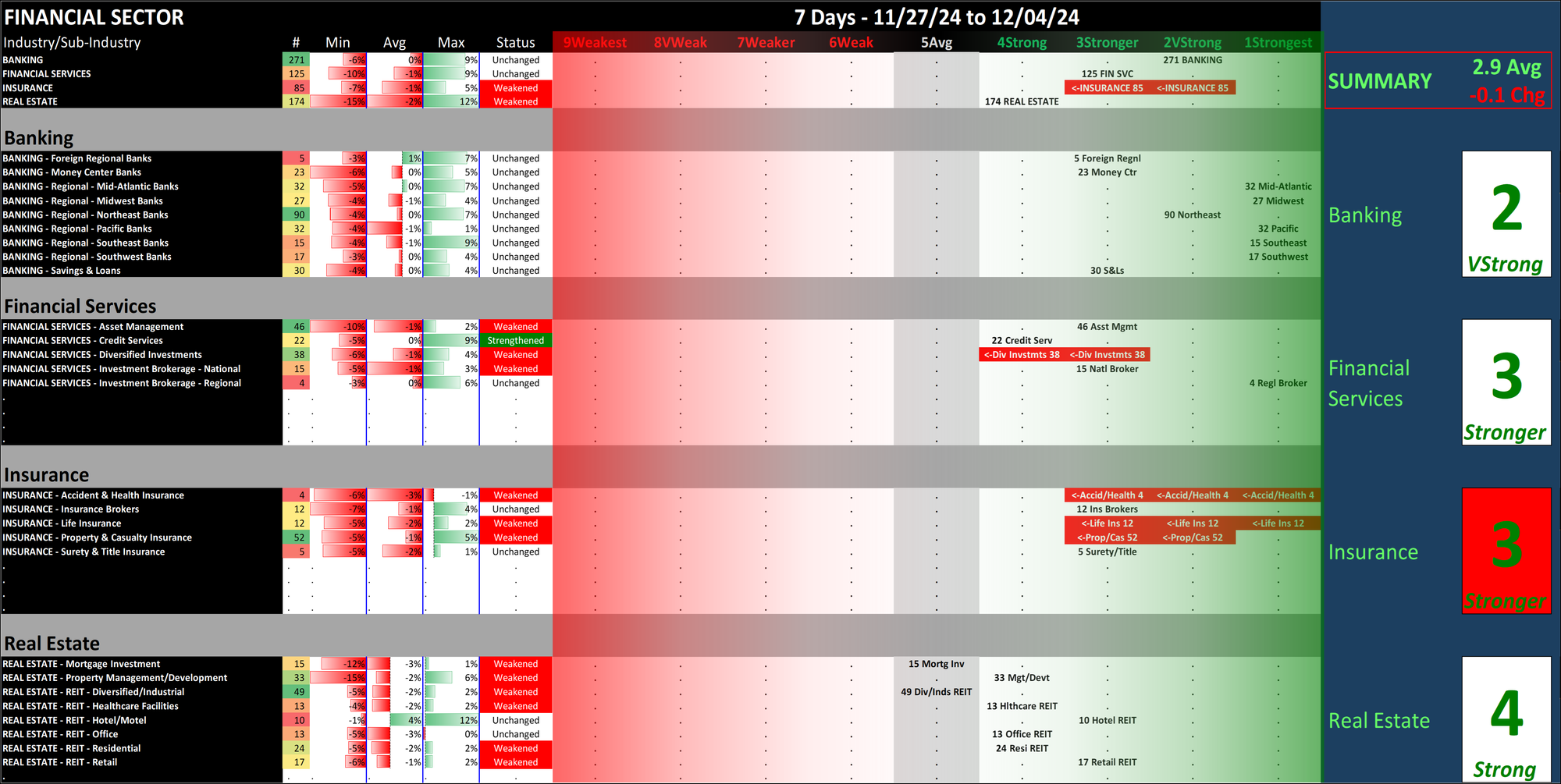

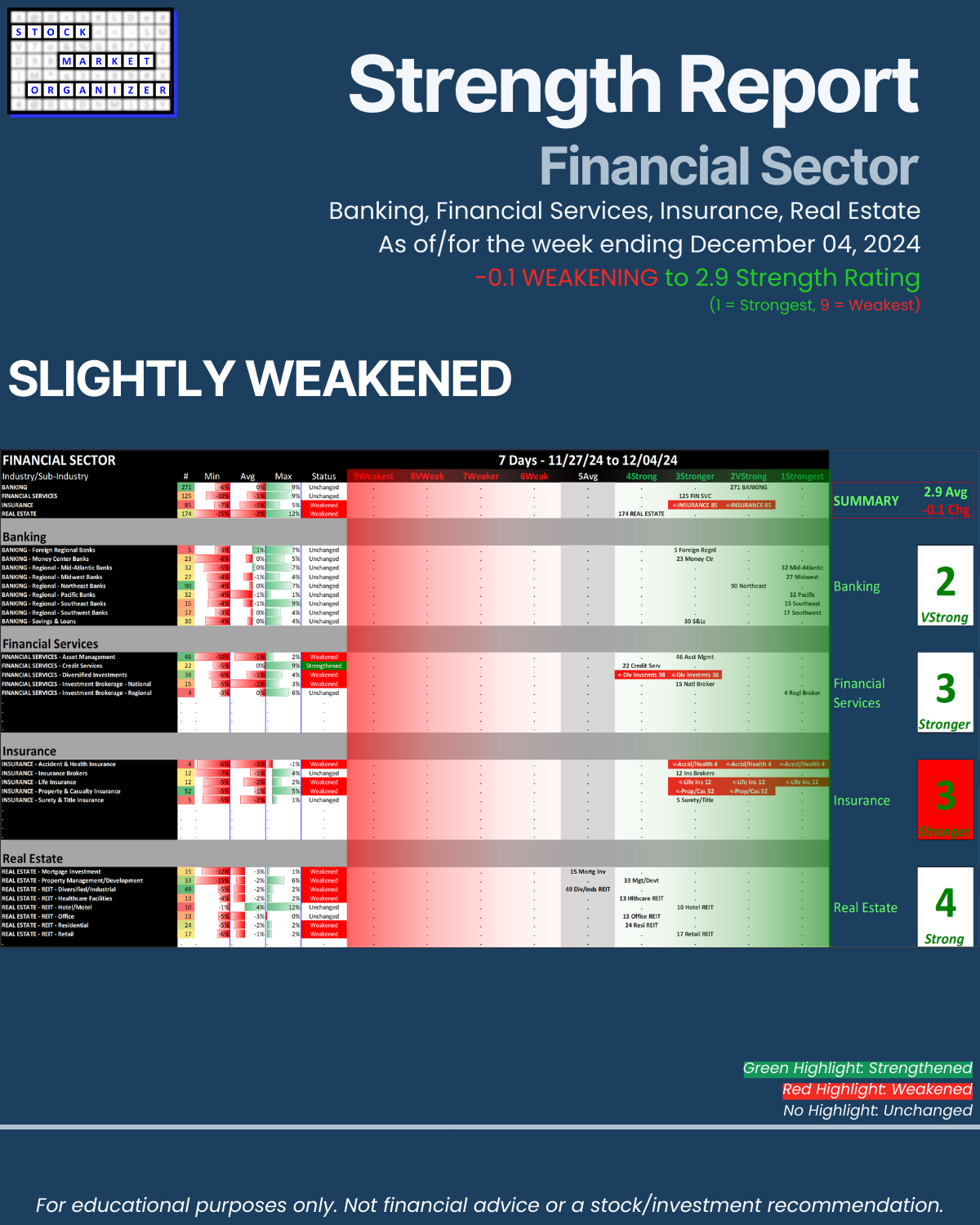

SMO Exclusive: Strength Report Financial Sector 2024-12-04 Weakened -0.1 to 2.9 Strength Score

