SMO Exclusive: Strength Report Group 1 2024-04-16

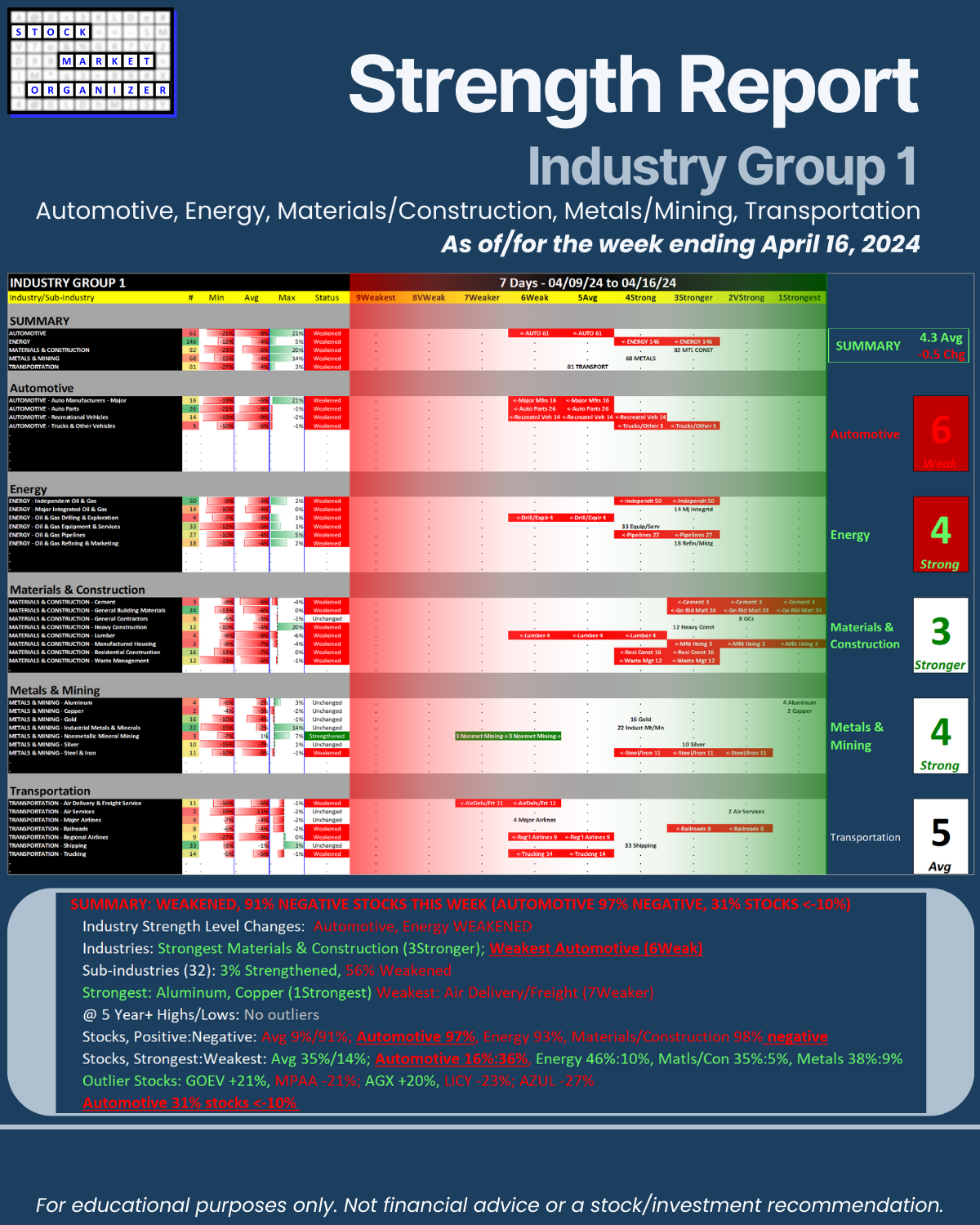

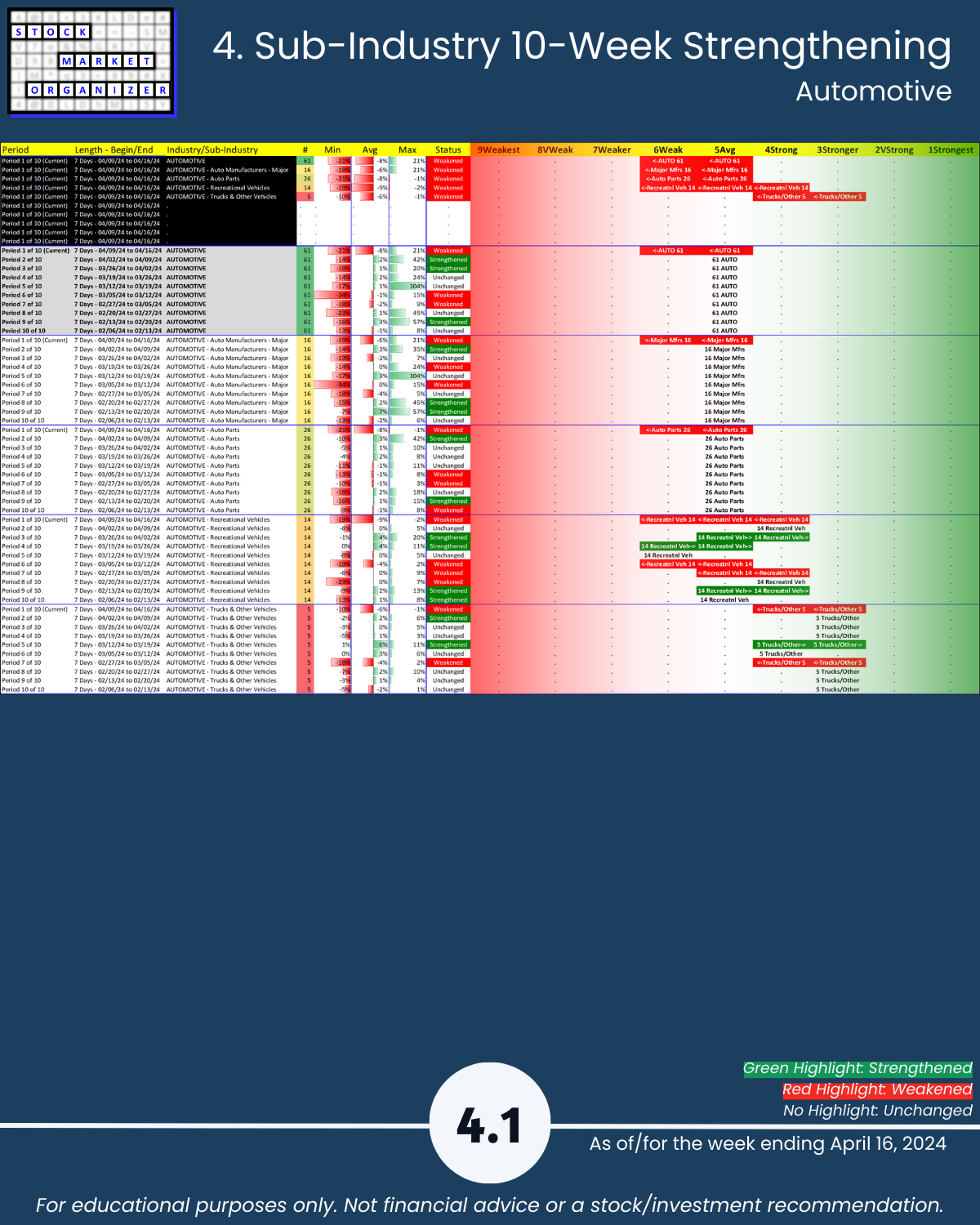

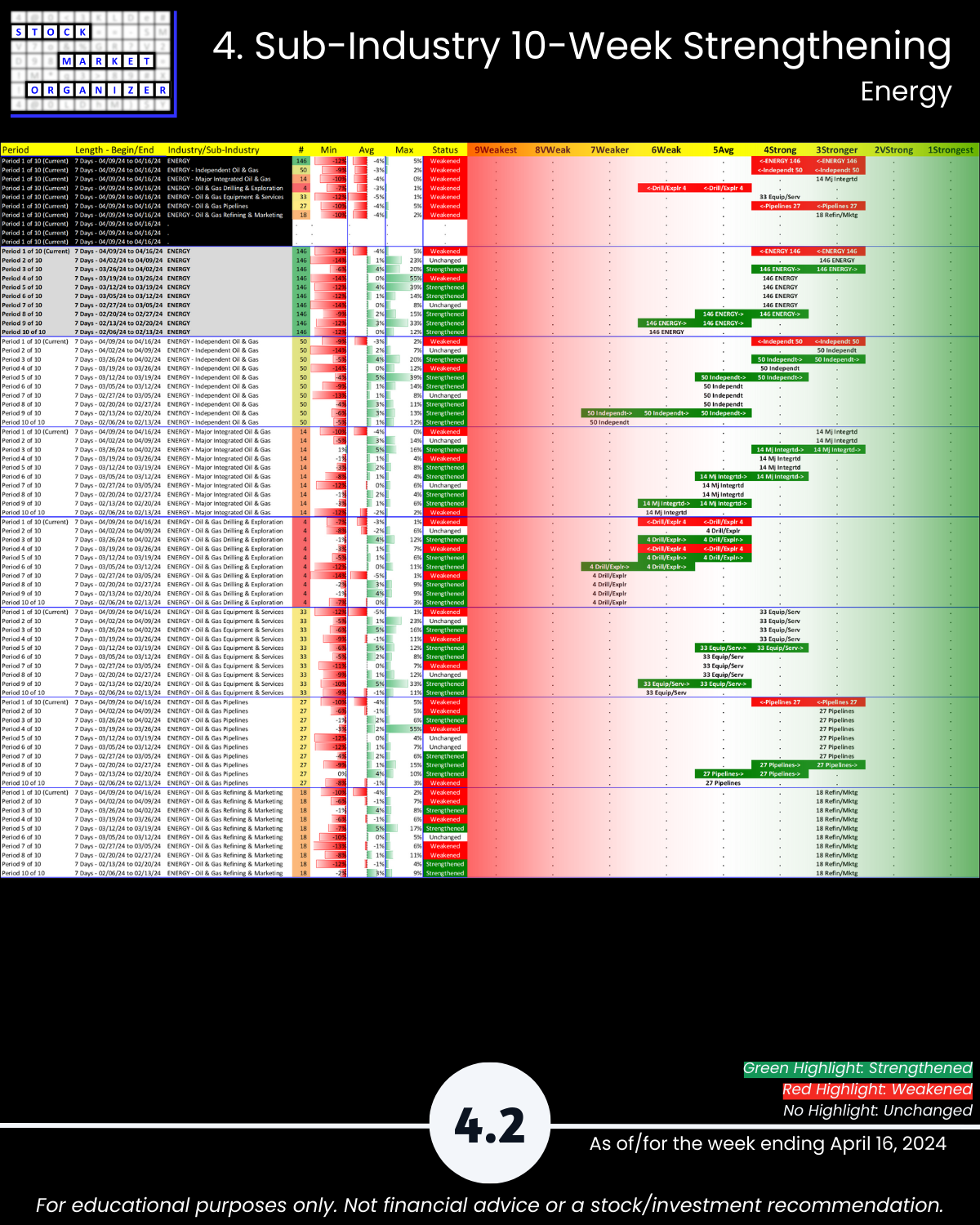

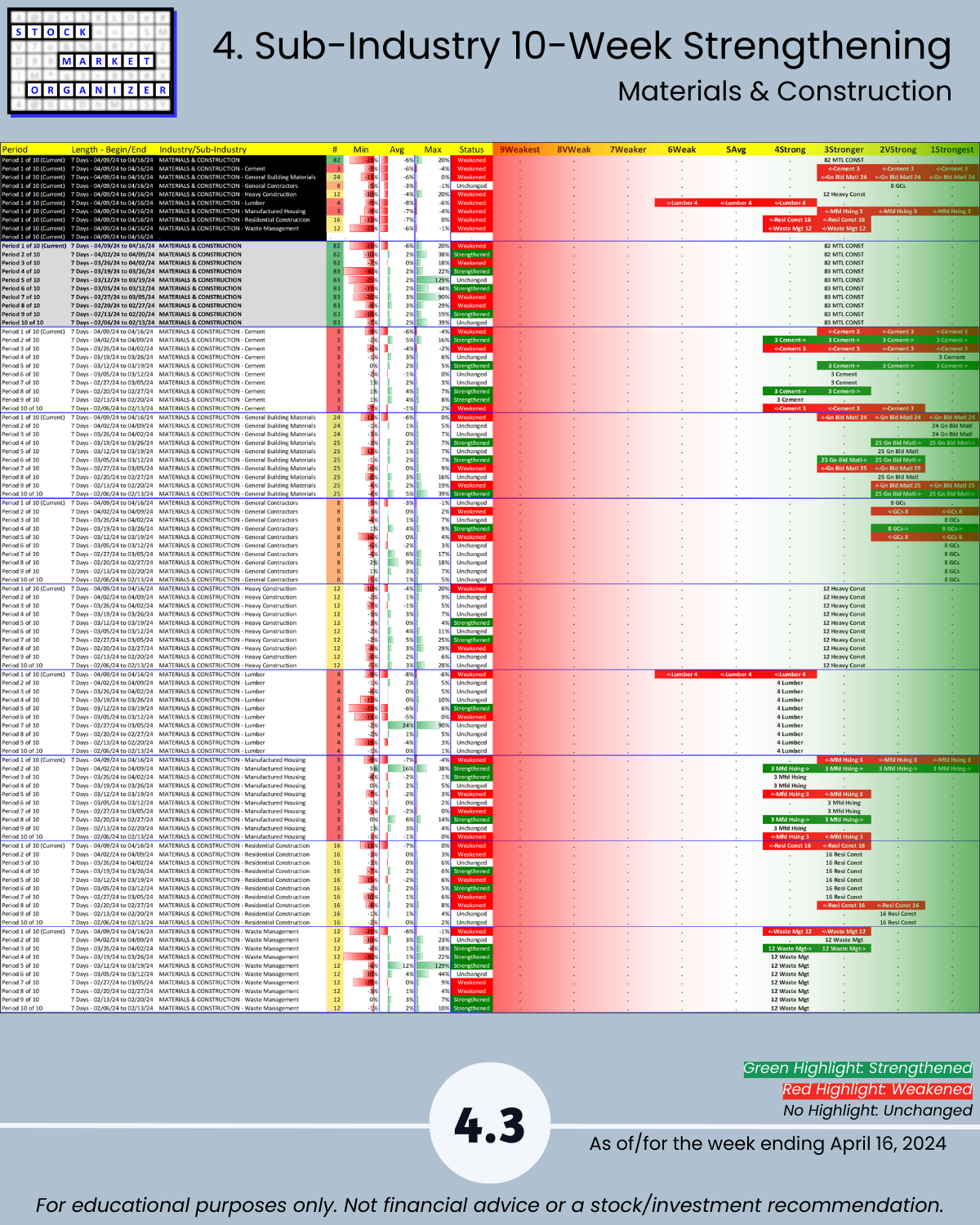

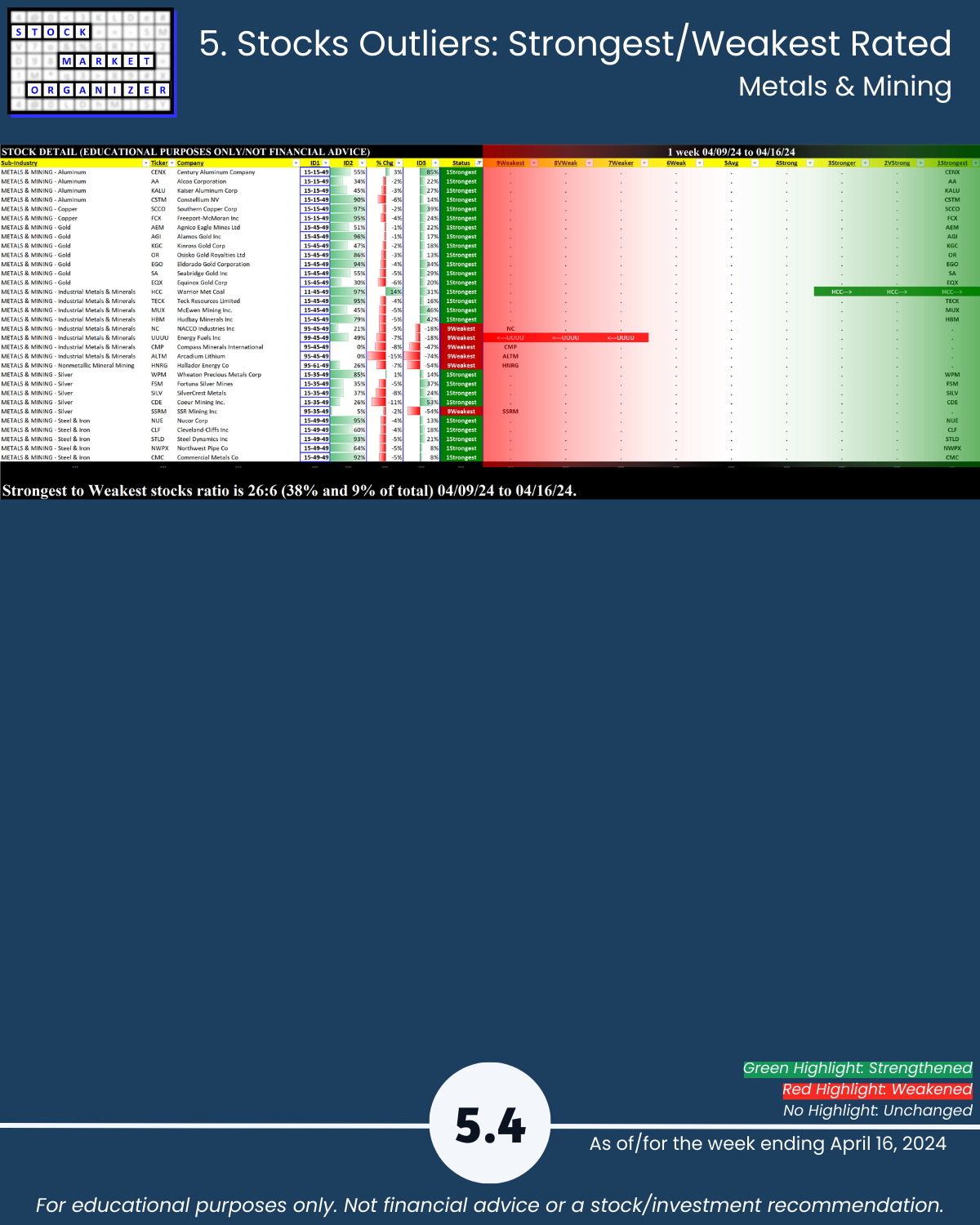

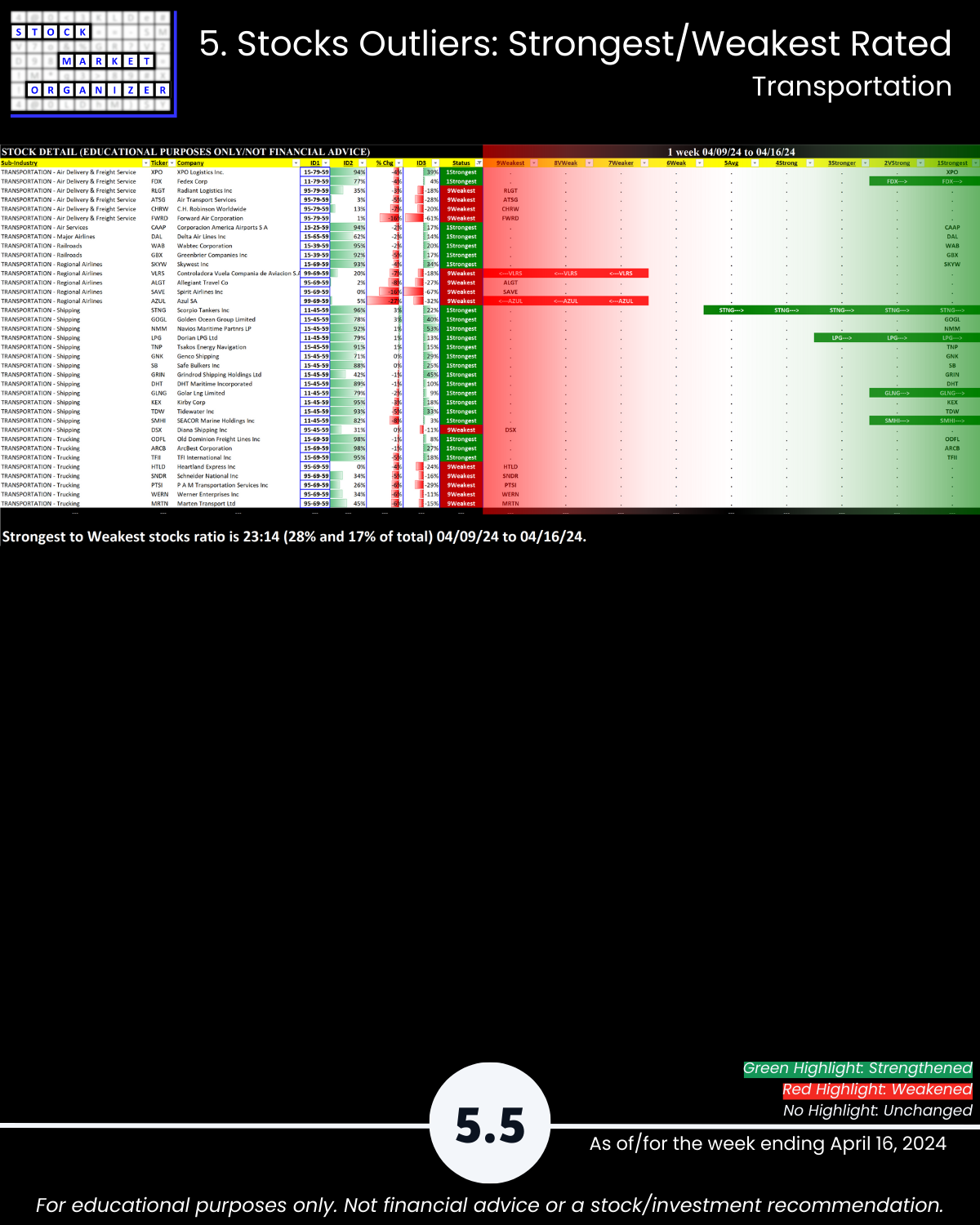

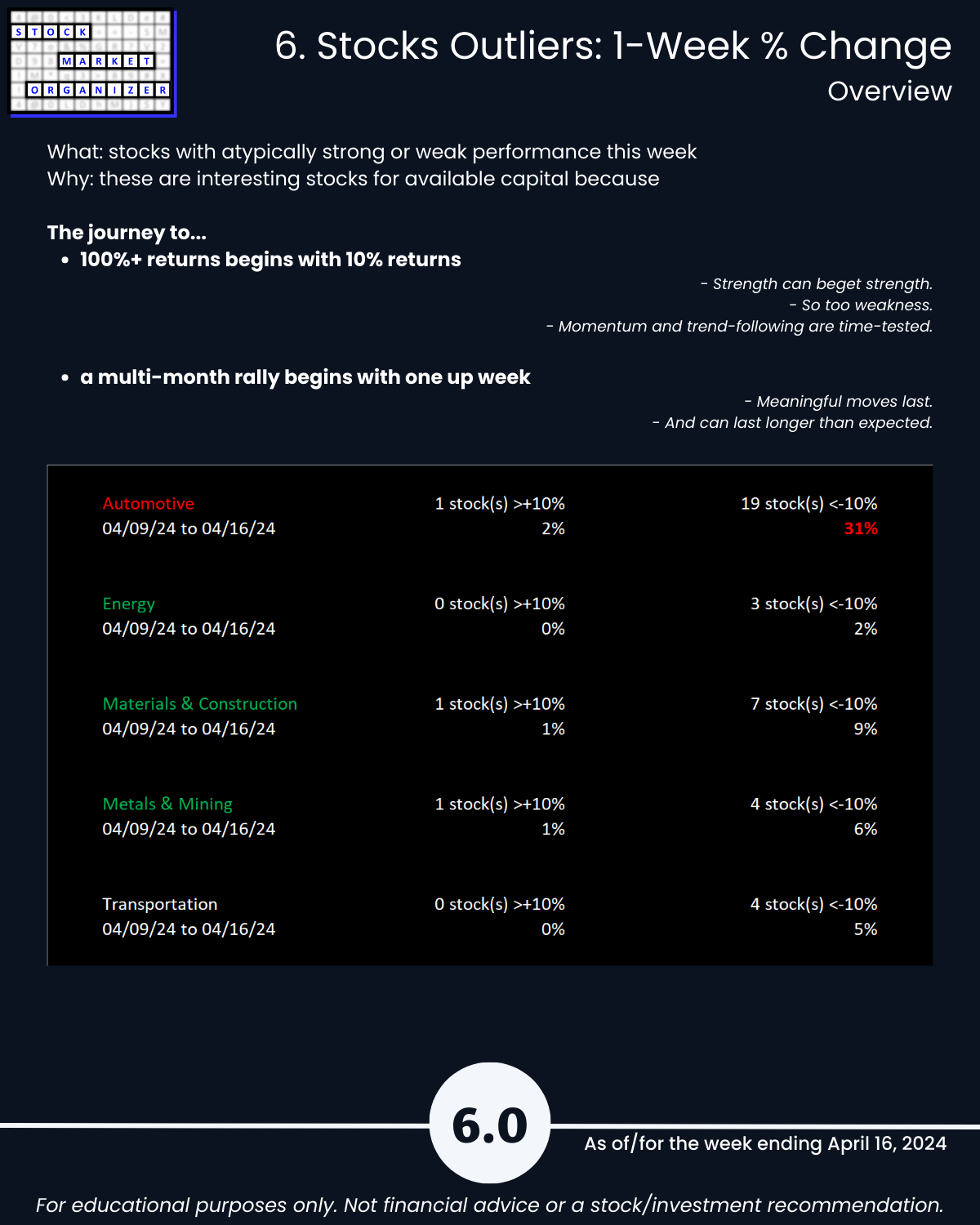

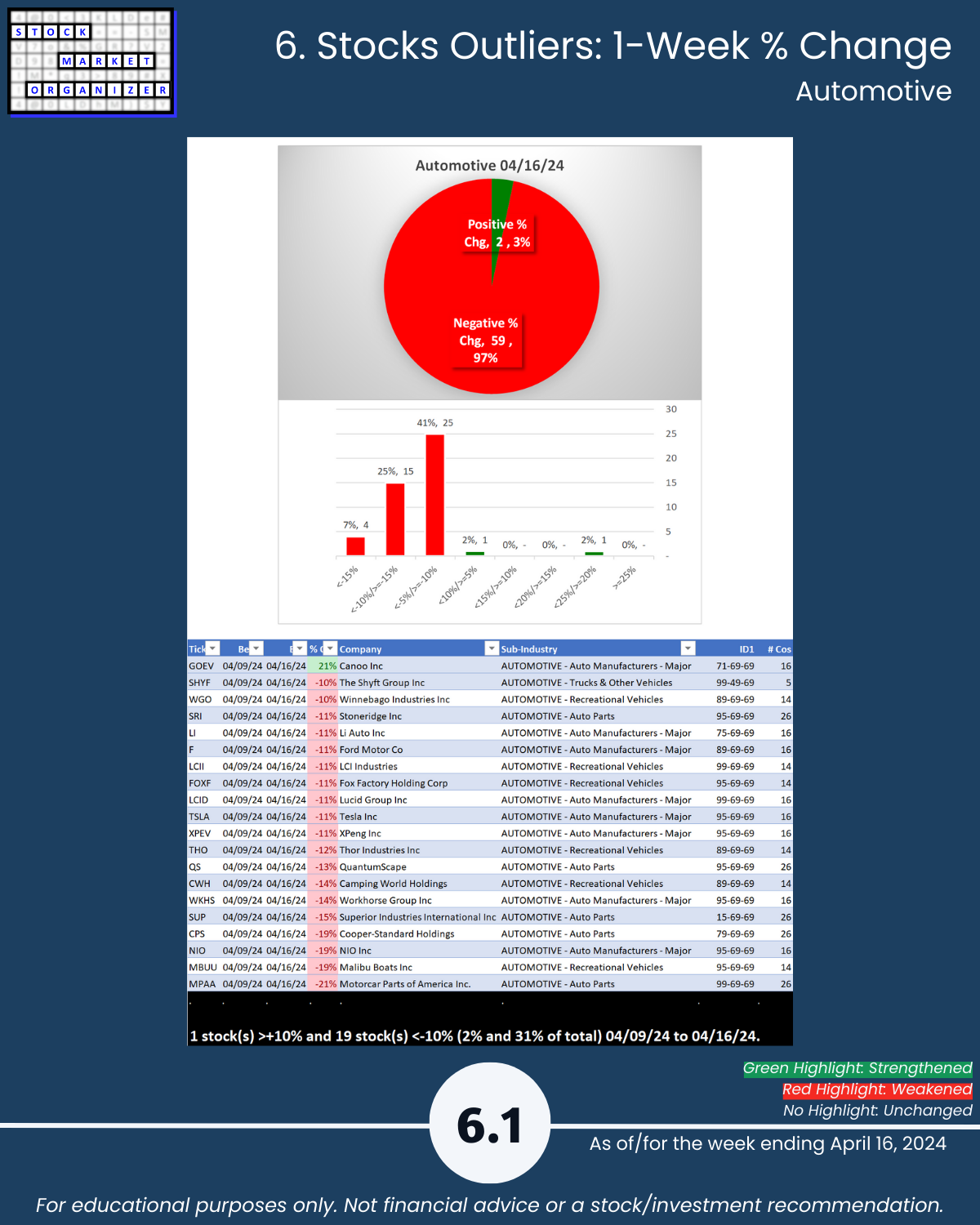

