SMO Exclusive: Strength Report Group 1 2024-04-09

Today’s strength report, Industry Group 1 with Energy and Metals & Mining. Truth: the stronger your stocks, the greener your P&L. Also true: the market does not have to be so complicated. It takes work to blow it when you have a strong stock, strengthening sub-industry, strengthening industry, strengthening sector, and strengthening market. But how do you know you have strengthening at each level unless you are explicitly looking for it?

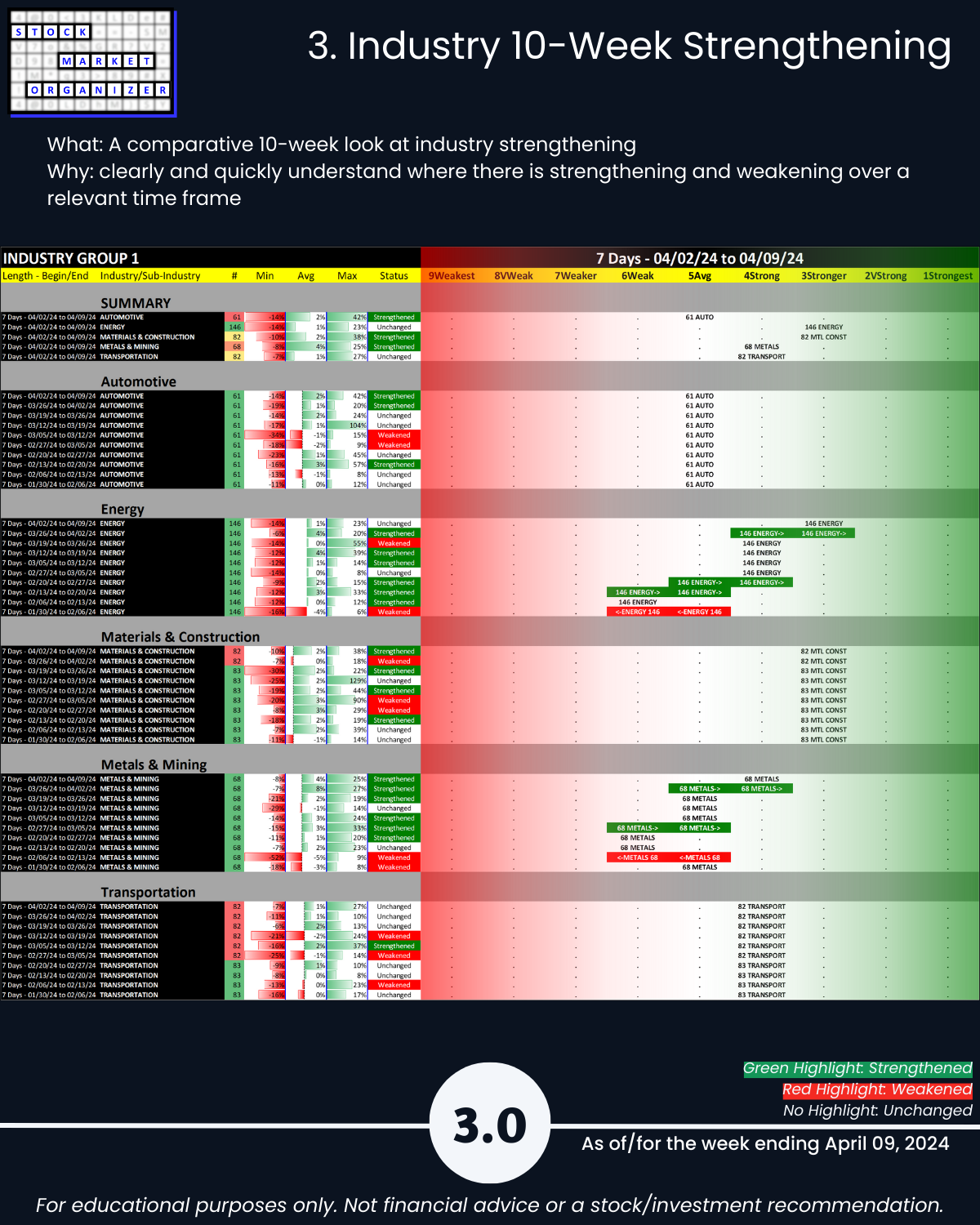

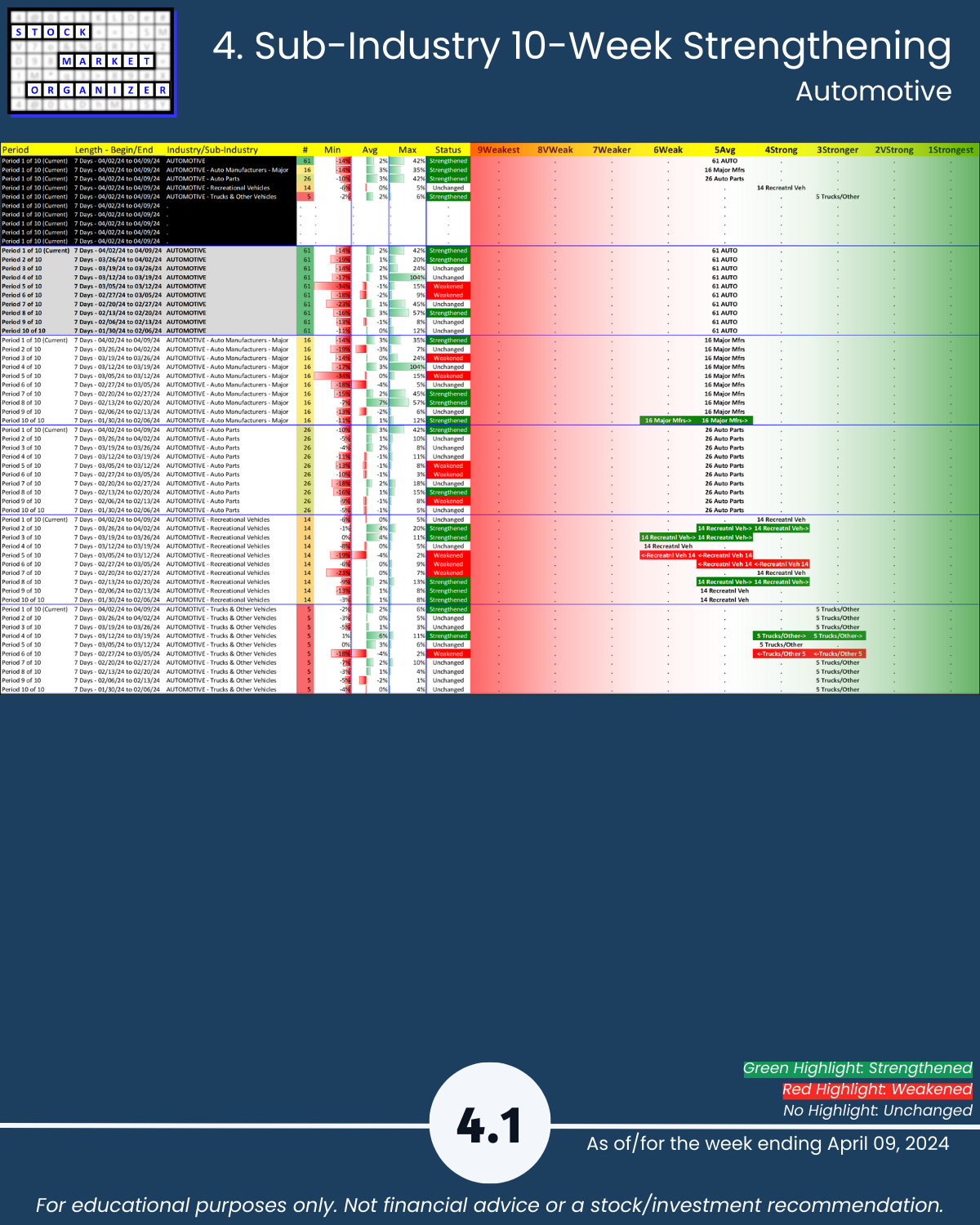

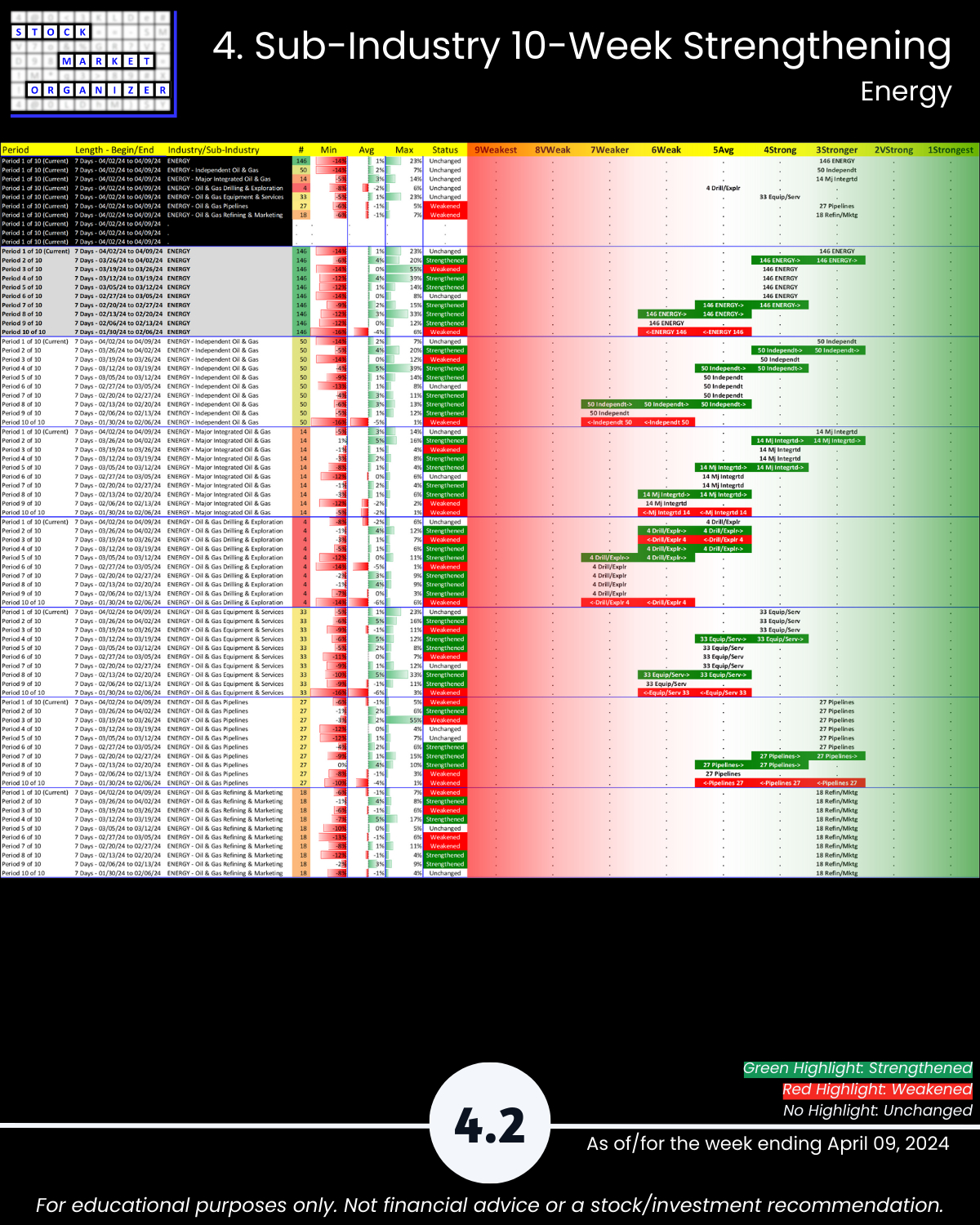

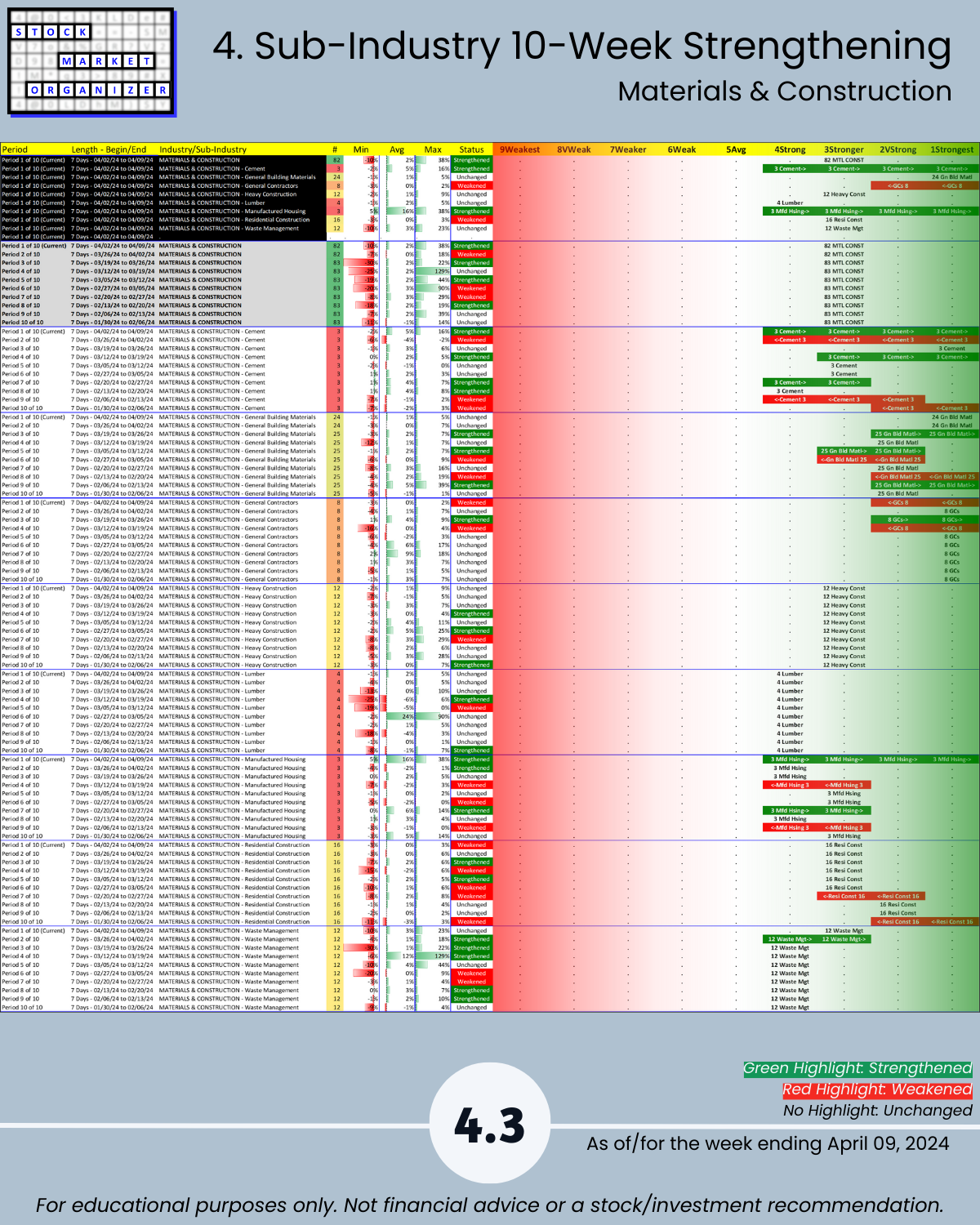

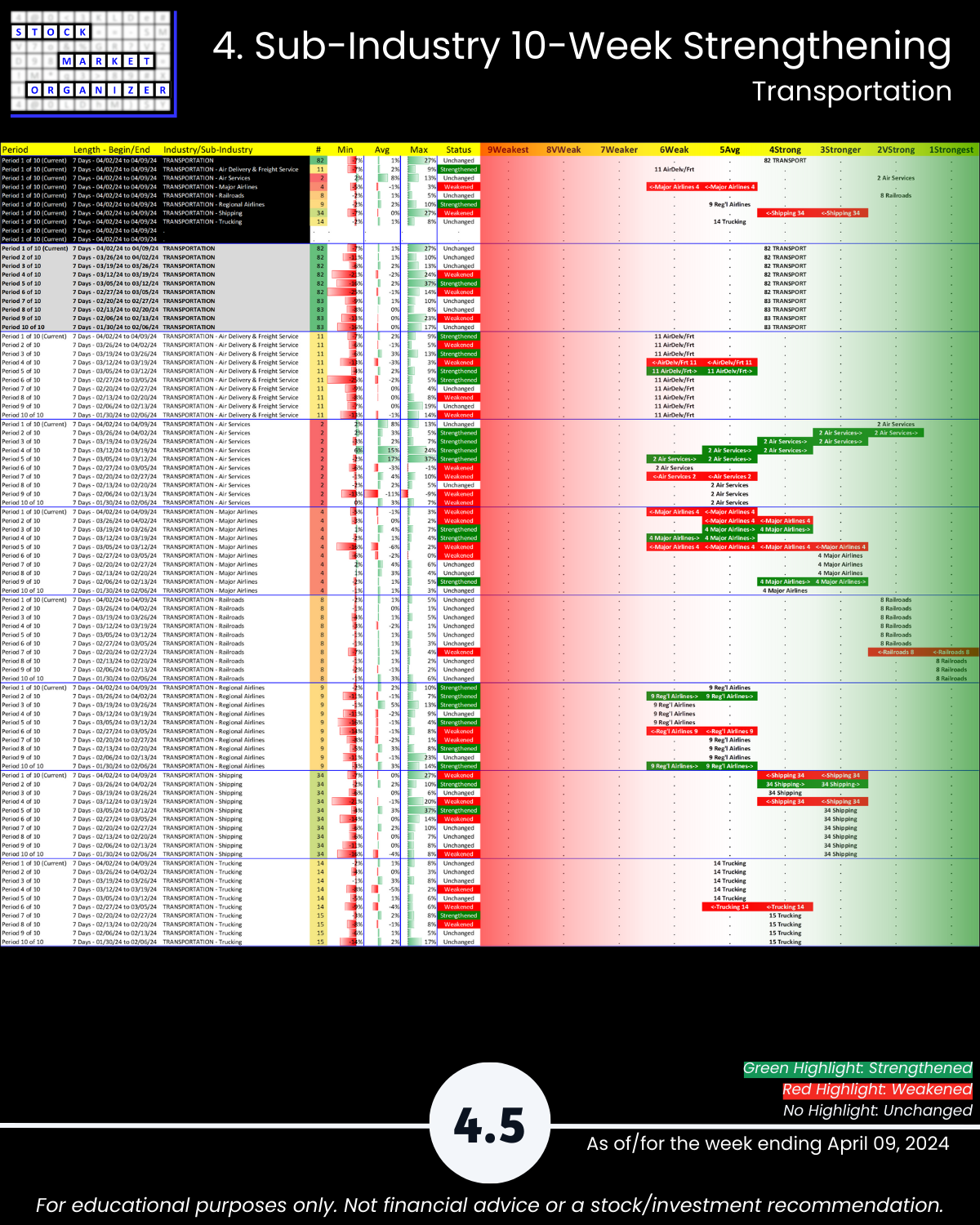

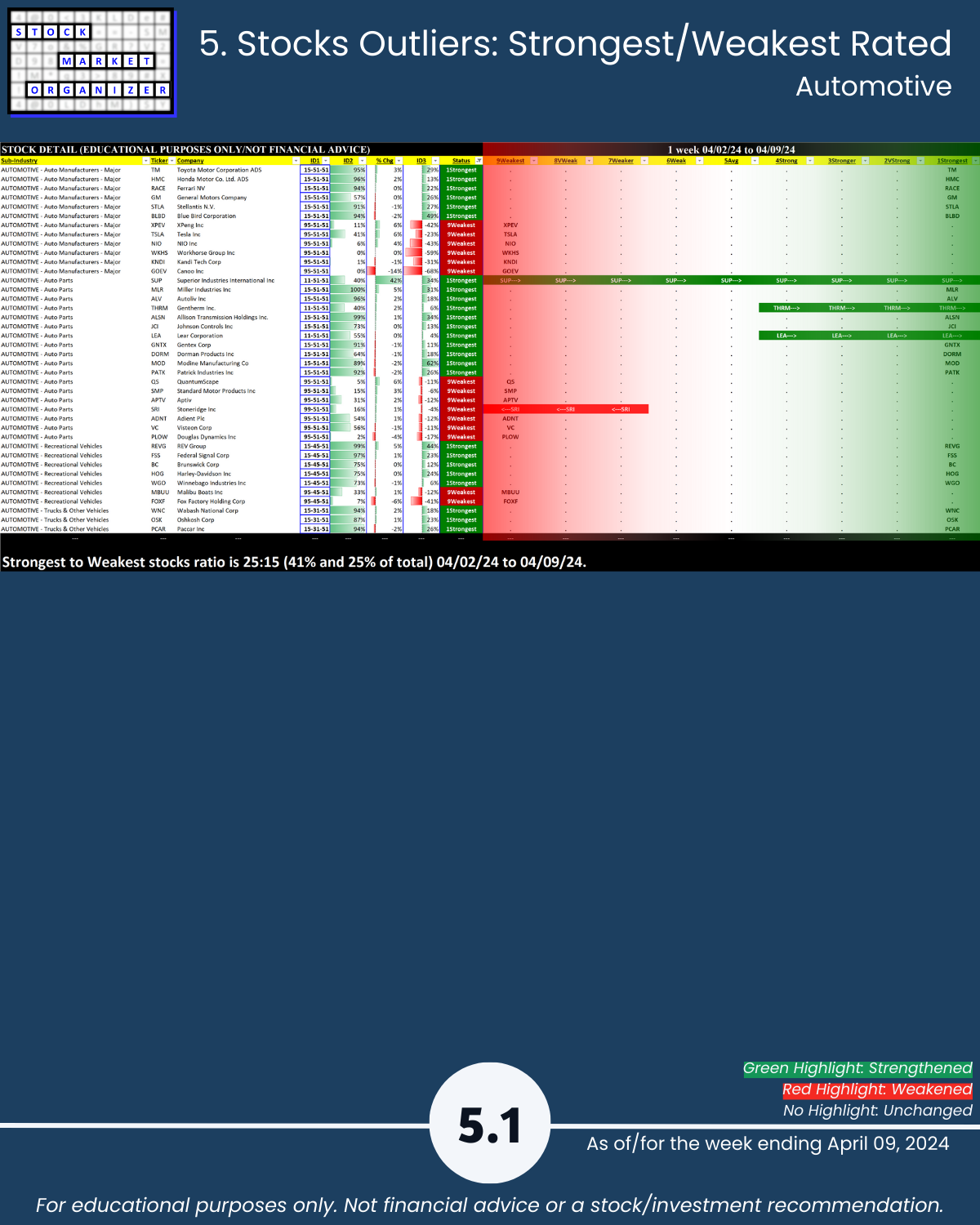

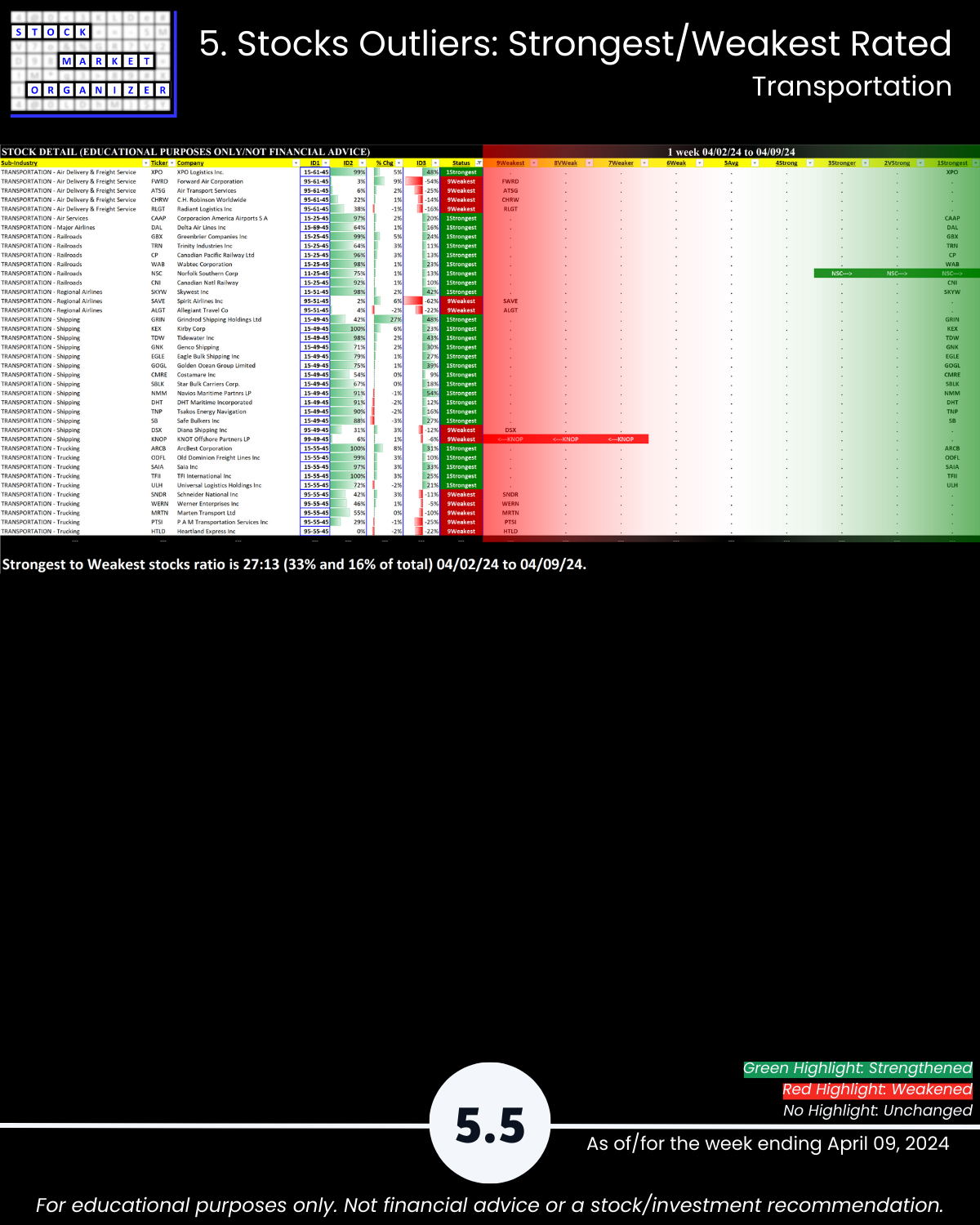

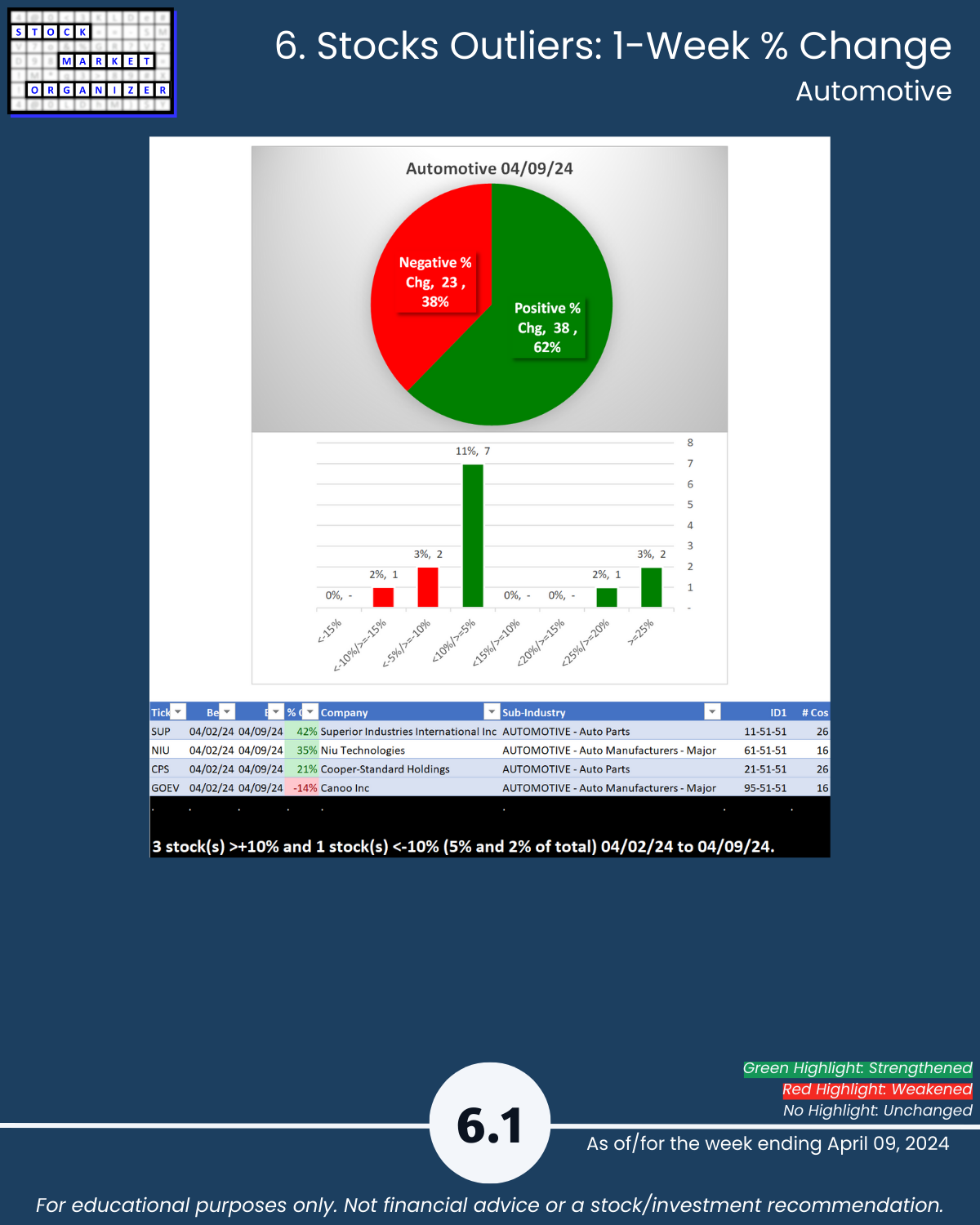

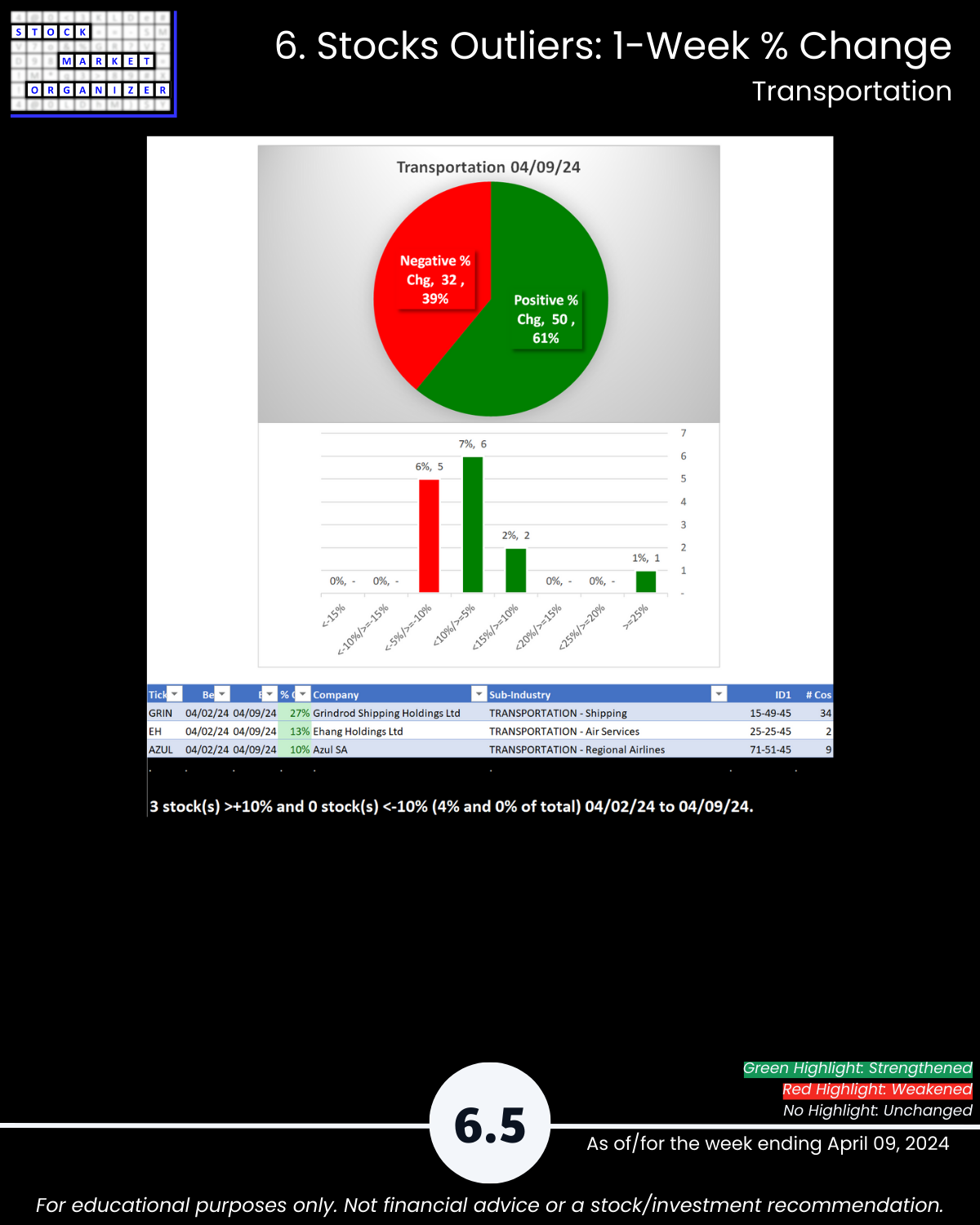

Today’s report also includes Homebuilders (part of Materials & Construction), Automotive (hello ex-Mag 7 member TSLA) and Transportation (no, BA is not here it’s in Aerospace/Defense – but it does include Railroads and Airlines). It wasn’t long ago that Energy and Metals were market laggards. See page 3.0 to pinpoint the weeks each started strengthening.

These are industries I update twice per week. Along with 14 others (10 industries are 1x/week).

Too frequent? Not for my purposes. By tracking them this frequently I’m able to discern when any changes are happening.

Of course this involves plenty of watching paint dry. But I enjoy closely monitoring the underlying changes, because unlike paint drying the market is dynamic and changes happen all the time. And change = opportunity.

Why? Because of these two additional truths:

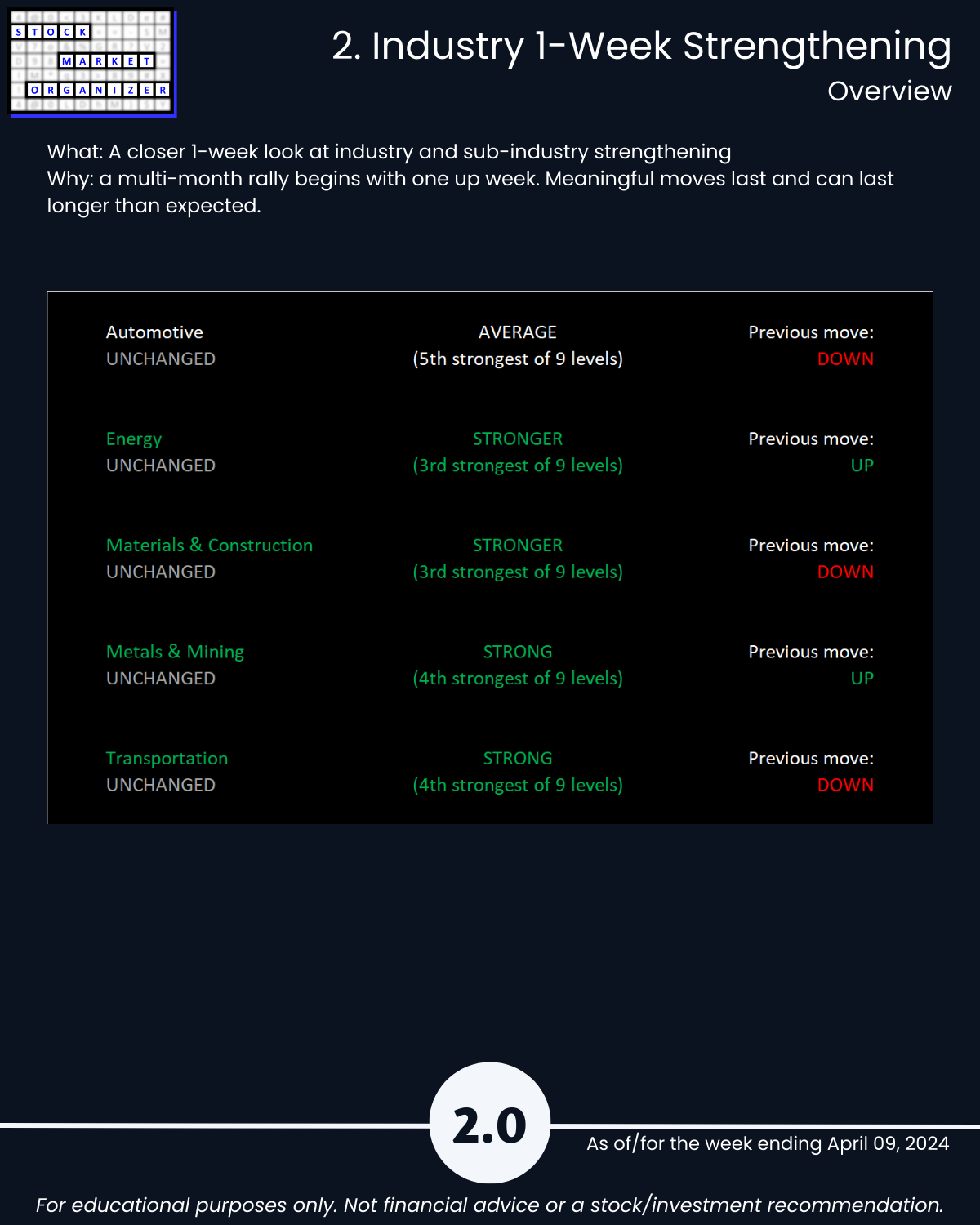

- The journey to a multi-month rally begins with one week.

- The journey to 100%+ returns begins with 10% returns.

The market does not need to be so complicated.

