SMO Exclusive: Strength Report Group 1 2024-03-19

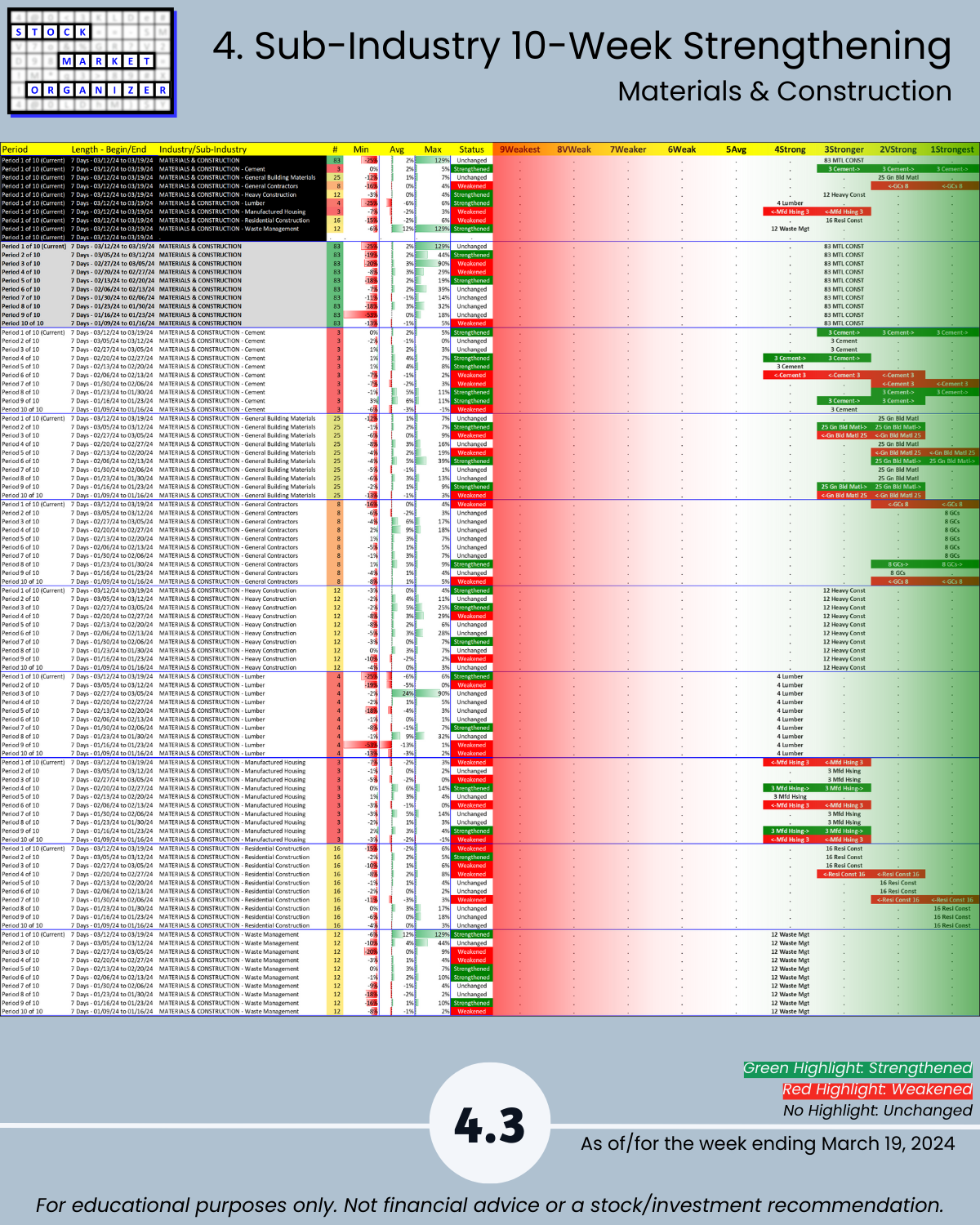

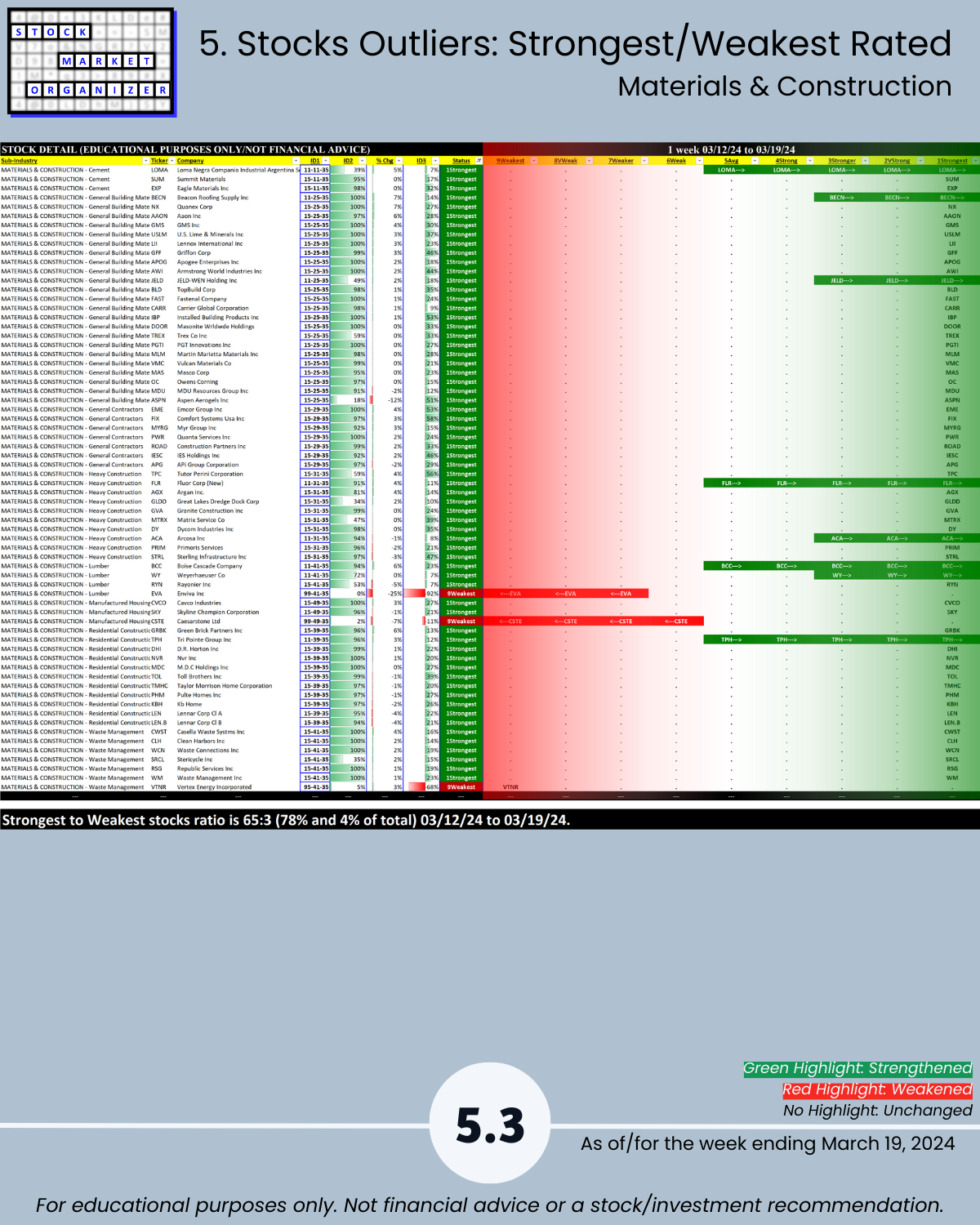

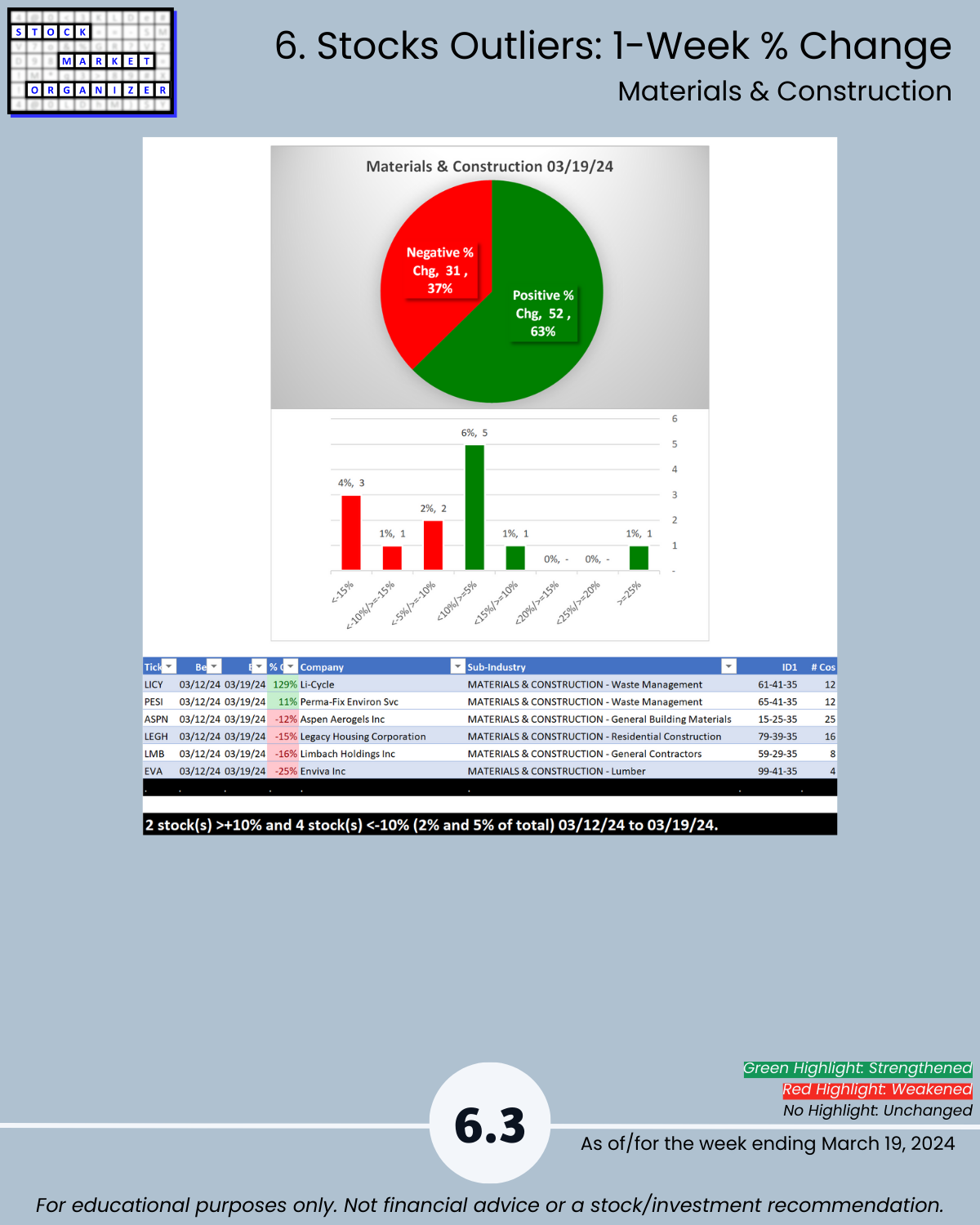

Potentially helpful stock market strength insights below/attached (3/19/24 Group 1 industries Automotive, Energy, Materials & Construction, Metals, and Transportation). Matls/Const = LEADER 🔹 strongest industry of 29 at Stronger (3rd strongest of 9 levels, tied with Insurance), 🔹 78%:4% stocks rated Strongest:Weakest, 🔹 28% of stocks at 5+ year highs, 🔹 63% positive stocks this week.