4/16/24 As Utilities yesterday had a bad week, now Automotive has gone splat. Unique U.S. Stock Market strength-based insights into Industry Group 1 = Automotive, Energy, Materials & Construction, Metals & Mining, and Transportation: 🔹 Automotive weakened one rating, all 5 of 5 sub-industries weakened, for the week it had 97% negative stocks as 13% of stocks fell more than -10%, and it has a poor 16%:36% 1Strongest:9Weakest stocks ratio, 🔹 the industry group composite ranking fell 0.5 points to 4.3 and it had 91% negative stocks (Materials & Construction 98%, Energy 93%) 🔹 the group’s 5+ year highs:lows ratio has fallen from 55:12 on 3/19/24 to 4:10 this week.

WHAT’S HAPPENING HERE?

I am…

Finding U.S. Stock Market strength from the

top down,

inside out,

and bottom up, because

the stronger your stocks, the greener your P&L.

UNIQUE STRENGTHENING ANALYSIS INSIGHTS

SUMMARY: WEAKENED, 91% NEGATIVE STOCKS THIS WEEK (AUTOMOTIVE 97% NEGATIVE, 31% STOCKS <-10%)

🔹 Industry Strength Level Changes: Automotive, Energy WEAKENED

🔹 Industries

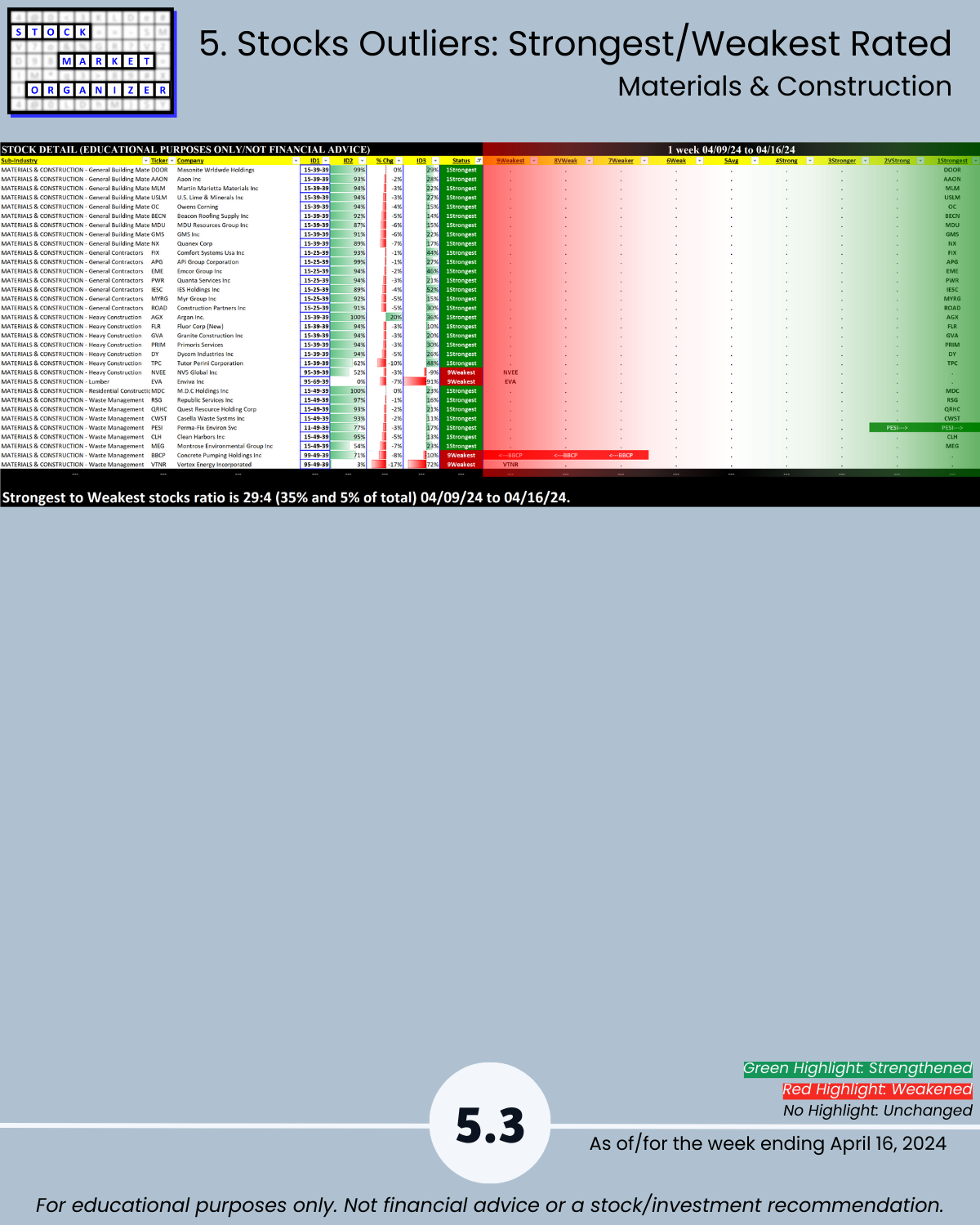

- Strongest Materials & Construction (3Stronger)

- Weakest Automotive (6Weak)

🔹 Sub-industries (32)

- 3% Strengthened, 56% Weakened

- Strongest: Aluminum, Copper (1Strongest) Weakest: Air Delivery/Freight (7Weaker)

