SMO Exclusive: Strength Report Financial Sector 2024-04-24

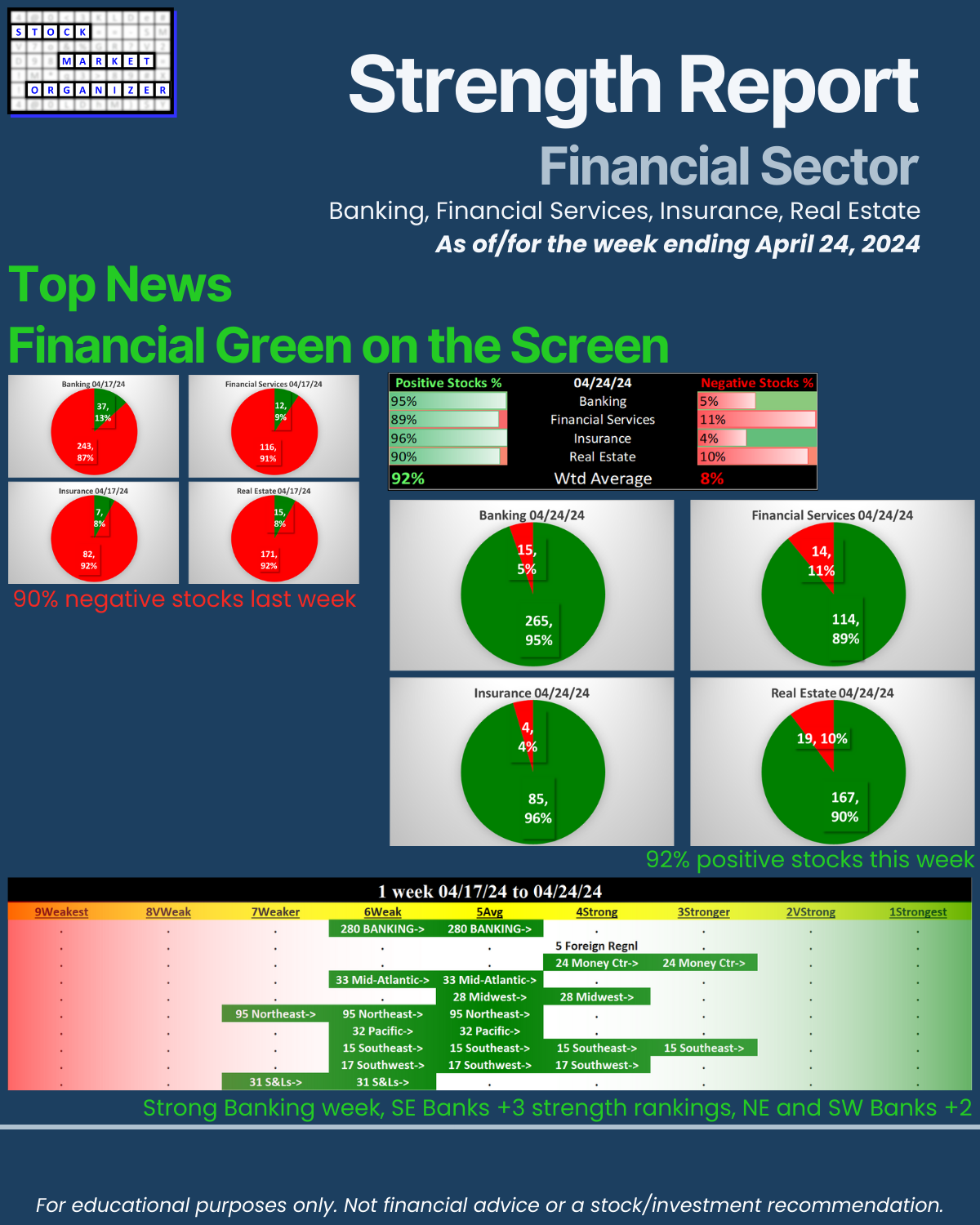

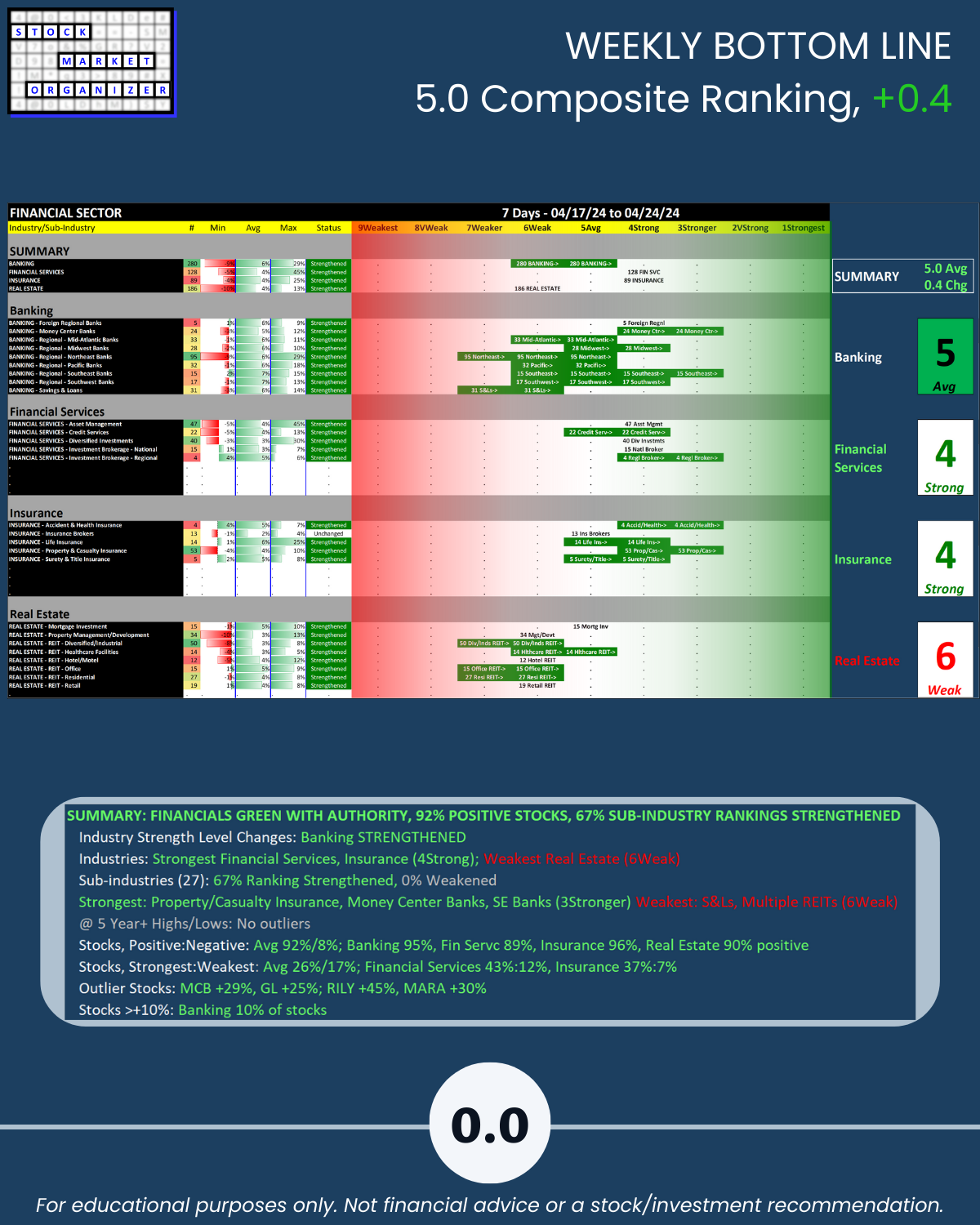

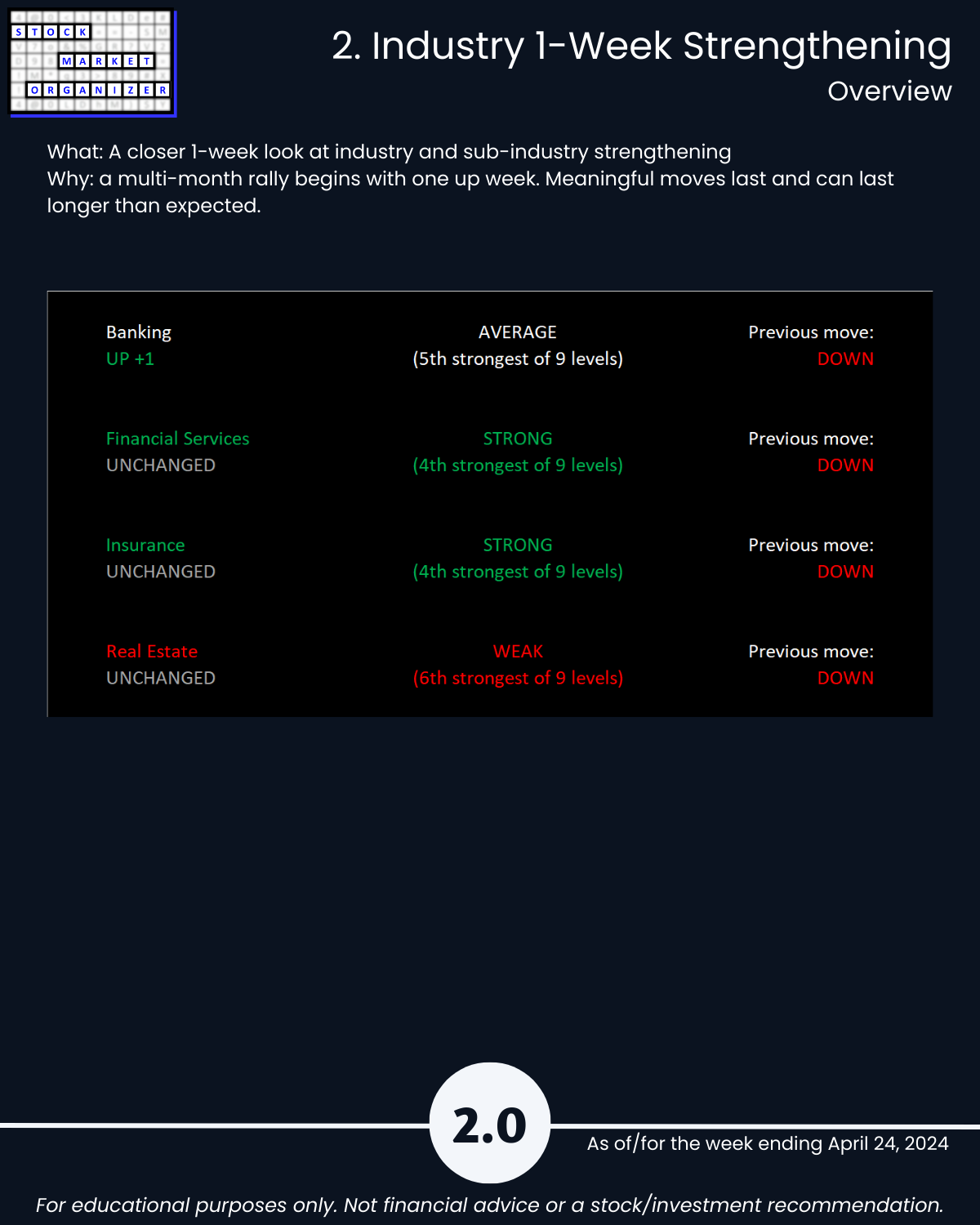

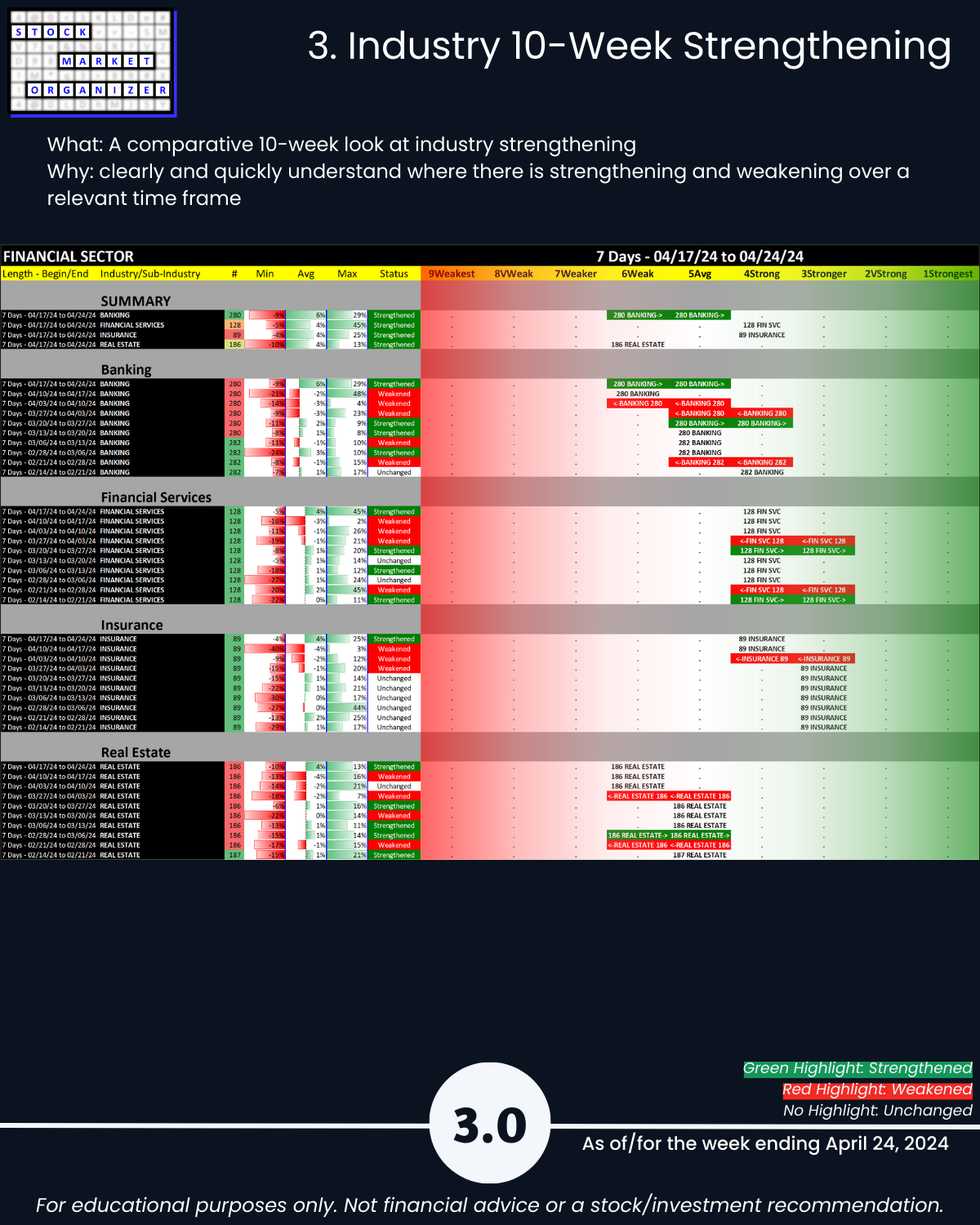

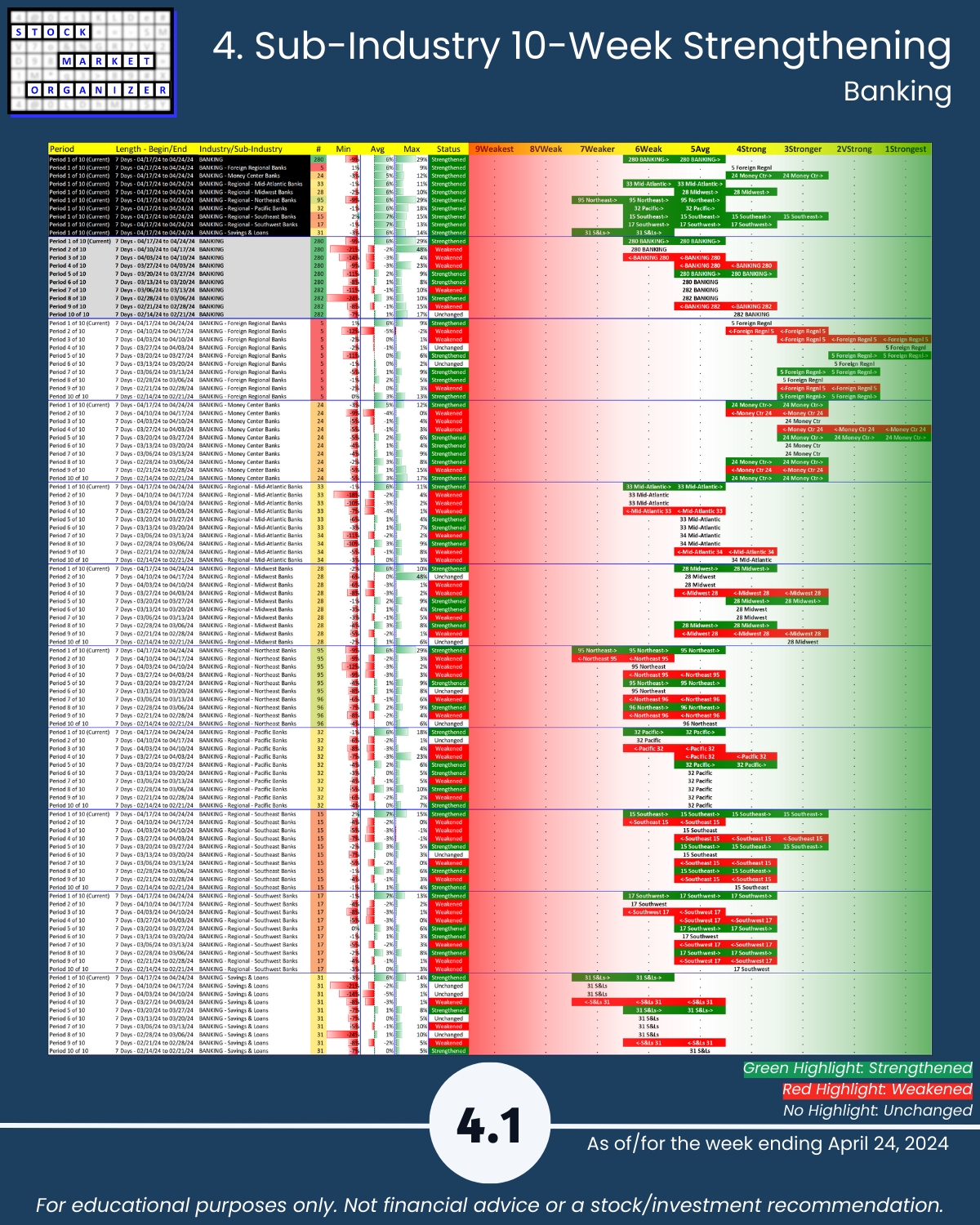

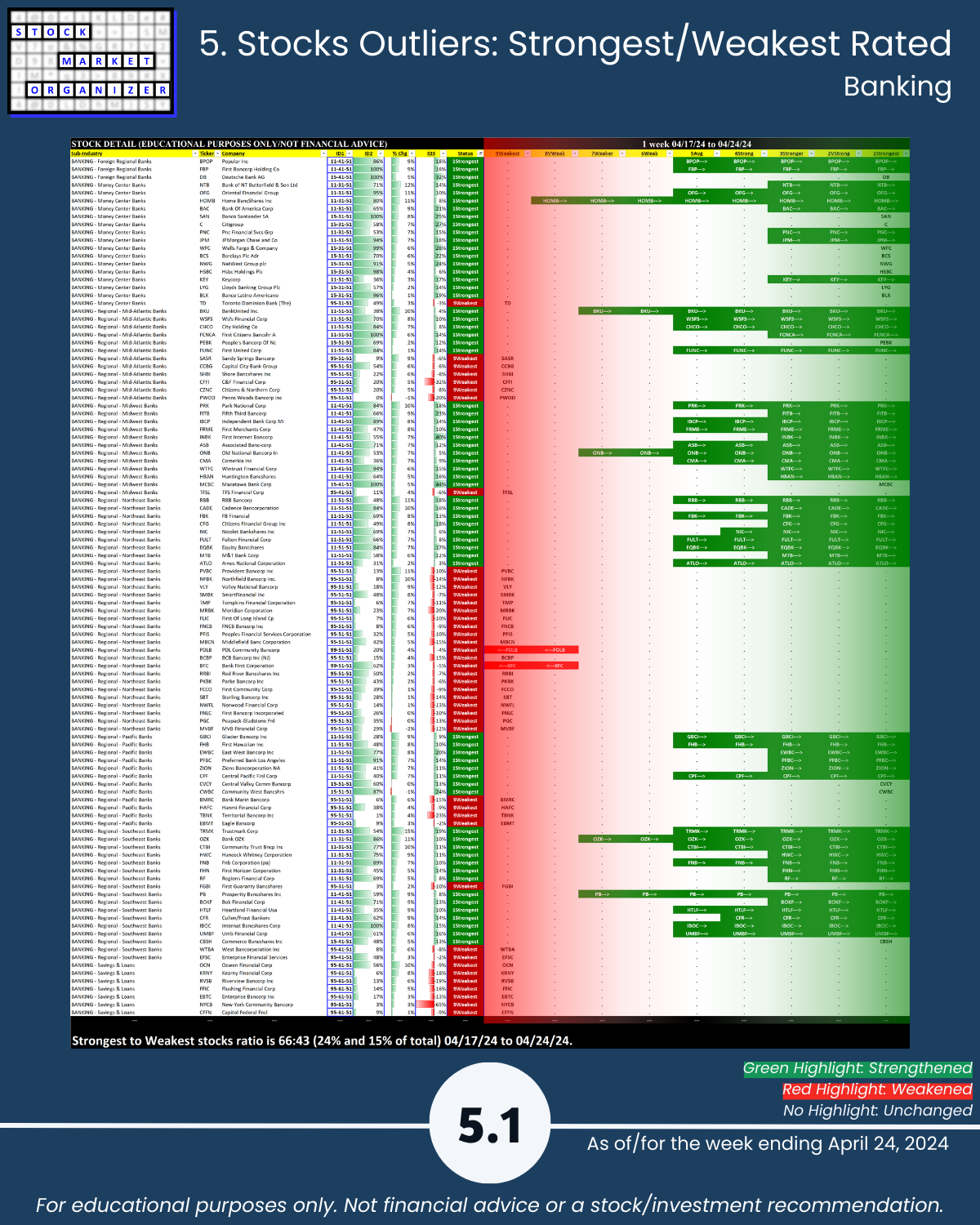

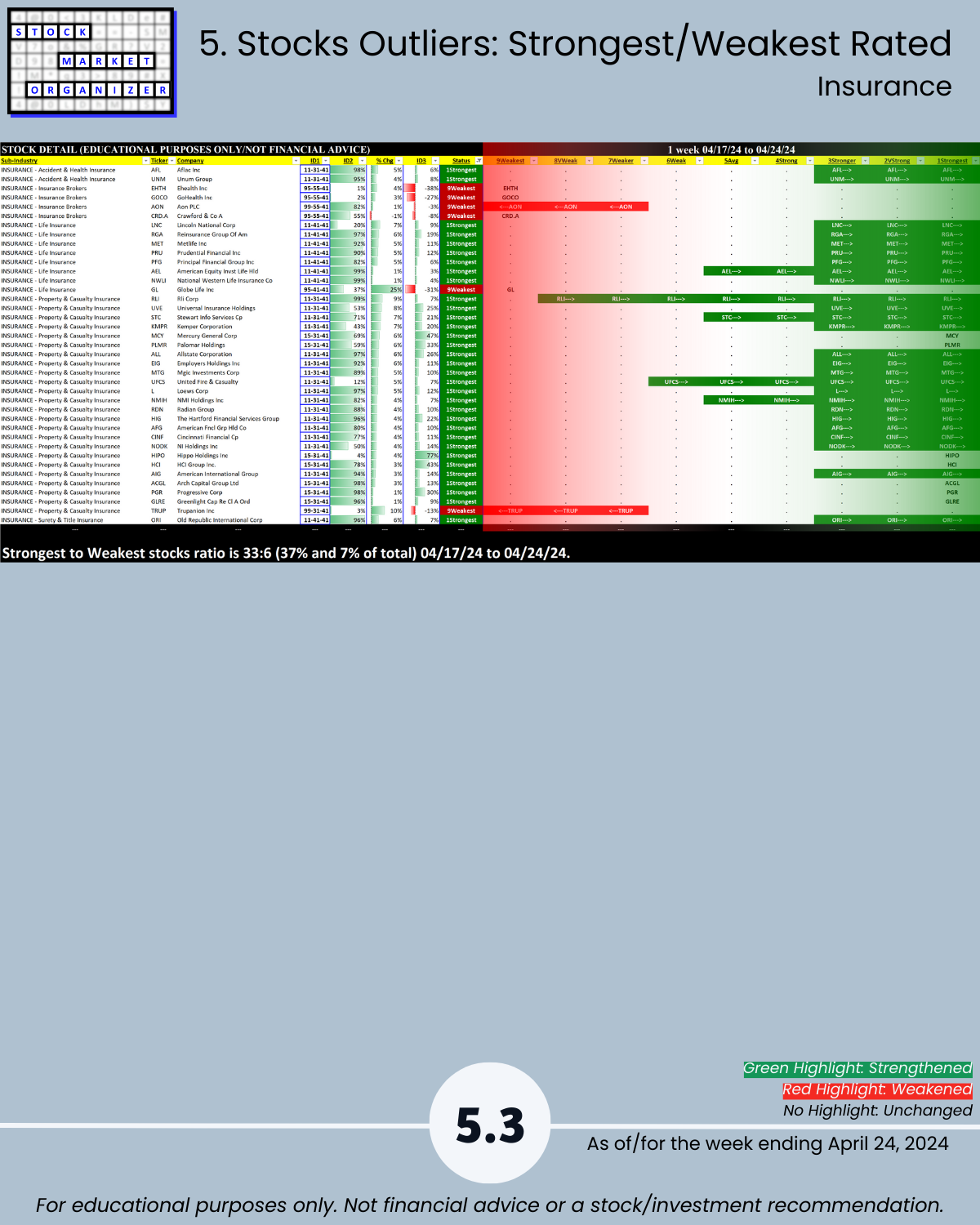

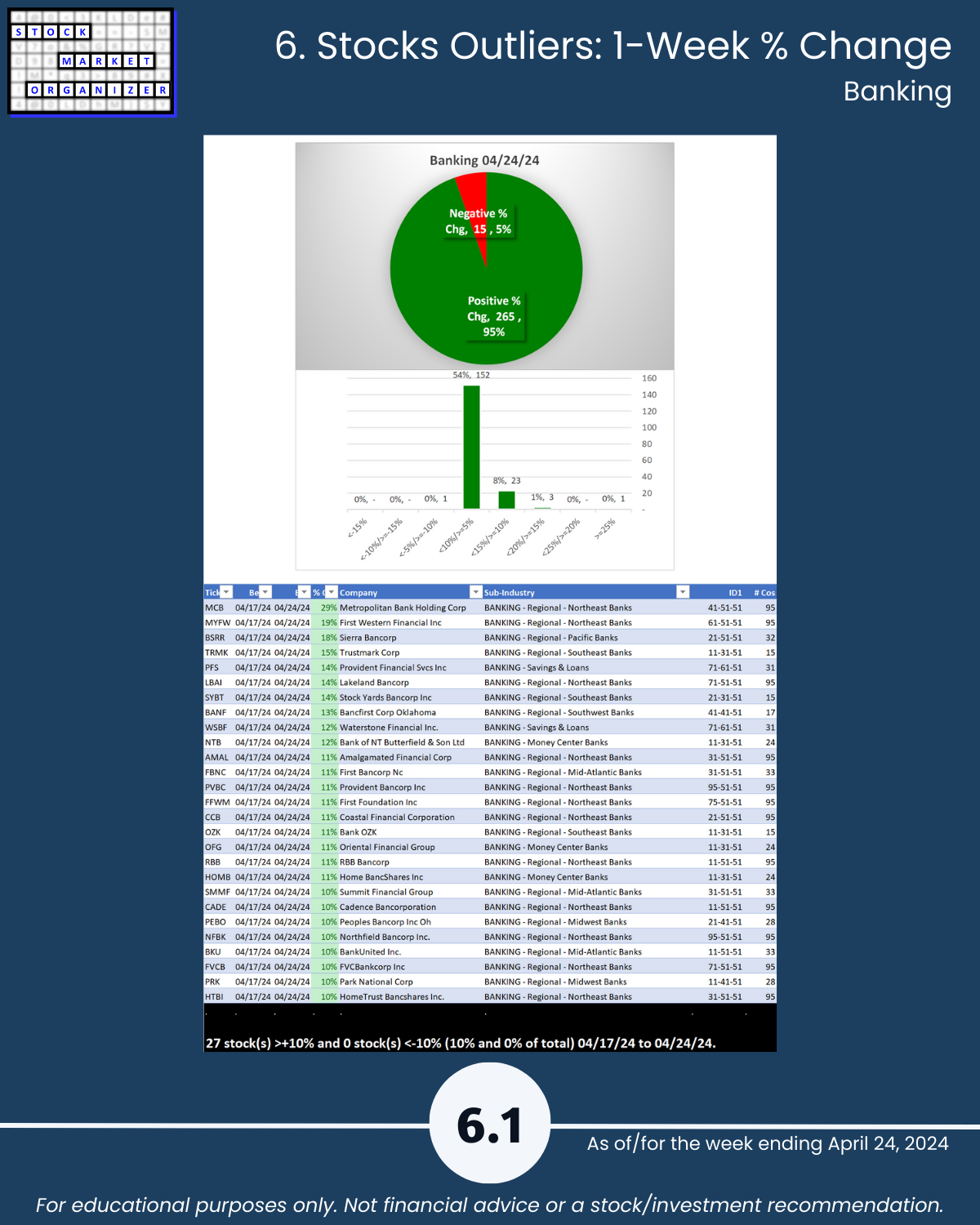

U.S. stock market 4/24/24 – no big deal, just another day of converting chaotic confusion into crystal clear calming context through obsessive organization. Today’s strength status for the Financial Sector (Banking, Financial Services, Insurance, and Real Estate): 🔹 strong Banking industry week as it strengthens 1 ranking to 5Average with 8 of 9 sub-industries strengthening, nearly 10% of its stocks rising more than 10%, and 95% positive stocks, 🔹 2 of every 3 sector sub-industries rankings strengthened, with Southeast Banks strengthening 3 rankings and both Northeast and Southwest Banks 2 rankings, 🔹 26/27 sub-industries generally strengthened, 🔹 Insurance industry very high 96% positive stocks with 37%:7% 1Strongest:9Weakest ratio, 🔹 composite strength ranking +0.4 for this week to 5.0.

