SMO Exclusive: Strength Report Group 1 2024-04-02

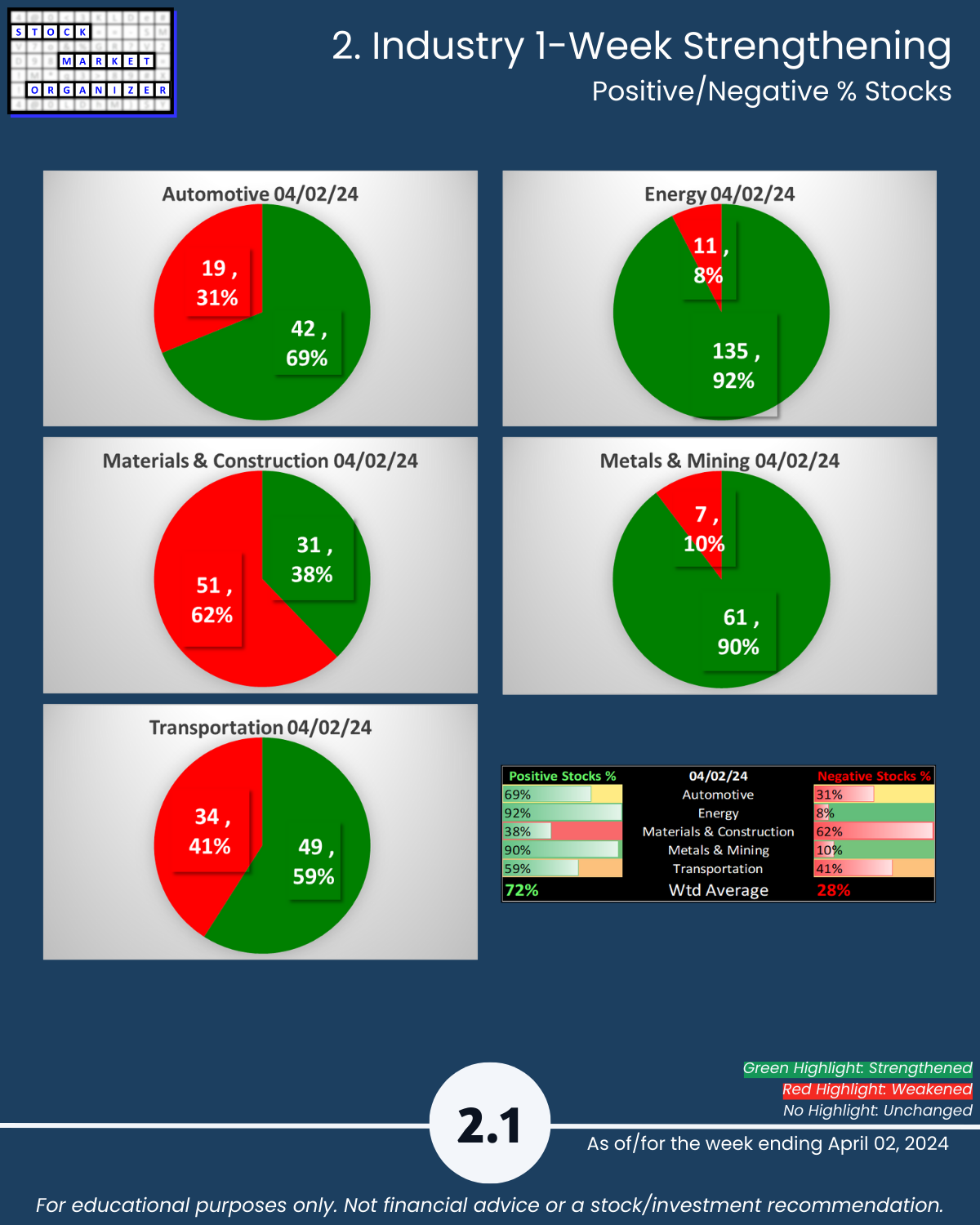

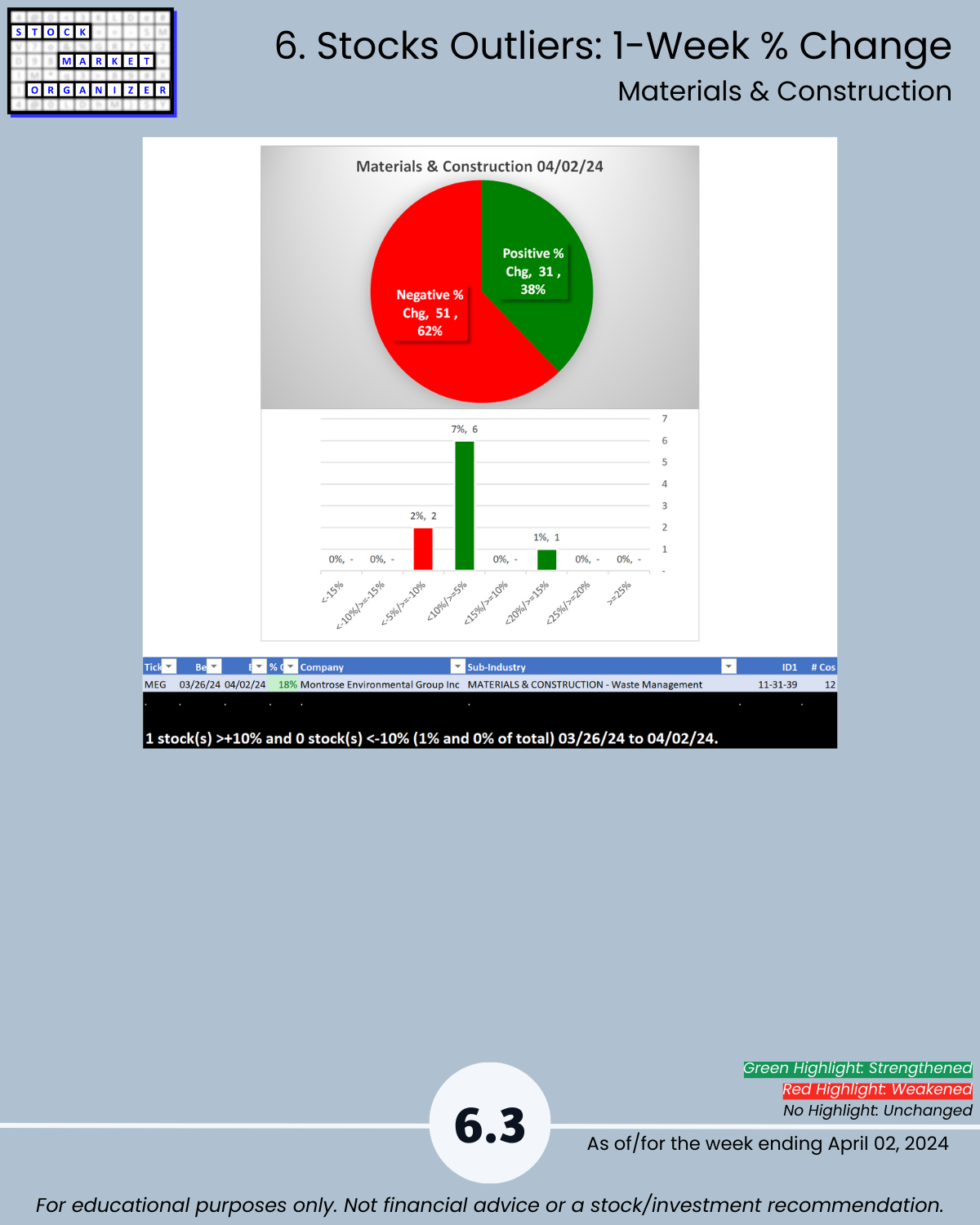

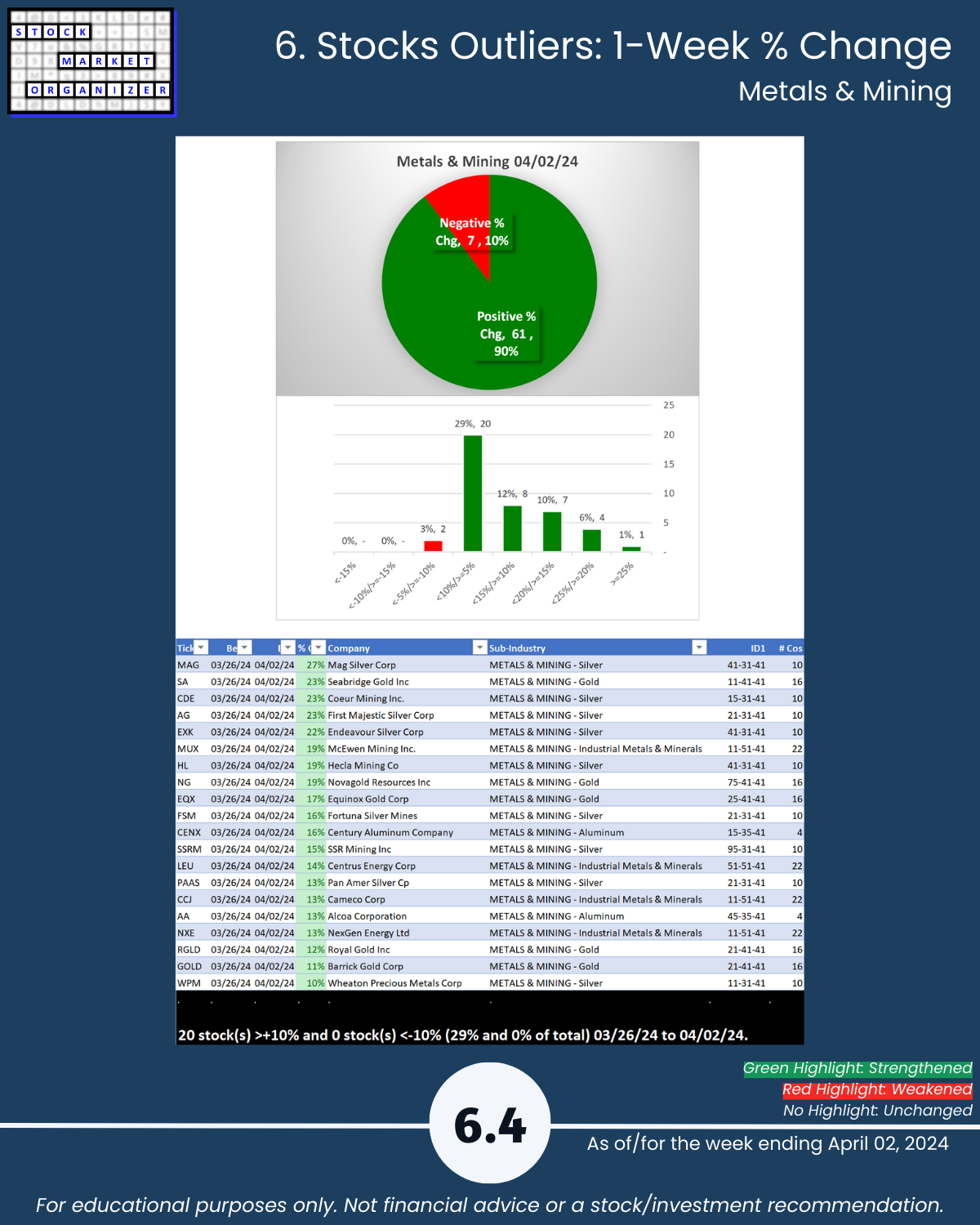

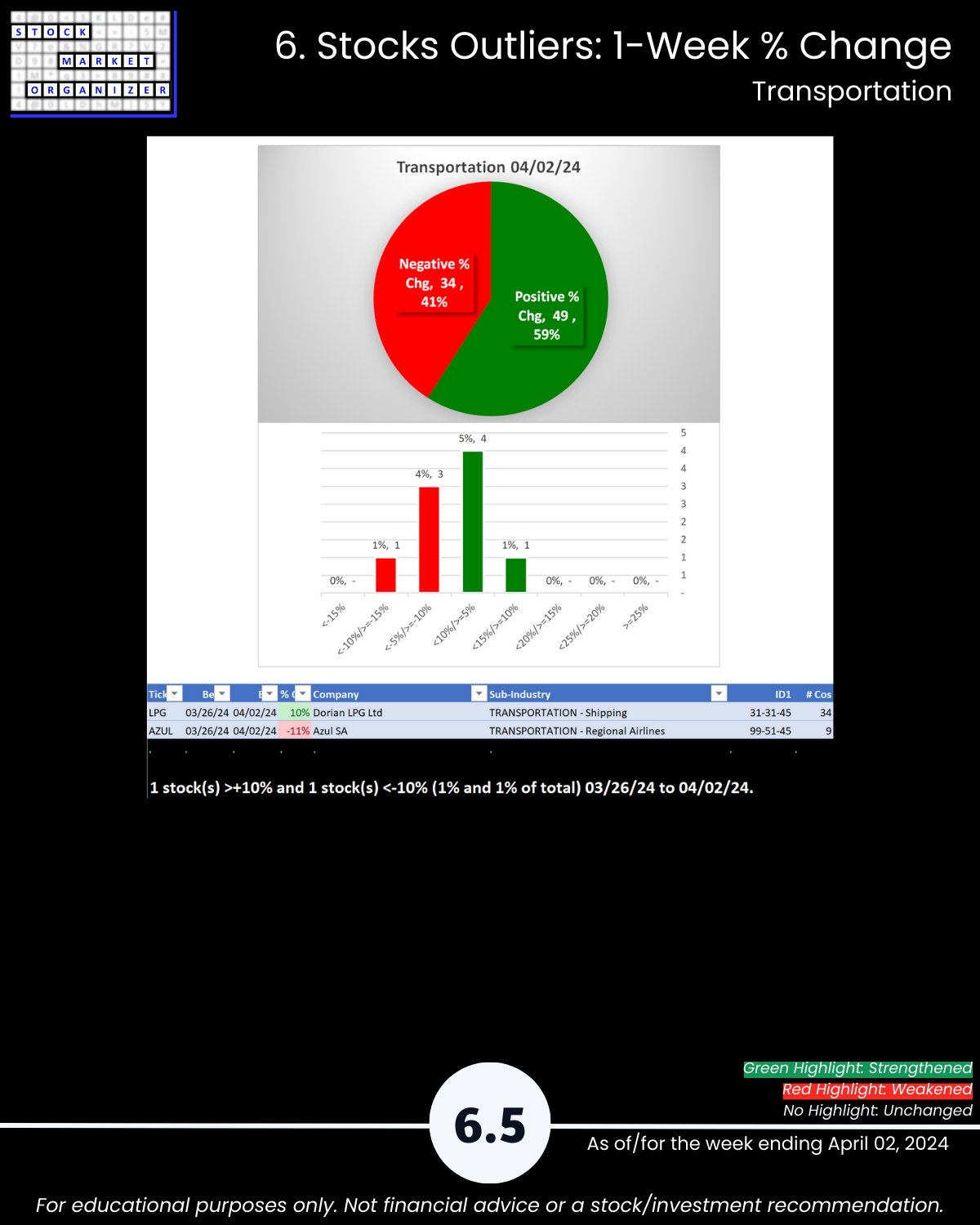

4/2/24 unique U.S. Stock Market strength-based insights into Industry Group 1 = Automotive, Energy, Materials & Construction, Metals & Mining, and Transportation: 🔹 Energy 92%, Metals/Mining 90% positive stocks this week, 🔹 Energy 20% of stocks at multi-year highs, 🔹 Metals & Mining 29% stocks >+10%, 🔹 Gold has strengthened 5 (of 9) levels in 5 weeks, 🔹 Matls/Const 78%:1% Stocks rated Strongest:Weakest, but 62% negative stocks this week.

WHAT’S HAPPENING HERE?

