SMO Exclusive: Strength Report Financial Sector 2024-04-10

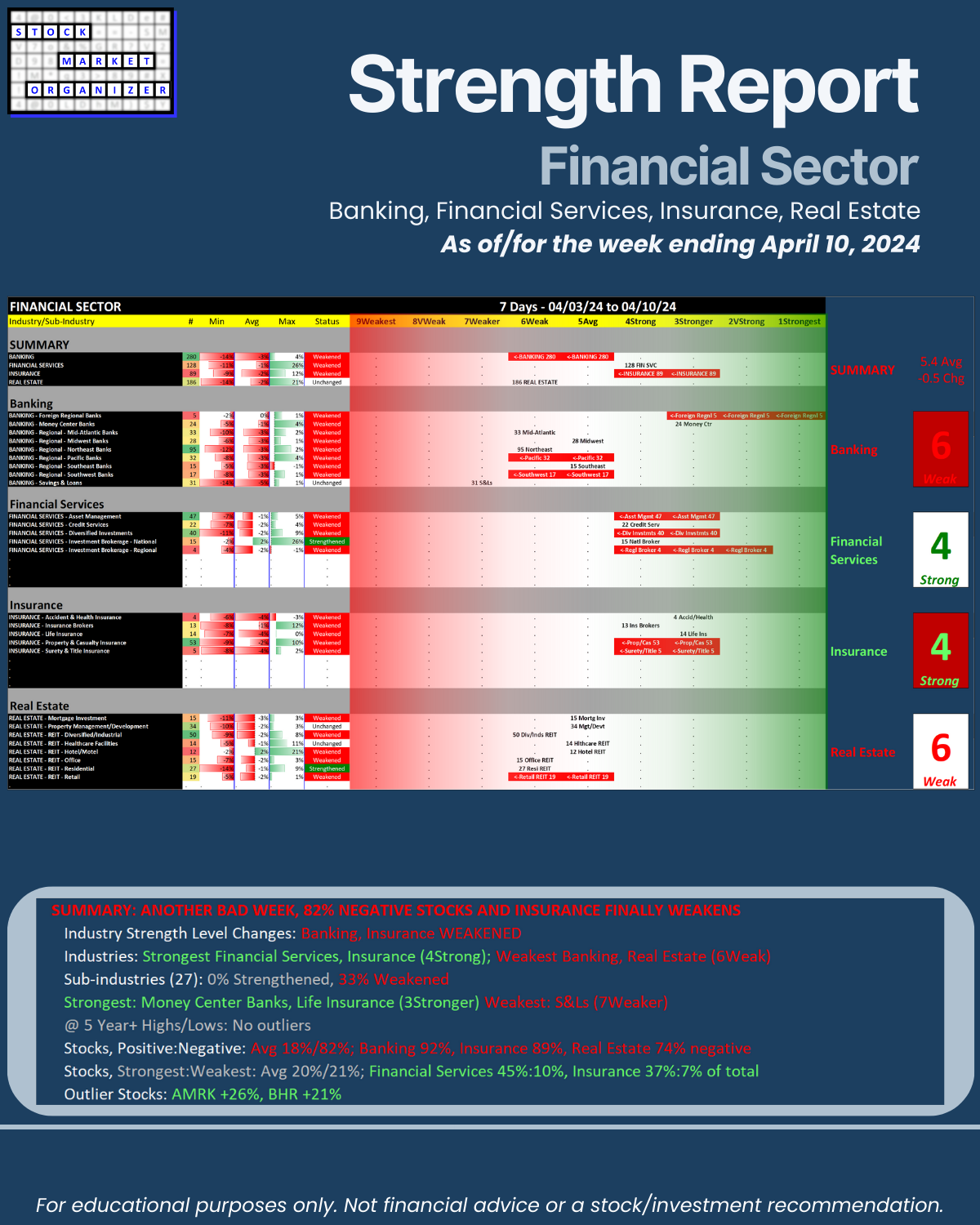

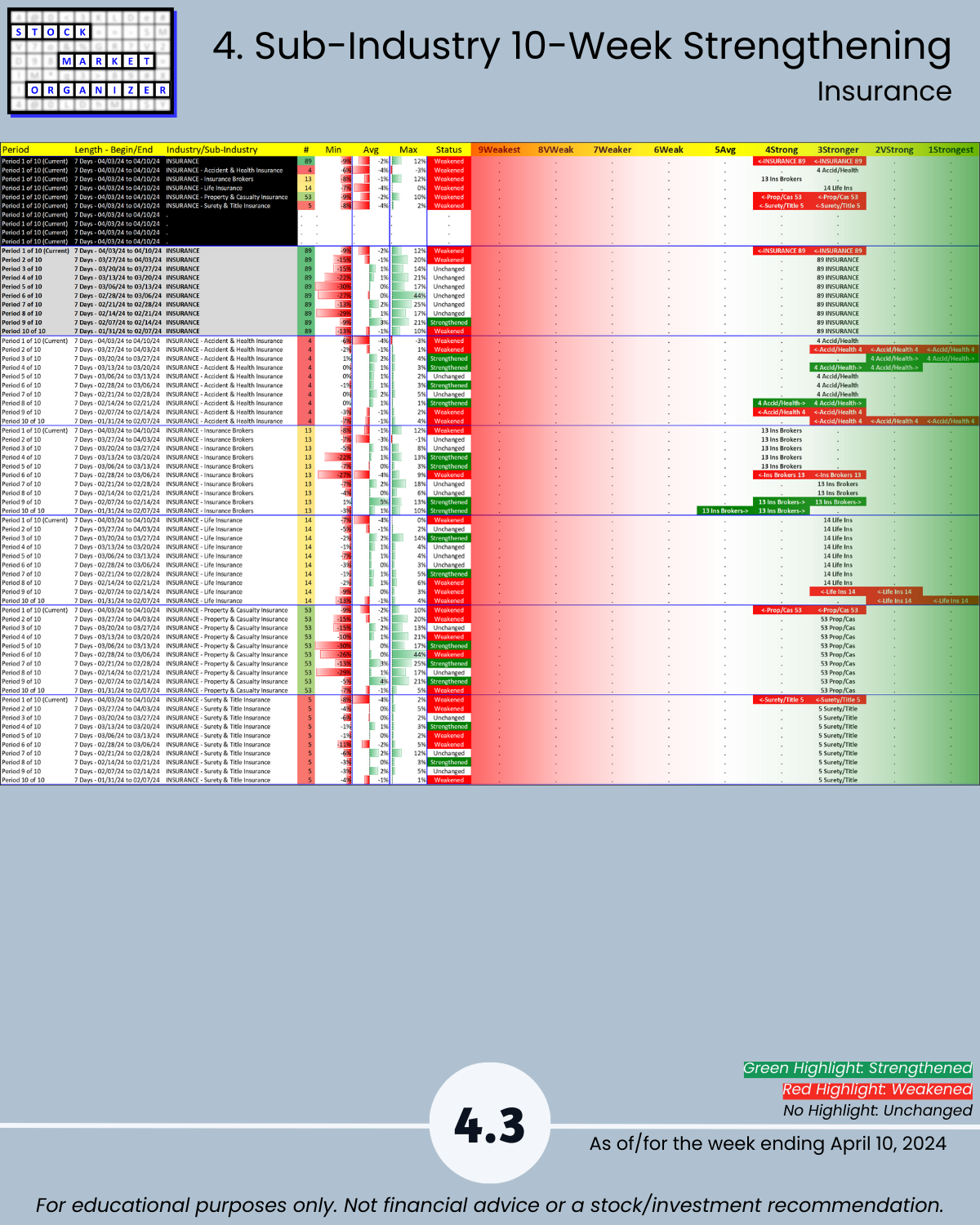

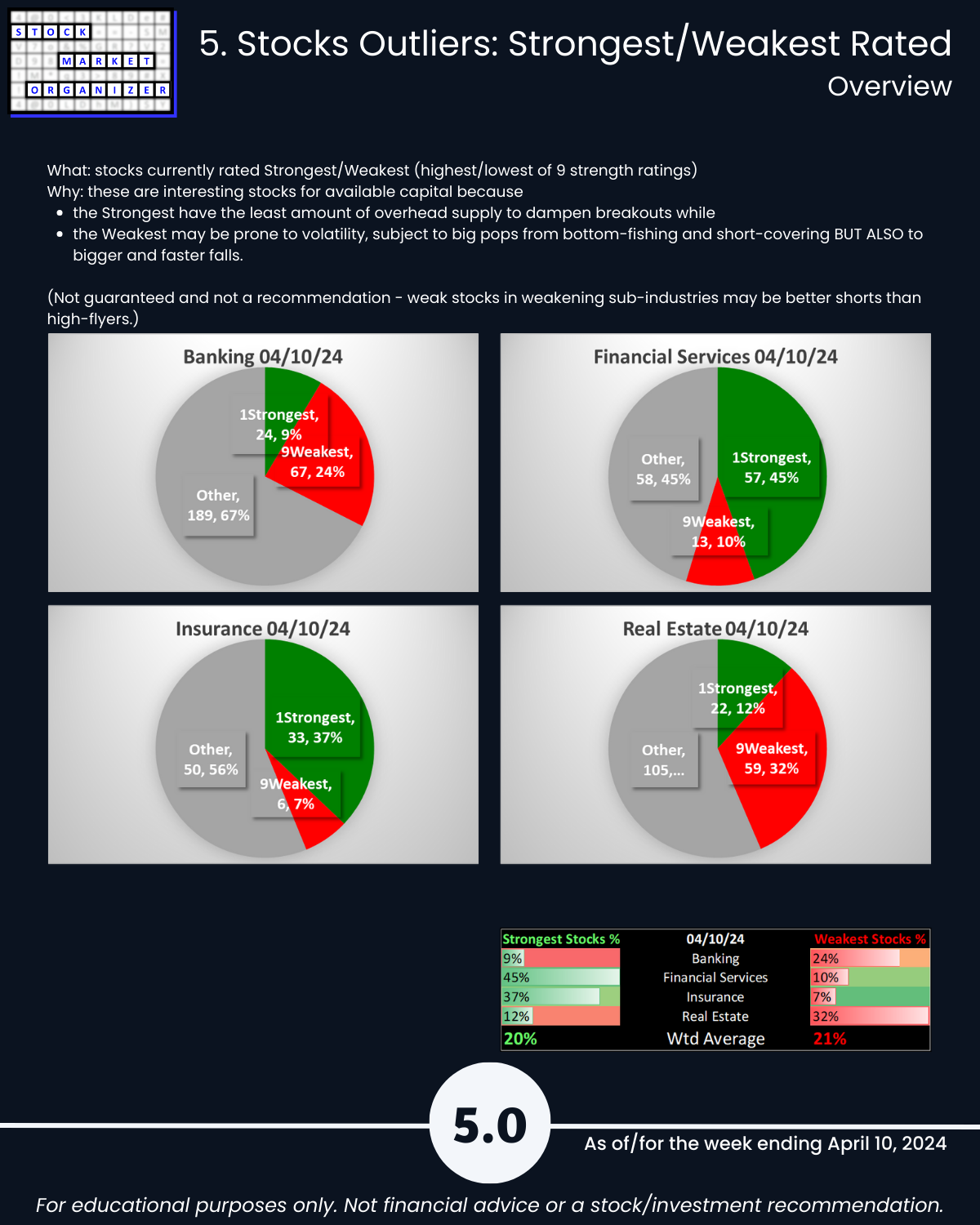

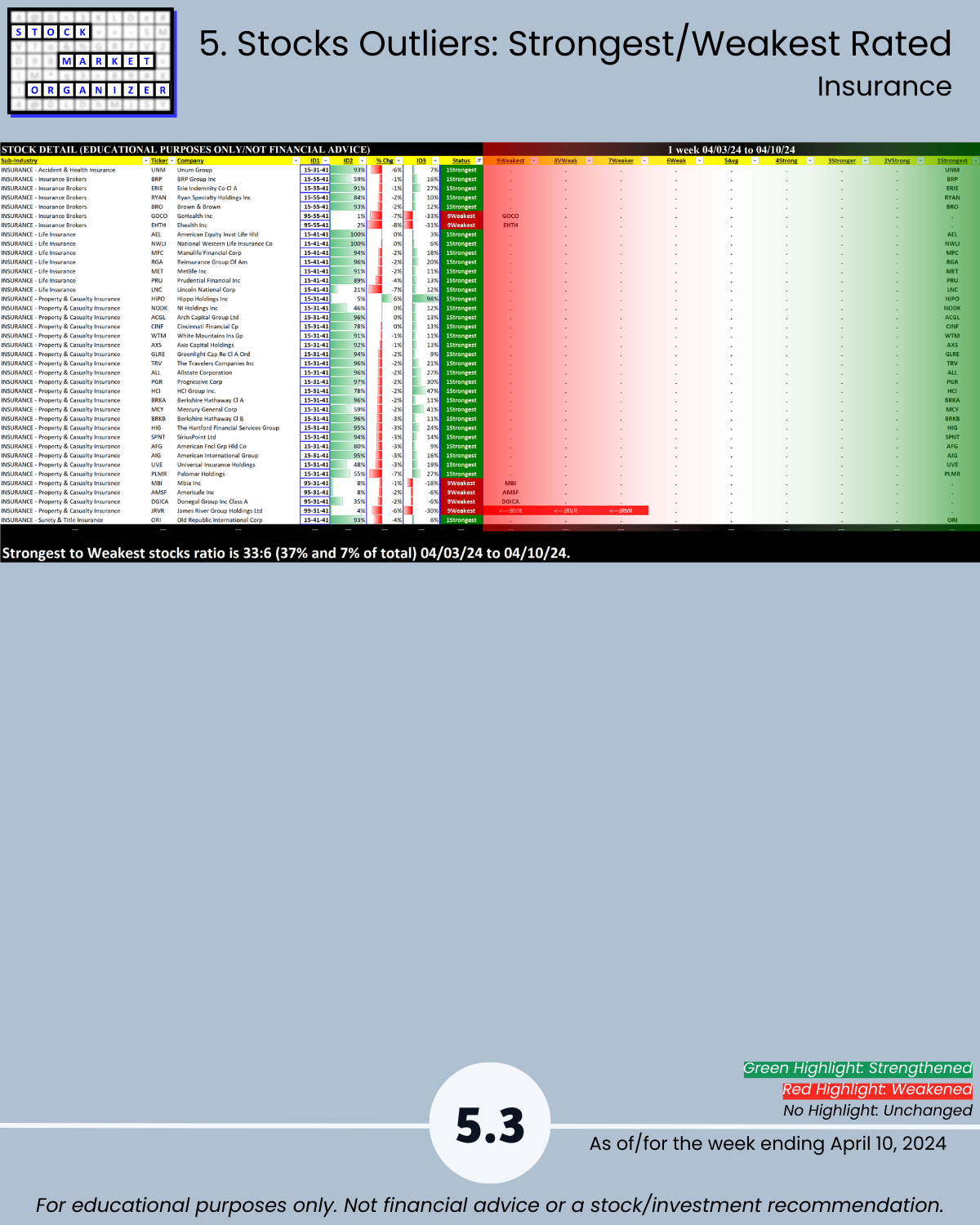

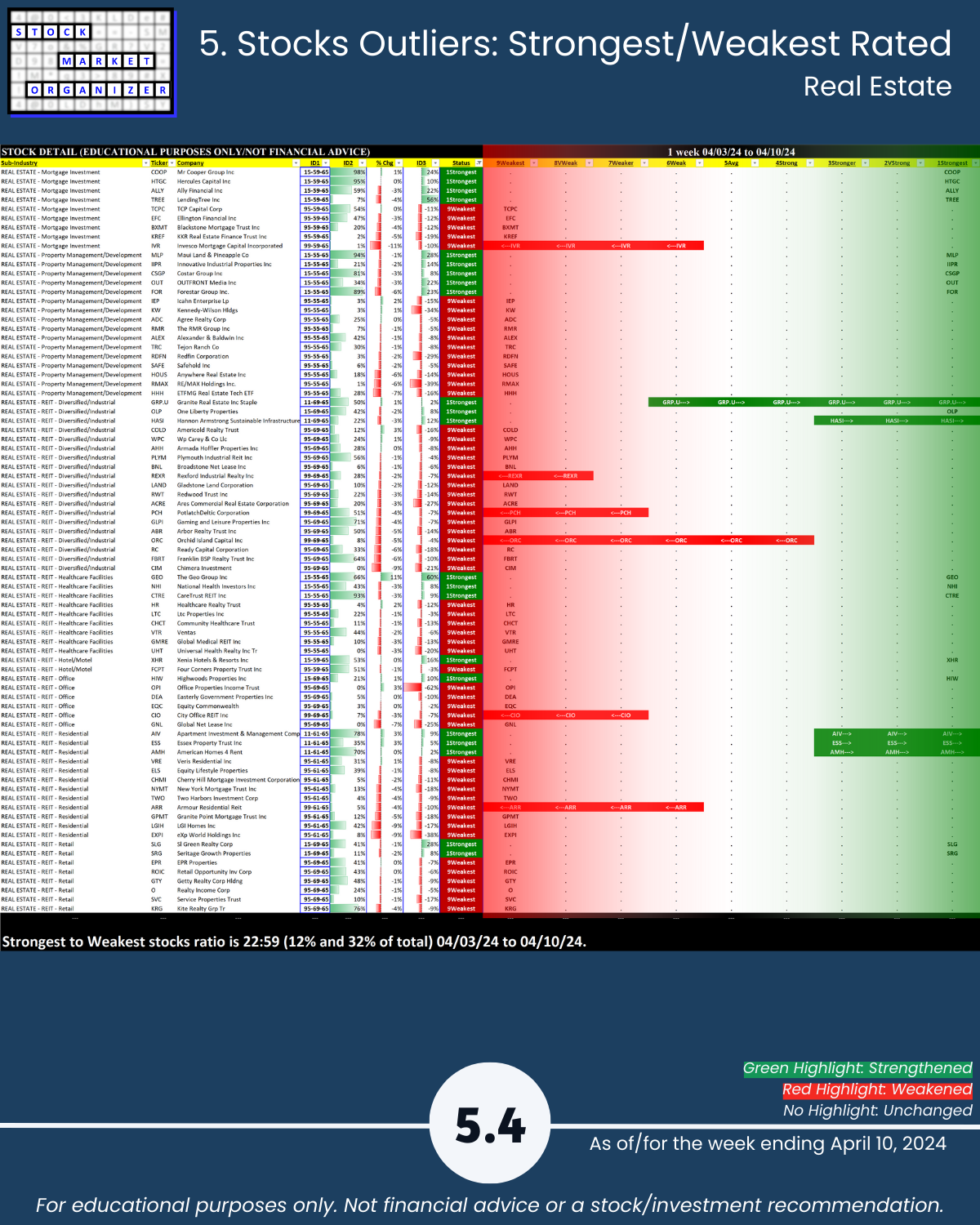

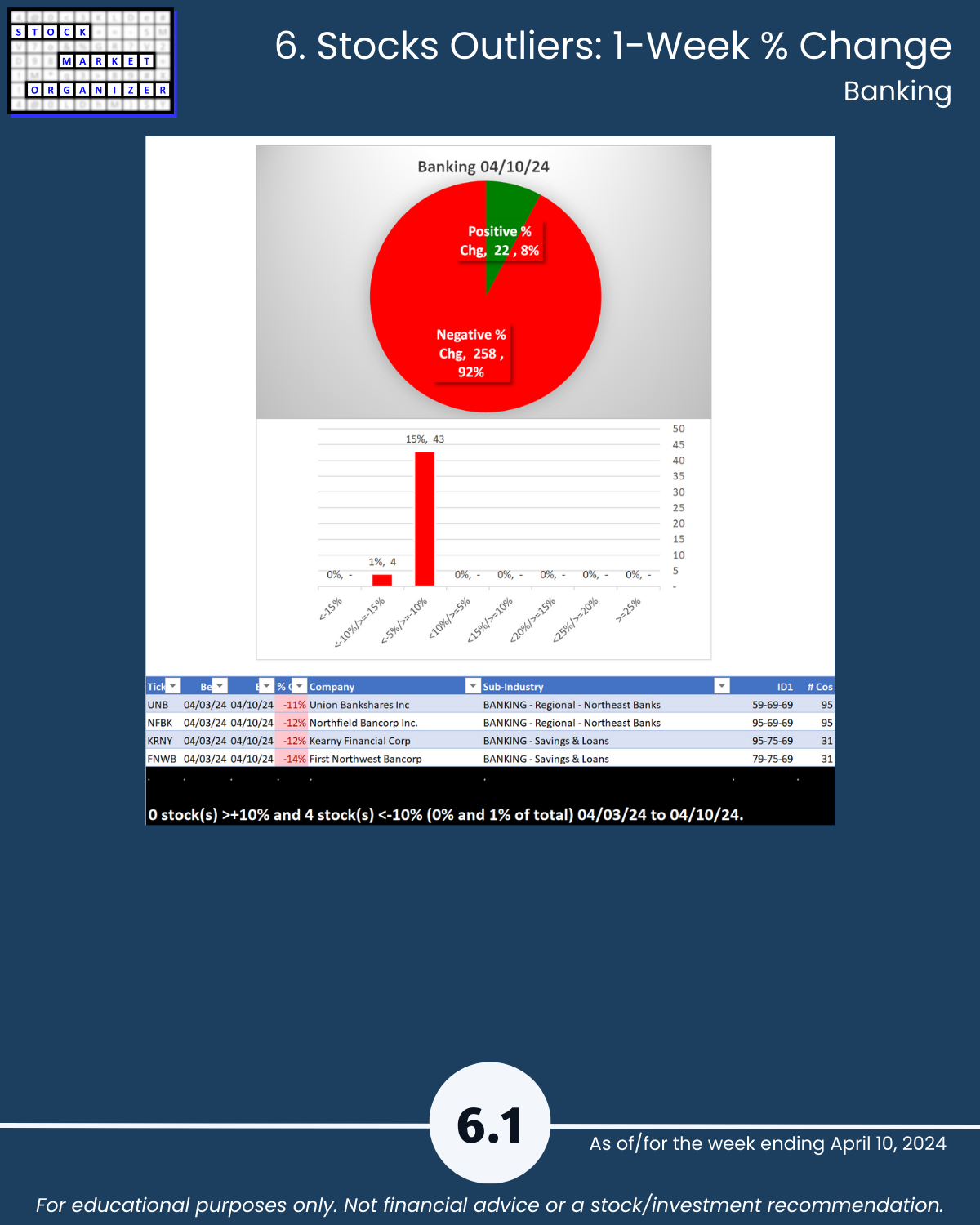

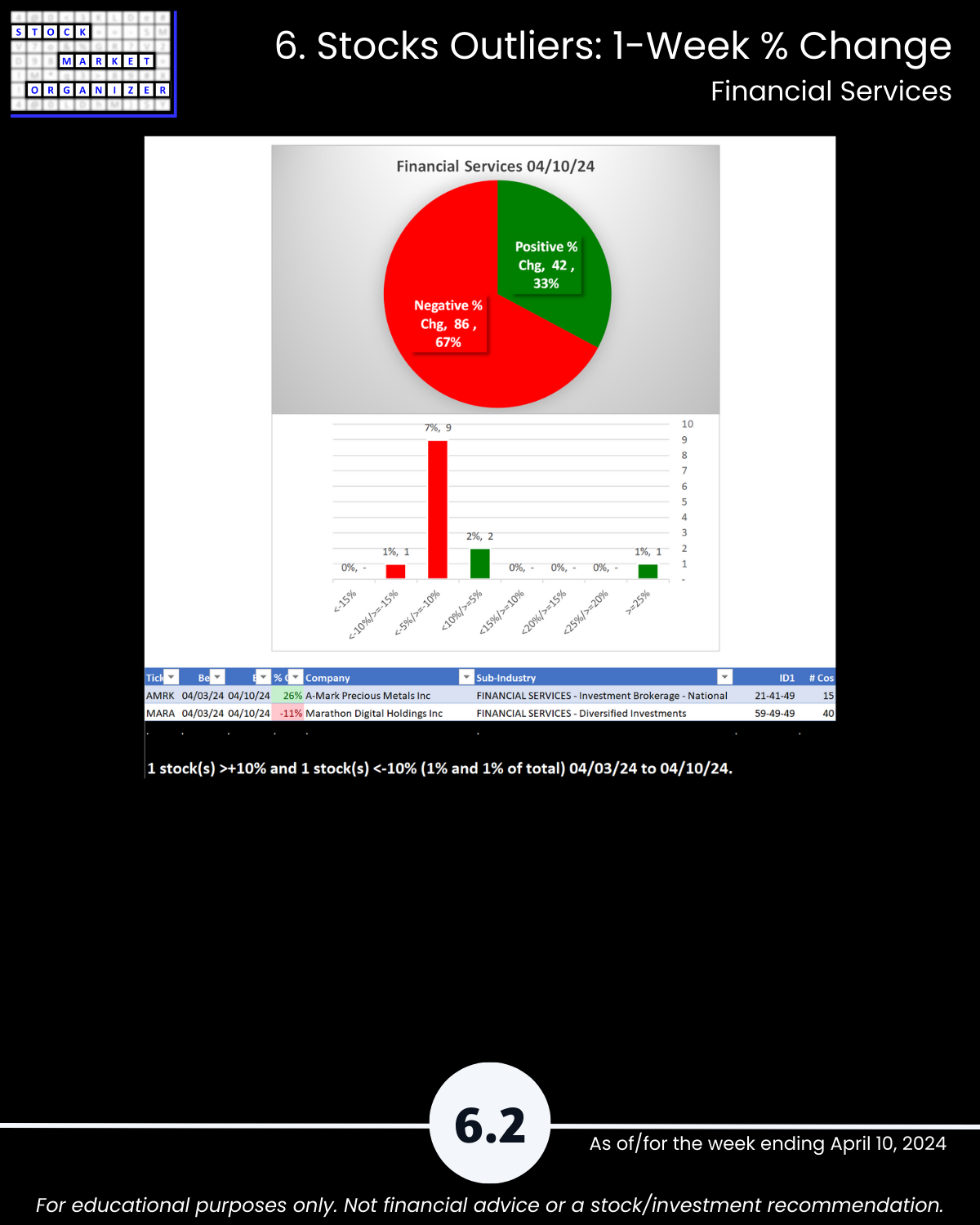

