SMO Exclusive: Strength Report Financial Sector 2024-08-07

Get your unique context then stack strength/weakness in the Financial Sector with the help of the attached Stock Market Organizer Strength Report as of/for the week ending 08/07/24 focusing on the Banking, Financial Services, Insurance, and Real Estate industries. Details attached in a manner not available elsewhere because I created it from scratch to continually answer this question: “Where is there strengthening and weakening in the market at the stock, sub-industry, industry, and sector levels?” Combine this with the top-down Market Strength Score and Sector Risk Gauge to get a key competitive advantage of understanding strength at every level.

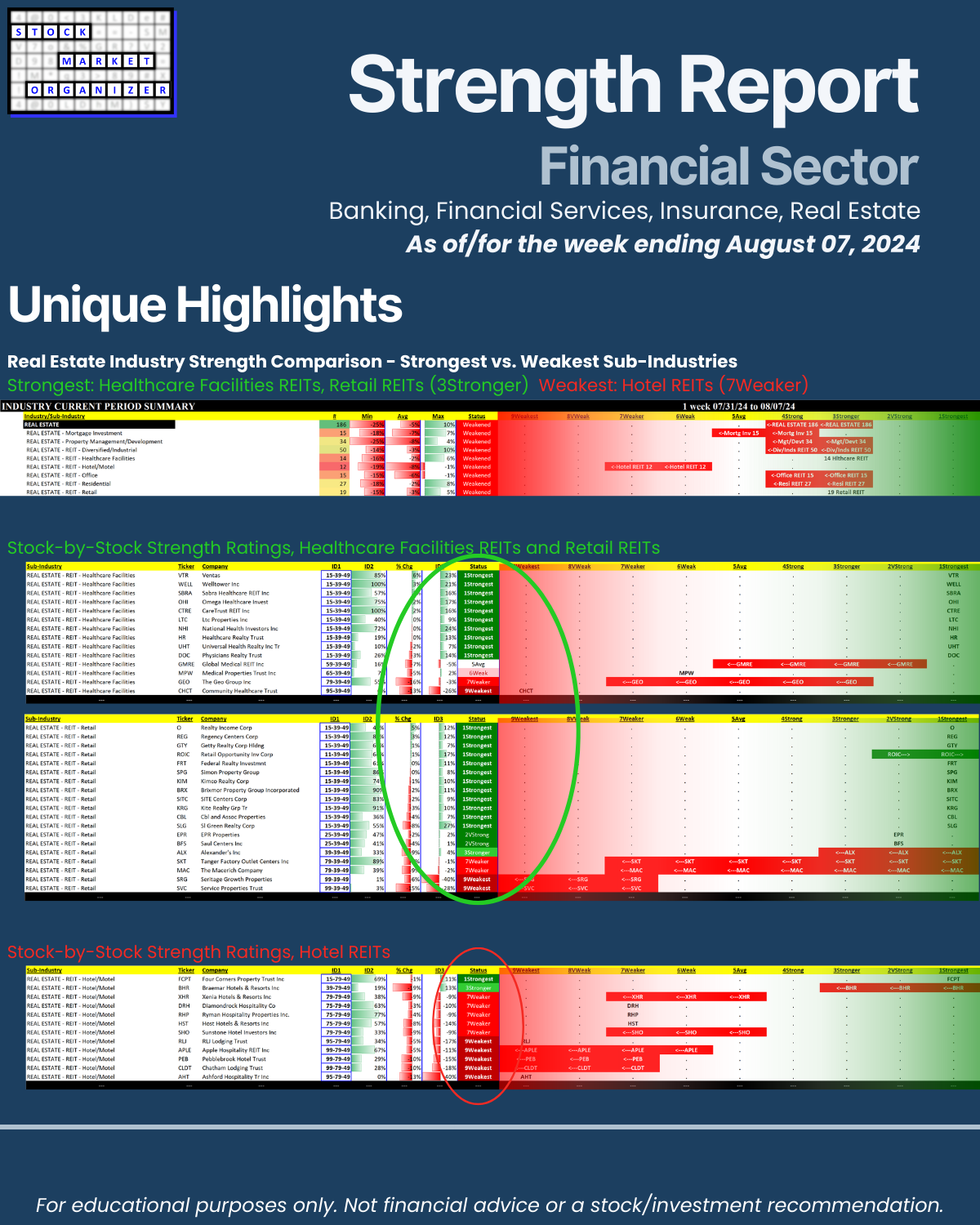

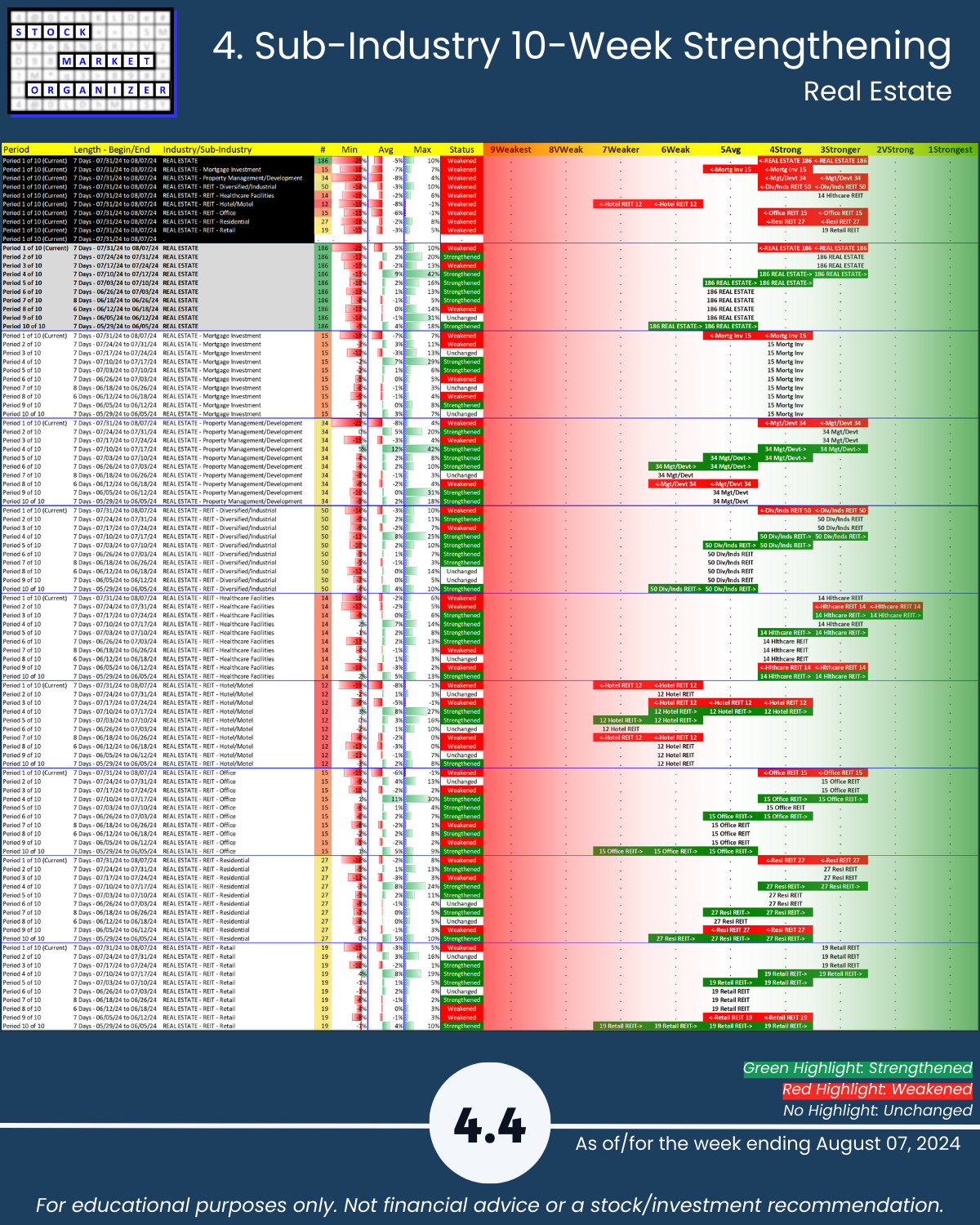

Today’s special cover highlight: a direct comparison of stock-by-stock strength within the two strongest Real Estate Industry sub-industries (Healthcare Facilities REITs and Retail REITs, both rated at 3 Stronger) and the weakest (Hotel REITs, rated at 7Weaker).

Some relevant resulting questions:

🔹 Is it better to buy the

- strongest stock in the strongest sub-industry,

- strongest stock in the weakest sub-industry,

- weakest stock in the weakest sub-industry, or

- weakest stock in the strongest sub-industry?

🔹 Is it better to short the

- weakest stock in the weakest sub-industry,

- weakest stock in the strongest sub-industry,

- strongest stock in the strongest sub-industry, or

- strongest stock in the weakest sub-industry?

🔹 Is one better off ignoring these and looking in the Tech or Consumer sectors, or in other sub-industries, for candidates fulfilling the above conditions?

🔹 Exactly how does one objectively and repeatably incorporate sub-industry, industry, sector, and market strength in such decisions?

The answers to the first three questions are personal. The fourth one can be answered in at least one way – read these Stock Market Organizer posts.

