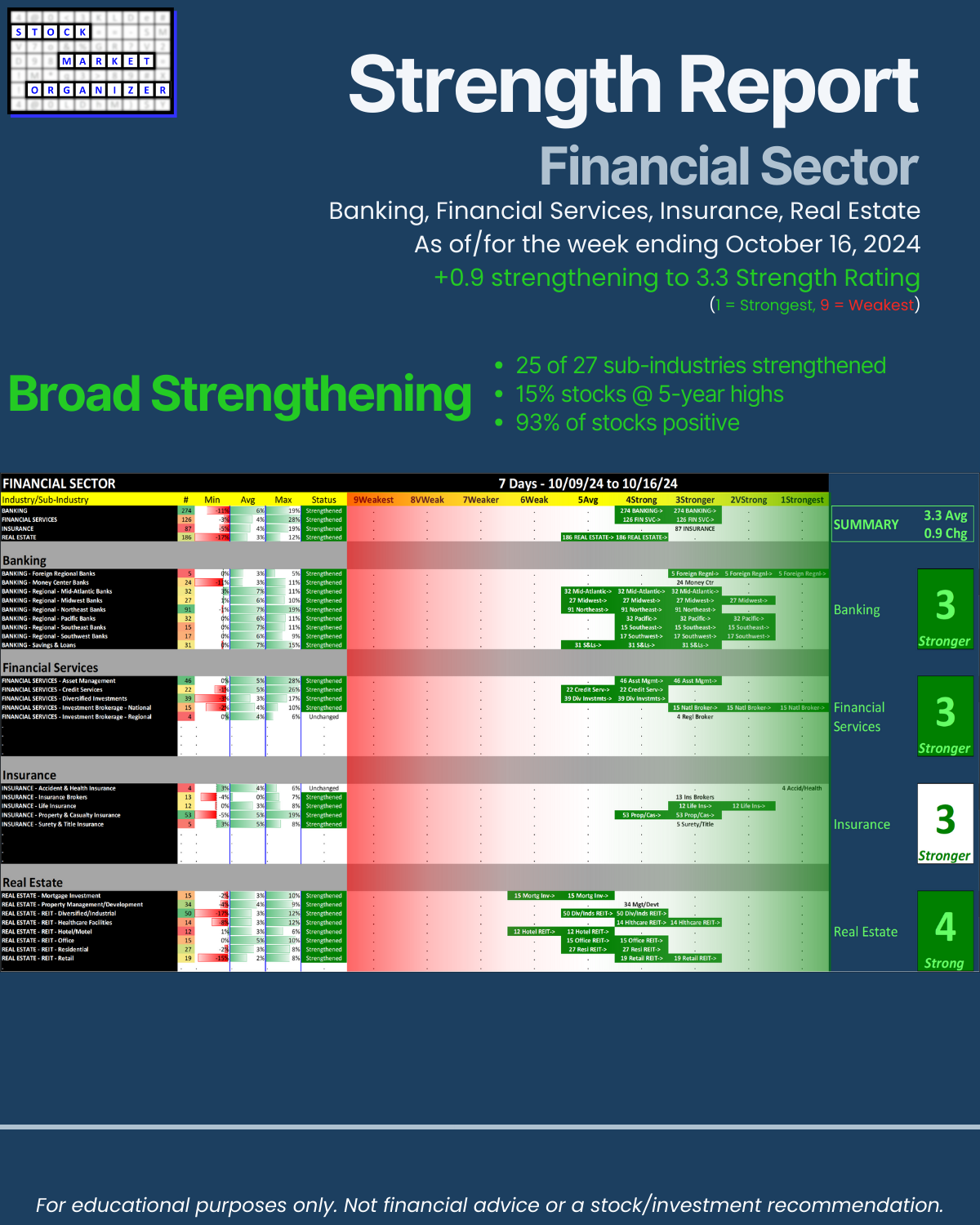

SMO Exclusive: Strength Report Financial Sector 2024-10-16

Broad Strengthening in Banking, Financial Services, Insurance, and Real Estate:

- 25 of 27 sub-industries strengthened

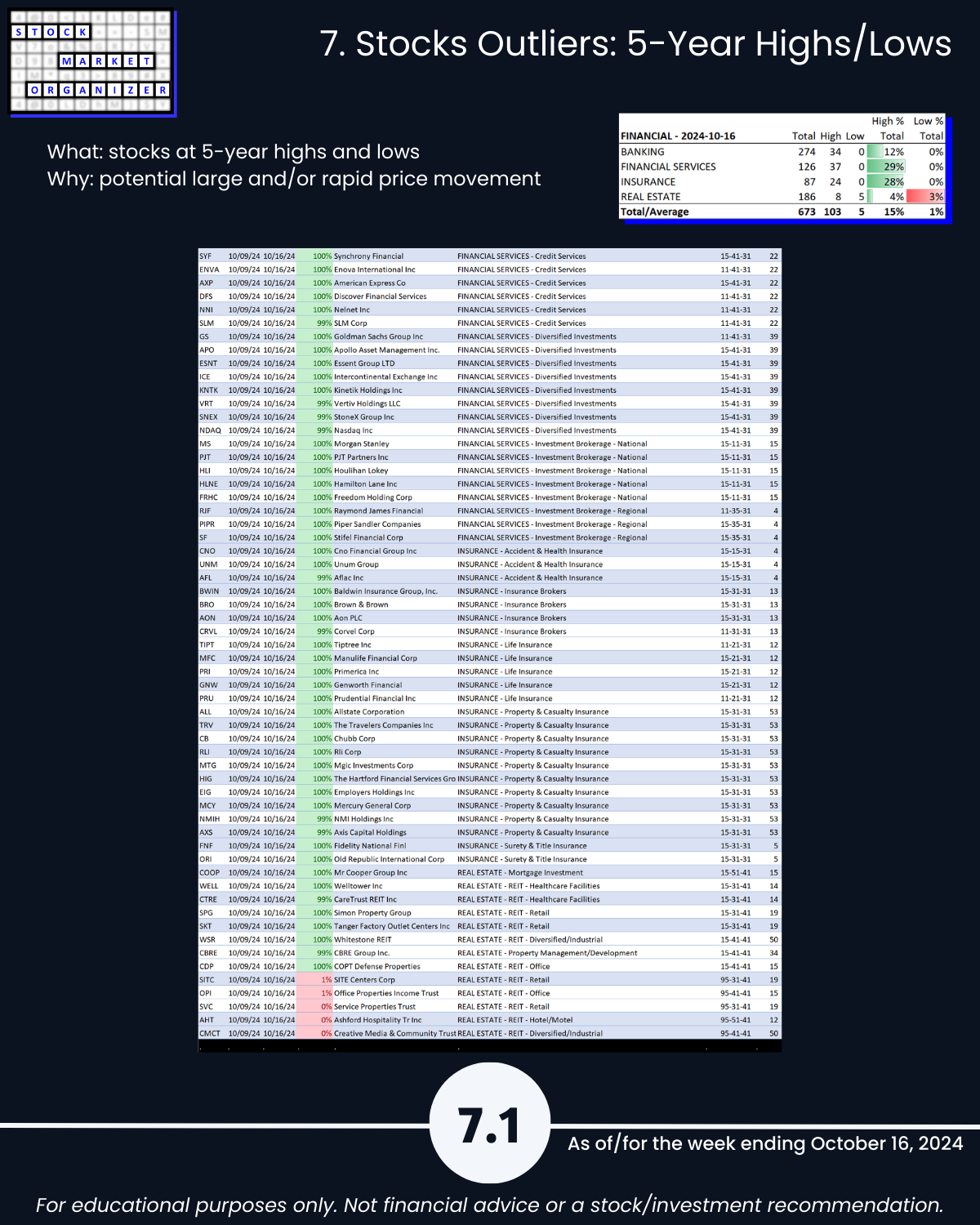

- 15% of sector stocks are at 5-year highs

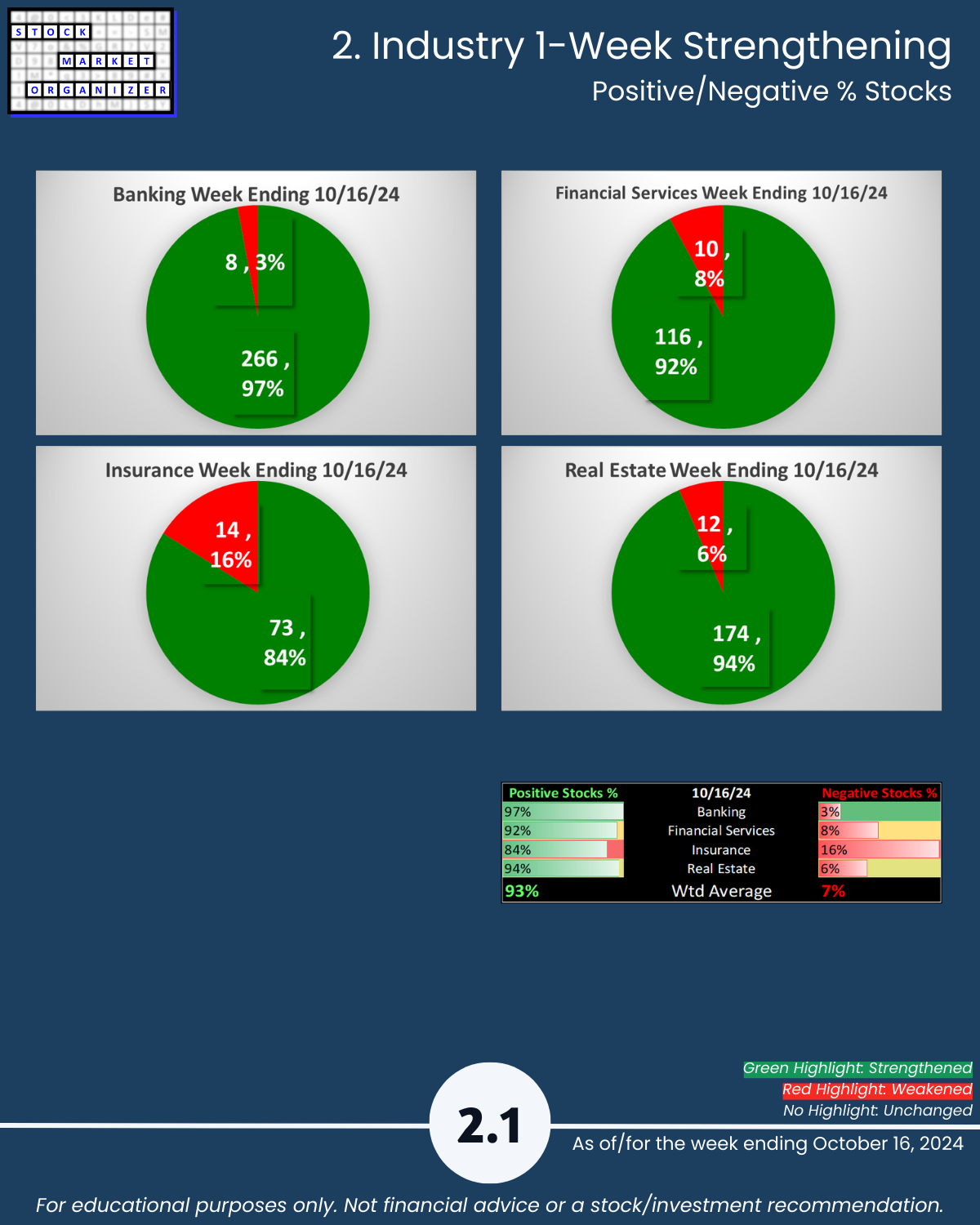

- 93% of stocks were positive

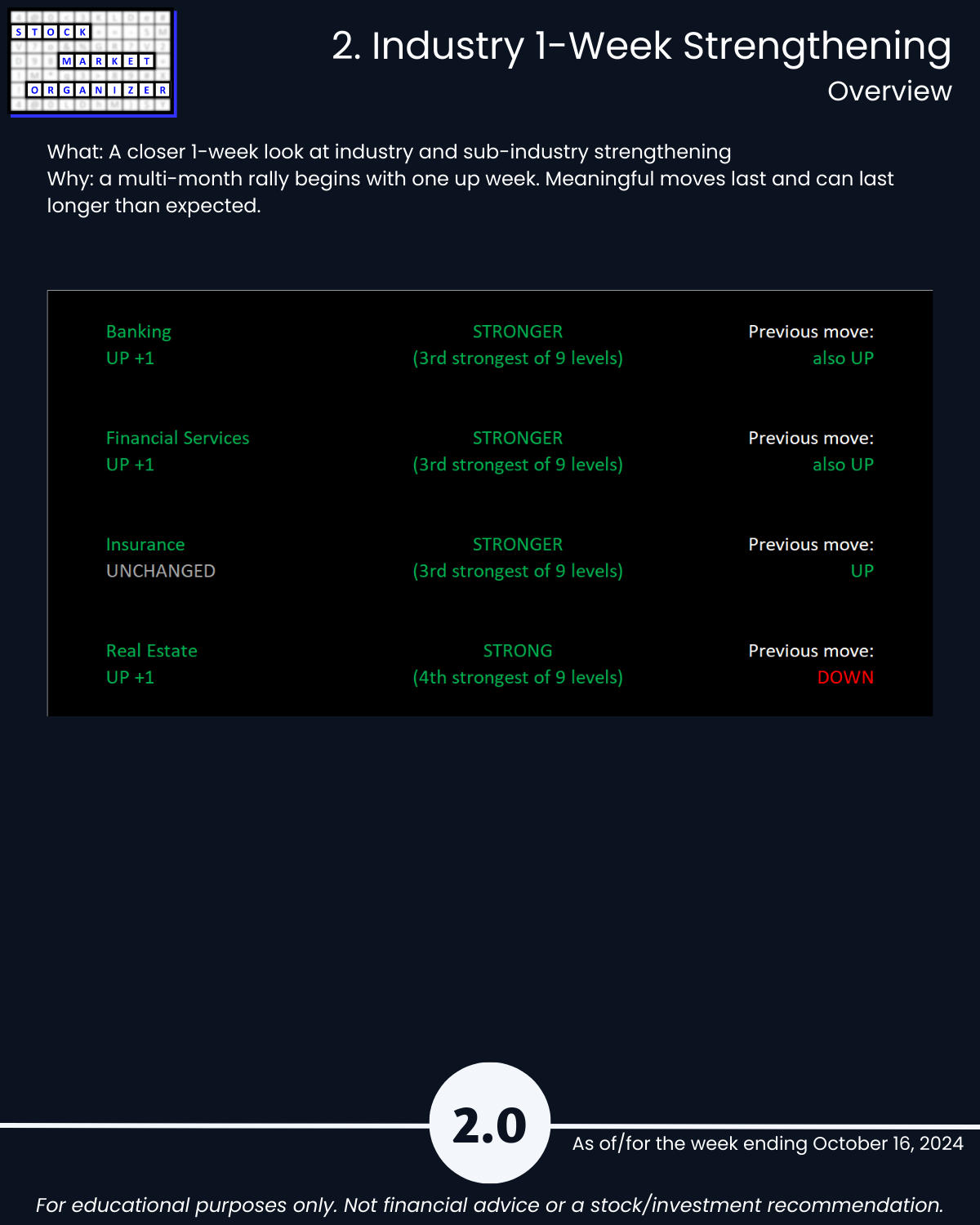

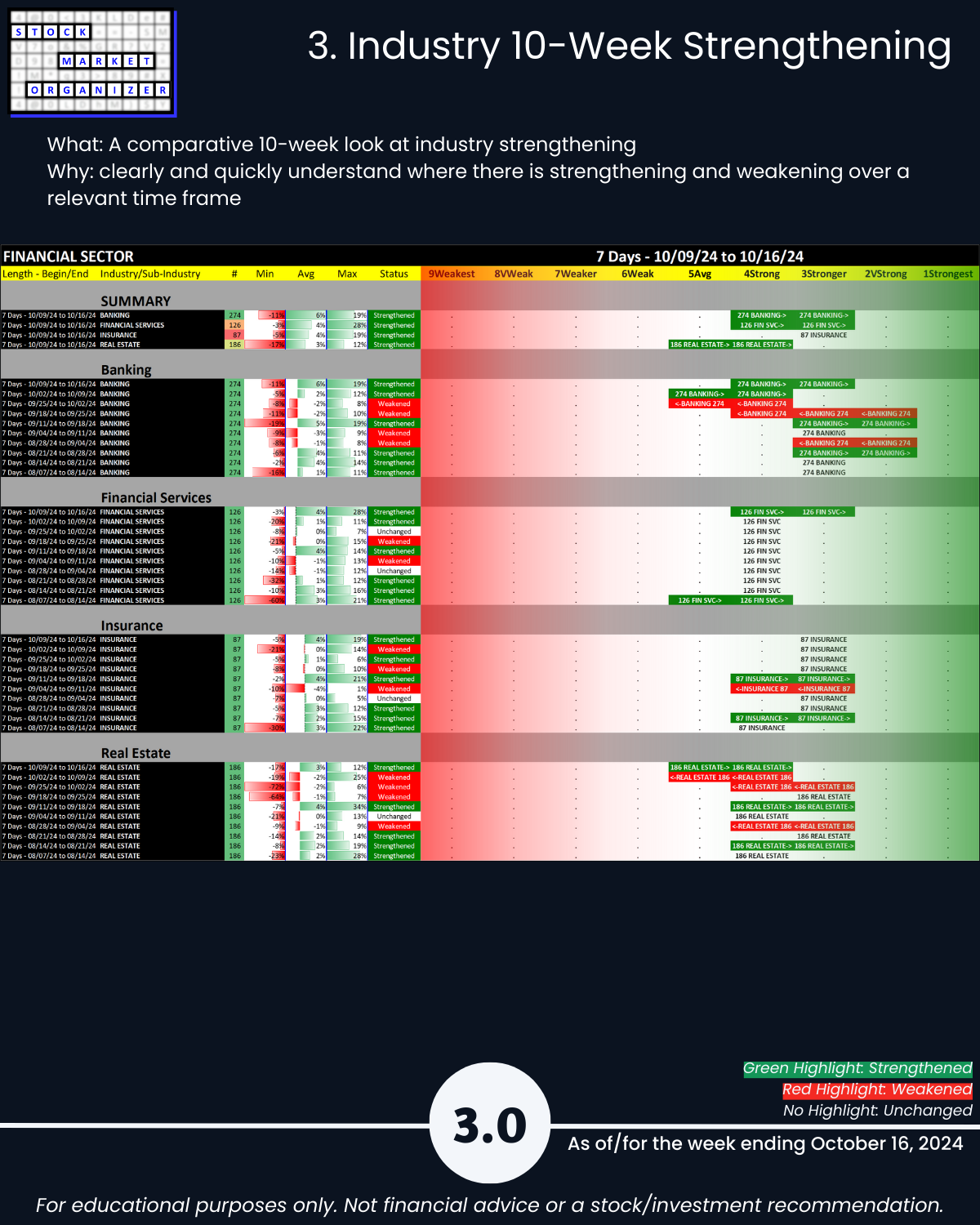

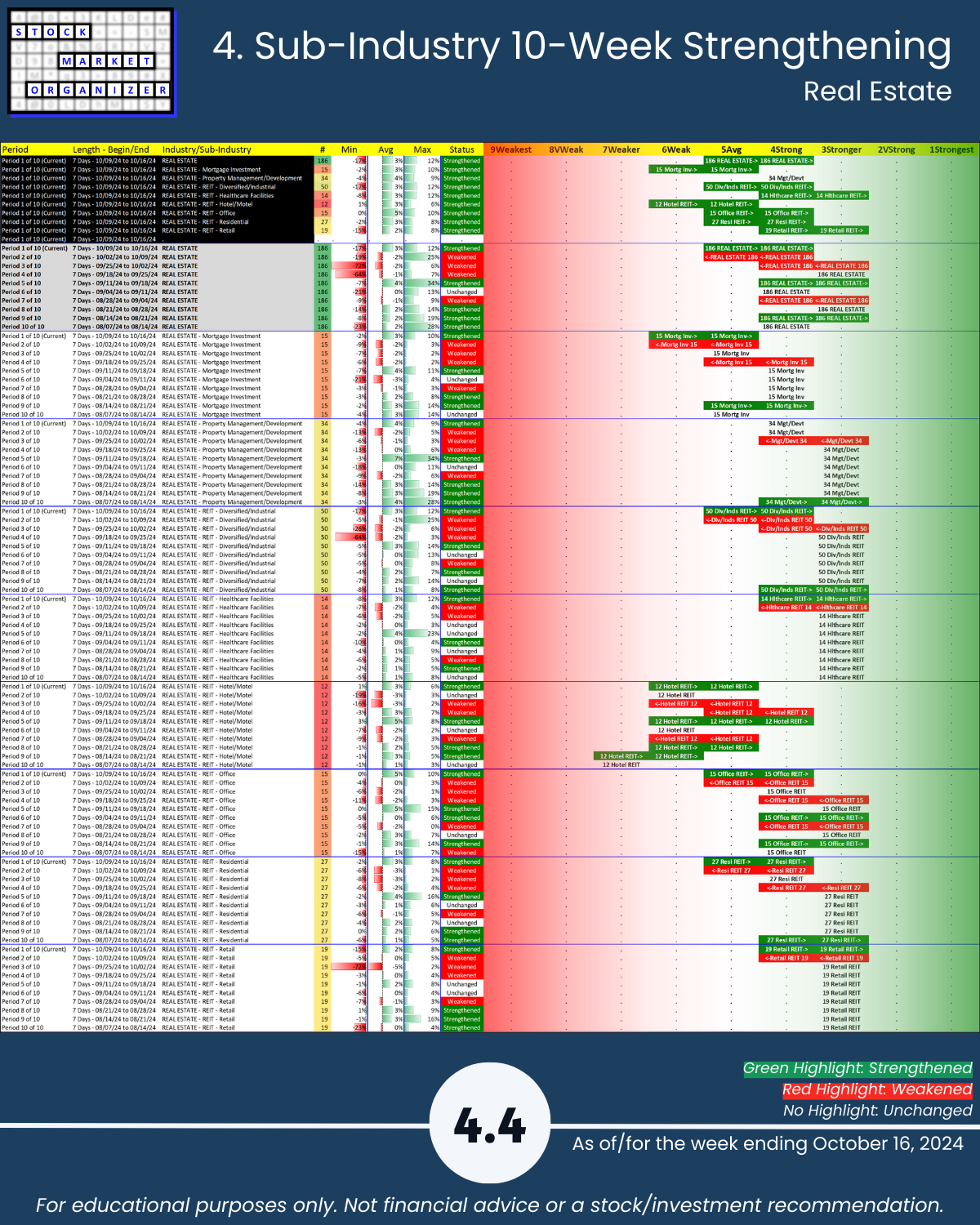

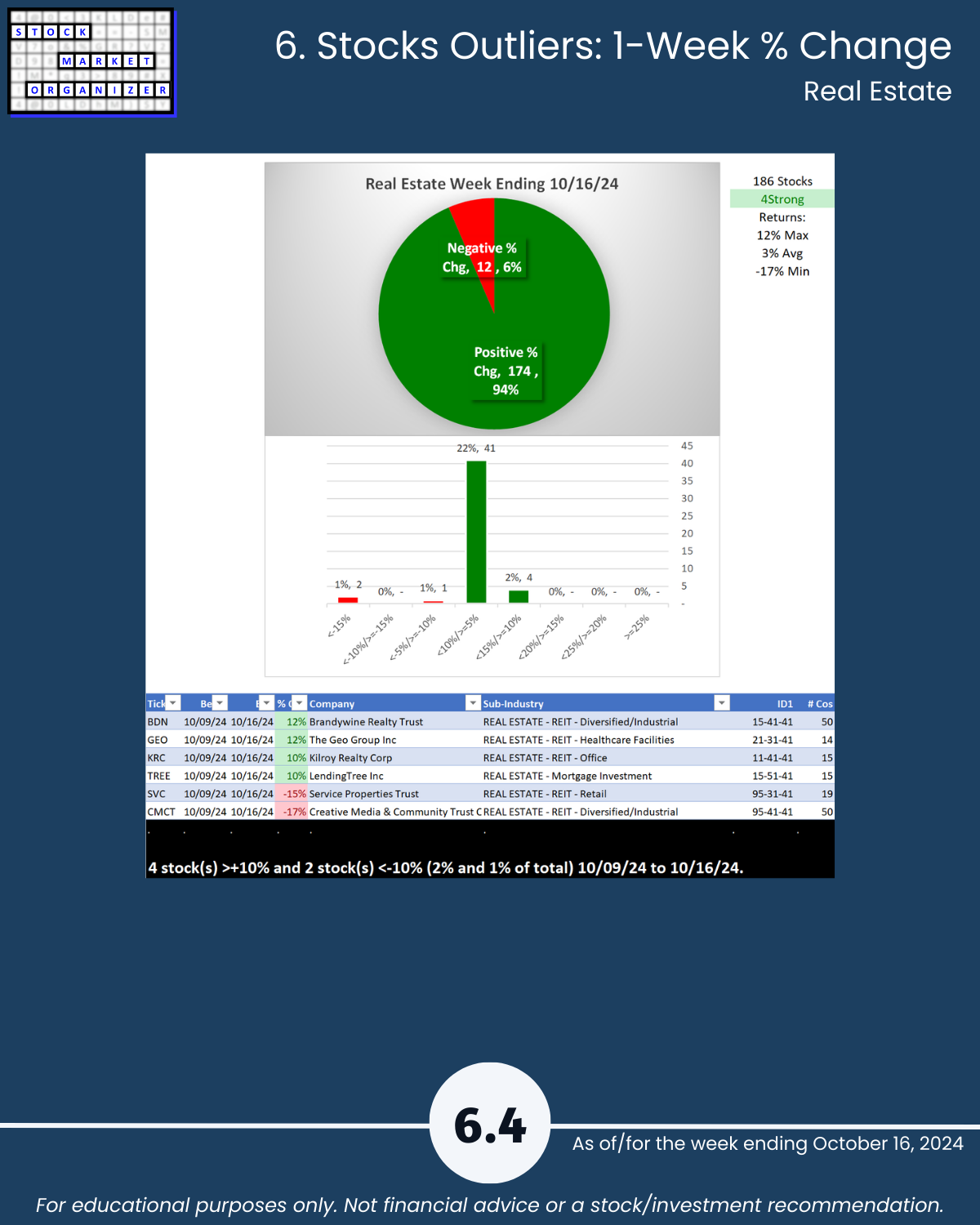

For the week ending Wednesday, October 16, 2024, three of four industries strengthened and this sector is crushing it. Real Estate bounced back - as of the end of last week (October 9), Real Estate for the first time in 10 weeks weakened below 4Strong, to a new recent low of 5Average. This week, the Real Estate industry strengthened to 4Strong again powered by all eight sub-industries strengthening (seven enough to increase one strength rating each).

Difference This vs. ETFs Analysis

Note this analysis is the same as that used for the SPDR ETFs but the two main differences are

1. Universe of stocks. The ETFs are the largest capitalization stocks, 500 of them in the 11 sector ETFs. In this analysis, there are approximately 2,700 stocks.

2. Sub-categorization below the market level. The ETF analysis with 500 stocks is limited to sector strengthening and weakening. This analysis with +/-2,700 stocks can be and is segregated into 29 industry groups and in turn 189 sub-industry groups.

There is a Financials ETF (symbol XLF) which is separate from the Real Estate ETF (symbol XLRE). The Financials sector in this analysis includes Real Estate with Banking, Financial Services, and Insurance.

Per yesterday's ETF strength analysis, XLF/Financials is rated 2VeryStrong and XLRE/Real Estate is rated 3Stronger. This week's broad strengthening confirms that all sizes of financials stocks are participating.

How would I use this information?

The Market Strength Score is now positive and the Financial Sector is strong and strengthening both here and in the two relevant sector ETFs (XLF/Financials and XLRE/Real Estate). Considering shorting? I would not. I'd find strong candidates and go long the ones that fit your selection criteria knowing that the market and sector forces are at your back.

There is absolutely no way of determining how long this environment will last. All one can do is find an objective way of measuring whether any given environment offers headwinds or tailwinds and then act accordingly based on these measurements.

Details are below shown in a manner not available elsewhere because I created it from scratch to continually answer this question: “Where is there strengthening and weakening in the market at the stock, sub-industry, industry, and sector levels?” Combine this with the top-down Market Strength Score and Sector Risk Gauge to get a key competitive advantage of understanding strength at every level.