Summary

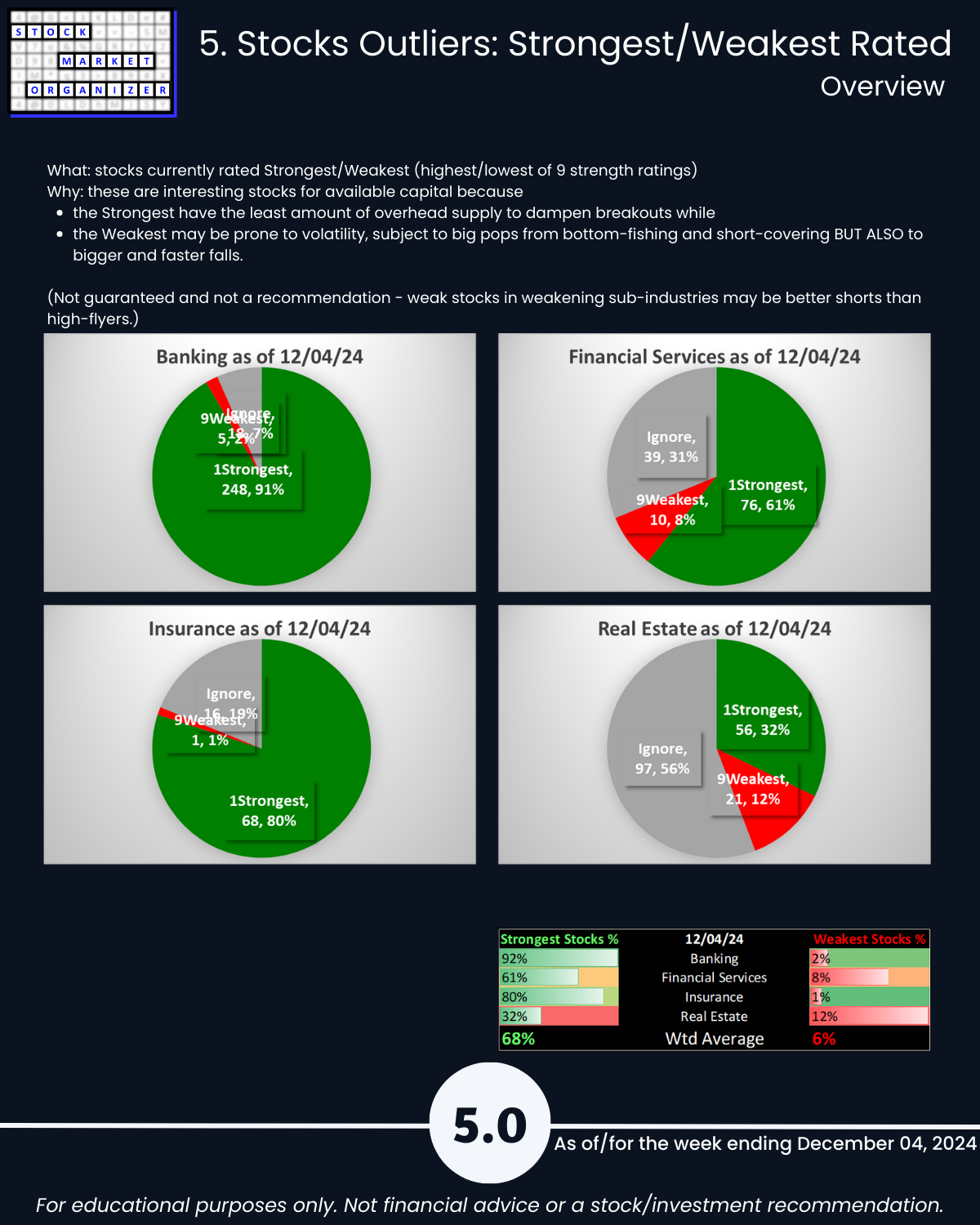

Financial Sector slightly weakened to a 2.9 composite score this week. Banking leads at 2VeryStrong, followed by Financial Services and Insurance at 3Stronger. Real Estate remains the sector's laggard with a 4Strong rating. The weakening was slight and 2.9 is a strong score.

Difference This vs. ETFs Analysis

Note this analysis is the same as that used for the SPDR ETFs but the two main differences are:

1. Universe of stocks. The ETFs are the largest capitalization stocks, 500 of them in the 11 sector ETFs. In this analysis, there are approximately 2,700 stocks.

2. Sub-categorization below the market level. The ETF analysis with 500 stocks is limited to sector strengthening and weakening. This analysis with +/-2,700 stocks can be and is segregated into 29 industry groups and in turn 189 sub-industry groups.

There is a Financials ETF (symbol XLF) which is separate from the Real Estate ETF (symbol XLRE). The Financials sector in this analysis includes Real Estate with Banking, Financial Services, and Insurance.

Per yesterday's ETF strength analysis, XLF/Financials is rated 3Stronger and XLRE/Real Estate is rated 4Strong. This is generally a match for the Financial Sector's readings from today. This means the larger cap Financial stocks aligned with the smaller caps.

How would I interpret and use this information?

Recognizing that anything can happen at any time and I will never know the reason why until after the fact if ever, I am looking to give myself the best chances of an individual stock going my desired direction by stacking strength going long or stacking weakness going short, depending on strength/strengthening and weakness/weakening at the stock, sub-industry, industry, sector, and market levels.

Current Market and Sector Environment: TAILWIND/Neutral

- MARKET: The Market Strength Score is currently positive = TAILWIND

- SECTOR: The Financial sector was flat/slightly weakened for the week but has a strong 2.9 overall rating = Tailwind/Neutral

- If at all interested in positions in this sector, it is better to go where there is strength/strengthening - as reflected by price. This Stock Market Organizer methodology explicitly reveals this.