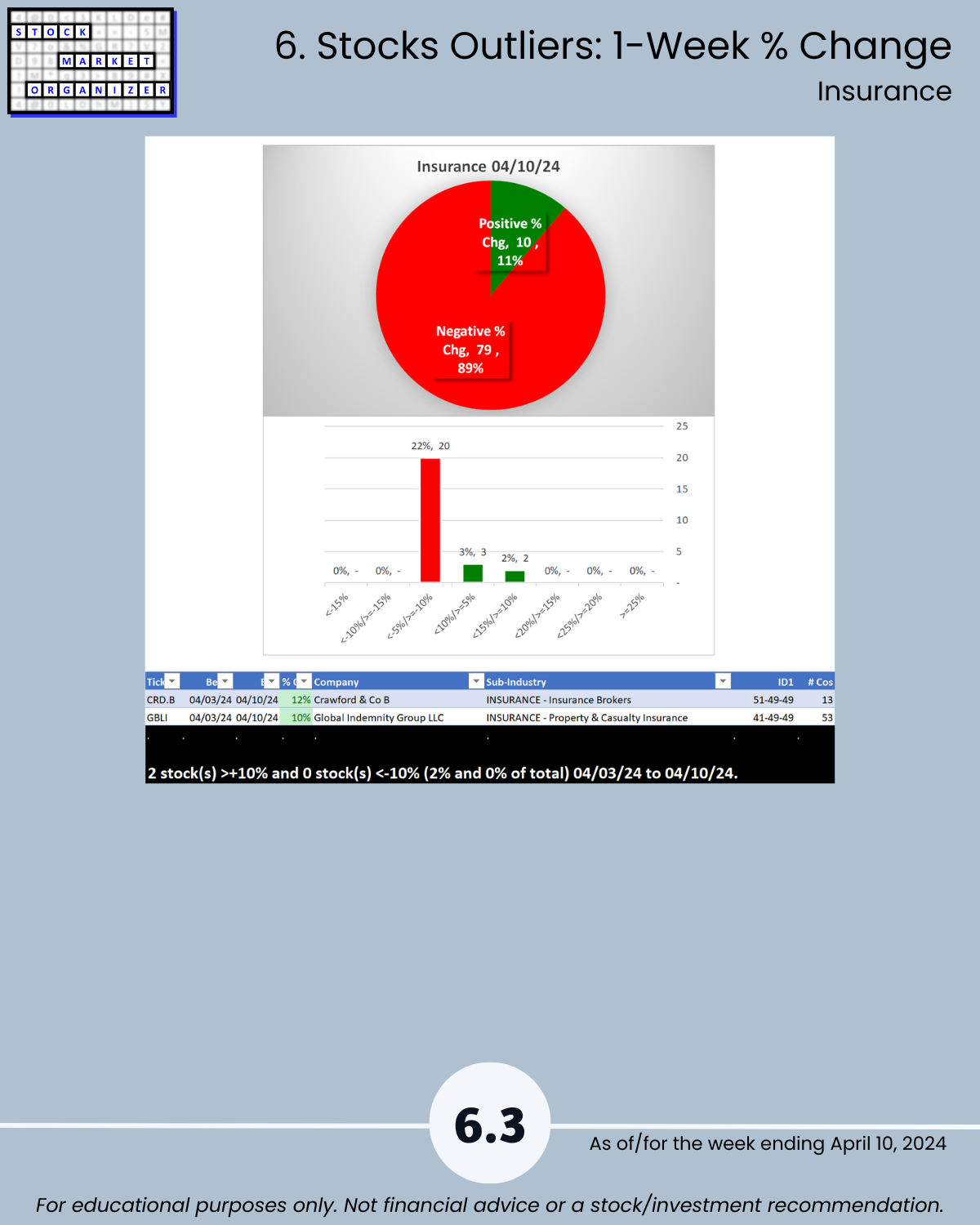

Coincidentally today’s 4/10/24 market-hammering hot CPI print coincides with my weekly Financial sector report. June rate cut at risk? Banking, Financial Services, Insurance, and Real Estate detailed today – spoiler alert, it wasn’t a good week. Biggest news: Insurance weakened to 4Strong after more than 10 weeks at a 3Stronger rating. See Section 5 for a listing of the stocks rated Strongest and Weakest after today’s small-cap face plant. (Yet AMRK +26% and BHR +21% had good weeks.)

Repeating yesterday’s lead-in, which I’ll stand by all day long:

<<Truth: the stronger your stocks, the greener your P&L. Also true: the market does not have to be so complicated. It takes work to blow it when you have a strong stock, strengthening sub-industry, strengthening industry, strengthening sector, and strengthening market. But how do you know you have strengthening at each level unless you are explicitly looking for it?>>

Follow me for regular market strengthening - and weakening - updates.

