SMO Exclusive: Strength Report Financial Sector 2024-04-17

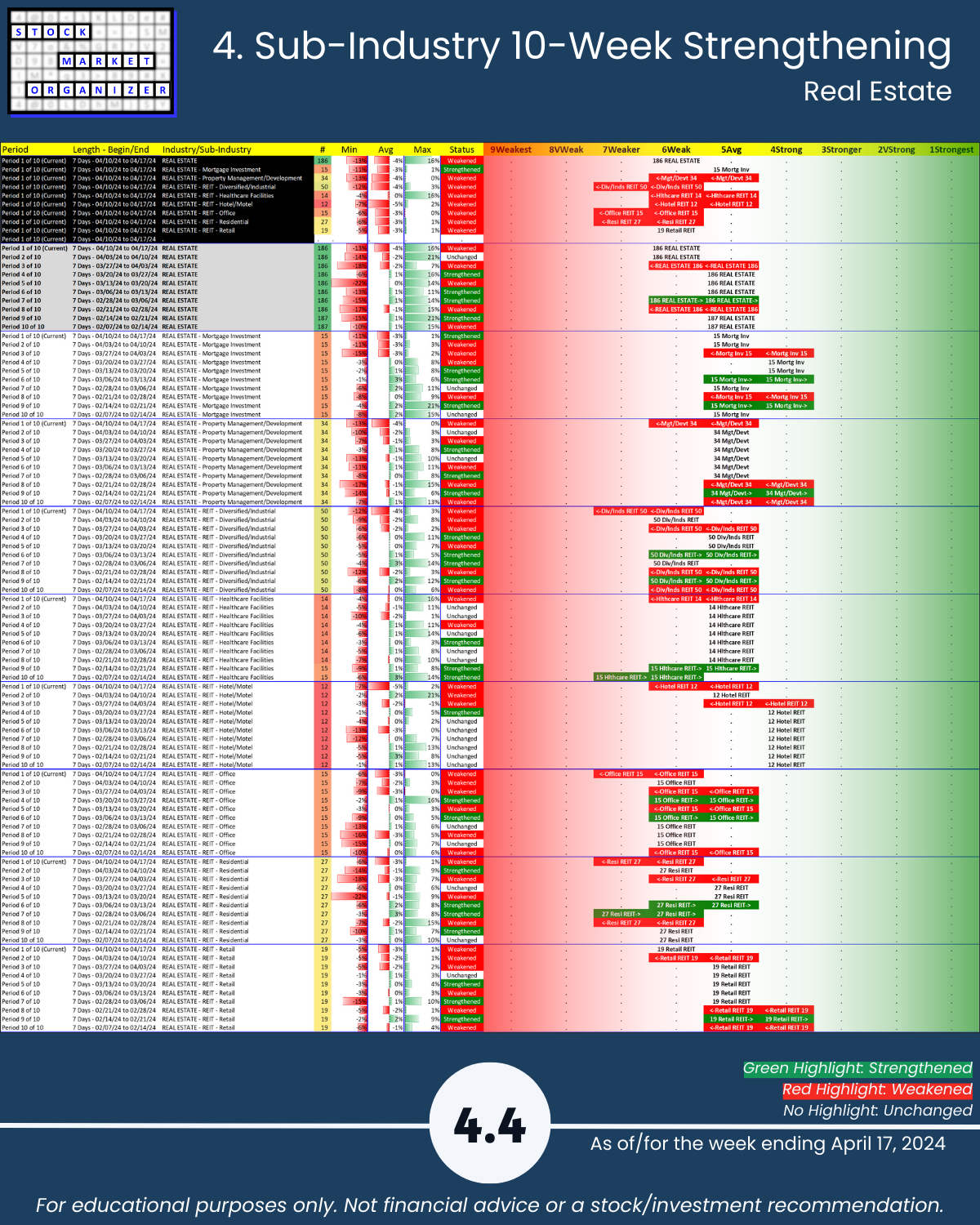

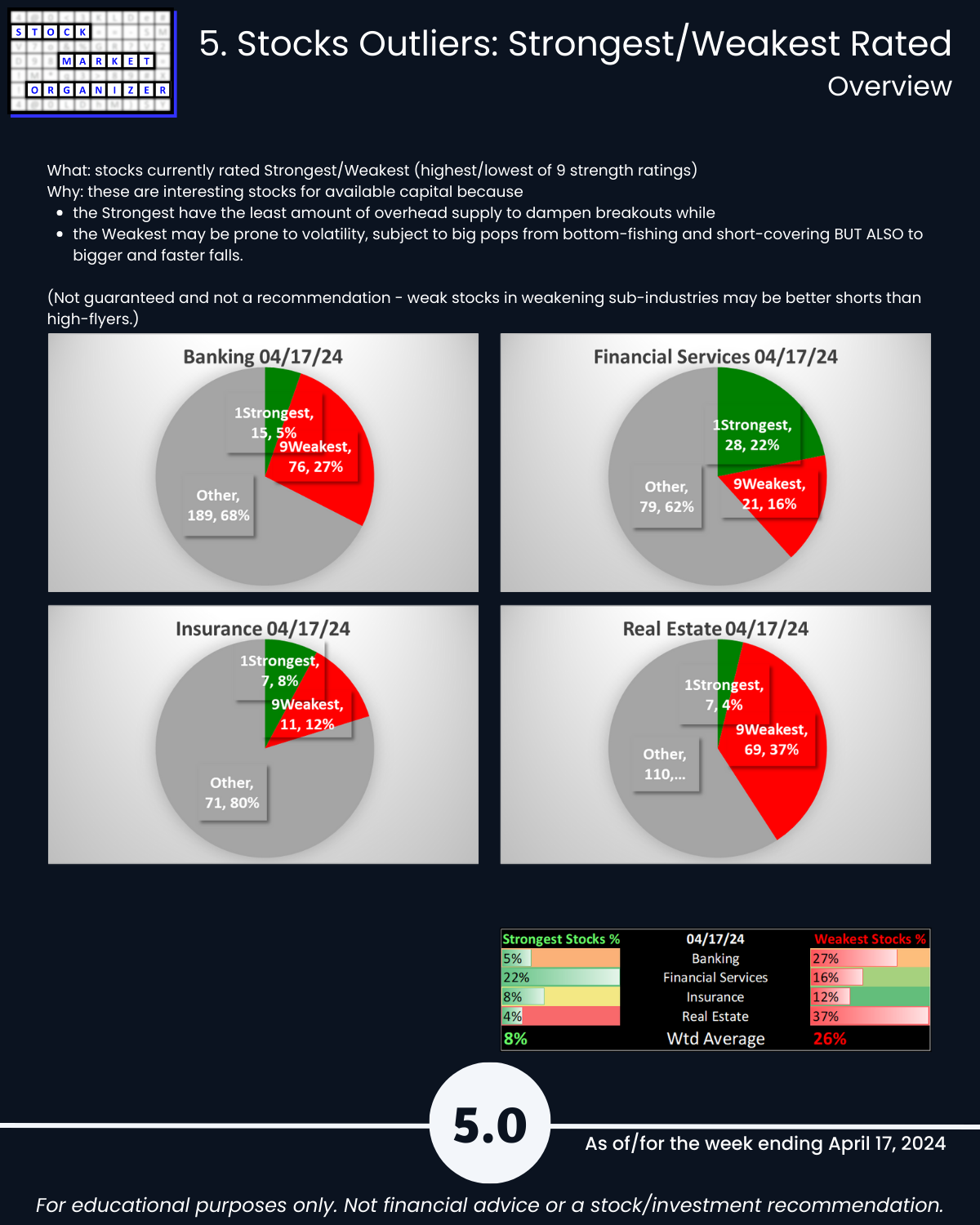

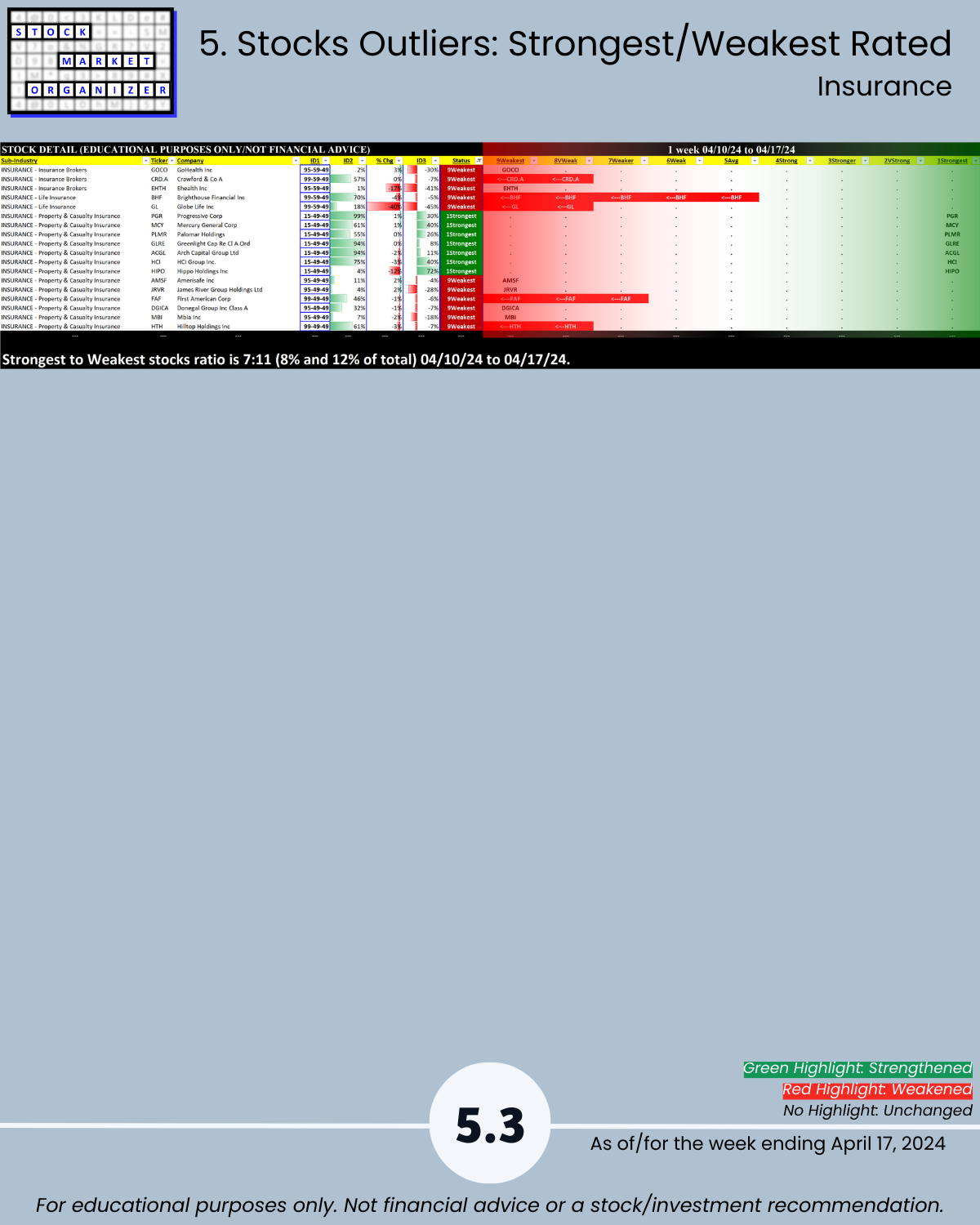

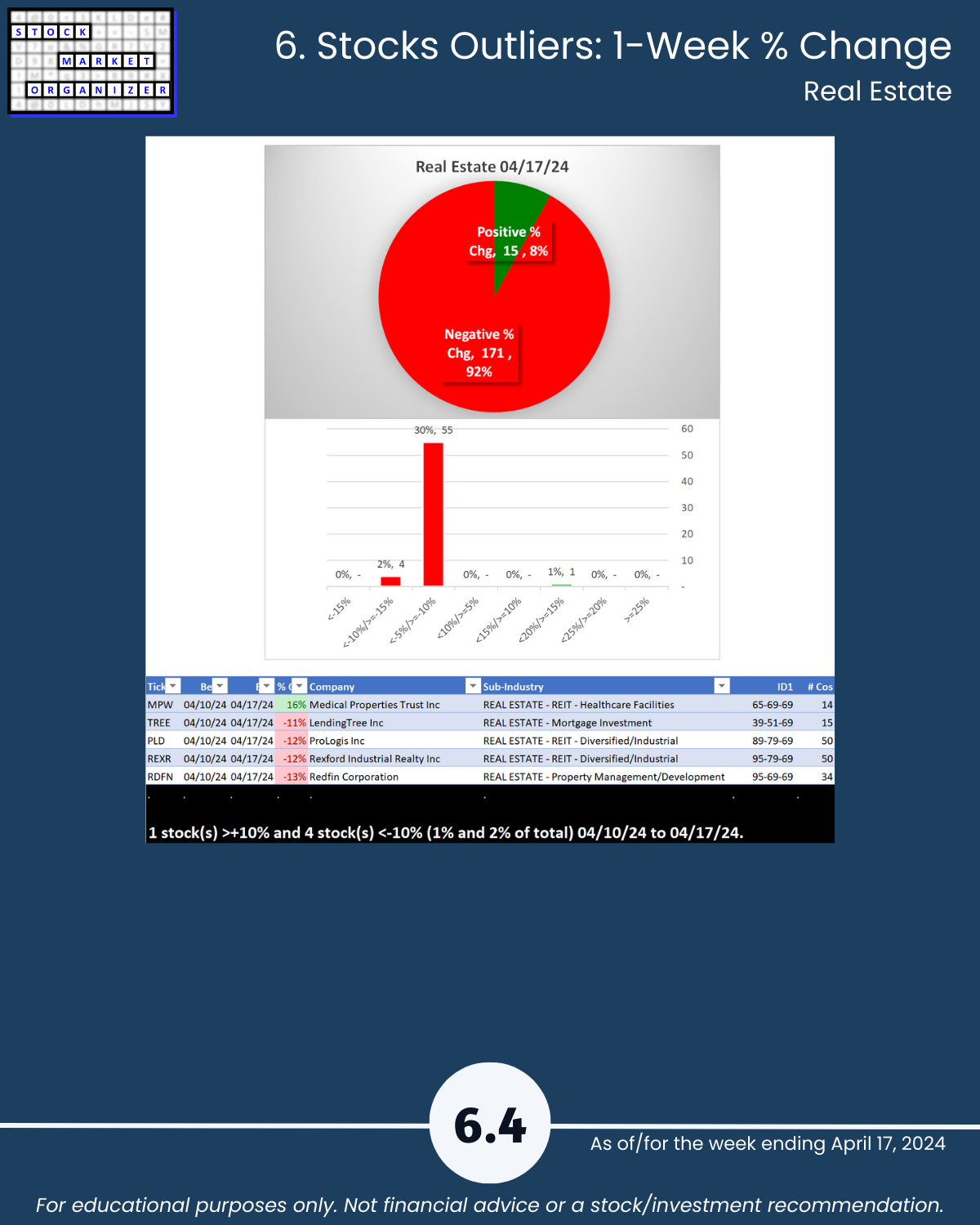

Can you make stock market order from chaos? And context from confusion? Attached is one possible way as of 4/17/24. Because the stronger your stocks the greener your P&L, here’s a current picture of strength in today’s Financial Sector industries - Banking, Financial Services, Insurance, and Real Estate: 🔹 2 days ago Utilities were highlighted as problematic, yesterday Automotive, today it is Real Estate’s turn – the rankings for 6 of 8 sub-industries weakened, 92% negative stocks and a poor 4%:37% 1Strongest:9Weakest stocks ratio for/after this week, 3 sub-industries are weakest of the 27 in this sector (Diversified/Industrial, Office, and Residential Retail REITs are 7Weaker), 🔹 4/5 Insurance sub-industries weakened and it had 92% negative stocks, 🔹 the composite sector ranking is 5.4, below 5Average with only 8% stocks rated 1Strongest and 26% rated 1Weakest.