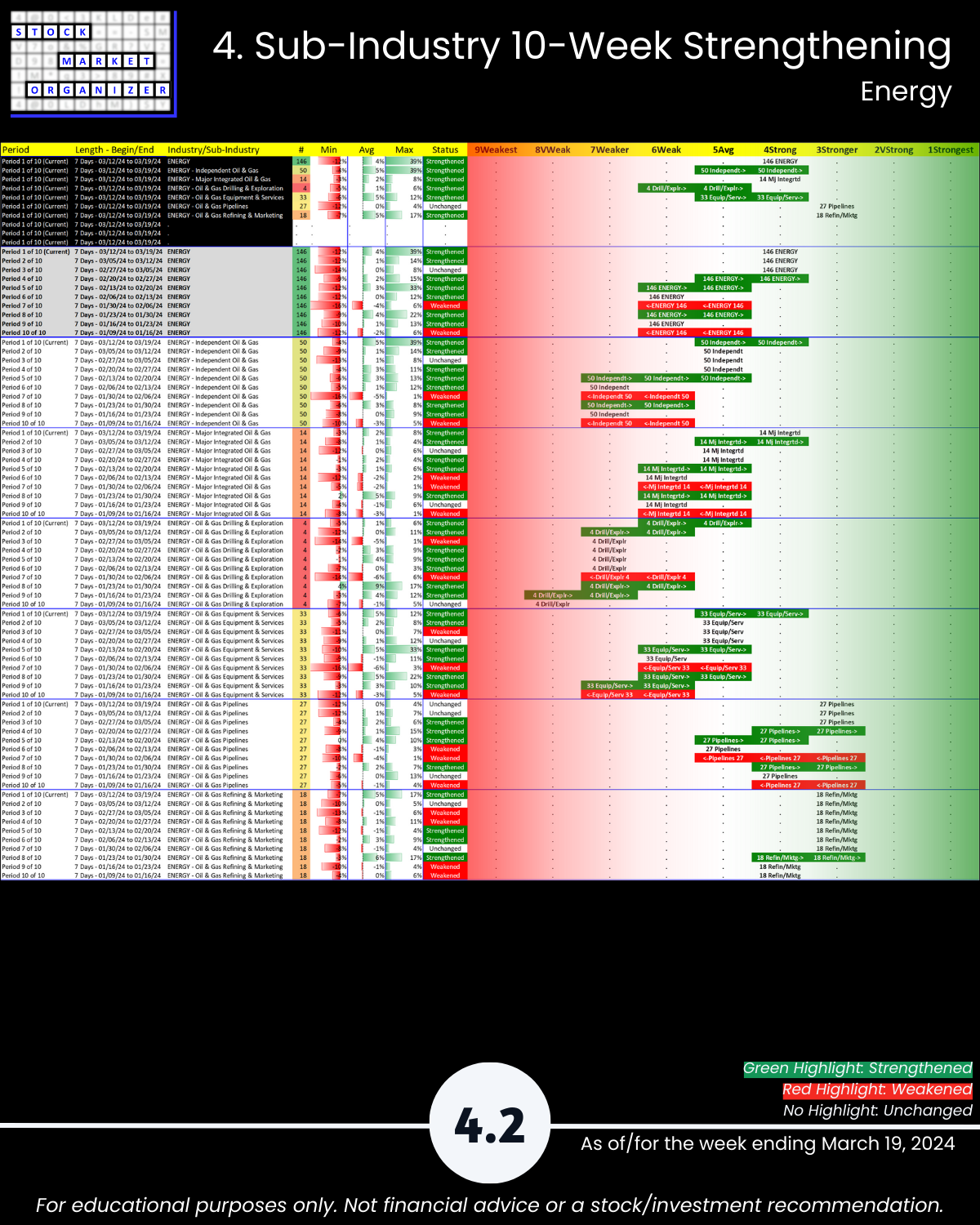

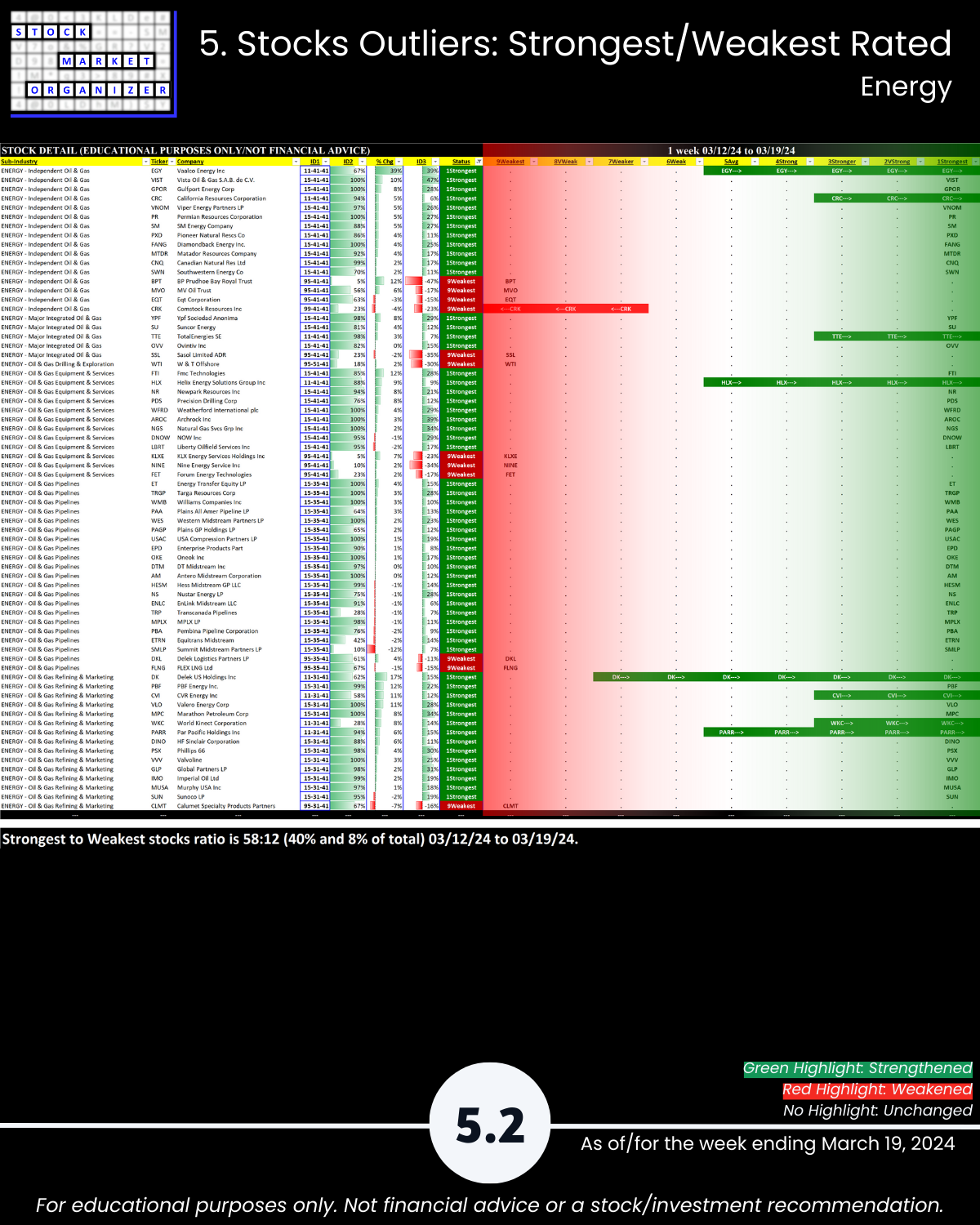

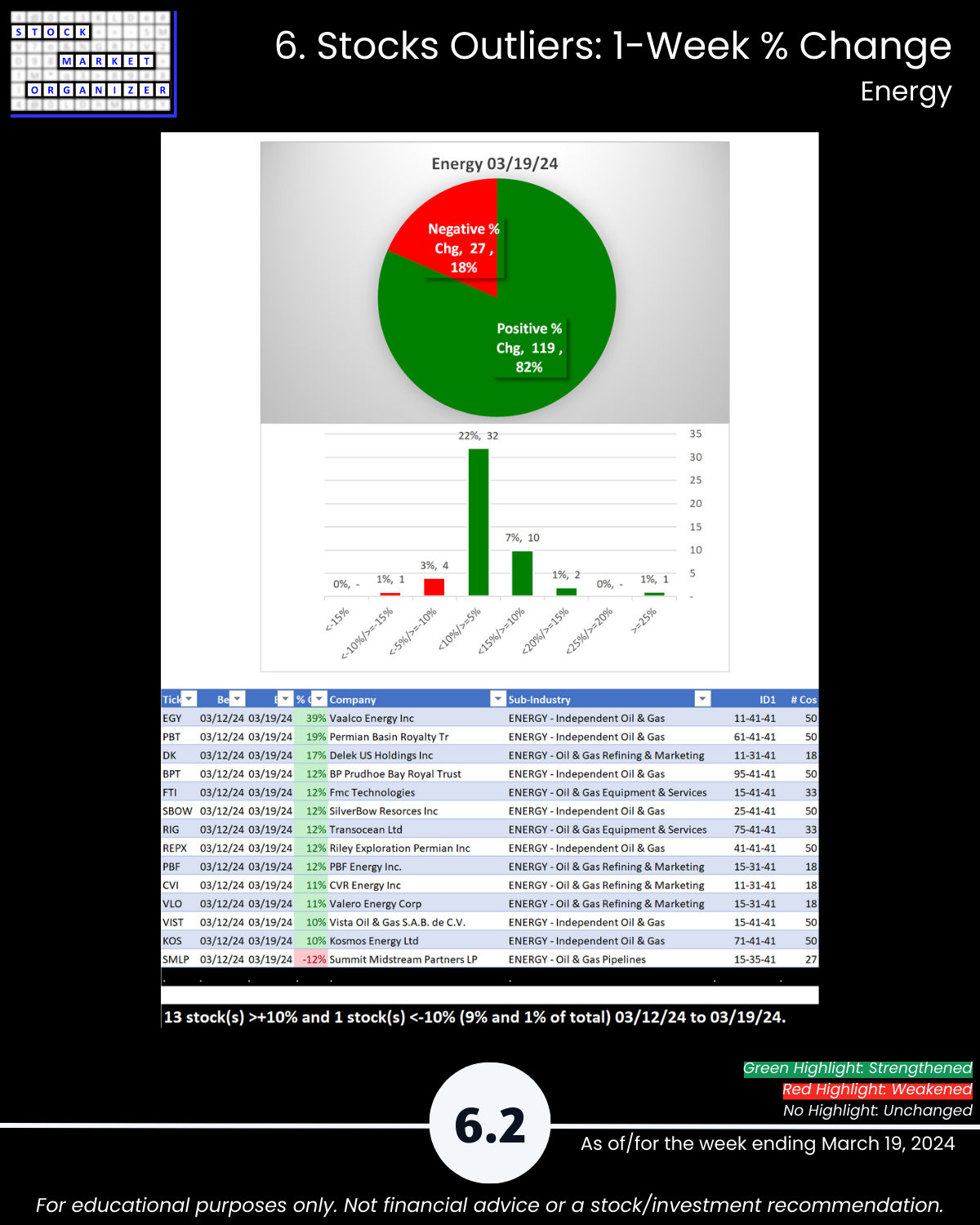

Also note Energy:

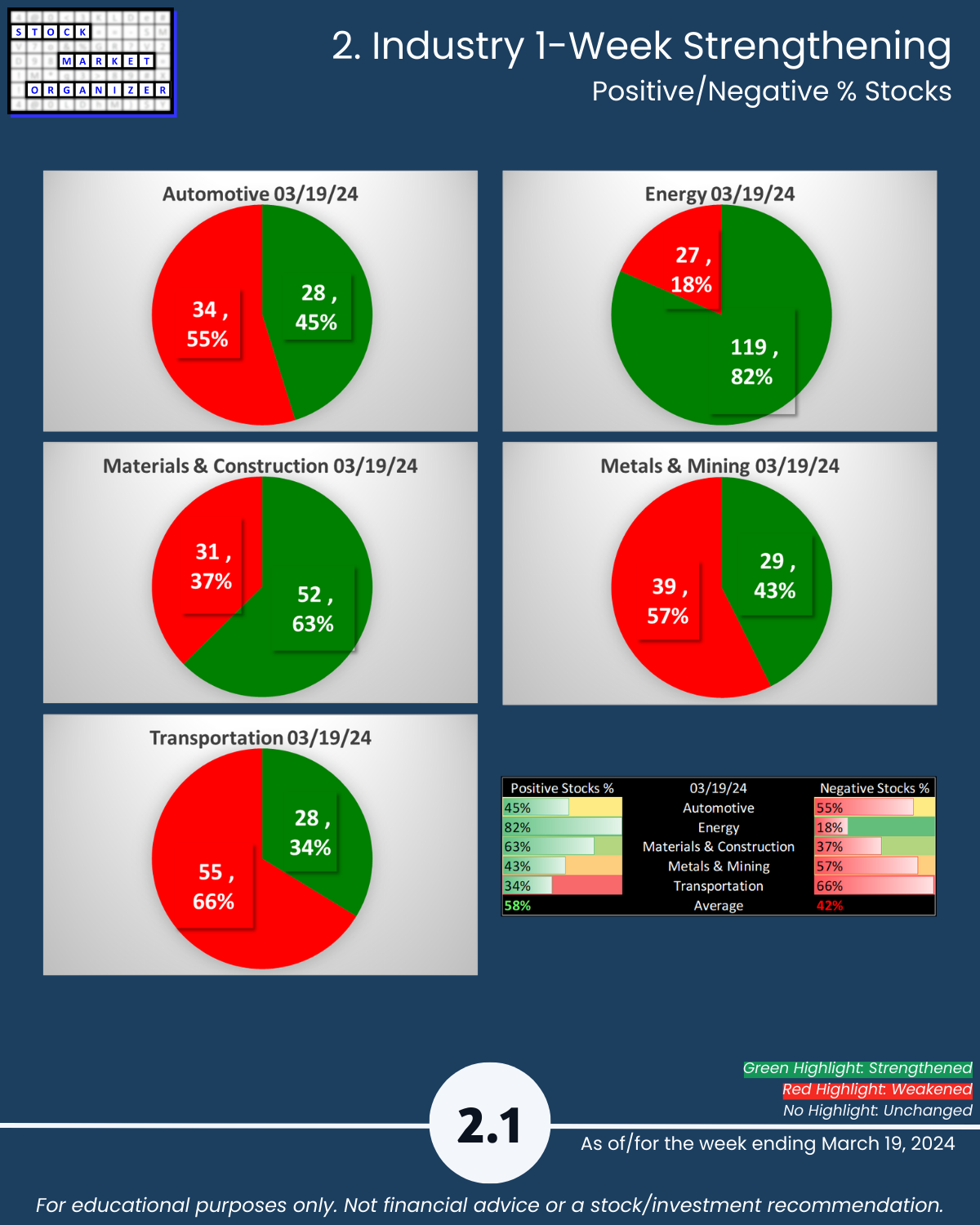

🔹 3/6 strengthening sub-industries

🔹 82% positive stocks for the week

🔹 14% of stocks at 5+ year highs

🔹 40% of its stocks rated Strongest (8% Weakest)

THE “WHY” BEHIND THIS METHOD (SEEKING STRENGTH MARKETWIDE)

The stronger your stocks the greener your P&L.

The journey to 100%+ returns begins with 10% returns.

The journey to multi-month rallies begins with one up week.

You won’t find what you aren’t looking for.

Look at any number of triple-digit gainers over the past year or less - obviously NVDA, certainly CVNA, SKYW, POWL, ANF, SMCI.

Each started with 10% gains.

Maybe 10% gainers keep going, and maybe they don’t.

But if you aren’t looking for them, and what might keep them rising (strengthening sub-industry, industry, and market), then you won’t find them.

The market does not have to be so complicated.

TAKEAWAYS:

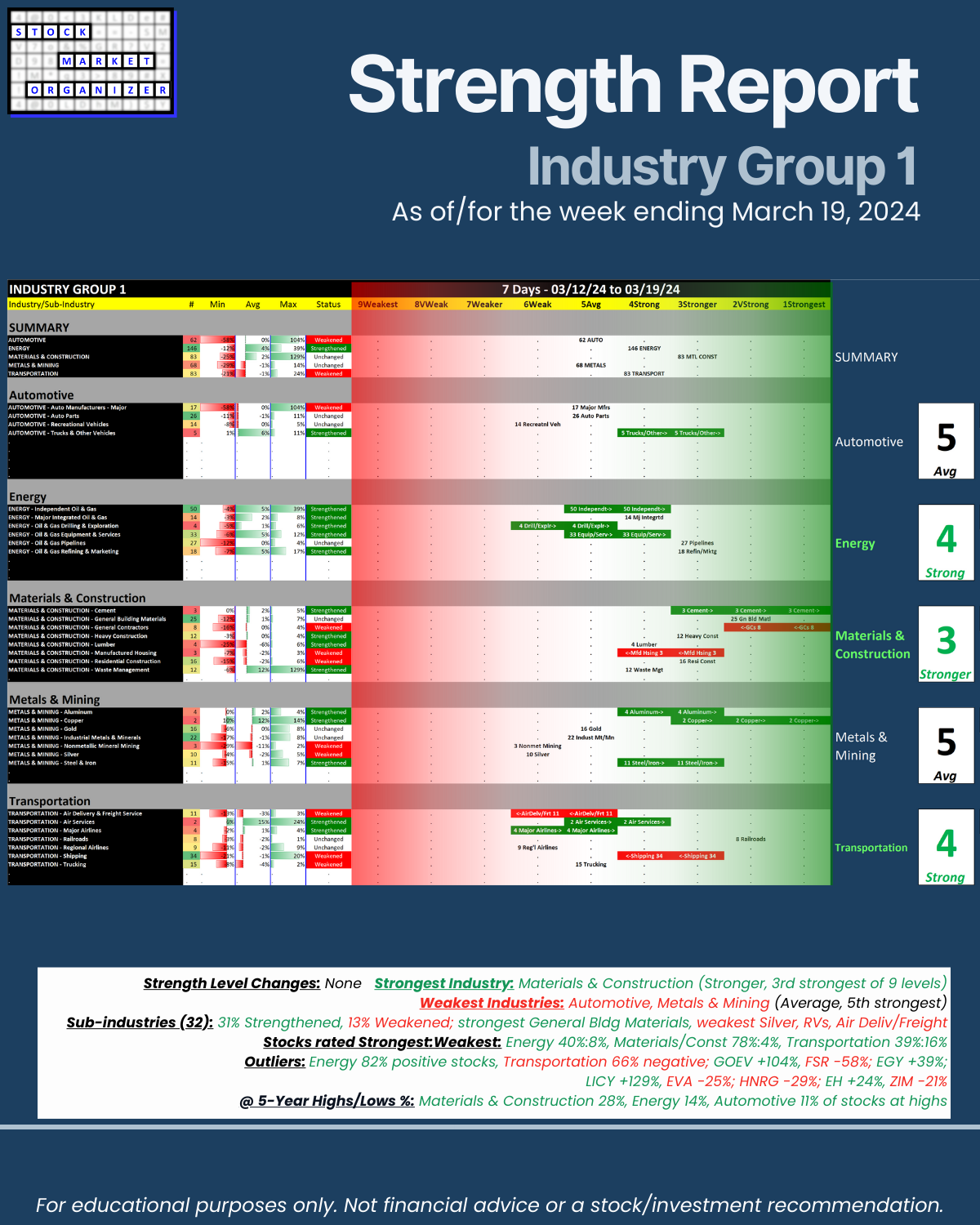

🔹 Strength Level Changes: None

🔹 Strongest Industry: Materials & Construction (Stronger, 3rd strongest of 9 levels)

