SMO Exclusive: Strength Report Group 1 2024-04-23

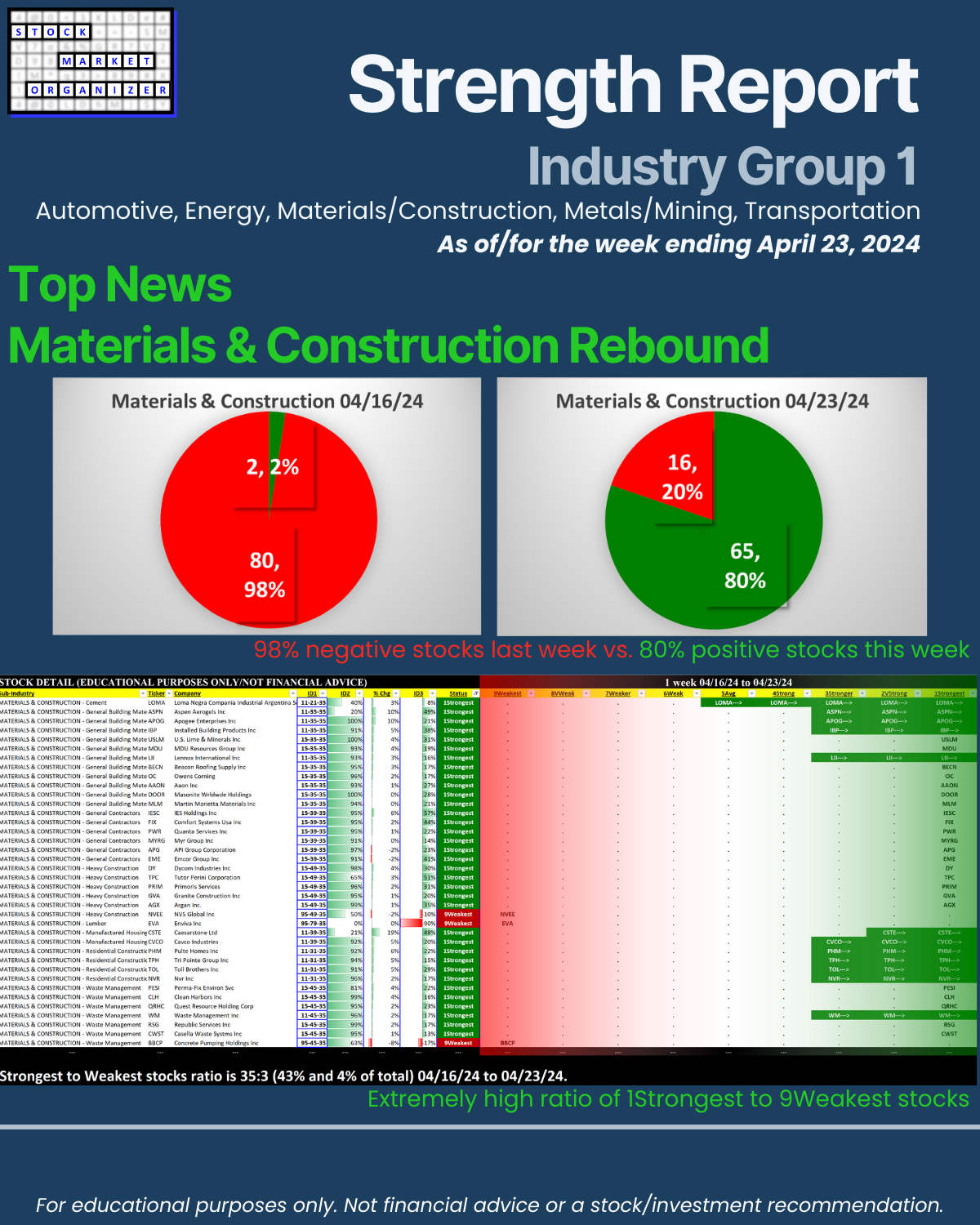

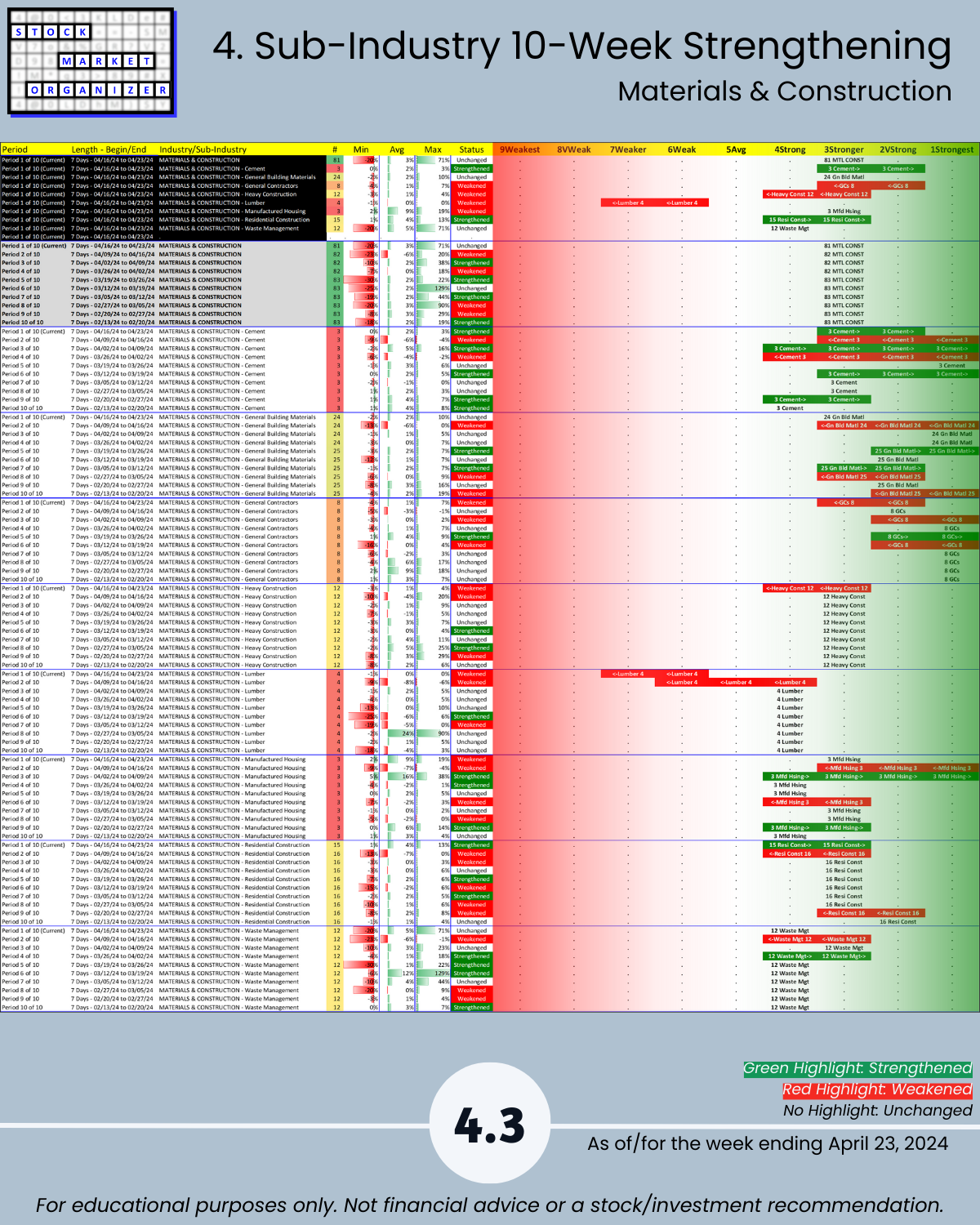

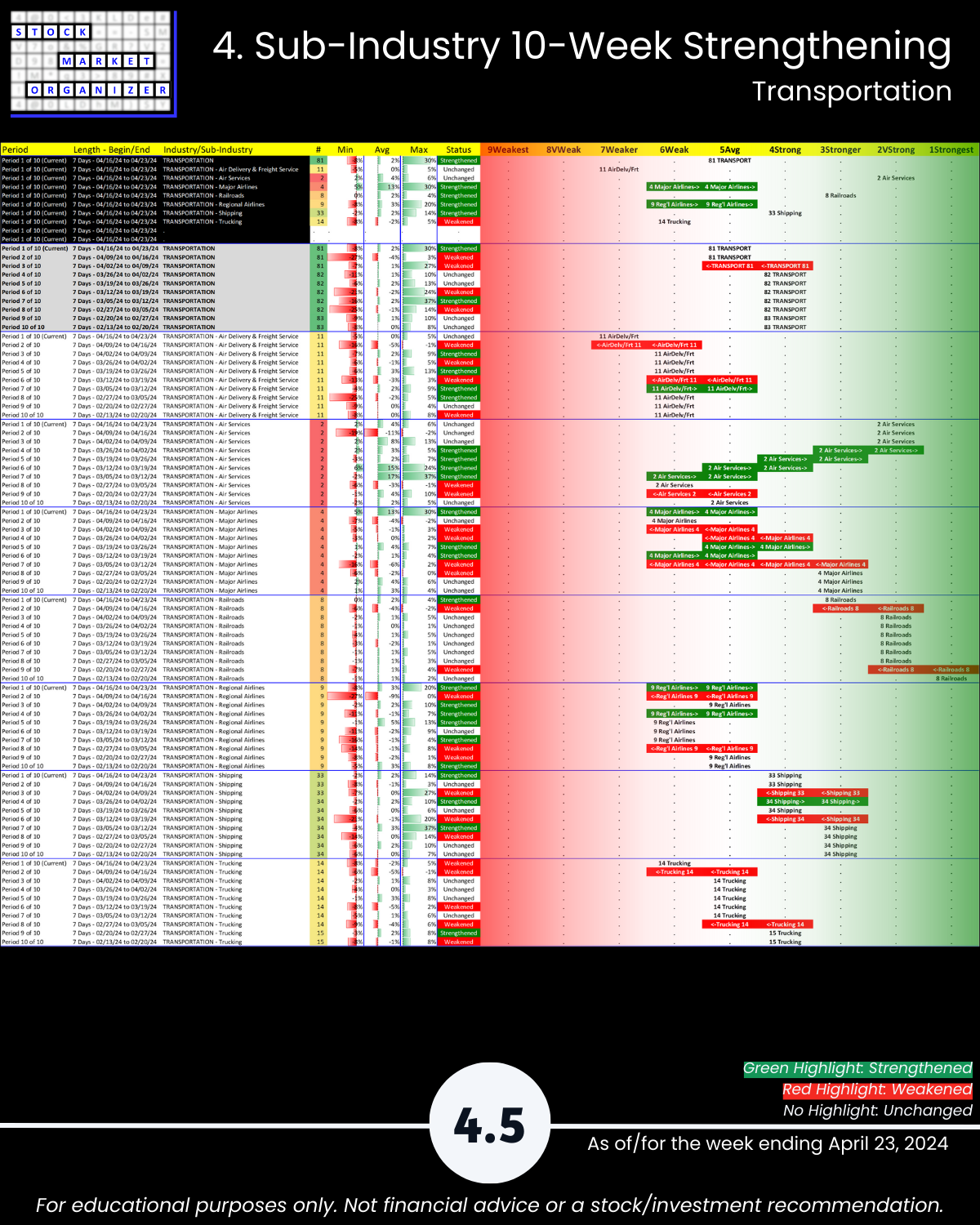

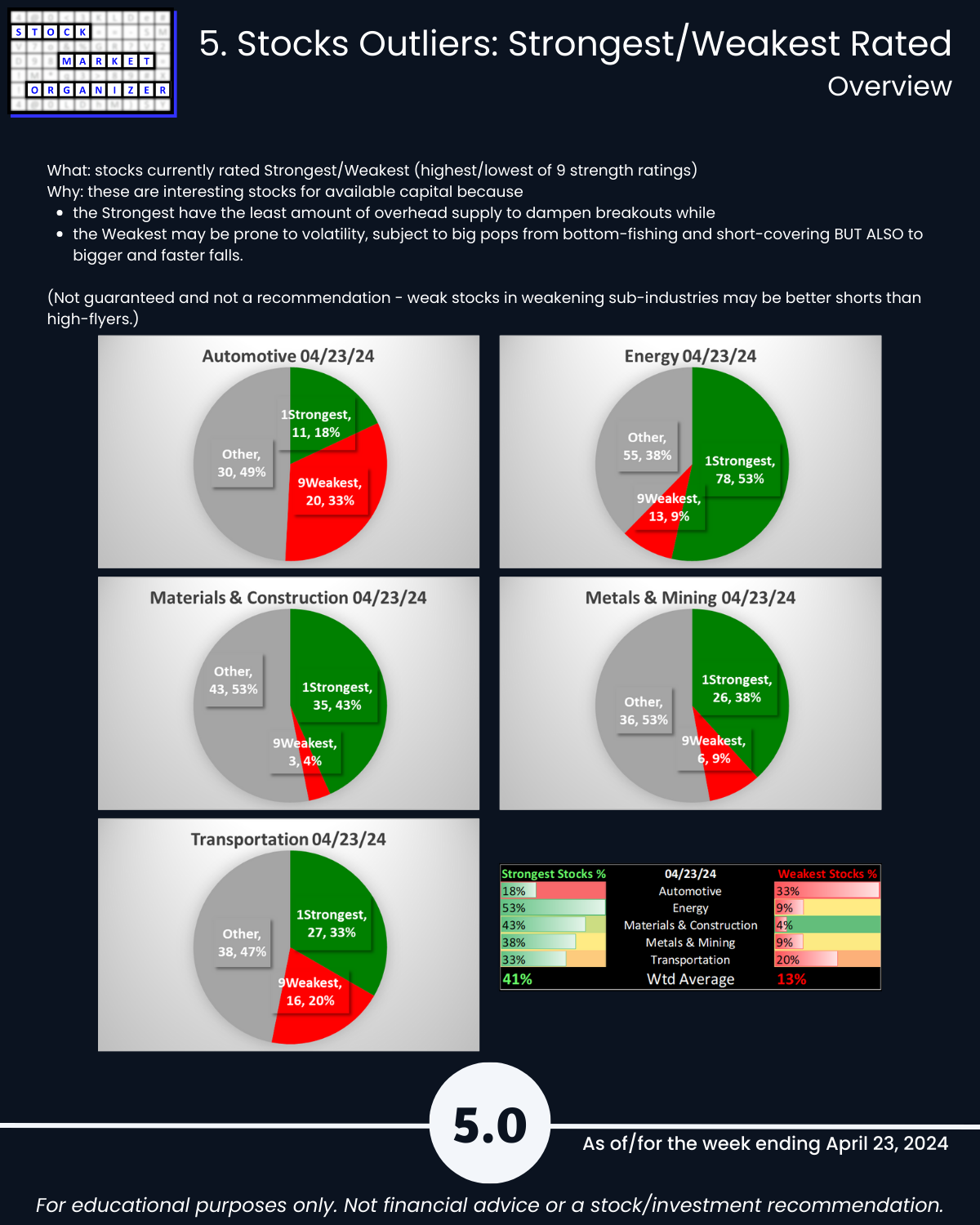

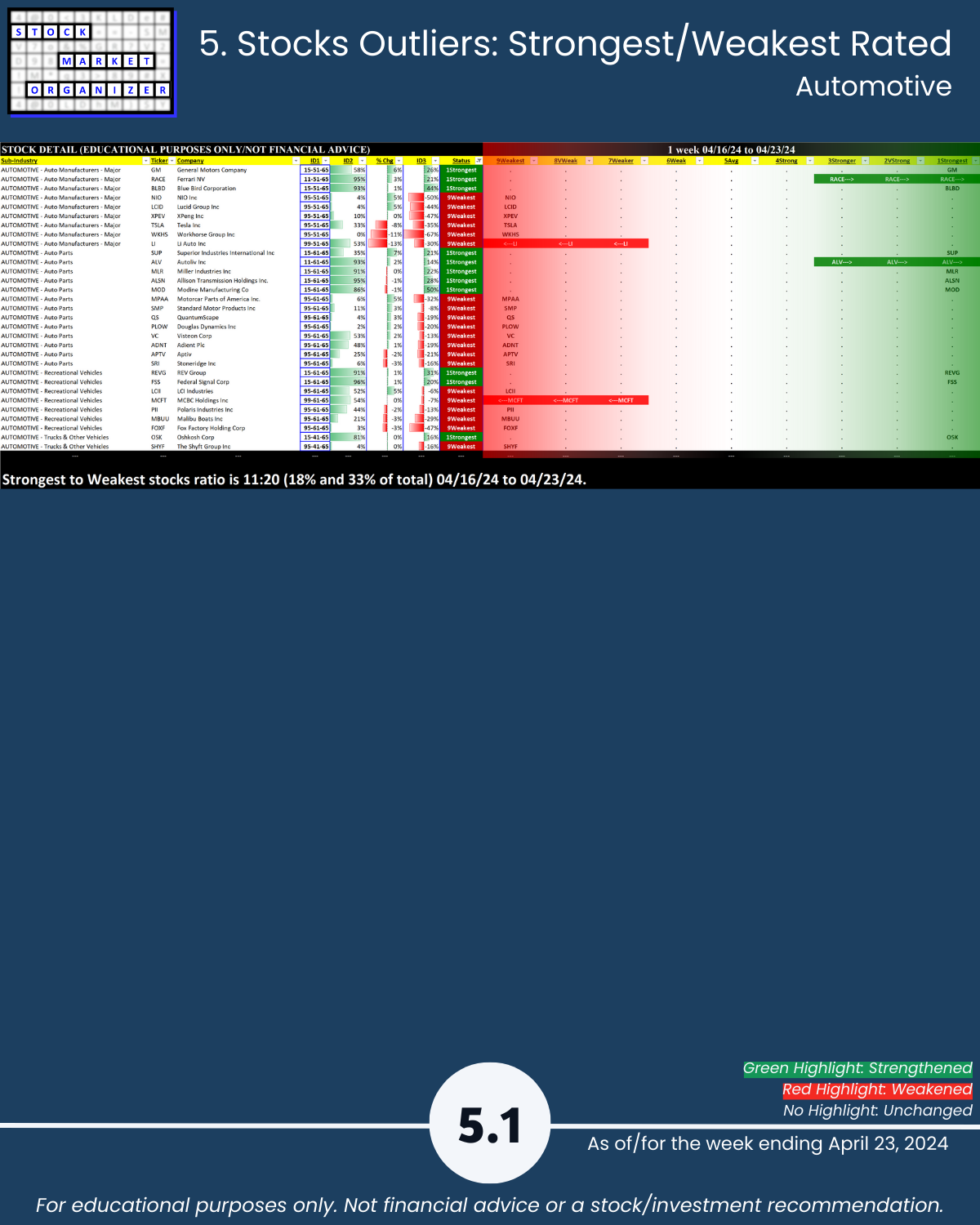

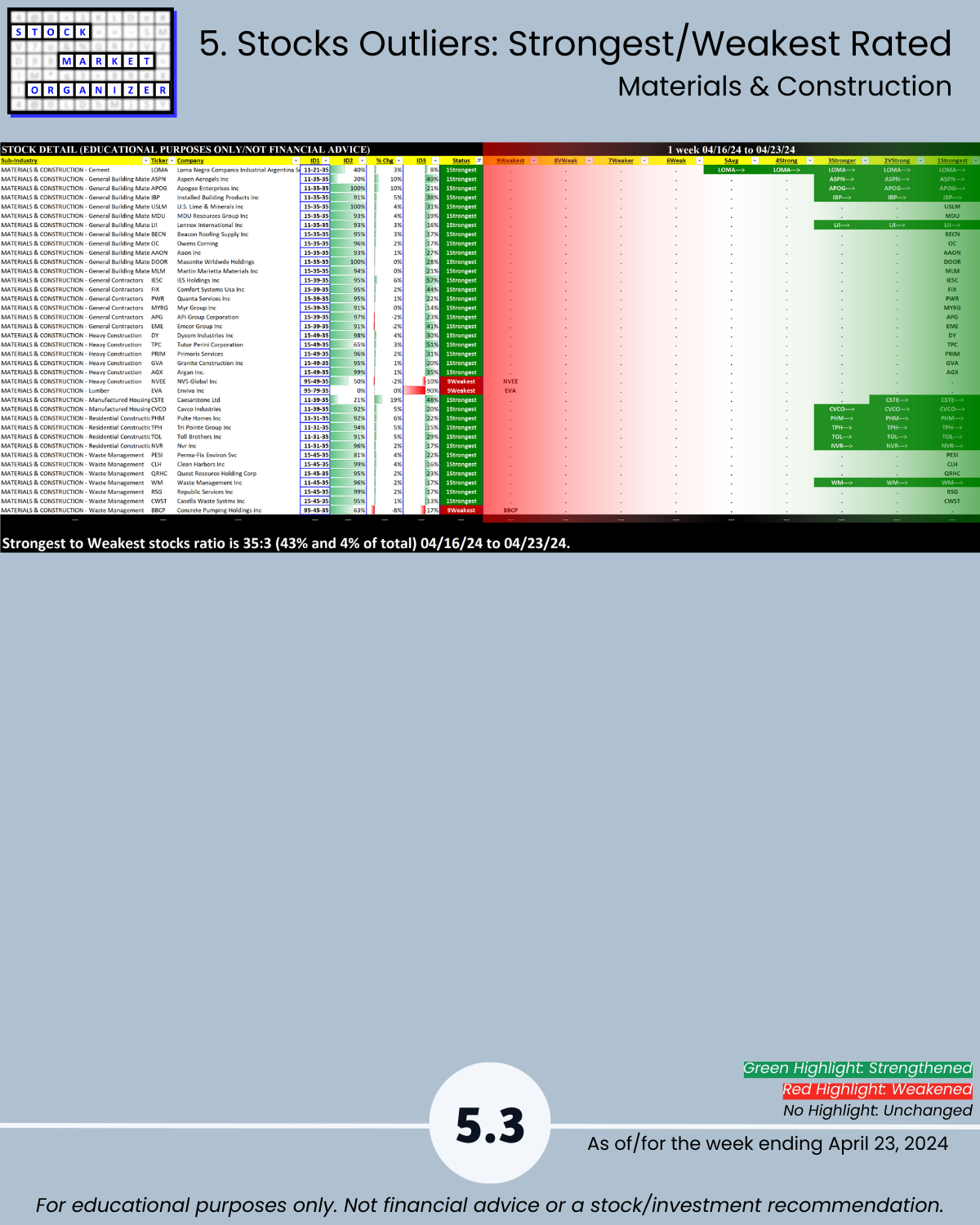

