SMO Exclusive: Strength Report Group 1 2024-01-23

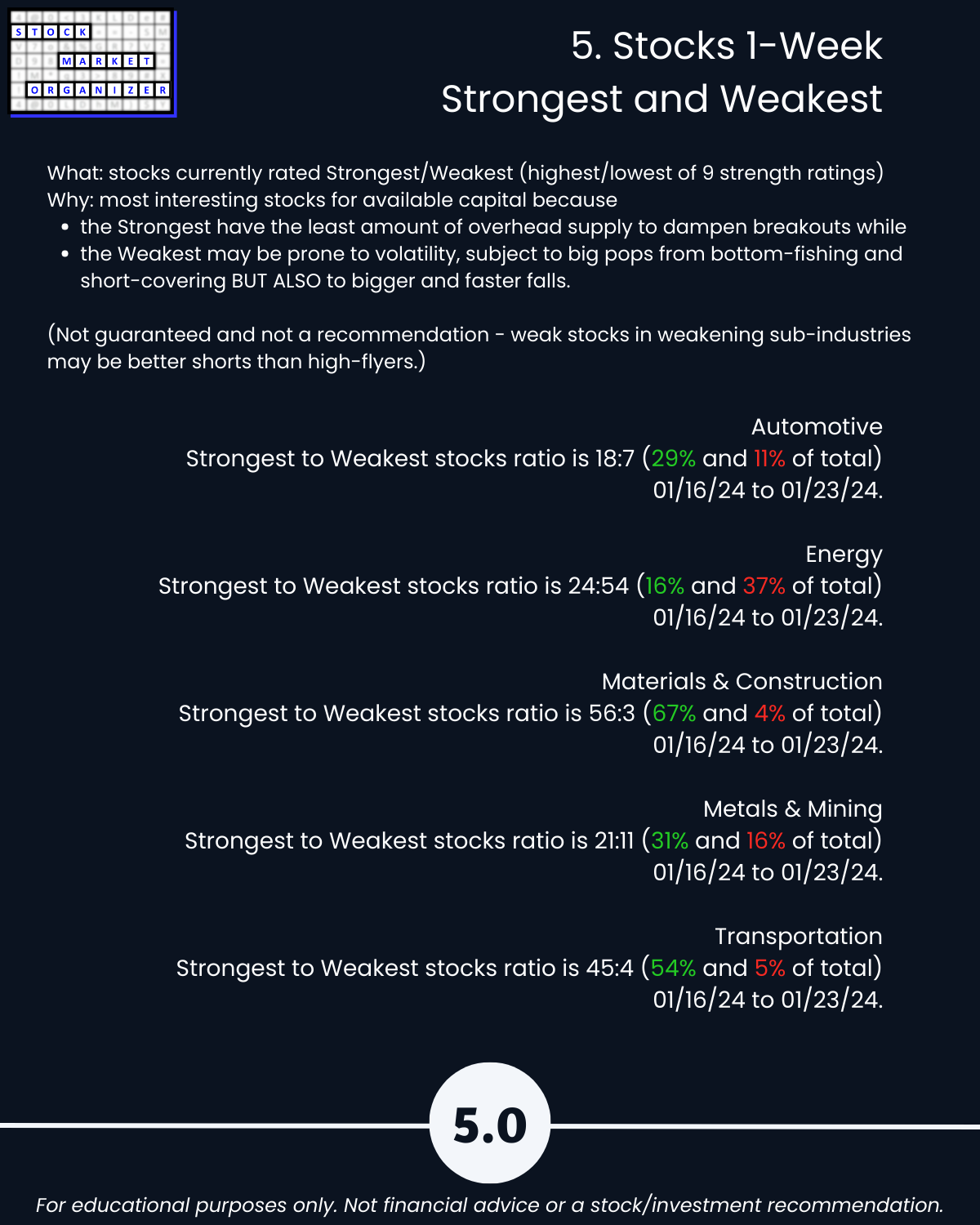

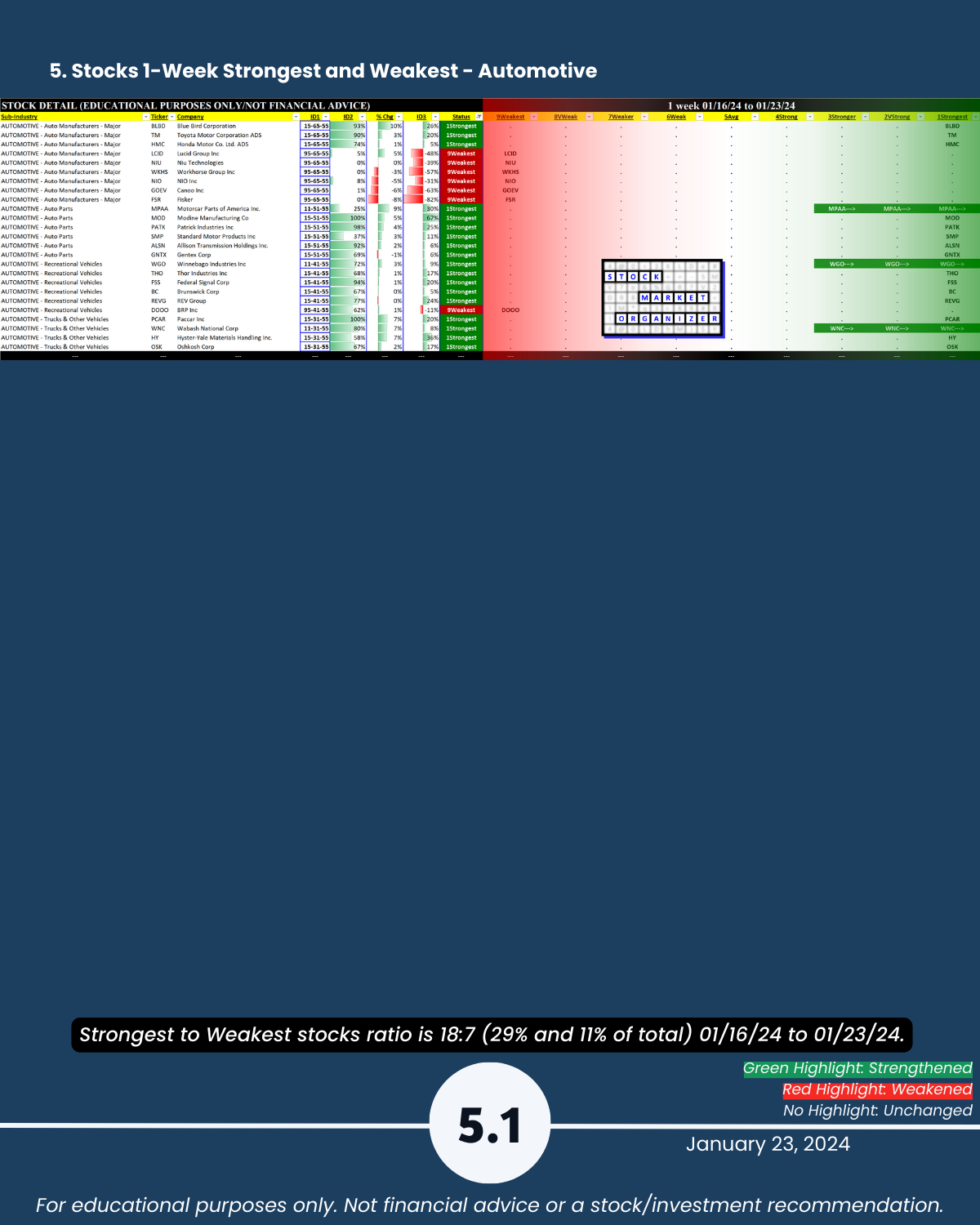

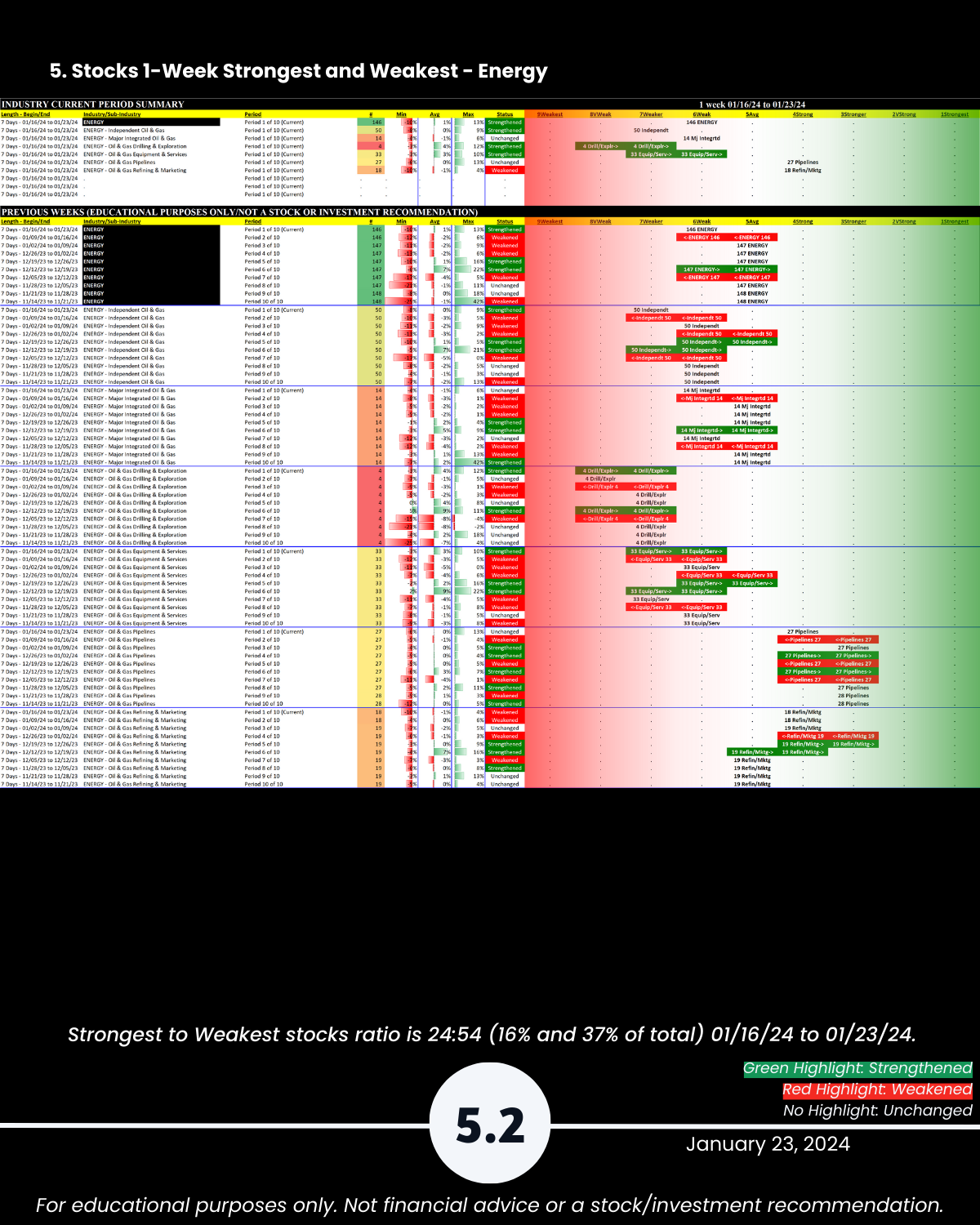

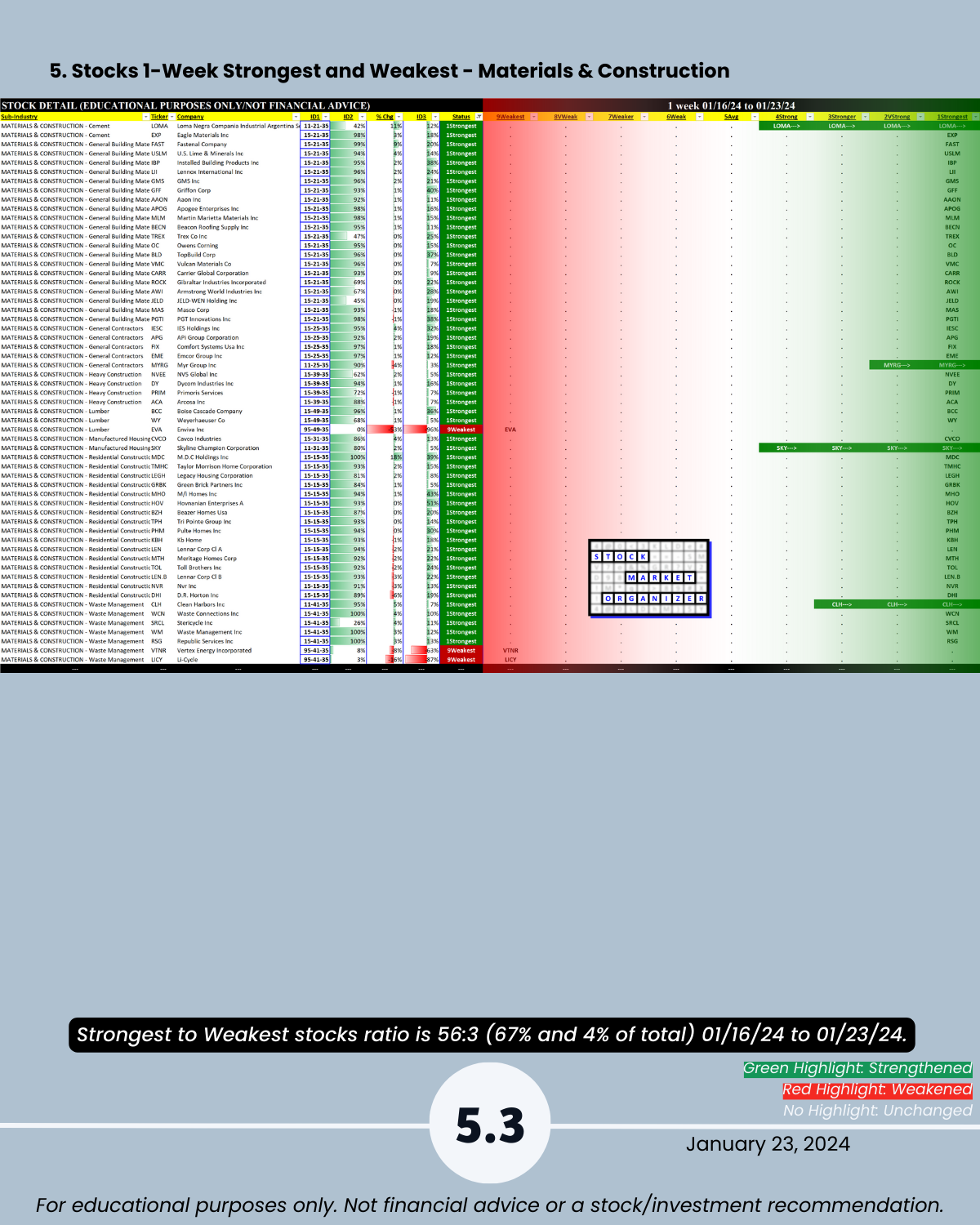

Below: 1/23/24 Strongest- and Weakest-rated Stock Market Organizer stocks and objective strengthening/weakening measurements in the Automotive, Energy, Materials/Construction, Metals/Mining, and Transportation industries. Why should you care? Well…

Why WOULDN’T you want to be in the strongest stocks, proven by their price action to be those which