1. Introduction

2. Industry 1-Week Strengthening

3. Industry 10-Week Strengthening

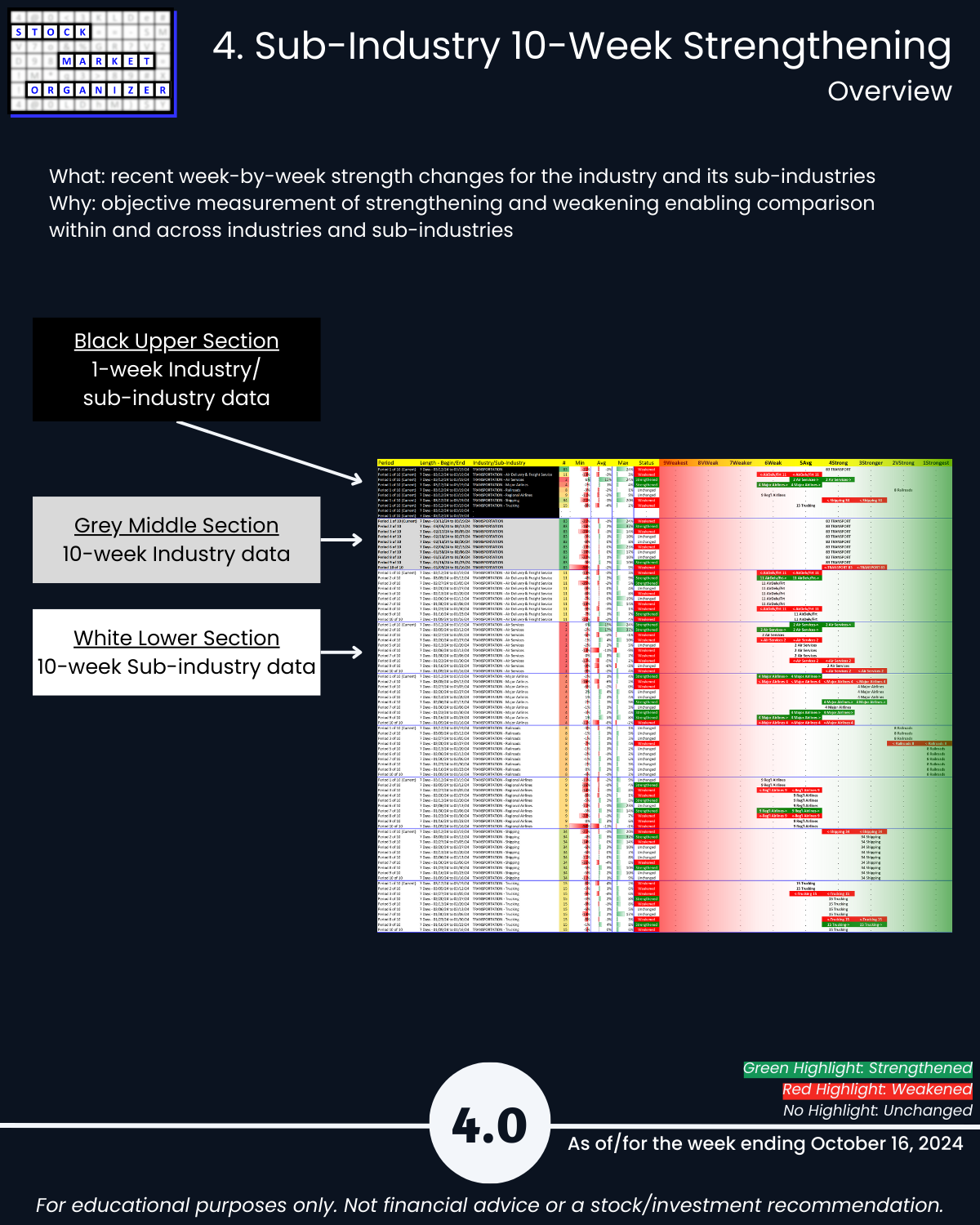

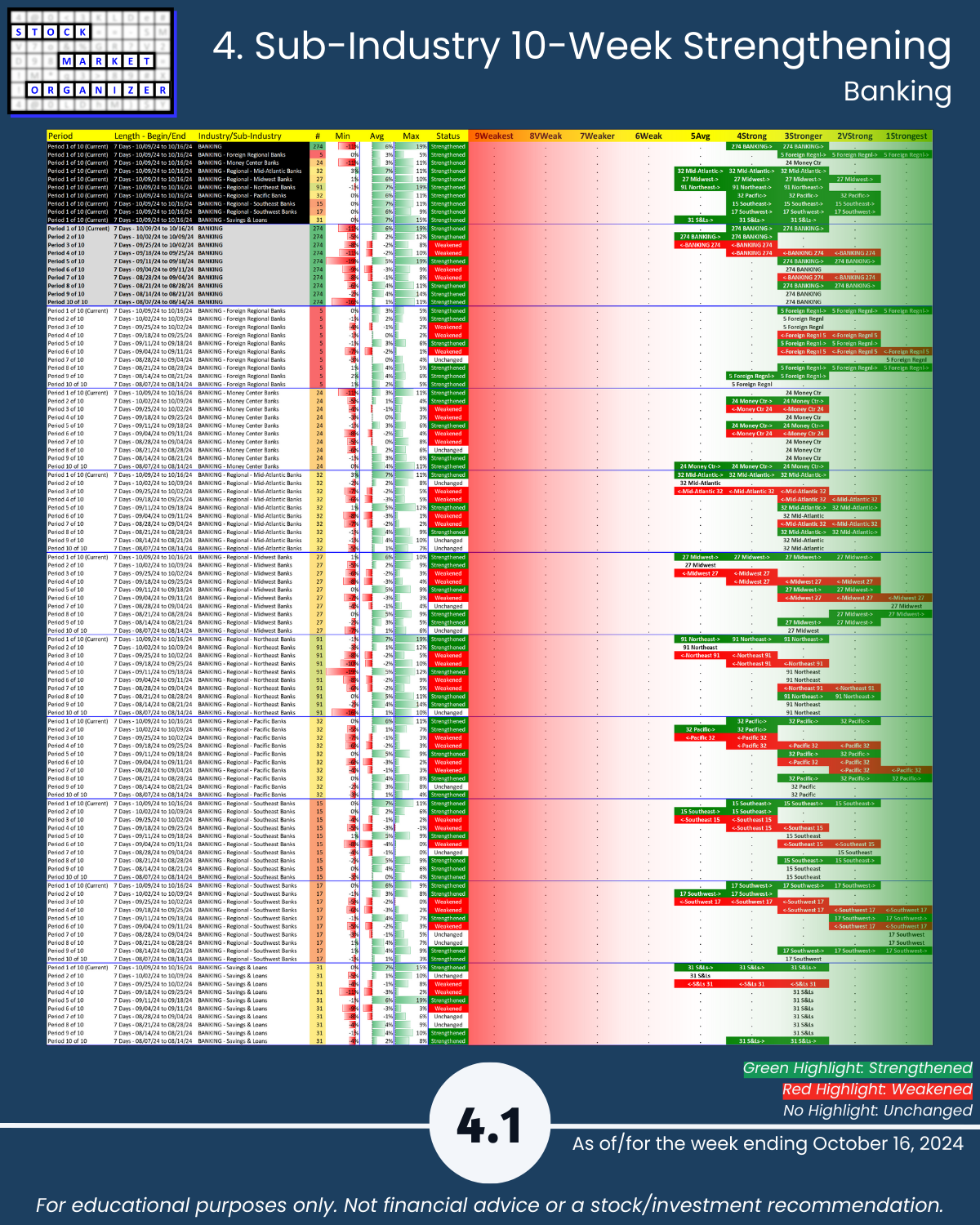