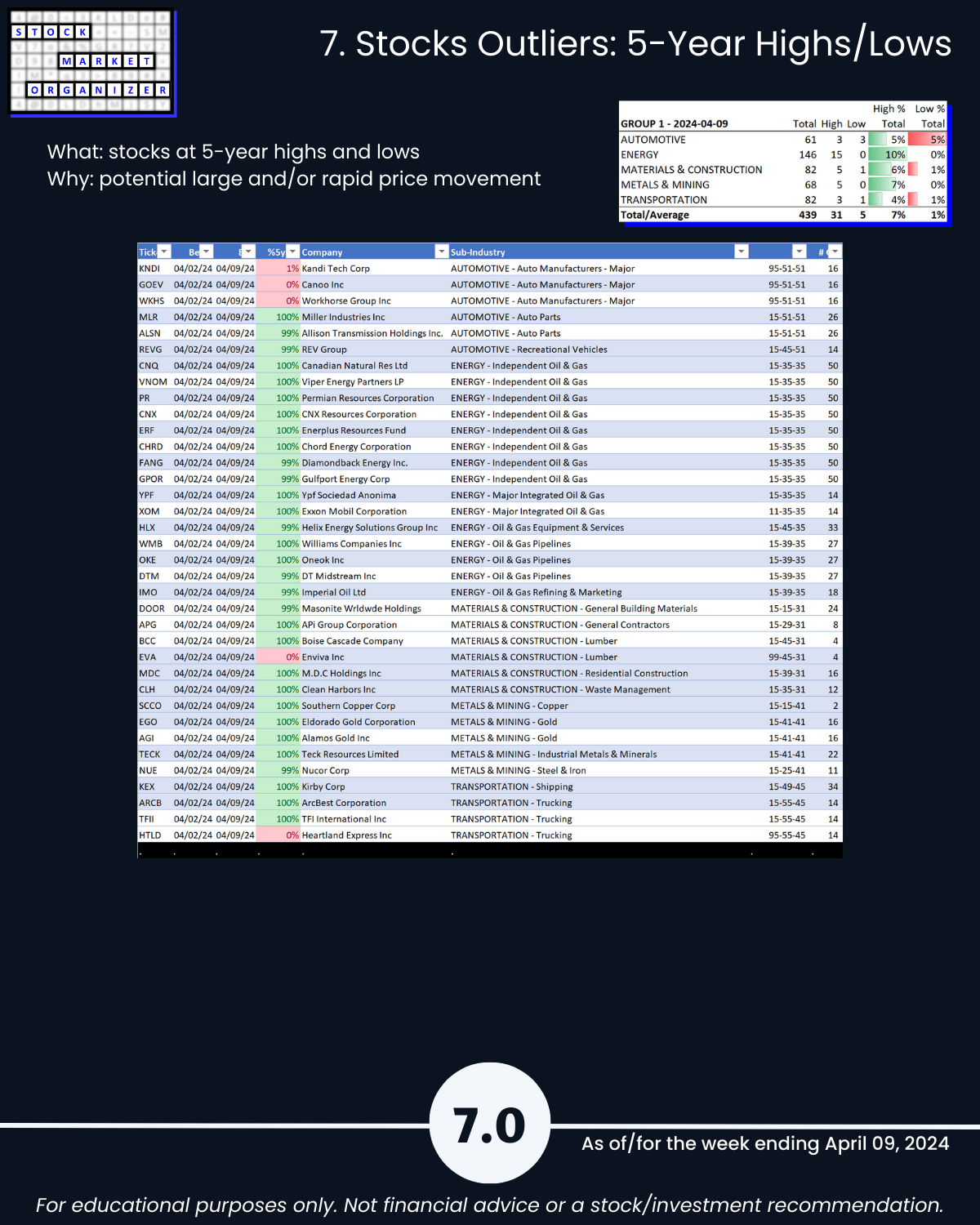

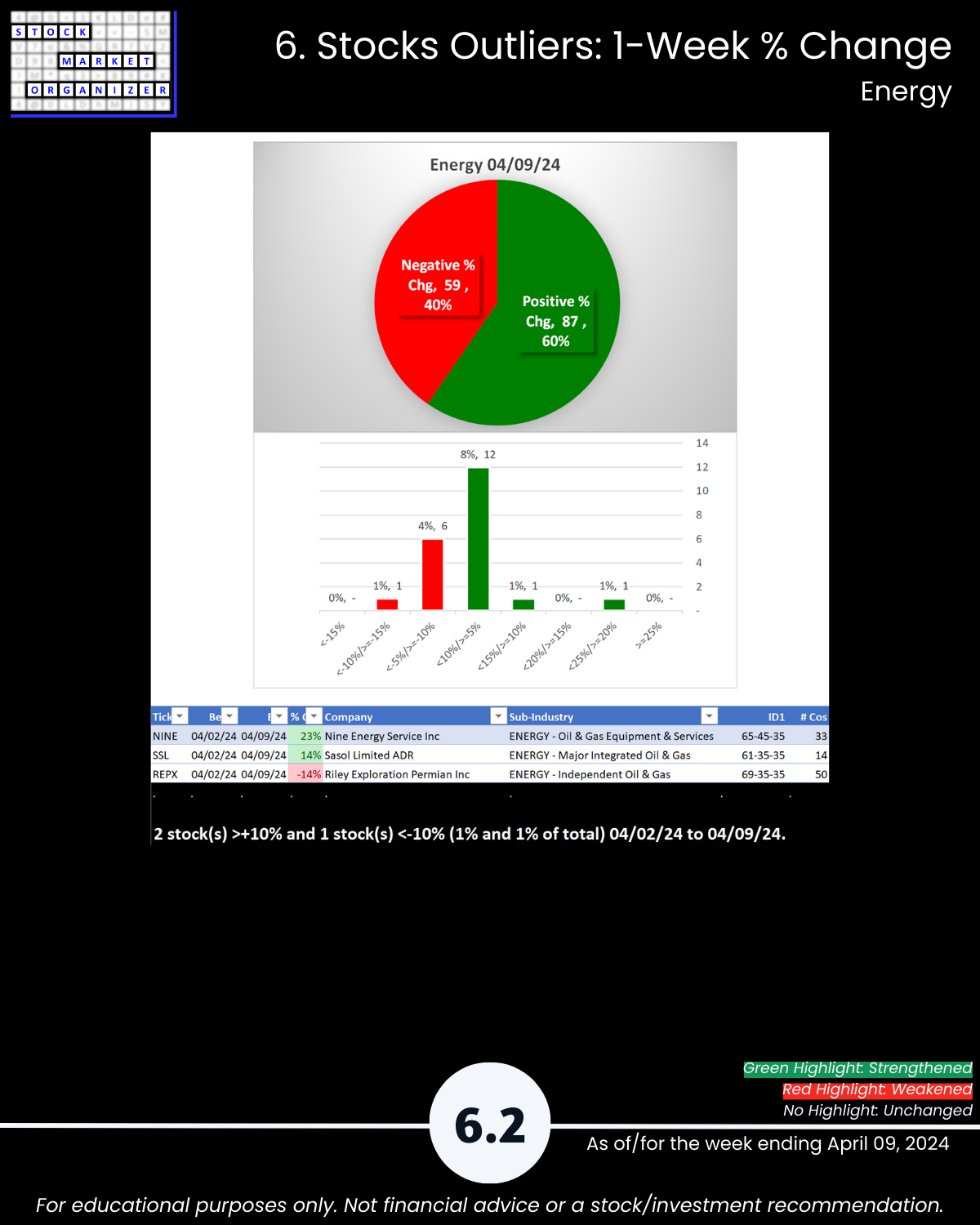

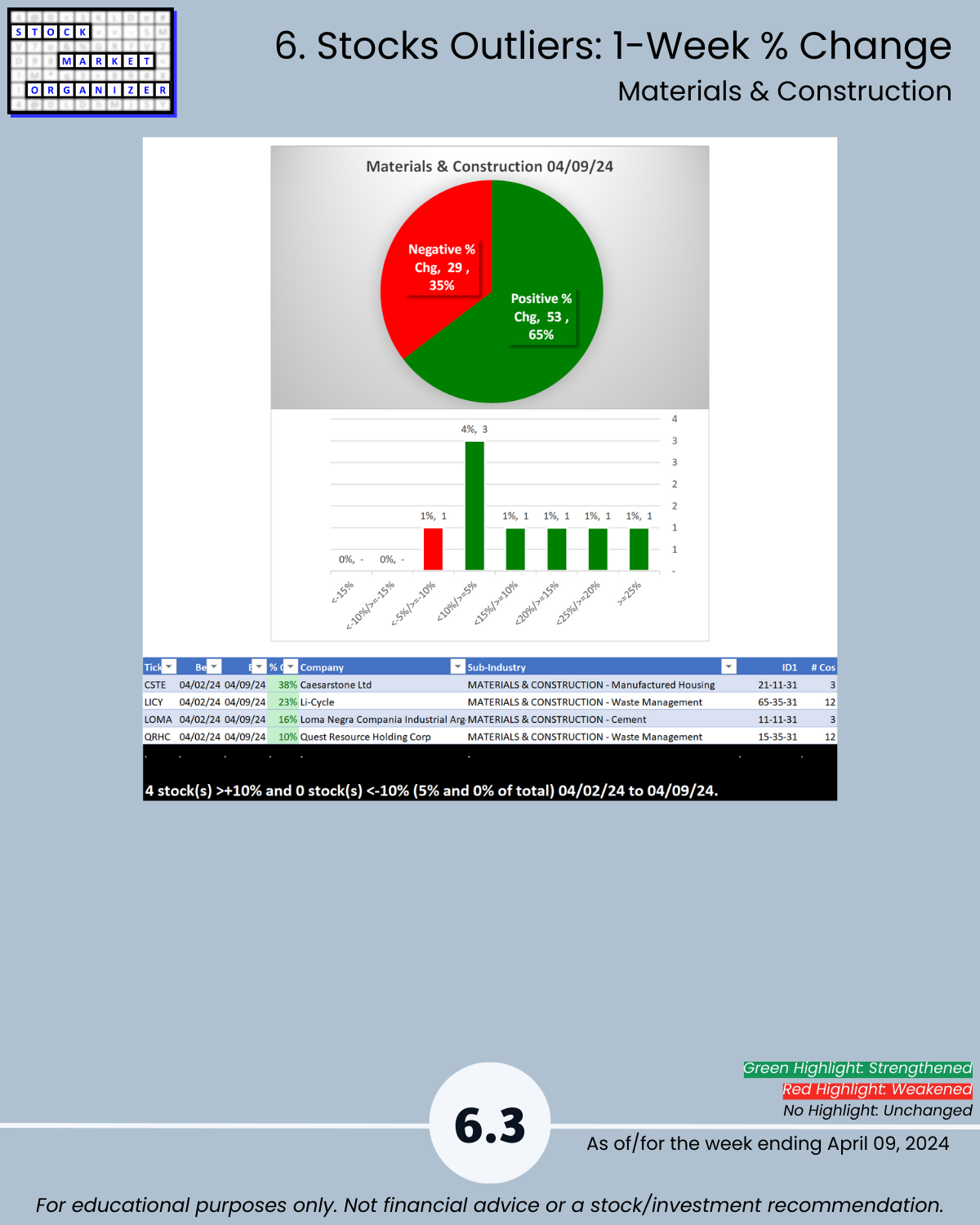

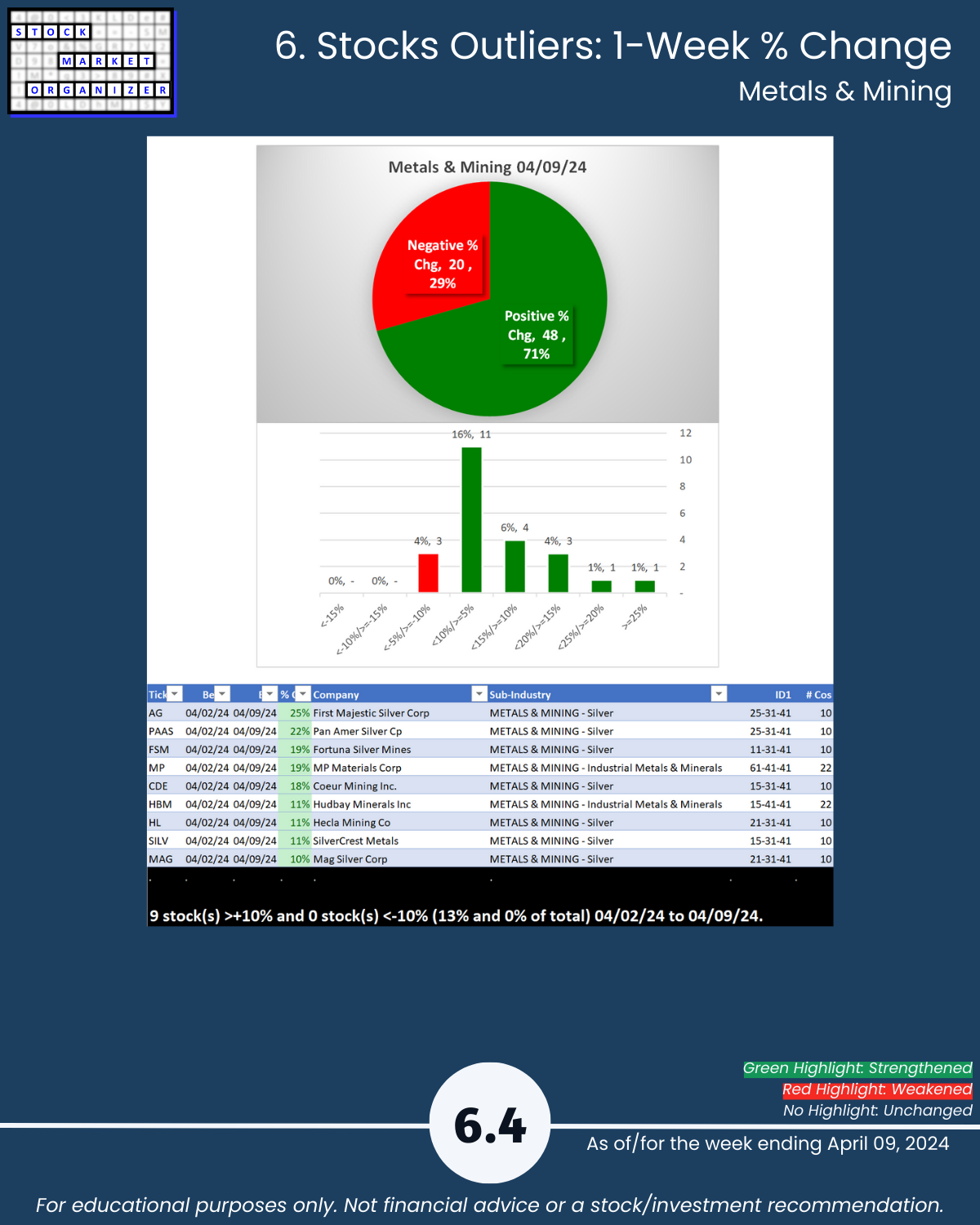

OUTLIER STOCKS: SUP +42%, NIU +35%, CPS +21%; NINE +23%; CSTE +38%, LICY +23%; AG +25%, PAAS +22%; GRIN +27%. Do you know which ones have supporting sub-industry and industry strengthening conditions?