- @ 5 Year+ Highs/Lows: No outliers

🔹 Stocks

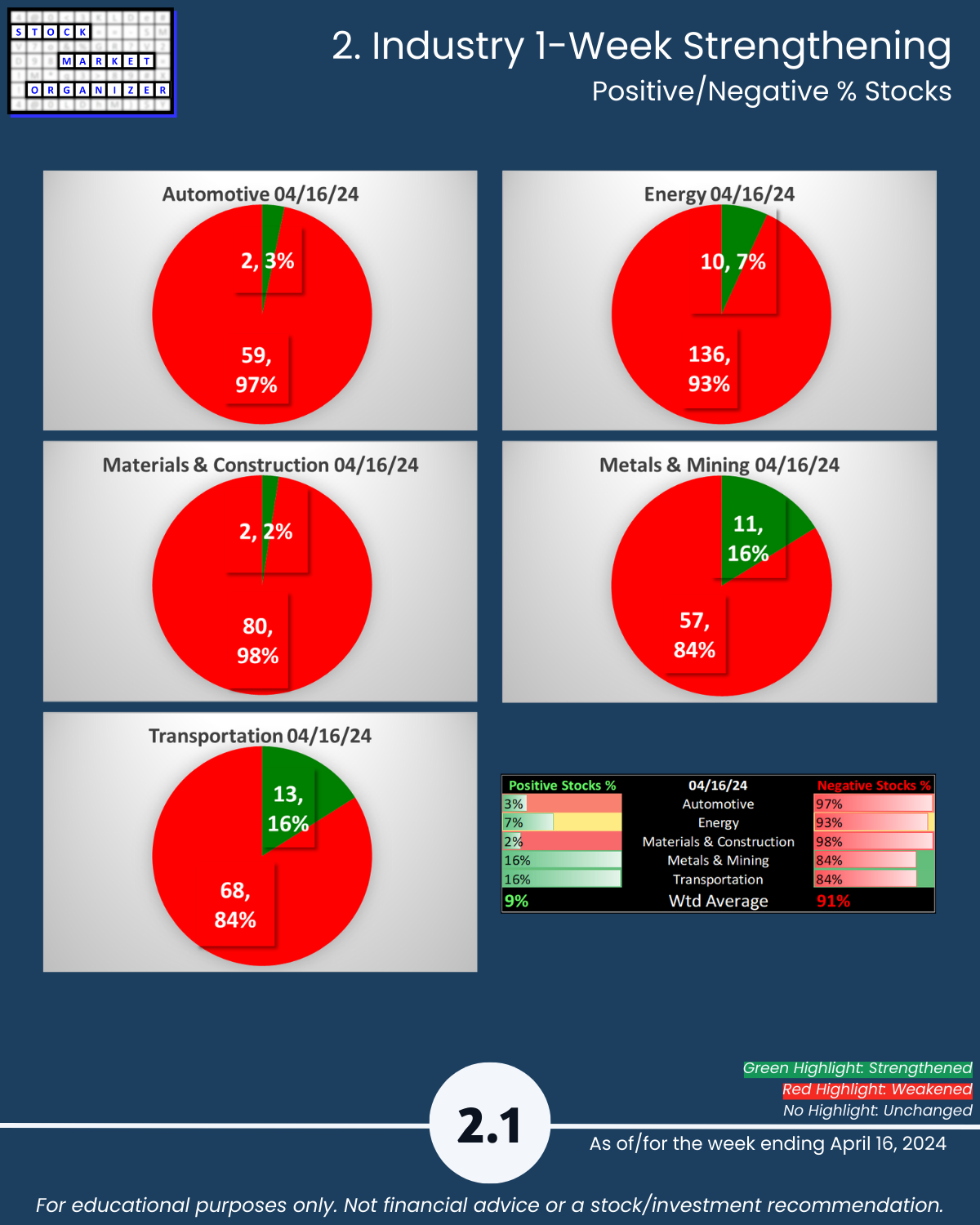

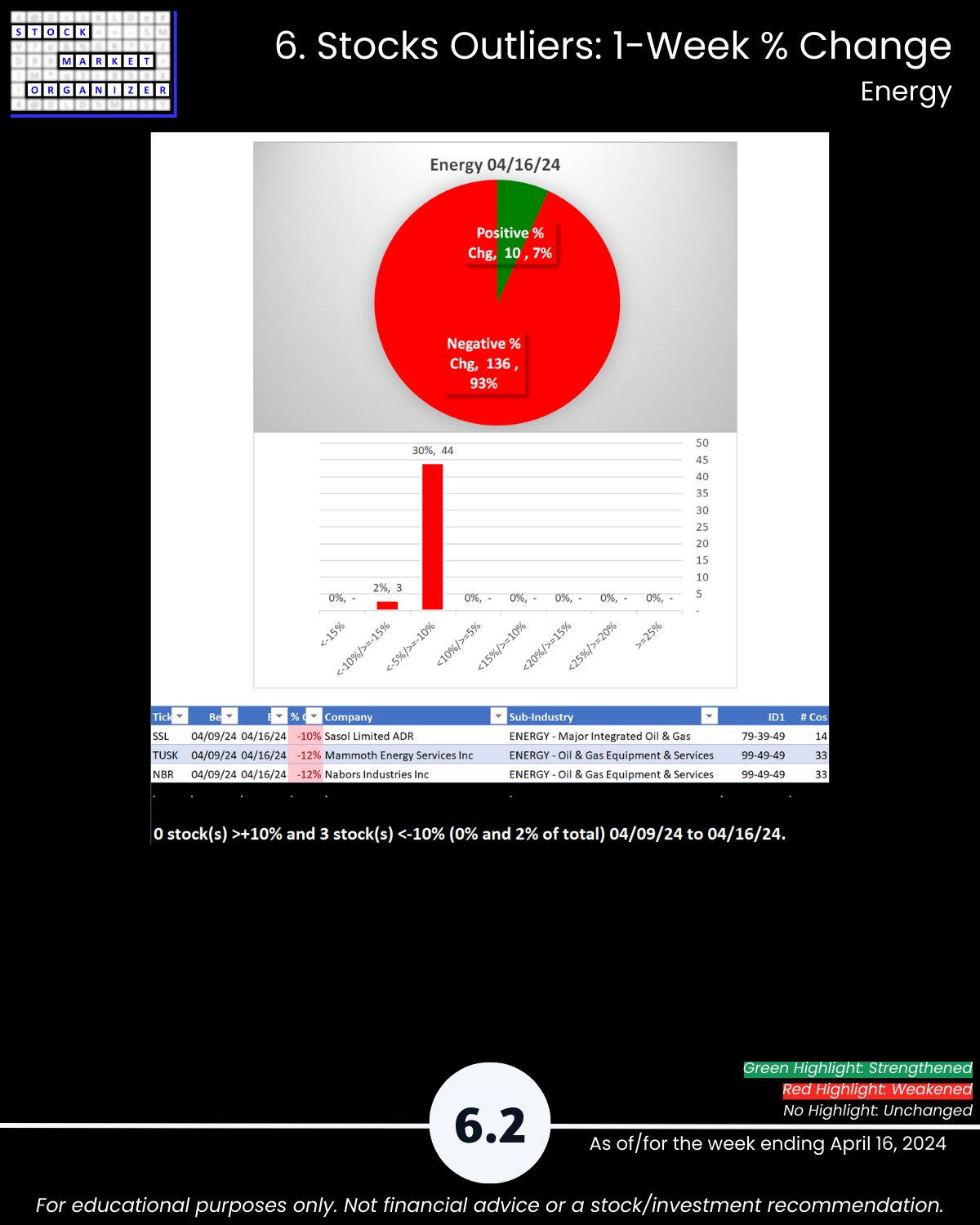

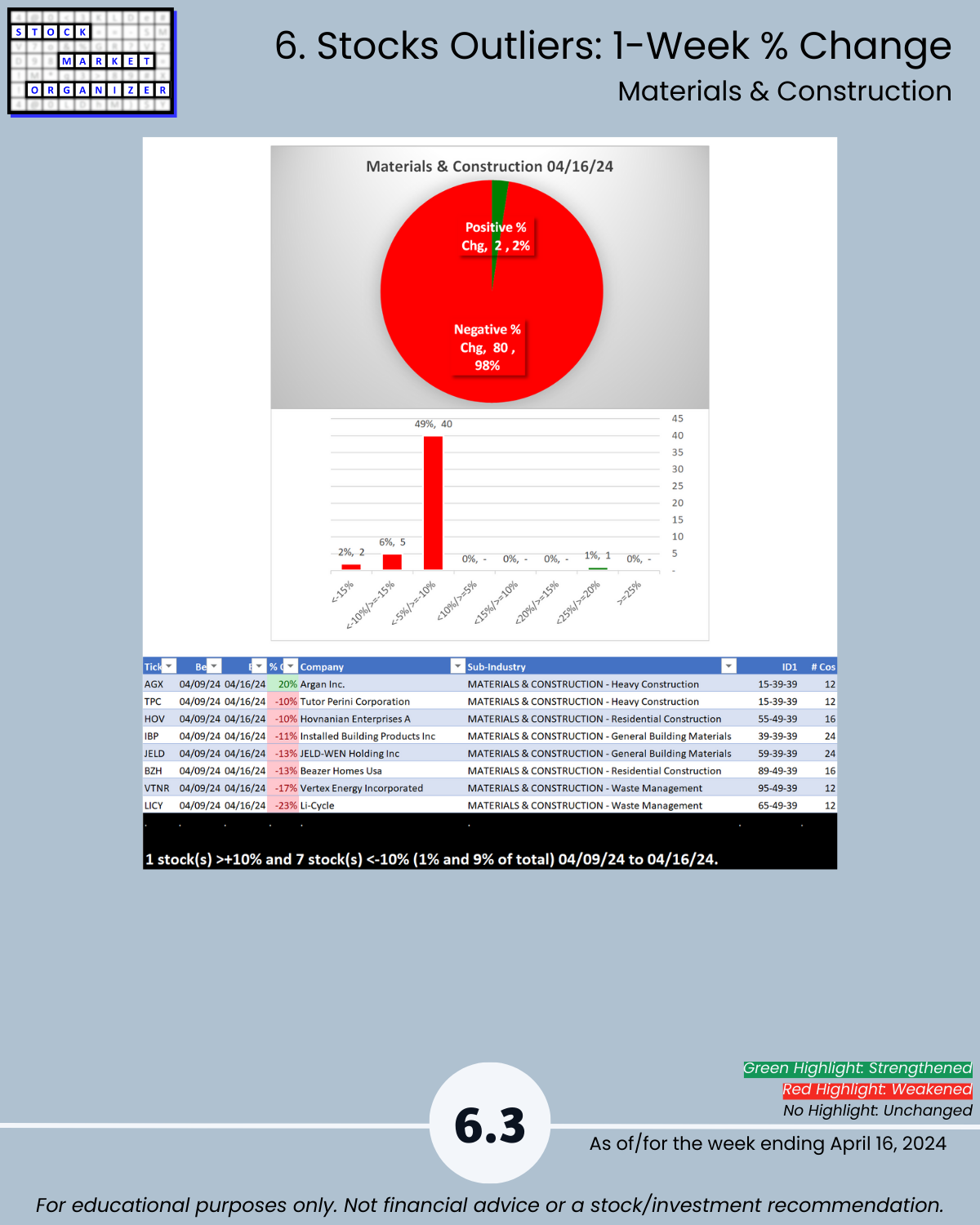