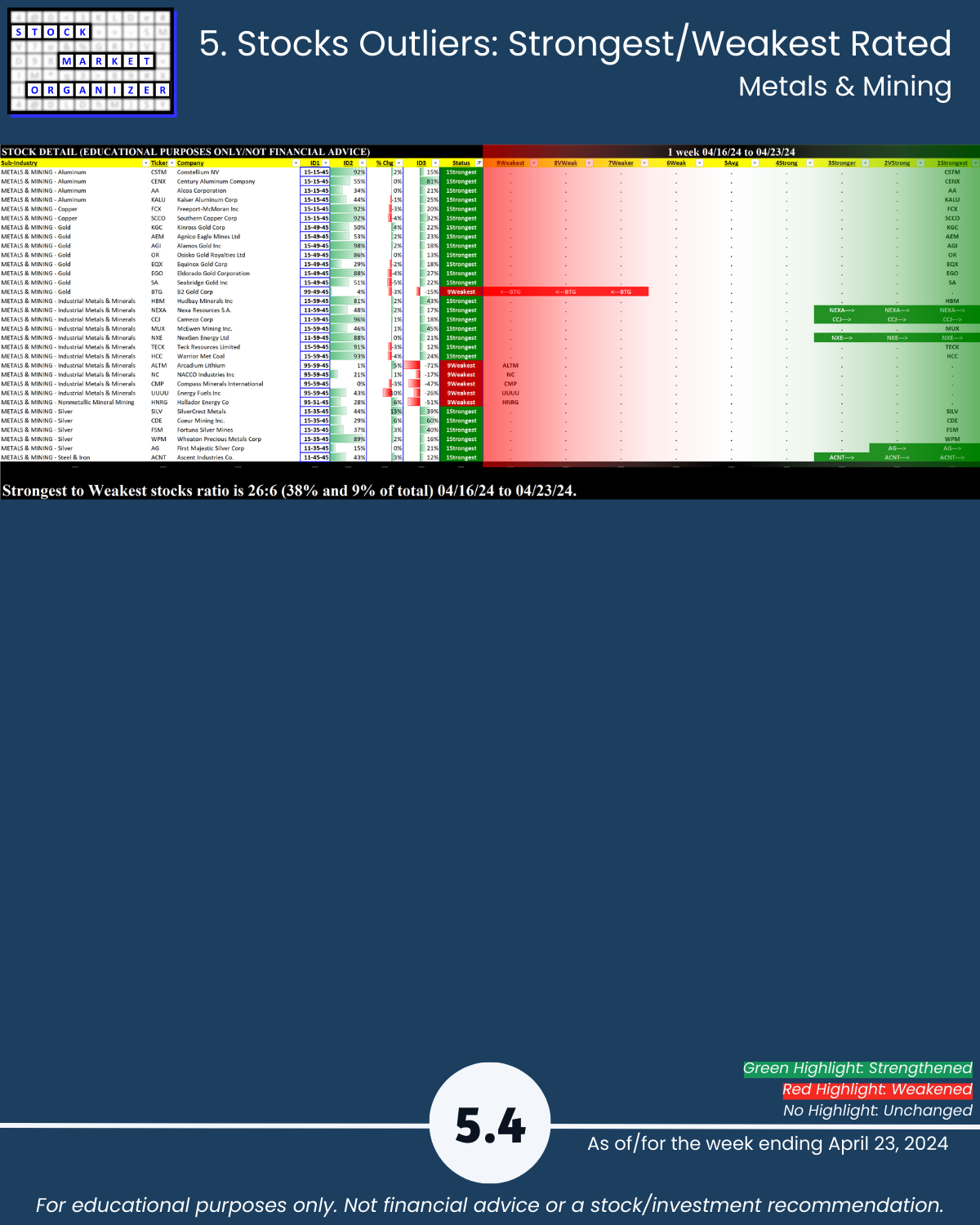

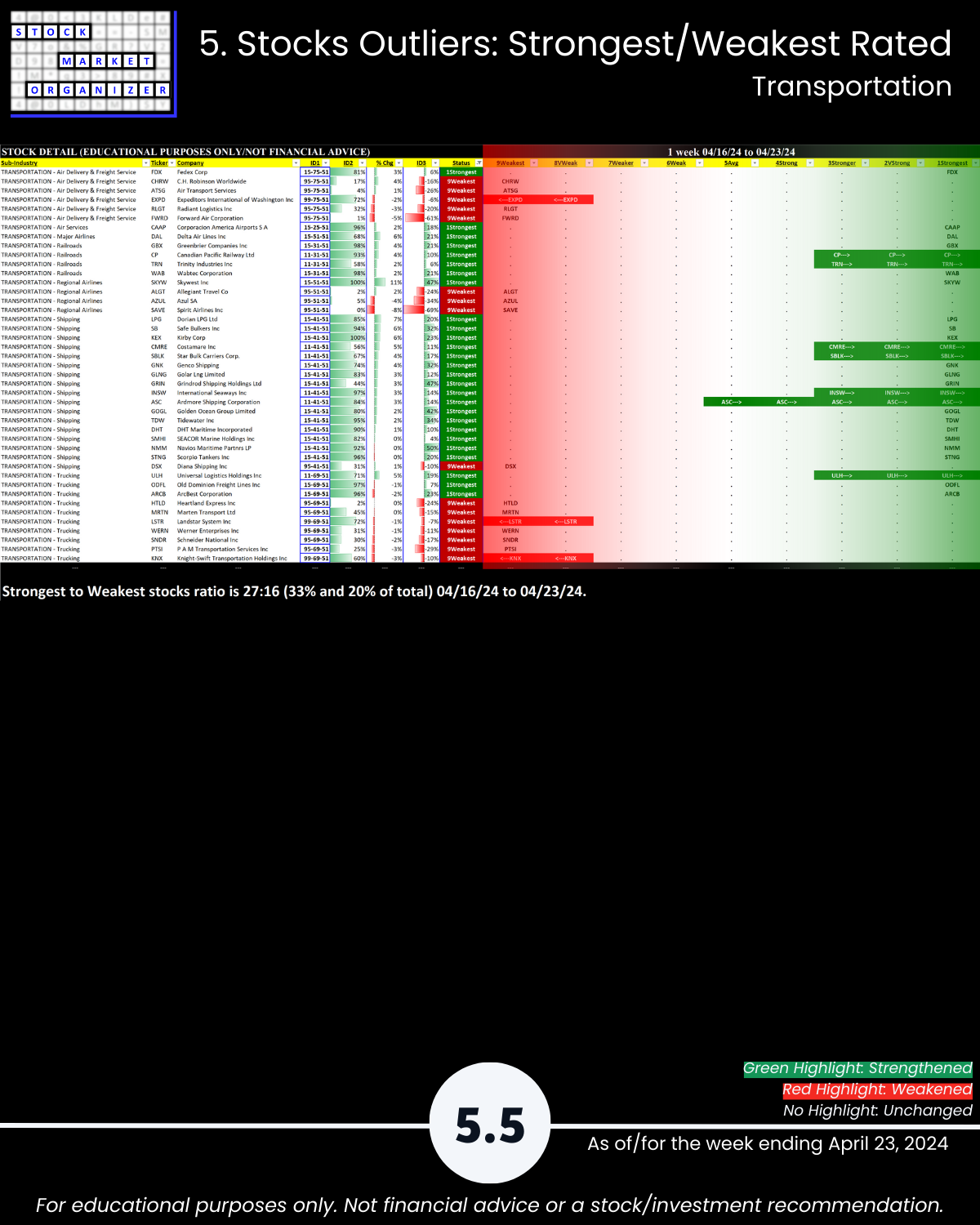

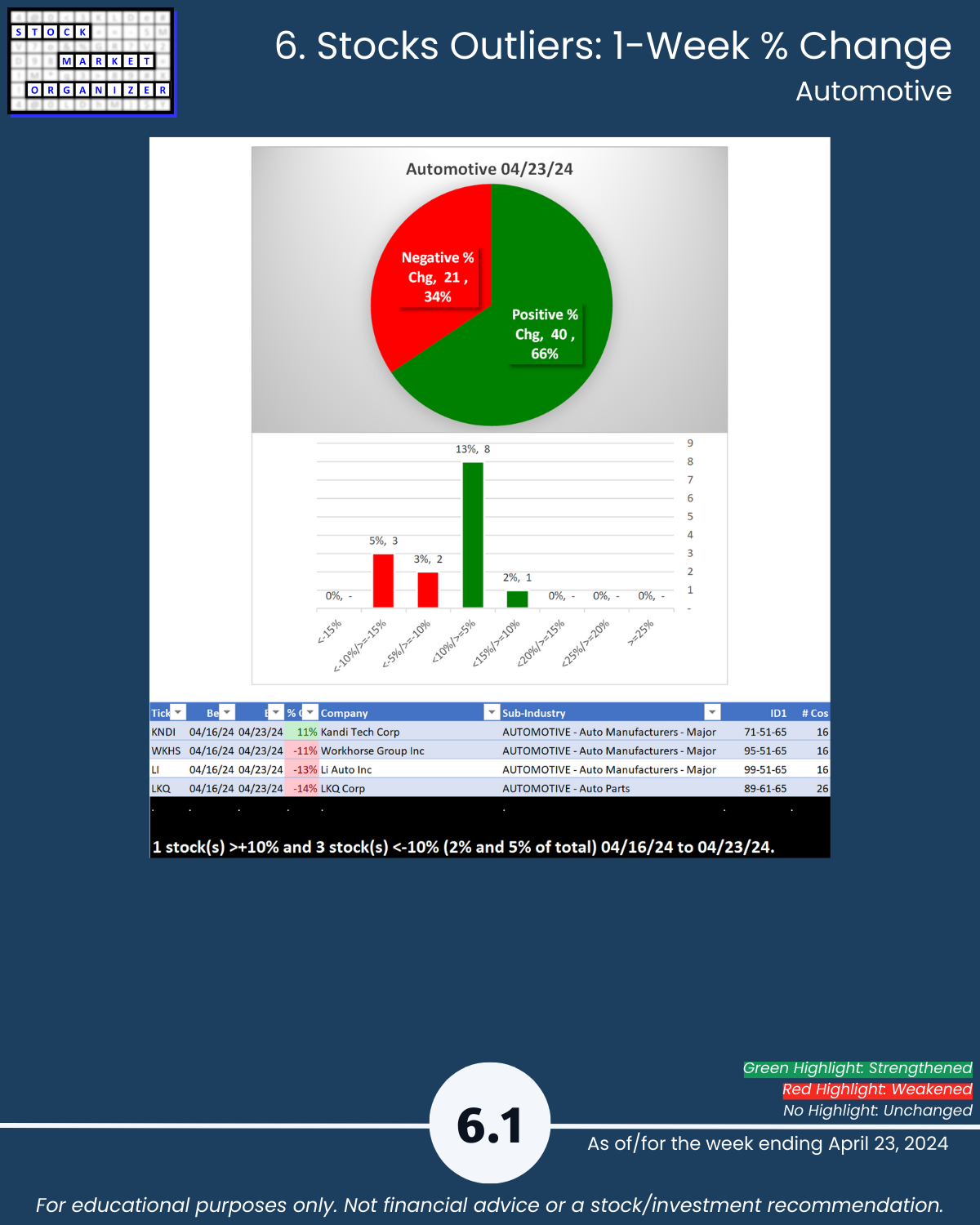

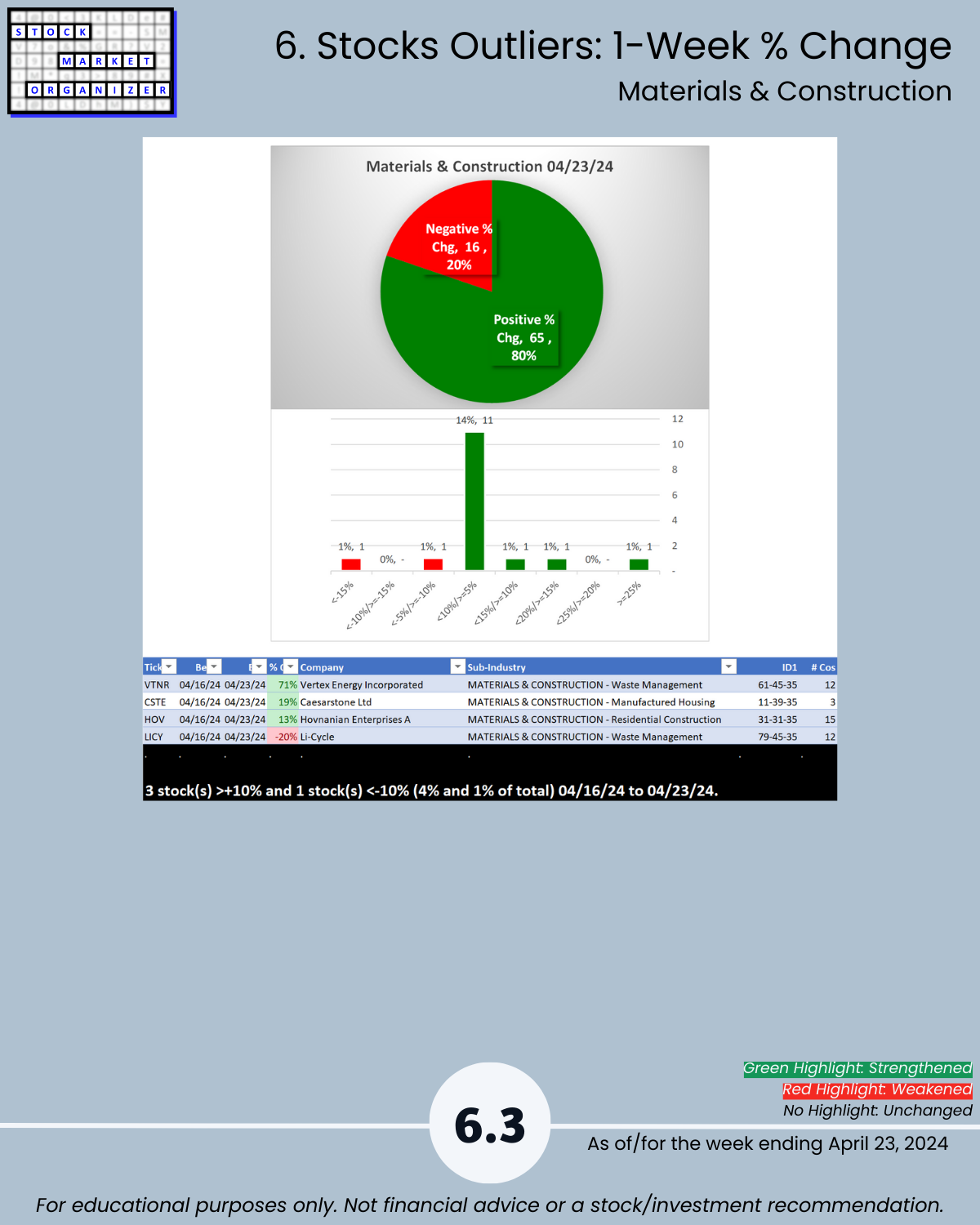

U.S. stock market 4/23/24 Industry Group 1 today (Automotive, Energy, Materials/Construction, Metals/Mining, Transportation), after hours TSLA +11% headed “To the moon, Alice!” TSLA earnings report sparks a move and maybe this is the crank handle start this Major Auto Manufacturer needed to get out of its slump. More on this below. In the meantime, what you may not know that could be relevant: 🔹 no ranking changes in this industry group which is the strongest at a 4.3 composite ranking, 🔹 Materials & Construction went from 98% negative stocks last week to 80% positive stocks this week, 🔹 excellent average 41%:13% 1Strongest:9Weakest ratio led by Energy 53%:9%, Materials & Construction 43%:4%, and Metals & Mining 38%:9%.