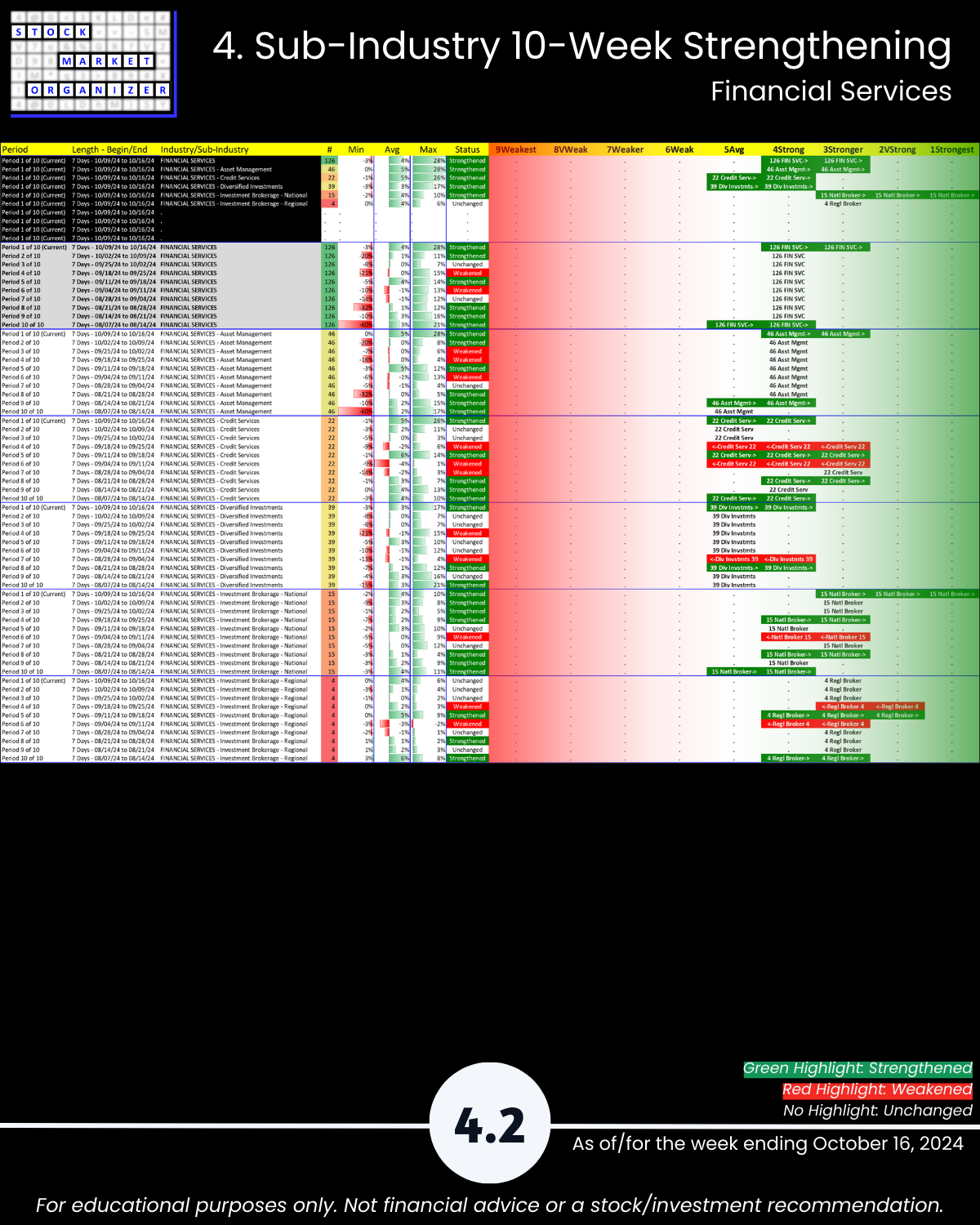

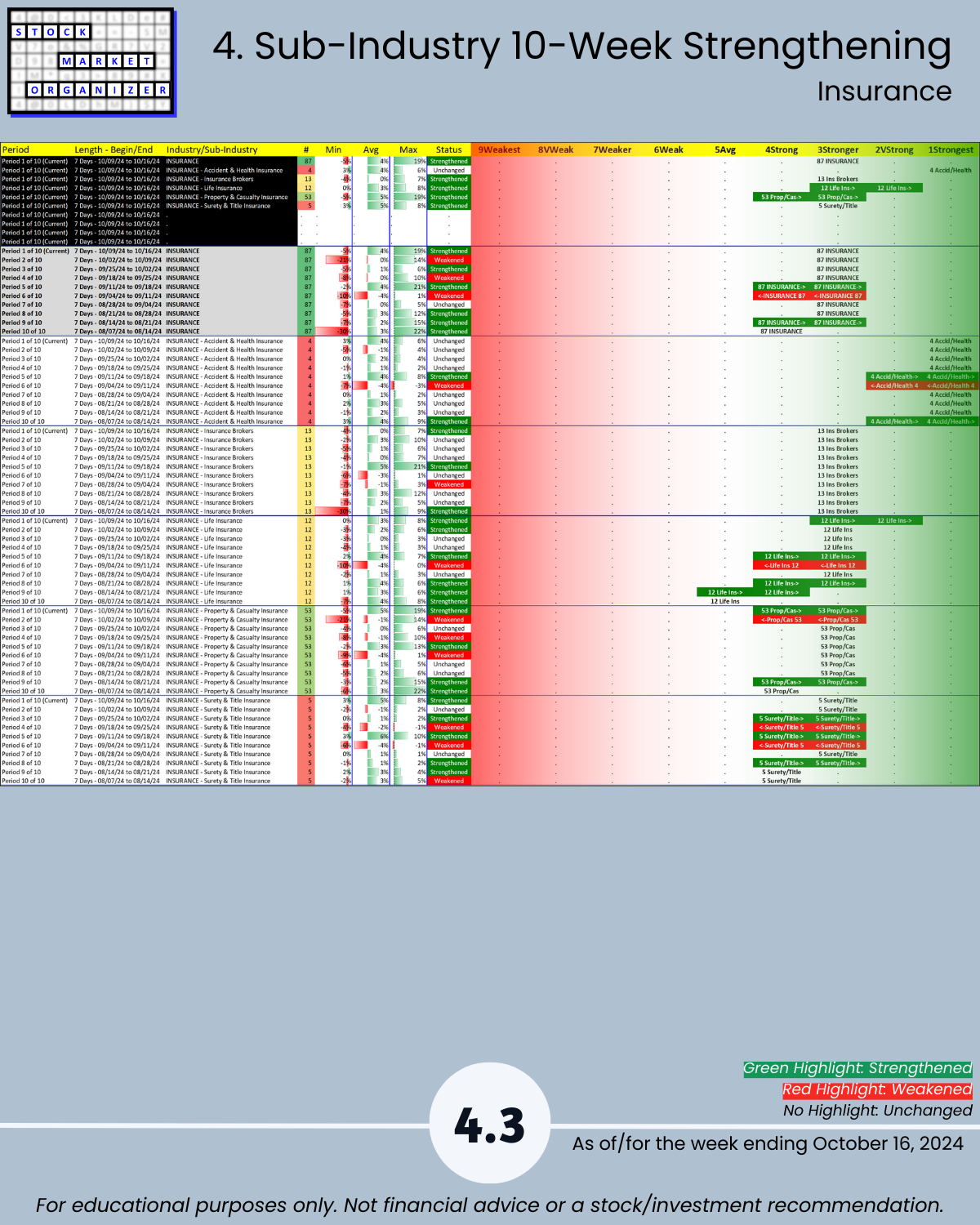

4. Sub-Industry 10-Week Strengthening

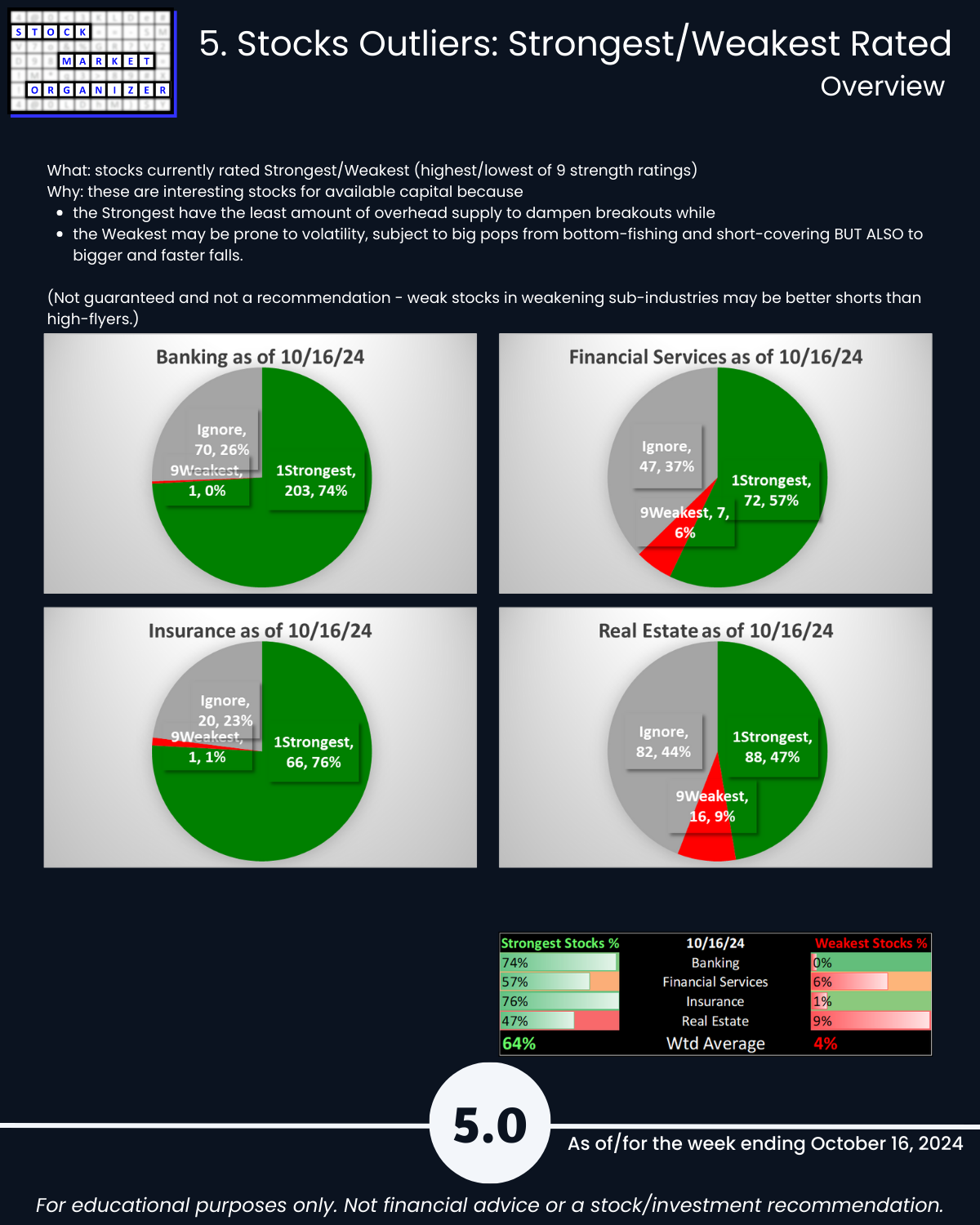