others are favoring? This analysis enables you to see if there are better options than whatever you may currently own.

Why WOULDN’T you want an objective method for comparing all stocks in a sub-industry and industry? This analysis enables you to quickly see the best and worst stocks and ignore the rest.

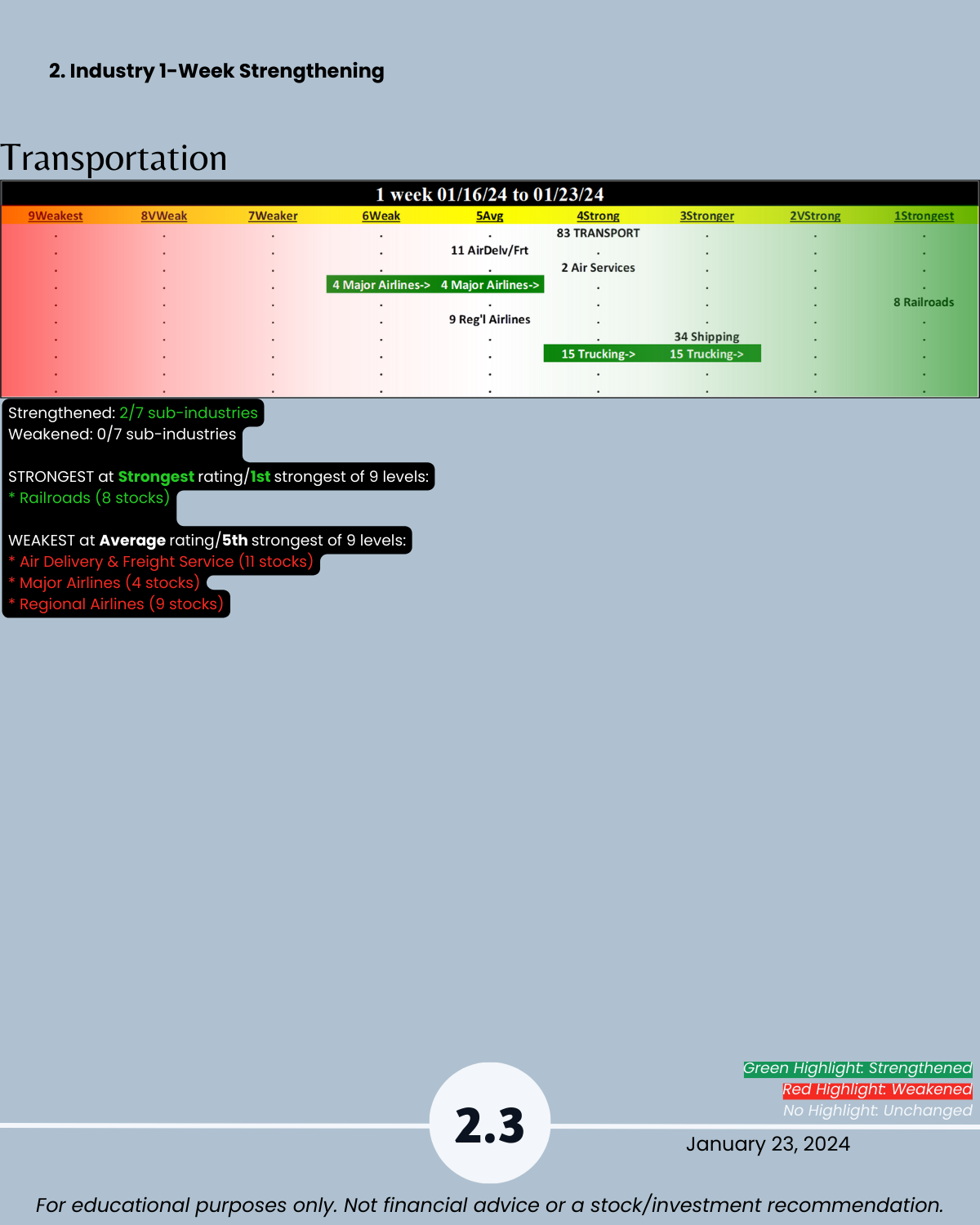

Why WOULDN’T you want to know if a stock’s sub-industry and industry are currently strengthening? This analysis helps you know if the sub-industry and industry currently support new entries, or if you are better off waiting.

Why WOULDN’T you want to know if now is a good time for new long positions based on current market strengthening or weakening? This analysis helps you know if the market currently supports new entries, or if you are better off waiting.

By tracking strengthening and weakening from the individual stock level up through the market level, you can know all the above.

This cannot guarantee profits. The market is no one’s ATM. But…

It aligns with the concepts that

THE STRONGER YOUR STOCKS, THE GREENER YOUR P&L, and

IT DOESN’T HAVE TO BE SO COMPLICATED.