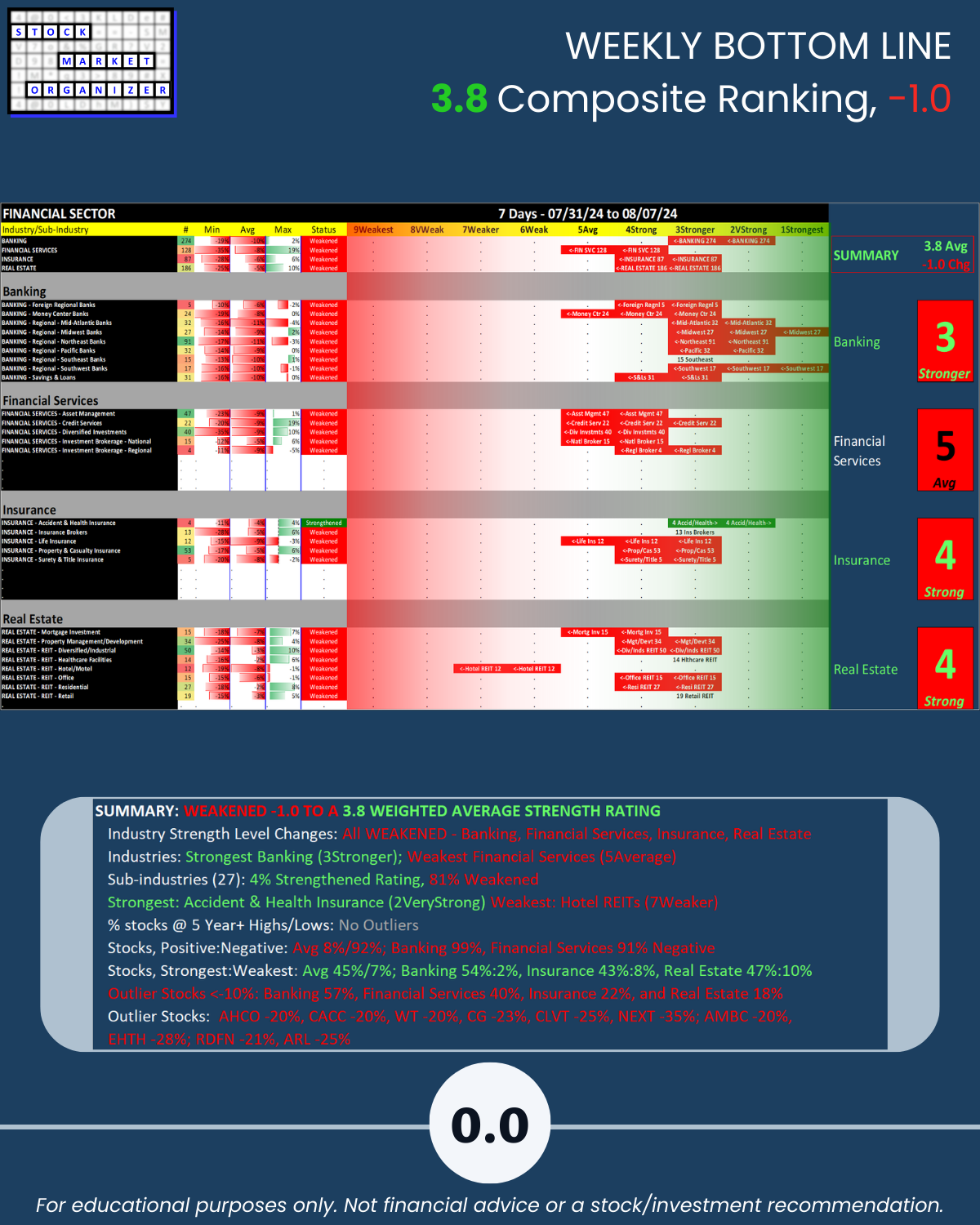

1. Introduction

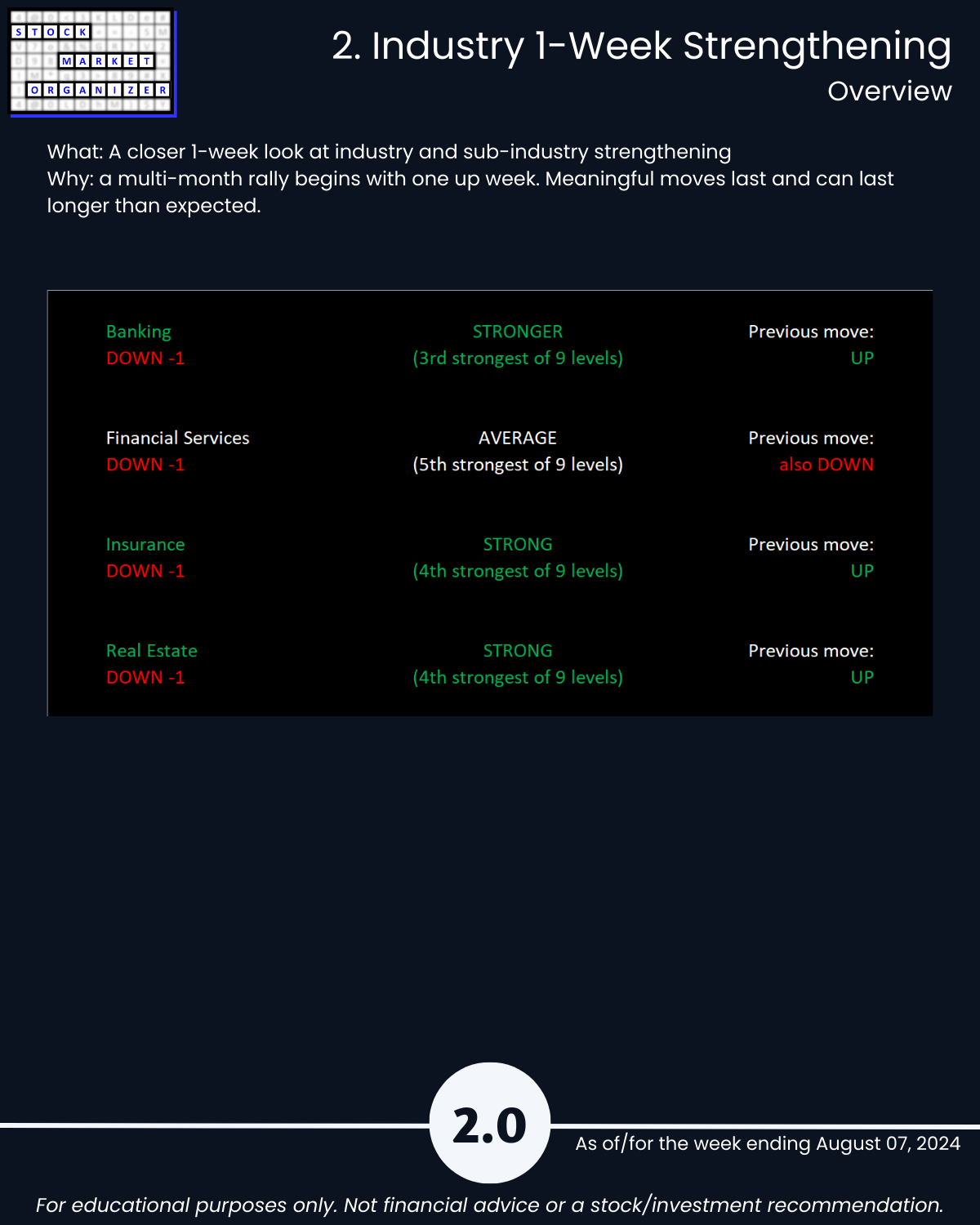

2. Industry 1-Week Strengthening