I am…

Finding U.S. Stock Market strength from the

top down,

inside out,

and bottom up, because

the stronger your stocks, the greener your P&L

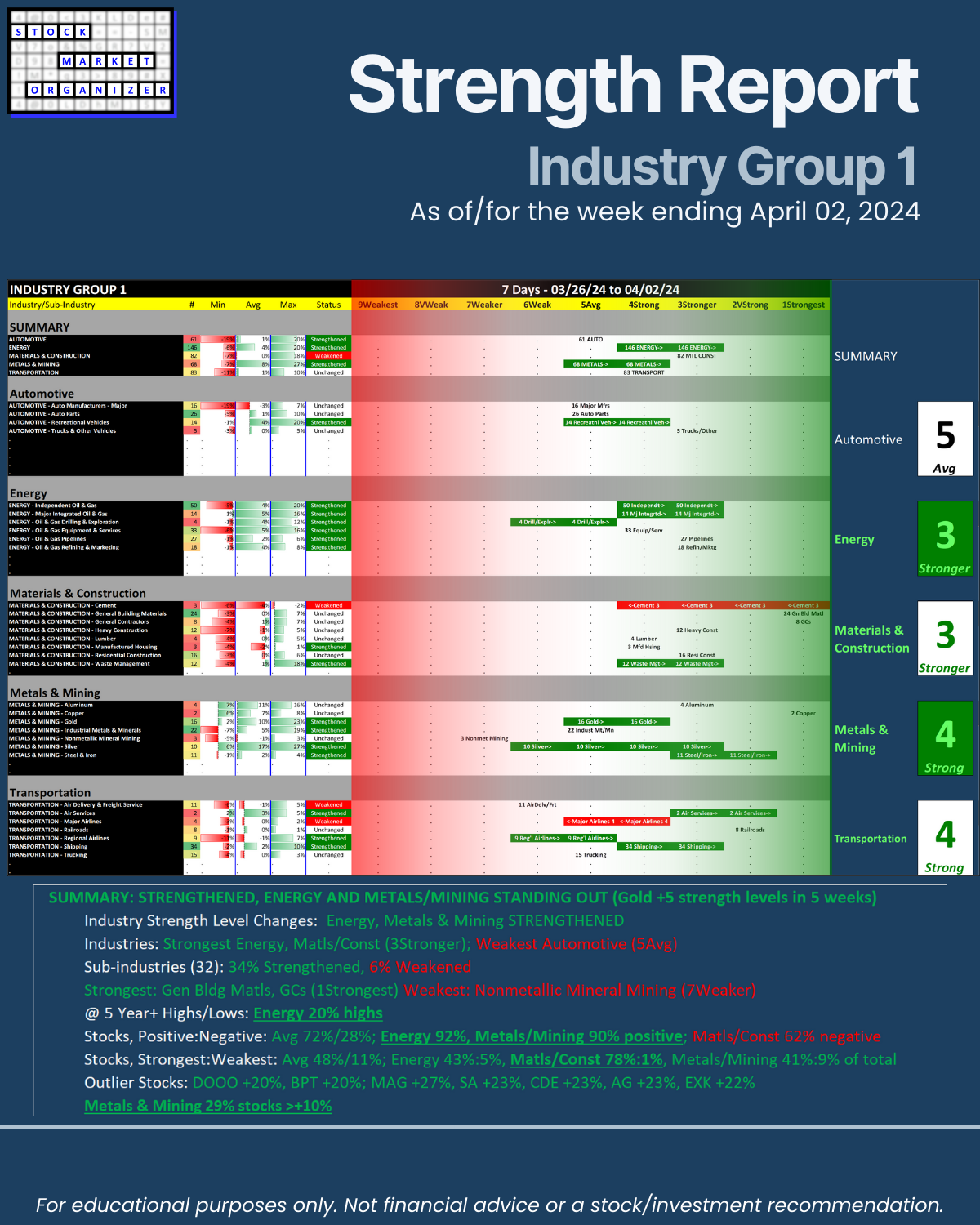

SUMMARY: INDUSTRY GROUP 1 STRENGTHENED, ENERGY AND METALS/MINING STANDING OUT (Gold +5 strength levels in 5 weeks)

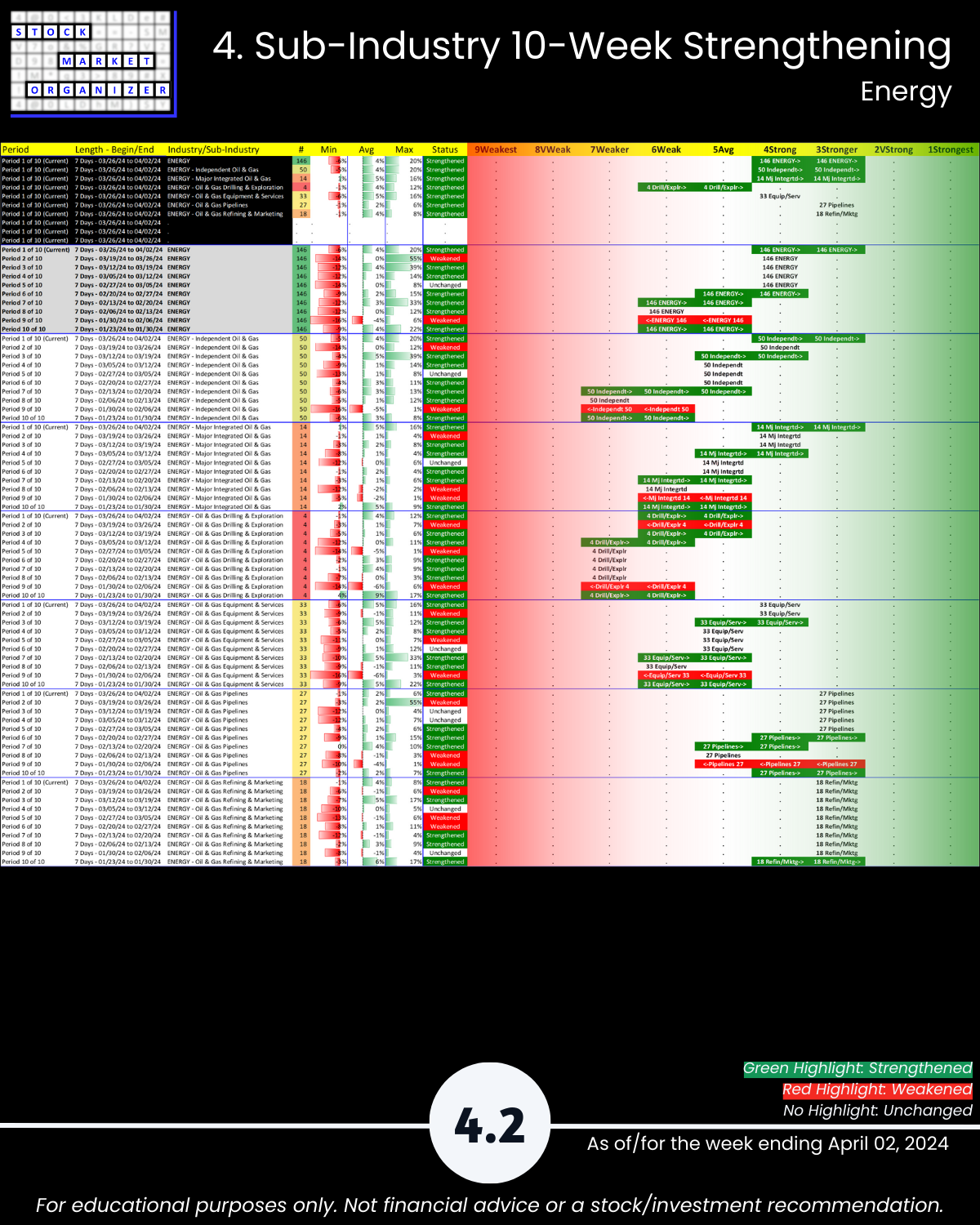

🔹 Industry Strength Level Changes: Energy, Metals & Mining STRENGTHENED

🔹 Industries

- Strongest Energy, Matls/Const (3Stronger)

- Weakest Automotive (5Avg)

