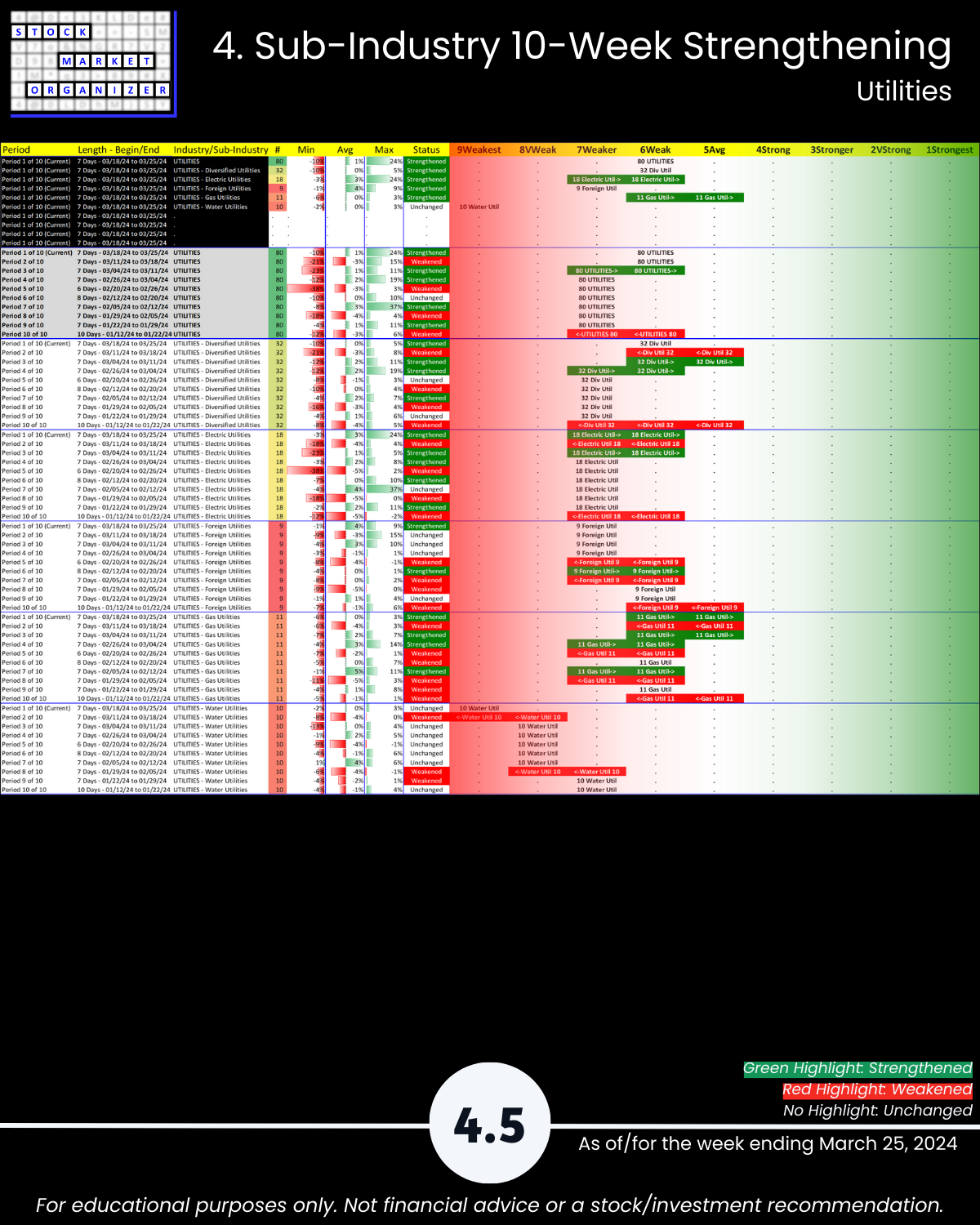

🔹 Sub-industries (38): 11% Strengthened, 16% Weakened; strongest Technical Services, weakest Water Utilities