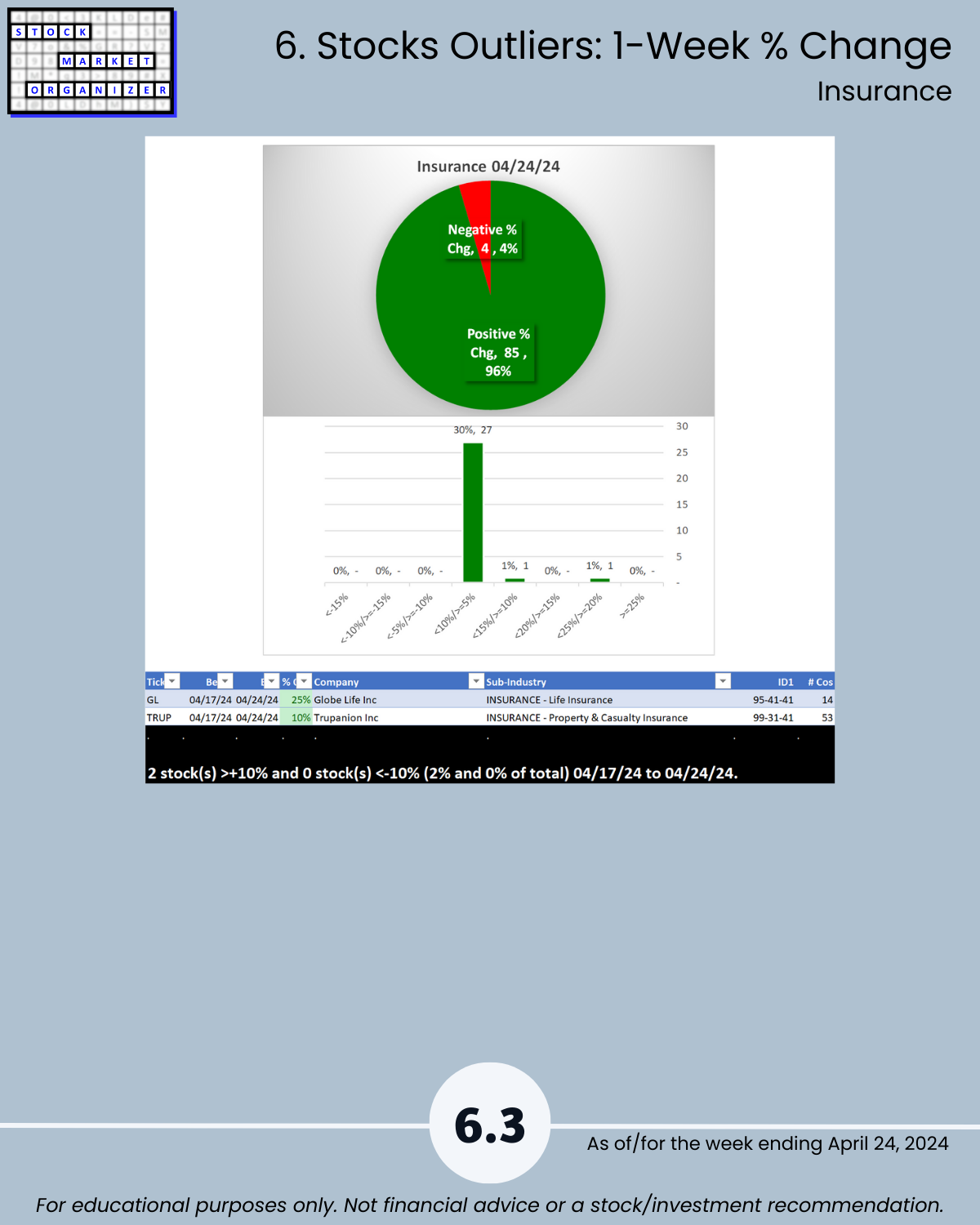

FOLLOW-UP: INSURANCE AND GLOBE LIFE/GL (-40% last week, +25% this week)

Strong GL rebound but its ranking is still only 95-41-41 =

🔹 9Weakest stock flat for the week,

🔹 4Strong sub-industry which strengthened this week

🔹 4Strong industry which strengthened this week

With the Market Strength Score turning positive after today’s action (new post coming soon), the market environment is No New Shorts.

IF I were to consider any Insurance industry stocks, they’d be rated 1Strong – there are currently 33 such candidates and all are listed by sub-industry on page 5.3 in the attached.

GL’s bounce back from its atrocious week last week does not elevate it into “Non-Ignore” status.