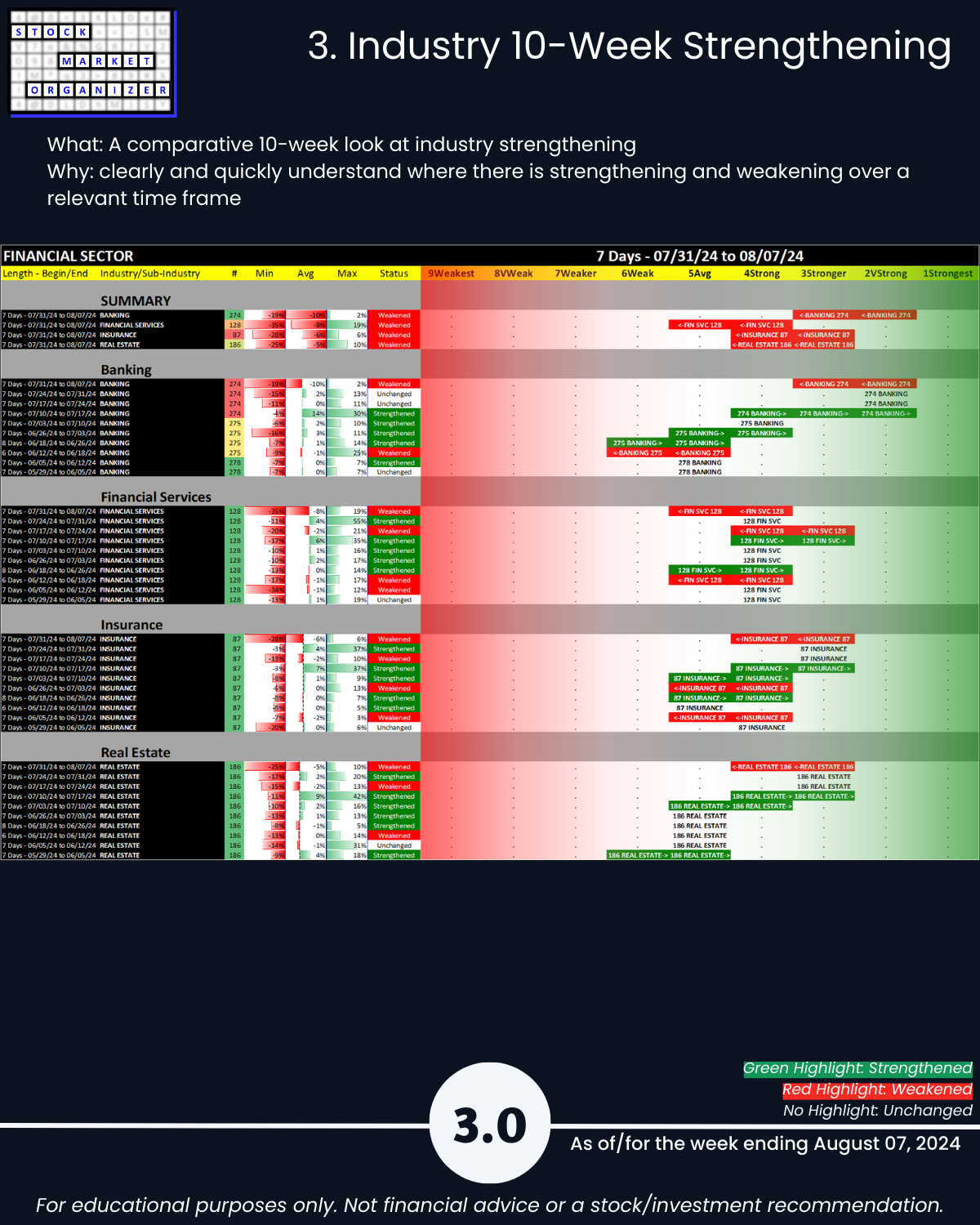

3. Industry 10-Week Strengthening

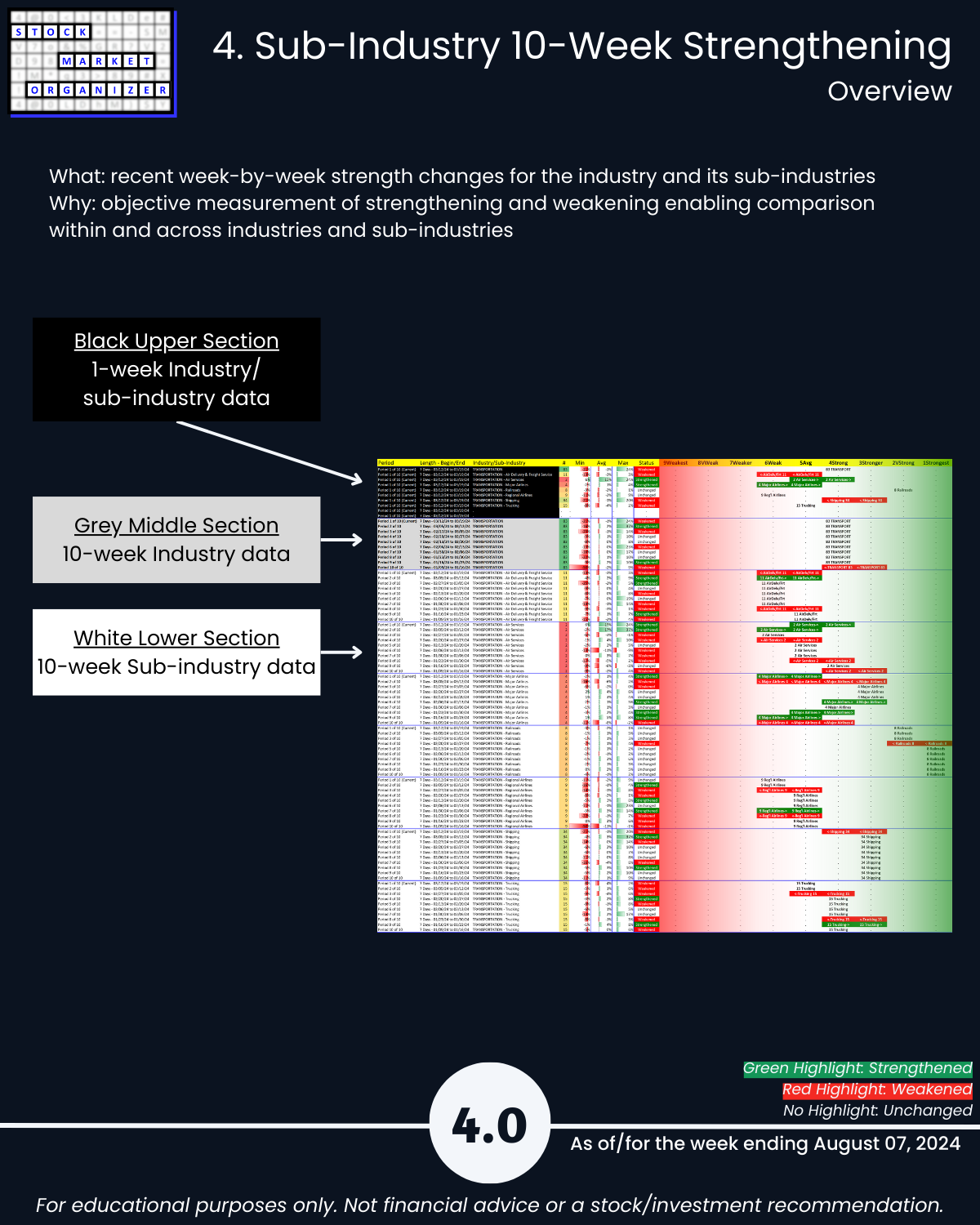

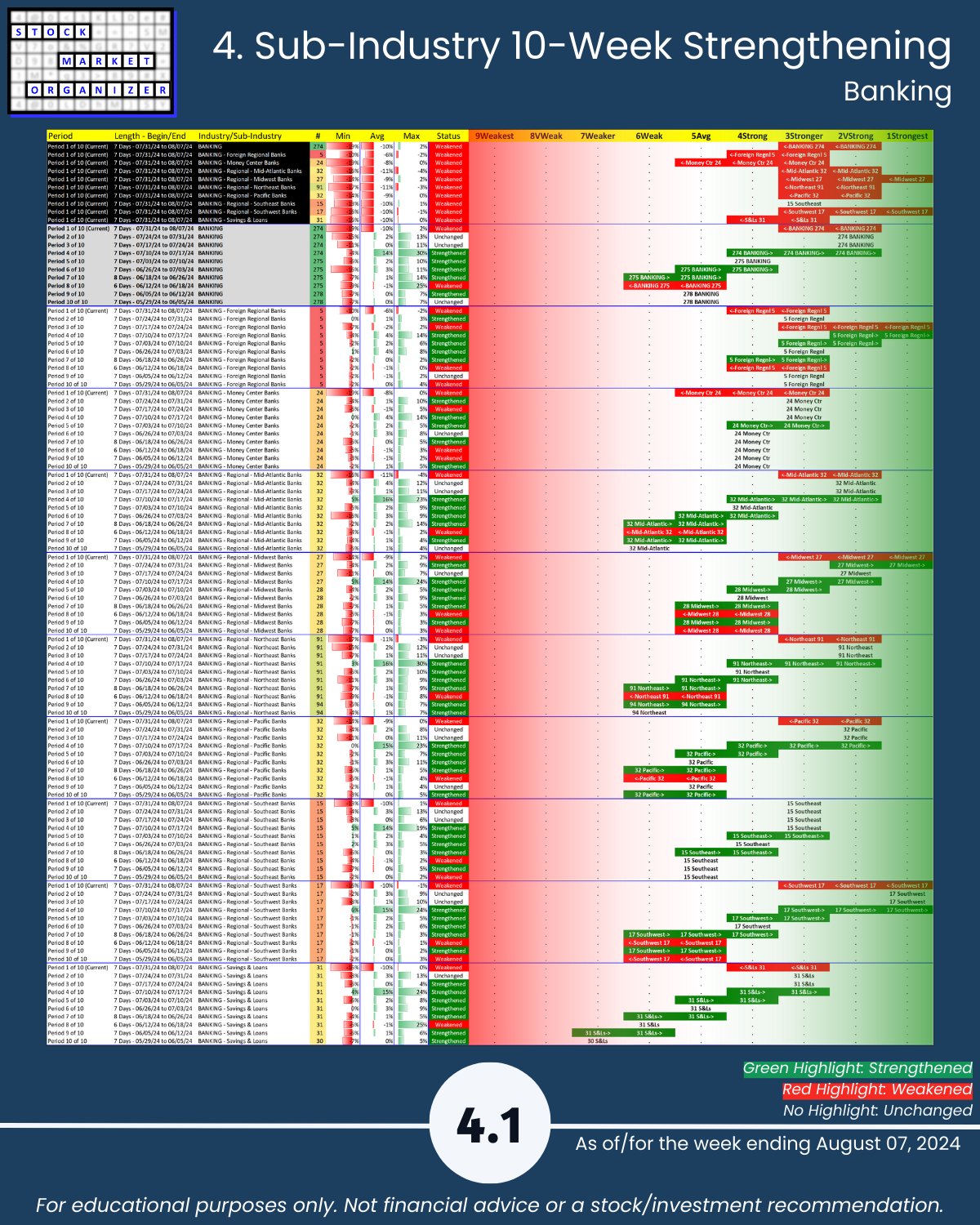

