SMO Exclusive: Strength Report Group 2 2024-03-11

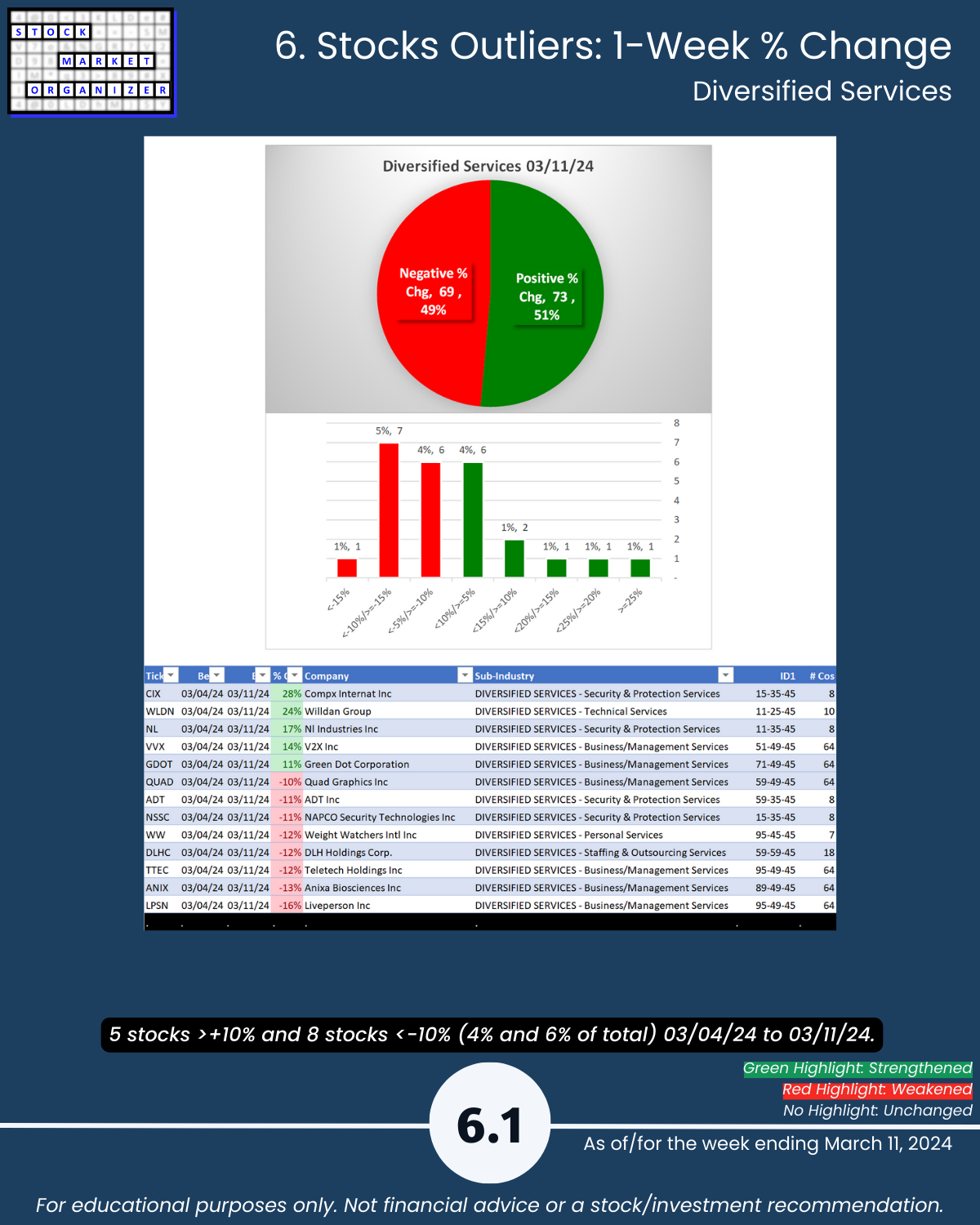

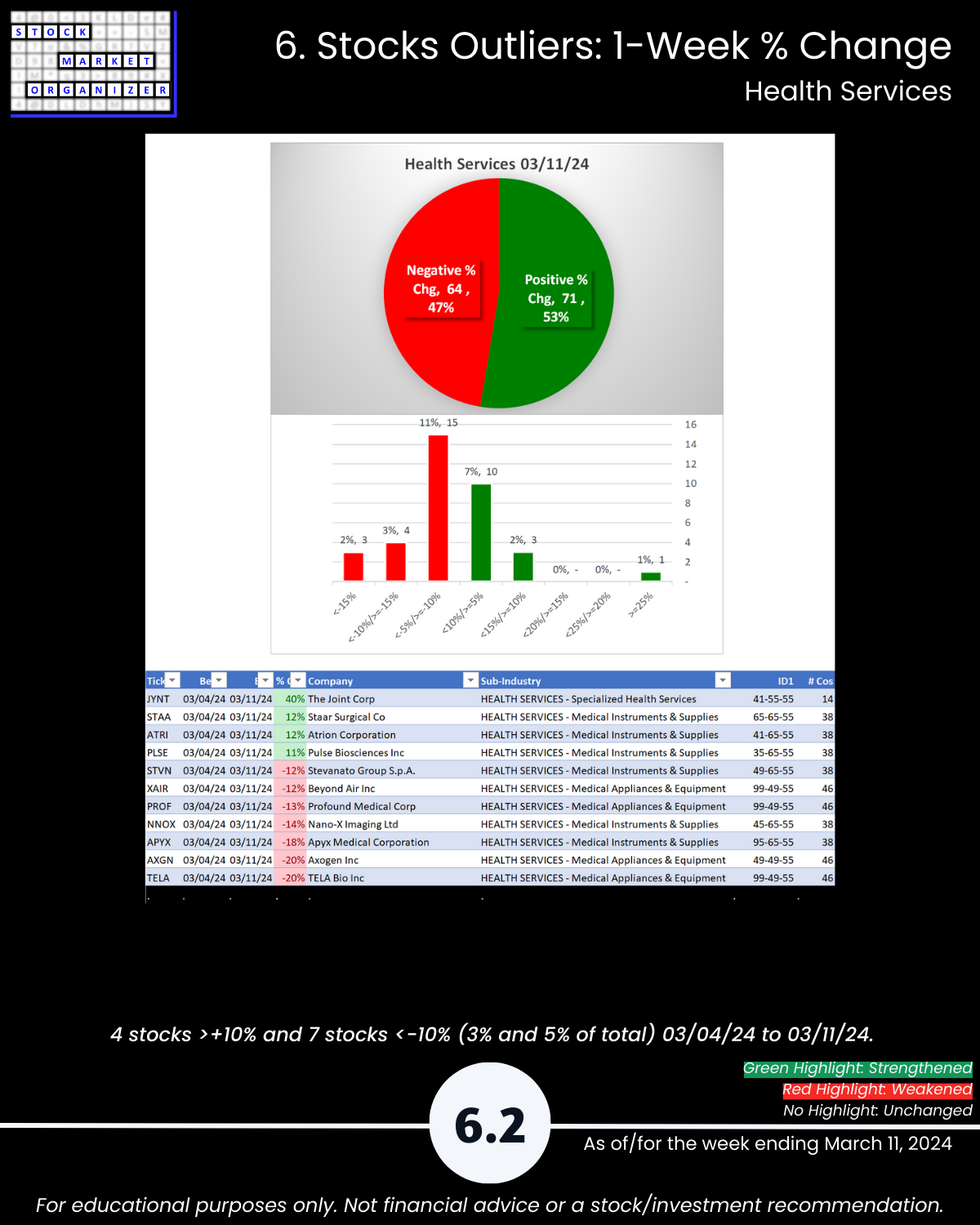

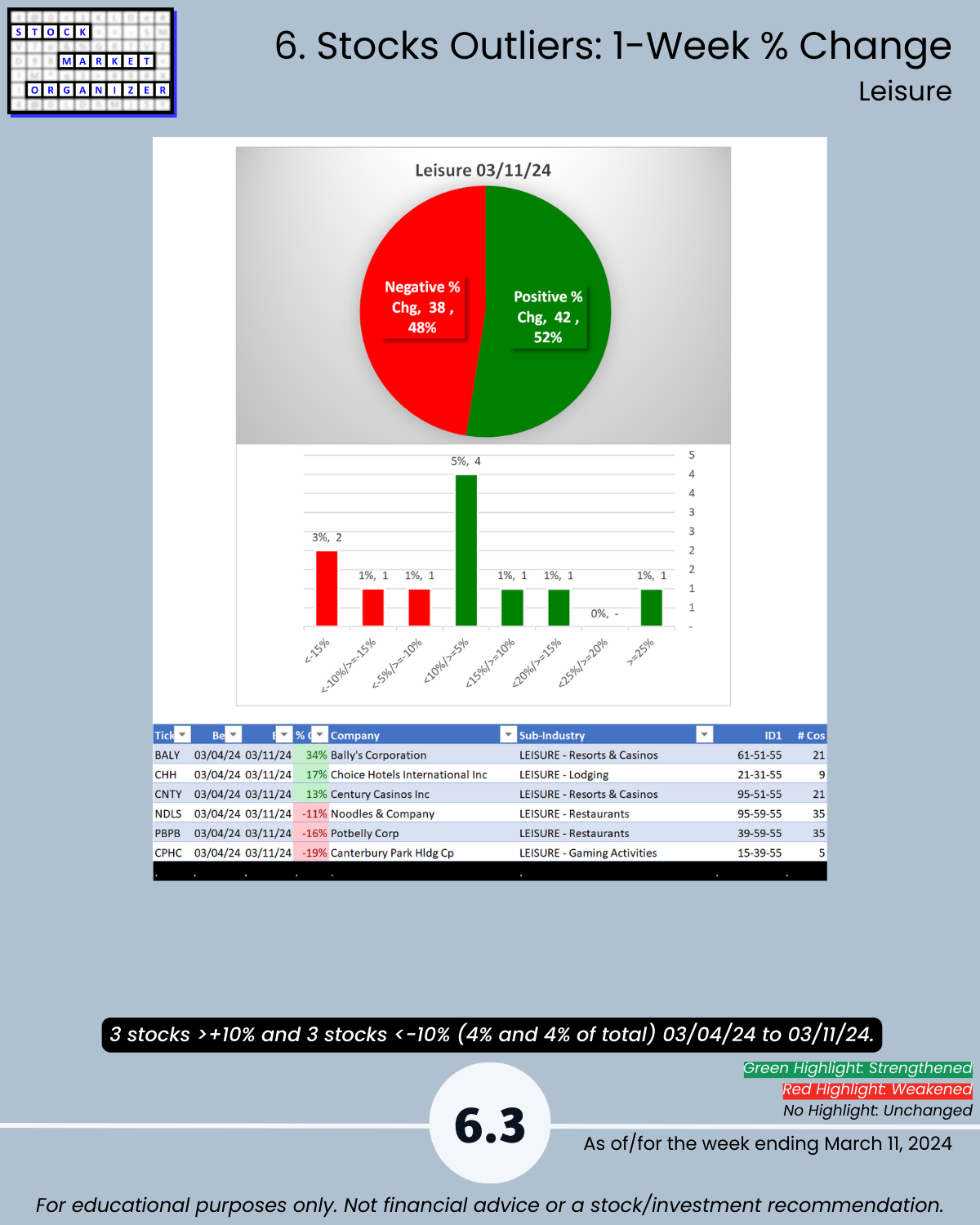

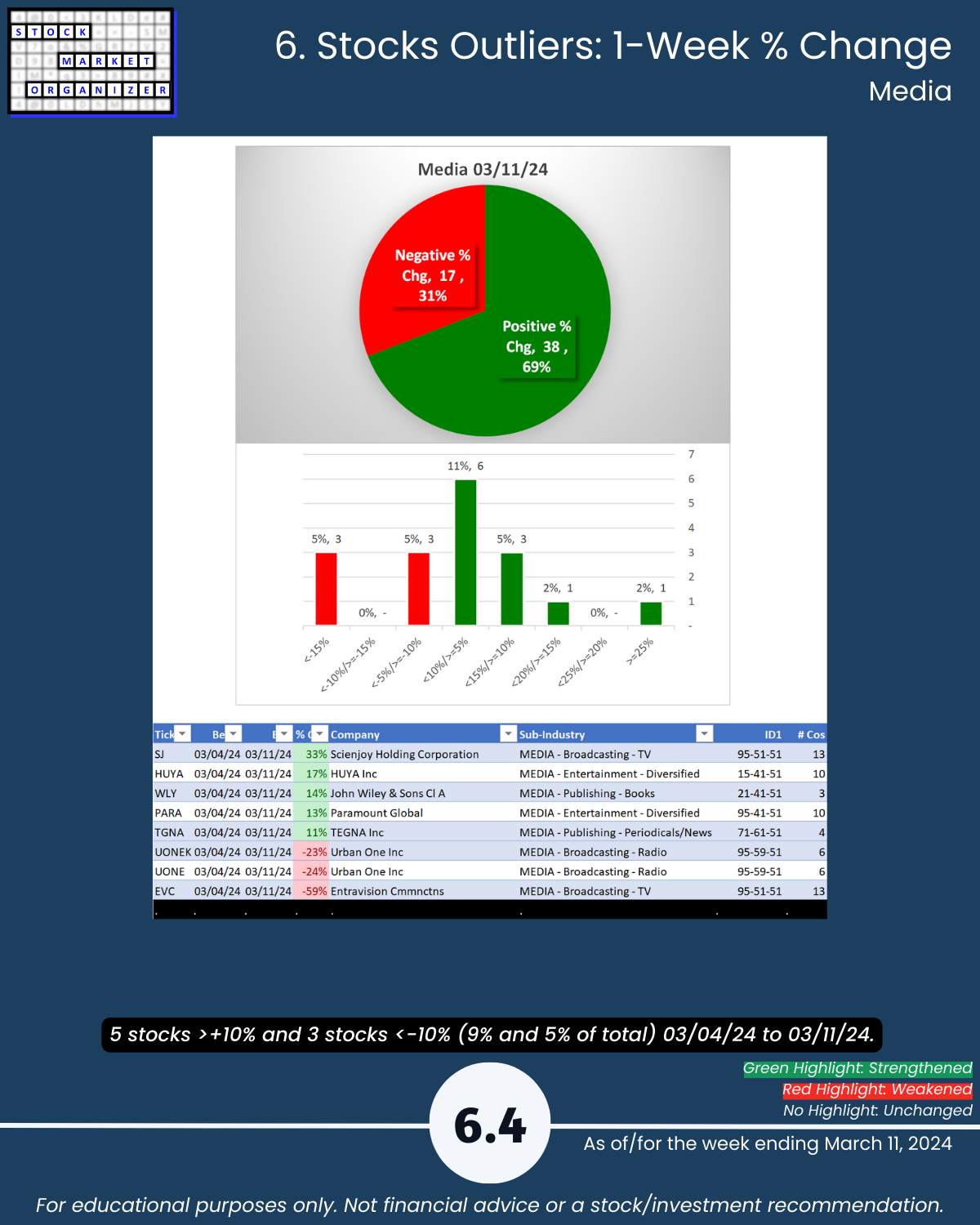

Stock Market Strength Stacking: your P&L’s BFF. (More below.) Group 2 (loosely, Services Sector) analysis 3/11/24, 2 of 5 industries STRENGTHENED. If you’re not watching everywhere for strengthening opportunities, how do you know what you are missing? 1-week return outliers – why did the following take off or implode? CIX +28%, WLDN +24%; JYNT +40%, TELA - 20%, AXGN - 20%; BALY +34%; SJ +33%, EVC -59%, UONE -24%; NOVA -23%.

In December 2022, CVNA was the subject of potential bankruptcy rumors. It took off. And kept going. And has kept going. At 50% returns, people likely thought it was overdone. More so at 100%. And 200%, 400%, 600%...

Sure, CVNA +1900% from a cherry-picked bottom is unusual. But if you aren’t looking for such activity you won’t find it.

If you ignore something because it shows strength, because you don’t think it can continue to show that strength, then you are placing your opinion over the market’s. And predicting – even though none of us are good at that.

The market’s is the only opinion that matters. Channel it.

Strength can beget strength. Same with weakness. Yes, 10% returns can turn into -10% returns. Yet 10% returns are needed to turn into 100% returns. And more. 10%+ returns = strengthening = something to look for, not fear.

Stock strengthening + a rising sub-industry, industry, and market = strength stacking at its finest.

And you don’t have to catch exact bottoms to enjoy healthy returns. SKYW +49% in 4 months 11/14/23 to 3/8/24 - AFTER it rose 200% December 2022 to August 2023. (49% in this period was a top 5% return in my universe.)

Strength can beget strength. Look for it.