CURRENT PUBLISHING SCHEDULE

Monday: Industry Group 2, loosely Services (Diversified Services, Health Services, Leisure, Media, Utilities)

Tuesday: Industry Group 1 (Automotive, Energy, Materials & Construction, Metals & Mining, Transportation)

Wednesday: Financial Sector (Banking, Financial Services, Insurance, Real Estate)

Thursday: Technology Sector (Computer Hardware, Computer Software & Services, Electronics - chips/semis, Internet, Telecommunications)

Friday:

— Consumer Sector (Consumer Durables, Consumer Non-durables, Food & Beverage, Retail, Specialty Retail)

— Industry Group 3 (Aerospace/Defense, Chemicals, Drugs, Manufacturing, Wholesale)

— Comprehensive market report directly comparing all 29 industries, 198 sub-industries, and not quite 2,700 stocks

UNIQUE STRENGTHENING ANALYSIS INSIGHTS

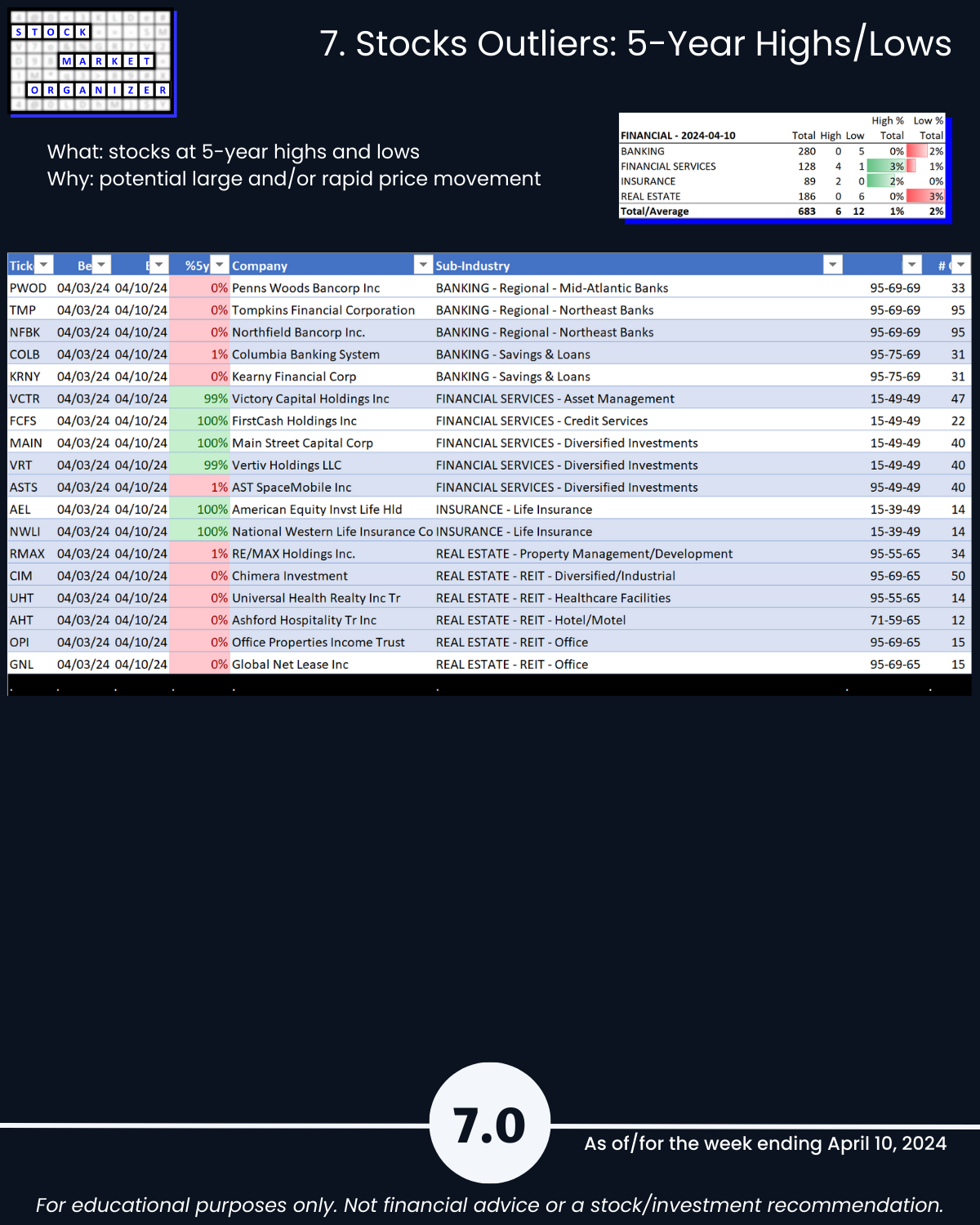

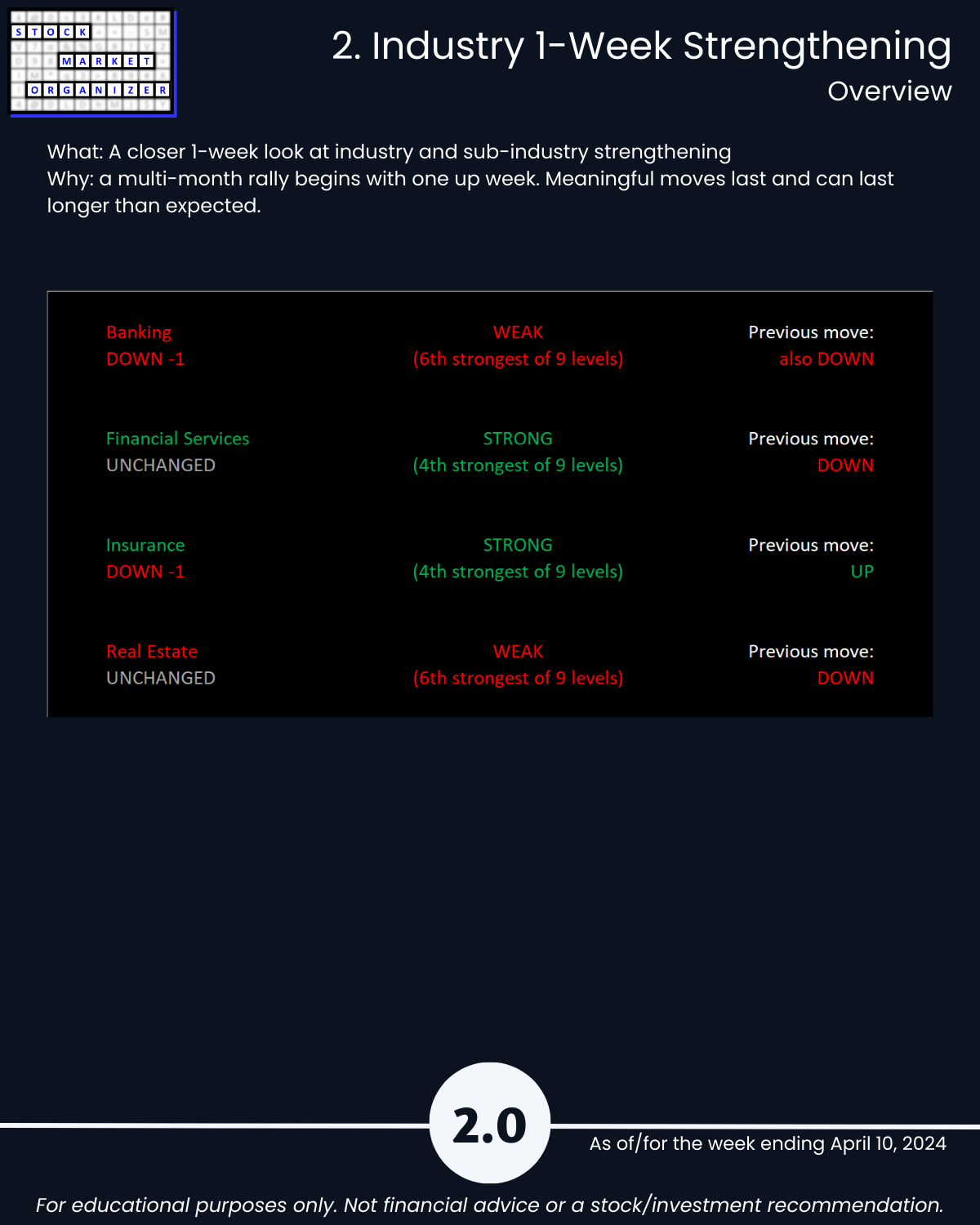

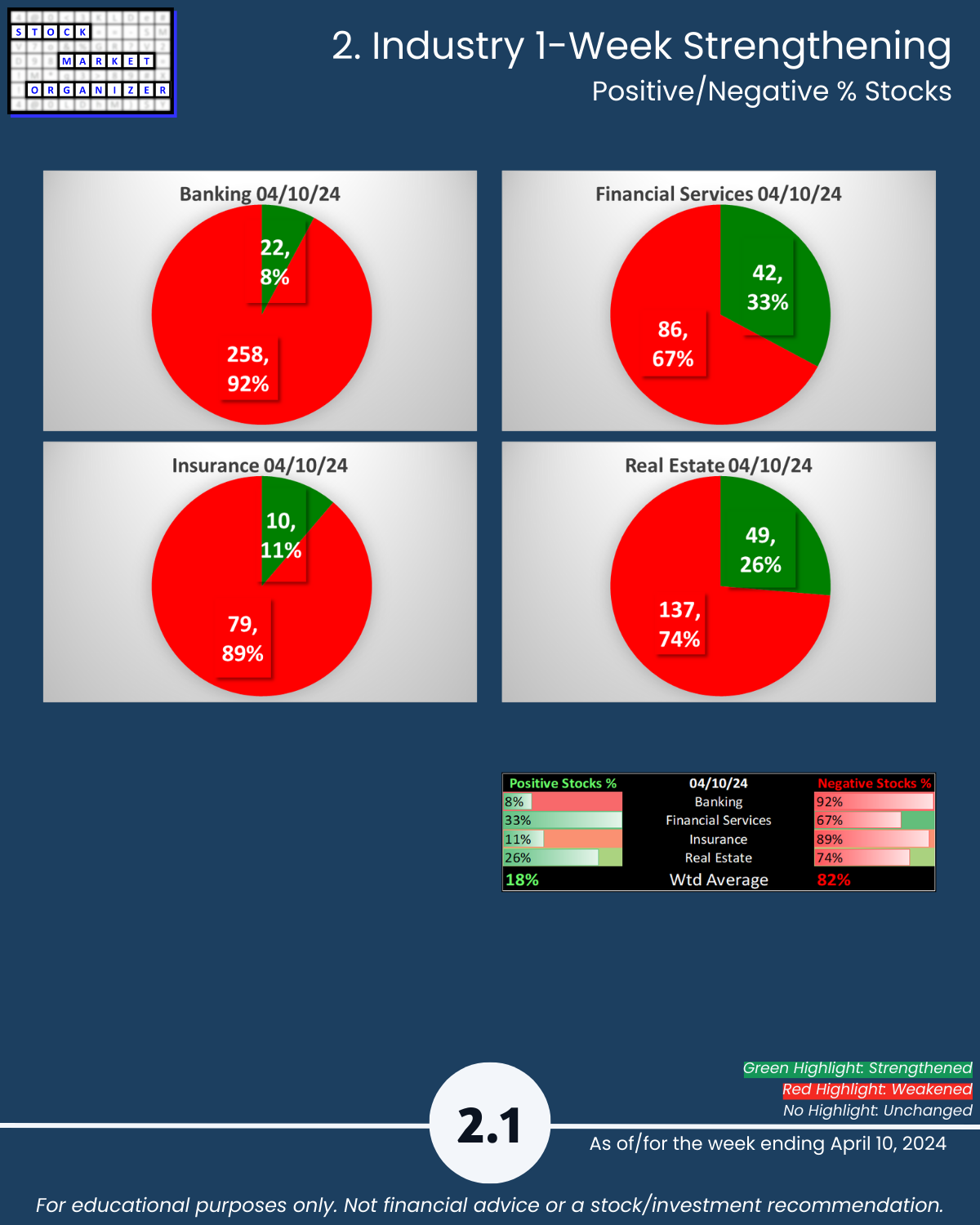

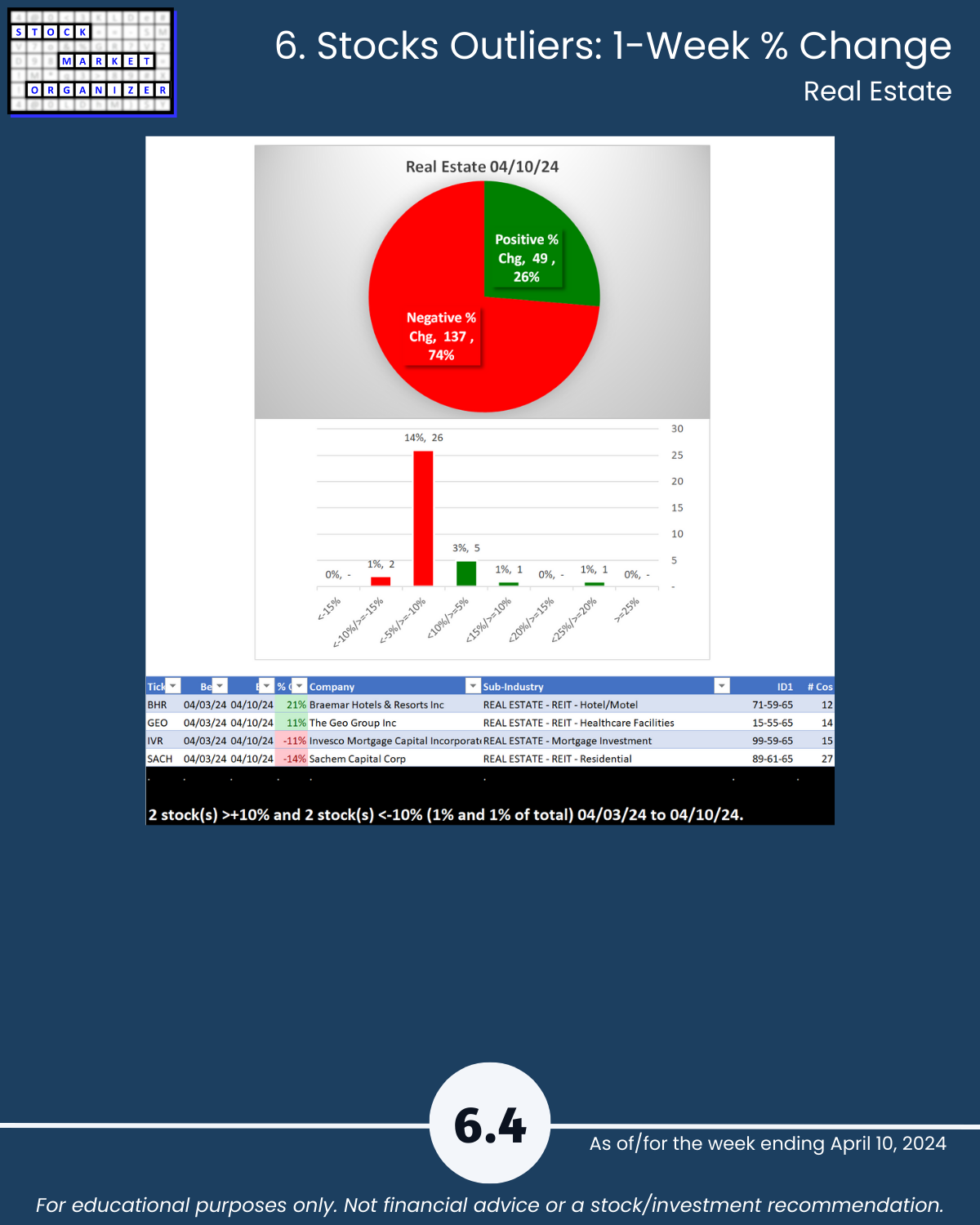

SUMMARY: ANOTHER BAD WEEK, 82% NEGATIVE STOCKS AND INSURANCE FINALLY WEAKENS

🔹 Industry Strength Level Changes: Banking, Insurance WEAKENED

🔹 Industries

- Strongest Financial Services, Insurance (4Strong)