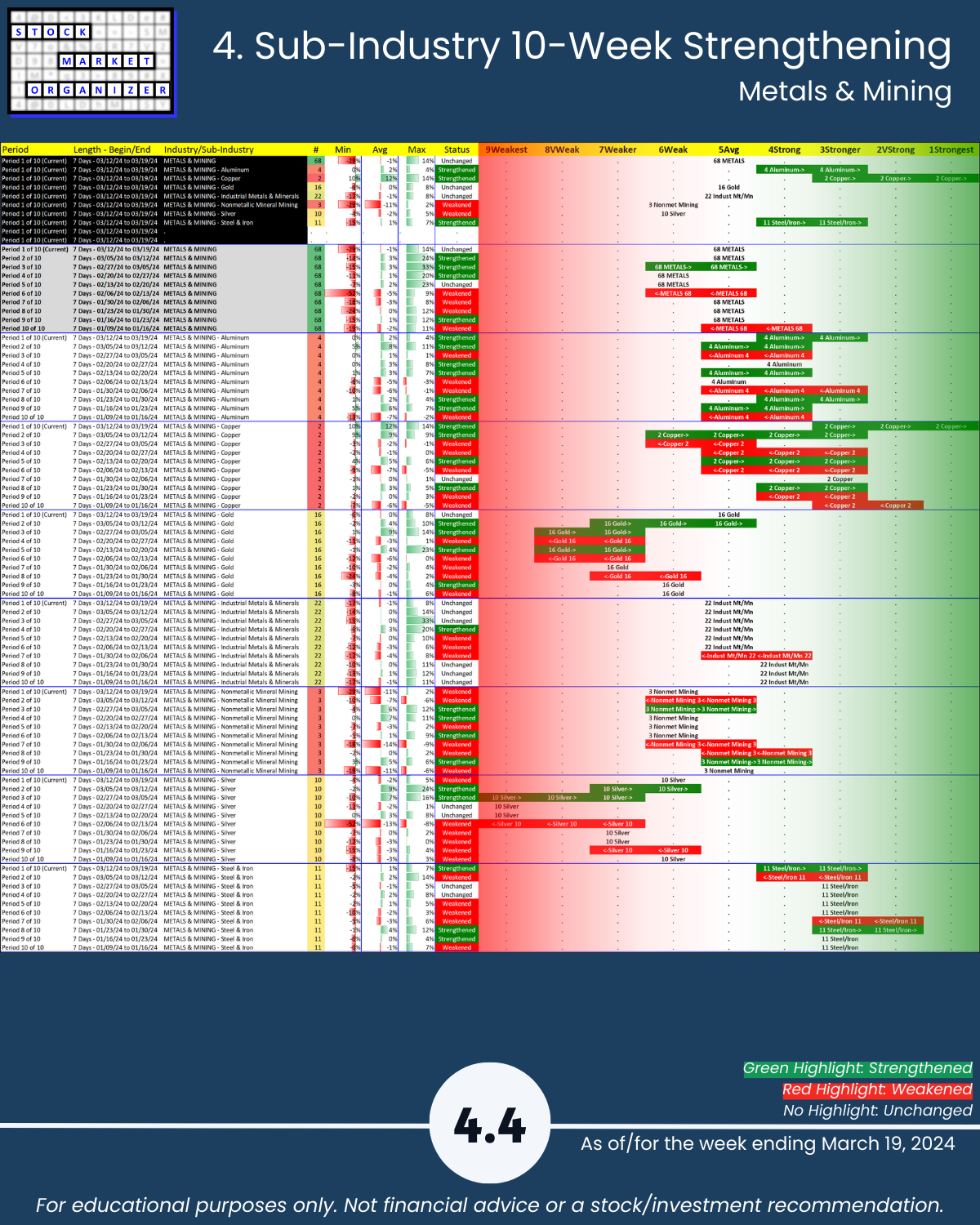

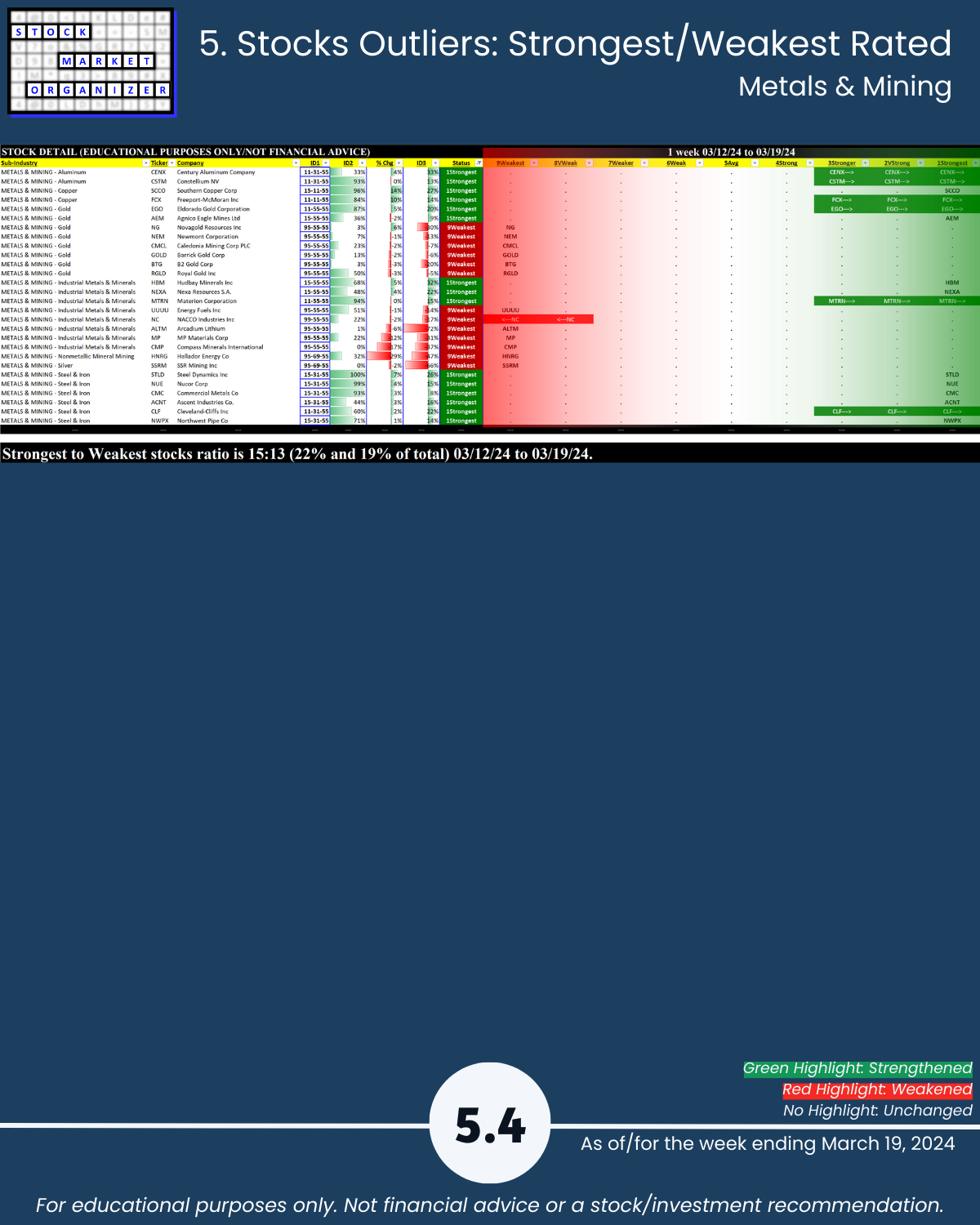

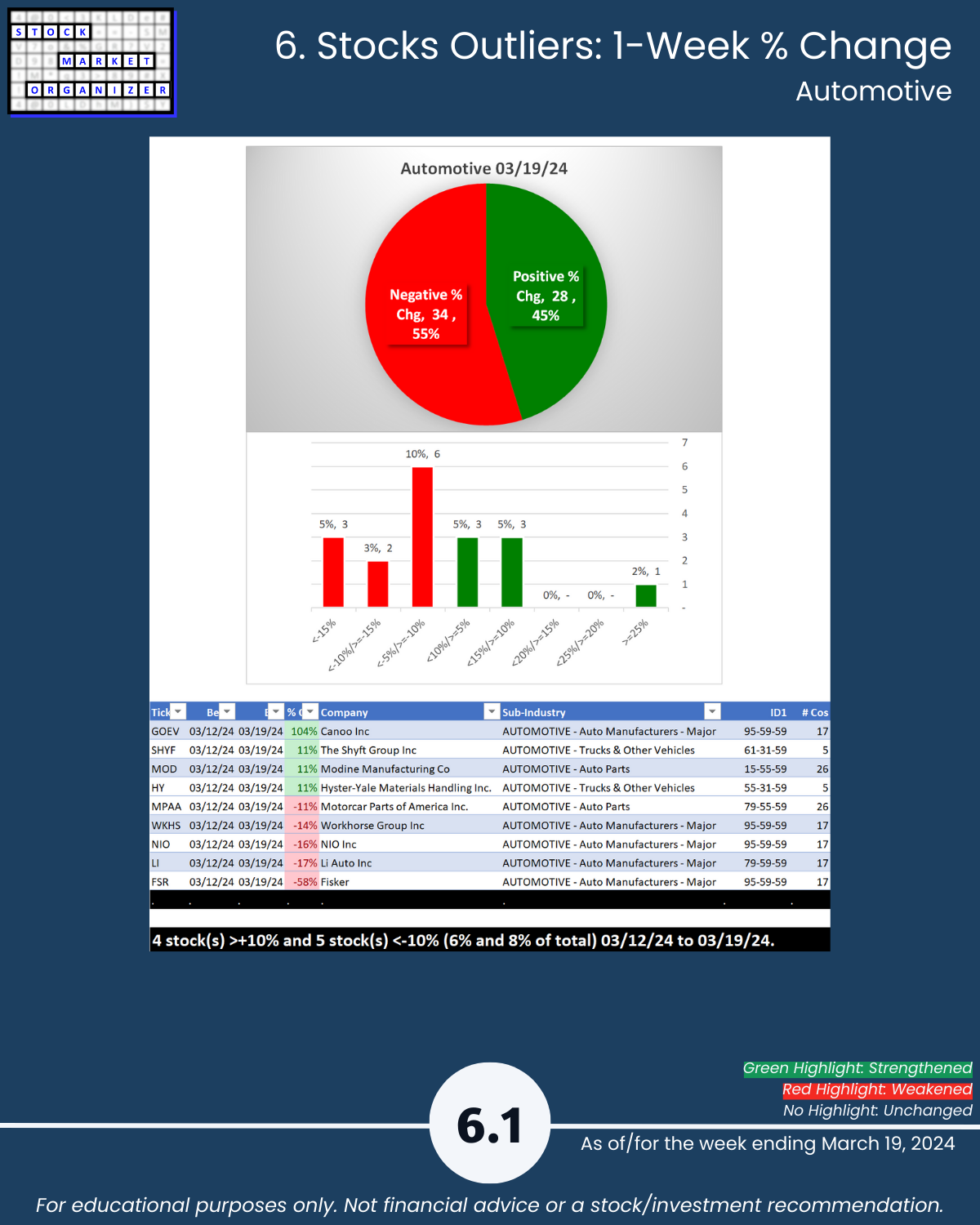

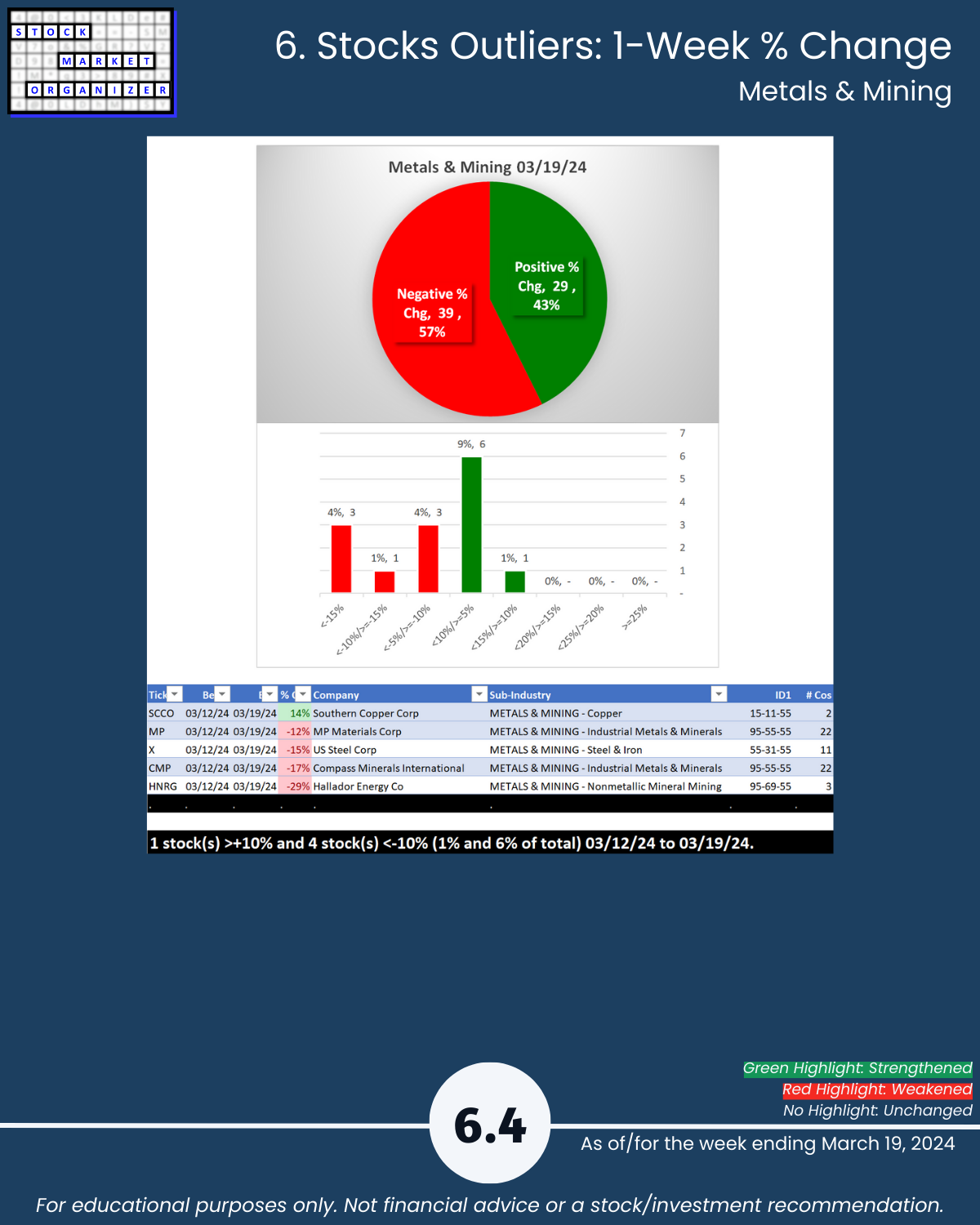

🔹 Weakest Industries: Automotive, Metals & Mining (Average, 5th strongest)