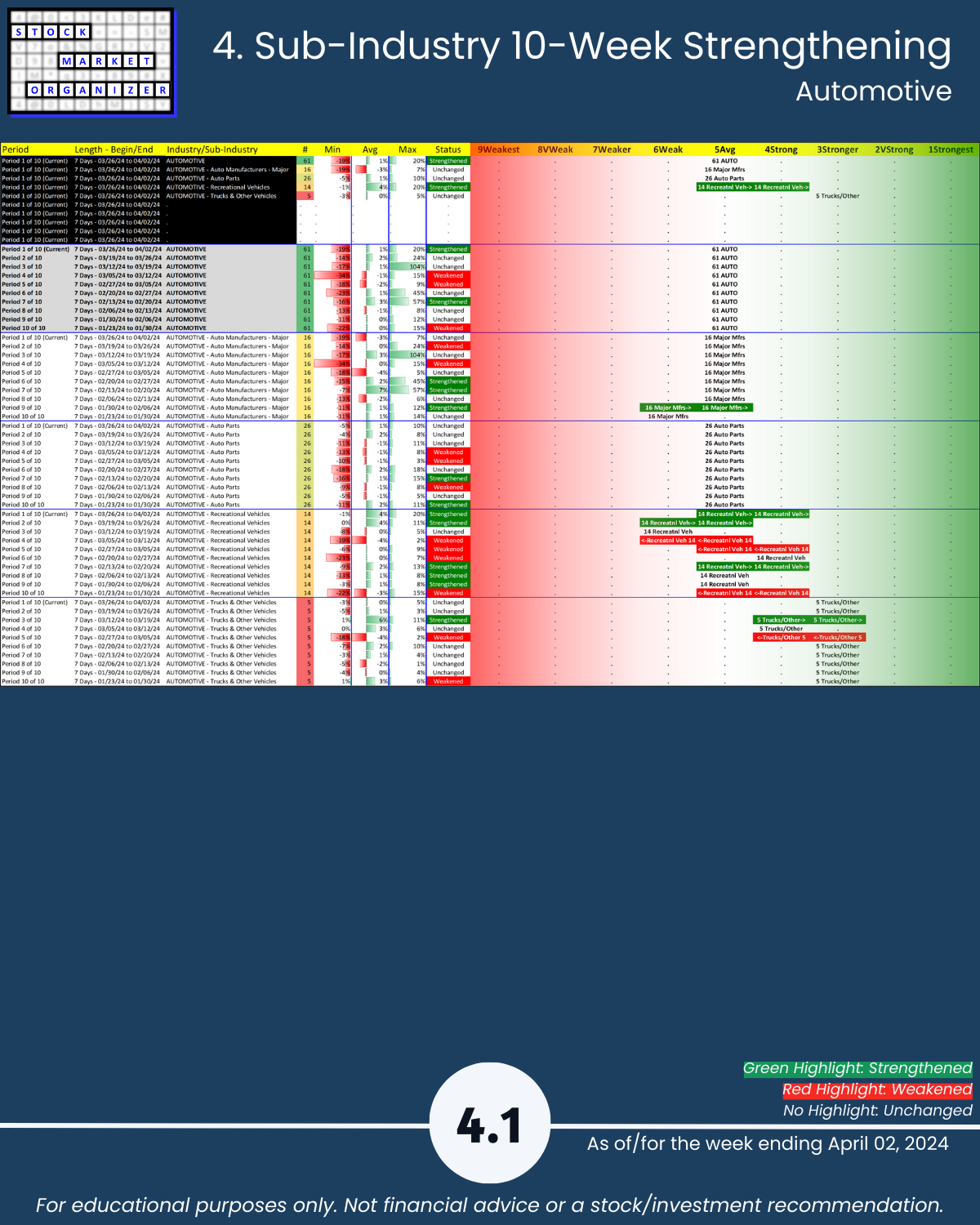

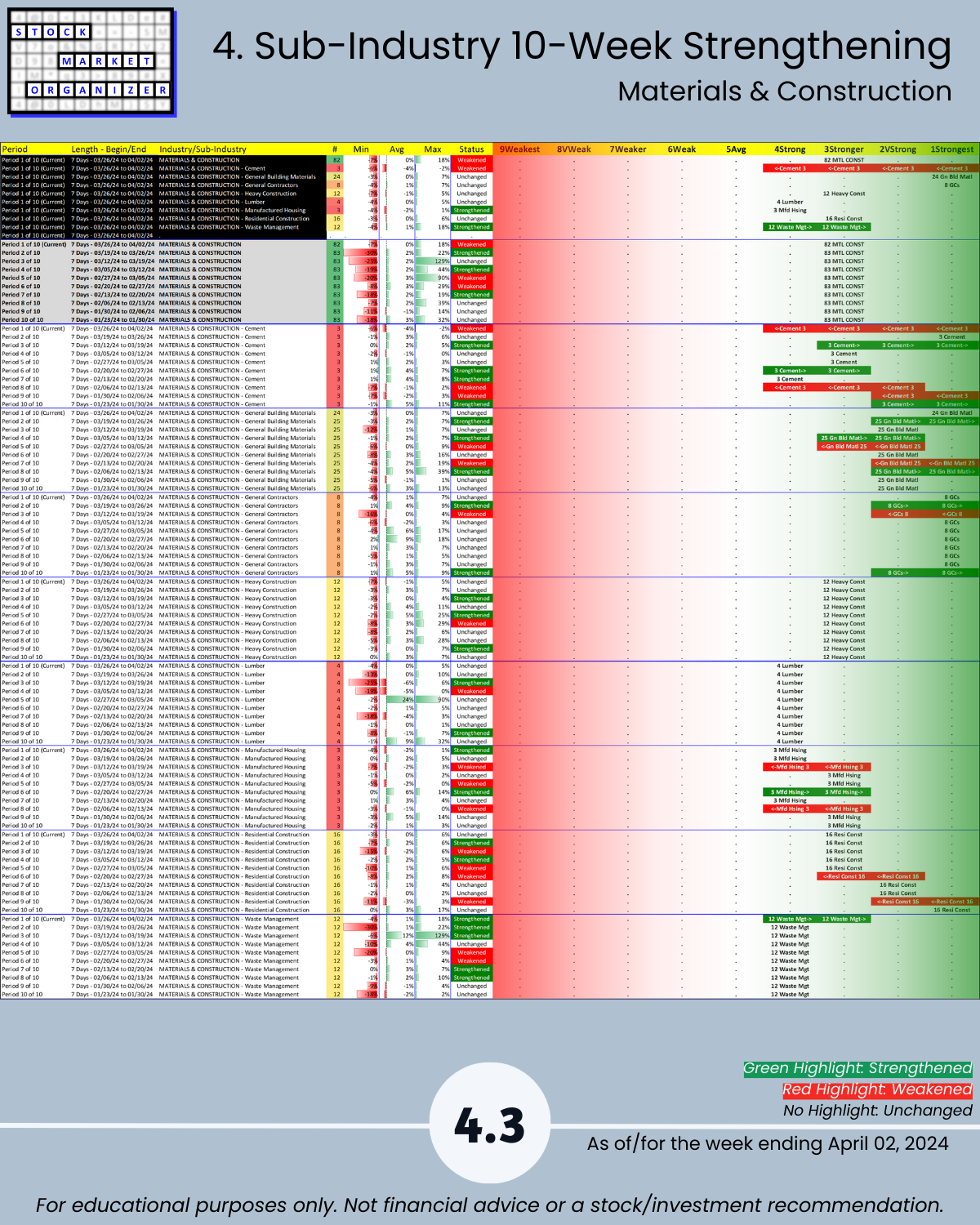

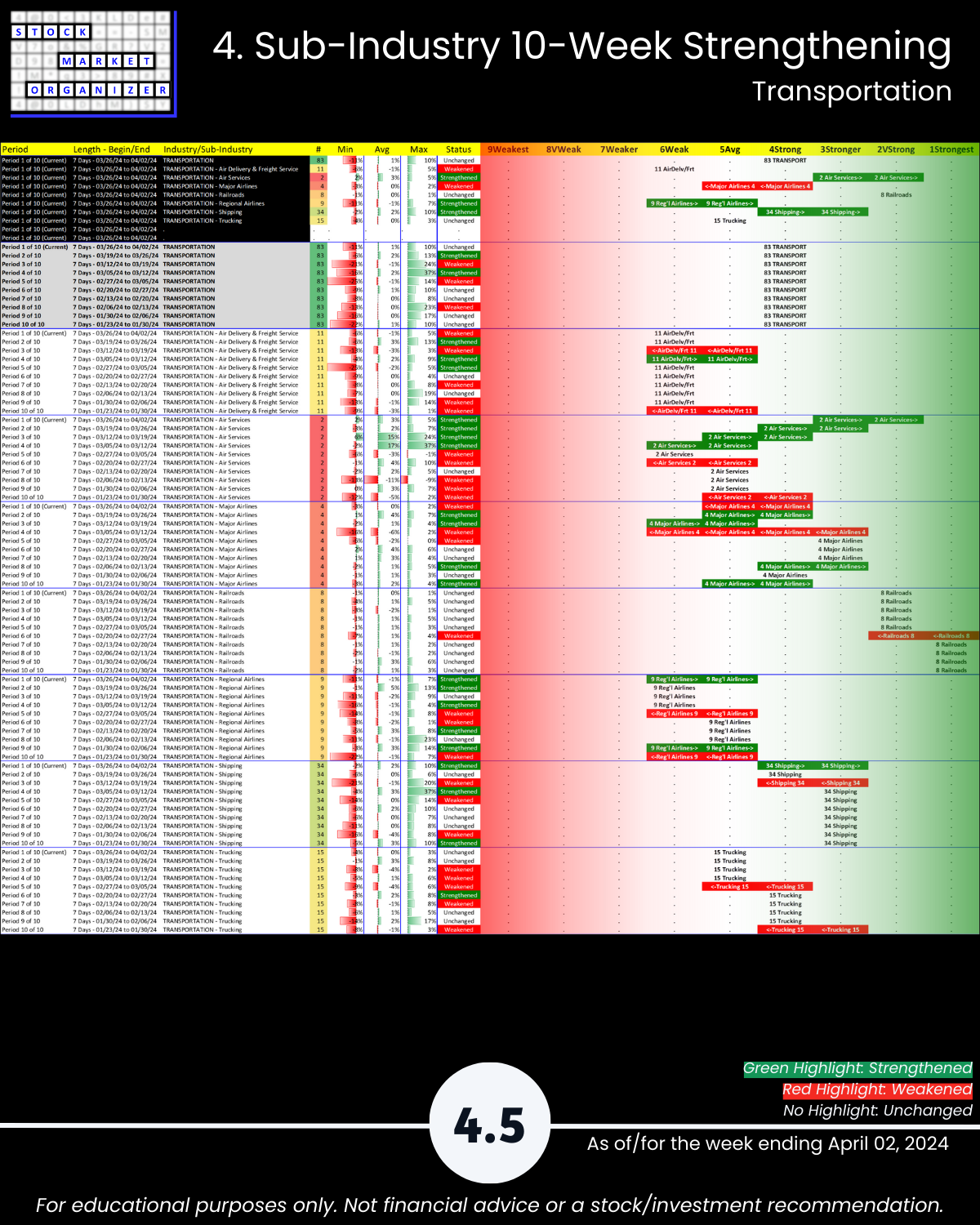

🔹 Sub-industries (32):

- 34% Strengthened, 6% Weakened

- Strongest: Gen Bldg Matls, GCs (1Strongest) Weakest: Nonmetallic Mineral Mining (7Weaker)