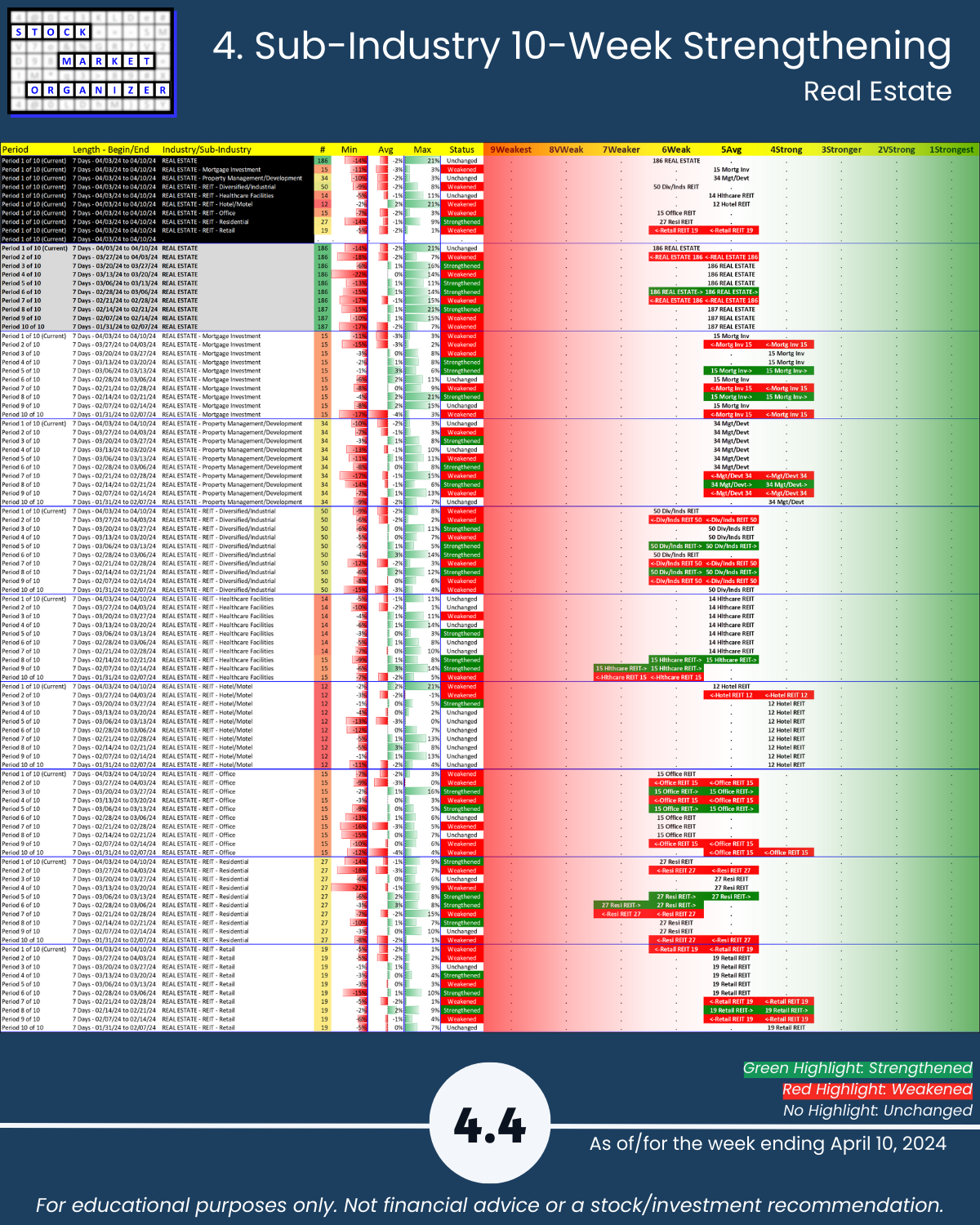

- Weakest Banking, Real Estate (6Weak)