REPORT HIGHLIGHTS

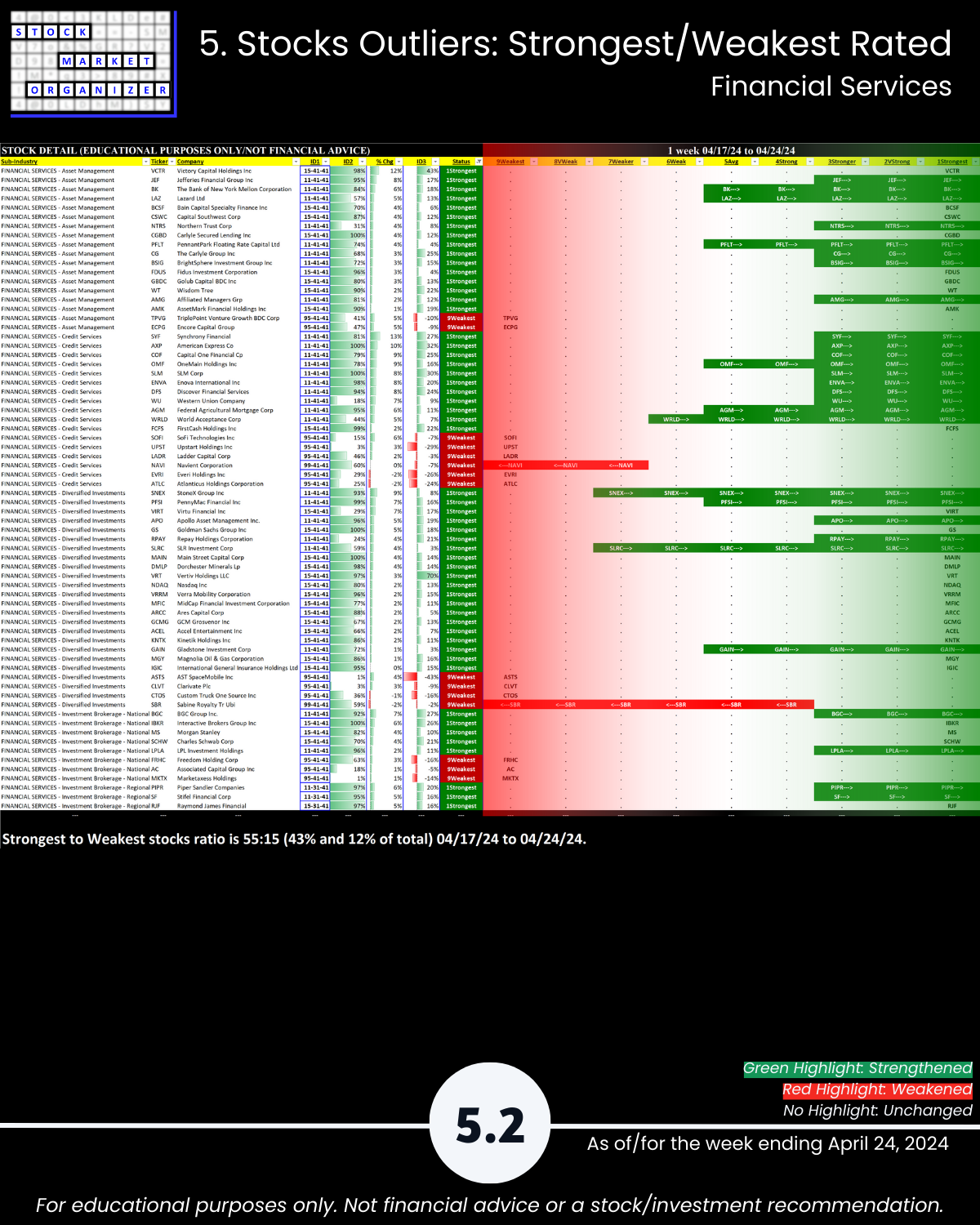

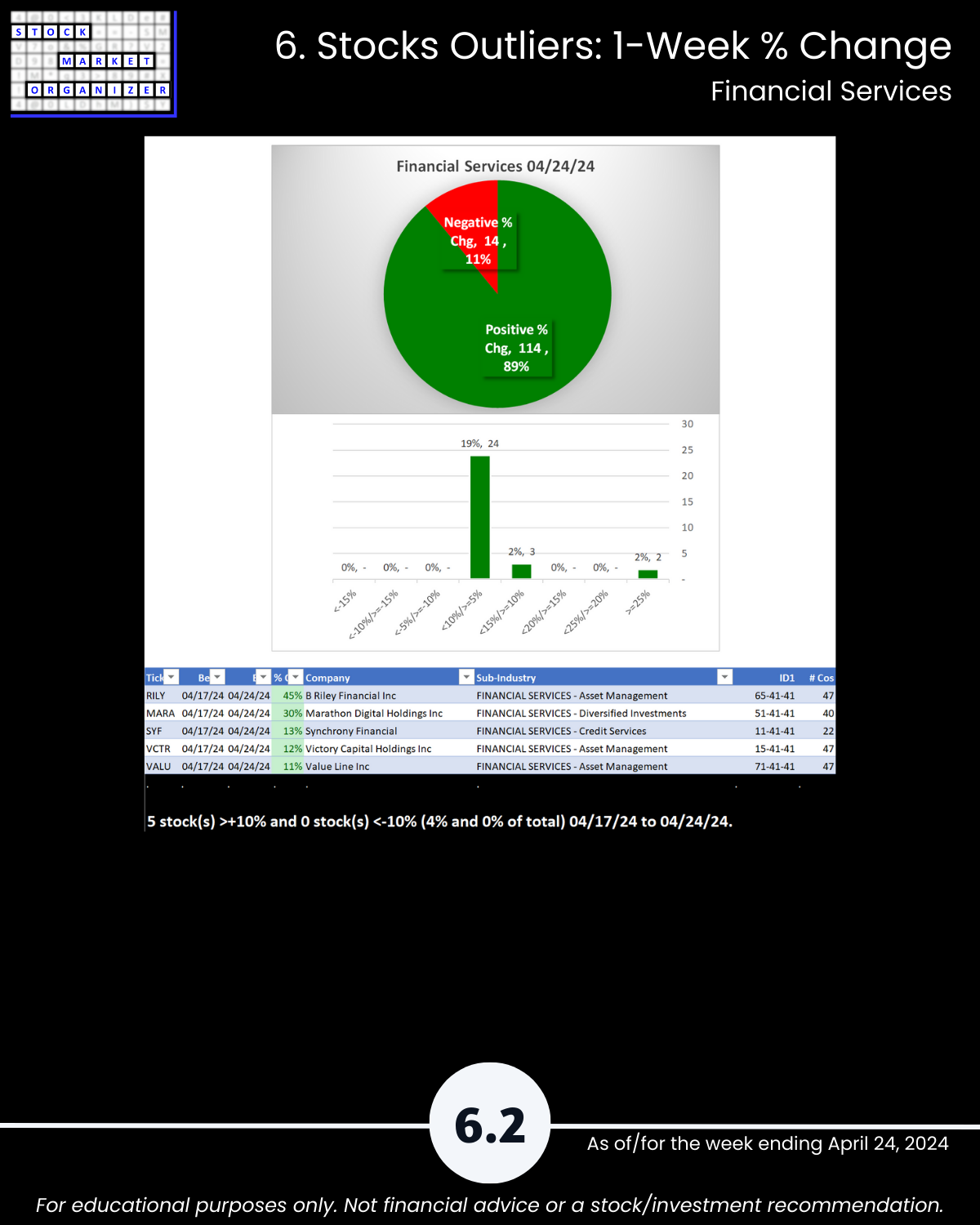

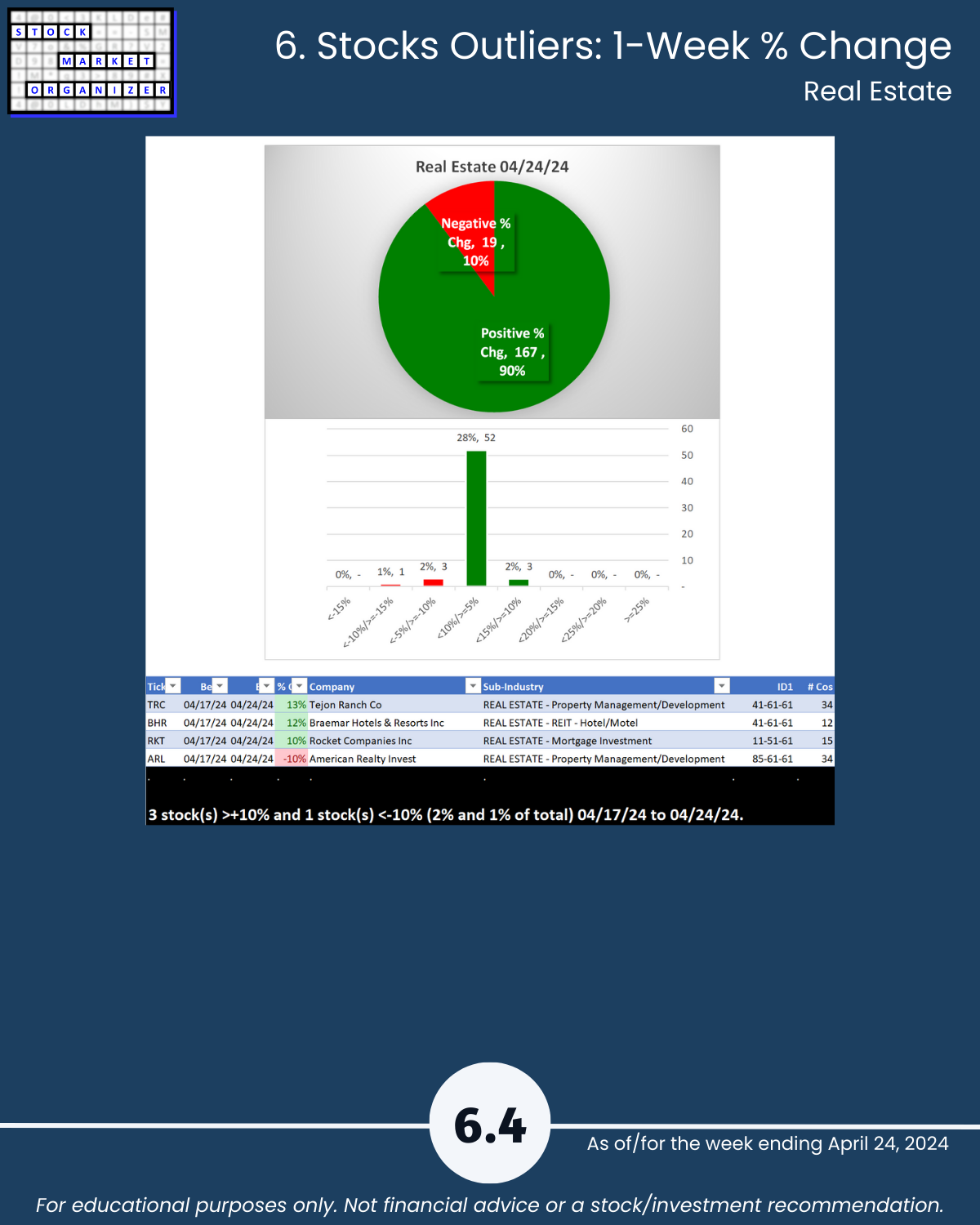

SUMMARY: FINANCIALS GREEN WITH AUTHORITY, 92% POSITIVE STOCKS, 67% SUB-INDUSTRY RANKINGS STRENGTHENED