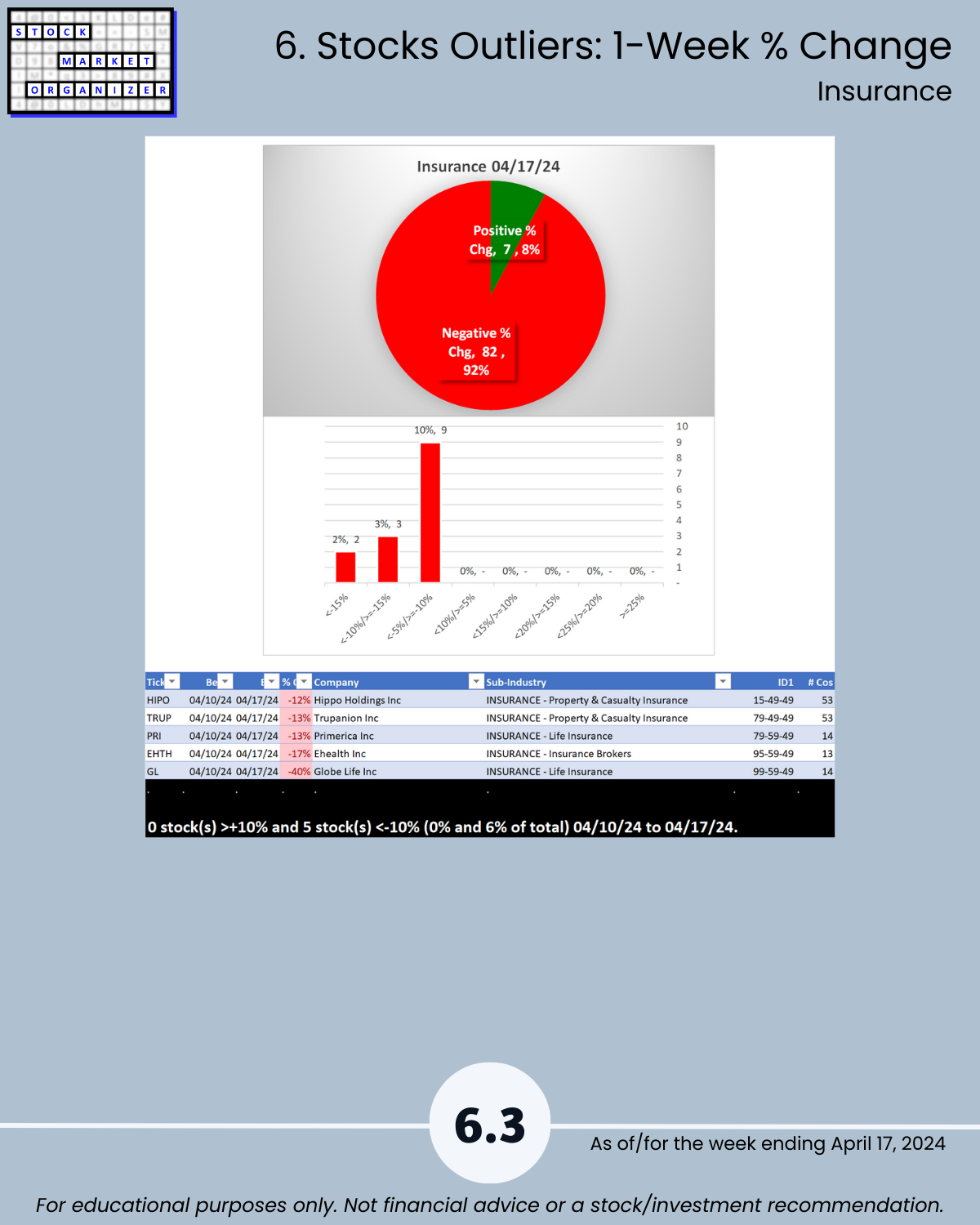

OBJECTIVELY KNOW WHAT TO AVOID: INSURANCE AND GLOBE LIFE/GL (-40% this week)

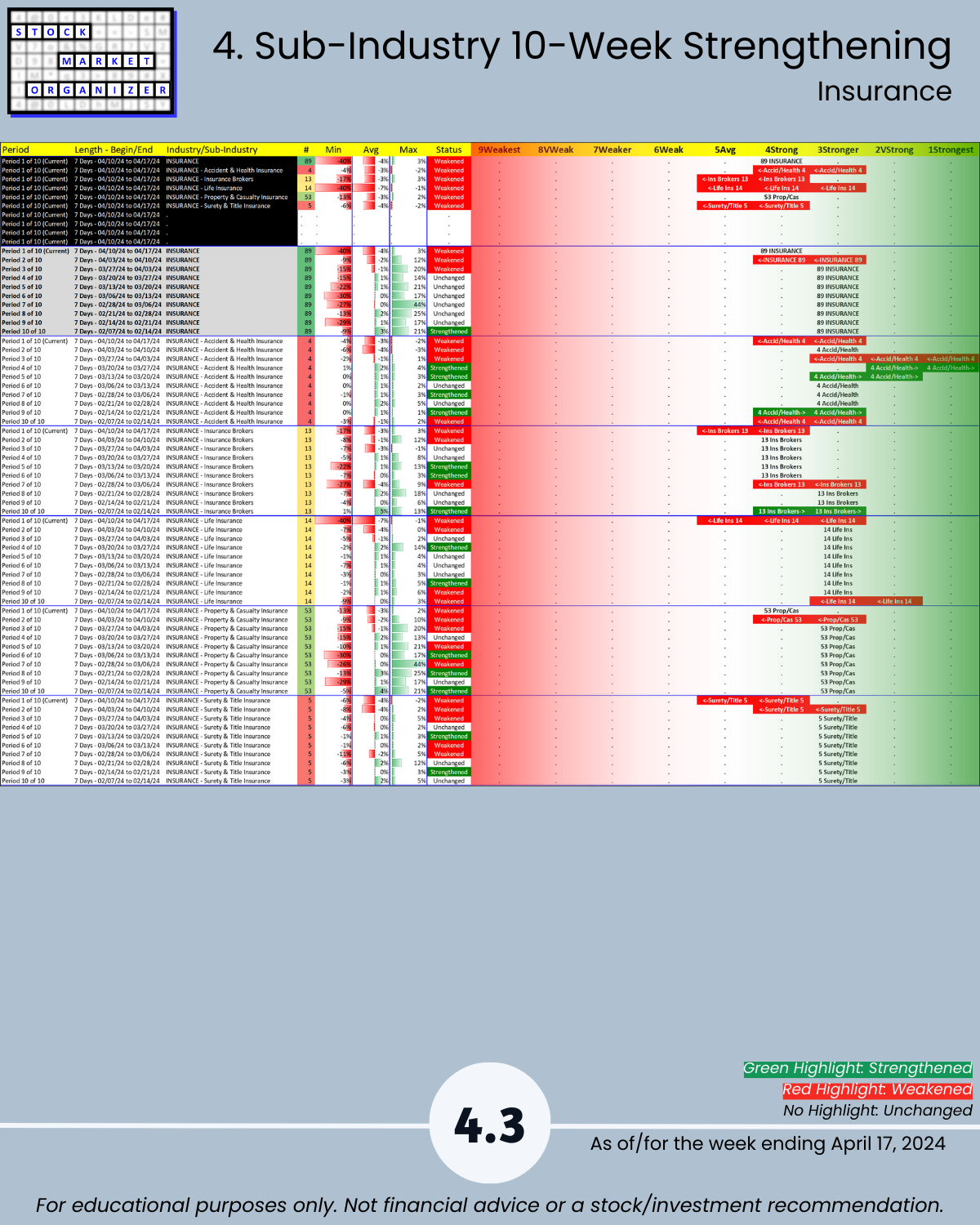

Insurance industry facts from my tracking:

🔹 1/3/24 through 4/3/24, Insurance was a market strength leader at 3Stronger (with Materials & Construction)

🔹 Week ending 4/10/24, Insurance weakened to 4Strong

🔹 As of 3/27/24 Insurance had a powerful ratio of 27:0 stocks at 5+ year highs:lows

🔹 This ratio has dropped to 12:0, 2:0, and now 0:0 at 4/17/24.