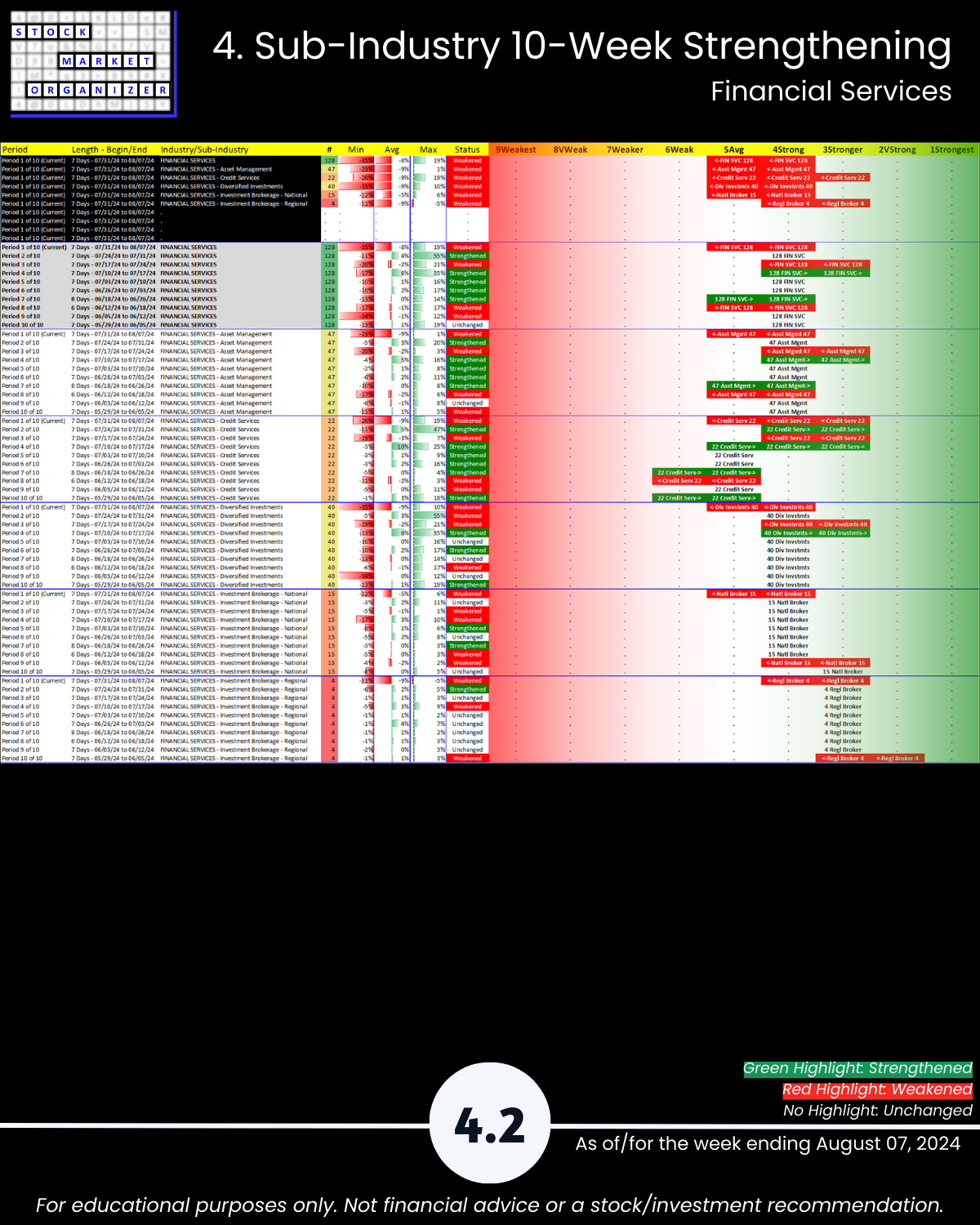

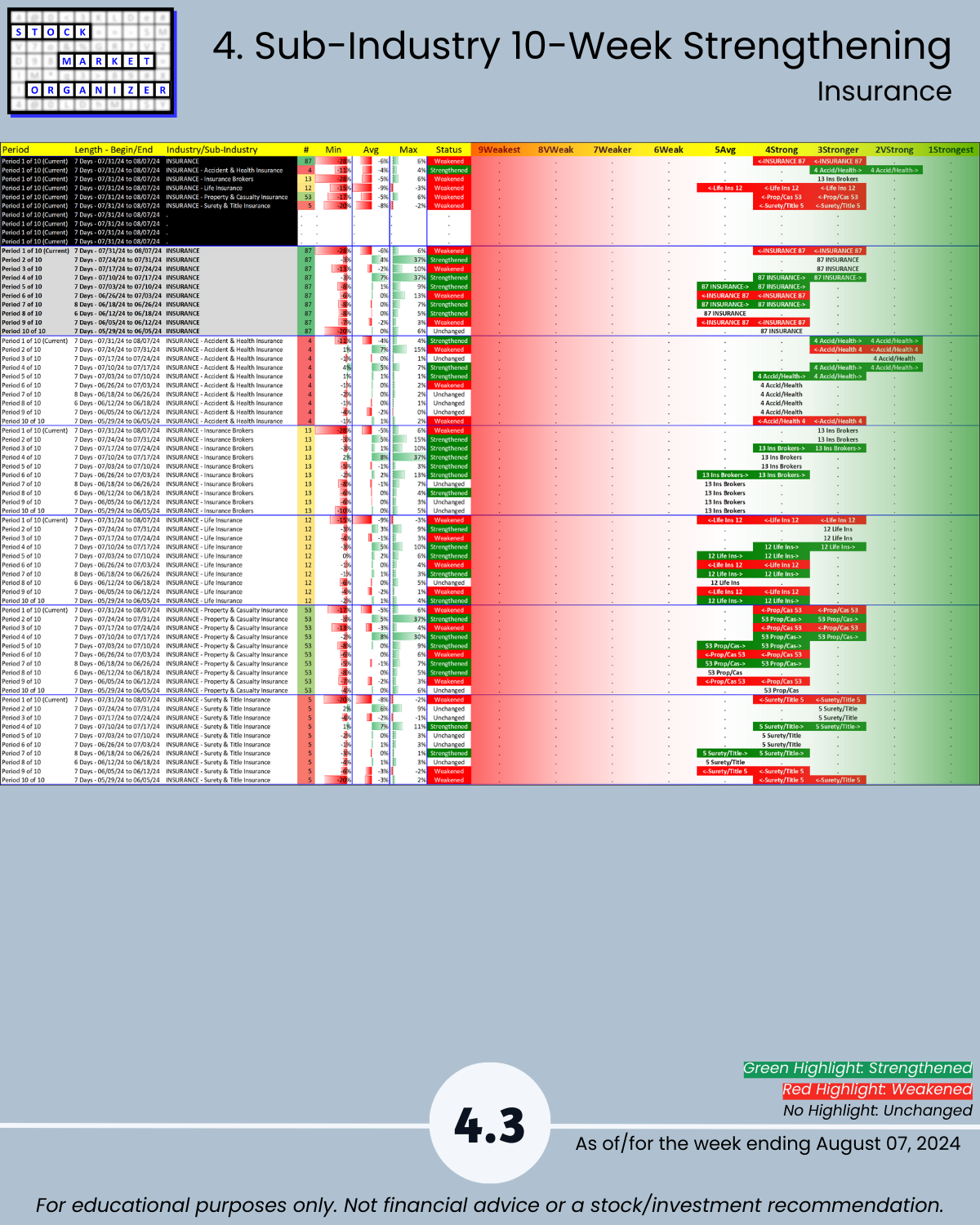

4. Sub-Industry 10-Week Strengthening

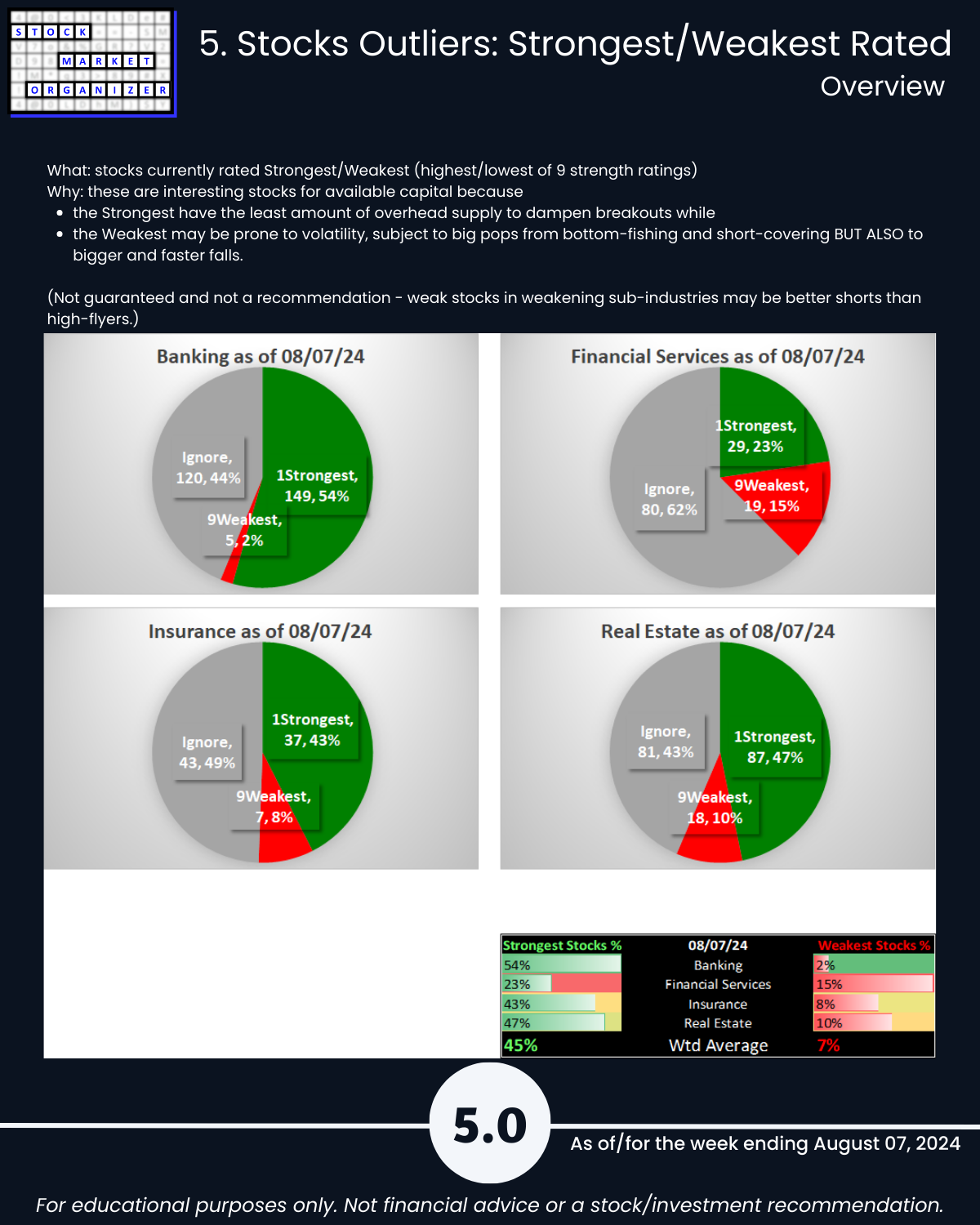