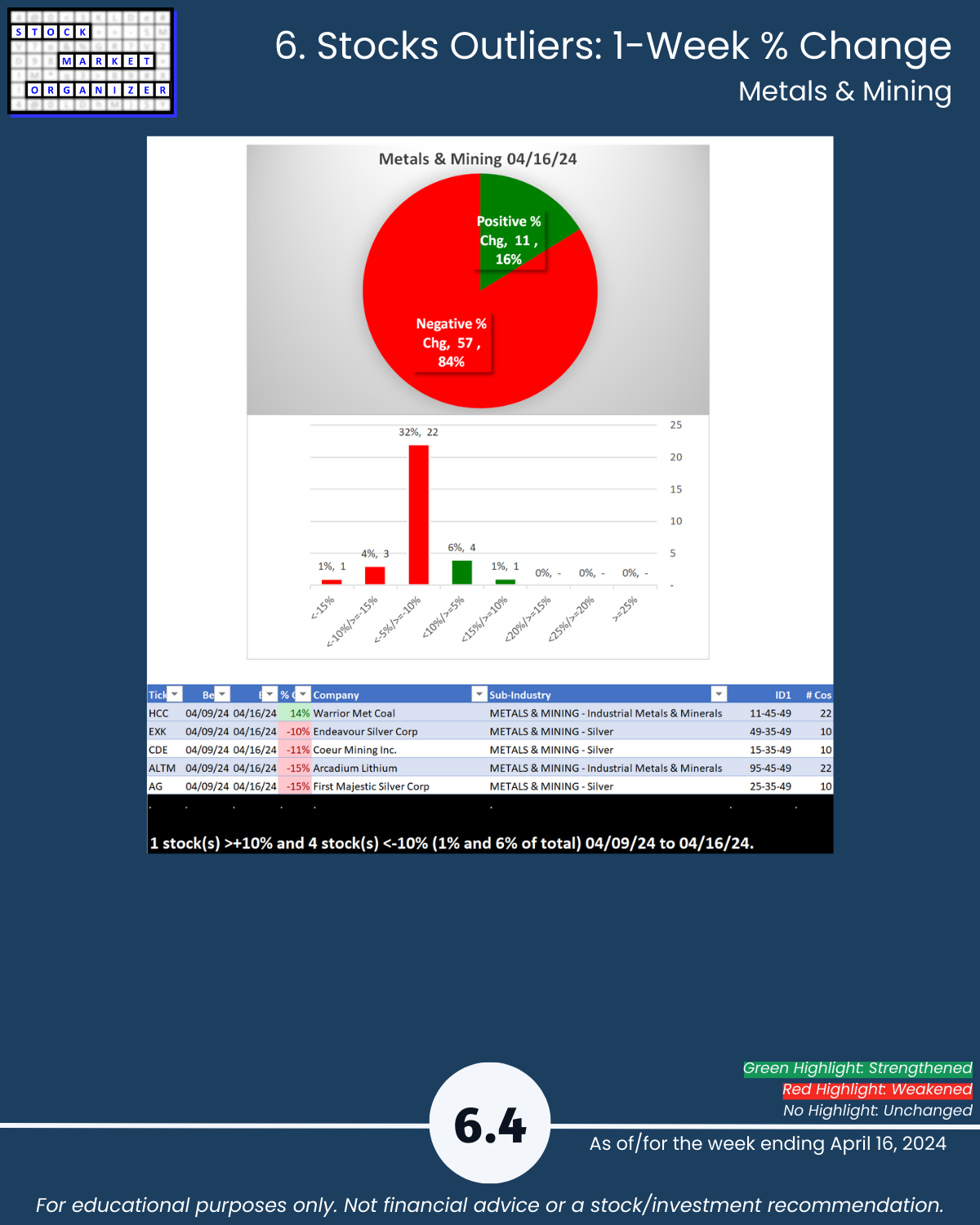

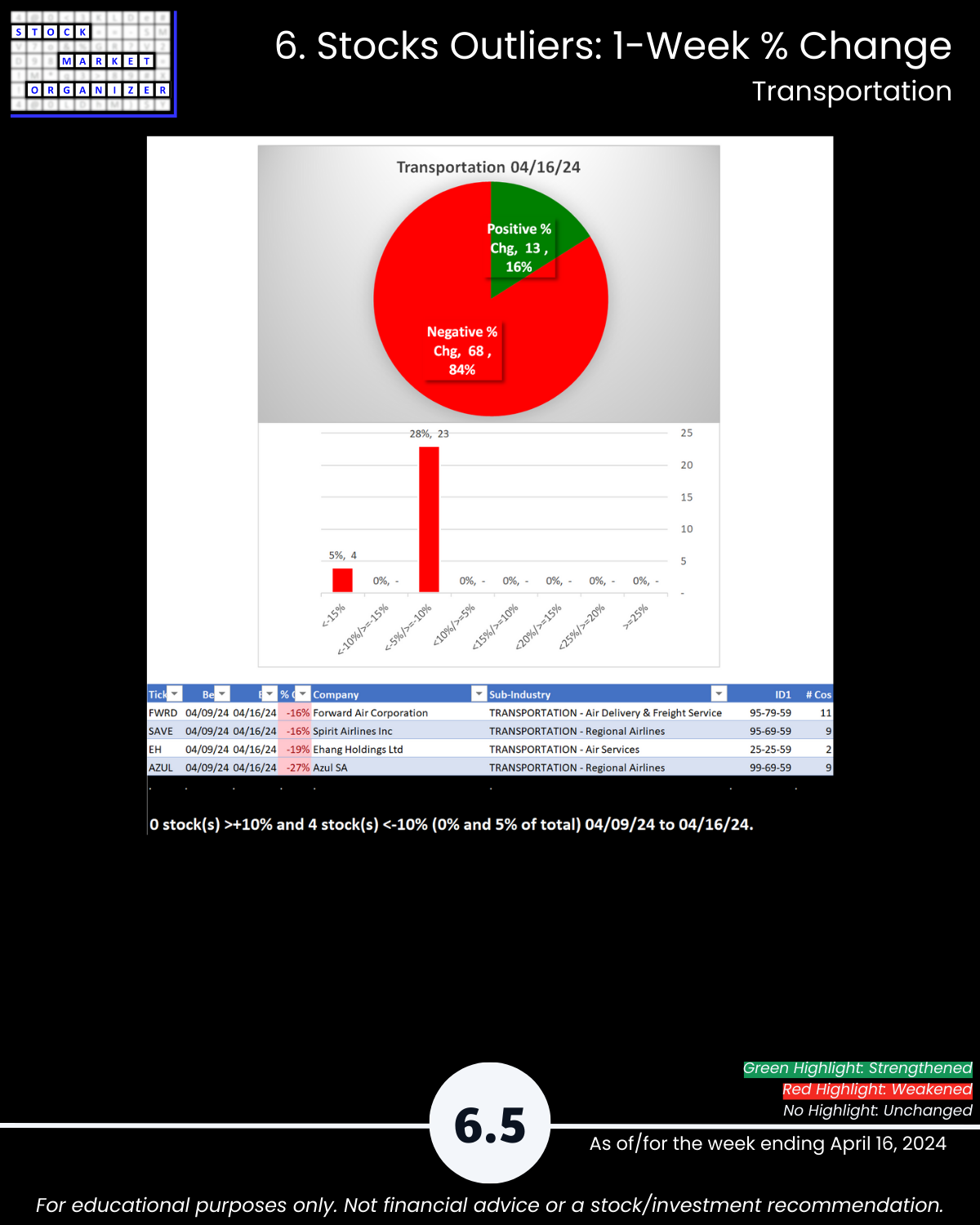

- Positive:Negative: Avg 9%/91%; Automotive 97%, Energy 93%, Materials/Construction 98% negative