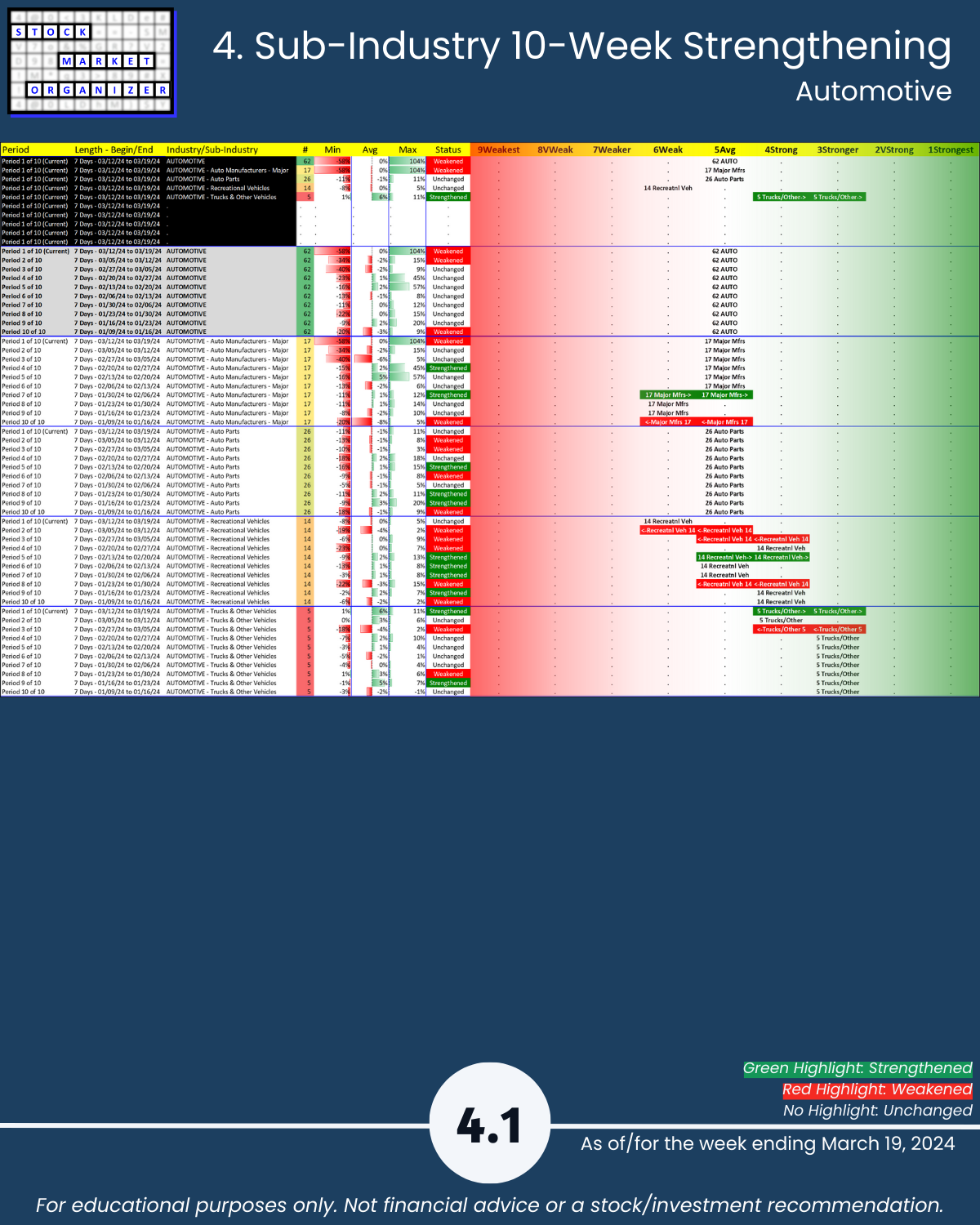

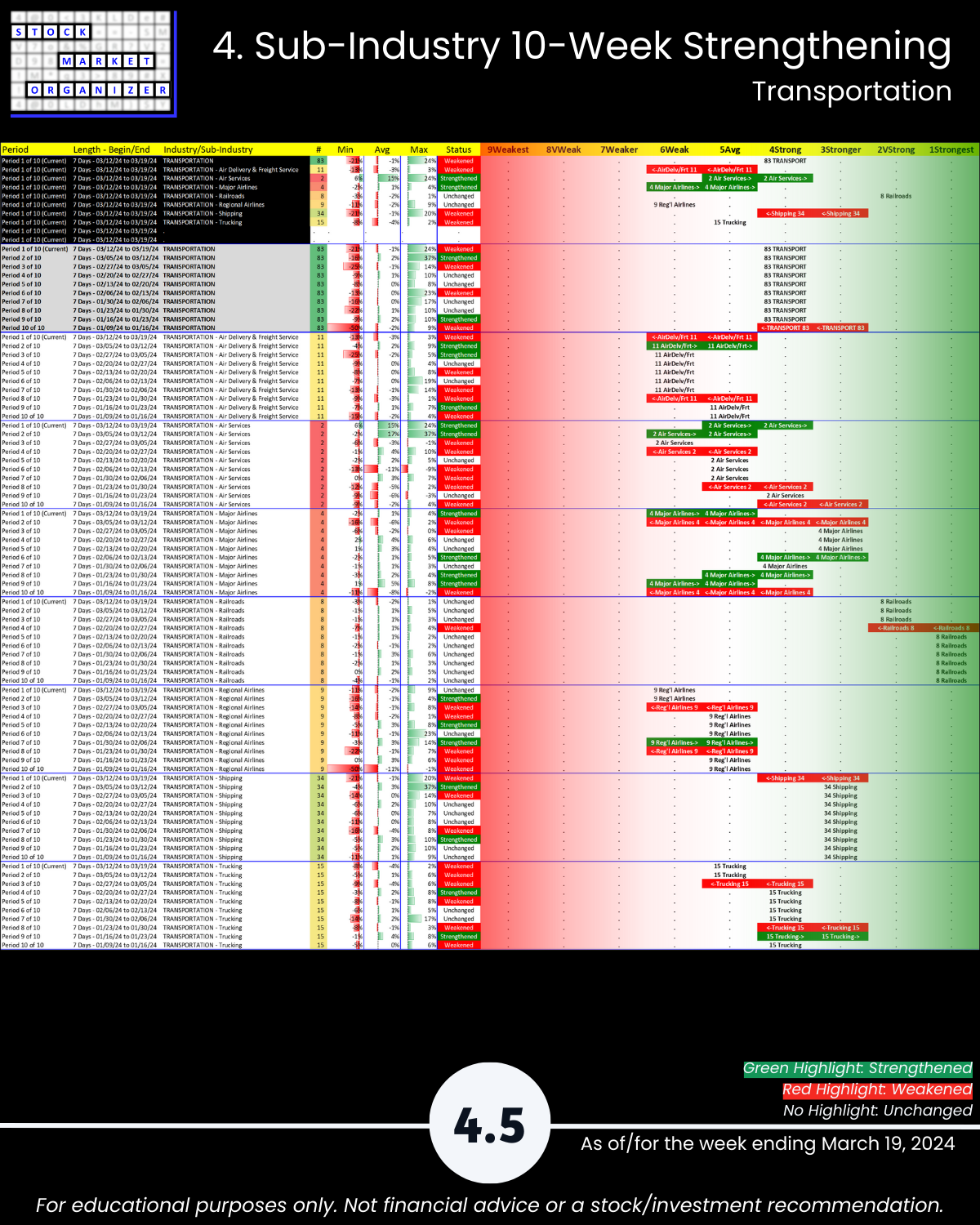

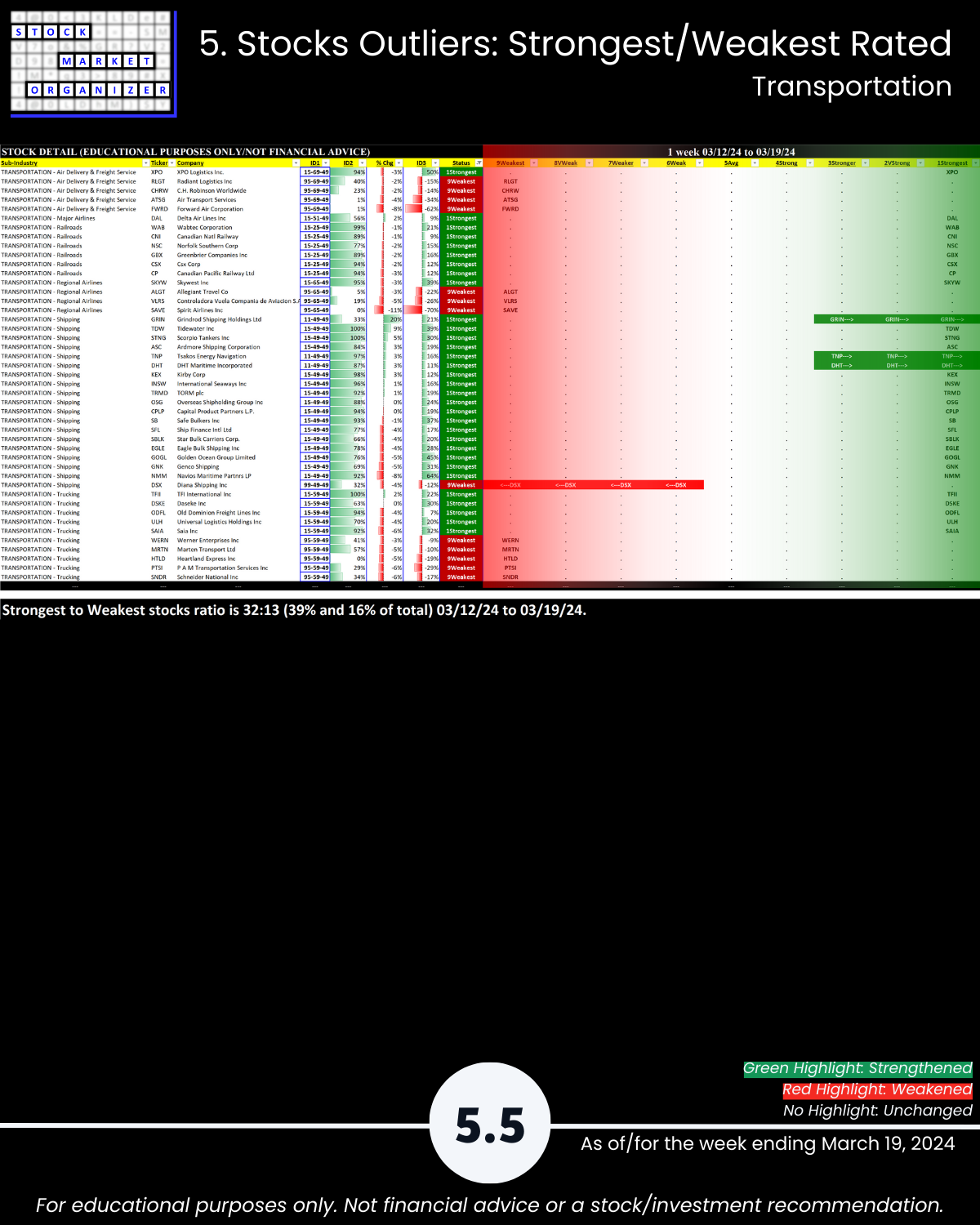

🔹 Sub-industries (32): 31% Strengthened, 13% Weakened; strongest General Bldg Materials, weakest Silver, RVs, Air Deliv/Freight