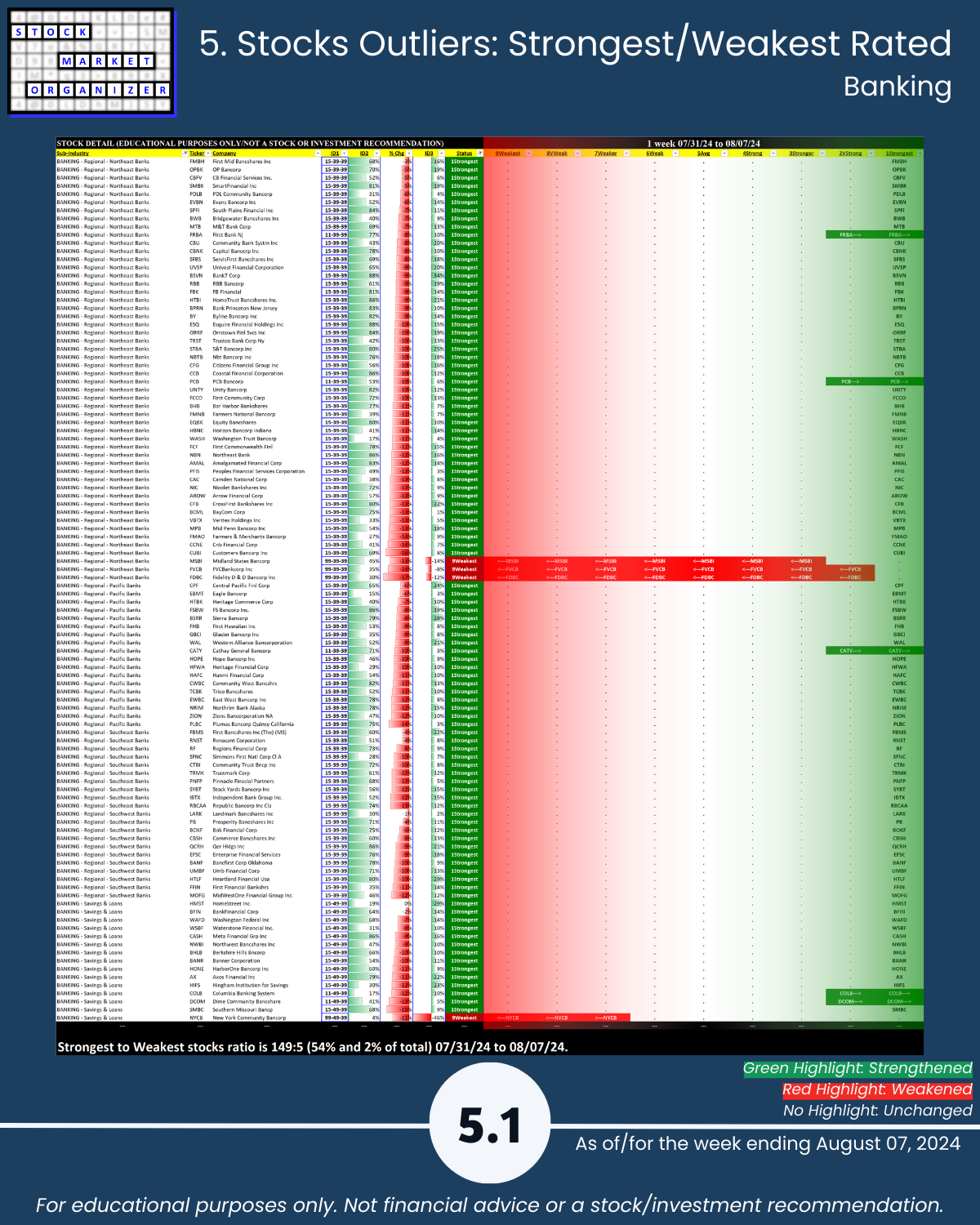

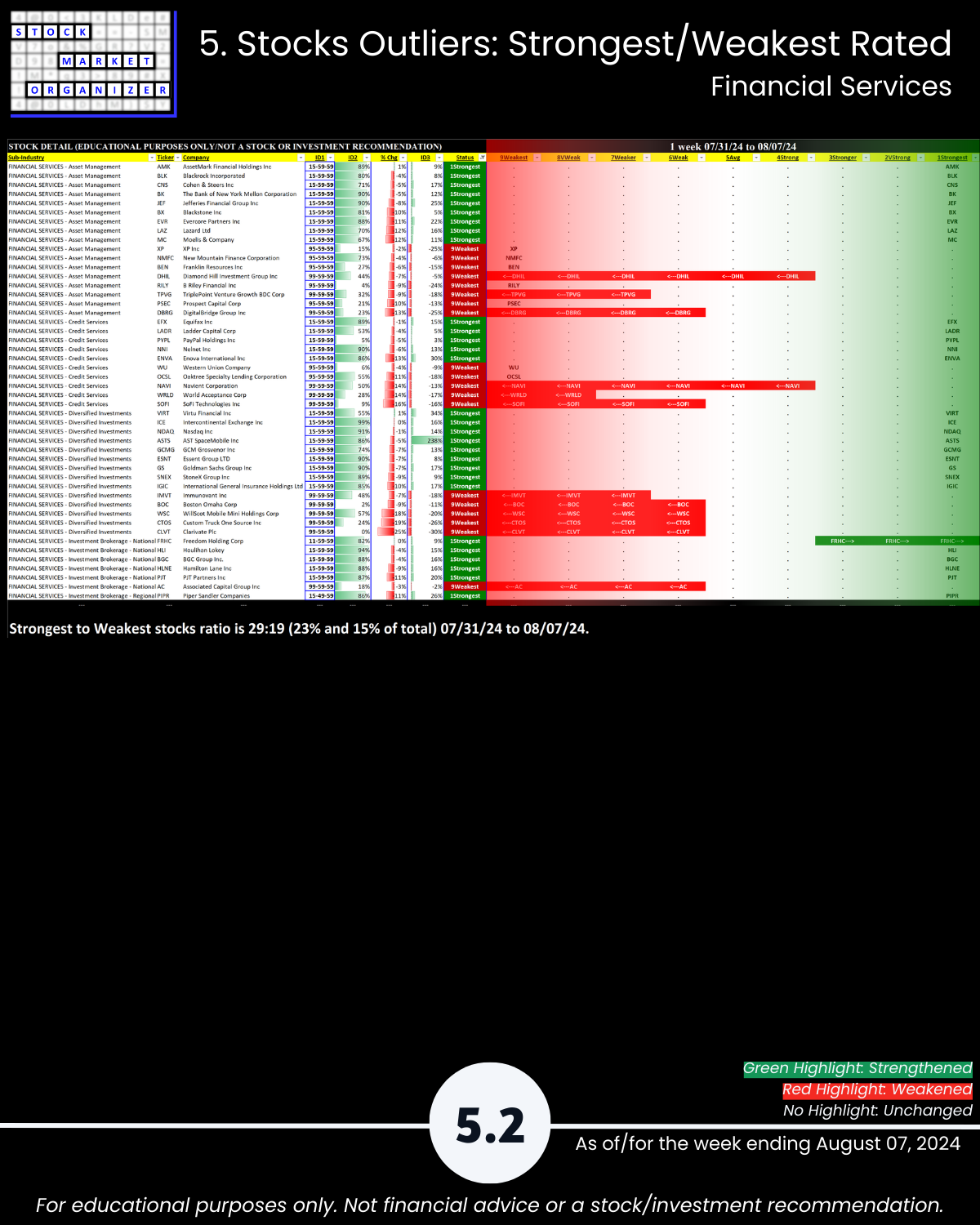

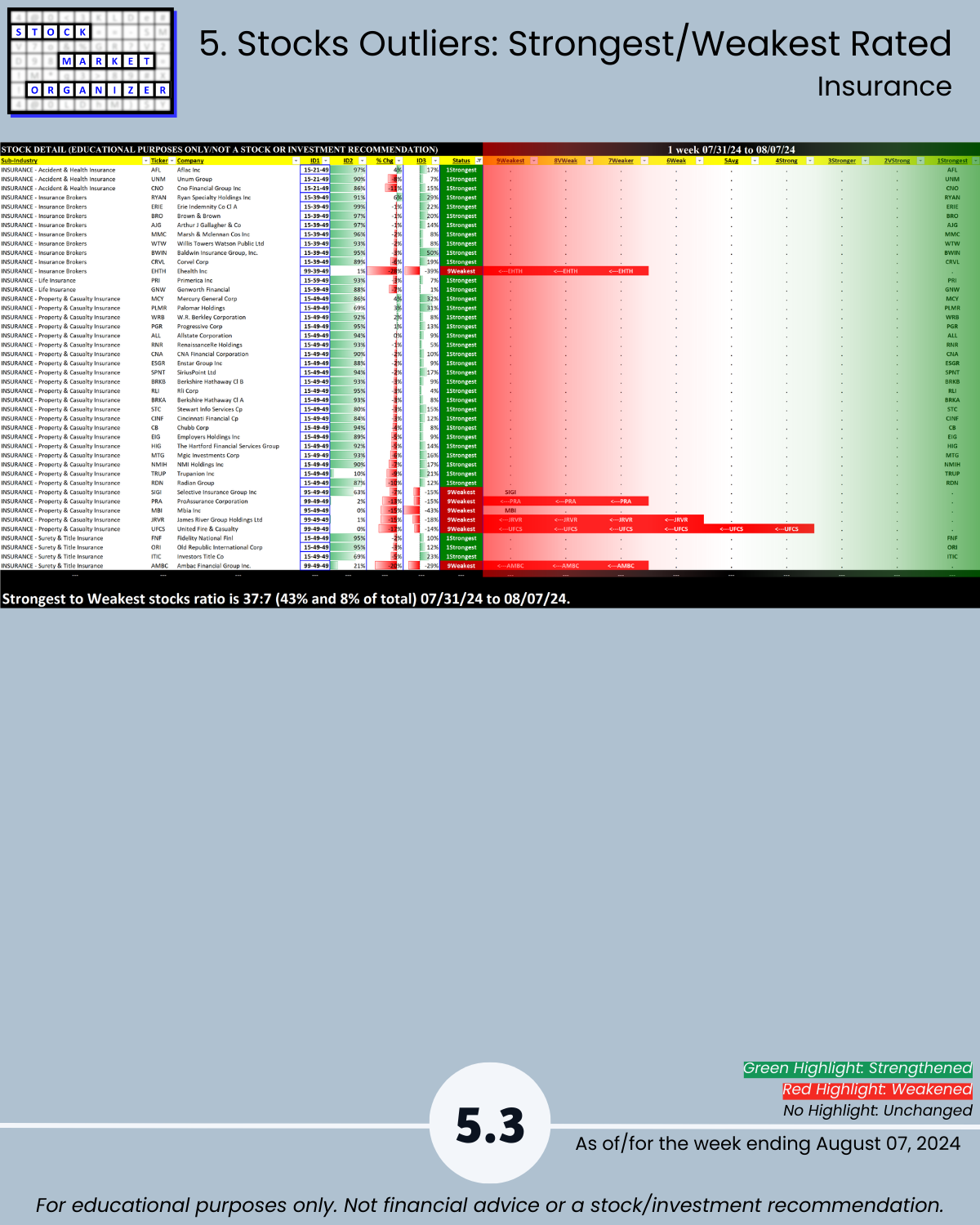