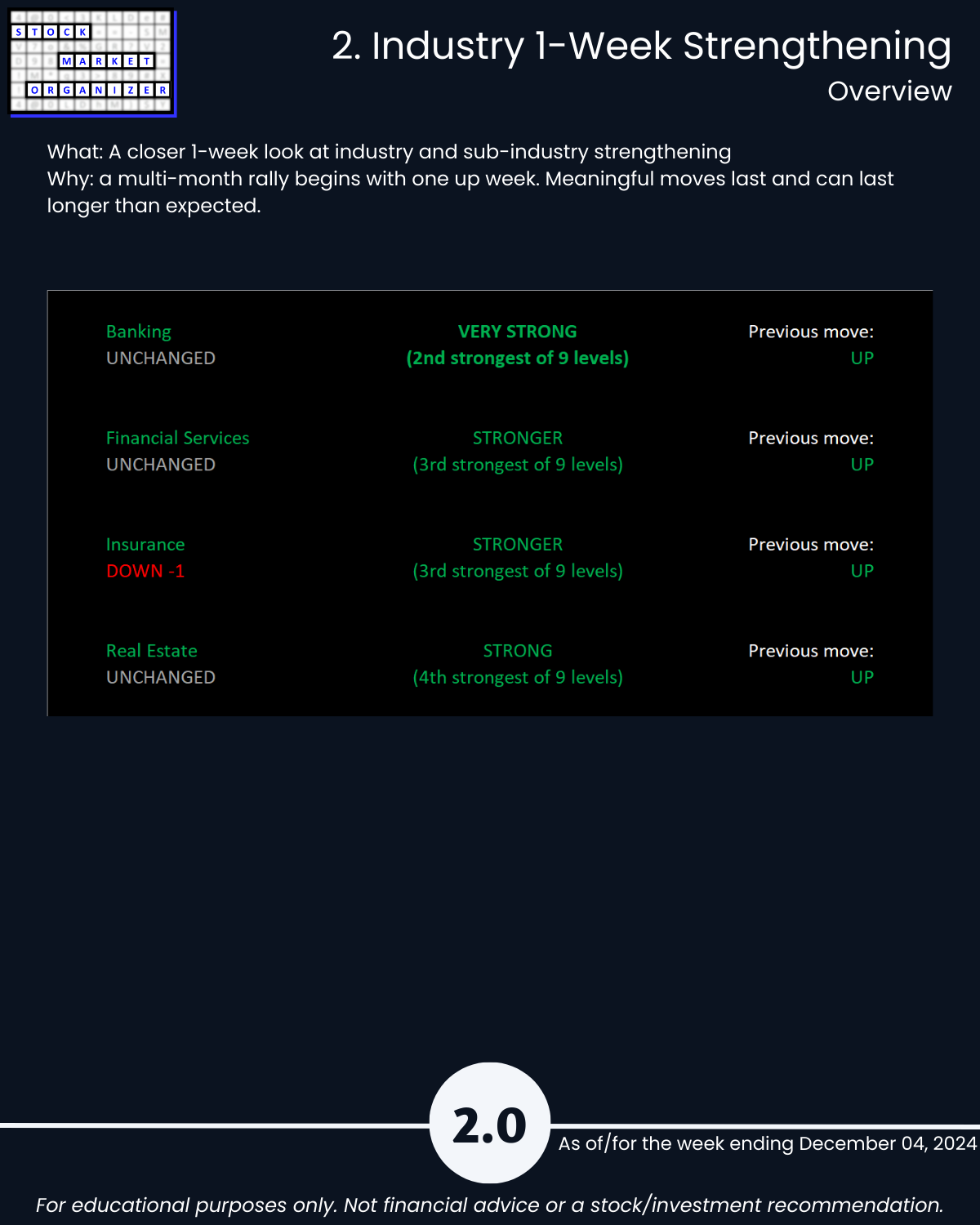

Current Industry/Sub-Industry Environment: mixed

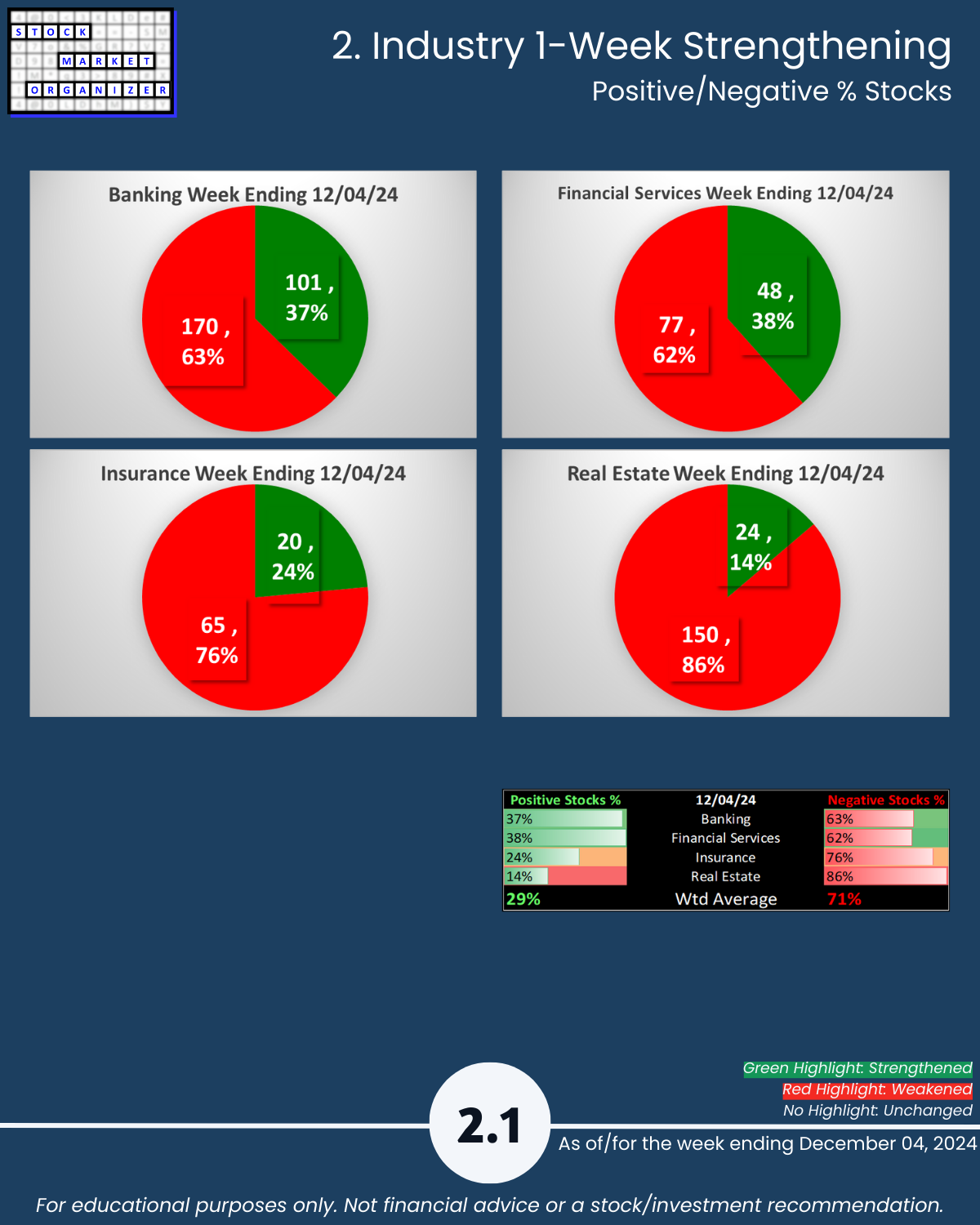

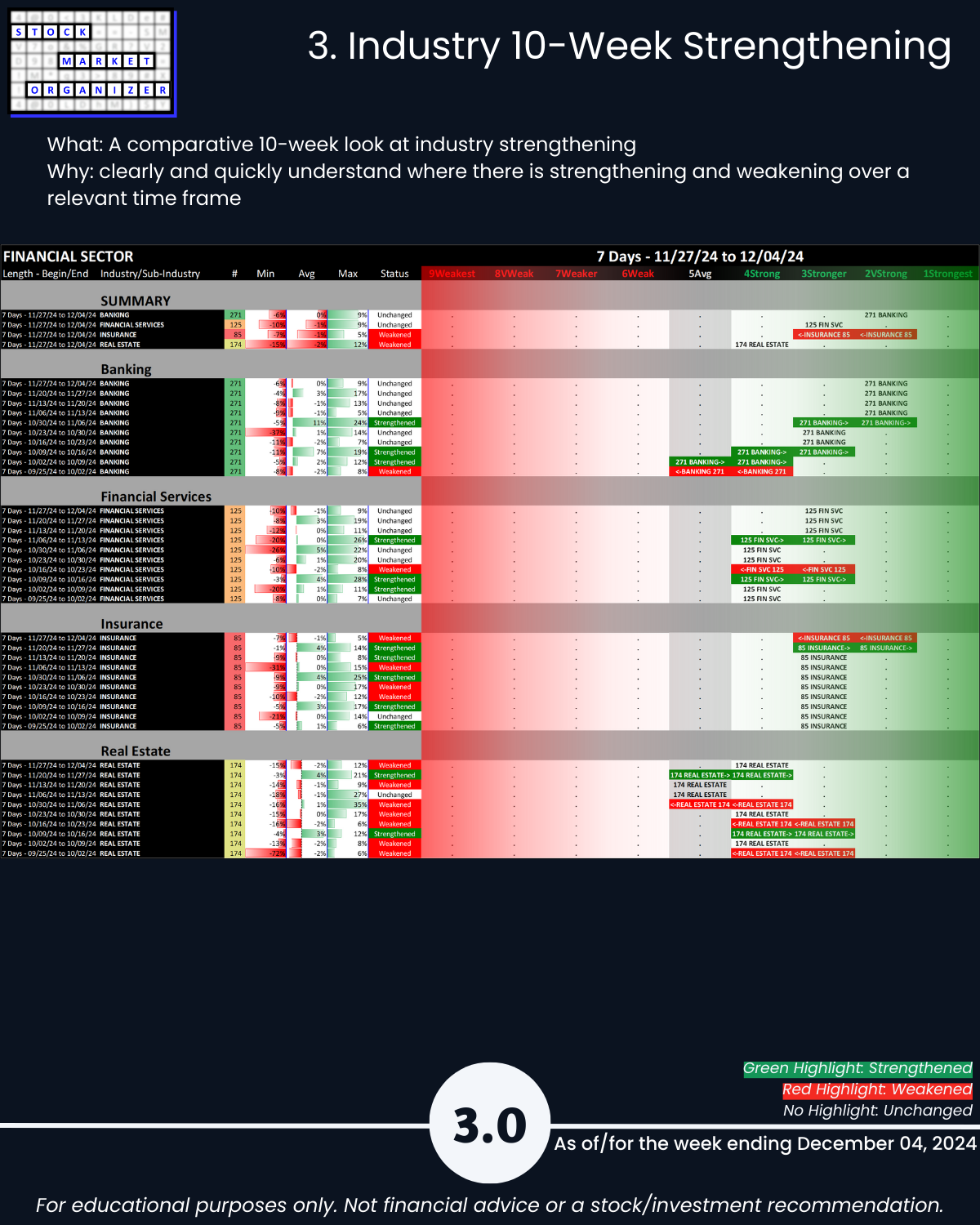

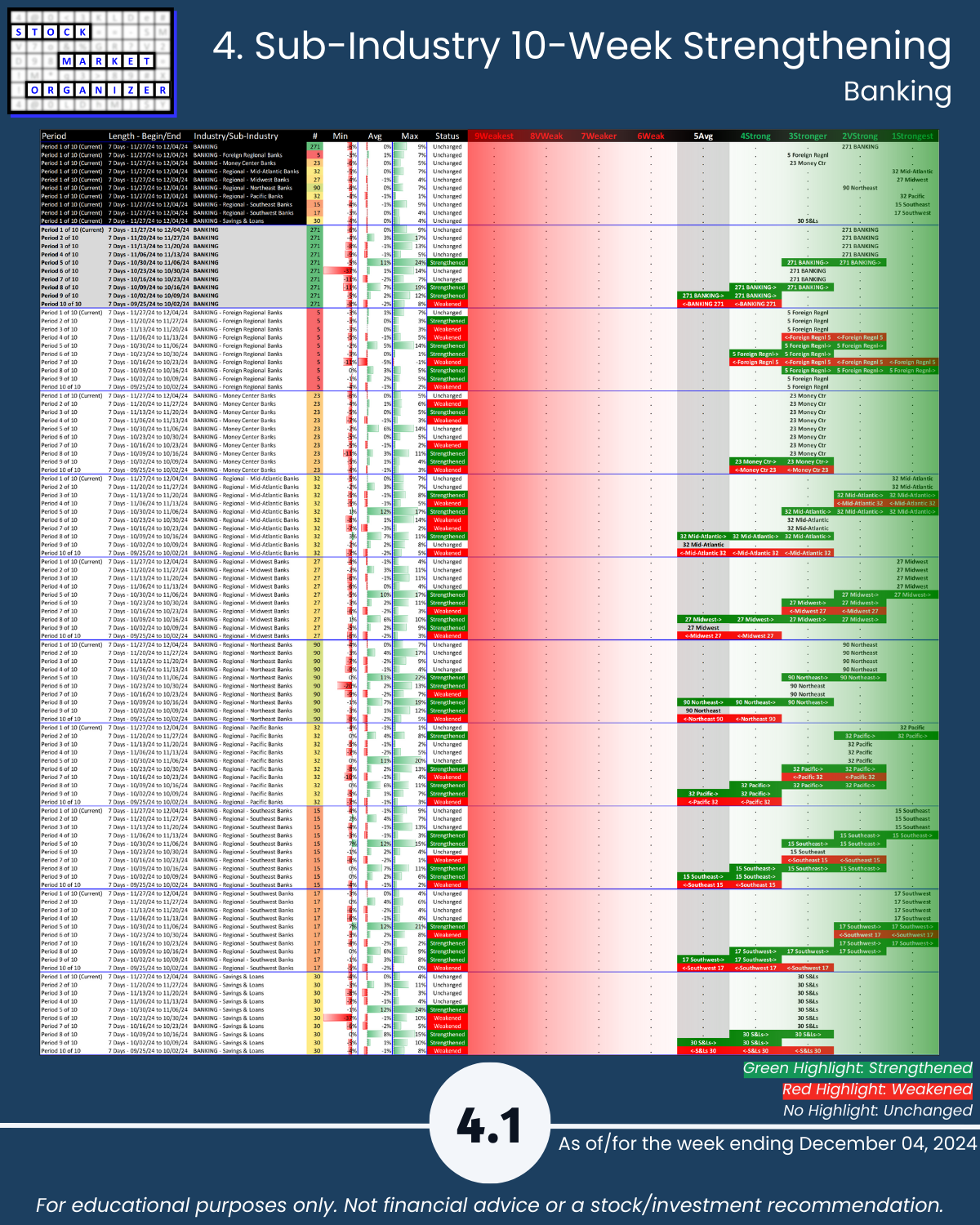