Obviously, this is not the only way of seeing industry weakness. But its message is clear.

This is an example of Making Order from Chaos.

GL – Globe Life recent Stock Market Organizer rankings:

🔹 4/12/24: 89-49-49

🔹 4/5/24: 75-39-39

🔹 3/28/24: 75-31-31

🔹 3/22/24: 75-35-39

COMMENTS:

🔹 At 3/28/24 GL had a 7Weaker ranking while both its sub-industry and industry were ranked 3Stronger and strengthening

🔹 Therefore, GL was not a long candidate regardless of its industry and sub-industry strength

Heeding these rankings would have kept prospective GL holders out of trouble.

And it’s an example of Making Order from Chaos.

REPORT HIGHLIGHTS

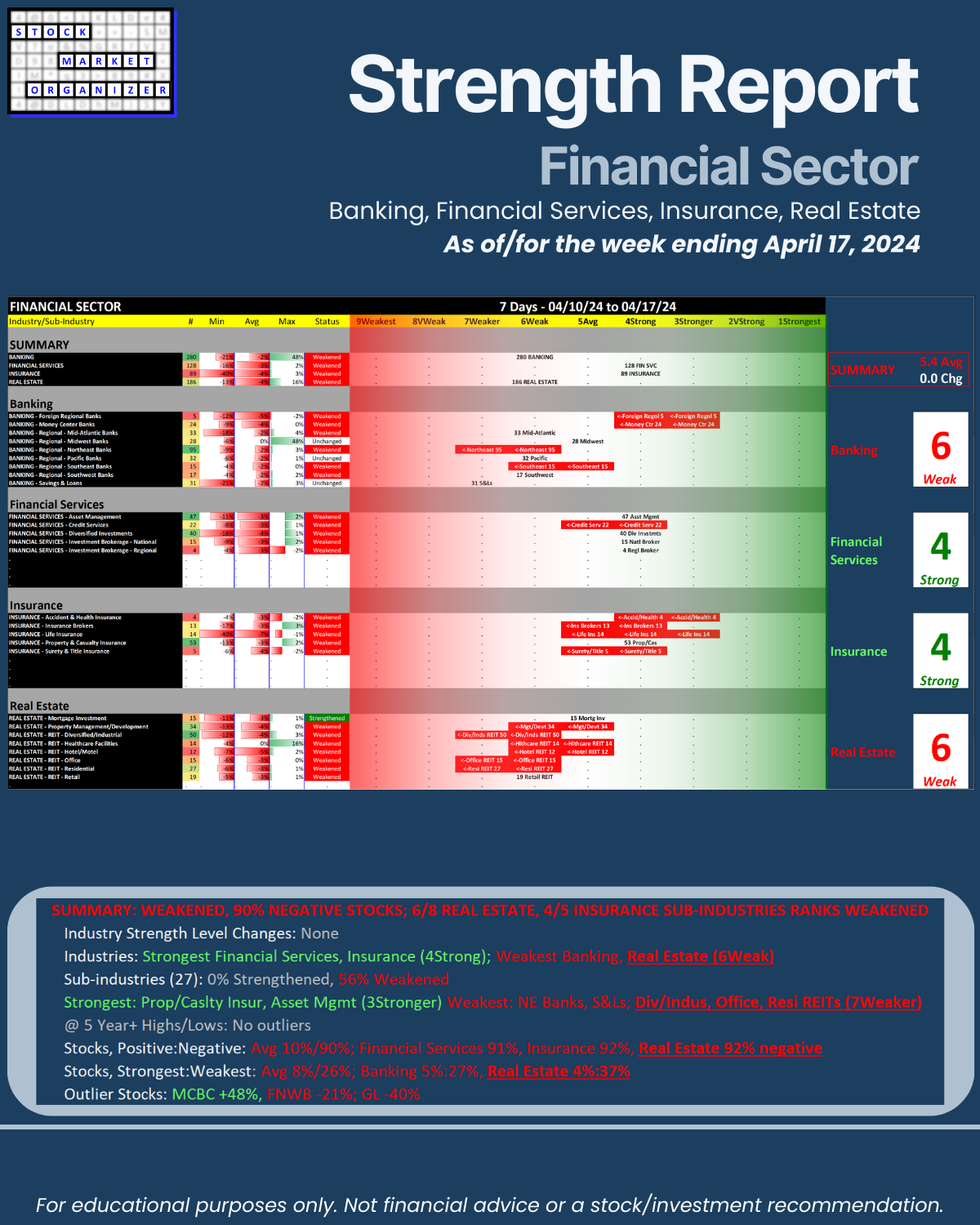

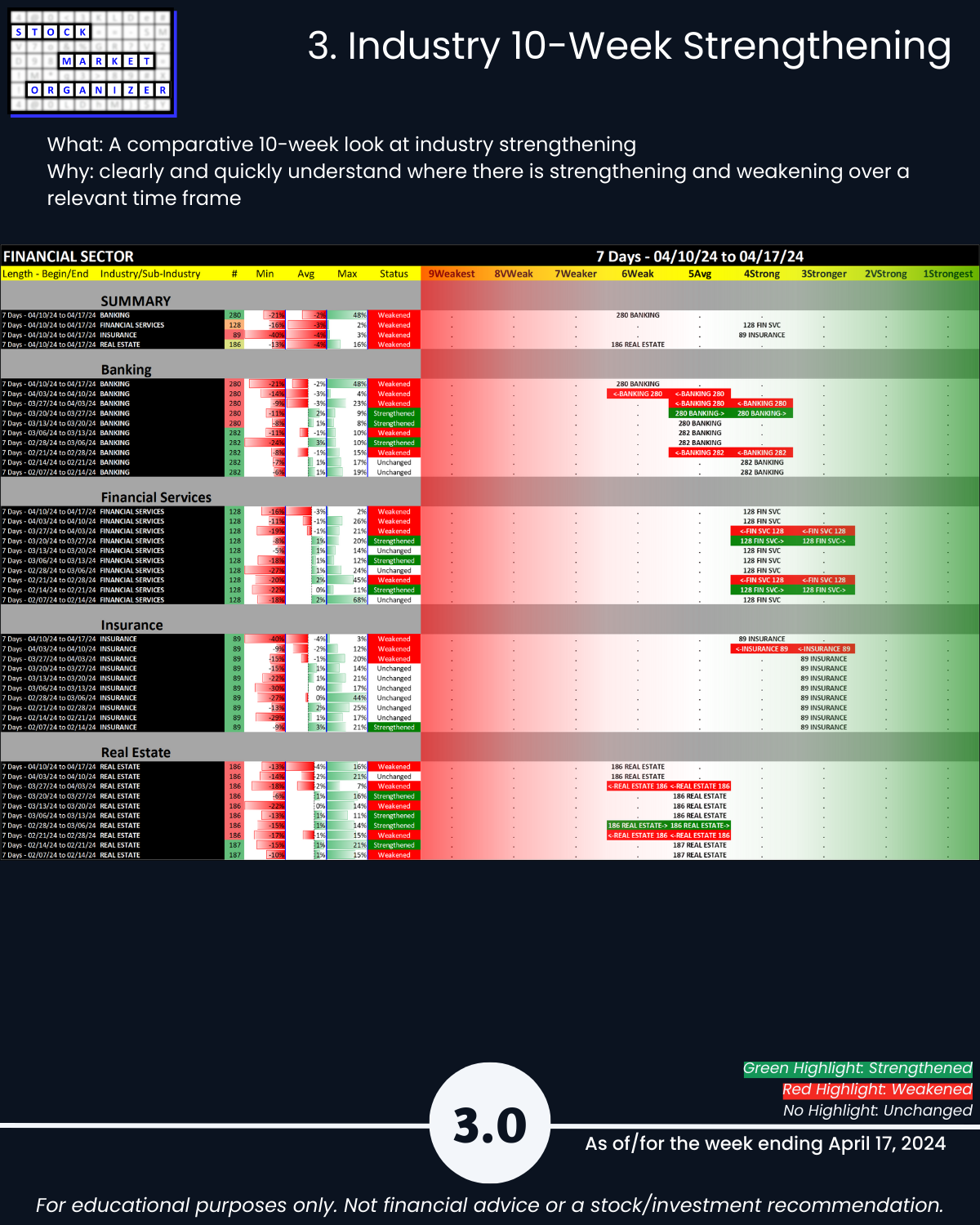

SUMMARY: WEAKENED, 90% NEGATIVE STOCKS; 6/8 REAL ESTATE, 4/5 INSURANCE SUB-INDUSTRIES RANKS WEAKENED

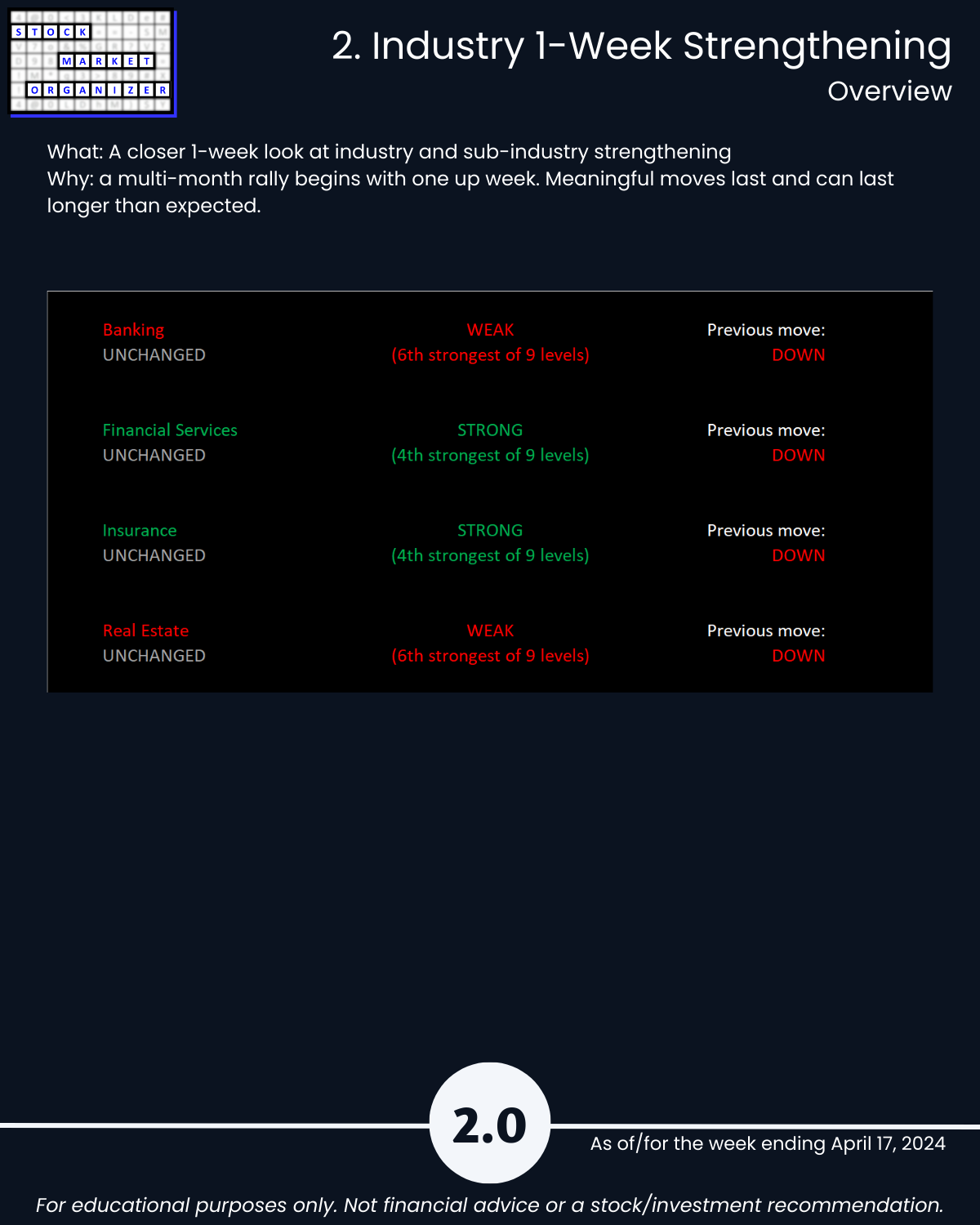