5. Stocks Outliers: Strongest/Weakest Rated

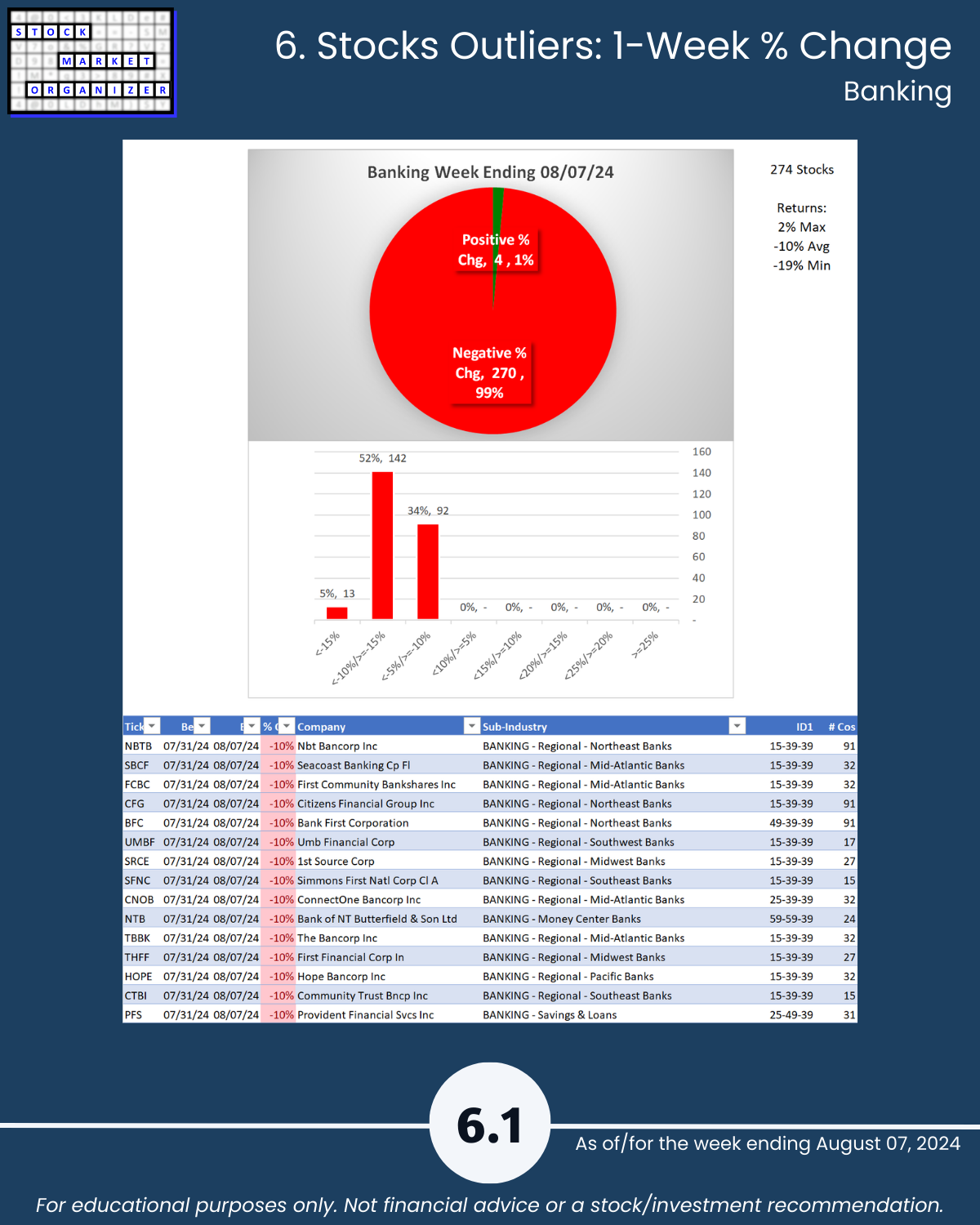

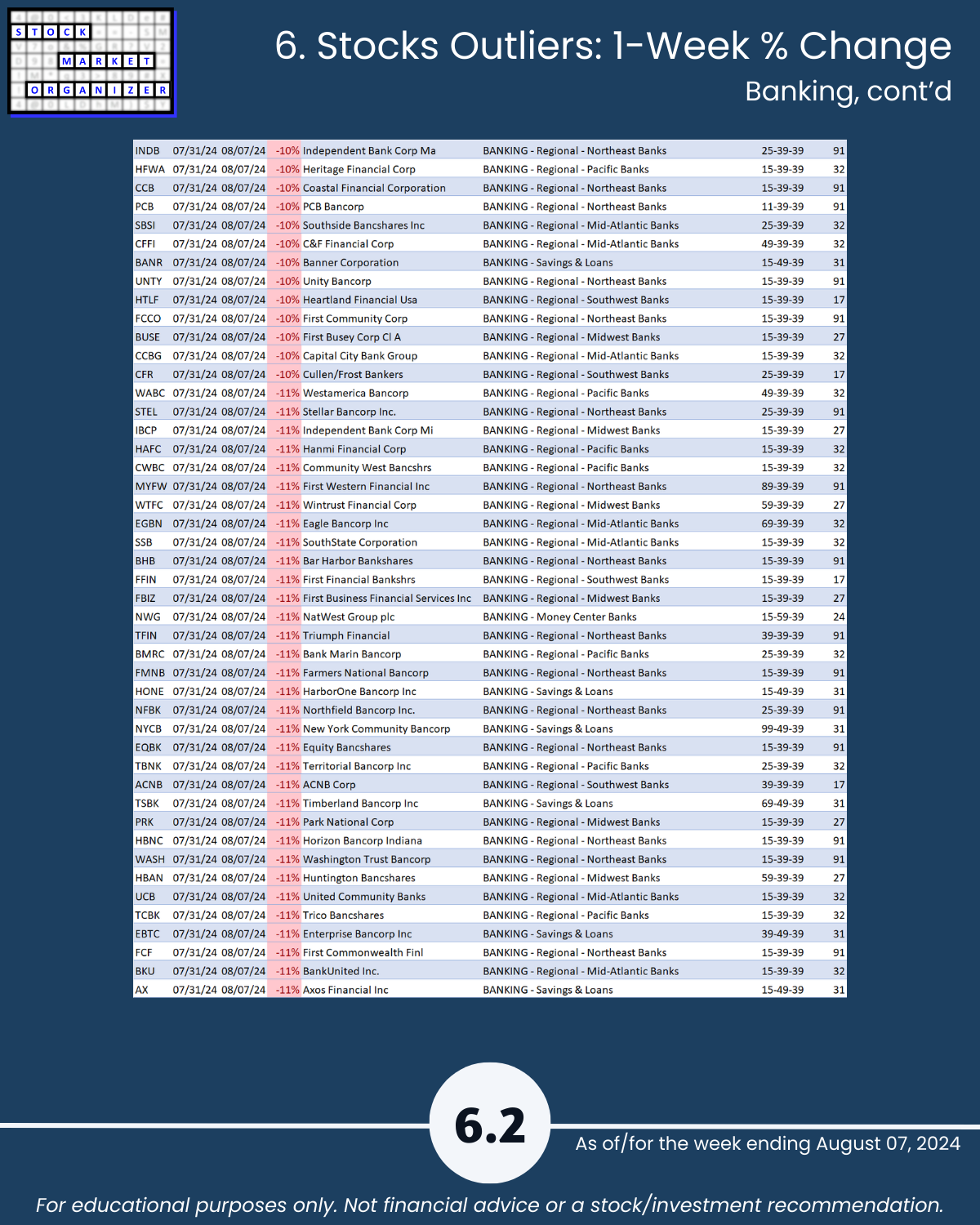

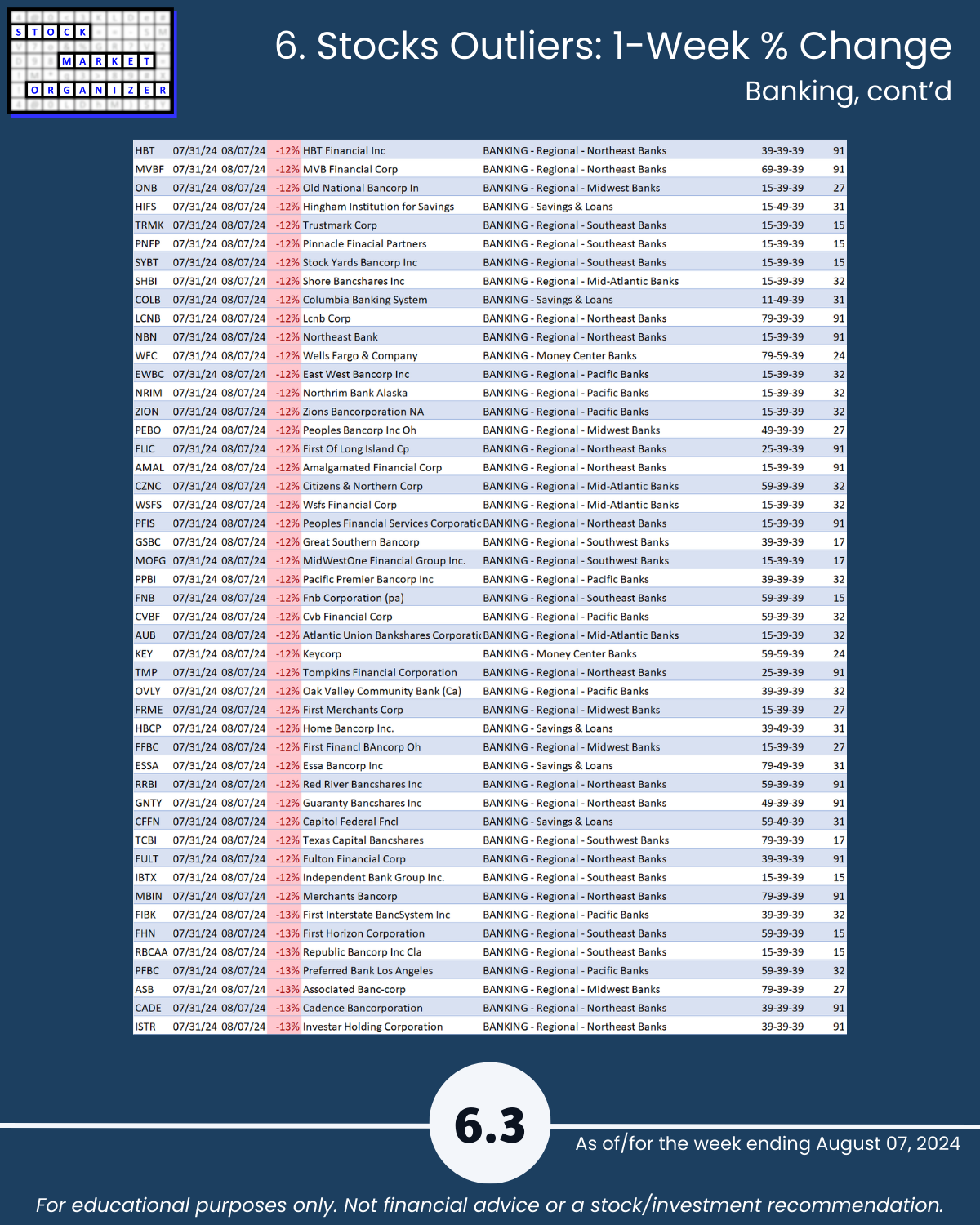