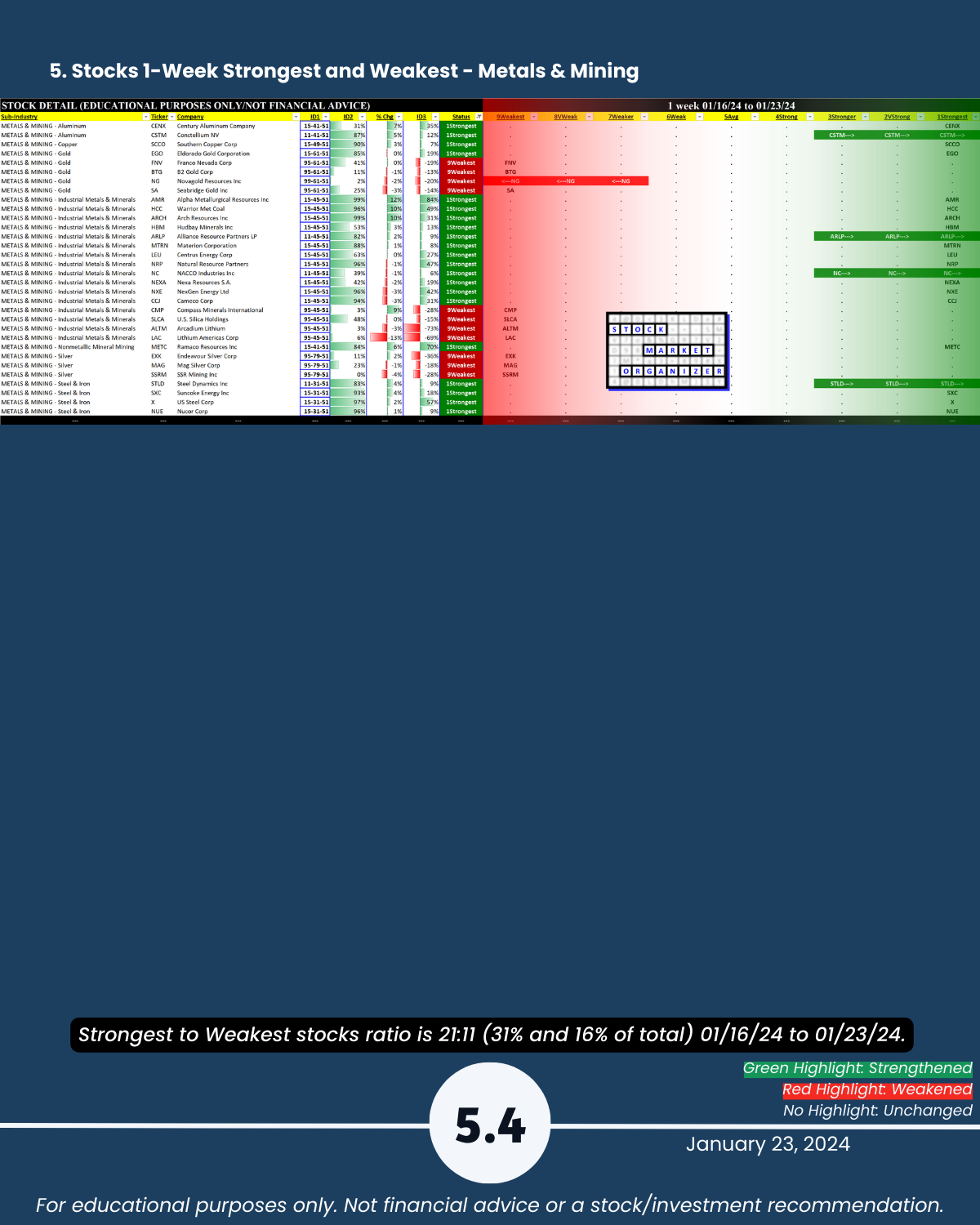

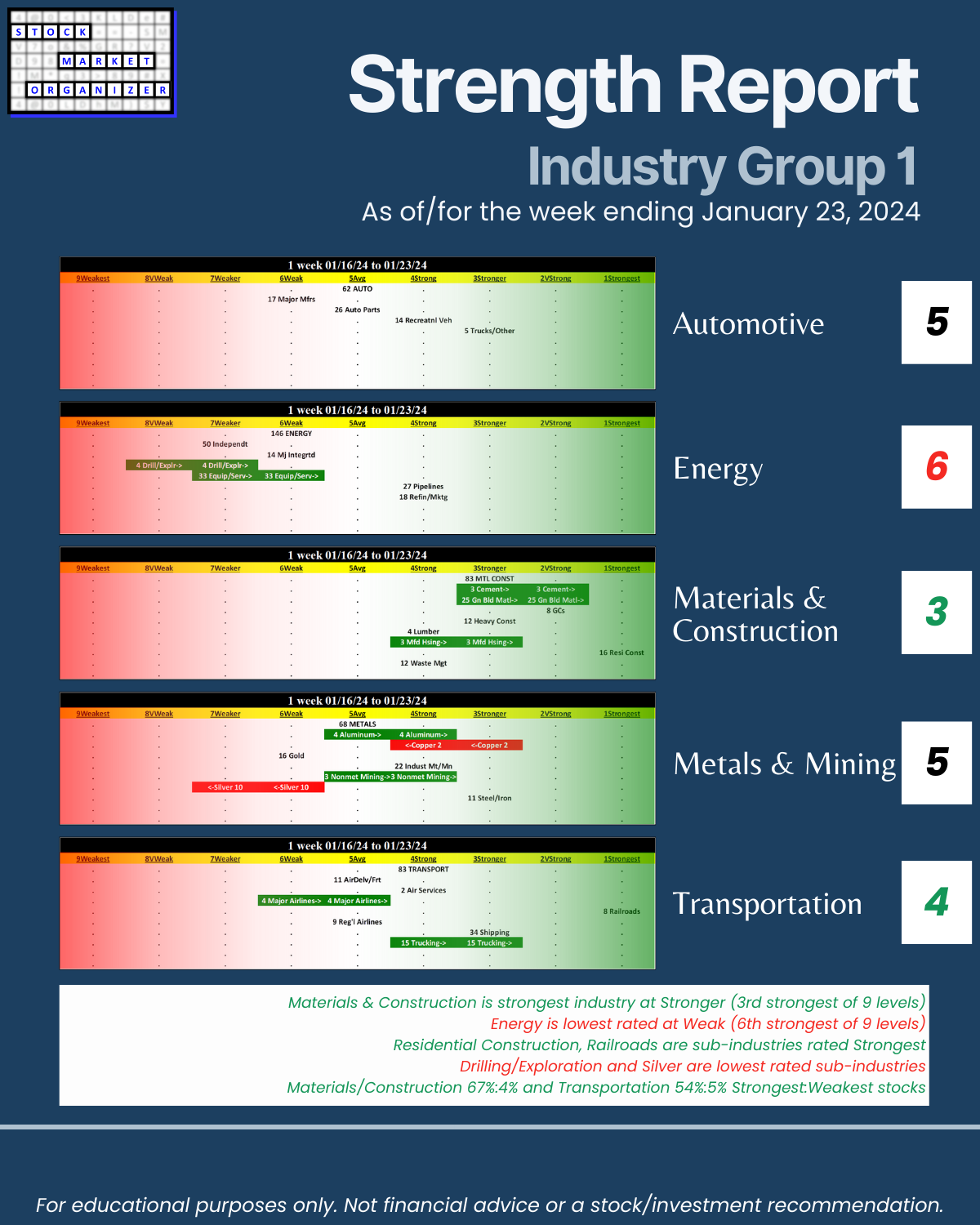

Takeaways from the attached:

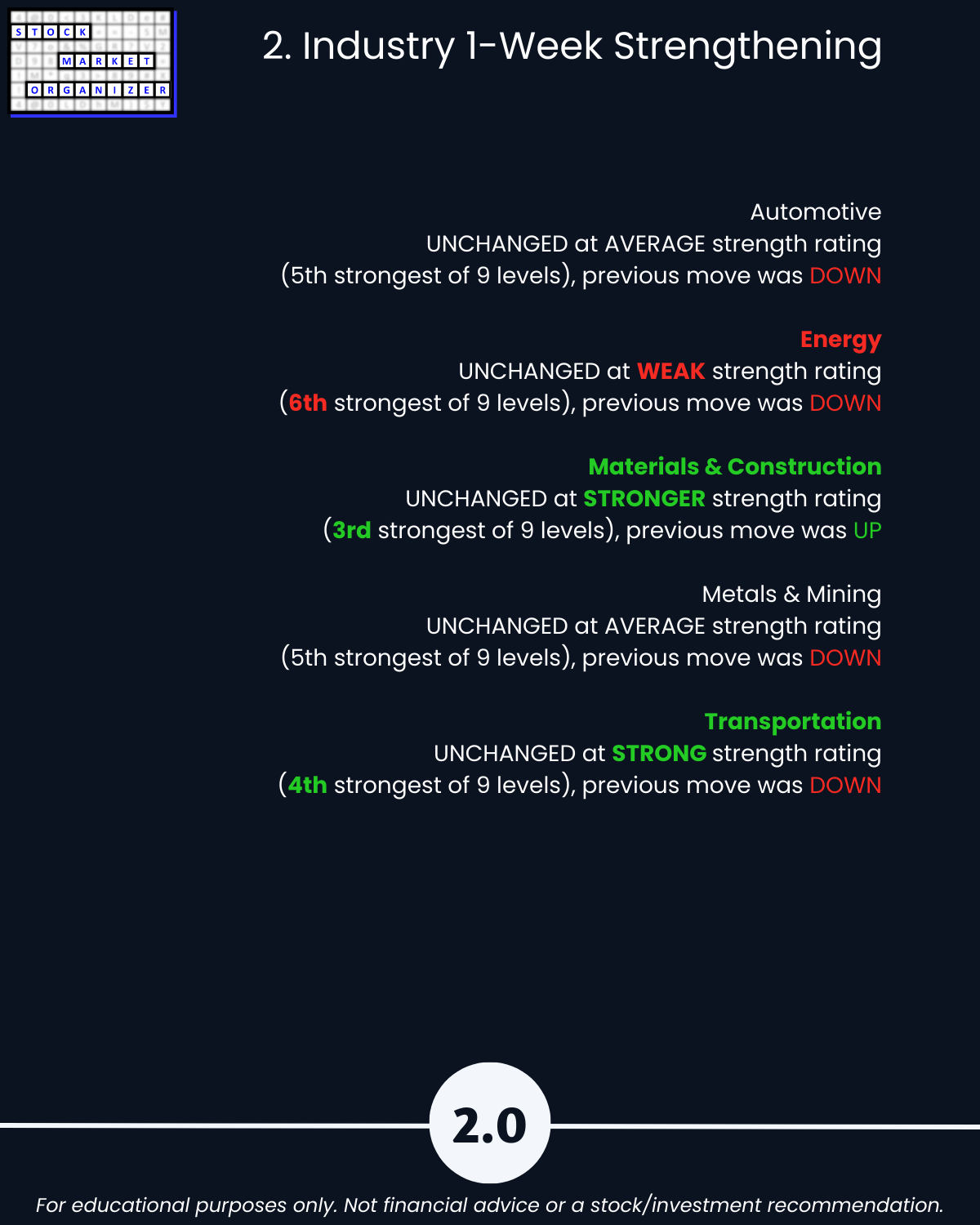

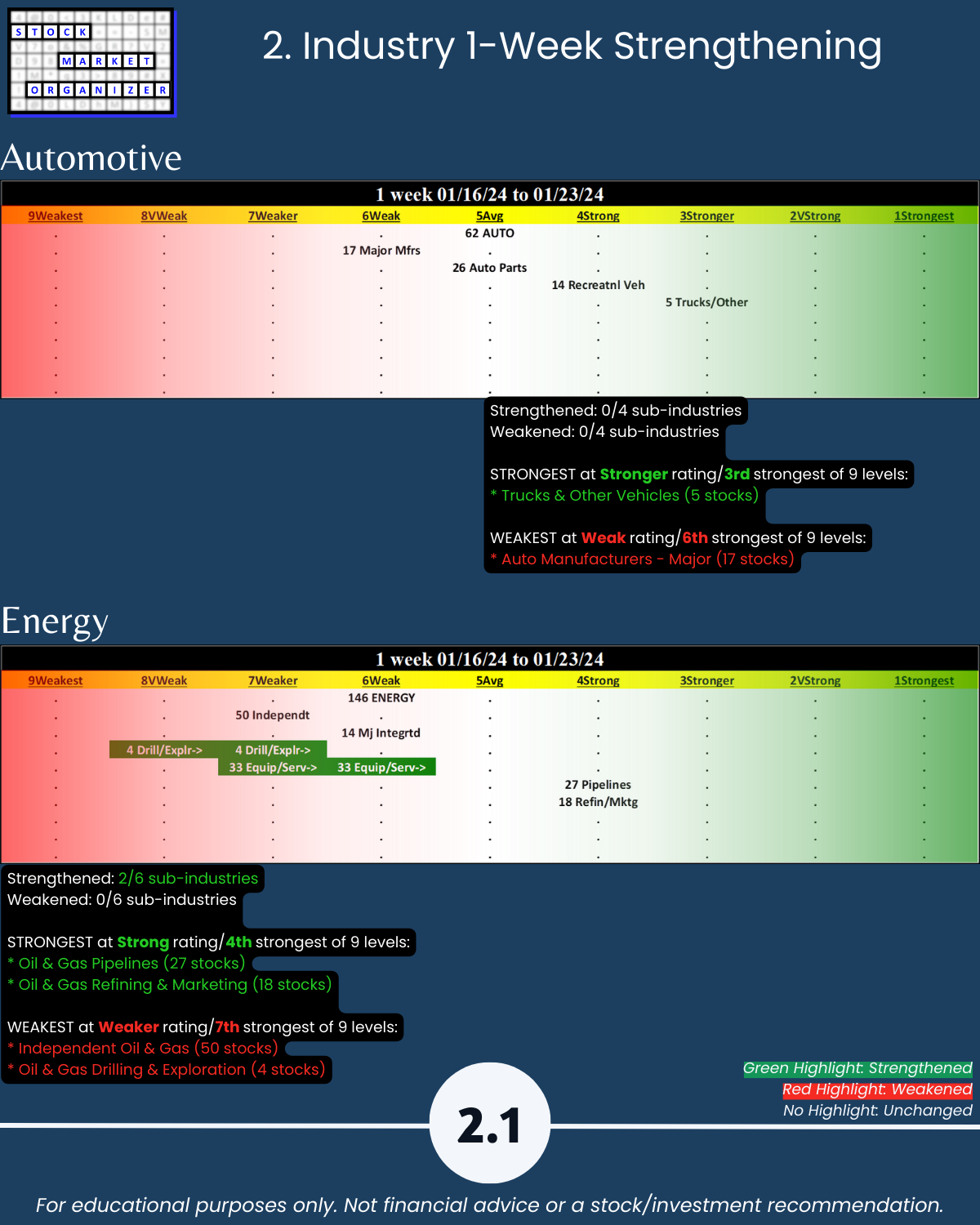