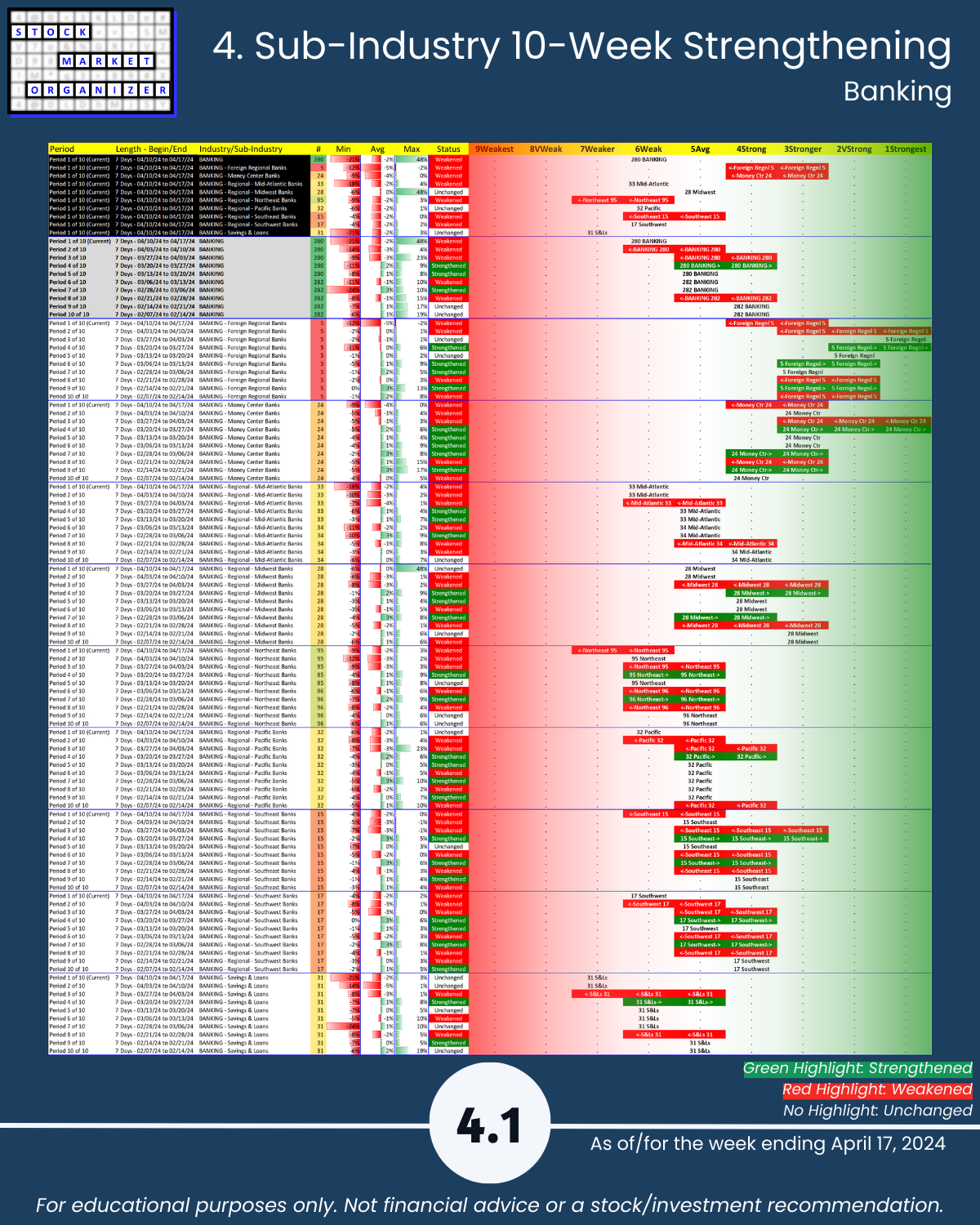

🔹 Industry Strength Level Changes: None

🔹 Industries

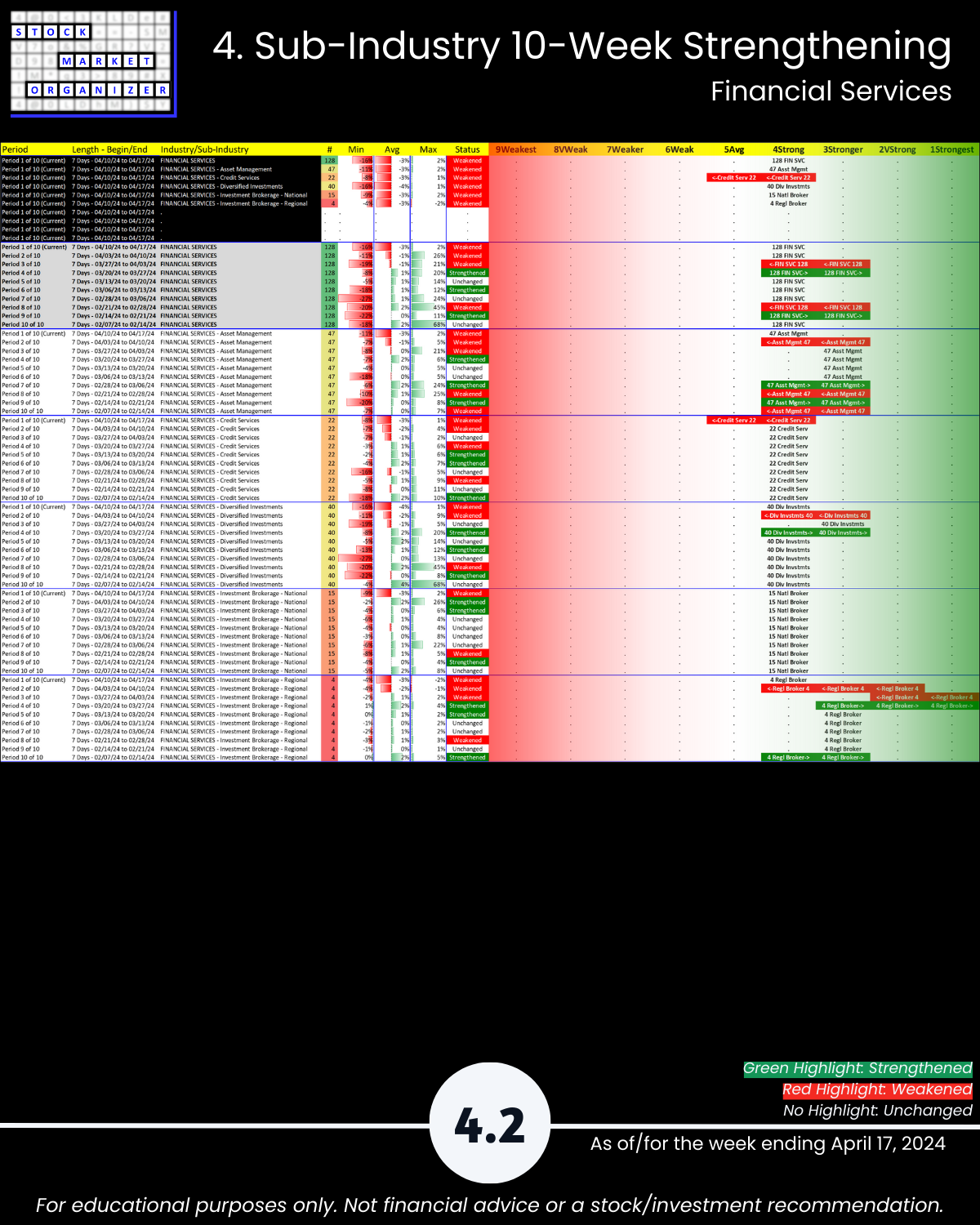

- Strongest Financial Services, Insurance (4Strong)

- Weakest Banking, Real Estate (6Weak)

🔹 Sub-industries (27):

- 0% Strengthened, 56% Weakened

- Strongest: Prop/Casualty Insurance, Asset Management, Money Center Banks (3Stronger)

- Weakest: NE Banks, S&Ls; Diversified/Industrial, Office, and Residential REITs (7Weaker)