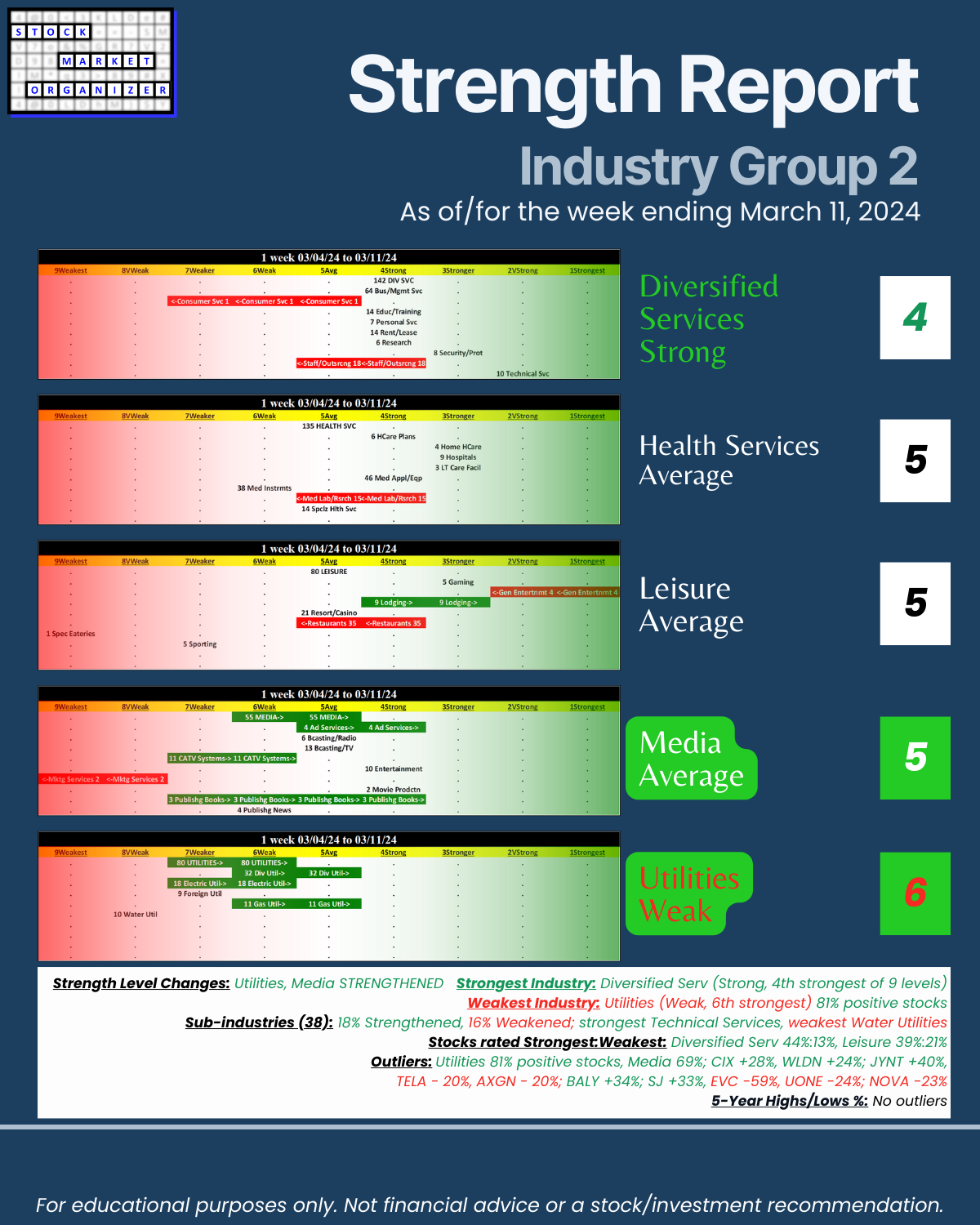

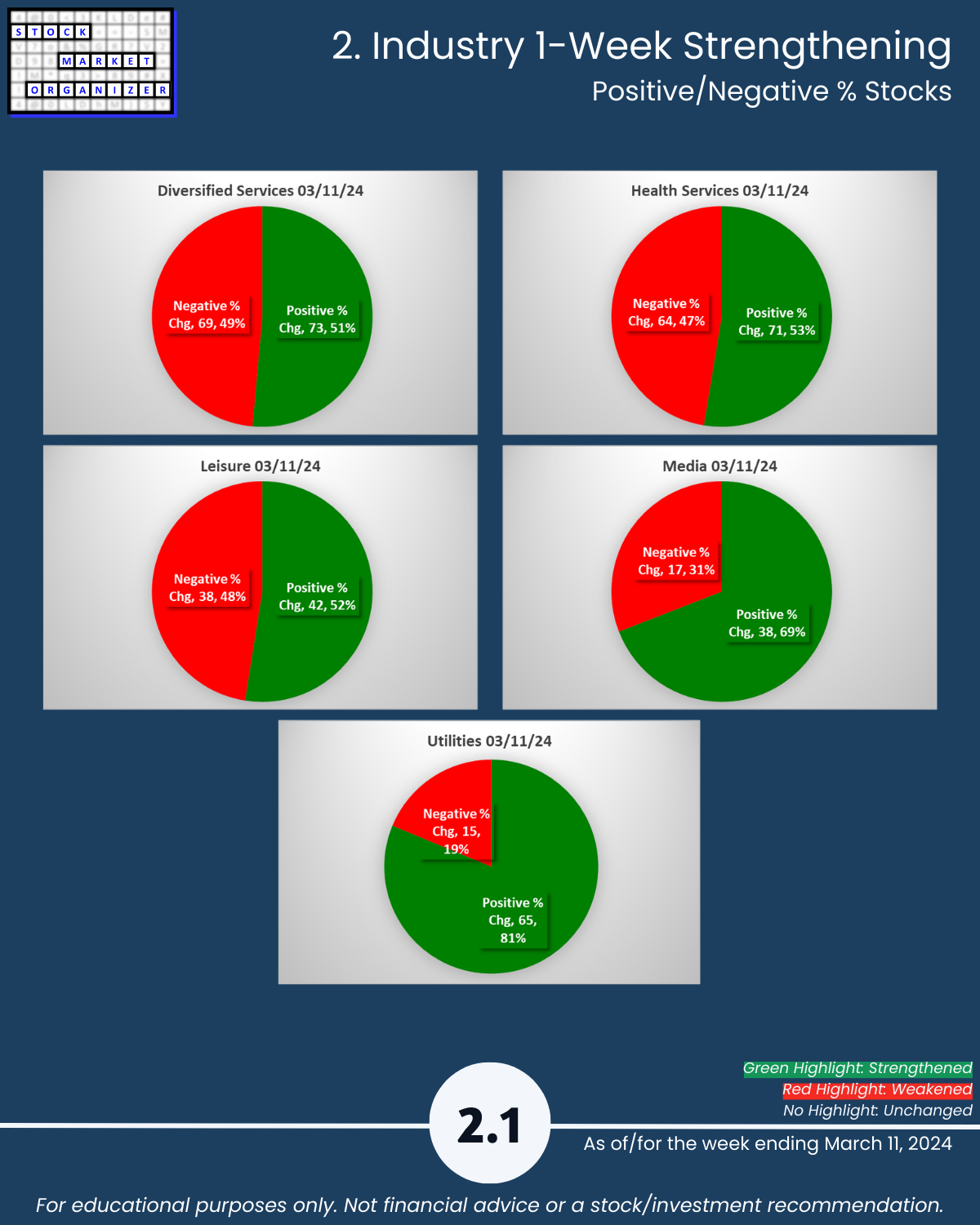

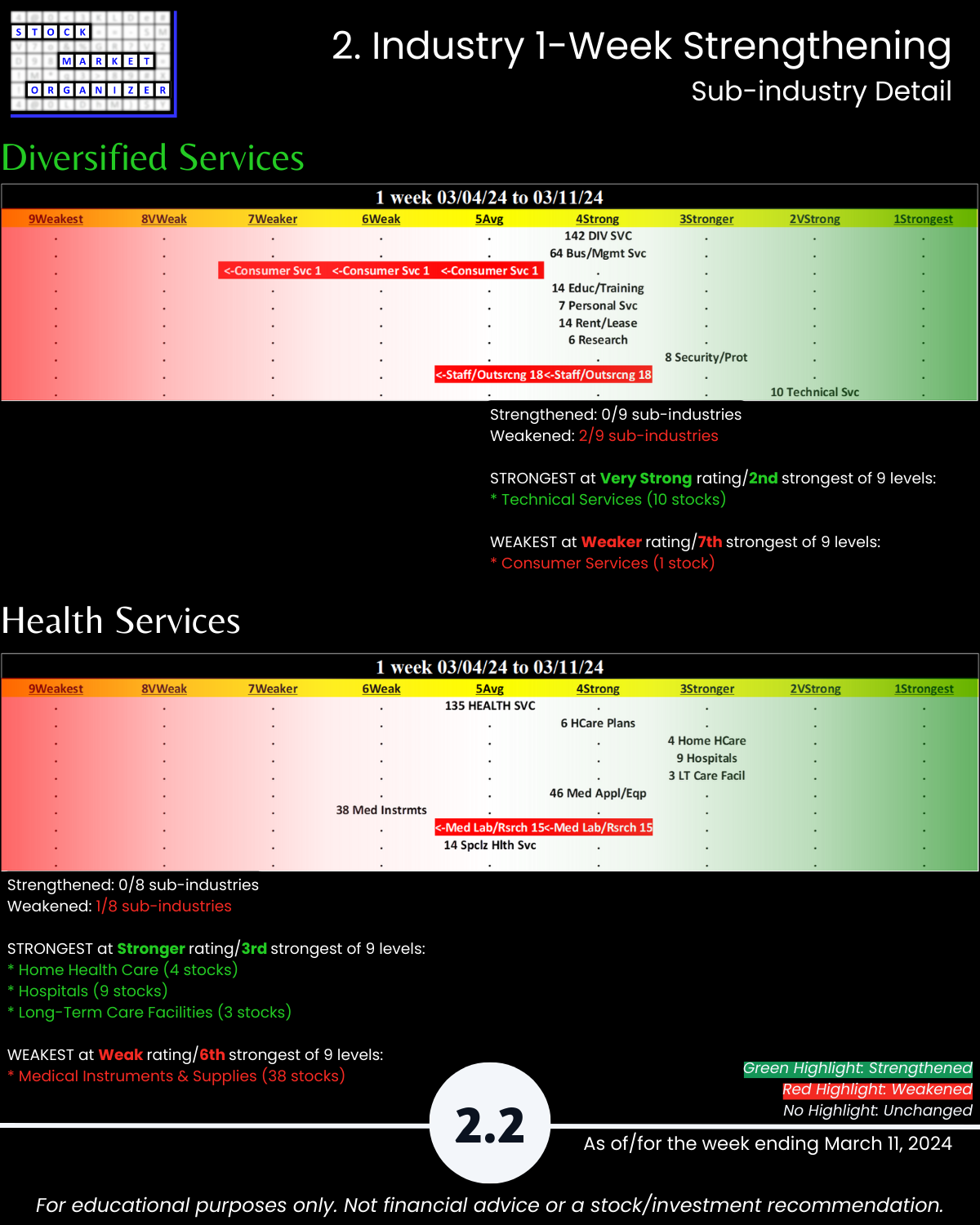