TSLA EARNINGS

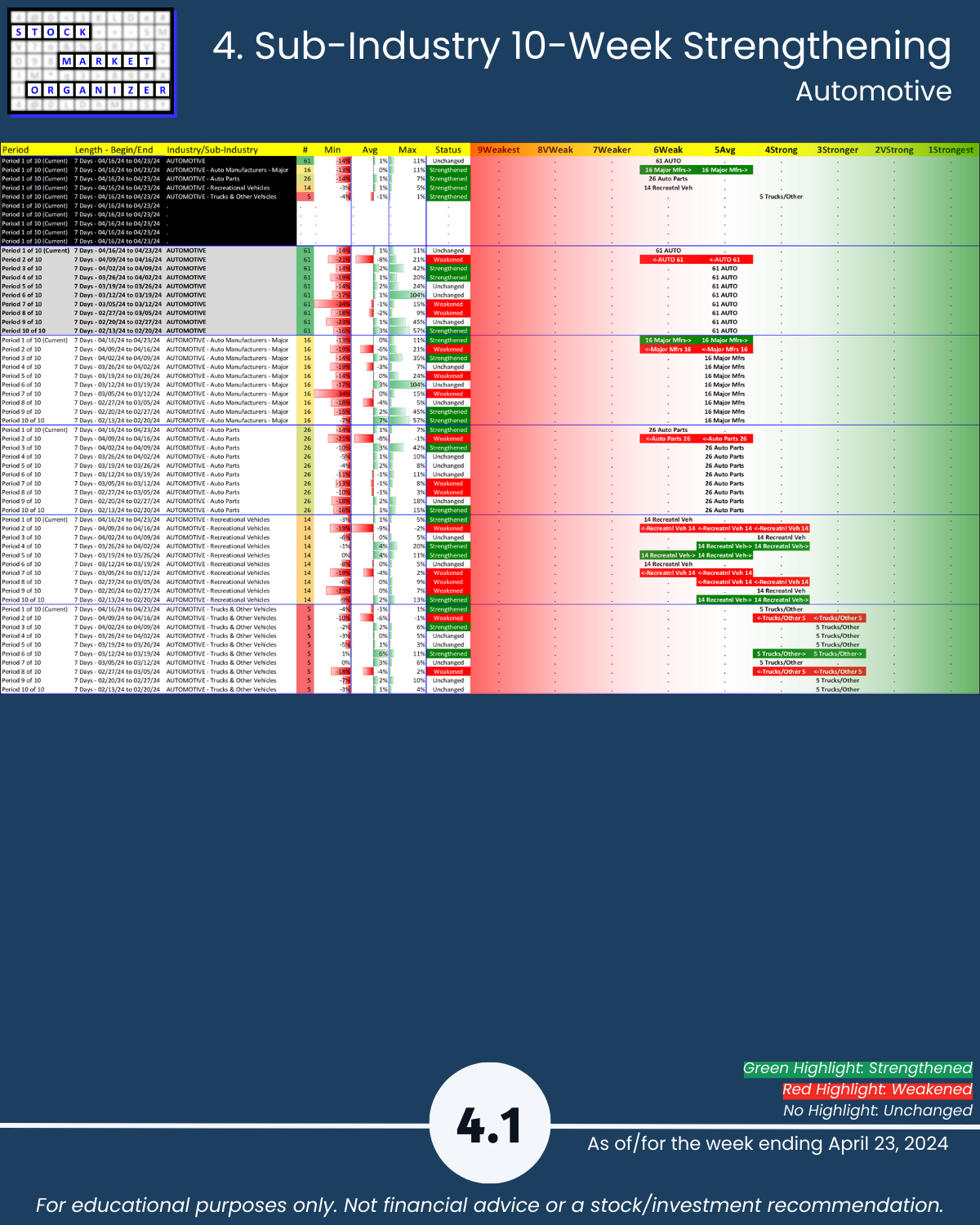

Yesterday I mentioned I’m not a chartist but “TSLA’s chart does not look good to me” and Friday 4/19/24 TSLA’s ID was 95-69-69. (Stock had a 9Weakest ranking and was flat for the week, sub-industry Major Auto Manufacturers had a 6Weak ranking and WEAKENED during the week, industry Automotive had a 6Weak ranking and WEAKENED during the week). Added up to an “ignore at this moment.”

Rating after today’s trading but before TSLA earnings: 95-51-65 =

🔹 stock 9Weakest ranking, was FLAT for the week

🔹 sub-industry Major Auto Manufacturers 5Avg ranking and STRENGTHENED during the week

🔹 industry Automotive 6Weak ranking and was FLAT during the week.

So, this dynamic situation has improved even from Friday. TSLA still wouldn’t be of interest at this moment – only stocks rated 1Strongest - but perhaps this ranking will come in time.

There are others already there.

TODAY’S REPORT TAKEAWAYS

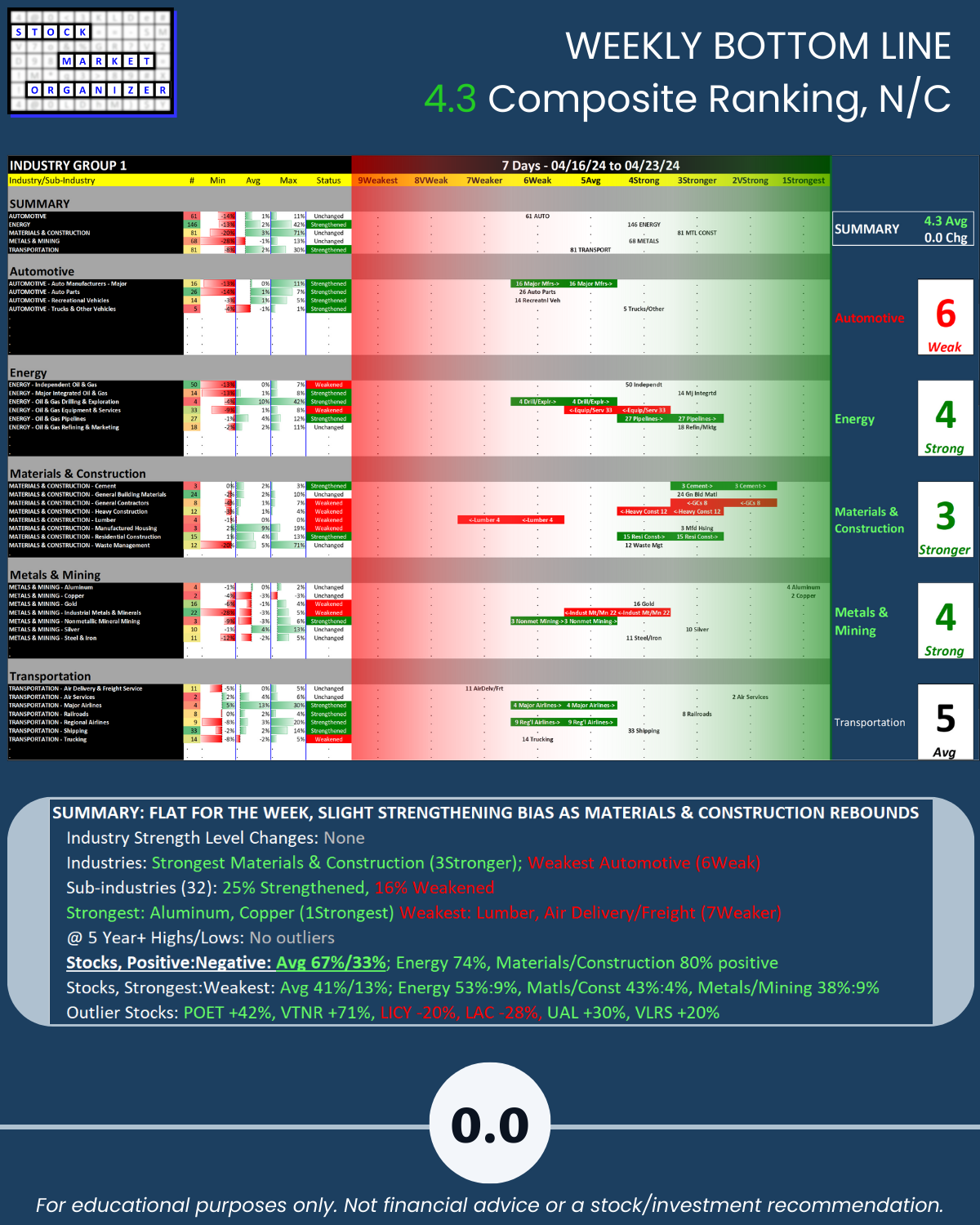

SUMMARY: FLAT FOR THE WEEK, SLIGHT STRENGTHENING BIAS AS MATERIALS & CONSTRUCTION REBOUNDS

🔹 Industry Strength Level Changes: None

🔹 Industries

- Strongest Materials & Construction (3Stronger)

- Weakest Automotive (6Weak)