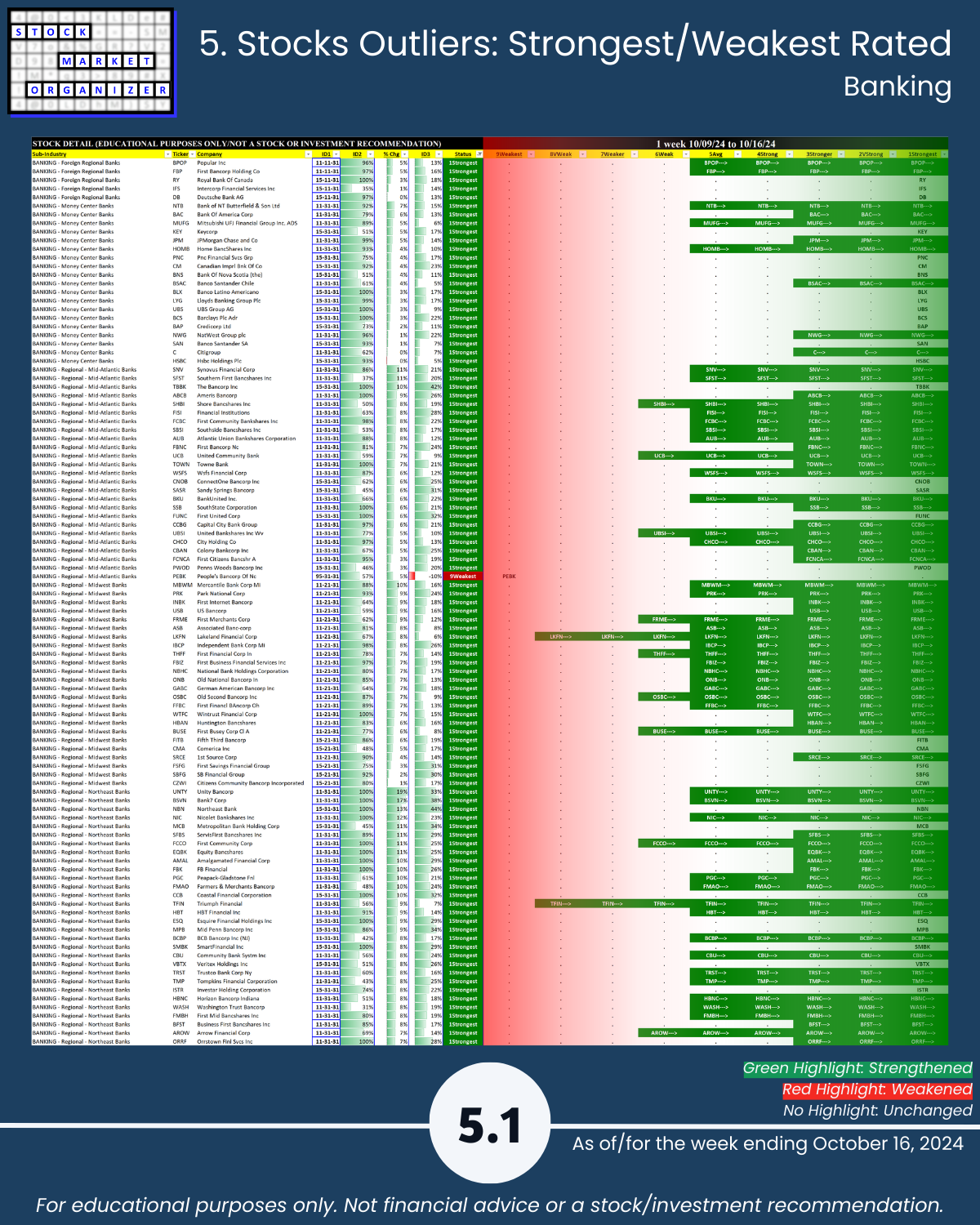

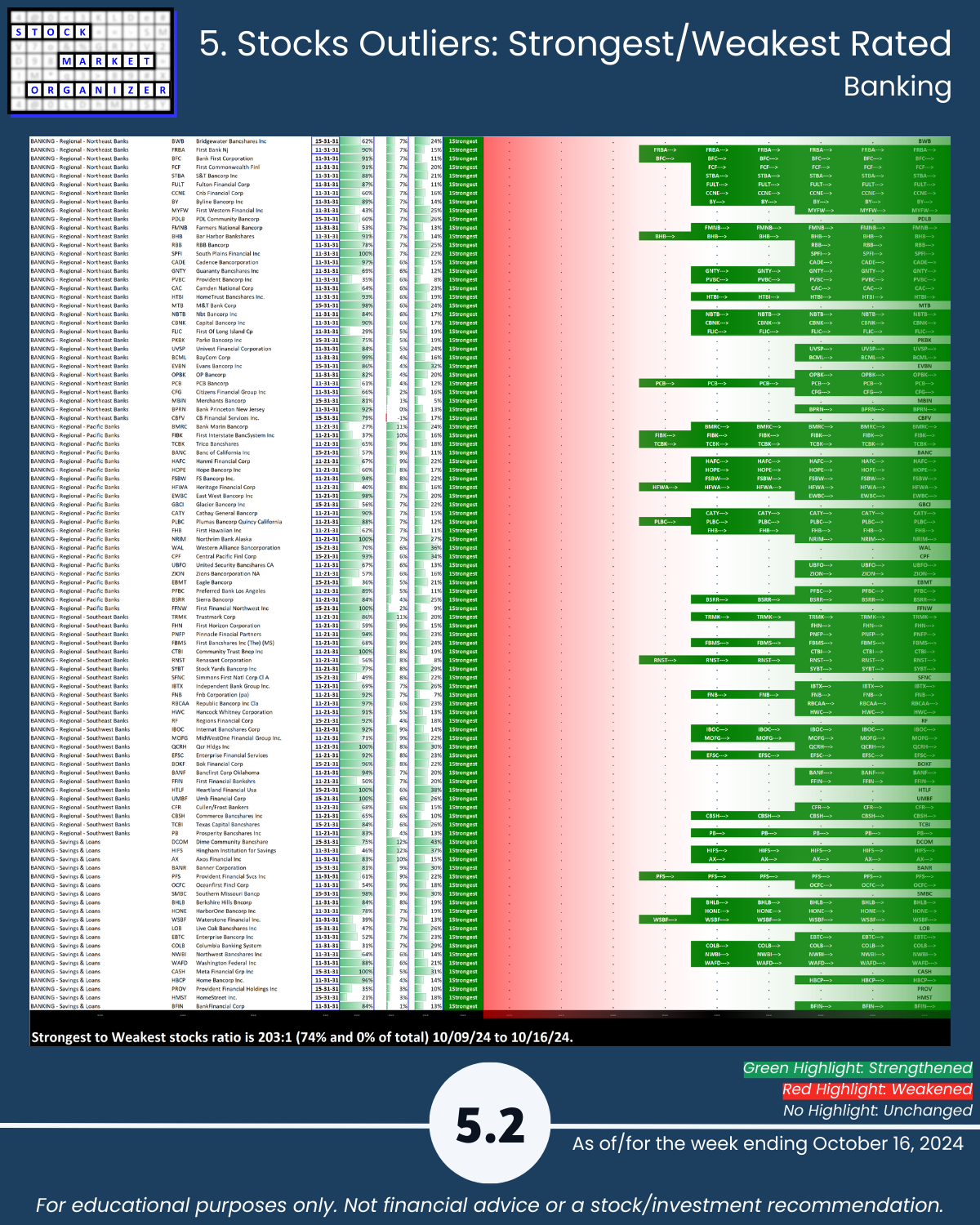

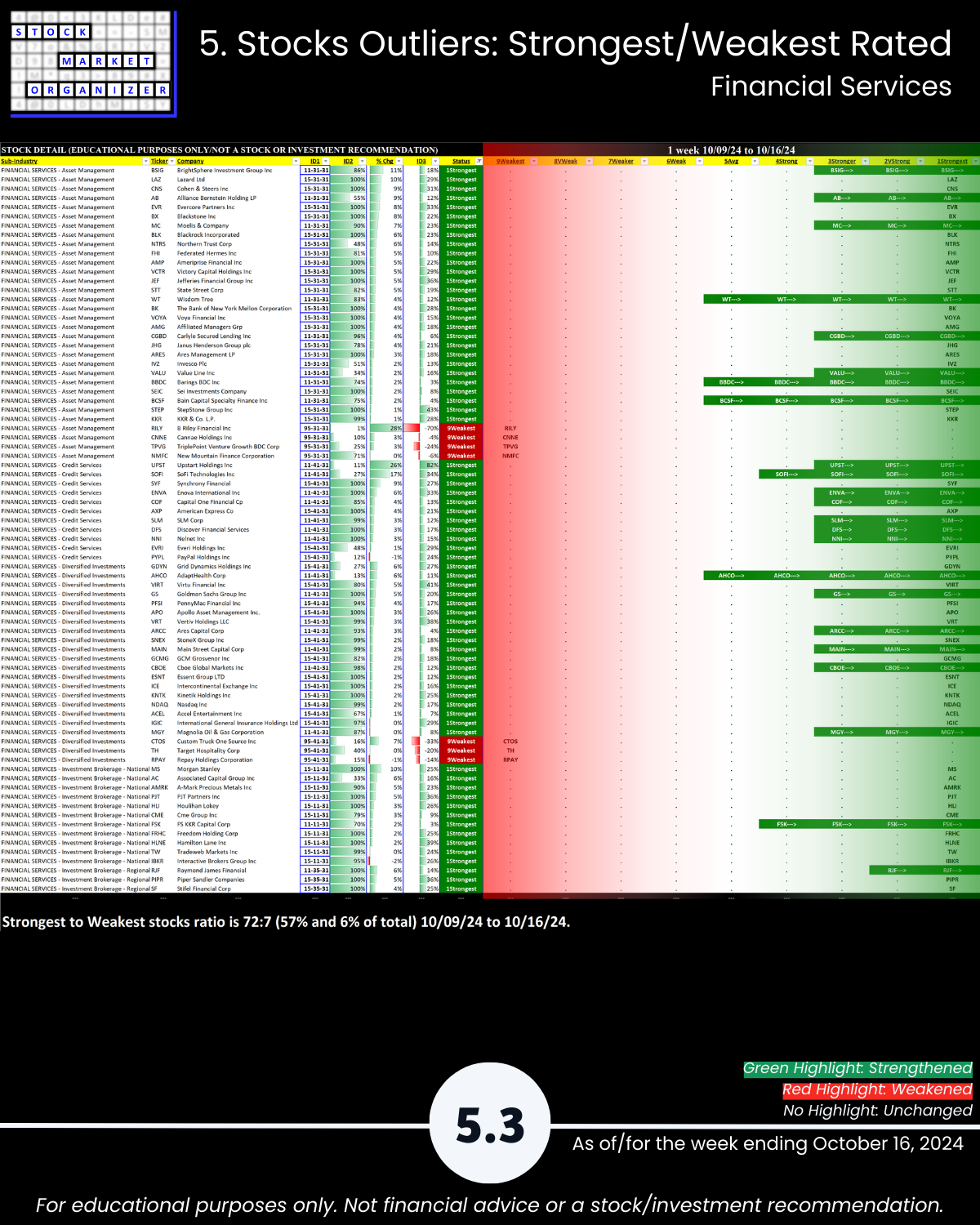

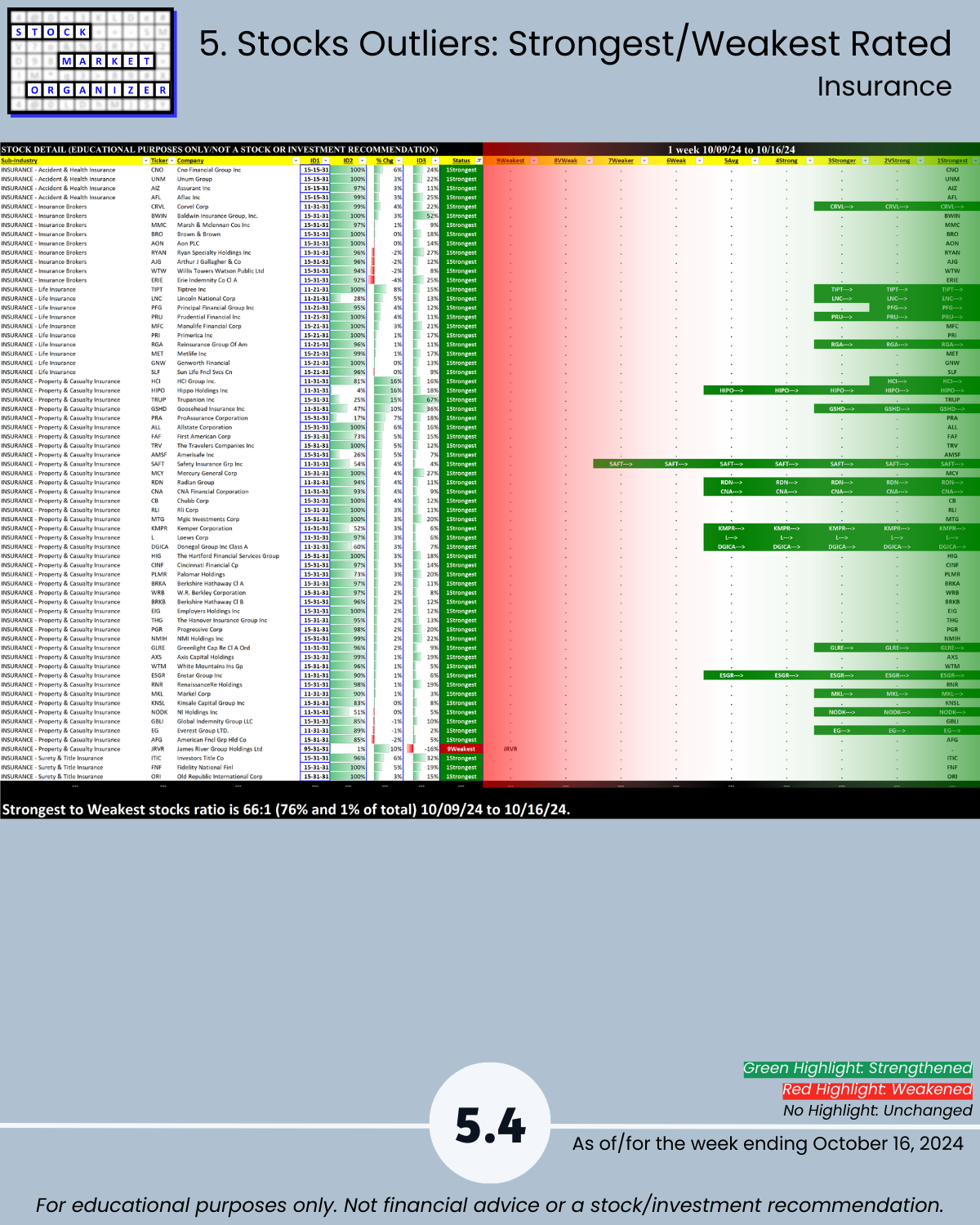