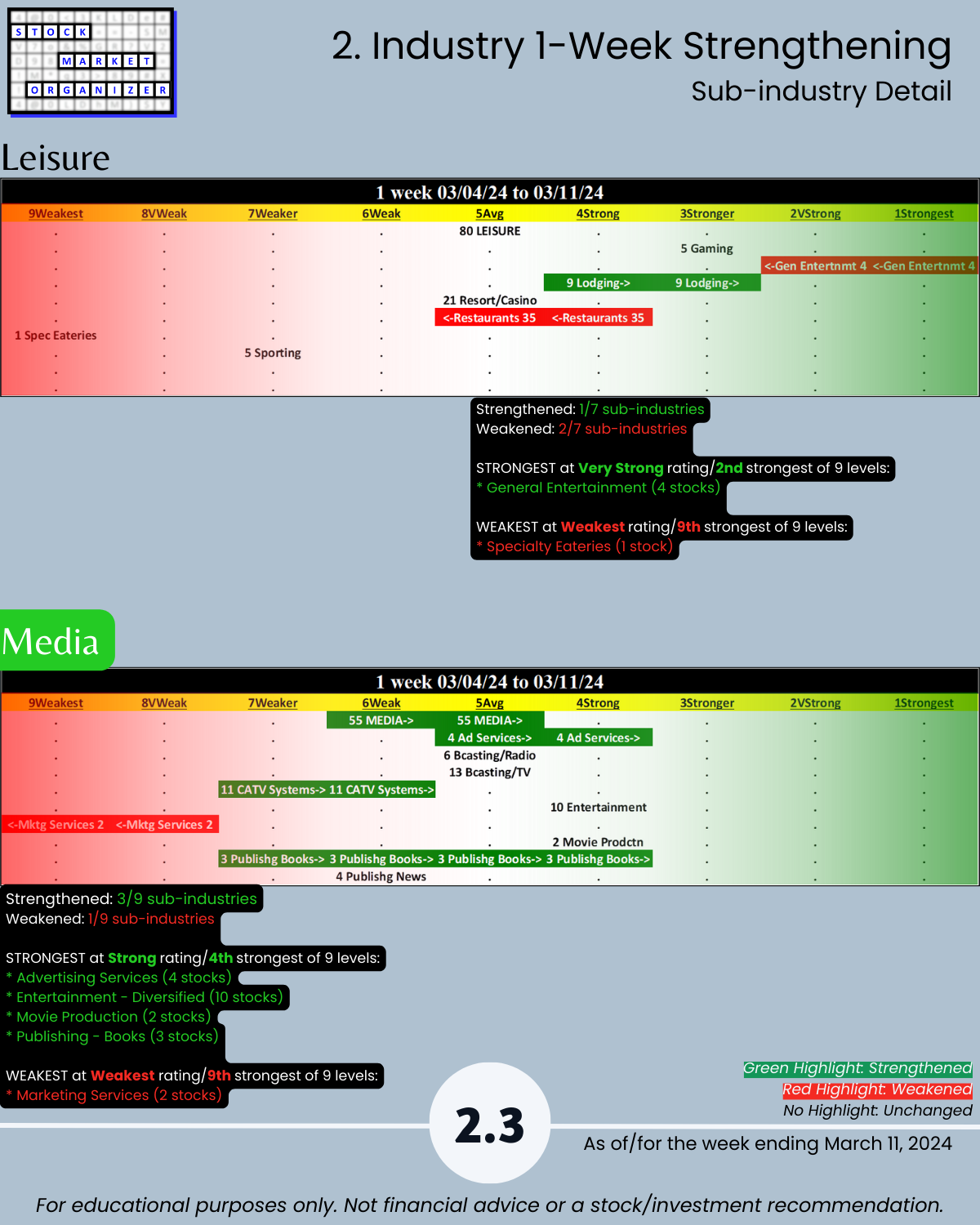

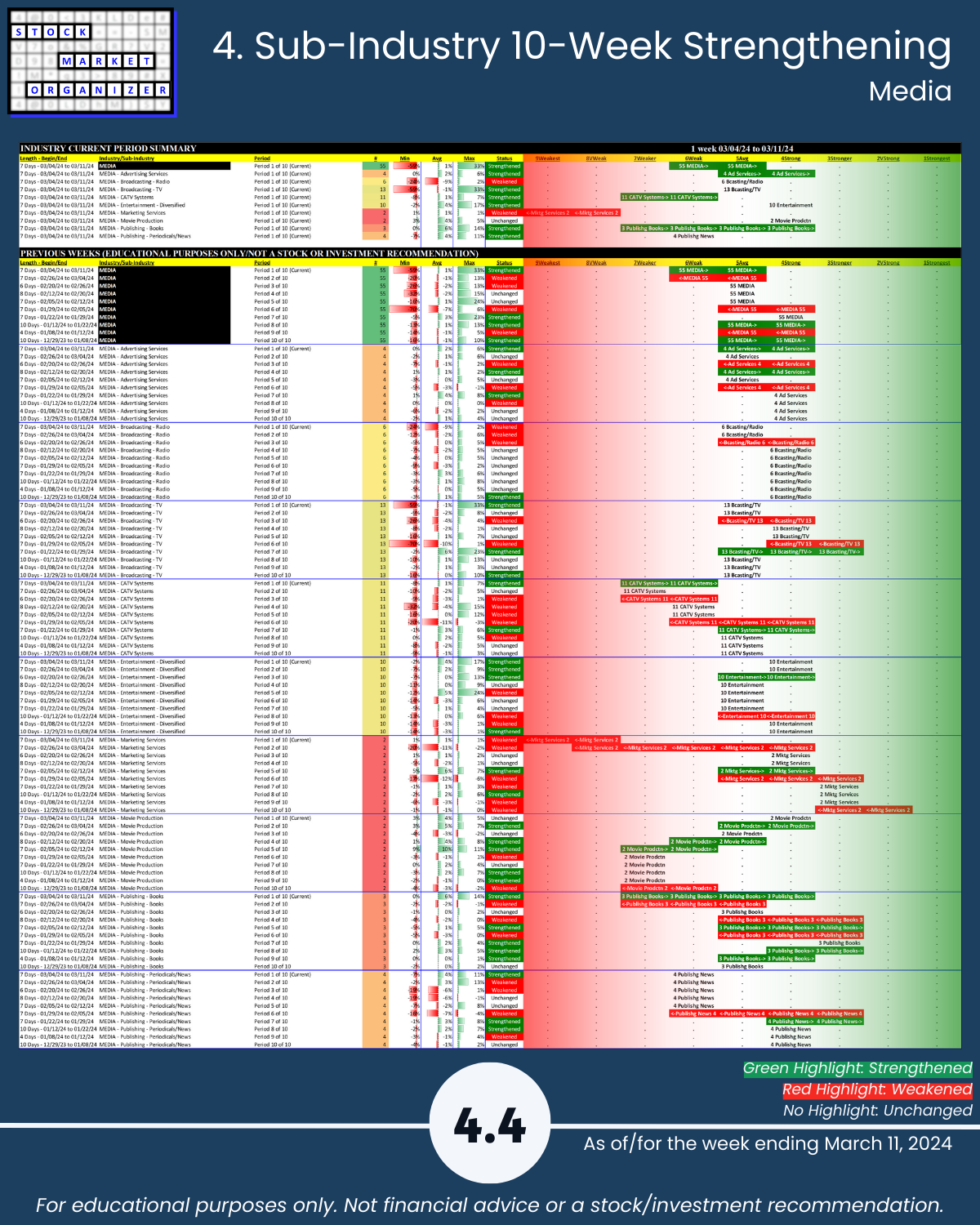

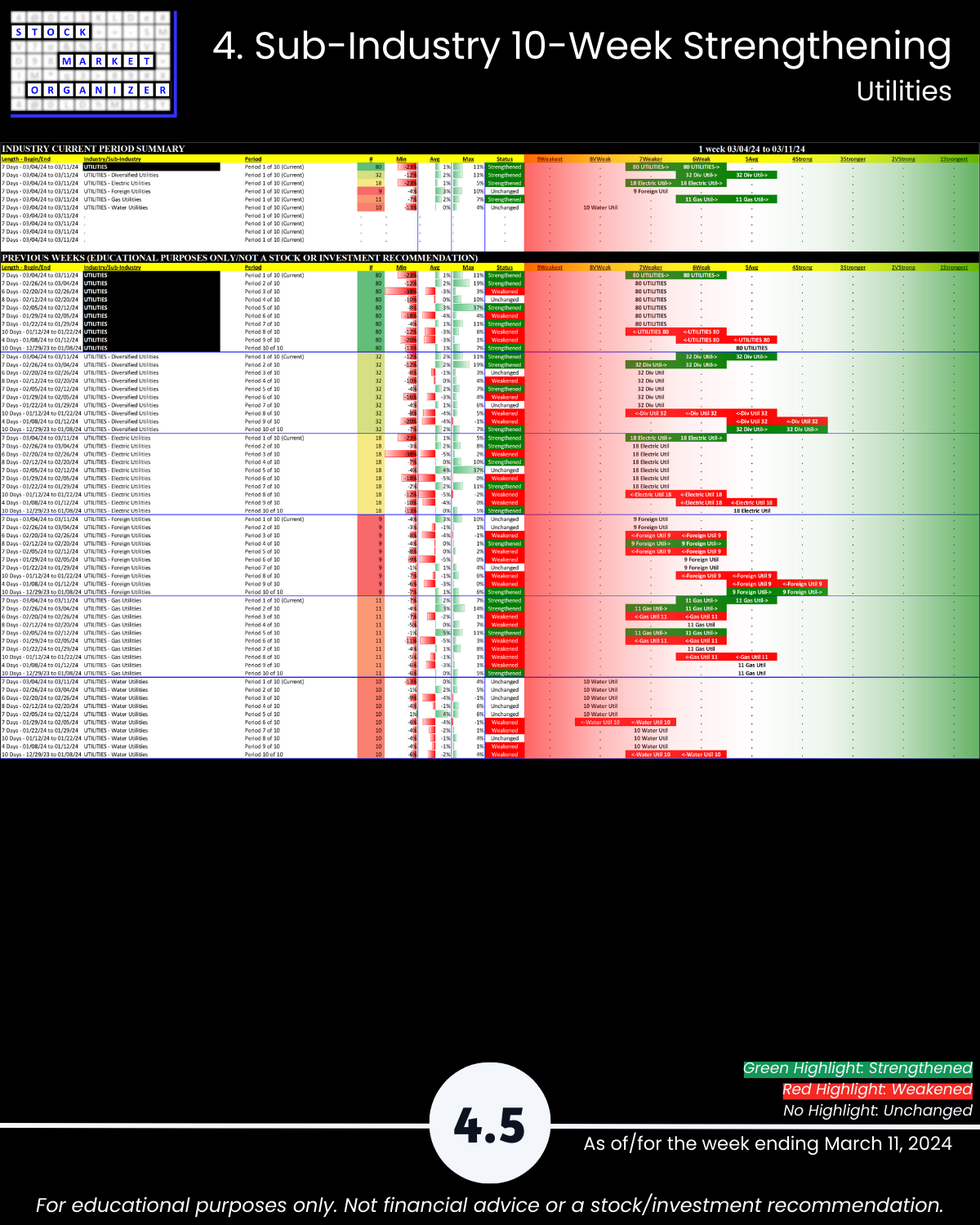

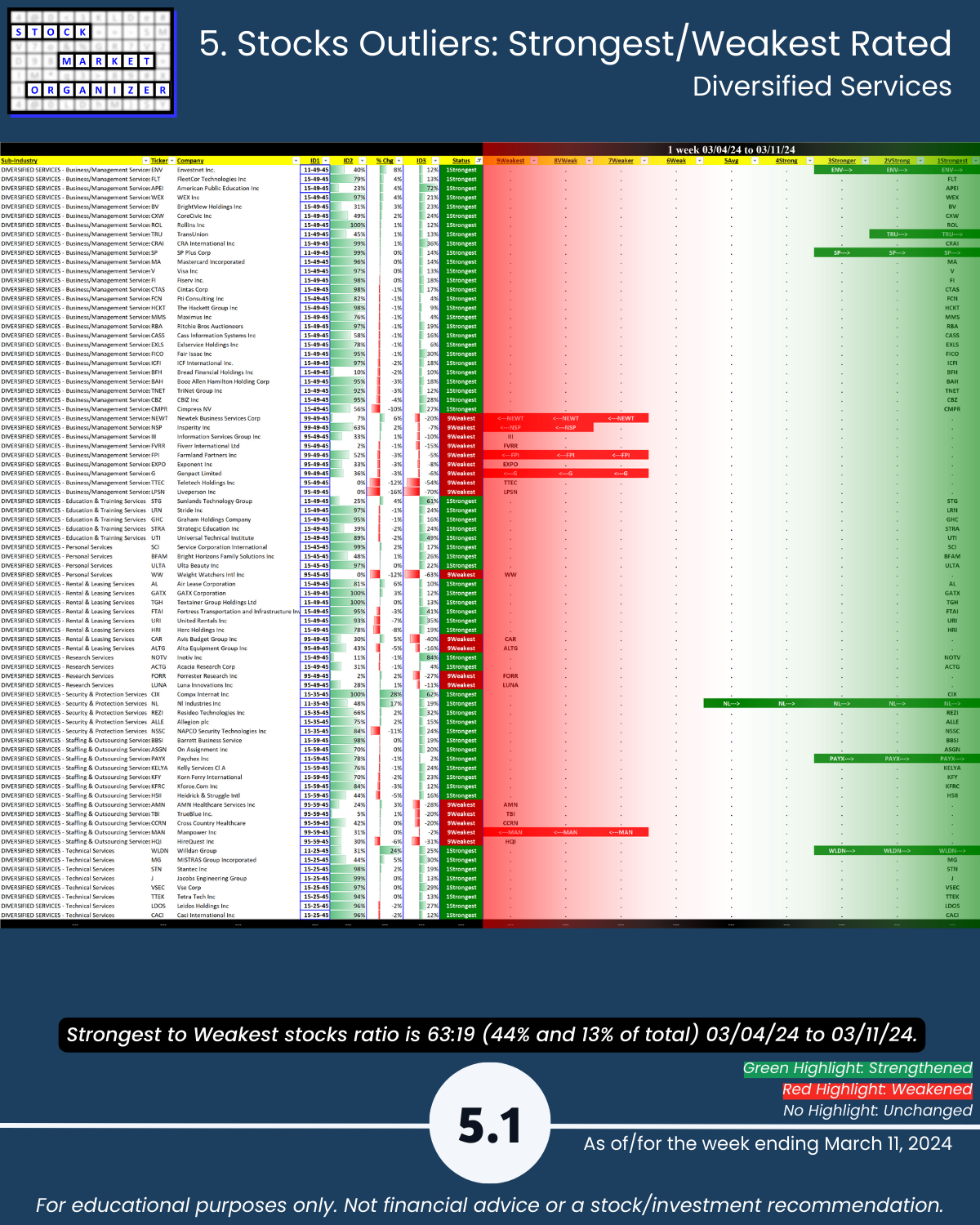