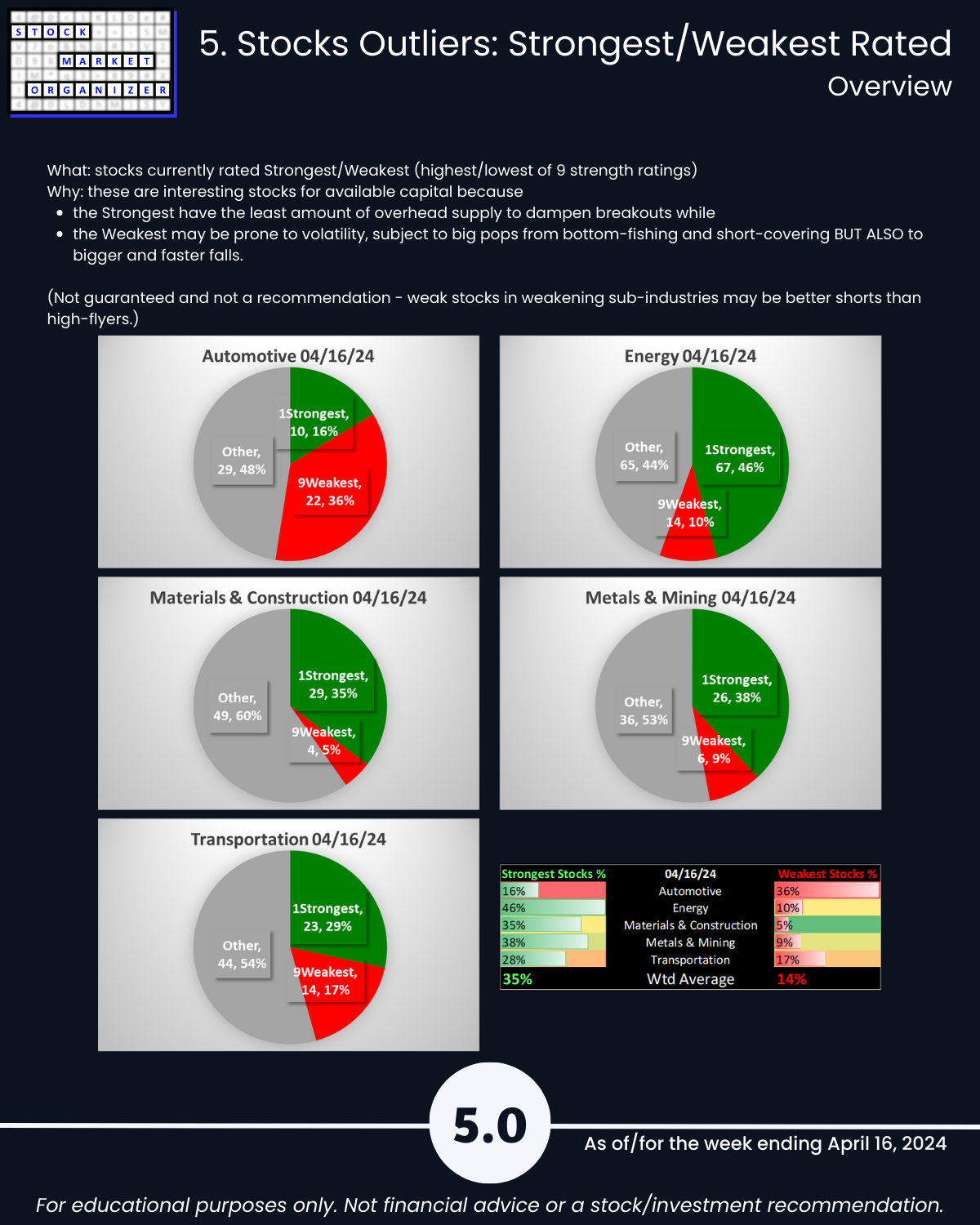

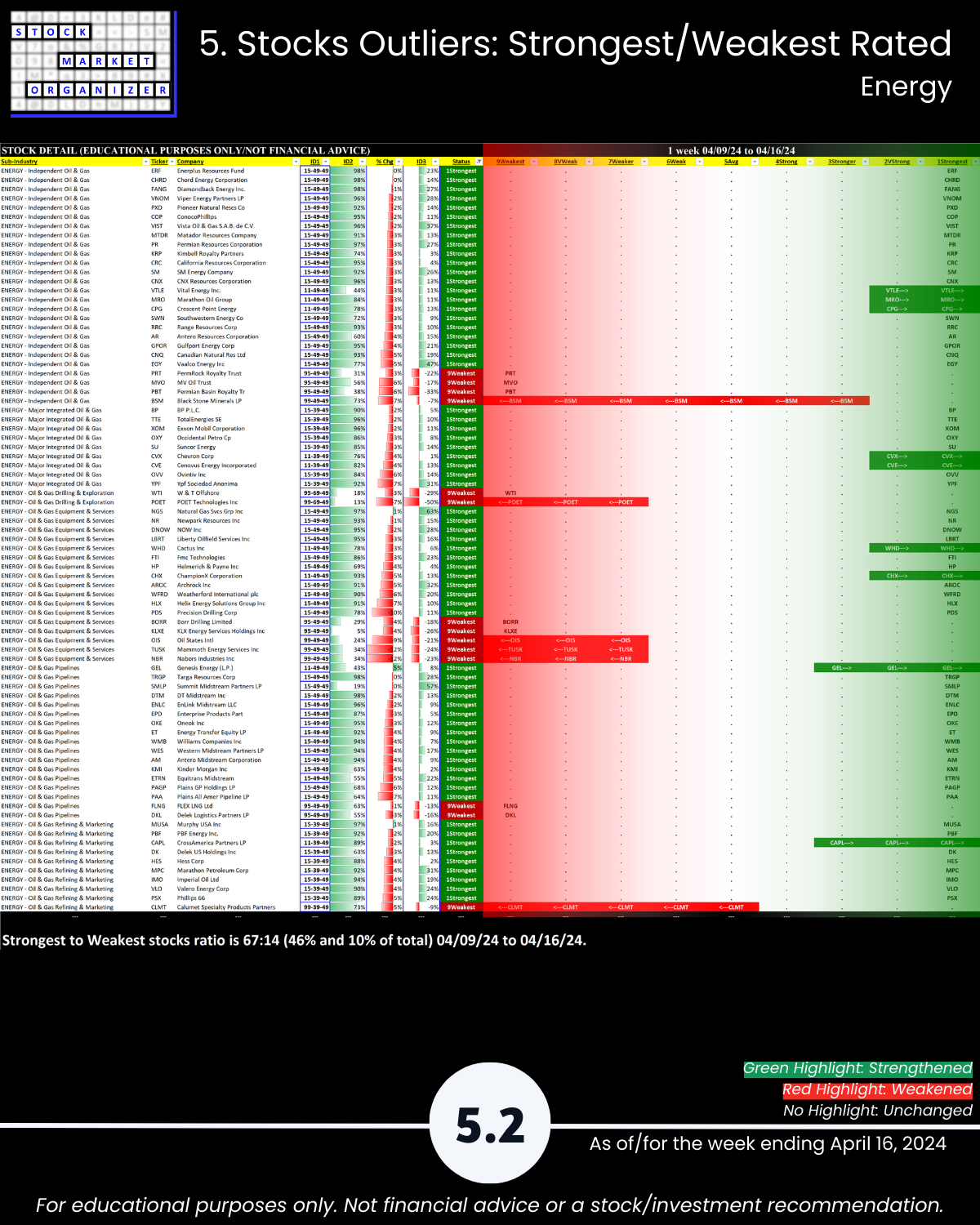

- Strongest:Weakest: Avg 35%/14%; Automotive 16%:36%, Energy 46%:10%, Matls/Con 35%:5%, Metals 38%:9%

- Outlier Stocks: GOEV +21%, MPAA -21%; AGX +20%, LICY -23%; AZUL -27%

- Automotive 31% stocks <-10%

Following are galleries with page-by-page views of this report.