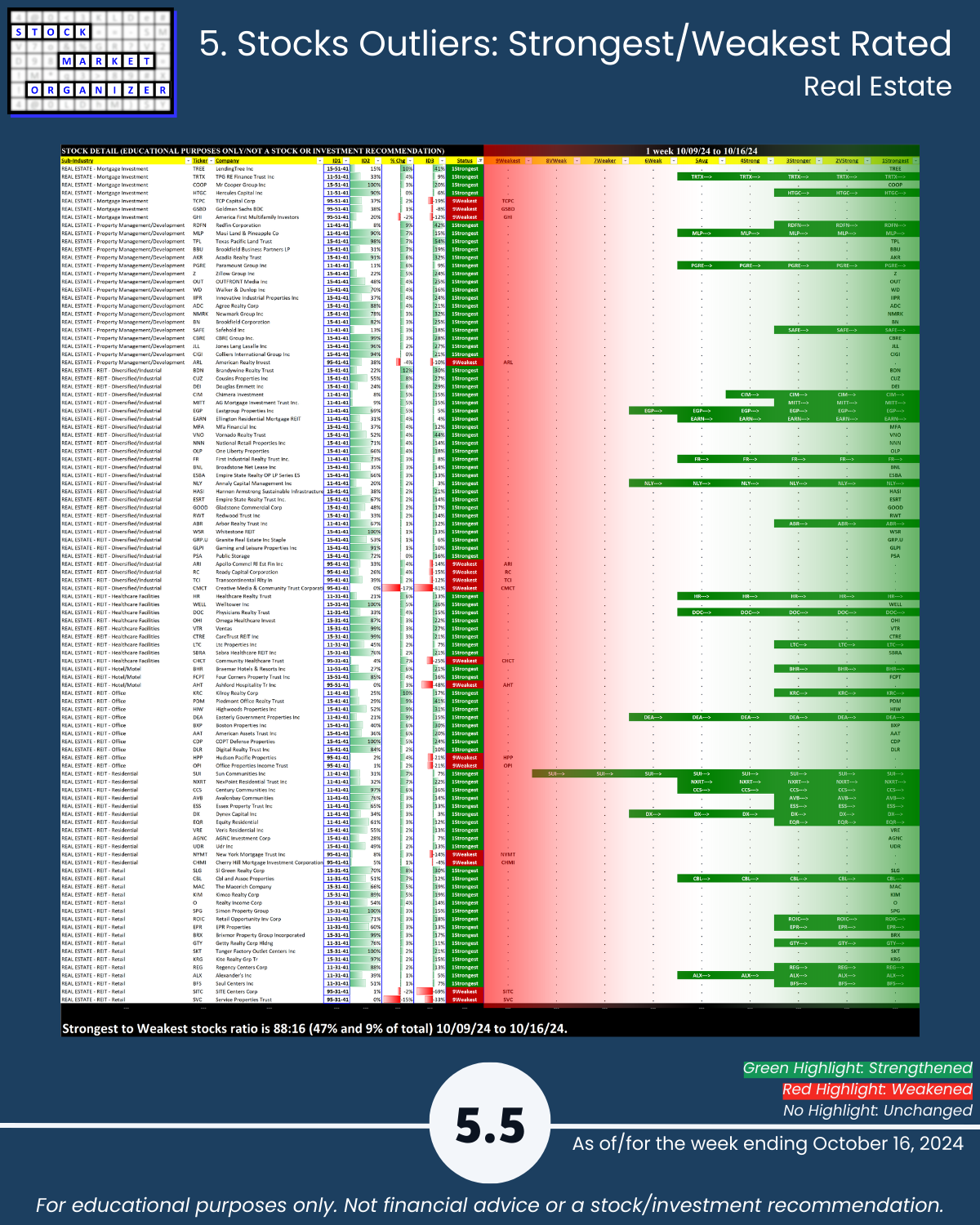

5. Stocks Outliers: Strongest/Weakest Rated

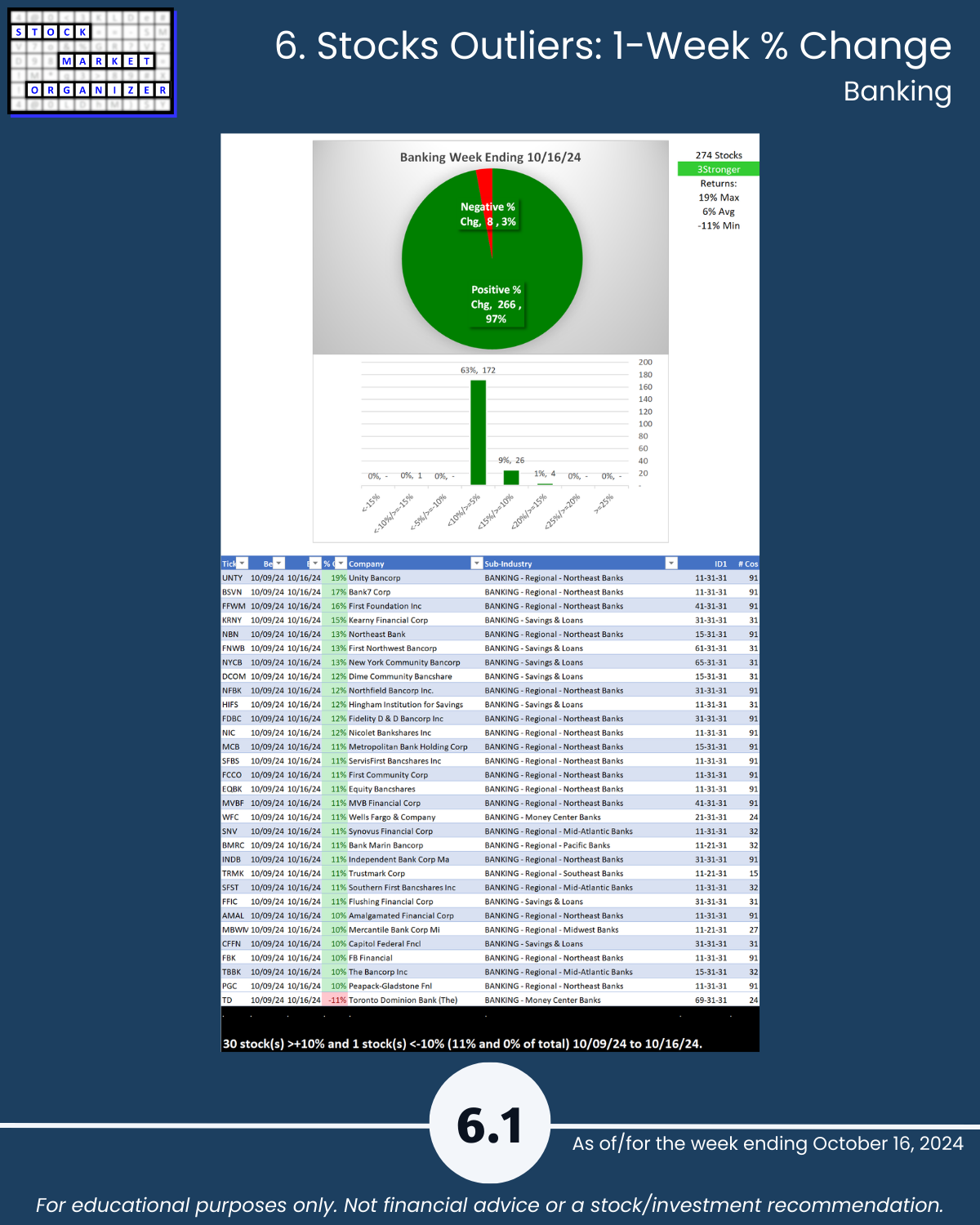

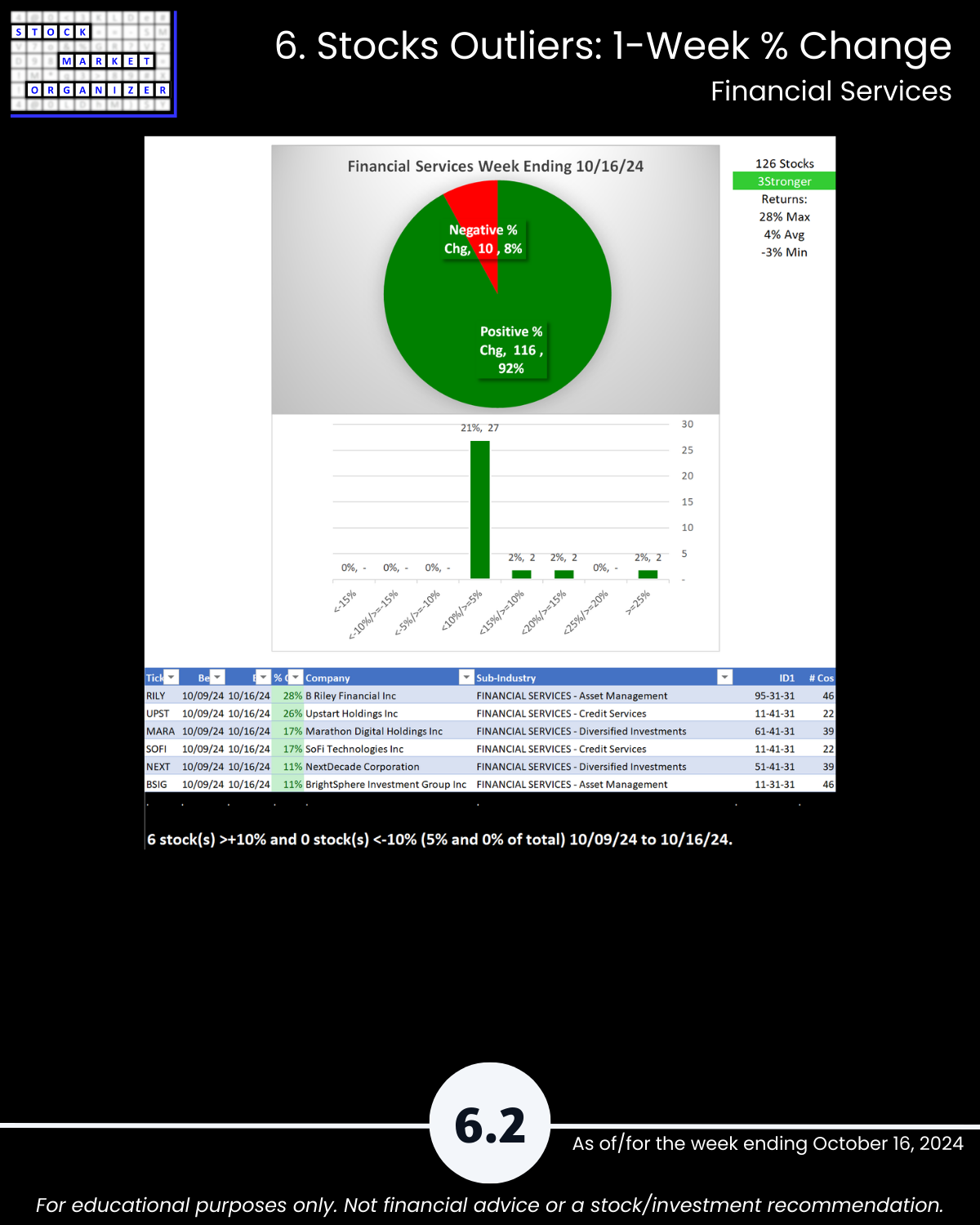