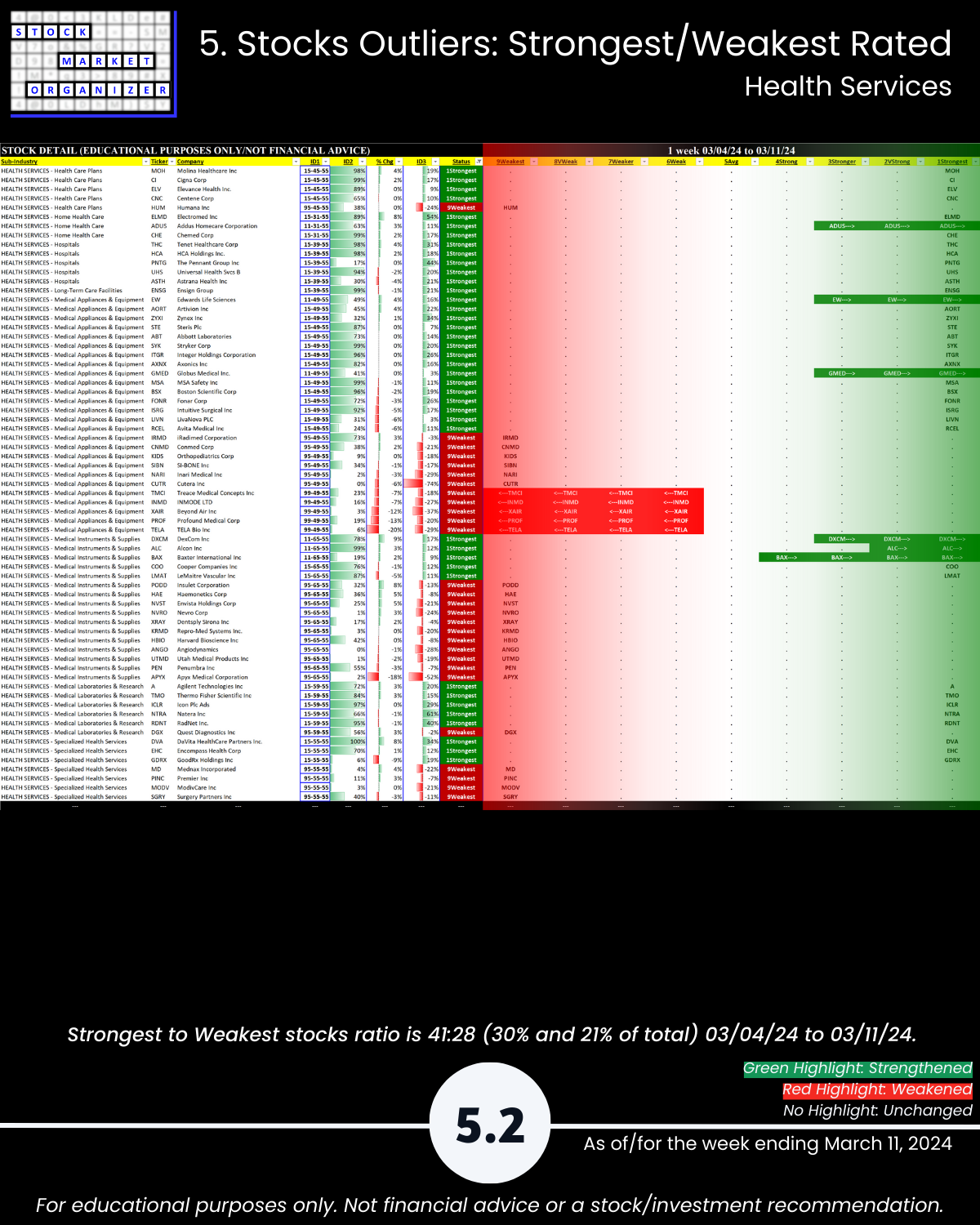

Attached: Strongest- and Weakest-rated Stock Market Organizer stocks and objective strengthening/weakening measurements in the Diversified Services, Health Services, Leisure, Media, and Utilities industries.

Takeaways:

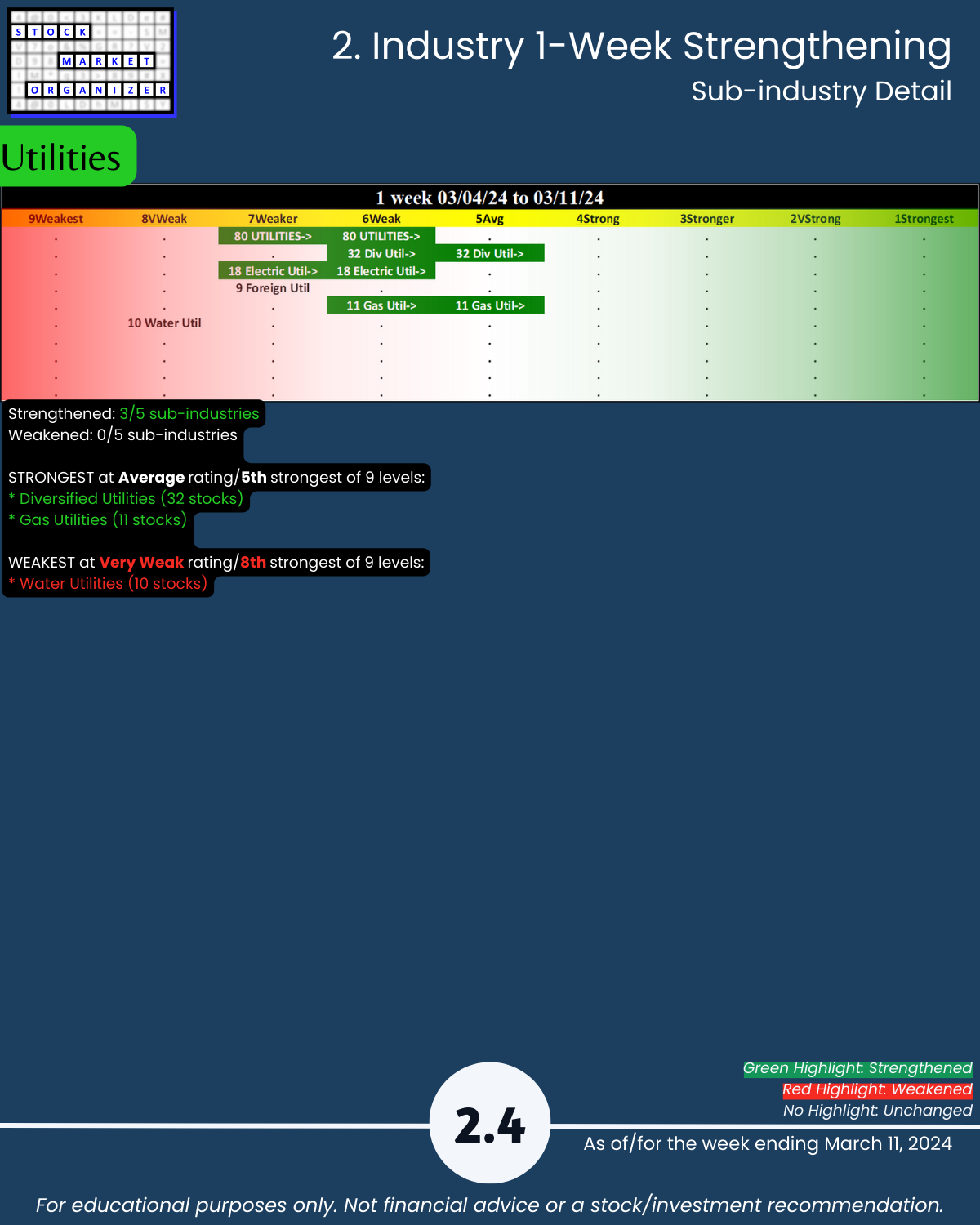

🔹 Strength Level Changes: Utilities, Media STRENGTHENED

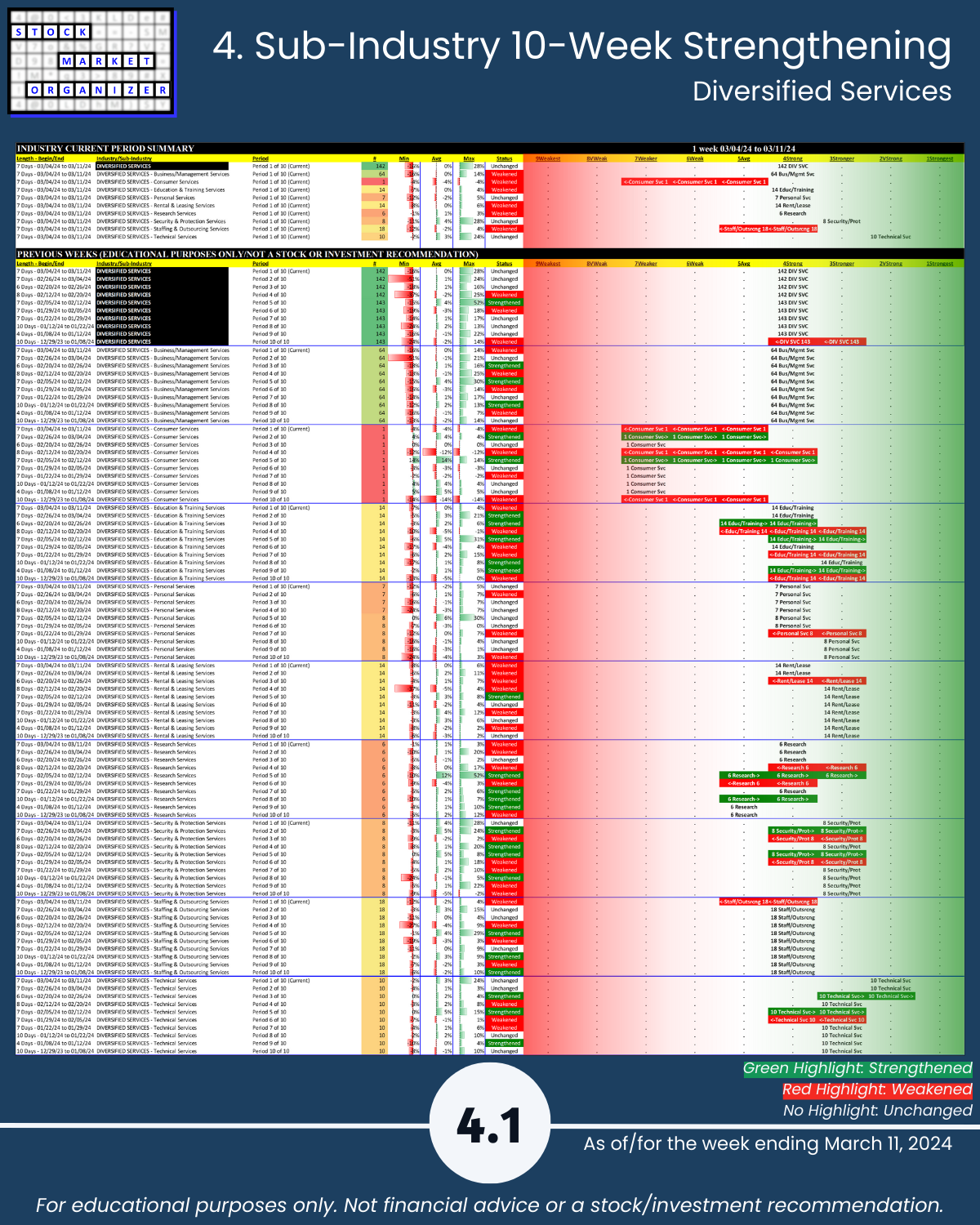

🔹 Strongest Industry: Diversified Serv (Strong, 4th strongest of 9 levels)