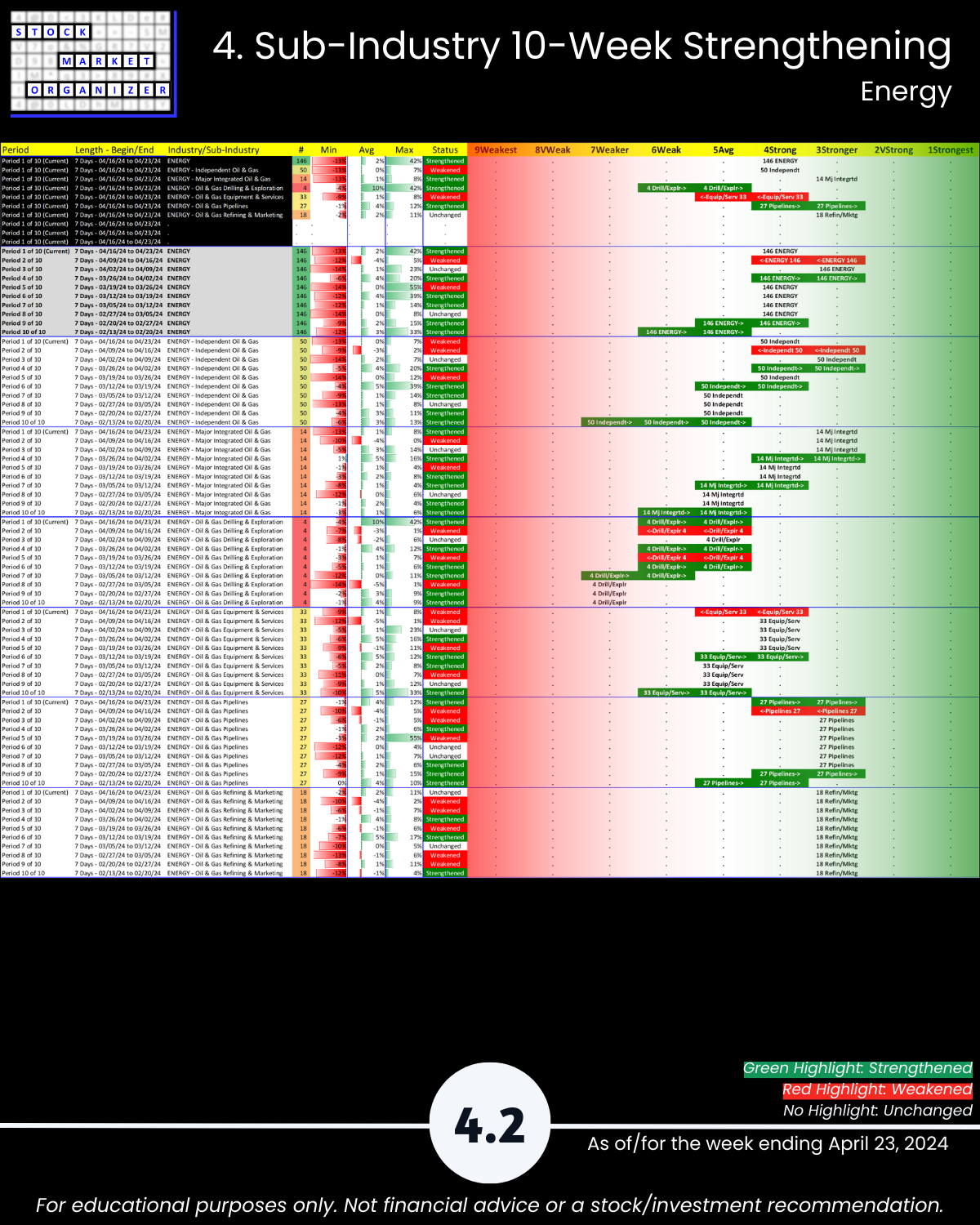

🔹 Sub-industries (32)

- 25% Strengthened, 16% Weakened

- Strongest: Aluminum, Copper (1Strongest)

- Weakest: Lumber, Air Delivery/Freight (7Weaker)