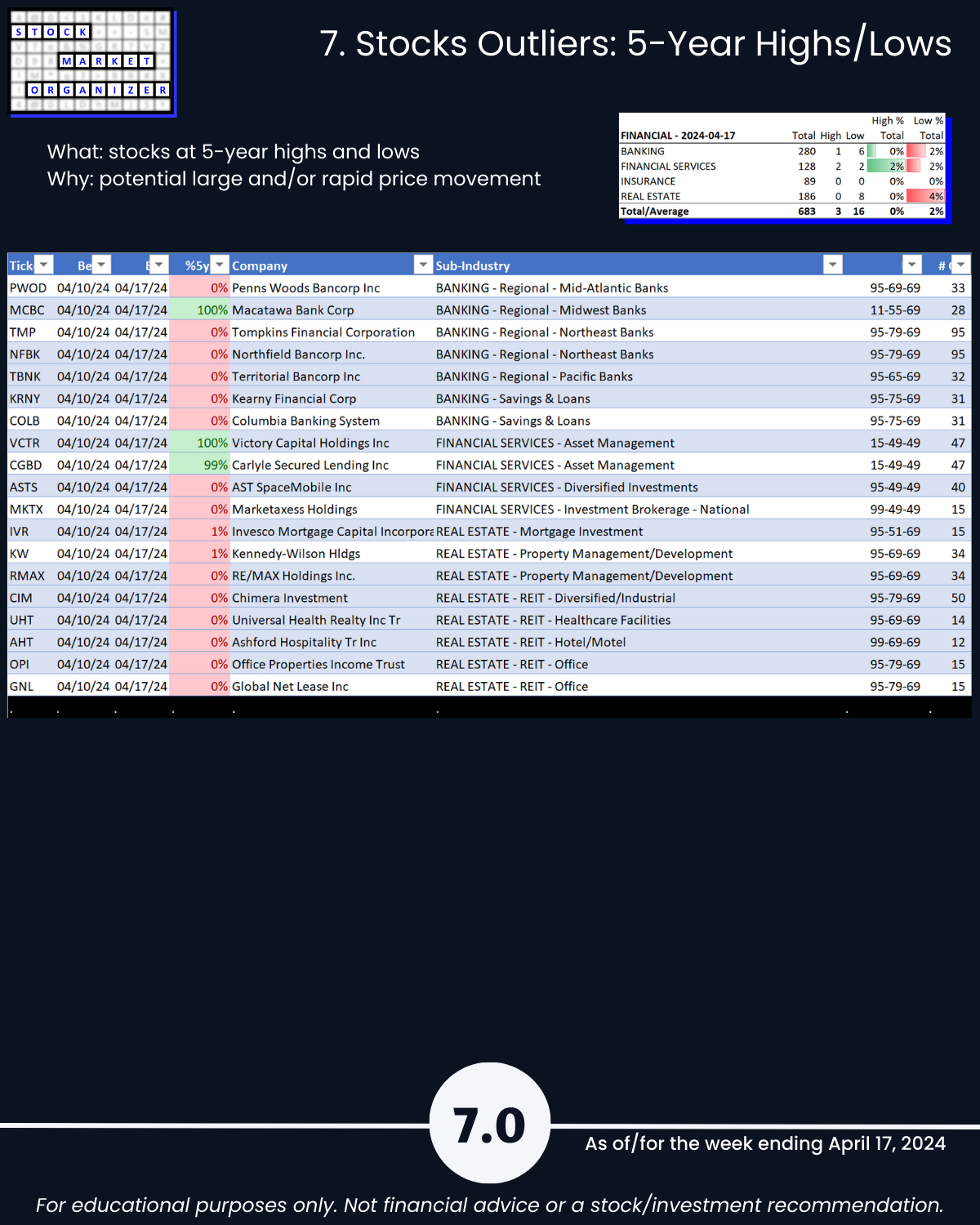

- @ 5 Year+ Highs/Lows: No outliers

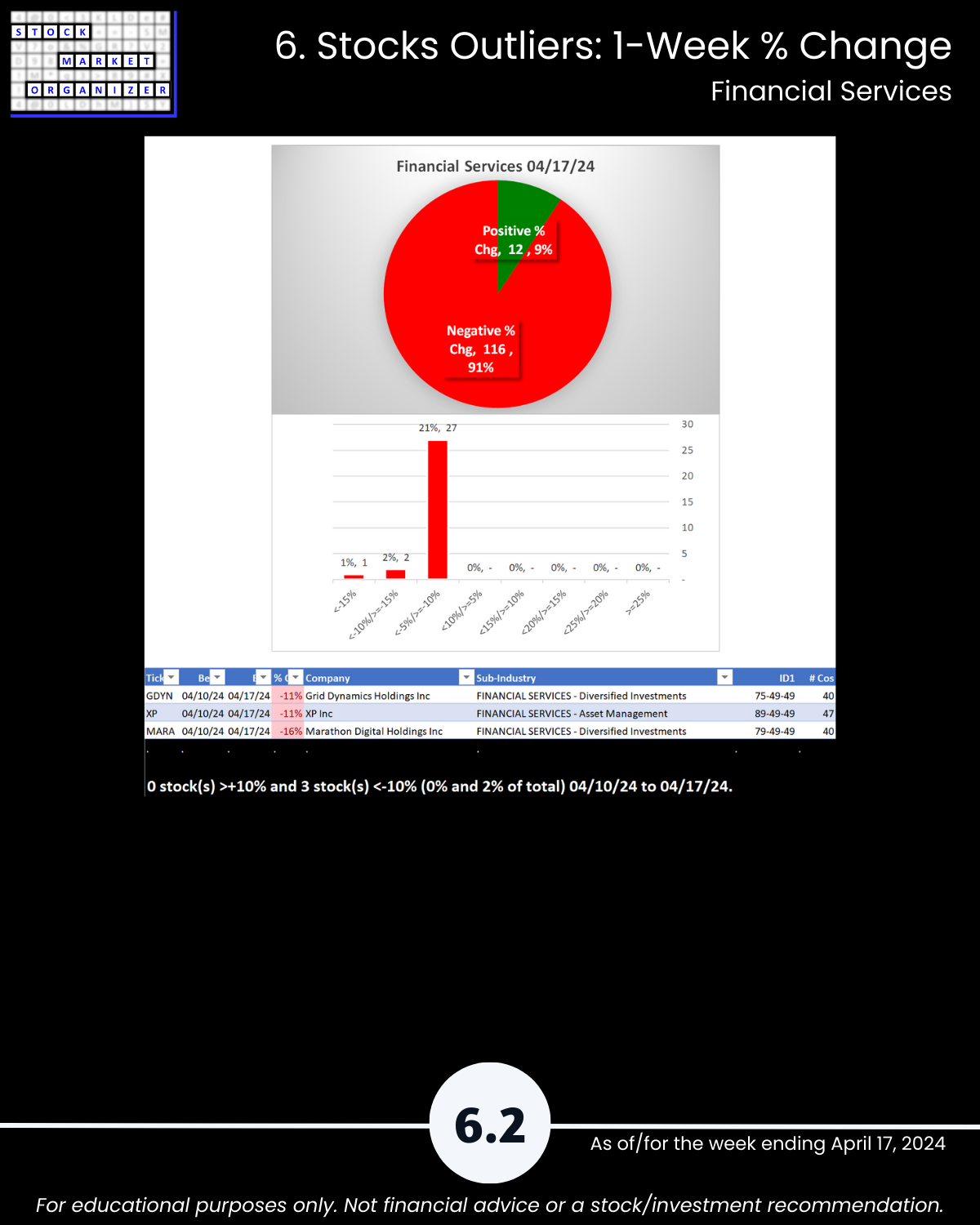

🔹 Stocks

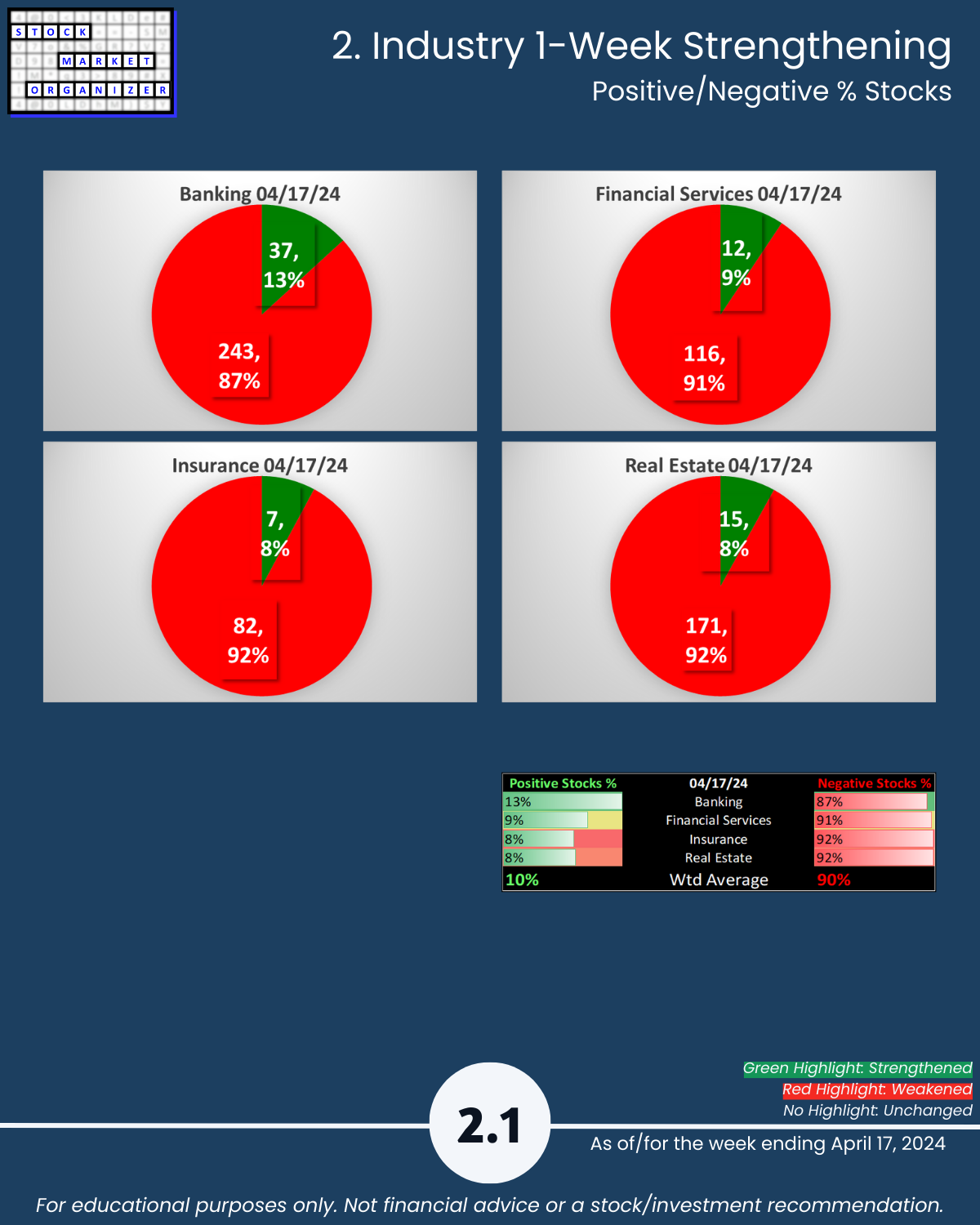

- Positive:Negative: Avg 10%/90%; Financial Services 91%, Insurance 92%, Real Estate 92% negative

- Strongest:Weakest: Avg 8%/26%; Banking 5%:27%, Real Estate 4%:37%

- Outlier Stocks: MCBC +48%, FNWB -21%; GL -40%

Following are galleries with page-by-page views of this report.