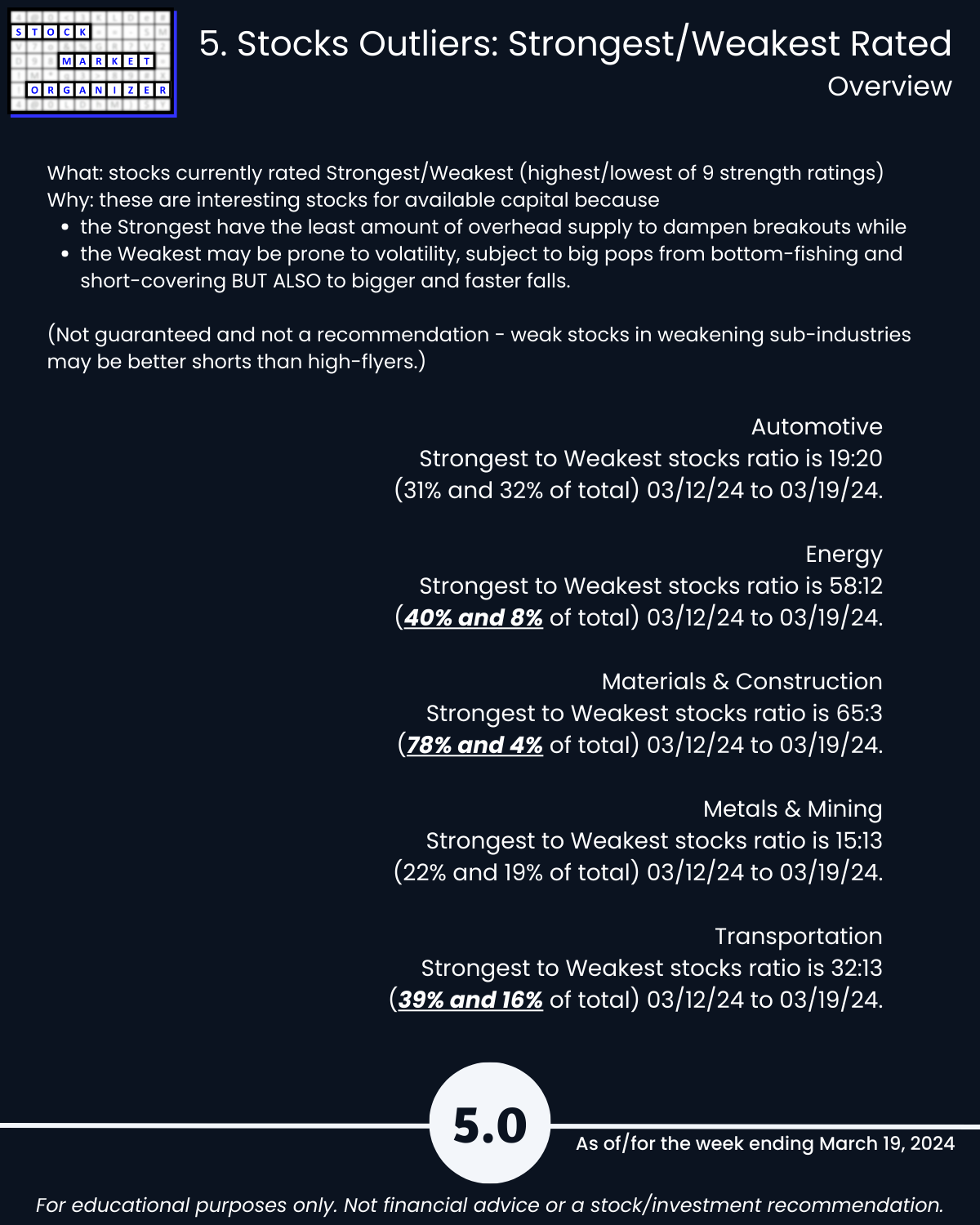

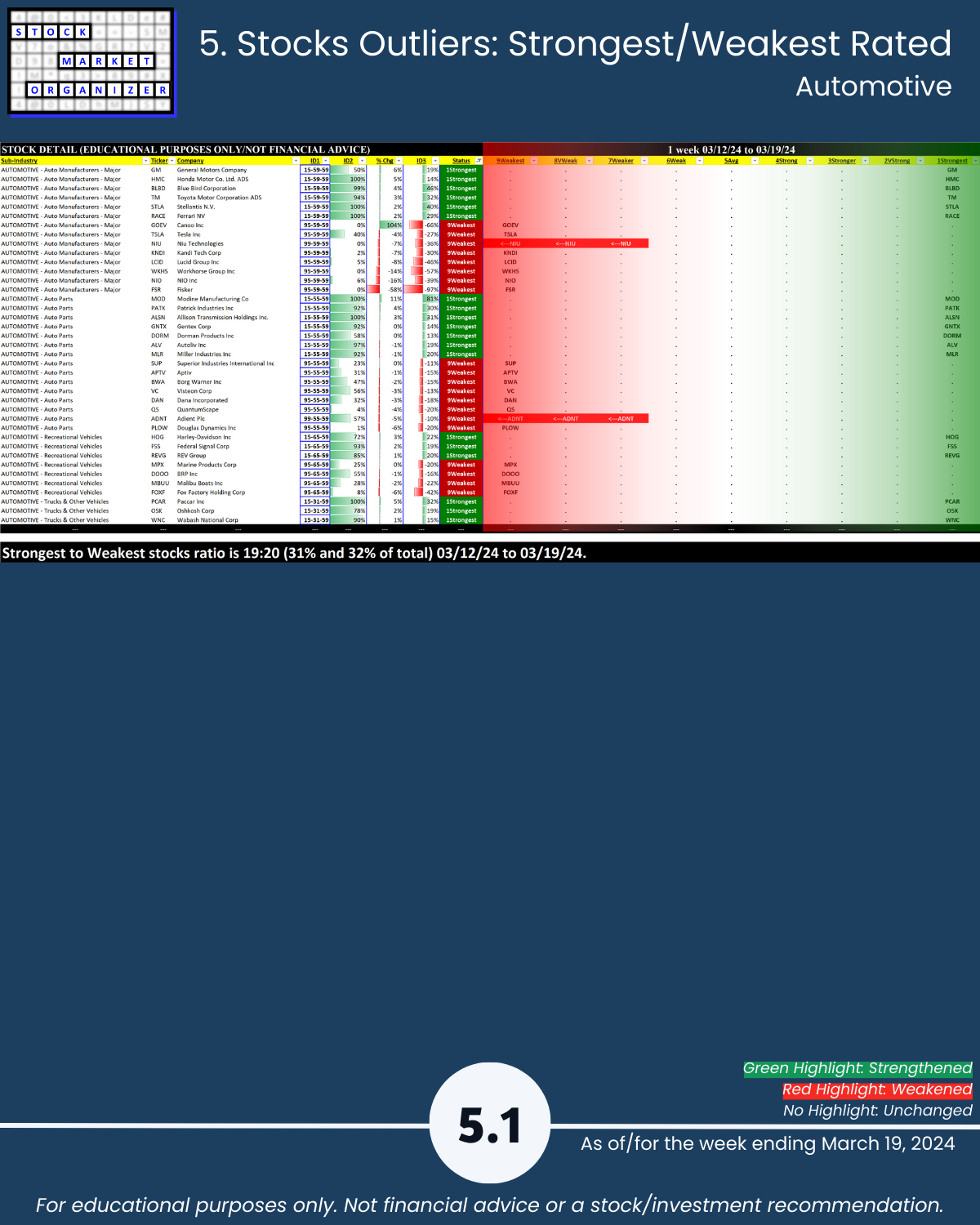

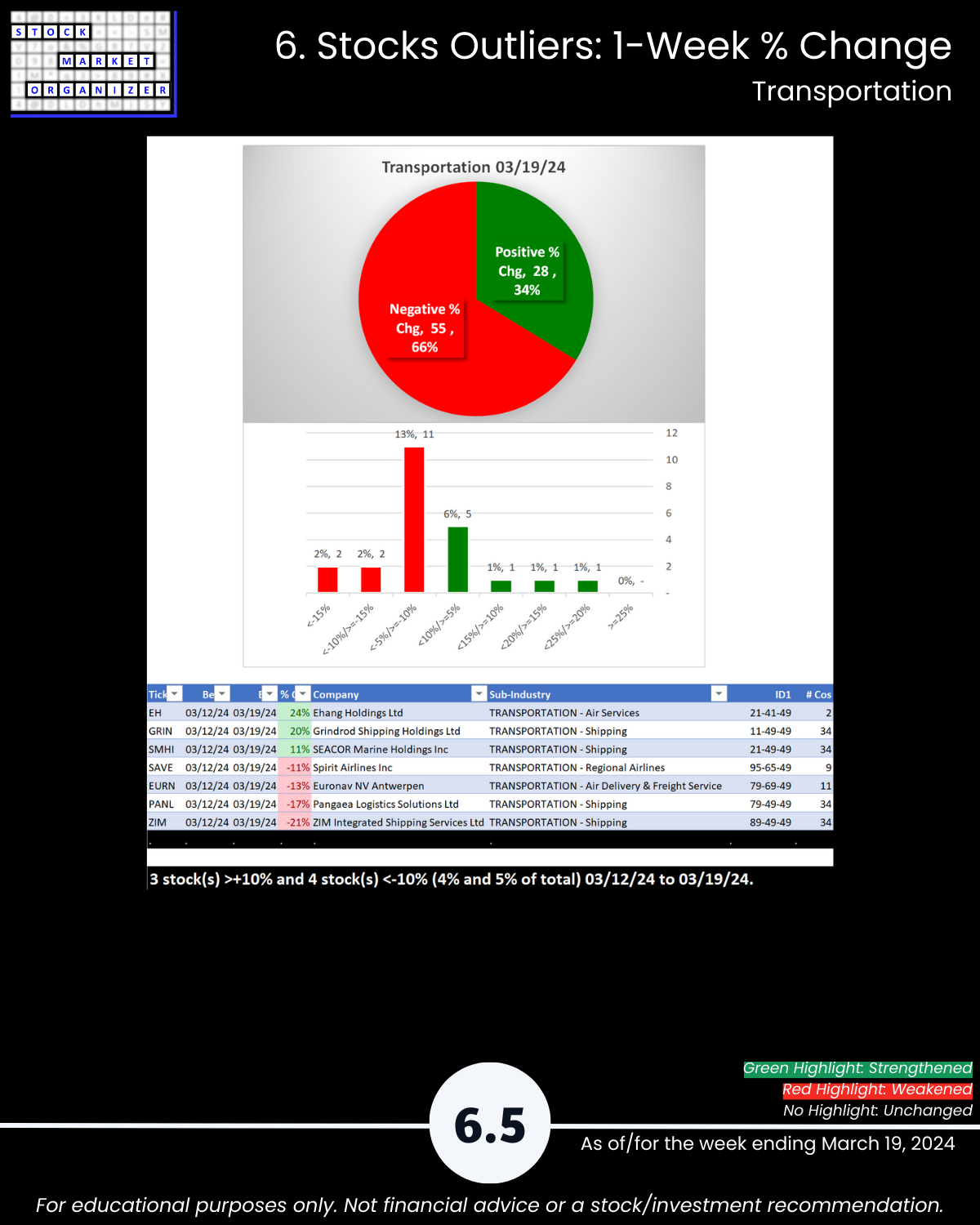

🔹 Stocks rated Strongest:Weakest: Energy 40%:8%, Materials/Const 78%:4%, Transportation 39%:16%