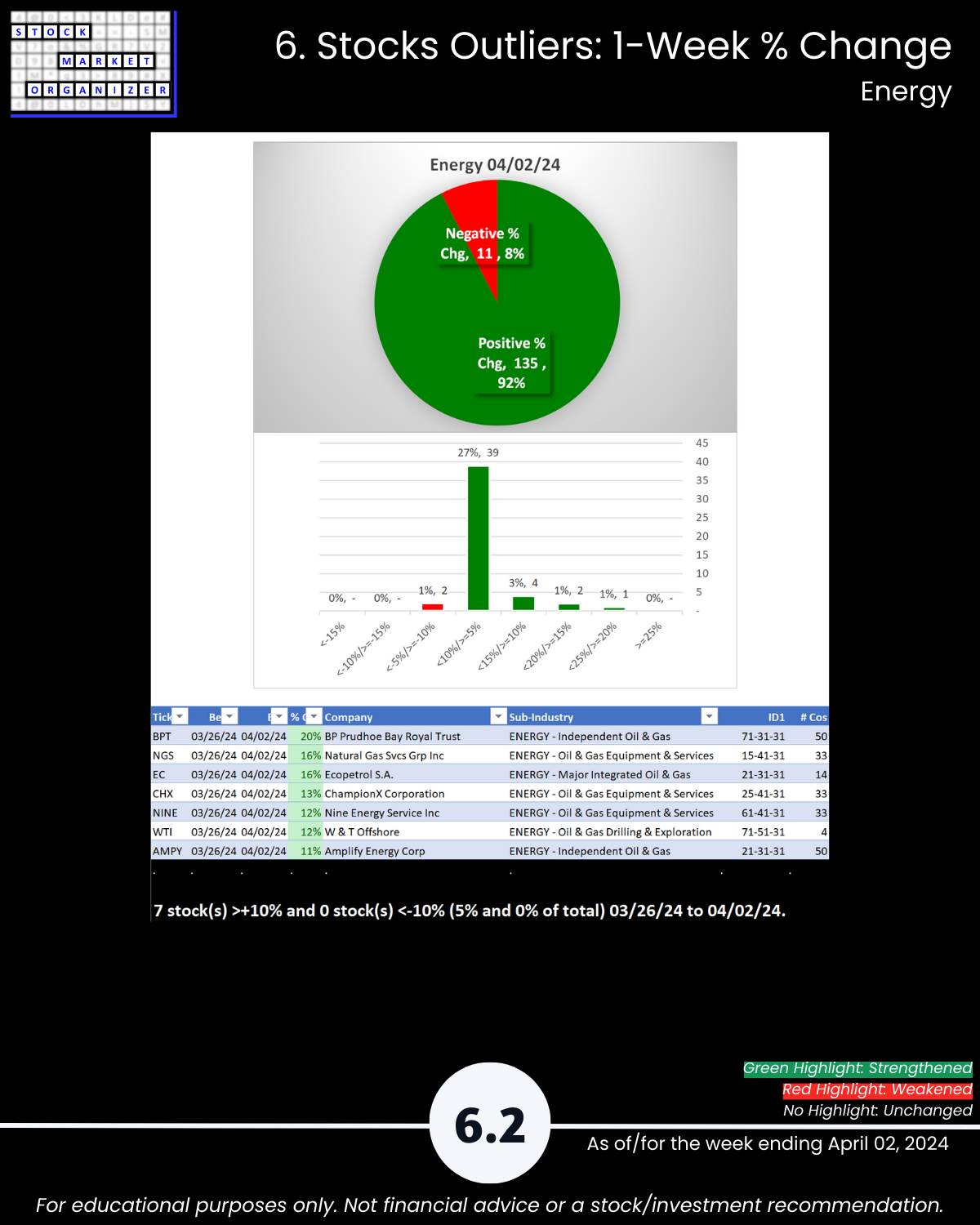

- @ 5 Year+ Highs/Lows: Energy 20% highs

🔹 Stocks:

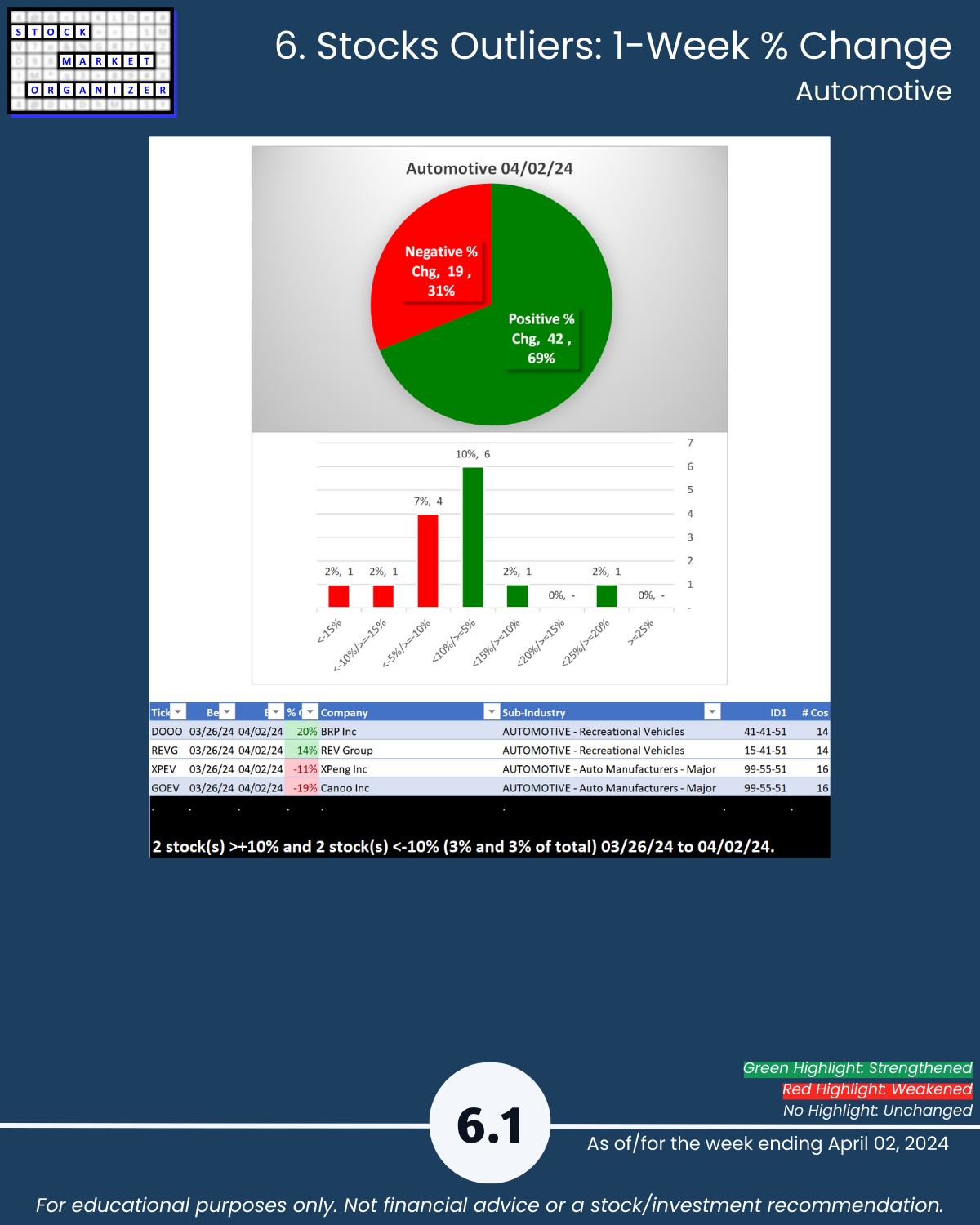

- Positive:Negative: Avg 72%/28%; Energy 92%, Metals/Mining 90% positive; Matls/Const 62% negative