UNIQUE STRENGTHENING ANALYSIS INSIGHTS

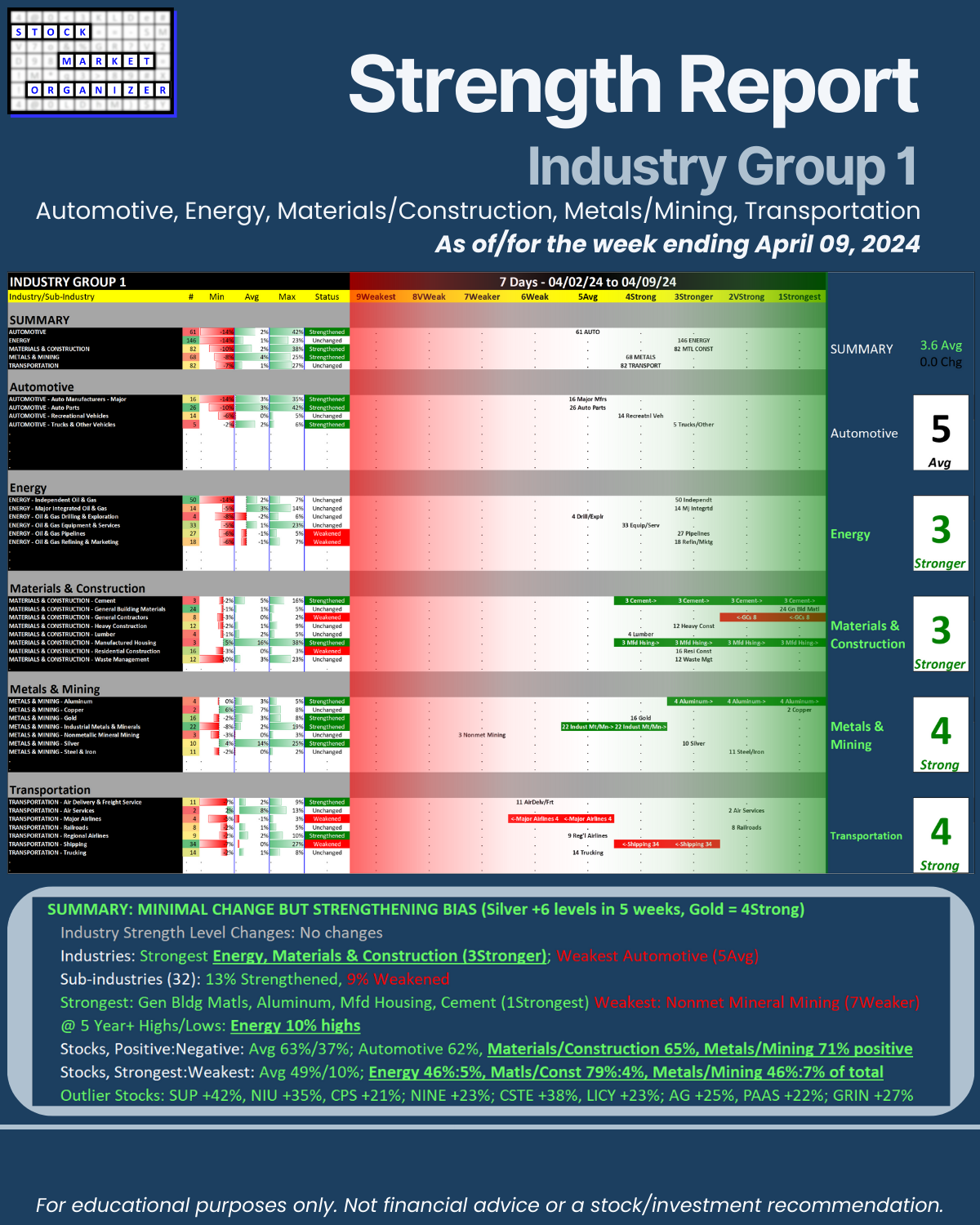

SUMMARY: MINIMAL CHANGE BUT STRENGTHENING BIAS (Silver +6 levels in 5 weeks, Gold = 4Strong)

🔹 Industry Strength Level Changes: No changes

🔹 Industries

- Strongest Energy, Materials & Construction (3Stronger)

- Weakest Automotive (5Avg)

🔹 Sub-industries (32):

- 13% Strengthened, 9% Weakened

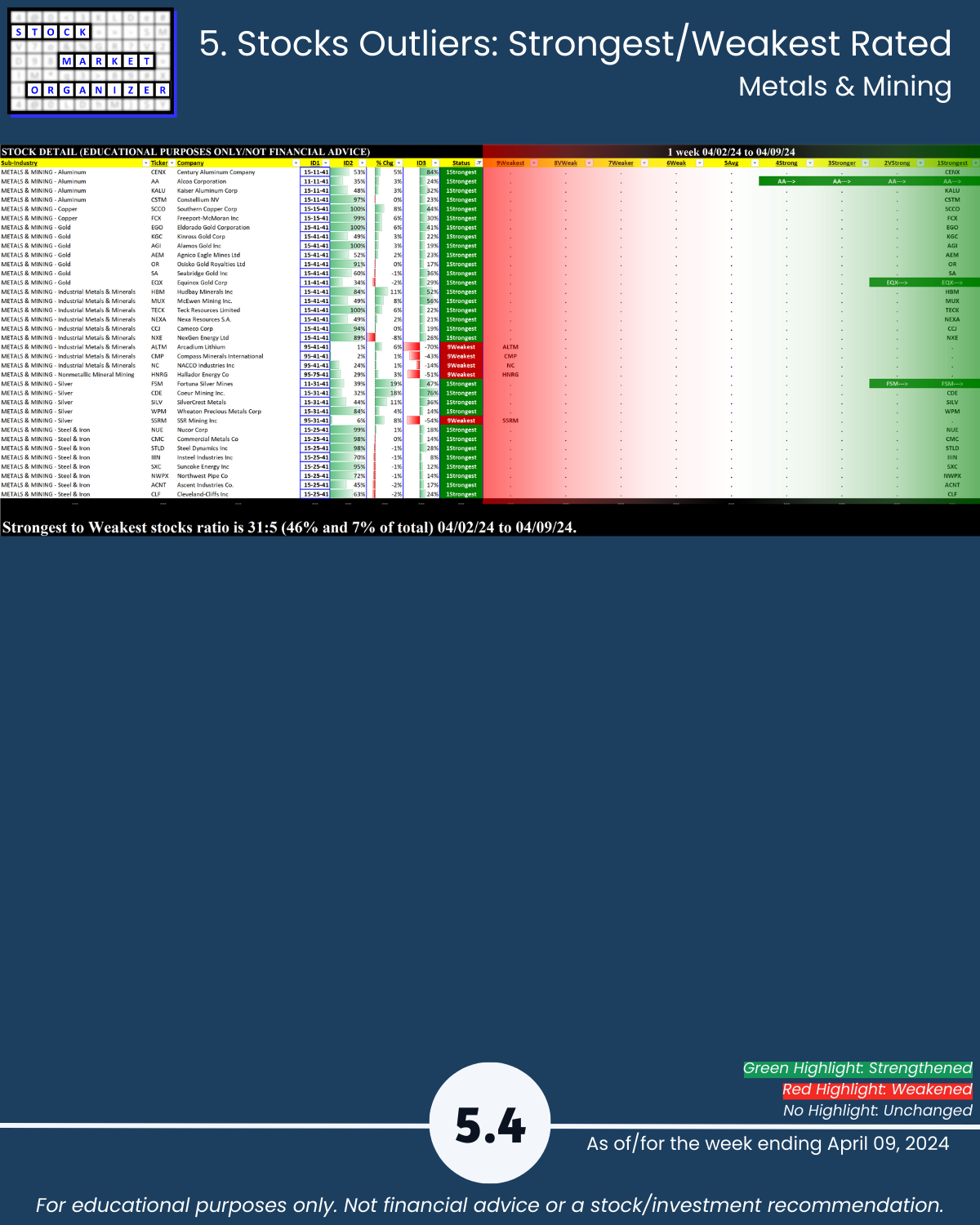

- Strongest: Gen Bldg Matls, Aluminum, Mfd Housing, Cement (1Strongest)

- Weakest: Nonmet Mineral Mining (7Weaker)