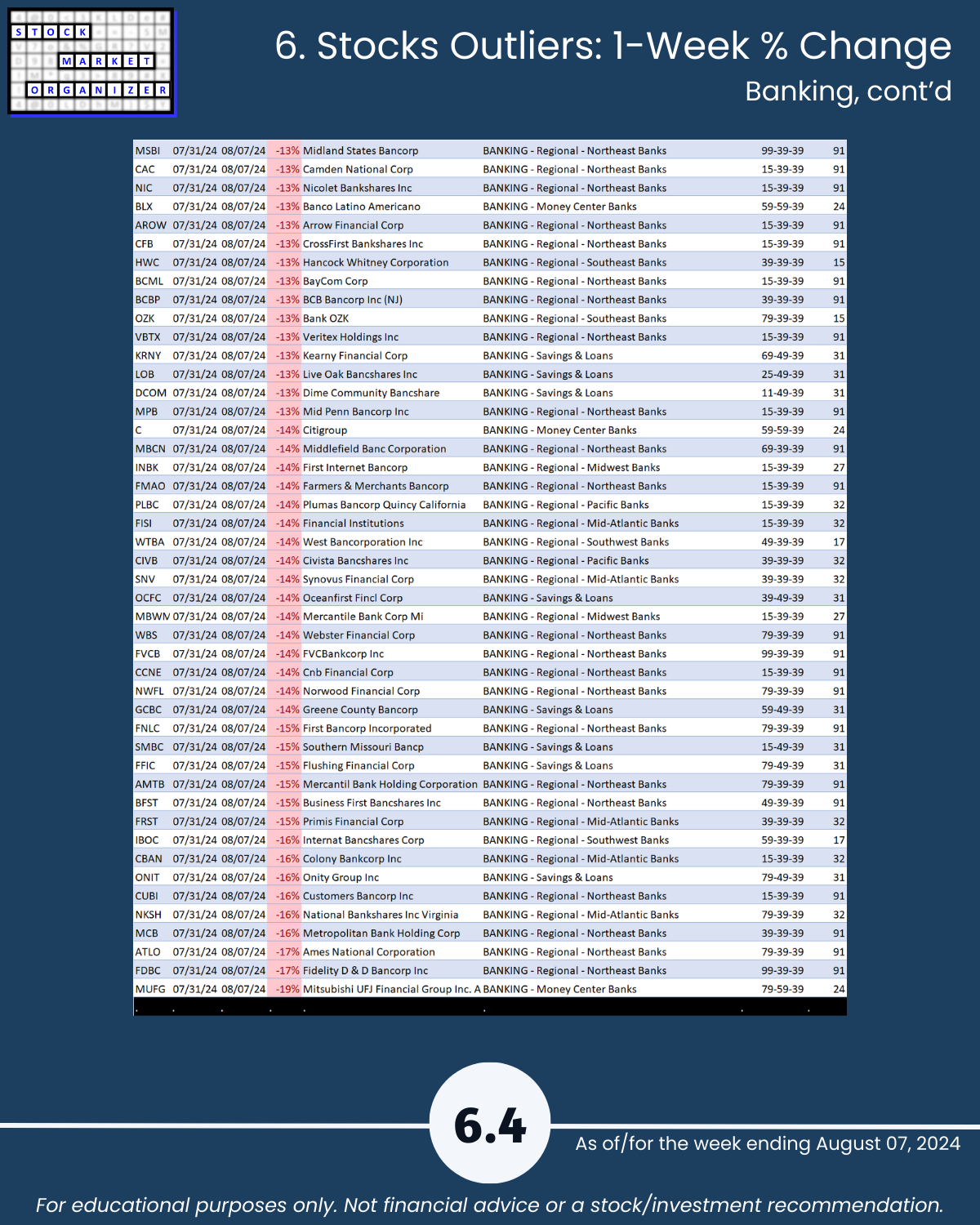

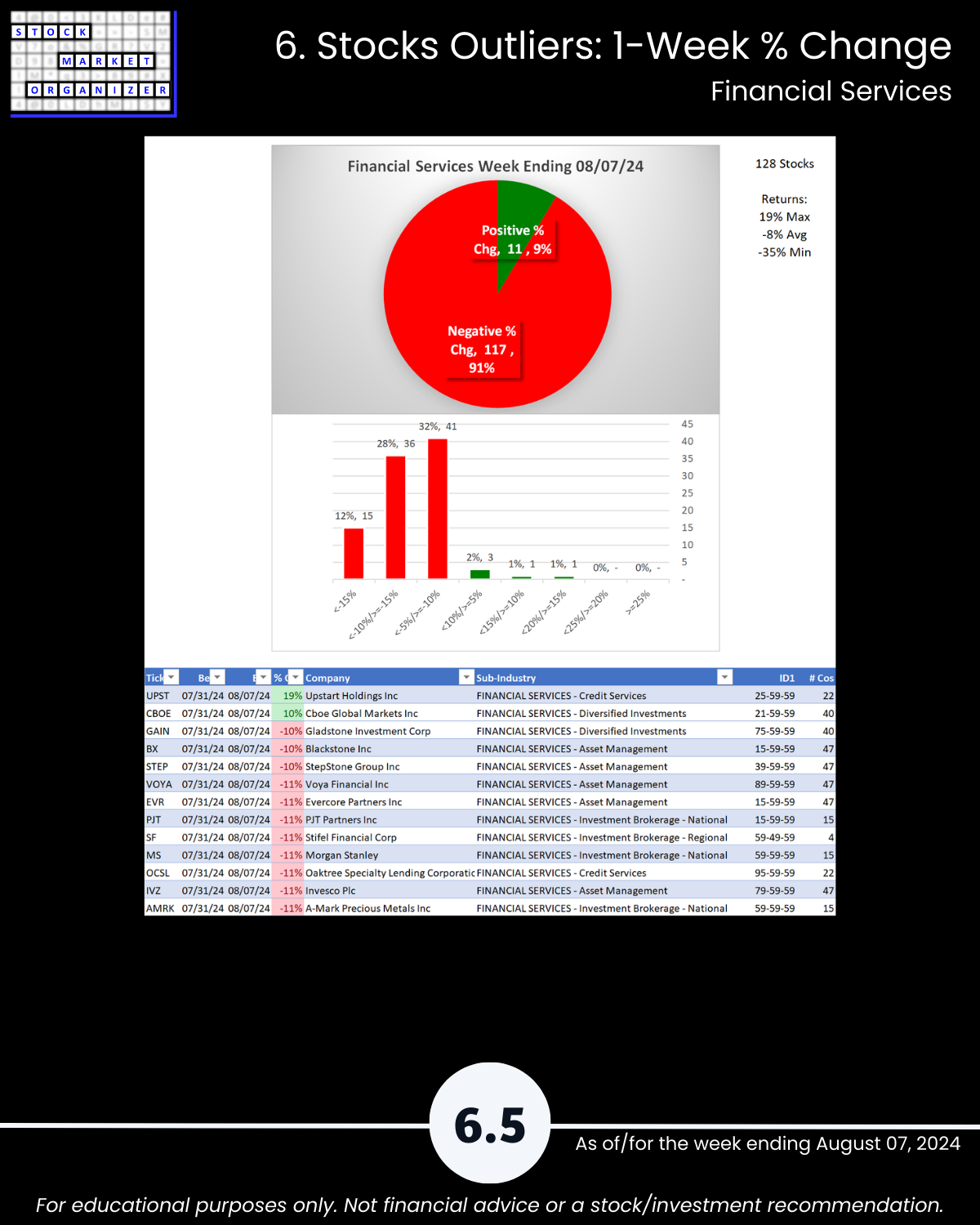

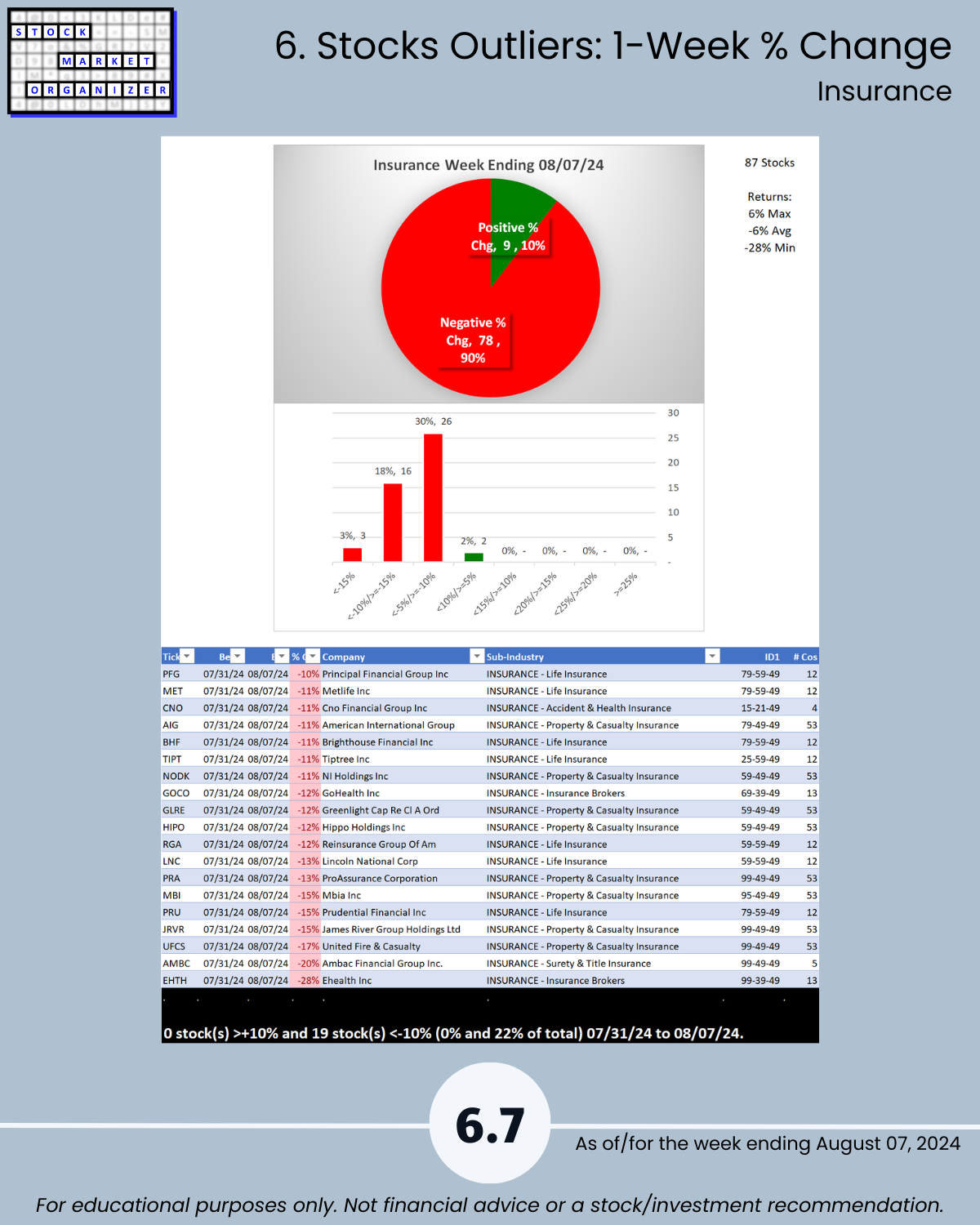