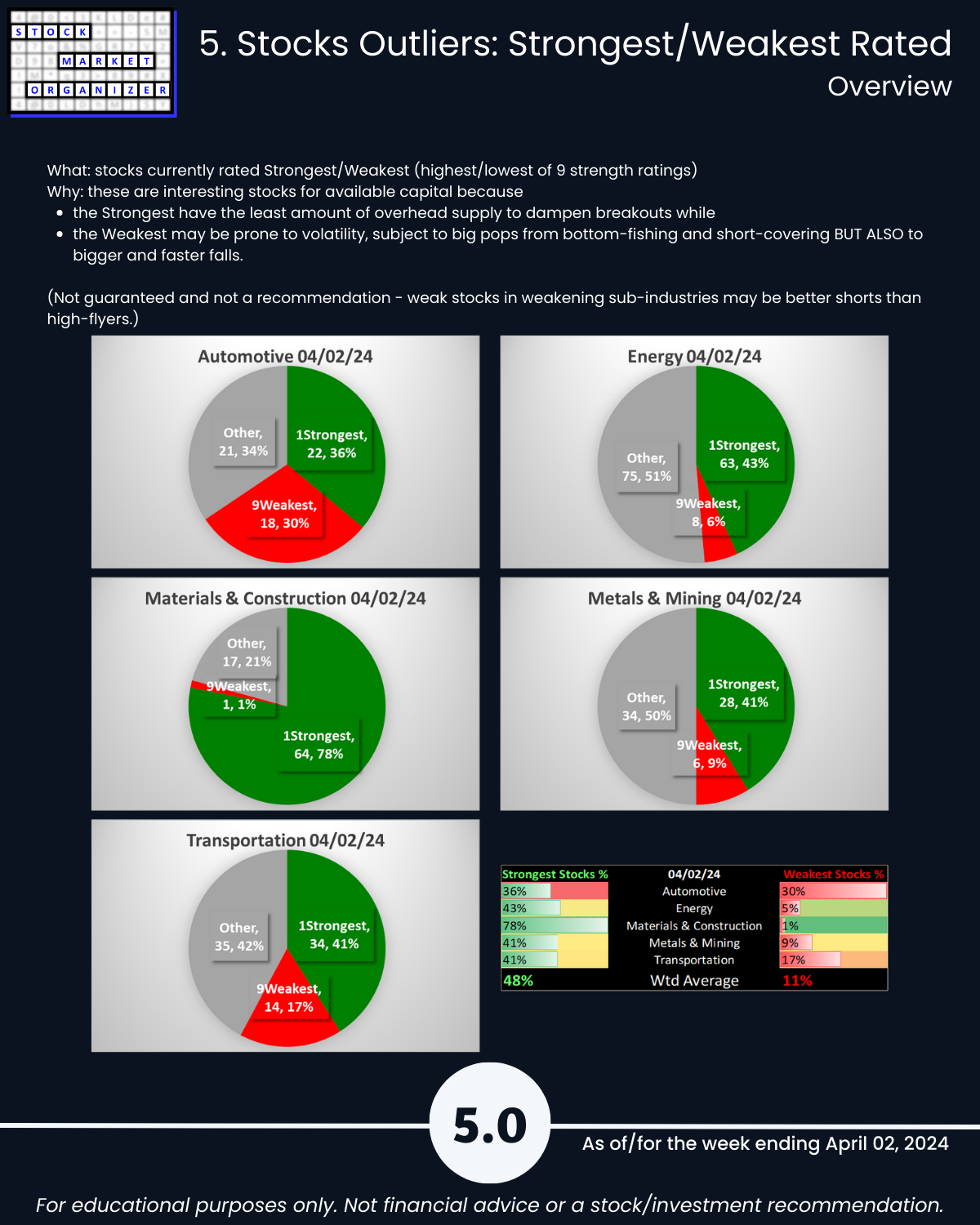

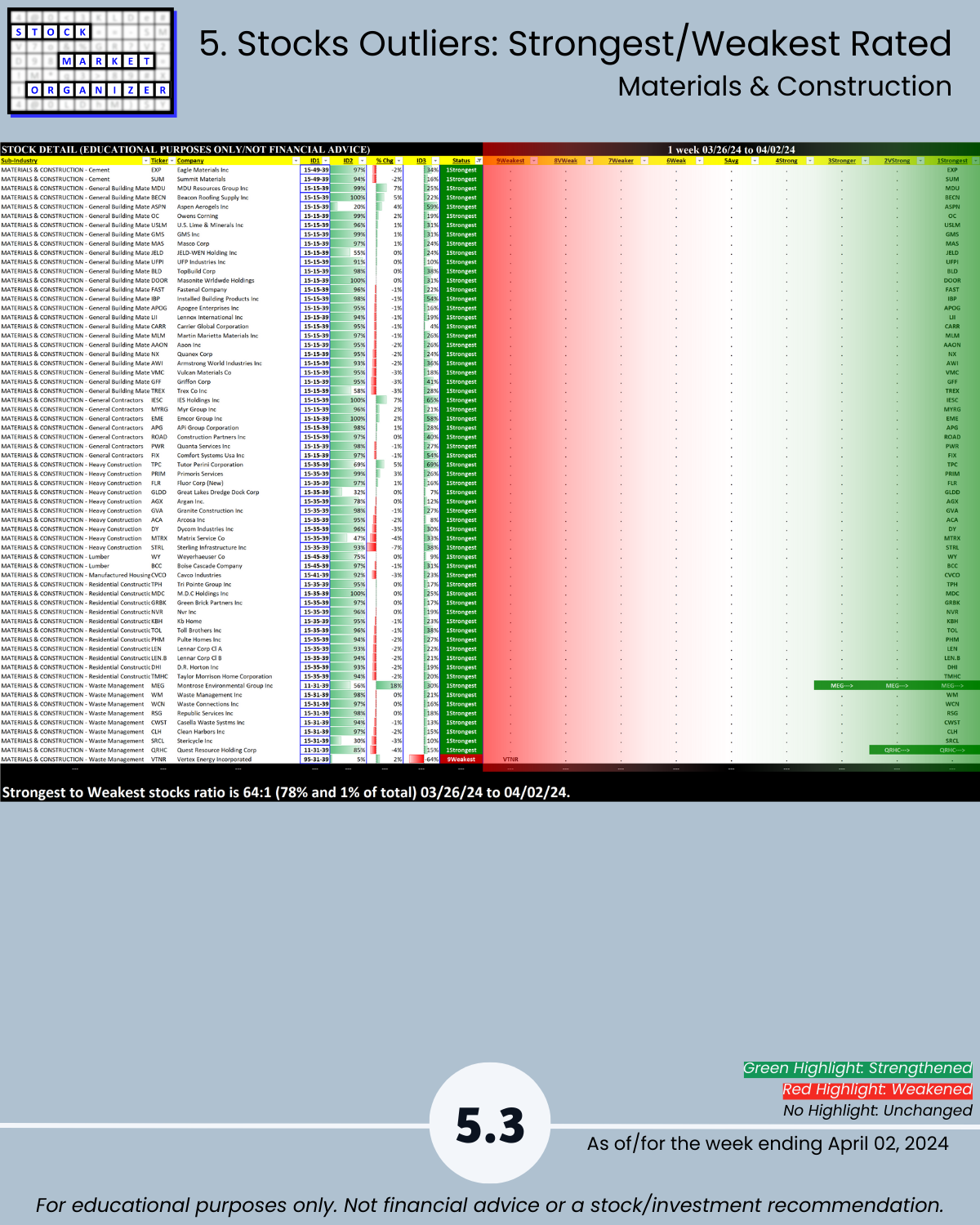

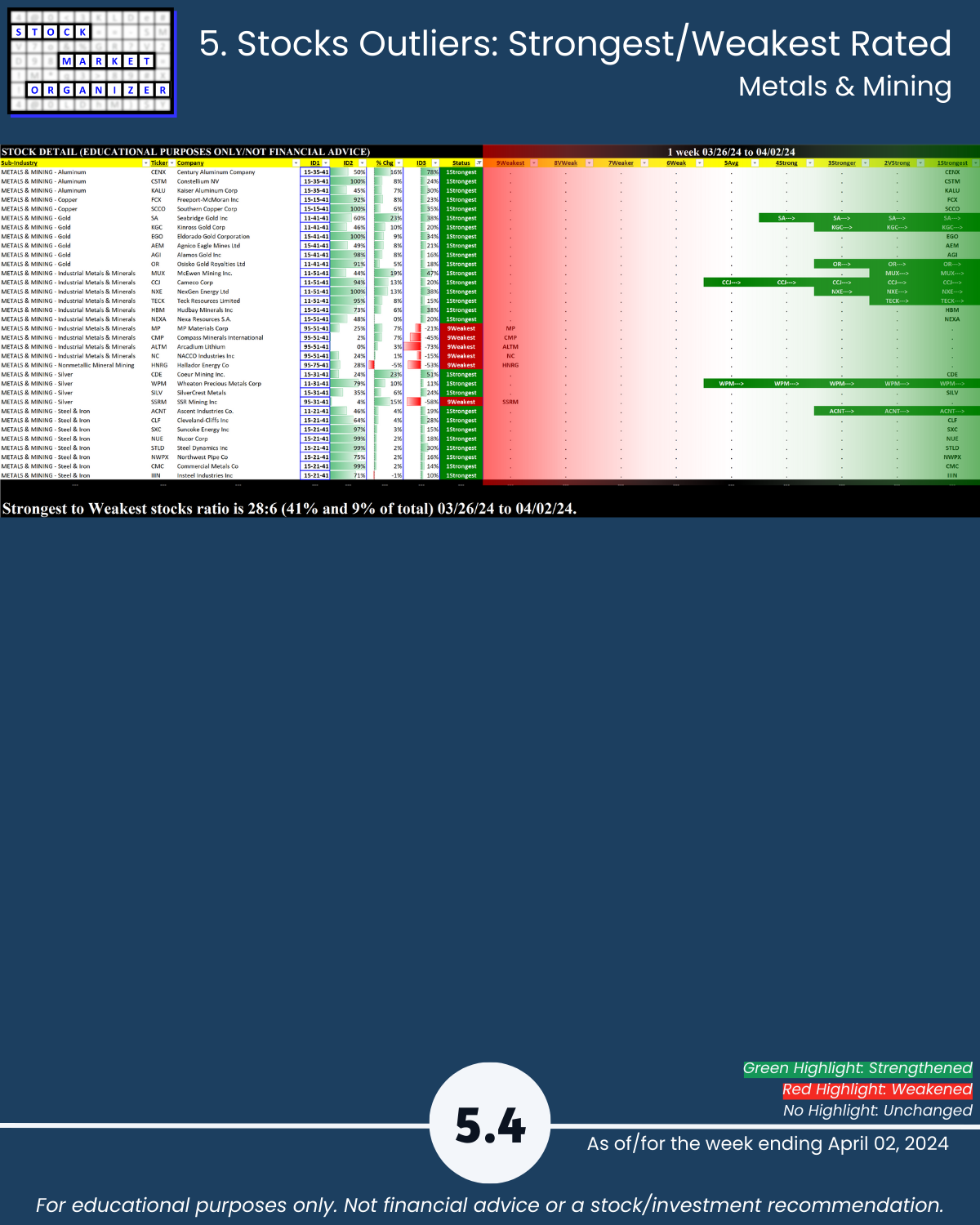

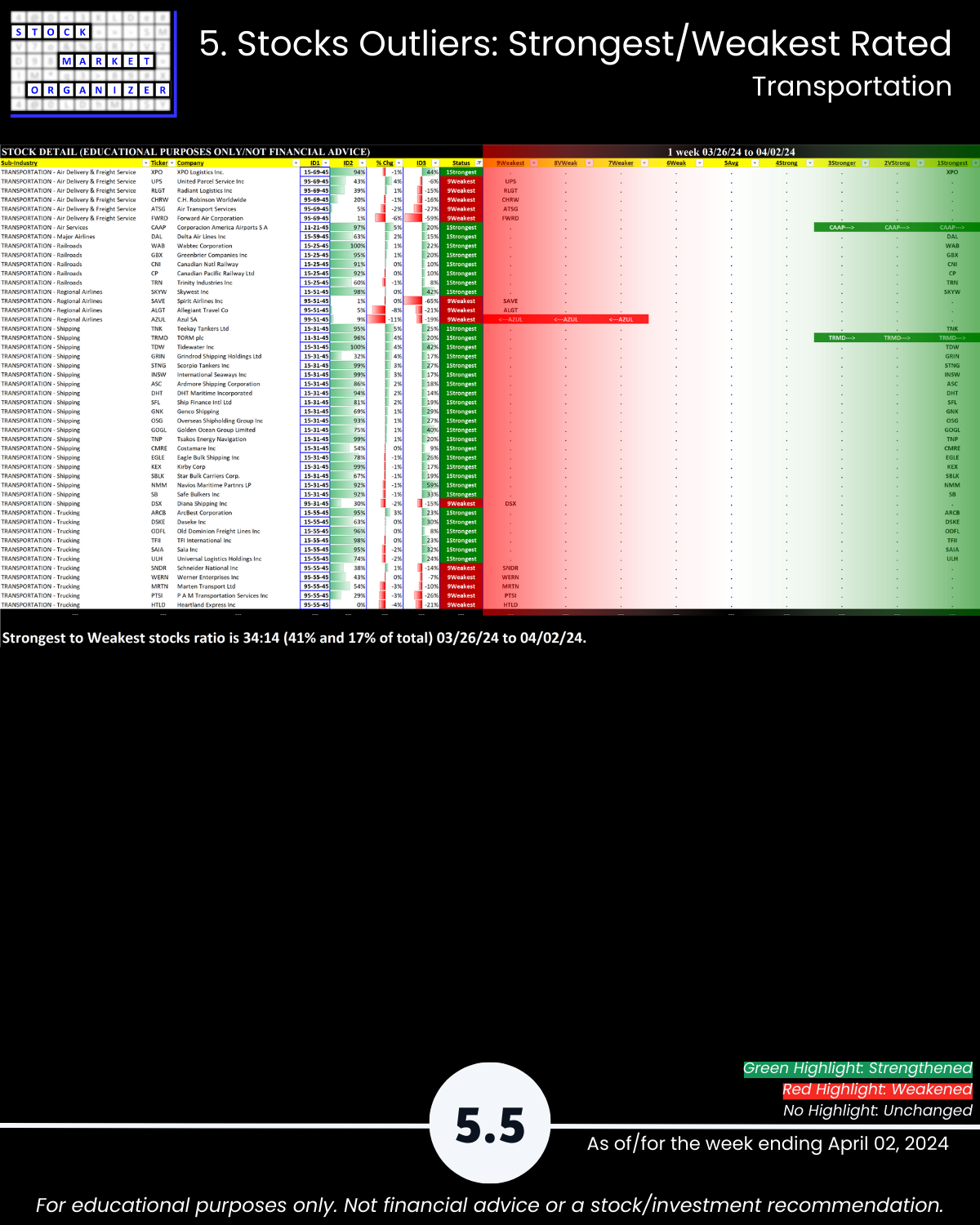

- Strongest:Weakest: Avg 48%/11%; Energy 43%:5%, Matls/Const 78%:1%, Metals/Mining 41%:9% of total

- Outlier Stocks: DOOO +20%, BPT +20%; MAG +27%, SA +23%, CDE +23%, AG +23%, EXK +22%

- Metals & Mining 29% stocks >+10%

THE “WHY” BEHIND THIS METHOD (SEEKING STRENGTH MARKETWIDE)

The stronger your stocks the greener your P&L.

The journey to 100%+ returns begins with 10% returns.

The journey to multi-month rallies begins with one up week.

You won’t find what you aren’t looking for.

Look at any number of triple-digit gainers over the past year or less - obviously NVDA, certainly CVNA, SKYW, POWL, ANF, SMCI.

Each started with 10% gains.

Maybe 10% gainers keep going, and maybe they don’t.

But if you aren’t looking for them, and what might keep them rising (strengthening sub-industry, industry, and market), then you won’t find them.

The market does not have to be so complicated.

Following are galleries with page-by-page views of this report.