1. Introduction

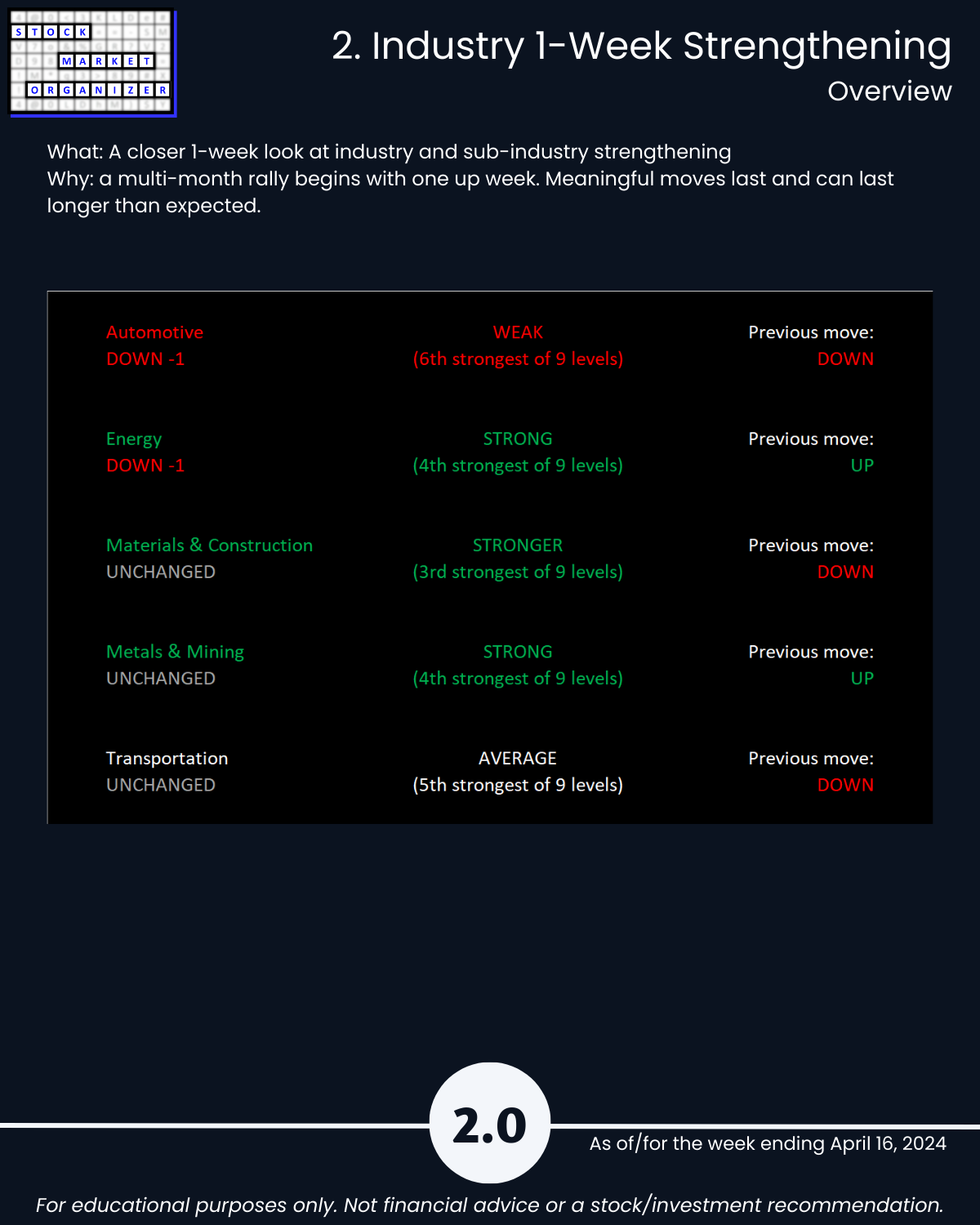

2. Industry 1-Week Strengthening

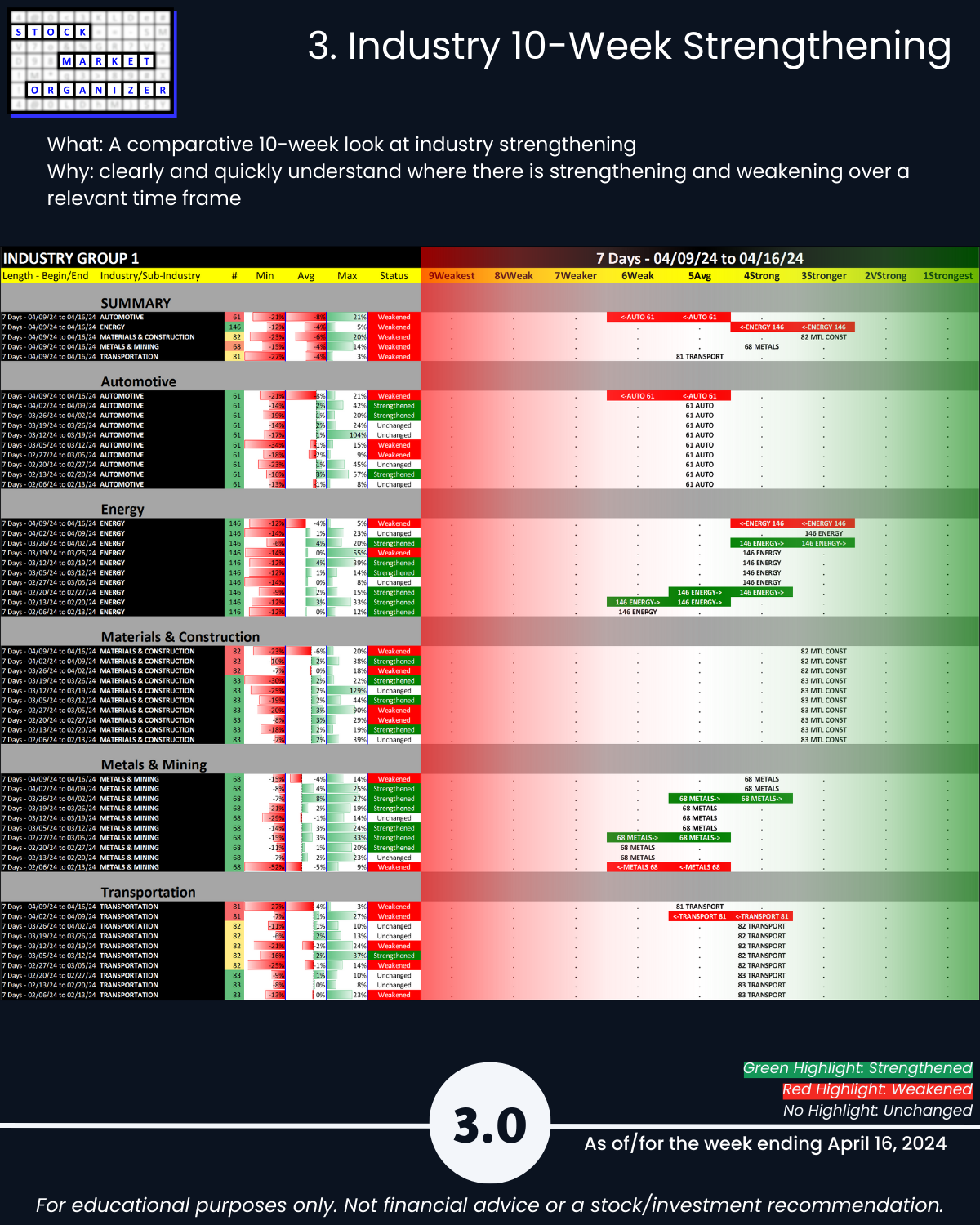

3. Industry 10-Week Strengthening

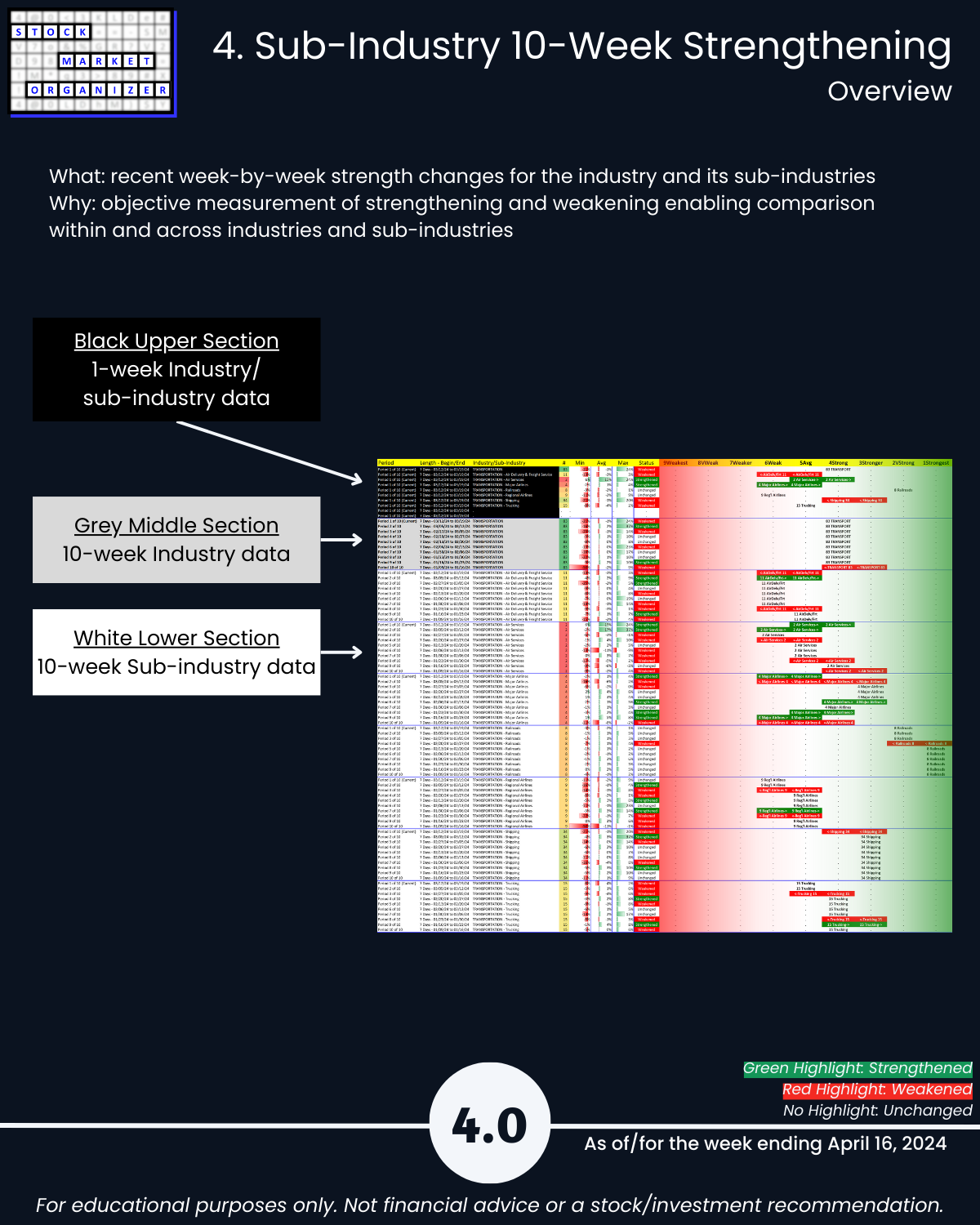

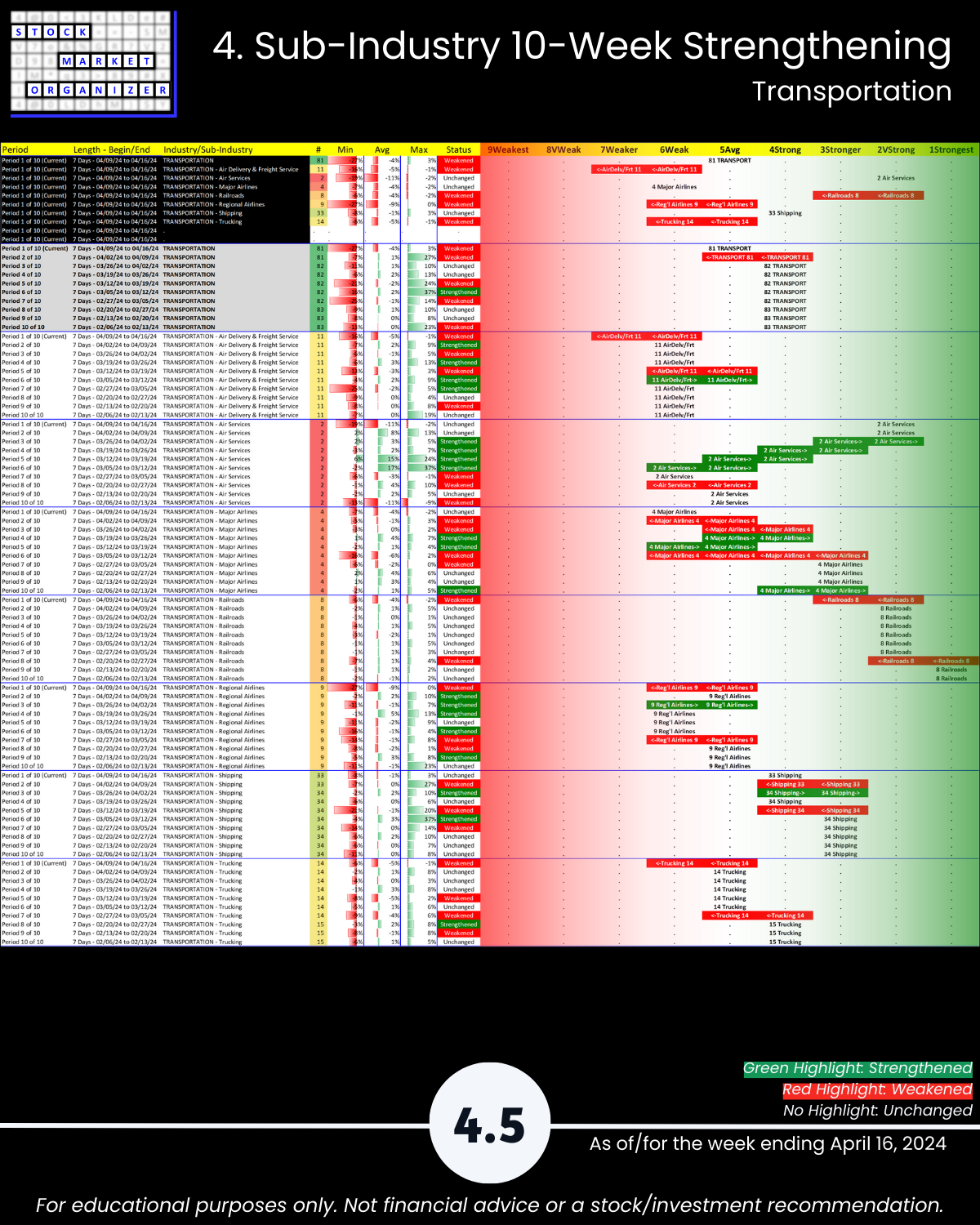

4. Sub-Industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

6. Stocks Outliers: 1-Week % Change

7. Stocks Outliers: 5-Year Highs/Lows