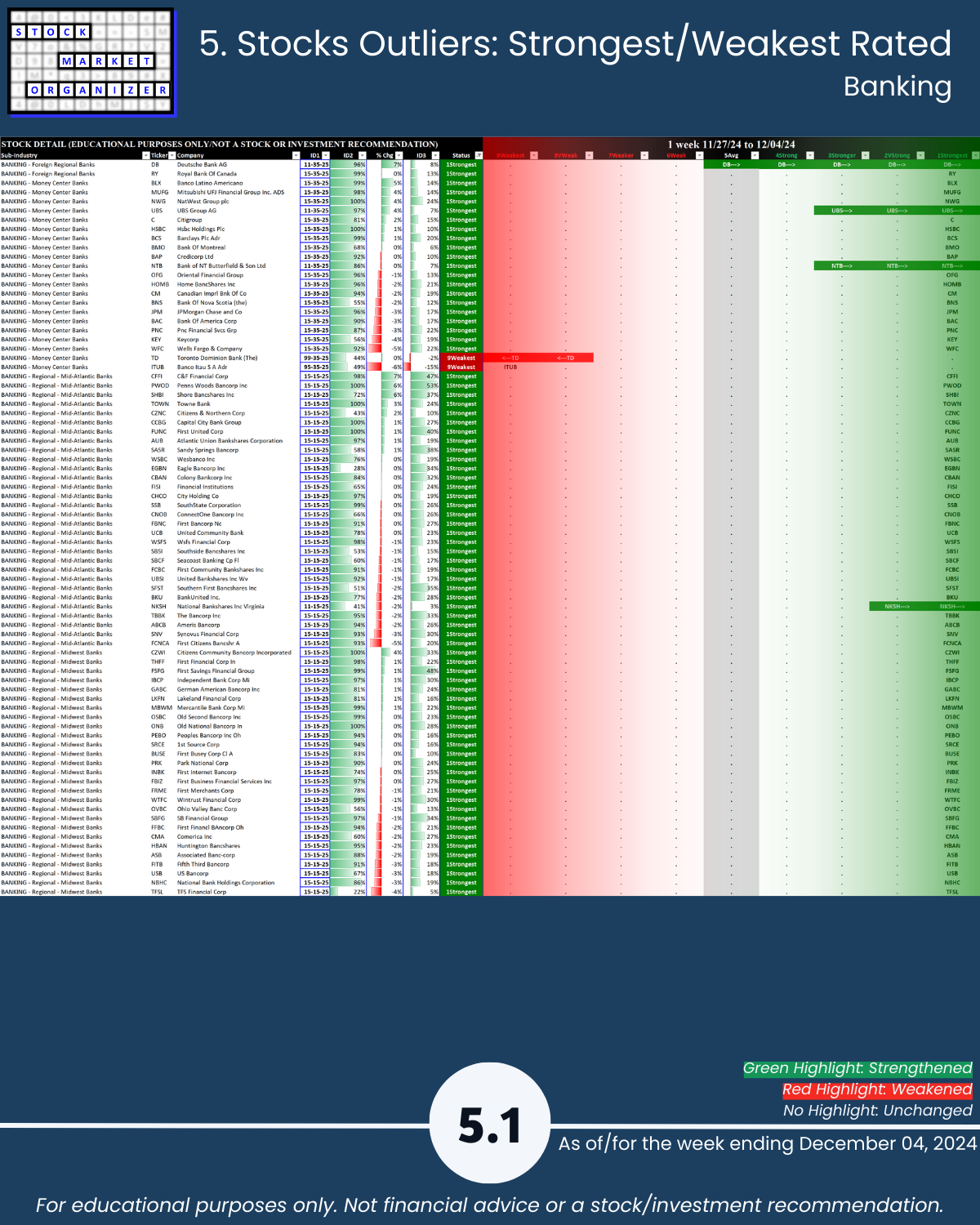

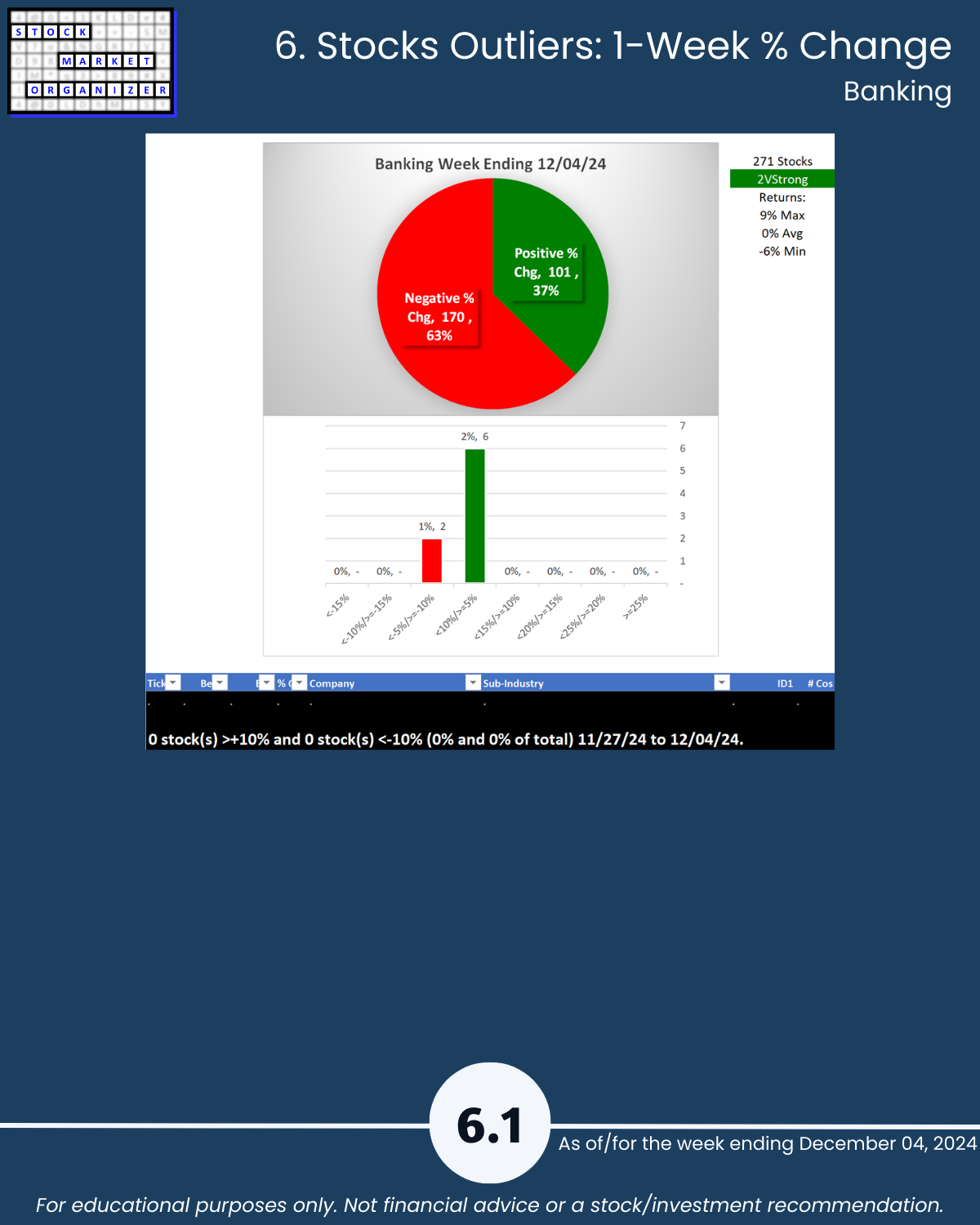

- Banking industry was unchanged while still retaining a 2VeryStrong rating = tailwind/neutral