- @ 5 Year+ Highs/Lows: No outliers

🔹 Stocks

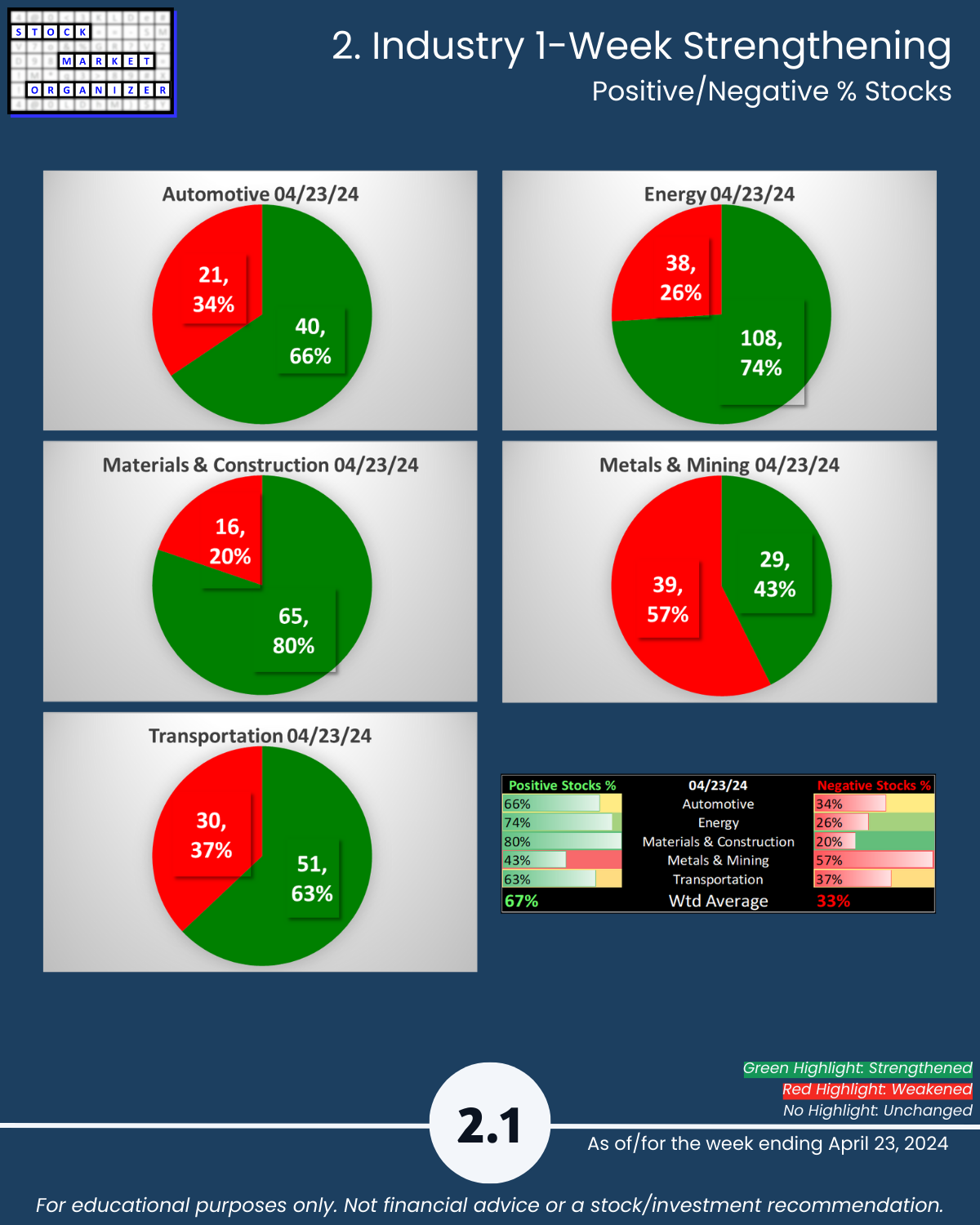

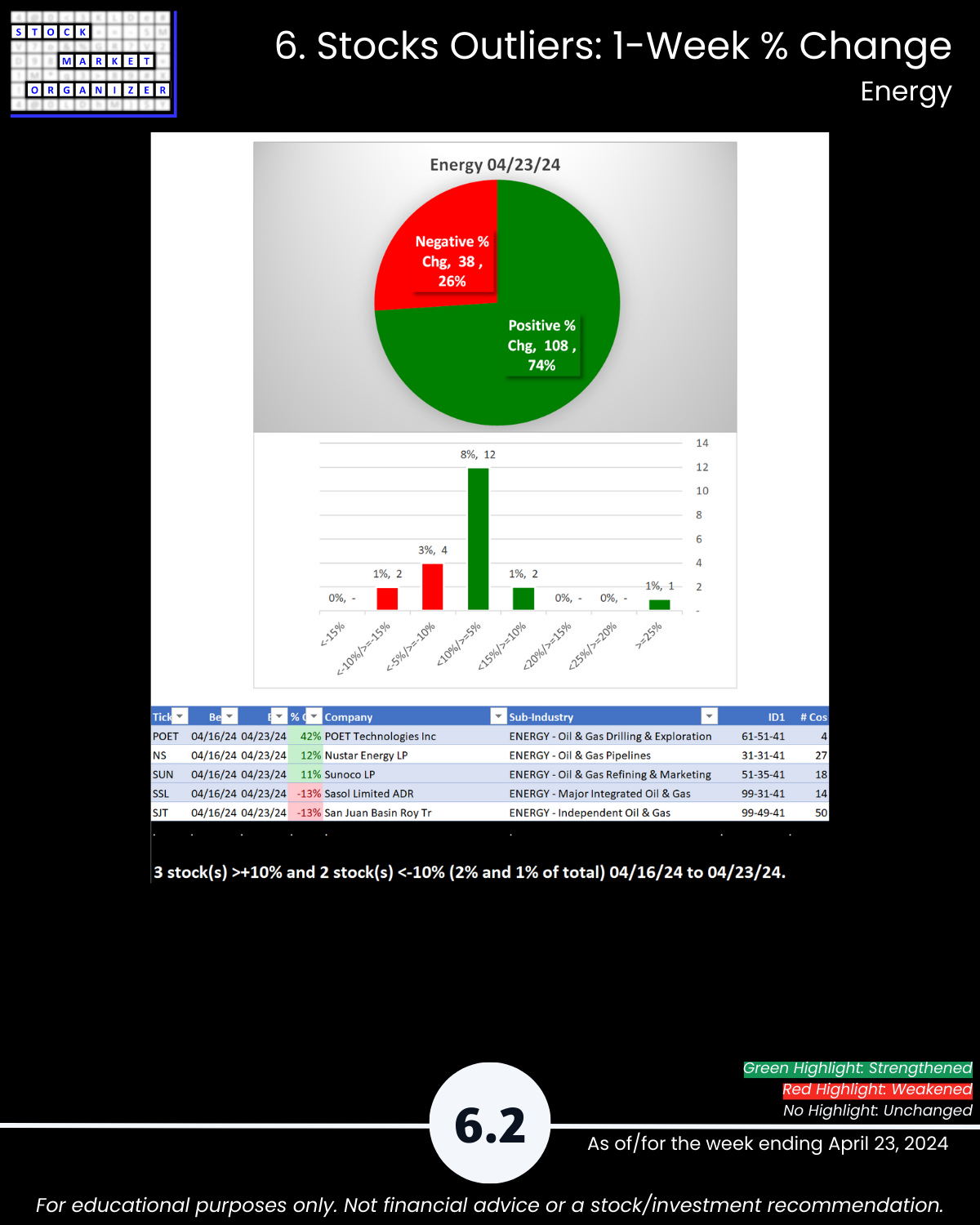

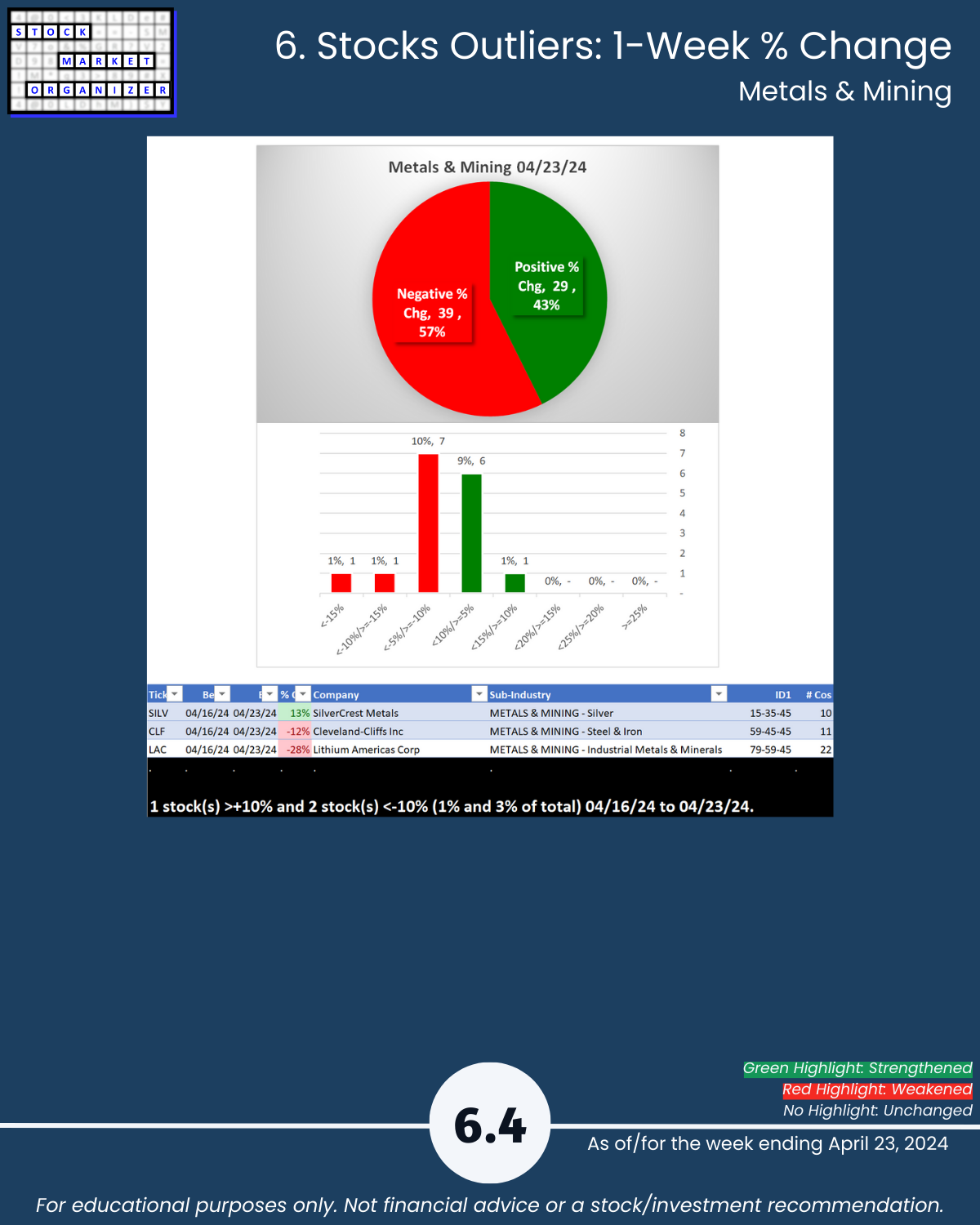

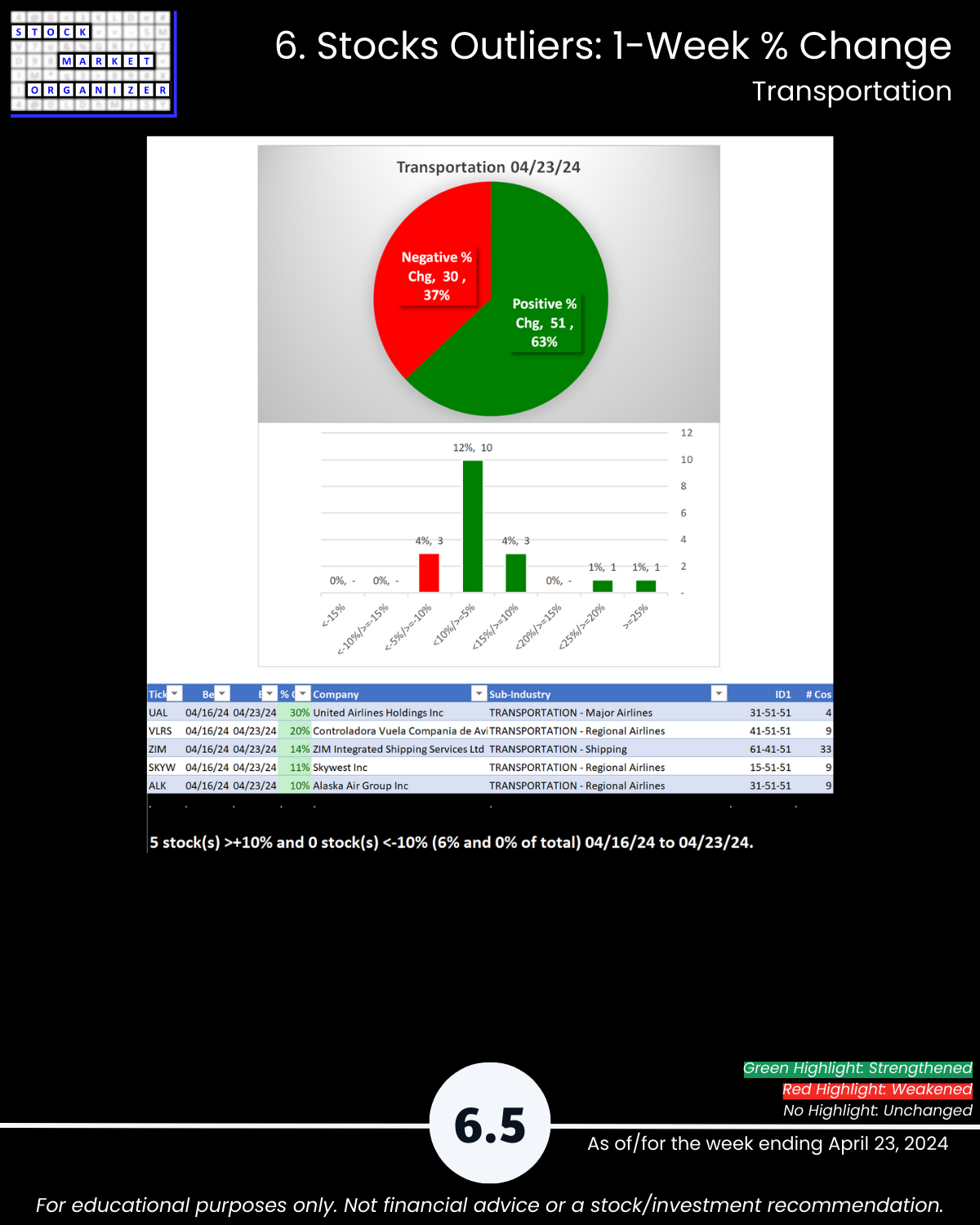

Positive:Negative: Average 67%/33%; Energy 74%, Materials/Construction 80% positive

Stocks, Strongest:Weakest: Average 41%/13%; Energy 53%:9%, Materials & Construction 43%:4%, Metals/Mining 38%:9%