🔹 Industry Strength Level Changes: Banking STRENGTHENED

🔹 Industries

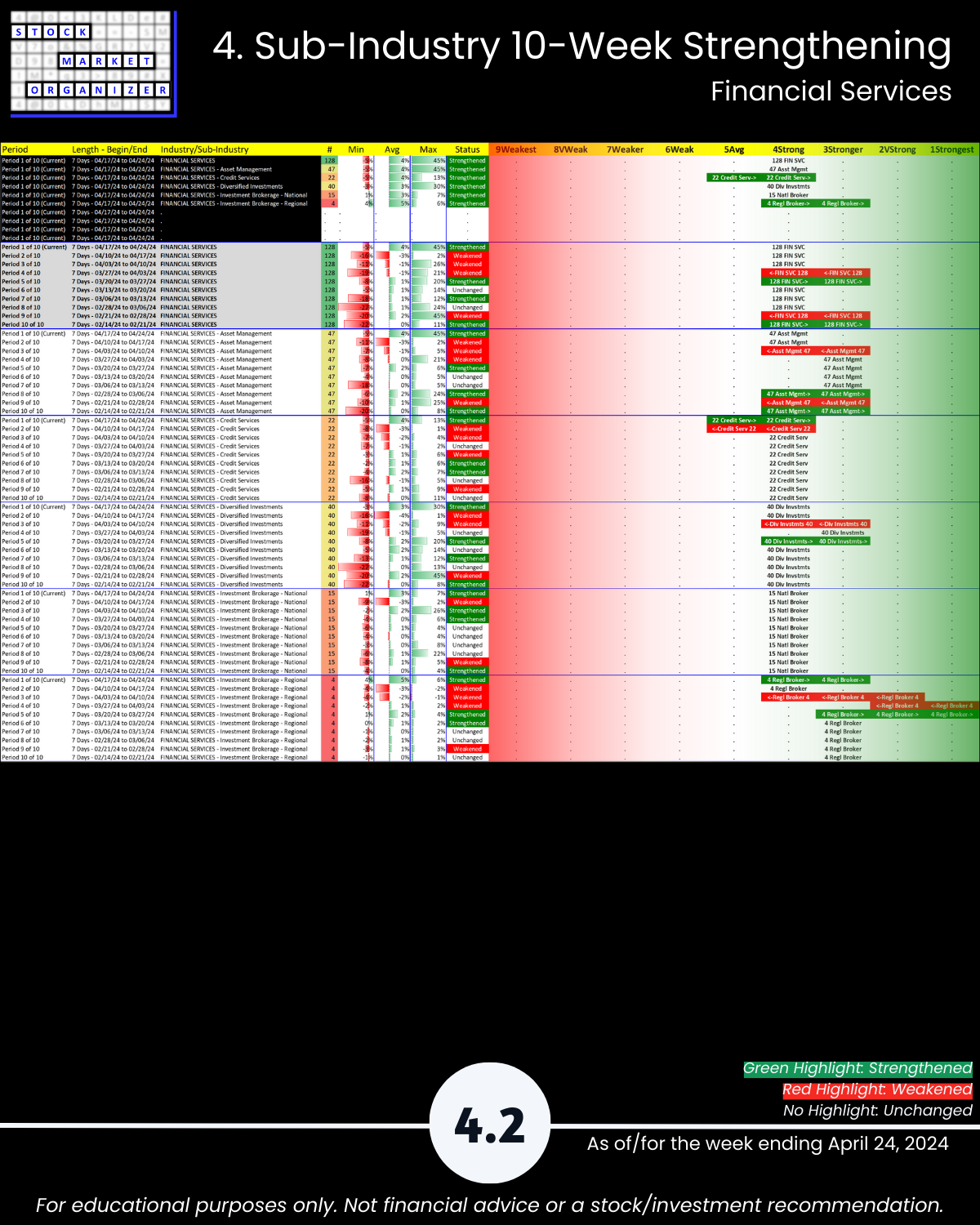

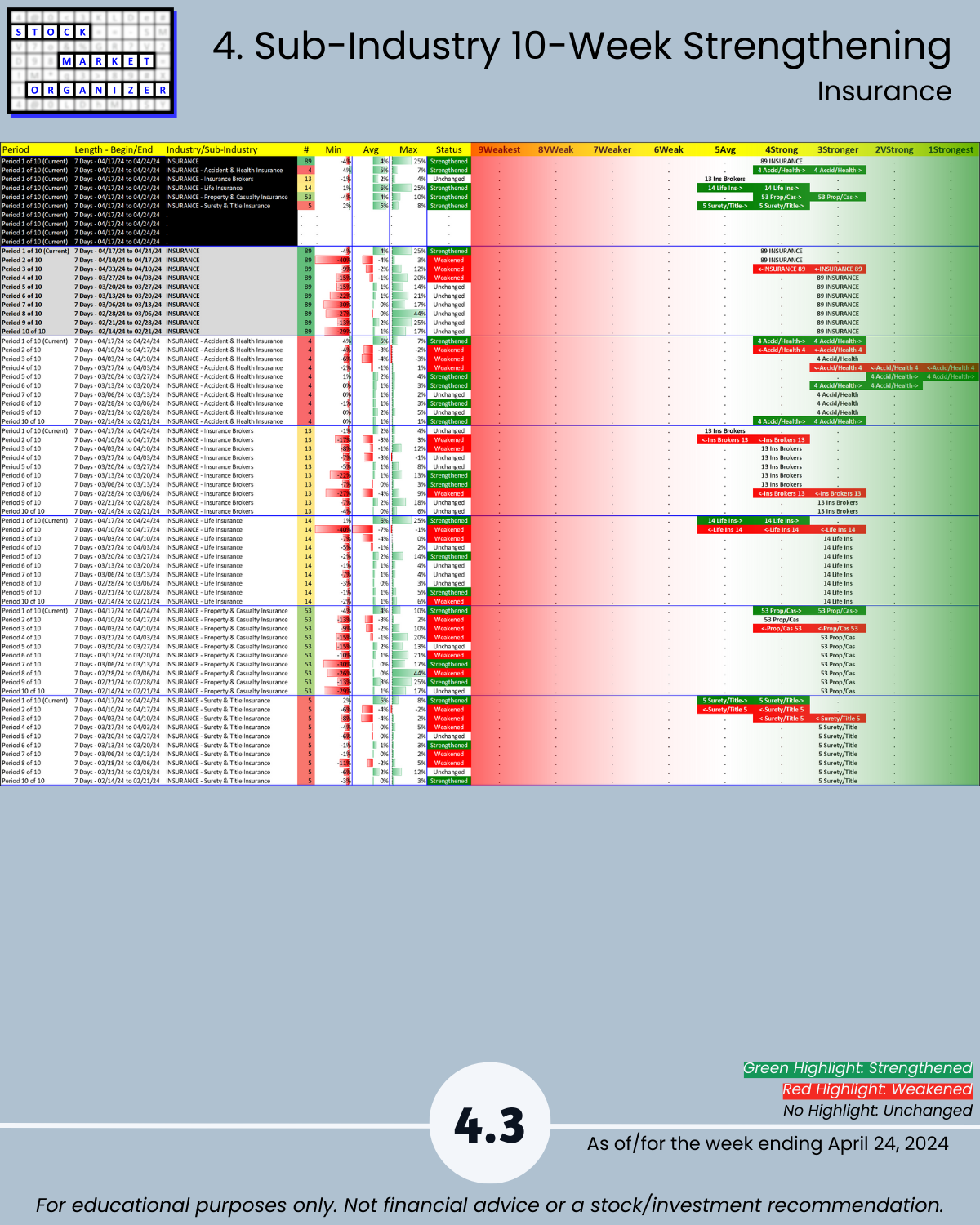

- Strongest Financial Services, Insurance (4Strong)