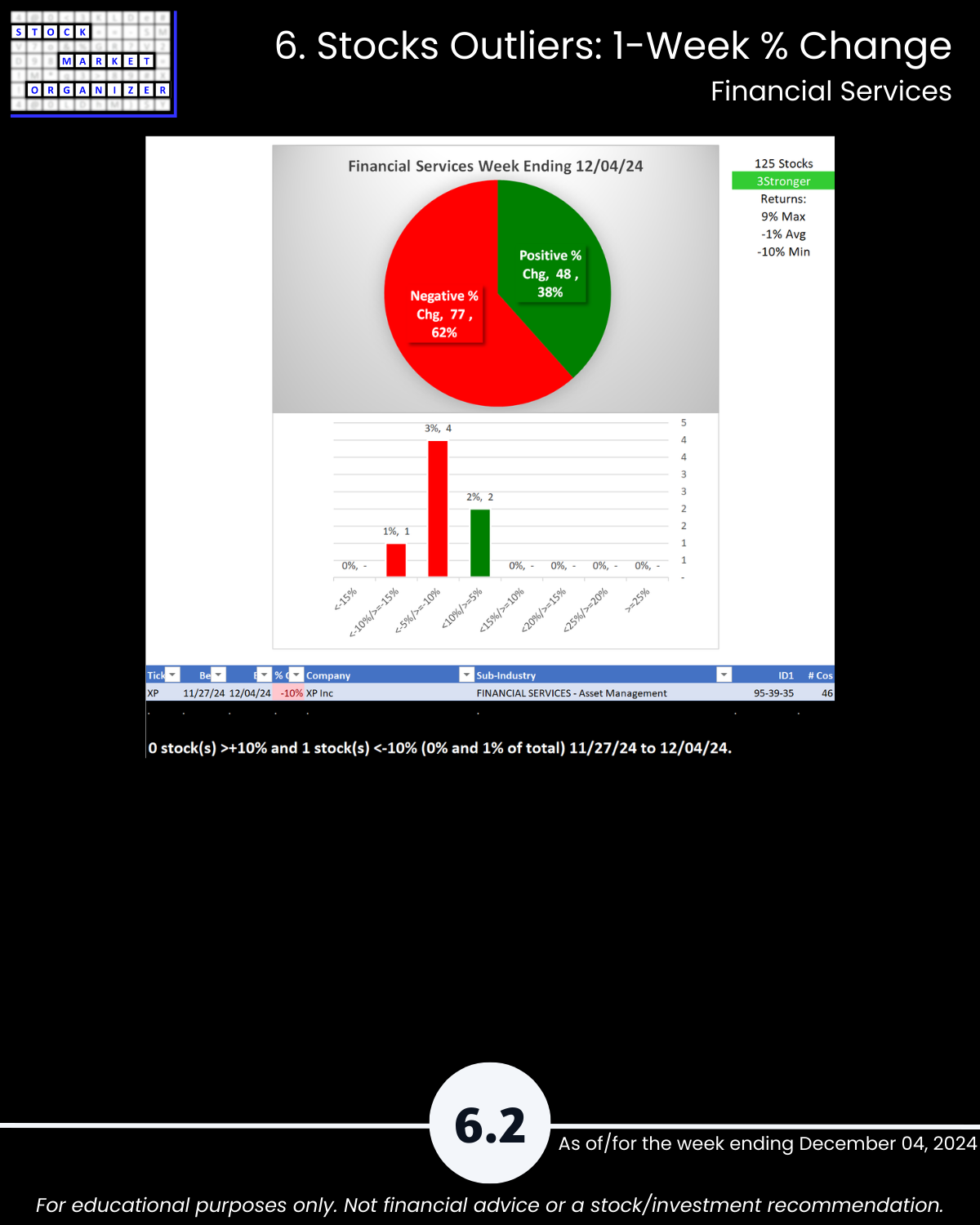

- Financial Services industry was unchanged and retained a 3Stronger rating = neutral/tailwind