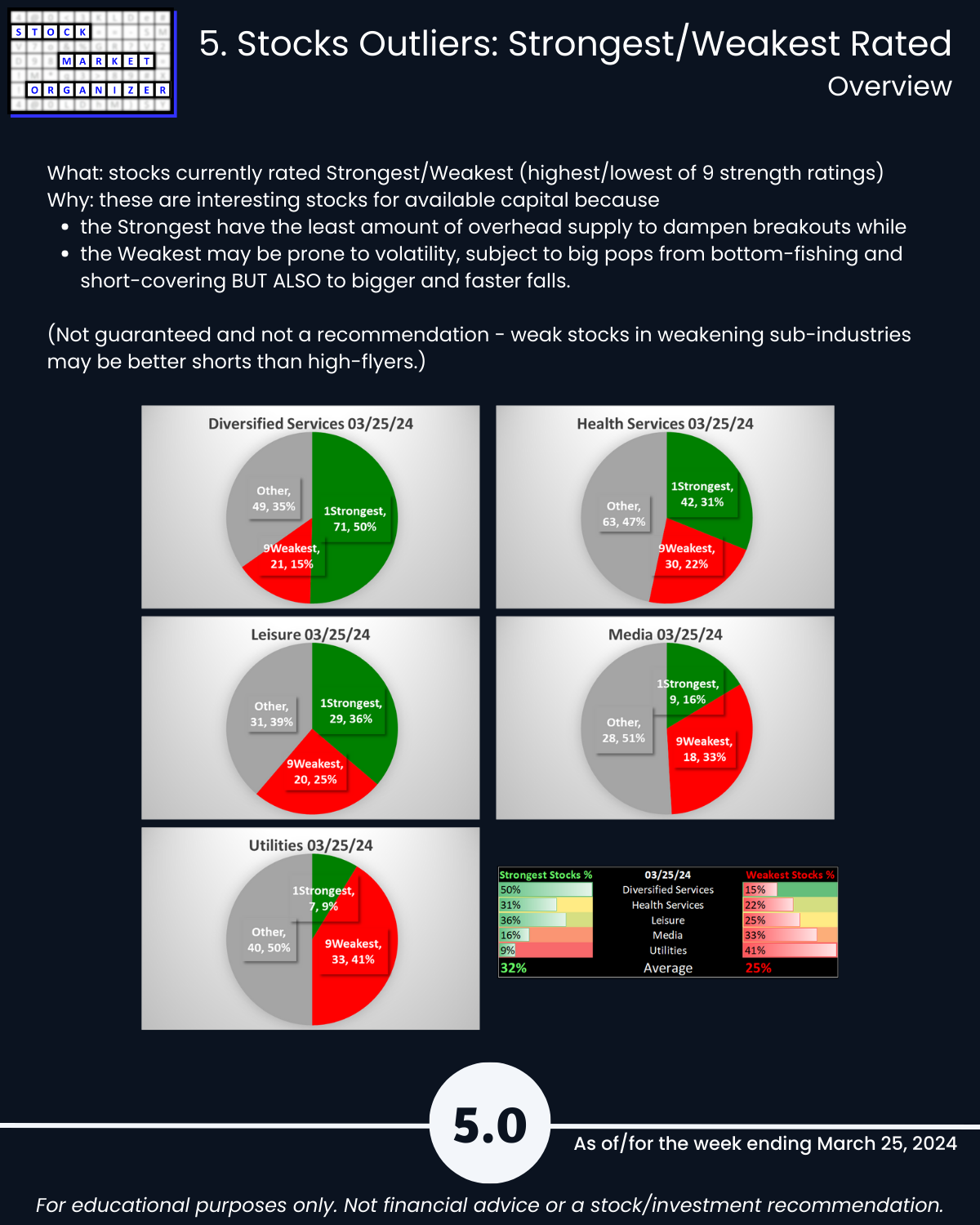

🔹 Stocks rated Strongest:Weakest: Diversified Services 50%:15%, Utilities 9%:41%

🔹 Outliers: Diversified Services 74%, Utilities 70% positive stocks; NOTV +23%, WW -25%; CUTR -22%, APYX -28%; NOVA +24%