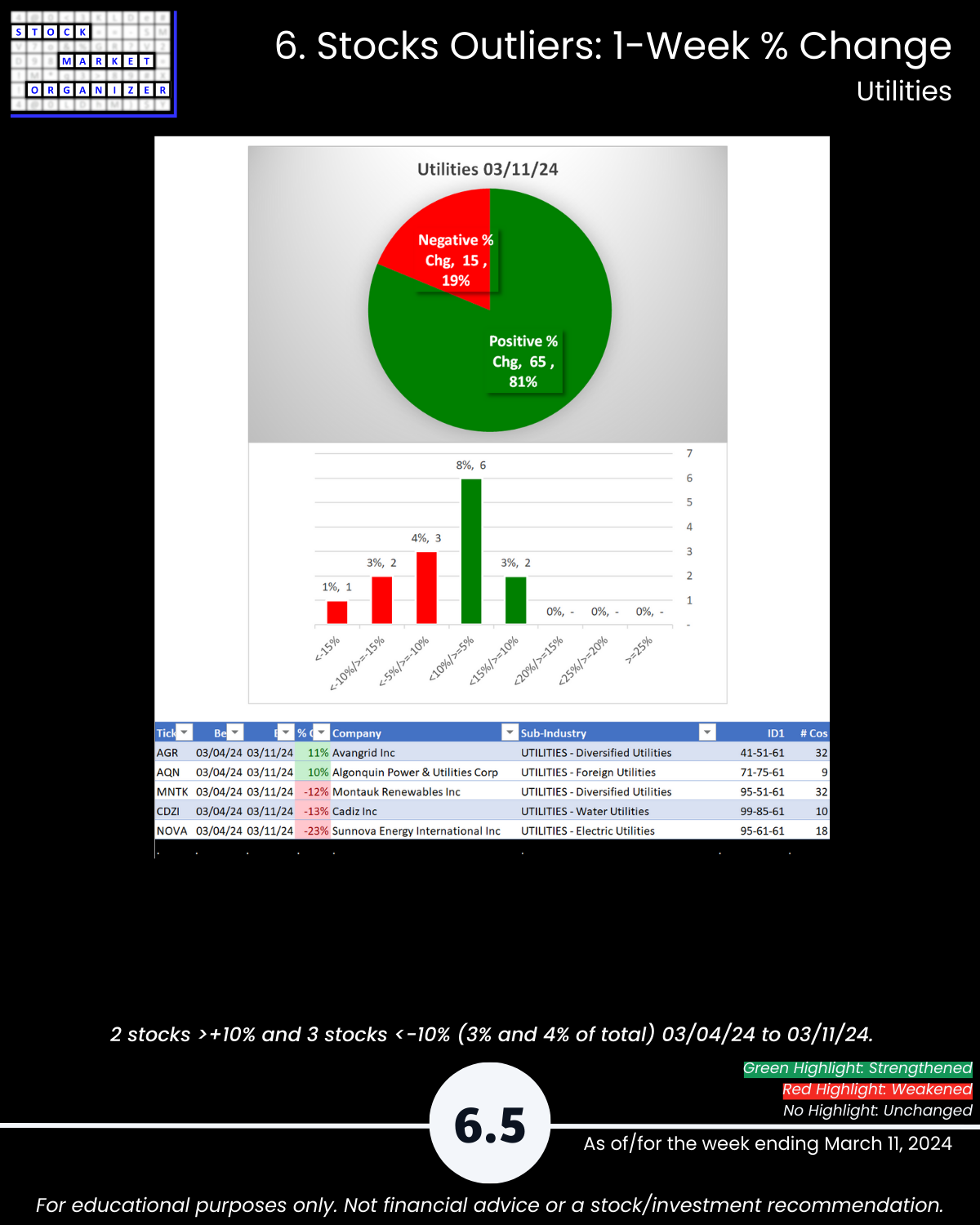

🔹 Weakest Industry: Utilities (Weak, 6th strongest) 81% positive stocks

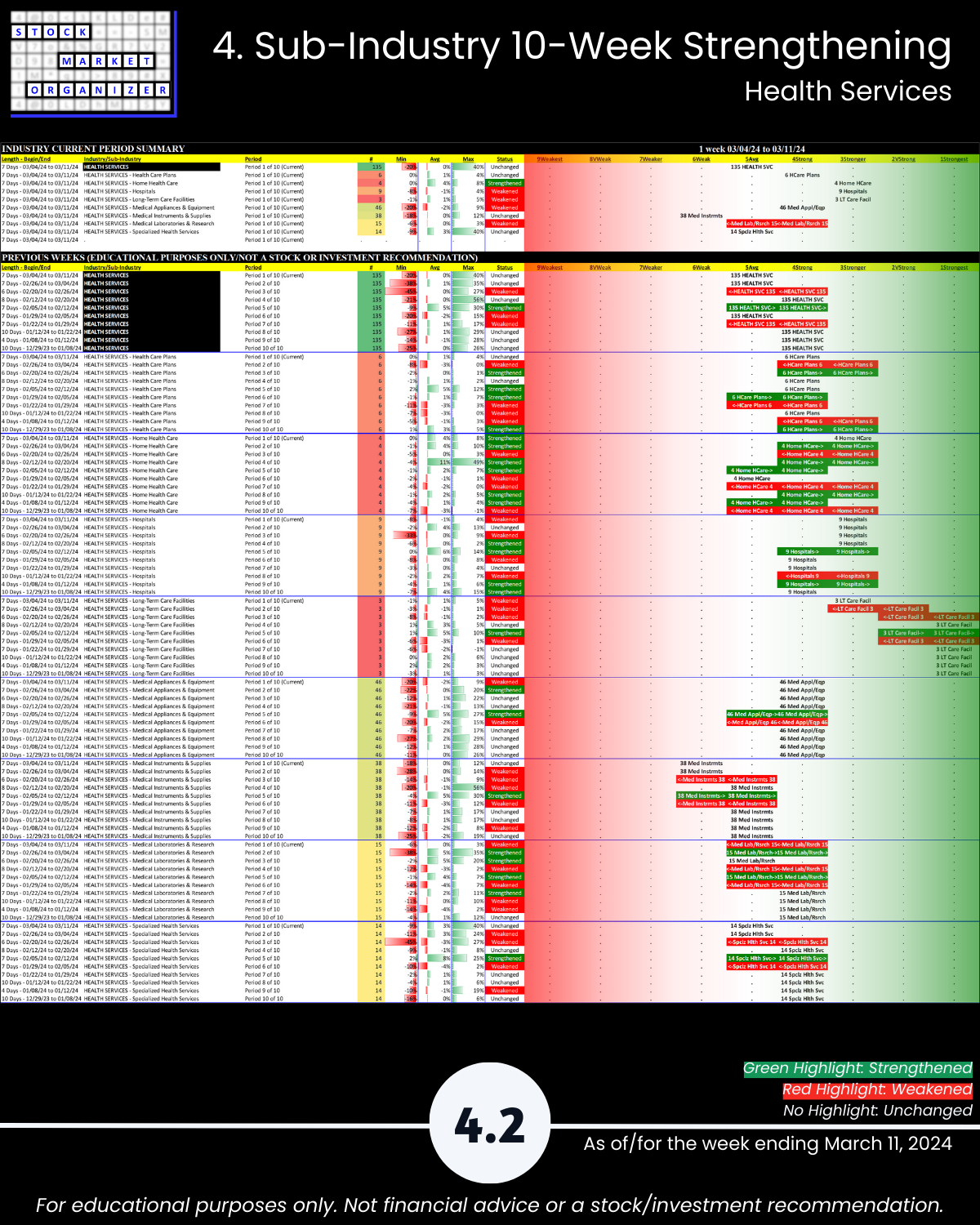

🔹 Sub-industries (38): 18% Strengthened, 16% Weakened; strongest Technical Services, weakest Water Utilities

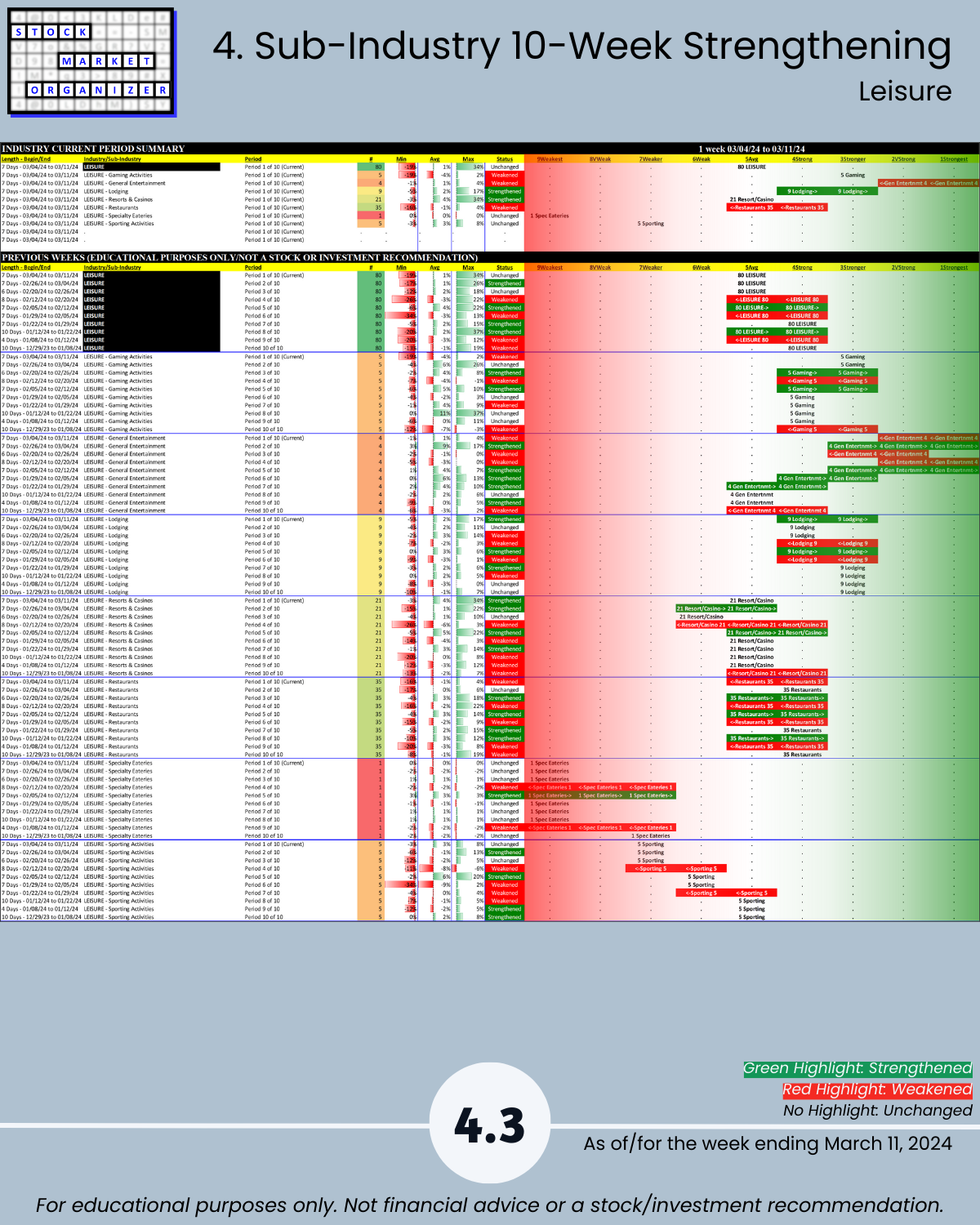

🔹 Stocks rated Strongest:Weakest: Diversified Serv 44%:13%, Leisure 39%:21%

🔹 Outliers: Utilities 81% positive stocks, Media 69%; CIX +28%, WLDN +24%; JYNT +40%,

TELA - 20%, AXGN - 20%; BALY +34%; SJ +33%, EVC -59%, UONE -24%; NOVA -23%

🔹 5-Year Highs/Lows %: No outliers

This report may particularly be of interest if the following 5 concepts resonate with you:

- The stronger your stocks, the greener your P&L.

- The journey to 100%+ returns begins with 10% returns.

- The journey to a multi-month rally begins with one up week.

- Most stocks do what the market does. (While the market can only do what its underlying stocks, sub-industries, and industries do.)

- 80/20: not all information is created equal. (Press buttons, not balloons.)

Following are galleries with page-by-page views of this report.

1. Introduction

2. Industry 1-Week Strengthening

3. Industry 10-Week Strengthening

4. Sub-Industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

6. Stocks Outliers: 1-Week % Change

7. Stocks Outliers: 5-Year Highs/Lows