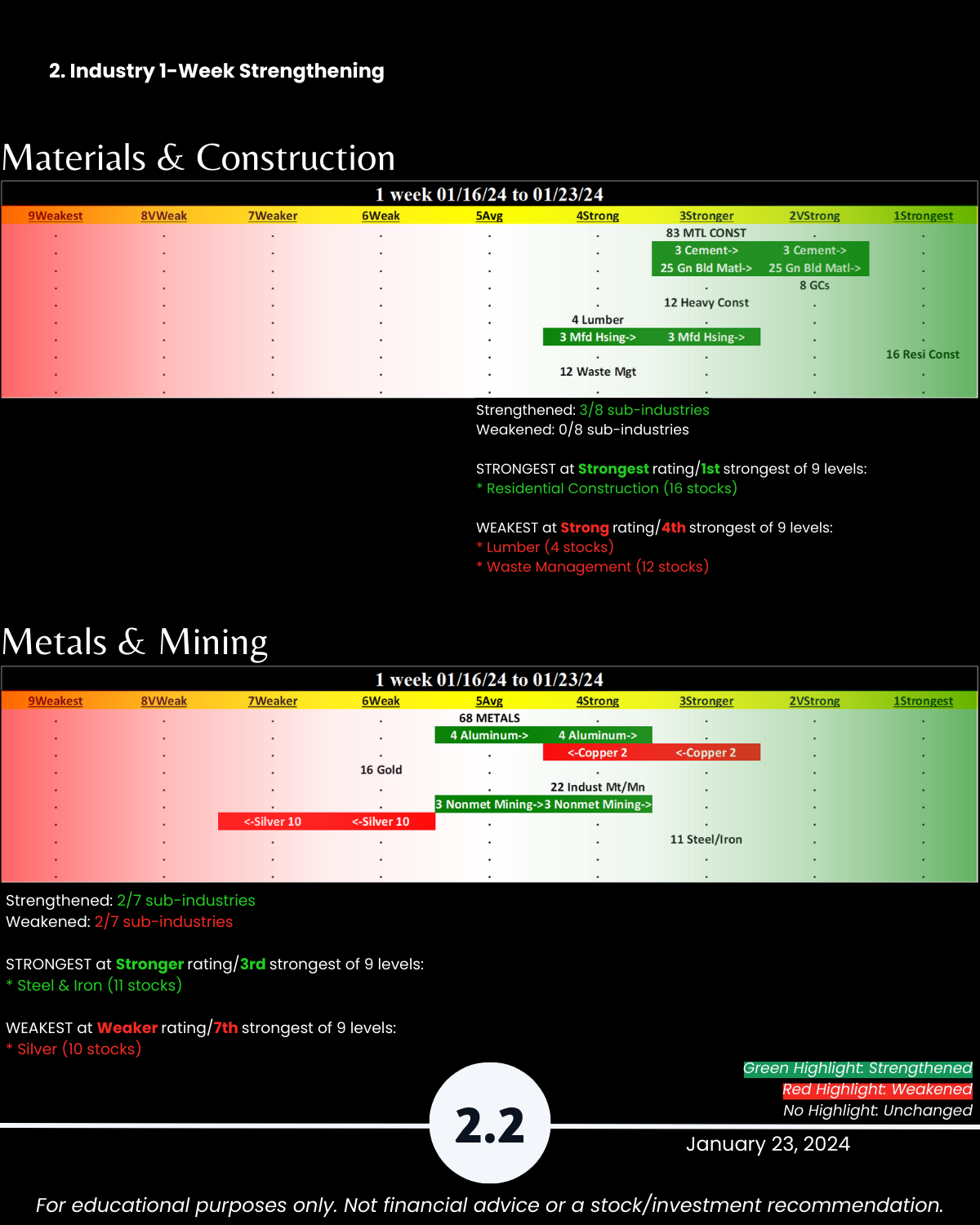

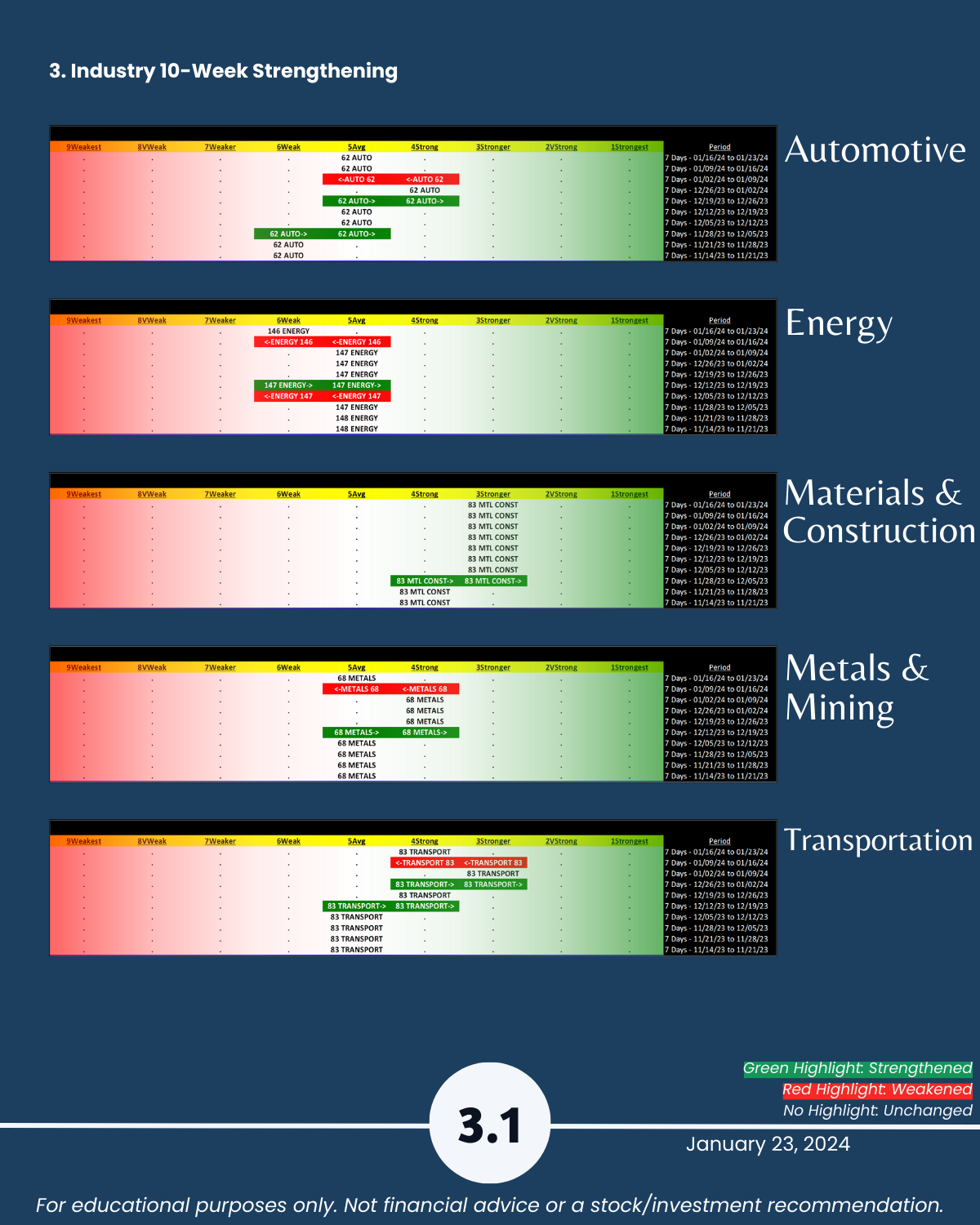

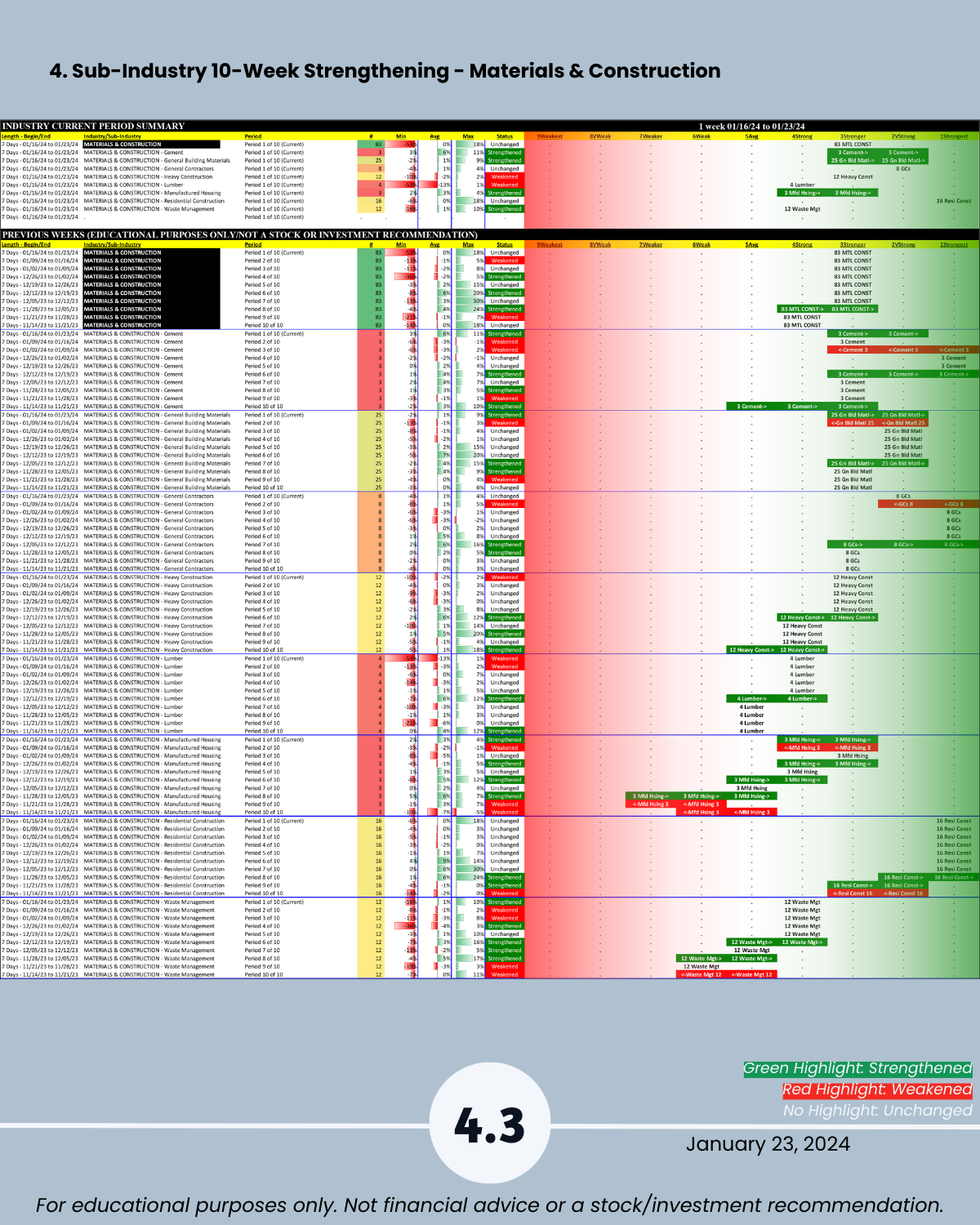

🔹 Materials & Construction is strongest industry at Stronger (3rd strongest of 9 levels)