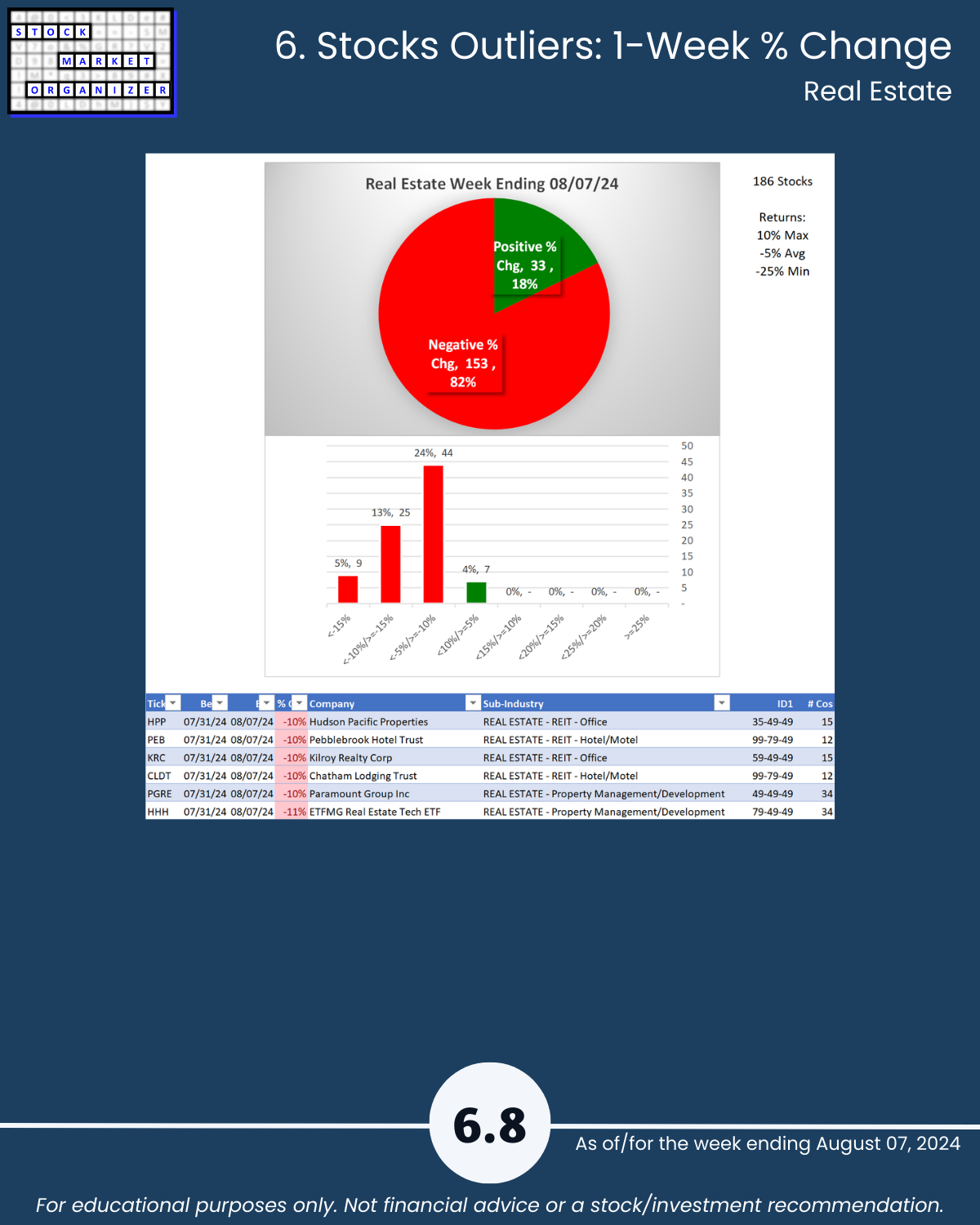

6. Stocks Outliers: 1-Week % Change

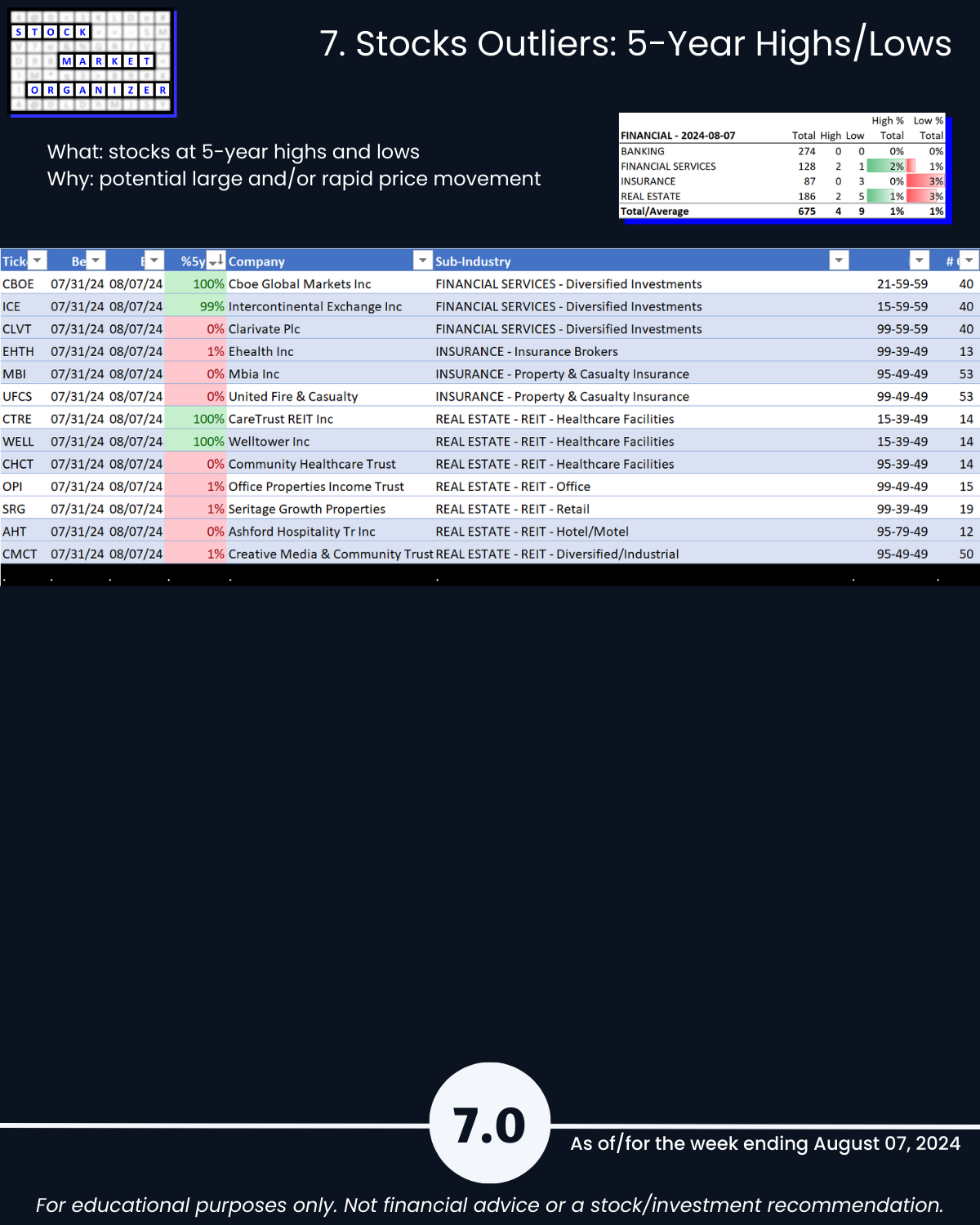

7. Stocks Outliers: 5-Year Highs/Lows