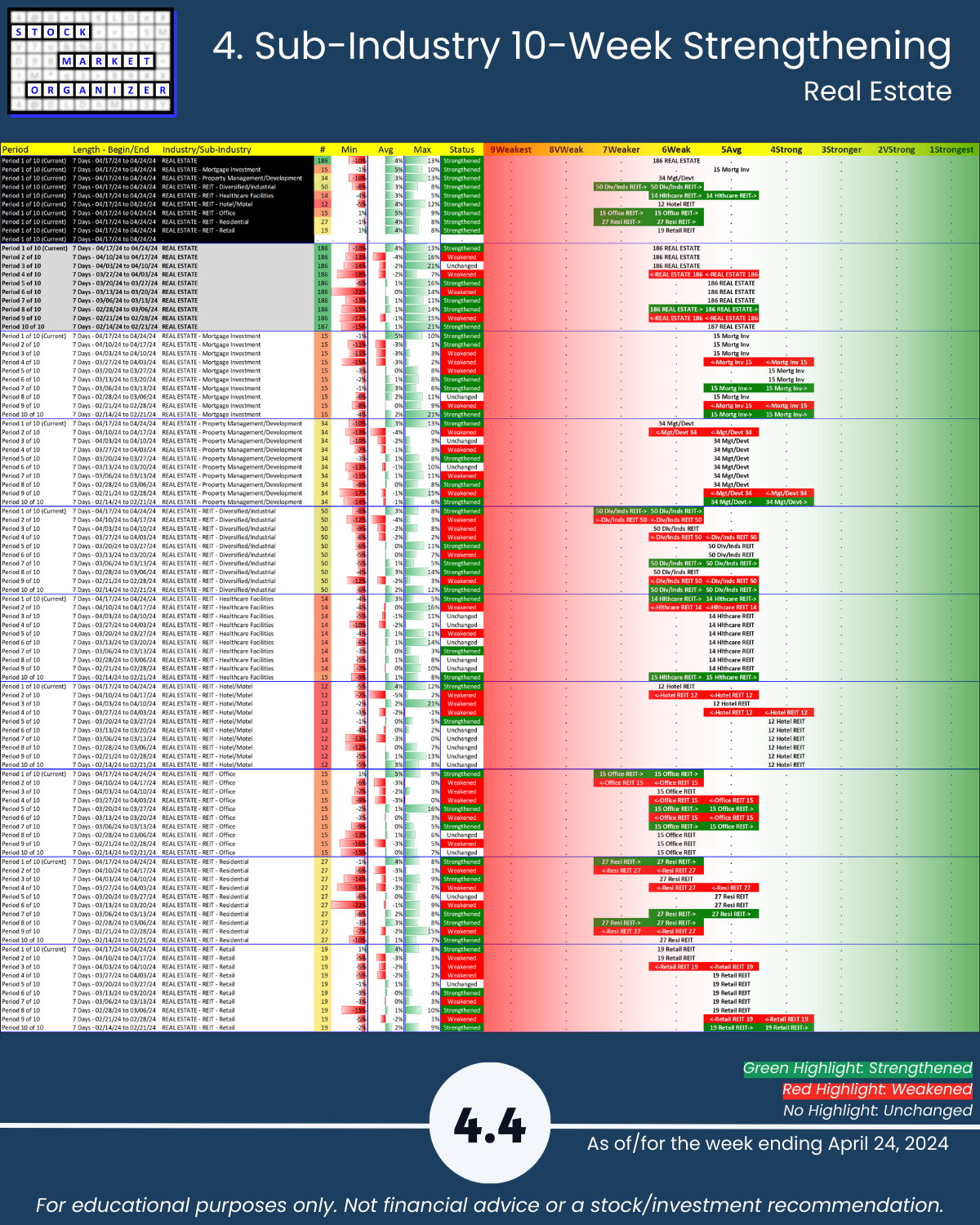

- Weakest Real Estate (6Weak)

🔹 Sub-industries (27)

- 67% Ranking Strengthened, 0% Weakened

- Strongest: Property/Casualty Insurance, Money Center Banks, SE Banks (3Stronger)