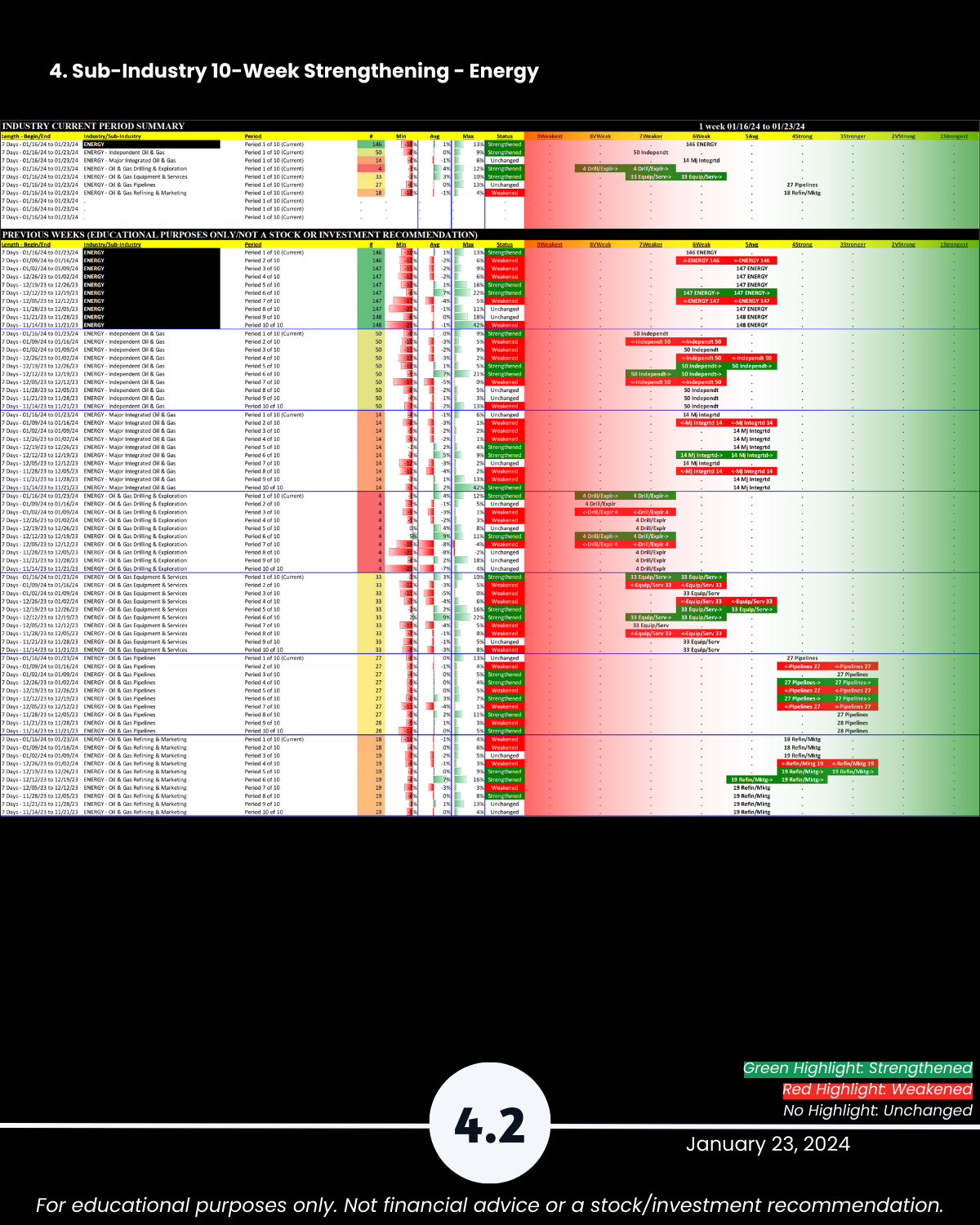

🔹 Energy is lowest rated at Weak (6th strongest of 9 levels)

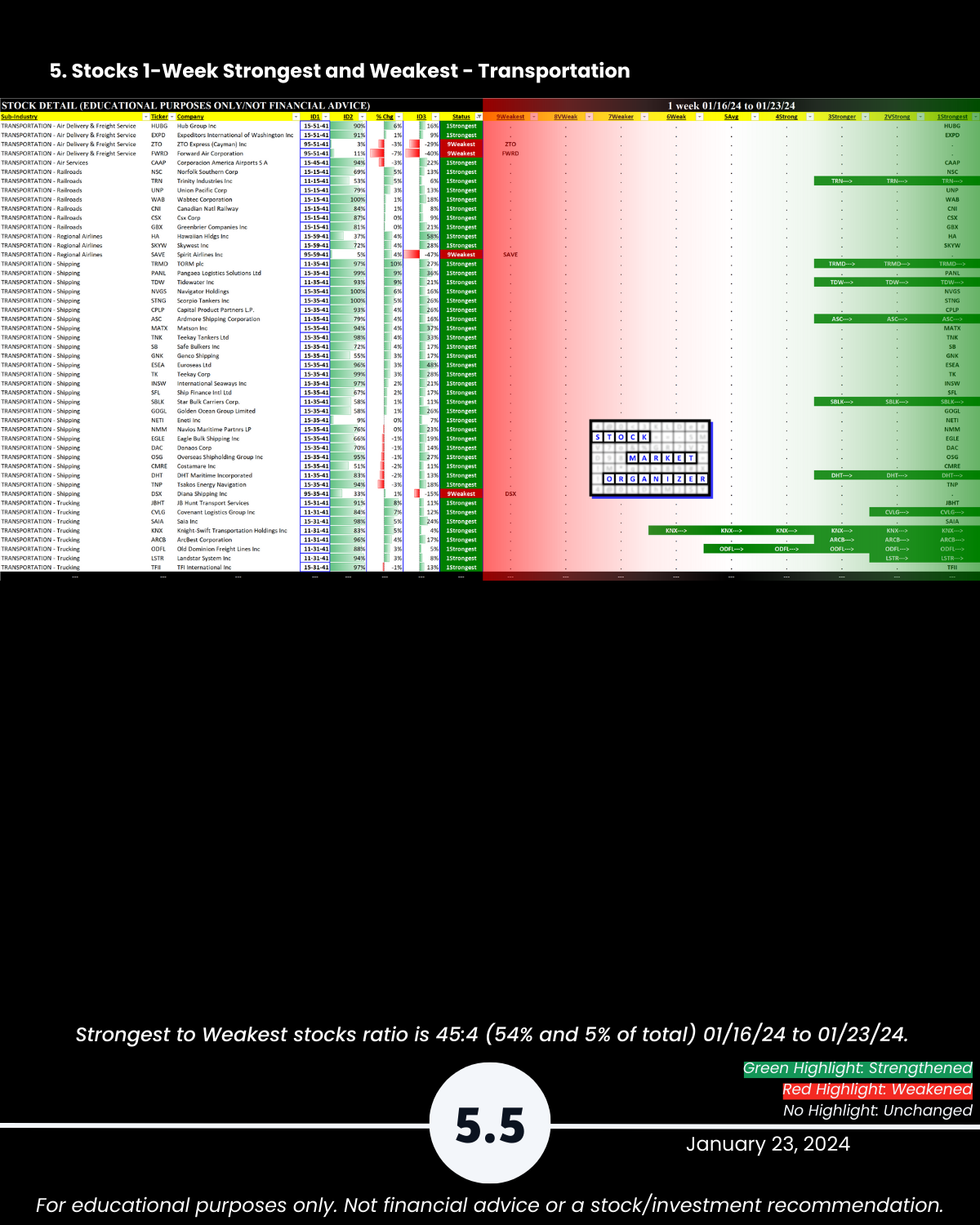

🔹 Residential Construction, Railroads are sub-industries rated Strongest

🔹 Drilling/Exploration and Silver are lowest rated sub-industries

🔹 Materials/Construction 67%:4% and Transportation 54%:5% Strongest:Weakest stocks

This report may particularly be of interest if the following 5 concepts resonate with you:

- The stronger your stocks, the greener your P&L.

- The journey to 100%+ returns begins with 10% returns.

- The journey to a multi-month rally begins with one up week.

- Most stocks do what the market does. (While the market can only do what its underlying stocks, sub-industries, and industries do.)

- 80/20: not all information is created equal. (Press buttons, not balloons.)

Following are galleries with page-by-page views of this report.

1-2. Introduction/Industry 1-Week Strengthening

3-4. Industry and Sub-industry 10-Week Strengthening

5. Stocks 1-Week Strongest and Weakest