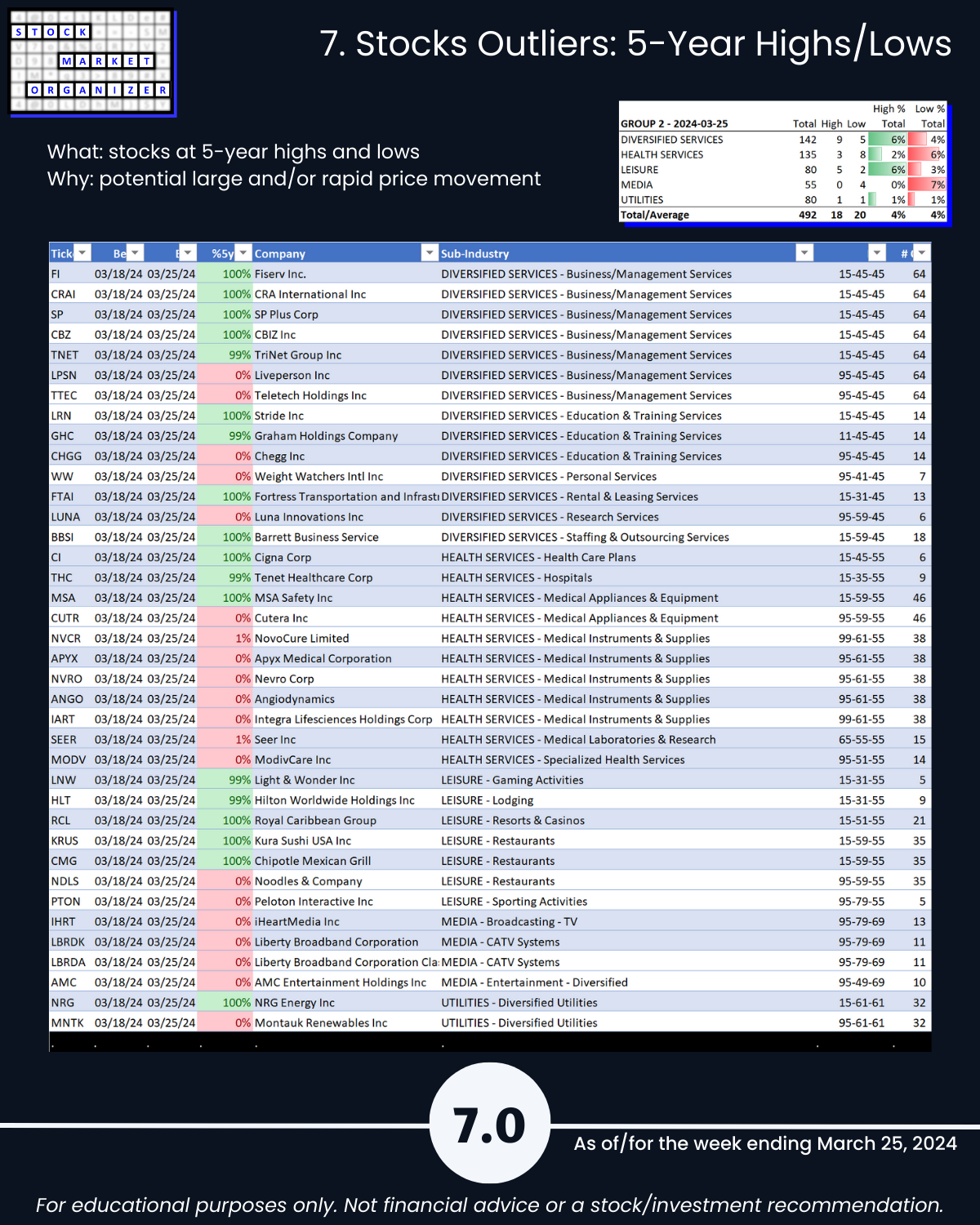

🔹 @ 5-Year Highs/Lows %: No outliers

This report may particularly be of interest if the following 5 concepts resonate with you:

- The stronger your stocks, the greener your P&L.

- The journey to 100%+ returns begins with 10% returns.

- The journey to a multi-month rally begins with one up week.

- Most stocks do what the market does. (While the market can only do what its underlying stocks, sub-industries, and industries do.)

- 80/20: not all information is created equal. (Press buttons, not balloons.)