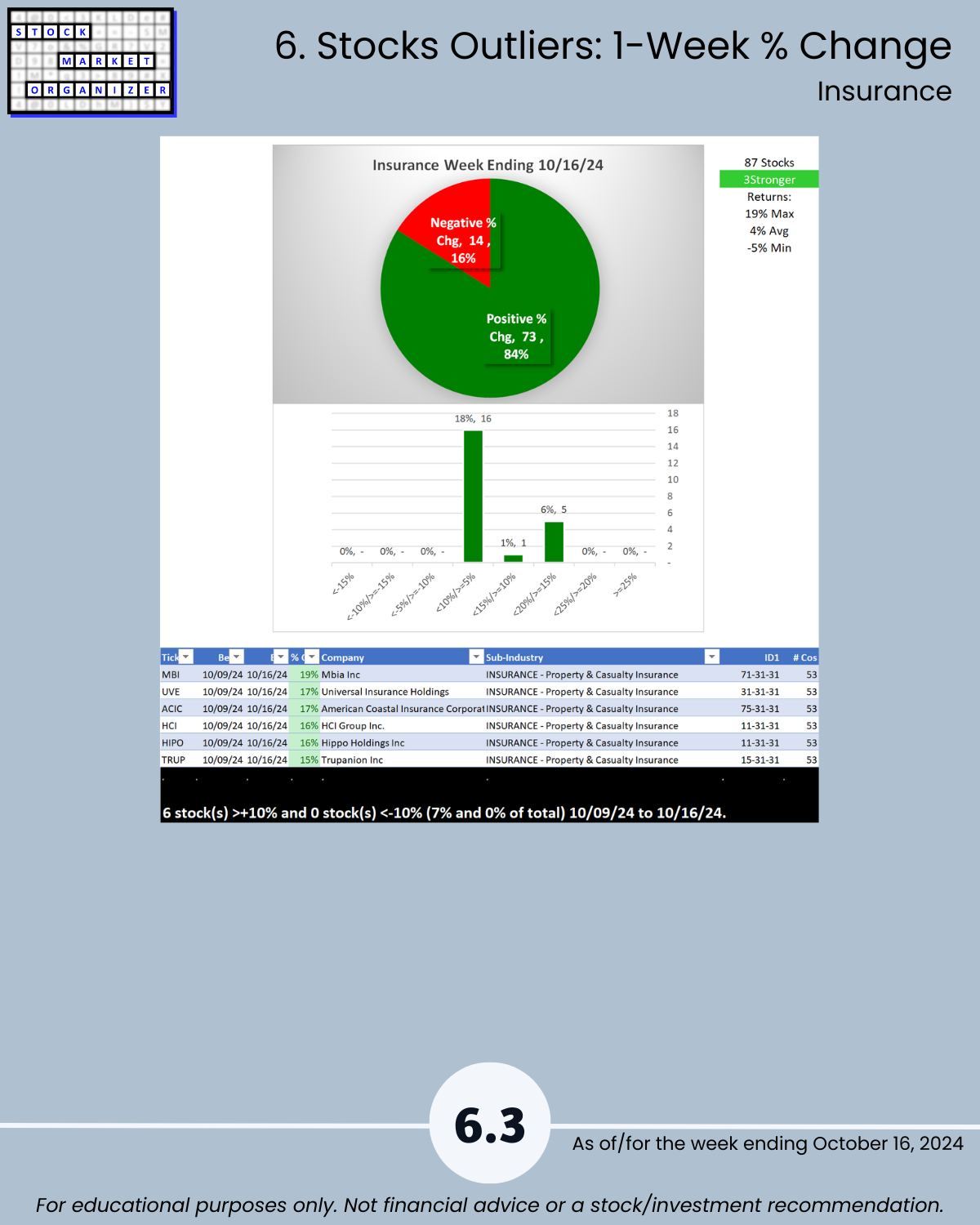

6. Stocks Outliers: 1-Week % Change

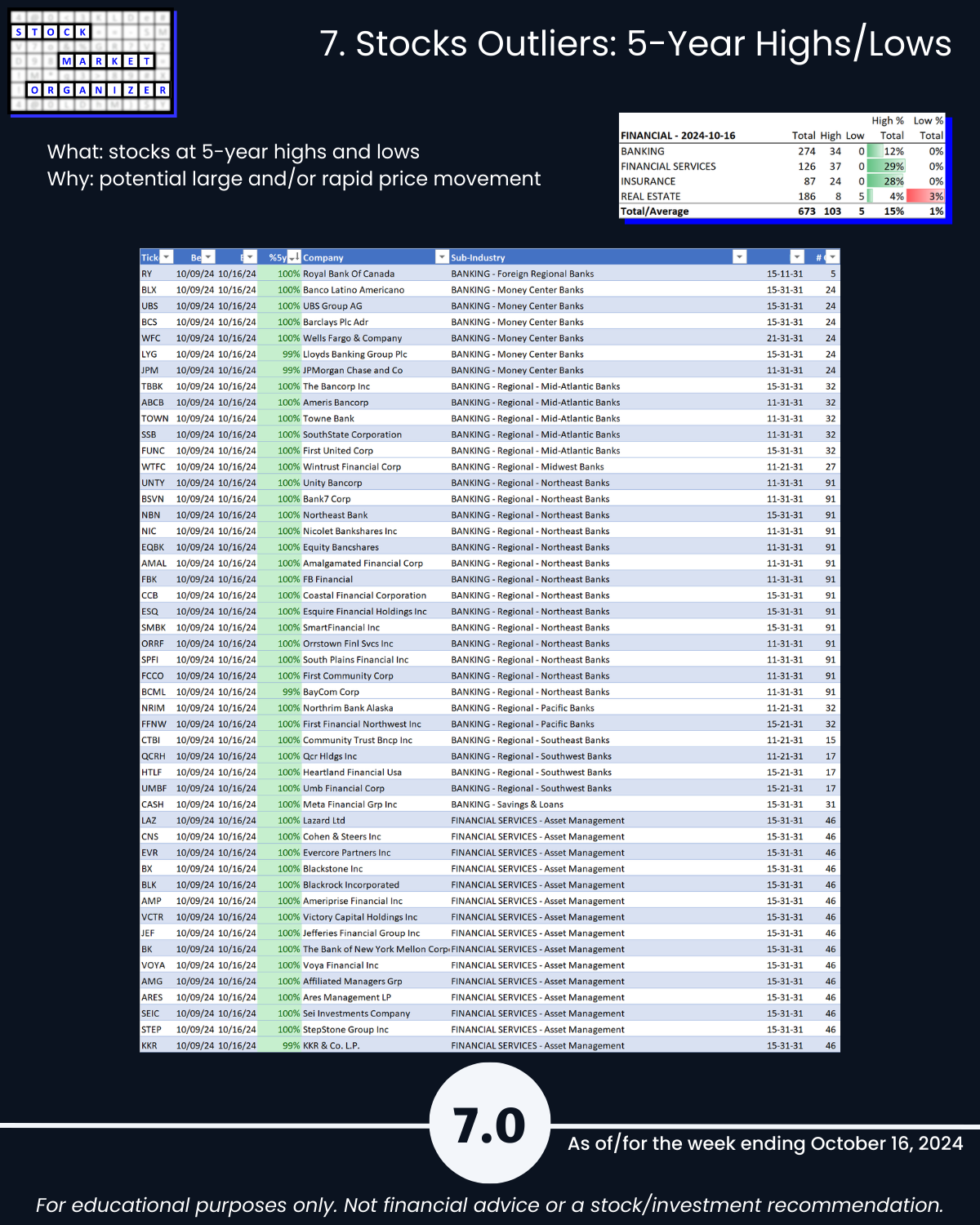

7. Stocks Outliers: 5-Year Highs/Lows