- @ 5 Year+ Highs/Lows: Energy 10% highs

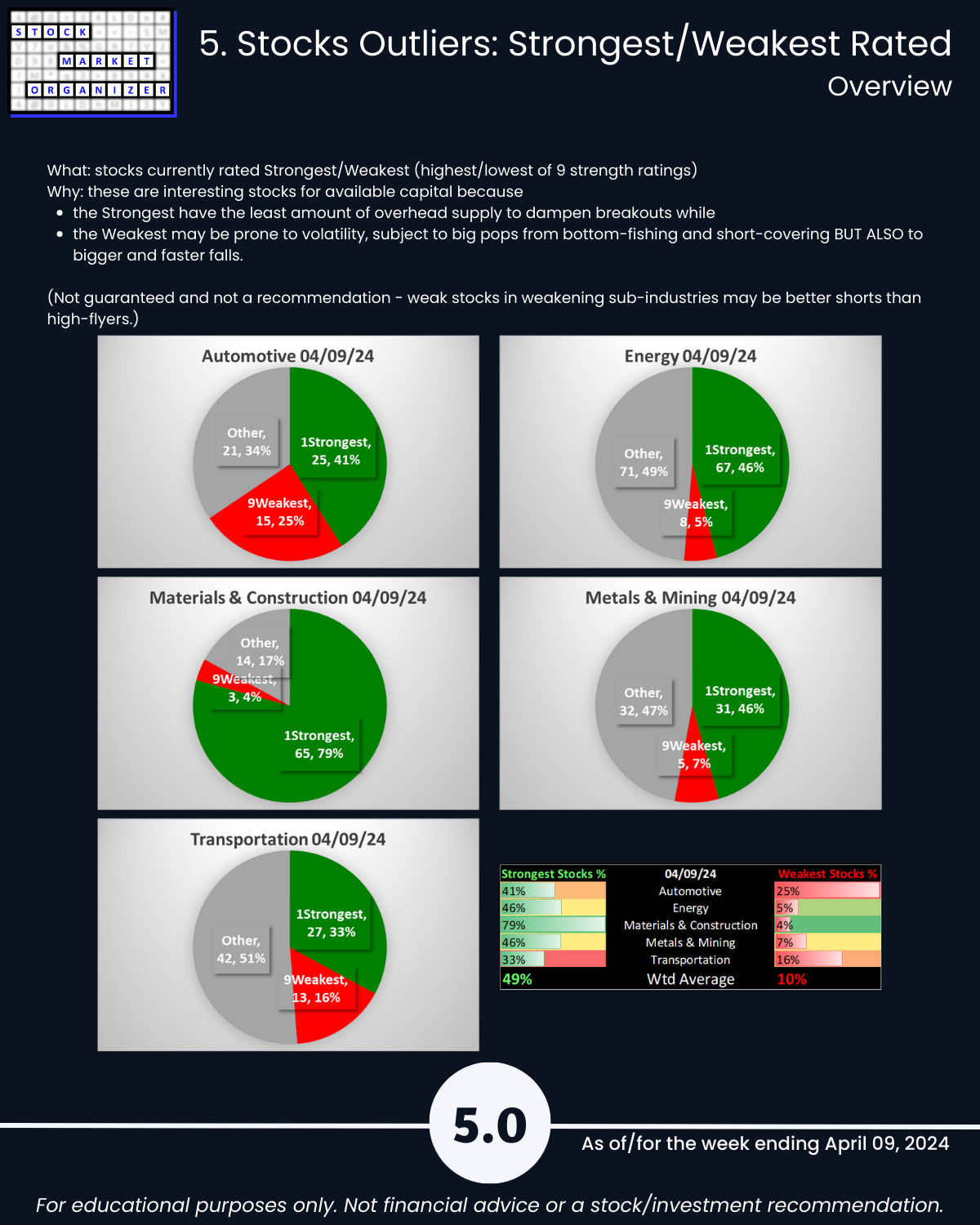

🔹 Stocks

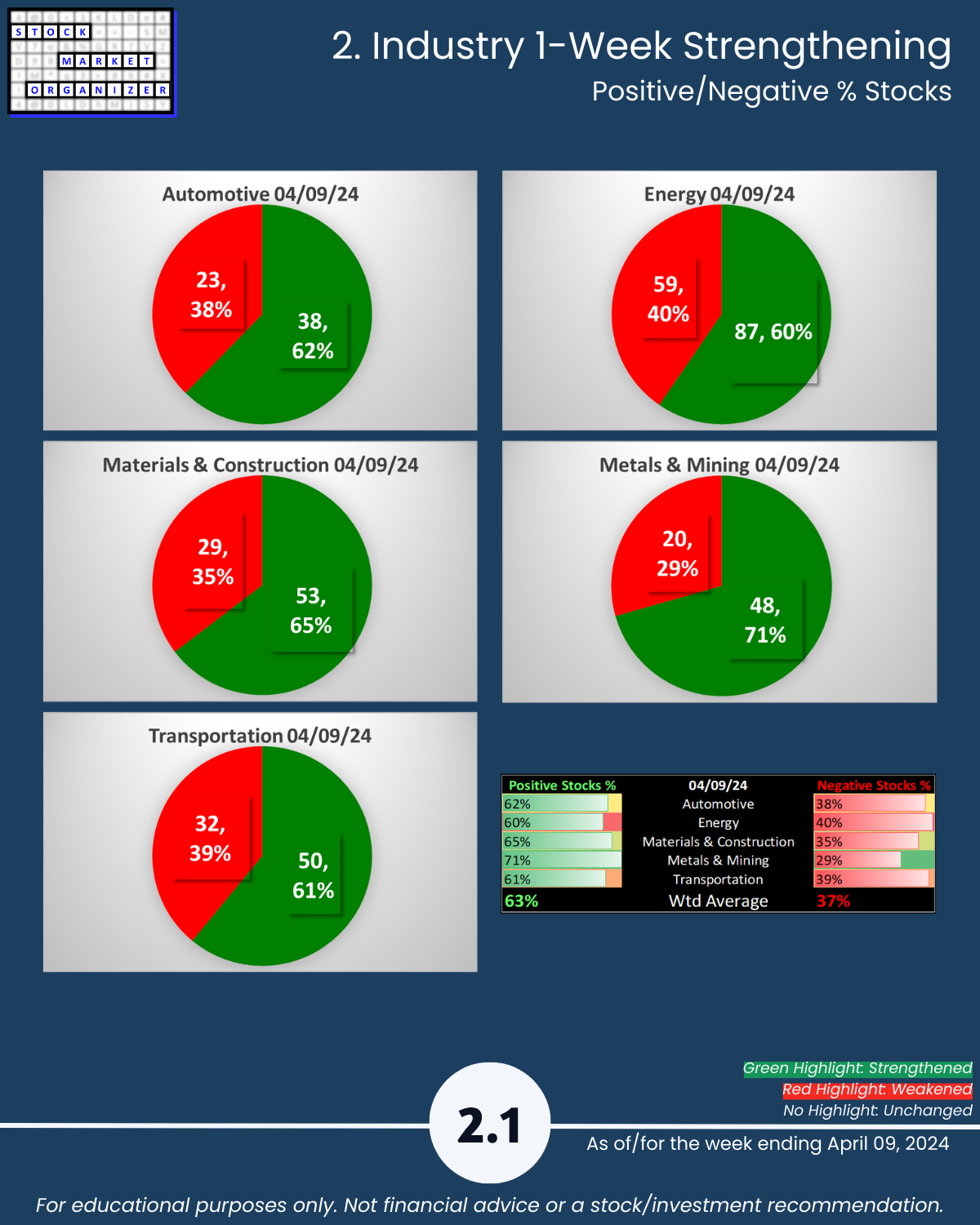

- Positive:Negative: Avg 63%/37%; Automotive 62%, Materials/Construction 65%, Metals/Mining 71% positive

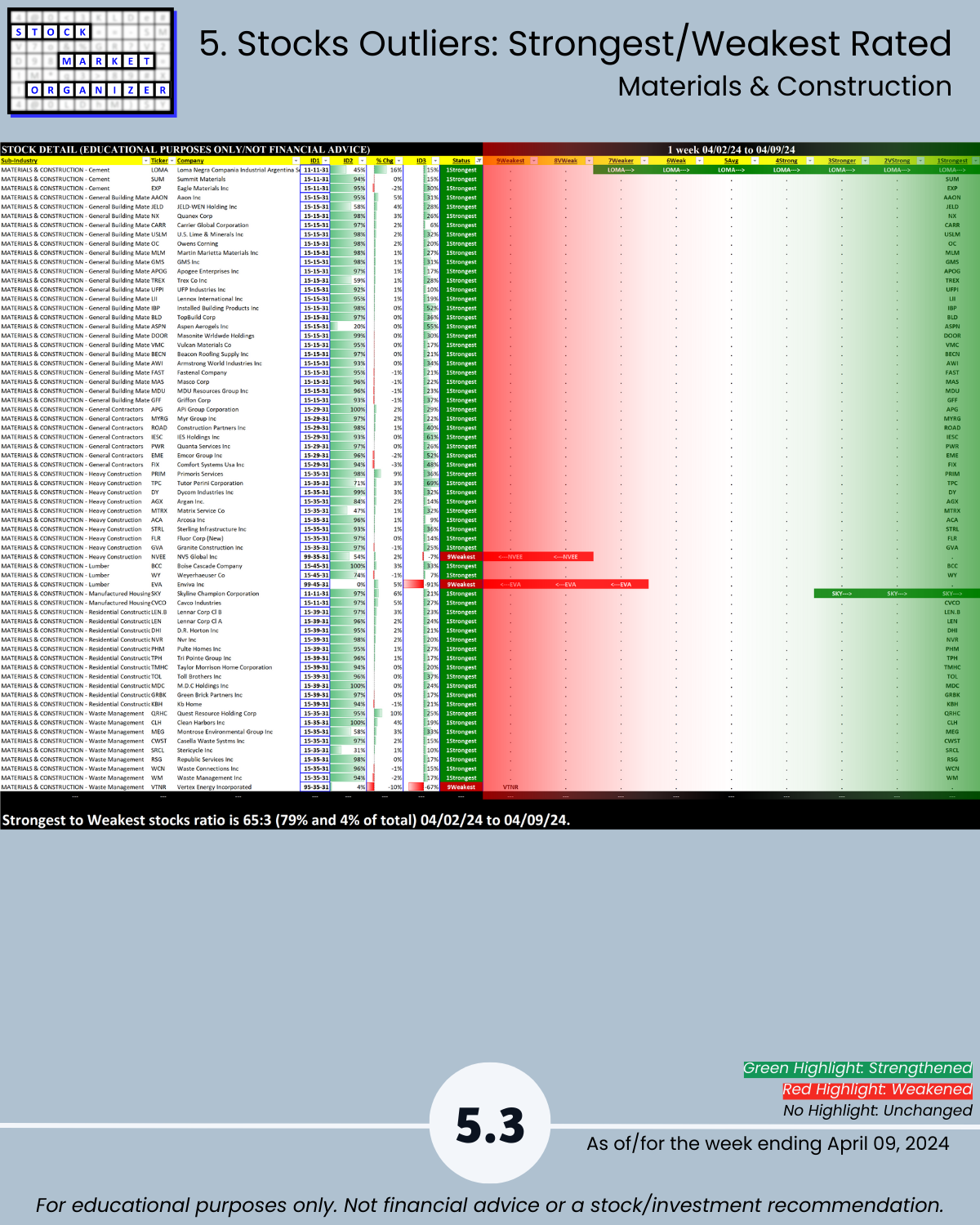

- Strongest:Weakest: Avg 49%/10%; Energy 46%:5%, Matls/Const 79%:4%, Metals/Mining 46%:7% of total

Following are galleries with page-by-page views of this report.

1. Introduction

2. Industry 1-Week Strengthening

3. Industry 10-Week Strengthening

4. Sub-Industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

6. Stocks Outliers: 1-Week % Change

7. Stocks Outliers: 5-Year Highs/Lows