🔹 Outliers: Energy 82% positive stocks, Transportation 66% negative; GOEV +104%, FSR -58%; EGY +39%; LICY +129%, EVA -25%; HNRG -29%; EH +24%, ZIM -21%

🔹 @ 5-Year Highs/Lows %: Materials & Construction 28%, Energy 14%, Automotive 11% of stocks at highs

This report may particularly be of interest if the following 5 concepts resonate with you:

- The stronger your stocks, the greener your P&L.

- The journey to 100%+ returns begins with 10% returns.

- The journey to a multi-month rally begins with one up week.

- Most stocks do what the market does. (While the market can only do what its underlying stocks, sub-industries, and industries do.)

- 80/20: not all information is created equal. (Press buttons, not balloons.)

Following are galleries with page-by-page views of this report.

1. Introduction

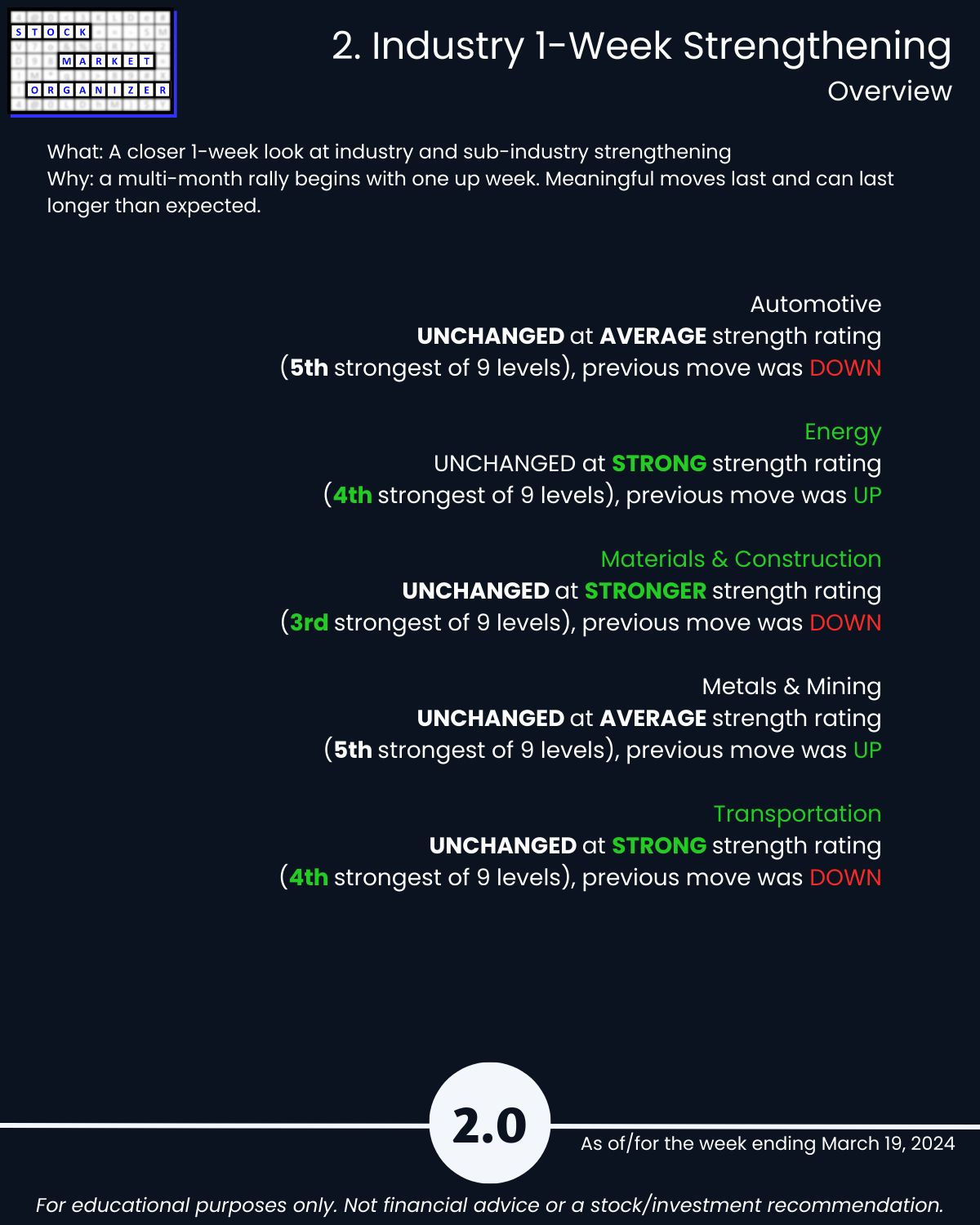

2. Industry 1-Week Strengthening

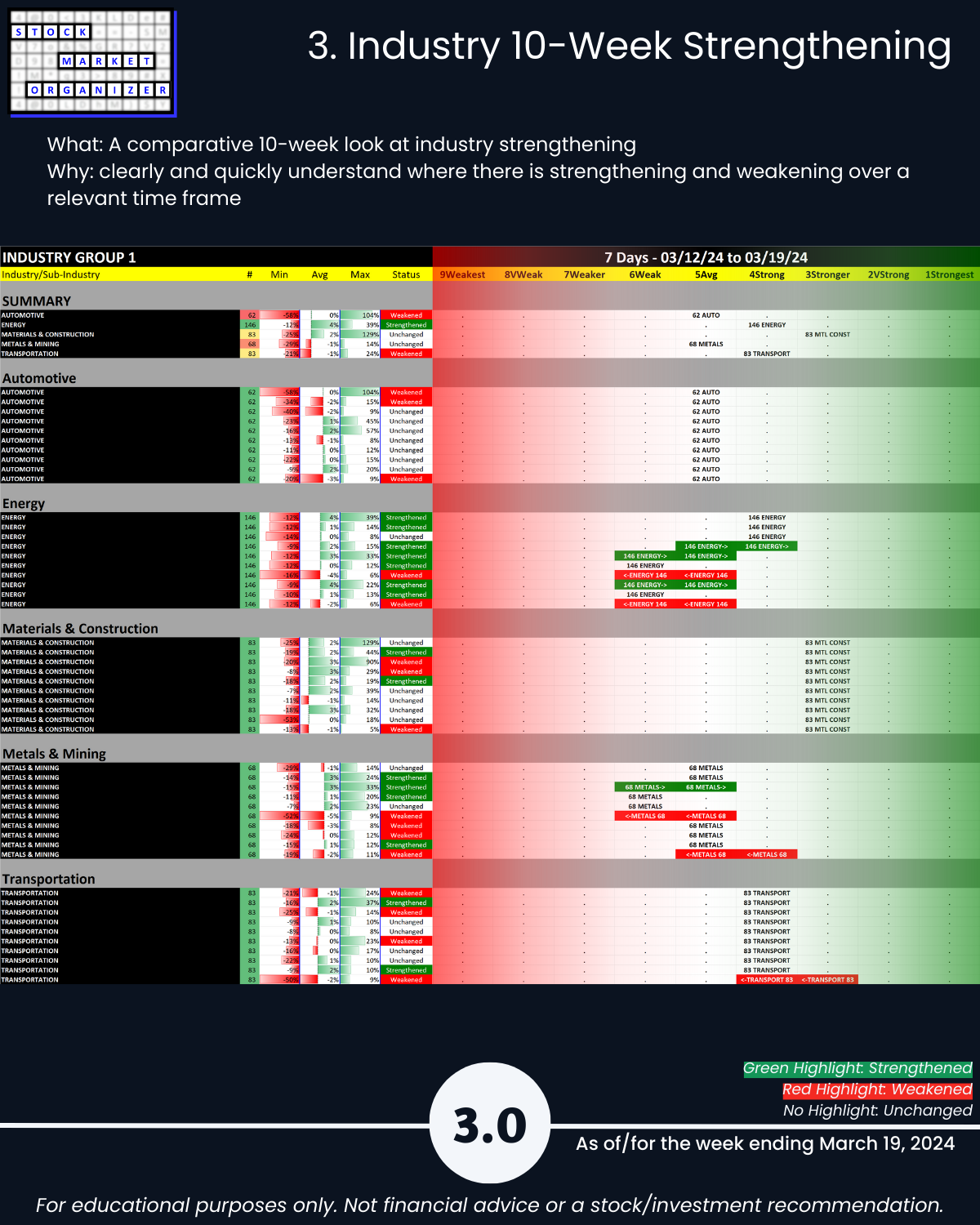

3. Industry 10-Week Strengthening

4. Sub-Industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

6. Stocks Outliers: 1-Week % Change

7. Stocks Outliers: 5-Year Highs/Lows