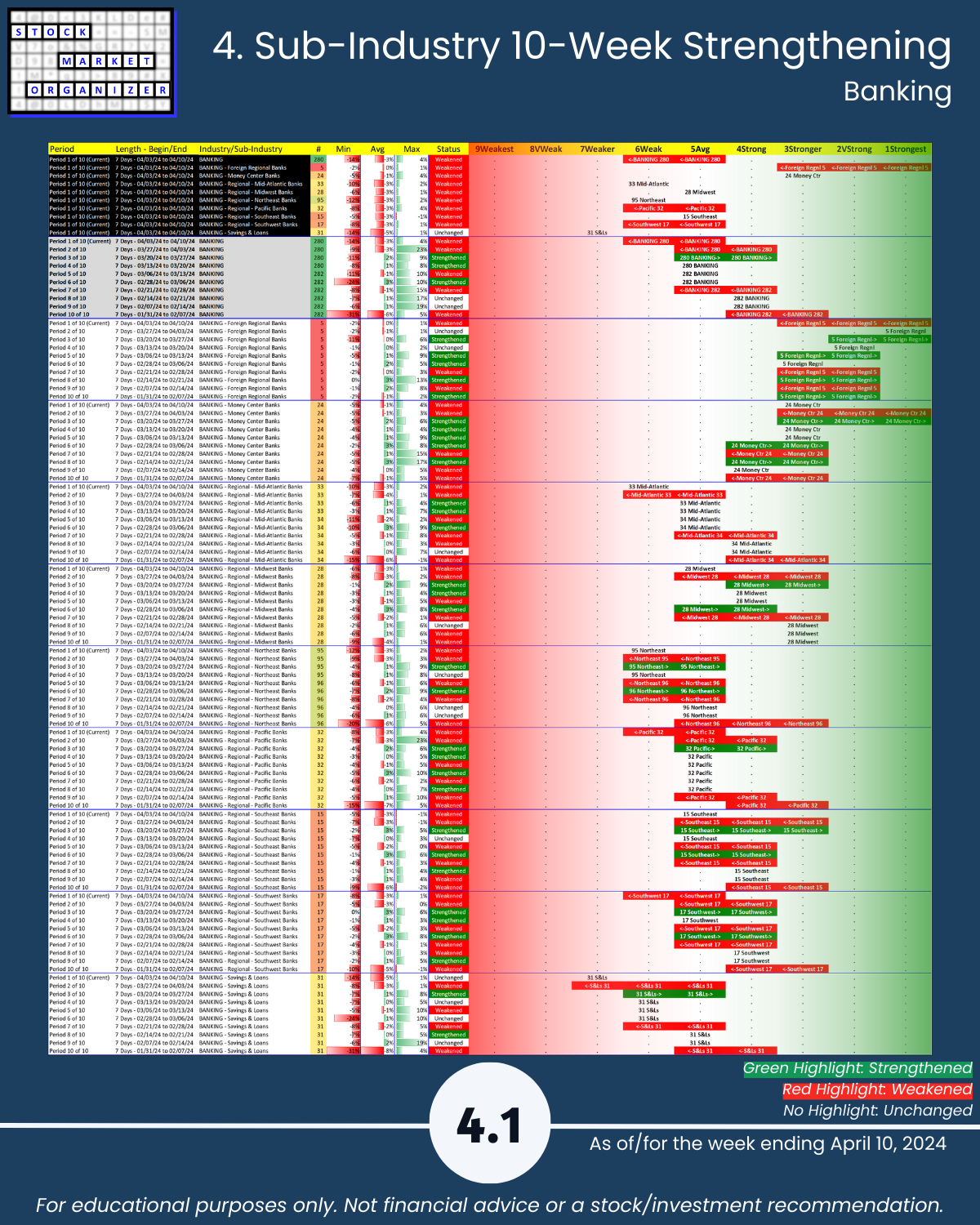

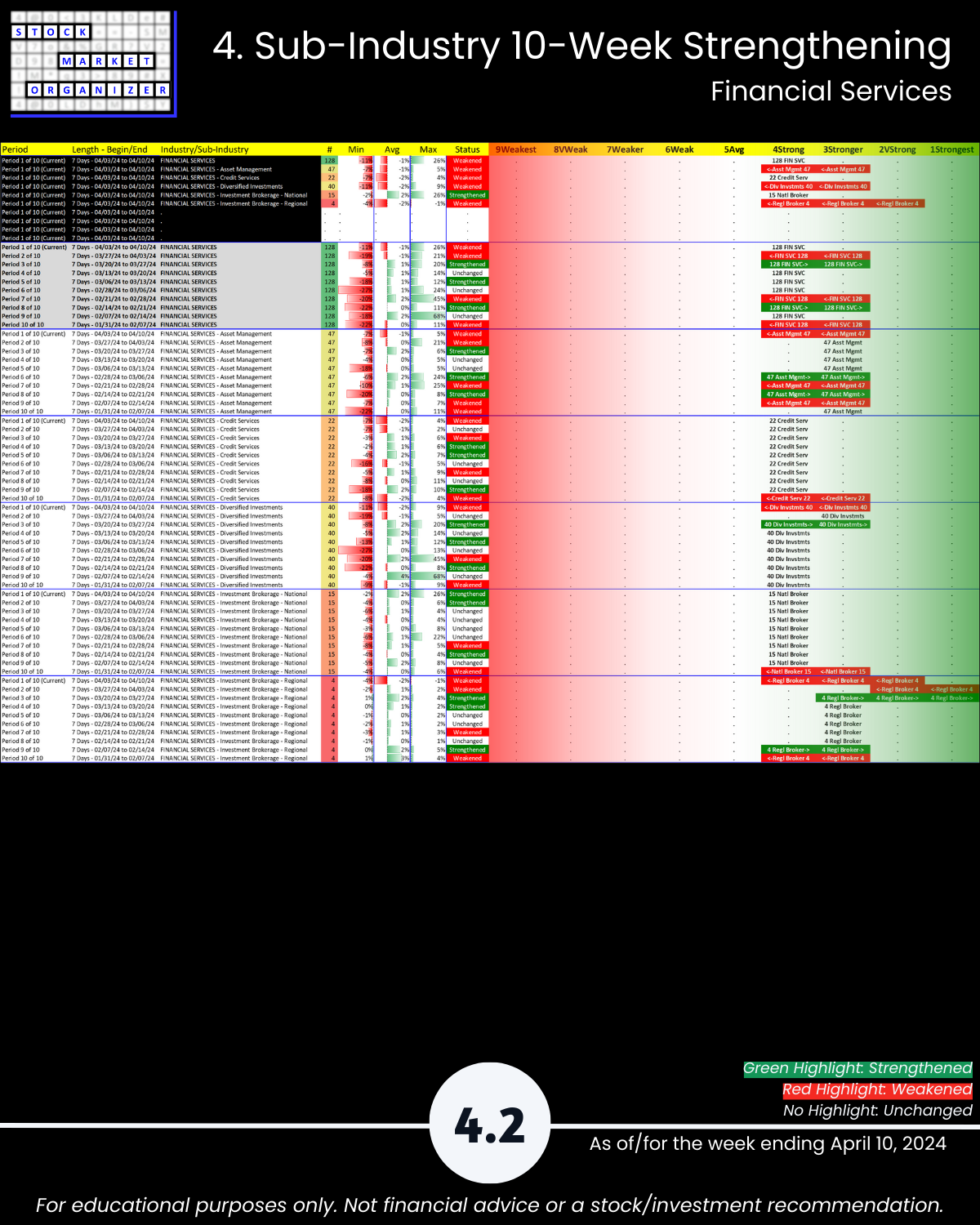

🔹 Sub-industries (27)

- 0% Strengthened, 33% Weakened

- Strongest: Money Center Banks, Life Insurance (4Strong)

- Weakest: S&Ls (7Weaker)

- @ 5 Year+ Highs/Lows: No outliers

🔹 Stocks

- Positive:Negative: Avg 18%/82%; Banking 92%, Insurance 89%, Real Estate 74% negative

- Stocks, Strongest:Weakest: Avg 20%/21%; Financial Services 45%:10%, Insurance 37%:7% of total

- Outlier Stocks: AMRK +26%, BHR +21%

This report may particularly be of interest if the following 5 concepts resonate with you:

- The stronger your stocks, the greener your P&L.

- The journey to 100%+ returns begins with 10% returns.

- The journey to a multi-month rally begins with one up week.

- Most stocks do what the market does. (While the market can only do what its underlying stocks, sub-industries, and industries do.)

- 80/20: not all information is created equal. (Press buttons, not balloons.)

Following are galleries with page-by-page views of this report.

1. Introduction - Industry Components

2. Industry 1-Week Strengthening

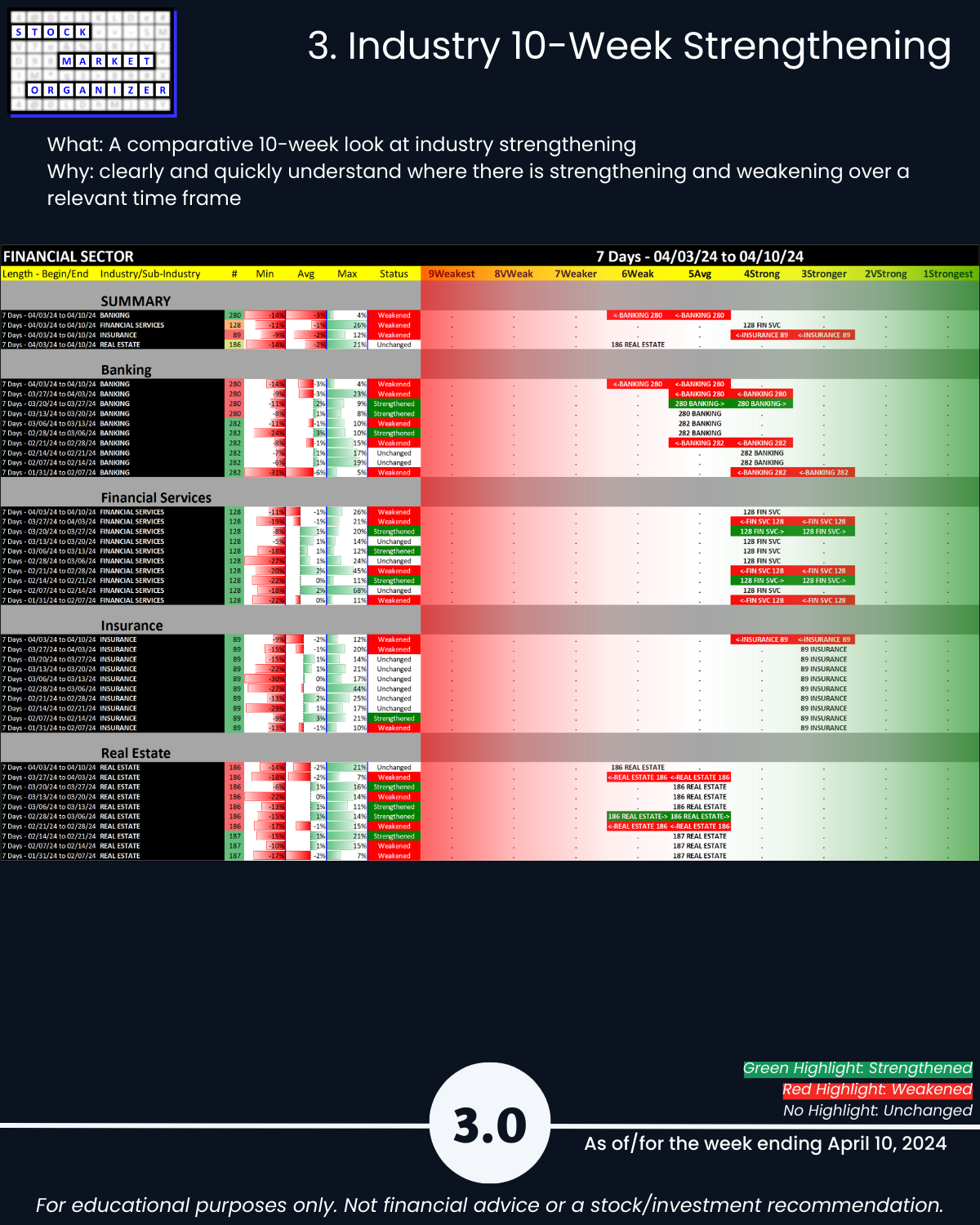

3. Industry 10-Week Strengthening

4. Sub-Industry 10-Week Strengthening

5. Stocks Outliers: Strongest/Weakest Rated

6. Stocks Outliers: 1-Week % Change

7. Stocks Outliers: 5-Year Highs/Lows