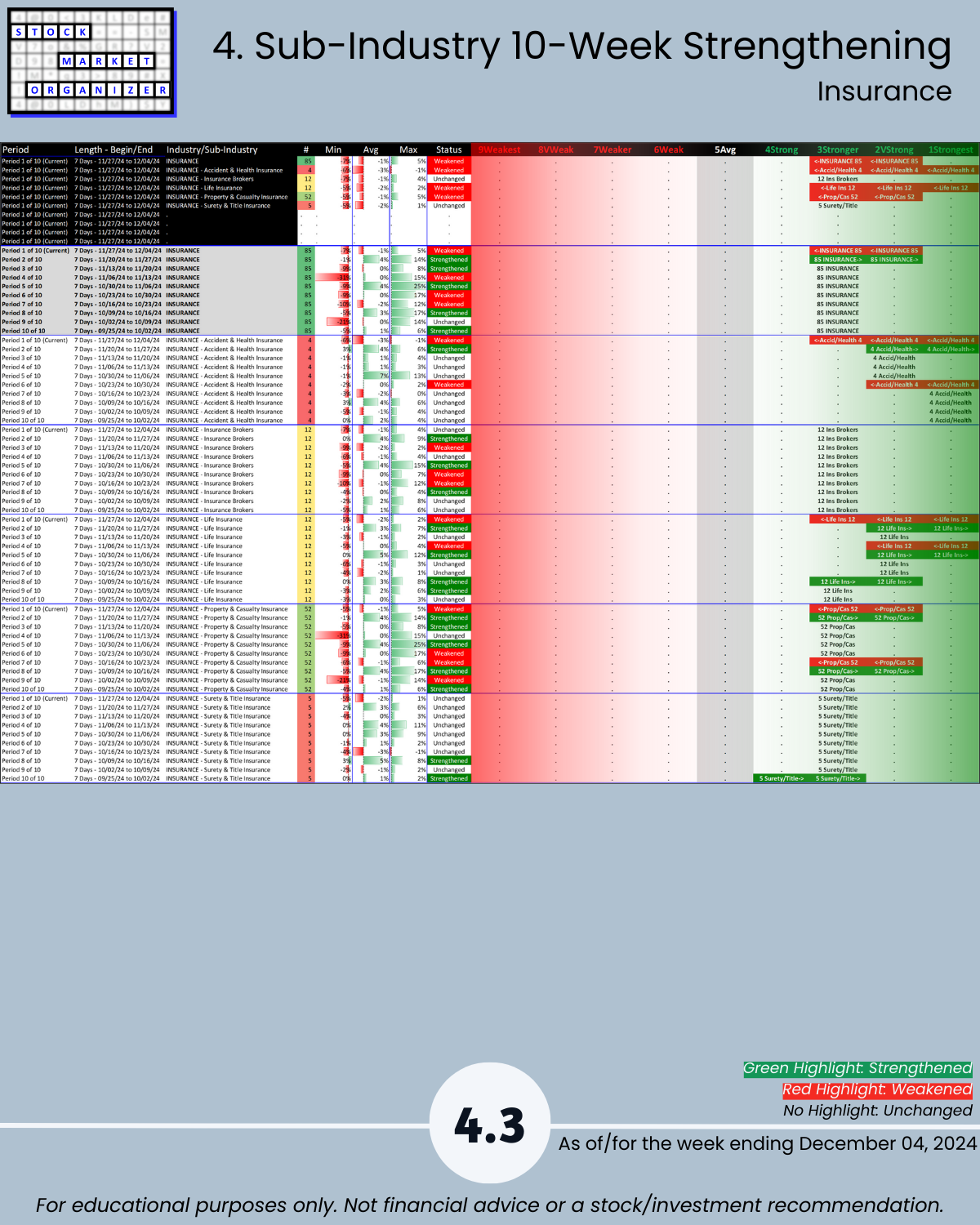

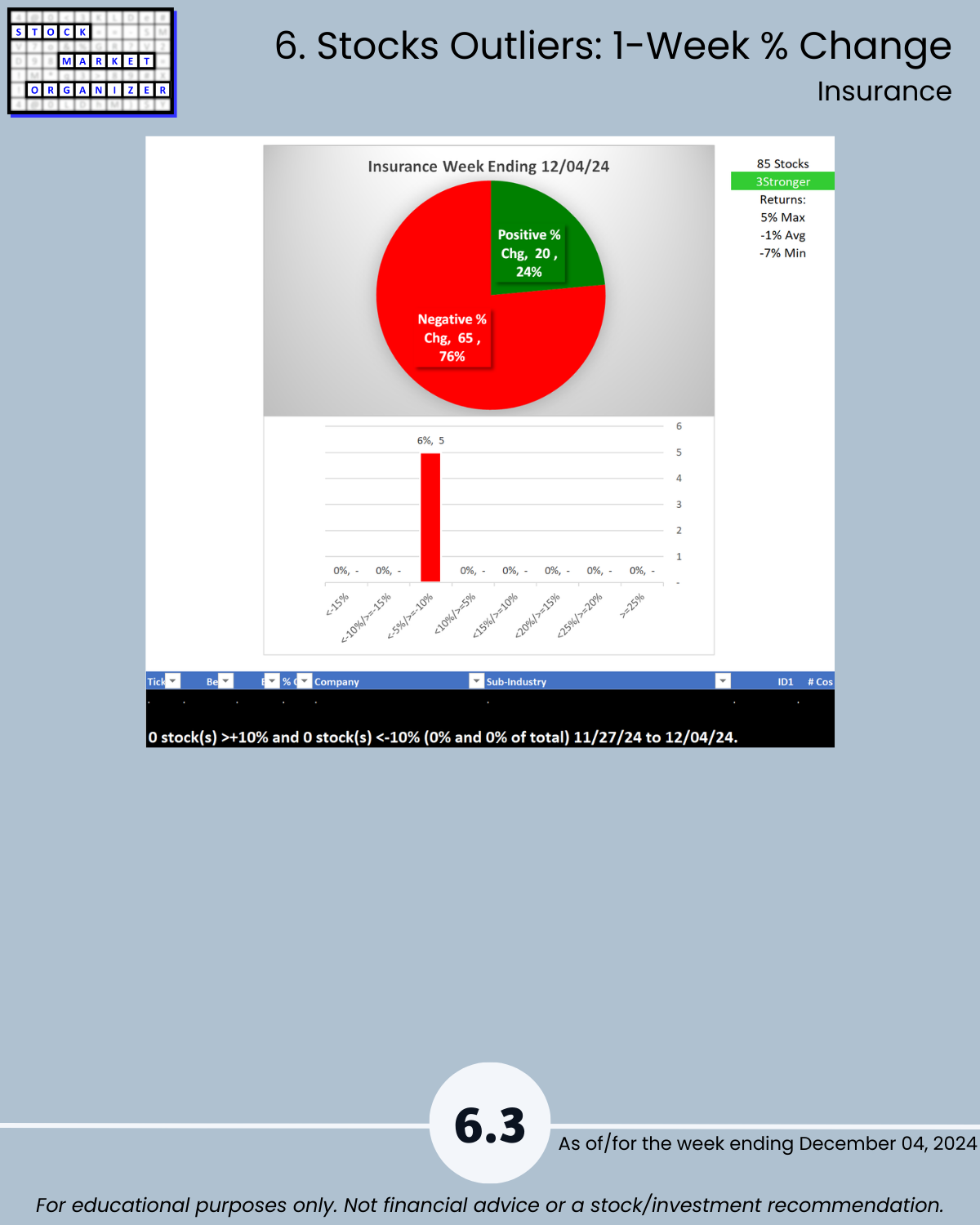

- Insurance weakened rating and now has a 3Stronger rating = headwind

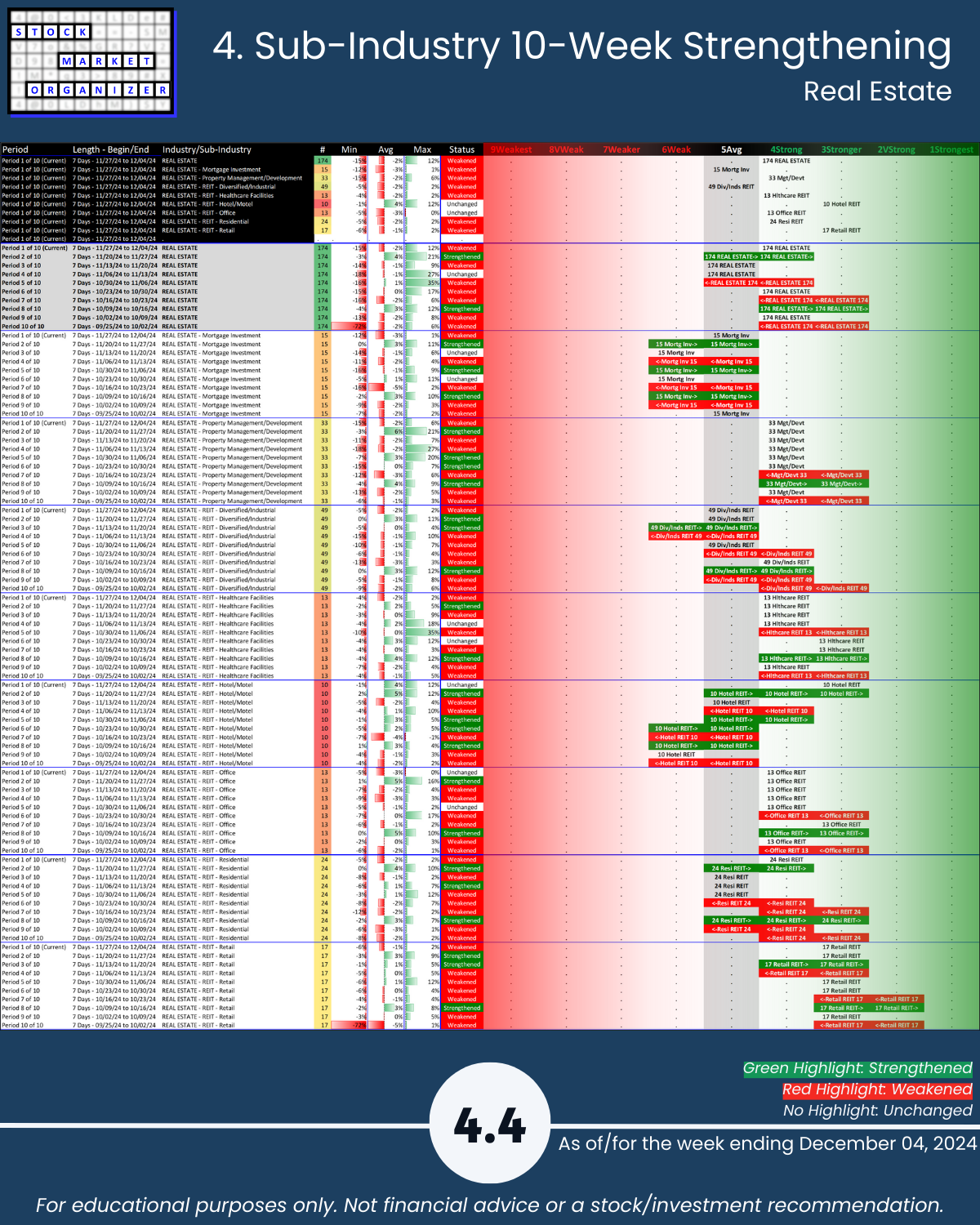

- Real Estate weakened but not enough to change rating and retains a 4Weak rating = neutral/headwind

Final Comments

There is absolutely no way of determining how long this environment will last. All one can do is find an objective way of measuring whether any given environment offers headwinds or tailwinds and then act accordingly based on these measurements.

Details are below shown in a manner not available elsewhere because I created it from scratch to continually answer this question: “Where is there strengthening and weakening in the market at the stock, sub-industry, industry, and sector levels?” Combine this with the top-down Market Strength Score and Sector Risk Gauge to get a key competitive advantage of understanding strength at every level.