Outlier Stocks: POET +42%, VTNR +71%, LICY -20%, LAC -28%, UAL +30%, VLRS +20%

1. Introduction

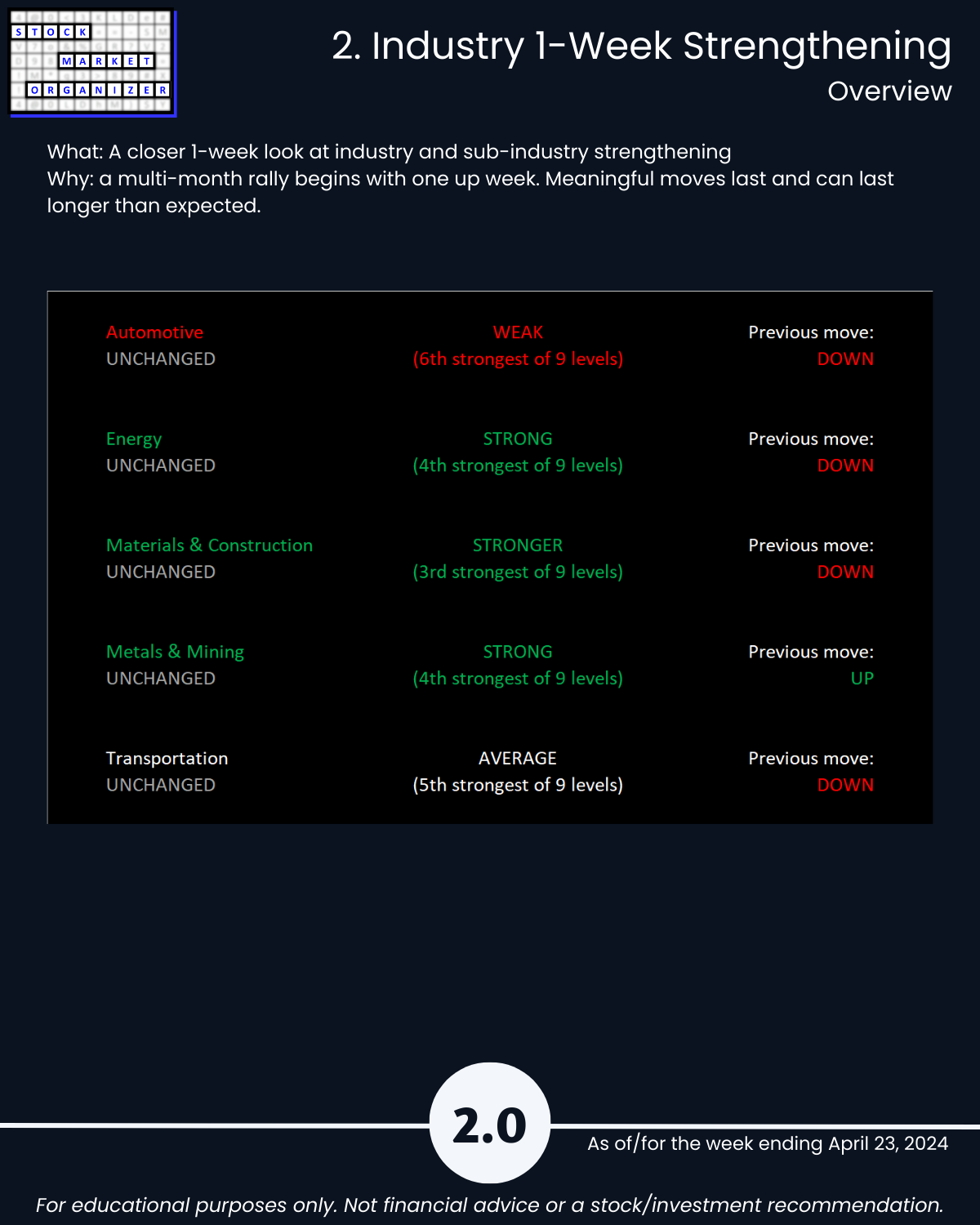

2. Industry 1-Week Strengthening

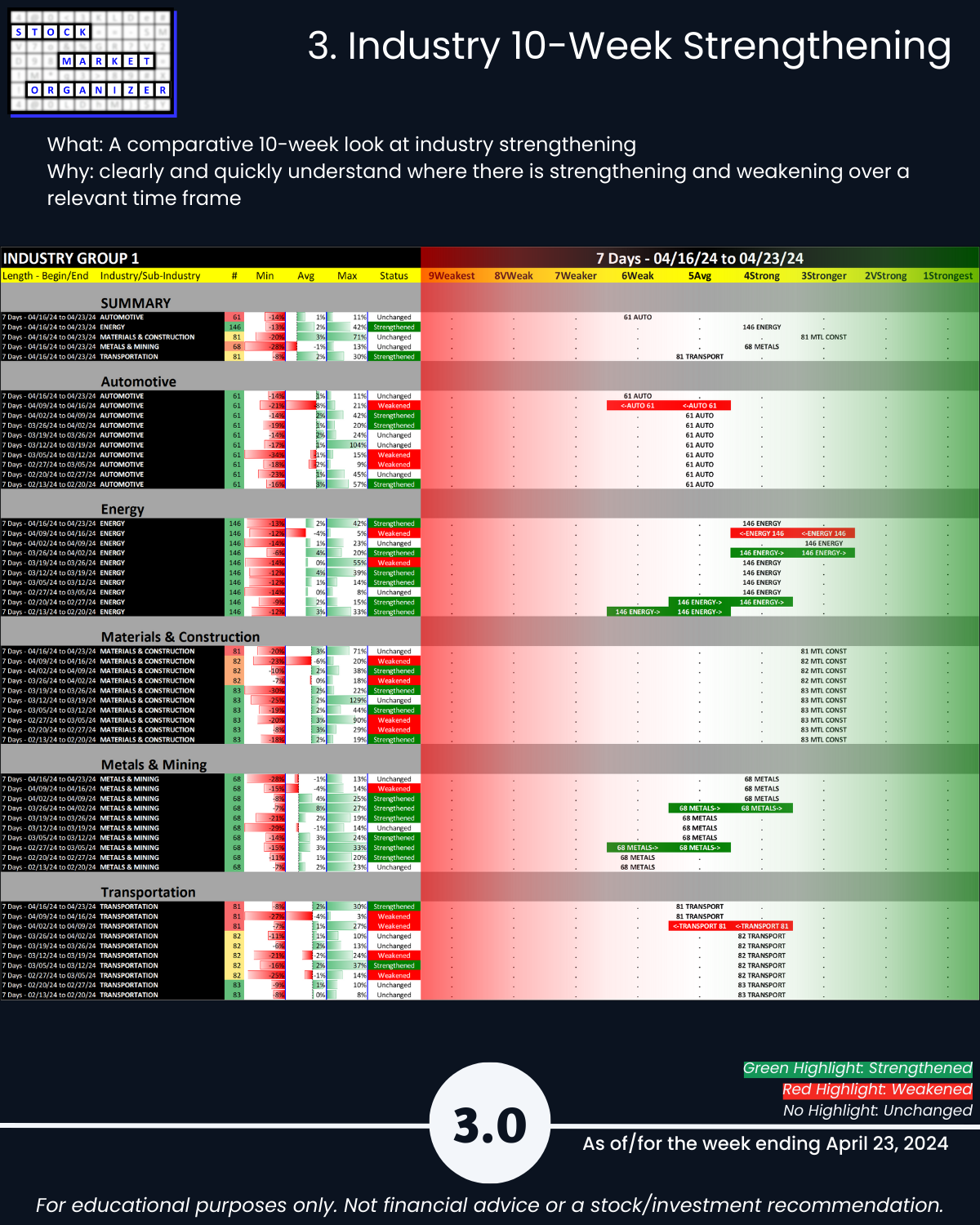

3. Industry 10-Week Strengthening

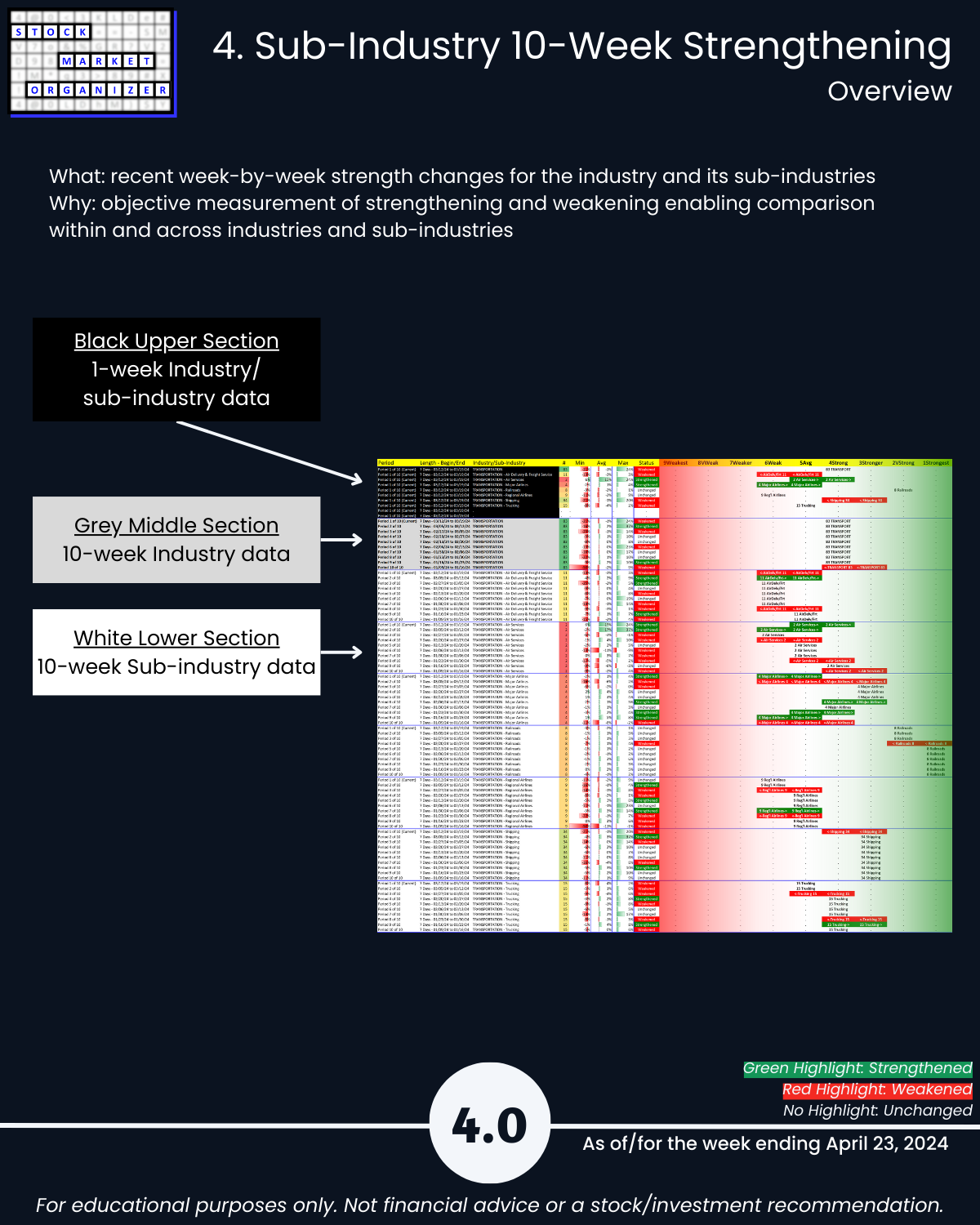

4. Sub-Industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

6. Stocks Outliers: 1-Week % Change

7. Stocks Outliers: 5-Year Highs/Lows