Following are galleries with page-by-page views of this report.

1. Introduction

2. Industry 1-Week Strengthening

3. Industry 10-Week Strengthening

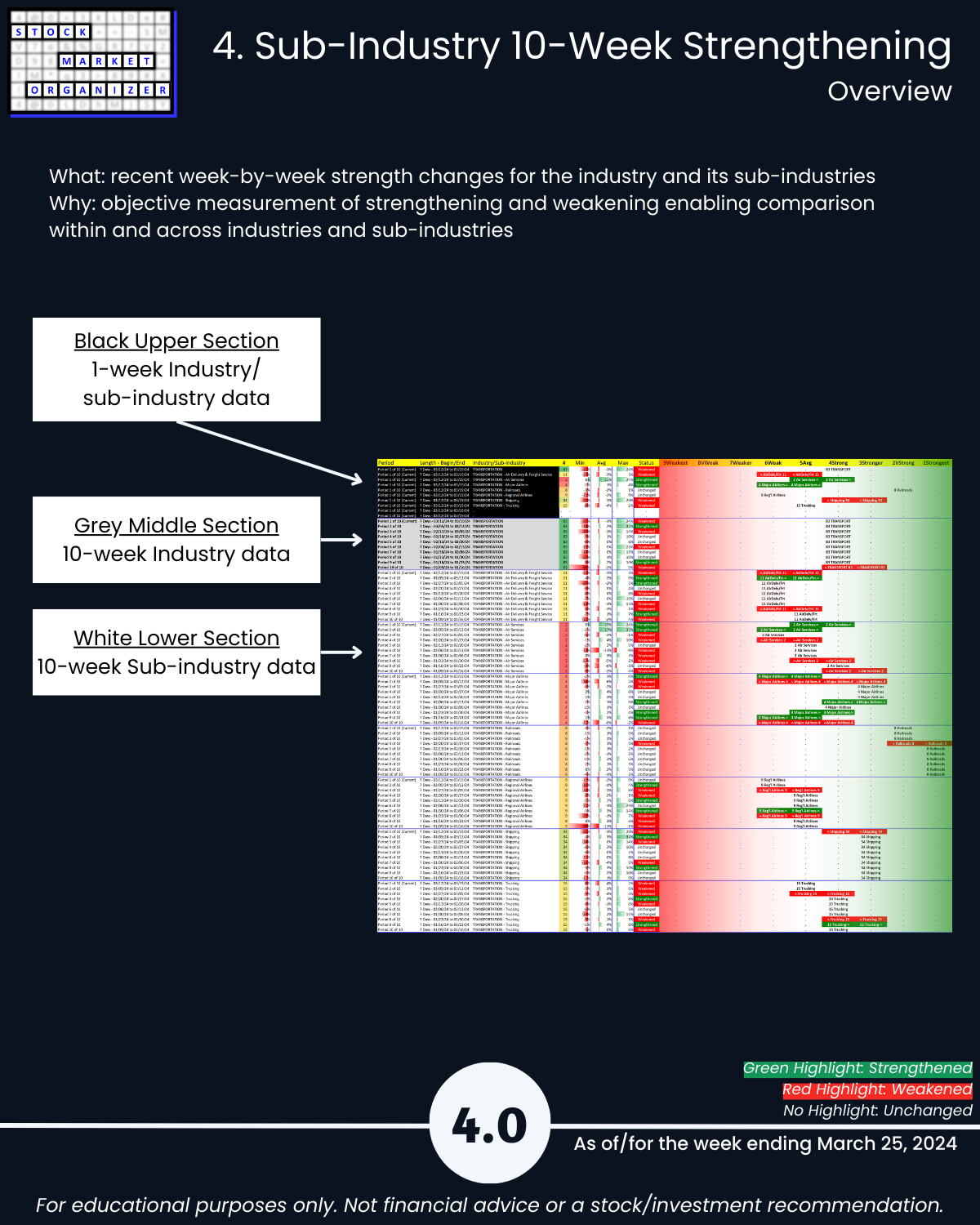

4. Sub-Industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

6. Stocks Outliers: 1-Week % Change

7. Stocks Outliers: 5-Year Highs/Lows