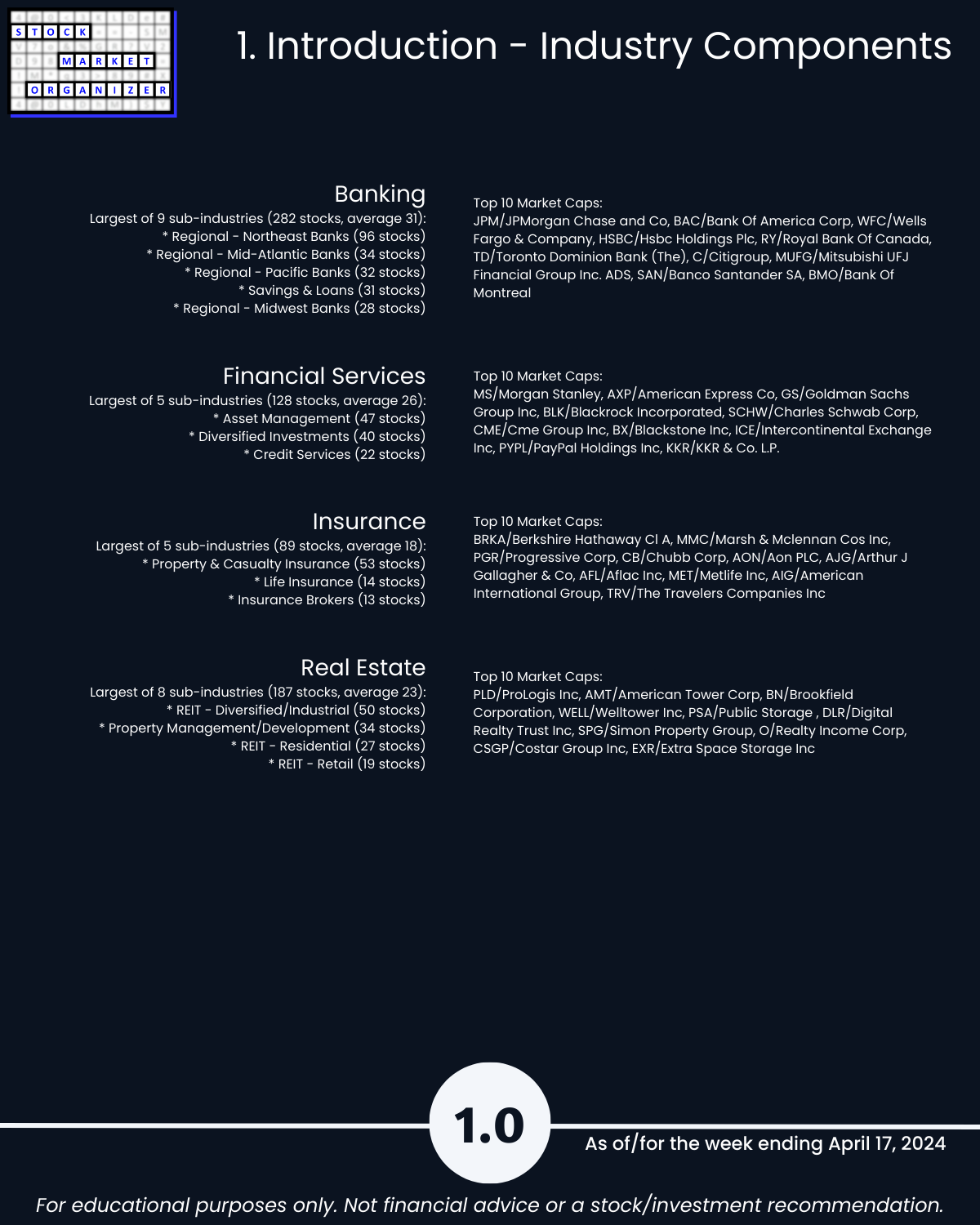

1. Introduction - Industry Components

2. Industry 1-Week Strengthening

3. Industry 10-Week Strengthening

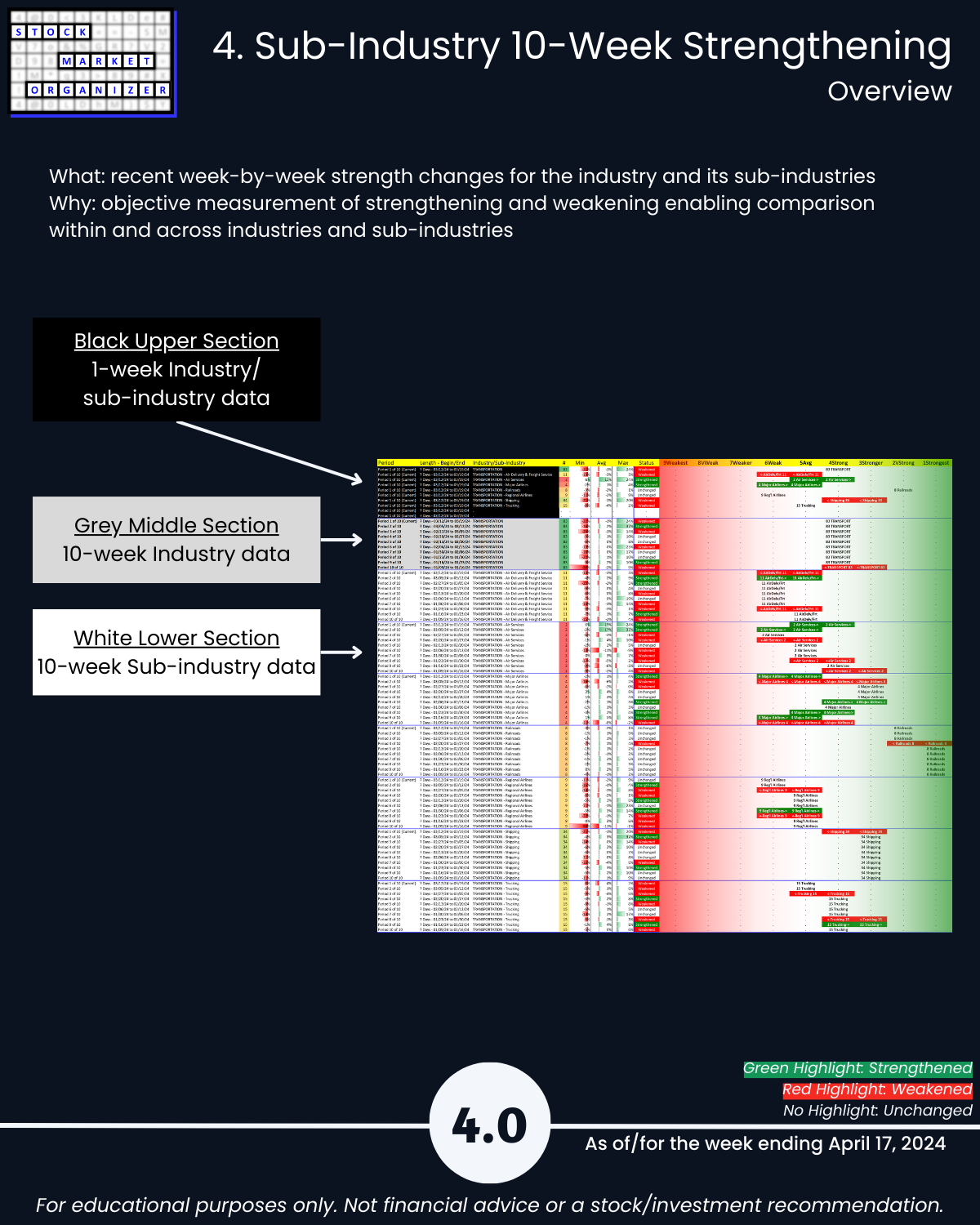

4. Sub-Industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

6. Stocks Outliers: 1-Week % Change

7. Stocks Outliers: 5-Year Highs/Lows