- Weakest: S&Ls, Multiple REITs (6Weak)

- @ 5 Year+ Highs/Lows: No outliers

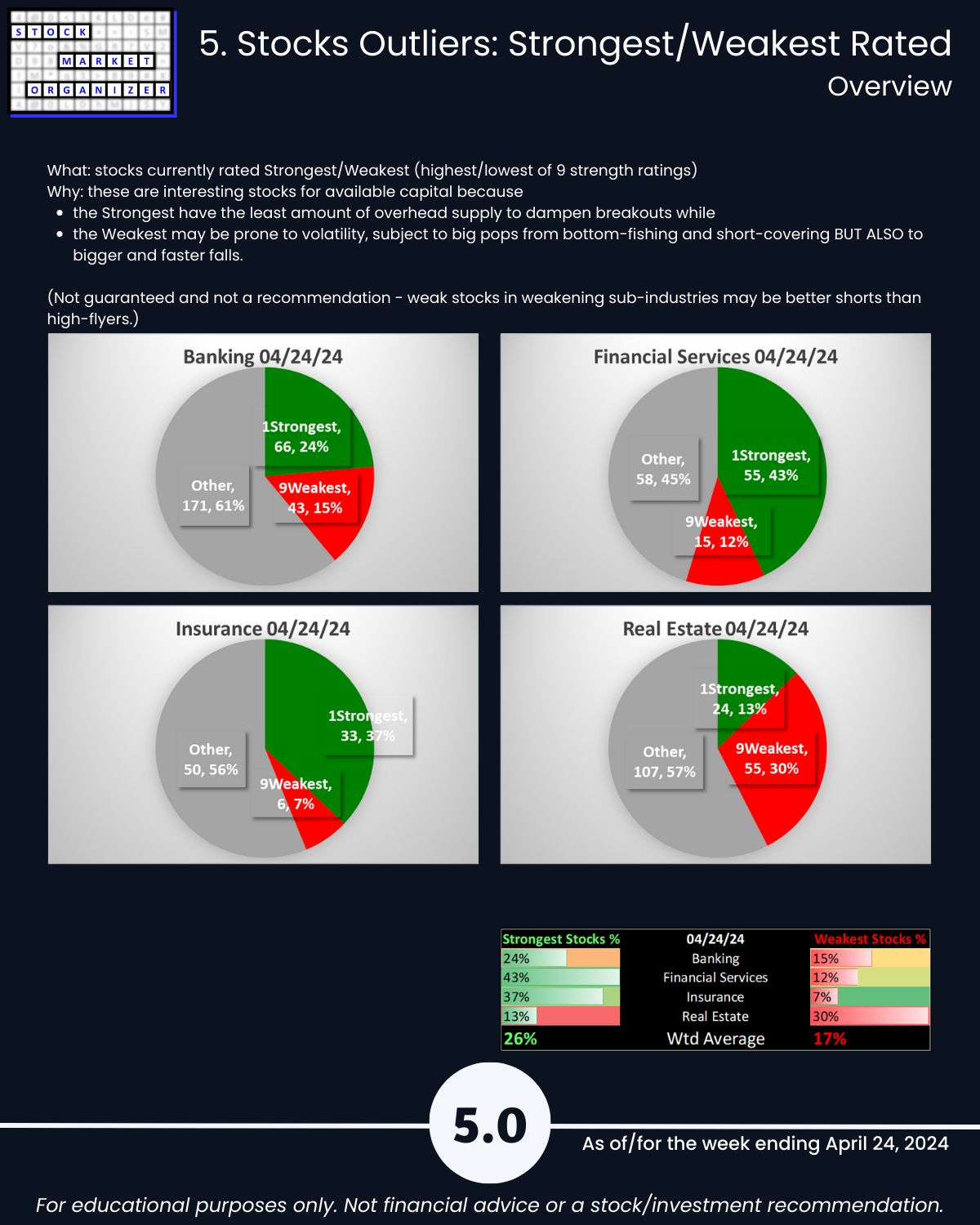

🔹 Stocks

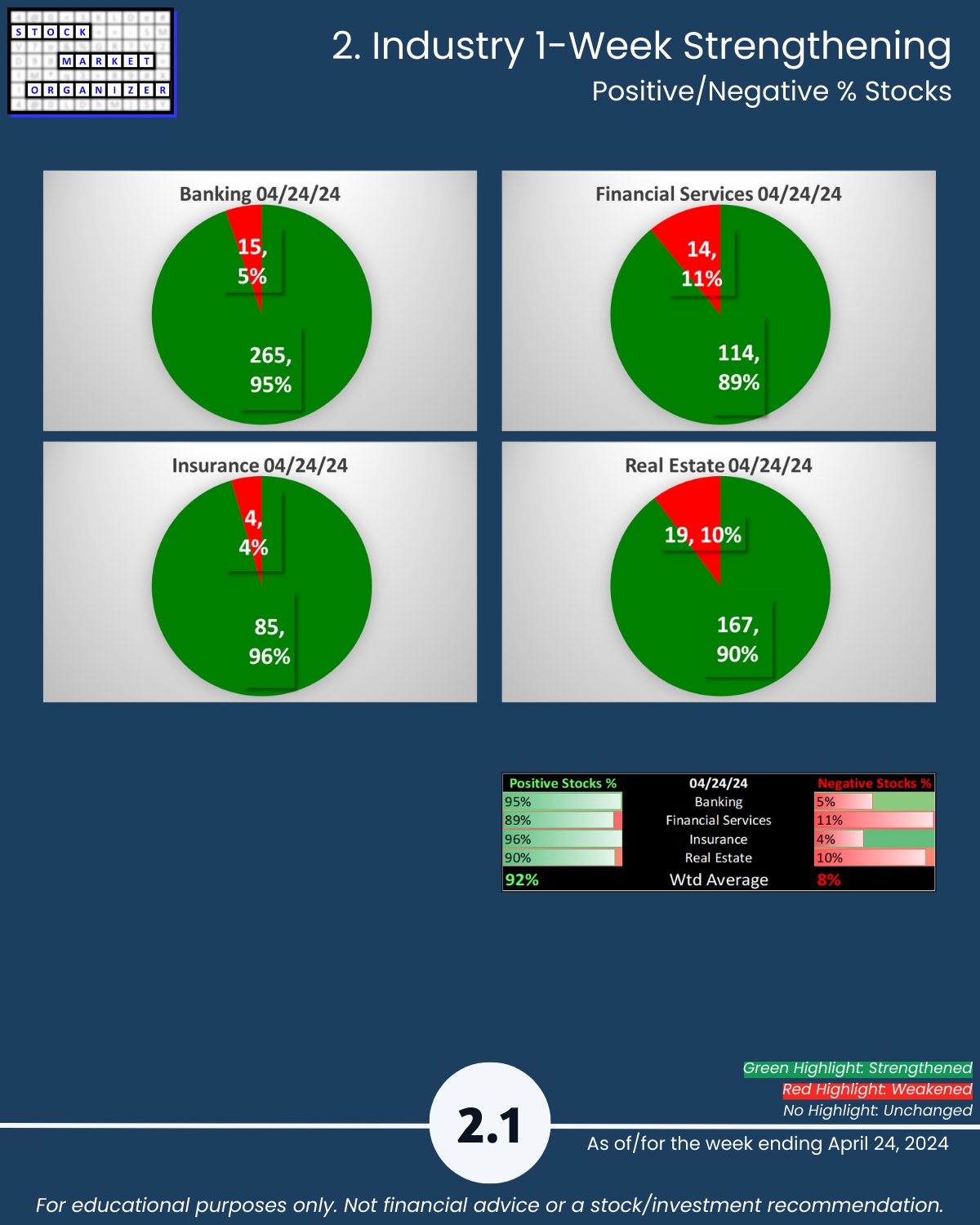

- Positive:Negative: Avg 92%/8%; Banking 95%, Financial Services 89%, Insurance 96%, Real Estate 90% positive

- Strongest:Weakest: Avg 26%/17%; Financial Services 43%:12%, Insurance 37%:7%

- Outlier Stocks: MCB +29%, GL +25%; RILY +45%, MARA +30%

- Stocks >+10%: Banking 10% of stocks

1. Introduction - Industry Components

2. Industry 1-Week Strengthening

3. Industry 10-Week Strengthening

4. Sub-Industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

6. Stocks Outliers: 1-Week % Change

7. Stocks Outliers: 5-Year Highs/Lows