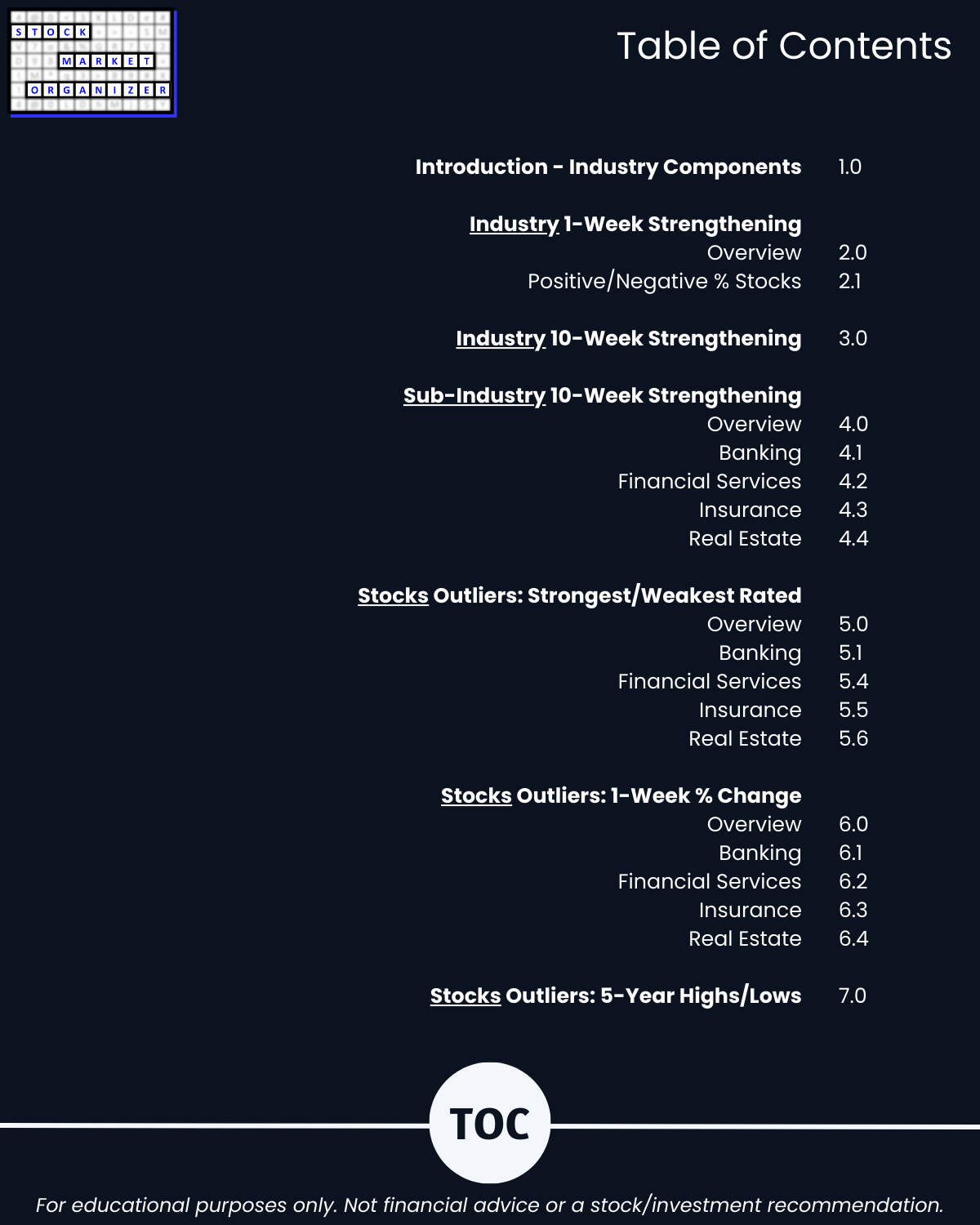

1. Introduction

2. Industry 1-Week Strengthening

3. Industry 10-Week Strengthening

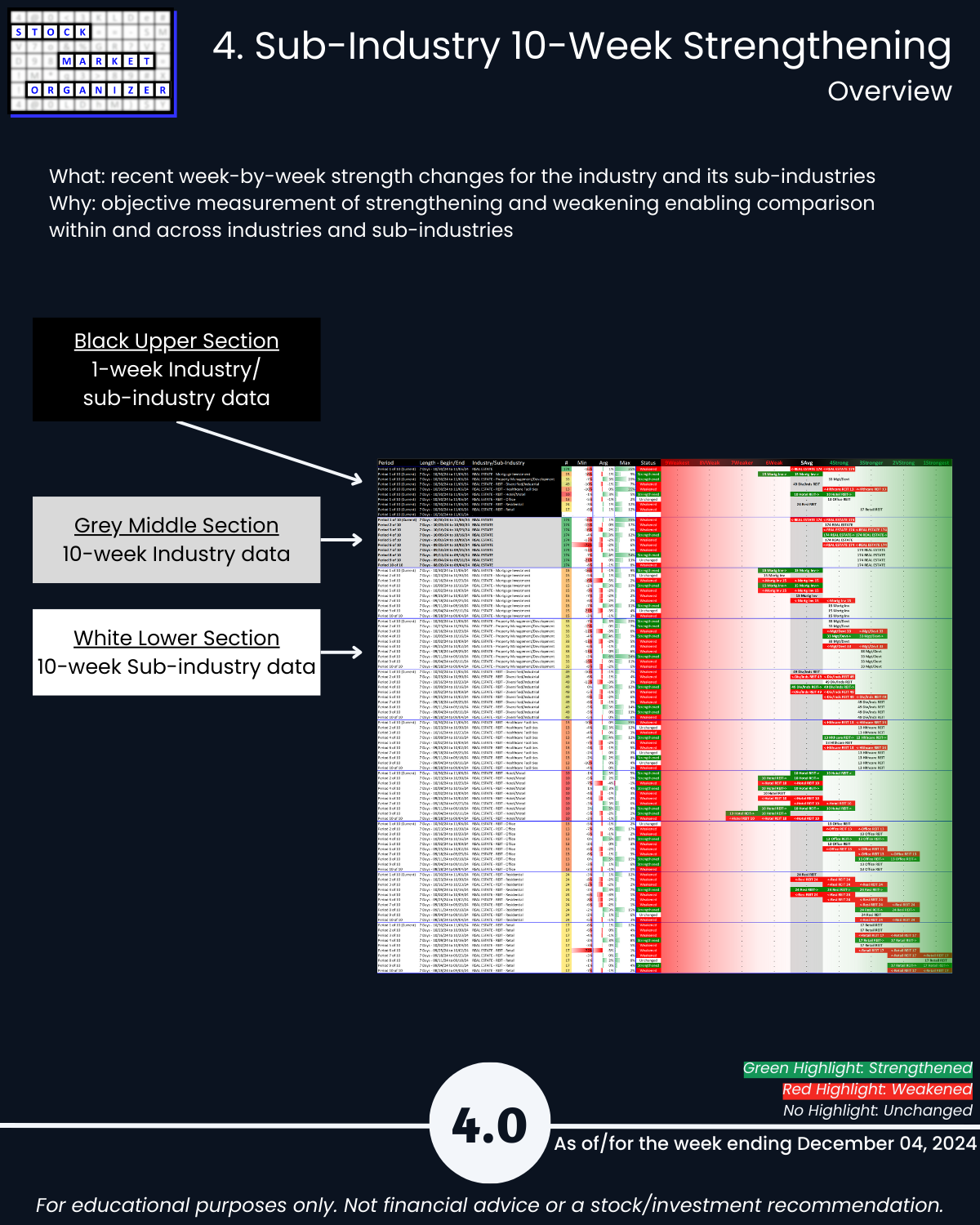

4. Sub-Industry 10-Week Strengthening

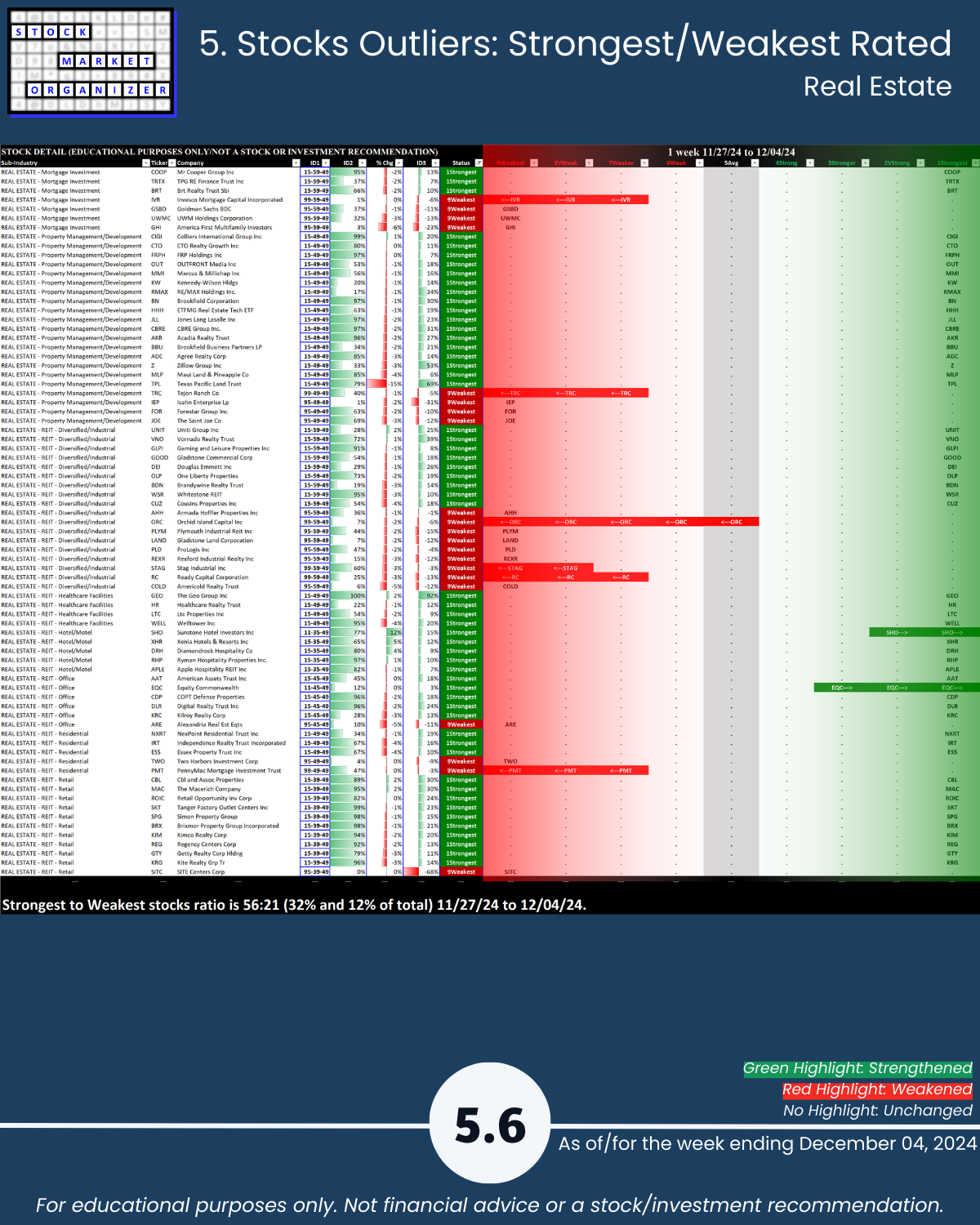

5. Stocks Outliers: Strongest/Weakest Rated

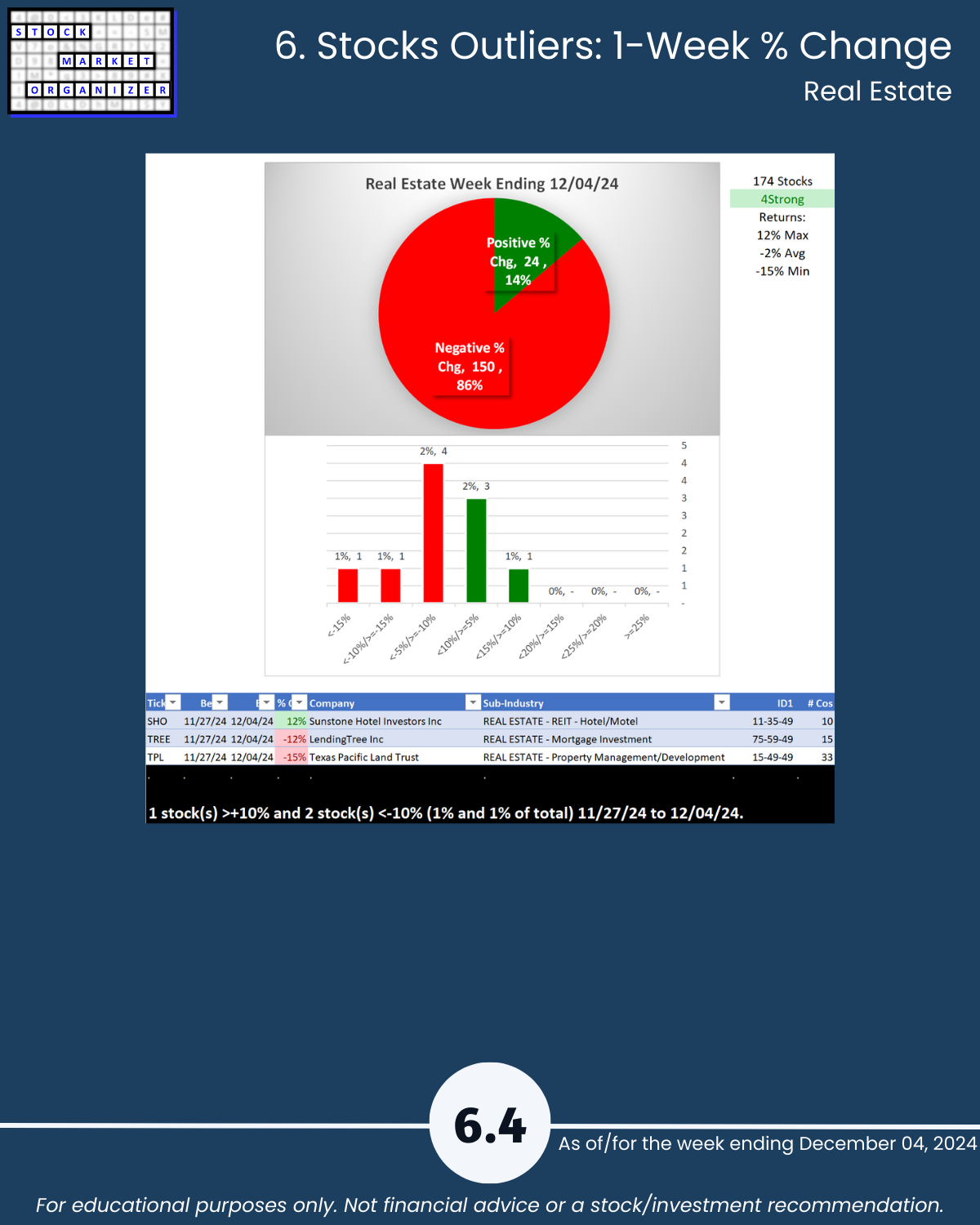

6. Stocks Outliers: 1-Week % Change