1. Introduction

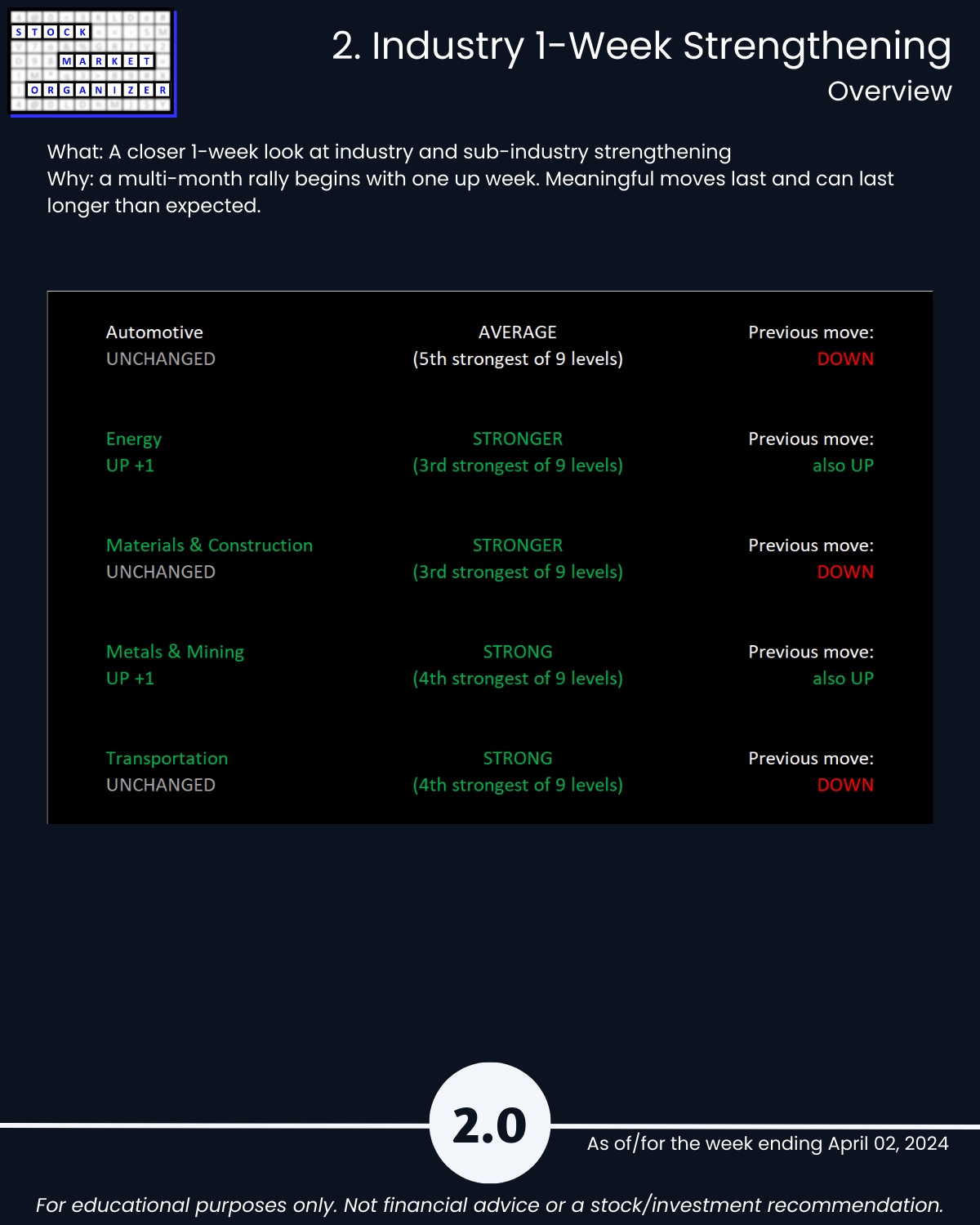

2. Industry 1-Week Strengthening

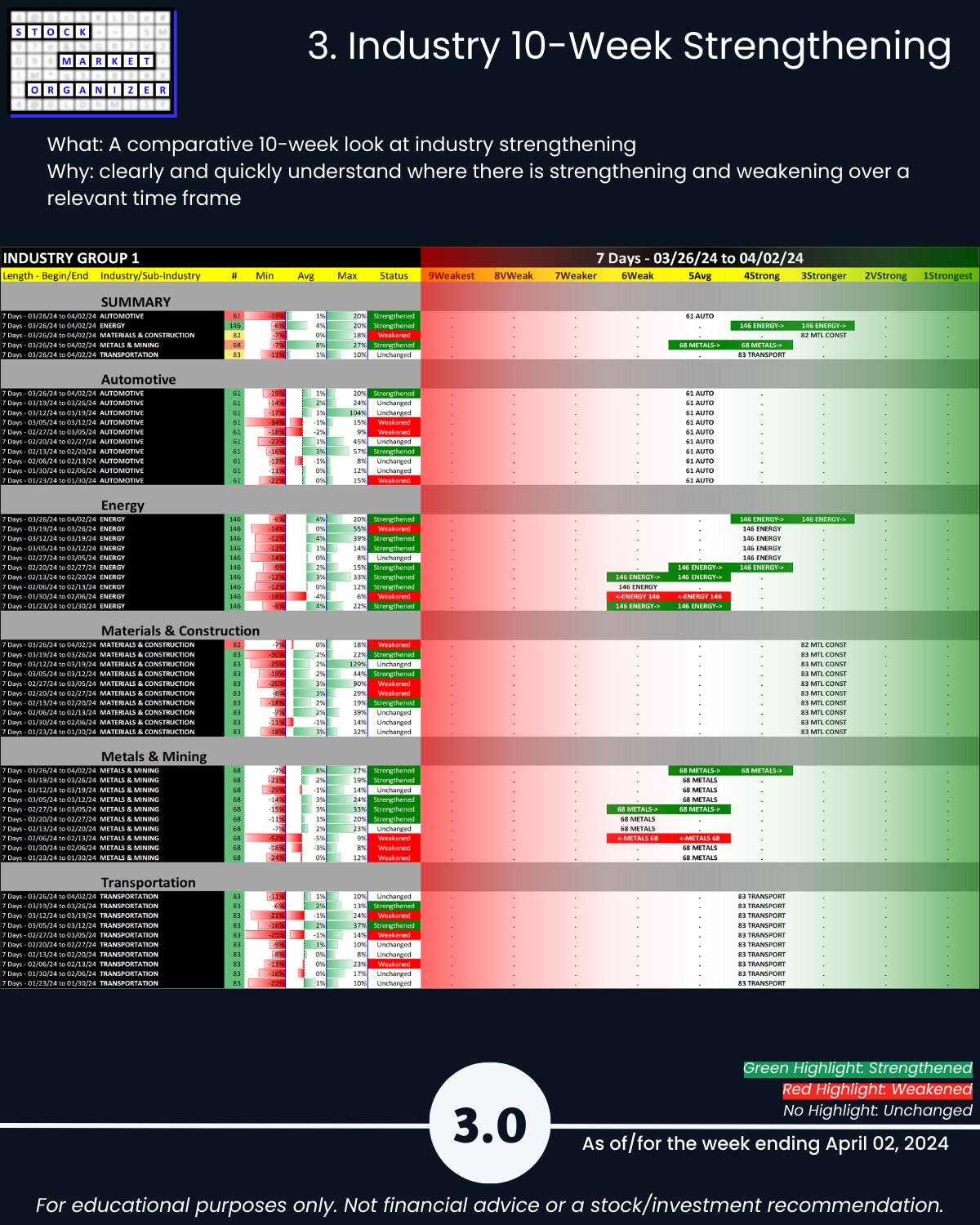

3. Industry 10-Week Strengthening

4. Sub-Industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

6. Stocks Outliers: 1-Week % Change

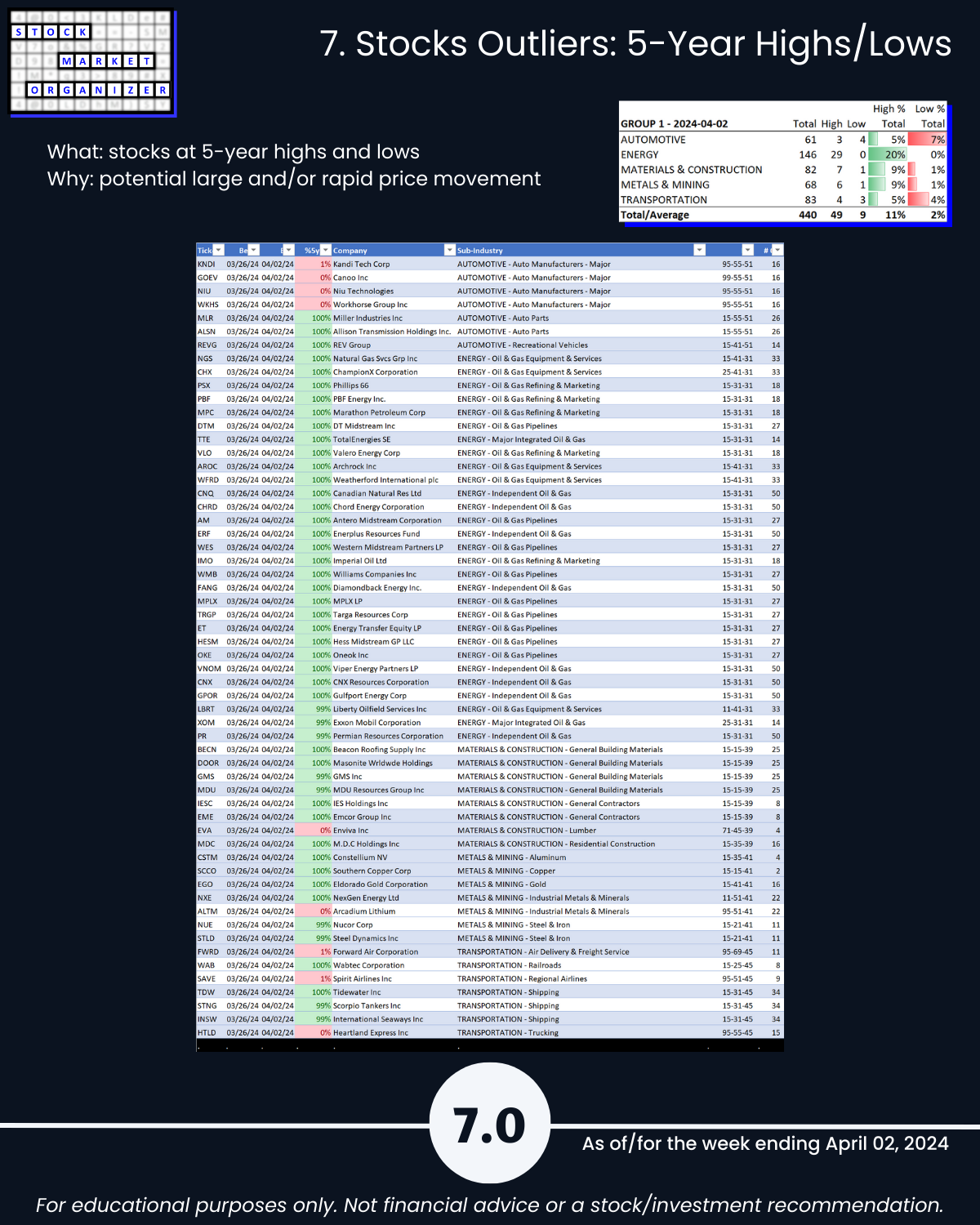

7. Stocks Outliers: 5-Year Highs/Lows