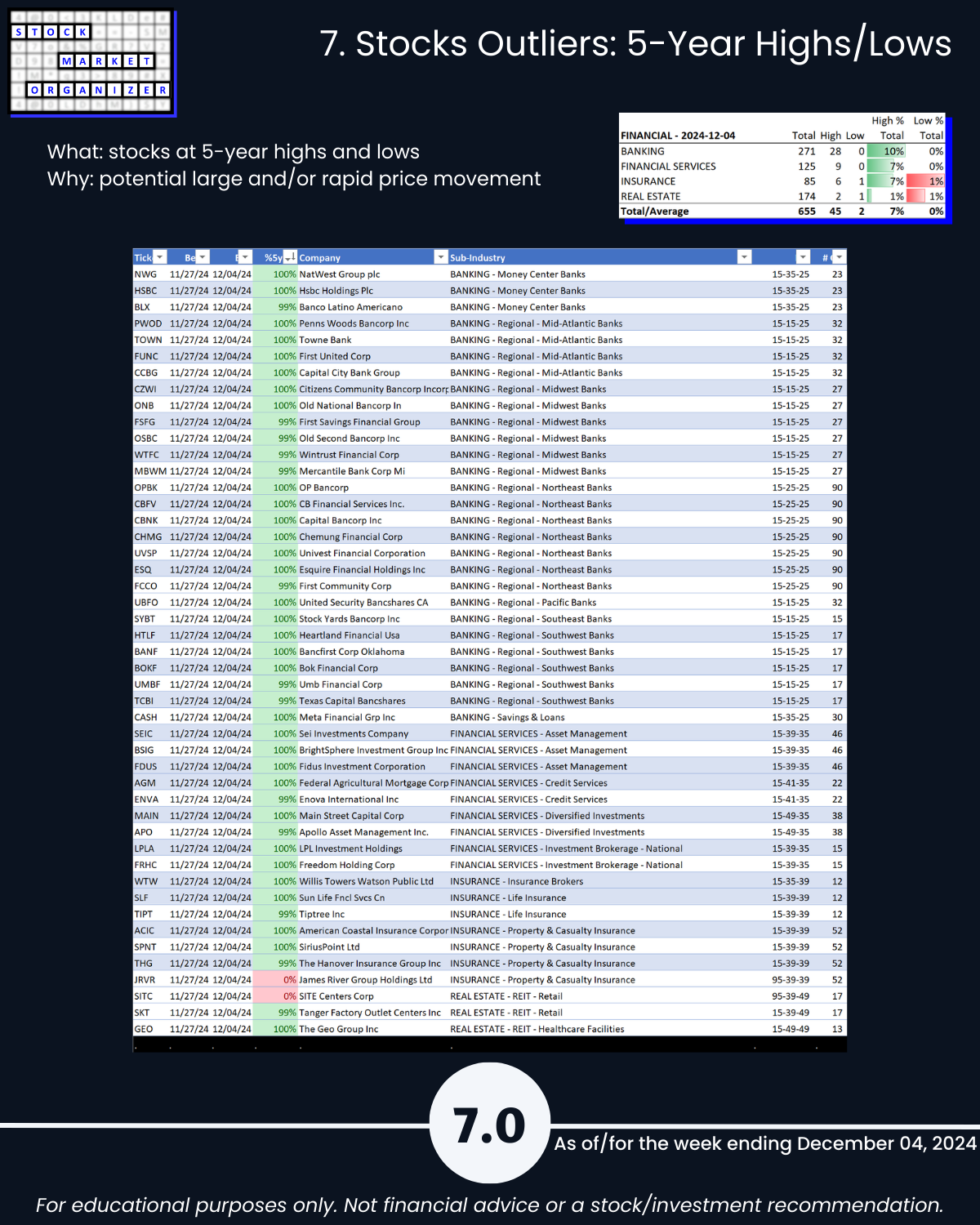

7. Stocks Outliers: 5-Year Highs/Lows

This section shows the strongest of the strong and the weakest of the weak, hitting 5-year highs and lows, respectively. The strongest are the leaders of the market that is hitting new highs. Meanwhile, there appears to be no rational reason to hold weak stocks that are at multi-year lows despite massive market tailwinds.